Washington, D.C. 20549

For the fiscal ended December 31, 2009.

For the transition period from ______________ to ______________.

FIRST GUARANTY BANCSHARES, INC.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2009 was $49,077,538 based upon the price from the last trade which occurred on June 19, 2009 in which 1,184 shares were traded at a price of $17.00 per share. The common stock is not quoted or traded on an exchange and there is no established or liquid market for the common stock.

As of March 30, 2010, there were issued and outstanding 5,559,644 shares of the Registrant’s Common Stock.

First Guaranty Bancshares, Inc.

(references to “our,” “we” or similar terms under this subheading refer to First Guaranty Bancshares, Inc.)

A portion of our loan portfolio is secured by real estate. If the economy deteriorated and depressed real estate values beyond a certain point, that collateral value of the portfolio and the revenue stream from those loans could come under stress and possibly require additional provision to the allowance for loan losses. Our ability to dispose of foreclosed real estate at prices above the respective carrying values could also be impinged, causing additional losses.

Disruptions in the global financial markets could adversely affect our results of operations and financial condition.

Since mid-2007, global financial markets have suffered substantial disruption, illiquidity and volatility. These circumstances resulted in significant government assistance to a number of major financial institutions. These events have significantly diminished overall confidence in the financial markets and in financial institutions and have increased the uncertainty we face in managing our business. If these disruptions continue or other disruptions in the financial markets or the global or our regional economic environment arise, they could have an adverse effect on our future results of operations and financial condition, including our liquidity position, and may affect our ability to access capital.

Difficult market conditions have adversely affected the industry in which we operate.

The capital and credit markets have been experiencing volatility and disruption for more than twelve months. The volatility and disruption has reached unprecedented levels. Dramatic declines in the housing market over the past year, with falling home prices and increasing foreclosures, unemployment and under-employment, have negatively impacted the credit performance of mortgage loans and resulted in significant write-downs of asset values by financial institutions, including government-sponsored entities as well as major commercial and investment banks. These write-downs have caused many financial institutions to seek additional capital, to merge with larger and stronger institutions and, in some cases, to fail. Reflecting concern about the stability of the financial markets generally and the strength of counterparties, many lenders and institutional i nvestors have reduced or ceased providing funding to borrowers, including to other financial institutions. This market turmoil and tightening of credit have led to an increased level of commercial and consumer delinquencies, lack of consumer confidence, increased market volatility and widespread reduction of business activity generally. We do not expect that the difficult conditions in the financial markets are likely to improve in the near future. A worsening of these conditions would likely exacerbate the adverse effects of these difficult market conditions on us and others in the financial institution industry. In particular, we may face the following risks in connection with these events:

There can be no assurance that the Emergency Economic Stabilization Act of 2008 will help stabilize the U.S. Financial System.

On October 3, 2008, President Bush signed into law the Emergency Economic Stabilization Act of 2008 (EESA) in response to the current crisis in the financial sector. The U.S. Department of the Treasury and banking regulators are implementing a number of programs under this legislation to address capital and liquidity issues in the banking system. There can be no assurance, however, as to the actual impact that the EESA will have on the financial markets, including the extreme levels of volatility and limited credit availability currently being experienced. The failure of the EESA to help stabilize the financial markets and a continuation or worsening of current financial market conditions could materially and adversely affect our business, financial condition, results of operations, access to credit or the trading price of our common stock.

Certain changes in interest rates, inflation, deflation, or the financial markets could affect demand for our products and our ability to deliver products efficiently.

Loan originations, and potentially loan revenues, could be adversely impacted by sharply rising interest rates. Conversely, sharply falling rates could increase prepayments within our securities portfolio lowering interest earnings from those investments. An underperforming stock market could reduce brokerage transactions, therefore reducing investment brokerage revenues; in addition, wealth management fees associated with managed securities portfolios could also be adversely affected. An unanticipated increase in inflation could cause our operating costs related to salaries & benefits, technology, and supplies to increase at a faster pace than revenues.

The fair market value of our securities portfolio and the investment income from these securities also fluctuate depending on general economic and market conditions. In addition, actual net investment income and/or cash flows from investments that carry prepayment risk, such as mortgage-backed and other asset-backed securities, may differ from those anticipated at the time of investment as a result of interest rate fluctuations.

Changes in the policies of monetary authorities and other government action could adversely affect our profitability.

The results of operations are affected by credit policies of monetary authorities, particularly the Federal Reserve Board. The instruments of monetary policy employed by the Federal Reserve Board include open market operations in U.S. government securities, changes in the discount rate or the federal funds rate on bank borrowings and changes in reserve requirements against bank deposits. In view of changing conditions in the national economy and in the money markets, particularly in light of the continuing threat of terrorist attacks and the current military operations in the Middle East, we cannot predict possible future changes in interest rates, deposit levels, loan demand or our business and earnings. Furthermore, the actions of the United States government and other governments in responding to such terrorist attacks or the military operations in t he Middle East may result in currency fluctuations, exchange controls, market disruption and other adverse effects.

We engage in acquisitions of other businesses from time to time.

On occasion, we will engage in acquisitions of other businesses. Inability to successfully integrate acquired businesses can pose varied risks to us, including customer and employee turnover, thus increasing the cost of operating the new businesses. The acquired companies may also have legal contingencies, beyond those that we are aware of, that could result in unexpected costs. Moreover, there can be no assurance that acquired businesses will achieve prior or planned results of operations.

We may not be able to successfully maintain and manage our growth.

Our loan portfolio consists of a high percentage of loans secured by non-farm non-residential real estate. These loans are riskier than loans secured by one- to four-family properties.

Emphasis on the origination of short-term loans could expose us to increased lending risks.

Hurricane Activity in Louisiana can have an adverse impact on our market area.

If the allowance for loan losses is not sufficient to cover actual loan losses, earnings could decrease.

Adverse events in Louisiana, where our business is concentrated, could adversely affect our results and future growth.

Our continued pace of growth may require us to raise additional capital in the future, but that capital may not be available when it is needed and could result in dilution of shareholders’ ownership.

We rely on our Management team for the successful implementation of our business strategy.

There is no assurance that we will be able to successfully compete with others for business.

We depend primarily on net interest income for our earnings rather than noninterest income.

Fluctuations in interest rates could reduce our profitability.

We expect to incur additional expenses in connection with our compliance with Sarbanes-Oxley.

The Company’s expenses may increase as a result of increases in FDIC insurance premiums.

Future legislative or regulatory actions responding to perceived financial and market problems could impair the Company’s rights against borrowers.

Continued or further declines in the value of certain investment securities could require write-downs, which would reduce the Company’s earnings.

We operate in a highly regulated environment and may be adversely affected by changes in federal, state and local laws and regulations.

We are subject to extensive regulation, supervision and examination by federal and state banking authorities. Any change in applicable regulations or federal, state or local legislation could have a substantial impact on us and our operations. Additional legislation and regulations that could significantly affect our powers, authority and operations may be enacted or adopted in the future, which could have a material adverse effect on our financial condition and results of operations. Further, regulators have significant discretion and authority to prevent or remedy unsafe or unsound practices or violations of laws by banks and bank holding companies in the performance of their supervisory and enforcement duties. The exercise of regulatory authority may have a negative impact on our results of operations and financial condition. Like other bank holding companies and financial institutions, we must comply with significant anti-money laundering and anti-terrorism laws. Under these laws, we are required, among other things, to enforce a customer identification program and file currency transaction and suspicious activity reports with the federal government. Government agencies have substantial discretion to impose significant monetary penalties on institutions which fail to comply with these laws or make required reports.

We hold certain intangible assets that could be classified as impaired in the future. If these assets are considered to be either partially or fully impaired in the future, our earnings and the book values of these assets would decrease.

Pursuant to FASB ASC 350, Intangibles – Goodwill and Other (SFAS No. 142), we are required to test our goodwill and core deposit intangible assets for impairment on a periodic basis. The impairment testing process considers a variety of factors, including the current market price of our common shares, the estimated net present value of our assets and liabilities and information concerning the terminal valuation of similarly situated insured depository institutions. The market price for our common shares was above our tangible book value at October 1, 2009, the date of our impairment testing, and at December 31, 2009. If there is a decline in the market value of our common shares and a decline in the market pri ces of the common shares of similarly situated insured depository institutions during future reporting periods it is possible that future impairment testing could result in a partial or full impairment of the value of our goodwill or core deposit intangible assets, or both. If an impairment determination is made in a future reporting period, our earnings and the book value of these intangible assets will be reduced by the amount of the impairment. If an impairment loss is recorded, it will have little or no impact on the tangible book value of our common shares or our regulatory capital levels.

