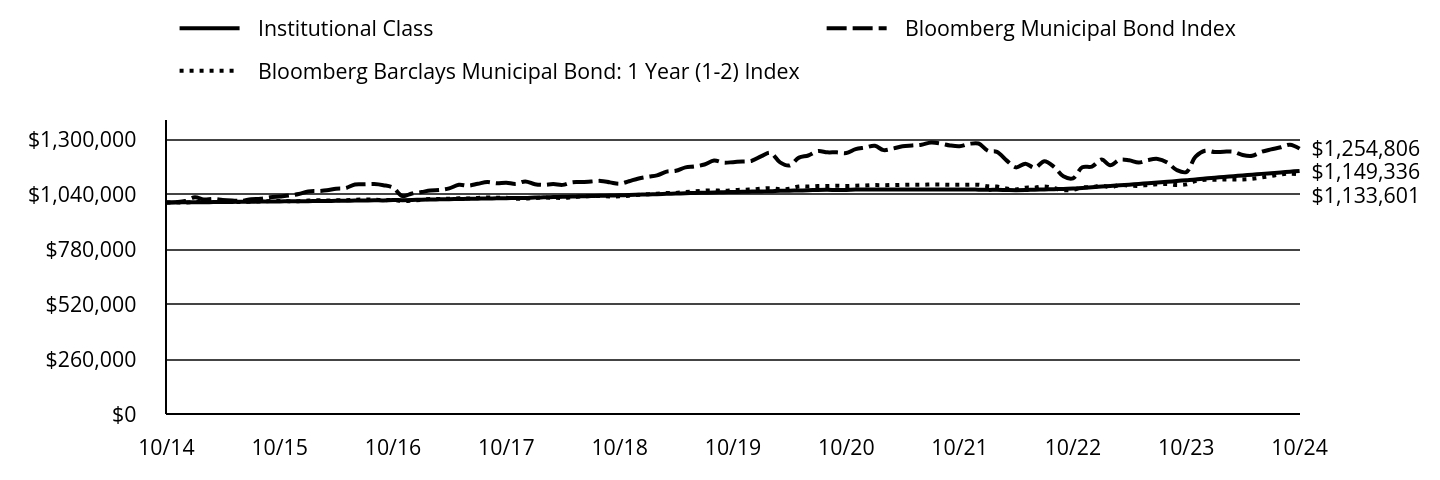

UNITED STATES

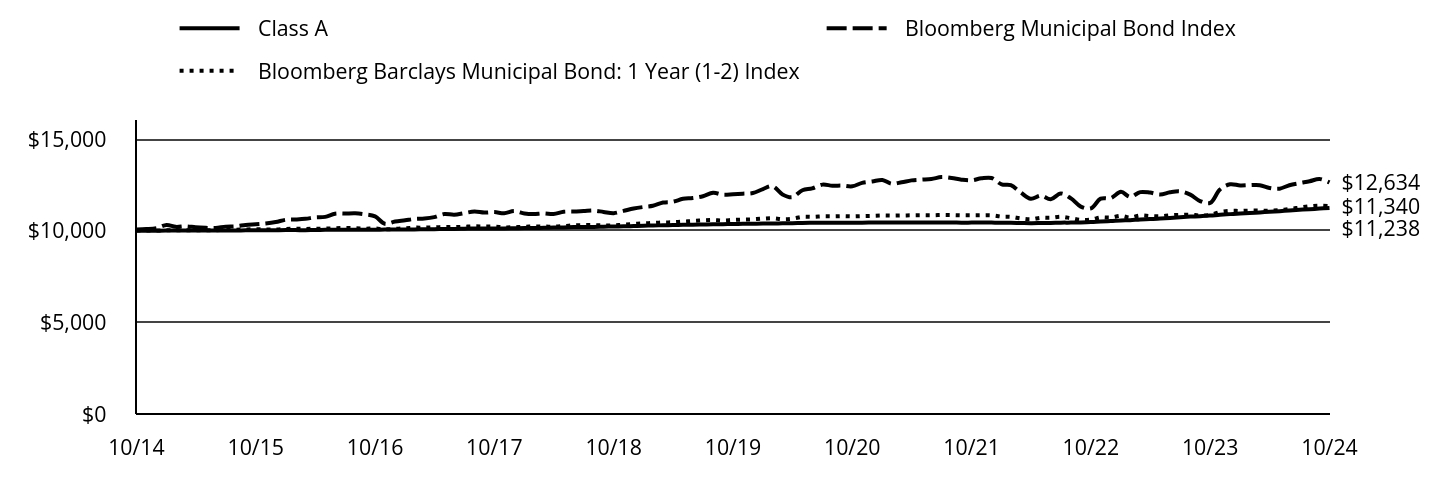

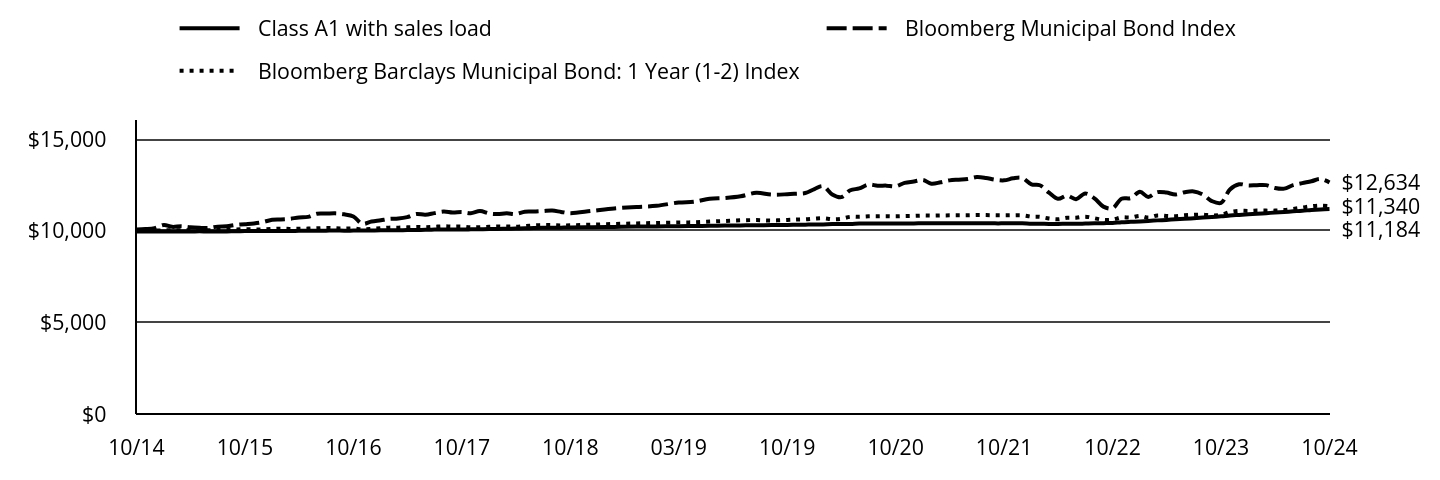

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-22132 |

| | |

| Exact name of registrant as specified in charter: | abrdn Funds |

| | |

| Address of principal executive offices: | 1900 Market Street, Suite 200 |

| | Philadelphia, PA 19103 |

| | |

| Name and address of agent for service: | Michael Marsico |

| | abrdn Inc. |

| | 1900 Market Street, Suite 200 |

| | Philadelphia, PA 19103 |

| | |

| Registrant’s telephone number, including area code: | 866-667-9231 |

| | |

| Date of fiscal year end: | October 31 |

| | |

| Date of reporting period: | October 31, 2024 |

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

0001413594 aberdeen:AberdeenIndexMSCIChinaAOnshoreIndexNetTR7003BroadBasedIndexMember 2018-11-30 0001413594 aberdeen:AberdeenIndexMSCIChinaAOnshoreIndexNetTR7006BroadBasedIndexMember 2015-07-31 0001413594 aberdeen:AberdeenIndexMSCIEmergingMarketsexMinusChinaIndexNetTR7015BroadBasedIndexMember 2020-02-29 0001413594 aberdeen:C000057051Member 2015-08-31 0001413594 aberdeen:C000111354Member 2023-05-31 0001413594 aberdeen:C000229254Member 2020-02-29 0001413594 aberdeen:AberdeenIndexICEBofAUSHighYieldConstrainedIndex6955AdditionalIndexMember 2015-09-30 0001413594 aberdeen:C000123602Member 2015-02-28 0001413594 aberdeen:AberdeenIndexMSCIAllCountryWorldMinusexUSAIndexNetTR7040BroadBasedIndexMember 2020-01-31 0001413594 aberdeen:AberdeenIndexMSCIAllCountryWorldMinusexUSASmallCapIndexNetTR7044AdditionalIndexMember 2024-01-31 0001413594 aberdeen:AberdeenIndexSP500Index2431BroadBasedIndexMember 2018-01-31 0001413594 aberdeen:AberdeenIndexRussell3000Index7000BroadBasedIndexMember 2023-08-31 0001413594 aberdeen:C000103445Member aberdeen:FR443510607CTIMember 2024-10-31 0001413594 aberdeen:AberdeenIndexBloombergMunicipalBondIndex12180BroadBasedIndexMember 2016-05-31

abrdn Emerging Markets Dividend Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the abrdn Emerging Markets Dividend Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at abrdn.com/us/literature. You can also request this information by contacting us at 866-667-9231.

This report describes material changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $116 | 1.01% |

How did the fund perform last year and what affected its performance?

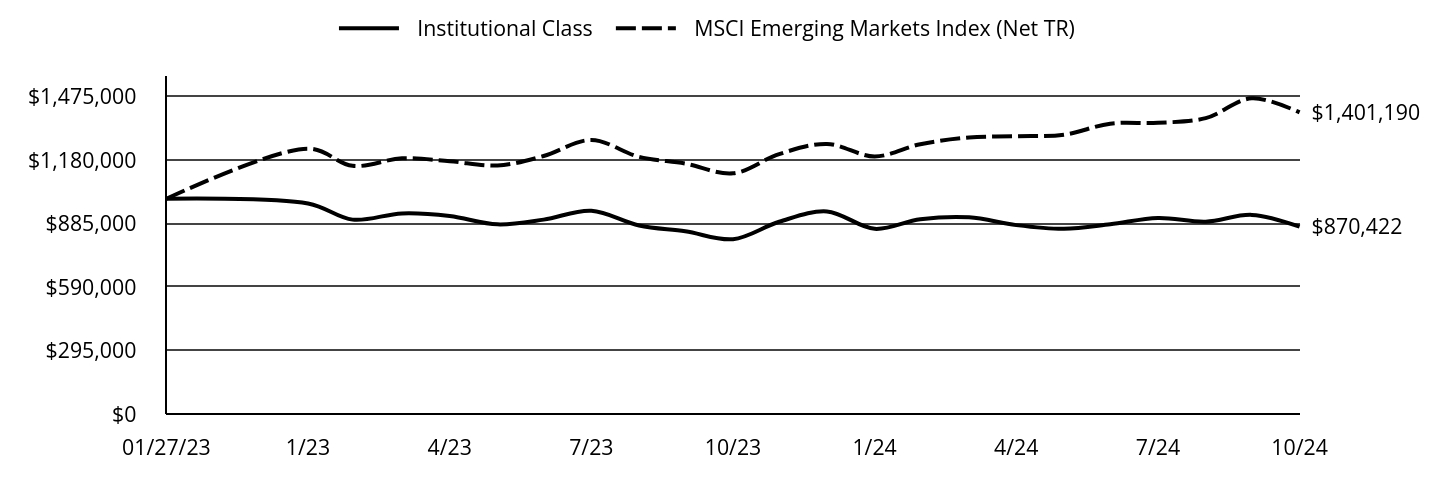

The following discussion compares the performance of the Fund to the MSCI Emerging Markets Index (Net TR) (the “Index”) to show how the Fund’s performance measures against the returns of similar investments for the reporting period.

What contributed to performance?

Taiwanese chip maker Taiwan Semiconductor Manufacturing Company executed consistently well and reported strong results that exceeded expectations. Our semiconductor stock in the Netherlands, ASML Holding, also boosted gains, although we exited the position during the review period for opportunities elsewhere. Both the stocks’ outperformance was mostly driven by a cyclical upturn in semiconductor pricing and strong artificial intelligence (AI)-led demand. The tech rally faded in the final three months of the review period on global macro uncertainties and a September rotation into Chinese equities following the government’s comprehensive stimulus announcements. Elsewhere in the Netherlands, financial services company Adyen, which was held in the portfolio before the strategy change, posted solid second half results in February, with better-than-expected volumes and where the company gave full year guidance for the first time since IPO. We sold the holding when the Fund’s scope transitioned towards the emerging markets.

What detracted from performance?

South Korea’s Samsung Electronics’ preferred shares lagged on uncertainty around its high bandwidth memory (HBM) product, designed to service high-end tech around AI, qualifying for use by a key customer. However, we believe Samsung remains on a track for a turnaround in the medium term. Elsewhere, Chinese equities softened due to slow demand recovery and stimulus measures by the government not having a sustainable impact. Consequently, brewer Budweiser APAC underperformed. In addition, its results were affected by the challenging Korea business, while its China business fared within expectations. In Hong Kong, insurer AIA Group sold off amid concerns over the impact of low Chinese rates on its business and AIA Group management’s decision to focus on growth rather than boost shareholder returns.

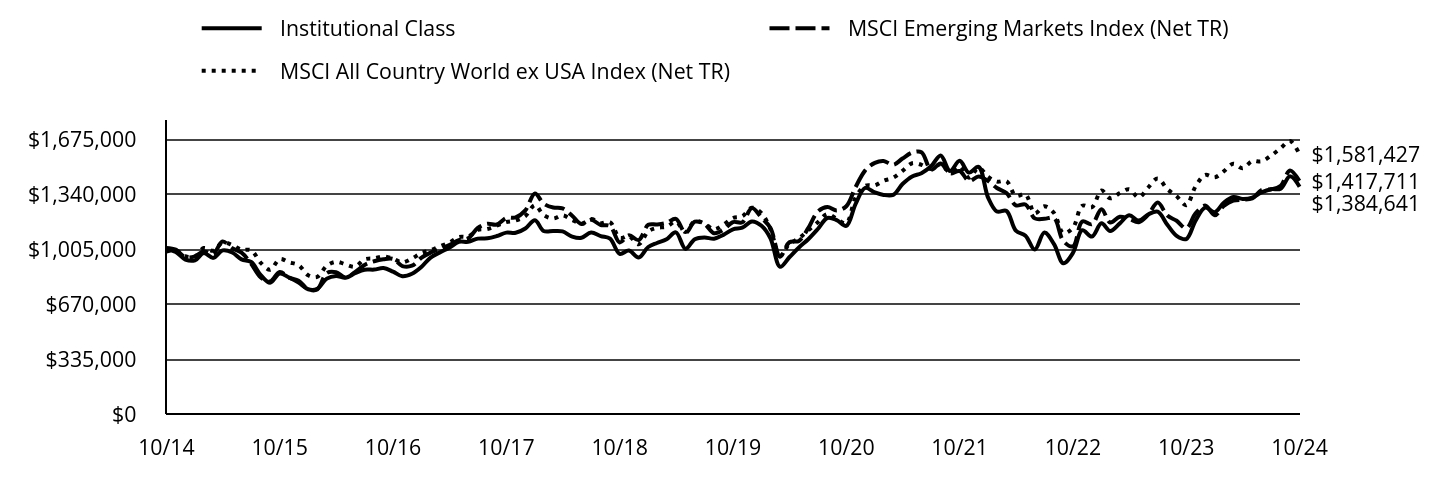

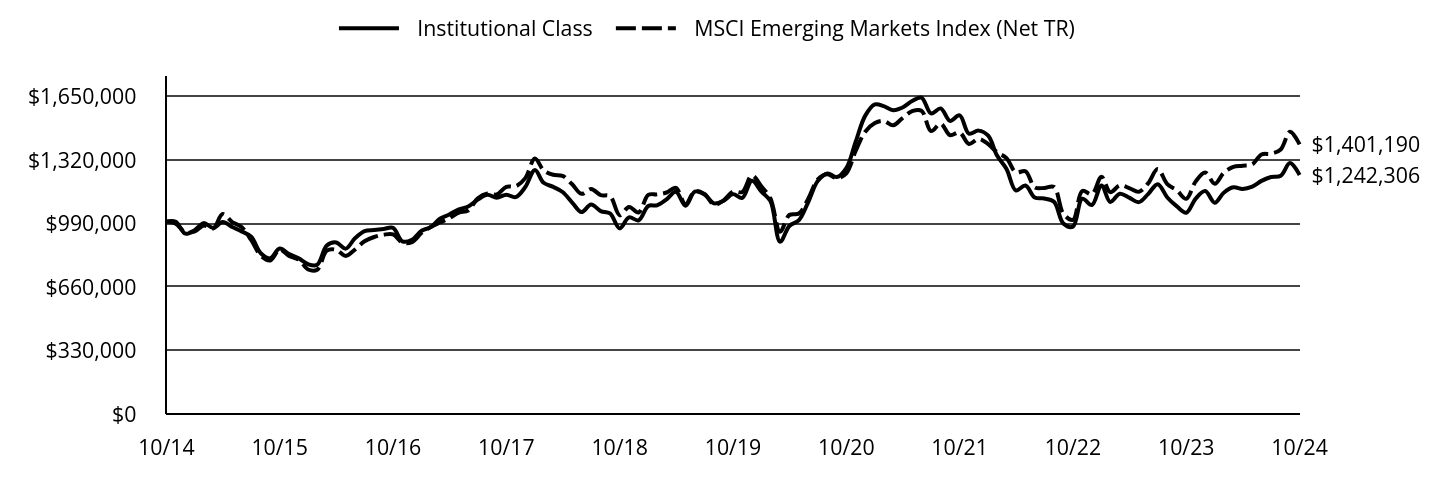

abrdn Emerging Markets Dividend Fund

(JIEIX)

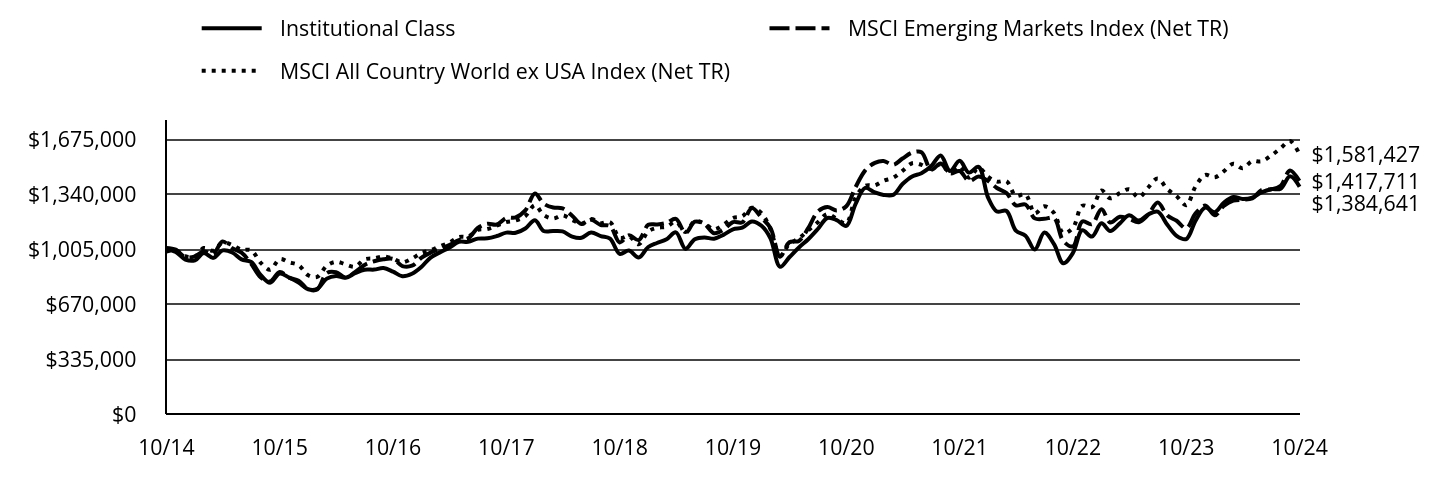

Total Return Based on $1,000,000 Investment

The following graph reflects a hypothetical $1,000,000 investment for the most recently completed 10 fiscal years as compared to a broad-based securities market index and an additional performance benchmark.

| Institutional Class | MSCI Emerging Markets Index (Net TR) | MSCI All Country World ex USA Index (Net TR) |

|---|

| 10/14 | $1,000,000 | $1,011,791 | $990,102 |

| 11/14 | $987,104 | $1,001,089 | $997,265 |

| 12/14 | $940,862 | $954,953 | $961,307 |

| 01/15 | $936,107 | $960,677 | $959,883 |

| 02/15 | $980,736 | $990,422 | $1,011,201 |

| 03/15 | $951,105 | $976,338 | $994,856 |

| 04/15 | $996,466 | $1,051,433 | $1,045,115 |

| 05/15 | $984,028 | $1,009,327 | $1,028,795 |

| 06/15 | $941,960 | $983,113 | $1,000,095 |

| 07/15 | $925,864 | $914,965 | $997,314 |

| 08/15 | $845,752 | $832,209 | $921,084 |

| 09/15 | $799,660 | $807,173 | $878,379 |

| 10/15 | $855,995 | $864,752 | $943,768 |

| 11/15 | $831,120 | $831,020 | $924,286 |

| 12/15 | $800,316 | $812,495 | $906,877 |

| 01/16 | $759,693 | $759,785 | $845,188 |

| 02/16 | $762,350 | $758,542 | $835,528 |

| 03/16 | $824,614 | $858,918 | $903,464 |

| 04/16 | $840,939 | $863,586 | $927,243 |

| 05/16 | $829,929 | $831,373 | $911,591 |

| 06/16 | $857,265 | $864,600 | $897,645 |

| 07/16 | $879,285 | $908,109 | $942,036 |

| 08/16 | $879,664 | $930,677 | $947,994 |

| 09/16 | $889,156 | $942,644 | $959,684 |

| 10/16 | $867,136 | $944,892 | $945,886 |

| 11/16 | $839,041 | $901,398 | $924,007 |

| 12/16 | $854,546 | $903,388 | $947,642 |

| 01/17 | $897,235 | $952,824 | $981,212 |

| 02/17 | $951,462 | $981,992 | $996,859 |

| 03/17 | $984,536 | $1,006,781 | $1,022,131 |

| 04/17 | $1,012,611 | $1,028,822 | $1,044,012 |

| 05/17 | $1,048,761 | $1,059,239 | $1,077,890 |

| 06/17 | $1,049,146 | $1,069,902 | $1,081,237 |

| 07/17 | $1,068,375 | $1,133,678 | $1,121,089 |

| 08/17 | $1,070,298 | $1,158,965 | $1,126,955 |

| 09/17 | $1,084,143 | $1,154,357 | $1,147,876 |

| 10/17 | $1,104,911 | $1,194,824 | $1,169,471 |

| 11/17 | $1,103,757 | $1,197,222 | $1,178,971 |

| 12/17 | $1,130,260 | $1,240,199 | $1,205,322 |

| 01/18 | $1,180,905 | $1,343,565 | $1,272,453 |

| 02/18 | $1,114,986 | $1,281,600 | $1,212,454 |

| 03/18 | $1,114,584 | $1,257,771 | $1,191,070 |

| 04/18 | $1,112,173 | $1,252,206 | $1,210,086 |

| 05/18 | $1,080,821 | $1,207,836 | $1,182,145 |

| 06/18 | $1,073,184 | $1,157,654 | $1,159,926 |

| 07/18 | $1,105,742 | $1,183,084 | $1,187,668 |

| 08/18 | $1,083,635 | $1,151,095 | $1,162,810 |

| 09/18 | $1,067,959 | $1,144,985 | $1,168,107 |

| 10/18 | $975,513 | $1,045,277 | $1,073,096 |

| 11/18 | $996,012 | $1,088,353 | $1,083,253 |

| 12/18 | $953,202 | $1,059,521 | $1,034,222 |

| 01/19 | $1,017,290 | $1,152,290 | $1,112,366 |

| 02/19 | $1,041,627 | $1,154,880 | $1,134,101 |

| 03/19 | $1,063,936 | $1,164,573 | $1,140,855 |

| 04/19 | $1,106,526 | $1,189,090 | $1,170,994 |

| 05/19 | $1,005,933 | $1,102,808 | $1,108,146 |

| 06/19 | $1,065,153 | $1,171,635 | $1,174,873 |

| 07/19 | $1,075,699 | $1,157,308 | $1,160,652 |

| 08/19 | $1,067,992 | $1,100,882 | $1,124,806 |

| 09/19 | $1,091,112 | $1,121,897 | $1,153,752 |

| 10/19 | $1,125,184 | $1,169,204 | $1,194,009 |

| 11/19 | $1,135,325 | $1,167,595 | $1,204,535 |

| 12/19 | $1,173,286 | $1,254,704 | $1,256,697 |

| 01/20 | $1,146,948 | $1,196,217 | $1,222,938 |

| 02/20 | $1,070,485 | $1,133,136 | $1,126,271 |

| 03/20 | $896,744 | $958,608 | $963,195 |

| 04/20 | $954,941 | $1,046,391 | $1,036,186 |

| 05/20 | $1,014,412 | $1,054,428 | $1,070,098 |

| 06/20 | $1,064,538 | $1,131,938 | $1,118,456 |

| 07/20 | $1,126,983 | $1,233,090 | $1,168,321 |

| 08/20 | $1,194,101 | $1,260,347 | $1,218,333 |

| 09/20 | $1,180,932 | $1,240,132 | $1,188,384 |

| 10/20 | $1,146,099 | $1,265,682 | $1,162,835 |

| 11/20 | $1,280,334 | $1,382,742 | $1,319,254 |

| 12/20 | $1,377,061 | $1,484,392 | $1,390,560 |

| 01/21 | $1,349,614 | $1,529,900 | $1,393,582 |

| 02/21 | $1,334,604 | $1,541,602 | $1,421,170 |

| 03/21 | $1,335,032 | $1,518,320 | $1,439,139 |

| 04/21 | $1,401,077 | $1,556,123 | $1,481,502 |

| 05/21 | $1,447,393 | $1,592,210 | $1,527,844 |

| 06/21 | $1,467,121 | $1,594,954 | $1,517,944 |

| 07/21 | $1,508,720 | $1,487,616 | $1,492,929 |

| 08/21 | $1,575,193 | $1,526,554 | $1,521,307 |

| 09/21 | $1,480,415 | $1,465,888 | $1,472,594 |

| 10/21 | $1,542,171 | $1,480,346 | $1,507,745 |

| 11/21 | $1,470,551 | $1,420,017 | $1,439,854 |

| 12/21 | $1,505,289 | $1,446,662 | $1,499,358 |

| 01/22 | $1,316,592 | $1,419,278 | $1,444,107 |

| 02/22 | $1,233,393 | $1,376,855 | $1,415,522 |

| 03/22 | $1,236,824 | $1,345,758 | $1,417,778 |

| 04/22 | $1,116,744 | $1,270,898 | $1,328,751 |

| 05/22 | $1,086,295 | $1,276,494 | $1,338,289 |

| 06/22 | $1,001,382 | $1,191,671 | $1,223,160 |

| 07/22 | $1,105,165 | $1,188,744 | $1,265,033 |

| 08/22 | $1,034,404 | $1,193,707 | $1,224,346 |

| 09/22 | $918,183 | $1,053,766 | $1,101,997 |

| 10/22 | $981,225 | $1,021,048 | $1,134,926 |

| 11/22 | $1,119,746 | $1,172,488 | $1,268,902 |

| 12/22 | $1,080,955 | $1,156,008 | $1,259,414 |

| 01/23 | $1,161,506 | $1,247,288 | $1,361,562 |

| 02/23 | $1,114,750 | $1,166,411 | $1,313,769 |

| 03/23 | $1,161,506 | $1,201,738 | $1,345,885 |

| 04/23 | $1,210,114 | $1,188,119 | $1,369,267 |

| 05/23 | $1,178,172 | $1,168,163 | $1,319,483 |

| 06/23 | $1,215,670 | $1,212,518 | $1,378,687 |

| 07/23 | $1,232,798 | $1,287,999 | $1,434,740 |

| 08/23 | $1,152,710 | $1,208,658 | $1,369,939 |

| 09/23 | $1,085,122 | $1,177,049 | $1,326,670 |

| 10/23 | $1,065,678 | $1,131,315 | $1,271,933 |

| 11/23 | $1,177,709 | $1,221,854 | $1,386,426 |

| 12/23 | $1,257,334 | $1,269,621 | $1,456,083 |

| 01/24 | $1,229,558 | $1,210,668 | $1,441,620 |

| 02/24 | $1,286,499 | $1,268,263 | $1,478,117 |

| 03/24 | $1,322,145 | $1,299,690 | $1,524,323 |

| 04/24 | $1,309,646 | $1,305,505 | $1,496,950 |

| 05/24 | $1,317,979 | $1,312,879 | $1,540,405 |

| 06/24 | $1,350,384 | $1,364,663 | $1,538,940 |

| 07/24 | $1,369,364 | $1,368,725 | $1,574,573 |

| 08/24 | $1,372,605 | $1,390,823 | $1,619,416 |

| 09/24 | $1,448,064 | $1,483,696 | $1,663,023 |

| 10/24 | $1,384,641 | $1,417,711 | $1,581,427 |

Average Annual Total Returns for the Period Ended October 31, 2024 (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 30.02% | 4.25% | 3.31% |

| MSCI Emerging Markets Index (Net TR) | 25.32% | 3.93% | 3.43% |

| MSCI All Country World ex USA Index (Net TR) | 24.33% | 5.78% | 4.79% |

THE FUND'S PAST PERFORMANCE IS NOT A GOOD PREDICTOR OF THE FUND'S FUTURE PERFORMANCE.

Fund performance data shown above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

In connection with a change in name and strategy of the Fund, the Fund's primary prospectus benchmark changed to the MSCI Emerging Markets Index (Net TR) effective as of February 29, 2024.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | $78,415,816 |

| Total Number of Portfolio Holdings | 85 |

| Portfolio Turnover Rate | 122% |

| Total Advisory Fees Paid | $264,051 |

abrdn Emerging Markets Dividend Fund

(JIEIX)

What did the Fund invest in?

The tables below show the investment makeup of the Fund as of October 31, 2024.

Geographic Allocation (% of total net assets)

| China | 23.5% | |

| Taiwan | 18.3% | |

| India | 10.6% | |

| South Korea | 10.0% | |

| Mexico | 7.0% | |

| Brazil | 5.1% | |

| Indonesia | 4.6% | |

| United States | 4.1% | |

| South Africa | 2.1% | |

| Other | 14.7% | |

Ten Largest Holdings (% of total net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd. | 10.7% |

| Tencent Holdings Ltd. | 5.9% |

| Samsung Electronics Co. Ltd. | 5.6% |

| HDFC Bank Ltd. | 5.0% |

| iShares MSCI India ETF | 4.1% |

| Grupo Mexico SAB de CV | 3.5% |

| MediaTek, Inc. | 2.8% |

| ICICI Bank Ltd. | 2.7% |

| Alibaba Group Holding Ltd. | 2.4% |

| Infosys Ltd. | 2.2% |

Below is a summary of certain changes for the Fund since November 1, 2023. For more information, you may refer to the Fund's next prospectus, which we expect to be available by February 28, 2025 at abrdn.com/us/literature or upon request at 866-667-9231.

Effective February 29, 2024, the Fund changed its name from abrdn International Sustainable Leaders Fund to abrdn Emerging Markets Dividend Fund.

The Fund changed its investment objective from "The Fund seeks long-term growth of capital" to "The Fund seeks total return consisting of income and long-term capital appreciation".

The Fund’s 80% policy changed from a policy where the Fund invests at least 80% of the value of its net assets, plus any borrowings for investment purposes, in equity securities issued by companies located throughout the world to a policy where the Fund invests at least 80% of the value of its net assets, plus any borrowings for investment purposes, in equity securities of emerging market companies that pay dividend income.

Dividend Strategy Risk was added as a principal risk of the Fund and Sustainable Investing Risk was removed as a principal risk of the Fund.

Availability of Additional Information

You can find additional information, including the Fund's prospectus, financial information, fund holdings, and proxy voting information at abrdn.com/us/literature or call 866-667-9231. The QR code can be used to access the Fund's prospectus, financial information and holdings.

abrdn Emerging Markets Dividend Fund

(JIEIX)

abrdn Focused U.S. Small Cap Equity Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the abrdn Focused U.S. Small Cap Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at abrdn.com/us/literature. You can also request this information by contacting us at 866-667-9231.

