UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

(Mark One)

[ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011.

OR

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to _______

OR

[ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report________

Commission file number: 001-33840

WSP HOLDINGS LIMITED

(Exact Name of Registrant as Specified in Its Charter)

N/A

(Translation of Registrant’s Name Into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

No. 38 Zhujiang Road

Xinqu, Wuxi

Jiangsu Province

People’s Republic of China

(Address of Principal Executive Offices)

Choon-Hoi Then

WSP Holdings Limited

No. 38 Zhujiang Road

Xinqu, Wuxi

Jiangsu Province

People’s Republic of China

Phone: 510-8536-0401

Email: info@wsphl.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of exchange on which each class is to be registered |

American Depositary Shares, each representing ten ordinary shares, par value $0.0001 per share | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

204,375,226 ordinary shares, par value $0.0001 per share, as of December 31, 2011.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes[ ] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.��

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP[X] International Financial Reporting Standards as issued by the Other[ ]

International Accounting Standards Board[ ]

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17[ ] Item 18[ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes [ ] No [ ]

| Page | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| INTRODUCTION | 1 | |||||||||

| PART I | 2 | |||||||||

| Item 1. | Identity of Directors, Senior Management and Advisers | 2 | ||||||||

| Item 2. | Offer Statistics and Expected Timetable | 2 | ||||||||

| Item 3. | Key Information | 2 | ||||||||

| Item 4. | Information on the Company | 21 | ||||||||

| Item 4A. | Unresolved Staff Comments | 38 | ||||||||

| Item 5. | Operating and Financial Review and Prospects | 38 | ||||||||

| Item 6. | Directors, Senior Management and Employees | 60 | ||||||||

| Item 7. | Major Shareholders and Related Party Transactions | 69 | ||||||||

| Item 8. | Financial Information | 70 | ||||||||

| Item 9. | The Offer and Listing | 72 | ||||||||

| Item 10. | Additional Information | 73 | ||||||||

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 82 | ||||||||

| Item 12. | Description of Securities Other than Equity Securities | 83 | ||||||||

| PART II | 85 | |||||||||

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 85 | ||||||||

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 85 | ||||||||

| Item 15. | Controls and Procedures | 85 | ||||||||

| Item 16A. | Audit Committee Financial Expert | 86 | ||||||||

| Item 16B. | Code of Ethics | 86 | ||||||||

| Item 16C. | Principal Accountant Fees and Services | 86 | ||||||||

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 86 | ||||||||

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 87 | ||||||||

| Item 16F. | Change in Registrant’s Certifying Accountant | 87 | ||||||||

| Item 16G. | Corporate Governance | 87 | ||||||||

| PART III | 88 | |||||||||

| Item 17. | Financial Statements | 88 | ||||||||

| Item 18. | Financial Statements | 88 | ||||||||

| Item 19. | Exhibits | 88 | ||||||||

| • | “we,” “us,” “our company,” “our” or “WSP Holdings” refers to WSP Holdings Limited, which, unless otherwise required under the context, includes its predecessor entities and its consolidated subsidiaries; |

| • | “ADSs” refers to our American depositary shares, each representing ten ordinary shares; |

| • | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report on Form 20-F only, Taiwan, Hong Kong and Macau; |

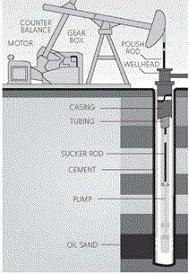

| • | “Oil Country Tubular Goods,” or “OCTG,” refers to pipes and other tubular products used in the exploration, drilling and extraction of oil, gas and other hydrocarbon products. OCTG mainly consist of casing, tubing and drill pipes. Unless otherwise indicated, discussions relating to OCTG in this annual report on Form 20-F are limited to these three types of OCTG; |

| • | “Production capacity” refers to the maximum production capacity that can be achieved at the optimal level of operations of a production line, calculated using an estimated product mix for such production line, which may differ from its actual product mix; |

| • | “RMB” or “Renminbi” refers to the legal currency of China, “HK$” refers to the legal currency of Hong Kong, and “$,” “US$” or “U.S. dollars” refers to the legal currency of the United States; and |

| • | “shares” or “ordinary shares” refers to our ordinary shares, par value $0.0001 per share. |

Item 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Item 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Item 3. | KEY INFORMATION |

| A. | Selected Financial Data |

| For the year ended December 31, | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except for share and per share data) | 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||||

Selected Consolidated Income Statement Data: | |||||||||||||||||||||||

| Net revenues | $ | 483,783 | $ | 912,090 | $ | 577,029 | $ | 470,465 | $ | 686,125 | |||||||||||||

| Cost of revenues | (357,997 | ) | (703,531 | ) | (496,656 | ) | (467,400 | ) | (637,615 | ) | |||||||||||||

| Gross profit | 125,786 | 208,559 | 80,373 | 3,065 | 48,510 | ||||||||||||||||||

| Selling and marketing expenses | (8,578 | ) | (22,770 | ) | (18,244 | ) | (20,841 | ) | (34,486 | ) | |||||||||||||

| General and administrative expenses | (13,591 | ) | (41,740 | ) | (44,798 | ) | (67,008 | ) | (61,774 | ) | |||||||||||||

| Impairment on long-lived assets | — | — | — | (17,055 | ) | — | |||||||||||||||||

| Gain on disposal of subsidiary | — | — | — | — | 3,268 | ||||||||||||||||||

| Other operating (expenses) income, net | (32 | ) | 2,589 | 2,559 | 5,446 | 2,777 | |||||||||||||||||

| Income (loss) from operations | 103,585 | 146,638 | 19,890 | (96,393 | ) | (41,705 | ) | ||||||||||||||||

| Interest income (expense), net | (10,541 | ) | (15,319 | ) | (17,026 | ) | (26,043 | ) | (30,609 | ) | |||||||||||||

| Other income | 212 | 767 | 767 | 767 | 767 | ||||||||||||||||||

| Exchange differences | (1,898 | ) | (6,984 | ) | 218 | (1,484 | ) | (5,144 | ) | ||||||||||||||

| Income (loss) from continuing operations before provision for income taxes | 91,358 | 125,102 | 3,849 | (123,153 | ) | (76,691 | ) | ||||||||||||||||

| Provision for income taxes | (15,188 | ) | (24,405 | ) | (2,137 | ) | (9,388 | ) | (99 | ) | |||||||||||||

| Net income (loss) from continuing operations before earnings in equity investments | 76,170 | 100,697 | 1,712 | (132,541 | ) | (76,790 | ) | ||||||||||||||||

| Loss in equity investments | — | 1 | (105 | ) | (211 | ) | (10 | ) | |||||||||||||||

| Net income (loss) from continuing operations | 76,170 | 100,698 | 1,607 | (132,752 | ) | (76,800 | ) | ||||||||||||||||

| Net income (expense) from discontinued operations | — | — | — | — | — | ||||||||||||||||||

| Net income (loss) | 76,170 | 100,698 | 1,607 | (132,752 | ) | (76,800 | ) | ||||||||||||||||

| Less: Net income (loss) attributable to the non-controlling interests | (1,609 | ) | (1,349 | ) | 2,568 | 13,989 | 8,320 | ||||||||||||||||

| Net income (loss) attributable to WSP Holdings Limited | $ | 74,561 | $ | 99,349 | $ | 4,175 | $ | (118,763 | ) | (68,480 | ) | ||||||||||||

| Net income (loss) per share—basic | |||||||||||||||||||||||

| Net income (loss) from continuing operations | $ | 0.49 | $ | 0.48 | $ | 0.02 | $ | (0.58 | ) | (0.34 | ) | ||||||||||||

| Loss on discontinued operations | — | — | — | — | — | ||||||||||||||||||

| Net income (loss) per share | $ | 0.49 | $ | 0.48 | $ | 0.02 | $ | (0.58 | ) | (0.34 | ) | ||||||||||||

| Net income (loss) per share—diluted | |||||||||||||||||||||||

| Net income (loss) from continuing operations | $ | 0.48 | $ | 0.48 | $ | 0.02 | $ | (0.58 | ) | (0.34 | ) | ||||||||||||

| Loss on discontinued operations | — | — | — | — | — | ||||||||||||||||||

| Net income (loss) per share | $ | 0.48 | $ | 0.48 | $ | 0.02 | $ | (0.58 | ) | (0.34 | ) | ||||||||||||

| Weighted average ordinary shares used in computation of earnings per share: | |||||||||||||||||||||||

| Basic | 153,561,644 | 205,663,247 | 205,789,800 | 204,771,144 | 204,375,226 | ||||||||||||||||||

| Diluted | 153,738,133 | 205,663,247 | 205,789,800 | 204,771,144 | 204,375,226 | ||||||||||||||||||

| As of December 31, | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||||

Consolidated balance sheet data | �� | ||||||||||||||||||||||

| Cash and cash equivalents | $ | 179,973 | $ | 89,097 | $ | 133,250 | $ | 48,688 | $ | 27,742 | |||||||||||||

