UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2020

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36779

On Deck Capital, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 42-1709682 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1400 Broadway, 25th Floor

New York, New York 10018

(Address of principal executive offices)

(888) 269-4246

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.005 per share | ONDK | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data file required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ý NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

| Emerging growth company | ¨ | |||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO ý

The number of shares of the registrant’s common stock outstanding as of April 30, 2020 was 58,423,600.

On Deck Capital, Inc.

Table of Contents

| Page | ||

| Item 1. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| Item 1. | ||

| Item 1A | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| Item 5. | ||

| Item 6. | ||

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

| March 31, | December 31, | ||||||

| 2020 | 2019 | ||||||

| Assets | |||||||

| Cash and cash equivalents | $ | 121,148 | $ | 56,344 | |||

| Restricted cash | 29,094 | 40,524 | |||||

| Loans and finance receivables | 1,291,586 | 1,265,312 | |||||

| Less: Allowance for credit losses | (205,703 | ) | (151,133 | ) | |||

| Loans and finance receivables, net | 1,085,883 | 1,114,179 | |||||

| Property, equipment and software, net | 23,714 | 20,332 | |||||

| Other assets | 77,339 | 73,204 | |||||

| Total assets | $ | 1,337,178 | $ | 1,304,583 | |||

| Liabilities, mezzanine equity and stockholders' equity | |||||||

| Liabilities: | |||||||

| Accounts payable | $ | 6,804 | $ | 6,470 | |||

| Interest payable | 3,100 | 2,334 | |||||

| Debt | 1,043,924 | 914,995 | |||||

| Accrued expenses and other liabilities | 56,834 | 70,110 | |||||

| Total liabilities | 1,110,662 | 993,909 | |||||

| Commitments and contingencies (Note 13) | |||||||

| Mezzanine equity: | |||||||

| Redeemable noncontrolling interest | 13,112 | 14,428 | |||||

| Stockholders’ equity: | |||||||

| Common stock—$0.005 par value, 1,000,000,000 shares authorized and 80,247,423 and 80,095,061 shares issued and 58,419,304 and 66,363,555 outstanding at March 31, 2020 and December 31, 2019, respectively. | 406 | 405 | |||||

| Treasury stock—at cost | (82,503 | ) | (49,641 | ) | |||

| Additional paid-in capital | 514,785 | 513,571 | |||||

| Accumulated deficit | (217,509 | ) | (169,002 | ) | |||

| Accumulated other comprehensive loss | (2,923 | ) | (1,333 | ) | |||

| Total On Deck Capital, Inc. stockholders' equity | 212,256 | 294,000 | |||||

| Noncontrolling interest | 1,148 | 2,246 | |||||

| Total stockholders' equity | 213,404 | 296,246 | |||||

| Total liabilities, mezzanine equity and stockholders' equity | $ | 1,337,178 | $ | 1,304,583 | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(in thousands, except share and per share data)

| Three Months Ended March 31, | |||||||

| 2020 | 2019 | ||||||

| Interest and finance income | $ | 106,935 | $ | 105,799 | |||

| Interest expense | 11,569 | 11,332 | |||||

| Net interest income | 95,366 | 94,467 | |||||

| Provision for credit losses | 107,907 | 43,291 | |||||

| Net interest income (loss), after credit provision | (12,541 | ) | 51,176 | ||||

| Other revenue | 3,620 | 4,176 | |||||

| Operating expense: | |||||||

| Sales and marketing | 11,664 | 11,960 | |||||

| Technology and analytics | 16,484 | 16,806 | |||||

| Processing and servicing | 6,689 | 5,489 | |||||

| General and administrative | 16,280 | 14,029 | |||||

| Total operating expense | 51,117 | 48,284 | |||||

| Income (loss) from operations, before provision for income taxes | (60,038 | ) | 7,068 | ||||

| Provision for (Benefit from) income taxes | — | 1,740 | |||||

| Net income (loss) | (60,038 | ) | 5,328 | ||||

| Less: Net income (loss) attributable to noncontrolling interest | (1,063 | ) | (338 | ) | |||

| Net income (loss) attributable to On Deck Capital, Inc. common stockholders | $ | (58,975 | ) | $ | 5,666 | ||

| Net income (loss) per share attributable to On Deck Capital, Inc. common stockholders: | |||||||

| Basic | $ | (0.94 | ) | $ | 0.08 | ||

| Diluted | $ | (0.94 | ) | $ | 0.07 | ||

| Weighted-average common shares outstanding: | |||||||

| Basic | 62,534,517 | 75,539,535 | |||||

| Diluted | 62,534,517 | 79,115,037 | |||||

| Comprehensive income (loss): | |||||||

| Net income (loss) | $ | (60,038 | ) | $ | 5,328 | ||

| Other comprehensive income (loss): | |||||||

| Foreign currency translation adjustment | (3,213 | ) | 366 | ||||

| Unrealized gain (loss) on derivative instrument | 270 | (742 | ) | ||||

| Comprehensive income (loss) | (62,981 | ) | 4,952 | ||||

| Less: Comprehensive income (loss) attributable to noncontrolling interests | (1,353 | ) | 26 | ||||

| Less: Net income (loss) attributable to noncontrolling interest | (1,063 | ) | (338 | ) | |||

| Comprehensive income (loss) attributable to On Deck Capital, Inc. common stockholders | $ | (60,565 | ) | $ | 5,264 | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Changes in Equity and Redeemable Noncontrolling Interest(in thousands, except share data)

| On Deck Capital, Inc.'s stockholders' equity | |||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Deficit | Treasury Stock | Accumulated Other Comprehensive Income (Loss) | Total Stockholders' Equity | Noncontrolling interest | Total Equity | Redeemable Noncontrolling Interest | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||||||

| Balance—December 31, 2018 | 75,375,341 | $ | 396 | $ | 502,003 | $ | (196,959 | ) | $ | (5,656 | ) | $ | (1,832 | ) | $ | 297,952 | $ | 4,533 | $ | 302,485 | $ | — | |||||||||||||||||

| Stock-based compensation | — | — | 2,743 | — | — | — | 2,743 | — | 2,743 | — | |||||||||||||||||||||||||||||

| Issuance of common stock through vesting of restricted stock units and option exercises | 264,364 | 2 | 45 | — | — | — | 47 | — | 47 | — | |||||||||||||||||||||||||||||

| Employee stock purchase plan | 267,688 | 1 | 1,659 | — | — | — | 1,660 | — | 1,660 | — | |||||||||||||||||||||||||||||

| Tax withholding related to vesting of restricted stock units | — | — | (291 | ) | — | — | — | (291 | ) | — | (291 | ) | — | ||||||||||||||||||||||||||

| Currency translation adjustment | — | — | — | — | — | 340 | 340 | 26 | 366 | — | |||||||||||||||||||||||||||||

| Cash flow hedge and other | — | — | — | — | — | (742 | ) | (742 | ) | — | (742 | ) | — | ||||||||||||||||||||||||||

| Net Income (loss) | — | — | — | 5,666 | — | — | 5,666 | (338 | ) | 5,328 | — | ||||||||||||||||||||||||||||

| Balance—March 31, 2019 | 75,907,393 | $ | 399 | $ | 506,159 | $ | (191,293 | ) | $ | (5,656 | ) | $ | (2,234 | ) | $ | 307,375 | $ | 4,221 | $ | 311,596 | $ | — | |||||||||||||||||

| Balance—December 31, 2019 | 66,363,555 | $ | 405 | $ | 513,571 | $ | (169,002 | ) | $ | (49,641 | ) | $ | (1,333 | ) | $ | 294,000 | $ | 2,246 | $ | 296,246 | $ | 14,428 | |||||||||||||||||

| Transition to ASU 2016-13 Adjustment | — | — | — | 10,468 | — | — | 10,468 | — | 10,468 | — | |||||||||||||||||||||||||||||

| Stock-based compensation | — | — | 1,738 | — | — | — | 1,738 | — | 1,738 | — | |||||||||||||||||||||||||||||

| Issuance of common stock through vesting of restricted stock units and option exercises | 152,362 | 1 | 15 | — | — | — | 16 | — | 16 | — | |||||||||||||||||||||||||||||

| Employee stock purchase plan | — | — | (310 | ) | — | — | — | (310 | ) | — | (310 | ) | — | ||||||||||||||||||||||||||

| Repurchases of Common Stock | (8,096,613 | ) | — | — | — | (32,862 | ) | — | (32,862 | ) | — | (32,862 | ) | — | |||||||||||||||||||||||||

| Tax withholding related to vesting of restricted stock units | — | — | (229 | ) | — | — | — | (229 | ) | — | (229 | ) | — | ||||||||||||||||||||||||||

| Currency translation adjustment | — | — | — | — | — | (1,860 | ) | (1,860 | ) | (253 | ) | (2,113 | ) | (1,100 | ) | ||||||||||||||||||||||||

| Cash flow hedge and other | — | — | — | — | — | 270 | 270 | 2 | 272 | — | |||||||||||||||||||||||||||||

| Net Income (loss) | — | — | — | (58,975 | ) | — | — | (58,975 | ) | (847 | ) | (59,822 | ) | (216 | ) | ||||||||||||||||||||||||

| Balance—March 31, 2020 | 58,419,304 | $ | 406 | $ | 514,785 | $ | (217,509 | ) | $ | (82,503 | ) | $ | (2,923 | ) | $ | 212,256 | $ | 1,148 | $ | 213,404 | $ | 13,112 | |||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

| Three Months Ended March 31, | |||||||

| 2020 | 2019 | ||||||

| Cash flows from operating activities | |||||||

| Net income (loss) | $ | (60,038 | ) | $ | 5,328 | ||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||

| Provision for credit losses | 107,907 | 43,291 | |||||

| Depreciation and amortization | 1,630 | 1,748 | |||||

| Amortization of debt issuance costs | 955 | 802 | |||||

| Stock-based compensation | 1,416 | 2,743 | |||||

| Amortization of net deferred origination costs | 15,544 | 17,832 | |||||

| Changes in servicing rights, at fair value | — | 69 | |||||

| Unfunded loan commitment reserve | — | 48 | |||||

| Loss on disposal of fixed assets | — | 674 | |||||

| Amortization of intangibles | 122 | — | |||||

| Changes in operating assets and liabilities: | |||||||

| Other assets | (5,177 | ) | (3,781 | ) | |||

| Accounts payable | 518 | 859 | |||||

| Interest payable | 781 | 369 | |||||

| Accrued expenses and other liabilities | (6,249 | ) | (1,007 | ) | |||

| Net cash provided by operating activities | 57,409 | 68,975 | |||||

| Cash flows from investing activities | |||||||

| Purchases of property, equipment and software | (2,370 | ) | (536 | ) | |||

| Capitalized internal-use software | (2,766 | ) | (1,379 | ) | |||

| Originations of loans and finance receivables, excluding rollovers into new originations | (510,613 | ) | (537,147 | ) | |||

| Payments of net deferred origination costs | (17,030 | ) | (18,529 | ) | |||

| Principal repayments of loans and finance receivables | 426,014 | 469,894 | |||||

| Net cash used in investing activities | (106,765 | ) | (87,697 | ) | |||

| Cash flows from financing activities | |||||||

| Tax withholding related to vesting of restricted stock units | (229 | ) | (291 | ) | |||

| Repurchases of common stock | (32,862 | ) | — | ||||

| Proceeds from exercise of stock options | 15 | 45 | |||||

| Issuance of common stock under employee stock purchase plan | — | 1,281 | |||||

| Proceeds from the issuance of debt | 261,743 | 210,789 | |||||

| Payments of debt issuance costs | (155 | ) | (3,097 | ) | |||

| Repayments of debt principal | (126,323 | ) | (182,849 | ) | |||

| Net cash (used in) provided by financing activities | 102,189 | 25,878 | |||||

| Effect of exchange rate changes on cash and cash equivalents | 541 | (77 | ) | ||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | 53,374 | 7,079 | |||||

| Cash and cash equivalents at beginning of period | 96,868 | 97,638 | |||||

| Cash and cash equivalents at end of period | $ | 150,242 | $ | 104,717 | |||

| Reconciliation to amounts on consolidated balance sheets | |||||||

| Cash and cash equivalents | $ | 121,148 | $ | 60,085 | |||

| Restricted cash | 29,094 | 44,632 | |||||

6

| Three Months Ended March 31, | |||||||

| 2020 | 2019 | ||||||

| Total cash, cash equivalents and restricted cash | $ | 150,242 | $ | 104,717 | |||

| Supplemental disclosure of other cash flow information | |||||||

| Cash paid for interest | $ | 9,582 | $ | 9,887 | |||

| Cash paid for income taxes | $ | 30 | $ | — | |||

| Supplemental disclosures of non-cash investing and financing activities | |||||||

| Stock-based compensation included in capitalized internal-use software | $ | 14 | $ | 57 | |||

| Unpaid principal balance of term loans rolled into new originations | $ | 79,740 | $ | 98,481 | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. Organization and Summary of Significant Accounting Policies

On Deck Capital, Inc.’s principal activity is providing financing to small businesses located throughout the United States as well as Canada and Australia, through term loans, lines of credit, equipment finance loans and additionally in Canada through a variable pay product. We use technology and analytics to aggregate data about a business and then quickly and efficiently analyze the creditworthiness of the business using our proprietary credit-scoring model. We originate most of the loans in our portfolio and also purchase loans from an issuing bank partner. We subsequently transfer most of our loan volume into one of our wholly-owned subsidiaries for financing purposes.

In October 2018, we announced the launch of ODX, a wholly-owned subsidiary that helps banks digitize their small business lending process. ODX offers a combination of software, analytic insights, and professional services that allow banks to bring their small business lending process online.

In April 2019, we combined our Canadian operations with Evolocity Financial Group, or Evolocity, to create a new holding company in which we own a 58.5% majority interest. We have accounted for this transaction as a business combination and have consolidated the financial position and results of operations of the holding company. The noncontrolling interest has been classified as mezzanine equity because it was deemed to be a redeemable noncontrolling interest. See Note 9 for further discussion.

Basis of Presentation and Principles of Consolidation

We prepare our consolidated financial statements and footnotes in accordance with accounting principles generally accepted in the United States of America, or GAAP, as contained in the Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC. All intercompany transactions and accounts have been eliminated in consolidation. When used in these notes to consolidated financial statements, the terms "we," "us," "our" or similar terms refer to On Deck Capital, Inc. and its consolidated subsidiaries.

At December 31, 2019, we changed the presentation of the revenue portion of our Consolidated Statements of Operations and Comprehensive Income to present new line items for "Net interest income" and "Net interest revenue, after credit provision" and "Total non-interest income." We no longer present the line items, "Gross revenue," "Total cost of revenue" and "Net revenue." "Gains on sales of loans" and "Other revenue" for the quarter ended March 31, 2019, which were previously reported as components of "Gross revenue", have been recast to be presented as components of "Total non-interest income". "Interest expense" and "Provision for credit losses" for the quarter ended March 31,2019, which were previously reported as components of "Total cost of revenue", have been recast to be presented as components of "Net interest income" and "Net interest revenue, after credit provision", respectively. The change in presentation had no effect on our "Income (loss) from operations, before provision for income taxes" or "Net income (loss)". The new presentation solely repositions our existing financial statement line items and does not create any new financial statement line items except for new subtotals. The change was made to better align with industry standards and to reflect key metrics which we use to measure our business.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts in the consolidated financial statements and accompanying notes. Significant estimates include allowance for credit losses, stock-based compensation expense, capitalized software development costs, the useful lives of long-lived assets, goodwill, our effective income tax rate and valuation allowance for deferred tax assets. We base our estimates on historical experience, current events and other factors we believe to be reasonable under the circumstances. These estimates and assumptions are inherently subjective in nature; actual results may differ from these estimates and assumptions.

Recently Adopted Accounting Standards

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. ASU 2016-13 which changed the impairment model and how entities measure credit losses for most financial assets. The standard requires entities to use the new expected credit loss impairment model which replaced the incurred loss model used previously. We adopted the new standard effective January 1, 2020. Upon adoption, the $7 million liability for unfunded line of credit commitments previously included in Other liabilities was released and other transition related adjustments to the allowance for credit losses were $3 million. On January 1, 2020, the transition adjustments of a total of $10 million were recorded against retained earnings.

In January 2017, the FASB issued ASU 2017-04, Intangibles-Goodwill and Other: Simplifying the Test for Goodwill Impairment, which eliminated the requirement to determine the fair value of individual assets and liabilities of a reporting unit to measure goodwill impairment. Under the amendments in the new ASU, goodwill impairment testing will be performed by comparing the fair value of the reporting unit with its carrying amount and recognizing an impairment charge for the amount by

8

which the carrying amount exceeds the reporting unit’s fair value. We adopted the new standard prospectively on January 1, 2020 and it did not have a material impact on our unaudited consolidated financial statements.

