united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22131

Miller Investment Trust

(Exact name of registrant as specified in charter)

20 William Street Wellesley, MA 02481

(Address of principal executive offices) (Zip code)

Gemini Fund Services, LLC., 80 Arkay Drive Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 781-416-4000

Date of fiscal year end: 10/31

Date of reporting period:10/31/20

Item 1. Reports to Stockholders.

| | | |

| | | |

| |  | |

| | | |

| | | |

| | | |

| | Miller Convertible Bond Fund | |

| | Miller Convertible Plus Fund | |

| | Miller Intermediate Bond Fund | |

| | | |

| | | |

| | | |

| | | |

| | Annual Report | |

| | | |

| | October 31, 2020 | |

| | | |

| | | |

| | | |

| | | |

| | 877- 441- 4434 | |

| | www.MillerFamilyofFunds.com | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Investment Advisor | |

| | Wellesley Asset Management, Inc. | |

| | The Wellesley Office Park | |

| | 20 William Street, Suite 310 | |

| | Wellesley, MA 02481 | |

| | 781-416-4000 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of Miller Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. Distributed by Northern Lights Distributors, LLC. Member FINRA | |

| | | |

| | | |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.MillerFamilyofFunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you. |

Dear Fellow Shareholder,

We would like to share an overview of the performance of the Miller mutual funds for the one-year period ending October 31st, 2020 (“the reporting period’). This letter will discuss factors that influenced performance over the last year and will provide an update on the impact Covid-19 is having on our business.

During the reporting period, all share classes of the Miller funds family outperformed the S&P 500 index; and all but one outperformed Bloomberg Barclays US Aggregate Index. Since inception all share classes have outperformed the Bloomberg Barclays US Aggregate Index while most have underperformed the S&P Total Return Index. We would like to remind investors that unlike many of our peers who run “equity-like” convertible strategies, we maintain a fixed income convertible strategy approach with respect to the Miller Convertible Bond Fund and Miller Convertible Plus Fund, purchasing convertible bonds close to par value with low deltas. As a result, we may lag equity performance and our convertible fund peers in long bull markets, but due to our more conservative risk profile, we strive to outperform over full market cycles. Our funds’ performance for the one year ending October 31, 2020 and since inception is:

| | | One Year Ended | | Annualized Since |

| Miller Convertible Bond Fund | | October 31, 2020 | | Inception |

| A shares (MCFAX.LW) | | 12.33% | | 6.03% (12/27/07) |

| I shares (MCIFX) | | 12.93% | | 6.59% (12/27/07) |

| C shares (MCFCX) | | 11.68% | | 6.28% (12/01/09) |

| | | | | |

| | | | | Annualized Since |

| Miller Convertible Plus Fund | | | | Inception |

| I shares (MCPIX) | | 14.54% | | 8.17% (12/31/14) |

| | | | | |

| | | | | Annualized Since |

| Miller Intermediate Bond Fund | | | | Inception |

| I shares (MIFIX) | | 7.45% | | 4.87% (12/31/14) |

The funds’ total assets under management for the period ended 10/31/2020 were as follows:

| Miller Convertible Bond Fund | | $ | 731,576,880 | |

| Miller Convertible Plus Fund | | $ | 118,942,682 | |

| Miller Intermediate Bond Fund | | $ | 76,558,389 | |

| | | | | |

Convertible Bond Market Review

For the year ending October 31, 2020, the Bloomberg Barclays US Aggregate Bond Index was up 6.19% while the S&P Total Return Index was up 9.71%. Convertible bond market performance was helped by the strength of underlying equities, low interest rates and higher market volatility. Slightly wider credit spreads partially offset gains attributable to the previously mentioned factors. Note the following definitions:

| ● | The Bloomberg/Barclays US Aggregate Bond Index represents most investment grade bonds traded in the United States |

| ● | The S&P 500 Total Return Index is a cap-weighted index of 500 common stocks and is regarded as a leading proxy for the US stock market |

| ● | A credit spread is the difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality |

Please note: Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses, or sales charges.

The fiscal year beginning November, 2019 and first two months of 2020 were relatively calm without any indication of the heightened volatility to follow. Equities continued to trend higher with the S&P 500 Total Return Index reaching an all-time in February. Following the outbreak of the Covid-19 virus in late February, financial markets abruptly pivoted and entered a state of panic. Uncertainty surrounding a global shutdown, rapid spread of the pandemic, collapse of energy prices, unprecedented unemployment, and little to no earnings visibility caused equities to plummet with stocks quickly entering a bear market. Fortunately, the U.S. government provided both monetary and fiscal relief in response exceeding the stimulus of 2008. The Federal Reserve cut the Federal Funds rate from a range of 1.50%-1.75% in February to 0.00%-0.25% in April. The $2.2 trillion CARES Act was passed by Congress in March to provide economic relief to workers and businesses. Equities responded favorably by re-entering bull market territory with the S&P Total Return trading at another all-time high in September.

Trading in other markets was also dramatically impacted by the pandemic. U.S. 10-year Treasury bond yields which had been trading at 1.80% in November, 2019 plunged to 0.54% by March, 2020. The VIX, a measure of short-term equity volatility, traded as low as 12 in November but jumped to 82 in March and closed the fiscal year at 38. Credit spreads widened significantly, most notably in the high yield market.

High yield spreads widened to almost 1100 bps in March before closing out 100 bps wider by the end of the reporting period than the year’s opening level of 400 bps. Investment grade credit spreads opened and closed the reporting period around 140 bps but widened to north of 300 bps during the year. The large moves in high yield credit spreads played a substantial factor in the attribution of convertible returns. High yield convertibles returned 61% during the reporting period whereas investment grade convertibles returned less than 1% during the reporting period. year. The new issue convertible market was very robust with issuance increasing 65% over the same period last year resulting in issuance volumes not seen since 2008.

Miller Convertible Bond Fund

During the reporting period, the Miller Convertible Bond Fund outperformed the S&P 500 Total Return Index and the Bloomberg Barclays US Aggregate Bond Index. The fund’s overweight positions in materials and healthcare contributed to outperformance versus the S&P 500 Total Return Index. The combination of lower rates, increased volatility, and higher stock prices led to the fund’s outperformance compared to the Bloomberg Barclays US Aggregate Bond Index.

The fund’s position in Apple Inc (2.4% weight) produced a gain of 62% for that position. On the negative side, the fund’s position in CorEnergy Infrastructure (.50% weight) resulted in a 25% loss for that position.

The fund remains well diversified with 83 positions, the largest which accounts for 3.18% of assets. The March selloff created severe market volatility and the Fund’s largest drawdown, or peak to trough decline, was 11.27% for the reporting period.

Miller Convertible Plus Fund

The Miller Convertible Plus Fund also outperformed both the Bloomberg Barclays US Aggregate Bond Index and the S&P 500 Total Return Index for the reporting period. The fund’s overweight positions in technology and healthcare helped performance. Similar to the Miller Convertible Fund, lower interest rates, higher volatility and higher stock prices led to outperformance versus the Bloomberg Barclays US Aggregate Bond Index for the reporting period.

The Miller Convertible Plus Fund’s top performing position was Enphase Energy (3.7% weight) which returned 108%. The Fund’s worst position was in CorEnergy (.97% weight) which resulted in a 24% loss for that position.

The fund is diversified with 52 positions. Jazz Pharmaceuticals is the largest holding representing 3.98% of the fund’s assets. The Miller Convertible Plus Fund is often the most volatile in the Miller family of funds because of leverage. During the reporting period, the largest drawdown in the Miller Convertible Plus Fund was 16.89%.

Miller Intermediate Bond Fund

The Miller Intermediate Bond Fund outperformed the S&P 500 Total Return Index for the reporting period, but underperformed the Bloomberg Barclays US Aggregate Bond Index. Overweight exposure to healthcare led to outperformance versus the S&P 500 Total Return Index for the reporting period. In a period of falling rates, the fund’s shorter duration led to it underperforming relative to the Bloomberg Barclays US Aggregate Bond Index.

The Intermediate Bond Fund’s best performing position was Apple Inc (1.83% weight) which returned 62% for that position. The Fund’s worst performing position was MFA Financial (.62% weight) which lost 30%.

The Intermediate Bond Fund has 51 positions. Smart Global Holdings is the largest position representing 2.98% of the fund’s assets. The fund’s largest drawdown during the reporting period was 10.93%.

Convertible Bond Strategy Review

We remain committed to the same strategy we have utilized since our company was founded in 1991. It is important to note that we do not change our investment strategy regardless of what the current investment climate is. When investing in convertibles we only buy convertible bonds and notes (no convertible preferreds, mandatory preferreds, or other convertible structures) which typically offer the return of the majority of principal within seven years of issuance. Before making an investment, we perform a thorough analysis of a company’s balance sheet and income statement. We seek to invest in profitable companies and avoid companies with unsafe debt loads. While we usually invest with the idea of holding bonds until the next liquidity date (maturity, put or call), we consider selling or reducing our exposure if one of the following scenarios occur:

| ● | An issuer’s credit quality deteriorates |

| ● | The bond loses its favorable risk/reward characteristics due to price appreciation |

| ● | We perceive an opportunity to increase portfolio diversification |

| ● | We believe more attractive investments are available. |

Because one of our key risk management practices involves careful limits on prices we pay, we tend not to purchase convertibles that trade at prices substantially above par and thus have significantly negative yields to the next liquidity date. This discipline often results in the elimination of some of the most equity-sensitive convertibles. As a result, our performance tends to lag broader equity indices in rising markets but tends to decline less in falling stock markets. Our holdings span the convertible market, from investment-grade to small-cap, with a broad distribution of industries represented. Many of our rated convertible bonds are investment grade, although a large percentage of the bonds are not rated.

New Issuance

As previously mentioned, primary issuance flourished over the reporting period with the volume of new issues approaching all-time records. Increased volatility, higher equity prices and lower interest rates were an ideal environment for companies to issue convertibles. About $86 billion of new paper came to market over the last year representing new sectors and helping to diversify the convertible bond market. Below is a sampling of some of the new issues that met the strategy’s rigid criteria and found their way into various portfolios (weightings as of October 31st 2020):

| ● | Hannon Armstrong Sustainable Infrastructure Capital (2.85% weight), a REIT which provides financing to the energy efficiency and renewable energy markets |

| ● | Smart Global Holdings (3.54% weight), a provider of computer memory for desktops, notebooks, servers and smartphones |

| ● | PET IQ (2.36% weight), a producer of health and wellness products for dogs and cats |

ICE Bank of America All Yield Alternatives US Convertibles Index (VYLD)

We are pleased to announce that effective January 1, 2021 we are changing the benchmarks of the Miller Convertible Bond Fund and the Miller Convertible Plus Fund to the ICE BofA All Yield Alternatives US Convertibles Index (VYLD). Similar to the Miller Convertible Bond Fund’s convertible bond strategy, the VYLD is a subset of the ICE BofA US Convertible Index and includes convertible securities with a delta less than 0.4. Delta is the measure of the change in a convertible bond’s price given a change in the underlying stock. Given the Funds’ correlation to this index, we believe the VYLD is a more suitable convertible bond index to benchmark to our convertible bond mutual funds.

Covid-19

The Covid-19 pandemic has wreaked havoc on many industries over the past eight months, but fortunately the financial services sector has been relatively spared. Due to the ability of financial service professionals to work from home, the industry has remained strong. As the year progressed, Wellesley Asset Management’s employees (approximately 25%) have returned to the office. For those working from home, Wellesley Asset Management utilizes video conferencing to foster team collaboration. Outside vendors such as our fund administrator, trading counterparties and other service providers have remained fully functional and we have not experienced any business disruptions because of Covid-19. We look forward to continuing to provide best in class service during these difficult times.

Summary

Early in the year, the outbreak of the global pandemic led to unprecedented volatility in the financial markets. Fortunately, it appears that we are much closer to a Covid-19 vaccine, and like many historical events, have become better able to navigate the crisis. Companies have learned to adapt, become more efficient and figure things out. Further, governmental agencies both from a fiscal and monetary perspective seem capable and hopefully willing to provide support if needed. As the fiscal year closes, we are cognizant of two trends that have historically been tailwinds for convertible performance – elevated levels of volatility and rising interest rates – and their juxtaposition with what many believe to be an excessively valued equity market. Looking beyond the pandemic and the elections, company fundamentals and rigorous analysis will once again matter with market participants becoming far more discerning in their investment selections.

For more detailed and timely information on our funds and Wellesley Asset Management, please visit our website at www.wellesleyassetmanagement.com where you can access quarterly commentaries and fund fact sheets. In conclusion, we hope you and your loved ones are healthy and safe during these challenging times. As always, we thank you for your continued trust and confidence in our management. We look forward to helping you achieve your future goals.

Sincerely,

Greg Miller, Portfolio Manager

Michael Miller, Portfolio Manager

For Professional Use Only

Investments in convertible securities subject the Fund to the risks associated with both fixed-income securities, including credit risk and interest risk, and common stocks. A portion of the Fund’s convertible securities may be rated below investment grade. Exchangeable and synthetic convertible securities may be more volatile and less liquid than traditional convertible securities. In general, stock and other equity security values fluctuate, and sometimes widely fluctuate, in response to activities specific to the company as well as general market, economic and political conditions. Lower rated fixed-income securities are subject to greater risk of loss of income and principal than higher-rated securities. The prices of lower rated bonds are likely to be more sensitive to adverse economic changes or individual corporate developments. All fixed-income securities are subject to two types of risk: credit risk and interest rate risk. When the general level of interest rates goes up, the prices of most fixed-income

securities go down. When the general level of interest rates goes down, the prices of most fixed income securities go up.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Miller Convertible Bond Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling 781-416-4000. The prospectus should be read carefully before investing. The Miller Convertible Bond Fund is distributed by Northern Lights Distributors, LLC, member FINRA/SIPC. Wellesley Asset Management, Inc. and Northern Lights Distributors, LLC are not affiliated entities.

There is no assurance that the Fund will achieve its investment objective

Past Performance is not indicative of future returns.

2376-NLD-12/2/2020

DB12022020-1-437

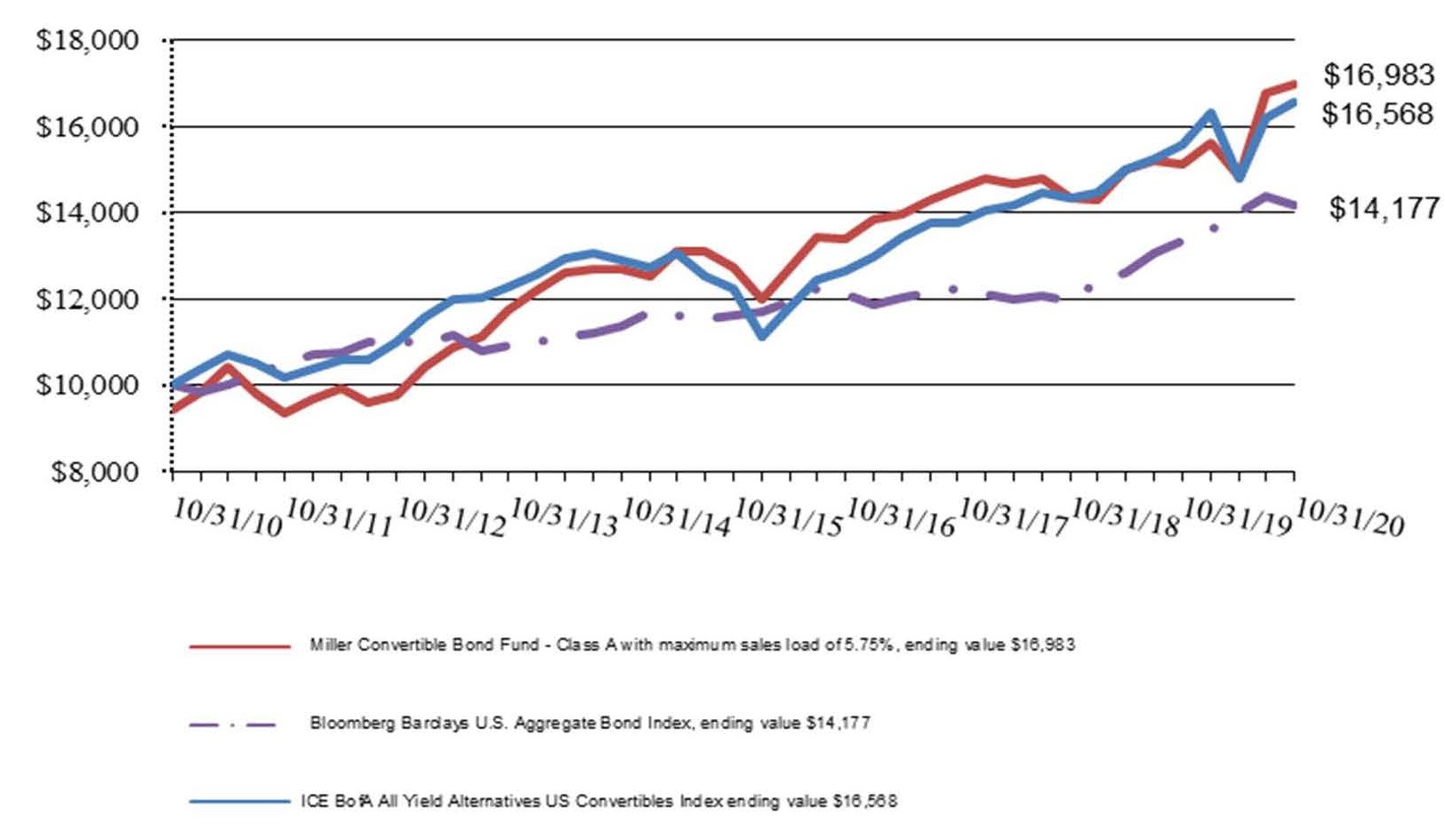

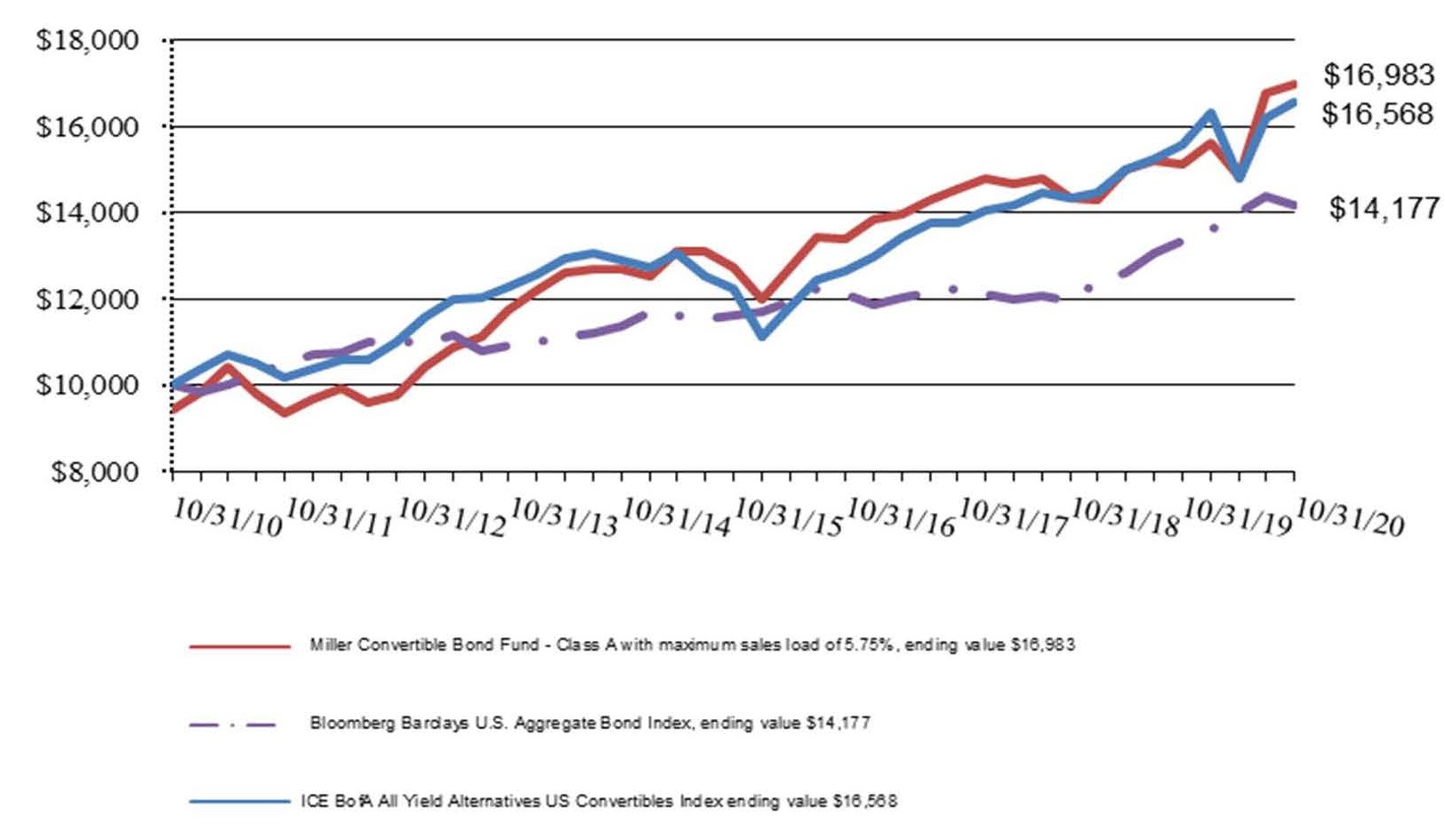

| Miller Convertible Bond Fund |

| GROWTH OF A $10,000 INVESTMENT (Unaudited) |

| For Periods Ending October 31, 2020 |

| |

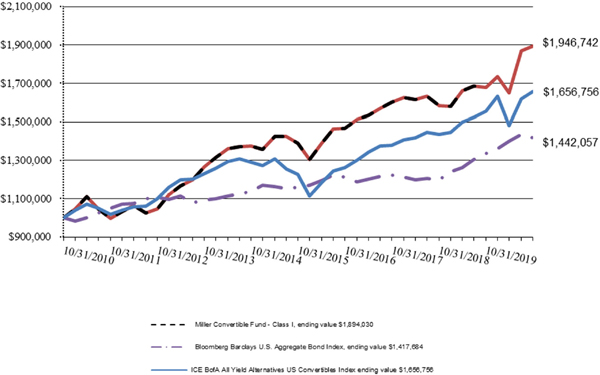

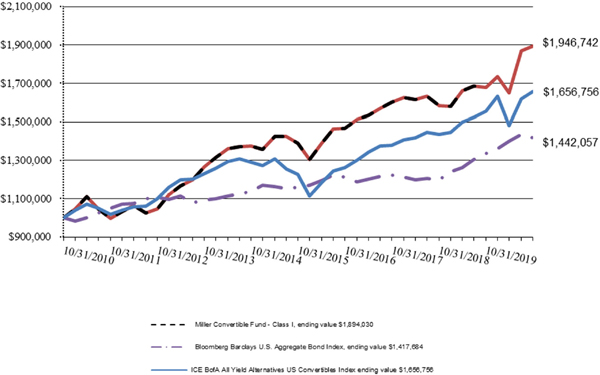

Miller Convertible Bond Fund |

| GROWTH OF A $1,000,000 INVESTMENT (Unaudited) |

| For Periods Ending October 31, 2020 |

| |

| Total Returns as of October 31, 2020 |

| | | Annualized |

| | | | | Since Inception * | Since Inception ** |

| | One Year | Five Years | Ten Years | (Class A and I) | (Class C) |

| Miller Convertible Bond Fund: | | | | | |

| Class A, without sales charge | 12.33% | 5.90% | 6.06% | 6.03% | — |

| Class A, with sales charge of 5.75% | 5.84% | 4.65% | 5.44% | 5.54% | — |

| Class I | 12.93% | 6.41% | 6.60% | 6.59% | — |

| Class C | 11.68% | 5.34% | 5.53% | — | 6.28% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 6.19% | 4.08% | 3.55% | 4.34% | 3.88% |

| ICE BofA All Yield Alternatives US Convertibles Index | 6.47% | 6.21% | 5.18% | 5.28% | 5.93% |

| | | | | | |

| * | Class A and Class I shares commenced operations on December 27, 2007. |

| ** | Class C shares commenced operations on December 1, 2009. |

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated, fixed-rate, taxable, investment grade fixed-income securities with remaining maturities of one year and longer. The Index includes Treasury, government, corporate, mortgage-backed, commercial mortgage-backed and asset-backed securities.

The ICE BofA All Yield Alternatives US Convertibles Index tracks the performance of U.S. dollar denominated convertible debt.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions and the payment of the maximum 5.75% sales charge. Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived a portion of its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated March 1, 2020, including the indirect expenses of underlying funds, are 1.47%, 0.97%, and 1.97% for Class A shares, Class I shares, and Class C shares, respectively. For performance information current to the most recent month-end, please call 877-441-4434.

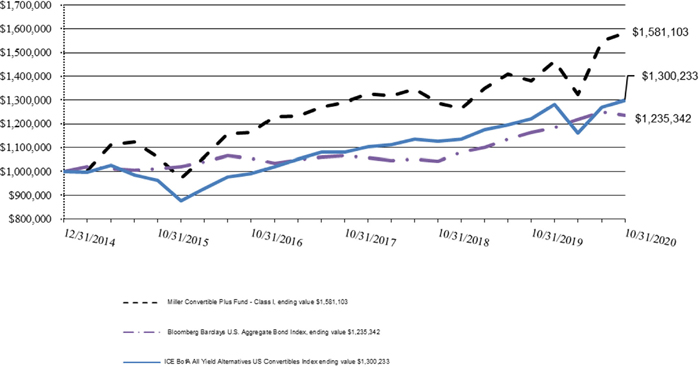

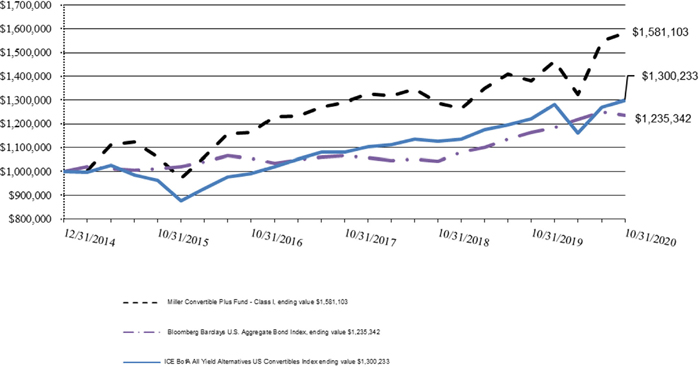

| Miller Convertible Plus Fund |

| GROWTH OF A $1,000,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2020 |

| |

| Total Returns as of October 31, 2020 |

| | | Annualized |

| | One Year | Five Years | Since Inception* |

| Miller Convertible Plus Fund: | | | |

| Class I | 14.54% | 8.33% | 8.17% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 6.19% | 4.08% | 3.69% |

| ICE BofA All Yield Alternatives US Convertibles Index | 6.47% | 6.21% | 4.60% |

| | | | |

| * | Class I shares commenced operations on December 31, 2014. |

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated, fixed-rate, taxable, investment grade fixed-income securities with remaining maturities of one year and longer. The Index includes Treasury, government, corporate, mortgage-backed, commercial mortgage-backed and asset-backed securities.

The ICE BofA All Yield Alternatives US Convertibles Index tracks the performance of U.S. dollar denominated convertible debt.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived a portion of its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated March 1, 2020, including the indirect expenses of underlying funds, is 3.61% for Class I shares. For performance information current to the most recent month-end, please call 877-441-4434.

| Miller Intermediate Bond Fund |

| GROWTH OF A $1,000,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2020 |

| Total Returns as of October 31, 2020 |

| | | Annualized |

| | One Year | Five Years | Since Inception* |

| Miller Intermediate Bond Fund: | | | |

| Class I | 7.45% | 4.89% | 4.87% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 6.19% | 4.08% | 3.69% |

| ICE BofA All Yield Alternatives US Convertibles Index | 6.47% | 6.21% | 4.60% |

| | | | |

| * | Class I shares commenced operations on December 31, 2014. |

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated, fixed-rate, taxable, investment grade fixed-income securities with remaining maturities of one year and longer. The Index includes Treasury, government, corporate, mortgage-backed, commercial mortgage-backed and asset-backed securities.

The ICE BofA All Yield Alternatives US Convertibles Index tracks the performance of U.S. dollar denominated convertible debt.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions and . Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived a portion of its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated March 1, 2020, including indirect expenses of underlying funds, is 1.20% for Class I shares. For performance information current to the most recent month-end, please call 877-441-4434.

| Miller Convertible Bond Fund |

| SCHEDULE OF INVESTMENTS |

| October 31, 2020 |

| | | Principal | | | | | | | | | |

| Security | | Amount | | | Interest Rate (%) | | | Maturity Date | | Fair Value | |

| | | | | | | | | | | | |

| CONVERTIBLE BONDS - 91.74% | | | | | | | | | | | | | | |

| AEROSPACE/DEFENSE - 0.41% | | | | | | | | | | | | | | |

| Kaman Corp. | | $ | 3,000,000 | | | | 3.2500 | | | 5/1/2024 | | $ | 3,000,391 | |

| | | | | | | | | | | | | | | |

| ASSET MANAGEMENT - 0.06% | | | | | | | | | | | | | | |

| Ares Capital Corp. | | | 100,000 | | | | 3.7500 | | | 2/1/2022 | | | 100,800 | |

| Ares Capital Corp. | | | 100,000 | | | | 4.6250 | | | 3/1/2024 | | | 104,130 | |

| Goldman Sachs BDC, Inc. | | | 100,000 | | | | 4.5000 | | | 4/1/2022 | | | 102,000 | |

| Sixth Street Specialty Lending, Inc. | | | 100,000 | | | | 4.5000 | | | 8/1/2022 | | | 102,958 | |

| | | | | | | | | | | | | | 409,888 | |

| BASIC & DIVERSIFIED CHEMICALS - 2.44% | | | | | | | | | | | | | | |

| Dow, Inc. - Bank of America Finance LLC Synthetic | | | 17,300,000 | | | | 2.6410 | ** | | 6/18/2024 | | | 17,844,950 | |

| | | | | | | | | | | | | | | |

| BIOTECH & PHARMA - 16.77% | | | | | | | | | | | | | | |

| BioMarin Pharmaceutical, Inc. | | | 100,000 | | | | 0.5990 | | | 8/1/2024 | | | 103,125 | |

| BioMarin Pharmaceutical, Inc. - 144A | | | 20,000,000 | | | | 1.2500 | | | 5/15/2027 | | | 19,325,000 | |

| Bristol-Myers Squibb Co. - Wells Fargo Finance, LLC Synthetic | | | 18,000,000 | | | | 2.3100 | ** | | 11/1/2024 | | | 19,040,400 | |

| Jazz Investments I Ltd. | | | 18,000,000 | | | | 1.5000 | | | 8/15/2024 | | | 18,436,898 | |

| Jazz Investments I Ltd. - 144A | | | 1,000,000 | | | | 2.0000 | | | 6/15/2026 | | | 1,201,268 | |

| Johnson & Johnson Co. - Citigroup Global Markets Holdings, Inc. Synthetic | | | 15,200,000 | | | | 1.7920 | ** | | 6/30/2027 | | | 14,744,000 | |

| Johnson & Johnson Co. - Citigroup Global Markets Holdings, Inc. Synthetic | | | 7,010,000 | | | | 1.5470 | ** | | 10/25/2027 | | | 6,795,494 | |

| Ligand Pharmaceuticals, Inc. | | | 100,000 | | | | 0.7500 | | | 5/15/2023 | | | 91,685 | |

| Merck & Co. - Credit Suisse AG Synthetic | | | 9,400,000 | | | | 1.2420 | ** | | 9/24/2027 | | | 9,118,940 | |

| Merck & Co. - Credit Suisse AG Synthetic | | | 12,000,000 | | | | 1.2420 | ** | | 9/24/2027 | | | 11,641,200 | |

| Pacira BioSciences, Inc. - 144A | | | 18,000,000 | | | | 0.7500 | | | 8/1/2025 | | | 18,345,565 | |

| Pacira BioSciences, Inc. | | | 100,000 | | | | 2.3750 | | | 4/1/2022 | | | 109,236 | |

| Supernus Pharmaceuticals, Inc. | | | 4,000,000 | | | | 0.6250 | | | 4/1/2023 | | | 3,714,913 | |

| | | | | | | | | | | | | | 122,667,724 | |

| CABLE & SATELLITE - 1.48% | | | | | | | | | | | | | | |

| Charter Communications, Inc. - Bank of America Finance LLC Synthetic | | | 100,000 | | | | 1.770 | ** | | 9/1/2022 | | | 112,800 | |

| Charter Communications, Inc. - Liberty Broadband Corp. Synthetic - 144A | | | 10,000,000 | | | | 3.7500 | ** | | 9/30/2050 | | | 10,749,197 | |

| | | | | | | | | | | | | | 10,861,997 | |

| CONSUMER SERVICES - 3.94% | | | | | | | | | | | | | | |

| Chegg, Inc. - 144A | | | 13,000,000 | | | | 0.0000 | *** | | 9/1/2026 | | | 13,178,393 | |

| K12, Inc. - 144A | | | 19,000,000 | | | | 1.1250 | | | 9/1/2027 | | | 15,643,635 | |

| | | | | | | | | | | | | | 28,822,028 | |

| ELECTRIC UTILITIES - 0.14% | | | | | | | | | | | | | | |

| NRG Energy, Inc. | | | 1,000,000 | | | | 2.7500 | | | 6/1/2048 | | | 1,045,000 | |

| | | | | | | | | | | | | | | |

| ELECTRICAL EQUIPMENT - 5.07% | | | | | | | | | | | | | | |

| OSI Systems, Inc. | | | 15,000,000 | | | | 1.2500 | | | 9/1/2022 | | | 15,243,663 | |

