UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

(Mark One)

o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR | |

|

|

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR | |

|

|

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR | |

|

|

o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

Commission file number: 001-33840

WSP HOLDINGS LIMITED |

(Exact Name of Registrant as Specified in Its Charter) |

|

N/A |

(Translation of Registrant’s Name Into English) |

|

Cayman Islands |

(Jurisdiction of Incorporation or Organization) |

|

No. 38 Zhujiang Road Xinqu, Wuxi Jiangsu Province People’s Republic of China |

(Address of Principal Executive Offices) |

|

Choon-Hoi Then WSP Holdings Limited No. 38 Zhujiang Road Xinqu, Wuxi Jiangsu Province People’s Republic of China Phone: 510-8536-0401 Email: info@wsphl.com |

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

| Name of exchange on which each class is to be |

American Depositary Shares, each representing ten ordinary shares, par value $0.0001 per share |

| New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None |

(Title of Class) |

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| 204,375,226 ordinary shares, par value $0.0001 per share, as of December 31, 2012. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

o Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o |

| Accelerated filer o |

| Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP x |

| International Financial Reporting Standards as issued |

| Other o |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

|

| Page |

| 1 | |

| 2 | |

2 | ||

2 | ||

2 | ||

25 | ||

43 | ||

43 | ||

67 | ||

76 | ||

77 | ||

80 | ||

81 | ||

91 | ||

93 | ||

| 94 | |

94 | ||

Material Modifications to the Rights of Security Holders and Use of Proceeds | 94 | |

94 | ||

95 | ||

95 | ||

95 | ||

96 | ||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 96 | |

96 | ||

96 | ||

| 97 | |

97 | ||

97 | ||

97 |

Unless the context otherwise requires, in this annual report on Form 20-F,

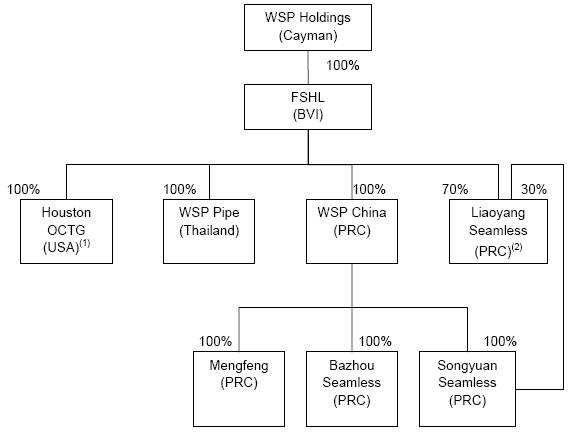

· “we,” “us,” “our company,” “our” or “WSP Holdings” refers to WSP Holdings Limited, which, unless otherwise required under the context, includes its predecessor entities and its consolidated subsidiaries;

· “ADSs” refers to our American depositary shares, each representing ten ordinary shares;

· “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report on Form 20-F only, Taiwan, and the special administrative regions of Hong Kong and Macau;

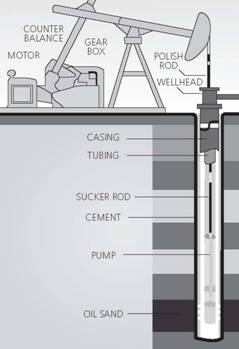

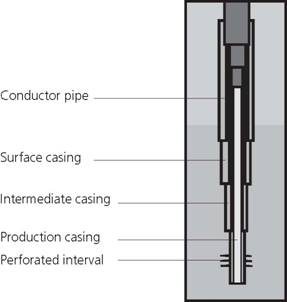

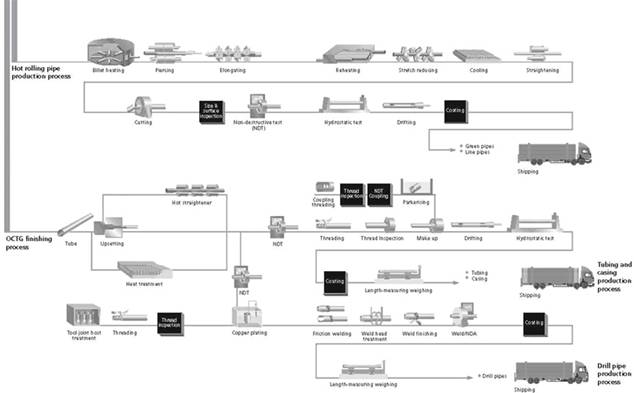

· “Oil Country Tubular Goods,” or “OCTG,” refers to pipes and other tubular products used in the exploration, drilling and extraction of oil, gas and other hydrocarbon products. OCTG mainly consist of casing, tubing and drill pipes. Unless otherwise indicated, discussions relating to OCTG in this annual report on Form 20-F are limited to these three types of OCTG;

· “Production capacity” refers to the maximum production capacity that can be achieved at the optimal level of operations of a production line, calculated using an estimated product mix for such production line, which may differ from its actual product mix;

· “RMB” or “Renminbi” refers to the legal currency of China, “HK$” refers to the legal currency of Hong Kong, and “$,” “US$” or “U.S. dollars” refers to the legal currency of the United States; and

· “shares” or “ordinary shares” refers to our ordinary shares, par value $0.0001 per share.

Names of certain companies provided in this annual report are translated or transliterated from their original Chinese legal names.

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report on Form 20-F includes our audited consolidated financial statements for the years ended December 31, 2010, 2011 and 2012.

We use U.S. dollars as the reporting currency in our financial statements and in this annual report. When reporting our operating results and financial position, we use the monthly average exchange rate for the year and the exchange rate at the balance sheet date, respectively, as published by the People’s Bank of China. With respect to amounts not recorded in our consolidated financial statements included elsewhere in this annual report, all translations of Renminbi into U.S. dollars were made at RMB6.2301 to $1.00, the noon buying rate on December 31, 2012 as set forth in the H.10 statistical release of the U.S. Federal Reserve Board. We make no representation that the Renminbi or U.S. dollar amounts in this annual report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. See “Item 3. Key Information—D. Risk Factors—Risks related to doing business in China—Fluctuations in exchange rates could adversely affect our business as well as result in foreign currency exchange losses.” On November 8, 2013, the noon buying rate was RMB6.0903 to $1.00.

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

A. Selected Financial Data

The following selected consolidated financial data should be read in conjunction with our consolidated financial statements and notes to those consolidated financial statements included elsewhere in this annual report and “Item 5. Operating and Financial Review and Prospects.” The selected consolidated statement of operations data for the years ended December 31, 2010, 2011 and 2012 and the selected consolidated balance sheet data as of December 31, 2011 and 2012 are derived from our audited consolidated financial statements, which are included elsewhere in this annual report. The selected consolidated statement of operations data for the years ended December 31, 2008 and 2009 and the selected consolidated balance sheet data as of December 31, 2008, 2009 and 2010 are derived from our audited consolidated financial statements, which are not included in this annual report. Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our historical results do not necessarily indicate our results expected for any future periods.

|

| For the year ended December 31, |

| |||||||||||||

(in thousands, except for share |

| 2008 |

| 2009 |

| 2010 |

| 2011 |

| 2012 |

| |||||

Selected Consolidated Income Statement Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

Net revenues |

| $ | 912,090 |

| $ | 577,029 |

| $ | 470,465 |

| $ | 686,125 |

| $ | 561,297 |

|

Cost of revenues |

| (703,531 | ) | (496,656 | ) | (467,400 | ) | (637,615 | ) | (536,823 | ) | |||||

Gross profit |

| 208,559 |

| 80,373 |

| 3,065 |

| 48,510 |

| 24,474 |

| |||||

Selling and marketing expenses |

| (22,770 | ) | (18,244 | ) | (20,841 | ) | (34,486 | ) | (17,192 | ) | |||||

General and administrative expenses |

| (41,740 | ) | (44,798 | ) | (67,008 | ) | (61,774 | ) | (78,146 | ) | |||||

Impairment of long-lived assets |

| — |

| — |

| (17,055 | ) | — |

| — |

| |||||

—Gain on disposal of subsidiary |

| — |

| — |

| — |

| 3,268 |

| 2,512 |

| |||||

Other operating income, net |

| 2,589 |

| 2,559 |

| 5,446 |

| 2,777 |

| 6,190 |

| |||||

Income (loss) from operations |

| 146,638 |

| 19,890 |

| (96,393 | ) | (41,705 | ) | (62,162 | ) | |||||

Interest income (expense), net |

| (15,319 | ) | (17,026 | ) | (26,043 | ) | (30,609 | ) | (36,624 | ) | |||||

Other income |

| 767 |

| 767 |

| 767 |

| 767 |

| 64 |

| |||||

Exchange differences |

| (6,984 | ) | 218 |

| (1,484 | ) | (5,144 | ) | 2,676 |

| |||||

Income (loss) from continuing operations before provision for income taxes |

| 125,102 |

| 3,849 |

| (123,153 | ) | (76,691 | ) | (96,046 | ) | |||||

Provision for (benefit from) income taxes |

| (24,405 | ) | (2,137 | ) | (9,388 | ) | (99 | ) | 6,131 |

| |||||

Net income (loss) from continuing operations before earnings in equity investments |

| 100,697 |

| 1,712 |

| (132,541 | ) | (76,790 | ) | (89,915 | ) | |||||

Loss (earnings) in equity investments |

| 1 |

| (105 | ) | (211 | ) | (10 | ) | 44 |

| |||||

Net income (loss) from continuing operations |

| 100,698 |

| 1,607 |

| (132,752 | ) | (76,800 | ) | (89,871 | ) | |||||

Net income (expense) from discontinued operations |

| — |

| — |

| — |

| — |

|

|

| |||||

Net income (loss) |

| 100,698 |

| 1,607 |

| (132,752 | ) | (76,800 | ) | (89,871 | ) | |||||

Less: Net income (loss) attributable to the non-controlling interests |

| (1,349 | ) | 2,568 |

| 13,989 |

| 8,320 |

| 5,686 |

| |||||

Net income (loss) attributable to WSP Holdings Limited |

| $ | 99,349 |

| $ | 4,175 |

| $ | (118,763 | ) | $ | (68,480 | ) | $ | (84,185 | ) |

Net income (loss) per share—basic |

|

|

|

|

|

|

|

|

|

|

| |||||

Net income (loss) from continuing operations |

| $ | 0.48 |

| $ | 0.02 |

| $ | (0.58 | ) | $ | (0.34 | ) | $ | (0.41 | ) |

Loss on discontinued operations |

| — |

| — |

| — |

| — |

|

|

| |||||

Net income (loss) per share |

| $ | 0.48 |

| $ | 0.02 |

| $ | (0.58 | ) | $ | (0.34 | ) | $ | (0.41 | ) |

Net income (loss) per share—diluted |

|

|

|

|

|

|

|

|

|

|

| |||||

Net income (loss) from continuing operations |

| $ | 0.48 |

| $ | 0.02 |

| $ | (0.58 | ) | $ | (0.34 | ) | $ | (0.41 | ) |

Loss on discontinued operations |

| — |

| — |

| — |

| — |

|

|

| |||||

Net income (loss) per share |

| $ | 0.48 |

| $ | 0.02 |

| $ | (0.58 | ) | $ | (0.34 | ) | $ | (0.41 | ) |

Weighted average ordinary shares used in computation of earnings per share: |

|

|

|

|

|

|

|

|

|

|

| |||||

Basic |

| 205,663,247 |

| 205,789,800 |

| 204,771,144 |

| 204,375,226 |

| 204,375,226 |

| |||||

Diluted |

| 205,663,247 |

| 205,789,800 |

| 204,771,144 |

| 204,375,226 |

| 204,375,226 |

| |||||

The following table presents a summary of our consolidated balance sheet data as of December 31, 2008, 2009, 2010, 2011 and 2012:

|

| As of December 31, |

| |||||||||||||

(in thousands) |

| 2008 |

| 2009 |

| 2010 |

| 2011 |

| 2012 |

| |||||

Consolidated balance sheet data |

|

|

|

|

|

|

|

|

|

|

| |||||

Cash and cash equivalents |

| $ | 89,097 |

| $ | 133,250 |

| $ | 48,688 |

| $ | 27,742 |

| $ | 26,105 |

|

Restricted cash |

| 231,988 |

| 205,613 |

| 142,027 |

| 249,812 |

| 206,802 |

| |||||

Accounts and bills receivable, net of allowance for doubtful accounts |

| 246,463 |

| 204,906 |

| 199,970 |

| 260,139 |

| 217,030 |

| |||||

Advances to suppliers |

| 15,049 |

| 23,514 |

| 17,123 |

| 19,229 |

| 25,866 |

| |||||

Inventories |

| 311,383 |

| 266,090 |

| 240,713 |

| 242,240 |

| 205,229 |

| |||||

Total current assets |

| 919,931 |

| 870,166 |

| 692,435 |

| 866,562 |

| 732,431 |

| |||||

Property and equipment, net |

| 313,936 |

| 407,052 |

| 536,942 |

| 653,783 |

| 597,619 |

| |||||

Intangible assets, net |

| 136 |

| 971 |

| 244 |

| 108 |

| 96 |

| |||||

Total assets |

| $ | 1,310,611 |

| $ | 1,394,394 |

| $ | 1,331,062 |

| $ | 1,571,116 |

| $ | 1,390,322 |

|

Accounts payable |

| $ | 344,817 |

| $ | 162,557 |

| $ | 176,379 |

| $ | 307,740 |

| $ | 332,107 |

|

Borrowings—due within one year |

| 337,438 |

| 506,448 |

| 596,546 |

| 773,541 |

| 786,987 |

| |||||

Total current liabilities |

| 796,135 |

| 764,428 |

| 877,956 |

| 1,245,000 |

| 1,205,972 |

| |||||

Total liabilities |

| 808,616 |

| 960,082 |

| 1,028,287 |

| 1,339,734 |

| 1,237,928 |

| |||||

Total WSP Holdings Limited shareholders’ equity |

| 482,606 |

| 410,738 |

| 297,031 |

| 238,873 |

| 151,154 |

| |||||

Non-controlling interest |

| 19,389 |

| 23,574 |

| 5,744 |

| (2,491 | ) | 1,240 |

| |||||

Total equity |

| 501,995 |

| 434,312 |

| 302,775 |

| 231,382 |

| 152,394 |

| |||||

Total liabilities and equity |

| $ | 1,310,611 |

| $ | 1,394,394 |

| $ | 1,331,062 |

| $ | 1,571,116 |

| $ | 1,390,322 |

|

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

Risks related to our business

Our financial statements indicate that we have a going concern uncertainty, which could adversely affect our ability to meet our ongoing financing needs and obtain third party financing.

We have suffered significant operating losses, working capital deficiencies and negative operating cash flow, and a significant amount of our short-term borrowings needs to be refinanced. In addition, starting in 2009, we experienced a significant decline in sales in the United States due to the anti-dumping and countervailing duties on seamless pipes made in China, which resulted in low utilization of our production capacity. Additionally, in connection with the global credit and economic crisis in the past few years, some of our customers experienced reductions in cash flows and availability of credit and increased costs of borrowing due to tightening of the credit markets, which had significant adverse effects on the their financial conditions. This may result in project modifications, delays or cancellations, general business disruptions, and delays in, or nonpayment of, amounts that are owed to us, which could have a significant adverse effect on our results of operations and cash flows. Moreover, because we depend on a limited number of customers, any decline in our major customers’ businesses could lead to a decline in purchase orders from these customers and materially and adversely affect our business, results of operations and financial condition.

We rely largely on operating cash flow and short-term borrowings for the working capital needs of our operations. As of December 31, 2012, our total bank and other borrowings amounted to $802.9 million, of which $787.0 million were short-term bank borrowings. Our substantial indebtedness could have important consequences to our investors. For example, it could:

· limit our ability to satisfy our obligations under our debt;

· increase our vulnerability to adverse general economic and industry conditions;

· require us to dedicate a substantial portion of our cash flow from operations to servicing and repaying our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes;

· limit our flexibility in planning for or reacting to changes in our businesses and the industry in which we operate;

· place us at a competitive disadvantage compared to our competitors that have less debt;

· impair our ability to develop business opportunities or make strategic acquisitions; and

· increase the cost of additional financing.

In addition, our facility agreements with certain commercial banks contain various covenants. A failure to maintain the financial covenants, or a breach of any of the other restrictive covenants, would result in a default under the relevant facility agreements. If the lender accelerates the repayment of borrowings, we may not have sufficient cash or assets to repay the loans under the facility agreements. The existence of these conditions may raise the issue about our ability to continue as a going concern. We cannot assure you that our business will generate sufficient cash flow from operations in the future to service our debts and make necessary capital expenditures, in which case we may (i) seek additional financing, (ii) seek to refinance some or all of our debts or (iii) dispose of certain assets. See “—Restrictive covenants under our facility agreements and any future indebtedness may limit the manner in which we operate and an event of default under any of our facility agreements and any future indebtedness may adversely affect our operations; and our financial leverage may hinder our ability to expand and materially affect our results of operations.” and “—We and our subsidiaries have been in breach of certain financial covenants under certain loan agreements, which, if not managed carefully, may trigger events of default and accelerated payment and adversely affect our business, financial condition and results of operations.” Additionally, in 2012 and 2013 we also obtained high interest loans from non-commercial lenders. These loans typically had durations of no longer than seven days and annualized interest rates of approximately 90%. We paid interest of approximately RMB4.4 million ($0.7 million) and RMB2.7 million ($0.4 million) on these high interest loans in the year ended December 31, 2012 and the nine months ended September 30, 2013. If we are forced to place more reliance on these types of high interest loans in the future as sources of financing, our business and results of operations may be materially and adversely affected.

The existence of a going concern uncertainty could affect our ability to obtain financing from third parties or could result in increased costs of such financing. See our financial statements included in this annual report for more details. Although we believe that we will be able to renew a substantial portion of our bank borrowings and bank credit facilities when they fall due, any additional financing may not be available in the amounts we need or on terms acceptable to us, if at all. The incurrence of debt would divert cash for working capital and capital expenditures to service debt obligations and could result in operating and financial covenants that restrict our operations and our ability to pay dividends to our shareholders. We may not be able to refinance some or all of our existing facilities on commercially reasonable terms and in a timely manner. Our ability to refinance existing facilities and borrow additional funds is affected by a variety of factors, including (i) limitations imposed on us under the financing agreements that contain restrictive covenants and borrowing conditions that may limit our ability to raise additional debt, (ii) the decline in liquidity in the credit markets, (iii) prevailing interest rates, (iv) the strength of the lenders from whom we borrow, and (v) changes in the PRC government’s policies in connection with commercial loans. An event of default, any material negative change of our operation and financial conditions, an adverse action by a regulatory authority or a general deterioration in the economy that constricts the availability of credit may increase our cost of funds and make it difficult for us to renew existing credit facilities and obtain new loans. In the event that we are unable to meet our liabilities when they become due or if our creditors take legal actions against us for payment, we may have to liquidate long-term assets to repay our creditors. We may have difficulty converting our long-term assets into current assets in such a situation and may suffer material losses upon the sale of our long-term assets.

Restrictive covenants under our facility agreements and any future indebtedness may limit the manner in which we operate and an event of default under any of our facility agreements and any future indebtedness may adversely affect our operations; and our financial leverage may hinder our ability to expand and materially affect our results of operations.

Our facility agreements with certain commercial banks contain, and any future indebtedness we incur may contain, various covenants and conditions that limit our ability to, among other things:

· incur or guarantee additional debt;

· secure loans, make capital expenditures or engage in investments and acquisitions;

· enter into transactions with affiliates;

· create liens;

· announce cash dividends;

· make major investments;

· merge or consolidate with other companies, implement any divesture, reorganization, restructuring, discontinuance of business, receivership, bankruptcy, dissolution or other similar proceedings; and

· dispose of, lease, transfer or sell more than 10% of our assets.

As a result of these covenants, we are limited in the manner in which we conduct our business and may be unable to engage in certain business activities. Some of the facility agreements also include certain financial covenants including, but not limited to, specified financial ratios that we must comply over the term of the borrowings. In August 2011, one of our subsidiaries entered into a syndicated bank credit facility agreement with two major lead commercial banks and six other participating commercial banks that provided us with a syndicated bank credit facility of up to RMB3.5 billion, with an initial commitment of RMB2.86 billion for a term up to three years from the first drawdown date. This agreement contains financial covenants applicable to one of our major subsidiaries, including maintenance of debt to asset ratio not exceeding 72% in 2011, 71% in 2012 and 67% in 2013, minimum sales of RMB4 billion in 2011, RMB4.5 billion ($722.3 million) in 2012 and RMB5.5 billion ($882.8 million) in 2013, minimum net income of RMB80 million in 2011, RMB150 million ($24.1 million) in 2012 and RMB350 million ($56.2 million) in 2013, minimum current ratios of 170% in 2011, 180% in 2012 and 180% in 2013, and minimum quick ratios of 120% in 2011, 130% in 2012 and 130% in 2013. Additionally, we must also meet certain ratios and thresholds at the end of a one-year special observation period from July 1, 2011 to June 30, 2012. These ratios and thresholds include maximum debt to asset ratio of 70%, minimum sales of RMB4.2 billion ($674.1 million), minimum net income of RMB100 million ($16.1 million), minimum current ratio of 170% and minimum quick ratio of 120%.

A failure to maintain the financial covenants, or a breach of any of the other restrictive covenants, would result in a default under the relevant facility agreements. Upon the occurrence of any default under any of the facility agreements, the lender could elect to declare all borrowings outstanding, together with accrued and unpaid interests and fees, to be due and payable, or could require us to apply all of our available cash to repay these borrowings. If the lender accelerates the repayment of borrowings, we may not have sufficient cash or assets to repay the loans under the facility agreements. Even if we are able to obtain new financing, we may not be on commercially reasonable terms, or terms that are acceptable to us. Our failure to comply with the financial or other covenants under our facility agreements could lead us to seek a waiver or an amendment of the covenants contained in the facility agreements, or alternative financing. Any waiver of the covenants in or amendment of the terms of our facility agreements may involve upfront fees, higher annual interest costs and other terms less favorable to us than those currently offered by the existing facilities. Additionally, we may not be able to obtain alternative financing on commercially reasonable terms or terms accepted to us, if at all. For example, we did not meet certain ratios and thresholds set forth in the financial covenants in our syndicated bank credit facility agreement for the year ended December 31, 2011, the special observation period from July 1, 2011 to June 30, 2012 and the year ended December 31, 2012. See “—We and our subsidiaries have been in breach of certain financial covenants under certain loan agreements, which, if not managed carefully, may trigger events of default and accelerated payment and adversely affect our business, financial condition and results of operations.”

We may not be able to comply with the covenants contained in our facility agreements in the future, and if we breach the covenants, we may not be able to obtain waivers for the breaches or obtain alternative financing at commercially reasonable terms. Furthermore, defaults under our existing facility agreements may result in cross-defaults under our other loans with banks in China. Such events of default may result in a substantial amount of our debt becoming immediately due, which would have a material adverse effect on our financial condition and results of operations. Our ability to make scheduled payments under our financing agreements and any future financing transactions and our ability to refinance our debts, if necessary, will depend, among other things, on our future operating performance. See above for a discussion on the risks regarding our ability to service our debt.

We and our subsidiaries have been in breach of certain financial covenants under certain loan agreements, which, if not managed carefully, may trigger events of default and accelerated payment and adversely affect our business, financial condition and results of operations.

In August 2011, one of our subsidiaries entered into a syndicated bank credit facility agreement with two major lead commercial banks and six other participating commercial banks that provided us with a syndicated bank credit facility of up to RMB3.5 billion, with an initial commitment of RMB2.86 billion for a term up to three years from the first drawdown date. This agreement contains financial covenants applicable to one of our major subsidiaries, including maintenance of debt to asset ratio not exceeding 72% in 2011, 71% in 2012 and 67% in 2013, minimum sales of RMB4 billion in 2011, RMB4.5 billion ($722.3 million) in 2012 and RMB5.5 billion ($882.8 million) in 2013, minimum net income of RMB80 million in 2011, RMB150 million ($24.1 million) in 2012 and RMB350 million ($56.2 million) in 2013, minimum current ratios of 170% in 2011, 180% in 2012 and 180% in 2013, and minimum quick ratios of 120% in 2011, 130% in 2012 and 130% in 2013. Additionally, we must also meet certain ratios and thresholds at the end of a one-year special observation period from July 1, 2011 to June 30, 2012. These ratios and thresholds also include maximum debt to asset ratio of 70%, minimum sales of RMB4.2 billion ($674.1 million), minimum net income of RMB100 million ($16.1 million), minimum current ratio of 170% and minimum quick ratio of 120%.

The subsidiary did not meet certain financial covenants under the syndicated loan facility agreement for the year ended December 31, 2011, the special observation period from July 1, 2011 to June 30, 2012 and the year ended December 31, 2012. In December 2012, the bank syndicate waived the past breaches of financial covenants during the observation period and agreed to continue to fulfill the terms of the syndicated loan facility. Additionally, we have informed the bank syndicate that we did not meet certain financial covenants for the year ended December 31, 2012. The bank syndicate held a review meeting and reached an agreement to waive the aforementioned breaches of financial covenants. The formal approval process within the bank syndicate is currently underway. However, the bank syndicate may not grant us a waiver for these breaches or any future breaches or noncompliance. Additionally, two of our other subsidiaries are also in breach of their financial covenants under project loans. Our lenders have not accelerated the repayment of these borrowings under the aforementioned credit facilities. Due to our breaches, we have classified our long-term loans under the syndicate loan facility and project loans from such banks into short-term loans due within one year. These two subsidiaries have entered into agreements with the lenders regarding the treatment and remedying of these breaches of financial covenants and the extension of the repayment schedules of these loans. However, if we have future breaches of financial covenants under these project loans and are unable to reach an agreement with our lenders, they may accelerate repayment of these loans and we may not be able to repay the loans, which would have a material and adverse effect on our financial condition, results of operations and business prospects. See the risk factor entitled “—Our financial statements indicate that we have a going concern uncertainty, which could adversely affect our ability to meet our ongoing financing needs and obtain third party financing.” Furthermore, accelerated payments and/or defaults under our existing facility agreements may result in cross-defaults or cross-accelerations under our other loans with banks in China, which would have a material adverse effect on our business, financial condition and results of operations.

Certain of our subsidiaries entered into bill financing arrangements and transactions which may not be and in certain cases were not in compliance with relevant PRC laws and regulations, and we cannot assure you that there will not be any legal or regulatory action taken against us which would result in material adverse effect on our business conditions and cash flows.

In the years ended December 31, 2010, 2011 and 2012 and to date in 2013, certain of our subsidiaries have used a portion of our credit facilities from certain banks as bill financing to fund a portion of our working capital requirements and business operational needs. These transactions may not be in compliance and in certain cases were not with relevant PRC laws and regulations.

Under their terms, the bill financing facilities should be used to finance trade purchases. However, we entered into certain bill financing arrangements where the amounts of bank and commercial acceptance notes drawn down on the banks under the facilities were greater than our real expectation of purchasing needs from suppliers, which included both our subsidiaries and third parties. Moreover, on some occasions, the same purchase contracts (required for the issuance of bank acceptance notes under the bill financing facilities) were presented to two or more different banks to obtain financing. A portion of the notes we issued to our subsidiaries and third-party suppliers were then presented by the relevant suppliers to the banks for collection of an amount equal to the face value of the notes after deducting interest. Cash received from the notes presented in excess of the actual amount of purchases was then provided to us and utilized for operational purposes.

These bill financing arrangements may not be in compliance with the general principles under the PRC Negotiable Instruments Law. We have sought legal advice from our PRC legal advisor regarding these bill financing arrangements. Considering the relevant factors including, in particular, that we have settled in the past these notes when they were due, and under the assumption that we are able to settle the outstanding notes when they become due, our PRC legal advisor subsequently issued a legal opinion stating that our bill financing arrangements in the years ended December 31, 2010, 2011 and 2012 would not result in any criminal or administrative liabilities on us or our senior management or directors, and there would not be any civil liabilities. The nature of our bill financing arrangements in the year ended December 31, 2012 has remained consistent with previous years. We have also obtained written confirmations from all of the endorsing banks that they will not take any legal action against us in connection with the bank and commercial acceptance notes that have been duly settled. We have settled all of the bank and commercial acceptance notes involved in the bill financing transactions in 2010, 2011 and 2012 that have become due. We expect to settle the notes from bill financing transactions that are outstanding on the date of this annual report when they become due. Although we have obtained the written confirmations from all of the endorsing banks that they will not take any legal action against us in connection with the bank and commercial acceptance notes that have been duly settled, the endorsing banks may legal action regarding notes that we have settled regardless due to unforeseen reasons and circumstances beyond our control.

In 2012, additionally, for purposes of raising financing from a number of commercial banks, Wuxi Seamless Oil Pipes Company Limited, or WSP China, Liaoyang Seamless Oil Pipes Co., Ltd., or Liaoyang Seamless, and Songyuan Seamless Oil Pipes Co., Ltd., or Songyuan Seamless, entered into a number of intragroup transactions, under which WSP China sold approximately RMB251 million ($40.1 million) worth of goods to Liaoyang Seamless, Liaoyang Seamless sold approximately RMB252 million ($40.3 million) of goods to Songyuan Seamless and Songyuan Seamless sold approximately RMB252 million ($40.3 million) of goods to WSP China. Official sales invoices were issued for these transactions. However, physical delivery of the underlying goods in these transactions did not occur. As these transactions were intragroup, they did not have an overall impact on our consolidated revenues and did not result in additional tax payable, although the PRC generally accepted accounting principles, or PRC GAAP, reports of each of these three respective individual entities would have reflected sales not supported by physical delivery of the underlying goods. These sales invoices allowed our subsidiaries to obtain additional bill financing from a number of commercial banks. Due to the nature of these transactions, these commercial banks may declare any of our borrowings to become immediately due and payable and terminate our credit facilities so that no additional borrowings can be obtained. If any of these borrowings become immediately due and payable, we may not have the means to repay them.

Our management has conducted an assessment, including obtaining PRC legal advice and testing the design and the effectiveness of our internal control over financial reporting as of December 31, 2012. This assessment identified a material weakness that these transactions occurred without proper approval and may not be in compliance and in certain cases were not compliant with relevant PRC laws and regulations, and therefore our internal controls have not been operating effectively. See “Item 15. Controls and Procedures — Management’s annual report on internal control over financial reporting.” In light of the current financial environment and our capital needs, we may continue to rely on such bill financing arrangements and continue to allow these borrowings relating to increased bills payable to remain until they are repaid upon maturity. Any actions by banks or regulators against us relating to these transactions could cause a disruption to our business operations and impact future financing arrangements with banks, which may have an adverse effect on our business conditions and cash flows. The banks may take legal action against us if we fail to settle outstanding bank and commercial acceptance notes when they become due, which may disrupt our business and impact our long-term relationships with the banks and future financing plans.

Declines in domestic and international oil and natural gas prices, or domestic and international exploration, drilling and production activities, would adversely affect our profitability.

Demand for our OCTG products depends significantly on the number of domestic and worldwide oil and gas wells drilled, completed and reworked, as well as the depth and drilling conditions of these wells. The level of such drilling activities in turn depends on the level of capital spending by major oil and gas companies. A decline in domestic and worldwide oil and gas exploration, drilling and production activities would adversely affect our results of operations. Capital spending on OCTG used for oil and natural gas exploration, drilling and production activities is driven in part by the prevailing prices for oil and natural gas and the perceived stability and sustainability of those prices. Although the prices of crude oil and natural gas rose in 2012, the global credit and economic crisis have in the past reduced worldwide demand for energy and resulted in significantly lower crude oil and natural gas prices. A substantial or extended decline in oil and natural gas prices can reduce our customers’ activities and their spending on our products. If the current global economic conditions and the availability of credit worsen or continue for an extended period, this could reduce our customers’ levels of expenditures and have a significant adverse effect on our revenue and operating results.

The reduction in cash flows being experienced by our customers resulting from declines in commodity prices, together with reduced availability of credit and increased costs of borrowing due to tightening of the credit markets, could have significant adverse effects on the financial conditions of some of our customers. This could result in project modifications, delays or cancellations, general business disruptions, and delays in, or nonpayment of, amounts that are owed to us, which could have a significant adverse effect on our results of operations and cash flows.

In addition, oil and natural gas prices are subject to significant volatility due to numerous factors beyond our control, including, but not limited to, changes in the supply and demand for oil and natural gas, market uncertainty, world events, regulatory control (including by the PRC government), political developments in petroleum producing regions and the price and availability of alternative energy sources. We cannot assure you that oil and natural gas prices will not decline further or that such prices will remain at sufficiently high levels to support levels of investment in exploration, drilling and production activities that will sustain demand for our products. Any further decline in the price of oil and natural gas, even for a short period of time, may reduce or curtail expenditures by oil and gas companies in connection with exploration, drilling and production activities, which may result in lower sales volumes and prices for our products in China and overseas and materially and adversely affect our results of operations and financial condition.

Our results of operations may be adversely affected by increases in raw material prices.

Steel is the principal raw material for our products. Cost for raw materials accounted for 73.4%, 78.3% and 77.5% of our cost of revenues in 2010, 2011 and 2012, respectively. Any increase in the price of steel could reduce our profit margin if we are unable to pass such increased costs on to our customers. From the end of 2003 to mid-2008, the price of steel increased substantially due in part to increasing demand, which significantly affected our gross margin. Since 2009, the price of steel has shown increasing volatility, although it exhibited a general upward trend through 2010 and the first half of 2011 before declining toward the end of 2011. We expect the volatility of price of steel to persist in the short to medium term. The price of steel has had, and will continue to have, a significant impact on our cost of revenues. If we are unable to manage our purchases of steel at prices acceptable to us or if the price of steel increase significantly and we are not able to pass on all or part of any such price increases to our customers, our profit margins may decrease and our results of operations would be materially and adversely affected.

Measures such as initiation of anti-dumping and anti-subsidy proceedings and imposition of anti-dumping and/or countervailing duties by governments in our overseas markets could materially and adversely affect our export sales.

Anti-dumping and anti-subsidy proceedings have been initiated by some countries in relation to steel products, resulting in anti-dumping and/or countervailing duties being imposed by those countries on steel products. Those and other similar measures could trigger trade disputes in the international steel product markets that could adversely affect our exports.

In April 2009, seven U.S. companies and the United Steelworkers Union filed a petition with the U.S. International Trade Commission, or the ITC, and the U.S. Department of Commerce, or the DOC, alleging that China-based OCTG manufacturers unfairly dumped OCTG products in the U.S. market and that Chinese producers were benefitting from massive government subsidies. WSP China was named as one of the major exporters of OCTG products from China. In June 2009, we were included as one of the mandatory respondent companies to the United States government’s countervailing duty investigation. On September 8, 2009, a preliminary determination was issued with a countervailing duty rate of 24.92% assigned to WSP China. On December 7, 2009, the DOC published its final determination in the countervailing duties investigation with a rate of 14.61% assigned to WSP China. The rate was subsequently changed to 14.95% in January 2010 due to certain ministerial errors made by the DOC. We were not selected as a mandatory respondent to the anti-dumping investigation and participated in this case as a separate rate respondent. In November 2009, we received a preliminary dumping rate of 36.53%, which was based on the average dumping rates of other OCTG producers that were selected as mandatory respondents. In December 2009, this rate was amended to 96.51% due to certain ministerial errors made by the DOC. On April 9, 2010, the DOC announced its final determination in the anti-dumping investigation with a rate of 29.94% assigned to WSP China. In May 2010, the ITC made a final ruling which requires all Chinese exports of OCTG products to the United States, including WSP China’s products, be subject up to approximately 32.07% of anti-dumping duties and 14.95% of countervailing duties. The anti-dumping and countervailing duties are applied to all Chinese exports of OCTG products to the United States starting from the date of the DOC’s preliminary determinations. WSP China has not exported OCTG products to the United States after the date of the DOC’s preliminary determinations. The anti-dumping and countervailing duties will apply to us if WSP China exports OCTG products to the United States in the future and we are not subject to any other penalties or fines. In 2010, 2011 and 2012, products sold to the United States by our subsidiaries accounted for 9.7%, 6.3% and 9.3% of our net revenues, respectively. The decrease in export revenue of products sold to the United States as a percentage of our net revenues mainly was attributable to the effect of anti-dumping and countervailing duties on the subject goods. As a result of the proceedings, our sales in the U.S. suffered and our results of operations have been materially and adversely affected.

Additionally, in 2012, we have identified an immaterial amount of goods originating from China that were incorrectly imported to the United States. We are presently repatriating the goods. We are unable to estimate the likelihood that legal liability will arise as a result of the incorrect importation of these goods, including any duties that may be imposed by regulators, or the amount of liability that we would incur should any legal proceedings take place.

There may be similar actions taken in the future in other countries against PRC-made seamless OCTG products. Any actions filed against us with respect to the products we sell, even without merit, may divert significant company resources and management attention, have an adverse impact on the prices and sales of our products in the relevant countries and adversely affect our business prospects and results of operations. If any decision is entered against us in such an action, we may be subject to additional tariff liabilities and our overseas sales may be materially and adversely affected. Additionally, in July 2013, nine US manufacturers sought anti-dumping and countervailing duty investigations on OCTG products from nine countries, including Thailand. In August 2013, the ITC announced that it had found reasonable grounds to pursue an anti-dumping case against the nine countries and that the DOC was investigating the matter. If anti-dumping duties are imposed on Thailand, our business in Thailand and the operations of WSP Pipe Company Limited, or WSP Pipe, may be significantly and adversely affected.

We depend on a limited number of customers, and any loss of these customers could materially and adversely affect our revenue and profitability.

Our customers include oil and gas companies in China and abroad. Aggregate sales attributable to our five largest customers represented approximately 46.5%, 69.5% and 63.8% of our net revenues for the years ended December 31, 2010, 2011 and 2012, respectively. We cannot assure you that we will be able to maintain or improve our relationships with these customers, or that we will be able to continue to supply products to these customers at current levels or at all. In addition, our business is affected by competition in the oil and gas industry, and any decline in our major customers’ businesses in these markets could lead to a decline in purchase orders from these customers. If any of our key customers were to substantially reduce the size or amount of the orders they place with us or were to terminate their business relationship with us entirely, we cannot assure you that we would be able to obtain orders from other customers to replace any such lost sales on comparable terms or at all. If any of these relationships were to be so altered and we were unable to obtain replacement orders, our business, results of operations and financial condition would be materially and adversely affected.

Our sales contracts typically have a term of less than six months and, as a result, customers may reduce their orders or terminate their relationships with us almost immediately.

Sales of our products are typically conducted through sales contracts with a term of less than six months. As a result, our customers may choose to terminate their relationship with us after completion of the shipment or expiration of the contract, as the case may be. Our customers are also not obligated to continue placing orders with us at historical levels or at all. If any of our customers, particularly our key customers, were to materially reduce their orders with us or were to terminate entirely their business relationship with us with short notice, we might not have sufficient time to locate alternative customers and our business and results of operations could be materially and adversely affected.

We cannot assure you that our products will pass periodic inspection by the American Petroleum Institute or the qualification processes of potential customers, and any failure by us to pass such inspection or qualifications would adversely affect our business prospects and results of operations.

We have obtained certificates from the American Petroleum Institute, or API, to use the official API monogram on our products to demonstrate that our products meet API standards. These certificates are subject to periodic inspections by API. Furthermore, our growth strategies include increasing our sales in the PRC domestic market, as well as expanding into international markets such as North America, South America, the Middle East, Asia, Africa and Russia. It is standard industry practice that an OCTG manufacturer must first pass a qualification process to become an approved supplier of an oil and gas company before providing OCTG products to that company. We cannot assure you that we will be able to obtain the necessary certifications from API or approvals for new products from our existing customers or approvals from any new customers. Even if we can ultimately secure such approvals or certifications, we cannot assure you that such certifications and approvals can be obtained in a timely manner or can be maintained. If we fail to become an approved supplier of our potential customers, or if we are unable to obtain or maintain such approval in a timely manner, we may not be able to execute our expansion plans and our business prospects and results of operations may be materially and adversely affected.

If we are unable to compete effectively in the OCTG industry, our revenues may decrease and losses may increase.

We face intense competition in the domestic and international markets in which we operate. Domestically, we face competition from a number of manufacturers that produce OCTG that are similar to ours. Our major domestic competitors include Tianjin Pipe (Group) Corporation, Shanghai Baosteel Group Corporation and Pangang Group Chengdu Iron & Steel Co., Ltd., which are mostly state-owned enterprises. We also face competition from international manufacturers, such as JFE Steel Corporation in Japan, US Steel in the United States, Tenaris in Argentina, Vallourec & Mannesmann Tubes in France, TMK in Russia and Sumitomo in Japan. Our major competitors may have longer operating history, larger customer base, stronger customer relationships, greater brand or name recognition and greater financial, technical, marketing and public relations resources than we do. Some of our competitors may also be better positioned to develop superior product features and technological innovations and be able to better adapt to market trends than we are.

Our ability to compete depends on, among other things, high product quality, short lead-time, timely delivery, competitive pricing, wide range of product offerings and superior customer service and support. Increased competition may require us to reduce our prices or increase our costs and may have a material adverse effect on our financial condition and results of operations. Any decrease in the quality of our products or the level of our service to our customers or any occurrence of a price war among our competitors and us may adversely affect our business and results of operations. If we are unable to remain competitive, we may not be able to increase or even maintain our current share of the OCTG market in China or overseas.

We cannot assure you that we will be successful in implementing our future expansion plans, in particular our plans for international expansion, or in managing our growth.

Historically, we have expanded our production capacity and developed our overseas sales as part of our growth strategy. For example, as a part of our international expansion strategy, in April 2008, we established our wholly-owned subsidiary, Houston OCTG Group, Inc., or Houston OCTG, in Houston, Texas. In April 2009, WSP China established Chaoyang Seamless Oil Steel Casting Pipes Co., Ltd., or Chaoyang Seamless, in Chaoyang, Liaoning Province, China. In February 2010, we acquired WSP Pipe, a company in the Thai-Chinese Rayong Industrial Zone, Thailand from Mr. Longhua Piao, our chairman and chief executive officer. In February 2010, Bazhou Seamless Oil Pipes Co., Ltd., or Bazhou Seamless, established a wholly-owned subsidiary, Kuitun Seamless Special Steel Company Co., Ltd. or Kuitun Seamless, in Kuitun, Xinjiang Autonomous Region, China. Although we disposed of Kuitun Seamless and Chaoyang Seamless in 2011 and 2012, respectively, we may expand through organic growth and selective acquisitions in the future. Furthermore, we may continue to be exposed to liabilities of a disposal entity after its disposal. In January 2012, we entered into an agreement with a third party to transfer our entire 51% equity interest in Chaoyang Seamless for nominal cash consideration. The disposal transaction was completed in January 2012. As part of this agreement, we waived the payment of RMB39.4 million ($6.3 million) owed by Chaoyang Seamless to WSP China. In October 2013, our board of directors approved the waiver of the payment of RMB27.0 million ($4.3 million) owed by Chaoyang Seamless to Bazhou Seamless and RMB78.5 million ($12.6 million) owed by Chaoyang Seamless to Liaoyang Seamless. In connection with this waiver, we recorded bad debt expenses of approximately RMB105.5 million ($16.9 million) reflected in our results of operations for the first half of 2013. Additionally, in November 2012, we sold production facilities held by Houston OCTG to a third party for approximately $43.0 million, and incurred a loss on disposal of approximately $5.1 million in the second half of 2012 related to the sale of these assets. Our future growth will depend on a number of factors, including but not limited to, our ability to manage expansion and overseas operations, obtain any required financing, achieve operational efficiency, and secure sufficient access to raw materials. Some of these factors are beyond our control. As a result, we may not be able to successfully manage our growth, expand our operations or achieve a satisfactory return on our investments in the expansion of our production capacity and international expansion, which could have a material adverse effect on our business, financial condition and results of operations. Additionally, we may incur further losses from any future dispositions of the equity or assets of our subsidiaries or additional types of restructuring, which will materially and adversely affect our results of operation.

In addition, we may need to increase the number of our employees and enhance our operational and financial systems to manage the increased complexity and the expanded geographical coverage of our operations associated with our growth. We cannot assure you that we will be able to attract and retain qualified management staff and employees or that our current operational and financial systems and controls will be adequate to accommodate future growth. This could have a material adverse effect on our business, financial condition and results of operations.

We face risks associated with the marketing, distribution and sale of our products internationally, and if we are unable to manage these risks effectively, they could impair our ability to expand our business overseas.

We have focused on international expansion in certain mature OCTG markets. In order to succeed, we need to take market share away from the existing suppliers of seamless OCTG in these markets. We cannot assure you that we will be able to do so in these competitive markets.

Moreover, our plans for international expansion may be hindered by the following:

· cultural differences and other difficulties in staffing and managing overseas operations;

· inherent difficulties and delays in contract enforcement and collection of receivables through the use of foreign legal systems;

· volatility in currency exchange rates;

· the risk that foreign countries may impose withholding taxes (or otherwise tax our foreign income or place restrictions on repatriation of profit);

· the risk of barriers, such as anti-dumping and other tariffs or other restrictions being imposed on foreign trade;

· changes in the political, regulatory, or economic conditions in a foreign country or region; and

· the burden of complying with foreign laws and regulations.

If we are unable to manage these risks effectively, our ability to conduct or expand our business overseas would be impaired, which may in turn materially and adversely affect our business, financial condition, results of operations and prospects.

Our business depends on our ability to attract and retain members of our senior management team and other key personnel.

Our future success is dependent on the efforts, performance and abilities of key members of our management team, particularly Mr. Longhua Piao, our chairman and chief executive officer. Mr. Piao founded our company and has extensive industry experience. We do not maintain key person insurance on any of our management personnel. As the OCTG industry in China becomes more competitive, we expect the competition for management and other skilled personnel to intensify. Failure to attract and retain qualified employees or the loss of any member of our senior management may result in a loss of organizational focus, poor operating execution or an inability to identify and execute potential strategic initiatives such as overseas expansion and new product offerings. This could, in turn, materially and adversely affect our business, financial condition and results of operations.

Our business relies on our ability to retain and attract experienced sales staff and our ability to maintain and expand our existing sales networks both domestically and overseas.

Our experienced sales staff constitutes an essential part of our business. In the domestic PRC market, our sales staff possesses strong technical backgrounds in the OCTG industry, which enable them to provide and deliver on-site technical support to our customers. We rely on our four sales offices located in the Daqing, Changqing, Xinjiang and Sichuan oilfields to directly sell our products to the major oilfields in China. In addition to providing on-site services to our customers throughout the sales process and after-sales support, our sales staff also helps us maintain good relationships with our customers. Internationally, we sell our products through our distributors and sales agents. The loss of services of any of our experienced sales staff without timely replacement, the inability to attract and retain sales personnel, or the loss of any of our major distributors or sales agents may have an adverse effect on our business. If we are unable to maintain our existing sales network, our operations may be materially and adversely affected.

We depend on a limited number of suppliers for a majority of our raw material requirements, and interruption of raw material delivery could prevent us from delivering our products in a timely manner to our customers in the required quantities, and in turn result in order cancellations, decreased revenue and loss of market share.

Our operations depend on our ability to obtain adequate and quality supplies of our primary raw materials, namely, round steel billets and green pipes, in a timely manner. If our suppliers fail to meet our quality standards or our quantity demands, our production and sales volume and our results of operation may be adversely affected. We made an upstream acquisition of Tuoketuo County Mengfeng Special Steel Co., Ltd., or Mengfeng, from Hebei Bishi Industry Group Co., Ltd., or Hebei Bishi, in July 2008 with the aim of stabilizing the supply, quality and cost of our raw materials. However, we stopped production at Mengfeng since the second half of 2011 as we are currently able to obtain raw materials at lower costs. As such, we will continue to rely on major suppliers to supply our primary raw materials to us. See “Item 4. Information on the Company—B. Business Overview—Manufacturing—Suppliers of raw materials.” We cannot guarantee that our long-term arrangements with these suppliers will provide us with a reliable supply of raw materials. If there is any supply shortage, we may be unable to deliver our products in a timely manner to our customers in the required quantities, which in turn could result in order cancellations, decreased revenue and loss of market share.

Significant product liability claims made against us, regardless of their success, could harm our business reputation, results of operations and financial condition.

Our OCTG products are sold primarily for use in oil and gas exploration, drilling and extraction activities. These activities are subject to inherent risks, including well failures, line pipe leaks and fires that could result in death, personal injury, property damage, pollution or loss of production, all of which could result in liability claims being made against us. We typically offer warranties on our products for a period of up to one year. During the warranty period, faulty products will be repaired or replaced by us, or returned to us. Actual defects or allegations of defects in our products may give rise to claims against us for losses and expose us to claims for damages. For instance, we are subject to multiple lawsuits alleging defective casing pipes used in oil and gas well operations the United States. See “—We are subject to litigation proceedings brought by third-parties. If any of the proceedings against us is successful, it may have an adverse effect on our financial condition and operating results.” and “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal proceedings” for further information about the lawsuits. Any such claim, regardless of merit, could cause us to incur significant costs, divert our management’s attention, harm our business reputation or cause significant disruption to our operations. Furthermore, we can provide no assurance that we will be able to successfully defend against such claims. We do not have any product liability insurance covering our products sold outside of North America, and limited product liability insurance for most of our products sold inside North America. If any such claims were successful, we could be subject to substantial liabilities, which could materially and adversely affect our results of operations and our financial condition.

We may be unable to prevent possible resales or transfers of our products to countries, governments, entities, or persons targeted by United States economic sanctions, especially when we sell our products to distributors over which we have limited control.

The U.S. Department of the Treasury’s Office of Foreign Assets Control, or OFAC, administers certain laws and regulations, or U.S. Economic Sanctions Laws, that impose restrictions upon U.S. persons and, in some instances, foreign entities owned or controlled by U.S. persons, with respect to activities or transactions with certain countries, including the Western Balkans, Belarus, Burma (Myanmar), Cote d’Ivoire (Ivory Coast), Cuba, Democratic Republic of the Congo, Iran, Iraq, Lebanon, Liberia (former Taylor regime), Libya, North Korea, Somalia, Sudan, Syria and Zimbabwe, and governments, entities and individuals that are the subject of U.S. Economic Sanctions Laws, or Sanctions Targets. U.S. persons are also generally prohibited from facilitating such activities or transactions. We believe that U.S. Economic Sanctions Laws under their current terms are not applicable to our activities, however, we have nonetheless decided to adopt commercially reasonable measures to prevent any sales of our products to Sanctions Targets. If we become subject to U.S. Economic Sanctions Laws, a violation of these laws and regulations could subject us to fines, penalties and other sanctions. In the three years ended December 31, 2012, we did not have any direct sales to Sanctions Targets. However, we sell our products in international markets primarily through independent non-U.S. distributors who are responsible for interacting with the end customers of our products. We have limited control over these independent non-U.S. distributors, and these distributors may breach their covenant to us not to resell our products to Sanctions Targets. In addition, we do not always know the end customers to whom our distributors resell our products. We are aware of an insignificant amount of resales of our products by two non-U.S. and non-affiliated distributor customers to Sudan, a Sanctions Target, during the three years ended December 31, 2012. See “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Internal control over distribution of our products.” Although we have adopted a written policy to prevent future direct or indirect sales to Sanctions Targets and have begun to implement internal control mechanisms to enforce such policy when possible, we cannot assure you that our measures will be able to prevent future sales or resales of our products, directly or indirectly, to Sanctions Targets.

If our products are sold or re-sold, directly or indirectly, to Sanctions Targets, we may fail to comply with U.S. Economic Sanctions Laws and we may be subject to civil or criminal penalties and other remedial measures, which could have an adverse impact on our business, results of operations, financial conditions, liquidity and reputation. Additionally, we act as suppliers to leading Chinese oil companies, such as China National Petroleum Corporation, or CNPC, and China Petroleum & Chemical Corporation, or Sinopec. These companies currently and have in the past had business transactions and relationships with Sanctions Targets. As a result of these transactions and relationships with U.S.-designated state sponsors of terrorism, CNPC and Sinopec have received negative publicity and been the target of divestment or similar initiatives by state and municipal governments, universities and other investors. As a supplier to CNPC, Sinopec and other companies with relations to Sanctions Targets, we have no control over their business or operations. We do not believe that our products sold to these companies have been used outside of China. However, our relationships with such companies may nevertheless harm our reputation. Some of our U.S. investors may be required to sell their interests in our company under the laws of certain U.S. states or under internal investment policies or may decide for reputational reasons to sell such interests, and some U.S. institutional investors may forego the purchase of our ADSs, all of which could materially and adversely affect the value of our ADSs and your investment in us.

If we are unable to continue developing our production technology or adopt new production technology, our business and prospects may be harmed.

The OCTG industry is competitive and the production technology underlying the industry is evolving. As customers’ needs, related technologies and market trends are subject to change, we cannot assure you that we will be able to correctly predict the trends in a timely manner, develop or adopt competitive technology on a timely basis, or respond effectively to competitive industry conditions and changing customer demands.

Responding and adapting to technological developments and changes in the OCTG industry and the integration of new technologies or industry standards may require substantial investment of resources, time and capital. Even if we implement such measures, there can be no assurance that we will succeed in adequately responding and adapting to such technological and industry changes. In the event that we are unable to respond successfully to technological and industry changes, our business, results of operations and competitiveness may be materially and adversely affected.

Failure to protect our intellectual property rights may materially and adversely affect our competitive position and operations, and we may be exposed to infringement or misappropriation claims by third parties.

Our success is in part attributable to the technologies, know-how and other intellectual properties that we have developed or acquired. See “Item 4. Information on the Company—B. Business Overview—Intellectual property rights” for information relating to our patents and trademarks. Although we rely upon a combination of trade secrets, confidentiality policies, non-disclosure and other contractual arrangements, and patent and trademark laws to protect our intellectual property rights, there can be no assurance that the steps we have taken to protect our intellectual property rights are adequate to prevent or deter infringement or other misappropriation of our intellectual property. We may not be able to detect unauthorized uses or take appropriate and timely steps to enforce our intellectual property rights. Any significant infringement of our proprietary technologies and processes or our intellectual property rights could weaken our competitive position and have an adverse effect on our operations. To protect our intellectual property rights, we may have to commence legal proceedings against any misappropriation or infringement. However, there can be no assurance that we will prevail in such proceedings. Furthermore, as we only hold PRC patents, if third parties manufacture and sell products using our technology outside of China in competition against us, we would not have a legal cause of action against them.

Furthermore, we may be subject to litigation involving claims of patent infringement or the violation of other intellectual property rights of third parties. The defense of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time-consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or subject us to injunctions prohibiting the manufacture and sale of our products or the use of our technologies, which could materially and adversely affect our business, financial condition or results of operations. Protracted litigation could also result in our customers or potential customers deferring or limiting their purchase or use of our products until resolution of such litigation, which could adversely affect our business.

Failure to maintain an effective quality control system at our manufacturing facilities could have a material adverse effect on our business and operations.

The performance, quality and safety of our products are critical to the success of our business. These factors depend significantly on the effectiveness of our quality control systems, which in turn depend on a number of factors, including the design of our quality control systems, our quality-training program, and our ability to ensure that our employees adhere to the quality control policies and guidelines. Any significant failure or deterioration of our quality control systems could have a material adverse effect on our business reputation, results of operations and financial condition.

If disruptions in our transportation network occur or our shipping costs substantially increase, we may be unable to deliver our products in a timely manner and our cost of revenues could increase.

We are highly dependent upon transportation systems, including train, truck and ocean shipping, to deliver our products. The transportation network is potentially exposed to disruption from a variety of causes, including labor disputes or port strikes, acts of war or terrorism and natural disasters. If our delivery times or our shipping costs increase unexpectedly for any reasons, our revenues and results of operation could be materially and adversely affected.

Our growth strategies require significant capital investments and may require us to seek external financing, which may not be available on terms favorable to us.

Our business operations and growth strategies require substantial capital investments, the availability of which depends on our ability to generate cash flow from operations, borrow funds on satisfactory terms and raise funds in the capital markets. Our ability to arrange for financing to support our capital expenditures and the cost of such financing are dependent on numerous factors, including general economic and capital markets conditions, interest rates and credit availability from banks or other lenders, many of which are beyond our control. In addition, increases in interest rates or failure to obtain external financing on terms favorable to us will affect our financing costs and our results of operations. We may not be able to obtain financing in amounts or on terms acceptable to us, if at all, especially in the current global credit and economic crisis, which may have an adverse effect on our operating results and financial condition.

We may not be successful in our future acquisitions and investments.

If we are presented with appropriate opportunities, we may acquire additional businesses or assets as part of our growth strategy. Future acquisitions, investments and joint ventures may expose us to potential risks, and the success of our acquisitions, investments and joint ventures depend on a number of factors, including:

· our ability to identify suitable opportunities for acquisitions, investments or joint ventures;

· whether we are able to reach an acquisition, investment or joint venture agreement on terms that are satisfactory to us;

· the extent to which we are able to exercise control over the acquired company or business;

· the economic, business or other strategic objectives and goals of the acquired company or business compared to those of our company;

· the diversion of management attention and resources from our existing business;

· our ability to finance the acquisition, investment or joint venture; and

· our ability to integrate successfully the acquired company or business.

If we fail to make acquisitions or investments or form joint ventures that are strategically important to us, our growth and business prospects may be limited. If we encounter difficulties in integrating the business we acquired, our financial condition and results of operations may be materially and adversely affected.

If we fail to establish or maintain an effective system of internal controls, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our ADSs may be adversely impacted.