| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 1 | $ 30 | 0.60 % |

| Fund net assets | $ 76,393,622 |

| Total number of portfolio holdings | 270 |

| Portfolio turnover for the reporting period | 57% |

| Long | |

| Foreign Exchange Risk | 47.8% |

| Interest Rate Risk | 128.9% |

| Short | |

| Foreign Exchange Risk | 94.8% |

| Interest Rate Risk | 29.2% |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 2 | $ 42 | 0.85 % |

| Fund net assets | $ 76,393,622 |

| Total number of portfolio holdings | 270 |

| Portfolio turnover for the reporting period | 57% |

| Long | |

| Foreign Exchange Risk | 47.8 % |

| Interest Rate Risk | 128.9 % |

| Short | |

| Foreign Exchange Risk | 94.8 % |

| Interest Rate Risk | 29.2 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 3 | $ 36 | 0.73 % |

| Fund net assets | $ 76,393,622 |

| Total number of portfolio holdings | 270 |

| Portfolio turnover for the reporting period | 57% |

| Long | |

| Foreign Exchange Risk | 47.8 % |

| Interest Rate Risk | 128.9 % |

| Short | |

| Foreign Exchange Risk | 94.8 % |

| Interest Rate Risk | 29.2 % |

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The registrant’s “Schedule I – Investments in securities of unaffiliated issuers” (as set forth in 17 CFR 210.12-12) is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Not FDIC or NCUA Insured | No Financial Institution Guarantee | May Lose Value |

Commercial Mortgage-Backed Securities - Non-Agency 1.2% | ||||

Issuer | Coupon Rate | Principal Amount ($) | Value ($) | |

Cayman Islands 0.3% | ||||

AREIT Ltd.(a),(b) | ||||

Series 2024-CRE9 Class A | ||||

1-month Term SOFR + 1.687% Floor 1.687% 05/17/2041 | 7.079% | 195,000 | 194,635 | |

United States 0.9% | ||||

AMSR Trust(a) | ||||

Subordinated Series 2022-SFR3 Class D | ||||

10/17/2039 | 4.000% | 155,000 | 144,658 | |

BFLD Mortgage Trust(a),(b),(c) | ||||

Series 2024-VICT Class A | ||||

1-month Term SOFR + 1.890% Floor 1.890% 07/15/2041 | 7.190% | 45,000 | 44,886 | |

COMM Mortgage Trust(a),(b) | ||||

Series 2024-WCL1 Class A | ||||

1-month Term SOFR + 1.841% Floor 1.841% 06/15/2041 | 7.141% | 30,000 | 29,856 | |

LBA Trust(a),(b) | ||||

Series 2024-BOLT Class A | ||||

1-month Term SOFR + 1.591% Floor 1.591% 06/15/2026 | 6.891% | 70,000 | 69,672 | |

New Residential Mortgage Loan Trust(a) | ||||

Subordinated CMO Series 2022-SFR2 Class D | ||||

09/04/2039 | 4.000% | 155,000 | 143,198 | |

Pagaya AI Technology in Housing Trust(a) | ||||

Series 2022-1 Class D | ||||

08/25/2025 | 4.250% | 100,000 | 95,725 | |

Progress Residential Trust(a) | ||||

Subordinated Series 2022-SFR7 Class D | ||||

10/27/2039 | 5.500% | 200,000 | 194,701 | |

Total | 722,696 | |||

Total Commercial Mortgage-Backed Securities - Non-Agency (Cost $912,000) | 917,331 | |||

