UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under §240.14a-12 |

RELYPSA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

RELYPSA, INC.

700 Saginaw Drive

Redwood City, California 94063

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 19, 2014

To the Stockholders of Relypsa, Inc.:

The 2014 Annual Meeting of Stockholders, or the 2014 Annual Meeting, of Relypsa, Inc., a Delaware corporation, or the Company, will be held on June 19, 2014 at 8:00 a.m. local time at the Company’s headquarters located at 700 Saginaw Drive, Redwood City, California 94063 for the following purposes:

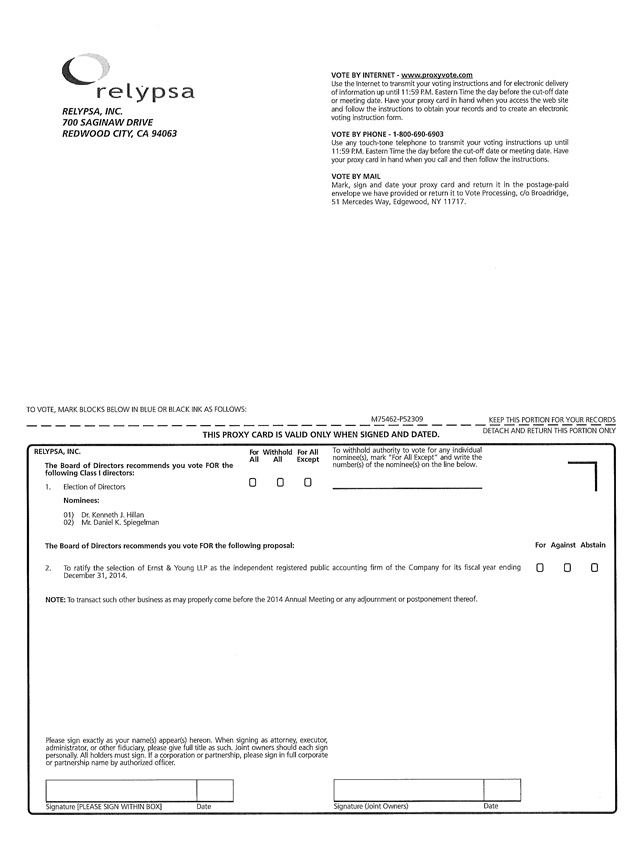

| | 1. | To elect two Class I directors to hold office until the 2017 Annual Meeting of Stockholders or until their successors are elected; |

| | 2. | To ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2014; and |

| | 3. | To transact such other business as may properly come before the 2014 Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice. Only stockholders who owned the Company’s common stock at the close of business on April 22, 2014 may vote at the 2014 Annual Meeting or any adjournments that take place.

We have elected to provide our proxy materials to our stockholders over the internet as permitted by the rules of the U.S. Securities and Exchange Commission. As a result, we are mailing most of our stockholders a paper copy of the Notice of Internet Availability of Proxy Materials, or the Notice, but not a paper copy of our proxy statement and our 2013 Annual Report to Stockholders. This process allows us to provide our proxy materials to our stockholders in a timelier and more readily accessible manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. The Notice contains instructions on how to access those documents over the internet. The Notice also contains instructions on how to request a paper copy of our proxy materials, including this proxy statement, our 2013 Annual Report to Stockholders and a form of proxy card or voting instruction card. All stockholders who have previously requested a paper copy of our proxy materials will continue to receive a paper copy of the proxy materials by mail.

You are cordially invited to attend the 2014 Annual Meeting in person. Whether or not you plan to attend the 2014 Annual Meeting, please vote as soon as possible. You may vote over the internet or by a toll-free telephone number. If, however, you requested to receive paper proxy materials, then you may vote by mailing a complete, signed and dated proxy card or voting instruction card in the envelope provided. Please note that any stockholder attending the 2014 Annual Meeting may vote in person, even if the stockholder has already returned a proxy card or voting instruction card.

Our board of directors recommends that you vote “FOR” the election of the director nominees named in Proposal No. 1 of the proxy statement and “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm as described in Proposal No. 2 of the proxy statement.

|

| By Order of the Board of Directors: |

|

/s/ RONALD A. KRASNOW |

Ronald A. Krasnow Senior Vice President, General Counsel and Corporate Secretary |

Redwood City, California

April 28, 2014

TABLE OF CONTENTS

RELYPSA, INC.

700 Saginaw Drive

Redwood City, California 94063

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 19, 2014

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 19, 2014

This proxy statement and our 2013 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, are available at our website at www.relypsa.com and at www.proxyvote.com.

QUESTIONS AND ANSWERS REGARDING THE PROXY MATERIALS AND THE VOTING PROCESS

Why am I receiving these proxy materials?

We have made these proxy materials available to you on the internet or, upon your request, have delivered paper proxy materials to you, because the board of directors of Relypsa, Inc., or the Company, is soliciting your proxy to vote at the 2014 Annual Meeting of Stockholders, or the 2014 Annual Meeting, or any adjournments that take place. The 2014 Annual Meeting will be held on June 19, 2014 at 8:00 a.m. local time at our headquarters, which are our principal executive offices, located at 700 Saginaw Drive, Redwood City, California 94063. As a stockholder, you are invited to attend the 2014 Annual Meeting and are requested to vote on the proposals described in this proxy statement. However, you do not need to attend the 2014 Annual Meeting to vote.

What is included in the proxy materials?

The proxy materials include:

| | • | | This proxy statement, which includes information regarding the proposals to be voted on at the 2014 Annual Meeting, the voting process, corporate governance, the compensation of our directors and certain executive officers, and other required information; |

| | • | | Our 2013 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2013; and |

| | • | | The proxy card or a voting instruction card for the 2014 Annual Meeting. |

The proxy materials are being mailed or made available to stockholders on or about May 6, 2014.

Why did I receive a Notice of Internet Availability of Proxy Materials, or the Notice, in the mail instead of a complete set of paper proxy materials?

We have elected to provide our proxy materials to our stockholders over the internet as permitted by the rules of the U.S. Securities and Exchange Commission, or SEC. As a result, we are mailing most of our stockholders a paper copy of the Notice, but not a paper copy of the proxy materials. This process allows us to provide our proxy materials to our stockholders in a timelier and more readily accessible manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. The Notice contains instructions on how to access the proxy materials over the Internet, and how to request a paper copy of the proxy materials. All stockholders who have previously elected to receive a paper copy of our proxy materials will continue to receive a paper copy of the proxy materials by mail until the stockholder terminates such election.

1

Why did I receive a complete set of paper proxy materials in the mail instead of a Notice of Internet Availability of Proxy Materials?

