UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

| | |

| For the fiscal year ended December 31, 2009 | | Commission file number: 001-33878 |

Gushan Environmental Energy Limited

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

No. 37, Golden Pond Road

Golden Mountain Industrial District

Fuzhou City, Fujian Province

People’s Republic of China

(Address of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act.

| | |

Title of each Class | | Name of each exchange

on which registered |

| American Depositary Shares, each representing two ordinary shares, par value HK$0.00001 per share | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| | |

Ordinary shares, par value HK$0.00001 per share | | 166,831,943 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of the Securities Exchange Act of 1934. Yes ¨ No x

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| | | | |

| Large accelerated filer ¨ | | Accelerated filer x | | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S.GAAP x | | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ | | Other ¨ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

GUSHAN ENVIRONMENTAL ENERGY LIMITED

TABLE OF CONTENTS

i

ii

INTRODUCTION

Unless the context otherwise requires, in this annual report on Form 20-F,

| | • | | “we,” “our,” “us,” “Company,” “Gushan” or “Gushan Environmental” refers to Gushan Environmental Energy Limited, a Cayman Islands company and its predecessor entities and consolidated subsidiaries, as the context requires; |

| | • | | “China” or the “PRC” refers to the People’s Republic of China, and, for the purposes of this annual report, excludes Hong Kong, Macau, and Taiwan; |

| | • | | “RMB” or “Renminbi” refers to the legal currency of China; |

| | • | | “$,” “US$” or “U.S. dollars” refers to the legal currency of the United States; |

| | • | | “HK$,” “HKD” or “Hong Kong dollars” refers to the legal currency of Hong Kong; |

| | • | | “production capacity” for any given year is estimated based upon 300 annual working days; |

| | • | | “tons” refers to metric tons; |

| | • | | “diesel” refers to conventional, petroleum-based diesel fuel; |

| | • | | “vegetable oil offal” refers to both acidified and non-acidified vegetable oil offal; |

| | • | | “2006 Notes” refers to the US$25.0 million zero coupon convertible notes that we issued in February 2006 in an aggregate principal amount of US$25.0 million, all of which were converted into 13,011,943 of our ordinary shares in November and December 2007; |

| | • | | “ordinary shares” refers to our ordinary shares, par value HK$0.00001 per share; |

| | • | | “ADSs” refers to our American depositary shares, each of which represents two of our ordinary shares; and |

| | • | | “U.S. GAAP” refers to generally accepted accounting principles in the United States. |

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

We and certain selling shareholders of our Company completed our initial public offering of 18,000,000 ADSs, representing 15,000,000 ADSs sold by our Company and 3,000,000 sold by the selling shareholders, on December 24, 2007. On December 19, 2007, we listed our ADSs on the New York Stock Exchange, or NYSE, under the symbol “GU.” In January 2008, the underwriters exercised their over-allotment option for the purchase of an additional 1,227,306 ADSs from the selling shareholders.

All share numbers reflect the 1:10,000 share split that became effective on November 9, 2007.

Unless otherwise indicated, all translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi are made at US$1.00 = RMB6.8259, the noon buying rate for U.S. dollars in effect on December 31, 2009 in The City of New York for cable transfers of RMB as certified for customs purposes by the Federal Reserve Bank of New York. See Item 3, “Key Information—Exchange Rate Information.” All translations from Hong Kong dollars to U.S. dollars were made at the rate of HK$7.7536 = US$1.00, the noon buying rate reported by the Federal Reserve Bank of New York on December 31, 2009. We make no representation that any amounts in Renminbi, Hong Kong dollars or U.S. dollars could be or could have been converted into each other at any particular rate or at all.

1

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F, including in particular Item 3.D, “Key information—Risk Factors,” Item 4, “Information on the Company,” and Item 5, “Operating and Financial Review and Prospects,” contains statements that relate to future events, including our future operating results and conditions, our prospects and our future financial performance and condition. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “anticipate,” “believe,” “expect,” “estimate,” “predict,” “seek”, “potential,” “continue,” “future,” “intend,” “may,” “ought to,” “plan,” “should,” “target,” “will,” negatives of such terms or other expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, without limitation, statements relating to:

| | • | | changes in governmental policies, laws or regulations in China, including PRC tax laws that may have uncertain implications on biodiesel companies; |

| | • | | the effects of price fluctuations for biodiesel and biodiesel by-products; |

| | • | | estimates of future production capacities, volumes and operating costs; |

| | • | | the effects of natural disasters; |

| | • | | the effect of intensifying competition in the biodiesel and alternative energy industries; |

| | • | | the availability of suitable raw materials on terms acceptable to us; |

| | • | | changes in the general operating environment in China; |

| | • | | various business opportunities that we may pursue; and |

| | • | | general economic, market and business conditions in China. |

This annual report also contains data related to the biodiesel fuel market in several countries. This market data includes projections that are based on a number of assumptions. The biodiesel fuel market may not grow at the rates projected by the market data, or at all. The failure of the market to grow at the projected rates may materially and adversely affect our business and the market price of our ADSs. In addition, the evolving nature of the biodiesel fuel market subjects any projections or estimates relating to the growth prospects or future condition of our market to significant uncertainties. If any one or more of the assumptions underlying the market data proves to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements. You should read these statements in conjunction with the risk factors disclosed in Item 3.D of this annual report, “Key Information—Risk Factors.” Those risks are not exhaustive.

The forward-looking statements contained in this annual report speak only as of the date of this annual report or, if obtained from third-party studies or reports, the date of the corresponding study or report and are expressly qualified in their entirety by the cautionary statements in this annual report. Since we operate in an emerging and evolving environment and new risk factors emerge from time to time, you should not rely upon forward-looking statements as predictions of future events. Except as otherwise required by the securities laws of the United States, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events. All forward-looking statements contained in this annual report are qualified by reference to this cautionary statement.

2

PART I.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

A. Selected Financial Data

The following selected consolidated statement of operations data and other selected consolidated financial data (other than ADS, margin and U.S. dollar data) for the years ended December 31, 2007, 2008 and 2009 and the selected consolidated balance sheet data (other than U.S. dollar data) as of December 31, 2008 and 2009 are derived from our audited consolidated financial statements included elsewhere in this annual report. The following selected consolidated statement of operations data and other consolidated financial data (other than ADS, margin and U.S. dollar data) for the years ended December 31, 2005 and 2006 and selected balance sheet data as of December 31, 2005, 2006 and 2007 are derived from our audited consolidated financial statements which are not included in this annual report. You should read the following information in conjunction with those financial statements and the accompanying notes and Item 5 of this annual report, “Operating and Financial Review and Prospects.” Our audited consolidated financial statements are prepared in accordance with U.S. GAAP, and have been audited by KPMG, an independent registered public accounting firm. Our historical results for any period are not necessarily indicative of results to be expected in any future period.

| | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2009 | |

| | | RMB | | | RMB | | | RMB | | | RMB | | | RMB | | | US$ | |

| | | (in thousands, except for percentage, per share and operating data) | |

Selected Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | |

Revenues | | 360,805 | | | 824,482 | | | 1,008,056 | | | 1,495,614 | | | 628,186 | | | 92,030 | |

Cost of revenues | | (179,861 | ) | | (446,742 | ) | | (568,973 | ) | | (962,606 | ) | | (766,686 | ) | | (112,320 | ) |

| | | | | | | | | | | | | | | | | | |

Gross profit (loss) | | 180,944 | | | 377,740 | | | 439,083 | | | 533,008 | | | (138,500 | ) | | (20,290 | ) |

