Q3 2019 RESULTS SUPPLEMENT Care.com 2019 | Proprietary Information November 6, 2019

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to information about the Company’s 2019 priorities and profitability expectations. These forward-looking statements are made as of November 6, 2019 and are based on expectations, estimates, forecasts and projections, as well as the beliefs and assumptions of management, as of such date. Words such as “plan,” "expect," "anticipate," "should," "believe," "hope," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "might," "could," "intend" and “designed,” as well as variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to risks and uncertainties, many of which involve factors or circumstances beyond the Company's control. The Company's actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: our ability to grow our membership while leveraging our investment in sales and marketing; our success in converting non-paying members to paying members and extending the length of time that paying members continue to pay for our services; our ability to cross-sell new and existing products and services to our members and to develop new products and services that members consider valuable; our ability to protect our brand and maintain our reputation among our members; and other risks detailed in the Company's filings with the Securities and Exchange Commission. Past performance is not necessarily indicative of future results. The forward-looking statements included in this presentation represent the Company's views as of the date of November 6, 2019, and should not be relied upon as representing the Company’s views as of any subsequent date. The Company anticipates that subsequent events and developments will cause its views to change. The Company has no intention nor undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Care.com 2019 | Proprietary Information 2

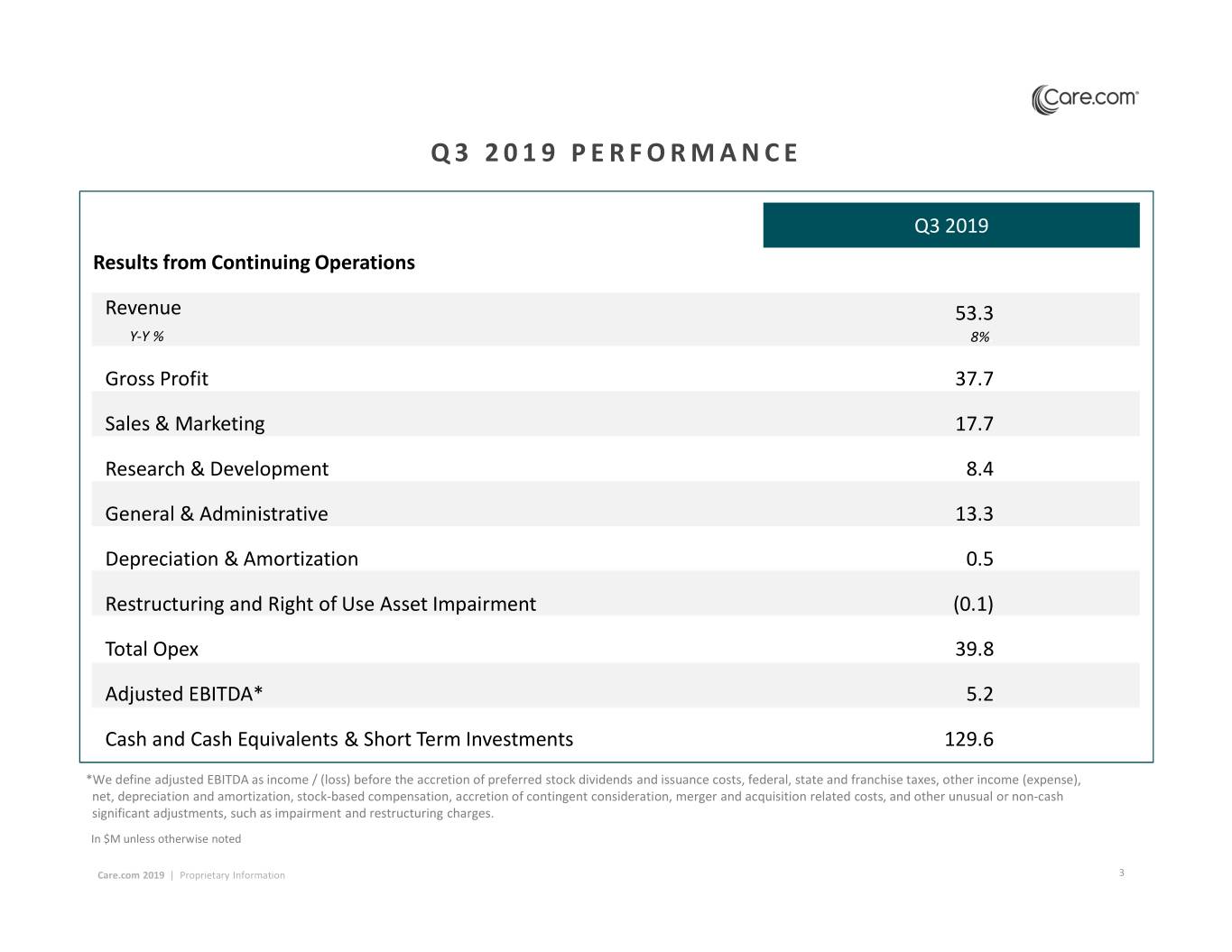

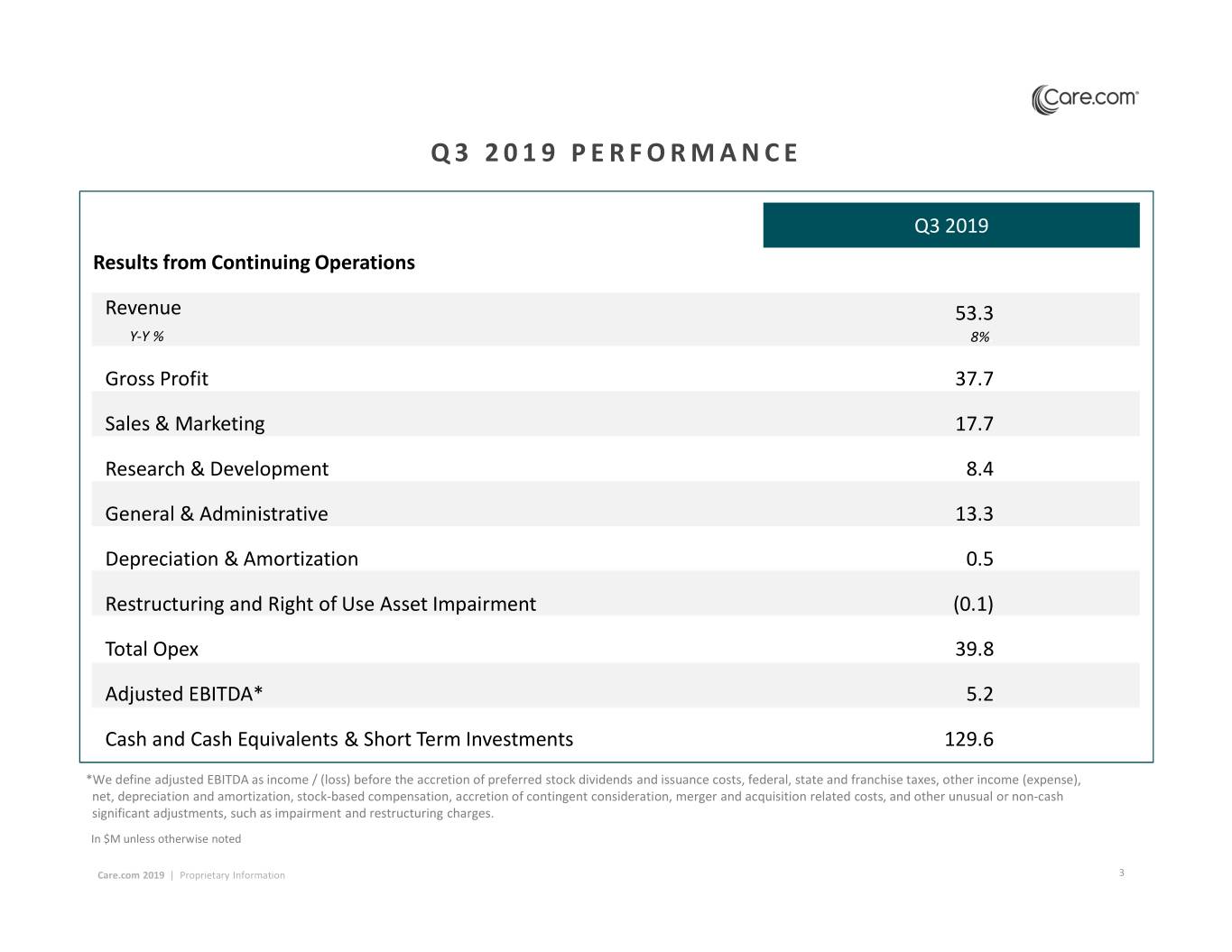

Q3 2019 PERFORMANCE Q3 2019 Results from Continuing Operations Revenue 53.3 Y-Y % 8%. Gross Profit 37.7 Sales & Marketing 17.7 Research & Development 8.4 General & Administrative 13.3 Depreciation & Amortization 0.5 Restructuring and Right of Use Asset Impairment (0.1) Total Opex 39.8 Adjusted EBITDA* 5.2 Cash and Cash Equivalents & Short Term Investments 129.6 *We define adjusted EBITDA as income / (loss) before the accretion of preferred stock dividends and issuance costs, federal, state and franchise taxes, other income (expense), net, depreciation and amortization, stock-based compensation, accretion of contingent consideration, merger and acquisition related costs, and other unusual or non-cash significant adjustments, such as impairment and restructuring charges. In $M unless otherwise noted Care.com 2019 | Proprietary Information 3

