UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22126

Name of Fund: BlackRock Defined Opportunity Credit Trust (BHL)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Defined Opportunity Credit Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 08/31/2016

Date of reporting period: 02/29/2016

Item 1 – Report to Stockholders

FEBRUARY 29, 2016

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | |  |

BlackRock Defined Opportunity Credit Trust (BHL)

BlackRock Floating Rate Income Strategies Fund, Inc. (FRA)

BlackRock Limited Duration Income Trust (BLW)

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| | | | | | |

| | | | | | | |

| 2 | | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | |

Dear Shareholder,

Diverging monetary policies and shifting economic outlooks across regions have been the overarching themes driving financial markets over the past couple of years. With U.S. growth outpacing the global economic recovery while inflationary pressures remained low, investors spent most of 2015 anticipating the curtailment of the Federal Reserve’s near-zero interest rate policy, which ultimately came in December. In contrast, the European Central Bank and the Bank of Japan took measures to stimulate growth. In this environment, the U.S. dollar strengthened considerably, causing profit challenges for U.S. exporters and high levels of volatility in emerging market currencies and commodities.

Global market volatility increased in the latter part of 2015 and continued into early 2016. Oil prices collapsed in mid-2015 due to excess supply, and remained precarious while the world’s largest oil producers sought to negotiate a deal. Developing countries, many of which rely heavily on oil exports to sustain their economies, were particularly affected by falling oil prices. Meanwhile, China, one of the world’s largest oil consumers, exhibited further signs of slowing economic growth. This, combined with a depreciating yuan and declining confidence in the country’s policymakers, stoked worries about the potential impact of China’s weakness on the broader global economy.

Toward the end of the period, volatility abated as investors were relieved to find that conditions were not as bad as previously feared. While the recent selloff in risk assets has resulted in more reasonable valuations and some appealing entry points, investors continue to face mixed economic data and uncertainty relating to oil prices, corporate earnings and an unusual U.S. presidential election season.

For the 12-month period, higher quality assets such as U.S. Treasuries, municipal bonds and investment grade corporate bonds generated positive returns, while risk assets such as equities and high yield bonds broadly declined.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of February 29, 2016 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | (0.92 | )% | | | (6.19 | )% |

U.S. small cap equities

(Russell 2000® Index) | | | (10.16 | ) | | | (14.97 | ) |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | (9.48 | ) | | | (15.18 | ) |

Emerging market equities

(MSCI Emerging Markets Index) | | | (8.85 | ) | | | (23.41 | ) |

3-month Treasury bills

(BofA Merrill Lynch 3-Month

U.S. Treasury Bill Index) | | | 0.06 | | | | 0.08 | |

U.S. Treasury securities

(BofA Merrill Lynch

10-Year U.S. Treasury

Index) | | | 5.01 | | | | 4.11 | |

U.S. investment-grade bonds

(Barclays U.S.

Aggregate Bond Index) | | | 2.20 | | | | 1.50 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | 3.56 | | | | 3.78 | |

U.S. high yield bonds

(Barclays U.S. Corporate

High Yield 2% Issuer

Capped Index) | | | (5.57 | ) | | | (8.26 | ) |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | | | | | |

| | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | | | |

| Fund Summary as of February 29, 2016 | | BlackRock Defined Opportunity Credit Trust |

BlackRock Defined Opportunity Credit Trust’s (BHL) (the “Fund”) primary investment objective is to provide high current income, with a secondary objective of long-term capital appreciation. The Fund seeks to achieve its investment objectives by investing substantially all of its assets in loan and debt instruments and loan-related and debt-related instruments (collectively “credit securities”). The Fund invests, under normal market conditions, at least 80% of its assets in any combination of the following credit securities: (i) senior secured floating rate and fixed rate loans; (ii) second lien or other subordinated or unsecured floating rate and fixed rate loans or debt; (iii) credit securities that are rated below investment grade quality; and (iv) investment grade corporate bonds. The Fund may invest directly in such securities or synthetically through the use of derivatives.

BHL is scheduled to terminate no later than December 31, 2017.

No assurance can be given that the Fund’s investment objectives will be achieved.

| | |

| Performance and Portfolio Management Commentary |

Returns for the six months ended February 29, 2016 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | NAV | |

BHL1,2 | | | 1.65 | % | | | (3.71 | )% |

Lipper Loan Participation Funds3 | | | (7.81 | )% | | | (7.18 | )% |

| | 1 | | All returns reflect reinvestment of dividends and/or distributions. |

| | 2 | | The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Fund’s absolute performance based on NAV:

What factors influenced performance?

| • | | Credit markets, including floating rate loan interests (bank loans), were in negative territory for the six months ended February 29, 2016, driven in large part by a continued decline in commodity prices. Following a brief recovery entering the period, energy prices were the hardest hit as crude oil slid during the period to below $30 a barrel. The Fund’s modest exposure to the energy sector was the most notable detractor from returns. Positions in collateralized loan obligations (“CLOs”) and high yield bonds detracted from performance as well. |

Describe recent portfolio activity.

| • | | During the period, the Fund maintained its overall focus on the higher quality segments of the loan market in terms of loan structure, liquidity and general credit quality. The Fund concentrated its investments in strong companies with stable cash flows, and high quality collateral with the ability to meet interest obligations and ultimately return principal. Although there’s been tighter supply in the floating rate loan interests (bank loans) market, the Fund has maintained its highly selective investment approach. From a sector standpoint, the Fund added to names in the technology and health care sectors, while trimming exposure in the pharmaceuticals and lodging sectors. The Fund also reduced its exposure to CLOs during the period. |

Describe portfolio positioning at period end.

| • | | At period end, the Fund held a majority of its total portfolio in floating rate loan interests (bank loans), with a small position in high yield corporate bonds. The Fund maintained its highest concentration in higher coupon B-rated loans of select issuers while limiting exposure to low coupon BB-rated loans. Additionally, the Fund held a reduced position in CCC-rated loans, while also avoiding the more volatile segments of that universe, such as oil field services, metals & mining and media companies. The largest individual positions included First Data Corp. (technology), Level 3 Communications, Inc. (wirelines), and Avago Technologies Ltd. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 4 | | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | |

| | |

| | | BlackRock Defined Opportunity Credit Trust |

| | |

| Fund Information | | |

Symbol on New York Stock Exchange (“NYSE”) | | BHL |

Initial Offering Date | | January 31, 2008 |

Current Distribution Rate on Closing Market Price as of February 29, 2016 ($12.83)1 | | 4.77% |

Current Monthly Distribution per Common Share2 | | $0.051 |

Current Annualized Distribution per Common Share2 | | $0.612 |

Economic Leverage as of February 29, 20163 | | 27% |

| | 1 | | Current Distribution Rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a tax return of capital. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. |

| | 3 | | Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings) minus the sum of liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 10. |

| | | | | | | | | | |

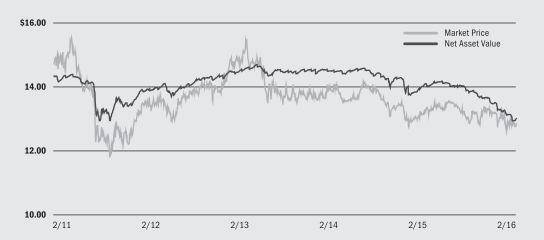

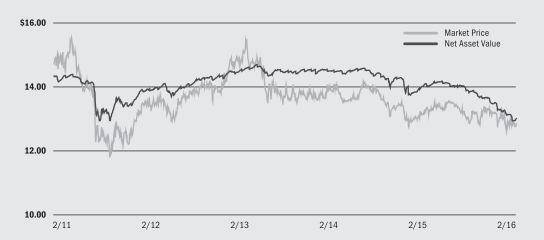

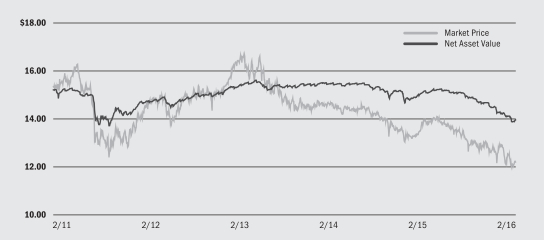

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 2/29/16 | | | 8/31/15 | | | Change | | | High | | | Low | |

Market Price | | $ | 12.83 | | | $ | 12.95 | | | | (0.93 | )% | | $ | 13.37 | | | $ | 12.50 | |

Net Asset Value | | $ | 12.99 | | | $ | 13.84 | | | | (6.14 | )% | | $ | 13.87 | | | $ | 12.92 | |

| | | | | | | | | | |

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Fund’s Total Investments |

| | | | | | | | |

| Portfolio Composition | | 2/29/16 | | | 8/31/15 | |

Floating Rate Loan Interests | | | 94 | % | | | 94 | % |

Corporate Bonds | | | 2 | | | | 3 | |

Asset-Backed Securities | | | 2 | | | | 3 | |

Short-Term Securities | | | 2 | | | | — | 4 |

Other5 | | | — | | | | — | |

| | 4 | | Representing less than 1% of the Fund’s total investments. |

| | 5 | | Includes less than 1% holding in each of the following investments types: Common Stocks, Investment Companies, Non-Agency Mortgage-Backed Securities, Short-Term Securities and Warrants. |

| | | | | | | | |

| Credit Quality Allocation5,6 | | 2/29/16 | | | 8/31/15 | |

A | | | — | | | | 1 | % |

BBB/Baa | | | 10 | % | | | 8 | |

BB/Ba | | | 46 | | | | 45 | |

B | | | 35 | | | | 40 | |

CCC/Caa | | | 3 | | | | 3 | |

N/R | | | 6 | | | | 3 | |

| | 5 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. |

| | | | Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | 6 | | Excludes Short-Term Securities. |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | 5 |

| | | | |

| Fund Summary as of February 29, 2016 | | BlackRock Floating Rate Income Strategies Fund, Inc. |

