UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

811-22175

ALPS ETF TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Erin D. Nelson, Esq.

ALPS ETF Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: (303) 623-2577

Date of fiscal year end: November 30

Date of reporting period: December 1, 2013 – November 30, 2014

| Item 1. | Reports to Stockholders. |

table of

CONTENTS

www.alpsfunds.com

| | |

Alerian MLP ETF | | |

Performance Overview | | November 30, 2014 (Unaudited) |

INVESTMENT OBJECTIVE

The Alerian MLP ETF (the “Fund”) seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index (the “Index”). The Shares of the Fund are listed and trade on the New York Stock Exchange (“NYSE”) Arca under the ticker symbol AMLP. The Fund generally will invest in all of the securities that comprise the Index in proportion to their weightings in the Index.

The Index is a rules based, modified capitalization weighted, float-adjusted index intended to give investors a means of tracking the overall performance of the United States energy infrastructure Master Limited Partnership (“MLP”) asset class. The Index is comprised of 25 energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

PERFORMANCE OVERVIEW

During the twelve month period of December 1, 2013 to November 30, 2014, the Alerian MLP ETF (AMLP) delivered a total return of 8.8% (8.8% NAV). This compares to the Fund’s index, the Alerian MLP Infrastructure Index (“AMZI Index”), which gained 7.8% on a price-return and 13.8% on a total return basis. The difference in the performance between the Index and AMLP is primarily attributable to the Fund’s operating expenses and the tax impact of the Fund’s C-corporation(1) structure.

During the period, the fund paid four distributions:

| • | | $0.278 on February 13, 2014 |

| • | | $0.284 on August 13, 2014 |

| • | | $0.289 on November 14, 2014 |

These distributions represent 1.5%, 0.4%, 1.8%, and 1.8% increases from their previous quarters. On an annual basis, the Fund has increased its distribution by 5.5% when comparing the November 14, 2014 distribution versus the November 15, 2013 distribution of $0.274.

Top performers in the Index during the period include TC PipeLines (TCP) and Magellan Midstream Partners (MMP), both gaining more than 30% on a price-return basis. Underperforms during the period include ONEOK Partners (OKS) and Genesis Energy (GEL). During the period, Crestwood Midstream Partners (CMLP), EnLink Midstream Partners (ENLK), EQT Midstream Partners (EQM), and NGL Energy Partners (NGL) were added to the Index. Boardwalk Pipeline Partners (BWP), PVR Partners, Kinder Morgan Energy Partners, and El Paso Pipeline Partners were removed from the Index.

In mid-March, the Interstate Natural Gas Association of America (INGAA) updated and expanded its capital spending report, estimating the need for $641 billion of natural gas, crude, and natural gas liquid infrastructure spending through 2035. For perspective, the total market capitalization of the 25 names in the Index at November 30, 2014 was $310 billion. The new spending estimate is $390 billion higher than the organization’s 2011 estimate. Several companies have noted that “North America is undergoing a major repiping” in describing the construction of new and repurposing of existing midstream assets to accommodate new and growing supply areas. In 2014, many pipeline reversal and/or conversion projects were announced, and the industry even saw a revival in natural gas pipeline projects. Overlaid with increased international demand for cheaper energy resources, the stage is set for more natural gas and ethane export projects.

During the latter half of the period, master limited partnership equity prices told a different story. Starting in June and lasting even beyond November, crude prices plummeted. From its June 13 high of $107.49, West Texas Intermediate (WTI) oil prices had fallen nearly 40% to $65.94 by the end of November. However, MLP unit prices were relatively unaffected by the pullback until October. While the majority of MLPs operate toll-road business models that rarely take title to the underlying commodity, MLPs have not been immune to the headline risk. In the span of two months, the Index fell 7.1%. Investors that feared catching a falling knife took the opportunity to do some early tax loss harvesting, while longer-term investors used the selloffs to add to positions in defensive names, which tend to be larger, investment grade, and with less direct sensitivity to commodity prices. Over the long run, MLPs have exhibited a weak correlation to commodity prices, whether they are crude oil, natural gas, or natural gas liquids.

Despite the volatility, the amount of announced organic projects from master limited partnerships seemingly has not slowed down. Regardless of commodity prices, the MLP-owned energy infrastructure assets, including pipelines, storage facilities, and processing plants, are and will be the bridge by which the reserves and production in supply basins make their way to demand centers. With toll-road business models anchored by inflation-indexed tariff increases and billions of dollars of infrastructure opportunities over the next few decades, we believe that MLPs continue to represent a compelling potential investment opportunity for investors seeking after-tax yield.

1 | November 30, 2014

| | |

Alerian MLP ETF | | |

Performance Overview | | November 30, 2014 (Unaudited) |

| (1) | Under current law, the Fund is not eligible to elect treatment as a regulated investment company due to its investments primarily in MLPs. The Fund is classified for federal income tax purposes as a taxable regular corporation or so-called Subchapter “C” corporation. Whereas the NAV of Fund Shares is reduced by the accrual of any deferred tax liabilities, the Alerian MLP Infrastructure Index is calculated without any tax deductions. |

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. ALPS Advisors, Inc. and Alerian do not accept any liability for losses either direct or consequential caused by the use of this information.

Performance (as of November 30, 2014)

| | | | | | |

| | | 1 Year | | 3 Year | | Since Inception^ |

Alerian MLP ETF – NAV | | 8.82% | | 10.82% | | 11.09% |

Alerian MLP ETF – Market Price* | | 8.82% | | 10.85% | | 11.09% |

Alerian MLP Infrastructure Index | | 13.79% | | 17.38% | | 17.96% |

S&P 500® Total Return Index | | 16.86% | | 20.93% | | 19.67% |

Total Expense Ratio (per the current prospectus) 8.56%.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For most current month-end performance data please visit www.alpsfunds.com. The Fund accrues deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax-deferred return of capital and for any net operating gains as well as capital appreciation of its investment. This deferred tax liability is reflected in the daily NAV and as a result the MLP fund’s after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked.

NAV is an exchange-traded fund’s per-share value. The per-share dollar amount of the fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commenced Investment Operations on August 24, 2010 with an Inception Date, the first day of trading on the Exchange, of August 25, 2010. |

| * | Market Price is based on the midpoint of the bid-ask spread at 4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. |

The Alerian MLP Infrastructure Index is comprised of 25 midstream energy Master Limited Partnerships and provides investors with an unbiased benchmark for the infrastructure component of this emerging asset class.

S&P 500® Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

One cannot invest directly in an index. Index performance does not reflect fund performance.

The Alerian MLP ETF is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

2 | November 30, 2014

| | |

Alerian MLP ETF | | |

Performance Overview | | November 30, 2014 (Unaudited) |

Top 10 Holdings* (as of November 30, 2014)

| | | | |

Enterprise Products Partners LP | | | 10.32 | % |

Energy Transfer Partners LP | | | 7.53 | % |

Plains All American Pipeline LP | | | 7.48 | % |

MarkWest Energy Partners LP | | | 7.45 | % |

Magellan Midstream Partners LP | | | 7.38 | % |

Buckeye Partners LP | | | 5.90 | % |

Williams Partners LP | | | 4.86 | % |

Enbridge Energy Partners LP | | | 4.80 | % |

Regency Energy Partners LP | | | 4.68 | % |

ONEOK Partners LP | | | 4.28 | % |

Total % of Top 10 Holdings | | | 64.68 | % |

Future holdings are subject to change.

