Exhibit 10.14

AMENDED AND RESTATED AND CONSOLIDATED LOAN AGREEMENT

between

KBSII HARTMAN BUSINESS CENTER, LLC,

KBSII PLANO BUSINESS PARK, LLC,

KBSII HORIZON TECH CENTER, LLC,

KBSII 2500 REGENT BOULEVARD, LLC,

KBSII CRESCENT VIII, LLC,

KBSII NATIONAL CITY TOWER, LLC,

KBSII GRANITE TOWER, LLC, and

KBSII GATEWAY CORPORATE CENTER, LLC,

as Borrowers

and

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as Administrative Agent

and

THE FINANCIAL INSTITUTIONS

NOW OR HEREAFTER SIGNATORIES HERETO

AND THEIR ASSIGNEES PURSUANT TO SECTION 13.13,

as Lenders

Entered into as of January 27, 2011

|

| | | | |

| | | Page |

|

| ARTICLE 1. |

| DEFINITIONS | 1 |

|

| 1.1 |

| DEFINED TERMS | 1 |

|

| 1.2 |

| SCHEDULES AND EXHIBITS INCORPORATED | 15 |

|

| ARTICLE 2. |

| LOAN | 15 |

|

| 2.1 |

| LOAN | 15 |

|

| 2.2 |

| LOAN FEES | 15 |

|

| 2.3 |

| LOAN DOCUMENTS | 15 |

|

| 2.4 |

| EFFECTIVE DATE | 15 |

|

| 2.5 |

| MATURITY DATE | 16 |

|

| 2.6 |

| AMENDED AND RESTATED AND CONSOLIDATED LOAN | 16 |

|

| 2.7 |

| INTEREST ON THE LOAN | 16 |

|

| 2.8 |

| PAYMENTS | 19 |

|

| 2.9 |

| FULL REPAYMENT AND RECONVEYANCE | 20 |

|

| 2.10 |

| PARTIAL RELEASE OF PROPERTY | 20 |

|

| 2.11 |

| LENDERS' ACCOUNTING | 23 |

|

| 2.12 |

| SECURED SWAP OBLIGATIONS | 23 |

|

| 2.13 |

| PAR LOAN VALUE | 23 |

|

| 2.14 |

| EXTENSION OPTIONS | 23 |

|

| 2.15 |

| INCREASE IN AGGREGATE LOAN COMMITMENT | 24 |

|

| ARTICLE 3. |

| DISBURSEMENT | 25 |

|

| 3.1 |

| CONDITIONS PRECEDENT | 25 |

|

| 3.2 |

| APPRAISALS | 26 |

|

| 3.3 |

| INITIAL DISBURSEMENT | 27 |

|

| 3.4 |

| SUBSEQUENT DISBURSEMENT | 27 |

|

| 3.5 |

| FUNDS TRANSFER DISBURSEMENTS | 30 |

|

| 3.6 |

| BORROWERS REPRESENTATIVES | 31 |

|

| ARTICLE 4. |

| INTENTIONALLY OMITTED | 31 |

|

| ARTICLE 5. |

| INSURANCE | 31 |

|

| ARTICLE 6. |

| REPRESENTATIONS AND WARRANTIES | 32 |

|

| 6.1 |

| ORGANIZATION; CORPORATE POWERS | 32 |

|

| 6.2 |

| AUTHORITY | 32 |

|

| 6.3 |

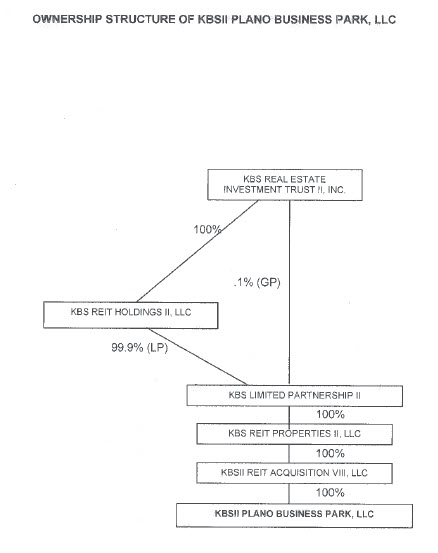

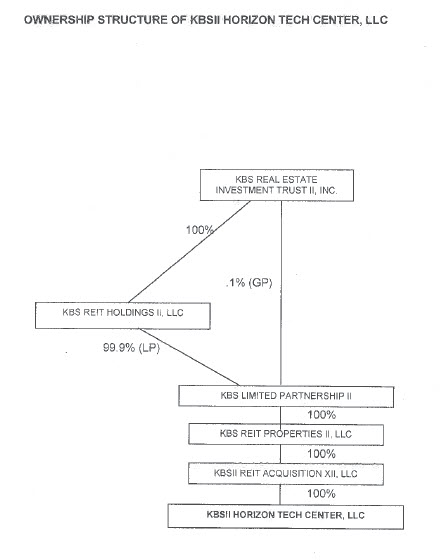

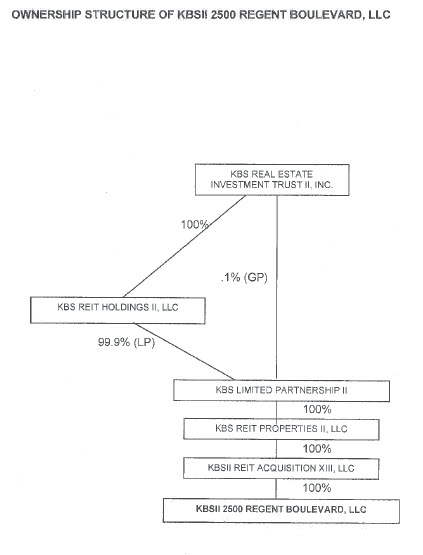

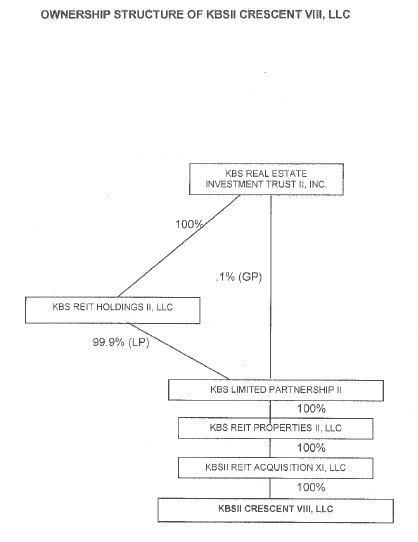

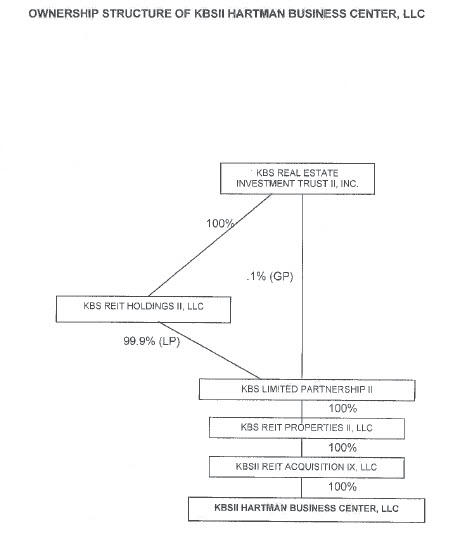

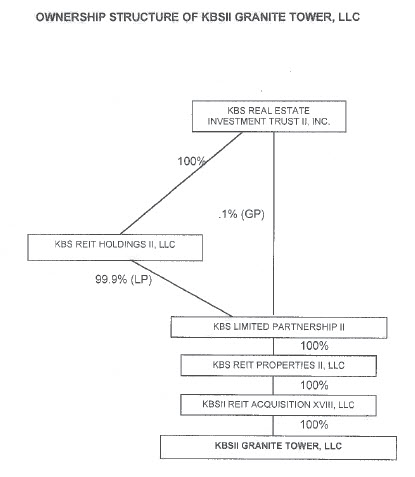

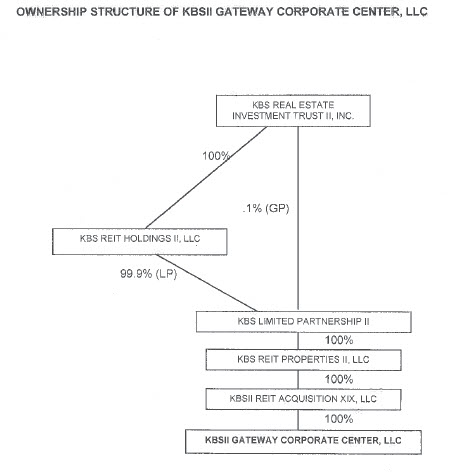

| OWNERSHIP OF BORROWERS | 32 |

|

| 6.4 |

| NO CONFLICT | 32 |

|

| 6.5 |

| CONSENTS AND AUTHORIZATIONS | 33 |

|

| 6.6 |

| GOVERNMENTAL REGULATION | 33 |

|

| 6.7 |

| PRIOR FINANCIALS | 33 |

|

| 6.8 |

| FINANCIAL STATEMENTS; PROJECTIONS AND FORECASTS | 33 |

|

TABLE OF CONTENTS

(CONTINUED)

|

| | | | |

| | | Page |

|

| 6.9 |

| PRIOR OPERATING STATEMENTS | 33 |

|

| 6.10 |

| OPERATING STATEMENTS AND PROJECTIONS | 33 |

|

| 6.11 |

| LITIGATION; ADVERSE EFFECTS | 33 |

|

| 6.12 |

| NO MATERIAL ADVERSE CHANGE | 34 |

|

| 6.13 |

| PAYMENT OF TAXES | 34 |

|

| 6.14 |

| MATERIAL ADVERSE AGREEMENTS | 34 |

|

| 6.15 |

| PERFORMANCE | 34 |

|

| 6.16 |

| FEDERAL RESERVE REGULATIONS | 34 |

|

| 6.17 |

| DISCLOSURE | 34 |

|

| 6.18 |

| REQUIREMENTS OF LAW; ERISA | 34 |

|

| 6.19 |

| ENVIRONMENTAL MATTERS | 34 |

|

| 6.20 |

| MAJOR AGREEMENTS; LEASES | 35 |

|

| 6.21 |

| SOLVENCY | 35 |

|

| 6.22 |

| TITLE TO PROPERTY; NO LIENS | 35 |

|

| 6.23 |

| USE OF PROCEEDS | 35 |

|

| 6.24 |

| PROPERTY MANAGEMENT AGREEMENTS | 36 |

|

| 6.25 |

| SINGLE PURPOSE ENTITY | 36 |

|

| 6.26 |

| INTENTIONALLY OMITTED | 36 |

|

| 6.27 |

| ORGANIZATIONAL DOCUMENTS | 36 |

|

| ARTICLE 7. |

| INTENTIONALLY OMITTED | 36 |

|

| ARTICLE 8. |

| LOAN CONSTANT COMPLIANCE | 36 |

|

| 8.1 |

| LOAN CONSTANT COVERAGE | 36 |

|

| 8.2 |

| DISBURSEMENTS OF FUNDS IN SWEPT FUNDS DISBURSEMENT ACCOUNT | 36 |

|

| 8.3 |

| DISBURSEMENTS OF FUNDS IN CASH FLOW COLLATERAL ACCOUNTS | 38 |

|

| ARTICLE 9. |

| OTHER COVENANTS OF BORROWER | 38 |

|

| 9.1 |

| EXPENSES | 38 |

|

| 9.2 |

| ERISA COMPLIANCE | 38 |

|

| 9.3 |

| LEASES; LEASE APPROVAL; LEASE TERMINATION | 39 |

|

| 9.4 |

| SNDAs | 40 |

|

| 9.5 |

| SUBDIVISION MAPS | 40 |

|

| 9.6 |

| OPINIONS OF LEGAL COUNSEL | 40 |

|

| 9.7 |

| FURTHER ASSURANCES | 40 |

|

| 9.8 |

| ASSIGNMENT | 40 |

|

| 9.9 |

| MANAGEMENT OF PROPERTY | 40 |

|

| 9.10 |

| REQUIREMENTS OF LAW | 41 |

|

| 9.11 |

| SPECIAL COVENANTS; SINGLE PURPOSE ENTITY | 41 |

|

TABLE OF CONTENTS

(CONTINUED)

|

| | | | |

| | | Page |

|

| 9.12 |

| LIMITATIONS ON DISTRIBUTIONS, ETC | 41 |

| 9.13 |

| INCURRENCE OF ADDITIONAL INDEBTEDNESS | 41 |

|

| 9.14 |

| SPECIAL REPRESENTATIONS, COVENANTS AND WAIVERS | 41 |

|

| 9.15 |

| ENVIRONMENTAL INSURANCE PROCEEDS | 42 |

|

| 9.16 |

| AMENDMENT OF CONSTITUENT DOCUMENTS | 43 |

|

| 9.17 |

| OWNERSHIP OF BORROWER | 43 |

|

| 9.18 |

| LIENS | 43 |

|

| 9.19 |

| TRANSFERS OF COLLATERAL | 43 |

|

| 9.20 |

| ADDITIONAL REIT COVENANTS | 43 |

|

| 9.21 |

| TERMINATION PAYMENTS | 43 |

|

| 9.22 |

| SWAP AGREEMENT | 44 |

|

| 9.23 |

| GRANITE TOWER PROPERTY | 45 |

|

| ARTICLE 10. |

| REPORTING COVENANTS | 45 |

|

| 10.1 |

| FINANCIAL STATEMENTS AND OTHER FINANCIAL AND OPERATING INFORMATION (BORROWERS) | 45 |

|

| 10.2 |

| FINANCIAL STATEMENTS AND OTHER FINANCIAL AND OPERATING INFORMATION (KBS REITS) | 45 |

|

| 10.3 |

| ENVIRONMENTAL NOTICES | 47 |

|

| 10.4 |

| CONFIDENTIALITY | 47 |

|

| ARTICLE 11. |

| DEFAULTS AND REMEDIES | 48 |

|

| 11.1 |

| DEFAULT | 48 |

|

| 11.2 |

| ACCELERATION UPON DEFAULT; REMEDIES | 50 |

|

| 11.3 |

| DISBURSEMENTS TO THIRD PARTIES | 50 |

|

| 11.4 |

| REPAYMENT OF FUNDS ADVANCED | 50 |

|

| 11.5 |

| RIGHTS CUMULATIVE, NO WAIVER | 50 |

|

| ARTICLE 12. |

| THE ADMINISTRATIVE AGENT; INTERCREDITOR PROVISIONS | 50 |

|

| 12.1 |

| APPOINTMENT AND AUTHORIZATION | 51 |

|

| 12.2 |

| WELLS FARGO AS LENDER | 51 |

|

| 12.3 |

| LOAN DISBURSEMENTS | 52 |

|

| 12.4 |

| DISTRIBUTION AND APPORTIONMENT OF PAYMENTS; DEFAULTING LENDERS | 52 |

|

| 12.5 |

| PRO RATA TREATMENT | 53 |

|

| 12.6 |

| SHARING OF PAYMENTS, ETC | 53 |

|

| 12.7 |

| COLLATERAL MATTERS; PROTECTIVE ADVANCES | 54 |

|

| 12.8 |

| POST-FORECLOSURE PLANS | 55 |

|

| 12.9 |

| APPROVALS OF LENDERS | 55 |

|

| 12.10 |

| NOTICE OF DEFAULTS | 56 |

|

TABLE OF CONTENTS

(CONTINUED)

|

| | | | |

| | | Page |

|

| 12.11 |

| ADMINISTRATIVE AGENT'S RELIANCE, ETC | 56 |

|

| 12.12 |

| INDEMNIFICATION OF ADMINISTRATIVE AGENT | 56 |

|

| 12.13 |

| LENDER CREDIT DECISION, ETC | 57 |

|

| 12.14 |

| SUCCESSOR ADMINISTRATIVE AGENT | 57 |

|

| ARTICLE 13. |

| MISCELLANEIOUS PROVISIONS | 58 |

|

| 13.1 |

| INDEMNITY | 58 |

|

| 13.2 |

| FORM OF DOCUMENTS | 58 |

|

| 13.3 |

| NO THIRD PARTIES BENEFITED | 59 |

|

| 13.4 |

| NOTICES | 59 |

|

| 13.5 |

| ATTORNEY-IN-FACT | 59 |

|

| 13.6 |

| ACTIONS | 59 |

|

| 13.7 |

| RIGHT OF CONTEST | 59 |

|

| 13.8 |

| RELATIONSHIP OF PARTIES | 59 |

|

| 13.9 |

| DELAY OUTSIDE LENDER'S CONTROL | 59 |

|

| 13.10 |

| ATTORNEYS' FEES AND EXPENSES; ENFORCEMENT | 59 |

|

| 13.11 |

| IMMEDIATELY AVAILABLE FUNDS | 60 |

|

| 13.12 |

| AMENDMENTS AND WAIVERS | 60 |

|

| 13.13 |

| SUCCESSORS AND ASSIGNS | 61 |

|

| 13.14 |

| CAPITAL ADEQUACY | 63 |

|

| 13.15 |

| LENDER'S AGENTS | 63 |

|

| 13.16 |

| TAX SERVICE | 63 |

|

| 13.17 |

| WAIVER OF RIGHT TO TRIAL BY JURY | 63 |

|

| 13.18 |

| SEVERABILITY | 63 |

|

| 13.19 |

| TIME | 63 |

|

| 13.20 |

| HEADINGS | 63 |

|

| 13.21 |

| GOVERNING LAW | 63 |

|

| 13.22 |

| USA PATRIOT ACT NOTICE | 64 |

|

| 13.23 |

| ELECTRONIC DOCUMENT DELIVERIES | 64 |

|

| 13.24 |

| INTEGRATION; INTERPRETATION | 64 |

|

| 13.25 |

| JOINT AND SEVERAL LIABILITY | 64 |

|

| 13.26 |

| COUNTERPARTS | 65 |

|

| 13.27 |

| LIMITATION ON PERSONAL LIABILITY OF SHAREHOLDERS, PARTNERS AND MEMEBER | 65 |

|

EXHIBITS AND SCHEDULES

SCHEDULE 1.1(A) -- PRO RATA SHARES

SCHEDULE 1.1(B) – PAR LOAN VALUES

SCHEDULE 1.1(C – INITIAL PROPERTIES

SCHEDULE 6.3 – OWNERSHIP OF BORROWERS

SCHEDULE 6.11 –LITIGATION DISCLOSURE

SCHEDULE 6.24 – PROPERTY MANAGEMENT AGREEMENTS

SCHEDULE 7.1 – ENVIRONMENTAL REPORTS

EXHIBIT A – DESCRIPTION OF INITIAL PROPERTIES

EXHIBIT B – DOCUMENTS

EXHIBIT C – FORM OF SUBORDINATION NON-DISTURBANCE AND ATTORNMENT AGREEMENT

EXHIBIT D – FORM OF ASSIGNMENT AND ASSUMPTION AGREEMENT

EXHIBIT E – FORM OF PROMISSORY NOTE

EXHIBIT F – FIXED RATE NOTICE

EXHIBIT G – TRANSFER AUTHORIZER DESIGNATION

EXHIBIT H – BORROWERS’ CERTIFICATE

EXHIBIT I – ADDITIONAL DEFINITIONS

EXHIBIT J – FORM OF JOINDER

EXHIBIT K – ADJUSTED LOAN CONSTANT CALCULATION

AMENDED AND RESTATED AND CONSOLIDATED LOAN AGREEMENT

(Secured Loan)

THIS AMENDED AND RESTATED AND CONSOLIDATED LOAN AGREEMENT ("Agreement"), dated as of January 27, 2011, by and among KBSII HARTMAN BUSINESS CENTER, LLC, a Delaware limited liability company, KBSII PLANO BUSINESS PARK, LLC, a Delaware limited liability company, KBSII HORIZON TECH CENTER, LLC, a Delaware limited liability company, KBSII 2500 REGENT BOULEVARD, LLC, a Delaware limited liability company, KBSII CRESCENT VIII, LLC, a Delaware limited liability company, KBSII NATIONAL CITY TOWER, LLC, a Delaware limited liability company, KBSII GRANITE TOWER, LLC, a Delaware limited liability company, KBSII GATEWAY CORPORATE CENTER, LLC, a Delaware limited liability company, and each other Person that may from time to time become liable for the Obligations, as evidenced by the execution by such party of a joinder hereto, as contemplated by Section 3.4 below (each individually "Borrower" and together, "Borrowers"), each of the financial institutions initially a signatory hereto together with their assignees under Section 13.13 ("Lenders"), and WELLS FARGO BANK, NATIONAL ASSOCIATION ("Wells Fargo") as contractual representative of the Lenders to the extent and in the manner provided in Article 12 (in such capacity, the "Administrative Agent").

R E C I T A L S

| |

| A. | KBSII Hartman Business Center, LLC, a Delaware limited liability company, KBSII Plano Business Park, LLC, a Delaware limited liability company, KBSII Horizon Tech Center, LLC, a Delaware limited liability company, KBSII 2500 Regent Boulevard, LLC, a Delaware limited liability company, KBSII Crescent VIII, LLC, a Delaware limited liability company (together, "Original Horizon Borrowers"), Administrative Agent and Lenders previously executed a Loan Agreement, dated September 30, 2010 (the "Horizon Loan Agreement"), whereby Lenders made a loan to Original Horizon Borrowers in the original principal amount of $50,000,000 (the "Original Horizon Loan"). The Original Horizon Loan is secured by liens on certain real properties located in the states of California, Texas, Georgia and Colorado (the "Horizon Properties"). |

| |

| B. | KBSII National City Tower, LLC, a Delaware limited liability company (the "Original National City Borrower," together with the Original Horizon Borrowers, collectively, the "Original Borrowers"), Administrative Agent and Lenders previously executed a Loan Agreement dated December 16, 2010 (the "National City Loan Agreement"), whereby Lenders made a loan to Original National City Borrower in the original principal amount of $69,000,000 (the "Original National City Loan," together with the Original Horizon Loan, the "Original Loan"). The Original National City Loan is secured by a lien on certain real property located in Kentucky (the "National City Property," together with the Horizon Properties, collectively, the "Original Properties"). |

| |

| C. | Borrowers have now requested that Administrative Agent and Lenders consolidate the Original National City Loan and the Original Horizon Loan and increase the amount of the Original Loan, on a consolidated basis, to $360,000,000. |

| |

| D. | Administrative Agent and Lenders are willing to make the Loan to Borrowers, subject to the terms and conditions contained herein. The Loan is to be secured by the Original Properties, the Granite Tower Property (as defined below), the Gateway Center Property (as defined below) and, subject to the terms hereof, certain additional properties (each a "Property" and together, the "Properties"); provided, that a property shall not be deemed a "Property" hereunder unless and until Administrative Agent (for the benefit of Lenders) has obtained a first priority lien on such property pursuant to a Security Document. |

NOW, THEREFORE, Borrowers, Administrative Agent and Lenders agree as follows:

ARTICLE 1. DEFINITIONS

1.1 DEFINED TERMS. The following capitalized terms generally used in this Agreement shall have the meanings defined or referenced below. Certain other capitalized terms used only in specific sections of this Agreement are defined in such sections.

"550 Oak Ridge Property" – means the property located at 550 Oak Ridge, Hazelton, Pennsylvania.

"Accommodation Obligations" – as applied to any Person, means (a) any Indebtedness of another Person in respect of which that Person is liable, including, without limitation, any such Indebtedness directly or indirectly guaranteed, endorsed (otherwise than for collection or deposit in the ordinary course of business), co-made or discounted or sold with recourse by that Person, or in respect of which that Person is otherwise directly or indirectly liable including in respect of any partnership in which that Person is a general partner; and (b) any Contractual Obligations (contingent or otherwise) of such Person arising through any agreement to purchase, repurchase or otherwise acquire such Indebtedness or any security therefor, or to provide funds for the payment or discharge thereof (whether in the form of loans, advances, stock purchases, capital contributions or otherwise), or to maintain solvency, assets, level of income, or other financial condition, or to make payment other than for value received.

"Accountants" – means any "big four" accounting firm or another firm of certified public accountants of national standing, if any, selected by Borrowers and acceptable to Administrative Agent.

"ADA" – means the Americans with Disabilities Act, of July 26, 1990, Pub. L. No. 101-336, 104 Stat. 327, 42 U.S.C. § 12101, et seq., as amended from time to time.

"Administrative Agent" – means Wells Fargo Bank, National Association, or any successor Administrative Agent appointed pursuant to Section 12.14.

"Affiliates" as applied to any Person, means any other Person directly or indirectly controlling, controlled by, or under common control with, that Person. For purposes of this definition, "control" (including, with correlative meanings, the terms "controlling", "controlled by" and "under common control with"), as applied to any Person, means (a) the possession, directly or indirectly, of the power to vote ten percent (10%) or more of all interests having voting power for the election of directors of such Person or otherwise to direct or cause the direction of the management and policies of that Person, whether through the ownership of voting interests or by contract or otherwise, or (b) the ownership of a general partnership interest or a limited partnership interest (or other ownership interest) representing ten percent (10%) or more of the outstanding limited partnership interests or other ownership interests of such Person. In no event shall Administrative Agent or any Lender be an Affiliate of any Borrower.

"Aggregate Loan Commitment" – means the sum of the Commitment amounts of all of the Lenders, initially totaling $360,000,000, and subject to increase or reduction in accordance with the terms of this Agreement.

"Aggregate Holdback" shall mean an undisbursed portion of the Loan in an amount equal to $126,383,507.

"Agreement" – shall have the meaning given to such term in the preamble hereto.

"Alternate Rate" – is a rate of interest per annum five percent (5%) in excess of the Variable Rate in effect from time to time.

"Allocated Share" means at any time, and from time to time, an amount expressed as a percentage that is calculated by dividing the cost basis of the Properties, on an aggregate basis, by the cost basis of all real property owned directly or indirectly by KBS REIT or the KBS Limited Partnership II.

"Amazon Expansion Option" – means the right of Amazon.com, pursuant to Addendum 5 to the Amazon Lease, to expand the premises under the Amazon Lease onto the “Expansion Area” (as such term is defined in the Amazon Lease).

"Amazon Lease" – means that certain Lease Agreement dated April 4, 2008, between Amazon.com (defined below), as tenant, and Borrower (as successor-in-interest to Mericle Humboldt 40, LLC), as landlord.

"Amazon.com" – means Amazon.com.dedc, LLC, a Delaware limited liability company.

"Applicable LIBO Rate" – is the rate of interest equal to the sum of: (a) the Applicable Spread plus (b) the LIBO Rate, which rate is divided by one (1.00) minus the Reserve Percentage:

|

| | |

| Applicable LIBO Rate = Applicable Spread | + | LIBO Rate |

| | | (1 - Reserve Percentage) |

"Applicable Spread" – means (i) for the period prior to the Initial Maturity Date, 2.15%, (ii) for the period beginning on the Initial Maturity Date and continuing until the First Extended Maturity Date, 2.40%, and (iii) for the period beginning on the First Extended Maturity Date and continuing until the Second Extended Maturity Date, 2.65%.

"Appraisal" – means a written appraisal prepared by an independent MAI appraiser acceptable to Administrative Agent and subject to Administrative Agent’s customary independent appraisal requirements and prepared in compliance with all applicable regulatory requirements, including the Financial Institutions Recovery, Reform and Enforcement Act of 1989, as amended from time to time.

"Appraised Value" – means, with respect to the property being appraised, the fair market value, on an "as-is" basis, as reflected in the then most recent Appraisal of the Property, as adjusted, if applicable, by Administrative Agent based upon its internal review of such Appraisal.

"Approved Fund" – means any Fund that is administered or managed by (a) a Lender, (b) an Affiliate of a Lender, or (c) an entity or an Affiliate of any entity that administers or manages a Lender.

"Assignment and Assumption Agreement" – means an Assignment and Assumption Agreement among a Lender, an Assignee and the Administrative Agent, substantially in the form of Exhibit D.

"Bankruptcy Code" – means the Bankruptcy Reform Act of 1978 (11 USC § 101-1330) as now or hereafter amended or recodified.

"Borrower" and "Borrowers" – shall have the meaning given to such term in the preamble hereto.

"Borrowers’ Certificate" – shall have the meaning given to such term in Section 10.1(c).

"Business Day" means (a) any day of the week other than Saturday, Sunday or other day on which the offices of Administrative Agent in San Francisco, California are authorized or required to close and (b) with reference to the LIBO Rate, any such day that is also a day on which dealings in Dollar deposits are carried out in the London interbank market. Unless specifically referenced in this Agreement as a Business Day, all references to "days" shall be to calendar days.

"Capital Leases", as applied to any Person, means any lease of any property (whether real, personal or mixed) by that Person as lessee which, in conformity with GAAP, is or should be accounted for as a lease on the balance sheet of that Person.

"Cash Flow Collateral Accounts" – shall have the meaning given to such term in Section 8.1.

"Cash Flow Sweep" – shall have the meaning given such term in Section 8.1.

"Cash Flow Sweep Commencement Date" – shall have the meaning given such term in Section 8.1.

"Collateral" – means the Properties and any personal property or other collateral with respect to which a Lien or security interest was granted to Administrative Agent, for the benefit of Lenders, pursuant to the Loan Documents.

"Commitment" – means, as to each Lender, such Lender’s obligation to make disbursements pursuant to Section 3.3 and Section 12.3, in an amount up to, but not exceeding the amount set forth for such Lender on Schedule 1.1(A) attached hereto as such Lender’s "Commitment Amount" or as set forth in the applicable Assignment and Assumption Agreement, as the same may be (i) reduced from time to time pursuant to the terms of this Agreement or as appropriate to reflect any assignments to or by such Lender effected in accordance with Section 13.13 or (ii) increased in accordance with Section 2.15.

"Concessions" shall mean all free-rent periods or abatements and all above-market amounts paid or foregone by Borrowers directly to or on behalf of any tenant for the purpose of inducing such tenant to enter into a lease, including, without limitation, tenant improvement allowances, moving expenses, and/or assumptions or buyouts of the tenant's obligations under other leases. (The term "above-market" shall be understood to mean amounts in excess of those assumed in the then most recent Appraisal for the Property in question, or, with respect to tenant improvement costs, such other amount as may be approved by Administrative Agent in its discretion.) Administrative Agent shall have the right to adjust any Concessions based, in part and as applicable, upon assumptions set forth in the then most current Appraisal for the Property in question. All Concessions shall be amortized over the full lease term with annual amortization only to be deducted for the purpose of determining Net Operating Income. (Example: Concessions in the form of above-market "tenant improvements" for a five year lease total $100,000; the annualized deduction in determining Net Operating Income shall be $20,000.)

"Contaminant" means any pollutant (as that term is defined in 42 U.S.C. 9601(33)) or toxic pollutant (as that term is defined in 33 U.S.C. 1362(13)), hazardous substance (as that term is defined in 42 U.S.C. 9601(14)), hazardous chemical (as that term is defined by 29 CFR Section 1910.1200(c)), toxic substance, hazardous waste (as that term is defined in 42 U.S.C. 6903(5)), radioactive material, special waste, petroleum (including crude oil or any petroleum-derived substance, waste, or breakdown or decomposition product thereof), any constituent of any such substance or waste, including, but not limited to, polychlorinated biphenyls and asbestos, or any other substance or waste deleterious to the environment the release, disposal or remediation of which is now or at any time becomes subject to regulation under any Hazardous Materials Laws, along with all Hazardous Materials.

"Contractual Obligation", as applied to any Person, means any provision of any securities issued by that Person or any indenture, mortgage, lease, contract, undertaking, document or instrument to which that Person is a party or by which it or any of its properties is bound, or to which it or any of its properties is subject (including, without limitation, any restrictive covenant affecting such Person or any of its properties).

"Crescent Property" means 8350 East Crescent Parkway, Greenwood Village, Colorado.

"Debit Account" means Wells Fargo Bank account number 4121828040 in the name of KBS REIT Properties II, LLC.

"Debt Service Coverage Ratio" – means the ratio of (a) Net Operating Income for all Properties (as of the date of determination), to (b) an annual interest payment calculated by multiplying (i) an interest rate equal to the DSC LIBO Rate plus the Applicable Spread effective with respect to the next-occurring extension period (for example, if calculated at any time after the Initial Maturity Date but before the First Extended Maturity Date, then the Applicable Spread would be 2.65%) times (ii) the amount of the Loan outstanding as of the date of determination.

"Default" – shall have the meaning given to such term in Section 11.1.

"Defaulting Lender" – means any Lender which (i) fails or refuses to perform any of its obligations under this Agreement or any other Loan Document to which it is a party within the time period specified for performance of such obligation or, if no time period is specified, if such failure or refusal continues for a period of five (5) Business Days after notice from Administrative Agent, (ii) notifies any Borrower, the Administrative Agent or any Lender in writing that it does not intend to comply with any of its funding obligations under this Agreement or makes a public statement to the effect that it does not intend to comply with its funding obligations under this Agreement or under other agreements in which it commits to extend credit, (iii) fails, within three (3) Business Days after request by the Administrative Agent, to confirm that it will comply with the terms of this Agreement relating to its obligations to fund disbursements of the Loan, or (iv) (A) becomes or is insolvent or has a parent company that has become or is insolvent or (B) becomes the subject of a bankruptcy or insolvency proceeding, or has had a receiver, conservator, trustee or custodian appointed for it, or has taken any action in furtherance of, or indicating its consent to, approval of or acquiescence in any such proceeding or appointment or has a parent company that has become the subject of a bankruptcy or insolvency proceeding, or has had a receiver, conservator, trustee or custodian appointed for it, or has taken any action in furtherance of, or indicating its consent to, approval of or acquiescence in any such proceeding or appointment.

"Distributions", with respect to Borrowers, means any distribution of money to any equity owner or Affiliate of Borrowers, whether in the form of earnings, income or other proceeds, repayment of any principal or interest on

any loan or other advance made to Borrowers by any such equity owner or Affiliate, or any loan or advance by Borrowers of any funds to any such equity owner or Affiliate.

"Dollars" and "$" – means the lawful money of the United States of America.

"DSC LIBO Rate" – is the rate of interest quoted by Administrative Agent as the London Inter‑Bank Offered Rate for deposits in U.S. Dollars at approximately 9:00 a.m. California time two (2) Business Days prior to the date of determination for purposes of calculating effective rates of interest for loans or obligations making reference thereto for an amount approximately equal to the outstanding amount of the Loan, for a period of one (1) year, which rate is divided by one (1.00) minus the Reserve Percentage.

"Effective Date" – means the date on which Lenders make the initial disbursement of Loan proceeds hereunder (without regard to the dates on which proceeds were previously disbursed with respect to the Original Horizon Loan or the Original National City Loan).

"Effective Rate" – shall have the meaning given to such term in Section 2.7(e).

"Eligible Assignee" –means (a) a Lender, (b) an Affiliate of a Lender, (c) an Approved Fund and (d) any other Person (other than a natural person) approved by (i) the Administrative Agent and (ii) unless a Default or Potential Default exists, Borrowers (each such approval not to be unreasonably withheld or delayed); provided that notwithstanding the foregoing, "Eligible Assignee" shall not include any of the Borrowers or any of Borrowers’ Affiliates.

"Environmental Laws" – shall have the meaning given to such term in Section 6.19.

"ERISA" – means the Employee Retirement Income Security Act of 1974, as in effect from time to time.

"Existing Swap" – means ISDA Master Agreement dated December 20, 2010, as amended by the Joinder and First Amendment to ISDA Master Agreement dated January 27, 2011, executed by Borrowers and Wells Fargo Bank, together with the ISDA schedule and any confirmation of transactions thereunder, as amended, modified or replaced from time to time.

“Exit Fee” – shall have the meaning given to such term in Section 2.8(e).

"Federal Funds Rate" – means, for any period, a fluctuating interest rate per annum equal for each day during such period to the weighted average of the rates on overnight Federal Funds transactions with members of the Federal Reserve System arranged by Federal Funds brokers, as published for such day (or, if such day is not a Business Day, for the next preceding Business Day) by the Federal Reserve Bank of New York, or, if such rate is not so published for any day which is a Business Day, the average of the quotations for such day on such transactions received by Administrative Agent from three Federal Funds brokers of recognized standing selected by Administrative Agent.

"Fee Letter" – shall have the meaning given in Section 2.2.

"First Extended Maturity Date" – means January 27, 2017.

"First Extension Option" – shall have the meaning given to such term in Section 2.14.

"Fiscal Quarter" – means each of the calendar quarters ending March 31, June 30, September 30 and December 31.

"Fixed Rate" – is the Applicable LIBO Rate as accepted by Borrowers as an Effective Rate for a particular Fixed Rate Period and Fixed Rate Portion.

"Fixed Rate Commencement Date" – means the date upon which the Fixed Rate Period commences.

"Fixed Rate Notice" – is a written notice in the form shown on Exhibit F hereto which requests a Fixed Rate for a particular Fixed Rate Period and Fixed Rate Portion.

"Fixed Rate Period" – is the period or periods of (a) one month; or (b) any other shorter period which ends at the Maturity Date, which periods are selected by Borrowers and confirmed in a Fixed Rate Notice; provided that no Fixed Rate Period shall extend beyond the Maturity Date.

"Fixed Rate Portion" – is the portion or portions of the principal balance of the Loan which Borrowers select to have subject to a Fixed Rate, each of which is an amount: (a) equal to the unpaid principal balance of the Loan not subject to a Fixed Rate; and (b) is not less than One Hundred Thousand Dollars ($100,000) and is an even multiple of One Hundred Thousand Dollars ($100,000). In the event Borrowers are subject to a principal amortization schedule under the terms and conditions of the Loan Documents, the Fixed Rate Portion(s) from time to time in effect shall in no event exceed, in the aggregate, the maximum outstanding principal balance which will be permissible on the last day of the Fixed Rate Period selected.

"Fixed Rate Price Adjustment" – shall have the meaning given to such term in Section 2.7(h).

"Fixed Rate Taxes" – are, collectively, all withholdings, interest equalization taxes, stamp taxes or other taxes (except income and franchise taxes) imposed by any domestic or foreign Governmental Authority and related in any manner to a Fixed Rate.

"Free Cash Flow" means, for a particular period, Gross Operating Income for such period for all Properties minus (a) debt service on the Loan for such period, (b) any Permitted Operating Expenses actually incurred for such period, (c) the REIT Operating Expense for such period, (d) accrued liability for taxes and insurance for such period and (e) any other expenses relating to the Property actually incurred for such period, provided such expenses are approved, in advance, by Administrative Agent, which approval shall not be unreasonably withheld, conditioned or delayed.

"Fund" means any Person (other than a natural person) that is (or will be) engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in the ordinary course of its business.

"Future Borrower" – means a Single Purpose Entity that owns a Future Property and is an Affiliate of Borrowers.

"Future Property" shall mean one or more parcels of real property acquired after the Effective Date by a Future Borrower which becomes a Property hereunder; provided that this term shall not apply to the I-81 Properties or the Torrey Reserve Property.

"Gateway Center Property" – means 160 and 180 Promenade Circle, Sacramento, California.

"Governmental Authority" – means any nation or government, any federal, state, local, municipal or other political subdivision thereof or any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government.

"Granite Tower Property" – means 1099 18th Street, Denver, Colorado.

"Gross Operating Income" – shall mean the sum of any and all amounts, payments, fees, rentals, additional rentals, expense reimbursements (including, without limitation, all reimbursements by tenants, lessees, licensees and other users of a Property), discounts or credits to any Borrower, income, interest and other monies directly or indirectly received by or on behalf of or credited to any Borrower from any person with respect to such Borrower’s ownership, use, development, operation, leasing, franchising, marketing or licensing of such Property, including, without limitation, from parking operations. Gross Operating Income shall be computed on a cash basis and shall include all amounts actually received in the relevant period whether or not such amounts are attributable to a charge arising in such period.

"Gross Rental Income" – means the actual sum of the Net Effective Rental Rates of all tenants in possession at each of the Properties, as of the date of determination.

"Gross Rents" – means, with respect to a Property, the sum of (a) the Gross Rental Income of the Property plus (b) any expense reimbursements required to be paid by the tenants at such Property.

"Ground Lease" – means the Ground Lease Agreement, dated May 29, 2009, by and between Dallas/Fort Worth International Airport Board, as lessor ("Ground Lessor"), and BVDC, LP ("BVDC"), as lessee, as evidenced by a Memorandum of Lease recorded June 1, 2009 under Clerk’s File No. D209143392, Real Property Records, Tarrant County, Texas; and filed for record on May 29, 2009 under Clerk’s File No. 200900153683, Real Property Records, Dallas County, Texas, as amended by that certain Lease Amendment (Roof-Top Sign) dated July 6, 2010, by and between Ground Lessor and BVDC, as assigned to KBSII 2500 Regent Boulevard, LLC, as evidenced by that certain Assignment and Assumption of Ground Lease dated July 8, 2010, filed for record on July 8, 2010 and recorded under Document No. 201000173571, Official Public Records, Dallas County, Texas; and filed for record on July 8, 2010 under Document No. D210164479, Official Public Records, Tarrant County, Texas.

"Ground Leased Property" – means the leasehold interest in the real property located at 2500 Regent Boulevard, Irving, Texas, which is subject to the Ground Lease.

"Guarantor" – means KBS REIT Properties II, LLC, a Delaware limited liability company, and any other person or entity who, or which, in any manner, is or becomes obligated to Lenders under any guaranty now or hereafter executed in connection with respect to the Loan (collectively or severally as the context thereof may suggest or require).

"Hazardous Materials" – means any oil, flammable explosives, asbestos, urea formaldehyde insulation, radioactive materials, hazardous wastes, toxic or contaminated substances or similar materials, including, without limitation, any substances which are "hazardous substances," "hazardous wastes," "hazardous materials," "toxic substances," "wastes," "regulated substances," "industrial solid wastes," or "pollutants" under the Hazardous Materials Laws, as described below, and/or other applicable environmental laws, ordinances and regulations.

"Hazardous Materials Indemnity Agreement" – means the Amended and Restated and Consolidated Hazardous Materials Indemnity Agreement executed by the Borrowers for the benefit of Administrative Agent and Lenders dated on or about the date hereof, as the same may be amended, modified or replaced from time to time.

"Hazardous Materials Laws" – means all laws, ordinances and regulations relating to Hazardous Materials, including, without limitation: the Clean Air Act, as amended, 42 U.S.C. Section 7401 et seq.; the Federal Water Pollution Control Act, as amended, 33 U.S.C. Section 1251 et seq.; the Resource Conservation and Recovery Act of 1976, as amended, 42 U.S.C. Section 6901 et seq.; the Comprehensive Environment Response, Compensation and Liability Act of 1980, as amended (including the Superfund Amendments and Reauthorization Act of 1986, "CERCLA"), 42 U.S.C. Section 9601 et seq.; the Toxic Substances Control Act, as amended, 15 U.S.C. Section 2601 et seq.; the Occupational Safety and Health Act, as amended, 29 U.S.C. Section 651, the Emergency Planning and Community Right-to-Know Act of 1986, 42 U.S.C. Section 11001 et seq.; the Mine Safety and Health Act of 1977, as amended, 30 U.S.C. Section 801 et seq.; the Safe Drinking Water Act, as amended, 42 U.S.C. Section 300f et seq.; and all comparable state and local laws, laws of other jurisdictions or orders and regulations.

“Holdback Extension Fee” – shall mean the Holdback Fee payable pursuant to the Fee Letter with respect to any portion of the Aggregate Holdback that has not been disbursed as of the date which occurs one hundred eighty (180) days following the Effective Date.

“Holdback Fee” – shall have the meaning given to such term in the Fee Letter.

"Horizon Loan Agreement" – shall have the meaning given to such term in the Recitals hereto.

"I-81 Borrower" – means a Single Purpose Entity that owns the I-81 Properties and is an Affiliate of Borrowers.

"I-81 Holdback Amount" means an amount equal to $51,085,375, or such lesser amount as would cause the conditions in Section 3.4(a)(ix) to be satisfied.

"I-81 Properties" shall mean 325 Centerpoint, Jenkins Township, Pennsylvania; 550 Oak Ridge, Hazleton Pennsylvania; 125 Capital, Jenkins Township, Pennsylvania; and 14-46 Alberigi, Jessup Borough, Pennsylvania each, an "I-81 Property."

"Indebtedness", as applied to any Person (and without duplication), means (a) the principal amount of all indebtedness of such Person for borrowed money, whether or not subordinated and whether with or without recourse beyond any collateral security, (b) the principal amount of all indebtedness of such Person evidenced by securities or other similar instruments, (c) all reimbursement obligations and other liabilities of such Person with respect to letters of credit or banker’s acceptances issued for such Person’s account, (d) all obligations of such Person to pay the deferred purchase price of property or services, (e) all obligations in respect of both operating and capital leases of such Person, (f) all Accommodation Obligations of such Person, (g) all indebtedness, obligations or other liabilities of such Person or others secured by a Lien on any asset of such Person, whether or not such indebtedness, obligations or liabilities are assumed by, or are a personal liability of, such Person (including, without limitation, the principal amount of any assessment or similar indebtedness encumbering any property (except for non-delinquent, accrued but unpaid real estate taxes as provided under Section 9.13)), (h) all indebtedness, obligations or other liabilities (other than interest expense liability) in respect of interest rate swap, collar, cap or similar agreements providing interest rate protection and foreign currency exchange agreements, (i) ERISA obligations currently due and payable, and (j) without duplication or limitation, all liabilities and other obligations included in the financial statements (or notes thereto) of such Person as prepared in accordance with GAAP.

“Initial Disbursement” – means $123,994,578.

"Initial Maturity Date" means January 27, 2016.

"Joinder" means a joinder agreement in the form of Exhibit J hereto.

"KBS REIT" – means KBS Real Estate Investment Trust II, Inc., a Maryland corporation.

"KBS Limited Partnership II" – means KBS Limited Partnership II, a Delaware limited partnership.

"Lease" – means a tenant lease of all or any portion of a Property.

"Lender" – means each financial institution from time to time party hereto as a "Lender", together with its respective successors and permitted assigns. With respect to matters requiring the consent or approval of all Lenders at any given time, all then existing Defaulting Lenders will be disregarded and excluded, and, for voting purposes only, "all Lenders" shall be deemed to mean "all Lenders other than Defaulting Lenders".

"Liabilities and Costs" – means all claims, judgments, liabilities, obligations, responsibilities, losses, damages (including lost profits), punitive or treble damages, costs, disbursements and expenses (including, without limitation, reasonable attorneys’, experts’ and consulting fees and costs of investigation and feasibility studies), fines, penalties and monetary sanctions, interest, direct or indirect, known or unknown, absolute or contingent, past, present or future.

"LIBO Rate" – is, for any Fixed Rate Portion, the rate of interest quoted by Administrative Agent from time to time as the London Inter‑Bank Offered Rate for deposits in U.S. Dollars at approximately 9:00 a.m. California time two (2) Business Days prior to a Fixed Rate Commencement Date or a Price Adjustment Date, as appropriate, for purposes of calculating effective rates of interest for loans or obligations making reference thereto for an amount approximately equal to a Fixed Rate Portion and for a period of time approximately equal to a Fixed Rate Period or the time remaining in a Fixed Rate Period after a Price Adjustment Date, as appropriate.

"LIBOR Market Index Rate" – means at any time the rate of interest obtained by dividing (i) the rate of interest quoted by the Administrative Agent from time to time as the London Inter-Bank Rate for one-month deposits in U.S. Dollars at approximately 9:00 a.m. Pacific time for such day; provided, if such day is not a Business Day, the immediately preceding Business Day by (ii) a percentage equal to 1 minus the stated maximum rate (stated as a decimal) of all reserves, if any, required to be maintained with respect to Eurocurrency funding (currently referred to as "Eurocurrency liabilities") as specified in Regulation D of the Board of Governors, of the Federal Reserve System (or against any other category of liabilities which includes deposits by reference to which the interest rate on LIBOR loans is determined or any applicable category of extensions of credit or other assets which includes loans by an office of any Lender outside of the United States of America). Any change in such maximum rate shall result in a change in the LIBOR Market Index Rate on the date on which such change in such maximum rate becomes effective.

"Lien" – means any mortgage, deed of trust, pledge, hypothecation, assignment, deposit arrangement, security interest, encumbrance (including, but not limited to, easements, rights-of-way, zoning restrictions and the like), lien (statutory or other), preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever, including without limitation any conditional sale or other title retention agreement, the interest of a lessor under a Capital Lease, any financing lease having substantially the same economic effect as any of the foregoing, and the filing of any financing statement or document having similar effect (other than a financing statement filed by a "true" lessor pursuant to Section 9408 (or a successor section) of the Uniform Commercial Code) naming the owner of the asset to which such Lien relates as debtor, under the Uniform Commercial Code or other comparable law of any jurisdiction.

"Loan" – means the cumulative principal amount of up to Three Hundred and Sixty Million Dollars ($360,000,000), as such amount may be increased or decreased in accordance with the terms of this Agreement.

"Loan Constant" means a fraction, expressed as a percentage, determined by dividing (i) the Net Operating Income of the Properties by (ii) the sum of the then outstanding principal amount of the Loan less the amount of any Termination Payments then being held in a blocked and pledged cash collateral account pursuant to Section 9.21.

"Loan Constant Requirement" – shall have the meaning given such term in Section 8.1.

"Loan Documents" – means those documents, as hereafter amended, supplemented, replaced or modified, properly executed and in recordable form, if necessary, listed in Exhibit B as Loan Documents.

"Loan Party" – means Borrowers and any other person or entity obligated under the Loan Documents or Other Related Documents.

"Loan-to-Value Percentage" – means the outstanding principal amount of the Loan as a percentage of the aggregate Appraised Value of the Properties.

"Major Agreements" – means, at any time, (a) each cross-easement, restrictions or similar agreement encumbering or affecting a Property and any adjoining property, and (b) each property management agreement and leasing agreement with respect to a Property entered into with any Person.

"Major Lease" means any Lease (or collection of Leases to one tenant) (a) which encumbers more than the lesser of (i) 10% of the net rentable space of the Properties, in the aggregate (as of the date of determination) or (ii) the greater of (A) 10% of the net rentable space of a Property or (B) 50,000 square feet, or (b) under which a Borrower’s obligation as to the cost of tenant improvements exceeds 130% of the estimated tenant improvement allowance (per rentable square foot) as set forth in the then most recent Appraisal, or (c) under which the Net Effective Rental Rate is less than 85% of the amount assumed for such lease in the then most recent Appraisal.

"Manager" means KBS Capital Advisors LLC.

"Management Agreement" means the Advisory Agreement dated May 21, 2008 between Manager and KBS REIT.

"Material Adverse Effect" means (a) with respect to a Borrower, a material adverse effect upon the condition (financial or otherwise), operations, performance, properties or prospects of such Borrower that could reasonably be expected to impair, to a material extent, such Borrower’s ability to perform its obligations under the Loan Documents; and (b) with respect to a Property, a material adverse effect upon the physical condition of such Property, or upon its operations, performance or prospects, that reduces the Appraised Value of the Property to an amount that is less than eighty percent (80%) of the Appraised Value of the Property as of the date hereof. The phrase "has a Material Adverse Effect" or "will result in a Material Adverse Effect" or words substantially similar thereto shall in all cases be intended to mean "has resulted, or will or could reasonably be anticipated to result, in a Material Adverse Effect", and the phrase "has no (or does not have a) Material Adverse Effect" or "will not result in a Material Adverse Effect" or words substantially similar thereto shall in all cases be intended to mean "does not or will not or could not reasonably be anticipated to result in a Material Adverse Effect".

"Maturity Date" – means the Initial Maturity Date, the First Extended Maturity Date or the Second Extended Maturity Date, as applicable.

"Maximum Applicable Loan-to-Value Percentage" – means a percentage determined with reference to the outstanding principal balance of the Loan (as of the date of determination) in accordance with the following:

|

| |

| Outstanding Principal Balance of the Loan | Maximum Applicable Loan-to-Value Percentage |

| Greater than or equal to $70,000,000 | 57.00% |

| Less than $70,000,000 | 50.00% |

"Minimum Applicable Loan Constant" – means a percentage determined with reference to the outstanding principal balance of the Loan (as of the date of determination) in accordance with the following:

|

| |

| Outstanding Principal Balance of the Loan | Minimum Applicable Loan Constant |

| Greater than $115,000,000 | 13% |

| Less than or equal to $115,000,000 but greater than $70,000,000 | 15% |

| Less than or equal to $70,000,000 | 17% |

"Minimum DSCR" – means Debt Service Coverage Ratio of not less than 1.50:1.00.

"National City Loan Agreement" – shall have the meaning given to such term in the Recitals hereto.

"National City Property" – shall have the meaning given to such term in the Recitals hereto.

"Net Effective Rental Rate" means (i) the actual recurring contractual base rental payment required to be paid by a tenant under a Lease, taking into account any adjustment regarding Concessions, plus (ii) with respect to triple-net Leases, expense reimbursement payments required to be paid by a tenant under a Lease, which shall be calculated on a historical basis for the purpose of projecting Gross Rental Income.

"Net Operating Income" shall mean, as of any date of determination: (a) Gross Operating Income ((i) adjusted downwards by Administrative Agent in accordance with the definition of “Concessions” and (ii) adjusted upward to give credit for rents of tenants in possession but not paying rent due to a free rent period; provided, (a) the amount credited shall be the monthly rent, at the monthly Net Effective Rental Rate, that the applicable tenant is required to pay during the first month in which it is required to pay rent under its lease and (b) no credit shall be given for any month if after such month six months would remain in the applicable tenant’s free rent period (whether or not consecutive)*) for the immediately preceding Fiscal Quarter (excluding any amounts received by tenants under Leases not entered into in compliance with Section 9.3 and, for purposes of calculating Net Operating Income as an input for calculating “Loan Constant” under Section 2.10 only, excluding any amounts received by tenants under Leases which are subject to a tenant’s right of termination (to the extent such right has been exercised) occurring in the twelve months following the calculation date) multiplied by four, excluding security or other deposits, late fees, lease termination or other similar charges, delinquent rent recoveries to the extent the same would not have been included in the relevant testing period, unless previously reflected in reserves, or any other items of a non-recurring nature and adjusted for the impacts of any change in occupancy during such period; minus (b) the sum of (i) the actual reasonable Operating Expenses for the immediately preceding Fiscal Quarters multiplied by four (and adjusted for the impacts of any changes in occupancy during such period, which adjustment shall be consistent with the adjustment made to Gross Operating Income); and (ii) an amount for reasonable capital reserves equal to (A) $0.10 per square foot of net

rentable area of any industrial properties, and (B) $0.25 per square foot of net rentable area of office properties, and adjusted by Administrative Agent to account for items that have accrued, but have not been paid during the relevant period (e.g., real estate taxes and insurance premiums).

*By way of example, if at the expiration of the applicable test quarter, four months remain in the free rent period for a particular tenant, then Net Operating Income shall be adjusted upward to give credit for two months of the rent to be paid by the applicable tenant. The amount credited shall be two times the monthly rent (at the Net Effective Rental Rate) that such tenant is required to pay for the first month in which it is required to pay rent under its lease.

"Non-Pro Rata Advance" – shall mean a Protective Advance or a disbursement under the Loan with respect to which fewer than all Lenders have funded their respective Pro Rata Shares in breach of their obligations under this Agreement.

"Note" or "Notes" – means each secured promissory note, collectively in the original principal amount of the Loan, executed by Borrowers and payable to the order of a Lender, together with such other replacement notes as may be issued from time to time pursuant to Section 13.13, as hereafter amended, supplemented, replaced or modified.

"Obligations" means, from time to time, all Indebtedness of Borrowers owing to Lenders, to any Person entitled to indemnification pursuant to Section 13.1, or to any of their respective successors, transferees or assigns, of every type and description, whether or not evidenced by any note, guaranty or other instrument, arising under or in connection with this Agreement or any other Loan Document, whether or not for the payment of money, whether direct or indirect (including those acquired by assignment), absolute or contingent, due or to become due, now existing or hereafter arising and however acquired. The term includes, without limitation, all interest, charges, expenses, fees, reasonable attorneys’ fees and disbursements, reasonable fees and disbursements of expert witnesses and other consultants, and any other sum now or hereinafter chargeable to Borrowers under or in connection with this Agreement or any other Loan Document. (Notwithstanding the foregoing definition of "Obligations", Borrowers’ obligations under any environmental indemnity agreement constituting a Loan Document, or any environmental representation, warranty, covenant, indemnity or similar provision in this Agreement or any other Loan Document, shall be secured by the Properties only to the extent, if any, specifically provided in the Security Documents).

"Operating Expenses" shall mean all reasonable operating expenses of the Properties, including, without limitation, those for maintenance, property management (subject to an imputed minimum of two and one half percent (2.5%) of Gross Rental Income for all Properties other than the Granite Tower Property, the National City Property, the Two Westlake Property, the Ground Leased Property and the Crescent Property, for which such imputed amount shall equal two percent (2.0%) of Gross Rental Income), repairs, annual taxes, bond assessments, ground lease payments (if any), insurance, utilities and other annual expenses (but not costs of tenant retrofit, lease commission, capital improvements or capital repairs) and non-capital reserves that are customary and standard for properties of this type. Operating Expenses for this purpose shall not include any interest or principal payments on the Loan or any allowance for depreciation; recurring expenses, which are not paid monthly, shall be accounted for monthly, without duplication, on an accrual basis.

"Operating Statement" – shall have the meaning given to such term in Section 10.1.

"Original Horizon Loan" – shall have the meaning given to such term in the Recitals hereto.

"Original National City Loan" – shall have the meaning given to such term in the Recitals hereto.

"Other Related Documents" – means those documents, as hereafter amended, supplemented, replaced or modified from time to time, properly executed and in recordable form, if necessary, listed in Exhibit B as Other Related Documents.

"Par Loan Value" – means the amount of the Commitment allocable to an individual Property, as more specifically detailed on Schedule 1.1(B) attached hereto.

"Participant" – shall have the meaning given to such term in Section 13.13.

"Permit" – means any permit, approval, authorization, license, variance or permission required from a Governmental Authority under an applicable Requirement of Law.

"Permitted Liens" – means:

| |

| (a) | Liens (other than environmental Liens and any Lien imposed under ERISA) for taxes, assessments or charges of any Governmental Authority for claims not yet due; |

| |

| (b) | Any laws, ordinances or regulations affecting the Properties; |

| |

| (c) | Liens imposed by laws, such as mechanics’ liens and other similar liens, arising in the ordinary course of business which secure payment of obligations not more than thirty (30) days past due; |

| |

| (d) | All matters shown on the Title Policies as exceptions to Lender’s coverage thereunder; |

| |

| (e) | Liens in favor of Administrative Agent, for the benefit of Lenders, under the Security Documents; |

| |

| (f) | All existing Leases at the Properties and any future Leases at the Properties entered into in accordance with this Agreement; and |

| |

| (g) | Liens in favor of Wells Fargo Bank, National Association, relating to any Swap Agreement, which liens shall be pari passu with the liens of all other Secured Obligations, as such term is defined in the Security Documents. |

"Permitted Operating Expenses" – shall mean the following expenses to the extent that such expenses are reasonable in amount and customary for properties of the same type as the Properties: (i) taxes and assessments imposed upon any Property to the extent that such taxes and assessments are required to be paid by the Borrower that owns such Property and are actually paid or reserved for by such Borrower; (ii) bond assessments; (iii) insurance premiums for casualty insurance (including, without limitation, earthquake and terrorism coverage) and liability insurance carried in connection with any Property to the extent that such premiums are actually paid or reserved for by the Borrower that owns such Property, provided, however, if any, insurance is maintained as part of a blanket policy covering such Property and other properties, the insurance premium included in this subparagraph shall be the premium fairly allocable to such Property; and (iv) operating expenses and capital expenditures incurred by a Borrower for the management, operation, cleaning, leasing, maintenance and repair of a Property owned by such Borrower in the ordinary course. Permitted Operating Expenses shall not include any interest or principal payments on the Loan or any allowance for depreciation.

"Person" – means any natural person, corporation, limited partnership, general partnership, joint stock company, limited liability company, limited liability partnership, joint venture, association, company, trust, bank, trust company, land trust, business trust or other organization, whether or not a legal entity, or any other nongovernmental entity, or any Governmental Authority.

"Potential Default" – means an event, circumstance or condition which, with the giving of notice or the lapse of time, or both, would constitute a Default.

"Price Adjustment Date" – shall have the meaning given to such term in Section 2.7(h).

"Proceedings" means, collectively, all actions, suits, arbitrations and proceedings, at law, in equity or otherwise, before, and investigations commenced or threatened by or before, any court or Governmental Authority with respect to a Person.

"Property" or "Properties" – shall have the meaning given to such term in Recital D. The initial Properties as of the Effective Date are identified on Schedule 1.1(C).

"Property Release" – shall have the meaning given to such term in Section 2.10.

"Pro Rata Share" – means, as to each Lender, the ratio, expressed as a percentage, of (a) the amount of such Lender’s Commitment to (b) the aggregate amount of the Commitments of all Lenders hereunder; provided, however, that if at the time of determination the Commitments have terminated or been reduced to zero, the "Pro

Rata Share" of each Lender shall be calculated based upon each Lender’s outstanding Commitment (i.e., advanced to Borrower) in effect immediately prior to such termination or reduction.

"Protective Advance" – shall mean any advances made by Administrative Agent in accordance with the provisions of Section 12.7(e) to protect the Collateral securing the Loan.

"Regulatory Costs" – are, collectively, future, supplemental, emergency or other changes in Reserve Percentages, assessment rates imposed by the Federal Deposit Insurance Corporation, or similar requirements or costs imposed by any domestic or foreign Governmental Authority and related in any manner to a Fixed Rate.

"REIT Operating Expenses" means the Allocated Share of all actual costs, expenses and/or amounts incurred by, or payable or reimbursable by, KBS REIT or KBS Limited Partnership II for any of the following: (a) charges and fees charged by banks, audit fees, tax preparation fees, legal fees, transfer agent fees, accounting consulting fees related to emerging technical pronouncements, tax consulting fees relating to Real Estate Investment Trust issues, due diligence costs and fees arising from state and local taxes, fees and expenses incurred in connection with annual corporate filings, and local, state and federal income taxes, and (b) professional fees related to corporate structuring and/or filings, consulting fees and filing fees arising from SEC reporting requirements including, without limitation, 10K filings, 10Q filings, and 8k filings, consulting fees and other fees and costs related to Sarbanes- Oxley 404 compliance requirements.

"Release" means the release, spill, emission, leaking, pumping, injection, deposit, disposal, discharge, dispersal, leaching or migration into the indoor or outdoor environment or into or out of any property, including the movement of Contaminants through or in the air, soil, surface water, groundwater or property.

"Release Price" means an amount equal to the Par Loan Value of the relevant Property multiplied by the Release Percentage determined with reference to the following schedule:

|

| |

| Aggregate Loan Commitment After the Applicable Release | Release Percentage |

| Greater than $115,000,000 | 110% |

| Less than or equal to $115,000,000 but greater than $70,000,000 | 120% |

| Less than or equal to $70,000,000 | 125% |

Notwithstanding the foregoing, with respect to the National City Property, "Release Price" means an amount equal to the Par Loan Value of the National City Property multiplied by the Release Percentage determined with reference to the following schedule:

|

| |

| Aggregate Loan Commitment After the Applicable Release | Release Percentage |

| Greater than $70,000,000 | 120% |

| Less than or equal to $70,000,000 | 125% |

In each case, the Release Percentage shall be determined after giving effect to the relevant release of Collateral and any accompanying prepayment.

"Remedial Action" means any action required by applicable Hazardous Materials Laws to (a) clean up, remove, treat or in any other way address Hazardous Materials in the indoor or outdoor environment; (b) prevent the Release or threat of Release or minimize the further Release of Hazardous Materials so they do not migrate

or endanger or threaten to endanger public health or welfare or the indoor or outdoor environment; or (c) perform pre-remedial studies and investigations and post-remedial monitoring and care.

"Requirements of Law" – means, as to any entity, the charter and by-laws, partnership agreement or other organizational or governing documents of such entity, and any law, rule or regulation, Permit, or determination of an arbitrator or a court or other Governmental Authority, in each case applicable to or binding upon such entity or any of its property or to which such entity or any of its property is subject, including without limitation, applicable securities laws and any certificate of occupancy, zoning ordinance, building, environmental or land use requirement or Permit or occupational safety or health law, rule or regulation.

"Requisite Lenders" – means, as of any date, Lenders (which must include the Lender then acting as Administrative Agent) having at least 66-2/3% of the aggregate amount of the Commitments, or, if the Commitments have been terminated or reduced to zero, Lenders holding at least 66-2/3% of the principal amount outstanding under the Loan, provided that (a) in determining such percentage at any given time, all then existing Defaulting Lenders will be disregarded and excluded and the Pro Rata Shares of the Loan of Lenders shall be redetermined, for voting purposes only, to exclude the Pro Rata Shares of the Loan of such Defaulting Lenders, and (b) at all times when two or more Lenders are party to this Agreement, the term "Requisite Lenders" shall in no event mean less than two Lenders.

"Reserve Percentage" – is at any time the percentage announced by Administrative Agent as the reserve percentage under Regulation D for loans and obligations making reference to an Applicable LIBO Rate for a Fixed Rate Period or time remaining in a Fixed Rate Period on a Price Adjustment Date, as appropriate. The Reserve Percentage shall be based on Regulation D or other regulations from time to time in effect concerning reserves for Eurocurrency Liabilities as defined in Regulation D from related institutions as though Administrative Agent were in a net borrowing position, as promulgated by the Board of Governors of the Federal Reserve System, or its successor.

"Second Extended Maturity Date" – means January 27, 2018.

"Second Extension Option" – shall have the meaning given to such term in Section 2.14.

"Secured Swap Obligations" – means all liabilities of Borrowers under any Swap Agreement; provided that any such liabilities under any Swap Agreement with an Affiliate of a Lender shall not constitute "Swap Obligations" hereunder unless and until such liabilities are certified as such in writing to Administrative Agent by Borrowers and such Affiliate of a Lender.

"Security Documents" – means, individually and collectively, each of the deeds of trust and mortgages (including any modifications or amendments thereto) executed by a Borrower in favor of Administrative Agent, for the benefit of Lenders, which recite that they are security for the Loan, as the same may be amended, supplemented, replaced or modified from time to time.

"Single Purpose Entity" means a corporation or other limited liability organization which, at all times since its formation and thereafter, was and will be organized solely for the purpose of acquiring and developing its interest in a Property.

"Solvent" means, as to any Person at the time of determination, that such Person (a) owns property the value of which (both at fair valuation and at present fair salable value and taking into account (i) the value of such Person’s rights of reimbursement, contribution, subrogation and indemnity against any other Person, and (ii) the value of any property, owned by another Person, that secures any liabilities of the Person whose Solvency is being determined) is equal to or greater than the amount required to pay all of such Person’s liabilities (including contingent liabilities and debts); (b) is able to pay all of its debts as such debts mature; and (c) has capital sufficient to carry on its business and transaction and all business and transactions in which it is about to engage.

"Subdivision Map" – shall have the meaning given to such term in Section 9.5.

"Swap Agreement" – means any rate swap, forward rate, cap, floor, collar, exchange, hedge or similar transaction (including, but not limited to, any transaction subject to the terms of any form of master agreement published by the International Swaps and Derivatives Association, Inc., and any related confirmations) entered

into between Borrowers and any Lender or any Affiliate of any Lender, providing protection against fluctuations in interest rates with respect to the Loan.

"Swept Funds Blocked Account" – shall have the meaning given to such term in Section 8.1.

"Swept Funds Disbursement Account" – shall have the meaning given to such term in Section 8.1.

"Termination Payment" – shall have the meaning given to such term in Section 9.3(d).

"Title Policy" – means each ALTA Lender’s Policy of Title Insurance issued or to be issued by Commonwealth Land Title Insurance Company with respect to the Properties, together with any endorsements which Administrative Agent may require. Such policies shall, insure Administrative Agent, for the benefit of Lenders, in the aggregate amount of the outstanding principal amount of the Loan, of the validity and priority of the liens of the Security Documents on the Properties, subject only to matters approved by Administrative Agent in writing and shall be referred to herein together as the "Title Policies".

"Torrey Reserve Borrower" means, KBSII Torrey Reserve West, LLC, a Delaware limited liability company.

"Torrey Reserve Holdback Amount" means an amount equal to $15,298,132, or such lesser amount as would cause the conditions in Section 3.4(b)(viii) to be satisfied.

"Torrey Reserve Property" shall mean 3390, 3394 and 3398 Carmel Mountain Road, San Diego, California.

"Two Westlake Borrower" – means a Single Purpose Entity that owns the Two Westlake Property and is an Affiliate of Borrowers.

“Two Westlake Property” – means the Property located at 580 Westlake Park Blvd., Houston, Texas.

“Two Westlake Holdback Amount" means an amount equal to $48,300,000, or such lesser amount as would cause the conditions in Section 3.4(c)(viii) to be satisfied.

“Variable Rate” - means the sum of: (a) the LIBOR Market Index Rate and (b) the Applicable Spread; provided, that if for any reason the LIBOR Market Index Rate is unavailable, Variable Rate shall mean the sum of: (a) the per annum rate of interest equal to the Federal Funds Rate plus 1.50%, and (b) the Applicable Spread.

"Wells Fargo" – shall have the meaning given to such term in the preamble hereto.

1.2 SCHEDULES AND EXHIBITS INCORPORATED. Schedules 1.1(A), 1.1(B), 1.1(C), 6.3, 6.11, 6.24, and 7.1 and Exhibits A, B, C, D, E, F, G, H, I, J and K all attached hereto, are hereby incorporated into this Agreement.

ARTICLE 2. LOAN

2.1 LOAN. By and subject to the terms of this Agreement, Administrative Agent and Lenders have agreed to make a loan to Borrowers in the aggregate principal sum of Three Hundred and Sixty Million Dollars ($360,000,000) (which amount may be increased up to a maximum amount of $372,000,000, subject to the terms of Section 2.15), which Loan shall be evidenced by the Notes. The Notes shall be secured, in part, by the Security Documents encumbering certain real property and improvements as legally defined therein. The Loan shall be used to finance the Properties and for such other purposes as Borrowers may elect.

2.2 LOAN FEES. Borrowers shall pay to Administrative Agent, at Loan closing, a loan fee as set forth in a separate letter agreement between Borrowers and Administrative Agent. Additionally, Borrowers shall pay to Administrative Agent for Administrative Agent’s sole benefit certain other fees, each in the amount and at the times as set forth in a separate letter agreement between Borrowers and Administrative Agent dated January 27, 2011 (the "Fee Letter").

2.3 LOAN DOCUMENTS. Borrowers shall execute and deliver to Administrative Agent (or cause to be executed and delivered) concurrently with this Agreement each of the documents, properly executed and in recordable form, as applicable, described in Exhibit B as Loan Documents, together with those documents described in Exhibit B as Other Related Documents, but excluding the deeds of trust relating to the I-81 Properties, the Torrey Reserve Property, the Two Westlake Property and any Future Property, each of which shall be delivered when required pursuant to Section 3.4.

2.4 EFFECTIVE DATE. The date of the Loan Documents is for reference purposes only. The effective date of delivery and transfer to Administrative Agent of the security under the Loan Documents and of Borrowers’ and Lenders’ obligations under the Loan Documents shall be the Effective Date.

2.5 MATURITY DATE. The outstanding balance of the Loan, together with all accrued and unpaid interest and other amounts accrued and unpaid under the Loan Documents, shall be payable in full on the Maturity Date.

2.6 AMENDED AND RESTATED AND CONSOLIDATED LOAN. Borrowers acknowledge that this Agreement amends and restates and consolidates the Horizon Loan Agreement and the National City Loan Agreement and that such amendment and restatement shall not cause or constitute a novation, release, impairment or discharge of the obligations existing under the Horizon Loan Agreement or the National City Loan Agreement. Borrowers acknowledge that as of the Effective Date, the Original Horizon Loan has been disbursed by Lenders in the aggregate principal amount of $40,621,915 and the Original National City Loan has been disbursed by Lenders in the aggregate principal amount of $69,000,000.

2.7 INTEREST ON THE LOAN.

(a) Interest Payments. Interest accrued on the outstanding principal balance of the Loan shall be due, and payable in the manner provided in Section 2.8, on the first Business Day of each month commencing with the first month after the Effective Date.

(b) Default Interest. Notwithstanding the rates of interest specified in Sections 2.7(e) below and the payment dates specified in Section 2.7(a), at Requisite Lenders’ discretion at any time following the occurrence and during the continuance of any Default, the principal balance of the Loan then outstanding and, to the extent permitted by applicable law, any interest payments on the Loan not paid when due, shall bear interest payable upon demand at the Alternate Rate. All other amounts due Administrative Agent or Lenders (whether directly or for reimbursement) under this Agreement or any of the other Loan Documents if not paid when due, or if no time period is expressed, if not paid within ten (10) days after demand, shall likewise, at the option of Requisite Lenders, bear interest from and after demand at the Alternate Rate.

(c) Late Fee. Borrowers acknowledge that late payment to Administrative Agent will cause Administrative Agent and Lenders to incur costs not contemplated by this Agreement. Such costs include, without limitation, processing and accounting charges. Therefore, if Borrowers fail timely to pay interest due hereunder within fifteen (15) days after such payment is due, then Borrowers shall at, Administrative Agent's option, pay a late or collection charge equal to four percent (4%) of the amount of such unpaid interest payment to Administrative Agent (for the benefit of Lenders). Borrowers and Administrative Agent agree that this late charge represents a reasonable sum considering all of the circumstances existing on the date hereof and represents a fair and reasonable estimate of the costs that Administrative Agent and Lenders will incur by reason of late payment. Borrowers and Administrative Agent further agree that proof of actual damages would be costly and inconvenient. Acceptance of any late charge shall not constitute a waiver of the default with respect to the overdue installment, and shall not prevent Administrative Agent from exercising any of the other rights available hereunder or any other Loan Document. Such late charge shall be paid without prejudice to any other rights of Administrative Agent.

(d) Computation of Interest. Interest shall be computed on the basis of the actual number of days elapsed in the period during which interest or fees accrue and a year of three hundred sixty (360) days on the principal balance of the Loan outstanding from time to time. In computing interest on the Loan, the date of the making of a disbursement under the Loan shall be included and the date of payment

shall be excluded. Notwithstanding any provision in this Section 2.7, interest in respect of the Loan shall not exceed the maximum rate permitted by applicable law.

(e) Effective Rate. The "Effective Rate" upon which interest shall be calculated for the Loan shall, from and after the Effective Date of this Agreement, be one or more of the following:

(i) Provided no Default exists under this Agreement:

(A) For those portions of the principal balance of the Notes which are not Fixed Rate Portions, the Effective Rate shall be the Variable Rate.

(B) For those portions of the principal balance of the Notes which are Fixed Rate Portions, the Effective Rate for the Fixed Rate Period thereof shall be the Fixed Rate accepted by Borrowers for the Fixed Rate Period selected by Borrowers with respect to each Fixed Rate Portion and set in accordance with the provisions hereof.

(C) With respect to any portion of the Loan then subject to a Swap Agreement, Borrowers may not select a rate of interest, including, without limitation, a Fixed Rate for a Fixed Rate Period, that is inconsistent with the terms of such Swap Agreement.