UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| Cape Bancorp, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

N/A

| (2) | Aggregate number of securities to which transaction applies: |

N/A

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

N/A

| (4) | Proposed maximum aggregate value of transaction: |

N/A

N/A

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

N/A

| (2) | Form, Schedule or Registration Statement No.: |

N/A

N/A

N/A

March 24, 2015

Dear Stockholder:

We cordially invite you to attend the 2015 Annual Meeting of Stockholders of Cape Bancorp, Inc., the parent company of Cape Bank. The Annual Meeting will be held at The Greate Bay Country Club, 901 Mays Landing Road, Somers Point, New Jersey 08244 at 9:00 a.m., local time, on April 27, 2015.

The enclosed Notice of Annual Meeting and Proxy Statement describes the formal business to be transacted. During the Annual Meeting we will also report on the operations of Cape Bancorp, Inc. and Cape Bank. Our Directors and officers will be present to respond to any questions that stockholders may have.

The business to be conducted at the Annual Meeting includes the election of three Directors, the ratification of the appointment of Crowe Horwath LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015, and the approval of an advisory, non-binding resolution with respect to executive compensation, as described in the Proxy Statement.

Our Board of Directors has determined that the matters to be considered at the Annual Meeting are in the best interests of Cape Bancorp, Inc. and its stockholders. For the reasons set forth in the Proxy Statement, the Board of Directors unanimously recommends a vote “FOR” the election of the Director nominees as well as each matter to be considered.

YOUR VOTE IS IMPORTANT. We encourage you to read the Proxy Statement and vote your shares as soon as possible. Stockholders may vote via the Internet, by telephone or by completing the enclosed Proxy Card in the enclosed postage-paid envelope. Voting in advance of the Annual Meeting will not prevent you from voting in person, but will assure that your vote is counted if you are unable to attend the Annual Meeting.

Also enclosed for your review is our Annual Report on Form 10-K for the year ended December 31, 2014, which contains detailed information concerning our business activities and operating performance.

| Sincerely, | |

| | |

| /s/ Michael D. Devlin | |

| President and Chief Executive Officer | |

CAPE BANCORP, INC.

225 North Main Street

Cape May Court House, New Jersey 08210

(609) 465-5600

NOTICE OF

2015 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On April 27, 2015

Notice is hereby given that the Annual Meeting of Stockholders of Cape Bancorp, Inc. will be held at The Greate Bay Country Club, 901 Mays Landing Road, Somers Point, New Jersey 08244 on April 27, 2015 at 9:00 a.m., local time.

A Proxy Statement and Proxy Card for the Annual Meeting are enclosed. The Annual Meeting is for the purpose of considering and acting upon:

| 1. | The election of three Directors; |

| 2. | The ratification of the appointment of Crowe Horwath LLP as independent registered public accountants for the fiscal year ending December 31, 2015; |

| 3. | An advisory, non-binding resolution with respect to executive compensation, as described in the Proxy Statement; and |

| 4. | Such other business as may properly come before the Annual Meeting, and any adjournments or postponement thereof. |

The Board is not aware of any other such business. Any action may be taken on the foregoing proposals at the Annual Meeting, including all adjournments thereof. Stockholders of record at the close of business on March 6, 2015 are entitled to vote at the Annual Meeting. A list of stockholders entitled to vote will be open and available for inspection at The Greate Bay Country Club, 901 Mays Landing Road, Somers Point, New Jersey 08244 during the entire Annual Meeting.

| | By Order of the Board of Directors |

| | Cape Bancorp, Inc. |

| | |

| | /s/ B. Matthew McCue |

| | |

| Cape May Court House, New Jersey | B. Matthew McCue |

| March 24, 2015 | Corporate Secretary |

It is important that your shares be represented and voted at the Annual Meeting. Stockholders whose shares are held in registered form have a choice of voting by proxy card, telephone or the Internet, as described on your proxy card. Stockholders whose shares are held in the name of a broker, bank or other holder of record must vote in the manner directed by SUCH HOLDER. TO VOTE YOUR SHARES, PLEASE FOLLOW THE INSTRUCTIONS LOCATED ON your proxy card or the information forwarded by your broker, bank or other holder of record. THIS PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING. Any Stockholder OF RECORD present at the Annual Meeting may withdraw his or her proxy and vote personally on any matter properly brought before the Annual Meeting.IF YOU ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR OWN NAME, YOU WILL NEED APPROPRIATE DOCUMENTATION FROM THE STOCKHOLDER OF RECORD TO VOTE IN PERSON AT THE ANNUAL MEETING.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 27, 2015—This Proxy Statement, PROXY CARD and Cape Bancorp, Inc.’s 2014 Annual Report to Stockholders are each available at www.proxyvote.com.

Proxy Statement

CAPE BANCORP, INC.

