abrdn China A Share Equity Fund (Unaudited)

Chinese stock markets had a volatile1 ride over the 12 months in review. The period began with a significant rally in November 2022, driven by the expectation of an economic reopening. Increased liquidity support for the struggling property sector from the government and state-owned banks also boosted sentiment.

The government duly diluted the zero-COVID policy in December 2022, and all social distancing measures were lifted. Chinese stock markets subsequently enjoyed solid gains over the first quarter of 2023. The optimistic tone proved short-lived, though, as the second quarter saw investors focus on fundamentals amid ongoing concerns about the strength of China’s post-COVID recovery. The absence of any announcements about government stimulus measures compounded these concerns.

Entering the summer months, market participants were initially lifted by news that the People's Bank of China had key interest rates decrease, as well as a request by the authorities for state-owned banks to cut their deposit rates. The mood was also helped when the long-awaited Politburo meeting signaled the government’s desire to improve the operating environment for private enterprises and the platform economy, boost capital markets, and increase investor confidence.

Yet, by August 2023, stocks were held in check by heightened concerns about the health of the real estate sector, as Country Garden, one of the country’s top three property developers, faced a serious liquidity issue. Around this time, we also saw stamp duty cut by half to boost capital-market confidence and a mortgage-rate reduction by the large banks designed to increase homeowners’ disposable income. The market slid again in the final months of the period amid uncertainty about the U.S. Federal Reserve’s policy direction, growing tensions between China and the West, and ongoing investor outflows despite the economy showing signs of recovery.

On the economic front, concerns over the pace of the recovery lingered, and sentiment had yet to recover fully. The government announced a 5% economic growth target for 2023, down from last year’s 5.5% GDP goal-the COVID affected Chinese economy grew by a relatively modest 3% in 2022. More positively, the economy expanded by 5.5% year over year in the first half of 2023.

Meanwhile, the ongoing, if somewhat patchy, recovery in the manufacturing and services sectors as evidenced by purchasing managers’ survey (PMI)2 readings, showed both segments in expansionary territory. Analysts believed this increase was underpinned by the supportive policy measures announced during the summer.

Fund performance review

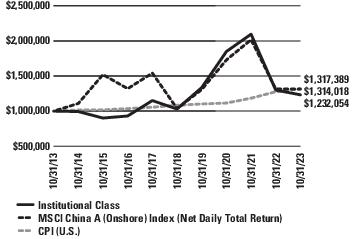

The abrdn China A Share Equity Fund (Institutional Class shares, net of fees) returned -5.19% for the 12-month reporting period ended

October 31, 2023, versus the -0.11% return of its benchmark, the Morgan Stanley Capital International (MSCI) China A Onshore Index (Net Daily Total Return), during the same period.

The Fund underperformed its benchmark over the 12-month review period. Looking at the laggards, the consumer sectors retreated as initial hopes of a recovery faded in the first quarter of 2023, and domestic investors rotated away from consumer names. Notably, China Tourism Group Duty Free was the biggest detractor at the stock level, as some one-off impacts from currency, changes to tax legislation, and a softer sales recovery pace hurt its share price. However, we continue to back the company, as we believe it remains uniquely positioned as the largest duty-free group globally with near-monopoly status in China and a clear cost advantage. Construction software company Glodon was also weak after underwhelming results alongside relatively soft real estate sentiment. However, we remain constructive on Glodon’s ability to meet its growth target and capitalize on opportunities, primarily as developers focus more on cost management and operational efficiency in this environment. In the alternative energy space, solar energy names such as Longi Green Energy fell on concerns over demand and geopolitical tensions. Battery separator leader Yunnan Energy was also weak due to concerns about overcapacity in the electric vehicle (EV) battery supply chain, alongside corporate governance issues.

Despite the negative sentiment around the Chinese consumer, some of our holdings were able to continue to deliver satisfactory earnings growth, including spirits producer Kweichow Moutai, electrical appliance manufacturer Midea Group, and Fuyao Glass, which all contributed positively to performance. Maxscend Microelectronics delivered strong third-quarter results thanks to the recovering smartphone market. At the same time, China Merchants Bank and Bank of Ningbo were lifted by improving investor sentiment following recent concerns about their mortgage and real estate exposure. Lastly, Jiangsu Hengrui Pharmaceuticals benefited from recovering fundamentals.

In notable portfolio activity over the period, we established a position in Zhejiang Weixing New Building Materials, a leading plastic pipe manufacturer with a solid track record. The company has demonstrated its resilience during the property downturn, and we feel it is well positioned to benefit from a potential recovery of the secondary housing market. We also initiated a position in Hefei Meiya Optoelectronic Technology for its unique exposure in dental equipment and our conviction in the long-term growth potential of the Chinese dental industry. Lasty, in June this year, we introduced BYD, a leading new-energy EV manufacturer that controls multiple steps in its supply chain, as we were attracted by the company’s market share gains and its model cycle trajectory, supported by its vertical penetration in battery and in-house supply of components.

{foots1}

| 1 | If the price of a fund moves significantly over a short period of time it is said to be 'volatile' or has 'high volatility'. If the price remains relatively stable, it is said to have 'low volatility'. Volatility can be used as a measure of risk. |

{foots1}

| 2 | Purchasing Managers’ Index (PMI) is a common economic indicator of the health of the manufacturing sector. |

abrdn Dynamic Dividend Fund (Unaudited)

Global stock markets generally rose over the 12 months under review. Inflation dominated the economic environment. Central banks in Western economies raised interest rates faster and much further than previously anticipated to counter multi-decade-high inflation. Despite these aggressive central bank actions, core inflation-which strips out volatile items such as energy and food-stayed at elevated levels in many countries. Nevertheless, global economic growth held up better than many investors expected, defying fears of a recession triggered by higher rates.

As U.S. and Eurozone inflation trended down towards the end of 2022, investors’ hopes rose that an end to interest rate rises could be in sight. Therefore, 2023 started with strong stock market gains. However, the collapse of two regional U.S. banks and the forced sale of Credit Suisse to rival UBS in March then evoked fears of a banking crisis. Despite an initial sell-off, stock markets recovered, helped by expectations of lower peak interest rates. After more market volatility1 in April and May, equities performed strongly over June and July due to news of a compromise agreement on the U.S. debt ceiling2 and further encouraging inflation data. This was despite still-hawkish rhetoric from central banks. Equities then generated negative returns in August, September, and October given concerns that interest rates would stay higher for longer, with the outbreak of war between Israel and Hamas adding to existing inflationary worries.

Fund performance review

The abrdn Dynamic Dividend Fund (Institutional Class shares, net of fees) returned 6.67% for the 12-month period ending October 31, 2023, versus the 10.50% return of its benchmark, the Morgan Stanley Capital International (MSCI) All Country (AC) World Index (Net Daily Total Return), during the same period.

The Fund posted a positive total return but underperformed its benchmark. Asset allocation and, to a lesser extent, stock selection detracted from performance. The Fund’s stock selection and underweight3 positions in both the communication services and information technology sectors were headwinds. By region, North America detracted the most due to stock selection. Africa and the Middle East had a broadly neutral effect as negative stock selection offset the value added from being underweight the region relative to the benchmark.

The largest detractors from performance were the Fund’s lack of exposure to semiconductor manufacturer NVIDIA and social media giant Meta Platforms (with the former only paying a small dividend

and the latter not paying a dividend). A holding in U.S.-based discount retailer Target Corporation also hurt performance.

Shares in U.S.-based chipmaker NVIDIA surged after the company gave a very bullish sales forecast on the demand for artificial intelligence (AI) processors. This took the stock to an all-time high and dragged the rest of the sector up with it. Shares in social media and advertising giant Meta Platforms also rose strongly as the company benefited from its aggressive cost-cutting program and its investments in AI. The latter have helped the company to attract traffic to Facebook and Instagram, as well as to increase its advertising revenues. Target Corporation's performance for the year was hindered by a challenging macroeconomic environment, diminished consumer confidence, and a normalisation of discretionary spending post-pandemic. Earnings estimates for the company steadily declined throughout the year. In addition, Target Corporation’s share price was negatively affected by the controversy surrounding its Pride Month merchandise.

