INDEPENDENT AUDITORSʹ REPORT AND FINANCIAL STATEMENTS FOR LONGBRIDGE FINANCIAL, LLC AS OF DECEMBER 31, 2021 AND 2020 FOR THE YEARS ENDED DECEMBER 31, 2021, 2020 AND 2019

LONGBRIDGE FINANCIAL, LLC TABLE OF CONTENTS Page INDEPENDENT AUDITORS’ REPORT 1 ‐ 2 FINANCIAL STATEMENTS Balance Sheets 3 Statements of Operations 4 Statements of Changes in Membersʹ Equity 5 Statements of Cash Flows 6 ‐ 7 Notes to Financial Statements 8 ‐ 34

9780 S. Meridian Blvd., Suite 500 Englewood, CO 80112 303‐721‐6131 www.richeymay.com Assurance | Tax | Advisory INDEPENDENT AUDITORSʹ REPORT To the Members Longbridge Financial, LLC Mahwah, New Jersey Report on the Audit of the Financial Statements Opinion We have audited the accompanying financial statements of Longbridge Financial, LLC, which comprise the balance sheets as of December 31, 2021 and 2020, and the related statements of operations, changes in members’ equity, and cash flows for the years ended December 31, 2021, 2020 and 2019 and the related notes to the financial statements. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of Longbridge Financial, LLC as of December 31, 2021 and 2020, and the results of its operations and its cash flows for the years ended December 31, 2021, 2020 and 2019 in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of Longbridge Financial, LLC and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about Longbridge Financial, LLC’s ability to continue as a going concern for one year after the date the financial statements are issued.

INDEPENDENT AUDITORSʹ REPORT Auditors’ Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users made on the basis of these financial statements. In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Longbridge Financial, LLC’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about Longbridge Financial, LLC’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit. Englewood, Colorado February 25, 2022

December 31, 2021 2020 ASSETS Cash and cash equivalents 19,537,013$ 24,564,164$ Certificate of deposit 211,370 210,876 Escrow cash 958,242 1,396,094 Restricted cash 2,250,000 1,250,000 Mortgage loans held for sale, at fair value 39,779,030 11,706,047 Accounts receivable and advances 14,333,163 2,406,046 Loan commitments 8,394,907 4,778,352 Prepaid expenses 1,208,377 695,765 Property and equipment, net 548,878 301,695 Mortgage servicing rights, at fair value 3,320,136 1,184,675 Reverse mortgage loans held for investment, subject to HMBS obligations, at fair value 6,636,434,301 5,133,980,349 Deposits 85,209 95,692 Intangible assets, net 747,224 188,437 TOTAL ASSETS 6,727,807,850$ 5,182,758,192$ LIABILITIES AND MEMBERSʹ EQUITY LIABILITIES Accounts payable and accrued expenses 13,420,706$ 11,243,842$ Customer deposits and loan escrows 10,258,900 4,482,070 Derivative liabilities 16,563 ‐ Warehouse lines of credit 238,292,573 91,009,588 Other financing facilities 48,527,994 35,396,047 HMBS related obligations, at fair value 6,293,833,795 4,948,770,847 Total liabilities 6,604,350,531 5,090,902,394 COMMITMENTS AND CONTINGENCIES (Note M) MEMBERSʹ EQUITY 123,457,319 91,855,798 TOTAL LIABILITIES AND MEMBERSʹ EQUITY 6,727,807,850$ 5,182,758,192$ LONGBRIDGE FINANCIAL, LLC BALANCE SHEETS The accompanying notes are an integral part of these financial statements. 3

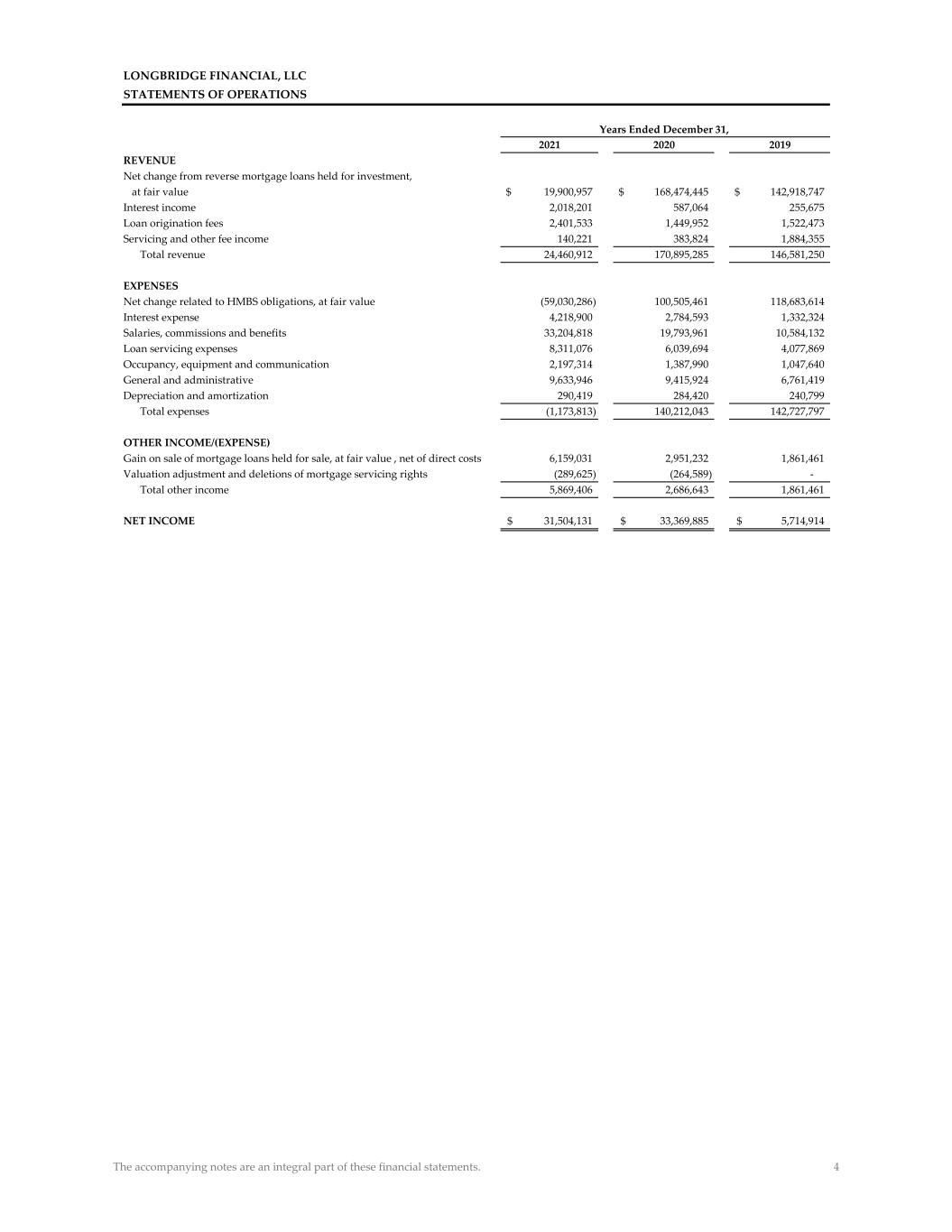

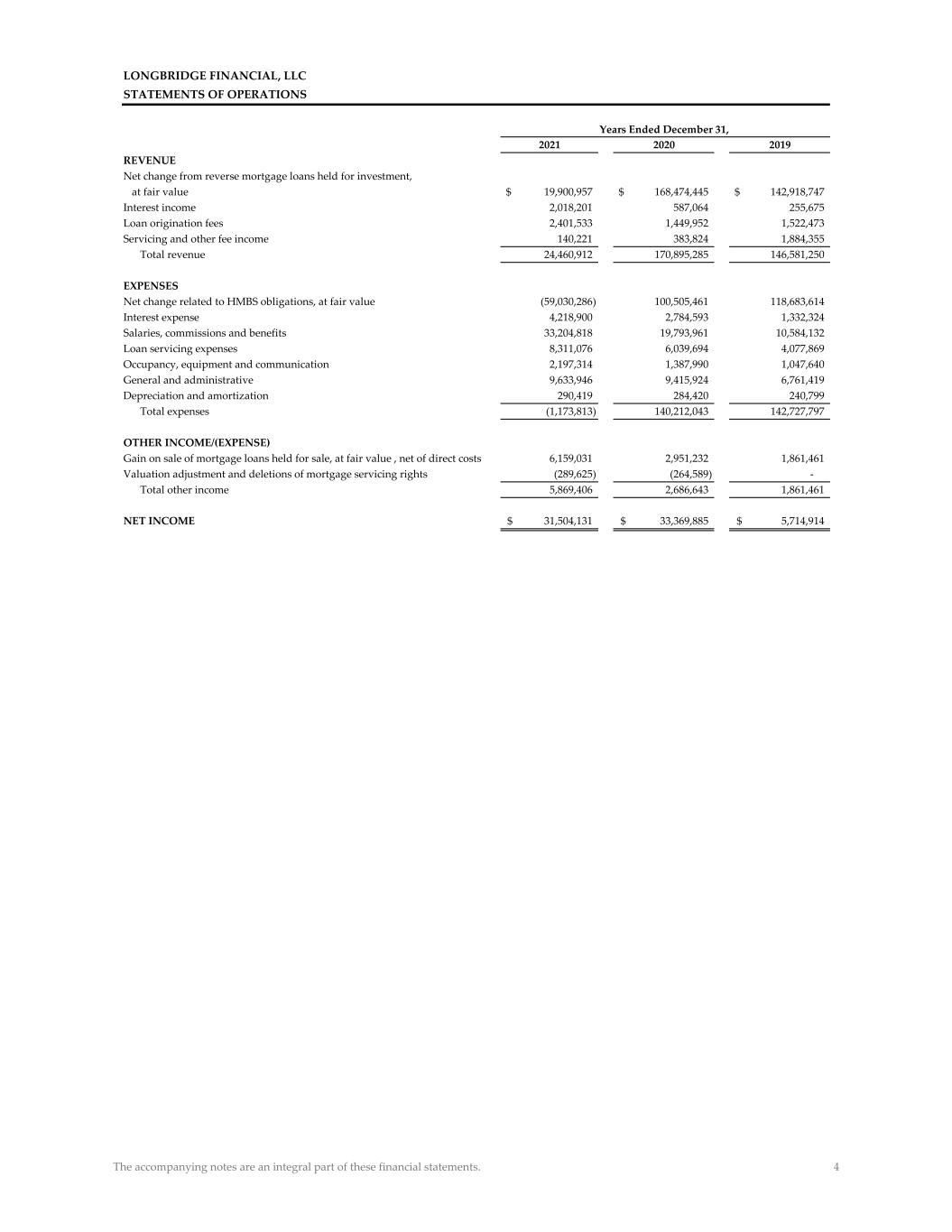

LONGBRIDGE FINANCIAL, LLC STATEMENTS OF OPERATIONS Years Ended December 31, 2021 2020 2019 REVENUE Net change from reverse mortgage loans held for investment, at fair value 19,900,957$ 168,474,445$ 142,918,747$ Interest income 2,018,201 587,064 255,675 Loan origination fees 2,401,533 1,449,952 1,522,473 Servicing and other fee income 140,221 383,824 1,884,355 Total revenue 24,460,912 170,895,285 146,581,250 EXPENSES Net change related to HMBS obligations, at fair value (59,030,286) 100,505,461 118,683,614 Interest expense 4,218,900 2,784,593 1,332,324 Salaries, commissions and benefits 33,204,818 19,793,961 10,584,132 Loan servicing expenses 8,311,076 6,039,694 4,077,869 Occupancy, equipment and communication 2,197,314 1,387,990 1,047,640 General and administrative 9,633,946 9,415,924 6,761,419 Depreciation and amortization 290,419 284,420 240,799 Total expenses (1,173,813) 140,212,043 142,727,797 OTHER INCOME/(EXPENSE) Gain on sale of mortgage loans held for sale, at fair value , net of direct costs 6,159,031 2,951,232 1,861,461 Valuation adjustment and deletions of mortgage servicing rights (289,625) (264,589) ‐ Total other income 5,869,406 2,686,643 1,861,461 NET INCOME 31,504,131$ 33,369,885$ 5,714,914$ The accompanying notes are an integral part of these financial statements. 4

LONGBRIDGE FINANCIAL, LLC STATEMENTS OF CHANGES IN MEMBERSʹ EQUITY FOR THE YEARS ENDED DECEMBER 31, 2021, 2020, and 2019 Balance, December 31, 2018 52,710,092$ Net income 5,714,914 Balance, December 31, 2019 58,425,006 Stock‐based compensation 60,907 Net income 33,369,885 Balance, December 31, 2020 91,855,798 Stock‐based compensation 97,390 Net income 31,504,131 Balance, December 31, 2021 123,457,319$ The accompanying notes are an integral part of these financial statements. 5

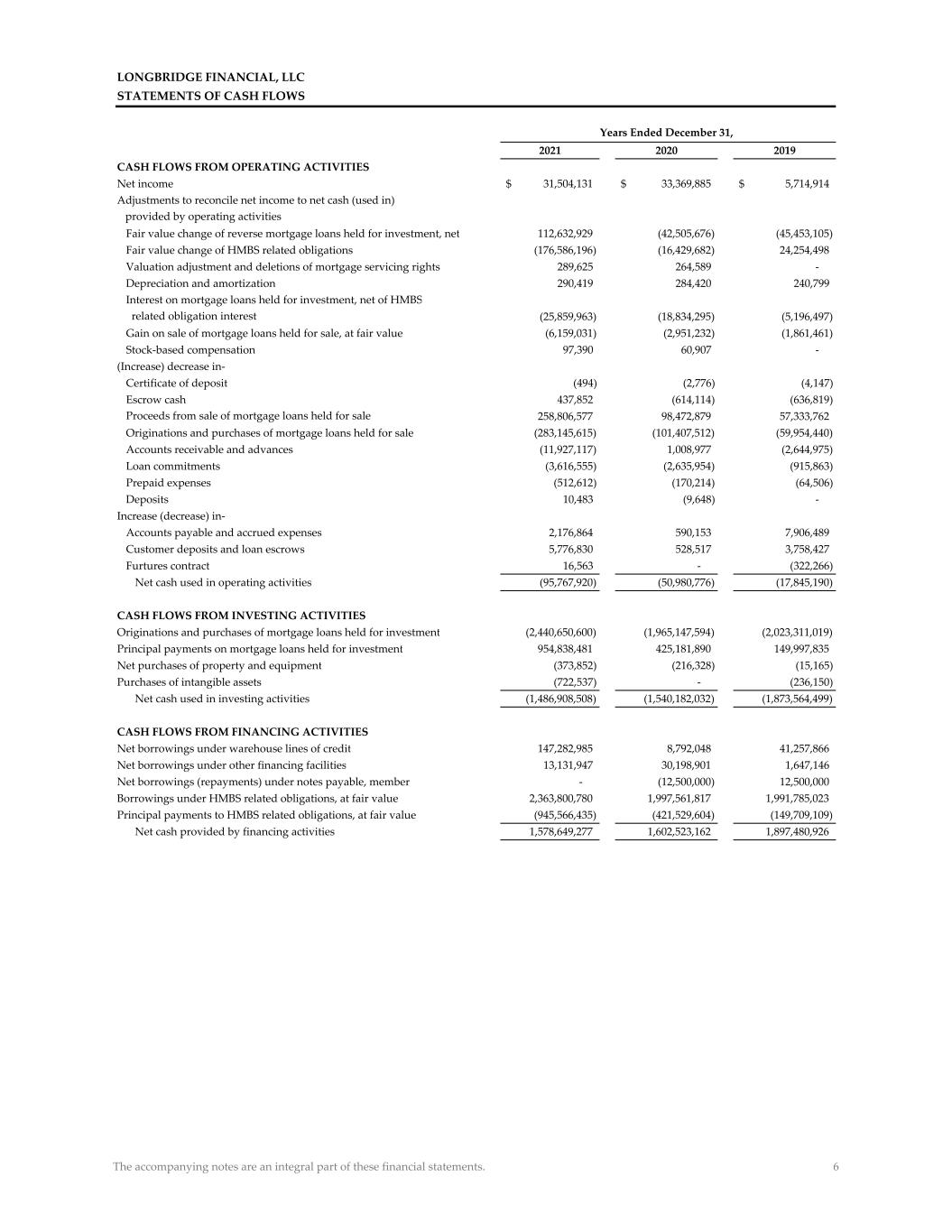

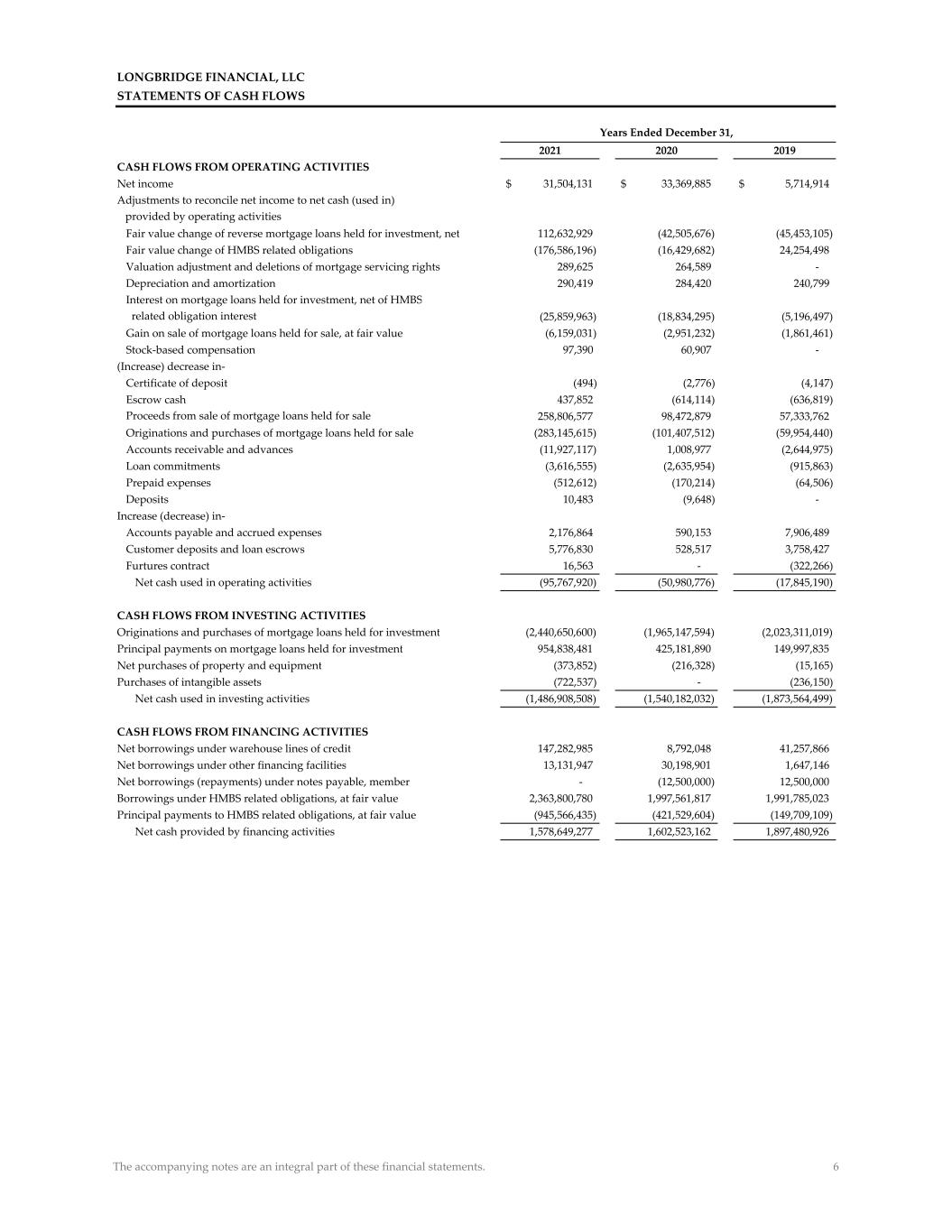

LONGBRIDGE FINANCIAL, LLC STATEMENTS OF CASH FLOWS Years Ended December 31, 2021 2020 2019 CASH FLOWS FROM OPERATING ACTIVITIES Net income 31,504,131$ 33,369,885$ 5,714,914$ Adjustments to reconcile net income to net cash (used in) provided by operating activities Fair value change of reverse mortgage loans held for investment, net 112,632,929 (42,505,676) (45,453,105) Fair value change of HMBS related obligations (176,586,196) (16,429,682) 24,254,498 Valuation adjustment and deletions of mortgage servicing rights 289,625 264,589 ‐ Depreciation and amortization 290,419 284,420 240,799 Interest on mortgage loans held for investment, net of HMBS related obligation interest (25,859,963) (18,834,295) (5,196,497) Gain on sale of mortgage loans held for sale, at fair value (6,159,031) (2,951,232) (1,861,461) Stock‐based compensation 97,390 60,907 ‐ (Increase) decrease in‐ Certificate of deposit (494) (2,776) (4,147) Escrow cash 437,852 (614,114) (636,819) Proceeds from sale of mortgage loans held for sale 258,806,577 98,472,879 57,333,762 Originations and purchases of mortgage loans held for sale (283,145,615) (101,407,512) (59,954,440) Accounts receivable and advances (11,927,117) 1,008,977 (2,644,975) Loan commitments (3,616,555) (2,635,954) (915,863) Prepaid expenses (512,612) (170,214) (64,506) Deposits 10,483 (9,648) ‐ Increase (decrease) in‐ Accounts payable and accrued expenses 2,176,864 590,153 7,906,489 Customer deposits and loan escrows 5,776,830 528,517 3,758,427 Furtures contract 16,563 ‐ (322,266) Net cash used in operating activities (95,767,920) (50,980,776) (17,845,190) CASH FLOWS FROM INVESTING ACTIVITIES Originations and purchases of mortgage loans held for investment (2,440,650,600) (1,965,147,594) (2,023,311,019) Principal payments on mortgage loans held for investment 954,838,481 425,181,890 149,997,835 Net purchases of property and equipment (373,852) (216,328) (15,165) Purchases of intangible assets (722,537) ‐ (236,150) Net cash used in investing activities (1,486,908,508) (1,540,182,032) (1,873,564,499) CASH FLOWS FROM FINANCING ACTIVITIES Net borrowings under warehouse lines of credit 147,282,985 8,792,048 41,257,866 Net borrowings under other financing facilities 13,131,947 30,198,901 1,647,146 Net borrowings (repayments) under notes payable, member ‐ (12,500,000) 12,500,000 Borrowings under HMBS related obligations, at fair value 2,363,800,780 1,997,561,817 1,991,785,023 Principal payments to HMBS related obligations, at fair value (945,566,435) (421,529,604) (149,709,109) Net cash provided by financing activities 1,578,649,277 1,602,523,162 1,897,480,926 The accompanying notes are an integral part of these financial statements. 6

LONGBRIDGE FINANCIAL, LLC STATEMENTS OF CASH FLOWS Years Ended December 31, 2021 2020 2019 INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH (4,027,151)$ 11,360,354$ 6,071,237$ CASH AND CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF YEAR 25,814,164 14,453,805 8,382,568 CASH AND CASH EQUIVALENTS AND RESTRICTED CASH, END OF YEAR 21,787,013$ 25,814,164$ 14,453,805$ SUPPLEMENTAL INFORMATION Cash paid for interest 3,966,123$ 3,492,544$ 351,141$ NON‐CASH OPERATING AND INVESTING ACTIVITIES The Company increased retained mortgage servicing rights in connection with loan sales. 2,425,086$ 1,227,088$ 222,176$ The accompanying notes are an integral part of these financial statements. 7

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 8 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Organization Longbridge Financial, LLC (the Company) was organized in the State of Delaware and is primarily engaged in the business of originating, purchasing, selling and servicing home equity conversion mortgage (HECM) loans through various channels. The Company maintains its corporate office in Mahwah, New Jersey, with branch offices in multiple states. The Company is approved as a Title II, non‐supervised direct endorsement mortgagee with the United States Department of Housing and Urban Development (HUD). In addition, the Company is an approved issuer of Government National Mortgage Association (GNMA) HECM mortgage backed securities (HMBS). HMBS are guaranteed by GNMA and collateralized by participation interests in HECMs, which are insured by the Federal Housing Administration (FHA). The Company also originates and services non‐FHA guaranteed reverse jumbo proprietary products, for borrowers in high property value areas that exceed FHA limits. Basis of Accounting The financial statements of the Company are prepared on the accrual basis of accounting. Basis of Presentation The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP) as codified in the Financial Accounting Standards Board’s (FASB) Accounting Standards Codification (ASC). Use of Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities, at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Variable Interest Entities The Company issues GNMA HMBS securities by pooling eligible HECM loans through a custodian and assigning rights to the loans to GNMA. GNMA provides credit enhancements for the HECM loans through certain guarantee provisions. These securitizations involve variable interest entities (VIEs) as the trusts or similar vehicles, by design, that either (1) lack sufficient equity to permit the entity to finance its activities without additional subordinated financial support from other parties, or (2) have equity investors that do not have the ability to make significant decisions relating to the entity’s operations through voting rights, or do not have the obligation to absorb the expected losses, or do not have the right to receive the residual returns of the entities.

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 9 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Variable Interest Entities (Continued) The primary beneficiary of a VIE (i.e., the party that has a controlling financial interest) is required to consolidate the assets and liabilities of the VIE. The primary beneficiary is the party that has both (1) the power to direct the activities of an entity that most significantly impact the VIE’s economic performance; and (2) through its interests in the VIE, the obligation to absorb losses or the right to receive benefits from the VIE that could potentially be significant to the VIE. The Company typically retains the right to service HECM loans sold or securitized by GNMA. Due to the significant influence of GNMA over the VIEs that hold the assets from HECM loan securitizations, principally through their rights and responsibilities as master servicer, the Company is not the primary beneficiary of the VIEs and therefore the VIEs are not consolidated. The Company performs on‐going reassessments of whether changes in the facts and circumstances regarding the Company’s involvement with a VIE cause the Company’s consolidation determination to change. Cash and Cash Equivalents For cash flow purposes, the Company considers cash and temporary investments with original maturities of three months or less, to be cash and cash equivalents. The Company has diversified its credit risk for cash by maintaining deposits in several financial institutions, which may at times exceed amounts covered by insurance from the Federal Deposit Insurance Corporation. The Company evaluates the creditworthiness of these financial institutions in determining the risk associated with these balances. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant credit risk related to cash and cash equivalents. Restricted Cash The Company maintains a cash balance that is restricted under a warehouse line of credit agreement. Mortgage Loans Held for Sale, at Fair Value Mortgage loans held for sale are carried at fair value under the fair value option with changes in fair value recorded in gain on sale of mortgage loans held for sale, at fair value, on the statements of operations. The fair value of mortgage loans held for sale committed to investors is calculated using observable market information such as the investor commitment, assignment of trade or other mandatory delivery commitment prices. The Company bases the fair value of loans committed to Agency investors based on the Agency’s quoted mortgage backed security (MBS) prices. The fair value of mortgage loans held for sale not committed to investors is based on quoted best execution secondary market prices. If no such quoted price exists, the fair value is determined using quoted prices for a similar asset or assets, such as MBS prices, adjusted for the specific attributes of that loan, which would be used by other market participants.

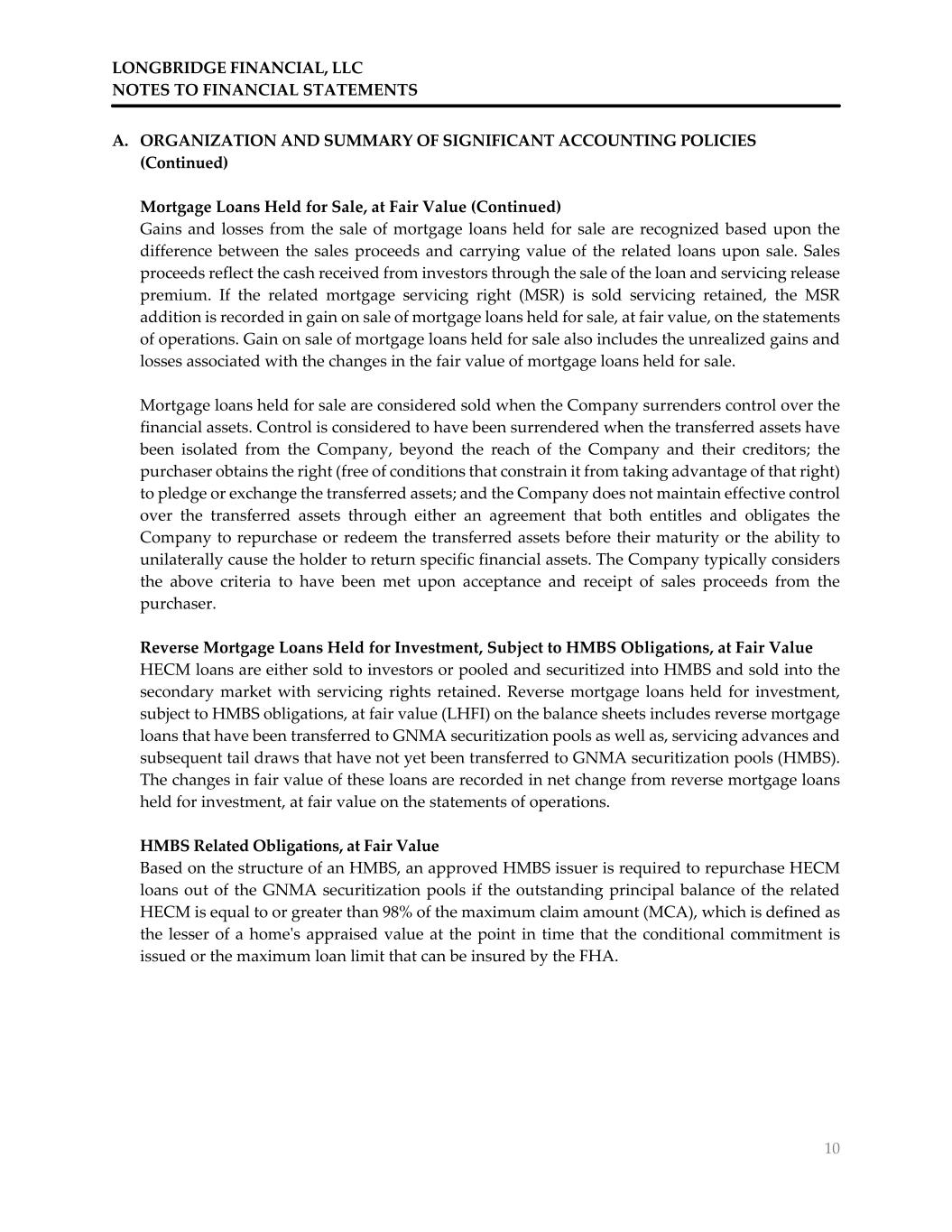

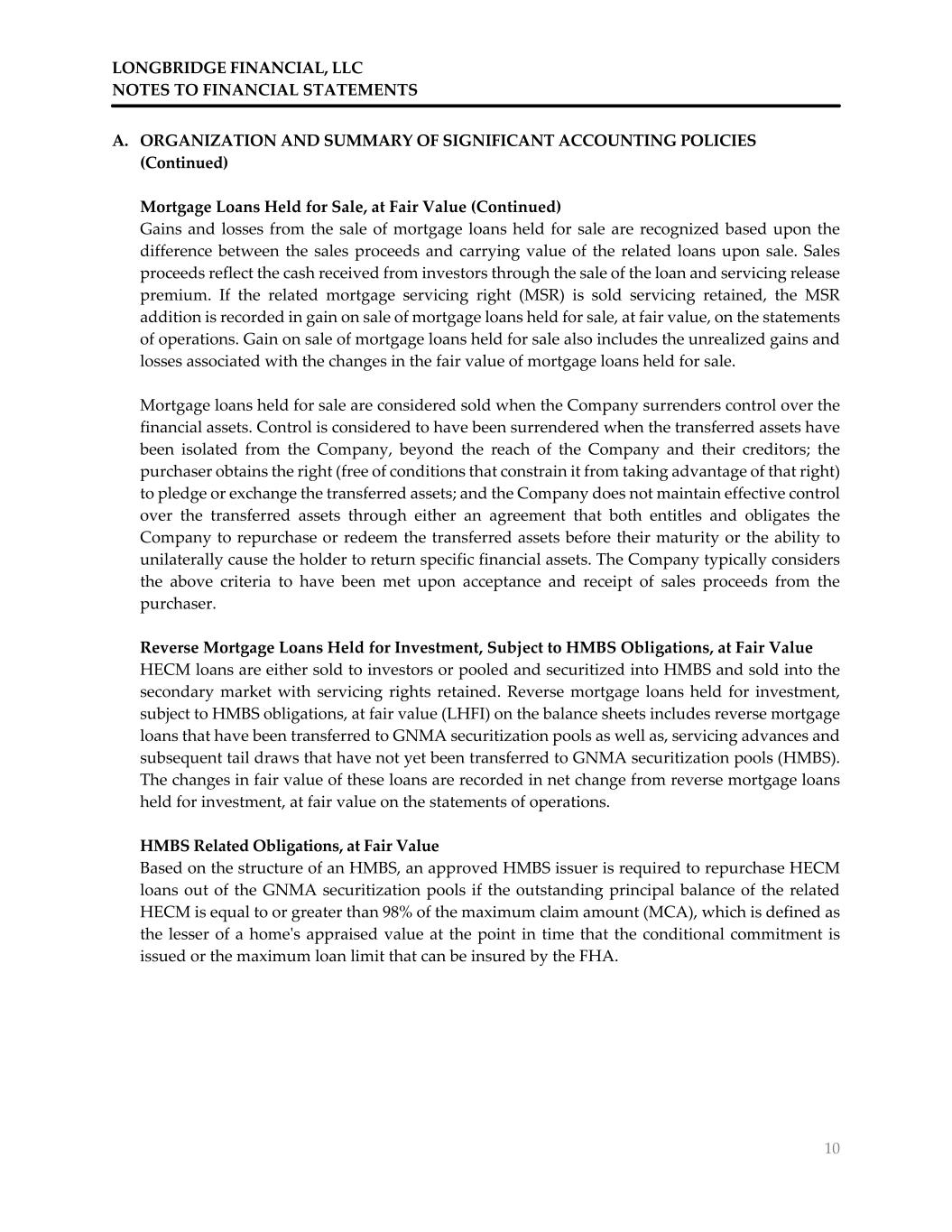

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 10 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Mortgage Loans Held for Sale, at Fair Value (Continued) Gains and losses from the sale of mortgage loans held for sale are recognized based upon the difference between the sales proceeds and carrying value of the related loans upon sale. Sales proceeds reflect the cash received from investors through the sale of the loan and servicing release premium. If the related mortgage servicing right (MSR) is sold servicing retained, the MSR addition is recorded in gain on sale of mortgage loans held for sale, at fair value, on the statements of operations. Gain on sale of mortgage loans held for sale also includes the unrealized gains and losses associated with the changes in the fair value of mortgage loans held for sale. Mortgage loans held for sale are considered sold when the Company surrenders control over the financial assets. Control is considered to have been surrendered when the transferred assets have been isolated from the Company, beyond the reach of the Company and their creditors; the purchaser obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets; and the Company does not maintain effective control over the transferred assets through either an agreement that both entitles and obligates the Company to repurchase or redeem the transferred assets before their maturity or the ability to unilaterally cause the holder to return specific financial assets. The Company typically considers the above criteria to have been met upon acceptance and receipt of sales proceeds from the purchaser. Reverse Mortgage Loans Held for Investment, Subject to HMBS Obligations, at Fair Value HECM loans are either sold to investors or pooled and securitized into HMBS and sold into the secondary market with servicing rights retained. Reverse mortgage loans held for investment, subject to HMBS obligations, at fair value (LHFI) on the balance sheets includes reverse mortgage loans that have been transferred to GNMA securitization pools as well as, servicing advances and subsequent tail draws that have not yet been transferred to GNMA securitization pools (HMBS). The changes in fair value of these loans are recorded in net change from reverse mortgage loans held for investment, at fair value on the statements of operations. HMBS Related Obligations, at Fair Value Based on the structure of an HMBS, an approved HMBS issuer is required to repurchase HECM loans out of the GNMA securitization pools if the outstanding principal balance of the related HECM is equal to or greater than 98% of the maximum claim amount (MCA), which is defined as the lesser of a homeʹs appraised value at the point in time that the conditional commitment is issued or the maximum loan limit that can be insured by the FHA.

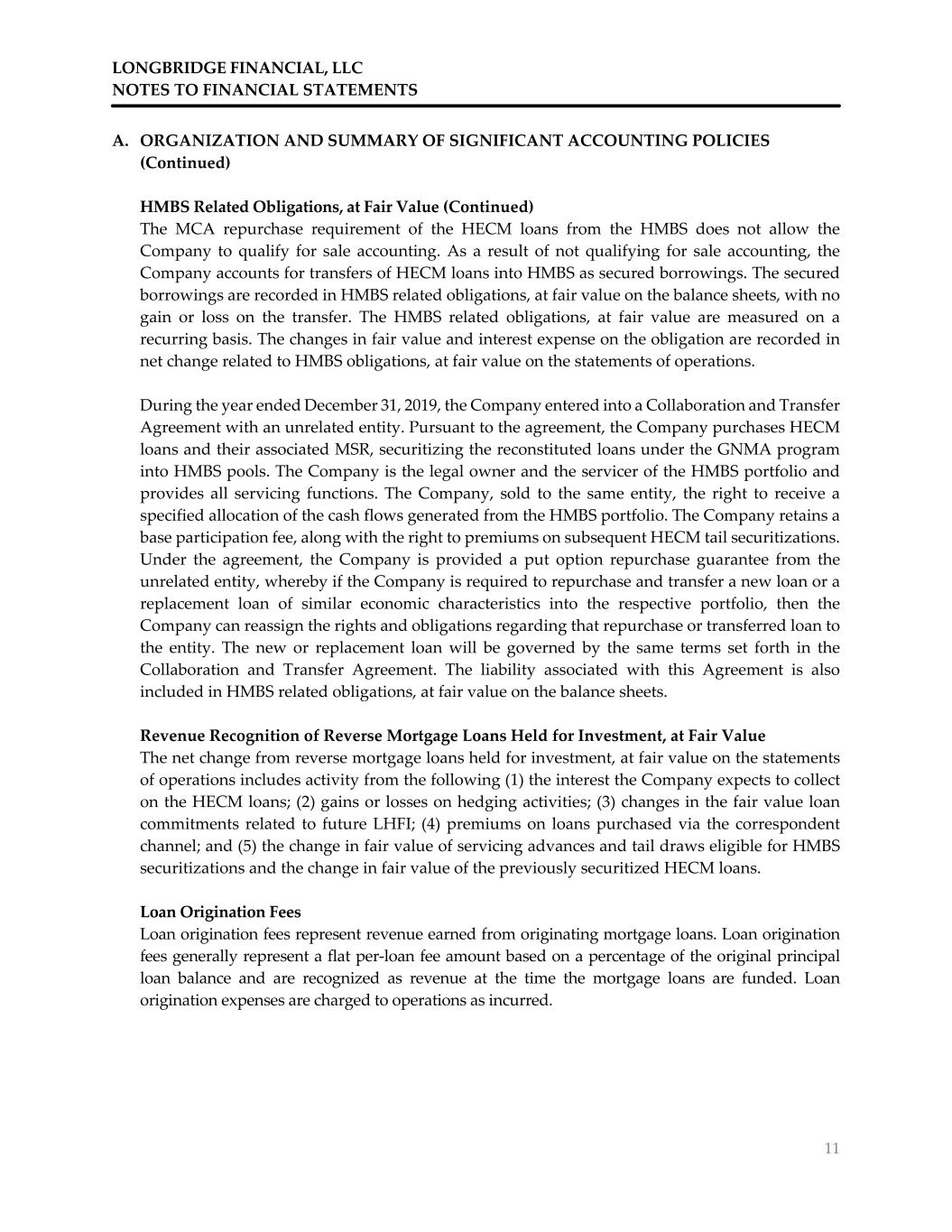

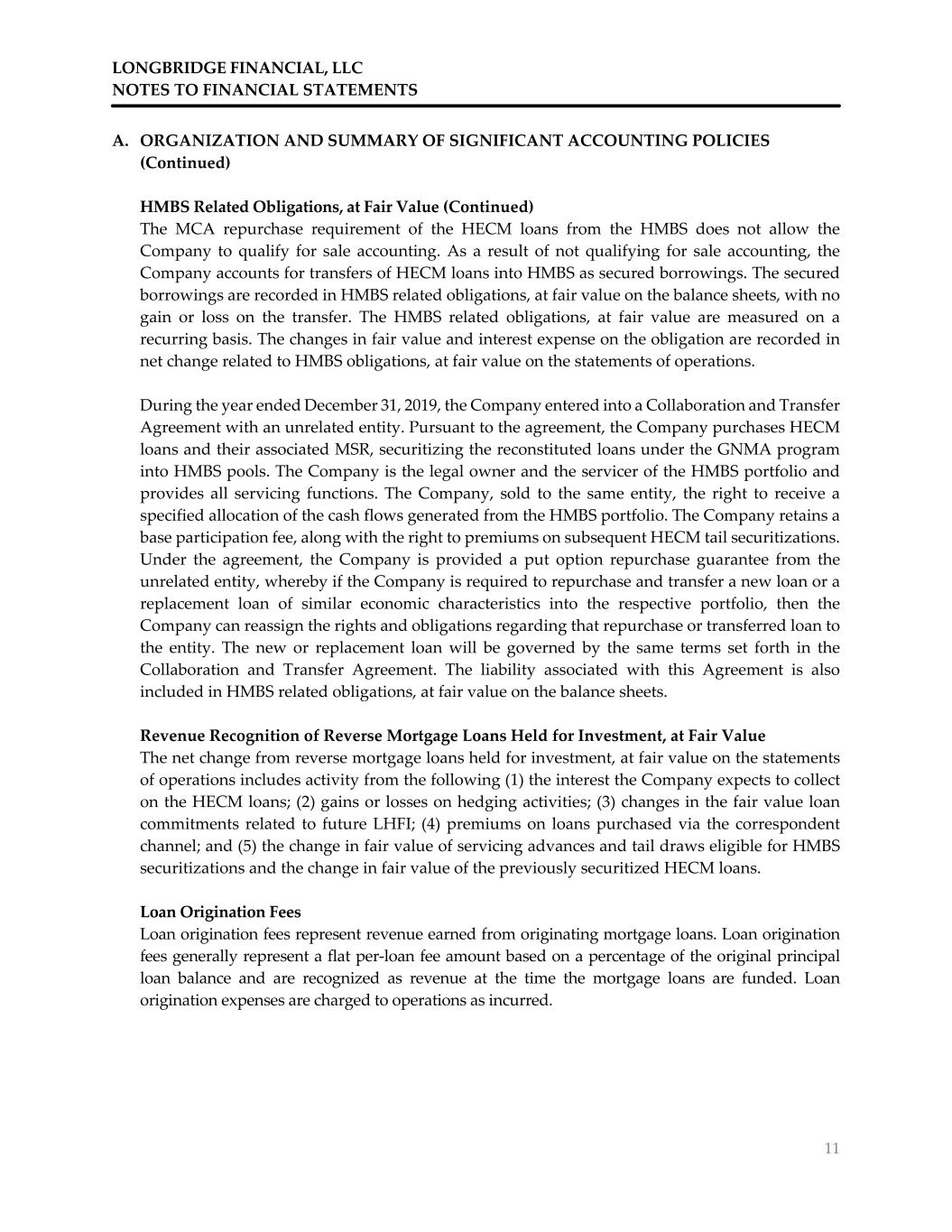

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 11 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) HMBS Related Obligations, at Fair Value (Continued) The MCA repurchase requirement of the HECM loans from the HMBS does not allow the Company to qualify for sale accounting. As a result of not qualifying for sale accounting, the Company accounts for transfers of HECM loans into HMBS as secured borrowings. The secured borrowings are recorded in HMBS related obligations, at fair value on the balance sheets, with no gain or loss on the transfer. The HMBS related obligations, at fair value are measured on a recurring basis. The changes in fair value and interest expense on the obligation are recorded in net change related to HMBS obligations, at fair value on the statements of operations. During the year ended December 31, 2019, the Company entered into a Collaboration and Transfer Agreement with an unrelated entity. Pursuant to the agreement, the Company purchases HECM loans and their associated MSR, securitizing the reconstituted loans under the GNMA program into HMBS pools. The Company is the legal owner and the servicer of the HMBS portfolio and provides all servicing functions. The Company, sold to the same entity, the right to receive a specified allocation of the cash flows generated from the HMBS portfolio. The Company retains a base participation fee, along with the right to premiums on subsequent HECM tail securitizations. Under the agreement, the Company is provided a put option repurchase guarantee from the unrelated entity, whereby if the Company is required to repurchase and transfer a new loan or a replacement loan of similar economic characteristics into the respective portfolio, then the Company can reassign the rights and obligations regarding that repurchase or transferred loan to the entity. The new or replacement loan will be governed by the same terms set forth in the Collaboration and Transfer Agreement. The liability associated with this Agreement is also included in HMBS related obligations, at fair value on the balance sheets. Revenue Recognition of Reverse Mortgage Loans Held for Investment, at Fair Value The net change from reverse mortgage loans held for investment, at fair value on the statements of operations includes activity from the following (1) the interest the Company expects to collect on the HECM loans; (2) gains or losses on hedging activities; (3) changes in the fair value loan commitments related to future LHFI; (4) premiums on loans purchased via the correspondent channel; and (5) the change in fair value of servicing advances and tail draws eligible for HMBS securitizations and the change in fair value of the previously securitized HECM loans. Loan Origination Fees Loan origination fees represent revenue earned from originating mortgage loans. Loan origination fees generally represent a flat per‐loan fee amount based on a percentage of the original principal loan balance and are recognized as revenue at the time the mortgage loans are funded. Loan origination expenses are charged to operations as incurred.

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 12 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Interest Income Interest income on mortgage loans held for sale, at fair value is recognized for the period from loan funding to sale based upon the principal balance outstanding and stated interest rate. Revenue recognition is discontinued when loans become 90 days delinquent, or when, in management’s opinion, the recovery of principal and interest becomes doubtful and the mortgage loans held for sale are put on nonaccrual status. Servicing and Other Fee Income Servicing and other fee income represents certain fees pursuant to the Collaboration and Transfer Agreement and are recognized into revenue at the time the initial HMBS is securitized. Servicing Advances Servicing advances represent mortgage insurance premiums advanced on behalf of HECM borrowers. Servicing advances are made in accordance with the servicing agreements and are recoverable through the collection of proceeds from subsequent securitizations of HMBS tail pools. Servicing advances are initially recorded at the original advance balance. Upon eligibility for HMBS securitization, servicing advances are carried at fair value under the fair value option and included in reverse mortgage loans held for investment, subject to HMBS obligations, at fair value on the balance sheets, with changes in fair value recorded in net change from reverse mortgage loans held for investment, at fair value on the statements of operations. Servicing advances not eligible for HMBS securitizations are carried at the original advance balance and are included in LHFI on the balance sheets. The Company periodically reviews servicing advances for collectability and establishes a valuation allowance for estimated uncollectible amounts. No allowance has been recorded as of December 31, 2021 and 2020, as management has determined that all amounts are fully collectible. Capitalized Software Development Costs FASB ASC 350‐40, Goodwill and Other—Internal‐Use Software (ASC 350‐40), requires the Company to expense development costs as they are incurred in the preliminary project stage. Once the capitalization criteria of ASC 350‐40 have been met, external direct costs of materials and services consumed in developing or obtaining internal‐use computer software, payroll and payroll related costs for employees who are directly associated with and who devote time to the internal‐use computer software; as well as related consulting fees are capitalized. The Company capitalized $722,537 and $236,150 of internally developed software during the years ended December 31, 2021 and 2019, respectively; no such costs were capitalized during the year ended December 31, 2020. Amortization expense of $163,750, 196,702, and $162,124 was recorded in depreciation and amortization expense on the statement of operations during the years ended December 31, 2021, 2020, and 2019, respectively.

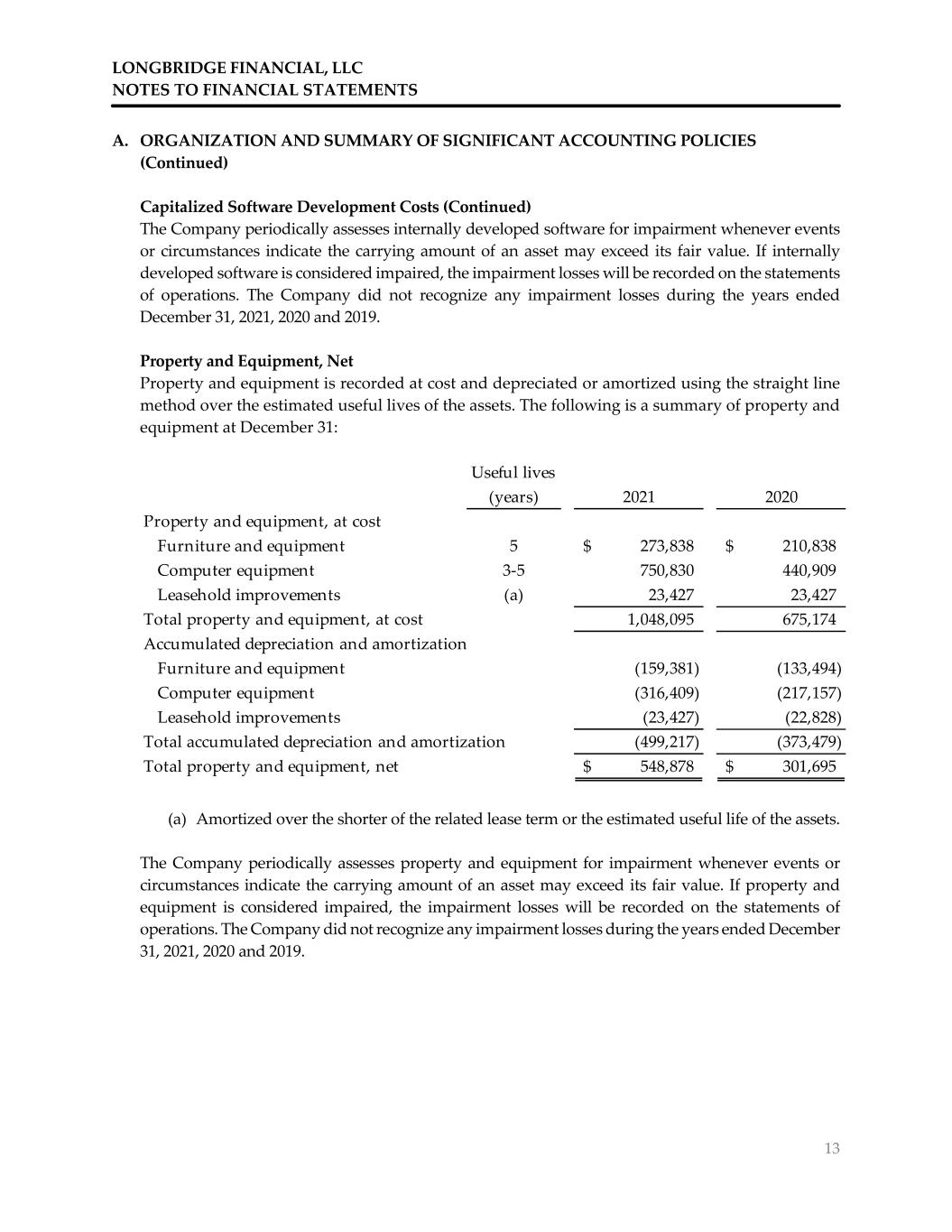

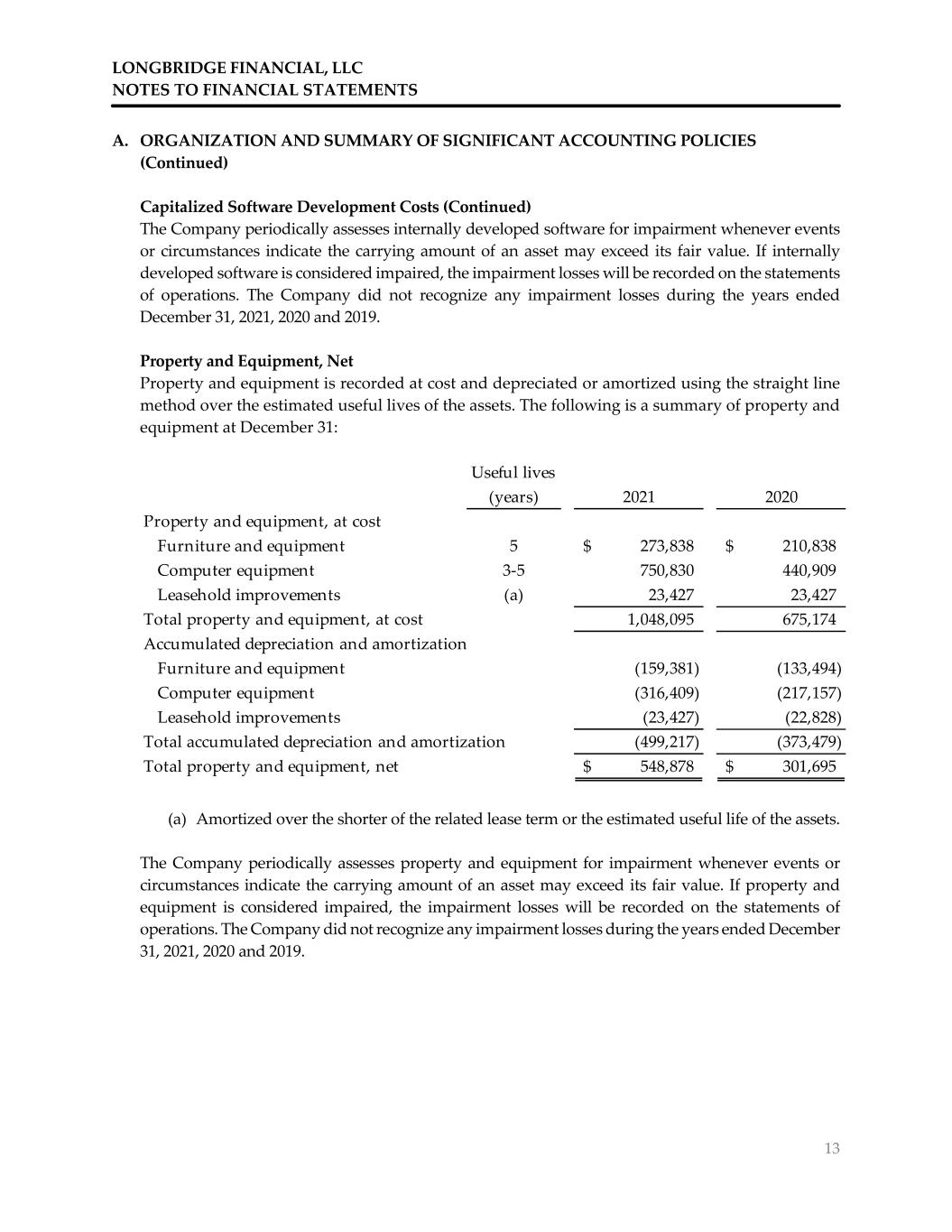

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 13 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Capitalized Software Development Costs (Continued) The Company periodically assesses internally developed software for impairment whenever events or circumstances indicate the carrying amount of an asset may exceed its fair value. If internally developed software is considered impaired, the impairment losses will be recorded on the statements of operations. The Company did not recognize any impairment losses during the years ended December 31, 2021, 2020 and 2019. Property and Equipment, Net Property and equipment is recorded at cost and depreciated or amortized using the straight line method over the estimated useful lives of the assets. The following is a summary of property and equipment at December 31: (a) Amortized over the shorter of the related lease term or the estimated useful life of the assets. The Company periodically assesses property and equipment for impairment whenever events or circumstances indicate the carrying amount of an asset may exceed its fair value. If property and equipment is considered impaired, the impairment losses will be recorded on the statements of operations. The Company did not recognize any impairment losses during the years ended December 31, 2021, 2020 and 2019. Useful lives (years) 2021 2020 Property and equipment, at cost Furniture and equipment 5 273,838$ 210,838$ Computer equipment 3‐5 750,830 440,909 Leasehold improvements (a) 23,427 23,427 Total property and equipment, at cost 1,048,095 675,174 Accumulated depreciation and amortization Furniture and equipment (159,381) (133,494) Computer equipment (316,409) (217,157) Leasehold improvements (23,427) (22,828) Total accumulated depreciation and amortization (499,217) (373,479) Total property and equipment, net 548,878$ 301,695$

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 14 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Loan Commitments The Company holds and issues loan commitments (LCs) and futures contracts. LCs are subject to price risk primarily related to fluctuations in market interest rates. To hedge the interest rate risk on mandatory LCs, the Company enters into futures contracts. Management expects these futures contracts to experience changes in fair value opposite to the changes in fair value of the LCs thereby reducing earnings volatility. Futures contracts are also used to hedge the interest rate risk on mortgage loans held for sale and mortgage loans held for investment that are not committed to investors and still subject to price risk. The Company considers various factors and strategies in determining what portion of the LCs and uncommitted mortgage loans to economically hedge. LCs are recognized as assets or liabilities on the balance sheets at fair value. Changes in the fair value of the LCs and futures contracts are recognized in net change from reverse mortgage loans held for investment, at fair value on the statements of operations in the period in which they occur. Mortgage Servicing Rights and Revenue Recognition FASB ASC 860‐50, Transfers and Servicing, requires that MSRs be initially recorded at fair value at the time the underlying loans are sold. To determine the fair value of the MSR created, the Company uses a valuation model that calculates the net present value of future cash flows. The valuation model incorporates assumptions that market participants would use in estimating future cash flows, estimated discount rates, estimated prepayment speeds, estimated liquidation and foreclosure losses, estimated contractual participation fees, and estimated default rates. The credit quality and stated interest rates of the HECM loans underlying the MSRs affects the inputs used in the cash flow models. MSRs are not actively traded in open markets; accordingly, considerable judgment is required to estimate their fair value, and changes in these estimates could materially change the estimated fair value. The Company accretes a fixed servicing fee margin monthly based on the outstanding principal balances of the sold loans. The Company has elected to report its MSRs at fair value, during which time the Company is exposed to fair value risk related to changes in the fair value of the Company’s MSRs. Changes in fair value are recorded in valuation adjustment and deletions of mortgage servicing rights on the statements of operations in the period in which changes in fair value occur. Estimates of remaining loan lives, prepayment speeds, liquidation and foreclosure losses are incorporated into the model. These inputs can, and generally do, change from period to period as market conditions change. Changes in these estimates could materially change the estimated fair value. The key unobservable inputs used in determining the fair value of MSRs when they are initially recorded are as follows for the years ended December 31: 2021 2020 2019 Average discount rate 12.00% 12.00% 12.00% Average prepayment speed 13.40% 16.80% 9.20%

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 15 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Mortgage Servicing Rights and Revenue Recognition (Continued) During the year ended December 31, 2020, the Company and an unrelated entity entered into a sale and servicing agreement. Under the agreement, the Company sells certain reverse mortgage loans to the entity based on a commitment price. The Company retains the benefits and obligations related to the MSRs. The MSRs related to the private proprietary reverse mortgages yield a servicing fee margin, which is agreed upon with the unrelated entity as stated in the sale and servicing agreement. Escrow and Fiduciary Funds The Company maintains segregated bank accounts for escrow balances in trust for borrowers’ draws. The balance of the accounts totaled $3,457,812 and $2,500,331 at December 31, 2021 and 2020 respectively, which is excluded from the balance sheets. Advertising and Marketing Advertising and marketing is expensed as incurred and amounted to $4,367,570, $3,633,212 and $3,451,891 for the years ended December 31, 2021, 2020 and 2019, respectively, and are included in general and administrative on the statements of operations. Income Taxes The Company has elected to be taxed as a partnership under the Internal Revenue Code. Accordingly, no federal income tax provision and state income taxes, to the extent possible, have been recorded in the financial statements, as all items of income and expense generated by the Company are reported on the members’ income tax returns. The Company has no federal or state tax examinations in process as of December 31, 2021. Stock‐Based Compensation Company management may grant executive common unit options to certain employees and non‐ employee directors under the executive common unit option plan. Common unit option awards are generally granted with an exercise price equal to the market price of the Company’s executive common units at the date of grant. Grant‐date fair value is determined using the Black‐Scholes pricing model adjusted for the unique characteristics of the specific awards.

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 16 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Stock‐Based Compensation (Continued) FASB ASC 718‐10, Compensation‐ Stock Compensation, requires compensation expense related to the award to be recognized for unit options issued to employees over the required requisite service period, generally defined as the vesting period, which is five years. For service period awards with graded vesting, compensation expense is recognized based on the graded vesting basis (based on each respective agreement) over the requisite service period for the entire award. Recognized compensation expense related to the service period option awards is recognized and included in salaries, commissions, and employee benefits on the statements of operations. For performance‐based awards, compensation expense is recognized over the requisite service period when the Company determines that it is probable the performance condition will be achieved. At December 31, 2021 and 2020, and 2019 management determined it is not estimable for the performance condition to be achieved and the Company did not recognize compensation expense related to the performance‐ based award. The Company periodically evaluates the probability of the performance condition being achieved and will recognize compensation expense when the performance condition is met. Risks and Uncertainties In the normal course of business, companies in the mortgage banking industry encounter certain economic and regulatory risks. Economic risks include interest rate risk and credit risk. The Company is subject to interest rate risk to the extent that in a rising interest rate environment, the Company may experience a decrease in loan production, as well as decreases in the value of LHFI and commitments to originate and purchase loans, which may negatively impact the Company’s operations. Credit risk is the risk of default that may result from the borrowers’ inability or unwillingness to make contractually required payments during the period in which loans are being held for investment prior to securitization or subsequent to securitization while serviced by the Company. Risks associated with HECMs and servicing HMBS are subject to the Company’s ability to accurately estimate interest curtailment liabilities, fund HECM repurchase obligations and principal additions, and the ability to securitize the HECM loans and tails. Additional risks are present when default, bankruptcy, or death by borrower; or subsequent discovery that underwriting standards were not met which may result in a loan repurchase. The Company’s business requires substantial cash to support its operating activities. As a result, the Company is dependent on its warehouse lines of credit other financing facilities in order to finance its continued operations. If the Company’s principal lenders decided to terminate or not to renew any of these financing facilities with the Company, the loss of borrowing capacity could have a material adverse impact on the Company’s financial statements unless the Company found a suitable alternative source. The global outbreak of COVID‐19 has disrupted economic markets, and the prolonged economic impact is uncertain. The operational and financial performance of the Company depends on future developments, including the duration and spread of the outbreak, and such uncertainty may have an adverse impact on the Company’s financial performance.

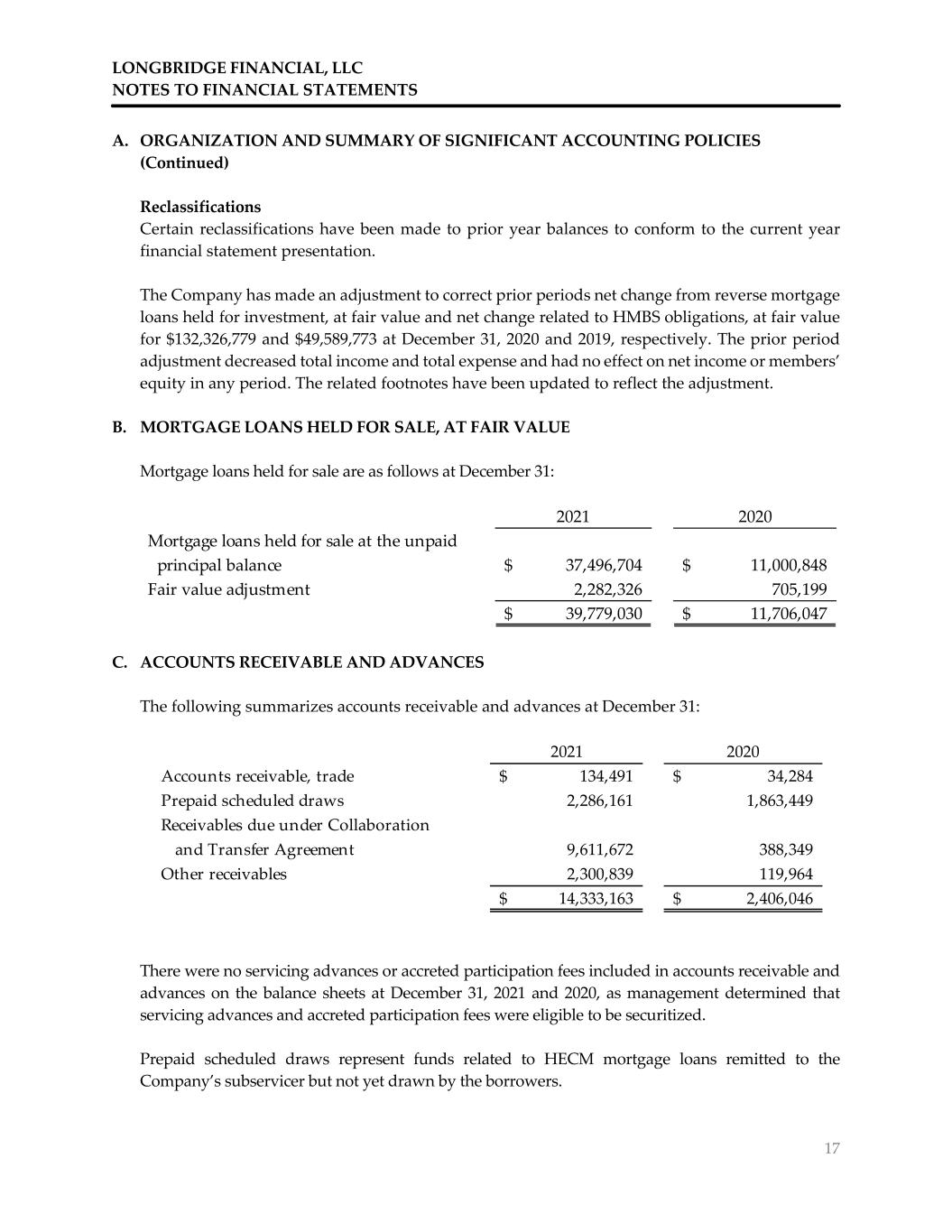

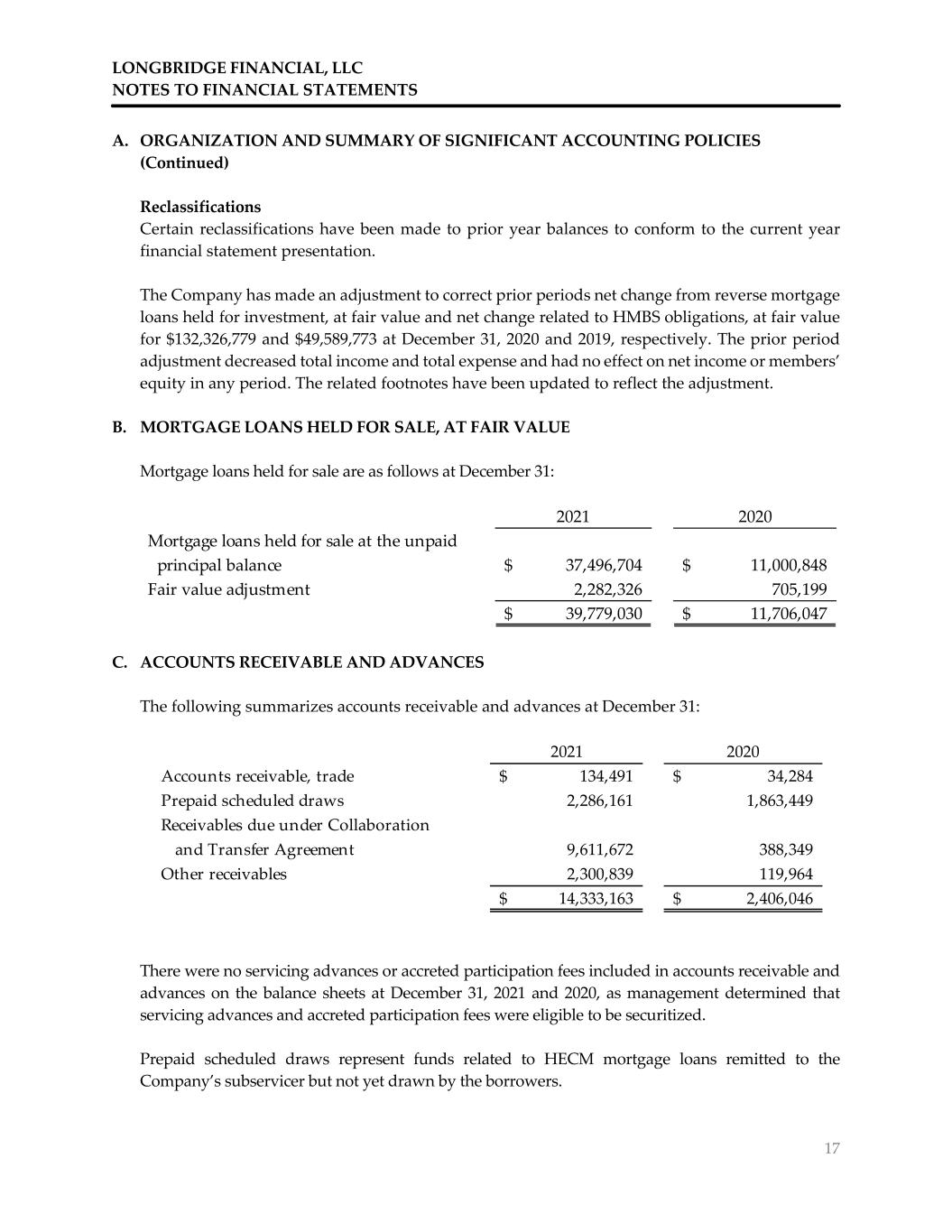

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 17 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Reclassifications Certain reclassifications have been made to prior year balances to conform to the current year financial statement presentation. The Company has made an adjustment to correct prior periods net change from reverse mortgage loans held for investment, at fair value and net change related to HMBS obligations, at fair value for $132,326,779 and $49,589,773 at December 31, 2020 and 2019, respectively. The prior period adjustment decreased total income and total expense and had no effect on net income or members’ equity in any period. The related footnotes have been updated to reflect the adjustment. B. MORTGAGE LOANS HELD FOR SALE, AT FAIR VALUE Mortgage loans held for sale are as follows at December 31: C. ACCOUNTS RECEIVABLE AND ADVANCES The following summarizes accounts receivable and advances at December 31: There were no servicing advances or accreted participation fees included in accounts receivable and advances on the balance sheets at December 31, 2021 and 2020, as management determined that servicing advances and accreted participation fees were eligible to be securitized. Prepaid scheduled draws represent funds related to HECM mortgage loans remitted to the Company’s subservicer but not yet drawn by the borrowers. 2021 2020 Mortgage loans held for sale at the unpaid principal balance 37,496,704$ 11,000,848$ Fair value adjustment 2,282,326 705,199 39,779,030$ 11,706,047$ 2021 2020 Accounts receivable, trade 134,491$ 34,284$ Prepaid scheduled draws 2,286,161 1,863,449 Receivables due under Collaboration and Transfer Agreement 9,611,672 388,349 Other receivables 2,300,839 119,964 14,333,163$ 2,406,046$

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 18 C. ACCOUNTS RECEIVABLE AND ADVANCES (Continued) The Company periodically evaluates the carrying value of accounts receivable and advance balances with delinquent balances written‐off based on specific credit evaluations and circumstances of the debtor. No allowance for doubtful accounts has been established at December 31, 2021 and 2020, as management has determined that all amounts are fully collectible. D. LOAN COMMITMENTS The Company enters into LCs to originate and purchase HECM mortgage loans held for sale and LHFI, at stated interest rate margins and within a specified period of time (generally between 30 and 180 days), with borrowers who have applied for a loan and have met certain credit and underwriting criteria. The LCs are adjusted for estimated costs to originate or purchase the loan, as well as, the probability that the mortgage loan will fund within the terms of the LC (the pullthrough rate). Estimated costs to originate include the acquisition price of the mortgage loans purchased through its correspondent channel, account executive and loan officer commissions and related employer payroll taxes, and lender credits. The pullthrough rate is based on estimated changes in market conditions, loan stage, and actual borrower behavior using a historical analysis of actual funding rates. The Company analyzes the pullthrough on a quarterly basis to ensure the pullthrough estimate is reasonable. The key unobservable inputs used in determining the fair value of LCs are as follows for the years ended December 31: The following summarizes LCs at December 31: The notional amounts of mortgage loans held for sale and LHFI not committed to investors amounted to approximately $196,635,000 and $106,000,000 at December 31, 2021 and 2020 respectively. 2021 2020 2019 Average pullthrough rate 80.81% 86.35% 77.08% Average costs to originate 3.99% 7.06% 5.86% Fair Notional Fair Notional Value Amount Value Amount LCs 8,394,907$ 259,368,000$ (b) 4,778,352$ 86,551,000$ (b) Futures contracts (16,563) 1,309,000$ ‐ ‐$ Total 8,378,344$ 4,778,352$ (b) Pullthrough rate adjusted 2021 2020

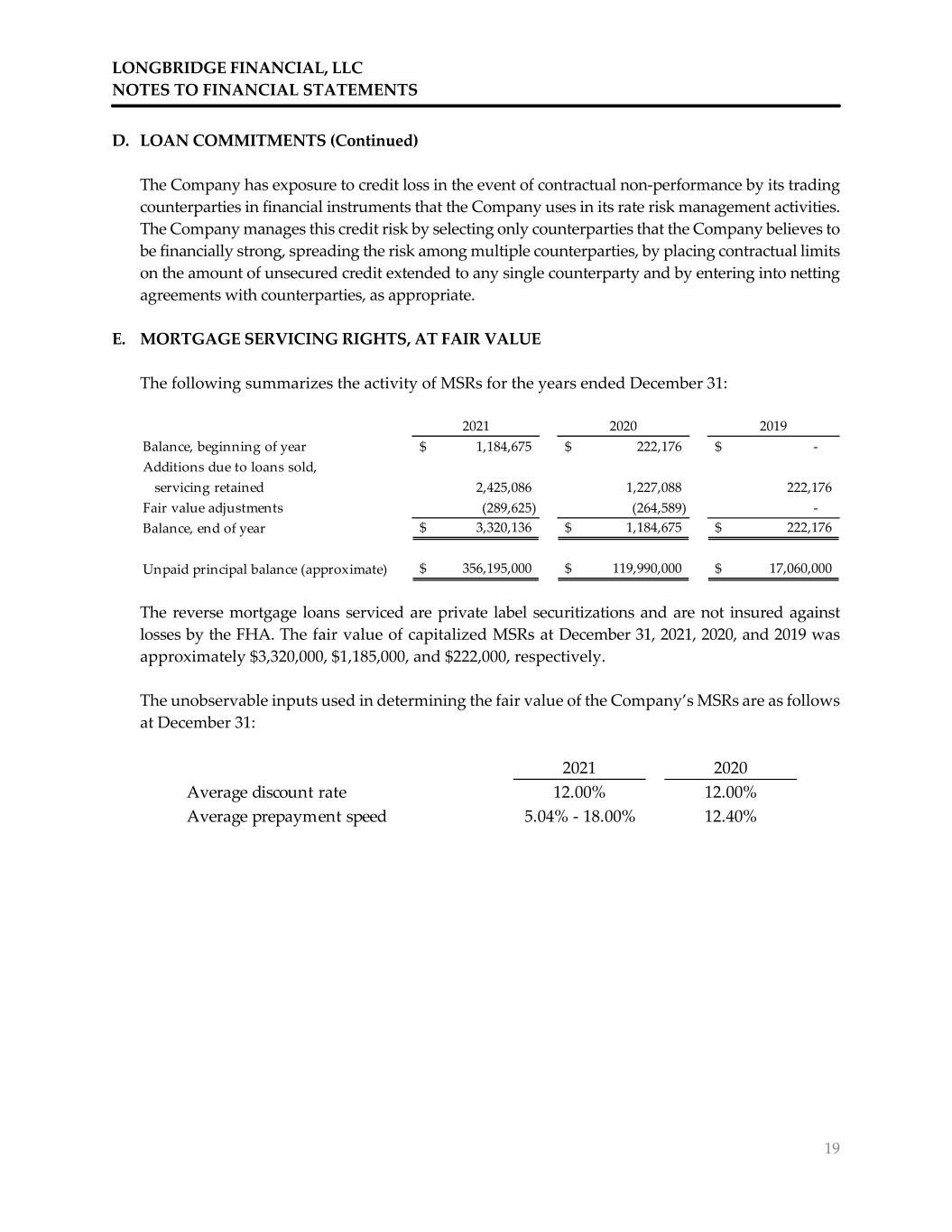

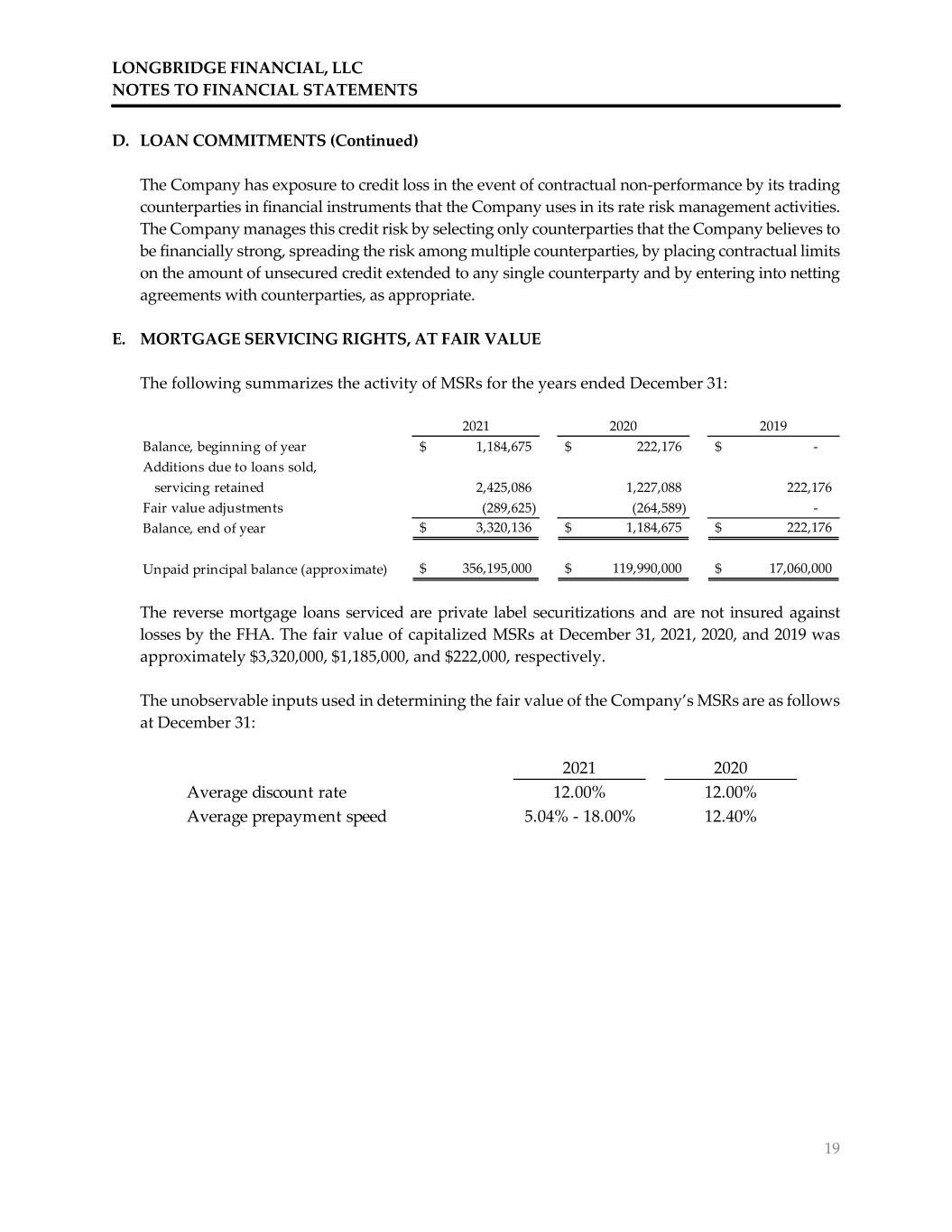

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 19 D. LOAN COMMITMENTS (Continued) The Company has exposure to credit loss in the event of contractual non‐performance by its trading counterparties in financial instruments that the Company uses in its rate risk management activities. The Company manages this credit risk by selecting only counterparties that the Company believes to be financially strong, spreading the risk among multiple counterparties, by placing contractual limits on the amount of unsecured credit extended to any single counterparty and by entering into netting agreements with counterparties, as appropriate. E. MORTGAGE SERVICING RIGHTS, AT FAIR VALUE The following summarizes the activity of MSRs for the years ended December 31: The reverse mortgage loans serviced are private label securitizations and are not insured against losses by the FHA. The fair value of capitalized MSRs at December 31, 2021, 2020, and 2019 was approximately $3,320,000, $1,185,000, and $222,000, respectively. The unobservable inputs used in determining the fair value of the Company’s MSRs are as follows at December 31: 2021 2020 2019 Balance, beginning of year 1,184,675$ 222,176$ ‐$ Additions due to loans sold, servicing retained 2,425,086 1,227,088 222,176 Fair value adjustments (289,625) (264,589) ‐ Balance, end of year 3,320,136$ 1,184,675$ 222,176$ Unpaid principal balance (approximate) 356,195,000$ 119,990,000$ 17,060,000$ 2021 2020 Average discount rate 12.00% 12.00% Average prepayment speed 5.04% ‐ 18.00% 12.40%

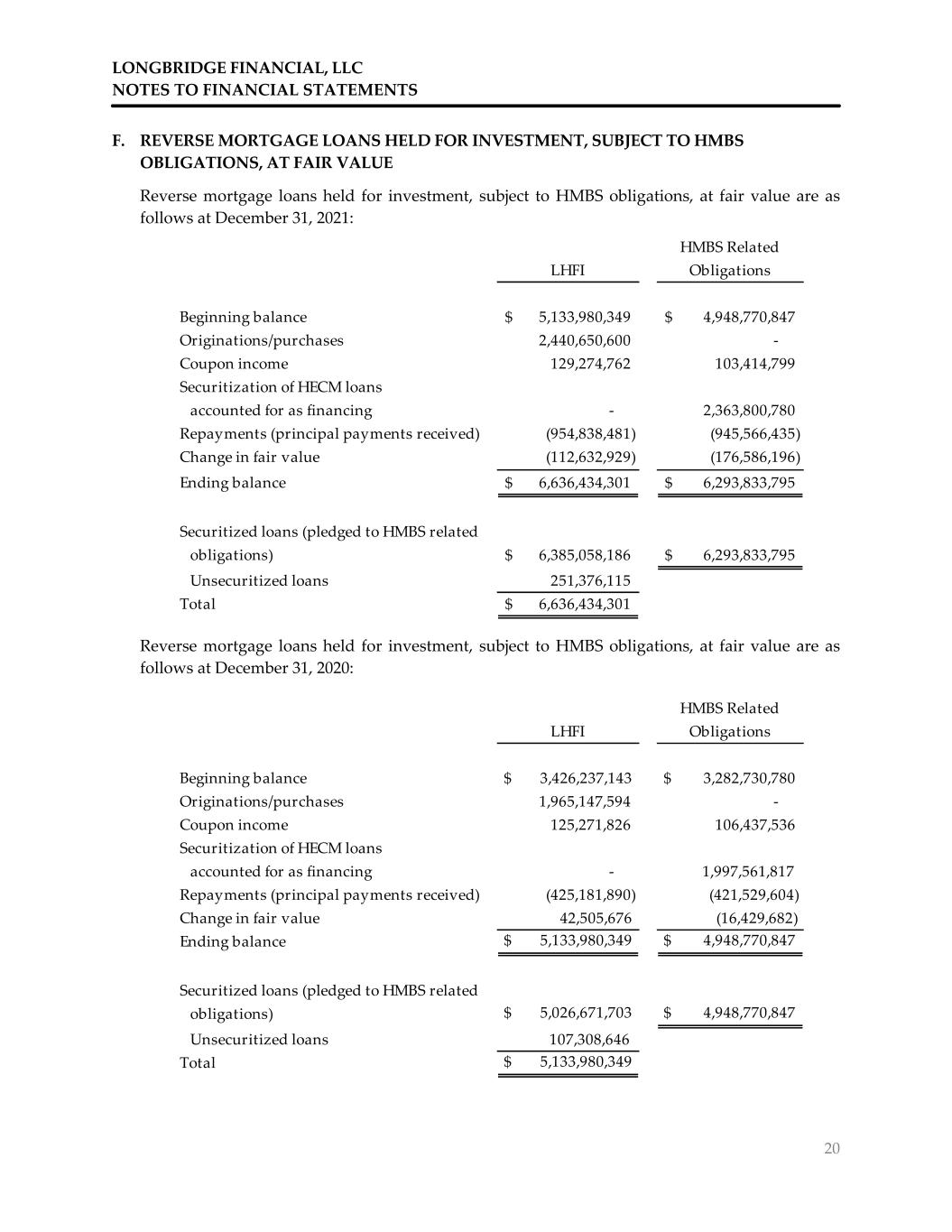

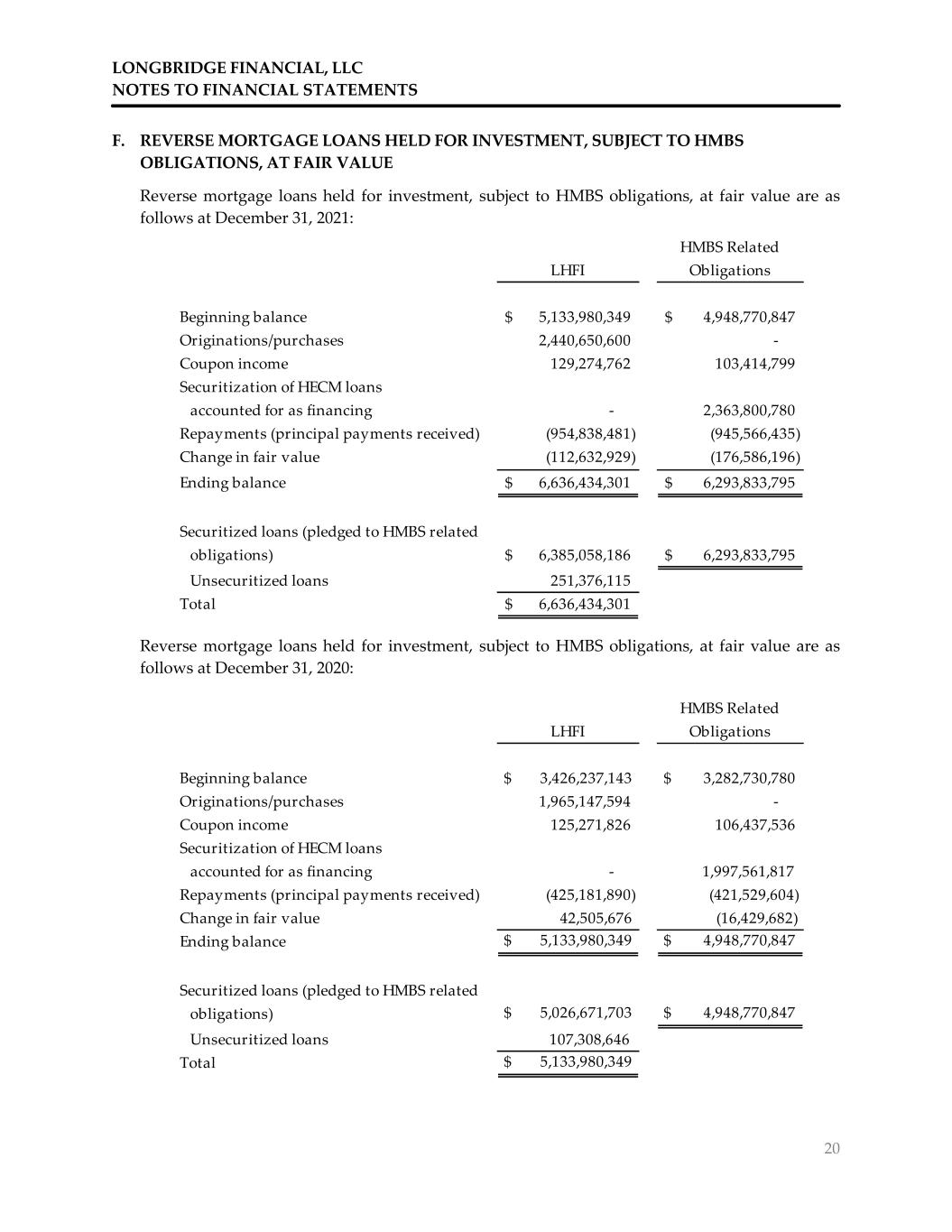

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 20 F. REVERSE MORTGAGE LOANS HELD FOR INVESTMENT, SUBJECT TO HMBS OBLIGATIONS, AT FAIR VALUE Reverse mortgage loans held for investment, subject to HMBS obligations, at fair value are as follows at December 31, 2021: Reverse mortgage loans held for investment, subject to HMBS obligations, at fair value are as follows at December 31, 2020: LHFI HMBS Related Obligations Beginning balance 5,133,980,349$ 4,948,770,847$ Originations/purchases 2,440,650,600 ‐ Coupon income 129,274,762 103,414,799 Securitization of HECM loans accounted for as financing ‐ 2,363,800,780 Repayments (principal payments received) (954,838,481) (945,566,435) Change in fair value (112,632,929) (176,586,196) Ending balance 6,636,434,301$ 6,293,833,795$ Securitized loans (pledged to HMBS related obligations) 6,385,058,186$ 6,293,833,795$ Unsecuritized loans 251,376,115 Total 6,636,434,301$ LHFI HMBS Related Obligations Beginning balance $ 3,426,237,143 $ 3,282,730,780 Originations/purchases 1,965,147,594 ‐ Coupon income 125,271,826 106,437,536 Securitization of HECM loans accounted for as financing ‐ 1,997,561,817 Repayments (principal payments received) (425,181,890) (421,529,604) Change in fair value 42,505,676 (16,429,682) Ending balance $ 5,133,980,349 $ 4,948,770,847 Securitized loans (pledged to HMBS related obligations) $ 5,026,671,703 $ 4,948,770,847 Unsecuritized loans 107,308,646 Total $ 5,133,980,349

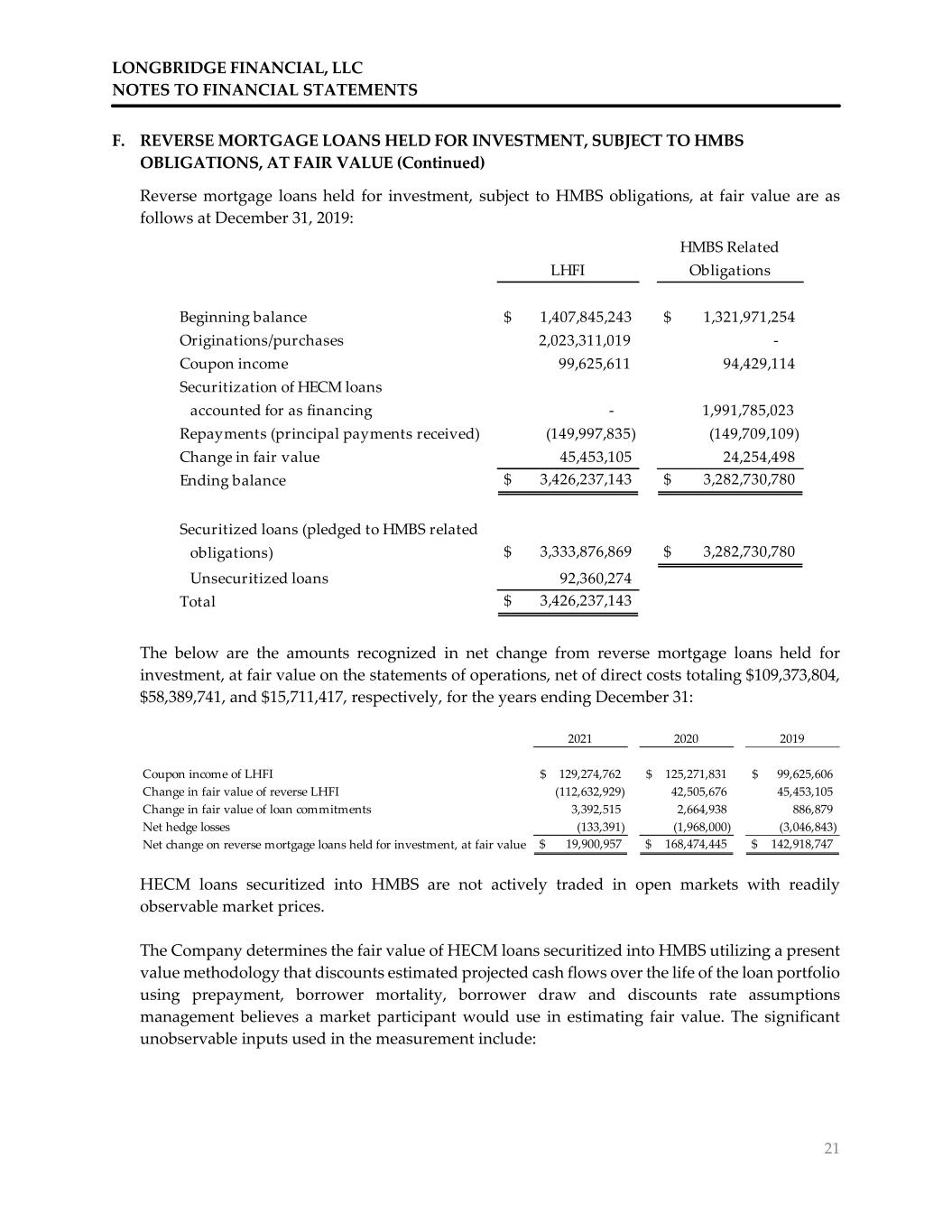

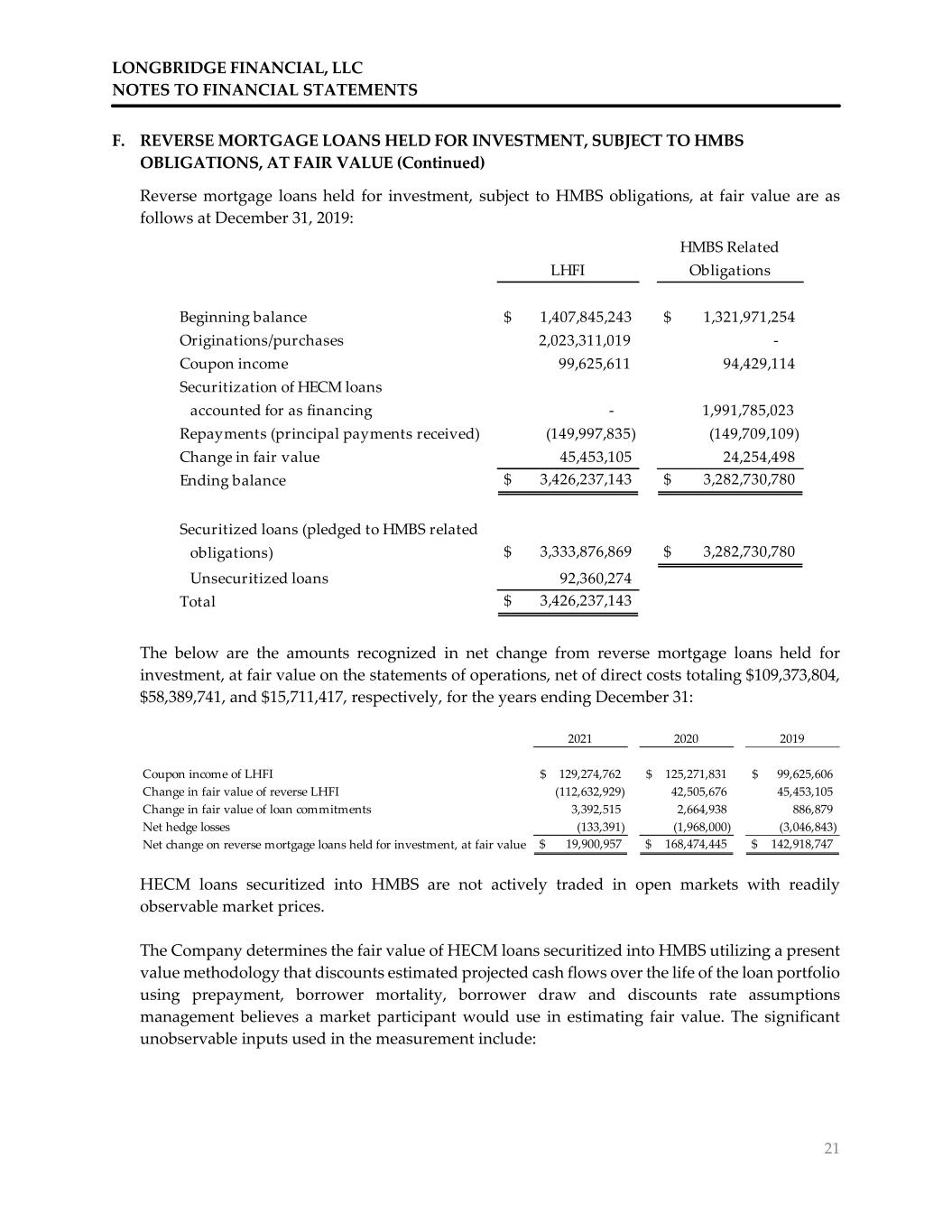

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 21 F. REVERSE MORTGAGE LOANS HELD FOR INVESTMENT, SUBJECT TO HMBS OBLIGATIONS, AT FAIR VALUE (Continued) Reverse mortgage loans held for investment, subject to HMBS obligations, at fair value are as follows at December 31, 2019: The below are the amounts recognized in net change from reverse mortgage loans held for investment, at fair value on the statements of operations, net of direct costs totaling $109,373,804, $58,389,741, and $15,711,417, respectively, for the years ending December 31: HECM loans securitized into HMBS are not actively traded in open markets with readily observable market prices. The Company determines the fair value of HECM loans securitized into HMBS utilizing a present value methodology that discounts estimated projected cash flows over the life of the loan portfolio using prepayment, borrower mortality, borrower draw and discounts rate assumptions management believes a market participant would use in estimating fair value. The significant unobservable inputs used in the measurement include: LHFI HMBS Related Obligations Beginning balance $ 1,407,845,243 $ 1,321,971,254 Originations/purchases 2,023,311,019 ‐ Coupon income 99,625,611 94,429,114 Securitization of HECM loans accounted for as financing ‐ 1,991,785,023 Repayments (principal payments received) (149,997,835) (149,709,109) Change in fair value 45,453,105 24,254,498 Ending balance $ 3,426,237,143 $ 3,282,730,780 Securitized loans (pledged to HMBS related obligations) $ 3,333,876,869 $ 3,282,730,780 Unsecuritized loans 92,360,274 Total $ 3,426,237,143 2021 2020 2019 Coupon income of LHFI 129,274,762$ 125,271,831$ 99,625,606$ Change in fair value of reverse LHFI (112,632,929) 42,505,676 45,453,105 Change in fair value of loan commitments 3,392,515 2,664,938 886,879 Net hedge losses (133,391) (1,968,000) (3,046,843) Net change on reverse mortgage loans held for investment, at fair value $ 19,900,957 $ 168,474,445 $ 142,918,747

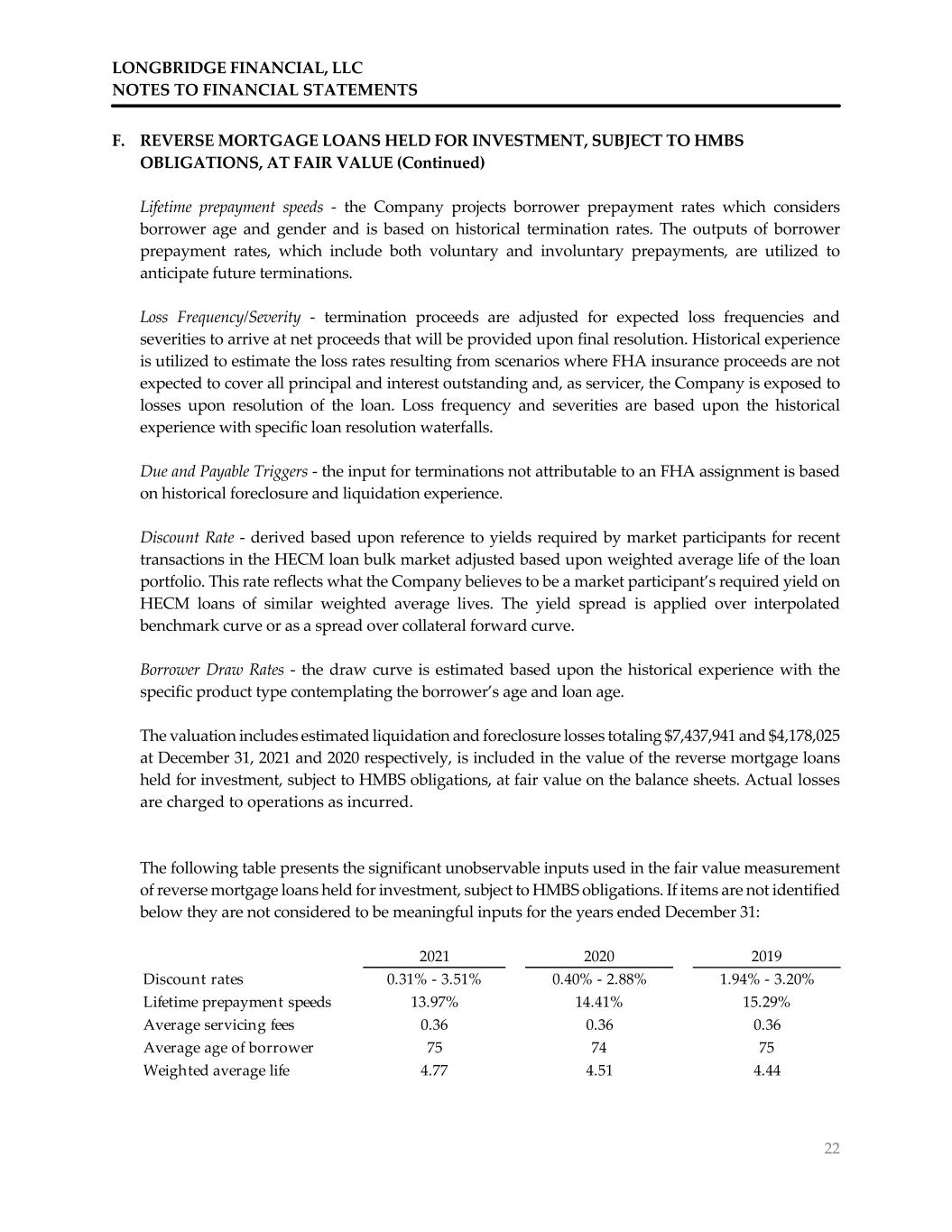

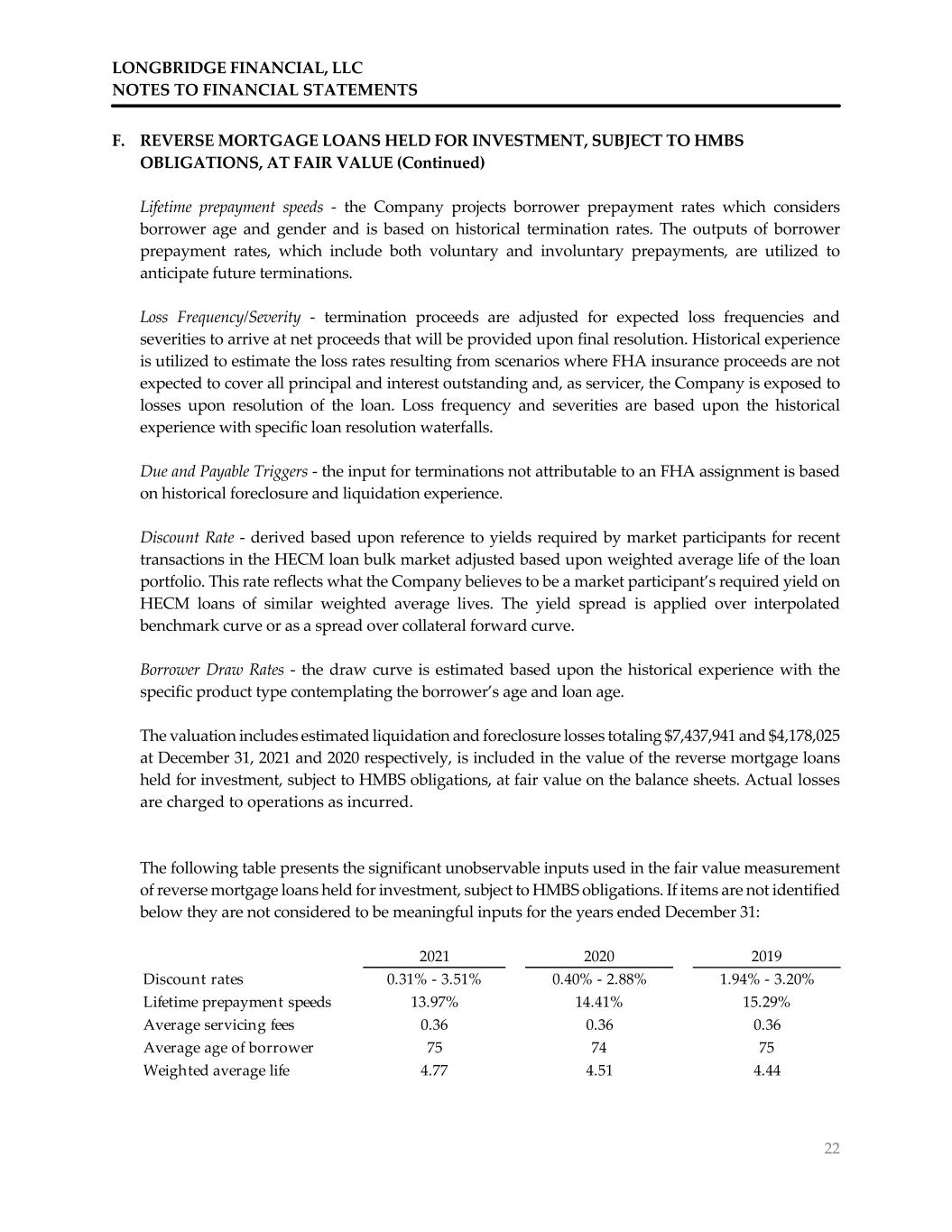

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 22 F. REVERSE MORTGAGE LOANS HELD FOR INVESTMENT, SUBJECT TO HMBS OBLIGATIONS, AT FAIR VALUE (Continued) Lifetime prepayment speeds ‐ the Company projects borrower prepayment rates which considers borrower age and gender and is based on historical termination rates. The outputs of borrower prepayment rates, which include both voluntary and involuntary prepayments, are utilized to anticipate future terminations. Loss Frequency/Severity ‐ termination proceeds are adjusted for expected loss frequencies and severities to arrive at net proceeds that will be provided upon final resolution. Historical experience is utilized to estimate the loss rates resulting from scenarios where FHA insurance proceeds are not expected to cover all principal and interest outstanding and, as servicer, the Company is exposed to losses upon resolution of the loan. Loss frequency and severities are based upon the historical experience with specific loan resolution waterfalls. Due and Payable Triggers ‐ the input for terminations not attributable to an FHA assignment is based on historical foreclosure and liquidation experience. Discount Rate ‐ derived based upon reference to yields required by market participants for recent transactions in the HECM loan bulk market adjusted based upon weighted average life of the loan portfolio. This rate reflects what the Company believes to be a market participant’s required yield on HECM loans of similar weighted average lives. The yield spread is applied over interpolated benchmark curve or as a spread over collateral forward curve. Borrower Draw Rates ‐ the draw curve is estimated based upon the historical experience with the specific product type contemplating the borrower’s age and loan age. The valuation includes estimated liquidation and foreclosure losses totaling $7,437,941 and $4,178,025 at December 31, 2021 and 2020 respectively, is included in the value of the reverse mortgage loans held for investment, subject to HMBS obligations, at fair value on the balance sheets. Actual losses are charged to operations as incurred. The following table presents the significant unobservable inputs used in the fair value measurement of reverse mortgage loans held for investment, subject to HMBS obligations. If items are not identified below they are not considered to be meaningful inputs for the years ended December 31: 2021 2020 2019 Discount rates 0.31% ‐ 3.51% 0.40% ‐ 2.88% 1.94% ‐ 3.20% Lifetime prepayment speeds 13.97% 14.41% 15.29% Average servicing fees 0.36 0.36 0.36 Average age of borrower 75 74 75 Weighted average life 4.77 4.51 4.44

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 23 F. REVERSE MORTGAGE LOANS HELD FOR INVESTMENT, SUBJECT TO HMBS OBLIGATIONS, AT FAIR VALUE (Continued) Significant increases or decreases in any of these assumptions in isolation could result in a significantly lower or higher fair value. The effects of changes in the assumptions used to value the LHFI, excluding future draw commitments, are partially offset by the effects of changes in the assumptions used to value the HMBS related obligations, at fair value that are associated with these loans. G. HMBS RELATED OBLIGATIONS, AT FAIR VALUE The Company determines the valuation of the HMBS obligation using Level 3 unobservable market inputs. The estimated fair value is based on the net present value of projected cash flows over the estimated life of the liability. The estimated fair value of the HMBS obligations also includes the consideration required by a market participant to transfer the HECM and HMBS servicing obligations including exposure resulting from shortfalls in FHA insurance proceeds. The Company’s valuation considers assumptions that it believes a market participant would consider in valuing the liability, including, but not limited to, assumptions for repayment, costs to transfer servicing obligations, shortfalls in FHA insurance proceeds, and discount rates. The significant unobservable inputs used in the measurement include: Lifetime prepayment speeds ‐ the conditional repayment rate curve that considers borrower age and gender is based on historical termination rates. Discount Rates ‐ derived based on an assessment of current market yields and spreads that a market participant would consider for entering into an obligation to pass FHA insured cash flows through to holders of the HMBS beneficial interests. Yield spread applied over interpolated benchmark curve or as a spread over collateral forward curve. Monthly cash flows generated from the HECM loans are used to service the outstanding HMBS. HMBS related obligations, at fair value, consist of the following at December 31: 2021 2020 GNMA loan pools ‐ UPB $ 5,981,824,547 $ 4,641,441,977 Fair value adjustment 312,009,248 307,328,870 Total HMBS related obligations, at fair value $ 6,293,833,795 $ 4,948,770,847 Weighted average life 4.77 4.51 Weighted average interest rate 2.16% 2.53% Lifetime prepayment speeds 13.97% 14.41% Discount rates 0.11% ‐ 3.37% 0.17% ‐ 2.70%

