111 Sutter Street

22nd Floor

San Francisco, CA 94104

PH 415.593.5400

FAX 415.362.7233

www.prosper.com

April 6, 2011

Via Facsimile and U.S. Mail

Christian Windsor

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549-7010

| Re: | Prosper Marketplace, Inc. Post-Effective Amendment No. 6 to Registration Statement on Form S-1 File No. 333-147019 |

Dear Mr. Windsor:

On behalf of Prosper Marketplace, Inc., a Delaware corporation (“Prosper”), we are providing the following responses to the comment letter dated March 29, 2011 from the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) regarding Prosper’s Post-Effective Amendment No. 6 to the Registration Statement on Form S-1 (“Amendment No. 6”). The responses set forth below are numbered to correspond to the numbered comments in the Staff’s comment letter, which have been reproduced here for ease of reference. The following provides the Staff our responses to the comments made in connection with Amendment No. 6.

General

| 1. | It appears that you have conducted a general solicitation for warrants through your promotional program during the first quarter of 2011. Please tell the staff upon which exemption from registration you have relied and why you think that exemption is appropriate. |

Response: In January 2011, we inadvertently distributed a promotional e-mail to approximately 55,000 of our lender members that we only intended to distribute to 75 of our largest lender members. In this e-mail, we indicated that we would distribute warrants to purchase Prosper common stock to lenders who invested at least $250,000 in Notes between January 10, 2011 and February 28, 2011. We only intended to make this offer to a small group of our largest lenders with whom we already had a pre-existing relationship and whom we believed qualified as accredited investors under Regulation D. We intended for the offer to qualify as a private placement under the Securities Act of 1933. Through an administrative error, however, we distributed this promotional e-mail to a larger group of lender members than we intended. After we discovered the error, we immediately imposed a “cooling off” period during which we ceased offering the promotional warrants. Because of the error, we have decided to discontinue including warrants in these types of promotional programs for accredited investors going forward. Because we sent the more broadly distributed email containing the warrant offer inadvertently, and instituted a cooling off period as soon as we became aware of the error, we do not believe that we may be held liable for our inadvertent distribution of the e-mail. Accordingly, we do not propose to add disclosure regarding this error in the registration statement or prospectus.

Christian Windsor

U.S. Securities and Exchange Commission

April 6, 2011

Page 2

| 2. | We note that you have recently filed a rescission offer that you do not mention in the prospectus. Please update the prospectus to include disclosure regarding this offer and any remaining risks or liabilities that you may have in connection with the original sale of these securities. |

Response: We have revised the registration statement at pages 39-40 and 106 to include a disclosure regarding the rescission offer, including a discussion of the risks and liabilities associated with the original sale of the securities. As is discussed in the revised document, we made this rescission offer on February 4, 2011. The offer expired on March 6, 2011, and on March 20, 2011, we repurchased $21.9 thousand of Notes from persons who accepted the rescission offer.

| 3. | Revise this document to present all information as of a recent date. We note that much of the information included is as of June 30, 2010. For example, please revise the Risk Factors section and the discussion of the results of your verification activity as of a more recent date. |

Response: We have updated the registration statement to present all information regarding Prosper and its platform as of the most recent practicable date. In general, we have revised the document to present information as of December 31, 2010, including the following sections:

· “Risk Factors” (pp. 19-43);

· “About Prosper¾Risk Management” (pp. 49-57), which includes “Borrower Identity and Financial Information Verification” (pp. 55-57);

· “About Prosper¾Historical Performance of Prosper Borrower Loans” (pp. 58-65);

· “Information about Prosper Marketplace, Inc.” (pp. 95-103);

· “Management¾Director Compensation” (p. 109); and

· “Transactions with Related Parties ¾Participation in our Platform” (pp. 112).

In addition, we have revised the registration statement to present information in the following section as of February 28, 2011:

Christian Windsor

U.S. Securities and Exchange Commission

April 6, 2011

Page 3

| · | “Principal Securityholders” (pp. 114-117); and |

| · | “Management” (except for “Director Compensation”) (pp. 107-111). |

About the Platform, page 1

| 4. | We note your reference on page 1 to the "estimated average annualized loss rate" which you explain is calculated, in part, based on the "historical performance of previous borrower loans." Please provide your analysis as to how you determined this metric was appropriate for investors and what assumptions you have made with regard to this data. |

Response: “Estimated average annualized loss rate,” which we also refer to as “estimated loss rate,” is intended to provide investors reviewing a given loan listing with information about how loans previously originated on our platform have performed that possessed characteristics similar to that listing. We believe the estimated loss rate is an important supplement to the borrower-specific information included in listings because it gives investors a more complete picture of a listing’s risk-return characteristics. By subtracting the estimated loss rate for a listing from the Note rate, lenders are given a better sense of the likely return the Note will generate. Although we make our historical performance data available to all of our members on our website, we believe the great majority of our lender members do not have the time or expertise necessary to perform meaningful estimated loss calculations on their own. In this respect, we believe it would likely be materially misleading to present lender members with the interest rate for a Note at the time of their investment decision (i.e., when they are reviewing the listing for the Note) without also providing them with a meaningful estimated loss rate for that Note.