Conversely, the Fund’s stock selection was positive in both the materials and financials sectors. By region, the U.K. was the largest positive as stock selection was only partially offset by a negative effect from being overweight4. Holdings in Asia-Pacific (excluding Japan) also added value due to stock selection.

At the individual stock level, key contributors to performance included holdings in semiconductor manufacturers BE Semiconductor Industries and Broadcom, as well as U.K.-listed industrial turnaround specialist Melrose Industries. BE Semiconductor Industries benefited from U.S.-based chipmaker NVIDIA’s previously mentioned very bullish sales forecast on the demand for AI processors. Broadcom shares performed well as the company reported strong results, helped by surging demand for its AI-related semiconductors. Melrose Industries spun off its automotive business to become a pure-play aerospace company. In addition, it held its first ‘capital markets day’ as a standalone company. Management presented a comprehensive overview of the aerospace business's positive fundamentals.

The Fund earns income through a combination of investing in companies that pay dividends and implementing a dividend-capture strategy. In a dividend-capture trade, the Fund sells a stock on or shortly after the stock's ex-dividend5 date and reinvests the sales proceeds into one or more other stocks that are expected to pay dividends before the next dividend payment on the stock that it is selling. While employing this strategy, the Fund purchases companies

{foots1}

| 1 | If the price of a fund moves significantly over a short period of time it is said to be 'volatile' or has 'high volatility'. If the price remains relatively stable, it is said to have 'low volatility'. Volatility can be used as a measure of risk. |

{foots1}

| 2 | The maximum amount of money that the U.S. government is allowed to borrow to meet its obligations. |

{foots1}

| 3 | A portfolio holding less of a particular security (or sector or region) than the security’s weight in the benchmark portfolio. |

{foots1}

| 4 | A portfolio holding an excess amount of a particular security (or sector or region) compared to the security’s weight in the benchmark portfolio. |

{foots1}

| 5 | Also abbreviated as 'xd', this is a share sold without the right to receive the declared dividend payment which is marked as due to those shareholders who are on the share register. The stock market authorities usually specify the date on which a share will begin trading 'xd'. The share price invariably drops when the share goes 'xd' taking the known income of the dividend out of the share price. |

abrdn EM SMA Completion Fund (Unaudited)

Emerging market equities generally fell over the period under review, driven largely by interest-rate expectations and the pace of China’s economic recovery after Beijing rolled back its controversial zero-COVID policy at the end of 2022. Geopolitical risks heightened at the close of the period amid the threat of a wider conflict in the Middle East between Israel and Hamas, and the subsequent ongoing military response.

An aggressive series of interest rate hikes by the U.S. Federal Reserve (Fed) to rein in inflation had initially sparked concerns over a potential slowdown in the U.S. economy. However, an exceptionally resilient labor market, together with moderating inflation levels as the period progressed, led to renewed market optimism about a benign soft landing1 in the world’s largest economy and fueled hopes that the Fed could be nearing the end of its monetary tightening2 cycle. Towards the period-end, investor sentiment shifted once again to worries about higher-for-longer U.S. interest rates, which pushed the U.S. dollar higher and dampened the outlook for the emerging market asset class.

Over in China, initial optimism surrounding the country’s reopening from COVID restrictions fizzled as it became apparent that the pace of recovery in domestic consumption would be slower than investors had expected. Authorities stepped in to try and speed up the recovery, with the Beijing government rolling out targeted stimulus measures and the People’s Bank of China drumming up support with interest rate cuts. China’s 2023 budget deficit was also raised from 3% of GDP to about 3.8%-a move that is considered rare and one that the government had resisted even during the COVID crisis. The flurry of policy moves resulted in some signs of recovery emerging towards the end of the period amid signs of stabilization in the economy. The property sector, however, remained fragile but is still well-supported by policymakers.

Against this backdrop, emerging Asia trailed the wider asset class, dragged lower by double-digit losses in China. Taiwan’s technology-heavy market outperformed on global artificial intelligence (AI)-related trends, while Indian equities bucked the downtrend to close higher. In emerging Europe, the Middle East and Africa, Gulf bourses3 fell on volatile oil prices and geopolitical concerns. Latin America was underpinned by the outperformance in Brazil and Mexico.

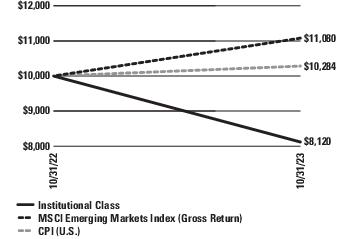

Fund performance review

The abrdn EM SMA Completion Fund returned -18.80% (Institutional Class shares, net of fees) for the period from January 27, 2023 (inception) to October 31, 2023, versus the -10.39% return of its

benchmark, the Morgan Stanley Capital International (MSCI) Emerging Markets Index4 (Gross Return), during the same period.

The Fund’s performance fell, underperforming its benchmark during the reporting period. The major drag on relative returns was China, including the off-benchmark position in Hong Kong. Our domestic consumption-focused names disappointed due to a slower-than-expected pace of economic recovery in China following the post-COVID reopening.

China Tourism Group Duty Free was weighed down by sluggish holiday duty-free sales in Hainan over the period. Our new position in digital platform provider Glodon also detracted from performance, alongside the exposure to condiment maker Foshan Haitian Flavoring & Food and LONGi Green Energy Technology, which we exited on waning conviction. Hong Kong-listed brewer Budweiser APAC was not spared from the sell-off as the weak investor sentiment carried over to the H-share market.5

We remain constructive on China as there are signs that growth is stabilizing. We believe the recovery will pick up pace in the coming months and in 2024, as consumers have a better outlook on their income and bonus prospects heading into next year. Broadly, the Fund remains well positioned to take advantage of a gradual recovery in domestic consumption. The portfolio has exposure to both onshore and offshore names that are potential beneficiaries. Policy measures will likely remain accommodative and calibrated towards specific sectors like autos, electronics, household products, and property.

The Fund’s holdings in South Korea also proved costly. A notable laggard was LG Chem, which sold off alongside other domestic electric vehicle (EV) battery plays due to concerns over slowing demand and global supply risk. In our view, LG Chem remains an attractive EV battery name and the company’s better-than-expected results and a strong order backlog reassure us of its positioning. Meanwhile, Samsung Electronics recovered with the memory cycle, as we expected. However, our holding is in the preference shares6, which lagged the ordinary shares this year. We own the preference shares as they trade on a cheaper valuation relative to the ordinary shares, while paying a higher dividend yield. We have been engaging Samsung Electronics actively on governance, stewarding them toward better governance standards, which we believe will benefit the company over the long term.

On a more positive note, stock selection in Taiwan contributed to relative returns, thanks to the outperformance of our two new information technology holdings, which we introduced and built up over the period. Fabless semiconductor company MediaTek and

{foots1}

| 1 | A milder economic slowdown compared to a recession. |

{foots1}

| 2 | Monetary policy - Decisions made by a government, usually through its central bank, regarding the amount of money in circulation in the economy. This includes setting official interest rates. |

{foots1}

| 3 | Bourses refer to stock markets in non-English speaking countries. |

{foots1}

| 4 | The MSCI Emerging Markets Index is an unmanaged index considered representative of growth stocks of developing countries. The index is computed using the net return, which withholds applicable taxes for non‐resident investors. |

{foots1}

| 5 | Shares of mainland Chinese companies traded on the Hong Kong Stock Exchange in Hong Kong dollars. |

{foots1}

| 6 | Shares in a company that have a higher claim on the assets and earnings than common stock. Dividends for preference shares generally must be paid out before those to common shares. Preference shares usually don’t have voting rights. |

abrdn Emerging Markets ex-China Fund (Unaudited)

Emerging market equities generally rose over the 12 months under review, driven largely by interest-rate expectations and the pace of China’s economic recovery as Beijing rolled back its controversial zero-COVID-19 policy at the end of 2022. Geopolitical risks heightened at the close of the period amid the threat of a wider conflict in the Middle East between Israel and Hamas, and the subsequent ongoing military response.

An aggressive series of interest rate hikes by the U.S. Federal Reserve (Fed) to rein in inflation initially sparked concerns over a potential slowdown in the U.S. economy. However, an exceptionally resilient labor market, together with moderating inflation levels as the year progressed, led to renewed market optimism about a benign soft landing1 in the world’s largest economy and fueled hopes that the Fed could be nearing the end of its monetary tightening2 cycle. Towards the period-end, investor sentiment shifted once again to worries about ‘higher-for-longer’ U.S. interest rates, which pushed the U.S. dollar higher and dampened the outlook for the emerging market asset class.

Over in China, initial optimism surrounding the country’s reopening from COVID-19 restrictions fizzled as it became apparent that the pace of recovery in domestic consumption would be slower than investors had expected. Authorities stepped in to try and speed up the recovery, with the Beijing government rolling out targeted stimulus measures and the People’s Bank of China drumming up support with interest-rate cuts. The flurry of policy moves resulted in some signs of recovery emerging towards the end of the period amid signs of stabilization in the economy. The property sector, however, remained fragile but is still well-supported by policymakers.

Across emerging Asia, the technology-heavy markets of South Korea and Taiwan advanced on global artificial intelligence (AI)-related trends. Elsewhere, Gulf indices fell on volatile oil prices and geopolitical concerns, while Latin America lagged amid the underperformance in Brazil.

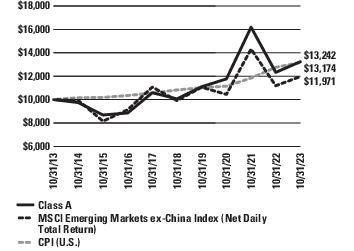

Fund performance review

The abrdn Emerging Markets ex-China Fund (Institutional Class shares, net of fees) returned 7.86% for the 12-month period ended October 31, 2023, versus the 7.03% return of its benchmark, the Morgan Stanley Capital International (MSCI) Emerging Markets ex-China Index (Net Daily Total Return), during the same period.

The Fund’s performance rose during the reporting period, outpacing its benchmark. From a regional perspective, emerging Europe, the Middle East, and Africa contributed most to the outperformance. The off-benchmark position in the Netherlands was especially rewarding, particularly e-commerce company Inpost, which reported strong results and fewer losses at its international division. Our semiconductor holdings in ASM International and ASML Holding were lifted by an AI-driven tech rally. The AI supercycle is an exciting theme

that requires significant investment in semiconductors and technology hardware to make possible, and it is part of a wider capital expenditure theme that should support emerging markets.

Also working in the portfolio’s favor was the underweight3 position to Gulf markets, where market sentiment was dominated by volatile energy prices and regional geopolitical uncertainties. Meanwhile, our new holding in Americana Restaurants International, a quick-service restaurant operator in the Middle East, added value as the company posted results that beat market estimates.

On the flip side, our exposure to South African mining company Anglo American Platinum detracted amid the decline in prices for the platinum group of metals it produces.

Within Latin America, our holdings in Mexico were underpinned by positive market sentiment, as economic indicators and domestic consumption strength proved encouraging. The country further benefits from nearshoring trends due to a global effort by companies to diversify their supply chains and shift manufacturing production to better manage reliance on China. Conglomerate Fomento Economico Mexicano turned in a robust performance.

Conversely, stock selection in Brazil disappointed. Not holding Petrobras was costly. The state-run oil company rallied in the second half of the period on higher oil prices, though this was partly mitigated by our position in French energy name TotalEnergies, which we introduced and built up over the period. A significant portion of TotalEnergies’ assets is in emerging markets. 3R Petroleum Oleo e Gas came under pressure after its board of directors approved a capital increase through the issuance of new shares. On a more encouraging note, e-commerce player MercadoLibre outperformed on strong domestic consumption trends and competitive strength.

There were some bright spots in emerging Asia. Taiwanese textile firm Makalot Industrial was the top single-stock contributor over the period, supported by its resilient fundamentals and rising margins. Kazakh financial technology company Kaspi.kz, which we initiated over the year, also contributed positively after reporting better-than-expected results with raised guidance that underscored its competitive advantages.

However, our overall exposure to the region weighed slightly on relative performance, largely owing to negative selection effects in South Korea. Samsung Electronics recovered with the memory cycle, as we expected. However, our holding is in the preference shares4, which lagged the ordinary shares this year. We own the preference shares as they trade on a cheaper valuation relative to the ordinary shares, while paying a higher dividend yield. We have been actively engaging with Samsung Electronics on governance, stewarding them toward better governance standards, which we believe will benefit the company over the long-term. Moreover, LG Chem sold off alongside other domestic electric vehicle (EV) battery plays due to concerns

{foots1}

| 1 | A milder economic slowdown compared to a recession. |

{foots1}

| 2 | Monetary policy - Decisions made by a government, usually through its central bank, regarding the amount of money in circulation in the economy. This includes setting official interest rates. |

{foots1}

| 3 | A portfolio holding less of a particular security (or sector or region) than the security’s weight in the benchmark portfolio. |

{foots1}

| 4 | Shares in a company that have a higher claim on the assets and earnings than common stock. Dividends for preference shares generally must be paid out before those to common shares. Preference shares usually don’t have voting rights. |

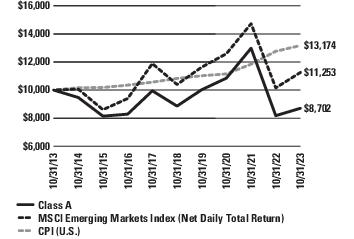

abrdn Emerging Markets Fund (Unaudited)

Emerging market equities generally rose over the 12 months under review, driven largely by interest-rate expectations and the pace of China’s economic recovery as Beijing rolled back its controversial zero-COVID policy at the end of 2022. Geopolitical risks heightened at the close of the period amid the threat of a wider conflict in the Middle East between Israel and Hamas, and the subsequent ongoing military response.

An aggressive series of interest rate hikes by the U.S. Federal Reserve (Fed) to rein in inflation initially sparked concerns over a potential slowdown in the U.S. economy. However, an exceptionally resilient labor market, together with moderating inflation levels as the year progressed, led to renewed market optimism about a benign soft landing1 in the world’s largest economy and fueled hopes that the Fed could be nearing the end of its monetary2 tightening cycle. Towards the period-end, investor sentiment shifted once again to worries about higher-for-longer U.S. interest rates, which pushed the U.S. dollar higher and dampened the outlook for the emerging market asset class.

Over in China, initial optimism surrounding the country’s reopening from COVID restrictions fizzled as it became apparent that the pace of recovery in domestic consumption would be slower than investors had expected. Authorities stepped in to try and speed up the recovery, with the Beijing government rolling out targeted stimulus measures and the People’s Bank of China drumming up support with interest-rate cuts. China’s 2023 budget deficit was also raised from 3.0% of GDP to about 3.8%—a move that is considered rare and one that the government had resisted even during the COVID crisis. The flurry of policy moves resulted in some signs of recovery emerging towards the end of the period amid signs of stabilization in the economy. The property sector, however, remained fragile but is still well-supported by policymakers.

Against this backdrop, emerging Asia finished ahead of the wider asset class, buoyed by double-digit returns in China. The technology-heavy markets of South Korea and Taiwan also advanced on global artificial intelligence (AI)-related trends. Emerging Europe, the Middle East, and Africa trailed, with Gulf indices falling on volatile oil prices and geopolitical concerns. Latin America was hurt by the underperformance in Brazil.

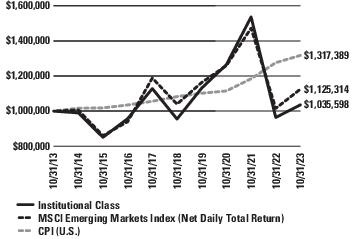

Fund performance review

The abrdn Emerging Markets Fund (Institutional Class shares, net of fees) returned 7.44% for the 12-month period ended October 31, 2023, versus the 10.80% return of its benchmark, the Morgan Stanley Capital International (MSCI) Emerging Markets Index (Net Daily Total Return), during the same period.3

The Fund’s performance rose but underperformed its benchmark during the reporting period. The major drag on relative returns was

China. Our domestic consumption-focused names disappointed due to a slower-than-expected pace of economic recovery in China following the post-COVID reopening. The losses from domestic China were partially offset by our off-benchmark position in Hong Kong, where our holdings posted resilient quarterly earnings.

China Tourism Group Duty Free was weighed down by sluggish holiday duty-free sales in Hainan over the period, while luxury car dealer Zhongsheng Group faced pressure from weak consumer sentiment and lackluster car sales. Condiment maker Foshan Haitian Flavoring & Food and LONGi Green Energy Technology also detracted—we exited both names over the period on waning conviction.

We remain constructive on China as there are signs that growth is stabilizing. We believe the recovery will pick up pace in the coming months and in 2024, as consumers have a better outlook on their income and bonus prospects heading into next year. Broadly, the Fund remains well positioned to take advantage of a gradual recovery in domestic consumption. The portfolio has exposure to both onshore and offshore names that are potential beneficiaries. Policy measures will likely remain accommodative and calibrated toward specific sectors like autos, electronics, household products, and property. We saw this in June as China introduced targeted measures to boost electric-vehicle (EV) and auto sales, which benefited our new position in EV maker Li Auto.

Positive stock selection in Mexico also helped to offset some of the drag on relative performance from our exposure to domestic China. Our holdings in Mexico were underpinned by positive market sentiment, as economic indicators and domestic consumption strength proved encouraging. The country further benefits from nearshoring trends due to a global effort by companies to diversify their supply chains and shift manufacturing production to better manage reliance on China. Conglomerate Fomento Economico Mexicano was the top single-stock contributor over the period. Elsewhere in Latin America, Brazilian e-commerce player MercadoLibre advanced on strong domestic consumption trends and competitive strength.

Also working in the portfolio’s favor was the underweight4 position to the Middle East, where market sentiment was dominated by volatile energy prices and regional geopolitical uncertainties. Towards the period-end, oil prices rose past $90 per barrel. We established a position in Saudi Arabian Oil Group (Aramco) during this period, which contributed to relative returns. Aramco’s high-quality, low-cost oil production assets should help support cash flow over the long-term, in our opinion. Likewise, we introduced and built up our position in French energy name TotalEnergies, which also added value. A significant portion of the company’s assets is in emerging markets. Meanwhile, our new holding in Americana Restaurants International, a

{foots1}

| 1 | A milder economic slowdown compared to a recession. |

{foots1}

| 2 | Monetary policy are decisions made by a government, usually through its central bank, regarding the amount of money in circulation in the economy. This includes setting official interest rates. |

{foots1}

| 3 | The MSCI Emerging Markets Index is an unmanaged index considered representative of growth stocks of developing countries. The index is computed using the net return, which withholds applicable taxes for non‐resident investors. |

{foots1}

| 4 | A portfolio holding less of a particular security (or sector or region) than the security’s weight in the benchmark portfolio. |

abrdn Emerging Markets Sustainable Leaders Fund (Unaudited)

Emerging market equities generally rose over the 12 months under review, driven largely by interest-rate expectations and the pace of China’s economic recovery as Beijing rolled back its controversial zero-COVID-19 policy at the end of 2022. Geopolitical risks heightened at the close of the period amid the threat of a wider conflict in the Middle East following Hamas’ attack on Israel, and the subsequent ongoing military response.

An aggressive series of interest rate hikes by the U.S. Federal Reserve (Fed) to rein in inflation initially sparked concerns over a potential slowdown in the U.S. economy. However, an exceptionally resilient labor market, together with moderating inflation levels as the year progressed, led to renewed market optimism about a benign soft landing1 in the world’s largest economy and fueled hopes that the Fed could be nearing the end of its monetary2 tightening cycle. Towards the period-end, investor sentiment shifted once again to worries about ‘higher-for-longer’ U.S. interest rates, which pushed the U.S. dollar higher and dampened the outlook for the emerging market asset class.

Over in China, initial optimism surrounding the country’s reopening from COVID-19 restrictions fizzled as it became apparent that the pace of recovery in domestic consumption would be slower than investors had expected. Authorities stepped in to try and speed up the recovery, with the Beijing government rolling out targeted stimulus measures and the People’s Bank of China drumming up support with interest-rate cuts. China’s 2023 budget deficit was also raised from 3% of GDP to about 3.8%—a move that is considered rare and one that the government had resisted even during the COVID-19 crisis. The flurry of policy moves resulted in some signs of recovery emerging towards the end of the period amid signs of stabilization in the economy. The property sector, however, remained fragile but is still well-supported by policymakers.

Against this backdrop, emerging Asia finished ahead of the wider asset class, buoyed by double-digit returns in China. The technology-heavy markets of South Korea and Taiwan also advanced on global artificial intelligence (AI)-related trends. Emerging Europe, the Middle East and Africa trailed, with Gulf indices falling on volatile oil prices and geopolitical concerns. Latin America was hurt by the underperformance in Brazil.

Fund performance review

The abrdn Emerging Markets Sustainable Leaders Fund (Institutional Class shares, net of fees) returned 6.97% for the 12-month period ended October 31, 2023, versus the 10.80% return of its benchmark, the Morgan Stanley Capital International (MSCI) Emerging Markets Index (Net Daily Total Returns)3, during the same period.

The Fund’s performance rose but underperformed its benchmark during the reporting period. The major drag on relative returns was China, including the off-benchmark position in Hong Kong. Our

domestic consumption-focused names disappointed due to a slower-than-expected pace of economic recovery in China following the post-COVID reopening.

China Tourism Group Duty Free was weighed down by sluggish holiday duty-free sales in Hainan over the period, while luxury car dealer Zhongsheng Group faced pressure from weak consumer sentiment and lackluster car sales. Our holdings in digital platform provider Glodon and financial software company Hundsun Technologies also detracted, alongside the exposure to LONGi Green Energy Technology, which we divested over the period on waning conviction.

We remain constructive on China as there are signs that growth is stabilizing. We believe the recovery will pick up pace in the coming months and in 2024, as consumers have a better outlook on their income and bonus prospects heading into next year. Broadly, the Fund remains well positioned to take advantage of a gradual recovery in domestic consumption. The portfolio has exposure to both onshore and offshore names that are potential beneficiaries. Policy measures will likely remain accommodative and calibrated towards specific sectors like autos, electronics, household products, and property.

Positive stock selection in Mexico helped to offset some of the drag on relative performance from our exposure to China. Our holdings in Mexico were underpinned by positive market sentiment, as economic indicators and domestic consumption strength proved encouraging. The country further benefits from nearshoring trends due to a global effort by companies to diversify their supply chains and shift manufacturing production to better manage reliance on China. The new position in soft drink bottler and convenience store operator Fomento Economico Mexicano, which also operates as the world’s largest Coca-Cola bottler through its subsidiary, proved favorable. Elsewhere in Latin America, Brazilian e-commerce player MercadoLibre advanced on strong domestic consumption trends and competitive strength.

Also working in the portfolio’s favor was the underweight4 to the Middle East, where market sentiment was dominated by volatile energy prices and regional geopolitical uncertainties.

At the stock level, South Korea-based LG Chem was the top single-stock detractor as the company sold off alongside other domestic electric vehicle (EV) battery plays due to concerns over slowing demand and global supply risk. In our view, LG Chem remains an attractive EV battery name and the company’s better-than-expected results and a strong order backlog assure us of its positioning. Another notable laggard was India’s Crompton Greaves Consumer Electricals, which we exited over the period. On the flip side, the position in Power Grid Corp of India, which has been successfully winning new transmission projects under competitive bidding, added value. Kazakh financial technology company Kaspi.kz also contributed positively after reporting better-than-expected

{foots1}

| 1 | A milder economic slowdown compared to a recession. |

{foots1}

| 2 | Monetary policy refers to decisions made by a government, usually through its central bank, regarding the amount of money in circulation in the economy. This includes setting official interest rates. |

{foots1}

| 3 | The MSCI Emerging Markets Index is an unmanaged index considered representative of growth stocks of developing countries. The index is computed using the net return, which withholds applicable taxes for non‐resident investors. |

{foots1}

| 4 | A portfolio holding less of a particular security (or sector or region) than the security’s weight in the benchmark portfolio. |

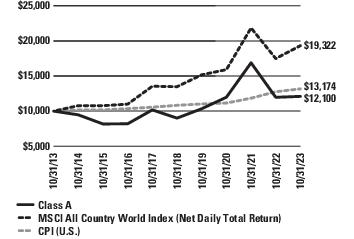

abrdn Global Equity Impact Fund (Unaudited)

Global stock markets generally rose over the 12 months under review. Inflation dominated the economic environment. Central banks in Western economies raised interest rates faster and much further than previously anticipated to counter multi-decade-high inflation. Despite these aggressive central bank actions, core inflation—which strips out volatile items such as energy and food—stayed at elevated levels in many countries. Nevertheless, global economic growth held up better than many investors expected, defying fears of a recession triggered by higher rates.

As U.S. and Eurozone inflation trended down towards the end of 2022, investors’ hopes rose that an end to interest-rate rises could be in sight. Therefore, 2023 started with strong stock market gains. However, the collapse of two regional U.S. banks and the forced sale of Credit Suisse to rival UBS in March then evoked fears of a banking crisis. Despite an initial sell-off, stock markets recovered, helped by expectations of lower peak interest rates. After more market volatility1 in April and May, equities performed strongly over June and July due to news of a compromise agreement on the U.S. debt ceiling2 and further encouraging inflation data. This was despite still-hawkish rhetoric from central banks. Equities then generated negative returns in August, September, and October given concerns that interest rates would stay higher for longer, with the outbreak of war between Israel and Hamas adding to existing inflationary worries.

Fund performance review

The abrdn Global Equity Impact Fund (Institutional Class shares, net of fees) returned 1.39% for the 12-month period ended October 31, 2023, versus the 10.50% return of its benchmark, the Morgan Stanley Capital International (MSCI) All Country (AC) World Index (Net Daily Total Return), during the same period.

The Fund underperformed its benchmark due to sector allocation and, to a lesser extent, stock selection. The main detractors from the Fund’s performance were information technology and communication services due to stock selection and underweight3 positions in both sectors. The Fund invests in companies that have products and services that we believe align with the United Nations’ Sustainable Development Goals (SDGs). None of the large technology companies pass our assessment process and this underweight was a major drag in the period. In contrast, stock selection in the healthcare sector added value but was partially offset by having an overweight4 exposure. Not having any holdings in the energy sector was also beneficial.

In terms of individual stock detractors, Samsung SDI, the South Korean electric-vehicle battery manufacturer, sits within our ‘Sustainable Energy’ pillar and had been a strong performer on the back of consistent delivery. However, negative sentiment towards China, along with uncertainty about the wider economic backdrop and automotive demand, weighed on the shares during the period.

Insulet shares underperformed after Novo Nordisk’s SELECT trial results showed that Wegovy, the GLP-1 drug, led to weight loss among obese patients. Medical device manufacturers, particularly in the diabetes area, sold off heavily as investors feared weight-loss drugs would reduce the amount of insulin required and may stop some patients developing Type 2 diabetes. Otherwise, two of the largest detractors were NVIDIA and Microsoft, which are both companies that do not fit within our ‘Impact Framework’.5

On the positive side, Novo Nordisk, the Denmark-based pharmaceutical company, released strong results as part of its SELECT trial for its drug Wegovy. The trial showed a 20% reduction in cardiovascular risk for obese patients. Novo Nordisk’s innovation around preventing and reducing the severity of cardiovascular issues reinforces our view of the positive impact that the company has within global healthcare and social care. Coursera, the education platform, delivered strong second-quarter results, beating expectations and raising guidance for the full year. Longer term, the platform reiterated its position within workforce retraining and its positive exposure to the disruption of artificial intelligence and reskilling requirements. This reinforces our view on Coursera’s positive impact on global education and employment needs. Schneider Electric’s full-year results exceeded expectations. The board also decided to split the office of chairman from that of chief executive officer. Guidance for 2023 also remains encouraging, given the secular trends of electrification, digitalization, and sustainability. This position continues to align with our focus in the ‘Sustainable Energy’ pillar.

In activity, we initiated a position in Wabtec, a U.S.-based business that sells equipment into the rail industry. Its components enhance efficiencies and drive down emissions. Wabtec is supporting the intermodal transport switch from trucks to trains. We believe we are at the starting point of market-share gains given that the industry has been underinvesting. We also purchased Litalico, a Japanese education business. As a provider of support and training services to people with disabilities in Japan, Litalico sits within our ‘Education and Employment’ pillar, where the twin focuses are on quality, affordable education and employment opportunities. In addition, we initiated a position in Medikaloka Hermina, which is one of the largest private hospital providers in Indonesia. It plays a key role in the Indonesian government's push to increase universal health coverage among Indonesians and to improve the quality of service. We had a positive meeting, covering some of the fundamentals concerning the company’s mix of patients, its aspirations for growth through managing more intensive cases, and the anticipated inflection point for information technology costs.

We sold our holding in Goodman Group. The Australian real estate business delivered good growth, but macroeconomic fears about the valuation of its assets continued to pressure the share price. Our large

{foots1}

| 1 | If the price of a fund moves significantly over a short period of time it is said to be 'volatile' or has 'high volatility'. If the price remains relatively stable, it is said to have 'low volatility'. Volatility can be used as a measure of risk. |

{foots1}

| 2 | The maximum amount of money that the U.S. government is allowed to borrow to meet its obligations. |

{foots1}

| 3 | A portfolio holding less of a particular security (or sector or region) than the security’s weight in the benchmark portfolio. |

{foots1}

| 4 | A portfolio holding an excess amount of a particular security (or sector or region) compared to the security’s weight in the benchmark portfolio. |

{foots1}

| 5 | The abrdn Impact Framework is a strategy for measuring and managing investments' impact, specifically aligning with the United Nations Sustainable Development Goals for sustainable and responsible investing. |

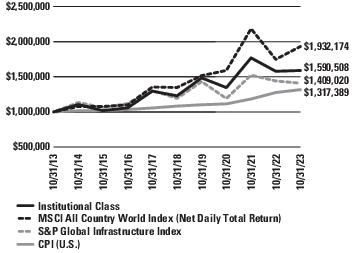

abrdn Global Infrastructure Fund (Unaudited)

Global stock markets generally rose over the 12 months under review. Inflation dominated the economic environment. Central banks in Western economies raised interest rates faster and much further than previously anticipated to counter multi-decade-high inflation. Despite these aggressive central bank actions, core inflation— which strips out volatile items such as energy and food—stayed at elevated levels in many countries. Nevertheless, global economic growth held up better than many investors expected, defying fears of a recession triggered by higher rates.

As U.S. and eurozone inflation trended down towards the end of 2022, investors’ hopes rose that an end to interest rate rises could be in sight. Therefore, 2023 started with strong stock market gains. However, the collapse of two regional U.S. banks and the forced sale of Credit Suisse to rival UBS in March then evoked fears of a banking crisis. Despite an initial sell-off, stock markets recovered, helped by expectations of lower peak interest rates. After more market volatility1 in April and May, equities performed strongly over June and July due to news of a compromise agreement on the U.S. debt ceiling2 and further encouraging inflation data. This was despite still-hawkish rhetoric from central banks. Equities then generated negative returns in August, September, and October given concerns that interest rates would stay higher for longer, with the outbreak of war between Israel and Hamas adding to existing inflationary worries.

In terms of listed infrastructure stocks, the past 12 months have seen them lag the overall market as investors focused on the impact of rising interest rates. This was especially seen in the utility sector, where renewables had been the main source of growth. Higher rates negatively affected the value of existing assets and, more importantly, raised questions about the returns on future projects and growth rates going forward. While higher rates are undoubtedly a negative for renewable projects, investors have only focused on the negative side of the return equation and have largely ignored the higher prices that renewable developers are able to lock in over the long term. We continue to be confident in the long-term prospects for renewables, due to continued support from governments worldwide and the increasing adoption of green-energy strategies by companies across most industries. Elsewhere in the infrastructure sector, we saw transportation continue to rebound post-COVID, with leisure travel being especially strong. A number of airports are now seeing traffic above their pre-pandemic numbers.

Fund performance review

The abdrn Global Infrastructure Fund returned 0.75% (Institutional Class shares, net of fees) for the 12-month reporting period ended October 31, 2023, versus the 10.50% return of its broad-based benchmark, the Morgan Stanley Capital International (MSCI) All Country (AC) World Index (Net Daily Total Return), and the -2.23% return of its secondary benchmark that more closely aligns with the Fund’s strategy, the S&P Global Infrastructure Index (Net Total Returns), during the same period.

