| 1585 Broadway New York, NY 10036-8299 Telephone 212.969.3000 Fax 212.969.2900 | BOCA RATON BOSTON LONDON LOS ANGELES NEW ORLEANS NEWARK PARIS SÃO PAULO WASHINGTON |

| | | |

| Peter M. Fass Member of the Firm Direct Dial 212-969-3445 | |

November 21, 2007

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Attention: Karen J. Garnett

| Re: | |

| | SEC#333-145949 |

| | CIK#0001410997 |

| | Response to October 10, 2007 comment letter and November 14, 2007 comment letter |

Dear Ms. Garnett:

This firm represents American Realty Capital Trust, Inc. (the “Company” or “Firm”) in connection with its application for registration under the Securities Act of 1933. In furtherance thereof, we are submitting the enclosed response to the comments and requests in your letter, dated October 10, 2007 (the “Comment Letter”), and your letter, dated November 14, 2007 (the “Supplemental Comment Letter”), and to indicate the changes that have been made in Amendment No. 1 to the Registration Statement (“Amendment No. 1”) that was filed on November 20, 2007 with the SEC. Five clean courtesy copies of Amendment No. 1 (without exhibits), five clean copies of the exhibits, and five marked copies of Amendment No. 1 (without exhibits) are enclosed for your reference. The marked copies show the changes between the original Registration Statement and Amendment No. 1. In addition, the Company has provided one marked copy of those exhibits that the Company has revised.

The headings and numbered paragraphs below correspond to the headings and numbered paragraphs in the Comment Letter. For your convenience, your comments are set forth in italics in this letter, followed by the Company’s responses. The page numbers referred to in your comments track the page numbers in the original Registration Statement, and the page numbers referred to in the Company’s responses track the page numbers in Amendment No. 1.

|

| |

November 21, 2007 Page 2 |

The revisions to the Registration Statement in Amendment No. 1 incorporate the comments and requests in your letter, dated October 10, 2007, as well as comments from the states and internal revisions

General

1. Please note that any sales literature that is to be used in connection with this offering must be submitted to us prior to use, including sales literature intended for broker-dealer use only. Please submit all written sales materials proposed to be transmitted to prospective investors, orally or in writing. Please be aware that we will need time to review these materials. In addition, note that sales materials must set forth a balanced presentation of the risks and rewards to investors and should not contain any information or disclosure that is inconsistent with or not also provided in the prospectus. For guidance, refer to Item 19.D of Industry Guide 5.

RESPONSE:

Please see the working draft of the Firm’s website, which is currently hosted at the following web address:

http://americanrealty.webdeskos.com/

and will move to www.americanrealtycap.com once approved by the SEC and following the Firm’s effective date.

Please see the sales materials attached hereto as Attachment No. 1.

2. Please provide us with copies of any graphics, maps, photographs, and related captions or other artwork including logos that you intend to use in the prospectus. Such graphics and pictorial representations should not be included in any preliminary prospectus distributed to prospective investors prior to our review.

RESPONSE:

Please see the items below, which we intend to add to Amendment No. 2 of the prospectus after review by the SEC. The following is an updated version of the representations approved by the SEC in the final prospectus of Boston Capital Real Estate Investment Trust, Inc., dated April 14, 2006.

Diversification Through Real Estate

Traditionally, investment portfolios have contained a balance of stocks, bonds, mutual funds and cash equivalents. To the extent investors seek portfolio diversification through real estate ownership, they often select publicly-traded real estate companies, primarily REITs. The issue with these REITs and other exchange traded companies, is that they tend to be closely correlated to the broader equities market, thus defeating in part the reason for owning this asset category. Investing in a private REIT such as ours may add an additional level of diversification and a low correlation to investments listed on the public exchanges. Moreover, such an investment may augment current returns, provide income growth, furnish asset appreciation, and allow ownership of a high quality, diversified portfolio of real estate investments.

|

| |

November 21, 2007 Page 3 |

Diversification is a strategy designed to reduce exposure to portfolio risk by combining a variety of investments which are unlikely to appreciate or depreciate at the same time. One way to diversify an existing portfolio of stocks and bonds is to add real estate to the portfolio mix. Because most investors cannot build a sufficiently diverse portfolio of real estate on their own, they may choose to invest in public real estate companies or Real Estate Investment Trusts (“REITs”). (See: “What is a REIT” in the FAQs).

Direct Private Placements As An Alternative To Traditional Investment Vehicles

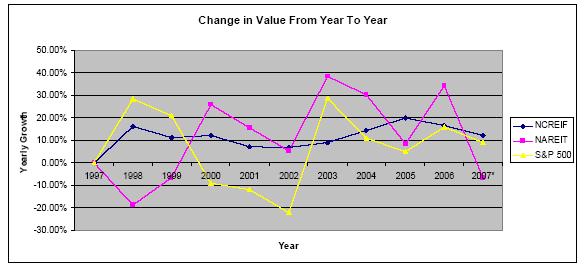

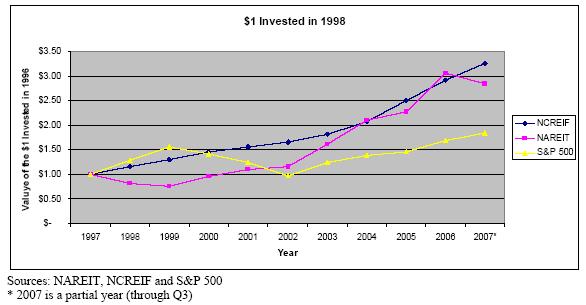

Over the past 10 years, privately traded REITS have provided stable returns.

The chart below follows the path of $1.00 invested in four separate indices from 1996 and 2006.

NCREIF Index: Is an unmanaged, market-weighted index of non-traded, tax-qualified REITs that are members of NCREIF. NCREIF was established to serve the institutional real estate investment community as a non-partisan collector, processor, validator and disseminator of real estate performance information. NCREIF members, like us, are not traded on any public exchange.

NAREIT Index: The NAREIT Equity REIT Index is an unmanaged, market-weighted index of publicly-traded, tax-qualified REITs traded on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market System. NAREIT includes dividends.

Franklin Income A Index: This investment fund seeks income while maintaining prospects for capital appreciation. The fund normally invests in a diversified portfolio of debt and equity securities. It may invest up to 100% of total assets in debt securities that are rated below investment-grade, but it is not currently expected that the fund will invest more than 50% of its assets in these securities. The fund seeks income by selecting investments such as bonds (e.g., corporate, foreign and U.S. Treasury), as well as stocks with attractive dividend yields. This is a conservative fund targeting minimal volatility.

|

| |

November 21, 2007 Page 4 |

S&P 500 Index: The Standard & Poor's 500 Index is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries and is adjusted to reflect dividends paid.

Past performance is no guarantee of future results.

The Franklin Income A fund represents the most conservative of the four investments chosen. One dollar invested in Franklin Income in 1996 would be worth almost $1.50 in 2006. The fund invests in a diverse portfolio of equity and debt securities, and is engineered to minimize volatility while providing returns that are slightly above inflation. While Franklin Income has the lowest volatility, it also has the lowest return.

The S&P 500 index has the greatest return in many of the years measured, but also has the largest volatility. One dollar invested in the S&P 500 in 1996, became almost $2.50 in 2000. By 2006, it was again worth $2.50, having dipped to $1.50 three years earlier.

Of the real estate indices evaluated in the graph above, the NAREIT index, an index of publicly-traded REITs, has modestly outperformed the conservative Franklin A Fund, but with greater volatility. However, NAREIT has done less well then the NCREIF index, an index comprised of non-traded REITS. Despite the fact that both the NAREIT and NCREIF indices are comprised of REITs, NAREIT member stock prices are highly susceptible to broader market movements, in juxtaposition to the NCREIF index which is not correlated to the public securities markets. This means that NCREIF members and there investors are less susceptible to market forces and impulse trading that can occur in conjunction with severe market movements. Not being listed on an exchange aligns management and the investors’ incentives to view the investment over the intended longer investment horizon.

|

| |

November 21, 2007 Page 5 |

Comparing NAREIT to NCREIF, one dollar invested in 1996 in NAREIT was worth almost two dollars by 2006, with some volatility, particularly a significant downturn from 1998 to 2000. On the other hand, one dollar invested in NCREIF was worth over three dollars by 2006, marked by steady, consistent growth in value and no correlation to the broader equity markets.

In addition to being an important tool in portfolio diversification and enjoying lower volatility, real estate is considered to be a good hedge against inflation. We believe that our portfolio can act as an inflation hedge because of the contractual rent increases that are built into many of our leases. As a result of such increases, additional revenue should increase the amount of cash available for distribution to our stockholders. However, our actual results of operations and, accordingly, cash available for distribution, will be affected by a number of factors, including the revenue we receive from our tenants, our debt obligations, interest expense, the ability of our tenants to meet their obligations, and unanticipated expenditures.

3. Please be advised that you are responsible for analyzing the applicability of the tender offer rules to your proposed share repurchase plan and for determining the availability of any exemption under Rule 13e-4 and Regulation 14E. We urge you to consider all the elements of your share repurchase program in determining whether the program is consistent with relief granted by the Division of Corporation Finance in prior no action letters. See, for example, T REIT Inc. (Letter dated June 4, 2001), Wells Real Estate Investment Trust II, Inc. (Letter dated December 3, 2003) and Hines Real Estate Investment Trust, Inc. (Letter dated June 4, 2004). To the extent you have questions as to whether the program is entirely consistent with the relief previously granted by the Division of Corporation Finance, you may contact the Division’s Office of Mergers and Acquisitions.

