INDEPENDENT AUDITORSʹ REPORT AND FINANCIAL STATEMENTS FOR LENDSURE MORTGAGE CORP. FOR THE YEAR ENDED DECEMBER 31, 2021

LENDSURE MORTGAGE CORP. TABLE OF CONTENTS Page INDEPENDENT AUDITORS’ REPORT 1‐2 FINANCIAL STATEMENTS Balance Sheet 3 Statement of Operations 4 Statement of Changes in Stockholdersʹ Equity 5 Statement of Cash Flows 6 Notes to Financial Statements 7‐17

9780 S Meridian Blvd., Suite 500 Englewood, CO 80112 303‐721‐6131 www.richeymay.com INDEPENDENT AUDITORSʹ REPORT To the Stockholders LendSure Mortgage Corp. San Diego, California Report on the Audit of the Financial Statements Opinion We have audited the accompanying financial statements of LendSure Mortgage Corp., which comprise the balance sheet as of December 31, 2021 and the related statements of operations, changes in stockholders’ equity, and cash flows for the year then ended, and the related notes to the financial statements. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of LendSure Mortgage Corp. as of December 31, 2021 and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of LendSure Mortgage Corp. and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about LendSure Mortgage Corp.’s ability to continue as a going concern for one year after the report date.

INDEPENDENT AUDITORSʹ REPORT Auditors’ Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users made on the basis of these financial statements. In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of LendSure Mortgage Corp.’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about LendSure Mortgage Corp.’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit. Englewood, Colorado February 25, 2022

CURRENT ASSETS Cash and cash equivalents 32,033,908$ Restricted cash 3,873,224 Escrow cash 448,314 Accounts receivable 15,726 Mortgage loans held for sale, net 167,604,674 Prepaid expenses 366,972 Federal and state income taxes receivable 1,362,649 Total current assets 205,705,467 OTHER ASSETS Property and equipment, net 414,783 Intangible assets, net 665,330 Deposits 125,268 Total other assets 1,205,381 TOTAL ASSETS 206,910,848$ LIABILITIES AND STOCKHOLDERSʹ EQUITY LIABILITIES Accounts payable and accrued expenses 6,097,521$ Loan escrows 483,595 Loan indemnification and premium recapture reserves 400,000 Warehouse lines of credit 162,499,304 Deferred taxes payable 113,883 Total current liabilities 169,594,303 COMMITMENTS AND CONTINGENCIES (Note E) STOCKHOLDERSʹ EQUITY Common stock, $0.001 par value, 40,000,000 shares authorized; 21,818,182 shares issued and outstanding 21,818 Zero coupon convertible preferred stock, $0.001 par value, 2,000,000 shares authorized; no shares issued and outstanding ‐ Additional paid‐in capital 5,579,374 Retained earnings 31,715,353 Total stockholdersʹ equity 37,316,545 TOTAL LIABILITIES AND STOCKHOLDERSʹ EQUITY 206,910,848$ LENDSURE MORTGAGE CORP. BALANCE SHEET DECEMBER 31, 2021 The accompanying notes are an integral part of these financial statements. 3

STATEMENT OF OPERATIONS REVENUE Gain on sale of mortgage loans held for sale, net of direct costs of $3,267,280 67,559,134$ Loan origination fees, net of direct costs of $1,128,709 3,102,199 Interest income 3,690,051 Interest expense and warehouse fees (2,798,101) Other income 192,264 Total revenue 71,745,547 EXPENSES Salaries, commissions and benefits 34,410,710 Occupancy, equipment and communication 1,730,397 General and administrative 2,172,692 Provision for premium recapture 422,547 Depreciation and amortization 183,545 Total expenses 38,919,891 NET INCOME BEFORE TAXES 32,825,656 Provision for income taxes, current 9,004,682 Deferred taxes 113,883 Total taxes 9,118,565 NET INCOME 23,707,091$ LENDSURE MORTGAGE CORP. FOR THE YEAR ENDED DECEMBER 31, 2021 The accompanying notes are an integral part of these financial statements. 4

LENDSURE MORTGAGE CORP. STATEMENT OF CHANGES IN STOCKHOLDERSʹ EQUITY FOR THE YEAR ENDED DECEMBER 31, 2021 Additional Retained Shares Par Value Paid‐in Capital Earnings Totals Balance, January 1, 2021 21,818,182 21,818$ 5,565,766$ 8,008,262$ 13,595,846$ Compensation expense for stock options ‐ ‐ 13,608 ‐ 13,608 Net income ‐ ‐ ‐ 23,707,091 23,707,091 Balance, December 31, 2021 21,818,182 21,818$ 5,579,374$ 31,715,353$ 37,316,545$ Common Stock The accompanying notes are an integral part of these financial statements. 5

LENDSURE MORTGAGE CORP. STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2021 CASH FLOWS FROM OPERATING ACTIVITIES Net income 23,707,091$ Non‐cash items‐ Gain on sale of mortgage loans held for sale, net of direct costs (67,559,134) Provision for premium recapture 422,547 Depreciation and amortization 183,545 Deferred taxes payable 113,883 Compensation expense for stock options 13,608 (Increase) decrease in‐ Escrow cash (448,314) Accounts receivable 31,154 Proceeds from sale and principal payments on mortgage loans held for sale 1,418,145,888 Originations and purchases of mortgage loans held for sale (1,512,722,566) Prepaid expenses (20,060) Federal and state income taxes receivable (2,056,931) Deposits (109,851) Increase (decrease) in‐ Accounts payable and accrued expenses 3,350,521 Loan escrows 483,595 Premium recapture reserve (372,547) Net cash used in operating activities (136,837,571) CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (330,776) Purchase of intangible assets (745,303) Net cash used in investing activities (1,076,079) CASH FLOWS FROM FINANCING ACTIVITIES Net borrowings under warehouse lines of credit 157,191,083 Net cash provided by financing activities 157,191,083 INCREASE IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH 19,277,433 CASH AND CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF YEAR 16,629,699 CASH AND CASH EQUIVALENTS AND RESTRICTED CASH, END OF YEAR 35,907,132$ SUPPLEMENTAL INFORMATION Cash paid for interest and warehouse fees 2,404,775$ Cash paid for taxes 11,068,575$ The accompanying notes are an integral part of these financial statements. 6

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 7 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Organization LendSure Mortgage Corp. (the Company) was incorporated on March 30, 2015. The Company is engaged in the business of originating, purchasing, financing, and selling residential mortgage loans secured by real estate throughout the United States. The Company derives income from fees charged for the origination of mortgage loans and from the subsequent sale of the loans to investors. The Company is authorized to issue 40,000,000 shares of common stock with par value of $0.001 and 2,000,000 shares of zero coupon convertible preferred stock with par value of $0.001. As of December 31, 2021, there were 21,818,182 shares of common stock issued and outstanding. Basis of Accounting The financial statements of the Company are prepared on the accrual basis of accounting. Basis of Presentation The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP) as codified in the Financial Accounting Standards Board’s (FASB) Accounting Standards Codification (ASC). Use of Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Cash and Cash Equivalents For cash flow purposes, the Company considers cash and temporary investments with original maturities of three months or less, to be cash and cash equivalents. The Company has diversified its credit risk for cash by maintaining deposits in several financial institutions, which may at times exceed amounts covered by insurance from the Federal Deposit Insurance Corporation. The Company evaluates the creditworthiness of these financial institutions in determining the risk associated with these balances. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant credit risk related to cash and cash equivalents. Restricted Cash The Company maintains certain cash balances that are restricted under the Company’s warehouse line of credit agreements. Escrow Cash The Company maintains an escrow account for funds held on behalf of borrowers for taxes and property insurance premiums, which are included in escrow cash on the balance sheet.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 8 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Mortgage Loans Held for Sale and Revenue Recognition The Company does not issue rate locks and therefore has elected not to use the fair value option on mortgage loans held for sale. Mortgage loans held for sale are recorded at the lower of cost or fair value as determined on an aggregate loan basis. Fair value for mortgage loans is generally based on current delivery prices. Loan origination fees, net of direct origination costs, are deferred and recognized at the time the loan is sold. Gains or losses from the sale of mortgages are recognized based on the difference between the selling price and carrying value of the related loans upon sale. Gains and losses from the sale of mortgage loans held for sale are recognized based upon the difference between the sales proceeds and carrying value of the related loans upon sale and are recorded in gain on sale of mortgage loans held for sale on the statement of operations. Sales proceeds reflect the cash received from investors through the sale of the loan and servicing release premium. Mortgage loans held for sale are considered sold when the Company surrenders control over the financial assets. Control is considered to have been surrendered when the transferred assets have been isolated from the Company, beyond the reach of the Company and its creditors; the investor obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets; and the Company does not maintain effective control over the transferred assets through either an agreement that both entitles and obligates the Company to repurchase or redeem the transferred assets before their maturity or the ability to unilaterally cause the holder to return specific financial assets. The Company typically considers the above criteria to have been met upon acceptance and receipt of sales proceeds from the investor. Loan Origination Fees Loan origination fees, premiums or discounts from producing loans and certain direct loan origination costs are deferred as an adjustment to the carrying value of mortgage loans. These fees and costs are recognized when the loan is sold to the investors. Interest Income Interest income on mortgage loans is recorded as earned and reported as interest income in the statement of operations. Mortgage loans held for sale are placed on nonaccrual status when any portion of the principal or interest is 90 days past due or earlier if factors indicate that the ultimate collectability of the principal or interest is not probable. Interest received from loans on nonaccrual status is recorded as income when collected. Loans return to accrual status when the principal and interest become current and it is probable that the amounts are fully collectible. No loans originated in 2021 were placed on nonaccrual status.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 9 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Property and Equipment, Net Property and equipment is recorded at cost and depreciated or amortized using the straight line method over the estimated useful lives of the assets. The following is a summary of property and equipment at December 31, 2021. (a) Amortized over the shorter of the related lease term or the estimated useful life of the assets. The Company periodically assesses property and equipment for impairment whenever events or circumstances indicate the carrying amount of an asset may exceed its fair value. If property and equipment is considered impaired, the impairment losses will be recorded on the statement of operations. The Company did not recognize any impairment losses during the year ended December 31, 2021. Intangible Assets – Capitalized Software Development Costs FASB ASC 350‐40, Goodwill and Other—Internal‐Use Software (ASC 350‐40), requires the Company to expense development costs as they are incurred in the preliminary project stage of internally developed software. Once the capitalization criteria of ASC 350‐40 have been met, external direct costs of materials and services consumed in developing or obtaining internal‐use computer software, payroll and payroll related costs for employees who are directly associated with, and who devote time to, the internal‐use computer software related consulting fees are capitalized. During the year ended December 31, 2021, the Company capitalized internally developed software of $745,303 and amortized $79,973 of the capitalized balance, respectively. The Company will amortize $149,060 each year of the 5‐year useful life of the software as of December 31, 2021. Useful lives (years) Amounts Property and equipment, at cost Furniture and equipment 5 795,606$ Leasehold improvements (a) 18,446 Total property and equipment, at cost 814,052 Accumulated depreciation and amortization Furniture and equipment (383,829) Leasehold improvements (15,440) Total accumulated depreciation and amortization (399,269) Total property and equipment, net 414,783$

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 10 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Loan Indemnification Reserve The Company sells mortgage loans to various investors under purchase contracts. When the Company sells its loans, it makes customary representations and warranties to the investors about various characteristics of each loan such as the origination and underwriting guidelines the validity of the lien securing the loan, property eligibility, borrower credit, income and asset requirements, and compliance with applicable federal, state and local law. In the event of a breach of its representations and warranties, the Company may be required to either repurchase the mortgage loans with the identified defects or indemnify the investor for any loss. The Companyʹs loss may be reduced by proceeds from the sale or liquidation of the repurchased loan. The Company records a provision for losses relating to such representations and warranties as part of its loan sale transactions. The method used to estimate the liability for representations and warranties is a function of the representations and warranties given and considers a combination of factors, including, but not limited to, estimate of future defaults and loan repurchase rates and potential severity of loss in the event of defaults, including any loss on sale or liquidation of the repurchased loan. The Company establishes a liability at the time loans are sold. The level of the repurchase liability is difficult to estimate and requires considerable management judgment and is noted based on a probable loss. Given that the level of mortgage loan repurchase losses is dependent on economic factors, investor demands for loan repurchases and other external conditions that may change over the lives of the underlying loans, market expectations around losses related to the Companyʹs obligations could vary significantly from the obligation recorded as of the balance sheet date. There was no activity in the loan indemnification reserve during the year ended December 31, 2021. The balance at December 31, 2021 was $250,000.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 11 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Premium Recapture Reserves In the case of loans sold to investors that pay off within a specified timeframe provided for in the purchase agreement, the Company may be required to return all or a portion of the premium initially received from the investor. The Company records a provision for premiums to be recaptured as part of its loan sale transactions. The method used to estimate the premium recapture reserves is a function of a combination of factors, including, but not limited to, an estimate of the likelihood each loan will be repaid within the timeframe provided for in the purchase agreement. The Company establishes a liability at the time loans are sold. The level of premiums that may be eventually recaptured is difficult to estimate and requires considerable management judgment. Given that the level of mortgage loan premium recapture is dependent on economic factors and other external conditions that may change over the lives of the underlying loans, the Companyʹs obligations could vary significantly from the obligation recorded as of the balance sheet date and is not based on a probable loss. The activity in the premium repurchase reserve is as follows for the year ended December 31, 2021: Income Taxes Income taxes are provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due plus deferred taxes related primarily to differences between the basis of certain assets and liabilities for financial and tax reporting. The deferred taxes represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred tax assets are limited to amounts considered to be realizable in future periods. The Company accounts for any interest and penalties related to unrecognized tax benefits as part of the income tax provision. The Company has no federal or state tax examinations in process as of December 31, 2021 that would have a material impact on the financial statements. The assumptions about future taxable income require significant judgment and are consistent with the plans and estimates the Company is using to manage the underlying business. In evaluating the objective evidence that historical results provide, the Company considers the past three years of operating history and cumulative operating income. Amounts Balance, beginning of year 100,000$ Provision for premium recapture 422,547 Premiums returned (372,547) Balance, end of year 150,000$

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 12 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Stock‐Based Compensation In July 2015, the Company adopted an Equity Incentive Plan pursuant to which the Companyʹs Board of Directors may grant stock options and other awards to employees. The Company accounts for stock‐based compensation in accordance with ASC 718 Compensation‐Stock Compensation. Accordingly, the Company measures the cost of stock‐based awards using the grant‐date fair value of the award and recognizes that cost over the requisite service period. The fair value of each stock option granted under the Companyʹs stock‐based compensation plan is estimated on the date of grant using the Black‐Scholes option‐pricing model and assumptions outlined in Note H. ASC‐718 requires forfeitures to be estimated at the time of grant and prospectively revised, if necessary, in subsequent periods if actual forfeitures differ from initial estimates. Stock‐based compensation recorded for those stock‐based awards that were expected to vest was $13,608 and included in salaries, commissions and benefits on the statement of operations for the year ended December 31, 2021. Advertising and Marketing Advertising and marketing is expensed as incurred and amounted to $403,448 for the year ended December 31, 2021, and is included in general and administrative expenses on the statement of operations. Risks and Uncertainties In the normal course of business, companies in the mortgage banking industry encounter certain economic and regulatory risks. Economic risks include interest rate risk and credit risk. The Company is subject to interest rate risk to the extent that in a rising interest rate environment, the Company may experience a decrease in loan production, as well as decreases in the value of mortgage loans held for sale not committed to investors and commitments to originate loans, which may negatively impact the Company’s operations. Credit risk is the risk of default that may result from the borrowers’ inability or unwillingness to make contractually required payments during the period in which loans are being held for sale by the Company. The Company sells loans to investors without recourse. As such, the investors have assumed the risk of loss or default by the borrower. However, the Company is usually required by these investors to make certain standard representations and warranties relating to credit information, loan documentation and collateral. To the extent that the Company does not comply with such representations, or there are early payment defaults, the Company may be required to repurchase the loans or indemnify these investors for any losses from borrower defaults. In addition, if loans payoff within a specified time frame, the Company may be required to refund a portion of the sales proceeds to the investors.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 13 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Risks and Uncertainties (Continued) A large portion of all properties securing the Companyʹs mortgage loans sold and held for sale for the year ended December 31, 2021 are located in California, and the downturn in economic conditions in that regionʹs real estate market could have a material adverse impact on the Companyʹs financial condition and results of operations. The Company’s business requires substantial cash to support its operating activities. As a result, the Company is dependent on its warehouse lines of credit, and other financing facilities to finance its continued operations. If the Company’s principal lenders decided to terminate or not to renew any of these financing facilities with the Company, the loss of borrowing capacity could have a material adverse impact on the Company’s financial statements unless the Company found a suitable alternative source. The global outbreak of COVID‐19 has disrupted economic markets, and the prolonged economic impact is uncertain. The operational and financial performance of the Company depends on future developments, including the duration and spread of the outbreak, and such uncertainty may have an adverse impact on the Company’s financial performance. B. MORTGAGE LOANS HELD FOR SALE, NET Mortgage loans held for sale, net are as follows at December 31, 2021: The deferred costs, net include such costs as borrower discount points, administrative fees, underwriting and processing fees, estimated commissions, and loan origination fees. Amounts Mortgage loans held for sale 168,418,429$ Deferred costs, net (813,755) 167,604,674$

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 14 C. WAREHOUSE LINES OF CREDIT The Company has the following warehouse lines of credit agreements with various financial institutions at December 31, 2021: (b) The Company may draw upon the warehouse line of credit agreements for purposes of funding a mortgage loan held for sale, prior to the loanʹs scheduled disbursement date. During the period from draw date to disbursement date, the funds are recorded by the Company as a loan funding receivable. As of December 31, 2021, the Company had mortgage loans held for sale pledged as collateral under the above $15,000,000 warehouse line of credit which is guaranteed by a stockholder. The above agreements also contain covenants which include certain financial requirements, including maintenance of minimum tangible net worth, minimum liquid assets, maximum debt to net worth ratio, minimum current ratio, minimum fidelity bond requirements, distribution restrictions and positive net income requirements, as defined in the agreements. The Company was in compliance with all significant debt covenants at December 31, 2021. The Company intends to renew the warehouse lines of credit agreements when they mature. D. EMPLOYEE BENEFIT PLAN The Company has a 401(k) plan for the benefit of eligible employees and their beneficiaries. The 401(k) plan is a defined contribution 401(k) plan that allows eligible employees to save for retirement through pretax and post‐tax contributions up to the specified limits. The Company must match employee contributions up to 4% of the employeeʹs eligible base salary. The Company contribution towards the 401(k) plan was $509,484 for the year ended December 31, 2021. Maturity Line Amount Interest Rate Restricted Cash Amounts July 2022 200,000,000$ Prime plus a margin, with a floor rate of 3.50% 3,723,224$ 156,153,796$ June 2022 15,000,000$ LIBOR plus a margin, with a floor rate of 4% 150,000 8,378,920 120 days written notice 5,000,000$ 10.00% ‐ ‐ (2,033,412) 3,873,224$ 162,499,304$ (b) Loan funding receivable

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 15 E. COMMITMENTS AND CONTINGENCIES Regulatory Contingencies The Company is subject to periodic audits and examinations, both formal and informal in nature, from various federal and state agencies, including those made as part of regulatory oversight of mortgage origination and financing activities. Such audits and examinations could result in additional actions, penalties or fines by state or federal governmental bodies, regulators or the courts. Operating Leases The Company leases office space and equipment under various operating lease arrangements, which expire through September 2027. Total rent expense under all operating leases amounted to $523,774 for the year ended December 31, 2021, and are included in occupancy, equipment and communication on the statement of operations. Future minimum rental payments under long‐term operating leases are as follows at December 31, 2021: F. RELATED PARTY TRANSACTIONS The Company has purchase and sale agreements with investors to sell the mortgage loans it produces, and one of these agreements is with multiple affiliates of a significant stockholder of the Company. The Company sold mortgage loans of approximately $988 million to these stockholder affiliates during the year ended December 31, 2021. The Company has gain on sale of mortgage loans held for sale, net, of approximately $41 million from the stockholder affiliates during the year ended December 31, 2021. Year Ending December 31, Amounts 2022 1,965,261$ 2023 1,856,887 2024 998,543 2025 860,229 2026 855,193 Thereafter 571,711 7,107,824$

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 16 G. INCOME TAXES The components of the income tax provision are as follows for the year ended December 31, 2021: The tax effects of significant temporary differences which give rise to the Companyʹs deferred tax assets and liabilities are as follows at December 31, 2021: H. STOCK‐BASED COMPENSATIONS In July 2015, the Company adopted an Equity Inventive Plan (the Plan), pursuant to which the Company’s Board of Directors may grant stock options and other awards to employees. The Plan authorizes grants of options to purchase up to 654,545 shares of authorized but unissued common stock. Stock options granted under the Plan have terms of ten years and vest over four years. In 2021, the Board of Directors granted 63,500 stock options to employees with an exercise price of 84 cents per common share. The per share weighted average fair value of stock options granted during 2021 was 30 cents on the date of grant, using the Black‐Scholes option‐pricing model. At December 31, 2021, there were 286,045 shares of common stock available for future grants under the Plan. Amounts Current income taxes 9,004,682$ Deferred income taxes 113,883 Provision for income taxes 9,118,565$ Amounts Deferred tax assets‐ Loan indemnification reserve 66,515$ Premium repurchase reserve 39,909 Total deferred tax assets 106,424 Deferred tax liabilities‐ Mortgage loans held for sale, net 66,073 Property and equipment, net 154,234 Total deferred tax liabilities 220,307 Net deferred tax liability 113,883$ Shares Price Outstanding beginning of the year 305,000 $0.36 Exercised ‐ ‐ Granted 63,500 $0.84 Forfeited or expired ‐ ‐ Outstanding end of the year 368,500 $0.52

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 17 I. FAIR VALUE MEASUREMENTS Due to their short‐term nature, the carrying value of cash and cash equivalents, short‐term receivables, mortgage loans held for sale, fixed assets, short‐term payables, and warehouse lines of credit approximate their fair value at December 31, 2021. J. SUBSEQUENT EVENTS During January 2022, the Company’s warrant holder extinguished 1,049,000 shares of Class B Common Stock in the Company. The warrant holder after the extinguishment holds the right to purchase 8,280,000 shares of Class B Common Stock in the Company. Management has evaluated subsequent events through February 25, 2022, the date on which the consolidated financial statements were available to be issued.

LENDSURE MORTGAGE CORP. FINANCIAL STATEMENTS DECEMBER 31, 2020 (UNAUDITED)

LENDSURE MORTGAGE CORP. TABLE OF CONTENTS Financial Statements (UNAUDITED) Balance Sheet Statement of Income and Retained Earnings Statement of Changes in Stockholders’ Equity Statement of Cash Flows Notes to Financial Statements Supplementary Information – Schedule of Gen & Admin expenses

LENDSURE MORTGAGE CORP. BALANCE SHEET December 31, 2020 (UNAUDITED) ASSETS CURRENT ASSETS Cash in bank $ 16,629,696 Accounts receivable 42,813 Interest receivable 4,067 Mortgage loans held for sale 5,468,862 Prepaid expenses 346,912 Total Current Assets $ 22,492,350 PROPERTY AND EQUIPMENT Computer equipment and software $ 16,500 Furniture & fixtures 62,035 Office equipment 405,905 Leasehold improvements 15,336 Less: Accumulated depreciation (312,196) Net Property and Equipment $ 187,580 OTHER ASSETS Security deposits $ 15,417 Total Other Assets $ 15,417 TOTAL ASSETS $ 22,695,347 See accompanying notes to financial statements