This report describes material changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $106 | 0.90% |

How did the fund perform last year and what affected its performance?

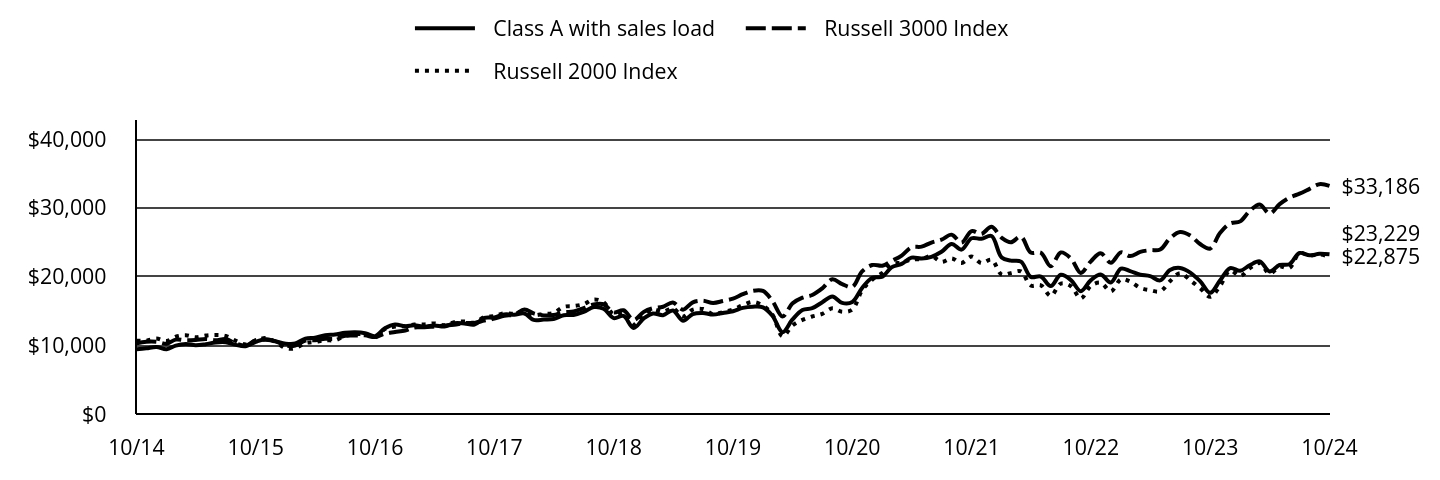

The following discussion compares the performance of the Fund to the Russell 2000 Index (the “Index”) to show how the Fund’s performance measures against the returns of similar investments for the reporting period.

What contributed to performance?

The Fund's overweight to Q2 Holdings was positive as robust demand for its digital banking solutions led to accelerated growth. Meanwhile, our overweight to casual diner Brinker International led the consumer discretionary sector’s outperformance for the Fund, as the company’s strong execution resulted in driving industry-leading traffic and sales growth. e.l.f. Beauty was also favorable as the company continued its above-category growth, benefitting from strong innovation and an attractive value proposition. However, we sold e.l.f Beauty as it became a mid-capitalization company and left the Russell 2000 Index. Lastly, within the information technology sector, CyberArk Software added to returns as demand for the company’s identity access management solutions accelerated. Despite this, we disposed of our position due to CyberArk Software’s market capitalization exceeding our targeted range.

What detracted from performance?

The Fund's exposure to Alphatec Holdings drove the healthcare sector’s underperformance for the Fund as concerns regarding the company’s increased capital needs were heightened due to weaker-than-expected cash generation. Also within this sector, Conmed Corporation detracted from performance due to underwhelming earnings and increased investor concern about the competitive environment. Therefore, the Fund sold both positions. Meanwhile, ATS Corporation also hurt performance, and we disposed of our position as we saw further risks to spending on electric-vehicle production lines among North American automotive manufacturers. Crown Holdings’ shares fell, and the Fund sold its position due to concerns about the growing competitiveness in the materials industry.

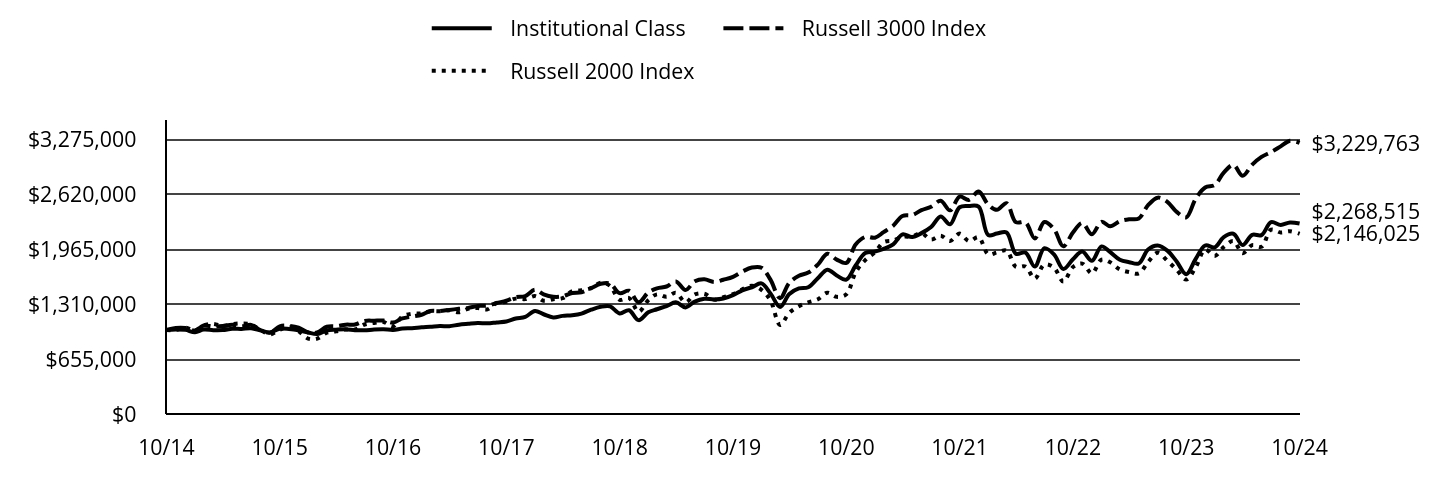

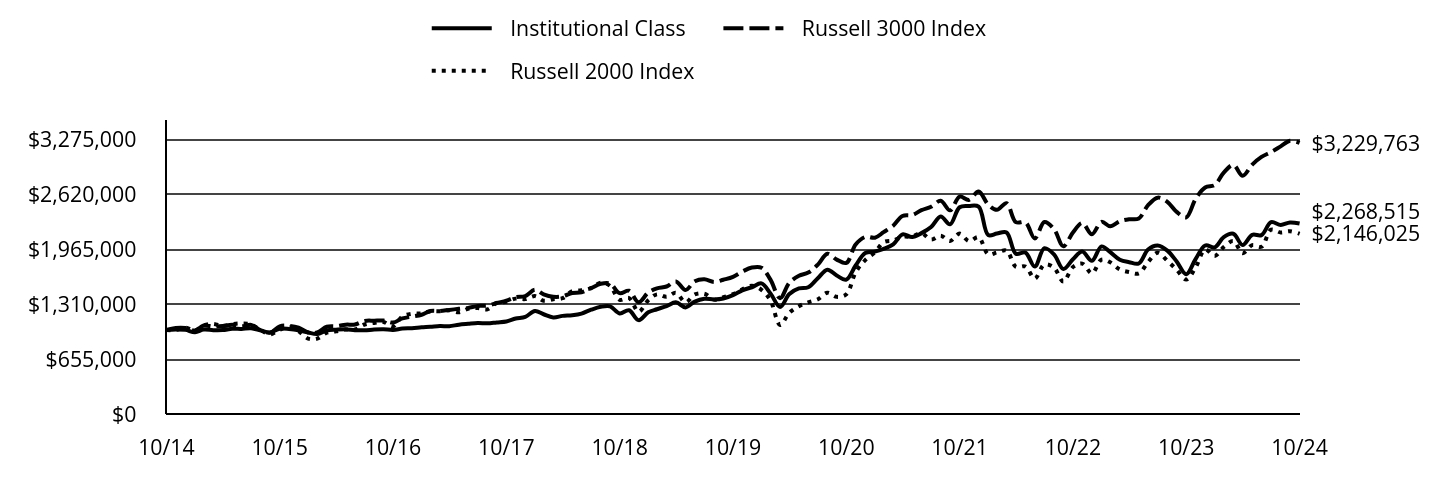

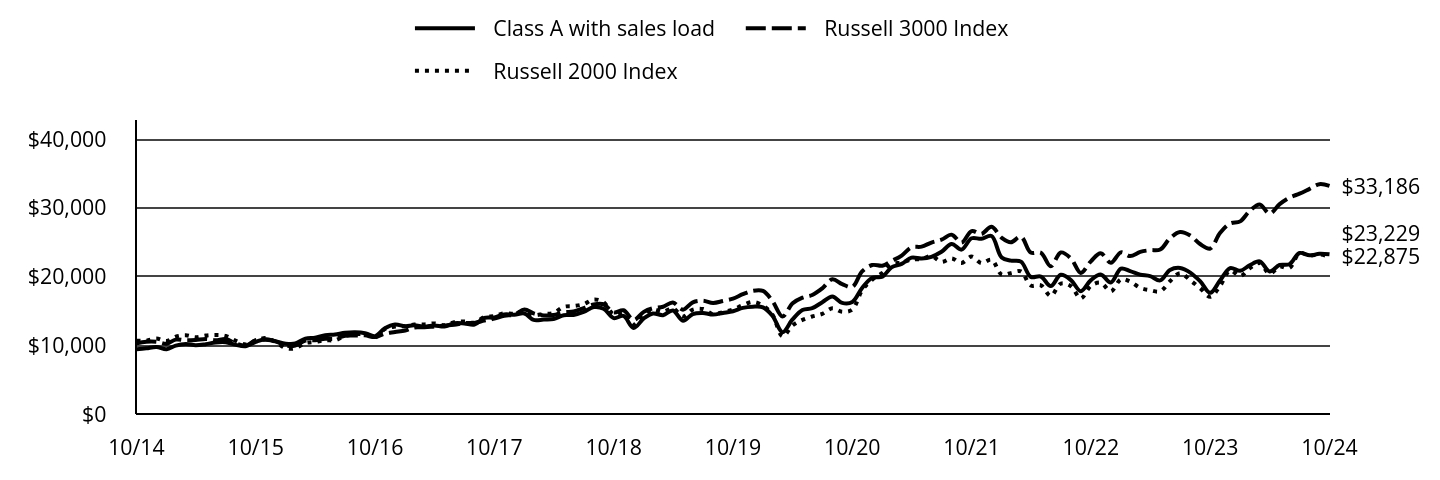

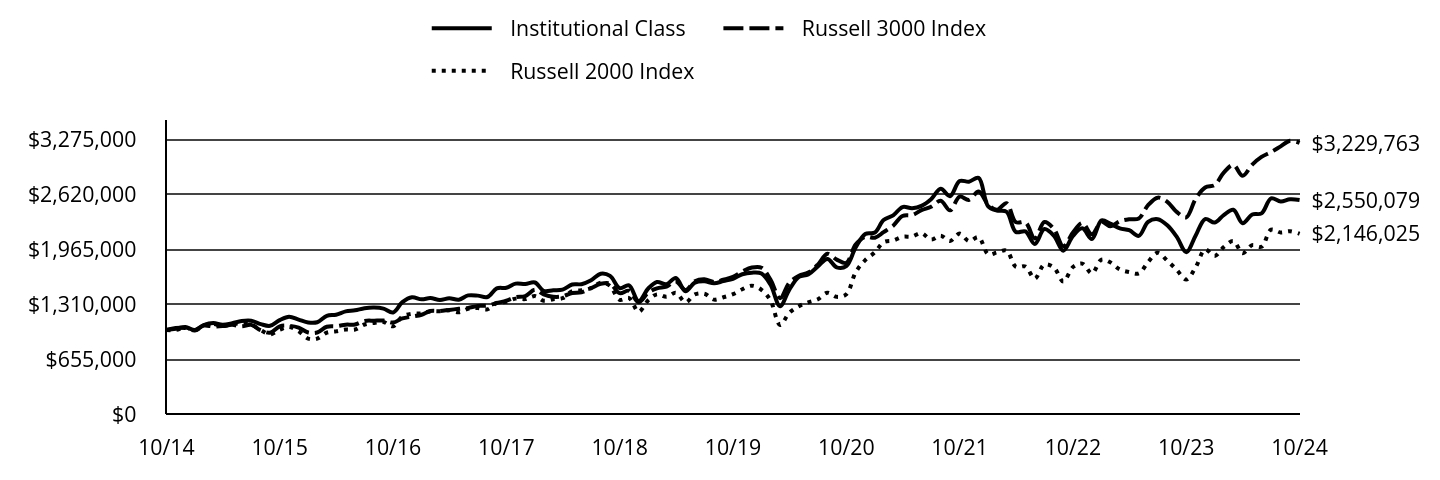

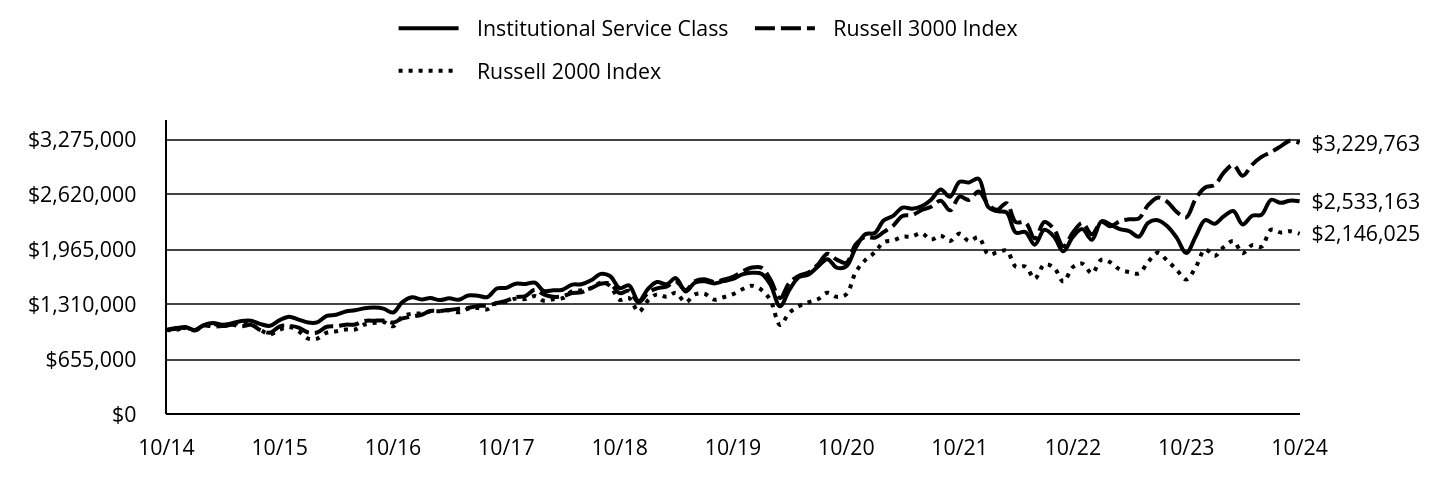

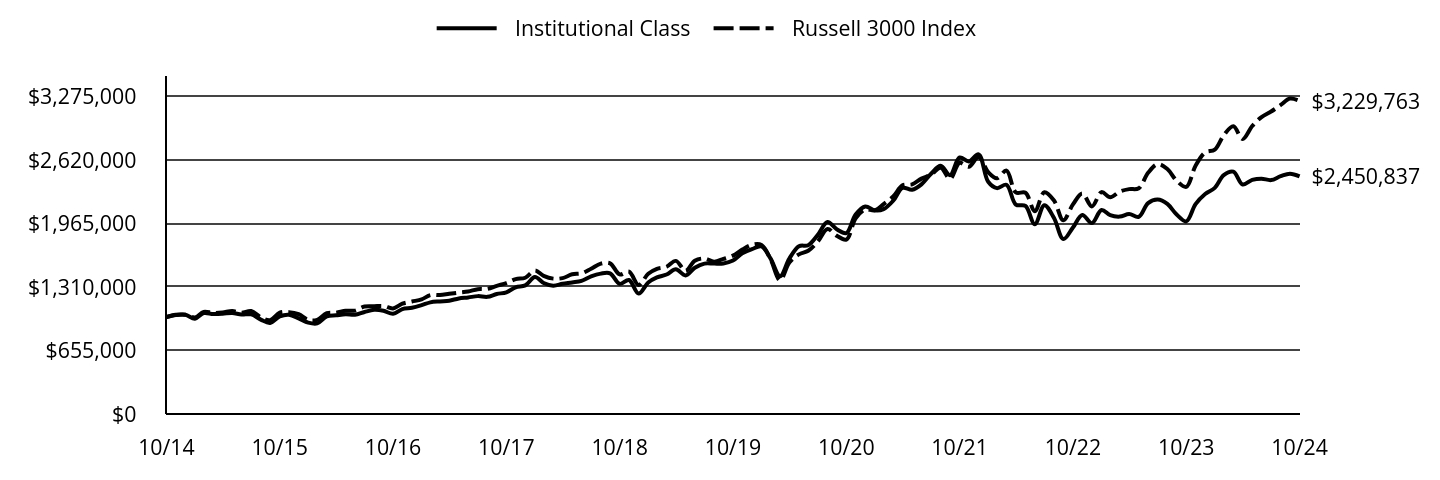

abrdn Focused U.S. Small Cap Equity Fund

(GGUIX)

Total Return Based on $1,000,000 Investment

The following graph reflects a hypothetical $1,000,000 investment for the most recently completed 10 fiscal years as compared to a broad-based securities market index and an additional performance benchmarks.

| Institutional Class | Russell 3000 Index | Russell 2000 Index |

|---|

| 10/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 11/14 | $1,006,369 | $1,024,234 | $1,000,896 |

| 12/14 | $1,001,817 | $1,024,222 | $1,029,422 |

| 01/15 | $974,148 | $995,717 | $996,309 |

| 02/15 | $1,006,588 | $1,053,370 | $1,055,457 |

| 03/15 | $998,955 | $1,042,661 | $1,073,844 |

| 04/15 | $999,909 | $1,047,377 | $1,046,458 |

| 05/15 | $1,014,220 | $1,061,864 | $1,070,349 |

| 06/15 | $1,013,266 | $1,044,098 | $1,078,364 |

| 07/15 | $1,019,945 | $1,061,561 | $1,065,831 |

| 08/15 | $994,184 | $997,475 | $998,854 |

| 09/15 | $972,240 | $968,409 | $949,847 |

| 10/15 | $1,015,175 | $1,044,899 | $1,003,361 |

| 11/15 | $1,012,312 | $1,050,692 | $1,036,000 |

| 12/15 | $997,689 | $1,029,126 | $983,982 |

| 01/16 | $971,492 | $971,057 | $897,456 |

| 02/16 | $952,935 | $970,744 | $897,416 |

| 03/16 | $994,414 | $1,039,091 | $969,040 |

| 04/16 | $1,004,239 | $1,045,530 | $984,249 |

| 05/16 | $1,009,696 | $1,064,235 | $1,006,419 |

| 06/16 | $998,781 | $1,066,424 | $1,005,785 |

| 07/16 | $996,598 | $1,108,747 | $1,065,837 |

| 08/16 | $1,006,422 | $1,111,575 | $1,084,685 |

| 09/16 | $1,009,696 | $1,113,322 | $1,096,767 |

| 10/16 | $1,000,964 | $1,089,235 | $1,044,627 |

| 11/16 | $1,017,337 | $1,137,981 | $1,161,115 |

| 12/16 | $1,022,230 | $1,160,186 | $1,193,649 |

| 01/17 | $1,032,083 | $1,182,023 | $1,198,357 |

| 02/17 | $1,038,241 | $1,225,984 | $1,221,484 |

| 03/17 | $1,048,094 | $1,226,818 | $1,223,083 |

| 04/17 | $1,045,631 | $1,239,822 | $1,236,495 |

| 05/17 | $1,064,105 | $1,252,511 | $1,211,340 |

| 06/17 | $1,073,957 | $1,263,814 | $1,253,214 |

| 07/17 | $1,082,579 | $1,287,643 | $1,262,525 |

| 08/17 | $1,080,115 | $1,290,124 | $1,246,463 |

| 09/17 | $1,091,200 | $1,321,587 | $1,324,254 |

| 10/17 | $1,102,284 | $1,350,427 | $1,335,542 |

| 11/17 | $1,136,769 | $1,391,433 | $1,374,031 |

| 12/17 | $1,157,277 | $1,405,340 | $1,368,486 |

| 01/18 | $1,225,833 | $1,479,417 | $1,404,250 |

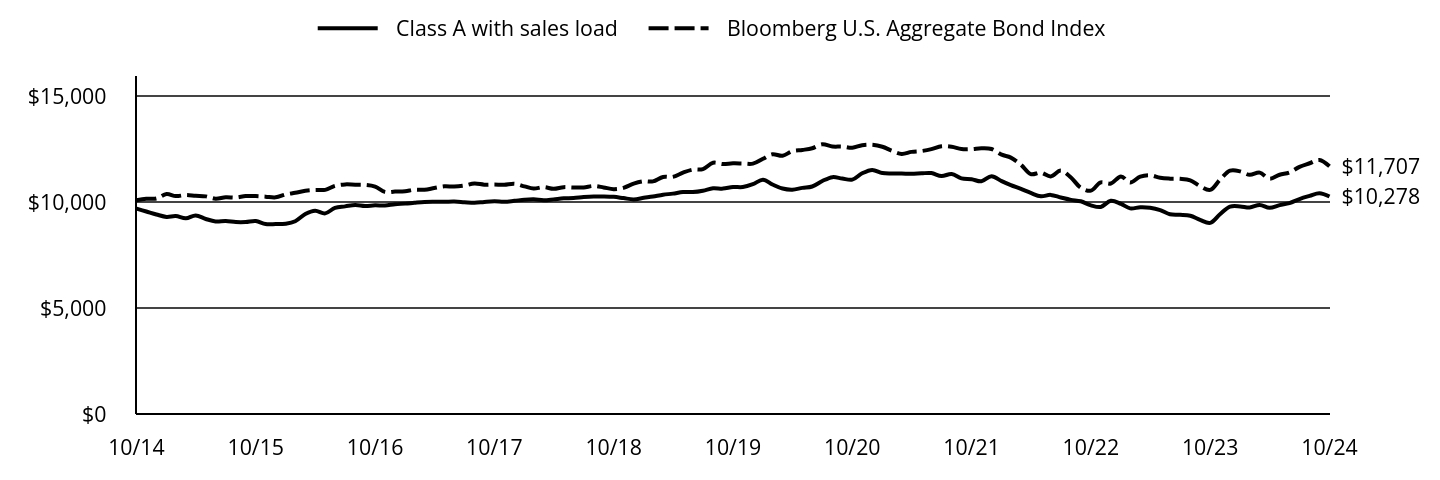

| 02/18 | $1,188,291 | $1,424,886 | $1,349,875 |

| 03/18 | $1,150,748 | $1,396,283 | $1,367,334 |

| 04/18 | $1,168,703 | $1,401,590 | $1,379,155 |

| 05/18 | $1,176,865 | $1,441,157 | $1,462,871 |

| 06/18 | $1,196,452 | $1,450,582 | $1,473,353 |

| 07/18 | $1,242,155 | $1,498,721 | $1,499,031 |

| 08/18 | $1,276,433 | $1,551,352 | $1,563,654 |

| 09/18 | $1,281,330 | $1,553,920 | $1,526,045 |

| 10/18 | $1,198,084 | $1,439,501 | $1,360,291 |

| 11/18 | $1,235,626 | $1,468,332 | $1,381,913 |

| 12/18 | $1,118,147 | $1,331,675 | $1,217,761 |

| 01/19 | $1,211,325 | $1,445,979 | $1,354,758 |

| 02/19 | $1,247,562 | $1,496,832 | $1,425,188 |

| 03/19 | $1,285,523 | $1,518,689 | $1,395,360 |

| 04/19 | $1,330,387 | $1,579,333 | $1,442,762 |

| 05/19 | $1,269,994 | $1,477,131 | $1,330,554 |

| 06/19 | $1,339,015 | $1,580,880 | $1,424,594 |

| 07/19 | $1,371,800 | $1,604,380 | $1,432,796 |

| 08/19 | $1,364,898 | $1,571,674 | $1,362,053 |

| 09/19 | $1,375,251 | $1,599,258 | $1,390,392 |

| 10/19 | $1,414,939 | $1,633,685 | $1,427,010 |

| 11/19 | $1,473,607 | $1,695,785 | $1,485,753 |

| 12/19 | $1,509,695 | $1,744,748 | $1,528,594 |

| 01/20 | $1,555,277 | $1,742,843 | $1,479,569 |

| 02/20 | $1,436,762 | $1,600,150 | $1,355,016 |

| 03/20 | $1,274,489 | $1,380,101 | $1,060,619 |

| 04/20 | $1,429,469 | $1,562,882 | $1,206,299 |

| 05/20 | $1,495,108 | $1,646,463 | $1,284,799 |

| 06/20 | $1,509,695 | $1,684,104 | $1,330,213 |

| 07/20 | $1,617,269 | $1,779,733 | $1,367,031 |

| 08/20 | $1,719,374 | $1,908,665 | $1,444,054 |

| 09/20 | $1,650,089 | $1,839,168 | $1,395,818 |

| 10/20 | $1,600,860 | $1,799,473 | $1,425,052 |

| 11/20 | $1,768,604 | $2,018,385 | $1,687,725 |

| 12/20 | $1,918,240 | $2,109,188 | $1,833,713 |

| 01/21 | $1,934,377 | $2,099,806 | $1,925,990 |

| 02/21 | $1,966,650 | $2,165,440 | $2,046,028 |

| 03/21 | $2,021,111 | $2,243,056 | $2,066,577 |

| 04/21 | $2,140,119 | $2,358,684 | $2,109,973 |

| 05/21 | $2,107,845 | $2,369,451 | $2,114,323 |

| 06/21 | $2,154,238 | $2,427,879 | $2,155,287 |

| 07/21 | $2,226,853 | $2,468,936 | $2,077,463 |

| 08/21 | $2,351,912 | $2,539,345 | $2,123,932 |

| 09/21 | $2,259,126 | $2,425,410 | $2,061,308 |

| 10/21 | $2,462,851 | $2,589,427 | $2,148,995 |

| 11/21 | $2,476,971 | $2,550,012 | $2,059,447 |

| 12/21 | $2,469,455 | $2,650,429 | $2,105,451 |

| 01/22 | $2,131,029 | $2,494,488 | $1,902,752 |

| 02/22 | $2,149,537 | $2,431,653 | $1,923,064 |

| 03/22 | $2,162,756 | $2,510,527 | $1,946,998 |

| 04/22 | $1,908,937 | $2,285,227 | $1,754,033 |

| 05/22 | $1,922,156 | $2,282,163 | $1,756,683 |

| 06/22 | $1,755,587 | $2,091,240 | $1,612,208 |

| 07/22 | $1,975,035 | $2,287,436 | $1,780,527 |

| 08/22 | $1,901,005 | $2,202,070 | $1,744,093 |

| 09/22 | $1,726,504 | $1,997,874 | $1,576,947 |

| 10/22 | $1,842,838 | $2,161,712 | $1,750,551 |

| 11/22 | $1,935,376 | $2,274,545 | $1,791,440 |

| 12/22 | $1,824,330 | $2,141,363 | $1,675,172 |

| 01/23 | $1,996,187 | $2,288,844 | $1,838,444 |

| 02/23 | $1,927,444 | $2,235,348 | $1,807,391 |

| 03/23 | $1,837,550 | $2,295,119 | $1,721,034 |

| 04/23 | $1,808,466 | $2,319,572 | $1,690,093 |

| 05/23 | $1,792,602 | $2,328,597 | $1,674,481 |

| 06/23 | $1,959,172 | $2,487,606 | $1,810,619 |

| 07/23 | $2,006,763 | $2,576,779 | $1,921,345 |

| 08/23 | $1,945,952 | $2,527,037 | $1,825,223 |

| 09/23 | $1,816,398 | $2,406,664 | $1,717,768 |

| 10/23 | $1,665,693 | $2,342,866 | $1,600,619 |

| 11/23 | $1,845,482 | $2,561,335 | $1,745,490 |

| 12/23 | $2,006,763 | $2,697,193 | $1,958,760 |

| 01/24 | $1,985,611 | $2,727,085 | $1,882,577 |

| 02/24 | $2,107,233 | $2,874,703 | $1,989,021 |

| 03/24 | $2,146,893 | $2,967,434 | $2,060,226 |

| 04/24 | $2,012,051 | $2,836,862 | $1,915,222 |

| 05/24 | $2,133,673 | $2,970,895 | $2,011,303 |

| 06/24 | $2,131,029 | $3,062,866 | $1,992,698 |

| 07/24 | $2,284,378 | $3,119,802 | $2,195,154 |

| 08/24 | $2,252,651 | $3,187,716 | $2,162,363 |

| 09/24 | $2,281,734 | $3,253,656 | $2,177,476 |

| 10/24 | $2,268,515 | $3,229,763 | $2,146,025 |

Average Annual Total Returns for the Period Ended October 31, 2024 (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 36.19% | 9.90% | 8.54% |

| Russell 3000 Index | 37.86% | 14.60% | 12.44% |

| Russell 2000 Index | 34.07% | 8.50% | 7.94% |

THE FUND'S PAST PERFORMANCE IS NOT A GOOD PREDICTOR OF THE FUND'S FUTURE PERFORMANCE.

Fund performance data shown above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the Russell 3000 Index effective as of February 29, 2024.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | $12,405,460 |

| Total Number of Portfolio Holdings | 39 |

| Portfolio Turnover Rate | 110% |

| Total Advisory Fees Paid | $0 |

abrdn Focused U.S. Small Cap Equity Fund

(GGUIX)

What did the Fund invest in?

The tables below show the investment makeup of the Fund as of October 31, 2024.

Sector Allocation (% of total net assets)

| Financials | 20.5% |

| Industrials | 17.3% |

| Health Care | 15.0% |

| Consumer Discretionary | 13.5% |

| Information Technology | 12.9% |

| Materials | 7.4% |

| Energy | 4.8% |

| Consumer Staples | 2.6% |

| Real Estate | 2.5% |

| Communication Services | 2.2% |

| Other | 1.3% |

Ten Largest Holdings (% of total net assets)

| Q2 Holdings, Inc. | 4.4% |

| Wintrust Financial Corp. | 3.9% |

| WSFS Financial Corp. | 3.8% |

| Corcept Therapeutics, Inc. | 3.5% |

| Brinker International, Inc. | 3.2% |

| Amicus Therapeutics, Inc. | 3.2% |

| Seacoast Banking Corp. of Florida | 3.1% |

| TMX Group Ltd. | 3.1% |

| Enpro, Inc. | 3.1% |

| Merit Medical Systems, Inc. | 3.1% |

Below is a summary of certain changes for the Fund since November 1, 2023. For more information, you may refer to the Fund's next prospectus, which we expect to be available by February 28, 2025 at abrdn.com/us/literature or upon request at 866-667-9231.

Effective February 29, 2024, the Fund changed its name from abrdn U.S. Sustainable Leaders Smaller Companies Fund to abrdn Focused U.S. Small Cap Equity Fund.

The Fund’s 80% policy changed from a policy where the Fund invests at least 80% of the value of its net assets, plus any borrowings for investment purposes, in equity securities issued by smaller U.S. companies to a policy where the Fund invests at least 80% of the value of its net assets, plus any borrowings for investment purposes, in equity securities issued by U.S. small-cap companies.

Focus Risk was added as a principal risk of the Fund and Sustainable Investing Risk was removed as a principal risk of the Fund.

