Technical Report Summary

of the

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for:

Intrepid Potash–Moab, LLC

Revised Report Date:

February 14, 2024

Effective Date:

December 31, 2023

Prepared by:

660 Rood Avenue, Suite A

Grand Junction, Colorado 81501

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | i |

Date and Signature Page

This report titled “Technical Report Summary of the 2023 Estimated Resources and Reserves at Intrepid Potash-Moab” is effective as of December 31, 2023, and was prepared and signed by RESPEC Company, LLC, acting as a Qualified Person Firm.

Signed and Dated February 14, 2024.

signed RESPEC Company, LLC

Susan B Patton, PE

On behalf of RESPEC Company, LLC

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | ii |

Technical Report Summary

of the

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Table of Contents

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | iii |

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | iv |

| | | | | | | | | | | | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| 17.5 | Adequacy of Current Plans and Compliance | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | |

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | v |

List of Tables

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | vi |

List of Figures

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | vii |

List of Abbreviations

| | | | | |

| ° | degree |

| % | percent |

| APR | Annual Percentage Rate |

| BLM | United States Bureau of Land Management |

| CFR | Code of Federal Regulations |

| cfs | cubic feet per second |

| CMC | carboxy-methyl cellulose |

| DRGW | Denver and Rio Grande Western Railroad |

| DSM | Dutch State Mines |

| EOY | end of year |

| F | Fahrenheit |

| ft | feet or foot |

| gpm | gallons per minute |

| Intrepid | Intrepid Potash, Inc. |

| Intrepid-Moab | Intrepid Potash–Moab, LLC |

| IRR | Internal Rate of Return |

K2O | potassium oxide |

| KCl | sylvite or potassium chloride |

| M | million |

| Ma | mega annum (one-million years) |

| mm | millimeter |

| MOP | Muriate of Potash |

| MSL | mean sea level |

| mm | millimeter |

| Mt | million tons |

| NaCl | sodium chloride |

| NPV | Net Present Value |

| NaCl | halite |

| % | percent |

| PFD | process flow diagrams |

| QP | Qualified Person |

| RESPEC | RESPEC Company, LLC |

| SEC | United States Securities Exchange Commission |

| SITLA | Utah School and Institutional Lands Administration |

| SME | Society for Mining, Metallurgy & Exploration |

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | viii |

| | | | | |

| SOE | statement of earnings |

| t | ton |

| tpd | tons per day |

| tpy | tons per year |

| TRS | Technical Report Summary |

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 1 |

1.0Executive Summary

RESPEC Company, LLC (RESPEC) was commissioned by Intrepid Potash, Inc. (Intrepid) to prepare the 2023 Technical Report Summary (TRS) for the Intrepid Potash–Moab, LLC (Intrepid-Moab) property. Previous TRS’s for the property are listed in Table 2-1. Resources and reserves are estimated according to United States (US) Securities and Exchange Commission (SEC) S-K 1300 regulations.

1.1Property Description and Ownership

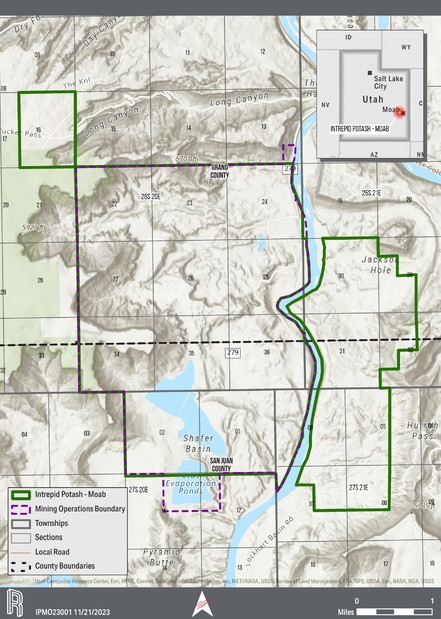

Intrepid-Moab’s Cane Creek Mine is located approximately 20 miles west of Moab, Utah, which is 234 miles southeast of Salt Lake City, Utah. The Colorado River runs north–south along the eastern operations boundary. Intrepid-Moab’s property covers an area of approximately 14,100 acres of land. Intrepid-Moab’s potash leases include 10,100 acres from the State of Utah and approximately 200 acres from the US federal government through the U.S. Bureau of Land Management (BLM).

1.2Geology and Mineralization

The depositional history of eastern Utah’s vast salt and potash resources begins during the regionally arid Pennsylvanian Period, 330–310 million years ago. An immense block of the Earth’s crust, in what is today western Colorado, was thrust upward to form the Uncompahgre Highlands and identified as the westernmost expression of the Ancestral Rocky Mountains. As is common throughout geologic history, dramatic uplift was coupled with subsidence in an adjoining area. The subsequent topographical basin was inundated by seawater as it subsided. Throughout the Pennsylvanian Period, sea levels rose and fell. With each retreat of the sea, the Paradox Basin, as it is called, became devoid of fresh sea water, allowing the process of evaporation to dominate which resulted in widespread precipitation of chloride minerals. This retreat/inflow cycle is known to have occurred a minimum of 29 times, with each marked by a specific and predictable sequence of sedimentary deposition. This series of depositional cycles is collectively known as the Paradox Formation. Potash is documented to exist in 17 of the 29 cycles, and it is from these formational cycles that commercial production of potash occurs.

1.3Status of Exploration, Development and Operations

The property has been in continuous operation by Intrepid-Moab since 1999. Confirmation drilling and mine development are an integral part of the mine operations.

1.4Mineral Resource Estimates

The resource model created from the exploration and sampling database served as the basis for the mineral resource estimate. The resources reported as mineralized rock in place, exclusive of mineral reserves effective December 31, 2023, are shown in Table 1-1.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 2 |

Table 1-1. Sylvinite In Situ Mineral Resource Estimate effective December 31, 2023

| | | | | | | | | | | | | | | | | |

| Moab - Sylvinite Mineral Resource Estimate effective December 31, 2023 based on $450/Product Ton Mine Site |

| Resources | | |

| Beds 5 & 9 | Sylvinite1 | Grade | Contained K2O | Cutoff2 | Processing Recovery |

| (Mt) | (%K2O) | (Mt) | | (%) |

| Measured Mineral Resources | 97 | 26 | 25 | Minimum of 3-ft and 18.95% K2O | 83 |

| Indicated Mineral Resources | 190 | 25 | 47 | Minimum of 3-ft and 18.95% K2O | 83 |

| Measured + Indicated Mineral Resources | 287 | 25 | 72 | | |

| Inferred Mineral Resources | 38 | 23 | 9 | Minimum of 3-ft and 18.95% K2O | 83 |

1Sylvinite is a mixed evaporite containing NaCl and KCl. Pure KCl equates to 63.17% K2O by mass. |

2Solution mining resource cutoff for flooded old working is the mining extents boundary. |

| Mineral Resources were prepared by RESPEC, a qualified firm for the estimate and independent of Intrepid Potash, for EOY 2023. |

| Mineral Resources are reported exclusive of Mineral Reserves, on a 100% basis. |

Mt = million tons, % = percentage, K2O = potassium oxide, ft = feet |

1.5Mineral Reserve Estimates

Using the mineral resource grids and applying modifying factors to a 25-year cavern mining plan EOY 2023 reserves were estimated. Table 1-2 shows the estimated reserve summaries for EOY 2023.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 3 |

Table 1-2. Potash Mineral Reserve Estimate effective December 31, 2023

| | | | | | | | | | | | | | | | | |

| Moab - Potash Mineral Reserve Estimate effective December 31, 2023, based on $360/Product Ton Mine Site |

| Reserves | | |

| Beds 5 and 9 | In-Place KCl | In-Situ Grade1 | Product2 | Brine Cutoff Grade3 | Processing Recovery |

| (Mt) | (%K2O) | (Mt) | (%K2O) | (%) |

| Proven Mineral Reserves | 3.1 | 28.3 | 2.3 | 2.5 | 83 |

| Probable Mineral Reserves | 0.4 | 28.9 | 0.3 | 2.5 | 83 |

| Total Mineral Reserves | 3.5 | 28.4 | 2.6 | | |

1In-situ grade is the amount of K2O in the remaining pillars of the old works and is used to calculate the In-Place KCl. |

2Product tons are calculated by multiplying In-Place KCl by: dissolution factor of 89%, areal recovery of 100%, geologic factor of 94%, plant recovery of 86%, handling loss factor of 97.5%, and product purity of 104% (1/0.96). |

3Brine cutoff grade is the amount of K2O in the extracted brine necessary to cover the cash costs of production. |

| Mineral Reserves were prepared by RESPEC, a qualified firm for the estimate and independent of Intrepid Potash, for EOY 2023. |

| Mineral Reserves are reported exclusive of Mineral Resources, on a 100% basis. |

Mt = million tons, % = percentage, K2O = potassium oxide |

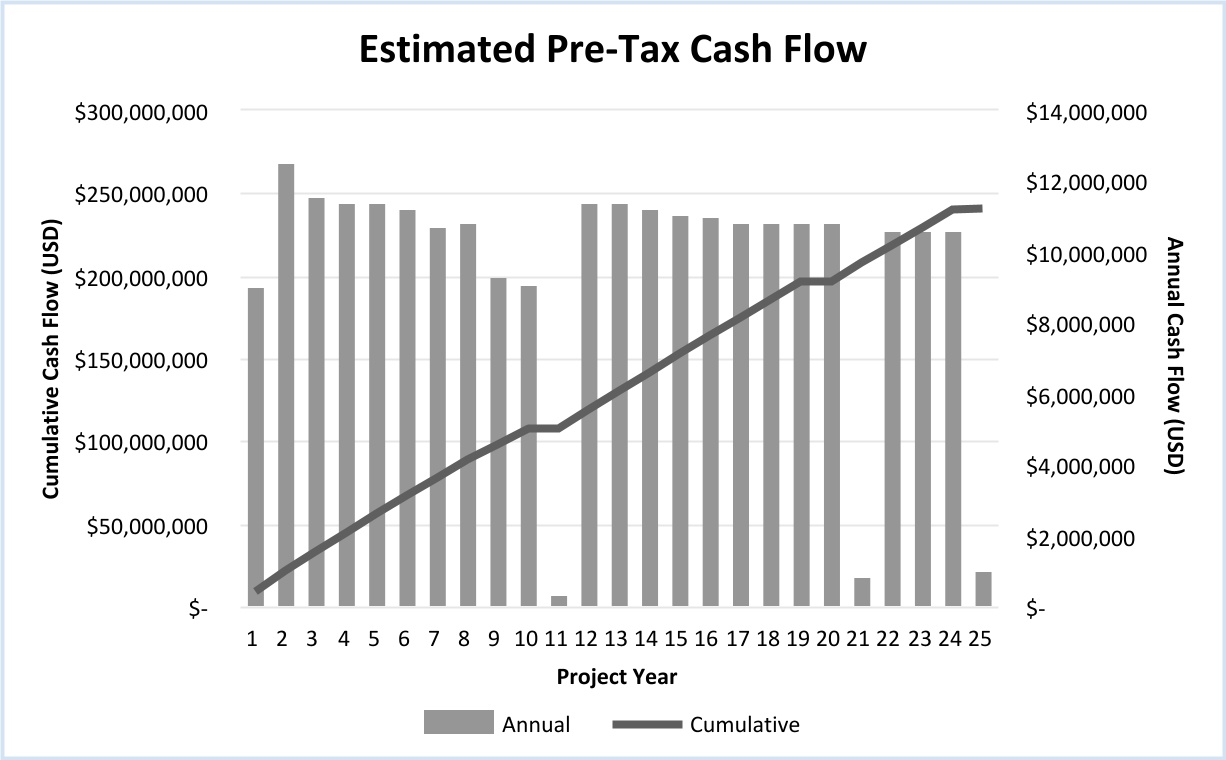

1.6Summary of Capital and Operating Cost Estimates

The operating cost per potash product ton from solution mining is estimated at $198/t for the next 5 years with a credit for the byproducts of $26/ton of potash. The estimated potash operating cost is $172/ton for the 25-Year Mine Plan.

Capital investment necessary to complete the mine plan includes $3M for well rehabilitation, the development of additional caverns at a cost of $10M. This investment is in addition to the ongoing sustaining capital requirements and occurs approximately every 10 years. Reclamation costs in Year 25 are estimated to be $9.6M.