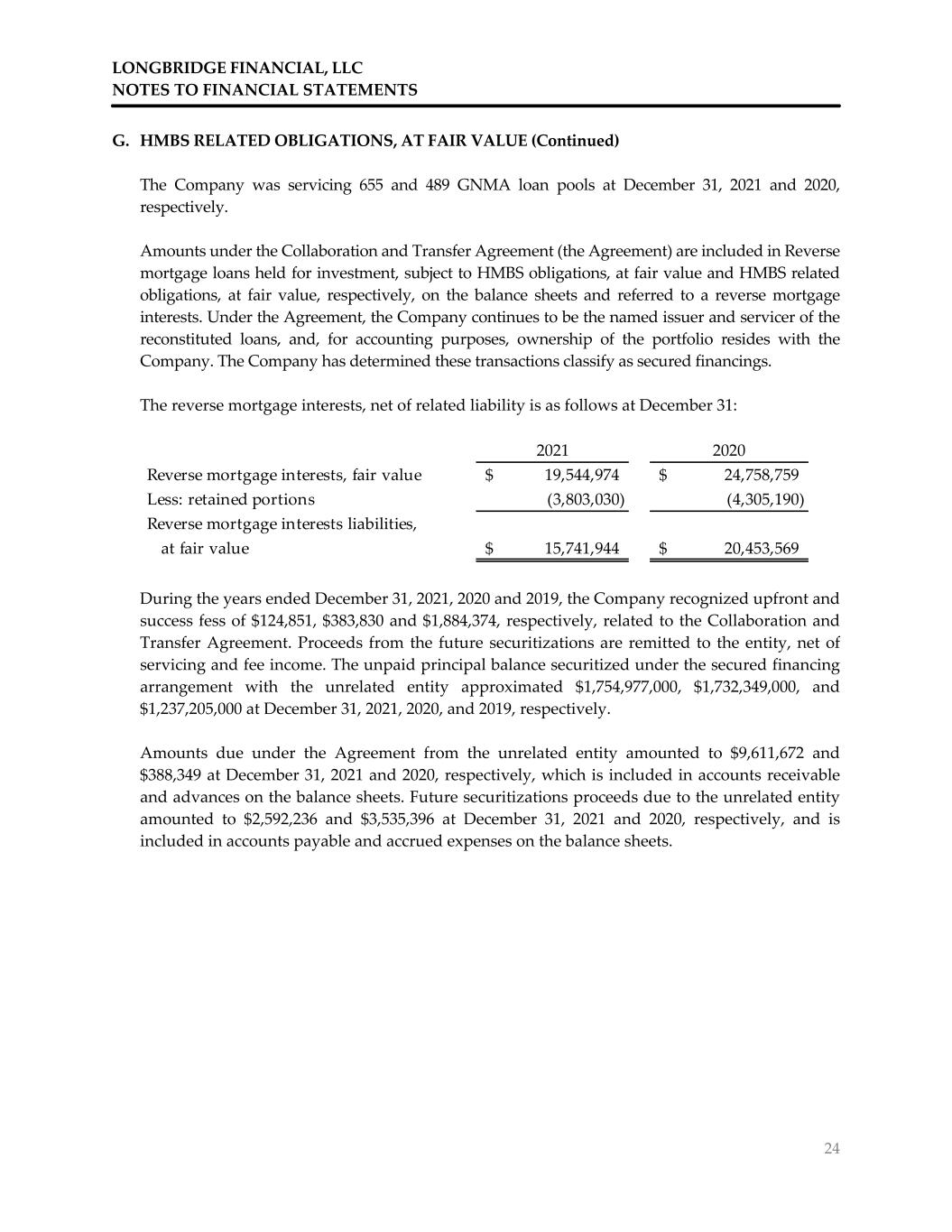

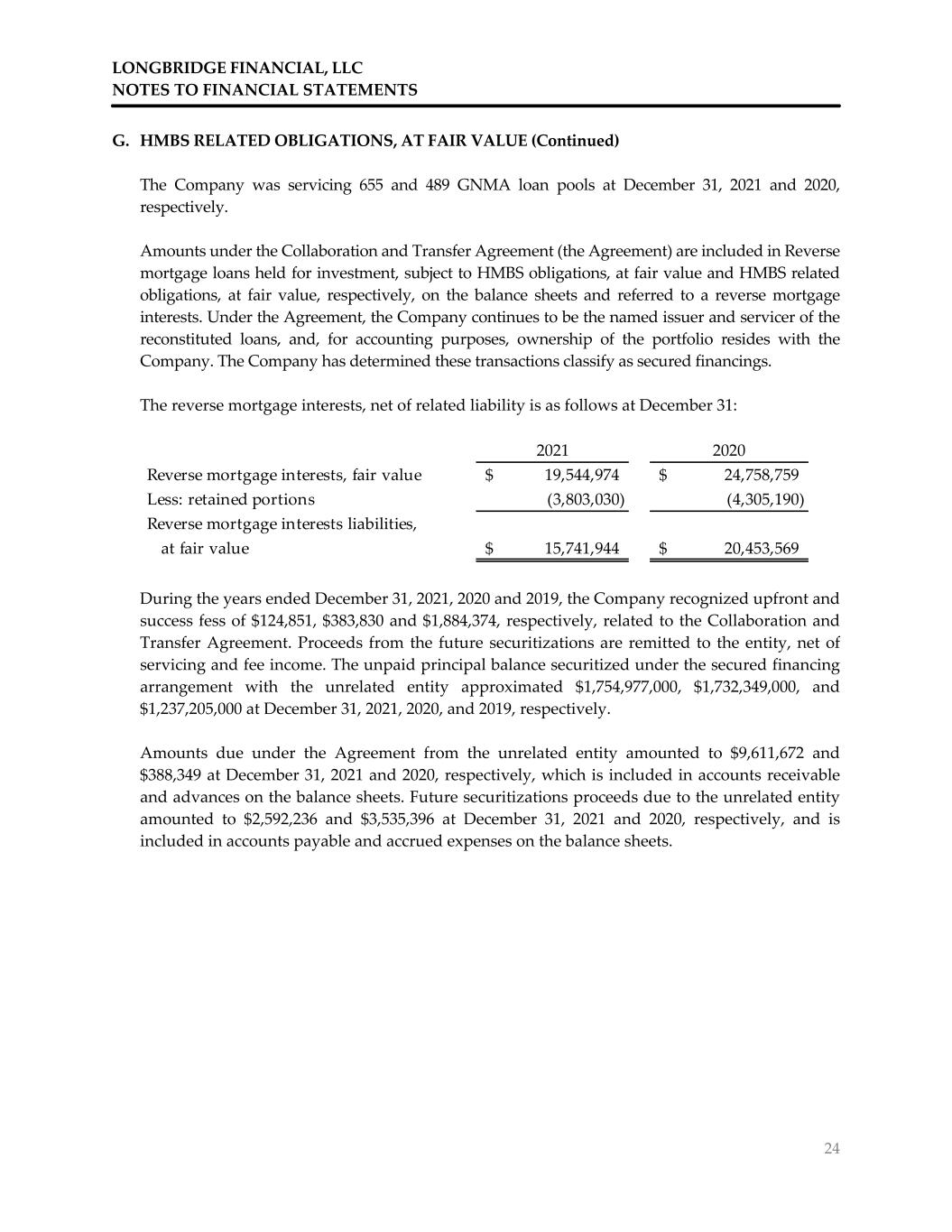

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 24 G. HMBS RELATED OBLIGATIONS, AT FAIR VALUE (Continued) The Company was servicing 655 and 489 GNMA loan pools at December 31, 2021 and 2020, respectively. Amounts under the Collaboration and Transfer Agreement (the Agreement) are included in Reverse mortgage loans held for investment, subject to HMBS obligations, at fair value and HMBS related obligations, at fair value, respectively, on the balance sheets and referred to a reverse mortgage interests. Under the Agreement, the Company continues to be the named issuer and servicer of the reconstituted loans, and, for accounting purposes, ownership of the portfolio resides with the Company. The Company has determined these transactions classify as secured financings. The reverse mortgage interests, net of related liability is as follows at December 31: During the years ended December 31, 2021, 2020 and 2019, the Company recognized upfront and success fess of $124,851, $383,830 and $1,884,374, respectively, related to the Collaboration and Transfer Agreement. Proceeds from the future securitizations are remitted to the entity, net of servicing and fee income. The unpaid principal balance securitized under the secured financing arrangement with the unrelated entity approximated $1,754,977,000, $1,732,349,000, and $1,237,205,000 at December 31, 2021, 2020, and 2019, respectively. Amounts due under the Agreement from the unrelated entity amounted to $9,611,672 and $388,349 at December 31, 2021 and 2020, respectively, which is included in accounts receivable and advances on the balance sheets. Future securitizations proceeds due to the unrelated entity amounted to $2,592,236 and $3,535,396 at December 31, 2021 and 2020, respectively, and is included in accounts payable and accrued expenses on the balance sheets. 2021 2020 Reverse mortgage interests, fair value 19,544,974$ 24,758,759$ Less: retained portions (3,803,030) (4,305,190) Reverse mortgage interests liabilities, at fair value 15,741,944$ 20,453,569$

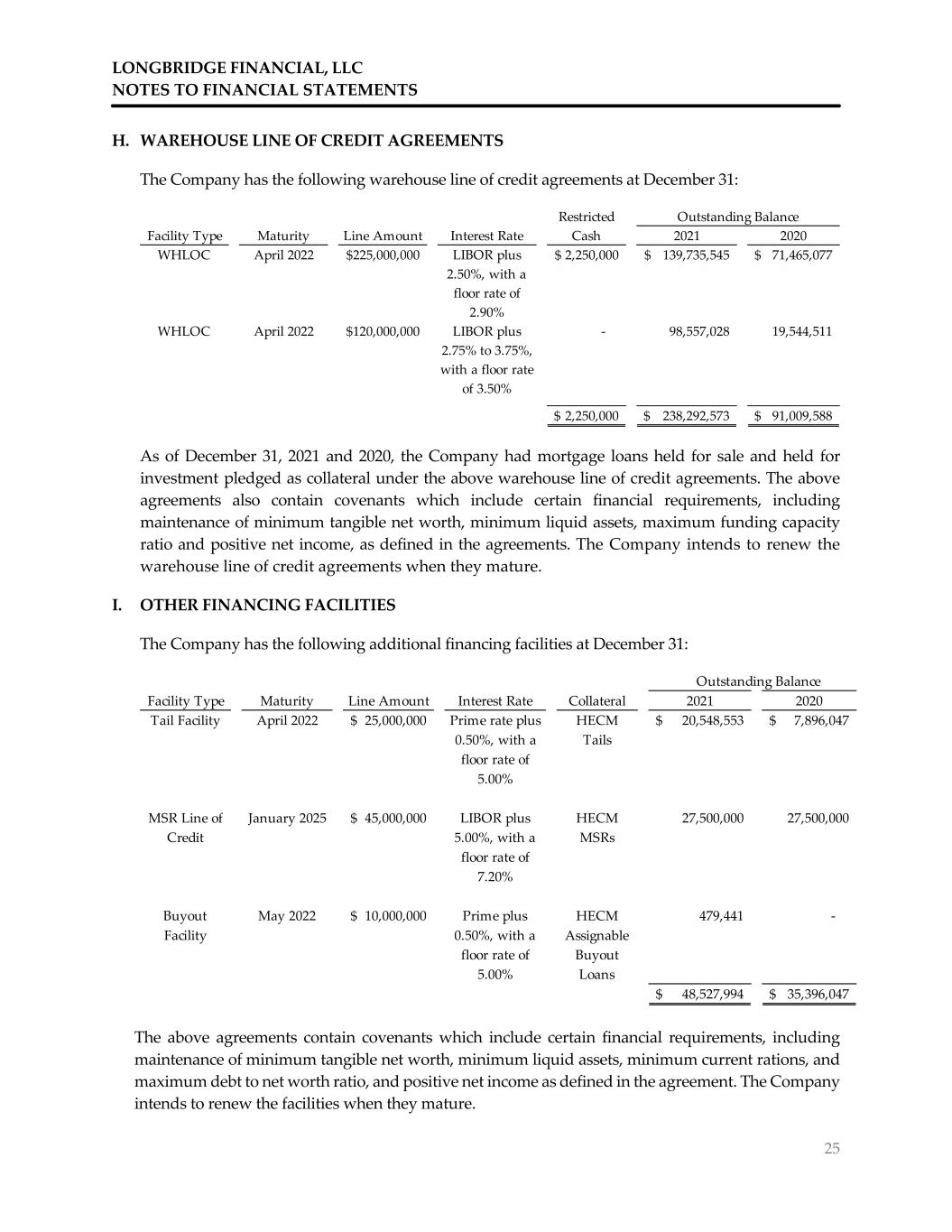

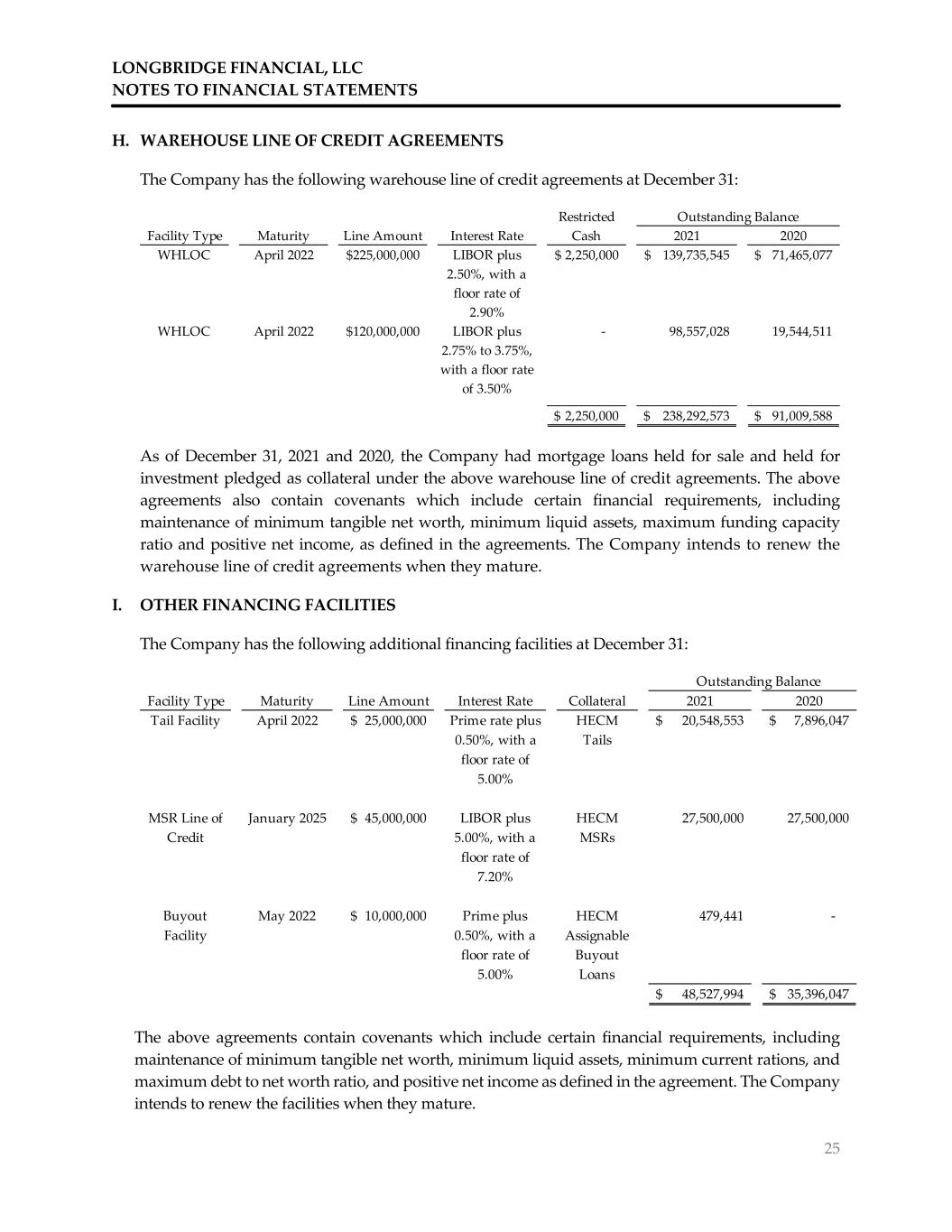

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 25 H. WAREHOUSE LINE OF CREDIT AGREEMENTS The Company has the following warehouse line of credit agreements at December 31: As of December 31, 2021 and 2020, the Company had mortgage loans held for sale and held for investment pledged as collateral under the above warehouse line of credit agreements. The above agreements also contain covenants which include certain financial requirements, including maintenance of minimum tangible net worth, minimum liquid assets, maximum funding capacity ratio and positive net income, as defined in the agreements. The Company intends to renew the warehouse line of credit agreements when they mature. I. OTHER FINANCING FACILITIES The Company has the following additional financing facilities at December 31: The above agreements contain covenants which include certain financial requirements, including maintenance of minimum tangible net worth, minimum liquid assets, minimum current rations, and maximum debt to net worth ratio, and positive net income as defined in the agreement. The Company intends to renew the facilities when they mature. Restricted Facility Type Maturity Line Amount Interest Rate Cash 2021 2020 WHLOC April 2022 225,000,000$ LIBOR plus 2.50%, with a floor rate of 2.90% 2,250,000$ 139,735,545$ 71,465,077$ WHLOC April 2022 120,000,000$ LIBOR plus 2.75% to 3.75%, with a floor rate of 3.50% ‐ 98,557,028 19,544,511 2,250,000$ 238,292,573$ 91,009,588$ Outstanding Balance Facility Type Maturity Line Amount Interest Rate Collateral 2021 2020 Tail Facility April 2022 25,000,000$ Prime rate plus 0.50%, with a floor rate of 5.00% HECM Tails 20,548,553$ 7,896,047$ MSR Line of Credit January 2025 45,000,000$ LIBOR plus 5.00%, with a floor rate of 7.20% HECM MSRs 27,500,000 27,500,000 Buyout Facility May 2022 10,000,000$ Prime plus 0.50%, with a floor rate of 5.00% HECM Assignable Buyout Loans 479,441 ‐ 48,527,994$ 35,396,047$ Outstanding Balance

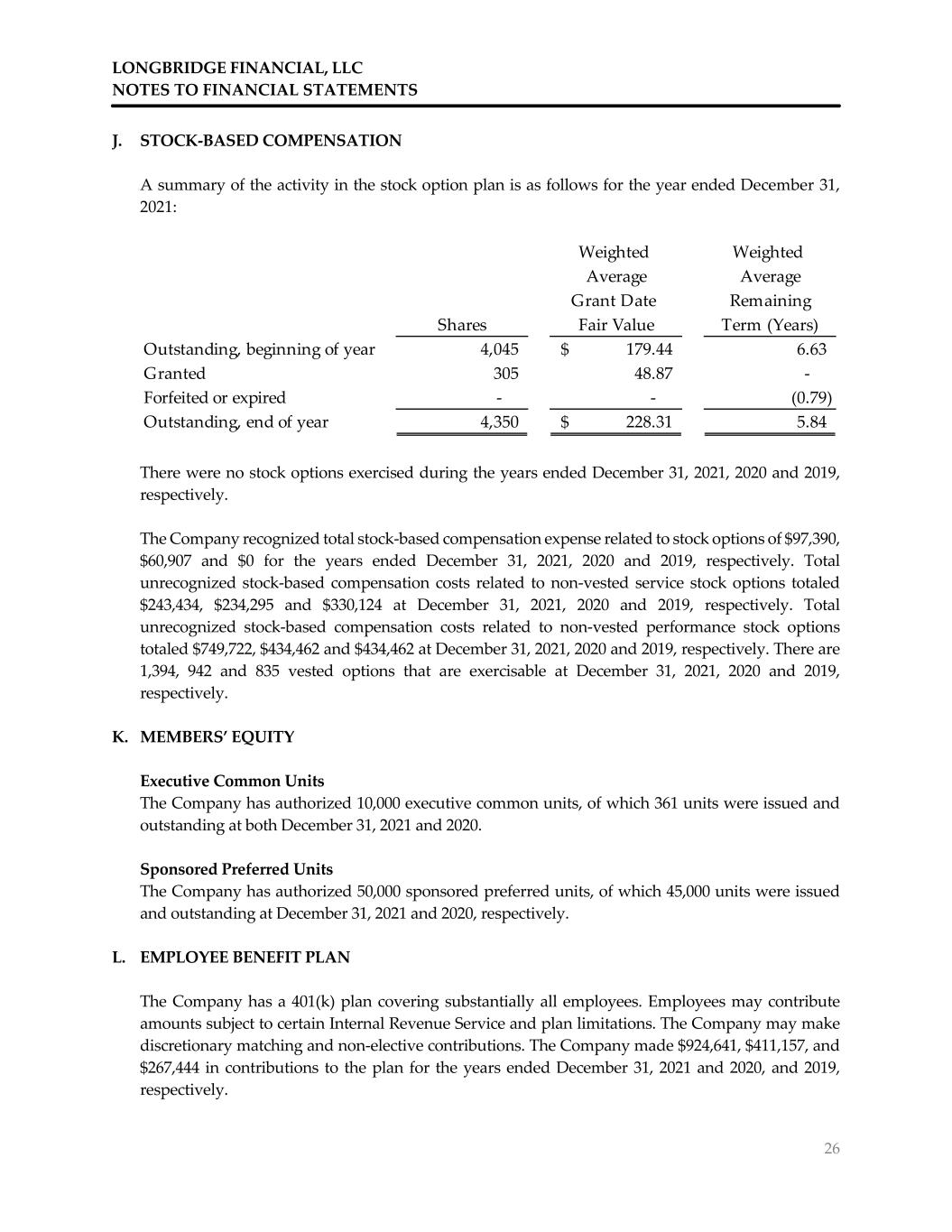

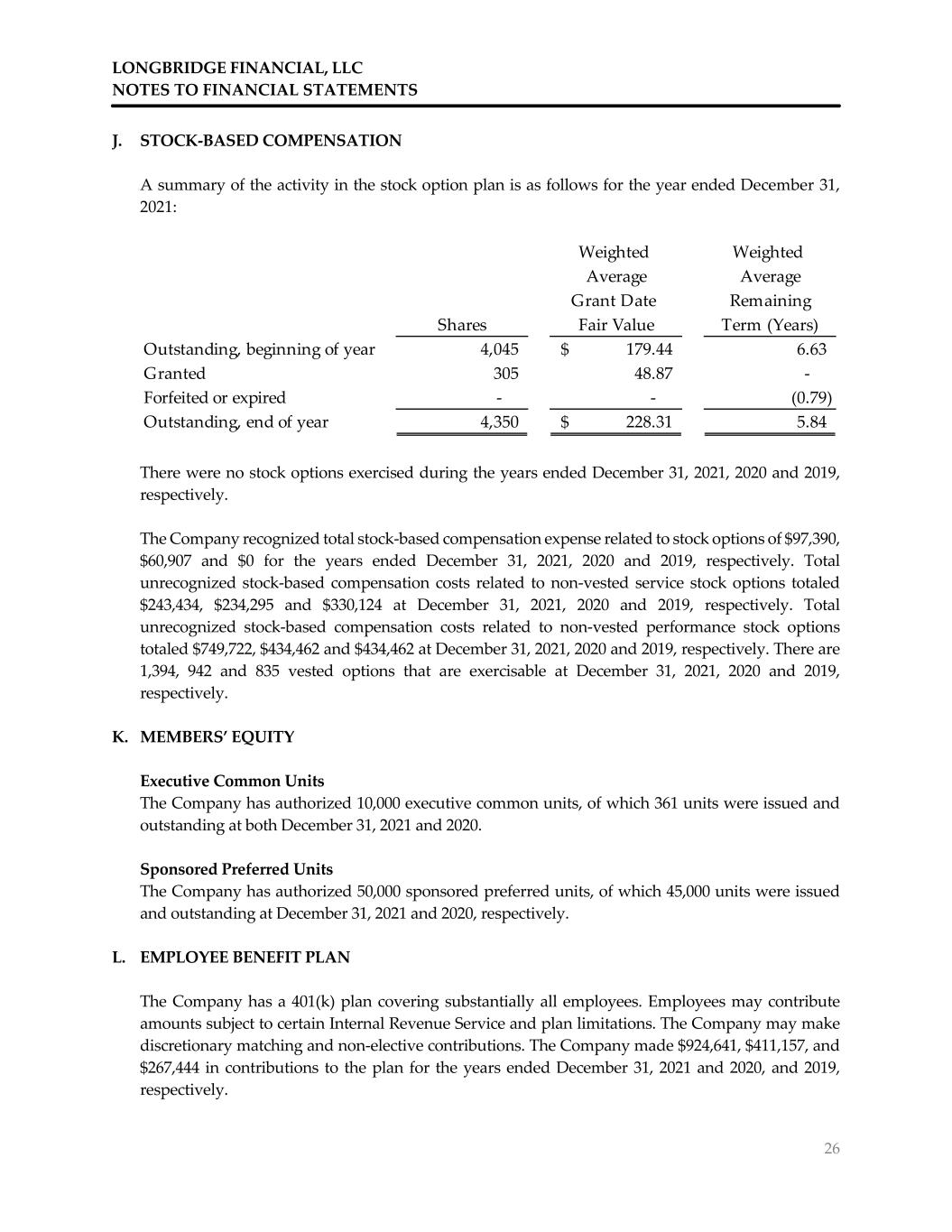

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 26 J. STOCK‐BASED COMPENSATION A summary of the activity in the stock option plan is as follows for the year ended December 31, 2021: There were no stock options exercised during the years ended December 31, 2021, 2020 and 2019, respectively. The Company recognized total stock‐based compensation expense related to stock options of $97,390, $60,907 and $0 for the years ended December 31, 2021, 2020 and 2019, respectively. Total unrecognized stock‐based compensation costs related to non‐vested service stock options totaled $243,434, $234,295 and $330,124 at December 31, 2021, 2020 and 2019, respectively. Total unrecognized stock‐based compensation costs related to non‐vested performance stock options totaled $749,722, $434,462 and $434,462 at December 31, 2021, 2020 and 2019, respectively. There are 1,394, 942 and 835 vested options that are exercisable at December 31, 2021, 2020 and 2019, respectively. K. MEMBERS’ EQUITY Executive Common Units The Company has authorized 10,000 executive common units, of which 361 units were issued and outstanding at both December 31, 2021 and 2020. Sponsored Preferred Units The Company has authorized 50,000 sponsored preferred units, of which 45,000 units were issued and outstanding at December 31, 2021 and 2020, respectively. L. EMPLOYEE BENEFIT PLAN The Company has a 401(k) plan covering substantially all employees. Employees may contribute amounts subject to certain Internal Revenue Service and plan limitations. The Company may make discretionary matching and non‐elective contributions. The Company made $924,641, $411,157, and $267,444 in contributions to the plan for the years ended December 31, 2021 and 2020, and 2019, respectively. Weighted Weighted Average Average Grant Date Remaining Shares Fair Value Term (Years) Outstanding, beginning of year 4,045 179.44$ 6.63 Granted 305 48.87 ‐ Forfeited or expired ‐ ‐ (0.79) Outstanding, end of year 4,350 228.31$ 5.84

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 27 M. COMMITMENTS AND CONTINGENCIES Commitments to Extend Credit The Company enters into LCs with borrowers who have applied for residential mortgage loans and commitments to purchase loans with third party originators who have met certain credit and underwriting criteria. These commitments expose the Company to market risk if interest rates change and the underlying loan is not economically hedged or committed to an investor. The Company is also exposed to credit loss if the loan is originated and not sold to an investor and the mortgagor does not perform. The collateral upon extension of credit typically consists of a first deed of trust in the mortgagor’s residential property. Commitments to originate or purchase loans do not necessarily reflect future cash requirements as some commitments are expected to expire without being drawn upon. Total commitments to originate or purchase loans approximated $320,977,000 and $100,230,000 at December 31, 2021 and 2020, respectively. The Company is required to fund further borrower advances (where the borrower has not fully drawn down the HECM loan proceeds available to them), and fund payments of the borrower’s monthly insurance premium to FHA. The outstanding unfunded commitments available to borrowers related to HECM loans was approximately $1,282,000,000 and $1,076,000,000 as of December 31, 2021 and 2020, respectively. This additional borrowing capacity is primarily in the form of undrawn lines of credit. HMBS Issuer Obligations As an HMBS issuer, the Company assumes certain obligations related to each security issued. The most significant obligation is the requirement to purchase loans out of the HMBS securities if the outstanding principal balance of the related HECM is equal to or greater than 98% of the maximum claim amount (MCA repurchases). Active repurchased loans are assigned to HUD and payment is received from HUD, typically within 60 days of repurchase. HUD reimburses the Company for the outstanding principal balance on the loan up to the maximum claim amount. The Company bears the risk of exposure if the amount of the outstanding principal balance on a loan exceeds the maximum claim amount. Inactive repurchased loans (the borrower is deceased, no longer occupies the property or is delinquent on tax and insurance payments) are generally liquidated through foreclosure and subsequent sale of REO, with a claim filed with HUD for recoverable remaining principal and advance balances. The recovery timeline for inactive repurchased loans depends on various factors, including foreclosure status at the time of repurchase, state‐level foreclosure timelines, and the post‐foreclosure REO liquidation timeline. The timing and amount of the Company obligation with respect to MCA repurchases is uncertain as repurchase is dependent largely on circumstances outside of the Company’s control including the amount and timing of future draws and the status of the loan. MCA repurchases are expected to continue to increase due to the increased flow of HECMs and REO that are reaching 98% of their maximum claim amount. In addition to having to fund these repurchases, the Company also typically earns a lower interest rate and incurs certain non‐reimbursable costs during the process of liquidating nonperforming loans.

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 28 M. COMMITMENTS AND CONTINGENCIES (Continued) HMBS Issuer Obligations (Continued) During the years ended December 31, 2021, 2020 and 2019, the Company repurchased $81,321,195, $38,641,146 and $37,963,892, respectively, of GNMA HECM loans including loans subject to the MCA requirement from GNMA HMBS pools of which $80,226,543, $38,536,036 and $37,963,892, respectively, was subsequently transferred to a third party in accordance with a put option guaranty under the Collaboration and Transfer Agreement. Regulatory Contingencies The Company is subject to periodic audits and examinations, both formal and informal in nature, from various federal and state agencies, including those made as part of regulatory oversight of mortgage origination, servicing and financing activities. Such audits and examinations could result in additional actions, penalties or fines by state or federal governmental bodies, regulators or the courts. Regulatory Net Worth Requirements In accordance with the regulatory requirements of HUD, governing non‐supervised, direct endorsement mortgagees, the Company is required to maintain a minimum net worth. At December 31, 2021, the Company exceeded the regulatory net worth requirement. In accordance with the regulatory requirements of GNMA, governing issuers of GNMA securities, the Company is required to maintain a minimum net worth. At December 31, 2021, the Company exceeded the regulatory net worth requirement. Operating Leases The Company leases office space under various operating lease arrangements, which expire through May 2024. Total rent expense under all operating leases amounted to $339,928, $310,847 and $390,243 for the years ended December 31, 2021, 2020 and 2019, respectively, and are included in occupancy, equipment and communication on the statements of operations. Future minimum rental payments under long‐term operating leases are as follows at December 31, 2021: Year Ending December 31, Amounts 2022 229,651$ 2023 165,447 2024 27,694 422,792$

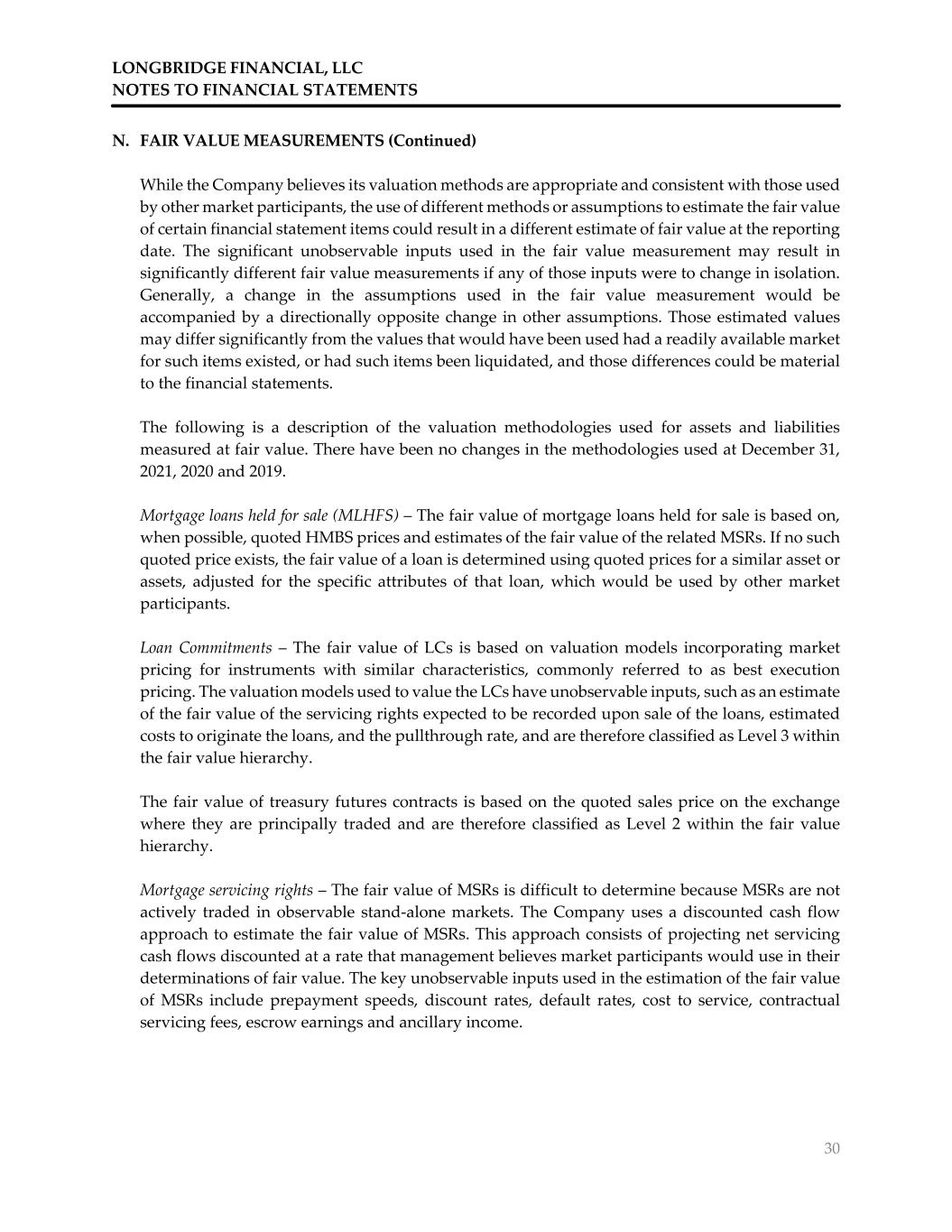

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 29 M. COMMITMENTS AND CONTINGENCIES (Continued) Legal The Company operates in a highly regulated industry and may be involved in various legal and regulatory proceedings, lawsuits and other claims arising in the ordinary course of its business. The amount, if any, of ultimate liability with respect to such matters cannot be determined, but despite the inherent uncertainties of litigation, management currently believes that the ultimate disposition of any such proceedings and exposure will not have, individually or taken together, a material adverse effect on the financial condition, results of operations, or cash flows of the Company. However, actual outcomes may differ from those expected and could have a material effect on the Company’s financial position, results of its operations or cash flows in a future period. The Company accrues for losses when they are probable to occur, and such losses are reasonably estimable. Legal costs are expensed as incurred and are included in general and administrative on the statements of operations. N. FAIR VALUE MEASUREMENTS FASB ASC 820, Fair Value Measurements and Disclosures, (ASC 820) defines fair value as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not assumptions specific to the entity. ASC 820 specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon the market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy: Level 1 Inputs – Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access. Level 2 Inputs – Inputs other than the quoted market prices in active markets that are observable either directly or indirectly. Level 3 Inputs – Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements. ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurements. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

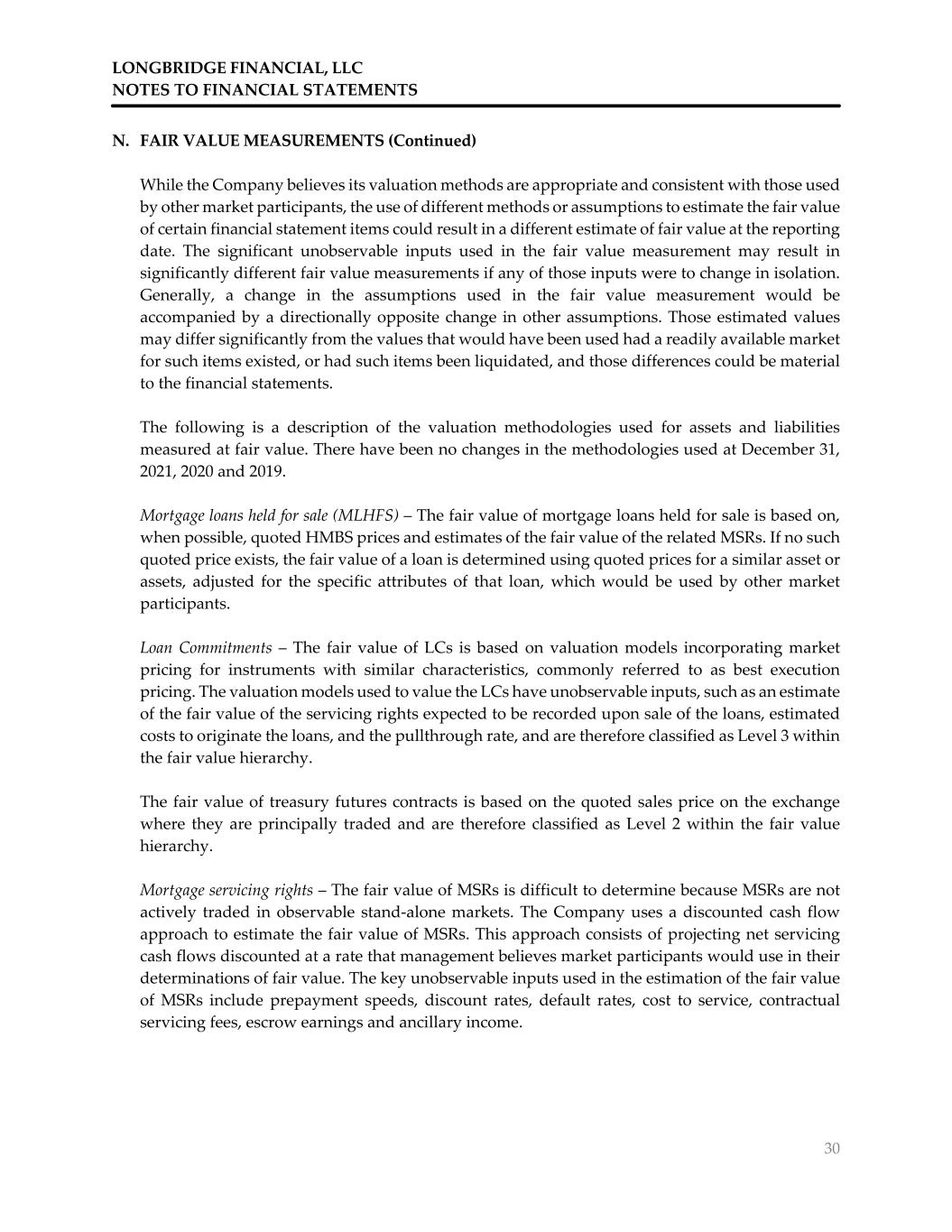

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 30 N. FAIR VALUE MEASUREMENTS (Continued) While the Company believes its valuation methods are appropriate and consistent with those used by other market participants, the use of different methods or assumptions to estimate the fair value of certain financial statement items could result in a different estimate of fair value at the reporting date. The significant unobservable inputs used in the fair value measurement may result in significantly different fair value measurements if any of those inputs were to change in isolation. Generally, a change in the assumptions used in the fair value measurement would be accompanied by a directionally opposite change in other assumptions. Those estimated values may differ significantly from the values that would have been used had a readily available market for such items existed, or had such items been liquidated, and those differences could be material to the financial statements. The following is a description of the valuation methodologies used for assets and liabilities measured at fair value. There have been no changes in the methodologies used at December 31, 2021, 2020 and 2019. Mortgage loans held for sale (MLHFS) – The fair value of mortgage loans held for sale is based on, when possible, quoted HMBS prices and estimates of the fair value of the related MSRs. If no such quoted price exists, the fair value of a loan is determined using quoted prices for a similar asset or assets, adjusted for the specific attributes of that loan, which would be used by other market participants. Loan Commitments – The fair value of LCs is based on valuation models incorporating market pricing for instruments with similar characteristics, commonly referred to as best execution pricing. The valuation models used to value the LCs have unobservable inputs, such as an estimate of the fair value of the servicing rights expected to be recorded upon sale of the loans, estimated costs to originate the loans, and the pullthrough rate, and are therefore classified as Level 3 within the fair value hierarchy. The fair value of treasury futures contracts is based on the quoted sales price on the exchange where they are principally traded and are therefore classified as Level 2 within the fair value hierarchy. Mortgage servicing rights – The fair value of MSRs is difficult to determine because MSRs are not actively traded in observable stand‐alone markets. The Company uses a discounted cash flow approach to estimate the fair value of MSRs. This approach consists of projecting net servicing cash flows discounted at a rate that management believes market participants would use in their determinations of fair value. The key unobservable inputs used in the estimation of the fair value of MSRs include prepayment speeds, discount rates, default rates, cost to service, contractual servicing fees, escrow earnings and ancillary income.

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 31 N. FAIR VALUE MEASUREMENTS (Continued) Mortgage Loans held for investment (LHFI) – The fair value of LHFI is based on the expected future cash flows discounted over the expected life of the loans at a rate commensurate with the risk of the estimated cash flows, including future draw commitments for HECM loans. Inputs of the discounted cash flows of these assets may include future draws and tail spread gains, voluntary prepayments, defaults, and discount rate. LHFI is classified as Level 3 within the fair value hierarchy. HMBS related obligations, at fair value – The fair value of HMBS related obligations, at fair value is based on a discounted cash flow approach, by discounting the projected recovery of principal and interest over the estimated life of the borrowing at a market rate commensurate with the risk of the estimated cash flows. HMBS related obligations, at fair value are classified as Level 3 within the fair value hierarchy. The Company engages valuation experts to support the valuation and provide observations and assumptions related to market activities. The Company evaluates the reasonableness of the fair value estimate and assumptions using historical experience, or cash flow back‐testing, adjusted for prevailing market conditions and benchmarks with valuations. Significant unobservable assumptions include voluntary prepayment speeds, defaults and discount rate. Assets and Liabilities Measured at Fair Value The following are the major categories of assets and liabilities measured at fair value on a recurring basis as of December 31, 2021: Description Level 1 Level 2 Level 3 Total MLHFS ‐$ 39,779,030$ ‐$ 39,779,030$ Loan commitments ‐ ‐ 8,394,907 8,394,907 Futures contract (16,563) ‐ (16,563) LHFI ‐ ‐ 6,636,434,301 6,636,434,301 MSRs ‐ ‐ 3,320,136 3,320,136 HMBS related obligations ‐ ‐ (6,293,833,795) (6,293,833,795) Total ‐$ 39,762,467$ 354,315,549$ 394,078,016$

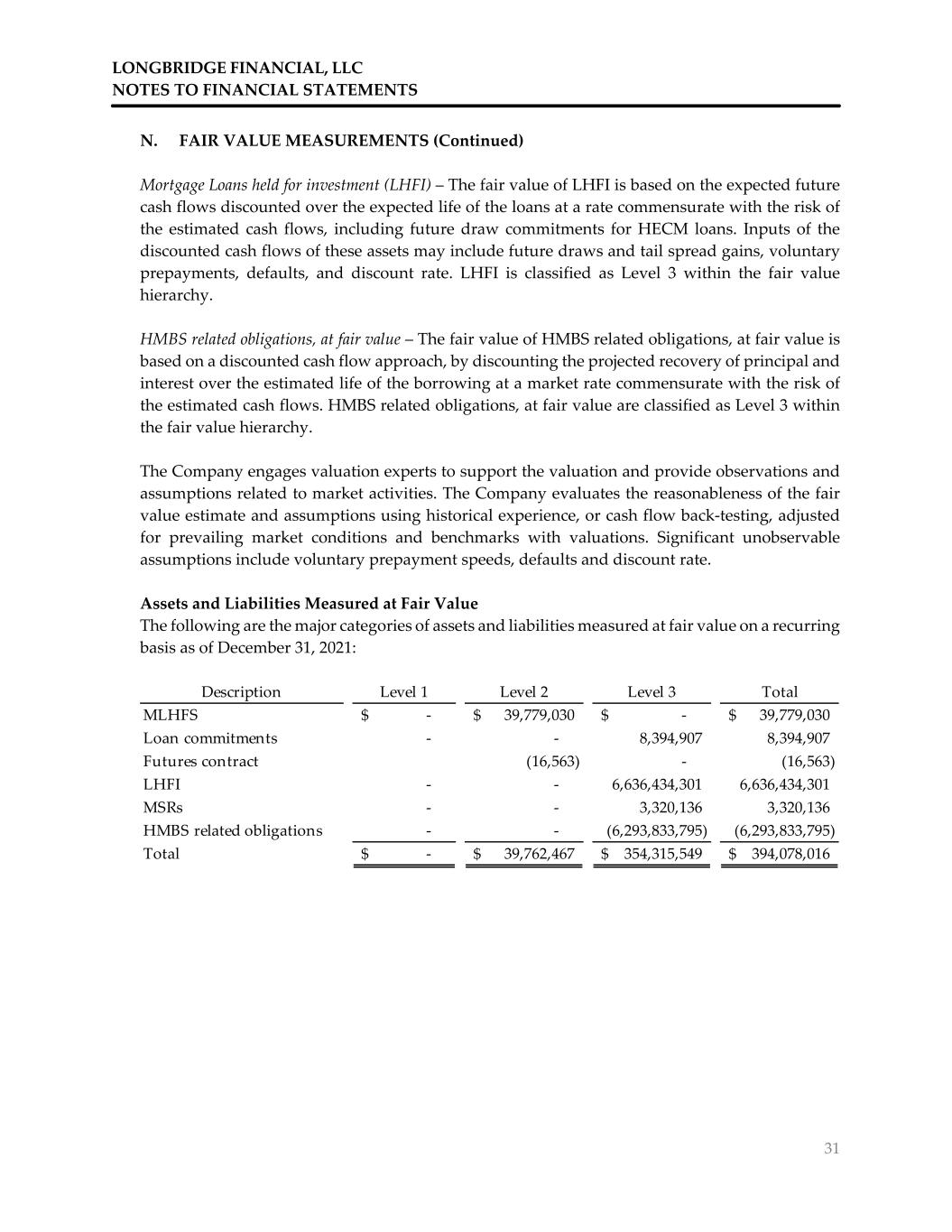

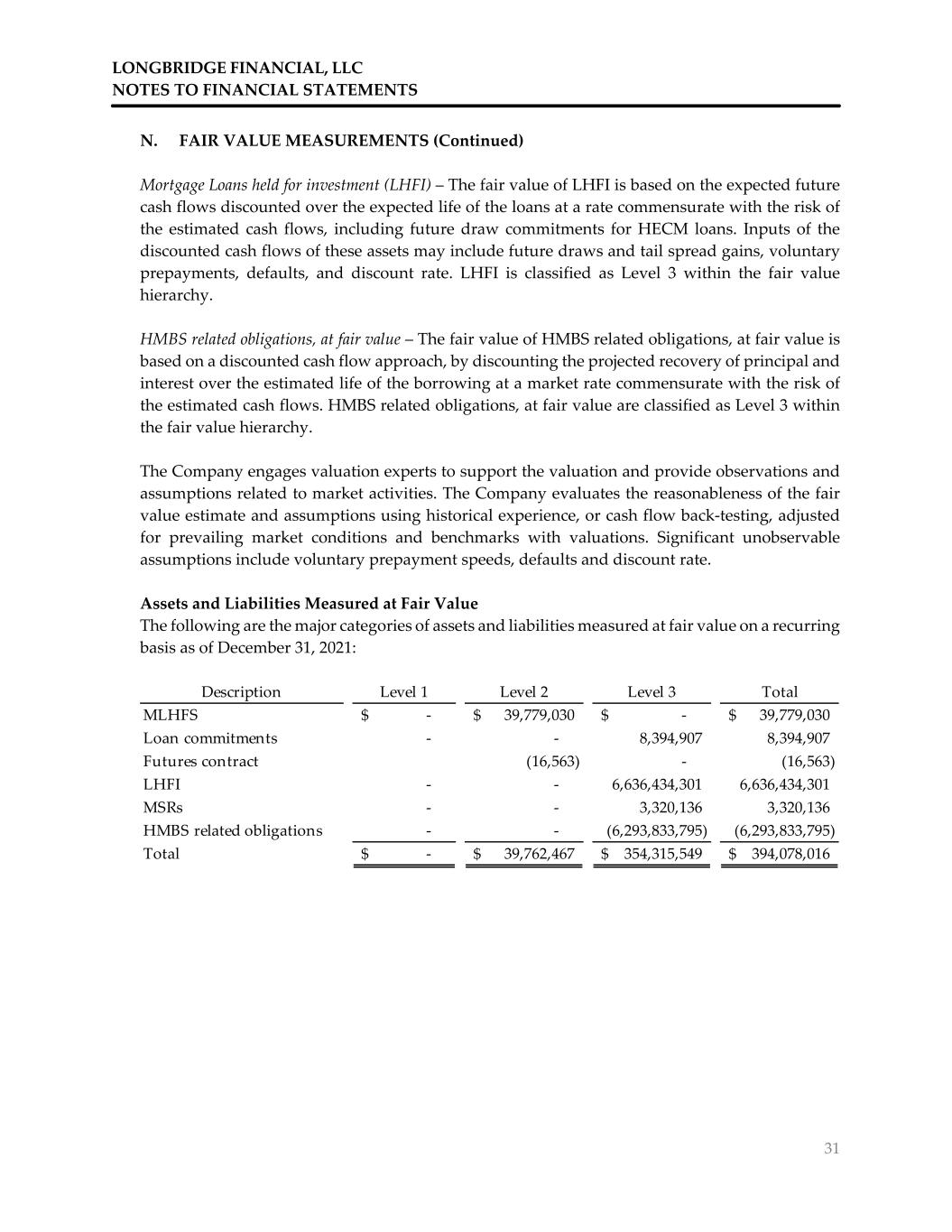

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 32 N. FAIR VALUE MEASUREMENTS (Continued) The following are the major categories of assets and liabilities measured at fair value on a recurring basis as of December 31, 2020: The following are the changes in fair value of Level 2 assets and liabilities measured at fair value on a recurring basis, as restated, for the years ended December 31: The Company does not have any impaired assets or liabilities that are recorded at fair value on a non‐recurring basis as of December 31, 2021 and 2020. Level 3 Purchases, Issuances and Transfers The following is a summary of the Company’s purchases, issuances, and transfers of assets which are measured at fair value on a recurring and non‐recurring basis using Level 3 inputs during the year ended December 31, 2021: Description Level 1 Level 2 Level 3 Total MLHFS ‐$ 11,706,047$ ‐$ 11,706,047$ Loan commitments ‐ ‐ 4,778,352 4,778,352 LHFI ‐ ‐ 5,133,980,349 5,133,980,349 MSRs ‐ ‐ 1,184,675 1,184,675 HMBS related obligations ‐ ‐ (4,948,770,847) (4,948,770,847) Total ‐$ 11,706,047$ 191,172,529$ 202,878,576$ Description 2021 2020 2019 MLHFS 1,577,127$ 321,572$ 270,031$ Futures contract (16,563) 28,984 351,250 Total 1,560,564$ 350,556$ 621,281$ MSRs LHFI HMBS related obligations, at fair value LCs Purchases ‐$ ‐$ ‐$ ‐$ Issuances (c) 2,425,086$ 2,440,650,600$ 2,363,800,780$ 100,742,695$ Transfers into Level 3 ‐$ ‐$ ‐$ ‐$ Transfers out of Level 3 (d) ‐$ ‐$ ‐$ 16,822,128$

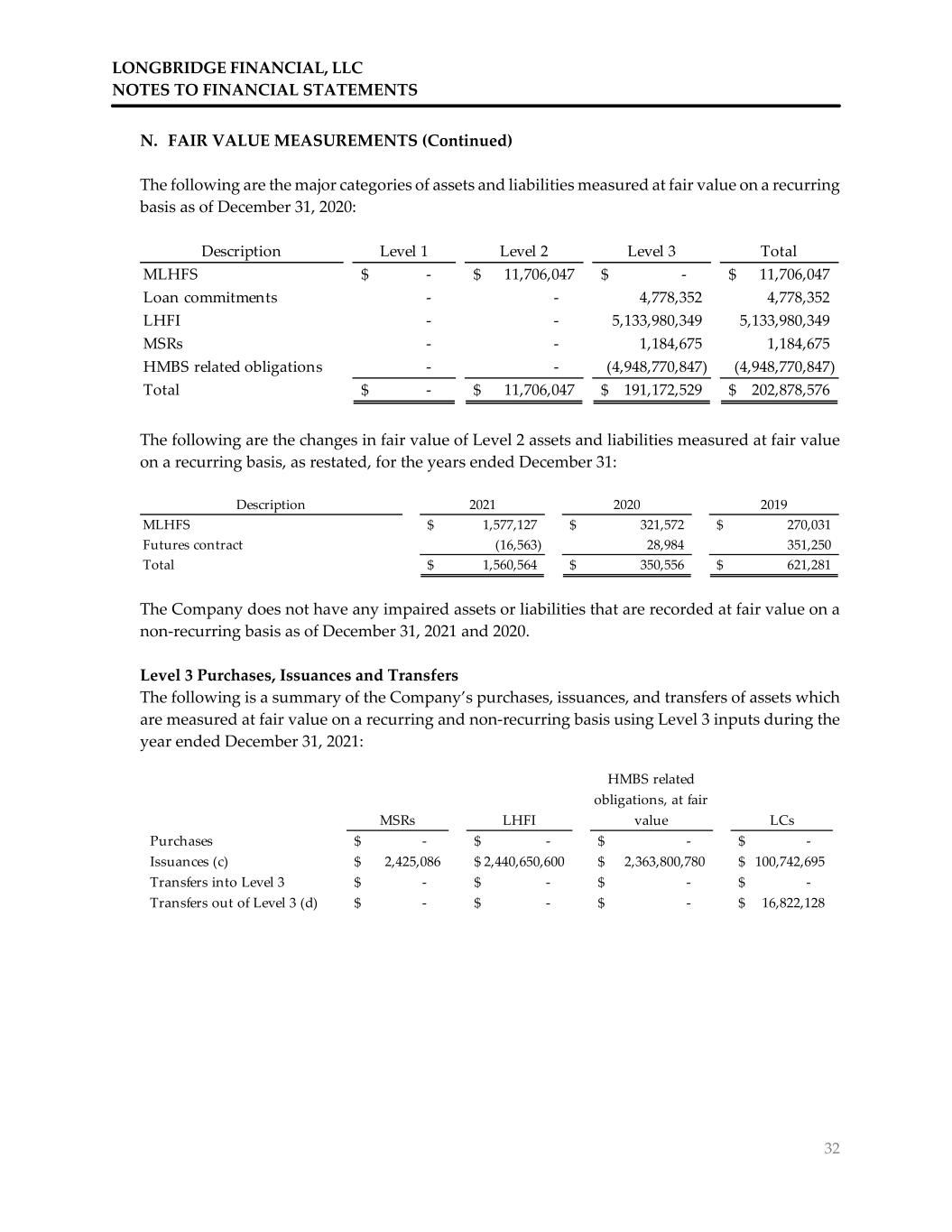

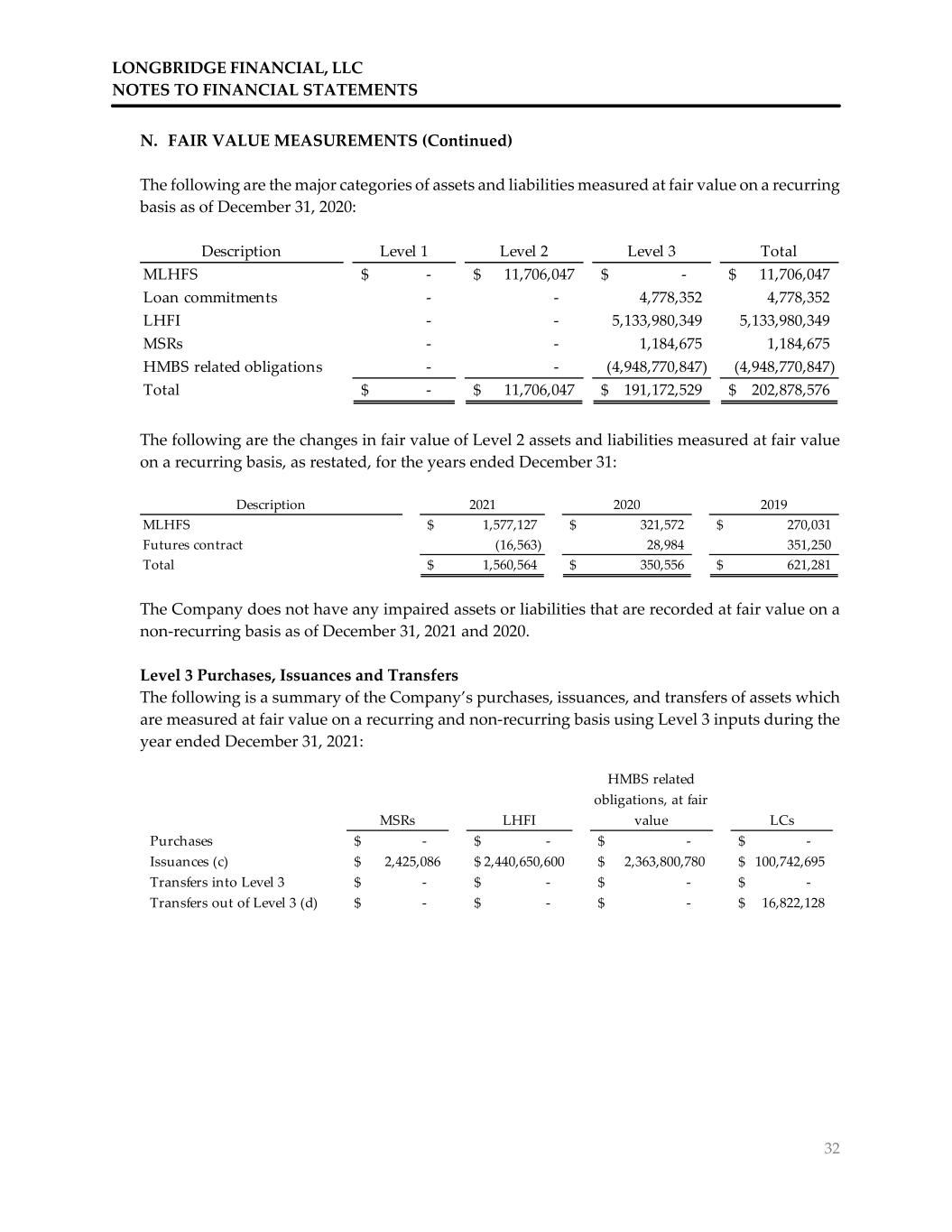

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 33 N. FAIR VALUE MEASUREMENTS (Continued) The following is a summary of the Company’s purchases, issuances, and transfers of assets which are measured at fair value on a recurring and non‐recurring basis using Level 3 inputs during the year ended December 31, 2020: The following is a summary of the Company’s purchases, issuances, and transfers of assets which are measured at fair value on a recurring and non‐recurring basis using Level 3 inputs during the year ended December 31, 2019: (c) Issuances of Level 3 MSRs represent additions due to loans sold, servicing retained. Issuance of Level 3 LHFI and HMBS related obligations, at fair value represent HECM loans pooled into GNMA guaranteed securities, that do not qualify for sale accounting. Issuances of Level 3 LCs represent the lock‐date market value of LCs issued to borrowers during the year, net of estimated pullthrough and costs to originate. (d) LCs transferred out of Level 3 represent LCs that were funded and moved to mortgage loans held for sale, at fair value. Fair Value of Other Financial Instruments Due to their short‐term nature, the carrying value of cash and cash equivalents, escrow cash, restricted cash, certificate of deposit, short‐term receivables, short‐term payables, warehouse line of credit agreements, financing facility agreements, and operating line of credit agreement approximate their fair value at December 31, 2021. MSRs LHFI HMBS related obligations, at fair value LCs Purchases ‐$ ‐$ ‐$ ‐$ Issuances (c) 1,227,088$ 1,965,147,594$ 1,997,561,817$ 40,784,490$ Transfers into Level 3 ‐$ ‐$ ‐$ ‐$ Transfers out of Level 3 (d) ‐$ ‐$ ‐$ 6,244,029$ MSRs LHFI HMBS related obligations, at fair value LCs Purchases ‐$ ‐$ ‐$ ‐$ Issuances (c) 222,176$ 2,023,311,019$ 1,991,785,023$ 9,880,259$ Transfers into Level 3 ‐$ ‐$ ‐$ ‐$ Transfers out of Level 3 (d) ‐$ ‐$ ‐$ 3,297,495$

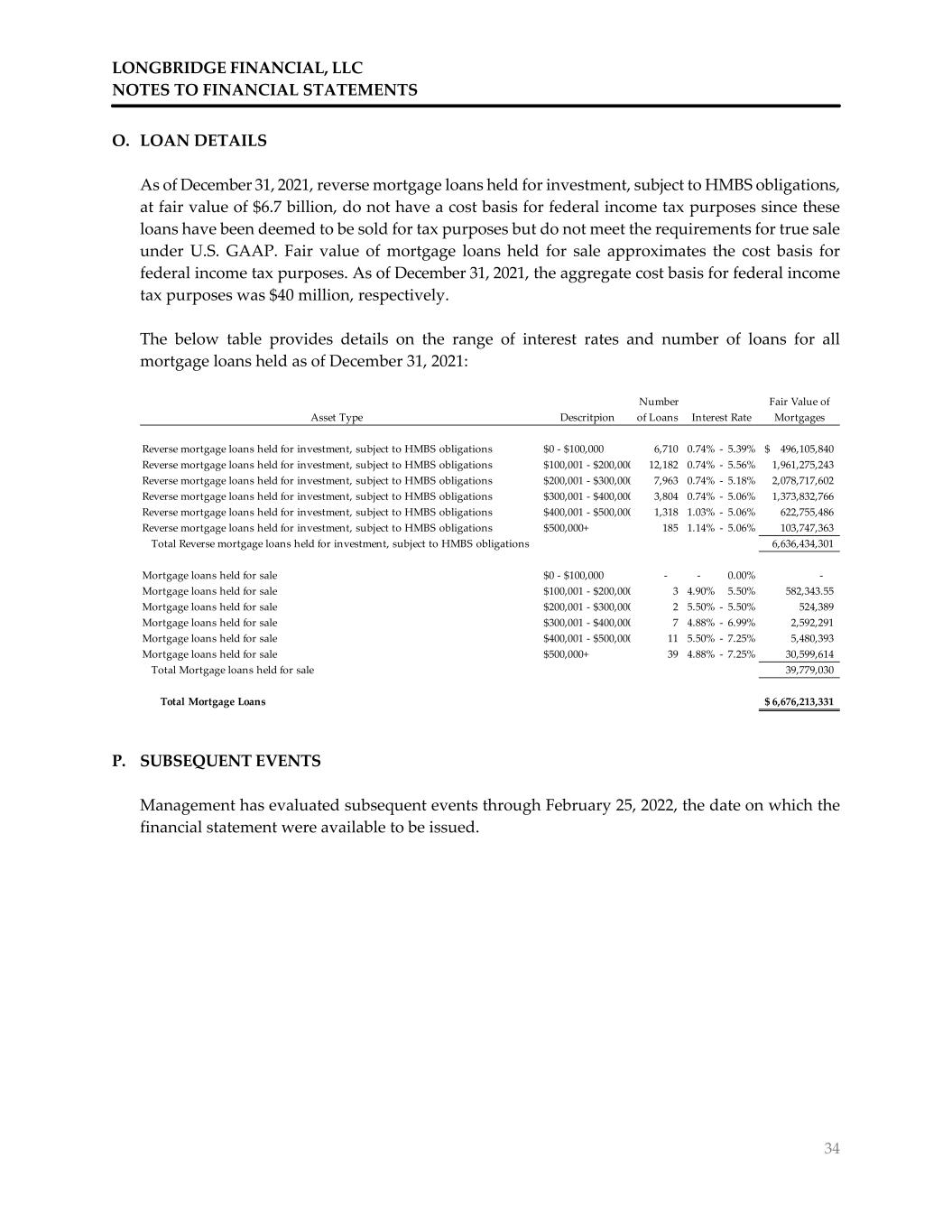

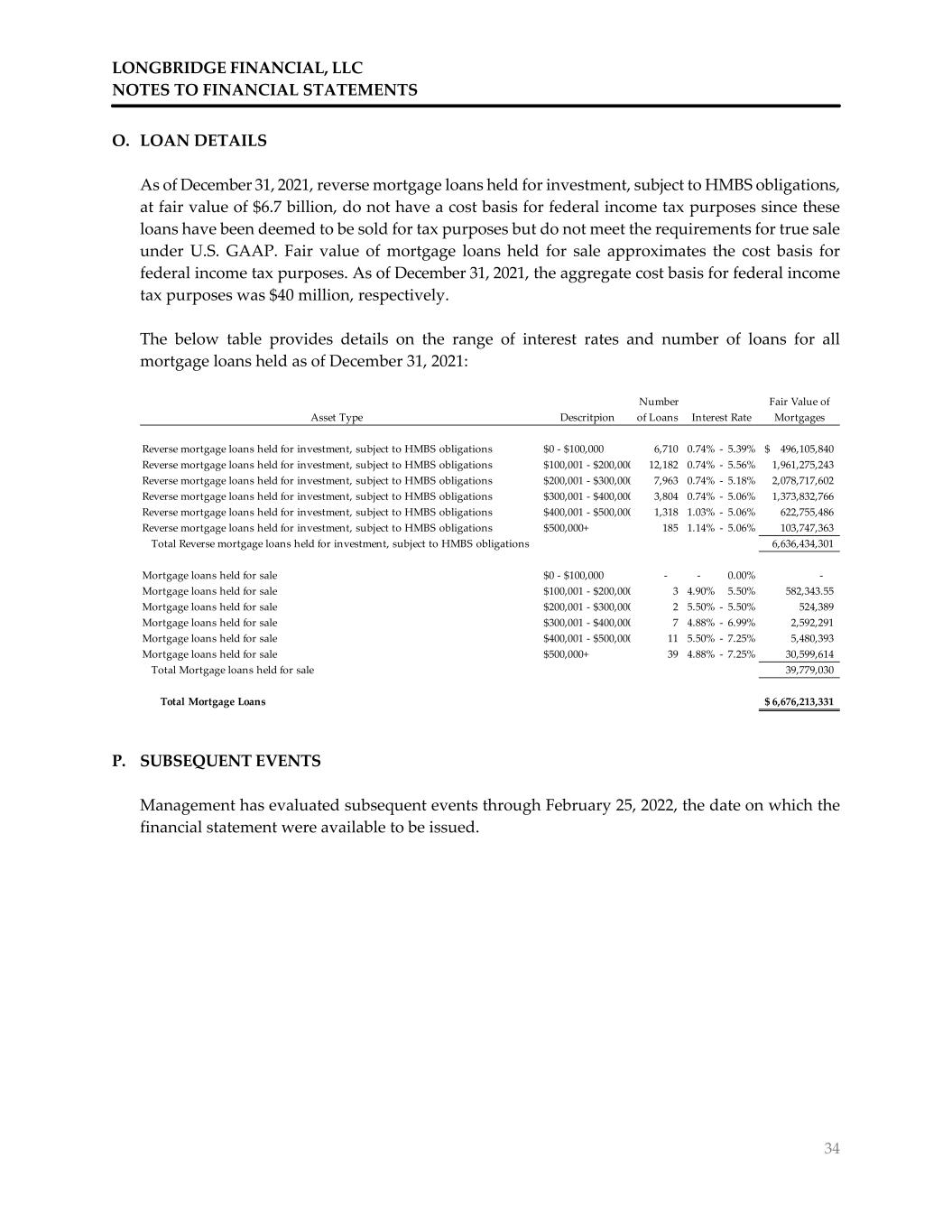

LONGBRIDGE FINANCIAL, LLC NOTES TO FINANCIAL STATEMENTS 34 O. LOAN DETAILS As of December 31, 2021, reverse mortgage loans held for investment, subject to HMBS obligations, at fair value of $6.7 billion, do not have a cost basis for federal income tax purposes since these loans have been deemed to be sold for tax purposes but do not meet the requirements for true sale under U.S. GAAP. Fair value of mortgage loans held for sale approximates the cost basis for federal income tax purposes. As of December 31, 2021, the aggregate cost basis for federal income tax purposes was $40 million, respectively. The below table provides details on the range of interest rates and number of loans for all mortgage loans held as of December 31, 2021: P. SUBSEQUENT EVENTS Management has evaluated subsequent events through February 25, 2022, the date on which the financial statement were available to be issued. Asset Type Descritpion Number of Loans Fair Value of Mortgages Reverse mortgage loans held for investment, subject to HMBS obligations $0 ‐ $100,000 6,710 0.74% ‐ 5.39% 496,105,840$ Reverse mortgage loans held for investment, subject to HMBS obligations $100,001 ‐ $200,000 12,182 0.74% ‐ 5.56% 1,961,275,243 Reverse mortgage loans held for investment, subject to HMBS obligations $200,001 ‐ $300,000 7,963 0.74% ‐ 5.18% 2,078,717,602 Reverse mortgage loans held for investment, subject to HMBS obligations $300,001 ‐ $400,000 3,804 0.74% ‐ 5.06% 1,373,832,766 Reverse mortgage loans held for investment, subject to HMBS obligations $400,001 ‐ $500,000 1,318 1.03% ‐ 5.06% 622,755,486 Reverse mortgage loans held for investment, subject to HMBS obligations $500,000+ 185 1.14% ‐ 5.06% 103,747,363 Total Reverse mortgage loans held for investment, subject to HMBS obligations 6,636,434,301 Mortgage loans held for sale $0 ‐ $100,000 ‐ ‐ 0.00% ‐ Mortgage loans held for sale $100,001 ‐ $200,000 3 4.90% 5.50% 582,343.55 Mortgage loans held for sale $200,001 ‐ $300,000 2 5.50% ‐ 5.50% 524,389 Mortgage loans held for sale $300,001 ‐ $400,000 7 4.88% ‐ 6.99% 2,592,291 Mortgage loans held for sale $400,001 ‐ $500,000 11 5.50% ‐ 7.25% 5,480,393 Mortgage loans held for sale $500,000+ 39 4.88% ‐ 7.25% 30,599,614 Total Mortgage loans held for sale 39,779,030 Total Mortgage Loans 6,676,213,331$ Interest Rate