If we were unable to borrow funds through access to capital markets, we may not be able to meet the cash flow requirements of our depositors and borrowers, or the operating cash needs to fund corporate expansion and other corporate activities.

Liquidity is the ability to meet cash flow needs on a timely basis at a reasonable cost. The liquidity of our Company is used to make loans and leases to repay deposit liabilities as they become due or are demanded by customers. Liquidity policies and limits are established by the board of directors. Management and the Investment Committee regularly monitor the overall liquidity position of the Company to ensure that various alternative strategies exist to cover unanticipated events that could affect liquidity. Management and the Investment Committee also establish policies and monitor guidelines to diversify the banks’ funding sources. Funding sources include Federal funds purchased, securities sold under repurchase agreements, non-core deposits, and shor t- and long-term debt. We are also members of the Federal Home Loan Bank (“FHLB”) System, which provides funding through advances to members that are collateralized with certain loans.

We maintain a portfolio of securities that can be used as a secondary source of liquidity. There are other sources of liquidity available to us should they be needed. These sources include sales of loans, additional collateralized borrowings such as FHLB advances, unsecured borrowing lines with other financial institutions, the issuance and sale of debt securities, and the issuance and sale of preferred or common securities. We can also borrow from the Federal Reserve’s discount window.

Amounts available under our existing credit facilities as of December 31, 2009, consist of $92.9 million available at the Federal Home Loan Bank and $63.2 million in the form of federal funds and/or other lines of credit.

If we were unable to access any of these funding sources when needed, we might be unable to meet customers’ needs, which could adversely impact our financial condition, results of operations, cash flows, and level of regulatory-qualifying capital.

Risk Associated with an Investment in our Common Stock

The market price of our common stock is established between a buyer and seller.

First Guaranty Bank acts as the transfer agent for First Guaranty Bancshares, Inc. All shares traded are agreed upon by mutual buyers and sellers. First Guaranty Bancshares, Inc. is not traded on an exchange, therefore liquidation and/or purchases of stock may not be readily available.

Our Management controls a substantial percentage of our common stock and therefore has the ability to exercise substantial control over our affairs.

As of December 31, 2009, our directors and executive officers (and their affiliates) beneficially owned 2,348,110 shares or approximately 42.2% of our common stock. Because of the large percentage of common stock held by our directors and executive officers, such persons could significantly influence the outcome of any matter submitted to a vote of our shareholders even if other shareholders were in favor of a different result.

Our participation in the U.S. Treasury’s Capital Purchase Program imposes restrictions on us that limit our ability to perform certain equity transactions, including the payment of dividends and common stock purchases.

On August 28, 2009, we issued and sold $20.7 million in Fixed Rate Cumulative Perpetual Preferred Stock, Series A and a warrant to purchase shares of the Company’s Fixed Rate Cumulative Preferred Stock, Series B to the Treasury Department as part of the Capital Purchase Program. The Series A preferred shares will pay a cumulative dividend rate of five percent (5%) per annum for the first five years and will reset to a rate of nine percent (9%) per annum after year five. Immediately following the issuance of the Series A Preferred Stock and the Warrant, the Treasury Department exercised its rights under the Warrant to acquire shares of the Series B Preferred Stock through a cashless exercise. The Series B Preferred Stock pays cumulative dividends at a rate of nine percent (9%) per annum. The Series B Preferred Stock genera lly has the same rights and privileges as the Series A Preferred Stock. The dividends and potential increase in dividends if we do not redeem the preferred stock may significantly impact our operating results, liquidity, and capital position.

Pursuant to the Purchase Agreement, prior to August 28, 2012, unless the Company has redeemed the Series A Preferred Stock and the Series B Preferred Stock or the Treasury Department has transferred the Series A Preferred Stock and the Series B Preferred Stock to a third party, the ability of the Company to declare or pay any dividend or make any distribution on its capital stock or other equity securities of any kind of the Company will be subject to restriction, including a restriction against (1) increasing the quarterly cash dividend per share to an amount larger than the last quarterly cash dividend paid on the common stock prior to November 17, 2008, $0.16 per share, or (2) redeeming, purchasing or acquiring any shares of its common stock or other equity or capital securities, other than in connection with benefit plans consistent w ith past practice and certain circumstances specified in the Purchase Agreement. In addition, prior to August 28, 2012, the Company may not redeem any of the Series A Preferred Stock or Series B Preferred Stock except with the proceeds of a qualified equity offering.

Following August 28, 2012 and until August 28, 2019 (unless the Series A Preferred Stock and Series B Preferred Stock has been redeemed or transferred to a third party), the Company may not, without the consent of the Treasury Department, pay any dividends on its capital stock that are in the aggregate greater than 103% of any dividends in the prior fiscal quarter. In addition, prior to August 28, 2019 (unless the Series A Preferred Stock and Series B Preferred Stock has been redeemed or transferred to a third party) the Company may not repurchase or acquire any equity security of the Company without the consent of the Treasury Department other than in certain circumstances specified in the Purchase Agreement. Following August 28, 2019, the Company may not pay any dividend or repurchase any equity securities without the consent of the Treasury Department unless the Series A Preferred Stock and the Series B Preferred Stock have been redeemed or the United States Treasury has transferred the securities. In addition, no shares of the Series B Preferred Stock may be redeemed unless all the shares of Series A Preferred Stock have been redeemed.

In addition, under the Articles of Amendment for the Series A Preferred Stock and the Series B Preferred Stock, the Company’s ability to declare or pay dividends or repurchase its common stock or other equity or capital securities will be subject to restrictions in the event that it fails to declare and pay or set aside for payment full dividends on the Series A Preferred Stock and the Series B Preferred Stock, respectively.

None.

The Company does not directly own any real estate, but it does own real estate indirectly through its subsidiary. The Bank operates 17 retail-banking centers. The following table sets forth certain information relating to each office. The net book value of our properties at December 31, 2009 was $9.0 million.

Location | | Use of Facilities | | Year Facility Opened or Acquired | | Owned/ Leased |

First Guaranty Square 400 East Thomas Street Hammond, LA 70401 | | Bank’s Main Office | | 1975 | | Owned |

2111 West Thomas Street Hammond, LA 70401 | | Guaranty West Banking Center | | 1974 | | Owned |

100 East Oak Street Amite, LA 70422 | | Amite Banking Center | | 1970 | | Owned |

455 Railroad Avenue Independence, LA 70443 | | Independence Banking Center | | 1979 | | Owned |

301 Avenue F Kentwood, LA 70444 | | Kentwood Banking Center | | 1975 | | Owned |

170 West Hickory Ponchatoula, LA 70454 | | Ponchatoula Banking Center1 | | 1960 | | Owned |

196 Burt Blvd Benton, LA 71006 | | Benton Banking Center2 | | 1999 | | Owned |

126 South Hwy. 1 Oil City, LA 71061 | | Oil City Banking Center | | 1999 | | Owned |

401 North 2nd Street Homer, LA 71040 | | Homer Main Banking Center | | 1999 | | Owned |

10065 Hwy 79 Haynesville, LA 71038 | | Haynesville Banking Center | | 1999 | | Owned |

117 East Hico Street Dubach, LA 71235 | | Dubach Banking Center | | 1999 | | Owned |

102 East Louisiana Avenue Vivian, LA 71082 | | Vivian Banking Center | | 1999 | | Owned |

500 North Cary Jennings, LA 70546 | | Jennings Banking Center | | 1999 | | Owned |

799 West Summers Drive Abbeville, LA 70510 | | Abbeville Banking Center | | 1999 | | Owned |

105 Berryland Ponchatoula, LA 70454 | | Berryland Banking Center | | 2004 | | Leased |

2231 S. Range Avenue Denham Springs, LA 70726 | | Denham Springs Banking Center | | 2005 | | Owned |

North 6th Street Ponchatoula, LA 70454 | | Ponchatoula Banking Center | | 2007 | | Owned |

29815 Walker Rd S Walker, LA 70785 | | Walker Banking Center | | 2007 | | Owned |

1 This banking facility was closed on March 14, 2008 and consolidated with the Ponchatoula Banking Center.

2 This banking facility was sold on January 27, 2010 and a new facility was opened at 189 Burt Boulevard, Benton, LA.

The Bank also owns four additional properties which are currently not being used as banking facilities. One of the properties is a banking center location previously owned and operated by Homestead Bank in Amite, Louisiana but was closed at the time of the merger. The Bank also acquired, in the Homestead Bank merger, a banking facility located in Ponchatoula, Louisiana. This facility was closed in March 2008 and currently is vacant. Management’s intentions are to sell these two properties. In addition, the Bank owns two parcels of raw land, located in Amite and Bossier City Louisiana, on which it intends to build de nevo banking center locations. During 2009, the Bank opened a stand-alone ATM on the Amite parcel of land.

