UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under §240.14a-12 |

RELYPSA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

RELYPSA, INC.

100 Cardinal Way

Redwood City, California 94063

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 21, 2016

To the Stockholders of Relypsa, Inc.:

The 2016 Annual Meeting of Stockholders, or the 2016 Annual Meeting, of Relypsa, Inc., a Delaware corporation, or the Company, will be held on June 21, 2016 at 8:00 a.m. local time at the Company’s headquarters located at 100 Cardinal Way, Redwood City, California 94063 for the following purposes:

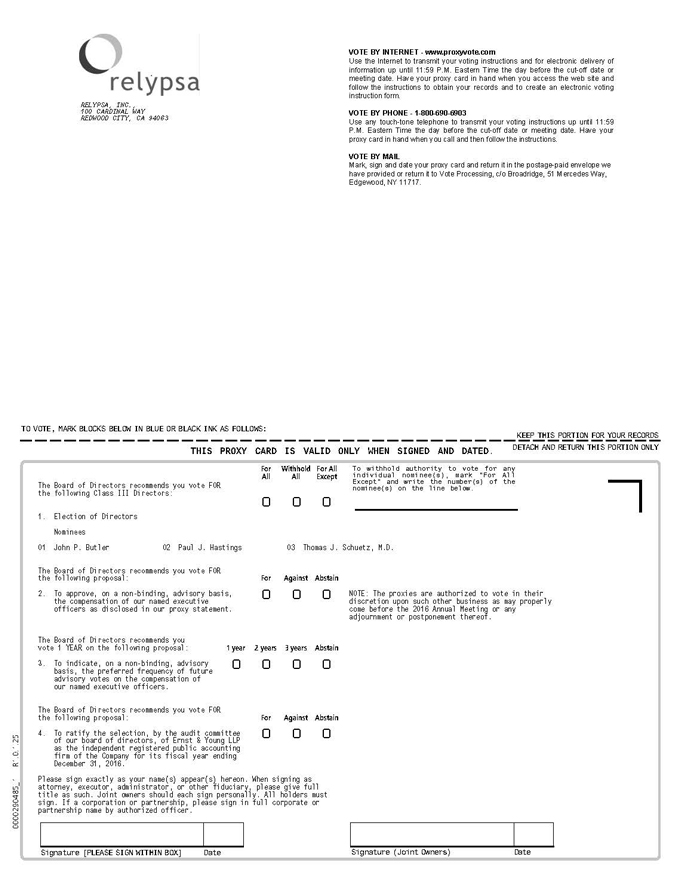

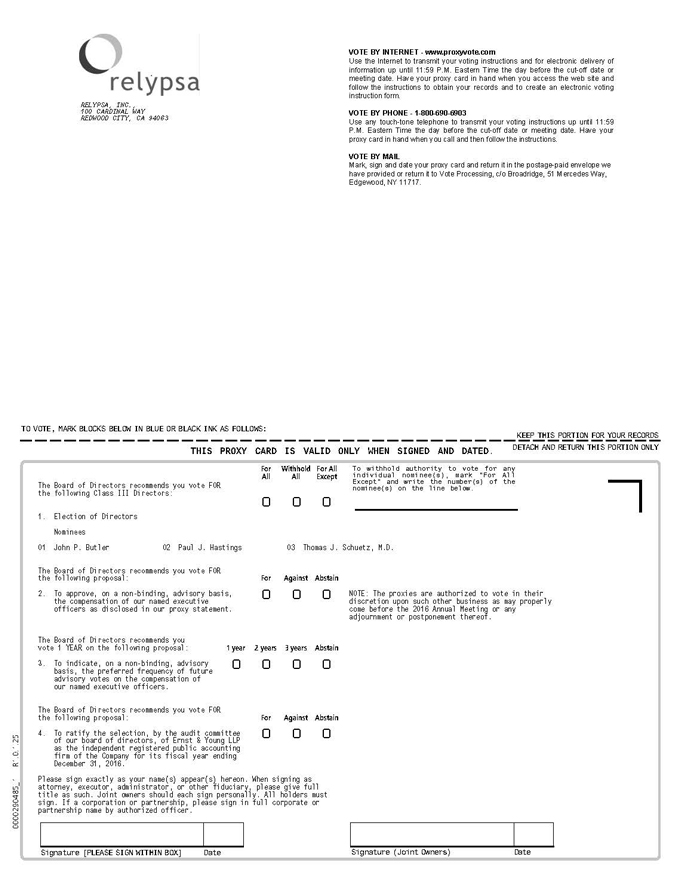

| | 1. | To elect three Class III directors to hold office until the 2019 Annual Meeting of Stockholders or until their successors are elected; |

| | 2. | To approve, on a non-binding, advisory basis, the compensation of our named executive officers, as disclosed in the proxy statement accompanying this notice; |

| | 3. | To indicate, on a non-binding, advisory basis, the preferred frequency of future advisory votes on the compensation of our named executive officers; |

| | 4. | To ratify the selection, by the audit committee of our board of directors, of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2016; and |

| | 5. | To transact such other business as may properly come before the 2016 Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice. Only stockholders who owned the Company’s common stock at the close of business on April 22, 2016 may vote at the 2016 Annual Meeting or any adjournments or postponements that take place.

We have elected to provide our proxy materials to our stockholders over the internet as permitted by the rules of the U.S. Securities and Exchange Commission. As a result, we are mailing most of our stockholders a paper copy of the Notice of Internet Availability of Proxy Materials, or the Notice, but not a paper copy of our proxy statement and our 2015 Annual Report to Stockholders. This process allows us to provide our proxy materials to our stockholders in a timelier and more readily accessible manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. The Notice contains instructions on how to access those documents over the internet. The Notice also contains instructions on how to request a paper copy of our proxy materials, including this proxy statement, our 2015 Annual Report to Stockholders and a form of proxy card or voting instruction card. All stockholders who have previously requested a paper copy of our proxy materials will continue to receive a paper copy of our proxy materials by mail.

You are cordially invited to attend the 2016 Annual Meeting in person. Whether or not you plan to attend the 2016 Annual Meeting, please vote as soon as possible. You may vote over the internet or by a toll-free telephone number. If, however, you requested to receive paper proxy materials, then you may vote by mailing a complete, signed and dated proxy card or voting instruction card in the envelope provided. Please note that any stockholder attending the 2016 Annual Meeting may vote in person, even if the stockholder has already returned a proxy card or voting instruction card.

Our board of directors recommends that you vote “FOR” the election of its director nominees, “FOR” the advisory vote to approve the compensation of our named executive officers, for the option of “1 year” as the preferred frequency of future advisory votes on the compensation of our named executive officers and “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm.

|

| By Order of the Board of Directors: |

|

Ronald A. Krasnow Senior Vice President, General Counsel and Corporate Secretary |

Redwood City, California

April 28, 2016

TABLE OF CONTENTS

RELYPSA, INC.

100 Cardinal Way

Redwood City, California 94063

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 21, 2016

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 21, 2016

This proxy statement and our 2015 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, are available at our website at www.relypsa.com and at www.proxyvote.com.

QUESTIONS AND ANSWERS REGARDING THE PROXY MATERIALS AND THE VOTING PROCESS

Why am I receiving these proxy materials?

We have made these proxy materials available to you on the internet or, upon your request, have delivered paper proxy materials to you, because the board of directors of Relypsa, Inc., or the Company, is soliciting your proxy to vote at the 2016 Annual Meeting of Stockholders, or the 2016 Annual Meeting, or any adjournments or postponements that take place. The 2016 Annual Meeting will be held on June 21, 2016 at 8:00 a.m. local time at our headquarters, which are our principal executive offices, located at 100 Cardinal Way, Redwood City, California 94063. As a stockholder, you are invited to attend the 2016 Annual Meeting and are requested to vote on the proposals described in this proxy statement. However, you do not need to attend the 2016 Annual Meeting to vote.

What is included in the proxy materials?

The proxy materials include:

| | • | | This proxy statement, which includes information regarding the proposals to be voted on at the 2016 Annual Meeting, the voting process, corporate governance, the compensation of our directors and certain executive officers, and other required information; |

| | • | | Our 2015 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2015; and |

| | • | | The proxy card or a voting instruction card for the 2016 Annual Meeting. |

The proxy materials are being mailed or made available to stockholders on or about April 28, 2016.

Why did I receive a Notice of Internet Availability of Proxy Materials, or the Notice, in the mail instead of a complete set of paper proxy materials?

We have elected to provide our proxy materials to our stockholders over the internet as permitted by the rules of the U.S. Securities and Exchange Commission, or the SEC. As a result, we are mailing most of our stockholders a paper copy of the Notice, but not a paper copy of the proxy materials. This process allows us to provide our proxy materials to our stockholders in a timelier and more readily accessible manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. The Notice contains instructions on how to access the proxy materials over the Internet, and how to request a paper copy of

1

the proxy materials. All stockholders who have previously elected to receive a paper copy of our proxy materials will continue to receive a paper copy of the proxy materials by mail until the stockholder terminates such election.

Why did I receive a complete set of paper proxy materials in the mail instead of a Notice of Internet Availability of Proxy Materials?

We are providing stockholders who have previously requested to receive paper copies of the proxy materials with paper copies of the proxy materials instead of the Notice. If you would like to reduce the environmental impact and the costs incurred by us in printing and distributing the proxy materials, you may elect to receive all future proxy materials electronically via email or the internet. To sign up for electronic delivery, please follow the instructions provided with your proxy materials and on your proxy card or voting instruction card.

Who can vote at the 2016 Annual Meeting?

Only stockholders of record at the close of business on April 22, 2016 will be entitled to vote at the 2016 Annual Meeting. On the record date, there were 44,746,915 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, at the close of business on April 22, 2016, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the 2016 Annual Meeting or vote by proxy. Whether or not you plan to attend the 2016 Annual Meeting, please vote as soon as possible by completing and returning the enclosed proxy card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If, at the close of business on April 22, 2016, your shares were not held in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the 2016 Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent how to vote the shares in your account. You are also invited to attend the 2016 Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the 2016 Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What proposals are scheduled for a vote?

There are four proposals scheduled for a vote at the 2016 Annual Meeting:

| | • | | Proposal No. 1 – To elect three Class III directors to hold office until the 2019 Annual Meeting of Stockholders or until their successors are elected; |

| | • | | Proposal No. 2 – To approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| | • | | Proposal No. 3 – To indicate, on a non-binding, advisory basis, the preferred frequency of future advisory votes on the compensation of our named executive officers; and |

| | • | | Proposal No. 4 – To ratify the selection, by the audit committee of our board of directors, of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016. |

2

How do I vote?

For Proposal No. 1, you may either vote “FOR” all nominees to the board of directors or you may “WITHHOLD” your vote for any nominee you specify.

For Proposal No. 2, you may either vote “FOR” or “AGAINST” or you may abstain from voting.

For Proposal No. 3, you may vote for either “1 year,” “2 years” or “3 years” or you may abstain from voting, and the option that receives the highest number of votes cast by stockholders will be considered to be the preferred frequency of future advisory votes on the compensation of our named executive officers.

For Proposal No. 4, you may either vote “FOR” or “AGAINST” or you may abstain from voting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the 2016 Annual Meeting or vote by proxy by telephone or internet or by mail. Whether or not you plan to attend the 2016 Annual Meeting, please vote as soon as possible to ensure your vote is counted. You may still attend the 2016 Annual Meeting and vote in person even if you have already voted by proxy.

| | • | | To vote in person. You may attend the 2016 Annual Meeting and we will give you a ballot when you arrive. |

| | • | | To vote by proxy by telephone or internet. If you have telephone or internet access, you may submit your proxy by following the instructions provided in the Notice, or if you received paper proxy materials by mail, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. |

| | • | | To vote by proxy by mail. If you received paper proxy materials, you may submit your proxy by mail by completing and signing your proxy card and mailing it in the enclosed envelope. Your shares will be voted as you have instructed. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, dealer or other similar organization, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or other agent. To vote in person at the 2016 Annual Meeting, you must obtain a valid proxy from your broker or other agent. Follow the instructions from your broker or other agent included with these proxy materials, or contact your broker or bank to request a proxy form.

Where can I find directions to the 2016 Annual Meeting?

To obtain directions to our 2016 Annual Meeting, which is to be held at our headquarters located at 100 Cardinal Way, Redwood City, California 94063, please visit http://www.relypsa.com/contact_index.html.

Can I vote my shares by completing and returning the Notice?

No. The Notice will, however, provide instructions on how to vote by telephone, by internet, by requesting and returning a paper proxy card or voting instruction card, or by submitting a ballot in person at the 2016 Annual Meeting.

3

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of the Company’s common stock you own as of April 22, 2016.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted as follows:

| | • | | “FOR” the election of each nominee for director (Proposal No. 1); |

| | • | | “FOR” approval, on a non-binding, advisory basis, of the compensation of our named executive officers (Proposal No. 2); |

| | • | | For the option of “1 year” as the preferred frequency of future advisory votes on the compensation of our named executive officers (Proposal No. 3); and |

| | • | | “FOR” the ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016 (Proposal No. 4). |

If any other matter is properly presented at the 2016 Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares in his or her discretion.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the 2016 Annual Meeting. If you are the stockholder of record of your shares, you may revoke your proxy in any one of three ways:

| | • | | You may submit another properly completed proxy with a later date. |

| | • | | You may send a timely written notice that you are revoking your proxy to the Company’s Corporate Secretary at Relypsa, Inc., 100 Cardinal Way, Redwood City, California 94063. |

| | • | | You may attend the 2016 Annual Meeting and vote in person. Simply attending the 2016 Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or other agent, you should follow the instructions provided by your broker or agent.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the 2016 Annual Meeting. On the

4

record date, there were 44,746,915 shares outstanding and entitled to vote. Accordingly, the holders of 22,373,458 shares must be present at the 2016 Annual Meeting to have a quorum. Your shares will be counted toward the quorum at the 2016 Annual Meeting only if you vote in person at the meeting, or you submit a valid proxy vote.

Abstentions and broker non-votes (as described below) will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present and entitled to vote at the meeting in person or represented by proxy may adjourn the 2016 Annual Meeting to another date.

What are “broker non-votes”?

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. Proposal Nos. 1, 2 and 3 are non-routine matters, but Proposal No. 4 is a “routine” matter.

How many votes are needed to approve each proposal?

Votes will be counted by the Inspector of Elections appointed for the 2016 Annual Meeting. The Inspector of Elections will separately count votes and approval will be determined as set forth below.

| | • | | Proposal No. 1 – To elect three Class III directors to hold office until the 2019 Annual Meeting of Stockholders or until their successors are elected. The three nominees receiving the most “FOR” votes (from the votes of shares present in person or represented by proxy and entitled to vote on the election of directors) cast by stockholders will be elected. Broker non-votes will not be counted in any nominee’s favor. |

| | • | | Proposal No. 2 – To approve, on a non-binding, advisory basis, the compensation of our named executive officers. A majority of “FOR” votes cast by stockholders in person or by proxy at this meeting is required to approve this Proposal No. 2. Shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on the outcome of this Proposal No. 2. |

| | • | | Proposal No. 3 – To indicate, on a non-binding, advisory basis, the preferred frequency of future advisory votes on the compensation of our named executive officers. The frequency of “1 year,” “2 years” or “3 years” that receives the highest number of votes cast by stockholders in person or by proxy at this meeting will be considered to be the preferred frequency with which the Company is to hold an advisory vote on the compensation of the Company’s named executive officers. Shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on the outcome of this Proposal No. 3. |

| | • | | Proposal No. 4 – To ratify the selection, by the audit committee of our board of directors, of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016. A majority of “FOR” votes cast by stockholders in person or by proxy at this meeting is required to approve this Proposal No. 4. Shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on the outcome of this Proposal No. 4. Because Proposal No. 4 is considered a “routine” matter, we do not expect broker-non votes for this proposal. |

If your shares are held by your broker or other agent as your nominee (that is, held beneficially in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker or other agent to vote your shares. If you do not give voting instructions to your broker or other agent, your broker or other agent can only vote your shares with respect to “routine” matters (as described above).

5

How can I find out the results of the voting at the 2016 Annual Meeting?

We will disclose final voting results in a Current Report on Form 8-K filed with the SEC within four business days after the 2016 Annual Meeting. If final voting results are unavailable at that time, then we intend to file a Current Report on Form 8-K to disclose preliminary voting results and file an amended Current Report on Form 8-K within four business days after the date the final voting results are available.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in the proxy materials for the 2017 Annual Meeting of Stockholders, your proposal must be submitted in writing by December 29, 2016 to the Company’s Corporate Secretary at Relypsa, Inc., 100 Cardinal Way, Redwood City, California 94063. However, if the meeting is not held within 30 days of June 21, 2017, then the deadline will be a reasonable time before we begin to print and mail our proxy materials for that meeting.

If you wish to submit a proposal before the stockholders or nominate a director at the 2017 Annual Meeting of Stockholders, but you are not requesting that your proposal or nomination be included in the proxy materials for that meeting, then you must follow the procedures set forth in our bylaws and, among other things, notify the Company’s Corporate Secretary in writing between February 21, 2017 and March 23, 2017. However, if the date of the 2017 Annual Meeting of Stockholders is more than 30 days before or more than 60 days after June 21, 2017, then you must give notice not later than the 90th day prior to that meeting or, if later, the 10th day following the day on which public disclosure of that annual meeting date is first made. You are also advised to review our bylaws, which contain additional requirements regarding advance notice of stockholder proposals and director nominations.

6

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our board of directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Except as otherwise provided by law, vacancies on the board of directors may be filled only by individuals elected by a majority of the remaining directors. A director elected by the board of directors to fill a vacancy in a particular class, including a vacancy created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until such director’s successor is elected and qualified, or until such director’s earlier death, resignation or removal.

Our board of directors currently consists of eight directors and no vacancies, divided into the three following classes:

| | • | | The Class I directors are Kenneth J. Hillan, M.B., Ch.B., Daniel K. Spiegelman, and Helen I. Torley, M.B., Ch. B., M.R.C.P., and their terms will expire at the 2017 Annual Meeting; |

| | • | | The Class II directors are David W. J. McGirr, and John A. Orwin, and their terms will expire at the 2018 Annual Meeting of Stockholders; and |

| | • | | The Class III directors are John P. Butler, Paul J. Hastings and Thomas J. Schuetz, M.D., Ph.D., and their terms will expire at the 2016 Annual Meeting of Stockholders. |

Mr. Butler, Mr. Hastings and Dr. Schuetz have been nominated to serve as Class III directors and have agreed to stand for election. If the nominees for Class III are elected at the 2016 Annual Meeting, then each nominee will serve for a three-year term expiring at the 2019 Annual Meeting of Stockholders, or until such director’s successor is elected and qualified, or until such director’s earlier death, resignation or removal.

Our directors are elected by a plurality of the votes cast. If a choice is specified on the proxy card by a stockholder, the shares will be voted as specified. If a choice is not specified on the proxy card, and authority to do so is not withheld, the shares will be voted “FOR” the election of the three nominees for Class III above. If any of the nominees becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for the nominee will instead be voted for the election of a substitute nominee proposed by the Company’s management or the board of directors. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

The following is a brief biography and discussion of the specific attributes, qualifications, experience and skills of each nominee for director and each director whose term will continue after the 2016 Annual Meeting. Our board of directors and management encourage each nominee for director and each continuing director to attend the 2016 Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR” EACH OF THE THREE CLASS III NOMINEES FOR DIRECTOR.

CLASS III NOMINEES FOR DIRECTOR – To be elected for a three-year term expiring at the 2019 Annual Meeting of Stockholders

John P. Butler, age 51, has served as a member of our board of directors since September 2013. Mr. Butler has served as the President and Chief Executive Officer of Akebia Therapeutics, Inc., a biopharmaceutical company, since September 2013. From October 2011 to April 2013, Mr. Butler served as the Chief Executive Officer of Inspiration Biopharmaceuticals, Inc., a biopharmaceutical company that filed for protection under Chapter 11 of the U.S. Bankruptcy Code in October 2012 prior to the successful sale of its hemophilia assets to Cangene Corporation and Baxter International in early 2013. Prior to Inspiration, Mr. Butler held various positions at

7

Genzyme Corporation (acquired by Sanofi-Aventis), a biotechnology company, from 1997 to July 2011, including President, Personalized Genetic Health, President, Cardiometabolic and Renal Division and President, General Manager Renal Business. Prior to Genzyme, Mr. Butler held various positions of increasing responsibility at Amgen, Inc., a biopharmaceutical company, including serving as a product manager from 1995 to 1997. Mr. Butler currently serves on the board of directors of Keryx Biopharmaceuticals, Inc., a pharmaceutical company. Mr. Butler received a B.A. in Chemistry from Manhattan College and an M.B.A. from Baruch College. We believe that Mr. Butler is qualified to serve on our board of directors due to his deep industry experience in the biotechnology sector.

Paul J. Hastings, age 56, has served as a member of our board of directors since October 2012. Mr. Hastings has served as the Chairman, President, and Chief Executive Officer of OncoMed Pharmaceuticals, Inc., a pharmaceutical company, since 2013 and President and Chief Executive Officer since 2006. Prior to OncoMed, Mr. Hastings was President and Chief Executive Officer of QLT, Inc. from 2002 to 2005 and Axys Pharmaceuticals, Inc. (acquired by Celera Corporation) from 2001 to 2002, both pharmaceutical companies. Previously, Mr. Hastings served as the President of Chiron BioPharmaceuticals (acquired by Novartis), a pharmaceutical company, and President and Chief Executive Officer of LXR Biotechnology, a biotechnology company. Mr. Hastings has also served in various positions at Genzyme Corporation (acquired by Sanofi-Aventis) and Synergen, Inc. (acquired by Amgen), both biotechnology companies. Mr. Hastings has served on various private and public company boards, and currently serves on the board of directors of OncoMed and is lead director of Pacira Pharmaceuticals, Inc., a pharmaceutical company. Mr. Hastings received a B.S. in Pharmacy from the University of Rhode Island. We believe that Mr. Hastings is qualified to serve on our board of directors due to his deep industry experience and service on the boards of directors of several public life sciences companies.

Thomas J. Schuetz, M.D., Ph.D., age 55, has served as a member of our board of directors since August 2010. Dr. Schuetz has served as the Chief Executive Officer of Compass Therapeutics, LLC (formerly Kairos Biologics Foundation LLC), a biotechnology company, since August 2014. Dr. Schuetz was previously a consultant for clinical development programs at both public and privately-held biopharmaceutical companies from 2006 to 2014. Dr. Schuetz was previously the Chief Medical Officer of Therion Biologics Corporation, a pharmaceutical company, and the Vice President of Clinical Affairs at Transkaryotic Therapies, Inc. (acquired by Shire Pharmaceuticals). Dr. Schuetz received a B.S. in Chemistry from Xavier University, an M.D. from Harvard Medical School and a Ph.D. in Genetics from Harvard University. He completed an internal medicine residency at Massachusetts General Hospital, where he was also Chief Medical Resident, and a Medical Oncology fellowship at the Dana-Farber Cancer Institute. Dr. Schuetz is Board Certified in Medical Oncology. We believe that Dr. Schuetz is qualified to serve on our board of directors due to his clinical and executive experience and medical and scientific background.

CLASS I DIRECTORS – To continue in office until the 2017 Annual Meeting of Stockholders

Kenneth J. Hillan, M.B., Ch.B., age 55, has served as a member of our board of directors since June 2014. Dr. Hillan has served as President, Chief Executive Officer and a member of the board of directors of Achaogen, Inc., a biopharmaceutical company, since October 2011, and as Chief Medical Officer of Achaogen since April 2011. Prior to Achaogen, Dr. Hillan served in key leadership positions at Genentech, Inc. (acquired by Roche in 2009), a pharmaceutical company, from August 1994 to April 2011. Dr. Hillan was responsible for numerous successful drug approvals and led the medical and scientific strategies for its Immunology, Tissue Growth and Repair drug portfolio. Dr. Hillan served in a number of key leadership positions in research and development, including Senior Vice President Clinical Development, Inflammation, Vice President Immunology, Tissue Growth and Repair, Vice President Development Sciences and Vice President Research Operations and Pathology. Dr. Hillan also previously served as Senior Vice President and head of Clinical Development and Product Development Strategy in Asia-Pacific for Roche in Shanghai, China. Dr. Hillan received an M.B. Ch.B. (Bachelor of Medicine and Surgery) degree from the Faculty of Medicine at the University of Glasgow, U.K. Dr. Hillan is a Fellow of the Royal College of Surgeons (FRCS), and a Fellow of the Royal College of

8

Pathologists (FRCPath). We believe that Dr. Hillan is qualified to serve on our board of directors due to his management experience in the life sciences sector and medical and scientific background.

Daniel K. Spiegelman, age 57, has served as a member of our board of directors since June 2014. Mr. Spiegelman has served as Executive Vice President and Chief Financial Officer at BioMarin Pharmaceutical Inc., a biopharmaceutical company, since May 2012. From May 2009 until May 2012, Mr. Spiegelman served as a strategic and financial consultant to a portfolio of public and private life science companies. From 1998 to 2009, Mr. Spiegelman served in various roles, most recently as Senior Vice President and Chief Financial Officer, of CV Therapeutics, Inc., a biopharmaceutical company (acquired by Gilead Sciences, Inc.), where he was responsible for finance, accounting, investor relations, business development, and information systems. From 1991 to 1998, Mr. Spiegelman served in various roles at Genentech, Inc. (now a member of the Roche Group), a biotechnology company, most recently as Treasurer. Mr. Spiegelman serves on the board of directors of Oncothyreon, Inc., a biotechnology company, and previously served on the board of directors of the following biopharmaceutical companies: Affymax, Inc., Anthera Pharmaceuticals, Inc., Omeros Corporation, Cyclacel Pharmaceuticals, Inc., and Xcyte Therapies, Inc. Mr. Spiegelman received a B.A. from Stanford University and an M.B.A. from the Stanford Graduate School of Business. We believe that Mr. Spiegelman is qualified to serve on our board of directors due to his management experience and experience in the life sciences and financial sectors.

Helen I. Torley, M.B., Ch.B., M.R.C.P., age 52, has served as a member of our board of directors since January 2015. Dr. Torley has served as President and Chief Executive Officer of Halozyme Therapeutics, Inc., a biotechnology company, since January 2014. Prior to joining Halozyme, from August 2011 to December 2013. Dr. Torley served as executive vice president and chief commercial officer for Onyx Pharmaceuticals, Inc., a biopharmaceutical company, where she oversaw the collaboration with Bayer on Nexavar® and Stivarga® and the U.S. launch of Kyprolis®. From 2003 to 2011, she held management positions at Amgen Inc., a biopharmaceutical company, most recently as vice president and general manager of the U.S. Nephrology Business Unit and the U.S. Bone Health Business Unit. Previously, she held various senior management positions at Bristol-Myers Squibb, including regional vice president of Cardiovascular and Metabolic Sales and head of Cardiovascular Global Marketing. She began her career at Sandoz/Novartis, where she ultimately served as vice president of Medical Affairs, developing and conducting post-marketing clinical studies across all therapeutic areas. Dr. Torley received her Bachelor of Medicine and Bachelor of Surgery degrees (M.B. Ch.B.) from the University of Glasgow and is a Member of the Royal College of Physicians (M.R.C.P.). We believe that Dr. Torley is qualified to serve on our board of directors due to her management experience in the life sciences sector and medical and scientific background.

CLASS II DIRECTORS– To continue in office until the 2018 Annual Meeting of Stockholders

David W.J. McGirr, age 61, has served as a member of our board of directors since November 2012. Mr. McGirr served as Senior Vice President and Chief Financial Officer of Cubist Pharmaceuticals Inc., a pharmaceutical company, from 2002 to March 2013. Prior to Cubist, Mr. McGirr was the President and Chief Operating Officer of hippo inc, an internet technology company, and served as a member of their board of directors. Prior to hippo, Mr. McGirr was the President of GAB Robins North America, Inc., a risk management company, and served as Chief Executive Officer. Prior to that, Mr. McGirr served in various positions within the S.G. Warburg Group, an investment bank, ultimately serving as Chief Financial Officer, Chief Administrative Officer and Managing Director of its subsidiary S.G. Warburg & Co., Inc. Mr. McGirr currently serves on the board of directors of Insmed Incorporated, a biopharmaceutical company, and Roka Bioscience, Inc., a molecular diagnostics company. Mr. McGirr received a B.Sc. in Civil Engineering from the University of Glasgow and an M.B.A. from the Wharton School at the University of Pennsylvania. We believe that Mr. McGirr is qualified to serve on our board of directors due to his management experience and experience in the life sciences and financial sectors.

9

John A. Orwin, age 51, has served as our President and Chief Executive Officer and as a member of our board of directors since June 2013. Prior to Relypsa, Mr. Orwin served as President and Chief Operating Officer of Affymax, Inc., a biotechnology company, from April 2010 to January 2011, and as their Chief Executive Officer and a member of their board of directors from February 2011 to May 2013. From 2005 to April 2010, Mr. Orwin served as Vice President and then Senior Vice President of the BioOncology Business Unit at Genentech, Inc. (now a member of the Roche Group), a biotechnology company, where he was responsible for all marketing, sales, business unit operations and pipeline brand management for Genentech’s oncology portfolio in the United States. From 2001 to 2005, Mr. Orwin served in various executive-level positions at Johnson & Johnson, a life sciences company, overseeing oncology therapeutic commercial and portfolio expansion efforts in the U.S. Prior to such roles, Mr. Orwin held senior marketing and sales positions at various life sciences and pharmaceutical companies, including Alza Corporation (acquired by Johnson & Johnson), Sangstat Medical Corporation (acquired by Genzyme), Rhone-Poulenc Rorer Pharmaceuticals, Inc. (merged with Sanofi-Aventis) and Schering-Plough Corporation (merged with Merck). Mr. Orwin serves as a member of the board of directors of Array BioPharma Inc., a biopharmaceutical company, Seattle Genetics, Inc., a biotechnology company, and served on the board of directors of NeurogesX, Inc., a biopharmaceutical company, until July 2013 and Affymax, Inc., a biotechnology company, until November 2014. Mr. Orwin received a B.A. in Economics from Rutgers University and an M.B.A. from New York University. We believe Mr. Orwin is qualified to serve on our board of directors based on his management experience in the life sciences sector, including at Relypsa, and his service on the boards of directors of several public life sciences companies.

10

PROPOSAL NO. 2

ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, added Section 14A to the Securities Exchange Act of 1934, as amended, which requires that we provide our stockholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement, commonly known as a “Say-on-Pay” vote. Stockholders may also abstain from voting. This Say-on-Pay vote is not intended to address any specific element of compensation for our named executive officers, but rather the overall executive compensation for our named executive officers and our overall executive compensation program, philosophy and practices as described in this proxy statement.

This Say-on-Pay vote is advisory; therefore, it is not binding on the Company, our board of directors or our compensation committee. However, we plan to consider the results of this year’s vote in reviewing and determining the compensation of our named executive officers in the future because we value the opinions of our stockholders.

As described in this proxy statement, we believe the compensation of our named executive officers and our executive compensation program, philosophy and practices are appropriate, and enable us to attract, motivate and retain superior executive officers, including our named executive officers, while aligning the long-term interests of our executive officers with the long-term interests of our stockholders. Accordingly, we ask our stockholders to approve, on a non-binding, advisory basis, the following resolution at the 2016 Annual Meeting:

RESOLVED, that the compensation paid to the Company’s named executive officers as disclosed pursuant to Item 402 of Regulation S-K, including theCompensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL,

ON A NON-BINDING, ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

11

PROPOSAL NO. 3

ADVISORY VOTE ON THE PREFERRED FREQUENCY OF FUTURE

ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

The Dodd-Frank Act and Section 14A of the Securities Exchange Act of 1934, as amended, also provide that stockholders must be given the opportunity to vote, on a non-binding, advisory basis, for their preference as to how frequently we should seek future Say-on-Pay votes. We are asking our stockholders whether our future Say-on-Pay votes should occur every one, two or three years. Stockholders may also abstain from voting. If none of the frequency alternatives receives a majority of the votes cast by stockholders, we will consider the highest number of votes cast by stockholders to be the preferred frequency that has been selected by stockholders.

The vote on this Proposal No. 3 is advisory; therefore, it is not binding on the Company, our board of directors or our compensation committee. We may determine in the future that it is in the best interests of the Company and its stockholders to hold Say-on-Pay votes more or less frequently than the frequency indicated by stockholders in voting on this Proposal No. 3 or as currently recommended by our board directors. However, we plan to consider the results of the vote on this Proposal No. 3 in determining the frequency of our Say-on-Pay votes because we value the opinions of our stockholders.

Currently, we believe that it is in the best interests of the Company and its stockholders to hold a Say-on-Pay vote every year, and this is the frequency recommended by our board of directors. We believe this frequency will enable our stockholders to vote, on a non-binding, advisory basis, on our most recent executive compensation practices and decisions as presented in our annual proxy statements, which will lead to greater transparency and more meaningful and timely communication between the Company and our stockholders regarding the compensation of our named executive officers. Accordingly, we ask our stockholders to indicate their preferred voting frequency by voting for every “1 Year,” “2 Years” or “3 Years” (or abstaining from voting) in response to the following resolution at the 2016 Annual Meeting of Stockholders:

RESOLVED, that the alternative of every one year, two years, or three years that receives the highest number of votes cast by stockholders in person or by proxy at this meeting will be considered to be the preferred frequency with which the Company is to hold an advisory vote on the compensation of the Company’s named executive officers.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE OPTION OF ONE YEAR AS THE PREFERRED FREQUENCY FOR THE ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

12

PROPOSAL NO. 4

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has selected Ernst & Young LLP, or EY, as our independent registered public accounting firm for the year ending December 31, 2016, and is seeking ratification of such selection by our stockholders at the 2016 Annual Meeting. EY has audited our financial statements since the fiscal year ended December 31, 2007. Representatives of EY are expected to be present at the 2016 Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylaws nor other governing documents or law require stockholder ratification of the selection of EY as our independent registered public accounting firm. However, the audit committee is submitting the selection of EY to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the audit committee will reconsider whether or not to retain EY. Even if the selection is ratified, the audit committee in its discretion may select a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” PROPOSAL NO. 4.

THE RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

For the fiscal years ended December 31, 2015 and 2014, EY billed the approximate fees set forth below. All fees included below were approved by the audit committee.

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2015 | | | 2014 | |

Audit Fees(1) | | $ | 1,183,706 | | | $ | 762,189 | |

Tax Fees(2) | | | 34,636 | | | | 62,614 | |

All Other Fees(3) | | | 1,985 | | | | 1,995 | |

| | | | | | | | |

Total All Fees | | $ | 1,220,327 | | | $ | 826,798 | |

| | | | | | | | |

| (1) | This category consists of fees for professional services rendered for the audit of our financial statements, review of interim financial statements, assistance with registration statements filed with the SEC and services that are normally provided by EY in connection with statutory and regulatory filings or engagements. Related to the year ended December 31, 2015, $90,000 was billed in connection with registration statements and offerings of common stock. The increase in audit fees in 2015 was primarily due to the Company’s first year of compliance as required by Section 404(b) of the Sarbanes-Oxley Act and the audit of the controls for a new financial information system. Also included in audit fees are fees for accounting consultations. Related to the year ended December 31, 2014, $235,000 was billed in connection with our offerings of common stock. |

| (2) | This category consists of fees for professional services rendered for tax compliance and tax advice. |

| (3) | This category consists of fees for our annual subscription to EY’s Global Accounting and Auditing Information Tool. |

Pre-Approval Policies and Procedures

The audit committee has adopted a policy for the pre-approval of all audit and non-audit services to be performed for the Company by the Company’s independent registered public accounting firm. This policy is set forth in the charter of the audit committee and available at http://investor.relypsa.com/corporate-governance.cfm. The audit committee has considered the role of EY in providing audit and audit-related services to the Company and has concluded that such services are compatible with EY’s role as the Company’s independent registered public accounting firm.

13

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The primary purpose of the audit committee is to oversee our financial reporting processes on behalf of our board of directors. The audit committee’s functions are more fully described in its charter, which is available on our website at http://investor.relypsa.com/corporate-governance.cfm.

In fulfilling its oversight responsibilities, the audit committee reviewed and discussed with management the Company’s audited financial statements for the fiscal year ended December 31, 2015. The audit committee has discussed with EY, the Company’s independent registered public accounting firm, the matters required to be discussed by Auditing Standard No. 16, “Communications with Audit Committees,” issued by the Public Company Accounting Oversight Board, or PCAOB. In addition, the audit committee has discussed with EY their independence, and received from EY the written disclosures and the letter required by Ethics and Independence Rule 3526 of the PCAOB. Finally, the audit committee discussed with EY, with and without management present, the scope and results of EY’s audit of the financial statements for the fiscal year ended December 31, 2015.

Based on these reviews and discussions, the audit committee recommended to our board of directors that such audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2015 for filing with the SEC.

|

Audit Committee David W.J. McGirr, Chairman Daniel K. Spiegelman Thomas J. Schuetz, M.D., Ph.D. |

14

CORPORATE GOVERNANCE

Board Composition

Director Independence

Our board of directors currently consists of eight members. Our board of directors has determined that all of our directors, other than Mr. Orwin, qualify as “independent” directors in accordance with the NASDAQ listing requirements. Mr. Orwin is not considered independent because he is an employee of Relypsa.

In addition, Dr. Klaus Veitinger was not considered an independent director during his term on our board of directors because he had received in excess of $120,000 in compensation during a period of twelve consecutive months within the preceding three years for his services as a consultant to the Company. Dr. Veitinger is no longer a member of our board of directors; however, he served on our board of directors during the 2015 fiscal year and until our 2015 Annual Meeting of Stockholders.

The NASDAQ independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his or her family members has engaged in various types of business dealings with us. In addition, as required by NASDAQ rules, our board of directors has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our board of directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or our executive officers.

As described more fully below, the board of directors has also determined that each current member of the compensation committee, the audit committee and the nominating and corporate governance committee meets the independence standards applicable to those committees prescribed by NASDAQ, the SEC, and the Internal Revenue Service.

Classified Board of Directors

In accordance with our amended and restated certificate of incorporation, our board of directors is divided into three classes with staggered, three-year terms as set forth below. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election.

| | • | | The Class I directors are Dr. Hillan, Mr. Spiegelman and Dr. Torley, and their terms will expire at the 2017 Annual Meeting of Stockholders; |

| | • | | The Class II directors are Mr. McGirr and Mr. Orwin, and their terms will expire at the 2018 Annual Meeting of Stockholders; and |

| | • | | The Class III directors are Mr. Butler, Mr. Hastings and Dr. Schuetz, and their terms will expire at the 2016 Annual Meeting of Stockholders. |

The authorized number of directors may be changed only by resolution of the board of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our company.

15

Leadership Structure of the Board

Our amended and restated bylaws and corporate governance guidelines provide our board of directors with flexibility to combine or separate the positions of Chairman of the board and Chief Executive Officer and/or the implementation of a lead director in accordance with its determination that utilizing one or the other structure would be in the best interests of our company. Mr. Spiegelman currently serves as the Chairman of our board of directors. In that role, Mr. Spiegelman presides over the executive sessions of the board of directors in which Mr. Orwin does not participate and serves as a liaison to Mr. Orwin and management on behalf of the board of directors. In April 2016, our board of directors re-appointed Mr. Spiegelman to serve as Chairman of the board of directors.

Our board of directors has concluded that our current leadership structure is appropriate at this time. However, our board of directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board in Risk Oversight Process

Risk assessment and oversight are an integral part of our governance and management processes. Our board of directors encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings, and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the board of directors at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.

Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through our board of directors as a whole, as well as through various standing committees of our board of directors that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure and our audit committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. Our audit committee also monitors compliance with legal and regulatory requirements and reviews and approves related-party transactions. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines and oversees our healthcare compliance and cyber security programs. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Meetings of the Board of Directors and Committees

During 2015, the board of directors met 11 times, the audit committee met 6 times, the compensation committee met 11 times and the nominating and corporate governance committee met 4 times. During that year, each incumbent director attended at least 75% of the aggregate meetings of the board of directors, and each incumbent director attended at least 75% of the aggregate meetings of the committees on which he served.

Board Committees

Audit Committee

Our audit committee oversees our corporate accounting and financial reporting process. Among other matters, the audit committee:

| | • | | appoints our independent registered public accounting firm; |

| | • | | evaluates the independent registered public accounting firm’s qualifications, independence and performance; |

| | • | | determines the engagement of the independent registered public accounting firm; |

16

| | • | | reviews and approves the scope of the annual audit and the audit fee; |

| | • | | discusses with management and the independent registered public accounting firm the results of the annual audit and the review of our quarterly financial statements; |

| | • | | approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; |

| | • | | monitors the rotation of partners of the independent registered public accounting firm on our engagement team in accordance with requirements established by the SEC; |

| | • | | is responsible for reviewing our financial statements and our management’s discussion and analysis of financial condition and results of operations to be included in our annual and quarterly reports to be filed with the SEC; |

| | • | | reviews our critical accounting policies and estimates; |

| | • | | reviews and approves all related-party transactions which are required to be reported under applicable SEC regulations (other than compensation-related matters); and |

| | • | | reviews the audit committee charter and the committee’s performance at least annually. |

The current members of our audit committee are Mr. McGirr, Dr. Schuetz and Mr. Spiegelman. Mr. McGirr serves as the chairman of the committee.

Each of the current members of our audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ. Our board of directors has determined that each of Mr. McGirr and Mr. Spiegelman is an audit committee financial expert as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of NASDAQ. Under the rules of the SEC, members of the audit committee must also meet heightened independence standards. Our board of directors has determined that each of Mr. McGirr, Mr. Spiegelman and Dr. Schuetz is independent under the heightened independence standards under the applicable rules of NASDAQ. The audit committee operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ. A copy of the audit committee charter is available to security holders on the Company’s website at http://investor.relypsa.com/corporate-governance.cfm.

Compensation Committee

Our compensation committee reviews and recommends policies relating to compensation and benefits of our executive officers and other employees. The compensation committee reviews and recommends to our board of directors corporate objectives relevant to the compensation of our chief executive officer and our other executive officers, evaluates the performance of our executive officers in light of those objectives and approves the compensation of our executive officers, other than our chief executive officer, based on such evaluations. Our board of directors retains the authority to determine and approve, upon the recommendation of our compensation committee, the compensation of our chief executive officer, unless such authority has been delegated to our compensation committee. The compensation committee also recommends to our board of directors for approval, and approves, the issuance of stock options and other awards under our stock plans. The compensation committee will review and evaluate, at least annually, the performance of the compensation committee and its members, including compliance by the compensation committee with its charter. The current members of our compensation committee are Mr. Butler, Mr. Hastings and Dr. Hillan. Mr. Hastings serves as the chairman of the committee.

Each of the current members of our compensation committee is an “independent director” under the applicable rules and regulations of NASDAQ, is a “non-employee director” as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and is an “outside director” as that term is defined in Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended, or the Code. The compensation committee operates under a written charter that satisfies the applicable standards of the SEC and

17

NASDAQ. A copy of the compensation committee charter is available to security holders on the Company’s website at http://investor.relypsa.com/corporate-governance.cfm.

Our compensation committee has retained Radford, a nationally recognized compensation consulting firm, to serve as its independent compensation consultant and to conduct market research and provide data and analysis on our various executive officer positions, to assist the committee in developing appropriate incentive plans for our executive officers on an annual basis, to provide the committee with advice and ongoing recommendations regarding material executive compensation decisions, and to review compensation proposals of management. Radford reports directly to the compensation committee and does not provide any non-compensation related services to us. In compliance with the disclosure requirements of the SEC regarding the independence of compensation consultants, Radford addressed each of the six independence factors established by the SEC with our compensation committee. Its responses affirmed the independence of Radford on executive compensation matters. Based on this assessment, our compensation committee determined that the engagement of Radford does not raise any conflicts of interest or similar concerns. In addition, our compensation committee evaluated the independence of its other outside advisors to the compensation committee, including outside legal counsel, considering the same independence factors and concluded their work for our compensation committee does not raise any conflicts of interest. Our compensation committee operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is responsible for making recommendations to our board of directors regarding candidates for directorships and the size and composition of our board of directors. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies and our healthcare compliance and cyber security programs and reporting and making recommendations to our board of directors concerning governance matters. As part of its duties, the nominating and corporate governance committee will consider individuals who are properly proposed by stockholders to serve on the board of directors in accordance with laws and regulations established by the SEC and the NASDAQ listing requirements, our bylaws and applicable corporate law, and make recommendations to the board of directors regarding such individuals based on the established criteria for members of our board. The nominating and corporate governance committee may consider in the future whether we should adopt a more formal policy regarding stockholder nominations. The current members of our nominating and corporate governance committee are Mr. Hastings, Mr. Spiegelman and Dr. Torley. Mr. Spiegelman serves as the chairman of the committee.

Each of the current members of our nominating and corporate governance committee, and each of the directors who previously served as a member of our nominating and corporate governance committee other than Dr. Veitinger, is or was an “independent director” under the applicable rules and regulations of NASDAQ relating to nominating and corporate governance committee independence. From June 2014 to April 2015, Dr. Veitinger served as a non-independent member of our nominating and corporate governance committee. During such period, we complied with NASDAQ’s rules regarding independent director oversight of director nominations under NASDAQ Rule 5605(e)(1)(A) and our director nominees were selected, or recommended for our board of director’s selection, by independent directors constituting a majority of our board of director’s independent directors in a vote in which only independent directors participated. The nominating and corporate governance committee operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ. A copy of the nominating and corporate governance committee charter is available to security holders on the Company’s website at http://investor.relypsa.com/corporate-governance.cfm.

Board Diversity

Our nominating and corporate governance committee is responsible for reviewing with the board of directors, on a periodic basis, the appropriate characteristics, skills and experience required for the board of directors as a

18

whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominating and corporate governance committee, in recommending candidates for election (and, in the case of vacancies, appointing), and the board of directors, in approving such candidates, will take into account many factors, including the following:

| | • | | personal and professional integrity; |

| | • | | experience in corporate management, such as serving as an officer or former officer of a public company; |

| | • | | experience in the industries in which we compete; |

| | • | | experience as a board member of another public company; |

| | • | | diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; |

| | • | | conflicts of interest; and |

| | • | | practical and mature business judgment. |

Currently, our board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of business conduct and ethics is available on our website at www.relypsa.com. We will disclose any substantive amendments to the code of business conduct and ethics, or any waiver of its provisions, on our website. The reference to our website does not constitute incorporation by reference of the information contained at or available through our website.

Limitation on Liability and Indemnification Matters

Our amended and restated certificate of incorporation contains provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, our directors will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for:

| | • | | any breach of the director’s duty of loyalty to us or our stockholders; |

| | • | | any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| | • | | unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation Law; or |

| | • | | any transaction from which the director derived an improper personal benefit. |

Our amended and restated certificate of incorporation and amended and restated bylaws provide that we are required to indemnify our directors and officers, in each case to the fullest extent permitted by Delaware law. Our amended and restated bylaws also provide that we are obligated to advance expenses incurred by a director or officer in advance of the final disposition of any action or proceeding, and permit us to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in that capacity regardless of whether we would otherwise be permitted to indemnify him or her under Delaware law.

19

We have entered and expect to continue to enter into agreements to indemnify our directors, executive officers and other employees as determined by our board of directors. With specified exceptions, these agreements provide for indemnification for related expenses including, among other things, attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding. We believe that these bylaw provisions and indemnification agreements are necessary to attract and retain qualified directors and officers. We also maintain directors’ and officers’ liability insurance.

The limitation of liability and indemnification provisions in our amended and restated certificate of incorporation and amended and restated bylaws may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and our stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage. To the extent the indemnification for liabilities arising under the Securities Act of 1933, as amended, or the Securities Act, may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. At present, there is no pending litigation or proceeding involving any of our directors, officers or employees for which indemnification is sought, and we are not aware of any threatened litigation that may result in claims for indemnification.

Director Attendance at Annual Meetings

Our board of directors has a policy of encouraging director attendance at our annual meetings of stockholders, but attendance is not mandatory. Our board of directors and management team encourage all of our directors to attend the 2016 Annual Meeting. All of our directors attended the 2015 Annual Meeting of Stockholders.

Stockholder Communications with the Board of Directors

A stockholder may communicate with the board of directors, or an individual director, by sending written correspondence to the Company’s Corporate Secretary at Relypsa, Inc., 100 Cardinal Way, Redwood City, California 94063. The Corporate Secretary will review such correspondence and forward it to the board of directors, or an individual director, as appropriate.

Compensation Committee Interlocks and Insider Participation

During 2015, the following individuals served as members of our compensation committee: Mr. Butler, Mr. Hastings and Dr. Hillan. Mr. Hastings served as chairman of the compensation committee. None of the members of our compensation committee has at any time been one of our officers or employees. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers on our board of directors or compensation committee.

Compensation Risk Assessment

Our compensation committee assesses and considers potential risks when reviewing and approving our compensation policies and practices for our executive officers and our other employees. We have designed our compensation programs with features to address potential risks while rewarding employees for achieving corporate and individual objectives through prudent business judgment and appropriate risk taking. Based on its assessment, our compensation committee believes that any risks arising from our compensation programs do not create disproportionate incentives for our executive officers, including our NEOs, to take risks that could have a material adverse effect on the Company in the future.

20

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The following is a description of transactions since January 1, 2015 to which we have been a party, in which the amount involved exceeds $120,000, and in which any of our directors, executive officers or holders of more than 5% of our capital stock, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest.

Indemnification Agreements and Directors’ and Officers’ Liability Insurance

We have entered into indemnification agreements with each of our directors and executive officers. These agreements, among other things, require us to indemnify each director and executive officer to the fullest extent permitted by Delaware law, including indemnification of expenses such as attorneys’ fees, judgments, penalties fines and settlement amounts incurred by the director or executive officer in any action or proceeding, including any action or proceeding by or in right of us, arising out of the person’s services as a director or executive officer.

Investor Rights Agreements

We previously entered into an amended and restated investor rights agreement with certain holders of our common stock and warrants to purchase our common stock. As of March 31, 2016, the holders of approximately 7.5 million shares of our common stock, including the shares of common stock issuable upon exercise of warrants, are entitled to rights with respect to the registration of their shares under the Securities Act.

Policies and Procedures for Related Party Transactions

Our board of directors has adopted a written related person transaction policy setting forth the policies and procedures for the review and approval or ratification of related person transactions. This policy covers, with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act , any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships in which we were or are to be a participant, where the amount involved exceeds $120,000 and a related person had or will have a direct or indirect material interest, including, without limitation, purchases of goods or services by or from the related person or entities in which the related person has a material interest, indebtedness, guarantees of indebtedness and employment by us of a related person. In reviewing and approving any such transactions, our audit committee is tasked to consider all relevant facts and circumstances, including, but not limited to, whether the transaction is on terms comparable to those that could be obtained in an arm’s length transaction with an unrelated third party and the extent of the related person’s interest in the transaction.

21

NON-EMPLOYEE DIRECTOR COMPENSATION

Our Director Compensation Program for our non-employee directors in effect until the 2015 Annual Meeting of Stockholders provided for cash compensation as follows:

| | • | | Each non-employee director will receive an annual cash retainer in the amount of $35,000 per year. |

| | • | | The non-employee Chairman of the Board will receive an additional annual cash retainer in the amount of $25,000 per year. |

| | • | | The chairperson of the audit committee will receive additional annual cash compensation in the amount of $20,000 per year for such chairperson’s service on the audit committee. Each non-chairperson member of the audit committee will receive additional annual cash compensation in the amount of $10,000 per year for such member’s service on the audit committee. |

| | • | | The chairperson of the compensation committee will receive additional annual cash compensation in the amount of $15,000 per year for such chairperson’s service on the compensation committee. Each non-chairperson member of the compensation committee will receive additional annual cash compensation in the amount of $7,500 per year for such member’s service on the compensation committee. |

| | • | | The chairperson of the nominating and corporate governance committee will receive additional annual cash compensation in the amount of $10,000 per year for such chairperson’s service on the nominating and corporate governance committee. Each non-chairperson member of the nominating and corporate governance committee will receive additional annual cash compensation in the amount of $5,000 per year for such member’s service on the nominating and corporate governance committee. |