0001415726 tsr:C000247286Member tsr:bench2025010191215_2021Member 2024-10-31 0001415726 tsr:benchmark87543368_2149Member 2023-11-01 2024-10-31 0001415726 tsr:benchmark87653368_2180Member 2024-10-31 0001415726 tsr:C000215957Member 2022-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22135

Innovator ETFs Trust

(Exact name of registrant as specified in charter)

200 W Front Street

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, New Castle County, Delaware 19808

(Name and address of agent for service)

Copy to:

Morrison C. Warren, Esq.

Chapman and Cutler LLP

320 South Canal Street

Chicago, Illinois 60606

(Name and address of agent for service)

800-208-5212

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| | |

| Innovator Buffer Step-Up Strategy ETF® | |

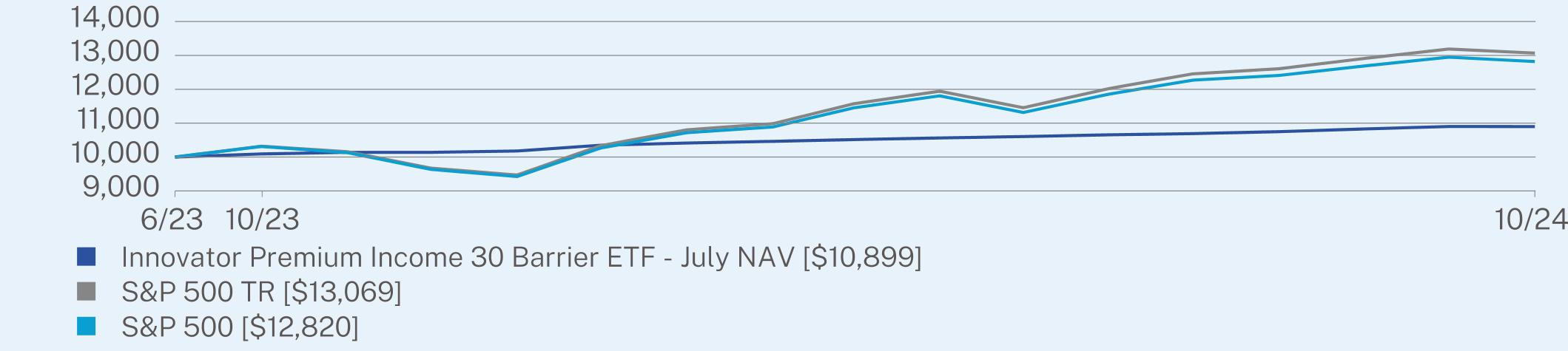

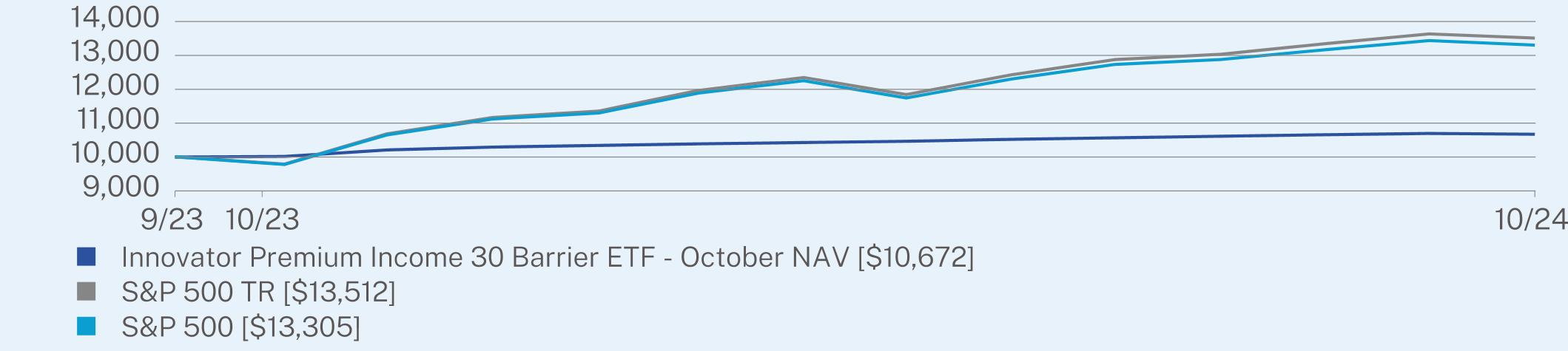

BSTP (Principal U.S. Listing Exchange: NYSE ArcaNYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Buffer Step-Up Strategy ETF® for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=BSTP. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Buffer Step-Up Strategy ETF | $100 | 0.89% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund is actively managed and seeks to provide risk-managed exposure to the SPDR S&P 500 ETF Trust (SPY). The Fund seeks to provide an alternative to managing and evaluating a series of buffer strategies, seeking to provide the upside of the SPY while mitigating downside losses with 9% or 15% built-in buffers.

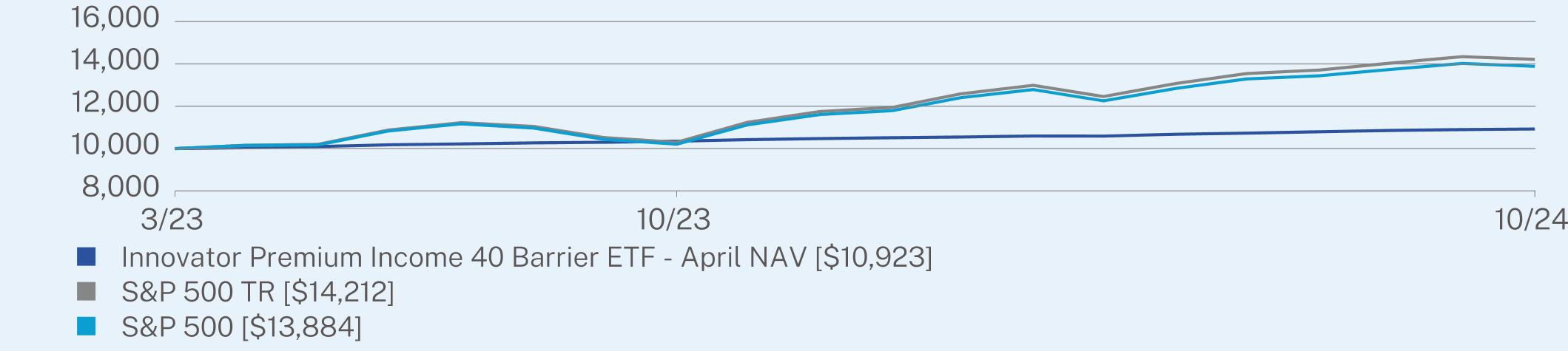

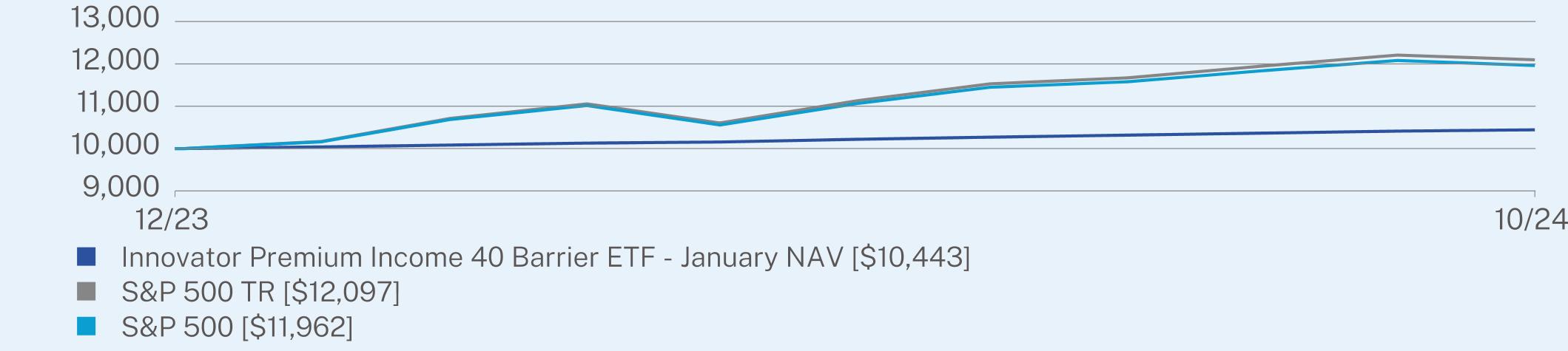

Through the Options Portfolio, the Fund will seek to participate in the price return of the SPY, subject to investment gains up to a limit, and provide protection against SPY losses up to a limit.

The Sub-Adviser will actively monitor the performance of the Options Portfolio and, if certain criteria are met, rebalance or “step-up” the portfolio to protect capital or capture portfolio gains experienced by the Fund, depending on its evaluation of market conditions.

During the 12 months ended October 31, 2024, gains were largely driven by tech and the market interest in AI, coupled with the expectation of a possible soft landing. Market breadth widened in the latter half of the time period, but remained fairly narrow overall.

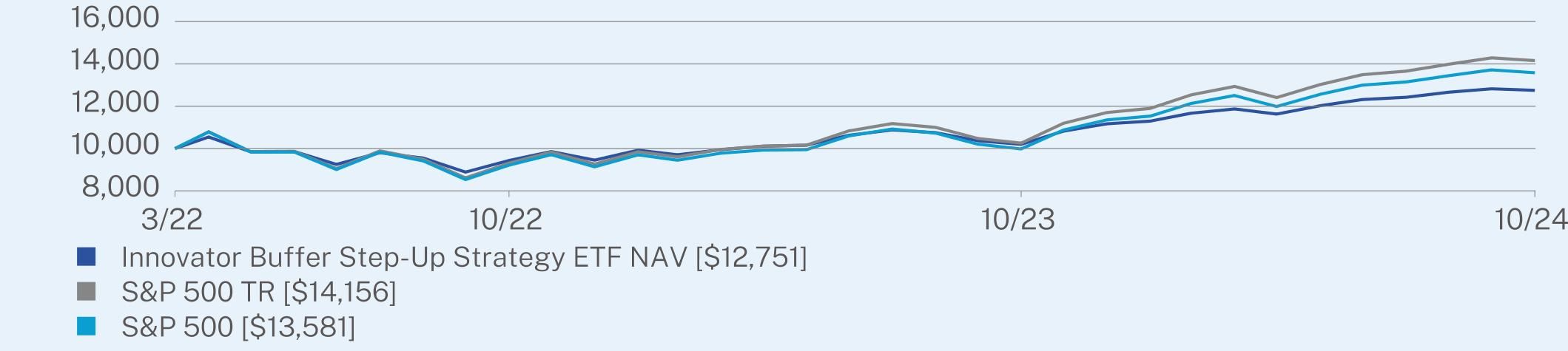

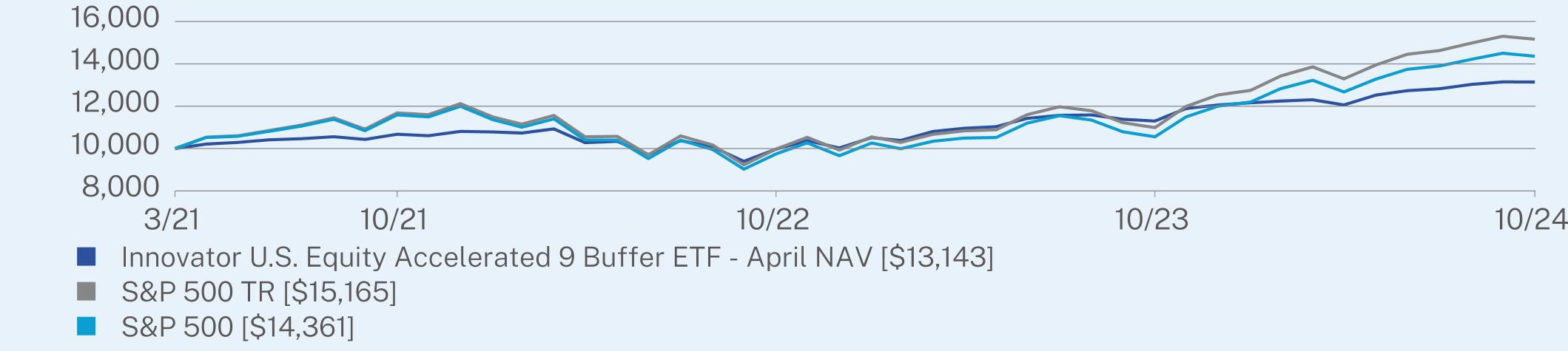

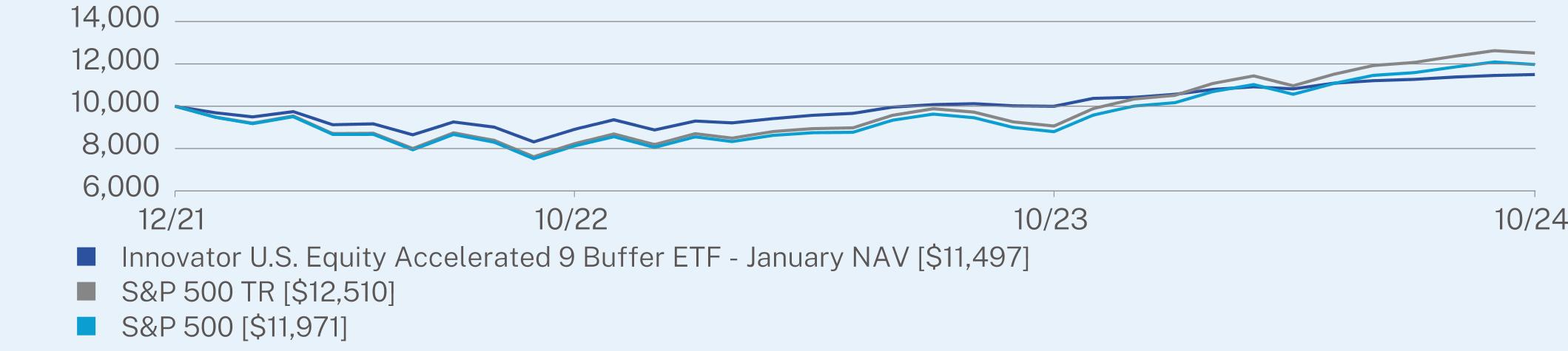

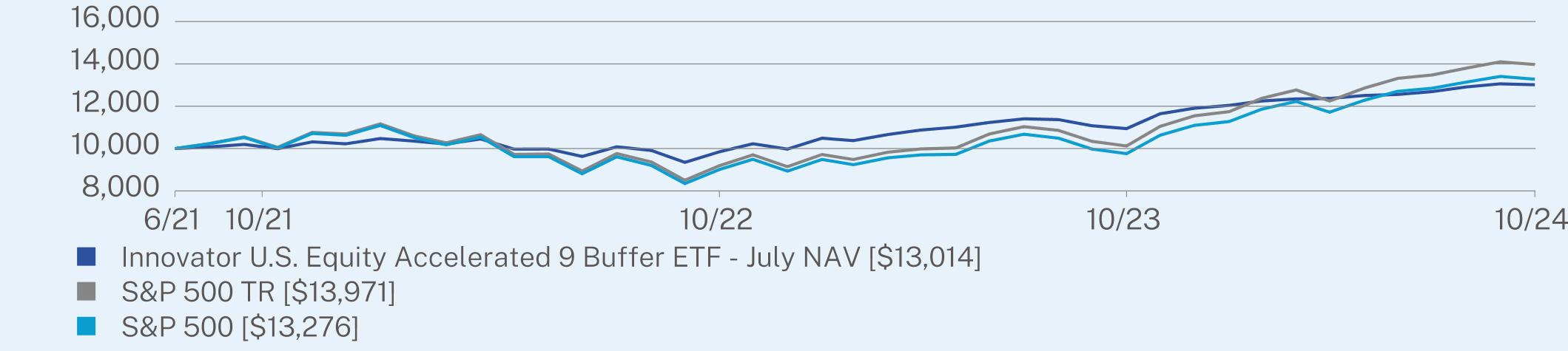

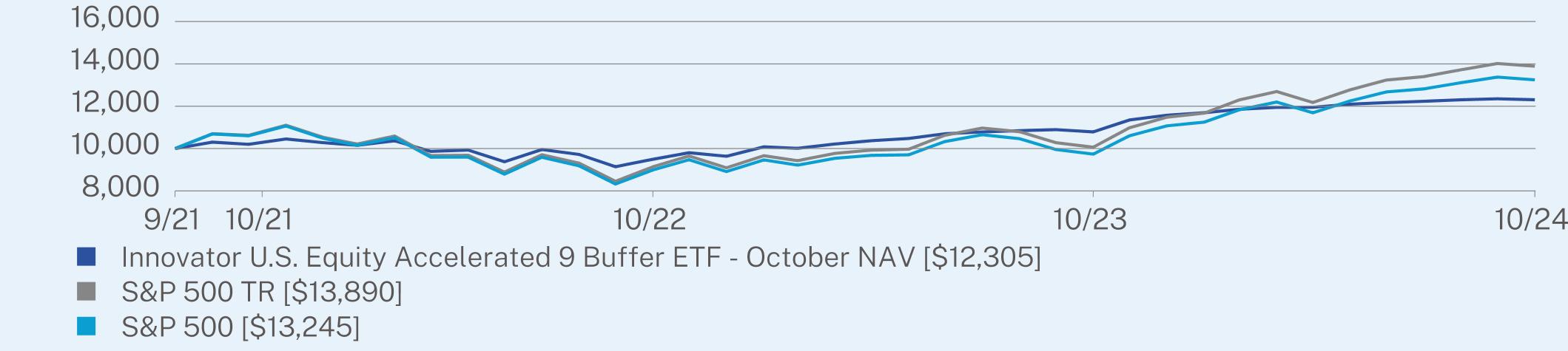

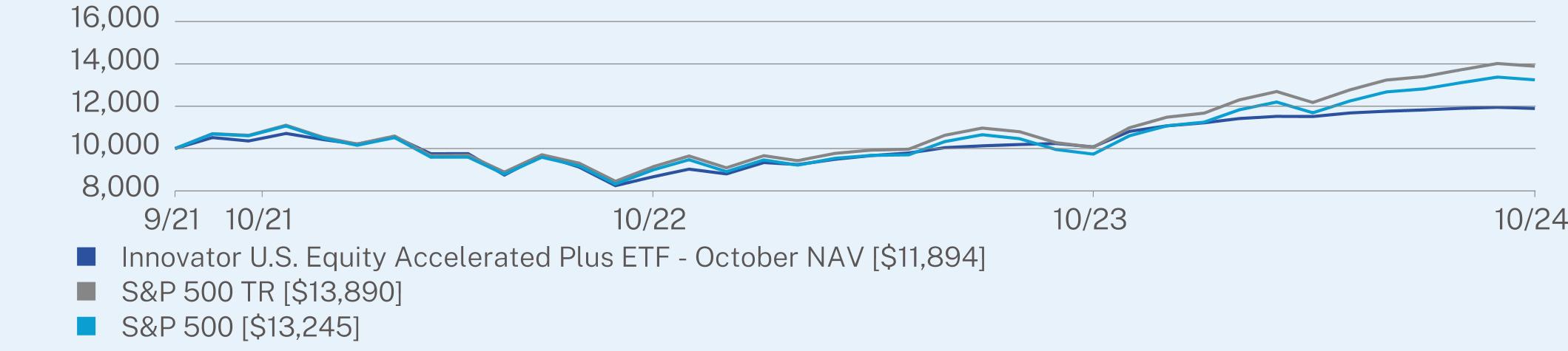

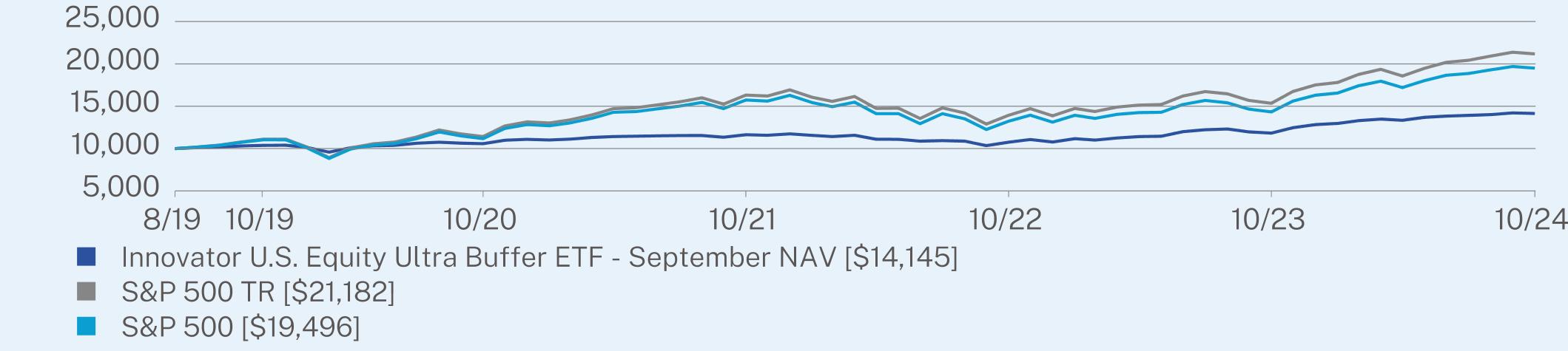

HOW DID THE FUND PERFORM SINCE INCEPTION?*

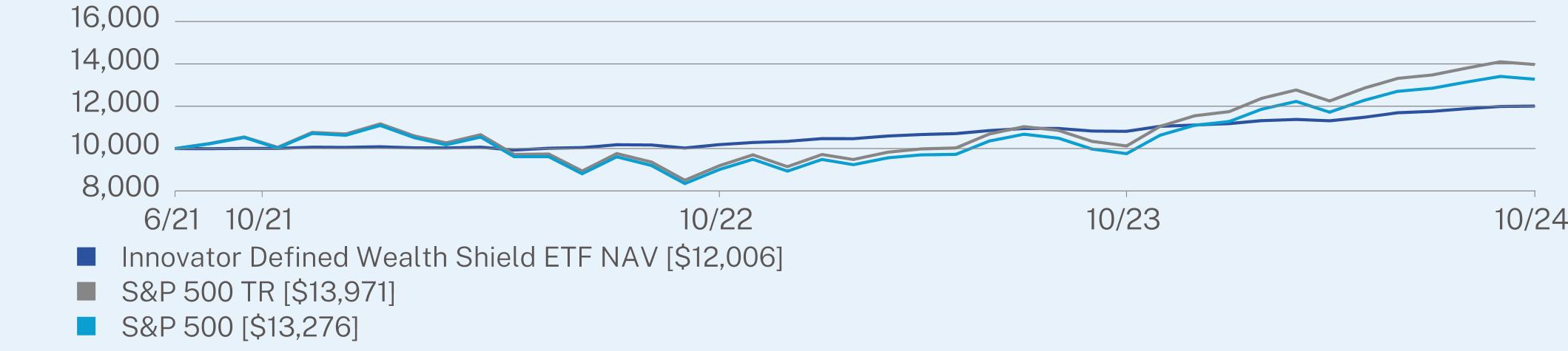

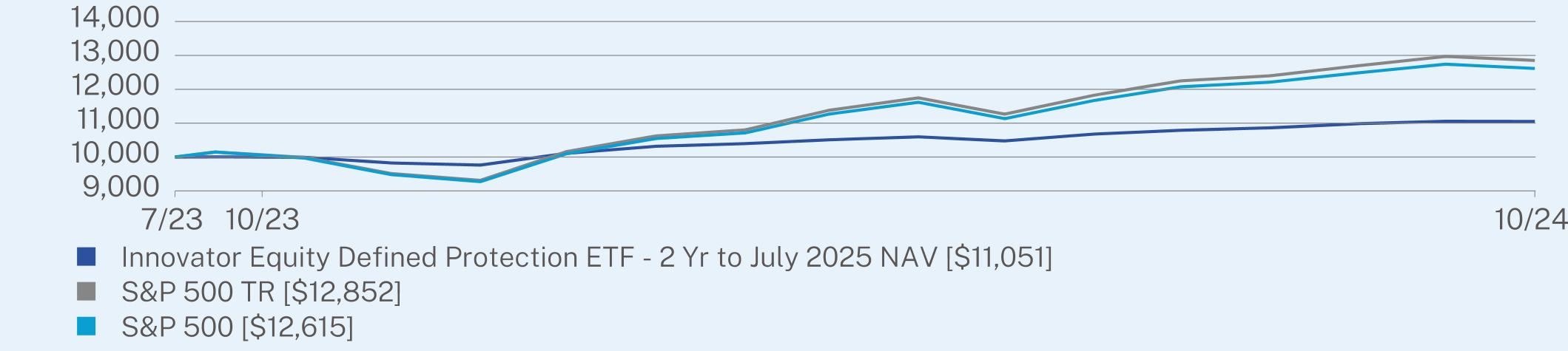

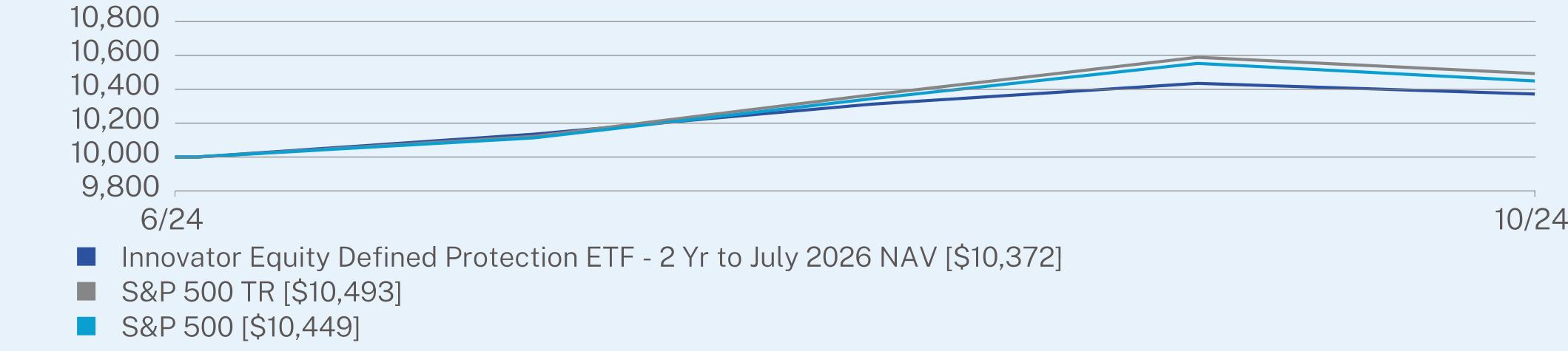

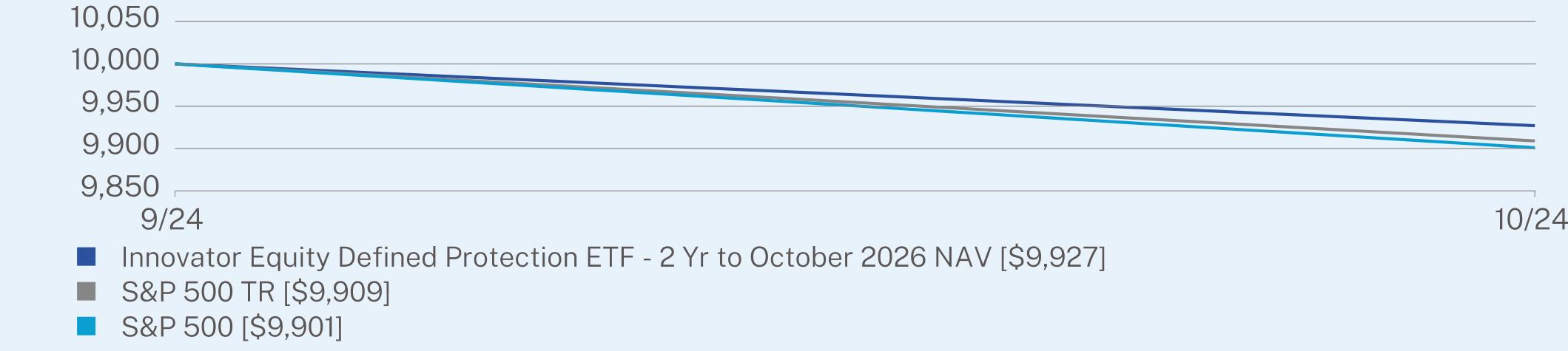

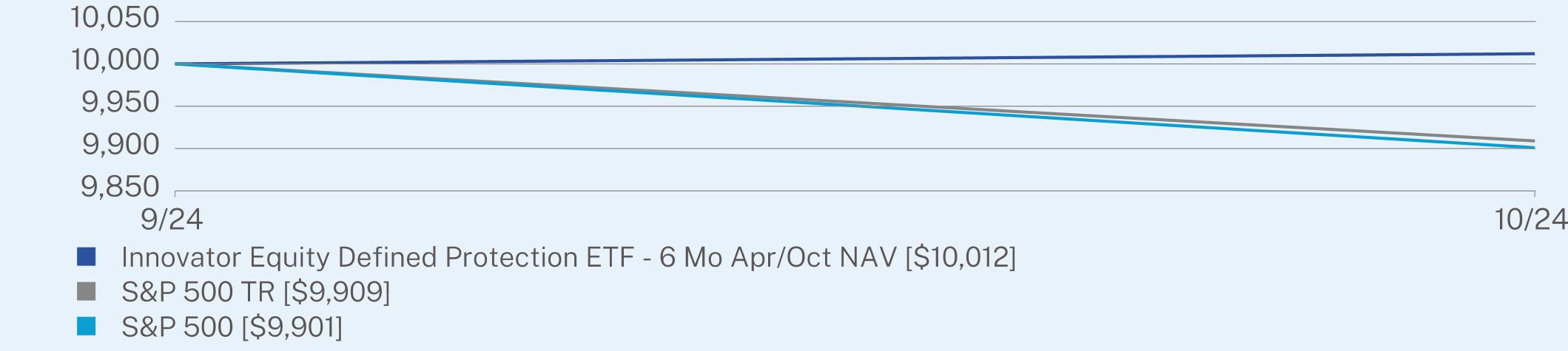

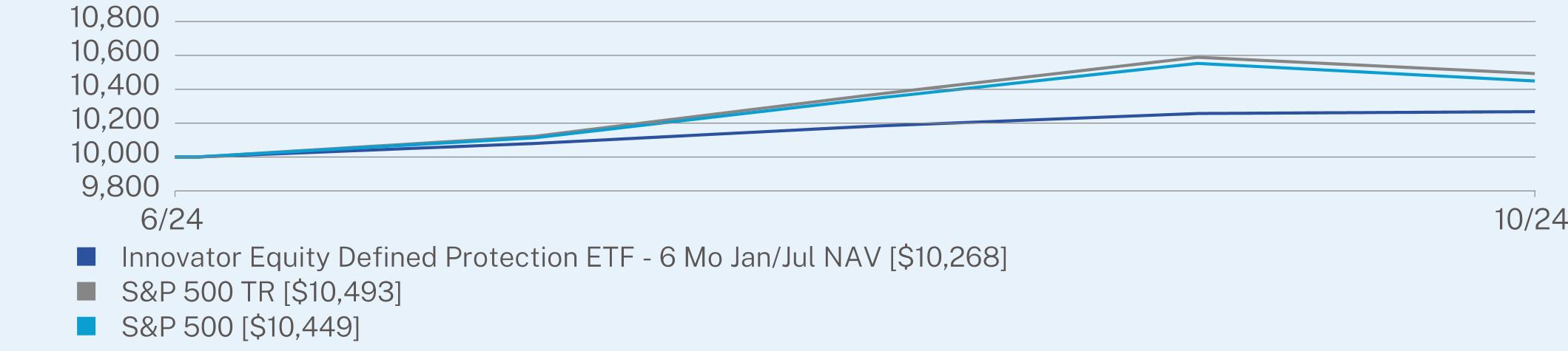

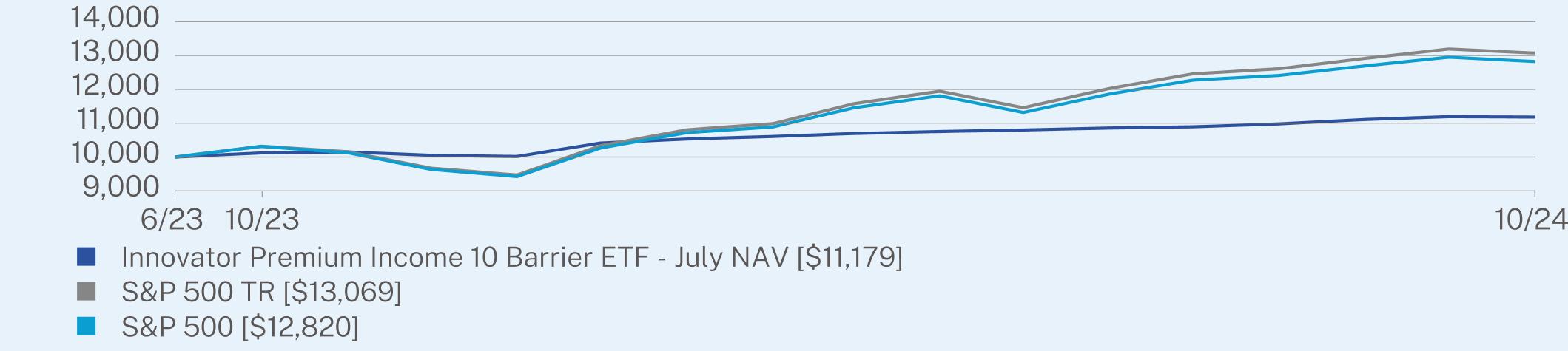

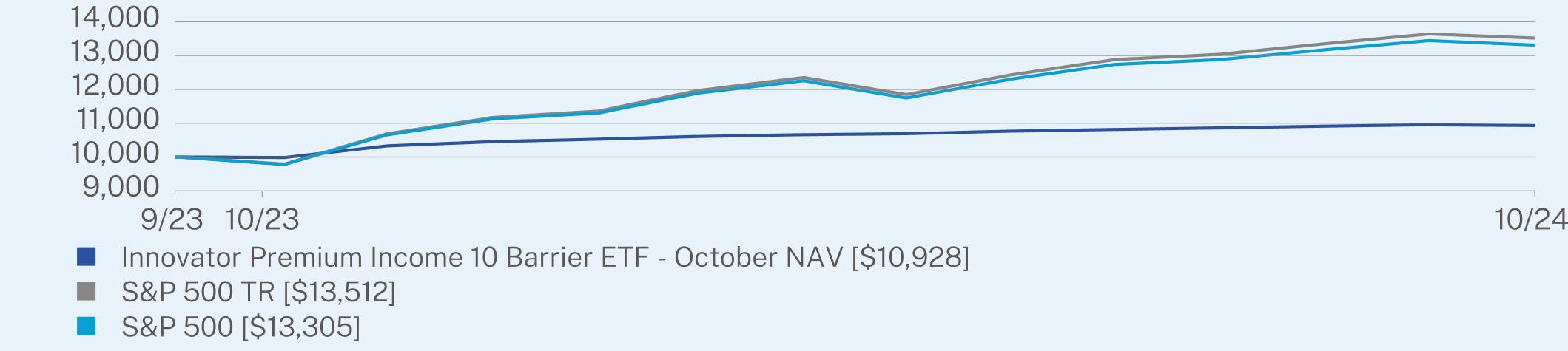

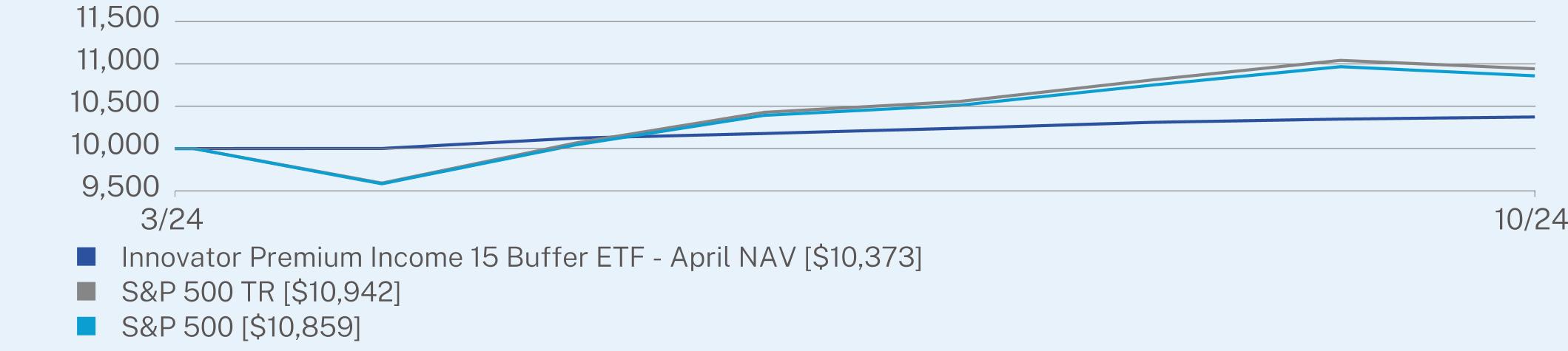

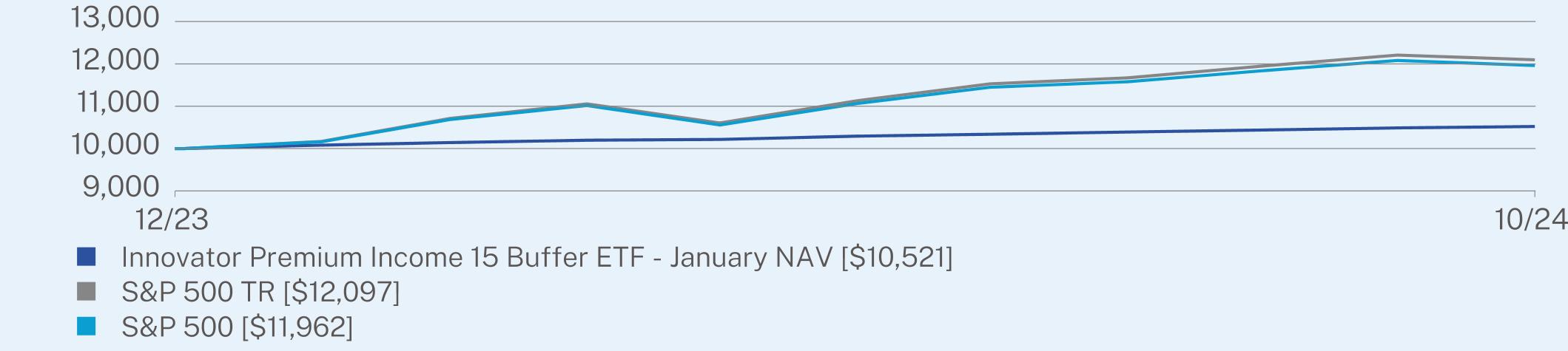

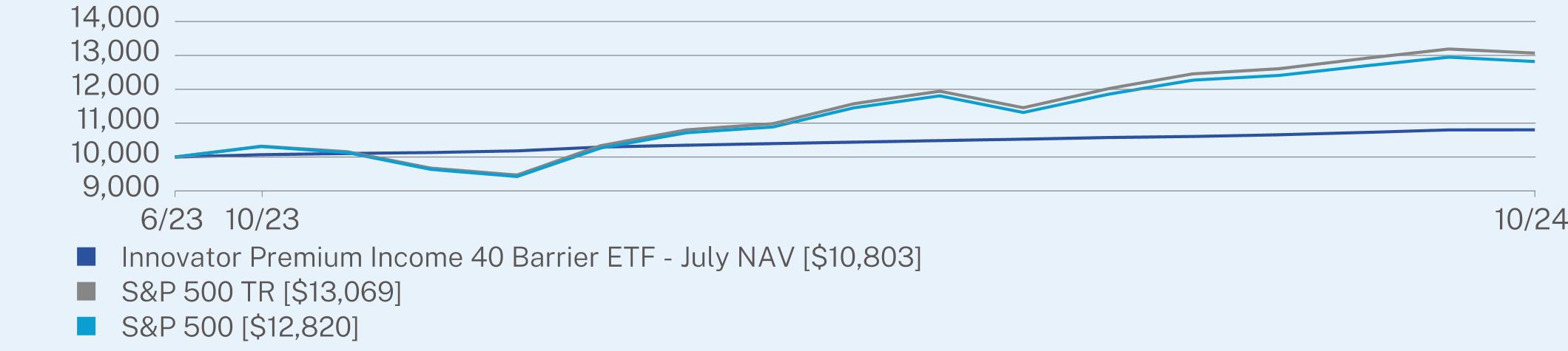

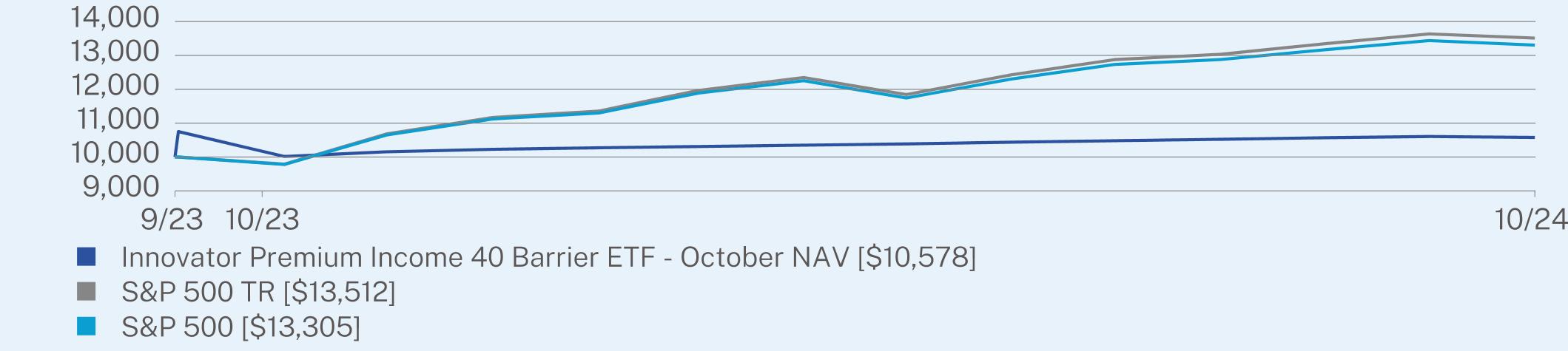

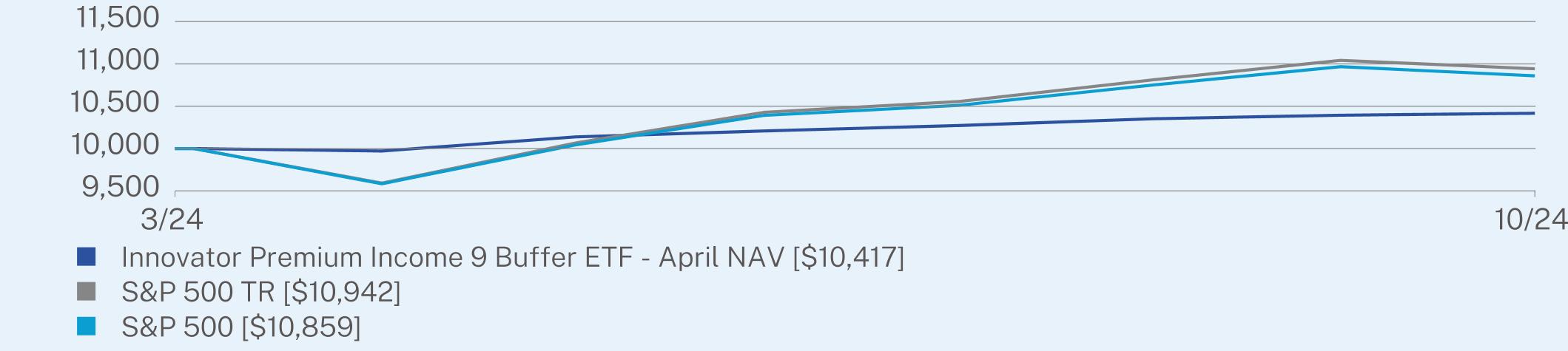

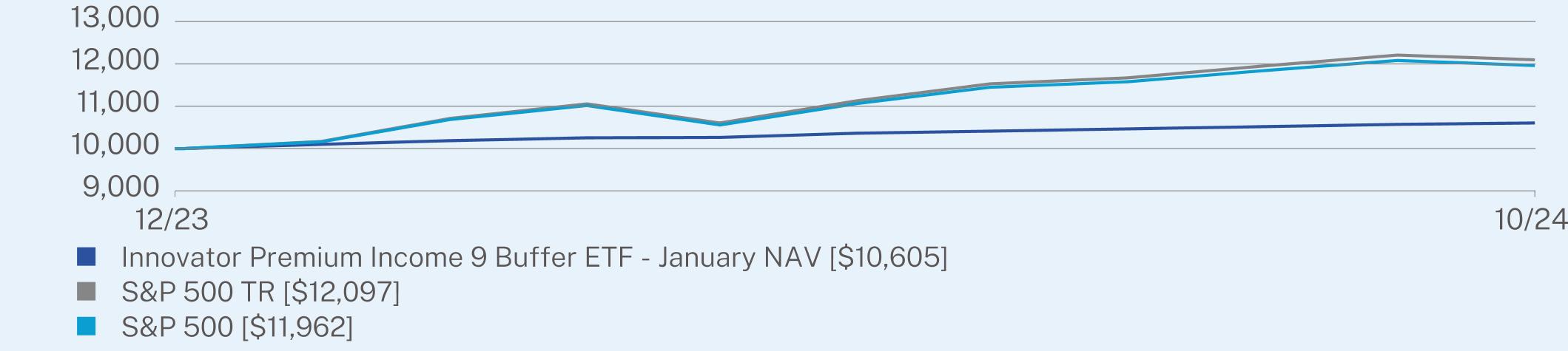

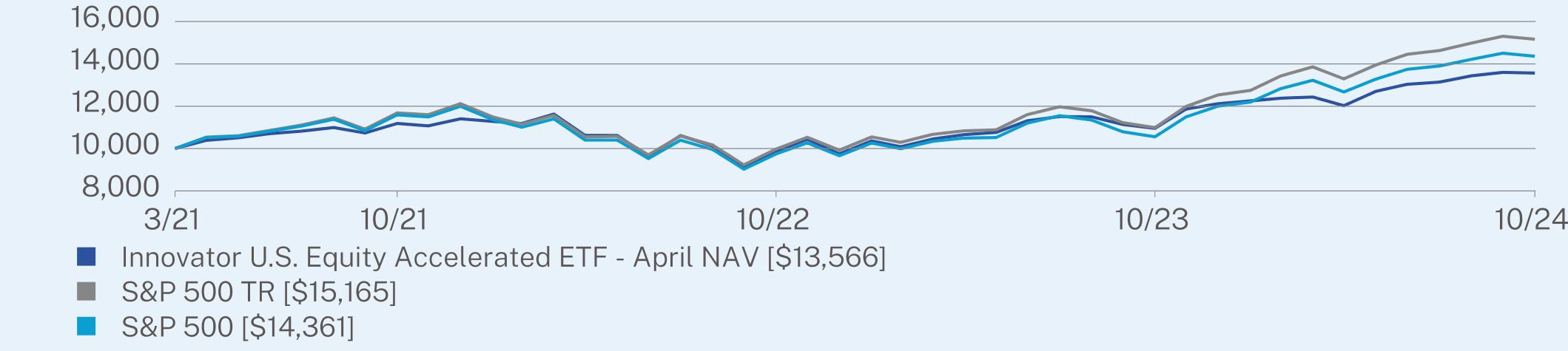

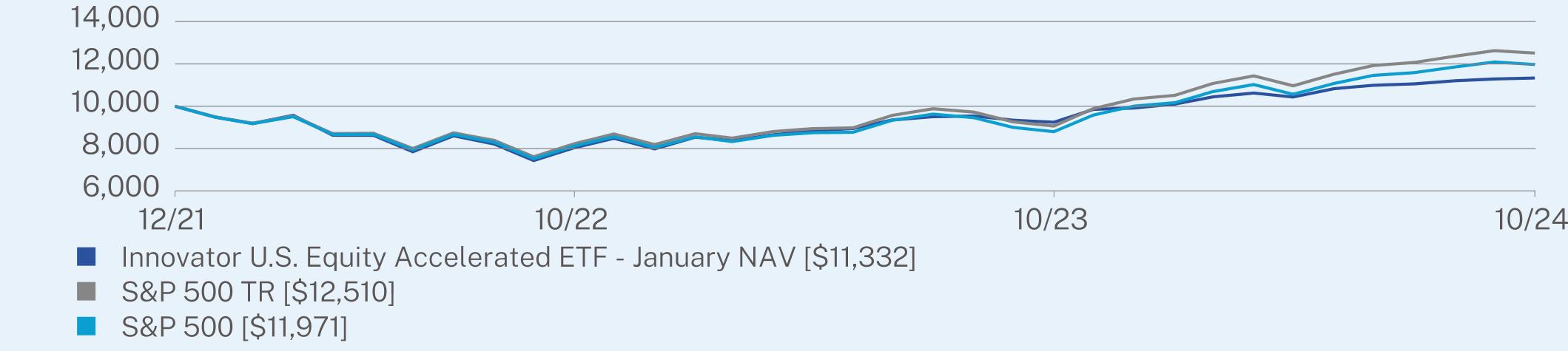

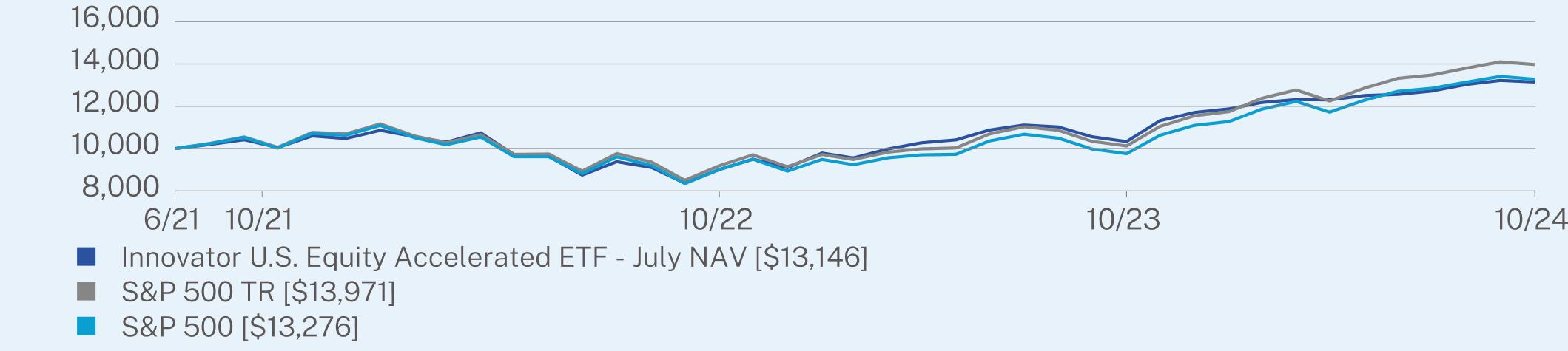

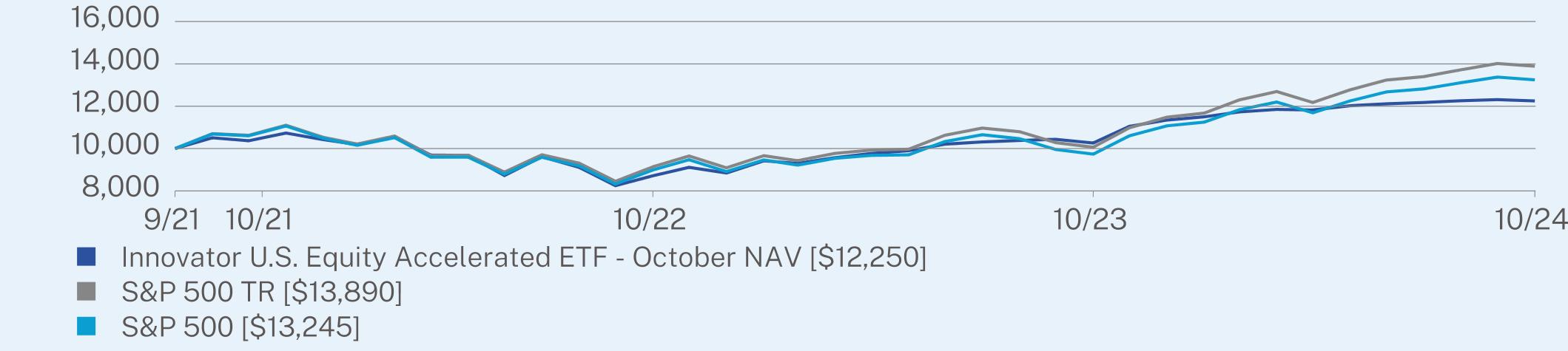

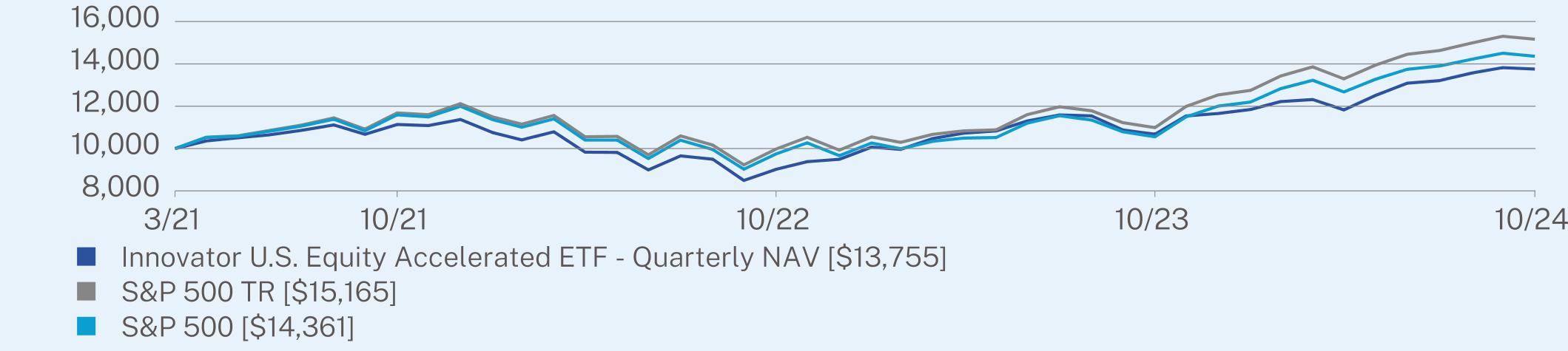

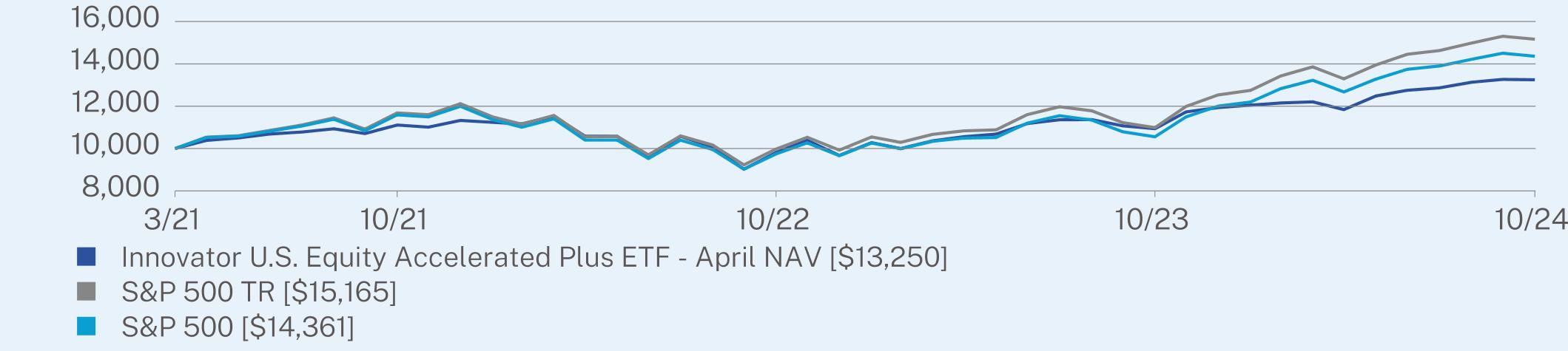

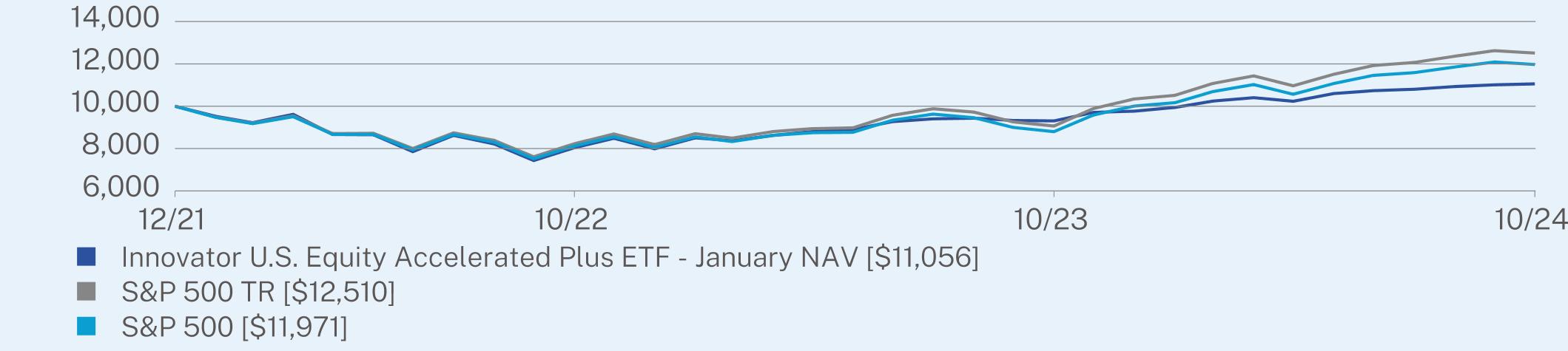

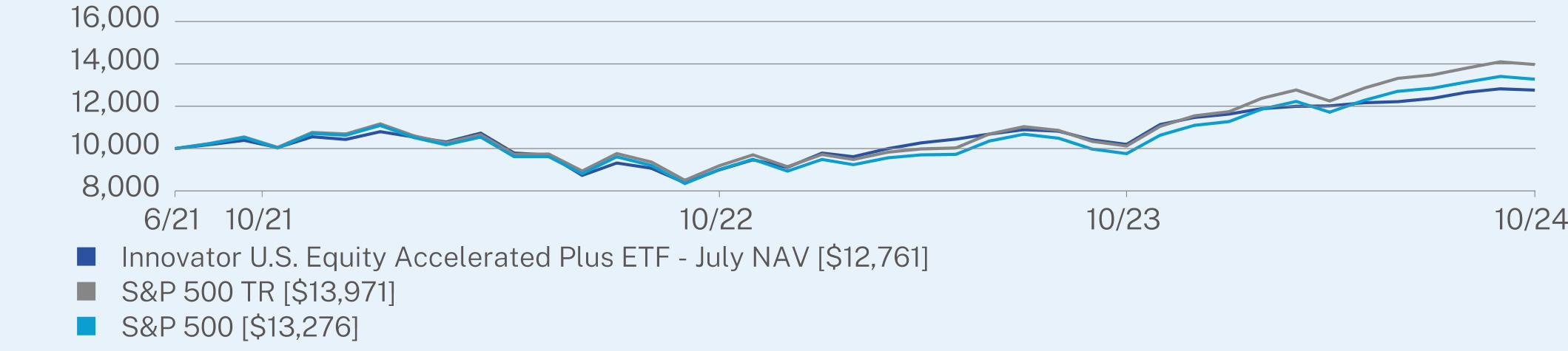

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Innovator Buffer Step-Up Strategy ETF® | PAGE 1 | TSR-AR-45783Y731 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(03/07/2022) |

Innovator Buffer Step-Up Strategy ETF NAV | 25.01 | 9.60 |

S&P 500 TR | 38.02 | 14.00 |

S&P 500 | 36.04 | 12.23 |

Visit https://www.innovatoretfs.com/etf/?ticker=BSTP for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $64,169,183 |

Number of Holdings | 4 |

Net Advisory Fee | $490,364 |

Portfolio Turnover | 0% |

30-Day SEC Yield | -0.87% |

30-Day SEC Yield Unsubsidized | -0.87% |

Visit https://www.innovatoretfs.com/etf/?ticker=BSTP for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Holdings | (%) |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $5.82 | 98.9% |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $573.81 | 5.2% |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $659.71 | -1.1% |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $522.16 | -3.1% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=BSTP.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Buffer Step-Up Strategy ETF® | PAGE 2 | TSR-AR-45783Y731 |

94361020012751931210257141569217998313581

| | |

| Innovator Deepwater Frontier Tech ETF | |

LOUP (Principal U.S. Listing Exchange: NYSE ArcaNYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Deepwater Frontier Tech ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=LOUP. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Deepwater Frontier Tech ETF | $87 | 0.70% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

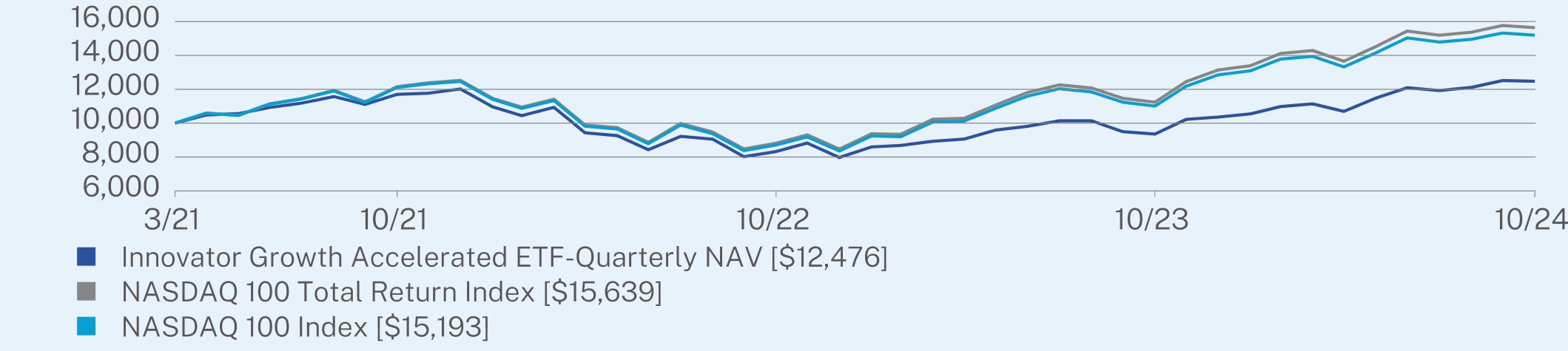

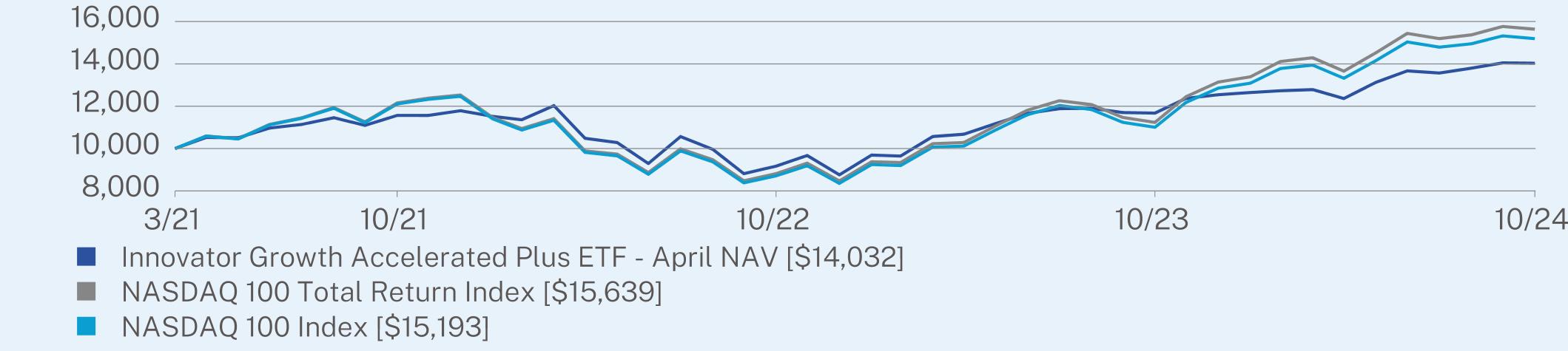

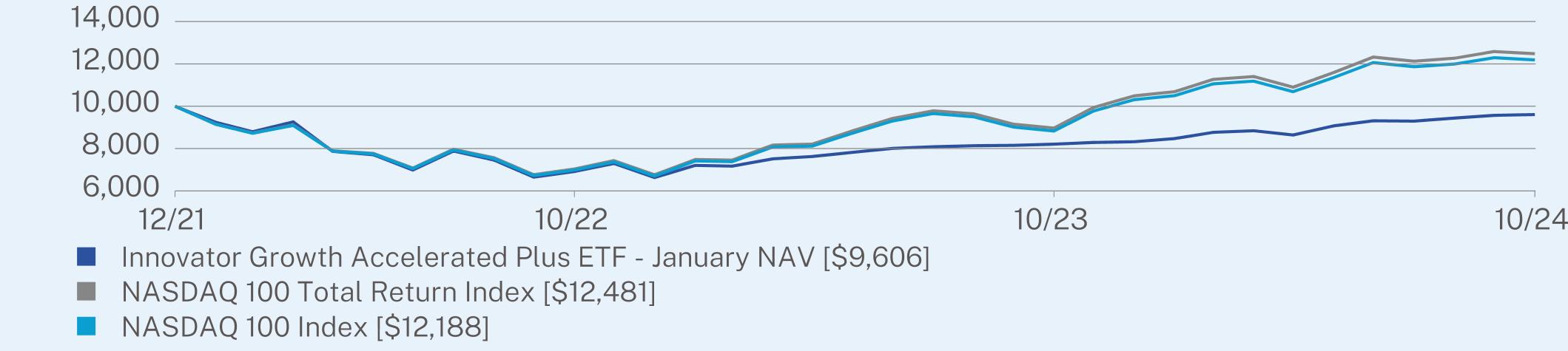

The Nasdaq-100 Index posted strong positive performance for the year ended October 31, 2024. The technology sector maintained its momentum, supported by ongoing investor enthusiasm for AI and the enduring leadership of the “Magnificent 7.” However, as the period progressed, market dynamics began to favor value-oriented names over the growth-focused companies that dominate the Nasdaq-100, leading to a modest rotation while the index still delivered solid gains overall.

Over this same period, LOUP outperformed the Nasdaq-100, largely attributable to its allocations to industrials and its security selection within large caps.

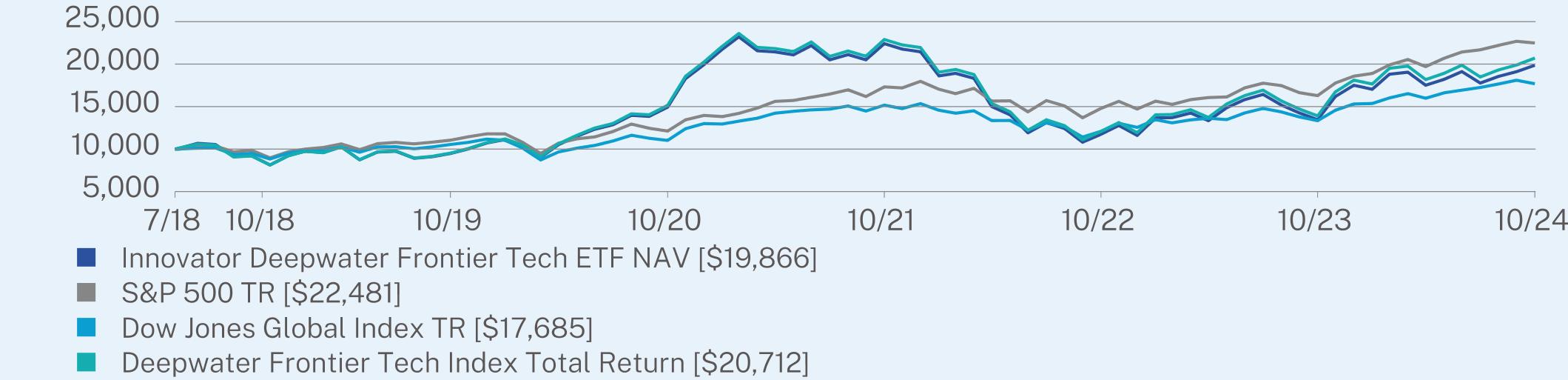

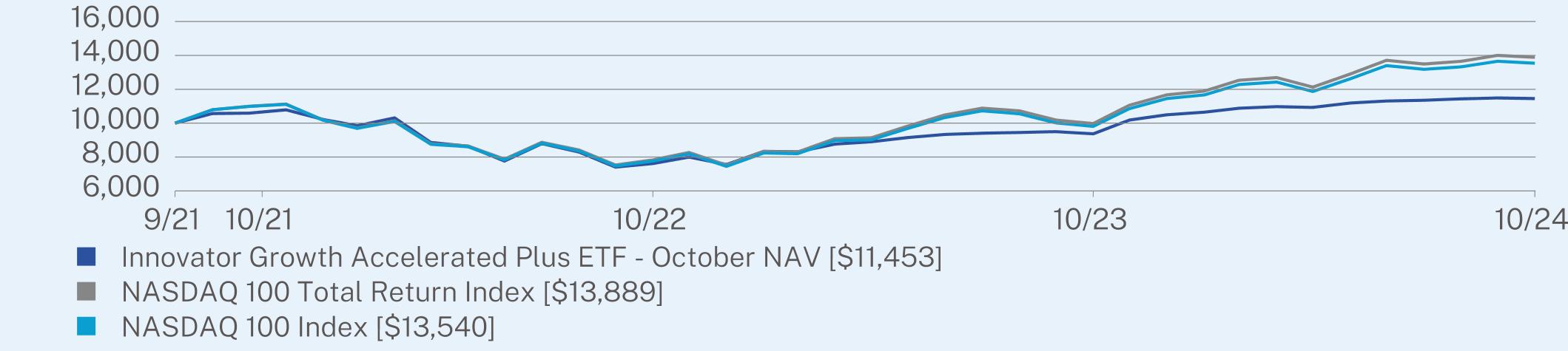

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Innovator Deepwater Frontier Tech ETF | PAGE 1 | TSR-AR-45782C862 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(07/24/2018) |

Innovator Deepwater Frontier Tech ETF NAV | 47.59 | 15.95 | 11.57 |

S&P 500 TR | 38.02 | 15.27 | 13.79 |

Dow Jones Global Index TR | 32.55 | 10.91 | 9.52 |

Deepwater Frontier Tech Index Total Return | 48.99 | 16.81 | 12.31 |

Visit https://www.innovatoretfs.com/etf/?ticker=LOUP for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $57,113,362 |

Number of Holdings | 31 |

Net Advisory Fee | $356,102 |

Portfolio Turnover | 165% |

30-Day SEC Yield | -0.37% |

30-Day SEC Yield Unsubsidized | -0.37% |

Visit https://www.innovatoretfs.com/etf/?ticker=LOUP for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Sectors | (%) |

Technology | 50.1% |

Communications | 15.1% |

Consumer, Non-cyclical | 12.0% |

Industrial | 8.9% |

Consumer, Cyclical | 5.5% |

Financial | 5.4% |

Basic Materials | 2.9% |

Cash & Other | 0.1% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=LOUP.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Deepwater Frontier Tech ETF | PAGE 2 | TSR-AR-45782C862 |

91089479149382240811741134601986696621104612119173191478916289224819348105361102015171120881334317685906495221515122894120731390220712

| | |

| Innovator Equity Managed Floor ETF® | |

SFLR (Principal U.S. Listing Exchange: NYSE ARCANYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Equity Managed Floor ETF® for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=SFLR. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Equity Managed Floor ETF | $101 | 0.89% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During the 12 months ended October 31, 2024, SFLR generated a total return of 26.97%. Over the same period, the S&P 500 Total Return Index returned 38.02%. The options overlay portion of the portfolio is comprised of two components: short-dated call selling (“Calls”) and long-dated put buying (“Puts”). Both components detracted from the fund’s return, with the calls generating a 4.89% loss and the puts contributing a 2.83% loss.

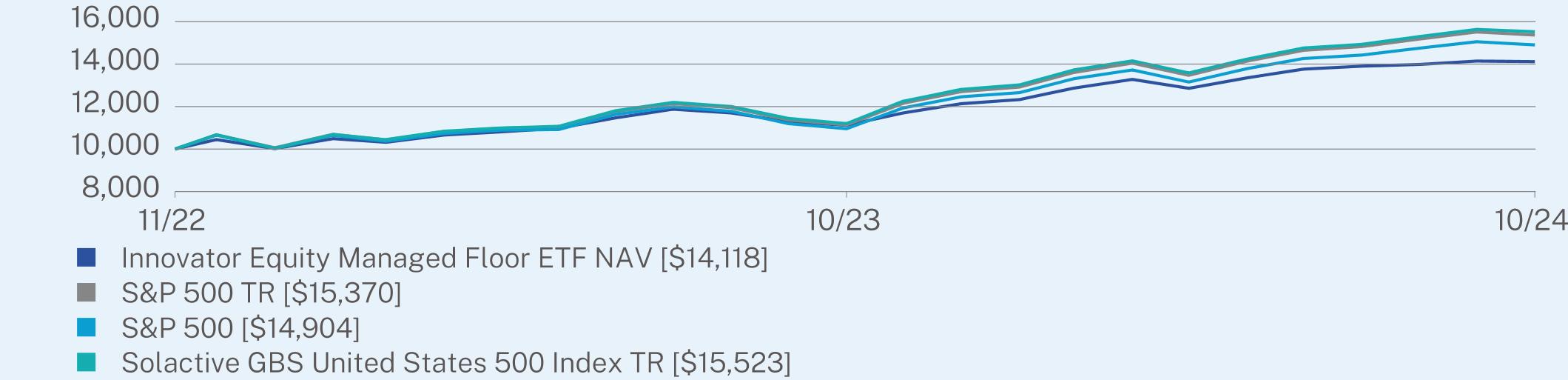

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(11/08/2022) |

Innovator Equity Managed Floor ETF NAV | 26.97 | 19.05 |

S&P 500 TR | 38.02 | 24.27 |

S&P 500 | 36.04 | 22.35 |

Solactive GBS United States 500 Index TR | 38.61 | 24.89 |

Visit https://www.innovatoretfs.com/etf/?ticker=SFLR for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Innovator Equity Managed Floor ETF® | PAGE 1 | TSR-AR-45783Y673 |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $513,268,763 |

Number of Holdings | 230 |

Net Advisory Fee | $2,265,817 |

Portfolio Turnover | 9% |

30-Day SEC Yield | 0.43% |

30-Day SEC Yield Unsubsidized | 0.43% |

Visit https://www.innovatoretfs.com/etf/?ticker=SFLR for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Sectors | (%) |

Technology | 29.7% |

Consumer, Non-cyclical | 15.5% |

Communications | 15.3% |

Financial | 14.5% |

Consumer, Cyclical | 8.2% |

Industrial | 6.8% |

Energy | 3.3% |

Utilities | 2.4% |

Basic Materials | 1.6% |

Cash & Other | 2.7% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=SFLR.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Equity Managed Floor ETF® | PAGE 2 | TSR-AR-45783Y673 |

1112014118111361537010955149041119915523

| | |

| Innovator Gradient Tactical Rotation Strategy ETF | |

IGTR (Principal U.S. Listing Exchange: NYSE ARCANYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Gradient Tactical Rotation Strategy ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=IGTR. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Gradient Tactical Rotation Strategy ETF | $90 | 0.80% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund’s strategy seeks to identify the global market segment displaying the strongest price momentum metrics. The strategy utilizes a rules-based, two-factor approach to create tactical investment opportunities. During the 12 months ended October 31, 2024, IGTR generated a total return of 24.91%. Over the same period, the S&P Global BMI Index returned 32.78%.

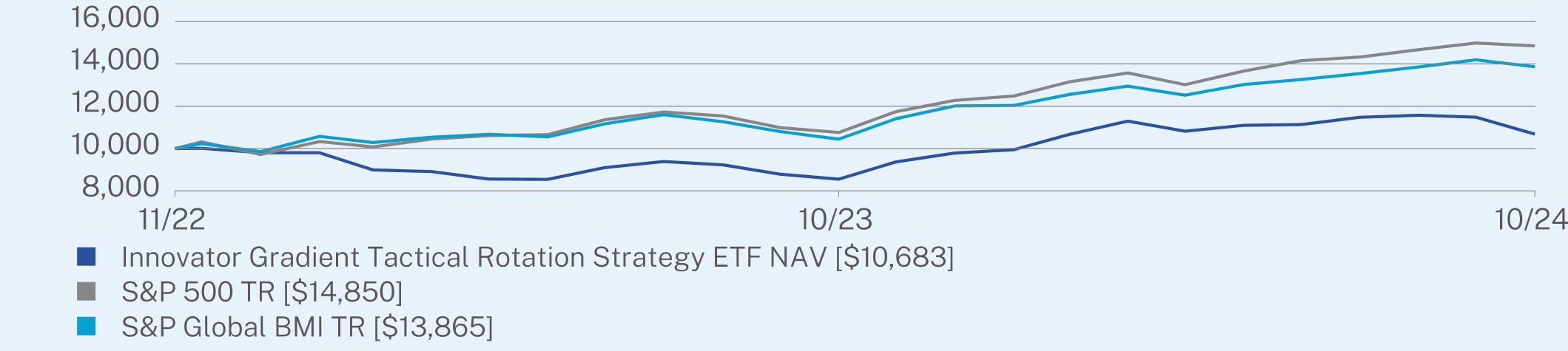

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(11/16/2022) |

Innovator Gradient Tactical Rotation Strategy ETF NAV | 24.91 | 3.43 |

S&P 500 TR | 38.02 | 22.40 |

S&P Global BMI TR | 32.78 | 18.18 |

Visit https://www.innovatoretfs.com/etf/?ticker=IGTR for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Innovator Gradient Tactical Rotation Strategy ETF | PAGE 1 | TSR-AR-45783Y665 |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $151,773,389 |

Number of Holdings | 134 |

Net Advisory Fee | $1,420,364 |

Portfolio Turnover | 458% |

30-Day SEC Yield | 1.59% |

30-Day SEC Yield Unsubsidized | 1.59% |

Visit https://www.innovatoretfs.com/etf/?ticker=IGTR for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Sectors | (%) |

Financial | 27.9% |

Communications | 17.4% |

Technology | 16.4% |

Energy | 8.6% |

Industrial | 8.4% |

Consumer, Cyclical | 6.9% |

Consumer, Non-cyclical | 5.4% |

Basic Materials | 5.3% |

Diversified | 0.8% |

Cash & Other | 2.9% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=IGTR.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Gradient Tactical Rotation Strategy ETF | PAGE 2 | TSR-AR-45783Y665 |

85521068310760148501044313865

| | |

| Innovator Hedged Nasdaq-100® ETF | |

| QHDG (Principal U.S. Listing Exchange: NASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

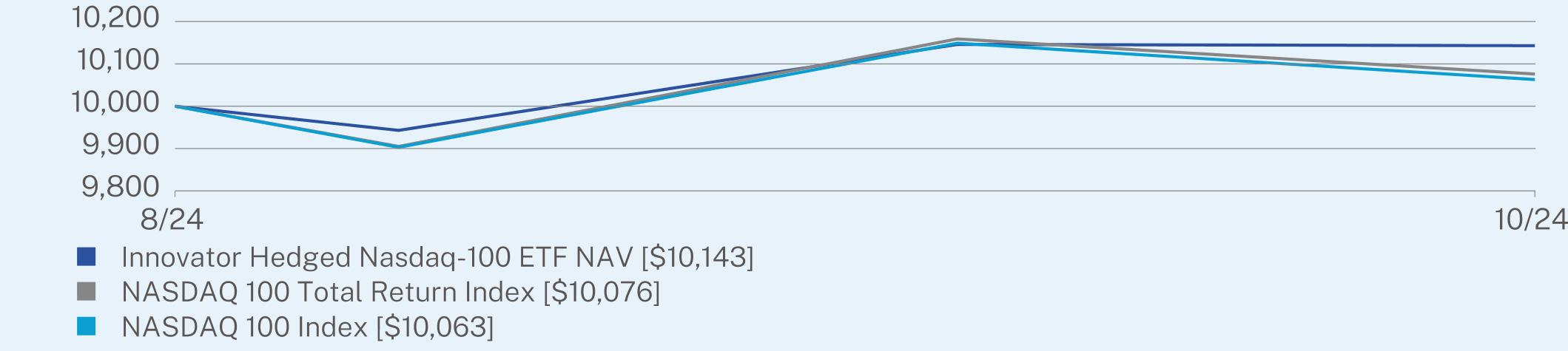

This annual shareholder report contains important information about the Innovator Hedged Nasdaq-100® ETF for the period of August 19, 2024, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=QHDG. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Hedged Nasdaq-100 ETF | $16 | 0.79% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

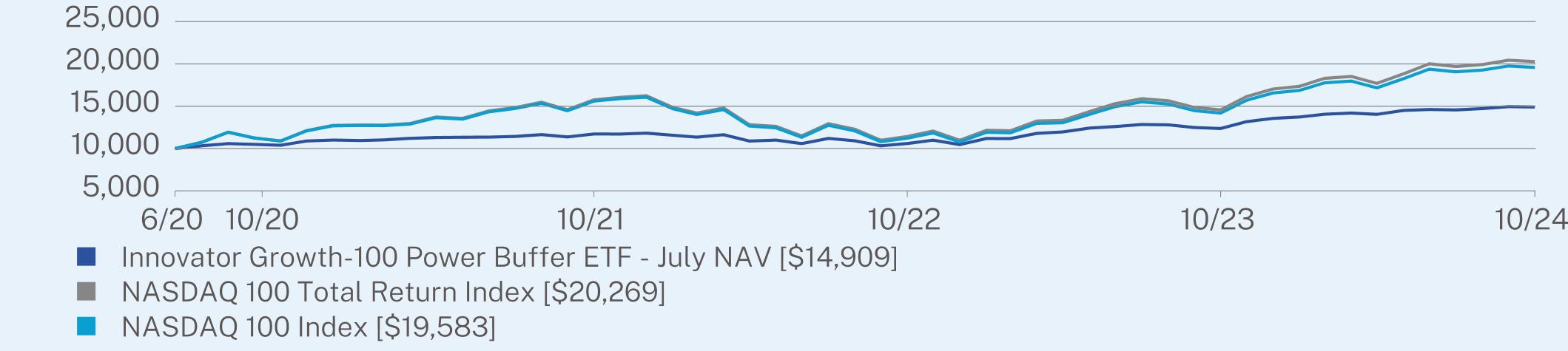

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund is designed to be a conservative growth equity solution that seeks to provide capital appreciation and a level of hedged downside protection over the Nasdaq-100® via an options hedge overlay.

Since its inception on August 19, 2024, through October 31, 2024, QHDG generated a total return of 1.44%. Over the same period, the Nasdaq-100 Total Return Index returned 0.76%.

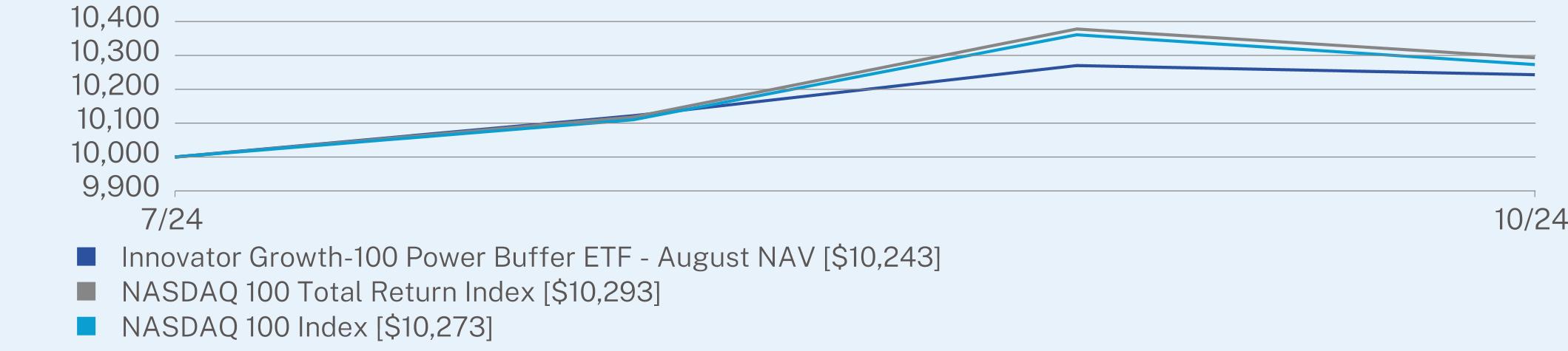

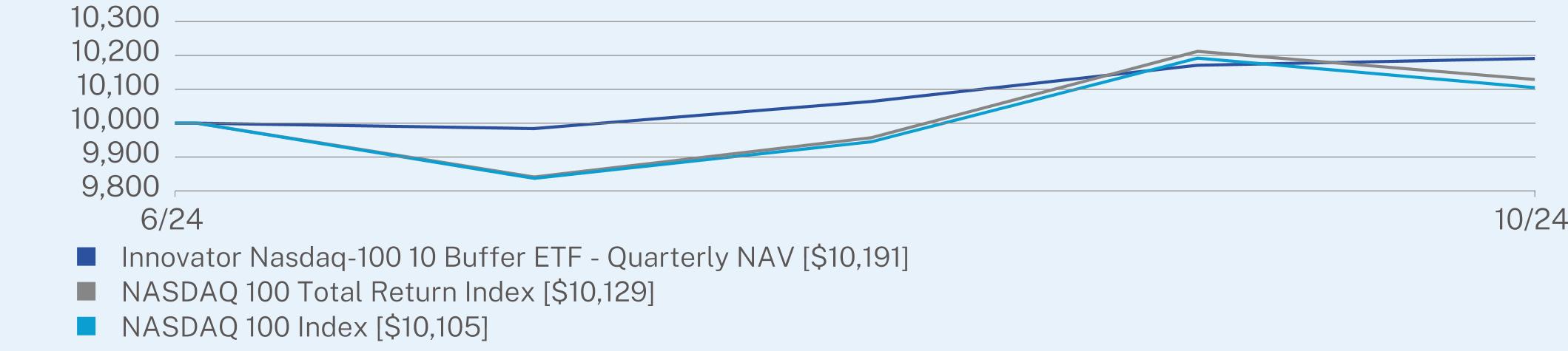

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(08/19/2024) |

Innovator Hedged Nasdaq-100 ETF NAV | 1.43 |

NASDAQ 100 Total Return Index | 0.76 |

NASDAQ 100 Index | 0.63 |

Visit https://www.innovatoretfs.com/etf/?ticker=QHDG for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Innovator Hedged Nasdaq-100® ETF | PAGE 1 | TSR-AR-45783Y152 |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $5,712,476 |

Number of Holdings | 104 |

Net Advisory Fee | $6,268 |

Portfolio Turnover | 13% |

Visit https://www.innovatoretfs.com/etf/?ticker=QHDG for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Sectors | (%) |

Technology | 47.8% |

Communications | 26.1% |

Consumer, Non-cyclical | 11.2% |

Consumer, Cyclical | 8.8% |

Industrial | 1.6% |

Basic Materials | 1.4% |

Utilities | 1.4% |

Energy | 0.5% |

Financial | 0.2% |

Cash & Other | 1.0% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=QHDG.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Hedged Nasdaq-100® ETF | PAGE 2 | TSR-AR-45783Y152 |

101431007610063

| | |

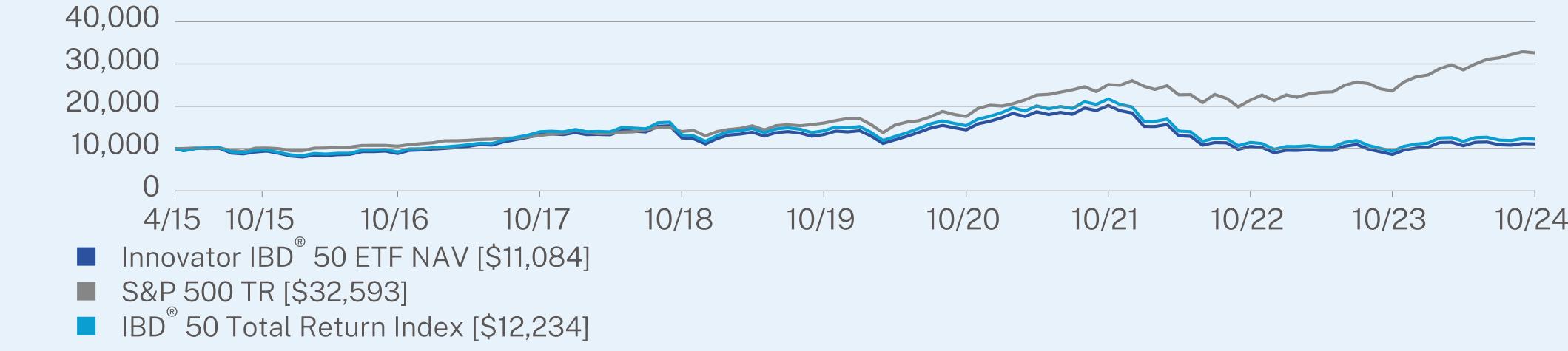

| Innovator IBD® 50 ETF | |

FFTY (Principal U.S. Listing Exchange: NYSE ARCANYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator IBD® 50 ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=FFTY. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Innovator IBD® 50 ETF | $92 | 0.80% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Innovator IBD® 50 ETF seeks to track the investment results of the IBD® 50 Index. IBD® 50 is Investor’s Business Daily’s signature investing tool—targeting companies that are generating outstanding profit growth, big sales increases, wide profit margins and a high return on equity.

The S&P 500 Index delivered strong performance for the year ended October 31, 2024. Gains were primarily driven by the continued strength in technology and growing market enthusiasm for artificial intelligence, alongside optimism surrounding a potential soft landing for the economy. While market breadth improved in the latter part of the year, it remained relatively narrow overall.

FFTY delivered a strong positive return over the same period, but trailed the S&P 500, largely attributable to its allocation to financials and midcaps.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(04/08/2015) |

Innovator IBD® 50 ETF NAV | 28.98 | -3.57 | 1.08 |

S&P 500 TR | 38.02 | 15.27 | 13.15 |

IBD® 50 Total Return Index | 30.68 | -2.92 | 2.13** |

Visit https://www.innovatoretfs.com/etf/?ticker=FFTY for more recent performance information.

| Innovator IBD® 50 ETF | PAGE 1 | TSR-AR-45782C102 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| ** | Since Inception return is -2.37% from the date the Fund began tracking the IBD® 50 Total Return Index, November 20, 2017. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $62,732,507 |

Number of Holdings | 51 |

Net Advisory Fee | $415,648 |

Portfolio Turnover | 1,304% |

30-Day SEC Yield | -0.46% |

30-Day SEC Yield Unsubsidized | -0.61% |

Visit https://www.innovatoretfs.com/etf/?ticker=FFTY for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Sectors | (%) |

Technology | 33.7% |

Industrial | 24.0% |

Consumer, Non-cyclical | 20.9% |

Communications | 7.7% |

Consumer, Cyclical | 7.1% |

Financial | 6.1% |

Cash & Other | 0.5% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=FFTY.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator IBD® 50 ETF | PAGE 2 | TSR-AR-45782C102 |

920088391333612516132921441220169105078594110841009910555130491400816015175702511021441236163259395489185139591320414187154142172111451936212234

| | |

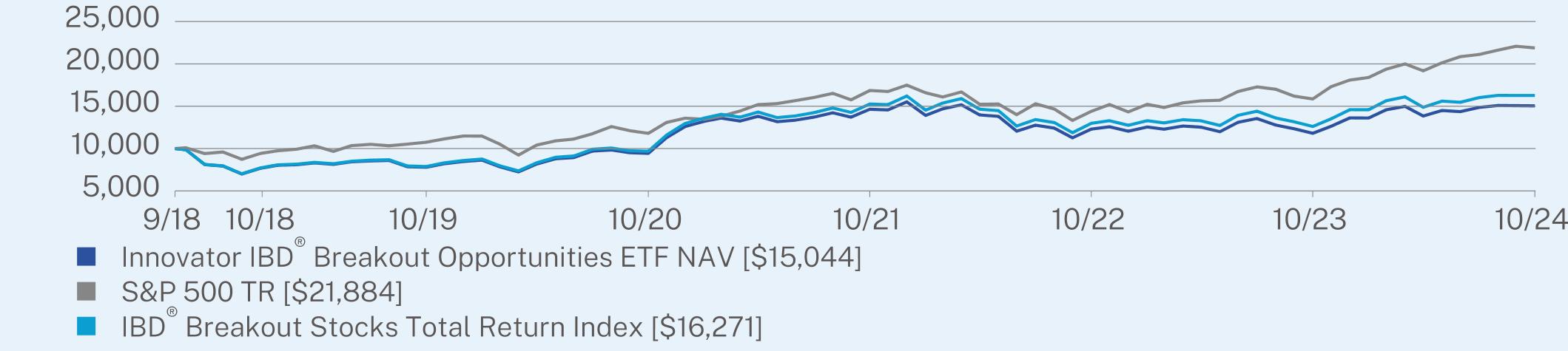

| Innovator IBD® Breakout Opportunities ETF | |

BOUT (Principal U.S. Listing Exchange: NYSE ARCANYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator IBD® Breakout Opportunities ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=BOUT. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Innovator IBD® Breakout Opportunities ETF | $91 | 0.80% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Innovator IBD® Breakout Opportunities ETF seeks to provide exposure to the investment results of the IBD® Breakout Stocks Index. The Index leverages decades of Investor’s Business Daily research and seeks to identify stock breakout opportunities, or stocks poised to experience a period of sustained price growth beyond the security’s recent “resistance level”, with consideration for various market conditions.

The S&P 500 Index delivered strong performance for the year ended October 31, 2024. Gains were primarily driven by the continued strength in technology and growing market enthusiasm for artificial intelligence, alongside optimism surrounding a potential soft landing for the economy. While market breadth improved in the latter part of the year, it remained relatively narrow overall.

BOUT delivered a strong positive return over the same period, but trailed the S&P 500, largely attributable to its allocations to information technology and small caps.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(09/12/2018) |

Innovator IBD® Breakout Opportunities ETF NAV | 27.45 | 14.06 | 6.88 |

S&P 500 TR | 38.02 | 15.27 | 13.62 |

IBD® Breakout Stocks Total Return Index | 29.04 | 15.59 | 8.26 |

Visit https://www.innovatoretfs.com/etf/?ticker=BOUT for more recent performance information.

| Innovator IBD® Breakout Opportunities ETF | PAGE 1 | TSR-AR-45782C763 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $12,791,130 |

Number of Holdings | 42 |

Net Advisory Fee | $103,612 |

Portfolio Turnover | 1,448% |

30-Day SEC Yield | 0.07% |

30-Day SEC Yield Unsubsidized | 0.07% |

Visit https://www.innovatoretfs.com/etf/?ticker=BOUT for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Sectors | (%) |

Technology | 28.6% |

Financial | 21.0% |

Communications | 19.2% |

Consumer, Non-cyclical | 11.6% |

Consumer, Cyclical | 9.4% |

Industrial | 5.3% |

Management of Companies and Enterprises | 4.4% |

Basic Materials | 0.5% |

Cash & Other | 0.0% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=BOUT.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator IBD® Breakout Opportunities ETF | PAGE 2 | TSR-AR-45782C763 |

81057794943414640123001180415044940510753117971685914396158562188481177884968015261129831260916271

| | |

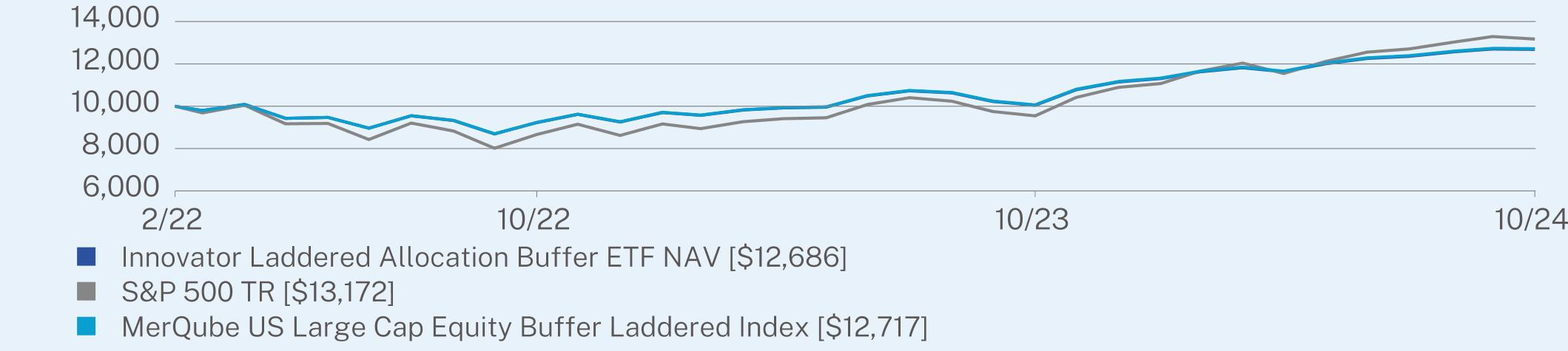

| Innovator Laddered Allocation Buffer ETF™ | |

BUFB (Principal U.S. Listing Exchange: CBOE BZXCboeBZX) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Laddered Allocation Buffer ETF™ for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=BUFB. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Laddered Allocation Buffer ETF | $11 | 0.10% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

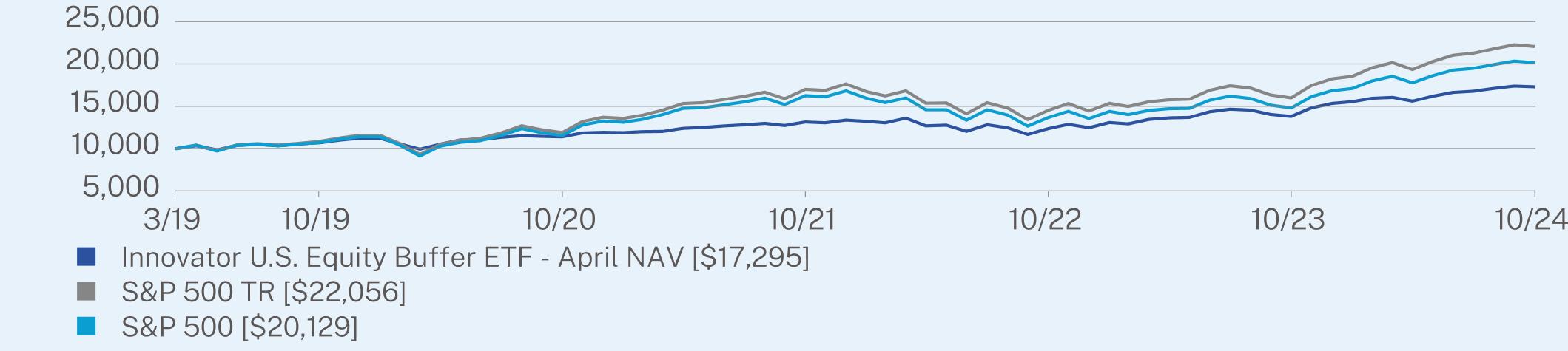

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund seeks to provide investors with returns of the MerQube U.S. Large Cap Equity Buffer Laddered Index. The Index is comprised of the shares of twelve Innovator U.S. Equity Buffer ETFs (Underlying ETFs), the investment in which seeks to provide investors with U.S. large-cap equity market exposure while attempting to limit downside risk through a laddered portfolio of the Underlying ETFs. Under normal market conditions, the Fund will invest substantially all of its assets in the Underlying ETFs, which seek to provide investors with returns that match the price return of the SPDR® S&P 500® ETF Trust (SPY) up to a stated upside Cap, while limiting downside losses to SPY by the amount of its stated Buffer over the course of its respective Outcome Period. Unlike the Underlying ETFs, the Fund itself does not pursue a defined outcome strategy. The Buffer is only provided by the Underlying ETFs and the Fund itself does not provide any stated Buffer against losses.

The S&P 500 Index delivered strong performance during the 12 months ended October 31, 2024. Gains were largely driven by tech and the market interest in AI, coupled with the expectation of a possible soft landing. Market breadth widened in the latter half of the time period, but remained fairly narrow overall.

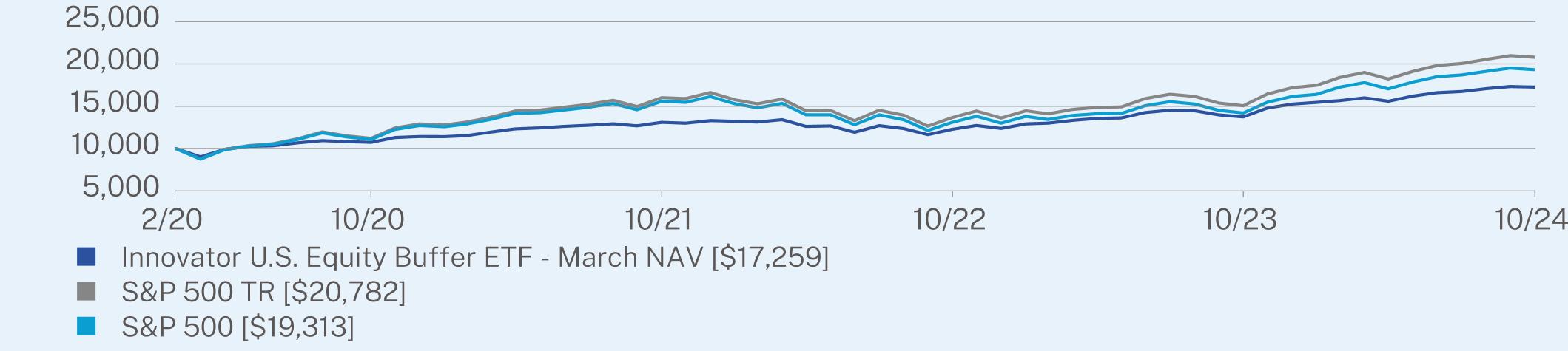

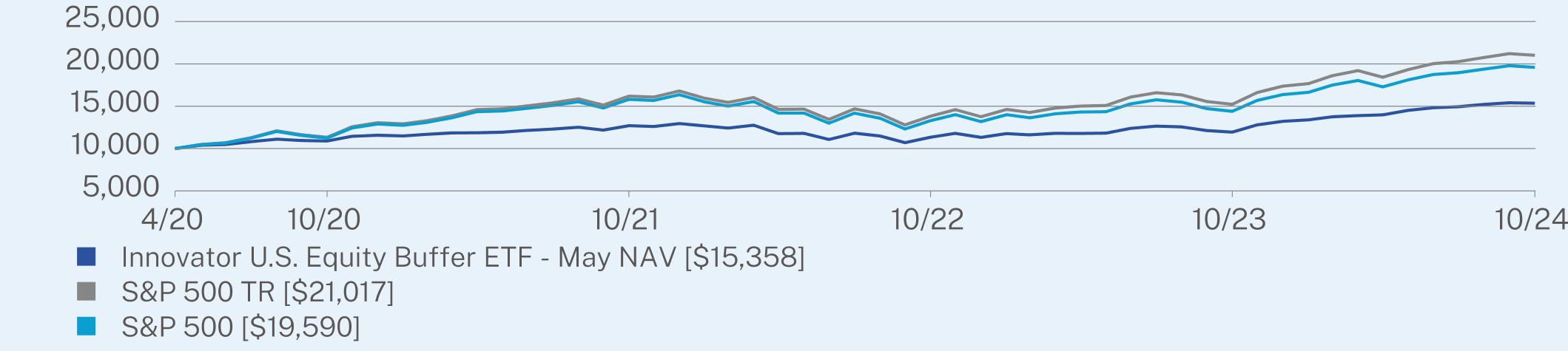

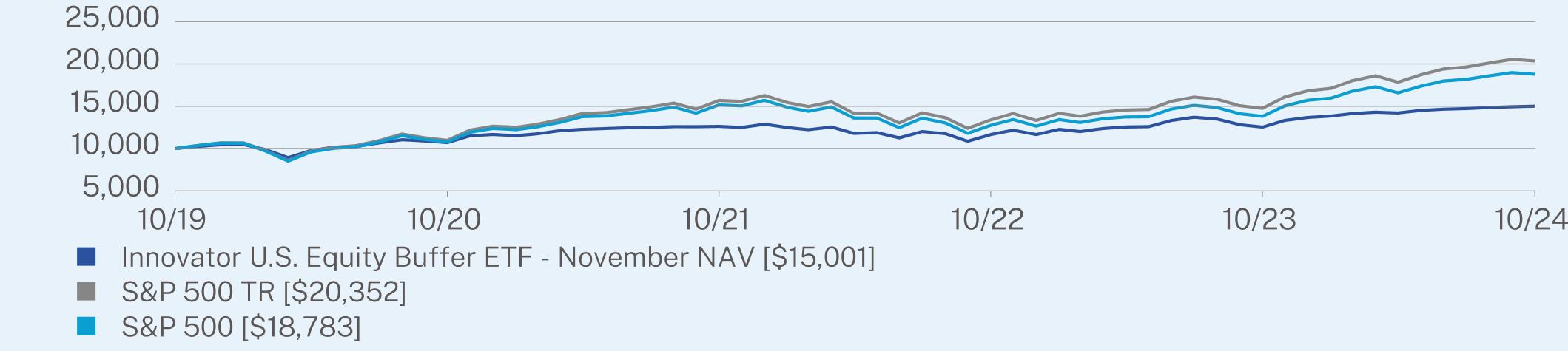

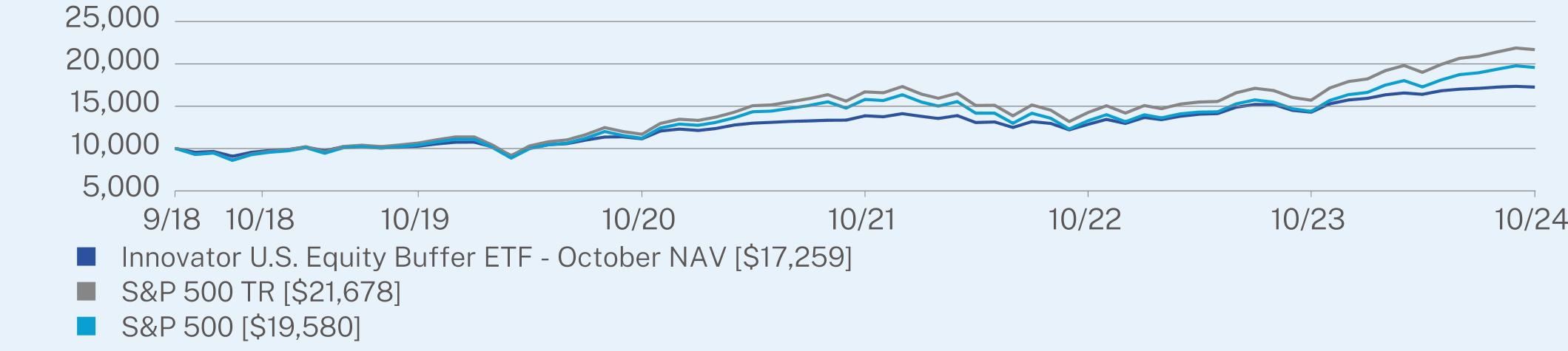

HOW DID THE FUND PERFORM SINCE INCEPTION?*

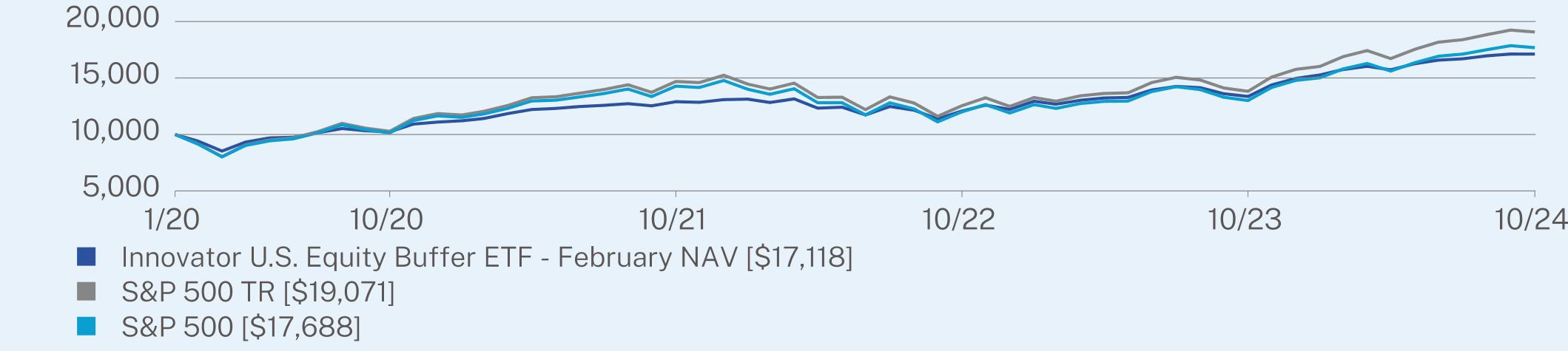

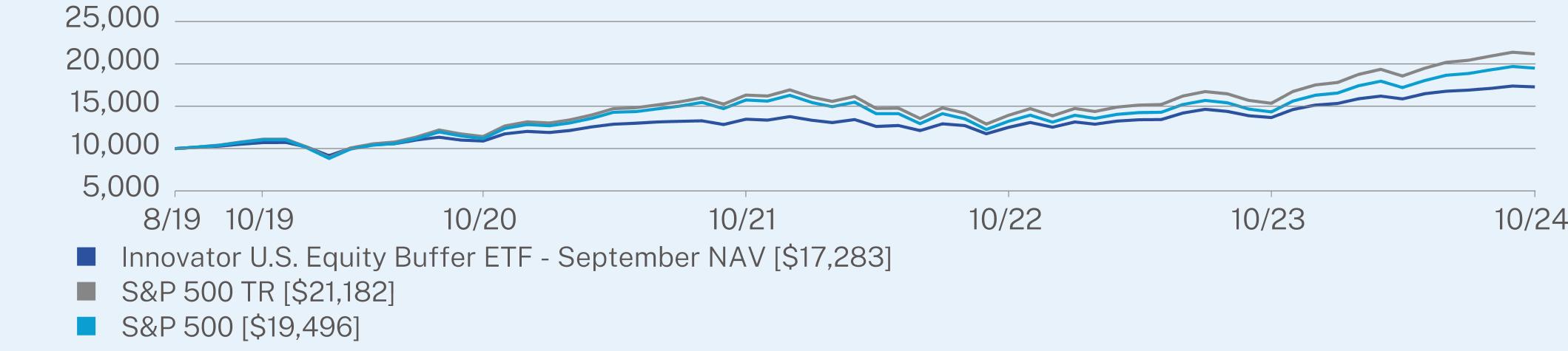

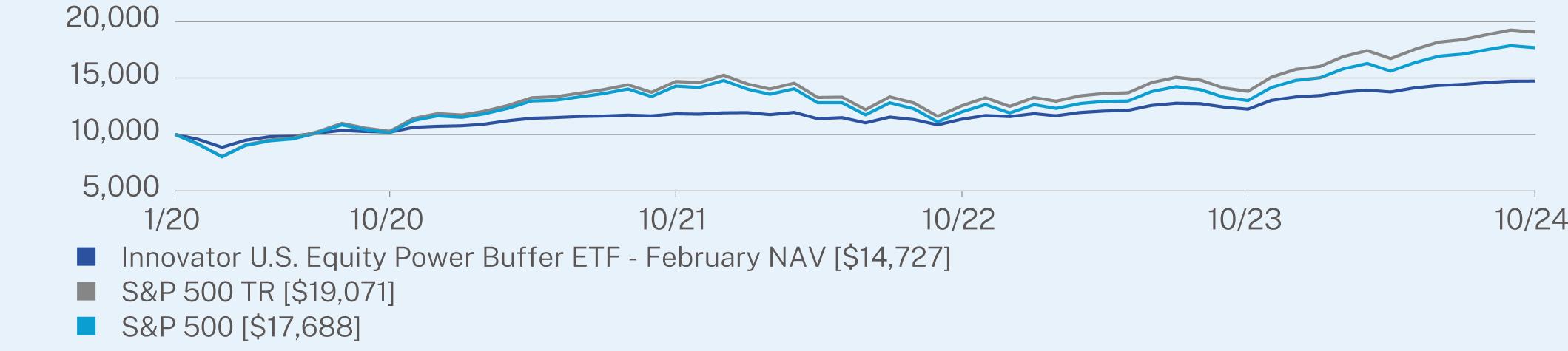

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Innovator Laddered Allocation Buffer ETF™ | PAGE 1 | TSR-AR-45783Y756 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(02/08/2022) |

Innovator Laddered Allocation Buffer ETF NAV | 26.25 | 9.12 |

S&P 500 TR | 38.02 | 10.64 |

MerQube US Large Cap Equity Buffer Laddered Index | 26.35 | 9.22 |

Visit https://www.innovatoretfs.com/etf/?ticker=BUFB for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $164,197,316 |

Number of Holdings | 13 |

Net Advisory Fee | $111,599 |

Portfolio Turnover | 2% |

30-Day SEC Yield | -0.06% |

30-Day SEC Yield Unsubsidized | -0.06% |

Visit https://www.innovatoretfs.com/etf/?ticker=BUFB for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Holdings | (%) |

Innovator U.S. Equity Buffer ETF - November | 8.4% |

Innovator U.S. Equity Buffer ETF -December | 8.4% |

Innovator U.S. Equity Buffer ETF - January | 8.4% |

Innovator U.S. Equity Buffer ETF - February | 8.4% |

Innovator U.S. Equity Buffer ETF - May | 8.3% |

Innovator U.S. Equity Buffer ETF - June | 8.3% |

Innovator U.S. Equity Buffer ETF - March | 8.3% |

Innovator U.S. Equity Buffer ETF - August | 8.3% |

Innovator U.S. Equity Buffer ETF April | 8.3% |

Innovator U.S. Equity Buffer ETF - September | 8.3% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=BUFB.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Laddered Allocation Buffer ETF™ | PAGE 2 | TSR-AR-45783Y756 |

92281004812686866595441317292341006512717

| | |

| Innovator Laddered Allocation Power Buffer ETF™ | |

BUFF (Principal U.S. Listing Exchange: CBOE BZXCboeBZX) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Laddered Allocation Power Buffer ETF™ for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=BUFF. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Laddered Allocation Power Buffer ETF | $11 | 0.10% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

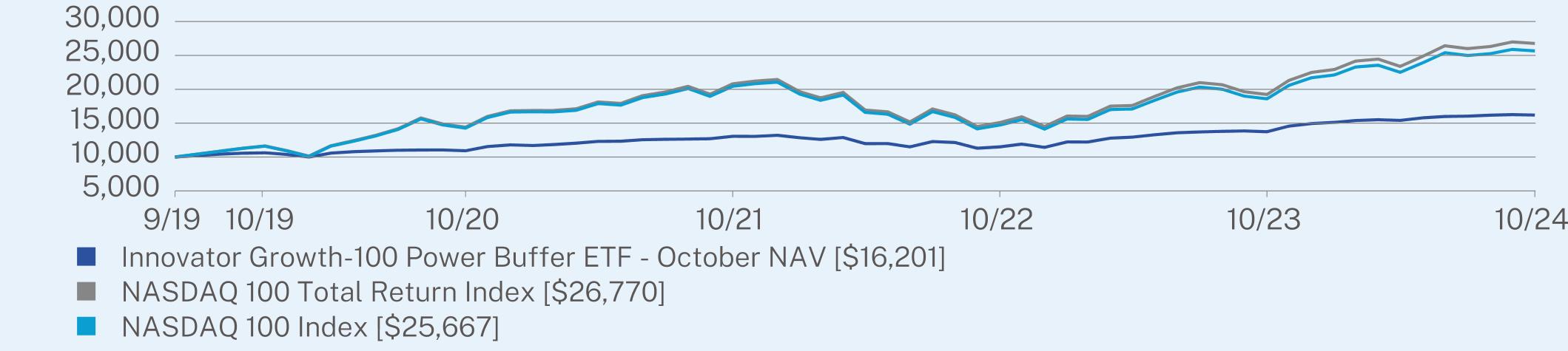

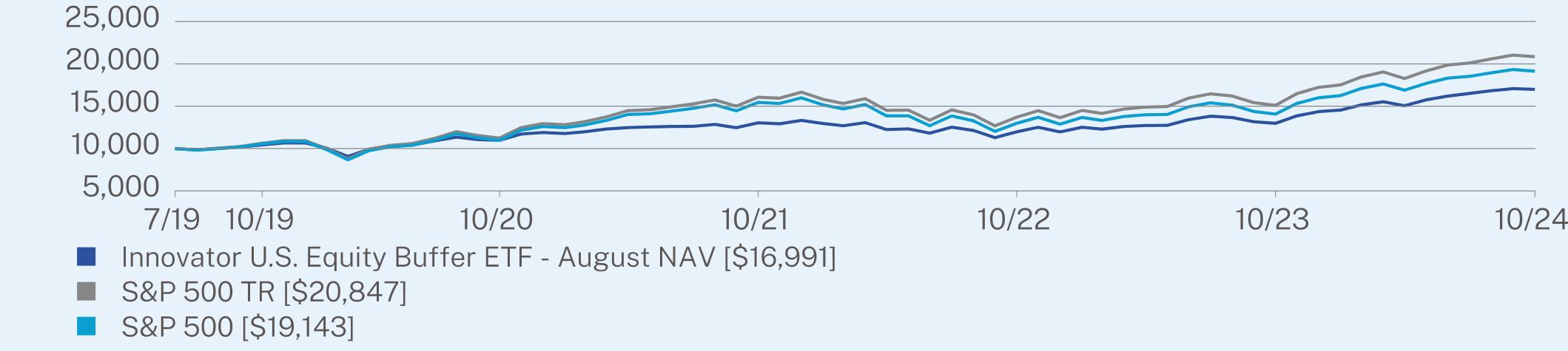

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

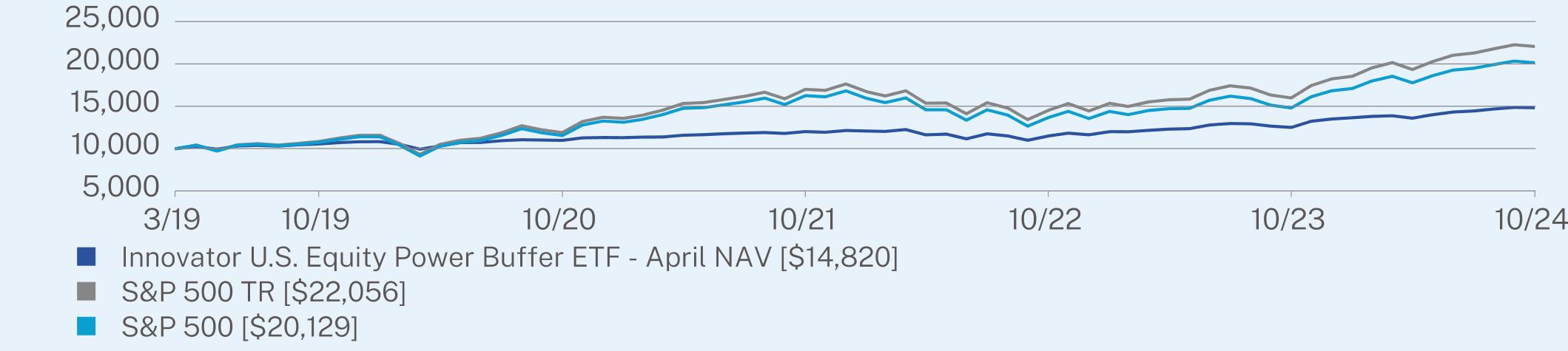

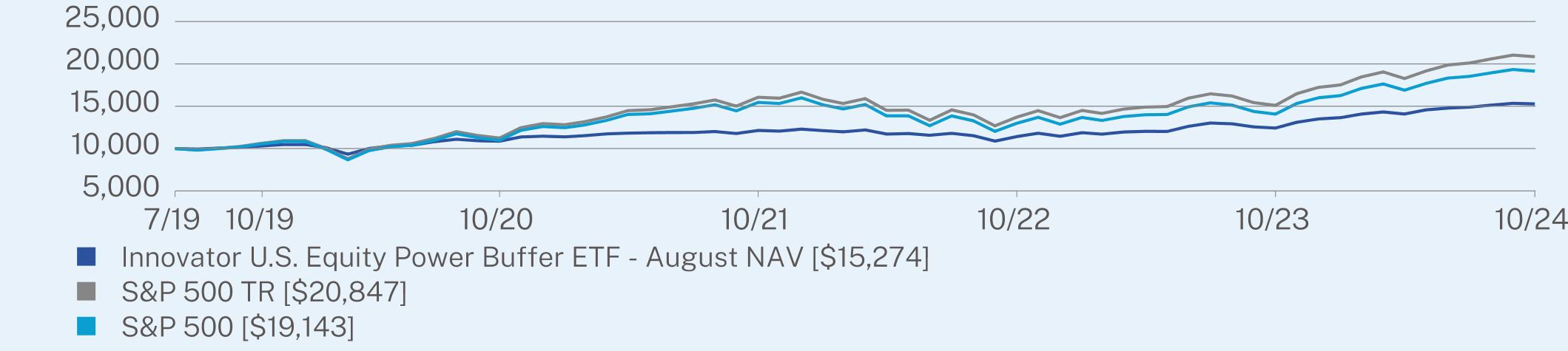

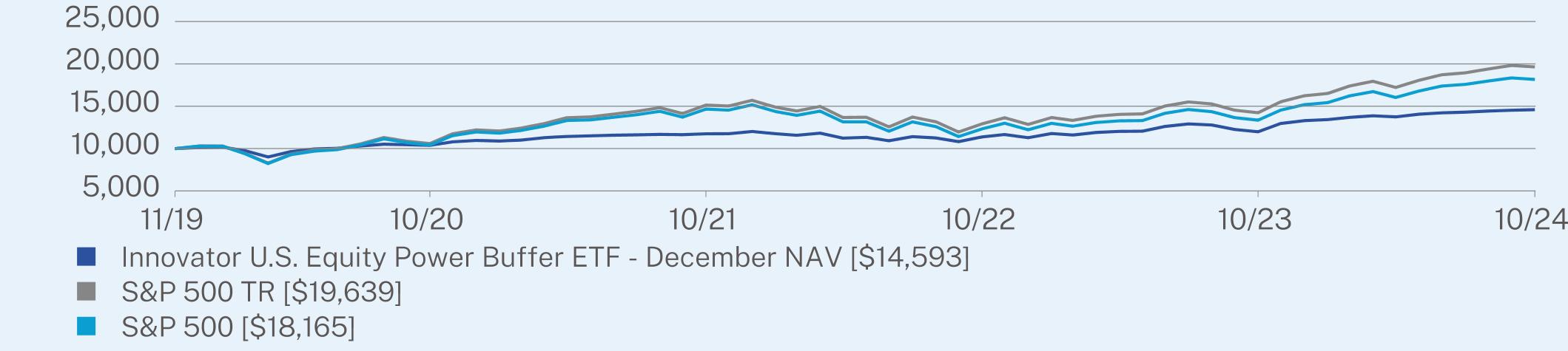

The Fund seeks to provide investors with returns of the FTSE Laddered Power Buffer Strategy Index (Index). The Index is comprised of the shares of twelve Innovator U.S. Equity Power Buffer ETFs (Underlying ETFs), the investment in which seeks to provide investors with U.S. large-cap equity market exposure while attempting to limit downside risk through a laddered portfolio of the Underlying ETFs. Under normal market conditions, the Fund will invest substantially all of its assets in the Underlying ETFs, which seek to provide investors with returns that match the price return of the SPDR® S&P 500® ETF Trust (SPY) up to a stated upside Cap, while limiting downside losses to SPY by the amount of its stated Buffer over the course of its respective Outcome Period. Unlike the Underlying ETFs, the Fund itself does not pursue a defined outcome strategy. The Buffer is only provided by the Underlying ETFs and the Fund itself does not provide any stated Buffer against losses.

The S&P 500 Index delivered strong performance during the 12 months ended October 31, 2024. Gains were largely driven by tech and the market interest in AI, coupled with the expectation of a possible soft landing. Market breadth widened in the latter half of the time period, but remained fairly narrow overall.

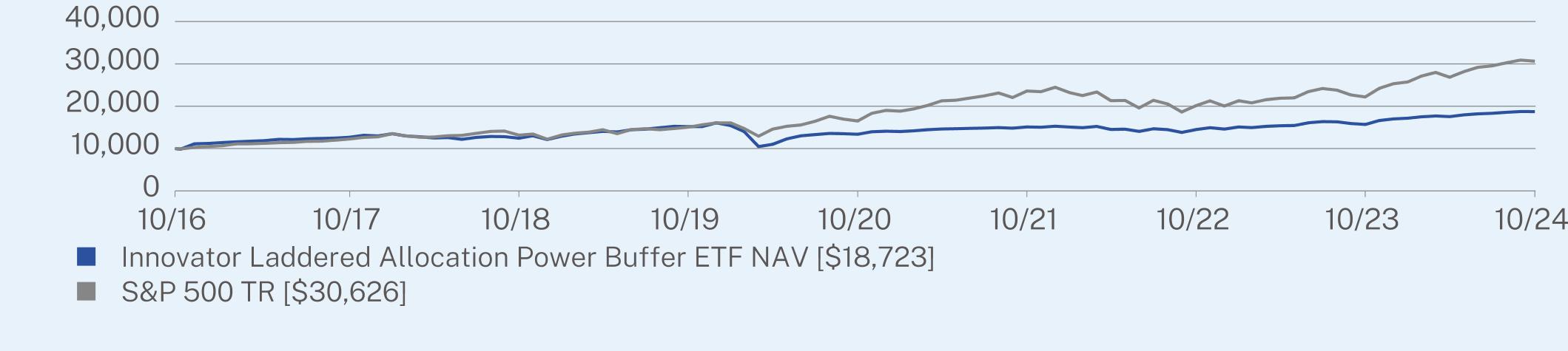

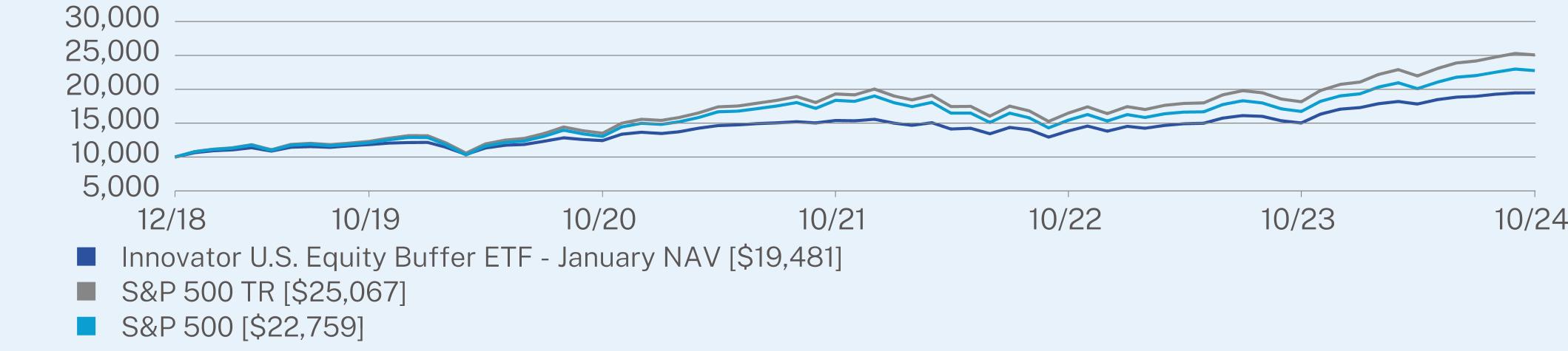

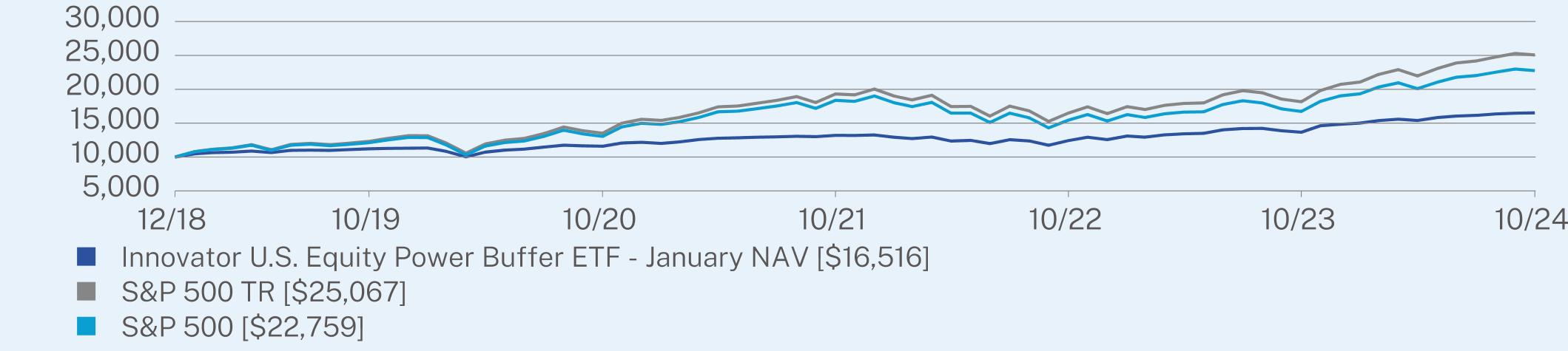

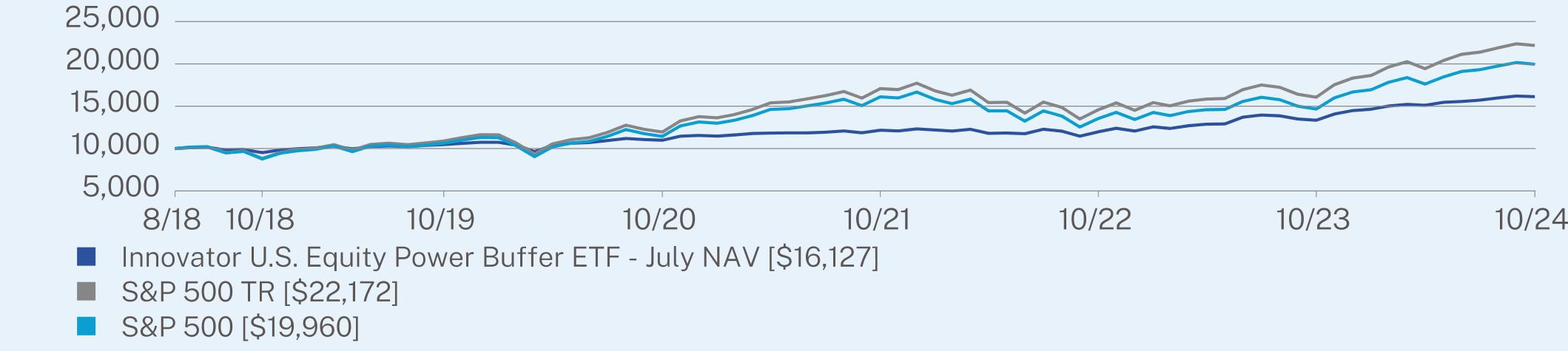

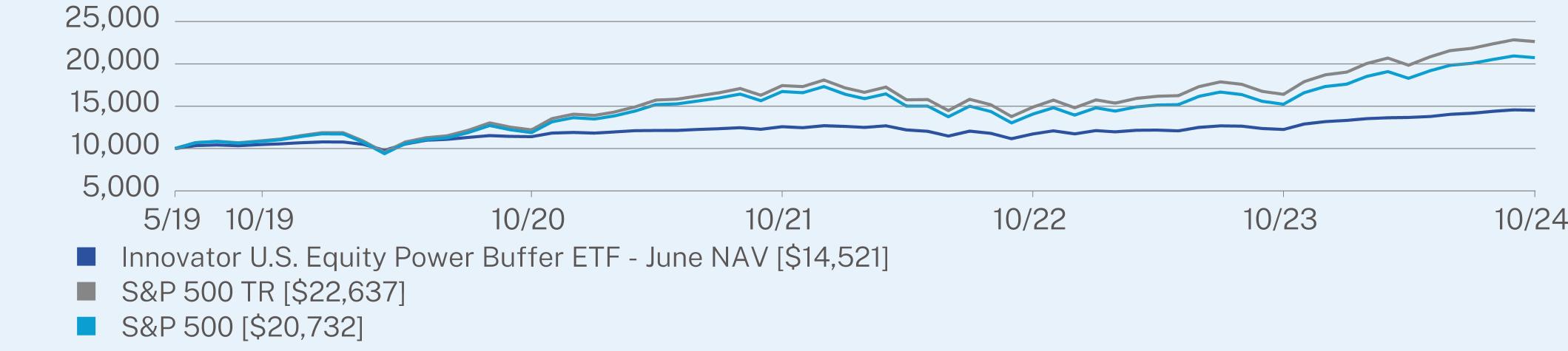

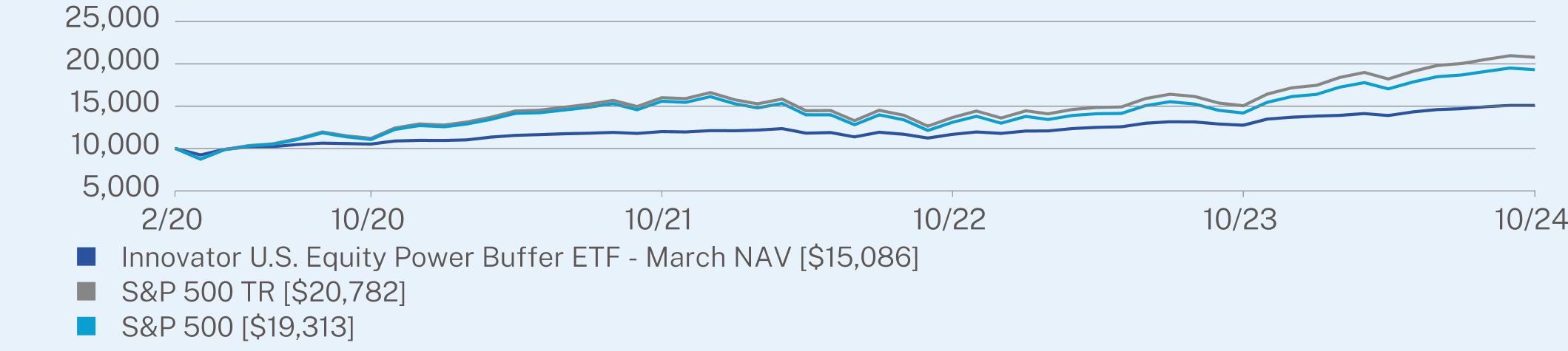

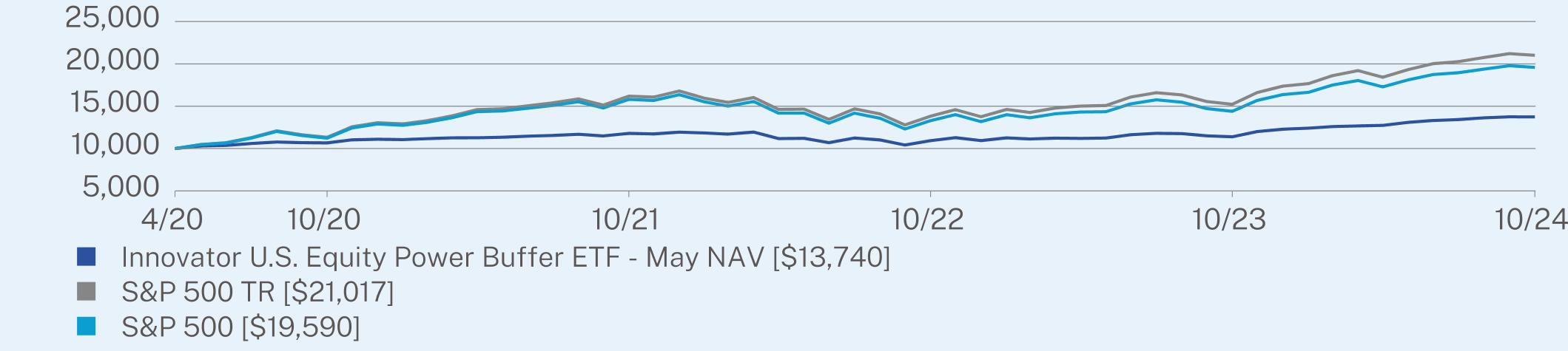

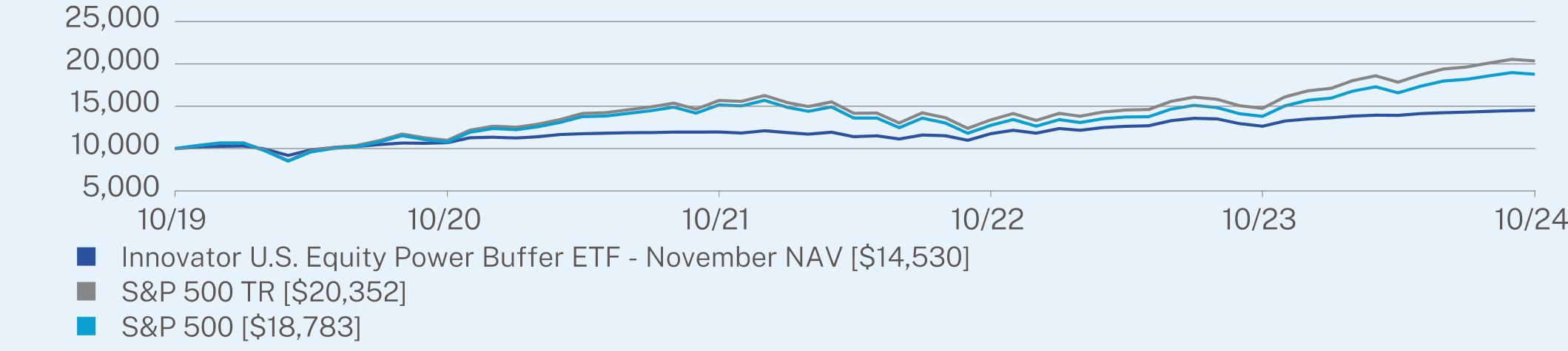

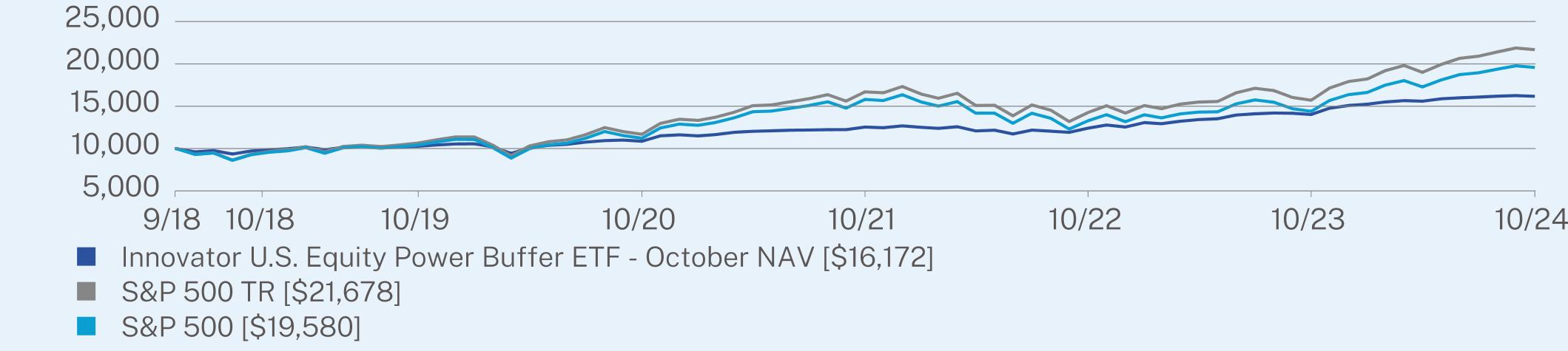

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Innovator Laddered Allocation Power Buffer ETF™ | PAGE 1 | TSR-AR-45783Y814 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(10/19/2016) |

Innovator Laddered Allocation Power Buffer ETF NAV | 19.33 | 4.27 | 8.12 |

S&P 500 TR | 38.02 | 15.27 | 14.95 |

FTSE Laddered Power Buffer Strategy Price Return Index | 19.42 | | 8.29** |

Visit https://www.innovatoretfs.com/etf/?ticker=BUFF for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| ** | Since Inception return is cumulative and from the date the Fund began tracking the FTSE Laddered Power Buffer Strategy Price Return Index. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $482,497,192 |

Number of Holdings | 13 |

Net Advisory Fee | $410,602 |

Portfolio Turnover | 1% |

30-Day SEC Yield | -0.05% |

30-Day SEC Yield Unsubsidized | -0.05% |

Visit https://www.innovatoretfs.com/etf/?ticker=BUFF for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Holdings | (%) |

Innovator U.S. Equity Power Buffer ETF - December | 8.4% |

Innovator U.S. Equity Power Buffer ETF - November | 8.4% |

Innovator U.S. Equity Power Buffer ETF - January | 8.4% |

Innovator U.S. Equity Power Buffer ETF - February | 8.3% |

Innovator U.S. Equity Power Buffer ETF - May | 8.3% |

Innovator U.S. Equity Power Buffer ETF - March | 8.3% |

Innovator U.S. Equity Power Buffer ETF - June | 8.3% |

Innovator U.S. Equity Power Buffer ETF - April | 8.3% |

Innovator U.S. Equity Power Buffer ETF - September | 8.3% |

Innovator U.S. Equity Power Buffer ETF - August | 8.3% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=BUFF.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Laddered Allocation Power Buffer ETF™ | PAGE 2 | TSR-AR-45783Y814 |

9855126741243515192133791510914487156901872399181226113162150481650923594201462219030626

| | |

| Innovator Nasdaq-100 Managed Floor ETF® | |

QFLR (Principal U.S. Listing Exchange: NYSE ARCANYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Nasdaq-100 Managed Floor ETF® for the period of January 24, 2024, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=QFLR. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Nasdaq-100 Managed Floor ETF | $72 | 0.89% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

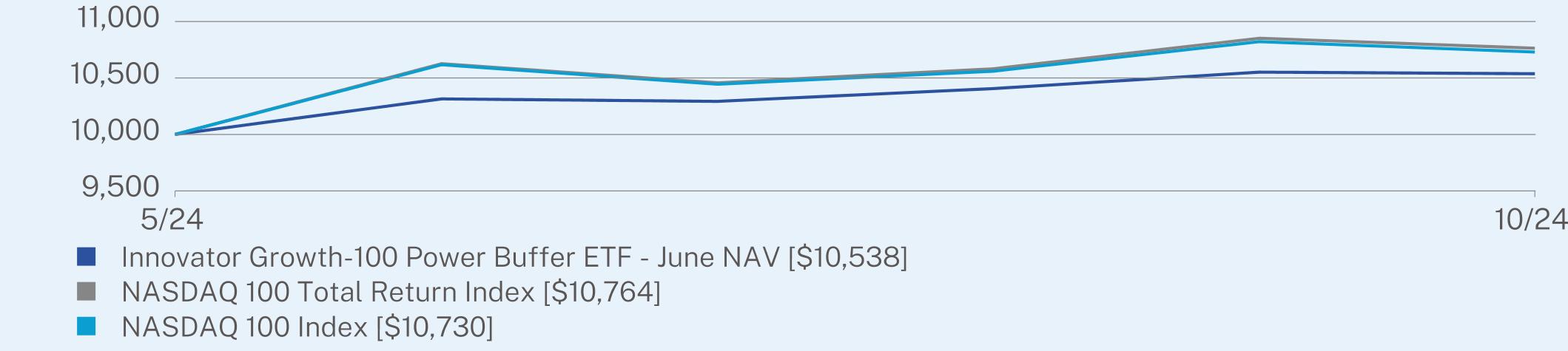

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

Since its inception on January 24, 2024, through October 31, 2024, QFLR generated a total return of 10.11%. Over the same period, the Nasdaq-100 Total Return Index returned 14.38%. The options overlay portion of the portfolio is comprised of two components: short-dated call selling (“Calls”) and long-dated put buying (“Puts”). The calls contributed a loss of 2.13%, while the puts contributed a loss of 2.37%.

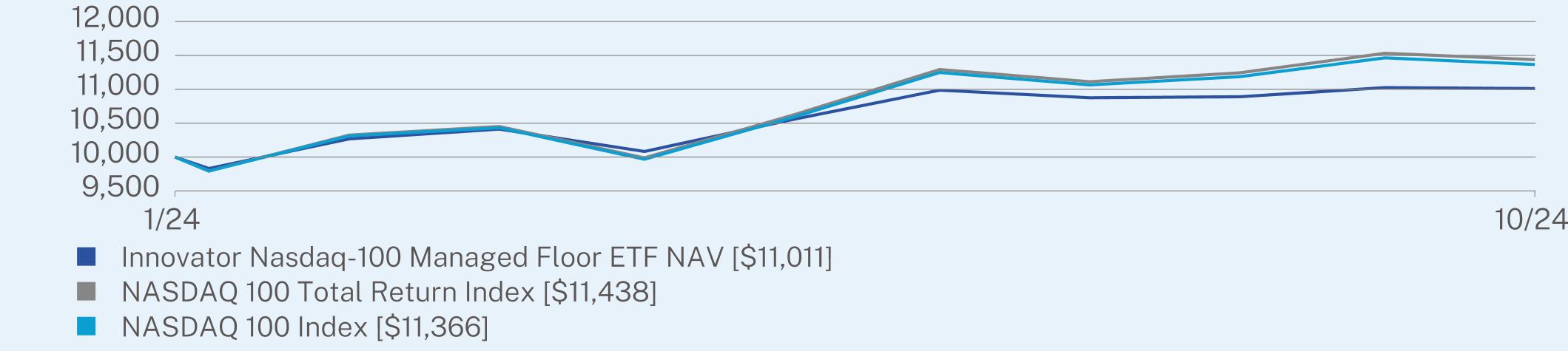

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(01/24/2024) |

Innovator Nasdaq-100 Managed Floor ETF NAV | 10.11 |

NASDAQ 100 Total Return Index | 14.38 |

NASDAQ 100 Index | 13.66 |

Visit https://www.innovatoretfs.com/etf/?ticker=QFLR for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Innovator Nasdaq-100 Managed Floor ETF® | PAGE 1 | TSR-AR-45783Y681 |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $207,760,873 |

Number of Holdings | 50 |

Net Advisory Fee | $816,897 |

Portfolio Turnover | 20% |

30-Day SEC Yield | -0.08% |

30-Day SEC Yield Unsubsidized | -0.08% |

Visit https://www.innovatoretfs.com/etf/?ticker=QFLR for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Sectors | (%) |

Technology | 47.7% |

Communications | 23.6% |

Consumer, Cyclical | 11.9% |

Consumer, Non-cyclical | 10.9% |

Finance and Insurance | 1.9% |

Utilities | 1.5% |

Energy | 0.8% |

Cash & Other | 1.7% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=QFLR.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Nasdaq-100 Managed Floor ETF® | PAGE 2 | TSR-AR-45783Y681 |

110111143811366

| | |

| Innovator Power Buffer Step-Up Strategy ETF® | |

PSTP (Principal U.S. Listing Exchange: NYSE ArcaNYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Power Buffer Step-Up Strategy ETF® for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=PSTP. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Power Buffer Step-Up Strategy ETF | $97 | 0.89% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund is actively managed and seeks to provide risk-managed exposure to the SPDR S&P 500 ETF Trust (SPY). The Fund seeks to provide an alternative to managing and evaluating a series of buffer strategies, seeking to provide the upside of the SPY while mitigating downside losses with 9% or 15% built-in buffers.

Through the Options Portfolio, the Fund will seek to participate in the price return of the SPY, subject to investment gains up to a limit, and provide protection against SPY losses up to a limit.

The Sub-Adviser will actively monitor the performance of the Options Portfolio and, if certain criteria are met, rebalance or “step-up” the portfolio to protect capital or capture portfolio gains experienced by the Fund, depending on its evaluation of market conditions.

During the 12 months ended October 31, 2024, gains were largely driven by tech and the market interest in AI, coupled with the expectation of a possible soft landing. Market breadth widened in the latter half of the time period, but remained fairly narrow overall.

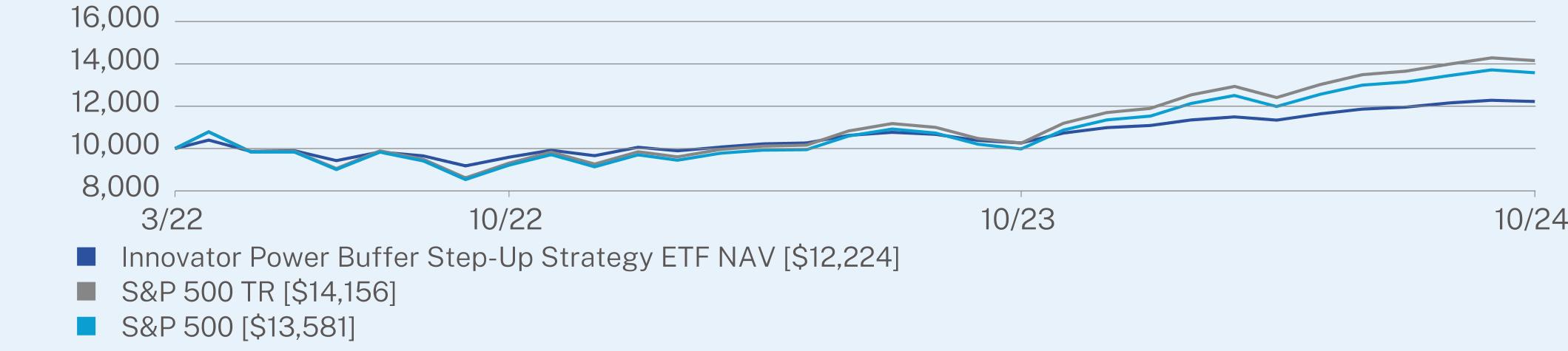

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Innovator Power Buffer Step-Up Strategy ETF® | PAGE 1 | TSR-AR-45783Y723 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(03/07/2022) |

Innovator Power Buffer Step-Up Strategy ETF NAV | 19.06 | 7.87 |

S&P 500 TR | 38.02 | 14.00 |

S&P 500 | 36.04 | 12.23 |

Visit https://www.innovatoretfs.com/etf/?ticker=PSTP for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $96,492,107 |

Number of Holdings | 4 |

Net Advisory Fee | $761,515 |

Portfolio Turnover | 0% |

30-Day SEC Yield | -0.87% |

30-Day SEC Yield Unsubsidized | -0.87% |

Visit https://www.innovatoretfs.com/etf/?ticker=PSTP for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Holdings | (%) |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $5.67 | 98.8% |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $573.73 | 5.2% |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $640.14 | -1.9% |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $487.68 | -2.1% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=PSTP.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Power Buffer Step-Up Strategy ETF® | PAGE 2 | TSR-AR-45783Y723 |

95921026712224931210257141569217998313581

| | |

| Innovator S&P Investment Grade Preferred ETF | |

EPRF (Principal U.S. Listing Exchange: CBOE BZXCboeBZX) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator S&P Investment Grade Preferred ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=EPRF. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator S&P Investment Grade Preferred ETF | $52 | 0.47% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

EPRF is the only 100% investment grade preferred ETF available. Investment grade preferred stocks tend to have more duration than benchmark preferred stocks because their higher credit quality typically means they are structured as perpetual cash flows (no maturity).

During the 12 months ended October 31, 2024, longer-term rates declined and pushed preferred stock prices higher. Preferred stocks were one of the best performing fixed income asset classes, outperforming Treasuries, investment grade, and high yield corporates.

Over the time period listed above, EPRF performed mostly in line with preferred stock benchmarks. The risk-on environment did not materially impact EPRF, with its higher credit quality. Even after its recent price rally, the asset class continues to provide attractive yields.

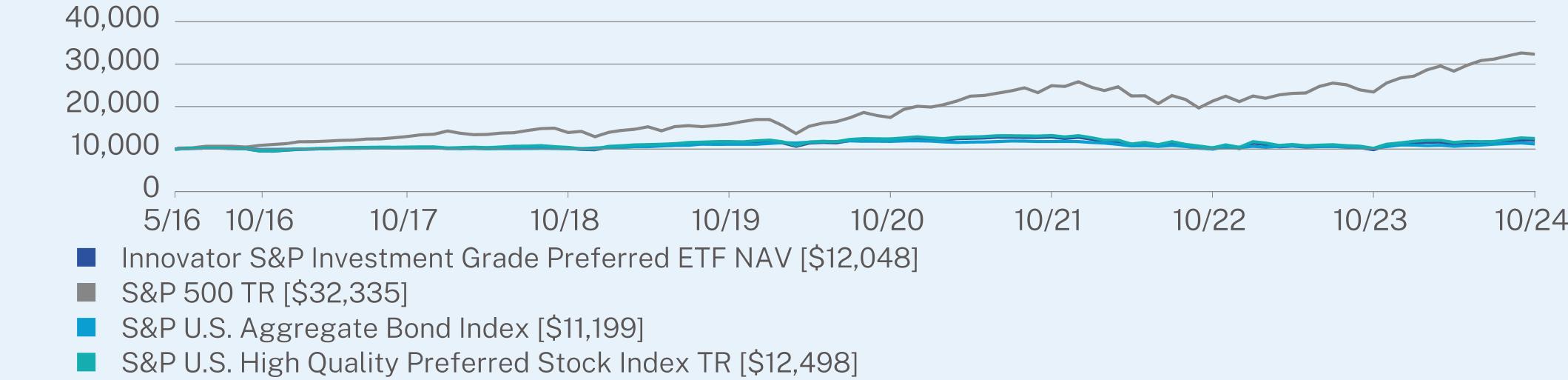

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Innovator S&P Investment Grade Preferred ETF | PAGE 1 | TSR-AR-45783Y822 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(05/23/2016) |

Innovator S&P Investment Grade Preferred ETF NAV | 22.36 | 0.88 | 2.23 |

S&P 500 TR | 38.02 | 15.27 | 14.92 |

S&P U.S. Aggregate Bond Index | 10.15 | 0.13 | 1.35 |

S&P U.S. High Quality Preferred Stock Index TR | 22.74 | 1.22 | 2.68 |

Visit https://www.innovatoretfs.com/etf/?ticker=EPRF for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $107,157,089 |

Number of Holdings | 73 |

Net Advisory Fee | $508,747 |

Portfolio Turnover | 33% |

Average Credit Quality | AAA |

Effective Duration | 2 yrs |

Visit https://www.innovatoretfs.com/etf/?ticker=EPRF for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Holdings | (%) |

Mount Vernon Liquid Assets Portfolio, LLC | 9.1% |

Enstar Group Ltd. | 5.0% |

Apollo Global Management, Inc. | 4.8% |

Voya Financial, Inc. | 4.7% |

Hartford Financial Services Group, Inc. | 4.6% |

State Street Corp. | 4.6% |

Axis Capital Holdings Ltd. | 4.5% |

Northern Trust Corp. | 4.4% |

Agree Realty Corp. | 4.3% |

Cullen/Frost Bankers, Inc. | 4.3% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=EPRF.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator S&P Investment Grade Preferred ETF | PAGE 2 | TSR-AR-45783Y822 |

1005910346102281153212113128369978984612048104711294613897158881743124911212712342832335101431023810053111271179311772100631016711199100931045210389117631240513201102871018312498

| | |

| Innovator U.S. Small Cap Managed Floor ETF® | |

RFLR (Principal U.S. Listing Exchange: NYSE ArcaNYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator U.S. Small Cap Managed Floor ETF® for the period of September 16, 2024, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=RFLR. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator U.S. Small Cap Managed Floor ETF | $11 | 0.89% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

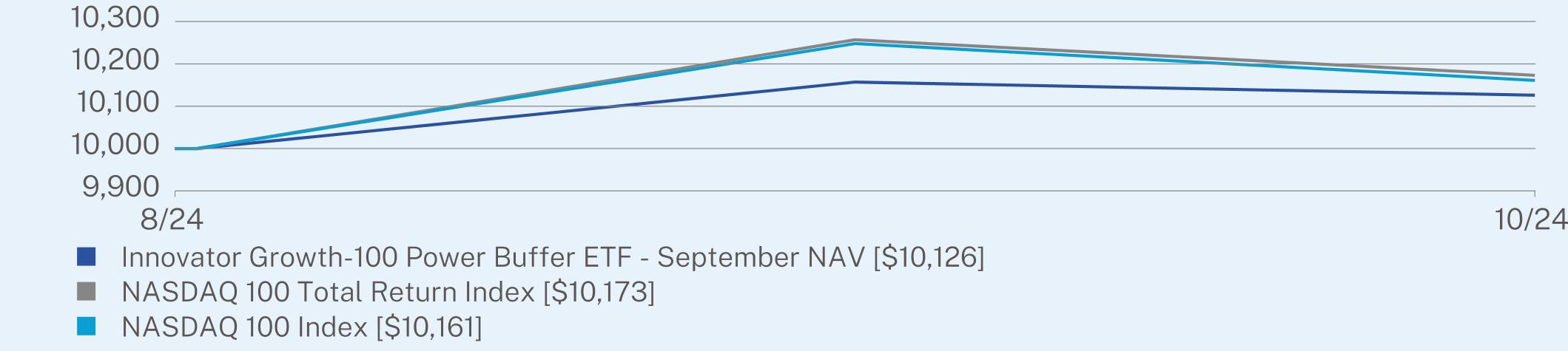

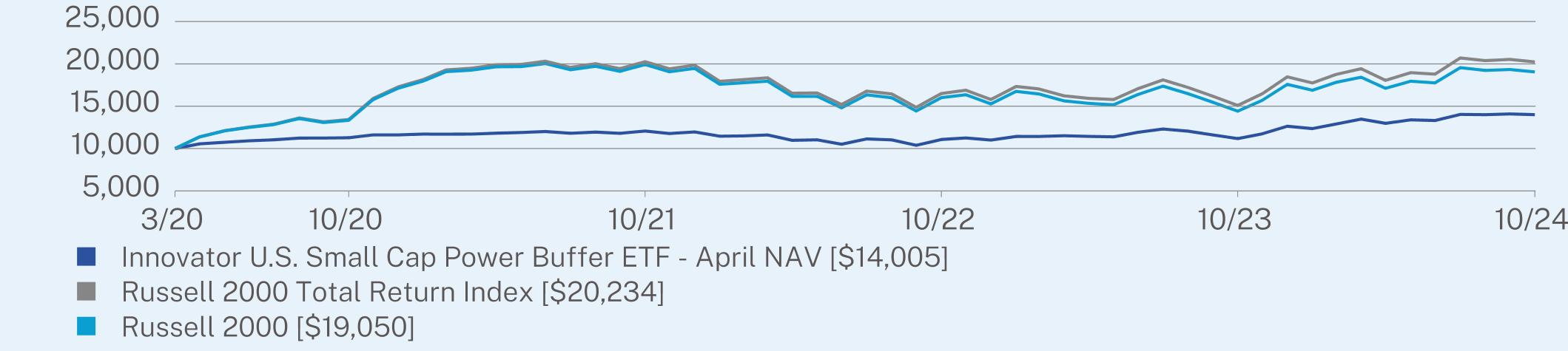

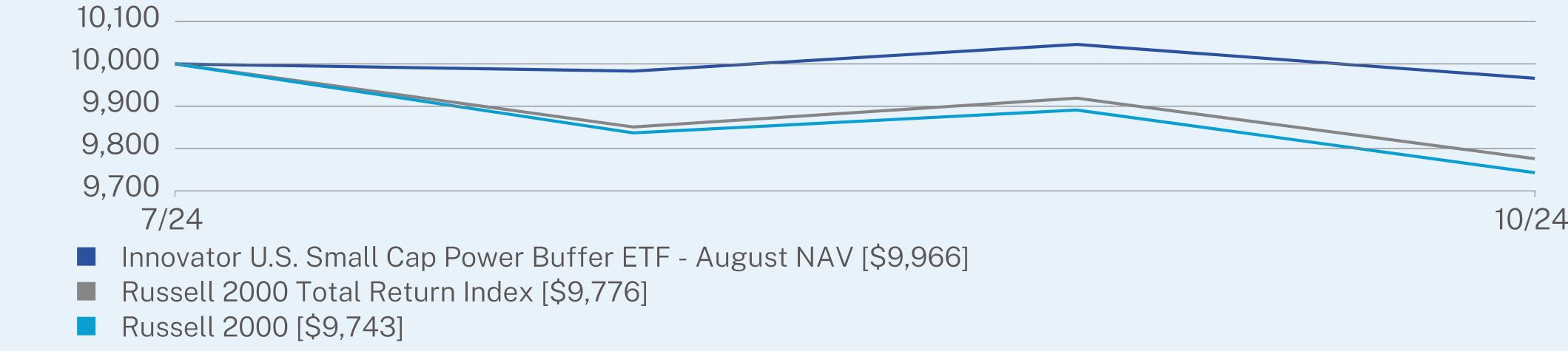

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

Since its inception on September 16, 2024, through October 31, 2024, RFLR generated a total return of 1.92%. Over the same period, the Russell 2000 returned 0.34%. The options overlay portion of the portfolio is comprised of two components: short-dated call selling (“Calls”) and long-dated put buying (“Puts”). The calls contributed a gain of 1.58%, while the puts contributed a loss of 0.29%.

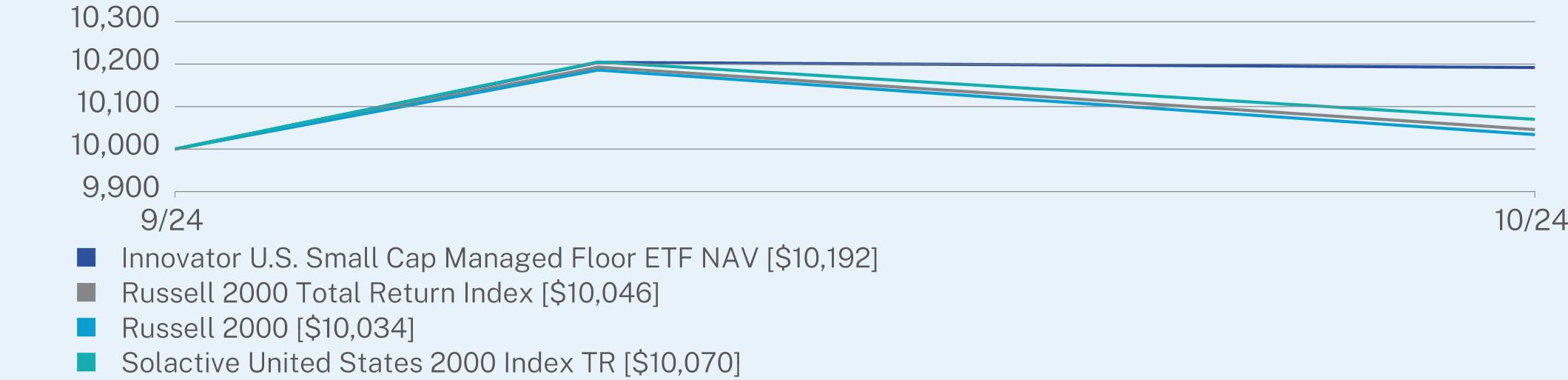

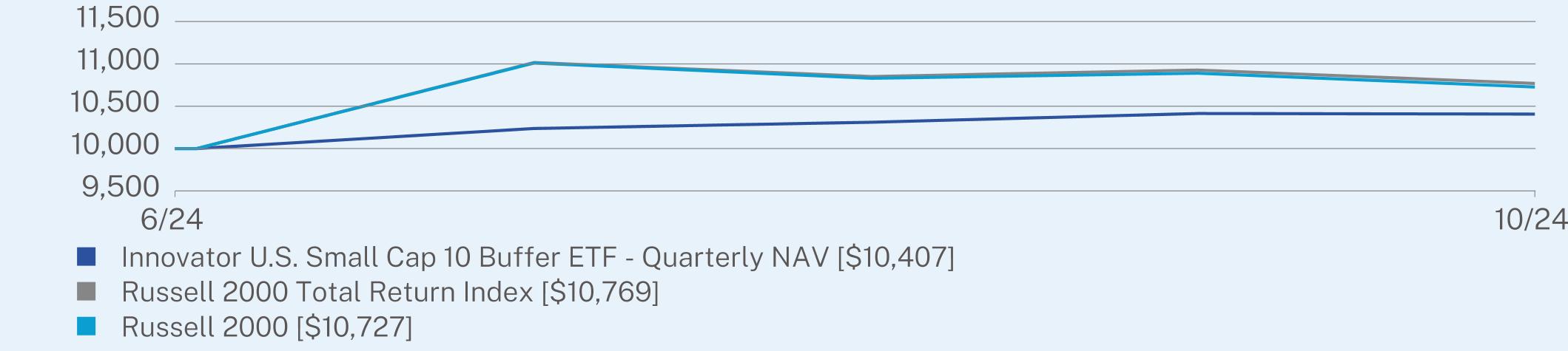

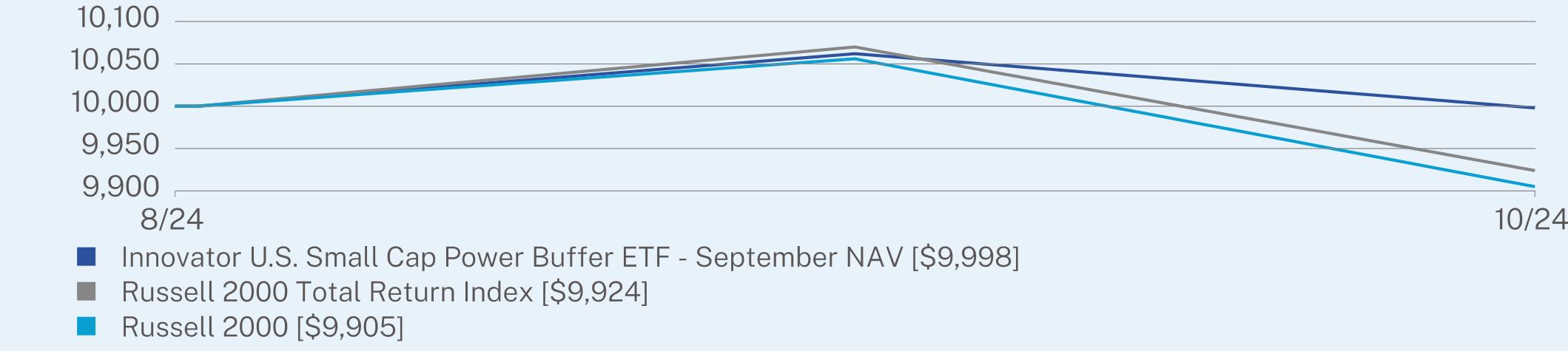

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(09/16/2024) |

Innovator U.S. Small Cap Managed Floor ETF NAV | 1.92 |

Russell 2000 Total Return Index | 0.46 |

Russell 2000 | 0.34 |

Solactive United States 2000 Index TR | 0.70 |

Visit https://www.innovatoretfs.com/etf/?ticker=RFLR for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Innovator U.S. Small Cap Managed Floor ETF® | PAGE 1 | TSR-AR-45784N502 |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $3,821,912 |

Number of Holdings | 1,227 |

Net Advisory Fee | $3,410 |

Portfolio Turnover | 24% |

30-Day SEC Yield | 0.61% |

30-Day SEC Yield Unsubsidized | 0.61% |

Visit https://www.innovatoretfs.com/etf/?ticker=RFLR for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Sectors | (%) |

Financial | 25.0% |

Consumer, Non-cyclical | 21.4% |

Industrial | 12.9% |

Consumer, Cyclical | 12.9% |

Technology | 9.6% |

Energy | 4.0% |

Communications | 3.7% |

Basic Materials | 3.4% |

Finance and Insurance | 2.3% |

Cash & Other | 4.8% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=RFLR.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator U.S. Small Cap Managed Floor ETF® | PAGE 2 | TSR-AR-45784N502 |

10192100461003410070

| | |

| Innovator Uncapped Accelerated U.S. Equity ETF™ | |

XUSP (Principal U.S. Listing Exchange: CBOE BZXCboeBZX) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Uncapped Accelerated U.S. Equity ETF™ for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=XUSP. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Uncapped Accelerated U.S. Equity ETF | $99 | 0.79% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund is actively managed and seeks to provide investors with the potential for rates of return that outperform the price return of the SPDR® S&P 500® ETF Trust (SPY) after achieving performance thresholds.

In markets where the S&P 500 Index is down, the Fund is designed to match the S&P 500 Index. Alternatively, in markets where the S&P 500 Index is appreciating, the Fund has potential to outperform the S&P 500 Index during periods where SPY achieves sustained positive performance.

The S&P 500 Index delivered strong performance during the 12 months ended October 31, 2024. Gains were largely driven by tech and the market interest in AI, coupled with the expectation of a possible soft landing. Market breadth widened in the latter half of the time period, but remained fairly narrow overall.

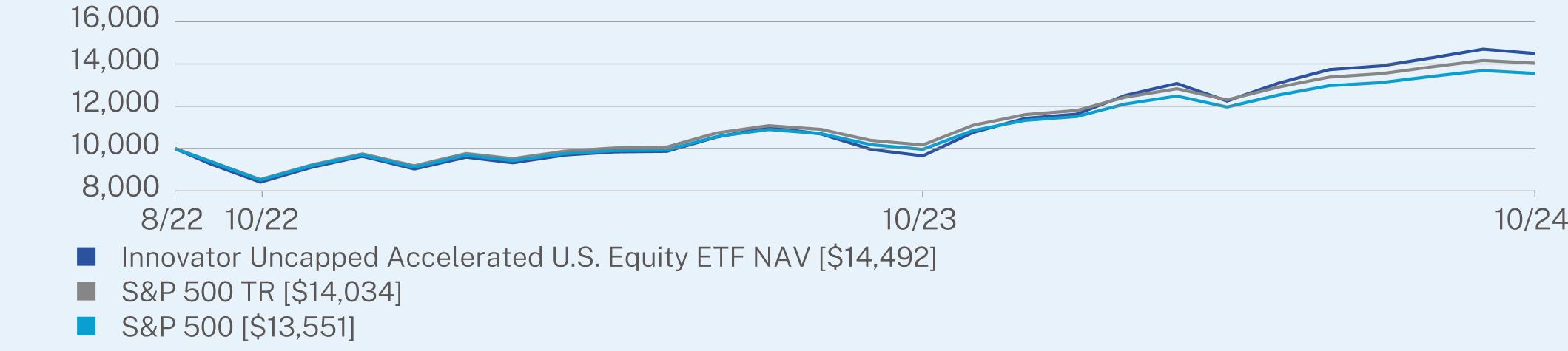

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(08/10/2022) |

Innovator Uncapped Accelerated U.S. Equity ETF NAV | 50.11 | 18.15 |

S&P 500 TR | 38.02 | 16.45 |

S&P 500 | 36.04 | 14.64 |

Visit https://www.innovatoretfs.com/etf/?ticker=XUSP for more recent performance information.

| Innovator Uncapped Accelerated U.S. Equity ETF™ | PAGE 1 | TSR-AR-45783Y699 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $34,085,234 |

Number of Holdings | 12 |

Net Advisory Fee | $188,427 |

Portfolio Turnover | 0% |

30-Day SEC Yield | -0.78% |

30-Day SEC Yield Unsubsidized | -0.78% |

Visit https://www.innovatoretfs.com/etf/?ticker=XUSP for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Holdings | (%) |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $5.79 | 25.8% |

SPDR S&P 500 ETF, Expiration: 03/31/2025; Exercise Price: $5.25 | 24.7% |

SPDR S&P 500 ETF, Expiration: 12/31/2024; Exercise Price: $4.80 | 23.8% |

SPDR S&P 500 ETF, Expiration: 06/30/2025; Exercise Price: $5.49 | 23.4% |

SPDR S&P 500 ETF, Expiration: 12/31/2024; Exercise Price: $499.08 | 5.6% |

SPDR S&P 500 ETF, Expiration: 03/31/2025; Exercise Price: $549.22 | 3.2% |

SPDR S&P 500 ETF, Expiration: 06/30/2025; Exercise Price: $571.43 | 2.6% |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $602.45 | 2.1% |

SPDR S&P 500 ETF, Expiration: 09/30/2025; Exercise Price: $573.78 | -2.0% |

SPDR S&P 500 ETF, Expiration: 06/30/2025; Exercise Price: $544.24 | -2.3% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=XUSP.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator Uncapped Accelerated U.S. Equity ETF™ | PAGE 2 | TSR-AR-45783Y699 |

9121965414492923210168140349197996113551

| | |

| Innovator 20+ Year Treasury Bond 5 Floor ETF® - Quarterly | |

TFJL (Principal U.S. Listing Exchange: Cboe BZXCboeBZX) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator 20+ Year Treasury Bond 5 Floor ETF® - Quarterly for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=TFJL. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator 20+ Year Treasury Bond 5 Floor ETF - Quarterly | $82 | 0.79% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund seeks to match the price returns of the iShares 20+ Year U.S. Treasury ETF (TLT) up to a stated upside Cap, while limiting downside losses to TLT by the amount of its stated Floor over the course of the Outcome Period. Because the period contemplated herein does not align with the Outcome Period of the Fund, the Fund’s performance stated over the period covered by this report does not reflect the implementation of the Fund’s investment strategy for the full Outcome Period.

In markets where the I.C.E US Treasury 20+ Year Index is down, the risk mitigation attributes of the stated Floor provide an opportunity for the Fund to soften market losses during the reporting period and outperform the I.C.E US Treasury 20+ Year Index. Alternatively, in markets where the I.C.E US Treasury 20+ Year Index is appreciating, the risk mitigation attributes of the Floor may limit the upside performance over the reporting period by virtue of the Fund’s Cap, which limits the amount of potential Fund gains and represents the absolute maximum return that the Fund can achieve for its Outcome Period. The effect of the Cap and the Floor will also cause the Fund to experience different returns than TLT.

The year ended October 31, 2024, was mixed for 20+ Year Treasuries, reflecting shifts in the rate environment and evolving market expectations. Performance for the period finished moderately positive, with a rally in longer-duration bonds in Q3 2024 driven by signs of easing inflation and softer economic data. However, renewed strength in the economy later in the period, coupled with persistent uncertainty over Federal Reserve policy, led to rising long-term yields, tempering gains and introducing volatility.

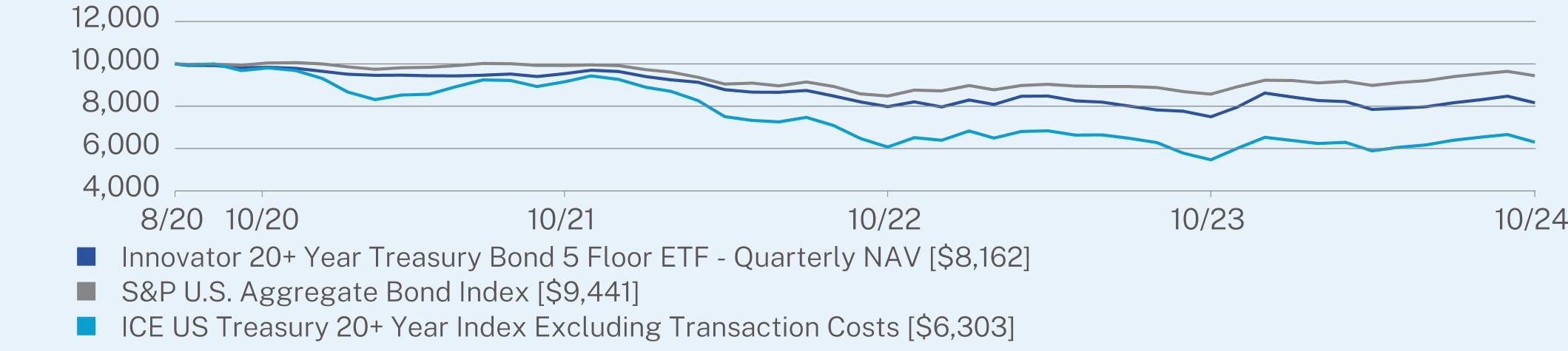

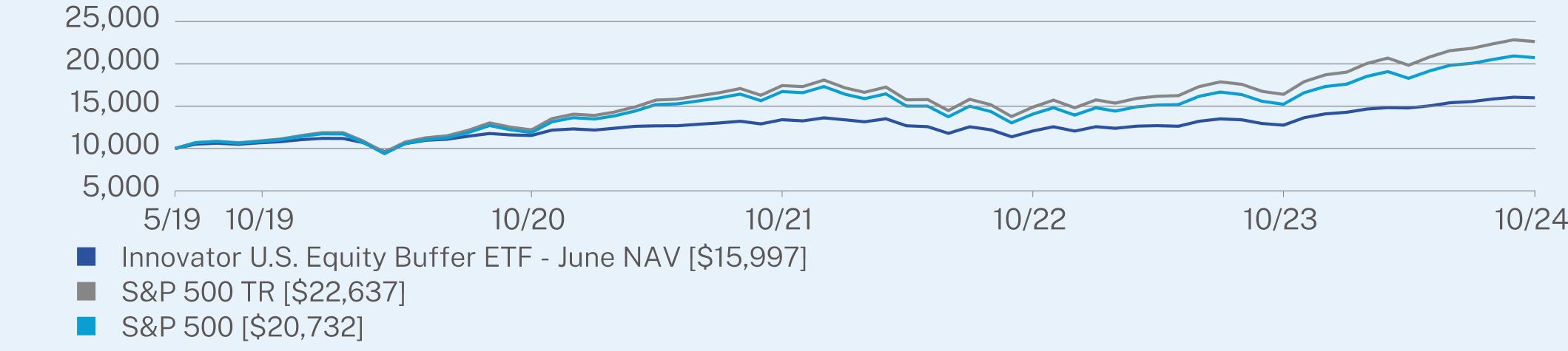

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Innovator 20+ Year Treasury Bond 5 Floor ETF® - Quarterly | PAGE 1 | TSR-AR-45782C243 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(08/17/2020) |

Innovator 20+ Year Treasury Bond 5 Floor ETF - Quarterly NAV | 8.79 | -4.72 |

S&P U.S. Aggregate Bond Index | 10.15 | -1.36 |

ICE US Treasury 20+ Year Index Excluding Transaction Costs | 15.22 | -10.39 |

Visit https://www.innovatoretfs.com/etf/?ticker=TFJL for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $76,624,113 |

Number of Holdings | 3 |

Net Advisory Fee | $390,417 |

Portfolio Turnover | 0% |

30-Day SEC Yield | -0.78% |

30-Day SEC Yield Unsubsidized | -0.78% |

Visit https://www.innovatoretfs.com/etf/?ticker=TFJL for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Holdings | (%) |

iShares 20+ Year Treasury Bond ETF, Expiration: 12/31/2024; Exercise Price: $0.25 | 96.8% |

iShares 20+ Year Treasury Bond ETF, Expiration: 12/31/2024; Exercise Price: $93.19 | 3.3% |

iShares 20+ Year Treasury Bond ETF, Expiration: 12/31/2024; Exercise Price: $107.90 | -0.1% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=TFJL.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator 20+ Year Treasury Bond 5 Floor ETF® - Quarterly | PAGE 2 | TSR-AR-45782C243 |

982195397982750281629942992484838571944196879155607454706303

| | |

| Innovator 20+ Year Treasury Bond 9 Buffer ETF™ - July | |

TBJL (Principal U.S. Listing Exchange: Cboe BZXCboeBZX) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator 20+ Year Treasury Bond 9 Buffer ETF™ - July for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=TBJL. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator 20+ Year Treasury Bond 9 Buffer ETF - July | $84 | 0.79% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund seeks to match the price returns of the iShares 20+ Year U.S. Treasury ETF (TLT) up to a stated upside Cap, while limiting downside losses to TLT by the amount of its stated Buffer over the course of the Outcome Period. Because the period contemplated herein does not align with the Outcome Period of the Fund, the Fund’s performance stated over the period covered by this report does not reflect the implementation of the Fund’s investment strategy for the full Outcome Period.

In markets where the I.C.E US Treasury 20+ Year Index is down, the risk mitigation attributes of the stated Buffer provide an opportunity for the Fund to soften market losses during the reporting period and outperform the I.C.E US Treasury 20+ Year Index. Alternatively, in markets where the I.C.E US Treasury 20+ Year Index is appreciating, the risk mitigation attributes of the Buffer may limit the upside performance over the reporting period by virtue of the Fund’s Cap, which limits the amount of potential Fund gains and represents the absolute maximum return that the Fund can achieve for its Outcome Period. The effect of the Cap and the Buffer will also cause the Fund to experience different returns than TLT.

The year ended October 31, 2024, was mixed for 20+ Year Treasuries, reflecting shifts in the rate environment and evolving market expectations. Performance for the period finished moderately positive, with a rally in longer-duration bonds in Q3 2024 driven by signs of easing inflation and softer economic data. However, renewed strength in the economy later in the period, coupled with persistent uncertainty over Federal Reserve policy, led to rising long-term yields, tempering gains and introducing volatility.

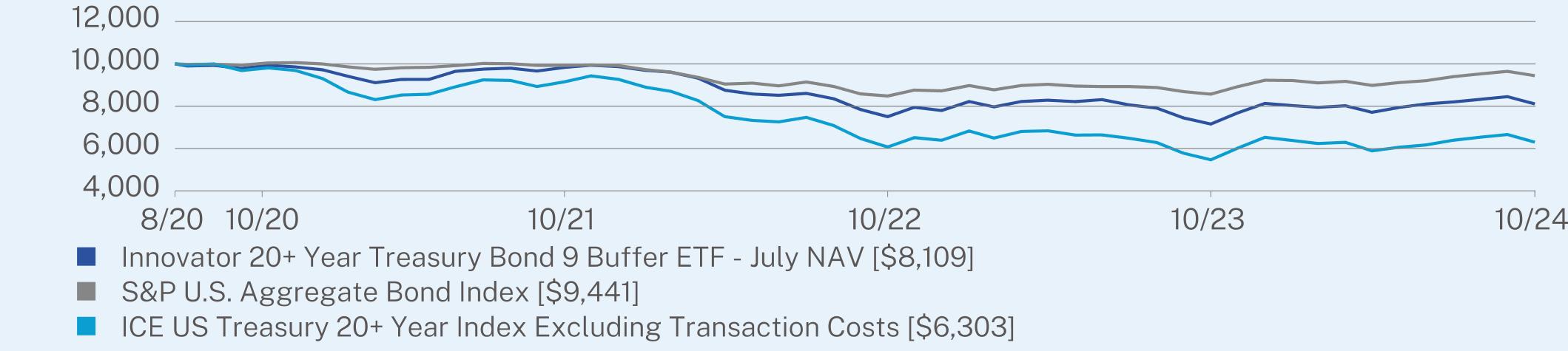

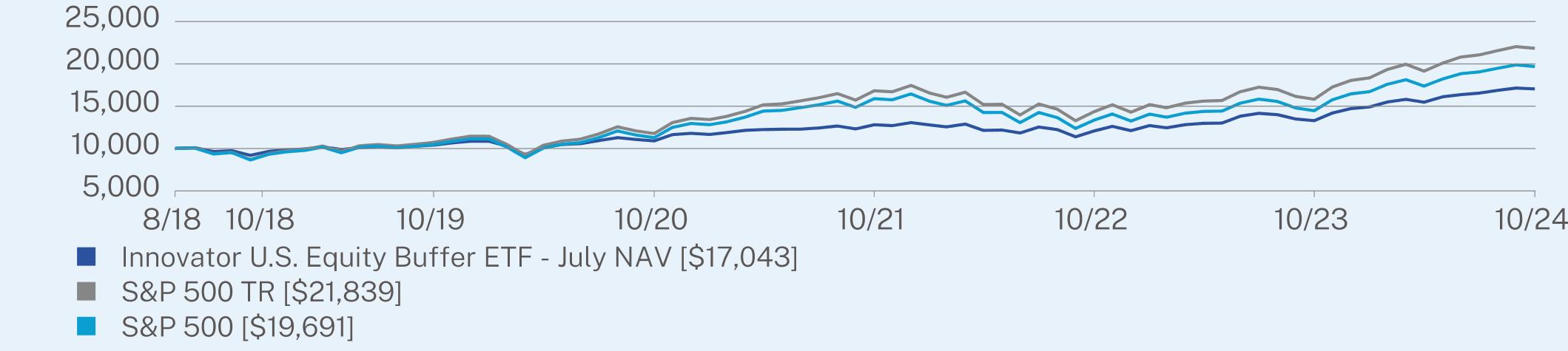

HOW DID THE FUND PERFORM SINCE INCEPTION?*

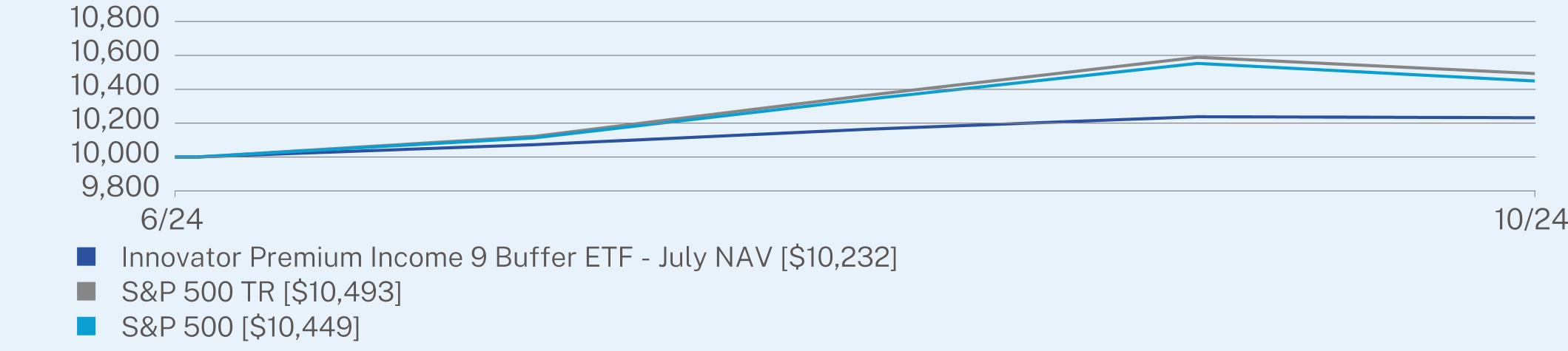

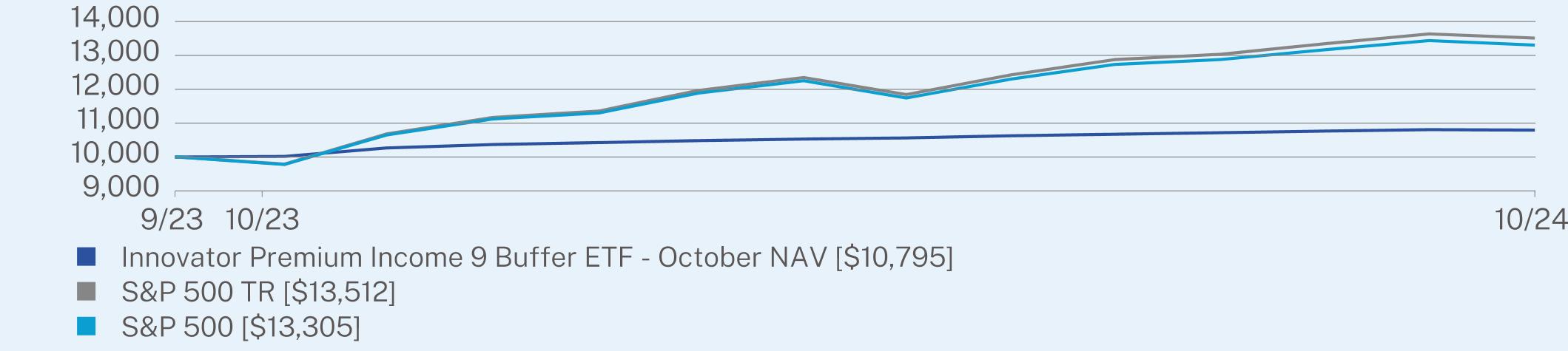

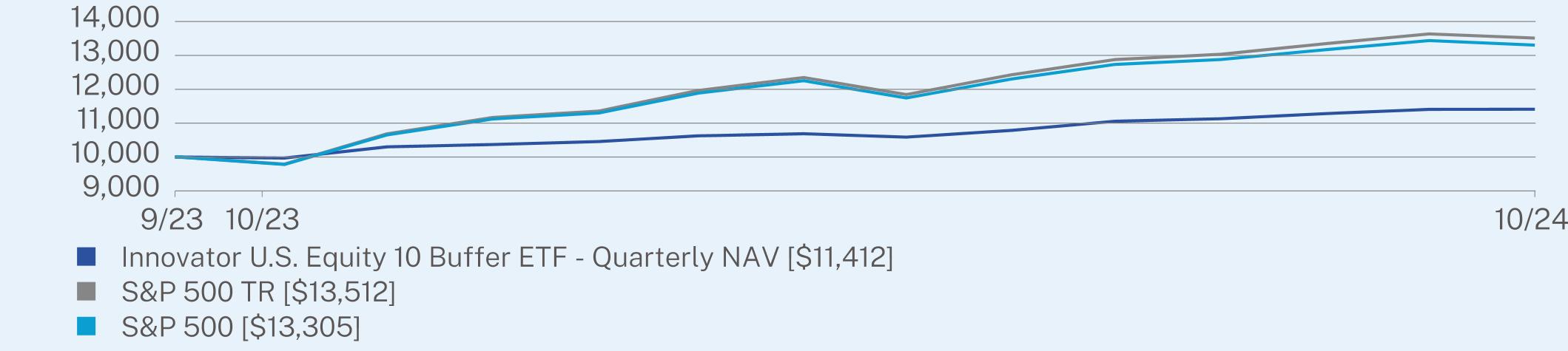

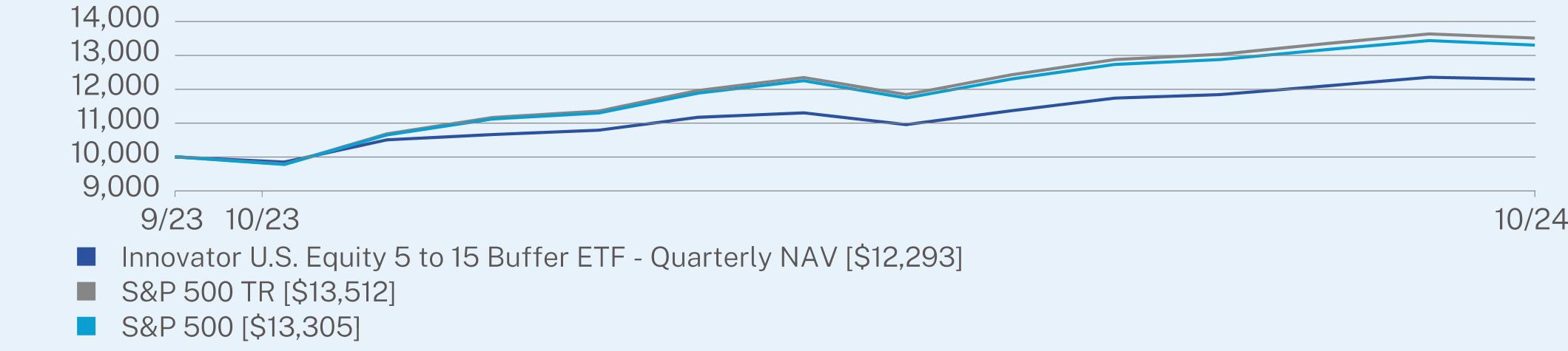

The $10,000 chart reflects a hypothetical $10,000 investment. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees, were deducted.

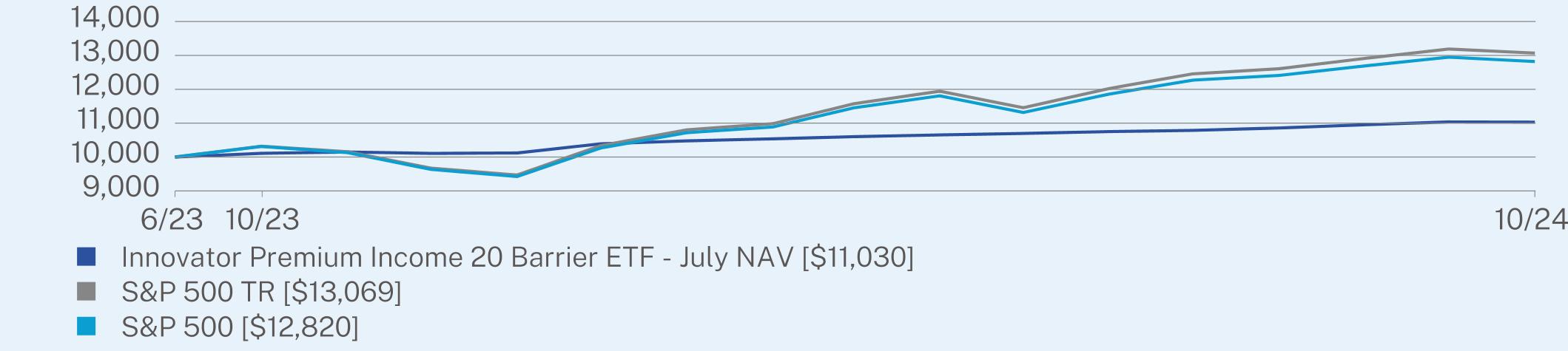

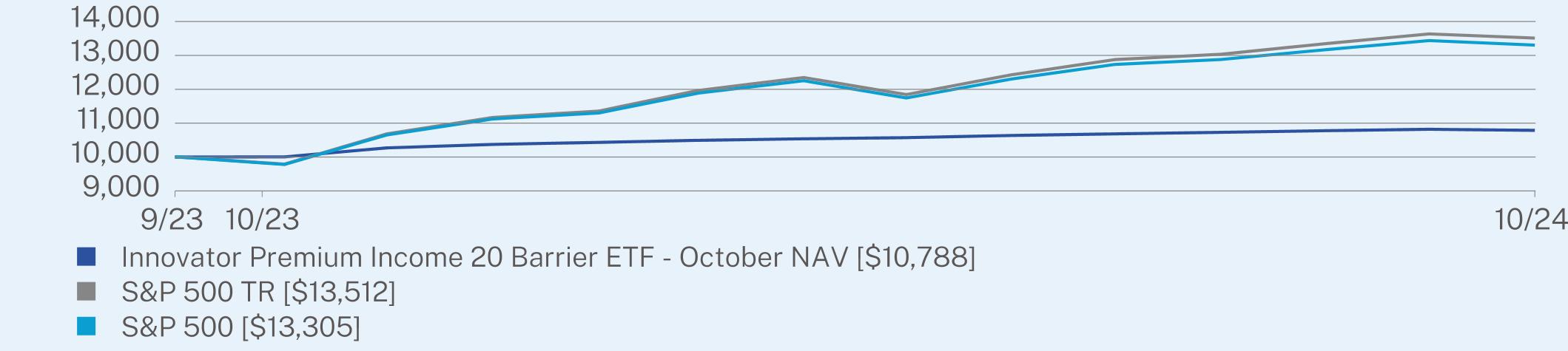

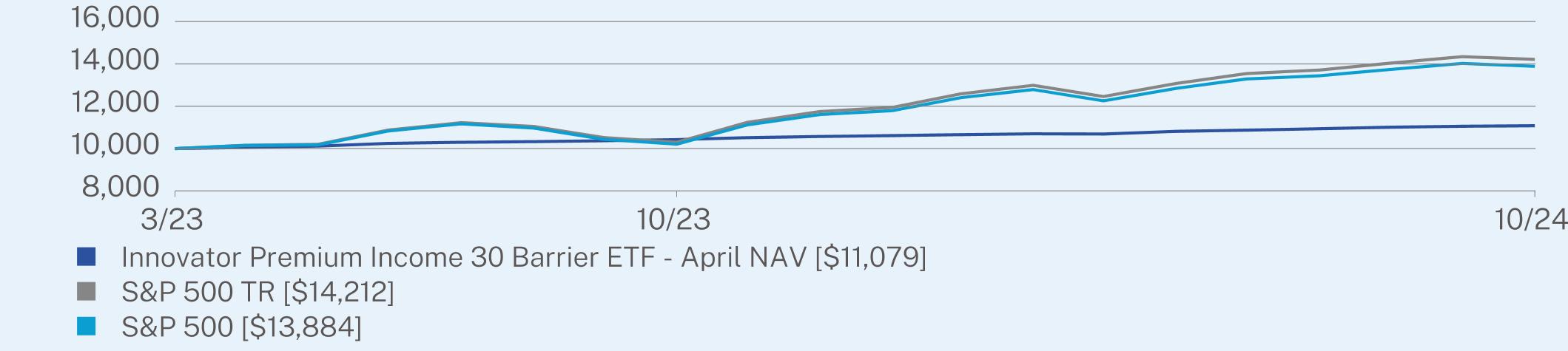

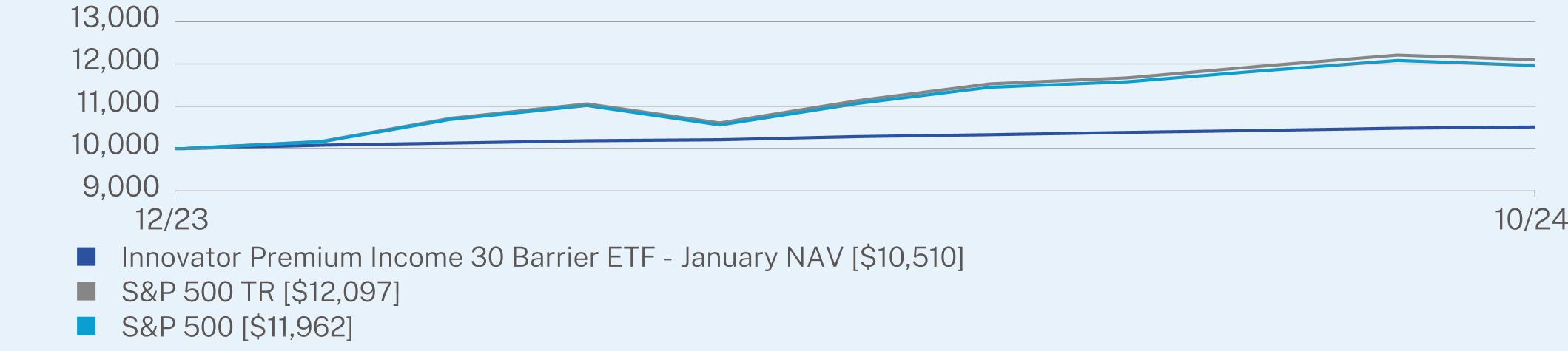

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Innovator 20+ Year Treasury Bond 9 Buffer ETF™- July | PAGE 1 | TSR-AR-45782C235 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(08/17/2020) |

Innovator 20+ Year Treasury Bond 9 Buffer ETF - July NAV | 13.28 | -4.86 |

S&P U.S. Aggregate Bond Index | 10.15 | -1.36 |

ICE US Treasury 20+ Year Index Excluding Transaction Costs | 15.22 | -10.39 |

Visit https://www.innovatoretfs.com/etf/?ticker=TBJL for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $15,124,566 |

Number of Holdings | 4 |

Net Advisory Fee | $465,741 |

Portfolio Turnover | 0% |

30-Day SEC Yield | -0.77% |

30-Day SEC Yield Unsubsidized | -0.77% |

Visit https://www.innovatoretfs.com/etf/?ticker=TBJL for more recent performance information.

WHAT DID THE FUND INVEST IN?* (as of October 31, 2024)

| |

Top Holdings | (%) |

iShares 20+ Year Treasury Bond ETF, Expiration: 06/30/2025; Exercise Price: $0.92 | 97.6% |

iShares 20+ Year Treasury Bond ETF, Expiration: 06/30/2025; Exercise Price: $92.12 | 4.8% |

iShares 20+ Year Treasury Bond ETF, Expiration: 06/30/2025; Exercise Price: $114.64 | -0.7% |

iShares 20+ Year Treasury Bond ETF, Expiration: 06/30/2025; Exercise Price: $83.83 | -1.9% |

| * | Percentages are stated as a percent of net assets. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.innovatoretfs.com/etf/?ticker=TBJL.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Innovator Capital Management, LLC documents not be householded, please contact Innovator Capital Management, LLC at 800.208.5212, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Innovator Capital Management, LLC or your financial intermediary.

| Innovator 20+ Year Treasury Bond 9 Buffer ETF™- July | PAGE 2 | TSR-AR-45782C235 |

978198357507715881099942992484838571944196879155607454706303

| | |

| Innovator Defined Wealth Shield ETF | |

BALT (Principal U.S. Listing Exchange: CBOE BZXCboeBZX) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Innovator Defined Wealth Shield ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.innovatoretfs.com/etf/?ticker=BALT. You can also request this information by contacting us at 800.208.5212.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR?* (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Innovator Defined Wealth Shield ETF | $73 | 0.69% |

| * | Expense ratio is annualized. Amount shown reflects the expenses of the Fund for the current reporting period. |

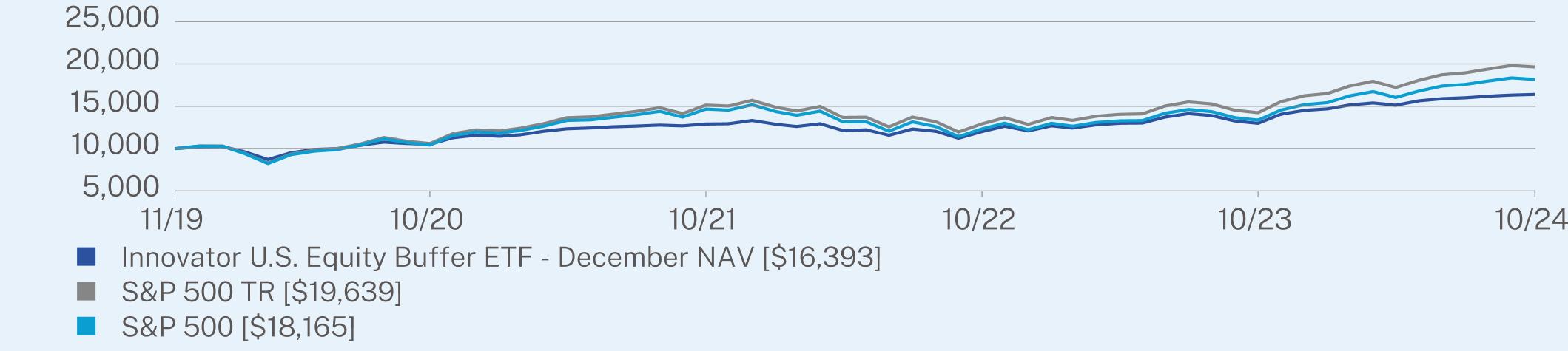

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund seeks to match the price returns of the SPDR S&P 500 ETF Trust (SPY) up to a stated upside Cap, while limiting downside losses to SPY by the amount of its stated Buffer over the course of the Outcome Period. Because the period contemplated herein does not align with the Outcome Period of the Fund, the Fund’s performance stated over the period covered by this report does not reflect the implementation of the Fund’s investment strategy for the full Outcome Period.

In markets where the S&P 500 Index is down, the risk mitigation attributes of the stated Buffer provide an opportunity for the Fund to soften market losses during the reporting period and outperform the S&P 500 Index. Alternatively, in markets where the S&P 500 Index is appreciating, the risk mitigation attributes of the Buffer may limit the upside performance over the reporting period by virtue of the Fund’s Cap, which limits the amount of potential Fund gains and represents the absolute maximum return that the Fund can achieve for its Outcome Period. The effect of the Cap and the Buffer will also cause the Fund to experience different returns than SPY.

The S&P 500 Index delivered strong performance for the year ended October 31, 2024. Gains were primarily driven by the continued strength in technology and growing market enthusiasm for artificial intelligence, alongside optimism surrounding a potential soft landing for the economy. While market breadth improved in the latter part of the year, it remained relatively narrow overall.