| | 1585 Broadway New York, NY 10036-8299 Telephone 212.969.3000 Fax 212.969.2900 | | BOCA RATON BOSTON LONDON LOS ANGELES NEW ORLEANS NEWARK PARIS SÃO PAULO WASHINGTON |

| | | Member of the Firm Direct Dial 212-969-3445 | | |

December 18, 2007

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Attention: Karen J. Garnett

Dear Ms. Garnett:

This firm represents American Realty Capital Trust, Inc. (the “Company” or “Firm”) in connection with its application for registration under the Securities Act of 1933. In furtherance thereof, we are submitting the enclosed response to the comments and requests in your letter, dated December 5, 2007 (the “Comment Letter”) and to indicate the changes that have been made in Amendment No. 2 to the Registration Statement (“Amendment No. 2”) that was filed on December 18, 2007 with the SEC. Five clean courtesy copies of Amendment No. 2 (without exhibits), five clean copies of the exhibits that have been revised, and five marked copies of Amendment No. 2 (without exhibits) are enclosed for your reference. The marked copies show the changes between the Amendment No. 1 to the Registration Statement (“Amendment No. 1”) and Amendment No. 2.

The headings and numbered paragraphs below correspond to the headings and numbered paragraphs in the Comment Letter. For your convenience, your comments are set forth in italics in this letter, followed by the Company’s responses. The page numbers referred to in your comments track the page numbers in Amendment No. 1, and the page numbers referred to in the Company’s responses track the page numbers in Amendment No. 2.

December 18, 2007

Page 2

The revisions to the Registration Statement in Amendment No. 2 incorporate the comments and requests in your letter, dated December 5, 2007, as well as comments from the states and internal revisions.

General

1. We note your response to prior comment 1 and understand that your website is currently under development. We are continuing to review your website, and we may have further comments.

2. We note your response to prior comment 2 and your related proposed disclosure. If you include this disclosure in your prospectus, please address the following comments:

| | · | Revise to clarify that an investor in your company should not expect the same performance as the NCREIF Index because the NCREIF Index does not factor in fees or expenses, which are significant to your company. |

| | · | Please tell us why you have included the reference to Franklin Income A Index. This fund does not seem comparable to your company. |

| | · | Please revise to clarify how the NCREIF index measures the "value" of $1 invested in 1996. Since there is no trading market, it is not clear how those investments are valued. |

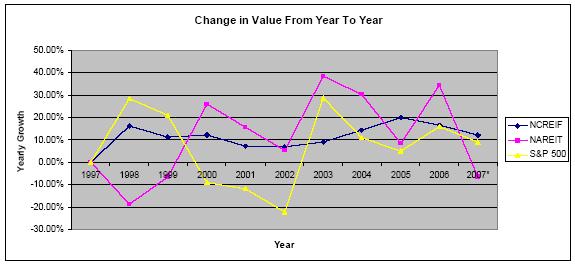

| | · | The narrative description of returns for the S&P 500 index and the NAREIT index do not appear to correspond to the graph. Please revise or advise. |

RESPONSE:

Please see the items below, which have been revised pursuant to the SEC comments above and added to Amendment No. 2 of the prospectus on pages 72-74 of the prospectus.

Diversification Through Real Estate

Traditionally, investment portfolios have contained a balance of stocks, bonds, mutual funds and cash equivalents. To the extent investors seek portfolio diversification through real estate ownership, they often select publicly-traded real estate companies, primarily REITs. The issue with these REITs and other exchange traded companies, is that they tend to be closely correlated to the broader equities market, thus defeating, in part, the rationale for owning this asset category. Investing in a private REIT such as ours may add an additional level of diversification and a low correlation to investments listed on the public exchanges. Moreover, such an investment may augment current returns, provide income growth, furnish asset appreciation, and allow ownership of a high quality, diversified portfolio of real estate.

Diversification is a strategy designed to reduce exposure to portfolio risk by combining a variety of investments which are unlikely to appreciate or depreciate at the same time. One way to diversify an existing portfolio of stocks and bonds is to add real estate to the portfolio mix. Because most investors cannot build a sufficiently diverse portfolio of real estate on their own, they may choose to invest in either publicly traded or non-traded Real Estate Investment Trusts (“REITs”). (See: “What is a REIT” in the FAQs).