On December 30, 2008, the Company purchased raw land located at 182 Burt Boulevard, Benton, Louisiana and began construction of a new banking facility. This purchase was to facilitate the sale of the existing Benton banking center, located at 196 Burt Boulevard, Benton, Louisiana, to the Law Enforcement District of Bossier. As of December 31, 2009, the Bank had a binding contract to sell the property located at 196 Burt Boulevard, Benton, Louisiana. The sale was consummated on January 27, 2010 and the new Benton banking center, located at 182 Burt Boulevard, Benton, Louisiana, was opened. The cost of the new Benton banking center, including land, building, furniture and equipment totaled approximately $1.5 million. See Note 24 to the Consolidated Financial Statements.

The Company is subject to various legal proceedings in the normal course of its business. It is Management’s belief that the ultimate resolution of such claims will not have a material adverse effect on the financial position or results of operations. At December 31, 2009, we were not involved in any material legal proceedings.

[Reserved]

PART II

There is no liquid or active market for our common stock. The Company’s shares of common stock are not traded on a stock exchange or in any established over-the-counter market. Trades occur primarily between individuals at a price mutually agreed upon by the buyer and seller. Trading in the Company’s common stock has been infrequent and such trades cannot be characterized as constituting an active trading market.

The following table sets forth the high and low bid quotations for First Guaranty Bancshares, Inc.’s common stock for the periods indicated. These quotations represent trades of which we are aware and do not include retail markups, markdowns, or commissions and do not necessarily reflect actual transactions. As of December 31, 2009, there were 5,559,644 shares of First Guaranty Bancshares, Inc. common stock issued and outstanding. At December 31, 2009, First Guaranty Bancshares, Inc. had 1,356 shareholders of record.

| | | 2009 | | | 2008 | |

| Quarter Ended: | | High | | | Low | | | Dividend | | | High | | | Low | | | Dividend | |

| March | | $ | 25.00 | | | $ | 17.00 | | | $ | 0.16 | | | $ | 25.00 | | | $ | 24.30 | | | $ | 0.16 | |

| June | | | 17.00 | | | | 17.00 | | | | 0.16 | | | | 25.00 | | | | 25.00 | | | | 0.16 | |

| September | | | 17.00 | | | | 15.00 | | | | 0.16 | | | | 25.00 | | | | 25.00 | | | | 0.16 | |

| December | | | 17.00 | | | | 12.00 | | | | 0.16 | | | | 25.00 | | | | 25.00 | | | | 0.16 | |

Our stockholders are entitled to receive dividends when, and if declared by the Board of Directors, out of funds legally available for dividends. We have paid consecutive quarterly cash dividends on our common stock for each of the last ten years and the Board of Directors intends to continue to pay regular quarterly cash dividends. The ability to pay dividends in the future will depend on earnings and financial condition, liquidity and capital requirements, regulatory restrictions, the general economic and regulatory climate and ability to service any equity or debt obligations senior to common stock.

There are legal restrictions on the ability of First Guaranty Bank to pay cash dividends to First Guaranty Bancshares, Inc. Under federal and state law, we are required to maintain certain surplus and capital levels and may not distribute dividends in cash or in kind, if after such distribution we would fall below such levels. Specifically, an insured depository institution is prohibited from making any capital distribution to its shareholders, including by way of dividend, if after making such distribution, the depository institution fails to meet the required minimum level for any relevant capital measure including the risk-based capital adequacy and leverage standards.

Additionally, under the Louisiana Business Corporation Act, First Guaranty Bancshares, Inc. is prohibited from paying any cash dividends to shareholders if, after the payment of such dividend, if its total assets would be less than its total liabilities or where net assets are less than the liquidation value of shares that have a preferential right to participate in First Guaranty Bancshares, Inc.’s assets in the event First Guaranty Bancshares, Inc. were to be liquidated.

First Guaranty Bancshares, Inc. must seek prior approval from the Federal Reserve Bank before paying dividends to its shareholders.

We have not repurchased any shares of our outstanding common stock during the past year.

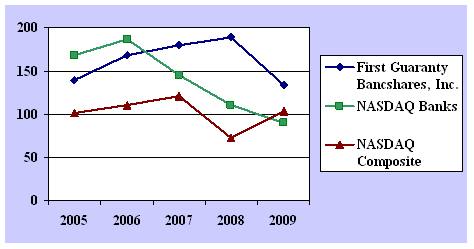

Stock Performance Graph

The line graph below compares the cumulative total return for the Company’s common stock with the cumulative total return of both the NASDAQ Stock Market Index for U.S. companies and the NASDAQ Index for bank stocks for the period December 31, 2004 through December 31, 2009. The total return assumes the reinvestment of all dividends and is based on a $100 investment on December 31, 2004. It also reflects the stock price on December 31st of each year shown, although this price reflects only a small number of transactions involving a small number of directors of the Company or affiliates or associates and cannot be taken as an accurate indicator of the market value of the Company’s common stock.

Performance Graph

Cumulative Total Return of First Guaranty Bancshares, Inc. Compared to NASDAQ Bank Index

and NASDAQ Composite Index

| | Total Returns for the Year | |

| | 2005 | 2006 | 2007 | 2008 | 2009 | |

| First Guaranty Bancshares, Inc. | $139 | $168 | $179 | $189 | $133 | |

| NASDAQ Index | $168 | $186 | $145 | $110 | $ 90 | |

| NASDAQ Composite | $101 | $110 | $121 | $ 72 | $103 | |

We have no equity based benefit plans.

The following selected financial data should be read in conjunction with the financial statements, including the related notes, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are included elsewhere in this Form 10-K. Except for the data under “Performance Ratios,” “Capital Ratios” and “Asset Quality Ratios,” the income statement data and share and per share data for the years ended December 31, 2009, 2008 and 2007 and the balance sheet data as of December 31, 2009 and 2008 are derived from the audited financial statements and related notes which are included elsewhere in this Form 10-K, and the income statement data and share and per share data for the years ended December 31, 2006 and 2005 and the balance sheet data as of December 31, 2 007, 2006 and 2005 are derived from the audited financial statements and related notes that are not included in this Form 10-K.

| | | At or For the Years Ended December 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Year End Balance Sheet Data: | | | | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | | | | | |

| Securities | | $ | 261,829 | | | $ | 139,162 | | | $ | 142,068 | | | $ | 158,352 | | | $ | 175,200 | |

| Federal funds sold | | | 13,279 | | | | 838 | | | | 35,869 | | | | 6,793 | | | | 1,786 | |

| Loans, net of unearned income | | | 589,902 | | | | 606,369 | | | | 575,256 | | | | 507,195 | | | | 491,582 | |

| Allowance for loan losses | | | 7,919 | | | | 6,482 | | | | 6,193 | | | | 6,675 | | | | 7,597 | |

Total assets(1) | | | 930,847 | | | | 871,233 | | | | 807,994 | | | | 715,216 | | | | 713,544 | |

| Total deposits | | | 799,746 | | | | 780,372 | | | | 723,094 | | | | 626,293 | | | | 632,908 | |

| Borrowings | | | 31,929 | | | | 18,122 | | | | 13,494 | | | | 24,568 | | | | 22,132 | |

Stockholders' equity(1) | | | 94,935 | | | | 65,487 | | | | 66,355 | | | | 59,471 | | | | 53,923 | |

Common Stockholders' equity(1) | | | 74,165 | | | | 65,487 | | | | 66,355 | | | | 59,471 | | | | 53,923 | |

| | | | | | | | | | | | | | | | | | | | | |

| Average Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | | | | | | | | | | |

| Securities | | $ | 245,952 | | | $ | 127,586 | | | $ | 152,990 | | | $ | 178,419 | | | $ | 109,236 | |

| Federal funds sold | | | 24,662 | | | | 17,247 | | | | 8,083 | | | | 3,115 | | | | 6,028 | |

| Loans, net of unearned income | | | 599,609 | | | | 600,854 | | | | 543,946 | | | | 505,623 | | | | 476,144 | |

| Total earning assets | | | 906,158 | | | | 752,093 | | | | 712,212 | | | | 690,057 | | | | 595,141 | |

| Total assets | | | 948,556 | | | | 797,024 | | | | 751,237 | | | | 726,593 | | | | 631,554 | |

| Total deposits | | | 842,274 | | | | 707,114 | | | | 658,456 | | | | 622,869 | | | | 526,995 | |

| Borrowings | | | 22,907 | | | | 16,287 | | | | 23,450 | | | | 42,435 | | | | 45,732 | |

| Stockholders' equity | | | 77,135 | | | | 67,769 | | | | 63,564 | | | | 56,640 | | | | 54,901 | |

| Stockholders' common equity | | | 70,055 | | | | 67,769 | | | | 63,564 | | | | 56,640 | | | | 54,901 | |

| | | | | | | | | | | | | | | | | | | | | |

| Performance Ratios: | | | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.80 | % | | | 0.69 | % | | | 1.30 | % | | | 1.16 | % | | | 0.95 | % |

| Return on average common equity | | | 10.84 | % | | | 8.13 | % | | | 15.37 | % | | | 14.88 | % | | | 10.89 | % |