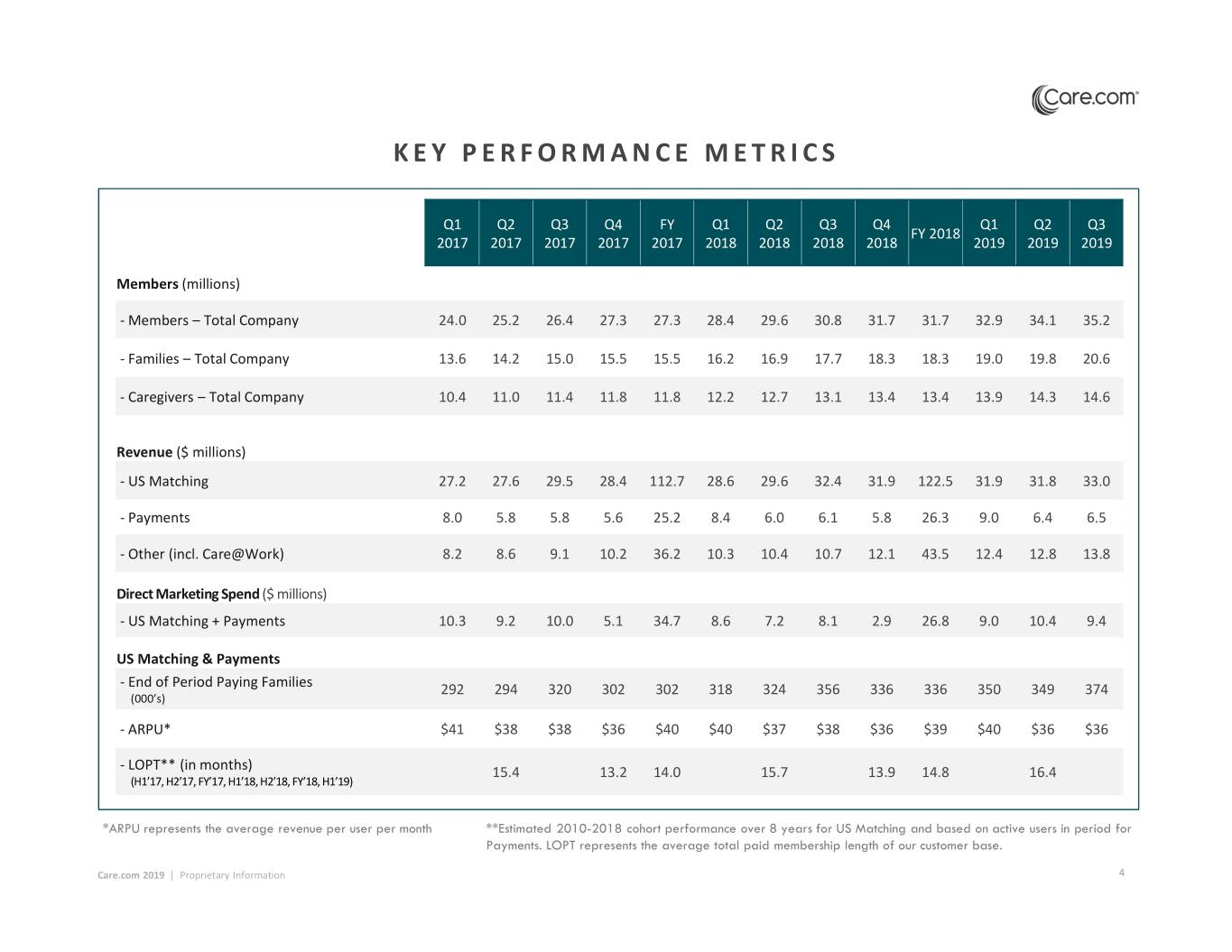

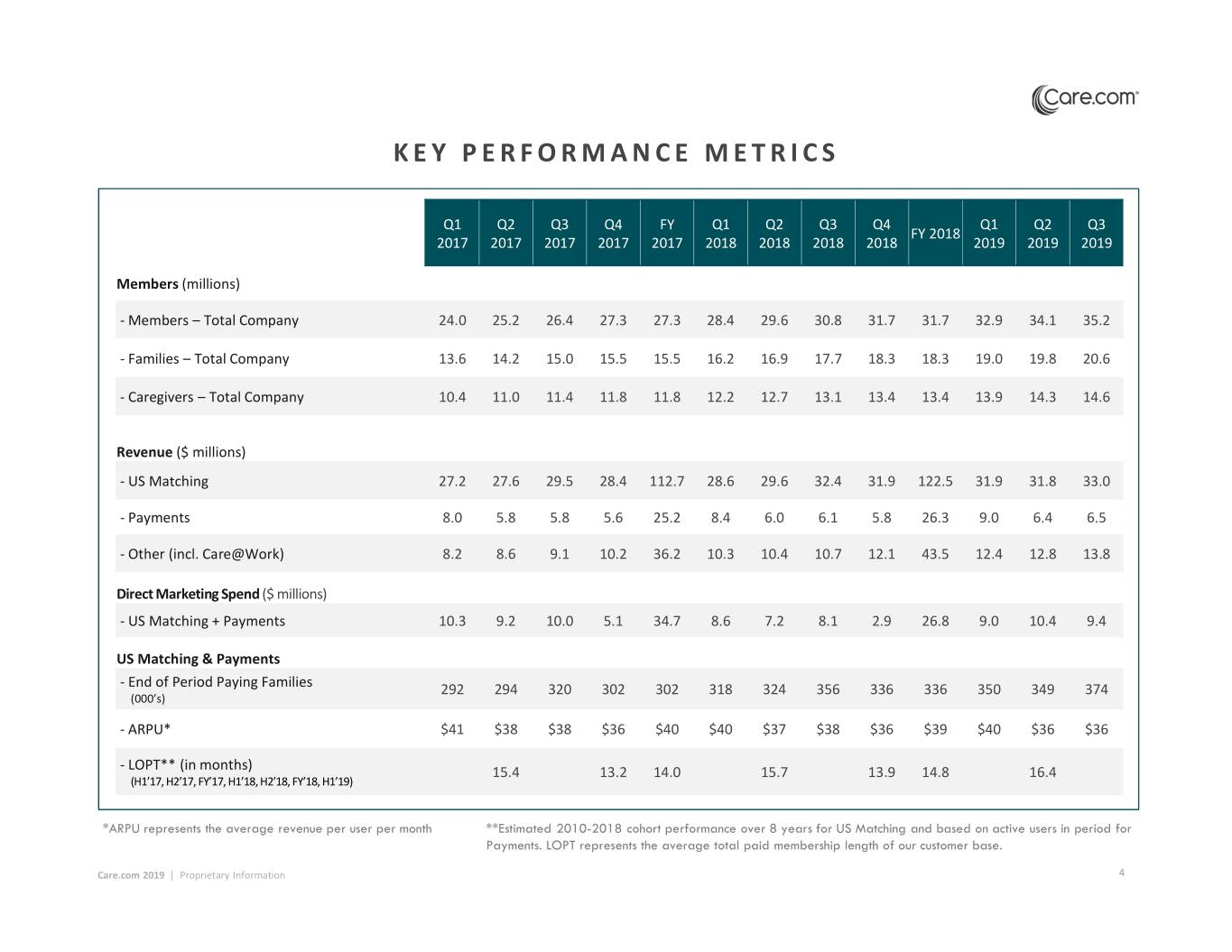

KEY PERFORMANCE METRICS Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 Q1 Q2 Q3 FY 2018 2017 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 Members (millions) - Members – Total Company 24.0 25.2 26.4 27.3 27.3 28.4 29.6 30.8 31.7 31.7 32.9 34.1 35.2 - Families – Total Company 13.6 14.2 15.0 15.5 15.5 16.2 16.9 17.7 18.3 18.3 19.0 19.8 20.6 - Caregivers – Total Company 10.4 11.0 11.4 11.8 11.8 12.2 12.7 13.1 13.4 13.4 13.9 14.3 14.6 Revenue ($ millions) - US Matching 27.2 27.6 29.5 28.4 112.7 28.6 29.6 32.4 31.9 122.5 31.9 31.8 33.0 - Payments 8.0 5.8 5.8 5.6 25.2 8.4 6.0 6.1 5.8 26.3 9.0 6.4 6.5 - Other (incl. Care@Work) 8.2 8.6 9.1 10.2 36.2 10.3 10.4 10.7 12.1 43.5 12.4 12.8 13.8 Direct Marketing Spend ($ millions) - US Matching + Payments 10.3 9.2 10.0 5.1 34.7 8.6 7.2 8.1 2.9 26.8 9.0 10.4 9.4 US Matching & Payments - End of Period Paying Families 292 294 320 302 302 318 324 356 336 336 350 349 374 (000’s) - ARPU* $41 $38 $38 $36 $40 $40 $37 $38 $36 $39 $40 $36 $36 - LOPT** (in months) 15.4 13.2 14.0 15.7 13.9 14.8 16.4 (H1’17, H2’17, FY’17, H1’18, H2’18, FY’18, H1’19) *ARPU represents the average revenue per user per month **Estimated 2010-2018 cohort performance over 8 years for US Matching and based on active users in period for Payments. LOPT represents the average total paid membership length of our customer base. Care.com 2019 | Proprietary Information 4

