CRCM INVESTOR PRESENTATION Care.com 2019 | Proprietary Information November 6, 2019

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to information about the Company’s 2019 priorities and profitability expectations. These forward- looking statements are made as of November 6, 2019 and are based on expectations, estimates, forecasts and projections, as well as the beliefs and assumptions of management, as of such date. Words such as “plan,” "expect," "anticipate," "should," "believe," "hope," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "might," "could," "intend" and “designed,” as well as variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to risks and uncertainties, many of which involve factors or circumstances beyond the Company's control. The Company's actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: our ability to grow our membership while leveraging our investment in sales and marketing; our success in converting non- paying members to paying members and extending the length of time that paying members continue to pay for our services; our ability to cross-sell new and existing products and services to our members and to develop new products and services that members consider valuable; our ability to protect our brand and maintain our reputation among our members; and other risks detailed in the Company's filings with the Securities and Exchange Commission. Past performance is not necessarily indicative of future results. The forward-looking statements included in this presentation represent the Company's views as of the date of November 6, 2019, and should not be relied upon as representing the Company’s views as of any subsequent date. The Company anticipates that subsequent events and developments will cause its views to change. The Company has no intention nor undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Care.com 2019 | Proprietary Information 2

Sheila Lirio Marcelo FOUNDER, CHAIRWOMAN & CEO Care.com 2019 || Proprietary Proprietary Information Information 3

Care Education Care for family members - the Financial Services most important Home Services decision in people’s lives Automotive Travel Services Entertainment Care.com 2019 | Proprietary Information 4

OUR MISSION Care.com launched in 2007 with the mission to connect families to great caregivers. Today, Care.com is the world's largest online marketplace for finding and managing family care. 35 MILLION MEMBERS* 20+ COUNTRIES* 1 MATCH MADE EVERY 3 MINUTES** *Care.com internal data as of September 2019 Care.com 2019 | Proprietary Information **Care.com member survey data as of December 2018 5

COMPANY OVERVIEW Market Massive fragmented market Leader Disruptive online marketplace Model Powerful economic model Network Effects Strong NPS and Word of Mouth Long Runway Multiple growth opportunities Financials Profitable growth Care.com 2019 | Proprietary Information 6

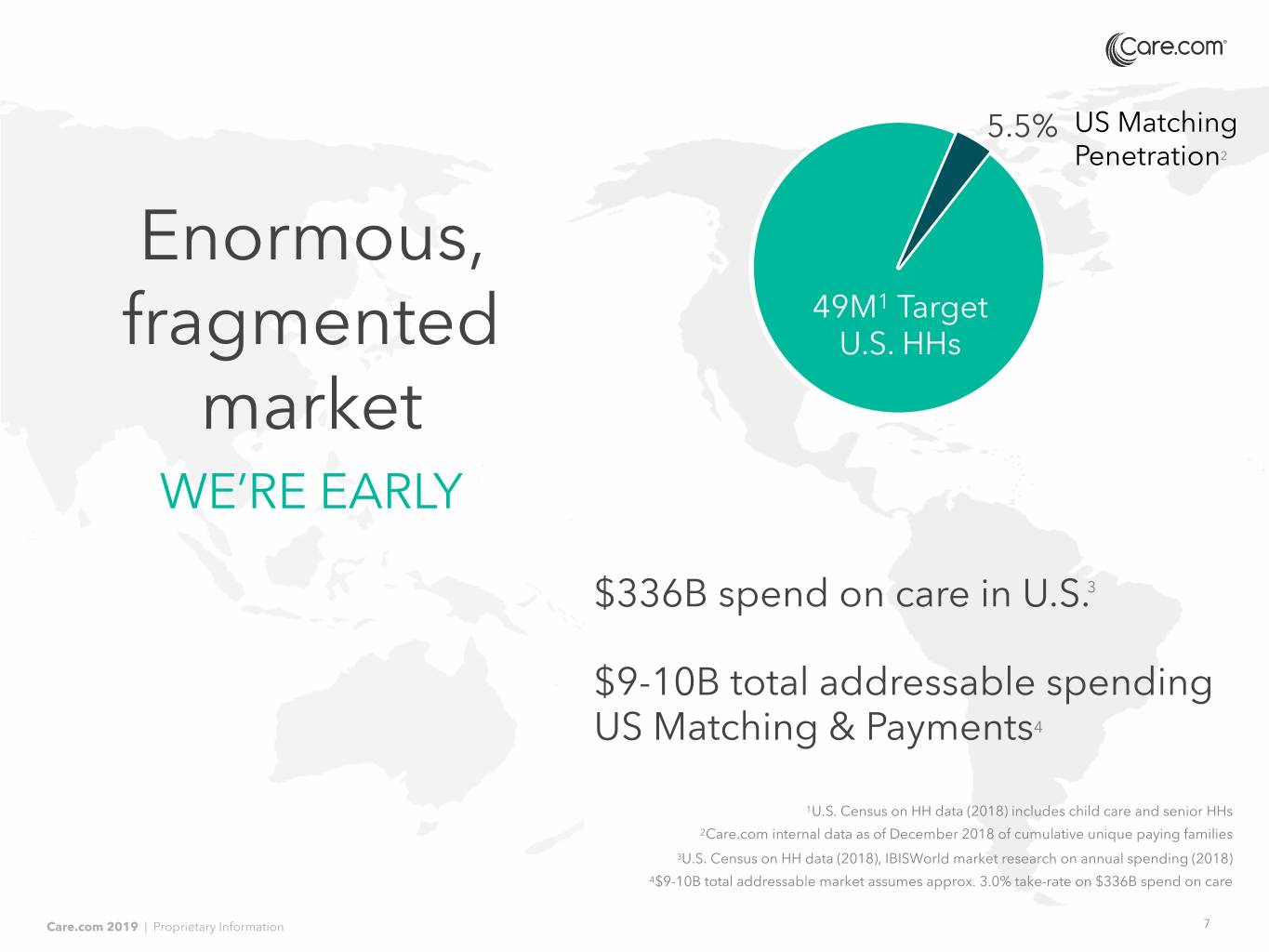

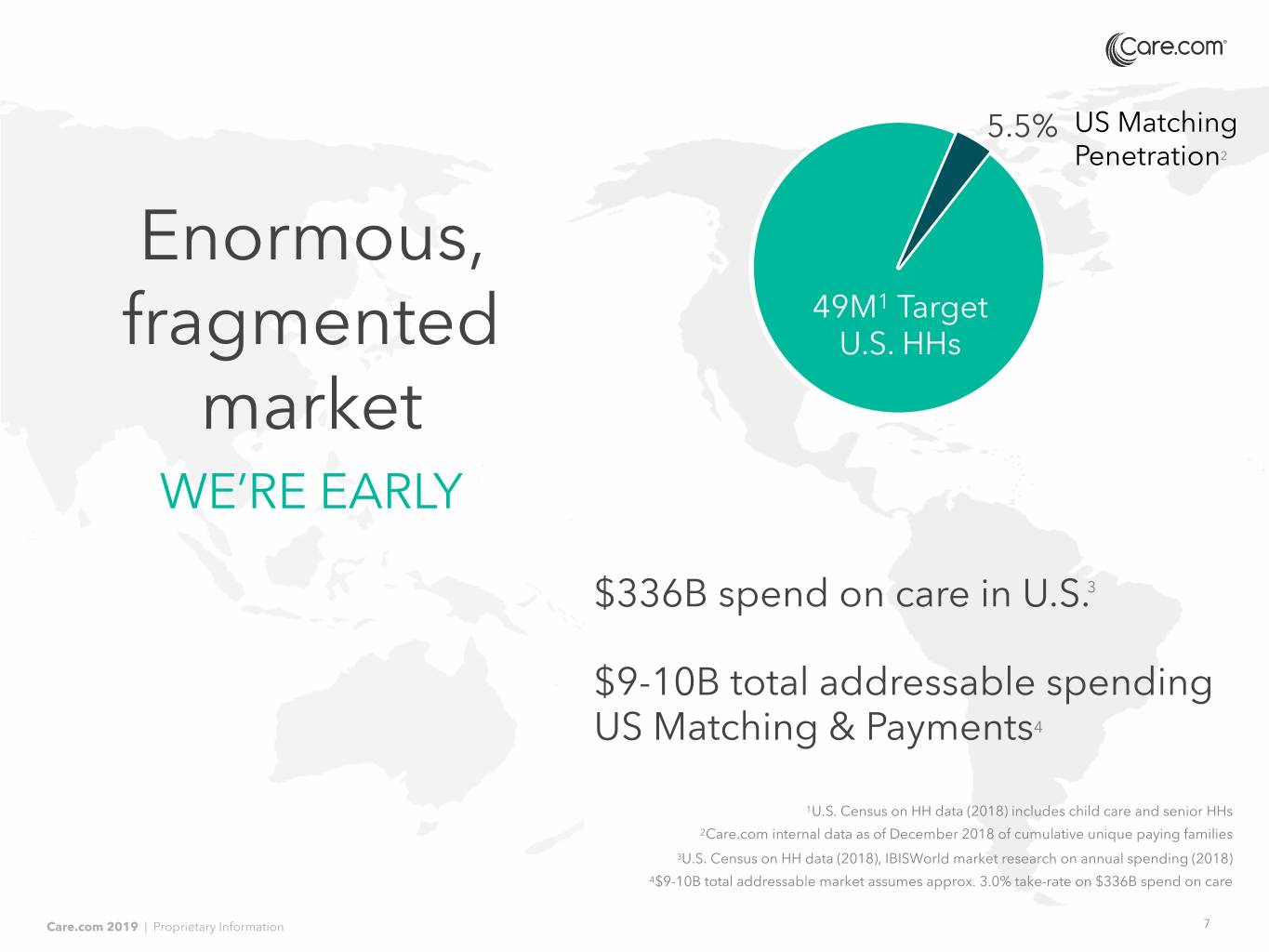

5.5% US Matching Penetration2 Enormous, 49M1 Target fragmented U.S. HHs market WE’RE EARLY $336B spend on care in U.S.3 $9-10B total addressable spending US Matching & Payments4 1U.S. Census on HH data (2018) includes child care and senior HHs 2Care.com internal data as of December 2018 of cumulative unique paying families 3U.S. Census on HH data (2018), IBISWorld market research on annual spending (2018) 4$9-10B total addressable market assumes approx. 3.0% take-rate on $336B spend on care Care.com 2019 | Proprietary Information 7

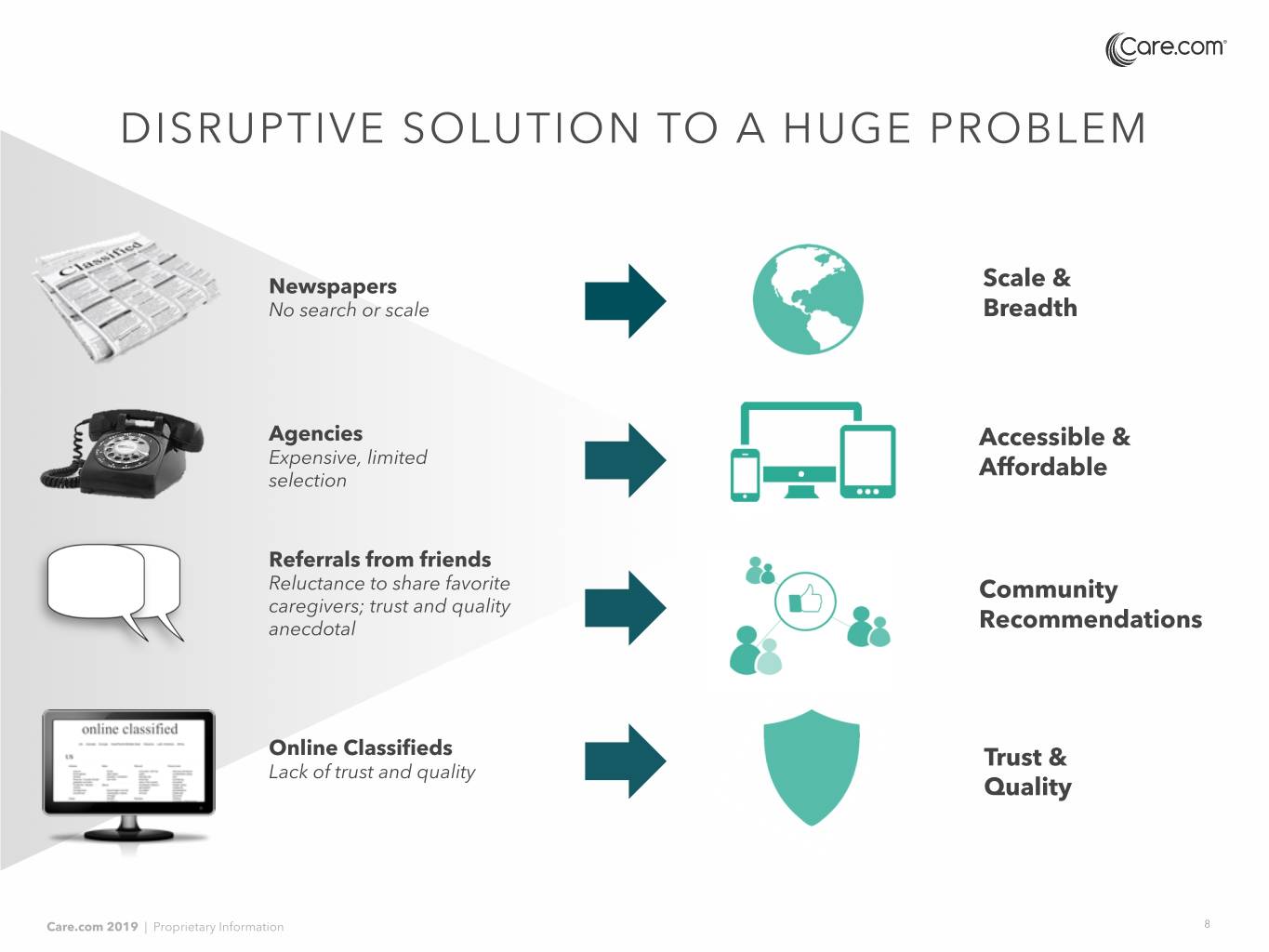

DISRUPTIVE SOLUTION TO A HUGE PROBLEM Newspapers Scale & No search or scale Breadth Agencies Accessible & Expensive, limited selection Affordable Referrals from friends Reluctance to share favorite Community caregivers; trust and quality anecdotal Recommendations Online Classifieds Trust & Lack of trust and quality Quality Care.com 2019 | Proprietary Information 8

