UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22143

WALTHAUSEN FUNDS

(Exact name of registrant as specified in charter)

2691 Route 9, Suite 102, Malta, NY 12020

(Address of principal executive offices) (Zip code)

Gerard S.E. Heffernan

Walthausen Funds

2691 Route 9, Suite 102, Malta, NY 12020

(Name and address of agent for service)

Registrant’s telephone number, including area code: (518) 348-7217

Date of fiscal year end: January 31

Date of reporting period: July 31, 2021

Item 1. Reports to Stockholders.

WALTHAUSEN SMALL CAP VALUE FUND

INSTITUTIONAL CLASS TICKER WFICX

INVESTOR CLASS TICKER WSCVX

For Investors Seeking Long-Term Capital Appreciation

SEMI-ANNUAL REPORT

July 31, 2021

Walthausen Small Cap Value Fund

Semi-Annual Report

July 31, 2021 |

Dear Fellow Shareholders,

The last few months have been a dynamic time in equity markets as investors start to think of a post pandemic world. We have been pleased with how the Fund has performed on both an absolute and relative basis. There has also been a change at Walthausen & Co., the adviser to the Fund. At the end of July, our Founder, John Walthausen retired. After founding the firm in 2007, and establishing an enduring process and team, John felt it was time to hand over the reins to Gerry Heffernan and DeForest Hinman. Their experience with the Advisor has provided a smooth transition. Gerry has co-managed the Fund since March 2018 and DeForest co-managed the Fund since November 2020. Additionally, Gerry and DeForest have served as portfolio managers of the Advisor for three years and one year, respectively. While shareholders should expect the same quality of professional investing that you are accustomed to, you will see some changes going forward. We believe the future of active management is being more active. You should expect to see Walthausen & Co be more active in our commentary and discussion in public forums.

As we position the portfolio for the remainder of 2021 and 2022, we have been spending a large amount of time discussing the following topics with company management teams:

Inflation. Almost every management team we talk to is facing inflation. They are not using the “transitory” term. Labor inflation is real and we are seeing companies take pay levels higher to improve inbound candidates and improve retention. Raw material price inflation is coming in a variety of areas. When looking at these factors we have been asking management teams about their ability to pass on pricing increases to customers. In most cases, companies are able to pass on increased pricing. In some instances, they are taking pricing in excess of the raw material increases and this will improve the forward margin outlook.

Interest Rates. The Federal Reserve has been weighing raising interest rates for some time. The pandemic has led to a clouded view of actual economic activity. Given the current interest rate levels, we believe it is not a matter of if, but is a matter of when rates will rise. Given our discussions with management teams, interest rates need to move higher sooner rather than later. When looking at the Fund’s non-bank names, we have been pleased with companies’ ability to take advantage of the low interest rate environment by extending debt maturities and lowering interest rates, which will benefit shareholders for many years. When looking at bank names, valuations remain suppressed and we have a situation where deposit levels are elevated and spreads are compressed. The Fund’s bank holdings should see a spread benefit from rising interest rates and have ample deposits to deploy as new loans.

Balance sheet positioning/capital deployments. Many management teams found themselves in a capital preservation and deleverage mode during the pandemic. As vaccine deployment increased, and the economic outlook improved, many of the Fund’s companies found themselves in a very strong capital position; in some instances, net cash balance sheets. In our discussions, we are seeing a good balance of opportunities for organic capital deployment, share repurchases, and bolt on acquisitions. When talking about acquisitions, we are hearing that deals that would have closed in 2020 and 2021 were delayed due to the pandemic, causing delays in due diligence process. As the environment becomes more normalized, we expect that accretive deal activity will be increasing. We also feel that potential changes to capital gains taxes and estate taxes by the Biden Administration will make private sellers more willing to complete transactions.

Supply chain issues. Similar to the experience of the Great Financial Crisis, the US supply chain went into cash harvest mode, and the supply chain became very slack as a result. History repeated as demand snapped back much faster than companies expected. This has led to the supply chain struggling to keep up. Supply chains into Asia are going to be the most impacted as shipping companies are operating all available vessels, and container availability is tight. Port congestion remains high. We do not see these factors abating until

2021 Semi-Annual Report 1

2022. We are finding that companies that are further vertically integrated and have less exposure to foreign supply chains are in a position to gain share in the current market environment. Generally, Fund securities do not have meaningful exposure to foreign supply chains, and we own companies that are assisting/benefiting from relieving supply chain pressures (shipping, logistics, distribution, chip manufacturing and testing equipment).

Our performance in the first half of the fiscal year was encouraging with the Fund outperforming the Russell 2000 Value Index with a return of 19.38% for the Investor Class compared to the benchmark return of 16.05% . Reviewing attribution reports, we see all of our outperformance coming from stock selection. It was also satisfying to see that stock selection was additive in most sectors. The biggest drag on performance was the Financial sector, which we feel strongly about and believe our names are attractively valued and positioned to execute well given our interest rate outlook.

As we look to the remainder of the year, we feel the Fund’s portfolio is well positioned to take advantage of the current environment. If you have additional questions regarding Walthausen & Co. please feel free to contact Gerry directly at 518-348-7221 or DeForest directly 518-348-7216.

Sincerely,

Gerry S.E. Heffernan CFA

DeForest R. Hinman

Past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-925-8428.

The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read and considered carefully before investing. To obtain a copy of the Fund’s prospectus, please visit our website at www.walthausenfunds.com or call 1-888-925-8428 and a copy will be sent to you free of charge. Distributed by Rafferty Capital Markets, LLC - Garden City, NY 11530.

2021 Semi-Annual Report 2

WALTHAUSEN SMALL CAP VALUE FUND (Unaudited)

PERFORMANCE INFORMATION

7/31/2021 Investor Class NAV $24.46 7/31/2021 Institutional Class NAV $24.54

AVERAGE ANNUAL RATE OF RETURN (%) FOR THE PERIODS ENDED JULY 31, 2021

| 1 Year(A) | 3 Years(A) | 5 Years(A) | 10 Years(A) |

| Walthausen Small Cap Value Fund- Investor Class | 59.13% | 5.66% | 9.78% | 10.34% |

| Russell 2000® Value Index(B) | 63.70% | 8.30% | 11.61% | 10.82% |

| | | Since |

| | 1 Year(A) | Inception(A) |

| Walthausen Small Cap Value Fund - Institutional Class | 59.49% | 17.53% |

| Russell 2000® Value Index(B) | 63.70% | 18.96% |

Annual Fund Operating Expense Ratios (from 6/1/2021 Prospectus):

Institutional Class - Gross 1.35%, Net 0.98%

Investor Class - Gross 1.35%, Net 1.21%

The Advisor reimbursed and/or waived certain expenses of the Fund’s Institutional and Investor Classes. Absent that arrangement, the performance of the Classes would have been lower.

Each Class’s expense ratios for the six month period ended July 31, 2021 can be found in the financial highlights included in this report. Prior to June 1, 2021, both share classes had a 2.00% redemption fee on shares redeemed within 90 days of purchase or less.

The Annual Fund Operating Expense Ratios reported above may not correlate to the expense ratios in the Fund’s financial highlights because (a) the financial highlights include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in acquired funds; and (b) the impact of breakpoints in expenses charged and the application of waivers as described in Note 4.

(A)1 Year, 3 Years, 5 Years, 10 Years and Since Inception returns include changes in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Walthausen Small Cap Value Fund Investor Class was February 1, 2008. Institutional Class commenced operations on December 31, 2018.

(B)The Russell 2000® Value Index (whose composition is different from that of the Fund) is an unmanaged index of small-capitalization stocks with lower price-to-book ratios and lower forecasted growth values than the total population of small-capitalization stocks. Investors cannot directly invest in an index.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH-END, PLEASE CALL 1-888-925-8428. THE FUND’S DISTRIBUTOR IS RAFFERTY CAPITAL MARKETS, LLC.

2021 Semi-Annual Report 3

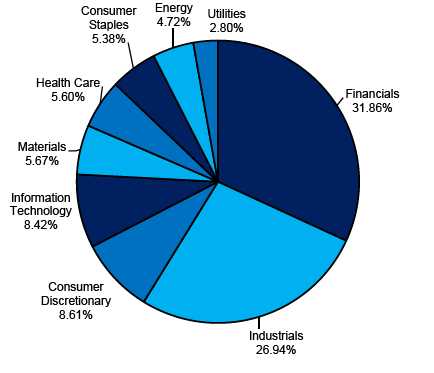

WALTHAUSEN SMALL CAP VALUE FUND (Unaudited)

WALTHAUSEN SMALL CAP VALUE FUND

by Sectors as of July 31, 2021

(as a percentage of Total Common Stocks)

AVAILABILITY OF QUARTERLY SCHEDULE OF INVESTMENTS (Unaudited)

The Fund publicly files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at http://www.sec.gov.

PROXY VOTING GUIDELINES

(Unaudited) |

Walthausen & Co., LLC, the Fund’s investment advisor (“Advisor”), is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Advisor in fulfilling this responsibility is available without charge on the Fund’s website at www.walthausenfunds.com. It is also included in the Fund’s Statement of Additional Information, which is available on the SEC’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies, Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30th, is available without charge, upon request, by calling our toll free number (1-888-925-8428). This information is also available on the SEC’s website at http://www.sec.gov.

2021 Semi-Annual Report 4

EXPENSE EXAMPLE

(Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs such as redemption fees and IRA maintenance fees, and (2) ongoing costs, including management fees, service fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested in the Fund on February 1, 2021 and held through July 31, 2021.

Actual Expenses

The first line of each table below provides information about actual account values and actual expenses. Additionally, although the Fund charges no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Ultimus Fund Solutions, LLC, the Fund’s transfer agent. You will be charged an annual maintenance fee of $15 for each tax deferred account you have with the Fund (“IRA maintenance fees”). To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example. The example includes management fees, service fees and other Fund expenses. However, the example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees, IRA maintenance fees described above or expenses of underlying funds. Therefore, the second line of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Investor Class | | | |

| |

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account Value | Account Value | February 1, 2021 |

| | February 1, 2021 | July 31, 2021 | to July 31, 2021 |

| |

| Actual | $1,000.00 | $1,193.75 | $6.58 |

| |

| Hypothetical | $1,000.00 | $1,018.79 | $6.06 |

| (5% annual return | | | |

| before expenses) | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.21%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| |

2021 Semi-Annual Report 5

| Institutional Class | | | |

| |

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account Value | Account Value | February 1, 2021 |

| | February 1, 2021 | July 31, 2021 | to July 31, 2021 |

| |

| Actual | $1,000.00 | $1,195.32 | $5.33 |

| |

| Hypothetical | $1,000.00 | $1,019.93 | $4.91 |

| (5% annual return | | | |

| before expenses) | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.98%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| |

2021 Semi-Annual Report 6

| Walthausen Small Cap Value Fund | | | | |

|

|

| | | | Schedule of Investments | |

| | | | July 31, 2021 (Unaudited) | |

|

| Shares | | | Fair Value | % of Net Assets | |

| COMMON STOCKS | | | | |

| Blankbooks, Looseleaf Binders & Bookbindg & Relatd Work | | | | |

| 68,960 | Deluxe Corporation | $ | 3,027,344 | 1.90 | % |

| Broadwoven Fabric Mils, Man Made Fiber & Silk | | | | |

| 24,370 | Albany International Corp. - Class A | | 2,104,350 | 1.32 | % |

| Canned, Fruits, Vegetables, Preserves, Jams & Jellies | | | | |

| 268,267 | Landec Corporation * | | 2,934,841 | 1.84 | % |

| Construction - Special Trade Contractors | | | | |

| 36,110 | Ameresco, Inc. - Class A * | | 2,474,618 | 1.55 | % |

| Crude Petroleum & Natural Gas | | | | |

| 94,000 | CNX Resources Corporation * | | 1,137,400 | | |

| 14,050 | Gulfport Energy Corporation * | | 959,615 | | |

| | | | 2,097,015 | 1.31 | % |

| Electric Lighting & Wiring Equipment | | | | |

| 63,670 | AZZ Inc. | | 3,373,873 | | |

| 328,190 | LSI Industries Inc. | | 2,471,271 | | |

| | | | 5,845,144 | 3.66 | % |

| Electrical Industrial Apparatus | | | | |

| 169,050 | Thermon Group Holdings, Inc. * | | 2,816,373 | 1.76 | % |

| Electronic Components & Accessories | | | | |

| 61,249 | Vishay Intertechnology Inc. | | 1,355,440 | | |

| 89,490 | Vishay Precision Group, Inc. * | | 3,251,172 | | |

| | | | 4,606,612 | 2.88 | % |

| Electronic Connectors | | | | |

| 62,770 | Methode Electronics, Inc. - Class A | | 3,002,289 | 1.88 | % |

| Finance Services | | | | |

| 67,040 | Green Dot Corporation - Class A * | | 3,088,533 | 1.93 | % |

| Heavy Construction Other Than Building Construction - Contractors | | | | |

| 114,236 | Great Lakes Dredge & Dock Corporation * | | 1,759,234 | | |

| 346,605 | Williams Industrial Services Group Inc. * | | 1,708,763 | | |

| | | | 3,467,997 | 2.17 | % |

| Household Audio & Video Equipment | | | | |

| 107,860 | Knowles Corporation * | | 2,161,514 | 1.35 | % |

| Instruments for Measuring & Testing of Electricity & Electric Signals | | | | |

| 94,105 | Allied Motion Technologies, Inc. | | 3,096,996 | 1.94 | % |

| Mobile Homes | | | | | |

| 23,310 | Skyline Champion Corporation * | | 1,314,684 | 0.82 | % |

| National Commercial Banks | | | | |

| 75,521 | Camden National Corporation | | 3,381,075 | | |

| 41,358 | City Holding Company | | 3,129,146 | | |

| 89,050 | NBT Bancorp Inc. | | 3,103,393 | | |

| 23,914 | Pinnacle Financial Partners, Inc. | | 2,142,934 | | |

| | | | 11,756,548 | 7.36 | % |

| Operative Builders | | | | |

| 40,219 | M/I Homes, Inc. * | | 2,602,571 | 1.63 | % |

| Plastic Materials, Synth Resins & Nonvulcan Elastomers | | | | |

| 6,280 | Rogers Corporation * | | 1,196,968 | 0.75 | % |

| Printed Circuit Boards | | | | |

| 138,740 | Kimball Electronics, Inc. * | | 2,828,909 | 1.77 | % |

| Pulp Mills | | | | | |

| 271,530 | Mercer International Inc. (Canada) | | 3,157,894 | 1.98 | % |

| Pumps & Pumping Equipment | | | | |

| 70,850 | Ampco-Pittsburgh Corporation * | | 441,395 | 0.28 | % |

| Refrigeration & Service Industry Machinery | | | | |

| 36,700 | Tennant Company | | 2,903,704 | 1.82 | % |

| Retail - Jewelry Stores | | | | |

| 50,030 | Signet Jewelers Limited * (Bermuda) | | 3,218,930 | 2.02 | % |

| Sanitary Services | | | | |

| 67,146 | Heritage-Crystal Clean, Inc. * | | 1,892,174 | 1.18 | % |

| |

| * Non-Income Producing Securities. | | | | |

The accompanying notes are an integral part of these financial statements.

2021 Semi-Annual Report 7

| Walthausen Small Cap Value Fund | | | | |

|

|

| | | | Schedule of Investments | |

| | | | July 31, 2021 (Unaudited) | |

|

| Shares | | | Fair Value | % of Net Assets | |

| COMMON STOCKS | | | | |

| Savings Institution, Federally Chartered | | | | |

| 71,820 | OceanFirst Financial Corp. | $ | 1,400,490 | 0.88 | % |

| Semiconductors & Related Devices | | | | |

| 23,350 | Kulicke and Soffa Industries, Inc. (Singapore) | | 1,269,306 | | |

| 21,710 | OSI Systems, Inc. * | | 2,172,086 | | |

| | | | 3,441,392 | 2.15 | % |

| Services - Automotive Repair, Services & Parking | | | | |

| 51,780 | Monro, Inc. | | 3,003,240 | 1.88 | % |

| Services - Educational Services | | | | |

| 306,630 | Perdoceo Education Corporation * | | 3,636,632 | 2.28 | % |

| Services - Engineering Services | | | | |

| 58,380 | VSE Corporation | | 2,921,919 | 1.83 | % |

| Services - Equipment Rental & Leasing, NEC | | | | |

| 106,218 | Textainer Group Holdings Limited (Bermuda) * | | 3,428,717 | 2.15 | % |

| Services - Help Supply Services | | | | |

| 166,720 | Kelly Services, Inc. - Class A | | 3,654,502 | 2.29 | % |

| Services - Home Health Care Services | | | | |

| 80,250 | Apria, Inc. * | | 2,530,283 | 1.58 | % |

| Services - Management Consulting Services | | | | |

| 140,082 | The Hackett Group, Inc. | | 2,510,269 | 1.57 | % |

| Services - To Dwellings & Other Buildings | | | | |

| 51,503 | ABM Industries Incorporated | | 2,394,374 | 1.50 | % |

| Special Industry Machinery, NEC | | | | |

| 11,480 | Axcelis Technologies, Inc. * | | 442,554 | 0.28 | % |

| State Commercial Banks | | | | |

| 74,530 | First Bancorp | | 2,981,200 | | |

| 76,110 | First Financial Corporation | | 3,048,206 | | |

| 59,265 | Great Southern Bancorp, Inc. | | 3,083,558 | | |

| 66,320 | Heartland Financial USA, Inc. | | 3,025,518 | | |

| 149,000 | Horizon Bancorp, Inc. | | 2,489,790 | | |

| 29,495 | Lakeland Financial Corporation | | 1,972,331 | | |

| 88,920 | Seacoast Banking Corporation of Florida * | | 2,702,279 | | |

| 29,150 | Stock Yards Bancorp, Inc. | | 1,388,706 | | |

| 55,980 | TriCo Bancshares | | 2,207,291 | | |

| 61,140 | Washington Trust Bancorp, Inc. | | 2,980,575 | | |

| | | | 25,879,454 | 16.20 | % |

| Steel Works, Blast Furnaces Rolling Mills (Coke Ovens) | | | | |

| 101,690 | Commercial Metals Company | | 3,335,432 | 2.09 | % |

| Surety Insurance | | | | |

| 111,882 | NMI Holdings, Inc. - Class A * | | 2,463,642 | 1.54 | % |

| Surgical & Medical Instruments & Apparatus | | | | |

| 773,610 | Accuray Incorporated * | | 3,171,801 | | |

| 39,870 | NuVasive, Inc. * | | 2,549,687 | | |

| 42,010 | UFP Technologies, Inc. * | | 2,511,358 | | |

| | | | 8,232,846 | 5.15 | % |

| Title Insurance | | | | | |

| 52,540 | Stewart Information Services Corporation | | 3,100,385 | 1.94 | % |

| Wholesale - Farm Product Raw Materials | | | | |

| 53,750 | The Andersons, Inc. | | 1,435,125 | 0.90 | % |

| Wholesale - Industrial Machinery & Equipment | | | | |

| 49,733 | Global Industrial Company | | 1,965,448 | 1.23 | % |

| Total for Common Stocks (Cost $110,195,961) | | 147,814,107 | 92.55 | % |

| REAL ESTATE INVESTMENT TRUSTS | | | | |

| 56,560 | EPR Properties | | 2,844,968 | | |

| 223,427 | Global Medical REIT Inc. | | 3,476,524 | | |

| 139,130 | UMH Properties, Inc. | | 3,238,946 | | |

| Total for Real Estate Investment Trusts (Cost $6,423,173) | | 9,560,438 | 5.99 | % |

* Non-Income Producing Securities.

The accompanying notes are an integral part of these financial statements.

2021 Semi-Annual Report 8

| Walthausen Small Cap Value Fund | | | | | |

|

| | | Schedule of Investments | |

| | | July 31, 2021 (Unaudited) | |

| Shares | | Fair Value | | % of Net Assets | |

| MONEY MARKET FUNDS | | | | | |

| 2,534,423 Fidelity Investments Money Market Government Portfolio - | | | | | |

| Class I 0.01% ** | $ | 2,534,423 | | 1.59 | % |

| (Cost $2,534,423) | | | | | |

| Total Investment Securities | | 159,908,968 | | 100.13 | % |

| (Cost $119,153,557) | | | | | |

| Liabilities in Excess of Other Assets | | (202,318 | ) | -0.13 | % |

| Net Assets | $ | 159,706,650 | | 100.00 | % |

** The rate shown represents the 7-day yield at July 31, 2021.

The accompanying notes are an integral part of these financial statements.

2021 Semi-Annual Report 9

| Walthausen Small Cap Value Fund | | | |

| |

| Statement of Assets and Liabilities (Unaudited) | | | |

| July 31, 2021 | | | |

| Assets: | | | |

| Investment Securities at Fair Value | $ | 159,908,968 | |

| (Cost $119,153,557) | | | |

| Receivable for Dividends | | 56,178 | |

| Receivable for Securities Sold | | 667,330 | |

| Receivable for Shareholder Subscriptions | | 48,872 | |

| Total Assets | | 160,681,348 | |

| Liabilities: | | | |

| Payable for Securities Purchased | | 229,606 | |

| Payable for Shareholder Redemptions | | 594,896 | |

| Payable to Advisor for Management Fees (Note 4) | | 137,831 | |

| Payable to Advisor for Service Fees (Note 4) | | 12,365 | |

| Total Liabilities | | 974,698 | |

| Net Assets | $ | 159,706,650 | |

| Net Assets Consist of: | | | |

| Paid In Capital | $ | 80,751,812 | |

| Total Distributable Earnings | | 78,954,838 | |

| Net Assets | $ | 159,706,650 | |

| |

| Investor Class | | | |

| Net Assets | $ | 78,241,115 | |

| Shares Outstanding | | | |

| (Unlimited shares authorized) | | 3,198,342 | |

| Net Asset Value and Offering Price Per Share | $ | 24.46 | |

| Redemption Price Per Share ($24.46 x 0.98) (Note 2) | $ | 23.97 | |

| |

| Institutional Class | | | |

| Net Assets | $ | 81,465,535 | |

| Shares Outstanding | | | |

| (Unlimited shares authorized) | | 3,319,680 | |

| Net Asset Value and Offering Price Per Share | $ | 24.54 | |

| Redemption Price Per Share ($24.54 x 0.98) (Note 2) | $ | 24.05 | |

| |

| Statement of Operations (Unaudited) | | | |

| For the six month period ended July 31, 2021 | | | |

| |

| Investment Income: | | | |

| Dividends (Net of foreign withholding tax of $0) | $ | 1,119,622 | |

| Total Investment Income | | 1,119,622 | |

| Expenses: | | | |

| Management Fees (Note 4) | | 882,553 | |

| Service Fees (Note 4) | | 319,817 | |

| Total Expenses | | 1,202,370 | |

| Less: Waived Management and Service Fees (Note 4) | | (245,585 | ) |

| Net Expenses | | 956,785 | |

| Net Investment Income (Loss) | | 162,837 | |

| Realized and Unrealized Gain (Loss) on Investments: | | | |

| Net Realized Gain (Loss) on Investments | | 37,492,272 | |

| Net Change In Unrealized Appreciation (Depreciation) on Investments | | (4,256,061 | ) |

| Net Realized and Unrealized Gain (Loss) on Investments | | 33,236,211 | |

| Net Increase (Decrease) in Net Assets from Operations | $ | 33,399,048 | |

The accompanying notes are an integral part of these financial statements.

2021 Semi-Annual Report 10

| Walthausen Small Cap Value Fund | | | | | | | |

| |

| Statements of Changes in Net Assets | | (Unaudited) | | | | | |

| | | 2/1/2021 | | | 2/1/2020 | | |

| | | to | | | to | | |

| | | 7/31/2021 | | | 1/31/2021 | | |

| From Operations: | | | | | | | |

| Net Investment Income (Loss) | $ | 162,837 | | $ | 805,349 | | |

| Net Realized Gain (Loss) on Investments | | 37,492,272 | | | 15,425,531 | | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments | | (4,256,061 | ) | | (26,922,763 | ) | |

| Increase (Decrease) in Net Assets from Operations | | 33,399,048 | | | (10,691,883 | ) | |

| From Distributions to Shareholders: | | | | | | | |

| Investor Class | | - | | | (714,630 | ) | |

| Institutional Class | | - | | | (1,019,665 | ) | |

| Change in Net Assets from Distributions | | - | | | (1,734,295 | ) | |

| From Capital Share Transactions: | | | | | | | |

| Proceeds From Sale of Shares | | | | | | | |

| Investor Class | | 5,046,535 | | | 10,314,289 | | |

| | | | | | | | |

| Institutional Class | | 12,941,159 | (a) | | 44,157,560 | (b) | |

| Proceeds From Redemption Fees (Note 2) | | | | | | | |

| Investor Class | | 622 | | | 5,255 | | |

| Institutional Class | | 6,027 | | | 13,563 | | |

| Shares Issued on Reinvestment of Dividends | | | | | | | |

| Investor Class | | - | | | 704,612 | | |

| Institutional Class | | - | | | 1,013,566 | | |

| Cost of Shares Redeemed | | | | | | | |

| Investor Class | | (12,502,193 | )(a) | | (101,165,845 | )(b) | |

| Institutional Class | | (47,831,615 | ) | | (83,803,643 | ) | |

| Net Increase (Decrease) from Shareholder Activity | | (42,339,465 | ) | | (128,760,643 | ) | |

| Net Increase (Decrease) in Net Assets | | (8,940,417 | ) | | (141,186,821 | ) | |

| Net Assets at Beginning of Period | | 168,647,067 | | | 309,833,888 | | |

| Net Assets at End of Period | $ | 159,706,650 | | $ | 168,647,067 | | |

| |

| Share Transactions: | | | | | | | |

| Issued | | | | | | | |

| Investor Class | | 208,455 | | | 690,760 | | |

| | | | | | | | |

| Institutional Class | | 536,073 | (c) | | 2,749,455 | (d) | |

| Reinvested | | | | | | | |

| Investor Class | | - | | | 36,227 | | |

| Institutional Class | | - | | | 52,004 | | |

| Redeemed | | | | | | | |

| Investor Class | | (513,746 | )(c) | | (6,671,712 | )(d) | |

| Institutional Class | | (1,934,587 | ) | | (5,103,938 | ) | |

| Net Increase (Decrease) in Shares | | (1,703,805 | ) | | (8,247,204 | ) | |

(a) Includes $407,992 of exchanges from Investor Class to Institutional Class.

(b) Includes $6,101,893 of exchanges from Investor Class to Institutional Class.

(c) Includes the exchange of 16,909 shares from Investor Class to 16,867 shares of Institutional Class.

(d) Includes the exchange of 394,918 shares from Investor Class to 393,630 shares of Institutional Class.

The accompanying notes are an integral part of these financial statements.

2021 Semi-Annual Report 11

| Walthausen Small Cap Value Fund | | | | | | | | | | | |

| | |

| Financial Highlights - Investor Class | (Unaudited) | | | | | | | | | | | |

| Selected data for a share outstanding throughout the period: | 2/1/2021 | | 2/1/2020 | | 2/1/2019 | | 2/1/2018 | | 2/1/2017 | | 2/1/2016 | |

| | to | | to | | to | | to | | to | | to | |

| | 7/31/2021 | | 1/31/2021 | | 1/31/2020 | | 1/31/2019 | | 1/31/2018 | | 1/31/2017 | |

| Net Asset Value - | | | | | | | | | | | | |

| Beginning of Period | $ 20.49 | | $ 18.80 | | $ 18.71 | | $ 23.87 | | $ 22.12 | | $ 15.87 | |

| Net Investment Income (Loss) (a) | 0.01 | | 0.05 | | 0.07 | | (0.02) | | (0.07) | | (0.01) | |

| Net Gain (Loss) on Investments (Realized and Unrealized) (b) | 3.96 | | 1.83 | | 0.43 | | (2.74) | | 2.99 | | 6.90 | |

| Total from Investment Operations | 3.97 | | 1.88 | | 0.50 | | (2.76) | | 2.92 | | 6.89 | |

| Distributions (From Net Investment Income) | - | | (0.19) | | (0.02) | | - | | - | | (0.01) | |

| Distributions (From Capital Gains) | - | | - | | (0.39) | | (2.40) | | (1.17) | | (0.63) | |

| Total Distributions | - | | (0.19) | | (0.41) | | (2.40) | | (1.17) | | (0.64) | |

| Proceeds from Redemption Fee (Note 2) | - | + | - | + | - | + | - | + | - | + | - | + |

| Net Asset Value - | | | | | | | | | | | | |

| End of Period | $ 24.46 | | $ 20.49 | | $ 18.80 | | $ 18.71 | | $ 23.87 | | $ 22.12 | |

| Total Return (c) | 19.38% * | 10.04% | | 2.55% | | (10.27)% | | 13.22% | | 43.33% | |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net Assets - End of Period (Thousands) | $ 78,241 | ** | $ 71,784 | | $ 177,627 | | $ 422,206 | | $ 621,122 | | $ 605,575 | |

| Before Reimbursement | | | | | | | | | | | | |

| Ratio of Expenses to Average Net Assets | 1.36% ** | 1.35% | | 1.30% | | 1.27% | | 1.26% | | 1.27% | |

| Ratio of Net Investment Income (Loss) to Average Net Assets | -0.09% ** | 0.16% | | 0.27% | | -0.09% | | -0.32% | | -0.05% | |

| After Reimbursement (d) | | | | | | | | | | | | |

| Ratio of Expenses to Average Net Assets | 1.21% ** | 1.21% | | 1.21% | | 1.27% | | 1.26% | | 1.27% | |

| Ratio of Net Investment Income (Loss) to Average Net Assets | 0.06% ** | 0.30% | | 0.36% | | -0.09% | | -0.32% | | -0.05% | |

| Portfolio Turnover Rate | 34.98% * | 65.91% | | 56.71% | | 45.51% | | 45.20% | | 39.17% | |

* Not Annualized.

** Annualized.

+ Amount less than $0.005 per share.

(a) Per share amounts were calculated using the average shares method.

(b) Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to rec-

oncile the change in net asset value for the period and may not reconcile with the aggregate gains and losses in

the Statement of Operations due to share transactions for the period.

(c) Total return represents the rate that the investor would have earned or lost on an investment in the Fund

assuming reinvestment of dividends.

(d) Effective December 31, 2018, the Advisor has agreed to waive a portion of its service fees and management

fees (See Note 4).

The accompanying notes are an integral part of these financial statements.

2021 Semi-Annual Report 12

| Walthausen Small Cap Value Fund | | | | | | | | | | | | |

| |

| Financial Highlights - Institutional Class | | | | | | | | | | | | |

| Selected data for a share outstanding throughout the period: | | (Unaudited) | | | | | | | | | |

| | 2/1/2021 | | | 2/1/2020 | | | 2/1/2019 | | | 12/31/2018* | |

| | | to | | | to | | | to | | | to | |

| | 7/31/2021 | | | 1/31/2021 | | | 1/31/2020 | | | 1/31/2019 | |

| Net Asset Value - | | | | | | | | | | | | |

| Beginning of Period | $ | 20.53 | | $ | 18.83 | | $ | 18.70 | | $ | 16.71 | |

| Net Investment Income (Loss) (a) | | 0.03 | | | 0.09 | | | 0.11 | | | - | + |

| Net Gain (Loss) on Investments (Realized and Unrealized) (b) | | 3.98 | | | 1.84 | | | 0.43 | | | 1.99 | |

| Total from Investment Operations | | 4.01 | | | 1.93 | | | 0.54 | | | 1.99 | |

| Distributions (From Net Investment Income) | | - | | | (0.23 | ) | | (0.02 | ) | | - | |

| Distributions (From Capital Gains) | | - | | | - | | | (0.39 | ) | | - | |

| Total Distributions | | - | | | (0.23 | ) | | (0.41 | ) | | - | |

| Proceeds from Redemption Fee (Note 2) | | - | + | | - | + | | - | + | | - | |

| Net Asset Value - | | | | | | | | | | | | |

| End of Period | $ | 24.54 | | $ | 20.53 | | $ | 18.83 | | $ | 18.70 | |

| Total Return (c) | | 19.53 | % ** | | 10.33 | % | | 2.80 | % | | 11.91 | % ** |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net Assets - End of Period (Thousands) | $ | 81,466 | | $ | 96,863 | | $ | 132,207 | | $ | 7,741 | |

| Before Reimbursement | | | | | | | | | | | | |

| Ratio of Expenses to Average Net Assets | | 1.36 | % *** | | 1.35 | % | | 1.30 | % | | 1.37 | % *** |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | -0.09 | % *** | | 0.15 | % | | 0.23 | % | | -0.23 | % *** |

| After Reimbursement | | | | | | | | | | | | |

| Ratio of Expenses to Average Net Assets | | 0.98 | % *** | | 0.98 | % | | 0.98 | % | | 0.98 | % *** |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | 0.29 | % *** | | 0.52 | % | | 0.55 | % | | 0.16 | % *** |

| Portfolio Turnover Rate | | 34.98 | % ** | | 65.91 | % | | 56.71 | % | | 45.51 | % ** |

* Commencement of Class.

** Not Annualized.

*** Annualized.

+ Amount less than $0.005 per share.

(a) Per share amounts were calculated using the average shares method.

(b) Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to rec-

oncile the change in net asset value for the period and may not reconcile with the aggregate gains and losses in

the Statement of Operations due to share transactions for the period.

(c) Total return represents the rate that the investor would have earned or lost on an investment in the Fund

assuming reinvestment of dividends.

The accompanying notes are an integral part of these financial statements.

2021 Semi-Annual Report 13

NOTES TO FINANCIAL STATEMENTS

WALTHAUSEN SMALL CAP VALUE FUND

July 31, 2021

(UNAUDITED)

1.) ORGANIZATION

Walthausen Small Cap Value Fund (the “Fund”) was organized as a diversified series of the Walthausen Funds (the “Trust”) on January 14, 2008. The Trust is registered as an open-end investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust was organized in Ohio as a business trust on October 10, 2007 and may offer an unlimited number of shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. The Fund currently offers Investor Class shares and Institutional Class shares. The Fund’s Investor Class shares commenced operations on February 1, 2008 and Institutional Class shares commenced operations on December 31, 2018. As of July 31, 2021, there are two series authorized by the Trust. All classes of shares have identical rights to earnings, assets and voting privileges, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. The classes differ principally in their respective distribution expenses and arrangements. The Fund’s investment objective is to seek long-term capital appreciation. The investment advisor to the Fund is Walthausen & Co., LLC.

2.) SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services - Investment Companies including accounting standards update 2013-08. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the significant accounting policies described in this section.

SECURITY VALUATION

All investments in securities are recorded at their estimated fair value, as described in Note 3.

FEDERAL INCOME TAXES

The Fund’s policy is to continue to comply with the requirements of the Internal Revenue Code (the "Code") that are applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Fund’s policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Code. This Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Fund’s policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Fund recognizes the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for the open tax years. The Fund identifies its major tax jurisdictions as U.S. federal and state tax authorities; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the six month period ended July 31, 2021, the Fund did not incur any interest or penalties.

SHARE VALUATION

The net asset value (“NAV”) per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding, rounded to the nearest cent. The offering and redemption price per share is equal to the NAV per share. Shares purchased prior to June 1, 2021 were subject to a redemption fee of 2% if redeemed after holding them for 90 days or less. During the six month period ended July 31, 2021, proceeds from redemption fees amounted to $622 and $6,027, respectively, for Investor Class and Institutional Class.

2021 Semi-Annual Report 14

Notes to Financial Statements (Unaudited) - continued

DISTRIBUTIONS TO SHAREHOLDERS

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Fund may utilize earnings and profits distributed to shareholders on redemptions of shares as part of the dividends paid deductions. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense, or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or NAV per share of the Fund.

USE OF ESTIMATES

The financial statements are prepared in accordance with GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

OTHER

The Fund records security transactions based on the trade date for financial reporting purposes. Dividend income is recognized on the ex-dividend date. Interest income, if any, is recognized on an accrual basis. The Fund uses the specific identification method in computing gain or loss on the sale of investment securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The Fund may hold investments in master limited partnerships (“MLPs”). It is common for distributions from MLPs to exceed taxable earnings and profits resulting in the excess portion of such dividends to be designated as return of capital. Annually, income or loss from MLPs is reclassified upon receipt of the MLPs tax reporting document. For financial reporting purposes, management does not estimate the tax character of MLP distributions for which actual information has not been reported.

EXPENSES

Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or an appropriate basis.

Class specific expenses are borne by each specific class. Income, non-class specific expenses, and realized and unrealized gains/losses are allocated to the respective classes based on the basis of relative net assets.

3.) SECURITIES VALUATIONS

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

2021 Semi-Annual Report 15

Notes to Financial Statements (Unaudited) - continued

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized as level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

FAIR VALUE MEASUREMENTS

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stocks and real estate investment trusts). Equity securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair value of such securities. Securities that are traded on any stock exchange or on the NASDAQ over-the-counter market are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an equity security is generally valued by the pricing service at its last bid price. Generally, if the security is traded in an active market and is valued at the last sale price, the security is categorized as a level 1 security, and if an equity security is valued by the pricing service at its last bid price, it is generally categorized as a level 2 security. When market quotations are not readily available, when the Advisor determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted securities are being valued, such securities are valued as determined in good faith by the Advisor, subject to review of the Board and are categorized in level 2 or level 3, when appropriate.

Money market funds. Shares of money market funds are valued at the net asset value provided by the funds and are classified as level 1 of the fair value hierarchy.

In accordance with the Trust’s good faith pricing guidelines, the Advisor is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. There is no single procedure for determining fair value, since fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Advisor would appear to be the amount that the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods.

The following table summarizes the inputs used to value the Fund’s assets measured at fair value as of July 31, 2021:

| Valuation Inputs of Assets | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $147,814,107 | $0 | $0 | $147,814,107 |

| Real Estate Investment Trusts | 9,560,438 | 0 | 0 | 9,560,438 |

| Money Market Funds | 2,534,423 | 0 | 0 | 2,534,423 |

| Total | $159,908,968 | $0 | $0 | $159,908,968 |

Refer to the Fund’s Schedule of Investments for a listing of securities by industry. The Fund did not hold any level 3 assets during the six month period ended July 31, 2021.

The Fund did not invest in any derivative instruments during the six month period ended July 31, 2021.

2021 Semi-Annual Report 16

Notes to Financial Statements (Unaudited) - continued

4.) INVESTMENT ADVISORY AGREEMENT AND RELATED PARTY TRANSACTIONS

The Trust, on behalf of the Fund, has entered into an investment advisory agreement (“Management Agreement”) with the Advisor. The Advisor manages the investment portfolio of the Fund, subject to policies adopted by the Board, and, at its own expense and without reimbursement from the Trust, furnishes office space and all necessary office facilities, equipment and executive personnel necessary for managing the Fund. For its services, the Advisor receives an investment management fee equal to 1.00% of the average daily net assets of the Fund.

Under the terms of the Services Agreement between the Trust, on behalf of the Fund, and the Advisor (the “Services Agreement”), the Advisor is obligated to pay the operating expenses of the Fund excluding management fees, any 12b-1 fees, brokerage fees and commissions, taxes, borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short), fees and expenses of acquired funds, extraordinary or non-recurring expenses as may arise, including litigation to which the Fund may be a party and indemnification of the Trust’s Trustees and officers. For its services, the Advisor receives service fees equal to an annual rate of 0.45% of the Fund’s average daily net assets up to $100 million, 0.25% of the Fund’s average daily net assets between $100 million and $500 million, and 0.15% of such assets in excess of $500 million.

Effective December 31, 2018, the Advisor has contractually agreed to waive Services Agreement fees and Management fees to the extent necessary to maintain total annual operating expenses of the Investor Class Shares and Institutional Class Shares, excluding brokerage fees and commissions, taxes, borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short), the cost of acquired funds and extraordinary expenses at 1.21% and 0.98% respectively, of its average daily net assets through May 31, 2022. The Advisor may not terminate the fee waiver before May 31, 2022.

For the six month period ended July 31, 2021, the Advisor earned management fees totaling $882,553, of which $137,831 was due to the Advisor at July 31, 2021. For the same period, the Advisor earned service fees of $319,817, of which $12,365 was due to the Advisor at July 31, 2021. Service and management fees in the amounts of $61,522 and $184,063 were waived with no recapture provision for the six month period ended July 31, 2021 for the Investor and Institutional Classes, respectively.

Certain officers and a shareholder of the Advisor are also officers and/or a Trustee of the Trust. These individuals may receive benefits from the Advisor resulting from management and services fees paid to the Advisor by the Fund.

The Trustees who are not interested persons of the Fund were each paid $4,000, for a total of $12,000, in Trustees’ fees plus travel and related expenses for the six month period ended July 31, 2021 for their services to the Fund. The Advisor pays these fees pursuant to the Services Agreement.

5.) PURCHASES AND SALES OF SECURITIES

For the six month period ended July 31, 2021, purchases and sales of investment securities other than U.S. Government obligations and short-term investments aggregated $60,138,654 and $99,674,751, respectively. Purchases and sales of U.S. Government obligations aggregated $0 and $0, respectively.

6.) CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. As of July 31, 2021, NFS, LLC located in New York, New York, for the benefit of its clients, held, in aggregate, 61.32% of the shares of the Fund, and therefore may be deemed to control the Fund.

7.) TAX MATTERS

For federal income tax purposes, the cost of investments owned at July 31, 2021 was $119,153,557. At July 31, 2021, the composition of unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value) was as follows:

| Appreciation | (Depreciation) | Net Appreciation (Depreciation) |

| $42,953,346 | ($2,197,935) | $40,755,411 |

2021 Semi-Annual Report 17

Notes to Financial Statements (Unaudited) - continued

The tax character of distributions for Investor Class was as follows:

| | Six Months Ended | | Fiscal Year Ended |

| | July 31, 2021 | | January 31, 2021 |

| Ordinary Income . | $ – | $ | 714,630 |

| Long-Term Capital Gain | – | | – |

| | $ – | $ | 714,630 |

The tax character of distributions for Institutional Class was as follows:

| | Six Months Ended | | Fiscal Year Ended |

| | July 31, 2021 | | January 31, 2021 |

| Ordinary Income . | $ – | $ | 1,019,665 |

| Long-Term Capital Gain | – | | – |

| | $ – | $ | 1,019,665 |

8.) CONCENTRATION OF SECTOR RISK

If the Fund has significant investments in the securities of issuers in industries within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s NAV per share. From time to time, circumstances may affect a particular sector and the companies within such sector. For instance, economic or market factors, regulation or deregulation, and technological or other developments may negatively impact all companies in a particular sector and therefore the value of a Fund’s portfolio will be adversely affected. As of July 31, 2021, the Fund had 29.93% and 29.86% of the value of its net assets invested in stocks within the Industrial and Financials sectors, respectively.

9.) COVID-19 RISKS

Unexpected local, regional or global events, such as war; acts of terrorism; financial, political or social disruptions; natural, environmental or man-made disasters; the spread of infectious illnesses or other public health issues; and recessions and depressions could have a significant impact on the Fund and its investments and may impair market liquidity. Such events can cause investor fear, which can adversely affect the economies of nations, regions and the market in general, in ways that cannot necessarily be foreseen. An outbreak of infectious respiratory illness known as COVID-19, which is caused by a novel coronavirus (SARS-CoV-2), was first detected in China in December 2019 and subsequently spread globally. This coronavirus has resulted in, among other things, travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, prolonged quarantines, significant disruptions to business operations, market closures, cancellations and restrictions, supply chain disruptions, lower consumer demand, and significant volatility and declines in global financial markets, as well as general concern and uncertainty. The impact of COVID-19 has adversely affected, and other infectious illness outbreaks that may arise in the future could adversely affect, the economies of many nations and the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

10.) SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has concluded that there is no impact requiring adjustment to or disclosure in the financial statements.

2021 Semi-Annual Report 18

Board of Trustees

Edward A. LaVarnway

John P. Mastriani

Hany A. Shawky |

Investment Advisor and Administrator

Walthausen & Co., LLC |

Legal Counsel

Thompson Hine LLP

Custodian

US Bank, N.A.

Dividend Paying Agent,

Shareholders' Servicing Agent,

Transfer Agent

Ultimus Fund Solutions, LLC

Sub-Administrator

Premier Fund Solutions, Inc. |

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

Distributor

Rafferty Capital Markets, LLC |

This report is provided for the general information of the shareholders of the Walthausen Small Cap Value Fund. This report is not intended for distribution to prospective investors in the Fund, unless preceded or accompanied by an effective prospectus.

WALTHAUSEN SMALL CAP VALUE FUND

2691 Route 9, Suite 102

Malta, NY 12020

WALTHAUSEN FOCUSED SMALL CAP VALUE FUND

INSTITUTIONAL CLASS TICKER WSVIX

For Investors Seeking Long-Term Capital Appreciation

SEMI-ANNUAL REPORT

July 31, 2021

Walthausen Focused Small Cap Value Fund

Semi-Annual Report

July 31, 2021 |

Dear Fellow Shareholders,

The last few months have been a dynamic time in equity markets as investors start to think of a post pandemic world. We have been pleased with how the Fund has performed on both an absolute and relative basis. There has also been a change at Walthausen & Co., the adviser to the Fund. At the end of July, our Founder, John Walthausen retired. After founding the firm in 2007, and establishing an enduring process and team, John felt it was time to hand over the reins to Gerry Heffernan and DeForest Hinman. Their experience with the Advisor has provided a smooth transition. Gerry has co-managed the Fund since March 2018 and DeForest has co-managed the Fund since May 2021. Additionally, Gerry and DeForest have served as portfolio managers of the Advisor for three years and one year, respectively. While shareholders should expect the same quality of professional investing that you are accustomed to, you will see some changes going forward. We believe the future of active management is being more active. You should expect to see Walthausen & Co be more active in our commentary and discussion in public forums.

As we position the portfolio for the remainder of 2021 and 2022, we have been spending a large amount of time discussing the following topics with company management teams:

Inflation. Almost every management team we talk to is facing inflation. They are not using the “transitory” term. Labor inflation is real and we are seeing companies take pay levels higher to improve inbound candidates and improve retention. Raw material price inflation is coming in a variety of areas. When looking at these factors we have been asking management teams about their ability to pass on pricing increases to customers. In most cases, companies are able to pass on increased pricing. In some instances, they are taking pricing in excess of the raw material increases and this will improve the forward margin outlook.

Interest Rates. The Federal Reserve has been weighing raising interest rates for some time. The pandemic has led to a clouded view of actual economic activity. Given the current interest rate levels, we believe it is not a matter of if, but is a matter of when rates will rise. Given our discussions with management teams, interest rates need to move higher sooner rather than later. When looking at the Fund’s non-bank names, we have been pleased with companies’ ability to take advantage of the low interest rate environment by extending debt maturities and lowering interest rates, which will benefit shareholders for many years. When looking at bank names, valuations remain suppressed and we have a situation where deposit levels are elevated and spreads are compressed. The Fund’s bank holdings should see a spread benefit from rising interest rates and have ample deposits to deploy as new loans.

Balance sheet positioning/capital deployments. Many management teams found themselves in a capital preservation and deleverage mode during the pandemic. As vaccine deployment increased, and the economic outlook improved, many of the Fund’s companies found themselves in a very strong capital position; in some instances, net cash balance sheets. In our discussions, we are seeing a good balance of opportunities for organic capital deployment, share repurchases, and bolt on acquisitions. When talking about acquisitions, we are hearing that deals that would have closed in 2020 and 2021 were delayed due to the pandemic, causing delays in due diligence process. As the environment becomes more normalized, we expect that accretive deal activity will be increasing. We also feel that potential changes to capital gains taxes and estate taxes by the Biden Administration will make private sellers more willing to complete transactions.

Supply chain issues. Similar to the experience of the Great Financial Crisis, the US supply chain went into cash harvest mode, and the supply chain became very slack as a result.

2021 Semi-Annual Report 1

History repeated as demand snapped back much faster than companies expected. This has led to the supply chain struggling to keep up. Supply chains into Asia are going to be the most impacted as shipping companies are operating all available vessels, and container availability is tight. Port congestion remains high. We do not see these factors abating until 2022. We are finding that companies that are further vertically integrated and have less exposure to foreign supply chains are in a position to gain share in the current market environment. Generally, current Fund securities do not have meaningful exposure to foreign supply chains, and we own companies that are assisting/benefiting from relieving supply chain pressures (shipping, logistics, distribution, chip manufacturing and testing equipment).

Our performance in the first half of the fiscal year was encouraging with the Fund outperforming the Russell 2000 Value Index with a return of 19.63% compared to the benchmark return of 16.05% . Reviewing attribution reports, we see all of our outperformance coming from stock selection. It was also satisfying to see that stock selection was additive in most sectors. The biggest drag on performance was the Financial sector, which we feel strongly about and believe our names are attractively valued and positioned to execute well given our interest rate outlook.

As we look to the remainder of the year, we feel the Fund’s portfolio is well positioned to take advantage of the current environment. If you have additional questions regarding Walthausen & Co. please feel free to contact Gerry directly at 518-348-7221 or DeForest directly 518-348-7216.

Sincerely,

Gerry S.E. Heffernan CFA

DeForest R. Hinman

Past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-925-8428.

The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read and considered carefully before investing. To obtain a copy of the Fund’s prospectus, please visit our website at www.walthausenfunds.com or call 1-888-925-8428 and a copy will be sent to you free of charge. Distributed by Rafferty Capital Markets, LLC - Garden City, NY 11530.

2021 Semi-Annual Report 2

WALTHAUSEN FOCUSED SMALL CAP VALUE FUND (Unaudited) PERFORMANCE INFORMATION

7/31/2021 Institutional Class NAV $14.08

AVERAGE ANNUAL RATE OF RETURN (%) FOR THE PERIODS ENDED JULY 31, 2021

| 1 Year(A) | 3 Years(A) | 5 Years(A) | 10 Years(A) |

| Walthausen Focused Small Cap Value Fund | 50.58% | 7.82% | 11.05% | 10.99% |

| Russell 2000® Value Index(B) | 63.70% | 8.30% | 11.61% | 10.82% |

| Russell 2500® Value Index(C) | 56.14% | 9.34% | 10.97% | 11.19% |

Annual Fund Operating Expense Ratios (from 6/1/2021 Prospectus): Gross 1.05%, Net 0.85%

The Advisor reimbursed and/or waived certain expenses of the Fund’s Institutional Class. Absent these arrangements, the performance of the Class would have been lower.

The Fund’s expense ratio for the fiscal year ended July 31, 2021 can be found in the financial highlights included in this report.

The Annual Fund Operating Expense Ratios reported above may not correlate to the expense ratios in the Fund’s financial highlights because the financial highlights include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in acquired funds.

(A)1 Year, 3 Years, 5 Years and 10 Years returns include changes in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Walthausen Focused Small Cap Value Fund was December 27, 2010.

(B)The Russell 2000® Value Index (whose composition is different from that of the Fund) is an unmanaged index of small-capitalization stocks with lower price-to-book ratios and lower forecasted growth values than the total population of small-capitalization stocks. Investors cannot directly invest in an index.

(C)The Russell 2500® Value Index (whose composition is different from that of the Fund) measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. The Index is constructed to provide a comprehensive and unbiased barometer of the small to mid-cap value market. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small to mid-cap opportunity set and that the represented companies continue to reflect value characteristics. Investors cannot directly invest in an index.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH-END, PLEASE CALL 1-888-925-8428. THE FUND’S DISTRIBUTOR IS RAFFERTY CAPITAL MARKETS, LLC.

2021 Semi-Annual Report 3

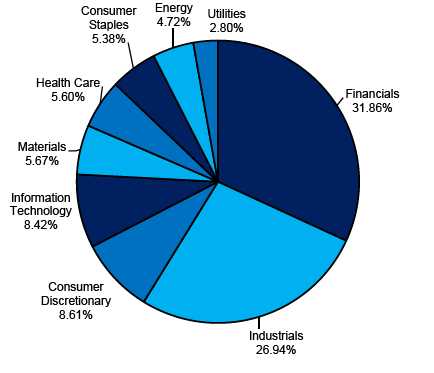

WALTHAUSEN FOCUSED SMALL CAP VALUE FUND (Unaudited)

WALTHAUSEN FOCUSED SMALL CAP VALUE FUND

by Sectors as of July 31, 2021

(as a percentage of Common Stocks)

Availability of Quarterly Schedule of Investments

The Fund publicly files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at http://www.sec.gov.

Walthausen & Co., LLC, the Fund’s investment advisor (“Advisor”), is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Advisor in fulfilling this responsibility is available without charge on the Fund’s website at www.walthausenfunds.com. It is also included in the Fund’s Statement of Additional Information, which is available on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies, Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30th, is available without charge, upon request, by calling our toll free number (1-888-925-8428). This information is also available on the SEC’s website at http://www.sec.gov.

2021 Semi-Annual Report 4

EXPENSE EXAMPLE

(Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs such as IRA maintenance fees, and (2) ongoing costs, including management fees, service fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested in the Fund on February 1, 2021 and held through July 31, 2021.

Actual Expenses

The first line of each table below provides information about actual account values and actual expenses. Additionally, although the Fund charges no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Ultimus Fund Solutions, LLC, the Fund’s transfer agent. You will be charged an annual maintenance fee of $15 for each tax deferred account you have with the Fund (“IRA maintenance fees”). To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example. The example includes management fees, service fees and other Fund expenses. However, the example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as IRA maintenance fees described above or expenses of underlying funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account Value | Account Value | February 1, 2021 |

| | February 1, 2021 | July 31, 2021 | to July 31, 2021 |

| |

| Actual | $1,000.00 | $1,196.26 | $4.63 |

| |

| Hypothetical | $1,000.00 | $1,020.58 | $4.26 |

| (5% annual return | | | |

| before expenses) | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.85%, multiplied by the aver- age account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| |

2021 Semi-Annual Report 5

| Walthausen Focused Small Cap Value Fund | | |

|

|

| | | | Schedule of Investments | |

| | | | July 31, 2021 (Unaudited) | |

|

| Shares | | | Fair Value | % of Net Assets | |

| COMMON STOCKS | | | | |

| Apparel & Other Finished Prods Of Fabrics & Similar Material | | | | |

| 13,850 | G-III Apparel Group, LTD. * | $ | 413,561 | 3.22 | % |

| Arrangement of Transportation of Freight & Cargo | | | | |

| 5,810 | Hub Group, Inc. - Class A * | | 385,087 | 3.00 | % |

| Crude Petroleum & Natural Gas | | | | |

| 6,270 | Chesapeake Energy Corporation | | 338,894 | 2.64 | % |

| Electric & Other Services Combined | | | | |

| 5,550 | NorthWestern Corporation | | 344,045 | 2.68 | % |

| Electrical Work | | | | |

| 2,570 | EMCOR Group, Inc. | | 313,052 | 2.44 | % |

| Fire, Marine & Casualty Insurance | | | | |

| 6,880 | AXIS Capital Holdings Limited (Bermuda) | | 349,986 | 2.73 | % |

| Heavy Construction Other than Building Construction - Contractors | | | | |

| 10,270 | Granite Construction Incorporated | | 394,573 | 3.08 | % |

| Life Insurance | | | | | |

| 1,550 | Primerica, Inc. | | 226,641 | 1.77 | % |

| Measuring & Controlling Devices, NEC | | | | |

| 3,360 | Onto Innovation Inc. * | | 235,468 | 1.84 | % |

| Metal Minning | | | | | |

| 22,750 | Cleveland-Cliffs Inc. * | | 568,750 | 4.44 | % |

| Miscellaneous Products of Petroleum & Coal | | | | |

| 4,230 | Valvoline Inc. | | 129,776 | 1.01 | % |

| Mobile Homes | | | | | |

| 1,520 | Cavco Industries, Inc. * | | 357,200 | 2.79 | % |

| Motor Vehicle Parts & Accessories | | | | |

| 1,980 | LCI Industries | | 288,724 | 2.25 | % |

| National Commercial Banks | | | | |

| 9,430 | PacWest Bancorp | | 375,503 | | |

| 7,310 | Webster Financial Corporation | | 351,611 | | |

| 11,330 | WesBanco, Inc. | | 365,732 | | |

| 8,090 | WSFS Financial Corporation | | 354,180 | | |

| | | | 1,447,026 | 11.28 | % |

| Poultry Slaughtering and Processing | | | | |

| 1,698 | Sanderson Farms, Inc. | | 317,254 | 2.47 | % |

| Pumps & Pumping Equipment | | | | |

| 2,870 | ITT Inc. | | 281,002 | 2.19 | % |

| Rolling Drawing & Extruding of Nonferrous Metals | | | | |

| 5,810 | Mueller Industries, Inc. | | 252,154 | 1.97 | % |

| Savings Institution, Federally Chartered | | | | |

| 17,550 | Eastern Bankshares, Inc. | | 320,287 | 2.50 | % |

| Services - Auto Rental & Leasing (No Drivers) | | | | |

| 5,210 | Ryder System, Inc. | | 396,742 | 3.09 | % |

| Services - Business Services, NEC | | | | |

| 2,620 | Concentrix Corporation * | | 428,973 | | |

| 4,180 | MAXIMUS, Inc. | | 372,020 | | |

| | | | 800,993 | 6.25 | % |

| Services - Equipment Rental & Leasing, NEC | | | | |

| 3,240 | McGrath RentCorp | | 254,081 | | |

| 6,150 | Triton International Limited (Bermuda) | | 324,659 | | |

| | | | 578,740 | 4.51 | % |

| Services - Hospitals | | | | |

| 4,620 | Encompass Health Corporation | | 384,615 | 3.00 | % |

* Non-Income Producing Securities.

The accompanying notes are an integral part of these financial statements.

2021 Semi-Annual Report 6

| Walthausen Focused Small Cap Value Fund | | |

|

| | | | Schedule of Investments | |

| | | | July 31, 2021 (Unaudited) | |

| Shares | | | Fair Value | % of Net Assets | |

| COMMON STOCKS | | | | |

| State Commercial Banks | | | | |

| 8,780 | Columbia Banking System, Inc. | $ | 306,773 | | |

| 8,410 | Hancock Whitney Corporation | | 367,601 | | |

| 4,880 | Independent Bank Corp. | | 344,918 | | |

| 4,670 | Independent Bank Group, Inc. | | 325,499 | | |

| | | | 1,344,791 | 10.49 | % |

| Surgical & Medical Instruments & Apparatus | | | | |

| 4,360 | Merit Medical Systems, Inc. * | | 305,592 | 2.38 | % |

| Title Insurance | | | | | |

| 3,460 | First American Financial Corporation | | 232,893 | 1.82 | % |

| Water Transportation | | | | |

| 6,630 | Kirby Corporation * | | 383,943 | 2.99 | % |

| Wholesale - Farm Product Raw Materials | | | | |

| 84 | Seaboard Corporation | | 345,240 | 2.69 | % |

| Wholesale - Lumber & Other Construction Materials | | | | |

| 6,150 | Beacon Roofing Supply, Inc. * | | 328,902 | 2.56 | % |

| Wholesale - Petroleum & Petroleum Products (No Bulk Stations) | | | | |