Availability of Additional Information

You can find additional information, including the Fund's prospectus, financial information, fund holdings, and proxy voting information at abrdn.com/us/literature or call 866-667-9231. The QR code can be used to access the Fund's prospectus, financial information and holdings.

abrdn Focused U.S. Small Cap Equity Fund

(GGUIX)

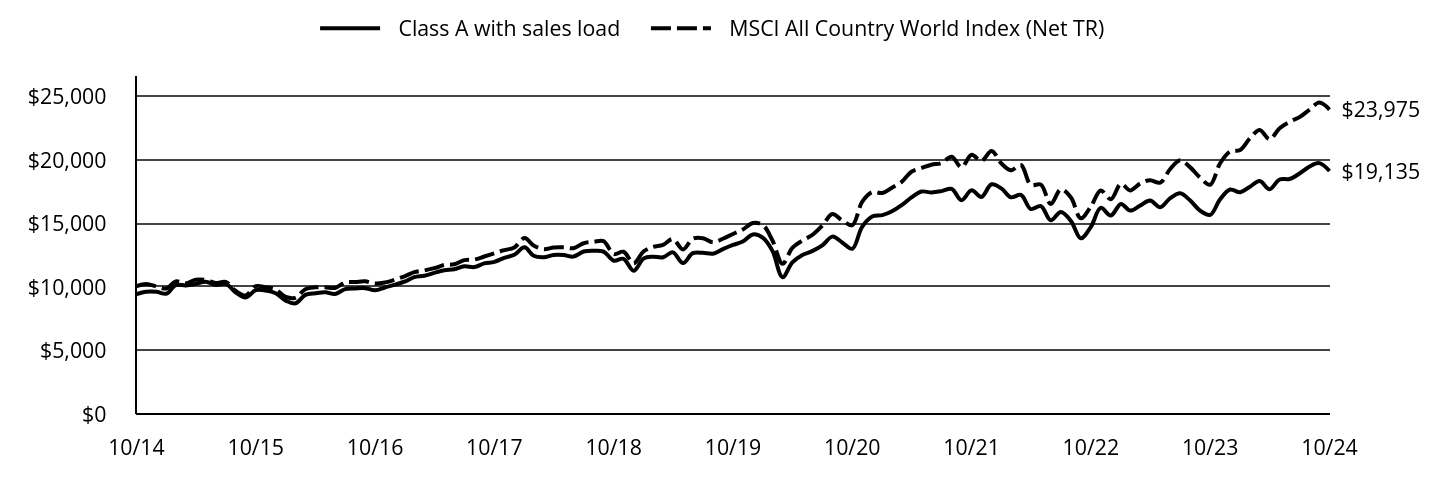

abrdn China A Share Equity Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the abrdn China A Share Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at abrdn.com/us/literature. You can also request this information by contacting us at 866-667-9231.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $141 | 1.38% |

How did the fund perform last year and what affected its performance?

The following discussion compares the performance of the Fund to the MSCI China A (Onshore) Index (Net TR) (the “Index”) to show how the Fund’s performance measures against the returns of similar investments for the reporting period.

What contributed to performance?

The Fund's holdings in select consumer names were key contributors, as policy support via “trade-in” programs for new energy vehicles, consumer appliances and electronics, and resilient overseas demand boosted Fuyao Glass and Midea Group. Both companies also delivered solid earnings results. In the industrials sector, Contemporary Amperex Technology rose sharply due to solid results, a low valuation and the anticipated vehicle trade-in programs. Similarly, Sungrow Power was also boosted by the September 2024 Chinese stimulus announcements. Among our financial holdings, Citic Securities was helped by an improving market backdrop, and China Merchants Bank rebounded on growing signs of a recovery in market sentiment.

What detracted from performance?

Weakness in our IT holdings was the largest detractor, amid a challenging domestic macro backdrop. Maxscend Microelectronics lagged after disappointing earnings, and we exited our position owing to softer guidance and persistent demand weakness. Hundsun Technologies and Glodon were weighed down by concerns over slowing IT spending, as local government financing remained under pressure. Elsewhere, private eyecare hospital chain Aier Eye Hospital remained weak following last year’s de-rating, driven by the market’s misaligned growth expectations. Yifeng Pharmacy lagged amid an unsettling sector-wide regulatory investigation into drug price transparency. Spirits producer Kweichow Moutai was impacted by weakness in the wholesale price of its premium products and slower growth in shipments.

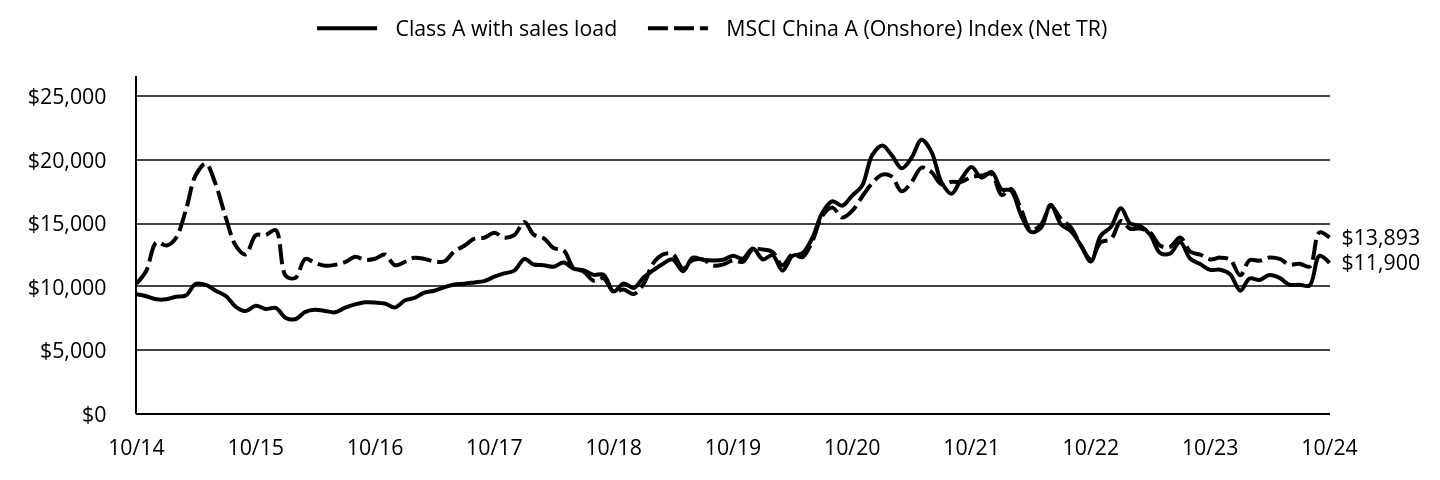

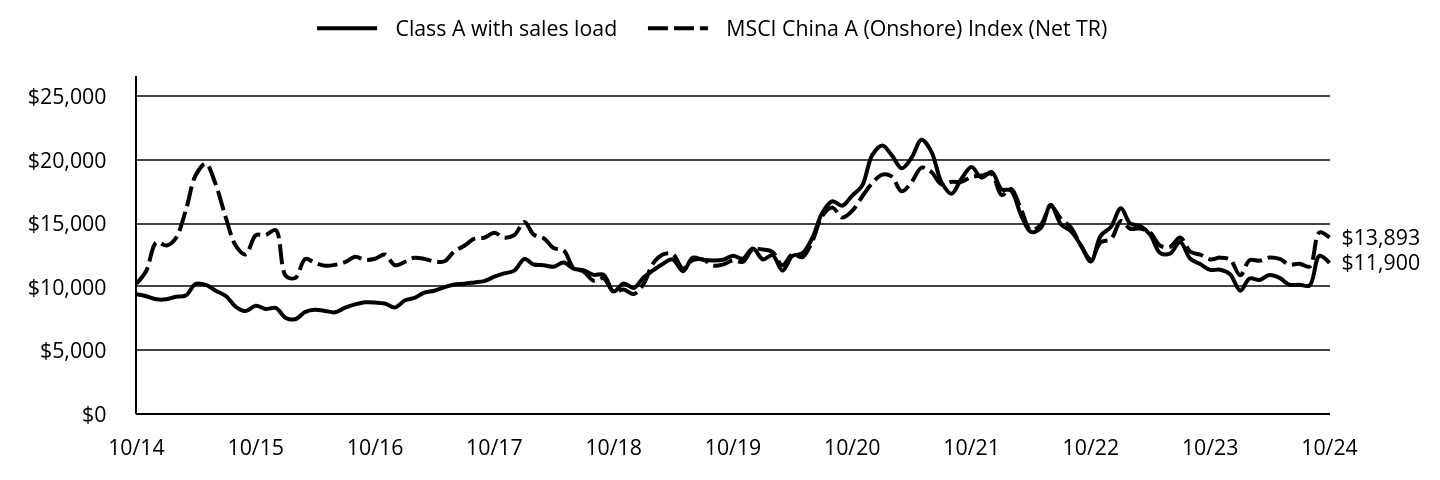

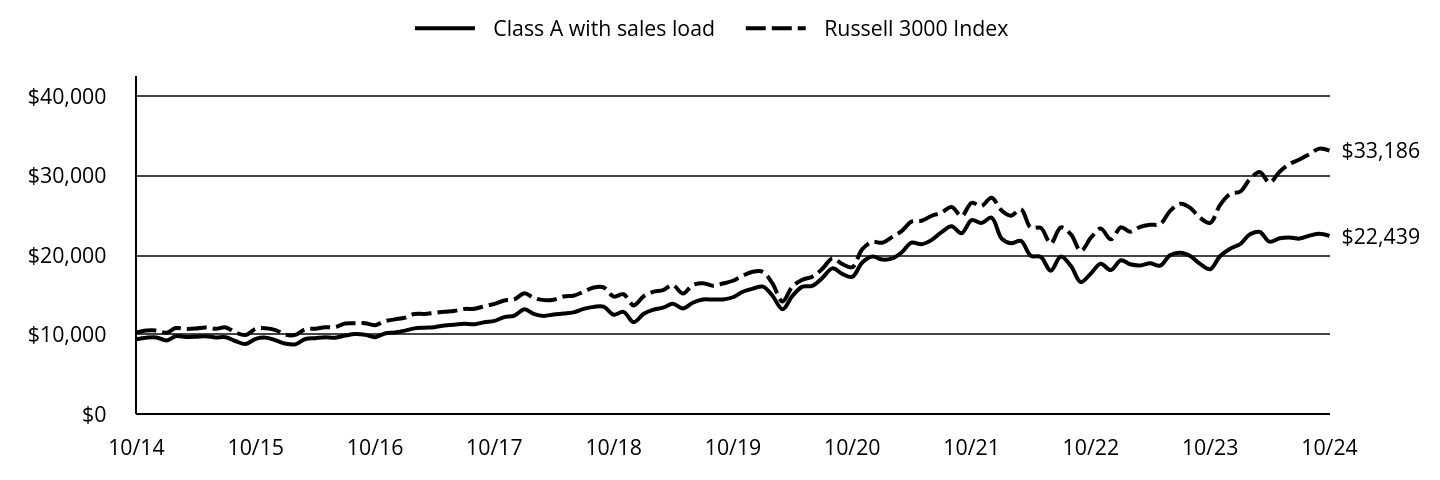

abrdn China A Share Equity Fund

(GOPAX)

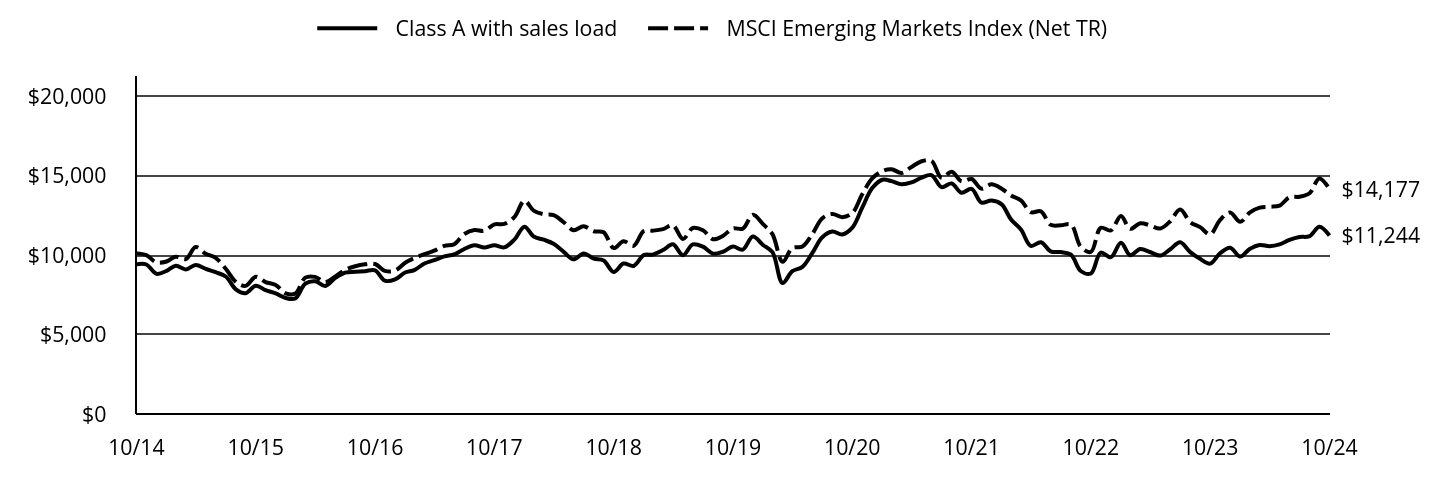

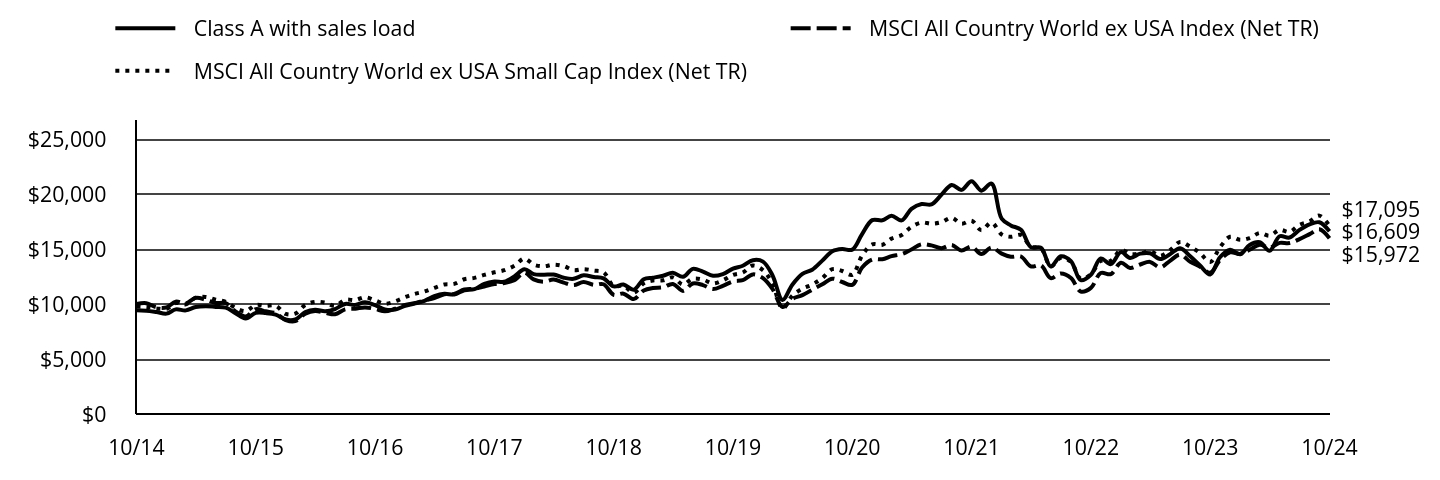

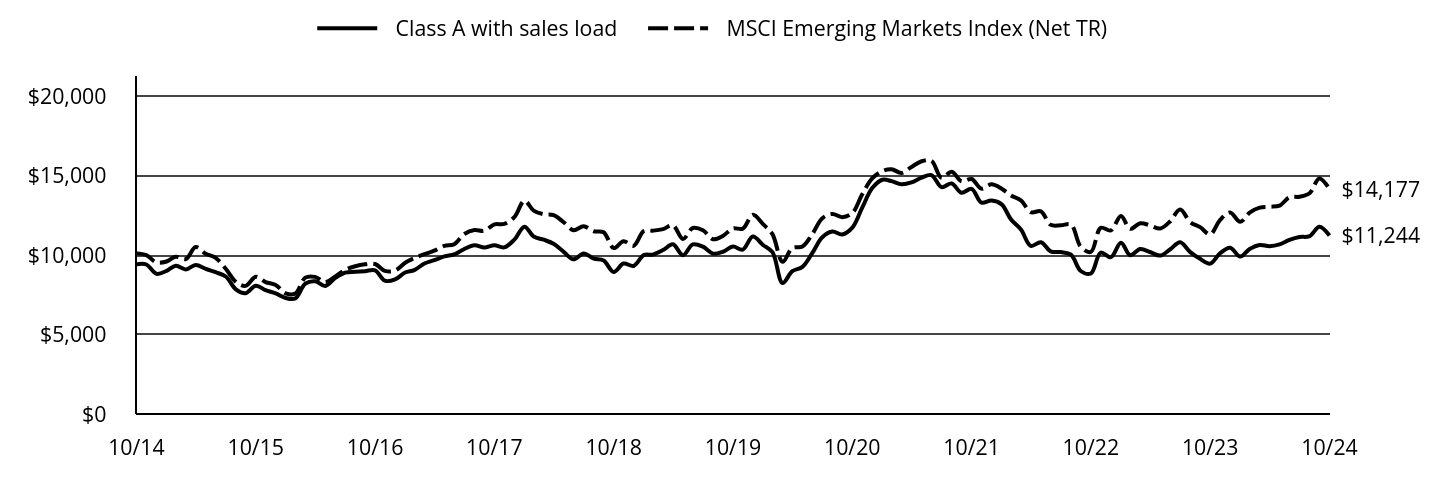

Total Return Based on $10,000 Investment

The following graph reflects a hypothetical $10,000 investment for the most recently completed 10 fiscal years as compared to a broad-based securities market index, which is also the performance benchmark.

| Class A with sales load | MSCI China A (Onshore) Index (Net TR) |

|---|

| 10/14 | $9,426 | $10,267 |

| 11/14 | $9,272 | $11,285 |

| 12/14 | $9,028 | $13,526 |

| 01/15 | $9,033 | $13,261 |

| 02/15 | $9,229 | $13,823 |

| 03/15 | $9,332 | $16,058 |

| 04/15 | $10,245 | $18,793 |

| 05/15 | $10,170 | $19,705 |

| 06/15 | $9,714 | $18,104 |

| 07/15 | $9,302 | $15,486 |

| 08/15 | $8,440 | $13,246 |

| 09/15 | $8,102 | $12,563 |

| 10/15 | $8,530 | $14,079 |

| 11/15 | $8,264 | $14,086 |

| 12/15 | $8,354 | $14,483 |

| 01/16 | $7,565 | $10,882 |

| 02/16 | $7,465 | $10,709 |

| 03/16 | $8,040 | $12,209 |

| 04/16 | $8,202 | $11,891 |

| 05/16 | $8,117 | $11,677 |

| 06/16 | $8,007 | $11,747 |

| 07/16 | $8,373 | $11,954 |

| 08/16 | $8,635 | $12,380 |

| 09/16 | $8,792 | $12,130 |

| 10/16 | $8,777 | $12,222 |

| 11/16 | $8,697 | $12,558 |

| 12/16 | $8,395 | $11,716 |

| 01/17 | $8,958 | $11,988 |

| 02/17 | $9,136 | $12,299 |

| 03/17 | $9,564 | $12,214 |

| 04/17 | $9,708 | $12,020 |

| 05/17 | $9,973 | $12,027 |

| 06/17 | $10,203 | $12,801 |

| 07/17 | $10,261 | $13,245 |

| 08/17 | $10,362 | $13,813 |

| 09/17 | $10,463 | $13,877 |

| 10/17 | $10,809 | $14,280 |

| 11/17 | $11,069 | $13,891 |

| 12/17 | $11,292 | $14,092 |

| 01/18 | $12,210 | $15,124 |

| 02/18 | $11,773 | $14,129 |

| 03/18 | $11,720 | $13,838 |

| 04/18 | $11,589 | $13,069 |

| 05/18 | $11,928 | $12,885 |

| 06/18 | $11,453 | $11,497 |

| 07/18 | $11,307 | $11,212 |

| 08/18 | $10,957 | $10,490 |

| 09/18 | $10,962 | $10,687 |

| 10/18 | $9,646 | $9,604 |

| 11/18 | $10,282 | $9,799 |

| 12/18 | $9,923 | $9,443 |

| 01/19 | $10,769 | $10,261 |

| 02/19 | $11,300 | $11,835 |

| 03/19 | $11,840 | $12,561 |

| 04/19 | $12,171 | $12,589 |

| 05/19 | $11,246 | $11,464 |

| 06/19 | $12,312 | $12,114 |

| 07/19 | $12,147 | $12,174 |

| 08/19 | $12,088 | $11,683 |

| 09/19 | $12,142 | $11,765 |

| 10/19 | $12,463 | $12,099 |

| 11/19 | $12,224 | $11,981 |

| 12/19 | $13,029 | $12,982 |

| 01/20 | $12,167 | $12,946 |

| 02/20 | $12,507 | $12,770 |

| 03/20 | $11,288 | $11,720 |

| 04/20 | $12,441 | $12,562 |

| 05/20 | $12,659 | $12,356 |

| 06/20 | $13,842 | $13,591 |

| 07/20 | $15,847 | $15,604 |

| 08/20 | $16,755 | $16,250 |

| 09/20 | $16,400 | $15,469 |

| 10/20 | $17,212 | $16,013 |

| 11/20 | $17,973 | $17,109 |

| 12/20 | $20,382 | $18,181 |

| 01/21 | $21,134 | $18,848 |

| 02/21 | $20,403 | $18,706 |

| 03/21 | $19,352 | $17,540 |

| 04/21 | $20,166 | $18,248 |

| 05/21 | $21,602 | $19,402 |

| 06/21 | $20,655 | $19,054 |

| 07/21 | $18,256 | $18,083 |

| 08/21 | $17,345 | $18,280 |

| 09/21 | $18,529 | $18,287 |

| 10/21 | $19,440 | $18,681 |

| 11/21 | $18,611 | $18,773 |

| 12/21 | $19,061 | $18,914 |

| 01/22 | $17,687 | $17,245 |

| 02/22 | $17,602 | $17,719 |

| 03/22 | $15,685 | $16,135 |

| 04/22 | $14,338 | $14,481 |

| 05/22 | $14,655 | $14,889 |

| 06/22 | $16,472 | $16,385 |

| 07/22 | $14,950 | $15,386 |

| 08/22 | $14,380 | $14,680 |

| 09/22 | $13,307 | $13,267 |

| 10/22 | $12,013 | $12,183 |

| 11/22 | $14,037 | $13,519 |

| 12/22 | $14,723 | $13,763 |

| 01/23 | $16,192 | $15,193 |

| 02/23 | $15,014 | $14,586 |

| 03/23 | $14,803 | $14,598 |

| 04/23 | $14,126 | $14,295 |

| 05/23 | $12,679 | $13,246 |

| 06/23 | $12,631 | $13,156 |

| 07/23 | $13,545 | $13,901 |

| 08/23 | $12,230 | $12,780 |

| 09/23 | $11,812 | $12,548 |

| 10/23 | $11,348 | $12,171 |

| 11/23 | $11,358 | $12,313 |

| 12/23 | $11,009 | $12,159 |

| 01/24 | $9,710 | $10,926 |

| 02/24 | $10,670 | $12,105 |

| 03/24 | $10,553 | $12,076 |

| 04/24 | $10,946 | $12,327 |

| 05/24 | $10,717 | $12,208 |

| 06/24 | $10,177 | $11,763 |

| 07/24 | $10,182 | $11,837 |

| 08/24 | $10,118 | $11,610 |

| 09/24 | $12,457 | $14,289 |

| 10/24 | $11,900 | $13,893 |

Average Annual Total Returns for the Period Ended October 31, 2024 (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A without sales load | 4.87% | (0.92%) | 2.36% |

| Class A with sales load - 5.75% | (1.16%) | (2.08%) | 1.75% |

| MSCI China A (Onshore) Index (Net TR) | 14.15% | 2.80% | 3.07% |

THE FUND'S PAST PERFORMANCE IS NOT A GOOD PREDICTOR OF THE FUND'S FUTURE PERFORMANCE.

Fund performance data shown above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | $19,502,737 |

| Total Number of Portfolio Holdings | 48 |

| Portfolio Turnover Rate | 61% |

| Total Advisory Fees Paid | $0 |

abrdn China A Share Equity Fund

(GOPAX)

What did the Fund invest in?

The tables below show the investment makeup of the Fund as of October 31, 2024.

Sector Allocation (% of total net assets)

| Industrials | 26.3% |

| Financials | 17.3% |

| Consumer Discretionary | 16.3% |

| Consumer Staples | 16.3% |

| Health Care | 6.7% |

| Information Technology | 5.9% |

| Exchange-Traded Funds | 3.9% |

| Utilities | 2.0% |

| Materials | 1.9% |

| Other | 3.4% |

Ten Largest Holdings (% of total net assets)

| Kweichow Moutai Co. Ltd., Class A | 7.8% |

| Contemporary Amperex Technology Co. Ltd., Class A | 7.3% |

| Fuyao Glass Industry Group Co. Ltd., Class A | 4.7% |

| China Merchants Bank Co. Ltd., Class A | 4.7% |

| KraneShares Bosera MSCI China A 50 Connect Index ETF | 3.9% |

| Midea Group Co. Ltd., Class A | 3.7% |

| Proya Cosmetics Co. Ltd., Class A | 3.7% |

| Sungrow Power Supply Co. Ltd., Class A | 3.6% |

| BYD Co. Ltd., Class A | 3.5% |

| Inner Mongolia Yili Industrial Group Co. Ltd., Class A | 3.1% |

Availability of Additional Information

You can find additional information, including the Fund's prospectus, financial information, fund holdings, and proxy voting information at abrdn.com/us/literature or call 866-667-9231. The QR code can be used to access the Fund's prospectus, financial information and holdings.

abrdn China A Share Equity Fund

(GOPAX)

abrdn China A Share Equity Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the abrdn China A Share Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at abrdn.com/us/literature. You can also request this information by contacting us at 866-667-9231.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| C | $204 | 2.00% |

How did the fund perform last year and what affected its performance?

The following discussion compares the performance of the Fund to the MSCI China A (Onshore) Index (Net TR) (the “Index”) to show how the Fund’s performance measures against the returns of similar investments for the reporting period.

What contributed to performance?

The Fund's holdings in select consumer names were key contributors, as policy support via “trade-in” programs for new energy vehicles, consumer appliances and electronics, and resilient overseas demand boosted Fuyao Glass and Midea Group. Both companies also delivered solid earnings results. In the industrials sector, Contemporary Amperex Technology rose sharply due to solid results, a low valuation and the anticipated vehicle trade-in programs. Similarly, Sungrow Power was also boosted by the September 2024 Chinese stimulus announcements. Among our financial holdings, Citic Securities was helped by an improving market backdrop, and China Merchants Bank rebounded on growing signs of a recovery in market sentiment.

What detracted from performance?

Weakness in our IT holdings was the largest detractor, amid a challenging domestic macro backdrop. Maxscend Microelectronics lagged after disappointing earnings, and we exited our position owing to softer guidance and persistent demand weakness. Hundsun Technologies and Glodon were weighed down by concerns over slowing IT spending, as local government financing remained under pressure. Elsewhere, private eyecare hospital chain Aier Eye Hospital remained weak following last year’s de-rating, driven by the market’s misaligned growth expectations. Yifeng Pharmacy lagged amid an unsettling sector-wide regulatory investigation into drug price transparency. Spirits producer Kweichow Moutai was impacted by weakness in the wholesale price of its premium products and slower growth in shipments.

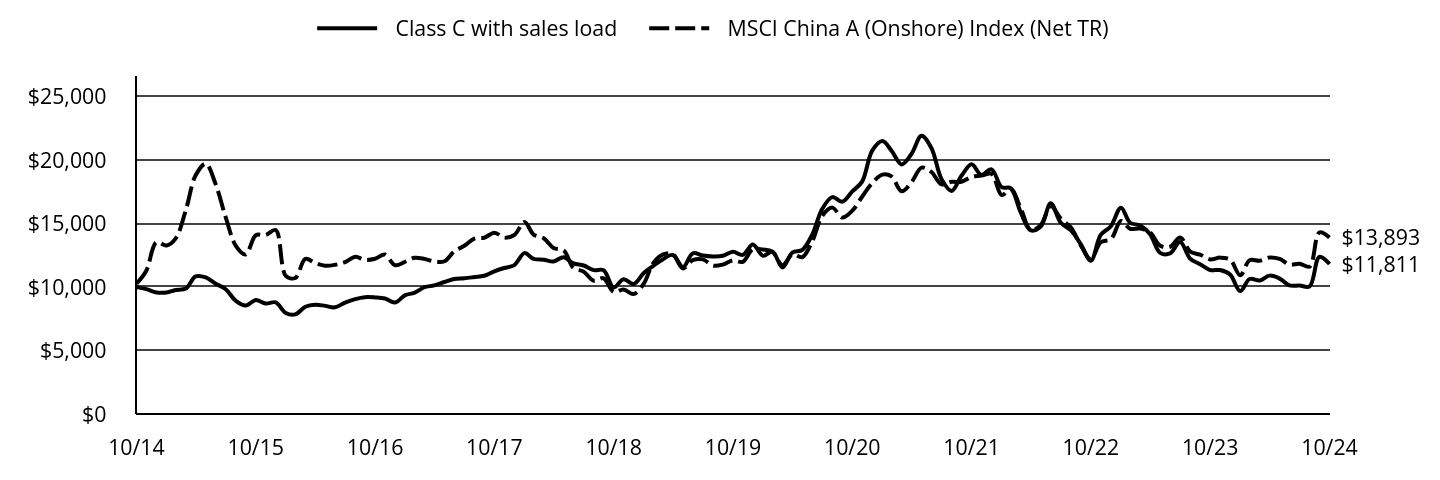

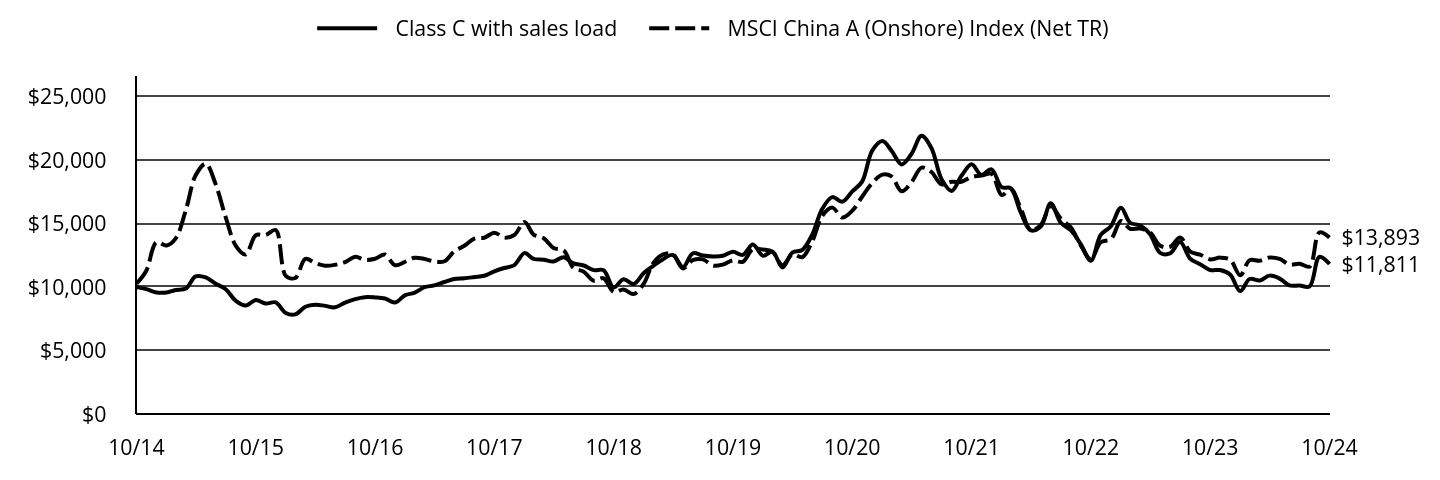

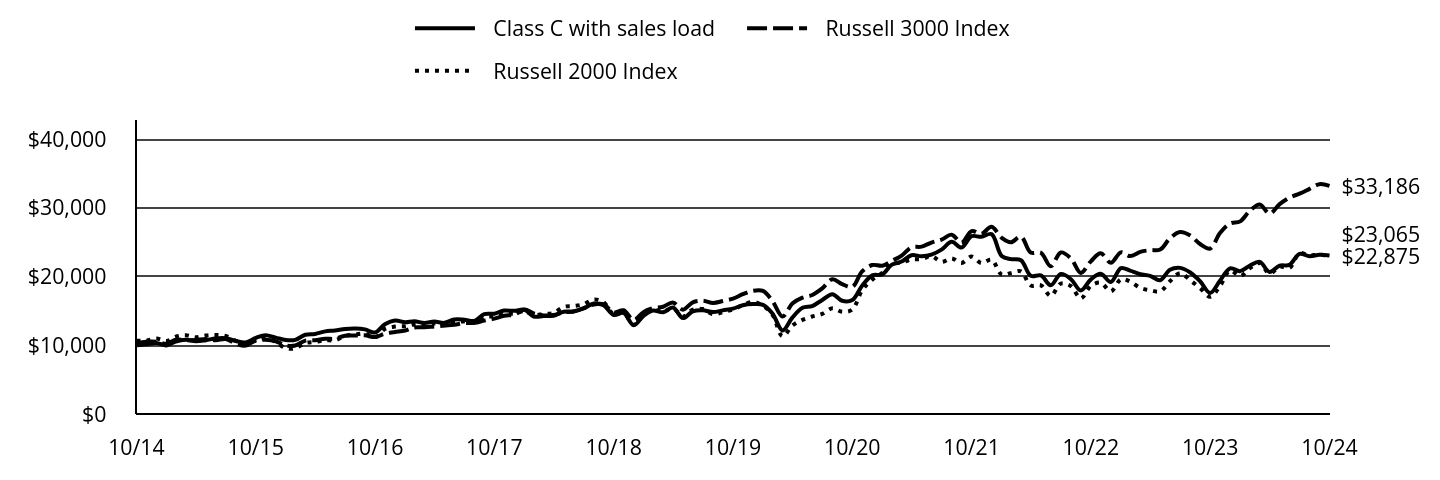

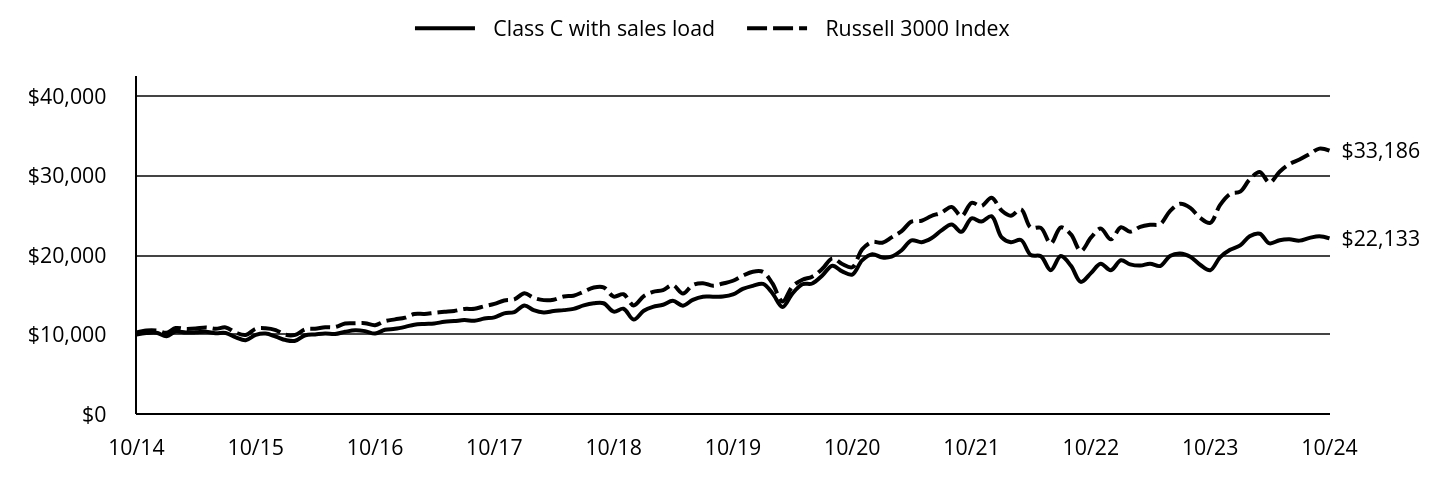

abrdn China A Share Equity Fund

(GOPCX)

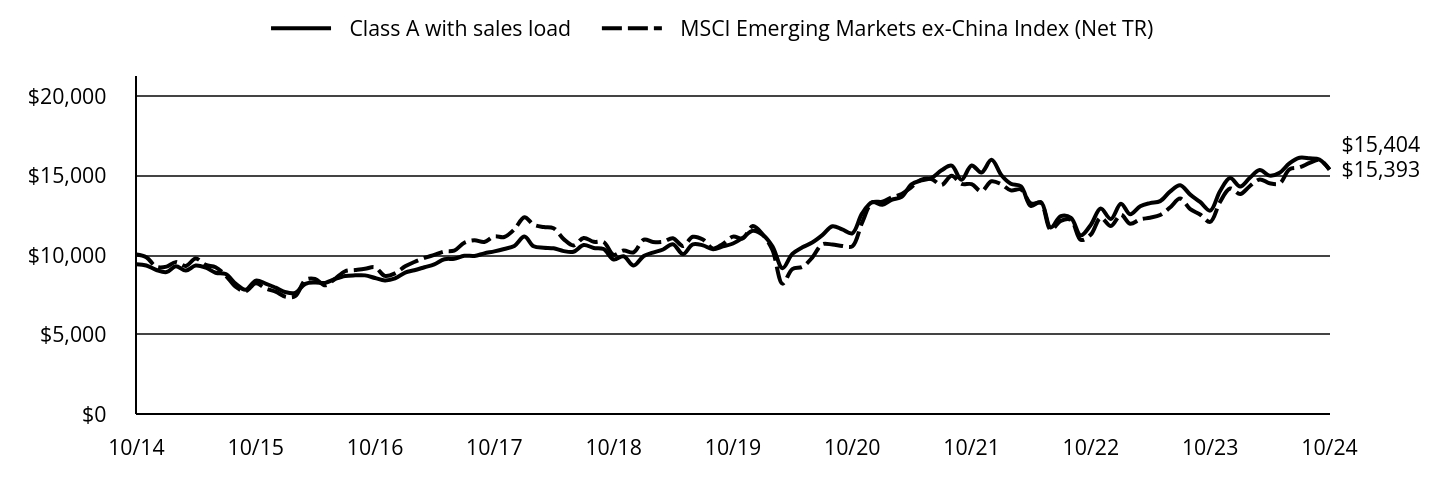

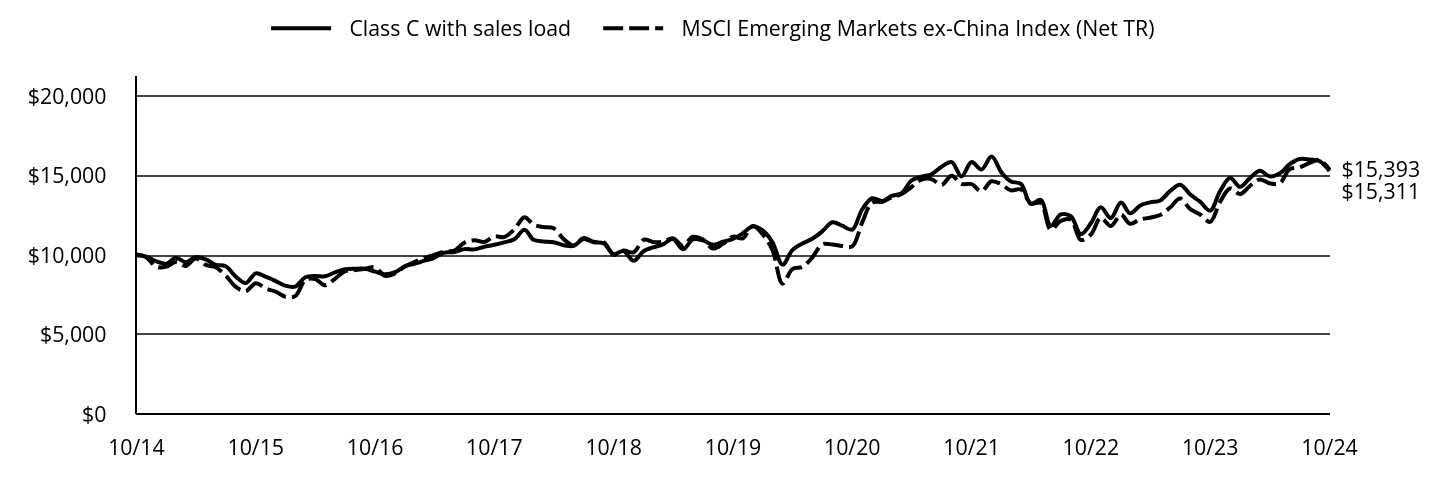

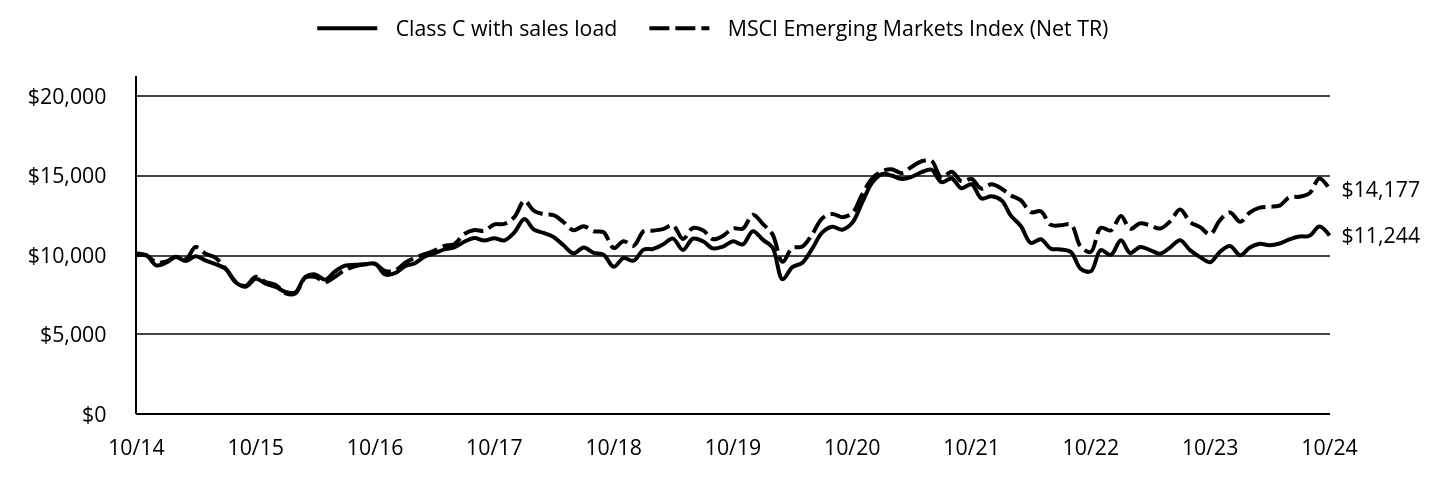

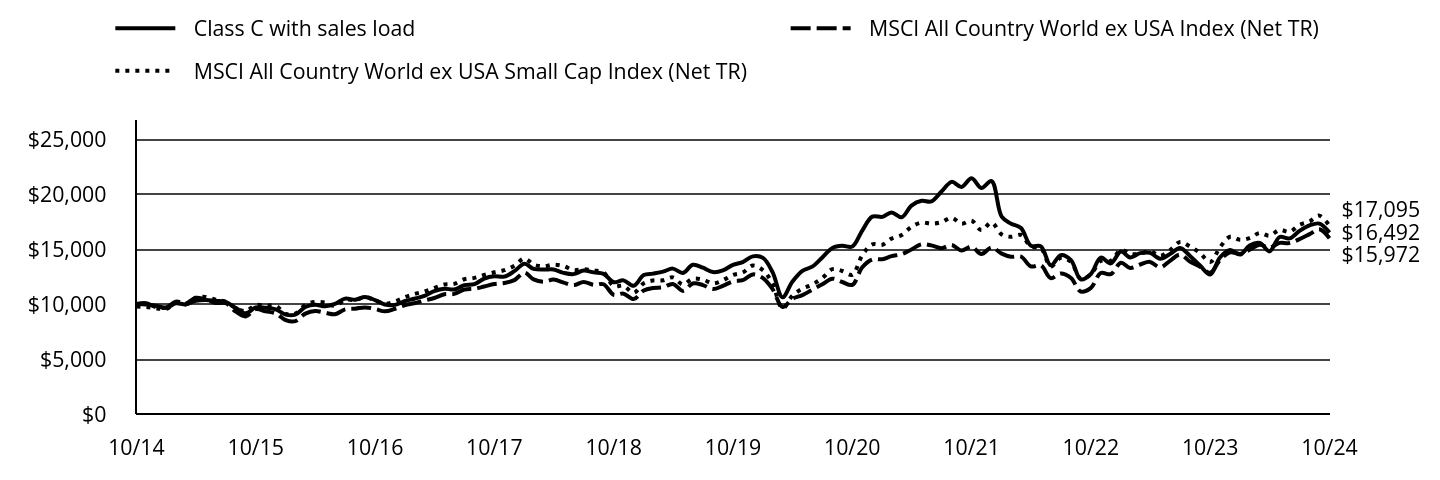

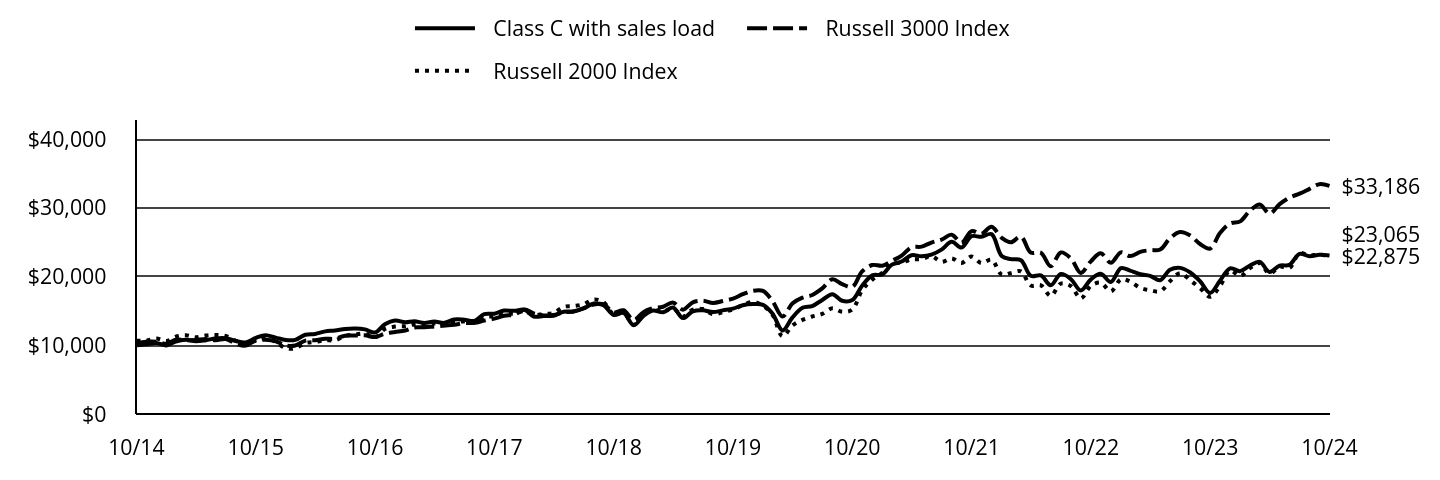

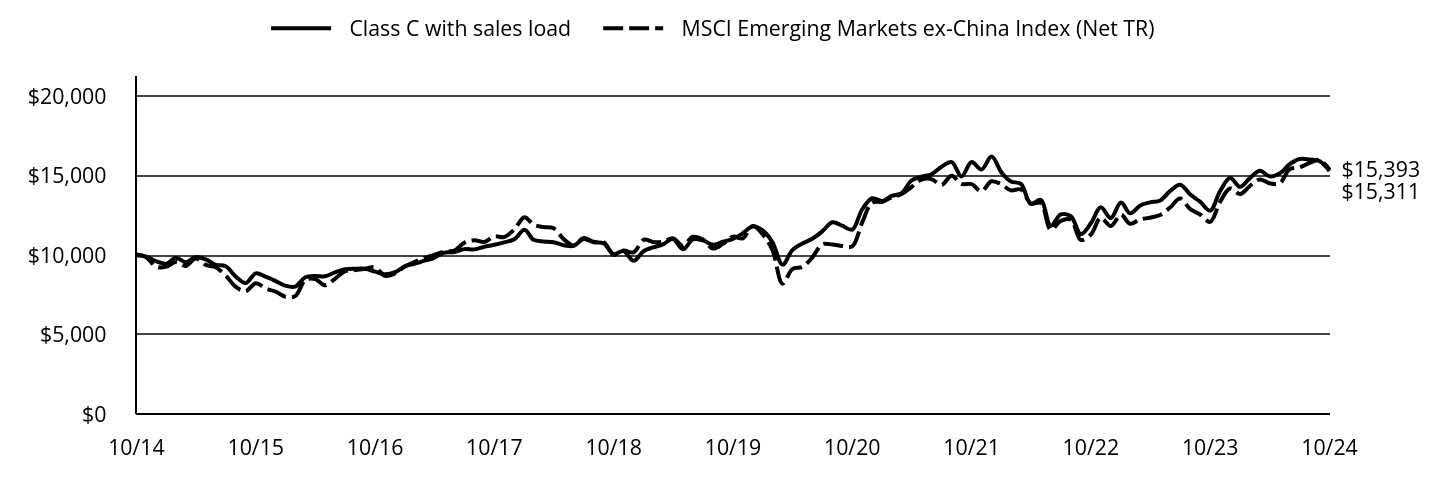

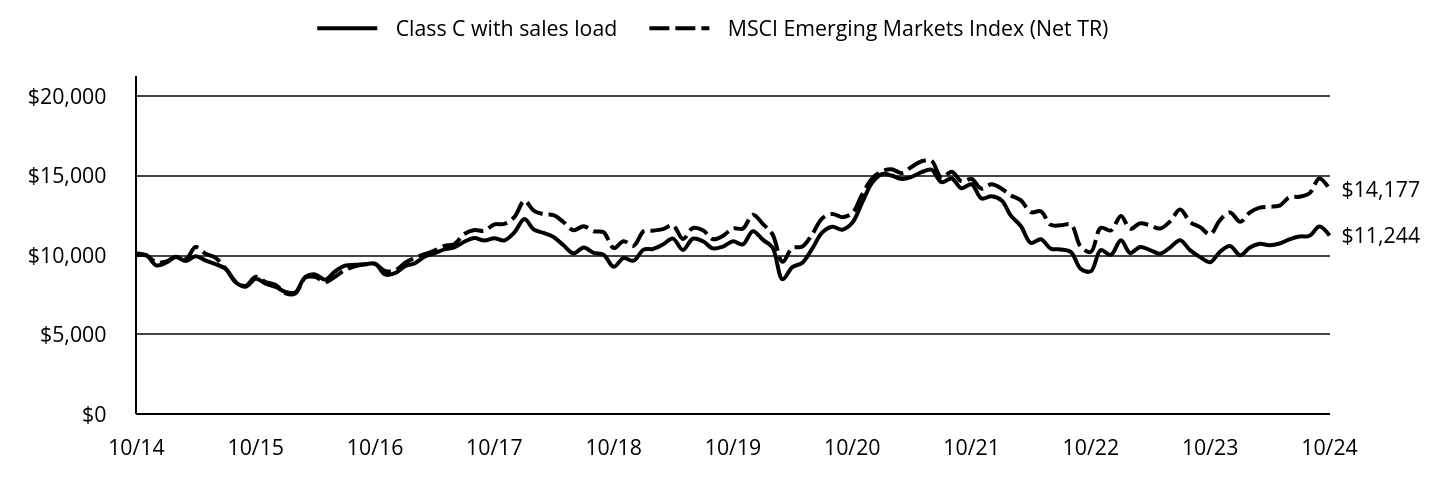

Total Return Based on $10,000 Investment

The following graph reflects a hypothetical $10,000 investment for the most recently completed 10 fiscal years as compared to a broad-based securities market index, which is also the performance benchmark.

| Class C with sales load | MSCI China A (Onshore) Index (Net TR) |

|---|

| 10/14 | $10,000 | $10,267 |

| 11/14 | $9,836 | $11,285 |

| 12/14 | $9,574 | $13,526 |

| 01/15 | $9,569 | $13,261 |

| 02/15 | $9,769 | $13,823 |

| 03/15 | $9,877 | $16,058 |

| 04/15 | $10,837 | $18,793 |

| 05/15 | $10,750 | $19,705 |

| 06/15 | $10,262 | $18,104 |

| 07/15 | $9,821 | $15,486 |

| 08/15 | $8,907 | $13,246 |

| 09/15 | $8,540 | $12,563 |

| 10/15 | $8,982 | $14,079 |

| 11/15 | $8,701 | $14,086 |

| 12/15 | $8,790 | $14,483 |

| 01/16 | $7,952 | $10,882 |

| 02/16 | $7,843 | $10,709 |

| 03/16 | $8,446 | $12,209 |

| 04/16 | $8,608 | $11,891 |

| 05/16 | $8,514 | $11,677 |

| 06/16 | $8,399 | $11,747 |

| 07/16 | $8,774 | $11,954 |

| 08/16 | $9,050 | $12,380 |

| 09/16 | $9,201 | $12,130 |

| 10/16 | $9,180 | $12,222 |

| 11/16 | $9,092 | $12,558 |

| 12/16 | $8,774 | $11,716 |

| 01/17 | $9,362 | $11,988 |

| 02/17 | $9,539 | $12,299 |

| 03/17 | $9,981 | $12,214 |

| 04/17 | $10,127 | $12,020 |

| 05/17 | $10,393 | $12,027 |

| 06/17 | $10,627 | $12,801 |

| 07/17 | $10,684 | $13,245 |

| 08/17 | $10,783 | $13,813 |

| 09/17 | $10,887 | $13,877 |

| 10/17 | $11,236 | $14,280 |

| 11/17 | $11,496 | $13,891 |

| 12/17 | $11,725 | $14,092 |

| 01/18 | $12,669 | $15,124 |

| 02/18 | $12,210 | $14,129 |

| 03/18 | $12,147 | $13,838 |

| 04/18 | $12,007 | $13,069 |

| 05/18 | $12,351 | $12,885 |

| 06/18 | $11,856 | $11,497 |

| 07/18 | $11,694 | $11,212 |

| 08/18 | $11,329 | $10,490 |

| 09/18 | $11,324 | $10,687 |

| 10/18 | $9,964 | $9,604 |

| 11/18 | $10,610 | $9,799 |

| 12/18 | $10,235 | $9,443 |

| 01/19 | $11,100 | $10,261 |

| 02/19 | $11,642 | $11,835 |

| 03/19 | $12,189 | $12,561 |

| 04/19 | $12,523 | $12,589 |

| 05/19 | $11,564 | $11,464 |

| 06/19 | $12,653 | $12,114 |

| 07/19 | $12,476 | $12,174 |

| 08/19 | $12,408 | $11,683 |

| 09/19 | $12,455 | $11,765 |

| 10/19 | $12,778 | $12,099 |

| 11/19 | $12,528 | $11,981 |

| 12/19 | $13,341 | $12,982 |

| 01/20 | $12,453 | $12,946 |

| 02/20 | $12,791 | $12,770 |

| 03/20 | $11,538 | $11,720 |

| 04/20 | $12,715 | $12,562 |

| 05/20 | $12,927 | $12,356 |

| 06/20 | $14,125 | $13,591 |

| 07/20 | $16,161 | $15,604 |

| 08/20 | $17,076 | $16,250 |

| 09/20 | $16,711 | $15,469 |

| 10/20 | $17,523 | $16,013 |

| 11/20 | $18,296 | $17,109 |

| 12/20 | $20,733 | $18,181 |

| 01/21 | $21,490 | $18,848 |

| 02/21 | $20,733 | $18,706 |

| 03/21 | $19,655 | $17,540 |

| 04/21 | $20,473 | $18,248 |

| 05/21 | $21,910 | $19,402 |

| 06/21 | $20,943 | $19,054 |

| 07/21 | $18,494 | $18,083 |

| 08/21 | $17,566 | $18,280 |

| 09/21 | $18,754 | $18,287 |

| 10/21 | $19,666 | $18,681 |

| 11/21 | $18,821 | $18,773 |

| 12/21 | $19,264 | $18,914 |

| 01/22 | $17,867 | $17,245 |

| 02/22 | $17,770 | $17,719 |

| 03/22 | $15,827 | $16,135 |

| 04/22 | $14,458 | $14,481 |

| 05/22 | $14,771 | $14,889 |

| 06/22 | $16,594 | $16,385 |

| 07/22 | $15,055 | $15,386 |

| 08/22 | $14,464 | $14,680 |

| 09/22 | $13,379 | $13,267 |

| 10/22 | $12,072 | $12,183 |

| 11/22 | $14,100 | $13,519 |

| 12/22 | $14,782 | $13,763 |

| 01/23 | $16,248 | $15,193 |

| 02/23 | $15,060 | $14,586 |

| 03/23 | $14,839 | $14,598 |

| 04/23 | $14,151 | $14,295 |

| 05/23 | $12,691 | $13,246 |

| 06/23 | $12,640 | $13,156 |

| 07/23 | $13,549 | $13,901 |

| 08/23 | $12,225 | $12,780 |

| 09/23 | $11,799 | $12,548 |

| 10/23 | $11,334 | $12,171 |

| 11/23 | $11,334 | $12,313 |

| 12/23 | $10,981 | $12,159 |

| 01/24 | $9,680 | $10,926 |

| 02/24 | $10,629 | $12,105 |

| 03/24 | $10,510 | $12,076 |

| 04/24 | $10,896 | $12,327 |

| 05/24 | $10,663 | $12,208 |

| 06/24 | $10,123 | $11,763 |

| 07/24 | $10,118 | $11,837 |

| 08/24 | $10,055 | $11,610 |

| 09/24 | $12,373 | $14,289 |

| 10/24 | $11,811 | $13,893 |

Average Annual Total Returns for the Period Ended October 31, 2024 (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class C without sales load | 4.21% | (1.56%) | 1.68% |

| Class C with sales load - 1.00% | 3.21% | (1.56%) | 1.68% |

| MSCI China A (Onshore) Index (Net TR) | 14.15% | 2.80% | 3.07% |

THE FUND'S PAST PERFORMANCE IS NOT A GOOD PREDICTOR OF THE FUND'S FUTURE PERFORMANCE.

Fund performance data shown above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | $19,502,737 |

| Total Number of Portfolio Holdings | 48 |

| Portfolio Turnover Rate | 61% |

| Total Advisory Fees Paid | $0 |

abrdn China A Share Equity Fund

(GOPCX)

What did the Fund invest in?

The tables below show the investment makeup of the Fund as of October 31, 2024.

Sector Allocation (% of total net assets)

| Industrials | 26.3% |

| Financials | 17.3% |

| Consumer Discretionary | 16.3% |

| Consumer Staples | 16.3% |

| Health Care | 6.7% |

| Information Technology | 5.9% |

| Exchange-Traded Funds | 3.9% |

| Utilities | 2.0% |

| Materials | 1.9% |

| Other | 3.4% |

Ten Largest Holdings (% of total net assets)

| Kweichow Moutai Co. Ltd., Class A | 7.8% |

| Contemporary Amperex Technology Co. Ltd., Class A | 7.3% |

| Fuyao Glass Industry Group Co. Ltd., Class A | 4.7% |

| China Merchants Bank Co. Ltd., Class A | 4.7% |

| KraneShares Bosera MSCI China A 50 Connect Index ETF | 3.9% |

| Midea Group Co. Ltd., Class A | 3.7% |

| Proya Cosmetics Co. Ltd., Class A | 3.7% |

| Sungrow Power Supply Co. Ltd., Class A | 3.6% |

| BYD Co. Ltd., Class A | 3.5% |

| Inner Mongolia Yili Industrial Group Co. Ltd., Class A | 3.1% |

Availability of Additional Information

You can find additional information, including the Fund's prospectus, financial information, fund holdings, and proxy voting information at abrdn.com/us/literature or call 866-667-9231. The QR code can be used to access the Fund's prospectus, financial information and holdings.

abrdn China A Share Equity Fund

(GOPCX)

abrdn China A Share Equity Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the abrdn China A Share Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at abrdn.com/us/literature. You can also request this information by contacting us at 866-667-9231.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R | $168 | 1.64% |

How did the fund perform last year and what affected its performance?

The following discussion compares the performance of the Fund to the MSCI China A (Onshore) Index (Net TR) (the “Index”) to show how the Fund’s performance measures against the returns of similar investments for the reporting period.

What contributed to performance?

The Fund's holdings in select consumer names were key contributors, as policy support via “trade-in” programs for new energy vehicles, consumer appliances and electronics, and resilient overseas demand boosted Fuyao Glass and Midea Group. Both companies also delivered solid earnings results. In the industrials sector, Contemporary Amperex Technology rose sharply due to solid results, a low valuation and the anticipated vehicle trade-in programs. Similarly, Sungrow Power was also boosted by the September 2024 Chinese stimulus announcements. Among our financial holdings, Citic Securities was helped by an improving market backdrop, and China Merchants Bank rebounded on growing signs of a recovery in market sentiment.

What detracted from performance?

Weakness in our IT holdings was the largest detractor, amid a challenging domestic macro backdrop. Maxscend Microelectronics lagged after disappointing earnings, and we exited our position owing to softer guidance and persistent demand weakness. Hundsun Technologies and Glodon were weighed down by concerns over slowing IT spending, as local government financing remained under pressure. Elsewhere, private eyecare hospital chain Aier Eye Hospital remained weak following last year’s de-rating, driven by the market’s misaligned growth expectations. Yifeng Pharmacy lagged amid an unsettling sector-wide regulatory investigation into drug price transparency. Spirits producer Kweichow Moutai was impacted by weakness in the wholesale price of its premium products and slower growth in shipments.

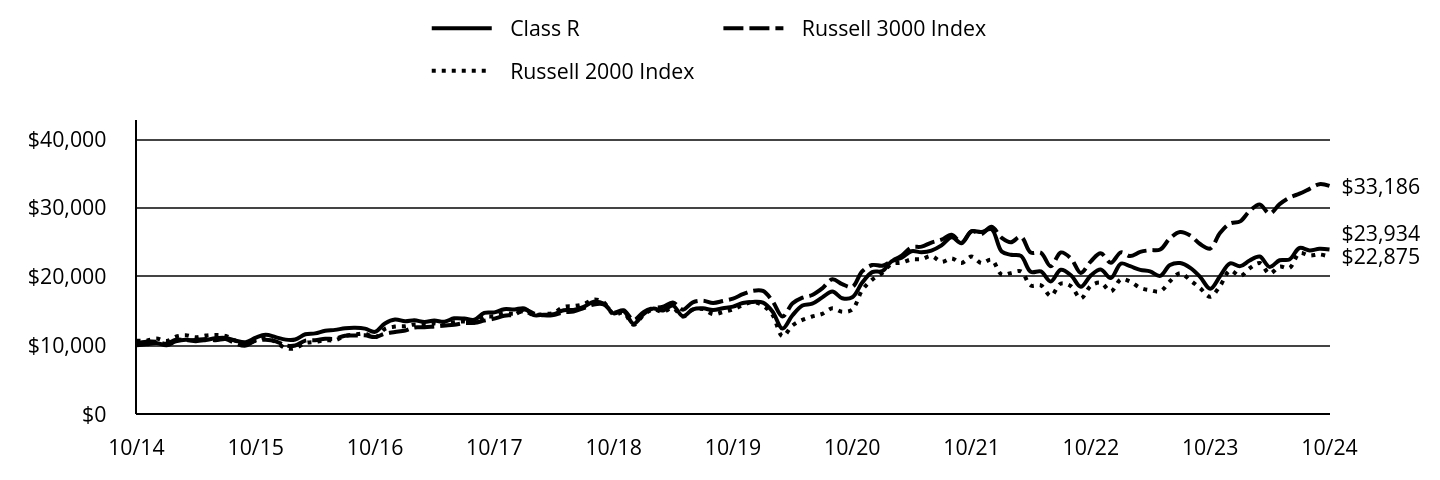

abrdn China A Share Equity Fund

(GOPRX)

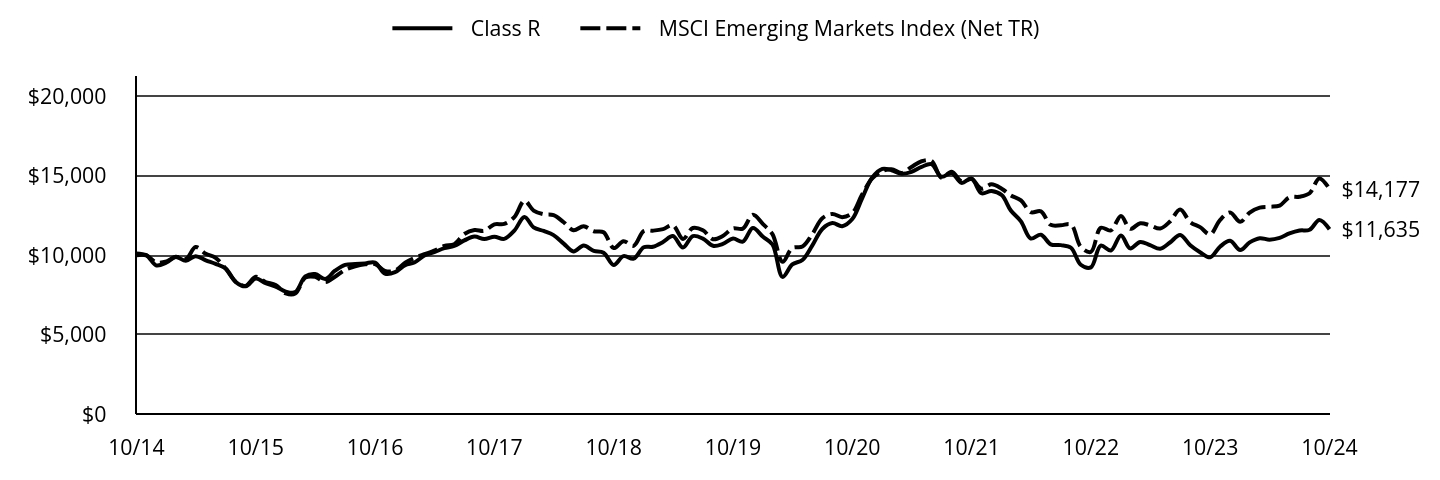

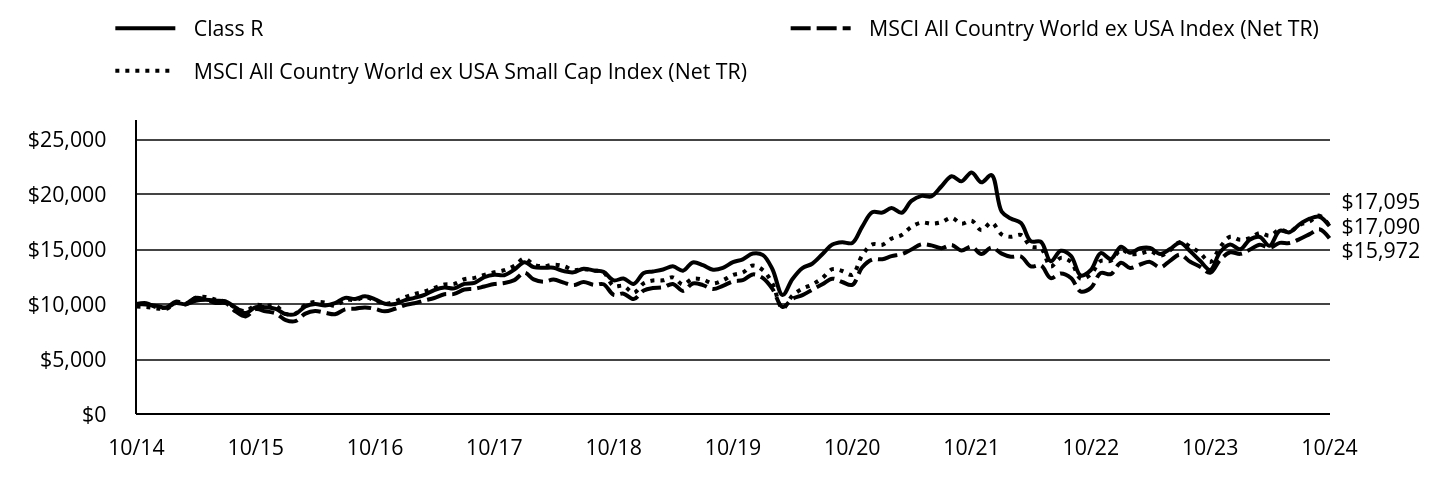

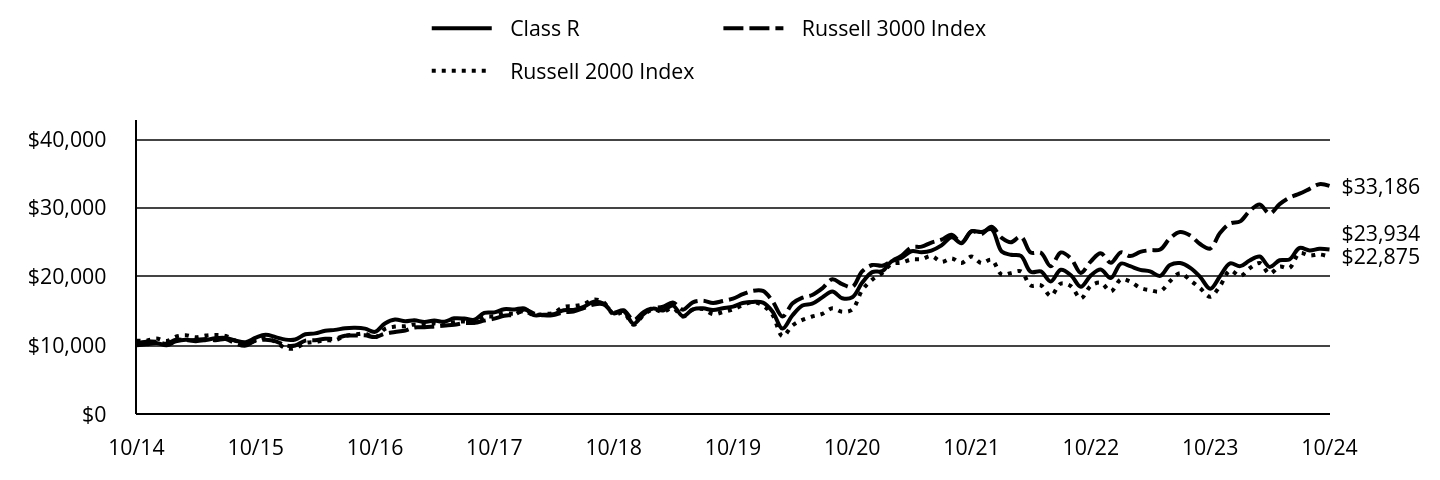

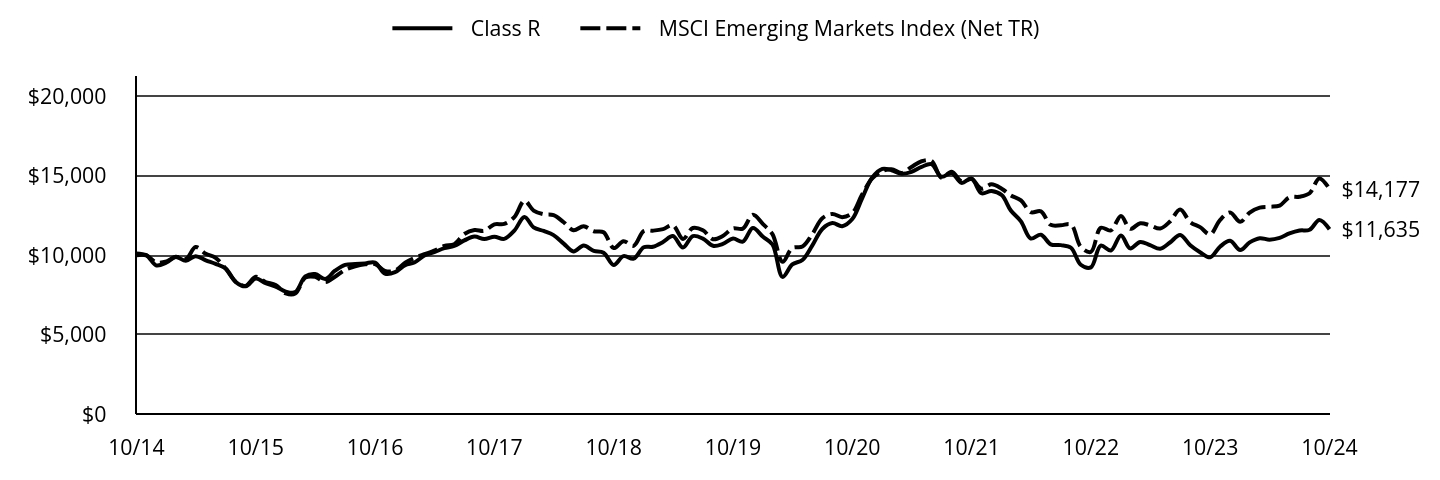

Total Return Based on $10,000 Investment

The following graph reflects a hypothetical $10,000 investment for the most recently completed 10 fiscal years as compared to a broad-based securities market index, which is also the performance benchmark.

| Class R | MSCI China A (Onshore) Index (Net TR) |

|---|

| 10/14 | $10,000 | $10,267 |

| 11/14 | $9,839 | $11,285 |

| 12/14 | $9,578 | $13,526 |

| 01/15 | $9,578 | $13,261 |

| 02/15 | $9,784 | $13,823 |

| 03/15 | $9,890 | $16,058 |

| 04/15 | $10,855 | $18,793 |

| 05/15 | $10,770 | $19,705 |

| 06/15 | $10,287 | $18,104 |

| 07/15 | $9,845 | $15,486 |

| 08/15 | $8,935 | $13,246 |

| 09/15 | $8,568 | $12,563 |

| 10/15 | $9,017 | $14,079 |

| 11/15 | $8,731 | $14,086 |

| 12/15 | $8,823 | $14,483 |

| 01/16 | $7,987 | $10,882 |

| 02/16 | $7,875 | $10,709 |

| 03/16 | $8,481 | $12,209 |

| 04/16 | $8,650 | $11,891 |

| 05/16 | $8,558 | $11,677 |

| 06/16 | $8,446 | $11,747 |

| 07/16 | $8,828 | $11,954 |

| 08/16 | $9,104 | $12,380 |

| 09/16 | $9,262 | $12,130 |

| 10/16 | $9,246 | $12,222 |

| 11/16 | $9,160 | $12,558 |

| 12/16 | $8,837 | $11,716 |

| 01/17 | $9,434 | $11,988 |

| 02/17 | $9,619 | $12,299 |

| 03/17 | $10,061 | $12,214 |

| 04/17 | $10,210 | $12,020 |

| 05/17 | $10,483 | $12,027 |

| 06/17 | $10,725 | $12,801 |

| 07/17 | $10,781 | $13,245 |

| 08/17 | $10,884 | $13,813 |

| 09/17 | $10,992 | $13,877 |

| 10/17 | $11,352 | $14,280 |

| 11/17 | $11,614 | $13,891 |

| 12/17 | $11,847 | $14,092 |

| 01/18 | $12,811 | $15,124 |

| 02/18 | $12,344 | $14,129 |

| 03/18 | $12,292 | $13,838 |

| 04/18 | $12,152 | $13,069 |

| 05/18 | $12,505 | $12,885 |

| 06/18 | $12,002 | $11,497 |

| 07/18 | $11,847 | $11,212 |

| 08/18 | $11,479 | $10,490 |

| 09/18 | $11,474 | $10,687 |

| 10/18 | $10,095 | $9,604 |

| 11/18 | $10,753 | $9,799 |

| 12/18 | $10,375 | $9,443 |

| 01/19 | $11,261 | $10,261 |

| 02/19 | $11,810 | $11,835 |

| 03/19 | $12,370 | $12,561 |

| 04/19 | $12,712 | $12,589 |

| 05/19 | $11,743 | $11,464 |

| 06/19 | $12,857 | $12,114 |

| 07/19 | $12,681 | $12,174 |

| 08/19 | $12,614 | $11,683 |

| 09/19 | $12,665 | $11,765 |

| 10/19 | $12,997 | $12,099 |

| 11/19 | $12,743 | $11,981 |

| 12/19 | $13,577 | $12,982 |

| 01/20 | $12,674 | $12,946 |

| 02/20 | $13,026 | $12,770 |

| 03/20 | $11,754 | $11,720 |

| 04/20 | $12,955 | $12,562 |

| 05/20 | $13,177 | $12,356 |

| 06/20 | $14,400 | $13,591 |

| 07/20 | $16,482 | $15,604 |

| 08/20 | $17,423 | $16,250 |

| 09/20 | $17,050 | $15,469 |

| 10/20 | $17,894 | $16,013 |

| 11/20 | $18,684 | $17,109 |

| 12/20 | $21,181 | $18,181 |

| 01/21 | $21,960 | $18,848 |

| 02/21 | $21,191 | $18,706 |

| 03/21 | $20,099 | $17,540 |

| 04/21 | $20,939 | $18,248 |

| 05/21 | $22,421 | $19,402 |

| 06/21 | $21,433 | $19,054 |

| 07/21 | $18,936 | $18,083 |

| 08/21 | $17,986 | $18,280 |

| 09/21 | $19,210 | $18,287 |

| 10/21 | $20,149 | $18,681 |

| 11/21 | $19,287 | $18,773 |

| 12/21 | $19,744 | $18,914 |

| 01/22 | $18,318 | $17,245 |

| 02/22 | $18,228 | $17,719 |

| 03/22 | $16,238 | $16,135 |

| 04/22 | $14,840 | $14,481 |

| 05/22 | $15,162 | $14,889 |

| 06/22 | $17,039 | $16,385 |

| 07/22 | $15,460 | $15,386 |

| 08/22 | $14,863 | $14,680 |

| 09/22 | $13,753 | $13,267 |

| 10/22 | $12,417 | $12,183 |

| 11/22 | $14,502 | $13,519 |

| 12/22 | $15,212 | $13,763 |

| 01/23 | $16,723 | $15,193 |

| 02/23 | $15,505 | $14,586 |

| 03/23 | $15,280 | $14,598 |

| 04/23 | $14,581 | $14,295 |

| 05/23 | $13,082 | $13,246 |

| 06/23 | $13,031 | $13,156 |

| 07/23 | $13,967 | $13,901 |

| 08/23 | $12,608 | $12,780 |

| 09/23 | $12,174 | $12,548 |

| 10/23 | $11,695 | $12,171 |

| 11/23 | $11,701 | $12,313 |

| 12/23 | $11,340 | $12,159 |

| 01/24 | $9,999 | $10,926 |

| 02/24 | $10,985 | $12,105 |

| 03/24 | $10,861 | $12,076 |

| 04/24 | $11,261 | $12,327 |

| 05/24 | $11,030 | $12,208 |

| 06/24 | $10,467 | $11,763 |

| 07/24 | $10,472 | $11,837 |

| 08/24 | $10,405 | $11,610 |

| 09/24 | $12,806 | $14,289 |

| 10/24 | $12,231 | $13,893 |

Average Annual Total Returns for the Period Ended October 31, 2024 (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class R | 4.58% | (1.21%) | 2.03% |

| MSCI China A (Onshore) Index (Net TR) | 14.15% | 2.80% | 3.07% |

THE FUND'S PAST PERFORMANCE IS NOT A GOOD PREDICTOR OF THE FUND'S FUTURE PERFORMANCE.

Fund performance data shown above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | $19,502,737 |

| Total Number of Portfolio Holdings | 48 |

| Portfolio Turnover Rate | 61% |

| Total Advisory Fees Paid | $0 |

abrdn China A Share Equity Fund

(GOPRX)

What did the Fund invest in?

The tables below show the investment makeup of the Fund as of October 31, 2024.

Sector Allocation (% of total net assets)

| Industrials | 26.3% |

| Financials | 17.3% |

| Consumer Discretionary | 16.3% |

| Consumer Staples | 16.3% |

| Health Care | 6.7% |

| Information Technology | 5.9% |

| Exchange-Traded Funds | 3.9% |

| Utilities | 2.0% |

| Materials | 1.9% |

| Other | 3.4% |

Ten Largest Holdings (% of total net assets)

| Kweichow Moutai Co. Ltd., Class A | 7.8% |

| Contemporary Amperex Technology Co. Ltd., Class A | 7.3% |

| Fuyao Glass Industry Group Co. Ltd., Class A | 4.7% |

| China Merchants Bank Co. Ltd., Class A | 4.7% |

| KraneShares Bosera MSCI China A 50 Connect Index ETF | 3.9% |

| Midea Group Co. Ltd., Class A | 3.7% |

| Proya Cosmetics Co. Ltd., Class A | 3.7% |

| Sungrow Power Supply Co. Ltd., Class A | 3.6% |

| BYD Co. Ltd., Class A | 3.5% |

| Inner Mongolia Yili Industrial Group Co. Ltd., Class A | 3.1% |

Availability of Additional Information

You can find additional information, including the Fund's prospectus, financial information, fund holdings, and proxy voting information at abrdn.com/us/literature or call 866-667-9231. The QR code can be used to access the Fund's prospectus, financial information and holdings.

abrdn China A Share Equity Fund

(GOPRX)

abrdn China A Share Equity Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the abrdn China A Share Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at abrdn.com/us/literature. You can also request this information by contacting us at 866-667-9231.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $103 | 1.00% |

How did the fund perform last year and what affected its performance?

The following discussion compares the performance of the Fund to the MSCI China A (Onshore) Index (Net TR) (the “Index”) to show how the Fund’s performance measures against the returns of similar investments for the reporting period.

What contributed to performance?

The Fund's holdings in select consumer names were key contributors, as policy support via “trade-in” programs for new energy vehicles, consumer appliances and electronics, and resilient overseas demand boosted Fuyao Glass and Midea Group. Both companies also delivered solid earnings results. In the industrials sector, Contemporary Amperex Technology rose sharply due to solid results, a low valuation and the anticipated vehicle trade-in programs. Similarly, Sungrow Power was also boosted by the September 2024 Chinese stimulus announcements. Among our financial holdings, Citic Securities was helped by an improving market backdrop, and China Merchants Bank rebounded on growing signs of a recovery in market sentiment.

What detracted from performance?

Weakness in our IT holdings was the largest detractor, amid a challenging domestic macro backdrop. Maxscend Microelectronics lagged after disappointing earnings, and we exited our position owing to softer guidance and persistent demand weakness. Hundsun Technologies and Glodon were weighed down by concerns over slowing IT spending, as local government financing remained under pressure. Elsewhere, private eyecare hospital chain Aier Eye Hospital remained weak following last year’s de-rating, driven by the market’s misaligned growth expectations. Yifeng Pharmacy lagged amid an unsettling sector-wide regulatory investigation into drug price transparency. Spirits producer Kweichow Moutai was impacted by weakness in the wholesale price of its premium products and slower growth in shipments.

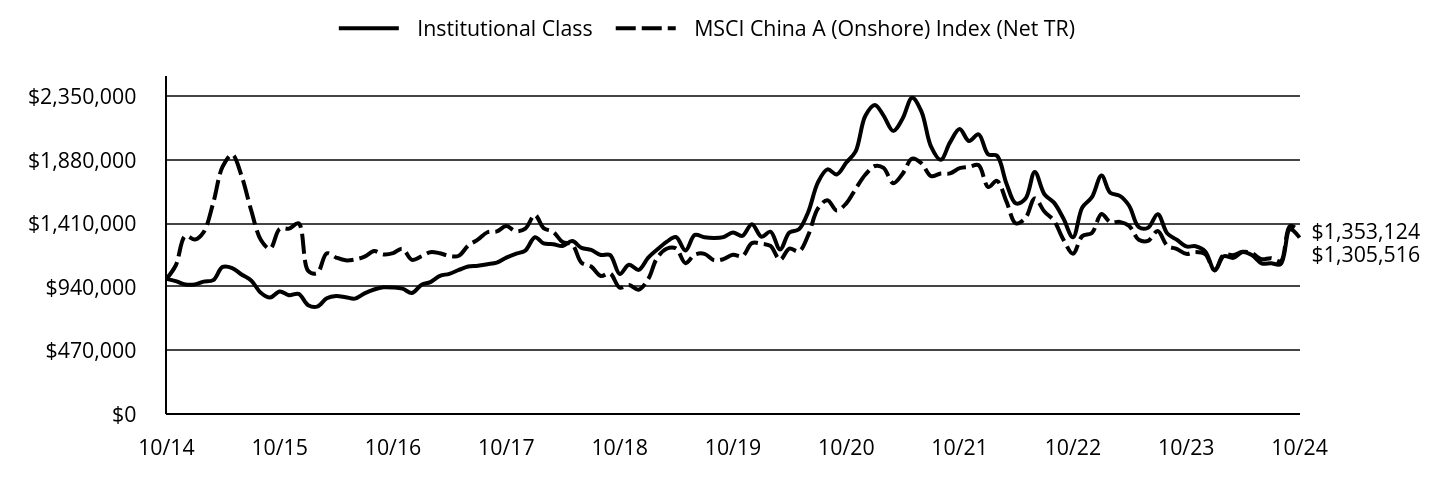

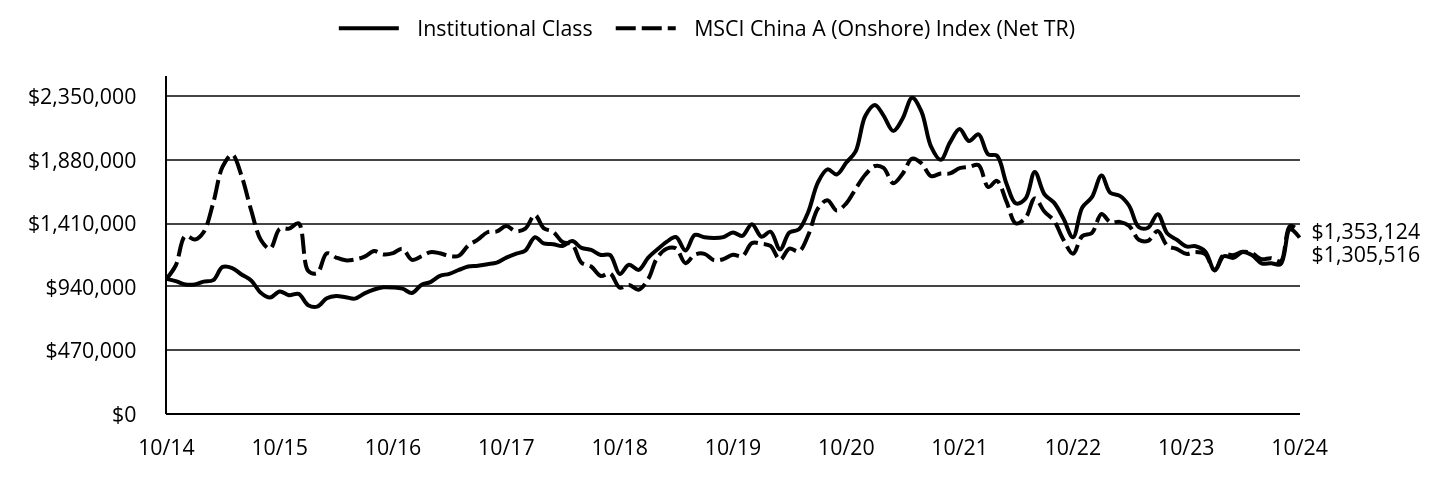

abrdn China A Share Equity Fund

(GOPIX)

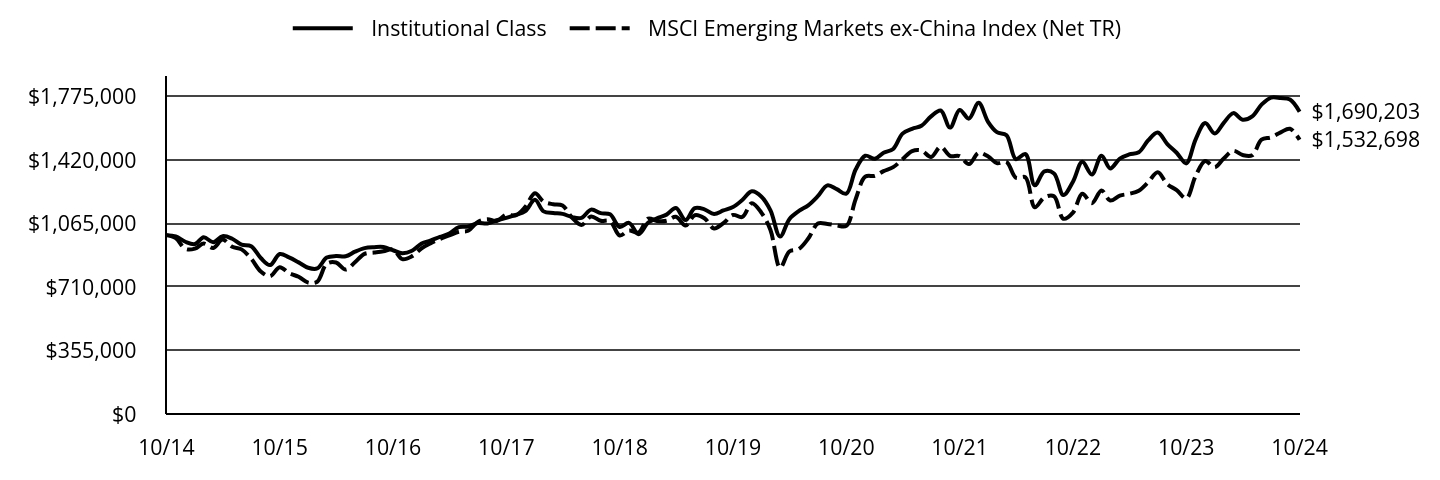

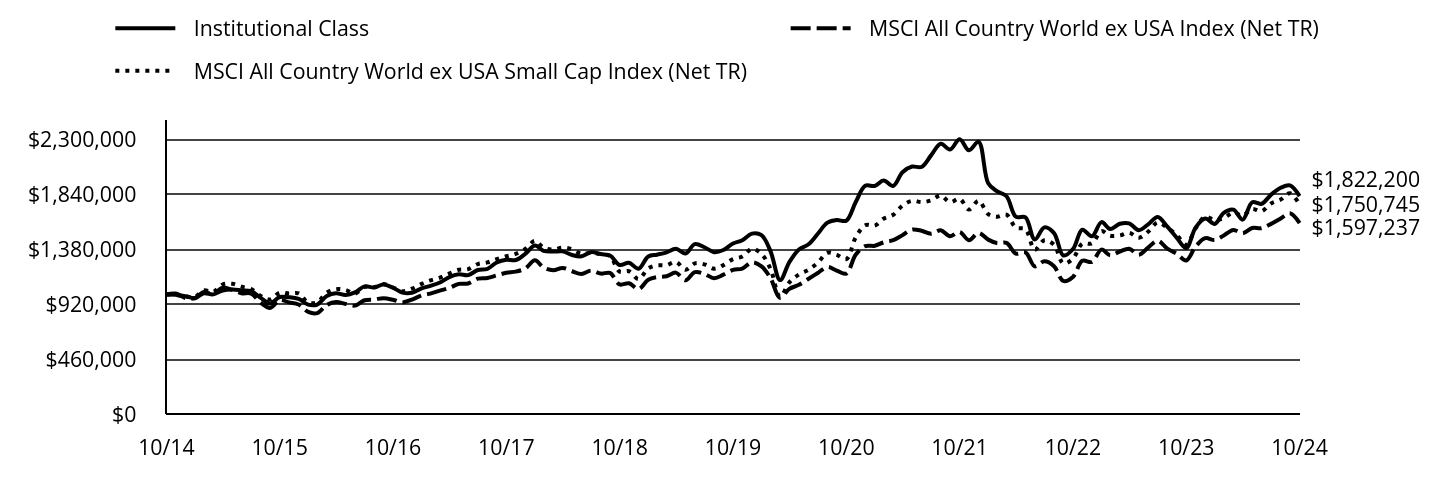

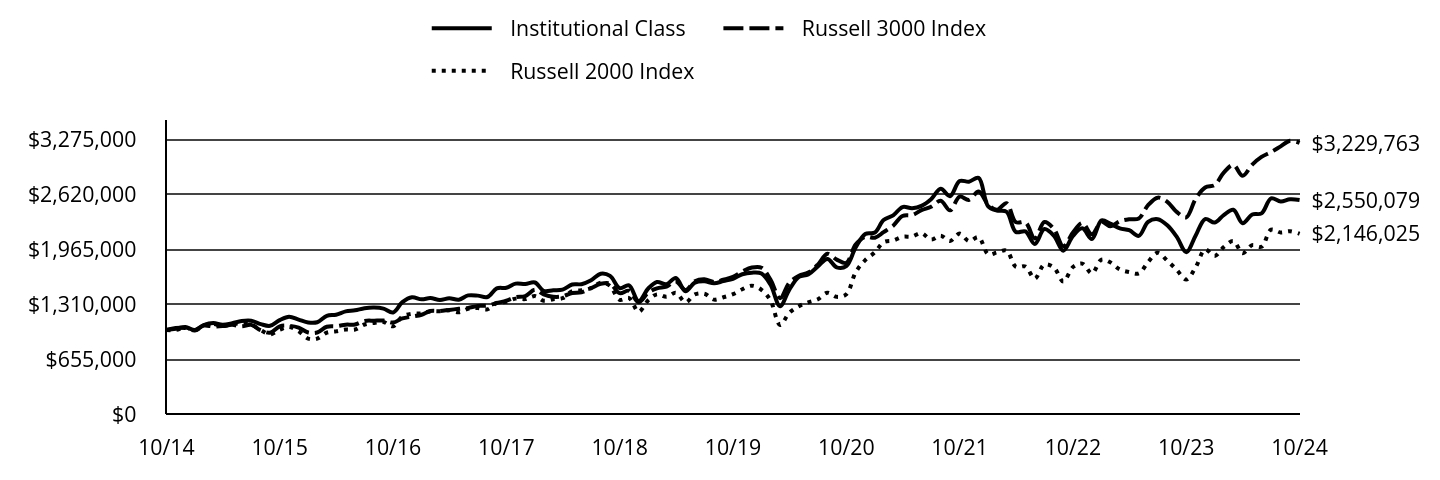

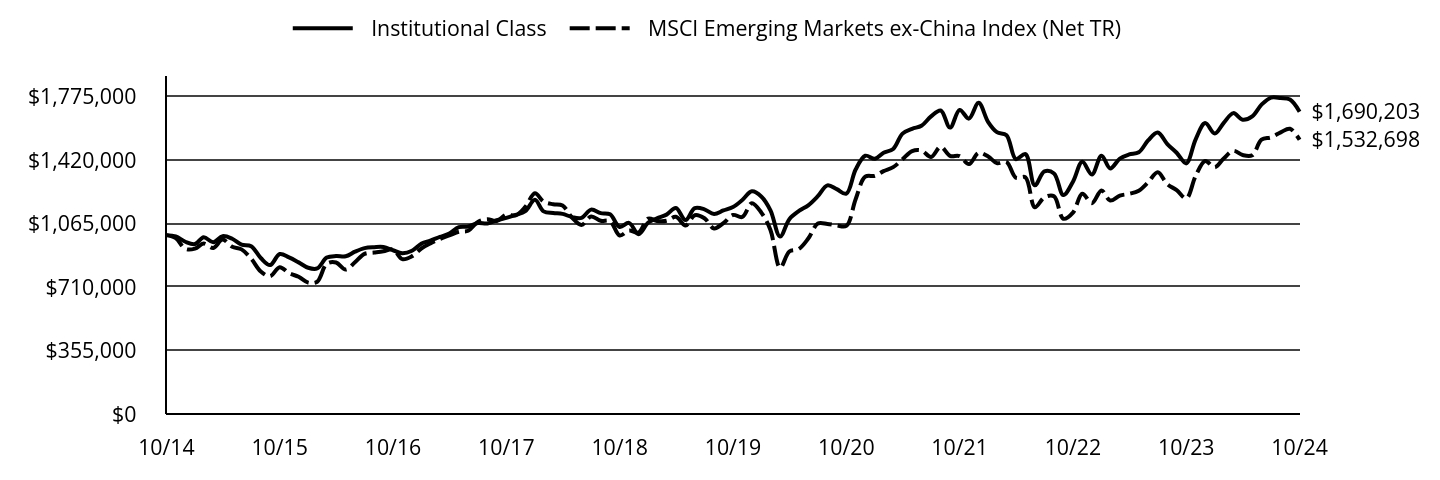

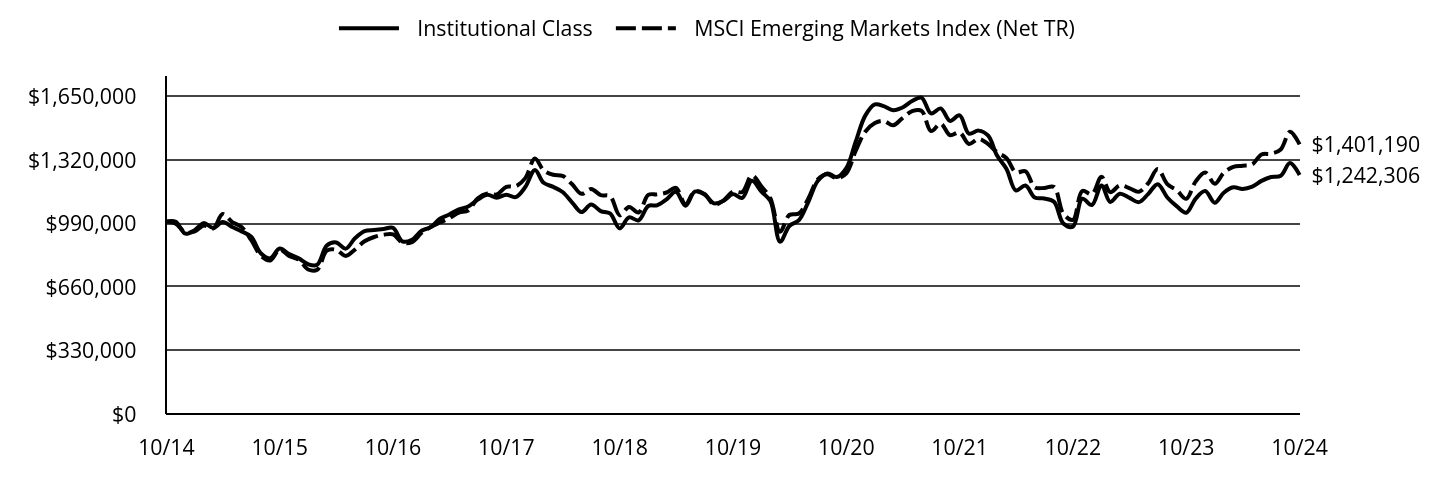

Total Return Based on $1,000,000 Investment

The following graph reflects a hypothetical $1,000,000 investment for the most recently completed 10 fiscal years as compared to a broad-based securities market index, which is also the performance benchmark.

