EXHIBIT 10.2

TERRA GOLD PROJECT

EXPLORATION, DEVELOPMENT AND

MINE OPERATING AGREEMENT

By and Between Participants

Raven Gold Alaska Inc.

and

Terra Gold Corporation

Effective Date: September 15, 2010

Using Form 5A as a Base

Copyright 81996 All Rights Reserved

Rocky Mountain Mineral Law Foundation

TABLE OF CONTENTS

Page

| ARTICLE I | DEFINITIONS AND CROSS-REFERENCES | 2 |

| ARTICLE II | NAME, PURPOSES AND TERM | 3 |

| ARTICLE III | REPRESENTATIONS AND WARRANTIES; TITLE TO ASSETS; INDEMNITIES | 4 |

| | 3.1 | Representations and Warranties of Both Participants | 4 |

| | 3.2 | Representations and Warranties of RAVEN | 4 |

| | 3.6 | Royalties, Production Taxes and Other Payments Based on Production | 7 |

| | 3.7 | Indemnities/Limitation of Liability | 7 |

| ARTICLE IV | RELATIONSHIP OF THE PARTICIPANTS | 8 |

| | 4.2 | Federal Tax Elections and Allocations | 8 |

| | 4.5 | Other Business Opportunities | 9 |

| | 4.6 | Waiver of Rights to Partition or Other Division of Assets | 9 |

| | 4.7 | Transfer or Termination of Rights to Properties | 9 |

| | 4.9 | No Third Party Beneficiary Rights | 9 |

| | ARTICLE V | CONTRIBUTIONS BY PARTICIPANTS | 10 |

| | 5.1 | Participants' Initial Contributions | 10 |

| | 5.2 | Failure to Make Initial Contribution | 14 |

| | 5.3 | Additional Contributions | 15 |

| | 5.4 | Failure to Complete a Secondary Contribution | 16 |

| | ARTICLE VI | INTERESTS OF PARTICIPANTS | 17 |

| | 6.1 | Initial Interests in the Business and Participating Interests | 17 |

| | 6.2 | Changes in Participating Interests | 17 |

| | 6.3 | Elimination of Minority Interest | 18 |

| | 6.4 | Continuing Liabilities Upon Adjustments of Participating Interests | 19 |

| | 6.5 | Documentation of Adjustments to Participating Interests | 19 |

| | 6.6 | Grant of Lien and Security Interest | 20 |

| | 6.7 | Subordination of Interests | 20 |

| | ARTICLE VII | MANAGEMENT COMMITTEE | 20 |

| | 7.1 | Organization and Composition | 20 |

| | 7.4 | Action Without Meeting in Person | 22 |

| | 7.5 | Matters Requiring Approval | 22 |

| | 8.2 | Powers and Duties of Manager | 22 |

| | 8.4 | Resignation; Deemed Offer to Resign | 26 |

| | 8.6 | Transactions With Affiliates | 27 |

| | 8.7 | Activities During Deadlock | 27 |

| ARTICLE IX | PROGRAMS AND BUDGETS | 28 |

| | 9.1 | Initial Program and Budget | 28 |

| | 9.2 | Operations Pursuant to Programs and Budgets | 28 |

| | 9.3 | Presentation of Programs and Budgets | 28 |

| | 9.4 | Review and Adoption of Proposed Programs and Budgets | 28 |

| | 9.5 | Election to Participate | 29 |

| | 9.6 | Recalculation or Restoration of Reduced Interest Based on Actual Expenditures | 30 |

| | 9.7 | Pre-Feasibility Study Program and Budgets | 31 |

| | 9.8 | Completion of Pre-Feasibility Studies and Selection of Approved Alternatives | 32 |

| | 9.9 | Programs and Budgets for Feasibility Study | 33 |

| | 9.10 | Development Programs and Budgets; Project Financing | 34 |

| | 9.11 | Expansion or Modification Programs and Budgets | 34 |

| | 9.12 | Budget Overruns; Program Changes | 34 |

| | 9.13 | Emergency or Unexpected Expenditures | 35 |

| ARTICLE X | ACCOUNTS AND SETTLEMENTS | 35 |

| | 10.1 | Quarterly Statements | 36 |

| | 10.3 | Failure to Meet Cash Calls | 35 |

| ARTICLE XI | DISPOSITION OF PRODUCTION | 38 |

| | 11.2 | Failure of Participant to Take In Kind | 39 |

| ARTICLE XII | WITHDRAWAL AND TERMINATION | 39 |

| | 12.1 | Termination by Expiration or Agreement | 39 |

| | 12.2 | Termination by Deadlock | 29 |

| | 12.4 | Continuing Obligations and Environmental Liabilities | 40 |

| | 12.5 | Disposition of Assets on Termination | 40 |

| | 12.6 | Non-Compete Covenants | 40 |

| | 12.7 | Right to Data After Termination | 40 |

| | 12.8 | Continuing Authority | 40 |

| | ARTICLE XIII | ACQUISITIONS WITHIN AREA OF INTEREST | 41 |

| | 13.2 | Notice to Non-Acquiring Participant | 41 |

| | 13.4 | Option Not Exercised | 42 |

| ARTICLE XIV | ABANDONMENT AND SURRENDER OF PROPERTIES | 42 |

| ARTICLE XV | SUPPLEMENTAL BUSINESS AGREEMENT | 43 |

| ARTICLE XVI | TRANSFER OF INTEREST; PREEMPTIVE RIGHT | 43 |

| | 16.2 | Limitations on Free Transferability | 43 |

| ARTICLE XVIII | CONFIDENTIALITY, OWNERSHIP, USE AND DISCLOSURE OF INFORMATION | 47 |

| | 18.1 | Business Information | 47 |

| | 18.2 | Participant Information | 48 |

| | 18.3 | Permitted Disclosure of Confidential Business Information | 48 |

| | 18.4 | Disclosure Required By Law | 48 |

| | 18.5 | Public Announcements | 49 |

| ARTICLE XIX | GENERAL PROVISIONS | 49 |

| | 19.8 | Rule Against Perpetuities | 52 |

| | 19.10 | Entire Agreement; Successors and Assigns | 52 |

EXHIBIT A ASSETS AND AREA OF INTEREST

EXHIBIT B ACCOUNTING PROCEDURES

EXHIBIT C TAX MATTERS

EXHIBIT D DEFINITIONS

EXHIBIT E NET SMELTER RETURNS CALCULATION

EXHIBIT F INSURANCE

EXHIBIT G INITIAL PROGRAM AND BUDGET

EXHIBIT H FORM OF MEMORANDUM OF AGREEMENT

TERRA GOLD PROJECT

EXPLORATION, DEVELOPMENT AND MINE OPERATING AGREEMENT

This Exploration, Development and Mine Operating Agreement is made effective as of September 15 , 2010 ("Effective Date") between and among Raven Gold Alaska Inc., an Alaska corporation ("RAVEN"); International Tower Hill Mines Ltd., a British Columbia corporation (“ITH”); Terra Gold Corporation, an Alaska corporation ("TERRA"); and Terra Mining Corporation, a British Columbia corporation (“TMC”). RAVEN, ITH, TERRA and TMC, are each a “Party” and collectively, whether two or more, are “Parties” to this Agreement.

RECITALS

| | A. | In February of 2010, ITH and American Mining Corporation entered into a Letter of Intent (“LOI”) concerning a possible joint venture concerning mining properties located in the Mt. McKinley Recording District, State of Alaska (collectively the Terra Gold Project), and American Mining Corporation paid a deposit in the amount of Ten Thousand Dollars ($10,000) to be applied to its initial contribution to that joint venture if and when applicable. |

| | B. | Under the joint venture contemplated by the LOI, ITH would contribute the Terra Gold Project properties and related assets to the joint venture, and American Mining Corporation could earn a majority interest in those properties over a three year period by making option payments, funding operations at or above agreed upon levels, and issuing an agreed upon number of shares to ITH. |

| | C. | In May of 2010, TMC succeeded to American Mining Corporation’s interest in the LOI, as amended. |

| | D. | During the summer of 2010, ITH and TMC undertook the prior steps needed to form a joint venture for the purposes of exploration, evaluation, and if appropriate the development and mining of mineral resources within the Terra Gold Project, acting through their respective Alaska subsidiaries during that time, RAVEN and TERRA, with RAVEN and TERRA designated as the Participants to the Terra Gold Project joint venture. |

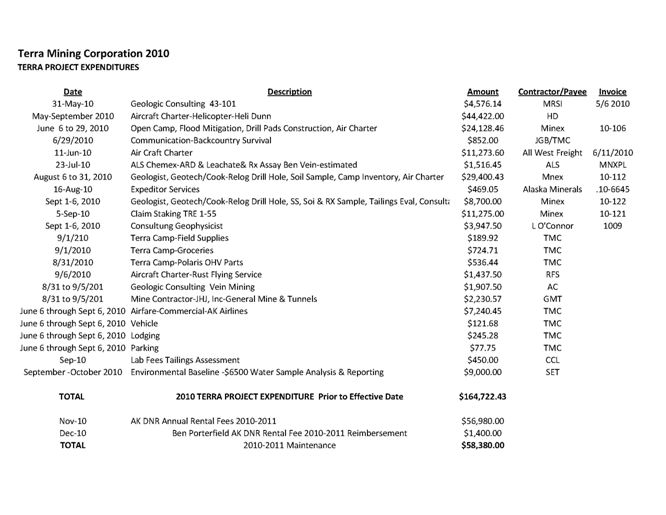

| | E. | Prior to the Effective Date, TMC and TERRA in good faith undertook actions and expenditures to benefit the contemplated Terra Gold Project joint venture with the understanding that such expenditures would be applied towards TERRA’s initial earn-in funding milestone. |

| | F. | Prior to the Effective Date, ITH spun off RAVEN, such that RAVEN was no longer a wholly owned subsidiary of ITH, and has agreed hereunder to convey to RAVEN all of its right, title and interest in the Terra Gold Project properties and assets. As between ITH and Raven, ITH has retained the right to receive option payments and shares received from TMC in furtherance of Terra’s Initial Contribution (as defined herein) and earn-in of interest in the Terra Gold Project. |

| | G. | On or about the same time, TMC entered into a reverse merger agreement and simultaneous private placement to secure funding for TERRA’s Initial Contribution and earn-in under the joint venture, with TMC to issue the share consideration under this Agreement to ITH following the closing of TMC’s reverse merger. |

| | H. | RAVEN desires to contribute all right title and interest in the Terra Gold Project properties and assets that it will receive from ITH (as described in Exhibit A), except for reserving unto itself a sliding scale Net Smelter Returns royalty interest on Production (as described specifically in Exhibit A and as defined in Exhibit E) of precious metals or base metals established on the properties contributed as RAVEN’s Initial Contribution under the joint venture. |

| | I. | TERRA wishes to participate with RAVEN in the exploration, evaluation, and if justified the development and mining of mineral resources within the Terra Gold Project in accordance with this Agreement, and RAVEN is willing to grant such rights to TERRA. |

NOW THEREFORE, in consideration of the covenants and conditions contained herein, the Parties agree as follows:

ARTICLE I

DEFINITIONS AND CROSS-REFERENCES

1.1 Definitions. The terms defined in Exhibit D and elsewhere shall have the defined meaning wherever used in this Agreement, including in Exhibits.

1.2 Cross-References. References to "Exhibits," "Articles," "Sections" and "Subsections" refer to Exhibits, Articles, Sections and Subsections of this Agreement. References to "Paragraphs" and "Subparagraphs" refer to paragraphs and subparagraphs of the referenced Exhibits.

ARTICLE II

NAME, PURPOSES AND TERM

2.1 General. RAVEN and TERRA hereby enter into this Agreement for the purposes hereinafter stated. All of the rights and obligations of the Participants in connection with the Assets or the Area of Interest and all Operations shall be subject to and governed by this Agreement.

2.2 Name. The Assets shall be managed and operated by the Participants under the name of Terra Gold Project Joint Venture. The Manager shall accomplish any registration required by applicable assumed or fictitious name statutes and similar statutes.

2.3 Purposes. This Agreement is entered into for the following purposes and for no others, and shall serve as the exclusive means by which each of the Participants accomplishes such purposes:

| | (a) | to conduct Exploration within the Area of Interest on an as-needed basis, |

| | (b) | to acquire additional real property and other interests within the Area of Interest on an as-needed basis, |

| | (c) | to evaluate the possible Development and Mining of the Properties, and, if determined by the Participants to be justified, to engage in Development and Mining, |

| | (d) | to engage in Operations on the Properties, |

| | (e) | to engage in marketing Products, to the extent provided by Article XI, |

| | (f) | to complete and satisfy all Environmental Compliance obligations and Continuing Obligations affecting the Properties, and |

| | (g) | to perform any other activity necessary, appropriate, or incidental to any of the foregoing. |

2.4 Limitation. Unless the Participants otherwise agree in writing, the Operations shall be limited to the purposes described in Section 2.3, and nothing in this Agreement shall be construed to enlarge such purposes or to change the relationships of the Participants as set forth in Section 4.

2.5 Term. The term of this Agreement shall be for twenty (20) years from the Effective Date and for so long thereafter as Products are produced from the Properties on a continuous basis, and thereafter until all materials, supplies, equipment and infrastructure have been salvaged and disposed of, any required Environmental Compliance is completed and accepted and the Participants have agreed to a final accounting, unless the Business is earlier terminated as herein provided. For purposes hereof, Products shall be deemed to be produced from the Properties on a "continuous basis" so long as production in commercial quantities is not halted for more than one year for reasons other than Force Majeure as provided for in Section 19.7.

ARTICLE III

REPRESENTATIONS AND WARRANTIES;

TITLE TO ASSETS; INDEMNITIES

3.1 Representations and Warranties of Both Participants. Except as expressly stated otherwise, as of the Effective Date each Participant warrants and represents to the other that:

(a) it is a corporation duly organized and in good standing in its state of incorporation and is qualified to do business and is in good standing in those states where necessary in order to carry out the purposes of this Agreement;

(b) it has the capacity to enter into and perform this Agreement and all transactions contemplated herein and that all applicable corporate actions (i.e., authorizations and approvals by such board of directors and such shareholders) as may be required and third party consents (except for the consent of Ben Porterfield under Section XII.D of the Porterfield Lease, which RAVEN shall warrant and represent it has obtained as of the date RAVEN completes its Initial Contribution hereunder pursuant to Section 5.01(a)) as may be required to authorize and enable it to enter into and perform this Agreement have been properly taken;

(c) it will not breach any other agreement or arrangement by entering into or performing this Agreement;

(d) it is not subject to any governmental order, judgment, decree, debarment, sanction or Laws that would preclude the permitting or implementation of all Operations under this Agreement; and

(e) this Agreement has been duly executed and delivered by it and is valid and binding upon it in accordance with its terms.

3.2 Representations and Warranties of RAVEN. As of the date RAVEN makes its Initial Contribution hereunder pursuant to Section 5.01(a), RAVEN makes the following representations and warranties to TERRA:

(a) RAVEN has delivered to or made available for inspection by TERRA all Existing Data in its possession or control, and true and correct copies of all leases or other contracts relating to the Properties.

(b) With respect to unpatented state mining locations not located by RAVEN but which are included within the Properties, except as provided in Paragraph 1.1 of Exhibit A and subject to the paramount titles of the United States (if any such title remains) and the State of Alaska: (i) all assessment work required to hold the unpatented state mining locations has been performed and all Governmental Fees have been paid in a manner consistent with that required of the Manager pursuant to Subsection 8.2(k) through the assessment year ending September 1, 2009, and through the rental year commencing on September 1, 2009 (for which rental was required to be paid on or before November 30, 2009); (ii) all affidavits of assessment work, evidence of payment of Governmental Fees, and other filings required to maintain said locations in good standing have been properly and timely recorded or filed with appropriate governmental agencies; (iii) said locations are free and clear of Encumbrances or defects in title; and (iv) RAVEN has no knowledge of conflicting mining claims. Nothing in this Subsection, however, shall be deemed to be a representation or a warranty that any of the unpatented state mining locations contains a valuable discovery of locatable minerals.

(c) With respect to those Properties in which RAVEN holds an interest (as successor to the interest of lessee AngloGold Ashanti (USA) Exploration Inc.) under the Porterfield Lease, except as provided therein and subject to the rights of lessor Ben Porterfield thereunder (including but not limited to the right of lessor to conduct simultaneous operations under Section II.I thereunder), and except as provided in Paragraph 1.1 of Exhibit A: (i) RAVEN is in exclusive possession of such Properties; (ii) RAVEN has not received any notice of default of any of the terms or provisions of such lease; (iii) RAVEN has the authority under such lease to perform fully its obligations under this Agreement; (iv) to RAVEN's knowledge, such lease is valid and is in good standing; (v) RAVEN has no knowledge of any act or omission or any condition on the Properties which could be considered or construed as a default under such lease; and (vi) to RAVEN's knowledge, such Properties are free and clear of all Encumbrances or defects in title except for those specifically identified in Paragraph 1.1 of Exhibit A.

(d) With respect to the Properties, to RAVEN's knowledge, there are no pending or threatened actions, suits, claims or proceedings, and there have been no previous transactions affecting its interests in the Properties which have not been for fair consideration.

(e) Except as to matters otherwise disclosed in writing to TERRA prior to the Effective Date,

(i) to RAVEN's knowledge, the conditions existing on or with respect to the Properties and its ownership and operation of the Properties are not in violation of any Laws (including without limitation any Environmental Laws), nor causing or permitting any damage (including Environmental Damage, as defined below) or impairment to the health, safety, or enjoyment of any person at or on the Properties or in the general vicinity of the Properties;

(ii) to RAVEN's knowledge, there have been no past violations by it or by any of its predecessors in title of any Environmental Laws or other Laws affecting or pertaining to the Properties, nor any past creation of damage or threatened damage to the air, soil, surface waters, groundwater, flora, fauna, or other natural resources on, about or in the general vicinity of the Properties ("Environmental Damage"); and

(iii) �� RAVEN has not received inquiry from or notice of a pending investigation from any governmental agency or of any administrative or judicial proceeding concerning the violation of any Laws.

The representations and warranties set forth above shall survive the execution and delivery of any documents of Transfer provided under this Agreement. For a representation or warranty made to a Participant's "knowledge," the term "knowledge" shall mean actual knowledge on the part of the officers, employees, and agents of the representing Participant or of facts that would reasonably lead to the indicated conclusions.

3.3 Disclosures. Each of the Participants represents and warrants that it is unaware of any material facts or circumstances that have not been disclosed in this Agreement, which should be disclosed to the other Participant in order to prevent the representations and warranties in this Article from being materially misleading. RAVEN has disclosed to TERRA all information it believes to be relevant concerning the Assets and has provided to or made available for inspection by TERRA all such information, but does not make any representation or warranty, express or implied, as to the accuracy or completeness of the information (except as provided in Section 3.2) or as to the boundaries or value of the Assets. Each Participant represents to the other that in negotiating and entering into this Agreement it has relied solely on its own appraisals and estimates as to the value of the Assets and upon its own geologic and engineering interpretations related thereto.

3.4 Record Title. Title to the Assets contributed by RAVEN as its Initial Contribution pursuant to Section 5.1 shall be held by RAVEN, subject to this Agreement and to the Raven Royalty, until TERRA completes its Initial Contribution at which time, RAVEN shall convey a fifty-one percent (51%) undivided interest in the Assets into TERRA or TERRA’s designee, subject to this Agreement and to the Raven Royalty. The Participants agree to make such further conveyances of record title from time to time, as their Participating Interests are determined or recalculated pursuant to this Agreement.

3.5 Loss of Title. Following RAVEN’s completion of its Initial Contribution, any failure or loss of title to the Assets, and all costs of defending title, shall be charged to the Business Account, except that all costs and losses arising out of or resulting from breach of the representations and warranties of RAVEN or TERRA as to title shall be charged to RAVEN or TERRA, as the case may be.

3.6 Royalties, Production Taxes and Other Payments Based on Production. All required payments of production royalties, taxes based on production of Products or on the gross or net income derived therefrom, and other payments out of production to private parties and governmental entities shall be determined and made by each Participant in proportion to its Participating Interest, and each Participant undertakes to make such payments timely and otherwise in accordance with applicable laws and agreements. If separate payment is not permitted, each Participant shall determine and pay its proportionate share in advance to the Participant obligated to make such payment and such Participant shall timely make such payment. Each Participant shall furnish to the other Participant evidence of timely payment for all such required payments. In the event that either Participant fails to make any such required payment, the other Participant shall have the right to make such payment and shall thereby become subrogated to the rights of such third party; provided, however, that the making of any such payment on behalf of the other Participant shall not constitute acceptance by the paying Participant of any liability to such third party for the underlying obligation.

3.7 Indemnities/Limitation of Liability.

(a) Each Participant shall indemnify the other Participant, its directors, officers, employees, agents and attorneys, or Affiliates (collectively "Indemnified Participant") from and against the entire amount of any Material Loss. A "Material Loss" shall mean all costs, expenses, damages or liabilities, including attorneys' fees and other costs of dispute resolution (either threatened or pending) arising out of or based on a breach by a Participant ("Indemnifying Participant") of any representation, warranty or covenant contained in this Agreement, including without limitation:

(i) any failure by a Participant to determine accurately and make timely payment of its proportionate share of required royalties, production taxes and other payments out of production to third parties as required by Section 3.6;

(ii) any action taken for or obligation or responsibility assumed on behalf of the other Participant, its directors, officers, employees, agents and attorneys, or Affiliates by a Participant, any of its directors, officers, employees, agents and attorneys, or Affiliates, in violation of Section 4.1;

(iii) failure of a Participant or its Affiliates to comply with the non-compete or Area of Interest provisions of Section 12.6 or Article XIII;

(iv) any Transfer that causes termination of the tax partnership established by Section 4.2, against which the transferring Participant shall indemnify the non-transferring Participant as provided in Article V of Exhibit C; and

(v) failure of a Participant or its Affiliates to comply with the preemptive right under Section 16.3.

A Material Loss shall not be deemed to have occurred until, in the aggregate, an Indemnified Participant incurs losses, costs, damages or liabilities in excess of Two Hundred Thousand Dollars ($200,000) relating to breaches of warranties, representations and covenants contained in this Agreement. RAVEN's aggregate liability to all Indemnified Participants under this Section for breaches of the representations in Subsection 3.2(g) shall not, however, exceed the total value of TERRA’s Initial Contribution described in Subsection 5.1(b) below.

(b) If any claim or demand is asserted against an Indemnified Participant in respect of which such Indemnified Participant may be entitled to indemnification under this Agreement, written notice of such claim or demand shall promptly be given to the Indemnifying Participant. The Indemnifying Participant shall have the right, but not the obligation, by notifying the Indemnified Participant within thirty (30) days after its receipt of the notice of the claim or demand, to assume the entire control of (subject to the right of the Indemnified Participant to participate, at the Indemnified Participant's expense and with counsel of the Indemnified Participant's choice), the defense, compromise, or settlement of the matter, including, at the Indemnifying Participant's expense, employment of counsel of the Indemnifying Participant's choice. Any damages to the assets or business of the Indemnified Participant caused by a failure by the Indemnifying Participant to defend, compromise, or settle a claim or demand in a reasonable and expeditious manner requested by the Indemnified Participant, after the Indemnifying Participant has given notice that it will assume control of the defense, compromise, or settlement of the matter, shall be included in the damages for which the Indemnifying Participant shall be obligated to indemnify the Indemnified Participant. Any settlement or compromise of a matter by the Indemnifying Participant shall include a full release of claims against the Indemnified Participant which has arisen out of the indemnified claim or demand.

ARTICLE IV

RELATIONSHIP OF THE PARTICIPANTS

4.1 No Partnership. Nothing contained in this Agreement shall be deemed to constitute either Participant the partner or the venturer of the other or, except as otherwise herein expressly provided, to constitute either Participant the agent or legal representative of the other or to create any fiduciary relationship between them. The Participants do not intend to create, and this Agreement shall not be construed to create, any mining, commercial or other partnership or joint venture. Neither Participant or any Affiliate thereof, nor any of the directors, officers, employees, agents or attorneys of said Participant or Affiliate, shall act for or assume any obligation or responsibility on behalf of the other Participant, except as otherwise expressly provided herein, and any such action or assumption by a Participant, any Affiliate thereof, or said Participant’s or any of the directors, officers, employees, agents or attorneys of said Participant or Affiliate shall be a breach by such Participant of this Agreement. The rights, duties, obligations and liabilities of the Participants shall be several and not joint or collective. Each Participant shall be responsible only for its obligations as herein set out and shall be liable only for its share of the costs and expenses as provided herein, and it is the express purpose and intention of the Participants that their ownership of Assets and the rights acquired hereunder shall be as tenants in common.

4.2 Federal Tax Elections and Allocations. Without changing the effect of Section 4.1, the relationship of the Participants shall constitute a tax partnership within the meaning of Section 761(a) of the United States Internal Revenue Code of 1986, as amended. Tax elections and allocations shall be made as set forth in Exhibit C.

4.3 State Income Tax. To the extent permissible under applicable law, the relationship of the Participants shall be treated for state income tax purposes in the same manner as it is for federal income tax purposes.

4.4 Tax Returns. After approval of the Management Committee, any tax returns or other required tax forms shall be filed in accordance with Exhibit C.

4.5 Other Business Opportunities. Except as expressly provided in this Agreement, each Participant shall have the right to engage in and receive full benefits from any independent business activities or operations, whether or not competitive with this Business, without consulting with, or obligation to, the other Participant. The doctrines of "corporate opportunity" or "business opportunity" shall not be applied to this Business nor to any other activity or operation of either Participant. Neither Participant shall have any obligation to the other with respect to any opportunity to acquire any property outside the Area of Interest at any time or, except as otherwise provided in Section 12.6, within the Area of Interest after the termination of the Business. Unless otherwise agreed in writing, neither Participant shall have any obligation to mill, beneficiate or otherwise treat any Products in any facility owned or controlled by such Participant.

4.6 Waiver of Rights to Partition or Other Division of Assets. The Participants hereby waive and release all rights of partition, or of sale in lieu thereof, or other division of Assets, including any such rights provided by Law.

4.7 Transfer or Termination of Rights to Properties. Except as otherwise provided in this Agreement, neither Participant shall Transfer all or any part of its interest in the Assets or this Agreement or otherwise permit or cause such interests to terminate.

4.8 Implied Covenants. There are no implied covenants contained in this Agreement other than those of good faith and fair dealing.

4.9 No Third Party Beneficiary Rights. Except for third parties indemnified under this Agreement, this Agreement shall be construed to benefit the Parties and their respective successors and assigns only, and shall not be construed to create third party beneficiary rights in any other party or in any governmental organization or agency, except to the extent required by Project Financing and as provided in Subsection 3.7(a).

ARTICLE V

CONTRIBUTIONS BY PARTICIPANTS

5.1 Participants' Initial Contributions.

(a) Subject to RAVEN’s right of withdrawal as set forth in Section 5.2, RAVEN’s Initial Contribution shall consist of the following two components described below in this Subsection 5.1(a) to be satisfied on or before October 14, 2010:

(1) ITH hereby agrees to cause Talon Gold Alaska Inc. (“Talon”) to convey and assign unto RAVEN, all of Talon’s right, title and interest in and to the Assets described in Exhibit A. In addition, ITH and Raven agree to use their best efforts to obtain from Ben Porterfield the following:

| | (A) | his written consent to |

| | (i) | the conveyance and assignment by Talon to Raven of all rights, titles, and interests of the “Lessee” under the Porterfield Lease, and |

| | (ii) | the contribution by Raven of said rights, titles, and interests (excluding and subject to the Raven Royalty) to the Terra Gold Project Joint Venture formed under this Agreement, and |

| | (B) | his written agreement as follows: |

| | (i) | In light of Section II.F of the Porterfield Lease (which provides that Porterfield shall be entitled to receive royalty under the Porterfield Lease on any and all mineral products recovered by Lessee from Porterfield’s tailings), Porterfield agrees to amend the Porterfield Lease to delete from the Porterfield Lease the last bulleted point set out in Section II.I of the Porterfield Lease (set out on page 9 of 38, immediately prior to the commencement of Section III of the Porterfield Lease); and |

| | (ii) | the “area of interest” referred to in Section II.G of the Porterfield Lease is agreed to comprise all lands within the geographic area made subject to that Lease as described by sections and quarter-sections. |

(2) RAVEN hereby agrees to contribute all of its right, title and interest in and to the Assets described in Exhibit A (except for and subject to the Raven Royalty) to the purposes of this Agreement. The amount of Dollars to be credited to RAVEN's Equity Account with respect to and upon the completion of RAVEN’s Initial Contribution shall be equal to Five Million Seven Hundred Sixty Four Thousand Seven Hundred Five Dollars and Eighty-Eight Cents ($5,764,705.88 [49/51 times $6,000,000]).

(b) Subject to TERRA's right of withdrawal as set forth in Section 5.2, TERRA’s Initial Contribution shall consist of the four components described below in this Subsection 5.1(b) to be satisfied on or before December 31, 2013. Upon completion of TERRA’s Initial Contribution, TERRA shall be deemed, automatically and without further act required by TERRA, to have earned an undivided fifty-one percent (51%) Participating Interest and RAVEN shall take all steps and execute all documents as necessary to convey to the Participants, as tenants in common, the following undivided interests in, to, and respecting the Assets (with the Properties being subject to the Raven Royalty), and to record evidence of the same:

TERRA: Fifty-one percent (51%);

RAVEN: Forty-nine percent (49%).

(i) First, TERRA shall pay or cause to be paid directly to ITH an option payment equal to Three Hundred Thousand Dollars ($300,000), of which

| | (A) | Ten Thousand Dollars ($10,000) already has been paid prior to this Agreement as a deposit under the LOI, |

| | (B) | Forty Thousand Dollars ($40,000) must be paid on or before execution of this Agreement, |

| | (C) | One Hundred Thousand Dollars ($100,000) must be paid on or before December 31, 2011, and |

| | (D) | One Hundred Fifty Thousand Dollars ($150,000) must be paid on or before December 31, 2012. |

Payment of the amounts described in (C) and (D) of this Subsection is not an obligation of TERRA, but failure to make such payments timely shall - after notice to ITH and RAVEN and an opportunity to cure as provided in Subsection 5.2(b) - be deemed to constitute a withdrawal by TERRA from the Business, and the provisions of Subsection 5.2(b) shall apply.

(ii) Second, TERRA shall fund or cause to be funded Operations under Subsection 5.1(c) totaling Six Million Dollars ($6,000,000) on or before December 31, 2013, of which

| | (A) | a total of One Million Dollars ($1,000,000) must be expended on or before December 31, 2011 (which amount must include a payment to the order of RAVEN in the amount of One Hundred Thousand Dollars ($100,000) as described below), |

| | (B) | an additional Two Million Five Hundred Dollars ($2,500,000) (for a total of Three Million Five Hundred Thousand Dollars ($3,500,000) equaling the $1,000,000 described in (A) plus this additional $2,500,000) must be expended on or before December 31, 2012 (which amount must include a second payment made to the order of RAVEN in the amount of One Hundred Thousand Dollars ($100,000) as described below (i.e., a total paid to RAVEN of $200,000 equaling the $100,000 described in (A) plus an additional $100,000)), and |

| | (C) | an additional Two Million Five Hundred Thousand Dollars (for a total of Six Million Dollars ($6,000,000) equaling the $3,500,000 described in (B) plus this additional $2,500,000) must be expended on or before December 31, 2013. |

In determining whether such funding obligation has been met, only costs (including costs incurred by TERRA both before and after the Effective Date so long as such costs otherwise are properly chargeable to the Business Account, but excluding any costs incurred to buy down the royalty interest of Ben Porterfield under the Porterfield Lease) that are properly chargeable to the Business Account under Exhibit B shall be included ("Qualifying Expenses"); provided, however, TERRA shall be entitled to an Administrative Charge, as described in Section 8.2, on all Qualifying Expenses other than $100,000 payments paid to the order of RAVEN as described in (A) and (B) and below) during the time it is making Qualifying Expenses, which Administrative Charge shall be included in Qualifying Expenses. The Participants agree that TERRA’s total payment to RAVEN of Two Hundred Thousand Dollars ($200,000) as described in (A) and (B) of this Subsection shall constitute TERRA’s share of the cost of constructing the 20-man camp for the Properties. Expenditure of the amounts described in (A), (B) and (C) of this Subsection is not an obligation of TERRA, but failure to expend such amounts timely, or to make timely either of the payments to RAVEN as described in (A) and (B), shall—after notice to RAVEN and an opportunity to cure as provided in Subsection 5.2(b)—be deemed to constitute a withdrawal by TERRA from the Business, and the provisions of Subsection 5.2(b) shall apply.

(iii) Third, promptly upon completion of its reverse merger but no later than the first anniversary of the Effective Date, TMC shall tender to ITH Two Hundred and Fifty Thousand (250,000) common shares (adjusted for any splits, reverse splits, exchanges upon merger or consolidation, or similar corporate transactions occurring after the Effective Date) of its stock, with a total of an additional Five Hundred Thousand (500,000) common shares (adjusted for any splits, reverse splits, exchanges upon merger or consolidation, or similar corporate transactions occurring after the Effective Date) of its stock to be delivered to ITH as follows: Two Hundred and Fifty Thousand (250,000) shares to be tendered to ITH on or before December 31 of each of 2011 and 2012. At its election, at any time prior to December 31, 2011 or 2012, as applicable, TMC may issue such additional shares into escrow prior to tender to ITH. All shares shall be subject to a two (2) year lock up sale restriction. Issuance of such common shares is subject to approval of any applicable stock exchange. Should TMC not have such approval within one year of the Effective Date, the common shares shall be issued from TMC’s treasury shares. For purposes of valuation, the TMC shares shall be equal to the then current market price at the time they are issued, either directly to ITH or into escrow. If TMC is a publicly traded company trading on any Canadian or United States stock exchange at the date of tender, the then current market price shall equal the thirty (30) day trailing average price of TMC common shares sold on the stock exchange on which TMC is traded on the date five (5) business days prior to tender. If TMC is not a publicly traded company at the date of tender, the then current market price shall equal the price of the most recent private placement completed for ownership in TMC. Tender to ITH of stock as described in this paragraph is not an obligation of TERRA, but failure to tender to ITH timely the number of shares required to be tendered shall—after notice to ITH and RAVEN and an opportunity to cure as provided in Subsection 5.2(b)—be deemed to constitute a withdrawal by TERRA from the Business, and the provisions of Subsection 5.2(b) shall apply.

(iv) As the fourth and final component of its Initial Contribution, TERRA shall contribute sample and survey data, laboratory analyses, written reports and interpretations, if any, obtained during its due diligence investigation of the Assets and conduct of Operations during the making of its Initial Contribution. Failure to satisfy this fourth requirement on or before December 31, 2013 shall—after notice and an opportunity to cure as provided in Subsection 5.2(b)—be deemed to constitute a withdrawal by TERRA from the Business, and the provisions of Section 5.2(b) shall apply.

(v) Any performance by TERRA in excess of the stated amounts for each year shall be credited towards TERRA’s subsequent year(s) commitment to the Initial Contribution.

(vi) Upon completion of its Initial Contribution, the amount of Dollars to be credited to TERRA's Equity Account shall be equal to Six Million Dollars ($6,000,000).

(c) Subject only to the provisions of Section 9.1, until TERRA has completed its Initial Contribution and until TERRA has completed its Secondary Contribution if Terra has elected to make a Secondary Contribution under Subsection 5.3 TERRA shall have the sole right to determine the nature, timing, scope, extent and method of all Operations without any obligation to hold meetings of the Management Committee, to prepare Programs and Budgets for review, comment or approval by RAVEN, or to obtain the approval or consent of RAVEN or the Management Committee. In conducting such Operations, TERRA shall be entitled, but shall not be obligated (except (i) for or with respect to Environmental Compliance and (ii) to the extent necessary to maintain the Properties (including but not limited to the Porterfield Lease) in good standing through the end of each calendar year during which this Agreement is in effect on June 1 of said calendar year), to exercise any of the applicable powers of the Manager in Section 8.2, except that until TERRA has completed its Initial Contribution it shall not be entitled or required to perform the activities described in Subsections 8.2(g), (i), (l) and (s) that would otherwise require consent of the Management Committee or of RAVEN. For all such Operations, TERRA shall provide for accrual of reasonably anticipated Environmental Compliance expenses, which shall constitute Qualifying Expenses, and upon completion of its Initial Contribution, TERRA shall transfer any accrued but unexpended amounts to the Environmental Compliance Fund established under Paragraph 2.14 of Exhibit B. Prior to completion of its Initial Contribution and its Secondary Contribution if it has elected to make a Secondary Contribution under Subsection 5.3, TERRA, in lieu of any reporting requirements under this Agreement, shall:

(i) keep RAVEN generally informed concerning all material Operations and other material activities affecting the Properties;

(ii) within thirty (30) days after the end of each calendar quarter, furnish to RAVEN a reasonably detailed written report of all Operations conducted on or for the benefit of the Properties during the preceding quarter;

(iii) make available for inspection and copying by RAVEN all factual and interpretive reports, studies and analyses concerning the Properties, and make all core and other samples available for inspection by RAVEN; and

(iv) on or before each December 15 immediately following each anniversary of the Effective Date, submit to RAVEN a statement of Qualifying Expenses incurred during the preceding year.

TERRA makes no representation or warranty, express or implied, as to the accuracy or completeness of the data and information provided to RAVEN in accordance with (i) through (iv) above.

(d) RAVEN shall provide TERRA with written notice of any exceptions it may have to the statement of Qualifying Expenses submitted to it as provided above within three (3) months after receipt of the statement. Failure to provide such notice within the three (3) month period shall constitute acceptance by RAVEN of the stated Qualifying Expenses.

5.2 Failure to Make Initial Contribution.

(a) RAVEN’s failure to make its Initial Contribution in accordance with the provisions of this Article, if not cured within ninety (90) days after notice by TERRA of such failure, shall be deemed to be a withdrawal of RAVEN from the Business. Upon such event, RAVEN and ITH shall immediately refund all funds received hereunder or under the LOI from TERRA, TMC, their Affiliates or their predecessors in interest, as well as reimburse TERRA for any Qualifying Expenses TERRA funded towards Operations prior to RAVEN’s default as well as one hundred percent (100%) of the amount needed to satisfy TERRA's contractual obligations to third parties made on behalf of the Business prior to RAVEN’s default. Nor shall such withdrawal relieve RAVEN of its responsibility to fund and satisfy RAVEN’s share of liabilities to third persons (regardless of whether such liabilities accrue before or after such withdrawal), including Environmental Liabilities, Continuing Obligations and Environmental Compliance, arising prior to RAVEN’s withdrawal, which responsibility shall be based on RAVEN’s initial Participating Interest.

(b) TERRA's failure to make its Initial Contribution in accordance with the provisions of this Article, if not cured where permitted within ninety (90) days (or in the case of any failure to pay cash, within thirty (30) days) after notice by RAVEN or ITH of such failure, shall be deemed to be a withdrawal of TERRA from the Business, the termination of all of its rights and interests hereunder and a transfer of all of said rights and interests and of its Capital Account to RAVEN. Upon such event, TERRA shall have no further right, title or interest in the Assets and it shall take such actions as are necessary to ensure that all Assets are free and clear of any Encumbrances arising by, through or under it, except for such Encumbrances to which the Participants may have agreed. Subject to Subsection 5.2(c) below, TERRA's withdrawal shall be effective upon such failure, but such withdrawal shall not relieve TERRA of its obligation to RAVEN to fund Operations up to the amount of TERRA's contractual obligations to third parties, nor shall such withdrawal relieve TERRA of its responsibility to fund and satisfy TERRA's share of liabilities to third persons (regardless of whether such liabilities accrue before or after such withdrawal), including Environmental Liabilities, Continuing Obligations and Environmental Compliance, arising prior to TERRA's withdrawal, which responsibility shall be based on the initial Participating Interest that TERRA would have earned had it completed its Initial Contribution.

(c) Notwithstanding Subsection 5.2(b) above, in the event TERRA, within one year after the Effective Date, determines that conditions existed on the Properties as of the Effective Date which may, in TERRA's judgment, result in violation of Environmental Laws, TERRA shall have the right to withdraw from the Business by giving written notice to RAVEN of such withdrawal. TERRA's withdrawal shall be effective upon receipt by RAVEN of such notice. Such withdrawal shall relieve TERRA of its responsibility to fund and satisfy TERRA's share of liabilities to third parties (regardless of whether such liabilities accrue before or after such withdrawal), including Environmental Liabilities, Continuing Obligations and Environmental Compliance, other than those arising out of Operations conducted by TERRA after the Effective Date and prior to its withdrawal. TERRA shall fund and satisfy one hundred percent (100%) of such liabilities only until it has contributed the full amount of its agreed contribution to the then currently adopted Program and Budget. Except as provided in this Subsection and except as may be otherwise expressly provided herein, TERRA's withdrawal shall relieve TERRA from any other obligation to make contributions hereunder.

5.3 Additional Contributions. At such time as TERRA has completed its Initial Contribution, TERRA may elect, at its sole discretion, to earn an additional twenty-nine percent (29%) Participating Interest, for a total Participating Interest of eighty percent (80%), by completing a secondary contribution consisting of undertaking, or causing TMC to undertake, as the case may be, the following three actions (“Secondary Contribution”):

(a) First, TERRA shall pay or cause to be paid directly to ITH an additional option payment equal to One Hundred Fifty Thousand Dollars ($150,000), payable on or before December 31, 2013.

(b) Second, TERRA shall fund or cause to be funded Operations under Subsection 5.1(c) totaling an additional Three Million Fifty Thousand Dollars ($3,050,000) on or before December 31, 2014. In determining whether such funding obligation has been met, only Qualifying Expenses that are properly chargeable to the Business Account under Exhibit B shall be included.

(c) Third, TMC shall tender an additional Two Hundred Fifty Thousand (250,000) common shares (adjusted for any splits, reverse splits, exchanges upon merger or consolidation, or similar corporate transactions occurring after the Effective Date) of its stock to ITH on or before December 31, 2014. All shares shall be subject to a two (2) year lock up sale restriction. At its election, at any time prior to December 31, 2014, TMC may issue such shares into escrow prior to tender to ITH. Issuance of such common shares is subject to approval of any applicable stock exchange. Should TMC not have such approval, the common shares shall be issued from TMC’s treasury shares. For purposes of valuation, the TMC shares shall be equal to the then current market price at the time they are issued to ITH or into escrow. If TMC is a publicly traded company trading on any Canadian or United States stock exchange at the date of tender, the then current market price shall equal the thirty (30) day trailing average price of TMC common shares sold on the stock exchange on which TMC is traded on the date five (5) business days prior to tender. If TMC is not a publicly traded company at the date of tender, the then current market price shall equal the price of the most recent private placement completed for ownership in TMC.

Upon completion of TERRA’s Secondary Contribution, TERRA shall be deemed, automatically and without further act required by TERRA, to have earned an additional undivided twenty-nine percent (29%) Participating Interest and RAVEN shall take all steps and execute all documents as necessary to convey to TERRA an additional undivided twenty-nine percent (29%) interest in the Assets (subject to the Raven Royalty) out of RAVEN’s undivided forty-nine percent (49%) interest therein, and to record evidence of the same, after which conveyance RAVEN shall have the remaining undivided twenty percent (20%) interest in the Assets and a total Participating Interest hereunder of twenty percent (20%).

The total amount of Dollars deemed to be in TERRA’s Equity Account on the date it completes its Secondary Contribution, if at all, is Nine Million Fifty Thousand Dollars ($9,050,000 [$6,000,000 plus $3,050,000]), and the total amount of Dollars deemed to be in RAVEN's Equity Account on said date shall be equal to Two Million Two Hundred Sixty-Two Thousand Five Hundred Dollars ($2,262,500 [20% of $9,050,000 + $ 2,262,500]).

5.4 Failure to Complete a Secondary Contribution. Making and completing the Secondary Contribution is solely at TERRA’s discretion. Should TERRA undertake but fail to complete a Secondary Contribution under Subsection 5.3 above, TERRA shall not earn an additional twenty-nine percent (29%) Participating Interest, but otherwise shall not be subject to any dilution, deemed withdrawal, termination, transfer of Participating Interest or Capital Account, or penalty, and the Equity Accounts of both TERRA and RAVEN shall remain as provided in Section 5.1.

5.5 Pro Rata Funding. During periods of sole funding by TERRA, RAVEN shall have no obligation to fund its pro rata share of expenditures, except in the event the Participants mutually agree to buy down the royalty interest of Ben Porterfield under the Porterfield Lease, which costs shall be borne pro rata by the Participants in proportion to their respective interests in the Business. Upon TERRA’s completion of its Secondary Contribution or upon TERRA’s completion of its Initial Contribution if TERRA does not elect to make, or does not complete, a Secondary Contribution, the Participants, subject to any election permitted by Subsection 9.5(a), shall be obligated to contribute funds to adopted Programs and Budgets in proportion to their respective Participating Interests.

ARTICLE VI

INTERESTS OF PARTICIPANTS

6.1 Initial Interests in the Business and Participating Interests.

Upon RAVEN’s completion of its Initial Contribution under Section 5.1(a) and prior to TERRA’s completion of its Initial Contribution under Section 5.1(b), the Participants shall have the following Participating Interests:

RAVEN - 100%

TERRA - 0%;

provided, however, that as of the Effective Date the Participants shall have the following initial interests in the Business (which initial interests shall equal each Participant’s respective share of any Products produced and sold from the Properties and of any costs incurred in connection with matters requiring pro rata funding, but which initial interests in the Business do not correspond to or constitute the Participating Interests of the Participants until such time as TERRA has completed its Initial Contribution):

RAVEN - 49%

TERRA - 51%.

Upon TERRA’s completion of its Initial Contribution under Section 5.1(b), the Participants shall have the following Participating Interests which shall equal the interests of each Participant in the Business:

RAVEN - 49%

TERRA - 51%.

6.2 Changes in Participating Interests. Following the Participants’ completion of their respective Initial Contributions, the Participating Interests shall be eliminated or changed as follows:

(a) (i) Upon the satisfactory making by TERRA of its Secondary Contribution as provided in Section 5.3; or

(ii) upon withdrawal or deemed withdrawal as provided in Sections 5.2, 6.3, and Article XII;

(b) Upon an election by either Participant pursuant to Section 9.5 to contribute less to an adopted Program and Budget than the percentage equal to its Participating Interest, or to contribute nothing to an adopted Program and Budget;

(c) In the event of default by either Participant in making its agreed upon contribution to an adopted Program and Budget, followed by an election by the other Participant to invoke any of the remedies in Section 10.5;

(d) Upon Transfer by either Participant of part or all of its Participating Interest in accordance with Article XVI; or

(e) Upon acquisition by either Participant of part or all of the Participating Interest of the other Participant, however arising.

6.3 Elimination of Minority Interest.

(a) A Reduced Participant whose Recalculated Participating Interest becomes less than ten percent (10%) shall be deemed to have withdrawn from the Business and shall relinquish its entire Participating Interest free and clear of any Encumbrances arising by, through or under the Reduced Participant, except any such Encumbrances listed in Paragraph 1.1 of Exhibit A or to which the Participants have agreed. Such relinquished Participating Interest shall be deemed to have accrued automatically to the other Participant, and the Reduced Participant's Capital Account shall be transferred to the remaining Participant. In such event, the Reduced Participant shall execute and deliver to the remaining Participant an appropriate conveyance of all of the Reduced Participant’s right, title and interest in the Assets, subject to any Encumbrances described in Paragraph 1.1 of Exhibit A or to which the Participants have agreed, and the Remaining Participant shall execute and deliver to the Reduced Participant an additional conveyance of a one percent (1%) interest in Net Smelter Returns, as defined in Exhibit E, on all Products, if any, realized after the effective date of the withdrawal. Upon receipt of such conveyance, and subject to Section 6.4 and any Encumbrances described in Paragraph 1.1 of Exhibit A or to which the Participants have agreed, the Reduced Participant shall thereafter have no other right, title, or interest in the Assets or under this Agreement, and the tax partnership established by Exhibit C shall dissolve pursuant to Paragraph 4.2 of Exhibit C.

(b) The relinquishment, withdrawal and entitlements for which this Section provides shall be effective as of the effective date of the recalculation under Sections 9.5 or 10.5. However, if the final adjustment provided under Section 9.6 for any recalculation under Section 9.5 results in a Recalculated Participating Interest of ten percent (10%) or more: (i) the Recalculated Participating Interest shall be deemed, effective retroactively as of the first day of the Program Period, to have automatically revested; (ii) the Reduced Participant shall be reinstated as a Participant, with all of the rights and obligations pertaining thereto; (iii) the right to any Net Smelter Returns interest arising under Subsection 6.3(a) shall terminate; and (iv) the Manager, on behalf of the Participants, shall make any necessary reimbursements, reallocations of Products, contributions and other adjustments as

provided in Subsection 9.6(d). Similarly, if such final adjustment under Section 9.6 results in a Recalculated Participating Interest for either Participant of less than ten percent (10%) for a Program Period as to which the provisional calculation under Section 9.5 had not resulted in a Participating Interest of less than ten percent (10%), then such Participant, at its election within thirty (30) days after notice of the final adjustment, may contribute an amount resulting in a revised final adjustment and resultant Recalculated Participating Interest of ten percent (10%). If no such election is made, such Participant shall be deemed to have withdrawn under the terms of Subsection 6.3(a) as of the beginning of such Program Period, and the Manager, on behalf of the Participants, shall make any necessary reimbursements, reallocations of Products, contributions and other adjustments as provided in Subsection 9.6(d), including of any Net Smelter Returns interest arising under Subsection 6.3(a) to which such Participant may be entitled for such Program Period.

6.4 Continuing Liabilities Upon Adjustments of Participating Interests. Any reduction or elimination of either Participant's Participating Interest under Section 6.2 shall not relieve such Participant of its share of any liability, including, without limitation, Continuing Obligations, Environmental Liabilities and Environmental Compliance, whether arising, before or after such reduction or elimination, out of acts or omissions occurring or conditions existing prior to the Effective Date or out of Operations conducted during the term of this Agreement but prior to such reduction or elimination, regardless of when any funds may be expended to satisfy such liability. For purposes of this Section, such Participant's share of such liability shall be equal to its Participating Interest at the time the act or omission giving rise to the liability occurred, after first taking into account any reduction, readjustment and restoration of Participating Interests under Sections 6.3, 9.5, 9.6 and 10.5 (or, as to such liability arising out of acts or omissions occurring or conditions existing prior to the Effective Date, equal to such Participant's initial Participating Interest). Should the cumulative cost of satisfying Continuing Obligations be in excess of cumulative amounts accrued or otherwise charged to the Environmental Compliance Fund as described in Exhibit B, each of the Participants shall be liable for its proportionate share (i.e., Participating Interest at the time of the act or omission giving rise to such liability occurred), after first taking into account any reduction, readjustment and restoration of Participating Interests under Sections 6.3, 9.5, 9.6 and 10.5, of the cost of satisfying such Continuing Obligations, notwithstanding that either Participant has previously withdrawn from the Business or that its Participating Interest has been reduced or converted to a Net Smelter Returns interest pursuant to Subsection 6.3(a).

6.5 Documentation of Adjustments to Participating Interests. Adjustments to the Participating Interests need not be evidenced during the term of this Agreement by the execution and recording of appropriate instruments, but each Participant's Participating Interest and related Equity Account balance shall be shown in the accounting records of the Manager, and any adjustments thereto, including any reduction, readjustment, and restoration of Participating Interests under Sections 6.3, 9.5, 9.6 and 10.5, shall be made quarterly. However, either Participant, at any time upon the request of the other Participant, shall execute and acknowledge instruments necessary to evidence such adjustments in form sufficient for filing and recording in the jurisdiction where the Properties are located.

6.6 Grant of Lien and Security Interest.

(a) Subject to Section 6.7, each Participant grants to the other Participant a lien upon and a security interest in its Participating Interest, including all of its right, title and interest in the Assets, whenever acquired or arising, and the proceeds from and accessions to the foregoing.

(b) The liens and security interests granted by Subsection 6.6(a) shall secure every obligation or liability of the Participant granting such lien or security interest created under this Agreement, including the obligation to repay a Cover Payment in accordance with Section 10.4. Each Participant hereby agrees to take all action necessary to perfect such lien and security interest and hereby appoints the other Participant its attorney-in-fact to execute, file and record all financing statements and other documents necessary to perfect or maintain such lien and security interest.

6.7 Subordination of Interests. Each Participant shall, from time to time, take all necessary actions, including execution of appropriate agreements, to pledge and subordinate its Participating Interest, any liens it may hold which are created under this Agreement other than those created pursuant to Section 6.6 hereof, and any other right or interest it holds with respect to the Assets (excluding (a) any Encumbrances described in Paragraph 1.1 of Exhibit A held by a Participant and not contributed hereunder and (b) any statutory lien of the Manager) to any secured borrowings for Operations approved by the Management Committee, including any secured borrowings relating to Project Financing, and any modifications or renewals thereof.

ARTICLE VII

MANAGEMENT COMMITTEE

7.1 Organization and Composition. The Participants hereby establish a Management Committee to determine overall policies, objectives, procedures, methods and actions under this Agreement. The Management Committee initially shall consist of two (2) members appointed by RAVEN and two(2) members appointed by TERRA. Upon TERRA’s completion of a Secondary Contribution under Subsection 5.3 above such that it has a eighty percent (80%) Participating Interest or either Participant otherwise acquiring a Participating Interest of sixty percent (60%) or greater, the Management Committee shall consist of five (5) members, with each Participant allowed to appoint a member to the Management Committee for each twenty percent (20%) Participating Interest it holds. Each Participant may appoint one or more alternates to act in the absence of a regular member. Any alternate so acting shall be deemed a member. Appointments by a Participant shall be made or changed by notice to the other members. For so long as TERRA remains Manager, TERRA shall designate one of its members to serve as the chair of the Management Committee.

7.2 Decisions. After TERRA has completed its Initial Contribution and its Secondary Contribution if it has elected to make a Secondary Contribution, each Participant, acting through its appointed member(s) in attendance at the meeting, shall have the votes on the Management Committee in proportion to its Participating Interest. Unless otherwise provided in this Agreement, the vote of the Participant with a Participating Interest over fifty percent (50%) shall determine the decisions of the Management Committee.

7.3 Meetings.

(a) After TERRA has completed its Initial Contribution and its Secondary Contribution if it has elected to make a Secondary Contribution, the Management Committee shall hold regular meetings at least annually in Anchorage, or at other agreed places. The Manager shall give fourteen (14) days notice to the Participants of such meetings. Additionally, either Participant may call a special meeting upon seven (7) days notice to the other Participant. In case of an emergency, reasonable notice of a special meeting shall suffice. There shall be a quorum if at least one member representing each Participant is present; provided, however, that if a Participant fails to attend two consecutive properly called meetings, then a quorum shall exist at the second meeting if the other Participant is represented by at least one appointed member, and a vote of such Participant shall be considered the vote required for the purposes of the conduct of all business properly noticed even if such vote would otherwise require unanimity.

(b) If business cannot be conducted at a regular or special meeting due to the lack of a quorum, either Participant may call the next meeting upon fourteen (14) days notice to the other Participant.

(c) Each notice of a meeting shall include an itemized agenda prepared by the Manager in the case of a regular meeting or by the Participant calling the meeting in the case of a special meeting, but any matters may be considered if either Participant adds the matter to the agenda at least seven (7) days before the meeting or with the consent of the other Participant. The Manager shall prepare minutes of all meetings and shall distribute copies of such minutes to the other Participant within thirty (30) days after the meeting. Either Participant may electronically record the proceedings of a meeting with the consent of the other Participant. The other Participant shall sign and return or object to the minutes prepared by the Manager within thirty (30) days after receipt, and failure to do either shall be deemed acceptance of the minutes as prepared by the Manager. The minutes, when signed or deemed accepted by both Participants, shall be the official record of the decisions made by the Management Committee. Decisions made at a Management Committee meeting shall be implemented in accordance with adopted Programs and Budgets. If a Participant timely objects to minutes proposed by the Manager, the members of the Management Committee shall seek, for a period not to exceed thirty (30) days from receipt by the Manager of notice of the objections, to agree upon minutes acceptable to both Participants. If the Management Committee does not reach agreement on the minutes of the meeting within such thirty (30) day period, the minutes of the meeting as prepared by the Manager together with the other Participant's proposed changes shall collectively constitute the record of the meeting. If personnel employed in Operations are required to attend a Management Committee meeting, reasonable costs incurred in connection with such attendance shall be charged to the Business Account. All other costs shall be paid by the Participants individually.

7.4 Action Without Meeting in Person. In lieu of meetings in person, the Management Committee may conduct meetings by telephone or video conference, so long as minutes of such meetings are prepared in accordance with Subsection 7.3(c). The Management Committee may also take actions in writing signed by all members.

7.5 Matters Requiring Approval. Except as provided in Subsection 5.1(c) and as otherwise delegated to the Manager in Section 8.2, the Management Committee shall have exclusive authority to determine all matters related to overall policies, objectives, procedures, methods and actions under this Agreement.

ARTICLE VIII

MANAGER

8.1 Appointment. The Participants hereby appoint TERRA as the Manager with overall management responsibility for Operations. TERRA hereby agrees to serve until it resigns as provided in Section 8.4.

8.2 Powers and Duties of Manager. Subject to the terms and provisions of this Agreement, the Manager shall have the following powers and duties, which shall be discharged in accordance with adopted Programs and Budgets. Beginning as of the Effective Date, the Manager shall be entitled to receive a management fee, which fee may be adjusted from time to time but except to the extent specifically provided otherwise in Exhibit B shall never be less than eight percent (8%) (“Administrative Charge”) for its performance of the following powers and duties:

(a) The Manager shall manage, direct and control Operations, and shall prepare and present to the Management Committee proposed Programs and Budgets as provided in Article IX.

(b) The Manager shall implement the decisions of the Management Committee, shall make all expenditures necessary to carry out adopted Programs, and shall promptly advise the Management Committee if it lacks sufficient funds to carry out its responsibilities under this Agreement.

(c) The Manager shall use reasonable efforts to: (i) purchase or otherwise acquire all material, supplies, equipment, water, utility and transportation services required for Operations, such purchases and acquisitions to be made to the extent reasonably possible on the best terms available, taking into account all of the circumstances; (ii) obtain such customary warranties and guarantees as are available in connection with such purchases and acquisitions; and (iii) keep the Assets free and clear of all Encumbrances, except any such Encumbrances listed in Paragraph 1.1 of Exhibit A and those existing at the time of, or created concurrent with, the acquisition of such Assets, or mechanic's or materialmen's liens (which shall be contested, released or discharged in a diligent matter) or Encumbrances specifically approved by the Management Committee.

(d) The Manager may conduct such title examinations of the Properties and undertake to cure such title defects pertaining to the Properties as may be advisable in its reasonable judgment. The Participants agree to use good faith efforts to promptly assist the Manager in curing any title defects relating to the Properties.

(e) The Manager shall: (i) make or arrange for all payments required by leases, licenses, permits, contracts and other agreements related to the Assets; (ii) pay all taxes, assessments and like charges on Operations and Assets except taxes determined or measured by a Participant's sales revenue or net income and taxes, including production taxes, attributable to a Participant's share of Products, and shall otherwise promptly pay and discharge expenses incurred in Operations; provided, however, that if authorized by the Management Committee, the Manager shall have the right to contest (in the courts or otherwise) the validity or amount of any taxes, assessments or charges if the Manager deems them to be unlawful, unjust, unequal or excessive, or to undertake such other steps or proceedings as the Manager may deem reasonably necessary to secure a cancellation, reduction, readjustment or equalization thereof before the Manager shall be required to pay them, but in no event shall the Manager permit or allow title to the Assets to be lost as the result of the nonpayment of any taxes, assessments or like charges; and (iii) do all other acts reasonably necessary to maintain the Assets.

(f) The Manager shall: (i) apply for all necessary permits, licenses and approvals; (ii) comply with all Laws; (iii) notify promptly the Management Committee of any allegations of substantial violation thereof; and (iv) prepare and file all reports or notices required for or as a result of Operations. The Manager shall not be in breach of this provision if a violation has occurred in spite of the Manager's good faith efforts to comply consistent with its standard of care under Section 8.3. In the event of any such violation, the Manager shall timely cure or dispose of such violation on behalf of both Participants through performance, payment of fines and penalties, or both, and the cost thereof shall be charged to the Business Account.

(g) The Manager shall prosecute and defend, but shall not initiate without consent of the Management Committee, all litigation or administrative proceedings arising out of Operations. The non-managing Participant shall have the right to participate, at its own expense, in such litigation or administrative proceedings. The non-managing Participant shall approve in advance any settlement involving payments, commitments or obligations in excess of One Hundred Thousand Dollars ($100,000) in cash or value.

(h) The Manager shall provide insurance for the benefit of the Participants as provided in Exhibit F or as may otherwise be determined from time to time by the Management Committee.

(i) The Manager may dispose of Assets, whether by abandonment, surrender, or Transfer in the ordinary course of business, except that Properties may be abandoned or surrendered only as provided in Article XIV. Without prior authorization from the Management Committee, however, the Manager shall not: (i) dispose of Assets in any one transaction (or in any series of related transactions) having a value in excess of Twenty-five Thousand Dollars ($25,000); (ii) enter into any sales contracts or commitments for Product, except as permitted in Section 11.2; (iii) begin a liquidation of the Business; or (iv) dispose of all or a substantial part of the Assets necessary to achieve the purposes of the Business.

(j) The Manager shall have the right to carry out its responsibilities hereunder through agents, Affiliates or independent contractors.

(k) The Manager shall perform or cause to be performed all assessment and other work, and shall pay all Governmental Fees required by Law in order to maintain the unpatented federal or state mining locations included within the Properties. The Manager shall have the right to perform the assessment work required hereunder pursuant to a common plan of exploration and continued actual occupancy of all such locations shall not be required. The Manager shall not be liable on account of any determination by any court or governmental agency that the work performed by the Manager does not constitute the required annual assessment work or occupancy for the purposes of preserving or maintaining ownership of the locations, provided that the work done is pursuant to an adopted Program and Budget and is performed in accordance with the Manager's standard of care under Section 8.3. The Manager shall timely record with the appropriate recording district and file with the appropriate federal or state agency any required affidavits, notices of intent to hold and other documents in proper form attesting to the payment of Governmental Fees, the performance of assessment work or intent to hold the locations, in each case in sufficient detail to reflect compliance with the requirements applicable to each location. The Manager shall not be liable on account of any determination by any court or governmental agency that any such document submitted by the Manager does not comply with applicable requirements, provided that such document is prepared and recorded or filed in accordance with the Manager's standard of care under Section 8.3.

(l) If authorized by the Management Committee, the Manager may: (i) locate, amend or relocate any unpatented federal or state mining location, (ii) locate any fractions resulting from such amendment or relocation, (iii) apply for patents or mining leases or millsite leases or other forms of mineral or surface tenure for any such unpatented locations, (iv) abandon any unpatented federal or state mining locations for the purpose of locating or otherwise acquiring from the United States or the State of Alaska mineral or surface rights to the ground covered thereby, (v) exchange with or convey to the United States or the State of Alaska or any other landowner or mineral owner any of the Properties for the purpose of acquiring rights to the ground covered thereby or adjacent ground, and (vi) convert any unpatented federal or state mining locations into one or more leases or other forms of mineral tenure pursuant to any Law hereafter enacted.

(m) The Manager shall keep and maintain all required accounting and financial records pursuant to the procedures described in Exhibit B and in accordance with customary cost accounting practices in the mining industry, and shall ensure appropriate separation of accounts unless otherwise agreed by the Participants.

(n) The Manager shall maintain Equity Accounts for each Participant. Each Participant's Equity Account shall be credited with the deemed value of such Participant's contributions under Subsections 5.1(a) and 5.1(b) and under Section 5.3, and shall be credited with amounts contributed by each Participant under Section 5.5. Each Participant's Equity Account shall be charged with the cash and the fair market value of property distributed to such Participant (net of liabilities assumed by such Participant and liabilities to which such distributed property is subject). Contributions and distributions shall include all cash contributions or distributions plus the agreed value (expressed in dollars) of all in-kind contributions or distributions. Solely for purposes of determining the Equity Account balances of the Participants, the Manager shall reasonably estimate the fair market value of all Products distributed to the Participants, and such estimated value shall be used regardless of the actual amount received by each Participant upon disposition of such Products.

(o) Subject to Subsection 5.1(c), the Manager shall keep the Management Committee advised of all Operations by submitting in writing to the members of the Management Committee: (i) quarterly progress reports that include statements of expenditures and comparisons of such expenditures to the adopted Budget; (ii) periodic summaries of data acquired; (iii) copies of reports concerning Operations; (iv) a detailed final report within thirty (30) days after completion of each Program and Budget, which shall include comparisons between actual and budgeted expenditures and comparisons between the objectives and results of Programs; and (v) such other reports as any member of the Management Committee may reasonably request. Subject to Article XVIII, at all reasonable times the Manager shall provide the Management Committee, or other representative of a Participant upon the request of such Participant’s member of the Management Committee, access to, and the right to inspect and, at such Participant's cost and expense, copies of the Existing Data and all maps, drill logs and other drilling data, core, pulps, reports, surveys, assays, analyses, production reports, operations, technical, accounting and financial records, and other Business Information, to the extent preserved or kept by the Manager, subject to Article XVIII. In addition, the Manager shall allow the non-managing Participant, at the latter's sole risk, cost and expense, and subject to reasonable safety regulations, to inspect the Assets and Operations at all reasonable times, so long as the non-managing Participant does not unreasonably interfere with Operations.