OUR VISION: FROM MICRO TO MACRO Improving the lives of families and caregivers by helping to build a global care infrastructure that helps companies and economies grow. Drive economic growth globally by increasing participation of women Help companies improve in the workforce productivity by providing care whenever their employees need it Provide peace at home by offering access to high quality child and senior care Care.com 2019 | Proprietary Information 9

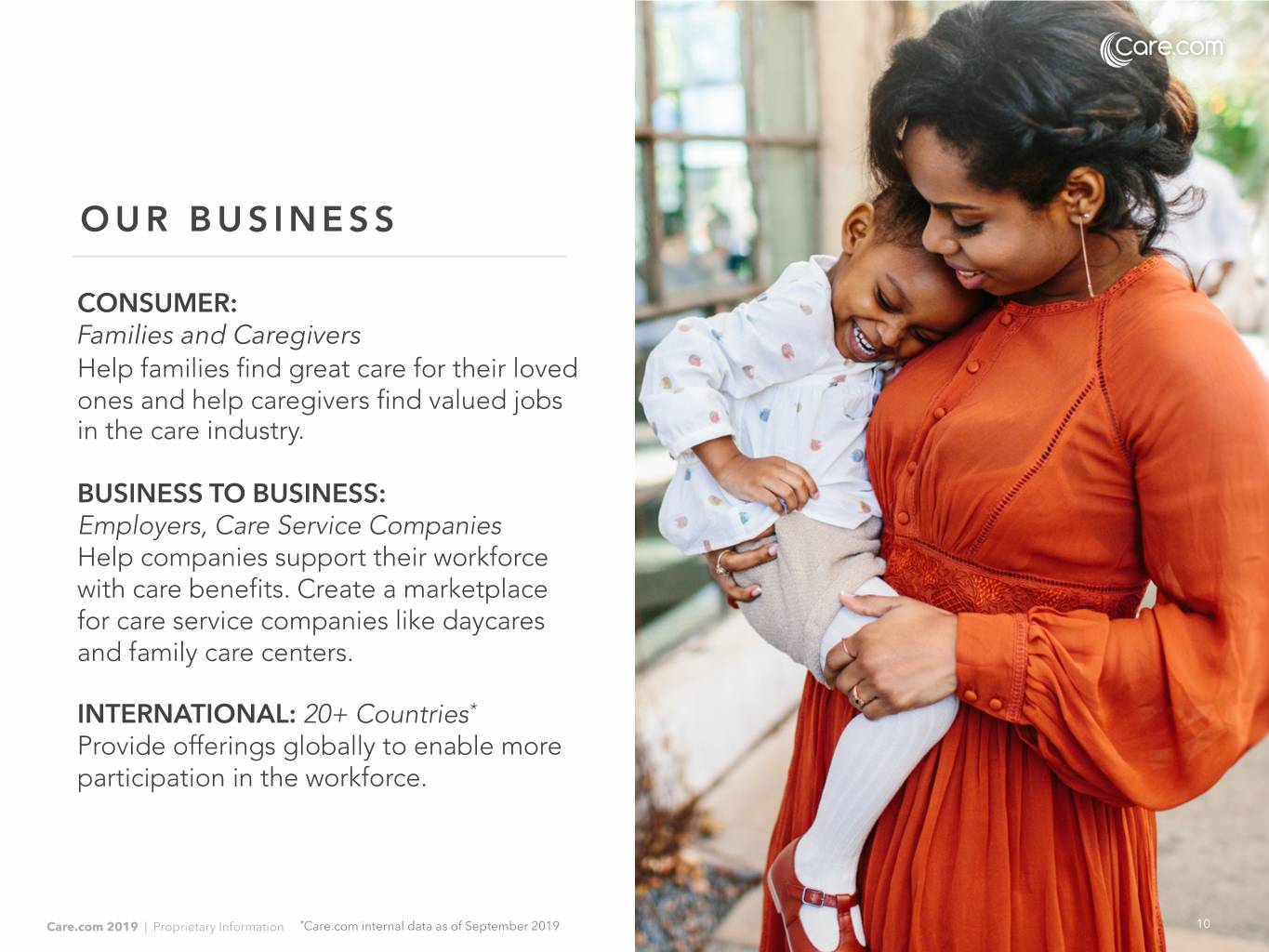

OUR BUSINESS CONSUMER: Families and Caregivers Help families find great care for their loved ones and help caregivers find valued jobs in the care industry. BUSINESS TO BUSINESS: Employers, Care Service Companies Help companies support their workforce with care benefits. Create a marketplace for care service companies like daycares and family care centers. INTERNATIONAL: 20+ Countries* Provide offerings globally to enable more participation in the workforce. Care.com 2019 | Proprietary Information *Care.com internal data as of September 2019 10

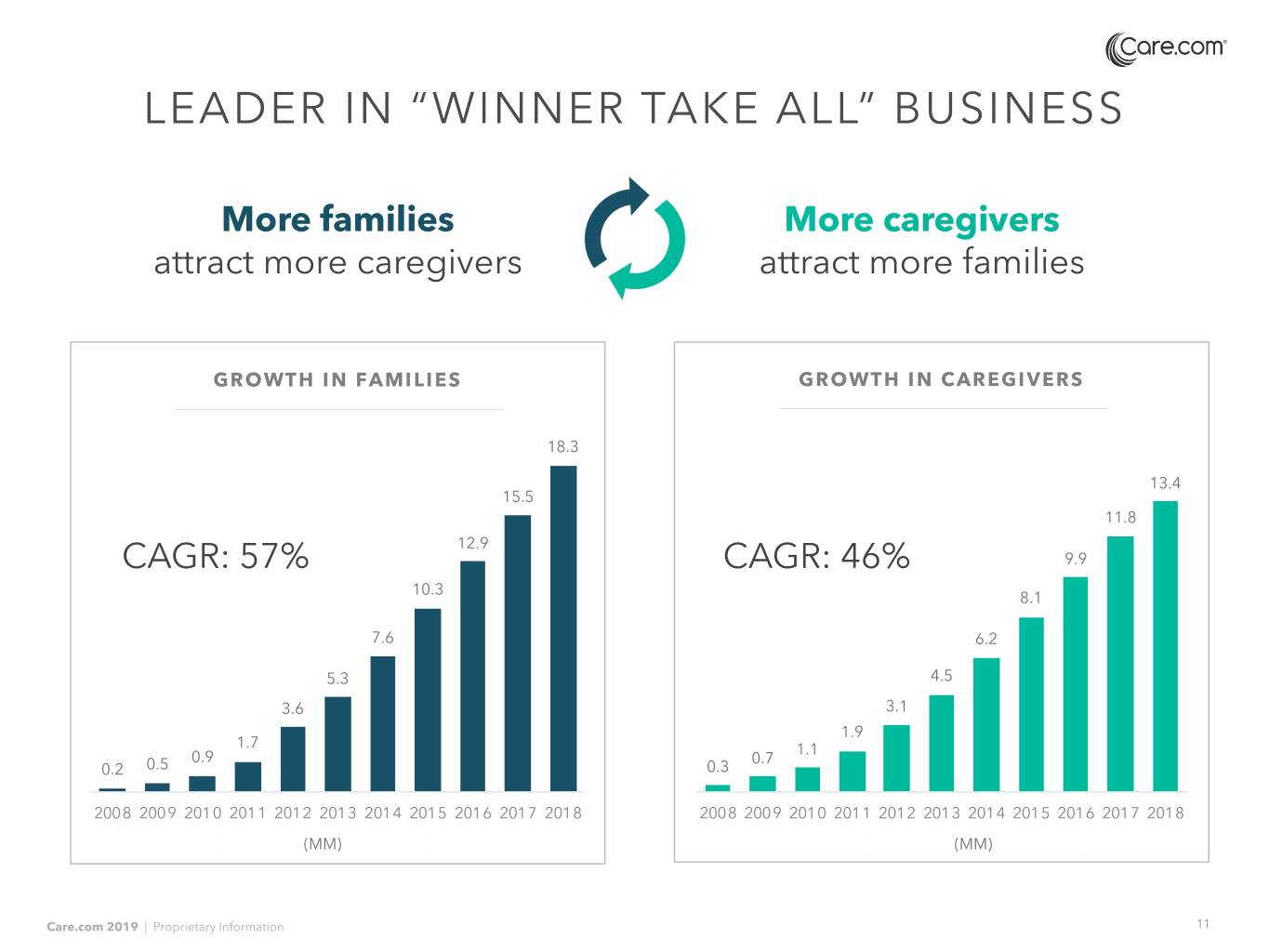

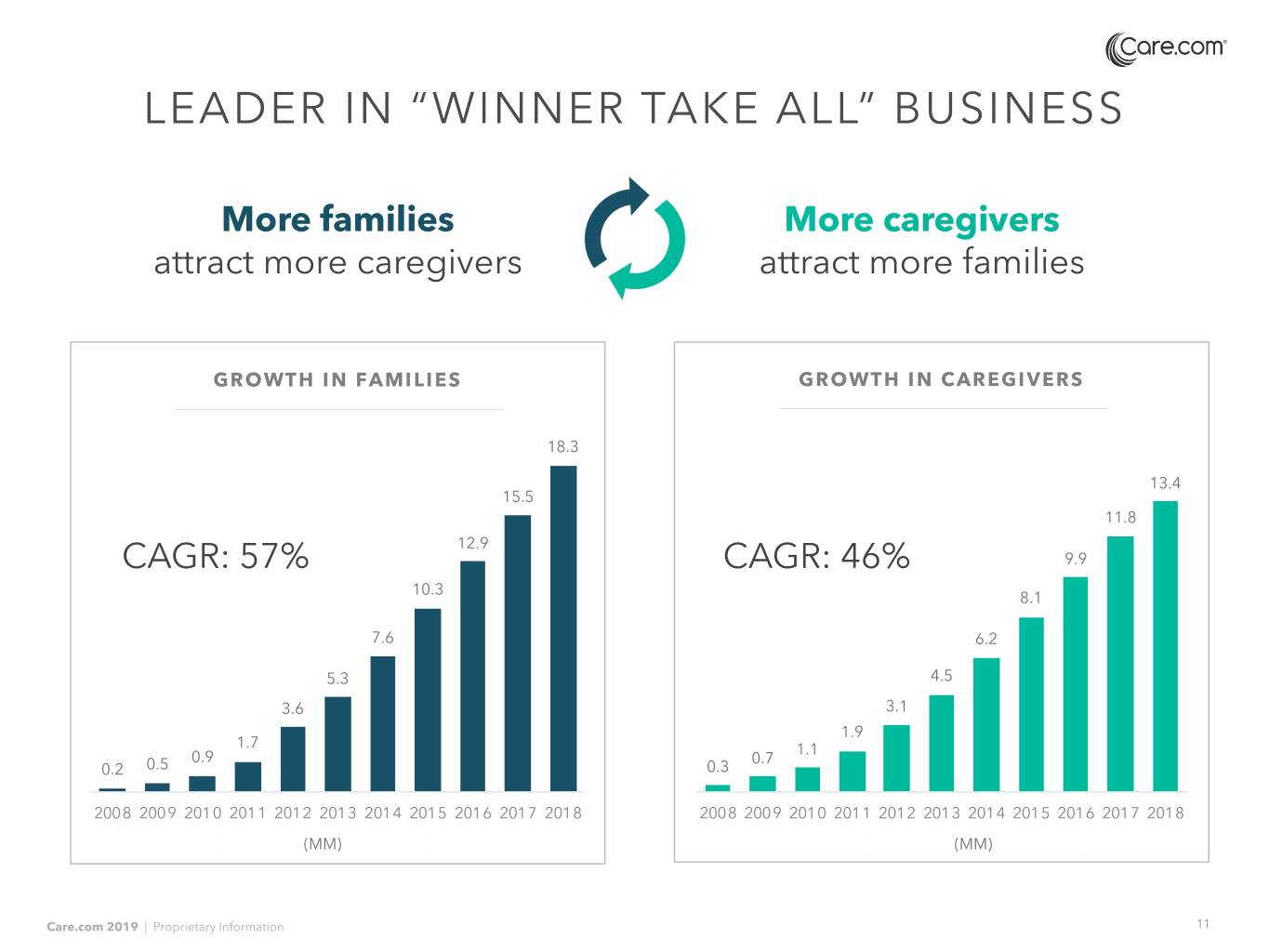

LEADER IN “WINNER TAKE ALL” BUSINESS More families More caregivers attract more caregivers attract more families GROWTH IN FAMILIES GROWTH IN CAREGIVERS 18.3 13.4 15.5 11.8 12.9 CAGR: 57% CAGR: 46% 9.9 10.3 8.1 7.6 6.2 5.3 4.5 3.6 3.1 1.9 1.7 1.1 0.9 0.7 0.2 0.5 0.3 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 (MM) (MM) Care.com 2019 | Proprietary Information 11

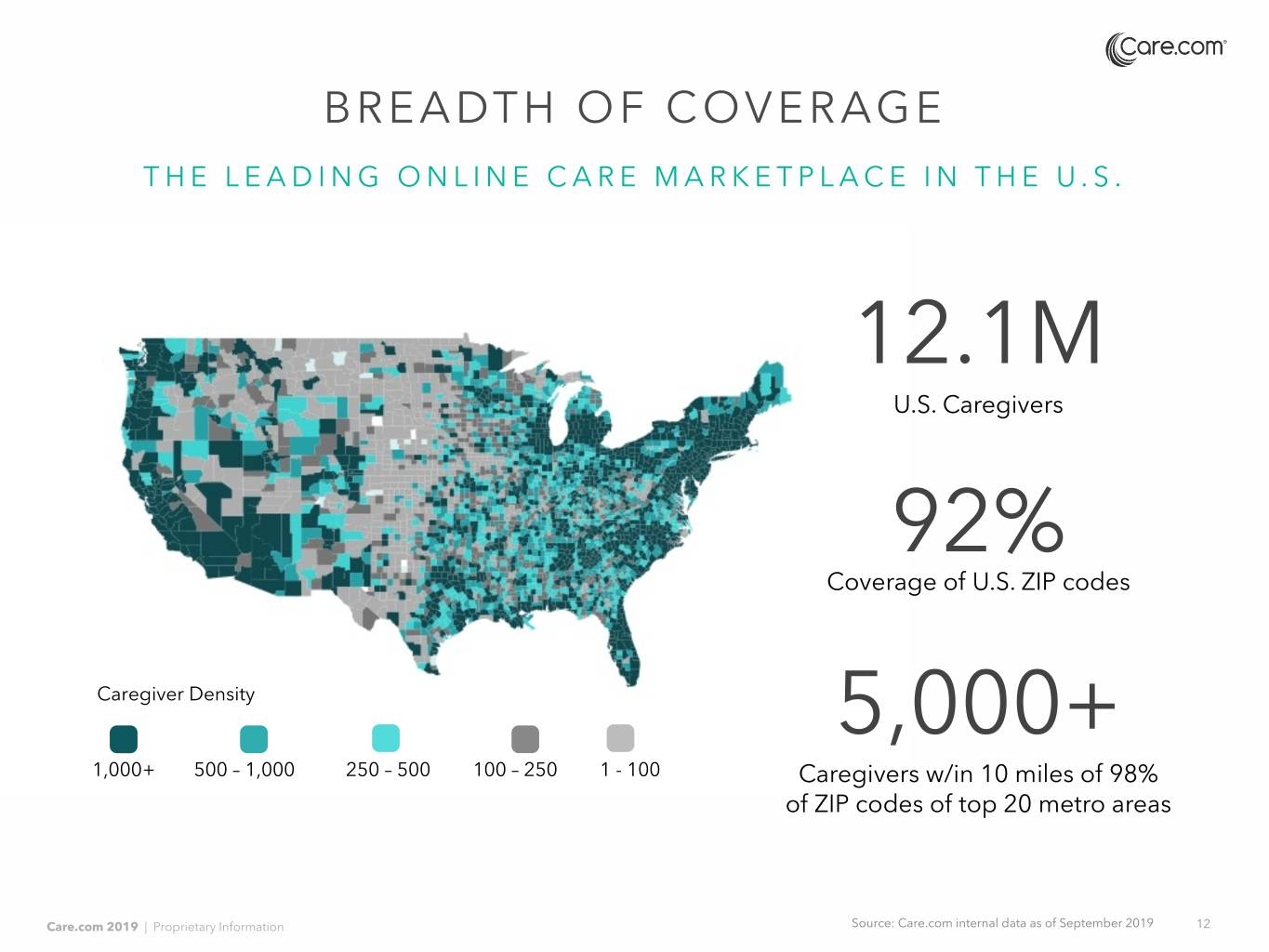

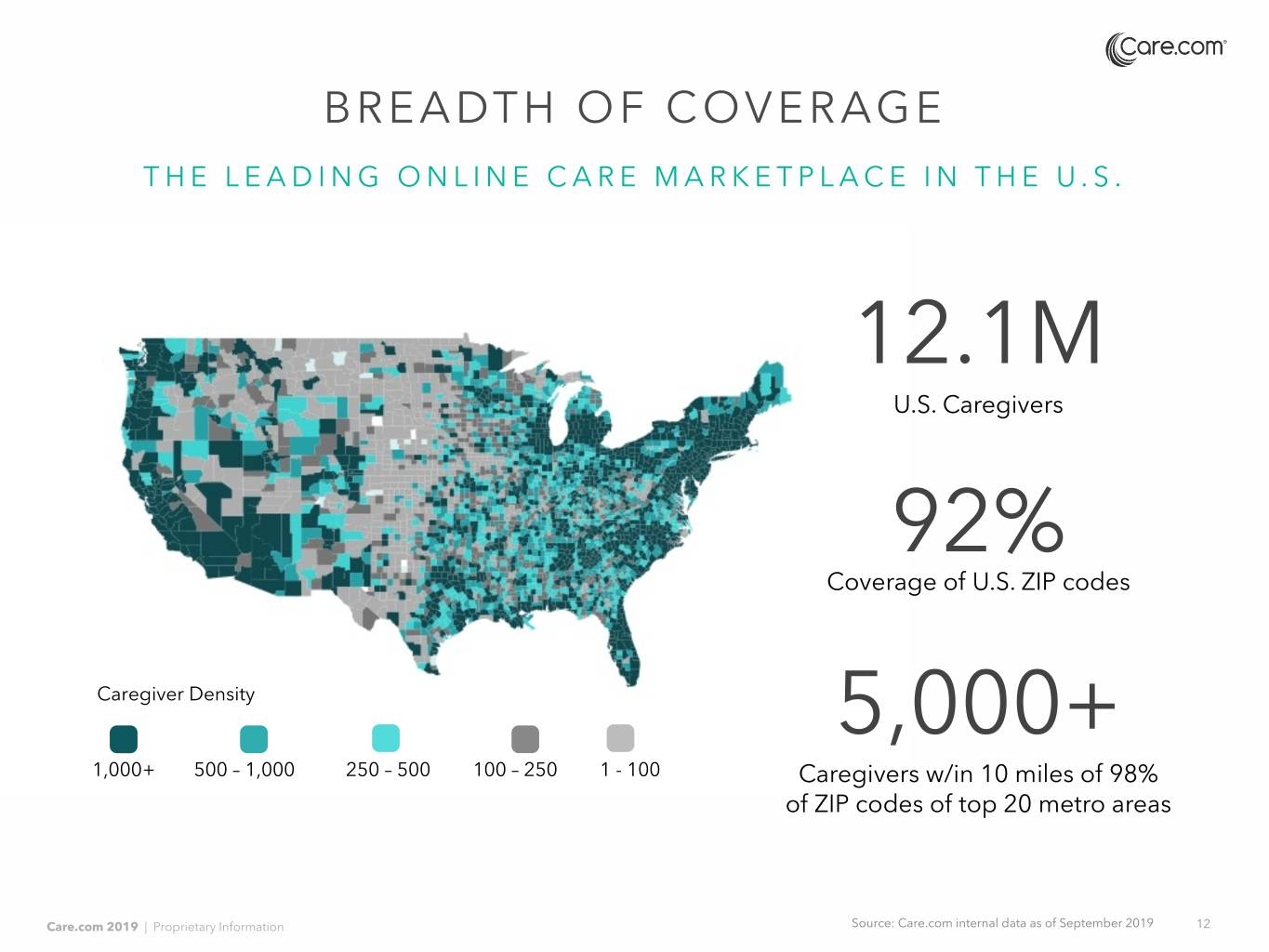

BREADTH OF COVERAGE THE LEADING ONLINE CARE MARKETPLACE IN THE U.S. 12.1M U.S. Caregivers 92% Coverage of U.S. ZIP codes Caregiver Density 5,000+ 1,000+ 500 – 1,000 250 – 500 100 – 250 1 - 100 Caregivers w/in 10 miles of 98% of ZIP codes of top 20 metro areas Care.com 2019 | Proprietary Information Source: Care.com internal data as of September 2019 12

AFFORDABLE FOR MASS MARKET $3,000 - $4,000 OUR MEMBERS 28% Below U.S. median HH income* 69% Dual-income or single parent families** $200 54% Seek part-time care*** Approx. Agency Fees Approx. Care.com per Placement Fees per Year *Based on U.S. Census Bureau and Care.com internal data **Based on 2017 Current Population Survey (CPS) Annual Social and Economic (ASEC) Supplement ***Care.com internal data from January – December 2018 Care.com 2019 | Proprietary Information 13

