Exhibit 99.1 Vantage Drilling Company Global Energy and Power Leveraged Finance Conference New York, NY May 14, 2013 |

Some of the statements in this presentation constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. The forward looking statements contained in this presentation involve risks and uncertainties as well as statements as to: • our limited operating history; • availability of investment opportunities; • general volatility of the market price of our securities; • changes in our business strategy; • our ability to consummate an appropriate investment opportunity within given time constraints; • availability of qualified personnel; • changes in our industry, interest rates, the debt securities markets or the general economy; • changes in governmental, tax and environmental regulations and similar matters; • changes in generally accepted accounting principles by standard-setting bodies; and • the degree and nature of our competition. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Forward-Looking Statements 2 |

Symbol: VTG (NYSE AMEX) Location: HQ – Houston; Operations – Singapore; Marketing – Dubai Market Cap: $500 million ($1.67per share) Book Value: $568 million ($1.93 per share) Enterprise Value: $2.7 billion Employees: > 1,000 Contract Backlog: approximately $3.0 billion Owned Fleet: 4 Ultra-Premium Jackups (operating in SE Asia & West Africa) 2 Ultra-Deepwater Drillships (operating offshore India & GOM) 1 Ultra-Deepwater Drillship (commissioning – Q2 2013 delivery) 1 approximately 42% owned Ultra-Deepwater Drillship (under construction – Q4 2015) Managed Fleet: 1 Ultra-Deepwater Drillship (under construction) 1 Ultra-Premium Jackup (mobilized and preparing for commencement) 3 Ultra-Premium Jackups (construction – deliveries 2013 through 2015) Corporate Overview 3 |

Recent Developments 4 |

Vantage Strategic Focus 5 To provide the long-term value to our shareholders, we must first invest in the right people and the right assets to pursue the business opportunities. The right customers have the long-term business opportunities that provide the sound cash flow necessary to achieve the right financial structure for our shareholders. |

• Industry leading safety record – in 2012, we completed over 2.2 million man-hours with 0 lost time incidents, • Jack-up fleet has achieved approximately 99% productive time over the first 48 months of operations. Each jack-up construction project was completed on-time and on budget. • Enhanced business opportunities as Vantage has been selected to manage 3 party shipyard projects and operations. • We are leveraging our technical expertise to manage 6 ultra-high specification jack-ups for service in Mexico without making a financial investment. • We are investing in leading-edge training programs – • CARE – Competency Assurance with Results and Effectiveness • GOLD – Global Operations Leadership Development Program Right People 6 Our senior management team averages over 29 years of Industry experience. The cornerstones of our corporate culture are safety and professionalism. rd |

Right Assets 7 We have built a fleet of new, premium assets that our customers demand now and for the future. Premium high-specification drilling units, including four jackup rigs and three drillships. Total costs of owned fleet of approximately $3.2 billion. High-specification drillships combined with deep in-house technical team, has allowed us to compete for ultra-deepwater projects; the Platinum Explorer and Titanium Explorer have worked in 9,300+ and 8,800+ feet of water, respectively. Recently ordered Palladium Explorer, a 7 generation, dual- activity UDW drillship equipped with (2) seven-ram BOP’s and 12,000 feet of riser th |

Owned Assets • Delivered On-Time, On- Budget - December 2008 • Hired by Financial Institution to provide shipyard oversight following bid process • 3 newbuild project at DSME • Leverages shipyard experience • Favorable costs and delivery schedule • Delivery Q2 2013 Premium Fleet with a Proven Track Record 8 • 2 Successful newbuild at DSME • Delivery April 2012 • On Contract in GoM Management Projects Newbuild Ultra-Premium Marine Pacific Class 375 Jackups Ultra-Deepwater 12,000 ft Drillships • Delivered On-Time, On- Budget - November 2010 • Delivered On-Time, On- Budget - July 2009 • Delivered On-Time, On- Budget - December 2009 • Delivered On-Time, On- Budget - September 2009 Ultra-Deepwater Drillship • Newbuild project at STX Offshore • 7 generation dual-BOP, dual-derrick • Delivery Q4 2015 6 Ultra-Premium Jackups • Hired by newly formed drilling company to manage fleet nd rd th |

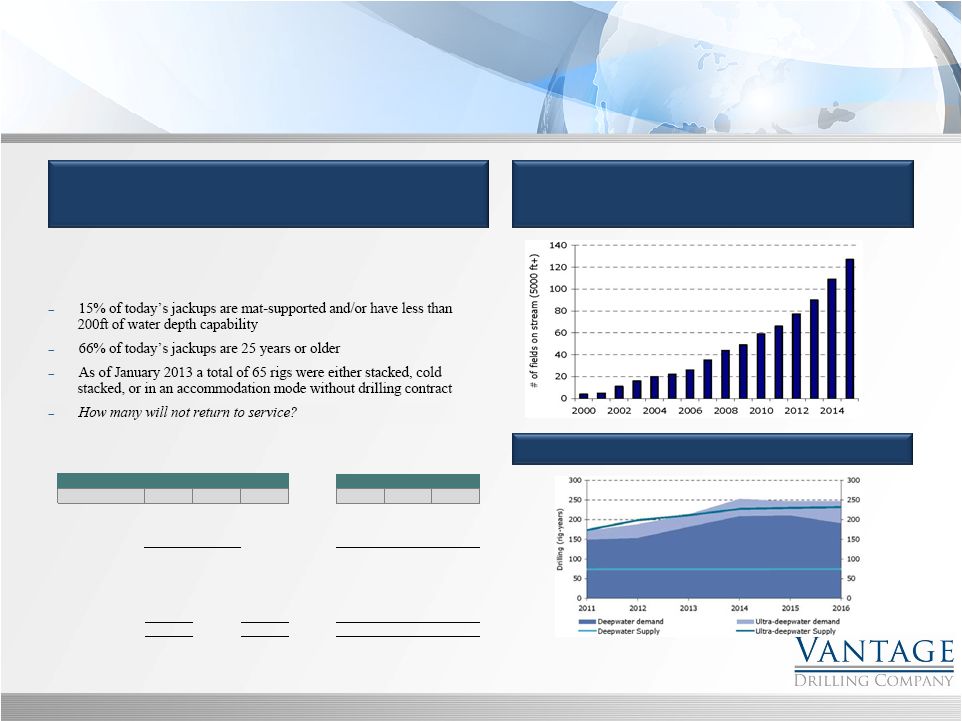

Strong Demand for Assets Jackup Market – Significant Replacement Cycle Deepwater and Ultra-deepwater Markets – Growth Cycle 9 Demand is Likely to Exceed Rig Supply Source: ODS-Petrodata, DnB NOR Age Rigs % % 300+ 200-299 <200 25 years or older 316 66% 56% 153 113 50 5 to 24 years 89 19% 16% 82 2 5 0 to 4 years 76 16% 13% 66 7 3 481 100% 301 122 58 2013 Deliveries 54 9% 53 1 0 2014 Deliveries 26 5% 23 3 0 2015 Deliveries 8 1% 5 2 1 569 100% 382 128 59 Age of Jackup Fleet Water Depth (feet) Capabilities and age – The current worldwide fleet is comprised mostly of older, inefficient rigs |

Right Customers 10 We have focused our marketing efforts on customers with long-term drilling requirements with the opportunity for long-term contracts. All of our jack-ups are currently working for repeat customers. We currently have over $3.0 billion of backlog. We have continuously improved our customer satisfaction ratings, based on direct surveys. |

(1) Average drilling revenue per day is based on the total estimated revenue divided by the minimum number of days committed in a contract. Unless otherwise noted, the total revenue includes any mobilization and demobilization fees and other contractual revenues associated with the drilling services. (2) The drilling revenue per day includes the achievement of the 12.5% bonus opportunity, but excludes mobilization revenues and revenue escalations included in the contract. Customers Provide Strong Backlog 11 Customer backlog of approximately $3.0 Billion provides visibility to cash flows |

Right Financial Structure 12 Our financial leverage is counter-balanced by a strong contract backlog and long-term visibility of cash flows. We have refinanced our senior debt – Staggered maturities through 2023, Added flexibility to pre-pay debt without premiums, Reduced annual cash interest costs by approximately $90 million, and Financed the remaining payments for the Tungsten Explorer. We have expanded our fleet with limited equity exposure – Palladium Explorer investment (42%) limits pre-delivery equity exposure to $31 million. Management contracts with Mexico-based rig owner to provide construction oversight and rig operations management for 6 new high specification jack- ups expands fleet with no initial equity investment. |

Strong Growing Cash Flow to Service Debt 13 Long-term contracts provide visibility to cash flow to support existing leverage. Investments made to-date generating favorable returns for the future. With the deployment of the Tungsten Explorer later this year, Vantage will have a full run rate for its fleet in 2014 and target 2014 metrics – Return on Capital Employed: 11% to 13% Net Debt to EBITDA: 4.8X to 5.0X EBITDA per Share: $1.65 to $1.80 EPS per Share: $.35 to $.40, or greater |

Strategic Focus Near Term Debt Refinancing – DONE Titanium Explorer back to full day rate – DONE • Tungsten Explorer contract commencing with shipyard delivery (“gap period”) – PENDING • Sapphire Driller Contracts – (a) continuity with existing (Rialto replacement); (b) long- term follow on job – BOTH PENDING • Deployment & startup of Tungsten Explorer – resulting in EBITDA run-rate > $500 million; dramatically increasing profitability • Deployment of Palladium Explorer – Nov. 2015 (42% VTG) • Add UDW asset (partial to full ownership)? • Accelerating reduction of debt / improved debt statistics and rating • Begin to return capital to shareholders 14 Next Steps |