| Restricted cash | 120,759 | 231,988 | 205,613 | 142,027 | 249,812 | ||||||||||||||||||

| Accounts and bills receivable, net of allowance for doubtful accounts | 137,497 | 246,463 | 204,906 | 199,970 | 260,139 | ||||||||||||||||||

| Advances to suppliers | 18,167 | 15,049 | 23,514 | 17,123 | 19,229 | ||||||||||||||||||

| Inventories | 163,246 | 311,383 | 266,090 | 240,713 | 242,240 | ||||||||||||||||||

| Total current assets | 626,042 | 919,931 | 870,166 | 692,435 | 866,562 | ||||||||||||||||||

| Property and equipment, net | 185,136 | 313,936 | 407,052 | 536,942 | 653,783 | ||||||||||||||||||

| Intangible assets, net | 187 | 136 | 971 | 244 | 108 | ||||||||||||||||||

| Total assets | $ | 827,221 | $ | 1,310,611 | $ | 1,394,394 | $ | 1,331,062 | $ | 1,571,116 | |||||||||||||

| Accounts payable | $ | 179,065 | $ | 344,817 | $ | 162,557 | $ | 176,379 | $ | 307,740 | |||||||||||||

| Borrowings—due within one year | 208,356 | 337,438 | 506,448 | 596,546 | 773,541 | ||||||||||||||||||

| Total current liabilities | 423,032 | 796,135 | 764,428 | 877,956 | 1,245,000 | ||||||||||||||||||

| Total liabilities | 482,095 | 808,616 | 960,082 | 1,028,287 | 1,339,734 | ||||||||||||||||||

| Total WSP Holdings Limited shareholders’ equity | 341,124 | 482,606 | 410,738 | 297,031 | 238,873 | ||||||||||||||||||

| Non-controlling interest | 4,002 | 19,389 | 23,574 | 5,744 | (2,491 | ) | |||||||||||||||||

| Total equity | 345,126 | 501,995 | 434,312 | 302,775 | 231,382 | ||||||||||||||||||

| Total liabilities and equity | $ | 827,221 | $ | 1,310,611 | $ | 1,394,394 | $ | 1,331,062 | $ | 1,571,116 | |||||||||||||

| B. | Capitalization and Indebtedness |

| C. | Reasons for the Offer and Use of Proceeds |

| D. | Risk Factors |

| • | limit our ability to satisfy our obligations under our debt; |

| • | increase our vulnerability to adverse general economic and industry conditions; |

| • | require us to dedicate a substantial portion of our cash flow from operations to servicing and repaying our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes; |

| • | limit our flexibility in planning for or reacting to changes in our businesses and the industry in which we operate; |

| • | place us at a competitive disadvantage compared to our competitors that have less debt; |

| • | impair our ability to develop business opportunities or make strategic acquisitions; and |

| • | increase the cost of additional financing. |

| • | incur or guarantee additional debt; |

| • | secure loans, make capital expenditures or engage in investments and acquisitions; |

| • | enter into transactions with affiliates; |

| • | create liens; |

| • | announce cash dividends; |

| • | make major investments; |

| • | merge or consolidate with other companies, implement any divesture, reorganization, restructuring, discontinuance of business, receivership, bankruptcy, dissolution or other similar proceedings; and |

| • | dispose of, lease, transfer or sell more than 10% of our assets. |

| • | cultural differences and other difficulties in staffing and managing overseas operations; |

| • | inherent difficulties and delays in contract enforcement and collection of receivables through the use of foreign legal systems; |

| • | volatility in currency exchange rates; |

| • | the risk that foreign countries may impose withholding taxes (or otherwise tax our foreign income or place restrictions on repatriation of profit); |

| • | the risk of barriers, such as anti-dumping and other tariffs or other restrictions being imposed on foreign trade; |

| • | changes in the political, regulatory, or economic conditions in a foreign country or region; and |

| • | the burden of complying with foreign laws and regulations. |

| • | our ability to identify suitable opportunities for acquisitions, investments or joint ventures; |

| • | whether we are able to reach an acquisition, investment or joint venture agreement on terms that are satisfactory to us; |

| • | the extent to which we are able to exercise control over the acquired company or business; |

| • | the economic, business or other strategic objectives and goals of the acquired company or business compared to those of our company; |

| • | the diversion of management attention and resources from our existing business; |

| • | our ability to finance the acquisition, investment or joint venture; and |

| • | our ability to integrate successfully the acquired company or business. |

Item 4. | Information on the Company |

| A. | History and Development of the Company |

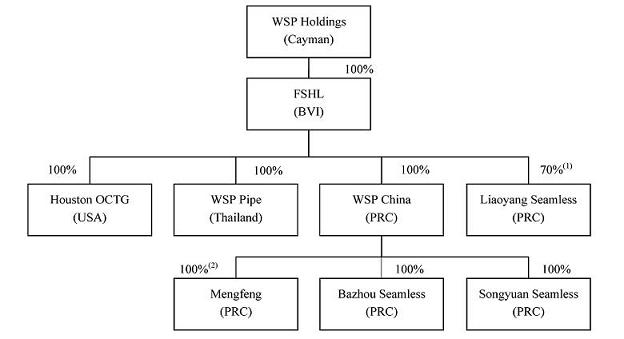

| (1) | The remaining 30% of Liaoyang Seamless is owned by Liaoning Steel Pipe Co., Ltd., or Liaoning Pipe. |

| (2) | In July 2008, WSP China entered into an agreement with Hebei Bishi to acquire 100% equity ownership of Mengfeng with a total consideration of approximately $40.5 million. As of the date of this annual report, WSP China has paid a total of approximately $38.2 million to Hebei Bishi. |

| B. | Business Overview |

| • | API products, which are products manufactured according to the standards formulated by the API; and |

| • | non-API products, which are products tailor-made to meet our customers’ specifications, and that are generally manufactured to a higher standard than API products. |

| • | Casing. Casing pipes serve as the structural retainer for the walls of oil and gas wells, or wellbore. Casing pipes are ordinarily produced with outside diameter sizes of 114.3 mm to 508.0 mm. Casing pipes are inserted into a well bore and cemented in place to protect both subsurface formations and the wellbore. |

| • | Tubing. Tubing pipes are steel tubes suspended inside casing pipes that are used to convey oil or gas to the surface. Tubing pipes typically have diameters of 60.3 mm to 114.3 mm. |

| • | Drill pipes. Drill pipes are pipes used to drill wells. Drill pipes are the conduit between the wellhead motor and the drill bit. Drill pipes, typically around nine meters in length, are screwed together to form a continuous pipe extending from the drilling rig to the drill bit at the bottom of the well. Rotation of the drill pipe, and the resulting rotation of the drill bit, causes the bit to bore through the rock formation. Drill pipes are reusable and not considered regular consumables. |

| • | API products. These are manufactured in accordance with a standard which is considered to be the basic or minimum standard that must be met for oilfield equipment. API is the primary trade association of the oil and natural gas industry in the United States and promotes the standardization of oilfield equipment by setting and maintaining more than 500 standards and recommended practices. The API standard is a benchmark standard, and API products are produced according to the API specifications. |

| • | Non-API products. These are custom-made products. In addition to meeting API standards, non-API products are made with qualifications or specifications developed to meet customers’ special needs, such as higher strength, higher corrosion resistance or premium connectors. Non-API products are generally made to a higher standard than API products, and therefore more stringent technical standards and complex manufacturing techniques are required. |

| For the year ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2009 | 2010 | 2011 | |||||||||||||

| API net revenues (in thousands) | $ | 414,250 | $ | 277,290 | $ | 446,223 | |||||||||

| Sales volume (tonnes) | 369,266 | 271,986 | 391,088 | ||||||||||||

| Average sales price | $ | 1,122 | $ | 1,020 | $ | 1,141 | |||||||||

| Non-API net revenues (in thousands) | $ | 102,186 | $ | 70,143 | $ | 144,766 | |||||||||

| Sales volume (tonnes) | 52,877 | 37,543 | 72,358 | ||||||||||||

| Average sales price | $ | 1,933 | $ | 1,868 | $ | 2,001 | |||||||||

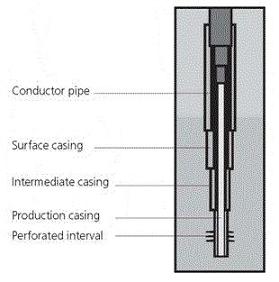

| • | Casing. Casing is a large-diameter pipe that lines the wellbore. Casing is used to prevent the wall of the wellbore from collapsing and allows drilling fluid to circulate and extraction to take place. The following diagram illustrates different types of casing used in the extraction process: |

| • | Tubing. Tubing is a pipe used for the transportation of crude oil and natural gas from the oil or gas layer to the surface after drilling has been completed. Tubing must be made to withstand the pressure generated from the extraction process. Tubing is manufactured in the same way as casing, except that an additional process known as “upsetting” is applied to thicken the pipes. |

