PROSPER MARKETPLACE, INC.

111 Sutter Street, 22nd Floor

San Francisco, CA 94104

November 24, 2009

Via Facsimile and U.S. Mail

Kathryn McHale

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549-7010

Re: Prosper Marketplace, Inc.

Post-Effective Amendment No. 1 to Registration Statement on Form S-1

File No. 333-147019

Dear Ms. McHale:

On behalf of Prosper Marketplace, Inc., a Delaware corporation (“Prosper”), we are providing the following responses to the comment letter dated October 23, 2009 from the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) regarding Prosper’s Post-Effective Amendment No. 1 to its Registration Statement on Form S-1 (“Amendment No. 1”). The responses set forth below are numbered to correspond to the numbered comments in the Staff’s comment letter, which have been reproduced here for ease of reference. Please note that all page numbers in our responses refer to Amendment No. 1.

General

| 1. | Please provide us with a complete description of how your portfolio plans operate. In particular, please address: |

| · | How Prosper selects the notes that will be invested in a particular pre-set portfolio plan based upon an investors selected risk level (balanced, moderate or aggressive). Also, please advise the staff how the interest rate bid on notes selected by Prosper using these forms of portfolio plan. |

| · | Please provide your analysis supporting your conclusion that the investors’ interests in the pre-set portfolio plans did not represent a separate security interest from the component notes. |

| · | For all portfolio plans, including the plans described in your registration statement, please describe all the steps taken when funds are reinvested in new notes under the portfolio program. In particular, please describe any notice |

Securities and Exchange Commission

Division of Corporation Finance

| · | provided to investors prior to or after bids are-placed and any opportunity-that you provide to investors to accept or reject notes purchased with reinvested funds. Furthermore, please provide your analysis as to how the investor makes a meaningful investment decision when Prosper reinvests funds that have been deposited into the investor’s accounts from payments on other Prosper notes. |

Response:

Overview:

Prosper’s portfolio plan program is designed to allow Prosper lender members to automate the process of bidding on loan listings. Portfolio plans allow lender members to set their preferred criteria for bidding on loan listings in advance, and then have bids placed automatically on their behalf on listings that meet those criteria. As an additional convenience for lender members, our model portfolio plans have default criteria set by Prosper. A lender member can use a model plan and retain these default criteria. Alternatively, she can fully customize the model plan by adding to, deleting or otherwise modifying any of the preset criteria, or she can build her own portfolio plan from scratch. Prosper’s portfolio plan program provides lender members with the tools to implement any of these options.