| Institutional Class | MSCI China A (Onshore) Index (Net TR) |

|---|

| 10/14 | $1,000,000 | $1,000,000 |

| 11/14 | $983,728 | $1,099,072 |

| 12/14 | $958,476 | $1,317,317 |

| 01/15 | $958,970 | $1,291,529 |

| 02/15 | $979,732 | $1,346,276 |

| 03/15 | $991,101 | $1,563,929 |

| 04/15 | $1,088,481 | $1,830,386 |

| 05/15 | $1,080,572 | $1,919,169 |

| 06/15 | $1,032,487 | $1,763,219 |

| 07/15 | $988,826 | $1,508,250 |

| 08/15 | $897,535 | $1,290,124 |

| 09/15 | $861,910 | $1,223,543 |

| 10/15 | $907,273 | $1,371,212 |

| 11/15 | $879,047 | $1,371,888 |

| 12/15 | $889,128 | $1,410,541 |

| 01/16 | $804,953 | $1,059,859 |

| 02/16 | $794,368 | $1,043,028 |

| 03/16 | $856,365 | $1,189,068 |

| 04/16 | $873,503 | $1,158,156 |

| 05/16 | $864,430 | $1,137,283 |

| 06/16 | $853,845 | $1,144,134 |

| 07/16 | $892,656 | $1,164,284 |

| 08/16 | $921,387 | $1,205,761 |

| 09/16 | $937,516 | $1,181,374 |

| 10/16 | $936,508 | $1,190,371 |

| 11/16 | $927,939 | $1,223,098 |

| 12/16 | $896,019 | $1,141,056 |

| 01/17 | $956,844 | $1,167,529 |

| 02/17 | $976,267 | $1,197,845 |

| 03/17 | $1,022,269 | $1,189,543 |

| 04/17 | $1,037,603 | $1,170,673 |

| 05/17 | $1,066,227 | $1,171,403 |

| 06/17 | $1,091,273 | $1,246,793 |

| 07/17 | $1,097,917 | $1,290,025 |

| 08/17 | $1,108,651 | $1,345,289 |

| 09/17 | $1,120,407 | $1,351,548 |

| 10/17 | $1,157,720 | $1,390,823 |

| 11/17 | $1,185,832 | $1,352,878 |

| 12/17 | $1,210,024 | $1,372,471 |

| 01/18 | $1,308,875 | $1,472,955 |

| 02/18 | $1,262,296 | $1,376,087 |

| 03/18 | $1,257,121 | $1,347,734 |

| 04/18 | $1,243,147 | $1,272,814 |

| 05/18 | $1,279,893 | $1,254,919 |

| 06/18 | $1,229,691 | $1,119,726 |

| 07/18 | $1,214,164 | $1,092,005 |

| 08/18 | $1,176,901 | $1,021,691 |

| 09/18 | $1,177,419 | $1,040,842 |

| 10/18 | $1,036,646 | $935,372 |

| 11/18 | $1,104,962 | $954,403 |

| 12/18 | $1,066,437 | $919,704 |

| 01/19 | $1,157,905 | $999,361 |

| 02/19 | $1,215,592 | $1,152,687 |

| 03/19 | $1,273,799 | $1,223,379 |

| 04/19 | $1,309,659 | $1,226,098 |

| 05/19 | $1,210,395 | $1,116,545 |

| 06/19 | $1,325,770 | $1,179,819 |

| 07/19 | $1,308,100 | $1,185,646 |

| 08/19 | $1,302,383 | $1,137,907 |

| 09/19 | $1,308,620 | $1,145,890 |

| 10/19 | $1,343,440 | $1,178,410 |

| 11/19 | $1,317,974 | $1,166,840 |

| 12/19 | $1,404,920 | $1,264,425 |

| 01/20 | $1,312,020 | $1,260,832 |

| 02/20 | $1,349,506 | $1,243,733 |

| 03/20 | $1,218,032 | $1,141,481 |

| 04/20 | $1,343,530 | $1,223,522 |

| 05/20 | $1,366,891 | $1,203,401 |

| 06/20 | $1,495,105 | $1,323,651 |

| 07/20 | $1,712,416 | $1,519,793 |

| 08/20 | $1,810,750 | $1,582,620 |

| 09/20 | $1,773,264 | $1,506,584 |

| 10/20 | $1,861,275 | $1,559,628 |

| 11/20 | $1,944,397 | $1,666,329 |

| 12/20 | $2,205,334 | $1,770,692 |

| 01/21 | $2,287,524 | $1,835,729 |

| 02/21 | $2,208,644 | $1,821,878 |

| 03/21 | $2,095,564 | $1,708,314 |

| 04/21 | $2,184,925 | $1,777,268 |

| 05/21 | $2,340,479 | $1,889,697 |

| 06/21 | $2,238,431 | $1,855,754 |

| 07/21 | $1,979,174 | $1,761,144 |

| 08/21 | $1,880,988 | $1,780,406 |

| 09/21 | $2,010,065 | $1,781,095 |

| 10/21 | $2,109,354 | $1,819,416 |

| 11/21 | $2,020,545 | $1,828,394 |

| 12/21 | $2,069,601 | $1,842,097 |

| 01/22 | $1,921,247 | $1,679,587 |

| 02/22 | $1,912,187 | $1,725,766 |

| 03/22 | $1,704,943 | $1,571,457 |

| 04/22 | $1,558,854 | $1,410,404 |

| 05/22 | $1,593,961 | $1,450,158 |

| 06/22 | $1,791,578 | $1,595,843 |

| 07/22 | $1,626,803 | $1,498,549 |

| 08/22 | $1,564,516 | $1,429,708 |

| 09/22 | $1,448,438 | $1,292,167 |

| 10/22 | $1,308,010 | $1,186,602 |

| 11/22 | $1,528,843 | $1,316,710 |

| 12/22 | $1,604,719 | $1,340,416 |

| 01/23 | $1,764,965 | $1,479,763 |

| 02/23 | $1,636,995 | $1,420,582 |

| 03/23 | $1,614,345 | $1,421,769 |

| 04/23 | $1,541,301 | $1,392,301 |

| 05/23 | $1,383,320 | $1,290,122 |

| 06/23 | $1,378,790 | $1,281,297 |

| 07/23 | $1,479,014 | $1,353,884 |

| 08/23 | $1,335,756 | $1,244,749 |

| 09/23 | $1,290,457 | $1,222,071 |

| 10/23 | $1,240,062 | $1,185,347 |

| 11/23 | $1,241,761 | $1,199,267 |

| 12/23 | $1,203,906 | $1,184,229 |

| 01/24 | $1,062,337 | $1,064,090 |

| 02/24 | $1,167,372 | $1,178,946 |

| 03/24 | $1,155,384 | $1,176,173 |

| 04/24 | $1,198,768 | $1,200,551 |

| 05/24 | $1,174,222 | $1,188,949 |

| 06/24 | $1,115,425 | $1,145,629 |

| 07/24 | $1,115,996 | $1,152,909 |

| 08/24 | $1,109,717 | $1,130,775 |

| 09/24 | $1,366,596 | $1,391,692 |

| 10/24 | $1,305,516 | $1,353,124 |

Average Annual Total Returns for the Period Ended October 31, 2024 (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 5.28% | (0.57%) | 2.70% |

| MSCI China A (Onshore) Index (Net TR) | 14.15% | 2.80% | 3.07% |

THE FUND'S PAST PERFORMANCE IS NOT A GOOD PREDICTOR OF THE FUND'S FUTURE PERFORMANCE.

Fund performance data shown above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | $19,502,737 |

| Total Number of Portfolio Holdings | 48 |

| Portfolio Turnover Rate | 61% |

| Total Advisory Fees Paid | $0 |

abrdn China A Share Equity Fund

(GOPIX)

What did the Fund invest in?

The tables below show the investment makeup of the Fund as of October 31, 2024.

Sector Allocation (% of total net assets)

| Industrials | 26.3% |

| Financials | 17.3% |

| Consumer Discretionary | 16.3% |

| Consumer Staples | 16.3% |

| Health Care | 6.7% |

| Information Technology | 5.9% |

| Exchange-Traded Funds | 3.9% |

| Utilities | 2.0% |

| Materials | 1.9% |

| Other | 3.4% |

Ten Largest Holdings (% of total net assets)

| Kweichow Moutai Co. Ltd., Class A | 7.8% |

| Contemporary Amperex Technology Co. Ltd., Class A | 7.3% |

| Fuyao Glass Industry Group Co. Ltd., Class A | 4.7% |

| China Merchants Bank Co. Ltd., Class A | 4.7% |

| KraneShares Bosera MSCI China A 50 Connect Index ETF | 3.9% |

| Midea Group Co. Ltd., Class A | 3.7% |

| Proya Cosmetics Co. Ltd., Class A | 3.7% |

| Sungrow Power Supply Co. Ltd., Class A | 3.6% |

| BYD Co. Ltd., Class A | 3.5% |

| Inner Mongolia Yili Industrial Group Co. Ltd., Class A | 3.1% |

Availability of Additional Information

You can find additional information, including the Fund's prospectus, financial information, fund holdings, and proxy voting information at abrdn.com/us/literature or call 866-667-9231. The QR code can be used to access the Fund's prospectus, financial information and holdings.

abrdn China A Share Equity Fund

(GOPIX)

abrdn China A Share Equity Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the abrdn China A Share Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at abrdn.com/us/literature. You can also request this information by contacting us at 866-667-9231.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Service | $112 | 1.09% |

How did the fund perform last year and what affected its performance?

The following discussion compares the performance of the Fund to the MSCI China A (Onshore) Index (Net TR) (the “Index”) to show how the Fund’s performance measures against the returns of similar investments for the reporting period.

What contributed to performance?

The Fund's holdings in select consumer names were key contributors, as policy support via “trade-in” programs for new energy vehicles, consumer appliances and electronics, and resilient overseas demand boosted Fuyao Glass and Midea Group. Both companies also delivered solid earnings results. In the industrials sector, Contemporary Amperex Technology rose sharply due to solid results, a low valuation and the anticipated vehicle trade-in programs. Similarly, Sungrow Power was also boosted by the September 2024 Chinese stimulus announcements. Among our financial holdings, Citic Securities was helped by an improving market backdrop, and China Merchants Bank rebounded on growing signs of a recovery in market sentiment.

What detracted from performance?

Weakness in our IT holdings was the largest detractor, amid a challenging domestic macro backdrop. Maxscend Microelectronics lagged after disappointing earnings, and we exited our position owing to softer guidance and persistent demand weakness. Hundsun Technologies and Glodon were weighed down by concerns over slowing IT spending, as local government financing remained under pressure. Elsewhere, private eyecare hospital chain Aier Eye Hospital remained weak following last year’s de-rating, driven by the market’s misaligned growth expectations. Yifeng Pharmacy lagged amid an unsettling sector-wide regulatory investigation into drug price transparency. Spirits producer Kweichow Moutai was impacted by weakness in the wholesale price of its premium products and slower growth in shipments.

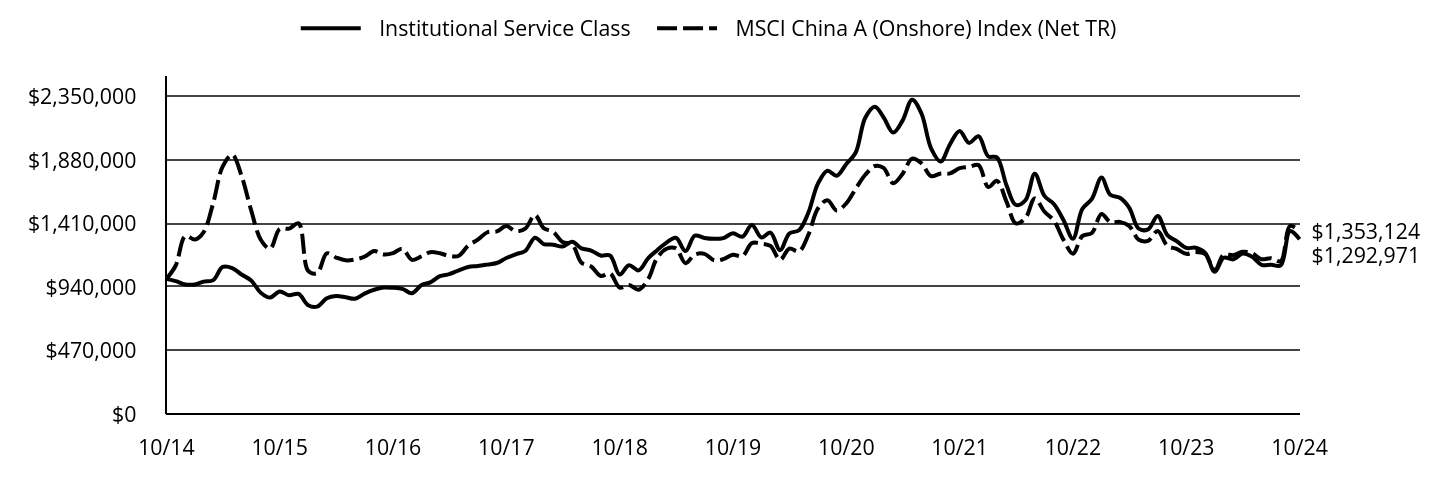

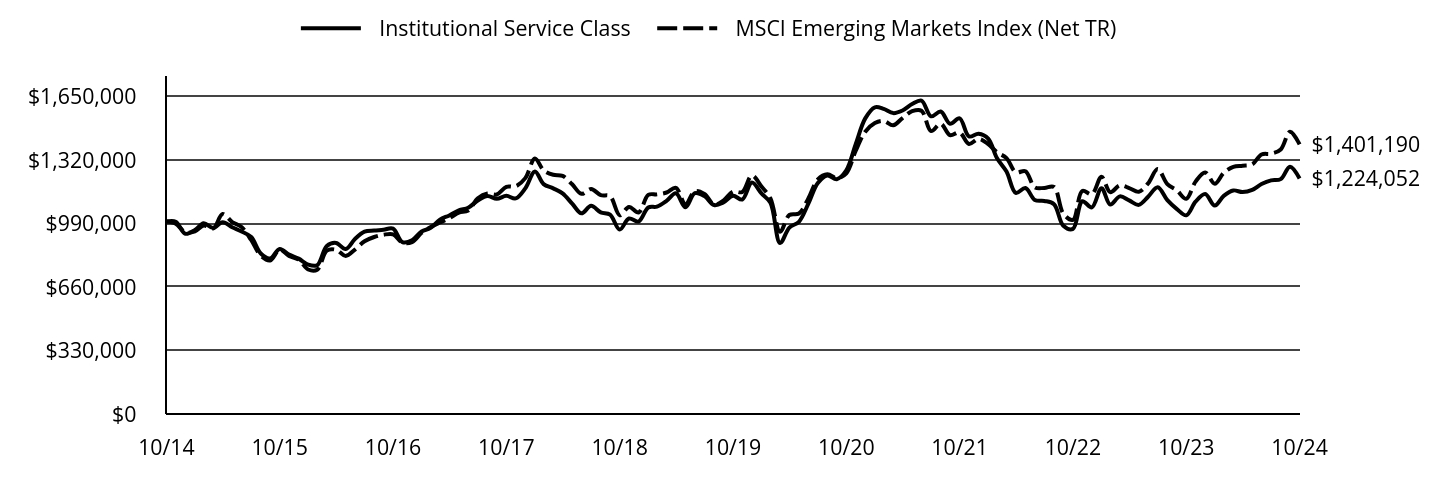

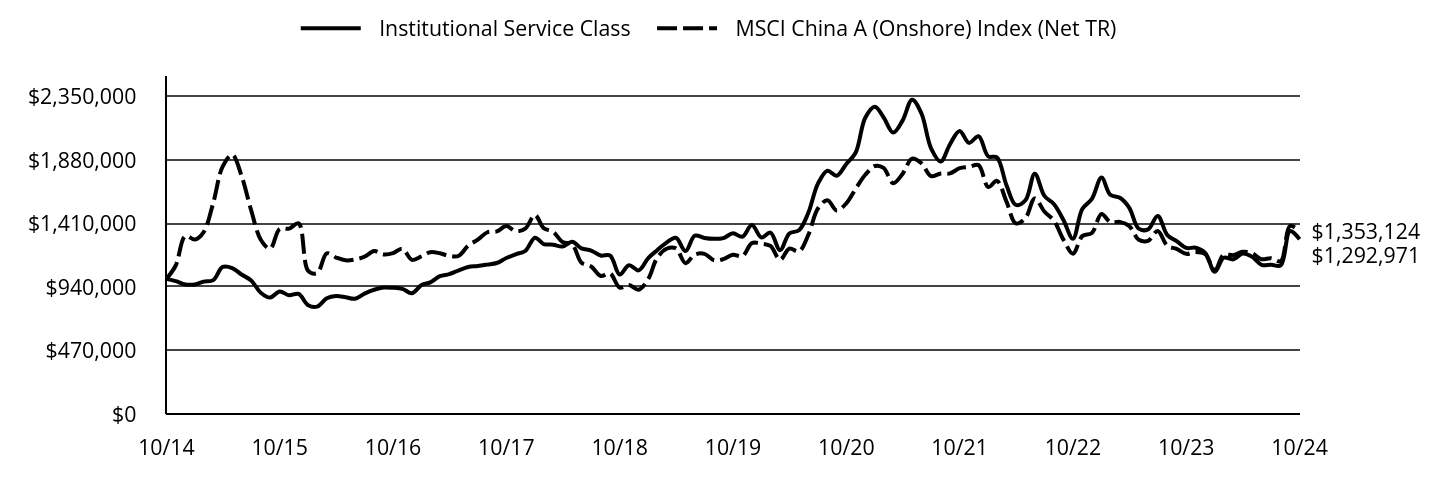

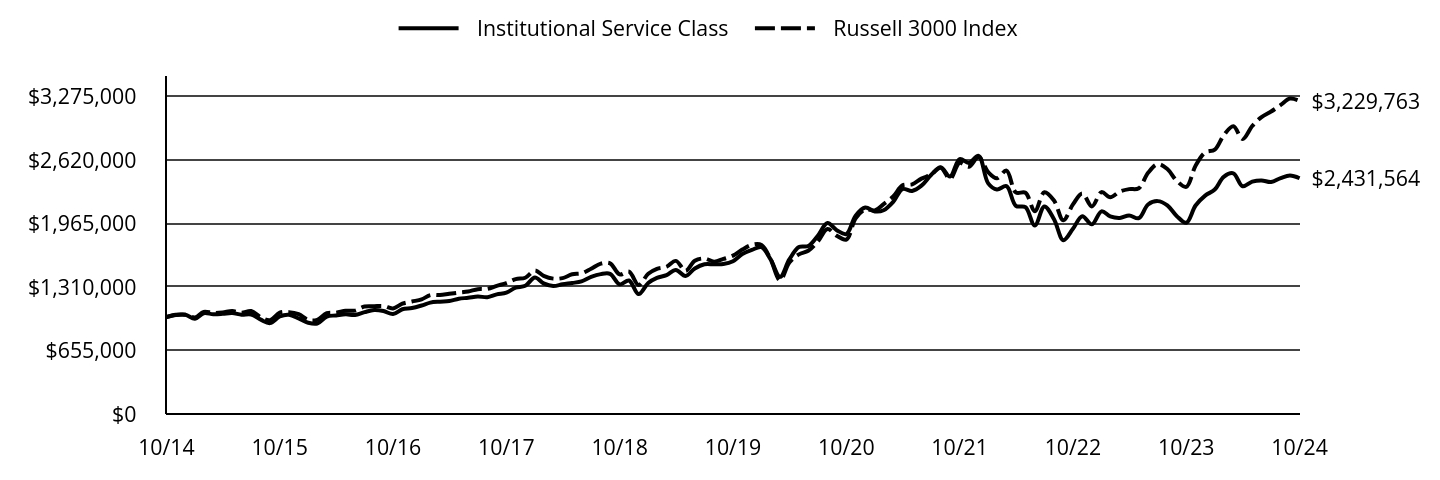

abrdn China A Share Equity Fund

(GOPSX)

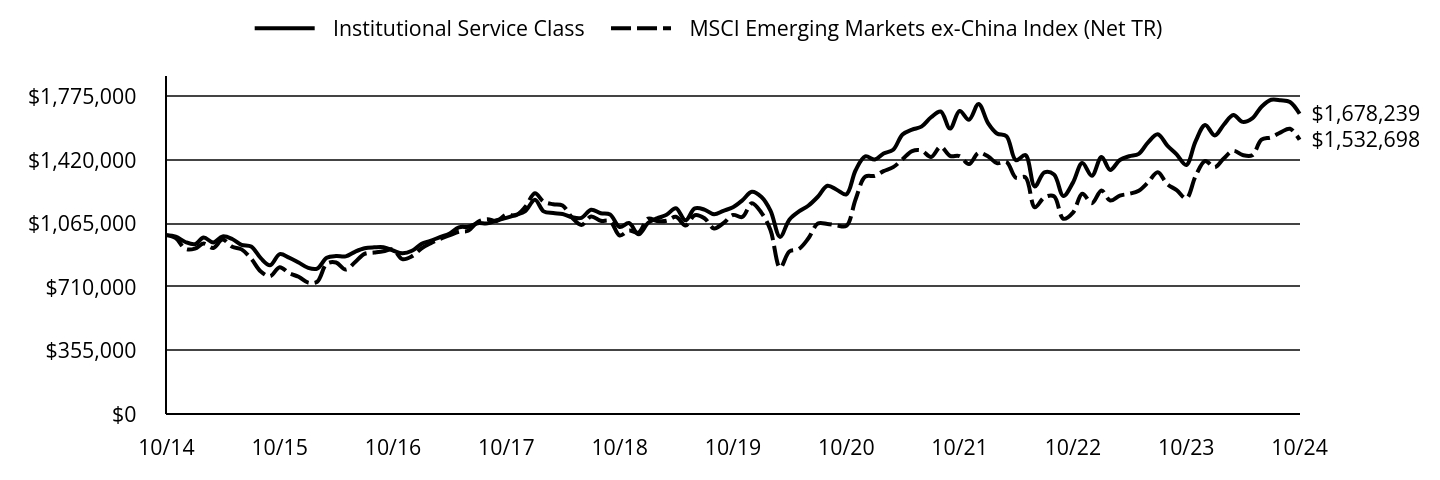

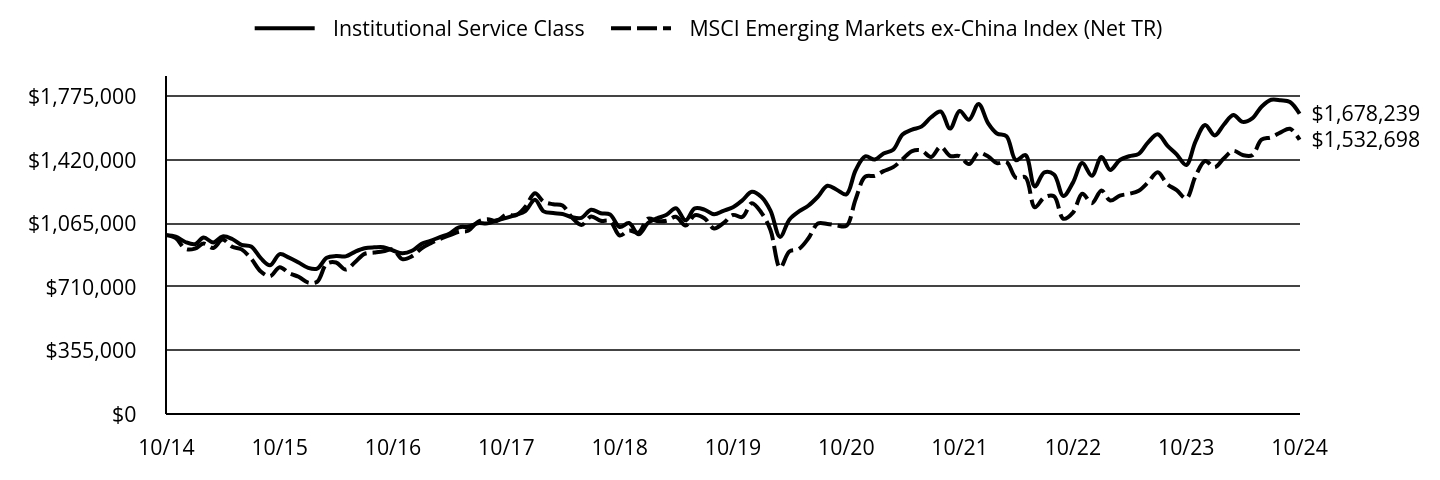

Institutional Service Class

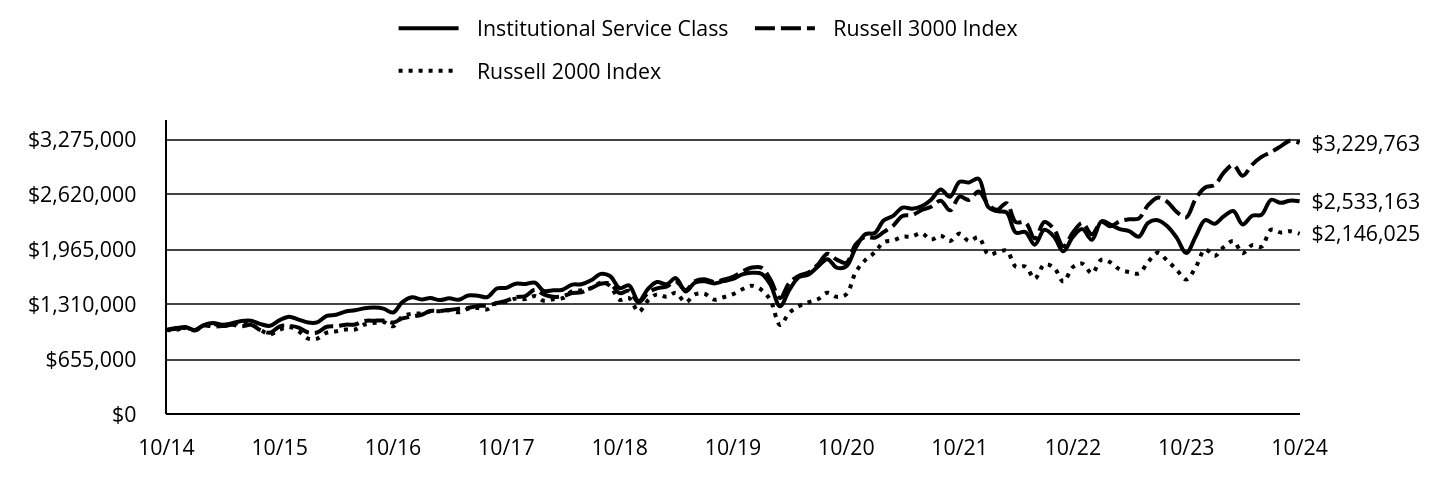

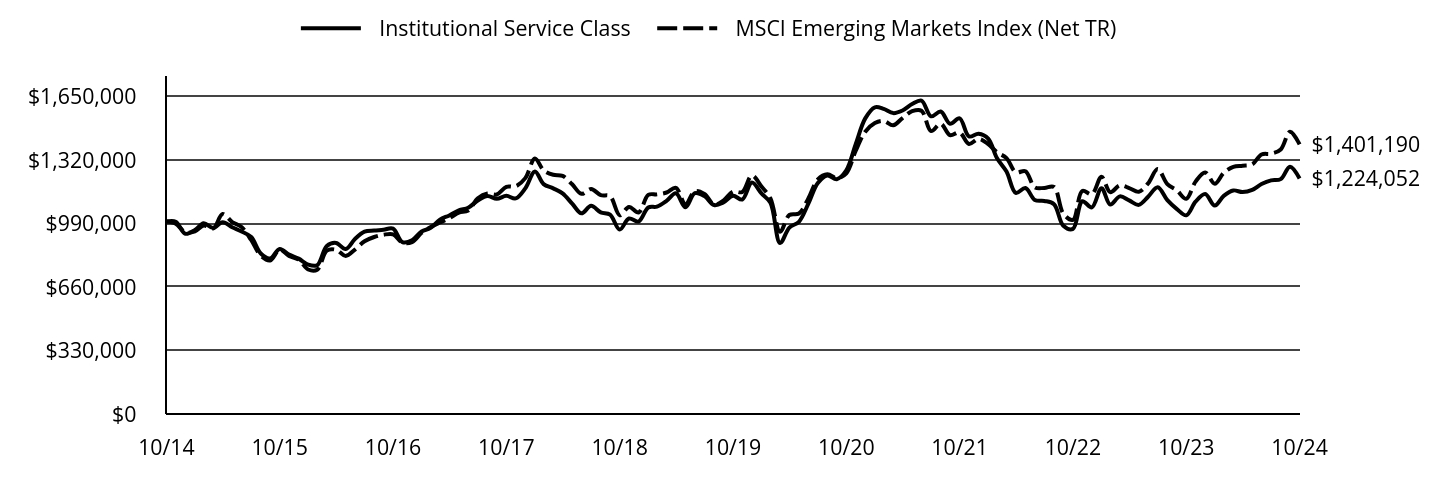

Total Return Based on $1,000,000 Investment

The following graph reflects a hypothetical $1,000,000 investment for the most recently completed 10 fiscal years as compared to a broad-based securities market index, which is also the performance benchmark.