Operating expenses | | (12,354 | ) | | (44,654 | ) | | (55,954 | ) | | (110,824 | ) | | (129,024 | ) | | (18,903 | ) |

| | | | | | | | | | | | | | | | | | |

Income (loss) from operations | | 168,590 | | | 333,086 | | | 383,129 | | | 422,184 | | | (267,524 | ) | | (39,193 | ) |

Other (expense) income | | (1,809 | ) | | 4,110 | | | (104,357 | ) | | (71,481 | ) | | 1,538 | | | 226 | |

| | | | | | | | | | | | | | | | | | |

Earnings (loss) before income tax expense | | 166,781 | | | 337,196 | | | 278,772 | | | 350,703 | | | (265,986 | ) | | (38,967 | ) |

Income tax expense | | (14,255 | ) | | (4,392 | ) | | (48,499 | ) | | (81,693 | ) | | (17,523 | ) | | (2,567 | ) |

| | | | | | | | | | | | | | | | | | |

Net income (loss) | | 152,526 | | | 332,804 | | | 230,273 | | | 269,010 | | | (283,509 | ) | | (41,534 | ) |

| | | | | | | | | | | | | | | | | | |

Earnings (loss) per share | | | | | | | | | | | | | | | | | | |

—Basic | | 1.48 | | | 2.75 | | | 1.84 | | | 1.61 | | | (1.70 | ) | | (0.25 | ) |

—Diluted | | 1.35 | | | 2.49 | | | 1.83 | | | 1.61 | | | (1.70 | ) | | (0.25 | ) |

3

| | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

Other Selected Consolidated Financial Data: | | | | | | | | | | | | | | | |

Gross profit (loss) margin(1) | | 50.2 | % | | 45.8 | % | | 43.6 | % | | 35.6 | % | | (22.0 | )% |

Operating profit (loss) margin(1) | | 46.7 | % | | 40.4 | % | | 38.0 | % | | 28.2 | % | | (42.6 | )% |

Net income (loss) margin(1) | | 42.3 | % | | 40.4 | % | | 22.8 | % | | 18.0 | % | | (45.1 | )% |

Earnings (loss) per ADS | | 2.96 | | | 5.50 | | | 3.68 | | | 3.22 | | | (3.40 | ) |

Effect of tax holiday on earnings (loss) per share—basic (in RMB)(2) | | 0.43 | | | 0.73 | | | 0.75 | | | 0.44 | | | 0.01 | |

Effect of tax holiday on earnings (loss) per share—diluted (in RMB)(2) | | 0.38 | | | 0.65 | | | 0.75 | | | 0.44 | | | 0.01 | |

Dividends paid(3) (in thousands of RMB) | | 46,996 | | | — | | | — | | | 68,401 | | | 26,693 | |

Dividend per ordinary share (in RMB)(4) | | 0.45 | | | — | | | — | | | 0.41 | | | 0.16 | |

| (1) | Gross profit (loss) margin, operating profit (loss) margin and net income (loss) margin represent gross profit (loss), operating profit (loss) and net income (loss), respectively, divided by revenues. |

| (2) | Our PRC subsidiaries enjoy tax holidays provided by local and national PRC tax authorities. See Item 5, “Operating and Financial Review and Prospects.” If our PRC subsidiaries had not enjoyed these tax holidays, they would have had higher corporate income tax rates. |

| (3) | Dividends paid during the year ended December 31, 2005 were made by Sichuan Gushan Vegetable Fat Chemistry Co., Ltd. (“Sichuan Gushan”), our predecessor, to our equity holders before we established our offshore holding company structure. |

| (4) | We were incorporated on May 16, 2006 and as part of a series of reorganization activities, became the holding company of our subsidiaries on September 20, 2007. Our financial results, including the determination of earnings (loss) per share and dividend per share, are presented as though the reorganization and share split were completed at the beginning of the earliest period presented, or January 1, 2005. |

| | | | | | | | | | |

| | | Year ended December 31, |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

Selected Operating Data: | | | | | | | | | | |

Sales volume of biodiesel(1) (tons) | | 61,119 | | 158,994 | | 182,969 | | 231,377 | | 143,818 |

Average selling price of biodiesel(1) (in RMB/ton) | | 3,667 | | 4,393 | | 4,621 | | 5,748 | | 4,040 |

Sales volume of by-products(2) (tons) | | 19,632 | | 21,479 | | 22,134 | | 23,878 | | 18,469 |

Average selling price of by-products(2) (in RMB/ton) | | 6,962 | | 5,868 | | 7,346 | | 6,936 | | 2,554 |

| (1) | Sales volume of biodiesel includes biodiesel sold as a refined oil product to the fuel market and biodiesel sold as fatty acid methyl ester, an intermediate product to the chemical industry. Average selling price of biodiesel represents total average selling price of biodiesel sold as a refined oil product to the fuel market and biodiesel sold as an intermediate product to the chemical industry. |

| (2) | By-products are comprised of glycerine, stearic acid, erucic acid, erucic amide, plant asphalt and refined glycerine. |

4

| | | | | | | | | | | | |

| | | As of December 31, |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2009 |

| | | RMB | | RMB | | RMB | | RMB | | RMB | | US$ |

| | | (in thousands, except number of shares) |

Selected Consolidated Balance Sheet Data: | | | | | | | | | | | | |

Cash | | 12,239 | | 275,142 | | 1,380,735 | | 963,228 | | 571,188 | | 83,680 |

Accounts receivable | | 19,850 | | 24,780 | | 31,110 | | 12,926 | | 2,414 | | 354 |

Inventories | | 6,734 | | 38,784 | | 31,580 | | 59,246 | | 33,418 | | 4,896 |

Property, plant and equipment | | 263,369 | | 498,085 | | 807,371 | | 1,451,533 | | 1,641,096 | | 240,422 |

Total assets | | 312,388 | | 879,118 | | 2,309,794 | | 2,604,036 | | 2,379,129 | | 348,545 |

Secured short-term bank loans | | 5,000 | | — | | — | | — | | — | | — |

Convertible notes | | 66,247 | | 41,043 | | — | | — | | — | | — |

Net assets | | 216,459 | | 798,121 | | 2,181,301 | | 2,377,770 | | 2,096,863 | | 307,193 |

Total shareholders’ equity | | 216,459 | | 798,121 | | 2,181,301 | | 2,377,770 | | 2,096,863 | | 307,193 |

Total liabilities and shareholders’ equity | | 312,388 | | 879,118 | | 2,309,794 | | 2,604,036 | | 2,379,129 | | 348,545 |

Number of ordinary shares(1) | | 105,250,000 | | 123,820,000 | | 166,831,943 | | 166,831,943 | | 166,831,943 | | 166,831,943 |

| (1) | We were incorporated on May 16, 2006 and as part of a series of reorganization activities, became the holding company of our subsidiaries on September 20, 2007. Our financial results are presented as though the reorganization and share split were completed at the beginning of the earliest period presented, or January 1, 2005. |

Exchange Rate Information

Our business is conducted in China and all of our revenue and the majority of our expenses are denominated in Renminbi. This annual report contains translations of Renminbi amounts into U.S. dollars at specified rates. Unless otherwise noted, all translations from Renminbi to U.S. dollar amounts were made at the noon buying rate in the City of New York for cable transfers of Renminbi as certified for customs purposes by the Federal Reserve Bank of New York, as of December 31, 2009, which was RMB6.8259 to US$1.00. We make no representation that the Renminbi or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

5

The following table sets forth information concerning exchange rates between the Renminbi and the U.S. dollars for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this annual report or will use in the preparation of our periodic reports or any other information to be provided to you. The exchange rate of Renminbi per U.S. dollar as set forth in the H.10 statistical release of the Federal Reserve Board was RMB6.8269 to US$1.00 as of March 26, 2010.

