UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | |

| [ ü ] | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 | |

| | For the fiscal year ended JULY 1, 2007 | |

| | OR | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 | |

| | For the transition period from ____________ to ____________ | |

| | | |

Commission file number 1-1370

| BRIGGS & STRATTON CORPORATION | |

(Exact name of registrant as specified in its charter) |

| A Wisconsin Corporation | | | | 39-0182330 | |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification No.) |

| | |

12301 WEST WIRTH STREET | | |

| WAUWATOSA, WISCONSIN | | | | 53222 | |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: 414-259-5333 |

|

Securities registered pursuant to Section 12(b) of the Act: | | |

| | | | | | | | | | |

| Title of Each Class | | | | Name of Each Exchange on Which Registered | |

Common Stock (par value $0.01 per share) | | New York Stock Exchange |

Common Share Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ü No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ü ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ü Accelerated filer Non-accelerated filer

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No ü

The aggregate market value of Common Stock held by non affiliates of the registrant was approximately $1.27 billion based on the reported last sale price of such securities as of December 31, 2006, the last business day of the most recently completed second fiscal quarter.

Number of Shares of Common Stock Outstanding at August 20, 2007: 49,706,060.

| DOCUMENTS INCORPORATED BY REFERENCE | |

| | Part of Form 10-K Into Which Portions |

| Document | | | | of Document are Incorporated | |

Proxy Statement for Annual Meeting | | |

on October 17, 2007 | | Part III |

| | | | | | |

The Exhibit Index is located on page 57.

BRIGGS & STRATTON CORPORATION

FISCAL 2007 FORM 10-K

TABLE OF CONTENTS

Cautionary Statement on Forward-Looking Statements

This release contains certain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. The words “anticipate”, “believe”, “estimate”, “expect”, “forecast”, “intend”, “may”, “objective”, “plan”, “project”, “seek”, “think”, “will”, and similar expressions are intended to identify forward-looking statements. The forward-looking statements are based on the Company’s current views and assumptions and involve risks and uncertainties that include, among other things, the ability to successfully forecast demand for our products and appropriately adjust our manufacturing and inventory levels; changes in our operating expenses; changes in interest rates; the effects of weather on the purchasing patterns of consumers and original equipment manufacturers (OEMs); actions of engine manufacturers and OEMs with whom we compete; the seasonal nature of our business; changes in laws and regulations, including environmental, tax, pension funding and accounting standards; work stoppages or other consequences of any deterioration in our employee relations; work stoppages by other unions that affect the ability of suppliers or customers to manufacture; acts of war or terrorism that may disrupt our business operations or those of our customers and suppliers; changes in customer and OEM demand; changes in prices of raw materials and parts that we purchase; changes in domestic economic conditions, including housing starts and changes in consumer disposable income; changes in foreign economic conditions, including currency rate fluctuations; the actions of customers of our OEM customers; the ability to bring new productive capacity on line efficiently and with good quality; the ability to successfully realize the maximum market value of assets that may require disposal if products or production methods change; new facts that come to light in the future course of litigation proceedings which could affect our assessment of those matters; and other factors that may be disclosed from time to time in our SEC filings or otherwise, including the factors discussed in Item 1A, Risk Factors, of the Company’s Annual Report on Form 10-K and in its periodic reports on Form 10-Q. Some or all of the factors may be beyond our control. We caution you that any forward-looking statement reflects only our belief at the time the statement is made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made.

PART I

ITEM 1. BUSINESS

Briggs & Stratton is the world’s largest producer of air cooled gasoline engines for outdoor power equipment. Briggs & Stratton designs, manufactures, markets and services these products for original equipment manufacturers (OEMs) worldwide. These engines are aluminum alloy gasoline engines with displacements ranging from 31 cubic centimeters to 993 cubic centimeters.

Additionally, through its wholly owned subsidiary, Briggs & Stratton Power Products Group, LLC, Briggs & Stratton is a leading designer, manufacturer and marketer of generators (portable and home standby), pressure washers, air compressors, snow throwers, lawn and garden powered equipment (riding and walk behind mowers, tillers, chipper/shredders, leaf blowers and vacuums) and related accessories.

Briggs & Stratton conducts its operations in two reportable segments: Engines and Power Products. Further information about Briggs & Stratton’s business segments is contained in Note 6 of the Notes to Consolidated Financial Statements.

The Company’s Internet address is www.briggsandstratton.com. The Company makes available free of charge (other than an investor’s own Internet access charges) through its Internet website the Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after it electronically files such material with, or furnishes such material to, the Securities and Exchange Commission. Charters of the Audit, Compensation, Nominating and Governance Committees; Corporate Governance Guidelines and code of business conduct and ethics contained in the Briggs & Stratton Business Integrity Manual are available on the Company’s website and are available in print to any shareholder upon request to the Corporate Secretary.

Engines

General

Briggs & Stratton’s Engines Segment’s engines are used primarily by the lawn and garden equipment industry, which accounted for 84% of the segment’s fiscal 2007 engine sales to OEMs. Major lawn and garden equipment applications include walk-behind lawn mowers, riding lawn mowers, garden tillers and snow throwers. The remaining 16% of engine sales to OEMs in fiscal 2007 were for use on products for industrial, construction, agricultural and other consumer applications, that include generators, pumps and pressure washers. Many retailers specify Briggs & Stratton’s engines on the powered equipment they sell, and the Briggs & Stratton name is often featured prominently on a product despite the fact that the engine is only a component.

In fiscal 2007, approximately 28% of Briggs & Stratton’s Engines Segment net sales were derived from sales in international markets, primarily to customers in Europe. Briggs & Stratton serves its key international markets through its European regional office in Switzerland, its distribution center in the Netherlands and sales and service subsidiaries and offices in Australia, Austria, Brazil, Canada, China, the Czech Republic, England, France, Germany, Italy, Japan, Mexico, New Zealand, Poland, Russia, South Africa, Spain, Sweden and United Arab Emirates. Briggs & Stratton is a leading supplier of gasoline engines in developed countries where there is an established lawn and garden equipment market. Briggs & Stratton also exports engines to developing nations where its engines are used in agricultural, marine, construction and other applications. More detailed information about our foreign operations is in Note 6 of the Notes to Consolidated Financial Statements.

Briggs & Stratton engines are sold primarily by its worldwide sales force through direct calls on customers. Briggs & Stratton’s marketing staff and engineers in the United States provide support and technical assistance to its sales force.

Briggs & Stratton also manufactures replacement engines and service parts and sells them to sales and service distributors. Briggs & Stratton owns its principal international distributors. In the United States the distributors are independently owned and operated. These distributors supply service parts and replacement engines directly to independently owned, authorized service dealers throughout the world. These distributors and service dealers implement Briggs & Stratton’s commitment to reliability and service.

1

Customers

Briggs & Stratton’s engine sales are made primarily to OEMs. Briggs & Stratton’s three largest external engine customers in fiscal years 2007, 2006 and 2005 were Husqvarna Outdoor Products Group (HOP), MTD Products Inc. (MTD) and John Deere Power Products. Sales to the top three customers combined were 54%, 51% and 45% of Engines Segment net sales in fiscal 2007, 2006 and 2005, respectively. Under purchasing plans available to all of its gasoline engine customers, Briggs & Stratton typically enters into annual engine supply arrangements.

Briggs & Stratton believes that in fiscal 2007 more than 80% of all lawn and garden powered equipment sold in the United States was sold through mass merchandisers such as Sears Holdings Corporation (Sears), The Home Depot, Inc. (The Home Depot), Wal-Mart Stores, Inc. (Wal-Mart) and Lowe’s Companies, Inc. (Lowe’s). Given the buying power of the mass merchandisers, Briggs & Stratton, through its customers, has continued to experience pricing pressure. Briggs & Stratton expects that this pricing trend will continue in the foreseeable future. Briggs & Stratton believes that a similar trend has developed for its products in industrial and consumer applications outside of the lawn and garden market.

Competition

Briggs & Stratton’s major domestic competitors in engine manufacturing are Honda Motor Co., Ltd. (Honda), Kawasaki Heavy Industries, Ltd. (Kawasaki), Kohler Co. (Kohler), and Tecumseh Products Company (Tecumseh). Several Japanese and Chinese small engine manufacturers, of which Honda and Kawasaki are the largest, compete directly with Briggs & Stratton in world markets in the sale of engines to other OEMs and indirectly through their sale of end products.

Briggs & Stratton believes it has a significant share of the worldwide market for engines that power outdoor equipment.

Briggs & Stratton believes the major areas of competition from all engine manufacturers include product quality, brand strength, price, timely delivery and service. Other factors affecting competition are short-term market share objectives, short-term profit objectives, exchange rate fluctuations, technology, product support and distribution strength. Briggs & Stratton believes its product value and service reputation have given it strong brand name recognition and enhance its competitive position.

Seasonality of Demand

Sales of engines to lawn and garden OEMs are highly seasonal because of consumer buying patterns. The majority of lawn and garden equipment is sold during the spring and summer months when most lawn care and gardening activities are performed. Sales of lawn and garden equipment are also influenced by weather conditions. Engine sales in Briggs & Stratton’s fiscal third quarter have historically been the highest, while sales in the first fiscal quarter have historically been the lowest.

In order to efficiently use its capital investments and meet seasonal demand for engines, Briggs & Stratton pursues a relatively balanced production schedule throughout the year. The schedule is adjusted to reflect changes in estimated demand, customer inventory levels and other matters outside the control of Briggs & Stratton. Accordingly, inventory levels generally increase during the first and second fiscal quarters in anticipation of customer demand. Inventory levels begin to decrease as sales increase in the third fiscal quarter. This seasonal pattern results in high inventories and low cash flow for Briggs & Stratton in the second and the beginning of the third fiscal quarters. The pattern results in higher cash flow in the latter portion of the third fiscal quarter and in the fourth fiscal quarter as inventories are liquidated and receivables are collected.

Manufacturing

Briggs & Stratton manufactures engines and parts at the following locations: Auburn, Alabama; Statesboro, Georgia; Murray, Kentucky; Poplar Bluff and Rolla, Missouri; Wauwatosa, Wisconsin; Chongqing, China; and Ostrava, Czech Republic. Briggs & Stratton has a parts distribution center in Menomonee Falls, Wisconsin.

In April 2007, the Company announced that it would be discontinuing operations at our Rolla, Missouri facility in October 2007. Engine manufacturing performed in Rolla will be moving to the Chongqing, China and Poplar Bluff, Missouri plants.

Briggs & Stratton manufactures a majority of the structural components used in its engines, including aluminum die castings, carburetors and ignition systems. Briggs & Stratton purchases certain parts such as

2

piston rings, spark plugs, valves, ductile and grey iron castings, zinc die castings and plastic components, some stampings and screw machine parts and smaller quantities of other components. Raw material purchases consist primarily of aluminum and steel. Briggs & Stratton believes its sources of supply are adequate.

Briggs & Stratton has joint ventures with Daihatsu Motor Company for the manufacture of engines in Japan, with Starting Industrial of Japan for the production of rewind starters in the United States, and The Toro Company for the manufacture of two-cycle engines in China.

Briggs & Stratton has a strategic relationship with Mitsubishi Heavy Industries (MHI) for the global distribution of air cooled gasoline engines manufactured by MHI in Japan under Briggs & Stratton’s Vanguard™ brand.

Power Products

General

Briggs & Stratton Power Products Group, LLC’s (BSPPG) principal product lines include portable and standby generators, pressure washers, air compressors, snow throwers and lawn and garden powered equipment. BSPPG sells its products through multiple channels of retail distribution, including consumer home centers, warehouse clubs, mass merchants and independent dealers. BSPPG product lines are marketed under various brands including Briggs & Stratton, Craftsman®, Ferris, Giant Vac, Murray, Simplicity, Snapper and Troy-Bilt®.

BSPPG has a network of independent dealers worldwide for the sale and service of snow throwers and lawn and garden powered equipment.

To support its international business, BSPPG has leveraged the existing Briggs & Stratton worldwide distribution network.

Customers

Historically, BSPPG’s major customers have been Lowe’s, The Home Depot and Sears. Other U.S. retail customers include Tractor Supply Inc., True Value Company, W.W. Grainger, Wal-Mart and Menards.

Competition

The principal competitive factors in the power products industry include price, service, product performance, technical innovation and delivery. BSPPG has various competitors, depending on the type of equipment. Primary competitors include: Honda (portable generators, pressure washers and lawn and garden equipment), Coleman Powermate Corporation (portable generators), Generac Power Systems, Inc. (“Generac”) (standby generators), DeVilbiss Air Power Company, a Division of Black & Decker (pressure washers), Alfred Karcher GmbH & Co. (pressure washers), John Deere (commercial and consumer lawn mowers), MTD (lawn mowers), the Toro Company (commercial and consumer lawn mowers), and Scag Power Equipment, a Division of Metalcraft of Mayville, Inc. (commercial lawn mowers).

BSPPG believes it has a significant share of the North American market for portable generators and consumer pressure washers.

Seasonality of Demand

Sales of BSPPG’s products are subject to seasonal patterns. Due to seasonal and regional weather factors, sales of pressure washers and lawn and garden powered equipment are typically higher during the fiscal third and fourth quarters than at other times of the year. Sales of portable generators and snow throwers are typically higher during the first and second fiscal quarters.

Manufacturing

BSPPG’s manufacturing facilities are located in Jefferson, Watertown and Port Washington, Wisconsin; McDonough, Georgia; Munnsville, New York; Newbern, Tennessee; and Qingpu, China. BSPPG also purchases certain powered equipment under contract manufacturing agreements.

BSPPG plans to close its Port Washington, Wisconsin manufacturing facility during the second quarter of fiscal 2009. Production will move to the McDonough, Georgia facility.

3

BSPPG manufactures core components for its products, where such integration improves operating profitability by providing lower costs.

BSPPG purchases engines from its parent, Briggs & Stratton, as well as from Generac, Honda, Kawasaki and Kohler. BSPPG has not experienced any difficulty obtaining necessary engines or other purchased components.

BSPPG assembles products for the international markets at its U.S. and China locations and through contract manufacturing agreements with other OEMs.

Consolidated

General Information

Briggs & Stratton holds patents on features incorporated in its products; however, the success of Briggs & Stratton’s business is not considered to be primarily dependent upon patent protection. The Company owns several trademarks which it believes significantly affect a consumer’s choice of outdoor powered equipment and therefore create value. Licenses, franchises and concessions are not a material factor in Briggs & Stratton’s business.

For the fiscal years ended July 1, 2007, July 2, 2006 and July 3, 2005, Briggs & Stratton spent approximately $25.7 million, $28.8 million and $33.5 million, respectively, on research activities relating to the development of new products or the improvement of existing products.

The average number of persons employed by Briggs & Stratton during fiscal 2007 was 7,666. Employment ranged from a high of 8,439 in July 2006 to a low of 7,235 in October 2006.

Export Sales

Export sales for fiscal 2007, 2006 and 2005 were $490.7 million (23% of net sales), $527.0 million (21% of net sales) and $477.4 million (18% of net sales), respectively. These sales were principally to customers in European countries. Refer to Note 6 of the Notes to Consolidated Financial Statements for financial information about geographic areas. Also, refer to Item 7A of this Form 10-K and Note 13 of the Notes to Consolidated Financial Statements for information about Briggs & Stratton’s foreign exchange risk management.

ITEM 1A. RISK FACTORS

In addition to the risks referred to elsewhere in this Annual Report on Form 10-K, the following risks, among others, may have affected, and in the future could affect, the Company and its subsidiaries’ business, financial condition or results of operations. Additional risks not discussed or not presently known to the Company or that the Company currently deems insignificant may also impact its business and stock price.

Demand for products fluctuates significantly due to seasonality. In addition, changes in the weather and consumer disposable income impact demand.

