Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2014 | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission File Number: 000-53072

Emmaus Life Sciences, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | 2834 (Primary Standard Industrial Classification Code Number) | 41-2254389 (I.R.S. Employer Identification No.) |

21250 Hawthorne Boulevard, Suite 800, Torrance, California 90503

(Address of principal executive offices, including zip code)

(310) 214-0065

(Registrant's telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

None.

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if smaller reporting company) | Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

There was no aggregate market value of shares of common stock held by non-affiliates of the registrant as of June 30, 2014, the last business day of the registrant's most recently completed second fiscal quarter, because the registrant's common stock was not trading on any exchange on that date.

There were 28,093,848 shares outstanding of the registrant's common stock, par value $0.001 per share, as of March 20, 2015. The registrant's common stock is not traded or listed on any exchange.

EMMAUS LIFE SCIENCES, INC.

TABLE OF CONTENTS TO ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

ITEM | | PAGE | |||

|---|---|---|---|---|---|

PART I |

| ||||

ITEM 1. | BUSINESS | 3 | |||

ITEM 1A. | RISK FACTORS | 28 | |||

ITEM 1B. | UNRESOLVED STAFF COMMENTS | 66 | |||

ITEM 2. | PROPERTIES | 66 | |||

ITEM 3. | LEGAL PROCEEDINGS | 67 | |||

ITEM 4. | MINE SAFETY DISCLOSURES | 68 | |||

PART II |

| ||||

ITEM 5. | MARKET FOR REGISTRANT'S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 69 | |||

ITEM 6. | SELECTED CONSOLIDATED FINANCIAL DATA | 70 | |||

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS AND RESULTS OF OPERATIONS | 70 | |||

ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 84 | |||

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 84 | |||

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 84 | |||

ITEM 9A. | CONTROLS AND PROCEDURES | 85 | |||

ITEM 9B. | OTHER INFORMATION | 86 | |||

PART III |

| ||||

ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 87 | |||

ITEM 11. | EXECUTIVE COMPENSATION | 93 | |||

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 103 | |||

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 105 | |||

ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 109 | |||

PART IV |

| ||||

ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 110 | |||

SIGNATURES | 118 | ||||

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Annual Report on Form 10-K contains some statements that are not purely historical and that are considered "forward-looking statements" within the meaning of Section 27A if the Securities Act of 1933, as amended, which we refer to as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. Such forward-looking statements include, but are not limited to, statements regarding our plans for our business and products; clinical studies and regulatory reviews of our products under development; our strategies and business outlook; our financial condition, results of operations and business prospects; the positioning of our products in relation to demographic and pricing trends in the relevant markets; and various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our management's expectations, hopes, beliefs, and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipates," "believes," "continue," "could," "estimates," "expects," "intends," "may," "might," "plans," "possible," "potential," "predicts," "projects," "seeks," "should," "will," "would" and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Annual Report on Form 10-K are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be those currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following:

- •

- the acceptance of our NDA by the FDA based on our single Phase 3 clinical trial;

- •

- completion of clinical trials or confirmatory study for our product candidates;

- •

- our ability to obtain and maintain U.S. Food and Drug Administration, or FDA, and other regulatory approvals to market our drug products under development, including our pharmaceutical grade L-glutamine treatment for sickle cell disease, or SCD;

- •

- our ability to manage our business despite continuing operating losses and cash outflows;

- •

- our ability to raise additional capital or enter into strategic relationships, or do both, in order to fund our operations and product development plans, including meeting our financial obligations under our existing agreements and any future licensing and related arrangements;

- •

- our ability to build and maintain the management and human resources and infrastructure necessary to support our business strategy and product development and commercialization plans;

- •

- our ability to find and obtain strategic partners on acceptable terms;

- •

- following approval, if any, of each of our product candidates by the FDA and other government regulators outside the United States, our ability to comply with any applicable pharmacovigilance (drug safety) regulatory requirements, including without limitation, implementation and operation of any Risk Evaluation Mitigation Strategies and successful completion of any post-approval safety studies, and the absence of any safety issues that would require withdrawal of such products from the market or any warning or other material limitation on their prescription for or use by patients or consumers;

3

- •

- our reliance on third party manufacturers for our product candidates and products;

- •

- the ability of our third party manufacturers to meet regulatory and supply requirements;

- •

- the approval and market entry of competitors' products and developments in science and medicine beyond our control;

- •

- market acceptance of our product candidates, including our pharmaceutical grade L-glutamine treatment for SCD, and our ability to commercialize the resulting products;

- •

- our reliance on the expected growth in demand for our products

- •

- our dependence on licenses for certain of our product candidates and products, including our pharmaceutical grade L-glutamine treatment for SCD, and our ability to obtain, maintain and, if necessary, enforce against third parties additional intellectual property rights, through patents or otherwise, to technology required or desirable for the conduct of our business;

- •

- exposure to product liability and defect claims;

- •

- the costs and uncertain outcome of remaining issues subject to litigation relating to our 2011 merger transaction;

- •

- exposure to intellectual property claims from third parties;

- •

- the lack of a current public trading market for our securities;

- •

- the cost of complying with current and future governmental regulations, our ability to comply with applicable governmental regulations, and the impact of any changes in governmental regulations upon our operations; and

- •

- such other factors referenced in this Annual Report, including, without limitation, under the sections entitled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and "Business."

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below under the heading "Risk Factors." Should one or more of these risks or uncertainties materialize, or should any of the parties' assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

4

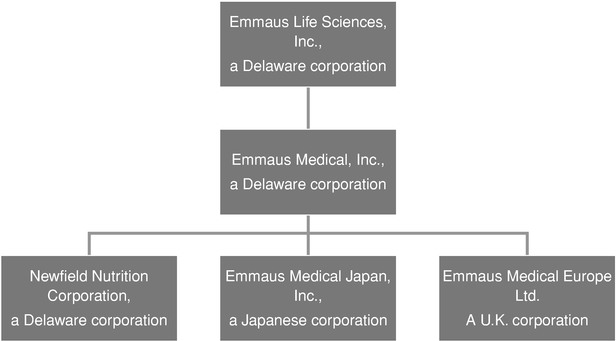

With respect to this discussion, the terms, "we," "us," "our" or the "Company" refer to Emmaus Life Sciences, Inc., and its wholly-owned subsidiary Emmaus Medical, Inc., a Delaware corporation which we refer to as Emmaus Medical, and Emmaus Medical's wholly-owned subsidiaries, Newfield Nutrition Corporation, a Delaware corporation which we refer to as Newfield Nutrition; Emmaus Medical Japan, Inc., a Japanese corporation which we refer to as EM Japan, and Emmaus Medical Europe Ltd., a U.K. corporation which we refer to as EM Europe.

Overview

We are a biopharmaceutical company engaged in the discovery, development and commercialization of innovative treatments and therapies primarily for rare and orphan diseases. We are initially focusing our product development efforts on sickle cell disease, or SCD, a genetic disorder and a significant unmet medical need. Our lead product candidate is an oral pharmaceutical grade L-glutamine treatment that demonstrated positive clinical results in our completed Phase 3 clinical trial for sickle cell anemia and sickle ß0-thalassemia, two of the most common forms of SCD.

We are in the process of preparing a new drug application, or NDA, for submission to the U.S. Food and Drug Administration, or FDA, with respect to this product candidate. If the FDA accepts our submission and approves this NDA, we may be authorized to market in the United States our pharmaceutical grade L-glutamine treatment for SCD patients who are at least five years old. L-glutamine for the treatment of SCD has received Fast Track designation from the U.S. Food and Drug Administration, or FDA, as well as Orphan Drug designation from both the FDA and the European Commission, or EC.

We plan to market our L-glutamine treatment in the United States, if approved, by either strategic partnership or by building our own targeted sales force of approximately 30 sales representatives. We intend to utilize strategic partnerships to market our treatment in the rest of the world.

SCD is an inherited blood disorder characterized by the production of an altered form of hemoglobin which polymerizes and becomes fıbrous, causing red blood cells to become rigid and change form so that they appear sickle-shaped instead of soft and rounded. Patients with SCD suffer from debilitating episodes of sickle cell crisis, which occur when the rigid, adhesive and inflexible red blood cells occlude blood vessels. Sickle cell crisis causes excruciating pain as a result of insufficient oxygen being delivered to tissue, referred to as tissue ischemia, and inflammation. These events may lead to organ damage, stroke, pulmonary complications, skin ulceration, infection and a variety of other adverse outcomes.

We have completed a 230 patient randomized, double-blind, placebo-controlled, parallel-group, multi-center Phase 3 clinical trial which enrolled adult and pediatric patients as young as five years of age, involving 31 sites in the United States. Our pharmaceutical grade L-glutamine treatment and the placebo were randomized by site and by patients using hydroxyurea, a chemotherapeutic agent first approved for SCD by the U.S. Food and Drug Administration, or FDA, in 1998. All participants other than those who received a placebo, including children, received up to 30 grams of pharmaceutical grade L-glutamine treatment daily, dissolved in liquid, split between morning and evening—the same dosage as our Phase 2 clinical trial completed in 2009.

We interpret the results of our Phase 3 clinical trial to indicate that our oral pharmaceutical grade L-glutamine treatment for SCD, when taken on a daily basis by a patient with SCD, can potentially decrease the incidence of sickle cell crisis by restoring the flexibility and function of red blood cells in patients with SCD. Further, we interpret these results to indicate that our prescription grade L-glutamine product candidate can reduce the number of costly hospitalizations as well as unexpected

5

emergency room and urgent care visits from patients with SCD. L-glutamine enhances nicotinamide adenine dinucleotide, or NAD, synthesis to reduce excessive oxidative stress in sickle red blood cells that induces much of the damage leading to characteristic symptoms of SCD.

Although non-prescription L-glutamine supplements are available, we are not aware of any reports in peer reviewed literature of any demonstrations of their clinical safety and effectiveness for the treatment of SCD in controlled clinical trials and they have not been approved by the FDA as a prescription drug for SCD. Our pharmaceutical grade, consistent formulation of L-glutamine may be able to meet the rigorous safety and effectiveness requirements of regulatory agencies for approval, as a prescription drug, and if so, may be preferred by treating physicians and payors as compared to non-prescription L-glutamine supplements.

We have extensive experience in the field of SCD, including the development, outsourced manufacturing and conduct of clinical trials of our L-glutamine product candidate for the treatment of SCD. Our chief executive officer, Yutaka Niihara, M.D., MPH, is a leading hematologist in the field of SCD. Dr. Niihara is licensed to practice medicine in both the United States and Japan and has been actively engaged in SCD research and the care of patients with SCD for over 20 years, primarily at the University of California Los Angeles and the Los Angeles Biomedical Research Institute at Harbor-UCLA Medical Center, or LA BioMed, a nonprofit biomedical research institute.

To a lesser extent, we are also engaged in the marketing and sale of NutreStore L-glutamine powder for oral solution, which has received FDA approval, as a treatment for short bowel syndrome ("SBS"), in patients receiving specialized nutritional support when used in conjunction with a recombinant human growth hormone that is approved for this indication. Our indirect wholly owned subsidiary, Newfield Nutrition, sells L-glutamine as a nutritional supplement under the brand name AminoPure through retail stores in multiple states and via importers and distributors in Japan, Taiwan and South Korea. Since inception, we have generated minimal revenues from the sale and promotion of NutreStore and AminoPure.

Sickle Cell Disease—Market Overview

Sickle cell disease is a genetic blood disorder that affects 20-25 million people worldwide, and occurs with increasing frequency among those whose ancestors are from regions including sub-Saharan Africa, South America, the Caribbean, Central America, the Middle East, India and Mediterranean regions such as Turkey, Greece and Italy. The CDC estimates that there are as many as 100,000 patients with SCD in the United States, and we estimate there are approximately 80,000 patients in the European Union. In regions such as Central Africa, 90% of patients with SCD die by age five and 99% of patients die by age 20. In all regions, SCD requires ongoing physician care and considerable medical intervention. The overall survival of patients in the United States with sickle cell anemia correlates with the severity of their disease state, especially the number of crises per year.

SCD is characterized by the production of an altered form of hemoglobin which polymerizes and becomes fıbrous, causing the red blood cells of patients with SCD to become sickle-shaped, inflexible and adhesive rather than round, smooth and flexible. The complications associated with SCD occur when these inflexible and sticky cells block, or occlude, small blood vessels, which can then cause severe and chronic pain throughout the body due to insufficient oxygen being delivered to tissue, or ischemia, and inflammation. According to an article in Annals of Internal Medicine, "In the Clinic: Sickle Cell Disease" by M.H. Steinberg (September 2011), which we refer to as the Steinberg Article, this leads to long-term organ damage, diminished exercise tolerance, increased risk of stroke and infection and decreased lifespan.

6

Sickle cell crisis, a broad term covering a range of disorders, is one of the most devastating complications of SCD. Types of sickle cell crisis include:

- •

- Vaso-occlusive crisis, characterized by obstructed blood flow to organs such as the bones, liver, kidney, eye, or central nervous system;

- •

- Aplastic crisis, characterized by acute anemia typically due to viral infection;

- •

- Hemolytic crisis, characterized by accelerated red blood cell death and hemoglobin loss;

- •

- Splenic sequestration crisis, characterized by painful enlargement of the spleen due to trapped red blood cells; and

- •

- Acute chest syndrome, a potentially life-threatening obstruction of blood supply to the lungs characterized by fever, chest pain, cough and lung infiltrates.

According to the Steinberg Article, acute chest syndrome affects more than half of all patients with SCD and is a common reason for hospitalization. Other symptoms and complications of SCD include swelling of the hands and feet, infections, pneumonia, vision loss, leg ulcers, gallstones and stroke.

A crisis is characterized by excruciating musculoskeletal pain, visceral pain and pain in other locations. These crises occur periodically throughout the life of a person with SCD. In adults, the acute pain typically persists for five to ten days or longer, followed by a dull, aching pain generally ending only after several weeks and sometimes persisting between crises. According to the Steinberg Article, frequency of sickle cell crises varies within patients with SCD from rare occurrences to occurrences several times a month. Approximately 30% of patients have rare crises, 50% have occasional crises, and 20% have weekly or monthly crises. Crisis frequency tends to increase late in the second decade of life and to decrease after the fourth decade. The overall survival of patients in the United States with sickle cell anemia correlates with the severity of their disease state, especially the number of crises per year.

Patients with more than 3 sickle cell crises per year will experience fatal complications during the fourth and fifth decades of life whereas patients who experience between 1 and 3 crises per year have a median survival of nearly 50 years(Hematology in Clinical Practice by Robert S. Hillman et. al. (5th ed. 2011)).

Treatment of sickle cell crisis is burdensome and expensive for patients and payors, as it encompasses costs for hospitalization, emergency room visits, urgent care visits, and prescription pain medication. According to an article in American Journal of Hematology, "The Burden of Emergency Department Use for Sickle Cell Disease: An Analysis of the National Emergency Department Sample Database" by S. Lanzkron (October 2010), there were approximately 70,000 hospitalizations and 230,000 emergency room visits with a combined emergency room and hospital inpatient charges for these SCD patients estimated to be $2.4 billion in 2006.

Limitations of the Current Standard of Care

The only approved pharmaceutical targeting sickle cell crisis is hydroxyurea, which is available in both generic and branded formulations. Hydroxyurea, a drug originally developed as an anticancer chemotherapeutic agent, has been approved as a once-daily oral treatment for reducing the frequency of sickle cell crisis and the need for blood transfusions in adult patients with recurrent moderate-to-severe sickle cell crisis. While hydroxyurea has been shown to reduce the frequency of sickle cell crisis in some patient groups, it is not suitable for many patients due to significant toxicities and side effects and is not approved by the FDA for pediatric use. In particular, hydroxyurea can cause a severe decrease in the number of blood cells in a patient's bone marrow, which may increase the risk that the patient will develop a serious infection or bleeding, or that the patient will develop certain cancers. Another potential treatment option for SCD, bone marrow transplant, is limited in its use due

7

to the lack of availability of matched donors and the risk of serious complications, including graft versus host disease, infection and potentially death, as well as by its high cost.

Upon onset of sickle cell crisis, the current standard of care is focused on symptom management. Narcotics are typically used for the management of acute pain associated with sickle cell crisis. Pain management often starts with oral medications taken at home at the onset of pain. However, if the pain is not relieved, or if it progresses, patients may seek medical attention in a clinic setting or emergency department. Pain that is not controlled in these settings may require hospitalization for more potent pain medications, typically opioids administered intravenously. The patient must stay in the hospital to receive these intravenous pain medications until the sickle cell crisis resolves and the pain subsides. Other supportive measures during hospitalization include hydration, supplemental oxygen and treatment of any concurrent infections or other conditions.

According toHematology in Clinical Practice, by Robert S. Hillman et. al. (5th ed. 2011), sickle cell crisis, once it has started, almost always results in tissue damage at the affected site in the body, increasing the importance of preventative measures. While pain medications can be effective in managing pain during sickle cell crisis, they do not affect or resolve the underlying vascular occlusion, tissue ischemia or potential tissue damage. Additionally, opioid narcotics that are generally prescribed to treat pain can also lead to tissue or organ damage and resulting complications and morbidities, prolonged hospital stays and associated continuation of pain and suffering. Given the duration and frequency of sickle cell crises, addiction to these opioid narcotics is also a significant concern.

Our Solution of a Pharmaceutical Grade L-glutamine Treatment for SCD

Our pharmaceutical grade L-glutamine treatment, if approved, may provide a safe and effective means for reducing the frequency of sickle cell crisis in patients with SCD and reducing the need for costly hospital stays or treatment with opioid narcotics. Published academic research identifies L-glutamine as a precursor to NAD and its reduced form known as NADH. NAD is the major molecule that regulates and prevents oxidative damage in red blood cells. Several published studies have identified that sickle red blood cells have a significantly increased rate of transport of glutamine, which appears to be driven by the cells' need to promote NAD synthesis, protecting against the oxidative damage and thereby leading to further improvement in their regulation of oxidative stress. In turn this made sickle red blood cells less adhesive to cells of the interior wall of blood vessels. This implied that there is decreased chance of blockage of blood vessels especially the small ones. In summary, improved regulation of oxidative stress appears to lead to less obstruction or blockage of small blood vessels, thereby alleviating a major cause of the problems that patients with SCD face.

Several of the studies in which our chief executive officer has participated have been published in peer-reviewed academic research journals. These publications include, "L-glutamine Therapy Reduces Endothelial Adhesion of Sickle Red Blood Cells to Human Umbilical Vein Endothelial Cells" by Yutaka Niihara et al., published in BMC Blood Disorders (2005), "Oral L-glutamine Therapy for Sickle Cell Anemia: I. Subjective Clinical Improvement and Favorable Change in Red Cell NAD Redox Potential" by Yutaka Niihara et al., published in the American Journal of Hematology (1998) and "Increased Red Cell Glutamine Availability in Sickle Cell Anemia: Demonstration of Increased Active Transport, Affinity, and Increased Glutamate Level in Intact Red Cells" by Yutaka Niihara et al., published in the Journal of Laboratory and Clinical Medicine (1997).

In December 2013, we completed a Phase 3 prospective, randomized, double-blind, placebo controlled, parallel-group multicenter clinical trial to measure, over a 48-week time frame, as its primary outcome, the reduction in the number of occurrences of painful sickle cell crises experienced by patients in the trial. This Phase 3 clinical trial enrolled a total of 230 patients across 31 clinical trial sites in the United States. Study participants included adults and children as young as five years of age. All participants other than those who received placebo, including children, received up to 30 grams of

8

pharmaceutical grade L-glutamine treatment daily, dissolved in liquid, split between morning and evening—the same dosage as our Phase 2 clinical trial completed in 2009. Patients were randomized to the study treatment using a 2:1 ratio of L-glutamine to placebo. The randomization was stratified by investigational site and hydroxyurea usage.

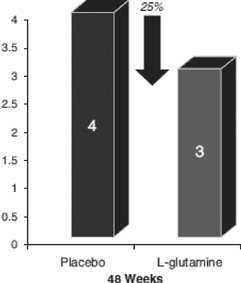

The following charts summarize the results of this Phase 3 clinical trial.

| Median Frequency of Sickle Cell Painful Crises | Median Frequency of Hospitalizations | |

|  |

Primary Endpoint—Reduction in the Frequency of Sickle Cell Crises

For the primary efficacy endpoint of number of sickle cell crises through 48 weeks, there was a trend favoring L-glutamine in the intent-to-treat population with 25% reduction in the median frequency of sickle cell crises (median 3 vs. 4; p=0.063). These results utilized the Cochran-Mantel-Haenszel, or CMH test, controlling for region and hydroxyurea use. The pre-specified p-value for this analysis was 0.045.

Additional sensitivity analyses of the number of sickle cell crises through Week 48 in which the statistical control for region was omitted showed a statistically significantly lower number of sickle cell crises through Week 48 in the L-glutamine group compared to the placebo group (p=0.008). Similarly, when region was included but not hydroxyurea use, a significant effect was seen (p=0.014), and when no covariates were included, a significant effect was also seen (p=0.005) as shown in the table below.

Sensitivity Analysis of Number of Sickle Cell Crises and Impact of Stratification Factors

| | Statistical Controls Used in Test(1) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Analysis | Hydroxyurea use and Region | Hydroxyurea use only | Region only | None | |||||||||

Number of Sickle Cell Crises | 0.063 | 0.008 | 0.014 | 0.005 | |||||||||

- (1)

- All p-values are from the CMH test controlling for stratification variables noted.

The above results include imputation of values for patients who dropped out of the trial before reaching 48 weeks. In order to evaluate results without the imputation of values we have performed further sensitivity analyses using a Poisson distribution which showed a statistically significant lower number of sickle cell crises at all of the above levels of stratification.

9

In addition, the severity of a patient's sickle cell crises was observed in our trial. The analyses of such data from the trial showed a statistically significant lower level in the severity of crises (p=0.0167 using the CMH test). Further, the data from the trial showed a statistically significant reduction in the severity of such incidence of ACS.

Another indication of the reduction in the frequency and severity of crises is the reduction in acute chest syndrome, or ACS, which was also part of our sickle cell crises definition. In the study, the incidence of ACS, was found to be significantly lower with the L-glutamine treatment compared to the placebo group experiencing ACS (26.9% of placebo patients compared to 11.9% of patients in the L-glutamine group) (P=0.006, Fisher's Exact test).

Secondary Endpoint—Reduction in the Frequency of Hospitalization

We also assessed the effect of our prescription grade L-glutamine treatment for SCD by evaluating the frequency of hospitalizations for sickle cell pain as a secondary efficacy endpoint. The number of such hospitalizations, a key secondary endpoint, was significantly less, demonstrating a benefit from our prescription grade L-glutamine treatment as compared to placebo through Week 48 (a lower median number of hospitalizations of 2 vs. 3; p=0.041). These results utilized the same CMH test controlling for region and hydroxyurea use as for the primary endpoint.

Sensitivity Analysis of Number of Hospitalizations and Impact of Stratification Factors

| | Statistical Controls Used in Test(a) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Analysis | Hydroxyurea use and Region | Hydroxyurea use only | Region only | None | |||||||||

Number of Hospitalizations | 0.041 | 0.005 | 0.012 | 0.006 | |||||||||

- (a)

- All p-values are from the CMH test controlling for stratification variables noted.

Further analyses

Further analyses revealed that the observed treatment effect was consistent across regions, prior hydroxyurea use, sex and age group.

Additional analyses were conducted to look at two key indicators which support the relevance of the efficacy findings. All such results demonstrated a benefit from our prescription grade L-glutamine treatment as compared to placebo:

- •

- the median number of days before the first sickle cell crisis was longer in the L-glutamine group (87 days) compared to the placebo group (54 days), a difference that was statistically significant (p=0.010); and

- •

- the median number of days in hospital was statistically significantly shorter in the L-glutamine group (6.5 days) compared to the placebo group (11 days) (p=0.022).

The analysis of subgroups within the trial for efficacy showed consistent results demonstrating the benefit of our prescription grade L-glutamine treatment as compared to placebo as described in the paragraphs below.

Efficacy across region: Subgroup analyses for efficacy as measured by the primary endpoint within regions were significant favoring L-glutamine for the number of sickle cell crises through Week 48 in two of the five regions: Northeast (median of 3 vs. 4) and West (median of 3 vs. 5). These two regions represented 48% of the patients. Two other regions favored L-glutamine, but the between-group differences were not statistically significant: South Atlantic (median of 3 vs. 4) and South Central (median of 3 vs. 4). These two regions represented 41% of the patients. The Midwest region, representing only 11% of the patients, showed no difference (median of 4 vs. 4). The number of hospitalizations for sickle cell pain showed very similar findings in both the between-group differences and statistical significance.

10

Efficacy across hydroxyurea use: Subgroup analysis for efficacy across prior hydroxyurea use showed a trend favoring L-glutamine in the number of sickle cell crises through Week 48. The number of hospitalizations for sickle cell pain showed similar results with significance found in the prior hydroxyurea subgroup (median of 2 vs. 3). The no prior hydroxyurea subgroup showed a trend favoring L-glutamine in both the number of sickle cell crises (median of 3 vs. 4) and the number of such hospitalizations (median of 2 vs. 3) through Week 48.

Efficacy across sex: Subgroup analysis for efficacy across sex showed a lower median number of sickle cell crises through Week 48 in the L-glutamine group as compared to the placebo group for both males and females (medians of 3 vs. 4 for both groups). The median number of hospitalizations for sickle cell pain was also lower in the L-glutamine group for both males and females (2 vs. 3 for both groups).

Efficacy across age: Subgroup analysis for efficacy across age (adults vs. children) showed a lower median number of sickle cell crises through Week 48 in the L-glutamine group as compared to the placebo group (3 vs. 4 for both groups). The median number of hospitalizations for sickle cell pain showed similar results in favor of L-glutamine (2 vs. 3 for both groups).

Regarding safety, adverse events, or AEs, were reported for 98% of patients in the L-glutamine group and 100% of the placebo group. Most AEs were mild or moderate (73.5% in the L-glutamine group, 83.4% in the placebo group). As expected in this disease population, the most common AE was sickle cell anemia with crisis, which was reported for 81.5% of patients in the L-glutamine group and 91.0% of patients in the placebo group. Other notable differences between the treatment groups (difference of about 10 percentage points or more) all favored L-glutamine treatment and included acute chest syndrome (11.9% L-glutamine, 26.9% placebo). Patients in both groups had AEs that were considered possibly related to the study medication (21.2% L-glutamine, 15.4% placebo). The majority of the possibly related AEs were due to gastrointestinal disorders.

Serious adverse events, or SAE, were reported for 78.1% of patients in the L-glutamine group and 87.2% of patients in the placebo group. The most common SAE was sickle cell crisis which was reported in fewer patients treated with L-glutamine (67.5% L-glutamine, 80.8% placebo).

In summary our trial data indicates that our pharmaceutical grade L-glutamine treatment achieved:

- •

- a 25% reduction in the median number of sickle cell crises;

- •

- a 33% reduction in the median number of sickle cell-related hospitalizations;

- •

- a 41% reduction in the median number of sickle cell-related cumulative hospital days;

- •

- a 56% lower reported incidence of sickle cell-related acute chest syndrome; and

- •

- and increase in the median number of days before the first sickle cell crisis from 54 to 87 days

Regulatory Status of L-glutamine for SCD

On June 11, 2014, we met with the FDA to discuss the preliminary data from our Phase 3 clinical trial and our plans to submit to the FDA a NDA, based on our single Phase 3 clinical trial. In minutes of the meeting that the FDA has provided to us, based on its review of preliminary data from our Phase 3 clinical trial, the FDA expressed concern that the primary endpoint of painful sickle cell crisis of 0.063 (controlling for both region and hydroxyurea use) did not reach the pre-specified p-value significance level of 0.045.

The FDA commented that the primary efficacy results were inconsistent among regions, as shown by the large difference in results observed based on the stratified analyses adjusted for both region and hydroxyurea use and the stratified analysis adjusted for hydroxyurea use only. The FDA also commented that a reduction in the median number of painful sickle cell crises by one (from four to three) is not clinically meaningful and is not consistent across regions. The FDA asked us to provide

11

explanations for the differences in results observed based on the stratified analysis adjusted for region and hydroxyurea.

The FDA also commented on the number of patients who discontinued the study, which was greater in the L-glutamine group, and the FDA would need to understand what impact the imputation of such data, which is a method of accounting for missing information, would have on the interpretation of the results.

Based on preliminary data, the FDA recommended a second Phase 3 study be conducted to support the indication for SCD and suggested enrolling patients with a higher baseline level of sickle cell crises to help demonstrate a larger difference in the mean results.

Based on other questions we submitted to the FDA regarding the previous pre-clinical work and evidence gathered for the L-glutamine treatment related to pharmacology, toxicology, and clinical pharmacology, the FDA noted that the information provided appeared to be acceptable; however, final affirmations regarding such matters would be made during the FDA's review of a NDA. The FDA also made certain recommendations to the chemistry, manufacturing and controls of our pharmaceutical grade L-glutamine treatment for SCD which we believe we will be able to successfully incorporate or address.

In September 2014 we submitted to the FDA the Clinical Study Report for our Phase 3 clinical trial, supplemental analyses and a new meeting request. Consequently, we met again with the FDA on October 15, 2014. In the minutes of the October 15 meeting, the FDA noted that it continued to be concerned that the primary endpoint did not meet the pre-specified p-value and observed that our efficacy finding would be more persuasive if supported by an additional, confirmatory study. We communicated to the FDA that over-stratification in our statistical analysis plan led to the pre-specified p-value not being met. We also provided sensitivity analyses and results to address the over stratification which demonstrated a statistically significant p-value for the primary endpoint.

At the October 15 meeting, in response to a question raised by the FDA at the June 11 meeting, we provided evidence of the clinical meaningfulness of a reduction in the median number of painful sickle cell crises by one (from four to three). In the October 15 minutes the FDA expressed the view that the reduction of one sickle cell crises may not be clinically significant and advised us to provide all information and data to support this clinical meaningfulness and the FDA stated they will evaluate the overall clinical benefit and risk of L-glutamine based on results from our Phase 3 trial and all available safety data.

In the October 15 minutes the FDA reiterated certain concerns outlined in the June 11 minutes. Other questions that we posed for discussion at the October 15 meeting related to the safety of L-glutamine use, the benefit-risk margin for L-glutamine use, the sufficiency of our Phase 2 and 3 trials to support a NDA submission and whether a confirmatory study could be conducted as a post-marketing commitment. The FDA noted that its decisions regarding these questions would be made after the submission of a NDA.

Based on our discussions with the FDA, we intend to conduct a confirmatory study of our L-glutamine treatment for SCD. We submitted a draft protocol outline to the FDA. We plan to work with the FDA to finalize the study design.

In addition to planning and conducting a confirmatory study, we plan to submit a NDA for our L-glutamine treatment for SCD during 2015 containing all efficacy and safety data through our completed Phase 3 trial and additional analyses and information in accord with the feedback the FDA provided in the context of the June 11 and October 15 meetings. We will request that our planned confirmatory study be accepted by the FDA as a post-approval study that is, a study to be completed after approval of the NDA.

12

There can be no assurance that the FDA will accept our submission for filing before the completion of a confirmatory study or that the information and data in the NDA will satisfy the concerns identified by the FDA.

Regarding the submission of NDAs that include only one Phase 3 clinical trial, the FDA has in some cases accepted evidence from one clinical trial to support a finding of substantial evidence of effectiveness. A change in the law under the U.S. Food and Drug Administration Modernization Act of 1997, or Modernization Act, made clear that the FDA may consider data from only one adequate and well controlled clinical investigation and confirmatory evidence if the FDA determines that such evidence is sufficient to establish effectiveness of the medicine under study.

In a guidance document titled "Providing Clinical Evidence of Effectiveness for Human Drug and Biological Products" (May 1998), the FDA stated that reliance on a single clinical trial is generally limited to situations in which a trial has demonstrated a clinically meaningful effect on mortality, irreversible morbidity, or prevention of a disease with a potential serious outcome, and where confirmation of the result in a second trial would be impractical or unethical. The factors the FDA considers for accepting a single clinical trial include, but are not limited to, having large multi centered studies, consistent data across subgroups, multiple endpoints, and statistically very persuasive findings.

Sales and Marketing Plans for our SCD Product Candidate

We plan to work with strategic partners to market our SCD product candidate on a worldwide basis. This effort could lead to a global strategic partner or a group of regional partners. This would permit us to access established sales, marketing and regulatory organizations to sell, distribute and provide regulatory compliance for our product sales. This would also permit us to focus our resources on the development of future pipeline products.

Although we have started a formal process, if we are not able to find a strategic partner on acceptable terms for the United States market, subject to FDA approval of our pharmaceutical grade L-glutamine treatment for SCD, we intend to build a focused sales and marketing force of approximately 30 sales representatives to commercialize this product in the United States. We intend to focus our sales and marketing efforts across several different groups, including patients, physicians, health care providers, hospitals, treatment centers, insurance carriers, non-profit associations, and potentially, collaborating pharmaceutical or biotechnology companies. Our in-house product specialists and sales representatives will focus on the following tasks as part of our marketing strategy:

- •

- promote our pharmaceutical grade L-glutamine treatment for SCD to SCD specialist physicians and key opinion leaders;

- •

- starting with our 31 clinical trial sites, promote awareness of our pharmaceutical grade L-glutamine treatment for SCD at all U.S. community-based treatment centers;

- •

- develop collateral materials and informational packets about our pharmaceutical grade L-glutamine treatment for SCD to educate patients and physicians and garner industry support;

- •

- establish collaborative relationships with non-profit organizations and patient advocacy groups that focus on SCD; and

- •

- identify license partners and other international opportunities to commercialize our pharmaceutical grade L-glutamine treatment for SCD, if approved by international regulatory authorities.

Currently Marketed Products

We currently market two L-glutamine-based products, NutreStore and AminoPure, in the United States and certain other territories. We generate limited revenues from the sale of these products, which we consider to be non-core operations.

13

NutreStore is our FDA-approved prescription L-glutamine powder for oral solution for the treatment of SBS in conjunction with an approved recombinant human growth hormone and other customary SBS management. Patients with SBS have had half or more of their small intestine surgically removed or have a poorly functioning small intestine due to inflammatory bowel disease. These patients cannot adequately absorb nutrition through their small intestine and thus require long-term intravenous nutrition, which is expensive, inconvenient, and poses significant infection risk. As cited in the NutreStore label, after four weeks of treatment with NutreStore, the patients enrolled in the Phase 3 trial showed:

- •

- Reduced mean frequency of intravenous nutrition in days per week from 5.4 to 1.2;

- •

- Reduced mean intravenous nutritional volume in liters per week from 10.5 to 2.9; and

- •

- Reduced mean intravenous nutritional calories per week from 7,895 to 2,144.

NutreStore is distributed through local treating medical centers and physicians. We also provide the product to the U.S. Department of Veterans Affairs, U.S. Department of Defense, U.S. Coast Guard and Public Health Service (Indian Health Service).

AminoPure is our dietary supplement L-glutamine, sold through our indirect wholly-owned subsidiary, Newfield Nutrition Corporation. AminoPure is currently sold in several U.S. states, and we export the product to Japan, Taiwan and South Korea. AminoPure is subject to regulation under the Dietary Supplement Health and Education Act of 1994.

CellSeed Collaboration

In April 2011, the Company entered into a Research Agreement and an Individual Agreement with the Japanese company CellSeed, Inc., or CellSeed, and, in August 2011, entered into an addendum to the Research Agreement. Pursuant to the Individual Agreement, CellSeed granted the Company the exclusive right to manufacture, sell, market and distribute Cultured Autologous Oral Mucosal Epithelial Cell Sheet, or CAOMECS, for the treatment of corneal impairments in the United States, which we would be able to exercise only after receiving FDA marketing approval for the product, and agreed to disclose to the Company its accumulated information package for the joint development of CAOMECS. Under the Individual Agreement, the Company agreed to pay CellSeed $1.5 million, which it paid in February 2012. The technology acquired under the Individual Agreement is being used to support an ongoing research and development project and management believes the technology has alternative future uses in other future development initiatives.

Pursuant to the Research Agreement, the Company and CellSeed formed a relationship regarding the future research and development of cell sheet engineering regenerative medicine products, and the future commercialization of such products. Under the Research Agreement, as supplemented by the addendum, the Company agreed to pay CellSeed $8.5 million within 30 days of the completion of all of the following: (i) the execution of the Research Agreement; (ii) the execution of the Individual Agreement; and (iii) CellSeed's delivery of the accumulated information package, as defined in the Research Agreement, to the Company and the Company providing written confirmation of its acceptance of the complete Package, which has not yet been completed as of March 31, 2015.

A cell sheet is a composite of cells grown and harvested in an intact sheet, rather than as individual cells. These cell sheets can be used for tissue transplantation. CellSeed's technology involves culturing cells on a surface coated with a temperature-responsive polymer. The thinness of this polymer coating is measured at the nanometer scale. The cells cultured on this polymer can be harvested intact as a composite cell sheet. Using a patient's own oral mucosal cells, we are working toward being able to grow and harvest a cell sheet for directly transplanting onto the cornea of the patient's affected eye to repair the damaged cornea.

14

Our lead CAOMECS program is for treatment of corneal diseases. CAOMECS products are in preclinical development and have not been approved for marketing in the United States or any jurisdiction. The development of therapeutic products based on this cell sheet technology is in its early stages. We are not aware that cell sheets of the type that CellSeed and we are developing for treating corneal and other diseases are currently being used or sold by any third parties. The potential market for the corneal cell sheet products that CellSeed and we are developing includes patients with damaged corneas, which we believe represents a small percentage of the approximately 40,000 corneal transplants in the United States performed each year. The principal steps to development of a corneal cell sheet product include engaging a manufacturer compliant with applicable current cGMP regulations and sufficient manufacturing capacity, conducting preclinical studies and human clinical trials, obtaining FDA approval of the product, training physicians who will use the product and perform procedures with the product, and marketing the product.

Under the Individual Agreement with CellSeed, we have the exclusive rights to manufacture, sell, market and distribute cell sheets for treating corneal disease in the United States. Since 2011, an Emmaus-led team at LA BioMed has been conducting preclinical studies on corneal cell sheet technology. Subject to filing an investigational new drug application, or IND, that the FDA allows to become effective, we are preparing to begin our first clinical studies with human participants. We currently intend, if our clinical studies are successful, to file with the FDA a Biological License Application, or BLA, for this product. Based on the current status of our research and development efforts relating to this technology, we anticipate it will be four to five years or longer before we would be able to submit and obtain FDA approval of a BLA that would allow us to begin to commercialize this product in the United States. If the product is approved for marketing, we plan to build a cGMP level facility as part of our U.S. commercialization plan for this technology.

We estimate that the cost to develop products based on corneal cell sheet technology in the United States will be approximately $3.0 million, in addition to the $8.5 million fee payable to CellSeed under the Research Agreement. This estimate includes the anticipated cost of obtaining FDA approval for the corneal cell sheets and assumes that we will need the FDA to approve a BLA for the corneal cell sheets, rather than a NDA. We estimate that we will need another $2.0 million to commercialize any approved products based on corneal cell sheet technology.

Raw Materials and Manufacturing

Our SCD treatment uses pharmaceutical grade L-glutamine. This differs from non-pharmaceutical grade L-glutamine available as a nutritional supplement. The manufacturing of large quantities of pharmaceutical grade L-glutamine is a complex and expensive undertaking, which we believe discourages entry of third parties into the market. As a result of these challenges, there are limited alternative suppliers from which we can obtain the pharmaceutical grade L-glutamine required to manufacture our current products and our SCD treatment product under development.

We currently obtain, and plan to continue to obtain, our pharmaceutical grade L-glutamine from Ajinomoto North America, Inc., a subsidiary of Ajinomoto U.S.A. referred to as Ajinomoto, a Japanese food, amino acid and pharmaceutical company, and from Kyowa Hakko Bio Co., Ltd., a Japanese pharmaceutical company referred to as Kyowa. Ajinomoto and Kyowa together produce the majority of pharmaceutical grade L-glutamine approved for sale in the United States.

Ajinomoto has provided pharmaceutical grade L-glutamine to us free of charge for our clinical work, including our completed Phase 2 and Phase 3 clinical trials. Pursuant to a letter of intent between Emmaus Medical and Ajinomoto, we agreed to purchase or cause relevant third party purchasers to purchase from Ajinomoto all of the L-glutamine that we will need for our commercial products. Pursuant to the letter of intent, we will be permitted to source pharmaceutical grade L-glutamine from third party suppliers for up to 10% of our requirement for L-glutamine on a back-up

15

basis. We also currently source pharmaceutical grade L-glutamine from Kyowa for our NutreStore product.

Eventually we plan to enter into exclusive long term supply contracts with these manufacturers for pharmaceutical grade L-glutamine for our SCD treatment that will require these companies to agree not to sell L-glutamine as a nutritional supplement or pharmaceutical for SCD applications. We do not currently have long term supply contracts with these manufacturers for L-glutamine or any other compound. As such, there is no assurance we will be able to obtain agreements for obtaining pharmaceutical grade L-glutamine from these proposed suppliers on terms acceptable to us, or on an exclusive basis, or that these suppliers will not experience an interruption in supply that could materially and adversely affect our business.

Our commercial products must be packaged by a facility that meets FDA requirements for cGMP. Packaging Coordinators, Inc., or PCI, of Rockville, Illinois, has handled the packaging for our Phase 2 and Phase 3 clinical trials of our pharmaceutical grade L-glutamine treatment for SCD, and we plan to use the same company for commercial packaging of the product, if approved. PCI packaged L-glutamine for the clinical trials that resulted in the FDA's marketing approval for L-glutamine for SBS using the same dosage and packaging protocol as we expect to use for the treatment of SCD. Previous compliance with cGMP requirements for the packaging of pharmaceutical products, however, does not guarantee the ability to maintain cGMP compliance for the packaging of pharmaceutical products in the future.

Facilities

We lease office space under operating leases from unrelated entities. The rent expense during the years ended December 31, 2014 and 2013 amounted to $277,866 and $137,147, respectively.

We lease approximately 13,329 square feet of headquarters offices in Torrance, California, at a base rental of $32,505 per month. The lease relating to this space expires on February 28, 2019. We lease an additional office suite in Torrance, California at a base rent of $1,750 per month for 1,400 square feet. The lease relating to this space expires on February 19, 2016.

In addition, EM Japan leases 1,322 total square feet of office space in Tokyo, Japan and 1,313 square feet of office space in Osaka, Japan. The leases relating to this space will expire on September 30, 2016 and February 19, 2016, respectively. Our existing facilities are adequate for our operations at this time and we expect to be able to renew our headquarters office lease on commercially reasonable terms. In the event we determine that we require additional space to accommodate expansion of our operations, we believe suitable facilities will be available in the future on commercially reasonable terms as needed.

Employees

As of December 31, 2014, we had 22 employees, 17 of whom are full time, and we retained three consultants. We have not experienced any work stoppages and we consider our relations with our employees to be good.

Competition

The biopharmaceutical industry is highly competitive and subject to rapid and significant technological change. While we believe that our development experience and scientific knowledge provide us with competitive advantages, we face potential competition from both large and small pharmaceutical and biotechnology companies, academic institutions, governmental agencies (such as the National Institutes of Health) and public and private research institutions. In comparison to us, many of the entities against whom we are competing, or against whom we may compete in the future, have significantly greater financial resources and expertise in research and development, manufacturing,

16

preclinical testing, conducting clinical trials, obtaining regulatory approvals, and marketing approved products. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in increasing concentration of resources among a smaller number of our competitors. These competitors compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our product development programs.

Any product candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the future. The key competitive factors affecting the success of each of our product candidates, if approved, are likely to be their safety, efficacy, convenience, price, the level of proprietary and generic competition, and the availability of coverage and reimbursement from government and other third-party payors. Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer or more effective, have fewer or less severe side effects, or are more convenient or less expensive than any products that we may develop. Our competitors may also obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for ours, which could result in their establishing a strong market position before we are able to enter the market.

Sickle Cell Disease

Our pharmaceutical grade L-glutamine treatment for SCD is being developed as a therapy to reduce the frequency of sickle cell crisis in patients with SCD. The only approved drug targeting a reduction in the frequency of sickle cell crisis is hydroxyurea, which is available in both generic and branded formulations. While hydroxyurea has been shown to reduce the frequency of sickle cell crisis in some patient groups, it is not suitable for all patients because it can have significant toxicities and side effects. Additionally, hydroxyurea has not been approved by the FDA for pediatric use in SCD patients.

There is a high level of interest in SCD and we understand several academic centers and pharmaceutical companies are researching new treatments and therapies for SCD. There are studies underway testing different compounds that target various aspects of SCD pathophysiology. We are aware of two studies targeting the reduction or duration of vaso occlusive crisis events in patients with SCD which are currently in Phase 3 clinical trials sponsored by Eli Lilly and Mast Therapeutics, Inc. In addition, GlycoMimetics Inc. has announced completion of its Phase 2 clinical trial evaluating GMI-1070, a pan-selectin inhibitor that it is developing in collaboration with Pfizer, Inc.

We are also aware of efforts to develop cures for SCD through approaches such as bone marrow transplant and gene therapy. Although bone marrow transplant is currently available for SCD patients, its use is limited by the lack of availability of matched donors and by the risk of serious complications, including graft versus host disease and infection. Attempts to develop a cure through gene therapy remain at an early stage, but if these attempts were to succeed and receive regulatory approval, this could limit the market for a product such as our L-glutamine product candidate.

L-glutamine is marketed and sold without a prescription as a nutritional supplement. Although our L-glutamine treatment for SCD requires pharmaceutical grade L-glutamine, which we believe offers a more consistent quality and purity profile than non-pharmaceutical grade L-glutamine sold as a nutritional supplement, our L-glutamine product candidate for the treatment for SCD may compete with non-pharmaceutical grade alternative sources of L-glutamine. If our L-glutamine treatment for SCD is approved, we expect that it will be priced at a significant premium over non-prescription L-glutamine products.

17

Oral Mucosa Epithelial Cell Sheet

The development of regenerative medicine products using cell sheet technology is in the early stages. Although there are many academic centers and biotechnology companies working on regenerative medicine in various fields, we are not aware of any treatments using cell sheet technology that have been approved by the FDA. Additionally, we are not aware of any other biotechnology companies in the United States who are currently working to develop products based on cell sheet technology. We are, however, aware of academic centers and biotechnology companies that are researching stem cells in various forms, including in cell sheets, with potential applications for the treatment of limbal stem cell deficiency, or LSCD, a disease of the cornea.

For example, two academic centers outside the United States researching the transplantation of cells as a treatment for LSCD are the Centre Hospitalier National d'Ophtalmologie des Quinze-Vingts located in Paris, France, who we believe is conducting Phase 2 clinical trials evaluating the survivability of transplanted epithelium, and the Instituto Universitario de Oftalmobiología Aplicada located in Valladolid, Spain, who we believe has completed Phase 3 clinical trials looking at the viability and safety of mesenchymal stem cell transplants but the study results are not published. We are also aware of Holostem Terapie Avanzate, an Italian biotechnological company, who we believe is working with autologous cultures of limbal stem cells for corneal regeneration and restoration of visual acuity in patients with severe corneal chemical and thermal burns associated with total unilateral or severe bilateral LSCD. Holostem Terapie Avanzate has received conditional marketing approval from the European Commission for its therapy based on autologous stem cells for patients with severe cornea damage.

Currently, the standard of care for LSCD patients is the treatment of symptoms. This treatment may include use of artificial tears, topical cyclosporine or topical steroids. In more advanced cases, the treatment plan will likely include surgery. The initial surgical interventions may include management of eyelid positioning, insertion of small plugs into the openings in the eye that allows tears to drain or partially sew the eyelids together to protect the cornea prior to considering transplantation of healthy limbal tissue using either cultured cells or whole tissue grafts. The source of the transplanted tissue can be from the patient's own cells from their healthy eye, matched living donors, or cadavers. Similar to other transplantations, there is the risk of serious complications, including graft versus host disease when not using the patient's own tissue.

In regenerative medicine and cell-based therapy, cell transplantation success not only depends on the cells, but also on the carrier/scaffold used, as it is not possible to graft separate cells in a suspension. Biodegradable polymers were the key technology for the first generation of cell therapy. Tremendous efforts have been made since to develop biofilms, acellular matrix (blood products e.g.; fibrin gel, amniotic membranes, etc.) to carry and deliver the cells to the target site. However, the risks of infection due to blood products or biomaterials cannot be completely denied. It has been repeatedly reported that decomposition of biodegradable transplanted scaffolds used for cell transplantations caused inflammation, foreign body reaction and cell damage. The use of an innovative temperature-responsive culture surface vessel technology eliminates these issues and, for the first time, offers the possibility to culture and engineer any type of cells to safely transplant cell-sheets to target organs for regenerative purpose, drug delivery, or tissue replacement.

This cell-sheet-based regenerative medicine technology is advanced, simple and has already shown dramatic results in pilot studies in Japan and Europe. An important feature of this novel and innovative cell sheet therapy is that harvested cell-sheets retain intact basal membranes and intact extracellular matrix (fibronectin, laminin, collagen type IV), eliminating the inherent risks of suture during transplantation. Another innovative feature this cell sheet therapy is that the construction of multiple layered cell sheets is made possible during the culture process and that cell sheet harvesting is

18

achieved without harmful enzymes use (trypsin or dispase) that may damage the cell-based therapeutic potential.

This technology has the unique potential to construct in vitro stratified tissue equivalents by alternately layering different harvested cell sheets to provide regenerated tissue architectures. This novel technique thus holds promise for the study of cell-cell communications and angiogenesis in reconstructed, three-dimensional environments, as well as for tissues engineering with complex, multicellular architectures.

Government Regulation

In 2001, the FDA granted Orphan Drug designation to L-glutamine for the treatment of SCD. In 2005, the FDA granted Fast Track designation to our clinical study program of L-glutamine for treating SCD. The FDA also approved, in 2004, our NDA for our L-glutamine product for the treatment of SBS. In addition, in July 2012, the European Commission, or EC, granted Orphan Drug designation to L-glutamine for the treatment of SCD. We describe below the significance of these designations and of data exclusivity under the Hatch/Waxman Act.

Orphan Drug Designation. The FDA has authority under the U.S. Orphan Drug Act to grant Orphan Drug designation to a drug or biological product intended to treat a rare disease or condition. This law defines a rare disease or condition generally as one that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of the development and distribution of the orphan product in the United States will be recovered from sales of the product. Being granted Orphan Drug designation provides tax benefits to mitigate expenses of developing the orphan product. More importantly, Orphan Drug designation provides seven years of market exclusivity if the product receives the first FDA approval for the disease or condition for which it was granted such designation and the indication for which approval is granted matches the indication for which Orphan Drug designation was granted. During the seven year exclusivity period, Orphan Drug exclusivity precludes FDA approval of a marketing application for the same product for the same indication. Orphan Drug exclusivity is limited and will not preclude the FDA from approving the same product for the same indication if the same product is shown to be clinically superior to the product previously granted exclusivity. For example, if the same product for the same indication is shown to have significantly fewer side effects, the FDA may approve the second product despite the Orphan Drug exclusivity granted to the first product. In addition, a product that is the same as the orphan product may receive approval for a different indication (whether orphan or not) during the exclusivity period of the orphan product. Also, Orphan Drug market exclusivity will not bar a different product intended to treat the same orphan disease or condition from obtaining its own Orphan Drug designation and Orphan Drug exclusivity. Orphan Drug status in the European Union has similar, but not identical, benefits, which includes a ten year Orphan Drug exclusivity period.

Fast Track Designation/Priority Review. The FDA has authority under the U.S. Food, Drug, and Cosmetic Act, or the FD&C Act, to designate for "Fast Track" review new drugs and biologics that are intended to treat a serious or life-threatening condition and demonstrate the potential to meet an unmet medical need for the condition. Fast Track designation applies to the combination of the product and the specific indication for which it is being studied. A product candidate that receives Fast Track designation is eligible for some or all of the following: more frequent meetings with the FDA to discuss the development plan for the product candidate and ensure collection of appropriate data needed to support marketing approval; more frequent written correspondence from the FDA about the development of the product candidate; the ability, if agreed to by the FDA, to submit a NDA on a rolling basis; and, if certain criteria are met, eligibility for Priority Review. These criteria for Priority Review include whether, if approved, the resulting product would provide significant improvements in the safety or effectiveness of the treatment, diagnosis, or prevention of serious conditions caused by a

19

disease when compared to standard treatment, diagnosis, or prevention of those conditions. Under Priority Review of a NDA, assuming that there are no requests from the FDA for additional information, the FDA's goal is to take action on the NDA within six months (compared to 10 months under standard review) after it is accepted for review, with the review clock starting at the time of submission. Requests for Priority Review of a NDA for the applicable product candidate must be submitted to the FDA when the NDA is submitted.

505(b)(2) Applications. Under Section 505(b)(2) of the FD&C Act, a person may submit a NDA for which one or more of the clinical studies relied upon by the applicant for approval were not conducted by or for the applicant and for which the applicant does not have a right of reference or use from the person by or for whom the clinical studies were conducted. Instead, a 505(b)(2) applicant may rely on published literature containing the specific information (e.g., clinical trials, animal studies) necessary to obtain approval of the application. The 505(b)(2) applicant may also rely on the FDA's finding of safety and/or effectiveness of a drug previously approved by the FDA when the applicant does not own or otherwise have the right to access the data in that previously approved application. The 505(b)(2) pathway to market thus allows an applicant to submit to the FDA a NDA without having to conduct its own studies to obtain data that are already documented in published reports or previously submitted NDAs. In addition to relying on safety data from our previously approved drug product, NutreStore, we intend to take advantage of the 505(b)(2) pathway to the extent published literature will further support our new drug marketing application.

Hatch/Waxman Data Exclusivity. Under the Drug Price Competition and Patent Term Restoration Act of 1984, or the Hatch/Waxman Act, a three-year period of data exclusivity is granted for a drug product that contains an active moiety that has been previously approved, when the application contains reports of new clinical investigations (other than bioavailability studies) conducted or sponsored by the sponsor that were essential to approval of the application. When granted to a sponsor, data exclusivity under the Hatch/Waxman Act prevents any third parties, such as generic drug manufacturers, from relying on or using the sponsor's data from the sponsor's new clinical investigations in order to obtain marketing approval for the same active moiety and indication for which the sponsor's NDA was approved. The FDA defines "new clinical investigation" as a "clinical study in humans the results of which have not been relied upon by FDA to demonstrate substantial evidence of effectiveness of a previously approved drug product for any indication or of safety for a new patient population and do not duplicate the results of another investigation that was relied upon by the agency to demonstrate the effectiveness or safety in a new patient population of a previously approved drug product." Our pharmaceutical grade L-glutamine drug product contains the same active moiety contained in our previously approved NutreStore drug product and we believe our Phase 3 clinical study meets the definition of a new clinical investigation for purposes of satisfying the requirements for Hatch/Waxman data exclusivity to be granted. Therefore, if approved, we anticipate receiving three years of data exclusivity under the Hatch/Waxman Act for our pharmaceutical grade L-glutamine treatment for SCD. These three years of data exclusivity would run concurrently with any other market exclusivity we may receive, as well as concurrently with any remaining patent term protection. However, the three-year exclusivity provided under the Hatch/Waxman Act would bar the approval of the same product for the same indication, even if the same product demonstrated clinical superiority. Thus, when running concurrently with Orphan Drug exclusivity, clinical superiority would not be sufficient to allow the FDA to approve a third party product during the first three years of Orphan Drug exclusivity. Similar to Orphan Drug exclusivity, the three-year exclusivity provided under Hatch/Waxman would not bar the FDA from approving another L-glutamine product for another indication, nor would it bar the FDA from approving a different active moiety to treat the same indication.

Regulation by United States and foreign governmental authorities is a significant factor in the development, manufacture and expected marketing of our product candidates and in our ongoing

20

research and development activities. The nature and extent to which such regulation will apply to us will vary depending on the nature of the product candidates we seek to develop.

In particular, human therapeutic products, such as drugs, biologics and cell-based therapies, are subject to rigorous preclinical and clinical testing and other preapproval requirements of the FDA and similar regulatory authorities in other countries. Various federal and state statutes and regulations govern and influence pre- and post-approval requirements related to research, testing, manufacturing, labeling, packaging, storage, distribution and record-keeping of such products to ensure the safety and effectiveness for their intended uses. The process of obtaining marketing approval and ensuring post-approval compliance with the FD&C Act for drugs and biologics (and applicable provisions of the Public Health Service Act for biologics), and the regulations promulgated thereunder, and other applicable federal and state statutes and regulations, requires substantial time and financial resources. Any failure by us or our collaborators to obtain, or any delay in obtaining, marketing approval could adversely affect the marketing of any of our product candidates, our ability to receive product revenues, and our liquidity and capital resources.

The manufacture of these products is subject to cGMP regulations. The FDA inspects manufacturing facilities for compliance with cGMP regulations before deciding whether to approve a product candidate for marketing. If the facility in which L-glutamine is manufactured is not ready for inspection at the time the FDA seeks to inspect it, or cGMP deficiencies are found upon such inspection, the FDA's approval of our NDA for our L-glutamine treatment for SCD could be delayed unless and until the facility is inspected and no deficiencies in need of correction prior to approval are identified or, if so identified, such deficiencies are corrected.