UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 28, 2011

WESTMOUNTAIN INDEX ADVISOR, INC.

(Exact Name of Small Business Issuer as specified in its charter)

| Colorado | 000- 53028 | 26-1315498 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

2186 S. Holly St., Suite 104, Denver, CO 80222

(Address of principal executive offices including zip code)

(303) 800-0678

(Registrant's telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

123 North College Ave, Ste 200, Ft. Collins, Colorado 80524

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Forward-Looking Statements

The following discussion, in addition to the other information contained in this Current Report, should be considered carefully in evaluating our prospects. This report (including without limitation the following factors that may affect operating results) contains forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act") regarding us and our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, development of new products, enhancements or technologies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Forward-looking statements in this report reflect the good faith judgment of our management and the statements are based on facts and factors as we currently know them. Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed below and in "Management's Discussion and Analysis of Financial Condition and Results of Operations" as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements which speak only as of the date of this report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report.

As used in this current report and unless otherwise indicated, the terms "we", “us”, "our" and the “Company” mean WestMountain Index Advisor, Inc. (“WMTN”), a Colorado corporation and its subsidiaries (including TMC and TGC– see Item 1.01), unless otherwise indicated. When “TMC” is used, unless otherwise indicated, that term means Terra Mining Corporation and subsidiaries.

CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED, AND INFERRED RESOURCES: The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” that are used below are defined in and required to be disclosed by Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”); however, these terms are not recognized under SEC Industry Guide 7. U.S. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations: however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, information contained in this Form 8-K contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under United States federal securities laws and the rules and regulations promulgated thereunder.

Exchange Rates

Our financial statements are stated in United States Dollars.

A Glossary of Technical Terms

This glossary is included as Appendix 1.

ITEM 1.01 ( and ITEM 3.02 | ENTRY INTO MATERIAL DEFINITIVE AGREEMENTS UNREGISTERED SALES OF EQUITY SECURITIES) CONFIRMATION OF CLOSE OF SHARE EXCHANGE AGREEMENT WITH TERRA MINING CORPORATION |

On February 28, 2011, WMTN and Terra Mining Corporation (“TMC”) entered into a Close of Share Exchange Agreement. This Agreement confirmed the closing of the acquisition of TMC by WMTN. In connection with this acquisition of TMC by WMTN, several other definitive agreements were entered into, including the sales of unregistered securities.

RESCISSION AGREEMENT WITH TMC DEBENTURE HOLDERS

On February 18, 2011, TMC signed a Rescission Agreement which was signed over the next ten days by the holders of Convertible Debenture Notes (“Debenture Notes”). TMC rescinded the Debenture Notes by returning the full amount invested by each Debenture Holder, plus all accrued and unpaid interest thereon in accordance with the terms of the Convertible Debentures.

During September and October, 2010, TMC issued interest bearing non-secured Debenture Notes totaling $625,000. During November 2010, an additional Debenture Note was issued for $5,000, increasing the total to $630,000.The Debenture Notes had a term of three years and included interest of 12% per year. The outstanding principal and interest were convertible at a rate of $0.0125 per TMC share. The Company accrued $30,547 in interest as of February 18, 2011. All Debenture Holders signed the Rescission Agreement and have received a return of their principal and accrued interest.

STOCK PURCHASE AGREEMENT WITH TERRA MINING CORPORATION

SHARE EXCHANGE AGREEMENT WITH TERRA MINING CORPORATION

On February 18, 2011, WMTN entered into a Stock Purchase Agreement with TMC related to the acquisition of Terra Gold Corporation (“TGC”), a wholly owned subsidiary of TMC. Under the terms of the Stock Purchase Agreement, WMTN acquired 100% of the TGC by assuming $500,000 in debt plus accrued interest owed to BOCO Investments LLC (“BOCO”).

In addition, WMTN entered into a Share Exchange Agreement with Gregory Schifrin, American Mining Corporation (“AMC”) and James Baughman to acquire 100% of the issued and outstanding shares of common stock of TMC in exchange for 1,500,000 shares of restricted common stock of WMTN, par value of $.001 per share. WMTN agreed to file a registration statement with the SEC with regard to this common stock within ninety days on a best efforts basis. As of February 28, 2011, this acquisition was closed and TMC and TGC are wholly owned subsidiaries of WMTN.

TMC is an exploration and development company that explores, acquires, and develops advanced stage properties. TMC has a high-grade gold system in the resource definition phase with 168,000 oz of inferred gold which in total offers potential of greater than 500,000 ounces. The property consists of 240 Alaska state mining claims covering approximately 130 square kilometers. All Government permits and reclamation plans for continued exploration through 2014 were renewed in 2010. For a more detailed discussion of this acquisition of TMC and TGC, see item 2.01 below.

POST CLOSING TRANSACTIONS

In addition to the Stock Purchase and Share Exchange Agreements with TMC, Gregory Schifrin, AMC and James Baughman, WMTN entered into additional transactions to add other mineral properties and increase working capital by approximately $1,500,000 in preparation for the development of the TMC properties. The additional transactions are summarized below.

Subscription Agreement with Mining Minerals, LLC

On February 18, 2011, WMTN entered into a Subscription Agreement with Mining Minerals LLC ( owned 60% and 40 % by Gregory Schifrin and James Baughman, respectively) whereby WMTN acquired the claims recorded with the Alaska Department of Natural Resources, Recording Numbers 2010-000468-0 through 2010-000481-0, recorded on October 19, 2010, in exchange for a total of 5,000,000 of the outstanding and issued common stock of WMTN. As of February 18, 2011, the Alaska claims are owned by WMTN.

Conversion of BOCO Demand Promissory Notes (“Notes”)

On August 5, 2010, TMC issued a Note to BOCO totaling $100,000. The Note included interest of 15% per annum and was payable on November 3, 2011. The Note was secured by the assets of TMC. If the Note should become in default, the Notes included additional interest of 29% per annum, compounded annually, above the rate that would otherwise be in effect. As part of the consideration for the loan, TMC issued warrants to BOCO to acquire 300,000 shares of TMC common stock at an exercise price of $0.001 per share.

On December 22, 2010, TMC issued a Note to BOCO in the amount of $400,000. The Note bears no interest except in the event of default. The default interest rate is 29 % per annum, compounded annually. The Promissory Note is collateralized by the assets of TMC and shares of a Company affiliated with an Officer of the Company. The Promissory Note is due on March 22, 2011. As part of the consideration for this loan, TMC issued warrants to BOCO to acquire 800,000 shares of TMC common stock at an exercise price of $0.001 per share.