Foreign Government Obligations(d),(e) 1.7% | ||||

Belgium 0.2% | ||||

Kingdom of Belgium Government Bond(a) | ||||

06/22/2054 | 3.300% | EUR | 179,960 | 181,753 |

France 0.1% | ||||

French Republic Government Bond OAT(a) | ||||

05/25/2054 | 3.000% | EUR | 92,960 | 86,812 |

Foreign Government Obligations(d),(e) (continued) | ||||

Issuer | Coupon Rate | Principal Amount ($) | Value ($) | |

Japan 0.1% | ||||

Japan Government Thirty-Year Bond | ||||

03/20/2054 | 1.800% | JPY | 16,650,000 | 95,368 |

Mexico 0.5% | ||||

Mexican Bonos | ||||

03/01/2029 | 8.500% | MXN | 1,000,000 | 51,468 |

05/31/2029 | 8.500% | MXN | 2,000,000 | 103,067 |

11/23/2034 | 7.750% | MXN | 1,000,000 | 47,197 |

Mexico Government International Bond | ||||

02/12/2034 | 3.500% | 200,000 | 162,459 | |

Total | 364,191 | |||

Supranational 0.4% | ||||

European Union(a) | ||||

03/04/2053 | 3.000% | EUR | 287,830 | 279,388 |

United Kingdom 0.4% | ||||

United Kingdom Gilt(a) | ||||

07/31/2033 | 0.875% | GBP | 235,000 | 224,342 |

07/31/2054 | 4.375% | GBP | 48,500 | 58,504 |

Total | 282,846 | |||

Total Foreign Government Obligations (Cost $1,323,391) | 1,290,358 | |||

Inflation-Indexed Bonds(d) 93.7% | ||||

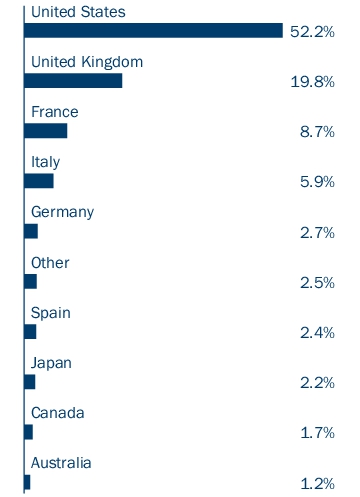

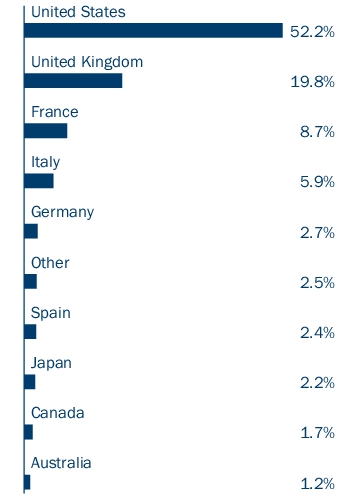

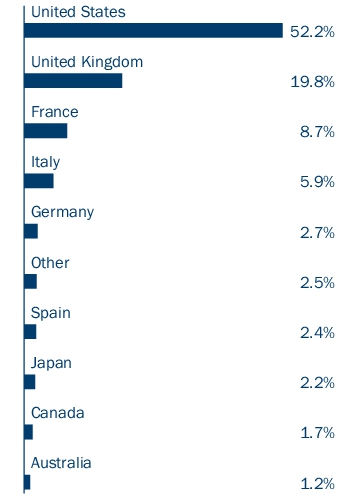

Australia 1.2% | ||||

Australia Government Bond(a) | ||||

11/21/2027 | 0.750% | AUD | 191,668 | 123,838 |

09/20/2030 | 2.500% | AUD | 265,526 | 184,199 |

11/21/2032 | 0.250% | AUD | 179,710 | 104,366 |

08/21/2035 | 2.000% | AUD | 193,400 | 128,987 |

08/21/2040 | 1.250% | AUD | 147,181 | 86,353 |

02/21/2050 | 1.000% | AUD | 139,505 | 71,072 |

Australia Government Index-Linked Bond(a) | ||||

09/20/2025 | 3.000% | AUD | 288,355 | 195,101 |

Total | 893,916 | |||

Canada 1.7% | ||||

Canadian Government Real Return Bond | ||||

12/01/2026 | 4.250% | CAD | 265,061 | 205,503 |

12/01/2031 | 4.000% | CAD | 263,529 | 223,715 |

12/01/2036 | 3.000% | CAD | 187,060 | 155,249 |

12/01/2041 | 2.000% | CAD | 238,181 | 180,269 |

12/01/2044 | 1.500% | CAD | 270,818 | 190,207 |

12/01/2047 | 1.250% | CAD | 279,969 | 188,871 |

12/01/2050 | 0.500% | CAD | 216,176 | 121,734 |

Inflation-Indexed Bonds(d) (continued) | ||||

Issuer | Coupon Rate | Principal Amount ($) | Value ($) | |

12/01/2054 | 0.250% | CAD | 40,231 | 20,715 |

Total | 1,286,263 | |||

Denmark 0.2% | ||||

Denmark I/L Government Bond(a) | ||||

11/15/2030 | 0.100% | DKK | 850,129 | 117,290 |

France 8.6% | ||||

France Government Bond OAT(a) | ||||

07/25/2027 | 1.850% | EUR | 736,587 | 808,873 |

07/25/2029 | 3.400% | EUR | 379,843 | 451,563 |

07/25/2030 | 0.700% | EUR | 552,768 | 584,028 |

07/25/2032 | 3.150% | EUR | 456,931 | 569,900 |

07/25/2047 | 0.100% | EUR | 393,863 | 327,058 |

French Republic Government Bond OAT(a) | ||||

03/01/2026 | 0.100% | EUR | 370,131 | 387,545 |

03/01/2028 | 0.100% | EUR | 469,659 | 480,543 |

03/01/2029 | 0.100% | EUR | 596,861 | 612,683 |

07/25/2031 | 0.100% | EUR | 352,767 | 356,017 |

03/01/2032 | 0.100% | EUR | 199,981 | 198,813 |

07/25/2034 | 0.600% | EUR | 103,222 | 105,368 |

03/01/2036 | 0.100% | EUR | 307,657 | 291,838 |

07/25/2036 | 0.100% | EUR | 357,341 | 337,505 |

07/25/2038 | 0.100% | EUR | 234,826 | 216,507 |

03/01/2039 | 0.550% | EUR | 68,169 | 66,750 |

07/25/2040 | 1.800% | EUR | 482,091 | 559,083 |

07/25/2043 | 0.950% | EUR | 81,770 | 83,021 |

07/25/2053 | 0.100% | EUR | 199,602 | 158,698 |

Total | 6,595,793 | |||

Germany 2.8% | ||||

Bundesrepublik Deutschland Bundesobligation Inflation-Linked Bond(a) | ||||

04/15/2030 | 0.500% | EUR | 708,910 | 757,938 |

Deutsche Bundesrepublik Inflation-Linked Bond(a) | ||||

04/15/2026 | 0.100% | EUR | 574,460 | 600,241 |

04/15/2033 | 0.100% | EUR | 288,348 | 299,685 |

04/15/2046 | 0.100% | EUR | 451,574 | 442,282 |

Total | 2,100,146 | |||

Italy 5.9% | ||||

Italy Buoni Poliennali Del Tesoro(a) | ||||

05/15/2026 | 0.650% | EUR | 274,846 | 287,399 |

09/15/2026 | 3.100% | EUR | 425,152 | 469,898 |

05/15/2028 | 1.300% | EUR | 721,902 | 760,916 |

05/15/2029 | 1.500% | EUR | 93,536 | 98,686 |

09/15/2032 | 1.250% | EUR | 486,810 | 497,617 |

05/15/2033 | 0.100% | EUR | 460,009 | 415,960 |

09/15/2035 | 2.350% | EUR | 486,736 | 536,908 |

05/15/2036 | 1.800% | EUR | 141,894 | 144,900 |

05/15/2039 | 2.400% | EUR | 67,196 | 72,110 |

09/15/2041 | 2.550% | EUR | 578,489 | 641,305 |

05/15/2051 | 0.150% | EUR | 216,227 | 139,555 |

Inflation-Indexed Bonds(d) (continued) | ||||

Issuer | Coupon Rate | Principal Amount ($) | Value ($) | |

Italy Buoni Poliennali Del Tesoro | ||||

05/15/2030 | 0.400% | EUR | 442,555 | 436,727 |

Total | 4,501,981 | |||

Japan 2.0% | ||||

Japanese Government CPI-Linked Bond | ||||

03/10/2026 | 0.100% | JPY | 42,387,448 | 270,438 |

03/10/2027 | 0.100% | JPY | 35,608,625 | 231,110 |

03/10/2028 | 0.100% | JPY | 32,684,085 | 212,592 |

03/10/2029 | 0.100% | JPY | 43,242,236 | 282,342 |

03/10/2030 | 0.200% | JPY | 13,908,960 | 87,948 |

03/10/2031 | 0.005% | JPY | 17,737,584 | 117,247 |

03/10/2032 | 0.005% | JPY | 28,349,700 | 186,097 |

03/10/2033 | 0.005% | JPY | 20,964,468 | 137,277 |

03/10/2034 | 0.005% | JPY | 4,725,615 | 30,857 |

Total | 1,555,908 | |||

New Zealand 0.4% | ||||

New Zealand Government Inflation-Linked Bond(a) | ||||

09/20/2030 | 3.000% | NZD | 118,507 | 74,968 |

09/20/2035 | 2.500% | NZD | 204,852 | 122,710 |

New Zealand Government Inflation-Linked Bond | ||||

09/20/2040 | 2.500% | NZD | 221,981 | 129,122 |

Total | 326,800 | |||

Spain 2.4% | ||||

Spain Government Inflation-Linked Bond(a) | ||||

11/30/2027 | 0.650% | EUR | 536,915 | 565,826 |

11/30/2030 | 1.000% | EUR | 525,441 | 559,651 |

11/30/2033 | 0.700% | EUR | 607,768 | 618,853 |

11/30/2039 | 2.050% | EUR | 110,809 | 126,380 |

Total | 1,870,710 | |||

Sweden 0.5% | ||||

Sweden Inflation-Linked Bond | ||||

12/01/2028 | 3.500% | SEK | 2,034,726 | 213,619 |

Sweden Inflation-Linked Bond(a) | ||||

06/01/2030 | 0.125% | SEK | 444,569 | 40,352 |

06/01/2032 | 0.125% | SEK | 795,330 | 71,873 |

06/01/2039 | 0.125% | SEK | 304,242 | 26,451 |

Total | 352,295 | |||

United Kingdom 19.5% | ||||

United Kingdom Gilt Inflation-Linked Bond(a) | ||||

03/22/2026 | 0.125% | GBP | 536,519 | 671,711 |

11/22/2027 | 1.250% | GBP | 684,194 | 891,324 |