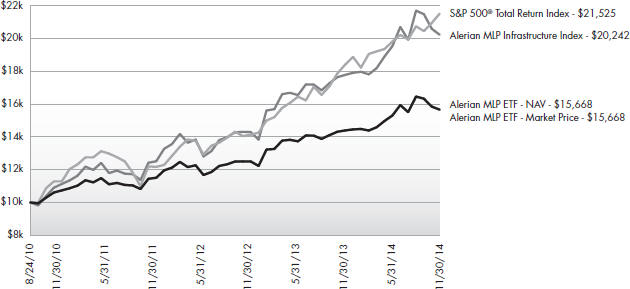

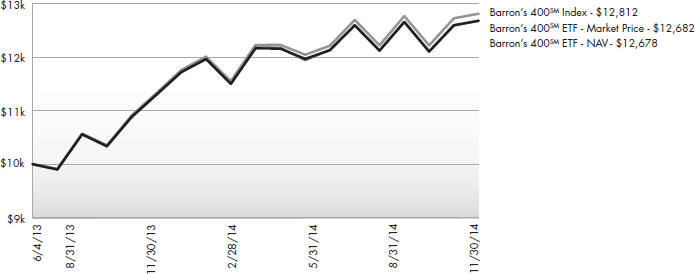

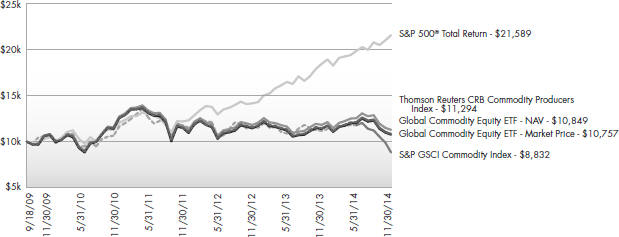

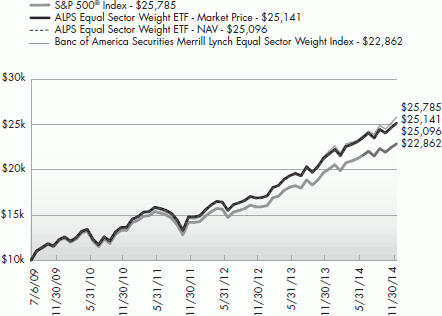

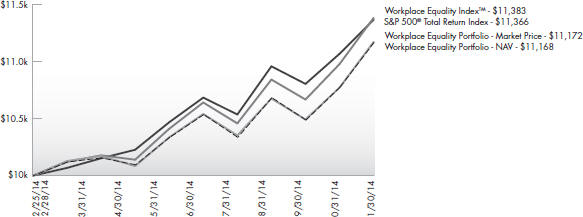

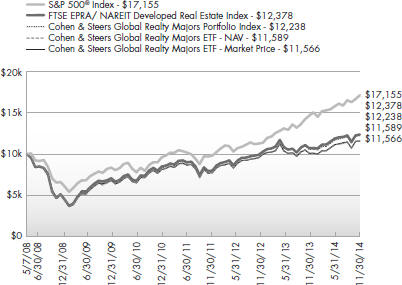

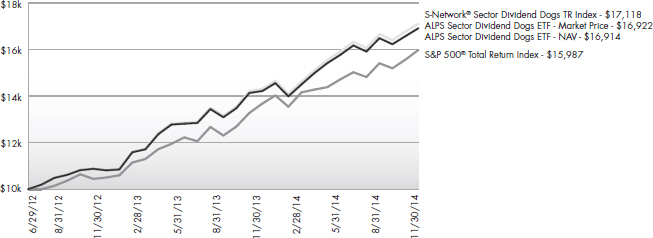

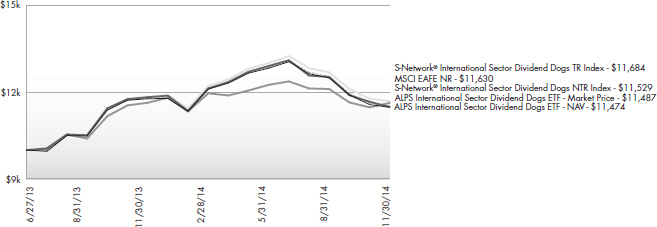

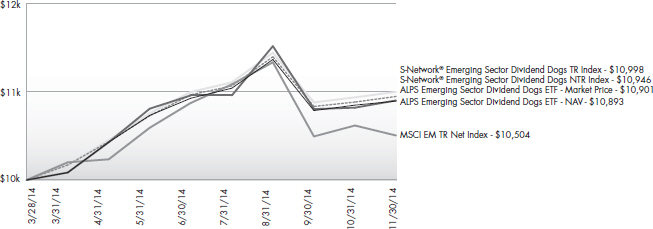

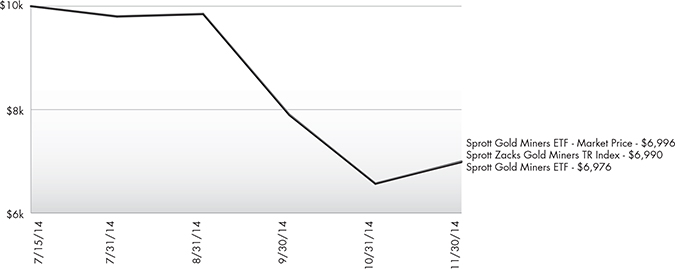

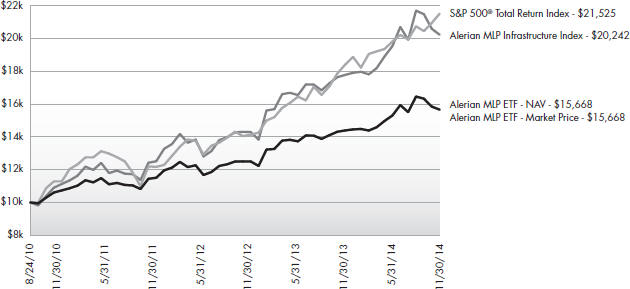

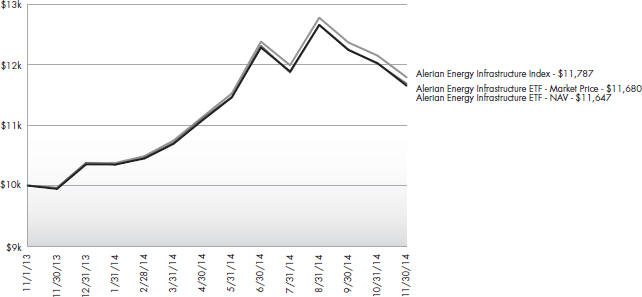

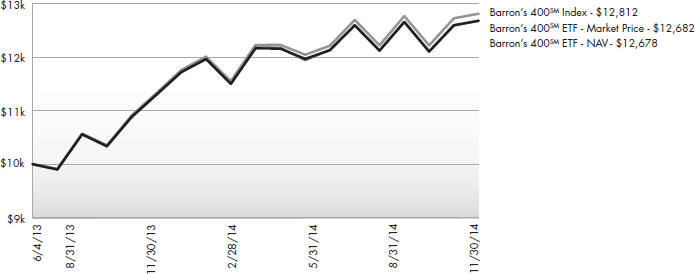

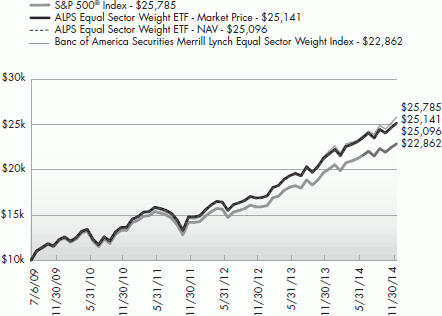

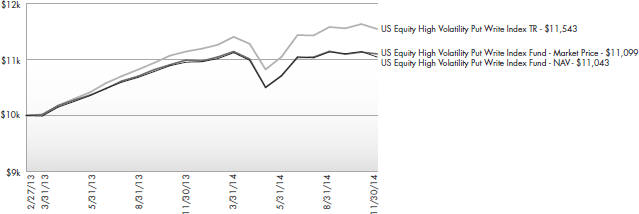

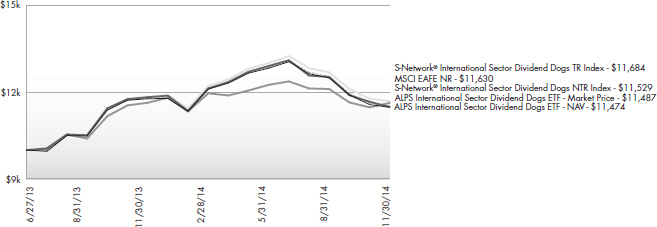

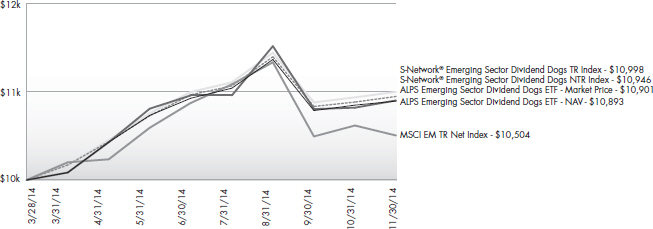

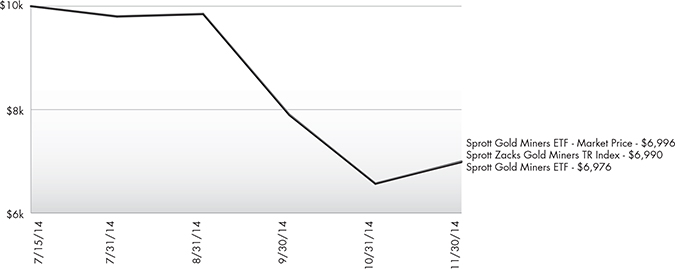

Growth of $10,000 (as of November 30, 2014)

Comparison of change in value of a $10,000 investment in the Fund and the Indexes

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the life of the Fund. Performance calculations are as of the end of each month. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3 | November 30, 2014

| | |

Alerian Energy Infrastructure ETF | | |

Performance Overview | | November 30, 2014 (Unaudited) |

INVESTMENT OBJECTIVE

The Alerian Energy Infrastructure ETF (the “Fund”) seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian Energy Infrastructure Index (AMEI) (the “Index”).