| SMART Global Holdings, Inc. - 144A | | | 24,000,000 | | | | 2.2500 | | | 2/15/2026 | | | 21,876,955 | |

| | | | | | | | | | | | | | 37,120,618 | |

| FOOD - 0.91% | | | | | | | | | | | | | | |

| The Kraft Heinz Co. - Citigroup Global Markets Holdings, Inc. Synthetic | | | 7,000,000 | | | | 1.7920 | ** | | 6/30/2027 | | | 6,652,800 | |

| | | | | | | | | | | | | | | |

| INSTITUTIONAL FINANCIAL SERVICES - 0.92% | | | | | | | | | | | | | | |

| Cowen, Inc. | | | 5,000,000 | | | | 3.0000 | | | 12/15/2022 | | | 6,613,499 | |

| Voya Financial, Inc. - Bank of America Finance LLC Synthetic | | | 100,000 | | | | 3.1425 | ** | | 5/1/2023 | | | 99,597 | |

| | | | | | | | | | | | | | 6,713,096 | |

| INSURANCE - 0.55% | | | | | | | | | | | | | | |

| HCI Group, Inc. | | | 4,000,000 | | | | 4.2500 | | | 3/1/2037 | | | 3,988,275 | |

| | | | | | | | | | | | | | | |

| INTERNET MEDIA & SERVICES- 4.64% | | | | | | | | | | | | | | |

| Amazon.com, Inc.- JPMorgan Chase Financial Co., LLC Synthetic | | | 14,500,000 | | | | 3.5900 | ** | | 4/21/2023 | | | 21,565,850 | |

| Google, Inc. - Bank of America Finance LLC Synthetic | | | 10,000,000 | | | | 3.6400 | ** | | 9/28/2023 | | | 12,299,000 | |

| Twitter, Inc. | | | 100,000 | | | | 0.2500 | | | 6/15/2024 | | | 109,430 | |

| | | | | | | | | | | | | | 33,974,280 | |

| LEISURE FACILITIES & SERVICES - 2.68% | | | | | | | | | | | | | | |

| McDonald’s Corp. - Credit Suisse AG Synthetic | | | 18,400,000 | | | | 1.9200 | ** | | 5/28/2027 | | | 19,608,880 | |

| | | | | | | | | | | | | | | |

| LEISURE PRODUCTS - 5.82% | | | | | | | | | | | | | | |

| Callaway Golf Co. - 144A | | | 10,000,000 | | | | 2.7500 | | | 5/1/2026 | | | 11,987,500 | |

| D.R. Horton, Inc. - Barclays Bank PLC Synthetic | | | 14,500,000 | | | | 3.8900 | ** | | 9/26/2023 | | | 20,234,750 | |

| Winnebago Industries, Inc. - 144A | | | 10,000,000 | | | | 1.5000 | | | 4/1/2025 | | | 10,338,000 | |

| | | | | | | | | | | | | | 42,560,250 | |

| MEDICAL EQUIPMENT & DEVICES - 1.93% | | | | | | | | | | | | | | |

| Varex Imaging Corp. - 144A | | | 14,720,000 | | | | 4.0000 | | | 6/1/2025 | | | 14,093,164 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2020 |

| | | Principal | | | | | | | | | |

| Security | | Amount | | | Interest Rate (%) | | | Maturity Date | | Fair Value | |

| | | | | | | | | | | | |

| CONVERTIBLE BONDS - 91.74% (Continued) | | | | | | | | | | | | | | |

| METALS & MINING - 4.15% | | | | | | | | | | | | | | |

| Livent Corp. - 144A | | $ | 5,000,000 | | | | 4.1250 | | | 7/15/2025 | | $ | 7,278,125 | |

| Newmont Mining Corp. - Barclays Bank PLC Synthetic | | | 14,000,000 | | | | 3.9200 | ** | | 10/30/2023 | | | 23,091,600 | |

| | | | | | | | | | | | | | 30,369,725 | |

| OIL & GAS - 2.49% | | | | | | | | | | | | | | |

| Exxon Mobil Corp. - Citigroup Global Markets Holdings, Inc. Synthetic | | | 100,000 | | | | 2.6320 | ** | | 12/23/2026 | | | 91,680 | |

| Exxon Mobil Corp. - Credit Suisse AG Synthetic | | | 17,000,000 | | | | 2.6886 | ** | | 4/21/2025 | | | 16,933,700 | |

| PDC Energy, Inc. | | | 100,000 | | | | 1.1250 | | | 9/15/2021 | | | 96,782 | |

| Pioneer Natural Resources Co. - 144A | | | 1,000,000 | | | | 0.2500 | | | 5/15/2025 | | | 1,070,383 | |

| | | | | | | | | | | | | | 18,192,545 | |

| REITS - 4.60% | | | | | | | | | | | | | | |

| CorEnergy Infrastructure Trust, Inc. | | | 5,000,000 | | | | 5.8750 | | | 8/15/2025 | | | 3,675,858 | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 17,000,000 | | | | 0.0000 | *** | | 8/15/2023 | | | 17,706,012 | |

| IIP Operating Partnership, LP - 144A | | | 6,675,000 | | | | 3.7500 | | | 2/21/2024 | | | 12,285,129 | |

| | | | | | | | | | | | | | 33,666,999 | |

| RENEWABLE ENERGY - 0.02% | | | | | | | | | | | | | | |

| SolarEdge Technologies, Inc. - 144A | | | 100,000 | | | | 0.0000 | *** | | 9/15/2025 | | | 123,100 | |

| | | | | | | | | | | | | | | |

| RETAIL - DISCRETIONARY - 2.02% | | | | | | | | | | | | | | |

| PetIQ, Inc. - 144A | | | 12,000,000 | | | | 4.0000 | | | 6/1/2026 | | | 14,767,200 | |

| | | | | | | | | | | | | | | |

| SEMICONDUCTORS - 2.73% | | | | | | | | | | | | | | |

| Nova Measuring Instruments Ltd. - 144A | | | 100,000 | | | | 0.0000 | *** | | 10/15/2025 | | | 100,805 | |

| ON Semiconductor Corp. | | | 100,000 | | | | 1.6250 | | | 10/15/2023 | | | 142,742 | |

| Silicon Laboratories, Inc. - 144A | | | 100,000 | | | | 0.6250 | | | 6/15/2025 | | | 111,688 | |

| Vishay Intertechnology, Inc. | | | 20,000,000 | | | | 2.2500 | | | 6/15/2025 | | | 19,587,500 | |

| | | | | | | | | | | | | | 19,942,735 | |

| SOFTWARE - 6.66% | | | | | | | | | | | | | | |

| Akamai Technologies, Inc. | | | 1,000,000 | | | | 0.1250 | | | 5/1/2025 | | | 1,173,125 | |

| Akamai Technologies, Inc. | | | 5,000,000 | | | | 0.3750 | | | 9/1/2027 | | | 5,356,250 | |

| Alteryx, Inc. | | | 3,000,000 | | | | 1.0000 | | | 8/1/2026 | | | 3,136,875 | |

| Microsoft Corp. - Morgan Stanley Finance, LLC. Synthetic | | | 10,000,000 | | | | 2.3773 | ** | | 10/25/2024 | | | 12,680,500 | |

| Nice Ltd. - 144A | | | 14,000,000 | | | | 0.0000 | *** | | 9/15/2025 | | | 14,324,614 | |

| Omnicell, Inc. - 144A | | | 11,000,000 | | | | 0.2500 | | | 9/15/2025 | | | 12,069,155 | |

| | | | | | | | | | | | | | 48,740,519 | |

| SPECIALTY FINANCE - 2.23% | | | | | | | | | | | | | | |

| EZCORP, Inc. | | | 17,100,000 | | | | 2.3750 | | | 5/1/2025 | | | 13,079,703 | |

| Granite Point Mortgage Trust, Inc. - 144A | | | 3,000,000 | | | | 5.6250 | | | 12/1/2022 | | | 2,883,477 | |

| Granite Point Mortgage Trust, Inc. | | | 100,000 | | | | 6.3750 | | | 10/1/2023 | | | 91,313 | |

| MFA Financial, Inc. | | | 100,000 | | | | 6.2500 | | | 6/15/2024 | | | 95,193 | |

| PRA Group, Inc. | | | 100,000 | | | | 3.5000 | | | 6/1/2023 | | | 101,858 | |

| Redwood Trust, Inc. | | | 100,000 | | | | 4.7500 | | | 8/15/2023 | | | 92,162 | |

| | | | | | | | | | | | | | 16,343,706 | |

| TECHNOLOGY HARDWARE - 7.68% | | | | | | | | | | | | | | |

| Apple, Inc. - JP Morgan Chase Financial Co. LLC Synthetic | | | 10,000,000 | | | | 3.8700 | ** | | 10/16/2023 | | | 17,502,000 | |

| InterDigital, Inc. | | | 20,000,000 | | | | 2.0000 | | | 6/1/2024 | | | 20,514,406 | |

| Knowles Corp. | | | 100,000 | | | | 3.2500 | | | 11/1/2021 | | | 105,007 | |

| Lumentum Holdings, Inc. - 144A | | | 16,000,000 | | | | 0.5000 | | | 12/15/2026 | | | 18,035,190 | |

| | | | | | | | | | | | | | 56,156,603 | |

| TECHNOLOGY SERVICES - 7.05% | | | | | | | | | | | | | | |

| Euronet Worldwide, Inc. | | | 15,000,000 | | | | 0.7500 | | | 3/15/2049 | | | 14,465,625 | |

| Insight Enterprises, Inc. | | | 18,000,000 | | | | 0.7500 | | | 2/15/2025 | | | 18,436,973 | |

| Parsons Corp. - 144A | | | 18,000,000 | | | | 0.2500 | | | 8/15/2025 | | | 17,595,558 | |

| Square, Inc. - 144A | | | 720,000 | | | | 0.1250 | | | 3/1/2025 | | | 1,059,992 | |

| | | | | | | | | | | | | | 51,558,148 | |

| TRANSPORTATION & LOGISTICS - 2.50% | | | | | | | | | | | | | | |

| Air Transport Services Group, Inc. | | | 100,000 | | | | 1.1250 | | | 10/15/2024 | | | 111,203 | |

| Atlas Air Worldwide Holdings, Inc. | | | 9,000,000 | | | | 1.8750 | | | 6/1/2024 | | | 10,708,122 | |

| Atlas Air Worldwide Holdings, Inc. | | | 7,000,000 | | | | 2.2500 | | | 6/1/2022 | | | 7,511,493 | |

| | | | | | | | | | | | | | 18,330,818 | |

| TRANSPORTATION EQUIPMENT - 1.85% | | | | | | | | | | | | | | |

| Greenbrier Cos, Inc. | | | 15,000,000 | | | | 2.8750 | | | 2/1/2024 | | | 13,592,173 | |

| | | | | | | | | | | | | | | |

TOTAL CONVERTIBLE BONDS

(Cost - $622,107,306) | | | | | | | | | | | | | 671,147,612 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2020 |

| Security | | Shares | | | Dividend Rate (%) | | | Maturity Date | | Fair Value | |

| PREFERRED STOCK - 3.54% | | | | | | | | | | | | | | |

| SPECIALTY FINANCE - 3.54% | | | | | | | | | | | | | | |

| Great Ajax Corp. | | | 574,385 | | | | 7.2500 | | | 4/30/2024 | | $ | 13,210,855 | |

| Ready Capital Corp. | | | 551,914 | | | | 7.0000 | | | 8/15/2023 | | | 12,694,022 | |