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework-Changes to the Disclosure Requirements for Fair Value Measurement, which modifies disclosure requirements for fair value measurements under ASC 820, Fair Value Measurement. We adopted the new standard effective January 1, 2020 and the adoption did not have a material impact on our unaudited consolidated financial statements.

In August 2018, the FASB issued ASU 2018-15, Customer's Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement that is a Service Contract, which requires implementation costs incurred by customers in cloud computing arrangements to be deferred over the noncancellable term of the cloud computing arrangements plus any optional renewal periods (1) that are reasonably certain to be exercised by the customer or (2) for which exercise of the renewal option is controlled by the cloud service provider. We adopted the new standard effective January 1, 2020 utilizing the prospective transition approach with no material impact on our unaudited consolidated financial statements as of March 31, 2020.

COVID-19 Pandemic

On March 11, 2020, the World Health Organization declared the current COVID-19 outbreak to be a global pandemic, which led to governmental requirements or recommendations for “non-essential” businesses to temporarily close or severely limit their operations. Our small business customers have been directly or indirectly affected by the COVID-19 pandemic due to the closures and reduced customer demand. We have included the COVID-19 impacts as part of our calculation of the allowance for credit losses for the quarter ended March 31, 2020. See Note 4.

The pandemic is having unprecedented negative economic consequences. We have changed our near-term priorities to actively monitor and respond to the impacts that COVID-19 is having on our business and customers. See Part I, Item 2- "Management's Discussion and Analysis of Financial Condition and Results of Operations" for more detail. It is currently unclear what the full impact of COVID-19, will be on our business, cash flows, available liquidity, financial condition, and results of operations, due to the many material uncertainties that exist.

Revision of Prior Period Financial Statements

During the second quarter of 2019, we identified an immaterial error in our historical financial statements relating to the accrual of commissions on a portion of our renewal loans. The aggregate amount of the under-accrual was $2.4 million, approximately 90% of which relates to 2015 and subsequent periods, and represents less than 1%, of our total stockholders’ equity at March 31, 2019. The amount of the error in each of the impacted annual and interim periods was less than 1% of total commissions paid for such period.

In accordance with the SEC’s SAB No. 99, “Materiality,” and SAB No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” we evaluated the error and concluded that the impact was not material to our financial statements for any prior annual or interim period. Accordingly, we have revised our previously reported financial information to correct the immaterial error contained in our Quarterly Report on Form 10-Q for the three-months ended March 31, 2019.

A summary of revisions to certain previously reported financial information is presented in Note 11.

9

2. Net Income (Loss) Per Common Share

Basic and diluted net income (loss) per common share is calculated as follows (in thousands, except share and per share data):

| Three Months Ended March 31, | |||||||

| 2020 | 2019 | ||||||

| Numerator: | |||||||

| Net Income (loss) | $ | (60,038 | ) | $ | 5,328 | ||

| Less: Net income (loss) attributable to noncontrolling interest | (1,063 | ) | (338 | ) | |||

| Net income (loss) attributable to On Deck Capital, Inc. common stockholders | $ | (58,975 | ) | $ | 5,666 | ||

| Denominator: | |||||||

| Weighted-average common shares outstanding, basic | 62,534,517 | 75,539,535 | |||||

| Net income (loss) per common share, basic | $ | (0.94 | ) | $ | 0.08 | ||

| Effect of dilutive securities | — | 3,575,502 | |||||

| Weighted-average common shares outstanding, diluted | 62,534,517 | 79,115,037 | |||||

| Net income (loss) per common share, diluted | $ | (0.94 | ) | $ | 0.07 | ||

| Anti-dilutive securities excluded | 12,410,306 | 4,863,474 | |||||

The difference between basic and diluted net income per common share has been calculated using the Treasury Stock Method based on the assumed exercise of outstanding stock options, the vesting of restricted stock units, or RSUs, performance restricted stock units, or PRSUs, and the issuance of stock under our employee stock purchase plan. Changes in the average market price of our stock can impact when stock equivalents are considered dilutive or anti-dilutive. For example, in periods of a declining stock price, stock equivalents have a greater likelihood of being recharacterized from dilutive to anti-dilutive. The following common share equivalent securities have been included in the calculation of dilutive weighted-average common shares outstanding:

| Three Months Ended March 31, | |||||

| Dilutive Common Share Equivalents | 2020 | 2019 | |||

| Weighted-average common shares outstanding | 62,534,517 | 75,539,535 | |||

| RSUs and PRSUs | — | 1,024,301 | |||

| Stock options | — | 2,549,887 | |||

| Employee stock purchase plan | — | 1,314 | |||

| Total dilutive common share equivalents | 62,534,517 | 79,115,037 | |||

The following common share equivalent securities were excluded from the calculation of diluted net income per share attributable to common stockholders. Their effect would have been antidilutive for the three months ended March 31, 2020 and 2019.

| Three Months Ended March 31, | |||||

| 2020 | 2019 | ||||

| Anti-Dilutive Common Share Equivalents | |||||

| Warrants to purchase common stock | — | 22,000 | |||

| RSUs and PRSUs | 5,716,536 | 669,075 | |||

| Stock options | 6,693,770 | 4,172,399 | |||

| Total anti-dilutive common share equivalents | 12,410,306 | 4,863,474 | |||

On July 29, 2019 we announced that our Board of Directors authorized the repurchase of up to $50 million of common stock with the repurchased shares to be retained as treasury stock and available for possible reissuance. Any share repurchases under the program will be made from time to time in the open market, in privately negotiated transactions or otherwise. The timing and amount of any share repurchases will be subject to market conditions and other factors as we may determine. The repurchase authorization expires August 31, 2020, however, we may suspend, modify or discontinue the program at any time in our discretion without prior notice. On February 11, 2020 we announced that our Board of Directors authorized the repurchase of up to an additional $50 million of common stock under the repurchase program described above, with no expiration on the additional

10

authorization. During the three months ended March 31, 2020 we repurchased 8,096,613 shares of common stock for $32.9 million, compared to the previous quarter where we repurchased 7,490,094 shares of common stock for $33.0 million. In late February 2020, we suspended repurchase activity under our program as part of our focus on liquidity and capital preservation, but maintain authorization to resume purchases at our sole discretion.

3. Interest Income

Interest income was comprised of the following components for the three months ended March 31, 2020 and 2019 (in thousands):

| Three Months Ended March 31, | |||||||

| 2020 | 2019 | ||||||

| Interest and finance income | $ | 122,283 | $ | 123,434 | |||

| Amortization of net deferred origination costs | (15,583 | ) | (17,892 | ) | |||

| Interest and finance income, net | 106,700 | 105,542 | |||||

| Interest on deposits and investments | 235 | 257 | |||||

| Total interest and finance income | $ | 106,935 | $ | 105,799 | |||

4. Loans and Finance Receivables Held for Investment and Allowance for Credit Losses

Loans and finance receivables consisted of the following as of March 31, 2020 and December 31, 2019 (in thousands):

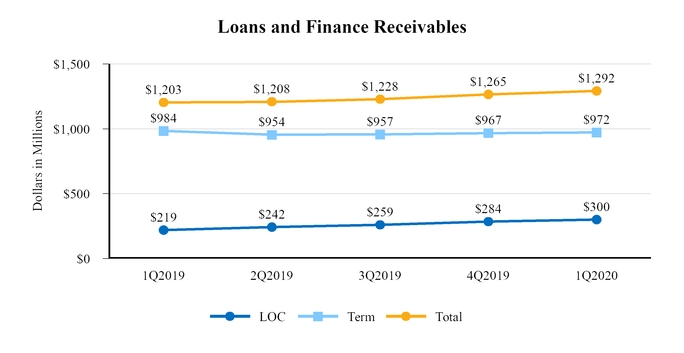

| March 31, 2020 | December 31, 2019 | ||||||

| Term loans | $ | 945,570 | $ | 946,322 | |||

| Lines of credit | 300,353 | 277,843 | |||||

Other loans and finance receivables (1) | 17,441 | 14,244 | |||||

| Total Unpaid Principal Balance | 1,263,364 | 1,238,409 | |||||

| Net deferred origination costs | 28,222 | 26,903 | |||||

| Total loans and finance receivables | $ | 1,291,586 | $ | 1,265,312 | |||

(1) | Includes loans secured by equipment and our variable pay product in Canada. |

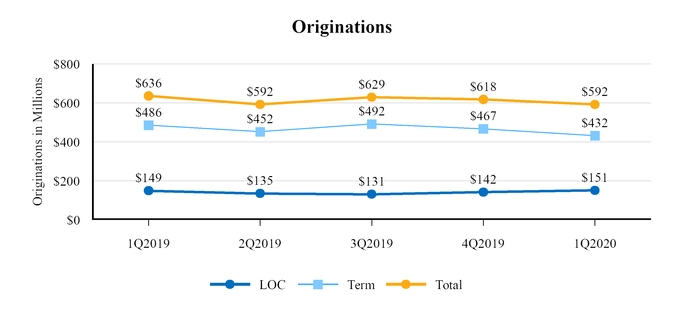

We include both loans we originate and loans originated by our issuing bank partner and later purchased by us as part of our originations. During the three months ended March 31, 2020 and 2019 we purchased loans from our issuing bank partner in the amount of $109.7 million and $111.5 million, respectively.

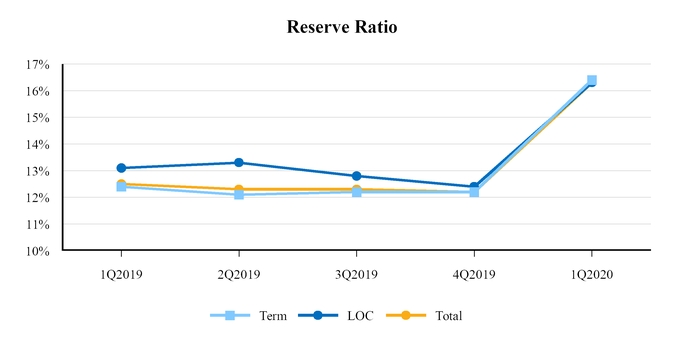

As of January 1, 2020, we began to utilize a model that is compliant with the Current Expected Credit Loss, or CECL, standard. The credit losses on our portfolio are estimated and recognized upon origination, based on expected credit losses for the life of the balance as of the period end date. We evaluate the creditworthiness of our portfolio on a pooled basis based on the product type. We use a proprietary model to project contractual lifetime losses at origination based on our historical lifetime losses of our actual loan performance. Future economic conditions include multiple macroeconomic scenarios provided to us by an independent third party and reviewed by management. These macroeconomic scenarios contain certain variables that are influential to our modelling process, including real gross domestic product and economic indicators such as small business and consumer sentiment and small business demand and performance metrics. We perform a Qualitative Assessment to address possible limitations within the model, and at times when deemed necessary include the Qualitative Assessment to our calculation.

Upon adoption, the net change in the required Allowance for credit losses was minimal with a $3 million decrease driven by lower required reserves for lines of credit. Additionally, the $7 million reserve for unfunded line of credit commitments previously included in Other liabilities was released as part of the adoption. Under the new model, we reserve for the committed debt balance on our outstanding line of credit balances. These changes resulted in a net increase of approximately $10 million in Stockholder's equity on January 1, 2020.

We increased our allowance for credit losses at March 31, 2020 due to higher expected losses related to the COVID-19 pandemic. Management's consideration at March 31, 2020 included the potential macro-economic impact of continued

11

government-mandated lockdowns for small businesses, expected timing for the reopening of the economy, as well as the effectiveness of the government stimulus programs.

The change in the allowance for credit losses for the three months ended March 31, 2020 and 2019 consisted of the following (in thousands):

| Three Months Ended March 31, | |||||||||||||||

| 2020 | 2019 | ||||||||||||||

| Term Loans and Finance Receivables | Lines of Credit | Total | Total | ||||||||||||

| Balance at beginning of period | $ | 116,752 | $ | 34,381 | $ | 151,133 | $ | 140,040 | |||||||

| Recoveries of previously charged off amounts | 5,042 | 555 | 5,597 | 3,914 | |||||||||||

| Loans and finance receivables charged off | (45,667 | ) | (9,561 | ) | (55,228 | ) | (39,839 | ) | |||||||

| Provision for credit losses | 78,278 | 29,629 | 107,907 | 43,291 | |||||||||||

| Transition to ASU 2016-13 Adjustment | 2,800 | (6,104 | ) | (3,304 | ) | — | |||||||||

| Foreign Currency Translation Adjustment | (402 | ) | — | (402 | ) | — | |||||||||

| Allowance for credit losses at end of period | $ | 156,803 | $ | 48,900 | $ | 205,703 | $ | 147,406 | |||||||

When loans and finance receivables are charged off, we typically continue to attempt to recover amounts from the respective borrowers and guarantors, including, when we deem it appropriate, through formal legal action. Alternatively, we may sell previously charged-off loans to third-party debt buyers. The proceeds from these sales are recorded as a component of the recoveries of loans previously charged off. For the three months ended March 31, 2020 loans sold accounted for $1.2 million of recoveries previously charged off. We did not sell any previously charged-off loans for the three months ended March 31, 2019.

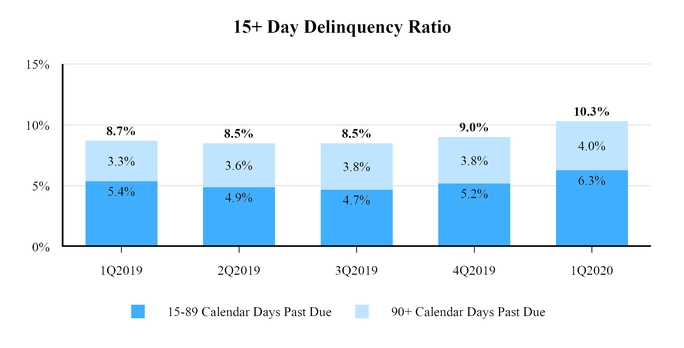

The following table contains information regarding the unpaid principal balance we originated related to non-delinquent, paying and non-paying delinquent loans and finance receivables as of March 31, 2020 and December 31, 2019 (in thousands). At March 31, 2020, approximately 30% of our delinquent loans and finance receivables were making payments.

| March 31, 2020 | |||||||||||

| Term Loans and Finance Receivables | Lines of Credit | Total | |||||||||

| Current loans and finance receivables | $ | 673,274 | $ | 249,301 | $ | 922,575 | |||||

| Delinquent: paying (accrual status) | 86,396 | 13,885 | 100,281 | ||||||||

| Delinquent: non-paying (non-accrual status) | 203,341 | 37,167 | 240,508 | ||||||||

| Total | 963,011 | 300,353 | 1,263,364 | ||||||||

| December 31, 2019 | |||||||||||

| Term Loans and Finance Receivables | Lines of Credit | Total | |||||||||

| Current loans and finance receivables | $ | 842,083 | $ | 255,981 | $ | 1,098,064 | |||||

| Delinquent: paying (accrual status) | 33,512 | 5,002 | 38,514 | ||||||||

| Delinquent: non-paying (non-accrual status) | 84,971 | 16,860 | 101,831 | ||||||||

| Total | $ | 960,566 | $ | 277,843 | $ | 1,238,409 | |||||

12

We consider the delinquency status of our loans and finance receivables as one of our primary credit quality indicators once loans advance beyond the origination underwriting stage. We monitor delinquency trends to manage our exposure to credit risk. The following tables show an aging analysis of the unpaid principal balance related to loans and finance receivables and lines of credit, by delinquency status and origination year as of March 31, 2020 (in thousands):

| March 31, 2020 | |||||||||||||||||||||||

| Term Loans and Finance Receivables | Lines of Credit | Total | |||||||||||||||||||||

| Origination Year | |||||||||||||||||||||||

| By delinquency status: | 2017 and prior | 2018 | 2019 | 2020 | 2020 | ||||||||||||||||||

| Current loans and finance receivables | $ | 5 | $ | 2,900 | $ | 347,911 | $ | 322,458 | $ | 249,301 | $ | 922,575 | |||||||||||

| 1-14 calendar days past due | — | 727 | 117,694 | 61,578 | 31,055 | 211,054 | |||||||||||||||||

| 15-29 calendar days past due | — | 153 | 16,763 | 4,745 | 3,800 | 25,461 | |||||||||||||||||

| 30-59 calendar days past due | — | 114 | 23,380 | 1,852 | 4,032 | 29,377 | |||||||||||||||||

| 60-89 calendar days past due | — | 323 | 19,844 | 313 | 4,256 | 24,737 | |||||||||||||||||

| 90 + calendar days past due | 944 | 7,592 | 33,715 | — | 7,909 | 50,160 | |||||||||||||||||

| Total unpaid principal balance | $ | 949 | $ | 11,809 | $ | 559,307 | $ | 390,946 | $ | 300,353 | $ | 1,263,364 | |||||||||||

At March 31, 2020 the amount of loans that were in the delinquent, especially in the 1 to 14 days past due bucket were at a historical high, due to the broad-based pressures from COVID-19 that our customers experienced late in quarter.

The following tables show an aging analysis of the unpaid principal balance related to loans and finance receivables and lines of credit, by delinquency status as of December 31, 2019 (in thousands):

| December 31, 2019 | |||||||||||

| By delinquency status: | Term Loans and Finance Receivables | Lines of Credit | Total | ||||||||

| Current loans and finance receivables | $ | 842,083 | $ | 255,981 | $ | 1,098,064 | |||||

| 1-14 calendar days past due | $ | 23,426 | $ | 4,949 | 28,375 | ||||||

| 15-29 calendar days past due | $ | 15,153 | $ | 2,230 | 17,383 | ||||||

| 30-59 calendar days past due | $ | 20,647 | $ | 4,419 | 25,067 | ||||||

| 60-89 calendar days past due | $ | 18,527 | $ | 3,477 | 22,004 | ||||||

| 90 + calendar days past due | $ | 40,730 | $ | 6,787 | 47,516 | ||||||

| Total unpaid principal balance | $ | 960,566 | $ | 277,843 | $ | 1,238,409 | |||||

We utilize OnDeck Score, industry data and term length to monitor the credit quality and pricing decisions of our portfolio. For our lines of credit, one of our primary credit quality indicators is delinquency, particularly whether they are in a paying or non-paying status. In addition to delinquency, the credit quality of US term loan portfolio is evaluated based on an internally developed credit risk model that assigns a risk grade based on credit bureau data, the OnDeck Score, business specific information and loan details. The risk grade is used in our model to calculate our allowance for credit losses. One of our credit quality indicators is the risk grade that we assign to our US term loan. Additionally, we utilize historical performance on the previous loan for our renewal customers. After grouping the loans according to their term length, they are further divided into the following risk grades based on probability of default.

W - lowest risk

X - low risk

Y - medium risk

Z - high risk

13

The following table contains the breakdown of our US Term Loans by the year of origination and our risk grades, at March 31, 2020:

| March 31, 2020 | |||||||||||||||||||

| Origination Year | |||||||||||||||||||

| Risk Grade | 2020 | 2019 | 2018 | 2017 and prior | Total | ||||||||||||||

| W | $ | 124,634 | $ | 169,776 | $ | 3,094 | $ | 317 | $ | 297,821 | |||||||||

| X | 73,033 | 99,501 | 2,626 | 35 | 175,195 | ||||||||||||||

| Y | 52,964 | 83,449 | 2,317 | 164 | 138,894 | ||||||||||||||

| Z | 56,372 | 78,831 | 1,306 | 290 | 136,799 | ||||||||||||||

| $ | 307,003 | $ | 431,557 | $ | 9,343 | $ | 806 | $ | 748,709 | ||||||||||

The COVID-19 pandemic created and will continue to create unprecedented economic impacts that our current model may not accurately predict, since such an event has not happened in the past. For our calculation of the allowance for credit losses at March 31, 2020 we bifurcated the delinquent receivable pool into two groups: delinquencies that existed prior to March 11th which we define as “normal” delinquencies, and delinquencies that occurred on or after March 11th, which we define as post- pandemic delinquencies. We further stratified the post-pandemic delinquencies into sub-groups based on payment performance. We then set reserve levels based on expected lifetime loss for each of the groups. Reserve levels were based on collection status and product type.

5. Debt

The following table summarizes our outstanding debt as of March 31, 2020 and December 31, 2019 (in thousands):

| Outstanding | |||||||||||||

| Type | Maturity Date | Weighted Average Interest Rate at March 31, 2020 | March 31, 2020 | December 31, 2019 | |||||||||

| Debt: | |||||||||||||

| OnDeck Asset Securitization Trust II - Series 2018-1 | Securitization | April 2022 | (1) | 3.8% | $ | 225,000 | $ | 225,000 | |||||

| OnDeck Asset Securitization Trust II - Series 2019-1 | Securitization | November 2024 | (2) | 3.0% | 125,000 | 125,000 | |||||||

| OnDeck Account Receivables Trust 2013-1 | Revolving | March 2022 | (3) | 2.7% | 143,241 | 129,512 | |||||||

| Receivable Assets of OnDeck, LLC | Revolving | September 2021 | (4) | 2.6% | 99,631 | 94,099 | |||||||

| OnDeck Asset Funding II LLC | Revolving | August 2022 | (5) | 4.0% | 166,913 | 123,840 | |||||||

| Prime OnDeck Receivable Trust II | Revolving | March 2022 | (6) | 3.3% | — | — | |||||||

| Loan Assets of OnDeck, LLC | Revolving | October 2022 | (7) | 2.7% | 122,403 | 120,665 | |||||||

| Corporate line of credit | Revolving | January 2021 | 4.0% | 105,000 | 40,000 | ||||||||

| International and other agreements | Various | Various | (8) | 4.0% | 63,546 | 64,585 | |||||||

| 3.4% | 1,050,734 | 922,701 | |||||||||||

| Deferred debt issuance cost | (6,810 | ) | (7,706 | ) | |||||||||

| Total Debt | $ | 1,043,924 | $ | 914,995 | |||||||||

(1) | The period during which new loans may be purchased under this securitization transaction expired in March 2020. |

(2) | The period during which new loans may be purchased under this securitization transaction expires in October 2021. An early amortization event has occurred under this transaction, please refer to Note 14 for details. |

(3) | The period during which new borrowings may be made under this facility expires in March 2021. |

(4) | The period during which new borrowings of Class A revolving loans may be made under this debt facility expires in December 2020. |

(5) | The period during which new borrowings may be made under this facility expires in August 2021. |

(6) | The period during which new borrowings may be made under this facility expires in March 2021. |

14

(7) | The period during which new borrowings may be made under this debt facility expires in April 2022. An amendment was made to the facility on April 27, 2020, please refer to Note 13 for details. |

(8) | Other Agreements include, among others, our local currency debt facilities in Australia and Canada. The periods during which new borrowings may be made under the various agreements expire between June 2020 and March 2023. Maturity dates range from June 2021 through March 2023. |

Certain of our loans are transferred to our special purpose vehicle subsidiaries and are pledged as collateral for borrowings in our funding debt facilities and for the issuance in our securitization. These loans totaled $1.2 billion and $1.0 billion as of March 31, 2020 and December 31, 2019, respectively. Our corporate debt facility includes a blanket lien on substantially all of our assets.

Recent Amendments to Debt Facilities

On March 23, 2020, our Canadian entities entered into a CAD 40 million revolving credit facility that amended and extended the terms of their prior facility with the Bank of Montreal. The revolving credit facility matures in March 2023. The facility is secured by substantially all the assets of our Canadian entities, including Canadian small business loans.

6. Fair Value of Financial Instruments

Assets and Liabilities Measured at Fair Value on a Recurring Basis Using Significant Unobservable Inputs

We evaluate our financial assets and liabilities subject to fair value measurements on a recurring basis to determine the appropriate level at which to classify them for each reporting period. Our interest rate cap is reported at fair value utilizing Level 2 inputs. The fair value is determined using third party valuations that are based on discounted cash flow analysis using observed market inputs.

The following tables present information about our assets and liabilities that are measured at fair value on a recurring basis as of March 31, 2020 and December 31, 2019 (in thousands):

| March 31, 2020 | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

| Interest rate cap | — | 3 | — | 3 | |||||||||||

| Total assets | $ | — | $ | 3 | $ | — | $ | 3 | |||||||

| December 31, 2019 | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

| Interest rate cap | $ | — | $ | — | $ | — | $ | — | |||||||

| Total assets | $ | — | $ | — | $ | — | $ | — | |||||||

There were no transfers between levels for the three months ended March 31, 2020 and December 31, 2019.

Assets and Liabilities Disclosed at Fair Value

Because our loans and finance receivables and fixed-rate debt are not measured at fair value, we are required to disclose their fair value in accordance with ASC 825. Due to the lack of transparency and comparable loans and finance receivables, we utilize an income valuation technique to estimate fair value. We utilize industry-standard modeling, such as discounted cash flow models, to arrive at an estimate of fair value and may utilize third-party service providers to assist in the valuation process. This determination requires significant judgments to be made. The following tables summarize the carrying value and fair value of our loans held for investment and fixed-rate debt (in thousands):

15

| March 31, 2020 | |||||||||||||||||||

| Carrying Value | Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||||

Assets: | |||||||||||||||||||

| Loans and finance receivables, net | $ | 1,085,883 | $ | 1,197,481 | $ | — | $ | — | $ | 1,197,481 | |||||||||

| Total assets | $ | 1,085,883 | $ | 1,197,481 | $ | — | $ | — | $ | 1,197,481 | |||||||||

| Liabilities: | |||||||||||||||||||

| Fixed-rate debt | $ | 350,000 | $ | 302,779 | $ | — | $ | — | $ | 302,779 | |||||||||

| Total fixed-rate debt | $ | 350,000 | $ | 302,779 | $ | — | $ | — | $ | 302,779 | |||||||||

| December 31, 2019 | |||||||||||||||||||

| Carrying Value | Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||||

Assets: | |||||||||||||||||||

| Loans and finance receivables, net | $ | 1,114,179 | $ | 1,241,893 | $ | — | $ | — | $ | 1,241,893 | |||||||||

| Total assets | $ | 1,114,179 | $ | 1,241,893 | $ | — | $ | — | $ | 1,241,893 | |||||||||

| Liabilities: | |||||||||||||||||||

| Fixed-rate debt | $ | 350,000 | $ | 337,510 | $ | — | $ | — | $ | 337,510 | |||||||||

| Total fixed-rate debt | $ | 350,000 | $ | 337,510 | $ | — | $ | — | $ | 337,510 | |||||||||

7. Income Taxes

For interim periods, the income tax provision is comprised of tax on ordinary income provided at the most recent estimated annual effective tax rate, adjusted for the tax effect of discrete items. We use an estimated annual effective tax rate which is based on expected annual income and statutory tax rates to determine our quarterly provision for income taxes. Certain significant or unusual items are separately recognized in the quarter in which they occur and can be a source of variability in the effective tax rates from quarter to quarter.

We did not book a provision for income taxes for the three months ended March 31, 2020 and our provision for income taxes for the three months ended March 31, 2019 was $1.7 million representing a quarterly effective income tax rate of 24% for the three months ended March 31, 2019.

8. Stock-Based Compensation and Employee Benefit Plans

Equity incentives are currently issued to employees and directors in the form of stock options and RSUs under our 2014 Equity Incentive Plan. Our 2007 Stock Option Plan was terminated in connection with our Initial Public Offering (IPO). Accordingly, no additional equity incentives are issuable under this plan although it continues to govern outstanding awards granted thereunder. Additionally, we offer an Employee Stock Purchase Plan through the 2014 Employee Stock Purchase Plan and a 401(k) plan to employees.

16

Options

The following is a summary of option activity for the three months ended March 31, 2020:

| Number of Options | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands) | ||||||||||

| Outstanding at January 1, 2020 | 6,822,219 | $ | 5.68 | — | — | ||||||||

| Exercised | (43,771 | ) | $ | 0.40 | — | — | |||||||

| Forfeited | (73,678 | ) | $ | 6.55 | — | — | |||||||

| Expired | (11,000 | ) | $ | 5.52 | — | — | |||||||

| Outstanding at March 31, 2020 | 6,693,770 | $ | 5.71 | 4.5 | $ | 2,621 | |||||||

| Exercisable at March 31, 2020 | 6,182,891 | $ | 5.72 | 4.2 | $ | 2,621 | |||||||

| Vested or expected to vest as of March 31, 2020 | 6,678,295 | $ | 5.71 | 4.5 | $ | 2,621 | |||||||

Total compensation cost related to nonvested option awards not yet recognized as of March 31, 2020 was $0.9 million and will be recognized over a weighted-average period of 1.7 years. The aggregate intrinsic value of employee options exercised during the periods ended March 31, 2020, and 2019 was $0.2 million, and $1.1 million, respectively.

Restricted Stock Units

The following table is a summary of activity in RSUs and PRSUs for the three months ended March 31, 2020:

| Number of RSUs and PRSUs | Weighted-Average Grant Date Fair Value Per Share | |||||

| Unvested at January 1, 2020 | 4,185,560 | $ | 5.32 | |||

| RSUs and PRSUs Granted | 1,961,929 | $ | 3.61 | |||

| RSUs and PRSUs Vested | (156,320 | ) | $ | 6.47 | ||

| RSUs and PRSUs Forfeited/Expired | (274,633 | ) | $ | 5.71 | ||

| Unvested at March 31, 2020 | 5,716,536 | $ | 4.69 | |||

| Expected to vest after March 31, 2020 | 4,525,071 | $ | 4.69 | |||

As of March 31, 2020, there was $16.1 million of unrecognized compensation cost related to unvested RSUs and PRSUs, which is expected to be recognized over a weighted-average period of 2.9 years.

Stock-based compensation expense related to stock options, RSUs, PRSUs and the employee stock purchase plan are included in the following line items in our accompanying consolidated statements of operations for the three months ended March 31, 2020 and 2019 (in thousands). We had a number of forfeitures in our Sales and Marketing personnel which resulted in a reversal of expenses for the three months ending March 31, 2020.

| For the three months ending March 31, | |||||||

| 2020 | 2019 | ||||||

| Sales and marketing | $ | (23 | ) | $ | 559 | ||

| Technology and analytics | 460 | 828 | |||||

| Processing and servicing | 99 | 90 | |||||

| General and administrative | 880 | 1,606 | |||||

| Total | $ | 1,416 | $ | 3,083 | |||

17

9. Business Combination

On April 1, 2019, we combined our Canadian operations with Evolocity Financial Group, or Evolocity, a Montreal-based online small business lender. The purpose of the transaction was to accelerate the growth of our Canadian operations and to enable us to provide a broader range of financing options to Canadian small businesses nationwide. In the transaction, Evolocity contributed its business to a holding company, and we contributed our Canadian business plus cash to that holding company such that we own a 58.5% majority interest in the holding company. The remainder is owned by former Evolocity stockholders. We have accounted for this transaction as a business combination.

The transaction has a purchase price for accounting purposes of approximately $16.7 million. Goodwill arising from the business combination is not amortized, but is subject to impairment testing at least annually or more frequently if there is an indicator of impairment. A quarterly impairment test was performed at March 31, 2020 that determined no impairment was needed. There have been no changes to goodwill since December 31, 2019.

The following table summarizes the preliminary fair value of the assets acquired and liabilities assumed in connection with the business combination (in thousands):

| Fair Value at Combination | |||

| Loans and finance receivables | $ | 36,763 | |

Intangibles and other assets (1) | 2,810 | ||

| Debt and other liabilities | (34,437 | ) | |

Goodwill (1) | 11,585 | ||

| Net assets acquired | $ | 16,721 | |

(1) Goodwill, and Intangibles and other assets were included in Other Assets on the Consolidated Balance Sheet as of March 31, 2020 and December 31, 2019.

We consolidate the financial position and results of operations of the holding company.

Our business combination with Evolocity resulted in a redeemable noncontrolling interest, which has been classified as mezzanine equity due to the option of the noncontrolling shareholders to require us to purchase their interest. The redeemable noncontrolling interest was recorded at fair value of $16.1 million as a result of the business combination. The fair value was measured using a mix of a discounted cash flow and cost approach. These interests are classified as mezzanine equity and measured at the greater of fair value at the end of each reporting period or the historical cost basis of the noncontrolling interest adjusted for cumulative earnings allocations. The mezzanine equity balance at March 31, 2020 was $13.1 million and at December 31, 2019 was $14.4 million.

10. Derivatives and Hedging

We are subject to interest rate risk in connection with borrowings under our debt agreements which are subject to variable interest rates. In December 2018 we entered into an interest rate cap, which is a derivative instrument, to manage our interest rate risk on a portion of our variable-rate debt. We do not use derivatives for speculative purposes. The interest rate cap is designated as a cash flow hedge. In exchange for our up-front premium, we would receive variable amounts from a counterparty if interest rates rise above the strike rate on the contract. The interest rate cap agreement is for a notional amount of $300 million and has a maturity date of January 2021.

For derivatives designated and that qualify as cash flow hedges of interest rate risk, the changes in the fair value of the derivative are recorded in Accumulated Other Comprehensive Income, or AOCI, and subsequently reclassified into interest expense in the same period(s) during which the hedged transaction affects earnings. Gains and losses on the derivative representing hedge components excluded from the assessment of effectiveness are recognized over the life of the hedge on a systematic and rational basis, as documented at hedge inception in accordance with our accounting policy election. The earnings recognition of excluded components is presented in interest expense. Amounts reported in AOCI related to derivatives will be reclassified to interest expense as interest payments are made on our variable-rate debt. We estimate that $0.6 million will be reclassified as an increase to interest expense over the next 12 months.

The table below presents the fair value of our derivative financial instruments as well as their classification on the Balance Sheet as of March 31, 2020 and December 31, 2019 (in thousands):

18

| Derivative Type | Classification | March 31, 2020 | December 31, 2019 | |||||||

| Assets: | ||||||||||

| Interest rate cap agreement | Other Assets | $ | 3 | $ | — | |||||

The table below presents the effect of cash flow hedge accounting on AOCI for the three months ended March 31, 2020 and 2019 (in thousands):

| March 31, 2020 | March 31, 2019 | ||||||

| Amount Recognized in OCI on Derivative: | |||||||

| Interest rate cap agreement | $ | 270 | $ | 742 | |||

The table below presents the effect of our derivative financial instruments on the Consolidated Statements of Operations and Comprehensive Income for the three months ended March 31, 2020 and 2019 (in thousands):

| Location and Amount of Gain or (Loss) Recognized in Income on Cash Flow Hedging Relationships | ||||||

| Three Months Ended March 31, | ||||||

| 2020 | 2019 | |||||

| Interest expense | (267 | ) | (135 | ) | ||

11. Revision of Prior Period Financial Statements

During the second quarter of 2019, we revised prior period financial statements to correct an immaterial error related to the channel attribution of certain loans and the commissions associated with those loans. Commissions become due upon the closing of a loan. Those commissions are capitalized as a component of the loan balance and are amortized as an adjustment to interest income over the life of the loan. A summary of those revisions is as follows:

Revised Consolidated Balance Sheet as of March 31, 2019 (in thousands):

| As Reported | Adjustment | As Revised | ||||||

| Loans and finance receivables | 1,202,531 | 240 | 1,202,771 | |||||

| Total assets | 1,224,658 | 240 | 1,224,898 | |||||

| Accrued expenses and other liabilities | 61,097 | 2,236 | 63,333 | |||||

| Total liabilities | 911,066 | 2,236 | 913,302 | |||||

| Accumulated deficit | (189,297 | ) | (1,996 | ) | (191,293 | ) | ||

| Total On Deck Capital, Inc. stockholders' equity | 309,371 | (1,996 | ) | 307,375 | ||||

| Total stockholders' equity | 313,592 | (1,996 | ) | 311,596 | ||||

Revised Consolidated Statements of Operations and Comprehensive Income (in thousands):

| Three Months Ended March 31, 2019 | |||||

| As Reported | Adjustment | As Revised | |||

| Interest and finance income | $105,991 | $(192) | $105,799 | ||

| Gross Revenue | $110,167 | $(192) | $109,975 | ||

| Net Revenue | $55,544 | $(192) | $55,352 | ||

| Income (loss) from operations, before provision for income taxes | $7,260 | $(192) | $7,068 | ||

| Net income (loss) | $5,520 | $(192) | $5,328 | ||

There was no impact to earnings per share for any period presented.

19

Revised Consolidated Statements of Cash Flows

We revised our condensed consolidated statement of cash flows for the three months ended March 31, 2019 to reflect the correction of the error, which had no impact to net cash provided by operating activities, net cash used in investing activities and net cash provided by financing activities in the period.

12. Commitments and Contingencies

Concentrations of Credit Risk

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of cash, cash equivalents, restricted cash and loans. We hold cash, cash equivalents and restricted cash in accounts at regulated domestic financial institutions in amounts that exceed or may exceed FDIC insured amounts and at non-U.S. financial institutions where deposited amounts may be uninsured. We believe these institutions to be of acceptable credit quality and we have not experienced any related losses to date.

We are exposed to default risk on loans we originate and hold and that we purchase from our issuing bank partner. We perform an evaluation of each customer's financial condition and during the term of the customer's loan(s), we have the contractual right to limit a customer's ability to take working capital loans or other financing from other lenders that may cause a material adverse change in the financial condition of the customer.

Contingencies

We are involved in lawsuits, claims and proceedings incidental to the ordinary course of our business. We review the need for any loss contingency accruals and establishes an accrual when, in the opinion of management, it is probable that a matter would result in liability, and the amount of loss, if any, can be reasonably estimated. When and to the extent that we do establish a reserve, there can be no assurance that any such recorded liability for estimated losses will be for the appropriate amount, and actual losses could be higher or lower than what we accrue from time to time. We believe that the ultimate resolution of its current matters will not have a material adverse effect on our condensed consolidated financial statements.

13. Going Concern

At each reporting period, we assess our ability to continue as a going concern for one year after the date the financial statements are issued. We evaluate whether relevant conditions and events, considered in the aggregate, raise substantial doubt about our ability to meet future financial obligations as they become due within one year after the date that the financial statements are issued. As required under ASC Topic 205-40, Presentation of Financial Statements - Going Concern, our initial evaluation does not initially take into consideration the potential mitigating effects of management’s plans if they have not been fully implemented as of the date the financial statements are issued.

As a result of the COVID-19 pandemic and its economic impacts, we are experiencing higher delinquencies in our portfolio and, in turn, lower cash collections. While we were in compliance with the terms of our debt agreements as of March 31, 2020, the reduced collections and higher COVID-19 related delinquencies have resulted in non-compliance with certain debt agreements and are expected to result in, additional non-compliance with debt agreements in future periods. If such non-compliance is not waived by our lenders, we are not able to obtain amendments or other relief, or are otherwise unable to obtain new or alternate methods of financing on acceptable terms, such non-compliance can result in loss of ability to borrow under the facilities, early amortization events and/or events of default. Absent the mitigating actions below that management is in the midst of executing, or has already executed, management concluded that the uncertainty surrounding our future non-compliance in our debt facilities, ability to negotiate some of our existing facilities or repay outstanding indebtedness, and maintain sufficient liquidity raises substantial doubt about our ability to continue as a going concern within one year of issuance date.

We have implemented the following plans to mitigate those doubts. In April 2020, we amended one of our debt facilities to obtain temporary relief from, among other things, borrowing base requirements and portfolio performance tests and in May 2020, lenders in another debt facility agreed to temporarily waive non-compliance with borrowing base requirements. Please see Note 14 for details. We are actively engaging with all of our lenders to amend our debt agreements or otherwise obtain relief, and in parallel we are exploring other financing options, including new or alternative methods of financing. We are also taking aggressive measures to reduce costs for the foreseeable future by reducing our operating expenses in the second quarter of 2020. If needed, we can choose to extend the decreases past the initial 90 day period or make them larger and/or more permanent. We have also suspended nearly all new term loan and line of credit originations, and ceased all equipment finance lending. These steps have been taken, and others are under consideration, to help manage our liquidity and preserve capital for at l

20

east the next 12 months, and we believe that such actions will alleviate the substantial doubt on our ability to continue as a going concern.

14. Subsequent Events

In late April 2020, we suspended nearly all new term loan and line of credit originations and having previously ceased all equipment finance lending. We are focused on liquidity and capital preservation and we expect there will be a significant portfolio contraction, reflecting an 80% or more reduction in the second quarter origination volume.

On April 27, 2020 we amended our Loan Assets of OnDeck, LLC, or LAOD debt facility so that no borrowing base deficiency shall occur during the period from April 27, 2020 to July 16,2020, the amended period. Additionally, no portfolio performance test will be performed on the facility until the first interest payment date following the amended period. No additional loans will be sold into the facility nor will we draw additional funds on the facility during the amended period.

On May 7, 2020, we obtained a temporary waiver for the OnDeck Asset Funding II, LLC, or ODAF II debt facility. Under the waiver, the lenders temporarily waived the occurrence and existence of a borrowing base deficiency reported by ODAF II on May 1, 2020 and any failure to cure such deficiency amount, in each case, until the close of business on May 14, 2020. ODAF II entered into the waiver in contemplation of obtaining a broader amendment to the ODAF II facility to enable ODAF II to remain in compliance with performance and other criteria in light of increased delinquency and other portfolio dynamics that result from COVID-impacted loans. If such an amendment is not entered into or if the borrowing base deficiency is not otherwise cured, the borrowing base deficiency would constitute an event of default under the ODAF II facility at close of business on May 14, 2020.

The foregoing descriptions of the amendment of the LAOD debt facility and the temporary waiver for the ODAF II debt facility do not purport to be complete and are qualified in their entirety by reference to the amendment of the LAOD debt facility and the temporary waiver for the ODAF II debt facility, filed as exhibits 10.1 and 10.2, respectively, to this report.

As of May 7, 2020, an early amortization event occurred with respect to the Series 2019-1 notes issued by OnDeck Asset Securitization Trust II LLC, or ODAST II as a result of an asset amount deficiency in that Series. Beginning on the next payment date under the ODAST II Agreement, all remaining collections held by ODAST II, after payment of accrued interest and certain expenses, will be applied to repay the principal balance of the Series 2018-1 notes and the Series 2019-1 notes on a pro rata basis.

21

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion and analysis of our financial condition and results of operations together with our unaudited condensed consolidated financial statements and the related notes, and other financial information included elsewhere in this report. Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. You should review the “Cautionary Note Regarding Forward-Looking Statements” below for a discussion of important factors that could cause actual results to differ materially from the results described in, or implied by, the forward-looking statements contained in the following discussion and analysis.

22

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other legal authority. These forward-looking statements concern our operations, economic performance, financial condition, goals, beliefs, future growth strategies, objectives, plans and current expectations.

Forward-looking statements appear throughout this report including in Part I - Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, including but not limited to statements under the subheading ["2020 Outlook"] and Part II - Item 1A. Risk Factors. Forward-looking statements can generally be identified by words such as “will,” “enables,” “expects,” "intends," "may," “allows,” "plan," “continues,” “believes,” “anticipates,” “estimates” or similar expressions.

Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on our current beliefs, expectations and assumptions regarding the future of our business, anticipated events and trends, the economy and other future conditions. As such, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and in many cases outside our control. Therefore, you should not rely on any of these forward-looking statements. Our expected results may not be achieved, and actual results may differ materially from our expectations.

The impact of the novel strain of coronavirus SARS-CoV-2, causing the Coronavirus Disease 2019, also known as COVID-19 could cause or contribute to such differences. The COVID-19 health crisis is fast moving and complex, creating material risks and uncertainties that cannot be predicted with accuracy. Other important factors that could cause or contribute to such differences, include the following, many of which may be exacerbated due to the impact of COVID-19: (1) our ability to achieve consistent profitability in the future in light of our prior loss history and competition; (2) our growth strategies, including the introduction of new products or features, expanding our platform to other lenders through ODX, maintaining ODX’s current clients or losing a significant ODX client, expansion into international markets, offering equipment financing and our ability to effectively manage and fund our growth; (3) possible future acquisitions of complementary assets, businesses, technologies or products with the goal of growing our business, and the integration of any such acquisitions; (4) any material reduction in our interest rate spread and our ability to successfully mitigate this risk through interest rate hedging or raising interest rates or other means; (5) worsening economic conditions that may result in decreased demand for our loans or services and increase our customers’ delinquency and default rates; (6) supply and demand driven changes in credit and increases in the availability of capital for our competitors that negatively impacts our loan pricing; (7) our ability to accurately assess creditworthiness and forecast and provision for credit losses; (8) our ability to prevent or discover security breaches, disruptions in service and comparable events that could compromise confidential information held in our data systems or adversely impact our ability to service our loans; (9) incorrect or fraudulent information provided to us by customers causing us to misjudge their qualifications to receive a loan or other financing; (10) the effectiveness of our efforts to identify, manage and mitigate our credit, market, liquidity, operational and other risks associated with our business and strategic objectives; (11) our ability to continue to innovate or respond to evolving technological changes and protect our intellectual property; (12) our reputation and possible adverse publicity about us or our industry; (13) failure of operating controls, including customer or partner experience degradation, and related legal expenses, increased regulatory cost, significant fraud losses and vendor risk; (14) changes in federal or state laws or regulations, or judicial decisions involving licensing or supervision of commercial lenders, interest rate limitations, the enforceability of choice of law provisions in loan agreements, the validity of bank sponsor partnerships, the use of brokers or other significant changes; (15) risks associated with pursuing a bank charter, either de novo or in a transaction, and risks associated with either failing to obtain or obtaining a bank charter; and other risks, including those described in Part I - Item IA. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2019, Part II - Item 1A. Risk Factors in this report, and other documents that we file with the Securities and Exchange Commission, or SEC, from time to time which are or will be available on the SEC website at www.sec.gov.Except as required by law, we undertake no duty to update any forward-looking statements. Readers are also urged to carefully review and consider all of the information in this report, as well as the other documents we make available through the SEC’s website.

;

In this report, when we use the terms “OnDeck,” the “Company,” “we,” “us” or “our,” we are referring to On Deck Capital, Inc. and its consolidated subsidiaries, and when we use the term "ODX" we are referring to our wholly-owned subsidiary ODX, LLC, in each case unless the context requires otherwise.

Overview

We are a leading online small business lender. We make it efficient and convenient for small businesses to access financing. Enabled by our proprietary technology and analytics, we aggregate and analyze thousands of data points from dynamic, disparate data sources to assess the creditworthiness of small businesses rapidly and accurately. Small businesses can apply for financing on our website in minutes and, using our loan decision process, including our proprietary OnDeck Score®, we can make a funding decision immediately and, if approved, fund as fast as 24 hours. We have originated more than $13 billion of loans since we made our first loan in 2007.

We have offered term loans since we made our first loan in 2007 and lines of credit since 2013. In 2019 we began offering equipment finance loans and, in Canada, merchant cash advances through Evolocity Financial Group with whom we combined operations on April 1, 2019. Our term loans range from $5,000 to $500,000, have maturities of 3 to 36 months and feature fixed dollar repayments. Our lines of credit range from $6,000 to $100,000, and are generally repayable within 6 or 12 months of the date of the most recent draw. As of April 2020, we decided to pause origination of equipment finance loans as part of our focus on preserving liquidity and capital resources. Qualified customers may have multiple financings with us concurrently, which we believe provides opportunities for repeat business, as well as increased value to our customers.

We originate loans throughout the United States, Canada and Australia, although, to date, the majority of our revenue has been generated in the United States. These loans are originated through our direct marketing channel, including direct mail, our outbound sales team, our social media and other online marketing channels; referrals from our strategic partner channel, including small business-focused service providers, payment processors, and other financial institutions; and through independent funding advisor program partners, or FAPs, who advise small businesses on available funding options.

We generate the majority of our revenue through interest income and fees earned on the loans we make to our customers. We earn interest on the balance outstanding and lines of credit are subject to a monthly fee unless the customer makes a qualifying minimum draw, in which case the fee is waived for the first six months. The balance of our other revenue primarily comes from our servicing and other fee income, most of which consists of fees generated by ODX, monthly fees earned from lines of credit, and marketing fees from our issuing bank partner.

We rely on a diversified set of funding sources for the loans we make to our customers. Our primary source of this financing has historically been debt facilities with various financial institutions and securitizations. We have also used proceeds from operating cash flow to fund loans in the past and continue to finance a portion of our outstanding loans with these funds. As of March 31, 2020, we had $1.1 billion of debt principal outstanding.

Recent Developments

In early to mid-April 2020, we saw continued declines in cash collections from borrowers and unprecedented increases in delinquency. We further tightened our underwriting standards, put draw limits on certain customer lines of credit and offered greater flexibility in customer loan repayment plans where circumstances warranted.

In the second half of April 2020, the rate of new customers entering delinquency slowed but remained well above pre-COVID-19 levels. At the end of April 2020, approximately 45% of our portfolio was one day or more delinquent, which was up from approximately 28% at March 31, 2020, and nearly 80% of our overall U.S. portfolio had made some amount of payment within the prior week, compared to approximately 82% at March 31, 2020.

We have changed our near-term priorities due to the COVID-19 crisis. We effectively paused all new term loan and line of credit originations by the end of April 2020, other than funding certain line of credit draws, and ceased all equipment finance lending as we focused our resources on supporting government stimulus programs including the Small Business Administration’s Paycheck Protection Program, or PPP. As a result, we expect second quarter originations to decline 80% or more from our first quarter originations.