The Index is intended to give investors a means of tracking the overall performance of the North American energy infrastructure sector. The Index is comprised of 30 equity securities of issuers headquartered or incorporated in the United States and Canada that engage in the transportation, storage, and processing of energy commodities. The following five categories of issuers are included in the Index: master limited partnerships (“MLPs”) and limited liability companies taxed as partnerships known as “Midstream MLPs” (25% total index weight), U.S. MLP affiliates (30% total index weight) taxed as corporations, Canadian MLP affiliates (10% total index weight) taxed as corporations, U.S. energy infrastructure and power companies (15% total index weight) taxed as corporations and Canadian energy infrastructure companies (20% total index weight) taxed as corporations.

PERFORMANCE OVERVIEW

During the period of December 1, 2013 to November 30, 2014, the Alerian Energy Infrastructure ETF (ENFR) delivered a total return of 17.3% (17.1% NAV) This compares to the Fund’s index, the Alerian Energy Infrastructure Index (“AMEI Index” or “Index”), which gained 14.0% on a price-return and 18.3% on a total return basis.

During the period, the fund paid four distributions:

| • | | $0.066079 on January 3, 2014 |

| • | | $0.153455 on April 2, 2014 |

| • | | $0.180812 on July 2, 2014 |

| • | | $0.161968 on October 1, 2014 |

Top performers in the Index during the period include Targa Resources Corp (TRGP) and Williams Companies (WMB), both gaining more than 40% on a price-return basis, largely due to positive restructuring and merger and acquisition (M&A) activity. Underperformers in the Index included ONEOK Inc. (OKE) and CenterPoint Energy (CNP).

During the period, Buckeye Partners (BPL), Plains GP Holdings (PAGP), DTE Energy (DTE), EnLink Midstream LLC (ENLC), and EQT Midstream Partners (EQM) were added to the Index. Plains All American Pipeline (PAA), Crosstex Energy Inc (XTXI), Boardwalk Pipeline Partners (BWP), New Jersey Resources (NJR), and SemGroup (SEMG) were removed from the Index.

Energy infrastructure companies continue to benefit from the increase in natural gas, crude oil, and natural gas liquids production (NGL) known as the energy renaissance. In mid-March, the Interstate Natural Gas Association of America (INGAA) updated and expanded its capital spending report, estimating the need for $641 billion of natural gas, crude, and natural gas liquid (NGL) infrastructure spending through 2035. For perspective, the total market capitalization of the 30 names in the Index at November 30, 2014 was $505 billion. The new spending estimate is $390 billion higher than the organization’s 2011 estimate.

Several companies have noted that “North America is undergoing a major repiping” in describing the construction of new and repurposing of existing midstream assets to accommodate new and growing supply areas. In 2014, many U.S. pipeline reversal and/or conversion projects were announced, and the industry even saw a revival in natural gas pipeline projects. Overlaid with increased international demand for cheaper energy resources, the stage is set for more natural gas and ethane export projects.

Across the border in Canada, as heavy crude, condensate, and natural gas liquid production increased in 2014, midstream companies were busy announcing additional pipeline and terminal projects to and from major product hubs such as Edmonton and Hardisty. In addition, Canadian energy infrastructure companies saw an uptick in demand for their crude-by-rail businesses, which offer flexibility and an interim solution until adequate infrastructure is put in place.

Despite some equity price volatility towards the latter few months of the period from declining oil prices, there is still a vast opportunity for the constituents in the Index to participate in the energy infrastructure build-out of North America. With billions of dollars of infrastructure opportunities over the next few decades, we continue to believe that energy infrastructure companies represent a compelling potential investment opportunity for investors seeking total return.

4 | November 30, 2014

| | |

Alerian Energy Infrastructure ETF | | |

Performance Overview | | November 30, 2014 (Unaudited) |

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. ALPS Advisors, Inc. and Alerian do not accept any liability for losses either direct or consequential caused by the use of this information.

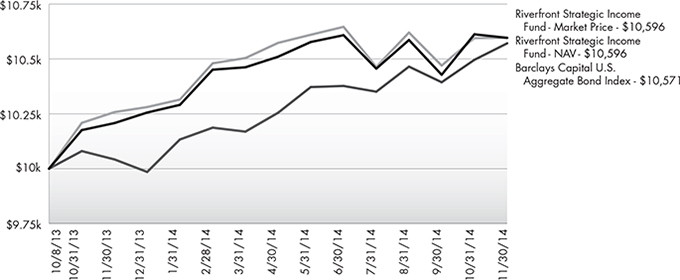

Performance (as of November 30, 2014)

| | | | |

| | | 1 Year | | Since Inception^ |

Alerian Energy Infrastructure ETF - NAV | | 17.12% | | 15.13% |

Alerian Energy Infrastructure ETF - Market Price* | | 17.26% | | 15.43% |

Alerian Energy Infrastructure Index | | 18.31% | | 16.40% |

S&P 500® Total Return Index | | 16.86% | | 18.73% |

Total Expense Ratio (per the current prospectus) 0.65%.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For most current month-end performance data please visit www.alpsfunds.com.

NAV is an exchange-traded fund’s per-share value. The per-share dollar amount of the fund is derived by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. Information detailing the number of days the Market Price of the Fund was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV can be obtained at www.alpsfunds.com.

| ^ | The Fund commenced Investment Operations on November 1, 2013. |

| * | Market Price is based on the midpoint of the bid-ask spread at 4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. |

The Alerian Energy Infrastructure Index is comprised of 30 equity securities of issuers headquartered or incorporated in the United States and Canada that engage in the transportation, storage, and processing of energy commodities.

One cannot invest directly in an index. Index performance does not reflect fund performance.

The Alerian Energy Infrastructure ETF is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

Top 10 Holdings* (as of November 30, 2014)

| | | | |

Enbridge, Inc. | | | 5.08% | |

Kinder Morgan, Inc. | | | 5.06% | |

TransCanada Corp. | | | 4.82% | |

Spectra Energy Corp. | | | 4.32% | |

Energy Transfer Partners LP | | | 4.22% | |

The Williams Cos., Inc. | | | 4.21% | |

EnLink Midstream LLC | | | 4.18% | |

Plains GP Holdings LP, Class A | | | 4.02% | |

Targa Resources Corp. | | | 3.88% | |

Magellan Midstream Partners LP | | | 3.72% | |

Total % of Top 10 Holdings | | | 43.51% | |

Future holdings are subject to change.

5 | November 30, 2014

| | |

Alerian Energy Infrastructure ETF | | |

Performance Overview | | November 30, 2014 (Unaudited) |

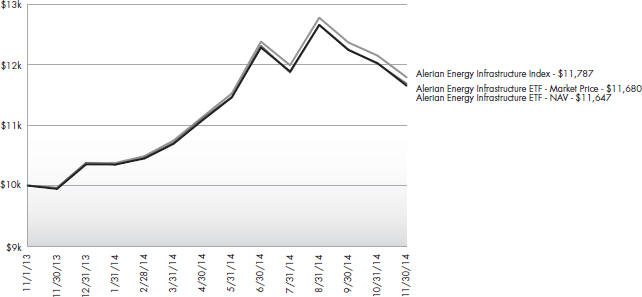

Growth of $10,000 (as of November 30, 2014)

Comparison of change in value of a $10,000 investment in the Fund and the Index

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the life of the Fund. Performance calculations are as of the end of each month. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6 | November 30, 2014

| | |

Alerian Exchange Traded Funds | | |

Disclosure of Fund Expenses | | November 30, 2014 (Unaudited) |

Shareholder Expense Example: As a shareholder of the Funds, you incur two types of costs: (1) transaction costs which may include creation and redemption fees or brokerage charges, and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. It is based on an investment of $1,000 invested at the beginning of the (six month) period and held though November 30, 2014.

Actual Return: The first line of the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses attributable to your investment during this period.

Hypothetical 5% Return: The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect any transaction costs, such as creation and redemption fees, or brokerage charges. Therefore, the second line is useful in comparing ongoing costs only, and will not help you deter- mine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

| | | | | | | | |

| | | Beginning Account

Value 6/1/14 | | Ending Account Value

11/30/14 | | Expense

Ratio(a) | | Expenses Paid

During Period

6/1/14 - 11/30/14(b) |

Alerian MLP ETF | | | | | | | | |

Actual | | $1,000.00 | | $1,023.20 | | 0.85% | | $4.31 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.81 | | 0.85% | | $4.31 |

| | | | |

Alerian Energy Infrastructure ETF | | | | | | | | |

Actual | | $1,000.00 | | $1,016.70 | | 0.65% | | $3.29 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.81 | | 0.65% | | $3.29 |

| (a) | Annualized, based on the Fund’s most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 365. |

7 | November 30, 2014

| | |

Alerian Exchange Traded Funds | | |

Report of Independent Registered Public Accounting Firm |

To the Board of Trustees and Shareholders of ALPS ETF Trust:

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Alerian MLP ETF and Alerian Energy Infrastructure ETF, two of the portfolios constituting the ALPS ETF Trust (the “Trust”) as of November 30, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for the periods presented for the Alerian MLP ETF, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for the year then ended and for the period November 1, 2013 (commencement of operations) to November 30, 2013 for the Alerian Energy Infrastructure ETF. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of November 30, 2014, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Alerian MLP ETF and Alerian Energy Infrastructure ETF of the ALPS ETF Trust as of November 30, 2014, the results of their operations for the year then ended, and the changes in their net assets and the financials highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America. .

DELOITTE & TOUCHE LLP

Denver, Colorado

January 29, 2015

8 | November 30, 2014

| | |

| Alerian MLP ETF | | |

| Schedule of Investments | | November 30, 2014 |

| | | | | | | | | | |

| Security Description | | | | Shares | | | Value | |

Master Limited Partnerships (110.91%) | | | | | | | | | | |

Gathering & Processing (38.93%) | | | | | | | | | | |

Access Midstream Partners LP | | | | | 6,582,078 | | | $ | 412,564,649 | |

Atlas Pipeline Partners LP | | | | | 4,933,023 | | | | 162,000,475 | |

Crestwood Midstream Partners LP | | | | | 9,693,570 | | | | 194,646,885 | |

DCP Midstream Partners LP | | | | | 5,567,338 | | | | 266,731,164 | |

EnLink Midstream Partners LP | | | | | 5,978,369 | | | | 166,736,711 | |

MarkWest Energy Partners LP | | | | | 10,888,894 | | | | 773,764,808 | |

Regency Energy Partners LP | | | | | 17,083,390 | | | | 486,705,781 | |

Targa Resources Partners LP | | | | | 6,555,578 | | | | 359,442,342 | |

Western Gas Partners LP | | | | | 4,397,444 | | | | 311,910,703 | |

Williams Partners LP | | | | | 9,765,177 | | | | 505,250,258 | |

| | | | | | | | | | |

Total Gathering & Processing | | | | | | | | | 3,639,753,776 | |

| | | | | | | | | | |

| | | |

Natural Gas Transportation (31.06%) | | | | | | | | | | |

Energy Transfer Partners LP | | | | | 12,011,910 | | | | 782,816,175 | |

Enterprise Products Partners LP | | | | | 28,705,103 | | | | 1,071,848,546 | |

EQT Midstream Partners LP | | | | | 2,538,569 | | | | 212,325,911 | |

ONEOK Partners LP | | | | | 10,084,028 | | | | 444,503,954 | |

Spectra Energy Partners LP | | | | | 3,259,252 | | | | 175,901,830 | |

TC PipeLines LP | | | | | 3,003,103 | | | | 216,193,385 | |

| | | | | | | | | | |

Total Natural Gas Transportation | | | | | | | | | 2,903,589,801 | |

| | | | | | | | | | |

| | | |

Petroleum Transportation (39.38%) | | | | | | | | | | |

Buckeye Partners LP | | | | | 7,974,056 | | | | 612,965,685 | |

Enbridge Energy Partners LP | | | | | 13,295,482 | | | | 498,580,575 | |

Genesis Energy LP | | | | | 4,730,930 | | | | 208,302,848 | |

Magellan Midstream Partners LP | | | | | 9,244,901 | | | | 766,309,844 | |

NuStar Energy LP | | | | | 4,210,250 | | | | 235,774,000 | |

Plains All American Pipeline LP | | | | | 15,105,107 | | | | 777,157,755 | |

Sunoco Logistics Partners LP | | | | | 9,225,637 | | | | 444,122,165 | |

Tesoro Logistics LP | | | | | 2,428,051 | | | | 139,054,481 | |

| | | | | | | | | | |

Total Petroleum Transportation | | | | | | | | | 3,682,267,353 | |

| | | | | | | | | | |

| | | |

Propane (1.54%) | | | | | | | | | | |

NGL Energy Partners LP | | | | | 4,128,704 | | | | 144,091,770 | |

| | | | | | | | | | |

| | | |

Total Master Limited Partnerships

(Cost $7,821,842,485) | | | | | | | | | 10,369,702,700 | |

| | | | | | | | | | |

| | | |

| | | 7 Day Yield | | Shares | | | Value | |

Short Term Investments (0.22%) | | | | | | | | | | |

Dreyfus Treasury Prime Cash Management Fund, Institutional Shares | | 0.000%(a) | | | 20,246,805 | | | | 20,246,805 | |

| | | | | | | | | | |

| | | |

Total Short Term Investments | | | | | | | | | | |

(Cost $20,246,805) | | | | | | | | | 20,246,805 | |

| | | | | | | | | | |

| | | |

Total Investments (111.13%) | | | | | | | | | | |

(Cost $7,842,089,290) | | | | | | | | $ | 10,389,949,505 | |

| | | |

Net Liabilities Less Other Assets (-11.13%) | | | | | | | | | (1,040,948,155) | |

| | | | | | | | | | |

| | | |

Net Assets (100.00%) | | | | | | | | $ | 9,349,001,350 | |

| | | | | | | | | | |

9 | November 30, 2014

| | |

Alerian MLP ETF | | |

Schedule of Investments | | November 30, 2014 |

Common Abbreviations:

LP - Limited Partnership.

| | |

See Notes to Financial Statements. | | |

| |

| | 10 | November 30, 2014 |

| | |

Alerian MLP ETF | | |

Statement of Assets and Liabilities | | November 30, 2014 |

| | | | |

ASSETS: | | | | |

Investments, at value | | $ | 10,389,949,505 | |

Receivable for securities sold | | | 18,562,357 | |

Receivable for shares sold | | | 86,845 | |

Income tax receivable | | | 5,547,683 | |

Total Assets | | | 10,414,146,390 | |

| |

LIABILITIES: | | | | |

Payable to custodian for overdraft | | | 10,107 | |

Franchise tax payable | | | 571,206 | |

Deferred tax liability | | | 1,039,371,378 | |

Payable for shares redeemed | | | 18,577,200 | |

Payable to adviser | | | 6,615,149 | |

Total Liabilities | | | 1,065,145,040 | |

NET ASSETS | | $ | 9,349,001,350 | |

| | |

| |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 7,907,097,124 | |

Accumulated net investment loss, net of deferred income taxes | | | (103,488,439) | |

Accumulated net realized loss on investments, net of deferred income taxes | | | (68,156,796) | |

Net unrealized appreciation on investments, net of deferred income taxes | | | 1,613,549,461 | |

NET ASSETS | | $ | 9,349,001,350 | |

| | |

| |

INVESTMENTS, AT COST | | $ | 7,842,089,290 | |

| |

PRICING OF SHARES | | | | |

Net Assets | | $ | 9,349,001,350 | |

Shares of beneficial interest outstanding (Unlimited number of shares authorized, par value $0.01 per share) | | | 516,512,100 | |

Net Asset Value, offering and redemption price per share | | $ | 18.10 | |

| | |

See Notes to Financial Statements. | | |

| |

| | 11 | November 30, 2014 |

| | |

Alerian MLP ETF | | |

Statement of Operations | | For the Year Ended November 30, 2014 |

| | | | |

INVESTMENT INCOME: | | | | |

Distributions from master limited partnerships | | $ | 508,572,769 | |

Less return of capital distributions | | | (508,572,769) | |

Total Investment Income | | | – | |

| |

EXPENSES: | | | | |

Franchise tax expense | | | 730,005 | |

Investment adviser fee | | | 72,402,447 | |

Total Expenses | | | 73,132,452 | |

NET INVESTMENT LOSS, BEFORE INCOME TAXES | | | (73,132,452) | |

Deferred income tax benefit | | | 26,414,177 | |

NET INVESTMENT LOSS | | | (46,718,275) | |

| |

REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

Net realized gain on investments, before income taxes | | | 421,995,992 | |

Deferred income tax expense | | | (154,612,911) | |

Net realized gain | | | 267,383,081 | |

Net change in unrealized appreciation on investments, before income taxes | | | 735,432,882 | |