08/10/2028 | 0.125% | GBP | 578,886 | 725,932 |

03/22/2029 | 0.125% | GBP | 607,890 | 757,598 |

07/22/2030 | 4.125% | GBP | 348,666 | 539,849 |

08/10/2031 | 0.125% | GBP | 242,505 | 301,886 |

03/22/2034 | 0.750% | GBP | 638,049 | 814,385 |

01/26/2035 | 2.000% | GBP | 500,130 | 714,553 |

Inflation-Indexed Bonds(d) (continued) | ||||

Issuer | Coupon Rate | Principal Amount ($) | Value ($) | |

11/22/2036 | 0.125% | GBP | 244,225 | 284,251 |

11/22/2037 | 1.125% | GBP | 618,472 | 805,853 |

03/22/2039 | 0.125% | GBP | 330,745 | 366,686 |

03/22/2040 | 0.625% | GBP | 639,896 | 758,018 |

08/10/2041 | 0.125% | GBP | 426,017 | 457,103 |

11/22/2042 | 0.625% | GBP | 588,718 | 679,426 |

03/22/2044 | 0.125% | GBP | 642,974 | 650,880 |

03/22/2046 | 0.125% | GBP | 491,181 | 480,538 |

11/22/2047 | 0.750% | GBP | 535,510 | 599,246 |

08/10/2048 | 0.125% | GBP | 406,165 | 384,508 |

03/22/2050 | 0.500% | GBP | 527,244 | 540,109 |

03/22/2051 | 0.125% | GBP | 359,860 | 326,864 |

03/22/2052 | 0.250% | GBP | 492,909 | 462,036 |

11/22/2055 | 1.250% | GBP | 584,710 | 719,797 |

11/22/2056 | 0.125% | GBP | 242,355 | 210,394 |

03/22/2058 | 0.125% | GBP | 416,622 | 356,717 |

03/22/2062 | 0.375% | GBP | 497,751 | 458,637 |

11/22/2065 | 0.125% | GBP | 292,602 | 236,081 |

03/22/2068 | 0.125% | GBP | 478,850 | 380,127 |

03/22/2073 | 0.125% | GBP | 162,275 | 133,099 |

United Kingdom Inflation-Linked Gilt(a) | ||||

11/22/2033 | 0.750% | GBP | 46,526 | 59,701 |

03/22/2045 | 0.625% | GBP | 100,463 | 111,448 |

Total | 14,878,757 | |||

United States 48.5% | ||||

U.S. Treasury Inflation-Indexed Bond | ||||

07/15/2025 | 0.375% | 1,150,001 | 1,121,026 | |

10/15/2025 | 0.125% | 893,994 | 864,555 | |

01/15/2026 | 0.625% | 633,235 | 612,556 | |

01/15/2026 | 2.000% | 837,061 | 826,696 | |

04/15/2026 | 0.125% | 705,227 | 673,740 | |

07/15/2026 | 0.125% | 910,187 | 869,940 | |

01/15/2027 | 0.375% | 1,195,682 | 1,136,879 | |

01/15/2027 | 2.375% | 652,848 | 652,644 | |

04/15/2027 | 0.125% | 988,096 | 929,659 | |

07/15/2027 | 0.375% | 1,146,898 | 1,088,522 | |

10/15/2027 | 1.625% | 1,047,608 | 1,030,994 | |

01/15/2028 | 0.500% | 1,193,173 | 1,124,472 | |

01/15/2028 | 1.750% | 620,960 | 611,064 | |

04/15/2028 | 1.250% | 1,076,422 | 1,040,093 | |

04/15/2028 | 3.625% | 796,555 | 837,347 | |

07/15/2028 | 0.750% | 1,122,662 | 1,067,231 | |

10/15/2028 | 2.375% | 1,110,411 | 1,125,375 | |

01/15/2029 | 0.875% | 335,189 | 317,683 | |

01/15/2029 | 2.500% | 521,957 | 531,275 | |

04/15/2029 | 2.125% | 1,043,853 | 1,045,892 | |

04/15/2029 | 3.875% | 886,667 | 957,946 | |

07/15/2029 | 0.250% | 1,127,432 | 1,035,608 | |

01/15/2030 | 0.125% | 1,133,084 | 1,020,307 | |

07/15/2030 | 0.125% | 1,289,854 | 1,154,318 | |

01/15/2031 | 0.125% | 1,288,473 | 1,137,178 | |

01/15/2032 | 0.125% | 1,373,946 | 1,189,376 | |

04/15/2032 | 3.375% | 231,347 | 252,458 | |

07/15/2032 | 0.625% | 1,305,445 | 1,170,413 | |

01/15/2033 | 1.125% | 1,278,593 | 1,182,998 | |

Inflation-Indexed Bonds(d) (continued) | ||||

Issuer | Coupon Rate | Principal Amount ($) | Value ($) | |

07/15/2033 | 1.375% | 1,238,556 | 1,169,903 | |

01/15/2034 | 1.750% | 1,171,716 | 1,137,480 | |

02/15/2040 | 2.125% | 519,207 | 513,610 | |

02/15/2041 | 2.125% | 858,846 | 850,962 | |

02/15/2042 | 0.750% | 775,478 | 605,479 | |

02/15/2043 | 0.625% | 736,252 | 552,736 | |

02/15/2044 | 1.375% | 773,381 | 661,996 | |

02/15/2045 | 0.750% | 765,423 | 573,080 | |

02/15/2046 | 1.000% | 654,865 | 510,744 | |

02/15/2047 | 0.875% | 577,868 | 433,762 | |

02/15/2048 | 1.000% | 572,027 | 437,712 | |

02/15/2049 | 1.000% | 373,716 | 283,805 | |

02/15/2050 | 0.250% | 445,030 | 271,572 | |

02/15/2051 | 0.125% | 553,845 | 320,170 | |

02/15/2052 | 0.125% | 561,566 | 318,733 | |

02/15/2053 | 1.500% | 474,543 | 398,820 | |

02/15/2054 | 2.125% | 240,027 | 233,454 | |

U.S. Treasury Inflation-Indexed Bond(f) | ||||

07/15/2031 | 0.125% | 1,368,385 | 1,201,453 | |

Total | 37,083,716 | |||

Total Inflation-Indexed Bonds (Cost $83,625,018) | 71,563,575 | |||

Residential Mortgage-Backed Securities - Agency 1.5% | ||||

United States 1.5% | ||||

Federal Home Loan Mortgage Corp. | ||||

06/01/2053 | 5.000% | 795,047 | 768,456 | |

Federal National Mortgage Association | ||||

02/01/2054 | 5.500% | 389,526 | 384,251 | |

Total | 1,152,707 | |||

Total Residential Mortgage-Backed Securities - Agency (Cost $1,164,179) | 1,152,707 | |||

Residential Mortgage-Backed Securities - Non-Agency 0.9% | ||||

United States 0.9% | ||||

CSMC Trust(a),(g) | ||||

CMO Series 2022-NQM5 Class A1 | ||||

05/25/2067 | 5.169% | 235,861 | 233,545 | |

Ellington Financial Mortgage Trust(a),(g) | ||||

CMO Series 2021-3 Class A1 | ||||

09/25/2066 | 1.241% | 123,385 | 98,237 | |

PRKCM Trust(a),(g) | ||||

CMO Series 2022-AFC2 Class A1 | ||||

08/25/2057 | 5.335% | 85,353 | 84,945 | |

SG Residential Mortgage Trust(a),(g) | ||||

CMO Series 2021-1 Class A1 | ||||

07/25/2061 | 1.160% | 142,436 | 113,961 | |

CMO Series 2022-2 Class A1 | ||||

08/25/2062 | 5.353% | 85,374 | 84,604 | |

Residential Mortgage-Backed Securities - Non-Agency (continued) | ||||

Issuer | Coupon Rate | Principal Amount ($) | Value ($) | |

Verus Securitization Trust(a),(g) | ||||

CMO Series 2022-7 Class A1 | ||||

07/25/2067 | 5.350% | 94,921 | 94,201 | |

Total | 709,493 | |||

Total Residential Mortgage-Backed Securities - Non-Agency (Cost $704,612) | 709,493 | |||

U.S. Treasury Obligations 0.2% | ||||

United States 0.2% | ||||

U.S. Treasury | ||||

02/15/2049 | 3.000% | 170,000 | 128,802 | |

Total U.S. Treasury Obligations (Cost $124,143) | 128,802 | |||

Call Option Contracts Purchased 0.0% | |||||

Value ($) | |||||

(Cost $25,867) | 15,668 | ||||

Put Option Contracts Purchased 0.0% | |||||

Value ($) | |||||

(Cost $14,601) | 8,280 | ||||

Money Market Funds 0.0% | ||

Shares | Value ($) | |

Columbia Short-Term Cash Fund, 5.547%(h),(i) | 20,714 | 20,708 |

Total Money Market Funds (Cost $20,708) | 20,708 | |

Total Investments in Securities (Cost $87,914,519) | 75,806,922 | |

Other Assets & Liabilities, Net | 586,700 | |

Net Assets | $76,393,622 | |

Forward foreign currency exchange contracts | |||||

Currency to be sold | Currency to be purchased | Counterparty | Settlement date | Unrealized appreciation ($) | Unrealized depreciation ($) |

22,738 CAD | 16,669 USD | Citi | 07/02/2024 | 48 | — |

828,000 DKK | 120,280 USD | Citi | 07/02/2024 | 1,381 | — |

18,000 EUR | 19,298 USD | Citi | 07/02/2024 | 21 | — |

12,384,040 GBP | 15,745,098 USD | Citi | 07/02/2024 | 90,433 | — |

10,268,000 JPY | 65,145 USD | Citi | 07/02/2024 | 1,325 | — |

535,237 NZD | 327,325 USD | Citi | 07/02/2024 | 1,312 | — |

41,613 SEK | 3,956 USD | Citi | 07/02/2024 | 30 | — |

6,170,000 SEK | 581,908 USD | Citi | 07/02/2024 | — | (223 ) |

42,215 USD | 58,000 CAD | Citi | 07/02/2024 | 181 | — |

200,728 USD | 186,107 EUR | Citi | 07/02/2024 | — | (1,417 ) |

15,558,293 USD | 12,297,000 GBP | Citi | 07/02/2024 | — | (13,655 ) |

1,658,572 USD | 266,164,000 JPY | Citi | 07/02/2024 | — | (4,249 ) |

323,289 USD | 530,000 NZD | Citi | 07/02/2024 | — | (466 ) |

61,686 CAD | 45,113 USD | Citi | 08/02/2024 | — | (12 ) |

12,037,000 GBP | 15,229,602 USD | Citi | 08/02/2024 | 10,722 | — |

84,667 GBP | 107,046 USD | Citi | 08/02/2024 | — | (2 ) |

267,472,746 JPY | 1,674,541 USD | Citi | 08/02/2024 | 3,963 | — |

537,142 NZD | 327,641 USD | Citi | 08/02/2024 | 463 | — |

72,509 SEK | 6,857 USD | Citi | 08/02/2024 | 5 | — |

56,023 USD | 52,196 EUR | Citi | 08/02/2024 | — | (39 ) |

15,395 USD | 12,173 GBP | Citi | 08/02/2024 | — | (4 ) |

441,541 MXN | 23,142 USD | Citi | 09/18/2024 | — | (695 ) |

1,345,000 AUD | 892,071 USD | Deutsche Bank | 07/02/2024 | — | (5,178 ) |

1,803,000 CAD | 1,316,967 USD | Deutsche Bank | 07/02/2024 | — | (967 ) |

14,953,000 EUR | 16,216,129 USD | Deutsche Bank | 07/02/2024 | 202,214 | — |

Forward foreign currency exchange contracts (continued) | |||||

Currency to be sold | Currency to be purchased | Counterparty | Settlement date | Unrealized appreciation ($) | Unrealized depreciation ($) |

255,896,000 JPY | 1,639,888 USD | Deutsche Bank | 07/02/2024 | 49,385 | — |

887,585 USD | 1,333,000 AUD | Deutsche Bank | 07/02/2024 | 1,659 | — |

1,254,583 USD | 1,717,000 CAD | Deutsche Bank | 07/02/2024 | 488 | — |

118,825 USD | 828,000 DKK | Deutsche Bank | 07/02/2024 | 74 | — |

15,746,957 USD | 14,694,000 EUR | Deutsche Bank | 07/02/2024 | — | (10,418 ) |

93,478 USD | 73,554 GBP | Deutsche Bank | 07/02/2024 | — | (499 ) |

585,788 USD | 6,184,000 SEK | Deutsche Bank | 07/02/2024 | — | (2,337 ) |

1,333,000 AUD | 888,360 USD | Deutsche Bank | 08/02/2024 | — | (1,655 ) |

1,717,000 CAD | 1,255,443 USD | Deutsche Bank | 08/02/2024 | — | (550 ) |

828,000 DKK | 119,036 USD | Deutsche Bank | 08/02/2024 | — | (81 ) |

14,766,000 EUR | 15,847,320 USD | Deutsche Bank | 08/02/2024 | 9,825 | — |

3,694,000 SEK | 349,425 USD | Deutsche Bank | 08/02/2024 | 345 | — |

Total | 373,874 | (42,447 ) | |||

Long futures contracts | ||||||

Description | Number of contracts | Expiration date | Trading currency | Notional amount | Value/Unrealized appreciation ($) | Value/Unrealized depreciation ($) |

Long Gilt | 10 | 09/2024 | GBP | 975,700 | 8,688 | — |

U.S. Treasury 2-Year Note | 16 | 09/2024 | USD | 3,267,500 | — | (2,878 ) |

Total | 8,688 | (2,878 ) | ||||

Short futures contracts | ||||||

Description | Number of contracts | Expiration date | Trading currency | Notional amount | Value/Unrealized appreciation ($) | Value/Unrealized depreciation ($) |

Canadian Government 10-Year Bond | (5) | 09/2024 | CAD | (600,350 ) | 3,609 | — |

U.S. Long Bond | (1) | 09/2024 | USD | (118,313 ) | 1,030 | — |

U.S. Treasury 10-Year Note | (2) | 09/2024 | USD | (219,969 ) | 1,028 | — |

U.S. Treasury Ultra 10-Year Note | (2) | 09/2024 | USD | (227,063 ) | 1,693 | — |

U.S. Treasury Ultra Bond | (1) | 09/2024 | USD | (125,344 ) | 3,022 | — |

Total | 10,382 | — | ||||

Call option contracts purchased | ||||||||

Description | Counterparty | Trading currency | Notional amount | Number of contracts | Exercise price/Rate | Expiration date | Cost ($) | Value ($) |

1-Year OTC interest rate swap with Deutsche Bank to receive exercise rate and pay SOFR | Deutsche Bank | USD | 12,646,000 | 12,646,000 | 4.54 | 10/16/2024 | 25,867 | 15,668 |

Put option contracts purchased | ||||||||

Description | Counterparty | Trading currency | Notional amount | Number of contracts | Exercise price/Rate | Expiration date | Cost ($) | Value ($) |

10-Year OTC interest rate swap with Citi to receive SOFR and pay exercise rate | Citi | USD | 449,000 | 449,000 | 4.43 | 10/17/2024 | 7,236 | 2,095 |

10-Year OTC interest rate swap with Citi to receive SOFR and pay exercise rate | Citi | USD | 224,500 | 224,500 | 4.43 | 10/17/2024 | 3,384 | 1,049 |

30-Year OTC interest rate swap with Citi to receive SOFR and pay exercise rate | Citi | USD | 194,000 | 194,000 | 3.93 | 12/18/2024 | 3,981 | 5,136 |

Total | 14,601 | 8,280 | ||||||

Call option contracts written | ||||||||

Description | Counterparty | Trading currency | Notional amount | Number of contracts | Exercise price/Rate | Expiration date | Premium received ($) | Value ($) |

10-Year OTC interest rate swap with Citi to receive SOFR and pay exercise rate | Citi | USD | (217,500 ) | (217,500 ) | 3.89 | 9/13/2024 | (3,306 ) | (3,105 ) |

10-Year OTC interest rate swap with Deutsche Bank to receive SOFR and pay exercise rate | Deutsche Bank | USD | (435,000 ) | (435,000 ) | 3.86 | 9/12/2024 | (6,656 ) | (5,700 ) |

10-Year OTC interest rate swap with Deutsche Bank to receive SOFR and pay exercise rate | Deutsche Bank | USD | (108,000 ) | (108,000 ) | 3.82 | 9/17/2024 | (1,760 ) | (1,330 ) |

1-Year OTC interest rate swap with Deutsche Bank to receive SOFR and pay exercise rate | Deutsche Bank | USD | (12,646,000 ) | (12,646,000 ) | 3.84 | 10/16/2024 | (10,471 ) | (3,234 ) |

Total | (22,193 ) | (13,369 ) | ||||||

Put option contracts written | ||||||||

Description | Counterparty | Trading currency | Notional amount | Number of contracts | Exercise price/Rate | Expiration date | Premium received ($) | Value ($) |

10-Year OTC interest rate swap with Citi to receive exercise rate and pay SOFR | Citi | USD | (217,500 ) | (217,500 ) | 3.89 | 09/13/2024 | (3,306 ) | (3,435 ) |

10-Year OTC interest rate swap with Deutsche Bank to receive exercise rate and pay SOFR | Deutsche Bank | USD | (435,000 ) | (435,000 ) | 3.86 | 09/12/2024 | (6,656 ) | (7,327 ) |

10-Year OTC interest rate swap with Deutsche Bank to receive exercise rate and pay SOFR | Deutsche Bank | USD | (108,000 ) | (108,000 ) | 3.82 | 09/17/2024 | (1,760 ) | (2,026 ) |

1-Year OTC interest rate swap with Citi to receive exercise rate and pay SOFR | Citi | USD | (1,884,500 ) | (1,884,500 ) | 5.10 | 10/17/2024 | (3,164 ) | (954 ) |

1-Year OTC interest rate swap with Citi to receive exercise rate and pay SOFR | Citi | USD | (3,769,000 ) | (3,769,000 ) | 5.10 | 10/17/2024 | (6,579 ) | (1,908 ) |

30-Year OTC interest rate swap with Citi to receive exercise rate and pay SOFR | Citi | USD | (194,000 ) | (194,000 ) | 3.86 | 09/18/2024 | (2,430 ) | (3,460 ) |

Total | (23,895 ) | (19,110 ) | ||||||

Cleared interest rate swap contracts | |||||||||||

Fund receives | Fund pays | Payment frequency | Counterparty | Maturity date | Notional currency | Notional amount | Value ($) | Upfront payments ($) | Upfront receipts ($) | Unrealized appreciation ($) | Unrealized depreciation ($) |

Fixed rate of 5.324% | SOFR | Receives Annually, Pays Annually | Goldman Sachs | 09/18/2024 | USD | 14,000,000 | 41 | — | — | 41 | — |

Fixed rate of 5.321% | SOFR | Receives Annually, Pays Annually | Goldman Sachs | 09/18/2024 | USD | 15,010,000 | 9 | — | — | 9 | — |

Fixed rate of 5.321% | SOFR | Receives Annually, Pays Annually | Goldman Sachs | 09/18/2024 | USD | 15,010,000 | (5 ) | — | — | — | (5 ) |

Fixed rate of 5.319% | SOFR | Receives Annually, Pays Annually | Goldman Sachs | 09/18/2024 | USD | 15,010,000 | (36 ) | — | — | — | (36 ) |

Fixed rate of 5.309% | SOFR | Receives Annually, Pays Annually | Goldman Sachs | 09/18/2024 | USD | 15,000,000 | (256 ) | — | — | — | (256 ) |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.192% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 12/27/2025 | USD | 375,000 | 3,520 | — | — | 3,520 | — |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.219% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 01/30/2026 | USD | 390,000 | 3,771 | — | — | 3,771 | — |

TONA | Fixed rate of 0.270% | Receives Annually, Pays Annually | Goldman Sachs | 03/11/2026 | JPY | 61,640,000 | 518 | — | — | 518 | — |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.481% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 03/20/2026 | USD | 405,000 | 1,961 | — | — | 1,961 | — |

TONA | Fixed rate of 0.408% | Receives Annually, Pays Annually | Goldman Sachs | 05/21/2026 | JPY | 60,225,000 | (87 ) | — | — | — | (87 ) |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.299% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 06/17/2026 | USD | 1,150,000 | 4,135 | — | — | 4,135 | — |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.452% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 07/02/2026 | USD | 415,000 | (3 ) | — | — | — | (3 ) |

Cleared interest rate swap contracts (continued) | |||||||||||

Fund receives | Fund pays | Payment frequency | Counterparty | Maturity date | Notional currency | Notional amount | Value ($) | Upfront payments ($) | Upfront receipts ($) | Unrealized appreciation ($) | Unrealized depreciation ($) |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.547% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 10/03/2028 | USD | 775,000 | 4,193 | — | — | 4,193 | — |

UK Retail Price Index All Items Monthly | Fixed rate of 3.884% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 06/15/2029 | GBP | 160,000 | 294 | — | — | 294 | — |

Fixed rate of 2.133% | Eurostat Eurozone HICP ex-Tobacco NSA | Receives at Maturity, Pays at Maturity | Goldman Sachs | 06/15/2029 | EUR | 380,000 | (463 ) | — | — | — | (463 ) |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.458% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 07/01/2029 | USD | 209,000 | 720 | — | — | 720 | — |

UK Retail Price Index All Items Monthly | Fixed rate of 3.790% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 03/15/2033 | GBP | 710,000 | 5,068 | — | — | 5,068 | — |

UK Retail Price Index All Items Monthly | Fixed rate of 3.752% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 05/15/2033 | GBP | 180,000 | (2,352 ) | — | — | — | (2,352 ) |

Fixed rate of 0.853% | TONA | Receives Annually, Pays Annually | Goldman Sachs | 03/11/2034 | JPY | 12,940,000 | (1,141 ) | — | — | — | (1,141 ) |

UK Retail Price Index All Items Monthly | Fixed rate of 3.670% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 03/15/2034 | GBP | 275,000 | 191 | — | — | 191 | — |

Fixed rate of 0.990% | TONA | Receives Annually, Pays Annually | Goldman Sachs | 05/21/2034 | JPY | 12,675,000 | (325 ) | — | — | — | (325 ) |

Fixed rate of 3.782% | SOFR | Receives Annually, Pays Annually | Goldman Sachs | 06/18/2034 | USD | 80,555 | (1,001 ) | — | — | — | (1,001 ) |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.550% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 05/07/2049 | USD | 105,000 | (610 ) | — | — | — | (610 ) |

Fixed rate of 2.780% | Eurostat Eurozone HICP ex-Tobacco NSA | Receives at Maturity, Pays at Maturity | Goldman Sachs | 08/15/2053 | EUR | 5,000 | 464 | — | — | 464 | — |

Fixed rate of 3.224% | Eurostat Eurozone HICP ex-Tobacco NSA | Receives at Maturity, Pays at Maturity | Goldman Sachs | 11/15/2053 | EUR | 15,000 | 667 | — | — | 667 | — |

Fixed rate of 2.529% | Eurostat Eurozone HICP ex-Tobacco NSA | Receives at Maturity, Pays at Maturity | Goldman Sachs | 11/15/2053 | EUR | 25,000 | 339 | — | — | 339 | — |

U.S. CPI Urban Consumers NSA | Fixed rate of 2.475% | Receives at Maturity, Pays at Maturity | Goldman Sachs | 12/18/2053 | USD | 75,000 | 869 | — | — | 869 | — |

6-Month EURIBOR | Fixed rate of 2.490% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 02/19/2054 | EUR | 90,090 | 1,781 | — | — | 1,781 | — |

6-Month EURIBOR | Fixed rate of 2.513% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 02/20/2054 | EUR | 126,000 | 1,849 | — | — | 1,849 | — |

6-Month EURIBOR | Fixed rate of 2.506% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 02/20/2054 | EUR | 90,090 | 1,471 | — | — | 1,471 | — |

6-Month EURIBOR | Fixed rate of 2.511% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 03/01/2054 | EUR | 45,000 | 654 | — | — | 654 | — |

6-Month EURIBOR | Fixed rate of 2.456% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 03/22/2054 | EUR | 19,000 | 484 | — | — | 484 | — |

6-Month EURIBOR | Fixed rate of 2.543% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 04/22/2054 | EUR | 73,000 | 482 | — | — | 482 | — |

6-Month EURIBOR | Fixed rate of 2.500% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 05/14/2054 | EUR | 41,500 | 729 | — | — | 729 | — |

6-Month EURIBOR | Fixed rate of 2.429% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 06/19/2054 | EUR | 17,000 | 445 | — | — | 445 | — |

Cleared interest rate swap contracts (continued) | |||||||||||

Fund receives | Fund pays | Payment frequency | Counterparty | Maturity date | Notional currency | Notional amount | Value ($) | Upfront payments ($) | Upfront receipts ($) | Unrealized appreciation ($) | Unrealized depreciation ($) |

6-Month EURIBOR | Fixed rate of 2.429% | Receives SemiAnnually, Pays Annually | Goldman Sachs | 06/20/2054 | EUR | 16,000 | 416 | — | — | 416 | — |

Fixed rate of 2.441% | 6-Month EURIBOR | Receives Annually, Pays SemiAnnually | Goldman Sachs | 06/24/2054 | EUR | 11,000 | (255 ) | — | — | — | (255 ) |

Total | 28,537 | — | — | 35,071 | (6,534 ) | ||||||

Reference index and values for swap contracts as of period end | ||

Reference index | Reference rate | |

6-Month EURIBOR | Euro Interbank Offered Rate | 3.682% |

Eurostat Eurozone HICP ex-Tobacco NSA | Harmonised Index of Consumer Price Index Excluding Tobacco | 2.500% |

SOFR | Secured Overnight Financing Rate | 5.340% |

TONA | Tokyo Overnight Average Rate | 0.077% |

UK Retail Price Index All Items Monthly | United Kingdom Retail Price Index All Items | 2.000% |

U.S. CPI Urban Consumers NSA | United States Consumer Price All Urban Non-Seasonally Adjusted Index | 2.970% |

(a) | Represents privately placed and other securities and instruments exempt from Securities and Exchange Commission registration (collectively, private placements), such as Section 4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified institutional buyers. At June 30, 2024, the total value of these securities amounted to $33,315,843, which represents 43.61% of total net assets. |

(b) | Variable rate security. The interest rate shown was the current rate as of June 30, 2024. |

(c) | Represents a security purchased on a when-issued basis. |

(d) | Principal amounts are denominated in United States Dollars unless otherwise noted. |

(e) | Principal and interest may not be guaranteed by a governmental entity. |

(f) | This security or a portion of this security has been pledged as collateral in connection with derivative contracts. |

(g) | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. The interest rate shown was the current rate as of June 30, 2024. |

(h) | The rate shown is the seven-day current annualized yield at June 30, 2024. |

(i) | As defined in the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. The value of the holdings and transactions in these affiliated companies during the period ended June 30, 2024 are as follows: |

Affiliated issuers | Beginning of period($) | Purchases($) | Sales($) | Net change in unrealized appreciation (depreciation)($) | End of period($) | Realized gain (loss)($) | Dividends($) | End of period shares |

Columbia Short-Term Cash Fund, 5.547% | ||||||||

76,094 | 8,837,746 | (8,893,127 ) | (5 ) | 20,708 | 168 | 7,744 | 20,714 | |

CMO | Collateralized Mortgage Obligation |

SOFR | Secured Overnight Financing Rate |

AUD | Australian Dollar |

CAD | Canada Dollar |

DKK | Danish Krone |

EUR | Euro |

GBP | British Pound |

JPY | Japanese Yen |

MXN | Mexican Peso |

NZD | New Zealand Dollar |

SEK | Swedish Krona |

USD | US Dollar |

Level 1 ($) | Level 2 ($) | Level 3 ($) | Total ($) | |

Investments in Securities | ||||

Commercial Mortgage-Backed Securities - Non-Agency | — | 917,331 | — | 917,331 |

Foreign Government Obligations | — | 1,290,358 | — | 1,290,358 |

Inflation-Indexed Bonds | — | 71,563,575 | — | 71,563,575 |

Residential Mortgage-Backed Securities - Agency | — | 1,152,707 | — | 1,152,707 |

Residential Mortgage-Backed Securities - Non-Agency | — | 709,493 | — | 709,493 |

U.S. Treasury Obligations | — | 128,802 | — | 128,802 |

Call Option Contracts Purchased | — | 15,668 | — | 15,668 |

Put Option Contracts Purchased | — | 8,280 | — | 8,280 |

Money Market Funds | 20,708 | — | — | 20,708 |

Total Investments in Securities | 20,708 | 75,786,214 | — | 75,806,922 |

Investments in Derivatives |

Level 1 ($) | Level 2 ($) | Level 3 ($) | Total ($) | |

Asset | ||||

Forward Foreign Currency Exchange Contracts | — | 373,874 | — | 373,874 |

Futures Contracts | 19,070 | — | — | 19,070 |

Swap Contracts | — | 35,071 | — | 35,071 |

Liability | ||||

Forward Foreign Currency Exchange Contracts | — | (42,447 ) | — | (42,447 ) |

Futures Contracts | (2,878 ) | — | — | (2,878 ) |

Call Option Contracts Written | — | (13,369 ) | — | (13,369 ) |

Put Option Contracts Written | — | (19,110 ) | — | (19,110 ) |

Swap Contracts | — | (6,534 ) | — | (6,534 ) |

Total | 36,900 | 76,113,699 | — | 76,150,599 |

Assets | |

Investments in securities, at value | |

Unaffiliated issuers (cost $87,853,343) | $75,762,266 |

Affiliated issuers (cost $20,708) | 20,708 |

Option contracts purchased (cost $40,468) | 23,948 |

Foreign currency (cost $178,192) | 178,078 |

Margin deposits on: | |

Futures contracts | 83,269 |

Swap contracts | 189,000 |

Unrealized appreciation on forward foreign currency exchange contracts | 373,874 |

Receivable for: | |

Investments sold | 414,148 |

Capital shares sold | 1,935 |

Dividends | 426 |

Interest | 274,642 |

Foreign tax reclaims | 3,496 |

Variation margin for futures contracts | 7,975 |

Variation margin for swap contracts | 13,311 |

Expense reimbursement due from Investment Manager | 302 |

Prepaid expenses | 2,746 |

Total assets | 77,350,124 |

Liabilities | |

Option contracts written, at value (premiums received $46,088) | 32,479 |

Unrealized depreciation on forward foreign currency exchange contracts | 42,447 |

Cash collateral due to broker for: | |

Option contracts written | 10,000 |

Payable for: | |

Investments purchased | 540,485 |

Investments purchased on a delayed delivery basis | 14,962 |

Capital shares redeemed | 59,240 |

Variation margin for futures contracts | 8,498 |

Variation margin for swap contracts | 2,935 |

Management services fees | 1,070 |

Distribution and/or service fees | 330 |

Service fees | 3,526 |

Compensation of chief compliance officer | 8 |

Compensation of board members | 1,367 |

Other expenses | 41,555 |

Deferred compensation of board members | 197,600 |

Total liabilities | 956,502 |

Net assets applicable to outstanding capital stock | $76,393,622 |

Represented by | |

Paid in capital | 98,990,768 |

Total distributable earnings (loss) | (22,597,146 ) |

Total - representing net assets applicable to outstanding capital stock | $76,393,622 |

Class 1 | |

Net assets | $1,092,266 |

Shares outstanding | 244,935 |

Net asset value per share | $4.46 |

Class 2 | |

Net assets | $20,758,608 |

Shares outstanding | 4,792,807 |

Net asset value per share | $4.33 |

Class 3 | |

Net assets | $54,542,748 |

Shares outstanding | 12,320,895 |

Net asset value per share | $4.43 |

Net investment income | |

Income: | |

Dividends — affiliated issuers | $7,744 |

Interest | 1,511,340 |

Total income | 1,519,084 |

Expenses: | |

Management services fees | 201,669 |

Distribution and/or service fees | |

Class 2 | 27,241 |

Class 3 | 35,152 |

Service fees | 23,706 |

Custodian fees | 17,370 |

Printing and postage fees | 11,761 |

Accounting services fees | 25,720 |

Legal fees | 5,996 |

Interest on collateral | 142 |

Compensation of chief compliance officer | 7 |

Compensation of board members | 5,905 |

Deferred compensation of board members | 25,762 |

Other | 3,655 |

Total expenses | 384,086 |

Fees waived or expenses reimbursed by Investment Manager and its affiliates | (84,277 ) |

Total net expenses | 299,809 |

Net investment income | 1,219,275 |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments — unaffiliated issuers | (2,490,720 ) |

Investments — affiliated issuers | 168 |

Foreign currency translations | (18,750 ) |

Forward foreign currency exchange contracts | 611,020 |

Futures contracts | 56,785 |

Option contracts purchased | (74,515 ) |

Option contracts written | 54,471 |

Swap contracts | (29,886 ) |

Net realized loss | (1,891,427 ) |

Net change in unrealized appreciation (depreciation) on: | |

Investments — unaffiliated issuers | (896,415 ) |

Investments — affiliated issuers | (5 ) |

Foreign currency translations | (5,511 ) |

Forward foreign currency exchange contracts | 624,887 |

Futures contracts | 38,671 |

Option contracts purchased | (28,836 ) |

Option contracts written | 27,912 |

Swap contracts | 62,041 |

Net change in unrealized appreciation (depreciation) | (177,256 ) |

Net realized and unrealized loss | (2,068,683 ) |

Net decrease in net assets resulting from operations | $(849,408 ) |

Six Months Ended June 30, 2024 (Unaudited) | Year Ended December 31, 2023 | |

Operations | ||

Net investment income | $1,219,275 | $2,911,202 |

Net realized loss | (1,891,427 ) | (7,246,010 ) |

Net change in unrealized appreciation (depreciation) | (177,256 ) | 7,532,215 |

Net increase (decrease) in net assets resulting from operations | (849,408 ) | 3,197,407 |

Distributions to shareholders | ||

Net investment income and net realized gains | ||

Class 1 | — | (101,745 ) |

Class 2 | — | (2,270,620 ) |

Class 3 | — | (5,577,192 ) |

Total distributions to shareholders | — | (7,949,557 ) |

Decrease in net assets from capital stock activity | (6,403,803 ) | (7,109,350 ) |

Total decrease in net assets | (7,253,211 ) | (11,861,500 ) |

Net assets at beginning of period | 83,646,833 | 95,508,333 |

Net assets at end of period | $76,393,622 | $83,646,833 |

Six Months Ended | Year Ended | |||

June 30, 2024 (Unaudited) | December 31, 2023 | |||

Shares | Dollars ($) | Shares | Dollars ($) | |

Capital stock activity | ||||

Class 1 | ||||

Shares sold | 27,928 | 123,723 | 63,042 | 292,916 |

Distributions reinvested | — | — | 23,177 | 101,745 |

Shares redeemed | (36,481 ) | (161,697 ) | (89,780 ) | (415,760 ) |

Net decrease | (8,553 ) | (37,974 ) | (3,561 ) | (21,099 ) |

Class 2 | ||||

Shares sold | 130,563 | 563,331 | 365,451 | 1,694,289 |

Distributions reinvested | — | — | 530,519 | 2,270,620 |

Shares redeemed | (657,983 ) | (2,840,889 ) | (1,384,641 ) | (6,114,266 ) |

Net decrease | (527,420 ) | (2,277,558 ) | (488,671 ) | (2,149,357 ) |

Class 3 | ||||

Shares sold | 347,775 | 1,526,435 | 406,295 | 1,947,245 |

Distributions reinvested | — | — | 1,276,245 | 5,577,192 |

Shares redeemed | (1,273,105 ) | (5,614,706 ) | (2,744,713 ) | (12,463,331 ) |

Net decrease | (925,330 ) | (4,088,271 ) | (1,062,173 ) | (4,938,894 ) |

Total net decrease | (1,461,303 ) | (6,403,803 ) | (1,554,405 ) | (7,109,350 ) |

Net asset value, beginning of period | Net investment income (loss) | Net realized and unrealized gain (loss) | Total from investment operations | Distributions from net investment income | Distributions from net realized gains | Total distributions to shareholders | |

Class 1 | |||||||

Six Months Ended 6/30/2024 (Unaudited) | $4.50 | 0.07 | (0.11 ) | (0.04 ) | — | — | — |

Year Ended 12/31/2023 | $4.74 | 0.16 | 0.02 | 0.18 | (0.42 ) | — | (0.42 ) |

Year Ended 12/31/2022 | $6.14 | 0.35 | (1.39 ) | (1.04 ) | (0.26 ) | (0.10 ) | (0.36 ) |

Year Ended 12/31/2021 | $6.04 | 0.18 | 0.09 | 0.27 | (0.05 ) | (0.12 ) | (0.17 ) |

Year Ended 12/31/2020 | $5.66 | (0.01 ) | 0.54 | 0.53 | (0.04 ) | (0.11 ) | (0.15 ) |

Year Ended 12/31/2019 | $5.42 | 0.03 | 0.40 | 0.43 | (0.19 ) | — | (0.19 ) |

Class 2 | |||||||

Six Months Ended 6/30/2024 (Unaudited) | $4.38 | 0.06 | (0.11 ) | (0.05 ) | — | — | — |

Year Ended 12/31/2023 | $4.62 | 0.14 | 0.03 | 0.17 | (0.41 ) | — | (0.41 ) |

Year Ended 12/31/2022 | $5.99 | 0.32 | (1.35 ) | (1.03 ) | (0.24 ) | (0.10 ) | (0.34 ) |

Year Ended 12/31/2021 | $5.89 | 0.14 | 0.12 | 0.26 | (0.04 ) | (0.12 ) | (0.16 ) |

Year Ended 12/31/2020 | $5.53 | (0.03 ) | 0.52 | 0.49 | (0.02 ) | (0.11 ) | (0.13 ) |

Year Ended 12/31/2019 | $5.30 | 0.02 | 0.38 | 0.40 | (0.17 ) | — | (0.17 ) |

Class 3 | |||||||

Six Months Ended 6/30/2024 (Unaudited) | $4.47 | 0.07 | (0.11 ) | (0.04 ) | — | — | — |

Year Ended 12/31/2023 | $4.71 | 0.15 | 0.03 | 0.18 | (0.42 ) | — | (0.42 ) |

Year Ended 12/31/2022 | $6.10 | 0.33 | (1.37 ) | (1.04 ) | (0.25 ) | (0.10 ) | (0.35 ) |

Year Ended 12/31/2021 | $6.00 | 0.15 | 0.12 | 0.27 | (0.05 ) | (0.12 ) | (0.17 ) |

Year Ended 12/31/2020 | $5.63 | (0.02 ) | 0.53 | 0.51 | (0.03 ) | (0.11 ) | (0.14 ) |

Year Ended 12/31/2019 | $5.39 | 0.03 | 0.39 | 0.42 | (0.18 ) | — | (0.18 ) |

Notes to Financial Highlights | |

(a) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

(b) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

(c) | Ratios include interest on collateral expense which is less than 0.01%. |

(d) | Ratios include interfund lending expense which is less than 0.01%. |

Net asset value, end of period | Total return | Total gross expense ratio to average net assets(a) | Total net expense ratio to average net assets(a),(b) | Net investment income (loss) ratio to average net assets | Portfolio turnover | Net assets, end of period (000’s) | |

Class 1 | |||||||

Six Months Ended 6/30/2024 (Unaudited) | $4.46 | (0.89% ) | 0.81% (c) | 0.60% (c) | 3.30% | 57% | $1,092 |

Year Ended 12/31/2023 | $4.50 | 4.10% | 0.74% (c),(d) | 0.60% (c),(d) | 3.39% | 112% | $1,141 |

Year Ended 12/31/2022 | $4.74 | (17.51% ) | 0.70% (c) | 0.60% (c) | 6.63% | 123% | $1,219 |

Year Ended 12/31/2021 | $6.14 | 4.56% | 0.72% (c) | 0.61% (c) | 2.99% | 58% | $682 |

Year Ended 12/31/2020 | $6.04 | 9.37% | 0.74% | 0.65% | (0.09% ) | 70% | $109 |

Year Ended 12/31/2019 | $5.66 | 7.90% | 0.71% (c) | 0.61% (c) | 0.57% | 62% | $28 |

Class 2 | |||||||

Six Months Ended 6/30/2024 (Unaudited) | $4.33 | (1.14% ) | 1.06% (c) | 0.85% (c) | 2.96% | 57% | $20,759 |

Year Ended 12/31/2023 | $4.38 | 3.89% | 0.99% (c),(d) | 0.85% (c),(d) | 3.15% | 112% | $23,286 |

Year Ended 12/31/2022 | $4.62 | (17.69% ) | 0.94% (c) | 0.85% (c) | 6.21% | 123% | $26,850 |