TOTAL PREFERRED STOCK

(Cost - $28,430,007) | | | | | | | | | | | | | 25,904,877 | |

| | | | | | | | | | | | | | | |

| | | Principal | | | | | | | | | | | |

| | | Amount | | | Interest Rate (%) | | | | | | | |

| U.S. TREASURY OBLIGATIONS - 0.89% | | | | | | | | | | | | | | |

| United States Treasury Notes | | $ | 100,000 | | | | 0.5000 | | | 5/31/2027 | | | 99,441 | |

| United States Treasury Notes | | | 6,000,000 | | | | 1.1250 | | | 2/28/2027 | | | 6,212,813 | |

| United States Treasury Notes | | | 100,000 | | | | 1.3750 | | | 1/31/2025 | | | 104,500 | |

| United States Treasury Notes | | | 100,000 | | | | 3.7500 | | | 7/31/2027 | | | 98,492 | |

TOTAL U.S. TREASURY OBLIGATIONS

(Cost - $6,546,824) | | | | | | | | | | | | | 6,515,246 | |

| | | | | | | | | | | | | | | |

| | | Shares | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 3.49% | | | | | | | | | | | | | | |

| MONEY MARKET FUND - 3.49% | | | | | | | | | | | | | | |

| Milestone Treasury Obligations Portfolio - Institutional Class | | | 25,527,495 | | | | 0.0100 | + | | | | | 25,527,495 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost - $25,527,495) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

TOTAL INVESTMENTS - 99.66%

(Cost - $682,611,632) | | | | | | | | | | | | $ | 729,095,230 | |

| OTHER ASSETS LESS LIABILITIES- 0.34% | | | | | | | | | | | | | 2,481,650 | |

| NET ASSETS - 100.00% | | | | | | | | | | | | $ | 731,576,880 | |

| | | | | | | | | | | | | | | |

| + | Money market fund; interest rate reflects seven-day effective yield on October 31, 2020. |

| ** | Interest rate represents the comparable yield on the contingent payment debt instrument. |

| *** | Non-income producing security. |

LLC - Limited Liability Company.

PLC - Public Limited Company.

REITS - Real Estate Investment Trusts.

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers.

| PORTFOLIO ANALYSIS |

| As of October 31, 2020 |

| | | % of Net | |

| Sector | | Assets | |

| Technology | | | 28.74 | % |

| Health Care | | | 18.70 | % |

| Industrial | | | 15.44 | % |

| Consumer Discretionary | | | 15.37 | % |

| Financial | | | 7.30 | % |

| Real Estate | | | 4.60 | % |

| Short-Term Investments | | | 3.49 | % |

| Energy | | | 2.50 | % |

| Communications | | | 1.50 | % |

| Materials | | | 0.99 | % |

| U.S. Treasury Obligations | | | 0.89 | % |

| Utilities | | | 0.14 | % |

| Other Assets Less Liabilities | | | 0.34 | % |

| | | | 100.00 | % |

| | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| SCHEDULE OF INVESTMENTS |

| October 31, 2020 |

| | | Principal | | | Interest Rate | | | | | | |

| Security | | Amount | | | (%) | | | Maturity Date | | Fair Value | |

| | | | | | | | | | | | |

| CONVERTIBLE BONDS - 134.82% | | | | | | | | | | | | | | |

| AEROSPACE/DEFENSE - 2.52% | | | | | | | | | | | | | | |

| Kaman Corp. * | | $ | 3,000,000 | | | | 3.2500 | | | 5/1/2024 | | $ | 3,000,391 | |

| | | | | | | | | | | | | | | |

| BASIC & DIVERSIFIED CHEMICALS - 3.21% | | | | | | | | | | | | | | |

| Dow, Inc. - Bank of America Finance LLC Synthetic * | | | 3,700,000 | | | | 2.641 | ** | | 6/18/2024 | | | 3,816,550 | |

| | | | | | | | | | | | | | | |

| BIOTECH & PHARMA - 25.33% | | | | | | | | | | | | | | |

| BioMarin Pharmaceutical, Inc. -144A * | | | 4,700,000 | | | | 1.2500 | | | 5/15/2027 | | | 4,541,375 | |

| Bristol-Myers Squibb Co. - Wells Fargo Finance, LLC Synthetic * | | | 3,500,000 | | | | 2.3100 | ** | | 11/1/2024 | | | 3,702,300 | |

| Jazz Investments I Ltd. * | | | 4,600,000 | | | | 1.5000 | | | 8/15/2024 | | | 4,711,652 | |

| Johnson & Johnson Co. - Citigroup Global Markets Holdings, Inc. Synthetic * | | | 2,840,000 | | | | 1.7920 | ** | | 6/30/2027 | | | 2,754,800 | |

| Johnson & Johnson Co. - Citigroup Global Markets Holdings, Inc. Synthetic * | | | 3,200,000 | | | | 1.5470 | ** | | 10/25/2027 | | | 3,102,080 | |

| Merck & Co. - Credit Suisse AG Synthetic * | | | 1,600,000 | | | | 1.2420 | ** | | 9/24/2027 | | | 1,552,160 | |

| Merck & Co. - Credit Suisse AG Synthetic * | | | 1,400,000 | | | | 1.2420 | ** | | 9/24/2027 | | | 1,358,140 | |

| Pacira BioSciences, Inc. - 144A * | | | 4,600,000 | | | | 0.7500 | | | 8/1/2025 | | | 4,688,311 | |

| Supernus Pharmaceuticals, Inc. * | | | 4,000,000 | | | | 0.6250 | | | 4/1/2023 | | | 3,714,913 | |

| | | | | | | | | | | | | | 30,125,731 | |

| CABLE & SATELLITE - 3.61% | | | | | | | | | | | | | | |

| Charter Communications, Inc. - Liberty Broadband Corp. Synthetic - 144A * | | | 4,000,000 | | | | 3.7500 | ** | | 9/30/2050 | | | 4,299,679 | |

| | | | | | | | | | | | | | | |

| CONSUMER SERVICES - 5.73% | | | | | | | | | | | | | | |

| Chegg, Inc. - 144A * | | | 4,000,000 | | | | 0.0000 | *** | | 9/1/2026 | | | 4,054,890 | |

| K12, Inc. - 144A * | | | 3,350,000 | | | | 1.2500 | | | 9/1/2027 | | | 2,758,220 | |

| | | | | | | | | | | | | | 6,813,110 | |

| ELECTRIC UTILITIES - 2.64% | | | | | | | | | | | | | | |

| NRG Energy, Inc. * | | | 3,000,000 | | | | 2.7500 | | | 6/1/2048 | | | 3,135,000 | |

| | | | | | | | | | | | | | | |

| ELECTRICAL EQUIPMENT - 7.50% | | | | | | | | | | | | | | |

| OSI Systems, Inc. * | | | 4,200,000 | | | | 1.2500 | | | 9/1/2022 | | | 4,268,226 | |

| SMART Global Holdings, Inc. - 144A * | | | 5,100,000 | | | | 2.2500 | | | 2/15/2026 | | | 4,648,853 | |

| | | | | | | | | | | | | | 8,917,079 | |

| INSURANCE - 1.26% | | | | | | | | | | | | | | |

| HCI Group, Inc. * | | | 1,500,000 | | | | 4.2500 | | | 3/1/2037 | | | 1,495,603 | |

| | | | | | | | | | | | | | | |

| INTERNET - 6.35% | | | | | | | | | | | | | | |

| Amazon.com, Inc.- JPMorgan Chase Financial Co., LLC Synthetic * | | | 2,600,000 | | | | 3.5900 | ** | | 4/21/2023 | | | 3,866,980 | |

| Google, Inc. - Bank of America Finance LLC Synthetic * | | | 3,000,000 | | | | 3.6400 | ** | | 9/28/2023 | | | 3,689,700 | |

| | | | | | | | | | | | | | 7,556,680 | |

| LEISURE FACILITIES & SERVICES - 3.32% | | | | | | | | | | | | | | |

| McDonald’s Corp. - Credit Suisse AG Synthetic * | | | 3,700,000 | | | | 1.9200 | ** | | 5/28/2027 | | | 3,943,090 | |

| | | | | | | | | | | | | | | |

| LEISURE PRODUCTS - 6.60% | | | | | | | | | | | | | | |

| Callaway Golf Co. * | | | 2,000,000 | | | | 2.7500 | | | 5/1/2026 | | | 2,397,500 | |

| D.R. Horton, Inc. - Barclays Bank PLC Synthetic * | | | 2,800,000 | | | | 3.8900 | ** | | 9/26/2023 | | | 3,907,400 | |

| Winnebago Industries, Inc. - 144A * | | | 1,500,000 | | | | 1.5000 | | | 4/1/2025 | | | 1,550,700 | |

| | | | | | | | | | | | | | 7,855,600 | |

| MEDICAL EQUIPMENT & DEVICES - 3.46% | | | | | | | | | | | | | | |

| Varex Imaging Corp. - 144A * | | | 4,300,000 | | | | 4.0000 | | | 6/1/2025 | | | 4,116,889 | |

| | | | | | | | | | | | | | | |

| METALS & MINING - 4.17% | | | | | | | | | | | | | | |

| Livent Corp. -144A * | | | 800,000 | | | | 4.1250 | | | 7/15/2025 | | | 1,164,500 | |

| Newmont Mining Corp. - Barclays Bank PLC Synthetic * | | | 2,300,000 | | | | 3.9200 | ** | | 10/30/2023 | | | 3,793,620 | |

| | | | | | | | | | | | | | 4,958,120 | |

| OIL & GAS - 3.60% | | | | | | | | | | | | | | |

| Exxon Mobil Corp. - Credit Suisse AG Synthetic * | | | 4,300,000 | | | | 2.6886 | ** | | 4/21/2025 | | | 4,283,230 | |

| | | | | | | | | | | | | | | |

| REITS - 3.99% | | | | | | | | | | | | | | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. * | | | 3,500,000 | | | | 0.0000 | *** | | 8/15/2023 | | | 3,645,355 | |

| IIP Operating Partnership, LP - 144A * | | | 600,000 | | | | 3.7500 | | | 2/21/2024 | | | 1,104,281 | |

| | | | | | | | | | | | | | 4,749,636 | |

| RETAIL DISCRETIONARY - 2.90% | | | | | | | | | | | | | | |

| PetIQ, Inc. -144A * | | | 2,800,000 | | | | 4.0000 | | | 6/1/2026 | | | 3,445,680 | |

| | | | | | | | | | | | | | | |

| SEMICONDUCTORS - 5.14% | | | | | | | | | | | | | | |

| Nova Measuring Instruments Ltd. -144A * | | | 1,500,000 | | | | 0.0000 | *** | | 10/15/2025 | | | 1,512,068 | |

| Vishay Intertechnology, Inc. * | | | 4,700,000 | | | | 2.2500 | | | 6/15/2025 | | | 4,603,062 | |

| | | | | | | | | | | | | | 6,115,130 | |

| SOFTWARE - 13.44% | | | | | | | | | | | | | | |

| Akamai Technologies, Inc. * | | | 2,000,000 | | | | 0.3750 | | | 9/1/2027 | | | 2,142,500 | |

| Alteryx, Inc. * | | | 2,500,000 | | | | 1.0000 | | | 8/1/2026 | | | 2,614,063 | |

| Microsoft Corp. - Morgan Stanley Finance, LLC. Synthetic * | | | 2,600,000 | | | | 2.3773 | ** | | 10/25/2024 | | | 3,296,930 | |

| Nice Ltd. - 144A * | | | 4,000,000 | | | | 0.0000 | *** | | 9/15/2025 | | | 4,092,747 | |

| Omnicell, Inc. - 144A * | | | 3,500,000 | | | | 0.2500 | | | 9/15/2025 | | | 3,840,186 | |

| | | | | | | | | | | | | | 15,986,426 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2020 |

| | | Principal | | | Interest Rate | | | | | | |

| Security | | Amount | | | (%) | | | Maturity Date | | Fair Value | |

| | | | | | | | | | | | |

| CONVERTIBLE BONDS - 134.82% (Continued) | | | | | | | | | | | | | | |

| SPECIALTY FINANCE - 1.80% | | | | | | | | | | | | | | |

| EZCORP, Inc. * | | $ | 1,600,000 | | | | 2.3750 | | | 5/1/2025 | | $ | 1,223,832 | |

| Redwood Trust, Inc. * | | | 1,000,000 | | | | 4.7500 | | | 8/15/2023 | | | 921,623 | |

| | | | | | | | | | | | | | 2,145,455 | |

| TECHNOLOGY HARDWARE - 10.53% | | | | | | | | | | | | | | |

| Apple, Inc. - JP Morgan Chase Financial Co. LLC Synthetic * | | | 2,000,000 | | | | 3.8700 | ** | | 10/16/2023 | | | 3,500,400 | |

| Interdigital, Inc. * | | | 4,400,000 | | | | 2.0000 | | | 6/1/2024 | | | 4,513,169 | |

| Lumentum Holdings, Inc. - 144A * | | | 4,000,000 | | | | 0.5000 | | | 12/15/2026 | | | 4,508,797 | |

| | | | | | | | | | | | | | 12,522,366 | |

| TECHNOLOGY SERVICES - 13.19% | | | | | | | | | | | | | | |

| Euronet Worldwide, Inc. * | | | 4,300,000 | | | | 0.7500 | | | 3/15/2049 | | | 4,146,812 | |

| Insight Enterprises, Inc. * | | | 4,000,000 | | | | 0.7500 | | | 2/15/2025 | | | 4,097,105 | |

| Parsons Corp. - 144A * | | | 4,600,000 | | | | 0.2500 | | | 8/15/2025 | | | 4,496,643 | |

| Square, Inc. - 144A * | | | 2,000,000 | | | | 0.1250 | | | 3/1/2025 | | | 2,944,422 | |

| | | | | | | | | | | | | | 15,684,982 | |

| TRANSPORTATION - 2.90% | | | | | | | | | | | | | | |

| Atlas Air Worldwide Holdings, Inc. * | | | 2,000,000 | | | | 1.8750 | | | 6/1/2024 | | | 2,379,583 | |

| Atlas Air Worldwide Holdings, Inc. * | | | 1,000,000 | | | | 2.2500 | | | 6/1/2022 | | | 1,073,070 | |

| | | | | | | | | | | | | | 3,452,653 | |

| TRANSPORTATION EQUIPMENT - 1.63% | | | | | | | | | | | | | | |

| Greenbrier Cos, Inc. * | | | 2,135,000 | | | | 2.8750 | | | 2/1/2024 | | | 1,934,619 | |

| | | | | | | | | | | | | | | |

TOTAL CONVERTIBLE BONDS

(Cost - $149,091,134) | | | | | | | | | | | | | 160,353,699 | |

| | | | | | | | | | | | | | | |

| | | | | | | Dividend Rate | | | | | | | |

| | | Shares | | | (%) | | | | | | | |

| PREFERRED STOCK - 5.05% | | | | | | | | | | | | | | |

| SPECIALTY FINANCE - 5.05% | | | | | | | | | | | | | | |

| Great Ajax Corp. * | | | 133,000 | | | | 7.2500 | | | 4/30/2024 | | | 3,059,000 | |

| Ready Capital Corp. * | | | 128,000 | | | | 7.0000 | | | 8/15/2023 | | | 2,944,000 | |

TOTAL PREFERRED STOCK

(Cost - $6,530,800) | | | | | | | | | | | | | 6,003,000 | |

| | | Expiration | | Contracts | | | Exercise Price | | | Notional Amount | | | | |

| OPTIONS PURCHASED *** - 3.22% | | | | | | | | | | | | | | |

| PUT OPTIONS PURCHASED - 3.22% | | | | | | | | | | | | |

| NASDAQ 100 Index | | January 2021 | | | 22 | | | $ | 11,700 | | | $ | 25,740,000 | | | | 2,252,360 | |

| S&P 500 Index | | December 2020 | | | 51 | | | | 3,500 | | | | 17,850,000 | | | | 1,428,255 | |

| S&P 500 Index | | January 2021 | | | 5 | | | | 3,500 | | | | 1,750,000 | | | | 146,625 | |

| TOTAL OPTIONS PURCHASED (Cost - $3,565,395) | | | | | | | | | | 3,827,240 | |

| | | | | | Interest Rate | | | | | | |

| | | Shares | | | (%) | | | | | | |

| SHORT-TERM INVESTMENTS - 0.65% | | | | | | | | | |

| MONEY MARKET FUND - 0.65% | | | | | | | | | |

| Milestone Treasury Obligations Portfolio - Institutional Class | | | 779,191 | | | | 0.0100 | + | | | | | 779,191 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost - $779,191) | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

TOTAL INVESTMENTS - 143.74%

(Cost - $159,966,520) | | | | | | | | | $ | 170,963,130 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (43.74)% | | | | | | | | | | (52,020,448 | ) |

| NET ASSETS - 100.0% | | | | | | | | | $ | 118,942,682 | |

| | | | | | | | | | | | | | | |

| + | Money market fund; interest rate reflects seven-day effective yield on October 31, 2020.

|

LLC - Limited Liability Company.

PLC - Public Limited Company.

REITS - Real Estate Investment Trusts.

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers.

| * | All or a portion of this security is segregated as collateral for the Line of Credit as of October 31, 2020 ; total fair value amount of collateral was $166,356,699. |

| ** | Interest rate represents the comparable yield on the contingent payment debt instrument. |

| *** | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2020 |

| PORTFOLIO ANALYSIS |

| As of October 31, 2020 |

| | | % of Net | |

| Sector | | Assets | |

| Technology | | | 48.65 | % |

| Health Care | | | 28.79 | % |

| Consumer Discretionary | | | 18.55 | % |

| Industrial | | | 17.74 | % |

| Financial | | | 11.32 | % |

| Real Estate | | | 3.99 | % |

| Communications | | | 3.61 | % |

| Energy | | | 3.60 | % |

| Options | | | 3.22 | % |

| Utilities | | | 2.64 | % |

| Materials | | | 0.98 | % |

| Short-Term Investments | | | 0.65 | % |

| Liabilities in Excess of Other Assets | | | (43.74 | )% |

| | | | 100.00 | % |

| | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Intermediate Bond Fund |

| SCHEDULE OF INVESTMENTS |

| October 31, 2020 |

| | | Principal | | | | | | | | | |

| Security | | Amount | | | Interest Rate (%) | | | Maturity Date | | Fair Value | |

| | | | | | | | | | | | |

| CONVERTIBLE BONDS - 92.88% | | | | | | | | | | | | | | |

| AEROSPACE/DEFENSE - 2.74% | | | | | | | | | | | | | | |

| Kaman Corp. | | $ | 2,100,000 | | | | 3.2500 | | | 5/1/2024 | | $ | 2,100,274 | |

| | | | | | | | | | | | | | | |

| ASSET MANAGEMENT - 2.71% | | | | | | | | | | | | | | |

| Ares Capital Corp. | | | 1,000,000 | | | | 4.6250 | | | 3/1/2024 | | | 1,041,300 | |

| Sixth Street Specialty Lending, Inc. | | | 1,000,000 | | | | 4.5000 | | | 8/1/2022 | | | 1,029,584 | |

| | | | | | | | | | | | | | 2,070,884 | |

| BASIC & DIVERSIFIED CHEMICALS - 2.29% | | | | | | | | | | | | | | |

| Dow, Inc. - Bank of America Finance LLC Synthetic | | | 1,700,000 | | | | 2.6410 | ** | | 6/18/2024 | | | 1,753,550 | |

| | | | | | | | | | | | | | | |

| BIOTECH & PHARMA - 17.15% | | | | | | | | | | | | | | |

| BioMarin Pharmaceutical, Inc. -144A | | | 2,000,000 | | | | 1.2500 | | | 5/15/2027 | | | 1,932,500 | |

| Bristol-Myers Squibb Co. - Wells Fargo Finance, LLC. Synthetic | | | 1,800,000 | | | | 2.3100 | ** | | 11/1/2024 | | | 1,904,040 | |

| Jazz Investments I, Ltd. | | | 2,200,000 | | | | 1.5000 | | | 8/15/2024 | | | 2,253,399 | |

| Johnson & Johnson Co. - Citigroup Global Markets Holdings, Inc. Synthetic | | | 1,500,000 | | | | 1.7920 | ** | | 6/30/2027 | | | 1,455,000 | |

| Johnson & Johnson Co. - Citigroup Global Markets Holdings, Inc. Synthetic | | | 1,000,000 | | | | 1.5470 | ** | | 10/25/2027 | | | 969,400 | |

| Merck & Co. - Credit Suisse AG Synthetic | | | 1,800,000 | | | | 1.2420 | ** | | 9/24/2027 | | | 1,746,180 | |

| Pacira BioSciences, Inc. -144A | | | 1,900,000 | | | | 0.7500 | | | 8/1/2025 | | | 1,936,476 | |

| Supernus Pharmaceuticals, Inc. | | | 1,000,000 | | | | 0.6250 | | | 4/1/2023 | | | 928,728 | |

| | | | | | | | | | | | | | 13,125,723 | |

| CABLE & SATELLITE - 2.84% | | | | | | | | | | | | | | |

| Charter Communications, Inc. - Bank of America Finance LLC Synthetic | | | 500,000 | | | | 1.7700 | ** | | 9/1/2022 | | | 564,000 | |

| Charter Communications, Inc. - Liberty Broadband Corp. Synthetic - 144A | | | 1,500,000 | | | | 3.7500 | ** | | 9/30/2050 | | | 1,612,380 | |

| | | | | | | | | | | | | | 2,176,380 | |

| CONSUMER SERVICES - 2.33% | | | | | | | | | | | | | | |

| Chegg, Inc. - 144A | | | 1,600,000 | | | | 0.0000 | *** | | 9/1/2026 | | | 1,621,956 | |

| K12, Inc. - 144A | | | 200,000 | | | | 1.1250 | | | 9/1/2027 | | | 164,670 | |

| | | | | | | | | | | | | | 1,786,626 | |

| ELECTRIC UTILITIES - 1.36% | | | | | | | | | | | | | | |

| NRG Energy, Inc. | | | 1,000,000 | | | | 2.7500 | | | 6/1/2048 | | | 1,045,000 | |

| | | | | | | | | | | | | | | |

| ELECTRICAL EQUIPMENT - 5.50% | | | | | | | | | | | | | | |

| OSI Systems, Inc. | | | 1,900,000 | | | | 1.2500 | | | 9/1/2022 | | | 1,930,864 | |

| SMART Global Holdings, Inc. - 144A | | | 2,500,000 | | | | 2.2500 | | | 2/15/2026 | | | 2,278,849 | |

| | | | | | | | | | | | | | 4,209,713 | |

| FOOD - 1.24% | | | | | | | | | | | | | | |

| The Kraft Heinz Co. - Citigroup Global Markets Holdings, Inc. Synthetic | | | 1,000,000 | | | | 1.7920 | ** | | 6/30/2027 | | | 950,400 | |

| | | | | | | | | | | | | | | |

| INSURANCE - 2.21% | | | | | | | | | | | | | | |

| HCI Group, Inc. | | | 1,700,000 | | | | 4.2500 | | | 3/1/2037 | | | 1,695,017 | |

| | | | | | | | | | | | | | | |

| INTERNET & MEDIA SERVICES - 3.55% | | | | | | | | | | | | | | |

| Amazon.com, Inc.- JPMorgan Chase Financial Co., LLC Synthetic | | | 1,000,000 | | | | 3.5900 | ** | | 4/21/2023 | | | 1,487,300 | |

| Google, Inc. - Bank of America Finance LLC Synthetic | | | 1,000,000 | | | | 3.6400 | ** | | 9/28/2023 | | | 1,229,900 | |

| | | | | | | | | | | | | | 2,717,200 | |

| LEISURE FACILITIES & SERVICES - 2.23% | | | | | | | | | | | | | | |

| McDonald’s Corp. - Credit Suisse AG Synthetic | | | 1,600,000 | | | | 1.9200 | ** | | 5/28/2027 | | | 1,705,120 | |

| | | | | | | | | | | | | | | |

| LEISURE PRODUCTS - 3.26% | | | | | | | | | | | | | | |

| Callaway Golf Co. -144A | | | 800,000 | | | | 2.7500 | | | 5/1/2026 | | | 959,000 | |

| D.R. Horton, Inc. - Barclays Bank PLC Synthetic | | | 1,100,000 | | | | 3.8900 | ** | | 9/26/2023 | | | 1,535,050 | |

| | | | | | | | | | | | | | 2,494,050 | |

| MEDICAL EQUIPMENT & DEVICES - 2.50% | | | | | | | | | | | | | | |

| Varex Imaging Corp. - 144A | | | 2,000,000 | | | | 4.0000 | | | 6/1/2025 | | | 1,914,832 | |

| | | | | | | | | | | | | | | |

| METALS & MINING - 2.59% | | | | | | | | | | | | | | |

| Newmont Mining Corp. - Barclays Bank PLC Synthetic | | | 1,200,000 | | | | 3.9200 | ** | | 10/30/2023 | | | 1,979,280 | |

| | | | | | | | | | | | | | | |

| OIL & GAS - 1.95% | | | | | | | | | | | | | | |

| Exxon Mobil Corp. - Credit Suisse AG Synthetic | | | 1,500,000 | | | | 2.6886 | ** | | 4/21/2025 | | | 1,494,150 | |

| | | | | | | | | | | | | | | |

| REITS - 3.55% | | | | | | | | | | | | | | |

| CorEnergy Infrastructure Trust, Inc. | | | 1,150,000 | | | | 5.8750 | | | 8/15/2025 | | | 845,447 | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 1,800,000 | | | | 0.0000 | *** | | 8/15/2023 | | | 1,874,754 | |

| | | | | | | | | | | | | | 2,720,201 | |

| RETAIL DISCRETIONARY - 1.29% | | | | | | | | | | | | | | |

| PetIQ, Inc. -144A | | | 800,000 | | | | 4.0000 | | | 6/1/2026 | | | 984,480 | |

| | | | | | | | | | | | | | | |

| SEMICONDUCTORS - 4.53% | | | | | | | | | | | | | | |

| Nova Measuring Instruments Ltd. -144A | | | 1,500,000 | | | | 0.0000 | | | 10/15/2025 | | | 1,512,068 | |

| Vishay Intertechnology, Inc. | | | 2,000,000 | | | | 2.2500 | | | 6/15/2025 | | | 1,958,750 | |

| | | | | | | | | | | | | | 3,470,818 | |

| SOFTWARE - 6.21% | | | | | | | | | | | | | | |

| Alteryx, Inc. | | | 1,600,000 | | | | 1.0000 | | | 8/1/2026 | | | 1,673,000 | |

| Nice Ltd. - 144A | | | 1,400,000 | | | | 0.0000 | *** | | 9/15/2025 | | | 1,432,461 | |

| Omnicell, Inc. - 144A | | | 1,500,000 | | | | 0.2500 | | | 9/15/2025 | | | 1,645,794 | |

| | | | | | | | | | | | | | 4,751,255 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Intermediate Bond Fund |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2020 |

| | | Principal | | | | | | Maturity | | | |

| Security | | Amount | | | Interest Rate (%) | | | Date | | Fair Value | |

| | | | | | | | | | | | |

| CONVERTIBLE BONDS - 92.88% (Continued) | | | | | | | | | | | | | | |

| SPECIALTY FINANCE - 3.20% | | | | | | | | | | | | | | |

| Granite Point Mortgage Trust, Inc. -144A | | $ | 1,875,000 | | | | 5.6250 | | | 12/1/2022 | | $ | 1,802,173 | |

| Redwood Trust, Inc. | | | 700,000 | | | | 4.7500 | | | 8/15/2023 | | | 645,136 | |

| | | | | | | | | | | | | | 2,447,309 | |

| TECHNOLOGY HARDWARE - 5.71% | | | | | | | | | | | | | | |

| Apple, Inc. - JP Morgan Chase Financial Co. LLC Synthetic | | | 800,000 | | | | 3.8700 | ** | | 10/16/2023 | | | 1,400,160 | |

| Interdigital, Inc. | | | 1,800,000 | | | | 2.0000 | | | 6/1/2024 | | | 1,846,297 | |

| Lumentum Holdings, Inc. - 144A | | | 1,000,000 | | | | 0.5000 | | | 12/15/2026 | | | 1,127,199 | |

| | | | | | | | | | | | | | 4,373,656 | |

| TECHNOLOGY SERVICES - 7.48% | | | | | | | | | | | | | | |

| Euronet Worldwide, Inc. | | | 2,000,000 | | | | 0.7500 | | | 3/15/2049 | | | 1,928,750 | |

| Insight Enterprises, Inc. | | | 1,700,000 | | | | 0.7500 | | | 2/15/2025 | | | 1,741,270 | |

| Parsons Corp. - 144A | | | 2,000,000 | | | | 0.2500 | | | 8/15/2025 | | | 1,955,062 | |

| Visa, Inc. - Barclays Bank PLC Synthetic | | | 100,000 | | | | 1.2800 | ** | | 2/18/2025 | | | 105,250 | |

| | | | | | | | | | | | | | 5,730,332 | |

| TRANSPORTATION & LOGISTICS - 1.86% | | | | | | | | | | | | | | |

| Atlas Air Worldwide Holdings, Inc. | | | 1,325,000 | | | | 2.2500 | | | 6/1/2022 | | | 1,421,818 | |

| | | | | | | | | | | | | | | |

| TRANSPORTATION EQUIPMENT - 2.60% | | | | | | | | | | | | | | |

| Greenbrier Cos, Inc. | | | 2,200,000 | | | | 2.8750 | | | 2/1/2024 | | | 1,993,519 | |

| | | | | | | | | | | | | | | |

TOTAL CONVERTIBLE BONDS

(Cost - $67,483,220) | | | | | | | | | | | | | 71,111,587 | |

| | | | | | | | | | | | | | | |

| | | Shares | | | Dividend Rate (%) | | | | | | | |

| PREFERRED STOCK - 4.51% | | | | | | | | | | | | | | |

| SPECIALTY FINANCE - 4.51% | | | | | | | | | | | | | | |

| Great Ajax Corp. | | | 70,000 | | | | 7.2500 | | | 4/30/2024 | | | 1,610,000 | |

| Ready Capital Corp. | | | 80,000 | | | | 7.0000 | | | 8/15/2023 | | | 1,840,000 | |

TOTAL PREFERRED STOCK

(Cost - $3,754,400) | | | | | | | | | | | | | 3,450,000 | |

| | | | | | | | | | | | | | | |

| | | Principal | | | | | | | | | | | |

| | | Amount | | | Interest Rate (%) | | | | | | | |

| U.S. TREASURY OBLIGATIONS - 2.03% | | | | | | | | | | | | | | |

| United States Treasury Notes | | $ | 1,500,000 | | | | 1.1250 | | | 2/28/2027 | | | 1,553,203 | |

TOTAL U.S. TREASURY OBLIGATIONS

(Cost - $1,560,528) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Shares | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 0.54% | | | | | | | | | | | | | | |

| MONEY MARKET FUND - 0.54% | | | | | | | | | | | | | | |

| Milestone Treasury Obligations Portfolio - Institutional Class | | | 410,154 | | | | 0.0100 | + | | | | | 410,154 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost - $410,154) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

TOTAL INVESTMENTS - 99.96%

(Cost - $73,208,302) | | | | | | | | | | | | $ | 76,524,944 | |

| OTHER ASSETS LESS LIABILITIES - 0.04% | | | | | | | | | | | | | 33,445 | |

| NET ASSETS - 100.00% | | | | | | | | | | | | $ | 76,558,389 | |

| | | | | | | | | | | | | | | |

| + | Money market fund; interest rate reflects seven-day effective yield on October 31, 2020. |

| ** | Interest rate represents the comparable yield on the contingent payment debt instrument. |

| *** | Non-income producing security. |

LLC - Limited Liability Company.

PLC - Public Limited Company.

REITS - Real Estate Investment Trusts.

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers.

| PORTFOLIO ANALYSIS |

| As of October 31, 2020 |

| | | % of Net | |

| Sector | | Assets | |

| Technology | | | 27.49 | % |

| Health Care | | | 19.65 | % |

| Industrial | | | 17.58 | % |

| Financial | | | 12.62 | % |

| Consumer Discretionary | | | 10.35 | % |

| Real Estate | | | 3.55 | % |

| Communications | | | 2.84 | % |

| U.S. Treasury Obligations | | | 2.03 | % |

| Energy | | | 1.95 | % |

| Utilities | | | 1.37 | % |

| Short-Term Investments | | | 0.53 | % |

| Other Assets Less Liabilities | | | 0.04 | % |

| | | | 100.00 | % |

| | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Funds |

| STATEMENTS OF ASSETS AND LIABILITIES |

| October 31, 2020 |

| | | Miller | | | Miller | | | Miller | |

| | | Convertible | | | Convertible | | | Intermediate | |

| | | Bond Fund | | | Plus Fund | | | Bond Fund | |

| Assets: | | | | | | | | | | | | |

| Investments in Securities at Cost | | $ | 682,611,632 | | | $ | 159,966,520 | | | $ | 73,208,302 | |

| Investments in Securities at Fair Value | | $ | 729,095,230 | | | $ | 170,963,130 | | | $ | 76,524,944 | |

| Segregated Cash - Collateral for Loan | | | — | | | | 492,738 | | | | — | |

| Receivable for Securities Sold | | | 5,630,400 | | | | — | | | | — | |

| Receivable for Fund Shares Sold | | | 1,653,446 | | | | 155,000 | | | | 50,000 | |

| Interest and Dividend Receivable | | | 2,600,441 | | | | 606,598 | | | | 357,546 | |

| Prepaid Expenses and Other Assets | | | 60,475 | | | | 17,706 | | | | 16,003 | |

| Total Assets | | | 739,039,992 | | | | 172,235,172 | | | | 76,948,493 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payable for Securities Purchased | | | 6,212,566 | | | | — | | | | 201,186 | |

| Line of Credit Payable | | | — | | | | 53,000,000 | | | | — | |

| Accrued Advisory Fees | | | 471,400 | | | | 187,641 | | | | 65,263 | |

| Interest Payable | | | — | | | | 60,735 | | | | — | |

| Accrued Distribution Fees | | | 74,903 | | | | — | | | | — | |

| Payable for Fund Shares Redeemed | | | 370,887 | | | | — | | | | 86,598 | |

| Accrued Expenses and Other Liabilities | | | 333,356 | | | | 44,114 | | | | 37,057 | |

| Total Liabilities | | | 7,463,112 | | | | 53,292,490 | | | | 390,104 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 731,576,880 | | | $ | 118,942,682 | | | $ | 76,558,389 | |

| | | | | | | | | | | | | |

| Composition of Net Assets: | | | | | | | | | | | | |

| At October 31, 2020, Net Assets consisted of: | | | | | | | | | | | | |

| Paid-in-Capital | | $ | 675,308,698 | | | $ | 105,479,196 | | | $ | 74,485,924 | |

| Accumulated Earnings | | | 56,268,182 | | | | 13,463,486 | | | | 2,072,465 | |

| Net Assets | | $ | 731,576,880 | | | $ | 118,942,682 | | | $ | 76,558,389 | |

| | | | | | | | | | | | | |

| Net Asset Value Per Share | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | | |

| Net Assets | | $ | 53,384,948 | | | | | | | | | |

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | | | 3,874,487 | | | | | | | | | |

| Net Asset Value and Redemption Price per Share | | $ | 13.78 | | | | | | | | | |

| Maximum Offering Price Per Share (Includes a Maximum Sales Charge of 5.75%) | | $ | 14.62 | | | | | | | | | |

| | | | | | | | | | | | | |

| Class I Shares | | | | | | | | | | | | |

| Net Assets | | $ | 619,010,167 | | | $ | 118,942,682 | | | $ | 76,558,389 | |

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | | | 45,034,746 | | | | 4,584,788 | | | | 4,599,768 | |

| Net Asset Value, Offering and Redemption Price per Share | | $ | 13.75 | | | $ | 25.94 | | | $ | 16.64 | |

| | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | | |

| Net Assets | | $ | 59,181,765 | | | | | | | | | |

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | | | 4,337,295 | | | | | | | | | |

| Net Asset Value, Offering and Redemption Price per Share | | $ | 13.64 | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Miller Funds |

| STATEMENTS OF OPERATIONS |

| For the Year Ended October 31, 2020 |

| | | Miller | | | Miller | | | Miller | |

| | | Convertible | | | Convertible | | | Intermediate | |

| | | Bond Fund | | | Plus Fund | | | Bond Fund | |

| Investment Income: | | | | | | | | | | | | |

| Interest Income | | $ | 11,191,710 | | | $ | 2,951,477 | | | $ | 1,889,180 | |

| Dividend Income | | | 2,006,923 | | | | 465,063 | | | | 293,750 | |

| Total Investment Income | | | 13,198,633 | | | | 3,416,540 | | | | 2,182,930 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment Advisory Fees | | | 5,265,652 | | | | 1,530,244 | | | | 717,171 | |

| Distribution Fees (Class A) | | | 295,579 | | | | — | | | | — | |

| Distribution Fees (Class C) | | | 592,365 | | | | — | | | | — | |

| Third Party Administrative Services Fees | | | 467,766 | | | | 37,190 | | | | 28,915 | |

| Administration Fees | | | 269,513 | | | | 66,540 | | | | 57,590 | |

| Transfer Agent Fees | | | 262,247 | | | | 30,005 | | | | 25,127 | |

| Trustees’ Fees | | | 188,523 | | | | 29,766 | | | | 30,643 | |

| Audit Fees | | | 94,344 | | | | 15,499 | | | | 13,216 | |

| Custodian Fees | | | 92,741 | | | | 35,013 | | | | 21,210 | |

| Registration and Filing Fees | | | 81,526 | | | | 36,488 | | | | 35,833 | |

| Legal Fees | | | 56,668 | | | | 10,268 | | | | 8,620 | |

| Printing Expense | | | 74,713 | | | | 6,583 | | | | 9,190 | |

| Chief Compliance Officer Fees | | | 41,113 | | | | 6,478 | | | | 6,156 | |

| Insurance Expense | | | 36,816 | | | | 9,565 | | | | 5,512 | |

| Interest Expense | | | — | | | | 1,159,010 | | | | — | |

| Miscellaneous Expenses | | | 5,527 | | | | 1,252 | | | | 1,239 | |

| Total Expenses | | | 7,825,093 | | | | 2,973,901 | | | | 960,422 | |

| Plus (Less): Expenses Recaptured (Fees Waived) by Adviser | | | — | | | | 426,136 | | | | (101,168 | ) |

| Net Expenses | | | 7,825,093 | | | | 3,400,037 | | | | 859,254 | |

| Net Investment Income | | | 5,373,540 | | | | 16,503 | | | | 1,323,676 | |

| | | | | | | | | | | | | |

| Net Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | | | | | |

| Net Realized Gain (Loss) on: | | | | | | | | | | | | |

| Investments | | | 43,411,044 | | | | 9,572,139 | | | | 3,402,539 | |

| Swaps | | | 453,780 | | | | (12,258 | ) | | | (12,240 | ) |

| Total Net Realized Gain | | | 43,864,824 | | | | 9,559,881 | | | | 3,390,299 | |

| | | | | | | | | | | | | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Investments | | | 25,734,048 | | | | 5,378,925 | | | | 500,018 | |

| Swaps | | | (126,011 | ) | | | — | | | | — | |

| Total Net Change in Unrealized Appreciation | | | 25,608,037 | | | | 5,378,925 | | | | 500,018 | |

| Net Realized and Unrealized Gain on Investments | | | 69,472,861 | | | | 14,938,806 | | | | 3,890,317 | |

| | | | | | | | | | | | | |

| Net Increase in Net Assets Resulting From Operations | | $ | 74,846,401 | | | $ | 14,955,309 | | | $ | 5,213,993 | |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Bond Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year | | | Year | |

| | | Ended | | | Ended | |

| | | October 31, 2020 | | | October 31, 2019 | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 5,373,540 | | | $ | 9,581,091 | |

| Net Realized Gain (Loss) on Investments and Swaps | | | 43,864,824 | | | | (7,389,648 | ) |

| Net Change in Unrealized Appreciation on Investments and Swaps | | | 25,608,037 | | | | 37,860,977 | |

| Net Increase in Net Assets Resulting From Operations | | | 74,846,401 | | | | 40,052,420 | |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Class A ($0.31 and $0.50 per share, respectively) | | | (1,415,858 | ) | | | (3,286,102 | ) |

| Class I ($0.39 and $0.56 per share, respectively) | | | (17,950,880 | ) | | | (31,380,443 | ) |

| Class C ($0.25 and $0.44 per share, respectively) | | | (1,163,625 | ) | | | (2,290,520 | ) |

| Total Distributions to Shareholders | | | (20,530,363 | ) | | | (36,957,065 | ) |

| | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from Shares Issued | | | 10,866,686 | | | | 9,713,107 | |

| Distributions Reinvested | | | 1,299,096 | | | | 3,003,584 | |

| Cost of Shares Redeemed | | | (31,912,638 | ) | | | (36,702,058 | ) |

| Total Class A Shares | | | (19,746,856 | ) | | | (23,985,367 | ) |

| Class I | | | | | | | | |

| Proceeds from Shares Issued | | | 225,951,524 | | | | 178,448,937 | |

| Distributions Reinvested | | | 13,064,107 | | | | 23,386,473 | |

| Cost of Shares Redeemed | | | (304,816,582 | ) | | | (385,086,056 | ) |

| Total Class I Shares | | | (65,800,951 | ) | | | (183,250,646 | ) |

| Class C | | | | | | | | |

| Proceeds from Shares Issued | | | 5,184,777 | | | | 11,490,448 | |

| Distributions Reinvested | | | 1,036,425 | | | | 2,088,491 | |

| Cost of Shares Redeemed | | | (14,327,153 | ) | | | (17,112,748 | ) |

| Total Class C Shares | | | (8,105,951 | ) | | | (3,533,809 | ) |

| Total Beneficial Interest Transactions | | | (93,653,758 | ) | | | (210,769,822 | ) |

| | | | | | | | | |

| Decrease in Net Assets | | | (39,337,720 | ) | | | (207,674,467 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Year | | | 770,914,600 | | | | 978,589,067 | |

| End of Year | | $ | 731,576,880 | | | $ | 770,914,600 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Class A: | | | | | | | | |

| Shares Issued | | | 866,118 | | | | 790,068 | |

| Shares Reinvested | | | 100,185 | | | | 254,157 | |

| Shares Redeemed | | | (2,539,236 | ) | | | (3,005,150 | ) |

| Net decrease in shares of beneficial interest outstanding | | | (1,572,933 | ) | | | (1,960,925 | ) |

| | | | | | | | | |

| Class I: | | | | | | | | |

| Shares Issued | | | 17,402,997 | | | | 14,573,907 | |

| Shares Reinvested | | | 1,008,737 | | | | 1,978,966 | |

| Shares Redeemed | | | (24,392,483 | ) | | | (31,761,626 | ) |

| Net decrease in shares of beneficial interest outstanding | | | (5,980,749 | ) | | | (15,208,753 | ) |

| | | | | | | | | |

| Class C: | | | | | | | | |

| Shares Issued | | | 413,651 | | | | 941,923 | |

| Shares Reinvested | | | 79,800 | | | | 178,583 | |

| Shares Redeemed | | | (1,137,729 | ) | | | (1,405,032 | ) |

| Net decrease in shares of beneficial interest outstanding | | | (644,278 | ) | | | (284,526 | ) |

The accompanying notes are an integral part of these financial statements.

| Miller Convertible Plus Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year | | | Year | |

| | | Ended | | | Ended | |

| | | October 31, 2020 | | | October 31, 2019 | |

| Operations: | | | | | | | | |

| Net Investment Income (Loss) | | $ | 16,503 | | | $ | (319,795 | ) |

| Net Realized Gain (Loss) on Investments and Swaps | | | 9,559,881 | | | | (3,241,079 | ) |

| Net Change in Unrealized Appreciation on Investments and Swaps | | | 5,378,925 | | | | 10,892,284 | |

| Net Increase in Net Assets Resulting From Operations | | | 14,955,309 | | | | 7,331,410 | |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Class A ($0.00 and $1.15 per share, respectively) | | | — | | | | (51,045 | ) |

| Class I ($0.42 and $1.24 per share, respectively) | | | (2,047,227 | ) | | | (6,734,728 | ) |

| Class C ($0.00 and $1.06 per share, respectively) | | | — | | | | (22,598 | ) |

| Total Distributions to Shareholders | | | (2,047,227 | ) | | | (6,808,371 | ) |

| | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | | |

| Class A* | | | | | | | | |

| Proceeds from Shares Issued | | | — | | | | 394,343 | |

| Distributions Reinvested | | | — | | | | 47,399 | |

| Transfers to Class I | | | — | | | | (987,053 | ) |

| Cost of Shares Redeemed | | | — | | | | (525,322 | ) |

| Total Class A Shares | | | — | | | | (1,070,633 | ) |

| Class I | | | | | | | | |

| Proceeds from Shares Issued | | | 10,921,430 | | | | 18,774,145 | |

| Distributions Reinvested | | | 1,981,817 | | | | 6,602,961 | |

| Transfers from Classes A and C | | | — | | | | 1,237,939 | |

| Cost of Shares Redeemed | | | (24,278,153 | ) | | | (50,413,563 | ) |

| Total Class I Shares | | | (11,374,906 | ) | | | (23,798,518 | ) |

| Class C* | | | | | | | | |