2017 First-Quarter Results April 20, 2017 Exhibit 99.3

2 Introduction ● Unless otherwise stated, we will be talking about results for the first quarter of 2017 and comparing them to the same period in 2016 ● Unless otherwise stated, references to total industry, total market, PMI volume and PMI market share performance reflect cigarettes and PMI’s heated tobacco units for those markets that have commercial sales of IQOS ● A glossary of terms, adjustments and other calculations, as well as reconciliations to the most directly comparable U.S. GAAP measures, are at the end of today’s webcast slides, which are posted on our website ● "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking. PMI has a range of RRPs in various stages of development, scientific assessment and commercialization. Because PMI's RRPs do not burn tobacco, they produce far lower quantities of harmful and potentially harmful compounds than found in cigarette smoke

3 Forward-Looking and Cautionary Statements ● This presentation and related discussion contain projections of future results and other forward-looking statements. Achievement of future results is subject to risks, uncertainties and inaccurate assumptions. In the event that risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could vary materially from those contained in such forward-looking statements. Pursuant to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, PMI is identifying important factors that, individually or in the aggregate, could cause actual results and outcomes to differ materially from those contained in any forward-looking statements made by PMI ● PMI's business risks include: excise tax increases and discriminatory tax structures; increasing marketing and regulatory restrictions that could reduce our competitiveness, eliminate our ability to communicate with adult consumers, or ban certain of our products; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; litigation related to tobacco use; intense competition; the effects of global and individual country economic, regulatory and political developments, natural disasters and conflicts; changes in adult smoker behavior; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations, and limitations on the ability to repatriate funds; adverse changes in applicable corporate tax laws; adverse changes in the cost and quality of tobacco and other agricultural products and raw materials; and the integrity of its information systems. PMI's future profitability may also be adversely affected should it be unsuccessful in its attempts to produce and commercialize reduced-risk products; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; or if it is unable to attract and retain the best global talent ● PMI is further subject to other risks detailed from time to time in its publicly filed documents, including the Form 10-K for the year ended December 31, 2016. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations

4 Increasing 2017 EPS Guidance for Favorable Tax Item Only ● Increasing 2017 reported diluted EPS guidance to a range of $4.84 to $4.99 at prevailing exchange rates, compared to $4.48 in 2016: - Includes four cents for favorable tax item - Includes eight cents of unfavorable currency at prevailing exchange rates - No share repurchases ● Excluding currency and favorable tax item, our guidance continues to represent a growth rate of approximately 9% to 12% versus our adjusted diluted EPS of $4.48 in 2016 ● Expect currency-neutral financial growth to be skewed toward H2, 2017, notably reflecting: - Increased heated tobacco unit capacity - Improving returns on our RRP investments as the year unfolds Note: "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking Source: PMI Financials or estimates

5 Note: Figures do not sum due to rounding Source: PMI Financials or estimates PMI Volume: Q1, 2017 Decline Driven Mainly by the Industry ● PMI volume down by 9.4%, or by 7.8% excluding estimated inventory movements, due primarily to: - The impact of lower total cigarette industry volume, partly reflecting the macroeconomic environment in Indonesia, Pakistan, the Philippines and Russia - High prevalence of illicit trade in Pakistan and the Philippines (13) (3) (3) 196 178 Q1, 2016 Industry SoM Inventory Q1, 2017 PMI Volume (units billion)

6 Note: Premium includes above premium. Low includes super low Source: PMI Financials or estimates PMI Volume: Over Half of Decline Due to Low-Price Segment 52% 21% 27% Mid Low PMI Portfolio Volume by Price Segment (Q1, 2017) 25% 23% 52% Premium Mid PMI Portfolio Volume Variance by Price Segment (Q1, 2017 vs. PY) Premium 178 billion units Low (19) billion units

7 Source: PMI Financials or estimates PMI Volume: Expect Decline of 3% to 4% for Full-Year 2017 ● Q1 volume decline slightly larger than anticipated ● Expect a combined decline of 3% to 4% for full-year 2017 ● Three main factors support the expected improvement for the full year: - The lapping of challenging H1, 2017 comparisons vs. 2016 in select geographies such as Argentina, the EU Region and Turkey - Lower impact of estimated unfavorable inventory movements on a full-year basis - Significantly higher heated tobacco unit volume