Return on average tangible assets(2) | | | 0.80 | % | | | 0.69 | % | | | 1.30 | % | | | 1.16 | % | | | 0.96 | % |

Return on average tangible common equity(3) | | | 11.14 | % | | | 8.77 | % | | | 16.47 | % | | | 15.73 | % | | | 11.24 | % |

| Net interest margin | | | 3.57 | % | | | 4.25 | % | | | 4.79 | % | | | 4.60 | % | | | 4.71 | % |

| Average loans to average deposits | | | 71.19 | % | | | 84.97 | % | | | 82.61 | % | | | 81.18 | % | �� | | 90.35 | % |

Efficiency ratio (1) | | | 60.80 | % | | | 70.73 | % | | | 55.80 | % | | | 51.80 | % | | | 55.44 | % |

| Efficiency ratio (excluding amortization of | | | | | | | | | | | | | |

intangibles and securities transactions) (1) | | | 61.99 | % | | | 61.20 | % | | | 54.59 | % | | | 49.90 | % | | | 53.66 | % |

| Full time equivalent employees (year end) | | | 230 | | | | 225 | | | | 222 | | | | 196 | | | | 189 | |

(1) For the years ended 2006, 2007 and 2008 amounts have been restated to reflect prior period adjustments. See Note 2 to the Consolidated Financial Statements for additional information.

(2) Average tangible assets represent average assets less average core deposit intangibles.

(3) Average tangible equity represents average equity less average core deposit intangibles.

| | | At or For the Years Ended December 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Capital Ratios: | | | | | | | | | | | | | | | |

| Average stockholders' equity to average assets | | | 8.13 | % | | | 8.50 | % | | | 8.46 | % | | | 7.80 | % | | | 8.69 | % |

Average tangible equity to average tangible assets(1),(2) | | | 7.95 | % | | | 8.25 | % | | | 8.31 | % | | | 7.71 | % | | | 8.51 | % |

Stockholders' equity to total assets(3) | | | 7.97 | % | | | 7.52 | % | | | 8.21 | % | | | 8.32 | % | | | 7.56 | % |

Tier 1 leverage capital(3) | | | 9.58 | % | | | 7.88 | % | | | 7.38 | % | | | 8.11 | % | | | 7.67 | % |

Tier 1 capital(3) | | | 11.90 | % | | | 9.19 | % | | | 10.13 | % | | | 9.85 | % | | | 8.80 | % |

Total risk-based capital(3) | | | 12.97 | % | | | 10.11 | % | | | 11.09 | % | | | 10.96 | % | | | 10.05 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Income Data: | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | | | | | | | | | | |

| Interest income | | $ | 47,191 | | | $ | 47,661 | | | $ | 55,480 | | | $ | 50,937 | | | $ | 40,329 | |

Interest expense(3) | | | 14,844 | | | | 15,881 | | | | 21,934 | | | | 19,769 | | | | 12,435 | |

Net interest income(3) | | | 32,347 | | | | 31,780 | | | | 33,546 | | | | 31,100 | | | | 27,962 | |

| Provision for loan losses | | | 4,155 | | | | 1,634 | | | | 1,918 | | | | 4,419 | | | | 5,621 | |

| Noninterest income (excluding securities transactions) | | | 5,909 | | | | 5,689 | | | | 5,176 | | | | 4,601 | | | | 5,221 | |

| Securities (losses) gains | | | 2,056 | | | | (1 | ) | | | (478 | ) | | | (234 | ) | | | 7 | |

| Loss on securities impairment | | | (829 | ) | | | (4,611 | ) | | | - | | | | - | | | | - | |

Noninterest expense(3) | | | 24,007 | | | | 23,241 | | | | 21,341 | | | | 18,373 | | | | 18,399 | |

Earnings before income taxes(3) | | | 11,321 | | | | 7,982 | | | | 14,985 | | | | 12,676 | | | | 9,170 | |

Net income(3) | | | 7,595 | | | | 5,512 | | | | 9,772 | | | | 8,431 | | | | 5,979 | |

Net income available to common shareholders(3) | | | 7,001 | | | | 5,512 | | | | 9,772 | | | | 8,431 | | | | 5,979 | |

| | | | | | | | | | | | | | | | | | | | | |

Per Common Share Data:(4) | | | | | | | | | | | | | | | | | | | | |

Net earnings(3) | | $ | 1.26 | | | $ | 0.99 | | | $ | 1.76 | | | $ | 1.52 | | | $ | 1.08 | |

| Cash dividends paid | | | 0.64 | | | | 0.64 | | | | 0.63 | | | | 0.60 | | | | 0.57 | |

Book value(3) | | | 13.34 | | | | 11.78 | | | | 11.94 | | | | 10.70 | | | | 9.70 | |

Dividend payout ratio(3) | | | 50.82 | % | | | 64.53 | % | | | 35.85 | % | | | 39.56 | % | | | 53.07 | % |

| Weighted average number of shares outstanding | | | 5,559,644 | | | | 5,559,644 | | | | 5,559,644 | | | | 5,559,644 | | | | 5,559,644 | |

| Number of shares outstanding (year end) | | | 5,559,644 | | | | 5,559,644 | | | | 5,559,644 | | | | 5,559,644 | | | | 5,559,644 | |

| Market data: | | | | | | | | | | | | | | | | | | | | |

| High | | $ | 25.00 | | | $ | 25.00 | | | $ | 24.30 | | | $ | 23.42 | | | $ | 20.00 | |

| Low | | $ | 12.00 | | | $ | 24.30 | | | $ | 23.42 | | | $ | 18.57 | | | $ | 15.27 | |

| Trading Volume | | | 165,386 | | | | 368,454 | | | | 924,692 | | | | 535,264 | | | | 279,503 | |

| Stockholders of record | | | 1,356 | | | | 1,343 | | | | 1,293 | | | | 1,181 | | | | 1,141 | |

| | | | | | | | | | | | | | | | | | | | | |

| Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | |

| Nonperforming assets to total assets | | | 1.68 | % | | | 1.14 | % | | | 1.39 | % | | | 1.86 | % | | | 3.08 | % |

| Nonperforming assets to loans | | | 2.65 | % | | | 1.63 | % | | | 1.95 | % | | | 2.62 | % | | | 4.48 | % |

| Loan loss reserve to nonperforming assets | | | 50.68 | % | | | 65.46 | % | | | 55.26 | % | | | 51.53 | % | | | 34.92 | % |

| Net charge-offs to average loans | | | 0.45 | % | | | 0.22 | % | | | 0.50 | % | | | 1.06 | % | | | 0.83 | % |

| Provision for loan loss to average loans | | | 0.69 | % | | | 0.27 | % | | | 0.35 | % | | | 0.87 | % | | | 1.18 | % |

| Allowance for loan loss to total loans | | | 1.34 | % | | | 1.07 | % | | | 1.08 | % | | | 1.32 | % | | | 1.55 | % |

(1) Average tangible assets represents average assets less average core deposit intangibles.

(2) Average tangible equity represents average equity less average core deposit intangibles.

(3) For the years ended 2006, 2007 and 2008 amounts have been restated to reflect prior period adjustments. See Note 2 to the Consolidated Financial Statements for additional information.

(4) For the year ended 2005 amounts have been restated to reflect a stock dividend of one-third of a share of $1 par value common stock for each share of $1 and $5 par value common stock outstanding, accounted for as a four-

for-three stock split, effective and payable to stockholders of record as of October 20, 2005.

First Guaranty Bancshares, Inc. became the holding company for First Guaranty Bank on July 27, 2007 in a corporate reorganization. Prior to becoming the holding company of First Guaranty Bank, First Guaranty Bancshares, Inc. had no assets, liabilities or operations.

This discussion and analysis reflects our financial statements and other relevant statistical data, and is intended to enhance your understanding of our financial condition and results of operations. Reference should be made to those financial statements of this Form 10-K and the selected financial data (above) presented in this report in order to obtain a better understanding of the commentary which follows.

Special Note Regarding Forward-Looking Statements

Congress passed the Private Securities Litigation Act of 1995 in an effort to encourage corporations to provide information about a company’s anticipated future financial performance. This act provides a safe harbor for such disclosure, which protects us from unwarranted litigation, if actual results are different from Management’s expectations. This discussion and analysis contains forward-looking statements and reflects Management’s current views and estimates of future economic circumstances, industry conditions, company performance and financial results. The words “may,” “should,” “expect,” “anticipate,” “intend,” “plan,” “continue,” “believe,” “seek,” “estimate” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of factors and uncertainties, which could cause our actual results and experience to differ from the anticipated results and expectations, expressed in such forward-looking statements.

Application of Critical Accounting Policies

The accounting and reporting policies of the Company conform to generally accepted accounting principles in the United States of America and to predominant accounting practices within the banking industry. Certain critical accounting policies require judgment and estimates which are used in the preparation of the financial statements.

Other-Than-Temporary Impairment of Investment Securities. Securities are evaluated periodically to determine whether a decline in their value is other-than-temporary. The term “other-than-temporary” is not intended to indicate a permanent decline in value. Rather, it means that the prospects for near term recovery of value are not necessarily favorable, or that there is a lack of evidence to support fair values equal to, or greater than, the carrying value of the investment. Management reviews criteria such as the magnitude and duration of the decline, the reasons for the decline, and the performance and valuation of the underlying collateral, when applicable, to predict whether the loss in value is other-than-temporary. Once a decline in value is determined to be other-than-temporary, the carrying value of the security is reduced to its fair value and a corresponding charge to earnings is recognized.

Allowance for Loan Losses. The Company’s most critical accounting policy relates to its allowance for loan losses. The allowance for loan losses is established through a provision for loan losses charged to expense. Loans are charged against the allowance for loan losses when Management believes that the collectability of the principal is unlikely. The allowance, which is based on the evaluation of the collectability of loans and prior loan loss experience, is an amount Management believes will be adequate to reflect the risks inherent in the existing loan portfolio and that exist at the reporting date. The evaluations take into consideration a number of subjective factors including changes in the natu re and volume of the loan portfolio, overall portfolio quality, review of specific problem loans, current economic conditions that may affect a borrower’s ability to pay, adequacy of loan collateral and other relevant factors.

Changes in such estimates may have a significant impact on the financial statements. For further discussion of the allowance for loan losses, see the “Allowance for Loan Losses” section of this analysis and Note 1 to the Consolidated Financial Statements.

Valuation of Goodwill, Intangible Assets and Other Purchase Accounting Adjustments. The Company accounts for goodwill and intangible assets in accordance with FASB ASC 350, Intangibles – Goodwill and Other (SFAS No. 142). Under FASB ASC 350, goodwill and intangible assets deemed to have indefinite lives are no longer amortized, but are subject to annual impairment tests in accordance with the provision of FASB ASC 350. The Company’s goodwill is tested for impairment on an annual basis, or more often if events or circumstances indicate that there may be impairment. A goodwill impairment test includes two steps. Step one, used to identify potential impairment, compares the estimated fair value of a reporting unit with its carrying amount, including goodwill. If the estimated fair value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not impaired. If the carrying amount of a reporting unit exceeds its estimated fair value, the second step of the goodwill impairment test is performed to measure the amount of impairment loss, if any. Step two of the goodwill impairment test compares the implied estimated fair value of reporting unit goodwill with the carrying amount of that goodwill. If the carrying amount of goodwill for that reporting unit exceeds the implied fair value of that unit’s goodwill, an impairment loss is recognized in an amount equal to that excess. Based on Management’s goodwill impairment tests, there was no impairment of goodwill at December 31, 2009. For additional information on goodwill and intangible assets, see Note 7 to the Consolidated Financial Statements.

Financial Condition

Assets. Total assets at December 31, 2009 were $930.8 million, an increase of $59.6 million, or 6.8%, from $871.2 million at December 31, 2008. Federal funds sold increased $12.4 million from December 31, 2008 to December 31, 2009 and loans for the same period decreased $16.5 million. Cash and due from banks decreased $43.7 from 2008 to 2009. Additionally, total investment securities increased $122.7 million to $261.8 million from December 31, 2008 to December 31, 2009. Total deposits increased by $19.4 million or 2.5% from 2008 to 2009. At December 31, 2009, long-term borrowings were $20.0 million, an increase of $11.6 million or 139.4%, from $8.4 million at December 31, 2008.

Cash and Cash Equivalents. Cash and cash equivalents at December 31, 2009 totaled $46.7 million, a decrease of $31.3 million compared to $78.0 million at December 31, 2008. Cash and due from banks decreased $43.7 million, and federal funds sold increased $12.4 million. The decrease in cash and cash equivalents reflects Management’s decision to increase its investment in higher yielding investment securities.

Investment Securities. The securities portfolio consisted principally of U.S. Government agency securities, mortgage-backed obligations, asset-backed securities, corporate debt securities and mutual funds or other equity securities. The securities portfolio provides us with a relatively stable source of income and provides a balance to interest rate and credit risks as compared to other categories of assets.

The securities portfolio totaled $261.8 million at December 31, 2009, representing an increase of $122.7 million from December 31, 2008. The primary changes in the portfolio consisted of $1.4 billion in purchases, sales totaling $21.8 million, calls and maturities of $1.3 billion. An other-than-temporary impairment charge totaling $0.8 million was taken on six securities during 2009. See Note 4 to the Consolidated Financial Statements for additional information.

At December 31, 2009 approximately 3.5% of the securities portfolio (excluding Federal Home Loan Bank stock) matures in less than one year while securities with maturity dates over 10 years totaled 25.2% of the portfolio. At December 31, 2009, the average maturity of the securities portfolio was 6.3 years, compared to the average maturity at December 31, 2008 of 3.7 years.

At December 31, 2009, securities totaling $249.5 million were classified as available for sale and $12.3 million were classified as held to maturity as compared to $114.4 million and $24.8 million, respectively at December 31, 2008.

Securities classified as available for sale are measured at fair market value. For these securities, the Company obtains fair value measurements from an independent pricing service. The fair value measurements consider observable data that may include dealer quotes, market spreads, cash flows, market yield curves, prepayment speeds, credit information and the instrument’s contractual terms and conditions, among other things. Securities classified as held to maturity are measured at book value. See Note 4 and Note 20 to the Consolidated Financial Statements for additional information.

The book yields on securities available for sale ranged from 0.8% to 19.9% at December 31, 2009, exclusive of the effect of changes in fair value reflected as a component of stockholders’ equity. The book yields on held to maturity securities ranged from 3.6% to 5.3%.

Securities classified as available for sale had gross unrealized losses totaling $2.8 million at December 31, 2009. These losses include $1.6 million in unrealized losses on U.S. Government agency securities, which have been in a loss position for less than 12 months. The Company believes that it will collect all amounts contractually due and has the intent and the ability to hold these securities until the fair value is at least equal to the carrying value. At December 31, 2008, securities classified as available for sale had gross unrealized losses totaling $5.7 million. See Note 4 to the Consolidated Financial Statements for additional information.

Average securities as a percentage of average interest-earning assets were 27.1% and 17.0% at December 31, 2009 and 2008, respectively. This increase reflected, in part, Management’s decision to display a certain amount of funds into investment securities, rather than loans, to manage out interest rate risk, in a low interest rate environment in 2009. At December 31, 2009, $163.6 million of the total securities portfolio did not qualify as pledgeable securities to collateralize repurchase agreements and public funds compared to $54.1 million in securities held at December 31, 2008. At December 31, 2009 and 2008, $154.5 million and $85.4 million in securities were pledged, respectively.

Mortgage Loans Held for Sale. The Company did not hold any mortgage loans for sale at December 31, 2009 or December 31, 2008.

Loans. The origination of loans is the primary use of our financial resources and represents the largest component of earning assets. At December 31, 2009, the loan portfolio (loans, net of unearned income) totaled $589.9 million, a decrease of approximately $16.5 million, or 2.7%, from the December 31, 2008 level of $606.4 million. The decrease in net loans primarily includes a reduction of $13.3 million in real estate construction and land development loans and a reduction of $23.2 million in commercial and industrial loans, partially offset with an increase of $38.9 million in non-farm non-residential loans secured by real estate.

Loans to related parties are included in total loans. Related parties include the Company’s executive officers, directors and certain business organizations and individuals with which such persons are associated. At December 31, 2009 and 2008, loans to related parties totaled $23.3 million and $22.5 million, respectively. See Note 14 to the Consolidated Financial Statements for additional information.

Loans represented 73.8% of deposits at December 31, 2009, compared to 77.7% of deposits at December 31, 2008. Loans secured by real estate increased $11.9 million to $477.1 million at December 31, 2009. Commercial and industrial loans decreased $23.2 million to $82.3 million at December 31, 2009. Real estate and related loans comprised 80.9% of the portfolio in 2009 as compared to 76.7% in 2008. Commercial and industrial loans comprised 14.0% of the portfolio in 2009 as compared to 17.4% in 2008.

Loan charge-offs taken during 2009 totaled $2.9 million, compared to charge-offs of $1.6 million in 2008. Of the loan charge-offs in 2009, approximately $1.6 million were loans secured by real estate, $0.7 million were commercial and industrial loans and $0.6 million were consumer and other loans. In 2009, recoveries of $0.2 million were recognized on loans previously charged off as compared to $0.3 million in 2008.

Nonperforming Assets. Nonperforming assets were $15.6 million, or 1.7% of total assets at December 31, 2009, compared to $9.9 million, or 1.1% of total assets at December 31, 2008. The increase resulted from a $5.1 million, or 55.4%, increase in nonaccrual loans, an increase of $0.6 million in 90 days past due loans and an increase of $0.1 million in other real estate. The increase in nonaccrual loans was primarily in construction and land development, one-to-four family residential, non-farm non-residential and commercial and industrial loans. The increase in other real estate was primarily the result of an increase in non-farm nonresidential properties.

Deposits. Total deposits increased by $19.4 million or 2.5%, to $799.7 million at December 31, 2009 from $780.4 million at December 31, 2008. In 2009, noninterest-bearing demand deposits increased $13.6 million, interest-bearing demand deposits increased $8.0 million and savings deposits decreased $1.1 million. Time deposits decreased $1.1 million, or 0.3% which includes brokered deposits totaling $10.1 million in reciprocal time deposits acquired from the Certificate of Deposit Account Registry Service (CDARS). The increase in deposits was due to a $23.3 million decrease in individual and business deposits offset with a $42.7 million increase in public fund deposits. The increase in public fund deposits was the primary result of three municipalities’ elevated deposit balan ces.

Public fund deposits totaled $268.5 million or 33.6% of total deposits at December 31, 2009. At December 31, 2008, public fund deposits represented 28.9% of total deposits with a balance of $225.8 million.

Borrowings. Short-term borrowings increased $2.2 million in 2009 to $11.9 million at December 31, 2009 from $9.8 million at December 31, 2008. Short-term borrowings are used to manage liquidity on a daily or otherwise short-term basis. The short-term borrowings at December 31, 2009 and 2008, respectively was solely comprised of repurchase agreements. Overnight repurchase agreement balances are monitored daily for sufficient collateralization.

Long-term borrowings increased $11.6 million to $20.0 million at December 31, 2009, compared to $8.4 million at December 31, 2008. At December 31, 2009, two long-term advances were outstanding at FHLB, one totaling $10.0 million with a rate of 0.9% and a maturity date of December 1, 2010 and the other totaling $10.0 million with a rate of 0.5% and a maturity date of December 20, 2010. At December 31, 2008, there was one long-term advance outstanding at FHLB totaling $8.4 million.

Stockholders’ Equity. Total stockholders’ equity increased $29.4 million or 45.0% to $94.9 million at December 31, 2009 from $65.5 million at December 31, 2008. The increase in stockholders’ equity includes $19.6 million and $1.1 million of preferred stock, Series A and Series B respectively, issued in August 2009 to the Treasury Department. See Note 11 to the Consolidated Financial Statements for additional information. In addition, stockholders’ equity reflected consolidated net income of $7.6 million during 2009 and changes in unrealized losses on available for sale securities totaling $5.2 million, offset by common stock dividends paid totaling $3.6 million and preferred stock dividends paid totaling $0.6. See N ote 4 to the Consolidated Financial Statements for additional information.

Loan Portfolio Composition. The following table sets forth the composition of our loan portfolio, excluding loans held for sale, by type of loan at the dates indicated.

| | | December 31, |

| | | 2009 | | 2008 | | 2007 |

| | | | | | As % of | | | | | As % of | | | | | As % of |

| | | Balance | | | Category | | Balance | | | Category | | Balance | | | Category |

| | | (dollars in thousands) |

| Real estate | | | | | | | | | | | | | | | | | | |

| Construction & land development | | $ | 78,686 | | | | 13.3 | % | | $ | 92,029 | | | | 15.2 | % | | $ | 98,127 | | | | 17.0 | % |

| Farmland | | | 11,352 | | | | 1.9 | % | | | 16,403 | | | | 2.7 | % | | | 23,065 | | | | 4.0 | % |

| 1-4 Family | | | 77,470 | | | | 13.1 | % | | | 79,285 | | | | 13.1 | % | | | 84,640 | | | | 14.7 | % |

| Multifamily | | | 8,927 | | | | 1.5 | % | | | 15,707 | | | | 2.6 | % | | | 13,061 | | | | 2.3 | % |

| Non-farm non-residential | | | 300,673 | | | | 51.0 | % | | | 261,744 | | | | 43.0 | % | | | 236,474 | | | | 41.1 | % |

| Total real estate | | | 477,108 | | | | 80.8 | % | | | 465,168 | | | | 76.6 | % | | | 455,367 | | | | 79.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Agricultural | | | 14,017 | | | | 2.4 | % | | | 18,536 | | | | 3.0 | % | | | 16,816 | | | | 2.9 | % |

| Commercial and industrial | | | 82,348 | | | | 13.9 | % | | | 105,555 | | | | 17.4 | % | | | 81,073 | | | | 14.1 | % |

| Consumer and other | | | 17,226 | | | | 2.9 | % | | | 17,926 | | | | 3.0 | % | | | 22,517 | | | | 3.9 | % |

| Total loans before unearned income | | | 590,699 | | | | 100.0 | % | | | 607,185 | | | | 100.0 | % | | | 575,773 | | | | 100.0 | % |

| Less: unearned income | | | (797 | ) | | | | | | | (816 | ) | | | | | | | (517 | ) | | | | |

| Total loans net of unearned income | | $ | 589,902 | | | | | | | $ | 606,369 | | | | | | | $ | 575,256 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, | | | | | | | | |

| | | 2006 | | 2005 | | | | | | | | |

| | | | | | | As % of | | | | | | As % of | | | | | | | | |

| | | Balance | | | Category | | Balance | | | Category | | | | | | | | |

| | | (dollars in thousands) | | | | | | | | |

| Real estate | | | | | | | | | | | | | | | | | | | | | | | | |

| Construction & land development | | $ | 49,837 | | | | 9.9 | % | | $ | 67,099 | | | | 13.6 | % | | | | | | | | |

| Farmland | | | 25,582 | | | | 5.0 | % | | | 24,903 | | | | 5.1 | % | | | | | | | | |

| 1-4 Family | | | 67,022 | | | | 13.2 | % | | | 78,789 | | | | 16.0 | % | | | | | | | | |

| Multifamily | | | 14,702 | | | | 2.9 | % | | | 11,125 | | | | 2.3 | % | | | | | | | | |

| Non-farm non-residential | | | 256,176 | | | | 50.5 | % | | | 223,622 | | | | 45.5 | % | | | | | | | | |

| Total real estate | | | 413,319 | | | | 81.5 | % | | | 405,538 | | | | 82.5 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Agricultural | | | 16,359 | | | | 3.2 | % | | | 11,490 | | | | 2.3 | % | | | | | | | | |

| Commercial and industrial | | | 59,072 | | | | 11.6 | % | | | 54,740 | | | | 11.1 | % | | | | | | | | |

| Consumer and other | | | 18,880 | | | | 3.7 | % | | | 20,078 | | | | 4.1 | % | | | | | | | | |

| Total loans before unearned income | | | 507,630 | | | | 100.0 | % | | | 491,846 | | | | 100.0 | % | | | | | | | | |

| Less: unearned income | | | (435 | ) | | | | | | | (264 | ) | | | | | | | | | | | | |

| Total loans net of unearned income | | $ | 507,195 | | | | | | | $ | 491,582 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The four most significant categories of our loan portfolio are construction and land development real estate loans, 1-4 family residential loans, non-farm non-residential real estate loans and commercial and industrial loans.