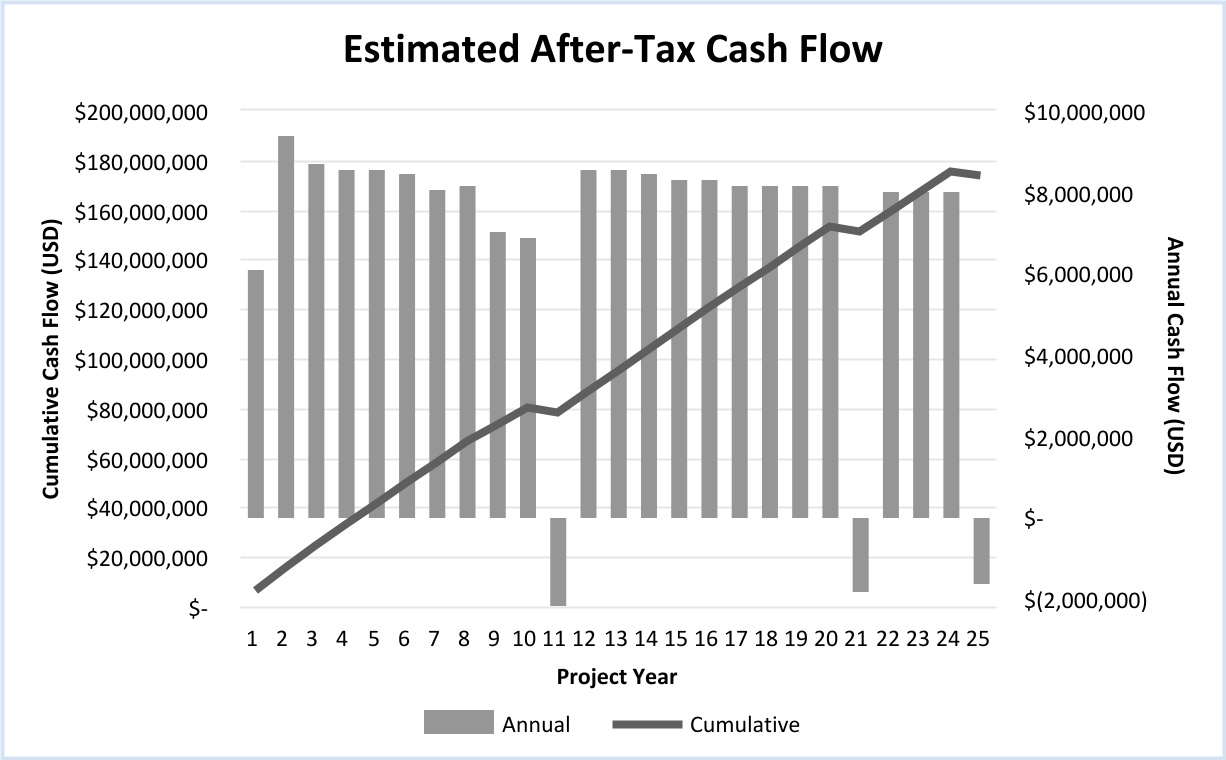

1.7Economic Analysis

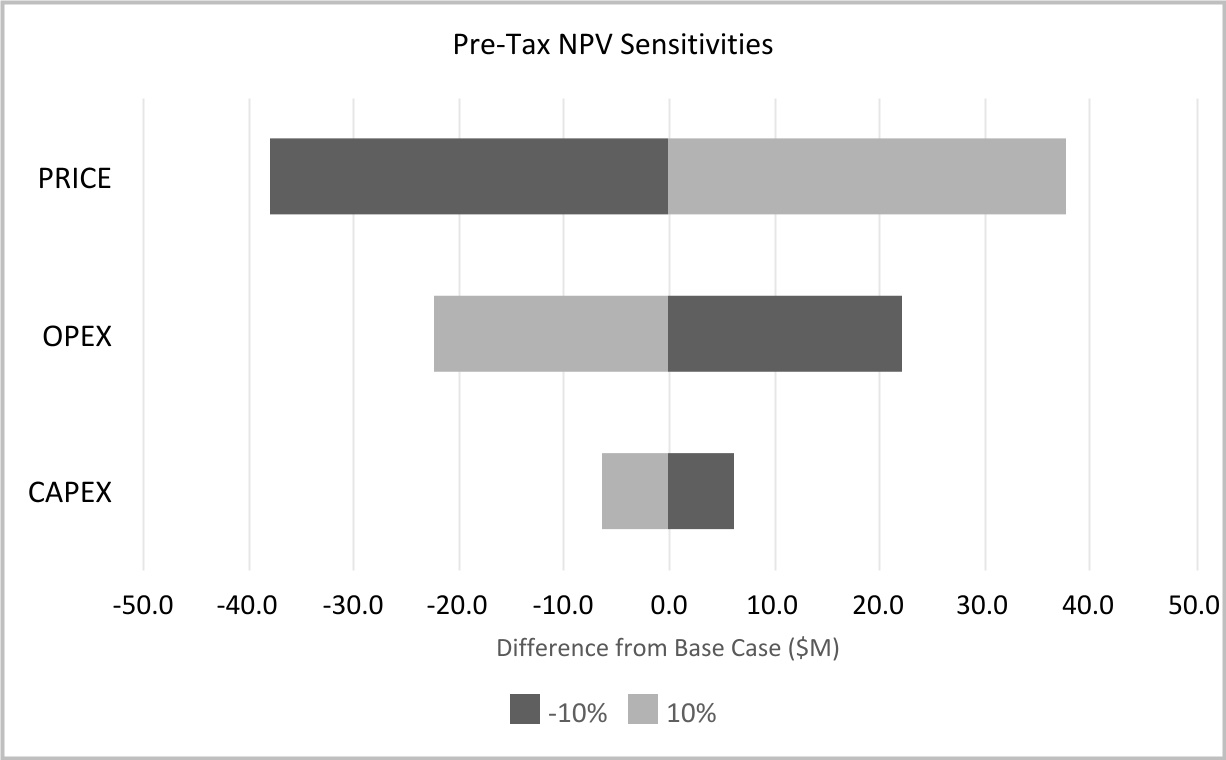

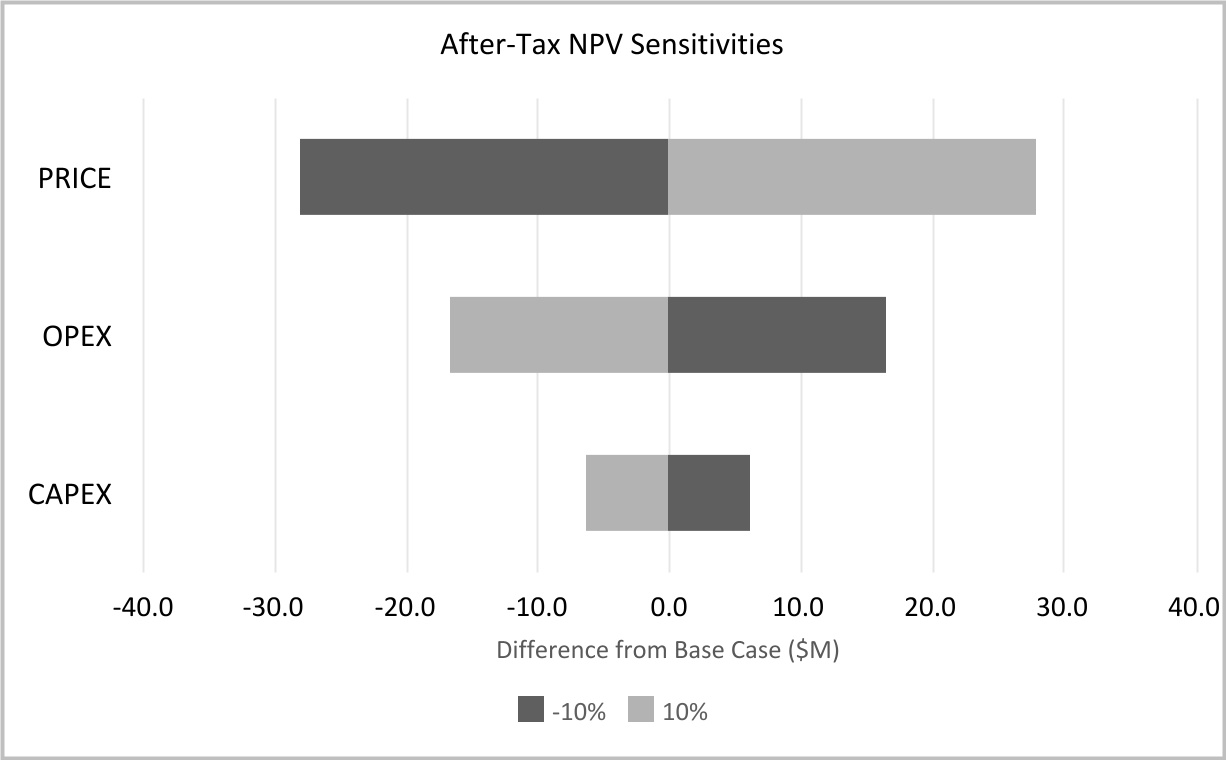

The Net Present Value (NPV) at 8% Annual Percentage Rate (APR) for the before- and after-tax estimated cash flow is positive. The sensitivity to product price and operating cost for an 8% APR was evaluated. Varying costs and sales price plus and minus 10% the NPV remains positive.

1.8Permitting

The mines are in operation and necessary state and federal operating permits are in place.

1.9Conclusions and Recommendations

There are significant potash resources within the area under the control of Intrepid-Moab such that the property can support an average 102,800 ton per year (tpy) production rate for the foreseeable future.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 4 |

2.0Introduction

2.1Purpose and Basis of Report

This document was prepared to report the Intrepid-Moab mineral resources in terms of in-situ tons and reserves in terms of saleable product at Intrepid-Moab under the SEC S-K 1300 rules (2018). The Society for Mining, Metallurgy & Exploration (SME) Guide for Reporting Exploration Information, Mineral Resources and Mineral Reserves (SME 2017) (The SME Guide) supplements the modifying factors used to convert mineral resources to mineral reserves. Previous TRS’s filed for the property are listed in Table 2-1.

2.2Terms of Reference

According to 17 Code of Federal Regulations (CFR) § 229.1301 (2021), the following definitions are included for reference:

An inferred mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. An inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability. An inferred mineral resource, therefore, may not be converted to a mineral reserve.

An indicated mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. An indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource and may only be converted to a probable mineral reserve. As used in this subpart, the term adequate geological evidence means evidence that is sufficient to establish geological and grade or quality continuity with reasonable certainty.

A measured mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. As used in this subpart, the term conclusive geological evidence means evidence that is sufficient to test and confirm geological and grade or quality continuity.

Modifying factors are the factors that a qualified person must apply to indicated and measured mineral resources and then evaluate in order to establish the economic viability of mineral reserves. A qualified person must apply and evaluate modifying factors to convert measured and indicated mineral resources to proven and probable mineral reserves. These factors include but are not restricted to mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 5 |

A probable mineral reserve is the economically mineable part of an indicated and, in some cases, a measured mineral resource.

A proven mineral reserve is the economically mineable part of a measured mineral resource. For a proven mineral reserve, the qualified person has a high degree of confidence in the results obtained from the application of the modifying factors and in the estimates of tonnage and grade or quality. A proven mineral reserve can only result from conversion of a measured mineral resource.

Throughout the report, reserves are presented in tons of K2O and KCl. Historically, assay data have been reported in terms of % K2O and reserves in equivalent tons of K2O. Sylvite is potassium chloride (KCl) and, in many historical reports, reserve tons or product tons are recorded in terms of tons of KCl. Pure KCl equates to 63.17% K2O by mass.