We are providing stockholders who have previously requested to receive paper copies of the proxy materials with paper copies of the proxy materials instead of the Notice. If you would like to reduce the environmental impact and the costs incurred by us in printing and distributing the proxy materials, you may elect to receive all future proxy materials electronically via email or the internet. To sign up for electronic delivery, please follow the instructions provided with your proxy materials and on your proxy card or voting instruction card.

Who can vote at the 2014 Annual Meeting?

Only stockholders of record at the close of business on April 22, 2014 will be entitled to vote at the 2014 Annual Meeting. On this record date, there were 33,845,329 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, at the close of business on April 22, 2014, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the 2014 Annual Meeting or vote by proxy. Whether or not you plan to attend the 2014 Annual Meeting, please vote as soon as possible by completing and returning the enclosed proxy card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If, at the close of business on April 22, 2014, your shares were not held in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the 2014 Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent how to vote the shares in your account. You are also invited to attend the 2014 Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the 2014 Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What proposals are scheduled for a vote?

There are two proposals scheduled for a vote at the 2014 Annual Meeting:

| | • | | Proposal No. 1 – To elect two Class I directors to hold office until the 2017 Annual Meeting of Stockholders or until their successors are elected; and |

| | • | | Proposal No. 2 – To ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2014. |

How do I vote?

For Proposal No. 1, you may either vote “FOR” all nominees to the board of directors or you may “WITHHOLD” your vote for any nominee you specify. For Proposal No. 2, you may either vote “FOR” or “AGAINST” or you may abstain from voting.

2

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the 2014 Annual Meeting or vote by proxy by telephone or internet or by mail. Whether or not you plan to attend the 2014 Annual Meeting, please vote as soon as possible to ensure your vote is counted. You may still attend the 2014 Annual Meeting and vote in person even if you have already voted by proxy.

| | • | | To vote in person. You may attend the 2014 Annual Meeting and we will give you a ballot when you arrive. If you need directions to the meeting, please visit http://www.relypsa.com/contact_index.html. |

| | • | | To vote by proxy by telephone or internet. If you have telephone or internet access, you may submit your proxy by following the instructions provided in the Notice, or if you received paper proxy materials by mail, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. |

| | • | | To vote by proxy by mail. If you received paper proxy materials, you may submit your proxy by mail by completing and signing your proxy card and mailing it in the enclosed envelope. Your shares will be voted as you have instructed. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, dealer or other similar organization, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or other agent. To vote in person at the 2014 Annual Meeting, you must obtain a valid proxy from your broker or other agent. Follow the instructions from your broker or other agent included with these proxy materials, or contact your broker or bank to request a proxy form.

Can I vote my shares by completing and returning the Notice?

No. The Notice will, however, provide instructions on how to vote by telephone, by internet, by requesting and returning a paper proxy card or voting instruction card, or by submitting a ballot in person at the 2014 Annual Meeting.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of the Company’s common stock you own as of April 22, 2014.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “FOR” the election of each nominee for director (Proposal No. 1) and “FOR” the ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2014 (Proposal No. 2). If any other matter is properly presented at the 2014 Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies.

3

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the 2014 Annual Meeting. If you are the stockholder of record of your shares, you may revoke your proxy in any one of three ways:

| | • | | You may submit another properly completed proxy with a later date. |

| | • | | You may send a timely written notice that you are revoking your proxy to the Company’s Corporate Secretary at Relypsa, Inc., 700 Saginaw Drive, Redwood City, California 94063. |

| | • | | You may attend the 2014 Annual Meeting and vote in person. Simply attending the 2014 Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or other agent, you should follow the instructions provided by your broker or agent.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the 2014 Annual Meeting. On the record date, there were 33,845,329 shares outstanding and entitled to vote. Accordingly, the holders of 16,922,665 shares must be present at the 2014 Annual Meeting to have a quorum. Your shares will be counted toward the quorum at the 2014 Annual Meeting only if you vote in person at the meeting, or you submit a valid proxy vote.

Abstentions and broker non-votes (as described below) will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present and entitled to vote at the meeting in person or represented by proxy may adjourn the 2014 Annual Meeting to another date.

How are votes counted?

Votes will be counted by the Inspector of Elections appointed for the 2014 Annual Meeting. The Inspector of Elections will separately count “FOR,” “WITHOLD” and broker non-votes for Proposal No. 1 (the election of directors) and “FOR” and “AGAINST” votes, abstentions and, if any, broker non-votes for Proposal No. 2 (the ratification of the selection of Ernst & Young LLP as the independent registered accounting firm of the Company for the fiscal year ending December 31, 2014).

If your shares are held by your broker or other agent as your nominee (that is, held beneficially in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker or other agent to vote your shares. If you do not give voting instructions to your broker or other agent, your broker or other agent can only vote your shares with respect to “routine” matters (as described below).

What are “broker non-votes”?

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. Proposal No. 1 to elect directors is a non-routine matter, but Proposal No. 2 to ratify the selection of Ernst & Young LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2014 is a “routine” matter. Broker non-votes will not be counted toward the vote total for any proposal at the 2014 Annual Meeting.

4

How many votes are needed to approve each proposal?

| | • | | Proposal No. 1 – To elect two Class I directors to hold office until the 2017 Annual Meeting of Stockholders or until their successors are elected. The two nominees receiving the most “FOR” votes (from the votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Broker non-votes will not be counted towards the vote total for this proposal. |

| | • | | Proposal No. 2 – To ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2014. “FOR” votes from the holders of a majority of the shares cast (excluding abstentions and broker non-votes) are required to approve this proposal. Because Proposal No. 2 is considered a “routine” matter, no broker non-votes are expected in connection with this proposal. |

How can I find out the results of the voting at the 2014 Annual Meeting?

We will disclose final voting results in a Current Report on Form 8-K filed with the SEC within four business days after the 2014 Annual Meeting. If final voting results are unavailable at that time, then we intend to file a Current Report on Form 8-K to disclose preliminary voting results and file an amended Current Report on Form 8-K within four business days after the date the final voting results are available.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in the proxy materials for the 2015 Annual Meeting of Stockholders, your proposal must be submitted in writing by January 6, 2015, to the Company’s Corporate Secretary at Relypsa, Inc., 700 Saginaw Drive, Redwood City, California 94063. However, if the meeting is not held between May 20, 2015 and July 19, 2015, then the deadline will be a reasonable time before we begin to print and mail our proxy materials for that meeting.