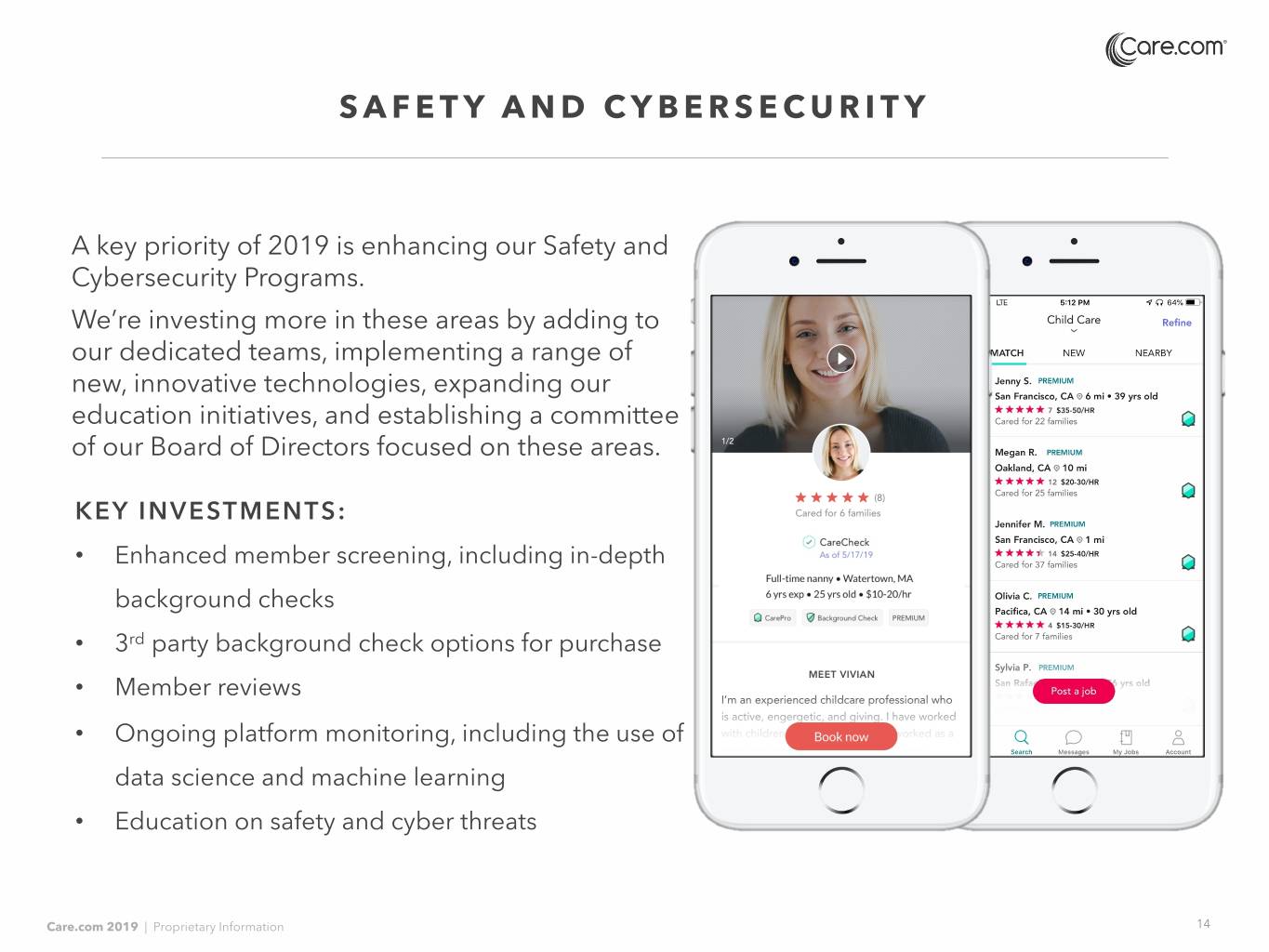

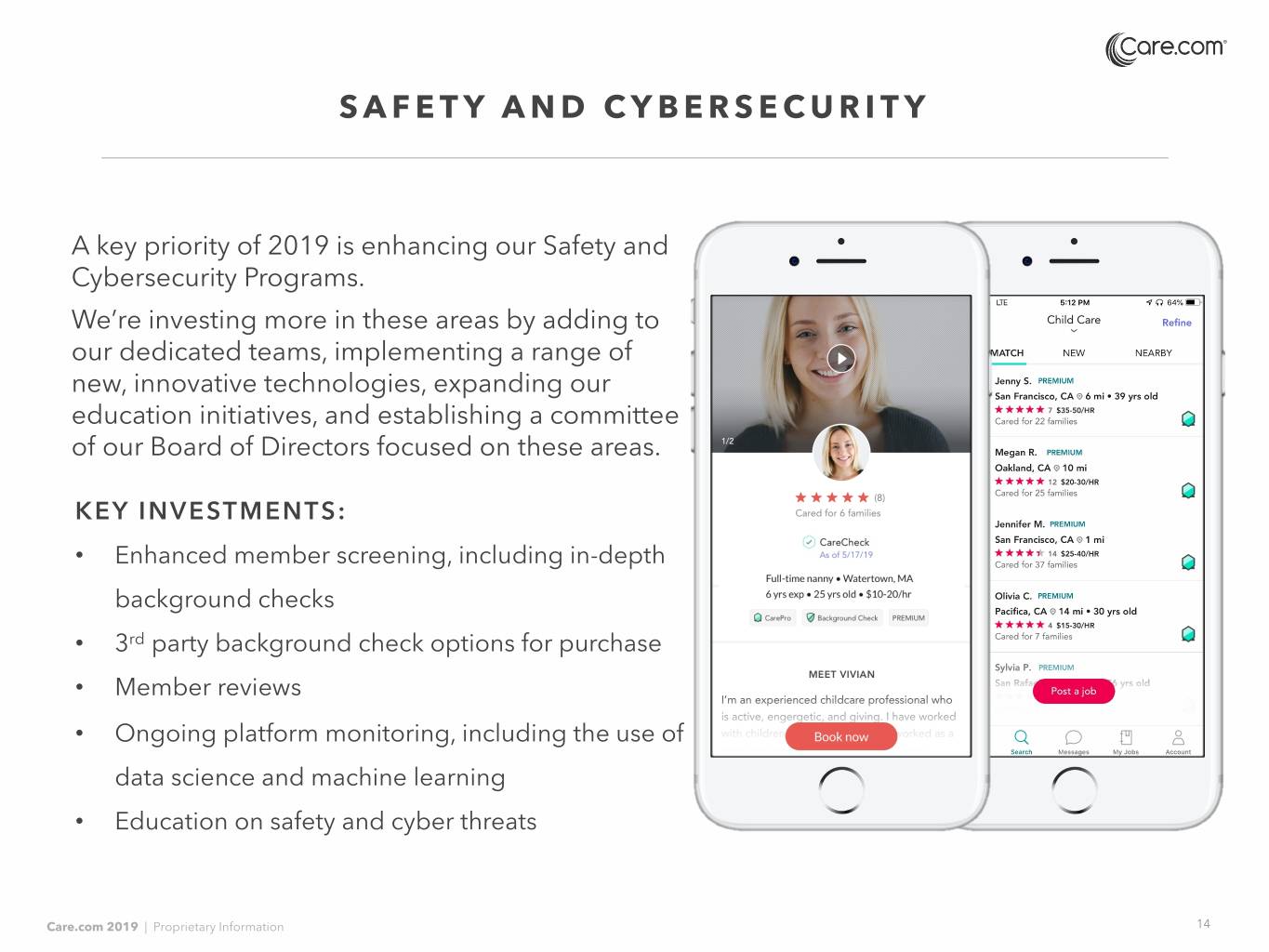

SAFETY AND CYBERSECURITY A key priority of 2019 is enhancing our Safety and Cybersecurity Programs. We’re investing more in these areas by adding to our dedicated teams, implementing a range of new, innovative technologies, expanding our education initiatives, and establishing a committee of our Board of Directors focused on these areas. KEY INVESTMENTS: • Enhanced member screening, including in-depth background checks • 3rd party background check options for purchase • Member reviews • Ongoing platform monitoring, including the use of data science and machine learning • Education on safety and cyber threats Care.com 2019 | Proprietary Information 14

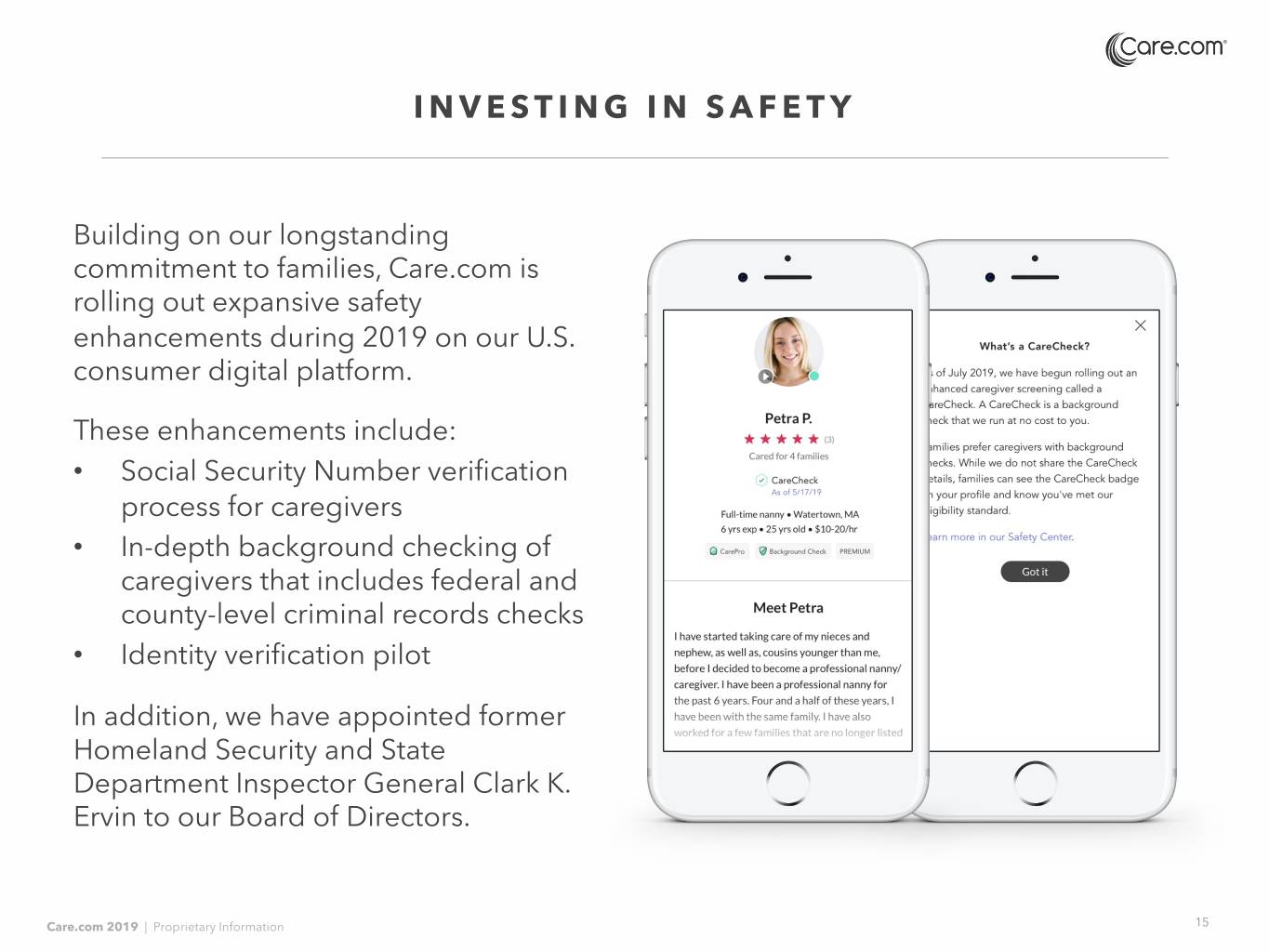

INVESTING IN SAFETY Building on our longstanding commitment to families, Care.com is rolling out expansive safety enhancements during 2019 on our U.S. consumer digital platform. These enhancements include: • Social Security Number verification process for caregivers • In-depth background checking of caregivers that includes federal and county-level criminal records checks • Identity verification pilot In addition, we have appointed former Homeland Security and State Department Inspector General Clark K. Ervin to our Board of Directors. Care.com 2019 | Proprietary Information 15