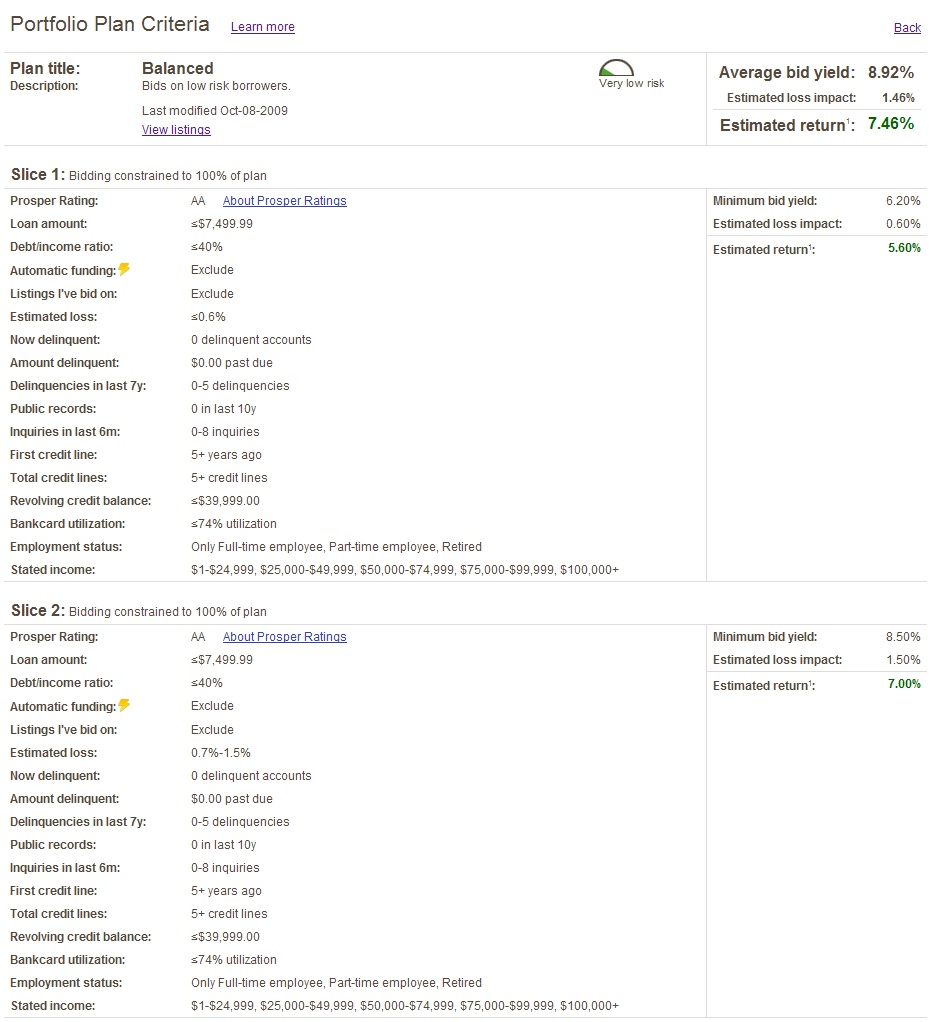

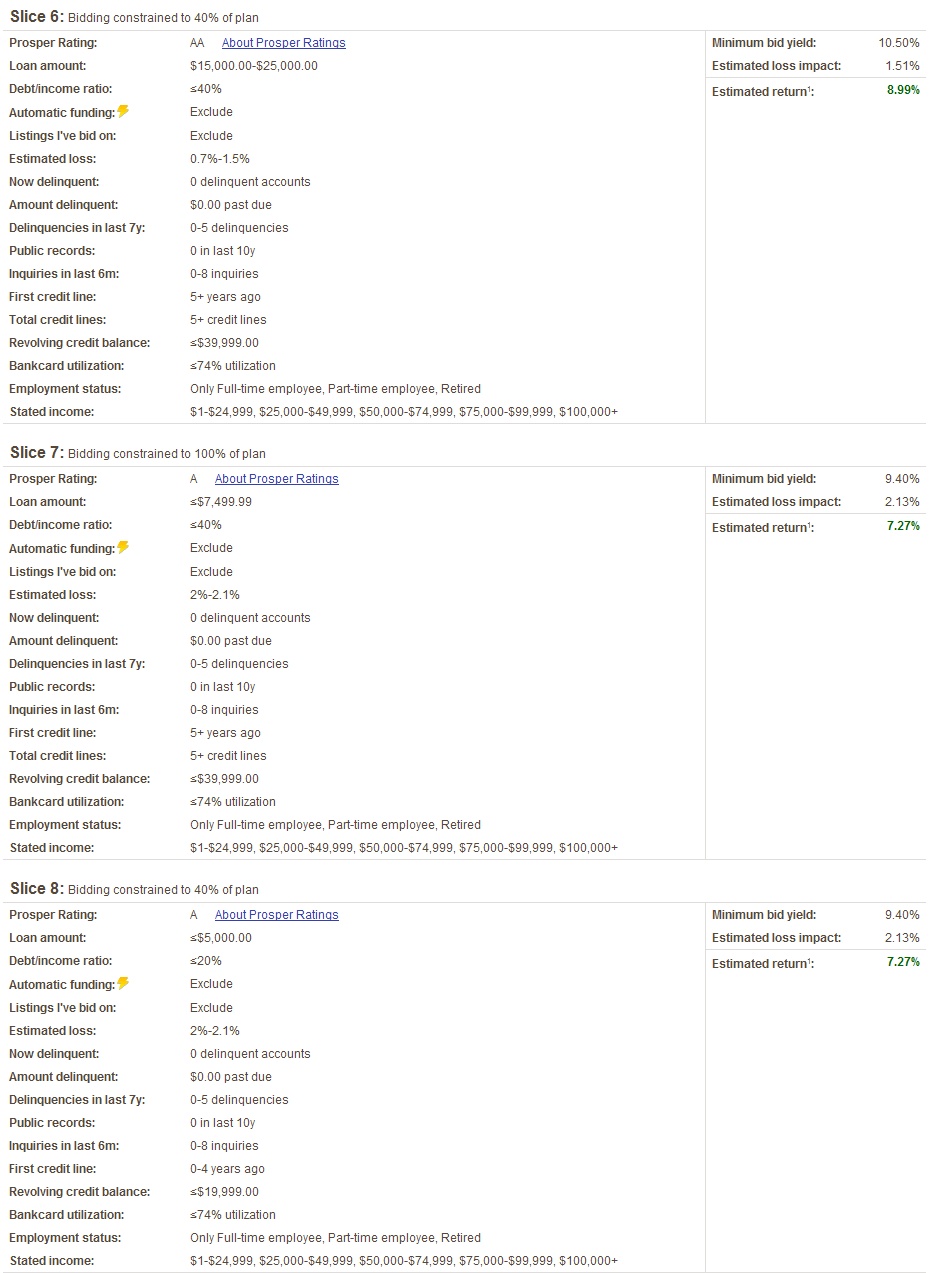

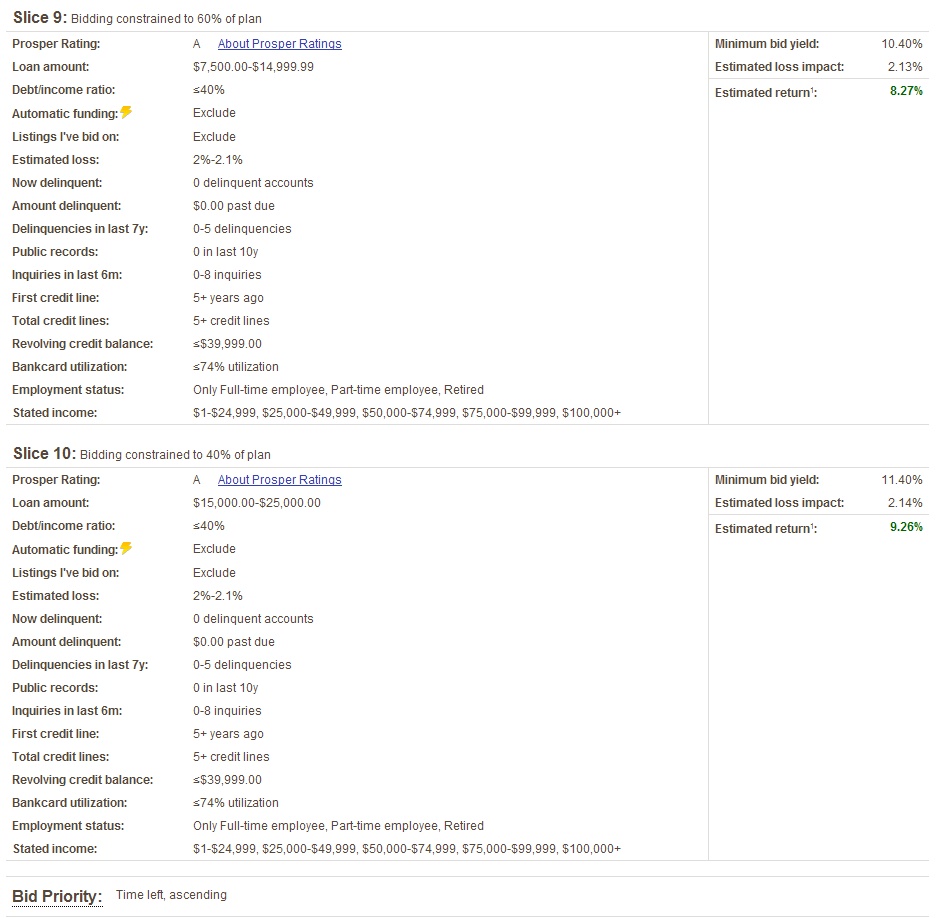

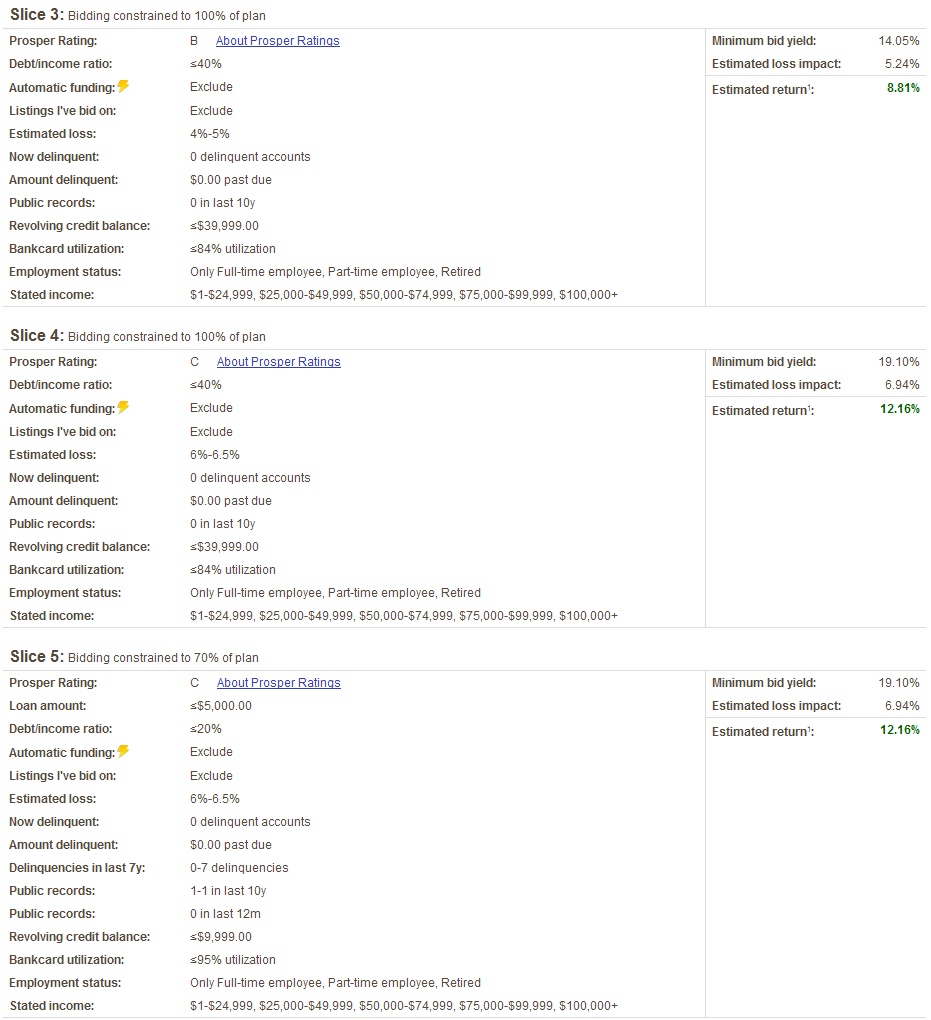

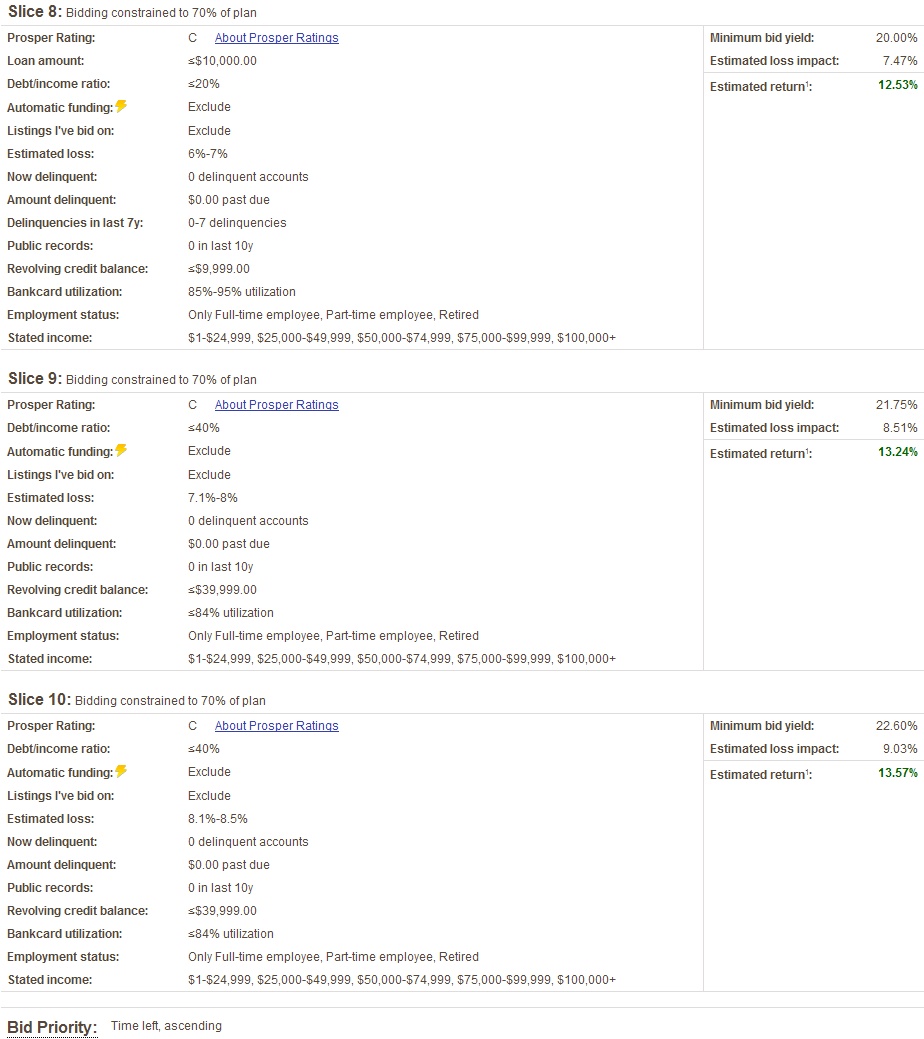

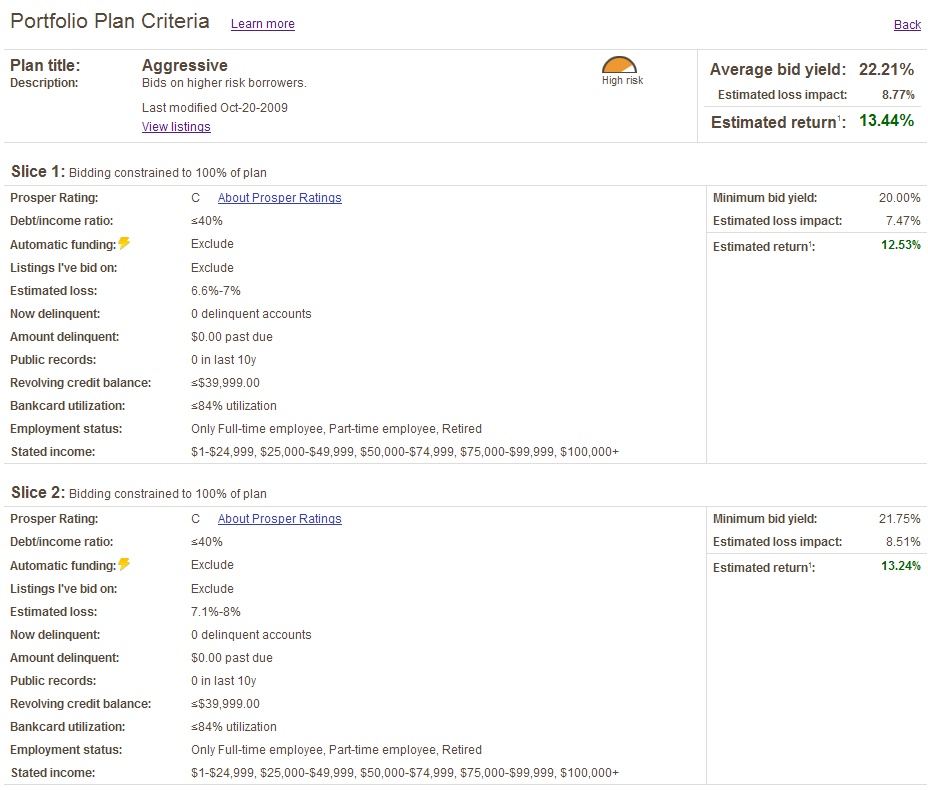

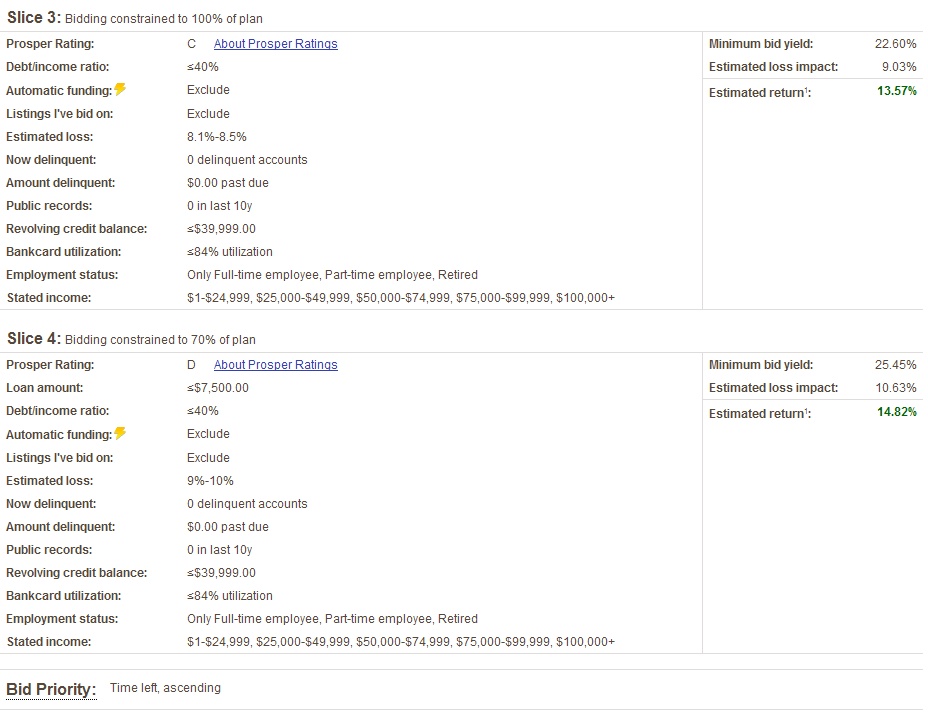

Each portfolio plan consists of a number of sets of loan criteria. We refer to each set as a “slice” of the portfolio plan. By way of example, the slices that comprise some of Prosper’s preset portfolio plans are attached hereto as Exhibit A. If a lender member elects to bid on loan listings through a portfolio plan, a bid will automatically be placed on the member’s behalf on new loan listings that satisfy all of the criteria set forth in any of her plan slices.

A lender member who uses a portfolio plan does not make an investment in the plan. Each portfolio plan represents an automated bidding model and is not a legal entity. A lender member who uses a portfolio plan will only invest in a security if she bids successfully on a loan listing pursuant to the plan. In that case, as with a successful manual bid on a loan listing, the lender member will receive an individual borrower payment dependent note tied to the listing. The member will not receive a note or any other security representing an interest in the portfolio plan.

A lender member who wishes to lend on our site and chooses to bid on loan listings manually, must do so by identifying listings that meet her investment criteria and then bidding on each such listing one-by-one. The member who takes this approach will have to review each loan listing to identify all of the listings that met her criteria. Alternatively, if the member chooses to use a portfolio plan, she can build her investment criteria into her plan and thereby automate the process of identifying and bidding on loan listings that meet those criteria. Regardless of which method the lender member chooses, however, the end result will be the same: in each case, she will obtain borrower payment dependent notes corresponding to the individual loan listings on which she bids successfully.

Response to First Bullet Point:

Securities and Exchange Commission

Division of Corporation Finance

If a lender member elects to place bids through one of Prosper’s preset portfolio plans, the specific loans on which the member bids through the plan will be determined by the criteria set forth in each plan slice. If a loan listing is posted that satisfies all of the criteria in a plan slice, a bid will automatically be placed on the listing on the member’s behalf in the bid amount designated by the member. If one or more existing loan listings meets the lender member’s plan criteria at the time the lender signs up for the plan, bids will be placed on such listings in reverse chronological order (i.e., bids will be placed on the most recent listing first).

As with manual, loan-specific bidding, a bid placed by a lender member through a portfolio plan must specify the minimum yield the member is willing to accept with respect to the listing. This minimum yield is one of the criteria contained in each portfolio plan slice. Any bid made by a lender member through a portfolio plan will be made at the minimum yield specified in the applicable plan slice.

Prosper configures the default criteria in each of its preset portfolio plans with the goal of allowing lender members who bid through the plan to achieve returns that are generally consistent with the characterization of the plan as “Balanced”, “Moderate” or “Aggressive”. Prosper estimates expected returns on its preset portfolio plans based on the historical performance of loans previously originated on its platform. Prosper continues to assess this historical performance on an ongoing basis and periodically makes adjustments to the default criteria within each slice of these plans to the extent merited by changes in such performance over time. .

Any changes made to a preset portfolio plan will only affect future bids made through the plan by lender members using that plan who opt to accept such changes. A lender member who signs up for a portfolio plan can also make additional or alternative changes to her plan criteria at any time. In either case, successful bids previously made by a lender member based on old plan criteria will not be affected by any such changes. In other words, if the lender member is bidding through a portfolio plan, and either she or Prosper modifies the plan criteria, no “rebalancing” of the member’s existing note portfolio will occur as a result of such modifications.

All of the criteria set forth in Prosper’s preset portfolio plans are fully customizable. A lender can adjust the criteria within any plan slice, including minimum yield, remove specific criteria from a slice, add additional criteria, or add or delete a plan slice altogether. Of all the successful bids made on our platform since our relaunch in July 2009, approximately 42% of those bids (measured in terms of dollar volume) were made through one of our preset portfolio plans.

Response to Second Bullet Point:

A portfolio plan is a system of automated bidding on loan listings that lender members may adopt. It is not a discrete entity in which lender members may acquire interests. By electing to make bids through a portfolio plan, a lender member does not obtain any interest in the plan.

Securities and Exchange Commission

Division of Corporation Finance

When signing up for a portfolio plan, the lender member indicates the total amount she wishes to invest in listings that meet plan criteria as well as the amount she wishes to invest per bid. But the lender member is not required to contribute this entire amount, or any portion of it, at the time of sign-up. Funds will only be debited from her account when she makes a successful bid on a listing through the plan, and then only in the amount of the successful bid. The plan does not hold any funds on the member’s behalf, and indeed cannot do so, since the plan is not a legal entity. In short, the flow of funds from the account of a lender member when the member bids on a loan listing through the portfolio plan is identical to the flow of funds when the member bids on a listing manually.

Response to Third Bullet Point:

Prosper does not have an automatic reinvestment plan for lender members who bid on loan listings through a portfolio plan. When signing up for a portfolio plan, a lender member indicates the total amount she wishes to bid through the plan. The lender member can increase or decrease this amount at any time (provided that any downward adjustment will not undo any bids already made by the lender member). To the extent a new loan listing appears that satisfies all of the criteria set forth in one of the lender member’s plan slices, a bid can only be made by the lender member if the successful bids already made by her through the plan do not in the aggregate exceed the total amount she has elected to invest through the plan. Furthermore, the lender member will not be permitted to place a bid through the plan unless the funds in her account at that time are sufficient to cover the bid. In both of these respects, the process of bidding on loan listings through a portfolio plan for lender members mirrors the process for bidding on individual loan listings manually. In each case, there is no scenario in which funds can be invested or reinvested on behalf of a lender member that are in excess of the amounts specifically and expressly authorized by the lender member.

Risk Factors

Some of the borrowers on our platform have “subprime” credit ratings..., page 18

| 2. | We note your disclosure that you have facilitated 29,013 borrower loans on your platform since your inception in November 2005 through June 30, 2009. This number is different from the number included in your registration statement that went effective on July 10, 2009. Please reconcile this disclosure with the disclosure contained in the “Corporate Information” section on page 3 which states that you did not make borrower loans on your platform during this time period. |

Response: The discrepancy between Amendment No. 1 and the S-1/A with respect to the loan origination total we disclose in the risk factor you cited relates to 13 loans that were originated by our wholly owned subsidiary Prosper Marketplace CA, Inc. (“Prosper CA”). Prosper CA originated these loans to California residents between April 28, 2009 and May 14, 2009 pursuant to an intrastate offering under Section 3(a)(11) of the Securities Act of 1933, as amended. Prosper repurchased all of these loans prior to our S-1/A becoming effective in July 2009. In the S-1/A, however, we inadvertently failed to include these loans in the total loan origination number included in the risk factor you cited. Therefore, in Amendment No. 1, we have updated the risk factor to correct this error.

Securities and Exchange Commission

Division of Corporation Finance

| 3. | Please include the delinquency and default rates as of September 30,2009 or some other recent date. |

Response: Prosper will revise the registration statement to include the information requested in the Staff’s comment.

Prosper Rating Assigned to Listings, page 41

| 4. | We note that you have represented that you will periodically update the ratings assigned to listings. Given the economic climate, please update the information in the tables on page 57-61 to reflect September 30, 2009 information and consider updating your rating data accordingly. |

Response: Prosper will revise the registration statement to include the information requested in the Staff’s comment.

Transactions with Related Persons, page 87

| 5. | Please tell the staff how the delinquency rates of the notes purchased by related persons compare to the average for each borrower category. |

Response: The delinquency rates of the notes purchased by our executive officers, directors, and affiliates are lower than the average for each borrower category. Of the total aggregate amount of loans purchased by executive officers, directors, and affiliates since inception through September 30, 2009, approximately $133,000 or 12% of principal has been charged off, as compared to approximately $50,803,000 or 28% of principal charged off for all loans originated since inception through September 30, 2009. Prosper will revise the registration statement to include this information.

Principal Security holders, page 89

| 6. | We note that you have disclaimed beneficial ownership in instances where officers and directors have, or share, voting and investment power. Please provide your analysis in light of Rule 13d-3 under the Exchange Act. In addition, please confirm that all relationships between officers and directors and the entities listed in this table have been disclosed. |

Response: Item 403 of Regulation S-K provides that the definition of beneficial ownership for completing the stockholder table is the definition of beneficial ownership under Rule 13d-3 of the Exchange Act. Under Rule 13d-3, a person beneficially owns shares if the person has, or shares, voting or investment power with respect to the shares. Prosper has disclaimed beneficial ownership for certain of the stockholders included in the table in accordance with Rule 13d-4. Each of the persons who disclaim beneficial ownership in the table is doing so because they are attributed under the SEC’s beneficial ownership rules with beneficial ownership of shares that they do not, in fact control or otherwise beneficially own.

| 7. | Please revise footnote 12 to reflect the ownership of Omidyar Network Fund. |

Securities and Exchange Commission

Division of Corporation Finance

Response: Prosper will revise the registration statement to include the information requested in the Staff’s comment.

The Division of Investment Management has asked us to deliver the following comment:

| 8. | Please explain whether Prosper Marketplace Inc. (“Prosper”) will register as an investment adviser under the Investment Advisers Act of 1940 in light of Prosper’s construction of the model portfolio plans that correspond to certain risk levels and estimated returns (see http://www.prosper.com/invest/portfolio_plans.aspx), and Prosper’s statements about the advisability for investing in various types of asset classes (e.g., stocks and bonds) as compared to investing in Notes, as that term is defined in the S-1/A. In addition, please explain how the portfolio plans described on Prosper’s website do not meet the definition of “investment company” under the Investment Company Act of 1940. |

Response: Prosper respectfully submits that it does not believe it is required to register as an investment adviser under the Investment Advisers Act of 1940 (the “Advisers Act”). Similarly, Prosper does not believe the portfolio plans meet the definition of “investment company” under the Investment Company Act of 1940 (the “ICA”).

Investment Advisers Act of 1940

Section 202(a)(11) of the Advisers Act defines “ investment adviser” to mean “any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or as to the advisability of investing in, purchasing, or selling securities, or who, for compensation and as part of a regular business, issues or promulgates analyses or reports concerning securities.” The Commission has stated that whether a person falls within the scope of this definition depends on whether such person satisfies three essential requirements.1 First, an investment adviser must provide advice, or issue reports or analyses, regarding securities. Second, an investment adviser must receive compensation for such services. Third, an investment adviser must be “engaged in the business” of providing investment advice.

Provision of Advice, Issuance of Reports or Analyses Regarding Securities

Prosper does not believe that it reasonably may be viewed as providing advice or issuing reports or analyses regarding securities. The Commission staff has stated that the exercise of discretionary authority over a portfolio of securities is an indirect form of investment advice sufficient to subject the person exercising such authority to regulation under the Advisers Act. 2 Prosper, however, does not exercise discretionary authority with respect to any notes a lender member may obtain through one of its preset portfolio plan. Prosper does not select individual

1 See SEC Release No. IA–1092, October 8, 1987.

Securities and Exchange Commission

Division of Corporation Finance

loan listings for bidding by users of such plans. Rather, Prosper simply selects the initial default criteria for use in loan selection by plan users. The primary purpose of Prosper portfolio plan programs is to allow lender members to create automated bidding models as a convenience to them, not to substitute Prosper’s judgment for the lender member’s regarding the advisability of investing in specific Prosper notes. As an added convenience to lender members, Prosper selects default criteria for its preset portfolio plans. These criteria are fully and easily customizable, however, and a lender member who uses one of the preset plans can delete, modify or add to, in whole or in part, any such criteria. Alternatively, the member can create her own portfolio plan with her own criteria from scratch.

Any changes made to a preset portfolio plan will only affect future bids of lender members who opt to accept such changes. Bids already successfully placed by a lender member based on the old plan criteria will not be affected by such changes. Therefore, if a lender member uses a preset portfolio plan, and Prosper modifies the plan criteria, no discretionary rebalancing of the member’s existing note portfolio will occur as a result of such modifications.

Compensation for Such Services

As noted above, Prosper does not provide advice or issue reports or analyses regarding securities. Since Prosper does not provide advice or issue reports or analyses regarding securities, it cannot be viewed as meeting the compensation “for such services” element of the test.3 In addition, Prosper does not receive compensation for the portfolio plans.

Prosper does not charge any fees or receive any compensation for the use of its portfolio plan program by lender members. Rather, the program simply provides lender members with an alternate, automated method to bid on loan listings. Prosper generates its entire revenue stream by (i) collecting from borrowers a one-time fee of 0.5% to 3% on funded loans as well as other miscellaneous fees (e.g., bank draft and NSF fees), and (ii) imposing an annual 1% loan servicing fee on lender members. These fees are fixed - no part of either fee is directly or indirectly attributable to the method by which a lender member bids on loans. Lender members are subject to the same 1% fee regardless of whether they bid manually or through a portfolio plan. Ultimately, we believe our lender members are drawn to Prosper based on our peer-to-peer lending platform, not the existence of various bidding tools on the platform, including portfolio plan bidding. Consequently, while the provision of our portfolio plan program may enhance our platform and, thus create some intangible, non-monetary benefits to Prosper, such benefits cannot be considered “compensation” for any purpose relevant to the Advisers Act, or under any published interpretation of the term.

Engaged In the Business of Providing Investment Advice

3 According to the Commission, “compensation” refers to the receipt of some economic benefit, whether in the form of an advisory fee, some other fee relating to the total services rendered, commissions or some combination of the foregoing. Id.

Securities and Exchange Commission

Division of Corporation Finance

In addition to the fact that Prosper does not satisfy the other two prongs of the investment adviser test, it also is not “engaged in the business” of providing investment advice. The Commission has stated that whether a person is “engaged in the business” of providing investment advice depends on all relevant facts and circumstances.4 The factors deemed relevant to this determination include: (1) whether the person holds himself out to the public as an investment adviser, (2) whether the person receives any separate or special compensation for providing advice and (3) whether the person provides advice on anything other than rare, isolated and non-periodic instances.5

Nowhere in its customer agreements, marketing materials or public filings does Prosper “hold itself out” as an investment adviser in any reasonable construction of that phrase. In fact, the Company affirmatively disclaims any characterization as an investment adviser in Amendment No. 1. Further, as described above, Prosper does not receive any compensation (special or otherwise) as a result of its operation of its portfolio plan program.

From a policy perspective, whether a person’s activities are “rare, isolated and non-periodic” should be based on whether the frequency of such activities shifts that person, even to a marginal degree, to the realm of the investment adviser business, such that it is appropriate, in the public interest, to impose upon him the burdens of regulation. In Zinn v. Parrish, a case cited by the Commission as adding texture to the “in the business” prong, the Seventh Circuit Court of Appeals noted that isolated activities “incident” to the main purpose of a non-advisory relationship do not constitute “engaging in the business” of advising others on investment securities.6 Prosper’s creation and administration of its portfolio plan program falls squarely within these boundaries. Prosper’s primary business activity is administering a peer-to-peer lending platform for interested borrowers and lenders. As noted above, the portfolio plans simply represent one means of bidding on loans. Accordingly, Prosper is not “in the business” of being an investment adviser based on its operation of its portfolio plan program.

Investment Company Act of 1940

Section 3(a)(1)(A) of the ICA defines an “investment company” as an issuer that “is, holds itself out as, or proposes to be engaged primarily in the business of investing, reinvesting, or trading in securities.” Section 3(a)(1)(C) of the ICA defines “investment company” to include any issuer that “[i]s engaged or proposes to engage in the business of investing, reinvesting, owning, holding, or trading in securities, and owns or proposes to acquire investment securities having a value exceeding 40 per centum of the value of such issuer’s total assets (exclusive of Government securities and cash items) on an unconsolidated basis.”

Prosper respectfully submits that its portfolio plans are not investment companies under the ICA. The portfolio plans provide lenders with an automated method for bidding on loans.

4 See SEC Release No. IA–1092, October 8, 1987. 5 Zinn v. Parrish, 644 F.2d 360 (7th Cir. 1981).

Securities and Exchange Commission

Division of Corporation Finance

Unlike an investment company, the portfolio plans are not separate investment vehicles and do not have interests to which a lender may contribute funds. Instead, as described in our response to Comment No. 1, each portfolio plan represents a system of automated bidding on loan listings that lender members may adopt. Lender members do not give funds to a portfolio plan, which then buys securities for the lender member. Instead, a portfolio plan allows a lender member to automatically bid, and if successful, make a loan to a borrower member to the extent that the loan satisfies the plan criteria selected by the lender. Lender members do not invest funds in the portfolio plans and such plans do not invest in securities. Portfolio plans are not separate legal entities and do not hold any assets that can be considered for purposes of applying the objective test for an investment company under Section 3(a)(1)(C) of the ICA. In light of these factors, Prosper does not believe that any of its portfolio plans meet the definition of an “investment company” under the ICA.

* * * * * * *

In connection with the Staff’s comments, we hereby acknowledge that:

| · | we are responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | we may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | | Very truly yours, |

| | | |

| | | /s/ Sachin Adarkar |

| | | Sachin Adarkar |

| | | General Counsel |

| | | |

| CC: David B.H. Martin, Esq | | |

| Keir D. Gumbs, Esq | | |

| | | |

| | | |