UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

Amendment No. 1

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22135

Innovator ETFs Trust

(Exact name of registrant as specified in charter)

109 North Hale Street

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

Chapman and Cutler LLP

320 South Canal Street, 27th Floor

Chicago, IL 60606

(Name and address of agent for service)

800-208-5212

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2022

Date of reporting period: October 31, 2022

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

Letter to Shareholders | 3 |

Fund Performance | 5 |

Expense Example | 25 |

Schedules of Investments | 27 |

Statements of Assets and Liabilities | 55 |

Statements of Operations | 58 |

Statements of Changes in Net Assets | 62 |

Financial Highlights | 70 |

Notes to Financial Statements | 78 |

Report of Independent Registered Public Accounting Firm | 100 |

Trustees and Officers | 103 |

Board Considerations Regarding Approval of Investment Management Agreement | 105 |

Additional Information | 112 |

INNOVATOR ETFs TRUST

Letter to Shareholders (Unaudited)

Dear Valued Shareholders,

During the year ended October 31, 2022, the U.S. equity market continued its pull-back on the heels of the swiftest interest rate hike in U.S. history. For more than a decade, we witnessed the Federal Reserve institute Quantitative Easing in an effort to spur economic growth and keep interest rates artificially low; and for the most part it worked. However, as the country emerged from the COVID-19 lockdowns and restrictions, there were a few key factors that we believe have contributed to a slowdown and to the elevated market volatility:

| | 1. | Record high inflation resulting both from supply chain disruptions and money supply growth |

| | 2. | A sharp and swift reversal in Fed policy, from highly accommodative to increasingly restrictive |

| | 3. | A process of revaluing future corporate earnings in light of the new interest rate regime |

Yet, while it’s important to identify short-term risks facing the economy, we believe that higher interest rates may ultimately lead to higher stock prices over time, as the increased prices of goods and services make their way through to the stock prices of the underlying companies. To that end, we think it’s important to maintain a diversified approach to investing that includes tools that both focus on growth, as well as those that seek to defend against market loss.

At Innovator, we are rooted in the development of risk-managed, growth, and income-oriented ETF solutions. Today, I’m happy to announce that more advisors are using Innovator ETFs than ever before. 2022 was a year of tremendous growth for the firm, with our flagship line of Defined Outcome ETFs™ garnering more than $5b in net flows, nearly doubling Innovator’s assets under management since this time last year.

On behalf of the team at Innovator, thank you for your confidence in us and in the products we offer. May the Lord grant all of us wisdom and peace in the months ahead.

Bruce Bond

Chief Executive Officer

INNOVATOR ETFs TRUST

Letter to Shareholders (Unaudited) (Continued)

The views in this report were those of the Fund’s CEO as of October 31, 2022 and may not reflect his views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice.

INNOVATOR IBD® 50 ETF

Fund Performance

October 31, 2022 (Unaudited)

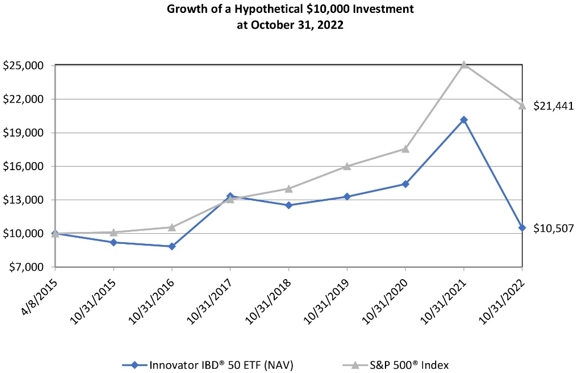

The following chart compares the value of a hypothetical $10,000 investment in the Innovator IBD® 50 ETF from its inception (April 8, 2015) to October 31, 2022 as compared with the S&P 500® Index.

| | | Average Annual Total Returns As of October 31, 2022 | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | Since Inception (a) | |

Innovator IBD® 50 ETF | | | | | | | | | | | | | | | | |

NAV Return | | | -47.90 | % | | | -7.54 | % | | | -4.66 | % | | | 0.66 | % |

Market Return | | | -47.83 | % | | | -7.48 | % | | | -4.65 | % | | | 0.68 | % |

S&P 500® Index | | | -14.61 | % | | | 10.22 | % | | | 10.44 | % | | | 10.61 | % |

IBD® 50 Index (b) | | | -47.28 | % | | | -6.89 | % | | | N/A | | | | -4.59 | %(c) |

(a) | Inception date is April 8, 2015. |

(b) | The Fund began tracking the IBD® 50 Index on November 20, 2017. |

(c) | Since Inception return is from the date the Fund began tracking the IBD® 50 Index, November 20, 2017. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.93% and 0.80%, respectively. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR IBD® 50 ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Total return calculations reflect the effect of the Advisor’s expense limitation agreement for the Fund. Returns shown for the Fund, S&P 500® Index and IBD® 50 Index include the reinvestment of all dividends, if any.

The S&P 500® Index is an unmanaged, capitalization–weighted index generally representative of the U.S. market for large capitalization stocks.

The IBD® 50 Index is a weekly, rule–based, computer–generated stock index compiled and published by Investor’s Business Daily® that seeks to identify the current top 50 growth stocks.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange–traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at Innovatoretfs.com/FFTY.

INNOVATOR IBD® BREAKOUT OPPORTUNITIES ETF

Fund Performance

October 31, 2022 (Unaudited)

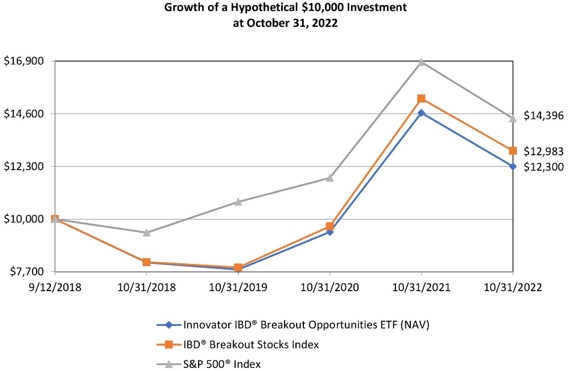

The following chart compares the value of a hypothetical $10,000 investment in the Innovator IBD® Breakout Opportunities ETF from its inception (September 12, 2018) to October 31, 2022 as compared with the S&P 500® Index and IBD® Breakout Stocks Index.

| | | Average Annual Total Returns As of October 31, 2022 | |

| | | 1 Year | | | 3 Years | | | Since Inception (a) | |

Innovator IBD® Breakout Opportunities ETF | | | | | | | | | | | | |

NAV Return | | | -15.98 | % | | | 16.42 | % | | | 5.13 | % |

Market Return | | | -15.33 | % | | | 16.78 | % | | | 5.35 | % |

S&P 500® Index | | | -14.61 | % | | | 10.22 | % | | | 9.21 | % |

IBD® Breakout Stocks Index | | | -14.93 | % | | | 18.09 | % | | | 6.52 | % |

(a) | Inception date is September 12, 2018. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the net expense ratio of the Fund was 0.80%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR IBD® BREAKOUT OPPORTUNITIES ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund, S&P 500® Index and IBD® Breakout Stocks Index include the reinvestment of all dividends, if any.

The S&P 500® Index is an unmanaged, capitalization–weighted index generally representative of the U.S. market for large capitalization stocks.

The IBD® Breakout Stocks Index is a rule–based index compiled and published by Investor’s Business Daily® that seeks to provide opportunistic investment exposure to those stocks with the potential to “break out” or experience a period of sustained price growth beyond the stock’s recent “resistance level,” with consideration for various market conditions.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange–traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at Innovatoretfs.com/BOUT.

INNOVATOR LOUP FRONTIER TECH ETF

Fund Performance

October 31, 2022 (Unaudited)

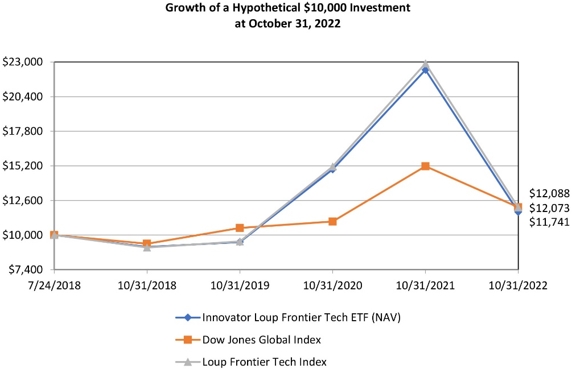

The following chart compares the value of a hypothetical $10,000 investment in the Innovator Loup Frontier Tech ETF from its inception (July 24, 2018) to October 31, 2022 as compared with the Dow Jones Global Index and Loup Frontier Tech Index.

| | | Average Annual Total Returns As of October 31, 2022 | |

| | | 1 Year | | | 3 Years | | | Since Inception (a) | |

Innovator Loup Frontier Tech ETF | | | | | | | | | | | | |

NAV Return | | | -47.60 | % | | | 7.40 | % | | | 3.83 | % |

Market Return | | | -47.90 | % | | | 7.31 | % | | | 3.73 | % |

Dow Jones Global Index | | | -20.32 | % | | | 4.69 | % | | | 4.54 | % |

Loup Frontier Tech Index | | | -47.26 | % | | | 8.23 | % | | | 4.51 | % |

(a) | Inception date is July 24, 2018. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the net expense ratio of the Fund was 0.70%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR LOUP FRONTIER TECH ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund, Dow Jones Global Index and Loup Frontier Tech Index include the reinvestment of all dividends, if any.

The Dow Jones Global Index is an unmanaged, capitalization–weighted index generally representative of the global market.

The Loup Frontier Tech Index is a rules–based stock index that seeks to identify and track those companies identified as being on the frontier of the development of new technologies that have the potential to have an outsized influence on the future.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange–traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at Innovatoretfs.com/LOUP.

INNOVATOR S&P INVESTMENT GRADE PREFERRED ETF

Fund Performance

October 31, 2022 (Unaudited)

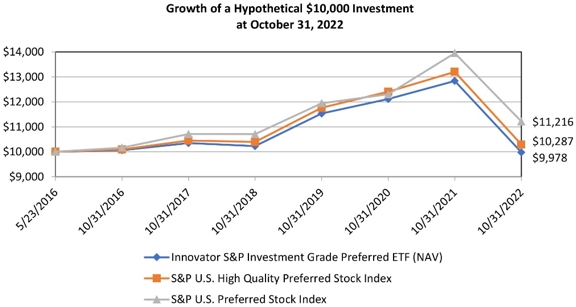

The following chart compares the value of a hypothetical $10,000 investment in the Innovator S&P Investment Grade Preferred ETF from its inception (May 23, 2016) to October 31, 2022 as compared with the S&P U.S. High Quality Preferred Stock Index and the S&P U.S. Preferred Stock Index.

| | | Average Annual Total Returns As of October 31, 2022 | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | Since Inception (a) | |

Innovator S&P Investment Grade Preferred ETF | | | | | | | | | | | | | | | | |

NAV Return | | | -22.27 | % | | | -4.71 | % | | | -0.72 | % | | | -0.03 | % |

Market Return | | | -22.30 | % | | | -4.84 | % | | | -0.72 | % | | | -0.10 | % |

S&P U.S. High Quality Preferred Stock Index | | | -22.07 | % | | | -4.37 | % | | | -0.32 | % | | | 0.44 | % |

S&P U.S. Preferred Stock Index | | | -19.61 | % | | | -2.08 | % | | | 0.93 | % | | | 1.80 | % |

(a) | Inception date is May 23, 2016. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the net expense ratio of the Fund was 0.47%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR S&P INVESTMENT GRADE PREFERRED ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund, S&P U.S. High Quality Preferred Stock Index and S&P U.S. Preferred Stock Index include the reinvestment of all dividends, if any.

The S&P U.S. High Quality Preferred Stock Index is designed to provide exposure to U.S. - listed preferred stocks that meet a minimum size, liquidity, type of issuance, and quality criteria.

The S&P U.S. Preferred Stock Index generally represents the U.S. preferred stock market.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange-traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at innovatoretfs.com/EPRF.

INNOVATOR LADDERED ALLOCATION POWER BUFFER ETF

Fund Performance

October 31, 2022 (Unaudited)

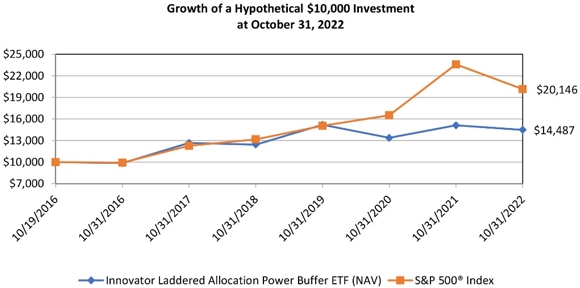

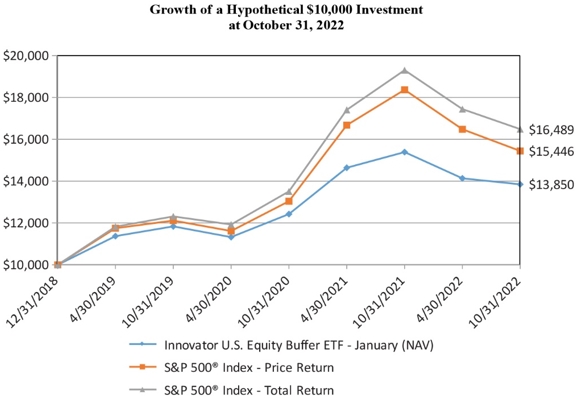

The following chart compares the value of a hypothetical $10,000 investment in the Innovator Laddered Allocation Power Buffer ETF from its inception (October 19, 2016) to October 31, 2022 as compared with the S&P 500® Index.

| | | Average Annual Total Returns As of October 31, 2022 | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | Since Inception (a) | |

Innovator Laddered Allocation Power Buffer ETF | | | | | | | | | | | | | | | | |

NAV Return | | | -4.11 | % | | | -1.57 | % | | | 2.71 | % | | | 6.34 | % |

Market Return | | | -4.18 | % | | | -1.49 | % | | | 2.73 | % | | | 6.37 | % |

S&P 500® Index | | | -14.61 | % | | | 10.22 | % | | | 10.44 | % | | | 12.31 | % |

Refinitiv Laddered Power Buffer Strategy Index (b) | | | -4.05 | % | | | N/A | | | | N/A | | | | 3.60 | %(c) |

(a) | Inception date is October 19, 2016. |

(b) | The Fund began tracking the Refinitiv Laddered Power Buffer Strategy Index on August 11, 2020. |

(c) | Since Inception return is cumulative and from the date the Fund began tracking the Refinitiv Laddered Power Buffer Strategy Index, August 11, 2020. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.99% and 0.89%, respectively. This expense ratio includes acquired fund fees and expenses of 0.79%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR LADDERED ALLOCATION POWER BUFFER ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund, Refinitiv Laddered Power Buffer Strategy Index and S&P 500® Index include the reinvestment of all dividends, if any.

The Refinitiv Laddered Power Buffer Strategy Index is equally weighted in the shares of the twelve Innovator U.S. Equity Power Buffer ETFs which each respectively seek to provide a defined outcome based upon the performance of the S&P 500® Index - Price Return over the course of an approximately one-year time period that begins on the first trading day of the month indicated in the respective ETF's name. Each Innovator U.S. Equity Power Buffer ETF seeks to provide an upside return that is capped for an applicable outcome period and a measure of downside protection from losses for such outcome period. The Index seeks to provide "laddered" investing in the twelve Innovator U.S. Equity Power Buffer ETFs. Laddered investing refers to investments in several similar securities that have different reset dates, with the goal of mitigating timing risks associated with investing in a single investment.

The S&P 500® Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange-traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at innovatoretfs.com/BUFF.

INNOVATOR LADDERED ALLOCATION BUFFER ETF

Fund Performance

October 31, 2022 (Unaudited)

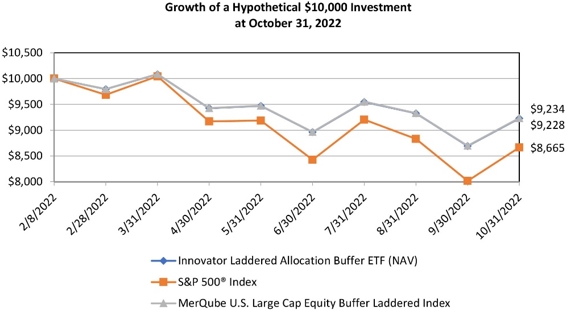

The following chart compares the value of a hypothetical $10,000 investment in the Innovator Laddered Allocation Buffer ETF from its inception (February 8, 2022) to October 31, 2022 as compared with the S&P 500® Index.

| | | Total Returns As of October 31, 2022 | |

| | | Since Inception (a) | |

Innovator Laddered Allocation Buffer ETF | | | | |

NAV Return | | | -7.72 | % |

Market Return | | | -7.67 | % |

S&P 500® Index | | | -13.35 | % |

MerQube U.S. Large Cap Equity Buffer Laddered Index | | | -7.66 | % |

(a) | Inception date is February 8, 2022. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.99% and 0.89%, respectively. This expense ratio includes acquired fund fees and expenses of 0.79%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR LADDERED ALLOCATION BUFFER ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund, MerQube U.S. Large Cap Equity Buffer Laddered Index and S&P 500® Index include the reinvestment of all dividends, if any.

The MerQube U.S. Large Cap Equity Buffer Laddered Index is equally weighted in the shares of the twelve Innovator U.S. Equity Buffer ETFs which each respectively seek to provide a defined outcome based upon the performance of the S&P 500® Index - Price Return over the course of an approximately one-year time period that begins on the first trading day of the month indicated in the respective ETF's name. Each Innovator U.S. Equity Buffer ETF seeks to provide an upside return that is capped for an applicable outcome period and a measure of downside protection from losses for such outcome period. The Index seeks to provide "laddered" investing in the twelve Innovator U.S. Equity Buffer ETFs. Laddered investing refers to investments in several similar securities that have different reset dates, with the goal of mitigating timing risks associated with investing in a single investment.

The S&P 500® Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange-traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at innovatoretfs.com/BUFB.

INNOVATOR BUFFER STEP-UP STRATEGY ETF

Fund Performance

October 31, 2022 (Unaudited)

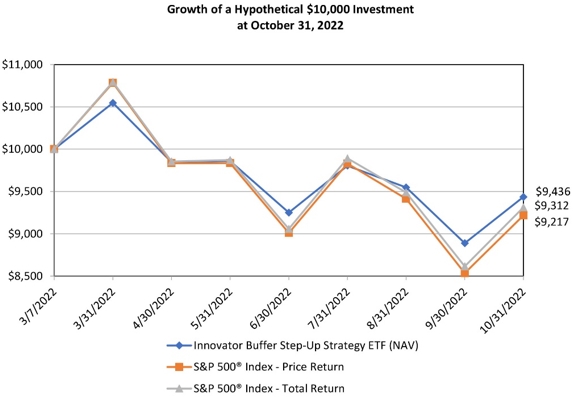

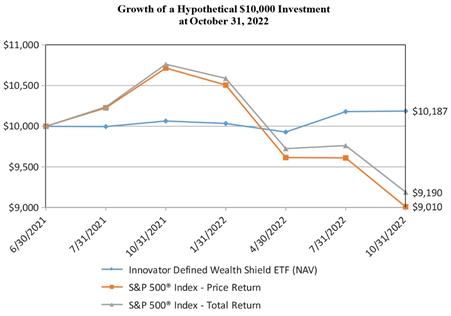

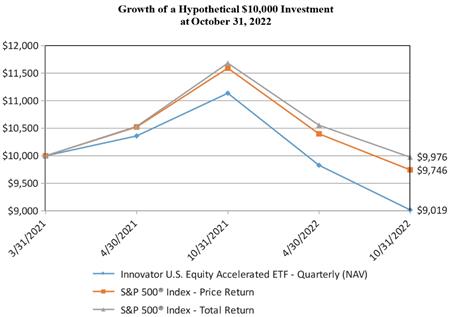

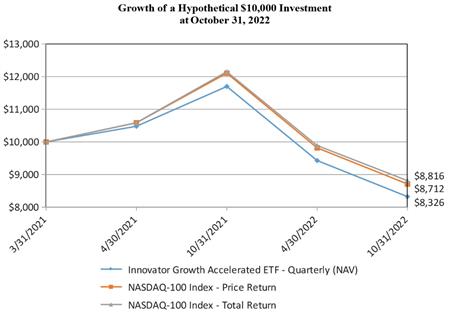

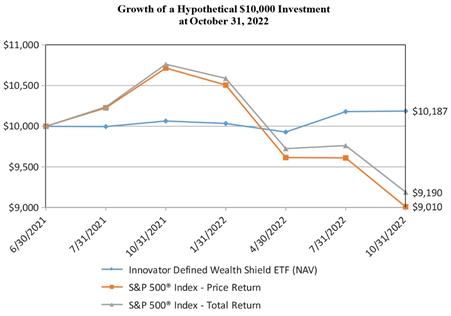

The following chart compares the value of a hypothetical $10,000 investment in the Innovator Buffer Step-Up Strategy ETF from its inception (March 7, 2022) to October 31, 2022 as compared with the S&P 500® Index - Price Return and Total Return.

| | | Total Returns As of October 31, 2022 | |

| | | Since Inception (a) | |

Innovator Buffer Step-Up Strategy ETF | | | | |

NAV Return | | | -5.64 | % |

Market Return | | | -5.52 | % |

S&P 500® Index - Price Return | | | -7.83 | % |

S&P 500® Index - Total Return | | | -6.88 | % |

(a) | Inception date is March 7, 2022. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the net expense ratio of the Fund was 0.89%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR BUFFER STEP-UP STRATEGY ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund and S&P 500® Index - Total Return include the reinvestment of all dividends, if any. Returns shown for the S&P 500® Index - Price Return do not include the reinvestment of dividends, if any.

The S&P 500® Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange-traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at Innovatoretfs.com/BSTP.

INNOVATOR POWER BUFFER STEP-UP STRATEGY ETF

Fund Performance

October 31, 2022 (Unaudited)

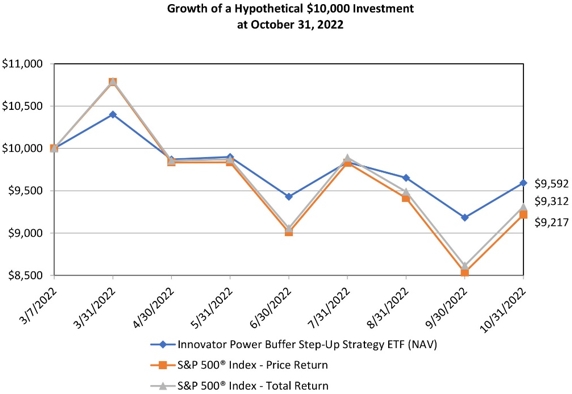

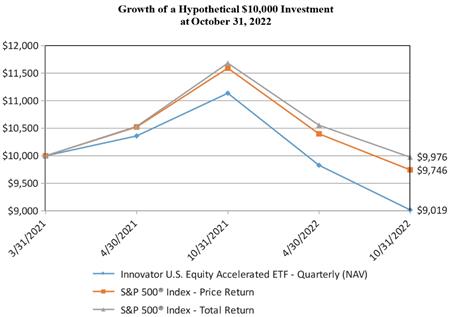

The following chart compares the value of a hypothetical $10,000 investment in the Innovator Power Buffer Step-Up Strategy ETF from its inception (March 7, 2022) to October 31, 2022 as compared with the S&P 500® Index - Price Return and Total Return.

| | | Total Returns As of October 31, 2022 | |

| | | Since Inception (a) | |

Innovator Power Buffer Step-Up Strategy ETF | | | | |

NAV Return | | | -4.08 | % |

Market Return | | | -4.08 | % |

S&P 500® Index - Price Return | | | -7.83 | % |

S&P 500® Index - Total Return | | | -6.88 | % |

(a) | Inception date is March 7, 2022. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the net expense ratio of the Fund was 0.89%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR POWER BUFFER STEP-UP STRATEGY ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund and S&P 500® Index - Total Return include the reinvestment of all dividends, if any. Returns shown for the S&P 500® Index - Price Return do not include the reinvestment of dividends, if any.

The S&P 500® Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange-traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at Innovatoretfs.com/PSTP.

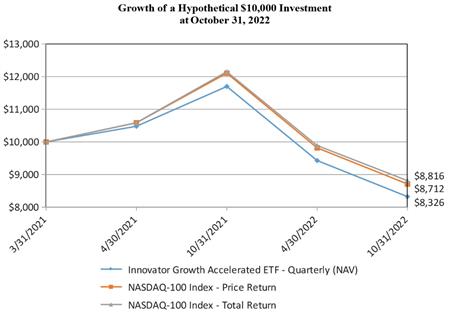

INNOVATOR HEDGED TSLA STRATEGY ETF

Fund Performance

October 31, 2022 (Unaudited)

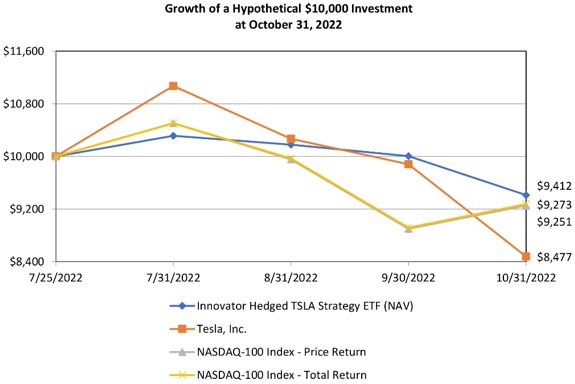

The following chart compares the value of a hypothetical $10,000 investment in the Innovator Hedged TSLA Strategy ETF from its inception (July 25, 2022) to October 31, 2022 as compared with Tesla, Inc. and the NASDAQ-100 Index - Price Return and Total Return.

| | | Total Returns As of October 31, 2022 | |

| | | Since Inception (a) | |

Innovator Hedged TSLA Strategy ETF | | | | |

NAV Return | | | -5.88 | % |

Market Return | | | -5.48 | % |

Tesla, Inc. | | | -15.23 | % |

NASDAQ-100 Index - Price Return | | | -7.49 | % |

NASDAQ-100 Index - Total Return | | | -7.27 | % |

(a) | Inception date is July 25, 2022. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the net expense ratio of the Fund was 0.79%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR HEDGED TSLA STRATEGY ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund, Tesla Inc. and NASDAQ-100 Index - Total Return include the reinvestment of all dividends, if any. Returns shown for the NASDAQ-100 Index - Price Return do not include the reinvestment of dividends, if any.

The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. The NASDAQ-100 Price Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnologies. It does not contain securities of financial companies including investment companies.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange-traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at Innovatoretfs.com/TSLH.

INNOVATOR UNCAPPED ACCELERATED U.S. EQUITY ETF

Fund Performance

October 31, 2022 (Unaudited)

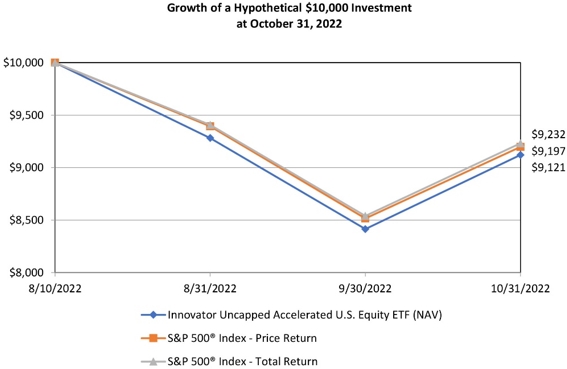

The following chart compares the value of a hypothetical $10,000 investment in the Innovator Uncapped Accelerated U.S. Equity ETF from its inception (August 10, 2022) to October 31, 2022 as compared with the S&P 500® Index - Price Return and Total Return.

| | | Total Returns As of October 31, 2022 | |

| | | Since Inception (a) | |

Innovator Uncapped Accelerated U.S. Equity ETF | | | | |

NAV Return | | | -8.79 | % |

Market Return | | | -8.63 | % |

S&P 500® Index - Price Return | | | -8.03 | % |

S&P 500® Index - Total Return | | | -7.68 | % |

(a) | Inception date is August 10, 2022. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the net expense ratio of the Fund was 0.79%. For the most recent performance, please visit the Fund’s website at innovatoretfs.com.

INNOVATOR UNCAPPED ACCELERATED U.S. EQUITY ETF

Fund Performance

October 31, 2022 (Unaudited) (Continued)

The line graph and performance table does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund and S&P 500® Index - Total Return include the reinvestment of all dividends, if any. Returns shown for the S&P 500® Index - Price Return do not include the reinvestment of dividends, if any.

The S&P 500® Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange-traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at Innovatoretfs.com/XUSP.

INNOVATOR ETFs TRUST

Expense Example

For the Period Ended October 31, 2022 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) ongoing costs, including management fees, and other Fund expenses; and (2) transaction costs, including brokerage commissions on the purchase and sale of Fund shares. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire respective period to October 31, 2022 for each Fund.

Actual Expenses

The first line under each Fund in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the applicable line under the heading titled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions on the purchase and sale of Fund shares. Therefore, the second line under the Fund in the table is useful in comparing the ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

INNOVATOR ETFs TRUST

Expense Example

For the Period Ended October 31, 2022 (Unaudited) (Continued)

| | | | | | | | | | | Expenses Paid | | | Annualized Expense | |

| | | Beginning Account | | | Ending Account | | | During the | | | Ratio for the | |

| | | Value | | | Value | | | Period | | | Period | |

Innovator IBD 50® ETF (NAV) | | | | | | | | | | | | | | | 0.80 | % |

Actual | | $ | 1,000.00 | | | $ | 806.00 | | | $ | 3.64 | (a) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,021.17 | | | | 4.08 | (a) | | | | |

Innovator IBD® Breakout Opportunities ETF (NAV) | | | | | | | | | | | | | | | 0.80 | % |

Actual | | | 1,000.00 | | | | 880.50 | | | | 3.79 | (a) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,021.17 | | | | 4.08 | (a) | | | | |

Innovator Loup Frontier Tech ETF (NAV) | | | | | | | | | | | | | | | 0.70 | % |

Actual | | | 1,000.00 | | | | 782.70 | | | | 3.15 | (a) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,021.68 | | | | 3.57 | (a) | | | | |

Innovator S&P Investment Grade Preferred ETF (NAV) | | | | | | | | | | | | | | | 0.47 | % |

Actual | | | 1,000.00 | | | | 918.10 | | | | 2.27 | (a) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,022.84 | | | | 2.40 | (a) | | | | |

Innovator Laddered Allocation Power Buffer ETF (NAV) | | | | | | | | | | | | | | | 0.10 | % |

Actual | | | 1,000.00 | | | | 997.80 | | | | 0.50 | (a) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,024.70 | | | | 0.51 | (a) | | | | |

Innovator Laddered Allocation Buffer ETF (NAV) | | | | | | | | | | | | | | | 0.10 | % |

Actual | | | 1,000.00 | | | | 979.00 | | | | 0.50 | (a) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,024.70 | | | | 0.51 | (a) | | | | |

Innovator Buffer Step-Up Strategy ETF (NAV) | | | | | | | | | | | | | | | 0.89 | % |

Actual | | | 1,000.00 | | | | 958.30 | | | | 4.39 | (a) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,020.72 | | | | 4.53 | (a) | | | | |

Innovator Power Buffer Step-Up Strategy ETF (NAV) | | | | | | | | | | | | | | | 0.89 | % |

Actual | | | 1,000.00 | | | | 971.90 | | | | 4.42 | (a) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,020.72 | | | | 4.53 | (a) | | | | |

Innovator Hedged TSLA Strategy ETF (NAV) | | | | | | | | | | | | | | | 0.79 | % |

Actual | | | 1,000.00 | | | | 941.20 | | | | 2.06 | (b) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,021.22 | | | | 4.02 | (d) | | | | |

Innovator Uncapped Accelerated U.S. Equity ETF (NAV) | | | | | | | | | | | | | | | 0.79 | % |

Actual | | | 1,000.00 | | | | 912.10 | | | | 1.70 | (c) | | | | |

Hypothetical | | | 1,000.00 | | | | 1,021.22 | | | | 4.02 | (d) | | | | |

(a) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the six month period). |

(b) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 98/365 (to reflect the period since the Fund’s inception). |

(c) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 82/365 (to reflect the period since the Fund’s inception). |

(d) | For comparative purposes only as the Fund was not in operation for the full six month period. |

INNOVATOR IBD® 50 ETF

Schedule of Investments

October 31, 2022

| | | Shares | | | Value | |

COMMON STOCKS - 99.22% | | | | | | | | |

Agriculture - 0.50% | | | | | | | | |

Darling Ingredients, Inc. (a) | | | 6,490 | | | $ | 509,335 | |

| | | | | | | | | |

Biotechnology - 2.95% | | | | | | | | |

Sarepta Therapeutics, Inc. (a)(b) | | | 26,417 | | | | 3,012,066 | |

| | | | | | | | | |

Chemicals - 4.93% | | | | | | | | |

CF Industries Holdings, Inc. | | | 33,448 | | | | 3,554,184 | |

Mosaic Co. | | | 9,436 | | | | 507,185 | |

Sociedad Quimica y Minera de Chile SA - ADR | | | 10,341 | | | | 968,745 | |

| | | | | | | | 5,030,114 | |

Commercial Services - 6.61% | | | | | | | | |

AMN Healthcare Services, Inc. (a) | | | 25,161 | | | | 3,157,705 | |

Cross Country Healthcare, Inc. (a)(b) | | | 96,896 | | | | 3,593,873 | |

| | | | | | | | 6,751,578 | |

Computers - 4.70% | | | | | | | | |

Pure Storage, Inc. - Class A (a) | | | 34,355 | | | | 1,060,195 | |

Super Micro Computer, Inc. (a) | | | 53,665 | | | | 3,734,547 | |

| | | | | | | | 4,794,742 | |

Distribution & Wholesale - 1.56% | | | | | | | | |

WESCO International, Inc. (a) | | | 7,512 | | | | 1,034,928 | |

WW Grainger, Inc. | | | 947 | | | | 553,380 | |

| | | | | | | | 1,588,308 | |

Diversified Financial Services - 1.01% | | | | | | | | |

Interactive Brokers Group, Inc. - Class A | | | 12,889 | | | | 1,033,053 | |

| | | | | | | | | |

Energy - Alternate Sources - 3.63% | | | | | | | | |

Enphase Energy, Inc. (a) | | | 12,071 | | | | 3,705,797 | |

| | | | | | | | | |

Healthcare - Products - 3.41% | | | | | | | | |

Shockwave Medical, Inc. (a) | | | 11,870 | | | | 3,479,691 | |

| | | | | | | | | |

Healthcare - Services - 3.96% | | | | | | | | |

Medpace Holdings, Inc. (a) | | | 15,906 | | | | 3,530,814 | |

UnitedHealth Group, Inc. (b) | | | 926 | | | | 514,069 | |

| | | | | | | | 4,044,883 | |

Insurance - 0.50% | | | | | | | | |

Corebridge Financial, Inc. | | | 22,390 | | | | 507,581 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR IBD® 50 ETF

Schedule of Investments

October 31, 2022 (Continued)

| | | Shares | | | Value | |

Machinery - Diversified - 1.00% | | | | | | | | |

Deere & Co. (b) | | | 2,573 | | | | 1,018,445 | |

| | | | | | | | | |

Metal Fabricate & Hardware - 0.52% | | | | | | | | |

The Timken Co. | | | 7,406 | | | | 527,974 | |

| | | | | | | | | |

Oil & Gas - 37.78% (c) | | | | | | | | |

Canadian Natural Resources Ltd. | | | 16,740 | | | | 1,003,396 | |

Cenovus Energy, Inc. | | | 100,762 | | | | 2,035,392 | |

Civitas Resources, Inc. (b) | | | 43,153 | | | | 3,016,826 | |

ConocoPhillips (b) | | | 15,906 | | | | 2,005,588 | |

Coterra Energy, Inc. (b) | | | 99,764 | | | | 3,105,653 | |

CVR Energy, Inc. | | | 49,980 | | | | 1,952,219 | |

Delek US Holdings, Inc. | | | 68,946 | | | | 2,044,938 | |

Devon Energy Corp. (b) | | | 13,086 | | | | 1,012,202 | |

Diamondback Energy, Inc. | | | 19,435 | | | | 3,053,433 | |

Earthstone Energy, Inc. - Class A (a) | | | 218,558 | | | | 3,531,897 | |

Hess Corp. | | | 3,537 | | | | 499,000 | |

Matador Resources Co. (b) | | | 51,704 | | | | 3,435,731 | |

Pioneer Natural Resources Co. (b) | | | 11,374 | | | | 2,916,407 | |

Ranger Oil Corp. - Class A | | | 71,866 | | | | 2,939,319 | |

SM Energy Co. (b) | | | 22,380 | | | | 1,006,652 | |

Talos Energy, Inc. (a)(b) | | | 141,048 | | | | 3,001,502 | |

Valero Energy Corp. | | | 15,885 | | | | 1,994,362 | |

| | | | | | | | 38,554,517 | |

Oil & Gas Services - 0.51% | | | | | | | | |

Liberty Energy, Inc. (a) | | | 30,541 | | | | 516,448 | |

| | | | | | | | | |

Packaging & Containers - 3.42% | | | | | | | | |

Graphic Packaging Holding Co. | | | 85,962 | | | | 1,973,687 | |

Silgan Holdings, Inc. | | | 21,560 | | | | 1,021,082 | |

Sonoco Products Co. | | | 8,036 | | | | 498,875 | |

| | | | | | | | 3,493,644 | |

Pharmaceuticals - 3.95% | | | | | | | | |

AdaptHealth Corp. (a)(b) | | | 87,532 | | | | 1,995,730 | |

Harmony Biosciences Holdings, Inc. (a)(b) | | | 39,138 | | | | 2,035,176 | |

| | | | | | | | 4,030,906 | |

Pipelines - 3.44% | | | | | | | | |

New Fortress Energy, Inc. | | | 63,686 | | | | 3,507,188 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR IBD® 50 ETF

Schedule of Investments

October 31, 2022 (Continued)

| | | Shares | | | Value | |

Retail - 5.23% | | | | | | | | |

Murphy USA, Inc. (b) | | | 10,452 | | | | 3,287,259 | |

Wingstop, Inc. | | | 12,950 | | | | 2,051,151 | |

| | | | | | | | 5,338,410 | |

Semiconductors - 0.90% | | | | | | | | |

ON Semiconductor Corp. (a) | | | 14,860 | | | | 912,850 | |

| | | | | | | | | |

Software - 2.41% | | | | | | | | |

Box, Inc. - Class A (a) | | | 17,748 | | | | 515,579 | |

DoubleVerify Holdings, Inc. (a)(b) | | | 66,443 | | | | 1,942,129 | |

| | | | | | | | 2,457,708 | |

Telecommunications - 3.50% | | | | | | | | |

Clearfield, Inc. (a) | | | 29,397 | | | | 3,570,854 | |

| | | | | | | | | |

Transportation - 2.80% | | | | | | | | |

FLEX LNG Ltd. | | | 91,399 | | | | 2,856,219 | |

TOTAL COMMON STOCKS (Cost $95,763,397) | | | | | | | 101,242,311 | |

| | | | | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 24.93% | | Units | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 3.24% (d) | | | 25,438,971 | | | | 25,438,971 | |

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $25,438,971) | | | | | | | 25,438,971 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS - 0.26% | | | | | | | | |

Money Market Deposit Account - 0.26% | | Principal Amount | | | Value | |

U.S. Bank Money Market Deposit Account, 2.750% (e) | | $ | 269,608 | | | | 269,608 | |

TOTAL SHORT TERM INVESTMENTS (Cost $269,608) | | | | | | | 269,608 | |

| | | | | | | | | |

Total Investments (Cost $121,471,976) - 124.41% | | | | | | | 126,950,890 | |

Liabilities in Excess of Other Assets - (24.41)% | | | | | | | (24,907,774 | ) |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 102,043,116 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR IBD® 50 ETF

Schedule of Investments

October 31, 2022 (Continued)

Asset Type | | % of Net Assets | |

Common Stocks | | | 99.22 | % |

Investments Purchased with Proceeds From Securities Lending | | | 24.93 | |

Short Term Investments | | | 0.26 | |

Total Investments | | | 124.41 | |

Liabilities in Excess of Other Assets | | | (24.41 | ) |

Net Assets | | | 100.00 | % |

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of October 31, 2022. The total value of securities on loan is $24,206,208, or 23.72% of net assets. See Note 6. |

(c) | To the extent that the Index concentrates in the securities of issuers in a particular industry or sector, the Fund will also concentrate its investments to approximately the same extent. |

(d) | Represents annualized seven-day yield as of the end of the reporting period. |

(e) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2022. |

The accompanying notes are an integral part of these financial statements.

INNOVATOR IBD® BREAKOUT OPPORTUNITIES ETF

Schedule of Investments

October 31, 2022

| | | Shares | | | Value | |

COMMON STOCKS - 96.24% | | | | | | | | |

Auto Manufacturers - 3.98% | | | | | | | | |

Cummins, Inc. (a) | | | 1,962 | | | $ | 479,729 | |

PACCAR, Inc. | | | 720 | | | | 69,717 | |

| | | | | | | | 549,446 | |

Banks - 6.20% | | | | | | | | |

Eastern Bankshares, Inc. | | | 6,300 | | | | 120,771 | |

ICICI Bank Ltd. - ADR | | | 20,754 | | | | 457,418 | |

United Community Banks, Inc. (a) | | | 7,218 | | | | 277,893 | |

| | | | | | | | 856,082 | |

Beverages - 2.97% | | | | | | | | |

PepsiCo, Inc. | | | 2,259 | | | | 410,189 | |

| | | | | | | | | |

Biotechnology - 8.47% | | | | | | | | |

Amgen, Inc. (a) | | | 1,557 | | | | 420,935 | |

Biogen, Inc. (a)(b) | | | 1,710 | | | | 484,683 | |

Sarepta Therapeutics, Inc. (a)(b) | | | 2,313 | | | | 263,728 | |

| | | | | | | | 1,169,346 | |

Commercial Services - 1.69% | | | | | | | | |

CBIZ, Inc. (b) | | | 2,799 | | | | 138,942 | |

Stride, Inc. (a)(b) | | | 2,808 | | | | 94,096 | |

| | | | | | | | 233,038 | |

Cosmetics & Personal Care - 2.95% | | | | | | | | |

elf Beauty, Inc. (b) | | | 9,414 | | | | 407,250 | |

| | | | | | | | | |

Electric - 3.47% | | | | | | | | |

NRG Energy, Inc. (a) | | | 10,782 | | | | 478,721 | |

| | | | | | | | | |

Electronics - 0.48% | | | | | | | | |

Sanmina Corp. (b) | | | 1,179 | | | | 66,083 | |

| | | | | | | | | |

Engineering & Construction - 1.09% | | | | | | | | |

Comfort Systems USA, Inc. | | | 1,224 | | | | 150,895 | |

| | | | | | | | | |

Food - 8.99% | | | | | | | | |

Hershey Co. | | | 1,143 | | | | 272,914 | |

J M Smucker Co. (a) | | | 3,204 | | | | 482,714 | |

Kellogg Co. (a) | | | 6,318 | | | | 485,349 | |

| | | | | | | | 1,240,977 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR IBD® BREAKOUT OPPORTUNITIES ETF

Schedule of Investments

October 31, 2022 (Continued)

| | | Shares | | | Value | |

Healthcare - Services - 3.94% | | | | | | | | |

The Ensign Group, Inc. | | | 3,051 | | | | 273,919 | |

UnitedHealth Group, Inc. (a) | | | 486 | | | | 269,803 | |

| | | | | | | | 543,722 | |

Insurance - 14.96% | | | | | | | | |

Arch Capital Group Ltd. (b) | | | 8,118 | | | | 466,785 | |

Kinsale Capital Group, Inc. | | | 468 | | | | 147,500 | |

Old Republic International Corp. (a) | | | 19,962 | | | | 463,318 | |

Principal Financial Group, Inc. | | | 5,787 | | | | 510,008 | |

The Travelers Companies, Inc. | | | 2,592 | | | | 478,120 | |

| | | | | | | | 2,065,731 | |

Internet - 3.33% | | | | | | | | |

Netflix, Inc. (a)(b) | | | 1,575 | | | | 459,711 | |

| | | | | | | | | |

Iron & Steel - 4.36% | | | | | | | | |

Commercial Metals Co. (a) | | | 2,979 | | | | 135,544 | |

Reliance Steel & Aluminum Co. | | | 351 | | | | 70,719 | |

Steel Dynamics, Inc. (a) | | | 4,212 | | | | 396,139 | |

| | | | | | | | 602,402 | |

Machinery - Diversified - 2.11% | | | | | | | | |

Applied Industrial Technologies, Inc. (a) | | | 2,340 | | | | 291,049 | |

| | | | | | | | | |

Oil & Gas - 4.37% | | | | | | | | |

Chevron Corp. (a) | | | 747 | | | | 135,132 | |

ConocoPhillips | | | 522 | | | | 65,819 | |

Phillips 66 | | | 648 | | | | 67,580 | |

Sitio Royalties Corp. | | | 4,716 | | | | 133,746 | |

TotalEnergies SE - ADR | | | 2,502 | | | | 137,035 | |

Valero Energy Corp. | | | 504 | | | | 63,277 | |

| | | | | | | | 602,589 | |

Oil & Gas Services - 1.01% | | | | | | | | |

ProFrac Holding Corp. - Class A (b) | | | 6,381 | | | | 139,808 | |

| | | | | | | | | |

Packaging & Containers - 0.47% | | | | | | | | |

Sonoco Products Co. | | | 1,053 | | | | 65,370 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR IBD® BREAKOUT OPPORTUNITIES ETF

Schedule of Investments

October 31, 2022 (Continued)

| | | Shares | | | Value | |

Pharmaceuticals - 7.94% | | | | | | | | |

Cardinal Health, Inc. | | | 5,364 | | | | 407,128 | |

McKesson Corp. | | | 1,062 | | | | 413,511 | |

Merck & Co., Inc. | | | 2,727 | | | | 275,972 | |

| | | | | | | | 1,096,611 | |

Retail - 7.26% | | | | | | | | |

AutoZone, Inc. (b) | | | 171 | | | | 433,123 | |

Casey's General Stores, Inc. | | | 1,215 | | | | 282,743 | |

Genuine Parts Co. | | | 1,611 | | | | 286,532 | |

| | | | | | | | 1,002,398 | |

Savings & Loans - 0.50% | | | | | | | | |

Washington Federal, Inc. | | | 1,773 | | | | 68,615 | |

| | | | | | | | | |

Semiconductors - 2.80% | | | | | | | | |

Aehr Test Systems (a)(b) | | | 18,810 | | | | 386,922 | |

| | | | | | | | | |

Software - 2.90% | | | | | | | | |

Verra Mobility Corp. (b) | | | 23,418 | | | | 399,745 | |

TOTAL COMMON STOCKS (Cost $12,568,115) | | | | | | | 13,286,700 | |

| | | | | | | | | |

MASTER LIMITED PARTNERSHIPS - 2.87% | | | | | | | | |

Oil & Gas - 0.48% | | | | | | | | |

Kimbell Royalty Partners L.P. | | | 3,501 | | | | 66,659 | |

Pipelines - 2.39% | | | | | | | | |

MPLX L.P. | | | 7,839 | | | | 262,920 | |

Western Midstream Partners L.P. | | | 2,331 | | | | 66,923 | |

| | | | | | | | 329,843 | |

TOTAL MASTER LIMITED PARTNERSHIPS (Cost $386,330) | | | | | | | 396,502 | |

| | | | | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 30.08% | | Units | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 3.24% (c) | | | 4,152,384 | | | | 4,152,384 | |

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $4,152,384) | | | | | | | 4,152,384 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR IBD® BREAKOUT OPPORTUNITIES ETF

Schedule of Investments

October 31, 2022 (Continued)

SHORT TERM INVESTMENTS - 0.90% | | | | | | | | |

Money Market Deposit Account - 0.90% | | Principal Amount | | | Value | |

U.S. Bank Money Market Deposit Account, 2.750% (d) | | $ | 124,683 | | | | 124,683 | |

TOTAL SHORT TERM INVESTMENTS (Cost $124,683) | | | | | | | 124,683 | |

| | | | | | | | | |

Total Investments (Cost $17,231,512) - 130.09% | | | | | | | 17,960,269 | |

Liabilities in Excess of Other Assets - (30.09)% | | | | | | | (4,153,950 | ) |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 13,806,319 | |

| | | | | | | | | |

Asset Type | | % of Net Assets | | | | | |

Common Stocks | | | 96.24 | % | | | | |

Master Limited Partnerships | | | 2.87 | | | | | |

Investments Purchased with Proceeds From Securities Lending | | | 30.08 | | | | | |

Short Term Investments | | | 0.90 | | | | | |

Total Investments | | | 130.09 | | | | | |

Liabilities in Excess of Other Assets | | | (30.09 | ) | | | | |

Net Assets | | | 100.00 | % | | | | |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

(a) | All or a portion of this security is on loan as of October 31, 2022. The total value of securities on loan is $4,029,560, or 29.19% of net assets. See Note 6. |

(b) | Non-income producing security. |

(c) | Represents annualized seven-day yield as of the end of the reporting period. |

(d) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2022. |

The accompanying notes are an integral part of these financial statements.

INNOVATOR LOUP FRONTIER TECH ETF

Schedule of Investments |

October 31, 2022 |

| | | Shares | | | Value | |

COMMON STOCKS – 94.43% | | | | | | | | |

Aerospace & Defense - 6.60% | | | | | | | | |

AeroVironment, Inc. (a)(b) | | | 11,644 | | | $ | 1,065,426 | |

Lockheed Martin Corp. | | | 2,191 | | | | 1,066,316 | |

| | | | | | | | 2,131,742 | |

Auto Parts & Equipment - 8.35% | | | | | | | | |

LG Energy Solution Ltd. (a) | | | 4,433 | | | | 1,643,178 | |

Magna International, Inc. | | | 18,899 | | | | 1,053,241 | |

| | | | | | | | 2,696,419 | |

Commercial Services - 5.85% | | | | | | | | |

Block, Inc. (a) | | | 15,865 | | | | 953,010 | |

GXO Logistics, Inc. (a)(b) | | | 25,614 | | | | 935,936 | |

| | | | | | | | 1,888,946 | |

Computers - 2.78% | | | | | | | | |

Crowdstrike Holdings, Inc. - Class A (a) | | | 5,576 | | | | 898,851 | |

| | | | | | | | | |

Diversified Financial Services - 7.58% | | | | | | | | |

Coinbase Global, Inc. - Class A (a)(b) | | | 22,332 | | | | 1,479,495 | |

Nasdaq, Inc. | | | 15,568 | | | | 968,952 | |

| | | | | | | | 2,448,447 | |

Electrical Components & Equipment - 6.53% | | | | | | | | |

ABB Ltd. | | | 35,827 | | | | 996,079 | |

Novanta, Inc. (a) | | | 7,866 | | | | 1,112,252 | |

| | | | | | | | 2,108,331 | |

Electronics - 7.62% | | | | | | | | |

Coherent Corp. (a)(b) | | | 43,283 | | | | 1,454,742 | |

Trimble, Inc. (a) | | | 16,690 | | | | 1,004,070 | |

| | | | | | | | 2,458,812 | |

Hand & Machine Tools - 2.85% | | | | | | | | |

KUKA AG | | | 11,122 | | | | 919,973 | |

| | | | | | | | | |

Internet - 2.65% | | | | | | | | |

Snap, Inc. - Class A (a)(b) | | | 86,290 | | | | 855,134 | |

| | | | | | | | | |

Miscellaneous Manufacturing - 3.21% | | | | | | | | |

Axon Enterprise, Inc. (a) | | | 7,120 | | | | 1,035,533 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR LOUP FRONTIER TECH ETF

Schedule of Investments |

October 31, 2022 (Continued) |

| | | Shares | | | Value | |

Semiconductors - 26.78% (c) | | | | | | | | |

Advanced Micro Devices, Inc. (a) | | | 15,539 | | | | 933,272 | |

ams-OSRAM AG (a) | | | 156,200 | | | | 885,396 | |

Applied Materials, Inc. (b) | | | 11,344 | | | | 1,001,562 | |

ASML Holding NV | | | 2,139 | | | | 1,010,428 | |

Micron Technology, Inc. (b) | | | 17,484 | | | | 945,884 | |

NVIDIA Corp. | | | 7,697 | | | | 1,038,864 | |

Samsung Electronics Co. Ltd. | | | 22,835 | | | | 952,226 | |

Skyworks Solutions, Inc. | | | 10,704 | | | | 920,651 | |

Teradyne, Inc. (b) | | | 11,802 | | | | 960,093 | |

| | | | | | | | 8,648,376 | |

Software - 13.63% | | | | | | | | |

Palantir Technologies, Inc. - Class A (a)(b) | | | 111,450 | | | | 979,646 | |

Pegasystems, Inc. (b) | | | 29,014 | | | | 1,079,612 | |

Take-Two Interactive Software, Inc. (a) | | | 12,695 | | | | 1,504,104 | |

Unity Software, Inc. (a)(b) | | | 28,400 | | | | 837,800 | |

| | | | | | | | 4,401,162 | |

TOTAL COMMON STOCKS (Cost $39,000,616) | | | | | | | 30,491,726 | |

| | | | | | | | | |

PREFERRED STOCKS - 5.60% | | | | | | | | |

Auto Manufacturers - 5.60% | | | | | | | | |

Dr Ing hc F Porsche AG (a) | | | 17,666 | | | | 1,806,946 | |

TOTAL PREFERRED STOCKS (Cost $1,569,945) | | | | | | | 1,806,946 | |

| | | | | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 28.11% | | Units | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 3.24% (d) | | | 9,077,312 | | | | 9,077,312 | |

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $9,077,312) | | | | | | | 9,077,312 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR LOUP FRONTIER TECH ETF

Schedule of Investments |

October 31, 2022 (Continued) |

SHORT TERM INVESTMENTS - 0.33% | | | | | | | | |

Money Market Deposit Account - 0.33% | | Principal Amount | | | Value | |

U.S. Bank Money Market Deposit Account, 2.750% (e) | | $ | 105,626 | | | | 105,626 | |

TOTAL SHORT TERM INVESTMENTS (Cost $105,626) | | | | | | | 105,626 | |

| | | | | | | | | |

Total Investments (Cost $49,753,499) - 128.47% | | | | | | | 41,481,610 | |

Liabilities in Excess of Other Assets - (28.47)% | | | | | | | (9,193,327 | ) |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 32,288,283 | |

Country | | % of Net Assets | |

Austria | | | 2.74 | % |

Canada | | | 3.26 | |

Germany | | | 8.45 | |

Netherlands | | | 3.13 | |

South Korea | | | 8.04 | |

Switzerland | | | 3.08 | |

United States | | | 71.33 | |

Total Country | | | 100.03 | |

Investments Purchased with Proceeds From Securities Lending | | | 28.11 | |

Short Term Investments | | | 0.33 | |

Total Investments | | | 128.47 | |

Liabilities in Excess of Other Assets | | | (28.47 | ) |

Net Assets | | | 100.00 | % |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of October 31, 2022. The total value of securities on loan is $8,690,825, or 26.92% of net assets. See Note 6. |

(c) | To the extent that the Index concentrates in the securities of issuers in a particular industry or sector, the Fund will also concentrate its investments to approximately the same extent. |

(d) | Represents annualized seven-day yield as of the end of the reporting period. |

(e) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2022. |

The accompanying notes are an integral part of these financial statements.

INNOVATOR S&P INVESTMENT GRADE PREFERRED ETF

Schedule of Investments |

October 31, 2022 |

| | | Shares | | | Value | |

PREFERRED STOCKS - 99.69% (a) | | | | | | | | |

Banks - 39.97% (c) | | | | | | | | |

Bank of America Corp., Series 02, 3.693% to 11/28/2022 then 3-Month USD Libor + 0.650% | | | 22,403 | | | $ | 422,969 | |

Bank of America Corp., Series 4, 5.190% to 11/28/2022 then 3-Month USD Libor + 0.750% | | | 21,600 | | | | 406,728 | |

Bank of America Corp., Series 5, 4.000% to 11/21/2022 then 3-Month USD Libor + 0.500% | | | 21,242 | | | | 404,660 | |

Bank of America Corp., Series E, 4.790% to 11/15/2022 then 3-Month USD Libor + 0.350% | | | 21,807 | | | | 403,429 | |

Bank of America Corp., Series GG, 6.000% | | | 16,934 | | | | 403,029 | |

Bank of America Corp., Series HH, 5.875% | | | 17,513 | | | | 406,126 | |

Bank of America Corp., Series KK, 5.375% | | | 18,867 | | | | 403,754 | |

Bank of America Corp., Series LL, 5.000% | | | 20,057 | | | | 399,937 | |

Bank of America Corp., Series NN, 4.375% | | | 22,391 | | | | 389,827 | |

Bank of America Corp., Series PP, 4.125% | | | 23,637 | | | | 385,047 | |

Bank of America Corp., Series QQ, 4.250% | | | 23,454 | | | | 391,213 | |

Bank of America Corp., Series SS, 4.750% | | | 21,068 | | | | 410,405 | |

Bank of Hawaii Corp., Series A, 4.375% | | | 277,802 | | | | 4,722,634 | |

Cullen/Frost Bankers, Inc., Series B, 4.450% | | | 258,533 | | | | 5,002,614 | |

First Republic Bank/CA, Series J, 4.700% | | | 51,142 | | | | 898,565 | |

First Republic Bank/CA, Series K, 4.125% | | | 58,223 | | | | 898,381 | |

First Republic Bank/CA, Series L, 4.250% | | | 56,131 | | | | 891,360 | |

First Republic Bank/CA, Series M, 4.000% | | | 59,815 | | | | 897,823 | |

First Republic Bank/CA, Series N, 4.500% | | | 53,158 | | | | 895,181 | |

JPMorgan Chase & Co., Series DD, 5.750% | | | 33,305 | | | | 771,677 | |

JPMorgan Chase & Co., Series EE, 6.000% (b) | | | 32,864 | | | | 801,882 | |

JPMorgan Chase & Co., Series GG, 4.750% (b) | | | 39,327 | | | | 777,101 | |

JPMorgan Chase & Co., Series JJ, 4.550% (b) | | | 43,339 | | | | 789,203 | |

JPMorgan Chase & Co., Series LL, 4.625% | | | 42,785 | | | | 793,234 | |

JPMorgan Chase & Co., Series MM, 4.200% (b) | | | 46,247 | | | | 795,911 | |

Morgan Stanley, Series A, 5.140% to 01/16/2023 then 3-Month USD Libor + 0.700% | | | 31,830 | | | | 596,812 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR S&P INVESTMENT GRADE PREFERRED ETF

Schedule of Investments |

October 31, 2022 (Continued) |

| | | Shares | | | Value | |

Morgan Stanley, Series E, 7.125% to 10/15/2023 then 3-Month USD Libor + 4.320% | | | 24,326 | | | | 609,366 | |

Morgan Stanley, Series F, 6.875% to 01/15/2024 then 3-Month USD Libor + 3.940% | | | 24,442 | | | | 611,539 | |

Morgan Stanley, Series I, 6.375% to 10/15/2024 then 3-Month USD Libor + 3.708% | | | 25,019 | | | | 607,712 | |

Morgan Stanley, Series K, 5.850% to 04/15/2027 then 3-Month USD Libor + 3.491% | | | 25,571 | | | | 585,832 | |

Morgan Stanley, Series L, 4.875% (b) | | | 29,795 | | | | 578,619 | |

Morgan Stanley, Series O, 4.250% (b) | | | 34,646 | | | | 564,037 | |

Morgan Stanley, Series P, 6.500% | | | 24,461 | | | | 606,633 | |

Northern Trust Corp., Series E, 4.700% | | | 236,761 | | | | 4,739,955 | |

State Street Corp., Series D, 5.900% to 03/15/2024 then 3-Month USD Libor + 3.108% | | | 100,611 | | | | 2,451,890 | |

State Street Corp., Series G, 5.350% to 03/15/2026 then 3-Month USD Libor + 3.709% (b) | | | 102,327 | | | | 2,460,964 | |

Truist Financial Corp., Series O, 5.250% (b) | | | 111,058 | | | | 2,339,992 | |

Truist Financial Corp., Series R, 4.750% | | | 125,251 | | | | 2,373,506 | |

US Bancorp., Series B, 4.679% to 01/17/2023 then 3-Month USD Libor + 0.600% (b) | | | 51,194 | | | | 915,861 | |

US Bancorp., Series K, 5.500% | | | 41,853 | | | | 946,296 | |

US Bancorp., Series L, 3.750% | | | 61,614 | | | | 932,220 | |

US Bancorp., Series M, 4.000% | | | 58,586 | | | | 947,921 | |

US Bancorp., Series O, 4.500% | | | 51,350 | | | | 949,975 | |

| | | | | | | | 47,581,820 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR S&P INVESTMENT GRADE PREFERRED ETF

Schedule of Investments |

October 31, 2022 (Continued) |

| | | Shares | | | Value | |

Capital Markets - 8.55% | | | | | | | | |

KKR & Co., Inc., Series C, 6.000%, 09/15/2023 (b) | | | 87,000 | | | | 5,282,640 | |

Oaktree Capital Group LLC, Series A, 6.625% | | | 103,575 | | | | 2,454,728 | |

Oaktree Capital Group LLC, Series B, 6.550% | | | 105,305 | | | | 2,438,864 | |

| | | | | | | | 10,176,232 | |

Close-End Funds - 4.05% | | | | | | | | |

The Gabelli Dividend & Income Trust, Series K, 4.250% (b) | | | 258,806 | | | | 4,824,144 | |

| | | | | | | | | |

Diversified Financial Services - 5.21% | | | | | | | | |

Apollo Asset Management, Inc., Series A, 6.375% | | | 35,358 | | | | 766,208 | |

Apollo Asset Management, Inc., Series B, 6.375% | | | 35,343 | | | | 770,477 | |

The Charles Schwab Corp., Series D, 5.950% | | | 100,364 | | | | 2,311,383 | |

The Charles Schwab Corp., Series J, 4.450% | | | 128,255 | | | | 2,356,044 | |

| | | | | | | | 6,204,112 | |

Insurance - 30.40% (c) | | | | | | | | |

Arch Capital Group Ltd., Series F, 5.450% | | | 115,004 | | | | 2,329,981 | |

Arch Capital Group Ltd., Series G, 4.550% | | | 131,829 | | | | 2,314,917 | |

Athene Holding Ltd., Series A, 6.350% to 06/30/2029 then 3-Month USD Libor + 4.253% | | | 34,023 | | | | 810,088 | |

Athene Holding Ltd., Series B, 5.625% | | | 37,442 | | | | 769,433 | |

Athene Holding Ltd., Series C, 6.375% to 09/30/2025 then Five-Year Treasury Constant Maturity + 5.970% | | | 32,838 | | | | 818,651 | |

Athene Holding Ltd., Series D, 4.875% | | | 45,428 | | | | 781,816 | |

Axis Capital Holdings Ltd., Series E, 5.500% | | | 236,874 | | | | 4,680,630 | |

Equitable Holdings, Inc., Series A, 5.250% | | | 120,471 | | | | 2,243,170 | |

Equitable Holdings, Inc., Series C, 4.300% | | | 142,193 | | | | 2,322,012 | |

MetLife, Inc., Series A, 4.293% to 12/15/2022 then 3-Month USD Libor + 1.000% | | | 75,819 | | | | 1,556,564 | |

MetLife, Inc., Series E, 5.625% | | | 69,138 | | | | 1,607,458 | |

MetLife, Inc., Series F, 4.750% | | | 80,786 | | | | 1,588,253 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR S&P INVESTMENT GRADE PREFERRED ETF

Schedule of Investments |

October 31, 2022 (Continued) |

| | | Shares | | | Value | |

RenaissanceRe Holdings Ltd., Series F, 5.750% | | | 108,415 | | | | 2,358,026 | |

RenaissanceRe Holdings Ltd., Series G, 4.200% | | | 144,278 | | | | 2,405,114 | |

The Allstate Corp., 5.100% to 01/15/2023 then 3-Month USD Libor + 3.165%, 01/15/2053 | | | 67,822 | | | | 1,639,936 | |

The Allstate Corp., Series H, 5.100% | | | 78,768 | | | | 1,547,791 | |

The Allstate Corp., Series I, 4.750% | | | 82,910 | | | | 1,547,101 | |

The Hartford Financial Services Group, Inc., Series G, 6.000% (b) | | | 198,622 | | | | 4,874,184 | |

| | | | | | | | 36,195,125 | |

Real Estate Investment Trusts - 7.72% | | | | | | | | |

Kimco Realty Corp., Series L, 5.125% | | | 117,532 | | | | 2,255,439 | |

Kimco Realty Corp., Series M, 5.250% | | | 113,886 | | | | 2,236,721 | |

Public Storage, Series F, 5.150% | | | 16,083 | | | | 338,225 | |

Public Storage, Series G, 5.050% | | | 16,223 | | | | 335,492 | |

Public Storage, Series H, 5.600% | | | 14,709 | | | | 335,806 | |

Public Storage, Series I, 4.875% | | | 17,009 | | | | 334,567 | |

Public Storage, Series J, 4.700% | | | 17,596 | | | | 332,037 | |

Public Storage, Series K, 4.750% | | | 17,500 | | | | 344,050 | |

Public Storage, Series L, 4.625% | | | 17,938 | | | | 333,647 | |

Public Storage, Series M, 4.125% | | | 19,697 | | | | 329,531 | |

Public Storage, Series N, 3.875% | | | 21,559 | | | | 335,674 | |

Public Storage, Series O, 3.900% (b) | | | 21,285 | | | | 336,090 | |

Public Storage, Series P, 4.000% | | | 20,806 | | | | 338,722 | |

Public Storage, Series Q, 3.950% | | | 21,194 | | | | 338,468 | |

Public Storage, Series R, 4.000% | | | 20,831 | | | | 335,171 | |

Public Storage, Series S, 4.100% | | | 20,424 | | | | 335,975 | |

| | | | | | | | 9,195,615 | |

Savings & Loans - 3.79% | | | | | | | | |

Washington Federal, Inc., Series A, 4.875% | | | 258,941 | | | | 4,513,341 | |

TOTAL PREFERRED STOCKS (Cost $148,976,724) | | | | | | | 118,690,389 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR S&P INVESTMENT GRADE PREFERRED ETF

Schedule of Investments |

October 31, 2022 (Continued) |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 4.25% | | Units | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 3.24% (d) | | | 5,059,149 | | | | 5,059,149 | |

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $5,059,149) | | | | | | | 5,059,149 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS - 0.55% | | | | | | | | |

Money Market Deposit Account - 0.55% | | Principal Amount | | | | | |

U.S. Bank Money Market Deposit Account, 2.750% (e) | | $ | 658,579 | | | | 658,579 | |

TOTAL SHORT TERM INVESTMENTS (Cost $658,579) | | | | | | | 658,579 | |

| | | | | | | | | |

Total Investments (Cost $154,694,452) - 104.49% | | | | | | | 124,408,117 | |

Liabilities in Excess of Other Assets - (4.49)% | | | | | | | (5,351,573 | ) |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 119,056,544 | |

Asset Type | | % of Net Assets | |

Preferred Stocks | | | 99.69 | % |

Investments Purchased with Proceeds From Securities Lending | | | 4.25 | |

Short Term Investments | | | 0.55 | |

Total Investments | | | 104.49 | |

Liabilities in Excess of Other Assets | | | (4.49 | ) |

Net Assets | | | 100.00 | % |

Percentages are stated as a percent of net assets.

USD - United States Dollar

Libor - London Interbank Offered Rate

(a) | Securities with no stated maturity date are perpetual in nature. |

(b) | All or a portion of this security is on loan as of October 31, 2022. The total value of securities on loan is $4,855,509, or 4.08% of net assets. See Note 6. |

(c) | To the extent that the Index concentrates in the securities of issuers in a particular industry or sector, the Fund will also concentrate its investments to approximately the same extent. |

(d) | Represents annualized seven-day yield as of the end of the reporting period. |

(e) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2022. |

The accompanying notes are an integral part of these financial statements.

INNOVATOR LADDERED ALLOCATION POWER BUFFER ETF

Schedule of Investments |

October 31, 2022 |

| | | Shares | | | Value | |

AFFILIATED EXCHANGE TRADED FUNDS - 99.86% (a) | | | | | | | | |

Innovator U.S. Equity Power Buffer ETF - January | | | 402,547 | | | $ | 12,531,369 | |

Innovator U.S. Equity Power Buffer ETF - February | | | 447,235 | | | | 12,437,292 | |

Innovator U.S. Equity Power Buffer ETF - March | | | 410,059 | | | | 12,426,551 | |

Innovator U.S. Equity Power Buffer ETF - April | | | 448,556 | | | | 12,460,886 | |

Innovator U.S. Equity Power Buffer ETF - May | | | 445,099 | | | | 12,489,478 | |

Innovator U.S. Equity Power Buffer ETF - June | | | 419,745 | | | | 12,450,896 | |

Innovator U.S. Equity Power Buffer ETF - July | | | 416,275 | | | | 12,463,273 | |

Innovator U.S. Equity Power Buffer ETF - August | | | 441,845 | | | | 12,482,121 | |

Innovator U.S. Equity Power Buffer ETF - September | | | 428,527 | | | | 12,461,179 | |

Innovator U.S. Equity Power Buffer ETF - October | | | 418,509 | | | | 12,429,717 | |

Innovator U.S. Equity Power Buffer ETF - November (b) | | | 421,765 | | | | 12,682,474 | |

Innovator U.S. Equity Power Buffer ETF - December | | | 416,937 | | | | 12,495,227 | |

TOTAL AFFILIATED EXCHANGE TRADED FUNDS (Cost $150,154,756) | | | | | | | 149,810,463 | |

| | | | | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 0.66% | | Units | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 3.24% (c) | | | 988,825 | | | | 988,825 | |

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $988,825) | | | | | | | 988,825 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS - 0.14% | | | | | | | | |

Money Market Deposit Account - 0.14% | | Principal Amount | | | | | |

U.S. Bank Money Market Deposit Account, 2.750% (d) | | $ | 210,180 | | | | 210,180 | |

TOTAL SHORT TERM INVESTMENTS (Cost $210,180) | | | | | | | 210,180 | |

| | | | | | | | | |

Total Investments (Cost $151,353,761) - 100.66% | | | | | | | 151,009,468 | |

Liabilities in Excess of Other Assets - (0.66)% | | | | | | | (994,259 | ) |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 150,015,209 | |

The accompanying notes are an integral part of these financial statements.

INNOVATOR LADDERED ALLOCATION POWER BUFFER ETF

Schedule of Investments |

October 31, 2022 (Continued) |

Asset Type | | % of Net Assets | |

Affiliated Exchange Traded Funds | | | 99.86 | % |

Investments Purchased with Proceeds From Securities Lending | | | 0.66 | |

Short Term Investments | | | 0.14 | |

Total Investments | | | 100.66 | |

Liabilities in Excess of Other Assets | | | (0.66 | ) |

Net Assets | | | 100.00 | % |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of October 31, 2022. The total value of securities on loan is $959,233, or 0.64% of net assets. See Note 6. |

(c) | Represents annualized seven-day yield as of the end of the reporting period. |

(d) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2022. |

The accompanying notes are an integral part of these financial statements.

INNOVATOR LADDERED ALLOCATION BUFFER ETF

Schedule of Investments |

October 31, 2022 |

| | | Shares | | | Value | |

AFFILIATED EXCHANGE TRADED FUNDS - 99.95% (a) | | | | | | | | |

Innovator U.S. Equity Buffer ETF - January | | | 66,798 | | | $ | 2,214,100 | |

Innovator U.S. Equity Buffer ETF - February | | | 74,227 | | | | 2,197,661 | |

Innovator U.S. Equity Buffer ETF - March | | | 68,663 | | | | 2,190,288 | |

Innovator U.S. Equity Buffer ETF - April | | | 71,318 | | | | 2,192,943 | |

Innovator U.S. Equity Buffer ETF - May | | | 75,498 | | | | 2,196,237 | |

Innovator U.S. Equity Buffer ETF - June | | | 71,681 | | | | 2,192,199 | |

Innovator U.S. Equity Buffer ETF - July | | | 71,236 | | | | 2,195,892 | |

Innovator U.S. Equity Buffer ETF - August | | | 73,205 | | | | 2,199,810 | |

Innovator U.S. Equity Buffer ETF - September | | | 72,306 | | | | 2,190,872 | |

Innovator U.S. Equity Buffer ETF - October | | | 69,560 | | | | 2,188,705 | |

Innovator U.S. Equity Buffer ETF - November | | | 74,652 | | | | 2,223,883 | |

Innovator U.S. Equity Buffer ETF - December | | | 69,994 | | | | 2,216,710 | |

TOTAL AFFILIATED EXCHANGE TRADED FUNDS (Cost $27,101,020) | | | | | | | 26,399,300 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS - 0.06% | | | | | | | | |

Money Market Deposit Account - 0.06% | | Principal Amount | | | | | |

U.S. Bank Money Market Deposit Account, 2.750% (b) | | $ | 16,220 | | | | 16,220 | |

TOTAL SHORT TERM INVESTMENTS (Cost $16,220) | | | | | | | 16,220 | |

| | | | | | | | | |

Total Investments (Cost $27,117,240) - 100.01% | | | | | | | 26,415,520 | |

Liabilities in Excess of Other Assets - (0.01)% | | | | | | | (2,015 | ) |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 26,413,505 | |

| | | | | | | | | |

Asset Type | | % of Net Assets | | | | | |

Affiliated Exchange Traded Funds | | | 99.95 | % | | | | |

Short Term Investments | | | 0.06 | | | | | |

Total Investments | | | 100.01 | | | | | |

Liabilities in Excess of Other Assets | | | (0.01 | ) | | | | |

Net Assets | | | 100.00 | % | | | | |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2022. |

The accompanying notes are an integral part of these financial statements.

INNOVATOR BUFFER STEP-UP STRATEGY ETF

Schedule of Investments |

October 31, 2022 |

| | | Contracts | | | Notional Amount | | | Value | |

PURCHASED OPTIONS - 104.77% (a)(b) | | | | | | | | | | | | |

CALL OPTIONS - 98.62% | | | | | | | | | | | | |

SPY SPDR S&P 500® Trust ETF, Expires 6/30/2023, Strike Price $3.81 | | | 754 | | | $ | 29,120,234 | | | $ | 28,455,517 | |

| | | | | | | | | | | | 28,455,517 | |

PUT OPTIONS - 6.15% | | | | | | | | | | | | |

SPY SPDR S&P 500® Trust ETF, Expires 6/30/2023, Strike Price $377.24 | | | 754 | | | | 29,120,234 | | | | 1,773,026 | |

| | | | | | | | | | | | 1,773,026 | |

TOTAL PURCHASED OPTIONS (Cost $31,407,123) | | | | | | | | | | | 30,228,543 | |

| | | | | | | | | | | | | |