UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| |

Investment Company Act file number: | 811-22114 | |

Name of Registrant: | Vanguard Montgomery Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: | (610) 669-1000 | |

Date of fiscal year end: December 31 | |

Date of reporting period: January 1, 2014 – June 30, 2014 |

Item 1: Reports to Shareholders | |

| | |

| Semiannual Report | June 30, 2014 |

Vanguard Market Neutral Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles,

grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 6 |

| Fund Profile. | 8 |

| Performance Summary. | 10 |

| Financial Statements. | 11 |

| About Your Fund’s Expenses. | 25 |

| Trustees Approve Advisory Arrangement. | 27 |

| Glossary. | 28 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship’s wheel represents leadership and guidance, essential qualities in navigating difficult seas.

This one is a replica based on an 18th-century British vessel. The HMSVanguard, another ship of that era, served as the

flagship for British Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

Your Fund’s Total Returns

| |

| Six Months Ended June 30, 2014 | |

| | Total |

| | Returns |

| Vanguard Market Neutral Fund | |

| Investor Shares | 2.81% |

| Institutional Shares | 2.92 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.00 |

| Equity Market Neutral Funds Average | 0.60 |

| Equity Market Neutral Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

| Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria. |

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| December 31, 2013, Through June 30, 2014 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Market Neutral Fund | | | | |

| Investor Shares | $11.03 | $11.34 | $0.000 | $0.000 |

| Institutional Shares | 10.97 | 11.29 | 0.000 | 0.000 |

1

Chairman’s Letter

Dear Shareholder,

Helped by a diverse collection of holdings from airlines to food companies, Vanguard Market Neutral Fund outpaced its comparative standards for the first half of 2014.

The fund’s Investor Shares returned 2.81% for the six months ended June 30; Institutional Shares returned 2.92%. The fund’s benchmark, the Citigroup Three-Month U.S. Treasury Bill Index, returned 0.00%, and its peer funds, on average, returned 0.60%.

Returns for the broad U.S. stock market were strong, with major indexes finishing near record highs. Investors looked beyond challenges, among them conflict in the Middle East that contributed to a rise in oil prices. Instead, they focused on positives including lower unemployment, strong corporate earnings, a wave of mergers and acquisitions, and continued low borrowing costs.

During a broad stock market rally, the Market Neutral Fund’s results wouldn’t be expected to keep pace. The fund’s objective isn’t to outperform the equity market, but rather to be neutral to market conditions and produce results that exceed the returns of three-month Treasury bills.

2

After starting the half year slowly, stocks pushed higher

U.S. stocks declined in January but went on to advance in each of the next five months. For the half year, the broad U.S. stock market returned about 7%. Stocks were notably resilient, surging ahead after dips sparked by turmoil in Iraq and conflict in Ukraine.

Citing the U.S. economy’s progress, the Federal Reserve has steadily trimmed its stimulative monthly bond-buying since January. At the same time, investors have been reassured by the Fed’s decision to keep interest rates low for an extended period.

International stocks overall returned nearly 6%. Emerging markets stocks, which have rebounded sharply in recent months, were the top performers, followed by stocks of developed markets in Europe and then those in the Pacific region.

The period was strong for bonds as yields dropped and prices rose

Bond prices spent most of the six months regaining the ground they lost in 2013. Over the period, the broad U.S. taxable bond market returned 3.93%. The yield of the benchmark 10-year Treasury note ended June at 2.54%, down from almost 3% on December 31. (Bond prices and yields move in opposite directions.)

| | | |

| Market Barometer | | | |

| |

| | | | Total Returns |

| | | Periods Ended June 30, 2014 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 7.27% | 25.35% | 19.25% |

| Russell 2000 Index (Small-caps) | 3.19 | 23.64 | 20.21 |

| Russell 3000 Index (Broad U.S. market) | 6.94 | 25.22 | 19.33 |

| FTSE All-World ex US Index (International) | 5.75 | 21.93 | 11.40 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 3.93% | 4.37% | 4.85% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 6.00 | 6.14 | 5.81 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.00 | 0.04 | 0.07 |

| |

| CPI | | | |

| Consumer Price Index | 2.27% | 2.07% | 2.02% |

3

Municipal bonds returned 6.00% amid support from the broad bond market rally, investors’ greater appetite for tax-exempt income, and a decline in the pool of new issues.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned 5.59%. In June, the European Central Bank made the unprecedented move of lowering a key interest rate below zero, to –0.10%, in an effort to avert deflation and induce banks to lend and thus fuel economic growth.

Although the period was strong worldwide for bonds, it’s worth remembering that the current low yields imply lower future returns: As yields drop, the scope for further declines—and increases in prices—diminishes.

Returns remained tiny for money market funds and savings account returns because of the Fed’s target of 0%–0.25% for short-term interest rates.

The fund notched successes on both sides of the ledger

Your fund seeks to achieve market neutrality by holding both “long” and “short” portfolios of approximately equal value. In a sense, these portfolios are mirror images of each other, with similar weightings in each of the ten industry sectors the fund encompasses.

Short-selling is a technique that aims to profit from a decline in a stock’s price; it’s the opposite of the more familiar long approach, in which investors buy stocks

whose value they believe will rise. Investors don’t own the stock they’re shorting. Instead, they borrow shares of the stock and sell them, in hopes of returning them at a lower price.

Combining short investments with offsetting long investments can enhance the diversification of a portfolio by providing returns that aren’t closely correlated with the moves of the broad stock market. That, of course, is the goal of the Market Neutral Fund, whose overall performance reflects the net results of its short and long positions.

Extensive use of short-selling makes the Market Neutral Fund different from traditional mutual funds. Given the fund’s distinctive characteristics, investors should carefully evaluate its appropriateness for their specific situations. The fund can play a role as a small portion of a large, already well-diversified portfolio.

Your fund’s advisor—Vanguard Equity Investment Group, through its Quantitative Equity Group—uses sophisticated computer models in making both its long and short stock selections. Over the six months, the advisor had success on both sides of the ledger.

Long positions in the stocks of airlines did especially well. Airlines have benefited from industry consolidation that has allowed carriers to raise prices at a time when demand seems to be picking up. Investments in food companies and defense contractors also fared well.

4

On the short side, the fund benefited from declines in the shares of a range of companies that depend on consumer spending, from makers of cosmetics to restaurants. Consumer spending was weak in the first quarter, an apparent result of the harsh winter in much of the country.

The fund had disappointing results with its short positions in the shares of mining companies and utilities.

For more about the advisor’s strategy and the fund’s positioning during the six months, please see the Advisor’s Report that follows this letter.

Don’t let complacency set your portfolio adrift

At Vanguard, we often warn investors against letting their emotions become entangled with their investments. When the financial markets are in turmoil, for example, we’ll caution investors not to let fear lead to rash decisions. But complacency can also stand in the way of achieving your financial goals. And lately, conditions have been ripe for complacency.

Volatility, a hallmark of stock investing, seems to have vanished for the moment, and returns have been robust. In the more than five years since its March 2009 bottom, the broad U.S. stock market, as measured by the Russell 3000 Index, has produced average annual returns of about 26%. That’s more than double the market’s historical average annual return. And in recent weeks, several indexes have reached record highs.

The investment winds don’t always blow so favorably, of course. While the smooth sailing lasts, however, it creates risks of its own: In such a calm climate, it can be easy to lose sight of fundamentals, especially the importance of rebalancing. Without rebalancing—periodically adjusting your asset allocation so that it stays in line with your goals and risk tolerance—you can end up with a portfolio that’s very different from, and potentially riskier than, the one you intended to have.

Whether the market’s moving up, down, or sideways, we always encourage our clients to stay focused on four keys to Vanguard’s timeless principles for investment success: goals, balance, cost, and discipline. (You can read more about our principles in Vanguard’s Principles for Investment Success, available at vanguard.com/ research.)

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

July 21, 2014

5

Advisor’s Report

For the six months ended June 30, 2014, U.S. equities continued their march upward from very strong 2013 results. The broad U.S. equity market rose 6.94%, large-capitalization stocks bested smaller-cap equities by about 4 percentage points, and value-oriented companies surpassed their growth counterparts by about 2 percentage points. The U.S. equity market generally outpaced international markets, and emerging-market returns outpaced those of developed markets.

Performance within the U.S. market was broad-based as all ten industry sectors generated positive returns. Results were best in utilities, energy, and health care. Consumer discretionary stocks, though they advanced, were the laggards. Within this global environment, the Market Neutral Fund returned 2.81% for Investor Shares. We believe it is important to remind investors that the fund’s strategy is not to outperform the equity market, but rather to be neutral to market conditions and produce results that exceed those of three-month U.S. Treasury bills.