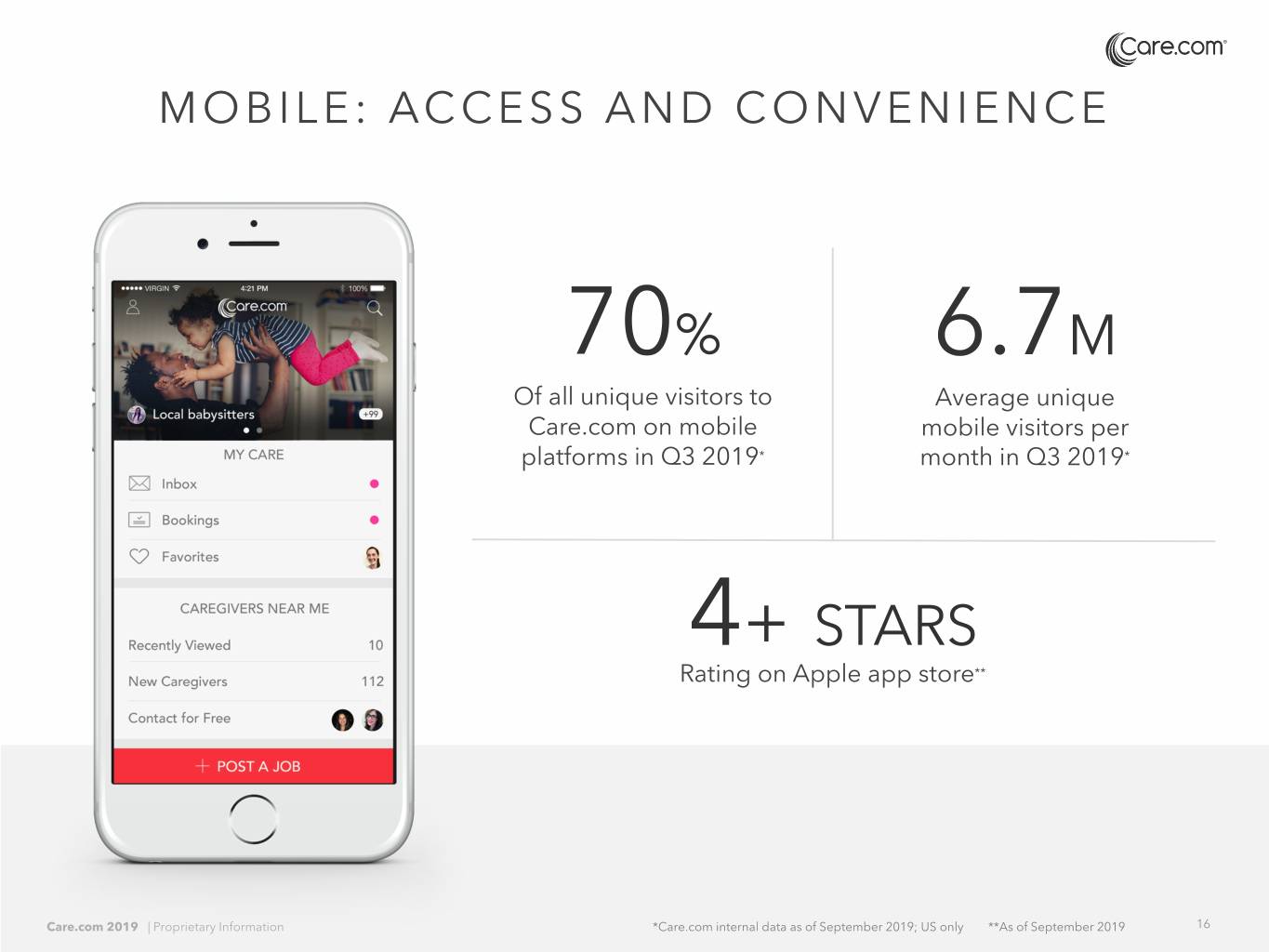

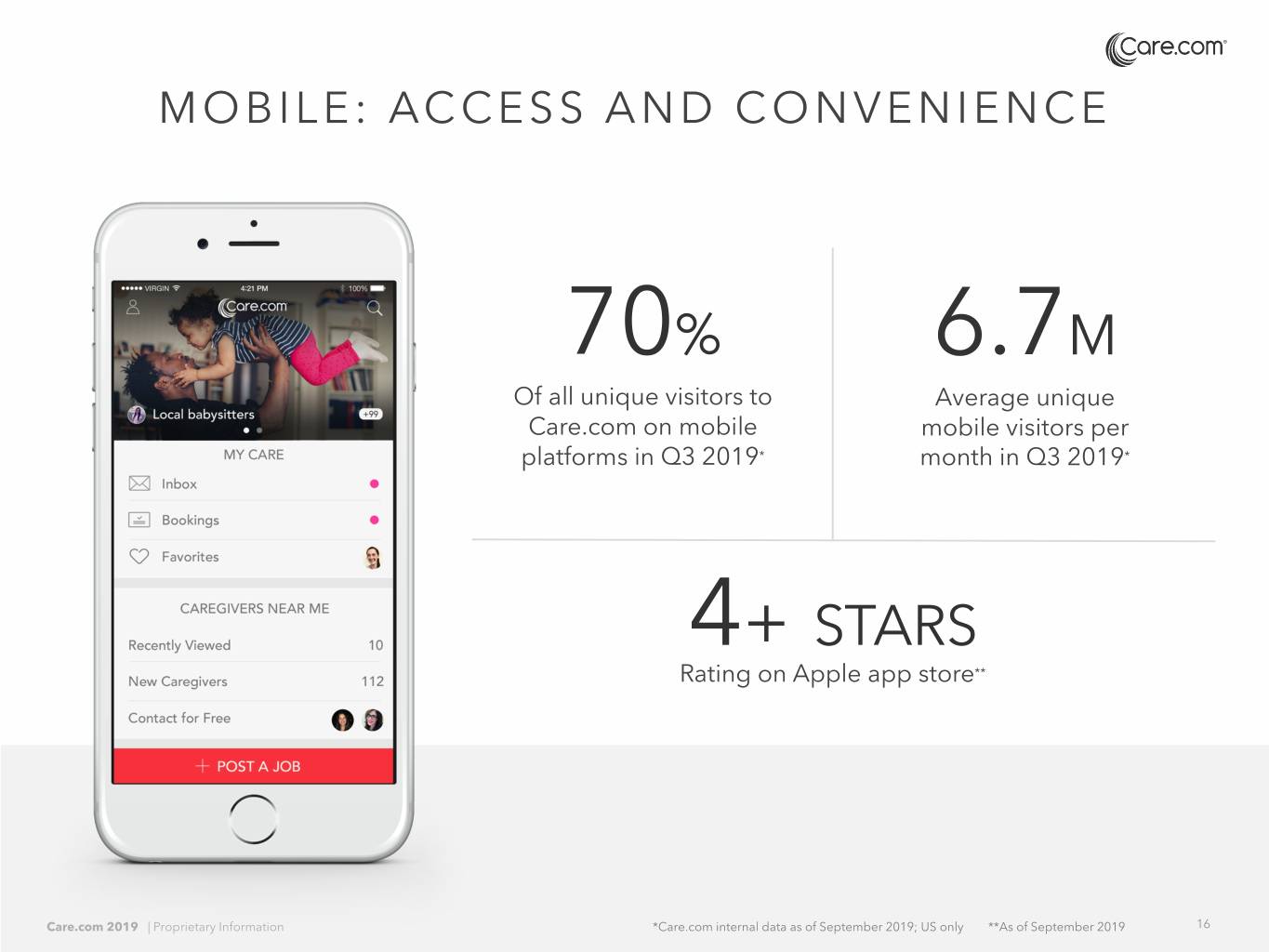

MOBILE: ACCESS AND CONVENIENCE 70% 6.7M Of all unique visitors to Average unique Care.com on mobile mobile visitors per platforms in Q3 2019* month in Q3 2019* 4++ STARS Rating on Apple app store** Care.com 2019 | | Proprietary Information *Care.com internal data as of September 2019; US only **As of September 2019 16

FULL SUITE OF PAYMENTS PRODUCTS CONVENIENCE PAYMENTS FULL PAYROLL & TAX SERVICE Support multiple Nanny Premium and transactional use cases Mobile client experience Care.com 2019 | Proprietary Information 17

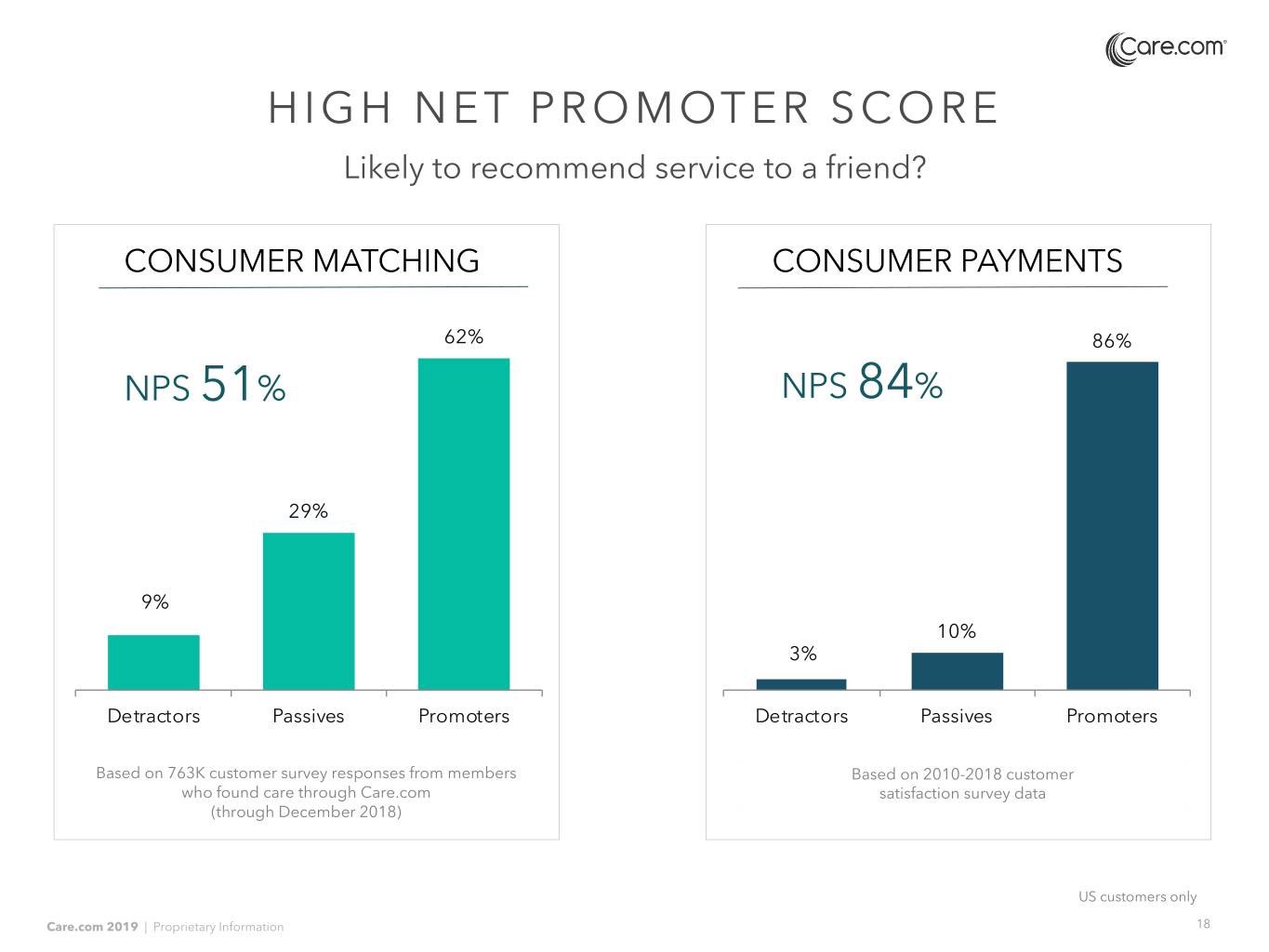

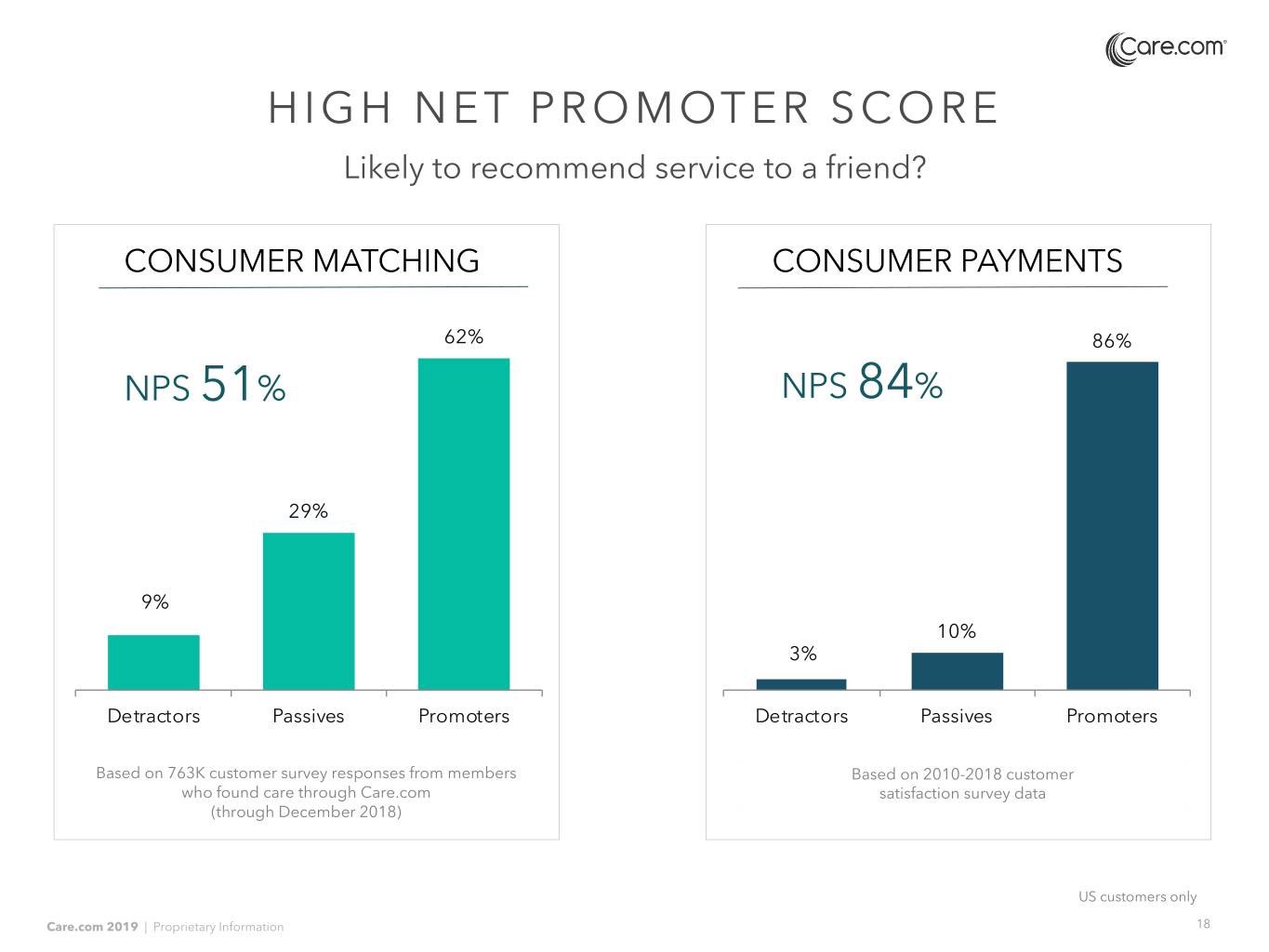

HIGH NET PROMOTER SCORE Likely to recommend service to a friend? CONSUMER MATCHING CONSUMER PAYMENTS 62% 86% NPS 51% NPS 84% 29% 9% 10% 3% Detractors Passives Promoters Detractors Passives Promoters Based on 763K customer survey responses from members Based on 2010-2018 customer who found care through Care.com satisfaction survey data (through December 2018) US customers only Care.com 2019 | Proprietary Information 18