| • | Drill pipes. Drill pipes are steel tubes fitted with threaded ends and are used to connect the rig surface equipment with the bottomhole assembly. Drill pipes are also used to transport drilling fluid to the bit and to raise, lower and rotate the bottomhole assembly and the bit. Drill pipes must be manufactured to withstand severe external and internal pressure, distortion, bending and vibration. |

| Largest customers | | Location | ||||||

|---|---|---|---|---|---|---|---|---|

2009 | ||||||||

CNPC(1) | PRC | |||||||

| CAMEG SPA Filiale Sonelgaz | Algeria | |||||||

| Yanchang Oil Field Co., Ltd. | PRC | |||||||

| PTT Exploration and Production Public Co., Ltd. | Thailand | |||||||

| Sinopec | PRC | |||||||

2010 | ||||||||

CNPC(1) | PRC | |||||||

| PDVSA Services B.V. | Venezuela | |||||||

| Yanchang Oil Field Co., Ltd. | PRC | |||||||

| Sinopec | PRC | |||||||

| Hongpeng Steel Co., Ltd. | PRC | |||||||

2011 | ||||||||

CNPC(1) | PRC | |||||||

| PDVSA Services B.V. | Venezuela | |||||||

| Petroamazonas EP | Ecuador | |||||||

| Sinopec | PRC | |||||||

| Lukoil Uzbekistan Operating Company LLC | Uzbekistan(1) | |||||||

(1) | Contracts are typically entered into separately with the oilfields controlled by CNPC. |

| | | | | | | | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Production facilities | | Product line | | Location | | Year of commencement | | Annual production capacity as of December 31, 2011(1) | | Actual production output in 2009(1) | | Actual production output in 2010(1) | | Actual production output in 2011(1) | ||||||||||||||

| (in tonnes) | (in tonnes) | (in tonnes) | (in tonnes) | |||||||||||||||||||||||||

| No. 1 threading line | Tubing, casing and premium connectors | Wuxi, Jiangsu Province, PRC | August 2001 | 100,000 | 44,871 | 29,822 | 44,421 | |||||||||||||||||||||

| No. 2 threading line | Tubing | Wuxi, Jiangsu Province, PRC | August 2001 | 50,000 | 19,5 07 | 9,278 | 14,819 | |||||||||||||||||||||

| No. 3 threading line | Casing and premium connectors | Wuxi, Jiangsu Province, PRC | August 2002 | 70,000 | 36,766 | 34,031 | 48,462 | |||||||||||||||||||||

| No. 4 threading line | Casing | Wuxi, Jiangsu Province, PRC | March 2005 | 90,000 | 65,361 | 57,131 | 62,477 | |||||||||||||||||||||

| No. 5 threading line | Tubing and casing | Wuxi, Jiangsu Province, PRC | April 2006 | 90,000 | 51,668 | 30,894 | 60,935 | |||||||||||||||||||||

| No. 6 threading line | Casing | Wuxi, Jiangsu Province, PRC | November 2008 | 60,000 | 6,361 | 7,738 | 2,037 | |||||||||||||||||||||

| No. 7 threading line | Casing and premium connectors | Wuxi, Jiangsu Province, PRC | May 2006 | 40,000 | 36,581 | 29,138 | 35,287 | |||||||||||||||||||||

| No. 8 threading line | Casing and premium connectors | Wuxi, Jiangsu Province, PRC | May 2007 | 100,000 | 14,364 | 24,536 | 34,922 | |||||||||||||||||||||

| No. 9 threading line | Tubing and premium connectors | Wuxi, Jiangsu Province, PRC | March 2007 | 20,000 | 4,816 | 1,693 | 6,358 | |||||||||||||||||||||

| No. 10 threading line | Tubing and casing | Wuxi, Jiangsu Province, PRC | June 2008 | 100,000 | 60 ,534 | 20,514 | 51,674 | |||||||||||||||||||||

| Drill pipe production line Drill pipes | Wuxi, Jiangsu Province, PRC | December 2006 | 12,000 | 5,561 | 4,019 | 2,004 | ||||||||||||||||||||||

| Drill pipe production line Drill pipes | Wuxi, Jiangsu Province, PRC | November 2007 | 12,000 | 1,341 | — | — | ||||||||||||||||||||||

Cold-draw pipe production line(2) | Green pipes | Xuyi, Jiangsu Province, PRC | January 2006 | 100,000 | 44,421 | — | — | |||||||||||||||||||||

| Hot-rolling pipe production line | Green pipes | Wuxi, Jiangsu Province, PRC | January 2007 | 450,000 | 248,120 | 240,716 | 293,932 | |||||||||||||||||||||

Hot-rolling pipe production line(2) | Green pipes | Xuyi, Jiangsu Province, PRC | July 2007 | 100,000 | 16,342 | — | — | |||||||||||||||||||||

| Threading line | Tubing and casing | Songyuan, Jilin Province, PRC | February 2009 | 60,000 | 10,794 | 9,966 | 13,018 | |||||||||||||||||||||

| Threading line | Tubing and casing | Liaoyang, Liaoning Province, PRC | March 2009 | 60,000 | 18,661 | 7,950 | 26,667 | |||||||||||||||||||||

| Threading line | Tubing and casing | Liaoyang, Liaoning Province, PRC | July 2009 | 60,000 | 2,207 | 4,131 | 20,862 | |||||||||||||||||||||

| Threading line | Casing and premium connectors | Houston, USA | July 2010 | 120,000 | — | 8,502 | 17,773 | |||||||||||||||||||||

| Threading line | Tubing and casing | Kuerle, Xinjiang Autonomous, PRC | October 2010 | 100,000 | — | — | 1,068 | |||||||||||||||||||||

| Threading line | Tubing and casing | Kuerle, Xinjiang Autonomous, PRC | October 2010 | 100,000 | — | — | 373 | |||||||||||||||||||||

| Threading line | Tubing and casing | Kuerle, Xinjiang Autonomous, PRC | November 2010 | 100,000 | — | — | — | |||||||||||||||||||||

| Threading line | Tubing and casing | Thai-Chinese Rayong Industrial Zone, Thailand | October 2011 | 50,000 | — | — | 6,787 | |||||||||||||||||||||

| Hot-rolling pipe production line | Green pipes | Liaoyang, Liaoning Province, PRC | May 2010 | 300,000 | — | 3,744 | 71,000 | |||||||||||||||||||||

| Hot-rolling pipe production line | Green pipes | Kuerle, Xinjiang Autonomous, PRC | April 2011 | 500,000 | — | — | — | |||||||||||||||||||||

| Hot-rolling pipe production line | Green pipes | Thai-Chinese Rayong Industrial Zone, Thailand | May 2011 | 60,000 | — | — | 12,286 | |||||||||||||||||||||

| Hot-rolling pipe production line | Green pipes | Thai-Chinese Rayong Industrial Zone, Thailand | September 2011 | 120,000 | — | — | 4,789 | |||||||||||||||||||||

| (1) | Comparison of actual output against annual production capacity is not meaningful as our annual production capacity is calculated using an estimated product mix for each production line, which may differ from the actual product mix manufactured from the production line. |

| (2) | We operated these production lines at Jiangsu Fanli. Following the disposal of our equity interest in Jiangsu Fanli in 2010, we ceased the operation of these production lines. |

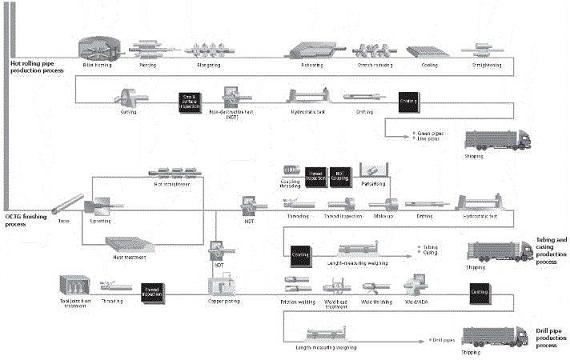

| • | Size and surface inspection. Our quality assurance staff inspects the size and surface of the tubes to ensure that the tubes meet the required standard during the tube manufacturing process. |

| • | Non-destructive test. This test is conducted to ensure that no damage occurred to the tube during the upsetting, heat treatment and hot straightening treatments. For the blind areas at the end of the pipes, a magnetic power detectoscope is used to conduct the test. If we find damage within the pipe during the course of this test, our quality assurance staff will further investigate the area with a portable ultrasound detectoscope. |

| • | Thread inspection. This test is conducted by our production staff by physically examining the thread after the threading stage of the production process to ensure that the thread accurately conforms to the required parameters. |

| • | Hydrostatic test. In this test, the pipes are rolled onto a hydrostatic testing machine where water is pumped into the pipes to ensure that the pipes can withstand the requisite internal pressure and to confirm that there is no leakage. |

| • | Drifting test. This test is conducted to inspect the straightness of the pipes and to determine if any protrusions exist along the inner walls. |

| • | Physical and chemical analysis. This test analyzes the chemical composition, mechanical performance and metallographic structure of the pipe materials. |

| • | Hardness and pressure test. The pipes are physically tested through a weld finishing test and hardness test to ensure that the pipes can withstand the requisite external pressure and exhibit the required hardness before final coating. |

| • | counterfeit negotiable instruments; |

| • | knowingly draft, sell or transfer counterfeit negotiable instruments; |

| • | issue cheques that cannot be honored either due to insufficient funds or incorrect signature or seal; |

| • | issue bills of exchange or promissory notes without reliable sources of funds for the purpose of obtaining money through fraud; |

| • | make false entries on bills of exchange or promissory notes when issuing such instruments for the purpose of obtaining property or money through fraud; |

| • | use negotiable instruments of others without authorization, or use overdue or invalid negotiable instruments for the purpose of obtaining property or money through fraud; or |

| • | commit one of the abovementioned acts as the payer, in conspiracy with the drawer or holder of the negotiable instrument. |

| • | Wholly Foreign-Owned Enterprise Law (1986), as amended in 2000; |

| • | Wholly Foreign-Owned Enterprise Law Implementing Rules (1990), as amended in 2001; |

| • | Sino-foreign Equity Joint Venture Enterprise Law (1979), as amended in 2001; and |

| • | Sino-foreign Equity Joint Venture Enterprise Law Implementing Rules (1983), as amended in 2001. |

| | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Name | Place of incorporation | | Ownership Interest | ||||||

| FSHL | British Virgin Islands | 100 | % | ||||||

| WSP China | PRC | 100 | % | ||||||

| Liaoyang Seamless | PRC | 70 | % | ||||||

| Songyuan Seamless | PRC | 100 | % | ||||||

| Houston OCTG | United States | 100 | % | ||||||

| Mengfeng | PRC | 100 | %(1) | ||||||

| Bazhou Seamless | PRC | 100 | % | ||||||

| WSP Pipe | Thailand | 100 | % | ||||||

| (1) | In July 2008, WSP China entered into an agreement with Hebei Bishi to acquire 100% equity ownership of Mengfeng for a total consideration of approximately $40.5 million. As of the date of this annual report, WSP China has paid a total of approximately $38.2 million to Hebei Bishi. |

| | | | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Production facilities | | Product line | | Location | | Expected time of completion | | Expected annual production capacity (in tonnes) | ||||||||

| Liaoyang pipe heat treatment production line | Heat treatment | Thai-Chinese Rayong Industrial Zone, Thailand | First half of 2012 | 100,000 | ||||||||||||

| Thailand pipe heat treatment production line | Heat treatment | Thai-Chinese Rayong Industrial Zone, Thailand | First half of 2012 | 20,000 | ||||||||||||

| | | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | For the year ended December 31, | | |||||||||||||

| | 2009 | | 2010 | | 2011 | ||||||||||

API | |||||||||||||||

| Sales volume (tonnes) | 369,266 | 271,986 | 391,088 | ||||||||||||

| Average sales price | $ | 1,122 | $ | 1,020 | $ | 1,141 | |||||||||

Non-API | |||||||||||||||

| Sales volume (tonnes) | 52,877 | 37,543 | 72,358 | ||||||||||||

| Average sales price | $ | 1,933 | $ | 1,868 | $ | 2,001 | |||||||||

| | | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | For the year ended December 31, | | |||||||||||||

| | 2009 | | 2010 | | 2011 | ||||||||||

| Sales volume (tonnes) | 648,055 | 633,272 | 607,897 | ||||||||||||

| Domestic | 520,880 | 510,994 | 411,525 | ||||||||||||

| Export | 127,175 | 122,278 | 196,372 | ||||||||||||

| Average sales price | $ | 890 | $ | 743 | $ | 1,129 | |||||||||

| Domestic | $ | 682 | $ | 577 | $ | 887 | |||||||||

| Export | $ | 1,743 | $ | 1,435 | $ | 1,636 | |||||||||

| | | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | For the year ended December 31, | | |||||||||||||

| Net revenues (in thousands) | | 2009 | | 2010 | | 2011 | |||||||||

| API | $ | 414,250 | $ | 277,290 | $ | 446,223 | |||||||||

| Non-API | 102,186 | 70,143 | 144,766 | ||||||||||||

| Iron ore | 19,968 | 31,918 | — | ||||||||||||

| Others | 40,625 | 91,114 | 95,136 | ||||||||||||

| Total | $ | 577,029 | $ | 470,465 | $ | 686,125 | |||||||||

| | | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | For the year ended December 31, | | |||||||||||||

| Net revenues (in thousands) | | 2009 | | 2010 | | 2011 | |||||||||

Domestic | |||||||||||||||

| PRC | $ | 355,402 | $ | 294,946 | $ | 364,940 | |||||||||

Export | |||||||||||||||

| Malaysia | 12,875 | 5,087 | 4,974 | ||||||||||||

| Singapore | 5,236 | 3,542 | 3,528 | ||||||||||||

| Hong Kong | 10,500 | 8,499 | 3,484 | ||||||||||||

| United Arab Emirates | 17,889 | 691 | 3,272 | ||||||||||||

Rest of Asia | 53,074 | 21,016 | 35,658 | ||||||||||||

Total Asia | 99,574 | 38,835 | 50,916 | ||||||||||||

| United States | 51,904 | 45,414 | 43,334 | ||||||||||||

| Canada | 936 | 7,318 | 914 | ||||||||||||

Total North America | 52,840 | 52,732 | 44,248 | ||||||||||||

| Venezuela | — | 62,295 | 153,506 | ||||||||||||

| Others | 69,213 | 21,657 | 72,515 | ||||||||||||

Total export | $ | 221,627 | $ | 175,519 | $ | 321,185 | |||||||||

| • | Net revenues will grow at a CAGR of 0.3% to 7.4% for 2012 through 2019 resulting in sales volume of 410,000 tonnes to 460,000 tonnes of finished products while sales price of finished products per tonne is expected to increase by 0% to 5.0% per annum. |

| • | Cost of revenues is projected to decrease by 1.4% to 4.1% for all asset groups from 2012 through 2019, except for Songyuan Seamless where cost of revenues is projected to increase by 0.4%, and the cost of revenues represents around 81.4% to 92.7% of sales. |

| • | Operating expenses as a percentage of net revenues are expected to remain at 2.0% to 10.0% for all asset groups during the projection period. |

| • | The availability of finance will not be a constraint on the forecasted growth of all asset groups’ related business. |

| • | There will be no material changes in the existing political, legal, fiscal and economic conditions in China; |

| • | There will be no material deviation in industry trends and market conditions from economic forecasts. |

| | | | | | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| For the year ended December 31, | | ||||||||||||||||||||||||

| (in thousands, except percentages) | 2009 | | 2010 | | 2011 | | |||||||||||||||||||

| Net revenues | $ | 577,029 | 100 | % | $ | 470,465 | 100 | % | 686,125 | 100 | % | ||||||||||||||

| Cost of revenues | (496,656 | ) | (86.1 | ) | (467,400 | ) | (99.3 | ) | (637,615 | ) | (92.9 | ) | |||||||||||||

| Gross profit | 80,373 | 13.9 | 3,065 | 0.7 | 48,510 | 7.1 | |||||||||||||||||||

| Selling and marketing expenses | (18,244 | ) | (3.2 | ) | (20,841 | ) | (4.4 | ) | (34,486 | ) | (5.0 | ) | |||||||||||||

| General and administrative expenses | (44,798 | ) | (7.8 | ) | (67,008 | ) | (14.2 | ) | (61,774 | ) | (9.0 | ) | |||||||||||||

| Impairment on long-lived assets | — | — | (17,055 | ) | (3.6 | ) | — | — | |||||||||||||||||

| Gain on disposal of subsidiary | — | — | — | — | 3,268 | 0.5 | |||||||||||||||||||

| Other operating (expenses) income, net | 2,559 | 0.4 | 5,446 | 1.2 | 2,777 | 0.4 | |||||||||||||||||||

| (Loss) income from operations | 19,890 | 3.4 | (96,393 | ) | (20.5 | ) | (41,705 | ) | (6.1 | ) | |||||||||||||||

| Interest income (expense), net | (17,026 | ) | (3.0 | ) | (26,043 | ) | (5.5 | ) | (30,609 | ) | (4.5 | ) | |||||||||||||

| Other income | 767 | 0.1 | 767 | 0.2 | 767 | 0.1 | |||||||||||||||||||

| Exchange differences | 218 | 0 | (1,484 | ) | (0.3 | ) | (5,144 | ) | (0.8 | ) | |||||||||||||||

| (Loss) income before provision for income taxes | 3,849 | 0.7 | (123,153 | ) | (26.2 | ) | (76,691 | ) | (11.2 | ) | |||||||||||||||

| Provision for income taxes | (2,137 | ) | (0.4 | ) | (9,388 | ) | (2.0 | ) | (99 | ) | 0 | ||||||||||||||

| Net (loss) income before earnings in equity investments | 1,712 | 0.3 | (132,541 | ) | (28.2 | ) | (76,790 | ) | (11.2 | ) | |||||||||||||||

| Earnings in equity investments | (105 | ) | 0 | (211 | ) | 0 | (10 | ) | 0 | ||||||||||||||||

| Net (loss) income | 1,607 | 0.3 | (132,752 | ) | (28.2 | ) | (76,800 | ) | (11.2 | ) | |||||||||||||||

| Less: Net income (loss) attributable to the non-controlling interests | 2,568 | 0.4 | 13,989 | 3.0 | 8,320 | 1.2 | |||||||||||||||||||

| Net (loss) income attributable to WSP Holdings Limited | $ | 4,175 | 0.7 | % | $ | (118,763 | ) | (25.2 | )% | (68,480 | ) | (10.0 | ) | ||||||||||||

| • | API products. Sales of our API products increased by 60.9% from $277.3 million in 2010 to $446.2 million in 2011 primarily due to increases in sales volume and average sales price. Sales volume of our API products increased by 43.8% from 271,986 tonnes in 2010 to 391,088 tonnes in 2011, primarily due to increased demand for our products in both the domestic and international markets as a result of contract wins in South America and increased orders from our primary PRC customers under improved market conditions. The average sales price of our API products increased from $1,020 per tonne in 2010 to $1,141 per tonne in 2011, primarily due to sales of higher-priced API products in both the domestic and international markets. |

| • | Non-API products. Sales of our non-API products increased by 106.4% from $70.1 million in 2010 to $144.8 million in 2011 primarily due to increases in sales volume and average sales price. Sales volume of our non-API products increased by 92.7% from 37,543 tonnes in 2010 to 72,358 tonnes in 2011, primarily due to increased demand for our products in both the domestic and international markets as a result of increased orders from our primary PRC customers under improved market conditions. The average sales price of our non-API products increased from $1,868 per tonne in 2010 to $2,001 per tonne in 2011 primarily, due to sales of higher-priced non-API products in the international markets. |

| • | Iron ore. Sales of iron ore was nil in 2011 compared to $31.9 million in 2010 due to our internal lack of iron ore pellet requirements and low market demand for sales of iron ore pellets. |

| • | Other products. Sales of other products increased by 4.4% from $91.1 million in 2010 to $95.1 million in 2011 due to an increase in sales of unfinished products to meet our customers’ production requirements. |

| • | API products. Sales of our API products decreased by 33.1% from $414.3 million in 2009 to $277.3 million in 2010 due to decreases in sales volume and average sales price. Sales volume of our API products decreased by 26.3% from 369,266 tonnes in 2009 to 271,986 tonnes in 2010 due to decreased demand for our products particularly in the domestic market. The average sales price of our API products decreased from $1,122 per tonne in 2009 to $1,020 per tonne in 2010, primarily due to the stiff price competition as a result of the oversupply of OCTG products in the domestic market. |

| • | Non-API products. Sales of our non-API products decreased by 31.4% from $102.2 million in 2009 to $70.1 million in 2010 due to decreases in sales volume and average sales price. Sales volume of our non-API products decreased by 29.0% from 52,877 tonnes in 2009 to 37,543 tonnes in 2010 mainly due to decreased demand for our products in the international markets. The average sales price of our non-API products decreased from $1,933 per tonne in 2009 to $1,868 per tonne in 2010 due to sales of lower priced non-API products in the international markets. |

| • | Iron ore. Sales of iron ore increased by 59.8% from $20.0 million in 2009 to $31.9 million in 2010. |

| • | Other products. Sales of other products increased by 124.3% from $40.6 million in 2009 to $91.1 million in 2010 due to an increase in sales of steel billets and unfinished products to meet our customers’ production requirements. |

| • | Continuing capital expenditures; |

| • | Repayment of bank borrowings; and |

| • | Continuing use of cash in operations |

| For the year ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | | 2009 | | 2010 | | 2011 | |||||||||

| Net cash flows from operating activities | $ | (116,456 | ) | $ | (5,142 | ) | $ | 60,791 | |||||||

| Net cash flows from investing activities | (120,141 | ) | (71,404 | ) | (187,567 | ) | |||||||||

| Net cash flows from financing activities | 280,697 | (9,776 | ) | 97,578 | |||||||||||

| Effect of foreign exchange rate changes on cash and cash equivalents | 53 | 1,760 | 8,270 | ||||||||||||

| Net increase/decrease in cash and bank balances | 44,153 | (84,562 | ) | (20,928 | ) | ||||||||||

| Cash and cash equivalents at beginning of the period | 89,097 | 133,250 | 48,688 | ||||||||||||

| Cash and cash equivalents at end of the period included in assets held for sale | — | — | (18 | ) | |||||||||||

| Cash and cash equivalents at end of the period | $ | 133,250 | $ | 48,688 | $ | 27,742 | |||||||||

| As of December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | | 2009 | | 2010 | | 2011 | |||||||||

| Short-term bank loans | $ | 432,490 | $ | 508,355 | $ | 714,310 | |||||||||

| Credit from bills receivable discounted with recourse | 66,636 | 88,191 | 38,916 | ||||||||||||

| Long-term bank loans due for settlement over one year | 189,069 | 135,896 | 79,354 | ||||||||||||

| Long-term bank loan due for settlement within one year | 7,322 | 0 | 20,315 | ||||||||||||

| Total | $ | 695,517 | $ | 732,442 | $ | 852,895 | |||||||||

| • | development and application of new materials; |

| • | design of premium connectors; |

| • | improvement of production techniques (including improved corrosion-resistance and upsetting); and |

| • | development of quality control systems. |

| D. | Trend Information |

| E. | Off-Balance Sheet Commitments and Arrangements |

| F. | Contractual Obligations and Commercial Commitments |

| | | | | | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Payment due by period(1)(2) | |||||||||||||||||||||||

| As of December 31, 2011 (in thousands)(1) (2) | | Total | | Less than 1 year | | 1-3 years | | 3-5 years | | More than 5 years | |||||||||||||

Long term debt obligations(3) | $ | 99,669 | 20,315 | $ | 79,354 | — | — | ||||||||||||||||

| Capital lease obligations | — | — | — | — | — | ||||||||||||||||||

| Operating lease obligations | $ | 1,940 | $ | 1,097 | $ | 837 | $ | 6 | — | ||||||||||||||

Purchase obligations(4) | $ | 17,915 | $ | 17,915 | — | — | — | ||||||||||||||||

| (1) | The above table does not include the unrecognized tax benefits amounting to $12.8 million as the timing of such obligation is not determinable. |

| (2) | The above table does not include a commitment to purchase a minimum amount of 0.3 million tonnes of iron ore pellets on a yearly basis from 2010 through 2014 as the purchase price of the iron ore pellets under such commitment is not determinable. |

| (3) | The figures are principal only and do not include interest. |

| (4) | Represents obligations relating to the production facilities in Wuxi, Liaoyang, Songyuan, Kuerle, Tuoketuo, Houston OCTG and Chaoyang. |

| G. | Safe Harbor |

| • | expectations regarding the worldwide demand for seamless OCTG products; |

| • | the company’s beliefs regarding the effects of environmental regulation, the lack of infrastructure reliability and long-term access to raw material supplies; |

| • | the importance of environmentally friendly seamless OCTG production; |

| • | expectations regarding governmental support for the deployment of OCTG industry; |

| • | expectations regarding the scaling of the company’s manufacturing capacity; |

| • | expectations with respect to the company’s ability to secure raw materials in the future; |

| • | future business development, results of operations and financial condition; and |

| • | competition from other manufacturers of OCTG products and conventional OCTG suppliers. |

Item 6. | Directors, Senior Management and Employees |

| A. | Directors and Senior Management |

| | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Directors and executive officers | | Age | | Position | ||||||

| Longhua Piao | 49 | Chairman and Chief Executive Officer | ||||||||

| Syed Hisham bin Syed Wazir | 57 | Vice Chairman | ||||||||

| Xizhong Xu | 43 | Director and Assistant General Manager | ||||||||

| Weidong Wang | 45 | Independent Director | ||||||||

| Jing Lu | 71 | Independent Director | ||||||||

| Dennis D. Zhu | 48 | Independent Director | ||||||||

| Michael Muhan Liu | 49 | Independent Director | ||||||||

| Baiqin Yu | 66 | Vice General Manager of Production | ||||||||

| Yi Zhang | 56 | Vice General Manager of Technology | ||||||||

| Zongdi Ye | 60 | Vice General Manager of Machinery | ||||||||

| Choon-Hoi Then | 55 | Chief Financial Officer | ||||||||

| Rixin Luo | 49 | Assistant General Manager of Sales and Marketing | ||||||||

| Yanping Dong | 49 | Assistant General Manager of Administration | ||||||||

| Jiaxing Liu | 65 | Vice General Manager of Human Resources | ||||||||

| B. | Compensation of Directors and Executive Officers |

| • | Options. Options provide for the right to purchase a specified number of our ordinary shares at a specified price and period determined by our compensation committee in one or more installments after the grant date. |

| • | Restricted Shares. A restricted share award is the grant of a specified number of our ordinary shares determined by our compensation committee. A restricted share is subject to restrictions on transferability and other restrictions as our compensation committee may impose. A restricted share may be repurchased by us upon termination of employment or service during a restricted period. Our compensation committee shall also determine in the award agreement whether the participant will be entitled to vote the restricted shares or receive dividends on such shares. |

| • | Restricted Share Units. Restricted share units represent the right to receive a specified number of our ordinary shares at a specified date in the future. On the date specified in the award agreement, we shall deliver to the holder unrestricted ordinary shares which will be freely transferable. |

| | | | | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | | Ordinary Shares Underlying Outstanding Options | | Exercise Price (per Share) | | Grant Date | | Expiration Date | ||||||||||

| Longhua Piao | 230,000 | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| Syed Hisham bin Syed Wazir | 100,000 | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| Xizhong Xu | * | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| Baiqin Yu | * | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| Yi Zhang | * | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| Zongdi Ye | * | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| Rixin Luo | * | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

Yanping Dong(1) | * | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| Directors and executive officers as a group | 1,580,000 | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| Other individuals as a group | 1,023,000 | $ | 4.0 | August 24, 2007 | August 24, 2012 | |||||||||||||

| * | Upon exercise of all options exercisable within 60 days of the date of this annual report, would beneficially own 1% or less of our ordinary shares. |

| (1) | Ms. Yanping Dong is Mr. Piao’s wife. |

| C. | Board Practices |

| • | selecting the independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by the independent auditors; |

| • | reviewing with the independent auditors any audit problems or difficulties and management’s response; |

| • | reviewing and approving all related party transactions; |

| • | discussing the annual audited financial statements with management and the independent auditors; |

| • | reviewing major issues as to the adequacy of our internal controls and any special audit steps adopted in light of material control deficiencies; and |

| • | meeting separately and periodically with management and the independent auditors. |

| • | reviewing the compensation philosophy of the company; |

| • | evaluating the performance of our chief executive officer and determining and approving the compensation of our chief executive officer as well as other executive officers and directors; and |

| • | reviewing periodically and approving any long-term incentive compensation or equity plans, programs or similar arrangements, annual bonuses, employee pension and welfare benefit plans. |

| • | identifying and recommending qualified candidates to the board for selection of nominees as directors, or for appointment to fill any vacancy; |

| • | reviewing annually with the board of directors the current composition of the board of directors with regards to characteristics such as independence, experience and availability of service to us; |

| • | advising the board of directors periodically with regard to significant developments in the law and practice of corporate governance as well as our compliance with applicable laws and regulations, and making recommendations to the board of directors on all matters of corporate governance and on any remedial actions to be taken; and |

| • | monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance. |

| • | solicit business from or perform services for any person who was a client, customer, supplier or prospective client of ours or of our subsidiaries during the executive officers’ employment; |

| • | solicit or induce any person to terminate his or her employment or consulting relationship with us or our subsidiaries; or |

| • | engage, invest or assist in any business that competes with our existing or future business or our subsidiaries. |

| D. | Employees |

As of December 31, 2011 | ||||||

| Production | 3,147 | |||||

| Technical services | 416 | |||||

| Quality assurance | 501 | |||||

| Logistics | 312 | |||||

| General administration | 345 | |||||

| Marketing and sales | 78 | |||||

| Total | 4,799 |

| E. | Share Ownership |

| (1) | each of our directors and executive officers; and |

| (2) | each person known to us to own beneficially more than 5.0% of our ordinary shares. |

| | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Shares beneficially owned | |||||||||||

| | Number | | % | ||||||||

Directors and executive officers: | |||||||||||

Longhua Piao(1)(6) | 104,330,000 | 51.0 | |||||||||

Syed Hisham bin Syed Wazir(2)(7) | 46,000,000 | 22.5 | |||||||||

| Xizhong Xu | * | * | |||||||||

| Weidong Wang | - | - | |||||||||

| Jing Lu | - | - | |||||||||

| Dennis D. Zhu | - | - | |||||||||

| Michael Muhan Liu | - | - | |||||||||

| Baiqin Yu | * | * | |||||||||

| Yi Zhang | * | * | |||||||||

| Zongdi Ye | * | * | |||||||||

| Choon-Hoi Then | * | * | |||||||||

| Rixin Luo | * | * | |||||||||

Yanping Dong(3) | * | * | |||||||||

| Jiaxing Liu | * | * | |||||||||

All directors and executive officers as a group(4) | 164,748,000 | 80.4 | |||||||||

Principal shareholders: | |||||||||||

Expert Master Holdings Limited(5) | 104,100,000 | 50.9 | |||||||||

UMW China Ventures (L) Ltd.(6) | 45,900,000 | 22.5 | |||||||||

OCM Asia Principal Opportunities Fund, L.P.(7) | 14,088,000 | 6.9 | |||||||||

| * | Upon exercise of all options exercisable within 60 days of the date of this annual report, would beneficially own 1% or less of our ordinary shares. |

| (1) | Includes (i) 104,100,000 ordinary shares owned by EMH, which is wholly-owned by Mr. Piao; and (ii) 230,000 ordinary shares issuable upon exercise of options held by Mr. Piao. The business address of Mr. Piao is No. 38 Zhujiang Road, Xinqu, Wuxi, Jiangsu Province, People’s Republic of China. |

| (2) | Includes (i) 45,900,000 ordinary shares owned by UMW China Ventures (L) Ltd.; and (ii) 100,000 ordinary shares issuable upon exercise of options held by Datuk Syed Hisham bin Syed Wazir, who is UMW Holdings Berhad’s group managing director and chief executive officer. UMW Holdings Berhad is the ultimate owner of UMW China Ventures (L) Ltd. Datuk Syed Hisham bin Syed Wazir disclaims beneficial ownership of all of the shares owned by UMW China Ventures (L) Ltd. The business address of Syed Hisham bin Syed Wazir is UMW Holdings Bhd, Jalan Utas 15/7, 40915 Shah Alam, Selangor, Malaysia. |

| (3) | Ms. Dong is Mr. Piao’s spouse. |

| (4) | Includes ordinary shares issuable upon exercise of options held by all of our directors and executive officers as a group. |

| (5) | EMH is wholly-owned by Mr. Piao. The address of Expert Master Holdings Limited is P.O. Box 957, Offshore Incorporations Centre, Road Town, Tortola, British Virgin Islands. |

| (6) | UMW China Ventures (L) Ltd., a corporation incorporated in Labuan, Malaysia, with the address at Brumby House, Jalan Bahasa, P.O. Box 80148, 87011 Labuan F.T. Malaysia, is wholly-owned by UMW Petropipe (L) Ltd., a corporation incorporated in Labuan, Malaysia, with the address at Brumby House, Jafan Bahasa, P.O. Box 80148, 87011 Labuan F.T. Malaysia, which is in turn a wholly-owned subsidiary of UMW Holdings Berhad, a company incorporated in Malaysia and whose shares are listed on the Malaysian Stock Exchange. The address of UMW Holdings Berhad is: 3rd Floor, The Corporate, No.10 Jalan Utas (15/7), Batu Tiga Industrial Estate, 40200 Shah Alam, Selangor Darul Ehsan, Malaysia. |

| (7) | OCM Asia Principal Opportunities Fund, L.P. is a Cayman Islands exempted limited partnership. The principal business address of OCM Asia Principal Opportunities Fund, L.P. is c/o Oaktree Capital Group Holdings GP, LLC, 333 South Grand Avenue, 28th Floor, Los Angeles, California 90071. |

Item 7. | Major Shareholders and Related Party Transactions |

| A. | Major Shareholders |

| B. | Related Party Transaction |

| C. | Interests of Experts and Counsel |

Item 8. | Financial Information |

| A. | Consolidated Statements and Other Financial Information |

| B. | Significant Changes |

Item 9. | The Offer and Listing |

| A. | Offering and Listing Details. |

| | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Trading Price | |||||||||||

| | High | | Low | ||||||||

Annual High and Low | |||||||||||

| 2007 (from December 6) | 47.50 | 40.80 | |||||||||

| 2008 | 46.20 | 18.25 | |||||||||

| 2009 | 37.50 | 11.15 | |||||||||

| 2010 | 17.40 | 5.00 | |||||||||

| 2011 | 8.35 | 1.05 | |||||||||

Quarterly High and Low | |||||||||||

| First Quarter 2010 | 17.40 | 12.75 | |||||||||

| Second Quarter 2010 | 14.95 | 7.75 | |||||||||

| Third Quarter 2010 | 10.95 | 5.25 | |||||||||

| Fourth Quarter 2010 | 8.45 | 5.00 | |||||||||

| First Quarter 2011 | 7.30 | 5.80 | |||||||||

| Second Quarter 2011 | 8.35 | 3.70 | |||||||||

| Third Quarter 2011 | 4.55 | 1.62 | |||||||||

| Fourth Quarter 2011 | 3.00 | 1.05 | |||||||||

| First Quarter 2012 | 2.47 | 1.80 | |||||||||

Monthly High and Low | |||||||||||

| October 2011 | 3.00 | 1.05 | |||||||||

| November 2011 | 2.35 | 1.75 | |||||||||

| December 2011 | 2.60 | 1.75 | |||||||||

| January 2012 | 2.37 | 2.10 | |||||||||

| February 2012 | 2.47 | 1.80 | |||||||||

| March 2012 | 2.06 | 1.91 | |||||||||

| April (through April 27), 2012 | 1.98 | 1.06 | |||||||||

| B. | Plan of Distribution |

| C. | Markets |

| D. | Selling Shareholders |

| E. | Dilution |

| F. | Expenses of the Issue |

Item 10. | Additional Information |

| A. | Share Capital |

| B. | Memorandum and Articles of Association |

| • | increase our capital by such sum, to be divided into shares of such amounts, as the resolution shall prescribe; |

| • | consolidate and divide all or any of our share capital into shares of larger amount than our existing shares; |

| • | cancel any shares which at the date of the passing of the resolution have not been taken or agreed to be taken by any person, and diminish the amount of its share capital by the amount of the shares so cancelled subject to the provisions of the Companies Law; |

| • | sub-divide our shares or any of them into shares of smaller amount than is fixed by our amended and restated memorandum of association, subject nevertheless to the Companies Law, and so that the resolution whereby any share is sub-divided may determine that, as between the holders of the shares resulting from such subdivision, one or more of the shares may have any such preferred or other special rights, over, or may have such deferred rights or be subject to any such restrictions as compared with the others as we have power to attach to unissued or new shares; and |

| • | divide shares into several classes and without prejudice to any special rights previously conferred on the holders of existing shares, attach to the shares respectively any preferential, deferred, qualified or special rights, privileges, conditions or such restrictions that in the absence of any such determination in general meeting may be determined by our directors. |

| • | the instrument of transfer is lodged with us accompanied by the certificate for the shares to which it relates and such other evidence as our directors may reasonably require to show the right of the transferor to make the transfer; |

| • | the instrument of transfer is in respect of only one class of share; |

| • | the instrument of transfer is properly stamped (in circumstances where stamping is required); and |

| • | a fee of such maximum sum as the New York Stock Exchange may determine to be payable or such lesser sum as our directors may from time to time require is paid to us in respect thereof. |

| • | all checks or warrants in respect of dividends of such shares, not being less than three in number, for any sums payable in cash to the holder of such shares have remained un-cashed for a period of 12 years prior to the publication of the advertisement and during the three months referred to in third bullet point below; |

| • | we have not during that time received any indication of the whereabouts or existence of the shareholder or person entitled to such shares by death, bankruptcy or operation of law; and |

| • | we have caused an advertisement to be published in newspapers in the manner stipulated by our amended and restated articles of association, giving notice of our intention to sell these shares, and a period of three months has elapsed since such advertisement and the New York Stock Exchange has been notified of such intention. |

| C. | Material Contracts |

| D. | Exchange Controls |

| E. | Taxation |

| • | that no law which is enacted in the Cayman Islands imposing any tax to be levied on profits or income or gains or appreciations shall apply to our company or its operations; and |

| • | that the aforesaid tax or any tax in the nature of estate duty or inheritance tax shall not be payable on the shares, debentures or other obligations of our company. |

| • | banks; |

| • | certain financial institutions; |

| • | insurance companies; |

| • | broker dealers; |

| • | traders that elect to mark to market; |

| • | tax-exempt entities; |

| • | persons liable for alternative minimum tax; |

| • | persons holding an ADS or ordinary share as part of a straddle, hedging, conversion or integrated transaction; |

| • | persons who acquired ADSs or ordinary shares pursuant to the exercise of any employee stock options or otherwise as compensation; |

| • | persons that actually or constructively own 10% or more of our voting stock; or |

| • | persons holding ADSs or ordinary shares through partnerships or other pass-through entities. |

| • | an individual who is citizen or resident of the United States; |

| • | a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) organized under the laws of the United States, any State or the District of Columbia; |

| • | an estate whose income is subject to U.S. federal income taxation regardless of its source; or |

| • | a trust that (1) is subject to the primary supervision of a court within the United States and the control of one or more U.S. persons or (2) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. |

| • | at least 75% of its gross income is passive income, or the “income test,” or |

| • | at least 50% of the value of its assets (based on an average of the quarterly values of the assets during a taxable year) is attributable to assets that produce or are held for the production of passive income, or the “asset test.” |

| • | the excess distribution or gain will be allocated ratably over your holding period for the ADSs or ordinary shares; |

| • | the amount allocated to the current taxable year, and any taxable year prior to the first taxable year in which we were a PFIC, will be treated as ordinary income; and |

| • | the amount allocated to each other year will be subject to the highest tax rate in effect for that year and the interest charge generally applicable to underpayments of tax will be imposed on the resulting tax attributable to each such year. |

| F. | Dividends and Paying Agents |

| G. | Statement by Experts |

| H. | Documents on Display |

| I. | Subsidiary Information |

Item 11. | Quantitative and Qualitative Disclosures About Market Risk |

Item 12. | Description of Securities Other Than Equity Securities |

| A. | Debt Securities |

| B. | Warrants and Rights |

| C. | Other Securities |

| D. | American Depositary Shares |

| • | a fee of $1.50 per ADR or ADRs for transfers of certificated or direct registration ADRs; |

| • | a fee of up to $0.05 per ADS (or portion thereof) for any cash distribution made pursuant to the deposit agreement; |

| • | a fee of up to $0.05 per ADS per calendar year (or portion thereof) for services performed by the depositary in administering our ADR program (which fee may be charged on a periodic basis during each calendar year and shall be assessed against holders of ADRs as of the record date or record dates set by the depositary during each calendar year and shall be payable in the manner described in the next succeeding provision); |

| • | reimbursement of such fees, charges and expenses incurred by the depositary and/or any of the depositary’s agents (including, without limitation, the custodian and expenses incurred on behalf of holders in connection with compliance with foreign exchange control regulations or any law or regulation relating to foreign investment) in connection with the servicing of the shares or other deposited securities, the delivery of deposited securities or otherwise in connection with the depositary’s or its custodian’s compliance with applicable law, rules or regulations (which charge shall be assessed on a proportionate basis against holders as of the record date or dates set by the depositary and shall be payable at the sole discretion of the depositary by billing such registered holders or by deducting such charge from one or more cash dividends or other cash distributions); |

| • | a fee for the distribution of securities (or the sale of securities in connection with a distribution), such fee being in an amount equal to the fee for the execution and delivery of ADSs which would have been charged as a result of the deposit of such securities (treating all such securities as if they were shares) but which securities or the net cash proceeds from the sale thereof are instead distributed by the depositary to those holders entitled thereto; |

| • | stock transfer or other taxes and other governmental charges; |

| • | cable, telex and facsimile transmission and delivery charges incurred at your request; |

| • | transfer or registration fees for the registration of transfer of deposited securities on any applicable register in connection with the deposit or withdrawal of deposited securities; and |

| • | expenses of the depositary in connection with the conversion of foreign currency into U.S. dollars. |

Item 13. | Defaults, Dividend Arrearages and Delinquencies |

Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds |

Item 15. | Controls and Procedures |

Item 16A. | Audit Committee Financial Expert |

Item 16B. | Code of Ethics |

Item 16C. | Principal Accountant Fees and Services |

| | | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | | 2009(3) | | 2010 | | 2011 | ||||||||

Audit fees(1) | $ | 1,868 | $ | 1,626 | 1,279 | |||||||||

| Audit-related fees | — | — | — | |||||||||||

Tax-related fees(2) | $ | 68 | $ | 15 | — | |||||||||

| (1) | “Audit fees” means the aggregate fees billed for professional services rendered by our principal auditor for the audit of the consolidated financial statements and of the effectiveness of internal control over financial reporting, statutory audits of certain subsidiaries, reviews of the quarterly financial statements, procedures related to registration statement filed with the SEC. |

| (2) | “Tax-related fees” means the aggregate fees billed for tax compliance, tax advice, and tax planning services. |

| (3) | In 2009, a member firm of DTTC provided audit and tax-related services to one of our subsidiaries for a fee of $370,000 and $350,000 respectively, in addition to the fees disclosed in the table above. |

Item 16D. | Exemptions From the Listing Standards for Audit Committees |

Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

| | | | | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Period | | Total Number of ADSs(1) Purchased | | Average Price Paid per ADS(1) | | Total Number of ADSs Purchased as Part of Publicly Announced Plan(2) | | Approximate Dollar Value of ADSs that May Yet Be Purchased Under the Plan(2) | ||||||||||

| March 1, 2010 to March 31, 2010 | 14,220 | $13.67 | 14,220 | $9,803,415.90 | ||||||||||||||

| April 1, 2010 to April 30, 2010 | 127,237 | $14.02 | 127,237 | $8,196,597.03 | ||||||||||||||

Total | 141,457 | $13.99 | 141,457 | $8,196,597.03 | ||||||||||||||

| (1) | Each of our ADSs represents ten ordinary shares. |

| (2) | The repurchase plan was approved by the board of directors on November 25, 2009 and provides for the repurchase of up to $10 million of our ordinary shares. |

Item 16F. | Change in Registrant’s Certifying Accountant |

Item 16G. | Corporate Governance |

Item 17. | Financial Statements |

Item 18. | Financial Statements |

Item 19. | Exhibits |

| 1.1 | Amended and Restated Memorandum and Articles of Association of the Registrant (incorporated by reference to Exhibit 1.1 of our Annual Report on Form 20-F/A (File No. 001-33840), filed with the Securities and Exchange Commission on June 30, 2008). |

| 2.1 | Registrant’s specimen American depositary receipt (included in Exhibit 2.3) (incorporated by reference to Exhibit 4.3 of Amendment No. 1 to our Registration Statement on Form F-1 (File No. 333-147351), filed with the Securities and Exchange Commission on November 20, 2007). |

| 2.2 | Registrant’s specimen certificate for ordinary shares (incorporated by reference to Exhibit 4.2 of our Registration Statement on Form F-1 (File No. 333-147351), filed with the Securities and Exchange Commission on November 13, 2007). |

| 2.3 | Deposit Agreement, dated as of December 6, 2007, among the Registrant, the depositary and holder of the American depositary receipts (incorporated by reference to Exhibit 4.3 of Amendment No. 1 to our Registration Statement on Form F-1 (File No. 333-147351), filed with the Securities and Exchange Commission on November 20, 2007). |

| 4.1 | 2007 Share Incentive Plan (incorporated by reference to Exhibit 10.1 of our Registration Statement on Form F-1 (File No. 333-147351), filed with the Securities and Exchange Commission on November 13, 2007). |

| 4.2 | Form of Employment Agreement between the Registrant and a Senior Executive Officer of the Registrant (incorporated by reference to Exhibit 10.3 of our Registration Statement on Form F-1 (File No. 333-147351), filed with the Securities and Exchange Commission on November 13, 2007). |

| 4.3 | English translation of Framework Agreement, dated January 5, 2007, between Wuxi Seamless Oil Pipes Company Limited and Wuxi Aihua Chemical Industry Co., Ltd. (incorporated by reference to Exhibit 10.20 of our Registration Statement on Form F-1 (File No. 333-147351), filed with the Securities and Exchange Commission on November 13, 2007). |

| 4.4 | English translation of Asset Transfer Agreement, dated January 31, 2007, between Wuxi Seamless Oil Pipes Company Limited and Hailong Drill Pipe (Wuxi) Co., Ltd. (incorporated by reference to Exhibit 10.21 of our Registration Statement on Form F-1 (File No. 333-147351), filed with the Securities and Exchange Commission on November 13, 2007). |

| 4.5 | English translation of Joint Venture Agreement, dated March 27, 2008, between First Space Holdings Limited and Liaoning Steel Pipe Co., Ltd. (incorporated by reference to Exhibit 4.39 of our Annual Report on Form 20-F (File No. 001-33840), filed with the Securities and Exchange Commission on June 12, 2008). |

| 4.6 | English translation of Equity Transfer Agreement, dated July 24, 2008, between Hebei Bishi Industry Group Co., Ltd. and Wuxi Seamless Oil Pipes Co., Ltd. regarding Inner Mongolia Tuoketuo County Mengfeng Special Steel Co., Ltd. (incorporated by reference to Exhibit 4.20 of our Annual Report on Form 20-F (File No. 001-33840), filed with the Securities and Exchange Commission on May 5, 2009) |

| 4.7 | English translation of the Syndicated Line of Credit and Loan Agreement, dated August 29, 2011, between Wuxi Seamless Oil Pipes Co. Ltd. and Bank of China, Agricultural Bank of China as lead banks and six other participating commercial banks (incorporated by reference to Exhibit 4.11 of our Annual Report on Form 20-F (File No. 001-33840), filed with the Securities and Exchange Commission on September 14, 2011) |

| 4.8* | English translation of the Shares Sale and Purchase Agreement, dated January 17, 2012, between Wuxi Seamless Oil Pipes Co. Ltd. and Liming Zhou |

| 4.9* | Guarantee, dated January 26, 2011, between Longhua Piao and Bangkok Bank Public Company Limited |

| 4.10* | Letter dated April 30, 2012 from Deloitte Touche Tohmatsu CPA Ltd. |

| 8.1* | Subsidiaries of the Registrant. |

| 11.1 | Code of Business Conduct and Ethics of the Registrant (incorporated by reference to Exhibit 99.1 of our Registration Statement on Form F-1 (File No. 333-147351), filed with the Securities and Exchange Commission on November 13, 2007). |

| 12.1* | CEO Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 12.2* | CFO Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 13.1* | CEO Certification Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 13.2* | CFO Certification Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 15.1* | Consent of Deloitte Touche Tohmatsu CPA Ltd. |

| 15.2* | Consent of MaloneBailey LLP |

| * | Filed with this Annual Report on Form 20-F |

| WSP Holdings Limited | ||||||||||

| By: | /s/ Longhua Piao | |||||||||

| Name: Longhua Piao | ||||||||||

| Title: Chairman and Chief Executive Officer | ||||||||||

and Financial Statements

For the years ended December 31, 2009, 2010 and 2011

| CONTENTS | PAGE(S) | |||||

|---|---|---|---|---|---|---|

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F-1 | |||||

| CONSOLIDATED BALANCE SHEETS AS OF DECEMBER 31, 2010 AND 2011 | F-3 | |||||

| CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2009, 2010 AND 2011 | F-5 | |||||

| CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY AND COMPREHENSIVE INCOME FOR THE YEARS ENDED DECEMBER 31, 2009, 2010 AND 2011 | F-6 | |||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2009, 2010 AND 2011 | F-7 | |||||

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | F-9 | |||||

WSP Holdings Limited

www.malone-bailey.com

Houston, Texas

April 30, 2012

Beijing, the People’s Republic of China

September 14, 2011

(In U.S. dollar thousands, except for share and share-related data)

| As of December 31, 2010 | As of December 31, 2011 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Assets | ||||||||||

| Current assets: | ||||||||||

| Cash and cash equivalents | $ | 48,688 | $ | 27,742 | ||||||

| Restricted cash | 142,027 | 249,812 | ||||||||

| Term deposit | 303 | 286 | ||||||||

| Accounts and bills receivable, net of allowance for doubtful accounts of $20,057 and $22,593 in 2010 and 2011, respectively | 199,970 | 260,139 | ||||||||

| Advances to suppliers | 17,123 | 19,229 | ||||||||

| Inventories, net | 240,713 | 242,240 | ||||||||

| Prepaid lease payments for land use rights, current | 766 | 761 | ||||||||

| Income taxes receivable | 1,080 | 763 | ||||||||

| Prepaid expenses and other current assets | 33,506 | 40,336 | ||||||||

| Amounts due from related parties | 799 | 148 | ||||||||

| Assets held for sale | — | 20,314 | ||||||||

| Deferred income tax assets | 7,460 | 4,792 | ||||||||

| Total current assets | 692,435 | 866,562 | ||||||||

| Property, plant and equipment, net | 536,942 | 653,783 | ||||||||

| Intangible assets, net | 244 | 108 | ||||||||

| Goodwill | 428 | — | ||||||||

| Prepaid lease payments for land use rights, non-current | 33,752 | 32,957 | ||||||||

| Deposits for acquisition of property, plant and equipment | 60,882 | 4,070 | ||||||||

| Equity-method investment | 787 | 817 | ||||||||

| Deferred income tax assets, non-current | 5,592 | 12,819 | ||||||||

| Total assets | $ | 1,331,062 | $ | 1,571,116 | ||||||

(In U.S. dollar thousands, except for share and share-related data)

| As of December 31, 2010 | As of December 31, 2011 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities and equity | ||||||||||

| Current liabilities: | ||||||||||

| Accounts payable | $ | 176,379 | $ | 307,740 | ||||||

| Advances from customers | 5,432 | 6,825 | ||||||||

| Amounts due to related parties | 11,070 | 17,939 | ||||||||

| Accrued expenses and other current liabilities | 86,761 | 88,377 | ||||||||

| Income taxes payable | 733 | 424 | ||||||||

| Borrowings — due within one year | 596,546 | 773,541 | ||||||||

| Product warranty | 1,035 | 2,595 | ||||||||

| Liabilities held for sale | — | 47,559 | ||||||||

| Total current liabilities | 877,956 | 1,245,000 | ||||||||

| Borrowings — due after one year | 135,896 | 79,354 | ||||||||

| Deferred income tax liabilities, non-current | 2,616 | 2,617 | ||||||||

| Unrecognized tax benefits | 11,819 | 12,763 | ||||||||

| Total liabilities | 1,028,287 | 1,339,734 | ||||||||

| Equity: | ||||||||||

| WSP Holdings Limited shareholders’ equity: | ||||||||||

| Share capital (Ordinary shares $0.0001 par value, 500,000,000 shares authorized, 204,375,226 shares issued and outstanding as of December 31, 2010 and 2011, see Note 19) | 20 | 20 | ||||||||