Deferred income tax expense | | | (261,584,094) | |

Net change in unrealized appreciation | | | 473,848,788 | |

NET REALIZED AND UNREALIZED GAIN | | | 741,231,869 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 694,513,594 | |

| | |

| | |

See Notes to Financial Statements. | | |

| |

| | 12 | November 30, 2014 |

| | |

Alerian MLP ETF | | |

| Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | For the Year Ended

November 30, 2014 | | | For the Year Ended

November 30, 2013 | |

OPERATIONS: | | | | | | | | |

Net investment loss | | $ | (46,718,275) | | | $ | (33,135,067) | |

Net realized gain/(loss) on investments | | | 267,383,081 | | | | (13,345,439) | |

Net change in unrealized appreciation on investments | | | 473,848,788 | | | | 841,731,398 | |

Net increase in net assets resulting from operations | | | 694,513,594 | | | | 795,250,892 | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

From net realized gains | | | (343,269,132) | | | | – | |

From tax return of capital | | | (191,041,392) | | | | (383,931,834) | |

Total distributions | | | (534,310,524) | | | | (383,931,834) | |

| | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 2,282,699,118 | | | | 2,828,412,621 | |

Issued to shareholders in reinvestment distributions | | | 4,571,254 | | | | 2,121,281 | |

Cost of shares redeemed | | | (483,156,705) | | | | (323,983,737) | |

Net increase from share transactions | | | 1,804,113,667 | | | | 2,506,550,165 | |

| | |

Net increase in net assets | | | 1,964,316,737 | | | | 2,917,869,223 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 7,384,684,613 | | | | 4,466,815,390 | |

End of year * | | $ | 9,349,001,350 | | | $ | 7,384,684,613 | |

| | |

*Including accumulated net investment loss, net of deferred income taxes of: | | $ | (103,488,439) | | | $ | (56,770,164) | |

| | |

OTHER INFORMATION: | | | | | | | | |

SHARE TRANSACTIONS: | | | | | | | | |

Beginning shares | | | 417,561,799 | | | | 273,740,266 | |

Shares sold | | | 125,050,000 | | | | 162,250,000 | |

Distributions reinvested | | | 250,301 | | | | 121,533 | |

Shares redeemed | | | (26,350,000) | | | | (18,550,000) | |

Shares outstanding, end of year | | | 516,512,100 | | | | 417,561,799 | |

| | |

| | |

See Notes to Financial Statements. | | |

| |

| | 13 | November 30, 2014 |

| | |

Alerian MLP ETF | | |

Financial Highlights | | For a Share Outstanding Throughout the Periods Presented |

| | | | | | | | | | | | | | | | | | | | |

| | | For the Year

Ended

November 30,

2014 | | | For the Year

Ended

November 30,

2013 | | | For the Year

Ended

November 30,

2012 | | | For the Period January 1, 2011

to November 30,

2011 (a) | | | For the Period

August 25, 2010

(Inception) to

December 31,

2010 | |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 17.69 | | | $ | 16.32 | | | $ | 15.97 | | | $ | 16.05 | | | $ | 15.00 | |

| | | | | |

INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(b) | | | (0.16) | | | | (0.09) | | | | (0.09) | | | | (0.08) | | | | (0.03) | |

Net realized and unrealized gain on investments | | | 1.70 | | | | 2.53 | | | | 1.44 | | | | 1.00 | | | | 1.33 | |

Total from investment operations | | | 1.54 | | | | 2.44 | | | | 1.35 | | | | 0.92 | | | | 1.30 | |

| | | | | |

DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

From net realized gains | | | (0.73) | | | | – | | | | (0.00) | (b)(c) | | | (0.14) | (b) | | | – | |

From tax return of capital | | | (0.40) | | | | (1.07) | | | | (1.00) | | | | (0.86) | | | | (0.25) | |

Total distributions | | | (1.13) | | | | (1.07) | | | | (1.00) | | | | (1.00) | | | | (0.25) | |

| | | | | |

NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 0.41 | | | | 1.37 | | | | 0.35 | | | | (0.08) | | | | 1.05 | |

NET ASSET VALUE, END OF PERIOD | | $ | 18.10 | | | $ | 17.69 | | | $ | 16.32 | | | $ | 15.97 | | | $ | 16.05 | |

| | |

TOTAL RETURN(d) | | | 8.82 | % | | | 15.16 | % | | | 8.62 | % | | | 5.93 | % | | | 8.66 | % |

| | | | | |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s) | | $ | 9,349,001 | | | $ | 7,384,685 | | | $ | 4,466,815 | | | $ | 1,713,387 | | | $ | 611,467 | |

| | | | | |

RATIO TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

Expenses (excluding net current and deferred tax expenses/benefits and franchise tax expense) | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | %(e) | | | 0.85 | %(e) |

Expenses (including net current and deferred tax expenses/benefits)(f) | | | 5.43 | % | | | 8.56 | % | | | 4.85 | % | | | 4.86 | %(e) | | | 13.56 | %(e) |

Expenses (including current and deferred tax expenses/

benefits)(g) | | | 0.55 | % | | | 0.55 | % | | | 0.54 | % | | | 0.53 | %(e) | | | 0.52 | %(e) |

Net investment loss (excluding deferred tax expenses/benefits and franchise tax expense) | | | (0.85) | % | | | (0.85) | % | | | (0.85) | % | | | (0.85) | %(e) | | | (0.85) | %(e) |

Net investment loss (including deferred tax expenses/benefits) | | | (0.55) | % | | | (0.55) | % | | | (0.54) | % | | | (0.53) | %(e) | | | (0.52) | %(e) |

PORTFOLIO TURNOVER RATE(h) | | | 29 | % | | | 12 | % | | | 12 | % | | | 10 | % | | | 12 | % |

| (a) | Effective March 7, 2011, the Board approved changing the fiscal year-end of the Fund from December 31 to November 30. |

| (b) | Based on average shares outstanding during the period. |

| (c) | Less than ($0.005) per share. |

| (d) | Total return is calculated assuming an initial investment made at the net assets value at the beginning of the period and redemption at the net asset value on the last day of the period, and assuming all distributions are reinvested at actual reinvestment prices. Total return calculated for a period of less than one year is not annualized. |

| (f) | Includes amount of current and deferred taxes/benefits for all components of the Statement of Operations. |

| (g) | Includes amount of current and deferred tax benefit associated with net investment loss. |

| (h) | Portfolio turnover is not annualized and does not include securities received or delivered from processing creations or redemptions. |

| | |

See Notes to Financial Statements. | | |

| |

| | 14 | November 30, 2014 |

| | |

| Alerian Energy Infrastructure ETF | | |

Schedule of Investments | | November 30, 2014 |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

Canadian Infrastructure (18.79%) | | | | | | | | |

Energy (12.61%) | | | | | | | | |

AltaGas, Ltd. | | | 11,465 | | | $ | 424,912 | |

Gibson Energy, Inc. | | | 16,062 | | | | 382,763 | |

Inter Pipeline, Ltd. | | | 15,994 | | | | 456,252 | |

Pembina Pipeline Corp. | | | 11,490 | | | | 391,474 | |

Veresen, Inc. | | | 32,262 | | | | 504,737 | |

| | | | | | | | |

Total Energy | | | | | | | 2,160,138 | |

| | | | | | | | |

| | |

Utilities (6.18%) | | | | | | | | |

Emera, Inc. | | | 17,631 | | | | 607,487 | |

Keyera Corp. | | | 6,069 | | | | 451,075 | |

| | | | | | | | |

Total Utilities | | | | | | | 1,058,562 | |

| | | | | | | | |

| | |

Total Canadian Infrastructure (Cost $3,359,193) | | | | | | | 3,218,700 | |

| | | | | | | | |

| | |

Canadian Master Limited Partnership Affiliates (9.88%) | | | | | | | | |

Energy (9.88%) | | | | | | | | |

Enbridge, Inc. | | | 18,919 | | | | 868,603 | |

TransCanada Corp. | | | 17,300 | | | | 823,774 | |

| | | | | | | | |

Total Energy | | | | | | | 1,692,377 | |

| | | | | | | | |

| | |

Total Canadian Master Limited Partnership Affiliates (Cost $1,696,567) | | | | | | | 1,692,377 | |