225 North Main Street

Cape May Court House, New Jersey 08210

(609) 465-5600

2015 ANNUAL MEETING OF STOCKHOLDERS

April 27, 2015

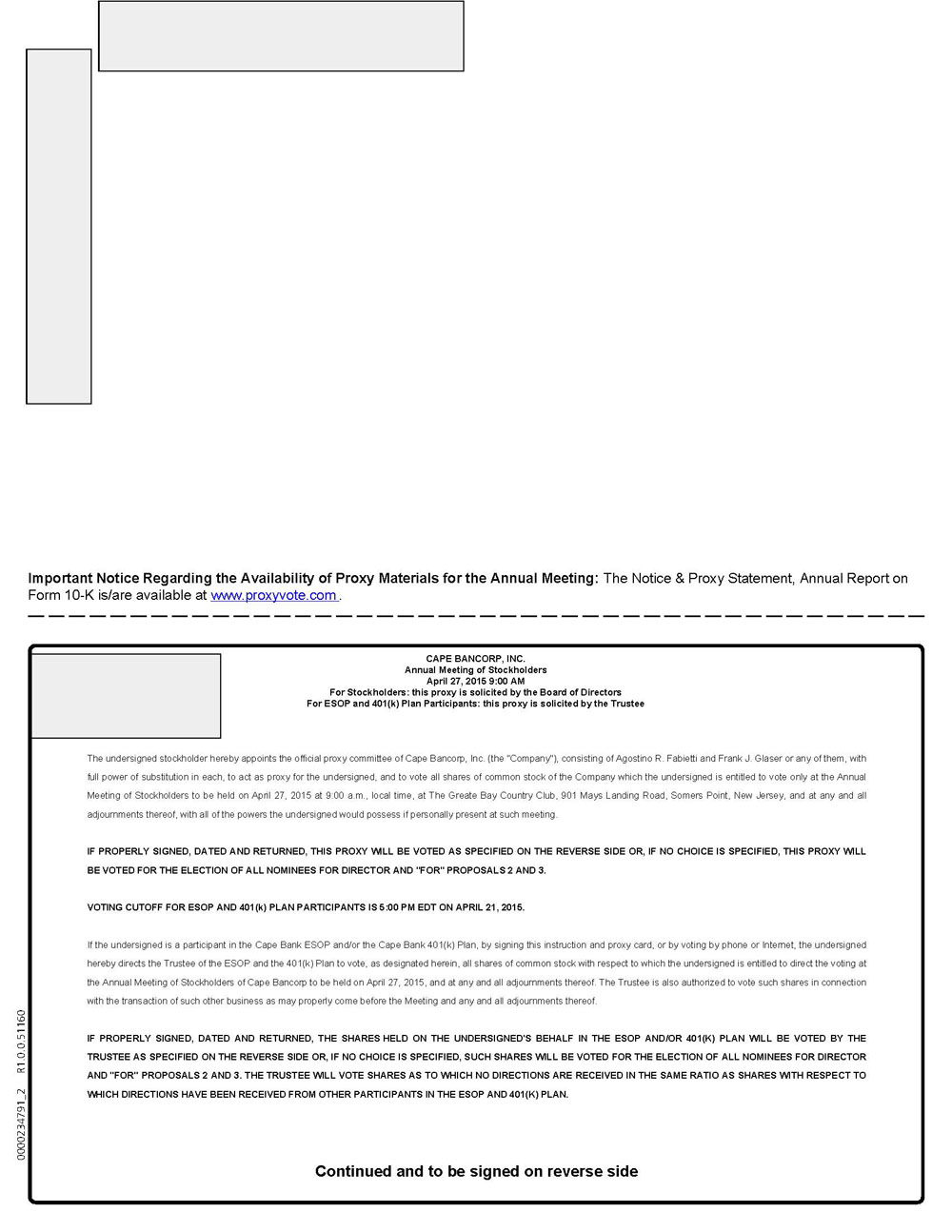

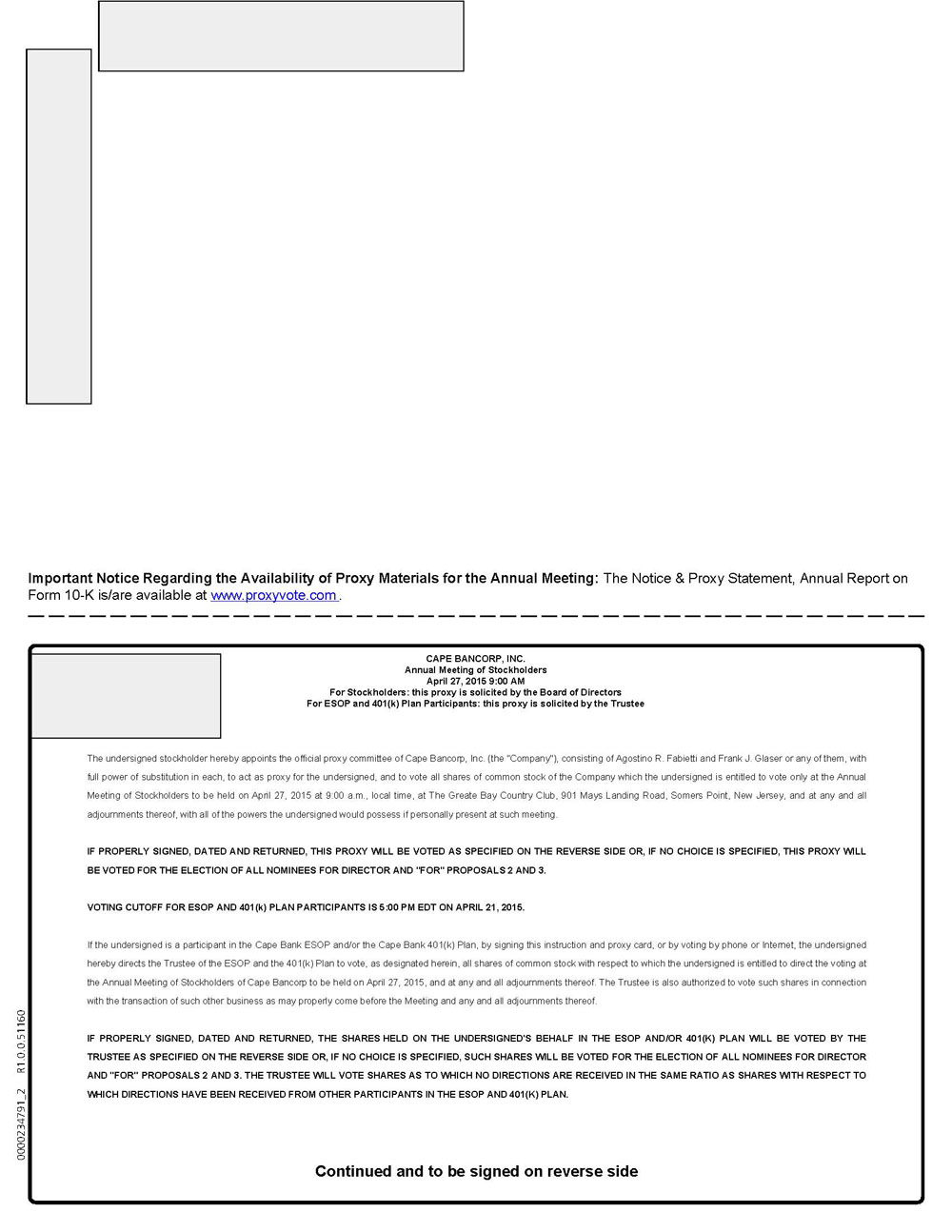

This Proxy Statement and the accompanying Proxy Card and the Annual Report to Stockholders are being furnished to the stockholders of Cape Bancorp, Inc. (the “Company”) in connection with the solicitation of proxies on behalf of the Board of Directors of Cape Bancorp, Inc. to be used at the 2015 Annual Meeting of Stockholders of Cape Bancorp, Inc., which will be held at The Greate Bay Country Club, 901 Mays Landing Road, Somers Point, New Jersey 08244, on April 27, 2015, at 9:00 a.m., local time, and all adjournments of the Annual Meeting. The accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement are first being mailed to stockholders on or about March 24, 2015.

Who Can Vote

The Board of Directors has fixed March 6, 2015 as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of Cape Bancorp, Inc. common stock, par value $0.01 per share, at the close of business on such date will be entitled to vote at the Annual Meeting. On March 6, 2015, 11,484,396 shares of Cape Bancorp, Inc. common stock were outstanding and held by approximately1,040holders of record. The presence, in person or by properly executed proxy, of the holders of a majority of the outstanding shares of Cape Bancorp, Inc. common stock is necessary to constitute a quorum at the Annual Meeting.

How Many Votes You Have

Each holder of shares of Cape Bancorp, Inc. common stock outstanding on March 6, 2015 will be entitled to one vote for each share held of record, except as limited by the following sentence: Cape Bancorp, Inc.’s Articles of Incorporation provide that stockholders of record who beneficially own in excess of 10% of the outstanding shares of common stock of Cape Bancorp, Inc. are not entitled to any vote with respect to the shares held in excess of that 10% limit. A person or entity is deemed to beneficially own shares that are owned by an affiliate, as well as by any person acting in concert with such person or entity.

Matters to Be Considered

The purpose of the Annual Meeting is to vote on the election of three Directors, to ratify the appointment of Crowe Horwath LLP as our independent registered public accountants for the fiscal year ending December 31, 2015, and to approve an advisory, non-binding resolution with respect to our executive compensation described in the Proxy Statement.

You may be asked to vote upon other matters that may properly be submitted to a vote at the Annual Meeting. You also may be asked to vote on a proposal to adjourn or postpone the Annual Meeting. Cape Bancorp, Inc. could use any adjournment or postponement for the purpose, among others, of allowing additional time to solicit proxies.

The Board of Directors is currently unaware of any other matters that may be presented for consideration at the Annual Meeting. If other matters properly come before the Annual Meeting, or at any adjournment or postponement of the Annual Meeting, shares represented by properly submitted proxies will be voted, or not voted, by the persons named as proxies on the Proxy Card in their best judgment.