BlackRock Floating Rate Income Strategies Fund, Inc.’s (FRA) (the “Fund”) investment objective is to provide shareholders with high current income and such preservation of capital as is consistent with investment in a diversified, leveraged portfolio consisting primarily of floating rate debt securities and instruments. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in floating rate debt securities, including floating or variable rate debt securities that pay interest at rates that adjust whenever a specified interest rate changes and/or which reset on predetermined dates (such as the last day of a month or calendar quarter). The Fund invests a substantial portion of its investments in floating rate debt securities consisting of secured or unsecured senior floating rate loans that are rated below investment grade. The Fund may invest directly in floating rate debt securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

| | |

| Performance and Portfolio Management Commentary |

Returns for the six months ended February 29, 2016 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | NAV | |

FRA1,2 | | | (2.59 | )% | | | (3.36 | )% |

Lipper Loan Participation Funds3 | | | (7.81 | )% | | | (7.18 | )% |

| | 1 | | All returns reflect reinvestment of dividends and/or distributions. |

| | 2 | | The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Fund’s absolute performance based on NAV:

What factors influenced performance?

| • | | Credit markets, including floating rate loan interests (bank loans), were in negative territory for the six months ended February 29, 2016, driven in large part by a continued decline in commodity prices. Following a brief recovery entering the period, energy prices were the hardest hit as crude oil slid during the period to below $30 a barrel. The Fund’s modest exposure to the energy sector was the most notable detractor from returns. Positions in collateralized loan obligations (“CLOs”) and high yield bonds detracted from performance as well. |

| • | | Leading positive contributors to the Fund’s absolute performance included holdings within health care, gaming and packaging. |

Describe recent portfolio activity.

| • | | During the period, the Fund maintained its overall focus on the higher quality segments of the loan market in terms of loan structure, liquidity and overall credit quality. The Fund concentrated its investments in strong companies with stable cash flows, and high quality collateral with the ability to meet interest obligations and ultimately return principal. Although there’s been tighter supply in the floating rate loan interests (bank loans) market, the Fund has maintained its highly selective investment approach. From a sector standpoint, the Fund added to names in the technology and health care sectors, while trimming exposure in the pharmaceuticals and lodging sectors. The Fund also reduced its exposure to CLOs during the period. |

Describe portfolio positioning at period end.

| • | | At period end, the Fund held a majority of its total portfolio in floating rate loan interests (bank loans), with a small position in asset-backed securities and high yield corporate bonds. The Fund maintained its highest concentration in higher coupon B-rated loans of select issuers while limiting exposure to low coupon BB-rated loans. Additionally, the Fund held a reduced position in CCC-rated loans, while also avoiding the more volatile segments of that universe, such as oil field services, metals & mining and media companies. The largest individual positions included First Data Corp. (technology), Level 3 Communications, Inc. (wirelines), and Avago Technologies Ltd. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 6 | | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | |

| | | | |

| | | BlackRock Floating Rate Income Strategies Fund, Inc. |

| | |

Symbol on NYSE | | FRA |

Initial Offering Date | | October 31, 2003 |

Current Distribution Rate on Closing Market Price as of February 29, 2016 ($12.23)1 | | 5.99% |

Current Monthly Distribution per Common Share2 | | $0.061 |

Current Annualized Distribution per Common Share2 | | $0.732 |

Economic Leverage as of February 29, 20163 | | 27% |

| | 1 | | Current Distribution Rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a tax return of capital. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. |

| | 3 | | Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings) minus the sum of liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 10. |

| | | | | | | | | | |

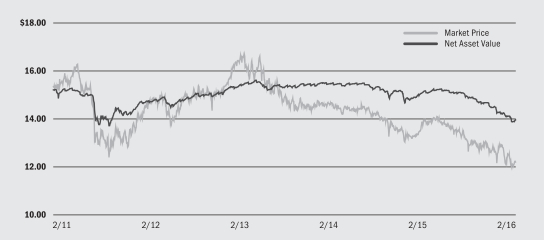

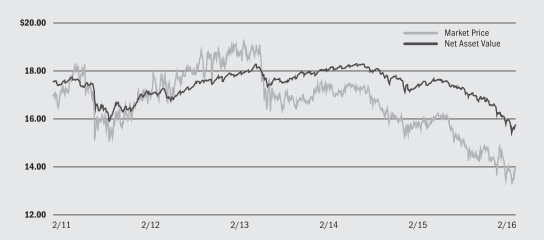

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 2/29/16 | | | 8/31/15 | | | Change | | | High | | | Low | |

Market Price | | | $12.23 | | | | $12.94 | | | | (5.49)% | | | | $13.20 | | | | $11.97 | |

Net Asset Value | | | $13.99 | | | | $14.91 | | | | (6.17)% | | | | $14.94 | | | | $13.91 | |

| | | | | | | | | | |

| Market Price and Net Asset Value History For the Past Five Years | | | | | | | | | | |

|

| Overview of the Fund’s Total Investments |

| | | | | | | | |

| Portfolio Composition | | 2/29/16 | | | 8/31/15 | |

Floating Rate Loan Interests | | | 94 | % | | | 92 | % |

Asset-Backed Securities | | | 3 | | | | 4 | |

Corporate Bonds | | | 2 | | | | 3 | |

Common Stocks | | | — | 4 | | | 1 | |

Short-Term Securities | | | 1 | | | | — | 4 |

Other5 | | | — | | | | — | |

| | 4 | | Representing less than 1% of the Fund’s total investments. |

| | 5 | | Includes a less than 1% holding in each of the following investment types: Common Stocks, Investment Companies, Non-Agency Mortgage-Backed Securities, Options Purchased, Other Interests, Preferred Securities, Short-Term Securities and Warrants. |

| | | | | | | | |

| Credit Quality Allocation5,6 | | 2/29/16 | | | 8/31/15 | |

A | | | — | | | | 1 | % |

BBB/Baa | | | 10 | % | | | 8 | |

BB/Ba | | | 41 | | | | 44 | |

B | | | 40 | | | | 40 | |

CCC/Caa | | | 4 | | | | 3 | |

N/R | | | 5 | | | | 4 | |

| | 5 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | 6 | | Excludes Short-Term Securities. |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | 7 |

| | | | |

| Fund Summary as of February 29, 2016 | | BlackRock Limited Duration Income Trust |

BlackRock Limited Duration Income Trust’s (BLW) (the “Fund”) investment objective is to provide current income and capital appreciation. The Fund seeks to achieve its investment objective by investing primarily in three distinct asset classes:

| • | | intermediate duration, investment grade corporate bonds, mortgage-related securities, asset-backed securities and U.S. Government and agency securities; |

| • | | senior, secured floating rate loans made to corporate and other business entities; and |

| • | | U.S. dollar-denominated securities of U.S. and non-U.S. issuers rated below investment grade and, to a limited extent, non-U.S. dollar denominated securities of non-U.S. issuers rated below investment grade. |

The Fund’s portfolio normally has an average portfolio duration of less than five years (including the effect of anticipated leverage), although it may be longer from time to time depending on market conditions. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

| | |

| Performance and Portfolio Management Commentary |

Returns for the six months ended February 29, 2016 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | NAV | |

BLW1,2 | | | (0.64 | )% | | | (3.56 | )% |

Lipper High Yield Funds (Leveraged)3 | | | (3.57 | )% | | | (8.51 | )% |

| | 1 | | All returns reflect reinvestment of dividends and/or distributions. |

| | 2 | | The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Fund’s absolute performance based on NAV:

What factors influenced performance?

| • | | The largest detractors from the Fund’s absolute performance over the period were its allocations to high yield corporate bonds and senior loans. Positions in asset backed securities (“ABS”), U.S. Treasuries, commercial mortgage-backed securities (“CMBS”) and investment-grade corporate bonds also detracted from performance as well. |

| • | | The largest contributors to the Fund’s absolute performance over the period were its exposure to foreign exchange markets and non-U.S. dollar |

| | | securities. The Fund’s duration (sensitivity to interest rate movements) and yield curve positioning also supported returns. |

| • | | The Fund held derivatives during the period including Treasury futures, currency forwards, options and credit default swaps. The derivatives were primarily used to adjust duration and yield curve exposure or to manage credit risk. The use of these derivatives did not have a material impact on Fund performance. |

Describe recent portfolio activity.

| • | | While the Fund’s core exposures remained largely consistent over the six-month period, its allocation to ABS, specifically credit loan obligations, was reduced in order to decrease the credit risk in the Fund. In addition, the Fund moved to a longer duration stance. |

Describe portfolio positioning at period end.

| • | | At period end, the Fund maintained a diversified exposure to non-government spread sectors including high yield and investment grade corporate credit, senior loans, CMBS and ABS, as well as agency and non-agency residential mortgage-backed securities. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 8 | | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | |

| | |

| | | BlackRock Limited Duration Income Trust |

| | |

Symbol on NYSE | | BLW |

Initial Offering Date | | July 30, 2003 |

Current Distribution Rate on Closing Market Price as of February 29, 2016 ($13.92)1 | | 7.50% |

Current Monthly Distribution per Common Share2 | | $0.087 |

Current Annualized Distribution per Common Share2 | | $1.044 |

Economic Leverage as of February 29, 20163 | | 28% |

| | 1 | | Current Distribution Rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a tax return of capital. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. |

| | 3 | | Represents reverse repurchase agreements outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowing) minus the sum of liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 10. |

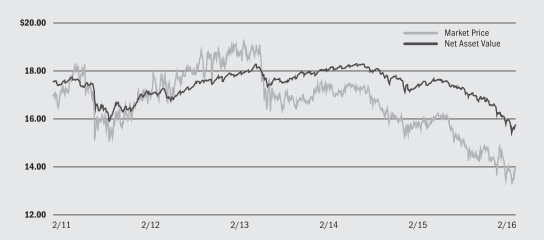

| | | | | | | | | | |

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2/29/16 | | | 8/31/15 | | | Change | | | High | | | Low | |