Our determination of estimated loss rates is based on two scores: (1) a custom Prosper Score and (2) the Scorex PLUS score from Experian. The Prosper Score predicts the probability of a loan going more than 60 days past due, using performance data for loans booked on our platform from April 2007 through October 2008. We have developed a loan model that uses our historical performance data to determine estimated loss rates for new listings based on the intersection of these two scores. The principal assumptions we relied on in building this model are as follows:

| | · | To calculate the average balance for each period, we use the amount of loan principal on loans that are still open and have not been charged-off or paid off. It is assumed that borrowers that are making scheduled payments on these loans do so according to their amortization schedule. When a loan is paid off early, it is no longer included in the outstanding balance for subsequent periods. Historical payoff rates are used to project the monthly payoffs, and these rates are assumed to remain constant throughout the life of the loans. Similarly, once a loan has been charged-off, the principal associated with this loan is considered a credit loss and is no longer included in the outstanding periodic balance. |

Christian Windsor

U.S. Securities and Exchange Commission

April 6, 2011

Page 4

| | · | To estimate the number of current and delinquent accounts on a monthly basis, we apply roll rates to each group of given loans based on historical roll rates of comparable loans. The average historical roll rates are assumed to be constant for the life of the loan term. |

| | · | An account is considered to be a loss or charged-off when it reaches 121+ days past due. The estimated monthly dollar charge-offs are calculated by multiplying the estimated number of accounts that reach 121+ days past due in that month by the average balance of loans in that month. An adjustment is made to account for the difference between the average loan amount for total loans and charged-off accounts. |

| | · | Collection expenses and recovery payments are applied to gross losses to calculate net losses. Payments collected by the collection agency reduce the amount of principal that is repaid to lenders. This expense is added to losses in the month the payment is made. In addition, once an account has been charged-off, any subsequent payments received or proceeds from the sale of the loan in a debt sale are considered recoveries and reduce the amount of principal lost. Recovery assumptions are based on historical recoveries through November 2009 on accounts that were 121+ days past due in 2008. The recovery rate assumptions are 6.0% annual recovery rate for Prosper Ratings AA-D and 2% for Prosper Ratings E-HR. |

We describe our method of determining estimated loss rates in greater detail at pages 49-55 of the registration statement.

| 5. | In addition, please tell us how you account for the relatively unseasoned loan experience of your portfolio when calculating "historical performance." For example, we note that you provide estimated returns for notes that mature in 3 and 5 years but the oldest notes in your portfolio are not yet 2 years old. |

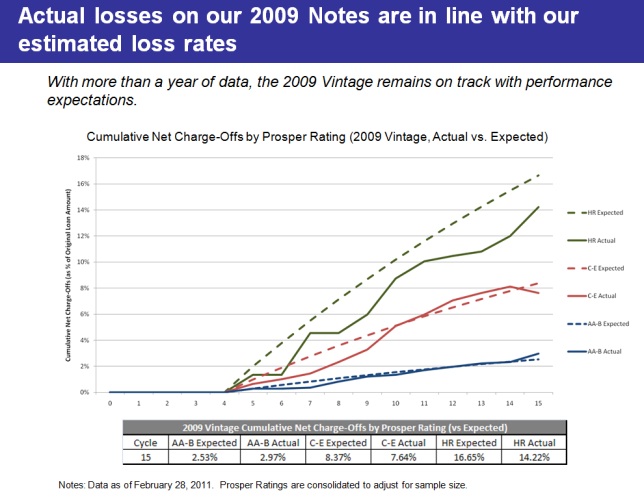

Response: We have developed our method for determining estimated loss rates using the historical performance of all the loans we have originated since inception, which covers over five years of originations and more than 38,000 loans. The validity of the approach we have developed based on this population of data is evidenced by the actual performance of our Notes since our offering commenced in July 2009 relative to our estimates. Across the spectrum of Prosper Ratings, the performance of these Notes has consistently been on par with or superior to the performance predicted by our estimated loss rates. Please see Appendix A hereto for a graph setting forth the performance of our Notes originated in 2009 relative to our estimated loss rates.

Christian Windsor

U.S. Securities and Exchange Commission

April 6, 2011

Page 5

Risk Factors

| 6. | Please update your risk factors to discuss the impact of the recent rescission offer you registered this quarter. |

Response: We have revised our risk factor at pages 39-40 of the registration statement relating to potential failures to comply with law to address the impact of our recently registered rescission offer.

| 7. | Provide risk factor disclosure consistent with your discussion on page 59 regarding the unsettled nature of your liability for statements made on your website. The resulting disclosure should clarify that the statements made on your website and made a part of your prospectus could be determined to be false and misleading and therefore could give rise to a liability under the Securities Act for Prosper. Make conforming changes to page 59. |

Response: We have added a risk factor disclosure at page 43 of the registration statement to clarify the unsettled nature of our liability for statements made on our website. Additionally, we have made conforming changes to our discussion of this risk at page 69 of the registration statement.

Prosper’s administration of the automated bidding plan system …could create additional liability, page 43

| 8. | Please include a discussion of your potential liability under the Securities Laws in connection with the administration of your automated bidding plan system as it operates prior to June 30, 2011. |

Response: We have revised the risk factor at page 43 of the registration statement regarding our potential liability with respect to our automated plan system to include a discussion of our potential liability with respect to such system under the securities laws.

About the Platform, page 45

| 9. | Revise this section to clarify what Prosper determines is an “acceptable answer” when performing verifications. Also, please clarify whether loan listings are revised based upon information provided as a result of the verifications, including changing debt-to-income, overall indebtedness or credit information. |

Response: We have revised the registration statement at pages 55-57 to clarify what constitutes an “acceptable answer” in the context of verifications, and also to clarify that loan listings are sometimes cancelled as a result of information obtained through our verification processes but are not revised as a result of such processes.

Christian Windsor

U.S. Securities and Exchange Commission

April 6, 2011

Page 6

Exhibits

| 10. | Please file the backup servicer agreement as a material contract. |

Response: We have filed the back up servicer agreement as an exhibit to the registration statement.

* * * * * * *

In connection with the Staff’s comments, we hereby acknowledge that:

| · | we are responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | we may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | Very, truly yours, |

| | /s/ Sachin Adarkar | |

| | Sachin Adarkar |

| | General Counsel |

Appendix A