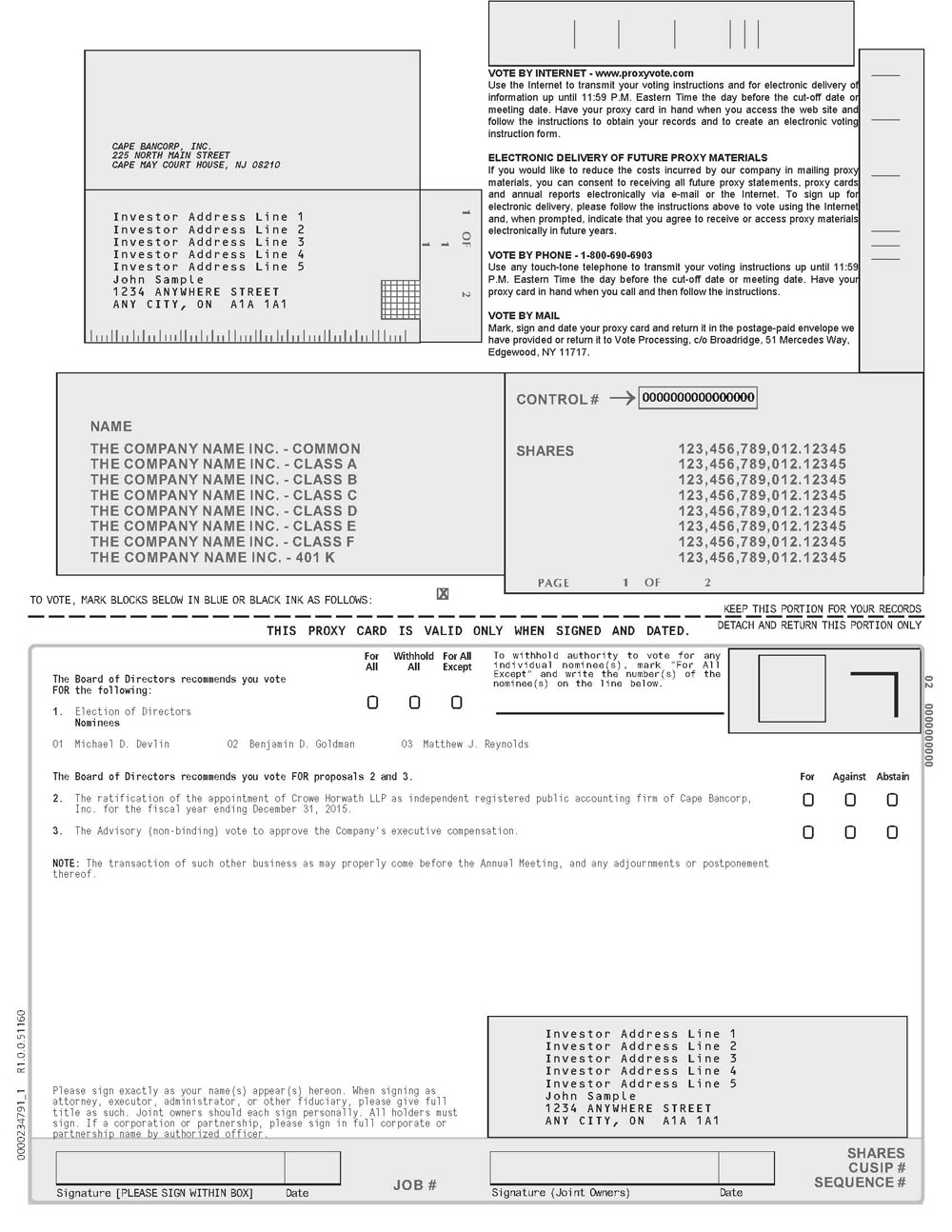

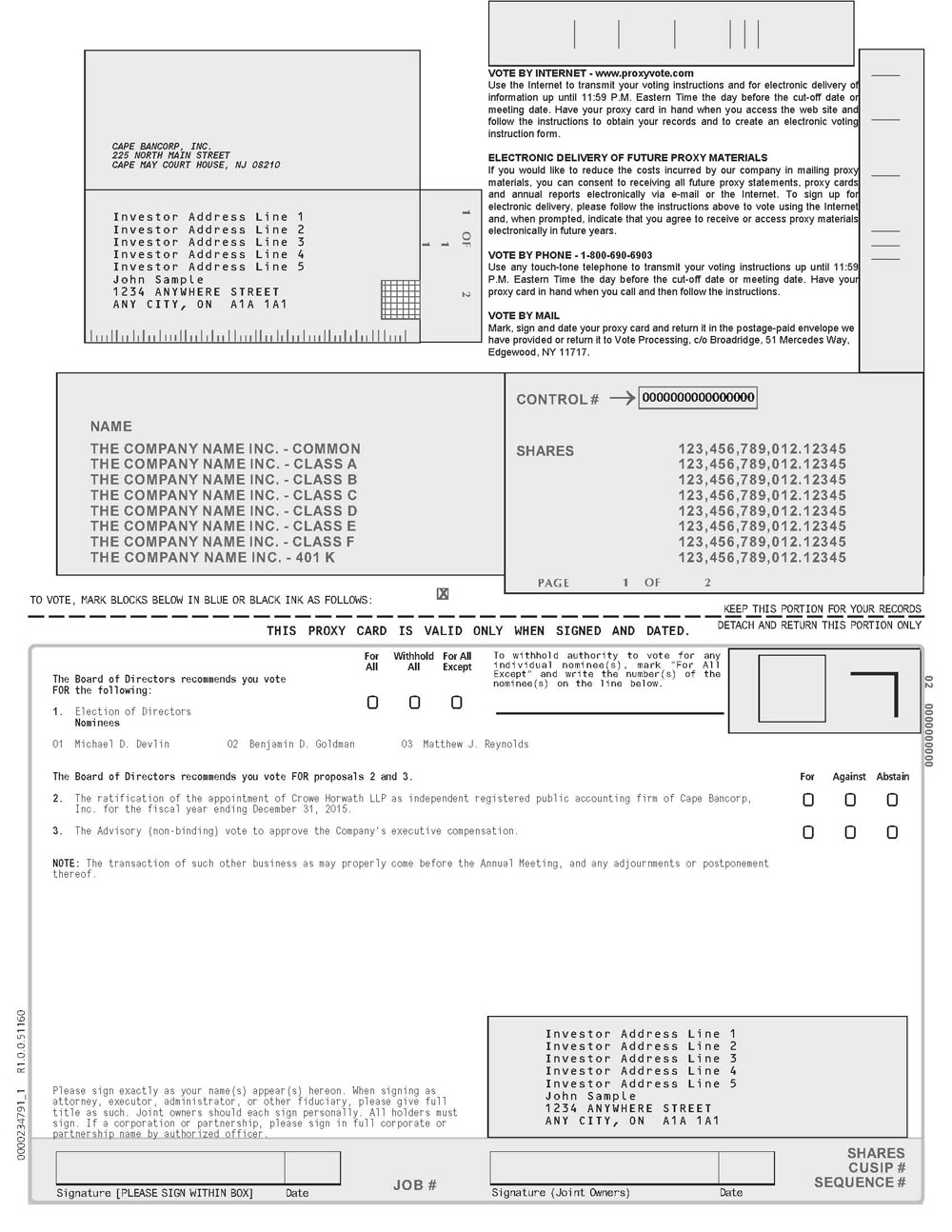

How to Vote

You may vote your shares by completing and signing the enclosed Proxy Card and returning it in the enclosed postage-paid envelope or by attending the Annual Meeting. Alternatively, you may choose to vote your shares using the Internet or telephone voting options, which are explained on your Proxy Card. You should complete and return the Proxy Card accompanying this document, or vote using the Internet or telephone voting options, in order to ensure that your vote is counted at the Annual Meeting, or at any adjournment or postponement thereof, regardless of whether you plan to attend. Where no instructions are indicated, validly executed proxies will be voted “FOR” the election of the three Director nominees named on the Proxy Statement as well as “FOR” each other proposal set forth in this Proxy Statement for consideration at the Annual Meeting.

If you are a stockholder whose shares are not registered in your own name, you will need appropriate documentation from the stockholder of record to attend the Annual Meeting. Examples of such documentation include a broker's statement or letter or other documentation that will confirm your ownership of shares of Cape Bancorp, Inc. common stock. If you want to vote your shares of Cape Bancorp, Inc. common stock that are held in street name in person at the Annual Meeting, you will need a written proxy in your name from the broker, bank or other nominee who holds your shares.

Participants in the Cape Bank ESOP or 401(k) Plan

If you participate in the Cape Bank Employee Stock Ownership Plan (the “ESOP”) or if you hold Cape Bancorp common stock through the Cape Bank Employees’ Savings & Profit Sharing Plan (the “401(k) Plan”), you will receive one Proxy Card for all plans that reflects all of the shares you may direct the trustees to vote on your behalf under the plans. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary responsibilities, will vote all unallocated shares of Cape Bancorp common stock held by the ESOP and allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions. Under the terms of the 401(k) Plan, a participant is entitled to provide instructions for all shares credited to his or her 401(k) Plan account and held in the Cape Bancorp, Inc. Stock Fund. Shares for which no voting instructions are given or for which instructions were not timely received will be voted in the same proportion as shares for which voting instructions were received.The deadline for returning your voting instructions isApril 21, 2015. Telephonic and Internet voting cutoff is 5:00 p.m. EDT.

Quorum and Vote Required

The presence, in person or by properly executed proxy, of the holders of a majority of the outstanding shares of Cape Bancorp, Inc. common stock is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted solely for the purpose of determining whether a quorum is present. A proxy submitted by a broker that is not voted is sometimes referred to as a broker non-vote.

Directors are elected by a plurality of votes cast, without regard to either broker non-votes or proxies as to which authority to vote for the nominees being proposed is “Withheld.” The ratification of the appointment of Crowe Horwath LLP as independent registered public accountants is determined by a majority of the votes cast, without regard to broker non-votes or proxies marked “ABSTAIN.” As to the advisory, non-binding resolution with respect to our executive compensation as described in this Proxy Statement, a stockholder may: (i) vote “FOR” the resolution; (ii) vote “AGAINST” the resolution; or (iii) “ABSTAIN” from voting on the resolution. The affirmative vote of a majority of the votes cast at the Annual Meeting, without regard to either broker non-votes, or shares as to which the “ABSTAIN” box has been selected on the Proxy Card, is required for the approval of this non-binding resolution. While this vote is required by law, it will neither be binding on Cape Bancorp, Inc. or the Board of Directors, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on Cape Bancorp, Inc. or the Board of Directors.

Revocability of Proxies

You may revoke your proxy at any time before the vote is taken at the Annual Meeting. You may revoke your proxy by:

| · | Submitting written notice of revocation to the Corporate Secretary of Cape Bancorp, Inc. prior to the voting of such proxy; |

| · | Submitting a properly executed proxy bearing a later date; |

| · | Using the Internet or telephone voting options, which are explained on the Proxy Card; or |

| · | Voting in person at the Annual Meeting; however, simply attending the Annual Meeting without voting will not revoke an earlier proxy. |

Written notices of revocation and other communications regarding the revocation of your proxy should be addressed to:

Cape Bancorp, Inc.

225 North Main Street

Cape May Court House, New Jersey 08210

Attention: B. Matthew McCue, Corporate Secretary

If your shares are held in street name, your broker votes your shares and you should follow your broker’s instructions regarding the revocation of proxies.

Recommendation of the Board of Directors

The Board of Directors has determined that the matters to be considered at the Annual Meeting are in the best interest of Cape Bancorp, Inc. and its stockholders, and the Board of Directors unanimously recommends a vote“FOR” the election of the Director nominees as well as each other matter to be considered. Unless otherwise instructed, validly executed proxies will be voted “FOR” the election of each of the nominees and each matter to be considered at the Annual Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Persons and groups who beneficially own in excess of 5% of our shares of common stock are required to file certain reports with the Securities and Exchange Commission regarding such ownership pursuant to the Securities Exchange Act of 1934. The following table sets forth, as of March 6, 2015, the shares of our common stock beneficially owned by each person known to us who was the beneficial owner of more than 5% of the outstanding shares of our common stock.

| | | Amount of Shares | | | | |

| | | Owned and Nature | | | Percent of Shares | |

| Name and Address of | | of Beneficial | | | of Common Stock | |

| Beneficial Owners | | Ownership(1) | | | Outstanding | |

| | | | | | | |

Patriot Financial Partners, GP, LLC(2) Cira Centre 2929 Arch Street, 27th Floor Philadelphia, PA 19104 | | | 1,409,205 | | | | 12.27 | |

| | | | | | | | | |

Cape Bank Employee Stock Ownership Plan(3) 225 North Main Street Cape May Court House, New Jersey 08210 | | | 1,084,465 | | | | 9.44 | |

| | | | | | | | | |

Wellington Management Group, LLP (4) 280 Congress Street Boston, MA 02210 | | | 901,224 | | | | 7.85 | |

| (1) | In accordance with Rule 13d-3 under the Securities Exchange Act of 1934, a person is deemed to be the beneficial owner for purposes of this table, of any shares of common stock if he has shared voting or investment power with respect to such security, or has a right to acquire beneficial ownership at any time within 60 days from the date as of which beneficial ownership is being determined. As used herein, “voting power” is the power to vote or direct the voting of shares and “investment power” is the power to dispose or direct the disposition of shares, and includes all shares held directly as well as by spouses and minor children, in trust and other indirect ownership, over which shares the named individuals effectively exercise sole or shared voting or investment power. |

| (2) | Based on information contained in a Form 4 filed by James J. Lynch on March 9, 2015. Patriot Financial Partners, L.P. possesses shared voting and dispositive power and beneficially owns 1,201,626 shares of Company stock. Patriot Financial Partners Parallel, L.P. possesses shared voting and dispositive power and beneficially owns 207,579 shares of Company stock. Patriot Financial Partners, L.P. and Patriot Financial Partners Parallel, L.P. are collectively referred to herein as the “Funds.” Patriot Financial Partners, GP, LLC (the “LLC”) serves as a general partner of Patriot Financial Partners GP, L.P. (the “GP”) and the GP serves as general partner of the Funds. Messrs. Wycoff, Lubert and Lynch also serve as general partners of the Funds and the GP and as members of the LLC. Based on these relationships, each of Messrs. Wycoff, Lubert and Lynch, the LLC and the GP may be deemed to possess shared voting and dispositive power over the shares of Company common stock held by the Funds, which totals 1,409,205 shares. This amount includes shares beneficially owned by Mr. Lynch who is a “managing partner” of Patriot Financial Partners and a Director of Cape Bancorp, Inc. Effective March 18, 2015, Mr. Lynch resigned from the Board of Directors of Cape Bancorp, Inc. Concurrent with Mr. Lynch’s resignation, the Board of Directors of Cape Bancorp, Inc. appointed James F. Deutsch to the Board. Mr. Deutsch is a Managing Director of Patriot Financial Partners, L.P. |

| (3) | Based on a Schedule 13G filed by Cape Bank Employee Stock Ownership Plan Trust with the SEC on February 5, 2015. |

| (4) | Based on a Schedule 13G/A filed by Wellington Management Group, LLP with the SEC on February 12, 2015. |