Year Ended 12/31/2021 | $5.99 | 4.43% | 0.97% (c) | 0.87% (c) | 2.41% | 58% | $31,002 |

Year Ended 12/31/2020 | $5.89 | 8.97% | 0.97% | 0.89% | (0.47% ) | 70% | $21,434 |

Year Ended 12/31/2019 | $5.53 | 7.63% | 0.96% (c) | 0.86% (c) | 0.38% | 62% | $19,663 |

Class 3 | |||||||

Six Months Ended 6/30/2024 (Unaudited) | $4.43 | (0.89% ) | 0.94% (c) | 0.73% (c) | 3.13% | 57% | $54,543 |

Year Ended 12/31/2023 | $4.47 | 3.95% | 0.86% (c),(d) | 0.73% (c),(d) | 3.26% | 112% | $59,220 |

Year Ended 12/31/2022 | $4.71 | (17.58% ) | 0.82% (c) | 0.73% (c) | 6.26% | 123% | $67,438 |

Year Ended 12/31/2021 | $6.10 | 4.48% | 0.85% (c) | 0.74% (c) | 2.46% | 58% | $90,783 |

Year Ended 12/31/2020 | $6.00 | 9.11% | 0.85% | 0.76% | (0.34% ) | 70% | $86,336 |

Year Ended 12/31/2019 | $5.63 | 7.81% | 0.83% (c) | 0.73% (c) | 0.49% | 62% | $89,128 |

Asset derivatives | ||

Risk exposure category | Statement of assets and liabilities location | Fair value ($) |

Foreign exchange risk | Unrealized appreciation on forward foreign currency exchange contracts | 373,874 |

Interest rate risk | Component of total distributable earnings (loss) — unrealized appreciation on futures contracts | 19,070 * |

Interest rate risk | Investments, at value — Option contracts purchased | 23,948 |

Interest rate risk | Component of total distributable earnings (loss) — unrealized appreciation on swap contracts | 35,071 * |

Total | 451,963 |

Liability derivatives | ||

Risk exposure category | Statement of assets and liabilities location | Fair value ($) |

Foreign exchange risk | Unrealized depreciation on forward foreign currency exchange contracts | 42,447 |

Interest rate risk | Component of total distributable earnings (loss) — unrealized depreciation on futures contracts | 2,878 * |

Interest rate risk | Option contracts written, at value | 32,479 |

Interest rate risk | Component of total distributable earnings (loss) — unrealized depreciation on swap contracts | 6,534 * |

Total | 84,338 |

* | Includes cumulative appreciation (depreciation) as reported in the tables following the Portfolio of Investments. Only the current day’s variation margin for futures and centrally cleared swaps, if any, is reported in receivables or payables in the Statement of Assets and Liabilities. |

Amount of realized gain (loss) on derivatives recognized in income | ||||||

Risk exposure category | Forward foreign currency exchange contracts ($) | Futures contracts ($) | Option contracts purchased ($) | Option contracts written ($) | Swap contracts ($) | Total ($) |

Foreign exchange risk | 611,020 | — | (986 ) | — | — | 610,034 |

Interest rate risk | — | 56,785 | (73,529 ) | 54,471 | (29,886 ) | 7,841 |

Total | 611,020 | 56,785 | (74,515 ) | 54,471 | (29,886 ) | 617,875 |

Change in unrealized appreciation (depreciation) on derivatives recognized in income | ||||||

Risk exposure category | Forward foreign currency exchange contracts ($) | Futures contracts ($) | Option contracts purchased ($) | Option contracts written ($) | Swap contracts ($) | Total ($) |

Foreign exchange risk | 624,887 | — | — | — | — | 624,887 |

Interest rate risk | — | 38,671 | (28,836 ) | 27,912 | 62,041 | 99,788 |

Total | 624,887 | 38,671 | (28,836 ) | 27,912 | 62,041 | 724,675 |

Derivative instrument | Average notional amounts ($) |

Futures contracts — long | 3,980,464 |

Futures contracts — short | 4,879,515 |

Derivative instrument | Average value ($) |

Option contracts purchased | 28,147 |

Option contracts written | (58,142 ) |

Derivative instrument | Average unrealized appreciation ($) | Average unrealized depreciation ($) |

Forward foreign currency exchange contracts | 267,082 | (135,829 ) |

Interest rate swap contracts | 26,306 | (15,657 ) |

Citi ($) | Deutsche Bank ($) | Goldman Sachs ($) | Total ($) | |

Assets | ||||

Centrally cleared interest rate swap contracts (a) | - | - | 13,311 | 13,311 |

Forward foreign currency exchange contracts | 109,884 | 263,990 | - | 373,874 |

Call option contracts purchased | - | 15,668 | - | 15,668 |

Put option contracts purchased | 8,280 | - | - | 8,280 |

Total assets | 118,164 | 279,658 | 13,311 | 411,133 |

Liabilities | ||||

Centrally cleared interest rate swap contracts (a) | - | - | 2,935 | 2,935 |

Forward foreign currency exchange contracts | 20,762 | 21,685 | - | 42,447 |

Call option contracts written | 3,105 | 10,264 | - | 13,369 |

Put option contracts written | 9,757 | 9,353 | - | 19,110 |

Total liabilities | 33,624 | 41,302 | 2,935 | 77,861 |

Total financial and derivative net assets | 84,540 | 238,356 | 10,376 | 333,272 |

Total collateral received (pledged) (b) | - | 10,000 | - | 10,000 |

Net amount (c) | 84,540 | 228,356 | 10,376 | 323,272 |

(a) | Centrally cleared swaps are included within payable/receivable for variation margin in the Statement of Assets and Liabilities. |

(b) | In some instances, the actual collateral received and/or pledged may be more than the amount shown due to overcollateralization. |

(c) | Represents the net amount due from/(to) counterparties in the event of default. |

Contractual expense cap July 1, 2024 through April 30, 2025 (%) | Voluntary expense cap May 1, 2024 through June 30, 2024 (%) | Contractual expense cap prior to May 1, 2024 (%) | |

Class 1 | 0.62 | 0.60 | 0.60 |

Class 2 | 0.87 | 0.85 | 0.85 |

Class 3 | 0.745 | 0.725 | 0.725 |

Federal tax cost ($) | Gross unrealized appreciation ($) | Gross unrealized (depreciation) ($) | Net unrealized (depreciation) ($) |

87,868,000 | 824,000 | (12,541,000 ) | (11,717,000 ) |

No expiration short-term ($) | No expiration long-term ($) | Total ($) |

(4,326,977 ) | (2,891,065 ) | (7,218,042 ) |

Agreements

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies is included in Item 7 of this Form N-CSR.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Statement regarding basis for approval of Investment Advisory Contract is included in Item 7 of this Form N-CSR.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders.

There were no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors implemented since the registrant last provided disclosure as to such procedures in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K or Item 15 of Form N-CSR.

Item 16. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer, based on their evaluation of the registrant’s disclosure controls and procedures as of a date within 90 days of the filing of this report, have concluded that such controls and procedures are adequately designed to ensure that information required to be disclosed by the registrant in Form N-CSR is accumulated and communicated to the registrant’s management, including the principal executive officer and principal financial officer, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

(b) There was no change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable.

Item 19. Exhibits.

(a)(1) Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (registrant) | Columbia Funds Variable Series Trust II |

| By (Signature and Title) | /s/ Daniel J. Beckman |

| Daniel J. Beckman, President and Principal Executive Officer | |

| Date | August 22, 2024 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title) | /s/ Daniel J. Beckman |

| Daniel J. Beckman, President and Principal Executive Officer | |

| Date | August 22, 2024 |

| By (Signature and Title) | /s/ Michael G. Clarke |

| Michael G. Clarke, Chief Financial Officer, | |

| Principal Financial Officer and Senior Vice President | |

| Date | August 22, 2024 |

| By (Signature and Title) | /s/ Charles H. Chiesa |

| Charles H. Chiesa, Treasurer, Chief Accounting | |

| Officer and Principal Financial Officer | |

| Date | August 22, 2024 |