| Institutional Service Class | MSCI China A (Onshore) Index (Net TR) |

|---|

| 10/14 | $1,000,000 | $1,000,000 |

| 11/14 | $983,728 | $1,099,072 |

| 12/14 | $958,421 | $1,317,317 |

| 01/15 | $958,916 | $1,291,529 |

| 02/15 | $979,676 | $1,346,276 |

| 03/15 | $991,044 | $1,563,929 |

| 04/15 | $1,088,419 | $1,830,386 |

| 05/15 | $1,080,510 | $1,919,169 |

| 06/15 | $1,032,217 | $1,763,219 |

| 07/15 | $988,568 | $1,508,250 |

| 08/15 | $897,796 | $1,290,124 |

| 09/15 | $861,677 | $1,223,543 |

| 10/15 | $907,028 | $1,371,212 |

| 11/15 | $878,810 | $1,371,888 |

| 12/15 | $888,888 | $1,410,541 |

| 01/16 | $804,736 | $1,059,859 |

| 02/16 | $794,657 | $1,043,028 |

| 03/16 | $856,134 | $1,189,068 |

| 04/16 | $873,267 | $1,158,156 |

| 05/16 | $864,196 | $1,137,283 |

| 06/16 | $853,110 | $1,144,134 |

| 07/16 | $891,407 | $1,164,284 |

| 08/16 | $919,626 | $1,205,761 |

| 09/16 | $936,255 | $1,181,374 |

| 10/16 | $934,743 | $1,190,371 |

| 11/16 | $926,177 | $1,223,098 |

| 12/16 | $894,426 | $1,141,056 |

| 01/17 | $955,177 | $1,167,529 |

| 02/17 | $974,066 | $1,197,845 |

| 03/17 | $1,020,013 | $1,189,543 |

| 04/17 | $1,035,328 | $1,170,673 |

| 05/17 | $1,063,917 | $1,171,403 |

| 06/17 | $1,088,422 | $1,246,793 |

| 07/17 | $1,095,059 | $1,290,025 |

| 08/17 | $1,105,780 | $1,345,289 |

| 09/17 | $1,117,521 | $1,351,548 |

| 10/17 | $1,154,789 | $1,390,823 |

| 11/17 | $1,182,357 | $1,352,878 |

| 12/17 | $1,206,420 | $1,372,471 |

| 01/18 | $1,305,146 | $1,472,955 |

| 02/18 | $1,258,109 | $1,376,087 |

| 03/18 | $1,252,940 | $1,347,734 |

| 04/18 | $1,239,501 | $1,272,814 |

| 05/18 | $1,275,683 | $1,254,919 |

| 06/18 | $1,225,545 | $1,119,726 |

| 07/18 | $1,210,038 | $1,092,005 |

| 08/18 | $1,172,822 | $1,021,691 |

| 09/18 | $1,173,339 | $1,040,842 |

| 10/18 | $1,032,745 | $935,372 |

| 11/18 | $1,100,974 | $954,403 |

| 12/18 | $1,062,816 | $919,704 |

| 01/19 | $1,153,722 | $999,361 |

| 02/19 | $1,210,862 | $1,152,687 |

| 03/19 | $1,268,523 | $1,223,379 |

| 04/19 | $1,304,365 | $1,226,098 |

| 05/19 | $1,205,668 | $1,116,545 |

| 06/19 | $1,319,949 | $1,179,819 |

| 07/19 | $1,302,807 | $1,185,646 |

| 08/19 | $1,296,573 | $1,137,907 |

| 09/19 | $1,302,288 | $1,145,890 |

| 10/19 | $1,337,611 | $1,178,410 |

| 11/19 | $1,311,638 | $1,166,840 |

| 12/19 | $1,398,330 | $1,264,425 |

| 01/20 | $1,306,084 | $1,260,832 |

| 02/20 | $1,342,440 | $1,243,733 |

| 03/20 | $1,212,211 | $1,141,481 |

| 04/20 | $1,336,471 | $1,223,522 |

| 05/20 | $1,359,804 | $1,203,401 |

| 06/20 | $1,487,319 | $1,323,651 |

| 07/20 | $1,703,281 | $1,519,793 |

| 08/20 | $1,800,953 | $1,582,620 |

| 09/20 | $1,763,512 | $1,506,584 |

| 10/20 | $1,850,874 | $1,559,628 |

| 11/20 | $1,933,352 | $1,666,329 |

| 12/20 | $2,192,836 | $1,770,692 |

| 01/21 | $2,274,337 | $1,835,729 |

| 02/21 | $2,195,589 | $1,821,878 |

| 03/21 | $2,083,249 | $1,708,314 |

| 04/21 | $2,171,359 | $1,777,268 |

| 05/21 | $2,326,102 | $1,889,697 |

| 06/21 | $2,224,225 | $1,855,754 |

| 07/21 | $1,966,503 | $1,761,144 |

| 08/21 | $1,869,032 | $1,780,406 |

| 09/21 | $1,996,791 | $1,781,095 |

| 10/21 | $2,095,364 | $1,819,416 |

| 11/21 | $2,006,703 | $1,828,394 |

| 12/21 | $2,055,718 | $1,842,097 |

| 01/22 | $1,907,629 | $1,679,587 |

| 02/22 | $1,899,151 | $1,725,766 |

| 03/22 | $1,692,844 | $1,571,457 |

| 04/22 | $1,547,582 | $1,410,404 |

| 05/22 | $1,582,060 | $1,450,158 |

| 06/22 | $1,778,193 | $1,595,843 |

| 07/22 | $1,614,278 | $1,498,549 |

| 08/22 | $1,552,669 | $1,429,708 |

| 09/22 | $1,437,363 | $1,292,167 |

| 10/22 | $1,297,753 | $1,186,602 |

| 11/22 | $1,517,060 | $1,316,710 |

| 12/22 | $1,591,669 | $1,340,416 |

| 01/23 | $1,750,497 | $1,479,763 |

| 02/23 | $1,623,322 | $1,420,582 |

| 03/23 | $1,600,713 | $1,421,769 |

| 04/23 | $1,528,364 | $1,392,301 |

| 05/23 | $1,371,797 | $1,290,122 |

| 06/23 | $1,366,710 | $1,281,297 |

| 07/23 | $1,466,190 | $1,353,884 |

| 08/23 | $1,324,318 | $1,244,749 |

| 09/23 | $1,279,101 | $1,222,071 |

| 10/23 | $1,229,361 | $1,185,347 |

| 11/23 | $1,230,491 | $1,199,267 |

| 12/23 | $1,192,679 | $1,184,229 |

| 01/24 | $1,052,498 | $1,064,090 |

| 02/24 | $1,156,779 | $1,178,946 |

| 03/24 | $1,144,812 | $1,176,173 |

| 04/24 | $1,187,550 | $1,200,551 |

| 05/24 | $1,163,047 | $1,188,949 |

| 06/24 | $1,104,354 | $1,145,629 |

| 07/24 | $1,104,923 | $1,152,909 |

| 08/24 | $1,099,225 | $1,130,775 |

| 09/24 | $1,353,374 | $1,391,692 |

| 10/24 | $1,292,971 | $1,353,124 |

Average Annual Total Returns for the Period Ended October 31, 2024 (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Service Class | 5.17% | (0.68%) | 2.60% |

| MSCI China A (Onshore) Index (Net TR) | 14.15% | 2.80% | 3.07% |

THE FUND'S PAST PERFORMANCE IS NOT A GOOD PREDICTOR OF THE FUND'S FUTURE PERFORMANCE.

Fund performance data shown above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | $19,502,737 |

| Total Number of Portfolio Holdings | 48 |

| Portfolio Turnover Rate | 61% |

| Total Advisory Fees Paid | $0 |

abrdn China A Share Equity Fund

(GOPSX)

Institutional Service Class

What did the Fund invest in?

The tables below show the investment makeup of the Fund as of October 31, 2024.

Sector Allocation (% of total net assets)

| Industrials | 26.3% |

| Financials | 17.3% |

| Consumer Discretionary | 16.3% |

| Consumer Staples | 16.3% |

| Health Care | 6.7% |

| Information Technology | 5.9% |

| Exchange-Traded Funds | 3.9% |

| Utilities | 2.0% |

| Materials | 1.9% |

| Other | 3.4% |

Ten Largest Holdings (% of total net assets)

| Kweichow Moutai Co. Ltd., Class A | 7.8% |

| Contemporary Amperex Technology Co. Ltd., Class A | 7.3% |

| Fuyao Glass Industry Group Co. Ltd., Class A | 4.7% |

| China Merchants Bank Co. Ltd., Class A | 4.7% |

| KraneShares Bosera MSCI China A 50 Connect Index ETF | 3.9% |

| Midea Group Co. Ltd., Class A | 3.7% |

| Proya Cosmetics Co. Ltd., Class A | 3.7% |

| Sungrow Power Supply Co. Ltd., Class A | 3.6% |

| BYD Co. Ltd., Class A | 3.5% |

| Inner Mongolia Yili Industrial Group Co. Ltd., Class A | 3.1% |

Availability of Additional Information

You can find additional information, including the Fund's prospectus, financial information, fund holdings, and proxy voting information at abrdn.com/us/literature or call 866-667-9231. The QR code can be used to access the Fund's prospectus, financial information and holdings.

abrdn China A Share Equity Fund

(GOPSX)

Institutional Service Class

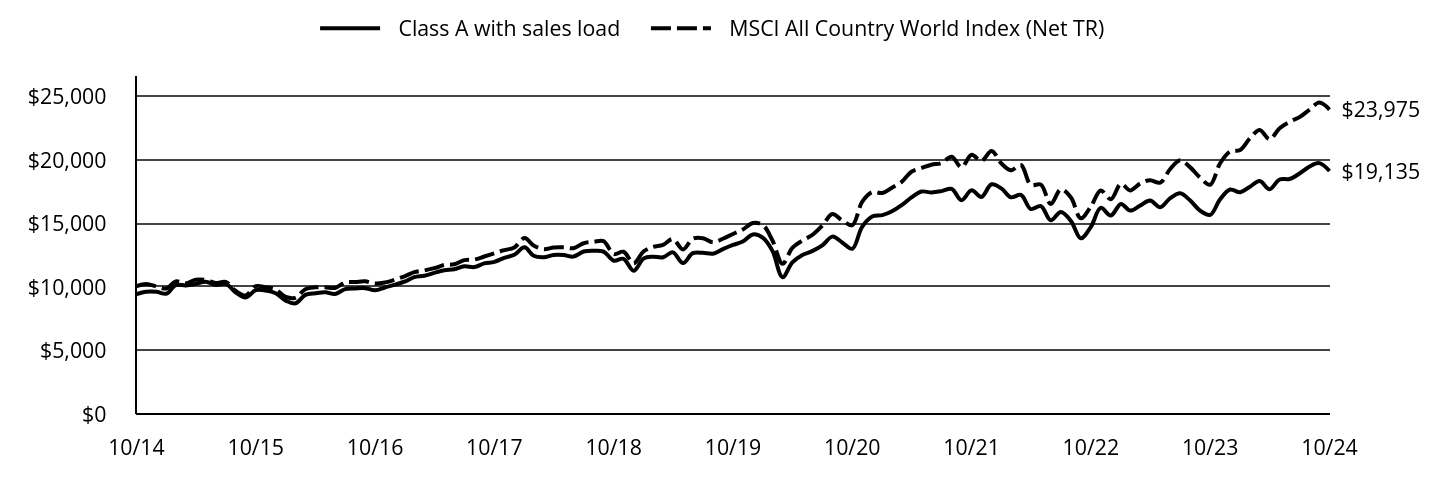

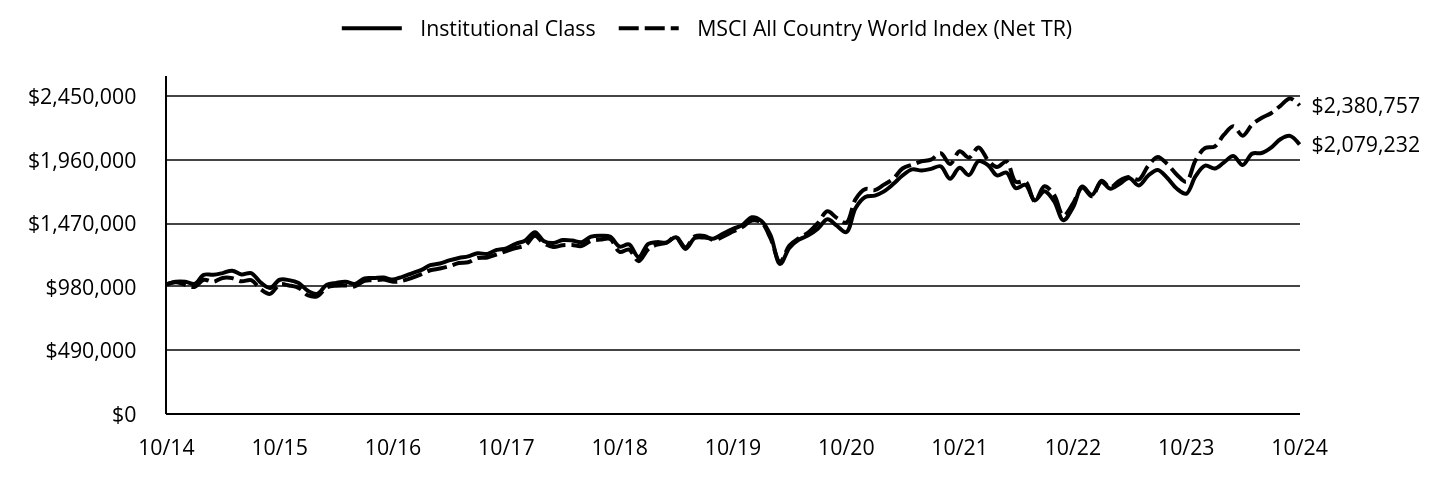

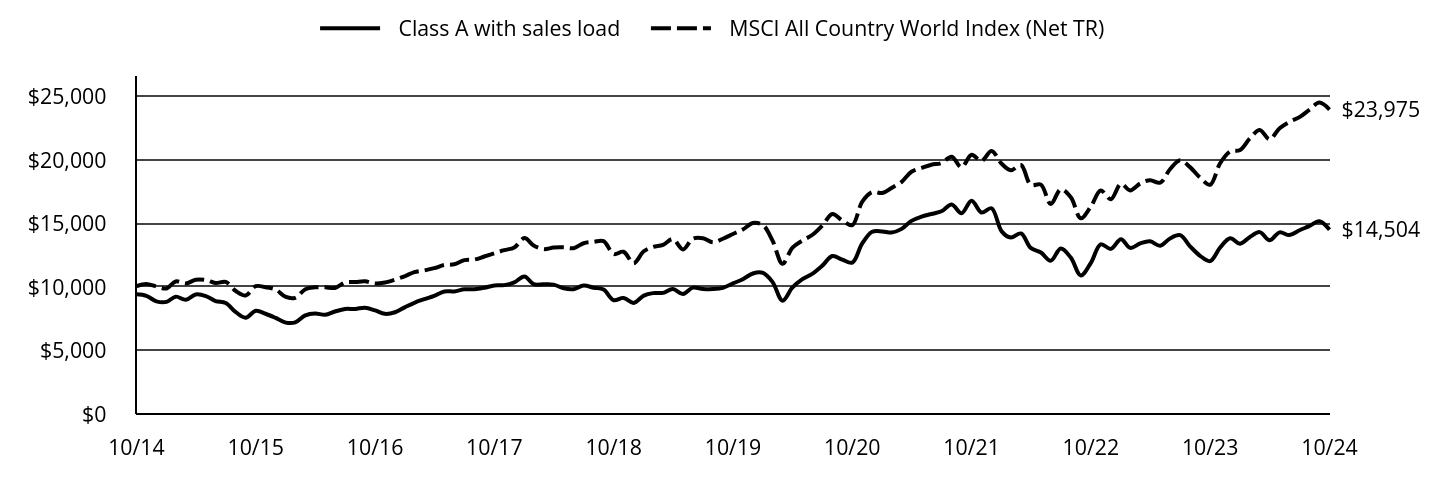

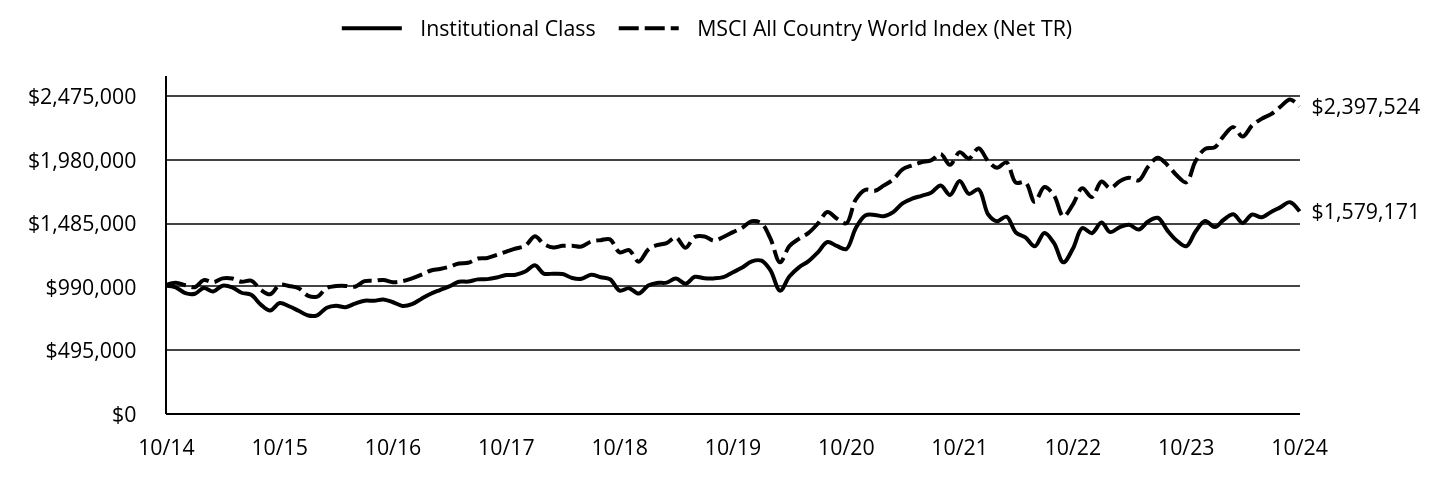

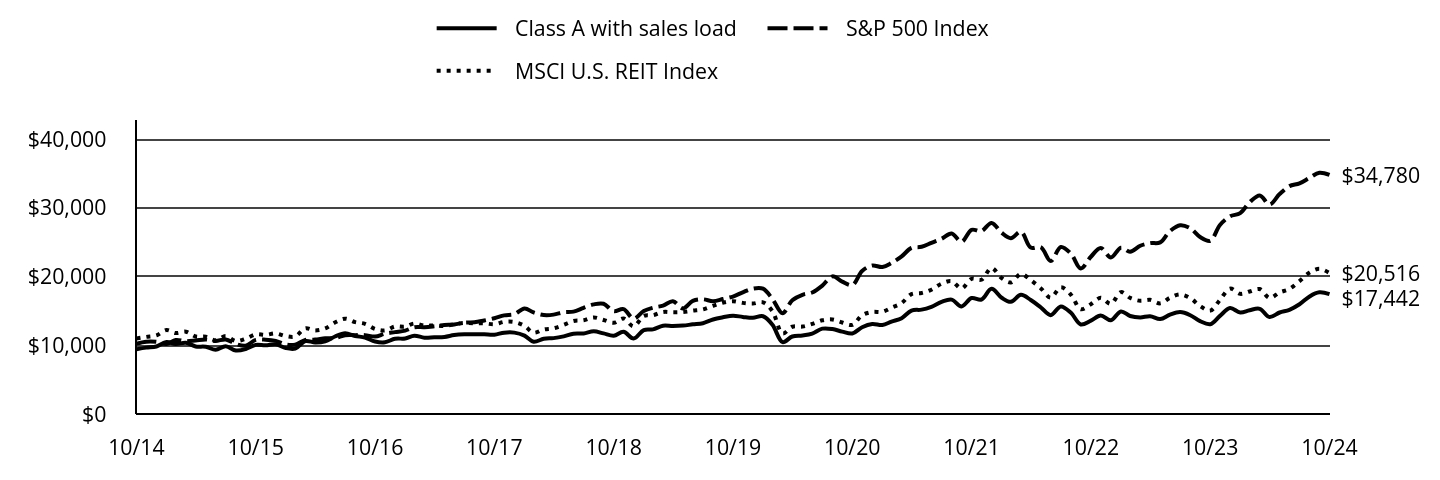

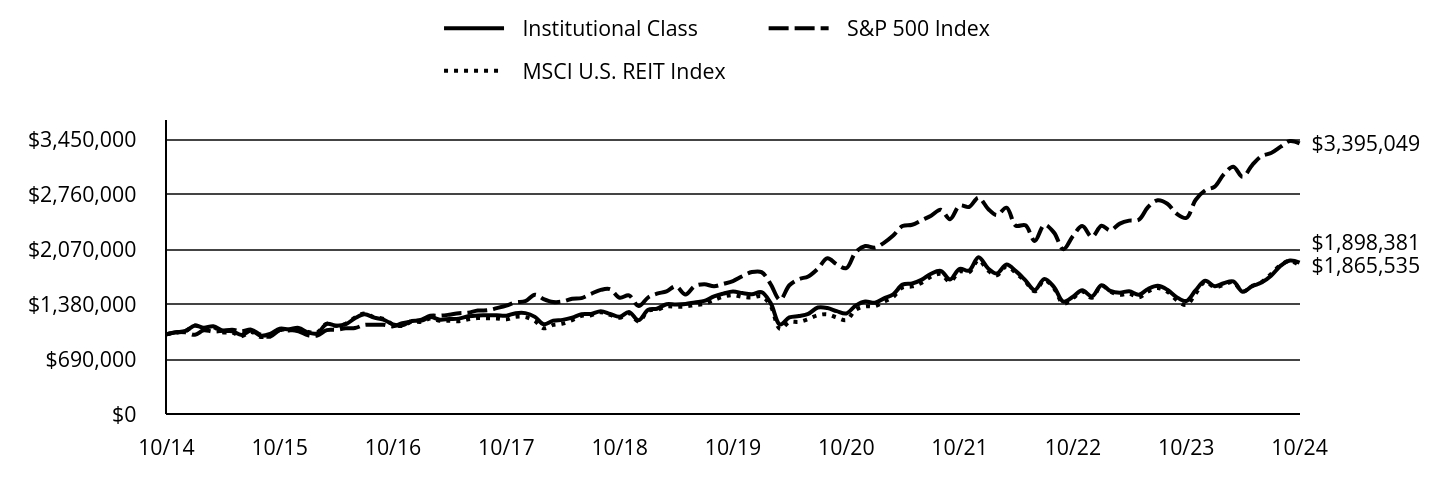

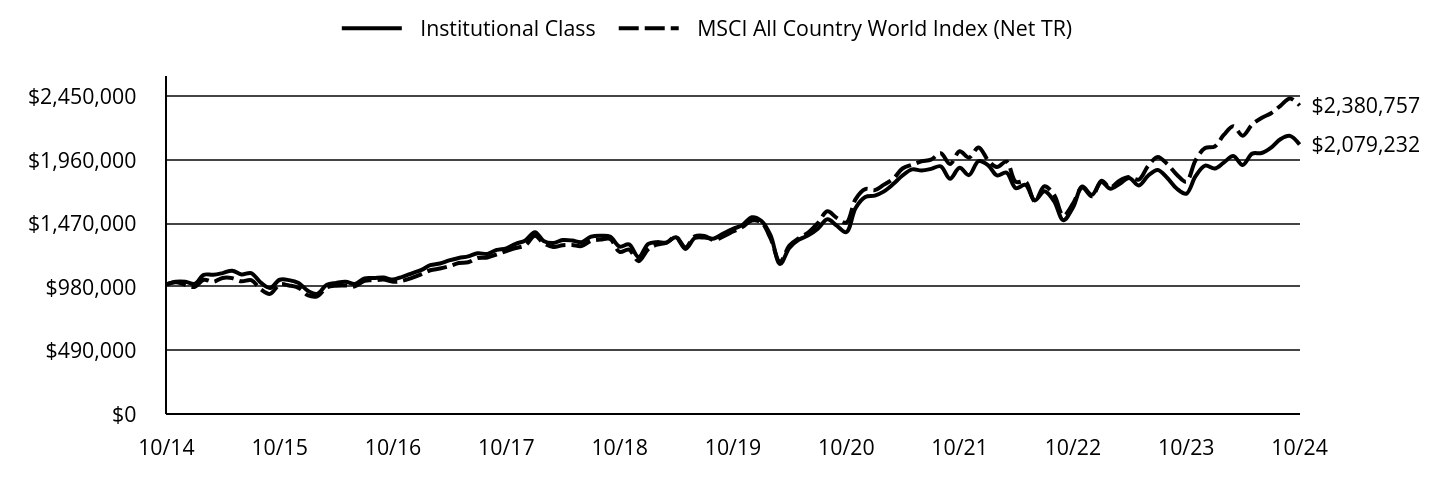

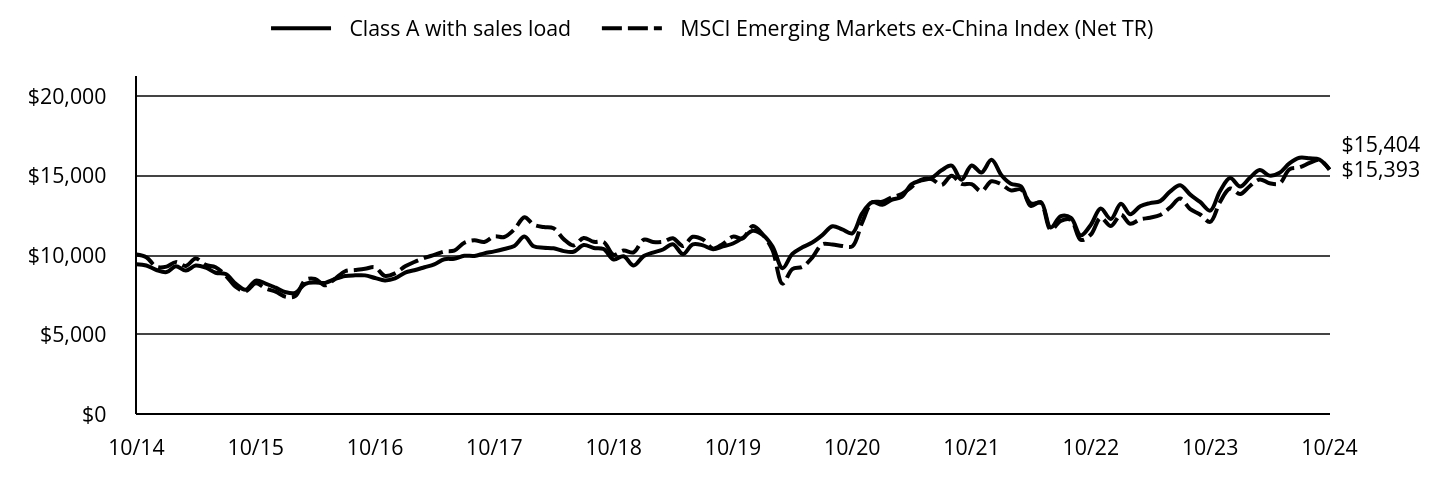

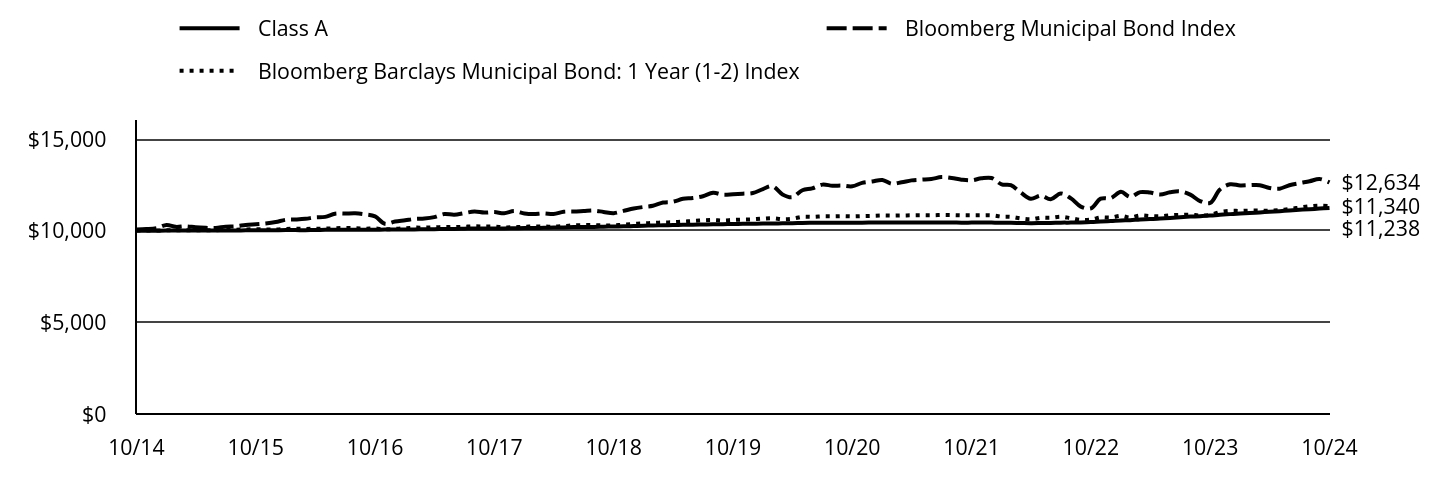

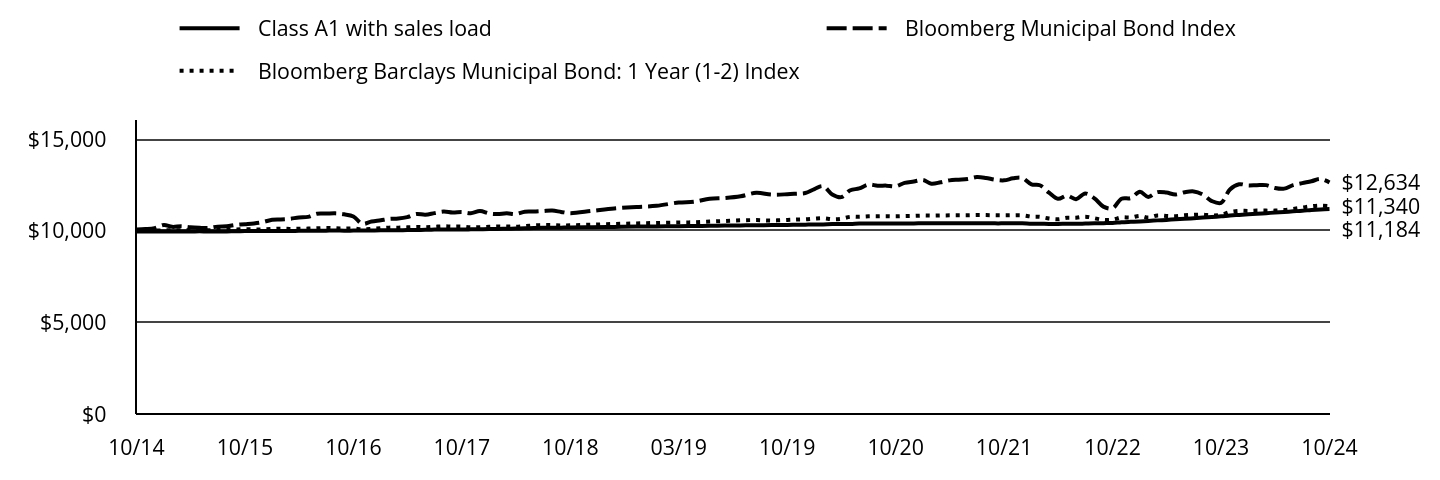

abrdn Dynamic Dividend Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the abrdn Dynamic Dividend Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at abrdn.com/us/literature. You can also request this information by contacting us at 866-667-9231.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $167 | 1.50% |