8 Q1, 2017: Financial Results ● Net revenues up by 1.7%, ex-currency, despite cigarette-driven volume decline, driven by: - Favorable pricing, particularly in the Asia and EEMA Regions - Higher heated tobacco unit and IQOS device sales ● Adjusted OCI down by 1.7%, ex-currency, primarily reflecting: - Lower cigarette volume - Significantly higher investments behind the commercialization of IQOS, notably in the EU Region and Japan ● Flat adjusted diluted EPS, with no currency impact Source: PMI Financials or estimates

9 Q1, 2017: Strong Pricing Variance Source: PMI Financials or estimates ● Strong pricing variance driven by all Regions ● Announced or implemented price increases in a number of markets, notably in Algeria, Argentina, Australia, Brazil, Canada, Egypt, Germany, Indonesia, Poland, Mexico, Russia, Turkey, Ukraine and the U.K. 6.7% of Q1, 2016 net revenues 272 408 Q1, 2016 Q1, 2017 Pricing Variance ($ million)

10 PMI International Market Share Note: Excluding China and the U.S. Below-premium includes mid, low and super-low. Premium also includes above-premium Source: PMI Financials or estimates +0.2pp (1.1)pp 27.7 26.8 Q1, 2016 Below-Premium Brands Premium Brands Q1, 2017

11 EU Region: Q1, 2017 Results Distorted by Inventory Movements ● Total industry volume down by 2.8%, consistent with our full-year 2017 decline forecast of 2% to 3% ● PMI volume down by 7.1%: - Impacted by unfavorable distributor cigarette inventory movements, notably related to the TPD implementation - Excluding inventory movements, our volume declined by 2.9%, broadly in line with the industry ● PMI share gains in France, Germany, Poland and the U.K. Source: PMI Financials or estimates 38.6 38.5 Q1, 2016 Q1, 2017 PMI Regional Market Share (%)

12 Russia: Balancing Cigarette Market Share and Profitability Growth ● Industry volume down by 7.9% in Q1, 2017, primarily reflecting the impact of excise tax-driven price increases: - Expect full-year decline of 5% to 6% ● PMI cigarette share down QTD February, 2017, due mainly to the slower penetration of competitors' price increases ● PMI sequential cigarette share growth over last two quarters PMI Cigarette Market Share (%) 5.1 5.1 5.0 5.3 5.1 5.0 16.5 17.0 17.4 26.9 27.2 27.4 Q3 Q4 QTD February Note: Low includes super-low Source: PMI Financials or estimates, and Nielsen 2016 2017 Premium Mid Low

13 Source: PMI Financials or estimates Philippines: Strong Performance of Marlboro Continued in Q1, 2017 Marlboro Cigarette Market Share (%) ● Profitability growth driven by higher pricing and favorable portfolio mix ● Cigarette industry volume down by 15.6%, due mainly to the impact of excise tax- driven price increases ● PMI cigarette share declined by 7.6 points, due mainly to the timing of competitors’ price increases and continued discounting at the bottom of the market ● Renewed Government focus on addressing illicit trade, including excise tax stamp compliance 27.5 32.5 Q1, 2016 Q1, 2017 +5.0pp

14 Source: PMI Financials or estimates Indonesia: U Bold and Marlboro Filter Black Performing Strongly ● Cigarette industry volume down by 5.5% in Q1, 2017, reflecting the continued soft economic environment and above- inflation tax-driven price increases: - Anticipate full-year decline of 1% to 2%, in line with 2016 ● Cigarette share decline in Q1, 2017 partly offset by the strong performance of U Bold and Marlboro Filter Black in the growing full-flavor machine-made kretek segment 4.9 4.2 19.1 18.3 2.3 3.6 7.2 6.9 33.5 33.0 Q1, 2016 Q1, 2017 Whites FF Machine- Made Kretek LTLN Machine- Made Kretek Hand-Rolled Kretek PMI Cigarette Market Share (%)