PROPOSAL I — ELECTION OF DIRECTORS

Our Board of Directors presently consists of 10 members. Our Bylaws provide that our Board of Directors shall be divided into three classes, and one class of Directors is to be elected annually. Our Directors are generally elected to serve for a three-year period, or a shorter period if the Director is elected to fill a vacancy, and until their respective successors shall have been elected and shall qualify. Three Directors will be elected at the Annual Meeting and will serve until their successors have been elected and qualified. The Nominating Committee has nominated Michael D. Devlin, Benjamin D. Goldman, and Matthew J. Reynolds to serve as Directors for three-year terms. Each of the nominees is currently a member of the Board of Directors, and Mr. Devlin is President and Chief Executive Officer of Cape Bank.

The following table sets forth certain information regarding the composition of our Board of Directors as of March 6, 2015, including the terms of office of Board members. It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the vote is withheld as to the nominee) will be voted at the Annual Meeting for the election of the nominees identified below. If the nominees are unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may recommend. At this time, the Board of Directors knows of no reason why the nominees might be unable to serve, if elected. Except as indicated herein, there are no arrangements or understandings between the nominees and any other person pursuant to which such nominees were selected.

| Name (1) | | Age | | Positions

Held in Cape Bancorp, Inc. | | Director

Since (2) | | Current Term

to Expire | | Shares of Common

Stock Beneficially

Owned (3) | | | Percent of

Class | |

| | | | | | | | | | | | | | | |

| NOMINEES | |

| | |

| Michael D. Devlin | | 65 | | Director and Chief Executive Officer / President | | 2008 | | 2015 | | | 458,919 | (4) | | | 4.00 | % |

| Benjamin D. Goldman | | 68 | | Director | | 2012 | | 2015 | | | 4,965 | (5) | | | * | |

| Matthew J. Reynolds | | 44 | | Director | | 2004 | | 2015 | | | 27,185 | (6) | | | * | |

| | | | | | | | | | | | | | | | | |

| DIRECTORS CONTINUING IN OFFICE | |

| | | | | | | | | | | | | | | | | |

| Frank J. Glaser | | 66 | | Director | | 2006 | | 2016 | | | 14,735 | (7) | | | * | |

| David C. Ingersoll, Jr. | | 68 | | Director | | 1977 | | 2016 | | | 40,735 | (8) | | | * | |

| Thomas K. Ritter | | 59 | | Director | | 2008 | | 2016 | | | 177,124 | (9) | | | 1.54 | % |

| Althea L.A. Skeels | | 63 | | Director | | 2012 | | 2016 | | | 16,356 | (10) | | | * | |

| Agostino R. Fabietti | | 70 | | Director | | 2008 | | 2017 | | | 106,432 | (11) | | | * | |

| Roy Goldberg | | 59 | | Director | | 2010 | | 2017 | | | 4,188 | (12) | | | * | |

| James J. Lynch (18) | | 65 | | Director | | 2009 | | 2017 | | | 1,412,840 | (13) | | | 12.30 | % |

| | | | | | | | | | | | | | | | | |

| EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS | | |

| | | | | | | | | | | | | | | | | |

| Guy Hackney | | 60 | | Executive Vice President Chief Financial Officer | | | | | | | 88,215 | (14) | | | * | |

| Michele Pollack | | 53 | | Executive Vice President Chief Lending Officer | | | | | | | 52,423 | (15) | | | * | |

| James F. McGowan, Jr. | | 68 | | Executive Vice President Chief Credit Officer | | | | | | | 54,115 | (16) | | | * | |

| Charles L. Pinto | | 59 | | Executive Vice President

Chief Marketing Officer | | | | | | | 40,951 | (17) | | | * | |

| | | | | | | | | | | | | | | | | |

| All Directors and Executive Officers, as a Group (14 individuals) | | 2,499,183 | | | | 21.76 | % |

| * | Less than 1% of the 11,484,396 shares of the outstanding Cape Bancorp, Inc. common stock. |

| (1) | The mailing address for each person listed is 225 North Main Street, Cape May Court House, New Jersey 08210. |

| (2) | Includes service on the board of Cape Bank. |

| (3) | See definition of “beneficial ownership” in the table in “Voting Securities and Principal Holders Thereof.” |

| (4) | Includes 34,568 shares held by Mr. Devlin’s spouse, 4,500 shares held by Mr. Devlin’s daughters, 27,507 shares held by Mr. Devlin in an individual retirement account, 30,735 shares held by Mr. Devlin in a Cape Bank 401(k) plan, 9,684 shares held by Mr. Devlin in a Cape Bank Employee Stock Ownership Plan and 240,000 shares of common stock issuable upon exercise of options issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (5) | Includes 2,100 shares of restricted stock held by Mr. Goldman under the Cape Bancorp, Inc. 2008 Equity Incentive Plan and 590 shares of common stock issuable upon exercise of options issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (6) | Includes 7,250 shares held by Mr. Reynolds’s company 401(k) plan, 4,000 shares held by Mr. Reynolds in an individual retirement account, 1,275 shares of restricted stock held by Mr. Reynolds under the Cape Bancorp, Inc. 2008 Equity Incentive Plan and 1,770 shares of common stock issuable upon exercise of option issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (7) | Includes 5,000 shares held by Mr. Glaser in an individual retirement account, 5,000 shares owned by a company controlled by Mr. Glaser, 1,275 shares of restricted stock held by Mr. Glaser under the Cape Bancorp, Inc. 2008 Equity Incentive Plan and 2,360 shares of common stock issuable upon exercise of options issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (8) | Includes 1,275 shares of restricted stock held by Mr. Ingersoll under the Cape Bancorp, Inc. 2008 Equity Incentive Plan and 2,360 shares of common stock issuable upon exercise of options issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (9) | Includes 107,389 shares held by Mr. Ritter’s spouse, 55,000 shares owned by a company controlled by Mr. Ritter, 10,000 shares in his company’s 401(k) plan, 1,275 shares of restricted stock held by Mr. Ritter under the Cape Bancorp, Inc. 2008 Equity Incentive Plan and 2,360 shares of common stock issuable upon exercise of option issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (10) | Includes 4,193 shares held by Ms. Skeels in an individual retirement account, 2,100 shares of restricted stock held by Ms. Skeels under the Cape Bancorp, Inc. 2008 Equity Incentive Plan, and 590 shares of common stock issuable upon exercise of options issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (11) | Includes 71,697 shares held by Mr. Fabietti’s spouse, 22,000 shares held in an individual retirement account, 1,275 shares of restricted stock held by Mr. Fabietti under the Cape Bancorp, Inc. 2008 Equity Incentive Plan and 2,360 shares of common stock issuable upon exercise of options issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (12) | Includes 223 shares held by Mr. Goldberg’s son, 2,100 shares of restricted stock held by Mr. Goldberg under the Cape Bancorp, Inc. 2008 Equity Incentive Plan, and 590 shares of common stock issuable upon exercise of options issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (13) | Includes 1,381,905 shares held in a partnership in which Mr. Lynch is a member, 1,275 shares of restricted stock held by Mr. Lynch under the Cape Bancorp, Inc. 2008 Equity Incentive Plan and 2,360 shares of common stock issuable upon exercise of options under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (14) | Includes 3,206 shares held by Mr. Hackney in an individual retirement account, 23,317 shares held by Mr. Hackney in a Cape Bank 401(k) plan, 8,159 shares held by Mr. Hackney in a Cape Bank Employee Stock Ownership Plan and 48,000 shares of common stock issuable upon exercise of options issued under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (15) | Includes 4,423 shares held by Ms. Pollack in a Cape Bank Employee Stock Ownership Plan and 48,000 shares of common stock issuable upon exercise of options under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (16) | Includes 2,000 shares held by Mr. McGowan in an individual retirement account, 4,115 shares held by Mr. McGowan in a Cape Bank Employee Stock Ownership Plan and 48,000 shares of common stock issuable upon exercise of options under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (17) | Includes 2,300 shares held by Mr. Pinto in an individual retirement account, 2,651 shares held by Mr. Pinto in a Cape Bank Employee Stock Ownership Plan and 36,000 shares of common stock issuable upon exercise of options under the Cape Bancorp, Inc. 2008 Equity Incentive Plan. |

| (18) | On March 18, 2015, Mr. Lynch resigned from the Board of Directors, effective immediately. Concurrent with Mr. Lynch’s resignation, the Board of Directors of the Company appointed James F. Deutsch to the Board to serve the remainder of Mr. Lynch’s term. |

Directors

The biographies of each of the nominees and continuing Directors below contains information regarding the person's service as a Director, business experience, Director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the Corporate Governance Committee and the Board to determine that the person should serve as a Director for the Company beginning in 2015.

Michael D. Devlin has served as a Director since January 31, 2008 and President and Chief Executive Officer since January 27, 2009. Mr. Devlin currently serves as a member of the Board of Directors of Marquette National Corporation, a bank holding company based in Chicago, Illinois. Mr. Devlin brings extensive banking and management expertise to the Board of Directors.

Agostino R. Fabietti has served as Chairman of the Board of Directors since April 26, 2011 and as a Director since January 31, 2008, previously serving as a Director of Boardwalk Bancorp, Inc. and Boardwalk Bank since 1999. He is a principal of Fabietti, Hale, Hammerstedt and Powers, PA, a regional accounting firm which provides accounting and financial services to businesses, professional corporations and individuals. Mr. Fabietti oversees 14 professionals at Fabietti, Hale, Hammerstedt and Powers. Mr. Fabietti is a certified public accountant whose background in this sector enhances the Board of Director’s oversight of financial reporting and its relationship with its independent public accounting firm.

Frank J. Glaser has served as a Director of Cape Bank since January 30, 2006. Mr. Glaser is the President and owner of James Candy Company, a retail, manufacturing and mail order business headquartered in Atlantic City, New Jersey. Mr. Glaser’s experience managing a local business and his knowledge of the local business landscape provides the Board of Directors a unique perspective.

Roy Goldberg has served as a Director since August 16, 2010, previously serving as a Director of Boardwalk Bancorp, Inc. and Boardwalk Bank since 1999. He is the former President and Chief Executive Officer of Gold Transportation Services, which had supplied air transportation services to the Atlantic City, New Jersey casino industry. He is currently Chairman of the Gold Foundation, Vice Chairman of the Bacharach Institute for Rehabilitation and sits on the board of Atlanticare. Mr. Goldberg brings extensive knowledge of the local community to the Board of Directors.

Benjamin D. Goldman has served as a Director since June 28, 2012. Mr. Goldman is a managing partner for Palm Aire Associates LP, a developer and a former golf course owner. Mr. Goldman serves on the Board of Directors for the ALC Group, an Environmental Testing and Remediation Company and on the Board of Advisors for Surety Title Company. Mr. Goldman brings extensive knowledge of the local real estate community to the Board of Directors.

David C. Ingersoll, Jr. has served as a Director of Cape Bank since January 1, 1977. Mr. Ingersoll is the owner and President of Ingersoll-Greenwood, a funeral home located in North Wildwood, New Jersey. Mr. Ingersoll has extensive knowledge of the local markets and communities served by Cape Bank.

James J. Lynchhas served as a Director since February 23, 2009, and, effective March 18, 2015, resigned from the Board of Directors. Mr. Lynchis a managing partner of Patriot Financial Partners, a firm focused on investing in community banks, headquartered in Philadelphia, Pennsylvania. Mr. Lynch has considerable experience in and knowledge of the capital markets, as well as significant executive level banking experience, which is valuable to the Board of Directors in its assessment of Cape Bancorp’s sources and uses of capital. Mr. Lynch currently serves as a member of the Board of Directors at other financial institutions.

Matthew J. Reynolds has served as a Director of Cape Bank since October 25, 2004. Mr. Reynolds is a Certified Public Accountant and the Co-Managing Partner of Capaldi, Reynolds and Pelosi, a certified public accounting firm located in Northfield, New Jersey, overseeing 72 employees. Capaldi, Reynolds and Pelosi provides auditing, tax planning and compliance and business consulting services. Mr. Reynolds is also Co-Managing partner of CRA Financial Services, an SEC registered investment advisory firm that manages more than $390 million in assets. Mr. Reynolds has multiple investment and insurance licenses, including the FINRA Series 66, and is a Certified Financial Planner. Mr. Reynolds brings extensive accounting experience that benefits the Board of Directors in its oversight of financial reporting and disclosure issues.

Thomas K. Ritter has served as a Director since January 31, 2008, previously serving as a Director of Boardwalk Bancorp, Inc. and Boardwalk Bank since 1999. He is the owner and President of A. E. Stone, Inc., an asphalt manufacturer and paving contractor located in Pleasantville, NJ. Mr. Ritter is a certified public accountant (retired). Mr. Ritter brings extensive knowledge of the local commercial real estate industry to the Board of Directors. Mr. Ritter currently serves on the Shore Medical Center Foundation Board and the Board of Trustees of Westminster College, New Wilmington, Pa., and is a Trustee of the J. Wood Platt Caddie Scholarship Trust.

Althea L.A. Skeels has served as a Director since November 19, 2012. Ms. Skeels is Co-Founder and Principal of Cobble Hill Financial Services, a consulting and investment management firm, located in Moorestown, New Jersey, dealing almost exclusively with institutional client portfolios. During her career, she has served as lead partner responsible for the Philadelphia Deloitte & Touche banking and financial services clients, then as Executive Vice President and Portfolio Manager responsible for the institutional client division for Rittenhouse Financial Services. Ms. Skeels is registered with the SEC as an investment advisor. Ms. Skeels brings extensive accounting/banking knowledge to the Board of Directors.

James F. Deutschwas appointed as a Director on March 18, 2015. Mr. Deutsch has served as a Managing Director of Patriot Financial Partners, L.P. since April 2011. From November 2004 until April 2011, Mr. Deutsch served as President, Chief Executive Officer and Director of Team Capital Bank, a community bank. Mr. Deutsch has over 35 years of banking and investment marketing experience, which is valuable to the Board of Directors. Mr. Deutsch currently serves as a member of the Board of Directors at other financial institutions.

Executive Officers of Cape Bank Who Are Not Also Directors

Guy Hackney has served as Chief Financial Officer since January 27, 2009. He was appointed Executive Vice President effective February 21, 2011. Mr. Hackney previously served as Senior Vice President, Accounting and Finance, at Cape Bank since the merger of Boardwalk Bank into Cape Bank on January 31, 2008. He has over 34 years of experience in banking.

Michele Pollack has served as Executive Vice President/Chief Lending Officer since May 7, 2010. Prior to that time, Ms. Pollack served as Managing Director and Chief Lending Officer for a Pennsylvania-based bank. She has over 33 years of experience in the banking industry, including 22 years in lending.

James F. McGowan, Jr. has served as Executive Vice President/Chief Credit Officer since April 19, 2010. Prior to that time, Mr. McGowan served as Executive Vice President/Chief Credit Officer of a large regional bank in the Northeast. He has over 30 years of experience of banking experience including executive management in the areas of Credit Management and Commercial Lending.

Charles L. Pintohas served as Executive Vice President/Chief Marketing Officer since July 5, 2011. Prior to that time, Mr. Pinto was Senior Vice President and Director of Corporate Communications for Wilmington Trust, a diversified financial services firm specializing in banking, trust and wealth management. He has over 29 years of industry experience, serving in a variety of sales, marketing and business line management positions.

In the sections that follow, the term “Named Executive Officers” shall refer to Mr. Michael D. Devlin, Mr. Guy Hackney, Ms. Michele Pollack, Mr. James F. McGowan, Jr., and Mr. Charles L. Pinto.

Board Independence and Leadership Structure

The Board of Directors affirmatively determines the independence of each Director in accordance with Nasdaq Stock Market rules, which include all elements of independence set forth in the Nasdaq listing standards. Based on these standards, the Board of Directors has determined that, with the exception of Michael D. Devlin, our President and Chief Executive Officer, each member of the Board of Directors is independent of Cape Bancorp, Inc.

The Board of Directors has determined that having an independent Director serve as Chairman of the Board is in the best interest of stockholders at this time. The structure ensures a greater role for the independent Directors in the oversight of Cape Bancorp, Inc. and active participation of the independent Directors in setting agendas and establishing Board priorities and procedures.

Meetings and Committees of the Board of Directors

The business of Cape Bancorp, Inc. is conducted at regular and special meetings of the full Board and its standing committees. In addition, our independent Directors meet in Executive Sessions. The standing committees consist of the Compensation, Audit, and Nominating and Corporate Governance Committees. During the year ended December 31, 2014, Cape Bancorp, Inc. and Cape Bank held regular meetings. The Board of Cape Bancorp, Inc. met at twelve regular meetings and the Board of Cape Bank met at twelve regular meetings and two special meetings during the year ended December 31, 2014. No member of the Board or any committee thereof attended fewer than 75% of the aggregate of: (i) the total number of meetings of the Board of Directors (held during the period for which he/she has been a Director); and (ii) the total number of meetings held by all committees of the Board on which he/she served (during the periods that he/she served). The duties and responsibilities of the Compensation, Audit, and Nominating and Corporate Governance Committees are as follows:

Compensation Committee. The Compensation Committee is comprised of non-employee Directors who satisfy the independence requirements of the Nasdaq Stock Exchange on which our shares are listed. The members of the Compensation Committee currently consist of Directors Goldman, who serves as Chairman, Glaser, Reynolds, Ritter and Skeels. The Compensation Committee meets at least annually or more frequently if necessary. Our Board of Directors has adopted a written charter for the Committee, which is available on our website atwww.capebanknj.com under the Investment Relations tab. The Compensation Committee met three times during the year ended December 31, 2014. The purpose of the Compensation Committee is to, among other things, assist the Board in fulfilling its responsibilities regarding the compensation and benefits of our Directors and executive management.

In furtherance of these objectives, the Compensation Committee is responsible for:

| · | Reviewing, evaluating and recommending objectives relevant to the Chief Executive Officer’s compensation; evaluating the Chief Executive Officer’s performance relative to established goals; and reviewing, evaluating and recommending to the Board of Directors the Chief Executive Officer’s compensation; |

| · | Reviewing, evaluating and recommending, in consultation with the Chief Executive Officer, goals relevant to the compensation of our other Named Executive Officers; and reviewing such Officers’ performance in light of these goals and determining such Officers’ cash and equity compensation based on this evaluation; |

| · | Establishing and administering our incentive cash compensation program for Executive Management; |

| · | Administering our equity incentive award program; |

| · | Reviewing, evaluating and recommending, in consultation with the Nominating and Corporate Governance Committee, the compensation to be paid to our Directors and to Directors of our affiliates for their service on the Board of Directors; |

| · | Reviewing, evaluating and recommending the terms of employment and severance agreements and arrangements for Executive Management, including any change of control and indemnification provisions, as well as other compensatory arrangements and perquisite programs for Executive Management; and |

| · | Reviewing and approving changes in our qualified benefit plans that result in a material change in costs or the benefit levels provided and changes in a plan trustee, administrator, or service provider. |

The Compensation Committee, in performing these duties and responsibilities with respect to Director and Executive Officer compensation, utilizes survey information provided by compensation consultants.

Audit Committee. The Audit Committee consists of Directors Reynolds, who serves as Chairman, Fabietti, Goldberg, Ingersoll and Ritter. Each member of the Audit Committee is “independent” as defined in the Nasdaq corporate governance listing standards and under Securities and Exchange Commission Rule 10A-3. The Board of Directors has determined that Directors Reynolds and Fabietti each qualify as an “audit committee financial expert”, as that term is used in the rules and regulations of the Securities and Exchange Commission. Information with respect to the experience of Directors Reynolds and Fabietti is included in “Directors.” Our Board of Directors has adopted a written charter for the Audit Committee, which is available at our website atwww.capebanknj.com under the Investment Relations tab. The Audit Committee met five times during the year ended December 31, 2014.

The duties and responsibilities of the Audit Committee include, among other things:

| · | Monitoring and overseeing the integrity of our accounting and financial reporting process, audits, financial statements and systems of internal controls; |

| · | Monitoring and overseeing the independence and performance of our external auditors, internal auditors and outsourced internal audit consultants; |

| · | Facilitating communication among the external auditors, management, internal auditors, and the outsourced internal audit consultants; and |

| · | Maintaining oversight of the external auditors, including the appointment, compensation, retention and, when considered necessary, the dismissal of the external auditors. |

Audit Committee Report

The Audit Committee has issued a report that states as follows:

| · | We have reviewed and discussed with management and the independent registered public accounting firm our audited consolidated financial statements for the year ended December 31, 2014; |

| · | We have discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended; and |

| · | We have received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and have discussed with the independent registered public accounting firm their independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2014 for filing with the Securities and Exchange Commission.

The Audit Committee

Matthew J. Reynolds (Chair)

Agostino R. Fabietti

Roy Goldberg

David C. Ingersoll, Jr.

Thomas K. Ritter

Nominating and Corporate Governance Committee.The Nominating and Corporate Governance Committee currently consists of Directors Glaser, who serves as Chairman, Fabietti, Goldberg, Goldman, Lynch and Skeels. Mr. Lynch served as a member of the Nominating and Corporate Governance Committee until his resignation on March 18, 2015. Concurrent with Mr. Lynch’s resignation, the Board of Directors appointed James F. Deutsch to serve the remainder of Mr. Lynch’s term and further appointed Mr. Deutsch to the Nominating and Corporate Governance Committee. Each member of the Nominating and Corporate Governance Committee is considered “independent” as defined in the Nasdaq corporate governance listing standards. Our Board of Directors has adopted a written charter for the Committee, which is available at our website atwww.capebanknj.com under the Investment Relations tab. The Nominating and Corporate Governance Committee met one time during the year ended December 31, 2014. The purpose of the Nominating and Corporate Governance Committee is to assist the Board of Directors in identifying qualified individuals to become Board members; recommending to the Board nominees for the next Annual Meeting of Stockholders; determining the size and composition of the Board and its committees; monitoring a process to assess Board effectiveness; developing and implementing corporate governance principles; developing and implementing our Code of Conduct and Ethics; and monitoring the Board’s compliance with applicable Nasdaq listing standards for independence.

The Nominating and Corporate Governance Committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are first considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. In addition, the Committee is authorized by its charter to engage a third party to assist in the

identification of Director nominees, if it chooses to do so. The Nominating and Corporate Governance Committee would seek to identify a candidate who, at a minimum, satisfies the following criteria:

| · | The highest personal and professional ethics and integrity and whose values are compatible with our values; |

| · | Experience and achievements that have given them the ability to exercise and develop good business judgment; |

| · | A willingness to devote the necessary time to the work of the Board and its committees, which includes being available for Board and committee meetings; |

| · | A familiarity with the communities in which we operate and/or is actively engaged in community activities; |

| · | Involvement in other activities or interests that do not create a conflict with their responsibilities to Cape Bancorp and its stockholders; and |

| · | The capacity and desire to represent the balanced, best interests of our stockholders as a group, and not primarily a special interest group or constituency. |

The Nominating and Corporate Governance Committee will also take into account whether a candidate satisfies the criteria for “independence” under the Nasdaq corporate governance listing standards.

Procedures for the Recommendation of Director Nominees by Stockholders. In February 2008, in connection with our becoming a public company, the Nominating and Corporate Governance Committee adopted procedures for the submission of recommendations for Director nominees by stockholders. If a determination is made that an additional candidate is needed for the Board of Directors, the Nominating and Corporate Governance Committee will consider candidates submitted by our stockholders. Stockholders can submit the names of qualified candidates for Director by writing to Cape Bancorp, Inc. at 225 North Main Street, Cape May Court House, New Jersey 08210, Attention: Corporate Secretary.

The submission must include the following information:

| · | A statement that the writer is a stockholder and is proposing a candidate for consideration by the Committee; |

| · | The name and address of the stockholder as they appear on our books, and the number of shares of our common stock owned beneficially by such stockholder (if the stockholder is not a holder of record, appropriate evidence of the stockholder’s ownership will be required); |

| · | The name, address and contact information for the candidate, and the number of shares of our common stock owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the candidate’s ownership should be provided); |

| · | A statement of the candidate’s business and educational experience; |

| · | Such other information regarding the candidate as would be required to be included in the Proxy Statement pursuant to Securities and Exchange Commission Regulation 14A; |

| · | A statement detailing any relationship between the candidate and Cape Bancorp, Inc. and its affiliates; |

| · | A statement detailing any relationship between the candidate and any customer, supplier or competitor of Cape Bancorp, Inc. or its affiliates; |

| · | Detailed information about any relationship or understanding between the proposing stockholder and the candidate; and |

| · | A statement of the candidate that the candidate is willing to be considered and willing to serve as a Director if nominated and elected. |

A nomination submitted by a stockholder for presentation by the stockholder at an Annual Meeting of Stockholders must comply with the procedural and informational requirements described in our Bylaws.

Stockholder Communications with the Board. A stockholder of Cape Bancorp, Inc. who wants to communicate with the Board of Directors or with any individual Director can write to us at 225 North Main Street, Cape May Court House, New Jersey 08210, Attention: Corporate Secretary. The letter should indicate that the author is a stockholder and, if shares are not held of record, should include appropriate evidence of stock ownership. Depending on the subject matter, the Corporate Secretary will:

| · | Forward the communication to the Board of Directors or Director to whom it is addressed; or |

| · | Attempt to handle the inquiry directly, or forward the communication for response by another employee of Cape Bancorp, Inc. For example, a request for information about us on a stock-related matter may be forwarded to our investor relations officer; or |

| · | Not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate. |

The Corporate Secretary will make those communications that were not forwarded available to the Board of Directors on request.

Enterprise Risk Management Committee. In addition to the above committees, the Board has adopted a charter for the Enterprise Risk Management Committee as part of its risk oversight process. The Enterprise Risk Management Committee consists of Directors Skeels, who serves as Chairwoman, Fabietti, Goldberg, Ingersoll, Lynch, and Director and President/CEO Devlin. Mr. Lynch served as a member of the Enterprise Risk Management Governance Committee until his resignation on March 18, 2015. Concurrent with Mr. Lynch’s resignation, the Board of Directors appointed James F. Deutsch to serve the remainder of Mr. Lynch’s term and further appointed Mr. Deutsch to the Enterprise Risk Management Committee.

Attendance at Annual Meetings of Stockholders

Although we do not have a formal written policy regarding Director attendance at Annual Meetings of Stockholders, it is expected that Directors will attend these meetings, absent unavoidable scheduling conflicts. All Directors attended the 2014 Annual Meeting of Stockholders.

Codes of Conduct and Ethics

We have adopted a Code of Conduct and Ethics for Senior Financial Officers that is applicable to our principal Executive Officer, principal Financial Officer and principal accounting officers. The Code of Conduct and Ethics for Senior Financial Officers is available on our website atwww.capebanknj.com. Amendments and waivers from the Code of Conduct and Ethics for Senior Financial Officers will be disclosed in the manner required by applicable law, rule or listing standard.

We annually adopt a Code of Conduct and Ethics that is applicable to all employees, officers and Directors. Employees, officers and Directors acknowledge that they will comply with all aspects of the Code of Conduct and Ethics.

Section 16(a) Beneficial Ownership Reporting Compliance

The common stock is registered pursuant to Section 12(b) of the Securities Exchange Act of 1934. The officers and Directors of Cape Bancorp, Inc. and beneficial owners of greater than 10% of our shares of common stock (“10% beneficial owners”) are required to file reports on Forms 3, 4 and 5 with the Securities and Exchange Commission disclosing beneficial ownership and changes in beneficial ownership. Securities and Exchange Commission rules require disclosure in our Proxy Statement and Annual Report on Form 10-K of the failure of an officer, Director or 10% beneficial owner of the shares of common stock to file a Form 3, 4 or 5 on a timely basis. During 2014, our Directors and officers complied with applicable requirements for transactions. The Company is not aware of any failure to report on a timely basis by Patriot Financial Partners, GP, LLC.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee determines the salaries to be paid each year to the Chief Executive Officer and those executive officers who report directly to the Chief Executive Officer. The Compensation Committee consists of Directors Goldman, who serves as Chairman, Glaser, Reynolds, Ritter and Skeels. None of these individuals were officers or employees of Cape Bancorp, Inc. during the year ended December 31, 2014, or former officers of Cape Bancorp, Inc. In addition, none of these Directors is an executive officer of another entity at which one of Cape Bancorp, Inc.’s executive officers serves on the Board of Directors, or had any transactions or relationships with Cape Bancorp, Inc. in 2014 requiring specific disclosure under Securities and Exchange Commission rules.

During the year ended December 31, 2014, (i) no executive officers of Cape Bancorp, Inc. served as a member of the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board of Directors) of another entity, one of whose executive officers served on the Compensation Committee of Cape Bancorp, Inc.; (ii) no executive officer of Cape Bancorp, Inc. served as a Director of another entity, one of whose executive officers served on the Compensation Committee of Cape Bancorp, Inc.; and (iii) no executive officer of Cape Bancorp, Inc. served as a member of the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board of Directors) of another entity, one of whose executive officers served as a Director of Cape Bancorp, Inc.

Compensation Committee Report

The Compensation Committee has issued a report that states that it has reviewed and discussed the section entitled “Compensation Discussion and Analysis” with management. Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that the “Compensation Discussion and Analysis” be included in our Proxy Statement.

The Compensation Committee

Benjamin D. Goldman (Chair)

Frank J. Glaser

Matthew J. Reynolds

Thomas K. Ritter

Althea L.A. Skeels

Compensation Discussion and Analysis

Executive Summary. It is the intent of the Compensation Committee to provide our Named Executive Officers with a total compensation package that is market competitive, promotes the achievement of our strategic objectives and is aligned with operating and other performance metrics to support long-term stockholder value. In addition, we have structured our executive compensation program to include elements that are intended to create appropriate balance between risk and reward.

Our results for 2014 were very strong, highlights include:

| · | Net income increased by $1.2 million to $6.8 million, a 22% increase over the previous 12 month period; |

| · | Earnings per share grew 33%. |

| · | Management successfully completed a third repurchase program of 5% improving both earnings per share and tangible book value, which ended the year at $10.28 per share; |

| · | Management continued to reduce non-performing assets, ending the year with the ratio of non-performing assets to total assets of 1.25% compared to prior year end of 1.35%. |

| · | Adversely Classified Assets ratio continued to drop, down to 17% from 26% the previous year; |

| · | Management continues commitment to drive value for the stockholders – Cape Bancorp, Inc. declared quarterly cash dividends in 2014; |

| · | Cape Bancorp, Inc. announced that they entered into an agreement and plan of merger with Colonial Financial Services Inc. scheduled to close early in the second quarter of 2015. |

These accomplishments are significant given the slow economic recovery, sustained very low interest rate environment, the threat of continued volatility in the U.S. and global markets, sustained higher level of unemployment, weak consumer confidence, and continued instability in the housing market.

Effect of 2014 Advisory Vote on Named Executive Officer Compensation. At our 2014 Annual Meeting, we provided our stockholders with the opportunity to cast an annual advisory vote on executive compensation (a “say-on-pay” proposal). At our 2014 Annual Meeting of Stockholders, 96.1% of the votes cast on the say-on-pay proposal at that meeting were voted in favor of the proposal. The Compensation Committee believes this affirms stockholders’ support of our approach to executive compensation, and therefore did not significantly change its approach in 2014. The Compensation Committee will continue to consider the outcome of our say-on-pay vote, regulatory changes and emerging best practices when making future compensation decisions for the Named Executive Officers.

2014 Compensation Highlights.In light of our improving financial performance, management’s contribution to the achievement of our business goals and in the furtherance of our compensation philosophy, the Compensation Committee took the following actions in 2014 with respect to the compensation programs for our Named Executive Officers:

| · | Increased Base Salary for our Chief Executive Officer. In determining Mr. Devlin’s compensation, the Board of Directors conducted a performance appraisal reviewing Mr. Devlin’s financial, strategic and operational achievements. Pearl Meyer & Partners provided the Compensation Committee with a competitive market analysis for the Chief Executive Officer. The Committee reviewed Mr. Devlin’s achievements and performance of the Bank and recommended to the Board of Directors and the Board of Directors approved, raising Mr. Devlin’s base salary 3% to $360,500 from $350,000 commencing the first pay period in 2014. |

| · | Increased Base Salaries for our Named Executive Officers. The Compensation Committee approved a base salary increase of 3% for the remaining Named Executive Officers, commencing in the first payroll period in 2014, raising the Executive Vice President and Chief Financial Officer’s base salary to $213,313 from $207,100, the Executive Vice President and Chief Lending Officer’s base salary to $210,834 from $204,693, the Executive Vice President and Chief Credit Officer’s base salary to $194,189 from $188,533 and the Executive Vice President and Chief Marketing Officer’s base salary to $202,647 from $196,745. |

| · | No Incentive Awards Earned Through the 2014 Incentive Compensation Plan.For the 2014 performance, our Named Executive Officers did not earn annual cash incentives since the threshold performance level was not achieved for any of the financial metrics. |

| · | Renewed Employment Agreement.On September 22, 2014, the Board of Directors approved an updated employment agreement with Mr. Devlin which was effective October 1, 2014. This agreement reflects a term of two years. |

| · | Renewed Change in Control Agreements. The Compensation Committee renewed the Change in Control Agreements for our Named Executive Officers for an additional year, so that the term of those agreements will expire on September 30, 2015, unless otherwise extended. |

Our Compensation Philosophy. Our compensation philosophy begins with the premise that the success of Cape Bank depends, in large part, on the dedication and commitment of the people we place in key management positions, and the incentives provided to them to successfully implement our business strategy and other corporate objectives. However, we recognize that Cape Bank operates in a competitive environment for talent. Therefore, our approach to compensation considers the full range of compensation techniques that enable us to compare favorably with our peers as we seek to attract and retain key personnel.

We base our compensation decisions on four basic principles:

| · | Meeting the Demands of the Market – Our goal is to compensate our employees at competitive levels that position us as the employer of choice among our peers who provide similar financial services in the markets we serve. |

| · | Aligning with Stockholders – We intend to use equity compensation as a key component of our compensation mix to develop a culture of ownership among our key personnel and to align their individual financial interests with the interests of our stockholders. |

| · | Driving Performance – We base compensation in part on the attainment of bank-wide, business unit and individual targets that return positive results to our bottom line. |

| · | Reflecting our Business Philosophy – Our approach to compensation reflects our values and the way we do business in the communities we serve. |

As a public company, we believe that we can meet the objectives of our compensation philosophy by achieving a balance among base compensation, cash-based short-term incentive compensation and long term equity incentive awards that is competitive with our industry peers and that creates appropriate incentives for our management team. To achieve the necessary balance, the Compensation Committee of our Board of Directors works closely with independent compensation advisors to provide us with their expertise on competitive compensation practices and help us evaluate and compare our compensation program and financial performance with that of our peers. For each Named Executive Officer, a significant percentage of total cash compensation is at-risk, meaning that it is performance based and will generally be earned when Cape Bank or the Named Executive Officer is successful in ways that are aligned with and support Cape Bancorp’s interests.

To date, executive officers have been compensated only for their services to Cape Bank. Cape Bank expects to continue this practice. Cape Bancorp, Inc. will not pay any additional or separate compensation until we have a business reason to establish separate compensation programs. However, any equity-based awards made as part of Cape Bank’s Executive compensation will be made in Cape Bancorp, Inc. common stock rather than Cape Bank common stock.

This discussion is focused specifically on the compensation of the following executive officers, each of whom is named in the Summary Compensation Table which appears later in this section. These executive officers are referred to in this discussion as the “Named Executive Officers.” Mr. Michael D. Devlin was appointed President and Chief Executive Officer of Cape Bancorp, Inc. and Cape Bank on January 27, 2009, having previously served as Executive Vice President and Chief Operating Officer. Mr. Guy Hackney was appointed Executive Vice President and Chief Financial Officer on February 21, 2011, having previously served as Senior Vice President, Chief Financial Officer. Ms. Michele Pollack was appointed Executive Vice President and Chief Lending Officer on May 7, 2010, Mr. James F. McGowan was appointed Executive Vice President and Chief Credit Officer on April 19, 2010 and Mr. Charles L. Pinto was appointed Executive Vice President and Chief Marketing Officer on July 5, 2011.

| Name | | Title |

| Michael D. Devlin | | President and Chief Executive Officer |

| Guy Hackney | | Executive Vice President and Chief Financial Officer |

| Michele Pollack | | Executive Vice President and Chief Lending Officer |

| James F. McGowan, Jr. | | Executive Vice President and Chief Credit Officer |

| Charles L. Pinto | | Executive Vice President and Chief Marketing Officer |

Role of the Compensation Committee. The Compensation Committee is responsible for reviewing all compensation components for the Chief Executive Officer and the Named Executive Officers annually, including base salary, annual incentive, long-term incentives/equity, benefits and other perquisites. The Compensation Committee examines the total compensation mix, pay-for-performance relationship, and how all these elements, in aggregate, comprise the Executive’s total compensation package, ensuring that it is competitive in the marketplace and that the mix of benefits accurately reflects our compensation philosophy. The Compensation Committee is charged with reviewing and approving the Chief Executive Officer’s Employment Agreement and the Named Executive Officer’s Change in Control Agreements. The Compensation Committee operates under a written charter that establishes its responsibilities. This charter is reviewed annually by the Compensation Committee and the Board of Directors to ensure that the scope of the charter is consistent with the role of the committee. A copy of the charter can be found atwww.capebanknj.com under the Investor Relations tab.

Role of Management. The executive officers who serve as a resource to the Compensation Committee are the President and Chief Executive Officer, the Executive Vice President and Chief Financial Officer and the Senior Vice President and Director of Human Resources for Cape Bank. These executives provide the Compensation Committee with data, analyses, input and recommendations. The Compensation Committee considers our Chief Executive Officer’s evaluation of each Named Executive Officer’s performance and recommendation of appropriate compensation. However, our Chief Executive Officer does not participate in any decisions relating to his own compensation.

Role of the Independent Compensation Consultant. Pursuant to its charter, the Compensation Committee has the sole authority to retain, terminate, obtain advice from, oversee and compensate its outside advisors, including its compensation consultant. Since 2008, the Compensation Committee has engaged Pearl Meyer & Partners to serve as its independent compensation consultant. The consultant reports directly to the Committee and carries out its responsibilities to the Committee in coordination with management as requested by the Committee. They work with the Committee in performing their duties and assist in the development of compensation programs that support Cape Bancorp’s strategies going forward in light of its public company status. Pearl Meyer & Partners provides various executive compensation services to the committee with respect to the Named Executive Officers and other key employees at the committee’s request. The services Pearl Meyer & Partners provides include advising the Committee on the principal aspects of the executive compensation program and evolving best practices, and providing market information and analysis regarding the competitiveness of our program design and awards in relationship to its performance.

The Compensation Committee regularly reviews the services provided by its outside consultants and believes that Pearl Meyer & Partners is independent in providing executive compensation consulting services. The Committee conducted a specific review of its relationship with Pearl Meyer & Partners in 2014, and determined that Pearl Meyer & Partners work for the committee did not raise any conflicts of interest, consistent with the guidance provided under the Dodd-Frank Act, the SEC and the NASDAQ. In making this determination, the Compensation Committee noted that during 2014:

| · | Pearl Meyer & Partners did not provide any services to Cape Bancorp, Inc. or its management other than service to the Compensation Committee, and its services were limited to executive and Director compensation consulting. |

| · | Fees from the Cape Bancorp, Inc. were less than 1% of Pearl Meyer & Partner’s total revenue for year 2014; |

| · | Pearl Meyer & Partners maintains a Conflicts Policy which details specific policies and procedures designed to ensure independence; |

| · | None of the Pearl Meyer & Partners consultants had any business or personal relationship with Committee members; |

| · | None of the Pearl Meyer & Partners consultants had any business or personal relationship with executive officers of the Cape Bancorp, Inc.; and |

| · | None of the Pearl Meyer & Partners consultants directly own Cape Bancorp, Inc. stock. |

The Compensation Committee continues to monitor the independence of its compensation consultant on a periodic basis.

Compensation Objectives. The overall objectives of the Company’s compensation programs are to retain, motivate and reward employees and officers (including the Named Executive Officers) for performance, and to provide competitive compensation to attract talent to the organization. The methods used to achieve these goals for Named Executive Officers are strongly influenced by the compensation and employment practices of the Company’s competitors within the financial services industry, and elsewhere in the marketplace. We also consider each Named Executive Officer’s individual performance and contribution in achieving corporate goals, which may be subjective in nature.

Our compensation program is designed to reward the Named Executive Officers based on their level of assigned management responsibilities, individual experience and performance levels, and knowledge of our organization. The creation of long-term value is highly dependent on the development and effective execution of a sound business strategy by our executive officers.

Other considerations influencing the design of our executive compensation program include the following:

| · | We operate in a highly regulated industry. We value experience in the financial services industry that promotes the safe and sound operation of Cape Bank; |

| · | We value executives with sufficient experience in our markets relating to the needs of our customers, products and investments in various phases of the economic cycle; |

| · | We operate in interest rate and credit markets that are often volatile. We value disciplined decision-making that respects our business plan but adapts quickly to change; |

| · | We value the retention and development of incumbent executives who meet or exceed performance objectives. Recruiting executives can be expensive, unpredictable, and have a disruptive effect on our operations; and |

| · | We value a constructive dialogue on executive compensation and other governance matters with our stockholders and consider the results of the annual “say-on-pay” advisory vote. |

Inputs to Committee Decisions – Benchmarking.The Compensation Committee seeks to create what it believes is the best mix of base salary and annual cash incentives in delivering the Named Executive Officers’ total cash compensation. These components are evaluated in relation to benchmark data derived from information reported in publicly-available Proxy Statements or from market survey data. The objective of the compensation-setting process is to establish the appropriate level and mix of total compensation for each Named Executive Officer.

The Compensation Committee evaluates the performance of the Chief Executive Officer annually. The Committee evaluates the performance on the development of specific strategic plan objectives, operational impact and management style and effectiveness.

The Chief Executive Officer evaluates the performance of the other Named Executive Officers annually. Each annual performance review serves as the basis for adjustments to their base salary. Individual performance evaluations are tied closely to achievement of short-term and long-term goals and objectives, individual initiatives, team-building skills, level of responsibility and corporate performance. From these performance reviews, the Chief Executive Officer makes annual recommendations for changes to the other Named Executive Officers for the following year. The Compensation Committee reviews these recommendations and makes its final recommendations to the Board of Directors.

For 2014, the Compensation Committee selected the following financial services compensation surveys for use in benchmarking Mr. Devlin’s and the other Named Executive Officers’ compensation:

Crowe Horwath’s New Jersey Bankers Association Compensation Survey

SNL Executive Compensation Review

Pearl Meyer & Partners’ Northeast Banking Compensation Survey

Another primary data source used in setting market-competitive guidelines for the executive officers is the information publicly disclosed by a peer group of other publicly traded banks. When needed, the Compensation Committee requests that Pearl Meyer & Partners develop a peer group using objective parameters that reflect banks of similar asset size (generally one-half to two times our asset size) and region. Overall, the goal is to have 15-20 comparative banks that provide a market perspective for executive total compensation. The peer group is approved by the Compensation Committee. The Compensation Committee did not utilize a public bank peer group in making decisions for 2014 regarding its executive compensation program and did not engage Pearl Meyer & Partners to conduct a full review of its executive compensation program until December 2014. The results of this study were used in making pay decisions for 2015.

The 2015 executive compensation review was completed by Pearl Meyer & Partners in the first quarter of 2015 and was used as a source in making compensation decisions for 2015. The peer group was comprised of 26 commercial banks ranging in assets size from $1.0 billion to $2.8 billion and geographically located in New Jersey, Pennsylvania, New York (metropolitan New York City was excluded), Maryland, Connecticut and Massachusetts. Banks with fewer than 12 branches or more than 40 branches were excluded from the sample. There were four local competitor thrift banks included in the sample.

The peer group in the 2015 executive compensation review was comprised of the following banks:

| ACNB Corp. | AmeriServ Financial, Inc. | Arrow Financial Corp. | Bridge Bancorp, Inc. |

| Bryn Mawr Bank Corp. | Cape Bancorp, Inc. | Chemung Financial Corp. | Citizens & Northern Corp. |

| CNB Financial Corp. | Codorus Valley Bancorp, Inc. | Enterprise Bancorp, Inc. | ESSA Bancorp, Inc.* |

| First of Long Island Corp. | First United Corp. | Fox Chase Bancorp, Inc.* | Metro Bancorp, Inc. |

| Ocean Shore Holding Co.* | OceanFirst Financial Corp.* | Old Line Bancshares, Inc. | Orrstown Financial Services, Inc. |

| Peapack-Gladstone Financial Corp. | People’s Financial Services | Republic First Bancorp, Inc. | Shore Bancshares, Inc. |

| Suffolk Bancorp | Univest Corp. of Pennsylvania | | |

* denotes local competitor thrift bank

Risk Oversight of Compensation Programs.We believe that the compensation program is structured to be reasonably unlikely to present a material adverse risk to us based on the following factors:

| · | As a community bank regulated by the Federal Deposit Insurance Corporation, the New Jersey Department of Banking and Insurance and the Federal Reserve Bank of Philadelphia, Cape Bank and Cape Bancorp, Inc. adhere to defined risk guidelines, practices and controls to ensure the safety and soundness of the organization; |

| · | Our management and Board of Directors conduct regular reviews of our business to ensure we remain within appropriate regulatory guidelines and practices that are monitored and supplemented by our internal audit function, as well as our external auditors; and |

| · | Our Incentive Compensation Plan is reviewed and approved by the Compensation Committee annually. The plan provides a maximum cap on payment along with weighted performance measures varying by executive depending on their role and area of focus at the Bank. |

Components of Executive Compensation and 2014 Decisions. The Company’s compensation program consists of four main components: Base Salary, Annual Incentives, Long-Term Incentive/Equity, and Benefits and Perquisites. The following section summarizes the role of each component, how decisions are made and the resulting 2014 decision process as it relates to the Named Executive Officers.