RESPONSE:

The Firm believes that Rule 13e-4 and Regulation 14E does not apply to its share repurchase program because the program as described in the following is of the type for which the SEC has previously granted exemptions from the tender offer rules including a class exemption pursuant to the no action letter, Class Relief for Real Estate Investment Trust Share Redemption Programs, Regulation M Rule 102, TP File No. 08-06, dated October 22, 2007 (“October 22, 2007 No Action Letter”):

| | · | There is no trading market for the REIT’s common stock; |

| | · | The REIT will terminate its share redemption program during the distribution of its common stock in the event that a secondary market for the REIT’s common stock develops; |

| | · | The REIT purchases shares of its common stock under its share redemption program at a price that does not exceed the then current public offering price of its common stock; |

| | · | The terms of the share redemption program will be fully disclosed in the REIT’s prospectus; |

| | · | Except as otherwise exempted herein, the REIT shall comply with Regulation M; |

|

| |

November 21, 2007 Page 6 |

| | · | Shareholders can withdraw tendered shares at any time prior to the end of the quarter; and |

| | · | The Firm will purchase shares on a pro rata basis at the end of each quarter in the event the amount of available proceeds is insufficient to satisfy all of the current repurchase requests. |

| | · | Please also note that since the October 22, 2007 No Action Letter requires no limit on the number of shares that may be redeemed, the Firm has revised its share repurchase program such that in any consecutive 12-month period the number of shares repurchased by the Firm under its redemption plan will be limited to the proceeds in the distribution reinvestment plan. |

4. We note that you may conduct the share repurchase program during the offering period of the shares being registered under this registration statement. Please advise us how the repurchases of shares will be conducted in a manner that is consistent with the restrictions on activities by issuers during distributions of securities set forth in Regulation M. See T REIT Inc. (Letter dated June 4, 2001), Wells: Real Estate Investment Trust II, Inc. (Letter dated December 3, 2003) and Hines Real Estate Investment Trust, Inc. (Letter dated June 4, 2004).

RESPONSE:

As described in item #3 above and on pages 120-121 (pages 120-121 of the marked prospectus) of the prospectus, the Firm will conduct the repurchases of shares in a manner consistent with the restrictions on activities by issuers during distributions of securities set forth in Regulation M and the October 22, 2007 No Action Letter.

Summary Risk Factors, page 2

5. In the first bullet point, you state that the advisor’s compensation arrangements may provide incentives that are not aligned with the interests of your stockholders. Please briefly explain this statement.

RESPONSE:

This risk factor and the conflict of interest is further explained on page 17 of the prospectus (page 17 of the marked prospectus) and is reproduced in the following:

“American Realty Capital Advisors, LLC faces conflicts of interest relating to the incentive fee structure under our advisory agreement, which could result in actions that are not necessarily in the long-term best interests of our stockholders.

|

| |

November 21, 2007 Page 7 |

Under our advisory agreement, American Realty Capital Advisors, LLC or its affiliates will be entitled to fees that are structured in a manner intended to provide incentives to our advisor to perform in our best interests and in the best interests of our stockholders. However, because our advisor does not maintain a significant equity interest in us and is entitled to receive substantial minimum compensation regardless of performance, our advisor’s interests are not wholly aligned with those of our stockholders. In that regard, our advisor could be motivated to recommend riskier or more speculative investments in order for us to generate the specified levels of performance or sales proceeds that would entitle our advisor to fees. In addition, our advisor’s or its affiliates’ entitlement to fees upon the sale of our assets and to participate in sale proceeds could result in our advisor recommending sales of our investments at the earliest possible time at which sales of investments would produce the level of return that would entitle the advisor to compensation relating to such sales, even if continued ownership of those investments might be in our best long-term interest. Our advisory agreement will require us to pay a performance-based termination fee to our advisor or its affiliates in the event that we terminate the advisor prior to the listing of our shares for trading on an exchange or, absent such listing, in respect of its participation in net sales proceeds. To avoid paying this fee, our independent directors may decide against terminating the advisory agreement prior to our listing of our shares or disposition of our investments even if, but for the termination fee, termination of the advisory agreement would be in our best interest. In addition, the requirement to pay the fee to the advisor or its affiliates at termination could cause us to make different investment or disposition decisions than we would otherwise make, in order to satisfy our obligation to pay the fee to the terminated advisor. Moreover, our advisor will have the right to terminate the advisory agreement upon a change of control of our company and thereby trigger the payment of the performance fee, which could have the effect of delaying, deferring or preventing the change of control.”

6. In the fifth bulleted paragraph, please quantify the amount of shares that you would need to sell in order to achieve such a diverse portfolio.

RESPONSE:

The Firm’s advisor believes that to build a diversified portfolio of real estate assets it is necessary to acquire retail, office and industrial properties each occupied by a different tenant with varying credit ratings, in assorted geographic locations. Additionally, the advisor is of the opinion that the acquisition of approximately twenty (20) properties with an average purchase price of $7,000,000 per property, the Firm would succeed in achieving a diversified portfolio. In order to acquire such a portfolio and anticipating a debt leverage ratio of 4:1, the Firm would need to raise approximately $45,000,000 and to sell 4,500,000 shares (3% of our target).

|

| |

November 21, 2007 Page 8 |

Please also see the revised fifth bullet on page 2 of the prospectus (page 2 of the marked prospectus).

Conflicts of Interest, page 4

7. Please revise the first and fourth bullet points to identify the other programs and direct investments sponsored by American Realty Capital. Provide similar clarification under the heading “Conflicts of Interest” beginning on page 54.

RESPONSE:

The Firm currently has no competing programs and anticipates 100% of its advisor’s time and effort will be allocated to finding properties on its behalf. There may be a time in the future when the Firm will establish additional programs. However, we anticipate that these programs will mostly target properties that would not fall within the scope of our investment objectives. In the event that the sponsors do establish other investment vehicles, and there are situations in which we are competing with the sponsors’ other programs for triple-net leases (NNN)1 and double-net leases (NN)2 for real estate leased to investment grade and other credit worthy tenants on long-term leases, the sponsors would devise a rotational plan based on factors such as: the entity with longest uninvested funds, credit and tenant diversification, property location and the amount of leverage on the individual property and total entity leverage; guaranteeing that the Firm had equal opportunities to acquire the properties.

Please also see the revised bullets on page 4 of the prospectus (page 4 of the marked prospectus) and the revised introduction to of the “Conflicts of Interest” section on page 59 of the prospectus (page 59 of the marked prospectus).

8. In the fifth bulleted statement, please disclose that American Realty Capital Advisors, LLC will receive substantial minimum compensation regardless of performance. We note your disclosure to this effect on page 16.

1 Triple-net leases typically require the tenant to pay all costs associated with a property in addition to the base rent and percentage rent, if any.

2 Double-net leases typically have the landlord responsible for the roof and structure, or other aspects of the property, while the tenant is responsible for all remaining expenses associated with the property.

|

| |

November 21, 2007 Page 9 |

RESPONSE:

Please see the revised fifth bulleted statement on page 4 of the prospectus (page 4 of the marked prospectus) incorporating the disclosure that American Realty Capital Advisors, LLC will receive substantial minimum compensation regardless of performance.

Prior Offering Summary, page 5

9. We note the discussion of the prior business experience of Messrs. Schorsch and Kahane. Placing this information in the summary may give it undue emphasis. We note that you have included this disclosure under the heading “Prior Performance Summary” on page 81. Please remove this disclosure from the summary.

RESPONSE:

Please see revised page 5 of the prospectus (page 5 of the marked prospectus) with the text in the “Prior Offering Summary” section revised.

Compensation to American Realty Capital Advisors, LLC and its Affiliates, page 6

10. Under “Acquisition and Advisory Fees,” you state that you will pay American Realty Capital Advisors, LLC 2% of the contract purchase price of each acquired property. However, on page 46, you state that they will receive “up to” 2%. Similarly, under “Property Management and Leasing Fees,” you state that American Realty Capital Properties, LLC, will receive “up to (i) 2%...” However, on page 47, you state that it will receive a flat 2% fee. Please reconcile these disclosures. Also, if applicable, please explain the circumstances under which either of these entities would receive less than the stated percentage.

RESPONSE:

The “Acquisition and Advisory Fees” and the “Property Management and Leasing Fees” will be flat percentages as they are respectively calculated. Please see pages 7, 49-50, and 52-53 of the prospectus (pages 7, 49-50, and 52-53 of the marked prospectus).

11. Refer to your descriptions of “Acquisition Expenses” and “Property Management and Leasing Fees” on page 7. Please tell us whether the reimbursement amounts will include reimbursement for personnel costs.

|

| |

November 21, 2007 Page 10 |

RESPONSE:

Reimbursement will include personnel costs and will never exceed, when combined with acquisition fees and acquisition expenses, a cumulative 4% of the purchase price for the property.

12. You state that you cannot determine “Acquisition Expenses” at this time; however, on page 33, you estimated this amount to be $6,000,000. Please reconcile these disclosures.

RESPONSE:

The “Acquisition Expenses” are estimated to be 0.4% of the offering amount, or $6,000,000 of the Maximum Offering Amount. Actual gross amounts, determined on a leveraged basis, are dependent upon the aggregate purchase price of our properties and, therefore, cannot be determined at the present time.

Please see the reconciled amounts of the Acquisition Expenses on pages 4, 7 and 52 of the prospectus (pages 4, 7 and 52 of the marked prospectus).

13. In the description of Property Management and Leasing Fees, please add the tenant improvements fee, which you discuss on page 45. In addition, please explain in greater detail the “survey of brokers and agents.” Will you conduct your own survey?

RESPONSE:

The Firm intends to build a portfolio comprised almost entirely of NNN and NN leased real estate. Given the terms of these leases, tenant improvements will almost always be the responsibility of the tenant. There may limited circumstances where tenant improvements become the landlord’s responsibility, e.g., Governmental Services Administration (GSA) leases, at which point the property manager will have to seek approval from us prior to providing tenant improvement services. The tenant improvement fee has been included in the description of Property Management and Leasing Fees on pages 7 and 53 of the prospectus (pages 7 and 53 of the marked prospectus). Also see the revised description of the tenant improvement fee on page 48 of the prospectus (page 48 of the marked prospectus).

The “survey of brokers and agents” will be conducted by the Advisor on behalf of the Firm pursuant to the terms of the Advisory Agreement. Please see the correlating revisions to the prospectus on pages 45 and 48 of the prospectus (pages 45 and 48 of the marked prospectus).

|

| |

November 21, 2007 Page 11 |

Risks Related to an Investment in American Realty Capital Trust, Inc., page 12

14. The second and third risk factors under this heading appear to describe the same risk. Please revise to clarify the distinction between the two risks or omit the redundant disclosure.

RESPONSE:

Please see revised Risk Factors on pages 13-14 of the prospectus (pages 13-14 of the marked prospectus), where the duplicative Risk Factor has been deleted.

Risks Related to Conflicts of Interest, page 15

American Realty Capital Advisors, LLC will face conflicts of interest..., page 15

15. Please provide more robust disclosure relating to the following two statements:

| | · | “[W]e may acquire properties in geographic areas where other American Realty Capital-sponsored programs own programs. |

| | · | [W]e may acquire properties from, or sell properties to, other American Realty Capital-sponsored programs. |

Explain why these situations create conflicts of interest and what the resulting risk is to your company.

RESPONSE:

Although not currently anticipated, our principals or affiliates of our advisor may sponsor other real estate investment programs in the future that may compete with the Firm. Please see the revised risk disclosure on page 16 of the prospectus (page 16 of the marked prospectus) reflecting this potential conflict of interest and associated risks. These risks are also further described in the “Conflicts of Interest” section on pages 59-63 of the prospectus (pages 59-63 of the marked prospectus).

General Risks Related to Investments in Real Estate, page 22

We may acquire or finance properties with lock-out provisions..., page 24

16. Please revise to briefly explain the term “lock-out provisions.”

|

| |

November 21, 2007 Page 12 |

RESPONSE:

Lock-out provisions in a financing preclude prepayments of a loan. Please see the revised disclosure on page 26 of the prospectus (page 26 of the marked prospectus) that includes the explanation of the term.

Estimated Use of Proceeds, page 33

17. Please revise the introductory paragraph to separately state the total percentage of offering proceeds that will be used to pay expenses and fees.

RESPONSE:

Please see the revised introductory paragraph on pages 34-35 of the prospectus (pages 34-35 of the marked prospectus).

18. Please expand the table to also show use amounts reflecting the minimum offering proceeds and percentages. Refer to Item 3.B of Industry Guide 5.

RESPONSE:

Please see revised table on page 35 of the prospectus (page 35 of the marked prospectus), reflecting the minimum offering proceeds and percentages.

19. In footnote two, please explain the “certain circumstances” under which the commissions may be reduced.

RESPONSE:

Commissions may be reduced for volume discounts described on pages 132-134 of the prospectus (pages 132-134 of the marked prospectus). Please also see the added cross reference in footnote 3 of the “Estimated Proceeds” section to the “Volume Discounts” section.

Executive Officers and Directors, page 37

20. Please revise to clarify whether the named executive officers are employees of American Realty Capital Trust, Inc., your Advisor, American Realty Capital II, LLC, or all three.

|

| |

November 21, 2007 Page 13 |

RESPONSE:

All of the named executive officers on page 39 of the prospectus (page 39 of the marked prospectus) are employees only of American Realty Capital Advisors, LLC and not of any of its affiliates. Please see revised page 39 of the prospectus (page 39 of the marked prospectus).

21. Please disclose how long Brian S. Block has been employed with your company.

RESPONSE:

Brian Block joined American Realty Capital on September 10, 2007. Please see revised page 40 of the prospectus (page 40 of the marked prospectus).

22. Please disclose Michael Weil’s years of service with each of his employers over the past five years. Refer to Item 401(e) of Regulation S-K.

RESPONSE:

The following is Michael Weil’s employment history over the past five years:

May 2007-present - Executive Vice President, American Realty Capital, LLC

October 2006-May 2007 - Managing Director, Milestone Partners, Limited

April 2004-October 2006 - Sr. Vice President, American Financial Realty

July 1987-April 2004 - President, Plymouth Pump & Systems Co.

Please see Michael Weil’s revised employment history on page 40 of the prospectus (page 40 of the marked prospectus).

Compensation of Directors, page 38

23. Please revise to include the disclosure required by Item 402(k) of Regulation S-K, using the tabular presentation prescribed by the rule.

RESPONSE:

Please see the tabular presentation added to page 41 of the prospectus (page 41 of the marked prospectus).

|

| |

November 21, 2007 Page 14 |

Property Manager, page 44

24. In the first full paragraph on page 45, please provide more detail about when American Realty Capital Properties, LLC would assist tenants with improvements. We note your disclosure elsewhere in the prospectus that you intend to provide net leases. Please clarify whether the property manager is required to obtain your approval before providing tenant improvements.

RESPONSE:

Please see the response to comment number 13 herein.

Certain Relationships and Related Transactions, page 46

25. Refer to the last paragraph on page 47. Please explain in greater detail how the fees that may be provided to American Realty Capital II, LLC, are “success-based fees.” Explain what they are being incentivized to do and how their successful performance relates to the actual payment of fees.

RESPONSE:

The mechanism for determining the “success-based fees” is described on page 51 of the prospectus (page 51 of the marked prospectus). The payment of these fees to American Realty Capital II, LLC is related to the successful performance of the REIT because of the fact that American Realty Capital II, LLC would receive this fee only if it is entitled to a subordinated participation in the net proceeds at the liquidation of the portfolio. The “subordinated participation in net sale proceeds,” also known as the “promote,” is a success-based performance fee. It is meant to motivate the advisor to obtain the highest possible selling price for the property. The fee is calculated as 15% of the remaining net sale proceeds after the investors have received a return of their net capital invested and a 6% annual cumulative, non-compounded return. If the Advisor does not succeed in achieving a purchase price that would result in an annual cumulative non-compounded return greater than 6%, then the Advisor would not earn this incentive fee.

Management Compensation, page 48

26. Please state your basis for your belief that acquisition expenses will be approximately 0.5% of the purchase price of each property.

|

| |

November 21, 2007 Page 15 |

RESPONSE:

Based on the Sponsors’ experience with the acquisitions of American Financial Realty Trust, acquisition expenses are generally 0.5% of the purchase price of each property.

Conflicts of Interest, page 54

Other Activities of American Realty Capital Advisors, LLC and its Affiliates, page 55

27. We note that your executive officers do not devote all of their time to your business.

Please expand your disclosure in this section and the risk factor on page 16 to quantify the amount of time your executive officers will devote to you.

RESPONSE:

All of the Firm’s executive officers will spend at least a majority of their time on the Firm’s operations. Accordingly, please see revised disclosures on pages 17 and 60 of the prospectus (pages 17 and 60 of the marked prospectus).

Receipt of Fees and Other Compensation by American Realty Capital Advisors, LLC and Its Affiliates, page 57

28. We note that your discussion of fees is limited to fees relating to the purchase and sale of properties. Please provide additional disclosure describing the conflicts of interest faced by your property manager and your advisor, considering that their fees are fixed and not based on performance of the properties.

RESPONSE:

Please see the revised discussion of “Receipt of Fees and Other Compensation by American Realty Capital Advisors, LLC and Its Affiliates” on page 61 of the prospectus (page 61 of the marked prospectus).

Certain Conflict Resolution Procedures, page 57

29. In the chart on page 59, please add footnote disclosure to indicate where the management agreements fit in.

|

| |

November 21, 2007 Page 16 |

RESPONSE:

Please see added footnotes to the charts on pages 5 and 63 of the prospectus (pages 5 and 63 of the marked prospectus).

30. Please revise footnote (2) to reflect the fact that American Realty Capital is actually a joint venture between three entities: Mr. Schorsch, Mr. Kahane, and GF Capital Management & Advisors LLC or tell us why you do not believe this is appropriate. We note related disclosure on your company’s website.

RESPONSE:

www.americanrealtycap.com is currently displaying the website for American Realty Capital I, which mentioned GF Capital as a JV partner. GF Capital will have no interest in American Realty Capital II, LLC, American Realty Capital Trust, Inc., or any of its affiliates. The draft website for American Realty Capital Trust, Inc. and its affiliates is currently hosted on: http://americanrealty.webdeskos.com/ and will move to www.americanrealtycap.com once the SEC has approved the content.

Investment Objectives and Policies

American Realty Capital’s Business Plan, page 60

31. Refer to the second full paragraph on page 61. Please revise to clarify how your ability to finance complicated real estate transactions will allow you to realize value in real estate assets. Similarly, please revise the second bullet point following this paragraph to explain how your underwriting methodology results in a collection of properties whose sum is more valuable than the individual parts.

RESPONSE:

Please see revised pages 64-65 in the prospectus (pages 64-65 of the marked prospectus)

32. Please further explain how the lease structures that you offer are different and more flexible than structures offered by other real estate buyers.

|

| |

November 21, 2007 Page 17 |

RESPONSE:

Please see revised pages 64-65 of the prospectus (pages 64-65 of the marked prospectus).

Acquisition of Properties from Affiliates, page 70

33. Add disclosure, if true, that an affiliate may receive substantial real estate commissions, even though the property was purchased by an affiliate.

RESPONSE:

The Firm intends to pay real estate commissions to affiliates from whom properties are purchased in amounts generally charged for similar services in the area by non-affiliated parties. This disclosure has been added to pages 45 and 74 of the prospectus (pages 45 and 74 of the marked prospectus).

Plan of Operation, page 74

Results of Operations, page 76

34. You state that your advisor is not aware of any material trends or uncertainties, other than national economic conditions affecting real estate generally, that may be reasonably anticipated to have a material impact, favorable or unfavorable, on revenues or income from the acquisition and operation of real properties and real estate-related investments, other than those referred to in this prospectus. Please revise to discuss the material trends referenced in the prospectus, including current competitive conditions in the real estate market (see, e.g., page 62). Please also discuss the effect of the recent issues in the credit markets.

RESPONSE:

Please see the revised “Results of Operations” section on page 81-82 of the prospectus (pages 81-82 of the marked prospectus).

Liquidity and Capital Resources, page 78

35. Discuss the impact on your investment opportunities if only the minimum subscription amount is achieved, as well as the impact on your operations, in light of the fact that you intend to reserve only 0.1 % of the gross proceeds from this offering for future capital needs.

|

| |

November 21, 2007 Page 18 |

RESPONSE:

If we only achieve the minimum subscription amount, we will be significantly limited in our ability to build a diversified portfolio. Additionally, our ability to achieve desired economies of scale and to become a market mover will be severely hampered. Please see the revised disclosure on page 86 of the prospectus (page 86 of the marked prospectus).

Prior Performance Summary, page 81

36. Please provide the narrative and tabular disclosure relating to prior performance, as required by Industry Guide 5. Refer to SEC Release 33-6900 for the application of Guide 5 to registration statements of REITs.

RESPONSE:

Please see the revised “Prior Performance Summary” section on pages 89-92 of the prospectus (pages 89-92 of the marked prospectus). Please also see the responses to the Supplemental Comment Letter attached hereto as Attachment No. 2. The information contained in the “Prior Performance Summary” was obtained from American Financial Realty Trust’s public documents filed with the Securities and Exchange Commission.

Federal Income Tax Considerations, page 81

37. Eliminate the following qualifying language: “[T]his summary does not address all possible tax considerations that may be material to an investor....” Instead, clarify that this section does summarize all material federal tax issues and consequences relevant to an investor.

RESPONSE:

Please see the revised introduction to the “Federal Income Tax Considerations” section on page 93 of the prospectus (page 93 of the marked prospectus).

Plan of Distribution, page 117

38. Please revise to describe the factors considered in determining the offering price of $10.00 per share.

|

| |

November 21, 2007 Page 19 |

RESPONSE:

Please see the revised language on page 130 of the prospectus (page 130 of the marked prospectus) describing the arbitrary selection of the offering price.

Volume discounts, page 120

39. We note that the purchase price per share is $10.00 for a single purchaser with an order of $1,000 - $250,000 and that the price drops to $9.85 per share for orders of $250,001 - $500,000. Please explain why the reduction in selling commissions reflected in the table appears to be less than the reduction in price per share.

RESPONSE:

Please see the revised table on pages 132-133 of the prospectus (pages 132-133 of the marked prospectus) reflecting the reduction in selling commissions consistent with the reduction in price per share.

Minimum Offering, page 122

40. Please revise to state whether shares purchased by your executive officers and directors, or the executive officers and directors of your affiliates, will count toward the minimum offering amount.

RESPONSE:

Shares purchased by our and our affiliates’ executive officers and directors will count toward the minimum offering amount, and the disclosure on page 135 of the prospectus (page 135 in the marked prospectus) has been revised accordingly.

Financial Statements

Note 1- Organization

41. We note that the Company may seek to acquire investments in mortgages secured by real estate. Tell us what consideration you have given to including your accounting policies related to the investment in mortgages in your summary of significant accounting policies.

|

| |

November 21, 2007 Page 20 |

RESPONSE:

We will revise our summary of significant accounting policies to include accounting policies relating to acquiring investment in mortgages secured by real estate.

Loan Loss Provisions

We may purchase or originate commercial mortgages and mezzanine loans to be held as long-term investments. The loans will be evaluated for possible impairment on a quarterly basis. In accordance with SFAS No. 114, Accounting by Creditors for Impairment of a Loan, impairment occurs when it is deemed we will not be able to collect all amounts due according to the contractual terms of the loan. Upon determination of impairment, we will establish a reserve for loan losses and a corresponding charge to earnings through the provision for loan losses. Significant judgments are required in determining impairment, which include making assumptions regarding the value of the loan, the value of the real estate or partnership interests that secure the loan, and any other applicable provisions, including guarantees and cross-collateralization features, if any.

Note 2 - Summary of Significant Accounting Policies

Allocation of Purchase Price of Acquired Assets

42. Explain to us how you determined it would be appropriate to capitalize the opportunity costs associated with lost rentals as a component of the fair values of in-place leases. Cite any relevant accounting literature in your response.

RESPONSE:

The Company deems it appropriate to capitalize the opportunity costs associated with lost rentals as a component of fair value of in-place leases based on accounting practices standard in the real estate industry. Specifically, we refer to the Statement of Financial Accounting Standards No. 141, ”Business Combinations,” White Paper prepared by KPMG in December 2003 and discussed with the staff of the SEC:

Step 5: Calculate the value of leases in-place at acquisition and allocate a portion of the amount calculated in Step 4, to in-place lease value (Step 4 is the value of intangible assets after accounting for the value of above and below market in-place leases). In-place lease value may consist of a variety of components including, but not necessarily limited to: (i) the value associated with avoiding the cost of originating the acquired in-place leases (i.e. the market cost to execute a lease, including leasing commissions, legal and other related costs); (ii) the value associated with lost revenue related to tenant reimbursable operating costs estimated to be incurred during the assumed re-leasing period (i.e., real estate taxes, insurance and other operating expenses); (iii) the value associated with lost rental revenue from existing leases during the assumed re-leasing period; and (iv) the value associated with avoided tenant improvement costs or other inducements to secure a tenant lease.

|

| |

November 21, 2007 Page 21 |

Accordingly, we believe facts and circumstances warrant our inclusion of such costs when determining the value of acquired in-place leases.

Part II. Information Not Required in Prospectus

Exhibits

43. Please file all required exhibits as promptly as possible. We will review the exhibits prior to granting effectiveness of the registration statement and may have further comments after our review. If you are not in a position to file your legal and tax opinions with the next amendment, please provide draft copies for us to review.

RESPONSE:

Submitted with the Firm’s S-11 are the following exhibits:

| | i) | Ex. 4.2: A Specimen Certificate for Shares is not applicable because our board of directors has authorized the issuance of shares of our stock without certificates. |

| | ii) | Ex. 5: Form of Opinion of Proskauer Rose LLP as to the legality of the Shares being registered |

| | iii) | Ex. 8: Form of Opinion of Proskauer Rose LLP as to tax matters |

| | iv) | Ex. 10.1: Form of Escrow Agreement by and among American Realty Capital Trust, Inc., [ ] and Realty Capital Securities, LLC |

| | v) | Ex. 10.4: Form of the Company’s Stock Option Plan |

| | vi) | Ex. 23.2: Form of Consent of Proskauer Rose LLP dated [Date] (included in Opinion of Proskauer Rose LLP On Exhibit 5) |

| | vii) | Ex. 23.3: Form of Consent of Venable LLP dated [Date] |

Regards,

/s/ Peter M. Fass

Peter M. Fass

|

| |

November 21, 2007 Page 22 |

ATTACHMENT NO. 1

SALES MATERIAL

|

| |

November 21, 2007 Page 23 |

ATTACHMENT NO. 2

RESPONSE TO

SUPPLEMENTAL COMMENT LETTER,

DATED NOVEMBER 14, 2007

The headings and numbered paragraphs below correspond to the headings and numbered paragraphs in the Supplemental Comment Letter. For your convenience, your comments are set forth in italics in this letter, followed by the Company’s responses.

1. Please file your correspondence and draft disclosure on EDGAR.

RESPONSE:

The correspondence and draft disclosure was filed on Edgar on November 15, 2007.

Introduction

2. The first paragraph indicates that the disclosure represents the historical experience of "certain" real estate programs managed by Messrs. Schorsch and Kahane. Please revise to disclose all prior programs sponsored by your sponsors over the last ten years. Refer

to Item 8.A. of Industry Guide 5.

RESPONSE:

Please see the revised “Prior Performance Summary” section on pages 89-92 of the prospectus (pages 89-92 of the marked prospectus).

3. Please revise the narrative summary to remove the examples of acquisitions by AFR during the tenure of Mr. Schorsch and Mr. Kahane. Instead disclose the more complete summary information identified in Item 8.A. of Industry Guide 5.

RESPONSE:

Please see the revised “Prior Performance Summary” section on pages 89-92 of the prospectus (pages 89-92 of the marked prospectus).

Prior Performance Tables

|

| |

November 21, 2007 Page 24 |

4. Please limit the disclosure in the first table to information covering the most recent three years of AFR's operations. In addition, please include the following information in the table:

| | · | total capital raised in each of the last three years; |

| | · | offering expenses paid to affiliates and to third parties; |

| | · | the amount of any acquisition costs; and |

| | · | the amount of leverage, stated as a percentage or ratio. |

RESPONSE:

Please see the revised “Prior Performance Summary” section on pages 89-92 of the prospectus (pages 89-92 of the marked prospectus).

5. Refer to the second table under this heading. Please revise the line items in the table to more closely track the line items identified in Table III of Guide 5. Alternatively, provide disclosure that more closely replicates the financial information in AFR's public filings. If you choose to retain line items for FFO and Adjusted FFO, please tell us why you believe these items are appropriate for the table and provide a footnote to explain how you derived Adjusted FFO.

RESPONSE:

Please see the revised “Prior Performance Summary” section on pages 89-92 of the prospectus (pages 89-92 of the marked prospectus).

6. Please tell us why you have omitted Tables II, IV, V, and VI prescribed by Industry Guide 5.

RESPONSE:

Please see the revised “Prior Performance Summary” section on pages 89-92 of the prospectus (pages 89-92 of the marked prospectus).

Table V (Sales or Disposals of Properties), prescribed by Industry Guide 5, has been added to page 91 of the prospectus (page 91 of the marked prospectus). The information in the table, "Three Year Summary of Sales by AFR," is extracted from AFR's Form 10-K's, which do not break out individual sales, but only shows all sales aggregated.

|

| |

November 21, 2007 Page 25 |

Table VI (Acquisitions of Properties by Programs), prescribed by Industry Guide 5, has been added to pages 90-91 of the prospectus (page 90-91 of the marked prospectus). The information in the table, "Three Year Summary of Acquisitions by AFR," is extracted from AFR's 10-Ks, which break out acquisitions by portfolio rather than by each individual property.

We have omitted Table II (Compensation to Sponsor) prescribed by Industry Guide 5 because the sponsors did not receive any compensation other than dividends and salaries disclosed in AFR’s proxy statements for the years 2003, 2004 and 2005. Table IV (Results of Completed Programs) prescribed by Industry Guide 5 is pending as the Firm is gathering the information.