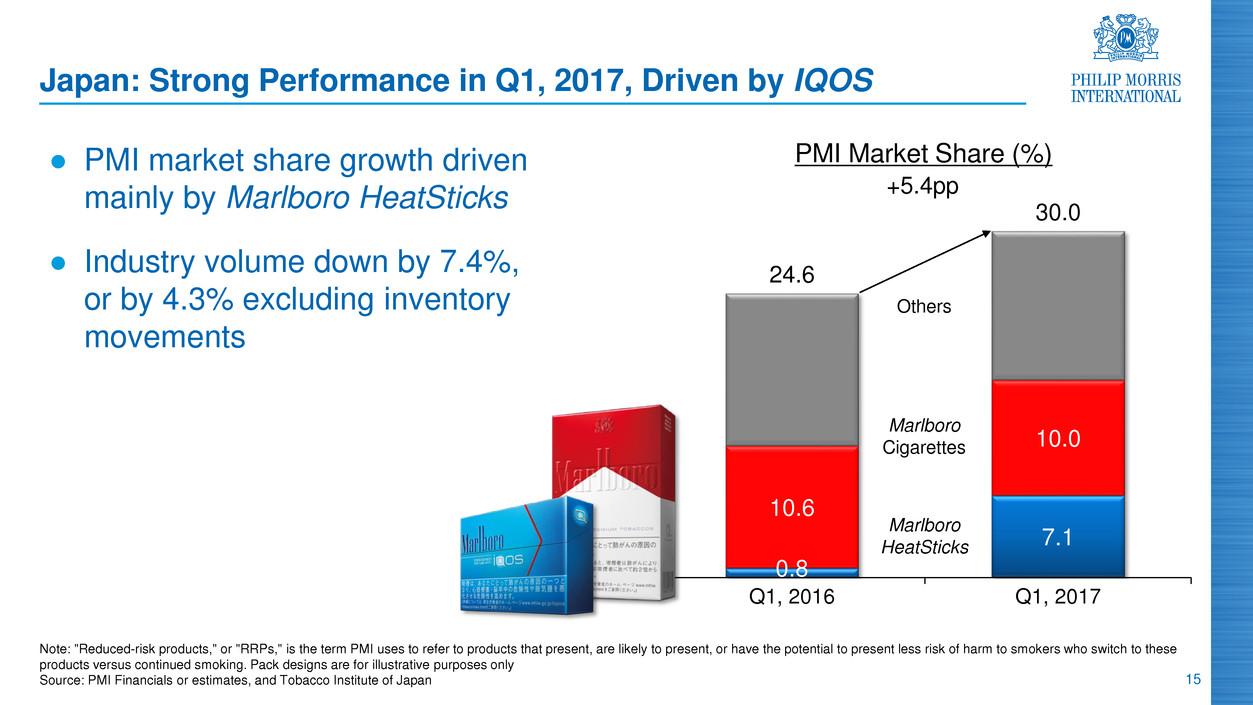

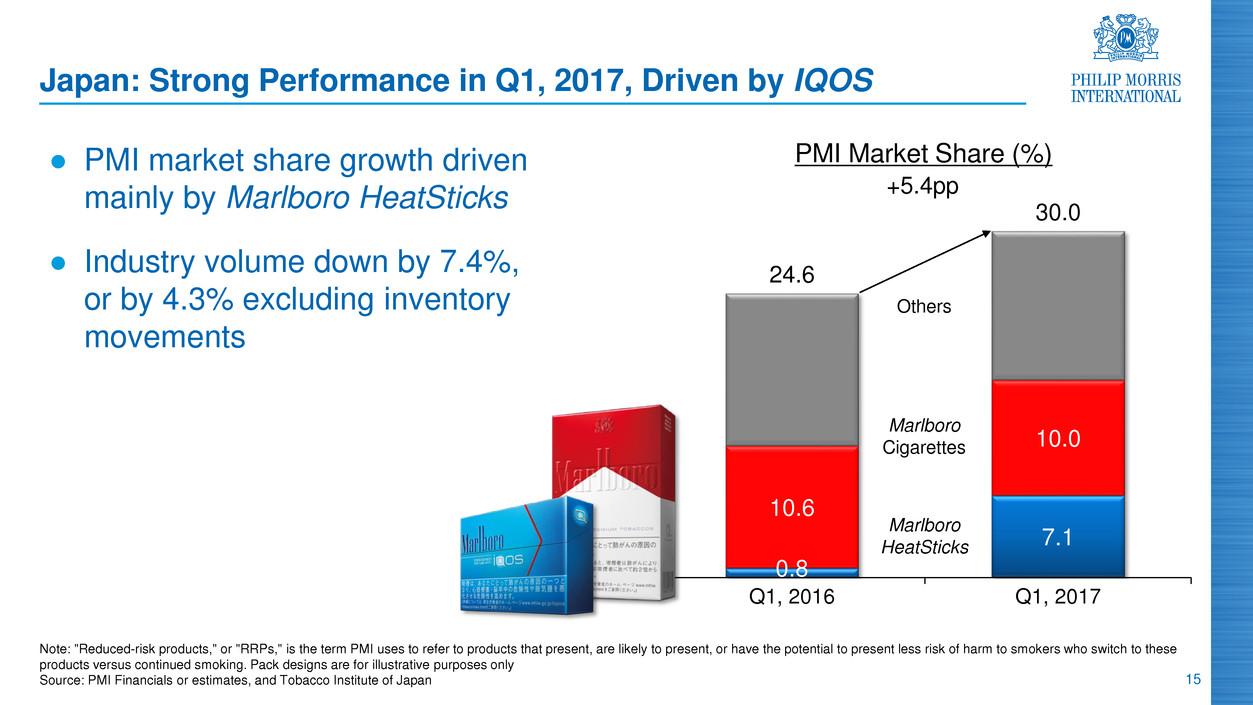

15 Note: "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking. Pack designs are for illustrative purposes only Source: PMI Financials or estimates, and Tobacco Institute of Japan Japan: Strong Performance in Q1, 2017, Driven by IQOS PMI Market Share (%) ● PMI market share growth driven mainly by Marlboro HeatSticks ● Industry volume down by 7.4%, or by 4.3% excluding inventory movements 0.8 7.1 10.6 10.0 24.6 30.0 Q1, 2016 Q1, 2017 +5.4pp Marlboro Cigarettes Marlboro HeatSticks Others

16 IQOS: Marlboro HeatSticks Share Growth in Japan Continues Weekly Offtake Shares (%) Sept 2015 Apr 2016 National Sendai 2.2 5.1 0.5 Tokyo 0.4 4.0 Mar 2017 14.9 11.6 9.6 Note: Offtake share represents select C-Store sales volume for Marlboro HeatSticks as a percentage of the total estimated retail sales volume for cigarettes and heated tobacco units. "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking. Pack designs are for illustrative purposes only Source: PMI Financials or estimates 7.6 12.9 9.5 Jan 2017