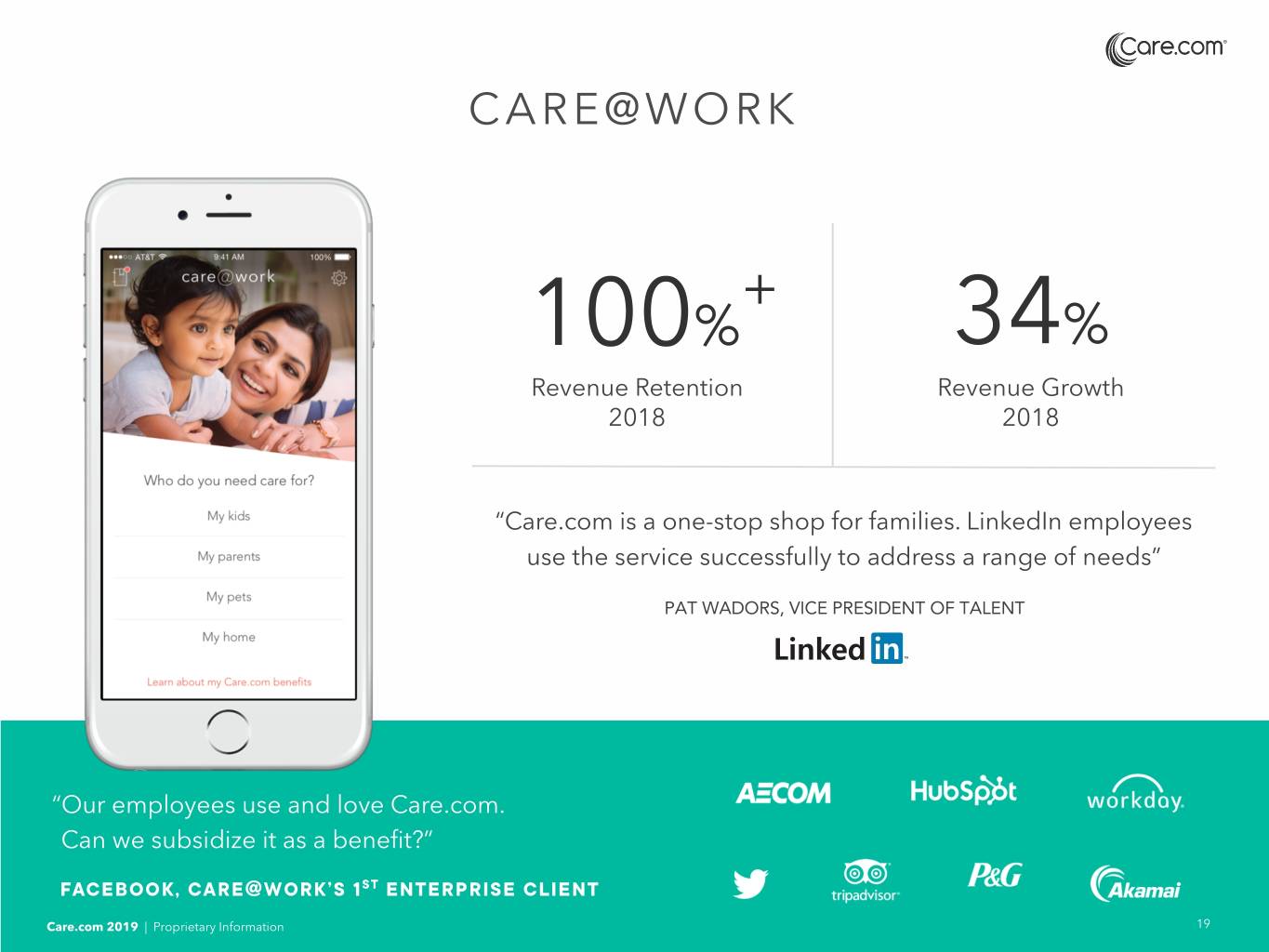

CARE@WORK + 100% 34% Revenue Retention Revenue Growth 2018 2018 “Care.com is a one-stop shop for families. LinkedIn employees use the service successfully to address a range of needs” PAT WADORS, VICE PRESIDENT OF TALENT “Our employees use and love Care.com. Can we subsidize it as a benefit?” FACEBOOK, CARE@WORK’S 1ST ENTERPRISE CLIENT Care.com 2019 | Proprietary Information 19

OUR 2019 INVESTMENT PRIORITIES • Safety and cybersecurity enhancements • Senior care marketing: vertical diversification • Care@Work • Operational excellence Care.com 2019 | Proprietary Information 20

KEY FINANCIAL HIGHLIGHTS Steady revenue growth Compelling unit economics Leveraging operating expenses and S&M spend Profitable expectation of sustained profitability* *Based on current projections of adjusted EBITDA Care.com 2019 | Proprietary Information 21

STEADY REVENUE GROWTH Total Company Revenue ($M) FY Revenue, 2010-2018 Q3 Revenue, 2012-2019 $53 $49 $192 $45 $174 $41 $39 $162 $139 $32 $111 $22 $81 $14 $48 $26 $13 2010 2011 2012 2013 2014 2015 2016 2017 2018 2012Q3 2013Q3 2014Q3 2015Q3 2016Q3 2017Q3 2018Q3 2019Q3 Note: 2016 includes the impact of the 53rd week. Care.com 2019 | Proprietary Information 22

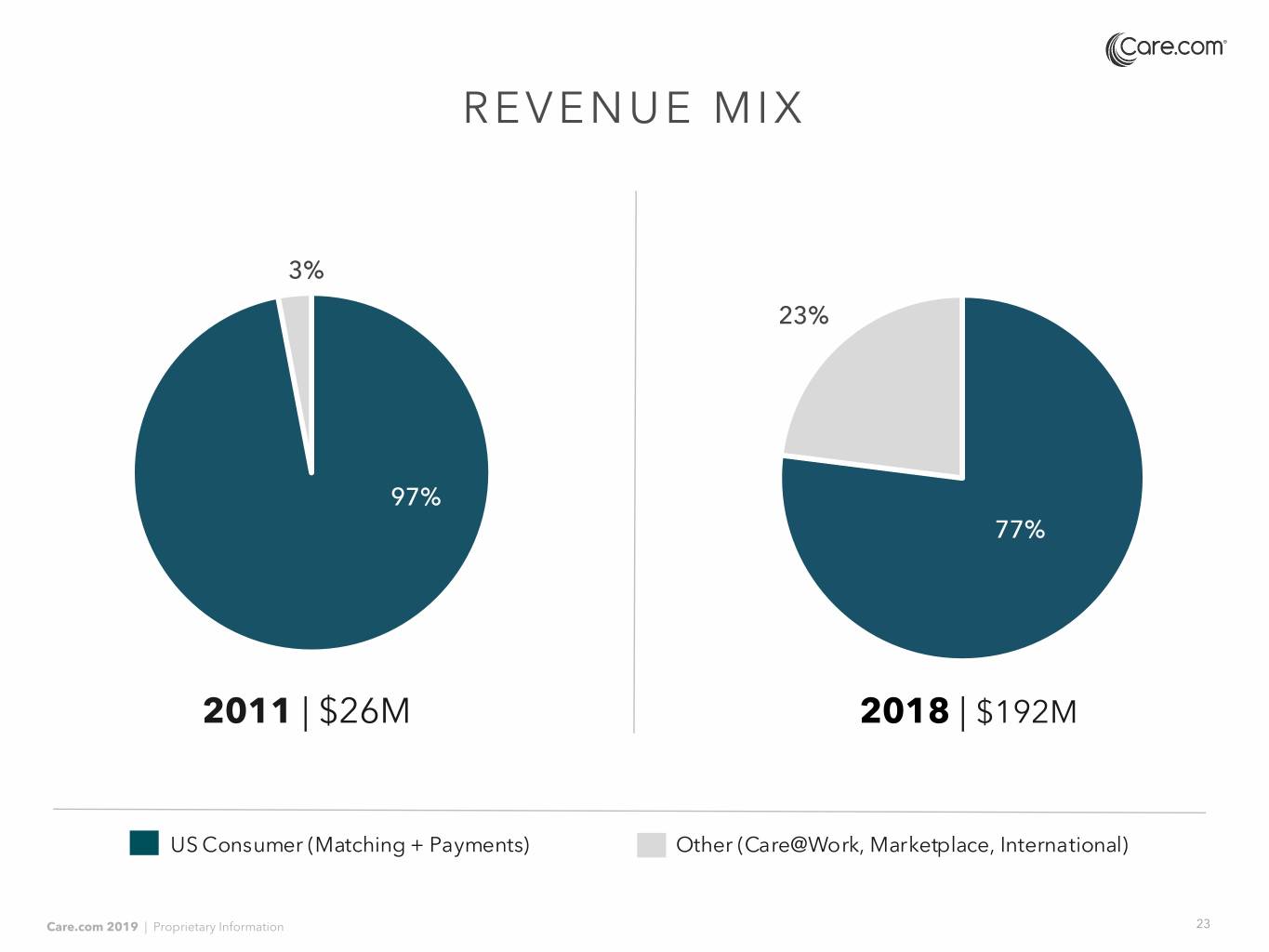

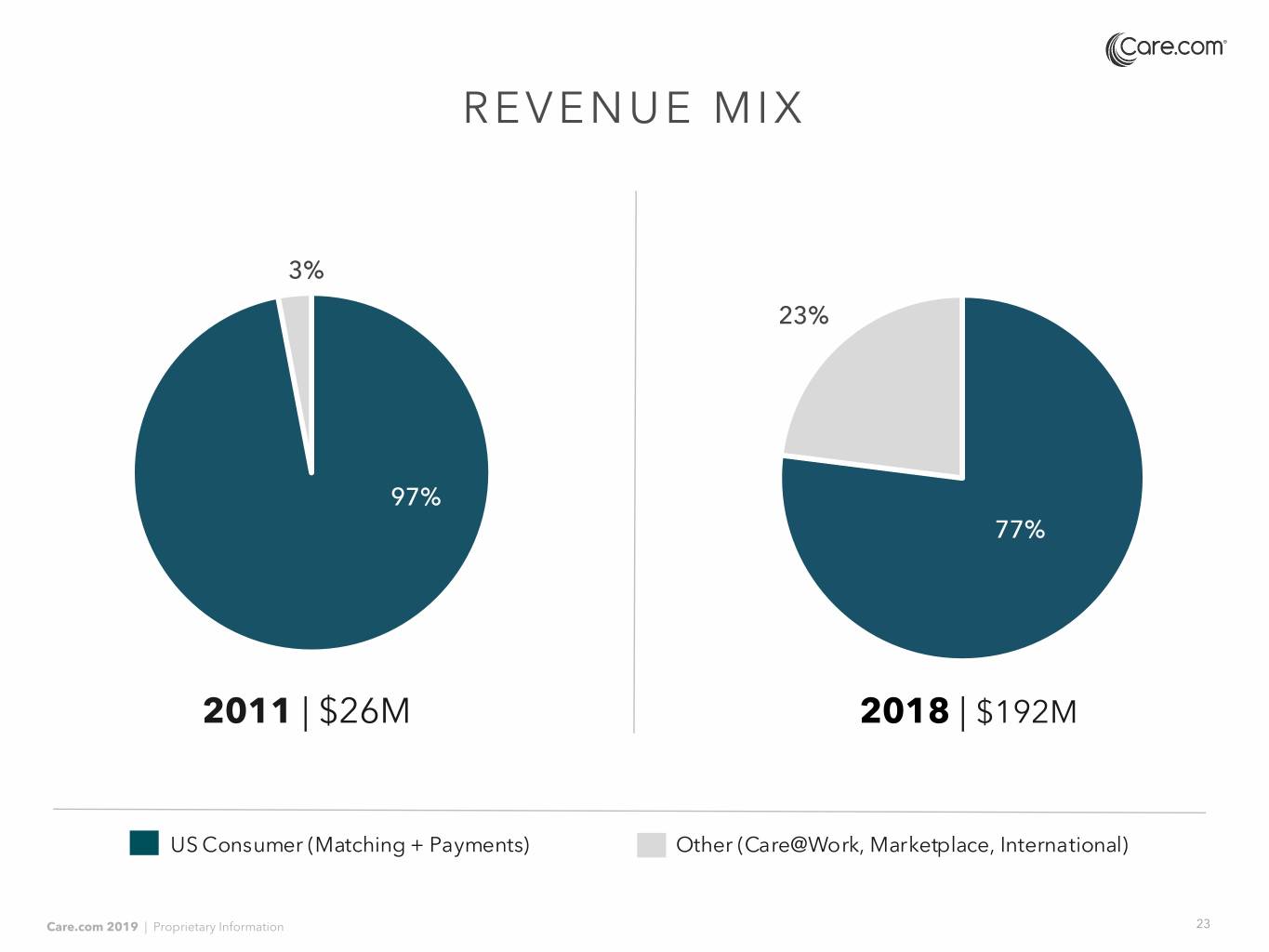

REVENUE MIX 3% 23% 97% 77% 2011 | $26M 2018 | $192M Consumer Matching 12% Other US Consumer (Matching + Payments) Other (Care@Work, 82%Marketplace, International) Care.com 2019 | Proprietary Information 23