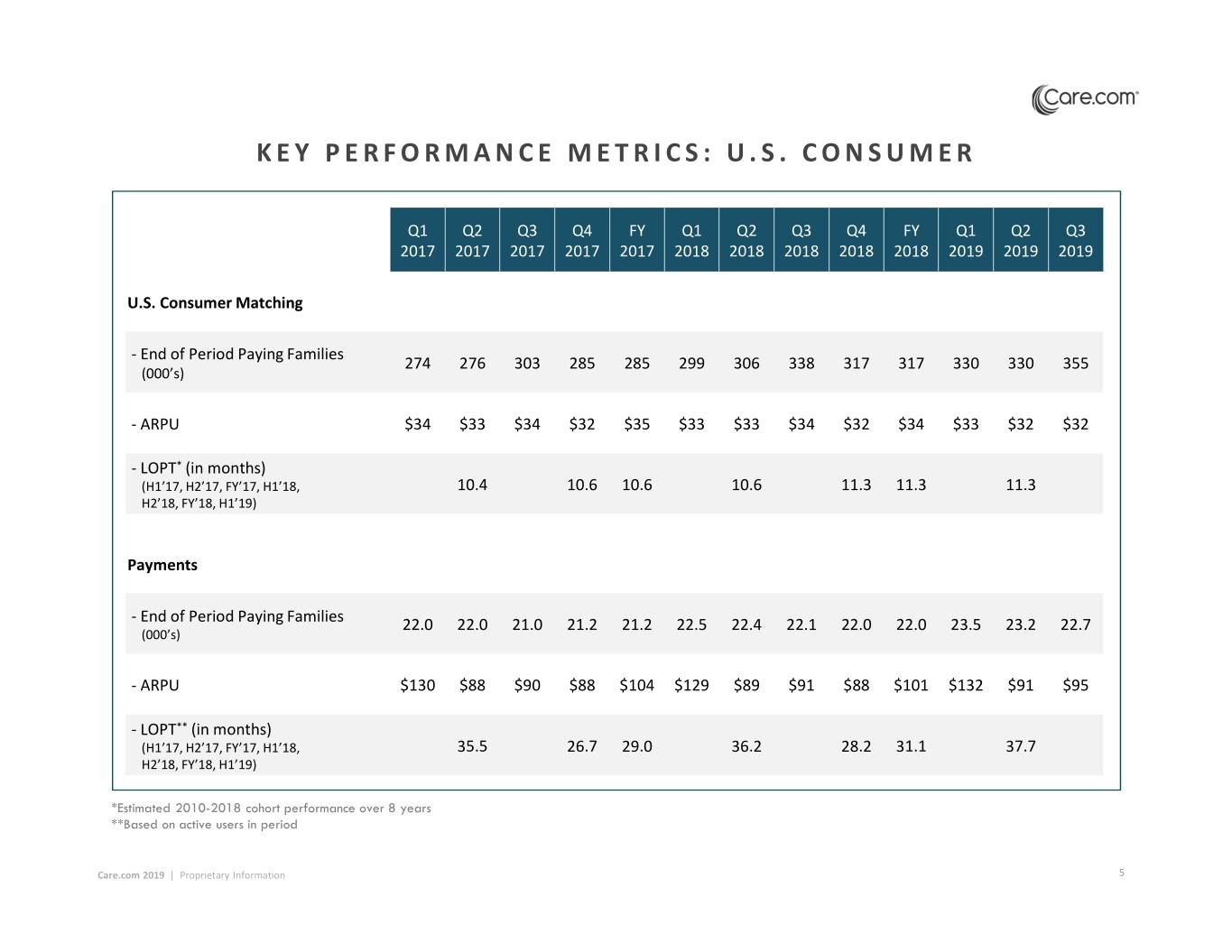

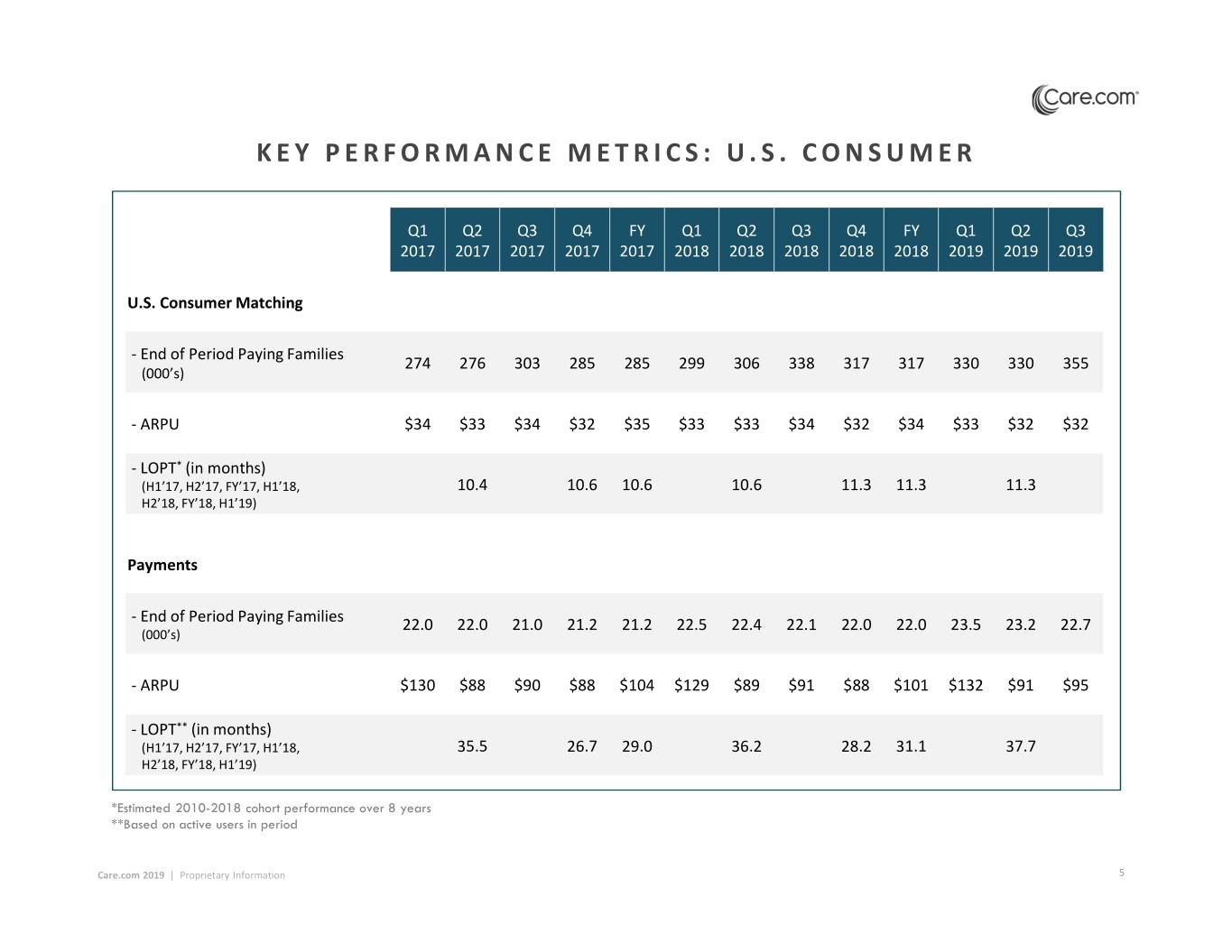

KEY PERFORMANCE METRICS: U.S. CONSUMER Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 2017 2017 2017 2017 2017 2018 2018 2018 2018 2018 2019 2019 2019 U.S. Consumer Matching - End of Period Paying Families 274 276 303 285 285 299 306 338 317 317 330 330 355 (000’s) -ARPU $34 $33 $34 $32 $35 $33 $33 $34 $32 $34 $33 $32 $32 - LOPT* (in months) (H1’17, H2’17, FY’17, H1’18, 10.4 10.6 10.6 10.6 11.3 11.3 11.3 H2’18, FY’18, H1’19) Payments - End of Period Paying Families 22.0 22.0 21.0 21.2 21.2 22.5 22.4 22.1 22.0 22.0 23.5 23.2 22.7 (000’s) -ARPU $130 $88 $90 $88 $104 $129 $89 $91 $88 $101 $132 $91 $95 - LOPT** (in months) (H1’17, H2’17, FY’17, H1’18, 35.5 26.7 29.0 36.2 28.2 31.1 37.7 H2’18, FY’18, H1’19) *Estimated 2010-2018 cohort performance over 8 years **Based on active users in period Care.com 2019 | Proprietary Information 5

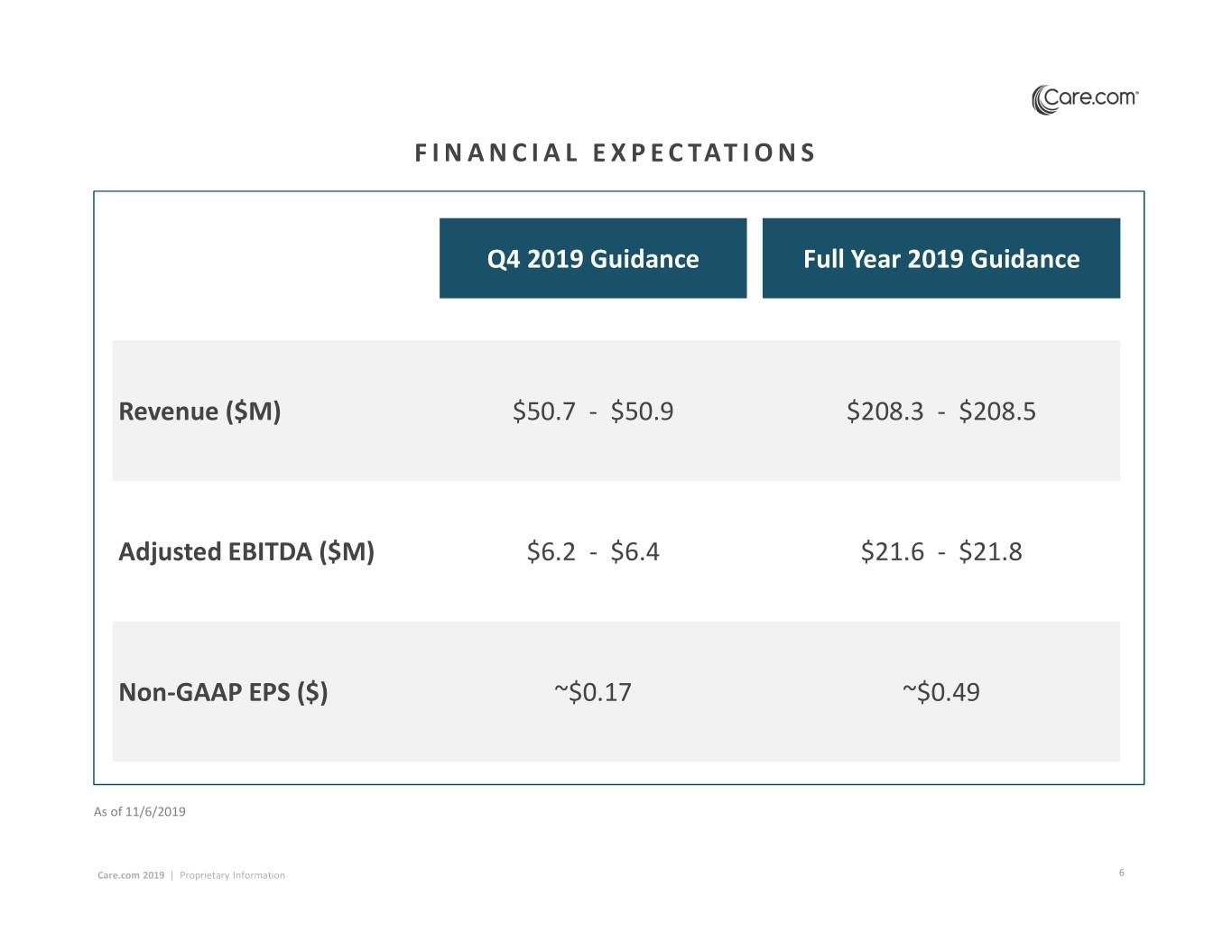

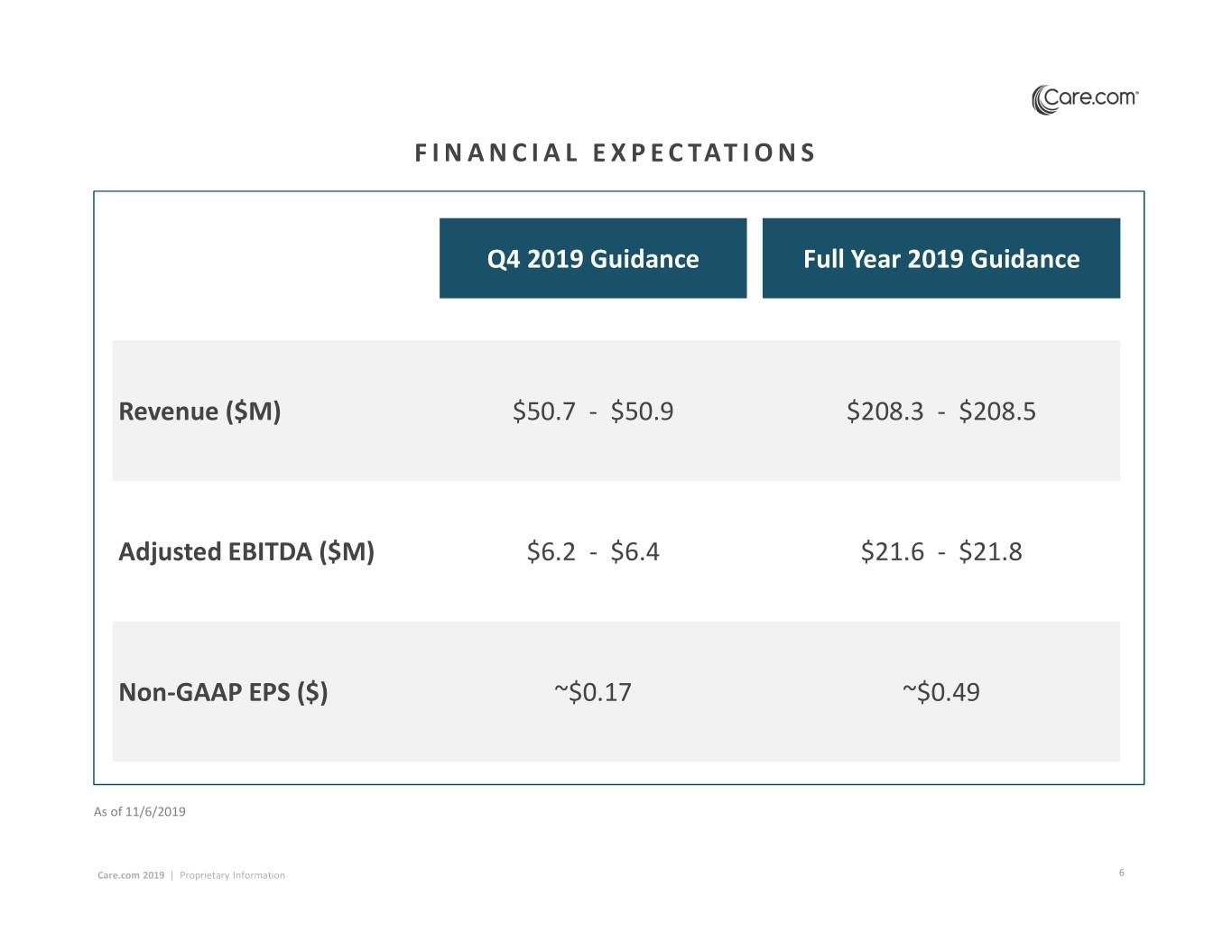

FINANCIAL EXPECTATIONS Q42019Guidance Full Year 2019 Guidance Revenue ($M) $50.7-$50.9 $208.3 -$208.5 Adjusted EBITDA ($M) $6.2-$6.4 $21.6 -$21.8 Non-GAAP EPS ($) ~$0.17 ~$0.49 As of 11/6/2019 Care.com 2019 | Proprietary Information 6