Market Price | | $ | 13.92 | | | $ | 14.60 | | | | (4.66 | )% | | $ | 14.91 | | | $ | 13.31 | |

Net Asset Value | | $ | 15.76 | | | $ | 17.04 | | | | (7.51 | )% | | $ | 17.10 | | | $ | 15.41 | |

| | | | | | | | | | |

| Market Price and Net Asset Value History For the Past Five Years | | | | | | | | | | |

| | | | | | | | | | |

| Overview of the Fund’s Total Investments | | | | | | | | | | |

| | | | | | | | |

| Portfolio Composition | | 2/29/16 | | | 8/31/15 | |

Corporate Bonds | | | 39 | % | | | 38 | % |

Floating Rate Loan Interests | | | 27 | | | | 26 | |

Asset-Backed Securities | | | 14 | | | | 16 | |

Non-Agency Mortgage-Backed Securities | | | 10 | | | | 10 | |

Preferred Securities | | | 8 | | | | 8 | |

Foreign Agency Obligations | | | 1 | | | | 1 | |

U.S. Government Sponsored Agency Securities | | | 1 | | | | 1 | |

Other4 | | | — | | | | — | |

| | 4 | | Includes a less than 1% holding in each of the following investment types: Common Stocks, Options Purchased, Options Written, Other Interests, Short-Term Securities and Warrants. |

| | | | | | | | |

| Credit Quality Allocation5,6 | | 2/29/16 | | | 8/31/15 | |

AAA/Aaa7 | | | 3 | % | | | 2 | % |

AA/Aa | | | 2 | | | | 2 | |

A | | | 7 | | | | 8 | |

BBB/Baa | | | 19 | | | | 17 | |

BB/Ba | | | 33 | | | | 31 | |

B | | | 23 | | | | 25 | |

CCC/Caa | | | 4 | | | | 5 | |

N/R | | | 9 | | | | 10 | |

| | 5 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | 6 | | Excludes Options Purchased, Options Written and Short-Term Securities. |

| | 7 | | The investment advisor evaluates the credit quality of not-rated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuer. Using this approach, the investment advisor has deemed U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations as AAA/Aaa. |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | 9 |

| | | | |

| The Benefits and Risks of Leveraging | | |

The Funds may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, these objectives cannot be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by a Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of the Funds (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Funds’ shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage is paid to shareholders in the form of dividends, and the value of these portfolio holdings is reflected in the per share NAV.

To illustrate these concepts, assume a Fund’s capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Fund’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by a Fund with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Fund’s financing cost of leverage is significantly lower than the income earned on a Fund’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed the Funds’ return on assets purchased with leverage proceeds, income to shareholders is lower than if the Funds had not used leverage. Furthermore, the value of the Funds’ portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the value of the Funds’ obligations under their respective leverage arrangements generally does not

fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Funds’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that the Funds’ intended leveraging strategy will be successful.

Leverage also generally causes greater changes in the Funds’ NAVs, market prices and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of Funds’ shares than if the Funds were not leveraged. In addition, the Funds may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Funds to incur losses. The use of leverage may limit the Funds’ ability to invest in certain types of securities or use certain types of hedging strategies. The Funds incur expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income to the shareholders. Moreover, to the extent the calculation of the Funds’ investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the Funds’ investment advisor will be higher than if the Funds did not use leverage.

Each Fund may utilize leverage through a credit facility or reverse repurchase agreements as described in the Notes to Financial Statements.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), the Funds are permitted to issue debt up to 33 1/3% of their total managed assets. A Fund may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, a Fund may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by its credit facility, which may be more stringent than those imposed by the 1940 Act.

If a Fund segregates or designates on its books and records cash or liquid assets having values not less than the value of a Fund’s obligations under the reverse repurchase agreement (including accrued interest), then such transaction is not considered a senior security and is not subject to the foregoing limitations and requirements under the 1940 Act.

| | |

| Derivative Financial Instruments | | |

The Funds may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the

derivative financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 10 | | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | |

| | |

Schedule of Investments February 29, 2016 (Unaudited) | | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Asset-Backed Securities (a)(b) | | Par (000) | | | Value | |

Asset-Backed Securities — 2.0% | | | | | | | | | | | | |

ALM Loan Funding, Series 2013-7RA, Class C, 4.07%, 4/24/24 | | | USD | | | | 500 | | | $ | 451,309 | |

ALM XIV Ltd., Series 2014-14A, Class C, 4.07%, 7/28/26 | | | | | | | 463 | | | | 386,836 | |

ALM XVII, Ltd., Series 2015-17A, Class C1, 4.75%, 1/15/28 | | | | | | | 250 | | | | 240,710 | |

Atlas Senior Loan Fund Ltd., Series 2014-6A, Class D, 4.32%, 10/15/26 | | | | | | | 250 | | | | 208,726 | |

Atrium CDO Corp., Series 9A, Class D, 4.14%, 2/28/24 | | | | | | | 250 | | | | 213,519 | |

Carlyle Global Market Strategies CLO Ltd., Series 2012-4A, Class D, 5.12%, 1/20/25 | | | | | | | 250 | | | | 235,098 | |

Octagon Investment Partners XVII Ltd., Series 2013-1A, Class D, 3.82%, 10/25/25 | | | | | | | 250 | | | | 198,172 | |

Octagon Investment Partners XXI Ltd., Series 2014-1A, Class C, 4.27%, 11/14/26 | | | | | | | 250 | | | | 205,774 | |

Webster Park CLO Ltd., Series 2015-1A, Class B1, 3.61%, 1/20/27 | | | | | | | 250 | | | | 242,995 | |

| Total Asset-Backed Securities — 2.0% | | | | 2,383,139 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | |

| Corporate Bonds | | | | | | | | | |

Airlines — 0.7% | | | | | | | | | | | | |

American Airlines Pass-Through Trust, Series 2013-2, Class C, 6.00%, 1/15/17 (a) | | | | | | | 247 | | | | 251,660 | |

Delta Air Lines Pass-Through Trust, Series 2009-1, Class B, 9.75%, 12/17/16 | | | | | | | 39 | | | | 41,431 | |

US Airways Pass-Through Trust, Series 2012-2, Class C, 5.45%, 6/03/18 | | | | | | | 590 | | | | 587,788 | |

| | | | | | | | | | | | |

| | | | | 880,879 | |

Commercial Services & Supplies — 0.1% | | | | | | | | | | | | |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 3.39%, 12/01/17 (b) | | | | | | | 68 | | | | 68,000 | |

Containers & Packaging — 0.2% | | | | | | | | | | | | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., 3.51%, 12/15/19 (a)(b) | | | | | | | 260 | | | | 252,850 | |

Diversified Telecommunication Services — 0.3% | | | | | | | | | | | | |

Level 3 Financing, Inc.: | | | | | | | | | | | | |

4.10%, 1/15/18 (b) | | | | | | | 228 | | | | 229,566 | |

6.13%, 1/15/21 | | | | | | | 127 | | | | 132,715 | |

| | | | | | | | | | | | |

| | | | | 362,281 | |

Health Care Equipment & Supplies — 0.1% | | | | | | | | | | | | |

DJO Finance LLC/DJO Finance Corp., 8.13%, 6/15/21 (a) | | | | | | | 75 | | | | 62,813 | |

Health Care Providers & Services — 0.3% | | | | | | | | | | | | |

Tenet Healthcare Corp., 4.01%, 6/15/20 (a)(b) | | | | | | | 310 | | | | 305,350 | |

Media — 1.2% | | | | | | | | | | | | |

Altice Financing SA, 6.63%, 2/15/23 (a) | | | | | | | 200 | | | | 197,000 | |

Altice US Finance I Corp., 5.38%, 7/15/23 (a) | | | | | | | 275 | | | | 278,438 | |

CCO Safari II LLC, 4.91%, 7/23/25 (a) | | | | | | | 420 | | | | 430,878 | |

Clear Channel Worldwide Holdings, Inc., 6.50%, 11/15/22 | | | | | | | 358 | | | | 347,260 | |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

Media (continued) | | | | | | | | | | | | |

Numericable Group SA, 6.00%, 5/15/22 (a) | | | USD | | | | 200 | | | $ | 198,000 | |

| | | | | | | | | | | | |

| | | | | 1,451,576 | |

Oil, Gas & Consumable Fuels — 0.1% | | | | | | | | | | | | |

CONSOL Energy, Inc., 5.88%, 4/15/22 | | | | | | | 90 | | | | 58,725 | |

MEG Energy Corp., 7.00%, 3/31/24 (a) | | | | | | | 100 | | | | 46,000 | |

| | | | | | | | | | | | |

| | | | | 104,725 | |

| Total Corporate Bonds — 3.0% | | | | 3,488,474 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | |

| Floating Rate Loan Interests (b) | | | | | | | | | |

Aerospace & Defense — 1.7% | | | | | | | | | | | | |

BE Aerospace, Inc., 2014 Term Loan B, 4.00%, 12/16/21 | | | | | | | 629 | | | | 628,356 | |

TASC, Inc., 2nd Lien Term Loan, 12.00%, 5/30/21 | | | | | | | 275 | | | | 257,812 | |

Transdigm, Inc.: | | | | | | | | | | | | |

2015 Term Loan E, 3.50%, 5/14/22 | | | | | | | 218 | | | | 208,268 | |

Term Loan C, 3.75%, 2/28/20 | | | | | | | 649 | | | | 629,478 | |

Term Loan D, 3.75%, 6/04/21 | | | | | | | 260 | | | | 247,988 | |

| | | | | | | | | | | | |

| | | | | 1,971,902 | |

Air Freight & Logistics — 0.6% | | | | | | | | | | | | |

CEVA Group PLC, Synthetic LC, 6.50%, 3/19/21 | | | | | | | 156 | | | | 120,084 | |

CEVA Intercompany BV, Dutch Term Loan, 6.50%, 3/19/21 | | | | | | | 162 | | | | 124,418 | |