| | | | | | | | |

| | | Exchange Rate (Renminbi per U.S. Dollar)(1) |

| | | Average(2) | | High | | Low | | Period-end |

| | | (RMB per US$1.00) |

2005 | | 8.1826 | | 8.2765 | | 8.0702 | | 8.0702 |

2006 | | 7.9579 | | 8.0702 | | 7.8041 | | 7.8041 |

2007 | | 7.6032 | | 7.8127 | | 7.2946 | | 7.2946 |

2008 | | 6.9477 | | 7.2946 | | 6.7800 | | 6.8225 |

2009 | | 6.8307 | | 6.8470 | | 6.8176 | | 6.8259 |

September | | 6.8277 | | 6.8303 | | 6.8247 | | 6.8262 |

October | | 6.8267 | | 6.8292 | | 6.8248 | | 6.8264 |

November | | 6.8271 | | 6.8300 | | 6.8255 | | 6.8265 |

December | | 6.8275 | | 6.8299 | | 6.8244 | | 6.8259 |

2010 | | | | | | | | |

January | | 6.8269 | | 6.8295 | | 6.8258 | | 6.8268 |

February | | 6.8285 | | 6.8330 | | 6.8258 | | 6.8258 |

March (through March 26) | | 6.8262 | | 6.8270 | | 6.8254 | | 6.8269 |

| Source: | Federal Reserve Bank of New York |

| (1) | The source of the exchange rate is: (i) with respect to any period ending on or prior to December 31, 2008, the Federal Reserve Bank of New York, and (ii) with respect to any period ending on or after January 1, 2009, the H.10 statistical release of the Federal Reserve Board. |

| (2) | Averages for a period are calculated by using the average of the exchange rates at the end of each month during the periods. Monthly averages are calculated by using the average of the daily rates during the relevant period. |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our ADSs involves significant risks. The risks and uncertainties described below are not the only ones we face. You should consider carefully all of the information in this annual report, including the risks and uncertainties described below and our consolidated financial statements and related notes, before making an investment in our ADSs. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ADSs could decline, and you may lose all or part of your investment.

6

RISKS RELATING TO OUR BUSINESS AND INDUSTRY

Our operations have been subject to significant suspensions and interruptions which have resulted in a reduction of our sales volume and may continue to materially and adversely affect our results of operations.

Our operations have been significantly affected by government policies such as taxation regulations. The PRC government introduced three new regulations in relation to consumption tax rates to be levied on diesel products, effective as of January 1, 2009, which raised the consumption tax on diesel products levied on diesel producers from RMB0.10 per liter to RMB0.80 per liter. We are currently seeking clarification from the relevant taxation authorities as to whether such consumption tax is applicable to our biodiesel products. In order to minimize operating cash outflows that would result from the assessment of consumption tax, our management decided to extend the suspension of operations at Fujian Gushan Biodiesel Energy Co., Ltd. or Fujian Gushan, following the completion of road maintenance by the Fuzhou municipal government in early June 2009. We have also deferred the commencement of production at our Chongqing and Hunan production facilities, which were completed in May and July 2009, respectively. As of the date of this annual report, Fujian Gushan has not resumed production and we cannot assure you that it will resume production in the near term, or at all. In addition, we have not commenced production at our Chongqing and Hunan production facilities pending resolution of the consumption tax issue. Fujian Gushan’s production capacity represents approximately 22.2%, and our Chongqing and Hunan production facilities combined represent a further 13.3%, of our total production capacity as of the date of this annual report. As a result of the suspension of operations, Fujian Gushan’s utilization rate decreased to 27.8% in 2009 from 99.0% in 2008, which materially and adversely affected our revenues for 2009.

In July 2009, Sichuan Gushan also received a notice from the local State Administration of Taxation, or SAT, requesting that it submit tax returns for consumption tax on all of Sichuan Gushan’s biodiesel sales at a rate of RMB0.8 per liter. After we discussed this matter with the local SAT for several months, in September 2009, the SAT of Sichuan Province agreed to defer the assessment of consumption tax on Sichuan Gushan until a decision is rendered by the PRC SAT. As a result, we kept Sichuan Gushan in operation. Up to the date of this annual report, other than Fujian Gushan and Sichuan Gushan, none of our production plants have received consumption tax assessments. However, no assurance can be given that we will not receive such assessments for our other plants. If at any time such request is received, we will evaluate the appropriateness of a suspension of production at the relevant plant on a case-by-case basis. Currently, all of our other production plants remain in operation. We did not pay consumption tax for our sales of biodiesel products in 2009, but made a provision of RMB103.8 million, based on the current consumption tax regulations, in respect of 129.7 million liters of biodiesel products sold as a refined oil product. This provision will be reversed in subsequent financial statements if the PRC SAT issues a reply in our favor with respect to the consumption tax issue. For more details, see “—Risks Relating to Our Business Operations in China—The PRC consumption tax policies may continue to affect our business, results of operations and financial condition.”

Our operations have also been subject to significant interruption or prolonged suspension due to repair and maintenance or technological upgrades of our production processes. Interruption and suspension of our operations have resulted in decreased capacity utilization, which have led to decreased sales volumes and adverse effects on our results of operations. We also periodically suspend production at certain of our facilities, typically for a few days to four weeks at a time, in order to carry out repair and maintenance operations or expand production capacity. For example, in November and December of 2008, we suspended production at our Fujian, Sichuan and Hebei plants for a few weeks to carry out repair and maintenance operations. We also suspended production at our Beijing and Shanghai plants in January 2009 and from mid June to mid August 2009, respectively, as a result of the installation of additional facilities, which were added in connection with capacity expansion and integration with existing facilities.

We have also suspended production as a result of interference with transportation networks. For example, in the third quarter of 2008, we suspended production at our Beijing plant from August 1 to September 20, 2008 due

7

to the heightened enforcement of traffic control measures adopted by the Beijing municipal government in preparation for the hosting of the Beijing 2008 Olympic and Paralympic games. In April 2009, the Fuzhou municipal government carried out road maintenance near the Fujian Gushan plant which restricted access to our plant by our suppliers and customers. As a result, we suspended operations at Fujian Gushan from mid April 2009 to early June 2009. In mid September 2009, the Handan municipal government of Hebei province also carried out road maintenance near Handan Gushan Bio-sources Energy Co., Ltd., or Handan Gushan, which restricted access to the plant by our suppliers and customers. As a result, we suspended operations at Handan Gushan from mid September 2009 to the end of November 2009.

Our operations may be subject to significant interruption or prolonged suspension if any of our facilities experience a major accident or are damaged by natural disasters, severe weather or unexpected or catastrophic events (such as typhoons, earthquakes, fires, floods, epidemics such as Severe Acute Respiratory Syndrome, avian flu, swine flu or other similar events) or interruptions in the operations of our plants caused by such events. On May 12, 2008, Sichuan province experienced a severe earthquake. As a result, our Sichuan facility experienced a temporary interruption of power supply and was required by the local government to suspend production for approximately two weeks as a safety precaution.

Furthermore, our operations may be subject to other disruptive events such as local protests, activism and labor disruptions. For example, in August 2007, we experienced local protests at our Fujian plant and our operations at the plant were disrupted for several hours. For more details, see “—Failure to comply with environmental regulations could harm our business.” Unscheduled downtime or operational hazards inherent in our industry, such as equipment failures, fires, explosions, release of toxic chemicals such as methanol, abnormal pressures, blowouts, pipeline ruptures, transportation accidents, power outages or shortages or other events outside of our control, may also result in the prolonged suspension of our operations. Some of these events may also cause personal injury or loss of life, severe damage to or destruction of property and equipment or environmental damage, and may result in the imposition of civil or criminal penalties. Our insurance may not be adequate to fully cover the potential events described above and we may not be able to renew this insurance on commercially reasonable terms or at all.

We cannot assure you that we will not experience further suspensions or interruptions or experience damage to our facilities as a result of further earthquakes, aftershocks, floods, governmental directives or policies, expansion of production capacity, repair and maintenance, relocation of facilities or other consequences associated with such events, which could materially and adversely affect our business, results of operations and financial condition.

We may not be able to resume production at Fujian Gushan in time to meet customer demand for our products.

Due to the consumption tax issue, our production operations at Fujian Gushan have remained suspended since mid April 2009. See “—Risks Relating to Our Business Operations in China—The PRC consumption tax policies may continue to affect our business, results of operations and financial condition” for further information regarding the consumption tax issue. We cannot assure you that the operating condition of our machinery and equipment will allow us to resume production at Fujian Gushan in a timely manner or at all. To resume production operations, we need to undertake substantial planning and mechanical work to, among other things, inspect, reconfigure, test and fine tune our machinery and equipment and it is uncertain how long this process will take. We may also experience equipment breakdowns or other technical problems during resumption of production that will delay our production and increase our operating expenditures. When we resume production, we may not be able to resume our production operations at the necessary production levels and our production facility may be permanently impaired by our suspension of operations. We will also need to procure an adequate amount of raw materials at acceptable costs in order to resume production. The price and availability of raw materials are affected by a number of factors beyond our control. We cannot assure you that we will be able to procure an adequate amount of raw materials at acceptable costs or at all in order to resume production at Fujian Gushan. See “—Our dependence on a limited number of third-party raw materials suppliers could adversely impact our production or increase our costs, which could harm our reputation or materially and adversely affect our business, results of operations and financial condition.” In addition, our supplier and customer base may have

8

been materially and adversely affected by our suspension of operations. As a result of any of the foregoing, we cannot assure you that we will be able to resume production in time to meet customer demand for our products, which may result in a loss of customer orders and have a material adverse effect on our business, results of operations, financial condition and cash flows.

A decline in the price of diesel or other fuel sources or an increase in their supply could constrain the selling price of our biodiesel and materially and adversely affect our business, results of operations and financial condition.

Our biodiesel prices are influenced by market prices for diesel, the pricing of which is affected by global and domestic market prices for crude oil. As a result, any decline in the price of diesel may adversely affect our business, results of operations and financial condition. The PRC government also publishes “guidance prices” with respect to diesel. These guidance prices typically establish a ceiling for retail prices for diesel that are generally followed by industry participants. As biodiesel prices are affected by the price of diesel, the PRC government’s prevailing guidance prices typically limit the price range for our biodiesel.

In recent years, the demand for and price of biodiesel in China has also been influenced by the level of energy consumption and prices of crude oil and natural gas in relation to the level of growth in the PRC economy. Demand for biodiesel in China declined significantly in 2009 as a result of the economic slowdown due to the global financial crisis. For example, the price of biodiesel in China began to decline significantly from the fourth quarter of 2008 and such decline continued throughout the first and second quarters of 2009, resulting from significant decreases in global oil prices and from the rapid contraction of China’s industrial production amid the global financial crisis. During the same periods, the average selling price of our biodiesel decreased from RMB6,344 per ton in the third quarter of 2008, to RMB5,092 per ton in the fourth quarter of 2008, to RMB4,003 (US$586.4) per ton in the first quarter of 2009 and RMB3,960 (US$580.1) per ton in the second quarter of 2009. The average selling price of biodiesel increased slightly to RMB4,111 (US$602.3) per ton in the third quarter of 2009 and RMB4,282 (US$627.3) in the fourth quarter of 2009. This represented a decrease of 32.5% in the average selling price of our biodiesel from the third quarter of 2008 to the fourth quarter of 2009. This decrease in average selling price contributed to our net loss for 2009. If supply of other energy sources continues to increase and exceed the demand for fuel products, demand for our biodiesel may cease to recover or may decline further and our business, results of operations and financial condition may be continue to be adversely affected.

Our dependence on a limited number of third-party raw materials suppliers could adversely impact our production or increase our costs, which could harm our reputation or materially and adversely affect our business, results of operations and financial condition.

We purchase our raw materials, including vegetable oil offal, used cooking oil and methanol, from a limited number of third-party suppliers, including waste management companies and vegetable oil producers. Our five largest suppliers accounted for approximately 35.7% of our total cost of revenues in 2009 and we conduct business with some of these suppliers under contracts with durations of up to two years but extendable by negotiation or through purchase orders. The failure of a supplier to supply raw materials satisfying our quality, quantity and cost requirements in a timely manner could impair our ability to produce our products or could increase our costs. If we fail to maintain our relationships with major raw materials suppliers or fail to develop new relationships with other raw materials suppliers, we may be unable to produce our products, or we may only be able to produce our products at a higher cost or after lengthy delays. If these suppliers identify alternative sales channels, such as to chemical plants or distributors, they may choose to sell to other buyers or raise their prices. As a result, we may be compelled to pay higher prices to secure our raw material supplies, which could adversely affect our business, results of operations and financial condition.

In addition, our efforts to diversify our source of raw materials through long-term supply contracts for castor bean oil may not be sufficient to ensure a steady supply of raw materials. The harvest of castor beans may be affected by natural disasters such as flooding, drought, earthquake, typhoon, and so on. Any such events may reduce harvest and in turn, reduce the supply of our raw materials, which could reduce our production volumes, increase our manufacturing costs, or both, either of which may adversely affect our business, results of operation and financial condition.

9

Our operations are materially affected by the cost and availability of raw materials.

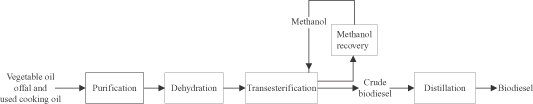

The principal raw materials we use in the production of biodiesel include vegetable oil offal, used cooking oil and methanol. From 2005 to the fourth quarter of 2009, the prices we have paid for raw materials have steadily increased, and the market price for used cooking oil has also risen significantly in the recent past. For the years ended December 31, 2007, 2008 and 2009, the overall average unit costs of our raw materials, which primarily consist of used cooking oil and vegetable oil offal, amounted to RMB1,925, RMB2,538 and RMB2,635 (US$386.0) per ton, respectively. Vegetable oil offal is a waste by-product of vegetable oil production, and the availability of vegetable oil offal depends on production levels of vegetable oil. Production levels of vegetable oil are affected by factors beyond our control, such as the quality of harvests of plant crops. Used cooking oil is the oil left over from food processing or preparation, mostly by restaurants and food producers. Therefore, any fluctuations in cooking oil consumption in the food industry in China will affect the supply of used cooking oil. If cooking oil consumption in China decreases, the supply of used cooking oil for our production would be adversely affected. Natural gas is the principal feedstock for methanol production, and our operations depend in large part on the availability, security of supply and price of natural gas. If our suppliers are unable to obtain continued access to sufficient natural gas or if they experience significant interruptions in their supply of natural gas, our biodiesel production would be adversely affected. Any such events that reduce the supply of our raw materials could reduce our production volumes, increase our manufacturing costs, or both, either of which may adversely affect our business, results of operation and financial condition.