APPENDIX Care.com 2019 | Proprietary Information

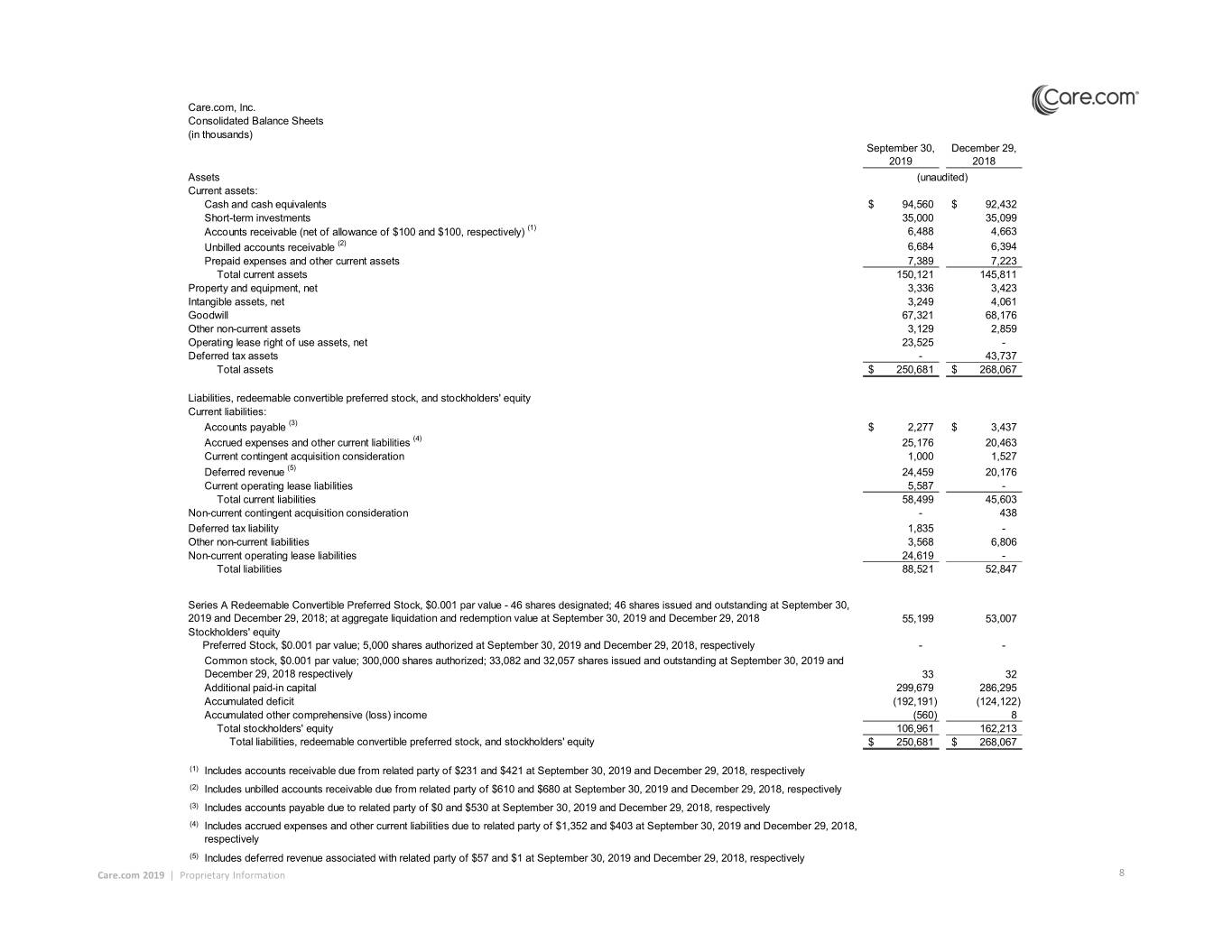

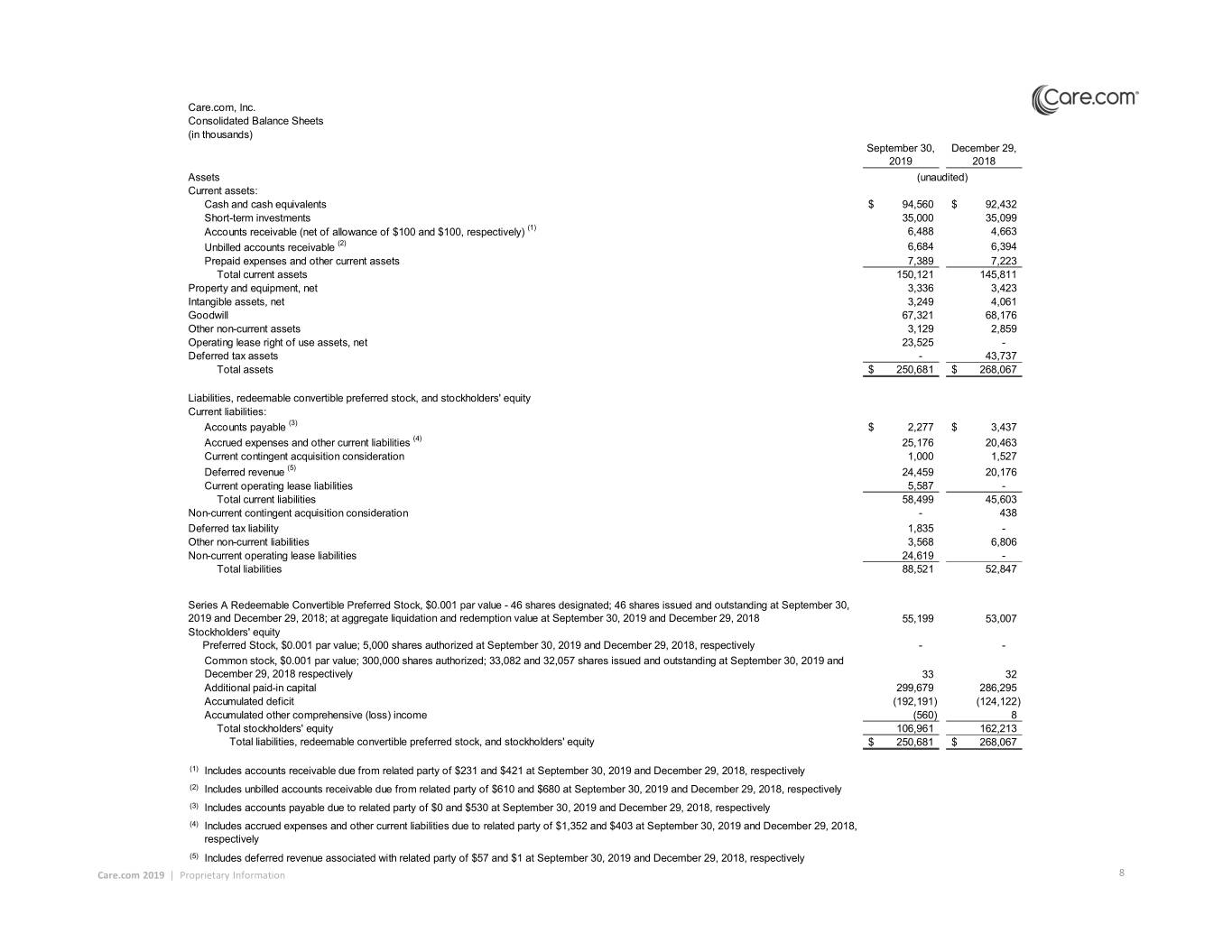

Care.com, Inc. Consolidated Balance Sheets (in thousands) September 30, December 29, 2019 2018 Assets (unaudited) Current assets: Cash and cash equivalents$ 94,560 $ 92,432 Short-term investments 35,000 35,099 Accounts receivable (net of allowance of $100 and $100, respectively) (1) 6,488 4,663 Unbilled accounts receivable (2) 6,684 6,394 Prepaid expenses and other current assets 7,389 7,223 Total current assets 150,121 145,811 Property and equipment, net 3,336 3,423 Intangible assets, net 3,249 4,061 Goodwill 67,321 68,176 Other non-current assets 3,129 2,859 Operating lease right of use assets, net 23,525 - Deferred tax assets - 43,737 Total assets$ 250,681 $ 268,067 Liabilities, redeemable convertible preferred stock, and stockholders' equity Current liabilities: Accounts payable (3) $ 2,277 $ 3,437 Accrued expenses and other current liabilities (4) 25,176 20,463 Current contingent acquisition consideration 1,000 1,527 Deferred revenue (5) 24,459 20,176 Current operating lease liabilities 5,587 - Total current liabilities 58,499 45,603 Non-current contingent acquisition consideration - 438 Deferred tax liability 1,835 - Other non-current liabilities 3,568 6,806 Non-current operating lease liabilities 24,619 - Total liabilities 88,521 52,847 Series A Redeemable Convertible Preferred Stock, $0.001 par value - 46 shares designated; 46 shares issued and outstanding at September 30, 2019 and December 29, 2018; at aggregate liquidation and redemption value at September 30, 2019 and December 29, 2018 55,199 53,007 Stockholders' equity Preferred Stock, $0.001 par value; 5,000 shares authorized at September 30, 2019 and December 29, 2018, respectively - - Common stock, $0.001 par value; 300,000 shares authorized; 33,082 and 32,057 shares issued and outstanding at September 30, 2019 and December 29, 2018 respectively 33 32 Additional paid-in capital 299,679 286,295 Accumulated deficit (192,191) (124,122) Accumulated other comprehensive (loss) income (560) 8 Total stockholders' equity 106,961 162,213 Total liabilities, redeemable convertible preferred stock, and stockholders' equity $ 250,681 $ 268,067 (1) Includes accounts receivable due from related party of $231 and $421 at September 30, 2019 and December 29, 2018, respectively (2) Includes unbilled accounts receivable due from related party of $610 and $680 at September 30, 2019 and December 29, 2018, respectively (3) Includes accounts payable due to related party of $0 and $530 at September 30, 2019 and December 29, 2018, respectively (4) Includes accrued expenses and other current liabilities due to related party of $1,352 and $403 at September 30, 2019 and December 29, 2018, respectively (5) Includes deferred revenue associated with related party of $57 and $1 at September 30, 2019 and December 29, 2018, respectively Care.com 2019 | Proprietary Information 8