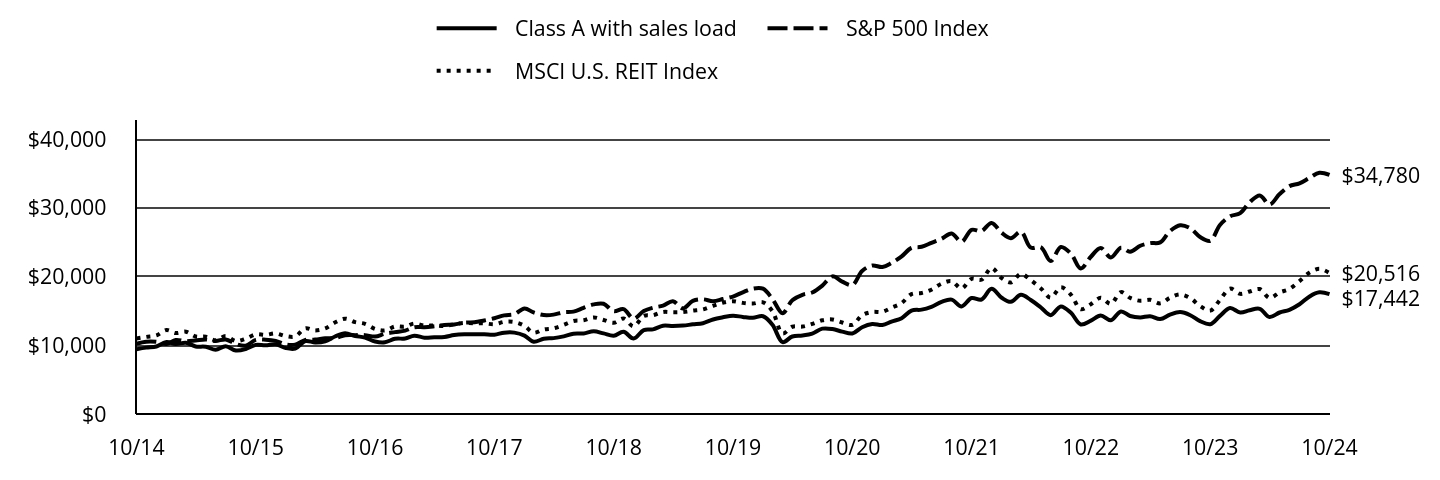

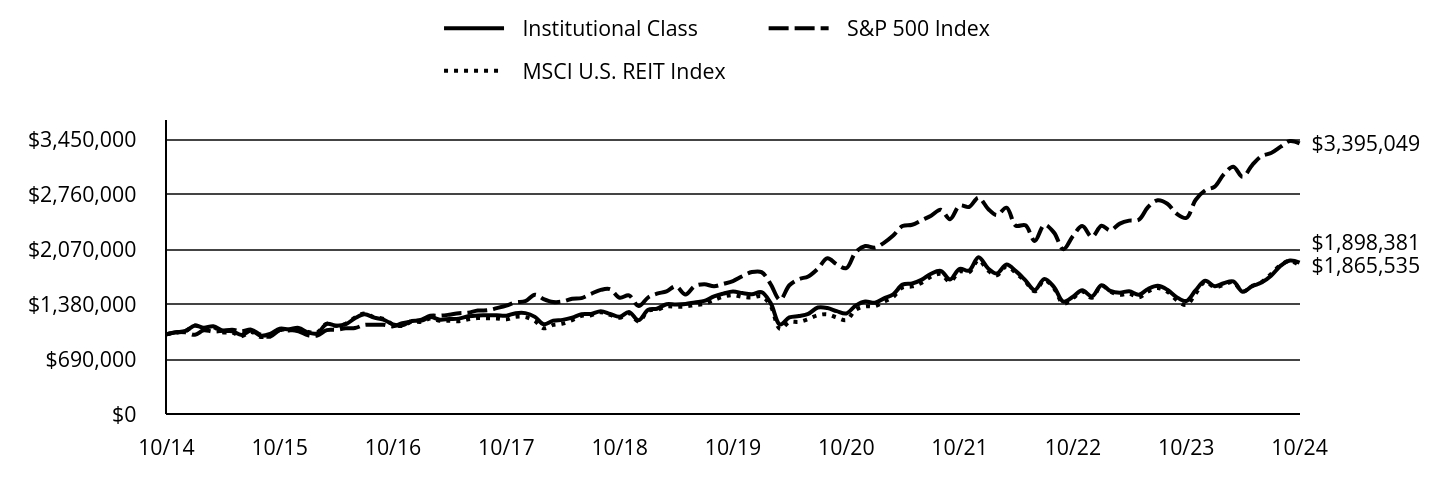

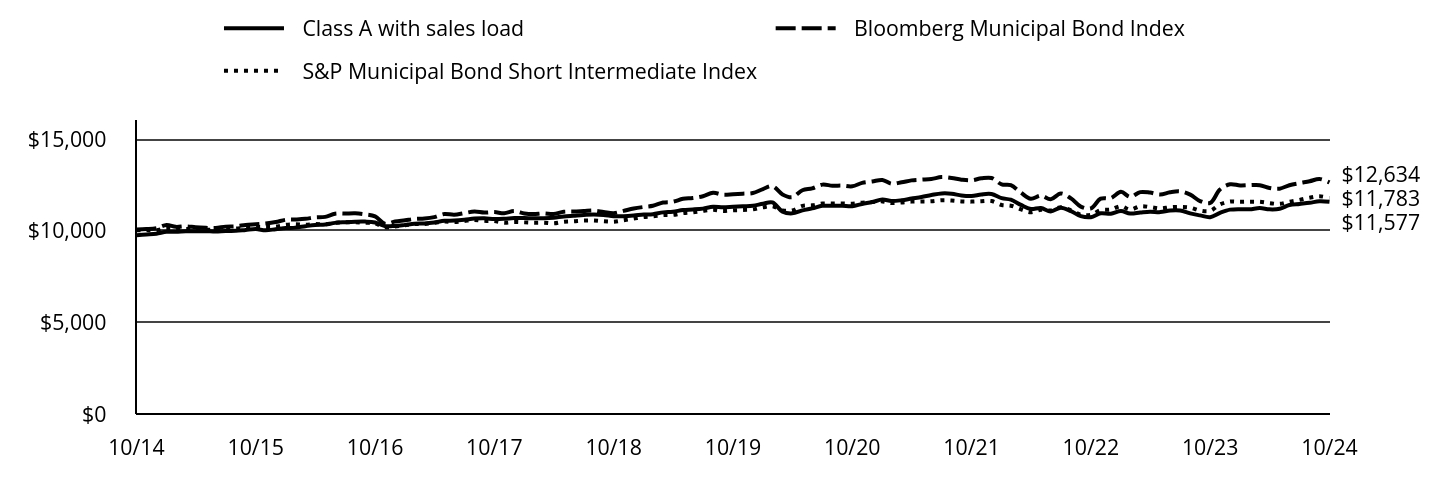

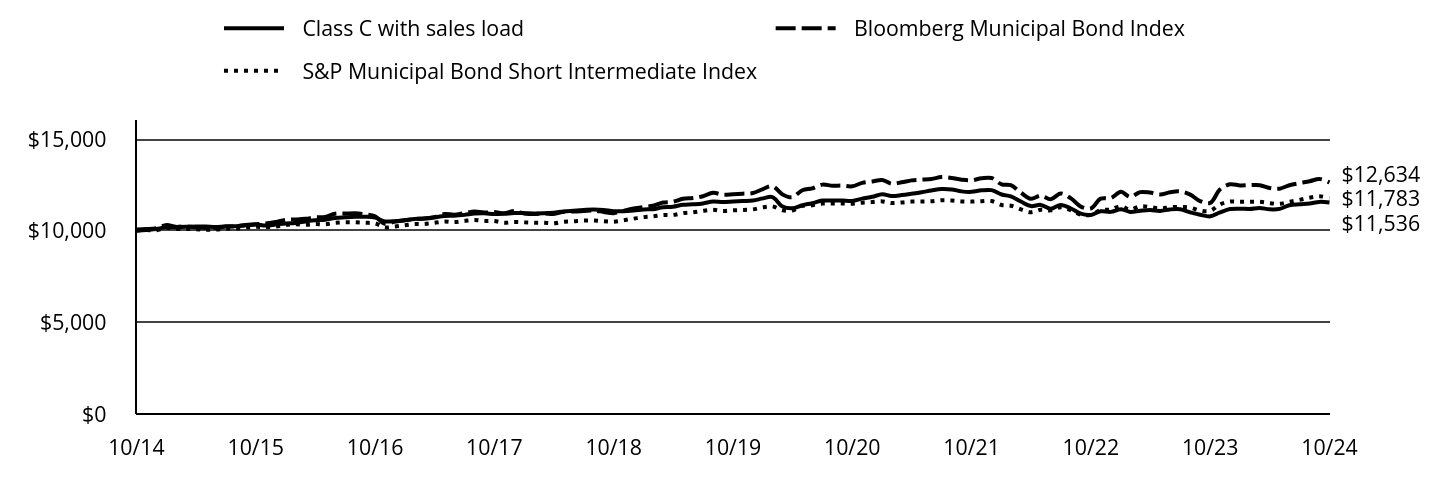

How did the fund perform last year and what affected its performance?

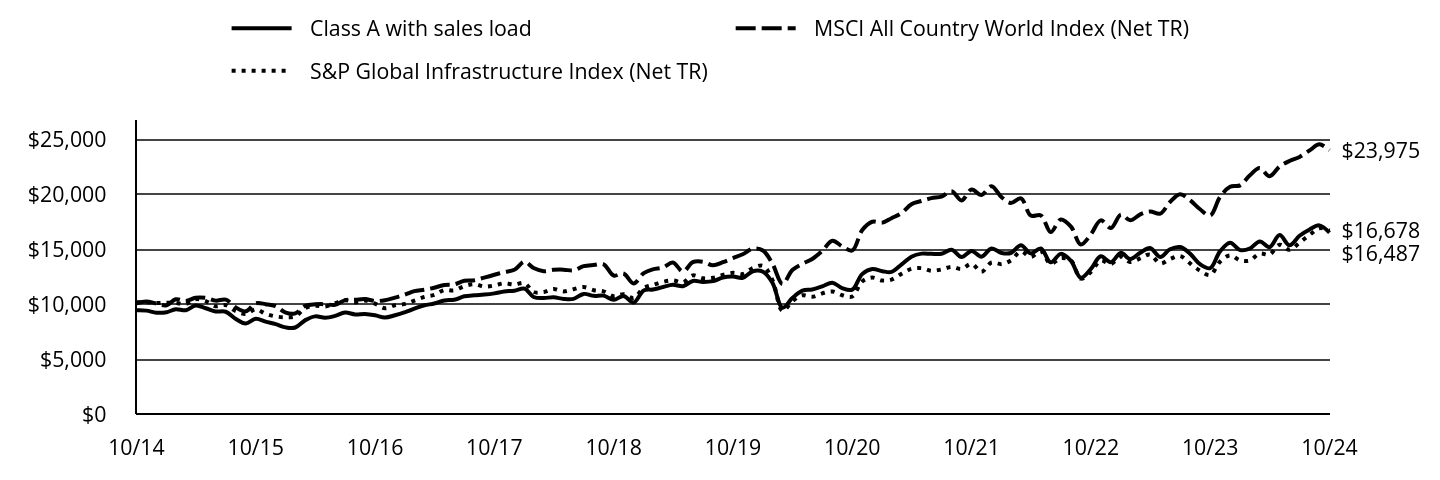

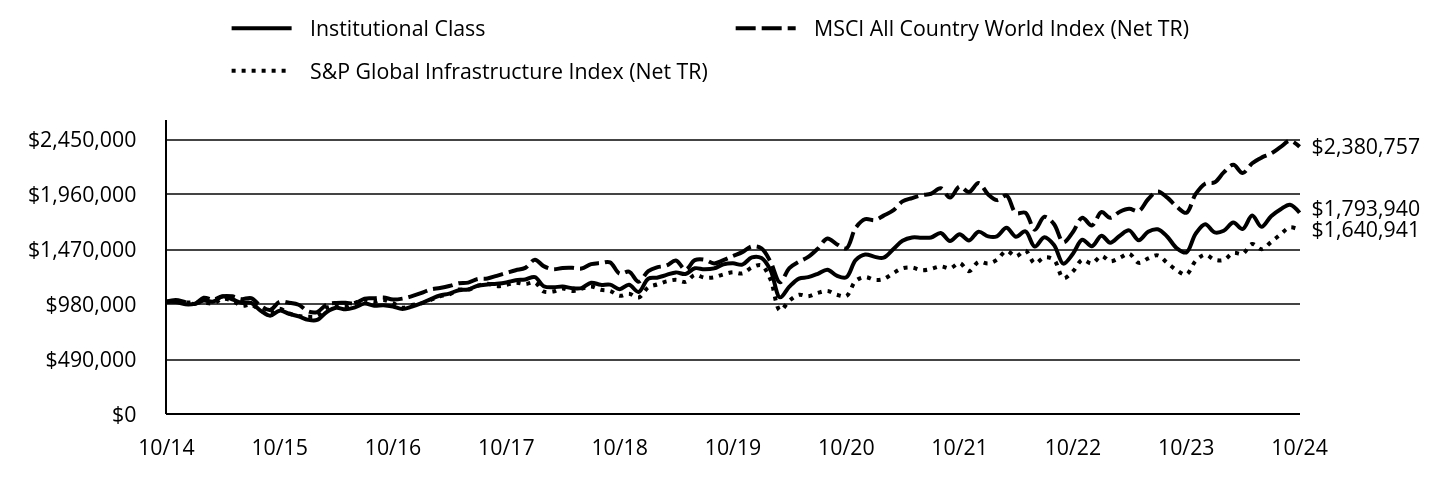

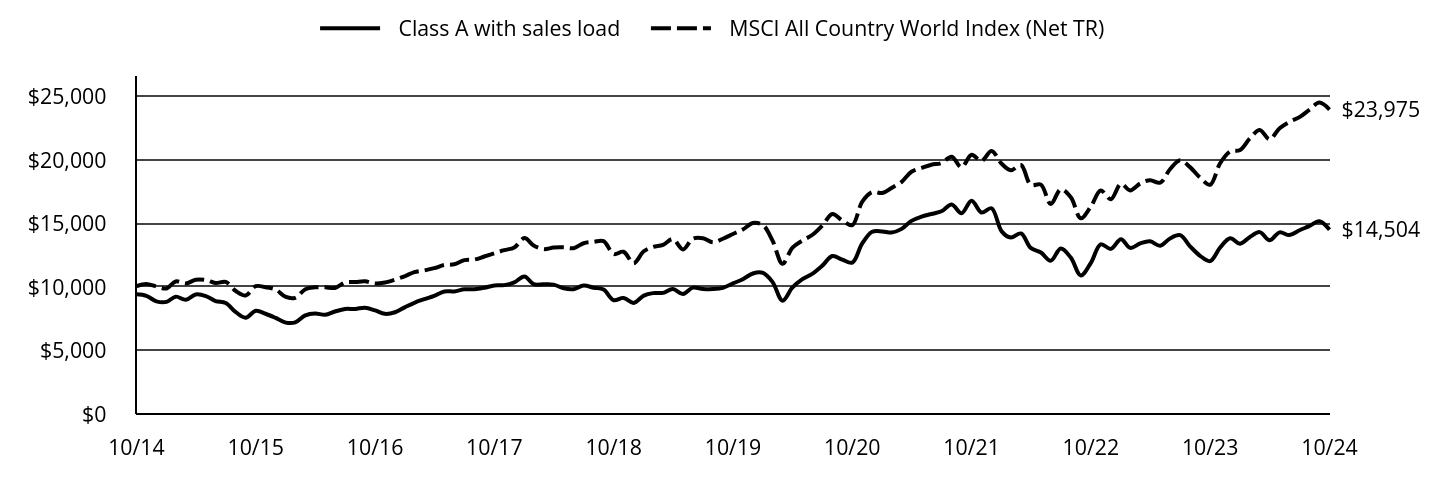

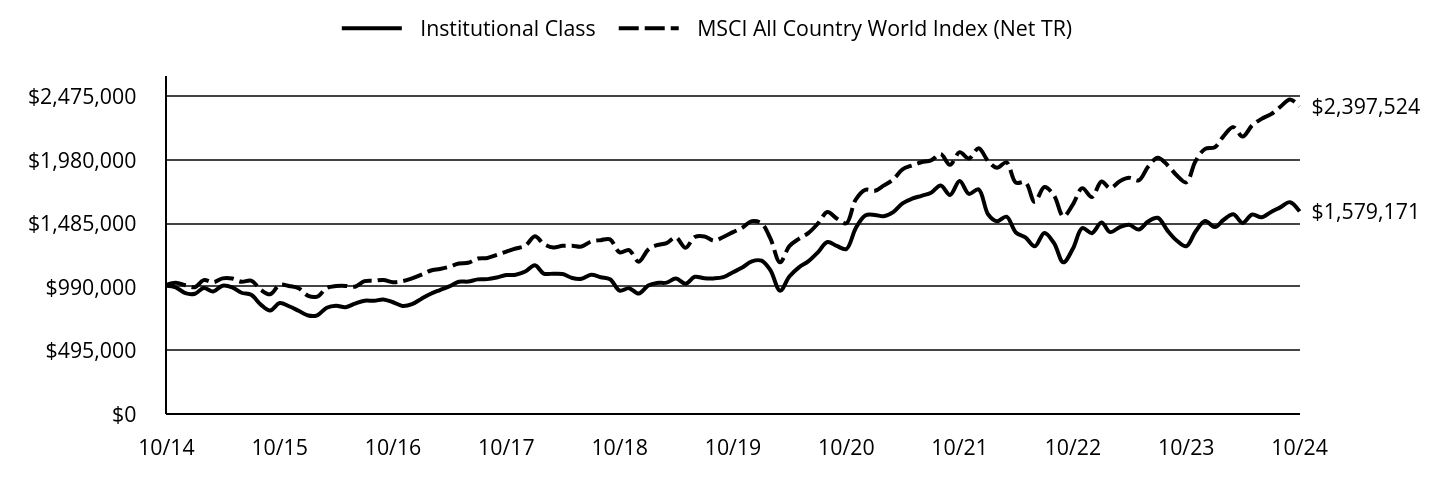

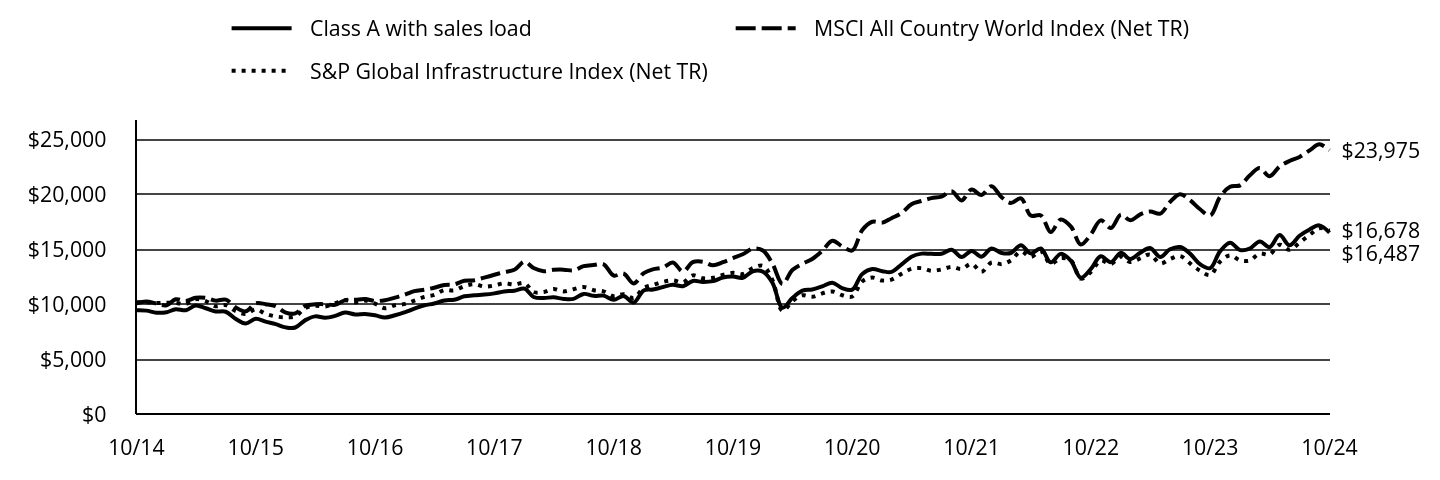

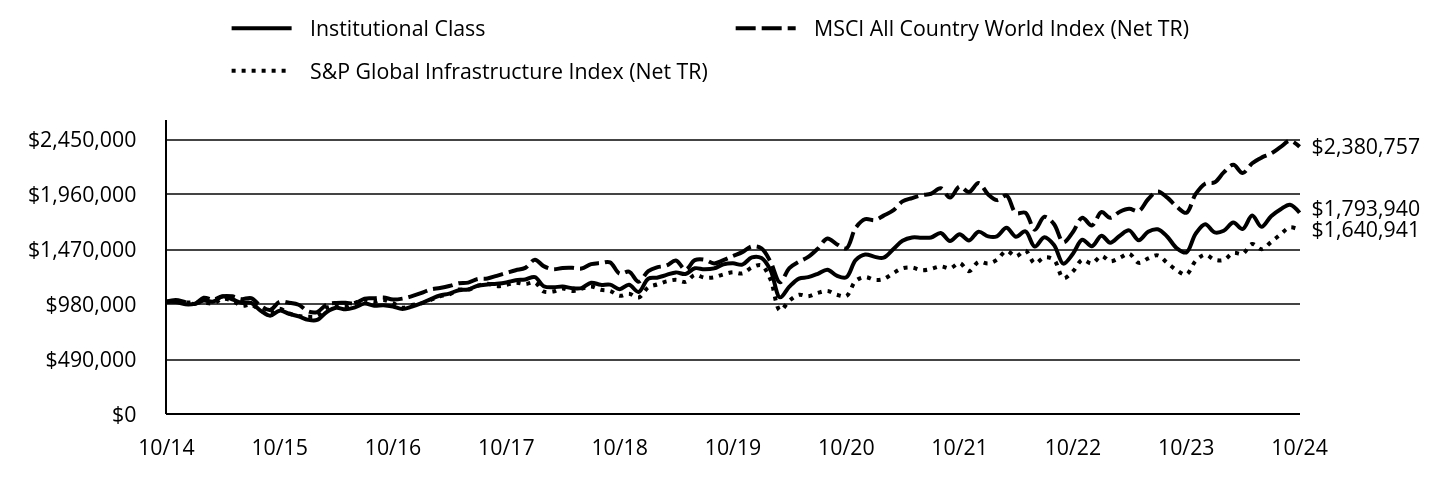

The following discussion compares the performance of the Fund to the MSCI All Country World Index (Net TR) to show how the Fund’s performance measures against the returns of similar investments for the reporting period.

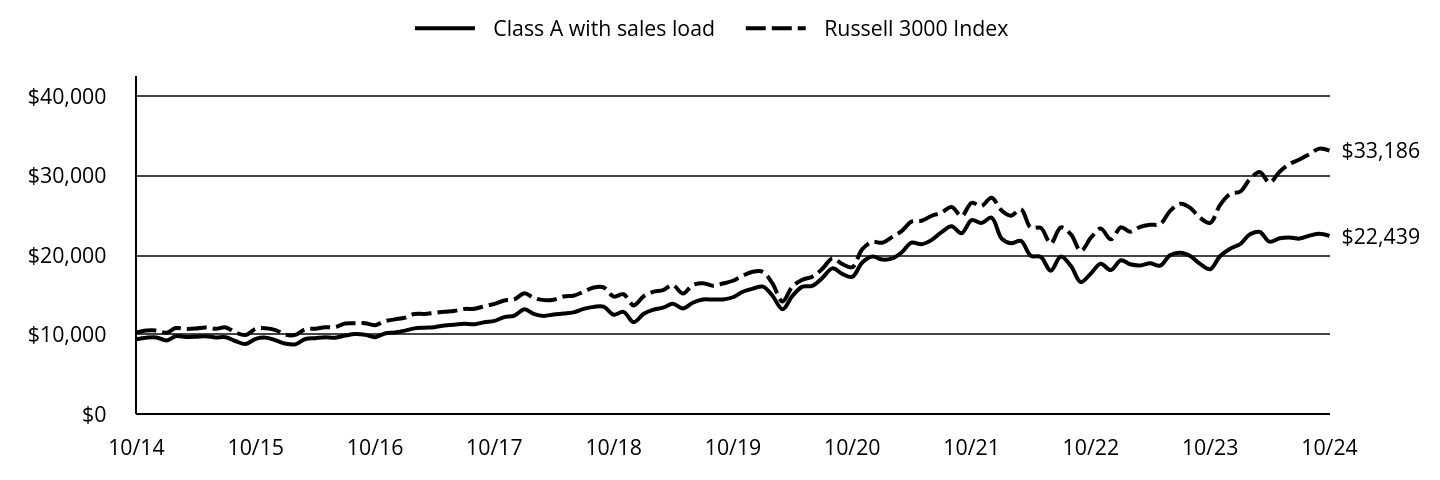

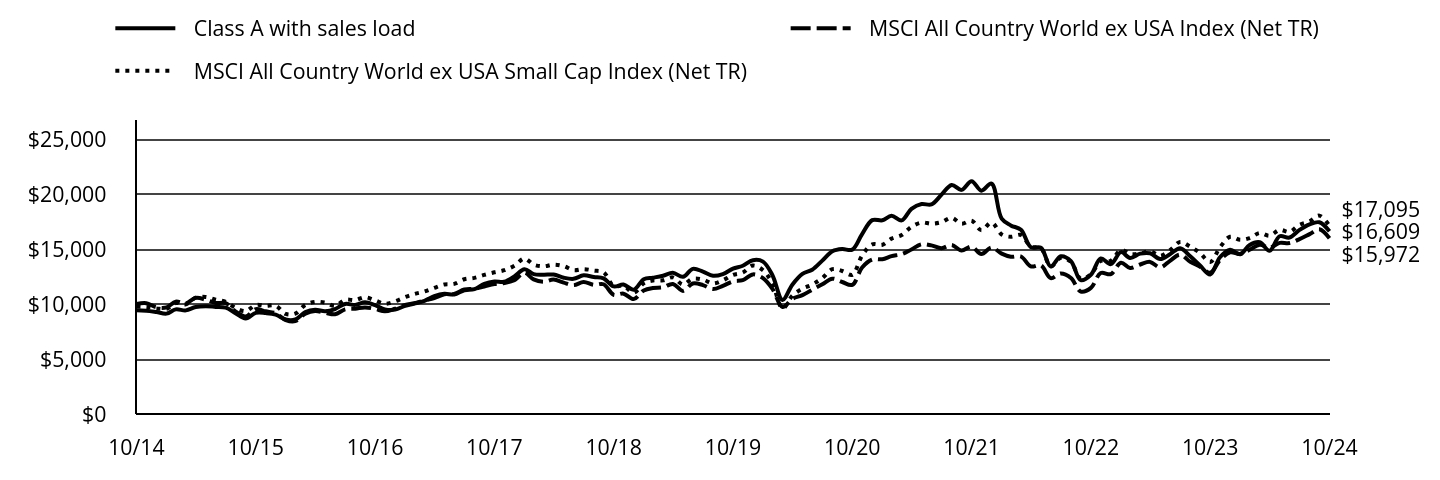

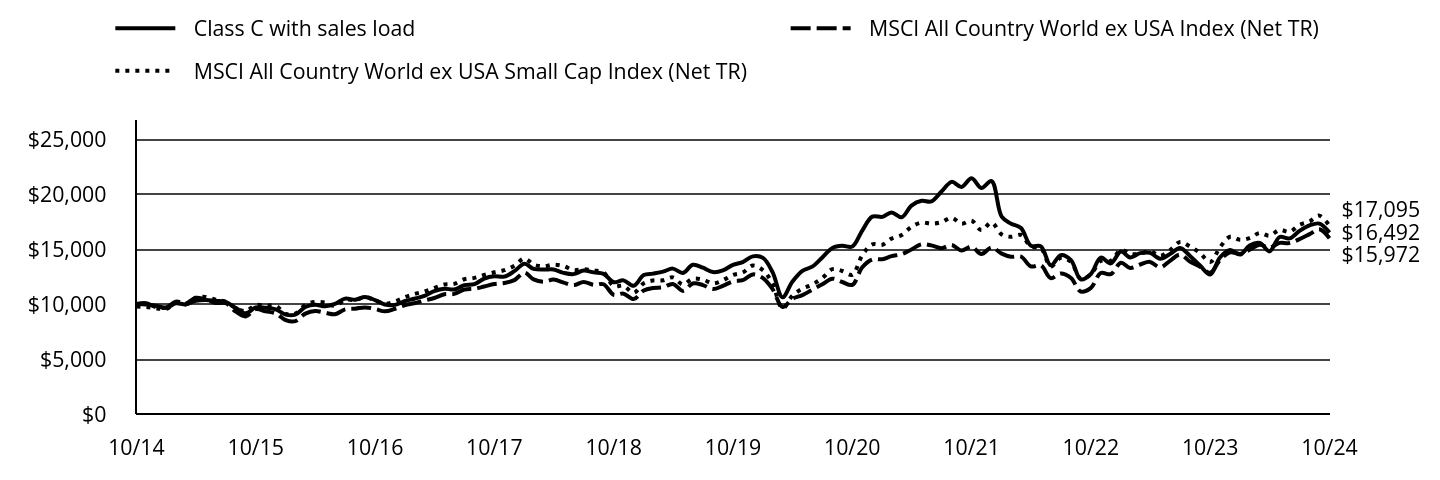

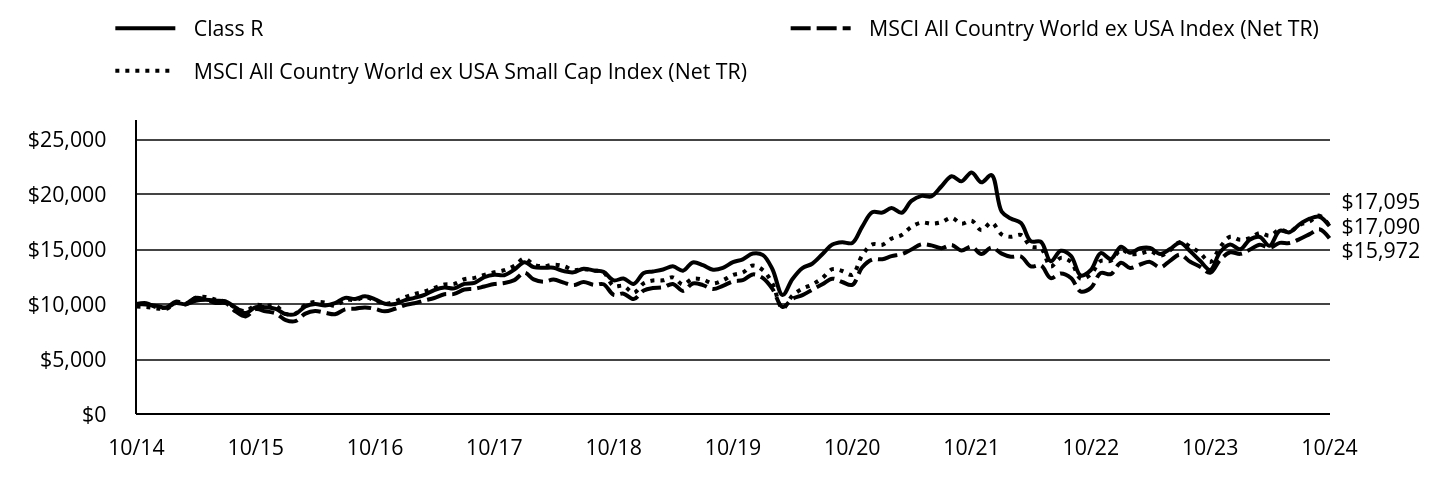

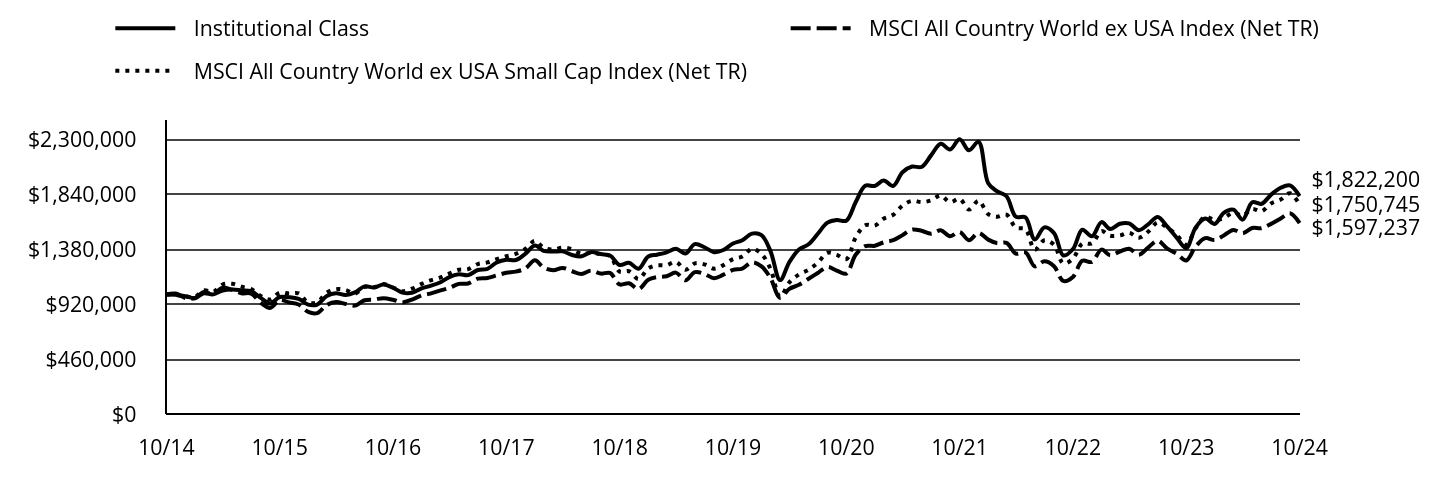

What contributed to performance?