2.3Sources of Information

Previously completed reserve estimations under SEC Guide 7 (2008) rules for this property and TRS’s reporting mineral resources and mineral reserves under the SEC S-K 1300 rules are listed in Table 2-1.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 6 |

Table 2-1. Summary of Reports

| | | | | | | | |

| | |

| Effective EOY | Title | Reference |

| 2007 | 2007 Resource and Reserve Estimate for Solution Mine at Cane Creek Mine | Agapito 2007a |

| 2007 | Determination of Estimated Proven and Probable Reserves at Intrepid Potash—Moab, LLC | Agapito 2007b |

| 2009 | Determination of Estimated Proven and Probable Potash Reserves at Intrepid Potash—Moab, LLC | Agapito 2010 |

| 2012 | Determination of Estimated Proven and Probable Potash Reserves at Intrepid Potash—Moab, LLC | Agapito 2013 |

| 2015 | Determination of Estimated Proven and Probable Potash Reserves at Intrepid Potash—Moab, LLC | Agapito 2016 |

| 2018 | 2018 Determination of Estimated Proven and Probable Reserves at Intrepid Potash—Moab, LLC | Agapito 2019 |

| 2021 | Technical Report Summary, 2021 Estimated Resources and Reserves at Intrepid Potash-Moab | Agapito 2022 |

| 2021 | Technical Report Summary, REVISED 2021 Estimated Resources and Reserves for Intrepid Potash–Moab | RESPEC 2023 |

2.4Personal Inspection

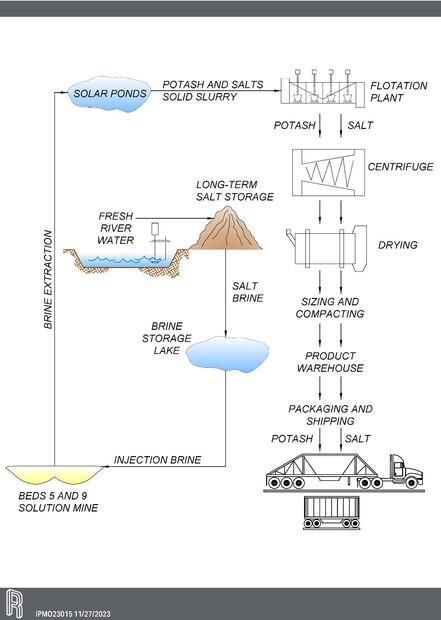

Personal inspection of the properties has occurred over the years by the QP. The most recent inspection by the QP took place on May 17, 2021. The inspection began with a tour of the tailings lake then the solar evaporating ponds. In addition, the wellfields (injection and extraction), processing plant, product packaging and shipping areas were all inspected. During the site visit, harvesting was occurring, and the plant was operating. The plant is typically idle during the peak evaporation season from June 1 to September 1.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 7 |

3.0Property Description

3.1Location and Area of the Property

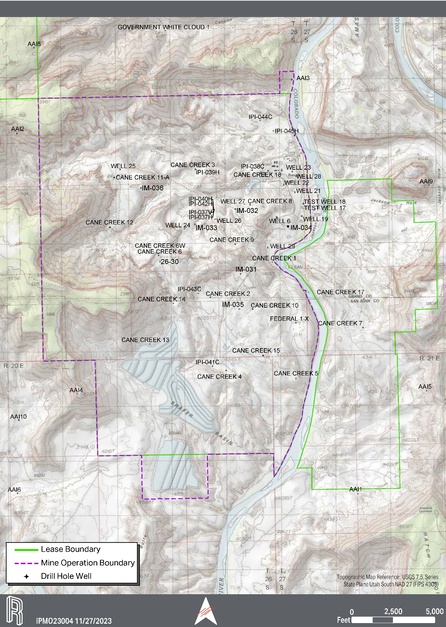

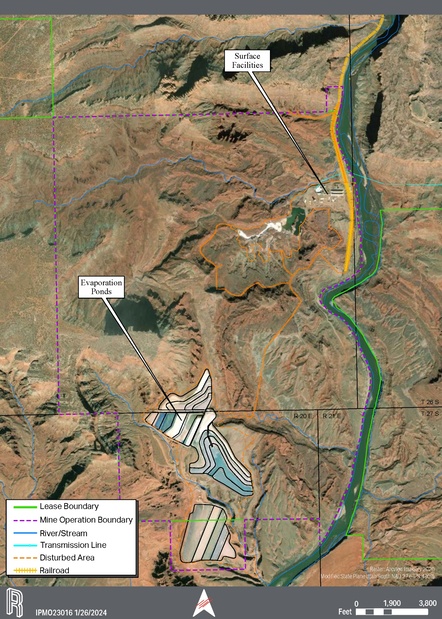

Intrepid-Moab’s Cane Creek Mine is located approximately 20 miles west of Moab, Utah, which is 234 miles southeast of Salt Lake City, Utah (Figure 3-1). The Colorado River runs north–south along the eastern operations boundary. Intrepid-Moab’s property covers an area of approximately 14,100 acres of land.

3.2Mineral Rights

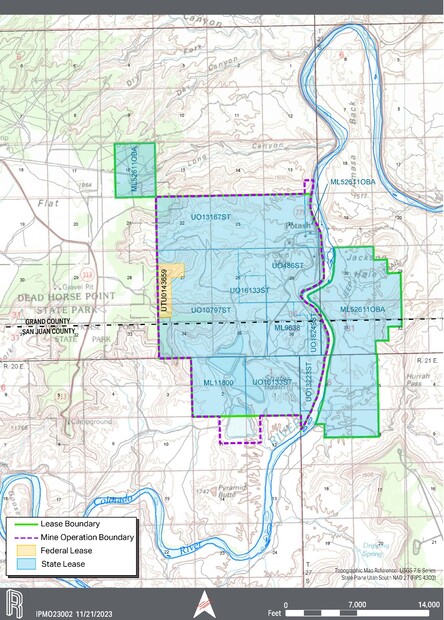

Intrepid leases approximately 10,100 acres from the State of Utah and approximately 200 acres from the U.S. federal government through the BLM. Intrepid-Moab owns approximately 3,800 surface acres overlying and adjacent to portions of the mining leases with the State of Utah as shown in Figure 3-2 and as described in the lease and property access in Table 3-1.

3.3Significant Encumbrances

There are no significant encumbrances to the property, including current and future permitting requirements and associated timelines, permit conditions, and violations and fines.

3.4Significant Factors

There are no significant factors and risks that may affect access, title, or the right or ability to perform work on the property.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 8 |

Figure 3-1. Intrepid-Moab Location Map

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 9 |

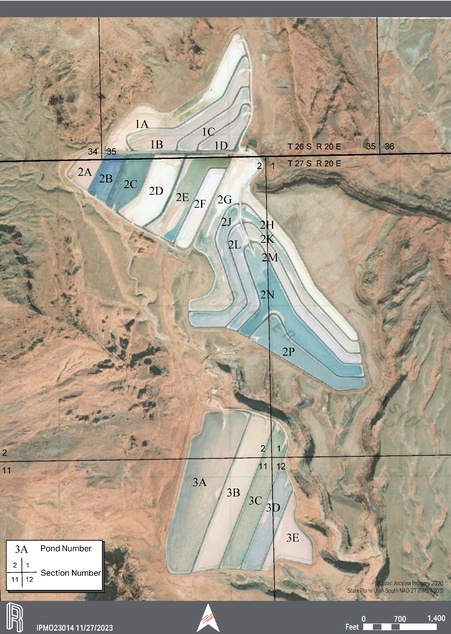

Figure 3-2. Intrepid-Moab Lease Map

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 10 |

Table 3-1. Leases and Property Rights

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Federal Land Lease Number | Lessee | Lease Type | Mine | Date | Royalty Rate | Readjustment Due | Acres (BLM) | Amount Paid |

| | | | | | | | |

| UTU0143659 | Intrepid Potash-Moab, LLC | Pot Fringe Acre NC Lse | Moab | 1959 | Minimum royalty $3/acre | 8/1/2039 | 200 | |

| State of Utah Land Lease Number | Lessee | Lease Type | Mine | Date | End Date | Rental Period | Acres (SITLA) | Rental Amount |

| | | | | | | | |

| ML9638 | Intrepid Potash-Moab, LLC | Potash | Moab | 1955 | 12/31/2024 | 1/1/2024–12/31/2024 | 440 | $1,760 | |

| ML11800 | Intrepid Potash-Moab, LLC | Potash | Moab | 1956 | 12/31/2024 | 1/1/2024–12/31/2024 | 699 | $2,796 | |

| ML52611OBA | Intrepid Potash-Moab, LLC | Potash | Moab | 2013 | 9/30/2023 | 9/3/2023–9/02/2024 | 3,030 | $35,310 | |

| UO486ST | Intrepid Potash-Moab, LLC | Potash | Moab | 1959 | 12/31/2024 | 1/1/2024–12/31/2024 | 818 | $3,276 | |

| UO10797ST | Intrepid Potash-Moab, LLC | Potash | Moab | 1959 | 12/31/2024 | 1/1/2024–12/31/2024 | 2,040 | $8,160 | |

| UO13167ST | Intrepid Potash-Moab, LLC | Potash | Moab | 1960 | 12/31/2024 | 1/1/2024–12/31/2024 | 1,800 | $7,200 | |

| UO13223ST | Intrepid Potash-Moab, LLC | Potash | Moab | 1960 | 12/31/2024 | 1/1/2024–12/31/2024 | 238 | $956 | |

| UO16133ST | Intrepid Potash-Moab, LLC | Potash | Moab | 1960 | 12/31/2024 | 1/1/2024–12/31/2024 | 885 | $3,540 | |

| UO18249ST | Intrepid Potash-Moab, LLC | Potash | Moab | 1960 | 12/31/2024 | 1/1/2024–12/31/2024 | 180 | $724 | |

| SITLA = Utah School and Institutional Lands Trust Administration |

| NOTE—Coordinate System: Utah South Zone State Plane, NAD83 |

| | | | | | | | |

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 11 |

4.0Accessibility

4.1Topography, Elevation, and Vegetation

The Intrepid-Moab property is a unique high-altitude desert landscape formed from the sandstone of ancient seafloors and sand dunes. Elevations range from 3,900 feet (ft) to 4,400 ft above mean sea level (MSL).

The sandy loam soil supports sparse perennial bunchgrasses such as galleta, alkali sacaton, three-awn, inland saltgrass, Indian ricegrass, and sand dropseed. Native plants include cold hardy agave, cactus, and yucca.

4.2Property Access

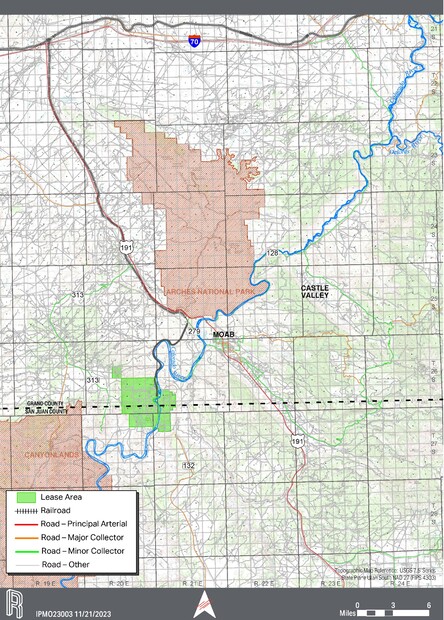

Access to the property is predominantly via state highway 191 and state road 279, locally referred to as Potash Road. A Union Pacific/Denver and Rio Grande Western Railroad (DRGW) rail spur services the property. The nearest town to the Intrepid Potash-Moab property is Moab, Utah (with an estimated population of about 5,300). Salt Lake City, Utah (population of 200,500) and Grand Junction, Colorado (population of 67,000), are located approximately 240 and 120 miles to the west and east, respectively, by road, and are the nearest major industrial and commercial airline terminals. Moab also has a commercial airline terminal with scheduled flights to Salt Lake City. Figure 4-1 shows the means of access to the property.

4.3Climate

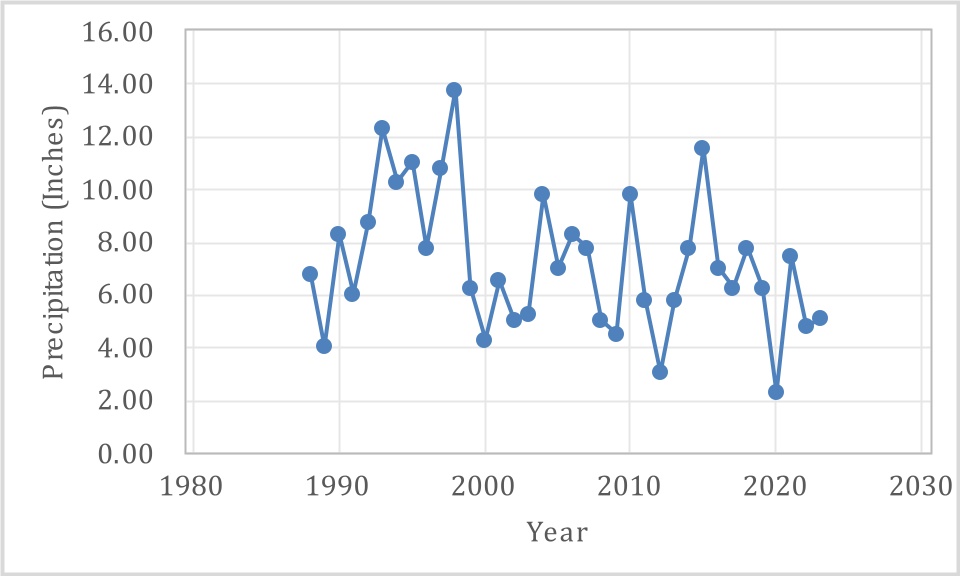

Average temperatures range between a low of approximately 10 degrees Fahrenheit (°F) during winter months and a high of approximately 100°F during summer months. The area experiences about 300 days of sunshine and an average of 5 percent (%) relative humidity. The semi-arid climate experiences an annual rainfall at the mine site of about 7.3 inches, distributed evenly throughout the year. Most precipitation occurs in late summer and early autumn months. Much of this precipitation comes in the form of sudden summer thunderstorms and is lost in runoff to the Colorado River. The climate is favorable for year-round solution mining operations. The precipitation history has been recorded on site since 1988 and is included in Figure 4-2.

4.4Infrastructure Availability

The nearby Colorado River provides the Intrepid-Moab mining operation with make-up water under existing water rights with the State of Utah for a water supply of 9 cubic feet per second (cfs).

The Intrepid-Moab mine has been in operation (solution mining) since 1970 and, as a result, has the infrastructure and available personnel. The local area population is sufficient to support the Intrepid-Moab mine.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 12 |

Figure 4-1. Property Access

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 13 |

Figure 4-2. Site Precipitation Record

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 14 |

5.0History

Conventional underground mining began in Bed 5 in 1964 by Texasgulf, Inc. (Texasgulf), but various mining problems caused a conversion to a system combining solution mining and solar evaporation in 1971. Prior to 1970, approximately 6.5 million tons (Mt) of sylvinite ore was mined and from that, 1.7 Mt of potash produced. Mining was by continuous miners and made difficult by the irregular floor, gas, and high rock temperatures. The height mined was typically 8 ft. The dip of the ore was such that maintaining the miners in the seam was difficult. The seam floor rolls and folds resulted in an irregular mine plan with many large areas left unmined as pillars. In some areas, secondary mining resulted in high extraction.

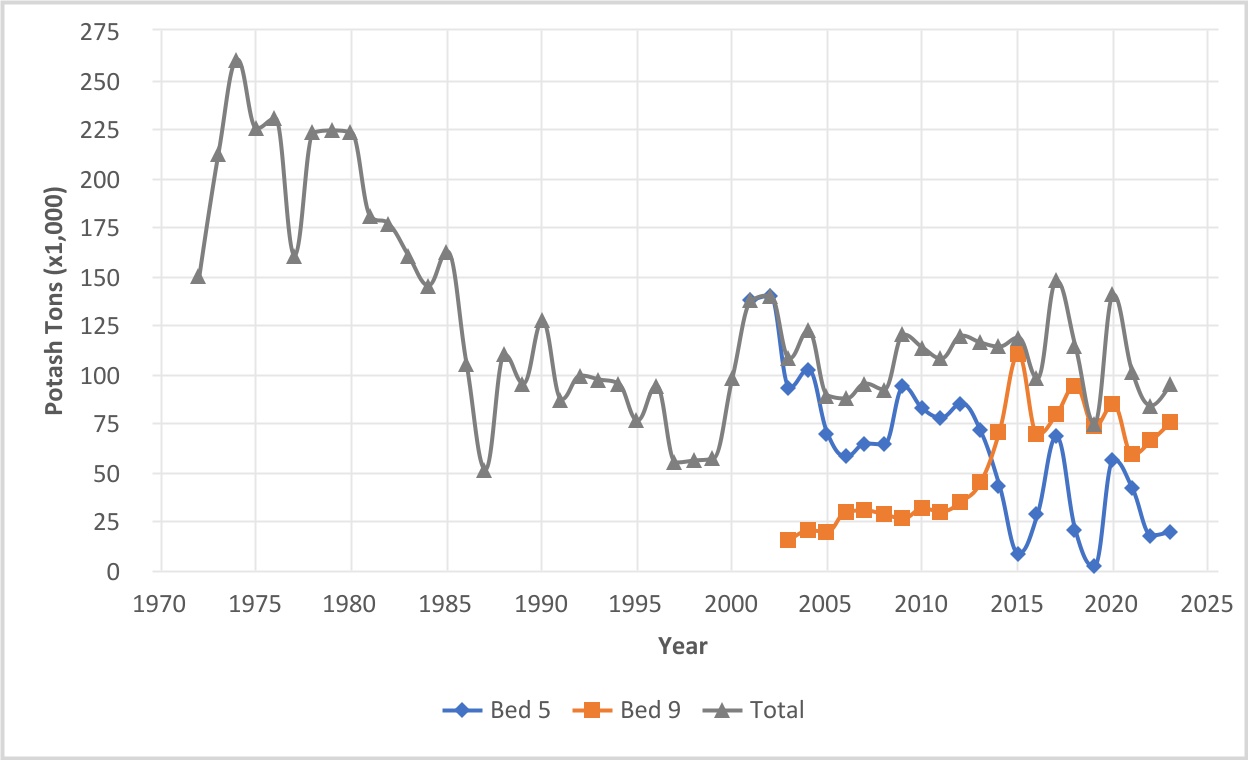

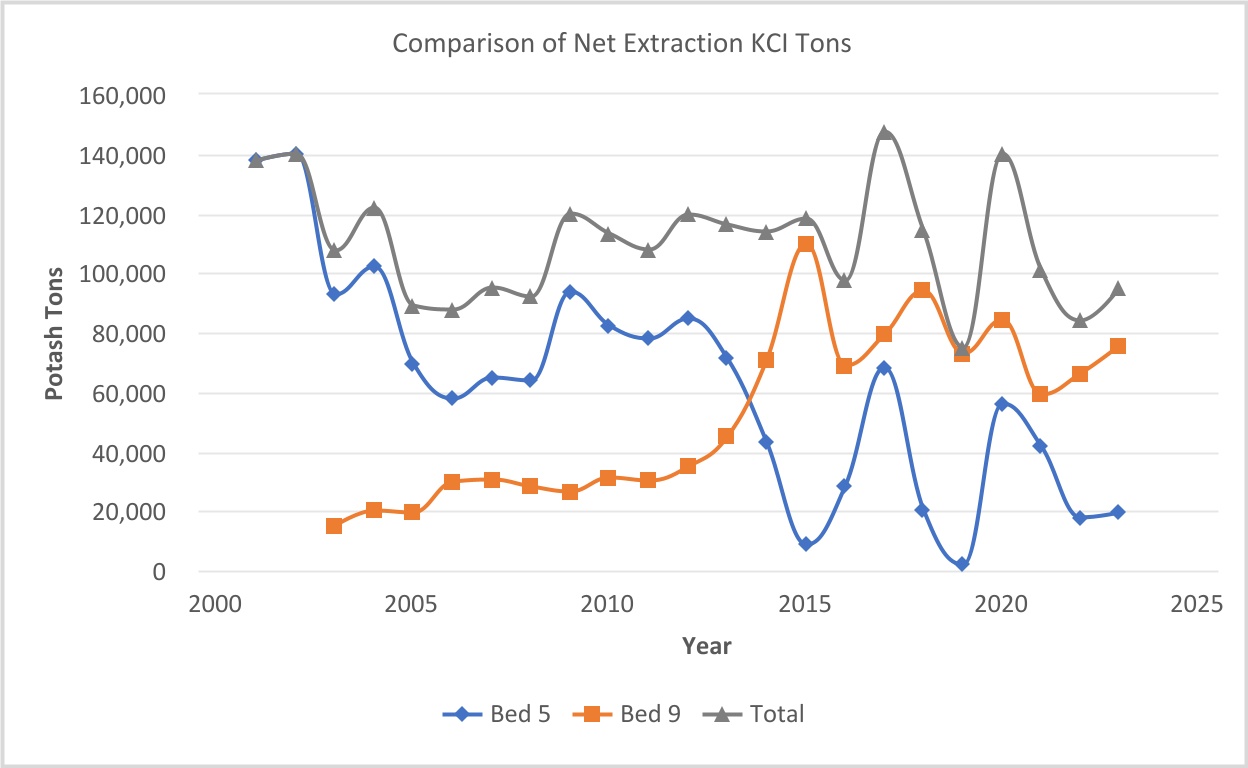

The Moab Salt operation was purchased by Intrepid in 1999. In 2000, Intrepid-Moab drilled two new recovery wells to revitalize production from Bed 5. Production from Bed 5 had declined from near 100,000 t in 1994 to 60,000 t in 1999 (see Figure 5-1). After completion of the two new recovery wells, the brine concentration improved, and production increased to near 100,000 t in 2001. Maintaining production at or near the target rate of 100,000 tpy was difficult from Bed 5 because of declining product concentration. It was believed that solution mining over the prior 32 years had solution mined most of the remnant pillars in the old workings and that active solution mining was restricted to the updip faces of the mine ribs.

Figure 5-1. Historical Product Tons of KCl from Beds 5 and 9

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 15 |

Methods to enhance the production rate were evaluated by Intrepid-Moab and resulted in the decision to develop solution mining in Bed 9. Bed 9 is located 800 to 1,000 ft below Bed 5 and is of higher KCl content. Bed 9 had not been solution mined previously, although, some test mining was completed by the prior owners in the late-1960s. A novel method of solution mining was adopted for recovery of potash from Bed 9. Moab Salt-27 and Moab Salt-28 were drilled “horizontally” in 2002 in Bed 9 to connect and provide pathways for the liquor injected in Moab Salt-27 to contact the sylvinite and differentially dissolve the sylvite before being lifted from Moab Salt-28. Currently, Moab Salt-29 connects Moab Salt-27 and -28 and serves as an alternative to Moab Salt-27 for injection. Figure 5-1 presents the total (Beds 5 and 9) historical potash production KCl tons from 1965 to 2023.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 16 |

6.0Geologic Setting

6.1Regional Geology

The depositional history of eastern Utah’s vast salt and potash resources begins during the regionally arid Pennsylvanian Period, 330–310 million years ago. An immense block of the Earth’s crust, in what is today western Colorado, was thrust upward to form the Uncompahgre Highlands and identified as the westernmost expression of the Ancestral Rocky Mountains. As is common throughout geologic history, dramatic uplift was coupled with subsidence in an adjoining area. In this instance, the adjacent landscape to the southwest experienced significant down-warping. The subsequent topographical basin was inundated by seawater as it subsided. Throughout the Pennsylvanian Period, sea levels rose and fell with stunning regularity as reflected by Pennsylvanian strata worldwide. With each retreat of the sea, the Paradox Basin, as it is called, became devoid of fresh sea water, allowing the process of evaporation to dominate which resulted in widespread precipitation of chloride minerals. This retreat/inflow cycle is known to have occurred a minimum of 29 times, with each marked by a specific and predictable sequence of sedimentary deposition. This series of depositional cycles is collectively known as the Paradox Formation. Potash is documented to exist in 17 of the 29 cycles, and it is from these formational cycles that commercial production of potash occurs.

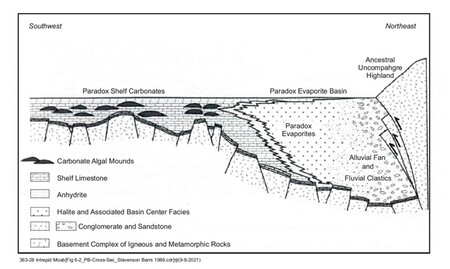

The Paradox Formation is bounded above by the Honaker Trail Formation and by the Pinkerton Trail Formation below. Collectively, these three units form the Hermosa Group and provide a comprehensive record of Pennsylvanian deposition within the Paradox Basin. Along the northeastern and eastern margins, the Hermosa Group is undifferentiated due to the considerable amount of uninterrupted alluvial fan and fluvial clastics sourced from the Uncompahgre Highlands.

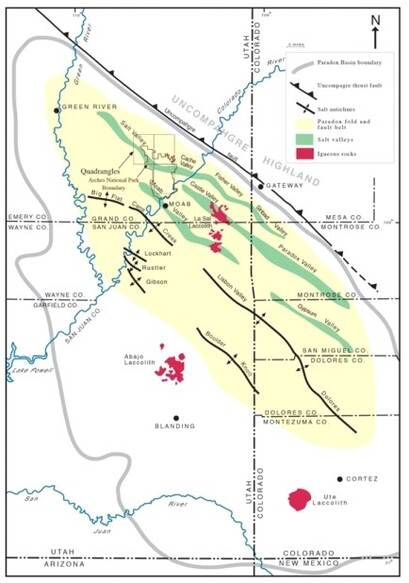

The majority of the Paradox Basin lies in southeastern Utah and far southwestern Colorado, with minor extents into northwestern New Mexico and northeastern Arizona (Figure 6-1). The elongate, northwest–southeast trending basin is roughly 100 miles wide by 200 miles long and is broadly defined by the lateral extent of the formation for which it is named. The Paradox Basin gradually shallows to the southwest generating thickness patterns for Pennsylvanian sediments that are strongly asymmetric when viewed along a northeast to southwest transect (Figure 6-2). Along the northeast basin margin that abuts the Uncompahgre Highlands, thicknesses can exceed 18,000 ft, with compositions of coarse sandstones and clastic detritus eroded off the adjacent highlands. A short distance southwest, at roughly the basin center, exists the evaporite sequences described above. Continuing southwest, the Basin thins gradually with an increasing prevalence of carbonate rocks indicative of a shallow marine depositional environment.

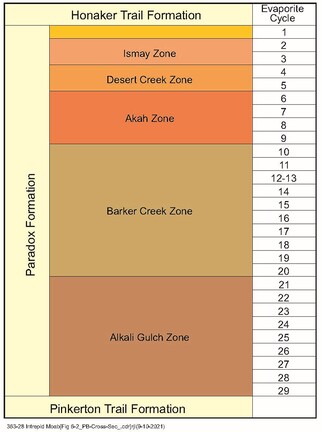

Exploration of the carbonate sequences mentioned above and their potential as hydrocarbon reservoirs in the southern Paradox Basin, led petroleum geologists to informally subdivide the Paradox Formation into five vertically sequenced zones that include, from bottom to top, the Alkali Gulch, Barker Creek, Akah, Desert Creek, and Ismay zones. The five zones are

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 17 |

Figure 6-1. Regional Paradox Basin (after Doelling 1985)

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 18 |

Figure 6-2. Paradox Basin Cross Section (after Stevenson and Barrs 1986)

defined by marker beds at their top and/or base that, in many instances, correlate well with equivalent beds in the central basin. These shelf carbonate cycles, like their evaporite counterparts to the north, record a regular rise and fall of sea levels. Similarities beyond the shared marker beds are few; nevertheless, many of the designated zones and their given name may be used when grouping evaporite cycles. Figure 6-3 illustrates how the depositional cycles identified by Hite (1960) correlate with the five named zones.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 19 |

Figure 6-3. Evaporite Cycles, 29 Cycles, 5 Zones (after Hite 1960)

6.2Local Geology

Locally, the documented stratigraphy ranges from Paleoproterozoic (2,500–1,500 mega annum [Ma]) igneous and metamorphic rocks to the surficial Mesozoic Era sedimentary units which form the majestic arches and monoliths commonly associated with nearby national parks. The following section describes this stratigraphic succession, beginning with the deepest occurring units and ascending through to those exposed at the surface.

The oldest, and deepest, rock unit within the Intrepid lease boundary is often referred to as the ‘Precambrian Basement Complex.’ This unit is Early- to Mid-Proterozoic in age and likely composed of biotite-quartz monzonite, a feldspathic gneiss and/or schist, or a related variety of coarse granitic rock based on surface outcrops to the east and through deep drillholes

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 20 |

located within the Paradox Basin (Joesting et al. 1966). Resting unconformably upon the Precambrian Basement is a series of Cambrian and Devonian sedimentary and meta-sedimentary units with an aggregate thickness ranging from 1,100 to 1,800 ft. These are, from oldest to youngest, the Tintic Quartzite, the Ophir Formation, the Maxfield Limestone, the Lynch Dolomite, and the Ignacio Quartzite. Next, the Mississippian Leadville Limestone ranges in thickness from 500 to 700 ft. The upper surface of Mississippian strata was exposed for a considerable time prior to further deposition and is therefore marked by substantial karstic erosional features. The subsequent Pennsylvanian Era was ushered in by deposition of the widespread Molas Formation. When present, the Molas Formation is composed of limestone, shale, dolomite, and sandstone that ranges in thickness from 0 to 150 ft.

Continuing up through the sequence, the Pennsylvanian Pinkerton Trail consists of varied rock types, but is dominated by gray, fossiliferous limestone, and gray-black, marine shales with a thickness up to 200 ft. Analysis of drill core recovered from the central Paradox Basin indicate the uppermost part of the Pinkerton Trail contains several thick beds composed of anhydrite. In terms of deposition, these beds are an indicator of increasing aridity and pose as a chronological precursor to the evaporitic deposits of the overlying Paradox Formation. Stratigraphically, the anhydrite beds serve as useful geologic markers for delineating formation boundaries.

Resting conformably upon the Pinkerton Trail is the unit of economic interest, the Paradox Formation. The depositional thickness of the Paradox exceeds 7,000 ft in the center of the Lisbon Valley anticline (Hite 1978) and gradually thins toward the west where it either pinches out entirely or interfingers with shallow-marine carbonate sequences of chronological equivalency. The Paradox Formation records multiple depositional cycles driven by climatic oscillations and their coincident sea level fluctuations throughout the middle Pennsylvanian Era. As large glacial events began in the polar regions, global sea levels fell, thereby restricting the flow of fresh sea water into the Paradox Basin from the open sea to the west. It was during these periods that evaporation dominated, resulting in prolific precipitation of evaporite minerals. Following each glacial maximum, as temperatures and sea levels rose, the isolated brines of the Paradox Basin were inundated with fresh sea water. These interglacial periods are marked by deposition of organic-rich black shale.

The late-Pennsylvanian Honaker Trail Formation conformably overlies the Paradox Formation and is the uppermost member of the Hermosa Group. Like the Pinkerton Trail, the Honaker Trail primarily consists of marine carbonates and shale, with the added presence of fluvial and eolian sandstones. Within the Intrepid lease boundary, the Honaker Trail-Paradox contact is placed at the top of the uppermost halite bed of the Paradox Formation. The Honaker Trail is further differentiated from the Paradox Formation by the generally recognized color differences between the red-, brown-, and buff-colored strata of the Honaker Trail and the predominantly gray, black, and occasional orange of the Paradox. The upper Honaker Trail marks the filling of the structural Paradox Basin. By the late-Pennsylvanian Age, an uninterrupted, low-relief slope extended from the topographic high of the Uncompahgre Highlands westward to the seashore in central Utah. In the central basin, the Honaker Trail has an average thickness of 0–5,000 ft.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 21 |

Continuing up sequence, the Late Pennsylvanian-Permian Cutler Formation is predominantly composed of arkosic sandstones and conglomerates. Because the source of clastic material continued from the Uncompahgre Highlands throughout the Permian, the Cutler exhibits a general fining-westward of clast and grain size as distance from the highlands increases. As was true with the Pennsylvanian Hermosa Group, the depositional zone immediately adjacent to the Uncompahgre Highlands accumulated a thick homogeneous succession of coarse conglomerates and sandstones, leading the Cutler Formation in this area to be termed undifferentiated. However, with added westward distance from the high-relief source area, the Cutler becomes easily subdivided and is then referred to as the Cutler Group. Within the Intrepid lease boundary, the Cutler Group usually contains, in ascending order, the Lower Cutler Beds, the Cedar Mesa Sandstone, the Organ Rock Formation, and the White Rim Sandstone. Typical thickness of the Cutler Group in this area ranges from 0 to 8,000 ft.

Continuing up sequence, the brown to deeply reddish-colored Moenkopi and Chinle Formations of Triassic age are largely composed of mudstones, siltstones, and sandstones. The early-Jurassic Wingate Sandstone is a prominent cliff-forming unit whose large-scale cross-bedding marks a period of eolian deposition. The Wingate is capped by the Kayenta Sandstone, a ledge and bench-forming unit deposited by fluvial processes. The mid-Jurassic Navajo Sandstone marks yet another eolian period of deposition and may be up to 740 ft thick. The Navajo is bounded above by the San Rafael Group, which may or may not contain its basal Dewey Bridge Member. The Dewey Bridge Member, if present, is overlain by the reddish-orange Entrada Sandstone. Within the Intrepid lease boundary, one is not likely to encounter competent layers younger than the Entrada Sandstone, however, isolated occurrences of the late-Jurassic Morrison Formation may be found.

Perhaps the most significant aspect of local geology is the degree of structural deformation caused by the buoyancy of Paradox Formation salts. Soon after the thick evaporite sequences were deposited, the increasing load of overlying sediments caused lateral and vertical migration of the lower density salt bodies. Local upward movement predominantly occurred along elongate, northwest-trending zones resulting in large anticlines cored by rising salt. Vertical extension of overlying strata along the limbs of some anticlines has resulted in normal faulting and fault block rotation, as well as extremely high-angle bedding, and in some instances, overturned beds.

The soluble nature of the rising salt makes it particularly susceptible to dissolution by groundwater, which eventually leads to the collapse of overlying sedimentary layers. The Cane Creek anticline, which dominates the landscape of Intrepid-Moab’s property, is one such structure.

6.3Property Geology

Intrepid-Moab’s mine operation boundary includes 7,656 acres straddling the Cane Creek anticline and is centered roughly 5 miles southwest of the town of Moab, Utah. The Cane Creek anticline is one of a series of northwest-trending anticlines with salt at the core that make up the fold fault belt of the north and northeast part of the Paradox Basin. Intrepid-Moab’s property overlies the Paradox Basin salts, which are up to 7,000 ft thick. The Colorado River

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 22 |

runs approximately north–south along the eastern property boundary. The Intrepid-Moab property is a high-altitude desert landscape formed of sedimentary rock units, originally deposited in a wide range of environments and processes. Actual elevations range from 3,900 ft to 4,400 ft MSL.

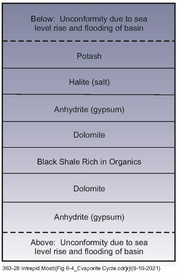

Within the Intrepid lease boundary, the Paradox Formation consists primarily of halite rock with occasional potash salts and smaller amounts of anhydrite, dolomite, silty dolomite, limestone, siltstone, and shale. Hite (1960) identified 29 depositional cycles within the Paradox Formation. A typical evaporite cycle consists of, in ascending order, basal anhydrite, dolomite, carbon-rich black mudstone, dolomite, anhydrite, and finally halite (Figure 6-4). A singular evaporite cycle is often referred to as a ‘bed’ (i.e., there are 29 beds). When potash occurs, it often overlies the halite to form the top of the cycle, or it may be interbedded within the halite. Each cycle is marked, top and bottom, by sharp contacts interpreted as disconformities. The potash-bearing ore, sylvinite, is a mixture of sylvite or potassium chloride (KCl) and halite or sodium chloride (NaCl).

Figure 6-4. Evaporative Cycle (after Fillmore 2010)

6.4Significant Mineralized Zones

Potash is documented to exist in 17 of the 29 evaporite cycles that comprise the Paradox Formation. Of these 17, two are principally targeted by Intrepid for commercial potash production: Bed 5 and Bed 9. Figure 6-5 stratigraphically illustrates the presence of potash beds 5 and 9 when depicted via a gamma-ray log.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 23 |

Figure 6-5. Stratigraphic Type Section (from Intrepid 2007)

Based on locally recovered drill core, geophysical logs, and on historical mining data, Bed 5 has an average thickness of 10.24 ft. Average depth to the top of Bed 5 is 3,113 ft and the average K2O grade is 22.98%. Likewise, Bed 9 has an average thickness of 8.1 ft, an average depth of 4,013 ft, and an average K2O grade of 29.75%. Although K2O, or potassium oxide, is not the preferred chemical form used in commercial consumption, potash grades are typically reported as ‘K2O equivalent’ to allow for a standard unit of comparison. In addition, it should be noted that K2O is approximately 83% potassium by weight, whereas KCl is 52% potassium by weight. Thus, KCl provides less potassium than an equal amount of K2O.

6.5Mineral Deposit

Evaporite cycles within the Paradox Formation exhibit a lateral extent of over 11,000 square miles in southeastern Utah and southwestern Colorado (Hite 1960). The Pennsylvanian-age Paradox Formation records multiple episodes of evaporitic deposition, predominantly consisting of massive, crystalline halite with economically attractive occurrences of potash. Deposition of the evaporites occurred in a vast, flat basin resulting in each additional layer, or bed, being originally deposited in a horizontally planar orientation. Subsequent deposition of overlying sediments provided enough lithostatic pressure to initiate lateral and vertical migration of the more buoyant salt deposits. In many instances, salt flowed toward linear subsurface structures, such as a fault, and then upward to form what is known as a salt wall. The rising salt typically forms an anticline in overlying strata with surficial expressions of 30 to

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 24 |

75 miles long and 2 to 4 miles wide (Doelling 1985). This collection of northwest-trending, elongate structures is referred to as the Paradox Basin fold and fault belt. Due to the highly deformed nature of the evaporite deposits, it is not uncommon to encounter very high-angle and even overturned strata in exploratory drillholes. The Intrepid lease area is in the southwestern portion of the fold and fault belt where broad salt anticlines are more common than high-angle salt walls. Local examples of these domal salt-cored anticlines include the Big Flat, Cane Creek, and Lisbon Valley anticlines. Because strata within the Intrepid lease boundary have experienced considerably less movement of salt bodies compared to areas to the northeast, the potash deposits of economic interest are significantly less deformed and therefore more suitable for economic extraction.

Intrepid-Moab commercially produces potash from two zones, referred to as Bed 5 and Bed 9. These beds are part of a thick sequence of evaporite cycles predominantly composed of halite interspersed with sedimentary layers of black shale and anhydrite. Within Beds 5 and 9, the sylvinite is bounded above and below by occurrences of halite. Sylvite and halite are both water-soluble by nature. By using water already saturated with sodium, it is possible to selectively dissolve a greater amount of the potassium chloride ore. The term ‘potash’ is used to describe a number of potassium-bearing compounds. Of these, the mineral sylvite commands the greatest economic interest. Sylvite is commonly found mixed with halite, or sodium-chloride (NaCl), to form the mineral sylvinite. Sylvinite is known to have a K2O content of up to 62% in its purest form.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 25 |

7.0Exploration

7.1Exploration Other than Drilling

No exploration other than drilling has taken place.

7.2Drilling Exploration

Exploration information is available from cored holes, drilled holes with geophysical logs, and from the experience gained from mining within Bed 5. The data has been collected over many years, but primarily prior to commencement of underground mining in 1964. The corehole data was collected by Behre Dolbear & Company, Inc. (1961) for the original pre-mining feasibility studies. The original source data, such as assay data sheets, are generally not available. Comprehensive and detailed reports are available and form the basis of this report. Tables 7-1 and 7-2 list the corehole location, elevation, depth intervals, thickness, and grade for holes in Beds 5 and 9, respectively. The locations of the exploration holes are shown on a map in Figure 7-1.

The bed thicknesses listed in Tables 7-1 and 7-2 are from drillholes as reported by Intrepid-Moab, the QP, or referenced sources; mining experience in the underground mine indicates that the seam thickness varies significantly over short distances. In the area of the Cane Creek anticline, the base of the seam is contorted, with areas where overthrusting is evident. In such areas, the apparent bed thickness can be significantly overestimated, and Intrepid-Moab and the QP have used professional judgement to modify those thicknesses. For example, in Cane Creek 14, Bed 9 thickness was estimated to be 40 ft from the gamma log. However, the core assay indicates a thickness of 11.8 ft, but the source assay data are not available. It is possible that the core may have intersected a fault.

Potash is easily identified in the gamma log. In four cases, estimates of bed thickness and potash grade are based on geophysical logs. This reflects the high level of confidence in the logs and is particularly important because it provides a Bed 9 thickness in the area of active solution mining to the north of the data provided by Cane Creek 8 and Well 19. For more detail on estimating grade from gamma logs, see Nelson (2007) and Schlumberger (1989).

No usable exploration data are available from within the Bed 5 old mine workings. The floor structure has been used for flow direction estimation, but no channel sampling or bed thickness data were used. Albertson (1972) lists the grade and bed thicknesses in panels and mains for the old workings. Although data from the recently drilled wells into the old workings of Bed 5 indicate that additional resource could be located at the roof of the old workings, no attempt has been made to estimate this resource.

The QP elected to exclude data from the geophysical logs and data from Government White Cloud 1. This hole is located approximately 4,000 ft north of the north lease boundary and 16,000 ft from the nearest cored hole. Bed 9 is reported to be 13 ft thick, and Bed 5 is 9 ft thick. Data from this hole was not used because it strongly influences the estimates of bed thickness in areas to the north where data are sparse.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 26 |

There are a limited number of holes that contain the thickness and grade values outside the property boundary. Such holes are desirable to provide control of grade and thickness beyond the existing data points. Artificial holes, designated Agapito1 through Agapito10, located outside the property boundary, were assigned zero thickness and grade for Beds 5 and 9. These artificial holes do not influence the grade and thickness within the existing drillholes nor influence the reserve within the mine plan. The artificial holes were created to conservatively estimate the resource within the property limits, recognizing that there is no known limit to the extent of Beds 5 and 9.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 27 |

Table 7-1. Grade and Thickness Data for Bed 5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Operator | | Elevation (ft) | Total Depth (ft) | Collar Coordinates | Top (ft) | Base (ft) | Assay Thickness (ft) | K2O Grade (%) | Data Source* |

| Well Name | Easting (ft) | Northing (ft) |

| Delhi-Taylor Oil Corp. | Cane Creek 1 | 3,964 | 2,805 | 2,526,652 | 675,049 | 2,678.4 | 2,690.8 | 12.33 | 27.56 | | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 2 | 4,223 | 2,968 | 2,522,913 | 672,932 | 2,764.3 | 2,780.2 | 15.87 | 28.69 | | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 3 | 4,115 | 3,378 | 2,522,011 | 680,646 | 3,244.6 | 3,249.8 | 5.23 | 24.13 | | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 4 | 4,127 | 4,297 | 2,523,864 | 668,532 | 2,658.2 | 2,662.7 | 4.50 | 24.89 | | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 5 | 4,148 | 3,653 | 2,528,066 | 668,040 | 2,617.8 | 2,623.2 | 5.42 | 27.75 | | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 6 | 4,563 | 4,082 | 2,519,798 | 675,445 | 3,175.0 | 3,187.5 | 12.50 | 25.37 | | 2, 3 |

| Delhi-Taylor Oil Corp. | Cane Creek 6W | 4,564 | 4,014 | 2,519,798 | 675,445 | 3,207.6 | 3,216.8 | 8.73 | 29.56 | | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 7 | 4,215 | 3,553 | 2,532,098 | 671,106 | 2,715.5 | 2,728.1 | 12.60 | 8.41 | | 3 |

| Delhi-Taylor Oil Corp. | Cane Creek 8 | 4,049 | 4,080 | 2,525,307 | 678,492 | 3,140.7 | 3,147.7 | 7.02 | 27.45 | | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 9 | 4,275 | 3,851 | 2,524,410 | 676,115 | 3,044.8 | 3,061.9 | 17.10 | 26.30 | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 10 | 4,239 | 3,719 | 2,525,456 | 672,215 | 2,881.8 | 2,899.0 | 17.23 | 28.00 | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 11-A | 4,571 | 4,314 | 2,517,119 | 680,144 | 3,415.5 | 3,431.4 | 15.89 | 24.04 | | 1, 3 |

| Delhi-Taylor Oil Corp. | Cane Creek 12 | 4,412 | 3,996 | 2,516,867 | 677,146 | 3,192.0 | 3,202.0 | 10.00 | 28.76 | | 1, 2 |

| Delhi-Taylor Oil Corp. | Cane Creek 13 | 4,342 | 4,025 | 2,519,273 | 670,115 | 3,199.0 | 3,202.0 | 3.00 | 10.00 | 1 |

| Delhi-Taylor Oil Corp. | Cane Creek 14 | 4,394 | 4,265 | 2,520,679 | 672,576 | 3,292.8 | 3,303.7 | 10.87 | 27.84 | | 1, 3 |

| Delhi-Taylor Oil Corp. | Cane Creek 15 | 4,168 | 3,220 | 2,526,092 | 669,419 | 2,977.5 | 2,987.3 | 9.83 | 27.88 | | 1, 3 |

| Delhi-Taylor Oil Corp. | Cane Creek 17 | 4,101 | 3,928 | 2,532,165 | 672,825 | 3,052.8 | 3,060.4 | 7.60 | 19.77 | | 1, 3 |

| Texasgulf | Cane Creek 18 | 4,040 | 3,830 | 2,526,389 | 680,533 | 3,542.9 | 3,553.9 | 11.00 | 21.05 | | 3 |

| Texasgulf | Federal 1X | 4,196 | 8,005 | 2,528,063 | 671,389 | 2,449.3 | 2,461.3 | 12.00 | 29.22 | | 1, 2 |

| Texasgulf | Test Well 17 | 3,991 | 3,533 | 2,528,501 | 678,540 | 3,472.0 | 3,483.0 | 11.00 | 22.00 | 8 |

| Texasgulf | Test Well 18 | 4,001 | 3,522 | 2,528,508 | 678,589 | 3,488.0 | 3,498.0 | 10.00 | 21.50 | 8 |

| Texasgulf | Well 19 | 3,961 | 4,192 | 2,528,421 | 677,817 | 3,326.0 | 3,336.5 | 10.45 | 19.90 | 7 |

| Texasgulf | Well 21 | 3,996 | 3,560 | 2,527,998 | 679,249 | 3,554.5 | 3,560.4 | 5.87 | 12.70 | 4 |

| Texasgulf | Well 22 | 4,010 | 3,603 | 2,527,338 | 679,700 | 3,553.3 | 3,574.0 | 20.69 | 20.87 | | 5 |

| Texasgulf | Well 23 | 4,011 | 3,842 | 2,527,840 | 680,492 | 3,789.4 | 3,798.0 | 8.51 | 21.65 | | 6 |

| Intrepid Mining | 26-30 | 4,549 | 6,530 | 2,519,875 | 675,082 | 3,123.8 | 3,137.7 | 14.10 | 20.96 | | 9 |

| Intrepid Mining | IM-031 | 4,400 | 4,100 | 2,524,734 | 674,335 | 3,081.5 | 3,090.0 | 8.60 | 28.86 | | 9 |

| Intrepid Mining | IM-035 | 4,274 | 3,003 | 2,524,657 | 672,216 | 2,851.3 | 2,865.5 | 11.20 | 29.54 | | 9 |

| Intrepid Mining | IPI-037V | 4,133 | 4,145 | 2,523,134 | 678,195 | 3,045.8 | 3,055.7 | 9.9 | 22.45 | | 9 |

| Intrepid Mining | IPI-038C | 4,075 | 4,540 | 2,525,432 | 680,580 | | | 0.0 | | 9 |

| Intrepid Mining | IPI-039H | 4,064 | 8,477 | 2,522,032 | 680,613 | 3,593.2 | 3,601.8 | 8.60 | 8.50 | 9 |

| Intrepid Mining | IPI-041C | 4,159 | 3,695 | 2,523,054 | 668,790 | 2,765.4 | 2,772.5 | 7.00 | 22.00 | 9 |

| Intrepid Mining | IPI-042H | 4,133 | 5,218 | 2,523,095 | 678,210 | 3,031.9 | 3,041.2 | 9.30 | 21.50 | 9 |

| Intrepid Mining | IPI-043C | 4,240 | 3,951 | 2,522,192 | 673,170 | 2,835.8 | 2,847.1 | 11.40 | 20.00 | 9 |

| Intrepid Mining | IPI-044C | 3,975 | 5,000 | 2,525,903 | 683,564 | 3,823.0 | 3,836.8 | 13.70 | 22.30 | 9 |

| | | | | | | | | | |

| Notes: |

| NS = no survey data. |

| *Sources: |

1.Behre Dolbear & Co. (1961). |

2.Texasgulf Sulphur Company, Potash Occurrences in the Paradox Basin, K.J. Kutz, June 24, 1966. |

3.Recapitulation sheets submitted to Hugh Harvey from Bob Hite, April 1, 1998. |

4.Texasgulf Chemicals, Geology of Well 21, letter from D.A. Gahr to J.H. Huizingh, October 29, 1982. |

5.Texasgulf Chemicals, Geology of Well 22, letter from D.A. Gahr to J.H. Huizingh, October 29, 1982. |

6.Texasgulf Chemicals, Geology of Well 23, letter from D.A. Gahr to J.H. Huizingh, October 29, 1982. |

7.Texasgulf Chemicals, Cane Creek Solution Mining Hole No. 19, memo from K.J. Kutz to K.O. Linn, September 10, 1979. |

8.Texasgulf Chemicals, Geology of Wells 17 and 18, memo from E.L. Follis to C.H. Huff, August 18, 1976. |

9.Drilled by Intrepid |

| | | | | | | | | | |

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 28 |

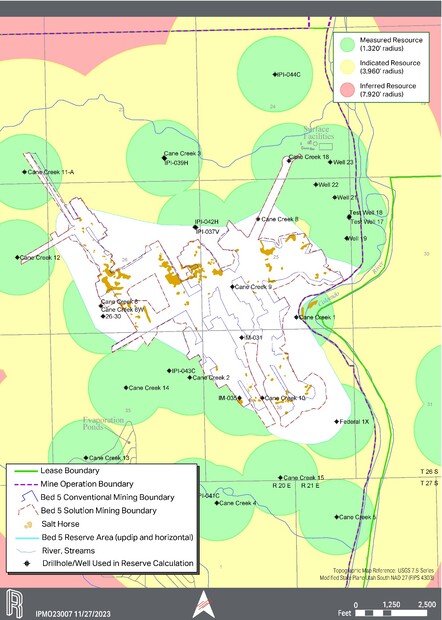

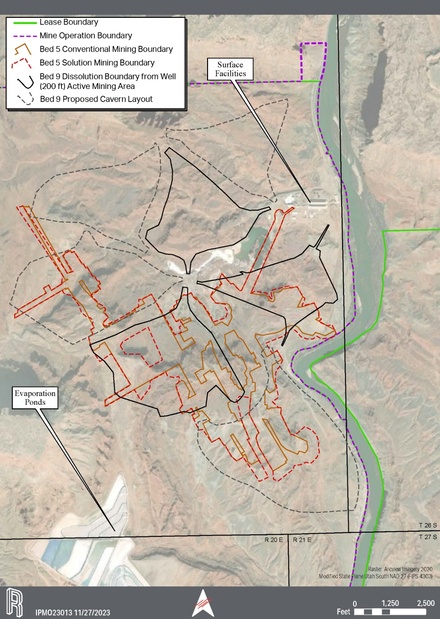

Figure 7-1. Plan View of Property Showing Drilling and Sample Locations

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 29 |

Table 7-2. Grade and Thickness Data for Bed 9

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Operator | Well Name | Elevation (ft) | Total Depth

(ft) | Collar Coordinates | Top (ft) | Base (ft) | Assay Thickness (ft) | K2O Grade (%) |

Easting (ft) | Northing (ft) |

| Delhi-Taylor Oil Corp. | Cane Creek 9 | 4,275 | 3,851 | 2,524,410 | 676,115 | 4,002.90 | 4,016.00 | 13.0 | 26.50 |

| Delhi-Taylor Oil Corp. | Cane Creek 8 | 4,049 | 4,080 | 2,525,307 | 678,492 | 3,945.36 | 3,949.87 | 5.0 | 19.90 |

| Delhi-Taylor Oil Corp. | Cane Creek 6 | 4,538 | 4,085 | 2,519,798 | 675,445 | 3,931.70 | 3,941.00 | 8.0 | 26.00 |

| Delhi-Taylor Oil Corp. | Cane Creek 5 | 4,148 | 3,653 | 2,528,066 | 668,040 | 3,554.33 | 3,569.75 | 14.9 | 28.00 |

| Delhi-Taylor Oil Corp. | Cane Creek 17 | 4,124 | 3,928 | 2,532,165 | 672,825 | 3,901.00 | 3,913.00 | 10.7 | 30.40 |

| Delhi-Taylor Oil Corp. | Cane Creek 14 | 4,368 | 4,265 | 2,520,679 | 672,576 | 4,265.00 | 4,273.00 | 11.8 | 33.10 |

| Delhi-Taylor Oil Corp. | Cane Creek 12 | 4,412 | 3,996 | 2,516,867 | 677,146 | 3,973.88 | 3,983.60 | 9.7 | 30.80 |

| Delhi-Taylor Oil Corp. | Cane Creek 10 | 4,239 | 3,719 | 2,525,456 | 672,215 | 3,696.00 | 3,711.00 | 12.9 | 31.60 |

| Texasgulf | Well 19 | 3,961 | 4,192 | 2,528,421 | 677,817 | 4,132.44 | 4,138.50 | 6.0 | 31.60 |

| Texasgulf | Federal 1-X | 4,196 | 8,005 | 2,528,063 | 671,389 | 3,302.46 | 3,309.54 | 6.0 | 34.80 |

| Utah Southern Oil Company | Frank Shafer 1 | 3,954 | 5,000 | 2,527,349 | 676,033 | 3,763.00 | 3,772.50 | 8.9 | 30.00 |

| Delhi-Taylor Oil Corp. | Cane Creek 4 | 4,127 | | 2,523,864 | 668,530 | | | 0.0 |

|

| Delhi-Taylor Oil Corp. | Cane Creek 7 | 4,215 | | 2,532,099 | 671,107 | | | 0.0 |

|

| Moab Salt | Well 28 | 4,021 | 6,896 | 2,528,070 | 680,176 | 4,980.00 | 4,998.50 | 6.2 | 37.50 |

| Intrepid Mining | 26-30 | 4,549 | 6,530 | 2519875 | 675,082 | 3,958.00 | 3,969.84 | 11.8 | 24.40 |

| Intrepid Mining | IM-031 | 4,400 | 4,100 | 2524734 | 674,335 | 3,861.22 | 3,863.06 | 1.8 | 20.02 |

| Intrepid Mining | IPI-037V | 4,133 | 4,145 | 2523133.6 | 678,195 | 3,886.78 | 3,882.78 | 8.00 | 31.28 |

| Intrepid Mining | IPI-038C | 4,075 | 4,540 | 2525431.6 | 680,580 | 4,337.30 | 4,345.80 | 8.50 | 30.30 |

| Intrepid Mining | IPI-043C | 4,240 | 3,951 | 2522192 | 673,170 | 3,700.40 | 3,711.50 | 10.10 | 30.12 |

| Intrepid Mining | IPI-044C | 3,975 | 5,000 | 2525903 | 683,564 | 4,589.95 | 4,598.46 | 7.00 | 34.60 |

| Intrepid Mining | IPI-040H | 4,134 | 6,817 | 2523101 | 678,239 | 4,470.00 | 4,445.01 | 10.20 | 34.26 |

| | | | | | | | | |

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 30 |

7.3Characterization of Hydrogeology Data

No hydrogeology data was evaluated.

7.4Characterization of Geotechnical Data

No geotechnical data was evaluated.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 31 |

8.0Sample Preparation

Intrepid-Moab has an internal protocol that provides for well-defined, safe practices and uniform guidelines for gamma-ray logging, core handling, and sample collection. The cores are collected and analyzed for ore zone identification. Cores are compared to the gamma-ray log to determine sampling intervals. Duplicate samples are collected with one sample sent to the on-site lab and the other stored with the corresponding core box from which the sample was sourced.

In the qualified person’s opinion, the sample preparation, security, and laboratory analytical procedures are conventional industry practice and are adequate for the reporting of resources and reserves.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 32 |

9.0Data Verification

The property is and has been in production for many years which verifies the exploration data.

9.1Data Verification Procedure

Exploration data is used as a guide during the construction of the horizontal caverns by directional drilling. The successful construction and operation of the caverns validates the data.

9.2Limitations on Verification

No limitations on the data verification process.

9.3Adequacy of the Data

It is the opinion of the Qualified Person (QP) that the data is adequate for geologic modeling, mine planning, and production. The successful experience with current and historical production validates the data.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 33 |

10.0Mineral Processing and Metallurgical Testing

Solution mining test work was conducted in the early 1970s. This included test ponds, saturation tests, crystal habitat and product size, soil tests, solar evaporation product flotation testing, KCl–NaCl brine shale reaction test, NaCl face blinding test, and clastic strength test salt (Higgins 1970).

The conclusion from the solution mining test work was that solution mining the Cane Creek Potash deposit was feasible but dependent to a great extent on keeping the injection water out of the overlying salt. The test also concluded that the hard anhydrite layer continuous throughout the formation provides a good stable shield against dissolution of the overlying salt (Higgins 1970). Higgins also concluded that it was highly improbable that fluids would be lost to the formation through open fractures.

Between 1975 and 1982, Texasgulf started extensive work on expanding the potash reserves by drilling vertical holes along the periphery of the old mine workings in Bed 5 to test and gain experience in solution mining and to connect newly created cavities with the old workings to extend the life of the mine (Gruschow 2000).

It is the opinion of the QP that the mineral processing data is adequate for purposes of estimating reserves.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 34 |

11.0Mineral Resource Estimates

According to 229.1301 (Item 1301), the following definitions of mineral resource categories are included for reference:

An inferred mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. An inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability. An inferred mineral resource, therefore, may not be converted to a mineral reserve.

An indicated mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. An indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource and may only be converted to a probable mineral reserve. As used in this subpart, the term adequate geological evidence means evidence that is sufficient to establish geological and grade or quality continuity with reasonable certainty.

A measured mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. As used in this subpart, the term conclusive geological evidence means evidence that is sufficient to test and confirm geological and grade or quality continuity.

11.1Key Assumptions, Parameters and Methods

The exploration drillhole and channel sample data were compiled to form the database that serves as the basis for estimating the resources. The geologic setting was evaluated, and zone assignments reviewed. All the core holes used in this resource estimation report both bed thickness and grade values that lie within the mine lease boundary. As an exception to this, the two potash exploration Wells 28 and IPI-037, which report bed thicknesses with no assay data, are included in the resource estimate for thickness modeling.

The rationale for the measured, indicated, and Inferred limits is based on industry practice in the potash industry. Measured resources are within ¼ of a mile (1,320 ft) of a hole, conveying the highest level of confidence. In addition, the indicated resources are selected to be within ¾ of a mile (3,960 ft) of a hole and the inferred resources are selected to be within 1½ miles (7,920 ft) of a hole. Indicated tons exclude measured tons, inferred tons exclude the indicated and measured tons. This convention is considered reasonable for the geologic characteristics of the Cane Creek potash deposit.

The mineral resource for the Cane Creek Mine was estimated using Carlson Software 2020 (Carlson 2020), a commercially available geology and mine modeling software package.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 35 |

The resources within the property were segregated in the model into 100-ft by 100-ft blocks. The resource estimates included in this report are based on the 2018 modeling.

A deterministic estimate of the potash mineral resource was made using the inverse distance-squared (ID2) method. Invoking the theory that closer samples should be better predictors than those further away, the method assigns weights to samples inversely proportional to the separation distance between the estimation point and the sample point. The ID2 method is useful for providing unbiased estimates of the overall resources (Society of Mining, Engineering, and Exploration, Inc. [SME] 1990).

The block grade and heights were generated within a 1.9-mile search radius. The 1.9-mile search radius was selected to capture more than one core hole in estimating block values in the areas of interest. The maximum number of drill holes for block estimation was limited to the 20 nearest drill holes. ID2 behaves as an exact interpolator. When calculating a block value, the weights assigned to the data points are fractions, and the sum of all the weights is equal to 1.0. An average unit density of 130 pounds per cubic foot (pcf) was used to convert in-place volume to tons. NaCl (salt) is not reported.

The proportion of the mineral deposit that is considered a resource depends on the following key factors: deposit thickness, deposit grade, and geologic factors. Areas where a bed thickness and potassium oxide (K2O) grade do not meet a 3-ft and 18.95% K2O cutoff are excluded from the resource. The minimum thickness cutoff is used because sufficient recovery in thin beds by selective solution mining has not been demonstrated and because of difficulties in locating/maintaining horizontal holes within the bed. The grade cutoff is used because of the difficulty in selective mining in beds with less than 30% KCl content (18.95% K2O), as described by Taylor et al. (1967).

11.2Mineral Resource Estimate

The gross in-place sylvinite tonnage for each resource block was calculated by multiplying the net area of the block by the thickness of the bed and the density. The Measured, Indicated, and Inferred Mineral Resource tonnages were estimated within the prescribed radius from the sampling location.

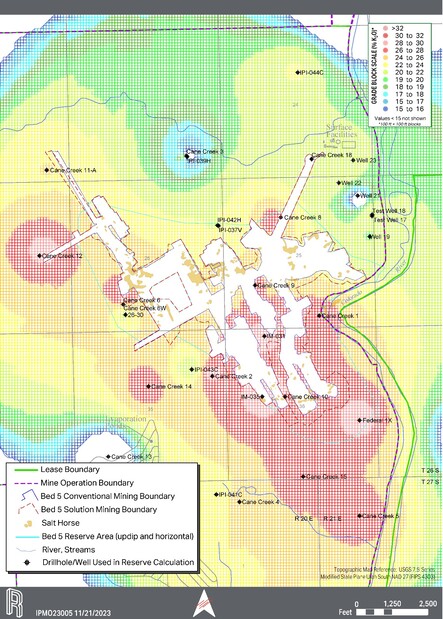

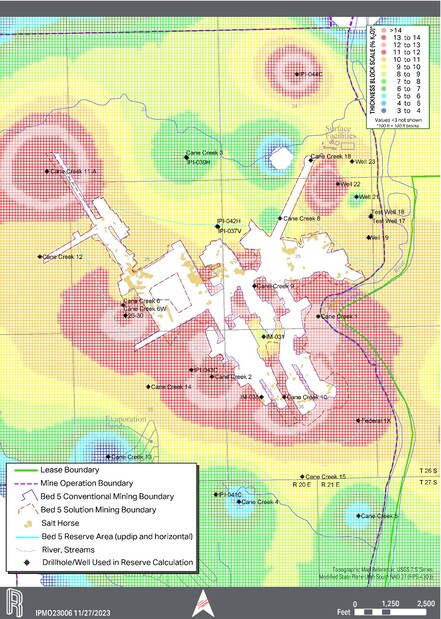

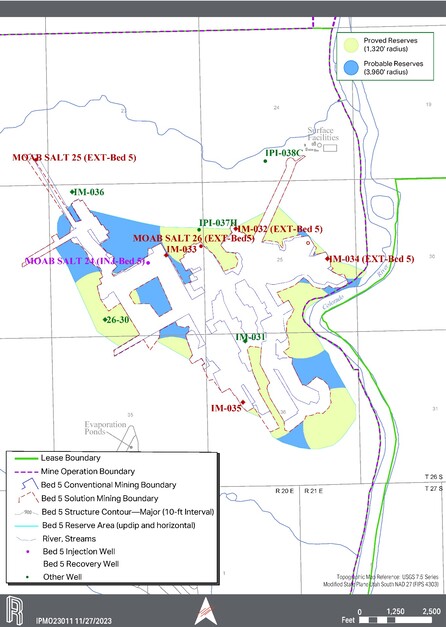

11.2.1Mineral Resource Estimates for Bed 5

The mineral resources for Bed 5 have been estimated using the EOY 2018 geologic model. Measured, Indicated, and Inferred resources were estimated by sampling blocks within a 1,320-ft, 3,960-ft, and 7,920-ft radius of influence (ROI), respectively, from a sample location (drill hole). Grade (% K2O) and thickness block values for the Intrepid-Moab property are presented in Figures 11-1 and 11-2, respectively. The maps show the 100-ft by 100-ft blocks lying both within the area of influence of drill holes containing grade and thickness data and the property boundary. Figure 11-3 shows the Measured, Inferred, and Indicated Mineral Resources for Bed 5. Mineral Resources for Bed 5 are presented exclusive of Reserves in Table 11-1.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 36 |

Figure 11-1. Bed 5% K2O Grade Blocks

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 37 |

Figure 11-2. Bed 5 Thickness Blocks

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 38 |

Figure 11-3. Mineral Resources for Bed 5

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 39 |

Table 11-1. Bed 5 Sylvinite Mineral Resource Estimate effective December 31,2023

| | | | | | | | | | | | | | | | | |

| Moab - Bed 5 Sylvinite Mineral Resource Estimate effective December 31, 2023, based on $450/Product Ton Mine Site |

| Resources | | |

| Bed 5 | Sylvinite1 | Grade | Contained K2O | Cutoff2 | Processing Recovery |

| (Mt) | (%K2O) | (Mt) | | (%) |

| Measured Mineral Resources | 62 | 24 | 15 | Flooded mine extent | 83 |

| Indicated Mineral Resources | 102 | 22 | 23 | Flooded mine extent | 83 |

| Measured + Indicated Mineral Resources | 164 | 23 | 38 | | |

| Inferred Mineral Resources | 10 | 21 | 2 | Flooded mine extent | 83 |

1Sylvinite is a mixed evaporite containing NaCl and KCl. |

2Solution mining resource cutoff for flooded old working is the mining extents boundary. |

| Mineral Resources were prepared by RESPEC, a qualified firm for the estimate and independent of Intrepid Potash, for EOY 2023. |

| Mineral Resources are reported exclusive of Mineral Reserves, on a 100% basis. |

Mineral Resources are reported using inverse Distance Squared (ID2) estimation methods. |

Mt = million tons, % = percentage, K2O = potassium oxide |

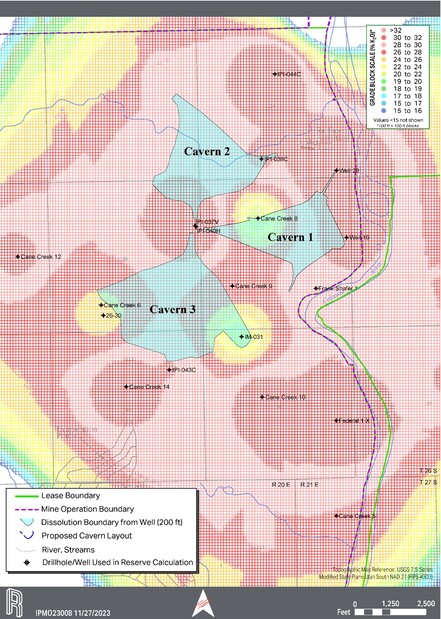

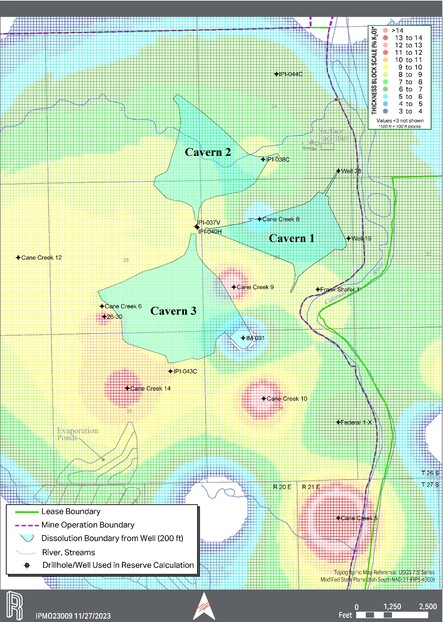

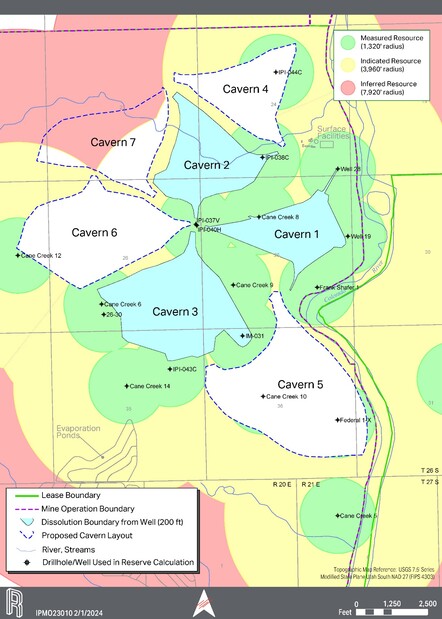

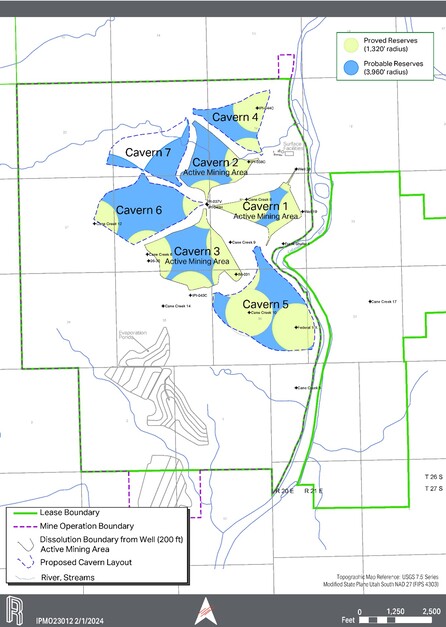

11.2.2Mineral Resource Estimates for Bed 9

The resource estimate for Bed 9 is based on cored intervals and assay data from 21 holes (19 with grade and thickness). A similar methodology used for the Bed 5 resource estimation was used in the resource estimate for Bed 9. The maps show the 100-ft by 100-ft blocks lying both within the radius of influence of drill holes containing grade and thickness data and the lease boundary. Measured, Indicated, and Inferred resources were estimated by sampling blocks within a 1,320-ft, 3,960-ft and 7,920-ft ROI, respectively, from the drill hole sample point. Bed 9 grade (% K2O) and thickness grids for the property boundary are presented in Figures 11-4 and 11-5, respectively. Figure 11-6 shows ROIs for Measured, Inferred, and Indicated Mineral Resources for Bed 9. Measured, Indicated, and Inferred Mineral Resources for Bed 9 are presented in Table 11-2.

11.3Mineral Resource Summary Bed 5 and Bed 9

Table 11-3 shows the summary of the mineral resources for Beds 5 and 9 for the Cane Creek Mine. Mineral resources are reported exclusive of mineral reserves with an effective date of December 31, 2023.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 40 |

Table 11-2. Bed 9 Sylvinite Mineral Resource Estimate effective December 31, 2023

| | | | | | | | | | | | | | | | | |

| Moab - Bed 9 Sylvinite Mineral Resource Estimate effective December 31, 2023, based on $450/Product Ton Mine Site |

| Resources | | |

| Bed 9 | Sylvinite1 | Grade | Contained K2O | Cutoff2 | Processing Recovery |

| (Mt) | (%K2O) | (Mt) | | (%) |

| Measured Mineral Resources | 35 | 29 | 10 | Minimum of 3-ft and 18.95% K2O | 83 |

| Indicated Mineral Resources | 88 | 27 | 24 | Minimum of 3-ft and 18.95% K2O | 83 |

| Measured + Indicated Mineral Resources | 123 | 28 | 34 | | |

| Inferred Mineral Resources | 28 | 24 | 7 | Minimum of 3-ft and 18.95% K2O | 83 |

1Sylvinite is a mixed evaporite containing NaCl and KCl. |

2Solution mining resource cutoff for flooded old working is the mining extents boundary. |

| Mineral Resources are reported exclusive of Mineral Reserves, on a 100% basis. |

| Mineral Resources were prepared by RESPEC, a qualified firm for the estimate and independent of Intrepid Potash, for EOY 2023. |

Mineral Resources are reported using inverse Distance Squared (ID2) estimation methods. |

Mt = million tons, % = percentage, K2O = potassium oxide, ft = feet |

11.4Qualified Persons Opinion – Further Work

No further work is needed to establish the mineral resources. Ongoing extraction from the deposit verifies the resource.

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 41 |

Figure 11-4. Bed 9 Resource % K2O Grade Blocks

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 42 |

Figure 11-5. Bed 9 Resource Thickness Blocks

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 43 |

Figure 11-6. Mineral Resources for Bed 9

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 44 |

Table 11-3. Sylvinite Mineral Resource Estimate effective December 31, 2023

| | | | | | | | | | | | | | | | | |

| Moab - Sylvinite Mineral Resource Estimate effective December 31, 2023 based on $450/Product Ton Mine Site |

| Resources | | |

| Beds 5 & 9 | Sylvinite1 | Grade | Contained K2O | Cutoff2 | Processing Recovery |

| (Mt) | (%K2O) | (Mt) | | (%) |

| Measured Mineral Resources | 97 | 26 | 25 | Minimum of 3-ft and 18.95% K2O | 83 |

| Indicated Mineral Resources | 190 | 25 | 47 | Minimum of 3-ft and 18.95% K2O | 83 |

| Measured + Indicated Mineral Resources | 287 | 25 | 72 | | |

| Inferred Mineral Resources | 38 | 23 | 9 | Minimum of 3-ft and 18.95% K2O | 83 |

1Sylvinite is a mixed evaporite containing NaCl and KCl. Pure KCl equates to 63.17% K2O by mass. |

2Solution mining resource cutoff for flooded old working is the mining extents boundary. |

| Mineral Resources were prepared by RESPEC, a qualified firm for the estimate and independent of Intrepid Potash, for EOY 2023. |

| Mineral Resources are reported exclusive of Mineral Reserves, on a 100% basis. |

Mt = million tons, % = percentage, K2O = potassium oxide, ft = feet |

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 45 |

12.0Mineral Reserve Estimates

Mineral reserves that are mined using solution mining methods are not subject to the traditional application of a cutoff grade but instead of operational limitations. According to 17 CFR § 229.1301 (2021), the following definitions are included for reference:

A probable mineral reserve is the economically mineable part of an indicated and, in some cases, a measured mineral resource.

A proven mineral reserve is the economically mineable part of a measured mineral resource. For a proven mineral reserve, the qualified person has a high degree of confidence in the results obtained from the application of the modifying factors and in the estimates of tonnage and grade or quality. A proven mineral reserve can only result from conversion of a measured mineral resource.

12.1Key Assumptions, Parameters, and Methods

By definition, modifying factors are the factors applied to a mine plan for the indicated and measured mineral resources and then evaluated in order to establish the economic viability of mineral reserves. The factors for Intrepid-Moab are solution mining parameters, mineral processing, and lease boundaries as shown in Table 12-1.

Intrepid has a long history of sales and marketing of their products. Sales are managed for all properties through the corporate office. Intrepid provided the historical demand and sales pricing through the statements of earnings (SOE) from 2007 to 2023. Potash market is further discussed in Section 16.

The product sale prices selected for analysis of brine cutoff grade is $360/product ton and a freight cost of $30/product ton. A cost of goods sold was estimated to be $198/t of product with a $28/ton credit for salt sales for an equivalent operating cost of $170/t. Economic modeling indicates brine grade equivalent to the production tonnage just to cover the cash expenses of 3.9% KCl, or in other words break-even.

The reserve estimate is based on a mine plan developed for the Cane Creek Mine. The estimate is based on the geologic model and assigned thicknesses and grades for the flooded old mine workings updip boundary (Bed 5) mapped to the decline curve and individual caverns (Bed 9). The production plan is included in Section 13. The plan is extended for 25 years. During that time, two to three sets of new caverns will need to be constructed.

12.2Mineral Reserves

12.2.1Mineral Reserve Estimates for Bed 5

Neuman (2000) developed the estimated area of reserves that have been depleted through solution mining inside and around the perimeter of the old mine workings, with the

| | | | | |

2023 Estimated Resources and Reserves at Intrepid Potash-Moab

Prepared for Intrepid Potash, Inc.

February 14, 2024 | 46 |

exception of a large pillar within the perimeter. As such, this perimeter area has been excluded

from the reserve estimates for Bed 5. Reserves were estimated for updip and horizontal areas outside of Neuman’s 2000 perimeter. The mineral reserves were estimated as the difference between the reserves from the resource area and the net KCl tons extracted since 2001.

Though Bed 5 resources can be solution mined with additional horizontal caverns, the reserves estimate in this report only focuses on the net reserves remaining in the old mine as the planned horizontal caverns in Bed 9 are more than enough to support the required mine life for this report. The sylvinite volume, tonnage, KCl grade, and average bed thickness within proven and probable reserve areas are included in Table 12-1.

Table 12-1. Potash Reserves Remaining Updip of Solution Mining from Bed 5 Old Workings effective December 31, 2023

| | | | | | | | | | | | | | | | | |

| Moab - Potash Reserves Remaining Updip of Solution Mining from Bed 5 Old Workings effective December 31, 2023, based on $360/Product Ton Mine Site |

| Reserves | | |

| Bed 5 | In-Place KCl | In-Situ Grade1 | Product2 | Brine Cutoff Grade3 | Processing Recovery |

| (Mt) | (%K2O) | (Mt) | (%K2O) | (%) |

| Proven Mineral Reserves | 0.9 | 25.5 | 0.6 | 2.5 | 83 |

| Probable Mineral Reserves | | | | | |

| Total Mineral Reserves | 0.9 | 25.5 | 0.6 | | |