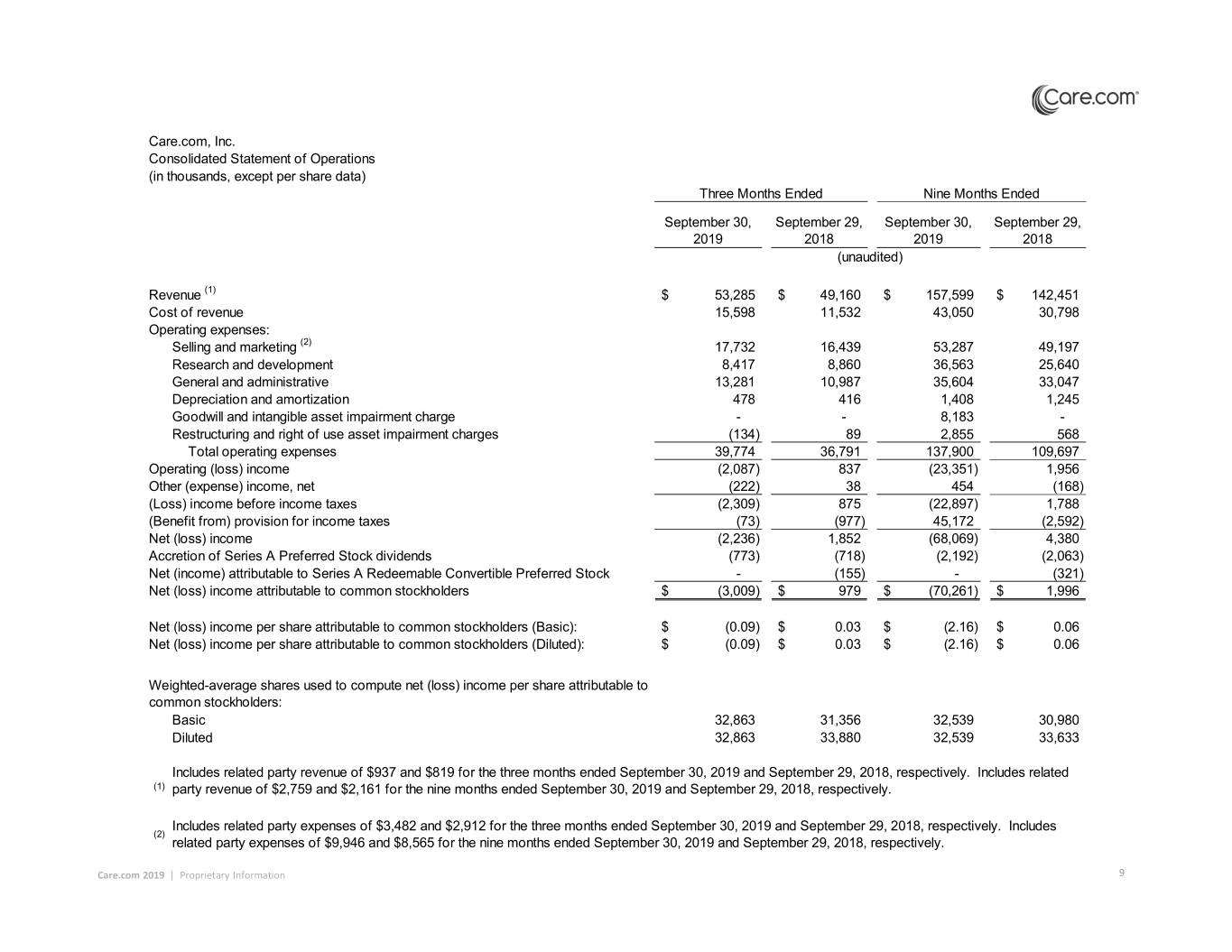

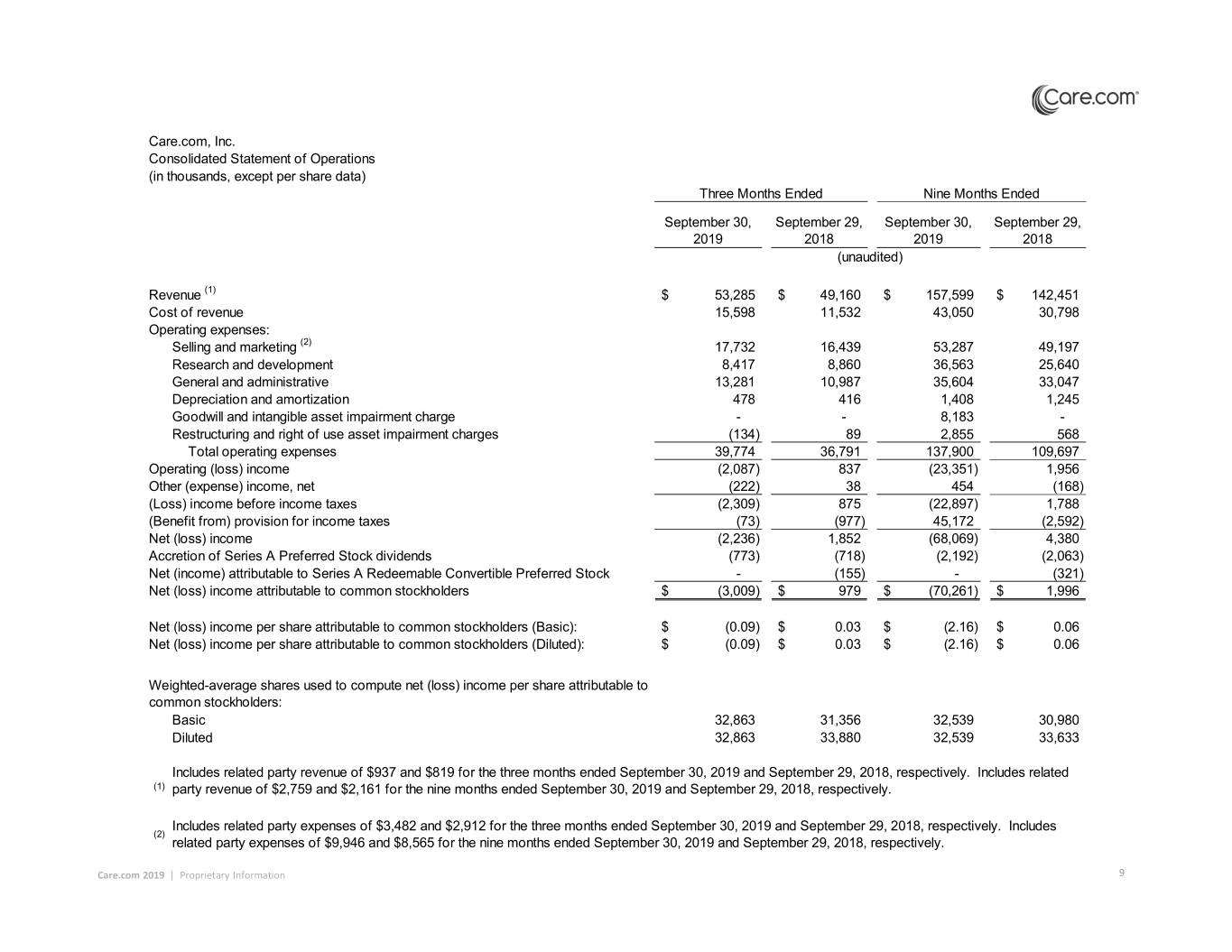

Care.com, Inc. Consolidated Statement of Operations (in thousands, except per share data) Three Months Ended Nine Months Ended September 30, September 29, September 30, September 29, 2019 2018 2019 2018 (unaudited) Revenue (1) $ 53,285 $ 49,160 $ 157,599 $ 142,451 Cost of revenue 15,598 11,532 43,050 30,798 Operating expenses: Selling and marketing (2) 17,732 16,439 53,287 49,197 Research and development 8,417 8,860 36,563 25,640 General and administrative 13,281 10,987 35,604 33,047 Depreciation and amortization 478 416 1,408 1,245 Goodwill and intangible asset impairment charge - - 8,183 - Restructuring and right of use asset impairment charges (134) 89 2,855 568 Total operating expenses 39,774 36,791 137,900 109,697 Operating (loss) income (2,087) 837 (23,351) 1,956 Other (expense) income, net (222) 38 454 (168) (Loss) income before income taxes (2,309) 875 (22,897) 1,788 (Benefit from) provision for income taxes (73) (977) 45,172 (2,592) Net (loss) income (2,236) 1,852 (68,069) 4,380 Accretion of Series A Preferred Stock dividends (773) (718) (2,192) (2,063) Net (income) attributable to Series A Redeemable Convertible Preferred Stock - (155) - (321) Net (loss) income attributable to common stockholders$ (3,009) $ 979 $ (70,261) $ 1,996 Net (loss) income per share attributable to common stockholders (Basic):$ (0.09) $ 0.03 $ (2.16) $ 0.06 Net (loss) income per share attributable to common stockholders (Diluted):$ (0.09) $ 0.03 $ (2.16) $ 0.06 Weighted-average shares used to compute net (loss) income per share attributable to common stockholders: Basic 32,863 31,356 32,539 30,980 Diluted 32,863 33,880 32,539 33,633 Includes related party revenue of $937 and $819 for the three months ended September 30, 2019 and September 29, 2018, respectively. Includes related (1) party revenue of $2,759 and $2,161 for the nine months ended September 30, 2019 and September 29, 2018, respectively. Includes related party expenses of $3,482 and $2,912 for the three months ended September 30, 2019 and September 29, 2018, respectively. Includes (2) related party expenses of $9,946 and $8,565 for the nine months ended September 30, 2019 and September 29, 2018, respectively. Care.com 2019 | Proprietary Information 9

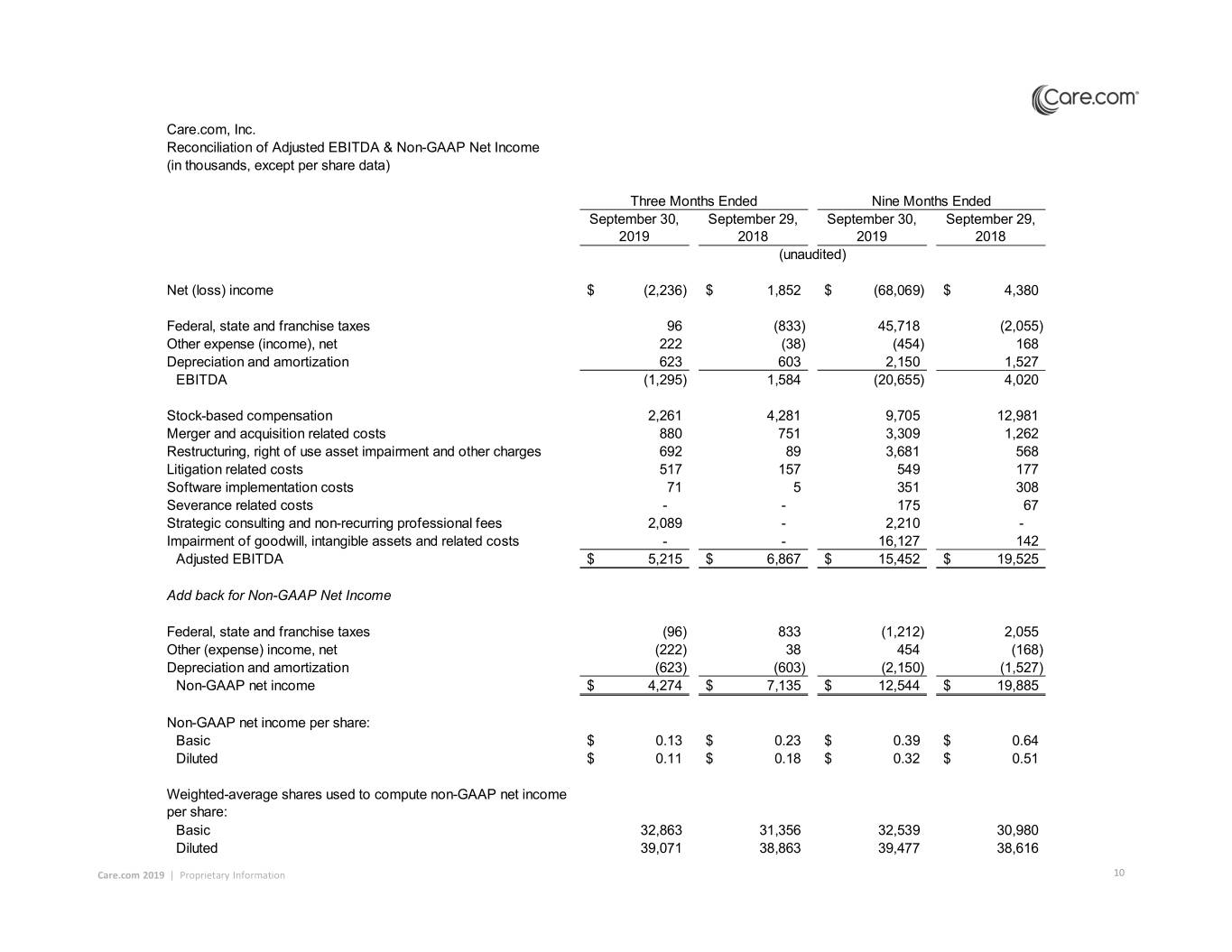

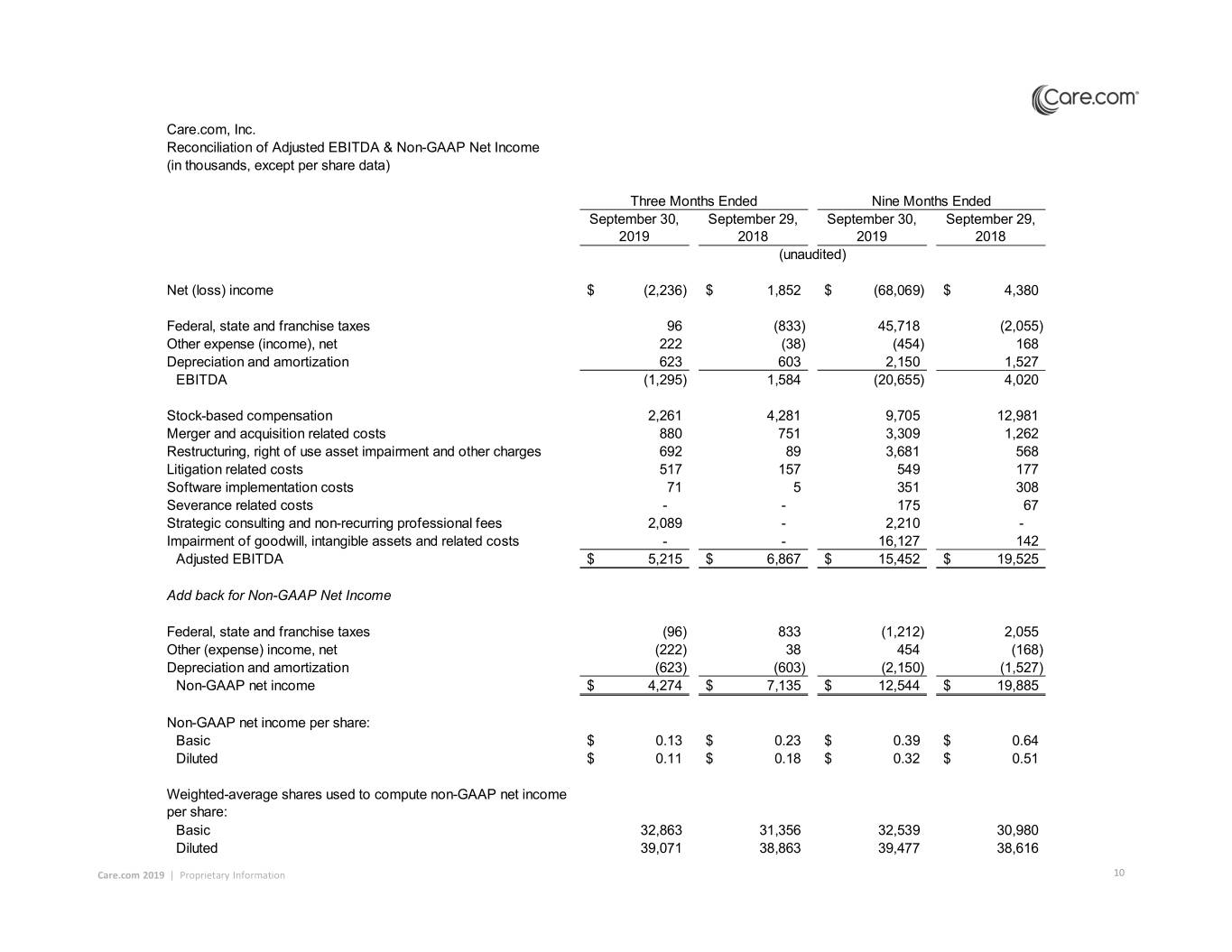

Care.com, Inc. Reconciliation of Adjusted EBITDA & Non-GAAP Net Income (in thousands, except per share data) Three Months Ended Nine Months Ended September 30, September 29, September 30, September 29, 2019 2018 2019 2018 (unaudited) Net (loss) income $ (2,236) $ 1,852 $ (68,069) $ 4,380 Federal, state and franchise taxes 96 (833) 45,718 (2,055) Other expense (income), net 222 (38) (454) 168 Depreciation and amortization 623 603 2,150 1,527 EBITDA (1,295) 1,584 (20,655) 4,020 Stock-based compensation 2,261 4,281 9,705 12,981 Merger and acquisition related costs 880 751 3,309 1,262 Restructuring, right of use asset impairment and other charges 692 89 3,681 568 Litigation related costs 517 157 549 177 Software implementation costs 71 5 351 308 Severance related costs - - 175 67 Strategic consulting and non-recurring professional fees 2,089 - 2,210 - Impairment of goodwill, intangible assets and related costs - - 16,127 142 Adjusted EBITDA$ 5,215 $ 6,867 $ 15,452 $ 19,525 Add back for Non-GAAP Net Income Federal, state and franchise taxes (96) 833 (1,212) 2,055 Other (expense) income, net (222) 38 454 (168) Depreciation and amortization (623) (603) (2,150) (1,527) Non-GAAP net income$ 4,274 $ 7,135 $ 12,544 $ 19,885 Non-GAAP net income per share: Basic$ 0.13 $ 0.23 $ 0.39 $ 0.64 Diluted$ 0.11 $ 0.18 $ 0.32 $ 0.51 Weighted-average shares used to compute non-GAAP net income per share: Basic 32,863 31,356 32,539 30,980 Diluted 39,071 38,863 39,477 38,616 Care.com 2019 | Proprietary Information 10

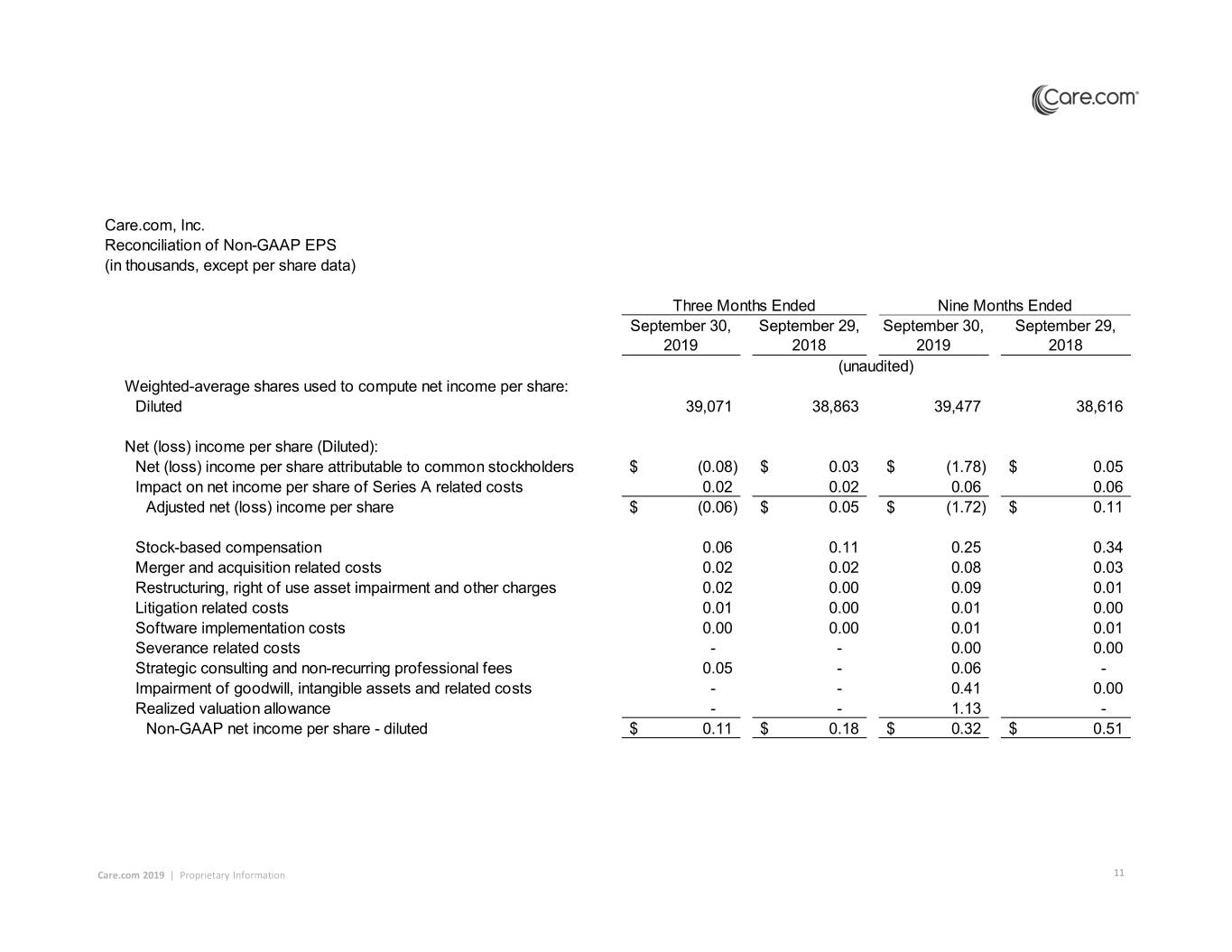

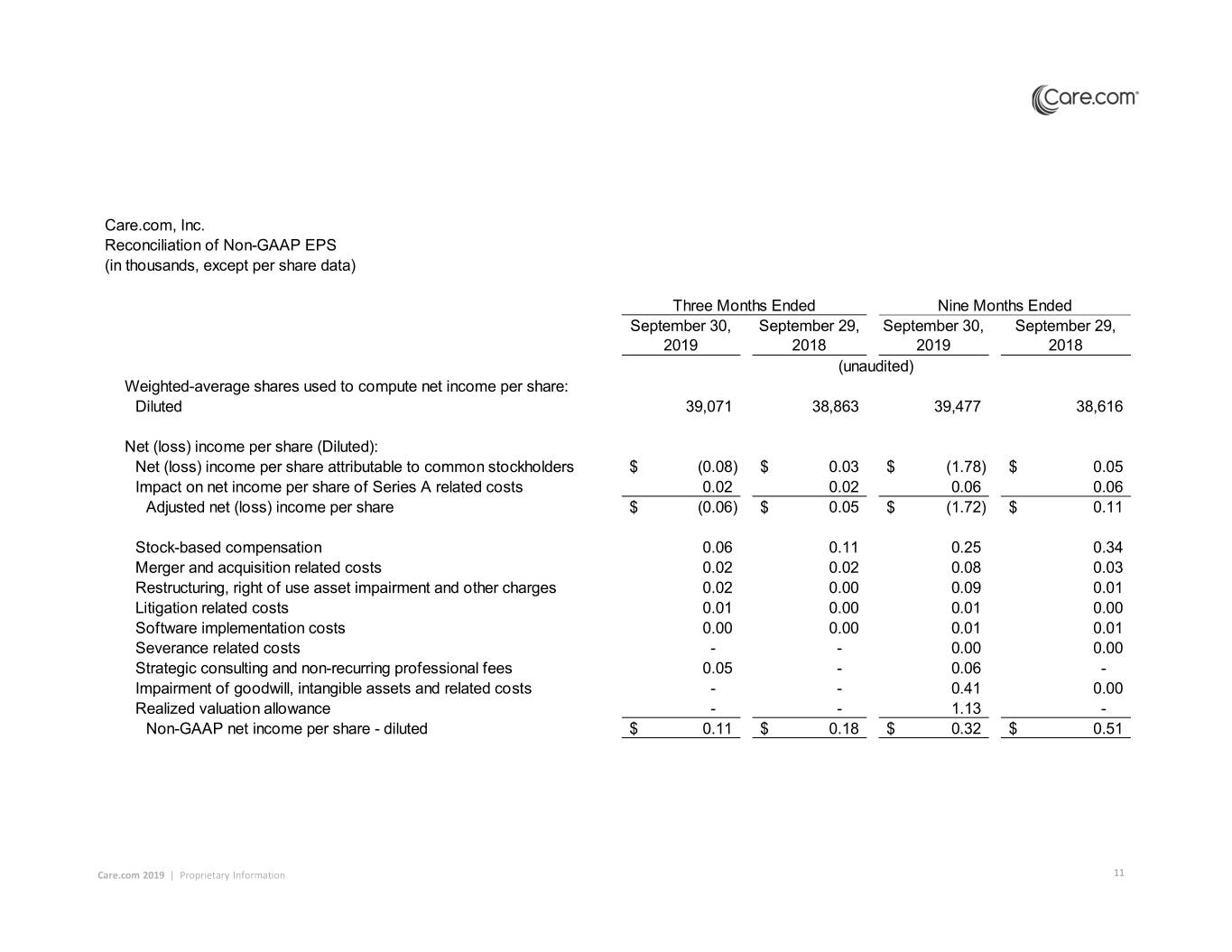

Care.com, Inc. Reconciliation of Non-GAAP EPS (in thousands, except per share data) Three Months Ended Nine Months Ended September 30, September 29, September 30, September 29, 2019 2018 2019 2018 (unaudited) Weighted-average shares used to compute net income per share: Diluted 39,071 38,863 39,477 38,616 Net (loss) income per share (Diluted): Net (loss) income per share attributable to common stockholders$ (0.08) $ 0.03 $ (1.78) $ 0.05 Impact on net income per share of Series A related costs 0.02 0.02 0.06 0.06 Adjusted net (loss) income per share$ (0.06) $ 0.05 $ (1.72) $ 0.11 Stock-based compensation 0.06 0.11 0.25 0.34 Merger and acquisition related costs 0.02 0.02 0.08 0.03 Restructuring, right of use asset impairment and other charges 0.02 0.00 0.09 0.01 Litigation related costs 0.01 0.00 0.01 0.00 Software implementation costs 0.00 0.00 0.01 0.01 Severance related costs - - 0.00 0.00 Strategic consulting and non-recurring professional fees 0.05 - 0.06 - Impairment of goodwill, intangible assets and related costs - - 0.41 0.00 Realized valuation allowance - - 1.13 - Non-GAAP net income per share - diluted$ 0.11 $ 0.18 $ 0.32 $ 0.51 Care.com 2019 | Proprietary Information 11

USE OF NON-GAAP FINANCIAL MEASURES To supplement the financial measures presented in this supplemental information, we also present, in accordance with accounting principles generally accepted in the United States ("GAAP“), the following non-GAAP measures of financial performance: adjusted EBITDA, non-GAAP net income (loss) and non-GAAP earnings per share (“EPS”). A “non-GAAP financial measure” refers to a numerical measure of the Company’s historical or future financial performance, financial position, or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in the Company’s financial statements. The Company provides certain non-GAAP measures as additional information relating to its operating results as a complement to results provided in accordance with GAAP. The Company believes the use of non-GAAP financial measures, as a supplement to GAAP measures, is useful to investors in that they eliminate items that are either not part of the Company's core operations or do not require a cash outlay, such as stock-based compensation. Care.com’s management uses these non-GAAP financial measures when evaluating the Company’s operating performance and for internal planning and forecasting purposes. The non-GAAP financial information presented here should be considered in conjunction with, and not as a substitute for or superior to, the financial information presented in accordance with GAAP and should not be considered a measure of the Company’s liquidity. There are significant limitations associated with the use of non-GAAP financial measures. Further, these measures may differ from the non-GAAP information, even where similarly titled, used by other companies and therefore should not be used to compare the Company’s performance to that of other companies. Care.com 2019 | Proprietary Information 12

Thank you Care.com 2019 | Proprietary Information