The Company’s credit policy dictates specific loan-to-value and debt service coverage requirements. The Company generally requires a maximum loan-to-value of 85% and a debt service coverage ratio of 1.25x to 1.0x for non-farm non-residential real estate loans. In addition, personal guarantees of borrowers are required as well as applicable hazard, title and flood insurance. Loans may have a maximum maturity of five years and a maximum amortization of 25 years. The Company may require additional real estate or non-real estate collateral when deemed appropriate to secure the loan.

The Company generally requires all one- to four- family residential loans to be underwritten based on the Fannie Mae guidelines provided through Desktop Underwriter. These guidelines include the evaluation of risk and eligibility, verification and approval of conditions, credit and liabilities, employment and income, assets, property and appraisal information. It is required that all borrowers have proper hazard, flood and title insurance prior to a loan closing. Appraisals and Desktop Underwriter approvals are good for six months. The Company has an in-house underwriter review the final package for compliance to these guidelines.

The Company generally requires a maximum loan-to value of 75% and a debt service coverage ratio of 1.25x to 1.0x for construction land development loans. In addition, detailed construction cost breakdowns, personal guarantees of borrowers and applicable hazard, title and flood insurance are required. Loans may have a maximum maturity of 12 months for the construction phase and a maximum maturity of 24 months for the sell-out phase. The Company may require additional real estate or non-real estate collateral when deemed appropriate to secure the loan.

The Company has specific guidelines for the underwriting of commercial and industrial loans that is specific for the collateral type and the business type. Commercial and industrial loans are secured by non-real estate collateral such as equipment, inventory or accounts receivable. Each of these collateral types has maximum loan to value ratios. Commercial and industrial loans have the same debt service coverage ratio requirements as other loans, which is 1.25x to 1.0x.

The Company will allow exceptions to each of the above policies with appropriate mitigating circumstances and approvals. The Company has a defined credit underwriting process for all loan requests. The Company actively monitors loan concentrations by industry type and will make adjustments to underwriting standards as deemed necessary. The Company has a loan review department that monitors the performance and credit quality of loans. The Company has a special assets department that manages loans that have become delinquent or have serious credit issues associated with them.

For new loan originations, appraisals and evaluations on all properties shall be valid for a period not to exceed two calendar years from the effective appraisal date for non-residential properties and one calendar year from the effective appraisal date for residential properties. However, an appraisal may be valid longer if there has been no material decline in the property condition or market condition that would negatively affect the bank’s collateral position. This must be supported with a “Validity Check Memorandum”.

For renewals with or without new money, any commercial appraisal greater than two years or greater than one year for residential appraisals must be updated with a Validity Check Memorandum. Any renewal loan request, in which new money will be disbursed, whether commercial or residential, and the appraisal is older than five years a new appraisal must be obtained.

The Company does not require new appraisals between renewals unless the loan becomes impaired and is considered collateral dependent. At this time, an appraisal may be ordered in accordance with the Company’s Allowance for Loan Losses policy.

The Company does not mitigate risk using products such as credit default agreements and/or credit derivatives. These, accordingly, have no impact on our financial statements.

The Company does not offer loan products with established loan-funded interest reserves.

Loan Maturities by Type. The following table summarizes the scheduled repayments of our loan portfolio at December 31, 2009. Loans having no stated repayment schedule or maturity and overdraft loans are reported as being due in one year or less. Maturities are based on the final contractual payment date and do not reflect the effect of prepayments and scheduled principal amortization.

| | | One Year | | | One Through | | | After | | | | |

| | | or Less | | | Five Years | | | Five Years | | | Total | |

| | | (in thousands) | |

| Real estate: | | | | | | | | | | | | |

| Construction and land development | | $ | 48,386 | | | $ | 30,233 | | | $ | 67 | | | $ | 78,686 | |

| Farmland | | | 8,038 | | | | 1,370 | | | | 1,944 | | | | 11,352 | |

| 1-4 Family | | | 26,479 | | | | 23,465 | | | | 27,526 | | | | 77,470 | |

| Multifamily | | | 1,991 | | | | 5,611 | | | | 1,325 | | | | 8,927 | |

| Non-farm non-residential | | | 167,092 | | | | 126,397 | | | | 7,184 | | | | 300,673 | |

| Total real estate | | | 251,986 | | | | 187,076 | | | | 38,046 | | | | 477,108 | |

| | | | | | | | | | | | | | | | | |

| Agricultural | | | 7,369 | | | | 3,422 | | | | 3,226 | | | | 14,017 | |

| Commercial and industrial | | | 48,169 | | | | 34,144 | | | | 35 | | | | 82,348 | |

| Consumer and other | | | 10,070 | | | | 7,042 | | | | 114 | | | | 17,226 | |

| Total loans before unearned income | | $ | 317,594 | | | $ | 231,684 | | | $ | 41,421 | | | $ | 590,699 | |

| Less: unearned income | | | | | | | | | | | | | | | (797 | ) |

| Total loans net of unearned income | | | | | | | | | | | $ | 589,902 | |

| | | | | | | | | | | | | | | | | |

The following table sets forth the scheduled contractual maturities at December 31, 2009 of fixed- and floating-rate loans excluding non-accrual loans.

| | | December 31, 2009 | |

| | | Fixed | | | Floating | | | Total | |

| | | (in thousands) | |

| | | | | | | | | | |

| One year or less | | $ | 224,963 | | | $ | 77,651 | | | $ | 302,614 | |

| One to five years | | | 229,276 | | | | 2,408 | | | | 231,684 | |

| Five to 15 years | | | 25,122 | | | | - | | | | 25,122 | |

| Over 15 years | | | 16,299 | | | | - | | | | 16,299 | |

| Subtotal | | | 495,660 | | | | 80,059 | | | | 575,719 | |

| Nonaccrual loans | | | | | | | | | | | 14,183 | |

| Total loans net of unearned income | | $ | 495,660 | | | $ | 80,059 | | | $ | 589,902 | |

| | | | | | | | | | | | | |

At December 31, 2009, total loans include $273.1 million in loans maturing after December 31, 2010. At December 31, 2009, fixed rate loans totaled $495.7 million or 84.0% of total loans, an increase from 51.0% of total loans for the same period in 2008. Throughout 2009, Management added floors to floating rate loans, primarily tied to prime rate. If the floor is higher than the current indexed loan rate, then the loan is classified as a fixed rate loan until such time as the floor equals the indexed loan rate.

Non-Performing Assets. The table below sets forth the amounts and categories of our non-performing assets at the dates indicated.

| | | At December 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | (dollars in thousands) | |

| Non-accrual loans: | | | | | | | | | | | | | | | |

| Real estate loans: | | | | | | | | | | | | | | | |

| Construction and land development | | $ | 2,841 | | | $ | 1,644 | | | $ | 1,841 | | | $ | 2,676 | | | $ | 16,376 | |

| Farmland | | | 54 | | | | 182 | | | | 419 | | | | 33 | | | | - | |

| 1 - 4 family residential | | | 2,814 | | | | 1,445 | | | | 1,819 | | | | 3,202 | | | | 3,548 | |

| Multifamily | | | - | | | | - | | | | 2 | | | | - | | | | - | |

| Non-farm non-residential | | | 7,439 | | | | 5,263 | | | | 4,950 | | | | 3,882 | | | | 153 | |

| Non-real estate loans: | | | | | | | | | | | | | | | | | | | | |

| Agricultural | | | - | | | | - | | | | - | | | | - | | | | - | |

| Commercial and industrial | | | 830 | | | | 275 | | | | 978 | | | | 267 | | | | 358 | |

| Consumer and other | | | 205 | | | | 320 | | | | 279 | | | | 302 | | | | 655 | |

| Total non-accrual loans | | | 14,183 | | | | 9,129 | | | | 10,288 | | | | 10,362 | | | | 21,090 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loans 90 days and greater delinquent | | | | | | | | | | | | | | | | | |

| and still accruing: | | | | | | | | | | | | | | | | | | | | |

| Real estate loans: | | | | | | | | | | | | | | | | | | | | |

| Construction and land development | | | - | | | | - | | | | - | | | | - | | | | - | |

| Farmland | | | - | | | | - | | | | - | | | | - | | | | - | |

| 1 - 4 family residential | | | 757 | | | | 185 | | | | 544 | | | | 334 | | | | 248 | |

| Multifamily | | | - | | | | - | | | | - | | | | - | | | | - | |

| Non-farm non-residential | | | - | | | | - | | | | - | | | | - | | | | - | |

| Non-real estate loans: | | | | | | | | | | | | | | | | | | | | |

| Agricultural | | | - | | | | - | | | | - | | | | - | | | | - | |

| Commercial and industrial | | | - | | | | 17 | | | | - | | | | - | | | | - | |

| Consumer and other | | | 28 | | | | 3 | | | | 3 | | | | - | | | | - | |

| Total loans 90 days greater | | | | | | | | | | | | | | | | | | | | |

| delinquent and still accruing | | | 785 | | | | 205 | | | | 547 | | | | 334 | | | | 248 | |

| | | | | | | | | | | | | | | | | | | | | |

| Restructured loans | | | - | | | | - | | | | - | | | | 51 | | | | 121 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total non-performing loans | | | 14,968 | | | | 9,334 | | | | 10,835 | | | | 10,747 | | | | 21,459 | |

| | | | | | | | | | | | | | | | | | | | | |

| Real estate owned: | | | | | | | | | | | | | | | | | | | | |

| Construction and land development | | | - | | | | 89 | | | | 84 | | | | 2,217 | | | | - | |

| Farmland | | | - | | | | - | | | | - | | | | - | | | | 144 | |

| 1 - 4 family residential | | | 292 | | | | 223 | | | | 170 | | | | 78 | | | | 81 | |

| Multifamily | | | - | | | | - | | | | - | | | | - | | | | - | |

| Non-farm non-residential | | | 366 | | | | 256 | | | | 119 | | | | 245 | | | | 321 | |

| Non-real estate loans: | | | | | | | | | | | | | | | | | | | | |

| Agricultural | | | - | | | | - | | | | - | | | | - | | | | - | |

| Commercial and industrial | | | - | | | | - | | | | - | | | | - | | | | - | |

| Consumer and other | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total real estate owned | | | 658 | | | | 568 | | | | 373 | | | | 2,540 | | | | 546 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total non-performing assets | | $ | 15,626 | | | $ | 9,902 | | | $ | 11,208 | | | $ | 13,287 | | | $ | 22,005 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios: | | | | | | | | | | | | | | | | | | | | |

| Non-performing assets to total loans | | | 2.65 | % | | | 1.63 | % | | | 1.95 | % | | | 2.62 | % | | | 4.48 | % |

| Non-performing assets to total assets | | | 1.68 | % | | | 1.14 | % | | | 1.39 | % | | | 1.86 | % | | | 3.08 | % |

For the years ended December 31, 2009 and 2008, gross interest income that would have been recorded had our non-accruing loans been current in accordance with their original terms was $0.4 million and $0.5 million, respectively. Interest income recognized on such loans for 2009 was $1.1 million.

Nonperforming assets totaled $15.6 million or 1.7% of total assets at December 31, 2009, an increase of $5.7 million from December 31, 2008. Management has not identified additional information on any loans not already included in impaired loans or the nonperforming asset total that indicates possible credit problems that could cause doubt as to the ability of borrowers to comply with the loan repayment terms in the future.

Nonaccrual loans increased $5.1 million from December 31, 2008 to December 31, 2009. There were increases in construction and land development nonaccrual loans, one- to four- family nonaccrual loans, nonfarm nonresidential nonaccrual loans and commercial and industrial nonaccrual loans.

During 2009, there was a $1.2 million increase in construction and land development nonaccrual loans. The increase in nonaccrual construction and land development loans is partially related to one loan for $522,000 secured by a subdivision development consisting of 17 remaining lots and 6.32 acres of excess land. The loan to value is 58% and the property was appraised for $896,000 in February 2005. The Company is currently in foreclosure and Management does not anticipate any loss. In addition, there is a townhome development in which the Company has four of the units financed totaling approximately $600,000. This loan had a loan to value of 83%. In the fourth quarter of 2007, the properties securing this loan were appraised at $180,000 each. The Company asked the borrower to pay the loans in full but the borrower was unable to do so. The Company has filed suit to repossess the property and is currently awaiting the foreclosure sale. Also included in nonaccrual construction and land development loans are two loans which account for a significant portion of the total. One is in the amount of $1.7 million which we are the participant of approximately $800,000. The collateral is a subdivision development in a neighboring parish and the lead bank has filed suit to foreclose on the property. Since the beginning of 2009, approximately $1.4 million in construction and land development nonaccrual loans have been removed through foreclosures and payoffs.

There was a $1.4 million increase in one- to four- family residential nonaccrual loans during 2009. The increase in nonaccrual one- to four- family residential loans resulted from a loan in the amount of $578,000 secured by several rental houses in the Baton Rouge area. The borrower has filed Chapter 11 bankruptcy and the Company is waiting for a plan of repayment to be filed with the bankruptcy court. The Company has not been able to determine the level of exposure, if any, it will experience as a result of the bankruptcy of the borrower. The Company is now receiving adequate protection payments from the bankruptcy court. Also, we have added a loan in the amount of $800,000 which is secured by two townhomes and five lots in a golf course community. One of the townhomes was sold in October 2009. The borrower is continuing to attempt to liquidate the remaining collateral to pay down the loan. Also included in this category are two loans in the amounts of $194,000 and $120,000 that are properties which were flooded during Hurricane Katrina. The borrowers have received commitments from the state to assist in funding the rebuilding of the properties.

Non-farm non-residential nonaccrual loans increased $2.2 million from December 31, 2008 to December 31, 2009. The increase is primarily from a $4.4 million loan secured by a hotel in Hattiesburg, Mississippi. We are currently negotiating with the borrower on a possible workout scenario. The primary cause of this loan moving into nonacccrual relates to the borrower’s health, which has resulted in poor management, as well as a decline in the hotel industry. The increase was primarily offset by a $2.6 million loan secured by a church and various other real estate properties, which began performing to its terms, therefore was removed from non-accrual loans.

Non-real estate commercial and industrial nonaccrual loans increased $0.6 million during 2009. The largest loan in this category totals $454,000 and is unsecured. The borrower is in Chapter 11 bankruptcy and has reflected a net worth in excess of $20 million on the bankruptcy schedules. A plan is being developed to allocate cash from one of the borrower’s partnerships to pay the unsecured creditors. Although this loan is unsecured, the Company currently anticipates receiving 100% payment. Another loan in this category totals $178,000 and is secured by dental equipment. We are in the process of obtaining a judgment on this credit. There are also some smaller loans included in this nonaccrual category. One is in the amount of $86,000 and the Company is in the process of taking a mortgage on the guarantor’s home to pay down a portion of the debt and renew the balance.

Allowance for Loan Losses. The allowance for loan losses is maintained at a level considered sufficient to absorb potential losses embedded in the loan portfolio. The allowance is increased by the provision for anticipated loan losses as well as recoveries of previously charged off loans and is decreased by loan charge-offs. The provision is the necessary charge to current expense to provide for current loan losses and to maintain the allowance at an adequate level commensurate with Management’s evaluation of the risks inherent in the loan portfolio. Various factors are taken into consideration when determining the amount of the provision and the adequacy of the allowance. These factors include but are not limited to:

· past due and nonperforming assets;

· specific internal analysis of loans requiring special attention;

· the current level of regulatory classified and criticized assets and the associated risk factors with each;

· changes in underwriting standards or lending procedures and policies;

· charge-off and recovery practices;

· national and local economic and business conditions;

· nature and volume of loans;

· overall portfolio quality;

· adequacy of loan collateral;

· quality of loan review system and degree of oversight by its Board of Directors;

· competition and legal and regulatory requirements on borrowers;

· examinations and review by our internal loan review department and independent accountants; and

· examinations of the loan portfolio by federal and state regulatory agencies.

The data collected from all sources in determining the adequacy of the allowance is evaluated on a regular basis by Management with regard to current national and local economic trends, prior loss history, underlying collateral values, credit concentrations and industry risks. An estimate of potential loss on specific loans is developed in conjunction with an overall risk evaluation of the total loan portfolio. This evaluation is inherently subjective as it requires estimates that are susceptible to significant revision as new information becomes available.

The allowance consists of specific, general and unallocated components. The specific component relates to loans that are classified as doubtful, substandard or special mention. For such loans that are also classified as impaired, an allowance is established when the discounted cash flows (or collateral value or observable market price) of the impaired loan is lower than the carrying value of that loan. The general component covers non-classified loans and is based on historical loss experience adjusted for qualitative factors. An unallocated component is maintained to cover uncertainties that could affect the estimate of probable losses. The unallocated component of the allowance reflects the margin of imprecision inherent in the underlying assumptions used in the methodologies for estimating specific and general losses in the portfolio.