UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007.

OR

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number: 001-33878

GUSHAN ENVIRONMENTAL ENERGY LIMITED

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

No. 37, Golden Pond Road

Golden Mountain Industrial District

Fuzhou City, Fujian Province

People’s Republic of China

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of exchange on which each class is to be registered |

American Depositary Shares, each representing two ordinary shares, par value HK$0.00001 per share | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

166,831,943 ordinary shares, par value HK$0.00001 per share, as of December 31, 2007.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

GUSHAN ENVIRONMENTAL ENERGY LIMITED

TABLE OF CONTENTS

i

ii

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F, including in particular Item 3.D, “Key information—Risk Factors,” Item 4, “Information on the Company,” and Item 5, “Operating and Financial Review and Prospects,” contains statements that relate to future events, including our future operating results and conditions, our prospects and our future financial performance and condition. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “anticipate,” “believe,” “expect,” “estimate,” “predict,” “potential,” “continue,” “future,” “intend,” “may,” “ought to,” “plan,” “should,” “target,” “will,” negatives of such terms or other expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, without limitation, statements relating to:

| | Ÿ | | the effect of intensifying competition in the biodiesel and alternative energy industries; |

| | Ÿ | | the availability of suitable raw materials on terms acceptable to us; |

| | Ÿ | | changes in the general operating environment in China; |

| | Ÿ | | various business opportunities that we may pursue; |

| | Ÿ | | general economic, market and business conditions in China; and |

| | Ÿ | | changes in governmental policies, laws or regulations in China. |

This annual report also contains data related to the biodiesel fuel market in several countries. This market data includes projections that are based on a number of assumptions. The biodiesel fuel market may not grow at the rates projected by the market data, or at all. The failure of the market to grow at the projected rates may materially and adversely affect our business and the market price of our ADSs. In addition, the evolving nature of the biodiesel fuel market subjects any projections or estimates relating to the growth prospects or future condition of our market to significant uncertainties. If any one or more of the assumptions underlying the market data proves to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

We have sourced biodiesel industry data used in this annual report from various sources. In particular, we have commissioned Frost & Sullivan, a market research and consulting firm, to prepare a report.

The forward-looking statements contained in this annual report speak only as of the date of this annual report or, if obtained from third-party studies or reports, the date of the corresponding study or report and are expressly qualified in their entirety by the cautionary statements in this annual report. Since we operate in an emerging and evolving environment and new risk factors emerge from time to time, you should not rely upon forward-looking statements as predictions of future events. Except as otherwise required by the securities laws of the United States, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events. All forward-looking statements contained in this annual report are qualified by reference to this cautionary statement.

1

INTRODUCTION

Unless the context otherwise requires, in this annual report on Form 20-F,

| | Ÿ | | “we,” “us,” “our company, ” “Gushan” or “Gushan Environmental” refers to Gushan Environmental Energy Limited, a Cayman Islands company and its predecessor entities and consolidated subsidiaries, as the context requires; |

| | Ÿ | | “China” or the “PRC” refers to the People’s Republic of China, and, for the purposes of this annual report, excludes Hong Kong, Macau, and Taiwan; |

| | Ÿ | | “RMB” or “Renminbi” refers to the legal currency of China; |

| | Ÿ | | “$,” “dollars,” “US$” or “U.S. dollars” refers to the legal currency of the United States; |

| | Ÿ | | “HK$,” “HKD” or “Hong Kong dollars” refers to the legal currency of Hong Kong; |

| | Ÿ | | “production capacity” for any given year is estimated based upon 300 annual working days; |

| | Ÿ | | “tons” refers to metric tons; |

| | Ÿ | | “diesel” refers to conventional, petroleum-based diesel fuel; |

| | Ÿ | | “vegetable oil offal” refers to both acidified and non-acidified vegetable oil offal; |

| | Ÿ | | “2005 Notes” refers to the HK$60.0 million 10% convertible notes that we issued in May 2005, all of which were converted into 18,570,000 of our ordinary shares in February 2006; |

| | Ÿ | | “2006 Notes” refers to the US$25.0 million zero coupon convertible notes that we issued in February 2006 in an aggregate principal amount of US$25.0 million, all of which were converted into 13,011,943 of our ordinary shares in November and December 2007; |

| | Ÿ | | “ordinary shares” refers to our ordinary shares, par value HK$0.00001 per share; and |

| | Ÿ | | “ADSs” refers to our American depositary shares, each of which represents two of our ordinary shares. |

We have sourced various biodiesel industry data used in this annual report from Frost & Sullivan, a market research and consulting firm commissioned by us. We have assumed the correctness and truthfulness of such data, including projections and estimates, when we use them in this annual report. You should read our cautionary statement in “Forward-Looking Statements” in this annual report.

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

We and certain selling shareholders of our company completed our initial public offering of 18,000,000 ADSs, representing 15,000,000 ADSs sold by our company and 3,000,000 sold by the selling shareholders, on December 24, 2007. Each ADS represents two of our ordinary shares. On December 19, 2007, we listed our ADSs on the New York Stock Exchange under the symbol “GU.” In January 2008, the underwriters exercised their over-allotment option for the purchase of an additional 1,227,306 ADSs from the selling shareholders. On June 23, 2008, we filed a Form F-1 with the Securities and Exchange Commission in connection with a proposed follow-on public offering of a certain number of ADSs to be sold by certain selling shareholders.

All share numbers reflect the 1:10,000 share split that became effective on November 9, 2007.

Unless otherwise indicated, all translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi are made at US$1.00 = RMB 7.0120, the noon buying rate for U.S. dollars in effect on March 31, 2008 in The City of New York for cable transfers of Renminbi as certified for customs purposes by the Federal Reserve Bank of New York. See “Exchange Rate Information.” All translations from Hong Kong dollars to U.S. dollars were made at the rate of HK$6.8796 = US$1.00, the noon buying rate reported by the Federal Reserve Bank of New York on March 31, 2008. We make no representation that any amounts in Renminbi, Hong Kong dollars or U.S. dollars could be or could have been converted into each other at any particular rate or at all.

2

Exchange Rate Information

Our business is conducted in China and all of our revenue and the majority of our expenses are denominated in Renminbi. This annual report contains translations of Renminbi amounts into U.S. dollars at specified rates. Unless otherwise noted, all translations from Renminbi to U.S. dollar amounts were made at the noon buying rate in the City of New York for cable transfers of Renminbi as certified for customs purposes by the Federal Reserve Bank of New York, as of March 31, 2008, which was RMB7.0120 to US$1.00. We make no representation that the Renminbi or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On June 27, 2008, the noon buying rate was RMB 6.8618 to US$1.00.

The following table sets forth information concerning exchange rates between the Renminbi and the U.S. dollars for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this annual report or will use in the preparation of our periodic reports or any other information to be provided to you.

| | | | | | | | |

| | | Noon Buying Rate |

| | | Average(1) | | High | | Low | | Period-end |

| | | (RMB per US $1.00) |

2003 | | 8.2771 | | 8.2800 | | 8.2765 | | 8.2767 |

2004 | | 8.2768 | | 8.2774 | | 8.2764 | | 8.2765 |

2005 | | 8.1826 | | 8.2765 | | 8.0702 | | 8.0702 |

2006 | | 7.9579 | | 8.0702 | | 7.8041 | | 7.8041 |

2007 | | 7.6032 | | 7.8127 | | 7.2946 | | 7.2946 |

December | | 7.3682 | | 7.4120 | | 7.2946 | | 7.2946 |

2008 | | | | | | | | |

January | | 7.2405 | | 7.2946 | | 7.1818 | | 7.1818 |

February | | 7.1644 | | 7.1973 | | 7.1100 | | 7.1115 |

March | | 7.0722 | | 7.1110 | | 7.0105 | | 7.0120 |

April | | 6.9997 | | 7.0185 | | 6.9840 | | 6.9870 |

May | | 6.9725 | | 7.0000 | | 6.9377 | | 6.9400 |

June (through June 27) | | 6.9013 | | 6.9633 | | 6.8618 | | 6.8618 |

Source: Federal Reserve Bank of New York

| (1) | | Averages for a period are calculated by using the average of the exchange rates on the end of each month during the periods. Monthly averages are calculated by using the average of the daily rates during the relevant period. |

3

PART I.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following selected consolidated statement of income data and other consolidated financial data (other than ADS and U.S. dollar data) for the years ended December 31, 2005, 2006 and 2007 and the selected consolidated balance sheet data (other than U.S. dollar data) as of December 31, 2006 and 2007 are derived from our audited consolidated financial statements included elsewhere in this annual report. The following selected consolidated statement of income data and other consolidated financial data (other than ADS data) for the year ended December 31, 2004 and selected balance sheet data as of December 31, 2005 are derived from our audited consolidated financial statements which are not included in this annual report. The following selected statement of income data and other consolidated financial data (other than ADS data) for the year ended December 31, 2003 and the selected balance sheet data as of December 31, 2003 and 2004 are derived from our unaudited consolidated financial statements. Our unaudited financial statements have been prepared on the same basis as our audited consolidated financial statements. The unaudited financial statements include all adjustments, consisting only of normal and recurring adjustments, that we consider necessary for a fair presentation of our financial position and operating results for the periods presented. You should read the following information in conjunction with those financial statements and the accompanying notes and Item 5 of this annual report, “Operating and Financial Review and Prospects”. Our audited consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, and have been audited by KPMG, an independent registered public accounting firm. Our historical results for any period are not necessarily indicative of results to be expected in any future period.

4

| | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2007 | |

| | | RMB | | | RMB | | | RMB | | | RMB | | | RMB | | | US$ | |

| | | (in thousands, except for percentage, per share and operating data) | |

Consolidated Statement of Income Data: | | | | | | | | | | | | | | | | | | |

Revenues | | | | | | | | | | | | | | | | | | |

Biodiesel | | 35,575 | | | 125,161 | | | 224,121 | | | 698,449 | | | 845,463 | | | 120,574 | |

By-products | | 39,870 | | | 47,078 | | | 136,684 | | | 126,033 | | | 162,593 | | | 23,188 | |

| | | | | | | | | | | | | | | | | | |

Total revenues | | 75,445 | | | 172,239 | | | 360,805 | | | 824,482 | | | 1,008,056 | | | 143,762 | |

Cost of revenue | | (27,359 | ) | | (83,386 | ) | | (179,861 | ) | | (446,742 | ) | | (568,973 | ) | | (81,143 | ) |

| | | | | | | | | | | | | | | | | | |

Gross profit | | 48,086 | | | 88,853 | | | 180,944 | | | 377,740 | | | 439,083 | | | 62,619 | |

Operating expenses | | (1,797 | ) | | (1,845 | ) | | (12,354 | ) | | (44,654 | ) | | (55,954 | ) | | (7,980 | ) |

| | | | | | | | | | | | | | | | | | |

Income from operations | | 46,289 | | | 87,008 | | | 168,590 | | | 333,086 | | | 383,129 | | | 54,639 | |

Other income (expense): | | | | | | | | | | | | | | | | | | |

Interest income | | 2 | | | 2 | | | 169 | | | 4,508 | | | 3,757 | | | 536 | |

Interest expense | | (1,246 | ) | | (911 | ) | | (3,101 | ) | | (3,216 | ) | | (108,893 | ) | | (15,530 | ) |

Foreign currency exchange losses | | — | | | — | | | (90 | ) | | (1,095 | ) | | (1,945 | ) | | (277 | ) |

Other income, net | | 719 | | | 1,162 | | | 1,213 | | | 3,913 | | | 2,724 | | | 388 | |

| | | | | | | | | | | | | | | | | | |

Income before income tax expense | | 45,764 | | | 87,261 | | | 166,781 | | | 337,196 | | | 278,772 | | | 39,756 | |

Income tax expense | | (6,955 | ) | | (13,093 | ) | | (14,255 | ) | | (4,392 | ) | | (48,499 | ) | | (6,916 | ) |

| | | | | | | | | | | | | | | | | | |

Net income | | 38,809 | | | 74,168 | | | 152,526 | | | 332,804 | | | 230,273 | | | 32,840 | |

| | | | | | | | | | | | | | | | | | |

Net income per share | | | | | | | | | | | | | | | | | | |

—Basic(4) | | 0.39 | | | 0.74 | | | 1.48 | | | 2.75 | | | 1.84 | | | 0.26 | |

—Diluted(4) | | 0.39 | | | 0.74 | | | 1.35 | | | 2.49 | | | 1.83 | | | 0.26 | |

| | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | |

Other selected Consolidated Financial Data: | | | | | | | | | | | | | | | |

Gross profit margin(1) | | 63.7 | % | | 51.6 | % | | 50.2 | % | | 45.8 | % | | 43.6 | % |

Operating profit margin(1) | | 61.4 | % | | 50.5 | % | | 46.7 | % | | 40.4 | % | | 38.0 | % |

Net income margin(1) | | 51.4 | % | | 43.1 | % | | 42.3 | % | | 40.4 | % | | 22.8 | % |

Net income per ADS (in RMB) | | 0.78 | | | 1.48 | | | 2.96 | | | 5.50 | | | 3.68 | |

Effect of tax holiday on net income per share—basic

(in RMB)(2) | | — | | | — | | | 0.43 | | | 0.73 | | | 0.75 | |

Effect of tax holiday on net income per share—diluted

(in RMB)(2) | | — | | | — | | | 0.38 | | | 0.65 | | | 0.75 | |

Dividends paid(3) (in thousands of RMB) | | — | | | 33,335 | | | 46,996 | | | — | | | — | |

| (1) | | Gross profit margin, operating profit margin and net income margin represent gross profit, operating profit and net income, respectively, divided by revenue. |

| (2) | | Our PRC subsidiaries enjoy tax holidays provided by local and national PRC tax authorities. See Item 5, “Operating and Financial Review and Prospects.” If our PRC subsidiaries had not enjoyed these tax holidays, they would have had higher enterprise income tax rates. |

| (3) | | Dividends paid during the years ended December 31, 2004 and 2005 were made by Sichuan Gushan, our predecessor, to our equity holders before we established our offshore holding company structure. |

| (4) | | We were incorporated on May 16, 2006 and as part of a series of reorganization activities, became the holding company of our subsidiaries on September 20, 2007. Our financial results, including the determination of earnings per share, are presented as though the reorganization and share split were completed at the beginning of the earliest period presented, or January 1, 2003. |

| | | | | | | | | | |

| | | Year ended December 31, |

| | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 |

Selected Operating Data | | | | | | | | | | |

Sale volume of biodiesel | | 11,856 | | 36,045 | | 61,119 | | 158,994 | | 182,969 |

Average Selling Price of biodiesel (in RMB) | | 3,001 | | 3,472 | | 3,667 | | 4,393 | | 4,621 |

Sale volume of by-products(1) | | 3,867 | | 5,957 | | 19,632 | | 21,479 | | 22,134 |

Average Selling Price of by-products(1) (in RMB) | | 10,310 | | 7,903 | | 6,962 | | 5,868 | | 7,346 |

| (1) | | By-products are comprised of glycerine, stearic acid, erucic acid, erucic amide, plant asphalt and refined glycerine. |

5

| | | | | | | | | | | | |

| | | As of December 31, |

| | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2007 |

| | | RMB | | RMB | | RMB | | RMB | | RMB | | US$ |

| | | (in thousands) |

Consolidated Balance Sheet Data: | | | | | | | | | | | | |

Cash | | 410 | | 2,240 | | 12,239 | | 275,142 | | 1,380,735 | | 196,910 |

Accounts receivable | | 3,962 | | 8,171 | | 19,850 | | 24,780 | | 31,110 | | 4,437 |

Inventories | | 3,458 | | 3,482 | | 6,734 | | 38,784 | | 31,580 | | 4,504 |

Property, plant and equipment | | 54,306 | | 86,875 | | 263,369 | | 498,085 | | 807,371 | | 115,141 |

Total assets | | 69,154 | | 123,002 | | 312,388 | | 879,118 | | 2,309,794 | | 329,406 |

Secured short-term bank loans | | 10,000 | | 13,000 | | 5,000 | | — | | — | | — |

Convertible notes | | — | | — | | 66,247 | | 41,043 | | — | | — |

Total shareholders’ equity | | 48,510 | | 89,343 | | 216,459 | | 798,121 | | 2,181,301 | | 311,081 |

Total liabilities and shareholders’ equity | | 69,154 | | 123,002 | | 312,388 | | 879,118 | | 2,309,794 | | 329,406 |

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

An investment in our ADSs involves significant risks. You should consider carefully all of the information in this annual report, including the risks and uncertainties described below and our consolidated financial statements and related notes, before making an investment in our ADSs. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ADSs could decline, and you may lose all or part of your investment.

RISKS RELATING TO OUR BUSINESS AND INDUSTRY

We may not be able to effectively manage our planned expansion, the failure of which could materially and adversely affect our business, results of operations and financial condition.

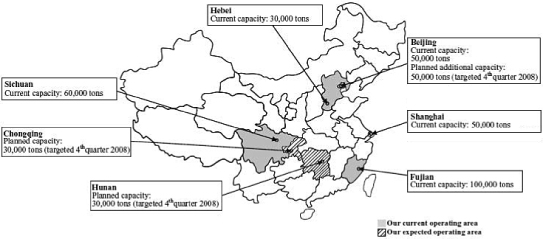

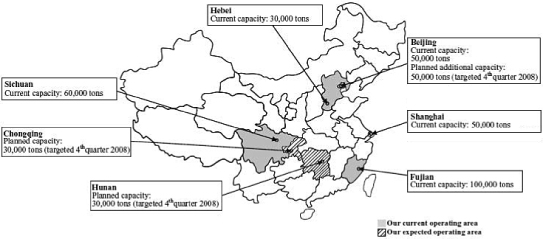

The further expansion of our business and production capacity is one of our key growth strategies. We intend to expand our annual production capacity to 400,000 tons by the end of 2008 from our current capacity of 290,000 tons, and we also plan to expand into new geographic markets in China.

Our planned expansion requires us to identify suitable locations that will enable us to secure raw materials at competitive prices and that host a sufficiently large local customer base to support the expanded production. Even if we successfully identify suitable locations, we may be unable to expand our business into these new locations if potential competitors enter the market before us. In addition, we may not have the necessary management or financial resources to oversee the successful and timely construction of new production facilities or expansion of existing facilities. Our expansion plans could also be affected by construction delays, cost overruns, failures or delays in obtaining government approvals of necessary permits and our inability to secure the necessary production equipment.

Furthermore, to effectively manage our planned expansion we must improve our operational and financial systems and procedures and system of internal control. Our rapid growth has strained our resources and made it difficult to maintain and update our internal procedures and controls as necessary to meet the expansion of our overall business. We must expand, train and manage our employee base, and successfully establish new subsidiaries for the new or expanded facilities. We must also continue to maintain and expand our relationships with our customers, suppliers and other third parties.

6

We cannot assure you that we will be able to effectively manage our planned expansion or achieve our expansion plans at all. If we are unable to do so, we may not be able to take advantage of market opportunities, execute our business strategies or respond to competitive pressures, any of which could materially and adversely affect our business, results of operations and financial condition.

A decline in the price of diesel or other fuel sources or an increase in their supply could constrain the selling price of our biodiesel and materially and adversely affect our business, results of operations and financial condition.

Our biodiesel prices are influenced by market prices for diesel, the pricing of which is affected by global and domestic market prices for crude oil. As a result, any decline in the price of diesel may adversely affect our business, results of operations and financial condition. The PRC government also publishes “guidance prices” with respect to diesel. These guidance prices typically establish a range for retail prices for diesel that are generally followed by industry participants. As biodiesel prices are affected by the price of diesel, the PRC government’s prevailing guidance prices typically limit the price range for our biodiesel.

Demand for and prices of biodiesel in China have also been influenced in recent years by increases in energy consumption and rising prices of crude oil and natural gas accompanying the growth of the PRC economy. However, demand for biodiesel may not continue to grow at current levels, or at all, and demand for biodiesel in China could decline. In addition, the price of fuel remains the principal factor that determines how consumers make their energy purchasing decisions. If increased supply of other energy sources matches or exceeds the demand for fuel products, or other fuels become more affordable than biodiesel, demand for our biodiesel may decline and our business, results of operations and financial condition may be adversely affected.

Our dependence on a limited number of third-party raw materials suppliers could adversely impact our production or increase our costs, which could harm our reputation or materially and adversely affect our business, results of operations and financial condition.

We purchase our raw materials, including vegetable oil offal, used cooking oil and methanol, from a limited number of third-party suppliers, including waste management companies and vegetable oil producers. Our five largest suppliers accounted for approximately 56.2% of our cost of revenues in 2007 and we conduct business with some of these suppliers under contracts with durations of one year or less or through purchase orders. We have also entered into long-term supply contracts of approximately three years in duration with certain of our suppliers. The failure of a supplier to supply raw materials satisfying our quality, quantity and cost requirements in a timely manner could impair our ability to produce our products or could increase our costs. If we fail to maintain our relationships with major raw materials suppliers or fail to develop new relationships with other raw materials suppliers, we may be unable to produce our products, or we may only be able to produce our products at a higher cost or after lengthy delays.

If our suppliers identify alternative sales channels, such as to chemical plants or distributors, they may choose to sell to other buyers or raise their prices. As a result, we may be compelled to pay higher prices to secure our raw material supply, which could adversely affect our business, results of operations and financial condition. Since 2005, the prices we have paid for raw materials have steadily increased, and the market price for used cooking oil also has risen significantly in the recent past.

Our operations are materially affected by the cost and availability of raw materials in the regions in which we operate production facilities.

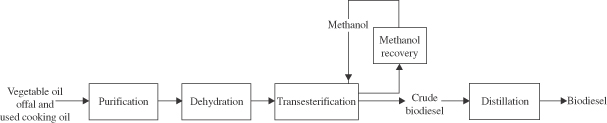

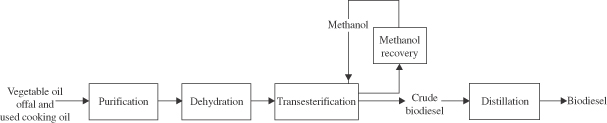

The principal raw materials we use in the production of biodiesel include vegetable oil offal, used cooking oil and methanol. An event that reduces the supply of our raw materials could reduce our production volumes, increase our manufacturing costs, or both, either of which may adversely affect our business, results of operation and financial condition. Vegetable oil offal is a waste by-product of vegetable oil production, and the availability of vegetable oil offal depends on production levels of vegetable oil. Production levels of vegetable oil

7

are affected by factors beyond our control, such as poor harvests of plant crops. Used cooking oil is the used oil left over from food processing, mostly by restaurants and food producers. Therefore, any fluctuations in cooking oil consumption in the food industry in China will affect the supply of used cooking oil. If cooking oil consumption in China decreases, the supply of used cooking oil for our production would be adversely affected. Natural gas is the principal feedstock for methanol production, and our operations depend in large part on the availability, security of supply and price of natural gas. If our suppliers are unable to obtain continued access to sufficient natural gas or if they experience significant interruptions in their supply of natural gas, our biodiesel production would be adversely affected.

Our overall operating performance is affected by the mix of raw materials we use as well as the product mix of our biodiesel and by-products, which command different profit margins. We source our raw materials from local used cooking oil disposal companies and vegetable oil manufacturers. Because the long-distance transport of used cooking oil and vegetable oil offal is not economical, we have limited control over the mix of raw materials we can supply to each of our facilities. In addition, the composition of our raw materials is determined by the geographical regions in which we operate, which may affect our profit margins. For example, rapeseed is a raw material essential for producing erucic acid, a by-product of biodiesel production which generates a higher profit margin than biodiesel. While the relative rapeseed content of the raw materials we use has no effect on biodiesel production, vegetable oil offal and used cooking oil containing rapeseed are only available in a few regions in China, such as Sichuan. As we expand our facilities into other regions of China, we may be unable to purchase vegetable oil offal or used cooking oil which contain rapeseed to enable us to produce erucic acid in these new production facilities. Moreover, as our by-products are produced from our biodiesel operations, we have relatively little control over the proportion of by-products that are produced in relation to our biodiesel. Further, other than selecting the regions in which we locate our facilities, we have limited ability to change our product mix to concentrate on products with higher profit margins. In addition, given that by-products command a higher profit margin than biodiesel in some regions while the opposite may be true in other regions, our ability to maximize profits through control of our product mix is further constrained.

The biodiesel industry faces a number of challenges, and there is no established market for biodiesel in China where biodiesel is considered a principal source of energy for any purpose.

Biodiesel has only recently been produced for commercial applications in China, and the market for biodiesel products is currently confined to specific regions and is relatively small at the national level. There is no established market in China where biodiesel is considered a principal source of energy for vehicles operating on diesel or for any other purpose. We cannot assure you that biodiesel will be accepted or will reach a broader consumer base in China. Our future prospects and operational results will be adversely affected if biodiesel and the biodiesel industry in China fail to develop.

The global biodiesel industry is also at an early stage of development and acceptance as compared to other, more established energy industries, and has experienced significant growth only recently. Demand for biodiesel may not grow as rapidly as expected or at all. Biodiesel and the global biodiesel industry also face a number of obstacles and drawbacks, including:

| | Ÿ | | potentially increased nitrogen oxide (NOx) emissions as compared with diesel in most formulations; |

| | Ÿ | | gelling at lower temperatures than diesel, which can require the use of low percentage biodiesel blends in colder climates or the use of heated fuel tanks; |

| | Ÿ | | potential water contamination that can complicate handling and long-term storage; |

| | Ÿ | | reluctance on the part of some auto manufacturers and industry groups to endorse biodiesel and their recommending against the use of biodiesel or high percentage biodiesel blends; |

| | Ÿ | | potentially reduced fuel economy due to the lower energy content of biodiesel as compared with diesel; and |

| | Ÿ | | potentially impaired growth due to a lack of infrastructure such as dedicated rail tanker cars and truck fleets, sufficient storage facilities, and refining and blending facilities. |

8

The success of our expansion plans depends on growth in domestic demand for biodiesel, and we may face overcapacity if the biodiesel market in China does not develop as expected. The expenditures we will incur to expand our facilities and increase our capacity therefore may not result in increased revenues. Our results of operations would be materially and adversely affected were this to occur.

We derive a significant portion of our revenues from a small number of customers and a loss of any of our major customers may cause significant declines in our revenues.

We derive a significant portion of our revenues from a small number of customers, and we may be unable to maintain and expand our current customer relationships. For 2005, 2006 and 2007, our five largest customers represented approximately 28.9%, 37.1% and 24.5% of our total revenues, respectively, while our largest customer represented approximately 9.1%, 14.4% and 8.7% of our total revenues, respectively. We expect we will continue to depend on a relatively small number of customers for a significant portion of our sales volume and revenues. If we lose any of our major customers for any reason, including, for example, if our reputation declines, a customer materially reduces its orders from us, our relationship with one or more of our major customers deteriorates, or a major customer becomes insolvent or otherwise unable to pay for our products, our business and results of operations may be materially and adversely affected.

We face significant competition, and if we do not compete successfully against existing and new competitors as well as competing technologies and other clean energy sources, we may lose our market share and our profitability may be materially and adversely affected.

Existing and future domestic competitors, who may have a greater presence in other regions through government support or enjoy greater popularity among local consumers, may be able to secure a significant market share in regions where we currently do not have operations. We are only active in a limited number of regions in China, including Mianyang in Sichuan province, Fuzhou in Fujian province, Handan in Hebei province and Beijing and Shanghai. In addition, our potential competitors might be able to secure raw materials at a lower cost than we can and could therefore threaten our competitive position, which could significantly impact our profitability and future prospects. Our domestic competitors include China Biodiesel International Holdings, China Clean Energy Inc., East River Energy Resources, SINOPEC, CNOOC, and PetroChina, most of which have greater resources, brand recognition and access to more extensive distribution channels than we do. Moreover, some of our competitors have the ability to manage their risk through diversification, whereas we lack diversification in both the geographic scope and the nature of our business. As a result, we could be potentially impacted more by factors affecting the biodiesel industry or the regions in which we operate than we would if our business were more diversified.

We also face potential competition from foreign producers of biodiesel, which may have greater financial and research and development resources. Biodiesel is a relatively new product that was initially introduced outside China, and the technology for producing biodiesel may be more advanced in countries other than China. If foreign competitors, or domestic competitors relying on alliances with or support from foreign producers, enter the PRC biodiesel market, they may develop biodiesel that is more economically viable, which would adversely affect our ability to compete and our results of operations.

In addition, new technologies may be developed or implemented for alternative energy sources and products that use such energy sources. Advances in the development of fuels other than biodiesel or diesel, or the development of products that use energy sources other than diesel, such as gasoline hybrid vehicles and plug-in electric vehicles, could significantly reduce demand for biodiesel and thus affect our sales. Biodiesel also faces competition from fuel additives that help diesel burn cleaner and therefore reduce the comparative environmental benefits of biodiesel in relation to diesel.

Other clean energy sources such as ethanol, liquefied petroleum gas, hydrogen and electricity from clean sources may be more cost-effective to produce, store, distribute or use, more environmentally friendly, or

9

otherwise more successfully developed for commercial production in China than our products. These other energy sources may also receive greater government support than our products in the form of subsidies, incentives or minimum use requirements. As a result, demand for our products may decline and our business model may no longer be viable and our results of operations and financial condition may be materially adversely affected.

Any increase in competition arising from an increase in the number or size of competitors or from competing technologies or other clean energy sources may result in price reductions, reduced gross profit margins, loss of our market share and departure of key management, any of which could adversely affect our financial condition and profitability.

Natural or man-made disasters or technological upgrades may result in interruption or suspension of our operations and may materially and adversely affect our results of operations.

Our operations may be subject to significant interruption or prolonged suspension if any of our facilities experiences a major accident or is damaged by natural disasters, severe weather or unexpected or catastrophic events (such as typhoons, earthquakes, fires, floods, epidemics such as Severe Acute Respiratory Syndrome or avian flu or other similar events) or interruptions in the operations of our plants caused by such events. Our operations may also be subject to significant interruption or prolonged suspension due to technological upgrades of our production processes. For example, in July 2006, we suspended production at our Sichuan and Hebei plants for approximately one month and two months, respectively, in order to perform technological equipment upgrades, which resulted in decreased capacity utilizations of 10% and 14% in 2006 as compared to 2005 for these plants, respectively. In addition, in October 2007, we suspended production for two weeks at our Fujian plant to carry out maintenance operations and for two weeks at our Sichuan plant to complete an expansion of our production capacity. When we perform further technological upgrades at any of our plants, we may have to suspend our operations and our results of operations may be materially adversely affected. Further, on May 12, 2008, Sichuan province experienced a severe earthquake. As a result, our Sichuan facility experienced a temporary interruption of power supply and was required by the local government to suspend production for approximately two weeks as a safety precaution. Our Sichuan facility resumed production on May 26, 2008. We cannot assure you that we will not experience further interruptions or experience damage to our facilities as a result of further earthquakes, aftershocks, floods or other consequences associated with such earthquakes and aftershocks, which could materially and adversely affect our business, results of operations and financial condition.

In addition, our operations may be subject to man-made disasters, such as local protests, activism and labor disruptions. For example, in August 2007, we experienced local protests at our Fujian plant and our operations at the plant were disrupted for several hours. For more details, see “Failure to comply with environmental regulations could harm our business.” Further, unscheduled downtime, other operational hazards inherent in our industry, such as equipment failures, explosions, release of toxic chemicals such as methanol, abnormal pressures, blowouts, pipeline ruptures, transportation accidents, power outages or shortages or other events outside of our control, may result in the prolonged suspension of our operations. Some of these events may also cause personal injury or loss of life, severe damage to or destruction of property and equipment or environmental damage, and may result in the imposition of civil or criminal penalties. Our insurance may not be adequate to fully cover the potential events described above and we may not be able to renew this insurance on commercially reasonable terms or at all.

Our future performance depends on the continued service of our senior management and our ability to attract, train and retain skilled personnel.

Our future success depends on the continued service of our key management and technical staff, in particular our founder, chairman and principal executive officer, Mr. Jianqiu Yu, and our chief technology officer, Mr. Deyu Chen. Mr. Yu, our founder, plays a key role in the formation of our business strategy and has extensive knowledge of the local markets in which we operate. In addition, Mr. Yu is instrumental in formulating

10

our strategies for entering new markets. Mr. Chen was instrumental in the development of our proprietary manufacturing process and continues to play a key role in our technological development. If one or more of our key executives were unable or unwilling to continue in their present positions, we may not be able to replace them easily, our future growth may be constrained and our business may be disrupted and our financial condition and results of operation may be materially adversely affected. While we have non-competition agreements with most members of our senior management, we may be unable to continue to retain their services and there can be no assurance that they will not compete against us.

Our success also depends upon the continued service of our skilled personnel and on our ability to continue to attract, retain and motivate such personnel. There is intense competition to recruit technically competent personnel with expertise in the biodiesel industry and we have periodically experienced difficulties in recruiting suitable personnel. We may also need to offer better compensation and other benefits in order to attract and retain these personnel in the future, and we cannot assure you that we will have the resources to achieve our staffing needs. Due to the skills involved in operating some of our equipment, skilled production workers are not easily replaceable, and considerable training is required for new hires. These difficulties could limit our output capacity or reduce our operating efficiency and product quality, which could reduce our profitability and limit our ability to grow.

We may not be able to adequately protect our intellectual property rights or may be subject to infringement claims.

We rely on a combination of patents, trademarks, domain names and contractual rights to protect our intellectual property. We cannot assure you that the measures we take to protect our intellectual property rights will be sufficient to prevent any misappropriation of our intellectual property, or that our competitors will not independently develop alternative technologies that are equivalent or superior to technologies based on our intellectual property. We have two registered patents in China, one with a validity period of 20 years from August 7, 2002 and another with a validity period of 20 years from March 9, 2005. We cannot assure you that these patent registrations will not be revoked or challenged during their 20-year validity period. The legal regime governing intellectual property in China is still evolving and the level of protection of intellectual property rights in China may not be as effective as those in other jurisdictions. In the event that the steps we have taken and the protection afforded by law do not adequately safeguard our proprietary technology, we could suffer losses due to the sales of competing products that exploit our intellectual property, and our profitability would be adversely affected. Furthermore, we may incur additional overhead costs in any intellectual property claims we initiate, which will impact our operating results.

Many international biodiesel producers and other domestic biodiesel producers in China may have also patented certain technologies in the production of their biodiesel products. To the best of our knowledge, our patented process does not infringe any third party’s intellectual property rights. However, intellectual property rights are complex and there exists the risk that our process may infringe, or be alleged to infringe, another party’s intellectual property rights. The defense and prosecution of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or manufacturing processes or subject us to injunctions prohibiting the manufacture and sale of our products or the use of our technologies.

It is difficult to evaluate our results of operations and future prospects due to our limited operating history and the rapidly evolving biodiesel market in China.

We began our business in 2001 and commenced commercial operations at our production facilities in Mianyang, Sichuan province in December 2001. We commenced operations at our facilities in Hebei, Fujian, Beijing and Shanghai in January 2004, February 2006, January 2008 and June 2008, respectively. Accordingly, we

11

have a limited operating history from which you can evaluate our business and future prospects. Moreover, with the rapid growth of the biodiesel industry in China, we have experienced a high growth rate since our inception. As such, our historical operating results may not provide a meaningful basis for evaluating our business, results of operations and financial condition. We may be unable to expand our production capacity in future periods and our business model at higher volumes is unproven. Accordingly, you should not rely on our results of operations for any prior periods as an indication of our future performance. In addition, our business and prospects should be considered in light of the risks and uncertainties commonly encountered by a company in rapidly evolving markets, such as the PRC biodiesel market, where supply and demand may change significantly within a short period of time.

The prices of our by-products may decrease significantly, which may adversely affect our operating results.

As biodiesel production increases in China, the prices for the by-products of biodiesel production may decrease significantly, which would materially adversely affect our business, results of operations and financial condition.

We may be unable to obtain adequate financing to fund our capital requirements.

We expect that over the next several years, a substantial portion of our cash flow will be used to finance the expansion of capacity in our existing production facilities, construction of new production facilities and research and development. We may need to incur additional financing in order to fund our capital expenditures. We cannot assure you that we will be successful in obtaining such financing at a reasonable cost or at all. Our inability to finance our planned capital expenditures could adversely affect our business, financial condition, results of operations or liquidity position.

If we fail to keep up with new technology, our ability to offer cost effective, technologically advanced and environmentally friendly products may be materially and adversely affected and our competitiveness may erode.

Our success depends on our ability to offer cost effective and environmentally friendly products. As the technology for manufacturing biodiesel is at an early stage of development, failure to keep up with technological improvements or to implement such improvements in commercial applications would impede our efforts to reduce unit production costs and correspondingly hinder our efforts to strengthen our competitiveness. Moreover, if alternative technologies that are more cost effective and environmentally friendly become available to the market, the biodiesel industry in general and our business in particular may not be able to compete against such new alternative energy sources. Further, the PRC government may introduce new standards regulating biodiesel quality with which we could not comply, or we may have to incur additional costs to invest in technology or equipment to meet a new PRC or industry-wide standard. If we fail to achieve any new standard, or if the cost of achieving such standard is prohibitively expensive, we may have to raise prices and our biodiesel may become less attractive to customers or we may have to suspend all or part of our operations, which could materially adversely affect our business, results of operations and financial condition.

We have not received NDRC approval for certain of our foreign investment related projects, which could materially and adversely affect our further expansion and our ability to benefit from certain preferential policies that might otherwise be available to us.

Our subsidiaries incorporated in the PRC are foreign invested enterprises that we established either through acquisition or incorporation. Certain of our subsidiaries have not obtained approval from the National Development and Reform Committee of China, or NDRC, for certain foreign investment related projects. PRC law requires the Ministry of Commerce, or its local counterparts, to issue final government approval as a pre-condition to foreign investment in China. Before this final approval may be granted, however, approval from the NDRC, or its local counterparts, is required for projects except for trade or services related projects that do not relate to fixed asset investment. In practice, the Ministry of Commerce, or its local counterparts, often grant

12

final approval for foreign invested projects before such projects have first obtained NDRC approval. However, our further expansion and ability to benefit from certain preferential policies that might otherwise be available to us may be adversely affected because the competent authorities for land, planning, quality supervision, safety supervision, customs, taxation, foreign exchange and the administration of industry and commerce could refuse to grant approval or consent to our future projects due to the lack of NDRC approval.

Failure to comply with environmental regulations could harm our business.

We are subject to various PRC national and local environmental regulations related to our operations, including regulations governing the use, storage, discharge and disposal of hazardous substances and waste emission levels. If we fail to comply with the applicable environmental regulations, we could be subject to significant monetary damages and fines or suspensions of our operations, and our business reputation and profitability would be adversely affected. Further, any amendments to these laws and regulations may impose substantial pollution control measures that may require us to make significant expenditures to modify our production process or change the design of our products to limit actual or potential impact to the environment. Moreover, new laws, new interpretations of existing laws, increased governmental enforcement of environmental laws or other developments could require us to make significant additional expenditures, which may adversely affect our business, results of operations and financial condition.

In November 2006, we installed a covered storage tank at our Fujian plant at the recommendation of the local environmental bureau. We currently use uncovered storage tanks at our Sichuan and Hebei facilities. If we are required to undertake compliance measures at any of our plants, our results of operations may be materially adversely affected. In November 2007, we completed construction on a biodiesel production line with a capacity of 20,000 tons located at our Sichuan plant before our environmental impact assessment for the production line received approval from the local environmental authorities. We received approval of the environmental impact assessment from the local environmental authorities on March 10, 2008. However, because we completed construction before receiving approval of the assessment, we could be fined up to RMB200,000 (US$28,523) or required to remove the new production line and restore the construction site to its original condition, which would materially adversely affect our operations. Furthermore, because we commenced operation of the biodiesel production line before the environmental protection inspection was conducted by the local environmental protection bureau, we could be fined up to RMB100,000 (US$14,261) or could be required to stop operations, which would materially adversely affect our operations. As of the date of this annual report, Beijing Gushan, which commenced operations in January 2008, has not obtained a waste discharge permit from the local environmental authorities. We cannot assure you that a waste discharge permit will be obtained or that our Beijing plant will not be materially adversely affected as a result of its failure to obtain such permit. In addition, any perception of our noncompliance with environmental regulations could harm our business. For example, in August 2007, we experienced protests at our Fujian plant alleging environmental issues and our operations at the plant were disrupted for several hours. These and other risks relating to environmental compliance may materially adversely affect our business, results of operations and financial condition.

We do not possess valid title to certain buildings that we occupy and commenced construction of certain buildings prior to obtaining the requisite construction approvals.

For some of the buildings and land we occupy, we have not yet obtained sufficient land use or title certificates that allow us to occupy, freely use or transfer the land or properties. As of the date of this annual report, we have not obtained the building ownership certificates for eleven buildings with a total gross floor area of approximately 9,146 square meters. We currently use these properties as production facilities and ancillary facilities. We are in the process of carrying out completion inspections of these buildings and applying for the relevant building ownership certificates. As advised by our PRC legal advisors, Chen & Co. Law Firm, we have obtained all necessary approvals for the construction of these eleven buildings and there is no legal impediment for us to obtain the building ownership certificates for these buildings. Further, Beijing Gushan is applying for land use right certificates with respect to land occupying a total gross floor area of approximately 85,137 square

13

meters. We cannot assure you that such building ownership or land use right certificates will be obtained. We may be required to incur additional costs to relocate our operations and our business operations and our financial condition may be adversely affected as a result of the absence of land use right certificates or vested legal title in these properties.

Beijing Gushan, Shanghai Gushan and Fujian Gushan commenced construction of certain workshops or ancillary facilities consisting of a total gross floor area of approximately 9,916, 14,150 and 319 square meters, respectively, prior to obtaining the construction approvals as required by PRC construction law. Each of Beijing Gushan, Shanghai Gushan and Fujian Gushan may be subject to a maximum administrative penalty of RMB30,000 (US$4,278) and the relevant government authority may require the buildings located on these sites to be demolished. The carrying value of these buildings as of December 31, 2007 amounted to RMB46.7 million (US$6.7 million). If the relevant government authority imposes penalties on us and requires us to cease construction of or demolish these properties, we may incur additional costs and expenses for the relocation of our facilities.

The modification or elimination of government initiatives promoting the adoption of clean energy sources in China could cause demand for our products and our revenues to decline.

A number of PRC government initiatives promote the adoption of clean energy sources, such as biodiesel. For example, pursuant to the Medium and Long Term Development Plan, China targets to increase its consumption of energy from renewable sources to 15% of total energy consumption in China by 2020. The plan also includes the promotion of renewable energy sources. Under the plan, China aims to increase its annual consumption of biofuel, with the consumption of biodiesel targeted at two million tons per year by 2020. According to the Law of Renewable Energy Resources, local governments are required to prepare a renewable energy development plan and provide financial support to renewable energy projects in rural areas. Further, the government may grant businesses engaged in biodiesel production certain benefits and incentives, while petroleum marketing enterprises are required to include biodiesel products that comply with the state standard with respect to fuel sales. These government initiatives could be modified or eliminated altogether. Such a change in policy could adversely affect the growth of the biodiesel market and cause our revenues to decline. Changes to or elimination of initiatives designed to increase general acceptance of clean energy sources could result in decreased demand for our products and have a material adverse effect on our business, results of operations and financial condition.

In addition, the PRC government has enacted regulations that are intended to affect corporate behavior pertaining to the environment. Many of these regulations may be favorable to companies that are engaged in environmentally friendly or “green” industries, such as us. According to the Medium and Long Term Development Plan, the share of renewables used in primary energy consumption is to be increased to roughly 10% by 2010 and nearly 15% by 2020, up from 7.5% in 2005. However, we cannot assure you that demand for our products will increase or that we will otherwise benefit from such regulations. For example, the Ministry of Finance has issued the Temporary Regulation on the Management of Special Funds for the Development of Renewable Resources. Pursuant to this regulation, special funds will be provided to companies for the development of renewable resources, including petroleum substitutes. These funds may be used to promote advancement in the development of energy sources that compete with biodiesel, which may in turn reduce demand for biodiesel.

If environmental regulations are relaxed in the future, or if the enforcement of environmental regulations is not sufficiently rigorous, we may not be able to compete effectively against other manufacturers of energy products, including traditional and other clean energy source products. For example, under the Rules on the Management of Waste Grease for Food Producers, food producers must properly dispose of used cooking oil or sell used cooking oil to used cooking oil processing entities or waste collection entities rather than discharging used cooking oil into the environment or reusing it for human consumption. However, in practice, these rules may not be strictly enforced and waste grease may be disposed of through illegal means by some food producers, which would reduce the supply of used cooking oil available for our production. Our business prospects and results of operations may be adversely affected as a result of any of the foregoing factors.

14

Our insurance coverage may not be sufficient to cover our liability risks.

Consistent with customary practice in China, we do not carry any business interruption insurance, third- party liability insurance for personal injury or coverage for environmental damage arising from accidents at our production facilities. In addition, we have very limited product liability insurance coverage for our biodiesel. The maximum payout for each claim is capped at RMB100,000, and the cumulative maximum payout under our product liability insurance policies ranges from RMB200,000 to RMB500,000. Should an uninsured liability or a liability claim in excess of our insured limits occur, our business operations and financial condition may be adversely affected. Further, if such incidents are publicized, our reputation maybe adversely affected, which could result in reduced and/or cancelled sales, thereby adversely affecting our revenues.

Our principal shareholders exert significant influence over us and their interests may not coincide with yours.

Our principal shareholders, acting individually or together, have substantial influence over our business and could control substantially all matters requiring shareholder approval, including the election of most directors and approval of significant corporate transactions. In addition, this concentration of ownership may delay or prevent a change in control of our company and make some transactions more difficult or impossible without the support of these shareholders. The interests of these shareholders may not always coincide with our interests as a company or the interest of other shareholders. Accordingly, these shareholders could cause us to enter into transactions or agreements with which you may not approve or make decisions with which you may disagree.

Anti-takeover provisions in our charter documents may adversely affect the rights of holders of our ADSs and common shares.

Our amended and restated articles of association include provisions that could limit the ability of others to acquire control of us, modify our structure or cause us to engage in change-of-control transactions. These provisions could have the effect of depriving shareholders of an opportunity to sell their shares at a premium over prevailing market prices by discouraging third parties from seeking to obtain control of us in a tender offer or similar transaction.

We have included the following provisions in our amended and restated articles of association:

| | Ÿ | | At each annual general meeting one third of our directors (or, if their number is not a multiple of three, the number nearest to but not less than one third) must retire from office by rotation, and every director is subject to retirement at least once every three years. This provision would delay the replacement of a majority of our directors and would make changes to the board of directors more difficult than if such provision were not in place. |

| | Ÿ | | Our board of directors has the authority to establish from time to time one or more series of preferred shares without action by our shareholders and to determine, with respect to any series of preferred shares, the terms and rights of that series, including the designation of the series, the number of shares of the series, the dividend rights, conversion rights, voting rights, and the rights and terms of redemption and liquidation preferences. |

| | Ÿ | | Our board of directors may issue series of preference shares without action by our shareholders to the extent authorized but unissued. Accordingly, the issuance of preference shares may adversely affect the rights of the holders of the ordinary shares. In addition, the issuance of preference shares may be used as an anti-takeover device without further action on the part of the shareholders. Issuance of preference shares may dilute the voting power of holders of ordinary shares. |

| | Ÿ | | Subject to applicable regulatory requirements, our board of directors may issue additional ordinary shares without action by our shareholders to the extent of available authorized but unissued shares. |

15

| | The issuance of additional ordinary shares may be used as an anti-takeover device without further action on the part of the shareholders. Such issuance may dilute the voting power of existing holders of ordinary shares. |

RISKS RELATING TO BUSINESS OPERATIONS IN CHINA

If foreign ownership of the biodiesel production business in China is restricted, we would have to rely on contractual arrangements to derive economic benefits from, and to control, our new PRC operating entities in the future, which may not be as effective in providing control over these entities as direct ownership.

On October 31, 2007, the National Development and Reform Committee of China, or the NDRC, and the Ministry of Commerce of China jointly promulgated a newly revised Catalogue for Guiding Foreign Investment in Industries, or the Catalogue, which came into effect on December 1, 2007. Pursuant to the Catalogue, biodiesel production is classified as a sub-category of the agricultural food processing industry as a restricted industry, and, as a result, any such biodiesel production business in China must be majority owned by PRC citizens and/or entities.

Our PRC legal counsel, Chen & Co. Law Firm, has advised us that based on their understanding of the Catalogue, only biodiesel production using agricultural food products as raw materials falls within the “restricted industry” category pursuant to the Catalogue. In the opinion of Chen & Co. Law Firm, our biodiesel production process, which utilizes used cooking oil and vegetable oil offal as raw materials, does not fall within the restricted industry category under the Catalogue. Further, even if biodiesel production utilizing used cooking oil and vegetable oil offal is classified as a restricted industry, Chen & Co. Law Firm is of the opinion that only new biodiesel production businesses established after December 1, 2007 or existing biodiesel production businesses that require new approvals from the Ministry of Commerce or its local branch in order to, for example, increase their registered capital or conduct an equity transfer would be classified within a restricted industry.

There are substantial uncertainties in the interpretation and application of existing and new PRC laws, regulations or policies, including the Catalogue. In the event our existing biodiesel production business is deemed a restricted business in China, we would have to reorganize our corporate structure and rely on contractual arrangements with our operating entities in China and their owners of record to derive economic benefits from and exercise control over these entities. These contractual arrangements may not be as effective in providing control over our operating entities as direct ownership. If our operating entities were to fail to perform their obligations under any agreements with us, we would have to resort to legal remedies which could be time consuming and costly and we cannot assure you that such remedies would be available. In addition, we cannot assure you that any of the future direct record owners of our operating entities in China would always act in our best interests.

A slow-down of the PRC economy could adversely affect our business, results of operations and growth prospects.

All of our operations are in the PRC and all of our revenues are sourced from China. The success of our biodiesel business depends primarily on the growth of the PRC economy and the resultant demand for energy resources. A slow-down of the PRC economy could adversely affect our businesses, results of operations and growth prospects. In addition, the PRC government from time to time adjusts its policies to regulate and monitor the growth of the China economy. To address concerns over China’s rapid growth in industrial production, bank credit, fixed investment and money supply, the PRC government has expressed an intention to take measures to avoid overheating of the economy and high inflation. Among the measures that the PRC government has taken are restrictions on bank loans to certain sectors in which some of our customers operate. The PRC government has implemented certain measures, including a recent interest rate increase, to control the pace of economic growth. These measures and any further increases in interest rates could reduce economic growth in China and therefore, reduce demand for diesel products, which could have an adverse effect on our financial condition and results of operations.

16

Changes in China’s political and economic policies could have a material adverse effect on our business operations.

Since 1978, the PRC government has promulgated various reforms of its economic system. These reforms have resulted in economic growth for China in the last two decades. Many of the reforms are unprecedented or experimental and are expected to be modified from time to time. Other political, economic and social factors may also lead to further readjustment or introduction of other reform measures. This process of reform may have a material impact on our operations in China or may adversely affect our results of operations as our current revenue is substantially derived from our operations in China. Our financial condition and results of operations may be adversely affected by changes in China’s political, economic and social conditions and by changes in laws, regulations or the interpretation or implementation thereof.

Electricity shortages could adversely affect our business.

All of our manufacturing assets and operations are located in China. Our operations are vulnerable to power shortages that generally affect enterprises located in China. Certain manufacturers in China, especially in eastern and southern China, have in recent years experienced electricity shortages. If there is insufficient electricity supply to satisfy our requirements and accommodate our planned growth, we may need to limit or delay our production or expansion plans. If the cities where we have operations are affected by power outages or must ration power, our production volumes would decrease and our results of operations may be adversely affected. We cannot assure you that power shortages will not affect us in the future. In addition, we do not have any insurance coverage for business interruptions, including loss of profits from such interruptions. Any losses that may occur as a result of these kinds of events could adversely affect our financial condition and results of operations.

Interpretation of PRC laws and regulations involves uncertainty that could materially impact our operations.

Our business and operations in China are governed by the legal system of China. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since the late 1970s, the PRC government has promulgated laws and regulations dealing with such economic matters as foreign investment, corporate organization and governance, commerce, taxation and trade. However, as these laws and regulations are relatively new and continue to evolve, interpretation and enforcement of these laws and regulations involve significant uncertainties and different degrees of inconsistency.

For example, China’s Ministry of Commerce recently released the Regulations for Oil Product Market and Regulations for Crude Oil Market, which were implemented in January 2007. The Ministry of Commerce does not currently interpret these regulations as applicable to biodiesel producers. However, we cannot assure you that the Ministry of Commerce will not change its interpretation. If we are ever subject to these regulations and are unable to obtain any required permits, we may be subject to monetary fines and our production of biodiesel may be temporarily or permanently interrupted. Furthermore, due to the limited volume of published cases and the non-binding nature of prior court decisions, the outcome of dispute resolution may not be as consistent or predictable as in other more developed jurisdictions, which may limit legal protections available to us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

In addition, the PRC government has recently requested certain companies in the petrochemical industry to temporarily suspend production at their facilities located in and around Beijing in preparation for the Beijing Olympics during the period leading up to and around the Olympic games. Our Beijing plant has not received any such suspension or shut-down notice. As of the date of this annual report, we are not aware of any laws or regulations which require our Beijing plant to shut down or suspend operations during the relevant period. We cannot assure you, however, that our production volume will continue to grow at the current levels, or at all, or that our Beijing plant will not be requested to suspend production or to shut-down.

17

Our PRC subsidiaries are subject to restrictions on dividend payments that could materially impact our ability to receive dividends.

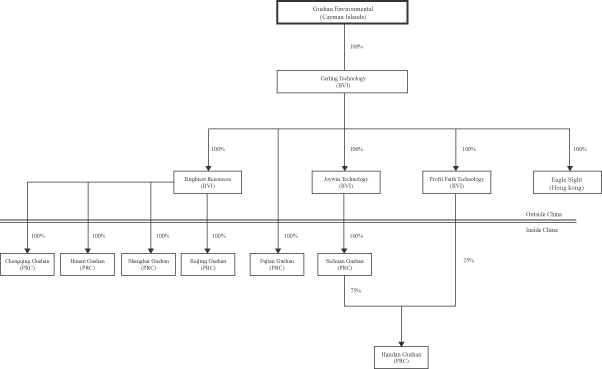

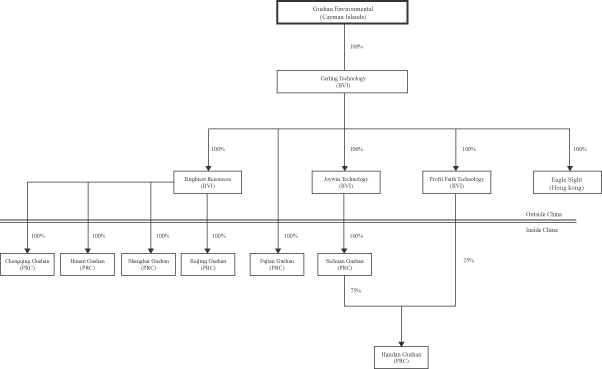

We are a holding company, and we rely principally on dividends and other distributions on equity paid by our intermediate holding companies, Carling Technology, Brightest Resources, Joywin Technology and Profit Faith Technology, and our PRC subsidiaries for our cash requirements, including the funds necessary to service any debt we may incur or financing we may need for operations other than through our PRC subsidiaries. If our PRC subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to our intermediate holding companies and us. Each of Chongqing Gushan, Hunan Gushan, Shanghai Gushan, Beijing Gushan, Fujian Gushan and Sichuan Gushan, as a wholly owned foreign enterprise in China, is required under PRC laws and regulations to provide for a statutory surplus reserve fund. Each is also required to allocate at least 10% of their after tax profits as reported in their PRC statutory financial statements to the general reserve and have the right to discontinue allocations to the general reserve once the reserve balance has reached 50% of their registered capital. These statutory reserves are not available for distribution to the shareholders, except in a liquidation, and may not be transferred in the form of loans, advances, or cash dividends. Handan Gushan, a sino-foreign joint equity enterprise, is required by its articles of association to allocate at least 5% of its after-tax profit to each of its reserve fund, its enterprise development fund and its staff and worker’s bonus and welfare fund. As of December 31, 2007, the amount of these restricted portions was RMB55.9 million (US$8.0 million) in total for our PRC subsidiaries. Limitations on the ability of our PRC subsidiaries or affiliated PRC entities to transfer funds to our intermediate holding companies and us in the form of dividends, loans or advances could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, and otherwise fund and conduct our business.

PRC laws and foreign exchange controls may affect our ability to receive dividends and other payments from our PRC subsidiaries.

Our operating PRC subsidiaries are subject to the PRC rules and regulations on currency conversion. The ability of our operating PRC subsidiaries to pay dividends or make other distributions to us may be restricted by these PRC foreign exchange control restrictions. We cannot assure you that the relevant regulations will be amended to our advantage such that the ability of our operating PRC subsidiaries to distribute dividends to us will not be adversely affected.

Changes in foreign exchange regulations and fluctuation in the value of the Renminbi may adversely affect our business and results of operations.