Our overall operating performance is also affected by the mix of raw materials we use as well as the product mix of our biodiesel and by-products, which command different profit margins. We source our vegetable oil offal and used cooking oil from local used cooking oil disposal companies and vegetable oil manufacturers. Because the long-distance transport of used cooking oil and vegetable oil offal is not economical, we have limited control over the mix of raw materials we can supply to each of our facilities. In addition, the composition of our raw materials is determined by the geographical regions in which we operate, which may affect our profit margins. For example, rapeseed is a raw material essential for producing erucic acid, a by-product of biodiesel production which generates a higher profit margin than biodiesel. Vegetable oil offal and used cooking oil containing rapeseed are only available in a few regions in China, such as Sichuan. Should we decide to expand our facilities into other regions of China, we may be unable to purchase vegetable oil offal or used cooking oil which contains rapeseed to enable us to produce erucic acid as a by-product in these new production facilities. Other than selecting the regions in which we locate our facilities, we have limited ability to change our product mix to concentrate on products with higher profit margins. In addition, given that by-products command a higher profit margin than biodiesel in some regions while the opposite may be true in other regions, our ability to maximize profits through control of our product mix is further constrained.

We may also be subject to increases in the cost of raw materials as a result of our entry into long-term castor bean oil supply contracts in Sichuan and Indonesia. Pursuant to our contract with a supplier in Sichuan, we have an exclusive right to purchase substantially all of the expected output of the supplier at the supplier’s cost plus a fixed percentage of commission, or a cost-plus basis, through 2012. Because the purchase price of castor bean oil is based on a cost-plus basis, it may be adjusted from time to time based on the supplier’s costs. Similarly, our contract with a supplier in Indonesia entitles us to purchase all of the supplier’s output of castor beans through 2014 and the purchase price of such castor beans may be adjusted based on the consumer price index in Indonesia. Although the contracts were structured to diversify the risk of increasing cost of feedstock, our costs may increase due to an increase in the costs of maintaining the plantation for the Sichuan supplier or an increase in the consumer price index in Indonesia.

10

Our gross margins in our sales of biodiesel are principally dependent on the spread between feedstock prices and biodiesel prices. If the unit cost of feedstock increases and the average selling price of biodiesel does not similarly increase or if the average selling price of biodiesel decreases and the unit cost of feedstock does not similarly decrease, our margins will decrease and our results of operations will be harmed.

Our gross margins in our sales of biodiesel are principally dependent on the spread between feedstock prices and biodiesel prices. If the unit cost of feedstock increases and the average selling price of biodiesel does not similarly increase or if the average selling price of biodiesel decreases and the unit cost of feedstock does not similarly decrease, our margins will decrease and results of operations will be harmed. The spread between biodiesel prices and feedstock prices has narrowed significantly since September 2008. Prices for vegetable oil offal and used cooking oil, which have historically been our principal feedstock and comprised approximately 73% of total cost of revenues during the year ended December 31, 2009, do not necessarily have a direct price relationship to the price of biodiesel in a particular period. Prices for vegetable oil offal and used cooking oil are principally influenced by general inflation, market and regulatory factors. Biodiesel prices, however, are primarily influenced by the guidance prices set by the National Development and Reform Committee of China, or the NDRC, and supply and demand for petroleum-based diesel fuel, rather than biodiesel production costs. This lack of correlation between production costs and product prices means that we may be unable to pass increased feedstock costs on to our customers. Any decrease in the spread between biodiesel prices and feedstock prices, whether as a result of an increase in feedstock prices or a reduction in biodiesel prices, would adversely affect our financial performance and cash flow.

We may incur a substantial impairment loss on our long-lived assets if the operating environment continues to deteriorate.

Under U.S. GAAP, our long-lived assets, consisting of property, plant and equipment and land use rights are reviewed for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. Recoverability of long-lived assets is measured by a comparison of the carrying amount of an asset to the estimated future undiscounted cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future undiscounted cash flows, an impairment loss is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the asset. Currently, we are facing a difficult operating environment caused by a decrease in our average selling price due to a significant decrease in global oil prices and the contraction of China’s industrial production, a general increase in the average unit cost of our raw materials, the consumption tax issue, see “—Risks Relating to Our Business Operations in China—The PRC consumption tax policies may continue to affect our business, results of operations and financial condition”, and suspension of production due to government directives from time to time, and such factors may reduce the undiscounted cash flows to be generated from the long-lived assets. For the fiscal year ended December 31, 2009, we performed an impairment test on our long-lived assets. We estimated the future undiscounted cash flows expected to be generated by the long-lived assets based on a number of assumptions, which included, among others, the average selling prices of our biodiesel and biodiesel by-products, the average unit cost of raw materials, production and sales volume, product mix, operating expenses, income tax rates, and our entitlement of certain tax benefits under tax laws in the PRC. Based on our estimation, we concluded that because the estimated future undiscounted cash flows of our long-lived assets exceeds their carrying value, no impairment loss was recognized for the year ended December 31, 2009. However, if the operating environment continues to deteriorate, the estimated future undiscounted cash flows of our long-lived assets may fall short of their carrying value, resulting in a substantial impairment loss, which may be reflected as a decrease in net assets on our future balance sheets and a decrease in net income on our future statements of operations. Although any such loss will have no impact on our business, it may adversely affect our financial condition, result of operations and share price in the future.

We may not be able to effectively manage our current expansion, the failure of which could materially and adversely affect our business, results of operations and financial condition.

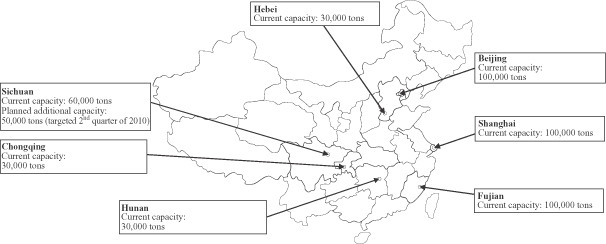

We are currently constructing a second plant near our existing production facilities in Sichuan, which we target to be completed by the end of the second quarter of 2010 with an initial annual production capacity of

11

50,000 tons. Such expansion plans could also be affected by construction delays, cost overruns, failures or delays in obtaining government approvals of necessary permits and our inability to secure the necessary production equipment.

After completion of the new plant in Sichuan, we do not expect to further expand our biodiesel production capacity in the near future. Should we decide to expand further, any such plans would require us to secure raw materials at competitive prices and to host a sufficiently large local customer base to support the expanded production. In addition, we may not have the necessary management or financial resources to oversee the successful and timely construction of new production facilities or expansion of existing facilities.

Furthermore, to effectively manage any future expansion we would need to improve our operational and financial systems and procedures and system of internal control. Our past growth has strained our resources and made it difficult to maintain and update our internal procedures and controls as necessary to meet the expansion of our overall business. We would need to expand, train and manage our employee base, or successfully establish new subsidiaries for the new or expanded facilities. We would also need to continue to maintain and expand our relationships with our customers, suppliers and other third parties.

We cannot assure you that we will be able to effectively manage any expansion or achieve any expansion at all in the future. If we are unable to do so, we may not be able to take advantage of market opportunities, execute our business strategies or respond to competitive pressures, any of which could materially and adversely affect our business, results of operations and financial condition.

The biodiesel industry faces a number of challenges, and there is no established market for biodiesel in China where biodiesel is considered a principal source of energy for any purpose.

Biodiesel has only recently been produced for commercial applications in China, and the market for biodiesel products is currently confined to specific regions and is relatively small at the national level. There is no established market in China where biodiesel is considered a principal source of energy for vehicles operating on diesel, or an intermediate product for the manufacture of chemicals, or for any other purpose. We cannot assure you that biodiesel will be accepted or will reach a broader consumer base in China. Our future prospects and operational results will be adversely affected if biodiesel and the biodiesel industry in China fail to develop.