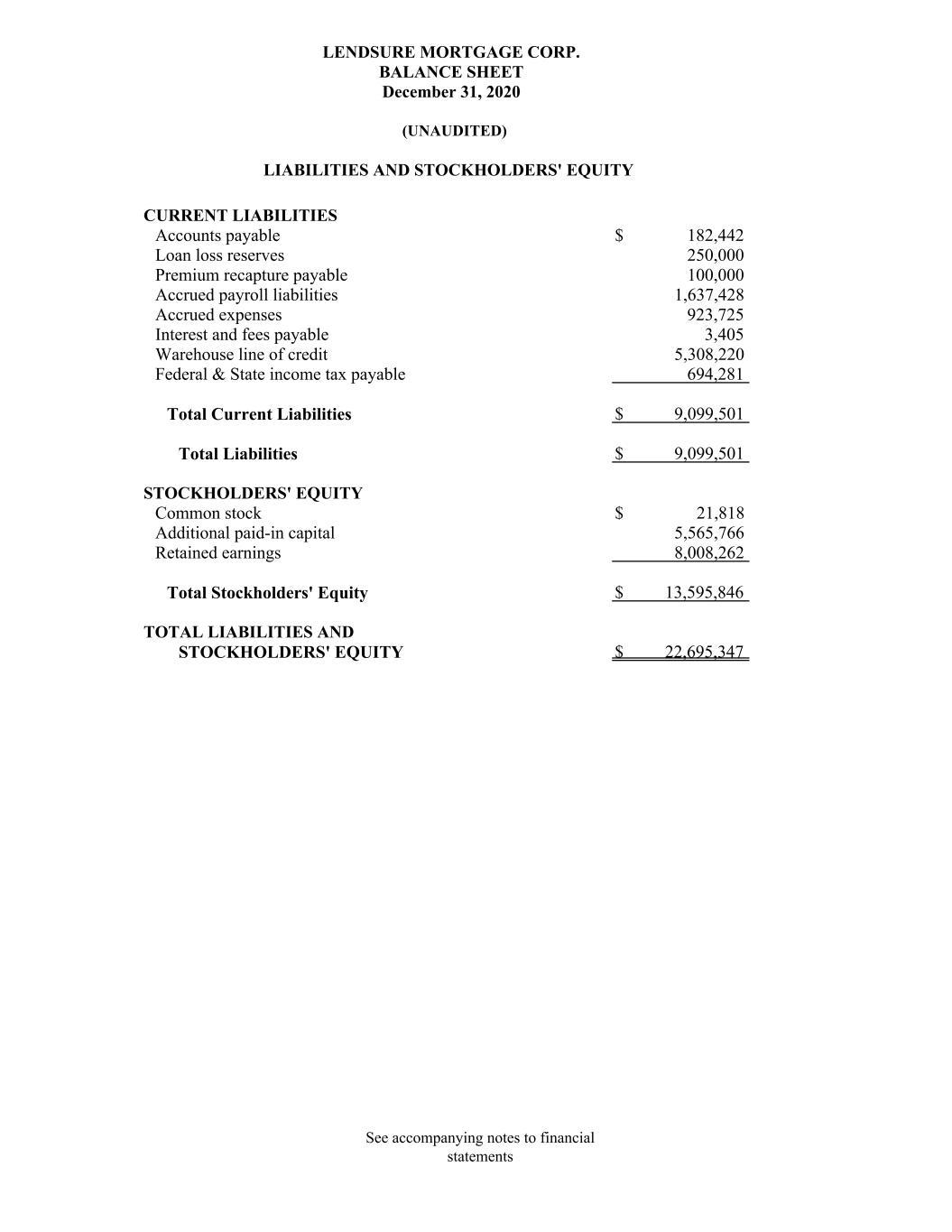

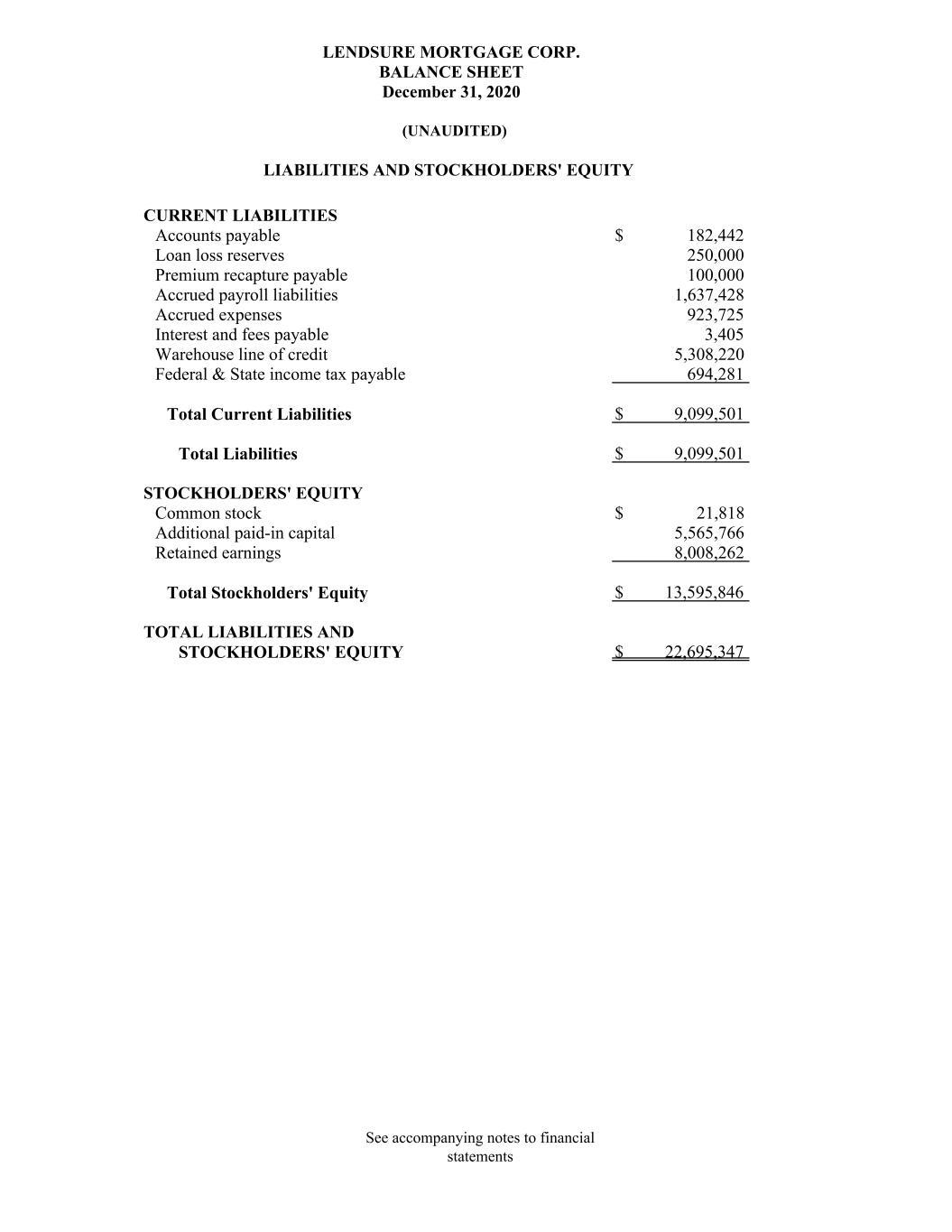

LENDSURE MORTGAGE CORP. BALANCE SHEET December 31, 2020 (UNAUDITED) LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable $ 182,442 Loan loss reserves 250,000 Premium recapture payable 100,000 Accrued payroll liabilities 1,637,428 Accrued expenses 923,725 Interest and fees payable 3,405 Warehouse line of credit 5,308,220 Federal & State income tax payable 694,281 Total Current Liabilities $ 9,099,501 Total Liabilities $ 9,099,501 STOCKHOLDERS' EQUITY Common stock $ 21,818 Additional paid-in capital 5,565,766 Retained earnings 8,008,262 Total Stockholders' Equity $ 13,595,846 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 22,695,347 See accompanying notes to financial statements

LENDSURE MORTGAGE CORP. STATEMENT OF INCOME & RETAINED EARNINGS For The Year Ended December 31, 2020 (UNAUDITED) Income Gains from mortgage banking activities $ 22,164,263 Loan interest income 1,731,537 Total Income $ 23,895,800 Gen & admin expenses 20,873,401 Operating Income $ 3,022,399 Other Income and Expense Interest earned $ 74,412 Other income 2,943 PPP loan forgiveness 2,185,600 Total Other Income $ 2,262,955 Income before taxes $ 5,285,354 Federal income tax 452,781 State income tax 267,228 Net Income $ 4,565,345 Retained earnings - beginning 3,442,917 Retained earnings - ending $ 8,008,262 See accompanying notes to financial statements

Shares Par Value Paid-in- capital Retained Earnings Total Beginning Balance at January 1, 2020 21,818,182 21,818$ 4,098,261 3,442,917$ 7,562,996$ Additional paid-in capital 1,467,505 1,467,505 Net income/(loss) 4,565,345 4,565,345 Ending Balance at December 31, 2020 21,818,182 21,818$ 5,565,766$ 8,008,262$ 13,595,846$ Common Stock LENDSURE MORTGAGE CORP. STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY For The Year Ended December 31, 2020 (UNAUDITED) See accompanying notes to financial statements

Cash Flows from Operating Activities Net income (loss) 4,565,345$ Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 91,339 Prepaid expenses (97,683) Amortization of stock options 10,103 Accounts receivable 71,210 Mortgage loans held for sale 11,753,197 Cash at closing agent 198,943 Accounts payable (1,873) Accrued liabilities 378,047 Federal & State taxes payable 22,973 Premium recapture / Loss reserves (747,390) PPP loan forgiveness (2,185,600) Net Cash Provided by (Used by) Operating Activities 14,058,611$ Cash Flows from Investing Activities Capital expenditures (320,135)$ Security deposits-leases 4,975 Net Cash Provided by (Used by) Investing Activities (315,160)$ Cash Flows from Financing Activities Warehouse line of credit (11,950,033)$ Proceeds from PPP loan 2,185,600 Additional paid-in capital 1,457,402 Net Cash Provided by (Used by) Financing Activities (8,307,031)$ Net Increase in Cash 5,436,420$ Cash at the Beginning of the Period 11,193,276 Cash at the End of the Period 16,629,696$ Income taxes paid 695,853$ Interest paid 1,152,909$ LENDSURE MORTGAGE CORP. STATEMENT OF CASH FLOWS For The Year Ended December 31, 2020 Increase (Decrease) in Cash and Cash Equivalents (UNAUDITED) See accompanying notes to financial statements

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Organization LENDSURE MORTGAGE CORP. (the Company) was incorporated on March 30, 2015. The Company is engaged in the business of originating, purchasing, financing, and selling residential mortgage loans secured by real estate throughout the United States. The Company derives income from fees charged for the origination of mortgage loans and from the subsequent sale of the loans to investors. The Company is authorized to issue 40,000,000 shares of common stock with par value of $0.001 and 2,000,000 shares of zero coupon convertible preferred stock with par value of $0.001. As of December 31, 2020, there were 21,818,182 shares of common stock issued and outstanding. Use of Estimates The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates. Cash and Cash Equivalents For the purposes of the statements of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents. There were no cash equivalents at December 31, 2020. Credit Risk Financial instruments, which potentially subject the Company to credit risk, consist of cash and mortgage loans held for sale. The Company maintains its cash in bank accounts which at times may exceed federally insured limits. The Company has not experienced any losses in such accounts. At various times during the period ending December 31, 2020, the Company had uninsured balances. Gains From Mortgage Banking Activities Loan Origination Fees and Costs: Loan origination fees, premiums or discounts from producing loans and certain direct loan origination costs are deferred as an adjustment to the carrying value of mortgage loans. These fees and costs are recognized when the loan is sold to a third-party investor.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) Mortgage Loans Held for Investment Mortgage loans originated with the ability and the intent to hold for the foreseeable future or until maturity are classified as held for investment. Mortgage loans held for investment are carried at aggregate cost. There were no mortgage loans held for investment at December 31, 2020. Mortgage Loans Held for Sale The Company does not issue rate locks and therefore has elected not to use the fair value option on mortgage loans held for sale. Mortgage loans held for sale are carried at the lower of aggregate cost or market value. The lower of aggregate cost or market value is determined by reference to outstanding commitments from investors or current yield requirements, calculated on an aggregate loan basis. Interest Income Interest income on mortgage loans is recorded as earned and reported as loan portfolio interest income in the statement of income. Mortgage loans held for sale and mortgage loans held for investment are placed on nonaccrual status when any portion of the principal or interest is 90 days past due or earlier if factors indicate that the ultimate collectability of the principal or interest is not probable. Interest received from loans on nonaccrual status is recorded as income when collected. Loans return to accrual status when the principal and interest become current and it is probable that the amounts are fully collectible. No loans originated in 2020 were placed on nonaccrual status. Revenue Recognition FASB ASC 606, Revenue from Contracts with Customers (ASC 606), establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods and services to customers. The core principle requires an entity to recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration it expects to be entitled to receive in exchange for those goods or services, recognized as performance obligations are satisfied. The majority of the Company’s revenue generating transactions are not subject to ASC 606.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) Loan Reserves The Company sells mortgage loans to various investors under purchase contracts. When the Company sells its loans, it makes customary representations and warranties to the purchasers about various characteristics of each loan such as the origination and underwriting guidelines, including but not limited to the validity of the lien securing the loan, property eligibility, borrower credit, income and asset requirements, and compliance with applicable federal, state and local law. In the event of a breach of its representations and warranties, the Company may be required to either repurchase the mortgage loans with the identified defects or indemnify the investor for any loss. The Company’s loss may be reduced by proceeds from the sale or liquidation of the repurchased loan. The Company records a provision for losses relating to such representations and warranties as part of its loan sale transactions. The method used to estimate the liability for representations and warranties is a function of the representations and warranties given and considers a combination of factors, including, but not limited to, estimate of future defaults and loan repurchase rates and the potential severity of loss in the event of defaults, including any loss on sale or liquidation of the repurchased loan. The Company establishes a liability at the time loans are sold. The level of the repurchase liability is difficult to estimate and requires considerable management judgment. Given that the level of mortgage loan repurchase losses is dependent on economic factors, investor demands for loan repurchases and other external conditions that may change over the lives of the underlying loans, market expectations around losses related to the Company’s obligations could vary significantly from the obligation recorded as of the balance sheet date. The estimated obligation associated with early loan payoffs is estimated based on management experience and judgement. The following presents changes in the Company’s loan loss reserves account for the year ended December 31, 2020: Loan loss reserves Beginning balance 550,747$ Current year provisions / reductions (300,747) Ending balance 250,000$

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) Premium Recapture Reserves In the case of loans sold to investors that pay off within a specified timeframe provided for in the purchase agreement, the Company may be required to return all or a portion of the premium initially received from the investor. The Company records a provision for premiums to be recaptured as part of its loan sale transactions. The method used to estimate the premium recapture reserves is a function of a combination of factors, including, but not limited to, an estimate of the likelihood each loan will be repaid within the timeframe provided for in the purchase agreement. The Company establishes a liability at the time loans are sold. The level of premiums that may be eventually recaptured is difficult to estimate and requires considerable management judgment. Given that the level of mortgage loan premium recapture is dependent on economic factors and other external conditions that may change over the lives of the underlying loans, the Company's obligations could vary significantly from the obligation recorded as of the balance sheet date. The estimated obligation associated with early loan payoffs is estimated based on management experience and judgement. During 2020, premium recapture reserves was reduced by $446,643 including $20,449 for an early payoff. Premium recapture reserves balance at December 31, 2020 was $ 100,000. Stock-Based Compensation In July 2015, the Company adopted an Equity Incentive Plan pursuant to which the Company’s Board of Directors may grant stock options and other awards to employees. The Company accounts for stock-based compensation in accordance with FASB ASC- 718 Compensation-Stock Compensation. Accordingly, the Company measures the cost of stock-based awards using the grant-date fair value of the award and recognizes that cost over the requisite service period. The fair value of each stock option granted under the Company’s stock-based compensation plan is estimated on the date of grant using the Black-Scholes option-pricing model and assumptions outlined in Note 8. FASB ASC-718 requires forfeitures to be estimated at the time of grant and prospectively revised, if necessary, in subsequent periods if actual forfeitures differ from initial estimates. Stock-based compensation recorded for those stock-based awards that were expected to vest was $10,103 and included in the statement of income for the year ended December 31, 2020.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) Compensated Absences The Company has not accrued compensated absences because the amount cannot be reasonably estimated. Advertising The Company utilizes the non-direct method of advertising whereby costs are expensed as incurred. Advertising expense for the year ended December 31, 2020 was approximately $6,600. Income Taxes The Company was formed as a C corporation. As a result, the Company will generally be subject to federal and state income tax at the corporate level. Deferred income taxes arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements. The temporary differences relate primarily to loan loss and premium recapture reserves recorded for financial statement purposes, not yet reflected for tax purposes. As described in Note 6, the Company received loan proceeds in the amount of $2,185,600 under the Paycheck Protection Program (“PPP”). The Company believes its use of the proceeds will meet the conditions for forgiveness under the Payroll Protection Program criteria. If the loan proceeds are forgiven, the Company, pursuant to guidance from the Internal Revenue Service and the Consolidated Appropriations Act, 2021 will not be taxed upon the proceeds, and eligible expenses paid with the loan proceeds will be allowed as business deductions. In evaluating our ability to recover our deferred tax assets related to future tax deductions of loan losses and premium recapture, we consider all available positive and negative evidence, projected future taxable income, and results of recent operations, including operating history. The assumptions about future taxable income require significant judgment and are consistent with the plans and estimates we are using to manage the underlying business. In evaluating the objective evidence that historical results provide, we consider our past three years of operating history and cumulative operating income over the past three years.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) Based upon our short operating history, we believe that it is more likely than not that the benefit from deferred tax assets may not be realized. In recognition of this risk, we have provided for a full valuation allowance on the deferred tax assets of $43,585. If our assumptions change and we determine we will be able to realize these tax benefits relating to any reversal of the valuation allowance on deferred tax assets, such will be reflected in future periods. Subsequent Events Date The subsequent events were evaluated by management of the Company through March 30, 2021. This is the date financial statements were available to be issued. 2. MORTGAGE LOANS HELD FOR INVESTMENT At December 31, 2020, the Company had no mortgage loans held for investment. 3. MORTGAGE LOANS HELD FOR SALE At December 31, 2020, the Company had 13 mortgage loans aggregating $5,468,862 held for sale. Substantially all the loans held for sale at December 31, 2020 were sold subsequent to year end. The Company does not have any delinquent loans held for sale and has not been requested by any investor to repurchase any loan previously sold. Accordingly, the Company does not have any non-accrual loans held for sale as of December 31, 2020. 4. PROPERTY AND EQUIPMENT Property and equipment are stated at cost, less accumulated depreciation or amortization. Depreciation on furniture and equipment is recorded using the straight-line method over the estimated useful lives of individual assets, typically three to five years. Amortization of leasehold improvements is recorded using the straight-line method over the estimated useful lives of improvements or remaining lease term, whichever is less. At December 31, 2020, property and equipment aggregated $499,776, less accumulated depreciation and amortization of $312,196. Depreciation expense for the year ended December 31, 2020 was $91,339.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 5. WAREHOUSE LINES OF CREDIT The Company has two warehouse line of credit agreements. The purpose of the credit lines is to fund real estate loans to be sold to investors. The Company also has a credit agreement with EF Holdco Inc, an affiliate of a significant stockholder. The credit line may be used to fund loans, as well as fund margin requirements on warehouse credit agreements. This credit line with a maximum line limit of $5,000,000 was not utilized in 2020. Interest is charged at a variable and fixed rate on the loans outstanding from the date disbursed. The warehouse credit line limit and principal amount outstanding at December 31, 2020 is as follows: Maximum line limit Principal amount Silvergate Bank 65,000,000$ 4,811,002$ Banc of California 15,000,000 497,218 80,000,000$ 5,308,220$ 6. NOTE PAYABLE – PPP LOAN FORGIVENESS On April 16, 2021, the Company received loan proceeds in the amount of $2,185,600 under the Paycheck Protection Program (the “PPP”). The PPP was established as part of the Coronavirus Aid, Relief and Economic Security Act. Under the PPP, if the loan proceeds are used for payroll, benefits, rent and utilities, subject to certain limitations, the loan and accrued interest are forgivable. The Company believes its use of the proceeds has met the conditions for forgiveness under the PPP criteria. Accordingly, the Company has taken the position under IAS 120 that a forgivable loan from the government is treated as a government grant when there is a reasonable assurance that the entity will meet the terms for forgiveness of the loan. The Company has reflected forgiveness of the loan in the financial statements for the year ended December 31, 2020. 7. LEASE COMMITMENTS At December 31, 2020, the Company leased five offices in San Diego, one in Rhode Island, one in Georgia, and utilized shared office space in New York. The leases require security deposits which aggregate $15,417. Current monthly rent under the leases is $28,304 with annual rent increases. Rent expense for the year ended December 31, 2020 was $330,345. Future minimum required rent is $304,918 and $264,915 for the years ended 2021 and 2022, respectively.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 8. STOCK-BASED COMPENSATION In July 2015, the Company adopted an Equity Incentive Plan (the Plan), pursuant to which the Company’s Board of Directors may grant stock options and other awards to employees. The Plan authorizes grants of options to purchase up to 654,545 shares of authorized but unissued common stock. Stock options granted under the Plan have terms of ten years and vest over four years. In 2020, the Board of Directors granted 25,000 stock options to employees with an exercise price of 84 cents per common share. The per share weighted average fair value of stock options granted during 2020 was 32 cents on the date of grant, using the Black-Scholes option-pricing model. At December 31, 2020, there were 326,045 shares of common stock available for future grants under the Plan. 9. EMPLOYEE BENEFIT PLANS The Company has a 401(k) plan for the benefit of eligible employees and their beneficiaries. The 401(k) plan is a defined contribution 401(k) plan that allows eligible employees to save for retirement through pretax and post-tax contributions up to the specified limits. The Company must match employee contributions up to 4% of the employee’s eligible base salary. The Company contribution towards the 401(k) plan was $234,057 for the year ended December 31, 2020. 10. RELATED PARTY TRANSACTIONS For the year ended December 31, 2020, the Company sold mortgage loans of $470.8 million to companies affiliated with a significant stockholder of the Company. Shortly after the World Health Organization declared the COVID-19 outbreak a global pandemic on March 19, 2020, investors ceased purchasing the Company’s loan production. To deal with this crisis, the Company entered into a $150 million forward purchase agreement with an affiliate of a significant stockholder of the Company. To entice the affiliate to enter into the forward purchase agreement, the Company agreed to issue warrants to the stockholder representing 15% of the Company’s issued and outstanding common stock, on a fully diluted basis. The warrants have a strike price of $0.01 per share. The warrants were earned over the period the $150 million forward was filled, all of which occurred by the end of October 2020. The estimated value for the warrants was based upon the relative fair values of the warrants and loan production sold. The fair value allocated to warrants was $1,457,402, which is included in paid in capital. No warrants had been exercised as of December 31, 2020.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 11. CONCENTRATIONS The Company maintains all of its cash with major financial institutions. At times, cash balances may be in excess of the amounts insured by the Federal Deposit Insurance Corporation. Substantially all of the Company’s revenue is derived from gains and fees from mortgage banking activities. Real estate activity is cyclical and is affected greatly by the cost and availability of long-term mortgage funds. Real estate activity and the Company’s revenue can be adversely affected during periods of high interest rates and/or limited money supply. The reduction of real estate activity and fees generated from such activity could have a material adverse effect on the financial condition and results of operations of the Company. The Company originates residential mortgage loans and generates revenues from the origination and sale of these loans. Although management closely monitors market conditions, such activity is sensitive to fluctuations in prevailing interest rates and the real estate markets. A large portion of all properties securing the Company’s mortgage loans sold and held for sale for the year ended December 31, 2020 were or are located in California, and the downturn in economic conditions in that region’s real estate market could have a material adverse impact on the Company’s financial condition and results of operations. Additionally, the Company has purchase and sale agreements with only a few companies to sell the mortgage loans it produces, and one of these agreements is with multiple affiliates of a significant stockholder of the Company. For the year ended December 31, 2020, the Company sold mortgage loans of $470.8 million to this investor, which represented the majority of loans it sold in the year ended December 31, 2020. 12. CONTINGENCIES The Company may be contractually obligated to repurchase a loan sold to an investor in the event of a breach of representations and warranties by the Company under the purchase and sale agreement with the investor. The terms of the purchase agreements, including repurchase obligations, vary by investor depending on each investor’s policies and procedures. The Company is subject to various capital and liquidity requirements in connection with credit agreements (see note 5). Failure to maintain minimum capital and liquidity requirements could result in default under the credit agreements, adversely impacting the Company’s ability to originate loans, and could have a material adverse effect on the Company’s financial statements.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2020 12. CONTINGENCIES (CONT.) In the third quarter of 2020, the Company hired employees from a competitor in the mortgage industry. Shortly thereafter, the Company was named as a co-defendant with three of the employees in a suit brought by the competitor. A fourth employee was subsequently added as a co-defendant. The suit alleges the former employees improperly took trade secrets and other confidential information and seeks injunctive relief against use of the information and damages according to proof. A preliminary investigation indicates that neither the employees hired by the Company, nor the Company, has used any information from the competitor. All parties are working on settlement of the lawsuit. In the fourth quarter of 2020, the Company was served with a summons and complaint in a matter entitled Anderson-Daik v. Frontier Title Company-WH LLC, 234th Judicial District Court of Harris County, Texas, Cause No. 202017166. The suit is based on the plaintiff, a loan recipient of the Company, having wired her closing funds in the approximate amount of $86,000 to someone who spoofed the closing agent’s email. The plaintiff does not know how the closing agent’s email was spoofed, and has sued multiple parties to the transaction, including the Company, the mortgage broker, the real estate broker, and the Company’s Texas documents attorneys. The Company is defending the action but may contribute to an expedient settlement. In the opinion of Company’s management and counsel, none of the litigation is anticipated to have any material adverse effect on the company.

LENDSURE MORTGAGE CORP. SCHEDULE - GEN & ADMIN EXPENSES For The Year Ended December 31, 2020 (UNAUDITED) Gen & admin expenses Bank charges $ 2,019 Computer and software expense 533,243 Contributions & donations 2,185 Depreciation 91,339 G&A, Postage, Off Supp, Fax, Phone 151,573 Interest expense 582 Interest and fee expense - warehouse 1,141,819 Insurance-medical 494,894 Loan costs & fees 2,468,669 Loan loss reserves (300,747) Payroll - salaries 14,699,788 Premium recapture (426,194) Pension plan contributions 234,057 Payroll service 40,765 Professional fees 94,814 Rent expense 330,345 Taxes & licenses 154,206 Taxes-payroll 973,567 Travel, Entertainment, Auto exp 186,477 Total gen & admin expenses $ 20,873,401

LENDSURE MORTGAGE CORP. FINANCIAL STATEMENTS DECEMBER 31, 2019 (UNAUDITED)

LENDSURE MORTGAGE CORP. TABLE OF CONTENTS Financial Statements (UNAUDITED) Balance Sheet Statement of Income and Retained Earnings Statement of Changes in Stockholders’ Equity Statement of Cash Flows Notes to Financial Statements Supplementary Information – Schedule of Gen & Admin expenses

LENDSURE MORTGAGE CORP. BALANCE SHEET December 31, 2019 (UNAUDITED) See accompanying notes to financial statements ASSETS CURRENT ASSETS Cash in bank $ 11,193,276 Accounts receivable 42,121 Interest receivable 75,969 Cash at closing agent 198,943 Mortgage loans held for sale 17,222,059 Prepaid expenses 12,413 Total Current Assets $ 28,744,781 PROPERTY AND EQUIPMENT Computer equipment and software $ 16,500 Furniture & fixtures 62,035 Office equipment 322,588 Leasehold improvements 15,336 Less: Accumulated depreciation (220,858) Net Property and Equipment $ 195,601 OTHER ASSETS Security deposit $ 20,392 Total Other Assets $ 20,392 TOTAL ASSETS $ 28,960,774

LENDSURE MORTGAGE CORP. BALANCE SHEET December 31, 2019 (UNAUDITED) See accompanying notes to financial statements LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable $ 184,314 Loan loss reserves 550,747 Premium recapture reserves 546,643 Accrued payroll liabilities 1,662,599 Accrued expenses 509,418 Interest and fees payable 14,495 Warehouse line of credit 17,258,254 Federal & State income tax payable 671,309 Total Current Liabilities $ 21,397,779 Total Liabilities $ 21,397,779 STOCKHOLDERS' EQUITY Common stock $ 21,818 Additional paid-in capital 4,098,261 Retained earnings 3,442,916 Total Stockholders' Equity $ 7,562,995 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 28,960,774

LENDSURE MORTGAGE CORP. STATEMENT OF INCOME & RETAINED EARNINGS For The Year Ended December 31, 2019 (UNAUDITED) See accompanying notes to financial statements Income Gains from mortgage banking activities $ 23,757,725 Loan interest income 1,760,996 Total Income $ 25,518,721 Gen & admin expenses 21,801,877 Operating Income $ 3,716,844 Other Income and Expense Interest earned $ 6,561 Other income 3,000 Total Other Income $ 9,561 Income before taxes $ 3,726,405 Federal income tax 736,688 State income tax 246,678 Net Income $ 2,743,039 Retained earnings - beginning 699,877 Retained earnings - ending $ 3,442,916

Shares Par Value Paid-in- capital Retained Earnings Total Beginning Balance at January 1, 2019 21,818,183 21,818$ 4,088,121 699,877$ 4,809,816$ Additional paid-in capital 10,140 10,140 Net income/(loss) 2,743,039 2,743,039 Ending Balance at December 31, 2019 21,818,183 21,818$ 4,098,261$ 3,442,916$ 7,562,995$ Common Stock LENDSURE MORTGAGE CORP. STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY For The Year Ended December 31, 2019 (UNAUDITED) See accompanying notes to financial statements

Cash Flows from Operating Activities Net income (loss) 2,743,039$ Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 81,109 Prepaid expenses (2,413) Amortization of stock options 10,140 Accounts receivable (94,867) Mortgage loans held for sale 1,370,656 Cash at closing agent (198,943) Accounts payable 129,682 Accrued liabilities 1,144,290 Federal & State taxes payable 845,392 Premium recapture reserves (83,065) Net Cash Provided by (Used by) Operating Activities 5,945,020$ Cash Flows from Investing Activities Capital expenditures (117,353)$ Security deposits-leases (16,139) Net Cash Provided by (Used by) Investing Activities (133,492)$ Cash Flows from Financing Activities Advances to employees 5,415$ Warehouse line of credit (910,276) Net Cash Provided by (Used by) Financing Activities (904,861)$ Net Increase in Cash 4,906,667$ Cash at the Beginning of the Period 6,286,609 Cash at the End of the Period 11,193,276$ Income taxes paid 138,800$ Interest paid 1,533,311$ LENDSURE MORTGAGE CORP. STATEMENT OF CASH FLOWS For The Year Ended December 31, 2019 Increase (Decrease) in Cash and Cash Equivalents (UNAUDITED) See accompanying notes to financial statements

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2019 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Organization LENDSURE MORTGAGE CORP. (the Company) was incorporated on March 30, 2015. The Company is engaged in the business of originating, purchasing, financing, and selling residential mortgage loans secured by real estate throughout the United States. The Company derives income from fees charged for the origination of mortgage loans and from the subsequent sale of the loans to investors. The Company is authorized to issue 25,000,000 shares of common stock with par value of $0.001 and 2,000,000 shares of zero coupon convertible preferred stock with par value of $0.001. As of December 31, 2019, there were 21,818,183 shares of common stock issued and outstanding. Use of Estimates The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates. Cash and Cash Equivalents For the purposes of the statements of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents. There were no cash equivalents at December 31, 2019. Credit Risk Financial instruments, which potentially subject the Company to credit risk, consist of cash and mortgage loans held for sale. The Company maintains its cash in bank accounts which at times may exceed federally insured limits. The Company has not experienced any losses in such accounts. At various times during the period ending December 31, 2019, the Company had uninsured balances. Gains From Mortgage Banking Activities Loan Origination Fees and Costs: Loan origination fees, premiums or discounts from producing loans and certain direct loan origination costs are deferred as an adjustment to the carrying value of mortgage loans. These fees and costs are recognized when the loan is sold to a third-party investor.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2019 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) Mortgage Loans Held for Investment Mortgage loans originated with the ability and the intent to hold for the foreseeable future or until maturity are classified as held for investment. Mortgage loans held for investment are carried at aggregate cost. There were no mortgage loans held for investment at December 31, 2019. Mortgage Loans Held for Sale The Company does not issue rate locks and therefore has elected not to use the fair value option on mortgage loans held for sale. Mortgage loans held for sale are carried at the lower of aggregate cost or market value. The lower of aggregate cost or market value is determined by reference to outstanding commitments from investors or current yield requirements, calculated on an aggregate loan basis. Interest Income Interest income on these loans is recorded as earned and reported as loan portfolio interest income in the statement of income. Mortgage loans held for sale and mortgage loans held for investment are placed on nonaccrual status when any portion of the principal or interest is 90 days past due or earlier if factors indicate that the ultimate collectability of the principal or interest is not probable. Interest received from loans on nonaccrual status is recorded as income when collected. Loans return to accrual status when the principal and interest become current and it is probable that the amounts are fully collectible. No loans originated in 2019 were placed on nonaccrual status. Loan Reserves The Company sells mortgage loans to various investors under purchase contracts. When the Company sells its loans, it makes customary representations and warranties to the purchasers about various characteristics of each loan such as the origination and underwriting guidelines, including but not limited to the validity of the lien securing the loan, property eligibility, borrower credit, income and asset requirements, and compliance with applicable federal, state and local law. In the event of a breach of its representations and warranties, the Company may be required to either repurchase the mortgage loans with the identified defects or indemnify the investor for any loss. The Company’s loss may be reduced by proceeds from the sale or liquidation of the repurchased loan.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2019 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) The Company records a provision for losses relating to such representations and warranties as part of its loan sale transactions. The method used to estimate the liability for representations and warranties is a function of the representations and warranties given and considers a combination of factors, including, but not limited to, estimate of future defaults and loan repurchase rates and the potential severity of loss in the event of defaults, including any loss on sale or liquidation of the repurchased loan. The Company establishes a liability at the time loans are sold. The level of the repurchase liability is difficult to estimate and requires considerable management judgment. Given that the level of mortgage loan repurchase losses is dependent on economic factors, investor demands for loan repurchases and other external conditions that may change over the lives of the underlying loans, market expectations around losses related to the Company’s obligations could vary significantly from the obligation recorded as of the balance sheet date. The estimated obligation associated with early loan payoffs is estimated based on management experience and judgement. The following presents changes in the Company’s loan loss reserves account for the year ended December 31, 2019: Loan loss reserves Beginning balance 550,747$ Current year provisions - Ending balance 550,747$ Premium Recapture Reserves In the case of loans sold to investors that pay off within a specified timeframe provided for in the purchase agreement, the Company may be required to return all or a portion of the premium initially received from the investor. The Company records a provision for premiums to be recaptured as part of its loan sale transactions. The method used to estimate the premium recapture reserves is a function of a combination of factors, including, but not limited to, an estimate of the likelihood each loan will be repaid within the timeframe provided for in the purchase agreement. The Company establishes a liability at the time loans are sold. The level of premiums that may be eventually recaptured is difficult to estimate and requires considerable management judgment. Given that the level of mortgage loan premium recapture is dependent on economic factors and other external conditions that may change over the lives of the underlying loans, the Company's obligations could vary significantly from the obligation recorded as of the balance sheet date. The estimated obligation associated with early loan payoffs is estimated based on management experience and judgement. During 2019, Premium recapture reserves was reduced by $ 72,937 for premiums returned to investors. Premium recapture reserves balace at December 31, 2019 was $ 546,643.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2019 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) Stock-Based Compensation The Company Board of Directors in July 2015 approved an Equity Incentive Plan for the Company. The Company accounts for stock-based compensation in accordance with FASB ASC-718 Compensation-Stock Compensation. Accordingly, the Company measures the cost of stock-based awards using the grant-date fair value of the award and recognizes that cost over the requisite service period. The fair value of each stock option granted under the Company’s stock-based compensation plan is estimated on the date of grant using the Black-Scholes option-pricing model and assumptions outlined in Note 7. FASB ASC-718 requires forfeitures to be estimated at the time of grant and prospectively revised, if necessary, in subsequent periods if actual forfeitures differ from initial estimates. Stock-based compensation recorded for those stock-based awards that were expected to vest was $10,140 and included in the statement of income for the year ended December 31, 2019. Compensated Absences The Company has not accrued compensated absences because the amount cannot be reasonably estimated. Advertising The Company utilizes the non-direct method of advertising whereby costs are expensed as incurred. Advertising expense for the year ended December 31, 2019 was approximately $42,000. Income Taxes The Company was formed as a C corporation. As a result, the Company will generally be subject to federal and state income tax at the corporate level. Deferred income taxes arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements. The temporary differences relate primarily to loan loss and premium recapture reserves recorded for financial statement purposes, not yet reflected for tax purposes.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2019 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.) In evaluating our ability to recover our deferred tax assets related to future tax deductions of loan losses and premium recapture, we consider all available positive and negative evidence, projected future taxable income, and results of recent operations, including operating history. The assumptions about future taxable income require significant judgment and are consistent with the plans and estimates we are using to manage the underlying business. In evaluating the objective evidence that historical results provide, we consider our past three years of operating history and cumulative operating income over the past three years. Based upon our short operating history, we believe that it is more likely than not that the benefit from deferred tax assets may not be realized. In recognition of this risk, we have provided for a full valuation allowance on the deferred tax assets of $228,079. If our assumptions change and we determine we will be able to realize these tax benefits relating to any reversal of the valuation allowance on deferred tax assets, such will be reflected in future periods. Subsequent Events Date The subsequent events were evaluated by management of the Company through March 27, 2020. This is the date financial statements were available to be issued. 2. MORTGAGE LOANS HELD FOR INVESTMENT At December 31, 2019 the company had no mortgage loans held for investment. 3. MORTGAGE LOANS HELD FOR SALE At December 31, 2019, the Company had 39 mortgage loans aggregating $17,222,059 held for sale. Substantially all the loans held for sale at December 31, 2019 were sold subsequent to year end. The Company does not have any delinquent loans held for sale and has not been requested by any investor to repurchase any loan previously sold. Accordingly, the Company does not have any non-accrual loans held for sale as of December 31, 2019.

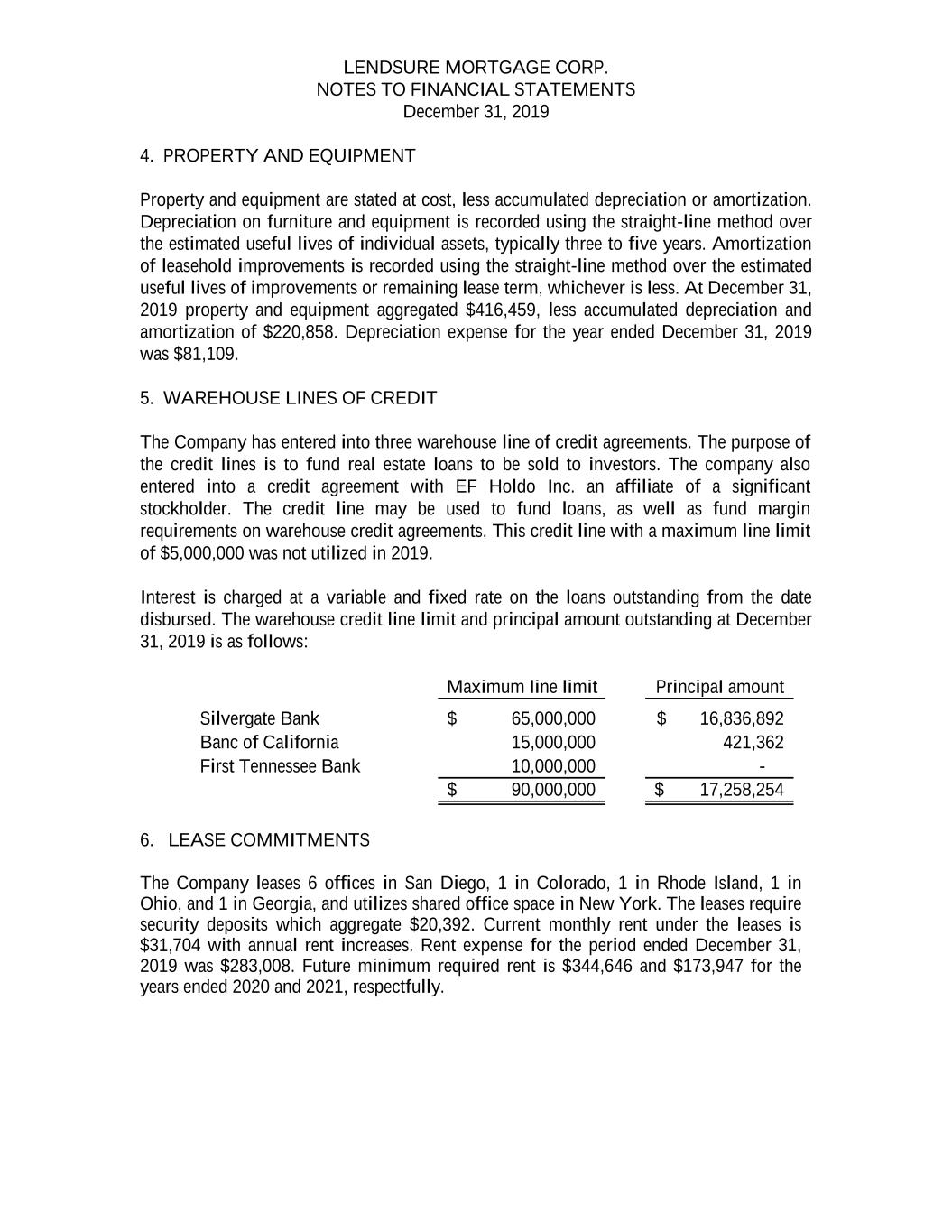

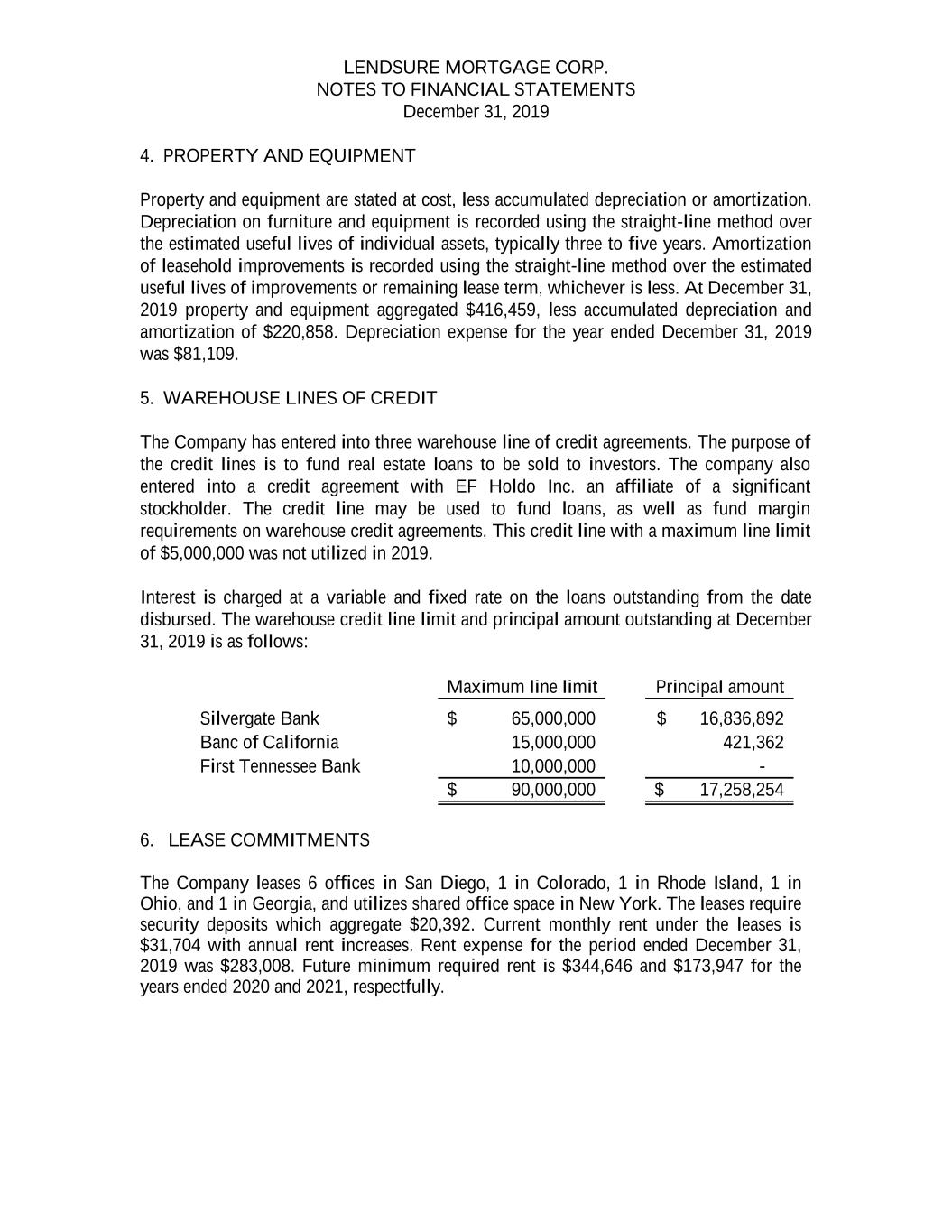

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS December 31, 2019 4. PROPERTY AND EQUIPMENT Property and equipment are stated at cost, less accumulated depreciation or amortization. Depreciation on furniture and equipment is recorded using the straight-line method over the estimated useful lives of individual assets, typically three to five years. Amortization of leasehold improvements is recorded using the straight-line method over the estimated useful lives of improvements or remaining lease term, whichever is less. At December 31, 2019 property and equipment aggregated $416,459, less accumulated depreciation and amortization of $220,858. Depreciation expense for the year ended December 31, 2019 was $81,109. 5. WAREHOUSE LINES OF CREDIT The Company has entered into three warehouse line of credit agreements. The purpose of the credit lines is to fund real estate loans to be sold to investors. The company also entered into a credit agreement with EF Holdo Inc. an affiliate of a significant stockholder. The credit line may be used to fund loans, as well as fund margin requirements on warehouse credit agreements. This credit line with a maximum line limit of $5,000,000 was not utilized in 2019. Interest is charged at a variable and fixed rate on the loans outstanding from the date disbursed. The warehouse credit line limit and principal amount outstanding at December 31, 2019 is as follows: Maximum line limit Principal amount Silvergate Bank 65,000,000$ 16,836,892$ Banc of California 15,000,000 421,362 First Tennessee Bank 10,000,000 - 90,000,000$ 17,258,254$ 6. LEASE COMMITMENTS The Company leases 6 offices in San Diego, 1 in Colorado, 1 in Rhode Island, 1 in Ohio, and 1 in Georgia, and utilizes shared office space in New York. The leases require security deposits which aggregate $20,392. Current monthly rent under the leases is $31,704 with annual rent increases. Rent expense for the period ended December 31, 2019 was $283,008. Future minimum required rent is $344,646 and $173,947 for the years ended 2020 and 2021, respectfully.