| | | | | | | | |

| | |

Master Limited Partnerships (28.88%) | | | | | | | | |

Energy (28.88%) | | | | | | | | |

Buckeye Partners LP | | | 7,953 | | | | 611,347 | |

Energy Transfer Partners LP | | | 11,074 | | | | 721,693 | |

Enterprise Products Partners LP | | | 15,702 | | | | 586,313 | |

EQT Midstream Partners LP | | | 6,650 | | | | 556,206 | |

Magellan Midstream Partners LP | | | 7,659 | | | | 634,854 | |

MarkWest Energy Partners LP | | | 7,949 | | | | 564,856 | |

Plains GP Holdings LP, Class A | | | 26,445 | | | | 687,041 | |

Western Gas Partners LP | | | 8,240 | | | | 584,463 | |

| | | | | | | | |

Total Energy | | | | | | | 4,946,773 | |

| | | | | | | | |

| | |

Total Master Limited Partnerships (Cost $4,901,221) | | | | | | | 4,946,773 | |

| | | | | | | | |

| | |

U.S. Infrastructure (16.92%) | | | | | | | | |

Utilities (16.92%) | | | | | | | | |

Atmos Energy Corp. | | | 8,011 | | | | 430,191 | |

CenterPoint Energy, Inc. | | | 16,428 | | | | 393,286 | |

Dominion Resources, Inc. | | | 5,765 | | | | 418,251 | |

DTE Energy Co. | | | 5,214 | | | | 424,732 | |

NiSource, Inc. | | | 10,171 | | | | 425,555 | |

OGE Energy Corp. | | | 10,906 | | | | 389,235 | |

Questar Corp. | | | 17,401 | | | | 417,450 | |

| | | | | | | | |

Total Utilities | | | | | | | 2,898,700 | |

| | | | | | | | |

| | |

Total U.S. Infrastructure (Cost $2,776,547) | | | | | | | 2,898,700 | |

| | | | | | | | |

15 | November 30, 2014

| | |

Alerian Energy Infrastructure ETF | | |

Schedule of Investments | | November 30, 2014 |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

U.S. Master Limited Partnership Affiliates (25.26%) | | | | | | | | |

Energy (25.26%) | | | | | | | | |

EnLink Midstream LLC | | | 19,754 | | | $ | 714,502 | |

Kinder Morgan, Inc. | | | 20,909 | | | | 864,587 | |

ONEOK, Inc. | | | 11,587 | | | | 627,552 | |

Spectra Energy Corp. | | | 19,499 | | | | 738,622 | |

Targa Resources Corp. | | | 5,806 | | | | 662,697 | |

The Williams Cos., Inc. | | | 13,900 | | | | 719,325 | |

| | | | | | | | |

Total Energy | | | | | | | 4,327,285 | |

| | | | | | | | |

| | |

Total U.S. Master Limited Partnership Affiliates (Cost $4,391,526) | | | | | | | 4,327,285 | |

| | | | | | | | |

| | |

Total Investments (99.73%) (Cost $17,125,054) | | | | | | $ | 17,083,835 | |

| | |

Net Other Assets and Liabilities (0.27%) | | | | | | | 47,008 | |

| | | | | | | | |

| | |

Net Assets (100.00%) | | | | | | $ | 17,130,843 | |

| | | | | | | | |

Common Abbreviations:

LLC - Limited Liability Company.

LP - Limited Partnership.

Ltd. - Limited.

| | |

See Notes to Financial Statements. | | |

| |

| | 16 | November 30, 2014 |

| | |

Alerian Energy Infrastructure ETF | | |

Statement of Assets and Liabilities | | November 30, 2014 |

| | | | |

ASSETS: | | | | |

Investments, at value | | $ | 17,083,835 | |

Foreign currency, at value (Cost $11,100) | | | 10,957 | |

Receivable for investments sold | | | 270,487 | |

Dividends receivable | | | 32,543 | |

Total Assets | | | 17,397,822 | |

| |

LIABILITIES: | | | | |

Payable for investments purchased | | | 175,991 | |

Payable to adviser | | | 9,376 | |

Payable to custodian for overdraft | | | 81,612 | |

Total Liabilities | | | 266,979 | |

NET ASSETS | | $ | 17,130,843 | |

| | |

| |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 17,081,254 | |

Accumulated net investment income | | | 35,972 | |

Accumulated net realized gain on investments and foreign currency transactions | | | 55,000 | |

Net unrealized depreciation on investments and translation of assets and liabilities denominated in foreign

currencies | | | (41,383) | |

NET ASSETS | | $ | 17,130,843 | |

| | |

| |

INVESTMENTS, AT COST | | $ | 17,125,054 | |

| |

PRICING OF SHARES | | | | |

Net Assets | | $ | 17,130,843 | |

Shares of beneficial interest outstanding (Unlimited number of shares authorized, par value $0.01 per share) | | | 600,002 | |

Net Asset Value, offering and redemption price per share | | $ | 28.55 | |

| | |

See Notes to Financial Statements. | | |

| |

| | 17 | November 30, 2014 |

| | |

Alerian Energy Infrastructure ETF | | |

Statement of Operations | | For the Year Ended November 30, 2014 |

| | | | |

INVESTMENT INCOME: | | | | |

Dividends | | $ | 371,149 | |

Foreign taxes withheld | | | (17,575) | |

Total Investment Income | | | 353,574 | |

| |

EXPENSES: | | | | |

Investment adviser fees | | | 63,341 | |

Total Expenses | | | 63,341 | |

NET INVESTMENT INCOME | | | 290,233 | |

| |

REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

Net realized gain on investments | | | 323,420 | |

Net realized loss on foreign currency transactions | | | (2,828) | |

Net realized gain | | | 320,592 | |

Net change in unrealized depreciation on investments | | | (19,447) | |

Net change in unrealized depreciation on translation of assets and liabilities denominated in foreign currencies | | | (129) | |

Net change in unrealized depreciation | | | (19,576) | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCIES | | | 301,016 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 591,249 | |

| | |

| | |

See Notes to Financial Statements. | | |

| |

| | 18 | November 30, 2014 |

| | |

Alerian Energy Infrastructure ETF | | |

Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | For the

Year Ended

November 30, 2014 | | | For the Period

November 1, 2013

(Commencement of

Operations) to

November 30, 2013 | |

| |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 290,233 | | | $ | 8,118 | |

Net realized gain on investments and foreign currency transactions | | | 320,592 | | | | – | |

Net change in unrealized depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | (19,576) | | | | (21,807) | |

| |

Net increase/(decrease) in net assets resulting from operations | | | 591,249 | | | | (13,689) | |

| |

| | |

DISTRIBUTIONS: | | | | | | | | |

From net investment income | | | (191,603) | | | | – | |

| |

Total distributions | | | (191,603) | | | | – | |

| |

| | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 18,346,104 | | | | 3,743,019 | |

Cost of shares redeemed | | | (5,344,237) | | | | – | |

| |

Net increase from share transactions | | | 13,001,867 | | | | 3,743,019 | |

| |

Net increase in net assets | | | 13,401,513 | | | | 3,729,330 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 3,729,330 | | | | – | |

| |

End of period * | | $ | 17,130,843 | | | $ | 3,729,330 | |

| |

| | |

*Including accumulated net investment income of: | | $ | 35,972 | | | $ | 4,749 | |

| | |

OTHER INFORMATION: | | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Beginning shares | | | 150,002 | | | | – | |

Shares sold | | | 650,000 | | | | – | |

Shares redeemed | | | (200,000) | | | | 150,002 | |

| |

Shares outstanding, end of period | | | 600,002 | | | | 150,002 | |

| |

| | |

See Notes to Financial Statements. | | |

| |

| | 19 | November 30, 2014 |

| | |

Alerian Energy Infrastructure ETF | | |

Financial Highlights | | For a Share Outstanding Throughout the Periods Presented |

| | | | | | | | |

| | | For the Year

Ended

November 30,

2014 | | | For the Period

November 1,

2013

(Commencement

of Operations) to

November 30,

2013 | |

| |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 24.86 | | | $ | 25.00 | |

| | |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | |

Net investment income(a) | | | 0.85 | | | | 0.06 | |

Net realized and unrealized gain/(loss) | | | 3.40 | | | | (0.20) | |

| |

Total from investment operations | | | 4.25 | | | | (0.14) | |

| |

| | |

DISTRIBUTIONS: | | | | | | | | |

From net investment income | | | (0.56) | | | | – | |

| |

Total distributions | | | (0.56) | | | | – | |

| |

| | |

NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 3.69 | | | | (0.14) | |

| |

NET ASSET VALUE, END OF PERIOD | | $ | 28.55 | | | $ | 24.86 | |

| |

TOTAL RETURN(b) | | | 17.12% | | | | (0.56)% | |

| | |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | |

Net assets, end of period (000s) | | $ | 17,131 | | | $ | 3,729 | |

| | |

Ratio of expenses to average net assets | | | 0.65% | | | | 0.65%(c) | |

Ratio of net investment income to average net assets | | | 2.98% | | | | 3.21%(c) | |

Portfolio turnover rate(d) | | | 27 % | | | | 0% | |

| |

| (a) | Based on average shares outstanding during the period. |

| (b) | Total return is calculated assuming an initial investment made at the net assets value at the beginning of the period and redemption at the net asset value on the last day of the period, and assuming all distributions are reinvested at actual reinvestment prices. Total return calculated for a period of less than one year is not annualized. |

| (d) | Portfolio turnover is not annualized and does not include securities received or delivered from processing creations or redemptions. |

| | |

See Notes to Financial Statements. | | |

| |

| | 20 | November 30, 2014 |

| | |

Alerian Exchange Traded Funds | | |

Notes to Financial Statements | | November 30, 2014 |

1. ORGANIZATION

The ALPS ETF Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As of November 30, 2014, the Trust consisted of sixteen separate portfolios. Each portfolio represents a separate series of the Trust. This report pertains to the Alerian MLP ETF and the Alerian Energy Infrastructure ETF (each a “Fund” and collectively, the “Funds”).

The investment objective of the Alerian MLP ETF is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The investment objective of the Alerian Energy Infrastructure ETF is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Alerian Energy Infrastructure Index. The investment advisor uses a “passive” or index approach to try to achieve each Fund’s investment objective. Each Fund is considered non-diversified and may invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Each Fund’s Shares (“Shares”) are listed on the New York Stock Exchange (“NYSE”) Arca. Each Fund issues and redeems Shares at Net Asset Value (“NAV”), in blocks of 50,000 Shares, each of which is called a “Creation Unit.” Creation Units are issued and redeemed principally in-kind for securities included in a specified index. Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund.

Pursuant to the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of the financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. Each Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946.

A. Portfolio Valuation

Each Fund’s NAV is determined daily, as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading. The NAV is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of shares outstanding.

Portfolio securities listed on any exchange other than the NASDAQ Stock Market LLC (“NASDAQ”) exchange are valued at the last sale price on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the most recent bid and asked prices on such day. Securities traded on the NASDAQ are valued at the NASDAQ Official Closing Price as determined by NASDAQ. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. Portfolio securities traded in the over-the-counter market, but excluding securities traded on the NASDAQ, are valued at the closing bid prices.

The Funds’ investments are valued at market value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the Trust’s Board of Trustees (the “Board”). When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Funds may be valued in good faith by or under the direction of the Board. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market price is not available from a pre-established primary pricing source or the pricing source is not willing to provide a price; a security with respect to which an event has occurred that is most likely to materially affect the value of the security after the market has closed but before the calculation of the Funds’ NAV or make it difficult or impossible to obtain a reliable market quotation; or a security whose price, as provided by the pricing service, does not reflect the security’s “fair value” due to the security being de-listed from a national exchange or the security’s primary trading market is temporarily closed at a time when, under normal conditions, it would be open. As a general

21 | November 30, 2014

| | |

Alerian Exchange Traded Funds | | |

Notes to Financial Statements | | November 30, 2014 |

principle, the current “fair value” of a security would be the amount which the owner might reasonably expect to receive from the closing sale prices on the applicable exchange and fair value prices may not reflect the actual value of a security. A variety of factors may be considered in determining the fair value of such securities.

B. Fair Value Measurements

Each Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Valuation techniques used to value the Funds’ investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the mean of the most recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy. Investments in open-end mutual funds are valued at their closing NAV each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy.

Various inputs are used in determining the value of the Funds’ investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | |

Level 1 – | | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

Level 2 – | | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

Level 3 – | | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used to value each Fund’s investments at November 30, 2014:

Alerian MLP ETF

| | | | | | | | | | | | | | | | |

| Investments in Securities at Value* | | Level 1- Unadjusted

Quoted Prices | | | Level 2- Other

Significant

Observable Inputs | | | Level 3- Significant

Unobservable Inputs | | | Total | |

Master Limited Partnerships | | $ | 10,369,702,700 | | | $ | – | | | $ | – | | | $ | 10,369,702,700 | |

Short Term Investments | | | 20,246,805 | | | | – | | | | – | | | | 20,246,805 | |

TOTAL | | $ | 10,389,949,505 | | | $ | – | | | $ | – | | | $ | 10,389,949,505 | |

| | |

22 | November 30, 2014

| | |

Alerian Exchange Traded Funds | | |

Notes to Financial Statements | | November 30, 2014 |

Alerian Energy Infrastructure ETF

| | | | | | | | | | | | | | | | |

| Investments in Securities at Value* | | Level 1- Unadjusted

Quoted Prices | | | Level 2- Other

Significant

Observable Inputs | | | Level 3- Significant

Unobservable Inputs | | | Total | |

Canadian Infrastructure | | $ | 3,218,700 | | | $ | – | | | $ | – | | | $ | 3,218,700 | |

Canadian Master Limited Partnership Affiliates | | | 1,692,377 | | | | – | | | | – | | | | 1,692,377 | |

Master Limited Partnerships | | | 4,946,773 | | | | – | | | | – | | | | 4,946,773 | |

U.S. Infrastructure | | | 2,898,700 | | | | – | | | | – | | | | 2,898,700 | |

U.S. Master Limited Partnership Affiliates | | | 4,327,285 | | | | – | | | | – | | | | 4,327,285 | |

TOTAL | | $ | 17,083,835 | | | $ | – | | | $ | – | | | $ | 17,083,835 | |

| | | | | | | | | | | | | | | | | |

| * | For a detailed breakdown of sectors, see the accompanying Schedule of Investments. |

Each Fund recognizes transfers between levels as of the end of the period. For the year ended November 30, 2014, the Funds did not have any transfers between Level 1 and Level 2 securities. The Funds did not have any securities which used significant unobservable inputs (Level 3) in determining fair value.

C. Foreign Currency Translation

The books and records of the Fund are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

D. Securities Transactions and Investment Income

Securities transactions are recorded as of the trade date. Realized gains and losses from securities transactions are recorded on the last in, first out (“LIFO”) cost basis. Dividend income and capital gains distributions, if any, are recorded on the ex-dividend date, net of any foreign taxes withheld. Interest income, if any, is recorded on the accrual basis, including amortization of premiums and accretion of discounts.

E. Dividends and Distributions to Shareholders

Each Fund intends to declare and make quarterly distributions, or as the Board may determine from time to time. Distributions of net realized capital gains earned by the Alerian Energy Infrastructure ETF, if any, are distributed at least annually. Distributions from net investment income and capital gains are determined in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Funds, timing differences and differing characterization of distributions made by the Funds.

The Alerian MLP ETF also expects a portion of the distributions it receives from MLPs to be treated as a tax deferred return of capital, thus reducing the Alerian MLP ETF’s current tax liability. Return of capital distributions are not taxable income to the shareholder, but reduce the investor’s tax basis in the investor’s Fund Shares. Such a reduction in tax basis will result in larger taxable gains and/or lower tax losses on a subsequent sale of Fund Shares. Shareholders who periodically receive the payment of dividends or other distributions consisting of a return of capital may be under the impression that they are receiving net profits from the Funds when, in fact, they are not. Shareholders should not assume that the source of the distributions is from the net profits of the Funds.

Distributions received from each Fund’s investments in Master Limited Partnerships (“MLPs”) may be comprised of both income and return of capital. Each Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded. For the year ended November 30, 2014, the Alerian MLP ETF distributed $534,310,524 of which 35% is anticipated to be characterized as return of capital from MLP distributions received.