The global biodiesel industry is also at an early stage of development and acceptance as compared to other more established industries, and has experienced significant growth only in recent years. Demand for biodiesel may not grow as rapidly as expected or at all. Biodiesel and the global biodiesel industry also face a number of obstacles and drawbacks, including:

| | • | | potentially increased nitrogen oxide (NOx) emissions as compared with most formulations of diesel; |

| | • | | gelling at lower temperatures than diesel, which can require the use of low percentage biodiesel blends in colder climates or the use of heated fuel tanks; |

| | • | | potential water contamination that can complicate handling and long-term storage; |

| | • | | reluctance on the part of some auto manufacturers and industry groups to endorse biodiesel and their recommending against the use of biodiesel or high percentage biodiesel blends; |

| | • | | potentially reduced fuel economy due to the lower energy content of biodiesel as compared with diesel; and |

| | • | | potentially impaired growth due to a lack of infrastructure such as dedicated rail tanker cars and truck fleets, sufficient storage facilities, and refining and blending facilities. |

The success of any future expansion plans depends on growth in domestic demand for biodiesel, and we may face overcapacity if the biodiesel market in China does not develop as expected. If overcapacity occurs, the

12

expenditures we incur to expand our facilities and increase our capacity may not result in increased revenues, which could cause our results of operations to be materially and adversely affected.

We derive a significant portion of our revenues from a small number of customers and a loss of any of our major customers may cause significant declines in our revenues.

We derive a significant portion of our revenues from a small number of customers, and we may be unable to maintain and expand our current customer relationships. For 2007, 2008 and 2009, our five largest customers represented approximately 24.3%, 20.6% and 22.4% of our total revenues, respectively, while our largest customer represented approximately 8.7%, 9.1% and 7.4% of our total revenues, respectively. We expect we will continue to depend on a relatively small number of customers for a significant portion of our sales volume and revenues. If we lose any of our major customers for any reason, including, for example, if our reputation declines, a customer materially reduces its orders from us, our relationship with one or more of our major customers deteriorates, or a major customer becomes insolvent or otherwise unable to pay for our products, our business and results of operations may be materially and adversely affected.

We face significant competition, and if we do not compete successfully against existing and new competitors as well as competing technologies and other products, we may lose our market share and our profitability may be materially and adversely affected.

Existing and future domestic competitors, who may have a greater presence in other regions through government support or enjoy greater popularity among local consumers, may be able to secure a significant market share in regions where we currently do not have plants in operation. We have only seven production plants in a limited number of regions in China, including Mianyang in Sichuan province, Fuzhou in Fujian province, Handan in Hebei province, Liuyang in Hunan province and Beijing, Shanghai and Chingqing. See Item 4.D, “Property, Plant and Equipment—Production Facilities” for further information. In addition, our potential competitors might be able to secure raw materials at a lower cost than we can and could therefore threaten our competitive position, which could significantly impact our profitability and future prospects. Our domestic competitors include China Biodiesel International Holding Co., Ltd., China Clean Energy Inc., East River Energy Resources and Science Technology (Zhejiang) Ltd., or East River Energy Resources, China Petroleum and Chemical Corporation, or SINOPEC, China National Offshore Oil Corporation, or CNOOC, and PetroChina Co. Ltd., or PetroChina, some of which have greater resources, brand recognition and access to more extensive distribution channels than we do. Moreover, some of our competitors have the ability to manage their risk through diversification, whereas we lack diversification in both the geographic scope and the nature of our business. As a result, we could be potentially impacted more by factors affecting the biodiesel industry or the regions in which we operate than we would if our business were more diversified.

We also face potential competition from foreign producers of biodiesel, which may have greater financial and research and development resources. Biodiesel is a relatively new product that was initially introduced outside China, and the technology for producing biodiesel may be more advanced in countries other than China. If foreign competitors, or domestic competitors relying on alliances with or support from foreign producers, enter the PRC biodiesel market, they may develop biodiesel that is more economically viable, which would adversely affect our ability to compete and our results of operations.

In addition, new technologies may be developed or implemented for alternative energy sources and products that use such energy sources. Advances in the development of fuels other than biodiesel or diesel, or the development of products that use energy sources other than diesel, such as gasoline hybrid vehicles and plug-in electric vehicles, could significantly reduce demand for biodiesel and thus affect our sales. Biodiesel also faces competition from fuel additives that help diesel burn cleaner and therefore reduce the comparative environmental benefits of biodiesel in relation to diesel. Other clean energy sources such as ethanol, liquefied petroleum gas, hydrogen and electricity from clean sources may be more cost-effective to produce, store, distribute or use, more environmentally friendly, or otherwise more successfully developed for commercial production in China than our

13

products. These other energy sources may also receive greater government support than our products in the form of subsidies, incentives or minimum use requirements. As a result, demand for our products may decline and our business model may no longer be viable and our results of operations and financial condition may be materially and adversely affected.

Any increase in competition arising from an increase in the number or size of competitors or from competing technologies or other clean energy sources may result in price reductions, reduced gross profit margins, loss of our market share and departure of key management, any of which could adversely affect our financial condition and profitability.

Our future performance depends on the continued service of our senior management and our ability to attract, train and retain skilled personnel.

Our future success depends on the continued service of our key management and technical staff, in particular our founder, chairman and principal executive officer, Mr. Jianqiu Yu, and our chief technology officer, Mr. Deyu Chen. Mr. Yu, our founder, plays a key role in the formation of our business strategy and has extensive knowledge of the local markets in which we operate. In addition, Mr. Yu is instrumental in formulating our strategies for entering new markets. Mr. Chen was instrumental in the development of our proprietary manufacturing process and continues to play a key role in our technological development. If one or more of our key executives were unable or unwilling to continue in their present positions, we may not be able to replace them easily, our future growth may be constrained and our business may be disrupted and our financial condition and results of operation may be materially and adversely affected. While we have non-competition agreements with most members of our senior management, we may be unable to continue to retain their services and there can be no assurance that they will not compete against us.

Our success also depends upon the continued service of our skilled personnel and on our ability to continue to attract, retain and motivate such personnel. There is intense competition to recruit technically competent personnel with expertise in the biodiesel industry and we have periodically experienced difficulties in recruiting suitable personnel. We may also need to offer better compensation and other benefits in order to attract and retain these personnel in the future, and we cannot assure you that we will have the resources to achieve our staffing needs. Due to the skills involved in operating some of our equipment, skilled production workers are not easily replaceable, and considerable training is required for new hires. These difficulties could limit our output capacity or reduce our operating efficiency and product quality, which could reduce our profitability and limit our ability to grow.

We may not be able to adequately protect our intellectual property rights or may be subject to infringement claims.

We rely on a combination of patents, trademarks, domain names and contractual rights to protect our intellectual property. We cannot assure you that the measures we take to protect our intellectual property rights will be sufficient to prevent any misappropriation of our intellectual property, or that our competitors will not independently develop alternative technologies that are equivalent or superior to technologies based on our intellectual property. We have three registered patents, two in China, each with a validity period of 20 years from August 7, 2002 and from March 9, 2005, respectively, and one in the United States with a validity period of 20 years and 5 months from April 25, 2008. We cannot assure you that these patent registrations will not be revoked or challenged during their validity periods. The legal regime governing intellectual property in China is still evolving and the level of protection of intellectual property rights in China may not be as effective as those in other jurisdictions. In the event that the steps we have taken and the protection afforded by law do not adequately safeguard our proprietary technology, we could suffer losses due to the sales of competing products that exploit our intellectual property, and our profitability would be adversely affected. Furthermore, we may incur additional overhead costs in any intellectual property claims we initiate, which will impact our operating results.

14

Many international biodiesel producers and other domestic biodiesel producers in China may have also patented certain technologies in the production of their biodiesel products. To the best of our knowledge, our patented process does not infringe any third party’s intellectual property rights. However, intellectual property rights are complex and there exists the risk that our process may infringe, or be alleged to infringe, another party’s intellectual property rights. The defense and prosecution of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or manufacturing processes or subject us to injunctions prohibiting the manufacture and sale of our products or the use of our technologies.

The prices of our by-products may decrease significantly, which may adversely affect our operating results.

The prices for the by-products of biodiesel production may decrease significantly due to increased production of biodiesel in China, a slowdown in the PRC economy, or for other reasons beyond our control. For the fourth quarter of 2009, our average selling price for biodiesel by-products was RMB2,055 (US$301.1) per ton, which represented a 58.2% decrease from our average selling price of RMB4,921 per ton for the fourth quarter of 2008. By-products accounted for 16.1%, 11.1% and 7.5% of our total revenue for the years ended December 31, 2007, 2008 and 2009, respectively. Accordingly, decreases in the market prices of by-products could materially and adversely affect our business, results of operations and financial condition.

We may be unable to obtain adequate financing to fund our capital requirements.

We expect to reach 500,000 tons of annual biodiesel production capacity by the end of the second quarter of 2010 after the completion of the new plant in Sichuan, which will add an additional annual biodiesel production capacity of 50,000 tons. Beyond that, we do not expect to further expand biodiesel production capacity in the near future, as the recovery of diesel demand, and hence biodiesel selling prices, continue to be slow. These conditions, together with the uncertainty of the consumption tax issue, see “—Risks Relating to Our Business Operations in China—The PRC consumption tax policies may continue to affect our business, results of operations and financial condition,” are expected to continue to adversely affect our profitability and cash flow generation in the short term. We expect that over the next several years, a substantial portion of our cash flow and cash balance will be used to finance the upgrading and/or modification of our existing production facilities, or investments in businesses in the energy and/or environmental sector and research and development. We may need to incur additional financing in order to fund our capital expenditures. We cannot assure you that we will be successful in obtaining such financing at a reasonable cost or at all. Our inability to finance our planned capital expenditures could adversely affect our business, financial condition, results of operations or liquidity position.

If we fail to keep up with new technology, our ability to offer cost-effective, technologically advanced and environmentally friendly products may be materially and adversely affected and our competitiveness may erode.

Our success depends on our ability to offer cost-effective and environmentally friendly products. As the technology for manufacturing biodiesel is at an early stage of development, failure to keep up with technological improvements or to implement such improvements in commercial applications would impede our efforts to reduce unit production costs and correspondingly hinder our efforts to strengthen our competitiveness. Moreover, if alternative technologies that are more cost-effective and environmentally friendly become available to the market, the biodiesel industry in general and our business in particular may not be able to compete against such new alternative energy sources. Further, the PRC government may introduce new standards regulating biodiesel quality with which we may be unable to comply, or we may have to incur additional costs to invest in technology

15

or equipment to meet a new PRC or industry-wide standard. If we fail to achieve any new standard, or if the cost of achieving such standard is prohibitively expensive, we may have to raise prices and our biodiesel may become less attractive to customers or we may have to suspend all or part of our operations, which could materially and adversely affect our business, results of operations and financial condition.

We have not received NDRC approval for certain of our foreign investment-related projects, which could materially and adversely affect our further expansion and our ability to benefit from certain preferential policies that might otherwise be available to us.

Our subsidiaries incorporated in the PRC are foreign invested enterprises that we established either through acquisition or incorporation. Certain of our subsidiaries have not obtained approval from the NDRC, for certain foreign investment related projects. PRC law requires the Ministry of Commerce, or its local counterparts, to issue final government approval as a pre-condition to foreign investment in China. Before this final approval may be granted, however, approval from the NDRC, or its local counterparts, is required for projects except for trade or services related projects that do not relate to fixed asset investment. In practice, the Ministry of Commerce, or its local counterparts, often grant final approval for foreign invested projects before such projects have first obtained NDRC approval. Our further expansion and ability to benefit from certain preferential policies that might otherwise be available to us may be adversely affected because the competent authorities for land, planning, quality supervision, safety supervision, customs, taxation, foreign exchange and the administration of industry and commerce could refuse to grant approval or consent to our future projects due to the lack of NDRC approval.

Failure to comply with environmental regulations could harm our business.

We are subject to various PRC national and local environmental regulations related to our operations, including regulations governing the use, storage, discharge and disposal of hazardous substances and waste emission levels. If we fail to comply with the applicable environmental regulations, we could be subject to significant monetary damages and fines or suspensions of our operations, and our business, reputation and profitability would be adversely affected. Further, any amendments to these laws and regulations may impose substantial pollution control measures that may require us to make significant expenditures to modify our production process or change the design of our products to limit actual or potential impact to the environment. Moreover, new laws, new interpretations of existing laws, increased governmental enforcement of environmental laws or other developments could require us to make significant additional expenditures, which may adversely affect our business, results of operations and financial condition.

In November 2006, we installed a covered storage tank at our Fujian plant at the recommendation of the local environmental bureau. We currently use uncovered storage tanks at our Sichuan and Hebei facilities. If we are required to undertake further compliance measures at any of our plants, our results of operations may be materially and adversely affected. As of the date of this annual report, Shanghai Gushan Bio-Energy Technologies Co. Ltd., or Shanghai Gushan, which commenced operation in June 2008, has obtained a water discharge permit as required by the management authority of the industrial area in Fengxian, from the Fengxian branch of the Shanghai Water Authority. Beijing Gushan Bio-sources Energy Co., Ltd., or Beijing Gushan, which commenced operation in January 2008, has not obtained waste discharge permit from the relevant local environmental authorities.

We cannot assure you that waste discharge permits will be obtained or that our Beijing plant will not be materially adversely affected as a result of its failure to obtain such permits. In addition, any perception of our noncompliance with environmental regulations could harm our business. For example, in August 2007, we

16

experienced protests at our Fujian plant alleging environmental issues. As a result, our operations at the Fujian plant were disrupted for several hours. These and other risks relating to environmental compliance may materially and adversely affect our business, results of operations and financial condition.

We do not possess valid title to certain buildings that we occupy and commenced construction of certain buildings prior to obtaining the requisite construction approvals

For some of the buildings and land we occupy, we have not yet obtained sufficient land use or title certificates that allow us to occupy, freely use or transfer the land or properties. As of the date of this annual report, Fujian Gushan, Beijing Gushan, Shanghai Gushan, Sichuan Gushan and Hunan Gushan Bio-Sources Energy Co., Ltd. (“Hunan Gushan”) have not obtained the building ownership certificates for buildings with a total gross floor area of approximately 319 square meters, 9,941 square meters, 7,956 square meters, 2,090 square meters and 6,949 square meters, respectively. We currently use these properties as production facilities and ancillary facilities. We are in the process of carrying out completion inspections of these buildings and applying for the relevant building ownership certificates. Beijing Gushan is also applying for land use right certificates with respect to land occupying a total gross floor area of approximately 54,965 square meters. We cannot assure you that such building ownership or land use right certificates will be obtained. As a result of the absence of land use right certificates or vested legal title in these properties, we may incur additional costs to relocate our operations and our business operations and our financial condition may be adversely affected.

In addition, Fujian Gushan, Beijing Gushan, Shanghai Gushan, Chongqing Gushan Bio-Sources Energy Co., Ltd., or Chongqing Gushan, Sichuan Gushan and Hunan Gushan commenced construction of certain workshops or ancillary facilities prior to obtaining the construction approvals required by PRC construction law. Each of Fujian Gushan, Beijing Gushan, Shanghai Gushan, Chongqing Gushan, Sichuan Gushan and Hunan Gushan may be subject to a maximum administrative penalty of RMB30,000 (US$4,395). As of the date of this annual report, Fujian Gushan, Beijing Gushan, Sichuan Gushan and Shanghai Gushan have not obtained all necessary approvals for construction of certain workshops or ancillary facilities of a total gross floor area of approximately 319 square meters, 9,941 square meters, 12,000 square meters and 2,335 square meters, respectively, and the relevant government authority may require the buildings located on these sites to be demolished. As of December 31, 2009, the carrying value of these buildings amounted to RMB42.1 million (US$6.2 million). If the relevant government authority imposes penalties on us and requires us to cease construction of or demolish these properties, we may incur additional costs and expenses for the relocation of our facilities.

The modification or elimination of government initiatives promoting the adoption of clean energy sources in China could cause demand for our products and our revenues to decline.

A number of PRC government initiatives promote the adoption of clean energy sources, such as biodiesel. For example, pursuant to the Medium and Long-Term Development Plan, China targets to increase its consumption of energy from renewable sources to 15% of total energy consumption in China by 2020. The plan also includes the promotion of renewable energy sources. Under the plan, China aims to increase its annual consumption of biofuel, with the consumption of biodiesel targeted at two million tons per year by 2020. According to the Law of Renewable Energy Resources, local governments are required to prepare a renewable energy development plan and provide financial support to renewable energy projects in rural areas. Further, the government may grant businesses engaged in biodiesel production certain benefits and incentives, while petroleum marketing enterprises are required to include biodiesel products that comply with the state standard with respect to fuel sales. These government initiatives could be modified or eliminated altogether. Such a change in policy could adversely affect the growth of the biodiesel market and cause our revenues to decline. Changes to or elimination of initiatives designed to increase general acceptance of clean energy sources could result in decreased demand for our products and have a material adverse effect on our business, results of operations and financial condition.

17

In addition, the PRC government has enacted regulations that are intended to affect corporate behavior pertaining to the environment. Many of these regulations may be favorable to companies, such as us, that are engaged in environmentally friendly or “green” industries. According to the Medium and Long-Term Development Plan, the share of renewables used in primary energy consumption is to be increased to roughly 10% by 2010 and nearly 15% by 2020, up from 7.5% in 2005. However, we cannot assure you that demand for our products will increase or that we will otherwise benefit from such regulations. For example, the PRC Ministry of Finance has issued the Temporary Regulation on the Management of Special Funds for the Development of Renewable Resources. Pursuant to this regulation, special funds will be provided to companies for the development of renewable resources, including petroleum substitutes. These funds may be used to promote advancement in the development of energy sources that compete with biodiesel, which may in turn reduce demand for biodiesel.

If environmental regulations are relaxed in the future, or if the enforcement of environmental regulations is not sufficiently rigorous, we may not be able to compete effectively against other manufacturers of energy products, including traditional and other clean energy source products. For example, under the Rules on the Management of Waste Grease for Food Producers, food producers must properly dispose of used cooking oil or sell used cooking oil to used cooking oil processing entities or waste collection entities rather than discharging used cooking oil into the environment or reusing it for human consumption. However, in practice, these rules may not be strictly enforced and waste grease may be disposed of through illegal means by some food producers, which would reduce the supply of used cooking oil available for our production. Our business prospects and results of operations may be adversely affected as a result of any of the foregoing factors.

Our insurance coverage may not be sufficient to cover our liability risks.

Consistent with customary practice in China, we do not carry any business interruption insurance, third- party liability insurance for personal injury or coverage for environmental damage arising from accidents at our production facilities. In addition, we have very limited product liability insurance coverage for our biodiesel. The maximum payout for each claim is capped at RMB100,000, and the cumulative maximum payout under our product liability insurance policies ranges from RMB500,000 to RMB1,000,000. Should an uninsured liability or a liability claim in excess of our insured limits occur, our business operations and financial condition may be adversely affected. Further, if such incidents are publicized, our reputation maybe adversely affected, which could result in reduced and/or cancelled sales, thereby adversely affecting our revenues.

Our principal shareholders exert significant influence over us and their interests may not coincide with yours.

Our principal shareholders, acting individually or together, have significant influence over our business and could control all matters requiring shareholder approval, including the election of most directors and approval of significant corporate transactions. In addition, this concentration of ownership may delay or prevent a change in control of our Company and make some transactions more difficult or impossible without the support of these shareholders. The interests of these shareholders may not always coincide with our interests as a company or the interest of other shareholders. Accordingly, these shareholders could cause us to enter into transactions or agreements with which you may not approve or make decisions with which you may disagree.

Anti-takeover provisions in our charter documents may adversely affect the rights of holders of our ADSs and common shares.

Our amended and restated articles of association include provisions that could limit the ability of others to acquire control of us, modify our structure or cause us to engage in change-of-control transactions. These provisions could have the effect of depriving shareholders of an opportunity to sell their shares at a premium over prevailing market prices by discouraging third parties from seeking to obtain control of us in a tender offer or similar transaction.

18

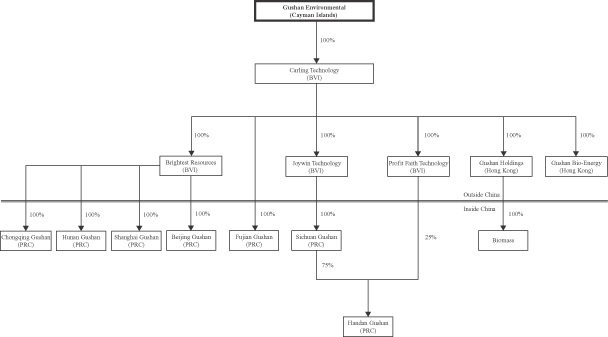

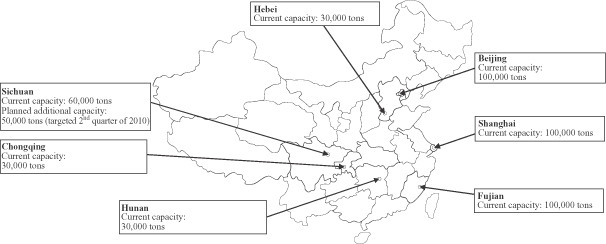

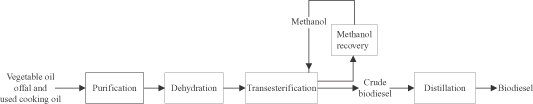

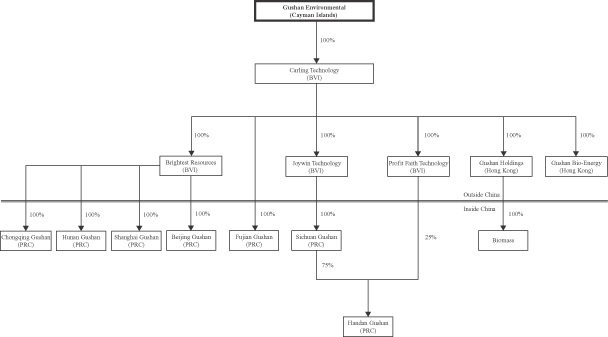

We have included the following provisions in our amended and restated articles of association: