UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_______to_______

Commission file number 000-53012

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | | 90-0687379 (I.R.S. Employer Identification No.) |

| | | |

709 S. Harbor City Blvd., Suite 250, Melbourne, FL (Address of principal executive offices) | | 32901 (Zip Code) |

Registrant’s telephone number, including area code(321) 725-0090

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes£ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes£ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesxNo£

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.£

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer£ Accelerated filer £ Non-accelerated filer £ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes£Nox

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $15,356,978.

As of March 28, 2013, there were 12,833,462 shares of common stock, par value $0.001 per share, outstanding.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

Fiscal Year Ended December 31, 2012

| | | Page |

| | | |

| | PART I | |

| | | |

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 8 |

| Item 1B. | Unresolved Staff Comments | 18 |

| Item 2. | Properties | 18 |

| Item 3. | Legal Proceedings | 18 |

| Item 4. | Mine Safety Disclosures | 18 |

| | | |

| | PART II | |

| | | |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and IssuerPurchases of Equity Securities | 19 |

| Item 6. | Selected Financial Data | 20 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 28 |

| Item 8. | Financial Statements and Supplementary Data | 28 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 28 |

| Item 9A. | Controls and Procedures | 28 |

| Item 9B. | Other Information | 29 |

| | | |

| | PART III | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 30 |

| Item 11. | Executive Compensation | 34 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 34 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 35 |

| Item 14. | Principal Accounting Fees and Services | 36 |

| | | |

| | PART IV | |

| | | |

| Item 15. | Exhibits, Financial Statement Schedules | 36 |

PART I

This report may contain forward-looking statements within the meaning of Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking state to all comments are based on our management’s beliefs and assumptions and on information currently available to our management and involve risks and uncertainties. Forward-looking statements include statements regarding our plans, strategies, objectives, expectations and intentions, which are subject to change at any time at our discretion. Forward-looking statements include our assessment, from time to time of our competitive position, the industry environment, potential growth opportunities and the effects of regulation. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We discuss many of these risks in greater detail in “Risk Factors.” Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report and have filed as exhibits to the report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

We were incorporated in the State of Colorado on May 30, 2007 to act as a holding corporation for I.V. Services Ltd., Inc. (“IVS”), a Florida corporation engaged in providing billing services to providers of medical services. IVS was incorporated in the State of Florida on September 28, 1987, and on June 30, 2007, 2,429,000 common shares were issued to Mr. Michael West and other IVS shareholders in exchange for 100% of the capital stock of IVS. In the second quarter of 2011, we disposed of IVS, which, at the time, was an inactive, wholly-owned subsidiary of the Company. The consideration for the disposition was the net liability assumption by the purchaser.

On December 29, 2010, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with FCID Medical, Inc., a Florida corporation (“FCID Medical”) and FCID Holdings, Inc., a Florida corporation (“FCID Holdings)”, which together will be referred to herein with FCID Medical as “FCID”, and the shareholders of FCID (the “FCID Shareholders”). Pursuant to the terms of the Share Exchange Agreement, the FCID Shareholders exchanged 100% of the outstanding common stock of FCID for a total of 10,000,000 common shares) of the Company, resulting in FCID Medical and FCID Holdings being 100% owned subsidiaries of the Company (the “Share Exchange”).

In connection with the Share Exchange Agreement, in addition to the foregoing and effective on the closing date, Michael West resigned as President, Treasurer and director of the Company. Mr. Steve West resigned as officer of the Company but retained a directorship with the Company and subsequently resigned in 2011. After such resignations, Christian Charles Romandetti was appointed President, Chief Executive Officer and a director of the Company, and Donald Bittar was appointed Chief Financial Officer, Treasurer and Secretary. Currently, Mr. Bittar also is a director.

Merger, Re-Incorporation and Name Change

On or about April 4, 2012, we obtained stockholder consent for (i) the approval of an agreement and plan of merger (the “Merger Agreement”) with First Choice Healthcare Solutions, Inc., (“FCHS Delaware”), a Delaware corporation formed exclusively for the purpose of merging with the Company, pursuant to which (a) the Company’s state of incorporation changed from Colorado to Delaware (the “Reincorporation”) (b) the Company’s name changed from Medical Billing Assistance, Inc. to First Choice Healthcare Solutions, Inc. (the “Name Change”), and (c) every four shares of Company’s common stock was exchanged for one share of FCHS Delaware common stock (effectively resulting in a four-to-one reverse split of the Company’s common stock) (the “Reverse Split”), and (ii) the approval of the Medical Billing Assistance, Inc. 2011 Incentive Stock Plan. The effective date for the Reincorporation and the Reverse Split was April 4, 2012. The company changed its name to be more closely aligned with its target market.

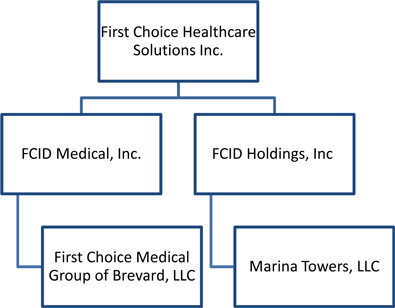

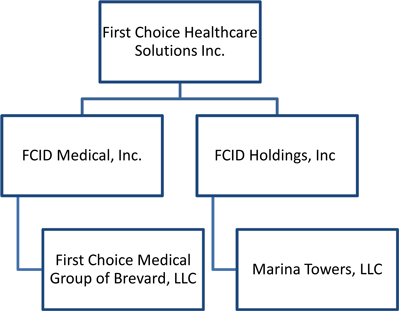

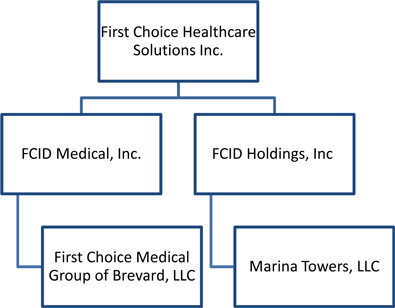

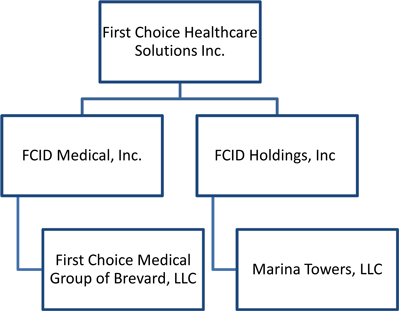

The operations of our two reporting business segments are conducted through our wholly-owned subsidiaries: FCID Medical, Inc. and FCID Holdings, Inc. The wholly-owned subsidiary operating the multi-specialty medical centers of excellence is owned by FCID Medical, Inc. We have real estate holdings through FCID Holdings, Inc., under which Marina Towers, LLC is a wholly-owned subsidiary. A diagram of our corporate structure is set forth below:

Our Business

The cornerstone of our business plan is developing, via acquisition or restructuring, multi-specialty clinics, into a synergistic, state-of-the-art, efficient medical multi-specialty centers of excellence. The Company has carved a new niche in the multi-billion dollar health care industry by offering a paradigm to the way physicians practice medicine. Our centers of excellence include an optimal mix of synergistic multi-specialty physicians combined with an array of diagnostic capabilities.

Business Strategy

We are dedicated to providing the excellent quality and cost effective healthcare services to the communities and patient’s we serve. Our steadfast goal is to create an environment of excellent patient care, proactive attitudes and the enthusiastic spirit in every member of our team. We strive to be the unsurpassed provider of orthopedic, neurology and interventional pain medicine services supported by an array of the latest technological and medical ancillary diagnostic tools located within each facility.

Our operational strategy for our medical facilities is devoted to the excellent care of our patients. Our driven willingness to address our patient’s needs, ranging from their physical health to their emotional well-being, has helped direct the operating improvements in our business.

Our strategic focus is to expand our healthcare business by making selective employment of physicians and or acquisition of physician practices in other select markets. Our expansion program plans to provide:

| · | Economies of scale in billing, collection, purchasing, advertising and compliance; |

| · | Increased exposure to our brand. |

First Medical Multi-Specialty Center of Excellence

On October 5, 2011, FCID Medical, Inc., a wholly owned subsidiary of the Company, entered into a management agreement to manage the medical practice of First Choice Medical Group of Brevard, LLC. On April 2, 2012, we completed the acquisition of the practice and acquired all of the issued and outstanding membership interests of First Choice Medical Group of Brevard, LLC. Since acquiring First Choice Medical Group of Brevard, LLC:

| · | Monthly patient visits have increased |

| · | Accounts receivable turnaround time has improved |

| · | The number of physicians and healthcare professionals has increased |

New MRI and X-ray Facility

Following the acquisition of First Choice Medical Group of Brevard, on May 21, 2012, the Company completed a $2.4 million financing with GE Healthcare Financial Services for a state-of-the-art, technologically advanced GE X-ray machine and MRI system. Both the X-ray and MRI systems were installed and fully operational within First Choice Medical Group of Brevard’s Center of Excellence on August 22, 2012, and September 27, 2012 respectively.

We are proud to have installed the newest and technologically advanced MRI system in our target market area. The GE MRI Gem Suite system has been certified. The MRI was positioned and installed to capitalize on the river views, which is intended to promote patient relaxation and comfort. This is intended to produce a better study which in turn relates to a better patient experience. The MRI system is housed in a newly constructed expansion space within First Choice Medical Group of Brevard’s Center of Excellence. The Center’s expansions space, specifically designed for the MRI system, is located within the Company’s headquarters building. Billing and patient volume for MRI and X-ray services continues to track on plan.

The Diagnostic Equipment and Facilities Expansion initiative was successful with all of the equipment, systems and the facility fully operational and revenue productive.

Customer service for our medical patients continues to significantly improve.

A new paradigm medical multi-specialty center of excellence

Some retail business models have been successful with broad customer demographics, easy service provider substitution, intense competition and continuing lower profit margins. We view medical centers as a retail-oriented business delivering excellent medical services direct to patients, whom are the consumers. Unlike transportation, fast food, electronics and other retailers, medical centers, generally, have not been quick to adapt themselves to operating successfully with lower profit margins and growing competition. The successful retail businesses recognized the importance of embracing information technology, telecommunication and functional economies of scale to allow high service levels to continue, while retaining acceptable profit margins. Their corporate cultures include a commitment to insuring the best possible customer experience through consistent, predictable and superior service levels in every aspect of their business. They have learned to become profitable in the face of lower margins and increasing competition. One of the keys to our success is our new paradigm of our multi-specialty medical centers of excellence. While adopting the leading edge retail service practices, the Company remains committed to excellent patient service levels intended to achieve predictable and acceptable profit margins.

Excellent medical service levels with a human touch

Our business model brings the best retail practices to operating a multi-specialty medical center successfully with a ‘human touch’. Patients want their pain, fear and concerns acknowledged and considered. They want to be treated with dignity and respect. From the patient’s first interaction with us, making an appointment to see a doctor, our strategic and tactical goals are to provide the best possible patient healthcare experience through consistent, predictable and superior service levels in every aspect of our medical centers of excellence. On time appointments, accurate and current patient information, attention to detail and careful patient follow up are part of our commitment to an excellent patient experience. Management actively monitors the daily service level objectives for every aspect of the patient experience from the initial appointment through the end of treatment. Clinic staff is encouraged and rewarded for exceeding their service level objectives.

Medical service mix

Like other successful business models for professional medical services, ours offers the most synergistic and profitable medical service mix. By their nature, some combinations of medical specialties can be more revenue positive than others. Physicians need access to diagnostic equipment like, X-Ray, MRI and physical therapy. Patients expect their physicians to have access to the best diagnostic and service delivery equipment to maintain the continuum of care. Without diagnostic services many medical practices will find it difficult to maintain their current margins of profitability. We combine medical specialties and diagnostic services at our locations to maintain or increase the capability for profit. While one specialty may have high reimbursements for their professional service but insufficient volume to profitably support the necessary diagnostic equipment, another medical specialty may have a lower professional service reimbursement but high volume diagnostic equipment use. Operating independently, each specialty group would face retreating profit margins and a significant challenge to maintain high service levels with adequate equipment and current technologies. However, operating together, they create the optimal mix of professional service fee income and diagnostic equipment procedure income. Since the combination is more profitable than either of its components, there is a most favorable opportunity to sustain profit margins that will allow the facility to maintain high service levels with leading edge equipment and state of the art technologies.

In recruiting, selecting and hiring physicians, we employ physicians with the highest patient care reviews always making superior quality of service our number one priority. Our expansion plan is to employee physicians in multiple multi-specialty medical centers of excellence located in other geographic markets. In future facilities, we will work to maintain the optimal combination of medical specialties we believe will support the most profitable mix of professional service fees. This business model, in turn, is most likely to provide our physicians with the best diagnostic equipment available, our patients with the best possible medical experience and our Company with the potential when combining physicians and diagnostic equipment to maintain attractive profit margins.

The model allows physicians to concentrate exclusively on delivering excellent patient care. The requirements for running the business functions of successful medical centers of excellence are the responsibility of the business management team and not the physicians.

Scalable back office and economies of scale

Fixed cost legacy administrative functions have subjected many established medical centers to a downward spiral of diminishing profit margins and losses. In legacy medical centers, administrative management, billing, compliance, accounting, marketing, advertising, scheduling, customer service, record keeping functions represent fixed overhead for the practice. The fixed administrative overhead of a practice has the effect of reducing profit margins as the practice experiences declining revenues as a result of lower patient volumes from increasing competition, lower pricing, lower reimbursements or patient migration to competitors.

A key to our success is our ability to employ a highly experienced team of business managers supported by an array of professional, experienced and compliant subcontractors. Using the best project management practices, our business managers contract services for billing, compliance, accounting, marketing, advertising, legal, information technology and record keeping functions. The cost of our ‘back office operation’ scales quickly in direct relation to our volume, allowing us to sustain profit margins with a cost effective and scalable back office. As the number of physicians increases so do the economies of scale for our back office. The economies of scale support selecting the best and not the lowest cost subcontractors, while allowing our multi-specialty medical centers to operate cost effectively with higher service levels.

Developing and operating additional multi-specialty medical centers of excellence in other geographic areas will take advantage of the economies of scale for our administrative back office functions. Our plan calls for opening up multiple centers in multiple states and cities at a pace that will allow us to maintain the same levels of quality and acceptable profitability from each location. We believe that the scalable structure of our administrative back office functions will efficiently support our expansion plans.

High technology infrastructure supporting excellent human touch patient experiences

Successful retail models in other industries already effectively use telecommunications, remote computing, mobile computing, cloud computing, virtual networks and other leading-edge technologies to manage geographically diverse operating units. These technologies create the infrastructure to allow a central management team to monitor, direct and control geographically disbursed operating units and subcontractors, including national operations.

The FCHS business model incorporates the best of these technologies. A central management team monitors, directs and controls our multi-specialty medical centers of excellence and all the necessary support subcontractors. We operate a secure paperless system with electronic patient medical records. Test results, X-ray and MRI images, diagnosis, patient notes, visit reports, billing information, insurance coverage, and patient identification information are all contained within the electronic medical record, allowing physicians and staff instant access to every aspect of a patient’s medical information from anywhere, in any clinic. The patient billing, accounts receivable and collection functions also are paperless. A majority of our third party payors remit by EFT and wire transfers. Accordingly, every aspect of the business is positioned to achieve high productivity and lower administrative headcounts and per capita expenses.

We intend to grow by replicating our multi-specialty medical centers of excellence, supported by our standardized policies, procedures and clinic setup guidelines. The administrative functions can be quickly scaled to handle multiple additional clinics. As we roll out our business model, we expect our administrative core and clinic retail model to transform the economics within each of our multi-specialty medical centers of excellence.

Our headquarters

Our corporate headquarters is located on the shore of the Indian River,at 709 S. Harbor City Blvd., Suite 250, Melbourne, FL 32901 in Marina Towers, which is owned by Marina Towers, LLC, a wholly owned subsidiary of FCID Holdings, Inc.

FCID Holdings manages our real estate. Marina Towers, LLC operates Marina Towers, a 75,267 square foot Class A six-story office building. The building has operated with a 95% average tenant occupancy and a rent roll that is supported by approximately 75% non-affiliate, high quality, commercial tenants. The building generates revenue and income for the Company that is intended to be available to fund the expansion of our operating businesses.

Employees

As of December 31, 2012, we employed a total of 26 employees. None of our employees are covered by a collective bargaining agreement. At the present time, the employment of all employees is “at-will”, including but not limited to the physicians.

The risk factors discussed below could cause our actual results to differ materially from those expressed in any forward-looking statements. Although we have attempted to list comprehensively these important factors, we caution you that other factors may in the future prove to be important in affecting our results of operations. New factors emerge from time to time and it is not possible for us to predict all of these factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

The risks described below set forth what we believe to be the most material risks associated with the purchase of our common stock. Before you invest in our common stock, you should carefully consider these risk factors, as well as the other information contained in this prospectus.

General Risks Regarding Our Business

Our Company implemented its unique business model in 2012 and we continue to enhance the strategy of the business plan.

Our limited operating history in our present format makes it difficult for us to evaluate our future business prospects and make decisions based on estimates of our future performance. To address these risks and uncertainties, we must do the following:

| · | Successfully execute our business strategy; |

| · | Respond to competitive developments; |

| · | Effectively and efficiently integrate new acquisitions and |

| · | Attract, integrate, retain and motivate qualified personnel. |

We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition and results of operations may be materially and adversely affected.

Our management has limited experience operating a public company.

Our management has limited experience operating a public company. We plan to comply with all of the rules and regulations which are applicable to public companies. However, if we cannot operate successfully as a public company, your investment may be materially adversely affected.

We are implementing a strategy to grow our business, which is expensive and may not generate income.

We intend to grow our business, and we plan to incur expenses associated with our growth and expansion. Although we are taking steps to raise funds through equity offerings to implement our growth strategy, these funds may not be adequate to offset all of the expenses we incur in expanding our business. We will need to generate revenues to offset expenses associated with our growth, and we may be unsuccessful in achieving sufficient revenues, despite our attempts to grow our business. If our growth strategies do not result in sufficient revenues and income, we may have to abandon our plans for further growth and/or cease operations, which could have a material and adverse effect on our business, prospects and financial condition.

We may need to raise additional capital. If we are unable to raise additional capital, our business may fail.

If we require additional capital, we may need to borrow money or sell more securities. Under these circumstances, we may be unable to secure additional financing on favorable terms or at all.

Selling additional stock, either privately or publicly, would dilute the equity interests of our stockholders. If we borrow money, we will have to pay interest and may also have to agree to restrictions that limit our operating flexibility. If we are unable to obtain required capital for operations or growth, we may have to curtail business operations which would have a material negative effect on operating results and most likely result in a lower stock price.

Adverse changes in general domestic and worldwide economic conditions and instability and disruption of credit markets could adversely affect our operating results, financial condition, or liquidity.

We are subject to risks arising from adverse changes in general domestic and global economic conditions, including recession or economic slowdown and disruption of credit markets. Recent global market and economic conditions have been unprecedented and challenging with tighter credit conditions and recession in most major economies. Continued concerns about the systemic impact of potential long-term and wide-spread recession, inflation, energy costs, geopolitical issues, the availability and cost of credit, the United States mortgage market and a declining real estate market in the United States have contributed to increased market volatility and diminished expectations for the United States economy. Added concerns fueled by the United States government financial assistance to certain companies and other federal government’s interventions in the United States financial system has led to increased market uncertainty and instability in both United States and international capital and credit markets. These conditions, combined with volatile oil prices, declining business and consumer confidence, increased unemployment, increased tax rates and governmental budget deficits and debt levels have contributed to volatility of unprecedented levels. We believe our healthcare clinics may be impacted by unemployment rates, the number of under-insured or uninsured patients and other conditions arising from the global economic conditions described above. At this time, it is unclear what impact this might have on our future revenues or business.

As a result of these market conditions, the cost and availability of credit has been and may continue to be adversely affected by illiquid credit markets and wider credit spreads. Concern about the stability of the markets generally and the strength of counterparties specifically has led many lenders and institutional investors to reduce, and in some cases, cease to provide funding to borrowers.

Continued turbulence in the United States and international markets and economies may adversely affect our liquidity and financial condition, and the liquidity and financial condition of our patients. If these market conditions continue, they may limit our ability, and the ability of our patients, to timely replace maturing liabilities, and access the capital markets to meet liquidity needs, resulting in material and adverse effects on our business, prospects, financial condition and results of operations.

Generally, the majority of the cost of medical care is typically reimbursed by third-party payers such as commercial healthcare insurance companies or government programs, including Medicare and Medicaid. The remaining portion of the cost of medical care is paid by the patient. Accordingly, our operating results may vary based upon the impact of changes in the disposable income of consumers interested in healthcare, among other economic factors. A significant decrease in consumer disposable income in a weak economy may result in a decrease in the number of medical procedures performed and a decline in our revenues and profitability. In addition, weak economic conditions may cause some of our patients to experience financial distress or declare bankruptcy, which may negatively impact our accounts receivable collection experience.

Since a significant percentage of our operating expenses are fixed, a relatively small decrease in revenues could have a significant negative impact on our financial results.

A significant percentage of our expenses will be fixed - meaning they do not vary significantly with the increase or decrease in revenues. Such expenses include, but will not be limited to, debt service and capital lease payments, rent and operating lease payments, salaries, maintenance and insurance. As a result, a small reduction in the prices we charge for our services or procedure volume could have a disproportionately negative effect on our financial results.

Loss of key executives and failure to attract qualified managers and sales persons could limit our growth and negatively impact our operations.

We depend upon our management team to a substantial extent. In particular, we depend upon Christian Charles Romandetti, our President and Chief Executive Officer for his skills, experience and knowledge of our Company and industry contacts. Mr. Romandetti does not have an employment agreement with the Company and we currently do not have key employee insurance policies covering any of our management team. The loss of Mr. Romandetti or other members of our management team could have a material adverse effect on our business, results of operations or financial condition.

We require medical clinic managers, medical professionals and marketing persons with experience in our industry to operate and market our medical clinic services. It is impossible to predict the availability of qualified persons or the compensation levels that will be required to hire them. The loss of the services of any member of our senior management or our inability to hire qualified persons at economically reasonable compensation levels could adversely affect our ability to operate and grow our business.

We may have difficulties managing growth which could lead to higher losses.

Rapid growth could strain our human and capital resources, potentially leading to higher operating losses. Our ability to manage operations and control growth will be dependent upon our ability to raise and spend capital to successfully attract, train, motivate, retain and manage new employees and continue to update and improve our management and operational systems, infrastructure and other resources, financial and management controls, and reporting systems and procedures. Should we be unsuccessful in accomplishing any of these essential aspects of our growth in an efficient and timely manner, then management may receive inadequate information necessary to manage our operations, possibly causing additional expenditures and inefficient use of existing human and capital resources or we otherwise may be forced to grow at a slower pace that could slow or eliminate our ability to achieve and sustain profitability. Such slower than expected growth may require us to restrict or cease our operations and go out of business.

We may not receive payment from some of our healthcare patients because of their financial circumstances.

Some of our healthcare provider patients may not have significant financial resources, liquidity or access to capital. If these patients experience financial difficulties they may be unable to pay for the healthcare services that we will provide. A significant deterioration in general or local economic conditions could have a material adverse effect on the financial health of our healthcare provider patients. As a result, this may adversely affect our financial condition and results of operations.

We may be subject to medical professional liability risks, which could be costly and could negatively impact our business and financial results.

We may be subject to professional liability claims. Although there currently are no known hazards associated with any of our procedures or technologies when performed or used properly, hazards may be discovered in the future. For example: there is a risk of harm to a patient during an MRI if the patient has certain types of metal implants or cardiac pacemakers within his or her body. Although patients are screened to safeguard against this risk, screening may nevertheless fail to identify the hazard. There also is potential risk to patients treated with therapy equipment secondary to inadvertent or excessive over- or under exposure to radiation—a topic on which the U.S. House of Representatives Committee on Energy and Commerce Subcommittee on Health held a hearing on February 26, 2010. We maintain professional liability insurance with coverage that we believe is consistent with industry practice and appropriate in light of the risks attendant to our business. However, any claim made against us could be costly to defend against, resulting in a substantial damage award against us and divert the attention of our management team from our operations, which could have an adverse effect on our financial performance.

We may not be able to achieve the expected benefits from future acquisitions, which would adversely affect our financial condition and results.

We plan to rely on acquisitions as a method of expanding our business. If we do not successfully integrate acquisitions, we may not realize anticipated operating advantages and cost savings. The integration of companies that have previously operated separately involves a number of risks, including:

| · | Demands on management related to the increase in our size after an acquisition; |

| · | The diversion of management’s attention from the management of daily operations to the integration of operations; |

| · | Difficulties in the assimilation and retention of employees; |

| · | Potential adverse effects on operating results and |

| · | Challenges in retaining patients. |

We may not be able to maintain the levels of operating efficiency acquired companies have achieved or might achieve separately. Successful integration of each of their operations will depend upon our ability to manage those operations and to eliminate redundant and excess costs. Difficulties in combining operations may not be able to achieve the cost savings and other size-related benefits that we hoped to achieve from these acquisitions, which would harm our financial condition and operating results.

The healthcare regulatory and political framework is uncertain and evolving.

Healthcare laws and regulations may change significantly in the future which could adversely affect our financial condition and results of operations. We continuously monitor these developments and modify our operations from time to time as the legislative and regulatory environment changes.

In March 2010, the President signed one of the most significant health care reform measures in decades providing healthcare insurance for approximately 30 million more Americans. The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (collectively, the “PPACA”), substantially changes the way health care is financed by both governmental and private insurers, including several payment reforms that establish payments to hospitals and physicians based in part on quality measures, and may significantly impact our industry. The PPACA requires, among other things, payment rates for services using imaging equipment that costs over $1 million to be calculated using revised equipment usage assumptions and reduced payment rates for imaging services paid under the Medicare Part B fee schedule. We are unable to predict what effect the PPACA or other healthcare reform measures that may be adopted in the future will have on our business.

Changes in the rates or methods of third-party reimbursements for medical services could result in reduced demand for our services or create downward pricing pressure, which would result in a decline in our revenues and harm to our financial position.

Third-party payors such as Medicare, Medicaid and commercial health insurance companies, may change the rates or methods of reimbursement for the services we plan to provide and could have a significant negative impact on those revenues. At this time, we cannot predict the impact of rate reductions will have on our future revenues or business. Moreover, patients on whom we will depend for the majority of our medical clinic revenues generally rely on reimbursement from third-party payors. If our patients receive decreased reimbursement, this could result in a reduced demand for our services or downward pricing pressures, which could have a material impact on our financial position.

Future requirements limiting access to or payment for medical services may negatively impact our future revenues or business. If legislation substantially changes the way healthcare is reimbursed by both governmental and commercial insurance carriers, it may negatively impact payment rates for certain medical services. We cannot predict at this time whether or the extent to which other proposed changes will be adopted, if any, or how these or future changes will affect the demand for our services.

Managed care organizations may prevent their members from using our services which would cause us to lose current and prospective patients.

Healthcare providers participating as providers under managed care plans may be required to refer medical services to specific medical clinics depending on the plan in which each covered patient is enrolled. These requirements may inhibit their members from using our medical services in some cases. The proliferation of managed care may prevent an increasing number of their members from using our services in the future which would cause our revenues to decline.

“Stark” Law prohibition on physician referrals may be interpreted so as to limit our prospects.

The Ethics in Patient Referral Act of 1989, as amended (the "Stark Law"), is a civil statute that generally (i) prohibits physicians from making referrals for designated health services to entities in which the physicians have a direct or indirect financial relationship and (ii) prohibits entities from presenting or causing to be presented claims or bills to any individual, third party payer, or other entity for designated health services furnished pursuant to a prohibited referral. Under the Stark Law, a physician may not refer patients for certain designated health services to entities with which the physician has a direct or indirect financial relationship, unless allowed under an enumerated exception. Under the Stark Law, there are numerous statutory and regulatory exceptions for certain otherwise prohibited financial relationships. A transaction must fall entirely within an exception to be lawful under the Stark Law.

The Stark Law contains significant civil sanctions for violations, including denial of payment, refunds of amounts collected in violation of the Stark Law and exclusion from Medicare or Medicaid programs. In addition, OIG may impose a penalty of $10,000 for submitting an illegal claim or not refunding such a claim on a timely basis and a civil monetary penalty of up to $100,000 for each circumvention arrangement or scheme.

On advise and representations by counsel and independent compliance consultants, we believe that any referrals between or among the company, the physicians providing services and the facilities where procedures are performed will be for services compliant under the Stark Law. If these arrangements are found to violate the Stark Law, we may be required to restructure such services or be subject to civil or criminal fines and penalties, including the exclusion of our company, the physicians, and the facilities from the Medicare and Medicaid programs, any of which events could have a material adverse effect on our business, financial condition and results of operations.

Some states have enacted statutes, similar to the federal Anti-Kickback Statute and Stark Law, applicable to our operations because they cover all referrals of patients regardless of the payer or type of healthcare service provided. These state laws vary significantly in their scope and penalties for violations. Although we have endeavored to structure our business operations to be in material compliance with such state laws, authorities in those states could determine that our business practices are in violation of their laws. This could have a material adverse effect on our business, financial condition and results of operations.

Advertising restrictions may be interpreted so as to limit our prospects.

Our healthcare clinic business will be dependent on advertising, which is subject to regulation by the Federal Trade Commission ("FTC"). We believe that we have structured our advertising practices to be in material compliance with FTC regulations and guidance. However, we cannot be certain that the FTC will not determine that our advertising practices are in violation of such laws and guidance.

In addition, the laws of many states restrict certain advertising practices by and on behalf of physicians. Many states do not offer clear guidance on the bounds of acceptable advertising practices or on the limits of advertising provided by management companies on behalf of physicians. Although we have endeavored to structure our advertising practices to be in material compliance with such state laws, authorities in those states could determine that our advertising practices are in violation of those laws.

Fee-splitting prohibitions in some states may be interpreted so as to limit our prospects.

Many states prohibit medical professionals from paying a portion of a professional fee to another individual unless that individual is an employee or partner in the same professional practice. If we violate a state's fee-splitting prohibition, we may be subject to civil or criminal fines, and the physician participating in such arrangements may lose his or her licensing privileges. Many states do not offer clear guidance on what relationships constitute fee-splitting, particularly in the context of providing management services for doctors. We have endeavored to structure our business operations in material compliance with these laws. However, state authorities could find that fee-splitting prohibitions apply to our business practices in their states. If any aspect of our operations were found to violate fee-splitting laws or regulations, this could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Facility licensure requirements in some states may be costly and time-consuming, limiting or delaying our operations.

State Departments of Health may require us to obtain licenses in the various states in which we have our medical multi-specialty centers of excellence or other business operations. We intend to obtain the necessary material licensure in states where licensure is required. However, not all of the regulations governing the need for licensure are clear and there is limited guidance available regarding certain interpretative issues. Therefore, it is possible that a state regulatory authority could determine that we are improperly conducting business operations without a license in that state. This could subject us to significant fines or penalties, result in our being required to cease operations in that state or otherwise have a material adverse effect on our business, financial condition and results of operations. Although we currently have no reason to believe that we will be unable to obtain the necessary licenses without unreasonable expense or delay, there can be no assurance that we will be able to obtain any required licensure.

Health Insurance Portability and Accountability Act compliance is critically import to our continuing operations.

In December 2000, the U.S. Department of Health and Human Services ("DHHS") released final health privacy regulations implementing portions of the Administrative Simplification Provisions of the Health Insurance Portability and Accountability Act of 1996 ("HIPAA"). These final health privacy regulations were effective in April 2003, for providers that engage in certain electronic transactions, including the submission of claims for payment. Additionally, DHHS published final standards to protect the security of health-related information in February 2003. Finally, in August 2009 DHHS published interim final breach notification regulations implementing section 13402 of the Health Information Technology for Economic and Clinical Health ("HITECH") Act. The HIPAA privacy and security regulations and the HITECH Act extensively regulate the use and disclosure of individually identifiable health-related information. Our physicians and the Company are covered entities under HIPAA if those entities provide services that are reimbursable under Medicare or other third-party payers (e.g., orthopedic services). Although the covered health care providers themselves are primarily liable for HIPAA compliance, as a "business associate" to these covered entities we are bound indirectly to comply with the HIPAA privacy regulations, and we are directly bound to comply with certain of the HIPAA security regulations. Although we cannot predict the total financial or other impact of these privacy and security regulations on our business, compliance with these regulations could require us to incur substantial expenses, which could have a material adverse effect on our business, financial condition and results of operations. In addition, we will continue to remain subject to any state laws that are more restrictive than the privacy regulations issued under the Administrative Simplification Provisions.

Our medical business may be reliant upon direct-to-patient marketing.

The effectiveness of our marketing programs and messages to patients can have a significant impact on our financial performance. The effectiveness of marketing may fluctuate, resulting in changes in the cost of marketing per procedure, and variations in our margins. Less effective marketing programs could materially and adversely affect our business, financial condition and results of operations.

If we are unable to attract and retain qualified medical professionals, our ability to maintain operations at existing medical centers, to attract patients or to open new medical multi-specialty centers of excellence could be negatively affected.

We generate our revenues through physicians and medical professionals who work for us to perform medical services and procedures. The retention of those physicians and medical professionals is a critical factor in the success of our medical multi-specialty centers, and the hiring of qualified physicians and medical professionals is a critical factor in our ability to launch newmedical multi-specialty centers of excellence successfully. However, at times it may be difficult for us to retain or hire qualified physicians and medical professionals. If we are unable consistently to hire and retain qualified physicians and medical professionals, our ability to open new centers, maintain operations at existing medical multi-specialty centers, and attract patients could be materially and adversely affected.

If technological changes occur rendering our equipment or services obsolete, or increase our cost structure, we may need to make significant capital expenditures or modify our business model, which could cause our revenues or results of operations to decline.

Industry competitive or clinical factors, among others, may require us to introduce alternate medical technology for the services and procedures we offer than those that may currently be in use in our medical multi-specialty centers. Introducing such technology could require significant capital investment or force us to modify our business model in such a way as to make our revenues or results of operations decline. An increase in costs could reduce our ability to maintain our margins. An increase in prices could adversely affect our ability to attract new patients. If we are unable to obtain or maintain state of the art equipment that is essential to the professional medical services provided by our clinics, our business, prospects, results of operations and financial condition could be materially and adversely affected.

If we are forced us to lower our procedure prices in order to compete with a better-financed or lower-cost provider of medical healthcare services our medical revenues and results of operations could decline.

Our clinic will compete with medical clinics and other technologies currently under development. Competition comes from other clinics and from hospitals, hospital-affiliated group entities and physician group practices.

Some of our current competitors, or other companies which may choose to enter the industry in the future, may have substantially greater financial, technical, managerial, marketing or other resources and experience than we do and may be able to compete more effectively. Similarly, competition could increase if the market for healthcare services does not experience growth, and existing providers compete for market share. Additional competition may develop, particularly if the price for services or reimbursement decreases. Our management, operations, strategy and marketing plans may not be successful in meeting this competition.

If more competitors offer healthcare services in our geographic markets, we might find it necessary to reduce the prices we charge, particularly if competitors offer the services at lower prices than we do. If that were to happen or we were not successful in cost effectively acquiring patients for our procedures, we may not be able to make up for the reduced gross profit margin by increasing the number of procedures that we perform, and our business, financial condition and results from operations could be adversely affected.

Risks related to our real estate assets and operations.

Our performance and value are subject to risks associated with our real estate assets and with the real estate industry.

Since a significant source of our current revenue is our real estate asset, we are subject to the risk that if our property does not generate revenues sufficient to meet our operating expenses, including debt service and capital expenditures, and the costs associated with our growth, our ability to operate and grow will be materially and adversely affected, which will materially and adversely affect our business, results of operations and financial condition and we may have to reduce or cease operations. The following factors, among others, may adversely affect the revenues generated by our property:

| · | Competition from other office and commercial properties; |

| · | Local real estate market conditions, such as oversupply or reduction in demand for office or other commercial space; |

| · | Costs to comply with new local, state and federal laws; |

| · | Changes in interest rates and availability of financing; |

| · | Vacancies, changes in market rental rates and the need to periodically repair, renovate and re-let space; |

| · | Increased operating costs, including insurance expense, utilities, real estate taxes, state and local taxes and heightened security costs; |

| · | Civil disturbances, hurricanes and other natural disasters, or terrorist acts or acts of war which may result in uninsured or underinsured losses; and |

| · | Declines in the financial condition of our tenants and our ability to collect rents from our tenants. |

We may face risks associated with the use of debt, including refinancing risk.

We are subject to the risks normally associated with debt financing, including the risk that our cash flow will be insufficient to meet required payments of principal and interest. We anticipate that only a small portion of the principal of our debt will be repaid prior to maturity. Therefore, we are likely to need to refinance at least a portion of our outstanding debt as it matures. There is a risk that we may not be able to refinance existing debt or that the terms of any refinancing will not be as favorable as the terms of our existing debt. If principal payments due at maturity cannot be refinanced, extended or repaid with proceeds from other sources, such as new equity capital, our cash flow may not be sufficient to repay all maturing debt when a significant "balloon" payment come due. There is a risk that we may be unable to refinance on favorable terms or at all. This risk is currently heightened because of tightened underwriting standards and increased credit risk premiums. These conditions, which may increase the cost and reduce the availability of debt, may continue or worsen in the future.

The risks associated with the physical effects of weather could have a material adverse effect on our property.

The physical effects of weather could have a material adverse effect on our property, operations and business. For example, our property is located on the riverfront in Brevard County Florida. To the extent weather patterns change, our market could experience increases in storm intensity or rising sea-levels that would make the property less desirable to tenants. Over time, these conditions could result in declining demand for office space in our building or the inability of us to operate the building at all. These conditions may also have indirect effects on our business by increasing the cost of (or making unavailable) property insurance on terms we find acceptable, increasing the cost of energy and increasing the cost of snow removal at our properties. There can be no assurance that weather will not have a material adverse effect on our properties, operations or business.

Risks related to our common stock.

Because our stock is traded on the Over-the-Counter Bulletin Board, it has a limited public trading market.As a result, it may be difficult or impossible for you to liquidate your investment.

While our common stock currently is listed for trading, the trading volume is limited. We are quoted on the Over-the-Counter Bulletin Board under the trading symbol FCHS. We cannot assure that such a market will improve in the future. The OTC Bulletin Board requires that we be a reporting company under the Securities Exchange Act of 1934. Further, we cannot assure that an investor will be able to liquidate his investment without considerable delay, if at all. If a more active market does develop, the price may be highly volatile. Our limited operating history, lack of profitability, negligible stock liquidity, potential extreme price and volume fluctuations, and regulatory burdens may have a significant impact on the market price of the common stock. It is also possible that the relatively low price of our common stock may keep many brokerage firms from engaging in transactions in our common stock.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our common stock cumbersome and may reduce the value of an investment in our common stock.

The SEC has adopted Rule 3a51-1 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that (i) has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, or (ii) is not registered on a national securities exchange or listed on an automated quotation system sponsored by a national securities exchange. For any transaction involving a penny stock, unless exempt, Rule 15g-9 of the Exchange Act requires:

| · | that a broker or dealer approve a person’s account for transactions in penny stocks; and |

| · | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| · | obtain financial information and investment experience objectives of the person; and |

| · | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

| · | sets forth the basis on which the broker or dealer made the suitability determination; and |

| · | attests that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading, and about the commissions payable to both the broker-dealer and the registered representative. Current quotations for the securities and the rights and remedies and to be available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult

If we raise additional capital by selling equity or equity-linked securities, the equity interests of our stockholders will be diluted.

Selling additional common stock or equity-linked securities, either privately or publicly, may be necessary to source sufficient capital to fund our operations or growth. Such issuances of securities will dilute the equity interests of our stockholders.

We do not expect to pay dividends in the foreseeable future.

We have not paid dividends on our common stock and do not anticipate paying dividends on our common stock in the foreseeable future. We currently plan to use all funds generated by operations for reinvestment in our operating activities. Investors should not count on dividends in evaluating an investment in our common stock.

Our largest shareholders hold significant control over our common stock and they may be able to control our Company indefinitely.

Our largest shareholders currently have beneficial ownership of approximately 60.6% of our outstanding common stock. These significant stockholders therefore have considerable influence over the outcome of all matters submitted to our stockholders for approval, including the election of directors, the approval of significant corporate transactions.

Possible volatility in our stock price could negatively affect us and our stockholders.

The price of our common stock could be subject to wide fluctuations in the future as a result of a number of other factors, including the following:

| · | changes in expectations as to future financial performance or buy/sell recommendations of securities analysts; |

| · | our, or a competitor’s, announcement of new products or services, or significant acquisitions, strategic partnerships, joint ventures or capital commitments; and |

| · | the operating and stock price performance of other comparable companies. |

In addition, the U.S. securities markets have experienced significant price and volume fluctuations. These fluctuations often have been unrelated to the operating performance of companies in these markets. Broad market and industry factors may lead to volatility in the price of our common stock, regardless of our operating performance. Moreover, our stock has limited trading volume, and this illiquidity may increase the volatility of our stock price.

If an active, liquid trading market for our common stock does not develop, you may not be able to sell your shares quickly or at or above the price you paid for it.

Although our common stock currently trades on the Over-the-Counter Bulletin Board, an active and liquid trading market for our common stock has not yet and may not ever develop or be sustained. You may not be able to sell your shares quickly or at or above the price you paid for our stock if trading in our stock is not active.

We cannot offer any assurance that an active trading market for our common stock will continue or how liquid that market may be. As a result, relatively small trades may have a disproportionate impact on the price of our common stock, which may contribute to the price volatility of our common stock and could limit your ability to sell your shares.

The market price of our common stock could also be subject to wide fluctuations in response to many risk factors described in this section and other matters, including:

| · | changes by securities analysts in financial estimates of our operating results and the operating results of our competitors; |

| · | publications of research reports by securities analysts about us, our competitors or our industry; |

| · | fluctuations in the valuation of companies perceived by investors to be comparable to us; |

| · | actual or anticipated fluctuations in our quarterly or annual operating results; |

| · | retention and departures of key personnel; |

| · | our failure or the failure of our competitors to meet analysts' projections or guidance that we or our competitors may give to the market; |

| · | strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy; |

| · | the passage of legislation or other regulatory developments affecting us or our industry; |

| · | speculation in the press or investment community; and |

| · | natural disasters, terrorist acts, acts of war or periods of widespread civil unrest. |

Furthermore, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating performance of those companies. These broad market and industry fluctuations, as well as general economic, political and market conditions, may negatively affect the market price of our common stock. As a result, the market price of our common stock is likely to be similarly volatile and investors in our common stock may experience a decrease, which could be substantial, in the value of their stock. In the past, many companies that have experienced volatility in the market price of their stock have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in substantial costs and divert our management's attention from other business concerns, which could have a material adverse effect on our business.

Failure to achieve and maintain internal controls in accordance with Sections 302 and 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our business and stock price.

If we fail to maintain adequate internal controls or fail to implement required new or improved controls, as we grow or as such control standards are modified, supplemented or amended from time to time; we may not be able to assert that we can conclude on an ongoing basis that we have effective internal controls over financial reporting. Effective internal controls are necessary for us to produce reliable financial reports and are important in the prevention of financial fraud. If we cannot produce reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and there could be a material adverse effect on our stock price.

| Item 1B. | Unresolved Staff Comments |

Not applicable.

Our corporate headquarters is located at 709 S. Harbor City Blvd., Suite 250, Melbourne, FL 32901 in Marina Towers, which is owned by Marina Towers, LLC, a wholly owned subsidiary of FCID Holdings, Inc.

FCID Holdings manages our real estate. Marina Towers, LLC operates Marina Towers, a 75,267 square foot Class A six-story office building. The building has operated with a 95% average tenant occupancy and a rent roll that is supported by approximately 75% non-affiliate, high quality, commercial tenants. The building generates revenue and income for the Company that is intended to be available to fund the expansion of our operating businesses.

We believe that our present facilities will be suitable for the operation of our business for the foreseeable future and should we need to expand, we expect that suitable additional space will be available on commercially reasonable terms, although no assurance can be made in this regard. We also believe our property is adequately covered by insurance.

There are no legal proceedings pending, and we are not aware of any material proceeding contemplated by a governmental authority, to which we are a party or any of our property is subject.

| Item 4. | Mine Safety Disclosure |

Not applicable

PART II

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

Our common stock is traded in the over-the-counter market under the symbol "FCHS". The following table sets forth the high and low bid, as reported by Nasdaq.com, for our common stock for the calendar periods indicated.

| FISCAL YEAR 2012 | | HIGH | | | LOW | |

| First Quarter * | | $ | 4.04 | | | $ | 2.60 | |

| Second Quarter | | $ | 3.00 | | | $ | 2.70 | |

| Third Quarter | | $ | 2.95 | | | $ | 2.25 | |

| Fourth Quarter | | $ | 2.38 | | | $ | 1.50 | |

| | | | | | | | | |

| FISCAL YEAR 2011 * | | | HIGH | | | | LOW | |

| First Quarter | | $ | 4.60 | | | $ | 3.56 | |

| Second Quarter | | $ | 4.80 | | | $ | 2.80 | |

| Third Quarter | | $ | 4.48 | | | $ | 2.20 | |

| Fourth Quarter | | $ | 4.04 | | | $ | 2.20 | |

* Fiscal Year 2011 and 2012 prices adjusted for reverse stock split effective April 4, 2012.

The last reported sales price of our common stock on March 28, 2013 was $1.75. The above quotations do not include retail mark-ups, mark-downs or commissions and represents prices between dealers and not necessarily actual transactions. The past performance of our securities is not necessarily indicative of future performance.

Shares Outstanding and Holders of Record

As of March 28, 2013, there were 12,833,462 shares of our common stock outstanding and approximately 62 shareholders of record of our common stock.

Dividend Policy

We have not declared or paid any cash dividends on our common stock since our inception. We do not intend to pay cash dividends on our common stock in the foreseeable future. We anticipate we will retain any earnings for use in our operations and development of our business.

Recent Sales of Unregistered Securities

On December 14, 2012, the Company entered into a Securities Purchase Agreement with an accredited investor (“Lender”), in reliance upon the exemption from registration under Section 4(2) of the Securities Act of 1933 (the “Securities Act”), for the sale of an 8% convertible note in the principal amount of $203,500 (the "Note"). The total net proceeds the Company received from this Offering was $200,000. The Note bears interest at the rate of 8% per annum. All interest and principal must be repaid on September 18, 2013. The Note is convertible into common stock, at Lender’s option, at a 39% discount to the average of the three lowest closing bid prices of the common stock during the 10 trading day period prior to conversion.

On February 19, 2013, the Company entered into a Securities Purchase Agreement with an accredited investor (Lender), in reliance upon the exemption from registration under Section 4(2) of the Securities Act for the sale of an 8% convertible note in the principal amount of $103,500 (the "Note"). The total net proceeds the Company received from this Offering was $100,000. The Note bears interest at the rate of 8% per annum. All interest and principal must be repaid on November 21, 2013. The Note is convertible into common stock, at Lender’s option, at a 39% discount to the average of the three lowest closing bid prices of the common stock during the 10 trading day period prior to conversion.

Securities Authorized for Issuance Under Equity Compensation Plans

We have adopted the First Choice Healthcare Solutions, Inc. 2011 Incentive Stock Plan (the “2011 Plan”), pursuant to which 500,000 shares of our common stock are reserved for issuance as awards to employees, directors, consultants, and other service providers. The term of the 2011 Plan is ten years from January 6, 2012, its effective date.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

MANAGEMENT'S DISCUSSION & ANALYSIS

This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements. Such forward-looking statements are based on current expectations, estimates, and projections about our industry, management beliefs, and certain assumptions made by our management. Words such as “anticipates”, “expects”, “intends”, “plans”, “believes”, “seeks”, “estimates”, variations of such words, and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict; therefore, actual results may differ materially from those expressed or forecasted in any such forward-looking statements. Unless required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. However, readers should carefully review the risk factors set forth herein and in other reports and documents that we file from time to time with the Securities and Exchange Commission, particularly the Annual Reports on Form 10-K, Quarterly reports on Form 10-Q and any Current Reports on Form 8-K.

Overview and History

First Choice Health Care Solutions, Inc. (“we,” “FCHS” or the “Company”) is an integrated, diversified, multi-specialty, healthcare services company focused on delivering state-of-the art, technologically advanced concierge physician and patient-centric services through the Company’s multi-specialty centers for excellence. We provide timely, innovative healthcare solutions which are also uniquely competitive, efficient, and responsively adaptive to the emerging healthcare delivery environment. At present, we operate one medical multi-specialty center of excellence. We also own Marina Towers, a fully occupied, six story Class A office building on prestigious waterfront in Melbourne, Florida. We plan to further expand our centers of excellence via physician buy out and or acquisition in 2013 and future years within Florida and other high value markets.

We were incorporated in the State of Colorado on May 30, 2007 to act as a holding corporation for I.V. Services Ltd., Inc. (“IVS”), a Florida corporation engaged in providing billing services to providers of medical services. IVS was incorporated in the State of Florida on September 28, 1987, and on June 30, 2007, 2,429,000 common shares were issued to Mr. Michael West and other IVS shareholders in exchange for 100% of the capital stock of IVS. In the second quarter of 2011, we disposed of IVS, which, at the time, was an inactive, wholly-owned subsidiary of the Company. The consideration for the disposition was the net liability assumption by the purchaser.

On December 29, 2010, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with FCID Medical, Inc., a Florida corporation (“FCID Medical”) and FCID Holdings, Inc., a Florida corporation (“FCID Holdings)”, which together will be referred to herein with FCID Medical as “FCID”, and the shareholders of FCID (the “FCID Shareholders”). Pursuant to the terms of the Share Exchange Agreement, the FCID Shareholders exchanged 100% of the outstanding common stock of FCID for a total of 10,000,000 common shares) of the Company, resulting in FCID Medical and FCID Holdings being 100% owned subsidiaries of the Company (the “Share Exchange”).

In connection with the Share Exchange Agreement, in addition to the foregoing and effective on the closing date, Michael West resigned as President, Treasurer and director of the Company. Mr. Steve West resigned as officer of the Company but retained a directorship with the Company and subsequently resigned in 2011. After such resignations, Christian Charles Romandetti was appointed President, Chief Executive Officer and a director of the Company, and Donald Bittar was appointed Chief Financial Officer, Treasurer and Secretary. Currently, Mr. Bittar also is a director.

Merger, Re-Incorporation and Name Change

On or about February 13, 2012, we obtained stockholder consent for (i) the approval of an agreement and plan of merger (the “Merger Agreement”) with First Choice Healthcare Solutions, Inc., (“FCHS Delaware”), a Delaware corporation formed exclusively for the purpose of merging with the Company, pursuant to which (a) the Company’s state of incorporation changed from Colorado to Delaware (the “Reincorporation”) (b) the Company’s name changed from Medical Billing Assistance, Inc. to First Choice Healthcare Solutions, Inc. (the “Name Change”), and (c) every four shares of Company’s common stock was exchanged for one share of FCHS Delaware common stock (effectively resulting in a four-to-one reverse split of the Company’s common stock) (the “Reverse Split”), and (ii) the approval of the Medical Billing Assistance, Inc. 2011 Incentive Stock Plan. The effective date for the Reincorporation and the Reverse Split was April 4, 2012. The company changed its name to be more closely aligned with its target market.

All operations are conducted through our wholly-owned subsidiaries: FCID Medical and FCID Holdings. The wholly-owned subsidiary operating the medical multi-specialty centers of excellence Center of Excellence is owned by FCID Medical. We have real estate holdings through FCID Holdings, Inc., under which Marina Towers, LLC is wholly-owned subsidiary. A diagram of our corporate structure is set forth below:

Our Business