UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

DUNHAM FUNDS

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary proxy materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

Dunham Funds

Proxy Statement

Notice of Special Meeting to be held on December 16, 2024

and Proxy Statement

This page intentionally left blank.

Dunham Funds

6256 Greenwich Drive, Ste. 550

San Diego, CA 92122

October 09, 2024

Dear Shareholder:

The enclosed proxy statement ("Proxy Statement") asks you to vote on the following important matters concerning the series (the "Funds") of The Dunham Funds (the "Trust"). The Board of Trustees of the Trust (the "Board") recommends that Fund shareholders ("Shareholders") cast their votes FOR the following proposal (the "Proposal"). In summary, the Proposal is:

1. To elect four trustees to the Board of Trustees of the Trust.

The Dunham Funds

A special meeting of the Funds' Shareholders will be held on December 16, 2024, at the offices of Dunham & Associates Investment Counsel, Inc. on 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122 at 05:30 pm, Pacific time, to consider these matters, and to transact any other business that may be properly considered at the Meeting. The enclosed Proxy Statement contains detailed information about the Proposals, and we recommend that you read it carefully. We have also attached a "Questions and Answers" section that we hope will assist you in evaluating the Proposals.

Your vote is very important, no matter how large or small your holdings. Please review the enclosed materials and vote your shares. Should you have any questions, please feel free to call us at (800) 442-4358. We will be happy to answer any questions you may have. For voting instructions, including toll-free number and website for voting, please refer to the enclosed proxy card.

Thank you for your attention to this matter and for your continuing investment in the Funds.

Sincerely,

Jeffrey A. Dunham President

Dunham & Associates Investment Counsel, Inc.

The Dunham Funds

A proxy card(s) covering each of your Fund(s) is/are enclosed along with the Proxy Statement.

Please vote your shares today.

You may vote by:

• Mail: sign and return the enclosed proxy card(s) in the postage prepaid envelope provided.

• Telephone: please have the proxy card(s) available and call the number on the enclosed card(s) and follow the instructions.

• Internet: you also may vote over the Internet by following the instructions on the enclosed proxy card(s).

The Board recommends that you vote "FOR" the Proposal.

This page intentionally left blank.

The Dunham Funds

Questions and Answers

Information about voting

Q. Who is asking for my vote?

A. The Board of Trustees (the "Board" or the "Trustees") of The Dunham Funds (the "Trust") requests your vote on the election of Trustees and on several other matters concerning the Trust series (the "Funds") in connection with the special meeting of shareholders (the "Meeting"). The Meeting will be held at 05:30 pm, Pacific time, on December 16, 2024, at the offices of Dunham & Associates Investment Counsel, Inc. on 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122.

Q. Who is eligible to vote?

A. Shareholders of record of the Funds at the close of business on October 04, 2024 (the "Record Date") are entitled to notice of and to vote at the Meeting or at any adjournment thereof. Shareholders of record will be entitled to one vote for each full share and a fractional vote for each fractional share that they hold on each matter presented for the Fund(s) they hold at the Meeting. The Trust proposes to mail the Notice of the Meeting, the Proxy Statement, and the proxy card to shareholders of record on or about October 17, 2024.

Q. On what proposals am I being asked to vote?

A. As more fully described below, you are being asked to vote on the following proposal affecting the Funds (the "Proposal"):

1. To elect four trustees to the Board of Trustees of the Trust.

The Dunham Funds

PROPOSAL 1: TO ELECT FOUR TRUSTEES TO THE BOARD OF THE TRUST

Q. Who am I being asked to elect as Trustees of the Board of the Trust?

A. Shareholders of the Trust will be asked to elect Jeffrey A. Dunham, Paul A. Rosinack, Michael J. Torvinen, each a current trustee of the Trust, and to elect Ray McKewon, a new nominee for Trustee of the Trust (the "Nominees"). As explained more fully below, each Nominee has been selected for election because the Board believes that they have the relevant experience, qualifications and skills necessary to effectively oversee the management of the Trust and protect the interests of shareholders. By having each of the Nominees elected by shareholders at this time, the Trust will comply with Section 16 of the Investment Company Act of 1940 (the "1940 Act") which provides that Trustees must be elected by shareholders, except that the Board may fill vacancies on the Board if at least two-thirds of the Trustees holding office immediately after the appointment of a Trustee to fill such vacancy have been elected by shareholders of the Trust. The Board recommends the election of all the Nominees.

General Questions

Q. How do the Trustees recommend that I vote on the Proposal?

The Board has unanimously approved the Proposal and recommends that you vote FOR the Proposal.

Q. When will the Proposal take effect if it is approved?

The Proposal will become effective immediately upon approval of the shareholders.

Q. How do I vote my shares?

You can vote in any one of four ways:

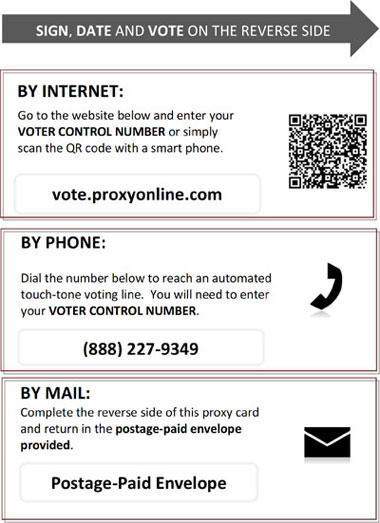

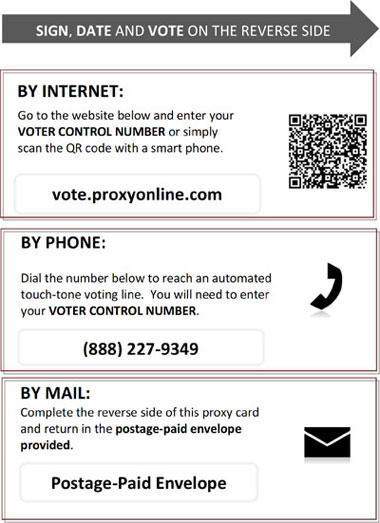

• Through the Internet by following the instructions on the enclosed proxy card(s);

• By telephone by calling the number on the enclosed proxy card(s);

• By mail, with the enclosed proxy card(s); or

• In person at the Meeting.

We encourage you to vote over the Internet or by telephone, following the instructions that appear on your proxy card(s). These voting methods will save money. Whichever method you choose, please take the time to read the Proxy Statement before you vote.

Proxy cards that are properly signed, dated and received at or prior to the Meeting will be voted as specified. If you specify a vote for the Proposals, your proxy will be voted as you indicate. If you simply sign, date, and return the proxy card, but do not specify a vote for the Proposals, your shares will be voted by the proxies "FOR" the approval of the Proposal.

Q. If I send my proxy in now as requested, can I change my vote later?

You may revoke your proxy at any time before it is voted by: (i) sending to the Secretary of the Trust a written revocation; (ii) forwarding a later-dated proxy that is received by the Trust at or prior to the Meeting; or (iii) attending the Meeting and voting in person. Even if you plan to attend the Meeting, we ask that you return the enclosed proxy. This will help us ensure that an adequate number of shares are present for the Meeting to be held.

Q. Who should I call with questions?

If you have any additional questions about the Proxy Statement or the upcoming Meeting, please call toll free at (800) 442-4358 (from within the United States).

THE ATTACHED PROXY STATEMENT CONTAINS MORE DETAILED INFORMATION ABOUT THE PROPOSALS, AND THE ABOVE DISCUSSION IS QUALIFIED IN ITS ENTIRETY BY REFERENCE TO THE MORE DETAILED DISCUSSION CONTAINED IN THE PROXY STATEMENT. PLEASE READ IT CAREFULLY.

This page intentionally left blank.

The Dunham Funds

Dunham Corporate/Government Bond Fund

Dunham Floating Rate Bond Fund

Dunham High-Yield Bond Fund

Dunham International Opportunity Bond Fund

Dunham Large Cap Value Fund

Dunham Small Cap Value Fund

Dunham Focused Large Cap Growth Fund

Dunham Small Cap Growth Fund

Dunham Emerging Markets Stock Fund

Dunham International Stock Fund

Dunham Dynamic Macro Fund

Dunham Long/Short Credit Fund

Dunham Monthly Distribution Fund

Dunham Real Estate Stock Fund

Dunham US Enhanced Market Fund

Investment Adviser:

Dunham & Associates Investment Counsel, Inc.

P.O. Box 910309

San Diego, California 92191

Notice of Special Meeting of Shareholders of The Dunham Funds to be held on December 16, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on December 16, 2024: this proxy statement ("Proxy Statement") is available at vote.proxyonline.com/dunham/docs/2024meeting.pdf.

To the Shareholders:

A special meeting ("Meeting") of holders of shares of beneficial interest (each, a "Shareholder" and collectively, "Shareholders") of the investment portfolios listed above (each, a "Fund" and collectively, the "Funds") of The Dunham Funds (the "Trust") will be held at the offices of Dunham & Associates Investment Counsel, Inc. 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122 at 05:30 pm, Pacific time, on December 16, 2024 for the following purposes:

Matter to be voted upon by Shareholders:

Proposal 1:

To elect four trustees to the Board of Trustees of the Trust.

Additionally, Shareholders will vote to transact such other business as may properly come before the Meeting or any adjournment thereof (e.g., adjourning the Meeting). Only those Shareholders of record of the Funds at the close of business on October 04, 2024 will be entitled to notice of, and to vote on, the proposal(s) at the Meeting, or at any adjournments thereof.

The Dunham Funds

Please execute the proxy card and return it promptly in the enclosed envelope accompanying the proxy card, which is being solicited by the Board, or vote your shares by telephone or the internet using the instructions on the proxy card. The Board recommends that you cast your vote "FOR" the above proposal as described in this Proxy Statement.

Returning your proxy promptly is important to ensure a quorum at the Meeting and to save the expense of further proxy solicitation, including mailings. You may revoke your proxy at any time before it is exercised by (i) the subsequent submission of a revised proxy, (ii) giving a written notice of revocation to the Trust, or (iii) voting in person at the Meeting.

By Order of the Board,

Helmut Boisch

Secretary

The Dunham Funds

October 09, 2024

This page intentionally left blank.

The Dunham Funds

Dunham Corporate/Government Bond Fund

Dunham Floating Rate Bond Fund

Dunham High-Yield Bond Fund

Dunham International Opportunity Bond Fund

Dunham Large Cap Value Fund

Dunham Small Cap Value Fund

Dunham Focused Large Cap Growth Fund

Dunham Small Cap Growth Fund

Dunham Emerging Markets Stock Fund

Dunham International Stock Fund

Dunham Dynamic Macro Fund

Dunham Long/Short Credit Fund

Dunham Monthly Distribution Fund

Dunham Real Estate Stock Fund

Dunham US Enhanced Market Fund

Investment Adviser:

Dunham & Associates Investment Counsel, Inc.

P.O. Box 910309

San Diego, California 92191

Proxy statement

Special Meeting of Shareholders to be held on December 16, 2024

This proxy statement ("Proxy Statement") is being furnished to holders of shares of beneficial interest ("Shareholders") of the above-listed funds (the "Funds") in connection with the solicitation by the Board of Trustees of the Trust (the "Board") of proxies to be used at a special meeting of Shareholders to be held at 05:30 pm, Pacific time, on December 16, 2024, at the offices of Dunham & Associates Investment Counsel, Inc. 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122, or at any postponement, adjournment or adjournments thereof (the "Meeting"). This Proxy Statement will first be mailed to Shareholders on or about October 14, 2024.

The Dunham Funds (the "Trust") is an investment company registered under the Investment Company Act of 1940 ("1940 Act" or "the Act"), and is organized as a Delaware statutory trust. As of the date of this Proxy Statement, the Trust consists of fifteen (15) Funds.

The Meeting is being held to consider and vote on the following matters, as indicated below and described more fully herein (the "Proposal"):

Proposal 1:

To elect four trustees to the Board of Trustees of the Trust.

The table below details the Proposal to be presented at the Meeting and the Funds whose Shareholders are solicited with respect to the Proposal.

| Proposal | | Affected Fund(s) | |

| 1. | | To elect four trustees to the Board of Trustees of the Trust. | | All Funds | |

| | | | | | |

| |

| | | | | | |

| Table of Contents | | | |

| Proxy statement | | | 1 | | |

| Voting information and Required Vote | | | 8 | | |

| Quorum | | | 8 | | |

| Required vote for adoption of the Proposals | | | 8 | | |

| Proposal 1. To elect four Trustees to the Board | | | 9 | | |

| Overview of the election of the Board | | | 9 | | |

| Nominee for Trustees of the Trust | | | 9 | | |

| Independent Trustees | | | 10 | | |

| Process used to select Nominees | | | 12 | | |

Role of Trustees, meetings of the Board, and compensation

of the Trustees | | | 12 | | |

| Compensation table | | | 13 | | |

| Standing committees of the Board | | | 13 | | |

| Board's oversight of risk management | | | 14 | | |

Nominee ownership of Fund shares and ownership of Dunham Investment Counsel, Inc. (“DAIC”) and their control persons | | | 15 | | |

| Information about Nominee ownership of Fund shares | | | 15 | | |

| Officers of the Trust | | | 15 | | |

| Additional information about voting and the meeting | | | 16 | | |

| Solicitation of proxies | | | 16 | | |

| Beneficial ownership of shares | | | 16 | | |

| Shareholder proposals | | | 16 | | |

| Additional information about the Funds | | | 16 | | |

| Investment adviser and administrator | | | 16 | | |

| Underwriter | | | 16 | | |

| Transfer agent | | | 16 | | |

| Custodian | | | 17 | | |

| Auditors | | | 17 | | |

| Audit fee information | | | 17 | | |

| Audit fees | | | 17 | | |

| Audit-related fees | | | 17 | | |

| Tax fees | | | 17 | | |

| All other fees | | | 17 | | |

| Audit committee pre-approval policies and procedures | | | 18 | | |

| Non-audit fees and services | | | 19 | | |

| Other business | | | 19 | | |

| Exhibit Index | | | 20 | | |

The Dunham Funds

Voting information

Shareholders are entitled to one vote for each share held and a proportionate vote for each fractional share held as of the record at the close of business on October 04, 2024 (the "Record Date"). Shareholders of each Fund will vote separately on each proposal, without regard to the class of shares held.

The number of shares of each class of each Fund that were issued and outstanding as of the Record Date is set forth in Exhibit A.

Quorum and Required Vote

The election of Trustees is a Trust-level vote. A Trust-level vote means that establishing quorum requires the presence, in person or by proxy, of one-third (33 ⅓%) of all Funds’ shares entitled to vote on the applicable Proposal (that is, the Trust’s shares entitled to vote in the aggregate, irrespective of Fund).

With respect to the Proposal, one-third percent (33 ⅓%) of the Trust’s shares entitled to vote constitutes a quorum for the transaction of business at the meeting. Trustees shall be elected by a plurality of the votes cast at meeting at which a quorum is present. Those nominees receiving the highest number of votes cast, provided a quorum is present, shall be elected. Votes to ABSTAIN and broker non-votes will have no effect.

For purposes of determining (i) the presence of a quorum, and (ii) whether sufficient votes have been received for approval of a particular proposal, abstentions and broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present at the meeting, but which have not been voted.

If, with respect to any Fund, either (a) a quorum is not present at the meeting, or (b) a quorum is present but sufficient votes in favor of the proposal have not been obtained, then the persons named as proxies may propose one or more adjournments of the meeting with respect to such Fund, without further notice to the shareholders of the Fund, to permit further solicitation of proxies, provided such persons determine, after consideration of all relevant factors, including the nature of the proposal, the percentage of votes then cast, the percentage of negative votes then cast, the nature of the proposed solicitation activities and the nature of the reasons for such further solicitation, that an adjournment and additional solicitation is reasonable and in the interests of shareholders. The persons named as proxies will vote those proxies that such persons are required to vote FOR the proposal, as well as proxies for which no vote has been directed, in favor of such an adjournment and will vote those proxies required to be voted AGAINST such proposal against such adjournment.

The meeting may be adjourned from time to time by the vote of a majority of the shares represented at the meeting, whether or not a quorum is present. If the meeting is adjourned to another time or place, notice need not be given of the adjourned meeting at which the adjournment is taken, unless a new record date of the adjourned meeting is fixed. At any adjourned meeting, the Trust may transact any business which might have been transacted at the original meeting.

The individuals named as proxies on the enclosed proxy card will vote in accordance with the shareholder’s direction, as indicated thereon, if the proxy card is received and is properly executed. If the shareholder properly executes a proxy and gives no voting instructions with respect to a proposal, the shares will be voted in favor of such proposal. The proxies, in their discretion, may vote upon such other matters as may properly come before the meeting. The Board of Trustees of the Trust is not aware of any other matters to come before the meeting.

The Dunham Funds

A listing of the owners of more than 5% of each class of shares of each Fund as of the Record Date, is set forth in Exhibit B to this Proxy Statement. To the knowledge of the Trust, the executive officers and the Nominees, as a group, owned less than 0.54% of the outstanding shares of each class of the Funds as of the Record October 04, 2024.

Copies of the Trust's most recent annual report, including financial statements for each Fund, have previously been mailed to Shareholders. Shareholders may request additional copies of a Fund's annual report and the most recent semiannual report succeeding the annual report, if any, without charge, by writing the Fund c/o Dunham & Associates Investment Counsel, Inc. at 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122, or by calling toll free (888) 3DUNHAM (338-6426).

The Dunham Funds

Proposal 1. To elect four Trustees to the Board

Overview of the election of the Board

The Board unanimously recommends that Shareholders vote to elect the nominees set forth below (each, a "Nominee" and collectively, the "Nominees") as Trustees of the Trust. The Board is responsible for supervising the management of the Trust and serving the needs of Fund Shareholders.

The Trust's Board currently consists of four persons, three of whom are not "interested persons" of the Trust within the meaning of Section 2(a)(19) under the 1940 Act ("Independent Trustees"). Shareholders are being asked to elect two of the current Independent Trustees, one current Interested Trustee and one new Independent Trustee. If elected, three of four Board members will be Independent Trustees.

If a shareholder wishes to send a communication to the Board, such correspondence should be in writing and addressed to the Board at the Fund's offices, c/o Helmut Boisch, Fund Secretary, Dunham & Associates Investment Counsel, Inc., 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122. The correspondence will be relayed by the Fund Secretary to the Board's independent counsel for their further handling in light of the nature of the communication, such as forwarding to the Board's Chairperson, a Board Committee's Chairperson or the full Board. It is recommended that such communication be sent by certified or registered mail or by another method that provides a receipt/record of delivery.

Nominees for Trustees of the Trust

The Board has nominated Jeffrey A. Dunham, Paul A. Rosinack, Michael J. Torvinen, and Ray McKewon to serve as Trustees of the Trust. Each Nominee, other than Ray McKewon, is currently a member of the Board. Messrs. Rosinack and Torvinen have served in their capacities as Trustees of the Trust since 2008 and 2021, respectively. Mr. Rosinack was last elected by Shareholders of the Trust on February 28, 2008. Mr. Torvinen served in his capacity as Trustee to the Board at that time, upon the recommendation of the Trustees, which consisted of Independent Trustees. Messrs. Rosinack and Goldstein based on their qualifications and experience. Mr. Torvinen has over 40 years of business experience, primarily as CFO for several state agencies in Nevada. He is a Certified Public Accountant (“CPA”).

Ray McKewon has not previously served on the Board and was nominated by the current Independent Trustees, based on the recommendation of the incumbent Independent Trustees.

All Nominees have consented to serve if elected. If elected, each Nominee will hold office throughout the continued lifetime of the Trust until they die, resign, are declared bankrupt or incompetent by a court of competent jurisdiction, or are removed. If each of the four Nominees is elected, then they will constitute the entire Board of the Trust. If any of the Nominees should withdraw or otherwise become unavailable for election, the selection of a substitute nominee shall be made by a majority of the Independent Trustees.

Listed below are the names, age and business address of each Nominee, along with their principal occupation for the last five years, the number of portfolios of registered investment companies advised by the Adviser overseen or to be overseen by the Nominees and other Board memberships held.

The Nominees, along with their principal occupations over the past five years and their affiliations, if any, with Dunham & Associates Investment Counsel, Inc., are listed below. Paul A. Rosinack, Michael J. Torvinen, and Ray McKewon are not an "interested person" (as defined in the 1940 Act) of the Trust. Jeffrey A. Dunham is an interested trustee.

Independent trustees

Name, directorships held, address, and age | | Position(s) held with trust | | Term of office1 and length of time served | | Principal occupations(s) during past 5 years | | Number of portfolios in fund complex overseen by trustee | |

Other

directorships held by trustee during past 5 years | |

Paul A. Rosinack; 77; 6256 Greenwich Drive, Suite 550, San Diego, CA 92122

| | Trustee | | Since January 2008 | | Retired; President/Chief Executive Officer / Director, Qualigen, Inc., (manufacturer of medical products and equipment) 2004–2017.

| | 15 | | None | |

Michael J. Torvinen2; 68; 6256 Greenwich Drive, Suite 550, San Diego, CA 92122

| | Trustee | | Since January 2021 | | Self-employed, Torvinen Accounting and Consulting LLC, August 2014–present.

| | 15 | | Mr. Torvinen is board member (since 2011) of the Reno Rodeo Association (Non-Profit) and held various officer positions from 2016 to 2019; board member and treasurer (since July 2020) of the Nevada Western Heritage Center Alliance (Non-Profit); board member (since July 2024) of the Reno Rodeo Charitable Foundation (Non-Profit). | |

Ray McKewon; 76 P.O. Box 9290, Rancho Santa Fe, CA 92067

| | Nominee | | N/A | | President, The Xceptional Music Company, 2007-present; Fund Advisor, Mesa Verde Partners III, 2018-present.

| | Mr. McKewon would serve as trustee overseeing 15 portfolios for which Dunham & Associates Investment Counsel, Inc. serves as investment adviser. | | Mr. McKewon is board member (since 2018) of Xceptional Networks Inc. (Information Technology and Client Services); chairman of the board (until 2023) and board member (since 2011) of the Kyoto Symposium Organization (Non-Profit); board member and treasurer (since 2016, treasurer until 2023) of the Catalina Island Medical Center Foundation (Non-Profit); founding board member (since 2006) of the San Diego Fire Rescue Foundation (Non-Profit) and board of managers member (since 2005) now emeritus member of the board of managers of the Jackie Robinson YMCA (Non-Profit). | |

| | | | | | | | | | | | |

The Dunham Funds

Interested trustees

Name, directorships held, address, and age | | Position(s) held with trust | | Term of office1 and length of time served | | Principal occupations(s) during past 5 years | | Number of portfolios in fund complex overseen by trustee | |

Other

directorships held by trustee during past 5 years | |

Jeffrey A. Dunham; 62; 6256 Greenwich Drive, Suite 550, San Diego, CA 92122

| | Trustee, Chairman of Board, President & Principal Executive Officer | | Since January 2008 | | Chief Executive Officer, Dunham & Associates Investment Counsel, Inc., (registered investment adviser, broker-dealer and distributor for mutual funds), 1985–present; Chief Executive Officer, Dunham & Associates Holdings, Inc. (holding company), 1999–present; Chief Executive Officer, Dunham & Associates Securities, Inc. (general partner for various limited partnerships), 1986–present; Chief Executive Officer, Asset Managers, Inc. (general partner and/or manager of various limited partnerships and/or limited liability companies), 1985–present; Chairman and Chief Executive Officer, Dunham Trust Company, 1999–present.

| | 15 | | None | |

| | | | | | | | | | | | |

1 Each Trustee holds office for an indefinite term.

2 Since 2017, Mr. Torvinen has served as Trustee of DTC. DTC is a trust company licensed by the Nevada Department of Business & Industry, Financial Division and is an affiliate of the Adviser.

The Dunham Funds

Process used to select Nominee

The Board believes that it is in the best interests of the Trust and its Shareholders to obtain highly qualified individuals to serve as members of the Board. In nominating candidates, the Board believes that no specific qualifications or disqualifications are controlling or paramount, or that specific qualities or skills are necessary for a candidate to possess. The Board takes into consideration such factors as it deems appropriate, which factors may include whether the candidate is an "interested person" as defined in the 1940 Act; whether the candidate is qualified under applicable laws and regulations to serve as a member of the Board; whether the candidate has any relationships that might impair his or her independence, such as any business, financial or family relationships with Fund management and/or its affiliates; whether the candidate is willing to serve and able to commit the time necessary to perform the duties of a Board member; the candidate's judgment, skill, diversity and experience with investment companies and other organizations of comparable purpose, complexity and size and subject to similar legal restrictions and oversight; and the interplay of the candidate's experience with the experience of other Board members; and the extent to which the candidate would be a desirable addition to the Board and any committees thereof.

The Nominee has been selected for election because the Board believes that he has the relevant experience, qualifications and skills necessary to effectively oversee the management of the Trust and protect the interests of Shareholders. The Board noted that Ray McKewon’s background as business founder, U.S. Navy veteran, President for a Music Production company and his engagement in philanthropy has the valuable and relevant skills and experience to serve as a member of the Board.

Role of Trustees, meetings of the Board, and compensation of the Trustees

The role of the Trustees is to provide general oversight of each Fund's business, and to ensure that the Fund is operated for the benefit of Shareholders. The Board is responsible for establishing the Trust's policies and for overseeing the management of the Trust and the Funds. The Board appoints the officers of the Trust, who, along with third-party service providers, are responsible for administering the day-to-day operations of the Trust. The Board is currently comprised of three Independent Trustees.

Ray McKewon, if elected by Shareholders would serve as the third Independent Trustee, replacing Henry R. Goldstein, incumbent Independent Trustee who is retiring and has provided over 16 years of distinguished service as a member of the Board of Trustees of the Dunham Funds; and consistently demonstrated commitment to effective oversight, strengthening shareholder results and promoting effective governance through a candid exchange of views. The Board of Trustees of the Dunham Funds expresses its sincere gratitude to Henry R. Goldstein for his personal integrity, extensive knowledge and tremendous dedication.

Jeffrey A. Dunham, Interested Trustee, President & Principal Executive Officer of Dunham & Associates Investment Counsel, Inc., is Chairperson of the Board. As Chairperson of the Board, Mr. Dunham approves agendas for Board meetings and generally facilitates communication and coordination among the Independent Trustees and between the Independent Trustees and management. The Board meets at least four times each year. At each regular meeting, the Independent Trustees meet in executive session to discuss matters outside the presence of management. In addition, the Board holds special telephonic meetings throughout the year, as needed and the Trustees also discuss other matters on a more informal basis at other times.

During the fiscal year ended October 31, 2023, there were four meetings of the Board.

The Dunham Funds

The following table provides the annual compensation paid by the Trust to each Trustee for the fiscal year ended October 31, 2023. Ray McKewon does not currently serve as a Trustee so no information is provided for him below.

Compensation table

Trustees

| Name and position held | | Annual

aggregate

compensation

from the Trust1 | | Pension or

retirement

benefits accrued

as part of fund

expenses | | Total

compensation

from the Trust and

fund complex

paid to trustees2 | |

| Henry R. Goldstein | | $ | 25,000 | | | | N/A | | | $ | 25,000 | | |

| Paul A. Rosinack | | | 25,000 | | | | N/A | | | | 25,000 | | |

| Michael J. Torvinen | | | 25,000 | | | | N/A | | | | 25,000 | | |

1 Represents aggregate annual compensation paid by the Trust to each Trustee indicated for the fiscal year ended October 31, 2023.

2 This amount represents the aggregate amount of compensation paid to the Trustees for service on the Board.

The Trust pays each Trustee of the Trust who is not an interested person a fee of $6,250 for each board meeting attended in person; $2,500 for each board meeting attended by telephone or video conference; $1,000 for attending a stand-alone (not held on the same day as a board meeting) committee meeting in person; and $500 for attending a stand-alone committee meeting by telephone.

No additional compensation will be provided for Committee meetings occurring on the same day as a Board meeting. The cost is allocated among the Funds pro rata based on assets under management. The Trust also reimburses each Trustee for travel and other expenses incurred in attending meetings of the Board. With the exception of the Trust’s Chief Compliance Officer, Trust officers and Trustees who are interested persons of the Trust do not receive any compensation from the Trust or any other Funds managed by the Adviser.

The table above provides information concerning the compensation of the Independent Trustees for the fiscal year ended October 31, 2023.

Standing committees of the Board

The Board has one standing committee: the Audit Committee. Each current Independent Trustee sits on the Trust's Audit Committee.

The Audit Committee has the responsibility, among other things, to (i) select, oversee and approve the compensation of the Trust's independent registered public accounting firm; (ii) oversee the Trust's accounting and financial reporting policies and practices, its internal controls and, as appropriate the internal controls of certain service providers; and (iii) oversee the quality and objectivity of the Funds' financial statements and the independent audit(s) thereof.

The Audit Committee met four times during the fiscal year ended October 31, 2023.

No member of the Audit Committee is an "interested person" as defined under the 1940 Act.

The Dunham Funds

Board's oversight of risk management

The Board, as a whole, considers risk management issues as part of its general oversight responsibilities throughout the year at regular board meetings, through regular reports that have been developed by Fund management and the Adviser. These reports address certain investment, valuation, liquidity, and compliance matters. The Board also may receive special written reports or presentations on a variety of risk issues, either upon the Board's request or upon the initiative of the Adviser (including, for example, Cybersecurity related matters). In addition, the Board meets at least annually with the Adviser's internal audit group to discuss the results of the internal audit group's examinations of the functions and processes of the Adviser that affect the Funds and to be advised regarding the internal audit group's plans for upcoming audits.

With respect to investment risk, the Board receives regular written reports describing and analyzing the investment performance of the Funds. The Board discusses these reports and the performance of the Fund and investment risks with management of the Adviser at the Board's regular meetings. To the extent that the Adviser seeks to change a Fund's investment strategy that may have a material impact on the Fund's risk profile or invest in a new type of security or instrument that is expected to have a material impact, the Board generally is provided information on such proposed changes for the Board's approval. In addition, the Adviser provides an annual report on the Fund's derivatives risk management program.

With respect to valuation, the Adviser, as the Fund's valuation designee pursuant to Rule 2a-5 of the 1940 Act, provides regular written reports to the Board that enables the Board to oversee the valuation designee and the valuation designee's fair value determinations for investments in the Funds. Such reports also include information concerning the reasons for the fair valuation and the methodology used to arrive at the fair value, information on illiquid investments held by the Funds, information on pricing vendor oversight, and a summary of material fair value matters, if any. In addition, the Audit Committee reviews valuation procedures and pricing results with the Trust's independent registered public accounting firm in connection with such Committee's review of the results of the audit of the Funds' year-end financial statements.

With respect to liquidity, pursuant to Rule 22e-4 of the 1940 Act, the Board has approved a liquidity risk management program, which provides the framework for evaluating the liquidity of a Fund's investments. The Board has approved the designation of an administrator of such program, and will review, no less frequently than annually, a written report prepared by the administrator that addresses the operation of the program and assesses its adequacy and effectiveness of implementation.

With respect to compliance risks, the Board receives regular compliance reports prepared by the Adviser's compliance department and meets regularly with the Trust's CCO to discuss compliance issues, including compliance risks. The Independent Trustees meet at least annually in executive session with the CCO, and the Trust's CCO prepares and presents an annual written compliance report to the Board. The Board adopts compliance policies and procedures for the Trust and receives information about the procedures in place for the Trust's service providers. The compliance policies and procedures are specifically designed to detect and prevent violations of the federal securities laws.

At the request of the Board, the Adviser also has provided presentations to the Board with respect to the Adviser's Cybersecurity.

Nominee ownership of Fund shares

The following table provides the dollar range of equity securities of the Funds and all registered investment companies within the same family of investment companies as the Fund overseen or to be overseen by each Nominee held by each Nominee as of October 04, 2024.

Information about Nominee ownership of Fund shares

| Nominee | | | Aggregate dollar range of

equity securities in all registered

investment companies overseen by

Trustee in Dunham Funds | |

| Paul A. Rosinack | | | Over $100,000 | |

| Michael J. Torvinen | | | Over $100,000 | |

| Jeffrey A. Dunham | | | Over $100,000 | |

| Ray McKewon | | | Over $100,000 | |

| | Jeffrey A.

Dunham | Michael J. Torvinen | Paul A.

Rosinack | Ray McKewon |

| Dunham Corporate/ Government Bond Fund | Over $100,000 | $10,001- $50,000 | Over $100,000 | Over $100,000 |

| Dunham Floating Rate Bond Fund | Over $100,000 | $10,001- $50,000 | Over $100,000 | Over $100,000 |

| Dunham High-Yield Bond Fund | Over $100,000 | $10,001- $50,000 | Over $100,000 | Over $100,000 |

| Dunham International Opportunity Bond Fund | Over $100,000 | $10,001- $50,000 | $50,001-$100,000 | Over $100,000 |

| Dunham Large Cap Value Fund | Over $100,000 | $10,001- $50,000 | $10,001- $50,000 | Over $100,000 |

| Dunham Small Cap Value Fund | $50,001-$100,000 | $10,001- $50,000 | $10,001- $50,000 | Over $100,000 |

| Dunham Focused Large Cap Growth Fund | Over $100,000 | $10,001- $50,000 | $50,001-$100,000 | Over $100,000 |

| Dunham Small Cap Growth Fund | $50,001-$100,000 | $10,001- $50,000 | $10,001- $50,000 | $50,001-$100,000 |

| Dunham Emerging Markets Stock Fund | Over $100,000 | $10,001- $50,000 | $50,001-$100,000 | Over $100,000 |

| Dunham International Stock Fund | Over $100,000 | $10,001- $50,000 | $50,001-$100,000 | Over $100,000 |

| Dunham Dynamic Macro Fund | Over $100,000 | $10,001- $50,000 | $10,001- $50,000 | Over $100,000 |

| Dunham Long/Short Credit Fund | Over $100,000 | $10,001- $50,000 | Over $100,000 | Over $100,000 |

| Dunham Monthly Distribution Fund | Over $100,000 | $10,001- $50,000 | Over $100,000 | Over $100,000 |

| Dunham Real Estate Stock Fund | $50,001-$100,000 | $1 - $10,000 | $10,001- $50,000 | $50,001-$100,000 |

| Dunham U.S. Enhanced Market Fund | Over $100,000 | $10,001- $50,000 | $10,001- $50,000 | Over $100,000 |

Note regarding ranges: In disclosing the dollar range of equity securities beneficially owned by a Trustee in these columns, the following ranges will be used consistent with SEC instructions: (i) none; (ii) $1 - $10,000; (iii) $10,001 - $50,000; (iv) $50,001 - $100,000; or (v) over $100,000.

Officers of the Trust

The Trustees appoint the Trust officers, who are responsible for administering the day-to-day operations of the Funds. None of these individuals receives compensation from the Trust for services to the Trust, with the exception of the Trust’s Chief Compliance Officer. Exhibit C of this Proxy Statement provides information about these officers, including certain biographical information, the positions they hold with the Trust and their principal occupations over the past five years.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES FOR TRUSTEE TO THE BOARD.

The Dunham Funds

Additional information about voting and the meeting

Solicitation of proxies

Your vote is being solicited by the Board. The cost of preparing and mailing the notice of meeting, proxy cards, this Proxy Statement, and any additional proxy materials, has been or will be borne by the Funds and allocated among the Funds by number of shareholder accounts. The Trust reimburses brokerage firms and others for their expenses in forwarding proxy material to the beneficial owners and soliciting them to execute proxies. The Trust does not reimburse Trustees and officers of the Trust, or regular employees and agents of the Adviser involved in the solicitation of proxies.

Proxy solicitations will be made primarily by mail, but they may also be made by telephone, personal interview or oral solicitations conducted by certain officers or employees of the Trust or the Adviser, without additional or special compensation.

Beneficial ownership of shares

A list of those persons who, to the knowledge of the Trust, owned beneficially 5% or more of the shares of any class of any Fund as of the Record Date is set forth in Exhibit B.

Shareholder proposals

The Trust is not required, and does not intend, to hold regular annual meetings of Shareholders. Shareholders wishing to submit proposals for consideration for inclusion in a proxy statement for the next meeting of Shareholders should send their written proposals to c/o Dunham & Associates Investment Counsel, Inc., 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122, Attn: Compliance Department, so they are received within a reasonable time before any such meeting. The Trustees know of no business, other than the matters mentioned in the Notice and described above, that is expected to come before the Meeting. Should any other matter requiring a vote of Shareholders arise, including any question as to an adjournment or postponement of the Meeting, the persons named as proxies will vote on such matters according to their best judgment in the interests of the Trust.

Additional information about the Funds

Investment adviser

Dunham & Associates Investment Counsel, Inc., with its principal offices located at 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122, serves as the investment adviser to the Funds.

Administrator

The Administrator for the Funds is Gemini Fund Services, LLC (“Gemini”), which has its principal office 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022-3474.

Underwriter

Dunham & Associates Investment Counsel, Inc., with its principal offices located at 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122, acts as the principal underwriter of each class of shares of the Funds pursuant to a Principal Underwriting Contract with the Trust. The Principal Underwriting Contract requires the Underwriter to use its best efforts, consistent with its other businesses, to sell shares of the Fund. Shares of the Fund are offered continuously. The Underwriter may enter into dealer agreements with other broker-dealers and with other financial institutions to authorize them to sell Fund shares.

Transfer agent

Gemini, located at 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022-3474, acts as transfer, dividend disbursing, and shareholder servicing agent for the Funds. Gemini maintains certain books and records of the Funds that are required by applicable federal regulations.

Custodian

US Bank, N.A. (“US Bank”), located at 425 Walnut Street, Cincinnati, OH 45202, provides custodian services for the securities and cash of each Fund and employs foreign sub-custodians in accordance with applicable requirements under the 1940 Act to provide custody of each Fund's foreign securities and cash. US Bank maintains certain books and records of each Fund that are required by applicable federal regulations.

Auditors

Cohen & Company, Ltd. (“Cohen & Company”), whose address is 1835 Market Street, Suite 310, Philadelphia, PA 19103, serves as the Funds’ independent registered public accounting firm providing audit and tax services. The Board has selected Cohen & Company as the independent registered public accounting firm for the Trust for the current fiscal year. Representatives of Cohen & Cohen are not expected to be present at the Shareholder Meetings, but will have the opportunity to make a statement if they wish, and will be available should any matter arise requiring their presence.

Audit fee information

Audit fees

The aggregate fees paid to Cohen & Company and BBD, LLP, the former Independent Registered Public Accounting firm of the Trust, in connection with the annual audit of the Trust's financial statements for the fiscal years ended October 31, 2023 and October 31, 2022, were approximately $192,000 and $173,000, respectively. Fees included in the audit fees category are those associated with the annual audits of financial statements and services that are normally provided in connection with statutory and regulatory filings.

Audit-related fees

The aggregate audit-related fees billed by Cohen & Cohen and BBD, LLP, the former Independent Registered Public Accounting firm of the Trust, for services rendered to the Trust which were not reported under "Audit Fees" above for the fiscal years ended October 31, 2023 and October 31, 2022, were approximately $0 and $0, respectively. Fees included in the audit-related category are those associated with the reading and providing of comments on the 2022 and 2021 semiannual financial statements. There were no audit-related fees required to be approved pursuant to paragraphs (c)(7)(ii) and (c)(7)(i)(C) of Rule 2-01 of Regulation S-X during the fiscal years indicated above.

Tax fees

The aggregate tax fees billed by Cohen & Cohen and BBD, LLP, the former Independent Registered Public Accounting firm of the Trust, for professional services rendered to the Trust for the fiscal years ended October 31, 2023 and October 31, 2022, were approximately $34,500 and $30,800, respectively. Fees included in the tax fees category comprise all services performed by professional staff in the independent accountant's tax division except those services related to the audits. This category comprises fees for review of tax compliance, tax return preparation and excise tax calculations. There were no tax fees required to be approved pursuant to paragraphs (c)(7)(ii) and (c)(7)(i)(C) of Rule 2-01 of Regulation S-X during the fiscal years indicated above.

All other fees

There were no additional fees paid by the Trust for products and services provided by Cohen & Cohen and BBD, LLP, the former Independent Registered Public Accounting firm of the Trust, other than the services reported above, for the Trust's fiscal years ended October 31, 2023 and October 31, 2022. Fees included in all other fees category would consist of services related to internal control reviews, strategy and other consulting, financial information systems design and implementation, consulting on other information systems, and other tax services unrelated to the Trust. There were no "all other fees" required to be approved pursuant to paragraphs (c)(7)(ii) and (c)(7)(i)(C) of Rule 2-01 of Regulation S-X during the fiscal years indicated above.

Audit committee pre-approval policies and procedures

The Audit Committee Charter contains the Audit Committee's pre-approval policies and procedures. Reproduced below is an excerpt from the Audit Committee Charter regarding pre-approval policies and procedures:

To carry out its purpose, the Audit Committee shall have the following duties and powers:

Selection of Auditor.

| (i) | The Audit Committee shall pre-approve the selection of the Auditor and shall recommend the selection, retention or termination of Auditor to the Board and, in connection therewith, to evaluate the independence of the Auditor, including whether the Auditor provides any consulting, auditing or non-audit services to the Adviser or its affiliates. The Audit Committee shall review the Auditor’s specific representations as to its independence; |

| (ii) | The Audit Committee shall review and approve the fees charged by the Auditor for audit and non-audit services in accordance with the pre-approval requirements. The Trust shall provide for appropriate funding, as determined by the Audit Committee, to compensate the Auditor for any authorized service provided to the Trust. |

Pre-Approval Requirements. Before the Auditor is engaged by the Trust to render audit or non-audit services, either:

| A. | The Audit Committee shall pre-approve all auditing services and permissible non-audit services (e.g., tax services) provided to the Trust. The Audit Committee may delegate to one or more of its members the authority to grant pre-approvals. The decisions of any member to whom authority is delegated under this section shall be presented to the full Audit Committee at each of its scheduled meetings; or |

| B. | The engagement to render the auditing service or permissible non audit service is entered into pursuant to pre-approval policies and procedures established by the Audit Committee. Any such policies and procedures must (1) be detailed as to the particular service and (2) not involve any delegation of the Audit Committee’s responsibilities to the Adviser. The Audit Committee must be informed of each service entered into pursuant to the policies and procedures. A copy of any such policies and procedures shall be attached as an exhibit to the Audit Committee Charter; |

| i. | De Minimis Exceptions to Pre-Approval Requirements. Pre-Approval for a service provided to the Trust other than audit, review or attest services is not required if: (1) the aggregate amount of all such non-audit services provided to the Trust constitutes not more than five (5) percent of the total amount of revenues paid by the Trust to the Auditor during the fiscal year in which the non-audit services are provided; (2) such services were not business of providing administrative, custodian, underwriting or transfer agent services to the Funds or Adviser recognized by the Trust at the time of the engagement to be non-audit services; and (3) such services are promptly brought to the attention of the Audit Committee and are approved by the Audit Committee or by one or more members of the Audit Committee to whom authority to grant such approvals has been delegated by the Audit Committee prior to the completion of the audit; |

| ii. | Pre-Approval of Non-Audit Services Provided to the Adviser and Certain Control Persons. The Audit Committee shall pre-approve any non-audit services proposed to be provided by the Auditor to (a) the Adviser and (b) any entity controlling, controlled by, or under common control with the |

Adviser that provides ongoing services to the Trust, if the Auditor’s engagement with the Adviser or any such control persons relates directly to the operations and financial reporting of the Trust. Application of De Minimis Exception. The De Minimis exception set forth above under Section 5(d)(ii) applies to pre-approvals under this Section (iii) as well, except that the “total amount of revenues” calculation is based on the total amount of revenues paid to the Auditor by the Trust and any other entity that has its services approved under this Section (i.e., the Adviser or any control person).

| iii. | The pre-approval requirements set forth above are optional to the extent that any engagement is entered into with the Auditor prior to May 6, 2003 (the effective date of the Securities and Exchange Commission (“SEC”) regulations establishing such requirements). Engagements entered into prior to May 6, 2003, are subject to any limitations set forth in the transition and grandfathering provisions in the SEC rules. |

Non-audit fees and services

For the fiscal years ended October 31, 2023 and October 31, 2022, there were no fees billed by Cohen & Cohen and BBD, LLP, the former Independent Registered Public Accounting firm of the Trust for non-audit services rendered on behalf of the Trust ("covered"), its investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and any entity controlling, controlled by, or under common control with the adviser ("non-covered") that provides ongoing services (or provided during the relevant fiscal period) to the Trust for each of the last two fiscal years of the Trust is shown in the table below:

| | | 2022 | | 2023 | |

| Covered Services | | $0 | | | | $0 | | | |

| Non-Covered Services | | $0 | | | | $0 | | | |

The Trust's audit committee was not required to consider whether the provision of non-audit services that were rendered to the Trust's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Trust that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant's independence.

Other business

Management knows of no business to be presented at the Meeting other than the matters set forth in this Proxy Statement, but should any other matter requiring a vote of Shareholders arise, the proxies will vote thereon according to their best judgment in the interest of the Trust or relevant Fund, as applicable.

By Order of the Board,

Helmut Boisch

Secretary

The Dunham Funds

The Dunham Funds

Exhibit index

| Exhibit A—Shares outstanding as of Record Date | | A-1 | |

Exhibit B—Beneficial ownership of greater than 5%

of the Funds' shares as of Record Date | | B-1 | |

| Exhibit C— Officers of the Trust | | C-1 | |

| |

The Dunham Funds

Exhibit A

Shares outstanding as of Record Date

| Fund Name | Shares Outstanding | Class |

| DUNHAM CORPORATE/GOVT | 1,142,770.51 | DACGX |

| DUNHAM CORPORATE/GOVT | 191,581.35 | DCCGX |

| DUNHAM CORPORATE/GOVT | 14,431,002.48 | DNCGX |

| DUNHAM INTERNATIONL STOCK | 757,812.68 | DAINX |

| DUNHAM INTERNATIONL STOCK | 246,683.67 | DCINX |

| DUNHAM INTERNATIONL STOCK | 6,618,801.99 | DNINX |

| DUNHAM EMERG MARKET STOCK | 990,222.41 | DAEMX |

| DUNHAM EMERG MARKET STOCK | 166,624.38 | DCEMX |

| DUNHAM EMERG MARKET STOCK | 7,098,001.91 | DNEMX |

| DUNHAM LARGE CAP VALUE | 826,115.73 | DALVX |

| DUNHAM LARGE CAP VALUE | 196,653.29 | DCLVX |

| DUNHAM LARGE CAP VALUE | 6,702,574.38 | DNLVX |

| DUNHAM REAL ESTATE STOCK | 314,068.84 | DAREX |

| DUNHAM REAL ESTATE STOCK | 150,056.21 | DCREX |

| DUNHAM REAL ESTATE STOCK | 2,772,270.89 | DNREX |

| DUNHAM SMALL CAP GROWTH | 509,874.36 | DADGX |

| DUNHAM SMALL CAP GROWTH | 174,320.33 | DCDGX |

| DUNHAM SMALL CAP GROWTH | 3,369,458.91 | DNDGX |

| DUNHAM SMALL CAP VALUE | 565,662.61 | DASVX |

| DUNHAM SMALL CAP VALUE | 154,272.72 | DCSVX |

| DUNHAM SMALL CAP VALUE | 5,352,285.03 | DNSVX |

| DUNHAM LONG/SHORT CREDIT | 1,790,160.17 | DAAIX |

| DUNHAM LONG/SHORT CREDIT | 280,226.78 | DCAIX |

| DUNHAM LONG/SHORT CREDIT | 23,574,923.92 | DNAIX |

| DUNHAM HIGH YIELD BOND | 1,615,427.03 | DAHYX |

| DUNHAM HIGH YIELD BOND | 389,869.09 | DCHYX |

| DUNHAM HIGH YIELD BOND | 20,524,760.09 | DNHYX |

| DUNHAM MONTHLY DISTRIB | 756,408.78 | DAMDX |

| DUNHAM MONTHLY DISTRIB | 634,588.95 | DCMDX |

| DUNHAM MONTHLY DISTRIB | 6,663,596.40 | DNMDX |

| DUNHAM DYNAMIC MACRO FUND | 781,116.53 | DAAVX |

| DUNHAM DYNAMIC MACRO FUND | 144,655.09 | DCAVX |

| DUNHAM DYNAMIC MACRO FUND | 5,466,811.81 | DNAVX |

| DUNHAM FOCUSED LG CAP GR | 512,734.13 | DAFGX |

| DUNHAM FOCUSED LG CAP GR | 255,094.62 | DCFGX |

| DUNHAM FOCUSED LG CAP GR | 3,496,424.89 | DNFGX |

| DUNHAM FLOATING RATE BOND | 1,018,174.17 | DAFRX |

| DUNHAM FLOATING RATE BOND | 580,112.42 | DCFRX |

| DUNHAM FLOATING RATE BOND | 14,485,482.03 | DNFRX |

| DUNHAM INTERNATL OPP BOND | 692,607.83 | DAIOX |

| DUNHAM INTERNATL OPP BOND | 110,555.69 | DCIOX |

| DUNHAM INTERNATL OPP BOND | 8,634,070.73 | DNIOX |

| DUNHAM US ENHANCED MARKET | 519,163.05 | DASPX |

| DUNHAM US ENHANCED MARKET | 41,597.29 | DCSPX |

| DUNHAM US ENHANCED MARKET | 4,682,585.49 | DNSPX |

The Dunham Funds

Exhibit B

Beneficial ownership of greater than 5% of the Funds' shares as of Record Date

As of the Record Date, the following shareholders owned beneficially 5% or more of the outstanding shares of the Funds.

DUNHAM TRUST COMPANY 200 S VIRGINIA ST, STE 400 RENO, NV 89501 | Holds the following percentages of the class: |

| Dunham Corporate/ Government Bond Fund—Class N | 96% |

| Dunham Corporate/ Government Bond Fund—Class C | 41% |

| Dunham Floating Rate Bond Fund—Class N | 94% |

| Dunham Floating Rate Bond Fund—Class C | 11% |

| Dunham High-Yield Bond Fund—Class N | 91% |

| Dunham High-Yield Bond Fund—Class C | 26% |

| Dunham International Opportunity Bond Fund—Class N | 94% |

| Dunham International Opportunity Bond Fund—Class C | 37% |

| Dunham Large Cap Value Fund—Class N | 92% |

| Dunham Large Cap Value Fund—Class C | 32% |

| Dunham Small Cap Value Fund—Class N | 85% |

| Dunham Small Cap Value Fund—Class C | 40% |

| Dunham Focused Large Cap Growth Fund—Class N | 77% |

| Dunham Focused Large Cap Growth Fund—Class C | 11% |

| Dunham Small Cap Growth Fund—Class N | 85% |

| Dunham Small Cap Growth Fund—Class C | 30% |

| Dunham Emerging Markets Stock Fund—Class N | 95% |

| Dunham Emerging Markets Stock Fund—Class C | 41% |

| Dunham International Stock Fund—Class N | 80% |

| Dunham International Stock Fund—Class C | 32% |

| Dunham Dynamic Macro Fund—Class N | 94% |

| Dunham Dynamic Macro Fund—Class C | 29% |

| Dunham Long/Short Credit Fund—Class N | 84% |

| Dunham Long/Short Credit Fund—Class C | 36% |

| Dunham Monthly Distribution Fund—Class N | 94% |

| Dunham Monthly Distribution Fund—Class C | 11% |

| Dunham Real Estate Stock Fund—Class N | 86% |

| Dunham Real Estate Stock Fund—Class C | 20% |

| Dunham U.S. Enhanced Market Fund—Class N | 94% |

| Dunham U.S. Enhanced Market Fund—Class C | 78% |

| FUND | CLASS | % of CLASS |

| Dunham Monthly Distribution Fund | | |

Midwest Trust Company 5901 College Blvd Ste 100 Leawood KS, 66211 | A | 5% |

| Dunham Floating Rate Bond Fund | | |

Stifel Nicolaus & Company, Inc 501 North Broadway St. Louis, MO 63102 | C | 12% |

Pershing LLC

P.O. Box 2052 Jersey City, NJ 07303 | C | 7% |

| Dunham Small Cap Value Fund | | |

LPL Financial 4707 Executive Drive San Diego, CA 92121 | C | 13% |

| Dunham Dynamic Macro Fund | | |

Kathleen Schanbeck 7282 Parkway CT Canton, MI 48187 | C | 16% |

Barbara Kaluz 180 Middle RD Highland, MI 48357 | C | 7% |

| Dunham Focused Large Cap Growth Fund | | |

LPL Financial 4707 Executive Drive San Diego, CA 92121 | C | 7% |

| Dunham U.S. Enhanced Market Fund | | |

Jeffrey Besnier 11305 Belhaven CT Richmond, VA 23233 | C | 7% |

| Dunham International Opportunity Bond Fund | C | |

Alberta Warner 11 Rivo Altp Canal Long Beach, CA 90803 | | 5% |

| *The shareholders may be contacted c/o Dunham & Associates Investment Counsel, Inc. Compliance Department, 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122 |

The Dunham Funds

Exhibit C

Officers of the Trust

Name,

address

and age | | Position(s) held

with the Trust | | Term of office†

and length of

time served | | Principal occupation(s)

during past 5 years | |

Jeffrey A. Dunham Age: 63 6256 Greenwich Drive, Suite 550, San Diego, CA 92122 | | Trustee, Chairman of Board, President & Principal Executive Officer | | Since 2008 | | Chief Executive Officer, Dunham & Associates Investment Counsel, Inc., (registered investment adviser, Broker-Dealer and distributor for mutual funds), 1985–present; Chief Executive Officer, Dunham & Associates Holdings, Inc. (holding company), 1999–present; Chief Executive Officer, Dunham & Associates Securities, Inc. (general partner for various limited partnerships), 1986–present; Chief Executive Officer, Asset Managers, Inc. (general partner and/or manager of various limited partnerships and/or limited liability companies), 1985–present; Chairman and Chief Executive Officer, Dunham Trust Company, 1999–present. | |

Christine Zou Age: 51 6256 Greenwich Drive, Suite 550, San Diego, CA 92122 | | Treasurer & Principal Financial Officer | | Since 2024 | | Chief Financial Officer, Dunham & Associates Investment Counsel, Inc. (registered investment adviser, Broker-Dealer, and distributor for mutual funds), 2024–present; Chief Financial Officer, Dunham & Associates Holdings, Inc. (holding company), 2024–present; Chief Financial Officer, Dunham & Associates Securities, Inc. (passive member in various private securities), 2024– present; Chief Financial Officer, Dunham Trust Company, 2024–present. | |

Viktoria Palermo, CRCP®, CICCP Age: 46 6256 Greenwich Drive, Suite 550, San Diego, CA 92122 | | Chief Compliance Officer & AML Officer | | Since 2021 | | Chief Compliance Officer, Dunham & Associates, Investment Counsel, Inc. (registered investment adviser, Broker-Dealer and distributor for mutual funds), September 2021– present; Operations Manager (2021), Chief Compliance Officer and AML Officer (2017–2021), Lucia Capital Group. | |

Helmut Boisch Age: 45 6256 Greenwich Drive, Suite 550, San Diego, CA 92122 | | Secretary | | Since 2022 | | Chief Operating Officer, Dunham & Associates, Investment Counsel, Inc. (registered investment adviser, Broker-Dealer and distributor for mutual funds), March 2022–present; Director, Global Head of Vendor Management (2018–2022), Director, Head of Operations Project Management (2017–2018), Vice President, Deputy Chief Compliance Officer (2014–2017), Allianz Global Investors. | |

Ryan Dykmans, CFA Age: 42 6256 Greenwich Drive, Suite 550, San Diego, CA 92122 | | Assistant Secretary | | Since 2015 | | Chief Investment Officer, August 2022–present; Director of Research, (June 2013–July 2022); Senior Investment Analyst from (2009– 2013), Dunham & Associates Investment Counsel, Inc. (registered investment adviser, Broker-Dealer and distributor for mutual funds). | |

James Colantino Gemini Fund Services, LLC 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022-3474 Age: 54 | | Assistant Treasurer | | Since 2008 | | Senior Vice President – Fund Administration, 2012–present; Vice President (2004–2012); Senior Fund Administrator (1999–2004), Gemini Fund Services, LLC. | |

† Each Trustee will serve an indefinite term until his successor, if any, is duly elected and qualified. Officers of the Trust are elected annually.

This page intentionally left blank.

| VOTER PROFILE: |

| Voter ID: | 12345678910 |

| Household ID: | 123456789 |

VOTER CONTROL NUMBER:

1234 5678 9101 1234

YOUR VOTE IS IMPORTANT.

PLEASE CAST YOUR PROXY VOTE TODAY! |

PROXY CARD

The Dunham Funds

SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 16, 2024

The undersigned, revoking all Proxies heretofore given, hereby appoints Jeffrey A. Dunham and Helmut Boisch, each the attorney, agent, and proxy of the undersigned, with full power of substitution, to vote at the Special Meeting of Shareholders of the Dunham Funds to be to be held at 05:30 pm, Pacific time, on December 16, 2024, at the offices of Dunham & Associates Investment Counsel, Inc. 6256 Greenwich Drive, Ste. 550, San Diego, CA 92122, or at any postponement, adjournment or adjournments thereof, with all the powers which the undersigned would possess if personally present, and instructs them to vote in their discretion upon any matters which may properly be acted upon at this Meeting and specifically as indicated on the reverse side of this proxy card.

| Important Notice Regarding the Availability of Proxy Materials: The Notice of the Meeting and Proxy Statement are available at vote.proxyonline.com/dunham/docs/2024meeting.pdf |

The Dunham Funds

NOTE: PLEASE SIGN EXACTLY AS YOUR NAME(S) APPEAR ON THIS PROXY, If joint owners, EITHER may sign this Proxy. When signing as attorney, executor, administrator, trustee, guardian, or custodian for a minor, please give your full title. When signing on behalf of a corporation or as a partner for a partnership, please give the full corporate or partnership name and your title, if any.

| PROXY CARD |

| | |

| | |

| | |

| SIGNATURE (AND TITLE IF APPLICABLE) | DATE |

| | |

| | |

| SIGNATURE (IF HELD JOINTLY) | DATE |

The votes entitled to be cast by the undersigned will be cast according to instructions given below with respect to the Proposal. If this Proxy Ballot is executed but no instructions are given, the undersigned acknowledges that the votes entitled to be cast by the undersigned will be cast by the proxies, or any of them, “FOR” the proposal. Additionally, the votes entitled to be cast by the undersigned will be cast at the discretion of the proxy holder on any other matter that may properly come before the special meeting.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES FOR TRUSTEE TO THE BOARD.

TO VOTE YOUR SHARES FOR ALL DUNHAM FUNDS INDICATED, MARK CIRCLE(S) IN BLUE OR BLACK INK. Example: ●

| The Dunham Funds | |

| | |

| Dunham Corporate/Government Bond Fund | Dunham Emerging Markets Stock Fund |

| Dunham Floating Rate Bond Fund | Dunham International Stock Fund |

| Dunham High-Yield Bond Fund | Dunham Dynamic Macro Fund |

| Dunham International Opportunity Bond Fund | Dunham Long/Short Credit Fund |

| Dunham Large Cap Value Fund | Dunham Monthly Distribution Fund |

| Dunham Small Cap Value Fund | Dunham Real Estate Stock Fund |

| Dunham Focused Large Cap Growth Fund | Dunham US Enhanced Market Fund |

| Dunham Small Cap Growth Fund | |

PROPOSAL: To elect four trustees to the Board of Trustees of the Trust:

(01) Paul A. Rosinack; (02) Michael J. Torvinen; (03) Ray McKewon; (04) Jeffrey A. Dunham

| TO VOTE TRUSTEES AS A GROUP FOR ALL FUNDS. |

| PLEASE MARK THE APPROPRIATE CIRCLE TO VOTE AS A GROUP “FOR ALL” OR “WITHHOLD ALL” FOR ALL TRUSTEES FOR ALL FUNDS. | For ALL

○ | WithHold ALL

○ | For ALL, except

○ |

INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark the box “FOR ALL EXCEPT” and write the nominee’s number on the line provided. _______________________________________________

THANK YOU FOR VOTING

| MAIL ID: |  | |