17 IQOS: Launched in Key Cities in 24 Markets To Date EU Region ● Denmark ● Germany ● Greece ● Italy ● Lithuania (Feb 2017) ● Monaco ● Netherlands ● Poland (Apr 2017) ● Portugal ● Romania ● Spain ● Switzerland ● United Kingdom (a) Japan (Chitose, Chubu, Fukuoka, Osaka and Tokyo airports); Switzerland (Geneva and Zurich airports) Note: "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking EEMA Region ● Duty Free(a) ● Israel ● Kazakhstan ● Russia ● Serbia (Apr 2017) ● South Africa ● Ukraine LA&C Region ● Canada ● Colombia (Mar 2017) Asia Region ● Japan ● New Zealand

18 Japan Italy Switzerland Portugal National SoM (%) Focus Area (December 2016) National 5 cities 6 cities Lisbon Focus Area Cigarette Industry Volume Coverage(a) ̴ 100% ̴ 20% ̴ 35% ̴ 25% (a) Portion of cigarette industry volume covered by IQOS focus area in each market (as of December 2016) Note: "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking Source: PMI Financials or estimates 3.5 4.9 7.1 Q3 Q4 Q1 IQOS: Growing Heated Tobacco Unit National Market Shares 2016 2017 0.1 0.3 0.5 Q3 Q4 Q1 0.1 0.2 0.4 Q3 Q4 Q1 2016 2017 2016 2017 2016 2017 0.4 0.7 0.9 Q3 Q4 Q1

19 Japan Italy Switzerland Portugal Germany National SoM (%) Focus Area (December 2016) National 5 cities 6 cities Lisbon 3 cities Focus Area Cigarette Industry Volume Coverage(b) ̴ 100% ̴ 20% ̴ 35% ̴ 25% ̴ 8% (a) Offtake share for three-city focus area (Berlin, Frankfurt and Munich) (b) Portion of cigarette industry volume covered by IQOS focus area in each market (as of December 2016) Note: "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking Source: PMI Financials or estimates 3.5 4.9 7.1 Q3 Q4 Q1 IQOS: Growing Heated Tobacco Unit National Market Shares 2016 2017 0.1 0.3 0.5 Q3 Q4 Q1 0.4 0.7 0.9 Q3 Q4 Q1 0.1 0.2 0.4 Q3 Q4 Q1 0.1 0.3 0.6 Q3 Q4 Q1 2016 2017 2016 2017 2016 2017 2016 2017 Focus Area Offtake Share(a)

20 IQOS: Expanding Heated Tobacco Unit Capacity Note: "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking. Pack designs are for illustrative purposes only Source: PMI Financials or estimates Dec 2017 Dec 2016 32+ Year-End Installed Capacity 15 50 Dec 2018 Annual Capacity Available for Commercialization 75+ 100 Heated Tobacco Unit Capacity Forecast (units billion)

21 Conclusion: Outlook Remains Strong for Full-Year 2017 ● Q1 results generally came in as expected, though cigarette volume was lower than anticipated ● Full-year 2017 key assumptions remain intact ● Exceptional IQOS performance: - Making significant investments behind commercialization and the expansion of heated tobacco unit capacity - Approximately 1.8 million adult consumers have already quit smoking cigarettes and switched to IQOS ● Expect capital expenditures of $1.6 billion; continue to target operating cash flow(a) of approximately $8.5 billion ● Our 2017 guidance reflects a growth rate of approximately 9% to 12%, excluding currency and favorable tax item, compared to adjusted diluted EPS of $4.48 in 2016 (a) Net cash provided by operating activities Note: "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking Source: PMI Financials or estimates

Lorem ipsum sit amet dolor donec 2017 First-Quarter Results Questions & Answers Have you downloaded the PMI Investor Relations App yet? The free IR App is available to download at the Apple App Store for iOS devices and at Google Play for Android mobile devices. iOS Download Android Download Or go to: www.pmi.com/irapp

Glossary and Reconciliation of Non-GAAP Measures

24 Glossary: General Terms ● "PMI" refers to Philip Morris International Inc. and its subsidiaries ● Until March 28, 2008, PMI was a wholly owned subsidiary of Altria Group, Inc. ("Altria"). Since that time the company has been independent and is listed on the New York Stock Exchange (ticker symbol "PM") ● Trademarks are italicized ● Comparisons are made to the same prior-year period, unless otherwise stated ● Unless otherwise stated, references to total industry, total market, PMI volume and PMI market share performance reflect cigarettes and PMI’s heated tobacco units for those markets that have commercial sales of IQOS ● References to total international market, defined as worldwide cigarette and PMI heated tobacco unit volume excluding the United States, total industry, total market and market shares are PMI tax-paid estimates based on the latest available data from a number of internal and external sources and may, in defined instances, exclude the People's Republic of China and/or PMI's duty free business ● "Combustible products" is the term PMI uses to refer to cigarettes and OTP, combined ● "OTP" is defined as other tobacco products, primarily roll-your-own and make-your-own cigarettes, pipe tobacco, cigars and cigarillos, and does not include reduced-risk products ● "PMI volume" is defined as the combined total of cigarette shipment volume and heated tobacco unit shipment volume ● "EU" is defined as the European Union Region ● "EEMA" is defined as Eastern Europe, Middle East and Africa and includes PMI's international duty free business ● "LA&C" is defined as the Latin America & Canada Region ● FF stands for full flavor ● LTLN stands for low tar/low nicotine ● SoM stands for share of market ● TPD stands for the EU Tobacco Products Directive ● "Whites" stands for non-kretek cigarettes