The U.S. equity market, after falling more than 3% in January, rose for five straight months as central banks maintained their accommodative policies and as volatility decreased across financial markets. In mid-June, the Chicago Board Options Exchange Volatility Index (VIX) registered its lowest level (10.61) in seven years. Real estate and labor markets continued to

recover slowly but consistently. Although first-quarter gross domestic product was hampered by a difficult winter, growth expectations for the rest of 2014 and beyond are in the range of 2% to 3%. Lastly, bond credit spreads have decreased to a level not seen since 2006, an indicator of risk-taking and optimism that can drive equity markets higher.

Although it’s important to understand how these macroeconomic factors affect overall portfolio performance, our approach to investing focuses on specific stock fundamentals. We seek to compare all stocks in our investment universe within industry groups to identify those with characteristics that we believe will outperform over the long run. To do this, we use a strict quantitative process that concentrates on a combination of valuation and other factors focused on fundamental growth. Using the results of our model, we then construct our portfolio, aiming to maximize expected return by overweighting our most attractively ranked stocks and shorting the most unattractive ones, dollar for dollar. Importantly, we also minimize exposure to risks relative to our benchmark that our research indicates do not improve returns, such as market capitalization and industry representation.

For the six months, our analysis shows that our stock selection model was effective, with four of its five signals producing positive performance. The

6

valuation model was the strongest contributor, followed by growth; the sentiment signal slightly detracted.

Our model’s results across sectors was effective, as we produced positive stock selection results in seven of the ten sectors, led by industrials and consumer staples. Selections in materials and utilities detracted the most from performance.

Long positions in Trinity Industries and Delta Air Lines and a short position in UTi Worldwide led the results in industrials. In consumer staples, long positions in Keurig Green Mountain and Pilgrim’s Pride and a short position in Elizabeth Arden drove results. Short positions in Royal Gold and Flotek Industries, both in materials, and in Dynegy and Integrys Energy Group, both in utilities, declined the most within those sectors.

We thank you for your investment and look forward to the second half of the fiscal year.

James D. Troyer, CFA, Principal,

Portfolio Manager

James P. Stetler, Principal,

Portfolio Manager

Michael R. Roach, CFA, Portfolio Manager

Vanguard Equity Investment Group

July 25, 2014

7

Market Neutral Fund

Fund Profile

As of June 30, 2014

| | |

| Share-Class Characteristics | | |

| | Investor | Institutional |

| | Shares | Shares |

| Ticker Symbol | VMNFX | VMNIX |

| Total Expense Ratio1 | 1.60% | 1.50% |

| Management Expenses | 0.19% | 0.09% |

| Dividend Expenses on | | |

| Securities Sold Short2 | 1.18% | 1.18% |

| Borrowing Expenses on | | |

| Securities Sold Short2 | 0.14% | 0.14% |

| Other Expenses | 0.09% | 0.09% |

| | |

| Portfolio Characteristics | | |

| | Long | Short |

| | Portfolio | Portfolio |

| Number of Stocks | 258 | 246 |

| Median Market Cap | $4.4B | $5.2B |

| Price/Earnings Ratio | 18.8x | 42.7x |

| Price/Book Ratio | 2.7x | 2.6x |

| Return on Equity | 14.1% | 13.8% |

| Earnings Growth | | |

| Rate | 17.2% | 9.9% |

| Foreign Holdings | 1.8% | 2.6% |

| Fund Characteristics | |

| |

| Turnover Rate (Annualized) | 73% |

| Short-Term Reserves | 6.7% |

| | |

| Volatility Measures | | |

| | Citigroup | DJ |

| | Three-Month | U.S. Total |

| | U.S. Treasury | Market |

| | Bill Index | FA Index |

| R-Squared | 0.01 | 0.12 |

| Beta | -23.67 | 0.10 |

| These measures show the degree and timing of the fund’s fluctuations compared with the index over 36 months. |

|

| | |

| Sector Diversification (% of equity exposure) |

| | Long | Short |

| | Portfolio | Portfolio |

| Consumer Discretionary | 15.7% | 15.3% |

| Consumer Staples | 5.5 | 4.9 |

| Energy | 6.6 | 6.2 |

| Financials | 13.8 | 14.9 |

| Health Care | 9.4 | 9.8 |

| Industrials | 17.4 | 18.2 |

| Information Technology | 19.5 | 19.4 |

| Materials | 7.0 | 7.1 |

| Telecommunication Services | 0.8 | 0.5 |

| Utilities | 4.3 | 3.7 |

1 The total expense ratios shown are from the prospectus dated April 25, 2014, and represent estimated costs for the current fiscal year. For the

six months ended June 30, 2014, the annualized total expense ratios were 1.74% for Investor Shares and 1.64% for Institutional Shares.

2 In connection with a short sale, the fund may receive income or be charged a fee based on the market value of the borrowed stock. When a

cash dividend is declared on a stock the fund has sold short, the fund is required to pay an amount equal to that dividend to the party from which

the fund borrowed the stock and to record the payment of the dividend as an expense.

8

Market Neutral Fund

| | |

| Ten Largest Holdings1 (% of total net assets) |

| Long Portfolio | | |

| Best Buy Co. Inc. | Computer & | |

| | Electronics Retail | 0.5% |

| SM Energy Co. | Oil & Gas Exploration | |

| | & Production | 0.5 |

| Matador Resources Co. | Oil & Gas Exploration | |

| | & Production | 0.5 |

| Clayton Williams Energy | Oil & Gas Exploration | |

| Inc. | & Production | 0.5 |

| Trinity Industries Inc. | Construction | |

| | Machinery & Heavy | |

| | Trucks | 0.5 |

| Popular Inc. | Regional Banks | 0.5 |

| Quintiles Transnational | Life Sciences Tools & | |

| Holdings Inc. | Services | 0.5 |

| Kosmos Energy Ltd. | Oil & Gas Exploration | |

| | & Production | 0.5 |

| Barnes & Noble Inc. | Specialty Stores | 0.5 |

| Netflix Inc. | Internet Retail | 0.5 |

| Top Ten | | 5.0% |

| | |

| Ten Largest Holdings1 (% of total net assets) |

| Short Portfolio | | |

| |

| ServiceNow Inc. | Systems Software | 0.5% |

| Palo Alto Networks Inc. | Communications | |

| | Equipment | 0.5 |

| Pacira Pharmaceuticals | | |

| Inc. | Pharmaceuticals | 0.5 |

| Medidata Solutions Inc. | Health Care | |

| | Technology | 0.5 |

| Williams Cos. Inc. | Oil & Gas Storage & | |

| | Transportation | 0.5 |

| Stratasys Ltd. | Electronic | |

| | Equipment & | |

| | Instruments | 0.5 |

| Allegheny Technologies | | |

| Inc. | Steel | 0.5 |

| Community Health | Health Care | |

| Systems Inc. | Facilities | 0.5 |

| XPO Logistics Inc. | Air Freight & | |

| | Logistics | 0.5 |

| IHS Inc. Class A | Research & | |

| | Consulting Services | 0.5 |

| Top Ten | | 5.0% |

1 The holdings listed exclude any temporary cash investments and equity index products.

9

Market Neutral Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

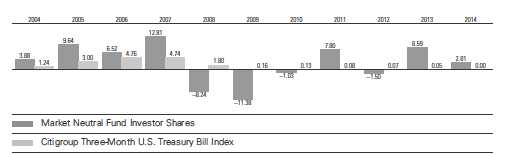

Fiscal-Year Total Returns (%): December 31, 2003, Through June 30, 2014

Note: For 2014, performance data reflect the six months ended June 30, 2014.

| | | | |

| Average Annual Total Returns: Periods Ended June 30, 2014 | | | |

| |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 11/11/1998 | 6.68% | 2.79% | 2.78% |

| Institutional Shares | 10/19/1998 | 6.81 | 2.89 | 2.94 |

See Financial Highlights for dividend and capital gains information.

10

Market Neutral Fund

Financial Statements (unaudited)

Statement of Net Assets

As of June 30, 2014

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks—Long Positions (97.3%) | |

| Consumer Discretionary (15.3%) | | |

| † | Best Buy Co. Inc. | 43,200 | 1,340 |

| * † | Barnes & Noble Inc. | 56,100 | 1,278 |

| * † | Netflix Inc. | 2,900 | 1,278 |

| † | Brown Shoe Co. Inc. | 43,600 | 1,247 |

| * | Live Nation | | |

| | Entertainment Inc. | 48,300 | 1,192 |

| † | Hanesbrands Inc. | 12,100 | 1,191 |

| * † | Marriott Vacations | | |

| | Worldwide Corp. | 20,200 | 1,184 |

| * | Visteon Corp. | 12,200 | 1,184 |

| * † | O’Reilly Automotive Inc. | 7,800 | 1,175 |

| † | Columbia Sportswear Co. | 14,100 | 1,165 |

| * | Skechers U.S.A. Inc. | | |

| | Class A | 25,400 | 1,161 |

| † | Cablevision Systems Corp. | | |

| | Class A | 64,600 | 1,140 |

| † | Macy’s Inc. | 19,500 | 1,131 |

| † | Jack in the Box Inc. | 18,900 | 1,131 |

| * † | Murphy USA Inc. | 23,100 | 1,129 |

| | Home Depot Inc. | 13,900 | 1,125 |

| * † | Outerwall Inc. | 18,950 | 1,125 |

| † | GameStop Corp. Class A | 27,200 | 1,101 |

| † | Domino’s Pizza Inc. | 15,050 | 1,100 |

| † | Brinker International Inc. | 21,300 | 1,036 |

| * † | Starz | 34,700 | 1,034 |

| † | Wynn Resorts Ltd. | 4,700 | 976 |

| | Whirlpool Corp. | 6,800 | 947 |

| † | Tupperware Brands Corp. | 10,700 | 896 |

| † | PetSmart Inc. | 14,900 | 891 |

| † | Cracker Barrel Old | | |

| | Country Store Inc. | 8,300 | 826 |

| † | Sturm Ruger & Co. Inc. | 13,800 | 814 |

| † | Gap Inc. | 18,900 | 786 |

| † | Dillard’s Inc. Class A | 6,670 | 778 |

| * | Federal-Mogul | | |

| | Holdings Corp. | 37,800 | 765 |

| † | Buckle Inc. | 16,800 | 745 |

| † | Staples Inc. | 63,600 | 689 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Marriott International Inc. | | |

| | Class A | 10,500 | 673 |

| | CBS Corp. Class B | 10,700 | 665 |

| † | Viacom Inc. Class B | 7,550 | 655 |

| † | TJX Cos. Inc. | 11,100 | 590 |

| † | Dana Holding Corp. | 21,980 | 537 |

| | Thor Industries Inc. | 6,155 | 350 |

| | AMC Entertainment | | |

| | Holdings Inc. | 9,800 | 244 |

| | | | 37,274 |

| Consumer Staples (5.4%) | | |

| † | Herbalife Ltd. | 19,600 | 1,265 |

| † | Keurig Green Mountain Inc. | 10,100 | 1,258 |

| † | Tyson Foods Inc. Class A | 32,700 | 1,227 |

| † | Sanderson Farms Inc. | 12,600 | 1,225 |

| * † | Pilgrim’s Pride Corp. | 44,100 | 1,207 |

| † | Kroger Co. | 24,100 | 1,191 |

| † | Andersons Inc. | 22,450 | 1,158 |

| | Kimberly-Clark Corp. | 10,000 | 1,112 |

| * † | Rite Aid Corp. | 145,900 | 1,046 |

| | Dr Pepper Snapple | | |

| | Group Inc. | 11,300 | 662 |

| | Archer-Daniels-Midland Co. | 11,100 | 490 |

| | Kraft Foods Group Inc. | 8,000 | 480 |

| * | WhiteWave Foods Co. | | |

| | Class A | 11,972 | 387 |

| * | Sprouts Farmers | | |

| | Market Inc. | 11,300 | 370 |

| | | | 13,078 |

| Energy (6.4%) | | |

| † | SM Energy Co. | 15,800 | 1,329 |

| * † | Matador Resources Co. | 45,200 | 1,323 |

| * † | Clayton Williams Energy Inc. | 9,600 | 1,319 |

| * † | Kosmos Energy Ltd. | 114,100 | 1,281 |

| † | Exterran Holdings Inc. | 27,900 | 1,255 |

| † | ConocoPhillips | 14,600 | 1,252 |

| | Chesapeake Energy Corp. | 40,000 | 1,243 |

| † | Helmerich & Payne Inc. | 10,600 | 1,231 |

| † | Green Plains Inc. | 35,700 | 1,173 |

| | Valero Energy Corp. | 19,800 | 992 |

11

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | SEACOR Holdings Inc. | 11,800 | 971 |

| † | Hess Corp. | 8,500 | 841 |

| | RPC Inc. | 32,500 | 763 |

| † | Western Refining Inc. | 19,680 | 739 |

| | | | 15,712 |

| Financials (13.5%) | | |

| * † | Popular Inc. | 37,900 | 1,295 |

| † | International Bancshares | | |

| | Corp. | 46,800 | 1,264 |

| | Fidelity & Guaranty Life | 52,400 | 1,254 |

| † | Nelnet Inc. Class A | 29,600 | 1,226 |

| * † | KCG Holdings Inc. Class A | 102,800 | 1,221 |

| † | Voya Financial Inc. | 33,100 | 1,203 |

| † | Montpelier Re Holdings Ltd. | 37,600 | 1,201 |

| | RenaissanceRe Holdings Ltd. | 11,200 | 1,198 |

| † | KeyCorp | 83,100 | 1,191 |

| | AmTrust Financial | | |

| | Services Inc. | 27,500 | 1,150 |

| † | Everest Re Group Ltd. | 7,100 | 1,140 |

| † | Ameriprise Financial Inc. | 9,300 | 1,116 |

| † | PrivateBancorp Inc. | 37,800 | 1,099 |

| † | Unum Group | 31,400 | 1,092 |

| | Lincoln National Corp. | 21,100 | 1,085 |

| * † | Western Alliance Bancorp | 43,800 | 1,042 |

| * † | Portfolio Recovery | | |

| | Associates Inc. | 16,100 | 958 |

| | Aspen Insurance | | |

| | Holdings Ltd. | 20,600 | 936 |

| † | Washington Federal Inc. | 40,600 | 911 |

| | Comerica Inc. | 17,500 | 878 |

| † | Regions Financial Corp. | 81,700 | 868 |

| † | Platinum Underwriters | | |

| | Holdings Ltd. | 13,200 | 856 |

| | Huntington Bancshares Inc. | 87,400 | 834 |

| † | Torchmark Corp. | 10,100 | 827 |

| | Astoria Financial Corp. | 61,300 | 825 |

| * † | Credit Acceptance Corp. | 6,684 | 823 |

| | StanCorp Financial Group Inc. | 12,800 | 819 |

| * | World Acceptance Corp. | 10,650 | 809 |

| | Assurant Inc. | 10,500 | 688 |

| | Travelers Cos. Inc. | 7,100 | 668 |

| | Lazard Ltd. Class A | 9,300 | 480 |

| | XL Group plc Class A | 14,100 | 461 |

| | Cathay General Bancorp | 17,000 | 435 |

| | American Express Co. | 3,900 | 370 |

| † | Goldman Sachs Group Inc. | 2,200 | 368 |

| | FBL Financial Group Inc. | | |

| | Class A | 5,700 | 262 |

| | | | 32,853 |

| Health Care (9.1%) | | |

| * † | Quintiles Transnational | | |

| | Holdings Inc. | 24,100 | 1,284 |

| * † | Centene Corp. | 16,800 | 1,270 |

| † | WellPoint Inc. | 11,000 | 1,184 |

| * † | Charles River Laboratories | | |

| | International Inc. | 22,100 | 1,183 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * † | PAREXEL International | | |

| | Corp. | 21,400 | 1,131 |

| † | AbbVie Inc. | 20,000 | 1,129 |

| * † | Mylan Inc. | 21,800 | 1,124 |

| † | Select Medical Holdings | | |

| | Corp. | 71,200 | 1,111 |

| | Kindred Healthcare Inc. | 44,400 | 1,026 |

| * | CorVel Corp. | 22,300 | 1,008 |

| † | Eli Lilly & Co. | 15,400 | 957 |

| * † | Endo International plc | 13,500 | 945 |

| † | Chemed Corp. | 9,600 | 900 |

| * † | HCA Holdings Inc. | 15,355 | 866 |

| | Omnicare Inc. | 13,000 | 865 |

| * † | Bruker Corp. | 34,900 | 847 |

| * | Boston Scientific Corp. | 64,800 | 827 |

| * | Covance Inc. | 9,300 | 796 |

| * | MedAssets Inc. | 31,100 | 710 |

| * † | CareFusion Corp. | 15,800 | 701 |

| † | ResMed Inc. | 12,800 | 648 |

| * | VCA Inc. | 14,800 | 519 |

| * | Myriad Genetics Inc. | 9,600 | 374 |

| † | West Pharmaceutical | | |

| | Services Inc. | 7,400 | 312 |

| * † | Isis Pharmaceuticals Inc. | 7,000 | 241 |

| | CR Bard Inc. | 1,600 | 229 |

| | | | 22,187 |

| Industrials (16.9%) | | |

| † | Trinity Industries Inc. | 29,840 | 1,305 |

| † | Pitney Bowes Inc. | 45,500 | 1,257 |

| * † | Greenbrier Cos. Inc. | 21,800 | 1,256 |

| | AAON Inc. | 37,000 | 1,240 |

| * | Avis Budget Group Inc. | 20,700 | 1,236 |

| | SPX Corp. | 11,300 | 1,223 |

| † | Manpowergroup Inc. | 14,300 | 1,213 |

| † | Southwest Airlines Co. | 44,800 | 1,203 |

| * † | Spirit AeroSystems | | |

| | Holdings Inc. Class A | 35,700 | 1,203 |

| † | AMERCO | 4,100 | 1,192 |

| † | Deluxe Corp. | 20,200 | 1,183 |

| † | Alaska Air Group Inc. | 12,410 | 1,180 |

| | Copa Holdings SA Class A | 8,200 | 1,169 |

| * † | H&E Equipment | | |

| | Services Inc. | 31,700 | 1,152 |

| * † | United Rentals Inc. | 10,900 | 1,141 |

| † | CIRCOR International Inc. | 14,800 | 1,141 |

| | Hyster-Yale Materials | | |

| | Handling Inc. | 12,500 | 1,107 |

| † | Oshkosh Corp. | 19,900 | 1,105 |

| † | Northrop Grumman Corp. | 9,230 | 1,104 |

| † | Delta Air Lines Inc. | 28,100 | 1,088 |

| † | Steelcase Inc. Class A | 69,000 | 1,044 |

| † | Huntington Ingalls | | |

| | Industries Inc. | 10,883 | 1,029 |

| | ArcBest Corp. | 22,800 | 992 |

| | West Corp. | 34,300 | 919 |

| | Lennox International Inc. | 10,020 | 897 |

12

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Nortek Inc. | 9,800 | 880 |

| * | JetBlue Airways Corp. | 79,200 | 859 |

| † | Raytheon Co. | 9,100 | 839 |

| † | Lockheed Martin Corp. | 5,200 | 836 |

| † | UniFirst Corp. | 7,800 | 827 |

| † | Masco Corp. | 37,200 | 826 |

| * | Spirit Airlines Inc. | 12,800 | 809 |

| † | Towers Watson & Co. | | |

| | Class A | 7,700 | 803 |

| † | Cintas Corp. | 11,800 | 750 |

| * | AECOM Technology Corp. | 21,700 | 699 |

| † | ITT Corp. | 13,700 | 659 |

| | Boeing Co. | 5,000 | 636 |

| | AAR Corp. | 21,800 | 601 |

| * | Swift Transportation Co. | 18,700 | 472 |

| | Barnes Group Inc. | 12,200 | 470 |

| † | Union Pacific Corp. | 4,300 | 429 |

| † | Manitowoc Co. Inc. | 12,900 | 424 |

| † | Terex Corp. | 8,900 | 366 |

| † | RR Donnelley & Sons Co. | 18,000 | 305 |

| † | Allegion plc | 4,033 | 229 |

| | | | 41,298 |

| Information Technology (19.0%) | |

| * † | Take-Two Interactive | | |

| | Software Inc. | 56,900 | 1,266 |

| * † | Aspen Technology Inc. | 27,100 | 1,257 |

| * † | Manhattan Associates Inc. | 36,400 | 1,253 |

| † | CDW Corp. | 39,200 | 1,250 |

| † | Western Digital Corp. | 13,150 | 1,214 |

| * | Super Micro Computer Inc. | 47,700 | 1,205 |

| * | Electronic Arts Inc. | 33,100 | 1,187 |

| | Lexmark International Inc. | | |

| | Class A | 24,500 | 1,180 |

| † | Heartland Payment | | |

| | Systems Inc. | 28,500 | 1,175 |

| * † | Freescale | | |

| | Semiconductor Ltd. | 49,810 | 1,171 |

| * † | AVG Technologies NV | 58,100 | 1,170 |

| * † | Advanced Micro | | |

| | Devices Inc. | 278,930 | 1,169 |

| * † | SYNNEX Corp. | 16,006 | 1,166 |

| * † | Ciena Corp. | 53,700 | 1,163 |

| * † | RF Micro Devices Inc. | 121,000 | 1,160 |

| † | Computer Sciences Corp. | 18,300 | 1,157 |

| * | iGATE Corp. | 31,500 | 1,146 |

| † | Anixter International Inc. | 11,400 | 1,141 |

| † | Booz Allen Hamilton | | |

| | Holding Corp. Class A | 52,600 | 1,117 |

| † | Broadridge Financial | | |

| | Solutions Inc. | 26,800 | 1,116 |

| | DST Systems Inc. | 11,900 | 1,097 |

| * † | Rambus Inc. | 75,300 | 1,077 |

| * † | Ubiquiti Networks Inc. | 23,400 | 1,057 |

| * | Benchmark Electronics Inc. | 40,400 | 1,029 |

| † | Brocade Communications | | |

| | Systems Inc. | 110,100 | 1,013 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * † | PTC Inc. | 25,500 | 989 |

| * † | Tech Data Corp. | 15,700 | 982 |

| * | SunPower Corp. Class A | 23,900 | 979 |

| † | MAXIMUS Inc. | 22,500 | 968 |

| * | Blackhawk Network | | |

| | Holdings Inc. | 33,600 | 948 |

| * | Alliance Data Systems Corp. | 3,300 | 928 |

| * † | Gartner Inc. | 12,500 | 882 |

| † | Symantec Corp. | 36,500 | 836 |

| † | Jack Henry & Associates Inc. | 13,900 | 826 |

| * | OmniVision Technologies Inc. | 36,400 | 800 |

| † | Avnet Inc. | 17,600 | 780 |

| * | TeleTech Holdings Inc. | 26,900 | 780 |

| * † | Micron Technology Inc. | 19,100 | 629 |

| * | comScore Inc. | 17,300 | 614 |

| | Cypress Semiconductor | | |

| | Corp. | 52,000 | 567 |

| * | ON Semiconductor Corp. | 60,500 | 553 |

| * | CommScope Holding | | |

| | Co. Inc. | 23,900 | 553 |

| * | Cirrus Logic Inc. | 23,700 | 539 |

| * | Unisys Corp. | 19,900 | 492 |

| | IAC/InterActiveCorp | 6,500 | 450 |

| * † | CACI International Inc. | | |

| | Class A | 6,300 | 442 |

| * | Ingram Micro Inc. | 14,700 | 429 |

| * | Acxiom Corp. | 17,800 | 386 |

| * † | Electronics For Imaging Inc. | 5,600 | 253 |

| * | Genpact Ltd. | 13,100 | 230 |

| | Marvell Technology | | |

| | Group Ltd. | 15,200 | 218 |

| † | Accenture plc Class A | 2,500 | 202 |

| | | | 46,191 |

| Materials (6.8%) | | |

| * | Stillwater Mining Co. | 71,800 | 1,260 |

| † | PPG Industries Inc. | 5,951 | 1,251 |

| † | Westlake Chemical Corp. | 14,560 | 1,220 |

| | Cytec Industries Inc. | 11,500 | 1,212 |

| † | LyondellBasell Industries | | |

| | NV Class A | 11,900 | 1,162 |

| | CF Industries Holdings Inc. | 4,700 | 1,130 |

| * † | Berry Plastics Group Inc. | 43,800 | 1,130 |

| | Scotts Miracle-Gro Co. | | |

| | Class A | 16,800 | 955 |

| * | Graphic Packaging | | |

| | Holding Co. | 81,200 | 950 |

| † | NewMarket Corp. | 2,400 | 941 |

| | Sealed Air Corp. | 27,300 | 933 |

| | Avery Dennison Corp. | 17,600 | 902 |

| | Minerals Technologies Inc. | 13,050 | 856 |

| * | Ferro Corp. | 67,900 | 853 |

| | Sherwin-Williams Co. | 2,300 | 476 |

| * | Owens-Illinois Inc. | 13,700 | 475 |

| | Olin Corp. | 16,600 | 447 |

| † | Packaging Corp. of America | 5,000 | 357 |

| | | | 16,510 |

13

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Telecommunication Services (0.8%) | |

| * | Level 3 Communications Inc. | 27,800 | 1,221 |

| † | Verizon Communications Inc. | 9,300 | 455 |

| | Atlantic Tele-Network Inc. | 4,800 | 278 |

| | | | 1,954 |

| Utilities (4.1%) | | |

| | Vectren Corp. | 29,800 | 1,266 |

| † | Edison International | 21,400 | 1,244 |

| | New Jersey Resources Corp. | 21,400 | 1,223 |

| | Entergy Corp. | 14,500 | 1,190 |

| | Ameren Corp. | 27,700 | 1,132 |

| † | Pinnacle West Capital Corp. | 15,900 | 920 |

| | Empire District Electric Co. | 30,700 | 788 |

| † | Portland General Electric Co. | 22,300 | 773 |

| | Otter Tail Corp. | 22,500 | 682 |

| † | UGI Corp. | 13,200 | 667 |

| | Great Plains Energy Inc. | 8,300 | 223 |

| | | | 10,108 |

| Total Common Stocks— | | |

| Long Positions (Cost $182,553) | | 237,165 |

| Common Stocks Sold Short (-97.5%) | |

| Consumer Discretionary (-14.9%) | |

| * | Office Depot Inc. | (222,800) | (1,268) |

| | Abercrombie & Fitch Co. | (28,800) | (1,246) |

| * | Tempur Sealy | | |

| | International Inc. | (20,500) | (1,224) |

| * | DreamWorks Animation | | |

| | SKG Inc. Class A | (52,400) | (1,219) |

| * | Groupon Inc. Class A | (183,900) | (1,217) |

| | International Game | | |

| | Technology | (76,400) | (1,216) |

| | Family Dollar Stores Inc. | (18,300) | (1,210) |

| * | AMC Networks Inc. Class A | (19,400) | (1,193) |

| * | Select Comfort Corp. | (56,700) | (1,171) |

| * | Loral Space & | | |

| | Communications Inc. | (16,100) | (1,170) |

| | General Motors Co. | (32,200) | (1,169) |

| * | HomeAway Inc. | (33,500) | (1,167) |

| * | BJ’s Restaurants Inc. | (33,300) | (1,163) |

| * | Ascent Capital Group Inc. | | |

| | Class A | (17,600) | (1,162) |

| | DR Horton Inc. | (47,000) | (1,155) |

| | American Eagle | | |

| | Outfitters Inc. | (101,300) | (1,137) |

| | Rent-A-Center Inc. | (37,400) | (1,073) |

| | PVH Corp. | (9,100) | (1,061) |

| * | American Axle & | | |

| | Manufacturing | | |

| | Holdings Inc. | (54,700) | (1,033) |

| | Churchill Downs Inc. | (10,800) | (973) |

| * | Toll Brothers Inc. | (26,200) | (967) |

| | Harley-Davidson Inc. | (13,600) | (950) |

| | Signet Jewelers Ltd. | (8,400) | (929) |

| * | Vitamin Shoppe Inc. | (21,300) | (916) |

14

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Darden Restaurants Inc. | (19,800) | (916) |

| * | Panera Bread Co. Class A | (6,100) | (914) |

| * | Amazon.com Inc. | (2,700) | (877) |

| * | LKQ Corp. | (31,000) | (827) |

| * | Chipotle Mexican Grill Inc. | | |

| | Class A | (1,070) | (634) |

| * | Ulta Salon Cosmetics | | |

| | & Fragrance Inc. | (6,850) | (626) |

| | Yum! Brands Inc. | (7,400) | (601) |

| | Coach Inc. | (17,400) | (595) |

| | Dick’s Sporting Goods Inc. | (11,800) | (549) |

| * | TripAdvisor Inc. | (4,900) | (532) |

| * | Discovery | | |

| | Communications Inc. | | |

| | Class A | (7,000) | (520) |

| | Gannett Co. Inc. | (11,500) | (360) |

| * | Liberty Media Corp. Class A | (2,300) | (314) |

| * | Liberty Global plc Class A | (7,100) | (314) |

| * | CarMax Inc. | (5,271) | (274) |

| * | Sally Beauty Holdings Inc. | (10,900) | (273) |

| | Scripps Networks | | |

| | Interactive Inc. Class A | (3,200) | (260) |

| | | | (36,375) |

| Consumer Staples (-4.8%) | | |

| * | Post Holdings Inc. | (24,600) | (1,252) |

| | Coty Inc. Class A | (72,100) | (1,235) |

| * | Darling Ingredients Inc. | (56,800) | (1,187) |

| * | Fresh Market Inc. | (35,400) | (1,185) |

| | B&G Foods Inc. | (34,100) | (1,115) |

| | Estee Lauder Cos. Inc. | | |

| | Class A | (14,200) | (1,054) |

| | Sysco Corp. | (28,050) | (1,050) |

| | Philip Morris | | |

| | International Inc. | (11,100) | (936) |

| | Flowers Foods Inc. | (44,055) | (929) |

| * | Elizabeth Arden Inc. | (42,700) | (915) |

| | Coca-Cola Co. | (7,100) | (301) |

| | Costco Wholesale Corp. | (2,300) | (265) |

| | Whole Foods Market Inc. | (5,100) | (197) |

| | | | (11,621) |

| Energy (-6.1%) | | |

| | Williams Cos. Inc. | (22,500) | (1,310) |

| * | Cheniere Energy Inc. | (17,700) | (1,269) |

| | SemGroup Corp. Class A | (15,600) | (1,230) |

| * | Dresser-Rand Group Inc. | (19,100) | (1,217) |

| | CONSOL Energy Inc. | (26,400) | (1,216) |

| | Energen Corp. | (13,600) | (1,209) |

| * | Cobalt International | | |

| | Energy Inc. | (63,100) | (1,158) |

| * | Antero Resources Corp. | (17,000) | (1,116) |

| | Spectra Energy Corp. | (24,400) | (1,037) |

| * | Gulfport Energy Corp. | (16,500) | (1,035) |

| | Rowan Cos. plc Class A | (24,250) | (774) |

| | National Oilwell Varco Inc. | (8,800) | (725) |

| * | Cameron International Corp. | (9,100) | (616) |

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Concho Resources Inc. | (4,200) | (607) |

| * | Rosetta Resources Inc. | (4,500) | (247) |

| | | | (14,766) |

| Financials (-14.5%) | | |

| * | Virtus Investment | | |

| | Partners Inc. | (6,000) | (1,271) |

| | Prudential Financial Inc. | (13,700) | (1,216) |

| | M&T Bank Corp. | (9,800) | (1,216) |

| | Cincinnati Financial Corp. | (25,300) | (1,215) |

| * | Markel Corp. | (1,850) | (1,213) |

| | Intercontinental | | |

| | Exchange Inc. | (6,400) | (1,209) |

| * | PHH Corp. | (52,400) | (1,204) |

| | UMB Financial Corp. | (18,500) | (1,173) |

| | Sterling Bancorp | (97,500) | (1,170) |

| | Marsh & McLennan | | |

| | Cos. Inc. | (22,100) | (1,145) |

| * | Alleghany Corp. | (2,600) | (1,139) |

| | Leucadia National Corp. | (43,200) | (1,133) |

| | Fidelity National | | |

| | Financial Inc. Class A | (34,500) | (1,130) |

| | Loews Corp. | (25,500) | (1,122) |

| | Bank of the Ozarks Inc. | (33,400) | (1,117) |

| | Hartford Financial Services | | |

| | Group Inc. | (30,500) | (1,092) |

| | Erie Indemnity Co. Class A | (14,500) | (1,091) |

| | Arthur J Gallagher & Co. | (23,400) | (1,090) |

| * | Texas Capital | | |

| | Bancshares Inc. | (20,200) | (1,090) |

| | Zions Bancorporation | (35,700) | (1,052) |

| | Mercury General Corp. | (22,300) | (1,049) |

| | BB&T Corp. | (26,500) | (1,045) |

| | CME Group Inc. | (14,500) | (1,029) |

| | T. Rowe Price Group Inc. | (11,300) | (954) |

| | Eaton Vance Corp. | (25,200) | (952) |

| | FirstMerit Corp. | (48,100) | (950) |

| | BOK Financial Corp. | (14,100) | (939) |

| | Charles Schwab Corp. | (34,800) | (937) |

| | New York Community | | |

| | Bancorp Inc. | (44,600) | (713) |

| | Cullen/Frost Bankers Inc. | (8,800) | (699) |

| | MetLife Inc. | (12,500) | (695) |

| | Solar Capital Ltd. | (24,900) | (530) |

| | Synovus Financial Corp. | (20,442) | (498) |

| | Raymond James | | |

| | Financial Inc. | (8,400) | (426) |

| | CNA Financial Corp. | (8,300) | (336) |

| | City National Corp. | (3,900) | (295) |

| | Union Bankshares Corp. | (9,000) | (231) |

| | | | (35,366) |

| Health Care (-9.5%) | | |

| * | Pacira Pharmaceuticals Inc. | (14,400) | (1,323) |

| * | Medidata Solutions Inc. | (30,800) | (1,319) |

| * | Community Health | | |

| | Systems Inc. | (28,600) | (1,298) |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Portola | | |

| | Pharmaceuticals Inc. | (43,900) | (1,281) |

| * | Synageva BioPharma Corp. | (12,000) | (1,258) |

| | Perrigo Co. plc | (8,200) | (1,195) |

| * | athenahealth Inc. | (9,400) | (1,176) |

| * | BioMarin | | |

| | Pharmaceutical Inc. | (18,800) | (1,169) |

| * | HMS Holdings Corp. | (53,600) | (1,094) |

| * | Allscripts Healthcare | | |

| | Solutions Inc. | (65,500) | (1,051) |

| * | Waters Corp. | (10,000) | (1,044) |

| * | Wright Medical Group Inc. | (32,800) | (1,030) |

| * | Tenet Healthcare Corp. | (21,600) | (1,014) |

| * | Catamaran Corp. | (22,800) | (1,007) |

| * | Volcano Corp. | (56,800) | (1,000) |

| | Patterson Cos. Inc. | (21,800) | (861) |

| * | Varian Medical Systems Inc. | (10,300) | (856) |

| * | Clovis Oncology Inc. | (20,300) | (841) |

| * | TESARO Inc. | (26,600) | (828) |

| | Baxter International Inc. | (11,300) | (817) |

| * | Pharmacyclics Inc. | (6,300) | (565) |

| | DENTSPLY International Inc. | (11,700) | (554) |

| * | Celldex Therapeutics Inc. | (21,800) | (356) |

| * | Intuitive Surgical Inc. | (600) | (247) |

| | | | (23,184) |

| Industrials (-17.8%) | | |

| * | XPO Logistics Inc. | (45,300) | (1,297) |

| * | IHS Inc. Class A | (9,500) | (1,289) |

| * | NCI Building Systems Inc. | (66,100) | (1,284) |

| * | Chart Industries Inc. | (15,400) | (1,274) |

| | Iron Mountain Inc. | (35,000) | (1,241) |

| * | Roadrunner Transportation | | |

| | Systems Inc. | (44,100) | (1,239) |

| * | DXP Enterprises Inc. | (16,200) | (1,224) |

| | Cubic Corp. | (27,200) | (1,211) |

| | Healthcare Services | | |

| | Group Inc. | (40,800) | (1,201) |

| * | Genesee & Wyoming Inc. | | |

| | Class A | (11,400) | (1,197) |

| | MSC Industrial Direct | | |

| | Co. Inc. Class A | (12,300) | (1,176) |

| | Heartland Express Inc. | (54,900) | (1,172) |

| * | Clean Harbors Inc. | (18,200) | (1,169) |

| | Kennametal Inc. | (25,200) | (1,166) |

| | Triumph Group Inc. | (16,600) | (1,159) |

| | CH Robinson | | |

| | Worldwide Inc. | (18,000) | (1,148) |

| | FedEx Corp. | (7,500) | (1,135) |

| * | UTi Worldwide Inc. | (109,300) | (1,130) |

| * | Jacobs Engineering | | |

| | Group Inc. | (21,000) | (1,119) |

| * | Stericycle Inc. | (9,400) | (1,113) |

| * | MRC Global Inc. | (39,000) | (1,103) |

| | Granite Construction Inc. | (30,500) | (1,097) |

| | Raven Industries Inc. | (33,100) | (1,097) |

| | Forward Air Corp. | (22,800) | (1,091) |

15

Market Neutral Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | JB Hunt Transport | | |

| | Services Inc. | (14,700) | (1,085) |

| | Fastenal Co. | (21,700) | (1,074) |

| | Roper Industries Inc. | (7,200) | (1,051) |

| | AZZ Inc. | (22,800) | (1,051) |

| | Precision Castparts Corp. | (3,900) | (984) |

| | TransDigm Group Inc. | (5,800) | (970) |

| * | WESCO International Inc. | (11,200) | (968) |

| * | Atlas Air Worldwide | | |

| | Holdings Inc. | (26,000) | (958) |

| * | Copart Inc. | (26,100) | (939) |

| * | DigitalGlobe Inc. | (33,400) | (929) |

| * | Advisory Board Co. | (17,800) | (922) |

| | Eaton Corp. plc | (11,800) | (911) |

| | Cummins Inc. | (5,100) | (787) |

| | KBR Inc. | (31,200) | (744) |

| | Xylem Inc. | (18,700) | (731) |

| * | Wesco Aircraft Holdings Inc. | (17,500) | (349) |

| | Waste Connections Inc. | (5,750) | (279) |

| | WW Grainger Inc. | (900) | (229) |

| | | | (43,293) |

| Information Technology (-18.9%) | |

| * | ServiceNow Inc. | (21,400) | (1,326) |

| * | Palo Alto Networks Inc. | (15,800) | (1,325) |

| * | Stratasys Ltd. | (11,500) | (1,307) |

| * | Concur Technologies Inc. | (13,800) | (1,288) |

| * | Cornerstone | | |

| | OnDemand Inc. | (27,700) | (1,275) |

| * | salesforce.com inc | (21,780) | (1,265) |

| * | Equinix Inc. | (5,900) | (1,239) |

| | Corning Inc. | (56,100) | (1,231) |

| * | SunEdison Inc. | (54,000) | (1,220) |

| * | Twitter Inc. | (29,400) | (1,204) |

| | Analog Devices Inc. | (22,100) | (1,195) |

| | Altera Corp. | (34,300) | (1,192) |

| * | Dealertrack | | |

| | Technologies Inc. | (25,900) | (1,174) |

| | InterDigital Inc. | (24,500) | (1,171) |

| * | Fortinet Inc. | (46,400) | (1,166) |

| | Microchip Technology Inc. | (23,700) | (1,157) |

| | EMC Corp. | (43,500) | (1,146) |

| | Apple Inc. | (12,150) | (1,129) |

| * | Nuance | | |

| | Communications Inc. | (58,900) | (1,106) |

| | Solera Holdings Inc. | (16,300) | (1,095) |

| | FLIR Systems Inc. | (31,400) | (1,090) |

| * | ViaSat Inc. | (18,700) | (1,084) |

| * | II-VI Inc. | (73,400) | (1,061) |

| * | Trimble Navigation Ltd. | (28,400) | (1,049) |

| * | Cree Inc. | (20,000) | (999) |

| * | Workday Inc. Class A | (10,700) | (962) |

| * | Bottomline | | |

| | Technologies de Inc. | (32,100) | (960) |

| * | Marketo Inc. | (32,900) | (957) |

| * | Rackspace Hosting Inc. | (27,300) | (919) |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Informatica Corp. | (25,500) | (909) |

| | AVX Corp. | (66,700) | (886) |

| * | Citrix Systems Inc. | (14,000) | (876) |

| * | Splunk Inc. | (15,000) | (830) |

| * | Bankrate Inc. | (46,160) | (810) |

| * | BroadSoft Inc. | (29,600) | (781) |

| * | Teradata Corp. | (19,400) | (780) |

| | MKS Instruments Inc. | (24,900) | (778) |

| | Tessera Technologies Inc. | (33,500) | (740) |

| * | SolarWinds Inc. | (18,100) | (700) |

| | Avago Technologies Ltd. | | |

| | Class A | (9,400) | (677) |

| * | Cognex Corp. | (17,600) | (676) |

| * | FleetCor Technologies Inc. | (4,950) | (652) |

| * | Qlik Technologies Inc. | (28,600) | (647) |

| | QUALCOMM Inc. | (8,000) | (634) |

| | Visa Inc. Class A | (2,900) | (611) |

| | Maxim Integrated | | |

| | Products Inc. | (15,300) | (517) |

| | j2 Global Inc. | (5,400) | (275) |

| | | | (46,071) |

| Materials (-6.9%) | | |

| | Allegheny Technologies Inc. | (28,800) | (1,299) |

| * | Flotek Industries Inc. | (39,900) | (1,283) |

| * | SunCoke Energy Inc. | (59,000) | (1,268) |

| * | Coeur Mining Inc. | (135,900) | (1,248) |

| | Royal Gold Inc. | (16,350) | (1,245) |

| * | Boise Cascade Co. | (41,600) | (1,191) |

| * | WR Grace & Co. | (12,200) | (1,153) |

| | Southern Copper Corp. | (37,950) | (1,153) |

| | Freeport-McMoRan | | |

| | Copper & Gold Inc. | (31,200) | (1,139) |

| | Air Products & | | |

| | Chemicals Inc. | (8,650) | (1,113) |

| | Mosaic Co. | (21,000) | (1,038) |

| | Praxair Inc. | (7,600) | (1,010) |

| | FMC Corp. | (13,800) | (982) |

| | Nucor Corp. | (17,300) | (852) |

| | Innophos Holdings Inc. | (10,088) | (581) |

| | Newmont Mining Corp. | (12,400) | (315) |

| | | | (16,870) |

| Telecommunication Services (-0.5%) | |

| * | SBA Communications | | |

| | Corp. Class A | (12,310) | (1,259) |

| | | | (1,259) |

| Utilities (-3.6%) | | |

| | ALLETE Inc. | (23,300) | (1,196) |

| | Pattern Energy Group Inc. | | |

| | Class A | (35,900) | (1,189) |

| | Southern Co. | (25,800) | (1,171) |

| * | Calpine Corp. | (47,200) | (1,124) |

| | South Jersey Industries Inc. | (18,400) | (1,112) |

| | Laclede Group Inc. | (22,700) | (1,102) |

| | FirstEnergy Corp. | (26,100) | (906) |

| * | Dynegy Inc. Class A | (13,800) | (480) |

16

Market Neutral Fund

| | |

| | | Market |

| | | Value |

| | Shares | ($000) |

| American Water | | |

| Works Co. Inc. | (6,500) | (321) |

| ITC Holdings Corp. | (6,900) | (252) |

| | | (8,853) |

| Total Common Stocks Sold Short | |

| (Proceeds $211,732) | | (237,658) |

| Temporary Cash Investment (6.4%) | |

| Money Market Fund (6.4%) | | |

| 1 Vanguard Market | | |

| Liquidity Fund, 0.111% | | |

| (Cost $15,635) | 15,634,630 | 15,635 |

| † Other Assets and Liabilities— | |

| Net (93.8%) | | 228,588 |

| Net Assets (100%) | | 243,730 |

| |

| | Amount |

| | ($000) |

| Statement of Assets and Liabilities | |

| Assets | |

| Investment in Securities, | |

| Long Positions, at Value | |

| Unaffiliated Issuers | 237,165 |

| Affiliated Vanguard Funds | 15,635 |

| Total Long Positions | 252,800 |

| Cash Segregated for Short Positions | 227,689 |

| Receivables for Securities Sold | 11,888 |

| Other Assets | 648 |

| Total Assets | 493,025 |

| Liabilities | |

| Securities Sold Short, at Value | 237,658 |

| Payables for Securities Purchased | 11,276 |

| Other Liabilities | 361 |

| Total Liabilities | 249,295 |

| Net Assets (100%) | 243,730 |

| |

| At June 30, 2014, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 236,753 |

| Accumulated Net Investment Losses | (652) |

| Accumulated Net Realized Losses | (21,057) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities—Long Positions | 54,612 |

| Investment Securities Sold Short | (25,926) |

| Net Assets | 243,730 |

| |

| |

| Investor Shares—Net Assets | |

| Applicable to 18,185,764 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 206,292 |

| Net Asset Value Per Share— | |

| Investor Shares | $11.34 |

| |

| |

| Institutional Shares—Net Assets | |

| Applicable to 3,316,398 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 37,438 |

| Net Asset Value Per Share— | |

| Institutional Shares | $11.29 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

† Long security positions with a value of $145,126,000 and cash of $227,689,000 are held in a segregated account at the fund’s custodian

bank and pledged to a broker-dealer as collateral for the fund’s obligation to return borrowed securities. For so long as such obligations

continue, the fund’s access to these assets is subject to authorization from the broker-dealer.

1 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is

the 7-day yield.

See accompanying Notes, which are an integral part of the Financial Statements.

17

Market Neutral Fund

Statement of Operations

| |

| | Six Months Ended |

| | June 30, 2014 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 1,352 |

| Interest1 | 2 |

| Total Income | 1,354 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 99 |

| Management and Administrative—Investor Shares | 112 |

| Management and Administrative—Institutional Shares | 4 |

| Marketing and Distribution—Investor Shares | 23 |

| Marketing and Distribution—Institutional Shares | 5 |

| Custodian Fees | 13 |

| Shareholders’ Reports—Investor Shares | 1 |

| Shareholders’ Reports—Institutional Shares | — |

| Dividend Expense on Securities Sold Short | 1,442 |

| Borrowing Expense on Securities Sold Short | 202 |

| Total Expenses | 1,901 |

| Net Investment Income (Loss) | (547) |

| Realized Net Gain (Loss) | |

| Investment Securities—Long Positions | 19,619 |

| Investment Securities Sold Short | (13,170) |

| Realized Net Gain (Loss) | 6,449 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities—Long Positions | (1,663) |

| Investment Securities Sold Short | 1,909 |

| Change in Unrealized Appreciation (Depreciation) | 246 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 6,148 |

| 1 Interest income from an affiliated company of the fund was $2,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

18

Market Neutral Fund

Statement of Changes in Net Assets

| | |

| | Six Months Ended | Year Ended |

| | June 30, | December 31, |

| | 2014 | 2013 |

| | ($000) | ($000) |

| Increase (Decrease) In Net Assets | | |

| Operations | | |

| Net Investment Income (Loss) | (547) | (88) |

| Realized Net Gain (Loss) | 6,449 | 8,423 |

| Change in Unrealized Appreciation (Depreciation) | 246 | 9,099 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 6,148 | 17,434 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | — | (33) |

| Institutional Shares | — | (8) |

| Realized Capital Gain | | |

| Investor Shares | — | — |

| Institutional Shares | — | — |

| Return of Capital | | |

| Investor Shares | — | (16) |

| Institutional Shares | — | (4) |

| Total Distributions | — | (61) |

| Capital Share Transactions | | |

| Investor Shares | 27,529 | 7,869 |

| Institutional Shares | 1,251 | 1,333 |

| Net Increase (Decrease) from Capital Share Transactions | 28,780 | 9,202 |

| Total Increase (Decrease) | 34,928 | 26,575 |

| Net Assets | | |

| Beginning of Period | 208,802 | 182,227 |

| End of Period1 | 243,730 | 208,802 |

| 1 Net Assets—End of Period includes accumulated net investment losses of ($652,000) and ($105,000). |

See accompanying Notes, which are an integral part of the Financial Statements.

19

Market Neutral Fund

Financial Highlights

| | | | | | |

| Investor Shares | | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | June 30, | | | Year Ended December 31, |

| Throughout Each Period | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $11.03 | $10.16 | $10.36 | $9.61 | $9.71 | $10.97 |

| Investment Operations | | | | | | |

| Net Investment Income (Loss) | (.025) | (.007) | .045 | (.024) | (.038)1 | (.105) |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments2 | .335 | .880 | (.200) | .774 | (.062) | (1.143) |

| Total from Investment Operations | .310 | .873 | (.155) | .750 | (.100) | (1.248) |

| Distributions | | | | | | |

| Dividends from Net Investment Income | — | (.002) | (.045) | — | — | (.012) |

| Distributions from Realized Capital Gains — | — | — | — | — | — |

| Return of Capital | — | (.001) | — | — | — | — |

| Total Distributions | — | (.003) | (.045) | — | — | (.012) |

| Net Asset Value, End of Period | $11.34 | $11.03 | $10.16 | $10.36 | $9.61 | $9.71 |

| |

| Total Return3 | 2.81% | 8.59% | -1.50% | 7.80% | -1.03% | -11.38% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $206 | $174 | $151 | $158 | $116 | $53 |

| Ratio of Expenses to Average Net Assets | | | | | |

| Based on Total Expenses4,5 | 1.74% | 1.57% | 1.88% | 1.69% | 1.84% | 2.80% |

| Net of Dividend and Borrowing Expense | | | | | | |

| on Securities Sold Short4 | 0.25% | 0.25% | 0.25% | 0.25% | 0.30% | 0.39% |

| Ratio of Net Investment Income (Loss) | | | | | | |

| to Average Net Assets | (0.51%) | (0.06%) | 0.44% | (0.22%) | (0.38%) | (0.97%) |

| Portfolio Turnover Rate | 73% | 68% | 89% | 91% | 153% | 142% |

The expense ratio, net income ratio, and turnover rate for the current period have been annualized.

1 Calculated based on average shares outstanding.

2 Includes increases from redemption fees of $.00, $.00, $.00, $.00, $.00, and $.04. Effective May 23, 2012, the redemption fee was

eliminated.

3 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide

information about any applicable transaction and account service fees.

4 Includes performance-based advisory fee increases (decreases) of (0.07%) for fiscal 2010 and (0.10%) for fiscal 2009. Performance-based

investment advisory fees did not apply after fiscal 2010.

5 Includes 2014 dividend and borrowing expense on securities sold short of 1.31% and 0.18%, respectively. Includes 2013 dividend and

borrowing expense on securities sold short of 1.18% and 0.14%, respectively. Includes 2012 dividend and borrowing expense on securities

sold short of 1.52% and 0.11%, respectively. Includes 2011 dividend and borrowing expense on securities sold short of 1.30% and 0.14%,

respectively. Includes 2010 dividend and borrowing expense on securities sold short of 1.49% and 0.05%, respectively. Includes 2009

dividend and borrowing expense on securities sold short of 1.42% and 0.99%, respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

20

Market Neutral Fund

Financial Highlights

| | | | | | |

| Institutional Shares | | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | June 30, | | | Year Ended December 31, |

| Throughout Each Period | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $10.97 | $10.10 | $10.33 | $9.57 | $9.66 | $10.90 |

| Investment Operations | | | | | | |

| Net Investment Income (Loss) | (.020) | .006 | .071 | (.010) | (.015)1 | (.093) |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments2 | .340 | .868 | (.215) | .770 | (.075) | (1.139) |

| Total from Investment Operations | .320 | .874 | (.144) | .760 | (.090) | (1.232) |

| Distributions | | | | | | |

| Dividends from Net Investment Income | — | (.003) | (.086) | — | — | (.008) |

| Distributions from Realized Capital Gains | — | — | — | — | — | — |

| Return of Capital | — | (.001) | — | — | — | — |

| Total Distributions | — | (.004) | (.086) | — | — | (.008) |

| Net Asset Value, End of Period | $11.29 | $10.97 | $10.10 | $10.33 | $9.57 | $9.66 |

| |

| Total Return3 | 2.92% | 8.66% | -1.39% | 7.94% | -0.93% | -11.31% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $37 | $35 | $31 | $16 | $3 | $16 |

| Ratio of Expenses to Average Net Assets | | | | | |

| Based on Total Expenses4,5 | 1.64% | 1.47% | 1.78% | 1.59% | 1.74% | 2.73% |

| Net of Dividend and Borrowing Expense | | | | | | |

| on Securities Sold Short4 | 0.15% | 0.15% | 0.15% | 0.15% | 0.20% | 0.32% |

| Ratio of Net Investment Income (Loss) | | | | | | |

| to Average Net Assets | (0.41%) | 0.04% | 0.54% | (0.12%) | (0.28%) | (0.90%) |

| Portfolio Turnover Rate | 73% | 68% | 89% | 91% | 153% | 142% |

The expense ratio, net income ratio, and turnover rate for the current period have been annualized.

1 Calculated based on average shares outstanding.

2 Includes increases from redemption fees of $.00, $.00, $.00, $.00, $.00, and $.03. Effective May 23, 2012, the redemption fee was

eliminated.

3 Total returns do not include transaction fees that may have applied in the periods shown. Fund prospectuses provide information about

any applicable transaction fees.

4 Includes performance-based advisory fee increases (decreases) of (0.07%) for fiscal 2010 and (0.10%) for fiscal 2009. Performance-based

investment advisory fees did not apply after fiscal 2010.

5 Includes 2014 dividend and borrowing expense on securities sold short of 1.31% and 0.18%, respectively. Includes 2013 dividend and

borrowing expense on securities sold short of 1.18% and 0.14%, respectively. Includes 2012 dividend and borrowing expense on securities

sold short of 1.52% and 0.11%, respectively. Includes 2011 dividend and borrowing expense on securities sold short of 1.30% and 0.14%,

respectively. Includes 2010 dividend and borrowing expense on securities sold short of 1.49% and 0.05%, respectively. Includes 2009

dividend and borrowing expense on securities sold short of 1.42% and 0.99%, respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Market Neutral Fund

Notes to Financial Statements

Vanguard Market Neutral Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares, Investor Shares and Institutional Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Institutional Shares are designed for investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

2. Short Sales: Short sales are the sales of securities that the fund does not own. The fund sells a security it does not own in anticipation of a decline in the value of that security. In order to deliver the security to the purchaser, the fund borrows the security from a broker-dealer. The fund must segregate, as collateral for its obligation to return the borrowed security, an amount of cash and long security positions at least equal to the market value of the security sold short. This results in the fund holding a significant portion of its assets in cash. The fund later closes out the position by returning the security to the lender, typically by purchasing the security in the open market. A gain, limited to the price at which the fund sold the security short, or a loss, theoretically unlimited in size, is recognized upon the termination of the short sale. The fund may receive a portion of the income from the investment of collateral, or be charged a fee on borrowed securities, based on the market value of each borrowed security and a variable rate that is dependent upon the availability of such security. The net amounts of income or fees are recorded as interest income (for net income received) or borrowing expense on securities sold short (for net fees charged) on the Statement of Operations. Dividends on securities sold short are reported as an expense in the Statement of Operations.

Cash collateral segregated for securities sold short is recorded as an asset in the Statement of Assets and Liabilities. Long security positions segregated as collateral are shown in the Statement of Net Assets.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (December 31, 2010–2013), and for the period ended June 30, 2014, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Credit Facility: The fund and certain other funds managed by The Vanguard Group participate in a $2.89 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.06% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of

22

Market Neutral Fund

trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate equal to the higher of the federal funds rate or LIBOR reference rate plus an agreed-upon spread.

The fund had no borrowings outstanding at June 30, 2014, or at any time during the period then ended.

6. Other: Dividend income (or dividend expense on short positions) is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund on methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At June 30, 2014, the fund had contributed capital of $24,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.01% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At June 30, 2014, 100% of the market value of the fund’s investments was based on Level 1 inputs.

D. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at December 31, 2013, the fund had available capital losses totaling $27,320,000 to offset future net capital gains. Of this amount, $24,465,000 is subject to expiration dates; $19,593,000 may be used to offset future net capital gains through December 31, 2017, and $4,872,000 through December 31, 2018. Capital losses of $2,855,000 realized beginning in fiscal 2011 may be carried

23

Market Neutral Fund

forward indefinitely under the Regulated Investment Company Modernization Act of 2010, but must be used before any expiring loss carryforwards. The fund will use these capital losses to offset net taxable gains, if any, realized during the year ended December 31, 2014; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balance above.

At June 30, 2014, the cost of long security positions for tax purposes was $198,188,000. Net unrealized appreciation of long security positions for tax purposes was $54,612,000, consisting of unrealized gains of $56,216,000 on securities that had risen in value since their purchase and $1,604,000 in unrealized losses on securities that had fallen in value since their purchase. Tax-basis net unrealized depreciation on securities sold short was $25,926,000, consisting of unrealized gains of $7,918,000 on securities that had fallen in value since their sale and $33,844,000 in unrealized losses on securities that had risen in value since their sale.

E. During the six months ended June 30, 2014, the fund purchased $97,377,000 of investment securities and sold $79,218,000 of investment securities, other than temporary cash investments. The proceeds of short sales and the cost of purchases to cover short sales were $107,467,000 and $82,387,000 respectively.

F. Capital share transactions for each class of shares were:

| | | | |

| | Six Months Ended | | Year Ended |

| | | June 30, 2014 | December 31, 2013 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 36,034 | 3,204 | 79,310 | 7,510 |

| Issued in Lieu of Cash Distributions | — | — | 49 | 5 |

| Redeemed | (8,505) | (766) | (71,490) | (6,637) |

| Net Increase (Decrease)—Investor Shares | 27,529 | 2,438 | 7,869 | 878 |

| Institutional Shares | | | | |

| Issued | 1,301 | 115 | 3,557 | 335 |

| Issued in Lieu of Cash Distributions | — | — | 12 | 1 |

| Redeemed | (50) | (4) | (2,236) | (212) |

| Net Increase (Decrease)—Institutional Shares | 1,251 | 111 | 1,333 | 124 |

At June 30, 2014, the Vanguard Managed Payout Fund was the record or beneficial owner of 63% of the fund’s net assets. If the shareholder were to redeem its investment in the fund, the redemption might result in an increase in the fund’s expense ratio, cause the fund to incur higher transaction costs, or lead to the realization of taxable capital gains.

G. Management has determined that no material events or transactions occurred subsequent to June 30, 2014, that would require recognition or disclosure in these financial statements.

24

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.