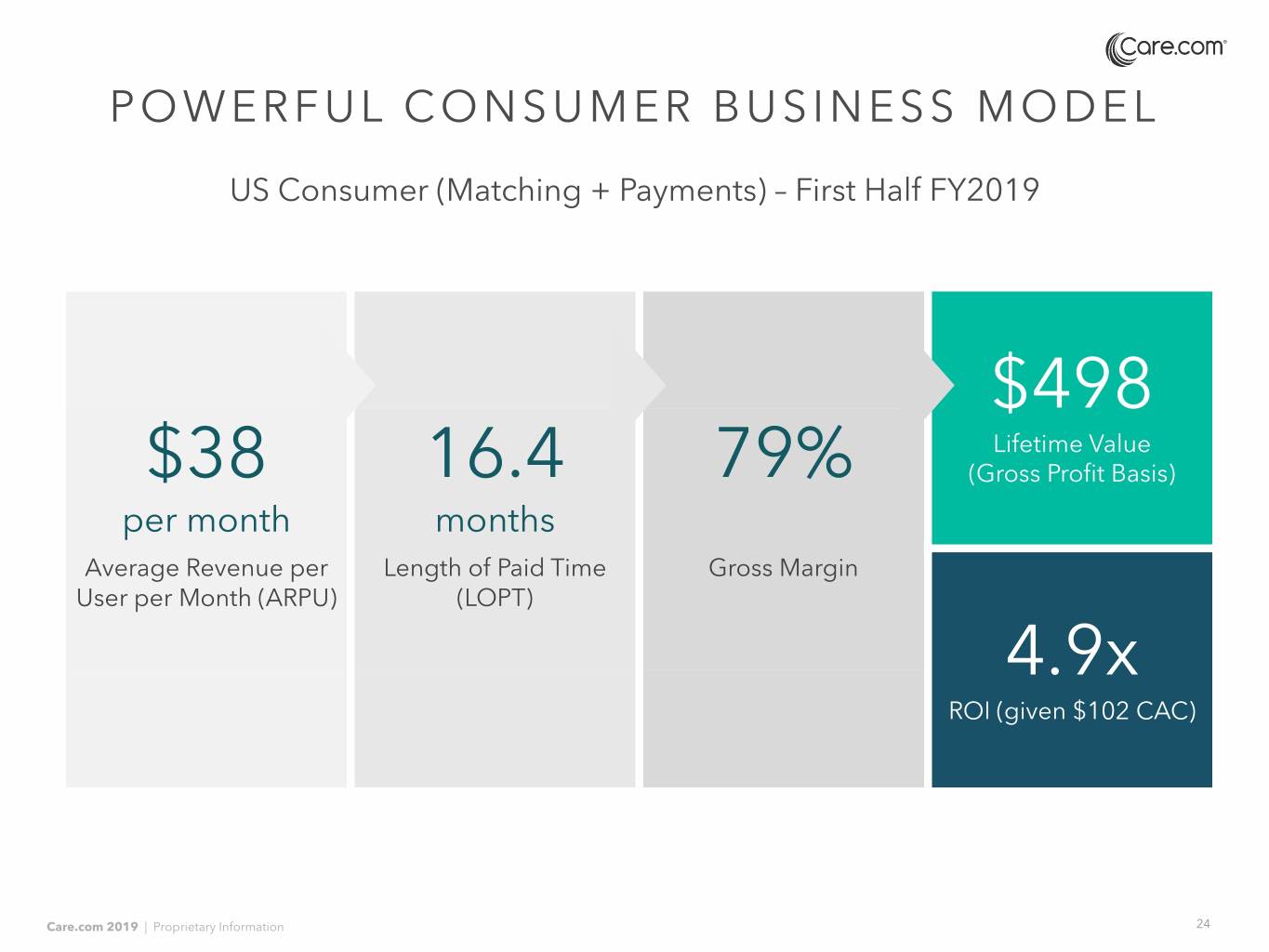

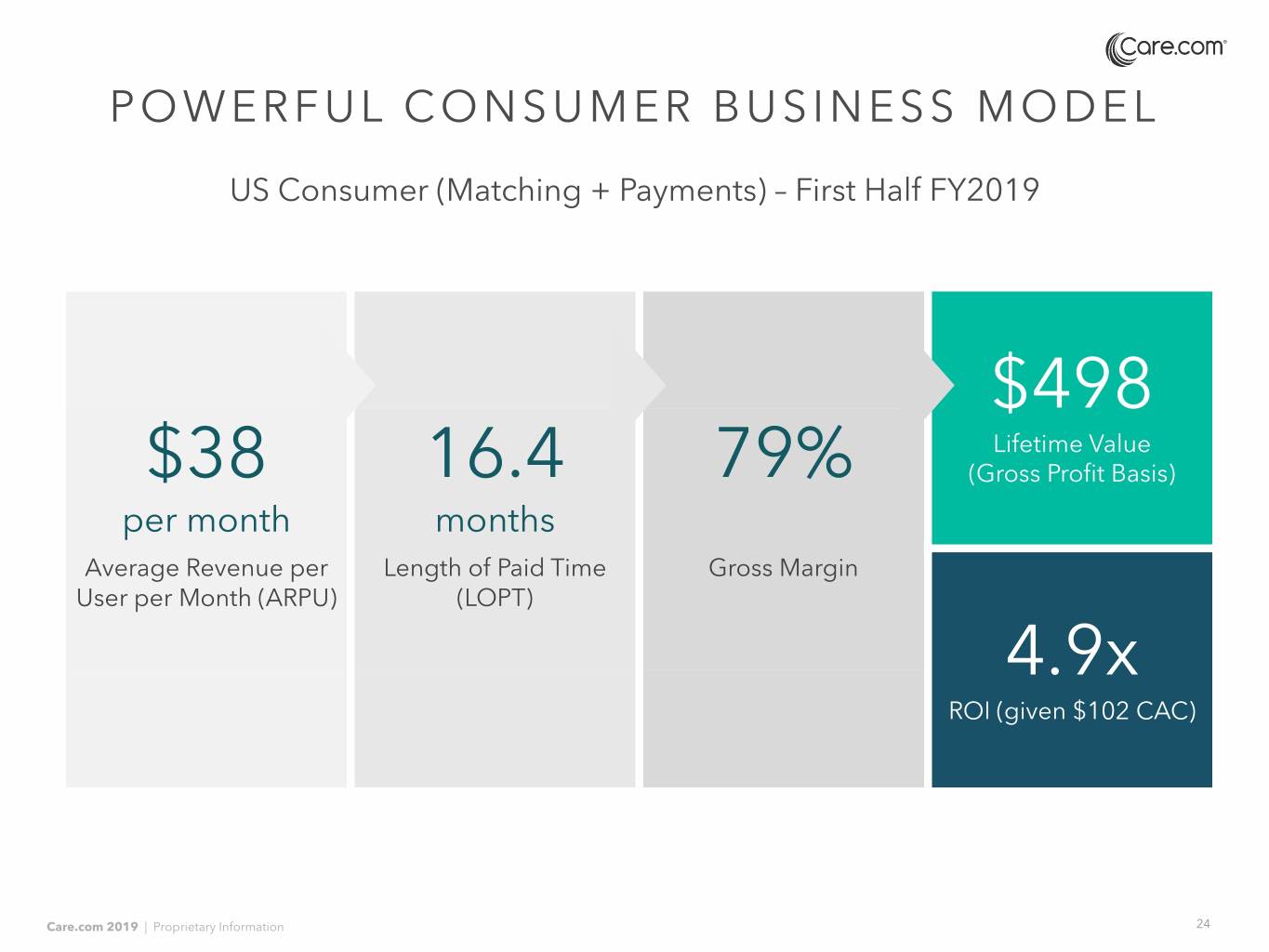

POWERFUL CONSUMER BUSINESS MODEL US Consumer (Matching + Payments) – First Half FY2019 $498 Lifetime Value $38 16.4 79% (Gross Profit Basis) per month months Average Revenue per Length of Paid Time Gross Margin User per Month (ARPU) (LOPT) 4.9x ROI (given $102 CAC) Care.com 2019 | Proprietary Information 24

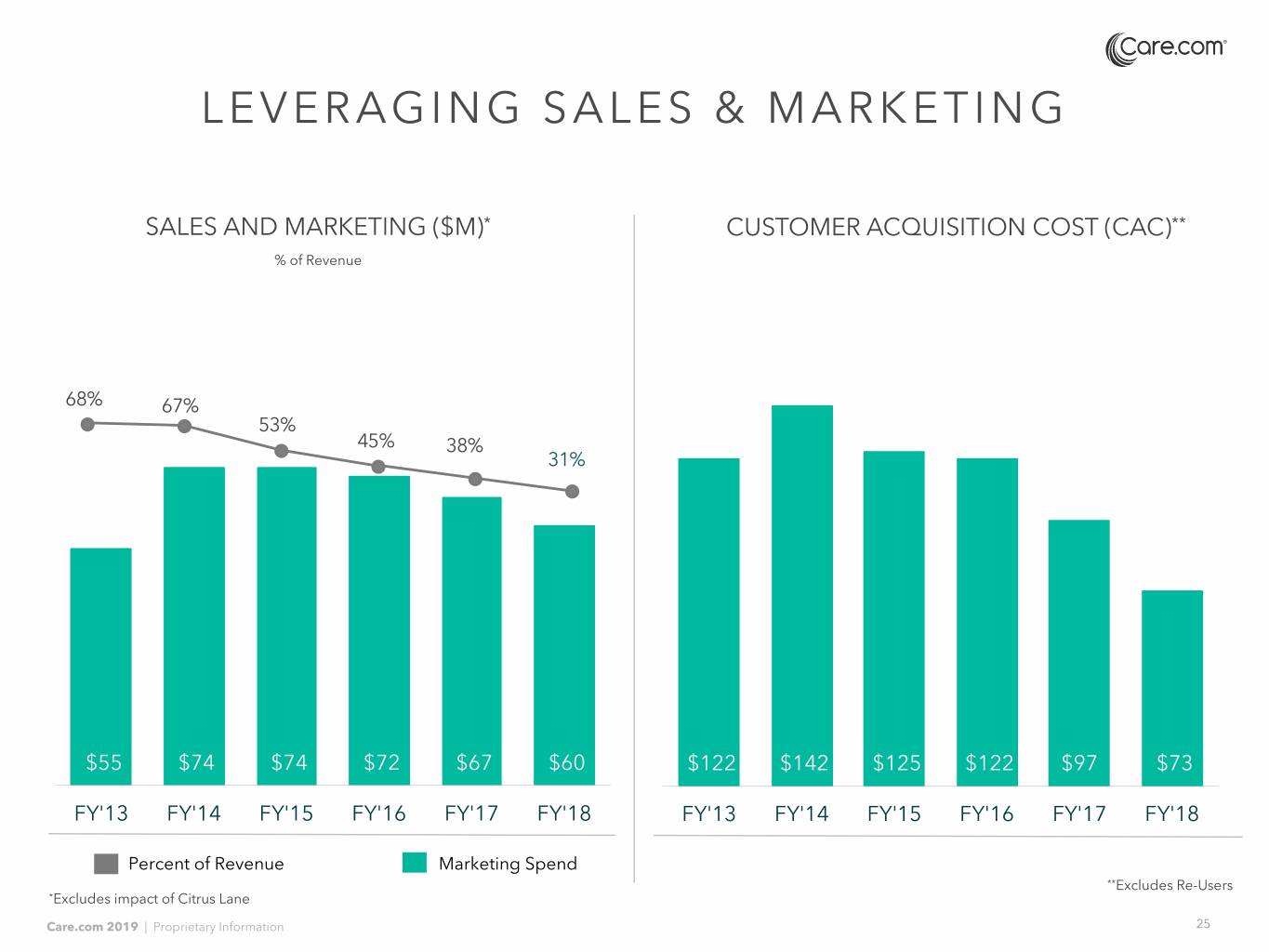

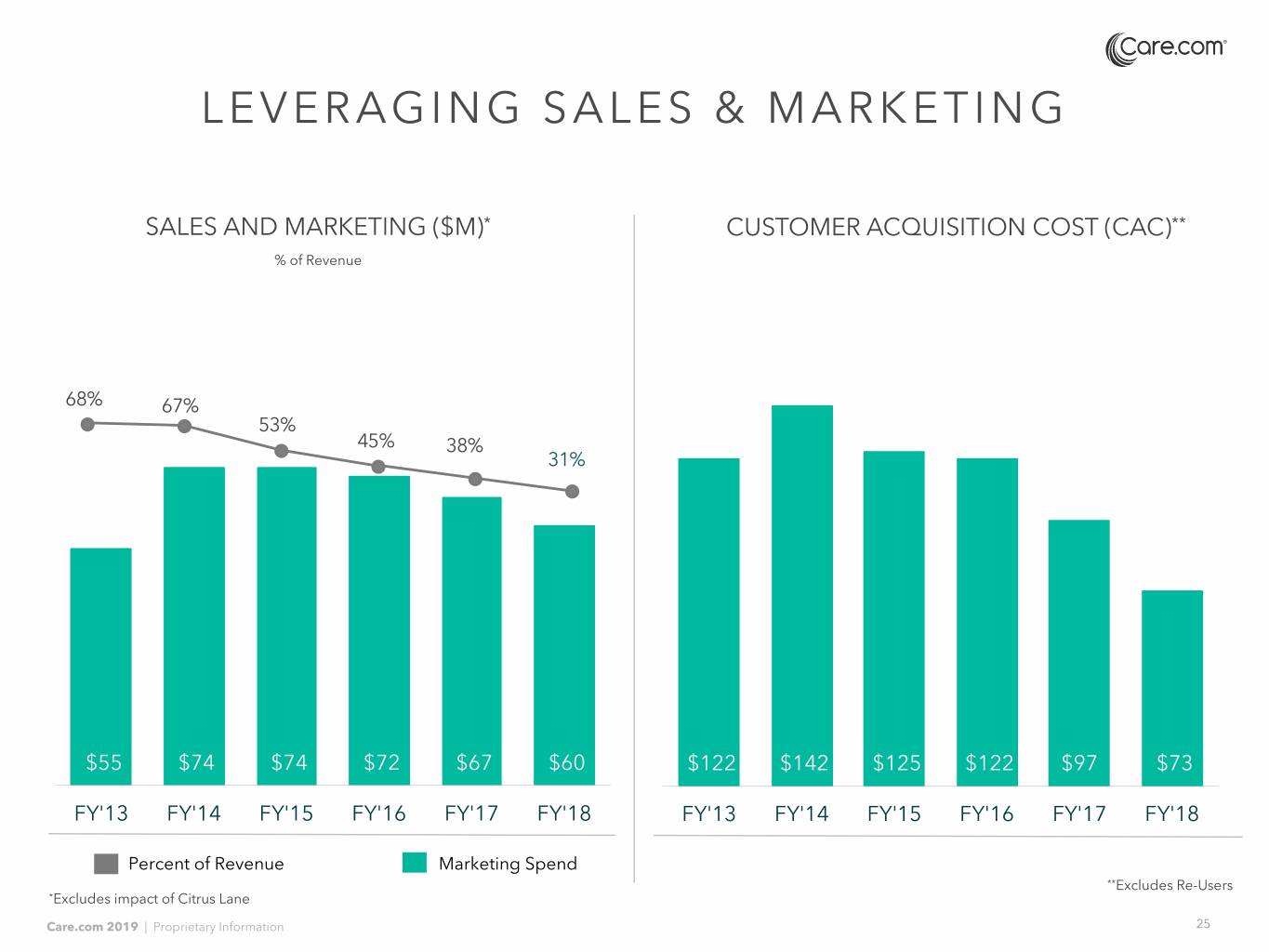

LEVERAGING SALES & MARKETING SALES AND MARKETING ($M)* CUSTOMER ACQUISITION COST (CAC)** % of Revenue 68% 67% 53% 45% 38% 31% $55 $74 $74 $72 $67 $60 $122 $142 $125 $122 $97 $73 FY'13 FY'14 FY'15 FY'16 FY'17 FY'18 FY'13 FY'14 FY'15 FY'16 FY'17 FY'18 Percent of Revenue Marketing Spend **Excludes Re-Users *Excludes impact of Citrus Lane Care.com 2019 | Proprietary Information 25

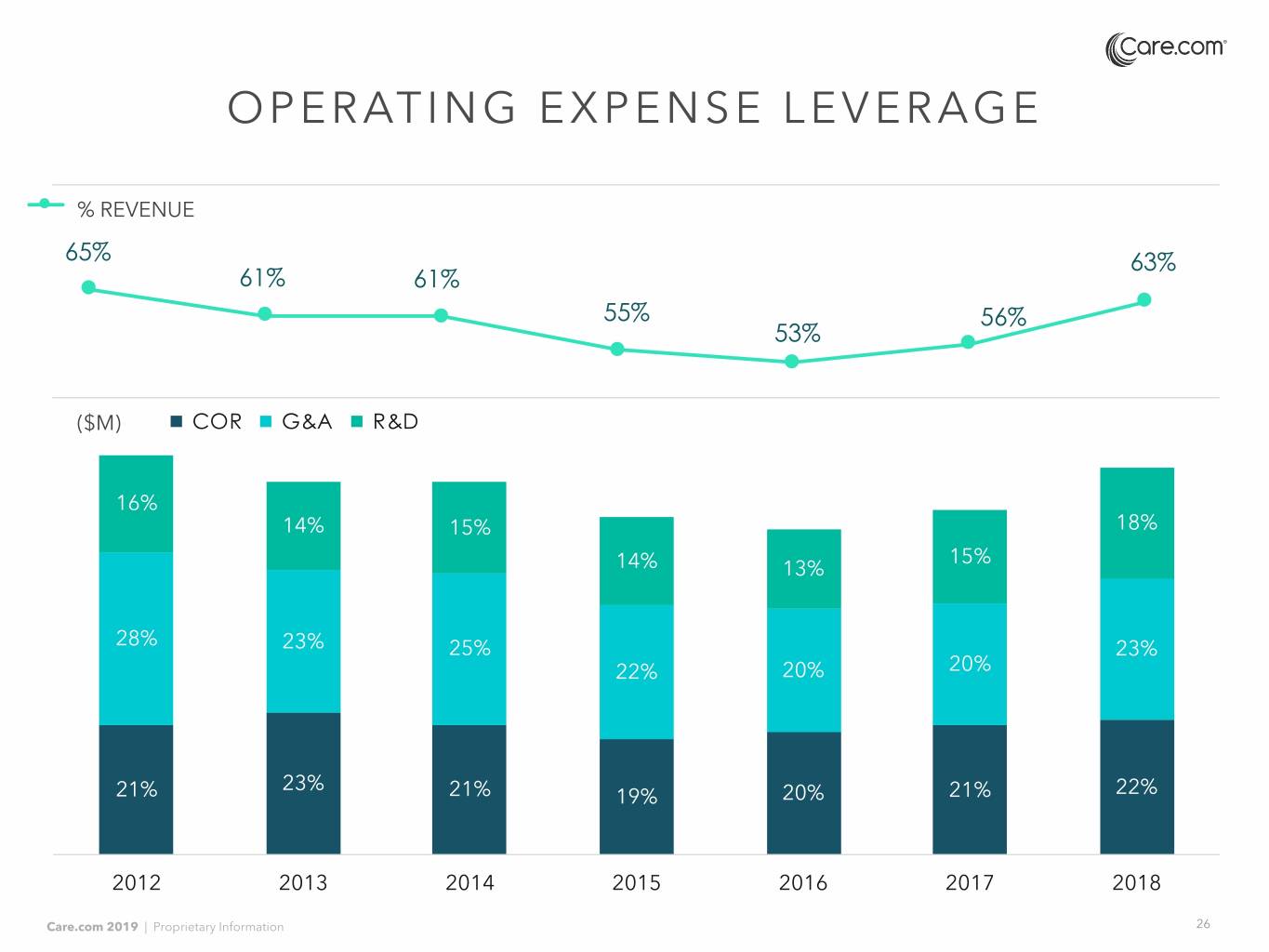

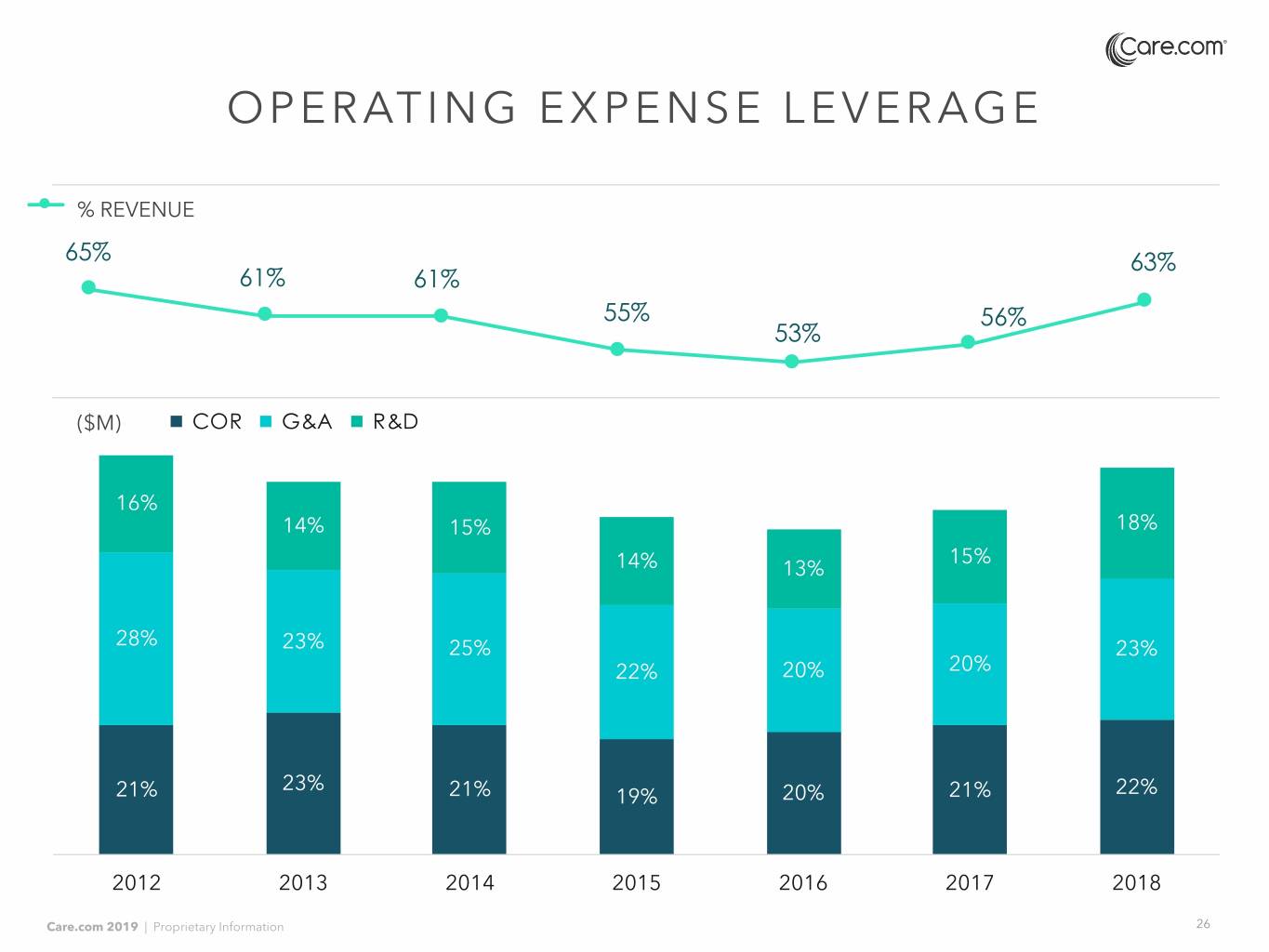

OPERATING EXPENSE LEVERAGE Column1% REVENUE 65% 63% 61% 61% 55% 56% 53% ($M) | COR G&A R&D 16% 14% 15% 18% 15% 14% 13% 28% 23% 25% 23% 22% 20% 20% 23% 21% 21% 19% 20% 21% 22% 2012 2013 2014 2015 2016 2017 2018 Care.com 2019 | Proprietary Information 26

NYSE: CRCM HIGHLIGHTS Dominant leader in large and CLEAR LEADER fragmented care services market Proven business model with compelling unit STRONG MODEL economics. Profitable growth.* Significant brand leadership and trusted TRUSTED BRAND platform for growth Still low penetration of addressable market; LONG RUNWAY both vertical and horizontal growth opportunity FAVORABLE TRENDS Strong demographic tailwinds MOTIVATED TEAM Experienced, passionate management *Based on current projections of adjusted EBITDA Care.com 2019 | Proprietary Information 27

ThankThank you you Care.com 2019 | Proprietary & Confidential