CEVA Logistics Canada ULC, Canadian Term Loan, 6.50%, 3/19/21 | | | | | | | 25 | | | | 19,486 | |

CEVA Logistics US Holdings, Inc., Term Loan, 6.50%, 3/19/21 | | | | | | | 223 | | | | 171,611 | |

XPO Logistics, Inc., Term Loan, 5.50%, 11/01/21 | | | | | | | 305 | | | | 302,523 | |

| | | | | | | | | | | | |

| | | | | 738,122 | |

Airlines — 0.7% | | | | | | | | | | | | |

Delta Air Lines, Inc., 2018 Term Loan B1, 3.25%, 10/18/18 | | | | | | | 319 | | | | 318,216 | |

Northwest Airlines, Inc.: | | | | | | | | | | | | |

2.39%, 3/10/17 | | | | | | | 90 | | | | 88,440 | |

1.77%, 9/10/18 | | | | | | | 164 | | | | 158,595 | |

US Airways Group, Inc., Term Loan B1, 3.50%, 5/23/19 | | | | | | | 255 | | | | 252,331 | |

| | | | | | | | | | | | |

| | | | | 817,582 | |

Auto Components — 2.2% | | | | | | | | | | | | |

Affinia Group Intermediate Holdings, Inc., Term Loan B2, 4.75%, 4/27/20 | | | | | | | 239 | | | | 238,897 | |

Autoparts Holdings Ltd.: | | | | | | | | | | | | |

1st Lien Term Loan, 7.00%, 7/29/17 | | | | | | | 593 | | | | 475,503 | |

2nd Lien Term Loan, 11.00%, 1/29/18 | | | | | | | 200 | | | | 95,760 | |

Dayco Products LLC, Term Loan B, 5.25%, 12/12/19 | | | | | | | 218 | | | | 213,563 | |

FPC Holdings, Inc., 1st Lien Term Loan, 5.25%, 11/19/19 | | | | | | | 323 | | | | 234,417 | |

Gates Global, Inc., Term Loan B, 4.25%, 7/05/21 | | | | | | | 1,110 | | | | 975,413 | |

Goodyear Tire & Rubber Co., 2nd Lien Term Loan, 3.75%, 4/30/19 | | | | | | | 200 | | | | 200,500 | |

| | | | | | | | | | |

| ABS | | Asset-Backed Security | | DIP | | Debtor-In-Possession | | NZD | | New Zealand Dollar |

| ADS | | American Depositary Shares | | EUR | | Euro | | OTC | | Over-the-Counter |

| AUD | | Australian Dollar | | GBP | | British Pound | | PIK | | Payment-In-Kind |

| CAD | | Canadian Dollar | | JPY | | Japanese Yen | | SEK | | Swedish Krona |

| CHF | | Swiss Franc | | LIBOR | | London Interbank Offered Rate | | USD | | U.S. Dollar |

| CLO | | Collateralized Loan Obligation | | NOK | | Norwegian Krone | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | 11 |

| | |

Schedule of Investments (continued) | | BlackRock Defined Opportunity Credit Trust (BHL) |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Auto Components (continued) | | | | | | | | | | | | |

INA Beteiligungsgesellschaft mbH, Term Loan B, 4.25%, 5/15/20 | | | USD | | | | 156 | | | $ | 155,554 | |

| | | | | | | | | | | | |

| | | | | 2,589,607 | |

Automobiles — 0.6% | | | | | | | | | | | | |

Chrysler Group LLC, Term Loan B: | | | | | | | | | | | | |

2018, 3.25%, 12/31/18 | | | | | | | 187 | | | | 184,887 | |

3.50%, 5/24/17 | | | | | | | 515 | | | | 512,293 | |

| | | | | | | | | | | | |

| | | | | 697,180 | |

Banks — 0.3% | | | | | | | | | | | | |

Redtop Acquisitions Ltd.: | | | | | | | | | | | | |

1st Lien Term Loan, 4.50%, 12/03/20 | | | | | | | 255 | | | | 250,871 | |

2nd Lien Term Loan, 8.25%, 6/03/21 | | | | | | | 69 | | | | 64,312 | |

| | | | | | | | | | | | |

| | | | | 315,183 | |

Biotechnology — 0.2% | | | | | | | | | | | | |

AMAG Pharmaceuticals, Inc., 2015 1st Lien Term Loan, 4.75%, 8/13/21 | | | | | | | 193 | | | | 185,823 | |

Building Materials — 0.5% | | | | | | | | | | | | |

USAGM HoldCo LLC: | | | | | | | | | | | | |

2015 2nd Lien Term Loan, 9.50%, 7/28/23 | | | | | | | 145 | | | | 133,400 | |

2015 Term Loan, 4.75%, 7/28/22 | | | | | | | 551 | | | | 514,135 | |

| | | | | | | | | | | | |

| | | | | 647,535 | |

Building Products — 2.7% | | | | | | | | | | | | |

Continental Building Products LLC, 1st Lien Term Loan, 4.00%, 8/28/20 | | | | | | | 283 | | | | 276,046 | |

CPG International, Inc., Term Loan, 4.75%, 9/30/20 | | | | | | | 1,178 | | | | 1,107,782 | |

GYP Holdings III Corp., 1st Lien Term Loan, 4.75%, 4/01/21 | | | | | | | 268 | | | | 251,996 | |

Hanson Building Products Ltd., 1st Lien Term Loan, 6.50%, 3/13/22 | | | | | | | 12 | | | | 10,517 | |

Jeld-Wen, Inc., Term Loan B, 5.25%, 10/15/21 | | | | | | | 418 | | | | 413,298 | |

Ply Gem Industries, Inc., Term Loan, 4.00%, 2/01/21 | | | | | | | 221 | | | | 208,535 | |

Quikrete Holdings, Inc., 1st Lien Term Loan, 4.00%, 9/28/20 | | | | | | | 383 | | | | 373,115 | |

Wilsonart LLC: | | | | | | | | | | | | |

Incremental Term Loan B2, 4.00%, 10/31/19 | | | | | | | 108 | | | | 104,746 | |

Term Loan B, 4.00%, 10/31/19 | | | | | | | 492 | | | | 477,814 | |

| | | | | | | | | | | | |

| | | | | 3,223,849 | |

Capital Markets — 1.0% | | | | | | | | | | | | |

Affinion Group, Inc., Term Loan B, 6.75%, 4/30/18 | | | | | | | 296 | | | | 258,181 | |

American Capital Holdings, Inc., 2017 Term Loan, 3.50%, 8/22/17 | | | | | | | 193 | | | | 191,335 | |

RPI Finance Trust, Term Loan B4, 3.50%, 11/09/20 | | | | | | | 780 | | | | 776,686 | |

| | | | | | | | | | | | |

| | | | | 1,226,202 | |

Chemicals — 3.6% | | | | | | | | | | | | |

Allnex (Luxembourg) & Cy SCA, Term Loan B1, 4.50%, 10/03/19 | | | | | | | 250 | | | | 246,495 | |

Allnex USA, Inc., Term Loan B2, 4.50%, 10/03/19 | | | | | | | 130 | | | | 127,894 | |

Axalta Coating Systems US Holdings, Inc., Term Loan, 3.75%, 2/01/20 | | | | | | | 486 | | | | 478,932 | |

CeramTec Acquisition Corp., Term Loan B2, 4.25%, 8/30/20 | | | | | | | 26 | | | | 25,891 | |

Charter NEX US Holdings, Inc., Term Loan B, 5.25%, 2/07/22 | | | | | | | 259 | | | | 254,556 | |

Chemours Co., Term Loan B, 3.75%, 5/12/22 | | | | | | | 190 | | | | 171,073 | |

Chemtura Corp., Term Loan B, 3.50%, 8/27/16 | | | | | | | 62 | | | | 61,991 | |

Chromaflo Technologies Corp., 2nd Lien Term Loan, 8.25%, 6/02/20 | | | | | | | 110 | | | | 81,397 | |

Evergreen Acqco 1 LP, Term Loan, 5.00%, 7/09/19 | | | | | | | 69 | | | | 51,163 | |

Huntsman International LLC, 2013 Incremental Term Loan, 3.75%, 10/01/21 | | | | | | | 305 | | | | 294,101 | |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Chemicals (continued) | | | | | | | | | | | | |

Klockner-Pentaplast of America, Inc., Term Loan, 5.00%, 4/28/20 | | | USD | | | | 164 | | | $ | 162,466 | |

MacDermid, Inc.: | | | | | | | | | | | | |

1st Lien Term Loan, 5.50%, 6/07/20 | | | | | | | 389 | | | | 352,646 | |

Term Loan B2, 5.50%, 6/07/20 | | | | | | | 32 | | | | 29,172 | |

Term Loan B3, 5.50%, 6/07/20 | | | | | | | 234 | | | | 213,022 | |

OXEA Finance LLC, Term Loan B2, 4.25%, 1/15/20 | | | | | | | 572 | | | | 550,754 | |

Royal Holdings, Inc.: | | | | | | | | | | | | |

2015 1st Lien Term Loan, 4.50%, 6/19/22 | | | | | | | 259 | | | | 249,213 | |

2015 2nd Lien Term Loan, 8.50%, 6/19/23 | | | | | | | 110 | | | | 105,234 | |

Solenis International LP: | | | | | | | | | | | | |

1st Lien Term Loan, 4.25%, 7/31/21 | | | | | | | 351 | | | | 331,502 | |

2nd Lien Term Loan, 7.75%, 7/31/22 | | | | | | | 390 | | | | 307,125 | |

Tata Chemicals North America, Inc., Term Loan B, 3.75%, 8/07/20 | | | | | | | 120 | | | | 116,144 | |

| | | | | | | | | | | | |

| | | | | 4,210,771 | |

Commercial Services & Supplies — 7.0% | | | | | | | | | | | | |

ADMI Corp., 2015 Term Loan B, 5.50%, 4/30/22 | | | | | | | 263 | | | | 261,755 | |

ADS Waste Holdings, Inc., Term Loan B2, 3.75%, 10/09/19 | | | | | | | 700 | | | | 678,856 | |

ARAMARK Corp.: | | | | | | | | | | | | |

Extended Synthetic Line of Credit 2, 0.28%, 7/26/16 | | | | | | | 2 | | | | 1,628 | |

Extended Synthetic Line of Credit 3, 3.65%, 7/26/16 | | | | | | | 1 | | | | 1,101 | |

Term Loan E, 3.25%, 9/07/19 | | | | | | | 571 | | | | 567,926 | |

Term Loan F, 3.25%, 2/24/21 | | | | | | | 193 | | | | 191,066 | |

Brand Energy & Infrastructure Services, Inc., Term Loan B, 4.75%, 11/26/20 | | | | | | | 640 | | | | 588,562 | |

Catalent Pharma Solutions, Inc., Term Loan B, 4.25%, 5/20/21 | | | | | | | 952 | | | | 941,925 | |

Connolly Corp.: | | | | | | | | | | | | |

1st Lien Term Loan, 4.50%, 5/14/21 | | | | | | | 675 | | | | 651,181 | |

2nd Lien Term Loan, 8.00%, 5/14/22 | | | | | | | 325 | | | | 318,500 | |

Creative Artists Agency LLC, Term Loan B, 5.50%, 12/17/21 | | | | | | | 238 | | | | 235,421 | |

Dealer Tire LLC, Term Loan B, 5.50%, 12/22/21 | | | | | | | 214 | | | | 212,865 | |

KAR Auction Services, Inc., Term Loan B2, 3.50%, 3/11/21 | | | | | | | 304 | | | | 302,584 | |

Koosharem LLC, Exit Term Loan, 7.50%, 5/16/20 | | | | | | | 482 | | | | 436,009 | |

Livingston International, Inc., 1st Lien Term Loan, 5.00%, 4/18/19 | | | | | | | 302 | | | | 275,048 | |

PSSI Holdings LLC, Term Loan B, 5.00%, 12/02/21 | | | | | | | 371 | | | | 367,537 | |

Spin Holdco, Inc., Term Loan B, 4.25%, 11/14/19 | | | | | | | 986 | | | | 936,468 | |

US Ecology, Inc., Term Loan, 3.75%, 6/17/21 | | | | | | | 163 | | | | 162,305 | |

Waste Industries USA, Inc., Term Loan B, 4.25%, 2/27/20 | | | | | | | 505 | | | | 503,372 | |

West Corp., Term Loan B10, 3.25%, 6/30/18 | | | | | | | 590 | | | | 579,644 | |

| | | | | | | | | | | | |

| | | | | 8,213,753 | |

Communications Equipment — 1.7% | | | | | | | | | | | | |

Applied Systems, Inc.: | | | | | | | | | | | | |

1st Lien Term Loan, 4.25%, 1/25/21 | | | | | | | 184 | | | | 178,205 | |

2nd Lien Term Loan, 7.50%, 1/24/22 | | | | | | | 85 | | | | 76,925 | |

Avaya, Inc., Term Loan B7, 6.25%, 5/29/20 | | | | | | | 166 | | | | 96,991 | |

CommScope, Inc., Term Loan B5, 3.83%, 12/29/22 | | | | | | | 209 | | | | 207,554 | |

Riverbed Technology, Inc., Term Loan B, 6.00%, 4/24/22 | | | | | | | 91 | | | | 88,700 | |

Telesat Canada, Term Loan B2, 3.50%, 3/28/19 | | | | | | | 140 | | | | 136,500 | |

Zayo Group LLC: | | | | | | | | | | | | |

Term Loan B, 3.75%, 5/06/21 | | | | | | | 1,023 | | | | 1,008,043 | |

Term Loan B2, 4.50%, 5/06/21 | | | | | | | 220 | | | | 219,505 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 2,012,423 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 12 | | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | |

| | |

Schedule of Investments (continued) | | BlackRock Defined Opportunity Credit Trust (BHL) |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Construction & Engineering — 0.1% | |

AECOM Technology Corp., 2014 Term Loan B, 3.75%, 10/15/21 | | | USD | | | | 133 | | | $ | 132,986 | |

Construction Materials — 1.2% | |

Filtration Group Corp., 1st Lien Term Loan, 4.25%, 11/21/20 | | | | | | | 309 | | | | 297,167 | |

HD Supply, Inc., 2015 Term Loan B, 3.75%, 8/13/21 | | | | | | | 843 | | | | 824,521 | |

Headwaters, Inc., Term Loan B, 4.50%, 3/24/22 | | | | | | | 163 | | | | 163,035 | |

McJunkin Red Man Corp., Term Loan, 4.75%, 11/08/19 | | | | | | | 99 | | | | 87,193 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 1,371,916 | |

Containers & Packaging — 1.8% | |

Ardagh Holdings USA, Inc., Incremental Term Loan, 4.00%, 12/17/19 | | | | | | | 505 | | | | 498,822 | |

Berry Plastics Holding Corp.: | | | | | | | | | | | | |

Term Loan E, 3.75%, 1/06/21 | | | | | | | 286 | | | | 281,215 | |

Term Loan F, 4.00%, 10/01/22 | | | | | | | 1,182 | | | | 1,174,387 | |

BWAY Holding Co., Inc., Term Loan B, 5.50%, 8/14/20 | | | | | | | 185 | | | | 175,243 | |

| | | | | | | | | | | | |

| | | | | 2,129,667 | |

Distributors — 0.6% | |

ABC Supply Co., Inc., Term Loan, 3.50%, 4/16/20 | | | | | | | 366 | | | | 360,501 | |

American Tire Distributors Holdings, Inc., 2015 Term Loan, 5.25%, 9/01/21 | | | | | | | 347 | | | | 336,738 | |

| | | | | | | | | | | | |

| | | | | 697,239 | |

Diversified Consumer Services — 3.5% | |

Allied Security Holdings LLC: | | | | | | | | | | | | |

1st Lien Term Loan, 4.25%, 2/12/21 | | | | | | | 645 | | | | 620,433 | |

2nd Lien Term Loan, 8.00%, 8/13/21 | | | | | | | 321 | | | | 280,662 | |

AssuredPartners, Inc., 2015 1st Lien Term Loan, 5.75%, 10/21/22 | | | | | | | 390 | | | | 372,938 | |

Bright Horizons Family Solutions, Inc.: | | | | | | | | | | | | |

Incremental Term Loan B1, 4.50%, 1/30/20 | | | | | | | 79 | | | | 78,804 | |

Term Loan B, 4.00%, 1/30/20 | | | | | | | 626 | | | | 622,966 | |

CT Technologies Intermediate Holdings, Inc., 1st Lien Term Loan, 5.25%, 12/01/21 | | | | | | | 273 | | | | 263,400 | |

ROC Finance LLC, Term Loan, 5.00%, 6/20/19 | | | | | | | 244 | | | | 219,021 | |

ServiceMaster Co., 2014 Term Loan B, 4.25%, 7/01/21 | | | | | | | 1,702 | | | | 1,686,192 | |

| | | | | | | | | | | | |

| | | | | 4,144,416 | |

Diversified Financial Services — 3.1% | |

AlixPartners LLP, 2015 Term Loan B, 4.50%, 7/28/22 | | | | | | | 434 | | | | 429,122 | |

Diamond US Holding LLC, Term Loan B, 4.75%, 12/17/21 | | | | | | | 223 | | | | 217,738 | |

Jefferies Finance LLC, Term Loan, 4.50%, 5/14/20 | | | | | | | 597 | | | | 586,553 | |

Onex Wizard US Acquisition, Inc., Term Loan, 4.25%, 3/13/22 | | | | | | | 462 | | | | 448,766 | |

Reynolds Group Holdings, Inc., Dollar Term Loan, 4.50%, 12/01/18 | | | | | | | 856 | | | | 852,796 | |

SAM Finance Luxembourg Sarl, Term Loan, 4.25%, 12/17/20 | | | | | | | 415 | | | | 409,794 | |

TransFirst, Inc.: | | | | | | | | | | | | |

2014 2nd Lien Term Loan, 9.00%, 11/12/22 | | | | | | | 190 | | | | 189,033 | |

Incremental Term Loan B, 4.75%, 11/12/21 | | | | | | | 494 | | | | 493,297 | |

| | | | | | | | | | | | |

| | | | | 3,627,099 | |

Diversified Telecommunication Services — 4.2% | |

Altice Financing SA, Term Loan: | | | | | | | | | | | | |

Delayed Draw, 5.50%, 7/02/19 | | | | | | | 676 | | | | 668,174 | |

5.25%, 2/04/22 | | | | | | | 9 | | | | 8,707 | |

Hawaiian Telcom Communications, Inc., Term Loan B, 5.00%, 6/06/19 | | | | | | | 513 | | | | 506,296 | |

Integra Telecom, Inc.: | | | | | | | | | | | | |

2015 1st Lien Term Loan, 5.25%, 8/14/20 | | | | | | | 507 | | | | 476,777 | |

2nd Lien Term Loan, 9.75%, 2/12/21 | | | | | | | 168 | | | | 158,377 | |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Diversified Telecommunication Services (continued) | |

Level 3 Financing, Inc.: | | | | | | | | | | | | |

2013 Term Loan B, 4.00%, 1/15/20 | | | USD | | | | 2,330 | | | $ | 2,325,643 | |

2019 Term Loan, 4.00%, 8/01/19 | | | | | | | 350 | | | | 349,027 | |

Virgin Media Investment Holdings Ltd., Term Loan F, 3.50%, 6/30/23 | | | | | | | 525 | | | | 508,122 | |

| | | | | | | | | | | | |

| | | | | 5,001,123 | |

Electrical Equipment — 0.9% | |

Texas Competitive Electric Holdings Co. LLC: | | | | | | | | | | | | |

DIP Term Loan, 3.75%, 11/07/16 | | | | | | | 1,023 | | | | 1,013,582 | |

Extended Term Loan, 4.91%, 10/10/17 (c)(d) | | | | | | | 380 | | | | 103,740 | |

| | | | | | | | | | | | |

| | | | | 1,117,322 | |

Electronic Equipment, Instruments & Components — 0.4% | |

CDW LLC, Term Loan, 3.25%, 4/29/20 | | | | | | | 370 | | | | 365,401 | |

CPI Acquisition, Inc., Term Loan B, 5.50%, 8/17/22 | | | | | | | 176 | | | | 171,091 | |

| | | | | | | | | | | | |

| | | | | 536,492 | |

Energy Equipment & Services — 0.9% | |

Dynegy Holdings, Inc., Term Loan B2, 4.00%, 4/23/20 | | | | | | | 174 | | | | 162,512 | |

Exgen Texas Power LLC, Term Loan B, 5.75%, 9/16/21 | | | | | | | 262 | | | | 156,969 | |

MEG Energy Corp., Refinancing Term Loan, 3.75%, 3/31/20 | | | | | | | 1,070 | | | | 758,940 | |

| | | | | | | | | | | | |

| | | | | 1,078,421 | |

Food & Staples Retailing — 3.0% | |

Albertsons LLC, Term Loan B4, 5.50%, 8/25/21 | | | | | | | 900 | | | | 877,814 | |

Hostess Brands LLC: | | | | | | | | | | | | |

1st Lien Term Loan, 4.50%, 8/03/22 | | | | | | | 494 | | | | 486,973 | |

2nd Lien Term Loan, 8.50%, 8/03/23 | | | | | | | 16 | | | | 14,883 | |

Rite Aid Corp.: | | | | | | | | | | | | |

5.75%, 8/21/20 | | | | | | | 235 | | | | 234,608 | |

4.88%, 6/21/21 | | | | | | | 405 | | | | 403,566 | |

Supervalu, Inc., Refinancing Term Loan B, 4.50%, 3/21/19 | | | | | | | 505 | | | | 475,456 | |

US Foods, Inc., Refinancing Term Loan, 4.50%, 3/31/19 | | | | | | | 1,035 | | | | 1,020,666 | |

| | | | | | | | | | | | |

| | | | | 3,513,966 | |

Food Products — 2.2% | |

CTI Foods Holding Co. LLC, 1st Lien Term Loan, 4.50%, 6/29/20 | | | | | | | 254 | | | | 240,172 | |

Dole Food Co., Inc., Term Loan B, 4.50%, 11/01/18 | | | | | | | 608 | | | | 590,351 | |

Pabst Brewing Co., Inc., Term Loan, 5.50%, 10/21/21 | | | | | | | 400 | | | | 392,765 | |

Performance Food Group Co., 2nd Lien Term Loan, 6.00%, 11/14/19 | | | | | | | 155 | | | | 155,140 | |

Pinnacle Foods Finance LLC: | | | | | | | | | | | | |

Incremental Term Loan I, 3.75%, 1/13/23 | | | | | | | 115 | | | | 115,245 | |

Term Loan G, 3.00%, 4/29/20 | | | | | | | 605 | | | | 598,889 | |

Post Holdings Inc., Series A Incremental Term Loan, 3.75%, 6/02/21 | | | | | | | — | (e) | | | 134 | |

Reddy Ice Corp.: | | | | | | | | | | | | |

1st Lien Term Loan, 6.75%, 5/01/19 | | | | | | | 361 | | | | 289,783 | |

2nd Lien Term Loan, 10.75%, 11/01/19 | | | | | | | 270 | | | | 176,175 | |

| | | | | | | | | | | | |

| | | | | 2,558,654 | |

Health Care Equipment & Supplies — 4.2% | |

Alere, Inc., 2015 Term Loan B, 4.25%, 6/18/22 | | | | | | | 708 | | | | 706,625 | |

Auris Luxembourg III Sarl, Term Loan B4, 4.25%, 1/15/22 | | | | | | | 422 | | | | 411,548 | |

Capsugel Holdings US, Inc., Term Loan B, 3.50%, 8/01/18 | | | | | | | 433 | | | | 428,462 | |

DJO Finance LLC, 2015 Term Loan, 4.25%, 6/08/20 | | | | | | | 746 | | | | 717,429 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | 13 |

| | |

Schedule of Investments (continued) | | BlackRock Defined Opportunity Credit Trust (BHL) |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Health Care Equipment & Supplies (continued) | |

Iasis Healthcare LLC, Term Loan B2, 4.50%, 5/03/18 | | | USD | | | | 689 | | | $ | 669,557 | |

Immucor, Inc., Refinancing Term Loan B2, 5.00%, 8/17/18 | | | | | | | 515 | | | | 464,821 | |

National Vision, Inc., 1st Lien Term Loan, 4.00%, 3/12/21 | | | | | | | 697 | | | | 651,953 | |

Ortho-Clinical Diagnostics, Inc., Term Loan B, 4.75%, 6/30/21 | | | | | | | 619 | | | | 527,113 | |

Sage Products Holdings III LLC, Refinancing Term Loan B2, 4.25%, 12/13/19 | | | | | | | 321 | | | | 320,545 | |

| | | | | | | | | | | | |

| | | | | 4,898,053 | |

Health Care Providers & Services — 8.8% | | | | | | | | | | | | |

Acadia Healthcare Co., Inc.: | | | | | | | | | | | | |

Term Loan B, 4.25%, 2/11/22 | | | | | | | 111 | | | | 110,811 | |

Term Loan B2, 4.50%, 2/16/23 | | | | | | | 490 | | | | 489,084 | |

Air Medical Group Holdings, Inc., Term Loan B, 4.25%, 4/28/22 | | | | | | | 104 | | | | 98,801 | |

Amsurg Corp., 1st Lien Term Loan B, 3.50%, 7/16/21 | | | | | | | 690 | | | | 685,763 | |

CHG Healthcare Services Inc., Term Loan, 4.25%, 11/19/19 | | | | | | | 562 | | | | 551,534 | |

Community Health Systems, Inc.: | | | | | | | | | | | | |

Term Loan F, 3.69%, 12/31/18 | | | | | | | 336 | | | | 326,665 | |

Term Loan G, 3.75%, 12/31/19 | | | | | | | 715 | | | | 681,515 | |

Curo Health Services LLC, 2015 1st Lien Term Loan, 6.50%, 2/07/22 | | | | | | | 347 | | | | 341,515 | |

DaVita HealthCare Partners, Inc., Term Loan B, 3.50%, 6/24/21 | | | | | | | 2,182 | | | | 2,177,412 | |

Envision Healthcare Corp., Term Loan: | | | | | | | | | | | | |

4.25%, 5/25/18 | | | | | | | 418 | | | | 415,855 | |

B2, 4.50%, 10/28/22 | | | | | | | 205 | | | | 203,770 | |

HC Group Holdings III, Inc., Term Loan B, 6.00%, 4/07/22 | | | | | | | 328 | | | | 325,148 | |

HCA, Inc., Term Loan B5, 3.19%, 3/31/17 | | | | | | | 312 | | | | 311,420 | |

MPH Acquisition Holdings LLC, Term Loan, 3.75%, 3/31/21 | | | | | | | 560 | | | | 545,337 | |

National Mentor Holdings, Inc., Term Loan B, 4.25%, 1/31/21 | | | | | | | 105 | | | | 102,216 | |

NVA Holdings, Inc.: | | | | | | | | | | | | |

1st Lien Term Loan, 4.75%, 8/14/21 | | | | | | | 4 | | | | 3,596 | |

2016 Term Loan, 5.50%, 8/14/21 | | | | | | | 100 | | | | 97,750 | |

Sterigenics-Nordion Holdings LLC, 2015 Term Loan B, 4.25%, 5/15/22 | | | | | | | 718 | | | | 689,472 | |

Surgery Center Holdings, Inc., 1st Lien Term Loan, 5.25%, 11/03/20 | | | | | | | 437 | | | | 423,009 | |

Surgical Care Affiliates, Inc., Term Loan B, 4.25%, 3/17/22 | | | | | | | 507 | | | | 501,727 | |

Team Health, Inc., 2015 Term Loan B, 4.50%, 11/23/22 | | | | | | | 488 | | | | 487,885 | |

U.S. Renal Care, Inc., 2015 Term Loan B, 5.25%, 12/31/22 | | | | | | | 345 | | | | 340,905 | |

Vizient, Inc., 1st Lien Term Loan, 6.25%, 2/13/23 | | | | | | | 465 | | | | 462,094 | |

| | | | | | | | | | | | |

| | | | | 10,373,284 | |

Health Care Technology — 0.6% | | | | | | | | | | | | |

IMS Health, Inc., Term Loan, 3.50%, 3/17/21 | | | | | | | 747 | | | | 730,520 | |

Hotels, Restaurants & Leisure — 8.7% | | | | | | | | | | | | |

Amaya Holdings BV: | | | | | | | | | | | | |

1st Lien Term Loan, 5.00%, 8/01/21 | | | | | | | 483 | | | | 446,683 | |

2nd Lien Term Loan, 8.00%, 8/01/22 | | | | | | | 322 | | | | 315,051 | |

Boyd Gaming Corp., Term Loan B, 4.00%, 8/14/20 | | | | | | | 219 | | | | 217,322 | |

Bronco Midstream Funding LLC, Term Loan B, 5.00%, 8/15/20 | | | | | | | 564 | | | | 315,966 | |

Burger King Newco Unlimited Liability Co., Term Loan B2, 3.75%, 12/10/21 | | | | | | | 1,078 | | | | 1,071,920 | |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Hotels, Restaurants & Leisure (continued) | | | | | | | | | | | | |

Caesars Entertainment Resort Properties LLC, Term Loan B, 7.00%, 10/11/20 | | | USD | | | | 1,742 | | | $ | 1,579,254 | |

CCM Merger, Inc., Term Loan B, 4.50%, 8/08/21 | | | | | | | 340 | | | | 337,455 | |

Diamond Resorts Corp., Term Loan, 5.50%, 5/09/21 | | | | | | | 421 | | | | 407,986 | |

Eldorado Resorts LLC, Term Loan B, 4.25%, 7/23/22 | | | | | | | 484 | | | | 477,331 | |

ESH Hospitality, Inc., Term Loan, 5.00%, 6/24/19 | | | | | | | 210 | | | | 210,351 | |

Hilton Worldwide Finance LLC, Term Loan B2, 3.50%, 10/26/20 | | | | | | | 593 | | | | 590,271 | |

La Quinta Intermediate Holdings LLC, Term Loan B, 3.75%, 4/14/21 | | | | | | | 370 | | | | 352,741 | |

Las Vegas Sands LLC, Term Loan B, 3.25%, 12/19/20 | | | | | | | 588 | | | | 585,060 | |

MGM Resorts International, Term Loan B, 3.50%, 12/20/19 | | | | | | | 874 | | | | 865,252 | |

Pinnacle Entertainment, Inc., Term Loan B2, 3.75%, 8/13/20 | | | | | | | 128 | | | | 127,946 | |

RHP Hotel Properties LP, Term Loan B, 3.50%, 1/15/21 | | | | | | | 291 | | | | 288,904 | |

Sabre, Inc.: | | | | | | | | | | | | |

Incremental Term Loan, 4.00%, 2/19/19 | | | | | | | 112 | | | | 111,288 | |

Term Loan B, 4.00%, 2/19/19 | | | | | | | 593 | | | | 587,028 | |

Scientific Games International, Inc., 2014 Term Loan B1, 6.00%, 10/18/20 | | | | | | | 267 | | | | 245,443 | |

Station Casinos LLC, Term Loan B, 4.25%, 3/02/20 | | | | | | | 1,085 | | | | 1,068,247 | |

| | | | | | | | | | | | |

| | | | | 10,201,499 | |

Household Durables — 0.3% | | | | | | | | | | | | |

Jarden Corp., 2015 Term Loan B2, 3.19%, 7/30/22 | | | | | | | 354 | | | | 353,153 | |

Household Products — 0.9% | | | | | | | | | | | | |

Bass Pro Group LLC, 2015 Term Loan, 4.00%, 6/05/20 | | | | | | | 181 | | | | 169,714 | |

Spectrum Brands, Inc., Term Loan, 3.50%, 6/23/22 | | | | | | | 925 | | | | 921,858 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 1,091,572 | |

Independent Power and Renewable Electricity Producers — 3.6% | |

Aria Energy Operating LLC, Term Loan, 5.00%, 5/27/22 | | | | | | | 328 | | | | 272,531 | |

Calpine Construction Finance Co., LP, Term Loan B1, 3.00%, 5/03/20 | | | | | | | 364 | | | | 341,767 | |

Calpine Corp.: | | | | | | | | | | | | |

Term Loan B3, 4.00%, 10/09/19 | | | | | | | 247 | | | | 238,966 | |

Term Loan B5, 3.50%, 5/27/22 | | | | | | | 270 | | | | 254,917 | |

Term Loan B6, 4.00%, 1/15/23 | | | | | | | 485 | | | | 468,025 | |

Energy Future Intermediate Holding Co. LLC, DIP Term Loan, 4.25%, 12/19/16 | | | | | | | 1,248 | | | | 1,241,490 | |

Granite Acquisition, Inc.: | | | | | | | | | | | | |

Term Loan B, 5.00%, 12/19/21 | | | | | | | 703 | | | | 633,185 | |

Term Loan C, 5.00%, 12/19/21 | | | | | | | 31 | | | | 28,142 | |

NRG Energy, Inc., Refinancing Term Loan B, 2.75%, 7/02/18 | | | | | | | 449 | | | | 440,569 | |

Terra-Gen Finance Co. LLC, Term Loan B, 5.25%, 12/09/21 | | | | | | | 348 | | | | 278,149 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 4,197,741 | |

Industrial Conglomerates — 0.1% | | | | | | | | | | | | |

Sequa Corp., Term Loan B, 5.25%, 6/19/17 | | | | | | | 153 | | | | 90,201 | |

Insurance — 1.4% | | | | | | | | | | | | |

AmWINS Group LLC, 2014 2nd Lien Term Loan, 9.50%, 9/04/20 | | | | | | | 144 | | | | 133,482 | |

Asurion LLC: | | | | | | | | | | | | |

Term Loan B1, 5.00%, 5/24/19 | | | | | | | 82 | | | | 77,138 | |

Term Loan B4, 5.00%, 8/04/22 | | | | | | | 278 | | | | 254,305 | |

Cooper Gay Swett & Crawford of Delaware Holding Corp., 1st Lien Term Loan, 5.00%, 4/16/20 | | | | | | | 365 | | | | 357,850 | |

Sedgwick Claims Management Services, Inc.: | | | | | | | | | | | | |

1st Lien Term Loan, 3.75%, 3/01/21 | | | | | | | 452 | | | | 430,202 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 14 | | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | |

| | |

Schedule of Investments (continued) | | BlackRock Defined Opportunity Credit Trust (BHL) |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Insurance (continued) | | | | | | | | | | | | |

Sedgwick Claims Management Services, Inc. (continued): | | | | | | | | | | | | |

2nd Lien Term Loan, 6.75%, 2/28/22 | | | USD | | | | 410 | | | $ | 358,065 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 1,611,042 | |

Internet Software & Services — 0.5% | | | | | | | | | | | | |

Go Daddy Operating Co. LLC, Term Loan B, 4.25%, 5/13/21 | | | | | | | 566 | | | | 562,048 | |

W3 Co., 2nd Lien Term Loan, 9.25%, 9/11/20 | | | | | | | 155 | | | | 61,845 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 623,893 | |

IT Services — 3.7% | | | | | | | | | | | | |

Blue Coat Holdings, Inc., 2015 Term Loan, 4.50%, 5/20/22 | | | | | | | 828 | | | | 784,459 | |

First Data Corp.: | | | | | | | | | | | | |

2018 Extended Term Loan, 3.93%, 3/24/18 | | | | | | | 2,845 | | | | 2,806,110 | |

2018 Term Loan, 3.93%, 9/24/18 | | | | | | | 295 | | | | 290,522 | |

2021 Extended Term Loan, 4.43%, 3/24/21 | | | | | | | 125 | | | | 122,949 | |

Vantiv LLC, 2014 Term Loan B, 3.75%, 6/13/21 | | | | | | | 387 | | | | 386,417 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 4,390,457 | |

Leisure Products — 0.3% | | | | | | | | | | | | |

Bauer Performance Sports Ltd., Term Loan B, 4.50%, 4/15/21 | | | | | | | 328 | | | | 302,105 | |

Machinery — 2.1% | | | | | | | | | | | | |

Allison Transmission, Inc., Term Loan B3, 3.50%, 8/23/19 | | | | | | | 273 | | | | 271,787 | |

Faenza Acquisition GmbH: | | | | | | | | | | | | |

Term Loan B1, 4.25%, 8/30/20 | | | | | | | 249 | | | | 243,568 | |

Term Loan B3, 4.25%, 8/30/20 | | | | | | | 76 | | | | 74,223 | |

Infiltrator Systems, Inc., 2015 Term Loan, 5.25%, 5/27/22 | | | | | | | 338 | | | | 332,364 | |

Mueller Water Products, Inc., Term Loan B, 4.00%, 11/25/21 | | | | | | | 178 | | | | 177,977 | |

Rexnord LLC, 1st Lien Term Loan B, 4.00%, 8/21/20 | | | | | | | 558 | | | | 533,616 | |

Silver II US Holdings LLC, Term Loan, 4.00%, 12/13/19 | | | | | | | 747 | | | | 606,560 | |

Wabash National Corp., 2015 Term Loan B, 4.25%, 3/16/22 | | | | | | | 201 | | | | 199,462 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 2,439,557 | |

Manufacture Goods — 0.1% | | | | | | | | | | | | |

KP Germany Erste GmbH, 1st Lien Term Loan, 5.00%, 4/28/20 | | | | | | | 70 | | | | 69,430 | |

Media — 12.7% | | | | | | | | | | | | |

Altice US Finance I Corp., Extended Term Loan, 4.25%, 12/14/22 | | | | | | | 840 | | | | 822,572 | |

Cengage Learning Acquisitions, Inc., Term Loan: | | | | | | | | | | | | |

1st Lien, 7.00%, 3/31/20 | | | | | | | 963 | | | | 924,000 | |

0.00%, 7/03/16 (c)(d)(f) | | | | | | | 591 | | | | — | |

Charter Communications Operating LLC: | | | | | | | | | | | | |

Term Loan H, 3.25%, 8/24/21 | | | | | | | 240 | | | | 235,757 | |

Term Loan I, 3.50%, 1/24/23 | | | | | | | 1,465 | | | | 1,455,844 | |

Clear Channel Communications, Inc., Term Loan D, 7.19%, 1/30/19 | | | | | | | 1,239 | | | | 810,500 | |

Gray Television, Inc., Term Loan C, 4.25%, 6/13/21 | | | | | | | 165 | | | | 164,381 | |

Hemisphere Media Holdings LLC, Term Loan B, 5.00%, 7/30/20 | | | | | | | 379 | | | | 356,399 | |

Houghton Mifflin Harcourt Publishing Co., 2015 Term Loan B, 4.00%, 5/31/21 | | | | | | | 629 | | | | 610,886 | |

Intelsat Jackson Holdings SA, Term Loan B2, 3.75%, 6/30/19 | | | | | | | 759 | | | | 674,636 | |

Liberty Cablevision of Puerto Rico LLC, 1st Lien Term Loan, 4.50%, 1/07/22 | | | | | | | 275 | | | | 262,281 | |

Live Nation Entertainment, Inc., 2020 Term Loan B1, 3.50%, 8/16/20 | | | | | | | 112 | | | | 111,991 | |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Media (continued) | | | | | | | | | | | | |

MCC Iowa LLC: | | | | | | | | | | | | |

Term Loan I, 2.90%, 6/30/17 | | | USD | | | | 246 | | | $ | 243,684 | |

Term Loan J, 3.75%, 6/30/21 | | | | | | | 123 | | | | 121,524 | |

Media General, Inc., Term Loan B, 4.00%, 7/31/20 | | | | | | | 242 | | | | 241,277 | |

Mediacom Communications Corp., Term Loan F, 2.90%, 3/31/18 | | | | | | | 251 | | | | 244,587 | |

Mediacom Illinois LLC, Term Loan E, 3.40%, 10/23/17 | | | | | | | 166 | | | | 164,587 | |

Neptune Finco Corp., 2015 Term Loan B, 5.00%, 10/09/22 | | | | | | | 910 | | | | 900,672 | |

Numericable U.S. LLC: | | | | | | | | | | | | |

Term Loan B1, 4.50%, 5/21/20 | | | | | | | 504 | | | | 484,453 | |

Term Loan B2, 4.50%, 5/21/20 | | | | | | | 436 | | | | 419,118 | |

Term Loan B6, 4.75%, 2/10/23 | | | | | | | 530 | | | | 509,023 | |

SBA Senior Finance II LLC, Term Loan B1, 3.25%, 3/24/21 | | | | | | | 1,028 | | | | 1,008,646 | |

Sinclair Television Group, Inc., Term Loan B, 3.00%, 4/09/20 | | | | | | | 39 | | | | 38,354 | |

Tribune Media Co., Term Loan, 3.75%, 12/27/20 | | | | | | | 820 | | | | 811,342 | |

Univision Communications, Inc., Term Loan C4, 4.00%, 3/01/20 | | | | | | | 1,315 | | | | 1,277,305 | |

Virgin Media Investment Holdings Ltd., Term Loan E, 4.25%, 6/30/23 | | | GBP | | | | 650 | | | | 862,553 | |

WideOpenWest Finance LLC, Term Loan B1, 3.75%, 7/17/17 | | | USD | | | | 105 | | | | 103,816 | |

Ziggo Financing Partnership: | | | | | | | | | | | | |

Term Loan B1, 3.50%, 1/15/22 | | | | | | | 425 | | | | 407,770 | |

Term Loan B2A, 3.60%, 1/15/22 | | | | | | | 276 | | | | 264,516 | |

Term Loan B3, 3.60%, 1/15/22 | | | | | | | 453 | | | | 435,033 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 14,967,507 | |

Metals & Mining — 0.5% | | | | | | | | | | | | |

Ameriforge Group, Inc., 2nd Lien Term Loan, 8.75%, 12/19/20 | | | | | | | 100 | | | | 15,625 | |

Novelis, Inc., 2015 Term Loan B, 4.00%, 6/02/22 | | | | | | | 588 | | | | 547,024 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 562,649 | |

Multiline Retail — 2.1% | | | | | | | | | | | | |

BJ’s Wholesale Club, Inc.: | | | | | | | | | | | | |

1st Lien Term Loan, 4.50%, 9/26/19 | | | | | | | 822 | | | | 780,136 | |

2nd Lien Term Loan, 8.50%, 3/26/20 | | | | | | | 200 | | | | 164,916 | |

Dollar Tree, Inc., Term Loan B1, 3.50%, 7/06/22 | | | | | | | 863 | | | | 862,788 | |

Hudson’s Bay Co., 2015 Term Loan B, 4.75%, 9/30/22 | | | | | | | 305 | | | | 302,599 | |

Neiman Marcus Group, Inc., 2020 Term Loan, 4.25%, 10/25/20 | | | | | | | 374 | | | | 313,229 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 2,423,668 | |

Oil, Gas & Consumable Fuels — 2.4% | | | | | | | | | | | | |

CITGO Holding, Inc., 2015 Term Loan B, 9.50%, 5/12/18 | | | | | | | 250 | | | | 245,904 | |

Drillships Financing Holding, Inc., Term Loan B1, 6.00%, 3/31/21 | | | | | | | 278 | | | | 78,459 | |

Energy Transfer Equity LP, Term Loan, 3.25%, 12/02/19 | | | | | | | 47 | | | | 37,567 | |

Green Energy Partners/Stonewall LLC, Term Loan B1, 6.50%, 11/13/21 | | | | | | | 205 | | | | 183,475 | |

Panda Patriot LLC, Term Loan B1, 6.75%, 12/19/20 | | | | | | | 325 | | | | 289,250 | |

Power Buyer LLC: | | | | | | | | | | | | |

1st Lien Term Loan, 4.25%, 5/06/20 | | | | | | | 114 | | | | 111,582 | |

2nd Lien Term Loan, 8.25%, 11/06/20 | | | | | | | 105 | | | | 98,306 | |

Samchully Midstream 3 LLC, Term Loan B, 5.75%, 10/20/21 | | | | | | | 329 | | | | 225,862 | |

Seventy Seven Operating LLC, Term Loan B, 3.75%, 6/25/21 | | | | | | | 60 | | | | 35,105 | |

Southcross Energy Partners LP, 1st Lien Term Loan, 5.25%, 8/04/21 | | | | | | | 540 | | | | 276,622 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | FEBRUARY 29, 2016 | | 15 |

| | |

Schedule of Investments (continued) | | BlackRock Defined Opportunity Credit Trust (BHL) |

| | | | | | | | | | | | |

| Floating Rate Loan Interests (b) | | Par (000) | | | Value | |

Oil, Gas & Consumable Fuels (continued) | | | | | | | | | | | | |

Southcross Holdings Borrower LP, Term Loan B, 6.00%, 8/04/21 | | | USD | | | | 137 | | | $ | 20,545 | |

Stonewall Gas Gathering LLC, Term Loan B, 8.75%, 1/28/22 | | | | | | | 270 | | | | 265,474 | |

TPF II Power LLC, Term Loan B, 5.50%, 10/02/21 | | | | | | | 494 | | | | 462,284 | |

Veresen Midstream Limited Partnership, Term Loan B1, 5.25%, 3/31/22 | | | | | | | 377 | | | | 351,062 | |

WTG Holdings III Corp., 1st Lien Term Loan, 4.75%, 1/15/21 | | | | | | | 132 | | | | 128,331 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 2,809,828 | |

Personal Products — 0.5% | | | | | | | | | | | | |

Prestige Brands, Inc., Term Loan B3, 3.50%, 9/03/21 | | | | | | | 641 | | | | 639,137 | |

Pharmaceuticals — 6.3% | | | | | | | | | | | | |

Akorn, Inc., Term Loan B, 6.00%, 4/16/21 | | | | | | | 333 | | | | 331,191 | |

Amneal Pharmaceuticals LLC, Term Loan, 4.50%, 11/01/19 | | | | | | | 397 | | | | 389,468 | |

CCC Information Services, Inc., Term Loan, 4.00%, 12/20/19 | | | | | | | 209 | | | | 201,424 | |

DPx Holdings BV, 2014 Incremental Term Loan, 4.25%, 3/11/21 | | | | | | | 782 | | | | 740,769 | |

Endo Luxembourg Finance Co. I Sarl, 2015 Term Loan B, 3.75%, 9/26/22 | | | | | | | 765 | | | | 755,652 | |

Grifols Worldwide Operations USA, Inc., Term Loan B, 3.44%, 2/27/21 | | | | | | | 966 | | | | 962,936 | |

Jaguar Holding Co. II, 2015 Term Loan B, 4.25%, 8/18/22 | | | | | | | 1,221 | | | | 1,189,862 | |

Valeant Pharmaceuticals International, Inc.: | | | | | | | | | | | | |

Series C2 Term Loan B, 3.75%, 12/11/19 | | | | | | | 849 | | | | 796,801 | |

Series D2 Term Loan B, 3.50%, 2/13/19 | | | | | | | 568 | | | | 531,437 | |

Series E Term Loan B, 3.75%, 8/05/20 | | | | | | | 461 | | | | 430,416 | |

Term Loan B F1, 4.00%, 4/01/22 | | | | | | | 1,095 | | | | 1,022,631 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 7,352,587 | |

Professional Services — 3.7% | | | | | | | | | | | | |

Acosta Holdco, Inc., 2015 Term Loan, 4.25%, 9/26/21 | | | | | | | 181 | | | | 170,105 | |

Advantage Sales & Marketing, Inc.: | | | | | | | | | | | | |

2014 1st Lien Term Loan, 4.25%, 7/23/21 | | | | | | | 484 | | | | 458,827 | |

2014 2nd Lien Term Loan, 7.50%, 7/25/22 | | | | | | | 160 | | | | 132,800 | |

Emdeon Business Services LLC, Term Loan B2, 3.75%, 11/02/18 | | | | | | | 710 | | | | 694,419 | |

ON Assignment, Inc., 2015 Term Loan, 3.75%, 6/03/22 | | | | | | | 551 | | | | 549,665 | |

SIRVA Worldwide, Inc., Term Loan, 7.50%, 3/27/19 | | | | | | | 408 | | | | 385,678 | |

Sterling Infosystems, Inc., 1st Lien Term Loan B, 5.75%, 6/20/22 | | | | | | | 493 | | | | 478,980 | |

TransUnion LLC, Term Loan B2, 3.50%, 4/09/21 | | | | | | | 1,235 | | | | 1,203,043 | |

Truven Health Analytics, Inc., Term Loan B, 4.50%, 6/06/19 | | | | | | | 287 | | | | 285,733 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 4,359,250 | |

Real Estate Investment Trusts (REITs) — 0.2% | | | | | | | | | | | | |

Communications Sales & Leasing, Inc., Term Loan B, 5.00%, 10/24/22 | | | | | | | 219 | | | | 203,236 | |