> | Vanguard Market Neutral Fund had a disappointing return of less than –9% in the first half of 2009. |

> | The fund significantly trailed its peers and its 3-month U.S. Treasury bill benchmark. The fund also lagged the gains of the broad U.S. stock market, as can be expected during market rallies. |

> | Stock selection within the financial and energy sectors, and a net short position in energy during a period of rising oil and stock prices, detracted from fund performance. |

Contents | |

| |

Your Fund’s Total Returns | 1 |

President’s Letter | 2 |

Advisors’ Report | 6 |

Fund Profile | 9 |

Performance Summary | 11 |

Financial Statements | 12 |

About Your Fund’s Expenses | 28 |

Trustees Approve Advisory Arrangements | 30 |

Glossary | 32 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Six Months Ended June 30, 2009 | | |

| Ticker | Total |

| Symbol | Returns |

Vanguard Market Neutral Fund | | |

Investor Shares | VMNFX | –9.37% |

Institutional Shares1 | VMNIX | –9.29 |

Citigroup 3-Month Treasury Bill Index | | 0.10 |

Average Equity Market Neutral Fund2 | | 0.66 |

Your Fund’s Performance at a Glance | | | | |

December 31, 2008–June 30, 2009 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard Market Neutral Fund | | | | |

Investor Shares | $10.97 | $9.93 | $0.012 | $0.000 |

Institutional Shares | 10.90 | 9.88 | 0.008 | 0.000 |

1 This class of shares carries lower expenses and is available for a minimum initial investment of $5 million.

2 Derived from data provided by Lipper Inc.

1

President’s Letter

Dear Shareholder,

A robust stock market rally began in March, led by companies that had been beaten down during the market’s descent. As investors became less risk-averse, the rebound in lower-quality stocks worked against the advisors’ stock-selection strategies. In the first half of 2009, Vanguard Market Neutral Fund returned about –9%, a disappointing performance relative to the 0.10% return of its benchmark, the Citigroup 3-Month Treasury Bill Index.

The fund’s advisors, AXA Rosenberg Investment Management and Vanguard Quantitative Equity Group, aim for a portfolio that is neutral with respect to general stock market risk. At times, however, the fund may have net long or short positions in certain sectors of the market—as it did during the first half. The advisors strive to increase portfolio returns through stock selection, by purchasing stocks that appear to be undervalued in the marketplace and selling short stocks that appear overvalued. (To engage in short selling, an advisor sells stocks it does not own but has “borrowed” for a fee.)

In the first half, disappointing selection among financial and energy stocks, coupled with a net short position in energy stocks—many of which rose along with rising oil prices—detracted from fund performance. As a result, the fund did not meet its goal of minimizing its exposure to U.S. stock market risk and outperforming the return on U.S. Treasury bills.

2

Stock gains petered out by the end of the period

For the six months ended June 30, the broad U.S. stock market returned 5%. The stock market began the period in negative territory, but then rallied through much of the spring. While the second quarter was the strongest quarter for U.S. stocks since 2003, equity gains fizzled in mid-June as investors were taken aback by a drop in consumer confidence, a decline in home prices, and a larger-than-expected rise in the unemployment rate.

International stocks registered a stronger showing, returning about 14% for the half-year. Emerging markets posted the best results as investors poured money into countries with strong growth prospects.

Higher commodity prices and a slight rebound in manufacturing orders helped reverse steep declines in international stocks from earlier in the period.

Still, pockets of the developed and developing markets, particularly in Europe, continued to struggle amid the global recession. After three consecutive monthly gains, the MSCI All Country World Index ex USA returned –1.07% for June, perhaps signaling a bumpy road ahead.

Bond investors grew confident, sought out higher yields

As the fiscal half-year began, investors who were panicked by the credit-market crisis sought shelter in U.S. Treasury bonds, considered the safest of all

Market Barometer | | | |

| | | Total Returns |

| | Periods Ended June 30, 2009 |

| Six Months | One Year | Five Years1 |

Stocks | | | |

Russell 1000 Index (Large-caps) | 4.32% | –26.69% | –1.85% |

Russell 2000 Index (Small-caps) | 2.64 | –25.01 | –1.71 |

Dow Jones U.S. Total Stock Market Index | 5.00 | –26.11 | –1.47 |

MSCI All Country World Index ex USA (International) | 14.35 | –30.54 | 4.95 |

| | | |

Bonds | | | |

Barclays Capital U.S. Aggregate Bond Index | | | |

(Broad taxable market) | 1.90% | 6.05% | 5.01% |

Barclays Capital Municipal Bond Index | 6.43 | 3.77 | 4.14 |

Citigroup 3-Month Treasury Bill Index | 0.10 | 0.78 | 3.02 |

| | | |

CPI | | | |

Consumer Price Index | 2.60% | –1.43% | 2.60% |

1 Annualized.

3

securities. The difference between the yields of Treasuries and those of corporate bonds surged to levels not seen since the 1930s.

By mid-March, investors had gained confidence from the federal government’s efforts to thaw the credit market and stimulate the economy. Bond investors were more optimistic and more willing to take on risk; they shifted their focus away from Treasuries to higher-yielding corporate bonds. For the six months, the Barclays Capital U.S. Aggregate Bond Index returned about 2%, while high-yield bonds, as measured by the Barclays Capital U.S. Corporate High Yield Bond Index, returned about 30%.

Despite some murmurs in the market about longer-term inflation risks, the Federal Reserve in recent months unveiled plans to purchase Treasury and mortgage-backed securities. The Fed hoped to drive up the securities’ prices and push down yields, and thus keep borrowing costs, such as mortgage rates, low. Government initiatives also helped bring down municipal bond yields, which earlier in the period were higher than those of Treasuries, a reversal in the traditional relationship between taxable and tax-exempt yields. For the six months, the tax-exempt bond market returned more than 6%.

The Fed kept the target for short-term interest rates at an all-time low of 0% to 0.25% throughout the period.

Long holdings lagged short-sale portfolio

The Market Neutral Fund has two portfolios: stocks the fund’s advisors hold because of their potential for capital appreciation and stocks sold short because they appear to be overvalued. When equities began to bounce back from the depths reached in 2008 and early 2009, the stocks chosen for the long portfolio in the Market Neutral Fund underperformed the stocks sold short. This performance mismatch was especially evident in the financial and energy sectors.

Although the dollar value of the fund’s long and short holdings in the financial sector was nearly in balance, the long holdings posted a double-digit loss while the stocks sold short had a positive return. This reflected, in part, the advisors’ preference for high-quality securities. As credit markets began to ease, investor assessments of many financial companies—especially those that were able to shore up their capital structures—improved. The shift in sentiment ignited a rally in the stocks of relatively weak companies with lower credit ratings and higher risk, which tend to be stocks that the advisors sell short.

In energy, the fund’s long positions advanced only about half as much as the stocks that were sold short. The fund’s net short position in the energy sector also detracted from performance, especially when oil prices rose significantly during the second quarter. Some oil field

4

equipment and services providers represented in the short portfolio benefited from higher prices that signaled a pickup in exploration and production activity.

Bright spots included the fund’s sizable holdings of information technology and consumer discretionary stocks, which were among the broad market’s best performers as consumers gained confidence that the worst of the economic recession may be over.

For more discussion of each advisor’s approach, please see the Advisors’ Report that follows.

Diversification pays off in the long run

Stocks and bonds have tested investor confidence, and patience, in recent times, as they have throughout history. That’s one reason some investor portfolios include “alternative investments”—for example, commodities, real estate, and strategies such as market-neutral investing—that offer the potential for returns independent of traditional stock and bond markets.

As with any active investment strategy, success with alternative investments can be highly dependent on manager skill. For market-neutral funds—which seek to generate positive returns regardless of stock market results—success depends not only on the selection and performance of the stocks held in the portfolio but also the stocks sold short. When stock prices are on the upswing, the fund’s short positions are likely to lose money and hold back fund performance compared with the long-only marketplace. This is the trade-off for trying to achieve some downside protection when markets are falling.

Given the markets’ inevitable swings, investors should evaluate the performance of any investment over the long run, not based on whether short-term results are rewarding or discouraging. And Vanguard always counsels you to focus on the time-tested principles of balance and diversification, both within and across asset classes, in developing a portfolio consistent with your goals, time horizon, and tolerance for risk. When included in such a portfolio, Vanguard Market Neutral Fund—managed by two experienced advisors, each with distinct stock-selection strategies—can help improve the overall portfolio’s risk-return profile.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

President and Chief Executive Officer

July 20, 2009

5

Advisors’ Report

In the first six months of 2009, Vanguard Market Neutral Fund returned about –9%. Your fund is managed by two independent advisors. The use of multiple advisors provides exposure to distinct, yet complementary, investment approaches, enhancing the fund’s diversification. It is not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. Each advisor has also prepared a discussion of the investment environment and of how the portfolio’s positioning reflected this assessment. This report was prepared on July 21, 2009.

AXA Rosenberg Investment Management LLC

Portfolio Manager:

William E. Ricks

Americas Chief Investment Officer

The significant reversal in equity market performance and the sudden shift in investor sentiment, from risk-averse to risk-embracing, presented a challenging market environment for our investment process during the first six months of 2009.

The biggest performance driver during this period was the extraordinary returns of stocks with low trailing momentum (as measured by our Relative Strength risk-exposure indicator). The outperformance

Vanguard Market Neutral Fund Investment Advisors |

| | | |

| Fund Assets Managed | |

Investment Advisor | % | $ Million | Investment Strategy |

AXA Rosenberg | 48 | 38 | Builds a portfolio based on fundamental analysis using |

Investment Management | | | a two-part quantitative model that considers valuations |

LLC | | | and earnings forecasts. |

Vanguard Quantitative | 46 | 38 | Conducts quantitative management using models that |

Equity Group | | | assess valuation, marketplace sentiment, and balance- |

| | | sheet characteristics of companies as compared with |

| | | their peers. |

Cash Investments | 6 | 5 | The fund’s daily cash balance may be invested in one |

| | | or more Vanguard CMT Funds, which are very low-cost |

| | | money market funds. Each advisor may also maintain |

| | | a modest cash position. |

| | | | |

6

of these beaten-down stocks was at a level virtually unseen in the last few decades. These stocks historically have poor fundamentals—a weak earnings yield and negative change in forward earnings—and tend not to be favored by our investment process. Our exposure along this dimension was fairly modest, yet the impact on overall portfolio performance was pronounced given these stocks’ outsized returns.

The uncertain earnings environment prompted us to maintain a modestly more defensive posture. This strategy favored select companies in health care, consumer staples, and information technology with favorable valuations and stable earnings, but these holdings trailed the more speculative, more volatile stocks that led the March rally. In financials, we maintained a consistent net long exposure with mixed results at the individual stock level. While long positions in JPMorgan Chase and State Street contributed to performance, they were more than offset by the weak showings of Wells Fargo, U.S. Bancorp, and PNC Financial Services Group, which detracted from performance as they failed to maintain their positive trend and succumbed to renewed worries about the economy.

We increased our active weights in technology, which helped our portfolio. Positive contributors included Hewlett-Packard, Oracle, and IBM, as the market expected companies to increase their spending on technology in order to replace and upgrade aging equipment.

In contrast, we decreased active weights in oil exploration and production, integrated oil, and biotechnology companies. Unfortunately, our consistent net short exposure to oil-related sectors was a drag on performance. A net short position in oil services companies, specifically Schlumberger, impaired the strategy’s performance as stock prices increased over the period despite their negative earnings trends.

We believe our focus on earnings will serve us well in the coming months. In most market environments, investors actively reconcile the earnings generated by stocks with the price paid to participate in those earnings. Our focus on creating an earnings advantage in the portfolio should keep us in good standing as the market works through the challenges that appear on the horizon.

7

Vanguard Quantitative Equity Group

Portfolio Manager:

James D. Troyer, CFA, Principal

We build our portfolio from the pool of stocks in the Russell 1000 Index, which returned 4.32% in the first half of 2009. After returning –10.45% in the first quarter, the index rebounded with a 16.50% return in the second quarter. Within the overall market, growth stocks continued to outperform more value-oriented names: The Russell 1000 Growth Index returned 11.53% for the six months compared with –2.87% for the Russell 1000 Value Index. For our value-oriented process, this created a head-wind that has been difficult to overcome, although the second quarter was more favorable as the growth and value indexes had similar returns. Reflecting the market’s shift, our model’s performance improved in the second quarter.

Our best-performing holdings were Ford Motor (which more than doubled during the time we held it), Temple-Inland (+150%) and Health Management Associates (up 150%). Offsetting these successes, our portfolio was short Sun Microsystems and Prudential, which both then had significant price gains.

The magnitude of these individual stock returns—each at least 150%—compared with our disheartening overall performance highlights the fact that a quantitative strategy such as ours is not about specific stocks. Rather, it is about the results that come from averaging the returns of a large number of stocks. Ford’s rise was stellar, yet—since our goal is to take many small stakes—our average position in Ford was slightly less than 0.3%, yielding a modest positive contribution to our portfolio’s return. At the same time, our small short position in Sun Microsystems, whose stock price then rose by 150%, generated a loss. The net effect of these two positions was a very slight gain for our portfolio.

This example illustrates that we seek to minimize the effects of individual stocks on the portfolio; instead, we attempt to capture the average return of a large basket of names. We designed our process to exploit the tendency of stocks that have attractive growth prospects and are trading at low valuations to—on average—outperform other stocks over longer-term time horizons. We are confident that this tendency will reassert itself in the market and will reward patient investors in the coming years.

8

Market Neutral Fund

Fund Profile

As of June 30, 2009

Portfolio Characteristics | |

| |

Turnover Rate1 | 136% |

Short-Term Reserves | 36.1% |

Investment Characteristics | | |

| Long | Short |

| Portfolio | Portfolio |

Number of Stocks | 277 | 267 |

Median Market Cap | $8.5B | $10.9B |

Price/Earnings Ratio | 14.4x | 50.4x |

Price/Book Ratio | 2.0x | 2.0x |

Return on Equity | 20.5% | 19.2% |

Earnings Growth Rate | 14.4% | 13.5% |

Foreign Holdings | 0.2% | 0.2% |

Expense Ratios2 | | |

| Investor | Institutional |

| Shares | Shares |

Management and | | |

Administrative Expenses | 0.50% | 0.40% |

Dividend Expense on | | |

Securities Sold Short3 | 1.67 | 1.67 |

Total | 2.17% | 2.07% |

Sector Diversification (% of equity exposure) |

| Long | Short |

| Portfolio | Portfolio |

Consumer Discretionary | 14.4% | 10.6% |

Consumer Staples | 10.3 | 7.0 |

Energy | 5.2 | 12.5 |

Financials | 14.3 | 13.7 |

Health Care | 13.1 | 10.4 |

Industrials | 13.2 | 14.4 |

Information Technology | 20.1 | 16.6 |

Materials | 4.4 | 8.7 |

Telecommunication Services | 0.8 | 1.3 |

Utilities | 4.2 | 4.8 |

Volatility Measures4 | |

| Fund Versus |

| S&P 500 Index |

R-Squared | 0.01 |

Beta | 0.04 |

1 Annualized.

2 The expense ratios shown are from the prospectus dated April 28, 2009, and were based on expenses incurred during the fund’s most recent fiscal year. For the six months ended June 30, 2009, the annualized expense ratios were: for Investor Shares, 2.84% (0.41% management and administrative expenses plus 1.57% dividend expense on securities sold short plus 0.86% borrowing expense on securities sold short); for Institutional Shares, 2.74% (0.31% management and administrative expenses plus 1.57% dividend expense on securities sold short plus 0.86% borrowing expense on securities sold short).

3 When a cash dividend is declared on a stock the fund has sold short, the fund is required to pay an amount equal to that dividend to the lender of the stock. Although the payment of the dividend amount reduces the return of the short sale transaction, SEC rules call for the inclusion of such payments in the fund’s operating expenses.

4 For an explanation of R-squared, beta, and other terms used here, see the Glossary.

9

Market Neutral Fund

Ten Largest Holdings1 (% of total net assets) |

Long Portfolio | | |

| | |

Bristol-Myers Squibb Co. | pharmaceuticals | 1.7% |

International Business | | |

Machines Corp. | computer hardware | 1.7 |

Oracle Corp. | systems software | 1.6 |

Hewlett-Packard Co. | computer hardware | 1.6 |

Gilead Sciences, Inc. | biotechnology | 1.6 |

Microsoft Corp. | systems software | 1.5 |

The Walt Disney Co. | movies and | |

| entertainment | 1.3 |

Lockheed Martin Corp. | aerospace | |

| and defense | 1.2 |

JPMorgan Chase & Co. | other diversified | |

| financial services | 1.2 |

Baxter International, Inc. | health care | |

| equipment | 1.1 |

Top Ten | | 14.5% |

Ten Largest Holdings1 (% of total net assets) |

Short Portfolio | | |

| | |

Citigroup Inc. | other diversified | |

| financial services | 2.3% |

Google Inc. | internet software | |

| and services | 1.7 |

The Procter & Gamble Co. | household products | 1.6 |

Schlumberger Ltd. | oil and gas | |

| equipment | |

| and services | 1.6 |

Intel Corp. | semiconductors | 1.5 |

News Corp., Class A | movies and | |

| entertainment | 1.4 |

ExxonMobil Corp. | integrated oil | |

| and gas | 1.2 |

3M Co. | industrial | |

| conglomerates | 1.2 |

Eli Lilly & Co. | pharmaceuticals | 1.1 |

Devon Energy Corp. | oil and gas | |

| exploration | |

| and production | 1.1 |

Top Ten | | 14.7% |

1 The holdings listed exclude any temporary cash investments and equity index products. See the Glossary.

10

Market Neutral Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

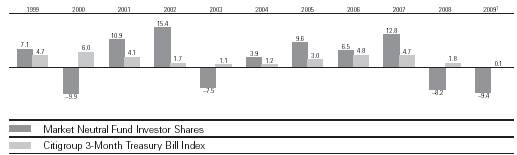

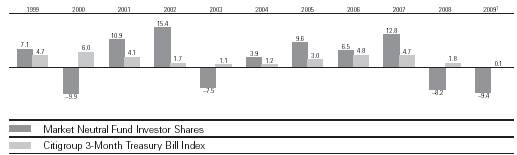

Fiscal-Year Total Returns (%): December 31, 1998–June 30, 2009

Average Annual Total Returns: Periods Ended June 30, 2009 |

| | | | |

| Inception Date | One Year | Five Years | Ten Years |

Investor Shares2 | 11/11/1998 | –15.99% | 2.78% | 3.00% |

Institutional Shares2 | 10/19/1998 | –15.91 | 3.00 | 3.26 |

1 Six months ended June 30, 2009.

2 Total returns do not reflect the 2% fee assessed until November 30, 2007, on redemptions of shares purchased within 30 days or the 1% fee assessed beginning December 1, 2007, on redemptions of shares held less than one year.

Note: See Financial Highlights tables for dividend and capital gains information.

11

Market Neutral Fund

Financial Statements (unaudited)

Statement of Net Assets

As of June 30, 2009

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market |

| | | Value• |

| | Shares | ($000) |

Common Stocks—Long Positions (84.1%) | | |

Consumer Discretionary (12.1%) | | |

† | The Walt Disney Co. | 45,400 | 1,059 |

* † | Amazon.com, Inc. | 8,400 | 703 |

* † | AutoZone Inc. | 4,100 | 620 |

† | Darden Restaurants Inc. | 11,500 | 379 |

† | Sherwin-Williams Co. | 6,000 | 322 |

* † | DISH Network Corp. | 18,500 | 300 |

† | Limited Brands, Inc. | 22,900 | 274 |

| Coach, Inc. | 8,900 | 239 |

† | The Gap, Inc. | 13,600 | 223 |

† | WABCO Holdings Inc. | 12,600 | 223 |

† | Ross Stores, Inc. | 5,700 | 220 |

† | Wyndham Worldwide Corp. | 17,600 | 213 |

† | McDonald’s Corp. | 3,700 | 213 |

* † | Jarden Corp. | 11,100 | 208 |

† | Advance Auto Parts, Inc. | 5,000 | 207 |

† | Phillips-Van Heusen Corp. | 7,200 | 207 |

† | Home Depot, Inc. | 8,400 | 198 |

* † | Ford Motor Co. | 32,600 | 198 |

† | Whirlpool Corp. | 4,600 | 196 |

† | RadioShack Corp. | 14,000 | 195 |

* † | Apollo Group, Inc. Class A | 2,700 | 192 |

† | Snap-On Inc. | 6,600 | 190 |

† | H & R Block, Inc. | 10,800 | 186 |

* † | Interpublic Group | | |

| of Cos., Inc. | 36,700 | 185 |

† | Comcast Corp. Class A | 12,500 | 181 |

* † | Priceline.com, Inc. | 1,600 | 178 |

* † | Big Lots Inc. | 8,100 | 170 |

† | Pulte Homes, Inc. | 19,000 | 168 |

† | Family Dollar Stores, Inc. | 5,900 | 167 |

* † | Dollar Tree, Inc. | 3,600 | 152 |

† | Foot Locker, Inc. | 13,200 | 138 |

* † | GameStop Corp. Class A | 5,900 | 130 |

† | MDC Holdings, Inc. | 4,000 | 120 |

† | Weight Watchers | | |

| International, Inc. | 4,500 | 116 |

† | International Speedway Corp. | 4,300 | 110 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

* † | Discovery | | |

| Communications Inc. | | |

| Class A | 4,600 | 104 |

* † | Warner Music Group Corp. | 16,600 | 97 |

* | Expedia, Inc. | 6,000 | 91 |

† | PetSmart, Inc. | 4,200 | 90 |

| Hasbro, Inc. | 3,600 | 87 |

† | Macy’s Inc. | 7,300 | 86 |

| Newell Rubbermaid, Inc. | 7,500 | 78 |

† | D. R. Horton, Inc. | 8,000 | 75 |

† | Yum! Brands, Inc. | 2,200 | 73 |

† | Centex Corp. | 7,600 | 64 |

| Brinker International, Inc. | 2,500 | 43 |

† | Meredith Corp. | 1,500 | 38 |

* † | Federal-Mogul Corp. | 3,700 | 35 |

† | The McGraw-Hill Cos., Inc. | 900 | 27 |

* | Chipotle Mexican Grill, Inc. | 300 | 24 |

| KB Home | 1,300 | 18 |

† | John Wiley & Sons Class A | 500 | 17 |

| Carnival Corp. | 200 | 5 |

| | | 9,832 |

Consumer Staples (8.6%) | | |

† | Walgreen Co. | 24,000 | 706 |

† | Colgate-Palmolive Co. | 9,600 | 679 |

† | Kellogg Co. | 13,520 | 630 |

† | ConAgra Foods, Inc. | 26,200 | 499 |

† | The Clorox Co. | 6,300 | 352 |

† | H.J. Heinz Co. | 9,700 | 346 |

† | Lorillard, Inc. | 4,800 | 325 |

† | Kimberly-Clark Corp. | 6,000 | 315 |

* † | Dean Foods Co. | 14,700 | 282 |

† | Del Monte Foods Co. | 26,600 | 250 |

† | Avon Products, Inc. | 8,300 | 214 |

† | Alberto-Culver Co. | 8,000 | 203 |

† | Archer-Daniels-Midland Co. | 7,500 | 201 |

† | Sara Lee Corp. | 20,200 | 197 |

* † | Dr. Pepper Snapple | | |

| Group, Inc. | 9,000 | 191 |

† | The Pepsi Bottling Group, Inc. | 5,600 | 189 |

† | The Hershey Co. | 4,900 | 176 |

12

Market Neutral Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

† | Campbell Soup Co. | 5,900 | 174 |

* † | Energizer Holdings, Inc. | 3,300 | 172 |

† | The Estee Lauder | | |

| Cos. Inc. Class A | 4,400 | 144 |

† | Tyson Foods, Inc. | 10,700 | 135 |

* † | Ralcorp Holdings, Inc. | 2,200 | 134 |

† | CVS Caremark Corp. | 4,200 | 134 |

† | The Kroger Co. | 4,900 | 108 |

* † | BJ’s Wholesale Club, Inc. | 3,100 | 100 |

* † | Bare Escentuals, Inc. | 10,200 | 90 |

† | Philip Morris International Inc. | 1,600 | 70 |

† | Wal-Mart Stores, Inc. | 300 | 15 |

| | | 7,031 |

Energy (4.3%) | | |

† | Chevron Corp. | 10,700 | 709 |

* † | Southwestern Energy Co. | 11,900 | 462 |

* † | Pride International, Inc. | 8,400 | 211 |

† | Marathon Oil Corp. | 6,800 | 205 |

† | Teekay Shipping Corp. | 9,600 | 202 |

* † | Oil States International, Inc. | 7,800 | 189 |

† | ENSCO International, Inc. | 5,400 | 188 |

† | Overseas | | |

| Shipholding Group Inc. | 5,200 | 177 |

* † | SEACOR Holdings Inc. | 2,300 | 173 |

† | Helmerich & Payne, Inc. | 5,200 | 161 |

† | Sunoco, Inc. | 6,900 | 160 |

† | Peabody Energy Corp. | 5,300 | 160 |

| Diamond Offshore | | |

| Drilling, Inc. | 1,900 | 158 |

† | Tesoro Corp. | 12,000 | 153 |

† | CONSOL Energy, Inc. | 4,200 | 143 |

* | Plains Exploration & | | |

| Production Co. | 2,900 | 79 |

| | | 3,530 |

Financials (10.1%) | | |

† | JPMorgan Chase & Co. | 29,300 | 999 |

† | The Travelers Cos., Inc. | 20,900 | 858 |

† | State Street Corp. | 14,600 | 689 |

† | Wells Fargo & Co. | 24,400 | 592 |

† | U.S. Bancorp | 19,100 | 342 |

† | Everest Re Group, Ltd. | 4,100 | 293 |

† | Northern Trust Corp. | 5,400 | 290 |

* † | TD Ameritrade Holding Corp. | 12,500 | 219 |

† | The Hanover | | |

| Insurance Group Inc. | 5,700 | 217 |

† | Ameriprise Financial, Inc. | 8,758 | 213 |

† | American Financial Group, Inc. | 9,800 | 211 |

† | The Chubb Corp. | 5,300 | 211 |

† | Torchmark Corp. | 5,700 | 211 |

† | Hudson City Bancorp, Inc. | 15,800 | 210 |

† | Federated Investors, Inc. | 8,500 | 205 |

* † | Progressive Corp. of Ohio | 13,500 | 204 |

† | Bank of New York | | |

| Mellon Corp. | 6,900 | 202 |

† | AFLAC Inc. | 6,500 | 202 |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| † | Bank of Hawaii Corp. | 5,500 | 197 |

| † | Unum Group | 12,300 | 195 |

| † | PNC Financial | | |

| | Services Group | 4,500 | 175 |

| † | Moody’s Corp. | 6,500 | 171 |

| † | Raymond James | | |

| | Financial, Inc. | 8,700 | 150 |

| † | PartnerRe Ltd. | 2,200 | 143 |

| † | Willis Group Holdings Ltd. | 5,200 | 134 |

| † | The Goldman Sachs Group, Inc. | 900 | 133 |

| † | BB&T Corp. | 4,900 | 108 |

| † | New York | | |

| | Community Bancorp, Inc. | 8,000 | 86 |

| † | Allied World Assurance | | |

| | Holdings, Ltd. | 1,700 | 69 |

| † | MGIC Investment Corp. | 15,300 | 67 |

* | | Jefferies Group, Inc. | 2,400 | 51 |

| † | Lincoln National Corp. | 2,500 | 43 |

* | | MBIA, Inc. | 6,400 | 28 |

| † | Cullen/Frost Bankers, Inc. | 500 | 23 |

| † | Axis Capital Holdings Ltd. | 800 | 21 |

| † | Capital One Financial Corp. | 800 | 18 |

* | † | Nasdaq OMX Group, Inc. | 700 | 15 |

* | | Conseco, Inc. | 3,900 | 9 |

| | | | 8,204 |

Health Care (11.0%) | | |

| † | Bristol-Myers Squibb Co. | 68,100 | 1,383 |

* | † | Gilead Sciences, Inc. | 27,200 | 1,274 |

| † | Baxter International, Inc. | 16,400 | 869 |

* | † | Express Scripts Inc. | 11,500 | 791 |

| † | Pfizer Inc. | 24,000 | 360 |

| † | Cardinal Health, Inc. | 10,800 | 330 |

| † | Omnicare, Inc. | 12,300 | 317 |

* | † | Mylan Inc. | 19,100 | 249 |

* | † | Watson Pharmaceuticals, Inc. | 7,100 | 239 |

* | † | DaVita, Inc. | 4,800 | 237 |

| † | Quest Diagnostics, Inc. | 4,200 | 237 |

* | † | Forest Laboratories, Inc. | 9,400 | 236 |

* | † | Mettler-Toledo | | |

| | International Inc. | 2,900 | 224 |

| † | AmerisourceBergen Corp. | 12,000 | 213 |

* | † | Lincare Holdings, Inc. | 9,000 | 212 |

* | † | LifePoint Hospitals, Inc. | 7,800 | 205 |

* | † | Community Health | | |

| | Systems, Inc. | 8,000 | 202 |

* | † | Millipore Corp. | 2,800 | 197 |

* | † | Biogen Idec Inc. | 4,300 | 194 |

| † | The Cooper Companies, Inc. | 7,500 | 185 |

| † | IMS Health, Inc. | 14,100 | 179 |

* | † | Health Management | | |

| | Associates Class A | 34,400 | 170 |

| † | Beckman Coulter, Inc. | 2,600 | 149 |

* | † | Amgen Inc. | 2,600 | 138 |

* | † | Sepracor Inc. | 3,900 | 68 |

13

Market Neutral Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

* † | Endo Pharmaceuticals | | |

| Holdings, Inc. | 3,700 | 66 |

* | Hospira, Inc. | 1,000 | 39 |

† | Techne Corp. | 200 | 13 |

| | | 8,976 |

Industrials (11.1%) | | |

† | Lockheed Martin Corp. | 12,400 | 1,000 |

† | General Dynamics Corp. | 14,200 | 787 |

† | Raytheon Co. | 17,500 | 778 |

† | Waste Management, Inc. | 22,200 | 625 |

† | L-3 Communications | | |

| Holdings, Inc. | 7,700 | 534 |

† | Goodrich Corp. | 8,800 | 440 |

† | Dover Corp. | 12,500 | 414 |

† | C.H. Robinson Worldwide Inc. | 7,500 | 391 |

† | Pitney Bowes, Inc. | 15,000 | 329 |

† | Equifax, Inc. | 10,600 | 277 |

† | W.W. Grainger, Inc. | 2,900 | 237 |

* † | AGCO Corp. | 7,700 | 224 |

† | Union Pacific Corp. | 4,200 | 219 |

† | Fluor Corp. | 4,200 | 215 |

† | The Dun & Bradstreet Corp. | 2,600 | 211 |

† | Norfolk Southern Corp. | 5,600 | 211 |

† | J.B. Hunt Transport | | |

| Services, Inc. | 6,900 | 211 |

† | Joy Global Inc. | 5,400 | 193 |

† | Flowserve Corp. | 2,700 | 188 |

† | Northrop Grumman Corp. | 4,000 | 183 |

* † | Delta Air Lines Inc. | 28,400 | 164 |

† | GATX Corp. | 6,200 | 159 |

* † | URS Corp. | 3,000 | 149 |

† | The Brink’s Co. | 5,000 | 145 |

† | ITT Industries, Inc. | 3,200 | 142 |

† | Ryder System, Inc. | 3,500 | 98 |

| Masco Corp. | 9,800 | 94 |

| Manpower Inc. | 2,200 | 93 |

† | Rockwell Collins, Inc. | 2,100 | 88 |

* † | Kirby Corp. | 2,600 | 83 |

* | Hertz Global Holdings Inc. | 7,900 | 63 |

† | Copa Holdings SA Class A | 1,300 | 53 |

* † | Corrections Corp. of America | 2,500 | 42 |

| | | 9,040 |

Information Technology (17.1%) | | |

† | International Business | | |

| Machines Corp. | 13,000 | 1,357 |

† | Oracle Corp. | 61,400 | 1,315 |

† | Hewlett-Packard Co. | 34,000 | 1,314 |

† | Microsoft Corp. | 51,900 | 1,234 |

† | Visa Inc. | 10,500 | 654 |

* † | Computer Sciences Corp. | 14,200 | 629 |

† | CA, Inc. | 19,100 | 333 |

† | QUALCOMM Inc. | 7,100 | 321 |

* † | Fiserv, Inc. | 6,500 | 297 |

* † | BMC Software, Inc. | 8,400 | 284 |

† | Harris Corp. | 8,500 | 241 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

* † | Genpact, Ltd. | 19,900 | 234 |

* † | Tech Data Corp. | 7,100 | 232 |

† | Intel Corp. | 13,600 | 225 |

* † | Ingram Micro, Inc. Class A | 12,700 | 222 |

† | Accenture Ltd. | 6,600 | 221 |

* † | SAIC, Inc. | 11,900 | 221 |

* † | Teradata Corp. | 9,400 | 220 |

† | Xilinx, Inc. | 10,500 | 215 |

† | Diebold, Inc. | 8,000 | 211 |

* † | Marvell Technology | | |

| Group Ltd. | 18,000 | 210 |

* † | Cisco Systems, Inc. | 11,200 | 209 |

* † | Dolby Laboratories Inc. | 5,600 | 209 |

* † | Sohu.com Inc. | 3,300 | 207 |

* † | NCR Corp. | 17,500 | 207 |

† | Altera Corp. | 12,400 | 202 |

* † | QLogic Corp. | 15,700 | 199 |

† | Xerox Corp. | 29,900 | 194 |

* † | Hewitt Associates, Inc. | 6,500 | 194 |

* † | Alliance Data Systems Corp. | 4,600 | 189 |

* † | Lexmark International, Inc. | 11,300 | 179 |

* † | Compuware Corp. | 25,700 | 176 |

† | Broadridge Financial | | |

| Solutions LLC | 10,500 | 174 |

* † | Affiliated Computer | | |

| Services, Inc. Class A | 3,400 | 151 |

* † | Amdocs Ltd. | 7,000 | 150 |

* † | Symantec Corp. | 9,600 | 149 |

| Maxim Integrated | | |

| Products, Inc. | 8,700 | 136 |

† | Seagate Technology | 11,800 | 123 |

* † | Broadcom Corp. | 4,500 | 112 |

* † | Synopsys, Inc. | 5,500 | 107 |

* † | Micron Technology, Inc. | 20,400 | 103 |

* † | Metavante Technologies | 3,800 | 98 |

* | SanDisk Corp. | 6,300 | 93 |

* | Avnet, Inc. | 4,000 | 84 |

* † | FLIR Systems, Inc. | 1,700 | 38 |

* † | Harris Stratex | | |

| Networks, Inc. Class A | 2,111 | 14 |

| | | 13,887 |

Materials (3.7%) | | |

† | Dow Chemical Co. | 24,500 | 395 |

† | Airgas, Inc. | 8,300 | 336 |

† | FMC Corp. | 6,800 | 322 |

† | Ball Corp. | 5,100 | 230 |

† | Greif Inc. Class A | 4,600 | 203 |

| PPG Industries, Inc. | 4,600 | 202 |

† | United States Steel Corp. | 5,400 | 193 |

† | Celanese Corp. Series A | 8,000 | 190 |

* † | Pactiv Corp. | 8,600 | 187 |

† | Monsanto Co. | 2,400 | 178 |

† | Eastman Chemical Co. | 4,300 | 163 |

† | Cliffs Natural Resources Inc. | 5,600 | 137 |

| E.I. du Pont de Nemours & Co. | 4,100 | 105 |

14

Market Neutral Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

† | Bemis Co., Inc. | 3,400 | 86 |

| International Paper Co. | 3,500 | 53 |

| | | 2,980 |

Other (2.0%) | | |

1 | Miscellaneous Securities | | 1,597 |

| | | |

Telecommunication Services (0.6%) | | |

† | CenturyTel, Inc. | 4,100 | 126 |

† | Windstream Corp. | 14,800 | 124 |

| Telephone & | | |

| Data Systems, Inc. | 3,000 | 85 |

† | Qwest Communications | | |

| International Inc. | 15,300 | 63 |

* † | Sprint Nextel Corp. | 12,800 | 62 |

* † | Level 3 Communications, Inc. | 39,300 | 59 |

* | U.S. Cellular Corp. | 100 | 4 |

| | | 523 |

Utilities (3.5%) | | |

† | PG&E Corp. | 16,900 | 650 |

† | Sempra Energy | 4,600 | 228 |

† | NiSource, Inc. | 18,900 | 220 |

† | CMS Energy Corp. | 18,000 | 217 |

† | American Electric | | |

| Power Co., Inc. | 7,500 | 217 |

† | Atmos Energy Corp. | 8,600 | 215 |

* † | Mirant Corp. | 13,100 | 206 |

† | Exelon Corp. | 4,000 | 205 |

† | UGI Corp. Holding Co. | 7,400 | 189 |

† | FirstEnergy Corp. | 4,800 | 186 |

† | DTE Energy Co. | 5,800 | 186 |

* | AES Corp. | 12,500 | 145 |

| DPL Inc. | 900 | 21 |

| | | 2,885 |

Total Common Stocks—Long Positions | | |

(Cost $66,995) | | 68,485 |

Common Stocks Sold Short (–75.6%) | | |

Consumer Discretionary (–8.0%) | | |

| News Corp., Class A | (125,000) | (1,139) |

* | Bed Bath & Beyond, Inc. | (7,300) | (224) |

| Johnson Controls, Inc. | (10,200) | (222) |

| Mattel, Inc. | (13,700) | (220) |

* | O’Reilly Automotive, Inc. | (5,700) | (217) |

* | Starbucks Corp. | (15,400) | (214) |

| Staples, Inc. | (10,500) | (212) |

* | LKQ Corp. | (12,800) | (211) |

| Target Corp. | (5,200) | (205) |

| American Eagle | | |

| Outfitters, Inc. | (14,300) | (203) |

| Marriott International, Inc. | | |

| Class A | (9,133) | (202) |

| McDonald’s Corp. | (3,400) | (195) |

| Harman International | | |

| Industries, Inc. | (10,100) | (190) |

| Williams-Sonoma, Inc. | (15,900) | (189) |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Fortune Brands, Inc. | (5,200) | (181) |

* | Dick’s Sporting Goods, Inc. | (10,400) | (179) |

| Best Buy Co., Inc. | (5,300) | (177) |

| Time Warner Inc. | (6,933) | (175) |

| The Walt Disney Co. | (7,300) | (170) |

* | Ascent Media Corp. | (6,400) | (170) |

* | Urban Outfitters, Inc. | (7,700) | (161) |

* | Mohawk Industries, Inc. | (4,500) | (161) |

| Scripps Networks Interactive | (5,200) | (145) |

| International Game | | |

| Technology | (7,000) | (111) |

| Washington Post Co. Class B | (300) | (106) |

| Abercrombie & Fitch Co. | (4,000) | (102) |

| The Stanley Works | (3,000) | (102) |

* | ITT Educational Services, Inc. | (900) | (91) |

| DeVry, Inc. | (1,700) | (85) |

* | Scientific Games Corp. | (4,700) | (74) |

* | Brink’s Home | | |

| Security Holdings, Inc. | (2,600) | (74) |

| Garmin Ltd. | (2,800) | (67) |

| Newell Rubbermaid, Inc. | (5,900) | (61) |

| Tim Hortons, Inc. | (2,500) | (61) |

* | Expedia, Inc. | (3,600) | (54) |

* | NVR, Inc. | (100) | (50) |

* | Toll Brothers, Inc. | (2,900) | (49) |

| Gentex Corp. | (3,500) | (41) |

* | The Goodyear Tire & | | |

| Rubber Co. | (1,500) | (17) |

| | | (6,507) |

Consumer Staples (–5.3%) | | |

| The Procter & Gamble Co. | (25,500) | (1,303) |

| J.M. Smucker Co. | (5,100) | (248) |

* | NBTY, Inc. | (8,100) | (228) |

| Sara Lee Corp. | (23,200) | (226) |

| Hormel Foods Corp. | (6,500) | (224) |

| The Coca-Cola Co. | (4,600) | (221) |

| The Estee Lauder Cos. Inc. | | |

| Class A | (6,600) | (216) |

| Tyson Foods, Inc. | (16,700) | (211) |

| Church & Dwight, Inc. | (3,600) | (196) |

| Altria Group, Inc. | (11,200) | (184) |

| Kimberly-Clark Corp. | (3,400) | (178) |

| Bunge Ltd. | (2,900) | (175) |

| Kellogg Co. | (3,400) | (158) |

| SUPERVALU Inc. | (9,600) | (124) |

| Molson Coors Brewing Co. | | |

| Class B | (2,700) | (114) |

| Walgreen Co. | (3,300) | (97) |

| PepsiCo, Inc. | (1,400) | (77) |

| McCormick & Co., Inc. | (1,700) | (55) |

| Reynolds American Inc. | (1,200) | (46) |

| Costco Wholesale Corp. | (900) | (41) |

| | | (4,322) |

Energy (–9.5%) | | |

| Schlumberger Ltd. | (24,000) | (1,299) |

| ExxonMobil Corp. | (14,200) | (993) |

15

Market Neutral Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Devon Energy Corp. | (16,100) | (877) |

| Apache Corp. | (8,900) | (642) |

| Hess Corp. | (11,200) | (602) |

| Occidental Petroleum Corp. | (7,200) | (474) |

| Spectra Energy Corp. | (21,100) | (357) |

* | Newfield Exploration Co. | (10,600) | (346) |

| El Paso Corp. | (21,500) | (198) |

| Range Resources Corp. | (4,700) | (195) |

| Pioneer Natural Resources Co. | (7,600) | (194) |

* | Petrohawk Energy Corp. | (8,600) | (192) |

| Cabot Oil & Gas Corp. | (6,200) | (190) |

| BJ Services Co. | (13,500) | (184) |

* | CNX Gas Corp. | (7,000) | (184) |

| Smith International, Inc. | (7,000) | (180) |

| Peabody Energy Corp. | (5,700) | (172) |

* | Ultra Petroleum Corp. | (4,400) | (172) |

* | SandRidge Energy, Inc. | (9,800) | (83) |

| Murphy Oil Corp. | (1,500) | (81) |

* | Forest Oil Corp. | (5,100) | (76) |

| | | (7,691) |

Financials (–10.4%) | | |

| Citigroup Inc. | (625,000) | (1,856) |

| American Express Co. | (20,400) | (474) |

* | IntercontinentalExchange Inc. | (3,800) | (434) |

| T. Rowe Price Group Inc. | (8,800) | (367) |

| AFLAC Inc. | (10,800) | (336) |

| MetLife, Inc. | (10,400) | (312) |

* | Leucadia National Corp. | (14,400) | (304) |

| Franklin Resources, Inc. | (3,300) | (238) |

| Legg Mason Inc. | (9,300) | (227) |

| CNA Financial Corp. | (14,300) | (221) |

| Invesco, Ltd. | (12,200) | (217) |

| Mercury General Corp. | (6,500) | (217) |

| Waddell & Reed | | |

| Financial, Inc. | (8,200) | (216) |

| Fidelity National | | |

| Financial, Inc. Class A | (15,900) | (215) |

| BlackRock, Inc. | (1,200) | (210) |

| RenaissanceRe Holdings Ltd. | (4,500) | (209) |

| Wesco Financial Corp. | (700) | (204) |

| Loews Corp. | (7,400) | (203) |

| Old Republic | | |

| International Corp. | (20,500) | (202) |

* | Markel Corp. | (700) | (197) |

| Lazard Ltd. Class A | (6,700) | (180) |

| Comerica, Inc. | (8,500) | (180) |

| Fulton Financial Corp. | (30,100) | (157) |

| Whitney Holdings Corp. | (14,500) | (133) |

* | SLM Corp. | (10,700) | (110) |

| Arthur J. Gallagher & Co. | (4,900) | (105) |

| American National | | |

| Insurance Co. | (1,300) | (98) |

| W.R. Berkley Corp. | (4,500) | (97) |

| Cincinnati Financial Corp. | (3,500) | (78) |

| OCH-Ziff Capital | | |

| Management Group | (8,200) | (73) |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Discover Financial Services | (6,700) | (69) |

| KeyCorp | (12,000) | (63) |

| Commerce Bancshares, Inc. | (1,900) | (60) |

| Eaton Vance Corp. | (1,900) | (51) |

| Erie Indemnity Co. Class A | (1,300) | (46) |

| People’s United | | |

| Financial Inc. | (2,400) | (36) |

| Brown & Brown, Inc. | (900) | (18) |

| Washington Federal Inc. | (1,200) | (16) |

| Wilmington Trust Corp. | (700) | (10) |

| Prudential Financial, Inc. | (200) | (7) |

| Astoria Financial Corp. | (700) | (6) |

| | | (8,452) |

Health Care (–7.8%) | | |

| Eli Lilly & Co. | (25,800) | (894) |

* | Celgene Corp. | (14,000) | (670) |

| Medtronic, Inc. | (13,400) | (468) |

* | Boston Scientific Corp. | (24,000) | (243) |

* | Vertex Pharmaceuticals, Inc. | (6,800) | (242) |

* | St. Jude Medical, Inc. | (5,800) | (238) |

* | VCA Antech, Inc. | (8,500) | (227) |

* | Covance, Inc. | (4,600) | (226) |

| Stryker Corp. | (5,500) | (219) |

* | Patterson Companies, Inc. | (9,900) | (215) |

* | Health Net Inc. | (13,700) | (213) |

| DENTSPLY International Inc. | (6,900) | (211) |

* | Zimmer Holdings, Inc. | (4,900) | (209) |

* | King Pharmaceuticals, Inc. | (21,200) | (204) |

| Allergan, Inc. | (4,200) | (200) |

* | Intuitive Surgical, Inc. | (1,200) | (196) |

| Cardinal Health, Inc. | (6,200) | (189) |

* | BioMarin Pharmaceutical Inc. | (11,700) | (183) |

* | Coventry Health Care Inc. | (9,600) | (180) |

* | Genzyme Corp. | (3,100) | (173) |

* | Abraxis BioScience | (3,400) | (125) |

* | Gilead Sciences, Inc. | (2,600) | (122) |

| Perrigo Co. (U.S.Shares) | (3,800) | (106) |

* | Kinetic Concepts, Inc. | (3,600) | (98) |

| PerkinElmer, Inc. | (5,100) | (89) |

* | Edwards Lifesciences Corp. | (1,300) | (88) |

* | Alexion Pharmaceuticals, Inc. | (1,900) | (78) |

* | Myriad Genetics, Inc. | (2,100) | (75) |

* | Myriad Pharmaceuticals Inc. | (525) | (2) |

| | | (6,383) |

Industrials (–10.9%) | | |

| 3M Co. | (15,800) | (950) |

| United Parcel Service, Inc. | (17,500) | (875) |

| The Boeing Co. | (20,500) | (871) |

| Caterpillar, Inc. | (23,200) | (767) |

| Eaton Corp. | (9,100) | (406) |

| Deere & Co. | (9,500) | (380) |

| Robert Half | | |

| International, Inc. | (13,700) | (324) |

| Con-way, Inc. | (6,700) | (237) |

| Illinois Tool Works, Inc. | (6,000) | (224) |

16

Market Neutral Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Republic Services, Inc. | | |

| Class A | (8,900) | (217) |

| Danaher Corp. | (3,500) | (216) |

| Fluor Corp. | (4,200) | (215) |

| IDEX Corp. | (8,600) | (211) |

* | FTI Consulting, Inc. | (4,000) | (203) |

| Landstar System, Inc. | (5,600) | (201) |

| FedEx Corp. | (3,600) | (200) |

* | Kansas City Southern | (12,200) | (197) |

| Graco, Inc. | (8,900) | (196) |

* | McDermott | | |

| International, Inc. | (9,400) | (191) |

* | BE Aerospace, Inc. | (12,900) | (185) |

| Southwest Airlines Co. | (26,900) | (181) |

| Ingersoll-Rand Co. | (8,100) | (169) |

| Masco Corp. | (15,300) | (147) |

| Flowserve Corp. | (1,900) | (133) |

| Roper Industries Inc. | (2,900) | (131) |

* | Monster Worldwide Inc. | (9,700) | (115) |

* | Stericycle, Inc. | (2,000) | (103) |

| The Corporate | | |

| Executive Board Co. | (4,900) | (102) |

* | Terex Corp. | (8,400) | (101) |

| Cintas Corp. | (4,200) | (96) |

| Avery Dennison Corp. | (3,600) | (92) |

| Alexander & Baldwin, Inc. | (3,100) | (73) |

| Steelcase Inc. | (12,200) | (71) |

* | Copart, Inc. | (900) | (31) |

* | Iron Mountain, Inc. | (800) | (23) |

| | | (8,834) |

Information Technology (–12.5%) | | |

* | Google Inc. | (3,340) | (1,408) |

| Intel Corp. | (72,700) | (1,203) |

* | Yahoo! Inc. | (50,900) | (797) |

* | Apple Inc. | (5,100) | (726) |

| Corning, Inc. | (43,200) | (694) |

* | Dell Inc. | (17,000) | (233) |

* | Cognizant Technology | | |

| Solutions Corp. | (8,400) | (224) |

* | Intuit, Inc. | (7,900) | (222) |

| QUALCOMM Inc. | (4,900) | (221) |

* | Electronic Arts Inc. | (10,100) | (219) |

| National Instruments Corp. | (9,700) | (219) |

* | Activision Blizzard, Inc. | (17,300) | (218) |

* | Citrix Systems, Inc. | (6,800) | (217) |

* | NVIDIA Corp. | (19,000) | (214) |

* | Tyco Electronics Ltd. | (11,300) | (210) |

* | Cadence Design | | |

| Systems, Inc. | (35,500) | (209) |

* | Agilent Technologies, Inc. | (10,000) | (203) |

* | LAM Research Corp. | (7,800) | (203) |

| Molex, Inc. | (13,000) | (202) |

| Paychex, Inc. | (7,900) | (199) |

| KLA-Tencor Corp. | (7,700) | (194) |

| Applied Materials, Inc. | (17,500) | (192) |

* | Ciena Corp. | (18,200) | (188) |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Global Payments Inc. | (5,000) | (187) |

* | CommScope, Inc. | (6,700) | (176) |

| Texas Instruments, Inc. | (6,300) | (134) |

* | SanDisk Corp. | (8,900) | (131) |

* | EchoStar Corp. | (8,100) | (129) |

* | salesforce.com, inc. | (3,300) | (126) |

* | Akamai Technologies, Inc. | (6,400) | (123) |

* | Cisco Systems, Inc. | (6,300) | (117) |

* | FLIR Systems, Inc. | (4,500) | (102) |

* | MEMC Electronic | | |

| Materials, Inc. | (5,400) | (96) |

* | Itron, Inc. | (1,300) | (72) |

* | Novellus Systems, Inc. | (3,300) | (55) |

| MasterCard, Inc. Class A | (300) | (50) |

* | ANSYS, Inc. | (1,500) | (47) |

* | Teradyne, Inc. | (4,900) | (34) |

* | Varian Semiconductor | | |

| Equipment Associates, Inc. | (700) | (17) |

| | | (10,211) |

Materials (–6.6%) | | |

| Freeport-McMoRan | | |

| Copper & Gold, Inc. | | |

| Class B | (16,800) | (842) |

| Monsanto Co. | (9,700) | (721) |

| Cliffs Natural Resources Inc. | (29,000) | (710) |

| Nucor Corp. | (11,300) | (502) |

| Alcoa Inc. | (46,300) | (478) |

| Weyerhaeuser Co. | (13,400) | (408) |

| Packaging Corp. of America | (13,100) | (212) |

| Air Products & | | |

| Chemicals, Inc. | (3,200) | (207) |

| Commercial Metals Co. | (12,500) | (200) |

| MeadWestvaco Corp. | (11,200) | (184) |

| The Mosaic Co. | (3,700) | (164) |

| PPG Industries, Inc. | (3,300) | (145) |

| Southern Copper Corp. | | |

| (U.S. Shares) | (6,500) | (133) |

* | Crown Holdings, Inc. | (5,300) | (128) |

| Allegheny Technologies Inc. | (2,300) | (80) |

| Martin Marietta Materials, Inc. | (1,000) | (79) |

| Newmont Mining Corp. | | |

| (Holding Co.) | (1,800) | (74) |

| RPM International, Inc. | (4,500) | (63) |

* | Century Aluminum Co. | (2,400) | (15) |

| | | (5,345) |

Telecommunication Services (–1.0%) | |

* | American Tower Corp. | | |

| Class A | (9,100) | (287) |

| Telephone & | | |

| Data Systems, Inc. | (6,300) | (178) |

* | Leap Wireless | | |

| International, Inc. | (4,300) | (142) |

| Windstream Corp. | (10,600) | (89) |

* | NII Holdings Inc. | (3,700) | (71) |

* | SBA Communications Corp. | (1,100) | (27) |

17

Market Neutral Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Crown Castle | | |

| International Corp. | (1,000) | (24) |

| AT&T Inc. | (100) | (2) |

| | | (820) |

Utilities (–3.6%) | | |

| Dominion Resources, Inc. | (11,800) | (394) |

| EQT Corp. | (9,600) | (335) |

| Alliant Energy Corp. | (9,000) | (235) |

| MDU Resources Group, Inc. | (11,600) | (220) |

| Southern Co. | (7,000) | (218) |

| Constellation | | |

| Energy Group, Inc. | (7,800) | (207) |

| Northeast Utilities | (8,800) | (196) |

| Integrys Energy Group, Inc. | (6,200) | (186) |

| Allegheny Energy, Inc. | (7,200) | (185) |

| Pinnacle West Capital Corp. | (6,000) | (181) |

| Questar Corp. | (5,000) | (155) |

| Wisconsin Energy Corp. | (3,100) | (126) |

| Energen Corp. | (2,900) | (116) |

| NSTAR | (2,900) | (93) |

| CenterPoint Energy Inc. | (7,900) | (88) |

| National Fuel Gas Co. | (900) | (32) |

| | | (2,967) |

Total Common Stocks Sold Short | | |

(Proceeds $58,106) | | (61,532) |

Temporary Cash Investment (32.4%) | | |

Money Market Fund (32.4%) | | |

2 | Vanguard Market Liquidity | | |

| Fund, 0.395% | | |

| (Cost $26,319) | 26,318,571 | 26,319 |

† Other Assets and Liabilities— | | |

Net (59.1%) | | 48,077 |

Net Assets (100%) | | 81,349 |

At June 30, 2009, net assets consisted of: | |

| Amount |

| ($000) |

Paid-in Capital | 100,558 |

Accumulated Net Investment Losses | (553) |

Accumulated Net Realized Losses | (16,720) |

Unrealized Appreciation (Depreciation) | |

Investment Securities—Long Positions | 1,490 |

Investment Securities Sold Short | (3,426) |

Net Assets | 81,349 |

| |

Investor Shares—Net Assets | |

Applicable to 6,762,588 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 67,169 |

Net Asset Value Per Share— | |

Investor Shares | $9.93 |

| |

Institutional Shares—Net Assets | |

Applicable to 1,435,375 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 14,180 |

Net Asset Value Per Share— | |

Institutional Shares | $9.88 |

• | See Note A in Notes to Financial Statements. |

* | Non-income-producing security. |

† Long security positions with a value of $65,387,000 and cash of $42,287,000 have been segregated in connection with securities sold short.

1 Securities representing up to 5% of the market value of unaffiliated securities are permitted to be combined and reported as “miscellaneous securities” provided that they have been held for less than one year and not previously reported by name.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

See accompanying Notes, which are an integral part of the Financial Statements.

18

Market Neutral Fund

Statement of Assets and Liabilities

As of June 30, 2009

| Market Value |

| ($000) |

Assets | |

Investment in Securities, Long Positions at Value | |

Common Stocks | 68,485 |

Temporary Cash Investments | 26,319 |

Cash Deposited with Broker for Short Positions | 42,287 |

Receivables for Capital Shares Issued | 1,511 |

Other Assets | 4,418 |

Total Assets | 143,020 |

Liabilities | |

Securities Sold Short, at Value | 61,532 |

Other Liabilities | 139 |

Total Liabilities | 61,671 |

Net Assets (100%) | 81,349 |

See accompanying Notes, which are an integral part of the Financial Statements.

19

Market Neutral Fund

Statement of Operations

| Six Months Ended |

| June 30, 2009 |

| ($000) |

Investment Income | |

Income | |

Dividends | 802 |

Interest1 | 49 |

Total Income | 851 |

Expenses | |

Investment Advisory Fees—Note B | |

Basic Fee | 98 |

Performance Adjustment | (32) |

The Vanguard Group—Note C | |

Management and Administrative—Investor Shares | 37 |

Management and Administrative—Institutional Shares | — |

Marketing and Distribution—Investor Shares | 12 |

Marketing and Distribution—Institutional Shares | 3 |

Custodian Fees | 42 |

Auditing Fees | 1 |

Shareholders’ Reports and Proxies—Investor Shares | 1 |

Shareholders’ Reports and Proxies—Institutional Shares | — |

Dividend Expense on Securities Sold Short | 647 |

Borrowing Expense on Securities Sold Short | 559 |

Total Expenses | 1.368 |

Net Investment Income (Loss) | (517) |

Realized Net Gain (Loss) | |

Investment Securities—Long Positions | (14,924) |

Investment Securities Sold Short | 3,972 |

Futures Contracts | (23) |

Realized Net Gain (Loss) | (10,975) |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities—Long Positions | 18,696 |

Investment Securities Sold Short | (15,485) |

Futures Contracts | 5 |

Change in Unrealized Appreciation (Depreciation) | 3,216 |

Net Increase (Decrease) in Net Assets Resulting from Operations | (8,276) |

1 Interest income from an affiliated company of the fund was $49,000.

See accompanying Notes, which are an integral part of the Financial Statements.

20

Market Neutral Fund

Statement of Changes in Net Assets

| | April 1, | |

| Six Months Ended | 2008, to | Year Ended |

| June 30, | December 31, | March 31, |

| 2009 | 20081 | 2008 |

| ($000) | ($000) | ($000) |

Increase (Decrease) in Net Assets | | | |

Operations | | | |

Net Investment Income (Loss) | (517) | 797 | 638 |

Realized Net Gain (Loss) | (10,975) | (1,034) | 2,059 |

Change in Unrealized Appreciation (Depreciation) | 3,216 | (6,467) | (1,291) |

Net Increase (Decrease) in Net Assets | | | |

Resulting from Operations | (8,276) | (6,704) | 1,406 |

Distributions | | | |

Net Investment Income | | | |

Investor Shares | (76) | (819) | (344) |

Institutional Shares | (12) | (187) | (206) |

Realized Capital Gain2 | | | |

Investor Shares | — | (3,716) | (200) |

Institutional Shares | — | (861) | (112) |

Total Distributions | (88) | (5,583) | (862) |

Capital Share Transactions | | | |

Investor Shares | 1,422 | 37,746 | 35,479 |

Institutional Shares | (1,489) | 7,271 | 1,704 |

Net Increase (Decrease) from Capital Share Transactions | (67) | 45,017 | 37,183 |

Total Increase (Decrease) | (8,431) | 32,730 | 37,727 |

Net Assets | | | |

Beginning of Period | 89,780 | 57,050 | 19,323 |

End of Period3 | 81,349 | 89,780 | 57,050 |

| | | | |

1 The fund’s fiscal year-end changed from March 31 to December 31, effective December 31, 2008.

2 Includes short-term gain distributions totaling $0, $4,163,000, and $0, for fiscal periods ended June 30, 2009, December 31, 2008, and March 31, 2008, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

3 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($553,000), $52,000, and $244,000.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Market Neutral Fund

Financial Highlights

Investor Shares | | | | | | | |

| Six Months | April 1, | | | | | |

| Ended | 2008, to | | | | | |

For a Share Outstanding | June 30, | Dec. 31, | Year Ended March 31, |

Throughout Each Period | 2009 | 20081 | 20082 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, | | | | | | | |

Beginning of Period | $10.97 | $12.45 | $12.19 | $12.12 | $11.46 | $10.86 | $11.61 |

Investment Operations | | | | | | | |

Net Investment Income (Loss) | (.063) | .084 | .3113 | .500 | .220 | (.040)3 | (.100)3 |

Net Realized and | | | | | | | |

Unrealized Gain (Loss) | | | | | | | |

on Investments | (.965) | (.838) | .909 | .060 | .590 | .640 | (.650) |

Total from | | | | | | | |

Investment Operations | (1.028) | (.754) | 1.220 | .560 | .810 | .600 | (.750) |

Distributions | | | | | | | |

Dividends from | | | | | | | |

Net Investment Income | (.012) | (.132) | (.607) | (.490) | (.150) | — | — |

Distributions from | | | | | | | |

Realized Capital Gains | — | (.594) | (.353) | — | — | — | — |

Total Distributions | (.012) | (.726) | (.960) | (.490) | (.150) | — | — |

Net Asset Value, | | | | | | | |

End of Period | $9.93 | $10.97 | $12.45 | $12.19 | $12.12 | $11.46 | $10.86 |

| | | | | | | |

Total Return4 | –9.37% | –6.11% | 10.15% | 4.68% | 7.09% | 5.52% | –6.46% |

| | | | | | | |

Ratios/Supplemental Data | | | | | | | |

Net Assets, | | | | | | | |

End of Period (Millions) | $67 | $73 | $45 | $9 | $12 | $13 | $9 |

Ratio of Expenses to | | | | | | | |

Average Net Assets | | | | | | | |

Based on Total Expenses | 2.84%5 | 2.13%5 | 3.09% | 3.46% | 3.31% | 3.55% | 3.51% |

Net of Expenses | | | | | | | |

Waived/Reimbursed2 | 2.84%5 | 2.13%5 | 2.79% | 2.98% | 3.02% | 3.26% | 3.12% |

Net of Expenses | | | | | | | |

Waived/Reimbursed and | | | | | | | |

Dividend and Borrowing | | | | | | | |

Expense on Securities | | | | | | | |

Sold Short | 0.41%5 | 0.46%5 | 1.16% | 1.54% | 1.59% | 1.61% | 1.55% |

Ratio of Net Investment | | | | | | | |

Income (Loss) to | | | | | | | |

Average Net Assets | (0.77%)5 | 1.15%5 | 2.69% | 3.40% | 2.14% | (0.33%) | (0.93%) |

Portfolio Turnover Rate | 136%5 | 161% | 214% | 169% | 213% | 180% | 189% |

1 The fund’s fiscal year-end changed from March 31 to December 31, effective December 31, 2008.

2 Laudus Rosenberg U.S. Large/Mid Capitalization Long/Short Equity Fund reorganized into Vanguard Market Neutral Fund effective December 1, 2007. For periods prior to December 1, 2007, the fund’s advisor and other service providers had agreed to waive or reimburse certain of the fund’s expenses.

3 Calculated based on average shares outstanding.

4 Total returns do not reflect the 2% fee assessed until November 30, 2007, on redemptions of shares purchased within 30 days; the 1% fee assessed beginning December 1, 2007, on redemptions of shares held less than one year; or the account service fee that may be applicable to certain accounts with balances below $10,000.

5 Annualized.

See accompanying Notes, which are an integral part of the Financial Statements.

22

Market Neutral Fund

Financial Highlights

Institutional Shares | | | | | | | |

| Six Months | April 1, | | | | | |

| Ended | 2008, to | | | | | |

For a Share Outstanding | June 30, | Dec. 31, | Year Ended March 31, |

Throughout Each Period | 2009 | 20081 | 20082 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, | | | | | | | |

Beginning of Period | $10.90 | $12.39 | $12.14 | $12.08 | $11.44 | $10.80 | $11.51 |

Investment Operations | | | | | | | |

Net Investment Income (Loss) | (.058) | .085 | .3903 | .600 | .250 | (.010)3 | (.060)3 |

Net Realized and | | | | | | | |

Unrealized Gain (Loss) | | | | | | | |

on Investments | (.954) | (.846) | .864 | — | .580 | .650 | (.650) |

Total from | | | | | | | |

Investment Operations | (1.012) | (.761) | 1.254 | .600 | .830 | .640 | (.710) |

Distributions | | | | | | | |

Dividends from | | | | | | | |

Net Investment Income | (.008) | (.138) | (.651) | (.540) | (.190) | — | — |

Distributions from | | | | | | | |

Realized Capital Gains | — | (.591) | (.353) | — | — | — | — |

Total Distributions | (.008) | (.729) | (1.004) | (.540) | (.190) | — | — |

Net Asset Value, | | | | | | | |

End of Period | $9.88 | $10.90 | $12.39 | $12.14 | $12.08 | $11.44 | $10.80 |

| | | | | | | |

Total Return4 | –9.29% | –6.20% | 10.49% | 4.98% | 7.29% | 5.93% | –6.17% |

| | | | | | | |

Ratios/Supplemental Data | | | | | | | |

Net Assets, | | | | | | | |

End of Period (Millions) | $14 | $17 | $12 | $10 | $20 | $12 | $20 |

Ratio of Expenses to | | | | | | | |

Average Net Assets | | | | | | | |

Based on Total Expenses | 2.74%5 | 2.08%5 | 2.97% | 3.07% | 3.01% | 3.23% | 3.22% |

Net of Expenses | | | | | | | |

Waived/Reimbursed2 | 2.74%5 | 2.08%5 | 2.56% | 2.67% | 2.71% | 2.94% | 2.82% |

Net of Expenses | | | | | | | |

Waived/Reimbursed and | | | | | | | |

Dividend and Borrowing | | | | | | | |

Expense on Securities | | | | | | | |

Sold Short | 0.31%5 | 0.41%5 | 0.93% | 1.24% | 1.24% | 1.24% | 1.25% |

Ratio of Net Investment | | | | | | | |

Income (Loss) to | | | | | | | |

Average Net Assets | (0.67%)5 | 1.20%5 | 2.92% | 3.68% | 2.50% | (0.13%) | (0.57%) |

Portfolio Turnover Rate | 136%5 | 161% | 214% | 169% | 213% | 180% | 189% |

1 The fund’s fiscal year-end changed from March 31 to December 31, effective December 31, 2008.

2 Laudus Rosenberg U.S. Large/Mid Capitalization Long/Short Equity Fund reorganized into Vanguard Market Neutral Fund effective December 1, 2007. For periods prior to December 1, 2007, the fund’s advisor and other service providers had agreed to waive or reimburse certain of the fund’s expenses.

3 Calculated based on average shares outstanding.

4 Total returns do not reflect the 2% fee assessed until November 30, 2007, on redemptions of shares purchased within 30 days or the 1% fee assessed beginning December 1, 2007, on redemptions of shares held less than one year.

5 Annualized.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Market Neutral Fund

Notes to Financial Statements

Vanguard Market Neutral Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares, Investor Shares and Institutional Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Institutional Shares are designed for investors who meet certain administrative and service criteria and invest a minimum of $5 million.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Short Sales: Short sales are the sales of securities that the fund does not own. The fund may sell a security it does not own in anticipation of a decline in the value of that security. In order to deliver the security to the purchaser, the fund borrows the security from a broker-dealer. The fund must segregate, as collateral for its obligation to return the borrowed security, an amount of cash and long security positions at least equal to the market value of the security sold short. The fund later closes out the position by returning the security to the lender, typically by purchasing the security in the open market. A gain, limited to the price at which the fund sold the security short, or a loss, theoretically unlimited in size, is recognized upon the termination of the short sale. The fund may receive a portion of the income from the investment of collateral, or be charged a fee on borrowed securities, based on the market value of each borrowed security and a variable rate that is dependent upon the availability of such security. The net amounts of income or fees are recorded as interest income (for net income received) or borrowing expense on securities sold short (for net fees charged) on the Statement of Operations. Dividends on securities sold short are reported as an expense in the Statement of Operations.

Cash collateral segregated for securities sold short is recorded as an asset in the Statement of Assets and Liabilities. Long security positions segregated as collateral are shown in the Statement of Net Assets.

24

Market Neutral Fund

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of limiting exposure to general stock market risk while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

4. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken on federal income tax returns for all open tax years (tax years ended March 31, 2005–December 31, 2008) and for the period ended June 30, 2009, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

5. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

6. Other: Dividend income (or dividend expense on short positions) is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses), shareholder reporting, and proxies. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. AXA Rosenberg Investment Management LLC (AXA) provides investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee for AXA is subject to quarterly adjustments based on performance since December 31, 2007, relative to the Citigroup 3-Month Treasury Bill Index.

The Vanguard Group provides investment advisory services to a portion of the fund on an at-cost basis.

For the six months ended June 30, 2009, the aggregate investment advisory fee represented an effective annual basic rate of 0.24% of the fund’s average net assets, before a decrease of $32,000 (0.08%) based on performance.

25

Market Neutral Fund

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At June 30, 2009, the fund had contributed capital of $19,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.01% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At June 30, 2009, 100% of the fund’s investments were valued based on Level 1 inputs.

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at December 31, 2008, the fund had available realized losses of $3,175,000 to offset future net capital gains through December 31, 2017. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending December 31, 2009; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balance above.

The fund had realized losses totaling $2,452,000 through December 31, 2008, which are deferred for tax purposes and reduce the amount of unrealized appreciation on investment securities for tax purposes.

At June 30, 2009, the cost of long security positions for tax purposes was $95,409,000. Net unrealized depreciation of long security positions for tax purposes was $605,000, consisting of unrealized gains of $6,455,000 on securities that had risen in value since their purchase and $7,060,000 in unrealized losses on securities that had fallen in value since their purchase. Tax-basis net unrealized depreciation on securities sold short was $4,074,000, consisting of unrealized gains of $4,364,000 on securities that had fallen in value since their sale and $8,438,000 in unrealized losses on securities that had risen in value since their sale.

26

F. During the six months ended June 30, 2009, the fund purchased $52,253,000 of investment securities and sold $71,909,000 of investment securities, other than temporary cash investments. The proceeds of short sales and the cost of purchases to cover short sales were $59,553,000 and $88,849,000, respectively.

G. Capital share transactions for each class of shares were:

| Six Months Ended | April 1, 2008, to | Year Ended |

| June 30, 2009 | December 31, 20081 | March 31, 2008 |

| Amount | Shares | Amount | Shares | Amount | Shares |

| ($000) | (000) | ($000) | (000) | ($000) | (000) |

Investor Shares | | | | | | |

Issued | 24,629 | 2,422 | 63,080 | 5,143 | 42,479 | 3,395 |

Issued in Lieu of Cash Distributions | 68 | 7 | 4,119 | 370 | 436 | 36 |

Redeemed2 | (23,275) | (2,279) | (29,453) | (2,488) | (7,436) | (593) |

Net Increase (Decrease)— | | | | | | |

Investor Shares | 1,422 | 150 | 37,746 | 3,025 | 35,479 | 2,838 |

Institutional Shares | | | | | | |

Issued | 1,915 | 191 | 8,972 | 726 | 9,106 | 742 |

Issued in Lieu of Cash Distributions | 12 | 1 | 1,046 | 95 | 318 | 26 |

Redeemed2 | (3,416) | (341) | (2,747) | (235) | (7,720) | (608) |

Net Increase (Decrease)— | | | | | | |

Institutional Shares | (1,489) | (149) | 7,271 | 586 | 1,704 | 160 |

1 The fund’s fiscal year-end changed from March 31 to December 31, effective December 31, 2008. |

2 Net of redemption fees of $50,000, $5,000, and $4,000 (fund totals). |