Sales of our products are subject to seasonal and consumer buying patterns. Consumer demand in our markets can be reduced by unfavorable weather, a reduction in disposable income, and other factors. We manufacture throughout the year although our sales are concentrated in the second half of our fiscal year. This operating method requires us to anticipate demand of our customers many months in advance. If we overestimate or underestimate demand during a given year, we may not be able to adjust our production quickly enough to avoid excess or insufficient inventories, and that may in turn limit our ability to maximize our potential sales.

We have only a limited ability to pass through cost increases in our raw materials to our customers during the year.

We generally enter into annual purchasing plans with our largest customers, so our ability to raise our prices during a particular year to reflect increased raw materials costs is limited.

4

A significant portion of our net sales comes from major customers and the loss of any of these customers would negatively impact our financial results.

In fiscal 2007, our three largest customers accounted for 36% of our consolidated net sales. The loss of a significant portion of the business of one or more of these key customers would significantly impact our net sales and profitability.

Changes in environmental or other laws could require extensive changes in our operations or to our products.

Our operations and products are subject to a variety of foreign, federal, state and local laws and regulations governing, among other things, emissions to air, discharges to water, noise, the generation, handling, storage, transportation, treatment and disposal of waste and other materials and health and safety matters. New engine emission regulations are being phased in through 2008 by the federal government and the State of California. We do not expect these changes to have a material adverse effect on us, but we cannot be certain that these or other proposed changes in applicable laws or regulations will not adversely affect our business or financial condition in the future.

Foreign economic conditions and currency rate fluctuations can reduce our sales.

In fiscal 2007, we derived approximately 23% of our consolidated net sales from international markets, primarily Europe. Weak economic conditions in Europe could reduce our sales and currency fluctuations could adversely affect our sales or profit levels in U.S. dollar terms.

Actions of our competitors could reduce our sales or profits.

Our markets are highly competitive and we have a number of significant competitors in each market. Competitors may reduce their costs, lower their prices or introduce innovative products that could hurt our sales or profits. In addition, our competitors may focus on reducing our market share to improve their results.

Disruptions caused by labor disputes or organized labor activities could harm our business.

A portion of our workforce is currently represented by labor unions. In addition, we may from time to time experience union organizing activities in our non-union facilities. Disputes with the current labor union or new union organizing activities could lead to work slowdowns or stoppages and make it difficult or impossible for us to meet scheduled delivery times for product shipments to our customers, which could result in loss of business. In addition, union activity could result in higher labor costs, which could harm our financial condition, results of operations and competitive position.

As of July 1, 2007, we had approximately $384.0 million of long-term debt. In addition, we have the ability to incur additional borrowings on our revolving credit facility. This level of debt could adversely affect our operating flexibility and put us at a competitive disadvantage.

Our level of debt and the limitations imposed on us by the indentures for the notes and our other credit agreements could have important consequences, including the following:

• we will have to use a portion of our cash flow from operations for debt service rather than for our operations;

• we may not be able to obtain additional debt financing for future working capital, capital expenditures or other corporate purposes or may have to pay more for such financing;

• some or all of the debt under our current or future revolving credit facilities will be at a variable interest rate, making us more vulnerable to increases in interest rates;

• we could be less able to take advantage of significant business opportunities, such as acquisition opportunities, and to react to changes in market or industry conditions;

• we will be more vulnerable to general adverse economic and industry conditions; and

• we may be disadvantaged compared to competitors with less leverage.

The terms of the indentures for the senior notes do not fully prohibit us from incurring substantial additional debt in the future and our revolving credit facilities permit additional borrowings, subject to certain conditions. If new debt is added to our current debt levels, the related risks we now face could intensify.

We expect to obtain the money to pay our expenses and to pay the principal and interest on the outstanding 8.875% senior notes, the 7.25% senior notes, the variable rate term notes, the credit facilities and other debt primarily from our operations. Our ability to meet our expenses thus depends on our future performance,

5

which will be affected by financial, business, economic and other factors. We will not be able to control many of these factors, such as economic conditions in the markets where we operate and pressure from competitors. We cannot be certain that the money we earn will be sufficient to allow us to pay principal and interest on our debt and meet our other obligations. If we do not have enough money, we may be required to refinance all or part of our existing debt, sell assets or borrow more money. We cannot guarantee that we will be able to do so on terms acceptable to us. In addition, the terms of existing or future debt agreements, including the revolving credit facilities and our indentures, may restrict us from adopting any of these alternatives.

We are restricted by the terms of the outstanding senior notes and our other debt, which could adversely affect us.

The indentures relating to the senior notes and our revolving credit agreements each include a number of financial and operating restrictions, which may prevent us from capitalizing on business opportunities and taking some corporate actions. These covenants could adversely affect us by limiting our ability to plan for or react to market conditions or to meet our capital needs. These covenants include, among other things, restrictions on our ability to:

• pay dividends or make distributions in respect of our capital stock or to make certain other restricted payments;

• incur indebtedness or issue preferred shares;

• create liens;

• make loans or investments;

• enter into sale and leaseback transactions;

• agree to payment restrictions affecting our restricted subsidiaries;

• consolidate, merge, sell or lease all or substantially all of our assets;

• enter into transactions with affiliates; and

• dispose of assets or the proceeds of sales of our assets.

In addition, our revolving credit facility contains financial covenants that, among other things, require us to maintain a minimum interest coverage ratio and impose a maximum leverage ratio.

Our failure to comply with restrictive covenants under the indentures governing the senior notes and our revolving credit facilities could trigger prepayment obligations.

Our failure to comply with the restrictive covenants described above could result in an event of default, which, if not cured or waived, could result in us being required to repay these borrowings before their due date. If we are forced to refinance these borrowings on less favorable terms, our results of operations and financial condition could be adversely affected by increased costs and rates.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The corporate offices and one of Briggs & Stratton’s engine manufacturing facilities are located in Wauwatosa, Wisconsin. Briggs & Stratton also has engine manufacturing facilities in Auburn, Alabama; Statesboro, Georgia; Murray, Kentucky; Poplar Bluff, Missouri; Ostrava, Czech Republic and Chongqing, China. These are owned facilities containing approximately 3.1 million square feet of office and production area. The Company currently leases an engine manufacturing facility in Rolla, Missouri, which contains approximately 404,000 square feet. Briggs & Stratton also leases warehouse space in the localities of its engine manufacturing facilities, except China, totaling approximately 619,750 square feet. Additionally, a service parts distribution center consisting of approximately 335,400 square feet is leased in Menomonee Falls, Wisconsin.

BSPPG maintains office space and manufacturing facilities in Brookfield, Jefferson, Watertown and Port Washington, Wisconsin; McDonough, Georgia; Newbern, Tennessee; Munnsville, New York and Qingpu, China. Of these, the domestic facilities, except Brookfield, Wisconsin, are owned and contain approximately

6

1.5 million square feet. The Brookfield, Wisconsin office space is leased and contains approximately 26,000 square feet. BSPPG also leases warehouse space in Jefferson, Watertown and Fort Atkinson, Wisconsin; McDonough, Georgia; Grand Prairie, Texas; Greenville, Ohio; Reno, Nevada; and Sherrill and Hamilton, New York totaling approximately 1.8 million square feet. Additionally, the Qingpu, China facility is leased and contains approximately 131,000 square feet.

Briggs & Stratton leases approximately 290,000 square feet of space to house its foreign sales and service operations.

As Briggs & Stratton’s business is seasonal, additional warehouse space may be leased when inventory levels are at their peak. Briggs & Stratton’s owned properties are well maintained. Briggs & Stratton believes that its owned and leased facilities are adequate to perform its operations in a reasonable manner.

ITEM 3. LEGAL PROCEEDINGS

Briggs & Stratton is subject to various unresolved legal actions that arise in the normal course of its business. These actions typically relate to product liability (including asbestos-related liability), patent and trademark matters, and disputes with customers, suppliers, distributors and dealers, competitors and employees.

On June 3, 2004, eight individuals who claim to have purchased lawnmowers in Illinois and Minnesota filed a lawsuit (Ronnie Phillips et al. v. Sears Roebuck Corporation et al., No. 04-L-334 (20th Judicial Circuit, St. Clair County, IL)) against the Company and other defendants alleging that the horsepower labels on the products they purchased were inaccurate. The plaintiffs have amended their complaint several times and currently seek an injunction, compensatory and punitive damages, and attorneys’ fees under various federal and state laws including the Racketeer Influenced and Corrupt Organization Act on behalf of all persons in the United States who, beginning January 1, 1994 through the present, purchased a lawnmower containing a two-stroke or four-stroke gasoline combustion engine up to 30 horsepower that was manufactured or sold by the defendants. On May 31, 2006, the defendants removed the case to the U.S. District Court for the Southern District of Illinois (No. 06-412-DRH). The defendants subsequently filed cross claims against each other for indemnification and contribution and filed a motion to dismiss the amended complaint. On March 30, 2007, the Court issued an order granting the defendants’ motion to dismiss the amended complaint in its entirety, but the order permits the plaintiffs to refile a complaint after amending several claims. An opinion of the Court providing more detail concerning its order is expected but has not yet been filed. Two defendants, MTD Products, Inc. and American Honda Motor Company, have notified the Court that they have reached a settlement with the putative plaintiff class, but neither defendant’s agreement has yet been approved by the Court.

Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss, Briggs & Stratton believes the range of possible losses for these unresolved legal actions will not have a material effect on its financial position.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders, through the solicitation of proxies or otherwise, during the three months ended July 1, 2007.

7

Executive Officers of the Registrant

| Name, Age, Position | | | | Business Experience for Past Five Years | |

| | |

JOHN S. SHIELY, 55

Chairman, President and Chief Executive Officer

(1)(2)(3) | | Mr. Shiely was elected to his current position effective January 2003, after serving as President and Chief Executive Officer since July 2001 and President and Chief Operating Officer since August 1994. |

| | |

TODD J. TESKE, 42

Executive Vice President and Chief

Operating Officer | | Mr. Teske was elected to his current position effective September 2005 after serving as Senior Vice President and President – Briggs & Stratton Power Products Group, LLC since September 2003. He previously served as Vice President and President – Briggs & Stratton Power Products Group, LLC since February 2003. He also served as Vice President – Corporate Development from March 2001 after serving as Controller since October 1998. |

| | |

JAMES E. BRENN, 59

Senior Vice President and Chief Financial Officer | | Mr. Brenn was elected to his current position in October 1998, after serving as Vice President and Controller since November 1988. He also served as Treasurer from November 1999 until January 2000. |

| | |

DAVID G. DEBAETS, 44

Vice President – North American Operations

(Engine Power Products Group) | | Mr. DeBaets was elected to his current position effective September 2007. He has served as Vice President and General Manager – Large Engine Division since April 2000. He also served as Vice President and General Manager –Die Cast Components from May 1996 to April 2000. |

| | |

MARK R. HAZELTINE, 64

Vice President and

Sales Manager – Consumer Products | | Mr. Hazeltine was elected to his current position in May 2002, after serving as Vice President and Sales Manager –Consumer Lawn & Garden since July 1999. He also served as Sales Manager from February 1995 to June 1999. |

| | |

ROBERT F. HEATH, 59

Secretary | | Mr. Heath was elected to his current position in January 2002. He served as Assistant Secretary from January 2001 to December 2001. In addition, Mr. Heath is Vice President and General Counsel and has served in these positions since January 2001. He also served as General Counsel since December 1997. |

| | |

HAROLD L. REDMAN, 43

Vice President and President –

Home Power Products Group | | Mr. Redman was elected to his current position effective September 2006. He has served as Vice President and President – Home Power Products since May 2006. He also served as Senior Vice President – Sales & Marketing –Simplicity Manufacturing, Inc. since July 1995. |

| | |

WILLIAM H. REITMAN, 51

Senior Vice President – Sales &

Customer Support | | Mr. Reitman was elected to his current position effective September 2007, after serving as Senior Vice President – Sales & Marketing since May 2006, and Vice President –Sales & Marketing since October 2004. He also served as Vice President – Marketing since November 1995. |

8

DAVID J. RODGERS, 36

Controller | | Mr. Rodgers was elected as an executive officer in September 2007 and has served as Controller since December 2006. He was previously employed by Roundy’s Supermarkets, Inc. as Vice President – Controller from September 2005 to November 2006 and Vice President – Retail Controller from May 2003 to August 2005. He also was previously employed by Arthur Andersen LLP and Deloitte & Touche LLP. |

| | |

THOMAS R. SAVAGE, 59

Senior Vice President – Administration | | Mr. Savage was elected to his current position effective July 1997, after serving as Vice President – Administration and General Counsel since November 1994. He also served as Secretary from November 1999 to June 2000. |

| | |

MICHAEL D. SCHOEN, 47

Senior Vice President and President –

International Power Products Group | | Mr. Schoen was elected to his current position effective September 2005 after serving as Vice President – International Group since July 2001. He was elected an executive officer in August 2000, after serving as Vice President – Operations Support since July 1999. He previously held the position of Vice President – International Operations since July 1996. |

| | |

VINCENT R. SHIELY, 47

Senior Vice President and President –

Yard Power Products Group (3) | | Mr. Shiely was elected to his current position effective May 2006, after serving as Vice President and President – Home Power Products Group since September 2005. He also served as Vice President and General Manager –Home Power Products Division October 2004 to September 2005. He previously served as Vice President and General Manager – Engine Products Group since September 2002. He has also served as Vice President and General Manager – Business Units since December 2001, and as Vice President and General Manager – Electrical Products Division since October 1998. |

| | |

CARITA R. TWINEM, 52

Treasurer | | Ms. Twinem was elected to her current position in February 2000. In addition, Ms. Twinem is Tax Director and has served in this position since July 1994. |

| | |

JOSEPH C. WRIGHT, 48

Senior Vice President and President –

Engine Power Products Group | | Mr. Wright was elected to his current position in May 2006 after serving as Vice President and President – Yard Power Products Group since September 2005. He also served as Vice President and General Manager – Lawn and Garden Division from September 2004 to September 2005. He was elected an executive officer effective September 2002. He previously served as Vice President and General Manager – Small Engine Division since July 1997. |

(1) Officer is also a Director of Briggs & Stratton. (2) Member of the Board of Directors Executive Committee.

(3) John S. Shiely and Vincent R. Shiely are brothers.

Officers are elected annually and serve until they resign, die, are removed, or a different person is appointed to the office.

9

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Briggs & Stratton common stock and its common share purchase rights are traded on the NYSE under the symbol “BGG”. Information required by this Item is incorporated by reference from the “Quarterly Financial Data, Dividend and Market Information” (unaudited) on page 52.

Changes in Securities, Use of Proceeds and Issuer Purchases of Equity Securities

Briggs & Stratton did not make any purchases of equity securities registered by the company pursuant to Section 12 of the Exchange Act during the fourth quarter of fiscal 2007.

Five-year Stock Performance Graph

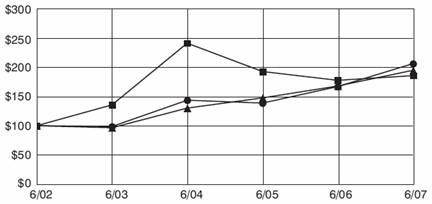

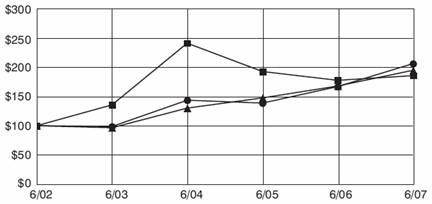

The chart below is a comparison of the cumulative return over the last five fiscal years had $100 been invested at the close of business on June 30, 2001 in each of Briggs & Stratton common stock, the Standard & Poor’s (S&P) Smallcap 600 Index and the S&P Machinery Index.

FIVE YEAR CUMULATIVE TOTAL RETURN COMPARISON*

Briggs & Stratton versus Published Indices

| | 6/02 | | 6/03 | | 6/04 | | 6/05 | | 6/06 | | 6/07 | |

n | Briggs & Stratton | | 100.00 | | 135.83 | | 242.40 | | 193.44 | | 178.24 | | 186.34 | |

| S&P Smallcap 600 | | 100.00 | | 96.42 | | 130.41 | | 147.95 | | 168.55 | | 195.58 | |

• | S&P Machinery (diversified) | | 100.00 | | 98.61 | | 143.97 | | 139.05 | | 167.53 | | 207.08 | |

* | Total return calculation is based on compounded monthly returns with reinvested dividends. | | | |

10

ITEM 6. SELECTED FINANCIAL DATA

Fiscal Year | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

(dollars in thousands, except per share data) | | | | | | | | | | |

| | | | | | | | | | |

SUMMARY OF OPERATIONS (1) (2) | | | | | | | | | | |

NET SALES | $ | 2,157,233 | | $ | 2,542,171 | | $ | 2,654,875 | | $ | 1,947,364 | | $ | 1,657,633 | |

GROSS PROFIT ON SALES | 287,132 | | 491,684 | | 504,891 | | 439,872 | | 328,079 | |

PROVISION (CREDIT) FOR INCOME TAXES | (7,465) | | 50,020 | | 57,548 | | 68,890 | | 37,940 | |

INCOME BEFORE EXTRAORDINARY GAIN | 146 | | 102,346 | | 116,767 | | 136,114 | | 80,638 | |

INCOME BEFORE EXTRAORDINARY GAIN PER SHARE OF COMMON STOCK: | 0.00 | | 1.99 | | 2.27 | | 3.01 | | 1.86 | |

Basic Earnings | 0.00 | | 1.98 | | 2.25 | | 2.77 | | 1.74 | |

Diluted Earnings | | | | | | | | | | |

PER SHARE OF COMMON STOCK: | .88 | | .88 | | .68 | | .66 | | .64 | |

Cash Dividends | $ | 17.09 | | $ | 19.33 | | $ | 17.22 | | $ | 16.03 | | $ | 11.83 | |

Shareholders’ Investment | | | | | | | | | | |

WEIGHTED AVERAGE NUMBER OF SHARES OF COMMON STOCK OUTSTANDING (in 000’s) | 49,715 | | 51,479 | | 51,472 | | 45,286 | | 43,279 | |

DILUTED NUMBER OF SHARES OF COMMON STOCK OUTSTANDING (in 000’s) | 49,827 | | 51,594 | | 51,954 | | 50,680 | | 48,959 | |

| | | | | | | | | | |

OTHER DATA (1) (2) | $ | 846,054 | | $ | 987,206 | | $ | 889,186 | | $ | 817,595 | | $ | 514,987 | |

SHAREHOLDERS’ INVESTMENT | 384,048 | | 383,324 | | 486,321 | | 360,562 | | 503,397 | |

LONG-TERM DEBT | 2,379 | | 1,385 | | 1,988 | | - | | | - | | |

CAPITAL LEASES | 1,887,168 | | 1,944,200 | | 1,998,968 | | 1,637,153 | | 1,475,193 | |

TOTAL ASSETS | 1,006,402 | | 1,008,164 | | 1,005,644 | | 867,987 | | 876,664 | |

PLANT AND EQUIPMENT | 388,318 | | 430,288 | | 447,255 | | 356,542 | | 370,784 | |

PLANT AND EQUIPMENT, NET OF RESERVES | 70,379 | | 72,734 | | 66,348 | | 59,816 | | 58,325 | |

PROVISION FOR DEPRECIATION | 68,000 | | 69,518 | | 86,075 | | 52,962 | | 40,154 | |

EXPENDITURES FOR PLANT AND EQUIPMENT | $ | 526,623 | | $ | 688,506 | | $ | 766,537 | | $ | 681,432 | | $ | 505,752 | |

WORKING CAPITAL | 2.1 to 1 | | 3.0 to 1 | | 3.2 to 1 | | 3.3 to 1 | | 2.7 to 1 | |

Current Ratio | 7,260 | | 8,701 | | 9,073 | | 7,732 | | 7,249 | |

NUMBER OF EMPLOYEES AT YEAR-END | 3,693 | | 3,874 | | 4,058 | | 4,230 | | 4,503 | |

NUMBER OF SHAREHOLDERS AT YEAR-END | | | | | | | | | | |

QUOTED MARKET PRICE: | | | | | | | | | | |

High | $ | 33.07 | | $ | 40.38 | | $ | 44.50 | | $ | 44.22 | | $ | 25.75 | |

Low | $ | 24.29 | | $ | 30.01 | | $ | 30.83 | | $ | 24.68 | | $ | 15.38 | |

| | | | | | | | | | | | | | | | | |

(1) The amounts include the acquisitions of Simplicity Manufacturing, Inc. since July 7, 2004 and certain assets of Murray, Inc. since February 11, 2005. See Note 3 of the Notes to Consolidated Financial Statements for additional information.

(2) Share data adjusted for effect of 2-for-1 stock split effective October 29, 2004.

11

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Results of Operations

FISCAL 2007 COMPARED TO FISCAL 2006

Net Sales

Fiscal 2007 consolidated net sales were approximately $2.16 billion, a decrease of $385 million compared to the previous year. The decrease is primarily due to lower sales volumes in both segments.

Engines Segment net sales were $1.45 billion compared to $1.65 billion in the prior year, a decrease of $201.2 million or 12%. The decrease is primarily the result of a 12% decrease in engine unit shipments between years. The shipment decline is due to a 66% reduction of engine shipments for portable generators caused by a lack of events, such as hurricanes, that cause power outages. The reminder of the decrease is due to lower retail demand for lawn and garden equipment in the U.S. along with a smaller market share in Europe. Unfavorable weather conditions and various economic factors contributed to difficult market conditions for lawn and garden products. Pricing improvements and the impact of favorable Euro exchange rates in fiscal 2007 were almost entirely offset by an unfavorable mix shift to smaller displacement, lower priced engines.

Power Products Segment net sales were $890.4 million in fiscal 2007 compared to $1.19 billion in fiscal 2006, a decrease of $295.6 million or 25%. Approximately $113.0 million of the decrease was the result of the anticipated reduction of Murray branded lawn and garden product sold to retailers. Excluding Murray branded product, lawn and garden equipment sales were comparable between years. The remainder of the net sales decrease was primarily due to a 58% reduction of portable generator unit shipments because of no landed hurricane activity in fiscal 2007 and lower pre-hurricane season sales. These sales decreases were partially offset by an increase in pressure washer unit shipments compared to the same period in the prior year and the introduction of new air compressor and home standby generator products.

Gross Profit

Consolidated gross profit was $287.1 million in fiscal 2007 compared to $491.7 million in fiscal 2006, a decrease of $204.6 million or 42%. In fiscal 2007, the Company recorded impairment charges of $43.1 million ($26.2 million, net of taxes) related to write-downs of assets primarily associated with the announced rationalization of two manufacturing plants. The remainder of the decrease is the result of lower sales and production volumes in both segments.

Engines Segment gross margins decreased to $208.4 million in fiscal 2007 from $381.9 million in fiscal 2006, a decrease of $173.5 million. Engines Segment gross profit margins decreased to 14.4% in fiscal 2007 from 23.2% in fiscal 2006. Approximately $33.9 million of the decline is attributable to expense incurred with the write-down of assets primarily associated with the rationalization of a major operating plant in the United States. The balance of the reduction resulted primarily from lower sales and production volumes, and increased costs for raw materials. Lower unit sales negatively impacted fiscal 2007 margins by approximately $70.0 million. Pricing improvements and the impact of favorable Euro exchange rates in fiscal 2007 were almost entirely offset by an unfavorable mix shift to smaller displacement, lower priced engines. Raw material cost increases primarily related to aluminum, steel, and zinc also negatively impacted margins. Engine production volumes decreased 18.9% in fiscal 2007 compared to fiscal 2006 reducing fixed cost absorption by approximately $45.0 million. In addition, fiscal 2006 included gains of approximately $12.2 million associated with certain asset sales that were not recurring in fiscal 2007.

The Power Products Segment gross margins decreased to $80.8 million in fiscal 2007 from $113.2 million in fiscal 2006, a decrease of $32.4 million. The Power Products Segment margin decreased to 9.1% in fiscal 2007 from 9.5% in fiscal 2006. Asset impairment charges of $9.2 million primarily related to the write-down of assets associated with a plan to close the Port Washington manufacturing facility by October 2008 accounted for a gross profit margin decline of approximately 1.0%. Portable generator production volume declines of 65% offset by increased production of pressure washers decreased fixed cost absorption by approximately $13.6 million. These declines were offset by a decrease of $19 million of 2006 expenses associated with the wind down of operations at the Murray, Inc. operating facility and the write-off of excess inventory related to Murray product.

12

Engineering, Selling, General and Administrative Costs

Engineering, selling, general and administrative costs decreased to $265.6 million in fiscal 2007 from $315.7 million in fiscal 2006, a decrease of $50.1 million. Engineering, selling, general and administrative costs as a percent of sales decreased to 12.3% in fiscal 2007 from 12.4% in fiscal 2006.

The decrease in engineering, selling, general and administrative expenses is due to planned reductions in salaries and benefits of $14 million, reduced professional services and legal fees of $21 million and reduced selling, marketing and advertising expenses of $12 million.

Interest Expense

Interest expense increased $1.6 million in fiscal 2007 compared to fiscal 2006. The increase is attributable to higher average borrowings between years to support higher average working capital requirements.

Other Income

Other income decreased $3.7 million in fiscal 2007 as compared to fiscal 2006. The decrease in other income is due to lower dividends received as well as the Company’s portion of lower earnings at its joint venture investments.

Provision for Income Taxes

The effective tax rate was 102% for fiscal 2007 and 33% for fiscal 2006. The fiscal 2007 effective tax rate results primarily from our ability to exclude from taxable income a portion of the distributions received from investments and the benefit from the research credit and the production activities deduction.

FISCAL 2006 COMPARED TO FISCAL 2005

Net Sales

Fiscal 2006 consolidated net sales were approximately $2.5 billion, a decrease of $113 million compared to the previous year. The decrease is primarily due to lower sales volumes in both segments.

Engines Segment net sales were $1.6 billion versus $1.7 billion in the prior year, a decrease of $91 million or 5%. The decrease is primarily the result of a 7% decrease in engine unit shipments between years. The shipment decline is attributable to softer retail demand for lawn and garden equipment and efforts by retailers and OEMs to control inventory levels in the wake of reduced demand. This unit shipment decline was partially offset by $30 million from a price increase implemented in the beginning of the fiscal year, as well as a favorable mix of engine unit shipments.

Power Products net sales were $1.2 billion in both fiscal 2006 and 2005. Lower volumes in fiscal 2006 of $105 million for pressure washer and lawn and garden equipment sales were almost fully offset by $75 million of increased volume and pricing on generators as well as $23 million from a favorable mix of lawn and garden product. Management believes the decline in volume of lawn and garden and pressure washer sales is attributable to lower consumer discretionary spending, which resulted in lower demand at retailers.

Gross Profit

Consolidated gross profit decreased $13 million in fiscal 2006. The decrease is primarily the result of the volume decreases noted above offset by pricing improvements in both segments.

Engines Segment margins increased from 21% in fiscal 2005 to 23% in fiscal 2006. The increase in margin is attributable to the price increase discussed above as well as $13 million in gains on the sale of operating assets. In addition, ongoing cost reduction programs contributed $8 million to the margin. These positive margin enhancers were enough to overcome the impact of a 4% production volume decline, a mix of product that favored lower margin units and other manufacturing cost increases.

The Power Products Segment margin decreased to 10% in fiscal 2006 from 11% in fiscal 2005. The decline is primarily attributable to $19 million in losses associated with the wind down of operations at the Murray, Inc. operating facility and the write-off of excess inventory related to Murray product. Partially offsetting these losses was $16 million in pricing improvements, primarily on generators.

Engineering, Selling, General and Administrative Costs

Engineering, selling, general and administrative costs increased $2 million between years. Excluding the impact of the $39 million write-off of the Murray, Inc. trade receivable that occurred in fiscal 2005 the category increased $41 million between years.

13

Increases in this category in fiscal 2006 as compared to fiscal 2005 included: $9 million from the expensing of stock based compensation in fiscal 2006, $12 million in increased legal fees associated with litigation, $9 million associated with increased information technology spending, and $2 million from increased engineering costs associated with new product development in the Power Products Segment. Planned increases of $9.0 million in selling and advertising costs also contributed to the year over year increase in this category.

Interest Expense

Interest expense increased $5 million in fiscal 2006 compared to fiscal 2005. The increase is attributable to higher borrowings between years associated with the term notes used for the Murray, Inc. asset acquisition in February 2005.

Other Income

Other income decreased $2 million in fiscal 2006 as compared to fiscal 2005. The decrease is attributed primarily to higher deferred financing expenses. Deferred financing expense increased as a result of the acceleration of debt repayments and the write-off of associated deferred financing costs.

Provision for Income Taxes

The effective tax rate was approximately 33% in both fiscal 2006 and fiscal 2005.

Liquidity and Capital Resources

FISCAL YEARS 2007, 2006 AND 2005

Cash flows from operating activities were $88 million, $155 million and $149 million in fiscal 2007, 2006 and 2005, respectively.

The fiscal 2007 cash flows from operating activities were $67 million less than the prior year. The primary reason for the decrease is due to net income being lower by $102 million in fiscal 2007 compared to fiscal 2006. The decrease in net income was partially offset by non-cash impairment charges of $43 million in fiscal 2007. In addition, higher fourth quarter sales within our Engines Segment increased working capital requirements for accounts receivable by $54 million partially offset by higher accounts payable and accrued liabilities.

The fiscal 2006 cash flows from operating activities were $6 million higher than the prior year. The primary reason for the increase is lower working capital requirements in fiscal 2006. Lower fourth quarter sales in fiscal 2006 resulted in higher inventory levels offset by lower receivables and accrued liabilities including rebates, incentive compensation and income taxes. The reduction in net income between years was more than offset by a series of increased non-cash items in fiscal 2006 including non-cash pension charges, stock compensation expense, gains on fixed asset sales, the deferred tax credit, and the elimination of the extraordinary gain.

The fiscal 2005 cash flows from operations were $98 million higher than the prior year. Fiscal 2005 did not experience the significant increase in inventories experienced in 2004, resulting in a $141 million improvement in cash flows in fiscal 2005. During fiscal 2004, inventories for engines and power products were increased to what management believes were a more normal level. Accordingly, no such incremental inventory build-up was required in fiscal 2005. Offsetting the favorable impact of inventory levels on cash flows was a $27 million reduction in accounts payable and accrued liabilities between years. The decrease is primarily attributable to a $19 million reduction in incentive compensation accruals between years and $5 million in lower rebate accruals.

Cash used in investing activities was $67 million, $55 million and $437 million in fiscal 2007, 2006 and 2005, respectively. These cash flows include capital expenditures of $68 million, $70 million and $86 million in fiscal 2007, 2006 and 2005, respectively. The capital expenditures relate primarily to reinvestment in equipment, capacity additions and new products. During fiscal 2007, we increased our Engines Segment capacity by opening a new plant in Ostrava, Czech Republic which accounted for $15 million of capital expenditures. This new plant began production in December 2006. In addition, the Power Products Segment is adding lawn and garden product capacity with a new plant in Newbern, Tennessee that accounted for $6 million of capital expenditures in fiscal 2007. This plant is expected to begin production in the second quarter of fiscal 2008.

In fiscal 2006, Briggs & Stratton received $12 million in cash from the sale of certain operating assets. In addition, Briggs & Stratton received $6 million as a refund of a portion of the cash paid for certain assets of Murray, Inc. in fiscal 2005.

In fiscal 2005, cash used in investing activities also includes $232 million in cash paid for the Simplicity acquisition and $123 million for the acquisition of certain Murray assets.

14

Briggs & Stratton used cash of $89 million and $169 million in financing activities in fiscal 2007 and fiscal 2006, respectively. Briggs & Stratton provided cash from financing activities of $106 million in fiscal 2005.

In fiscal 2007, Briggs & Stratton repurchased $48.2 million of its common shares outstanding as part of a $120 million share repurchase program authorized by the Board of Directors in fiscal 2007. In addition, the Company paid common stock dividends of $44 million in fiscal 2007.

In fiscal 2006, the Company paid off $104 million of its long term debt, including $90 million of its term notes due in fiscal 2008. In addition, Briggs & Stratton repurchased $35 million of its common shares in fiscal 2006.

Early in fiscal 2005, the Company used its available cash to finance the acquisition of Simplicity. To finance the acquisition of the Murray assets, the Company issued $125 million in term notes in fiscal 2005. The Company incurred $1 million in fees in fiscal 2005 negotiating the term notes and an amendment to its revolving credit facility.

The Company received $4 million, $12 million, and $20 million in fiscal years 2007, 2006 and 2005, respectively, from the exercise of stock options. The stock option activity is a direct reflection of the market value of the Company’s stock and option strike prices that encourage the exercise of the options.

Future Liquidity and Capital Resources

At the end of fiscal 2007, the Company had no borrowings outstanding under its $350 million revolving credit facility that was to expire in May 2009. On July 12, 2007, the Company entered into a $500 million amended and restated multicurrency credit agreement. The Amended Credit Agreement (“Revolver”) provides a revolving credit facility for up to $500 million in revolving loans, including up to $25 million in swing-line loans. The Company will use proceeds of the Revolver to, among other things, pay off amounts outstanding under the Company’s Term Loan Agreement dated February 11, 2005 with various financial institutions. The Revolver will also be used to fund seasonal working capital requirements and other financing needs. At any time during the term of the Revolver, the Company may, so long as no event of default has occurred and is continuing and certain other conditions are satisfied, elect to increase the maximum amount available under the Revolver from $500 million by up to an amount not to exceed $250 million through, at the Company’s election, increases of commitments by existing lenders and/or the addition of new lenders. The Revolver has a term of five years and all outstanding borrowings on the Revolver will be due and payable on July 12, 2012.

On August 10, 2006, Briggs & Stratton announced its intent to initiate repurchases of up to $120 million of its common stock through open market transactions during fiscal 2007 and fiscal 2008. The timing and amount of actual purchases will depend upon certain governing loan covenants. As of August 30, 2007, approximately $48.2 million of common stock has been repurchased under this plan.

Briggs & Stratton expects capital expenditures to be approximately $80 million in fiscal 2008. These anticipated expenditures reflect our plans to continue to reinvest in equipment, new products, and capacity enhancements.

Management believes that available cash, the credit facility, cash generated from future operations, existing lines of credit and access to debt markets will be adequate to fund Briggs & Stratton’s capital requirements for the foreseeable future.

Financial Strategy

Management believes that the value of Briggs & Stratton is enhanced if the capital invested in operations yields a cash return that is greater than the cost of capital. Consequently, management’s first priority is to reinvest capital into physical assets and products that maintain or grow the global cost leadership and market positions that Briggs & Stratton has achieved, and drive the economic value of the Company. Management’s next financial objective is to identify strategic acquisitions or alliances that enhance revenues and provide a superior economic return. Several successful joint ventures and the acquisition of Generac Portable Products, Inc. and Simplicity are examples of our successful execution of this strategy. Finally, management believes that when capital cannot be invested for returns greater than the cost of capital, we should return capital to the capital providers through dividends and/or stock buy-backs.

Off-Balance Sheet Arrangements

Briggs & Stratton has no off-balance sheet arrangements or significant guarantees to third parties not fully recorded in our Balance Sheets or fully disclosed in our Notes to Consolidated Financial Statements. Briggs & Stratton’s significant contractual obligations include our debt agreements and certain employee benefit plans.

15

Briggs & Stratton is subject to financial and operating restrictions in addition to certain financial covenants under its domestic debt agreements. As is fully disclosed in Note 8 of the Notes to Consolidated Financial Statements, these restrictions could limit our ability to: pay dividends; incur further indebtedness; create liens; enter into sale and/or leaseback transactions; consolidate, sell or lease all or substantially all of our assets; and dispose of assets or the proceeds of our assets. We believe we will remain in compliance with these covenants in fiscal 2008. Briggs & Stratton has obligations concerning certain employee benefits including its pension plans, postretirement benefit obligations and deferred compensation arrangements. All of these obligations are recorded on our Balance Sheets and disclosed more fully in the Notes to Consolidated Financial Statements.

Contractual Obligations

A summary of the Company’s expected payments for significant contractual obligations as of July 1, 2007 is as follows (in thousands):

| | | Total | | | | 2008 | | | 2009-2010 | | 2011-2012 | | Thereafter | |

Long-Term Debt | | $ | 386,139 | | $ | 116,139 | | $ | - | | $ | 270,000 | | $ | - | |

Interest on Long-Term Debt | | 89,658 | | 24,760 | | 47,925 | | 16,973 | | - | |

Capital Leases | | 2,892 | | 1,222 | | 755 | | 782 | | 133 | |

Operating Leases | | 49,473 | | 14,161 | | 19,289 | | 9,700 | | 6,323 | |

Consulting Agreement | | 153 | | 153 | | - | | - | | - | |

| | $ | 528,315 | | $ | 156,435 | | $ | 67,969 | | $ | 297,455 | | $ | 6,456 | |

| | | | | | | | | | | | | | | | | | | | |

Other Matters

Labor Agreement

Briggs & Stratton has collective bargaining agreements with its unions. These agreements expire at various times ranging from 2007-2011.

Emissions

The U.S. Environmental Protection Agency (EPA) has developed national emission standards under a two-phase process for small air cooled engines. Briggs & Stratton currently has a complete product offering that complies with the EPA’s Phase II engine emission standards.

The EPA issued proposed Phase III standards to further reduce engine exhaust emissions and to control evaporative emissions from small off-road engines and equipment they are used in. The proposed standards are similar to those adopted by the California Air Resources Board (CARB). The proposed Phase III program would require some evaporative controls in 2007 and go into full effect in 2011 for Class II engines (225 cubic centimeter displacement and larger) and 2012 for Class I engines (less than 225 cubic centimeter displacement). Briggs & Stratton does not believe compliance with the new standards will have a material adverse effect on its financial position or results of operations.

CARB’s Tier 3 regulation requires additional reductions to engine exhaust emissions and new controls on evaporative emissions from small engines. The Tier 3 regulation is phased in between 2006 and 2008 depending upon the size of the engine and type of control. While Briggs & Stratton believes the cost of the regulation may increase engine costs per unit, Briggs & Stratton does not believe the regulation will have a material effect on its financial condition or results of operations. This assessment is based on a number of factors, including revisions the CARB made to its adopted regulation from the proposal published in September 2003 in response to recommendations from Briggs & Stratton and others in the regulated category and intention to pass increased costs associated with the regulation on to consumers.

The European Commission adopted an engine emission Directive regulating exhaust emissions from engines manufactured by Briggs & Stratton. The Directive parallels the regulations previously promulgated by the U.S. EPA. Stage 1 was effective in February 2004 and Stage 2 phases in between calendar years 2005 and 2007, with some limited extensions available for specific size and type engines until 2010. Briggs & Stratton’s full European product line has been compliant with Stage 1 since 2004. Briggs & Stratton has certified the majority of its Class 2 engines to be compliant with the Stage 2 standards and intends to have a full European product line compliant with Stage 2 before the end of calendar year 2007. Briggs & Stratton does not believe compliance with the Directive will have a material adverse effect on its financial position or results of operations.

16

Critical Accounting Policies

Briggs & Stratton’s critical accounting policies are more fully described in Note 2 and Note 14 of the Notes to Consolidated Financial Statements. As discussed in Note 2, the preparation of financial statements in conformity with accounting principles generally accepted in the U.S. (“GAAP”) requires management to make estimates and assumptions about future events that affect the amounts reported in the financial statements and accompanying notes. Future events and their effects cannot be determined with absolute certainty. Therefore, the determination of estimates requires the exercise of judgment. Actual results inevitably will differ from those estimates, and such differences may be material to the financial statements.

The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the recovery of accounts receivable and inventory reserves, as well as those used in the determination of liabilities related to customer rebates, pension obligations, postretirement benefits, warranty, product liability, litigation and taxation.

The reserves for customer rebates, warranty, product liability, inventory and doubtful accounts are fact specific and take into account such factors as specific customer situations, historical experience, and current and expected economic conditions.

The Company’s estimate of income taxes payable, deferred income taxes, and the effective tax rate is based on a complex analysis of many factors including interpretations of Federal, state and foreign income tax laws, the difference between tax and financial reporting bases of assets and liabilities, estimates of amounts currently due or owed in various jurisdictions, and current accounting standards. We review and update our estimates on a quarterly basis as facts and circumstances change and actual results are known. In addition, Federal, state and foreign taxing authorities periodically review the Company’s estimates and interpretation of income tax laws. Adjustments to the effective income tax rate and recorded tax related assets and liabilities may occur in future periods if actual results differ significantly from original estimates and interpretations.

The pension benefit obligation and related pension expense or income are calculated in accordance with Statement of Financial Accounting Standard (SFAS) No.158, “Employer’s Accounting for Defined Benefit Pension and Other Postretirement Plans - an amendment of FASB Statements No. 87, 88, 106 and 132 (R)”, and are impacted by certain actuarial assumptions, including the discount rate and the expected rate of return on plan assets. These rates are evaluated on an annual basis considering such factors as market interest rates and historical asset performance. Actuarial valuations at July 1, 2007 used a discount rate of 6.35% and an expected rate of return on plan assets of 8.75%. Our discount rate was selected using a methodology that matches plan cash flows with a selection of Moody’s Aa or higher rated bonds, resulting in a discount rate that better matches a bond yield curve with comparable cash flows. A 0.25% decrease in the discount rate would increase annual pension expense by approximately $0.1 million. A 0.25% decrease in the expected return on plan assets would increase our annual pension expense by approximately $2.0 million. In estimating the expected return on plan assets, the Company considers the historical returns on plan assets, adjusted for forward looking considerations, including inflation assumptions and active management of the plan’s invested assets. Changes in the discount rate and return on assets can have a significant effect on the funded status of our pension plans, stockholders’ equity and expense. We cannot predict these changes in discount rates or investment returns and, therefore, cannot reasonably estimate whether the impact in subsequent years will be significant.

The funded status of the Company’s pension plan is the difference between the projected benefit obligation and the fair value of its plan assets. The projected benefit obligation is the actuarial present value of all benefits expected to be earned by the employees’ service adjusted for future potential wage increases. At July 1, 2007 the fair value of plan assets exceeded the projected benefit obligation by approximately $63 million.

The other postretirement benefits obligation and related expense or income are also calculated in accordance with SFAS No. 158, “Employer’s Accounting for Defined Benefit Pension and Other Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106 and 132 (R)” and are impacted by certain actuarial assumptions, including the health care trend rate. An increase of one percentage point in health care costs would increase the accumulated postretirement benefit obligation by $11.5 million and would increase the service and interest cost by $0.9 million. A corresponding decrease of one percentage point, would decrease the accumulated postretirement benefit by $10.8 million and decrease the service and interest cost by $0.8 million.

For pension and postretirement benefits, actuarial gains and losses are accounted for in accordance with GAAP. Refer to Note 14 of the Notes to the Consolidated Financial Statements for additional discussion.

17

New Accounting Pronouncements

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities – Including an Amendment of FASB Statement No. 115,” (SFAS 159). This standard permits an entity to choose to measure many financial instruments and certain other items at fair value. The fair value option permits a company to choose to measure eligible items at fair value at specified election dates. A company will report unrealized gains and losses on items for which the fair value option has been elected in earnings after adoption. Statement 159 is effective for fiscal years beginning after November 15, 2007. At this time, the impact of adoption of SFAS 159 on our consolidated financial position is being assessed.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” (SFAS 157), which defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15, 2007. At this time, the impact of adoption of SFAS 157 on our consolidated financial position is being assessed.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans - an amendment of FASB Statements No. 87, 88, 106, and 132(R),” (SFAS 158). SFAS 158 requires recognition of the overfunded or underfunded status of a postretirement benefit plan in the statement of financial position, as well as recognition of changes in that funded status through comprehensive income in the year in which they occur. SFAS 158 also requires a change in the measurement of a plan’s assets and benefit obligations as of the end date of the employer’s fiscal year. SFAS 158 is effective for fiscal years ending after December 15, 2006, except for the measurement date provisions, which are effective for fiscal years ending after December 15, 2008. See Note 14 – Pension and Other Postretirement Benefits in the Notes to Consolidated Financial Statements for further discussion regarding the Company’s adoption of SFAS 158 in its 2007 fiscal year.

In June 2006, the FASB issued FASB Interpretation No. 48 Accounting for Uncertainty in Income Taxes (FIN 48) an interpretation of FASB Statement No. 109 (SFAS 109). This interpretation clarifies the accounting for uncertainty in income taxes recognized in a company’s financial statements in accordance with SFAS 109. FIN48 details how companies should recognize, measure, present and disclose uncertain tax positions that have been or expect to be taken. As such, financial statements will reflect expected future tax consequences of uncertain tax positions presuming the taxing authorities’ full knowledge of the position and all relevant facts. FIN48 is effective for public companies for annual periods that begin after December 15, 2006. Briggs & Stratton Corporation is required to and intends to adopt the provisions of FIN 48 as of July 2, 2007. The cumulative effect of adoption will be recorded as an adjustment to the opening balance of retained earnings for fiscal 2008. We have evaluated the impact of FIN 48 and do not expect it to have a material impact on our financial condition or results of operations.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs – an amendment of ARB No. 43, Chapter 4,” (SFAS No. 151). SFAS No. 151 seeks to clarify the accounting for abnormal amounts of idle facility expense, freight, handling costs and wasted material (spoilage) in the determination of inventory carrying costs. The statement requires such costs to be treated as a current period expense. This statement became effective for the company on July 2, 2006. The adoption of SFAS No. 151 did not have a material impact on the Consolidated Financial Statements.

18

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Briggs & Stratton is exposed to market risk from changes in foreign exchange and interest rates. To reduce the risk from changes in foreign exchange rates, Briggs & Stratton uses financial instruments. Briggs & Stratton does not hold or issue financial instruments for trading purposes.

Foreign Currency

Briggs & Stratton’s earnings are affected by fluctuations in the value of the U.S. dollar against various currencies, with the Japanese Yen and the Euro as the most significant. The Yen is used to purchase engines from Briggs & Stratton’s joint venture. Briggs & Stratton purchases components in Euros from third parties and receives Euros for certain products sold to European customers. Briggs & Stratton’s foreign subsidiaries’ earnings are also influenced by fluctuations of the local currency against the U.S. dollar as these subsidiaries previously purchased inventory from the parent in U.S. dollars. Starting mid-year of fiscal 2007, subsidiaries make these purchases in Euros. Forward foreign exchange contracts are used to partially hedge against the earnings effects of such fluctuations. At July 1, 2007, Briggs & Stratton had the following forward foreign exchange contracts outstanding with the Fair Value (Gains) Losses shown (in thousands):

Hedge | | Notional | | Fair Market | | Conversion | | (Gain) Loss | |

Currency | | | | Value | | | | Value | | | | Currency | | | at Fair Value | |

Japanese Yen | | 2,300,000 | | | $ | 18,998 | | | U.S. | | $ | 229 | | |