| 5200 REPUBLIC PLAZA

370 SEVENTEENTH STREET

DENVER

COLORADO 80202-5638

TELEPHONE: 303.592.1500

FACSIMILE: 303.592.1510

WWW.MOFO.COM | | MORRISON & FOERSTER LLP

NEW YORK, SAN FRANCISCO,

LOS ANGELES, PALO ALTO,

SAN DIEGO, WASHINGTON, D.C.

NORTHERN VIRGINIA, DENVER,

SACRAMENTO, WALNUT CREEK

TOKYO, LONDON, BEIJING,

SHANGHAI, HONG KONG,

SINGAPORE, BRUSSELS |

| | | |

January 20, 2009 | | | Writer’s Direct Contact

303.592.2276

BLewandowski@mofo.com |

By EDGAR Submission

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E., Mail Stop 4561

Washington, D.C. 20549

Attention: Christian Windsor and Gregory Dundas

RE: | Prosper Marketplace, Inc. |

| Registration Statement on Form S-1 |

| File No. 333-147019 |

Gentlemen:

On behalf of Prosper Marketplace, Inc., a Delaware corporation (“Prosper” or the “Company”), submitted herewith for filing is Amendment No. 2 (“Amendment No. 2”) to the Registration Statement referenced above (the “Registration Statement”), which includes a preliminary prospectus dated January 16, 2009.

Amendment No. 2 is being filed in response to comments contained in the letter dated January 2, 2009 from Christian Windsor of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) to Edward Giedgowd, the Company’s Chief Compliance Officer and General Counsel. The responses set forth below are based upon information provided to Morrison & Foerster LLP by the Company. The responses are keyed to the numbering of the comments and the headings used in the Staff’s letter. Where appropriate, the Company has responded to the Staff’s comments by making changes to the disclosure in the Registration Statement as set forth in Amendment No. 2. Page numbers referred to in the responses reference the applicable pages of Amendment No. 2. Capitalized terms not otherwise defined in this letter shall have the meanings given to them in Amendment No. 2.

In addition to responding to the Staff’s comments, the Company wishes to draw the Staff’s attention to the following revisions set forth in Amendment No. 2:

· Prosper has adopted a new credit rating system, referred to as the “Prosper Rating”, represented by a letter grade that indicates the borrower’s level of risk and corresponds to an estimated average annualized loss rate range. There are currently seven Prosper Ratings, represented by seven letter scores, but this, as well as the loss ranges associated with each, may change over time. For Prosper borrower listings, the Prosper Rating will be derived from two scores: a consumer reporting agency score and an in-house custom score calculated using the historical performance of previous Prosper borrower loans with similar characteristics. For open market listings, the originator will provide us with a loss rate on the type of loan being offered for sale, and we will translate the loss rate to a Prosper Rating. The use of these two scores will determine an estimated loss rate for each listing, which correlates to a Prosper Rating.

· To alleviate, to the extent commercially practicable, the risks of non-payment under the Notes as a result of Prosper’s bankruptcy, Prosper intends to grant the indenture trustee, for the benefit of the trustee and the holders of the Notes, a security interest in all present and future rights of Prosper to payment under the corresponding borrower loans and all moneys and property received by Prosper and held by Prosper in a account for the benefit of the Note holders. With respect to each Note, the trustee would have a security interest in Prosper’s right to payment and payments it has received with respect to the corresponding borrower loan upon which a series of Notes is dependent for payment—i.e., the proceeds received on a specific borrower loan would not be available to the holders of Notes not dependent for payment on that borrower loan. Prosper is currently considering the exact nature of the security interest and the manner in which the security interest will be perfected in each series of Notes.

· Prosper has substantially revised Amendment No. 2 to distinguish the loans offered for sale on Prosper’s website by financial institution members, referred to as “open market loans” and loans requested by Prosper’s borrower members, referred to as “Prosper borrower loans.”

· In addition, Prosper wishes to advise the Staff that it currently anticipates that the Note trading platform will be operated by FOLIOfn Investments, Inc., a registered broker-dealer, subject to the completion of agreements between Prosper and FOLIOfn. The information set forth in the prospectus and in response to comments 7 and 27 below reflect the current terms of the agreements being negotiated with FOLIOfn.

2

General

1. Please tell the staff your plans for meeting the prospectus delivery requirements under Section 5(b) of the Securities Act.

Response:

Following the effectiveness of the Registration Statement, Prosper will deliver the final prospectus contained in the Registration Statement, as amended by any Post-Effective Amendment to the Registration Statement that has become effective at that time (collectively, the “Current Prospectus”), to each lender member at the time such lender member initially registers as a lender member. Delivery will be accomplished by notification to the lender members prior to submitting the lender member’s Lender Registration Agreement and transferring any funds to Prosper. The notice will (1) indicate that all Notes offered and sold on the platform are offered and sold only by means of the Current Prospectus, (2) encourage the lender member to read and familiarize themselves with the Current Prospectus, (3) contain prominent text noting that the prospective lender member should pay attention in particular to the Risk Factors contained in the Current Prospectus, (3) contain a hot link to the Current Prospectus and (4) indicate the e-mail and street addresses that the prospective lender member can write to in order to obtain a paper copy of the Current Prospectus free of charge.

2. Please tell us what information with regard to each borrower you believe is material to an investment decision and therefore you intend to include in the prospectus. Alternatively, please tell the staff why you believe such information is not material to investors.

Response:

Prosper believes that the information with regard to each individual borrower is not material to investors in the Notes being offered by Prosper. Individual borrower member information is made available on Prosper’s website because some lender members may be interested in information about a borrower (or about the nature of the borrower members in general) including the borrower members’ self-identified affiliations, intended use of funds and other borrower-supplied information. The mere fact that lender members can view an individual borrower’s posted information and that a borrower member’s loan will be made once sufficient funding is obtained to enable Prosper to purchase the loan, does not alone support a conclusion that that the borrower-supplied information is material to purchasers of the Notes. It has long been settled that the standard for determining what information constitutes material information about an issuer or security, and therefore must be disclosed to investors under the federal securities laws, is what information a hypothetical “reasonable investor” would consider material to an investment decision with respect the offered security. See TSC Industries v. Northway, 426 U.S. 438, 445 to 449, 96 S.Ct. 2126, 2130 to 2132 (1976), and the cases cited therein. In TSC Industries, the Supreme Court made it clear that the test for materiality is an objective standard (i.e. information is material information if there is a substantial likelihood that a reasonable investor would consider it to be important to an investment decision) not a subjective standard (i.e. what a specific investor might consider important). Id (1)For the reasons described below, Prosper believes that borrower-supplied information about a specific borrower member is information that a reasonable investor would not consider important under the circumstances described in the prospectus and therefore such information is not material information under the objective standard set forth in TSC Industries. As a result, it is not necessary to include such information in the prospectus. In addition, as noted in by the Supreme Court, some information may be of “such dubious significance that insistence on its disclosure might do more harm than good” and may cause issuers “to bury the [purchasers of the Notes] in an avalanche of trivial information[,] a result that is hardly conducive to informed decisionmaking.” TSC Industries at 448, 96 S. Ct at 2132. For the reasons described below, Prosper believes that including the borrower-supplied information in the prospectus would present a substantial likelihood of doing more harm than good and of burying the material information set forth in the Current Prospectus in a mountain of trivial information, most of which would be irrelevant and inapplicable to the investment decision being made at a particular time by a particular lender. Accordingly, no information about individual borrower members will be included in the prospectus.

(1) Although TSC Industries addressed the definition of “materiality” in the context of a proxy statement under Section 14(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), the Supreme Court has subsequently clarified that the TSC Industries formulation of the test for materiality also applies to the determination of materiality under Section 10(b) of the Exchange Act. See Basic Inc. v. Levinson, 485 U.S. 224, 108 S.Ct. 978 (1988). Because the intent of Section 10(b) of the Exchange Act as prescribed by the Commission in Rule 10b-5 under the Exchange Act is nearly identical to the operative statutory language of Sections 11 and 12 of the Securities Act of 1933 (the “Securities Act”), courts have applied the objective standard in TSC Industries and Basic to determine materiality under the same objective standard. See, e.g. Isquith v. Middle South Utilities, Inc., 847 F.2d 186 (5th Cir, 1988) at n. 16, the cases cited therein and the accompanying text; and In Re Craftmatic Securities Litigation, 860 F.2d 628, 641 (3rd Cir. 1990)

3

As explained in detail in the prospectus, the Notes are obligations of Prosper and are not obligations of the borrower-members, who are anonymous to the lender members. While Prosper’s obligation to make payments on a Note are dependent upon the underlying borrower making the corresponding payment on his or her loan, the likelihood of a borrower paying the loan in full and on a timely basis has little reliable correlation with the borrower-supplied information that is displayed to lenders. Prosper believes that an important underlying motivation for peer-to-peer lending is the affinity of the lenders to help other individuals, in addition to achieving attractive returns. Nevertheless, for the protection of each borrower, the borrower listings are anonymous to the lenders and the borrower-supplied information therefore serves as background context, for informational purposes only, and should not be taken by lenders as material to their determination whether to bid for a specific Note. Prosper therefore advises lender members of the limitations on the reliability of information supplied by borrower members. In addition, although the borrower-supplied information is available to registered lender members, the information is supplied by borrowers on an anonymous basis and is not independently verified and the lender members are appropriately warned of the risk of placing too much reliance on the borrower-supplied information in the Risk Factors appearing on pages 22 and 23 of the prospectus. Consequently, such information should not be material to an investment decision with regard to the Notes being issued and sold by Prosper.

In addition, Prosper’s platform is an online auction-style marketplace for loans that facilitates loans to borrowers with interest rates set through auction-style competitive bidding among individuals or institutions who register as lender members of Prosper. When a borrower registers on the platform, Prosper obtains the borrower member’s social security number, state driver’s license or state identification card number and bank account information to verify the borrower member’s identity against data from consumer reporting agencies and other identity and anti-fraud verification databases. This personally-identifiable information is not made available for viewing on the Website and is maintained in confidence by Prosper. Prosper will assign a Prosper Rating to each borrower member who posts a listing, which is indicated by one of seven letter grades (AA, A, B, C, D, E and HR (High Risk)). Thus, Prosper believes that the Prosper Rating, which is based on the borrower’s credit score and information derived by Prosper by reference to Prosper’s analysis of the performance of similar loans originated through Prosper, is the only material information related to the specific borrower that is provided to the lender members. The methodology used by Prosper to determine the Prosper Rating is described in detail in the prospectus.

Moreover, even if a particular lender consider a specific item of borrower-supplied information to be material to his or her investment decision, other lenders would not necessarily consider that same information to be material. As discussed above, the determination whether information is material depends on a finding that there is a substantial likelihood that a reasonable investor would consider the information to be important in making an investment decision. Given the nature of the borrower-supplied information (i.e. anonymous, unverified and supplied in a context that may motivate borrowers to describe themselves and their circumstances in a positive light), as compared to the Prosper Rating, which is derived from actual performance history of comparable loans and the borrower’s credit rating, which is prepared by a regulated

4

consumer credit rating service, Prosper does not believe that there is a significant likelihood that a reasonable lender would consider the borrower-supplied information to be important to an investment decision. Moreover, there may often be [dozens] of new borrower listings each day. To include all of the borrower-supplied information in the prospectus (presumably by means of supplements filed under Rule 424(b)) would produce exactly the result that the TSC Industries Court warned against and sought to avoid: burying investors in an “avalanche of trivial information” and thereby obscuring the material information that should be of most concerned to the lenders. Worse, including borrower-supplied information in the prospectus could imply to prospective lenders that the information is more reliable and important than it is, which could in itself be misleading, notwithstanding the warnings and risk factors set forth in the prospectus.

The prospectus makes it clear that lender members are being offered an investment in the form of the Notes issued by Prosper, which Notes will set forth the lenders’ very specific contractual rights. The lender members will not be offered an investment in a borrower’s loan or given any non-anonymous information regarding the borrowers. The lender members also will not have privity of contract or any other legal relationship with any borrower that would entitle a lender to institute collection efforts or legal proceedings against a defaulting borrower. The lenders’ legal rights and remedies under the Notes are exclusively against Prosper. Should Prosper default in its obligations to pay any Note when the corresponding borrower is not in default, the indenture trustee will have the right to enforce a security interest in Prosper’s right to payment under the corresponding borrower loan. However, because Prosper’s obligation to pay a Note is contingent on the receipt of payments by the corresponding borrower, only Prosper (or the trustee, when applicable) will have the right to undertake collection efforts against a borrower. Thus, the fact that borrower members will post information about themselves and benefit from lender members’ purchases of Notes does not change the nature of the securities being offered by Prosper.

Finally, including borrower member information in a prospectus supplement or term sheet in a filing with the Commission under Rule 424(b) would raise concerns about compliance with credit reporting laws and protecting the privacy of the borrowers’ personal information without enhancing the protection of the lenders investing in the Notes because the lender members do not have any right to enforce the borrowers’ notes or any other right to proceed against a borrower for any inaccuracy in the Borrower’s information. Specifically, Prosper believes that disclosing the credit detail of borrower’s credit report to the public at large would violate the provisions of the Federal Fair Credit Reporting Act. Currently, only registered lender members, not the general public, can view such information on Prosper’s website.

5

3. Since each series of notes will have differing terms, particularly with respect to maturity and interest rate, please advise the staff how you intend to update the prospectus to address the material information with regard to each series when offered and when closed.

Response:

Following effectiveness of the Registration Statement, the prospectus will include all of the information required pursuant to Section 10(a) of the Securities Act except identification of the specific interest rate to be borne by a particular series of Notes (and, in the case of Open Market Notes, the maturity date) being offered at any given time in the continuous offering as permitted by Rule 430A. All Prosper borrower notes have a maturity of 3 years, as disclosed in the prospectus. As discussed in the prospectus (see pages 11, 12, 53 and 54) lender members are electronically notified if they are winning bidders at the close of the auction process. At this time the interest rate payable on the Notes is determined based on the bids of the winning lender members and the interest rate and maturity date are included in the notice given to each lender member who is a winning bidder.

Prosper proposes to close the sales of Notes once per week, at which time it will send notice to the winning bidders setting forth the principal amount, interest rate and maturity date of the Notes purchased by them. In conjunction with the weekly closing, Prosper will file weekly supplements (each a “Weekly Sales Report”) to the prospectus under Rule 424(b)(3) to report Notes actually sold that week. In accordance with Rule 424(b), the Weekly Sales Report would be filed within two business days after first being sent to the lender members who are the winning bidders and will contain the following information about each series of Notes sold in tabular form:

· the title, aggregate principal amount, interest rate and initial maturity date of each series of Notes sold; and

· the Prosper Rating of the borrower loan funded with the proceeds of each series of Notes.

Prosper would appreciate the opportunity to speak with the Staff regarding any questions or concerns about the prospectus content, delivery and updating prior to revising the prospectus to describe the delivery and update methodology.

4. In a number of places throughout the prospectus you make reference to notes offered by financial institution members. Please revise your disclosure to clarify that these financial institution members are co-issuers or co-registrants of the notes that they are selling, and clarify how you plan to include their listings within the prospectus. Please also revise your disclosure to separately discuss the notes offered by the lender members, to discuss any additional collateralization or verification done with regard to those notes.

6

Response:

For the reasons discussed below, we respectfully disagree with the Staff’s position that the financial institution members are co-issuers or co-registrants of the Notes.

Legal Form and Substance of the Offering

First, the financial institution members will have no contractual obligations to or commercial relationship with the lender members. The Notes are debt instruments issued by Prosper pursuant to an indenture that will be governed by New York law. As a matter of New York contract law, Prosper will be the sole obligor in respect of the Notes. No other person will have any obligation to make payments in respect of the Notes as principal, guarantor or insurer. Lender members who purchase Notes will not be in contractual privity with the financial institution members in respect of the corresponding open market loans; nor are they in privity with WebBank. Therefore, according to their legal form, the sole issuer of the Notes will be Prosper. See, e.g., Reiss v. Financial Performance Corp., 764 N.E.2d 958, 960 (N.Y. 2001) (“[W]hen parties set down their agreement in a clear, complete document, their writing should as a rule be enforced according to its terms”) (citation omitted). Likewise, according to legal form, the sole parties to the indenture will be Prosper and the indenture trustee, acting for the benefit of the lender members who are holders of the Notes from time to time.

Financial Institution Members Are Not Co-Issuers

The open market loans are not securities and are not issued by the financial institution members. Consequently, the financial institution members are not co-issuers or co-registrants of the Notes.

The United States Supreme Court has made clear that not all “notes” constitute securities and that a literal interpretation of Section 2(1) is not appropriate. Reves v. Ernst & Young, 494 U.S. 56, 63 (1990). Rather, the Court held that notes are issued in a variety of consumer and commercial contexts in which the notes are not properly viewed as securities. Id. at 64-65. The Reves decision adopted a non-exclusive list for those types of notes that are not securities, including, as relevant here, notes delivered in consumer financing, and notes evidencing a character loan to a bank customer. Id. at 65. Reves also acknowledged that this list should extend to notes that bear a “family resemblance” to the types of notes identified by Reves. Id. The following factors are used in the “family resemblance” approach: (i) the motivations that would prompt a reasonable seller and buyer; (ii) the plan of distribution; (iii) the reasonable expectations of the public; and (iv) the presence of risk-reducing factors. Id. at 66-67.

Prosper submits that each of the factors suggests that no security of the financial institution members is present. However, under Reves’ balancing test, courts frequently find no security present where even one or two of the factors weigh in favor of finding of a security. See, e.g., Robyn Meredith, Inc. v. Levy, 440 F. Supp. 2d 378, 386-87 (D.N.J. 2006) (finding no security present despite that risk reducing factor weighed in favor of a finding of a security). The case law has consistently viewed the motivations of both the

7

borrowers and lenders to be relevant in determining whether a securities exists. In fact, the Supreme Court seemed to emphasize the borrower’s motives when it announced in Reves that:

If the seller’s [i.e., borrower’s] purpose is to raise money for the general use of a business enterprise or to finance substantial investments and the buyer [i.e., lender] is interested primarily in the profit the note is expected to generate, the instrument is likely to be a “security.” If the note is exchanged to facilitate the purchase and sale of a minor asset or consumer good, to correct for the [borrower’s] cash-flow difficulties, or to advance some other commercial or consumer purpose, on the other hand, the note is less sensibly described as a “security.”

Reves, 494 U.S. at 66.

Using the Supreme Court’s test, there is no question that the motivation of the borrower members is “to facilitate the purchase and sale of a minor asset or consumer good, to correct for the seller’s cash-flow difficulties, or to advance some other commercial or consumer purpose.” The open market loans represent a separate and distinct transaction between the financial institution member and the borrower. Because the open market loans are personal consumer loans or retail installment sales contracts, as well as small business loans, they fall squarely within the Reves “family resemblance” test as notes delivered in minor commercial or consumer financing, and they are not securities. See Reves, 494 U.S. at 65. Offering the open market loan for sale on the platform does not change the status of the open market loan from a standard loan to a security.

Thus, since the open market loans are not a security, and the financial institution members are not in contractual privity or otherwise obligated to, or in a commercial relationship with, the lender members, the financial institution members are not co-issuers or co-registrants of the Notes. Prosper is not aware of any other basis to disregard the form and substance of the transaction by treating financial institution members as co-issuers or co-registrants, directly or indirectly, of the Notes.

Analysis Under Rule 140. The Commission has defined in Rule 140, promulgated by the Commission under the Securities Act, certain circumstances under which an issuer of securities underlying the securities of another issuer (the registrant) being registered under the Securities Act will be consider a “co-issuer” or “co-registrant” with respect to the securities being offered by the registrant. Rule 140 provides that a registrant “the chief part of whose business consists of the purchase of the securities of one issuer, or of two or more affiliated issuers, and the sale of [such registrant’s] own securities . . . to furnish the proceeds with which to acquire the securities of such issuer or affiliated issuers, is to be regarded as engaged in the distribution of the securities of such issuer or affiliated issuers within the meaning of Section 2(11) of the Act.” In effect, Rule 140 therefore provides that the form of the obligation will be disregarded, and that the issuer or affiliated issuers of the underlying securities is deemed to also be the issuer of the

8

securities being registered by the registrant. The plain meaning of the text of Rule 140, however, makes it clear that this rule is not applicable to the offering of Notes being undertaken by Prosper.

By its express terms, Rule 140 is limited to transactions that in which the registrant acquires “securities” within the meaning of the Securities Act because it applies only to situations in which “ a chief part of the business [of the registrant] consists of the purchase of securities of one issuer, or of two or more affiliated issuers. . . .” (Emphasis added.) Thus, for Rule 140 to apply, the registrant must be purchasing “securities,” within the meaning of the Securities Act, with the proceeds of the registrant’s sale of its own securities. Accord Asset-Backed Securities, Securities Act Release No. 33-8518, 2004 WL 2964659 (Dec. 22, 2004) (discussing the applicability of Rule 140 to asset-backed offerings and emphasizing, “[I]f the assets being securitized are themselves securities under the Securities Act, the offering of those securities also must be registered or exempt from registration [under] the Securities Act.”) (emphasis added); First Boston Mortgage Securities Corporation, SEC No-Action Letter, 1987 WL 108646 (Oct. 6, 1987) (taking a Rule 140 no-action position where a conduit trust featured back to back participation certificates evidencing 100% ownership interests in mortgage loans, because the certificates were receipts for the mortgage loans, not securities); Rule 140 With Respect to Assessable Stock, Securities Act Release No. 33-3903, 1958 WL 6411 (Mar. 5, 1958) (proposing the amendment of Rule 140 to its current form and explaining the rule’s applicability to back to back assessable stock transactions by stating, “These transactions in effect constitute the offering of the securities of the new enterprise to the holders of the assessable stock”). Prosper’s institutional members, however, will offer to sell Prosper open market loans, which are not securities within the meaning of the Securities Act, as discussed above. Consequently, Rule 140 is not applicable to cause the institutional members to be deemed co-issuers or co-registrants with Prosper.

Rule 140 is also limited in its application to cases in which a “chief part” of the registrant’s business is “the purchase of the securities of one issuer, or of two or more affiliated issuers.” In the case of the open market loans to be purchased by Prosper with the proceeds of the Open Market Notes, the open market loans are obligations of many different underlying borrowers, not one (or two or more affiliated borrowers). Furthermore, even if the open market loans to be purchased by Prosper constitute securities by virtue of the origination and servicing functions of the institutional members, again such “securities” would be purchased from time to time from several different “issuers” who are not affiliates. Thus, the condition contained in the plain language of Rule 140 that the underlying securities be issued by one issuer or by two of more affiliated issuers is not satisfied by the open market loan program. Finally, because Prosper’s platform is primarily aimed at promoting peer-to-peer lending and the open market acquisition of loans is an adjunct that, effectively, allows for other originators to achieve liquidity by participating in the sale of loans to Prosper that would qualify as borrower loans if they were originally funded through Prosper’s platform, Prosper does not believe that “the chief part” of its business is the purchase of securities issued by the institutional members. As a result, the condition to the applicability of Rule 140 that the “chief part” of the registrant’s business is the purchase of securities is not satisfied in the case of Prosper’s platform.

9

For the reasons stated above, neither the legal form of the open market transactions, nor the substance of such transactions, supports the inference that the institutional members are co-issuers of, or should be co-registrants with respect to, the Open Market Notes offered by Prosper. This outcome is the same under both the letter and the spirit of the Securities Act and Rule 140.

In response to the Staff’s comment, we have revised pages 10, 14, 15, 30, 45 and 52 of the prospectus to discuss the additional diligence and verification performed by Prosper with respect to the open market loans. In addition, throughout the prospectus we have separately discussed the Prosper Borrower Notes and the Prosper Open Market Notes.

5. Since notes that are sold and supported by loans that are secured by real property or other collateral are made on an unsecured basis, please advise the staff, with a view towards revised disclosure, as to the impact upon collection procedures of having an unsecured note supported by a loan that does enjoy a security interest.

Response:

In response to the Staff’s comment, we revised pages 6, 13, 14, 21, 27, 30, 57 and 65 of the prospectus to reflect that open market loans will be serviced, both before and after default, by the originator of the open market loans and has agreed to use commercially reasonable efforts to service and collect the borrower loans in accordance with industry standards customary for loans of the same general type and character as the borrower loans. In addition, the prospectus discloses that although the originator is obligated to forward to Prosper any amounts it receives on the open market loans, including amounts received upon the sale of the collateral securing an open market loan, the holders of Prosper Open Market Notes do not have the right to take any legal action under the security interest or to require that the originator take such action.

6. Please tell the staff how you plan to comply with the requirements of the Trust Indenture Act of 1939 and how you plan to supplement the prospectus for each new series.

Response:

At the time a borrower loan or open market loan is purchased by Prosper with the proceeds of a series of Prosper Lender Notes or Prosper Open Market Notes, Prosper will enter into a supplemental indenture (each a “Supplemental Indenture”) with the trustee providing for the issuance of such Notes and setting forth their terms. Each Supplemental Indenture will be identical except for the principal amount, interest rate and maturity date of the series of Notes being issued thereunder. Pursuant to Item 601 of Regulation S-K, it will not be necessary for Prosper to file the Supplemental Indentures as exhibits to the Registration Statement as the rights of the holders of the Notes under each Supplemental Indenture will be identical as set forth in the Indenture and the Form of Supplemental Indenture filed as exhibits to the Registration Statement, except for the interest rate, maturity date and principal amount, which will be set forth in the applicable Weekly Sales Report filed as a supplemental prospectus under Rule 424(b). Please see the response to comment 3 with respect to updating the prospectus.

7. Please advise the staff regarding any and all actions taken to set up your trading platform, including the resale of notes by Financial Institution members.

Response:

When the registration statement becomes effective Prosper will activate a trading platform to enable registered lender members to sell and buy Notes issued by Prosper. Prosper is currently negotiating an agreement with FOLIOfn to manage its trading platform. FOLIOfn is not being used to manage Prosper’s main auction platform where borrowers request loans and originators offer previously-funded loans for sale, and Prosper issues securities in the form of Borrower Payment Dependent Notes to

10

the lenders who are the winning bidders for the borrower loan being requested or offered for sale.

Prosper is currently in the process of finalizing the contracts evidencing the arrangement. The trading platform will be operated by FOLIOfn but hosted by Prosper on the Prosper website. There will be a License Agreement under which Prosper will license to FOLIOfn certain software and technology that FOLIOfn will use to operate the trading platform, and a Hosting Services Agreement whereby Prosper will agree to host such software and technology for FOLIOfn’s exclusive use. There will also be a Services Agreement which will dictate the services (recordkeeping, etc.) that Prosper will provide to or for FOLIOfn.

The following process will apply to registered Prosper lenders who desire to sell their Notes on the trading platform, or to bid to purchase other lenders’ Notes on the trading platform:

· The lender member will click on a button saying the lender will be directed to the FOLIOfn website. That landing page will be designed by FOLIOfn and Prosper, and will be a FOLIOfn page, with the Prosper logo appearing lower on the page.

· The lender member will then need to become a FOLIOfn customer by entering his or her relevant information (name, social security number, address, birth date, etc.). FOLIOfn will take that information and run its own OFAC search and make an immediate decision as to whether to create an account for the customer. The account will be a FOLIOfn account, and will allow that customer to also trade in other FOLIOfn products, along with Prosper Notes.

· To become a FOLIOfn customer, lenders must accept FOLIOfn’s legal agreements, and receive specified Note Trading Platform Disclosures. Once a lender becomes a FOLIOfn customer, the lender can sell his or her own Notes on the trading platform, or buy other lenders’ Notes offered for sale on the trading platform. Notes sold and purchased may correspond to Prosper borrower loans, or to open market (i.e., previously-funded) loans originated by other financial institutions.

For each Note sold, the selling lender of the Note will pay FOLIOfn a transaction fee equal to a percentage of the proceeds received from the sale. Under the Service Agreement, Prosper will agree to pay FOLIOfn minimum transaction fees of $20,000 per month. Prosper also intends to charge the selling lender, at the time a Note is offered for sale, a listing fee of $0.25 per listing for each Note listed for sale on the trading platform.

11

On the day following the close of the auction bidding period for a Note offered for sale on the trading platform the following process will occur:

(a) Prosper relinquishes custody and control of the electronic original of the Note to FOLIOfn, such that ownership of the Note can only be transferred at FOLIOfn’s direction.

(b) Prosper transfers funds in the amount of the purchase price from the Note buyer’s Prosper funding account to FOLIOfn’s Wells Fargo account.

(c) FOLIOfn transfers 99% of sale proceeds (retaining their 1% fee) back to Prosper, which Prosper places, at FOLIOfn’s instruction, in the selling lender’s FOLIOfn Note trading account.

(d) Prosper moves the sale proceeds from the selling lender’s Note trading account to the selling lender’s Prosper funding account.

(e) Prosper, at FOLIOfn’s instruction, transfers ownership of the Note from the selling lender to the buying lender, and such transfer shall be reflected in the selling lender’s and buying lender’s Note trading accounts.

(f) Prosper, at FOLIOfn’s instruction, moves the Notes from the buying lender’s Note trading account to the buying lender’s Prosper account.

FOLIOfn’s telephone number and email address will be displayed on the trading platform web pages, and all customer service questions relating to the trading platform will be received by or directed to FOLIOfn. Prosper will maintain all records of the transactions in a separate database, on FOLIOfn’s behalf, that FOLIOfn may query on its own.

As disclosed on page 59 of the prospectus, the Note resale listings displayed for auction on the trading platform will include the following information: the selling subscriber’s screen name, the offered sale price of the Note, the interest rate on the Note, the remaining term of the Note, the yield to maturity that corresponds to the offered sale price, repayment status on the Note (i.e., current or delinquent), the borrower’s payment history, the next scheduled payment on the Note, the remaining duration of the resale listing, the number of bids, and whether the resale listing has an automatic sale feature.

Each resale listings will include a link to the original borrower listing (including the listing title, description, credit data, recommendations, questions and answers, and

12

original bidding history) that corresponds to the Note being offered for resale. Although resale listings will be displayed publicly on the trading platform, the borrower’s payment history and corresponding borrower listings will be viewable only by registered subscribers.

8. The first risk factor on page 16 states that the notes are speculative investments and are only suitable for lenders who can afford to lose their entire investment. Please tell us how you, or the operator of your secondary marketing platform plan to screen lenders for suitability.

Response:

In response to the Staff’s comment, Prosper advises the Staff that, except for verifying a prospective lender’s identity at the time of registration, Prosper does not otherwise require lender members to satisfy any suitability standards. Prosper believes that the lender members, not Prosper, are in the best position to determine if the Notes are suitable investments for them. As the Staff is aware, the Notes are not “covered securities” and Prosper is currently seeking to register the offer and sale of the Notes in all 50 states. As part of this ongoing process, we expect that certain states will impose minimum financial suitability standards and maximum investment limits for lenders residing in those states. If and when this occurs, Prosper will update the prospectus, either through a pre-effective amendment or prospectus supplement, to include such states suitability requirements. Under the lender registration agreement, lender members are required to represent and warrant that they satisfy the applicable minimum financial suitability standards and maximum investment limits of the state in which they reside. Prosper is in the process of implementing procedures on its platform to ensure that the lender members satisfy the suitability requirements of each state prior to placing a bid on the platform.

As discussed in response to comment 7, FOLIOfn Investments, Inc., a registered broker-dealer and FINRA member, is expected to manage the Note trading platform. Prosper will render any services required by FOLIOfn as an independent service provider subject to the supervision and direction of FOLIOfn. As FOLIOfn, not Prosper, will manage the trading platform, FOLIOfn has the responsibility for determining whether or not the Notes are suitable investments for the lender members. It is Prosper’s understanding that because the resale of the Notes on the trading platform should be characterized as unsolicited trades and, therefore, FOLIOfn’s due diligence obligations are correspondingly limited, that FOLIOfn does not intend to require lender members to satisfy any suitability requirements other than those imposed on Prosper by the various states. Prosper has also added additional disclosure to page 42 of the prospectus in response to the Staff’s comment.

13

9. Please advise the staff how you determined that Group Leaders were not offering participants or otherwise take liability for their actions on the platform.

Response:

As disclosed on pages 18, 45 and 46 of the prospectus, Borrower and lender members may choose to belong to certain groups of people with common interests, including social, cultural, ethnic, professional, educational, athletic, religious, or any other official or unofficial affiliation. Groups allow people to join together for the common goal of borrowing money at desirable interest rates and give borrowers an additional incentive—the borrower’s reputation within the group—to meet their obligation to repay a borrower loan. In addition, group leaders are able to condition membership on personal facts and characteristics that may not be available to lender members generally and have the ability, if they so choose, to review and approve their group members’ listings before they are posted on our platform for bidding.

Neither groups nor group leaders, however:

· guarantee their members’ obligations under any borrower loan in any way,

· make bidding decisions or set interest rates for listings of group members; or

· can take any collection action against the borrower members of their group.

Each individual borrower is fully responsible for his or her repayment obligations under a borrower loan.

Although certain group leaders may still receive compensation for borrower loans originated prior to September 13, 2007 (Prosper discontinued this practice for borrower loans originated after this date), compensation was only paid to group leaders based on the payment performance of borrower loans obtained by members of their group. Group leaders were never compensated based on the dollar value of the borrower loans made to the group member or the number of members in a group. As group leaders do not guarantee their member’s obligations, make bidding decisions or set interest rates for listings on their behalf and have never been compensated, as finders or otherwise, for loan origination activities, Prosper has never considered the group leaders to have been offering participants or to have any liability for their administrative actions as group leaders under its platform.

14

10. Please advise the staff whether the lender members funds held in the FBO account with Wells Fargo is reachable by the creditors of Prosper in the event of your entry into bankruptcy or other collection proceedings.

Response:

Similar to a trust account, the FBO account vests legal title, effectively the power to administer the account, in Prosper, while beneficial ownership of the funds remains with the lender members until the funds are either disbursed to fund a borrower loan or withdrawn and returned to the lender. The fact that beneficial ownership remains with the lender members is further evidenced by the presence of pass through Federal Deposit Insurance Corporation (“FDIC”) deposit insurance for each Lender member. Pursuant to FDIC regulations governing deposit insurance for custodial accounts or accounts held in the name of an agent on behalf of one or more principals (i.e. the lender members), the accounts are treated for deposit insurance purposes as if each principal had a separate deposit account in such principal’s name. See 12 C.F.R. Part 330.7. For FDIC insurance purposes, the depositary bank’s account records must disclose the fiduciary relationship in the account title, i.e. “for the benefit of” and either the bank’s account records or the agent’s records must disclose each owner’s identity and ownership interest in the deposit. As disclosed on pages 54 and 55 of the prospectus, the FBO account is clearly titled as held by prosper “for the benefit of” Prosper’s lender members and Prosper maintains sub-account records for each of the lender members to reflect the balance of funds owned by each lender member in the FBO account and such lender member’s transactions.

As the FBO account vests legal title in Prosper, with the attendant right to administer the FBO account, if Prosper were to file for protection under the United States Bankruptcy Code, the legal right to administer the funds in the FBO account would vest with the bankruptcy trustee or debtor in possession. Absent extenuating circumstances, however, neither the bankruptcy trustee, Prosper, as a debtor in possession, nor its creditors have a legal right to the funds in the FBO account, as the lender members, not Prosper, are the beneficial owners of such funds. The trustee or the lender members, however, may have to seek a bankruptcy court order lifting the automatic stay and permitting them to withdraw their funds and lender members may suffer delays in accessing their funds in the FBO account as a result. Moreover, United States Bankruptcy Courts have broad powers and as a result, Prosper has included risk factors relating to the amounts on deposit in the FBO account on pages 34 and 35 of the prospectus.

15

Questions and Answers, page 8

11. Revise this section to disclose, under its own subheading, that in the event of Prosper entering bankruptcy or otherwise encountering financial distress, lenders may not receive payments on their notes, even if the borrowers are making payments on the underlying loans.

Response:

As mentioned at the beginning of this letter, to mitigate the risk of Prosper’s bankruptcy, Prosper intends to grant the indenture trustee, for the benefit of the trustee and the holders of the Notes, a security interest in all present and future rights of Prosper to payment under the corresponding borrower loans and all moneys and property received by Prosper and held in trust under the indenture. Although the exact nature of the security interest and the manner in which the security interest will be perfected is still being considered, the intention is that the indenture trustee may exercise its legal rights to the collateral only if an event of default has occurred under the indenture solely by reason of Prosper becoming subject to a bankruptcy or similar proceeding and not for any other reason. In such case, the indenture trustee, but not the holders of the Notes for that series, would have a secured claim, limited in recovery, to the right to receive payments on, and to all payments previously received and held in the trust for the benefit of the Note holders, solely with respect to the corresponding borrower loan for that series of Notes, but not with respect to any other borrower loan. Prosper has revised the disclosure on pages 19, 21, 34 and 35 of the prospectus in response to the Staff’s comment and to reflect the grant of a security interest.

12. Please revise the Answer to the Question “What is a bid?,” to clarify how “winning bids” are selected if there are bids in excess of the requested amount of the loan. In particular, what happens if there are excess bids at the same interest rate?

Response:

Prosper has revised the disclosure on pages 5, 6, 11, 12, 53 and 54 of the prospectus in response to the Staff’s comment and included a description of what happens if there are excess bids at the same interest rate.

13. Please revise the Answer to the Question “Are the Notes secured by any collateral?” to disclose that when previously funded loans secured by collateral are offered by financial institutions, the new loan becomes unsecured.

16

Response:

Prosper has revised the disclosure on pages 6, 13, 14, 21, 27, 57 and 65 of the prospectus in response to the Staff’s comment.

What is a Group?; What are the benefits of group membership?, page 14

14. Revise this section to clarify that since none of the group membership information is verified by Prosper, any claims of affiliation by other lenders or borrowers may be erroneous.

Response:

Prosper has revised the disclosure on page 18 of the prospectus to provide the additional information requested in the Staff’s comment.

Risk Factors, page 16

15. We note in your introductory paragraph the statement that this section describes some, but not all, of the risks of purchasing shares in your company. Please revise to delete this language. You must disclose all risks that you believe are material at this time. Discussing the possibility of risks that are currently unknown or appear immaterial is unnecessarily confusing.

Response:

In response to the Staff’s comment, we have revised the disclosure on page 21 of the prospectus to delete the statement in the introductory paragraph. In addition, Prosper acknowledges that it must disclose all material risk of which it is aware.

16. Please include a risk factor discussing the fact that when a financial institution sells a previously funded loan through your platform, most of the information that the bank possesses regarding the borrower as well as the history of the loan will not be made available to the lender members. Specifically note, if true, that although such loans may have a history of late payments or other problems, that history may not be communicated to the lender members.

Response:

In response to the Staff’s comment, we have added additional risk factors and disclosure on pages 10, 13 and 30 of the prospectus. Please also see Prosper’s response to comment 24 as to the information contained in open market listings.

17

17. Revise this section to provide, under separate headings, disclosure about the current status of loans made on your platform. In particular, please discuss the percentage of loans that have been 30-days late at any time while they were outstanding, the number and percentage that have entered into collection proceedings and the number that have entered into “default.”

Response:

Prosper has revised the disclosure on page 22 of the prospectus to add the additional disclosure requested by the Staff in this comment and to comment 28. In addition, Prosper has added additional disclosure on page 60 and 61 of the prospectus discussing the payment history of the previously-funded loans. The revised disclosure on pages 22, 60 and 61 of the prospectus, reflects Prosper’s payment and default history for borrower loans that are 15 to 30 days past due and more than 30 days past due versus borrower loans that are 1 month and 2 months late. The 2 month date has no independent significance to lender members as no late charges or additional collection efforts occur after a borrower loan becomes 2 months late. After a borrower loan becomes 15 days late, however, a late fee is charged and after a borrower loan is more than 30 days past due Prosper may elect to refer the borrower loan to a third party collection agency.

18. Add a risk factor that clarifies that since the rate on the loans is set by the auction process, rather than tied directly to the creditworthiness of the borrower, the rate the lender receives on their loan may not adequately compensate them for the risks associated with a particular note.

Response:

Prosper has revised the disclosure on page 25 of the prospectus to add the additional information requested by the Staff in this comment.

19. Add a risk factor that addresses your current cash position and your history of negative cash flow from operations.

Response:

Prosper has revised the disclosure on pages 31 and 32 of the prospectus to add the additional information requested by the Staff in this comment.

Information supplied by borrowers may be inaccurate or intentionally false, page 17

20. Please briefly explain the significance of Rule 10b-5 and Securities Act liability for purchasers of Notes.

Response:

Prosper has revised the disclosure on pages 23 and 49 of the prospectus to add the additional information requested by the Staff in this comment.

18

Our platform is a new concept . . ., page 20

21. The subheading is vaguely worded. Please revise the subheading to clarify the risk to lenders.

Response:

Prosper has revised the subheading on page 26 of the prospectus in response to the Staff’s comment.

Federal law entitles borrower members who enter active military service . . ., page 22

22. Please disclose what measures, if any, Prosper takes to verify active military status and whether you consider military service in assigning a risk rating to each borrower.

Response:

Prosper has revised the disclosure on page 27 of the prospectus to add the additional information requested by the Staff in this comment.

Borrower Financial Information is Generally Unverified, page 43

23. In the third paragraph you state that in the majority of cases you do not verify the income or other information provided by borrowers. To the extent possible, please clarify under what circumstances you do verify such information.

Response:

In response to the Staff’s comment, Prosper has revised the disclosure on page 52 of the prospectus to clarify the circumstances Prosper verifies such information.

Borrower Payment Dependent Notes based on Previously-funded Loans, page 50

24. Revise this section to disclose whether the financial institution members will be required to make any representations to the lender members about the current payment status of the relevant loans marketed on the site. Also, please address whether the credit profile of the underlying borrowers will be updated when the loans are listed. Finally, please address what happens in the event that the rates agreed to by the lenders either exceeds or is less than the rate on the underlying loan.

19

Response:

In response to this comment, Prosper directs the Staff’s attention to page 9, 10, 49 and 50 of the prospectus, which discloses the information expected to appear in all open market loan listings. This information will include, but not be limited to, (1) the Prosper Rating, based on information at the time of origination (rather than the time of listing), (2) the credit score range and related credit data obtained at the time of origination (rather than the time of listing), and (3) the borrower’s credit score range at the time of listing, which will not include updated credit data. In addition, Prosper has revised the disclosure on pages 5, 6, 11, 12, 53 and 54 to discuss the bidding process in greater detail.

Participation in the Funding of Borrower Loans by Prosper, page 51

25. With respect to the purchase of notes by officers, directors, and major shareholders, please disclose what controls will exist, if any, against such insiders having access to more extensive information regarding the respective borrowers or previously funded loans than will be available to other lender members not related to the company.

Response:

Prosper has revised the disclosure on page 58 of the prospectus to add the additional information requested by the Staff in this comment.

Trading Platform, page 51

26. Revise this section to discuss the standards, if any, that a loan must reach in order to be listed on the trading platform.

Response:

Prosper has revised the disclosure on pages 13, 15, 30, 50 and 51 of the prospectus to add the additional information requested by the Staff in this comment.

27. Please advise the staff regarding the current status of your efforts to establish the trading platform.

Response:

In response to this comment, we direct the Staff’s attention to our response to comment 7.

20

Historical Information About Our Borrowers and Outstanding Borrower Loans, page 53

28. Revise this section to clarify the extent to which your loans have been 1 and 2 months late at any time during their loan history.

Response:

Prosper has revised the disclosure on pages 60 and 61 of the prospectus to add the additional information requested by the Staff in this comment. Please note that because Prosper repurchased one (1) additional loan due to identity fraud after November 20, 2008, the number of loans changed 28,940 loans versus 28,941. In addition, for the reasons discussed in response to comment 17, the revised disclosure reflects loans that have been between 15-30 days and more than 30 days late versus loans that have been at least 1 and 2 months late.

Description of the Notes, page 55

29. Revise this section to disclose the maturity of the notes, and any limitation on the payment of moneys received by Prosper or its collection agents after maturity or any extension of the maturity date.

Response:

Prosper has revised the disclosure on pages 64 and 65 of the prospectus to add the additional information requested by the Staff in this comment.

30. Revise this section to discuss any notification requirements by Prosper in the event that the underlying loans are not paid on time or otherwise fail to pay according to their terms.

Response:

Prosper has revised the disclosure on page 65 of the prospectus to add the additional information requested by the Staff in this comment.

31. Revise this section to identify all representations and warranties that lenders must give in order to participate on the platform.

Response:

Prosper has revised the disclosure on pages 68 through 71 of the prospectus to add the additional information requested by the Staff in this comment.

21

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Critical Accounting Policies and Estimates, page 89

32. Please revise your critical accounting policy for Borrower Loan Repurchase Obligation to supplement, not duplicate, the description of accounting policy that is already disclosed in the notes to the financial statements. The disclosure should provide greater insight into the quality and variability of information regarding financial condition and operating performance. The discussion in MD&A should present your analysis of the uncertainties involved in applying a principle at a given time or the variability that is reasonably likely to result from its application over time. Discuss the following: (1) why management believes the accounting policy is critical; (2) the specific estimates and assumptions you used to develop the obligation; (3) how accurate your estimates and assumptions have been in the past, how much they have changed in the past and whether they are likely to change in the future; and (4) include quantitative disclosure of your sensitivity to change based on other outcomes that are reasonably likely to occur and that would have a material effect on the company. Refer to Item V of Release Nos. 33-8350/34-48960.

Response:

Prosper has revised the disclosure of pages 99 through 101 of the prospectus to reflect the following discussion in response to the Staff’s comments. Prosper is obligated to indemnify the lenders and repurchase the loans sold to the lenders in the event of violation of the applicable federal/state/local lending laws or verifiable identify theft. Prosper’s limited operating history, the lack of industry comparables and the potential to impact financial performance make the Borrower Loan Repurchase Obligation a critical accounting policy.

Prosper accrues a provision for the repurchase obligation when the loans are funded to the lender in an amount considered appropriate to reserve for its repurchase obligation related to the loans sold to the lenders in the event of violation of the applicable federal/state/local lending laws or verifiable identify theft. Determining the overall adequacy of Prosper’s repurchase obligation is subjective in nature and requires judgment by management. The loan repurchase obligation is estimated based on historical experience and includes a judgmental management adjustment due to Prosper’s limited operating history, current economic conditions, the risk of new and as yet undetected fraud schemes, changes in origination unit and dollar volumes, and the lack of industry comparables. Prosper’s management evaluates the reasonableness of its assumptions and estimates quarterly.

22

At December 31, 2007 and September 30, 2008, Prosper had recorded a loan repurchase obligation of $100,151 and $100,067, respectively. For the year ended December 31, 2007 and the nine months ended September 30 2008, Prosper repurchased loans in the amount $457,000 and $36,000, respectively, due to identity theft and legal and regulatory requirements. Since the latter part of 2007, Prosper has been successful at identifying and preventing a number of fraud attempts involving a series of fraudulent loan requests as our risk indicators and related operational controls in this area have significantly improved. Although Prosper believes its fraud controls have resulted in a lower incidence of fraud in 2008, its controls are largely based on experience from past fraud attempts..

Liquidity and Capital Resources, page 94

33. We note your statement that you expect to continue to incur net losses for a number of years, while on page 94 you state that you do not expect to reach profitability before 2010. Please revise to reconcile these statements.

Response:

Prosper has revised the disclosure on page 104 of the prospectus to be consistent with similar statements elsewhere in the prospectus.

Financial Statements as of December 31, 2007

Consolidated Statements of Operations, F-4

34. Please tell us how your Consolidated Statements of Income presentation complies with Rule 5-03 of Regulation S-X related to the following items:

· You do not report operating and non-operating income separately;

· You do not report operating and non-operating expenses separately; and

· You do not report costs and expenses applicable to revenues separately.

Response:

Prosper has updated the presentation of its Consolidated Statements of Operations to adhere more closely to Rule 5-03 of Regulation S-X. Prosper believes that its current presentation is consistent with that of other financial services companies. In addition, due to the materiality of Prosper’s operating expenses, Prosper’s management is of the opinion that the detailed breakout of operating expenses is more meaningful to the user.

23

Notes to the Financial Statements

Note 2. Significant Accounting Policies

Revenue Recognition, F-10

35. In an effort to help us better understand your revenue recognition policy, please provide us with your analysis of the applicability of SFAS 91 and SFAS 140 and how you arrived at the conclusion that such guidance was not applicable.

Response:

The attached summary, as well as Appendix A, is included to assist the Staff in better understanding Prosper’s historical revenue recognition policy.

The historical financial statements submitted in this Registration Statement reflect the financial performance of Prosper’s previous operating structure. Under this structure, our online platform allowed borrowers to obtain unsecured loans up to a maximum of $25,000 by posting a listing on the platform indicating the principal amount requested and the maximum interest rate they were willing to pay to the lenders. By making a bid on the borrower’s listing, the lender made a commitment to purchase from Prosper a Note in the principal amount of the lender’s bid. Lender members must deposit amounts equal to the winning bid in an account for the benefit of lender members. The lender deposits are placed in a FDIC-insured non-interest bearing account held at Wells Fargo Bank NA and are separate from Prosper’s own funds. These amounts cannot be withdrawn as long as there is a winning bid. Prosper’s funds are never at risk given that the loans are collateralized by the deposits held by the lender. Once the loan is funded, the note is transferred to the lender member. Under the previous operating structure, Prosper did not hold any of the loans other than to facilitate the transfer of the loan to the lender member nor did it fund any loans out of its own funds. The transfer to the lender member typically occurred within one business day. Prosper collected a fee upon origination and funding of the loan from the Borrower and also receives a servicing fee from the lender for the on-going loan administration including loan repayments and collections on behalf of the lenders.

In assessing the accounting for the loans originated over the Prosper Marketplace, Management first assessed whether Prosper serves as an agent or a principal in the Prosper Marketplace. If it was determined that Prosper acted as an agent, Management believes that the lending arrangement and ownership of the loan would fall outside the scope of SFAS 140 because if Prosper is acting as an agent, it does

24

not own the loans for accounting purposes and, therefore, is not selling or transferring the loan.

In order to assess whether Prosper serves as an agent or a principal, Management looked to the specific guidance in EITF Issues No. 96-19, Debtor’s Accounting for a Modification or Exchange of Debt Instruments, and EITF 99-19, Reporting Revenue Gross as a Principal versus Net as an Agent, which addresses characteristics distinguishing an agent from a principal. Prosper’s management also considered whether the following four criteria have been met in order to conclude that Prosper is acting as an agent rather than a principal:

1. Lack of sufficient risks and rewards of ownership

2. Lack of sufficient holding period

3. No continuing involvement

4. Legal isolation

Under the guidance of EITF 96-19 and EITF 99-19 and its consideration of the additional four criteria, Prosper concluded that it is an agent in the lending arrangement between borrowers and lenders given the factors summarized below:

· Prosper did not bear the risk and rewards of ownership because all loans are funded by the lender and Prosper agrees only to originate the loan and transfer the loan to the lender as soon as commercially feasible (generally one business day). Therefore, Prosper did not bear any risk of ownership. This also demonstrates a lack of sufficient holding period.

· Prosper acted as an intermediary in bringing borrowers and lenders together on the platform. The Company originates all winning auctions and then transfers the loan to the winning bidder. Prosper’s funds are not at risk in the transaction. Lenders must have on deposit with the Company amounts equal to the winning bid.

· Prosper did not have any continuing involvement with respect to the loans other than processing loan repayments and collections. Prosper has no obligation to purchase delinquent loans, except in the event of identifiable identity theft or lending law violations.

· Once the loans were funded, Prosper transferred, and assigned title and interest in the Notes to the lenders in accordance with the Lender Registration Agreement. This demonstrates legal isolation from the transferred loan.

25

Based on Management’s analysis of EITF 96-19 and EITF 99-19, Prosper determined that the Company acted as an agent in the previous operating structure when the specific fact pattern was analyzed against the accounting guidance in assessing agent vs., principal relationships. Therefore, the transfer of the loans was not within the scope of FASB Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities (SFAS 140).

Please refer to the memorandum attached hereto as Appendix A for a more detailed discussion and analysis of the accounting guidance.

Under Prosper’s new operating structure, as described in the Registration Statement, this historical model will change materially with the registration of the borrower payment dependent notes. Under Prosper’s new operating structure, as described in the prospectus, Prosper believes that it will function as a principal in the Prosper Marketplace. Therefore, it will own the loans for accounting purposes and would apply the provisions of SFAS 140.

Under Prosper’s previous operating structure, agency fees were charged as a percentage of the amount borrowed ranging from 1% - 3% depending on the credit grade of the borrower or $75.00, whichever is greater, and the loan was funded to the borrower, net of the agency fees. Because Prosper was previously determined to be an agent rather than a principal in the transaction, it was not the owner of the loan for accounting purposes and received the agency fee for its services as an agent in the Prosper Marketplace. Therefore, we determined that FASB Statement No. 91, Accounting for Nonrefundable Fees and Costs Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases (SFAS 91), was not the applicable literature and revenue related to these services was recognized in accordance with SAB 101. Upon funding of the loan to the borrower, Prosper’s earnings process was deemed to be complete as Prosper did not have any additional on-going obligation with respect to the loan origination process, the amount of the agency fee was determinable, had been collected, and there was no recourse to Prosper in the event of default by the borrower. Based on these facts, the agency fee was recognized at the time the loan was funded to the borrower.

Under our new operating structure, as described in the Registration Statement, Prosper believes that both SFAS 140 and SFAS 91 will be applicable. Accordingly, Prosper will defer and amortize agency fees over the terms of the loans as an adjustment of yield.

26

Note 8. Loan Repurchase Obligations, F-15

36. We note from the table in this footnote that you repurchased and charged off $166,871 loans during 2007. However, in the paragraph immediately following the table, you state, “during 2007, the Company repurchased loans related to verifiable identity theft of $290,175.” Please reconcile these amounts in your next amendment.

Response:

As disclosed in footnote 8 to the December 31, 2008 consolidated financial statements, Prosper repurchased and immediately wrote off loans totaling $290,195. This activity was not reflected in the rollforward of the loan repurchase obligation. Prosper has revised the disclosure in footnote 8 to include this activity in the rollforward.

If you require additional information, please telephone either the undersigned at the telephone number indicated on the first page of this letter or Whitney Holmes of this firm at (303) 592-2205.

Sincerely,

Brian D. Lewandowski

cc: | Edward A. Giedgowd, Esq., Prosper Marketplace, Inc. |

| Whitney Holmes, Esq., Morrison & Foerster LLP |

27

APPENDIX A

Re: Accounting Analysis Related to the transfer of loans

under the Promissory Agreement

Authoritative Guidance:

FASB Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities

EITF 96-19, Debtor’s Accounting for a Modification or Exchange of Debt Instruments

EITF 99-19, Reporting Revenue Gross as a Principal versus Net as an Agent

Background:

Prosper is a people-to-people lending marketplace operated over the internet. Prosper’s loan marketplace is similar to eBay, but rather than listing and bidding on items, people list and bid on loans using Prosper’s online auction platform.

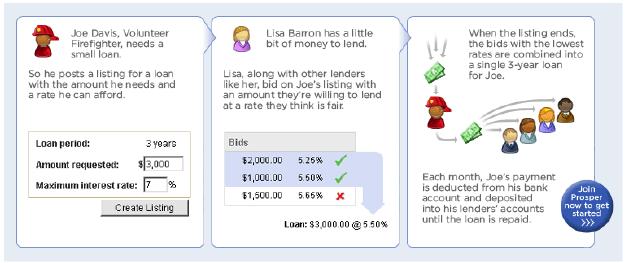

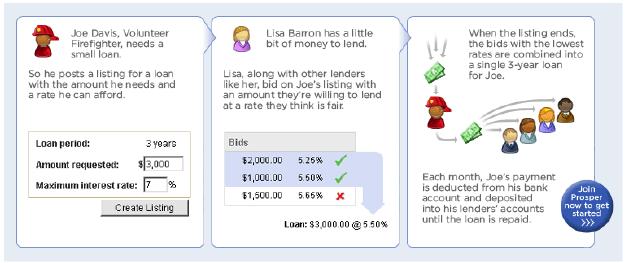

Borrowers create loan listings for up to $25,000 and set the maximum interest rate they are willing to pay a lender. Then the auction begins as people who lend bid down the interest rate. Once the auction ends, Prosper takes the bids with the lowest rates and combines them into one simple loan. Prosper handles all on-going loan administration tasks including loan repayment and collections on behalf of the matched borrower and lenders. Loan proceeds are deposited directly into borrower’s bank account and lenders receive monthly payments as the loan is repaid.

The following schematic was extracted from Prosper’s website for purposes of illustration:

A-1

Prosper generates revenue by collecting a one-time 1% or 2% fee on funded loans from borrowers, and assessing a 0.5% or 1.0% annual loan servicing fee to lenders.

The Company is regulated at a few different levels by the U.S. government.

At the federal level, Prosper is regulated by the Federal Trade Commission insofar as it must conform to the Truth in Lending Act, the Equal Credit Opportunity Act, and the Fair Credit Reporting Act.

At the state level, for states in which Prosper has an explicit license to lend, it is regulated by such state agencies as the Department of Banking or Department of Financial Institutions (this varies by state). For states in which Prosper does not hold a license, it is subject to limits and regulations established by the state’s Attorney General’s office or other agencies that regulate trade and commerce.

Summary of Lender and Loan Terms:

There are three key documents governing the origination and sale of loans.

1. Lender Registration Agreement” (“LRA”). (See Exhibit 10.2 to the Registration Statement.)

2. Promissory Note (“PN”). (See Exhibit 4.1 to the Registration Statement.)

3. Borrower Registration Agreement (“BRA”). (See Exhibit 10.1 to the Registration Statement.)

Each of these agreements is described below.

Each bidder for a loan (purchaser) must register with the Company using the “Lender Registration Agreement” (“LRA”). The purpose of the LRA is to outline the purchaser’s rights and obligations as a purchaser of Prosper loans. The following extracts were taken from the LRA to illustrate its content and relevant clauses pertaining to evaluating whether loans are sold or transferred as follows:

Prosper owns the loans it sells to winning bidders:

“Although you are referred to in this Agreement and on the Prosper website as a “lender,” you are not actually lending your money directly to Prosper borrowers, but are, instead, purchasing loans from Prosper. All loans originated through Prosper are made by Prosper Marketplace, Inc. from its own funds, and then sold by Prosper to the winning bidder or bidders on the listing. Prosper is the originating lender for licensing and regulatory reasons and is licensed in all states where licensing is required.”

Prosper agrees to sell loans without recourse and will retain servicing rights:

“Prosper agrees to sell and you agree to purchase, from time to time, without recourse, all Notes resulting from the matching of your bids with listings on the Prosper marketplace. Prosper agrees that promptly upon funding loans evidenced by such Notes, Prosper will sell, transfer, assign, set over and convey to you, and you will purchase, all of Prosper’s right, title and interest in and to the Notes; provided, however, that Prosper will retain the Servicing Rights with respect to the loans.”

A-2

Servicing compensation:

“As compensation for servicing the Notes, Prosper shall be entitled to retain from monthly payments on the Notes a servicing fee (the “Servicing Fee”). The current Servicing Fee amounts are posted in the Fees section of the Prosper website, and are subject to change by Prosper at any time without notice. The Servicing Fee on each of your Loans will be the amount of the Servicing Fee in effect at the time of the funding of the respective Note, and will remain unchanged for the term of the Notes.”

Prosper prevents the winning bidder from pledging or transferring the loan:

“You may not assign, transfer, sublicense or otherwise delegate your rights under this Agreement to another person without Prosper’s prior written consent. Any such assignment, transfer, sublicense or delegation in violation of this Section shall be null and void. This Agreement shall be governed by the laws of the State of California. Any waiver of a breach of any provision of this Agreement will not be a waiver of any other subsequent breach. Failure or delay by either party to enforce any term or condition of this Agreement will not constitute a waiver of such term or condition. If any part of this Agreement is determined to be invalid or unenforceable under applicable law, then the invalid or unenforceable provision will be deemed superseded by a valid enforceable provision that most closely matches the intent of the original provision, and the remainder of the Agreement shall continue in effect. “

Each loan is associated with a Promissory Note (“PN”) (See Attachment B). The purpose of the PN is to bind the winning bidder to the terms of the loan.