During the past 12 months, infrastructure sector returns have reflected developments in the global markets overall. The secondary benchmark S&P Global Infrastructure Index gives exposure to three main infrastructure segments: utilities, transportation, and energy. On the other hand, the Fund’s portfolio-held issuers, primarily in the industrials, utilities, energy, and communication sectors. In the past year, the industrials and utilities sectors were the two largest contributors to the Fund’s relative returns, thanks to positive stock selection in both sectors and an underweight3 exposure to the latter. Meanwhile, a non-benchmark exposure to communication services detracted from the Fund’s relative returns.

At a stock level, Ferrovial, a worldwide infrastructure operator, positively affected performance during the reporting period. The company's stock appreciated as traffic on its toll roads recovered. Furthermore, the 407 Express Toll Route has recommenced dividend payments, and there may be potential for toll increases. Early next year, management intends to have Ferrovial listed in the U.S. Vistra Corp., the U.S. independent power producer, saw its earnings estimates rise throughout the year, supported by strong power prices and output. As the company increased its hedges for 2024 and 2025, management also expressed confidence in achieving its guidance. Vinci, a Europe-based owner of infrastructure concessions and a construction company, reported strong earnings during the period. Traffic at its airports continues to improve as economies reopen post-COVID lockdowns. In addition, the company’s construction order book is at a record high.

On the other hand, NextEra Energy Partners, the U.S. renewables operator, announced that it would cut dividend growth guidance from 12–15% to 5–8% as a result of the higher cost of capital that has reduced its ability to acquire new renewable assets. Shares in Helios Towers, the African tower company, sold off as sentiment for highly levered, emerging-market firms soured. This was despite the company releasing good results that highlighted the strong growth in its key markets. Crown Castle International, the U.S. tower operator, continued to lag the benchmark as investors focused on a slowing growth rate in towers and a decline in fibre revenues. The share prices of both Helios and Crown Castle were also negatively affected by investor sentiment about higher interest rates.

Outlook

Macroeconomic factors continue to dominate market sentiment, with investors scrutinizing the latest data and trying to predict when a pause or pivot in the direction of interest rates might occur. Geopolitical pressures remain globally. Recessionary concerns are all too present as global growth stagnates against a backdrop of elevated inflationary pressures, in our view. Our focus remains at the stock level, ensuring the portfolio is diversified and robust enough to preserve capital in periods of market weakness. We have exposure to what we feel are high-quality businesses with the financial backbone to withstand volatility, underpinned by strong structural drivers.

{foots1}

| 1 | If the price of a fund moves significantly over a short period of time it is said to be 'volatile' or has 'high volatility'. If the price remains relatively stable, it is said to have 'low volatility'. Volatility can be used as a measure of risk. |

{foots1}

| 2 | The maximum amount of money that the U.S. government is allowed to borrow to meet its obligations. |

{foots1}

| 3 | A portfolio holding less of a particular security (or sector or region) than the security’s weight in the benchmark portfolio. |

abrdn International Small Cap Fund (Unaudited)

Global stock markets generally rose over the 12 months under review. Inflation dominated the economic environment. Central banks in Western economies raised interest rates faster and much further than previously anticipated to counter multi-decade-high inflation. Despite these aggressive central bank actions, core inflation—which strips out volatile items such as energy and food—stayed at elevated levels in many countries. Nevertheless, global economic growth held up better than many investors expected, defying fears of a recession triggered by higher rates.

As U.S. and Eurozone inflation trended down towards the end of 2022, investors’ hopes rose that an end to interest rate rises could be in sight. Therefore, 2023 started with strong stock market gains. However, the collapse of two regional U.S. banks and the forced sale of Credit Suisse to rival UBS in March then evoked fears of a banking crisis. Despite an initial sell-off, stock markets recovered, helped by expectations of lower peak interest rates. After more market volatility1 in April and May, equities performed strongly over June and July due to news of a compromise agreement on the U.S. debt ceiling2 and further encouraging inflation data. This was despite still-hawkish rhetoric from central banks. Equities then generated negative returns in August, September, and October given concerns that interest rates would stay higher for longer, with the outbreak of conflict between Israel and Hamas adding to existing inflationary worries.

Fund performance review

The abrdn International Small Cap Fund (Institutional Class shares, net of fees) returned 0.57% for the 12-month period ended October 31, 2023, versus the 8.82% return of its benchmark, the Morgan Stanley Capital International (MSCI) All Country (AC) World Index (ex-USA) Small Cap Index (Net Daily Total Return), during the same period.

The Fund underperformed its benchmark due to stock selection and, to a lesser extent, sector allocation.

In terms of individual stock detractors, WNS (Holdings), the Indian provider of business process management services, underperformed as investors became concerned that its business model could be adversely affected by artificial intelligence (AI). Affle (India), the digital advertising company that’s main role is matching the demand and supply of adverts, also underperformed. The company’s results were slightly weaker than expected, driven by macroeconomic headwinds in developed markets, which are causing an industry slowdown in digital advertising expenditure. However, Affle’s performance in emerging markets continued to be strong. Nonetheless, we have sold the Fund’s position in the company. IDP Education was another detractor after a regulatory change in Canada that opened up the English language-testing market to more competitors. IDP Education essentially lost its monopoly position, leading to the risks of a lower market share and margin erosion. Therefore, we sold the Fund’s position.

More positively, BE Semiconductor Industries benefited from U.S.-based chipmaker NVIDIA’s very bullish sales forecast on the demand for AI processors, which took the stock to an all-time high and dragged the rest of the sector up with it. Games Workshop, the world’s largest table-top hobby company, performed strongly. In the middle of December 2022, the company announced that it had reached an agreement in principle with Amazon for the latter to develop Games Workshop’s intellectual property into film and TV productions, and for Amazon to get associated merchandising rights. These rights will initially be for the Warhammer 40,000 universe. However, this has broader implications, with TV/film products improving the company’s brand reach and awareness. Dino Polska was another strong performer after investors welcomed data showing a slowdown in sequential food consumer price inflation in Poland.

In terms of activity, we initiated a holding for the Fund in ASICS. The company has come through a major restructuring, which has addressed multiple inefficiencies within its operations and sought to reposition it in a digital era. ASICS’ current operations are running ahead of consensus expectations as its strong market position in the performance running shoe category positively affects other shoe categories. The company continues to enjoy upward sales momentum across its product range, while also expanding into new geographies.

We also introduced a position for the Fund in Sanwa Holdings, which is a global leader in the manufacturing and supply of shutters, garage doors, and industrial doors. Management commentary suggests the demand outlook is less negative than consensus forecasts imply. Factors supportive of growth include (i) robust demand for non-residential construction in Japan and the U.S., (ii) expansion in Asia, (iii) the normalization of service revenue and (iv) a moderation in steel prices. Approximately 20% of the company’s sales are driven by service revenue, which has been negatively affected by the COVID-19 pandemic as engineers were unable to carry out work at customer locations.

Another new holding was Makalot, which is one of the largest listed-garment manufacturers globally. Over the last year or so, the industry has been negatively affected by the destocking cycle. However, management believes that this is now coming to an end. On a medium-to-long-term basis, Makalot continues to benefit from favorable industry tailwinds, such as end-market demand growth and ongoing supplier consolidation. These are in addition to management-led growth initiatives, namely new client wins, capacity expansion, and an improving product mix.

Meanwhile, we disposed of the Fund’s holding in Chunbo, a company that manufactures and sells chemical materials used in the electric-vehicle cycle. We sold the position given a lack of earnings momentum. In addition, we have some environmental, social, and governance concerns, particularly in relation to the company’s husband-and-wife co-chief executive officer (CEO) structure, the

{foots1}

| 1 | If the price of a fund moves significantly over a short period of time it is said to be 'volatile' or has 'high volatility'. If the price remains relatively stable, it is said to have 'low volatility'. Volatility can be used as a measure of risk. |

{foots1}

| 2 | The maximum amount of money that the U.S. government is allowed to borrow to meet its obligations. |

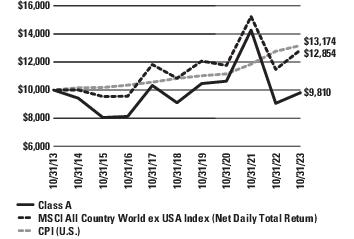

abrdn International Sustainable Leaders Fund (Unaudited)

Global stock markets generally rose over the 12 months under review. Inflation dominated the economic environment. Central banks in Western economies raised interest rates faster and much further than previously anticipated to counter multi-decade-high inflation. Despite these aggressive central bank actions, core inflation—which strips out volatile items such as energy and food—stayed at elevated levels in many countries. Nevertheless, global economic growth held up better than many investors expected, defying fears of a recession triggered by higher rates.

As U.S. and Eurozone inflation trended down towards the end of 2022, investors’ hopes rose that an end to interest rate rises could be in sight. Therefore, 2023 started with strong stock market gains. However, the collapse of two regional U.S. banks and the forced sale of Credit Suisse to rival UBS in March then evoked fears of a banking crisis. Despite an initial sell-off, stock markets recovered, helped by expectations of lower peak interest rates. After more market volatility1 in April and May, equities performed strongly over June and July due to news of a compromise agreement on the U.S. debt ceiling2 and further encouraging inflation data. This was despite still-hawkish rhetoric from central banks. Equities then generated negative returns in August, September, and October given concerns that interest rates would stay higher for longer, with the outbreak of war between Israel and Hamas adding to existing inflationary worries.

Fund performance review

The abrdn International Sustainable Leaders Fund (Institutional Class shares, net of fees) returned 8.61% for the 12-month period ending October 31, 2023, versus the 12.07% return of its benchmark, the Morgan Stanley Capital International (MSCI) All Country (AC) World (ex-USA) Index (Net Daily Total Return), during the same period.

The Fund underperformed its benchmark primarily due to style headwinds for high-quality sustainable leaders during the summer months, which punctuated an otherwise positive period of relative performance. This underperformance was due to a renewed rise in bond yields consistent with higher-for-longer interest rate expectations, prompting long-duration stocks3 to lag. These negative style dynamics were visible in both sector allocation and stock selection.

In terms of individual stock detractors, shares in global payment platform Adyen sold off materially after weaker-than-expected growth in the company’s first-half report, particularly in the North American market, where competition has intensified in some areas. However, the company has reiterated its mid-term targets. Although the timing for operating leverage to reaccelerate has been pushed out, we do not think that the company’s mid-to-long-term growth has been materially impaired. Shares in Samsung SDI, a leading manufacturer of batteries and electronic materials, were weak because of management’s comments about slightly

weaker-than-expected demand for cylindrical batteries used in automobiles and power-tools. However, we believe this tailwind should be short term in nature. Shares in specialist chemical company Croda International also fell after a profit warning. The company reduced its full-year guidance to a level 15% below where investors were previously expecting it to be for 2023, driven by customer destocking in Croda’s Consumer Care and Crop divisions.

In terms of contributors to performance, shares in pharmaceutical company Novo Nordisk rose on the back of positive SELECT trial results, which demonstrated a 20% cardiovascular risk benefit from weight loss induced by its GLP-1 drug, Wegovy. This significantly increased the probability of widespread commercial/Medicare coverage for GLP-1s, thereby leading to significant earnings upgrades. Shares in animal healthcare business Dechra Pharmaceuticals rose after the company announced that it had entered discussions with private equity firm EQT (with the Abu Dhabi Investment Authority as a potential co-investor) for a possible all-cash offer for the business. Elsewhere, China’s reopening following its ‘Zero-COVID’ policy buoyed consumer stocks, such as global cosmetics company L’Oréal. We continue to hold the position given the attractive compounding nature of the company’s earnings streams.

Meanwhile, in activity, we initiated a holding in Wolters Kluwer, the Dutch professional information and publishing company, given its attractive market position, pricing power, and relatively stable business model. We also introduced Edenred, the global market-leading provider of prepaid corporate services, given its attractive inflation and rates exposure. In addition, we introduced a holding in London Stock Exchange Group. The company is the global leader as a financial data and infrastructure provider, with a wide economic moat4 derived from its scale, large switching costs for customers, and high barriers to entry.

We sold the Fund’s holding in Spirax-Sarco Engineering after good performance in order to invest into higher conviction ideas. We also disposed of our positions in Danish insurer Tryg and Canadian wealth management firm CI Financial.

Outlook and strategy

Signs of a weakening economic cycle are becoming increasingly evident, along with indications of pressure on credit as savings are eroded and the labor market cools, in our view. We believe financing costs for businesses are rising and are starting to make investors nervous, with a few recent examples where we have seen the shares of companies with weaker balance sheets come under pressure. We believe that this is not a meaningful risk for the Fund given the importance we place on financial strength. We think we are clearly late in the rate-hiking cycle, particularly one where the pace and quantum of tightening has been so marked. This means that a highly uncertain outlook is likely to cause further volatility in our view, as

{foots1}

| 1 | If the price of a fund moves significantly over a short period of time it is said to be 'volatile' or has 'high volatility'. If the price remains relatively stable, it is said to have 'low volatility'. Volatility can be used as a measure of risk. |

{foots1}

| 2 | The maximum amount of money that the U.S. government is allowed to borrow to meet its obligations. |

{foots1}

| 3 | Shares of companies with expected long-term growth, typically in sectors like technology or healthcare. These stocks are often less sensitive to immediate economic cycles but more to interest rate changes. |

{foots1}

| 4 | A competitive advantage that a company has over its peers in the same industry. |

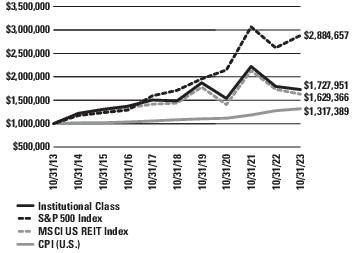

abrdn Realty Income & Growth Fund (Unaudited)

The U.S. real estate investment trust (REIT)1 market significantly underperformed the broader equity market, as measured by the S&P 500 Index, amid shifting sentiment around interest rates and the U.S. Federal Reserve (Fed) recently stating that interest rates would remain higher for a prolonged period. U.S. REITs also underperformed the global real estate index, as measured by the FTSE EPRA/NAREIT Global Net Index.

The key themes during the period included high inflation and high interest rates, and concerns of a banking sector crisis following the collapse of a few regional banks in the U.S. As the review period progressed, economic data generally was better than feared, although the risk of a global recession remained. The Fed indicated that, based on its “dot plot”2 projections, the federal funds rate would be roughly 50 basis points higher in every time period, and rates would remain above 3% up to and during 2026. Investors inferred that the new nominal neutral rate3 was 3% versus the long-term expectation of 2.5%, leading to a subsequent sell-off in risk assets.4 Indeed, the 10-year Treasury yield in the U.S. breached 5% during the reporting period. Not only were nominal interest rates on the rise, but with the sharp move, real interest rates5 closed above 2% for the first time since March 2009.

Additionally, the real estate sector faced increased scrutiny following the failure of some regional banks in the U.S. earlier in the period. These failures led to an examination into the health of all U.S. regional banks and with it a reassessment of loan portfolios, particularly for commercial real estate, exacerbating refinancing6 concerns for a number of landlords. In general, operating conditions have continued to moderate from the robust levels that we saw last year, where numerous sectors were able to pass through double-digit rental rate growth.

Fund performance review

The abrdn Realty Income & Growth Fund (Institutional Share Class, net of fees) returned -3.67% for the 12-month reporting period ending October 31, 2023, versus the -5.92% return of the Morgan Stanley Capital International (MSCI) US REIT Index during the same period.

Our holdings in the healthcare sector contributed to the Fund’s positive relative performance. The skilled nursing and senior housing REITs sub-sectors outperformed as occupancies continued to recover from the pandemic lows. Improving tenant health for skilled nursing REITs and outsized rental and net operating income7 growth for senior housing landlords also underpinned the sector. As a result, the Fund’s holdings Welltower and Sabra Health Care posted gains.

Meanwhile, our lack of exposure to diversified healthcare REIT Healthpeak Properties proved beneficial as it underperformed following concerns that life science tenants were experiencing funding difficulties in the wake of the regional banking crisis. Medical Properties Trust also underperformed as concerns around tenant health continue to plague the company; the Fund’s lack of exposure benefited the Fund. Our exposure to data centers was also positive, especially our overweight8position in Digital Realty Trust, as the potential demand driver of artificial intelligence (AI) became more apparent to the market.

Conversely, stock selection and underweight9allocation to the retail sector weighed on the Fund’s relative performance. Within the retail sector, our overweight position in triple net lease REIT Realty Income Corporation was a notable detractor amid the high interest-rate environment. Elsewhere, the Fund was negatively affected relative to the benchmark by not owning Iron Mountain, as its data business benefited from the excitement around AI. Additionally, the overweight position in multi-family residential REIT UDR underperformed after the company reported weaker-than-expected second-quarter results.

In key portfolio activity for the review period, the Fund purchased Equinix and Digital Realty where we see demand trends starting to show signs of improvement and the potential demand opportunity that exists from the growth of AI computing. We also increased the Fund’s position in Omega Healthcare due to increased confidence about the health of skilled nursing operators. Additionally, the Fund increased its exposure to the single-family rental sector by reinitiating a position in Invitation Homes, as we believe the lack of housing affordability due to rising interest rates could drive more families into the rental housing market as they outgrow traditional apartment space. Lastly, the Fund initiated a position in Hudson Pacific Properties, due to our increased conviction in the issuer.

These purchases were funded by reducing the Fund’s exposure to the apartment sector and exiting the Fund’s position in Equity Residential and UDR, due to concerns about supply pressures, particularly in the sunbelt markets. The Fund also reduced positions in industrial REIT Prologis due to the prospect for slowing near-term rental growth after several years of strong performance. We also reduced the Fund’s exposure to the cell tower sector, where we exited SBA Communications and reduced the Fund’s holdings in American Tower. While we think the long-term prospects for the cell tower sector remain positive, we believe that the lower capital expenditure spending by the carriers—reflecting the timing of their fifth generation (5G) deployments and the lack of a major consumer-facing product that drives a faster rollout of 5G capabilities—could negatively affect

{foots1}

| 1 | A form of indirect property investment. Distributions from REITs are made tax-free and are taxed according to the tax status of the shareholders. |

{foots1}

| 2 | A chart that the U.S. Federal Reserve uses to display its members' predictions for the future path of the federal funds rate. |

{foots1}

| 3 | An interest rate when the economy is producing its maximum output and inflation is steady. Nominal interest rate is the interest rate including inflation. |

{foots1}

| 4 | Investments that have a significant potential for price variation, either increasing or decreasing significantly. |

{foots1}

| 5 | The interest rate adjusted for inflation. This is calculated by subtracting the inflation rate from the interest rate before the adjustment. |

{foots1}

| 6 | The process of replacing existing debt with new debt. |

{foots1}

| 7 | Net operating income is a commonly used figure to assess the profitability of a property. The calculation involves subtracting all operating expenses on the property from all the revenue generated from the property. |

{foots1}

| 8 | A portfolio holding an excess amount of a particular security (or sector or region) compared to the security’s weight in the benchmark portfolio. |

{foots1}

| 9 | A portfolio holding less of a particular security (or sector or region) than the security’s weight in the benchmark portfolio. |

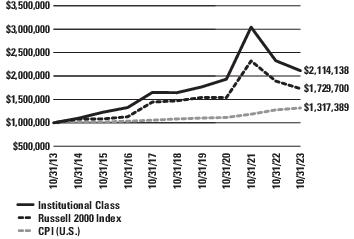

abrdn U.S. Small Cap Equity Fund (Unaudited)

Global stock markets generally rose over the 12 months under review. Inflation dominated the economic environment. Central banks in Western economies raised interest rates faster and much further than previously anticipated to counter multi-decade-high inflation. Despite these aggressive central bank actions, core inflation—which strips out volatile items such as energy and food—stayed at elevated levels in many countries. Nevertheless, global economic growth held up better than many investors expected, defying fears of a recession triggered by higher rates.

As U.S. and Eurozone inflation trended down towards the end of 2022, investors’ hopes rose that an end to interest-rate rises could be in sight. Therefore, 2023 started with strong stock market gains. However, the collapse of two regional U.S. banks and the forced sale of Credit Suisse to rival UBS in March then evoked fears of a banking crisis. Despite an initial sell-off, stock markets recovered, helped by expectations of lower peak interest rates. After more market volatility1 in April and May, equities performed strongly over June and July due to news of a compromise agreement on the U.S. debt ceiling2 and further encouraging inflation data. This was despite still-hawkish rhetoric from central banks. Equities then generated negative returns in August, September, and October given concerns that interest rates would stay higher for longer, with the outbreak of war between Israel and Hamas adding to existing inflationary worries.

Broader U.S. equity markets also posted gains, despite the macroeconomic uncertainty. U.S. small-cap companies, as represented by the Russell 2000 Index, declined over -8.6% in the past 12 months, underperforming the 10.1% return of large-cap stocks, as measured by the S&P 500 Index3. The Russell 2000 Index is a subset of the Russell 3000 Index4 and represents approximately 10% of the U.S. market. The small-cap asset class typically offers a different exposure to the U.S. sectors compared to large cap asset class. Thus, the Russell 2000 Index has a higher weighting towards the financials, healthcare, and industrials sectors. Eight of the 11 sectors in the Russell 2000 Index declined in the past 12 months. Healthcare, financials, utilities, and communication services sectors were the main detractors from the Index’s performance. Conversely, the energy sector returned approximately 6.7% on the back of elevated oil prices.

Fund performance revie

The abrdn U.S. Small Cap Equity Fund returned -9.14% (Institutional Class shares, net of fees) for the 12-month reporting period ending

October 31, 2023, versus the -8.56% return of its benchmark, the Russell 2000 Index, during the same period.

During the reporting period, stock selection in the consumer discretionary5 sector weighed on the Fund’s performance. On the other hand, stock selection in and an overweight6 allocation to the consumer staples7 sector benefited the Fund’s performance. Stock selection in and an underweight8 allocation to the healthcare sector also had a positive effect relative to the Fund’s benchmark.

At the stock level, Ameresco, a clean technology engineering and construction company, underperformed as investors became increasingly concerned that the demand for its services and project-level returns could be negatively affected by higher interest rates. Meanwhile, fashion retailer Aritzia declined after lowering its outlook due to decelerating traffic and higher-than-expected expenses. Eyewear retailer and optical exam provider National Vision Holding was also negative as the company announced its more-than-30-year partnership with Walmart will end in 2024.

Conversely, cosmetics company e.l.f. Beauty was a top performer after delivering accelerated sales growth on the back of continued market share gains. Semiconductor company Onto Innovation performed well as investors became increasingly confident that demand for its advanced packaging solutions would benefit from the rise in artificial intelligence applications. Online education provider Stride was also a top performer as improved operational performance resulted in a return to enrolment growth, following two years of post-pandemic declines.

In terms of key portfolio activity, we added several new positions. In the healthcare sector, the Fund initiated Pacira Biosciences, a biopharma company specializing in non-opioid pain management therapies. We also bought medical-device companies Merit Medical Systems and Alphatec Holdings. In the energy sector, the Fund introduced positions in several high-quality exploration and production companies: SM Energy, Magnolia Oil & Gas, and Callon Petroleum. Within the consumer sectors, the Fund initiated a position in Boot Barn, a leading national retailer in the niche western, country, and workwear market, and The Vita Coco Company, a leading

{foots1}

| 1 | If the price of a fund moves significantly over a short period of time it is said to be 'volatile' or has 'high volatility'. If the price remains relatively stable, it is said to have 'low volatility'. Volatility can be used as a measure of risk. |

{foots1}

| 2 | The maximum amount of money that the U.S. government is allowed to borrow to meet its obligations. |

{foots1}

| 3 | The S&P 500 Index is an unmanaged index considered representative of the broader U.S. stock market.. |

{foots1}

| 4 | The Russell 3000® Index measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market, as of the most recent reconstitution. |

{foots1}

| 5 | Sector associated with goods and services that rely upon consumers and are sensitive to changes in the economy. Examples include retailers and media companies. |

{foots1}

| 6 | A portfolio holding an excess amount of a particular security (or sector or region) compared to the security’s weight in the benchmark portfolio. |

{foots1}