Exhibit 99.2

February 20, 2009

Q4 2008 Earnings Call

The following information contains forward-looking statements, including forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, statements concerning Colfax's plans, objectives,

expectations and intentions and other statements that are not historical or current facts. Forward-

looking statements are based on Colfax's current expectations and involve risks and uncertainties that

could cause actual results to differ materially from those expressed or implied in such forward-looking

statements. Factors that could cause Colfax's results to differ materially from current expectations

include, but are not limited to factors detailed in Colfax's reports filed with the U.S. Securities and

Exchange Commission as well as its Registration Statement on Form S-1 under the caption “Risk

Factors”. In addition, these statements are based on a number of assumptions that are subject to

change. This presentation speaks only as of this date. Colfax disclaims any duty to update the

information herein.

Forward-Looking Statements

1

Adjusted net income of $17.5 million (40 cents per share), an increase of 19.1%

Net sales of $159.3 million, an increase of 10.9% (organic growth of 19.1%)

Adjusted operating income of $28.6 million, an increase of 14.9%

Adjusted EBITDA of $32.1 million, an increase of 10.8%

Fourth quarter orders of $126.3 million, a decrease of 19.3% (organic decrease of

15.8%)

Record backlog of $337.3 million

Strong performance in 2008

Q4 2008 Highlights

2

Adjusted net income of $53.7 million ($1.22 per share), an increase of 32.8%

Net sales of $604.9 million, an increase of 19.5% (organic growth of 13.9%)

Adjusted operating income of $90.8 million, an increase of 24.5%

Adjusted EBITDA of $105.6 million, an increase of 19.8%

Orders of $669.2 million, an increase of 15.1% (organic growth of 7.0%)

Strong performance in 2008

2008 Highlights

3

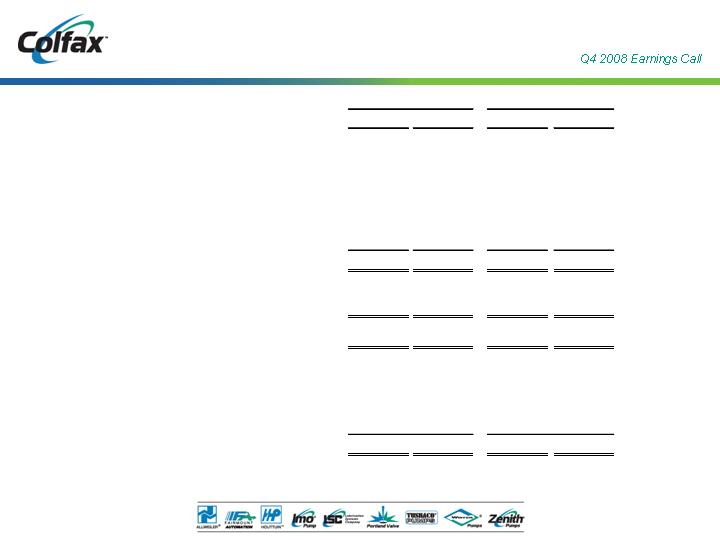

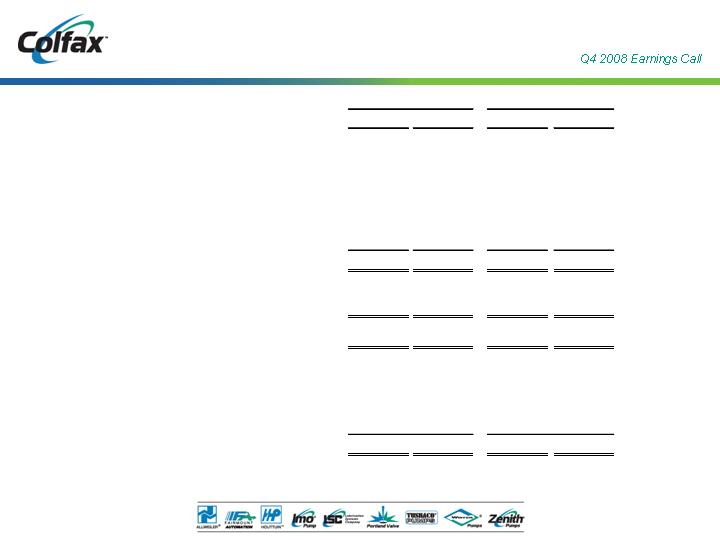

____________________

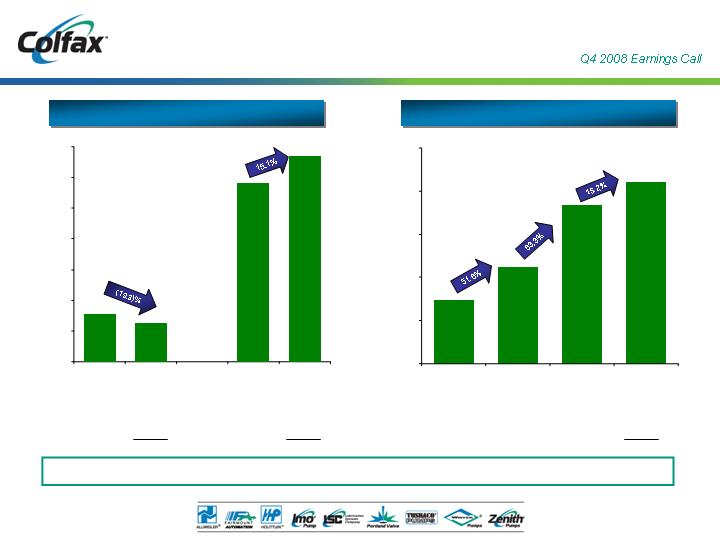

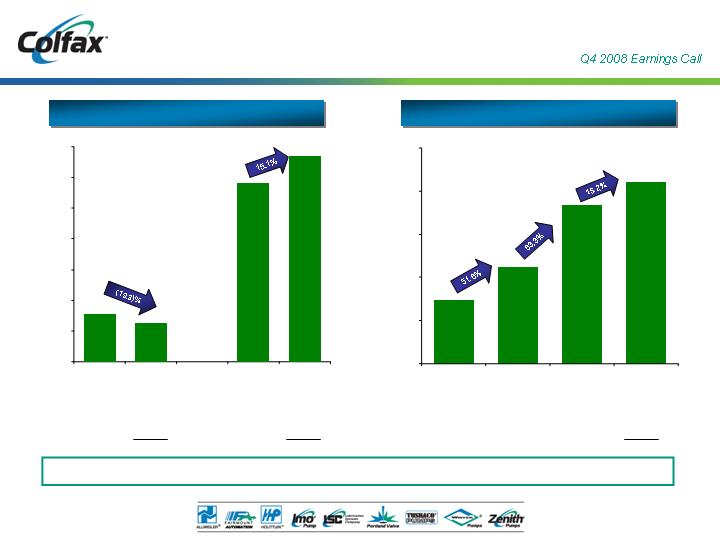

Note: Dollars in millions.

2008

2007

Q4 2008

Q4 2007

$700.0

$600.0

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

$669.2

$581.5

$126.3

$156.5

Orders

Backlog

Steady backlog growth

Orders and Backlog

15.2%

(5.0)%

--

5.2%

--

15.0%

--

15.1%

(19.3)%

Total Growth

6.1%

--

(5.5)%

--

FX Translation

2.0%

--

2.0%

--

Acquisitions

7.0%

--

(15.8)%

--

Existing

Businesses

$179.3

$292.8

$337.3

$118.3

$0.0

$80.0

$160.0

$240.0

$320.0

$400.0

2005

2006

2007

2008

4

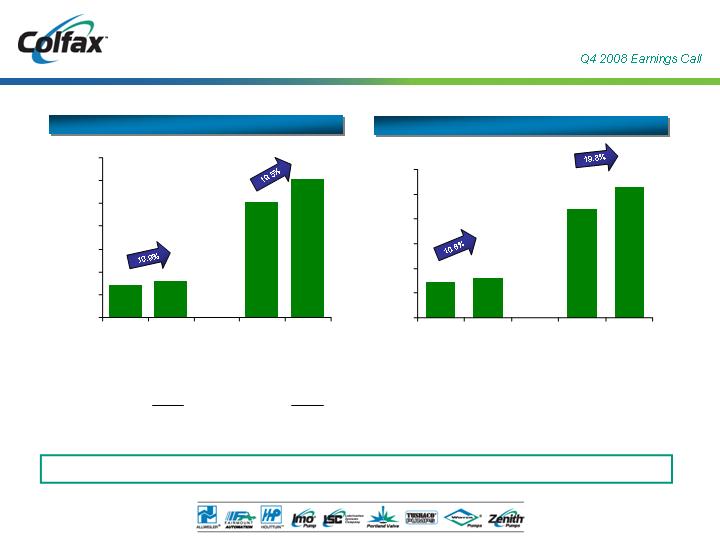

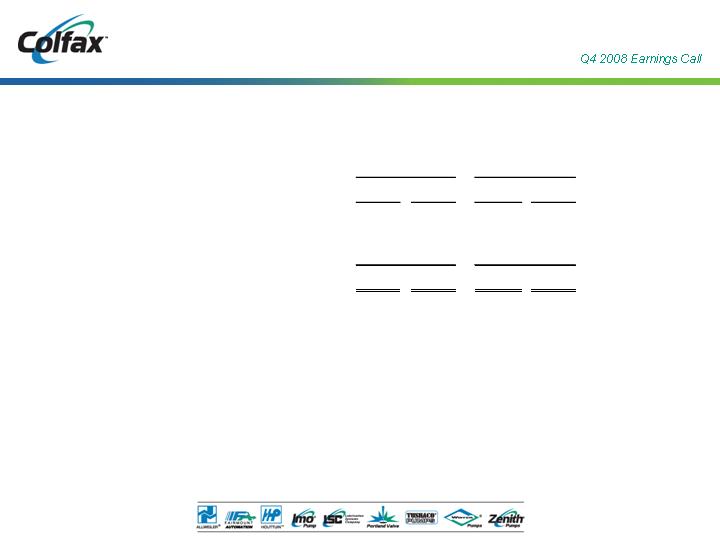

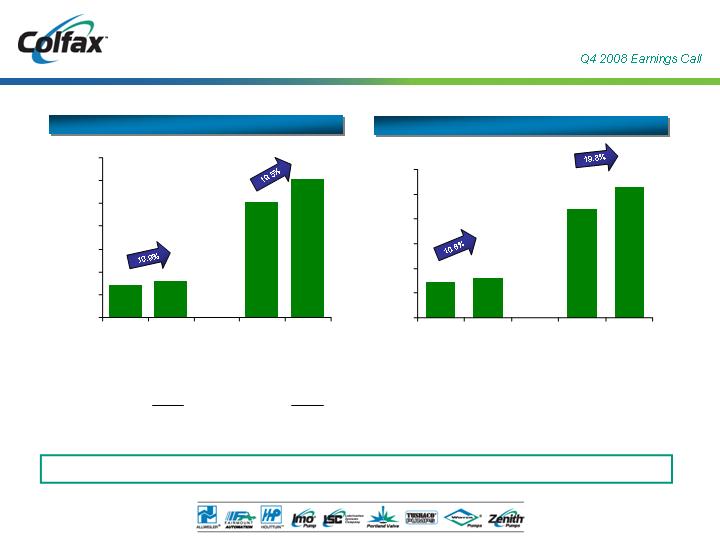

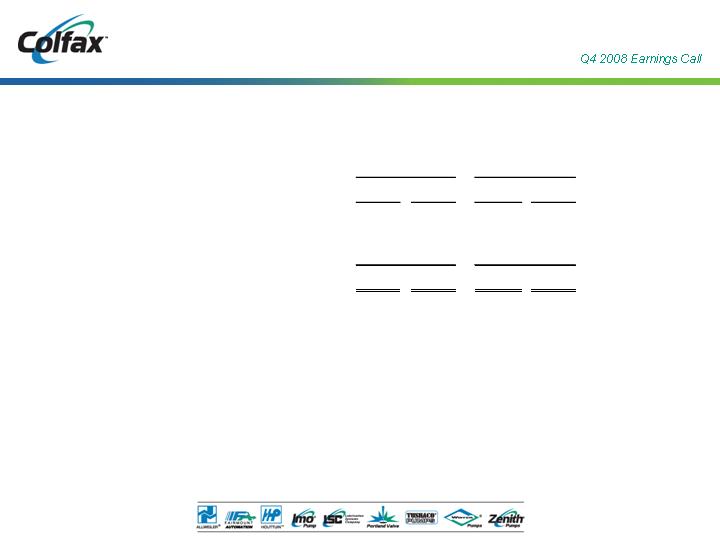

2008

2007

-

Q4 2008

Q4 2007

$700.0

$600.0

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

$604.9

$506.3

$159.3

$143.7

Consistent track record of profitable sales growth

Revenue and Adjusted EBITDA

(1)

Refer to Appendix for Non-GAAP reconciliation.

__________________

Note: Dollars in millions.

19.5%

10.9%

Total Growth

4.5%

--

(8.8)%

--

FX Translation

1.1%

--

0.6%

--

Acquisitions

13.9%

--

19.1%

--

Existing

Businesses

-

17.5%

17.4%

20.1%

20.1%

% Margin

Revenue

Adjusted EBITDA (1)

$28.9

$32.1

$88.2

$105.6

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

Q4 2007

Q4 2008

-

2007

2008

5

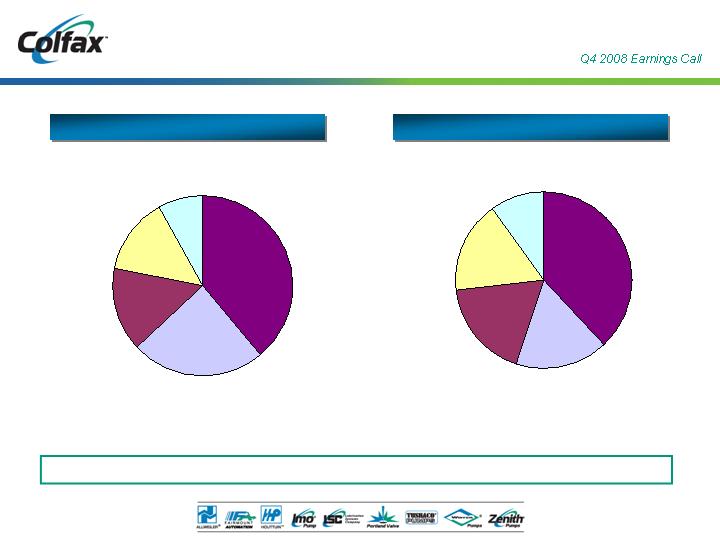

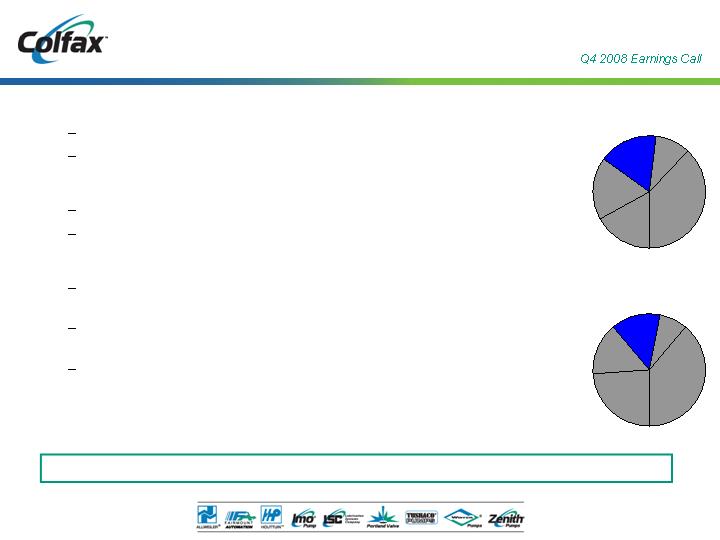

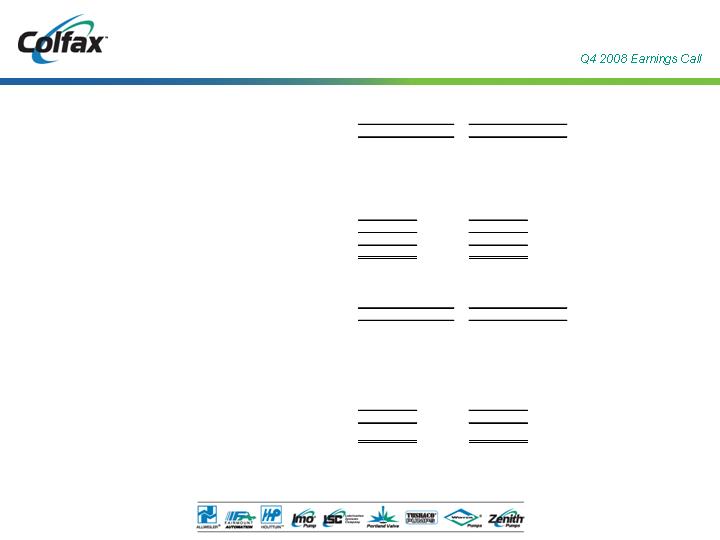

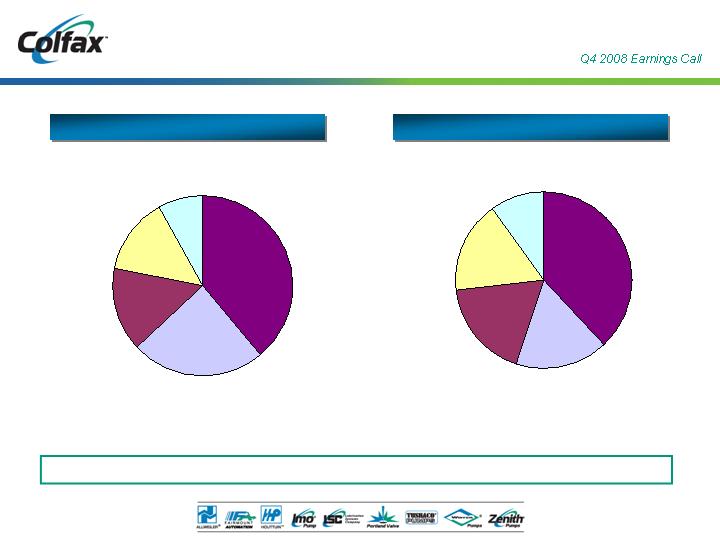

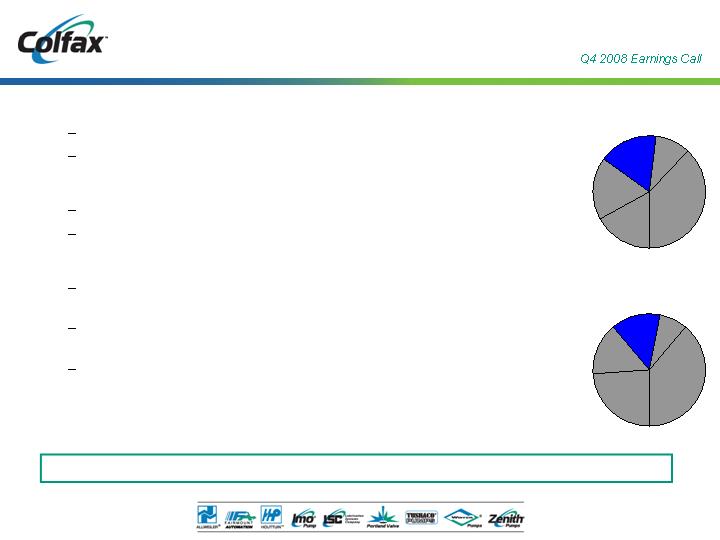

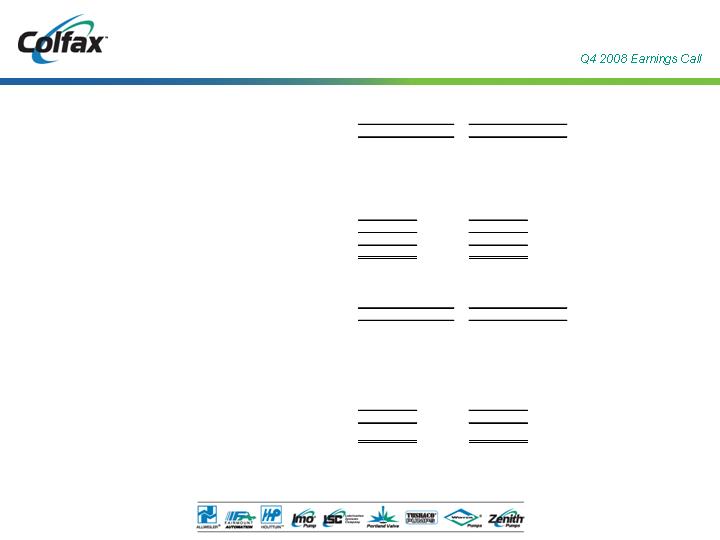

Well positioned in five attractive and diverse end markets

Q4 2008 Sales and Orders by End Market

Q4 2008 Orders: $126.3 million

Q4 2008 Sales: $159.3 million

8%

Global Navy

39%

Industrial

General

24%

Marine

Commercial

15%

Oil & Gas

14%

Generation

Power

Oil & Gas

18%

Commercial

Marine

17%

General

Industrial

38%

Global Navy

10%

Power

Generation

17%

6

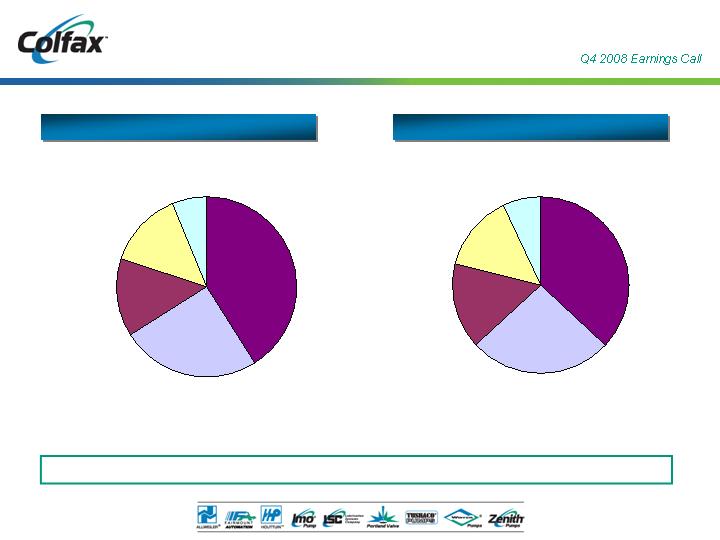

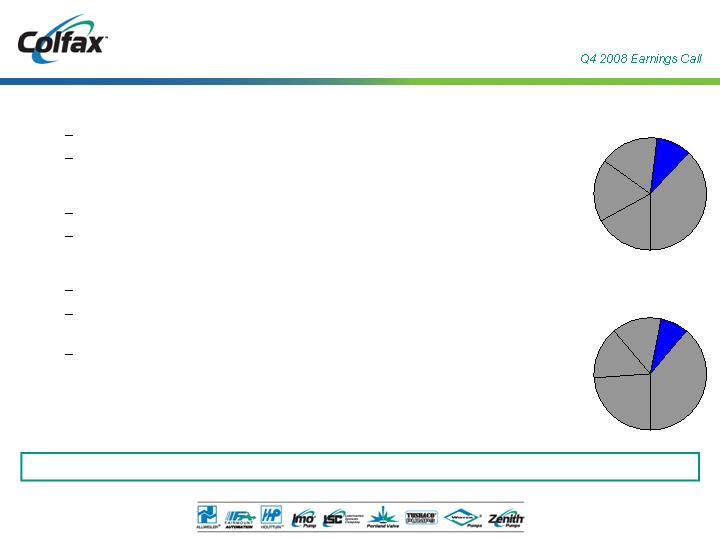

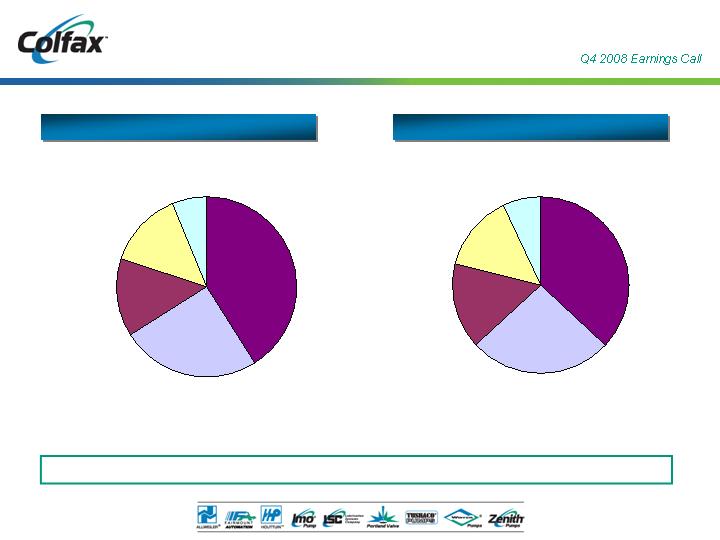

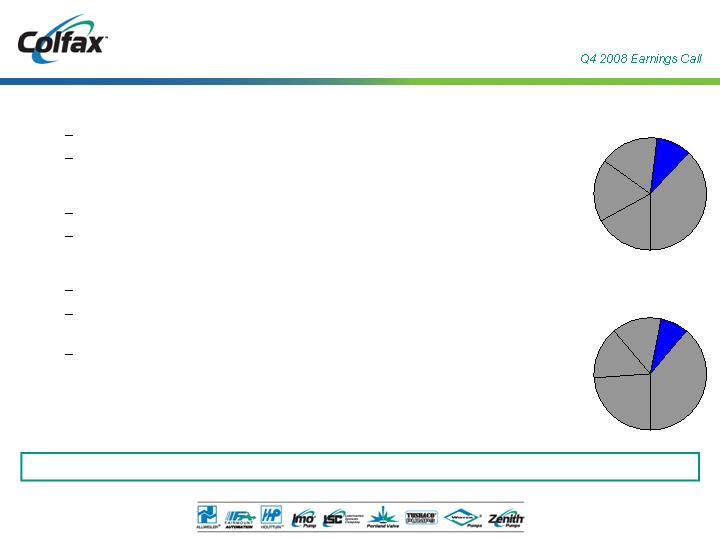

2008 Sales: $604.9 million

2008 Sales and Orders by End Market

Well positioned in five attractive and diverse end markets

2008 Orders: $669.2 million

14%

Generation

Power

6%

Global Navy

41%

Industrial

General

14%

Oil & Gas

25%

Marine

Commercial

Commercial

Marine

26%

Oil & Gas

16%

General

Industrial

37%

Global Navy

7%

Power

Generation

14%

7

Q4 2008 Year-Over-Year Results

Orders down 62.5% year-over-year (-58.2% organic growth)

Sales up 21.4% year-over-year (34.4% organic growth)

2008 Year-Over-Year Results

Orders up 4.9% year-over-year (-2.4% organic growth)

Sales up 24.1% year-over-year (17.1% organic growth)

Market Trends

International trade and demand for bulk commodities and oil continuing to drive

new ship construction

Aging fleet, environmental regulations requiring ship owners to upgrade or

replace ships

Local presence required to effectively serve customers and capture aftermarket

business

Declining orders and risk of potential cancellations/project delays

Executing strategies to drive profitable sales growth

Colfax Q4 08

Orders Split

17%

Comm.

Marine

Colfax Q4 08

Sales Split

24%

Comm.

Marine

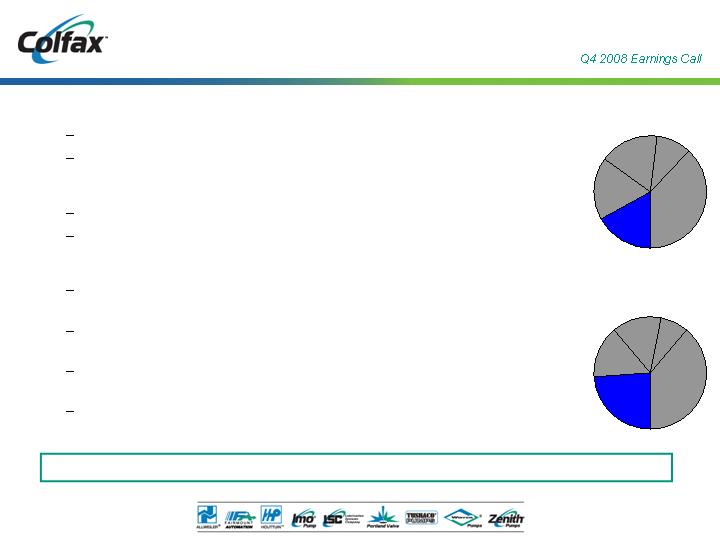

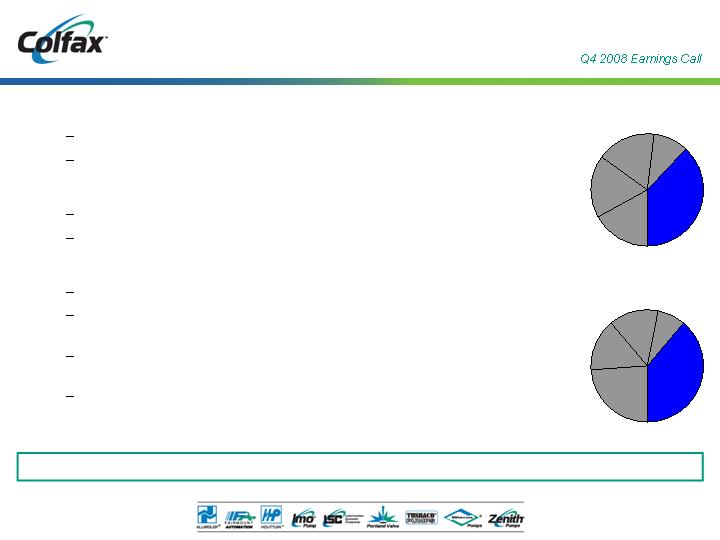

Commercial Marine Market Perspective

8

Strong product portfolio capable of solving needs of evolving oil & gas market

Colfax Q4 08

Orders Split

18%

O&G

Colfax Q4 08

Sales Split

15%

O&G

Q4 2008 Year-Over-Year Results

Orders up 35.8% year-over-year (37.2% organic growth)

Sales up 8.9% year-over-year (10.7% organic growth)

2008 Year-Over-Year Results

Orders up 38.2% year-over-year (33.6% organic growth)

Sales up 4.9% year-over-year (2.1% organic growth)

Market Trends

Capacity constraints and global demand spurring heavy oil exploration,

transport and processing

Customers focusing more on “total cost of ownership” to reduce downtime and

increase efficiency

Application expertise critical to winning large project orders

Volatile oil prices and economic downturn resulting in project delays

Oil & Gas Market Perspective

9

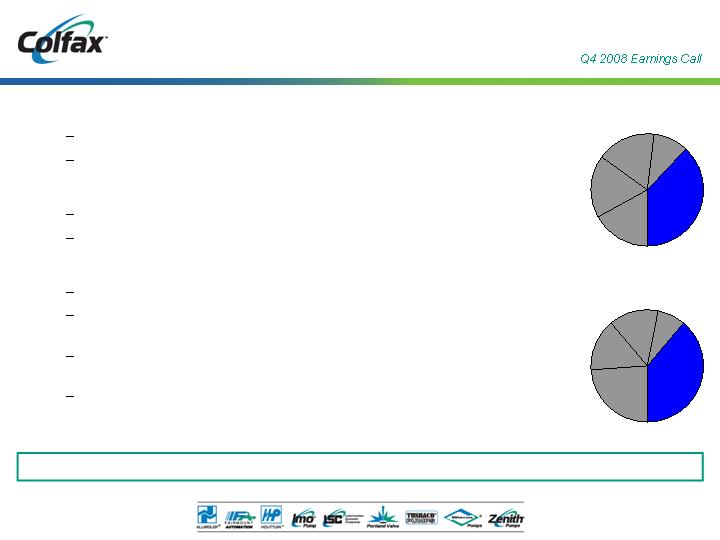

Leading supplier of lubrication solutions to power generation OEMs

Colfax Q4 08

Orders Split

17%

Power

Gen.

Colfax Q4 08

Sales Split

14%

Power

Gen.

Q4 2008 Year-Over-Year Results

Orders up 50.0% year-over-year (59.2% organic growth)

Sales down 8.4% year-over-year (-2.8% organic growth)

2008 Year-Over-Year Results

Orders up 17.6% year-over-year (12.9% organic growth)

Sales up 25.5% year-over-year (21.3% organic growth)

Market Trends

Economic growth in Asia and Middle East driving investment in energy

infrastructure projects

Aging power infrastructure in mature markets creating upgrade projects to

increase efficiency and lower operating costs

Multiple forms of power generation (gas, coal, hydro, nuclear) being employed

to satisfy growing global demand

Power Generation Market Perspective

10

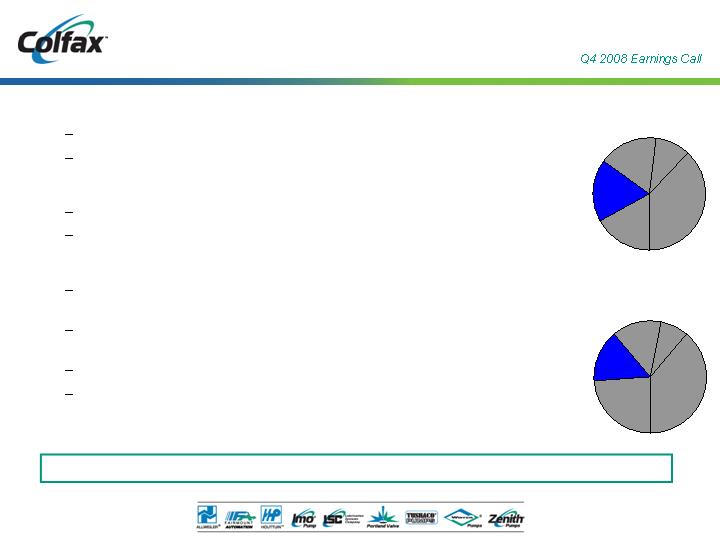

Developing innovative fluid handling products and systems to drive future growth

Colfax Q4 08

Orders Split

10%

Navy

Colfax Q4 08

Sales Split

8%

Navy

Q4 2008 Year-Over-Year Results

Orders up 84.7% year-over-year (38.3% organic growth)

Sales up 26.9% year-over-year (20.1% organic growth)

YTD 2008 Year-Over-Year Results

Orders up 58.0% year-over-year (22.1% organic growth)

Sales up 11.1% year-over-year (-2.3% organic growth)

Market Trends

New ships replacing older decommissioned vessels in the U.S.

Sovereign navies around the world expanding fleets to address heightened

national security level concerns

Increased demand for integrated fluid handling systems and solutions to reduce

operating costs

Global Navy Market Perspective

11

Leading supplier of highly engineered fluid handling products and systems with global reach

Colfax Q4 08

Orders Split

Colfax Q4 08

Sales Split

39%

General

Industrial

Q4 2008 Year-Over-Year Results

Orders down 22.2% year-over-year (-14.7% organic growth)

Sales up 11.0% year-over-year (22.8% organic growth)

2008 Year-Over-Year Results

Orders up 8.4% year-over-year (1.0% organic growth)

Sales up 21.9% year-over-year (16.9% organic growth)

Market Trends

Global economic development driving increased capital investment

Developing regions embracing engineered products and solutions that reduce

costs and increase efficiency

Global footprint and channel optimization required to cover broad end market

applications

Uncertain economy impacting some end markets

38%

General

Industrial

General Industrial Perspective

12

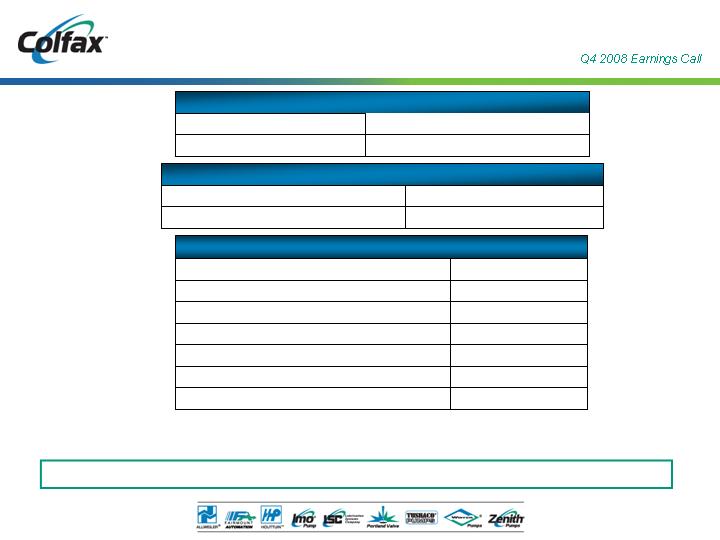

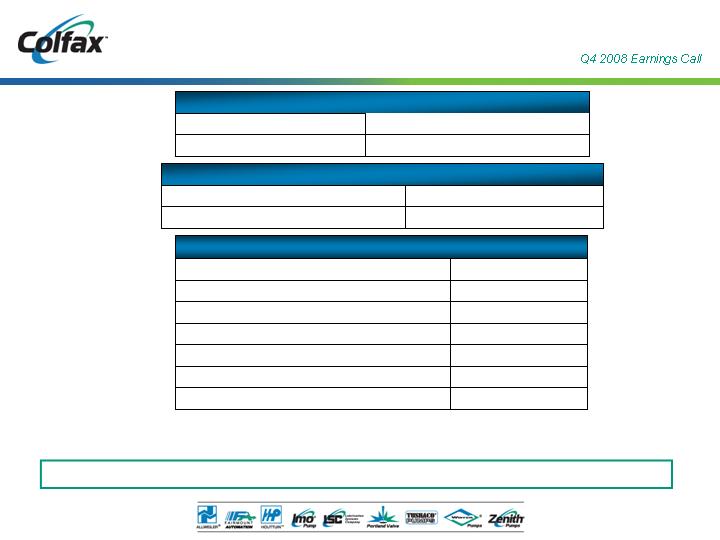

Refer to Appendix for Non-GAAP reconciliation.

__________________

Note: Dollars in millions.

Income Statement Summary

Three Months Ended

Delta

12/31/2008

12/31/2007

$

%

Orders

$ 126.3

$ 156.5

$ (30.2)

-19.3%

Sales

$ 159.3

$ 143.7

$ 15.6

10.9%

Gross Profit

$ 57.8

$ 49.2

$ 8.5

17.4%

% of Sales

36.3%

34.2%

SG&A Expense

$ 27.7

$ 23.2

$ 4.5

19.4%

R&D Expense

1.4

1.1

0.3

31.2%

Operating Expenses

$ 29.1

$ 24.3

$ 4.8

19.9%

% of Sales

18.3%

16.9%

Adjusted Operating Income

$ 28.6

$ 24.9

$ 3.7

14.9%

% of Sales

18.0%

17.3%

Adusted EBITDA

$ 32.1

$ 28.9

$ 3.1

10.8%

% of Sales

20.1%

20.1%

Adjusted Net Income

$ 17.5

$ 14.7

$ 2.8

19.1%

% of Sales

11.0%

10.2%

13

Refer to Appendix for Non-GAAP reconciliation.

__________________

Note: Dollars in millions.

Income Statement Summary

Delta

12/31/2008

12/31/2007

$

%

Orders

$ 669.2

$ 581.5

$ 87.7

15.1%

Sales

$ 604.9

$ 506.3

$ 98.6

19.5%

Gross Profit

$ 217.2

$ 175.6

$ 41.6

23.7%

% of Sales

35.9%

34.7%

Adjusted SG&A Expense

$ 120.5

$ 98.5

$ 22.0

22.4%

R&D Expense

5.9

4.2

1.7

40.7%

Operating Expenses

$ 126.4

$ 102.7

$ 23.7

23.1%

% of Sales

20.9%

20.3%

Adjusted Operating Income

$ 90.8

$ 72.9

$ 17.9

24.5%

% of Sales

15.0%

14.4%

Adusted EBITDA

$ 105.6

$ 88.2

$ 17.4

19.8%

% of Sales

17.5%

17.4%

Adjusted Net Income

$ 53.7

$ 40.4

$ 13.2

32.8%

% of Sales

8.9%

8.0%

Year Ended

14

____________________

Note: Dollars in millions.

Statement of Cash Flows Summary

(Preliminary & Unaudited)

Year Ended

December 31,

2008

2007

Net (Loss) Income

(0.6)

$

64.9

$

Non-Cash Expenses

18.4

39.0

Change in Working Capital and Accrued Liabilities

(27.7)

3.3

Other

(21.6)

(32.7)

Total Operating Activities

(31.5)

$

74.5

$

Capital Expenditures

(20.1)

$

(13.6)

$

Acquisitions

(0.4)

(33.0)

Proceeds from Sale of Fixed Assets

-

0.1

Total Investing Activities

(20.5)

$

(46.5)

$

Net Borrowings

(110.3)

$

14.7

$

Proceeds from IPO, Net of Offering Costs

193.0

-

Dividends Paid

(38.5)

-

Common Stock Repurchases

(5.7)

-

Other

(3.7)

(3.0)

Total Financing Activities

34.8

$

11.7

$

Effect of Exchange Rates on Cash

(2.1)

0.8

(Decrease) Increase in Cash

(19.3)

40.5

Cash Beginning of Period

48.1

7.6

Cash End of Period

28.8

$

48.1

$

15

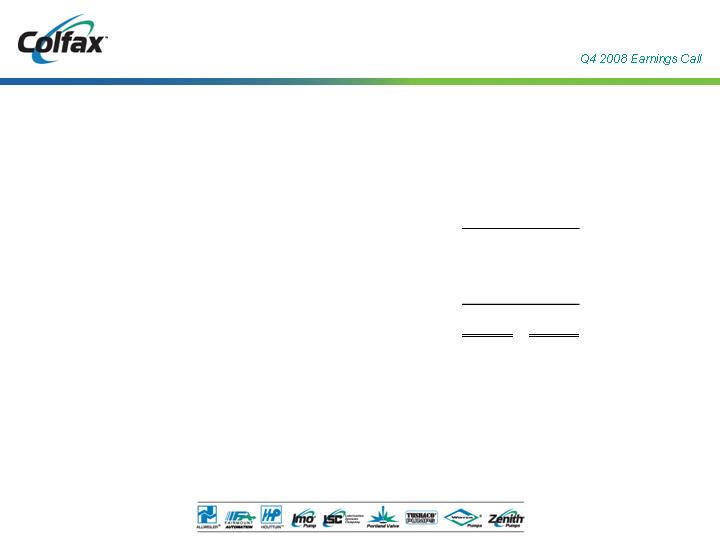

Strong Financial Condition(1)

Debt to adjusted EBITDA < 1 times

Approximately $130 million available on revolver (expires in 2013)

Approximately $29 million in cash

Strong balance sheet and credit availability provide flexibility

(1) As of FYE 2008

16

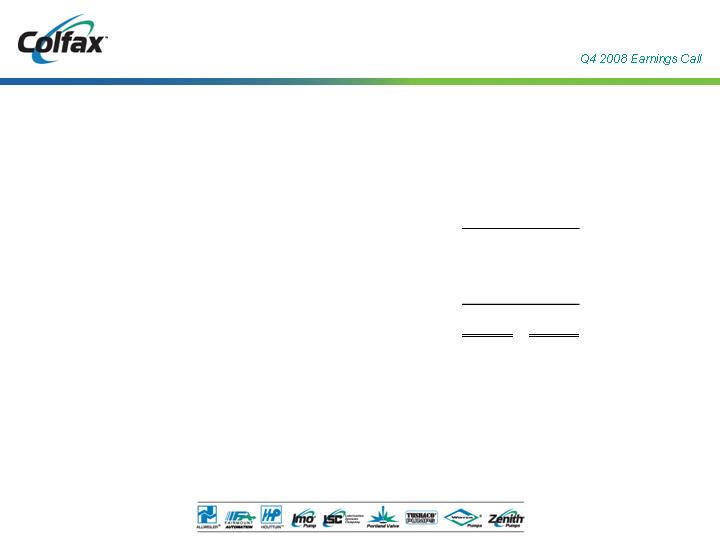

Adjusted EPS for 2009 of $1.10 to $1.17

2009 Outlook Summary

$585 million

to

$570 million

2009 Total

3%

to

1%

2009 Organic growth (1)

Revenue Range

$1.17

to

$1.10

2009 Adjusted net income per share (2)

$0.87

to

$0.80

2009 Net income per share

EPS Range

(1) Excludes impact of foreign exchange rate fluctuations and acquisitions

(2) Excludes impact of asbestos coverage litigation and asbestos liability and defense costs

(See Appendix for Non-GAAP reconciliation)

$2.5 million

Incremental public company costs

43.3 million

Outstanding shares

$8 million

Interest expense

32%

Tax rate

$1.41

Euro

$7 million

Asbestos liability and defense costs

$12 million

Asbestos coverage litigation

Assumptions

17

Well Positioned for the Future

Leading Brand Names

Generating Aftermarket

Sales and Services

Experienced Management

Team in Place to Grow

Organically and Through

Strategic Acquisitions

Global Leader in Specialty

Fluid Handling Products

Proven Application

Expertise in Solving

Critical Customer Needs

Serving Fast

Growing Infrastructure

Driven End Markets

CBS-Driven Culture Focused

on Profitable Sales Growth

18

Appendix

19

Adjusted net income, adjusted net income per share, adjusted operating income, EBITDA, adjusted EBITDA, adjusted

selling, general and administrative expenses, organic sales growth and organic order growth are non-GAAP financial

measures. Adjusted net income, adjusted net income per share, adjusted operating income and adjusted EBITDA

exclude asbestos liability and defense cost (income) and asbestos coverage litigation expense, certain legacy legal

charges, certain due diligence costs, as well as one time initial public offering-related costs. Adjusted selling, general

and administrative expenses exclude certain legacy legal charges and certain due diligence costs. Adjusted net income

also reflects interest expense as if the initial public offering (IPO) had occurred at the beginning of 2007 and presents

income taxes at an effective tax rate of 34%. Adjusted net income per share assumes the 44,006,026 shares outstanding

at the closing of the IPO to be outstanding since January 1, 2007. Projected adjusted net income per share excludes

asbestos coverage litigation and asbestos liability and defense costs, and presents income tax benefit at 32%. Organic

sales growth and organic order growth exclude the impact of acquisitions and foreign exchange rate fluctuations. These

non-GAAP financial measures assist Colfax in comparing its operating performance on a consistent basis because,

among other things, they remove the impact of changes in our capital structure and asset base, non-recurring items

such as IPO-related costs, legacy asbestos issues (except in the case of EBITDA) and items outside the control of its

operating management team.

Sales and order information by end market are estimates. We periodically update our customer groupings in order to

refine these estimates. During the fourth quarter of 2008, reclassifications of previously reported amounts were made to

conform to current period presentation. No changes have been made to total sales or orders.

Disclaimer

20

____________________

Note: Dollars in thousands.

Non-GAAP Reconciliation

December 31,

December 31,

December 31,

December 31,

2008

2007

2008

2007

EBITDA

Net income (loss)

10,379

$

28,992

$

(571)

$

64,882

$

Interest expense

2,138

4,830

11,822

19,246

Provision for income taxes

9,210

17,715

5,438

39,147

Depreciation and amortization

3,443

4,034

14,788

15,239

EBITDA

25,170

$

55,571

$

31,477

$

138,514

$

EBITDA margin

15.8%

38.7%

5.2%

27.4%

Adjusted EBITDA

Net income (loss)

10,379

$

28,992

$

(571)

$

64,882

$

Interest expense

2,138

4,830

11,822

19,246

Provision for income taxes

9,210

17,715

5,438

39,147

Depreciation and amortization

3,443

4,034

14,788

15,239

IPO-related costs

-

-

57,017

-

Legacy legal adjustment

-

-

4,131

-

Due diligence costs

-

-

582

-

Asbestos liability and defense (income) costs

1,978

(31,946)

(4,771)

(63,978)

Asbestos coverage litigation expense

4,905

5,314

17,162

13,632

Adjusted EBITDA

32,053

$

28,939

$

105,598

$

88,168

$

Adjusted EBITDA margin

20.1%

20.1%

17.5%

17.4%

Three Months Ended

Year Ended

21

____________________

Note: Dollars in thousands, except per share amounts.

Non-GAAP Reconciliation

December 31,

December 31,

December 31,

December 31,

2008

2007

2008

2007

Adjusted Net Income and Adjusted Earnings per Share

Net income (loss)

10,379

$

28,992

$

(571)

$

64,882

$

IPO-related costs

-

-

57,017

-

Legacy legal adjustment

-

-

4,131

-

Due diligence costs

-

-

582

-

Asbestos liability and defense (income) costs

1,978

(31,946)

(4,771)

(63,978)

Asbestos coverage litigation expense

4,905

5,314

17,162

13,632

Interest adjustment to effect IPO at beginning of period

-

2,143

2,302

7,536

Tax adjustment to 34% effective rate

210

10,161

(22,201)

18,333

Adjusted net income

17,472

$

14,664

$

53,651

$

40,405

$

Adjusted net income margin

11.0%

10.2%

8.9%

8.0%

Shares outstanding at closing of IPO

44,006,026

44,006,026

44,006,026

44,006,026

Adjusted net income per share

0.40

$

0.33

$

1.22

$

0.92

$

Net income (loss) per share-basic

and diluted in accordance with GAAP

0.24

$

0.77

$

(0.11)

$

1.79

$

Adjusted Operating Income

Operating income

21,727

$

51,537

$

16,689

$

123,275

$

IPO-related costs

-

-

57,017

-

Legacy legal adjustment

-

-

4,131

-

Due diligence costs

-

-

582

-

Asbestos liability and defense (income) costs

1,978

(31,946)

(4,771)

(63,978)

Asbestos coverage litigation expense

4,905

5,314

17,162

13,632

Adjusted operating income

28,610

$

24,905

$

90,810

$

72,929

$

Adjusted operating income margin

18.0%

17.3%

15.0%

14.4%

Three Months Ended

Year Ended

22

____________________

Note: Dollars in thousands.

Non-GAAP Reconciliation

December 31,

December 31,

December 31,

December 31,

2008

2007

2008

2007

Adjusted SG&A Expense

Selling, general and administrative expenses

27,718

$

23,223

$

125,234

$

98,500

$

Legacy legal adjustment

-

-

4,131

-

Due diligence costs

-

-

582

-

Adjusted selling, general and administrative expenses

27,718

$

23,223

$

120,521

$

98,500

$

Three Months Ended

Year Ended

23

____________________

Note: Dollars in millions.

Sales & Order Growth

$

%

$

%

Three Months Ended December 31, 2007

143.7

$

156.5

$

Components of Growth:

Organic growth from existing businesses

27.4

19.1%

(24.7)

(15.8%)

Acquisitions

0.8

0.6%

3.1

2.0%

Foreign currency translation

(12.6)

(8.8%)

(8.6)

(5.5%)

Total Growth

15.6

10.9%

(30.2)

(19.3%)

Three Months Ended December 31, 2008

159.3

$

126.3

$

$

%

$

%

Year Ended December 31, 2007

506.3

$

581.5

$

Components of Growth:

Organic growth from existing businesses

70.2

13.9%

40.9

7.0%

Acquisitions

5.5

1.1%

11.7

2.0%

Foreign currency translation

22.9

4.5%

35.1

6.1%

Total Growth

98.6

19.5%

87.7

15.1%

Year Ended December 31, 2008

604.9

$

669.2

$

Sales

Orders

Sales

Orders

24

Non-GAAP Reconciliation

Projected 2009 net income per share - fully diluted

0.80

$

0.87

$

Asbestos coverage litigation

0.28

0.28

Asbestos liability and defense costs

0.16

0.16

Income tax benefit at 32%

(0.14)

(0.14)

Projected 2009 adjusted net income per share - fully diluted

$ 1.10

$ 1.17

EPS Range

25