On January 12, 2011, the Company entered into a Forbearance Agreement with BOCO. Under the terms of the Forbearance Agreement, the Company and BOCO agreed to not exercise their rights under the Notes until the earlier of February 2, 2011, the date of an event of default occurs under the Note or the date the Company fails to comply with the terms and conditions of the Forbearance Agreement.

These Notes were assumed by WMTN as payment for its acquisition of TGC discussed above.

On February 18, 2011, BOCO agreed to convert all $500,000 of the Notes into common stock of WMTN effective immediately following the acquisition of TMC by WMTN and agreed to cancel its warrants to acquire 1,100,000 shares of TMC common stock and agreed to waive interest of $7,685. In consideration for this conversion, warrant cancellation and interest waiver, WMTN issued 1,000,000 shares of its common stock and a warrant to acquire an additional 1,000,000 shares of WMTN common stock exercisable for $0.001 per share.

Subscription Agreements with New Investors

During the period starting February 18, 2011, WMTN entered into Subscription Agreements with accredited investors totaling $630,000. WMTN agreed to issue 1,260,000 shares of restricted WMTN common stock at an average price of $.50. The shares do not have registration rights.

Additional Private Placement

During the period starting February 18, 2011, WMTN entered into Subscription Agreements with additional accredited investors totaling $370,000.WMTN agreed to issue 740,000 shares of restricted WMTN common stock at an average price of $.50 per share. The shares do not have registration rights.

Consulting Agreements

On February 18, 2011, WMTN entered into a Consulting Agreement with Mark Scott (“Scott Agreement”). Under the terms of the Scott Agreement, Mr. Scott agreed to consult on the TMC reorganization and complete the filing of certain SEC filings during the period ending April 8, 2011. Mr. Scott will receive $4,000 per month in cash and receive 24,000 shares of WMTN restricted common stock. The terms of his appointment as CFO are to be finalized at the conclusion of the Scott Agreement.

On February 18, 2011, WMTN entered into a Consulting Agreement with WestMountain Asset Management, Inc. (“WASM and WASM Agreement”). Under the terms of the WASM Agreement, WASM agreed to advise WMTN on the acquisition of TMC, funding of WMTN and strengthening the WMTN balance sheet during the period ending December 31, 2011. WASM received a Warrant for 650,000 shares at $.001 per share. The Warrant is in substantially the form and with the terms as contained in Exhibit 10.4 filed herewith (the “$0.001 Warrant Form”). WMTN agreed to file a registration statement with the SEC with regard to the shares issuable upon exercise of the Warrant within ninety days on a best efforts basis.

On February 18, 2011, WMTN entered into a Consulting Agreement with Capital Peak Partners LLC (“CPP and CPP Agreement”). Under the terms of the CPP Agreement, CPP agreed to advise WMTN on the acquisition of TMC, funding of WMTN and strengthening the WMTN balance sheet during the period ending February 17, 2012. CPP received a Warrant for 1,800,000 shares at $.001 per share (subject to terms as contained in the $0.001 Warrant Form). WMTN agreed to file a registration statement with the SEC with regard to the shares issuable upon exercise of the Warrant within ninety days on a best efforts basis. In addition, CPP is eligible for a $125,000 bonus if WMTN receives $1,500,000 in funding or debt conversions. If WMTN receives more than $1,000,000 in funding or debt conversions but less than $1,500,000, the $125,000 bonus is reduced on a pro-rata basis.

Warrants

On February 18, 2011, WMTN issued Warrants to the TMC founder investors Gregory Schifrin and James Baughman (subject to terms as contained in the $0.001 Warrant Form) for 300,000 and 200,000 shares of WMTN common stock, respectively. The Warrants expire February 17, 2014 and are exercisable at $.001 per share. WMTN agreed to file a registration statement with the SEC with regard to the shares issuable upon exercise of the Warrant within ninety days on a best efforts basis.

On February 18, 2011, WMTN issued Warrants with BOCO totaling 1,000,000 shares of WMTN common stock related to the cancellation of TMC warrants discussed above. The Warrants expire February 17, 2014 and are exercisable at $.001 per share. WMTN agreed to file a registration statement with the SEC with regard to the shares issuable upon exercise of the Warrant within ninety days on a best efforts basis.

Contingent Shares

On February 18, 2011, WMTN entered into Warrants with New Investors and an additional private placement related to Subscription Agreements totaling 1,260,000 and 740,000 shares, respectively, of common stock (substantially in the form and with the terms as contained in Exhibit 10.15 filed herewith (the “$0.75 Warrant Form”). The Warrants expire February 17, 2014 and are exercisable at $.75 per share. WMTN agreed to file a registration statement with the SEC with regard to the shares issuable upon exercise of the Warrants within ninety days on a best efforts basis.

On September 15, 2010, TMC, TGC and Raven signed an Exploration, Development and Mine Operating Agreement (“JV Agreement”). TMC agreed to have 250,000 shares of WMTN common stock issued to Raven no later than one year after the closing of the acquisition of TMC by WMTN and 250,000 shares of WMTN common stock on or before December 31, 2011, December 31, 2002 and December 31, 2014.

The WMTN ownership, at the conclusion of these transactions and including the post closing transactions summarized below, is as follows:

| | | No. of | Post Close Transaction | Fully Diluted | |

| | | Shares as of | Ownership | Ownership | |

| Shareholder | Description | 2/28/2011 | % | % | |

| Outstanding WMTN Shares prior to transactions described below | | | | | |

| WestMountain Purple LLC | Current shares issued and outstanding | 2,012,500 | 17.0% | 12.1% | |

| Other WMTN shareholders | Current shares issued and outstanding | 315,813 | 2.7% | 1.9% | |

| | Total WMTN issued and outstanding | 2,328,313 | 19.6% | 14.0% | |

| Share Exchange Agremeent - TMC shares exchanged for WMTN shares | | | | | |

| AMC shareholders | New issuance at $.001 per share | 468,750 | 4.0% | 2.8% | |

| Gregory Schifrin and James Baughman, TMC founder shareholders | New issuance at $.001 per share | 1,031,250 | 8.7% | 6.2% | |

| | Subtotals | 1,500,000 | 12.7% | 9.0% | |

| | | | | | |

| | Total after asset purchase | 3,828,313 | | 23.1% | |

| Post Share Exhange Transactions for Capitalization | | | | | |

| BOCO Investments LLC conversion of TMC Demand Promissory Notes | $500,000 at $.50 per share | 1,000,000 | 8.4% | 6.0% | |

| Mining Minerals, LLC | New issuance at $.001 per share | 5,000,000 | 42.2% | 30.2% | |

| New investment in WMTN | $630,000 at $.50 per share | 1,260,000 | 10.6% | 7.6% | |

| Additional private placement in WMTN | $370,000 at $.50 per share | 740,000 | 6.2% | 4.5% | |

| Mark Scott Consulting Agreement | 24,000 shares | 24,000 | 0.2% | 0.1% | |

| | Total new issuance | 8,024,000 | 67.7% | 48.4% | |

| | Total WMTN shares outstanding after share exchange and recapitalization | 11,852,313 | 100.0% | 85.5% | |

| | | | | | |

| Warrants | | | | | |

| TMC Founder Warrants | New issuance at $.001 per share | 1,000,000 | | 6.0% | |

| Capital Peak Partners LLC for Consulting Agreement | New issuance at $.001 per share | 1,800,000 | | 10.9% | |

| WestMountain Asset Management (WASM) warrants for Consulting Agreement | New issuance at $.001 per share | 925,000 | | 5.6% | |

| BOCO Investments LLC - Warrants for 1 million WASM shares total | New issuance at $.001 per share | 1,000,000 | | 6.0% | |

| | Total warrants | 4,725,000 | | 28.5% | |

| | | | | | |

| | Total fully diluted shares at closing of tranaction | 16,577,313 | | 100.0% | |

| Contingent Shares | | | | | |

| International Tower Hill Mines Ltd for TGC issuance obligation | 250,000 shares annually starting 12/31/11 | 1,000,000 | | | |

| New investment warrants | $630,000 at $.75 per share | 1,260,000 | | | |

| Additional private placement warrants | $370,000 at $.75 per share | 740,000 | | | |

| | | | | | |

| | | | | | |

| ITEM 2.01 | COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS |

THE ACQUISITION OF TMC

WMTN was incorporated in the state of Colorado on October 18, 2007 and commenced operations. We were a developer of indexes that allow investors to access specific market niches or sub-markets. We expected to earn income by helping investors identify and access specific market niches or sub-markets using our index products.

On February 18, 2011, WMTN entered into a Stock Purchase Agreement with TMC related to the acquisition of TGC, a wholly owned subsidiary of TMC. Under the terms of the Stock Purchase Agreement, WMTN acquired 100% of the TGC by assuming $500,000 in debt plus accrued interest owed to BOCO. In addition, WMTN entered into a Share Exchange Agreement with Gregory Schifrin, AMC and James Baughman to acquire 100% of the issued and outstanding shares of common stock of TMC in exchange for 1,500,000 shares of restricted common stock of WMTN. The shares were valued at $.001 per share and WMTN agreed to register the common stock within ninety days on a best efforts basis. As of February 28, 2011, this acquisition was closed and TMC and TGC are wholly owned subsidiaries of WMTN.

TMC was incorporated in British Columbia, on March 25, 2010 and is engaged in the acquisition, exploration and development of mining properties in the United States. TMC had a wholly owned subsidiary, TGC that was incorporated in Alaska, on March 2, 2010 to manage operational activity in Alaska on the Terra Project.

TGC was acquired by TMC from AMC on May 17, 2010 by assignment of all 10,000 shares of TGC stock owned by AMC as part of the Share Exchange and Assignment Agreement between AMC and TMC. Our Chief Executive Officer served as President and a Director of AMC in February and March 2010 and our Chief Operating Officer served as Chief Operating Officer and a Director of AMC in March 2010.

TMC is an exploration and development company that explores, acquires, and develops advanced stage properties. TMC has a high-grade gold system in the resource definition phase with 168,000 oz of inferred gold which in total offers potential of greater than 500,000 ounces. The property consists of 240 Alaska state mining claims covering approximately 130 square kilometers. All Government permits and reclamation plans for continued exploration through 2014 were renewed in 2010.

Additional information can be found at www.terraminingcorp.com.

TMC is a party to the following key agreements.

Share Exchange and Assignment Agreement

On May 17, 2010, TMC entered into a Share Exchange and Assignment Agreement with AMC, a Company that our Chief Executive Officer served as President and a Director in February and March 2010 and our Chief Operating Officer served as Chief Operating Officer and a Director in March 2010.

Under the terms of the agreement TMC issued 5,000,000 shares of common stock to AMC for the outstanding shares in the capital of TGC and was assigned a Letter of Intent (“LOI”) on the Terra Project in Alaska, to which AMC was a party.

The LOI was independently valued by RWE Growth Partners Business Valuaters at $150,000 after conducting a Business Valuation and Fairness Opinion for the assignment of the LOI from AMC to TMC.

Exploration, Development and Mine Operating Agreement

On September 15, 2010, TMC, TGC and Raven signed an Exploration, Development and Mine Operating Agreement (“JV Agreement”). The JV Agreement has a term of twenty years, which can continue longer as long as products are produced on a continuous basis and thereafter until all materials, equipment and infrastructure are salvaged and disposed of, environmental compliance is completed and accepted and the parties have completed a final accounting. The JV Agreement defines terms and conditions where TMC and TGC earns a 51% interest with the following payments and stock issuances-

Pay the following options payments-

Payment of $10,000 with the signing of the Letter of Intent in February 2010 (completed).

Payment of $40,000 with the signing of the JV Agreement (completed).

Payment of $100,000 on or before December 31, 2011.

Payment of $150,000 on or before December 31, 2012.

Provide the following project funding-

Payment of $1 million in project expenses on or before December 31, 2011, including $100,000 to Raven.

Payment of $2.5 million in additional project expenses on or before December 31, 2012, including $100,000 to Raven.

Payment of $2.5 million in additional project expenses on or before December 31, 2013.

Issue the following common stock, which is subject to a two year trading restriction, upon the completion of the acquisition of TMC by WMTN:

Issue 250,000 shares of WMTN common stock no later than one year after the closing of the reverse merger.

Issue 250,000 shares of WMTN common stock on or before December 31, 2011 and December 31, 2012.

TMC and TGC then can increase its interest to 80% in the project with the following payments and stock issuances-

Payment of $150,000 on or before December 31, 2013.

Payment of $3.05 million in additional project expenses on or before December 31, 2014.

Issue 250,000 shares of WMTN common stock on or before December 31, 2014.

The failure to operate in accordance with the JV Agreement could result in our ownership being reduced or the JV Agreement being terminated.

As of February 18, 2011, the $50,000 due with the signing of the Letter of Intent in February 2010 and the signing of JV Agreement was paid. As of February 18, 2011, TMC had incurred $223,102 of project expenses.

Going Concern

The WMTN Form 10-K for the year ended December 31, 2009 as filed with the SEC on April 14, 2010 was prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. WMTN is a development stage company with no history of operations, limited assets, and has incurred operating losses since inception. These factors, among others, raise substantial doubt about its ability to continue as a going concern.

TMC had an accumulated deficit incurred through October 31, 2010. TMC has relied primarily on small private sales of its common stock or loans from its officers and directors to fund TMC to date. TMC and or WMTN (now its parent corporation) will continue to seek capital from outside sources through sales of common stock or loans from its officers, directors, or outside investors in order to remain in business and fund its intended operations. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

An estimated $1,100,000 is necessary to continue operations and fund minimum operations through the next fiscal year. This estimated amount is for salaries of its officers, professional fees, land payments as well as claim maintenance fees, and work programs on it properties. Management intends to seek new capital from new equity securities issuances to provide funds needed to increase liquidity, fund internal growth, and fully implement its business plan. If TMC is successful in raising substantial new capital, it will implement a much more aggressive exploration program on its properties to further evaluate the mineral potential of the claims.

| ITEM 3.02 | UNREGISTERED SALES OF EQUITY SECURITIES |

Reference is made to the disclosure set forth under Item 1.01, Item 2.01 and Item 5.01 of this Current Report on Form 8-K, each of which is incorporated herein by reference.

| ITEM 5.01 | CHANGE IN CONTROL OF REGISTRANT (And ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS) |

| | |

On February 18, 2011 but effective February 28, 2011, WMTN consummated the transactions contemplated by the Share Exchange Agreement pursuant to which we acquired all of the issued and outstanding shares of TMC from the Sellers in exchange for the issuance of 1,500,000 or 39.2% shares of our restricted common stock to the Sellers at the close of the acquisition of TMC.

As of February 28, 2011, WMTN had 11,852,313 shares issued and outstanding. As of February 28, 2011, WMTN had 16,577,313 common shares and warrants issued and outstanding on a fully diluted basis.

After post closing transactions, a total of 14,249,000 or 86% shares of WMTN common stock and Forms of Warrants were issued on a fully diluted basis to add other mineral properties, increase working capital, strengthen its balance sheet and prepare to execute the development of the TMC properties.

The WMTN common shares issued to the Sellers were issued pursuant to the exemption from registration provided under Section 4(2) of the Securities Act, and Rule 506 promulgated thereunder and/or Regulation S of the Securities Act. We made this determination based on the representations of the persons obtaining such securities, which included, in pertinent part, that such persons were “accredited investors” within the meaning of Rule 501 of Regulation D promulgated under the Securities Act, and that such persons were acquiring such securities for investment purposes for their own respective accounts and not as nominees or agents, and not with a view to resale or distribution, and that each such person understood that such securities may not be sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

Other than the transactions and agreements disclosed in this Current Report on Form 8-K, we know of no arrangements which may result in a change of control.

No officer, director, promoter or affiliate has, or proposes to have, any direct or indirect material interest in any asset proposed to be acquired by us through security holdings, contracts, options, or otherwise.

Upon the closing of our acquisition of TMC on February 28, 2011 and ten (10) days following the filing and mailing of Information Statement Form 14F-1 to the Company’s stockholders the following director changes will be effective:

An independent director is expected to be appointed by the WMTN board and two independent TMC directors are expected to be appointed.

Brian L. Klemsz resigned as the WMTN Director. Mr. Klemsz’ resignation is not the result of a disagreement with management regarding the operations, policies or practices of the Company.

Joni Troska resigned as Secretary.

Greg Schifrin was appointed a Director.

James Baughman was a Director.

Mark Scott was appointed Secretary.

Upon the closing of our acquisition of TMC on February 28, 2011, the following officer changes occurred:

Brian L. Klemsz resigned as our President and Treasurer. Mr. Klemsz’ resignation is not the result of a disagreement with management regarding the operations, policies or practices of the Company.

Greg Schifrin was appointed President and Chief Executive Officer.

James Baughman was appointed Chief Operating Officer.

Mark Scott was appointed Chief Financial Officer.

For biographical information about these three individuals, see “Management” below.

These actions, viewed together with the transactions related to our acquisition of TMC, constitute a “change in control.”

Reference is made to the disclosure set forth under Item 1.01 and Item 2.01 of this Current Report on Form 8-K, each of which is incorporated herein by reference.

This acquisition results in the Company embarking on a different strategy and line of business from what was the case before we entered into the above agreements, we have included in this Current Report on Form 8-K, the information on our company that would be required if we were filing a general form for registration of securities on Form 10.

WMTN is now an exploration stage resource company, and are primarily engaged in the exploration for and development in the properties in which it has acquired interests. For further details on the WMTN business, please see the section entitled “Business” immediately below.

FORM 10 INFORMATION

BUSINESS

Overview

WMTN was incorporated in the state of Colorado on October 18, 2007 and commenced operations. We were a developer of indexes that allow investors to access specific market niches or sub-markets. We expected to earn income by helping investors identify and access specific market niches or sub-markets using our index products.

Between February 18 and 28, WMTN completed a series of transactions as described above to acquire TMC and its subsidiary TGC and to raise capital to further the Terra Gold project described below.

TMC is an exploration and development company that explores, acquires, and develops advanced stage properties. TMC has a high-grade gold system in the resource definition phase with 168,000 oz of inferred gold which in total offers potential of greater than 500,000 ounces. The property consists of 240 Alaska state mining claims covering approximately 130 square kilometers. All Government permits and reclamation plans for continued exploration through 2014 were renewed in 2010.

Business Subsequent to the Acquisition

The TGM project, which now constitutes our business, is summarized below.

Target Type: TMC has entered into a Definitive Agreement by which we (through TMC) can acquire a controlling interest in a high-grade gold vein system in the resource definition phase of project development gold with an inferred gold resource of 168,000 ounces which in total offers a potential of greater than 500,000 ounces. The gold bearing structures have been mapped for three miles of which a 300 yard zone has been drilled to date. TMC is planning a 2011 drill program to further define the gold vein along strike and at depth.

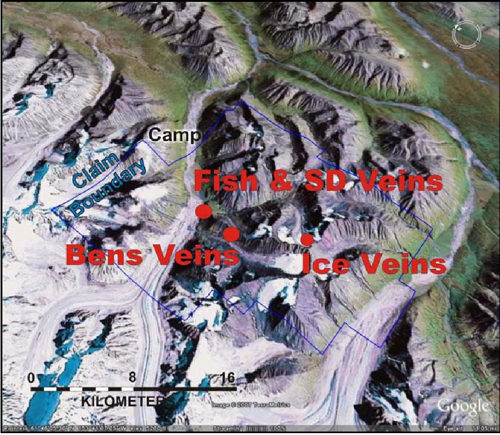

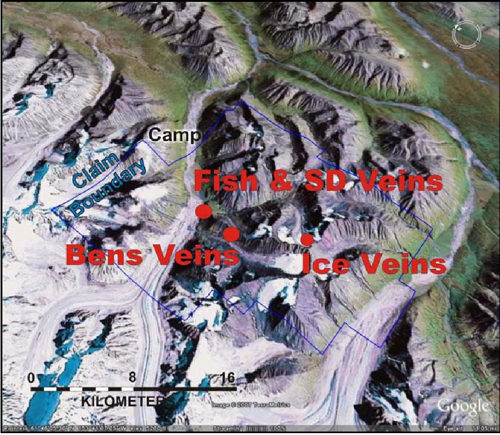

Land Status: The property consists of 240 Alaska state mining claims covering approximately 130 square kilometers (see Figure 1) that are under lease by Raven or its affiliates. All Government permits and reclamation plans for continued exploration through 2014 were renewed in 2010. On September 15, 2010, TMC signed a Definitive Agreement with Raven enabling us to earn a controlling interest, up to 80%, in the TMC project through earn in expenditures of $9,050,000 of work into the project over four years.

Background: The TMC property is located between the Revelation and Terra Cotta mountains of the Alaska Range in southwestern Alaska at 61° 41’ 52.17”N latitude by 153° 41’ 05.59W longitude. The camp is fully equipped with a core facility, kitchen and tents to accommodate 20 people, including small bulldozer and wireless internet on site. The 800m gravel airstrip provides seasonal aircraft access.

A total of 28 diamond drill holes have been completed on the TMC property, returning 111 vein intersections and indicating potential for a significant increase in resources. In addition, initial metallurgical work indicates a high recovery rate via gravity circuit, illustrating strong potential for near-term production. The primary target covers a 5km long area with high-grade gold mineralization hosted in four vein zones (Fish, SD and Bens zones in Figure 1). The vein systems appear to be intimately associated with the margins of diorite intrusions and generally trend north to northwest. To date, International Tower Hill Mines Ltd (“ITH”) has focused mainly on Bens Vein and a NI 43-101 compliant resource model was created the first quarter of 2008. TMC updated the NI 43-101 Summary Report (“43-101 Report”) in June 2010. This 43-101 Report is included as Exhibit 10-4.

| Figure 1: TMC property illustrating target vein locations |  |

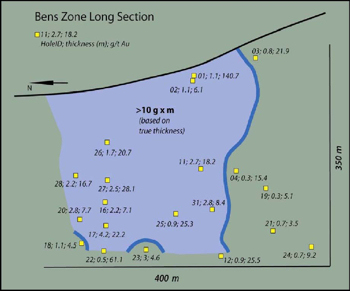

In the Bens Vein system the main vein has a core zone of about 12.2 g/t gold and 23.1 g/t gold at a 5 g/t cutoff which expands significantly when the cutoff is lowered to 1 g/t. Drilling on Bens Vein has outlined an open-ended mineralized zone over 350m long and 250m down dip with an average true width of ~1.3m at an average grade of 12.2) g/t gold. Drilling on the project has identified numerous veins, which in total offer potential of greater than 500,000 ounces. Environmental baseline studies were started in 2010 on the Terra property in anticipation of future development.

History: Outcropping gold veins were first discovered at the TMC project in the late 1990s by Kennecott Exploration, who transferred ownership of 5 State of Alaska claims (800 acres) to one individual. AngloGold Ashanti Exploration (U.S.A.) Inc. (“Anglo Gold”) acquired 100% of the TMC project in 2005 and conducted initial drill testing which returned encouraging results. ITH acquired the project in 2006 as part of a take-over of the AngloGold exploration assets in Alaska. Drilling conducted by ITH in 2006 and 2007 outlined highly attractive high-grade gold vein systems, which has now moved to the initial stage of resource delineation, development and expansion. TMC signed a Letter of Intent to acquire a controlling interest, up to an 80% interest in the project in February 2010 and the Definitive Agreement was signed in September 2010. Expenditures in excess of $6 million US have been spent on the project to date.

The TMC mineralization has been characterized as deep epithermal or mesothermal and could have significant extent down dip and along strike. Furthermore, there is potential to develop a number of continuous high-grade veins forming a highly attractive mining target. Gold characterization work on Bens Vein indicates a large percentage of the gold and silver reports to a gravity concentrate.

The 2007 results for the Bens Area are encouraging not only because they outlined a consistent and well mineralized main vein structure but also because a large number of well-mineralized subsidiary veins were encountered. These subsidiary veins offer significant potential for expansion of the system with intercepts such as holes TR-07-20 with new footwall zone of 0.6m @ 43.2 g/t gold and TR-07-22 with new hanging wall zone 0.8m @ 14.5 g/t gold. From the data currently available it appears that a higher grade shoot is developing within the overall Bens Vein system which could form the nucleus for an initial mining target on the project. Preliminary cash models of a prospective mining operation have a good internal rate of return based on a gold price of $800.

Opportunity: The TMC project has significant potential for not only the development of a large high-grade gold deposit but for near-term production through bulk sample mining and pilot milling. The excellent gravity recovery characteristics of the ore, favorable mining configuration and the high-grade nature of the deposit are all positives for near-term development of the initial ore zone while surface and underground core drilling exploration is developing additional ounces. TMC has positioned the project for drilling of the existing vein systems to increase the gold resource, for near-term small-scale gold production transitioning to anticipated 30,000 ounce per year gold mine operation.

Data Available: TMC has the Anglo Gold and ITH surface and subsurface geochemical and geological database including geological mapping, gold characterization study, and structural interpretations as well as the Kennecott Exploration surface geochemical data and geological map.

Figure 2: Bens Vein long section showing drill intercepts Figure 3: Bens Vein visible gold

and the most prospective area for mining based on these results

TMC Highlights

| | · | NI 43-101 Technical Reports (TSX compliant 2010) |

| | · | 168,000 oz Au , 310,000 oz Ag (ITH NI 43-101) |

| | · | Advanced project with operational revenue model – near term |

| | · | 2011 drill program - Key personnel and equipment are positioned |

| | · | Project potential to over 500,000 ounces of gold. |

| | · | Development Plan, Environmental Assessment and Permitting, in progress |

| | · | Significant exploration potential for additional resource |

| | · | Accredited management and directorship with proven track records |

| | · | Closely held capital structure with limited float |

| | · | $6 million US spent on project by Kennecott, Anglo Gold Ashanti, and ITH |

| | · | Project ownership structure (TMC 80%) |

2011 Drill Program and Beyond

| | · | Identification of additional high grade veins within the structural zone to increase gold resource to million plus ounce potential |

| | · | Upgrade and increase the ITH NI 43-101 inferred 168,000 oz Au resource and advance project to a measured and indicated resource |

| | · | 2011 bulk sampling program with anticipated revenues |

| | · | Exploration for bulk mineable intrusive deposits |

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Compliance with Government Regulations

We currently hold contractual rights to acquire interests in mine properties in Alaska. Our mineral exploration program will be subject to regulations covering the following phases of work:

| | · | Reporting work performed |

These regulations also govern the work requirements for a claim including the minimum annual work requirements necessary to maintain a claim. The holder of a mineral claim must perform exploration and development work on the claim of $100 in each of the first three years and $200 in the eighth and subsequent years. TMC has paid $58,530 to Alaska for exploration and development work.

We anticipate no discharge of water into stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law.

Exploration, Research or Development Expenditures

As of February 28, 2011, TMC incurred $223,102 of project expenses. TMC have not incurred any research and development expenditures over the past two fiscal years.

Intellectual Property

WMTN does not own, either legally or beneficially, any patent or trademark.

Employees

As of February 28, 2011, WMTN had 2 full time employees. We engage independent contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs.

Property

The WMTN principal executive offices are located at 2186 S. Holly St., Suite 104, Denver, CO 80222, and its telephone number is (303) 800-0678. Our corporate office is leased monthly lease at the rate of $560 per month. TMC shares an office with an affiliated officer at no expense. Other than our mining claims, leases, and other real property interests specifically related to mining, WMTN does not own real estate nor have plans to acquire any real estate.

Legal Proceedings

There are no pending legal proceedings against the Company that are expected to have a material adverse effect on its cash flows, financial condition or results of operations.

Risks Related to our Business

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

The volatility of the price of gold could adversely affect our future operations and, if warranted, our ability to develop our properties.

The potential for profitability of our operations, the value of our properties and our ability to raise funding to conduct continued exploration and development, if warranted, are directly related to the market price of gold and other precious metals. The price of gold may also have a significant influence on the market price of our common stock and the value of our properties. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of gold may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold prices.

As of February 25, 2011, the price of gold was $1,409 per ounce, based on the daily London PM fix on that date. The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold prices decline or remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, estimates of mineralized material presented in our press releases and regulatory filings are based upon estimates made by us and our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale metallurgical tests will be recovered at production scale.

The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove inaccurate. Extended declines in market prices for gold and silver may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

We need to continue as a going concern if our business is to succeed.

The WMTN Form 10-K for the year ended December 31, 2009 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. The audited financial statements for TMC for the period of inception from March 25, 2010 to October 31, 2010 indicates that there are a number of factors that raise substantial doubt about its ability to continue as a going concern. Such factors identified in the report result from our limited history of operations, limited assets, and operating losses since inception. If we are not able to continue as a going concern, it is likely investors will lose their investments.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

If we do not obtain additional financing, our business will fail.

Our current operating funds are less than necessary to complete all intended exploration of the property, and therefore we will need to obtain additional financing in order to complete our business plan. As of February 28, 2011 we had cash in the amount of $1.2 million. We currently have minimal operations and we have no income.

Our business plan calls for significant expenses in connection with the exploration of the property. We do not currently have sufficient funds to conduct continued exploration on the property and require additional financing in order to determine whether the property contains economic mineralization. We will also require additional financing if the costs of the exploration of the property are greater than anticipated.

We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including the market prices for copper, silver and gold, investor acceptance of our property and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be our sale of a partial interest in the property to a third party in exchange for cash or exploration expenditures, which is not presently contemplated.

Because we have commenced limited business operations, we face a high risk of business failure.

We are preparing to conduct exploration on our properties in the spring of 2011. Accordingly, we have no way to evaluate the likelihood that our business will be successful. Although we were incorporated in the state of Colorado on October 18, 2007, the Company just acquired our mineral properties with our acquisition of TMC on February 28, 2011. We have not earned any revenues as of the date of this Current Report on Form 8-K. TMC itself has only been in existence since March 25, 2010.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development of the mineral claims and the production of minerals from the claims, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We are dependent on key personnel.

Our success depends to a significant degree upon the continued contributions of key management and other personnel, some of whom could be difficult to replace. We do not maintain key man life insurance covering certain of our officers. Our success will depend on the performance of our officers, our ability to retain and motivate our officers, our ability to integrate new officers into our operations and the ability of all personnel to work together effectively as a team. Our failure to retain and recruit officers and other key personnel could have a material adverse effect on our business, financial condition and results of operations.

We lack an operating history and we expect to have losses in the future.

Except for TMC’s initial exploration efforts as described above, we have not started our proposed business operations or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the following:

| | · | Our ability to locate a profitable mineral property; |

| | · | Our ability to generate revenues; and |

| | · | Our ability to reduce exploration costs. |

Based upon current plans, we expect to incur operating losses in foreseeable future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. We cannot guarantee that we will be successful in generating revenues in the future. Failure to generate revenues will cause us to go out of business.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. Although we have conducted due diligence investigation prior to entering into the Definitive Agreement, risk remains regarding any undisclosed or unknown liabilities associated with this project. The payment of such liabilities may have a material adverse effect on our financial position.

Because we are small and do not have much capital, we may have to cease operation even if we have found mineralized material.

Because we are small and do not have much capital, we must limit our exploration. Because we may have to limit our exploration, we may be unable to mine mineralized material, although our mineral claims contain mineralized material. If we cannot mine mineralized material, we may have to cease operations.

If we become subject to onerous government regulation or other legal uncertainties, our business will be negatively affected.

Governmental regulations impose material restrictions on mineral property exploration and development. Under Alaska mining law, to engage in exploration will require permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. If we proceed to commence drilling operations on the mineral claims, we will incur additional regulatory compliance costs.

In addition, the legal and regulatory environment that pertains to mineral exploration is uncertain and may change. Uncertainty and new regulations could increase our costs of doing business and prevent us from exploring for ore deposits. The growth of demand for ore may also be significantly slowed. This could delay growth in potential demand for and limit our ability to generate revenues. In addition to new laws and regulations being adopted, existing laws may be applied to limit or restrict mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our financial condition and operating results may be harmed.

We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials after this offering is complete. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Because of the speculative nature of exploration of mineral properties, there is no assurance that our exploration activities will result in the discovery of new commercially exploitable quantities of minerals.

We plan to continue to source exploration mineral claims. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that additional commercially exploitable reserves of gold exist on our properties. Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates. These risks may result in us being unable to establish the presence of additional commercial quantities of ore on our mineral claims with the result that our ability to fund future exploration activities may be impeded.

Weather and location challenges may restrict and delay our work on our property.

We plan to conduct our exploration on a seasonal basis, it is possible that snow or rain could restrict and delay work on the properties to a significant degree. Our property is located in a relatively remote location, which creates additional transportation and energy costs and challenges.

As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

Trading of our stock may be restricted by Blue Sky eligibility and the SEC's penny stock regulations which may limit a stockholder's ability to buy and sell our stock.

The Company currently is not Blue Sky eligible. In addition, the SEC has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Under the penny stock rules, additional sales practice requirements are imposed on broker-dealers who sell to persons other than established customers and "accredited investors." The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to broker-dealers to trade in the Company’s securities.

The Blue Sky eligibility and the penny stock rules may discourage investor interest in and limit the marketability of, the Company’s common stock.

The sale of a significant Number of our shares of common stock could depress the price of our common stock.

Sales or issuances of a large number of shares of common stock in the public market or the perception that sales may occur could cause the market price of our common stock to decline. As of February 28, 2011, there were 16.6 million shares of common stock and Forms of Warrants issued and outstanding on a fully diluted basis. Significant shares of common stock are held by our principal shareholders, other Company insiders and other large shareholders. As “affiliates” (as defined under Rule 144 of the Securities Act (“Rule 144”)) of the Company, our principal shareholders, other Company insiders and other large shareholders may only sell their shares of common stock in the public market pursuant to an effective registration statement or in compliance with Rule 144.

We may engage in acquisitions, mergers, strategic alliances, joint ventures and divestitures that could result in financial results that are different than expected.

By signing the Definitive Agreement with Raven and ITH we entered into a joint venture to move the project forward. In the normal course of business, we may engage in other discussions relating to possible acquisitions, equity investments, mergers, strategic alliances, joint ventures and divestitures. All such transactions are accompanied by a number of risks, including:

| | · | Use of significant amounts of cash, |

| | · | Potentially dilutive issuances of equity securities on potentially unfavorable terms, |

| | · | Incurrence of debt on potentially unfavorable terms as well as impairment expenses related to goodwill and amortization expenses related to other intangible assets, and |

| | · | The possibility that we may pay too much cash or issue too many of our shares as the purchase price for an acquisition relative to the economic benefits that we ultimately derive from such acquisition. |

| | · | The process of integrating any acquisition may create unforeseen operating difficulties and expenditures. The areas where we may face difficulties in the foreseeable include: |

| | · | Diversion of management time, during the period of negotiation through closing and after closing, from its focus on operating the businesses to issues of integration, |

| | · | The need to integrate each Company's accounting, management information, human resource and other administrative systems to permit effective management, and the lack of control if such integration is delayed or not implemented, |

| | · | The need to implement controls, procedures and policies appropriate for a public Company that may not have been in place in private companies, prior to acquisition, |

| | · | The need to incorporate acquired technology, content or rights into our products and any expenses related to such integration, and |

| | · | The need to successfully develop any acquired in-process technology to realize any value capitalized as intangible assets. |

From time to time, we may engage in discussions with candidates regarding potential acquisitions. If a divestiture such as this does occur, we cannot be certain that our business, operating results and financial condition will not be materially and adversely affected. A successful divestiture depends on various factors, including our ability to:

| | · | Effectively transfer liabilities, contracts, facilities and employees to any purchaser, |

| | · | Identify and separate the intellectual property to be divested from the intellectual property that we wish to retain, |

| | · | Reduce fixed costs previously associated with the divested assets or business, and |

| | · | Collect the proceeds from any divestitures. |

In addition, if customers of the divested business do not receive the same level of service from the new owners, this may adversely affect our other businesses to the extent that these customers also purchase other products offered by us. All of these efforts require varying levels of management resources, which may divert our attention from other business operations.

If we do not realize the expected benefits or synergies of any divestiture transaction, our consolidated financial position, results of operations, cash flows and stock price could be negatively impacted.

The market price of our common stock may be volatile.

The market price of our common stock has been and is likely in the future to be volatile. Our common stock price may fluctuate in response to factors such as:

| | ● | Announcements by us regarding liquidity, significant acquisitions, equity investments and divestitures, strategic relationships, addition or loss of significant customers and contracts, capital expenditure commitments, loan, note payable and agreement defaults, loss of our subsidiaries and impairment of assets, |

| | ● | Issuance of convertible or equity securities for general or merger and acquisition purposes, |

| | ● | Issuance or repayment of debt, accounts payable or convertible debt for general or merger and acquisition purposes, |

| | ● | Sale of a significant number of our common stock by shareholders, |

| | ● | General market and economic conditions, |

| | ● | Quarterly variations in our operating results, |

| | ● | Investor relation activities, |

| | ● | Announcements of technological innovations, |

| | ● | New product introductions by us or our competitors, |

| | ● | Competitive activities, and |

| | ● | Additions or departures of key personnel. |

These broad market and industry factors may have a material adverse effect on the market price of our common stock, regardless of our actual operating performance. These factors could have a material adverse effect on our business, financial condition and results of operations.

Our management has substantial influence over our company.

As of February 28, 2011, Greg Schifrin, our CEO, and Mr. James Baughman either directly or indirectly, own or controls 6.5 million shares as of the filing date or approximately 39.4% of our common stock on a fully diluted basis.

Mr. Schifrin, in combination with other large shareholders, could cause a change of control of our board of directors, approve or disapprove any matter requiring stockholder approval, cause, delay or prevent a change in control or sale of the Company, which in turn could adversely affect the market price of our common stock.

Conflict of interest.

Some of the directors of the Company are also directors and officers of other companies, and conflicts of interest may arise between their duties as directors of the Company and as directors and officers of other companies. These factors could have a material adverse effect on our business, financial condition and results of operations.

We have limited insurance.

We have limited director and officer insurance and commercial insurance policies. Any significant insurance claims would have a material adverse effect on our business, financial condition and results of operations.

Dividend Policy.

We have never paid any cash dividends and intend, for the foreseeable future, to retain any future earnings for the development of our business. Our future dividend policy will be determined by the board of directors on the basis of various factors, including our results of operations, financial condition, capital requirements and investment opportunities.

Trends, risks and uncertainties.

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with the financial statements and the related notes which are included elsewhere in this report. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ substantially from those anticipated in any forward-looking statements included in this discussion as a result of various factors, including those set forth in “Risk Factors” contained elsewhere in this report.

Overview

WMTN was incorporated in the state of Colorado on October 18, 2007 and commenced operations. We were a developer of indexes that allow investors to access specific market niches or sub-markets. We expected to earn income by helping investors identify and access specific market niches or sub-markets using our index products. We screened investments with emphasis towards finding opportunities with long term potential.

On February 18, 2011, WMTN consummated the transactions contemplated by the Share Exchange Agreement pursuant to which we acquired all of the issued and outstanding shares of TMC from the Sellers in exchange for the issuance of 1,500,000 or 39.2% shares of our restricted common stock to the Sellers at the close of the acquisition of TMC.

As of February 28, 2011, WMTN had 11,852,313 shares issued and outstanding. As of February 28, 2011, WMTN had 16,577,313 common shares and warrants issued and outstanding on a fully diluted basis.

After post closing transactions, a total of 14,249,000 or 86% shares of WMTN common stock and Forms of Warrants were issued on a fully diluted basis to add other mineral properties, increase working capital, strengthen its balance sheet and prepare to execute the development of the TMC properties.

TMC is an exploration and development company incorporated on March 25, 2010, that explores, acquires, and develops advanced stage properties. Our objective is to be a leader in the exploration and development of U.S. base and precious metals. Our goal is to elevate standards of responsible practices for the resource industry while building a profitable business and to maximize shareholder value.

Results of Operations

From our inception on October 18, 2007 through December 31, 2009, WMTN generated no revenue. As a result we have no operating history upon which to evaluate our business. We had a net loss of $136,086 for this period.

For the period of inception from March 25, 2010 through October 31, 2010, TMC generated no revenue. As a result we have no operating history upon which to evaluate its business. TMC had a net loss of $495,018 for this period.

Operating expenses for WMTN, which consisted solely of general and administrative expenses, were $58,304 for the year ended December 31, 2009 compared to $60,860 for the fiscal year ended December 31, 2008. Operating expenses for the period October 18, 2007 (inception) through December 31, 2009 was $148,540. The major components of general and administrative expenses include professional fees (legal and accounting).

Operating expenses for TMC, which consisted primarily of exploration expense, general, administrative expenses and options fees were $442,459 for the period of inception from March 25, 2010 to October 31, The major components of general and administrative expenses include officer compensation and legal and professional fees.

Our accountants have expressed doubt about our ability to continue as a going concern as a result of our history of net loss. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to successfully execute the “Business Subsequent to the Acquisition” as described above.

With the acquisition of TMC, it is expected that expenses of the Company will now reflect the historic expenses incurred by TMC and, subject to raising additional capital, expenditures will ramp up as exploration and as appropriate, development and mining ramp up. We have budgeted expenditures for 2011 of approximately $1,100,000 for general and administrative expenses and exploration and development On the other hand, we may choose to scale back our operations to operate at break-even with a smaller level of business activity, while adjusting our overhead to meet the revenue from current operations. In addition, we expect that we will need to raise additional funds if we decide to pursue more rapid expansion, the development of new or enhanced services or products, appropriate responses to competitive pressures, or the acquisition of complementary businesses or technologies, or if we must respond to unanticipated events that require us to make additional investments. We cannot assure that additional financing will be available when needed on favorable terms, or at all.

We expect to incur operating losses in future periods because we will be incurring expenses and not generating sufficient revenues. We cannot guarantee that we will be successful in generating sufficient revenues or other funds in the future to cover these operating costs. Failure to generate sufficient revenues or additional financing when needed could cause us to go out of business.

Liquidity and Capital Resources

As of December 31, 2009, WMTN had cash or cash equivalents of $12,798.

WMTN’s cash flows used in operating activities were $47,389 for the fiscal year ended December 31, 2009 compared to $63,733 for the fiscal year ended December 31, 2008. Cash flows used in operating activities were $120,482 from our inception on October 18, 2007 through December 31, 2009.

WMTN’s cash flows used in investing activities were $94,186 for the fiscal year ended December 31, 2009 compared to cash flows provided by investing activities were $169,551 for the fiscal year ended December 31, 2008. Cash flows used in investing activities were $233,185 from our inception on October 18, 2007 through December 31, 2009. We purchased certificates of deposit in the amount of $224,233 during this period.

WMTN’s cash flows provided by financing activities were $-0- for the fiscal year ended December 31, 2009 and 2008. Cash flows provided by financing activities were $366,465 from our inception on October 18, 2007 through December 31, 2009. These cash flows were all related to sales of stock.

TMC’s cash flows used in operative activities were $285,719 for the period of inception from March 25, 2010 to October 31, 2010.

TMC’s cash flows provided by operating activities were $809,000 for the period of inception from March 25, 2010 to October 31, 2010. These cash flows primarily related to proceeds from Convertible Debentures issued in a principal amount of $630,000 and Demand Promissory Notes in a total principal amount of $150,000. After the closing of this transaction, WMTN (including TMC) had cash or cash equivalents of approximately $1.5 million.

Over the next twelve months WMTN expects that, subject to the availability of capital, we will expend approximately $1.1 million to implement the business plan as described above. For further details see “Cash Requirements” below.

WMTN believes that it has sufficient capital in the short term for our current level of operations but, as discussed in greater detail below under “Cash Requirements” (and under Item 1.01 above and elsewhere), we will have to raise substantial additional capital in order to fully implement the business plan. If economic reserves of gold and/or other minerals are proven, additional capital will be needed to actually develop and mine those reserves. As described in Item 1.01 above and discussed under “Cash Requirements” below, we must expend $9,050,000 over the next four years as our “earn in” on the TMC project to own rights to 80% of the project. Even if economic reserves are found, if we are unable to raise this capital, we will not be able to complete our earn in on this project.

Our principal source of liquidity for the next several years will need to be the continued raising of capital through the issuance of equity or debt. WMTN plan to raise funds for each step of the project and as each step is successfully completed, raise the capital for the next phase. WMTN believes this will reduce the cost of capital as compared to trying to raise all the anticipated capital at once up front. However, since WMTN’s ability to raise additional capital will be affected by many factors, most of which are not within our control (see “Risk Factors”), no assurance can be given that WMTN will in fact be able to raise the additional capital as it is needed.

Our primary activity will be to proceed with the TMC project and other mining opportunities that may present themselves from time to time. We cannot guarantee that the TMC project will be successful or that any project that we embark upon will be successful. Our goal is to build our company into a successful mineral exploration and development company.

Off-Balance Sheet Arrangements

WMTN has no off-balance sheet arrangements with any party.

Cash Requirements

WMTN intends to conduct exploration activities to continue to earn-in to our newly optioned properties over the next twelve months. We estimate our operating expenses and working capital requirements for the next twelve month period to be as follows: