UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-22114 | |

Name of Registrant: | Vanguard Montgomery Funds | |

Address of Registrant: | P.O. Box 2600 | |

| Valley Forge, PA 19482 | ||

Name and address of agent for service: | Heidi Stam, Esquire | |

| P.O. Box 876 | ||

| Valley Forge, PA 19482 | ||

Registrant’s telephone number, including area code: (610) 669-1000 | ||

Date of fiscal year end: December 31 | ||

Date of reporting period: January 1, 2015 – June 30, 2015 | ||

Item 1: Reports to Shareholders | ||

Semiannual Report | June 30, 2015

Vanguard Market Neutral Fund

The mission continues

On May 1, 1975, Vanguard began operations, a fledgling company based on the simple but revolutionary idea that a mutual fund company should be managed solely in the interest of its investors.

Four decades later, that revolutionary spirit continues to animate the enterprise. Vanguard remains on a mission to give investors the best chance of investment success.

As we mark our 40th anniversary, we thank you for entrusting your assets to Vanguard and giving us the opportunity to help you reach your financial goals in the decades to come.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 7 |

| Fund Profile. | 9 |

| Performance Summary. | 11 |

| Financial Statements. | 12 |

| About Your Fund’s Expenses. | 27 |

| Trustees Approve Advisory Arrangement. | 29 |

| Glossary. | 30 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Since our founding, Vanguard has drawn inspiration from the enterprise and valor demonstrated by British

naval hero Horatio Nelson and his command at the Battle of the Nile in 1798. The photograph displays a replica of a merchant

ship from the same era as Nelson’s flagship, the HMS Vanguard.

Your Fund’s Total Returns

| Six Months Ended June 30, 2015 | |

| Total | |

| Returns | |

| Vanguard Market Neutral Fund | |

| Investor Shares | -1.13% |

| Institutional Shares | -1.14 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.00 |

| Alternative Equity Market Neutral Funds Average | -0.76 |

Alternative Equity Market Neutral Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria.

Your Fund’s Performance at a Glance

December 31, 2014, Through June 30, 2015

| Distributions Per Share | ||||

| Starting | Ending | Income | Capital | |

| Share Price | Share Price | Dividends | Gains | |

| Vanguard Market Neutral Fund | ||||

| Investor Shares | $11.50 | $11.37 | $0.000 | $0.000 |

| Institutional Shares | 11.45 | 11.32 | 0.000 | 0.000 |

1

Chairman’s Letter

Dear Shareholder,

After handily outpacing both its benchmark and peer funds in 2014, Vanguard Market Neutral Fund fell a step behind its comparative standards in the first half of 2015.

The Market Neutral Fund’s Investor Shares returned –1.13% for the six months ended June 30, 2015; Institutional Shares returned –1.14%. Returns for Investor Shares were slightly better because of the transitory effects of rounding procedures. Over longer periods, the lower-cost Institutional Shares have had—and can be expected to continue to have—higher total returns.

The fund’s benchmark, the Citigroup Three-Month U.S. Treasury Bill Index, returned 0.00%, and its peer funds, on average, returned –0.76%. The broad stock market delivered a modest advance for the six months. The fund’s objective isn’t to outperform the equity market, but rather to be neutral to stock market conditions and produce returns that, over time, exceed the returns of 3-month Treasury bills.

On the whole, the fund’s information technology and energy stocks fared well. But those successes were offset by disappointing results from a diverse range of holdings, including retailers and building supply companies.

2

U.S. stocks held onto gains despite fading at the finish

U.S. stocks traveled a choppy course en route to a return of about 2% for the half year as Greece’s debt drama intensified. Mixed economic news, stock valuations perceived as high by some investors, and the strong U.S. dollar’s negative effect on the profits of U.S.-based multinational companies also unsettled markets. However, investors seemed reassured by the Federal Reserve’s careful approach to potentially raising short-term interest rates, other nations’ monetary stimulus programs, and corporate earnings that generally surpassed forecasts.

International stocks returned about 5% for U.S. investors; results would have been higher if not for the dollar’s strength against many foreign currencies. Returns for the developed markets of the Pacific region, led by Japan, surpassed those of Europe and emerging markets.

After bursting from the gate, bond prices lost momentum

Strong results in January didn’t hold up for the broad U.S. taxable bond market, which returned –0.10% for the half year after declining in four of the six months. The yield of the 10-year Treasury note ended June at 2.33%, up from 2.19% six months earlier. (Bond prices and yields move in opposite directions.)

| Market Barometer | |||

| Total Returns | |||

| Periods Ended June 30, 2015 | |||

| Six | One | Five Years | |

| Months | Year | (Annualized) | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 1.71% | 7.37% | 17.58% |

| Russell 2000 Index (Small-caps) | 4.75 | 6.49 | 17.08 |

| Russell 3000 Index (Broad U.S. market) | 1.94 | 7.29 | 17.54 |

| FTSE All-World ex US Index (International) | 4.61 | -4.36 | 8.16 |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | -0.10% | 1.86% | 3.35% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 0.11 | 3.00 | 4.50 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.00 | 0.02 | 0.05 |

| CPI | |||

| Consumer Price Index | 1.63% | 0.12% | 1.83% |

3

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –5.43% as the dollar’s strength limited returns. Without this currency effect, returns were just marginally negative. As investors grew more confident about Europe’s economic growth, European bond yields bounced back from their very low (and in some cases, negative) levels.

Returns were negligible for money market funds and savings accounts, which remained handcuffed by the Fed’s target of 0%–0.25% for short-term rates.

When a stock is sold short, a big advance hurts returns

Compared with traditional mutual funds, the Market Neutral Fund’s investing approach is distinctive because of its extensive use of short selling. This technique aims to profit from a decline in a stock’s price; it’s the opposite of the more familiar long approach, in which investors buy stocks they believe will rise in value. Investors don’t own the stocks they’re shorting. Instead, they borrow the shares and sell them, in hopes of returning them at a lower price.

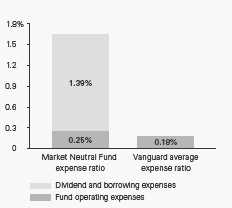

| A closer look at your fund’s expenses |

| By Vanguard standards, the Market Neutral |

| Fund’s 1.64% expense ratio looks like an |

| outlier. Why is it so much higher than our |

| average of 0.18%? The answer has to do |

| with short selling, which your fund uses to |

| “neutralize,” or limit, the effect of stock |

| market movements on returns. |

| Short selling involves selling borrowed |

| shares with the hope of buying them back |

| at a lower price and profiting from the |

| difference. When a cash dividend is declared |

| on a stock the fund has sold short, the fund |

| must pay an amount equal to that dividend |

| to the lender of the stock. That payment gets |

| recorded as an expense. The fund also incurs |

| borrowing costs on short sales. |

| Of course, the fund’s advisor anticipates that |

| returns on the shares sold short will, on the |

| whole, more than offset these costs. In the |

| advisor’s view, the outlook for these shares |

| is poor, and the fund can benefit from their |

| potential decline. Excluding borrowing and |

| dividend expenses on shares sold short, |

| your fund’s total annual operating expenses |

| are a much more Vanguard-like 0.25%. |

| Notes: Market Neutral Fund expense data are for Investor Shares |

| according to the prospectus dated April 28, 2015. The Vanguard |

| average expense ratio is as of December 31, 2014. |

| Source: Vanguard. |

4

The Market Neutral Fund combines short investments with long investments to offset them. This can enhance the diversification of a portfolio by providing returns that aren’t closely correlated with the moves of the broad stock market. That, of course, is the goal of the fund; its overall performance reflects the net results of its short and long positions. Your fund’s advisor—Vanguard Equity Investment Group, through its Quantitative Equity Group—uses sophisticated computer models to select both its long and short stocks.

During the six months, the Market Neutral Fund’s performance was hurt, in part, because some of the shares it sold short recorded outsized advances as compared with its long positions. In a sense, short selling turns the typical investing scenario on its head: A portfolio will benefit if its short investments decline relative to its long investments and suffer if they rise relative to its long investments. A diverse collection of short investments in the consumer discretionary and industrial categories had higher returns than the long positions and thus hindered the fund’s overall performance.

However, the value of the fund’s diversification—its investments span the market sectors that make up the broad stock market—was also on display. With both its long and short investments, the advisor notched successes in the technology and energy categories as the long positions outperformed the short positions.

For more about the advisor’s strategy and the fund’s positioning during the six months, please see the Advisor’s Report that follows this letter.

Promoting good corporate governance is one way we protect your interests

Our core purpose is “to take a stand for all investors, to treat them fairly, and to give them the best chance for investment success.” This means more than offering smart investments, trustworthy guidance, and low fees. It also means working with the companies held by Vanguard funds to make sure that your interests remain paramount.

Because promoting good corporate governance supports our core purpose, we want to inform our investors—regardless of which Vanguard fund they may own—about our efforts in this area. As one of the world’s largest investment managers, we are making our voice heard in corporate boardrooms to promote the highest standards of stewardship. Our advocacy encompasses a range of corporate governance issues, including executive compensation and succession planning, board composition and effectiveness, oversight of strategy and risk, and communication with shareholders.

5

We also exert our influence in a very important way when Vanguard funds cast their proxy votes at companies’ shareholder meetings.

We recently concluded a busy proxy voting season, making it an appropriate time to remind you that we work hard to represent your best interests. Good governance, we believe, is essential for any company seeking to maximize its long-term returns to shareholders. You can learn more about our efforts at vanguard.com/corporategovernance.

Thank you for your confidence in Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

July 15, 2015

6

Advisor’s Report

For the semiannual period ended June 30, 2015, U.S. equities slowed their upward march after strong 2014 results but continued to gain. The broad U.S. equity market rose about 2%, small-capitalization stocks bettered large-caps by about 3 percentage points, and growth-oriented companies outpaced their value counterparts by about 5 percentage points. Globally, international markets outpaced the United States, and developed markets surpassed emerging markets. Performance in the U.S. market was mixed—six out of ten sector groups generated positive returns. Results were best in health care, consumer discretionary, and telecommunication services; utilities, energy, and industrials were negative.

In this environment, the Market Neutral Fund returned –1.13% for Investor Shares. It is important to remember that the fund’s strategy is not to outperform the equity market. Rather, its goal is to be neutral to market conditions and produce results that exceed the returns of 3-month U.S. Treasury bills.

In the first quarter of 2015, the U.S. economy weakened as GDP contracted 0.2% against the fourth quarter of last year’s annual growth rate of 2.6%. Deceleration in consumption along with decreases in exports, nonresidential fixed investment, and spending by state and local governments all weighed on growth. However, nonfarm payroll employment rose by 223,000 in June, and the unemployment rate declined to 5.3%.

The economy faced various stumbling blocks, including harsh winter weather that hindered personal consumption and a strong U.S. dollar that dampened exports. As oil prices fell, corporate spending dropped substantially, particularly in the energy sector. Another source of uncertainty was the timing and degree of the Federal Reserve’s decision to increase interest rates—an event that hasn’t occurred but is widely anticipated. Other noteworthy developments contributed to increased market volatility in June and into July. Discussions about finances and reforms between Greece and the euro zone heightened investors’ sense of risk. And large fluctuations in China’s stock market spilled over to other parts of the world. Recent trading suspensions that led to substantial price movement in Chinese equities have unnerved global markets; it remains to be seen whether government intervention will add stability.

Our stock selection model was not effective in identifying industry group leaders and laggards for the period. Although our long positions boosted performance, our negative return from the short portfolio outweighed this effect. Our growth model was the only positive contributor. The other four signals did not perform as expected; valuation did worst, followed by management decisions, quality, and sentiment.

7

At the sector level, we were successful in only three of ten groups. Results were strongest in energy and information technology; consumer discretionary and industrial selections detracted the most.

Long positions in Newfield Exploration and Valero Energy and short positions in Bonanza Creek Energy and Eclipse Resources led results in energy. In information technology, long positions in Freescale Semiconductor and Ambarella and short positions in CommVault Systems and Knowles drove returns. Negative results in the consumer discretionary sector were driven by long positions in Lands’ End and Vince Holding and short positions in Meritage Homes and Men’s Wearhouse. Long positions in Meritor and ArcBest and short positions in Interface and Beacon Roofing Supply detracted most from industrials.

James D. Troyer, CFA, Principal,

Portfolio Manager

James P. Stetler, Principal,

Portfolio Manager

Michael R. Roach, CFA, Portfolio Manager

Vanguard Equity Investment Group

July 24, 2015

8

Market Neutral Fund

Fund Profile

As of June 30, 2015

| Share-Class Characteristics | ||

| Investor Institutional | ||

| Shares | Shares | |

| Ticker Symbol | VMNFX | VMNIX |

| Total Expense Ratio1 | 1.64% | 1.54% |

| Management Expenses | 0.19% | 0.09% |

| Dividend Expenses on | ||

| Securities Sold Short2 | 1.21% | 1.21% |

| Borrowing Expenses on | ||

| Securities Sold Short2 | 0.18% | 0.18% |

| Other Expenses | 0.06% | 0.06% |

| Portfolio Characteristics | ||

| Long | Short | |

| Portfolio | Portfolio | |

| Number of Stocks | 254 | 250 |

| Median Market Cap | $3.7B | $3.7B |

| Price/Earnings Ratio | 16.5x | 49.5x |

| Price/Book Ratio | 2.7x | 2.3x |

| Return on Equity | 14.3% | 11.8% |

| Earnings Growth | ||

| Rate | 15.2% | 10.2% |

| Foreign Holdings | 2.8% | 3.4% |

| Fund Characteristics | |

| Turnover Rate (Annualized) | 67% |

| Short-Term Reserves | 2.1% |

| Volatility Measures | ||

| Citigroup | DJ | |

| Three-Month | U.S. Total | |

| U.S. Treasury | Market | |

| Bill Index | FA Index | |

| R-Squared | 0.00 | 0.01 |

| Beta | 3.34 | 0.04 |

These measures show the degree and timing of the fund’s fluctuations compared with the index over 36 months.

| Sector Diversification (% of equity exposure) | ||

| Long | Short | |

| Portfolio | Portfolio | |

| Consumer Discretionary | 15.0% | 14.9% |

| Consumer Staples | 5.8 | 5.5 |

| Energy | 5.1 | 4.7 |

| Financials | 17.0 | 16.9 |

| Health Care | 12.6 | 12.4 |

| Industrials | 16.4 | 16.3 |

| Information Technology | 16.9 | 17.1 |

| Materials | 5.4 | 5.6 |

| Telecommunication Services | 0.8 | 1.2 |

| Utilities | 5.0 | 5.4 |

1 The total expense ratios shown are from the prospectus dated April 28, 2015, and represent estimated costs for the current fiscal year. For the

six months ended June 30, 2015, the annualized total expense ratios were 1.45% for Investor Shares and 1.36% for Institutional Shares.

2 In connection with a short sale, the fund may receive income or be charged a fee based on the market value of the borrowed stock. When a

cash dividend is declared on a stock the fund has sold short, the fund is required to pay an amount equal to that dividend to the party from which

the fund borrowed the stock and to record the payment of the dividend as an expense.

9

Market Neutral Fund

| Ten Largest Holdings1 (% of total net assets) | ||

| Long Portfolio | ||

| HCA Holdings Inc. | Health Care Facilities | 0.6% |

| INC Research Holdings | Life Sciences Tools & | |

| Inc. | Services | 0.6 |

| Electronic Arts Inc. | Home Entertainment | |

| Software | 0.6 | |

| Centene Corp. | Managed Health | |

| Care | 0.6 | |

| MGIC Investment Corp. | Thrifts & Mortgage | |

| Finance | 0.6 | |

| Penn National Gaming | ||

| Inc. | Casinos & Gaming | 0.5 |

| USANA Health Sciences | ||

| Inc. | Personal Products | 0.5 |

| Credit Acceptance Corp. Consumer Finance | 0.5 | |

| Expedia Inc. | Internet Retail | 0.5 |

| Nordic American | Oil & Gas Storage & | |

| Tankers Ltd. | Transportation | 0.5 |

| Top Ten | 5.5% | |

| Ten Largest Holdings1 (% of total net assets) | ||

| Short Portfolio | ||

| TreeHouse Foods Inc. | Packaged Foods & | |

| Meats | 0.6% | |

| Ultragenyx | ||

| Pharmaceutical Inc. | Biotechnology | 0.6 |

| Beacon Roofing Supply | Trading Companies | |

| Inc. | & Distributors | 0.6 |

| LKQ Corp. | Distributors | 0.6 |

| Demandware Inc. | Internet Software & | |

| Services | 0.6 | |

| Aaron's Inc. | Homefurnishing | |

| Retail | 0.6 | |

| Men's Wearhouse Inc. | Apparel Retail | 0.5 |

| Novavax Inc. | Biotechnology | 0.5 |

| Texas Capital Bancshares | ||

| Inc. | Regional Banks | 0.5 |

| Post Holdings Inc. | Packaged Foods & | |

| Meats | 0.5 | |

| Top Ten | 5.6% | |

1 The holdings listed exclude any temporary cash investments and equity index products.

10

Market Neutral Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

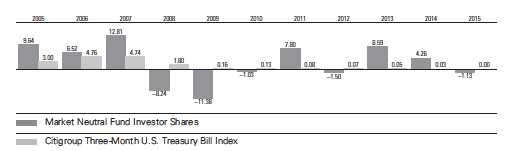

Fiscal-Year Total Returns (%): December 31, 2004, Through June 30, 2015

Average Annual Total Returns: Periods Ended June 30, 2015

| Inception | One | Five | Ten | |

| Date | Year | Years | Years | |

| Investor Shares | 11/11/1998 | 0.26% | 3.16% | 1.85% |

| Institutional Shares | 10/19/1998 | 0.27 | 3.24 | 1.98 |

See Financial Highlights for dividend and capital gains information.

11

Market Neutral Fund

Financial Statements (unaudited)

Statement of Net Assets

As of June 30, 2015

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Common Stocks—Long Positions (95.3%) | |||

| Consumer Discretionary (14.3%) | |||

| *,† | Penn National Gaming Inc. | 112,700 | 2,068 |

| † | Expedia Inc. | 18,800 | 2,056 |

| † | Foot Locker Inc. | 29,600 | 1,984 |

| *,† | Skechers U.S.A. Inc. Class A | 17,900 | 1,965 |

| † | Outerwall Inc. | 25,450 | 1,937 |

| † | Cablevision Systems Corp. | ||

| Class A | 80,800 | 1,934 | |

| † | Caleres Inc. | 60,200 | 1,913 |

| *,† | Madison Square Garden Co. | ||

| Class A | 22,800 | 1,904 | |

| * | Boyd Gaming Corp. | 126,800 | 1,896 |

| † | Marriott Vacations | ||

| Worldwide Corp. | 20,500 | 1,881 | |

| Cato Corp. Class A | 48,400 | 1,876 | |

| † | Big Lots Inc. | 39,400 | 1,773 |

| *,† | O’Reilly Automotive Inc. | 7,800 | 1,763 |

| *,† | American Axle & | ||

| Manufacturing Holdings Inc. | 84,000 | 1,756 | |

| † | Best Buy Co. Inc. | 53,000 | 1,728 |

| † | Jack in the Box Inc. | 18,900 | 1,666 |

| *,† | NVR Inc. | 1,200 | 1,608 |

| † | Home Depot Inc. | 13,900 | 1,545 |

| Cooper Tire & Rubber Co. | 45,500 | 1,539 | |

| * | Lands’ End Inc. | 59,700 | 1,482 |

| † | Marriott International Inc. | ||

| Class A | 19,000 | 1,413 | |

| † | Dana Holding Corp. | 67,780 | 1,395 |

| *,† | Murphy USA Inc. | 24,800 | 1,384 |

| * | Universal Electronics Inc. | 26,900 | 1,341 |

| † | Macy’s Inc. | 19,500 | 1,316 |

| * | Iconix Brand Group Inc. | 49,800 | 1,244 |

| * | BJ’s Restaurants Inc. | 22,900 | 1,110 |

| * | Zumiez Inc. | 40,300 | 1,073 |

| * | Diamond Resorts | ||

| International Inc. | 33,100 | 1,044 | |

| AMC Entertainment | |||

| Holdings Inc. | 26,000 | 798 | |

| † | TJX Cos. Inc. | 11,100 | 734 |

| † | Gap Inc. | 18,900 | 721 |

| Leggett & Platt Inc. | 14,800 | 720 | |

| † | Dillard’s Inc. Class A | 6,670 | 702 |

| *,† | Starz | 15,500 | 693 |

| *,† | Vince Holding Corp. | 54,500 | 653 |

| Walt Disney Co. | 4,900 | 559 | |

| † | Columbia Sportswear Co. | 5,700 | 345 |

| * | Burlington Stores Inc. | 6,400 | 328 |

| 53,847 | |||

| Consumer Staples (5.5%) | |||

| *,† | USANA Health Sciences Inc. | 15,100 | 2,064 |

| † | Cal-Maine Foods Inc. | 36,000 | 1,879 |

| † | Bunge Ltd. | 21,000 | 1,844 |

| † | Sanderson Farms Inc. | 24,200 | 1,819 |

| † | Pilgrim’s Pride Corp. | 78,100 | 1,794 |

| Universal Corp. | 30,800 | 1,765 | |

| *,† | SUPERVALU Inc. | 214,200 | 1,733 |

| Archer-Daniels-Midland Co. | 34,800 | 1,678 | |

| † | Dr Pepper Snapple | ||

| Group Inc. | 18,900 | 1,378 | |

| Kroger Co. | 17,600 | 1,276 | |

| Fresh Del Monte | |||

| Produce Inc. | 32,300 | 1,249 | |

| Vector Group Ltd. | 34,500 | 809 | |

| SpartanNash Co. | 23,800 | 774 | |

| * | Seaboard Corp. | 213 | 767 |

| 20,829 | |||

| Energy (4.9%) | |||

| Nordic American | |||

| Tankers Ltd. | 143,700 | 2,045 | |

| † | Marathon Petroleum Corp. | 37,400 | 1,956 |

| † | Valero Energy Corp. | 30,800 | 1,928 |

| † | Delek US Holdings Inc. | 50,800 | 1,871 |

| *,† | FMSA Holdings Inc. | 226,500 | 1,855 |

| † | Nabors Industries Ltd. | 125,200 | 1,807 |

| † | Tesoro Corp. | 21,300 | 1,798 |

| Alon USA Energy Inc. | 73,300 | 1,385 | |

| † | Green Plains Inc. | 43,800 | 1,207 |

12

Market Neutral Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Western Refining Inc. | 15,300 | 667 | |

| * | FMC Technologies Inc. | 16,000 | 664 |

| * | WPX Energy Inc. | 46,600 | 572 |

| US Silica Holdings Inc. | 19,100 | 561 | |

| 18,316 | |||

| Financials (16.2%) | |||

| *,† | MGIC Investment Corp. | 182,200 | 2,073 |

| *,† | Credit Acceptance Corp. | 8,360 | 2,058 |

| *,† | Western Alliance Bancorp | 59,600 | 2,012 |

| † | Radian Group Inc. | 106,600 | 2,000 |

| † | Associated Banc-Corp | 98,000 | 1,986 |

| † | Lazard Ltd. Class A | 34,800 | 1,957 |

| † | International | ||

| Bancshares Corp. | 72,500 | 1,948 | |

| † | Voya Financial Inc. | 41,500 | 1,929 |

| † | Allied World Assurance Co. | ||

| Holdings AG | 44,500 | 1,923 | |

| † | Validus Holdings Ltd. | 42,900 | 1,887 |

| † | Everest Re Group Ltd. | 10,300 | 1,875 |

| † | PrivateBancorp Inc. | 45,900 | 1,828 |

| Axis Capital Holdings Ltd. | 33,900 | 1,809 | |

| † | KeyCorp | 116,300 | 1,747 |

| † | Reinsurance Group of | ||

| America Inc. Class A | 17,700 | 1,679 | |

| Travelers Cos. Inc. | 17,300 | 1,672 | |

| JPMorgan Chase & Co. | 24,600 | 1,667 | |

| † | AmTrust Financial | ||

| Services Inc. | 25,100 | 1,644 | |

| † | Nelnet Inc. Class A | 37,700 | 1,633 |

| † | Assured Guaranty Ltd. | 66,800 | 1,603 |

| Investment Technology | |||

| Group Inc. | 64,300 | 1,595 | |

| † | Aspen Insurance | ||

| Holdings Ltd. | 33,100 | 1,585 | |

| * | Hilltop Holdings Inc. | 65,800 | 1,585 |

| † | Goldman Sachs Group Inc. | 7,500 | 1,566 |

| † | Capital One Financial Corp. | 17,500 | 1,539 |

| † | Navient Corp. | 81,700 | 1,488 |

| * | Santander Consumer | ||

| USA Holdings Inc. | 54,900 | 1,404 | |

| Wells Fargo & Co. | 23,200 | 1,305 | |

| National General | |||

| Holdings Corp. | 60,400 | 1,258 | |

| Citigroup Inc. | 22,200 | 1,226 | |

| PNC Financial | |||

| Services Group Inc. | 12,600 | 1,205 | |

| * | Arch Capital Group Ltd. | 16,000 | 1,071 |

| † | Huntington Bancshares Inc. | 87,400 | 989 |

| † | Washington Federal Inc. | 40,600 | 948 |

| * | First BanCorp | 166,400 | 802 |

| National Penn | |||

| Bancshares Inc. | 64,000 | 722 | |

| * | World Acceptance Corp. | 10,650 | 655 |

| OM Asset Management plc | 36,700 | 653 | |

| Cathay General Bancorp | 17,000 | 552 | |

| Banco Latinoamericano | |||

| de Comercio Exterior SA | 15,900 | 512 | |

| * | KCG Holdings Inc. Class A | 38,400 | 473 |

| Universal Insurance | |||

| Holdings Inc. | 18,000 | 436 | |

| FBL Financial Group Inc. | |||

| Class A | 5,700 | 329 | |

| 60,828 | |||

| Health Care (12.0%) | |||

| *,† | HCA Holdings Inc. | 23,455 | 2,128 |

| *,† | INC Research Holdings Inc. | ||

| Class A | 52,600 | 2,110 | |

| *,† | Centene Corp. | 26,000 | 2,091 |

| *,† | Merrimack | ||

| Pharmaceuticals Inc. | 161,700 | 2,000 | |

| *,† | PRA Health Sciences Inc. | 53,900 | 1,958 |

| *,† | Natus Medical Inc. | 45,800 | 1,949 |

| † | Ensign Group Inc. | 38,100 | 1,945 |

| *,† | ABIOMED Inc. | 29,200 | 1,919 |

| † | AmerisourceBergen Corp. | ||

| Class A | 17,800 | 1,893 | |

| *,† | Quintiles Transnational | ||

| Holdings Inc. | 26,000 | 1,888 | |

| *,† | NewLink Genetics Corp. | 42,300 | 1,873 |

| *,† | Health Net Inc. | 28,900 | 1,853 |

| *,† | Edwards Lifesciences Corp. | 12,800 | 1,823 |

| † | Anthem Inc. | 11,000 | 1,806 |

| *,† | Lannett Co. Inc. | 28,700 | 1,706 |

| *,† | Depomed Inc. | 76,900 | 1,650 |

| *,† | Charles River Laboratories | ||

| International Inc. | 23,400 | 1,646 | |

| *,† | Alder Biopharmaceuticals Inc. 31,000 | 1,642 | |

| Gilead Sciences Inc. | 13,600 | 1,592 | |

| *,† | PAREXEL International Corp. | 24,400 | 1,569 |

| * | VCA Inc. | 28,000 | 1,523 |

| * | Medivation Inc. | 11,300 | 1,291 |

| † | Eli Lilly & Co. | 15,400 | 1,286 |

| * | Array BioPharma Inc. | 156,900 | 1,131 |

| Cardinal Health Inc. | 9,600 | 803 | |

| *,† | Bruker Corp. | 34,900 | 712 |

| † | Chemed Corp. | 4,600 | 603 |

| Quality Systems Inc. | 35,300 | 585 | |

| * | Molina Healthcare Inc. | 3,800 | 267 |

| 45,242 | |||

| Industrials (15.6%) | |||

| *,† | Spirit AeroSystems | ||

| Holdings Inc. Class A | 36,800 | 2,028 | |

| *,† | Hawaiian Holdings Inc. | 85,200 | 2,024 |

| *,† | JetBlue Airways Corp. | 96,300 | 1,999 |

| † | Korn/Ferry International | 57,100 | 1,985 |

| † | General Dynamics Corp. | 13,500 | 1,913 |

| *,† | Virgin America Inc. | 67,100 | 1,844 |

| † | Aircastle Ltd. | 80,600 | 1,827 |

| † | PACCAR Inc. | 28,600 | 1,825 |

13

Market Neutral Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| † | Cintas Corp. | 21,200 | 1,793 |

| † | Northrop Grumman Corp. | 11,230 | 1,781 |

| † | Insperity Inc. | 34,600 | 1,761 |

| *,† | United Rentals Inc. | 19,800 | 1,735 |

| † | Deluxe Corp. | 27,600 | 1,711 |

| † | Southwest Airlines Co. | 50,800 | 1,681 |

| * | United Continental | ||

| Holdings Inc. | 30,300 | 1,606 | |

| † | Alaska Air Group Inc. | 24,820 | 1,599 |

| † | Textron Inc. | 35,800 | 1,598 |

| † | Pitney Bowes Inc. | 74,700 | 1,555 |

| † | Huntington Ingalls | ||

| Industries Inc. | 13,283 | 1,496 | |

| † | Greenbrier Cos. Inc. | 31,200 | 1,462 |

| † | Illinois Tool Works Inc. | 15,800 | 1,450 |

| CEB Inc. | 16,600 | 1,445 | |

| Boeing Co. | 10,100 | 1,401 | |

| *,† | Meritor Inc. | 106,300 | 1,395 |

| † | West Corp. | 44,900 | 1,352 |

| † | Masco Corp. | 49,000 | 1,307 |

| General Cable Corp. | 63,300 | 1,249 | |

| † | Lockheed Martin Corp. | 6,700 | 1,246 |

| Robert Half International Inc. | 22,400 | 1,243 | |

| *,† | TriNet Group Inc. | 46,800 | 1,186 |

| Harsco Corp. | 69,100 | 1,140 | |

| † | Trinity Industries Inc. | 37,740 | 997 |

| * | Aerojet Rocketdyne | ||

| Holdings Inc. | 46,000 | 948 | |

| John Bean | |||

| Technologies Corp. | 21,900 | 823 | |

| * | Spirit Airlines Inc. | 12,800 | 795 |

| Interface Inc. Class A | 31,500 | 789 | |

| † | UniFirst Corp. | 6,800 | 761 |

| ArcBest Corp. | 22,800 | 725 | |

| Matson Inc. | 16,100 | 677 | |

| 3M Co. | 4,300 | 664 | |

| † | ManpowerGroup Inc. | 5,800 | 518 |

| *,† | Avis Budget Group Inc. | 11,200 | 494 |

| ESCO Technologies Inc. | 9,900 | 370 | |

| Knoll Inc. | 12,900 | 323 | |

| * | TASER International Inc. | 8,600 | 286 |

| 58,807 | |||

| Information Technology (16.1%) | |||

| *,† | Electronic Arts Inc. | 31,500 | 2,095 |

| *,† | Aspen Technology Inc. | 44,500 | 2,027 |

| *,† | AVG Technologies NV | 74,300 | 2,022 |

| † | Blackbaud Inc. | 35,200 | 2,005 |

| *,† | Manhattan Associates Inc. | 32,700 | 1,951 |

| † | MAXIMUS Inc. | 29,400 | 1,932 |

| † | CSG Systems | ||

| International Inc. | 61,000 | 1,931 | |

| *,† | VASCO Data Security | ||

| International Inc. | 62,900 | 1,899 | |

| *,† | Sykes Enterprises Inc. | 77,900 | 1,889 |

| † | Science Applications | ||

| International Corp. | 34,400 | 1,818 | |

| *,† | ARRIS Group Inc. | 58,971 | 1,804 |

| *,† | MicroStrategy Inc. Class A | 10,300 | 1,752 |

| † | CDW Corp. | 49,800 | 1,707 |

| *,† | Ambarella Inc. | 16,300 | 1,674 |

| † | Booz Allen Hamilton | ||

| Holding Corp. Class A | 66,000 | 1,666 | |

| *,† | Blackhawk Network | ||

| Holdings Inc. | 40,000 | 1,648 | |

| *,† | Super Micro Computer Inc. | 55,000 | 1,627 |

| DST Systems Inc. | 12,800 | 1,613 | |

| TeleTech Holdings Inc. | 58,600 | 1,587 | |

| * | Unisys Corp. | 79,100 | 1,581 |

| † | Computer Sciences Corp. | 23,400 | 1,536 |

| Skyworks Solutions Inc. | 14,300 | 1,489 | |

| *,† | Gartner Inc. | 15,900 | 1,364 |

| † | Broadridge Financial | ||

| Solutions Inc. | 26,800 | 1,340 | |

| * | Sanmina Corp. | 65,900 | 1,329 |

| *,† | CommScope | ||

| Holding Co. Inc. | 43,300 | 1,321 | |

| *,† | Ciena Corp. | 53,700 | 1,272 |

| * | Amkor Technology Inc. | 190,300 | 1,138 |

| Lexmark International Inc. | |||

| Class A | 24,500 | 1,083 | |

| *,† | Advanced Micro | ||

| Devices Inc. | 448,430 | 1,076 | |

| * | Synaptics Inc. | 12,000 | 1,041 |

| † | Western Digital Corp. | 13,150 | 1,031 |

| † | Brocade Communications | ||

| Systems Inc. | 86,100 | 1,023 | |

| † | SYNNEX Corp. | 13,406 | 981 |

| *,† | Tech Data Corp. | 16,600 | 955 |

| * | Barracuda Networks Inc. | 22,800 | 903 |

| * | Benchmark Electronics Inc. | 40,400 | 880 |

| * | Callidus Software Inc. | 54,800 | 854 |

| † | Avnet Inc. | 17,600 | 723 |

| * | Cirrus Logic Inc. | 20,900 | 711 |

| Western Union Co. | 28,800 | 585 | |

| *,† | Anixter International Inc. | 7,200 | 469 |

| * | CACI International Inc. | ||

| Class A | 4,700 | 380 | |

| * | Ingram Micro Inc. | 14,700 | 368 |

| Leidos Holdings Inc. | 8,000 | 323 | |

| † | Accenture plc Class A | 2,500 | 242 |

| 60,645 | |||

| Materials (5.2%) | |||

| † | LyondellBasell Industries | ||

| NV Class A | 18,700 | 1,936 | |

| *,† | Chemtura Corp. | 65,800 | 1,863 |

| *,† | Berry Plastics Group Inc. | 55,300 | 1,792 |

| International Paper Co. | 36,900 | 1,756 | |

| *,† | Century Aluminum Co. | 161,800 | 1,688 |

| Ashland Inc. | 10,900 | 1,329 | |

14

Market Neutral Fund

| Market | ||||

| Value• | ||||

| Shares | ($000) | |||

| *,† | Stillwater Mining Co. | 105,300 | 1,220 | |

| † | Graphic Packaging | |||

| Holding Co. | 81,200 | 1,131 | ||

| Alcoa Inc. | 99,400 | 1,108 | ||

| Avery Dennison Corp. | 17,600 | 1,072 | ||

| * | Trinseo SA | 39,918 | 1,071 | |

| † | Westlake Chemical Corp. | 14,560 | 999 | |

| Scotts Miracle-Gro Co. | ||||

| Class A | 16,800 | 995 | ||

| * | Ferro Corp. | 45,400 | 762 | |

| Sherwin-Williams Co. | 2,300 | 632 | ||

| 19,354 | ||||

| Telecommunication Services (0.7%) | ||||

| *,† | Globalstar Inc. | 609,100 | 1,285 | |

| CenturyLink Inc. | 23,700 | 696 | ||

| Verizon Communications Inc. | 14,900 | 695 | ||

| 2,676 | ||||

| Utilities (4.8%) | ||||

| † | WGL Holdings Inc. | 35,200 | 1,911 | |

| † | American States Water Co. | 48,400 | 1,810 | |

| † | UGI Corp. | 52,400 | 1,805 | |

| Public Service Enterprise | ||||

| Group Inc. | 44,500 | 1,748 | ||

| New Jersey Resources Corp. | 60,100 | 1,656 | ||

| PPL Corp. | 54,800 | 1,615 | ||

| † | Vectren Corp. | 41,900 | 1,612 | |

| Exelon Corp. | 51,100 | 1,606 | ||

| † | Entergy Corp. | 22,600 | 1,593 | |

| † | Edison International | 21,400 | 1,189 | |

| † | Pinnacle West Capital Corp. | 15,900 | 904 | |

| California Water | ||||

| Service Group | 20,200 | 462 | ||

| 17,911 | ||||

| Total Common Stocks—Long Positions | ||||

| (Cost $312,844) | 358,455 | |||

| Common Stocks Sold Short (-95.2%) | ||||

| Consumer Discretionary (-14.2%) | ||||

| * | LKQ Corp. | (68,700) | (2,078) | |

| Aaron’s Inc. | (57,300) | (2,075) | ||

| Men’s Wearhouse Inc. | (32,200) | (2,063) | ||

| * | Netflix Inc. | (3,100) | (2,037) | |

| Lions Gate | ||||

| Entertainment Corp. | (53,700) | (1,990) | ||

| Yum! Brands Inc. | (22,000) | (1,982) | ||

| * | Meritage Homes Corp. | (41,700) | (1,964) | |

| * | Amazon.com Inc. | (4,500) | (1,953) | |

| * | Shutterfly Inc. | (39,400) | (1,884) | |

| * | Vista Outdoor Inc. | (41,800) | (1,877) | |

| Signet Jewelers Ltd. | (14,500) | (1,859) | ||

| Restaurant Brands | ||||

| International Inc. | (48,500) | (1,853) | ||

| * | Media General Inc. | (111,800) | (1,847) | |

| * | Standard Pacific Corp. | (206,100) | (1,836) | |

| * | Priceline Group Inc. | (1,580) | (1,819) |

| Starbucks Corp. | (33,600) | (1,801) | |

| Wynn Resorts Ltd. | (17,300) | (1,707) | |

| DR Horton Inc. | (61,300) | (1,677) | |

| * | Loral Space & | ||

| Communications Inc. | (25,800) | (1,629) | |

| * | CarMax Inc. | (24,171) | (1,600) |

| * | Pep Boys-Manny | ||

| Moe & Jack | (121,866) | (1,495) | |

| Harley-Davidson Inc. | (25,900) | (1,459) | |

| * | Apollo Education | ||

| Group Inc. | (110,300) | (1,421) | |

| Tiffany & Co. | (15,400) | (1,414) | |

| * | Vitamin Shoppe Inc. | (34,000) | (1,267) |

| * | Groupon Inc. Class A | (247,500) | (1,245) |

| Rent-A-Center Inc. | (41,500) | (1,177) | |

| Mattel Inc. | (42,700) | (1,097) | |

| Churchill Downs Inc. | (8,200) | (1,025) | |

| * | Ascent Capital Group Inc. | ||

| Class A | (17,600) | (752) | |

| * | Houghton Mifflin | ||

| Harcourt Co. | (22,000) | (554) | |

| Graham Holdings Co. | |||

| Class B | (500) | (538) | |

| * | TRI Pointe Homes Inc. | (33,500) | (513) |

| * | Dorman Products Inc. | (10,000) | (477) |

| Remy International Inc. | (18,955) | (419) | |

| BorgWarner Inc. | (6,900) | (392) | |

| * | Under Armour Inc. Class A | (4,400) | (367) |

| Standard Motor | |||

| Products Inc. | (10,000) | (351) | |

| (53,494) | |||

| Consumer Staples (-5.2%) | |||

| * | TreeHouse Foods Inc. | (27,000) | (2,188) |

| * | Post Holdings Inc. | (37,900) | (2,044) |

| * | Diplomat Pharmacy Inc. | (45,100) | (2,018) |

| * | Darling Ingredients Inc. | (122,000) | (1,788) |

| JM Smucker Co. | (16,100) | (1,745) | |

| B&G Foods Inc. | (57,300) | (1,635) | |

| Andersons Inc. | (41,300) | (1,611) | |

| Keurig Green Mountain Inc. | (18,500) | (1,418) | |

| * | United Natural Foods Inc. | (21,600) | (1,375) |

| Flowers Foods Inc. | (64,955) | (1,374) | |

| Philip Morris | |||

| International Inc. | (11,100) | (890) | |

| Procter & Gamble Co. | (5,600) | (438) | |

| Coca-Cola Co. | (9,500) | (373) | |

| Edgewell Personal Care Co. | (2,700) | (355) | |

| Kellogg Co. | (3,600) | (226) | |

| PriceSmart Inc. | (2,300) | (210) | |

| (19,688) | |||

15

Market Neutral Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Energy (-4.5%) | |||

| * | Parsley Energy Inc. | ||

| Class A | (109,100) | (1,900) | |

| Golar LNG Ltd. | (39,400) | (1,844) | |

| * | Cobalt International | ||

| Energy Inc. | (189,000) | (1,835) | |

| * | Whiting Petroleum Corp. | (53,300) | (1,791) |

| * | C&J Energy Services Ltd. | (135,100) | (1,783) |

| Williams Cos. Inc. | (30,200) | (1,733) | |

| * | Rice Energy Inc. | (82,300) | (1,714) |

| Anadarko Petroleum Corp. | (20,200) | (1,577) | |

| * | Diamondback Energy Inc. | (18,700) | (1,410) |

| * | Bonanza Creek Energy Inc. | (73,900) | (1,349) |

| (16,936) | |||

| Financials (-16.1%) | |||

| * | Texas Capital | ||

| Bancshares Inc. | (33,000) | (2,054) | |

| Zions Bancorporation | (63,800) | (2,025) | |

| Interactive Brokers | |||

| Group Inc. | (48,600) | (2,020) | |

| Old National Bancorp | (138,900) | (2,008) | |

| MB Financial Inc. | (58,100) | (2,001) | |

| * | Ally Financial Inc. | (87,200) | (1,956) |

| Assurant Inc. | (28,700) | (1,923) | |

| First Niagara Financial | |||

| Group Inc. | (203,600) | (1,922) | |

| PacWest Bancorp | (41,100) | (1,922) | |

| * | SLM Corp. | (193,100) | (1,906) |

| Umpqua Holdings Corp. | (105,000) | (1,889) | |

| Leucadia National Corp. | (77,700) | (1,887) | |

| XL Group plc Class A | (48,700) | (1,812) | |

| Arthur J Gallagher & Co. | (38,300) | (1,812) | |

| Unum Group | (50,300) | (1,798) | |

| Home BancShares Inc. | (48,100) | (1,759) | |

| * | Genworth Financial Inc. | ||

| Class A | (227,100) | (1,719) | |

| Union Bankshares Corp. | (72,600) | (1,687) | |

| McGraw Hill Financial Inc. | (16,700) | (1,678) | |

| * | SVB Financial Group | (11,500) | (1,656) |

| NorthStar Asset | |||

| Management Group Inc. | (88,800) | (1,642) | |

| Loews Corp. | (42,300) | (1,629) | |

| Investors Bancorp Inc. | (132,400) | (1,629) | |

| CNA Financial Corp. | (42,300) | (1,616) | |

| Cincinnati Financial Corp. | (28,800) | (1,445) | |

| White Mountains | |||

| Insurance Group Ltd. | (2,100) | (1,375) | |

| Old Republic | |||

| International Corp. | (84,500) | (1,321) | |

| American Equity | |||

| Investment Life | |||

| Holding Co. | (48,100) | (1,298) | |

| Evercore Partners Inc. | |||

| Class A | (23,100) | (1,246) | |

| M&T Bank Corp. | (9,800) | (1,224) | |

| LegacyTexas Financial | |||

| Group Inc. | (39,700) | (1,199) | |

| UMB Financial Corp. | (20,900) | (1,192) | |

| Charles Schwab Corp. | (34,800) | (1,136) | |

| First Horizon National Corp. | (60,000) | (940) | |

| T. Rowe Price Group Inc. | (11,300) | (878) | |

| * | FCB Financial Holdings Inc. | ||

| Class A | (25,800) | (820) | |

| Boston Private Financial | |||

| Holdings Inc. | (48,200) | (646) | |

| NASDAQ OMX Group Inc. | (9,800) | (478) | |

| Talmer Bancorp Inc. Class A | (28,500) | (477) | |

| * | FNFV Group | (27,800) | (428) |

| Erie Indemnity Co. Class A | (3,500) | (287) | |

| Fidelity & Guaranty Life | (10,100) | (239) | |

| (60,579) | |||

| Health Care (-11.8%) | |||

| * | Ultragenyx | ||

| Pharmaceutical Inc. | (21,100) | (2,160) | |

| * | Novavax Inc. | (184,900) | (2,060) |

| * | Insulet Corp. | (64,200) | (1,989) |

| * | Neurocrine Biosciences Inc. | (41,500) | (1,982) |

| Perrigo Co. plc | (10,400) | (1,922) | |

| * | Endologix Inc. | (123,700) | (1,898) |

| * | Medidata Solutions Inc. | (34,900) | (1,896) |

| * | WellCare Health Plans Inc. | (21,900) | (1,858) |

| * | Chimerix Inc. | (40,000) | (1,848) |

| Medtronic plc | (24,800) | (1,838) | |

| * | Bluebird Bio Inc. | (10,900) | (1,835) |

| Cooper Cos. Inc. | (10,300) | (1,833) | |

| Bio-Techne Corp. | (18,000) | (1,772) | |

| Owens & Minor Inc. | (52,100) | (1,771) | |

| * | Alnylam | ||

| Pharmaceuticals Inc. | (14,700) | (1,762) | |

| * | Sage Therapeutics Inc. | (23,400) | (1,708) |

| * | Brookdale Senior Living Inc. | (49,200) | (1,707) |

| * | Alkermes plc | (26,400) | (1,699) |

| * | Spectranetics Corp. | (72,600) | (1,671) |

| * | Relypsa Inc. | (43,900) | (1,453) |

| * | NxStage Medical Inc. | (98,600) | (1,408) |

| * | HMS Holdings Corp. | (76,300) | (1,310) |

| * | Allscripts Healthcare | ||

| Solutions Inc. | (90,200) | (1,234) | |

| * | Fluidigm Corp. | (45,700) | (1,106) |

| Baxter International Inc. | (11,300) | (790) | |

| * | Impax Laboratories Inc. | (13,000) | (597) |

| * | Varian Medical Systems Inc. | (6,900) | (582) |

| * | ACADIA | ||

| Pharmaceuticals Inc. | (8,800) | (369) | |

| * | Cardiovascular Systems Inc. | (7,800) | (206) |

| (44,264) | |||

| Industrials (-15.5%) | |||

| * | Beacon Roofing Supply Inc. | (64,700) | (2,149) |

| Mobile Mini Inc. | (48,000) | (2,018) | |

| * | Huron Consulting Group Inc. | (28,400) | (1,990) |

16

Market Neutral Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | KLX Inc. | (45,000) | (1,986) |

| Babcock & Wilcox Co. | (59,800) | (1,961) | |

| US Ecology Inc. | (40,100) | (1,954) | |

| * | Wesco Aircraft | ||

| Holdings Inc. | (127,300) | (1,929) | |

| * | Clean Harbors Inc. | (35,600) | (1,913) |

| Matthews International | |||

| Corp. Class A | (36,000) | (1,913) | |

| * | MRC Global Inc. | (122,900) | (1,898) |

| * | Advisory Board Co. | (34,100) | (1,864) |

| Forward Air Corp. | (35,100) | (1,834) | |

| * | Roadrunner Transportation | ||

| Systems Inc. | (71,080) | (1,834) | |

| * | MasTec Inc. | (87,100) | (1,731) |

| * | Colfax Corp. | (37,000) | (1,707) |

| EnPro Industries Inc. | (28,400) | (1,625) | |

| * | Armstrong World | ||

| Industries Inc. | (29,800) | (1,588) | |

| Healthcare Services | |||

| Group Inc. | (47,600) | (1,573) | |

| * | DigitalGlobe Inc. | (56,600) | (1,573) |

| SPX Corp. | (21,700) | (1,571) | |

| * | Nortek Inc. | (18,300) | (1,521) |

| * | UTi Worldwide Inc. | (141,300) | (1,412) |

| * | Hub Group Inc. Class A | (34,900) | (1,408) |

| * | WageWorks Inc. | (31,300) | (1,266) |

| * | Stericycle Inc. | (9,400) | (1,259) |

| JB Hunt Transport | |||

| Services Inc. | (14,700) | (1,207) | |

| * | Copart Inc. | (33,600) | (1,192) |

| Nielsen NV | (26,500) | (1,186) | |

| * | Jacobs Engineering | ||

| Group Inc. | (28,500) | (1,158) | |

| Raven Industries Inc. | (56,300) | (1,145) | |

| * | DXP Enterprises Inc. | (24,300) | (1,130) |

| Heartland Express Inc. | (54,900) | (1,111) | |

| * | Chart Industries Inc. | (29,200) | (1,044) |

| Fastenal Co. | (21,700) | (915) | |

| Applied Industrial | |||

| Technologies Inc. | (22,900) | (908) | |

| Precision Castparts Corp. | (3,900) | (779) | |

| * | Kirby Corp. | (9,400) | (721) |

| * | Proto Labs Inc. | (9,200) | (621) |

| * | Genesee & Wyoming Inc. | ||

| Class A | (7,500) | (571) | |

| Franklin Electric Co. Inc. | (17,200) | (556) | |

| Kennametal Inc. | (13,900) | (474) | |

| (58,195) | |||

| Information Technology (-16.2%) | |||

| * | Demandware Inc. | (29,200) | (2,076) |

| * | Cornerstone OnDemand Inc. | (58,700) | (2,043) |

| * | HomeAway Inc. | (62,800) | (1,954) |

| * | SunEdison Inc. | (64,600) | (1,932) |

| * | Splunk Inc. | (27,200) | (1,894) |

| Analog Devices Inc. | (29,500) | (1,893) | |

| FEI Co. | (22,700) | (1,883) | |

| * | Palo Alto Networks Inc. | (10,700) | (1,869) |

| * | CoStar Group Inc. | (9,200) | (1,852) |

| * | LinkedIn Corp. Class A | (8,800) | (1,818) |

| * | Zynga Inc. Class A | (634,400) | (1,814) |

| * | ServiceNow Inc. | (24,400) | (1,813) |

| * | Trimble Navigation Ltd. | (76,900) | (1,804) |

| * | Yahoo! Inc. | (44,900) | (1,764) |

| * | Twitter Inc. | (48,400) | (1,753) |

| * | Pandora Media Inc. | (108,400) | (1,685) |

| SanDisk Corp. | (28,000) | (1,630) | |

| * | Entegris Inc. | (111,500) | (1,625) |

| * | CommVault Systems Inc. | (38,000) | (1,612) |

| * | Alliance Data Systems Corp. | (5,500) | (1,606) |

| Visa Inc. Class A | (23,100) | (1,551) | |

| Equinix Inc. | (6,039) | (1,534) | |

| * | Salesforce.com inc | (21,780) | (1,517) |

| * | ViaSat Inc. | (22,600) | (1,362) |

| Cypress | |||

| Semiconductor Corp. | (110,300) | (1,297) | |

| Cognex Corp. | (26,000) | (1,251) | |

| EMC Corp. | (43,500) | (1,148) | |

| Solera Holdings Inc. | (25,000) | (1,114) | |

| Corning Inc. | (56,100) | (1,107) | |

| * | Nuance | ||

| Communications Inc. | (58,900) | (1,031) | |

| * | NCR Corp. | (34,000) | (1,023) |

| FLIR Systems Inc. | (31,400) | (968) | |

| * | First Solar Inc. | (20,100) | (944) |

| AVX Corp. | (66,700) | (898) | |

| * | Bottomline Technologies | ||

| de Inc. | (32,100) | (893) | |

| * | SolarWinds Inc. | (18,100) | (835) |

| * | Workday Inc. Class A | (10,700) | (817) |

| KLA-Tencor Corp. | (13,900) | (781) | |

| * | FleetCor Technologies Inc. | (4,950) | (772) |

| Motorola Solutions Inc. | (13,000) | (745) | |

| * | Yelp Inc. Class A | (17,000) | (732) |

| * | WEX Inc. | (5,900) | (672) |

| Maxim Integrated | |||

| Products Inc. | (15,300) | (529) | |

| * | Bankrate Inc. | (46,160) | (484) |

| j2 Global Inc. | (5,400) | (367) | |

| * | RealPage Inc. | (9,300) | (177) |

| * | Finisar Corp. | (9,100) | (163) |

| (61,032) | |||

| Materials (-5.4%) | |||

| * | Louisiana-Pacific Corp. | (116,200) | (1,979) |

| Martin Marietta | |||

| Materials Inc. | (13,500) | (1,910) | |

| * | WR Grace & Co. | (18,500) | (1,856) |

| FMC Corp. | (33,700) | (1,771) | |

| Carpenter Technology Corp. | (44,800) | (1,733) | |

| HB Fuller Co. | (40,700) | (1,653) | |

| Worthington Industries Inc. | (54,300) | (1,632) | |

17

Market Neutral Fund

| Market | ||||

| Value• | ||||

| Shares | ($000) | |||

| TimkenSteel Corp. | (57,900) | (1,563) | ||

| Freeport-McMoRan Inc. | (80,800) | (1,505) | ||

| Balchem Corp. | (23,500) | (1,309) | ||

| Royal Gold Inc. | (16,350) | (1,007) | ||

| Allegheny Technologies Inc. | (28,800) | (870) | ||

| SunCoke Energy Inc. | (63,800) | (829) | ||

| Praxair Inc. | (4,300) | (514) | ||

| (20,131) | ||||

| Telecommunication Services (-1.2%) | ||||

| * | SBA Communications | |||

| Corp. Class A | (16,110) | (1,852) | ||

| Cogent Communications | ||||

| Holdings Inc. | (50,200) | (1,699) | ||

| * | Sprint Corp. | (191,000) | (871) | |

| (4,422) | ||||

| Utilities (-5.1%) | ||||

| Laclede Group Inc. | (36,400) | (1,895) | ||

| Pattern Energy Group Inc. | ||||

| Class A | (66,700) | (1,893) | ||

| TerraForm Power Inc. | ||||

| Class A | (48,700) | (1,849) | ||

| * | Dynegy Inc. | (60,800) | (1,778) | |

| NRG Energy Inc. | (75,600) | (1,730) | ||

| NiSource Inc. | (37,700) | (1,719) | ||

| National Fuel Gas Co. | (28,900) | (1,702) | ||

| ITC Holdings Corp. | (52,400) | (1,686) | ||

| Dominion Resources Inc. | (23,100) | (1,545) | ||

| South Jersey Industries Inc. | (59,600) | (1,474) | ||

| ALLETE Inc. | (23,300) | (1,081) | ||

| OGE Energy Corp. | (34,700) | (991) | ||

| (19,343) | ||||

| Total Common Stocks Sold Short | ||||

| (Proceeds $338,007) | (358,084) | |||

| Temporary Cash Investment (2.2%) | ||||

| Money Market Fund (2.2%) | ||||

| 1 | Vanguard Market Liquidity | |||

| Fund, 0.137% | ||||

| (Cost $8,416) | 8,416,057 | 8,416 | ||

| †Other Assets and Liabilities— | ||||

| Net (97.7%) | 367,309 | |||

| Net Assets (100%) | 376,096 | |||

| Amount | |

| ($000) | |

| Statement of Assets and Liabilities | |

| Assets | |

| Investment in Securities, | |

| Long Positions, at Value | |

| Unaffiliated Issuers | 358,455 |

| Affiliated Vanguard Funds | 8,416 |

| Total Long Positions | 366,871 |

| Cash Segregated for Short Positions | 367,658 |

| Receivables for Securities Sold | 2,240 |

| Other Assets | 545 |

| Total Assets | 737,314 |

| Liabilities | |

| Securities Sold Short, at Value | 358,084 |

| Payables for Securities Purchased | 2,595 |

| Other Liabilities | 539 |

| Total Liabilities | 361,218 |

| Net Assets (100%) | 376,096 |

18

Market Neutral Fund

| At June 30, 2015, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 369,627 |

| Accumulated Net Investment Losses | (357) |

| Accumulated Net Realized Losses | (18,708) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities—Long Positions | 45,611 |

| Investment Securities Sold Short | (20,077) |

| Net Assets | 376,096 |

| Investor Shares—Net Assets | |

| Applicable to 27,950,686 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 317,716 |

| Net Asset Value Per Share— | |

| Investor Shares | $11.37 |

| Institutional Shares—Net Assets | |

| Applicable to 5,155,955 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 58,380 |

| Net Asset Value Per Share— | |

| Institutional Shares | $11.32 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

† Long security positions with a value of $219,306,000 and cash of $367,658,000 are held in a segregated account at the fund’s custodian

bank and pledged to a broker-dealer as collateral for the fund’s obligation to return borrowed securities. For so long as such obligations

continue, the fund’s access to these assets is subject to authorization from the broker-dealer.

1 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is

the 7-day yield.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Market Neutral Fund

Statement of Operations

| Six Months Ended | |

| June 30, 2015 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends | 2,392 |

| Interest1 | 5 |

| Total Income | 2,397 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 190 |

| Management and Administrative—Investor Shares | 153 |

| Management and Administrative—Institutional Shares | 5 |

| Marketing and Distribution—Investor Shares | 33 |

| Marketing and Distribution—Institutional Shares | 4 |

| Custodian Fees | 18 |

| Shareholders’ Reports—Investor Shares | 2 |

| Shareholders’ Reports—Institutional Shares | — |

| Dividend Expense on Securities Sold Short | 1,943 |

| Borrowing Expense on Securities Sold Short | 240 |

| Total Expenses | 2,588 |

| Net Investment Income (Loss) | (191) |

| Realized Net Gain (Loss) | |

| Investment Securities—Long Positions | 19,259 |

| Investment Securities Sold Short | (20,591) |

| Realized Net Gain (Loss) | (1,332) |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities—Long Positions | (3,455) |

| Investment Securities Sold Short | 295 |

| Change in Unrealized Appreciation (Depreciation) | (3,160) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | (4,683) |

| 1 Interest income from an affiliated company of the fund was $5,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

20

Market Neutral Fund

Statement of Changes in Net Assets

| Six Months Ended | Year Ended | |

| June 30, | December 31, | |

| 2015 | 2014 | |

| ($000) | ($000) | |

| Increase (Decrease) In Net Assets | ||

| Operations | ||

| Net Investment Income (Loss) | (191) | (889) |

| Realized Net Gain (Loss) | (1,332) | 10,135 |

| Change in Unrealized Appreciation (Depreciation) | (3,160) | 254 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | (4,683) | 9,500 |

| Distributions | ||

| Net Investment Income | ||

| Investor Shares | — | — |

| Institutional Shares | — | — |

| Realized Capital Gain | ||

| Investor Shares | — | — |

| Institutional Shares | — | — |

| Total Distributions | — | — |

| Capital Share Transactions | ||

| Investor Shares | 64,798 | 75,328 |

| Institutional Shares | 4,038 | 18,313 |

| Net Increase (Decrease) from Capital Share Transactions | 68,836 | 93,641 |

| Total Increase (Decrease) | 64,153 | 103,141 |

| Net Assets | ||

| Beginning of Period | 311,943 | 208,802 |

| End of Period1 | 376,096 | 311,943 |

| 1 Net Assets—End of Period includes accumulated net investment losses of ($357,000) and ($166,000). | ||

See accompanying Notes, which are an integral part of the Financial Statements.

21

Market Neutral Fund

Financial Highlights

| Investor Shares | ||||||

| Six Months | ||||||

| Ended | ||||||

| For a Share Outstanding | June 30, | Year Ended December 31, | ||||

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

| Net Asset Value, Beginning of Period | $11.50 | $11.03 | $10.16 | $10.36 | $9.61 | $9.71 |

| Investment Operations | ||||||

| Net Investment Income (Loss) | (.005) | (.032) | (.007) | .045 | (.024) | (.038)1 |

| Net Realized and Unrealized Gain (Loss) | ||||||

| on Investments | (.125) | .502 | .880 | (.200) | .774 | (.062) |

| Total from Investment Operations | (.130) | .470 | .873 | (.155) | .750 | (.100) |

| Distributions | ||||||

| Dividends from Net Investment Income | — | — | (.002) | (.045) | — | — |

| Distributions from Realized Capital Gains | — | — | — | — | — | — |

| Return of Capital | — | — | (.001) | — | — | — |

| Total Distributions | — | — | (.003) | (.045) | — | — |

| Net Asset Value, End of Period | $11.37 | $11.50 | $11.03 | $10.16 | $10.36 | $9.61 |

| Total Return2 | -1.13% | 4.26% | 8.59% | -1.50% | 7.80% | -1.03% |

| Ratios/Supplemental Data | ||||||

| Net Assets, End of Period (Millions) | $318 | $257 | $174 | $151 | $158 | $116 |

| Ratio of Expenses to Average Net Assets | ||||||

| Based on Total Expenses3 | 1.45% | 1.64% | 1.57% | 1.88% | 1.69% | 1.84%4 |

| Net of Dividend and Borrowing Expense | ||||||

| on Securities Sold Short | 0.24% | 0.25% | 0.25% | 0.25% | 0.25% | 0.30%4 |

| Ratio of Net Investment Income (Loss) | ||||||

| to Average Net Assets | (0.12%) | (0.38%) | (0.06%) | 0.44% | (0.22%) | (0.38%) |

| Portfolio Turnover Rate | 67% | 73% | 68% | 89% | 91% | 153% |

The expense ratio, net income ratio, and turnover rate for the current period have been annualized.

1 Calculated based on average shares outstanding.

2 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide

information about any applicable transaction and account service fees.

3 Includes 2015 dividend and borrowing expense on securities sold short of 1.08% and 0.13%, respectively. Includes 2014 dividend and

borrowing expense on securities sold short of 1.21% and 0.18%, respectively. Includes 2013 dividend and borrowing expense on securities

sold short of 1.18% and 0.14%, respectively. Includes 2012 dividend and borrowing expense on securities sold short of 1.52% and 0.11%,

respectively. Includes 2011 dividend and borrowing expense on securities sold short of 1.30% and 0.14%, respectively. Includes 2010

dividend and borrowing expense on securities sold short of 1.49% and 0.05%, respectively.

4 Includes performance-based advisory fee increases (decreases) of (0.07%). Performance-based investment advisory fees did not apply

after fiscal 2010.

See accompanying Notes, which are an integral part of the Financial Statements.

22

Market Neutral Fund

Financial Highlights

| Institutional Shares | ||||||

| Six Months | ||||||

| Ended | ||||||

| For a Share Outstanding | June 30, | Year Ended December 31, | ||||

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

| Net Asset Value, Beginning of Period | $11.45 | $10.97 | $10.10 | $10.33 | $9.57 | $9.66 |

| Investment Operations | ||||||

| Net Investment Income (Loss) | (.003) | (.023) | .006 | .071 | (.010) | (.015)1 |

| Net Realized and Unrealized Gain (Loss) | ||||||

| on Investments | (.127) | .503 | .868 | (.215) | .770 | (.075) |

| Total from Investment Operations | (.130) | .480 | .874 | (.144) | .760 | (.090) |

| Distributions | ||||||

| Dividends from Net Investment Income | — | — | (.003) | (.086) | — | — |

| Distributions from Realized Capital Gains | — | — | — | — | — | — |

| Return of Capital | — | — | (.001) | — | — | — |

| Total Distributions | — | — | (.004) | (.086) | — | — |

| Net Asset Value, End of Period | $11.32 | $11.45 | $10.97 | $10.10 | $10.33 | $9.57 |

| Total Return2 | -1.14% | 4.38% | 8.66% | -1.39% | 7.94% | -0.93% |

| Ratios/Supplemental Data | ||||||

| Net Assets, End of Period (Millions) | $58 | $55 | $35 | $31 | $16 | $3 |

| Ratio of Expenses to Average Net Assets | ||||||

| Based on Total Expenses3 | 1.36% | 1.54% | 1.47% | 1.78% | 1.59% | 1.74%4 |

| Net of Dividend and Borrowing Expense | ||||||

| on Securities Sold Short | 0.15% | 0.15% | 0.15% | 0.15% | 0.15% | 0.20%4 |

| Ratio of Net Investment Income (Loss) | ||||||

| to Average Net Assets | (0.03%) | (0.28%) | (0.04%) | 0.54% | (0.12%) | (0.28%) |

| Portfolio Turnover Rate | 67% | 73% | 68% | 89% | 91% | 153% |

The expense ratio, net income ratio, and turnover rate for the current period have been annualized.

1 Calculated based on average shares outstanding.

2 Total returns do not include transaction fees that may have applied in the periods shown. Fund prospectuses provide information about any

applicable transaction fees.

3 Includes 2015 dividend and borrowing expense on securities sold short of 1.08% and 0.13%, respectively. Includes 2014 dividend and

borrowing expense on securities sold short of 1.21% and 0.18%, respectively. Includes 2013 dividend and borrowing expense on securities

sold short of 1.18% and 0.14%, respectively. Includes 2012 dividend and borrowing expense on securities sold short of 1.52% and 0.11%,

respectively. Includes 2011 dividend and borrowing expense on securities sold short of 1.30% and 0.14%, respectively. Includes 2010

dividend and borrowing expense on securities sold short of 1.49% and 0.05%, respectively.

4 Includes performance-based advisory fee increases (decreases) of (0.07%). Performance-based investment advisory fees did not apply

after fiscal 2010.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Market Neutral Fund

Notes to Financial Statements

Vanguard Market Neutral Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares: Investor Shares and Institutional Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Institutional Shares are designed for investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

2. Short Sales: Short sales are the sales of securities that the fund does not own. The fund sells a security it does not own in anticipation of a decline in the value of that security. In order to deliver the security to the purchaser, the fund borrows the security from a broker-dealer. The fund must segregate, as collateral for its obligation to return the borrowed security, an amount of cash and long security positions at least equal to the market value of the security sold short. This results in the fund holding a significant portion of its assets in cash. The fund later closes out the position by returning the security to the lender, typically by purchasing the security in the open market. A gain, limited to the price at which the fund sold the security short, or a loss, theoretically unlimited in size, is recognized upon the termination of the short sale. The fund may receive a portion of the income from the investment of collateral, or be charged a fee on borrowed securities, based on the market value of each borrowed security and a variable rate that is dependent upon the availability of such security. The net amounts of income or fees are recorded as interest income (for net income received) or borrowing expense on securities sold short (for net fees charged) on the Statement of Operations. Dividends on securities sold short are reported as an expense in the Statement of Operations.

Cash collateral segregated for securities sold short is recorded as an asset in the Statement of Assets and Liabilities. Long security positions segregated as collateral are shown in the Statement of Net Assets.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (December 31, 2011–2014), and for the period ended June 30, 2015, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Credit Facility: The fund and certain other funds managed by The Vanguard Group participate in a $3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.06% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees

24

Market Neutral Fund

and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate equal to the higher of the federal funds rate or LIBOR reference rate plus an agreed-upon spread.

The fund had no borrowings outstanding at June 30, 2015, or at any time during the period then ended.

6. Other: Dividend income (or dividend expense on short positions) is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund based on methods approved by the board of trustees. The fund has committed to invest up to 0.40% of its net assets in Vanguard. At June 30, 2015, the fund had contributed capital of $34,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.01% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At June 30, 2015, 100% of the market value of the fund’s investments was determined based on Level 1 inputs.

D. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

25

Market Neutral Fund

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at December 31, 2014, the fund had available capital losses totaling $17,082,000 to offset future net capital gains. Of this amount, $13,688,000 is subject to expiration dates; $8,817,000 may be used to offset future net capital gains through December 31, 2017, and $4,871,000 through December 31, 2018. Capital losses of $3,394,000 realized beginning in fiscal 2011 may be carried forward indefinitely under the Regulated Investment Company Modernization Act of 2010, but must be used before any expiring loss carryforwards. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending December 31, 2015; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balance above.

At June 30, 2015, the cost of long security positions for tax purposes was $321,314,000. Net unrealized appreciation of long security positions for tax purposes was $45,557,000, consisting of unrealized gains of $59,790,000 on securities that had risen in value since their purchase and $14,233,000 in unrealized losses on securities that had fallen in value since their purchase. Tax-basis net unrealized depreciation on securities sold short was $20,077,000, consisting of unrealized gains of $19,036,000 on securities that had fallen in value since their sale and $39,113,000 in unrealized losses on securities that had risen in value since their sale.

E. During the six months ended June 30, 2015, the fund purchased $161,750,000 of investment securities and sold $116,905,000 of investment securities, other than temporary cash investments. The proceeds of short sales and the cost of purchases to cover short sales were $200,758,000 and $161,444,000, respectively.

F. Capital share transactions for each class of shares were:

| Six Months Ended | Year Ended | |||

| June 30, 2015 | December 31, 2014 | |||

| Amount | Shares | Amount | Shares | |

| ($000) | (000) | ($000) | (000) | |

| Investor Shares | ||||

| Issued | 84,716 | 7,353 | 108,782 | 9,542 |

| Issued in Lieu of Cash Distributions | — | — | — | — |

| Redeemed | (19,918) | (1,738) | (33,454) | (2,954) |

| Net Increase (Decrease)—Investor Shares | 64,798 | 5,615 | 75,328 | 6,588 |

| Institutional Shares | ||||

| Issued | 8,846 | 771 | 24,195 | 2,121 |

| Issued in Lieu of Cash Distributions | — | — | — | — |

| Redeemed | (4,808) | (421) | (5,882) | (521) |

| Net Increase (Decrease)—Institutional Shares | 4,038 | 350 | 18,313 | 1,600 |

At June 30, 2015, Vanguard Managed Payout Fund was the record or beneficial owner of 42% of the fund’s net assets. If the shareholder were to redeem its investment in the fund, the redemption might result in an increase in the fund’s expense ratio, cause the fund to incur higher transaction costs, or lead to the realization of taxable capital gains.

G. Management has determined that no material events or transactions occurred subsequent to June 30, 2015, that would require recognition or disclosure in these financial statements.

26

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”