23 | November 30, 2014

| | |

Alerian Exchange Traded Funds | | |

Notes to Financial Statements | | November 30, 2014 |

F. Federal Income Taxation and Tax Basis Information

Alerian MLP ETF

The Alerian MLP ETF is taxed as a regular C-corporation for federal income tax purposes. Currently, the maximum marginal regular federal income tax rate for a corporation is 35 percent. The Fund may be subject to a 20 percent federal alternative minimum tax on its federal alternative taxable income to the extent that its alternative minimum tax exceeds its regular federal income tax. This differs from most investment companies, which elect to be treated as “regulated investment companies” under the Code in order to avoid paying entity level income taxes. Under current law, the Fund is not eligible to elect treatment as a regulated investment company due to its investments primarily in MLPs invested in energy assets. As a result, the Fund will be obligated to pay applicable federal and state corporate income taxes on its taxable income as opposed to most other investment companies which are not so obligated. The Fund expects that a portion of the distributions it receives from MLPs may be treated as a tax-deferred return of capital, thus reducing the Fund’s current tax liability. However, the amount of taxes currently paid by the Fund will vary depending on the amount of income and gains derived from investments and/or sales of MLP interests and such taxes will reduce your return from an investment in the Fund.

Cash distributions from MLPs to the Fund that exceed such Fund’s allocable share of such MLP’s net taxable income are considered a tax-deferred return of capital that will reduce the Fund’s adjusted tax basis in the equity securities of the MLP. These reductions in such Fund’s adjusted tax basis in the MLP equity securities will increase the amount of gain (or decrease the amount of loss) recognized by the Fund on a subsequent sale of the securities. The Fund will accrue deferred income taxes for any future tax liability associated with (i) that portion of MLP distributions considered to be a tax-deferred return of capital as well as (ii) capital appreciation of its investments. Upon the sale of an MLP security, the Fund may be liable for previously deferred taxes. The Fund will rely to some extent on information provided by the MLPs, which is not necessarily timely, to estimate deferred tax liability for purposes of financial statement reporting and determining the NAV. From time to time, ALPS Advisors, Inc. will modify the estimates or assumptions related to the Fund’s deferred tax liability as new information becomes available. The Fund will generally compute deferred income taxes based on the marginal regular federal income tax rate applicable to corporations and an assumed rate attributable to state taxes.

The Fund recognizes interest and penalties related to unrecognized tax benefits within the income tax expense line in the accompanying statement of operations. Accrued interest and penalties are included within the related tax liability line in the balance sheet.

Since the Fund will be subject to taxation on its taxable income, the NAV of Fund shares will also be reduced by the accrual of any deferred tax liabilities. The Index however is calculated without any adjustments for taxes. As a result, the Fund’s after tax performance could differ significantly from the Index even if the pretax performance of the Fund and the performance of the Index are closely correlated.

The Fund’s income tax expense/(benefit) consists of the following:

| | | | | | | | | | | | | | |

| Alerian MLP ETF | | | | | Year ended November 30, 2014 | | | |

| | | Current | | | Deferred | | | Total | | | |

Federal | | $ | – | | | $ | 378,193,686 | | | $ | 378,193,686 | | | |

State | | | – | | | | 11,589,142 | | | | 11,589,142 | | | |

Total tax expense | | $ | – | | | $ | 389,782,828 | | | $ | 389,782,828 | | | |

| | | | | | | | | | | | | | | |

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes. Components of the Fund’s deferred tax assets and liabilities are as follows: |

| Alerian MLP ETF | | | | | | | | As of November 30, 2014 | | | |

Deferred tax assets: | | | | | | | | | | | | | | |

Accrued franchise taxes | | | | | | | | | | $ | 201,812 | | | |

Charitable contribution carryforward | | | | | | | | | | | 180,987 | | | |

Income recognized from MLP investments | | | | | | | | 103,261,310 | | | |

Credit for prior year minimum tax | | | | | | | | | | | 331,761 | | | |

Federal net operating loss carryforward | | | | | | | | 174,838,187 | | | |

Less Deferred tax liabilities: | | | | | | | | | | | | | | |

Net unrealized loss on investment securities | | | | (1,268,231,136 | ) | | |

State taxes, net of federal benefit | | | | | | | | | | | (49,954,299 | ) | | |

Net Deferred tax liability | | | | | | | | | | $ | (1,039,371,378 | ) | | |

| | | | | | | | | | | | | | | |

24 | November 30, 2014

| | |

Alerian Exchange Traded Funds | | |

Notes to Financial Statements | | November 30, 2014 |

The net operating loss carryforward is available to offset future taxable income. The net operating loss can be carried forward for 20 years and, accordingly, would begin to expire as of November 30, 2032. The Fund has net operating loss carryforwards for federal income tax purposes as follows:

| | | | | | | | | | | | | | |

| Alerian MLP ETF | | Period-Ended | | | | Amount | | | | | Expiration | | |

Federal | | 11/30/2012 | | | | $ | 92,112,756 | | | | | 11/30/2032 | | |

Federal | | 11/30/2013 | | | | | 349,770,934 | | | | | 11/30/2033 | | |

Federal | | 11/30/2014 | | | | | 57,653,987 | | | | | 11/30/2034 | | |

Total | | | | | | $ | 499,537,677 | | | | | | | |

| | | | | | | | | | | | | | | |

The Fund also has state tax net operating loss carryforwards of various amounts per state. The Deferred Tax Assets associated with these state tax net operating losses are as follows: |

| Alerian MLP ETF | | Period-Ended | | | | Amount | | | | | Expiration | | |

State | | 11/30/2012 | | | | $ | 2,950,477 | | | | | Varies by State (5-20 years) | | |

State | | 11/30/2013 | | | | | 10,853,441 | | | | | Varies by State (5-20 years) | | |

State | | 11/30/2014 | | | | | 1,108,430 | | | | | Varies by State (5-20 years) | | |

Total | | | | | | $ | 14,912,348 | | | | | | | |

| | | | | | | | | | | | | | | |

Although the Fund currently has a net deferred tax liability, it reviews the recoverability of its deferred tax assets based upon the weight of available evidence. When assessing the recoverability of its deferred tax assets, significant weight was given to the effects of potential future realized and unrealized gains on investments and the period over which these deferred tax assets can be realized. Currently, any capital losses that may be generated by the Fund in the future are eligible to be carried back up to three years and can be carried forward for five years to offset capital gains recognized by the fund in those years. For Federal Tax purposes, net operating losses that may be generated by the Fund in the future are eligible to be carried back up to two years and can be carried forward for 20 years to offset income generated by the Fund in those years.

Based upon the Fund’s assessment, it has determined that it is more likely than not that its deferred tax assets will be realized through future taxable income of the appropriate character. Accordingly, no valuation allowance has been established for the Fund’s deferred tax assets. The Fund will continue to assess the need for a valuation allowance in the future. Significant declines in the fair value of its portfolio of investments may change the Fund’s assessment of the recoverability of these assets and may result in the recording of a valuation allowance against all or a portion of the Fund’s gross deferred tax assets.

As of November 30, 2014 the Total income tax benefit (current and deferred) differs from the amount computed by applying the federal statutory income tax rate of 35% to net investment and realized and unrealized gain/(losses) on investment before taxes as follows:

| | | | | | |

| Alerian MLP ETF | | As of November 30, 2014 | | | |

Income tax expense at statutory rate | | $ | 379,503,748 | | | |

State income taxes (net of federal benefit) | | | 20,846,207 | | | |

Permanent differences, net | | | (1,662,209 | ) | | |

Change in estimated state referral rate | | | (4,813,538 | ) | | |

Other | | | (4,091,380 | ) | | |

Net income tax expense | | $ | 389,782,828 | | | |

| | | | | | | |

The following is a tabular reconciliation of the total amounts of unrecognized tax benefits:

| | | | | | |

| Alerian MLP ETF | | Inception to November 30, 2014 |

Unrecognized tax benefit - Beginning | | $ | – | | | |

Gross increases - tax positions in prior period | | | – | | | |

Gross decreases - tax positions in prior period | | | – | | | |

Gross increases - tax positions in current period | | | – | | | |

Settlement | | | – | | | |

Lapse of statute of limitations | | | – | | | |

Net income tax expense | | $ | – | | | |

| | | | | | | |

25 | November 30, 2014

| | |

Alerian Exchange Traded Funds | | |

Notes to Financial Statements | | November 30, 2014 |

The Fund recognizes interest accrued related to unrecognized tax benefits and penalties as income tax expense. For the period from inception to November 30, 2014, the Fund had no accrued penalties or interest.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed since inception of the fund. Currently, the tax period ending November 30, 2011 is under examination by the Internal Revenue Service. The tax period ended November 30, 2014 remains subject to examination by tax authorities in the United States. Due to the nature of the Fund’s investments, the Fund may be required to file income tax returns in several states. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

Alerian Energy Infrastructure ETF

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. GAAP. Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations.