UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Invesco India Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

3500 Lacey Road Downers Grove, IL 60515

(Address of principal executive offices) (Zip code)

Brian Hartigan, President

3500 Lacey Road

Downers Grove, IL 60515

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Reports to Stockholders.

(a) The Registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Act") is as follows:

Invesco India ETF

PIN | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco India ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco India ETF | $89 | 0.78% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, Indian equity securities benefited from a period of strong economic growth and accommodative central bank rate policy. Given the Fund's focus on Indian securities, it largely benefited from this market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the FTSE India Quality and Yield Select Index (the “Index”). The Fund generally will invest at least 90% of its total assets in the securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 27.90%, differed from the return of the Index, 35.94%, primarily due to India capital gains tax alongside the daily compounding of fees during a period of high returns.

What contributed to performance?

Sector Allocations | Consumer discretionary sector, followed by the industrials sector.

Positions | Bharti Airtel Ltd., a communication services company, and Infosys Ltd., an information technology company.

What detracted from performance?

Sector Allocations | No sectors detracted from the Fund's performance during the period.

Positions | Bajaj Finance Ltd., a financials company, and Axis Bank Ltd., a financials company.

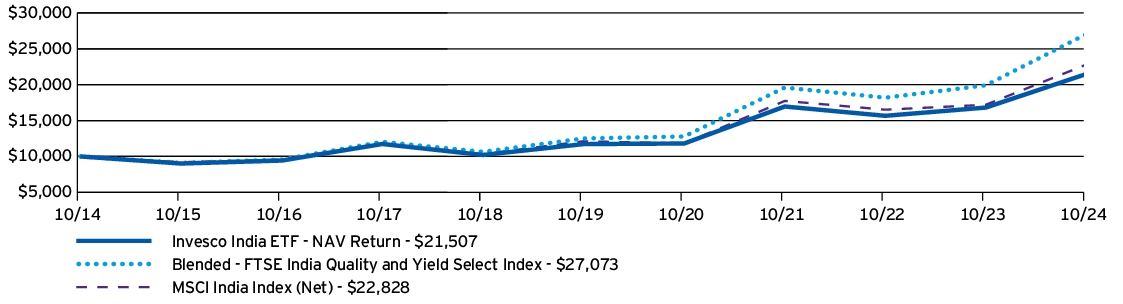

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco India ETF — NAV Return | 27.90% | 12.91% | 7.96% |

| Blended - FTSE India Quality and Yield Select Index | 35.94% | 16.69% | 10.47% |

| MSCI India Index (Net) | 32.69% | 13.50% | 8.60% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- The Blended - FTSE India Quality and Yield Select Index performance is comprised of the performance of the Indus India Index, the Fund's former underlying index, prior to June 22, 2019, followed by the performance of the Index thereafter.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $254,839,403 |

| Total number of portfolio holdings | 201 |

| Total advisory fees paid | $1,835,919 |

| Portfolio turnover rate | 31% |

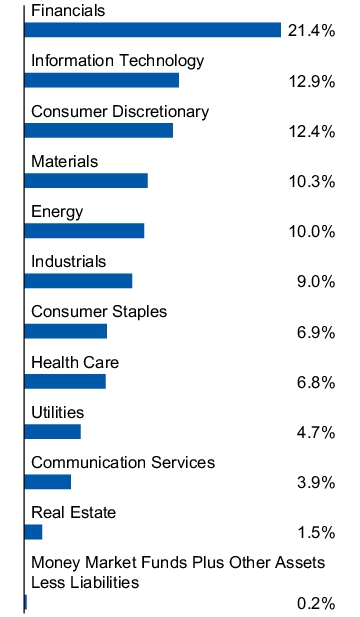

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| HDFC Bank Ltd. | 7.53% |

| Reliance Industries Ltd. | 6.84% |

| Infosys Ltd. | 4.76% |

| ICICI Bank Ltd. | 3.86% |

| Tata Consultancy Services Ltd. | 3.16% |

| Bharti Airtel Ltd. | 3.13% |

| Axis Bank Ltd. | 2.04% |

| Mahindra & Mahindra Ltd. | 1.92% |

| Larsen & Toubro Ltd. | 1.88% |

| Hindustan Unilever Ltd. | 1.73% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

The Registrant has adopted a Code of Ethics (the "Code") that applies to the Registrant's Principal Executive Officer ("PEO") and Principal Financial Officer ("PFO"). This Code is filed as an exhibit to this report on Form N-CSR under Item 19(a)(1). No substantive amendments to this Code were made during the reporting period. Administration of the Code was transferred from the Chief Legal Officer to the Chief Compliance Officer during the reporting period. There were no waivers for the fiscal year ended October 31, 2024.

Item 3. Audit Committee Financial Expert.

The Registrant's Board of Trustees (the "Board") has determined that the Registrant has four "audit committee financial experts" serving on its audit committee: Mr. Marc M. Kole, Ms. Joanne Pace, Mr. Gary R. Wicker and Mr. Donald H. Wilson. Each of these audit committee members is "independent," meaning that he/she is not an "interested person" of the Registrant (as that term is defined in Section 2(a)(19) of the Act) and he/she does not accept any consulting, advisory, or other compensatory fee from the Registrant (except in his/her capacity as a Board or committee member).

An "audit committee financial expert" is not an "expert" for any purpose, including for purposes of Section 11 of the Securities Act of 1933, as a result of being designated as an "audit committee financial expert." Further, the designation of a person as an "audit committee financial expert" does not mean that a person has any greater duties, obligations, or liability than those imposed on a person without the "audit committee financial expert" designation. Similarly, the designation of a person as an "audit committee financial expert" does not affect the duties, obligations, or liability of any other member of the audit committee or Board.

Item 4. Principal Accountant Fees and Services.

Fees Billed by PwC to the Registrant

PricewaterhouseCoopers LLP (“PwC”), the Registrant’s independent registered public accounting firm, billed the Registrant aggregate fees for pre-approved services rendered to the Registrant for the last two fiscal years as shown in the following table. The Audit Committee pre-approved all audit and non-audit services provided to the Registrant.

| | | |

| Fees Billed by PwC for Services Rendered to the Registrant for Fiscal Year Ended 2024 | Fees Billed by PwC for Services Rendered to the Registrant for Fiscal Year Ended 2023 |

Audit Fees | $ 33,100 | $ 31,650 |

Audit-Related Fees | $ 0 | $ 0 |

Tax Fees(1) | $ 12,060 | $ 13,400 |

All Other Fees | $ 0 | $ 0 |

Total Fees | $ 45,160 | $ 45,050 |

(1) | Tax Fees for the fiscal years ended 2024 and 2023 include fees billed for preparation of U.S. Tax Returns and Taxable Income calculations, including excise and year-to-date estimates for various book-to-tax differences. |

Fees Billed by PwC Related to Invesco and Affiliates

PwC billed Invesco Capital Management LLC (“Invesco” or “Adviser”), the Registrant’s investment adviser, and any entity controlling, controlled by or under common control with Invesco that provides ongoing services to the Registrant (“Affiliates”), aggregate fees for pre-approved non-audit services rendered to Invesco and Affiliates for the last two fiscal years as shown in the following table. The Audit Committee pre-approved all non-audit services provided to Invesco and Affiliates that were required to be pre-approved.

| | |

| Fees Billed for Non-Audit Services Rendered to Invesco and Affiliates for Fiscal Year Ended 2024 That Were Required to be Pre-Approved by the Registrant’s Audit Committee | Fees Billed for Non-Audit Services Rendered to Invesco and Affiliates for Fiscal Year Ended 2023 That Were Required to be Pre-Approved by the Registrant’s Audit Committee |

Audit-Related Fees(1) | $ 1,134,000 | $ 1,067,000 |

Tax Fees | $ 0 | $ 0 |

All Other Fees | $ 0 | $ 0 |

Total Fees | $ 1,134,000 | $ 1,067,000 |

(1) | Audit-Related Fees for the fiscal years ended 2024 and 2023 include fees billed related to reviewing controls at a service organization. |

(e)(1)Audit Committee Pre-Approval Policies and Procedures

Pre-Approval of Audit and Non-Audit Services Policies and Procedures

As Adopted by the Audit Committee of the Invesco ETFs

| | |

Applicable to | Invesco Exchange-Traded Fund Trust, Invesco Exchange-Traded Fund Trust II, Invesco India Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Fund Trust, Invesco Actively Managed Exchange-Traded Commodity Fund Trust and Invesco Exchange-Traded Self-Indexed Fund Trust (collectively the “Funds”) |

Risk Addressed by Policy | Approval of Audit and Non-Audit Services |

Relevant Law and Other Sources | Sarbanes-Oxley Act of 2002; Regulation S-X. |

Last Reviewed by Compliance for Accuracy | June 15, 2018 |

Effective Date | June 26, 2009 |

Amended Dates | March 12, 2015 and June 15, 2018 |

Statement of Principles

Under the Sarbanes-Oxley Act of 2002 and rules adopted by the Securities and Exchange Commission (“SEC”) (“Rules”), the Audit Committee of the Funds’ (the “Audit Committee”) Board of Trustees (the “Board”) is responsible for the appointment, compensation and oversight of the work of independent accountants (an “Auditor”). As part of this responsibility and to assure that the Auditor’s independence is not impaired, the Audit Committee pre-approves the audit and non-audit services provided to the Funds by each Auditor, as well as all non-audit services provided by the Auditor to the Funds’ investment adviser and to affiliates of the adviser that provide ongoing services to the Funds (“Service Affiliates”) if the services directly impact the Funds’ operations or financial reporting. The SEC Rules also specify the types of services that an Auditor may not provide to its audit client. The following policies and procedures comply with the requirements for pre-approval and provide a mechanism by which management of the Funds may request and secure pre-approval of audit and non-audit services in an orderly manner with minimal disruption to normal business operations.

Proposed services either may be pre-approved without consideration of specific case-by-case services by the Audit Committee (“general pre-approval”) or require the specific pre-approval of the Audit Committee (“specific pre-approval”). As set forth in these policies and procedures, unless a type of service has received general pre-approval, it will require specific pre-approval by the Audit Committee. Additionally, any fees exceeding 110% of estimated pre-approved fee levels provided at the time the service was pre-approved will also require specific approval by the Audit Committee before payment is made. The Audit Committee will also consider the impact of additional fees on the Auditor’s independence when determining whether to approve any additional fees for previously pre-approved services.

The Audit Committee will annually review and generally pre-approve the services that may be provided by each Auditor without obtaining specific pre-approval from the Audit Committee. The term of any general pre-approval runs from the date of such pre-approval through June 30th of the following year, unless the Audit Committee considers a different period and states otherwise. The Audit Committee will add to or subtract from the list of general pre-approved services from time to time, based on subsequent determinations.

The purpose of these policies and procedures is to set forth the guidelines to assist the Audit Committee in fulfilling its responsibilities.

Delegation

The Chairman of the Audit Committee (or, in his or her absence, any member of the Audit Committee) may grant specific pre-approval for non-prohibited services. All such delegated pre-approvals shall be presented to the Audit Committee no later than the next Audit Committee meeting.

Audit Services

The annual Audit services engagement terms will be subject to specific pre-approval of the Audit Committee. Audit services include the annual financial statement audit and other procedures such as tax provision work that is required to be performed by the independent auditor to be able to form an opinion on the Funds’ financial statements. The Audit Committee will obtain, review and consider sufficient information concerning the proposed Auditor to make a reasonable evaluation of the Auditor’s qualifications and independence.

In addition to the annual Audit services engagement, the Audit Committee may grant either general or specific pre-approval of other Audit services, which are those services that only the independent auditor reasonably can provide. Other Audit services may include services such as issuing consents for the inclusion of audited financial statements with SEC registration statements, periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings.

Non-Audit Services

The Audit Committee may provide either general or specific pre-approval of any non-audit services to the Funds and its Service Affiliates if the Audit Committee believes that the provision of the service will not impair the independence of the Auditor, is consistent with the SEC’s Rules on auditor independence, and otherwise conforms to the Audit Committee’s general principles and policies as set forth herein.

Audit-Related Services

“Audit-related services” are assurance and related services that are reasonably related to the performance of the audit or review of the Funds’ financial statements or that are traditionally performed by the independent auditor. Audit-related services include, among others, accounting consultations related to accounting, financial reporting or disclosure matters not classified as “Audit services”; and assistance with understanding and implementing new accounting and financial reporting guidance from rulemaking authorities.

Tax Services

“Tax services” include, but are not limited to, the review and signing of the Funds’ federal tax returns, the review of required distributions by the Funds and consultations regarding tax matters such as the tax treatment of new investments or the impact of new regulations. The Audit Committee will scrutinize carefully the retention of the Auditor in connection with a transaction initially recommended by the Auditor, the major business purpose of which may be tax avoidance or the tax treatment of which may not be supported in the Internal Revenue Code and related regulations. The Audit Committee will consult with the Funds’ Treasurer (or his or her designee) and may consult with outside counsel or advisors as necessary to ensure the consistency of Tax services rendered by the Auditor with the foregoing policy.

No Auditor shall represent any Fund or any Service Affiliate before a tax court, district court or federal court of claims.

Under rules adopted by the Public Company Accounting Oversight Board and approved by the SEC, in connection with seeking Audit Committee pre-approval of permissible Tax services, the Auditor shall:

| 1. | Describe in writing to the Audit Committee, which writing may be in the form of the proposed engagement letter: |

| a. | The scope of the service, the fee structure for the engagement, and any side letter or amendment to the engagement letter, or any other agreement between the Auditor and the Fund, relating to the service; and |

| b. | Any compensation arrangement or other agreement, such as a referral agreement, a referral fee or fee-sharing arrangement, between the Auditor and any person (other than the Fund) with respect to the promoting, marketing, or recommending of a transaction covered by the service; |

| 2. | Discuss with the Audit Committee the potential effects of the services on the independence of the Auditor; and |

| 3. | Document the substance of its discussion with the Audit Committee. |

All Other Auditor Services

The Audit Committee may pre-approve non-audit services classified as “All other services” that are not categorically prohibited by the SEC, as listed in Exhibit 1 to this policy.

Pre-Approval Fee Levels or Established Amounts

Pre-approval of estimated fees or established amounts for services to be provided by the Auditor under general or specific pre-approval policies will be set periodically by the Audit Committee. Any proposed fees exceeding 110% of the maximum estimated pre-approved fees or established amounts for pre-approved audit and non-audit services will be reported to the Audit Committee at the quarterly Audit Committee meeting and will require specific approval by the Audit Committee before payment is made. The Audit Committee will always factor in the overall relationship of fees for audit and non-audit services in determining whether to pre-approve any such services and in determining whether to approve any additional fees exceeding 110% of the maximum pre-approved fees or established amounts for previously pre-approved services.

Procedures

On an annual basis, the Auditor will submit to the Audit Committee for general pre-approval, a list of non-audit services that the Funds or Service Affiliates of the Funds may request from the Auditor. The list will describe the non-audit services in reasonable detail and will include an estimated range of fees and such other information as the Audit Committee may request.

Each request for services to be provided by the Auditor under the general pre-approval of the Audit Committee will be submitted to the Funds’ Treasurer (or his or her designee) and must include a detailed description of the services to be rendered. The Treasurer or his or her designee will ensure that such services are included within the list of services that have received the general pre-approval of the Audit Committee.

Each request to provide services that require specific approval by the Audit Committee shall be submitted to the Audit Committee jointly by the Funds’ Treasurer or his or her designee and the Auditor, and must include a joint statement that, in their view, such request is consistent with the pre-approval policies and procedures and the SEC Rules.

Each request to provide Tax services under either the general or specific pre-approval of the Audit Committee will describe in writing: (i) the scope of the service, the fee structure for the engagement, and any side letter or amendment to the engagement letter, or any other agreement between the Auditor and the audit client, relating to the service; and (ii) any compensation arrangement or other agreement between the Auditor and any person (other than the audit client) with respect to the promoting, marketing, or recommending of a transaction covered by the service. The Auditor will discuss with the Audit Committee the potential effects of the services on the Auditor’s independence and will document the substance of the discussion.

Non-audit services pursuant to the de minimis exception provided by the SEC Rules will be promptly brought to the attention of the Audit Committee for approval, including documentation that each of the conditions for this exception, as set forth in the SEC Rules, has been satisfied.

On at least an annual basis, the Auditor will prepare a summary of all the services provided to any entity in the investment company complex as defined in section 2-01(f)(14) of Regulation S-X in sufficient detail as to the nature of the engagement and the fees associated with those services.

The Audit Committee has designated the Funds’ Treasurer to monitor the performance of all services provided by the Auditor and to ensure such services are in compliance with these policies and procedures. The Funds’ Treasurer will report to the Audit Committee on a periodic basis as to the results of such monitoring. Both the Funds’ Treasurer and management will immediately report to the Chairman of the Audit Committee any breach of these policies and procedures that comes to the attention of the Funds’ Treasurer or senior management.

Exhibit 1 to Pre-Approval of Audit and Non-Audit Services Policies and Procedures

Conditionally Prohibited Non-Audit Services (not prohibited if the Fund can reasonably conclude that the results of the service would not be subject to audit procedures in connection with the audit of the Fund’s financial statements)

| • | | Bookkeeping or other services related to the accounting records or financial statements of the audit client |

| • | | Financial information systems design and implementation |

| • | | Appraisal or valuation services, fairness opinions, or contribution-in-kind reports |

| • | | Actuarial services |

| • | | Internal audit outsourcing services |

Categorically Prohibited Non-Audit Services

| • | | Management functions |

| • | | Human resources |

| • | | Broker-dealer, investment adviser, or investment banking services |

| • | | Legal services |

| • | | Expert services unrelated to the audit |

| • | | Any service or product provided for a contingent fee or a commission |

| • | | Services related to marketing, planning, or opining in favor of the tax treatment of confidential transactions or aggressive tax position transactions, a significant purpose of which is tax avoidance |

| • | | Tax services for persons in financial reporting oversight roles at the Fund |

| • | | Any other service that the Public Company Oversight Board determines by regulation is impermissible. |

(e)(2) | There were no amounts that were pre-approved by the Audit Committee pursuant to the de minimis exception under Rule 2-01 of Regulation S-X. |

(g) | In addition to the amounts shown in the tables above, PwC billed Invesco and Affiliates aggregate fees of $6,466,000 for the fiscal year ended October 31, 2024 and $6,507,000 for the fiscal year ended October 31, 2023 for non-audit services not required to be pre-approved by the Registrant’s Audit Committee. In total, PwC billed the Registrant, Invesco and Affiliates aggregate non-audit fees of $7,612,060 for the fiscal year ended October 31, 2024 and $7,587,400 for the fiscal year ended October 31, 2023. |

(h) | With respect to the non-audit services above billed to Invesco and Affiliates that were not required to be pre-approved by the Registrant’s Audit Committee, the Audit Committee received information from PwC about such services, including by way of comparison, that PwC provided audit services to entities within the Investment Company Complex, as defined by Rule 2-01(f)(14) of Regulation S-X, of approximately $34 million and non-audit services of approximately $26 million for the fiscal year ended 2024. The Audit Committee considered this information in evaluating PwC’s independence. |

Item 5. Audit Committee of Listed Registrants.

(a) The Registrant has a separately designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, which consists solely of independent trustees. The Audit Committee members are Marc M. Kole, Joanne Pace, Gary R. Wicker, and Donald H. Wilson.

(b) Not applicable.

(a) Investments in securities of unaffiliated issuers is filed under Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Invesco Annual Financial Statements and Other Information

Invesco India ETF (PIN)October 31, 2024

Schedule of Investments(a)

| | |

Common Stocks & Other Equity Interests-99.82%(b) |

Communication Services-3.93% |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Consumer Discretionary-12.41% |

| | | |

Balkrishna Industries Ltd. | | | |

| | | |

| | | |

| | | |

Dixon Technologies India Ltd.(c) | | | |

| | | |

Endurance Technologies Ltd.(c) | | | |

| | | |

| | | |

Indian Hotels Co. Ltd. (The) | | | |

| | | |

Kalyan Jewellers India Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Samvardhana Motherson International Ltd. | | | |

Sona Blw Precision Forgings Ltd.(c) | | | |

| | | |

| | | |

| | | |

Tube Investments of India Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

Britannia Industries Ltd. | | | |

Colgate-Palmolive (India) Ltd. | | | |

| | | |

| | | |

Godrej Consumer Products Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Tata Consumer Products Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

|

Bharat Petroleum Corp. Ltd. | | | |

| | |

|

| | | |

Hindustan Petroleum Corp. Ltd. | | | |

| | | |

Mangalore Refinery & Petrochemicals Ltd. | | | |

Oil & Natural Gas Corp. Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

|

AU Small Finance Bank Ltd.(c) | | | |

| | | |

| | | |

| | | |

Bajaj Holdings & Investment Ltd. | | | |

| | | |

| | | |

Cholamandalam Investment and Finance Co. Ltd. | | | |

| | | |

General Insurance Corp. of India(c) | | | |

HDFC Asset Management Co. Ltd.(c) | | | |

| | | |

Housing and Urban Development Corp. Ltd. | | | |

| | | |

ICICI Lombard General Insurance Co. Ltd.(c) | | | |

| | | |

Indian Railway Finance Corp. Ltd.(c) | | | |

| | | |

| | | |

| | | |

Mahindra & Mahindra Financial Services Ltd. | | | |

Motilal Oswal Financial Services Ltd. | | | |

| | | |

Nippon Life India Asset Management Ltd.(c) | | | |

| | | |

| | | |

| | | |

SBI Cards & Payment Services Ltd. | | | |

| | | |

| | | |

| | | |

|

| | | |

Apollo Hospitals Enterprise Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Dr. Reddy’s Laboratories Ltd. | | | |

GlaxoSmithKline Pharmaceuticals Ltd. | | | |

Glenmark Pharmaceuticals Ltd. | | | |

| | | |

| | | |

| | | |

Max Healthcare Institute Ltd. | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco India ETF (PIN)—(continued)October 31, 2024

| | |

|

Sun Pharmaceutical Industries Ltd. | | | |

Syngene International Ltd.(c) | | | |

Torrent Pharmaceuticals Ltd. | | | |

| | | |

| | | |

|

| | | |

| | | |

Adani Ports & Special Economic Zone Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Bharat Heavy Electricals Ltd. | | | |

CG Power and Industrial Solutions Ltd. | | | |

| | | |

Container Corp. of India Ltd. | | | |

| | | |

| | | |

GE Vernova T&D India Ltd. | | | |

| | | |

Hindustan Aeronautics Ltd.(c) | | | |

Hitachi Energy India Ltd. | | | |

Indian Railway Catering & Tourism Corp. Ltd. | | | |

IRB Infrastructure Developers Ltd. | | | |

| | | |

L&T Technology Services Ltd.(c) | | | |

| | | |

Mazagon Dock Shipbuilders Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Information Technology-12.92% |

| | | |

| | | |

Honeywell Automation India Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

Oracle Financial Services Software Ltd. | | | |

| | | |

Tata Consultancy Services Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | | |

| | | |

| | | |

| | | |

| | |

|

| | | |

| | | |

| | | |

| | | |

Coromandel International Ltd. | | | |

| | | |

| | | |

| | | |

Gujarat Fluorochemicals Ltd. | | | |

| | | |

| | | |

| | | |

Jindal Steel & Power Ltd. | | | |

| | | |

Kansai Nerolac Paints Ltd. | | | |

| | | |

Lloyds Metals and Energy Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

Solar Industries India Ltd. | | | |

| | | |

Steel Authority of India Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | | |

Embassy Office Parks REIT | | | |

Macrotech Developers Ltd.(c) | | | |

| | | |

| | | |

Prestige Estates Projects Ltd. | | | |

| | | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Power Grid Corp. of India Ltd. | | | |

| | | |

Tata Power Co. Ltd. (The) | | | |

| | | |

| | | |

Total Common Stocks & Other Equity Interests

(Cost $208,264,242) | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco India ETF (PIN)—(continued)October 31, 2024

| | |

|

|

Invesco Government & Agency Portfolio, Institutional Class, 4.77%(d)(e) (Cost $5,987,436) | | | |

TOTAL INVESTMENTS IN SECURITIES-102.17%

(Cost $214,251,678) | |

OTHER ASSETS LESS LIABILITIES-(2.17)% | |

| |

Investment Abbreviations: |

REIT-Real Estate Investment Trust |

Notes to Schedule of Investments: |

| Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| Country of issuer and/or credit risk exposure listed in Common Stocks & Other Equity Interests has been determined to be India unless otherwise noted. |

| Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at October 31, 2024 was $10,312,764, which represented 4.05% of the Fund’s Net Assets. |

| Affiliated holding. Affiliated holdings are investments in entities which are under common ownership or control of Invesco Ltd. or are investments in entities in which the Fund owns 5% or more of the outstanding voting securities. The table below shows the Fund’s transactions in, and earnings from, its investments in affiliates for the fiscal year ended October 31, 2024. |

| | | | Change in

Unrealized

Appreciation | | | |

Investments in Affiliated Money Market Funds: | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class | | | | | | | |

| The rate shown is the 7-day SEC standardized yield as of October 31, 2024. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Statement of Assets and LiabilitiesOctober 31, 2024

| |

| |

Unaffiliated investments in securities, at value | |

Affiliated investments in securities, at value | |

Foreign currencies, at value | |

| |

| |

| |

| |

| |

Accrued unitary management fees | |

| |

| |

| |

| |

Shares of beneficial interest | |

| |

| |

Shares outstanding (unlimited amount authorized, $0.01 par value) | |

| |

| |

Unaffiliated investments in securities, at cost | |

Affiliated investments in securities, at cost | |

Foreign currencies, at cost | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Statement of OperationsFor the year ended October 31, 2024

| |

| |

Unaffiliated interest income | |

Unaffiliated dividend income | |

Affiliated dividend income | |

| |

| |

| |

| |

| |

| |

| |

Realized and unrealized gain (loss) from: | |

Net realized gain (loss) from: | |

Unaffiliated investment securities (net of foreign taxes of $3,502,282) | |

| |

| |

Change in net unrealized appreciation (depreciation) of: | |

Unaffiliated investment securities (net of change of deferred foreign taxes of $(7,611,254)) | |

| |

Change in net unrealized appreciation | |

Net realized and unrealized gain | |

Net increase in net assets resulting from operations | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Statement of Changes in Net AssetsFor the years ended October 31, 2024 and 2023

| |

| | |

| | |

| | |

| | |

Change in net unrealized appreciation | | |

Net increase in net assets resulting from operations | | |

Distributions to Shareholders from: | | |

| | |

Shareholder Transactions: | | |

Proceeds from shares sold | | |

Value of shares repurchased | | |

| | |

Net increase in net assets resulting from share transactions | | |

Net increase in net assets | | |

| | |

| | |

| | |

Changes in Shares Outstanding: | | |

| | |

| | |

Shares outstanding, beginning of year | | |

Shares outstanding, end of year | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco India ETF (PIN)

| |

| | | | | |

Per Share Operating Performance: | | | | | |

Net asset value at beginning of year | | | | | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | | | |

Total from investment operations | | | | | |

Distributions to shareholders from: | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net asset value at end of year | | | | | |

Market price at end of year(b) | | | | | |

Net Asset Value Total Return(c) | | | | | |

Market Price Total Return(c) | | | | | |

Ratios/Supplemental Data: | | | | | |

Net assets at end of year (000’s omitted) | | | | | |

Ratio to average net assets of: | | | | | |

| | | | | |

| | | | | |

Portfolio turnover rate(d) | | | | | |

| Based on average shares outstanding. |

| The mean between the last bid and ask prices. |

| Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Notes to Financial Statements

Invesco India Exchange-Traded Fund Trust

October 31, 2024

Invesco India Exchange-Traded Fund Trust (the “Trust”) was organized as a Massachusetts business trust and is authorized to have multiple series of portfolios. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). This report includes Invesco India ETF (PIN) (the “Fund”).

The Fund represents a separate series of the Trust. The shares of the Fund are referred to herein as "Shares" or "Fund’s Shares." The Fund’s Shares are listed on NYSE Arca, Inc.

The market price of a Share may differ to some degree from the Fund’s net asset value (“NAV”). Unlike conventional mutual funds, the Fund issues and redeems Shares on a continuous basis, at NAV, only in a large specified number of Shares, each called a “Creation Unit”, as set forth in the Fund’s prospectus. Creation Units are issued and redeemed principally in exchange for the deposit or delivery of cash, though the Fund reserves the right to issue and redeem Creation Units in exchange for a basket of securities ("Deposit Securities"). Except when aggregated in Creation Units by authorized participants (“APs”), Shares are not individually redeemable securities of the Fund.

The investment objective of the Fund is to seek to track the investment results (before fees and expenses) of the FTSE India Quality and Yield Select Index (the “Underlying Index”).

NOTE 2—Significant Accounting Policies

The following is a summary of the significant accounting policies followed by the Fund in preparation of its financial statements.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services—Investment Companies.

A.

Security Valuation - Securities, including restricted securities, are valued according to the following policies:

A security listed or traded on an exchange is generally valued at its trade price or official closing price that day as of the close of the exchange where the security is principally traded or, lacking any trades or official closing price on a particular day, the security may be valued at the closing bid or ask price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued using prices provided by an independent pricing service they may be considered fair valued. Futures contracts are valued at the daily settlement price set by an exchange on which they are principally traded. Where a final settlement price exists, exchange-traded options are valued at the final settlement price from the exchange where the option principally trades. Where a final settlement price does not exist, exchange-traded options are valued at the mean between the last bid and ask price generally from the exchange where the option principally trades.

Securities of investment companies that are not exchange-traded (e.g., open-end mutual funds) are valued using such company’s end-of-business-day NAV per share.

Deposits, other obligations of U.S. and non-U.S. banks and financial institutions are valued at their daily account value.

Fixed income securities (including convertible debt securities) generally are valued on the basis of prices provided by independent pricing services. Prices provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Securities with a demand feature exercisable within one to seven days are valued at par. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but the Fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots, and their value may be adjusted accordingly. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts’) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the London world markets. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Invesco Capital Management LLC (the “Adviser”) may use various pricing services to obtain market quotations as well as fair value prices. Because trading hours for certain foreign securities end before the close of the New York Stock Exchange (“NYSE”), closing market quotations may become not representative of market value in the Adviser’s judgment ("unreliable"). If, between the time trading ends on a particular security and the close of the customary trading session on the NYSE, a significant event occurs that makes the closing price of the security unreliable, the Adviser may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith in accordance with Board-approved policies and

related Adviser procedures (“Valuation Procedures”). Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American depositary receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, the potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Unlisted securities will be valued using prices provided by independent pricing services or by another method that the Adviser, in its judgment, believes better reflects the security’s fair value in accordance with the Valuation Procedures.

Non-traded rights and warrants shall be valued at intrinsic value if the terms of the rights and warrants are available, specifically the subscription or exercise price and the ratio. Intrinsic value is calculated as the daily market closing price of the security to be received less the subscription price, which is then adjusted by the exercise ratio. In the case of warrants, an option pricing model supplied by an independent pricing service may be used based on market data such as volatility, stock price and interest rate from the independent pricing service and strike price and exercise period from verified terms.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The mean between the last bid and ask prices may be used to value debt obligations, including corporate loans, and unlisted equity securities.

Securities for which market quotations are not readily available are fair valued by the Adviser in accordance with the Valuation Procedures. If a fair value price provided by a pricing service is unreliable, the Adviser will fair value the security using the Valuation Procedures. Issuer-specific events, market trends, bid/ask quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors, including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general market conditions which are not specifically related to the particular issuer, such as real or perceived adverse economic conditions, changes in the general outlook for revenues or corporate earnings, changes in interest or currency rates, regional or global instability, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism, significant governmental actions or adverse investor sentiment generally and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

The price the Fund could receive upon the sale of any investment may differ from the Adviser’s valuation of the investment, particularly for securities that are valued using a fair valuation technique. When fair valuation techniques are applied, the Adviser uses available information, including both observable and unobservable inputs and assumptions, to determine a methodology that will result in a valuation that the Adviser believes approximates market value. Fund securities that are fair valued may be subject to greater fluctuation in their value from one day to the next than would be the case if market quotations were used. Because of the inherent uncertainties of valuation, and the degree of subjectivity in such decisions, the Fund could realize a greater or lesser than expected gain or loss upon the sale of the investment.

B.

Investment Transactions and Investment Income - Investment transactions are accounted for on a trade date basis. Realized gains and losses from the sale or disposition of securities are computed on the specific identified cost basis. Interest income is recorded on an accrual basis from settlement date and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Pay-in-kind interest income and non-cash dividend income received in the form of securities in lieu of cash are recorded at the fair value of the securities received. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. Realized gains, dividends and interest received by the Fund may give rise to withholding and other taxes imposed by foreign countries. Tax conventions between certain countries and the United States may reduce or eliminate such taxes.

The Fund may periodically participate in litigation related to the Fund’s investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s NAV and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment

income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the Adviser.

C.

Country Determination - For the purposes of presentation in the Schedule of Investments, the Adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include whether the Fund’s Underlying Index has made a country determination and may include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues, the country that has the primary market for the issuer’s securities and its "country of risk" as determined by a third party service provider, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be India, unless otherwise noted.

D.

Dividends and Distributions to Shareholders - The Fund declares and pays dividends from net investment income, if any, to its shareholders quarterly and records such dividends on the ex-dividend date. Generally, the Fund distributes net realized taxable capital gains, if any, annually in cash and records them on the ex-dividend date. Such distributions on a tax basis are determined in conformity with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America (“GAAP”). Distributions in excess of tax basis earnings and profits, if any, are reported in such Fund’s financial statements as a tax return of capital at fiscal year-end.

E.

Taxes - The Fund intends to comply with the provisions of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), applicable to regulated investment companies and to distribute substantially all of the Fund’s taxable earnings to its shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized gains) that is distributed to the shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to differing book and tax treatments for in-kind transactions, losses deferred due to wash sales and passive foreign investment company adjustments, if any.

The Fund files U.S. federal tax returns and tax returns in certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

The Fund is subject to capital gains tax in India on the sale of certain shares of Indian resident companies and withholding tax on dividends and interest received from Indian resident companies. Changes in the Indian tax law could reduce the return to the Fund on its investments and the return received by Fund shareholders.

F.

Expenses - The Fund has agreed to pay an annual unitary management fee to the Adviser. Out of the unitary management fee, the Adviser pays for substantially all expenses of the Fund, including the costs of transfer agency, custody, fund administration, legal, audit and other services, except for distribution fees, if any, brokerage expenses, taxes, interest, acquired fund fees and expenses, if any, litigation expenses and other extraordinary expenses, including proxy expenses (except for such proxies related to: (i) changes to the Investment Advisory Agreement, (ii) the election of any Board member who is an “interested person” of the Trust or the Adviser (an "Interested Trustee"), or (iii) any other matters that directly benefit the Adviser).

To the extent the Fund invests in other investment companies, the expenses shown in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the investment companies in which it invests. The effects of such investment companies’ expenses are included in the realized and unrealized gain or loss on the investments in the investment companies.

G.

Accounting Estimates - The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements, including estimates and assumptions related to taxation. Actual results could differ from these estimates. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print.

H.

Indemnifications - Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Each Board member who is not an "interested person" (as defined in the 1940 Act) of the Trust or the Adviser (each, an "Independent Trustee") is also indemnified against certain liabilities arising out of the performance of their duties to the Trust pursuant to an Indemnification Agreement between such trustee and the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers

that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote.

I.

Foreign Currency Translations - Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period-end, resulting from changes in exchange rates.

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests.

The performance of the Fund may be materially affected positively or negatively by foreign currency strength or weakness relative to the U.S. dollar. Currency rates in foreign countries may fluctuate for a number of reasons, including changes in interest rates, political, economic, or social instability and development, and imposition of currency controls. Currency controls in certain foreign jurisdictions may cause the Fund to experience significant delays in its ability to repatriate its assets in U.S. dollars at quoted spot rates, and it is possible that the Fund’s ability to convert certain foreign currencies into U.S. dollars may be limited and may occur at discounts to quoted rates. As a result, the value of the Fund’s assets and liabilities denominated in such currencies that would ultimately be realized could differ from those reported on the Statement of Assets and Liabilities. Certain foreign companies may be subject to sanctions, embargoes, or other governmental actions that may limit the ability to invest in, receive, hold, or sell the securities of such companies, all of which affect the market and/or credit risk of the investments. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

AP Concentration Risk. Only APs may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number of institutions that may act as APs, and such APs have no obligation to submit creation or redemption orders. Consequently, there is no assurance that APs will establish or maintain an active trading market for the Shares. This risk may be heightened to the extent that securities held by the Fund are traded outside a collateralized settlement system. In that case, APs may be required to post collateral on certain trades on an agency basis (i.e., on behalf of other market participants), which only a limited number of APs may be able to do. In addition, to the extent that APs exit the business or are unable to proceed with creation and/or redemption orders with respect to the Fund and no other AP is able to step forward to create or redeem Creation Units, this may result in a significantly diminished trading market for Fund Shares, and Shares may be more likely to trade at a premium or discount to the Fund’s NAV and to face trading halts and/or delisting. Additionally, investments in non-U.S. securities may have lower trading volumes or could experience extended market closures or trading halts. To the extent that the Fund invests in non-U.S. securities, it may face increased risks that APs may not be able to effectively create or redeem Creation Units, or that the Shares may be halted and/or delisted.

Cash Transaction Risk. Most exchange-traded funds ("ETFs") generally make in-kind redemptions to avoid being taxed at the fund level on gains on the distributed portfolio securities. However, unlike most ETFs, the Fund currently intends to effect creations and redemptions principally for cash, rather than principally in-kind, because of the nature of the Fund’s investments. As such, the Fund may be required to sell portfolio securities to obtain the cash needed to distribute redemption proceeds. Therefore, the Fund may recognize a capital gain on these sales that might not have been incurred if the Fund had made a redemption in-kind. This may decrease the tax efficiency of the Fund compared to ETFs that utilize an in-kind redemption process and there may be a substantial difference in the after-tax rate of return between the Fund and conventional ETFs.

Currency Risk. Because the Fund’s NAV is determined in U.S. dollars, the Fund’s NAV could decline if the Indian rupee in which the Fund invests depreciates against the U.S. dollar, even if the value of its holdings, measured in rupees, increases. Generally, an increase in the value of the U.S. dollar against a foreign currency will reduce the value of a security denominated in that foreign currency, thereby decreasing the Fund’s overall NAV. Exchange rates may be volatile and may change quickly and unpredictably in response to both global economic developments and economic conditions, causing an adverse impact on the Fund. As a result, investors have the potential for losses regardless of the length of time they intend to hold Shares.

Equity Risk. Equity risk is the risk that the value of equity securities, including common stocks, may fall due to both changes in general economic conditions that impact the market as a whole, as well as factors that directly relate to a specific company or its industry. Such general economic conditions include changes in interest rates, periods of market turbulence or instability, or general and prolonged periods of economic decline and cyclical change. It is possible that a drop in the stock market may depress the price of most or all of the common stocks that the Fund holds. In addition, equity risk includes the risk that investor sentiment toward one or more industries will become negative, resulting in those investors exiting their investments in those industries, which could cause a reduction in the value of companies in those industries more broadly. The value of a company’s common stock may fall solely because of factors, such as an increase in production costs that negatively impact other companies in the same region, industry or sector of the market. A company’s common stock also may decline significantly in price over a short period of time due to factors specific to that company, including decisions made by its management or lower demand for the company’s products or services. For example, an adverse event, such as an unfavorable earnings report or the failure to make anticipated dividend payments, may depress the value of common stock.

Index Risk. Unlike many investment companies that are "actively managed", the Fund is a "passive" investor and therefore does not utilize an investing strategy that seeks returns in excess of its Underlying Index. Therefore, the Fund would not necessarily buy or sell a security unless that security is added or removed, respectively, from its Underlying Index, even if that security generally is underperforming. If a specific security is removed from the Underlying Index, the Fund may be forced to sell such security at an inopportune time or for a price lower than the security’s current market value. The Underlying Index may not contain the appropriate mix of securities for any particular economic cycle. Additionally, the Fund rebalances its portfolio in accordance with its Underlying Index, and, therefore, any changes to the Underlying Index’s rebalance schedule will result in corresponding changes to the Fund’s rebalance schedule. Further, unlike with an actively managed fund, the Adviser does not use techniques or defensive strategies designed to lessen the impact of periods of market volatility or market decline. This means that, based on certain market and economic conditions, the Fund’s performance could be lower than other types of funds with investment advisers that actively manage their portfolio assets to take advantage of market opportunities or defend against market events.

Indian Securities Risk. Investment in Indian securities involves risks in addition to those associated with investments in securities of issuers in more developed countries, which may adversely affect the value of the Fund’s assets. Such heightened risks include, among others, political and legal uncertainty, greater government control over the economy, currency fluctuations or blockage and the risk of nationalization or expropriation of assets. In addition, religious and border disputes persist in India. Moreover, India has experienced civil unrest and hostilities with neighboring countries, including Pakistan, and the Indian government has confronted separatist movements in several Indian states.

The securities market of India is considered an emerging market that is characterized by a small number of listed companies that have significantly smaller market capitalizations, greater price volatility and substantially less liquidity than companies in more developed markets. These factors, coupled with restrictions on foreign investment and other factors, limit the supply of securities available for investment. This will affect the rate at which the Fund is able to invest in securities of Indian companies, the purchase and sale prices for such securities, and the timing of purchases and sales. Certain restrictions on foreign investment may decrease the liquidity of the Fund’s portfolio, subject the Fund to higher transaction costs, or inhibit the Fund’s ability to track the Underlying Index. The Fund’s investments in securities of issuers located or operating in India, as well as its ability to track the Underlying Index, also may be limited or prevented, at times, due to the limits on foreign ownership imposed by the Reserve Bank of India and/or by the Securities and Exchange Board of India (“SEBI”).

Market Risk. Securities in the Underlying Index are subject to market fluctuations. You should anticipate that the value of the Shares will decline, more or less, in correlation with any decline in value of the securities in the Underlying Index. Additionally, natural or environmental disasters, widespread disease or other public health issues, war, military conflicts, acts of terrorism, economic crises or other events could result in increased premiums or discounts to the Fund’s NAV.

Non-Correlation Risk. The Fund’s return may not match the return of its Underlying Index for a number of reasons. For example, the Fund incurs operating expenses not applicable to the Underlying Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of its Underlying Index. Because the Fund issues and redeems Creation Units principally for cash, the Fund will incur higher costs in buying and selling securities than if it issued and redeemed Creation Units in-kind. Additionally, the Fund’s use of a representative sampling methodology may cause the Fund not to be as well-correlated with the return of its Underlying Index as would be the case if the Fund purchased all of the securities in its Underlying Index in the proportions represented in the Underlying Index. In addition, the performance of the Fund and its Underlying Index may vary due to asset valuation differences and differences between the Fund’s portfolio and its Underlying Index resulting from legal restrictions, costs or liquidity constraints.

Non-Diversified Fund Risk. Because the Fund is non-diversified and can invest a greater portion of its assets in securities of individual issuers than can a diversified fund, changes in the market value of a single investment could cause greater fluctuations in Share price than would occur in a diversified fund. This may increase the Fund’s volatility and cause the performance of a relatively small number of issuers to have a greater impact on the Fund’s performance.

Regulatory Risk. The Fund is registered as a foreign portfolio investor (“FPI”) with SEBI in order to have the ability to make and dispose of investments in Indian securities. There can be no assurance that the Fund will qualify or continue to qualify as a FPI under the SEBI FPI Regulations, 2019, or that the Indian regulatory authorities will continue to grant such registrations,

and the loss of such registrations could adversely impact the ability of the Fund to make and dispose of investments in India. Investments by FPIs in Indian securities are also subject to certain limits and restrictions under applicable law, and the application of such limits and restrictions could adversely impact the ability of the Fund to make investments in India.

Small- and Mid-Capitalization Company Risk. Investing in securities of small- and mid-capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies. These securities may have returns that vary, sometimes significantly, from the overall securities market. Often small- and mid-capitalization companies and the industries in which they focus are still evolving and, as a result, they may be more sensitive to changing market conditions.

Valuation Risk. Financial information related to securities of non-U.S. issuers may be less reliable than information related to securities of U.S. issuers, which may make it difficult to obtain a current price for a non-U.S. security held by the Fund. In certain circumstances, market quotations may not be readily available for some Fund securities, and those securities may be fair valued. The value established for a security through fair valuation may be different from what would be produced if the security had been valued using market quotations. Fund securities that are valued using techniques other than market quotations, including “fair valued” securities, may be subject to greater fluctuations in their value from one day to the next than would be the case if market quotations were used. In addition, there is no assurance that the Fund could sell a portfolio security for the value established for it at any time, and it is possible that the Fund would incur a loss because a security is sold at a discount to its established value.

NOTE 3—Investment Advisory Agreement and Other Agreements

The Trust has entered into an Investment Advisory Agreement with the Adviser on behalf of the Fund, pursuant to which the Adviser has overall responsibility for the selection and ongoing monitoring of the Fund’s investments, managing the Fund’s business affairs and providing certain clerical, bookkeeping and other administrative services.

Pursuant to the Investment Advisory Agreement, the Fund accrues daily and pays monthly to the Adviser an annual unitary management fee of 0.78% of the Fund’s average daily net assets. Out of the unitary management fee, the Adviser pays for substantially all expenses of the Fund, including the costs of transfer agency, custody, fund administration, legal, audit and other services, except for distribution fees, if any, brokerage expenses, taxes, interest, acquired fund fees and expenses, if any, litigation expenses and other extraordinary expenses, including proxy expenses (except for such proxies related to: (i) changes to the Investment Advisory Agreement, (ii) the election of an Interested Trustee, or (iii) any other matters that directly benefit the Adviser).

Through at least August 31, 2026, the Adviser has contractually agreed to waive the management fee payable by the Fund in an amount equal to the lesser of: (i) 100% of the net advisory fees earned by the Adviser or an affiliate of the Adviser that are attributable to the Fund’s investments in money market funds that are managed by affiliates of the Adviser and other funds (including ETFs) managed by the Adviser or affiliates of the Adviser or (ii) the management fee available to be waived. There is no guarantee that the Adviser will extend the waiver of these fees past that date.

For the fiscal year ended October 31, 2024, the Adviser waived fees of $4,506.

The Trust has entered into a Distribution Agreement with Invesco Distributors, Inc. (the “Distributor”), which serves as the distributor of Creation Units for the Fund. The Distributor does not maintain a secondary market in the Shares. The Fund is not charged any fees pursuant to the Distribution Agreement. The Distributor is an affiliate of the Adviser.

The Adviser has entered into a licensing agreement on behalf of the Fund with FTSE International Ltd. (the “Licensor”). The Underlying Index name trademark is owned by the Licensor. The trademark has been licensed to the Adviser for use by the Fund. The Fund is entitled to use the Underlying Index pursuant to the Trust’s sub-licensing agreement with the Adviser. The Fund is not sponsored, endorsed, sold or promoted by the Licensor, and the Licensor makes no representation regarding the advisability of investing in the Fund. The Fund is not a party to the licensing agreement.

The Trust has entered into service agreements whereby The Bank of New York Mellon, a wholly-owned subsidiary of The Bank of New York Mellon Corporation, serves as the administrator, custodian, fund accountant and transfer agent for the Fund.

NOTE 4—Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

Level 1 — Prices are determined using quoted prices in an active market for identical assets.

Level 2 — Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. When significant events cause market movements to occur after the close of the relevant foreign securities markets, foreign securities may be fair valued utilizing an independent pricing service.

Level 3 — Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Adviser’s assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information.

The following is a summary of the tiered valuation input levels, as of October 31, 2024. The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| | | | |

Investments in Securities | | | | |

Common Stocks & Other Equity Interests | | | | |

| | | | |

| | | | |

NOTE 5—Distributions to Shareholders and Tax Components of Net Assets

Tax Character of Distributions to Shareholders Paid During the Fiscal Years Ended October 31, 2024 and 2023:

| Includes short-term capital gain distributions, if any. |

Tax Components of Net Assets at Fiscal Year-End:

Undistributed long-term capital gains | |

Net unrealized appreciation — investments | |

Net unrealized appreciation (depreciation) — foreign currencies and foreign taxes | |

Shares of beneficial interest | |

| |

Capital loss carryforwards are calculated and reported as of a specific date. Results of transactions and other activity after that date may affect the amount of capital loss carryforwards actually available for the Fund to utilize. The ability to utilize capital loss carryforwards in the future may be limited under the Internal Revenue Code and related regulations based on the results of future transactions.