Past performance is no guarantee of future results.

NCREIF Index: The National Council of Real Estate Investment Fiduciaries index is an unmanaged, market-weighted index of non-traded unleveraged properties owned by tax exempt entities. NCREIF was established to serve the institutional real estate investment community as a non-partisan collector, processor, validator and disseminator of real estate performance information. NCREIF members, like us, are not traded on any public exchange. NCREIF includes dividends.

NAREIT Index: The NAREIT Equity REIT Index is an unmanaged, market-weighted index of publicly-traded, tax-qualified REITs traded on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market System. NAREIT includes dividends.

S&P 500 Index: The Standard & Poor's 500 Index is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries and is adjusted to reflect dividends paid.

The chart above shows that the S&P 500 and NAREIT indices have exhibited significant volatility from 1997 to 2007. NCREIF, on the other hand, has returned stable and predictable returns year after year.

Direct Private Placements As An Alternative To Traditional Investment Vehicles

While the chart above tracks changes in value from 1997 to 2007 in the S&P 500, NAREIT and NCREIF indices the diagram below follows the growth of one dollar invested in these same 3 indices during the same time period.

Sources: NAREIT, NCREIF and S&P 500

* 2007 is a partial year (through Q3)

The chart shows that over the last 10 years real estate has outperformed the S&P 500, and that within the real estate sector itself, the NCREIF index has out performed publicly traded REITs. The value of one dollar invested in NAREIT almost tripled over the 10 year period in question, while one dollar invested in NCREIF more than tripled while demonstrating more consistent performance. During this time period the S&P 500 proved to be a less successful investment than either NAREIT or NCREIF. As you can see from comparing the two immediately preceding charts the S&P 500 was the most volatile index, while achieving the lowest comparative returns.

However, the NAREIT index, while only slightly underperforming the NCREIF index, has exhibited much more volatility. NAREIT is comprised of publicly traded REITs and stock prices are highly susceptible to broader market movements. The NCREIF index, however, is not correlated to the public securities markets. This means that NCREIF members and their investors are less susceptible to severe market movements. Not being listed on an exchange aligns management and the investors’ incentives to view the investment over a longer investment horizon.

In addition to being an important tool in portfolio diversification, real estate is considered to be a good hedge against inflation. We believe that our portfolio can act as an inflation hedge because of the contractual rent increases in many of our leases. However, actual results from operations and, accordingly, cash available for distribution, will be affected by a number of factors, including the rents we receive from our tenants, our financing costs, the ability of our tenants to meet their lease obligations, and unanticipated expenditures not otherwise paid by the tenant.

In addition to being an important tool in portfolio diversification and enjoying lower volatility, real estate is considered to be a good hedge against inflation. We believe that our portfolio can act as an inflation hedge because of the contractual rent increases that are built into many of our leases. As a result of such increases, additional revenue should increase the amount of cash available for distribution to our stockholders. However, our actual results of operations and, accordingly, cash available for distribution, will be affected by a number of factors, including the revenue we receive from our tenants, our debt obligations, interest expense, the ability of our tenants to meet their obligations, and unanticipated expenditures.

The qualifications for valuation of investments in the NCREIF Property Index (“NPI”) are:

| | · | Operating properties only |

| | · | Property types - apartments, hotels, industrial properties, office buildings, and retail only |

| | · | Can be wholly owned or in a joint venture structure. |

| | · | Investment returns are reported on a non-leveraged basis. While there are properties in the index that have leverage, returns are reported to NCREIF as if there is no leverage |

| | · | Must be owned/controlled by a qualified tax-exempt institutional investor or its designated agent |

| | · | Existing properties only (no development projects) |

| | · | Calculations are based on quarterly returns of individual properties before deduction of asset management fees. |

| | · | Each property's return is weighted by its market value. |

| | · | Income and Capital Appreciation changes are also calculated. |

| | · | The NPI is a quarterly time series composite total rate of return measure of investment performance of a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only. All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors - the great majority being pension funds. As such, all properties are held in a fiduciary environment. |