If you wish to submit a proposal before the stockholders or nominate a director at the 2015 Annual Meeting of Stockholders, but you are not requesting that your proposal or nomination be included in the proxy materials for that meeting, then you must follow the procedures set forth in our bylaws and, among other things, notify the Company’s Corporate Secretary in writing between February 19, 2015 and March 21, 2015. However, if the date of the 2015 Annual Meeting of Stockholders is more than 30 days before or more than 60 days after June 19, 2015, then you must give notice not later than the 90th day prior to that meeting or, if later, the 10th day following the day on which public disclosure of that annual meeting date is first made. You are also advised to review our bylaws, which contain additional requirements regarding advance notice of stockholder proposals and director nominations.

5

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our board of directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Except as otherwise provided by law, vacancies on the board of directors may be filled only by individuals elected by a majority of the remaining directors. A director elected by the board of directors to fill a vacancy in a particular class, including a vacancy created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until such director’s successor is elected and qualified, or until such director’s earlier death, resignation or removal.

Our board of directors currently consists of nine directors and no vacancies, divided into the three following classes:

| | • | | The Class I directors are Ronald M. Hunt, Scott M. Rocklage, Ph.D., and Jonathan T. Silverstein and their terms will expire at the 2014 Annual Meeting; |

| | • | | The Class II directors are David W. J. McGirr, John A. Orwin and Klaus Veitinger, M.D., and their terms will expire at the 2015 Annual Meeting of Stockholders; and |

| | • | | The Class III directors are John P. Butler, Paul J. Hastings and Thomas J. Schuetz, M.D., Ph.D., and their terms will expire at the 2016 Annual Meeting of Stockholders. |

Effective after the 2014 Annual Meeting of Stockholders, the board of directors has reduced the authorized number of directors on the board of directors from nine to eight, as permitted by the Company’s bylaws. In lieu of Mr. Hunt, Dr. Rocklage and Mr. Silverstein, our current Class I directors, Kenneth J. Hillan, M.B., Ch.B. and Daniel K. Spiegelman have been nominated to serve as Class I directors and have agreed to stand for election. If the nominees for Class I are elected at the 2014 Annual Meeting, then each nominee will serve for a three-year term expiring at the 2017 Annual Meeting of Stockholders, or until his or her successor is elected and qualified, or until his or her earlier death, resignation or removal.

Our directors are elected by a plurality of the votes cast. If a choice is specified on the proxy card by a stockholder, the shares will be voted as specified. If a choice is not specified on the proxy card, and authority to do so is not withheld, the shares will be voted “FOR” the election of the two nominees for Class I above. If any of the nominees becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for the nominee will instead be voted for the election of a substitute nominee proposed by the Company’s management or the board of directors. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

The following is a brief biography and discussion of the specific attributes, qualifications, experience and skills of each nominee for director and each director whose term will continue after the 2014 Annual Meeting. Our board of directors and management encourage each nominee for director and each continuing director to attend the 2014 Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE TWO CLASS I NOMINEES FOR DIRECTOR.

CLASS I NOMINEES FOR DIRECTOR –To be elected for a three-year term expiring at the 2017 Annual Meeting of Stockholders

Kenneth J. Hillan, M.B., Ch.B., age 53, has served as President, Chief Executive Officer and a member of the board of directors of Achaogen, Inc., a biopharmaceutical company, since October 2011, and as Chief Medical Officer of Achaogen since April 2011. Prior to Achaogen, Dr. Hillan served in key leadership positions at Genentech, Inc. (acquired by Roche in 2009), a pharmaceutical company, from August 1994 to April 2011. Dr. Hillan was responsible for numerous successful drug approvals and led the medical and scientific strategies

6

for its Immunology, Tissue Growth and Repair drug portfolio. Dr. Hillan served in a number of key leadership positions in research and development, including Senior Vice President Clinical Development, Inflammation, Vice President Immunology, Tissue Growth and Repair, Vice President Development Sciences and Vice President Research Operations and Pathology. Dr. Hillan also previously served as Senior Vice President and head of Clinical Development and Product Development Strategy in Asia-Pacific for Roche in Shanghai, China. Dr. Hillan received an M.B. Ch.B. (Bachelor of Medicine and Surgery) degree from the Faculty of Medicine at the University of Glasgow, U.K. Dr. Hillan is a Fellow of the Royal College of Surgeons (FRCS), and a Fellow of the Royal College of Pathologists (FRCPath). We believe that Dr. Hillan is qualified to serve on our board of directors due to his management experience in the life sciences sector and medical and scientific background.

Daniel K. Spiegelman, age 55, has served as Executive Vice President and Chief Financial Officer at BioMarin Pharmaceutical Inc., a biopharmaceutical company, since May 2012. From May 2009 until May 2012, Mr. Spiegelman served as a strategic and financial consultant to a portfolio of public and private life science companies. From 1998 to 2009, Mr. Spiegelman served in various roles, most recently as Senior Vice President and Chief Financial Officer, of CV Therapeutics, Inc., a biopharmaceutical company (acquired by Gilead Sciences, Inc.), where he was responsible for finance, accounting, investor relations, business development, and information systems. From 1991 to 1998, Mr. Spiegelman served in various roles at Genentech, Inc. (now a member of the Roche Group), a biotechnology company, most recently as Treasurer. Mr. Spiegelman serves on the board of directors of Anthera Pharmaceuticals, Inc., a biopharmaceutical company, and Oncothyreon, Inc., a biotechnology company, and previously served on the board of directors of the following biopharmaceutical companies: Affymax, Inc., Omeros Corporation, Cyclacel Pharmacetuicals, Inc., and Xcyte Therapies, Inc. Mr. Spiegelman received a B.A. from Stanford University and an M.B.A. from the Stanford Graduate School of Business. We believe that Mr. Spiegelman is qualified to serve on our board of directors due to his management experience and experience in the financial sector.

CLASS II DIRECTORS–To continue in office until the 2015 Annual Meeting of Stockholders

David W.J. McGirr, age 59, has served as a member of our board of directors since November 2012 and chairman of the audit committee since November 2012. Mr. McGirr served as Senior Vice President and Chief Financial Officer of Cubist Pharmaceuticals Inc., a pharmaceutical company, from 2002 to March 2013. Prior to Cubist, Mr. McGirr was the President and Chief Operating Officer of hippo inc, an internet technology company, and served as a member of their board of directors. Prior to hippo, Mr. McGirr was the President of GAB Robins North America, Inc., a risk management company, and served as Chief Executive Officer. Prior to that, Mr. McGirr served in various positions within the S.G. Warburg Group, an investment bank, ultimately serving as Chief Financial Officer, Chief Administrative Officer and Managing Director of its subsidiary S.G. Warburg & Co., Inc. Mr. McGirr currently serves on the board of directors of Insmed Incorporated, a biopharmaceutical company. Mr. McGirr received a B.Sc. in Civil Engineering from the University of Glasgow and an M.B.A. from the Wharton School at the University of Pennsylvania. We believe that Mr. McGirr is qualified to serve on our board of directors due to his management experience and experience in the financial sector.

John A. Orwin, age 49, has served as our President and Chief Executive Officer and as a member of our board of directors since June 2013. Prior to Relypsa, Mr. Orwin served as President and Chief Operating Officer of Affymax, Inc., a biotechnology company, from April 2010 to January 2011, and as their Chief Executive Officer and a member of their board of directors from February 2011 to May 2013. From 2005 to April 2010, Mr. Orwin served as Vice President and then Senior Vice President of the BioOncology Business Unit at Genentech, Inc. (now a member of the Roche Group), a biotechnology company, where he was responsible for all marketing, sales, business unit operations and pipeline brand management for Genentech’s oncology portfolio in the United States. From 2001 to 2005, Mr. Orwin served in various executive-level positions at Johnson & Johnson, a life sciences company, overseeing oncology therapeutic commercial and portfolio expansion efforts in the U.S. Prior to such roles, Mr. Orwin held senior marketing and sales positions at various life sciences and pharmaceutical companies, including Alza Corporation (acquired by Johnson & Johnson), Sangstat Medical Corporation

7

(acquired by Genzyme), Rhone-Poulenc Rorer Pharmaceuticals, Inc. (merged with Sanofi-Aventis) and Schering-Plough Corporation (merged with Merck). Mr. Orwin serves as a member of the board of directors of Array BioPharma Inc., a biopharmaceutical company, Seattle Genetics, Inc., a biotechnology company and Affymax, Inc., a biotechnology company, and served on the board of directors of NeurogesX, Inc., a biopharmaceutical company, until July 2013. Mr. Orwin received a B.A. in Economics from Rutgers University and an M.B.A. from New York University. We believe Mr. Orwin is qualified to serve on our board of directors based on his management experience in the life sciences sector and his service on the boards of directors of several public life sciences companies.

Klaus Veitinger, M.D., age 52, has served as a member of our board of directors since November 2010. Dr. Veitinger has served as a Venture Partner at OrbiMed since 2007. Prior to joining OrbiMed, during his prior 16-year pharmaceutical career, Dr. Veitinger was employed at Schwarz Pharma AG, a pharmaceutical company, where he held senior management positions in drug development, licensing and business development, strategic planning and M&A, as well as general management. Most recently, Dr. Veitinger was a member of the Executive Board of Schwarz Pharma AG, and the Chief Executive Officer of Schwarz Pharma Inc. with responsibility for the U.S. and Asia businesses culminating in the ultimate sale of the Schwarz Group. Dr. Veitinger currently serves on the boards of directors of various private companies in the life sciences sector and Intercept Pharmaceuticals, Inc., a pharmaceutical company. Dr. Veitinger received a medical degree, as well as a doctorate, from Heidelberg University and an M.B.A. from INSEAD in France. We believe that Dr. Veitinger is qualified to serve on our board of directors due to his management and investment experience in the life sciences sector and medical and scientific background.

CLASS III DIRECTORS – To continue in office until the 2016 Annual Meeting of Stockholders

John P. Butler, age 49, has served as a member of our board of directors since September 2013. Mr. Butler has served as the President and Chief Executive Officer of Akebia Therapeutics, Inc., a biopharmaceutical company, since September 2013. From October 2011 to April 2013, Mr. Butler served as the Chief Executive Officer of Inspiration Biopharmaceuticals, Inc., a biopharmaceutical company that filed for protection under Chapter 11 of the U.S. Bankruptcy Code in October 2012 prior to the successful sale of its hemophilia assets to Cangene Corporation and Baxter International in early 2013. Prior to Inspiration, Mr. Butler held various positions at Genzyme Corporation (acquired by Sanofi-Aventis), a biotechnology company, from 1997 to July 2011, including President, Personalized Genetic Health, President, Cardiometabolic and Renal Division and President, General Manager Renal Business. Prior to Genzyme, Mr. Butler held various positions of increasing responsibility at Amgen, Inc., a biopharmaceutical company, including serving as a product manager from 1995 to 1997. Mr. Butler received a B.A. in Chemistry from Manhattan College and an M.B.A. from Baruch College. We believe that Mr. Butler is qualified to serve on our board of directors due to his deep industry experience in the biotechnology sector.

Paul J. Hastings, age 54, has served as a member of our board of directors since October 2012. Mr. Hastings has served as the Chairman, President, and Chief Executive Officer of OncoMed Pharmaceuticals, Inc., a pharmaceutical company, since 2013 and President and Chief Executive Officer since 2006. Prior to OncoMed, Mr. Hastings was President and Chief Executive Officer of QLT, Inc. from 2002 to 2005 and Axys Pharmaceuticals, Inc. (acquired by Celera Corporation) from 2001 to 2002, both pharmaceutical companies. Previously, Mr. Hastings served as the President of Chiron BioPharmaceuticals (acquired by Novartis), a pharmaceutical company, and President and Chief Executive Officer of LXR Biotechnology, a biotechnology company. Mr. Hastings has also served in various positions at Genzyme Corporation (acquired by Sanofi-Aventis) and Synergen, Inc. (acquired by Amgen), both biotechnology companies. Mr. Hastings has served on various private and public company boards, and currently serves on the board of directors of OncoMed and Pacira Pharmaceuticals, Inc., a pharmaceutical company. Mr. Hastings received a B.S. in Pharmacy from the University of Rhode Island. We believe that Mr. Hastings is qualified to serve on our board of directors due to his deep industry experience and service on the boards of directors of several public life sciences companies.

8

Thomas J. Schuetz, M.D., Ph.D., age 53, has served as a member of our board of directors since August 2010. Dr. Schuetz has been a consultant for clinical development programs at both public and privately-held biopharmaceutical companies since 2006. Dr. Schuetz was previously the Chief Medical Officer of Therion Biologics Corporation, a pharmaceutical company, and the Vice President of Clinical Affairs at Transkaryotic Therapies, Inc. (acquired by Shire Pharmaceuticals). Dr. Schuetz received a B.S. in Chemistry from Xavier University, an M.D. from Harvard Medical School and a Ph.D. in Genetics from Harvard University. He completed an internal medicine residency at Massachusetts General Hospital, where he was also Chief Medical Resident, and a Medical Oncology fellowship at the Dana-Farber Cancer Institute. Dr. Schuetz is Board Certified in Medical Oncology. We believe that Dr. Schuetz is qualified to serve on our board of directors due to his clinical and executive experience and medical and scientific background.