25 Glossary: Financial Terms ● Net revenues exclude excise taxes ● Net revenues, excluding excise taxes, related to combustible products refer to the operating revenues generated from the sale of these products, net of sales and promotion incentives ● "Operating Companies Income," or "OCI," is defined as operating income, excluding general corporate expenses and the amortization of intangibles, plus equity (income)/loss in unconsolidated subsidiaries, net. Management evaluates business segment performance and allocates resources based on OCI ● Management reviews OCI, OCI margins, operating cash flow and earnings per share, or "EPS," on an adjusted basis, which may exclude the impact of currency and other items such as acquisitions, asset impairment and exit costs, discrete tax items and other special items

26 Glossary: Reduced-Risk Products ● "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking. PMI has a range of RRPs in various stages of development, scientific assessment and commercialization. Because PMI's RRPs do not burn tobacco, they produce far lower quantities of harmful and potentially harmful compounds than found in cigarette smoke ● IQOS is the brand name under which PMI has chosen to commercialize its Platform 1 controlled heating device into which a specially designed and proprietary tobacco unit is inserted and heated to generate an aerosol ● "Heated tobacco units" is the term PMI uses to refer to heat-not-burn consumables, which include HEETS, HEETS Marlboro and HEETS FROM MARLBORO, defined collectively as HEETS, as well as Marlboro HeatSticks and Parliament HeatSticks ● Aerosol refers to a gaseous suspension of fine solid particles and/or liquid droplets ● Net revenues, excluding excise taxes, related to RRPs represent the sale of heated tobacco units, IQOS devices and related accessories, and other nicotine-containing products, primarily e-vapor products, net of sales and promotion incentives ● Heated tobacco unit offtake volume represents the estimated retail offtake of heated tobacco units based on a selection of sales channels that vary by market, but notably include retail points of sale and e-commerce platforms ● Heated tobacco unit offtake share represents the estimated retail offtake volume of heated tobacco units divided by the sum of estimated total offtake volume for cigarettes, heated tobacco units and, where the data is available, other RRPs ● National market share for heated tobacco units is defined as the total sales volume for heated tobacco units as a percentage of the total estimated sales volume for cigarettes and heated tobacco units ● "Converted IQOS Users" means the estimated number of Legal Age (minimum 18-year-old) IQOS users that used HeatSticks/HEETS heated tobacco units for 95% or more of their daily tobacco consumption over the past seven days ● "Predominant IQOS Users" means the estimated number of Legal Age (minimum 18-year-old) IQOS users that used HeatSticks/HEETS heated tobacco units for between 70% and 94.9% of their daily tobacco consumption over the past seven days

27 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS For the Year Ended December 31, (Unaudited) 2016 Reported Diluted EPS 4.48$ Adjustments: Asset impairment and exit costs - Tax items - Adjuste Diluted EPS 4.48$

28 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Adjustments for the Impact of Currency and Acquisitions For the Quarters Ended March 31, ($ in millions) (Unaudited) Net Revenues Less Excise Taxes Net Revenues excluding Excise Taxes Less Currency Net Revenues excluding Excise Taxes & Currency Less Acquisi- tions Net Revenues excluding Excise Taxes, Currency & Acquisitions Net Revenues Less Excise Taxes Net Revenues excluding Excise Taxes Total Excluding Currency Excluding Currency & Acquisitions 5,889$ 4,149$ 1,740$ (55)$ 1,795$ -$ 1,795$ European Union 6,143$ 4,280$ 1,863$ (6.6)% (3.7)% (3.7)% 3,695 2,218 1,477 (99) 1,576 - 1,576 EEMA 3,997 2,395 1,602 (7.8)% (1.6)% (1.6)% 4,838 2,597 2,241 56 2,185 - 2,185 Asia 4,689 2,721 1,968 13.9% 11.0% 11.0% 2,134 1,528 606 (22) 628 - 628 Latin America & Canada 1,959 1,309 650 (6.8)% (3.4)% (3.4)% 16,556$ 10,492$ 6,064$ (120)$ 6,184$ -$ 6,184$ PMI Total 16,788$ 10,705$ 6,083$ (0.3)% 1.7% 1.7% Operating Companies I come Less Currency Operating Companies Income excluding Currency Less Acquisi- tions Operating Companies Income excluding Currency & Acquisitions Operating Companies Income Total Excluding Currency Excluding Currency & Acquisitions 772$ (28)$ 800$ -$ 800$ European Union 906$ (14.8)% (11.7)% (11.7)% 690 (12) 702 - 702 EEMA 633 9.0% 10.9% 10.9% 852 54 798 - 798 Asia 778 9.5% 2.6% 2.6% 177 (26) 203 - 203 Latin America & Canada 229 (22.7)% (11.4)% (11.4)% 2,491$ (12)$ 2,503$ -$ 2,503$ PMI Total 2,546$ (2.2)% (1.7)% (1.7)% 2017 2016 % Change in Operating Companies Income 2017 2016 % Change in Net Revenues excluding Excise Taxes