| | · | Properties in the NPI are accounted for using market value accounting standards. Data contributed to NCREIF is expected to comply with the Regional Economic Information System (REIS, Inc.). Because the NPI measures performance at the property level without considering investment or capital structure arrangements, information reported to the index will be different from information reported to investors. For example, interest expense reported to investors would not be included in the NPI. However, because the property information reported to the index is expected to be derived from the same underlying books and records, because it is expected to form the underlying basis for investor reporting, and because accounting methods are required to be consistent, fundamentally consistent information expectations exist. |

| | · | NCREIF requires that properties included in the NPI be valued at least quarterly, either internally or externally, using standard commercial real estate appraisal methodology. Each property must be independently appraised a minimum of once every three years. |

| | · | Because the NPI is a measure of private market real estate performance, the capital value component of return is predominately the product of property appraisals. As such, the NPI is often referred to as an "appraisal based index." |

Shareholders should not expect the same performance as the NPI because the NPI does not factor in the fees or expenses that we are subject to.

Compensation to American Realty Capital Advisors, LLC and its Affiliates, page 6

3. We note your response to prior comment 11. Please revise to clarify that acquisition expenses will include personnel costs and identify any other anticipated reimbursements. Provide similar disclosure on page 52.

RESPONSE:

Please see the revised disclosures on pages 7 and 52 of Amendment No. 2.

4. You state that your "Asset Management Fees" are payable "in advance." Please explain this statement further to clarify when these fees are due.

RESPONSE:

The Asset Management Fees will be paid quarterly in advance, on January 1, April 1, July 1 and October 1, based on the assets held by the Company on that date, adjusted for appropriate closing dates for individual property acquisitions. Please see the revised disclosures on pages 7 and 53 of Amendment No. 2.

Distribution Policy and Distributions, page 9

5. Please revise to omit the disclosure of your estimated distribution rate. Since you are a blind-pool company with no current operations, there is no basis for including projected distribution amounts. Refer to Item 10(b)(l) of Regulation S-K. Provide conforming changes to the disclosure on page 117 under "Distribution Policy and Distributions."

RESPONSE:

Please see the revised disclosures on pages 9 and 122 of Amendment No. 2, where the estimated distribution rate has been deleted.

Share Repurchase Program, page 10

6. Please explain in greater detail how the per share price for shares repurchased outside of an offering will be "based on" NAV and under what circumstances the board may choose to use a valuation method other than NAV. Disclose whether your board will inform the stockholders in the event it chooses to use a valuation method other than the NAV calculation.

RESPONSE:

The per share price for shares repurchased outside of an offering will be valued according to the net asset value, as determined by the board of directors. No valuation method other than net asset value will be used. The board of directors shall use the following criteria for determining net asset value of the shares: value of our assets (estimated market value) less the estimated market value of our liabilities, divided by the number of shares.

Please see the revised disclosures on pages 10 and 126 of Amendment No. 2.

Risk Related to Conflicts of Interest. page 16

We may have increased exposure.. .. page 18

7. Please explain the types of "certain financial guarantees" you provide in conjunction with the Section 1031 Exchange Program and, to the extent applicable, please separately address the risks associated with each type of guarantee you will provide.

RESPONSE:

The “certain financial guarantees” regarding the Company purchasing unsold con-tenancy interests are described in “Section 1031 Exchange Program” on page 78 of Amendment No. 2.

Please see the revised disclosure on page 17 of Amendment No. 2.

Executive Officers and Directors, page 39

8. Please disclose William Stanley's years of service with each of his employers over the past five years. Refer to Item 401(e) of Regulation S-K.

RESPONSE:

2004 - Present : Managing member of Stanley Laman Securities, LLC

1997 - Present: President of Stanley-Laman Group, Ltd

Please see revised disclosure on page 40 of Amendment No. 2.

Affiliated Companies, page 47

Property Manager, page 47

9. We note your revised disclosure in response to prior comment 10. However, we note that the first paragraph on page 48 still includes 'up to" language relating to the 2- 4% fee payable to American Realty Capital Properties, LLC. Please revise.

RESPONSE:

Please see the revised disclosure on page 48 of Amendment No. 2.

Certain Relationships and Related Transactions, page 49

10. We note your supplemental response to prior comment 25. Please revise your disclosure on page 51 to include your rationale for calling this a "success-based fee."

RESPONSE:

Please see the revised disclosure on page 51 of Amendment No. 2.

Management Compensation, page 52

11. We note your supplemental response to prior comment 26. Please add footnote disclosure to this effect.

RESPONSE:

Please see the revised footnote disclosure on pages 52 and 55 of Amendment No. 2.

Management's Discussion and Analysis of Financial Condition and Operations

Results of Operations. page 81

12. We note your revised disclosure relating to the current disruptions and the current state of the real estate capital markets. Please explain your belief that the current disruptions will "inevitably lead to improved fundamentals..." In addition, please balance this disclosure with the potential risks involved in investing in the real estate market in its current state. We note your related disclosure on 31 about risks associated with the current state of the debt markets.

RESPONSE:

The current credit crunch has resulted in mortgage lenders tightening their belts as they return to real estate fundamentals in search of guidance to help structure loans. Lenders are once again beginning to more closely underwrite real estate deals, scrutinizing tenant credit, the actual real estate, vacancy and absorption rates. This is resulting in lower leverage loans at higher interest rates and more amortization. The slowing of financing available to real estate purchasers has resulted in less transactions occurring and fewer sales, which in turn has caused cap rates to expand and real estate prices to begin inching back down to the historical levels of a few years ago.

Please see the revised disclosure on page 85 of Amendment No. 2.

Funds from Operations, page 85

13. Tell us how you determined that it would be appropriate to define FFO to exclude significant non-recurring items. Explain to us in detail the nature of these non-recurring items and how you determined that they met the criteria in Item 10(e) of Regulation S-K to be treated as such.

RESPONSE:

We have revised the definition of FFO on page 87 of Amendment No. 2 to exclude significant non-recurring items other than those “extraordinary items” defined under GAAP. This definition conforms to the recommendations set forth in a White Paper adopted by the National Association of Real Estate Investment Trusts (“NAREIT”) in April 2002.

Prior Performance Summary, page 89

14. Please revise the introduction to clarify that AFR is a self-managed, publicly traded REIT and therefore is not subject to the same types of fees and expenses that you will pay to your manager and its affiliates.

RESPONSE:

Please see the revised disclosure on page 94 of the “Prior Performance Summary” of Amendment No. 2.

15. Please revise each of the tables to show performance for the last three fiscal years, ending December 31,2006. Currently, the tables cover fiscal years 2003-2005.

RESPONSE:

Please see the revised tables in the “Prior Performance Summary” of Amendment No. 2.

Three Year Summary of Funds Raised by AFR, page 90

16. Please revise the first line to show total capital raised on a gross basis. Also, please include a line item in the table showing the total amount paid to affiliates of AFR, if any, from offering proceeds. If any additional amounts of fees or expenses were paid to third parties from the proceeds, please show those amounts in a separate line item.

RESPONSE:

Please see the revised table “Three Year Summary of Funds Raised by AFR.”

17. Please revise this table to include the amount of acquisition costs and the amount of leverage. We note that you have provided this information in the first table.

RESPONSE:

Please see the revised table “Three Year Summary of Funds Raised by AFR.”

Three Year Summary of Sales by AFR page 91

18. Please expand the table to include all of the information identified in Table V of Industry Guide 5.

RESPONSE:

Please see the revised table “Three Year Summary of Sales by AFR.”

Three Year Summary of Acquisitions by AFR, page 90

19. Please revise this table to include all of the information identified in Table VI of Industry Guide 5. We do not object to providing this information on a portfolio basis if information about individual properties is not available.

RESPONSE:

Please see the revised table “Three Year Summary of Acquisitions by AFR.”

Federal Income Tax Considerations

Opinion of Counsel. page 93

20. Please revise to disclose that counsel has also provided an opinion that the operating partnership will be treated as a partnership for federal income tax purposes.

RESPONSE:

Please see the revised disclosure on page 99 of Amendment No. 2.

Funds from operations (NAREIT defined), page C-5

21. Explain to us why your calculation of Funds from operations excludes minority interest in total rather than adjusting for the minority interests' share of other FFO adjustments. To the extent your intent is to present FFO available to all stakeholders (shareholders and OP unit holders) revise your description accordingly.

RESPONSE:

Since we do not have access to AFR’s financial information other than what is publicly available, we cannot make the SEC’s requested changes and have decided to delete any reference to AFR’s FFO or AFFO.

22. Revise your disclosure to include a reconciliation of the denominator used in the calculation of diluted FFO per share to that used in the calculation of diluted earnings per share.

RESPONSE:

Please see the response to item 21 above.

Adjusted funds from operations, page C-5

23. You disclose that adjusted funds from operations is helpful to investors as a measure of liquidity position. It appears from this disclosure that you intend AFFO to be used as a Liquidity measure. Explain to us how you applied the guidance in item 10(e)(ii)(A) in determining that the adjustments used in your calculation of AFFO were appropriate. Furthermore, given that AFFO is a non-GAAP liquidity measure, explain to us why you have not reconciled it to a GAAP liquidity measure.

RESPONSE:

Please see the response to item 21 above.

Exhibit 5.1 -Form of Legal Opinion

24. We note the reference in the first paragraph to the registration of 1,000 shares of common stock pursuant to your stock option plan; however, the fee table on your registration statement and the cover page of the prospectus do not appear to reference these shares. Please provide a revised opinion or revise your registration statement to discuss this aspect of your offering.

RESPONSE:

Please see the revised cover page of the registration statement referencing these shares.

25. We note that the opinion is limited to federal law and the laws of the State of New York. Please tell us the relevance of New York law to the legal opinion being provided.

RESPONSE:

Please see the revised opinion where the reference to New York law has been deleted.

26. Counsel providing the legal opinion must opine on the legality of the securities under the laws of the state in which the registrant is incorporated. We note that the registrant is incorporated in the state of Maryland and that Proskauer Rose is relying on the opinion of Venable with respect to matters of Maryland law. Please file the Venable opinion as an exhibit to the registration statement.

RESPONSE:

Please see Exhibit 23.1, which was also filed with Amendment No. 1.

Sales Literature, submitted on November 20,2007

Tri-fold Sales Literature

27. We note that you have included photographs of properties that you do not own. In addition, each of the photographs clearly identifies a prominent tenant. Considering that you do not currently own any properties and you do not have agreements with any prospective tenants, these photographs are not appropriate for your sales literature. Please revise the materials to remove the photographs.

RESPONSE:

The sales literature will be revised to include photographs of tenants that have done business with American Realty Capital, LLC, as described on page 92 of the prospectus. Revised sales literature will be submitted to the SEC following the filing of Amendment No. 2.

Front Pane

28. You state that an investment in your shares is appropriate for investors seeking, among other things, inflation hedge and low correlation to stock market. Please explain from what portion of the prospectus these statements are derived. We note that in the Q &A section on page "x" of the prospectus, you include the other goals listed here, but not these two.

RESPONSE:

Please see the revised Q&A section on page “x” of Amendment No. 2 that reflects the goals identified in the sales literature.

Why Invest in Real Estate?

29. Refer to the pie charts showing hypothetical investment portfolios. Please tell us why you have chosen a 32 year period to reflect hypothetical returns. It appears that a shorter period would be more relevant to current investors. Also, please include a statement to highlight the fact that the REIT returns shown reflect returns of REIT securities that trade on an exchange and explain the difference between those returns and returns that investors in a non-traded REIT might expect.

RESPONSE:

This chart was created by Ibbotson Associates (http://www.investinreits.com/reasons/diversification.cfm) and can be found on the NAREIT website. This chart follows REITS since the point at which NAREIT was established (1972) and the data collected. The 1972 is not an arbitrary number but rather a year that incorporates the entire universe of data available. The chart does not suggest that any given REIT would have yielded these results but simply showing that holding REITS in your portfolio will consistently increase your risk adjusted return.

Please note that the NAREIT is a compilation of publicly traded real estate securities and that there is no public market for our shares. While publicly traded securities are more liquid then our shares they are also more volatile. You should expect to see significantly lower volatility in our share price which could also mean forgoing higher returns.

30. Please add disclaimer disclosure relating to the fact that an investor in American Realty Capital Trust, Inc. should not expect the same performance as the NCREIF Index because, unlike the returns your investors will receive, which factor in fees and expenses, the NCREIF Index does not factor in such fees or expenses.

RESPONSE:

This disclaimer disclosure will be added to the sales literature. Revised sales literature will be submitted to the SEC following the filing of Amendment No. 2.

Regards,

/s/ Peter M. Fass

Peter M. Fass