9

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has selected Ernst & Young LLP, or EY, as our independent registered public accounting firm for the year ending December 31, 2014, and is seeking ratification of such selection by our stockholders at the 2014 Annual Meeting. EY has audited our financial statements for the fiscal years ended December 31, 2013 and 2012. Representatives of EY are expected to be present at the 2014 Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylaws nor other governing documents or law require stockholder ratification of the selection of EY as our independent registered public accounting firm. However, the audit committee is submitting the selection of EY to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the audit committee will reconsider whether or not to retain EY. Even if the selection is ratified, the audit committee in its discretion may select a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

The affirmative vote of a majority of the shares cast at the 2014 Annual Meeting will be required to ratify the selection of EY.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” PROPOSAL NO. 2.

For the fiscal years ended December 31, 2013 and 2012, EY billed the approximate fees set forth below. All fees included below were approved by the audit committee.

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2013 | | | 2012 | |

Audit Fees(1) | | $ | 1,207,763 | | | $ | 51,000 | |

Audit-Related Fees(2) | | | — | | | | — | |

Tax Fees(3) | | | 48,584 | | | | 11,000 | |

All Other Fees(4) | | | 306,096 | | | | — | |

| | | | | | | | |

Total All Fees | | $ | 1,562,443 | | | $ | 62,000 | |

| | | | | | | | |

| (1) | This category consists of fees for professional services rendered for the audit of our financial statements, review of interim financial statements, assistance with registration statements filed with the SEC and services that are normally provided by EY in connection with statutory and regulatory filings or engagements. Related to the year ended December 31, 2013 and 2012, fees of $969,511 and $0, respectively were billed in connection with the filing of our Registration Statements on Form S-1 in connection with the initial public offering of our common stock, or IPO. |

| (2) | This category consists of fees for assurance and related services reasonably related to the performance of the audit or review of financial statements and that are not reported under the Audit Fees category. We did not incur any fees in this category in the years ended December 31, 2013 or 2012. |

| (3) | This category consists of fees for professional services rendered for tax compliance and tax advice. |

| (4) | This category consists of fees for professional services rendered in connection with patiromer commercial strategy. |

Pre-Approval Policies and Procedures

The audit committee has adopted a policy for the pre-approval of all audit and non-audit services to be performed for the Company by the independent registered public accounting firm. This policy is set forth in the charter of the audit committee and available at http://investor.relypsa.com/corporate-governance.cfm. The audit committee has considered the role of EY in providing audit and audit-related services to the Company and has concluded that such services are compatible with EY’s role as the Company’s independent registered public accounting firm.

10

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The primary purpose of the audit committee is to oversee our financial reporting processes on behalf of our board of directors. The audit committee’s functions are more fully described in its charter, which is available on our website at http://investor.relypsa.com/corporate-governance.cfm.

In fulfilling its oversight responsibilities, the audit committee reviewed and discussed with management the Company’s audited financial statements for the fiscal year ended December 31, 2013. The audit committee has discussed with EY, the Company’s independent registered public accounting firm, the matters required to be discussed by Auditing Standard No. 16, “Communications with Audit Committees,” issued by the Public Company Accounting Oversight Board, or PCAOB. In addition, the audit committee has discussed with EY their independence, and received from EY the written disclosures and the letter required by Ethics and Independence Rule 3526 of the PCAOB. Finally, the audit committee discussed with EY, with and without management present, the scope and results of EY’s audit of the financial statements for the fiscal year ended December 31, 2013.

Based on these reviews and discussions, the audit committee has recommended to our board of directors that such audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2013 for filing with the SEC.

|

Audit Committee David W.J. McGirr, Chairman Paul J. Hastings Thomas J. Schuetz, M.D., Ph.D. |

11

CORPORATE GOVERNANCE

Board Composition

Director Independence

Our board of directors currently consists of nine members, and effective after the 2014 Annual Meeting shall consist of eight members. Our board of directors has determined that all of our directors, as well as each individual nominated by our board of directors for election to our board of directors at the 2014 Annual Meeting, other than Mr. Orwin and Dr. Veitinger, qualify as “independent” directors in accordance with the NASDAQ listing requirements. Mr. Orwin is not considered independent because he is an employee of Relypsa and Dr. Veitinger is not considered independent because he has received in excess of $120,000 in compensation during a period of twelve consecutive months within the past three years for his services as a consultant to the Company. Gerrit Klaerner, Ph.D., is no longer a member of our board of directors; however, Dr. Klaerner served on our board of directors during the 2013 fiscal year and until his resignation in June 2013. Our board of directors has also determined that Dr. Klaerner did not qualify as an “independent” director under the NASDAQ listing standards because he was an employee of Relypsa during the period in which he served as a director on our board of directors.

The NASDAQ independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his family members has engaged in various types of business dealings with us. In addition, as required by NASDAQ rules, our board of directors has made a subjective determination as to each independent director and director nominee that no relationships exist, which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our board of directors reviewed and discussed information provided by the directors and us with regard to each director’s and each nominee’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors, nominees for election to our board of directors or our executive officers.

As described more fully below, the board of directors has also determined that each current member of the compensation committee, other than Dr. Veitinger, and each current member of the audit committee and the nominating and corporate governance committee, as well as each director and director nominee that we expect to serve on such committees after the 2014 Annual Meeting, other than Dr. Veitinger, meets the independence standards applicable to those committees prescribed by NASDAQ, the SEC, and the Internal Revenue Service.

Classified Board of Directors

In accordance with our amended and restated certificate of incorporation, our board of directors is divided into three classes with staggered, three-year terms as set forth below. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election.

| | • | | The Class I directors are Mr. Hunt, Dr. Rocklage and Mr. Silverstein, and their terms will expire at the 2014 Annual Meeting of Stockholders; |

| | • | | The Class II directors are Mr. McGirr, Mr. Orwin and Dr. Veitinger, and their terms will expire at the 2015 Annual Meeting of Stockholders; and |

| | • | | The Class III directors are Mr. Butler, Mr. Hastings and Dr. Schuetz, and their terms will expire at 2016 Annual Meeting of Stockholders. |

The authorized number of directors may be changed only by resolution of the board of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our company.

12

Leadership Structure of the Board

Our amended and restated bylaws and corporate governance guidelines provide our board of directors with flexibility to combine or separate the positions of Chairman of the board and Chief Executive Officer and/or the implementation of a lead director in accordance with its determination that utilizing one or the other structure would be in the best interests of our company. Dr. Scott Rocklage currently serves as the Chairman of our board of directors. In that role, Dr. Rocklage presides over the executive sessions of the board of directors in which Mr. Orwin does not participate and serves as a liaison to Mr. Orwin and management on behalf of the board of directors. In April 2014, in connection with the expiration of Dr. Rocklage’s term as a director, our board of directors appointed Mr. Spiegelman to serve as Chairman of the board of directors, subject to election by our stockholders at the 2014 Annual Meeting and effective immediately following the 2014 Annual Meeting.

Our board of directors has concluded that our current leadership structure is appropriate at this time. However, our board of directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board in Risk Oversight Process

Risk assessment and oversight are an integral part of our governance and management processes. Our board of directors encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings, and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the board of directors at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.

Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through our board of directors as a whole, as well as through various standing committees of our board of directors that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure and our audit committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The audit committee also monitors compliance with legal and regulatory requirements. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines and considers and approves or disapproves any related-persons transactions. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Meetings of the Board of Directors and Committees

During 2013, the board of directors met 8 times, the audit committee met 4 times, the compensation committee met 4 times and the nominating and corporate governance committee met 3 times. In that year, each director attended at least 75% of the meetings of the board of directors and the committees on which he served.

Board Committees

Audit Committee

Our audit committee oversees our corporate accounting and financial reporting process. Among other matters, the audit committee:

| | • | | appoints our independent registered public accounting firm; |

| | • | | evaluates the independent registered public accounting firm’s qualifications, independence and performance; |

| | • | | determines the engagement of the independent registered public accounting firm; |

13

| | • | | reviews and approves the scope of the annual audit and the audit fee; |

| | • | | discusses with management and the independent registered public accounting firm the results of the annual audit and the review of our quarterly financial statements; |

| | • | | approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; |

| | • | | monitors the rotation of partners of the independent registered public accounting firm on our engagement team in accordance with requirements established by the SEC; |

| | • | | is responsible for reviewing our financial statements and our management’s discussion and analysis of financial condition and results of operations to be included in our annual and quarterly reports to be filed with the SEC; |

| | • | | reviews our critical accounting policies and estimates; and |

| | • | | reviews the audit committee charter and the committee’s performance at least annually. |

The current members of our audit committee are Messrs. Hastings and McGirr and Dr. Schuetz. Mr. McGirr serves as the chairman of the committee. After the 2014 Annual Meeting, and subject to election by our stockholders in the case of Mr. Spiegelman, we expect that our audit committee will be composed of Mr. McGirr, as chairman, Mr. Spiegelman and Dr. Schuetz.

Each of the current members of our audit committee, as well as the expected members of our audit committee after the 2014 Annual Meeting, meets or will meet the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ. Our board of directors has determined that Mr. McGirr is an audit committee financial expert as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of NASDAQ. Under the rules of the SEC, members of the audit committee must also meet heightened independence standards. However, a minority of the members of the audit committee may be exempt from the heightened audit committee independence standards for one year from the date of effectiveness of the registration statement filed in connection with our IPO. Our board of directors has determined that each of Messrs. Hastings, McGirr and Spiegelman and Dr. Schuetz are independent under the heightened independence standards under the applicable rules of NASDAQ. The audit committee operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ. A copy of the audit committee charter is available to security holders on the Company’s website at http://investor.relypsa.com/corporate-governance.cfm.

Compensation Committee

Our compensation committee reviews and recommends policies relating to compensation and benefits of our officers and employees. The compensation committee reviews and recommends corporate goals and objectives relevant to compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives and recommends to our board of directors the compensation of these officers based on such evaluations. The compensation committee also recommends to our board of directors for approval, and approves, the issuance of stock options and other awards under our stock plans. The compensation committee will review and evaluate, at least annually, the performance of the compensation committee and its members, including compliance by the compensation committee with its charter. The current members of our compensation committee are Messrs. Butler, Hastings and Hunt and Dr. Veitinger. Dr. Veitinger serves as the chairman of the committee. After the 2014 Annual Meeting, and subject to election by our stockholders in the case of Dr. Hillan, we expect that our compensation committee will be composed of Mr. Hastings, as chairman, Mr. Butler and Dr. Hillan.

Each of the current members of our compensation committee, other than Dr. Veitinger, as well as the expected members of our compensation committee after the 2014 Annual Meeting, is or will be an “independent director” under the applicable rules and regulations of The NASDAQ Global Select Market, is or will be a “non-employee

14

director” as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, and is or will be an “outside director” as that term is defined in Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended, or the Code. The compensation committee operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ. A copy of the compensation committee charter is available to security holders on the Company’s website at http://investor.relypsa.com/corporate-governance.cfm.

Dr. Veitinger does not qualify as an “independent” director in accordance with the NASDAQ listing requirements because he has received in excess of $120,000 in compensation during a period of twelve consecutive months within the past three years for his services as a consultant to the Company. However, as permitted by the applicable NASDAQ and SEC rules and regulations, we are phasing in our compliance with the independent compensation committee requirements in accordance with such rules and regulations that permit (1) one independent member of the committee at the time of listing; (2) a majority of independent members of the committee within 90 days of listing; and (3) all independent members of the committee within one year of listing. We do not believe our use of these phase-in periods adversely affects the ability of our compensation committee to act independently or to satisfy the other requirements thereof.

In addition, the compensation committee established a subcommittee comprised of Messrs. Butler, Hastings and Hunt, each of whom has been determined by our board of directors to be an “independent director” under the applicable NASDAQ rules and regulations, a “non-employee” director under Rule 16b-3 promulgated under the Exchange Act and an “outside director” under Section 162(m) of the Code. The compensation committee delegated power and authority to the independent committee to undertake all duties and responsibilities of the compensation committee as determined by the compensation committee, as required by the compensation committee charter, applicable law or the listing requirements of NASDAQ, or as may be delegated from the board of directors from time to time.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is responsible for making recommendations to our board of directors regarding candidates for directorships and the size and composition of our board of directors. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies and reporting and making recommendations to our board of directors concerning governance matters. As part of its duties, the nominating and corporate governance committee will consider individuals who are properly proposed by stockholders to serve on the board of directors in accordance with laws and regulations established by the SEC and the NASDAQ listing requirements, our bylaws and applicable corporate law, and make recommendations to the board of directors regarding such individuals based on the established criteria for members of our board. The nominating and corporate governance committee may consider in the future whether we should adopt a more formal policy regarding stockholder nominations. The current members of our nominating and corporate governance committee are Mr. Silverstein and Dr. Rocklage. Mr. Silverstein serves as the chairman of the committee. After the 2014 Annual Meeting, and subject to election by our stockholders in the case of Dr. Hillan, we expect that our nominating and corporate governance committee will be composed of Mr. McGirr, as chairman, Dr. Veitinger, and Mr. Hastings.

Each of the current members of our nominating and corporate governance committee, as well as the expected members of our nominating and corporate governance committee after the 2014 Annual Meeting, other than Dr. Veitinger, is or will be an “independent director” under the applicable rules and regulations of NASDAQ relating to nominating and corporate governance committee independence. However, following the 2014 Annual Meeting, we will continue to comply with NASDAQ’s rules regarding independent director oversight of director nominations under either NASDAQ Rule 5605(e)(1)(A) or 5605(e)(1)(B). The nominating and corporate governance committee operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ. A copy of the nominating and corporate governance committee charter is available to security holders on the Company’s website at http://investor.relypsa.com/corporate-governance.cfm.

15

Dr. Hillan was recommended to our board of directors and our nominating and corporate governance committee by our chief executive officer and by certain of our other existing directors. Mr. Spiegelman was recommended to our board of directors and our nominating and corporate governance committee by our chief executive officer and by certain of our other existing directors. In connection with identifying potential directors to serve on our board of directors, we retained a third party search firm, which assisted with identifying and evaluating potential nominees.

Board Diversity

Our nominating and corporate governance committee is responsible for reviewing with the board of directors, on an annual basis, the appropriate characteristics, skills and experience required for the board of directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominating and corporate governance committee, in recommending candidates for election (and, in the case of vacancies, appointing), and the board of directors, in approving such candidates, will take into account many factors, including the following:

| | • | | personal and professional integrity; |

| | • | | experience in corporate management, such as serving as an officer or former officer of a publicly held company; |

| | • | | experience in the industries in which we compete; |

| | • | | experience as a board member or executive officer of another publicly held company; |

| | • | | diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; |

| | • | | conflicts of interest; and |

| | • | | practical and mature business judgment. |

Currently, our board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of business conduct and ethics is available on our website at www.relypsa.com. We will disclose any substantive amendments to the code of business conduct and ethics, or any waiver of its provisions, on our website. The reference to our website does not constitute incorporation by reference of the information contained at or available through our website.

Limitation on Liability and Indemnification Matters

Our amended and restated certificate of incorporation contains provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, our directors will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for:

| | • | | any breach of the director’s duty of loyalty to us or our stockholders; |

| | • | | any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

16

| | • | | unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation Law; or |

| | • | | any transaction from which the director derived an improper personal benefit. |

Our amended and restated certificate of incorporation and amended and restated bylaws provide that we are required to indemnify our directors and officers, in each case to the fullest extent permitted by Delaware law. Our amended and restated bylaws also provide that we are obligated to advance expenses incurred by a director or officer in advance of the final disposition of any action or proceeding, and permit us to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in that capacity regardless of whether we would otherwise be permitted to indemnify him or her under Delaware law.

We have entered and expect to continue to enter into agreements to indemnify our directors, executive officers and other employees as determined by our board of directors. With specified exceptions, these agreements provide for indemnification for related expenses including, among other things, attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding. We believe that these bylaw provisions and indemnification agreements are necessary to attract and retain qualified directors and officers. We also maintain directors’ and officers’ liability insurance.

The limitation of liability and indemnification provisions in our amended and restated certificate of incorporation and amended and restated bylaws may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and our stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage. To the extent the indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. At present, there is no pending litigation or proceeding involving any of our directors, officers or employees for which indemnification is sought, and we are not aware of any threatened litigation that may result in claims for indemnification.

Director Attendance at Annual Meetings

Our board of directors has a policy of encouraging director attendance at our annual meetings of stockholders, but attendance is not mandatory. Our board of directors and management team encourage all of our directors to attend the 2014 Annual Meeting.

Stockholder Communications with the Board of Directors

A stockholder may communicate with the board of directors, or an individual director, by sending written correspondence to the Company’s Corporate Secretary at Relypsa, Inc., 700 Saginaw Drive, Redwood City, California 94063. The Corporate Secretary will review such correspondence and forward it to the board of directors, or an individual director, as appropriate.

Compensation Committee Interlocks and Insider Participation

During 2013, the following individuals served as members of our compensation committee: Drs. Rocklage and Veitinger and Messrs. Butler, Hastings and Hunt. Dr. Veitinger served as chairman of the compensation committee. None of the members of our compensation committee has at any time been one of our officers or employees, other than Dr. Veitinger. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers on our board of directors or compensation committee.

17

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The following is a description of transactions since January 1, 2013 to which we have been a party, in which the amount involved exceeds $120,000, and in which any of our directors, executive officers or holders of more than 5% of our capital stock, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest.

Sales and Purchases of Securities

Series C Preferred Stock and Warrant Financing

In October 2013 we issued an aggregate of 1,633,126 shares of our Series C-2 convertible preferred stock at a price per share of $9.1848. In connection with such issuances, we issued warrants to purchase an aggregate of 479,221 shares of our Series C-2 convertible preferred stock at a price per share of $0.17, which we refer to as our Series C-2 Financing Warrants herein. The Series C-2 Financing Warrants were exercised in connection with our IPO that was completed in November 2013. The aggregate gross consideration received for these issuances was $15.0 million.

The table below sets forth the number of shares of Series C-2 convertible preferred stock and the number of shares underlying the Series C-2 Financing Warrants sold, to our directors, executive officers or owners of more than 5% of a class of our capital stock, or an affiliate or immediate family member thereof:

| | | | | | | | | | | | |

Name | | Number of

Shares of

Series C-2

Convertible

Preferred

Stock | | | Number of

Shares

Underlying

Series C-2

Financing

Warrants | | | Aggregate

Purchase

Price ($) | |

OrbiMed Private Investments IV, LP | | | 693,991 | | | | 327,133 | | | $ | 6,374,169 | |

5AM Ventures II, L.P. | | | 47,849 | | | | 17,141 | | | | 439,483 | |

5AM Co-Investors II, L.P. | | | 1,888 | | | | 676 | | | | 17,341 | |

5AM Ventures III, L.P. | | | 284,822 | | | | 102,036 | | | | 2,616,033 | |

5AM Co-Investors III, L.P. | | | 7,340 | | | | 2,629 | | | | 67,416 | |

New Leaf Ventures I, L.P. | | | 125,067 | | | | — | | | | 1,148,715 | |

Sprout Capital IX, L.P. | | | 97,857 | | | | — | | | | 898,797 | |

Sprout Entrepreneurs Fund, L.P. | | | 410 | | | | — | | | | 3,766 | |

Delphi Ventures VII, L.P. | | | 110,562 | | | | — | | | | 1,015,490 | |

Delphi BioInvestments VII. L.P. | | | 1,105 | | | | — | | | | 10,149 | |

Participation in our IPO

In connection with our IPO, the underwriters allocated an aggregate of 1,807,084 shares of our common stock in the offering to certain of our principal stockholders and/or affiliates, including a limited partner of two of our existing investors and one of our executive officers, on the same terms as the other shares that were offered and sold in our IPO. These allocations included allocations to the following executive officer and owners of more than 5% of a class of our capital stock: 712,192 shares to OrbiMed Private Investments IV, LP, 363,328 shares to 5AM Ventures III, L.P., 9,364 shares to 5AM Co-Investors III, L.P., 185,978 shares to New Leaf Ventures I, L.P., 205,836 Delphi Ventures VII, L.P., 2,058 shares to Delphi BioInvestments VII. L.P. and 15,000 shares to John Orwin. All of the shares allocated to our principal stockholders and/or affiliates were sold at $11.00, which was the IPO price.

Warrant Exercises

In October 2013, we issued an aggregate of 22,088 shares of Series B-1 Preferred Stock pursuant to warrants exercised by Delphi Ventures VII, L.P. and Delphi BioInvestments VII. L.P. at a price per share of $13.502. The aggregate gross cash consideration received for these issuances was $0.3 million.

18

In November 2013, we issued an aggregate of 2,375,386 shares of common stock pursuant to the cashless net exercise of warrants at an effective price per share of $0.25 to OrbiMed Private Investments IV, LP, 5AM Ventures II, L.P., 5AM Co-Investors II, L.P., 5AM Ventures III, L.P., 5AM Co-Investors III, L.P., New Leaf Ventures I, L.P., Sprout Capital IX, L.P. and Sprout Entrepreneurs Fund, L.P.

Consulting Agreement with Dr. Klaus Veitinger

In October 2010, we entered into a Consulting and Independent Contractor Agreement with an entity controlled by Dr. Klaus Veitinger, a member of our board of directors, under which Dr. Veitinger previously provided certain consulting services to us in connection with patiromer. In 2012 and 2013, we paid $0.2 million and $0.1 million, respectively, pursuant to this agreement. Our board of directors has determined that Dr. Veitinger does not qualify as an “independent” director under the NASDAQ listing requirements due to the consideration Dr. Veitinger received pursuant to this agreement. We terminated this agreement with Dr. Veitinger upon the effectiveness of the registration statement filed in connection with our IPO.

Indemnification Agreements and Directors’ and Officers’ Liability Insurance

We have entered into indemnification agreements with each of our directors and executive officers. These agreements, among other things, require us to indemnify each director and executive officer to the fullest extent permitted by Delaware law, including indemnification of expenses such as attorneys’ fees, judgments, penalties fines and settlement amounts incurred by the director or executive officer in any action or proceeding, including any action or proceeding by or in right of us, arising out of the person’s services as a director or executive officer.

Investor Rights Agreements

We have entered into an amended and restated investor rights agreement with the purchasers of our outstanding convertible preferred stock and certain holders of common stock and warrants to purchase our convertible preferred stock, including entities with which certain of our directors are affiliated. As of April 17, 2014, the holders of approximately 21.6 million shares of our common stock, including the shares of common stock issuable upon the conversion of our convertible preferred stock and shares of common stock issued upon exercise of warrants, are entitled to rights with respect to the registration of their shares under the Securities Act. The investor rights agreement previously provided for a right of first refusal in favor of certain holders of convertible preferred stock with regard to certain issuances of our capital stock. The rights of first refusal terminated upon the pricing of our IPO.

Policies and Procedures for Related Party Transactions

Our board of directors has adopted a written related person transaction policy setting forth the policies and procedures for the review and approval or ratification of related person transactions. This policy covers, with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act , any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships in which we were or are to be a participant, where the amount involved exceeds $120,000 and a related person had or will have a direct or indirect material interest, including, without limitation, purchases of goods or services by or from the related person or entities in which the related person has a material interest, indebtedness, guarantees of indebtedness and employment by us of a related person. In reviewing and approving any such transactions, our audit committee is tasked to consider all relevant facts and circumstances, including, but not limited to, whether the transaction is on terms comparable to those that could be obtained in an arm’s length transaction with an unrelated third party and the extent of the related person’s interest in the transaction.

19

NON-EMPLOYEE DIRECTOR COMPENSATION

In June 2013, our board of directors approved a compensation policy for our non-employee directors, or the 2013 Director Compensation Program. Pursuant to the 2013 Director Compensation Program, our non-employee directors receive cash compensation as follows:

| | • | | Each non-employee director receives an annual cash retainer in the amount of $35,000 per year. |

| | • | | The non-employee Chairman of the Board receives an additional annual cash retainer in the amount of $25,000 per year. |

| | • | | The chairperson of the audit committee receives additional annual cash compensation in the amount of $17,000 per year for such chairperson’s service on the audit committee. Each non-chairperson member of the audit committee receives additional annual cash compensation in the amount of $7,500 per year for such member’s service on the audit committee. |

| | • | | The chairperson of the compensation committee receives additional annual cash compensation in the amount of $12,000 per year for such chairperson’s service on the compensation committee. Each non-chairperson member of the compensation committee receives additional annual cash compensation in the amount of $5,000 per year for such member’s service on the compensation committee. |

| | • | | The chairperson of the nominating and corporate governance committee receives additional annual cash compensation in the amount of $7,500 per year for such chairperson’s service on the nominating and corporate governance committee. Each non-chairperson member of the nominating and corporate governance committee receives additional annual cash compensation in the amount of $2,500 per year for such member’s service on the nominating and corporate governance committee. |

Under the 2013 Director Compensation Program, each non-employee director is automatically granted an option to purchase shares of our common stock having a grant date fair value, as calculated in accordance with Accounting Standards Codification, or ASC, 718, of $150,000 upon initial appointment or election to our board of directors. In addition, each continuing non-employee director who has been serving on our board of directors for at least six months as of the date of any annual meeting of our stockholders and will continue to serve as a non-employee director immediately following such meeting is automatically granted an option to purchase shares of our common stock having a grant date fair value, as calculated in accordance with ASC 718, of $75,000 on the date of each annual stockholders meeting. The Chairman of the Board is also automatically granted an additional option to purchase shares of our common stock having a grant date fair value, as calculated in accordance with ASC 718, of $15,000 on the date of each annual stockholders meeting. Each initial non-employee director stock option vests in substantially equal annual installments on each of the first three anniversaries of the grant date, subject to the non-employee director’s continued service on our board of directors through such date. Each annual stock option granted to our non-employee directors, including the Chairman of the Board stock option, vests on the earlier of the first anniversary of the date of grant or the next annual stockholders meeting, subject to the non-employee director’s continued service on our board of directors through such date.