29 (a) For the calculation of net revenues excluding excise taxes, currency and acquisitions, refer to previous slide PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Operating Companies Income to Adjusted Operating Companies Income & Reconciliation of Adjusted Operating Companies Income Margin, excluding Currency and Acquisitions For the Quarters Ended March 31, ($ in millions) (Unaudited) Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Less Currency Adjusted Operating Companies Income excluding Currency Less Acquisi- tions Adjusted Operating Companies Income excluding Currency & Acquisitions Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Adjusted Adjusted excluding Currency Adjusted excluding Currency & Acquisitions 772$ -$ 772$ (28)$ 800$ -$ 800$ European Union 906$ -$ 906$ (14.8)% (11.7)% (11.7)% 690 - 690 (12) 702 - 702 EEMA 633 - 633 9.0% 10.9% 10.9% 852 - 852 54 798 - 798 Asia 778 - 778 9.5% 2.6% 2.6% 177 - 177 (26) 203 - 203 Latin America & Canada 229 - 229 (22.7)% (11.4)% (11.4)% 2,491$ -$ 2,491$ (12)$ 2,503$ -$ 2,503$ PMI Total 2,546$ -$ 2,546$ (2.2)% (1.7)% (1.7)% % Points Change Adjusted Operating Companies Income excluding Currency Net Revenues excluding Excise Taxes & Currency(a) Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income excluding Currency & Acquisitions Net Revenues excluding Excise Taxes, Currency & Acquisitions(a) Adjusted Operating Companies Income Margin excluding Currency & Acquisitions Adjusted Operating Companies Income Net Revenues excluding Excise Taxes(a) Adjusted Operating Companies Income Margin Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income Margin excluding Currency & Acquisitions 800$ 1,795$ 44.6% 800$ 1,795$ 44.6% European Union 906$ 1,863$ 48.6% (4.0) (4.0) 702 1,576 44.5% 702 1,576 44.5% EEMA 633 1,602 39.5% 5.0 5.0 798 2,185 36.5% 798 2,185 36.5% Asia 778 1,968 39.5% (3.0) (3.0) 203 628 32.3% 203 628 32.3% Latin America & Canada 229 650 35.2% (2.9) (2.9) 2,503$ 6,184$ 40.5% 2,503$ 6,184$ 40.5% PMI Total 2,546$ 6,083$ 41.9% (1.4) (1.4) 2017 2016 2017 2016 % Change in Adjusted Operating Companies Income

30 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS, excluding Currency For the Quarters Ended March 31, (Unaudited) 2017 2016 % Change Reported Diluted EPS 1.02$ 0.98$ 4.1% Adjustments: Asset impairment and exit costs - - Tax items (0.04) - Adjuste iluted EPS 0.98$ 0.98$ - Less: Currency impact - Adjusted Diluted EPS, excluding Currency 0.98$ 0.98$ -

31 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding Currency For the Quarters Ended March 31, (Unaudited) 2017 2016 % Change Reported Diluted EPS 1.02$ 0.98$ 4.1% Less: Currency impact - Reported Diluted EPS, excluding Currency 1.02$ 0.98$ 4.1%

Lorem ipsum sit amet dolor donec 2017 First-Quarter Results April 20, 2017