UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22167

Allianz Funds Multi-Strategy Trust

(Exact name of registrant as specified in charter)

1633 Broadway, New York, New York 10019

(Address of principal executive offices) (Zip code)

Scott Whisten

1633 Broadway

New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3367

Date of fiscal year end: September 30

Date of reporting period: September 30, 2018

Item 1. Report to Shareholders

Allianz Multi-Strategy Funds

SHARE CLASSES A, C, R, P, INSTITUTIONAL, R6, ADMINISTRATIVE

Annual Report

September 30, 2018

AllianzGI Retirement 2020 Fund

AllianzGI Retirement 2025 Fund

AllianzGI Retirement 2030 Fund

AllianzGI Retirement 2035 Fund

AllianzGI Retirement 2040 Fund

AllianzGI Retirement 2045 Fund

AllianzGI Retirement 2050 Fund

AllianzGI Retirement 2055 Fund

AllianzGI Multi Asset Income Fund (formerly AllianzGI Retirement Income Fund)

AllianzGI Global Allocation Fund

AllianzGI Best Styles Global Equity Fund

AllianzGI Best Styles International Equity Fund

AllianzGI Best Styles U.S. Equity Fund

AllianzGI Convertible Fund

AllianzGI Core Bond Fund

AllianzGI Core Plus Bond Fund

AllianzGI Emerging Markets Consumer Fund

AllianzGI Emerging Markets Debt Fund

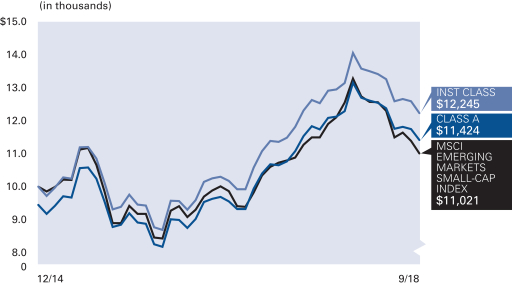

AllianzGI Emerging Markets Small-Cap Fund

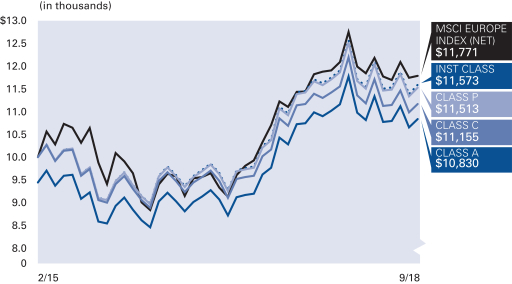

AllianzGI Europe Equity Dividend Fund

AllianzGI Global Dynamic Allocation Fund

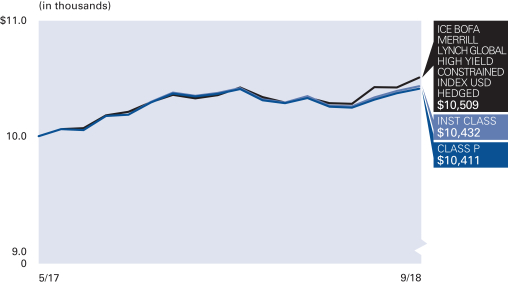

AllianzGI Global High Yield Fund

AllianzGI Global Sustainability Fund

AllianzGI Global Water Fund

AllianzGI High Yield Bond Fund

AllianzGI International Growth Fund

AllianzGI International Small-Cap Fund

AllianzGI Micro Cap Fund

AllianzGI NFJ Emerging Markets Value Fund

AllianzGI NFJ International Small-Cap Value Fund

AllianzGI PerformanceFee Managed Futures Strategy Fund

AllianzGI PerformanceFee Structured US Equity Fund

AllianzGI PerformanceFee Structured US Fixed Income Fund

AllianzGI Preferred Securities and Income Fund

AllianzGI Real Estate Debt Fund

AllianzGI Short Duration High Income Fund

AllianzGI Short Term Bond Fund

AllianzGI Structured Return Fund

AllianzGI U.S. Equity Hedged Fund

AllianzGI Ultra Micro Cap Fund

This material is authorized for use only when preceded or accompanied by the current Allianz Multi-Strategy Funds, prospectus. Investors should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. This and other information is contained in the Funds’ prospectuses and summary prospectuses. Please read the prospectus carefully before you invest.

Receive this report electronically and eliminate paper mailings.

To enroll, go to us.allianzgi.com/edelivery.

Table of Contents

A Word About Risk: A fund may be subject to various risks as described in its prospectus. Some of those risks may include, but are not limited to, the following: derivatives risk, smaller company risk, non-US investment risk, focused investment risk and specific sector investment risks. Use of derivative instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, counterparty risk, management risk and the risk that a fund is unable to close out a position when it is most advantageous to do so. Portfolios investing in derivatives could lose more than the principal amount invested in those instruments. Investing in foreign securities may entail risk due to foreign economic and political developments; this risk may be enhanced when investing in emerging markets. Smaller companies may be more volatile than larger companies and may entail more risk. Concentrating investments in individual sectors may add additional risk and additional volatility compared to a diversified equity portfolio. AllianzGI target-date funds seek to manage risk and return by blending two separately-managed portfolios: a return-generating portfolio for growth potential, and a defensive portfolio for principal protection. The balance grows increasingly defensive over time until the target date is reached, after which the Fund’s assets roll into a retirement income strategy. The principal values of the Funds are not guaranteed at any time, including the target date. Please refer to each Fund’s applicable current prospectus for complete details.

Letter from the President

Thomas J. Fuccillo

President & CEO

Dear Shareholder,

U.S. economic expansion accelerated during the twelve-month fiscal reporting period ended September 30, 2018. In contrast, economic growth overseas moderated. Against this backdrop, the overall U.S. equity market rallied sharply, whereas international equities generated mixed results. Elsewhere, the overall U.S. bond market posted a small decline during the reporting period.

12 Months in Review

For the 12-month period ended September 30, 2018, U.S. stocks, as measured by the Standard & Poor’s 500 Index, gained 17.91%. Two measures of stock performance in developed international and global markets, the MSCI EAFE (Europe, Australasia and Far East) Index (net) and the MSCI World Index (net), returned 2.74% and 11.24%, respectively, in dollar-denominated terms. Elsewhere, the MSCI Emerging Markets Index (net) returned -0.81%. With respect to bonds, the Bloomberg Barclays U.S. Credit Index returned -1.10%, whereas the Bloomberg Barclays Global High Yield Index rose 0.27%. The Bloomberg Barclays U.S. Government Bond Index returned 0.41%, while the broader bond market index, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, returned -1.22%.

Turning to the U.S. economy, gross domestic product (“GDP”), the value of goods and services produced in the country, which is the broadest measure of economic activity and the principal indicator of economic performance, expanded at an annual pace of 2.3% during the fourth quarter of 2017, 2.2% during the first quarter of 2018 and then accelerated to an annual pace of 4.2% during the second quarter of 2018 — the best reading since the third quarter of 2014. Finally, the Commerce Department’s initial reading — released after the reporting period had ended — showed that GDP grew at an annual pace of 3.5% during the third quarter of 2018.

After raising interest rates three times in 2017, the U.S. Federal Reserve (the “Fed”) again raised rates at its meetings in March, June and September 2018. The last hike pushed the federal funds rate to a range between 2.00% and 2.25%. At its meeting in September 2018, the Fed announced that it anticipated raising rates one more time before the end of the year.

| | | | | | |

| 2 | | September 30, 2018 | | | Annual Report | | |

Outlook

Economic growth in the U.S. accelerated during the second quarter of 2018, but the end of the economic cycle may be closer than anticipated by the consensus forecast. In our view, a pro-growth mix of economic policies has set conditions conducive to more rapid increases in consumer spending, business investment and labor compensation. Consumer spending is brisk and measures of business optimism seem to break records every month.

Looking ahead to the last few months of the year, however, these outcomes cannot be assured. Households and businesses may well rethink their spending plans over the months ahead as they evaluate the meaning of tax changes, government spending, economic policy adjustments and new risks to their well-being. If capital expenditures by businesses go to unproductive investment, productivity fails to accelerate and inflation-adjusted workers’ compensation does not increase, real economic growth could languish.

While Fed monetary policymakers will continue to base their interest-rate decisions on the flow of inflation, wage and labor market data, how the Fed implements monetary policy over the next several years may be at least as important as the timing and magnitude of its policy decisions.

Meanwhile, the interconnectedness of the U.S. economy to other countries remains intricate and deep. Even as trade relations deteriorate, we believe the forces of globalization and technological revolution promise to defeat the forces of nationalism, populism and withdrawal from multilateral arrangements. Even if U.S.-China and U.S.-European Union trade relations play out acrimoniously over the years ahead, for example, a complicated and extensive flow of goods, services, resources and intellectual property between the nations will continue based, for the time being, on a co-dependency built up over the last three decades.

On behalf of Allianz Global Investors U.S. LLC, the Funds’ investment manager, thank you for investing with us. We encourage you to consult with your financial advisor and to visit our website, us.allianzgi.com, for additional information. We remain dedicated to serving your investment needs.

Sincerely,

Thomas J. Fuccillo

President & Chief Executive Officer

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Receive this report electronically and eliminate paper mailings.

To enroll, go to us.allianzgi.com/edelivery.

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 3 |

Unaudited

AllianzGI Target-Date Funds*

For the period of October 1, 2017 through September 30, 2018, as provided by the Multi-Asset US Group.

Fund Insights

For the twelve-month period ended September 30, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI Target-Date Funds (the “Funds”) returned between 2.56% and 7.19% with longer dated Funds posting more favorable results. In terms of relative performance, all strategies underperformed their respective benchmarks (Morningstar Lifetime Moderate series) for the twelve-month period.

Market Overview

At the start of the period, political developments in the U.S. and Japan helped drive returns for global equities. The passage of the Tax Cuts and Jobs Act in late December drove US equities on the hope that the lower corporate tax rate would result in higher capital investment and provide a further boost to economic growth. Japanese equities rallied after Prime Minister Shinzo Abe’s victory in snap elections in October was perceived as a mandate for him to continue with his market-friendly policies. However, political outcomes in the euro zone, including a failure to resolve the question of Catalonia’s secession from Spain and Angela Merkel’s failure to establish a coalition government by year-end, led to declines in European equities. Macroeconomic and policy uncertainty led to several new themes including (i) a re-emergence of volatility, (ii) renewed vigilance about the possibility of creeping inflation, and (iii) revised forecasts for the pace and magnitude of increases in the benchmark interest rate of the U.S. Federal Reserve.

In March, these factors, combined with the looming threat of a global trade war between the U.S. and its major trading partners weighed on markets. While the trade war rhetoric receded for the most part in April, it returned in late May with the U.S. administration imposing tariffs on steel and aluminum imports from the EU, Canada and Mexico. Since June, slower growth in world trade, among other factors, contributed to a loss in momentum in economic activity across advanced economies. The U.S., however, remained ahead of the pack of major economies in terms of growth.

Overall for the period, after touching peaks in January, most equity markets suffered corrections in February and March and then rallied to finish the period with strongly positive returns. Global equities returned more than 9.0% (MSCI ACWI) while U.S. equities (MSCI U.S.) returned nearly two times the global equity return. Among the worst performers for the period were equities in emerging markets—especially in local terms in markets where currencies depreciated strongly—as well as in Europe. Within the US, large cap stocks outperformed small cap stocks and growth outperformed value. US government bonds and global sovereign bonds each finished down. Monetary policy continued to tighten in developed economies. In total, the U.S. Federal Reserve raised rates four times, while the Bank of England raised rates twice. While rates remained on hold in other developed economies, the European Central Bank announced it would end its bond-buying program by the end of 2018 and the Bank of Japan gave itself more flexibility by expanding its target for the 10-year bond yield. In contrast, the central banks of several emerging markets countries raised rates as they sought to stem currency weakness.

Portfolio Review

U.S. equities were the most important contributor for the Funds’ performance during the reporting period. In addition, Asian and emerging market equities contributed positively. European equities, government bonds and corporate bonds, on the other hand, detracted from performance. Furthermore, selection in equities detracted from relative performance versus the benchmark.

At the end of the reporting period, the Funds were overweight U.S. equities and underweight emerging market equities. The Funds also were underweight U.S. government bonds.

Outlook

Recognizing that the expansion in global growth that started in mid-2016 may have peaked in some major economies, we are focused on the sources of further downside risks. Such risks include escalation in trade and diplomatic tensions between the U.S. and China, persistently higher oil prices, currency volatility weighing on vulnerable emerging markets and a more abrupt tightening in financial market conditions in major economies, among others.

We believe that U.S. equities remain the most attractive of developed market equities in the near term. In Europe, in light of the deteriorating macro backdrop, we continue to expect fiscal policy uncertainty in the periphery and the prospect of further tightening in monetary policy to weigh on European equities. We anticipate challenges for broad emerging markets equities and debt but see opportunities to differentiate within the asset class. The returns on fixed income assets in recent months have been almost invariably negative and we see limited prospect of a significant broad turnaround—especially given the trend of rising global inflation, rising interest rates globally and a still-healthy global growth dynamic. Again, however, opportunities exist to differentiate among sovereign bonds. We remain constructive on the U.S. dollar versus major developed currencies as of the end of the period.

* The “Target-Date Funds” are the AllianzGI Retirement 2020 Fund, the AllianzGI Retirement 2025 Fund, the AllianzGI Retirement 2030 Fund, the AllianzGI Retirement 2035 Fund, the AllianzGI Retirement 2040 Fund, the AllianzGI Retirement 2045 Fund, the AllianzGI Retirement 2050 Fund, and the AllianzGI Retirement 2055 Fund.

| | | | | | |

| 4 | | September 30, 2018 | | | Annual Report | | |

Unaudited

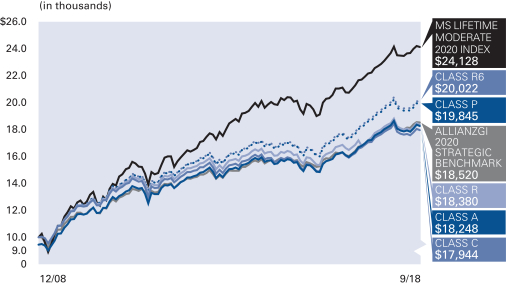

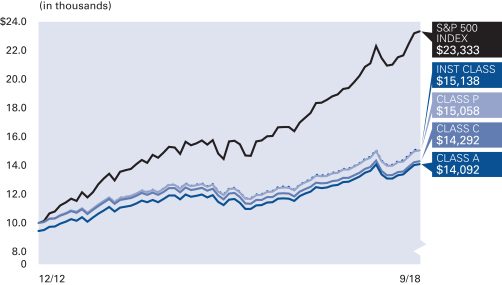

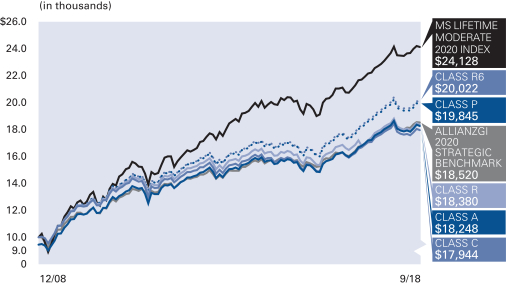

AllianzGI Retirement 2020 Fund

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2020 Fund Class A | | | 2.56% | | | | 4.30% | | | | 6.98% | |

| | AllianzGI Retirement 2020 Fund Class A (adjusted) | | | –3.08% | | | | 3.13% | | | | 6.36% | |

| | | AllianzGI Retirement 2020 Fund Class C | | | 1.79% | | | | 3.53% | | | | 6.18% | |

| | AllianzGI Retirement 2020 Fund Class C (adjusted) | | | 0.80% | | | | 3.53% | | | | 6.18% | |

| | AllianzGI Retirement 2020 Fund Class R | | | 2.21% | | | | 3.55% | | | | 6.44% | |

| | AllianzGI Retirement 2020 Fund Class P | | | 2.87% | | | | 4.61% | | | | 7.28% | |

| | AllianzGI Retirement 2020 Fund Class R6 | | | 2.95% | | | | 4.71% | | | | 7.38% | |

| | | AllianzGI Retirement 2020 Fund Administrative Class | | | 2.61% | | | | 4.34% | | | | 7.03% | |

| | Morningstar Lifetime Moderate 2020 Index | | | 5.50% | | | | 6.03% | | | | 9.45% | |

| | AllianzGI 2020 Strategic Benchmark | | | 4.67% | | | | 4.70% | | | | 6.53% | |

| | | Lipper Mixed-Asset Target 2020 Funds Average | | | 4.44% | | | | 5.29% | | | | 8.43% | |

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.19% for Class A shares, 1.94% for Class C shares, 1.44% for Class R shares, 0.79% for Class P shares, 0.69% for Class R6 shares, and 1.04% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

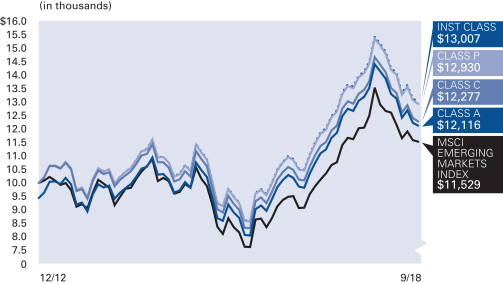

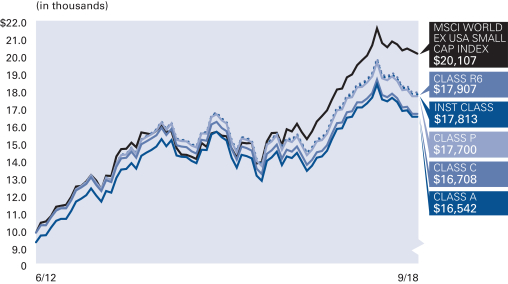

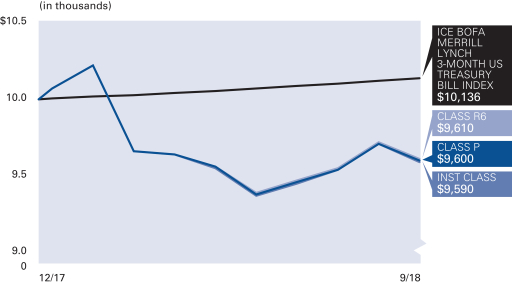

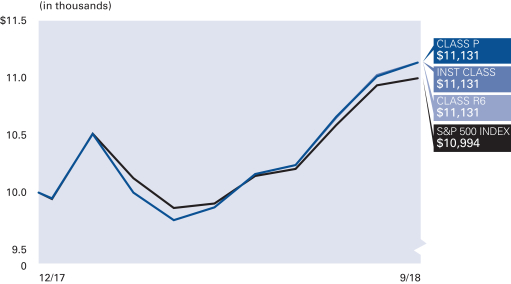

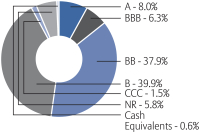

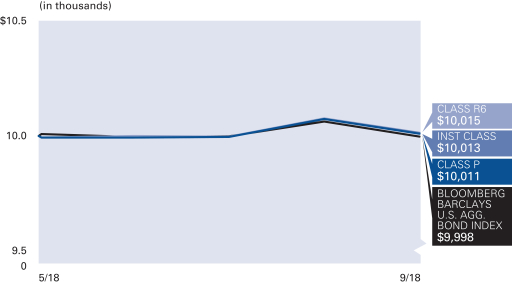

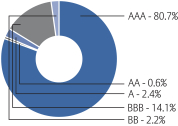

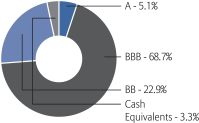

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Global Dynamic Allocation | | | 63.7% | |

| AllianzGI Advanced Core Bond | | | 17.5% | |

| AllianzGI Best Styles U.S. Equity | | | 6.1% | |

| Vanguard Mortgage-Backed Securities | | | 3.5% | |

| iShares TIPS Bond | | | 1.3% | |

| AllianzGI Short Duration High Income | | | 1.2% | |

| iShares U.S. Preferred Stock | | | 0.9% | |

| AllianzGI Emerging Markets Small-Cap | | | 0.9% | |

| Other | | | 0.9% | |

| Cash & Equivalents — Net | | | 4.0% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 5 |

Unaudited

AllianzGI Retirement 2020 Fund (cont’d)

| | | | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,018.10 | | $1,014.60 | | $1,016.30 | | $1,019.90 | | $1,020.40 | | $1,017.90 |

| Expenses Paid During Period | | $1.92 | | $5.66 | | $3.64 | | $0.35 | | $0.02 | | $1.62 |

| | | | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,023.16 | | $1,019.45 | | $1,021.46 | | $1,024.72 | | $1,025.05 | | $1,023.46 |

| Expenses Paid During Period | | $1.93 | | $5.67 | | $3.65 | | $0.36 | | $0.02 | | $1.62 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.38% for Class A, 1.12% for Class C, 0.72% for Class R, 0.07% for Class P, less than 0.005% for Class R6 and 0.32% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 6 | | September 30, 2018 | | | Annual Report | | |

Unaudited

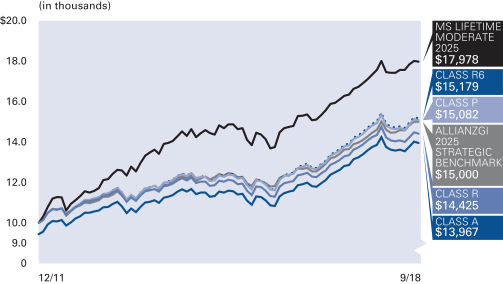

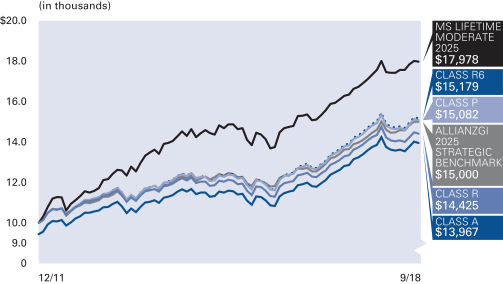

AllianzGI Retirement 2025 Fund

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2025 Fund Class A | | | 4.30% | | | | 5.27% | | | | 5.93% | |

| | AllianzGI Retirement 2025 Fund Class A (adjusted) | | | –1.44% | | | | 4.08% | | | | 5.04% | |

| | AllianzGI Retirement 2025 Fund Class R | | | 3.94% | | | | 4.89% | | | | 5.54% | |

| | AllianzGI Retirement 2025 Fund Class P | | | 4.65% | | | | 5.59% | | | | 6.25% | |

| | AllianzGI Retirement 2025 Fund Class R6 | | | 4.73% | | | | 5.69% | | | | 6.35% | |

| | | AllianzGI Retirement 2025 Fund Administrative Class | | | 4.34% | | | | 5.30% | | | | 5.97% | |

| | Morningstar Lifetime Moderate 2025 Index | | | 6.34% | | | | 6.76% | | | | 9.03% | |

| | AllianzGI 2025 Strategic Benchmark | | | 6.34% | | | | 5.58% | | | | 6.16% | |

| | | Lipper Mixed-Asset Target 2025 Funds Average | | | 5.49% | | | | 6.13% | | | | 8.13% | |

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.23% for Class A shares, 1.48% for Class R shares, 0.83% for Class P shares, 0.73% for Class R6 shares and 1.08% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

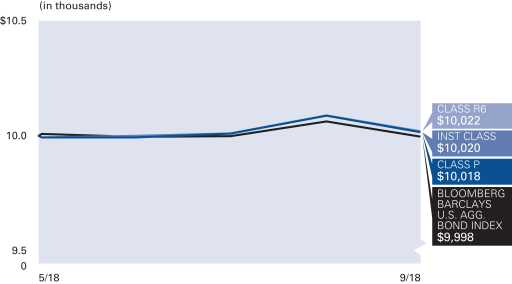

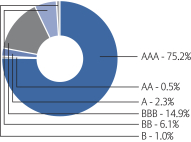

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Global Dynamic Allocation | | | 72.0% | |

| AllianzGI Advanced Core Bond | | | 13.4% | |

| AllianzGI Best Styles U.S. Equity | | | 9.5% | |

| AllianzGI Emerging Markets Small-Cap | | | 0.6% | |

| iShares TIPS Bond | | | 0.6% | |

| AllianzGI Short Duration High Income | | | 0.3% | |

| Cash & Equivalents — Net | | | 3.6% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 7 |

Unaudited

AllianzGI Retirement 2025 Fund (cont’d)

| | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,024.90 | | $1,023.40 | | $1,027.20 | | $1,027.70 | | $1,025.40 |

| Expenses Paid During Period | | $1.68 | | $3.45 | | $0.15 | | $0.01 | | $1.47 |

| | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,023.41 | | $1,021.66 | | $1,024.92 | | $1,025.06 | | $1,023.61 |

| Expenses Paid During Period | | $1.67 | | $3.45 | | $0.15 | | $0.01 | | $1.47 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.33% for Class A, 0.68% for Class R, 0.03% for Class P, less than 0.005% for Class R6 and 0.29% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 8 | | September 30, 2018 | | | Annual Report | | |

Unaudited

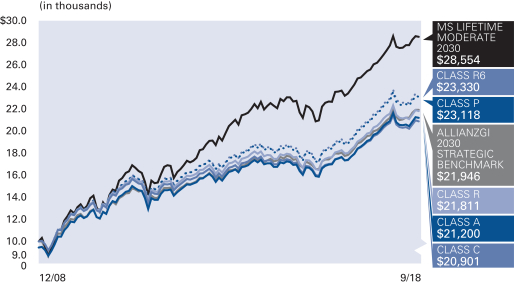

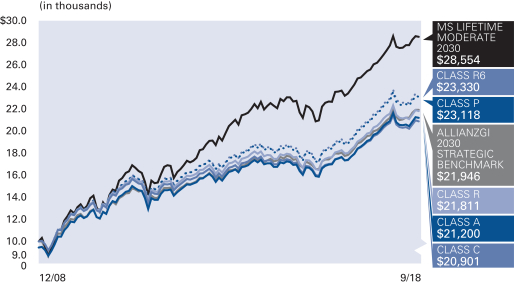

AllianzGI Retirement 2030 Fund

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2030 Fund Class A | | | 5.40% | | | | 5.85% | | | | 8.64% | |

| | AllianzGI Retirement 2030 Fund Class A (adjusted) | | | –0.40% | | | | 4.66% | | | | 8.01% | |

| | | AllianzGI Retirement 2030 Fund Class C | | | 4.64% | | | | 5.05% | | | | 7.86% | |

| | AllianzGI Retirement 2030 Fund Class C (adjusted) | | | 3.64% | | | | 5.05% | | | | 7.86% | |

| | AllianzGI Retirement 2030 Fund Class R | | | 5.03% | | | | 5.47% | | | | 8.32% | |

| | AllianzGI Retirement 2030 Fund Class P | | | 5.72% | | | | 6.16% | | | | 8.97% | |

| | AllianzGI Retirement 2030 Fund Class R6 | | | 5.83% | | | | 6.26% | | | | 9.07% | |

| | | AllianzGI Retirement 2030 Fund Administrative Class | | | 5.48% | | | | 5.90% | | | | 8.73% | |

| | Morningstar Lifetime Moderate 2030 Index | | | 7.49% | | | | 7.56% | | | | 11.36% | |

| | AllianzGI 2030 Strategic Benchmark | | | 7.84% | | | | 6.37% | | | | 8.40% | |

| | | Lipper Mixed-Asset Target 2030 Funds Average | | | 6.67% | | | | 6.83% | | | | 10.05% | |

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.22% for Class A shares, 1.97% for Class C shares, 1.47% for Class R shares, 0.82% for Class P shares, 0.72% for Class R6 shares and 1.07% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Global Dynamic Allocation | | | 70.0% | |

| AllianzGI Best Styles U.S. Equity | | | 12.9% | |

| AllianzGI Best Styles Global Equity | | | 9.2% | |

| AllianzGI Advanced Core Bond | | | 2.9% | |

| AllianzGI Emerging Markets Small-Cap | | | 1.3% | |

| iShares U.S. Preferred Stock | | | 0.2% | |

| iShares TIPS Bond | | | 0.2% | |

| Cash & Equivalents — Net | | | 3.3% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 9 |

Unaudited

AllianzGI Retirement 2030 Fund (cont’d)

| | | | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,030.30 | | $1,026.40 | | $1,028.00 | | $1,031.80 | | $1,032.10 | | $1,030.30 |

| Expenses Paid During Period | | $1.63 | | $5.44 | | $3.41 | | $0.10 | | $0.01 | | $1.37 |

| | | | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,023.46 | | $1,019.70 | | $1,021.71 | | $1,024.97 | | $1,025.06 | | $1,023.71 |

| Expenses Paid During Period | | $1.62 | | $5.42 | | $3.40 | | $0.10 | | $0.01 | | $1.37 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.32% for Class A, 1.07% for Class C, 0.67% for Class R, 0.02% for Class P, less than 0.005% for Class R6 and 0.27% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 10 | | September 30, 2018 | | | Annual Report | | |

Unaudited

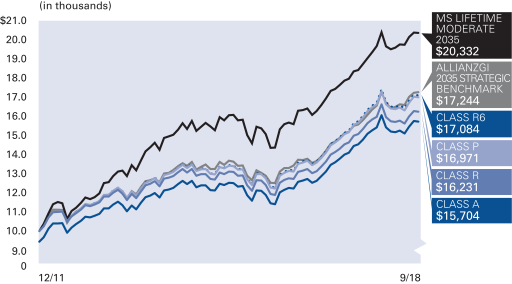

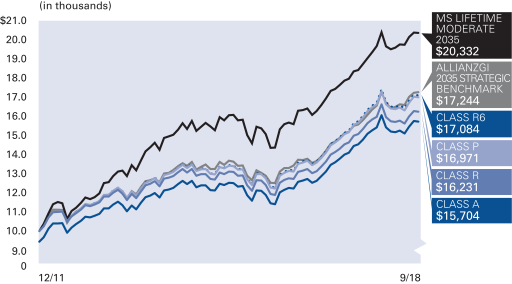

AllianzGI Retirement 2035 Fund

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2035 Fund Class A | | | 6.27% | | | | 6.47% | | | | 7.78% | |

| | AllianzGI Retirement 2035 Fund Class A (adjusted) | | | 0.42% | | | | 5.27% | | | | 6.88% | |

| | AllianzGI Retirement 2035 Fund Class R | | | 5.92% | | | | 6.10% | | | | 7.41% | |

| | AllianzGI Retirement 2035 Fund Class P | | | 6.59% | | | | 6.79% | | | | 8.12% | |

| | AllianzGI Retirement 2035 Fund Class R6 | | | 6.68% | | | | 6.90% | | | | 8.21% | |

| | | AllianzGI Retirement 2035 Fund Administrative Class | | | 6.28% | | | | 6.52% | | | | 7.83% | |

| | Morningstar Lifetime Moderate 2035 Index | | | 8.65% | | | | 8.22% | | | | 11.03% | |

| | AllianzGI 2035 Strategic Benchmark | | | 9.17% | | | | 7.00% | | | | 8.37% | |

| | | Lipper Mixed-Asset Target 2035 Funds Average | | | 7.95% | | | | 7.70% | | | | 9.78% | |

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.15% for Class A shares, 1.40% for Class R shares, 0.75% for Class P shares, 0.65% for Class R6 shares and 1.00% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Global Dynamic Allocation | | | 46.4% | |

| AllianzGI Best Styles Global Equity | | | 30.5% | |

| AllianzGI Best Styles U.S. Equity | | | 15.5% | |

| AllianzGI Advanced Core Bond | | | 2.4% | |

| AllianzGI Emerging Markets Small-Cap | | | 1.4% | |

| Cash & Equivalents — Net | | | 3.8% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 11 |

Unaudited

AllianzGI Retirement 2035 Fund (cont’d)

| | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,033.90 | | $1,032.00 | | $1,035.30 | | $1,035.80 | | $1,034.20 |

| Expenses Paid During Period | | $1.99 | | $3.77 | | $0.46 | | $0.02 | | $1.73 |

| | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,023.11 | | $1,021.36 | | $1,024.62 | | $1,025.05 | | $1,023.36 |

| Expenses Paid During Period | | $1.98 | | $3.75 | | $0.46 | | $0.02 | | $1.72 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.39% for Class A, 0.74% for Class R, 0.09% for Class P, less than 0.004% for Class R6 and 0.34% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 12 | | September 30, 2018 | | | Annual Report | | |

Unaudited

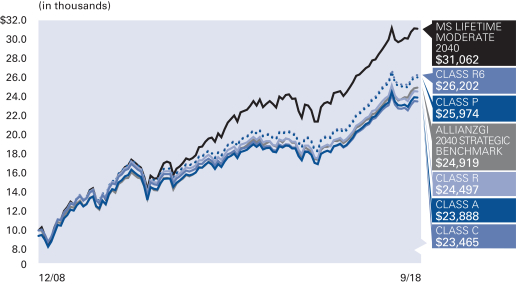

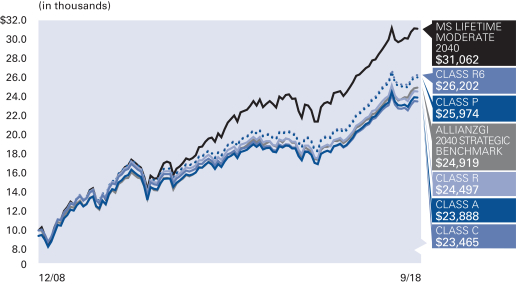

AllianzGI Retirement 2040 Fund

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2040 Fund Class A | | | 6.78% | | | | 6.82% | | | | 9.97% | |

| | AllianzGI Retirement 2040 Fund Class A (adjusted) | | | 0.91% | | | | 5.62% | | | | 9.34% | |

| | | AllianzGI Retirement 2040 Fund Class C | | | 6.00% | | | | 6.03% | | | | 9.14% | |

| | AllianzGI Retirement 2040 Fund Class C (adjusted) | | | 5.00% | | | | 6.03% | | | | 9.14% | |

| | AllianzGI Retirement 2040 Fund Class R | | | 6.42% | | | | 6.45% | | | | 9.62% | |

| | AllianzGI Retirement 2040 Fund Class P | | | 7.11% | | | | 7.15% | | | | 10.28% | |

| | AllianzGI Retirement 2040 Fund Class R6 | | | 7.20% | | | | 7.25% | | | | 10.38% | |

| | | AllianzGI Retirement 2040 Fund Administrative Class | | | 6.82% | | | | 6.86% | | | | 10.02% | |

| | Morningstar Lifetime Moderate 2040 Index | | | 9.42% | | | | 8.60% | | | | 12.32% | |

| | AllianzGI 2040 Strategic Benchmark | | | 10.25% | | | | 7.40% | | | | 9.82% | |

| | | Lipper Mixed-Asset Target 2040 Funds Average | | | 8.46% | | | | 7.88% | | | | 10.99% | |

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.09% for Class A shares, 1.84% for Class C shares, 1.34% for Class R shares, 0.69% for Class P shares, 0.59% for Class R6 shares and 0.94% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Best Styles Global Equity | | | 44.7% | |

| AllianzGI Global Dynamic Allocation | | | 32.6% | |

| AllianzGI Best Styles U.S. Equity | | | 18.0% | |

| AllianzGI Emerging Markets Small-Cap | | | 1.1% | |

| Cash & Equivalents — Net | | | 3.6% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 13 |

Unaudited

AllianzGI Retirement 2040 Fund (cont’d)

| | | | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,035.90 | | $1,032.20 | | $1,034.00 | | $1,037.50 | | $1,037.90 | | $1,036.40 |

| Expenses Paid During Period | | $2.25 | | $6.06 | | $4.03 | | $0.72 | | $0.20 | | $1.99 |

| | | | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,022.86 | | $1,019.10 | | $1,021.11 | | $1,024.37 | | $1,024.87 | | $1,023.11 |

| Expenses Paid During Period | | $2.23 | | $6.02 | | $4.00 | | $0.71 | | $0.20 | | $1.98 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.44% for Class A, 1.19% for Class C, 0.79% for Class R, 0.14% for Class P, 0.04% for Class R6 and 0.39% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 14 | | September 30, 2018 | | | Annual Report | | |

Unaudited

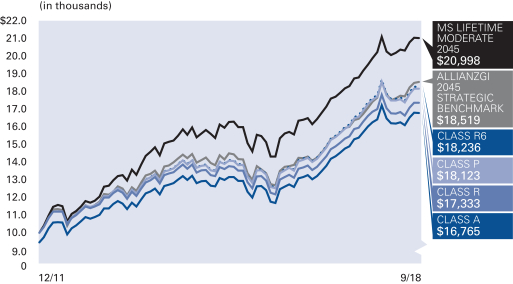

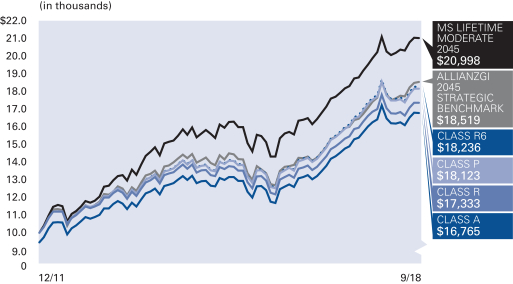

AllianzGI Retirement 2045 Fund

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2045 Fund Class A | | | 6.96% | | | | 7.13% | | | | 8.82% | |

| | AllianzGI Retirement 2045 Fund Class A (adjusted) | | | 1.08% | | | | 5.93% | | | | 7.91% | |

| | AllianzGI Retirement 2045 Fund Class R | | | 6.61% | | | | 6.78% | | | | 8.45% | |

| | AllianzGI Retirement 2045 Fund Class P | | | 7.29% | | | | 7.48% | | | | 9.16% | |

| | AllianzGI Retirement 2045 Fund Class R6 | | | 7.42% | | | | 7.60% | | | | 9.26% | |

| | | AllianzGI Retirement 2045 Fund Administrative Class | | | 7.02% | | | | 7.20% | | | | 8.86% | |

| | Morningstar Lifetime Moderate 2045 Index | | | 9.69% | | | | 8.69% | | | | 11.56% | |

| | AllianzGI 2045 Strategic Benchmark | | | 10.82% | | | | 7.61% | | | | 9.51% | |

| | | Lipper Mixed-Asset Target 2045 Funds Average | | | 9.12% | | | | 8.39% | | | | 10.66% | |

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.06% for Class A shares, 1.31% for Class R shares, 0.66% for Class P shares, 0.56% for Class R6 shares and 0.91% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Best Styles Global Equity | | | 53.7% | |

| AllianzGI Global Dynamic Allocation | | | 21.8% | |

| AllianzGI Best Styles U.S. Equity | | | 18.9% | |

| AllianzGI Emerging Markets Small-Cap | | | 1.0% | |

| Cash & Equivalents — Net | | | 4.6% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 15 |

Unaudited

AllianzGI Retirement 2045 Fund (cont’d)

| | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,036.40 | | $1,035.20 | | $1,038.40 | | $1,038.80 | | $1,036.60 |

| Expenses Paid During Period | | $2.35 | | $4.13 | | $0.82 | | $0.31 | | $2.09 |

| | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,022.76 | | $1,021.01 | | $1,024.27 | | $1,024.77 | | $1,023.01 |

| Expenses Paid During Period | | $2.33 | | $4.10 | | $0.81 | | $0.30 | | $2.08 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.46% for Class A, 0.81% for Class R, 0.16% for Class P, 0.06% for Class R6 and 0.41% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 16 | | September 30, 2018 | | | Annual Report | | |

Unaudited

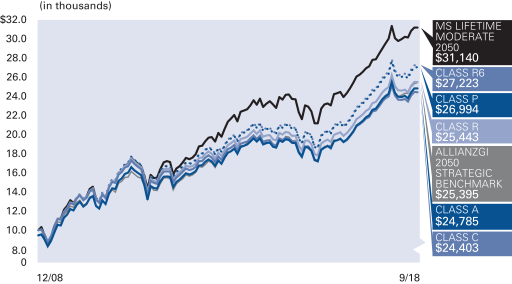

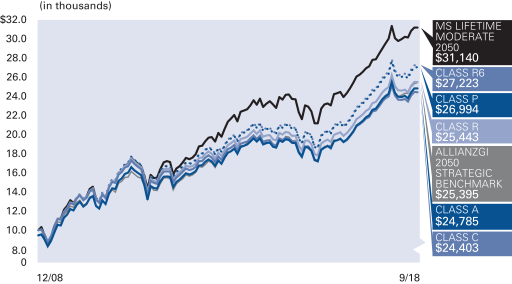

AllianzGI Retirement 2050 Fund

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2050 Fund Class A | | | 7.07% | | | | 7.13% | | | | 10.39% | |

| | AllianzGI Retirement 2050 Fund Class A (adjusted) | | | 1.18% | | | | 5.92% | | | | 9.75% | |

| | | AllianzGI Retirement 2050 Fund Class C | | | 6.29% | | | | 6.34% | | | | 9.58% | |

| | AllianzGI Retirement 2050 Fund Class C (adjusted) | | | 5.29% | | | | 6.34% | | | | 9.58% | |

| | AllianzGI Retirement 2050 Fund Class R | | | 6.70% | | | | 6.75% | | | | 10.05% | |

| | AllianzGI Retirement 2050 Fund Class P | | | 7.40% | | | | 7.47% | | | | 10.71% | |

| | AllianzGI Retirement 2050 Fund Class R6 | | | 7.47% | | | | 7.57% | | | | 10.81% | |

| | | AllianzGI Retirement 2050 Fund Administrative Class | | | 7.11% | | | | 7.19% | | | | 10.46% | |

| | Morningstar Lifetime Moderate 2050 Index | | | 9.62% | | | | 8.62% | | | | 12.35% | |

| | AllianzGI 2050 Strategic Benchmark | | | 11.07% | | | | 7.69% | | | | 10.03% | |

| | | Lipper Mixed-Asset Target 2050+ Funds Average | | | 9.06% | | | | 8.27% | | | | 11.24% | |

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.05% for Class A shares, 1.80% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Best Styles Global Equity | | | 59.0% | |

| AllianzGI Best Styles U.S. Equity | | | 18.4% | |

| AllianzGI Global Dynamic Allocation | | | 17.4% | |

| AllianzGI Emerging Markets Small-Cap | | | 0.9% | |

| Cash & Equivalents — Net | | | 4.3% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 17 |

Unaudited

AllianzGI Retirement 2050 Fund (cont’d)

| | | | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,036.40 | | $1,032.90 | | $1,034.60 | | $1,038.00 | | $1,038.70 | | $1,036.80 |

| Expenses Paid During Period | | $2.50 | | $6.32 | | $4.28 | | $0.97 | | $0.46 | | $2.25 |

| | | | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,022.61 | | $1,018.85 | | $1,020.86 | | $1,024.12 | | $1,024.62 | | $1,022.86 |

| Expenses Paid During Period | | $2.48 | | $6.28 | | $4.26 | | $0.96 | | $0.46 | | $2.23 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.49% for Class A, 1.24% for Class C, 0.84% for Class R, 0.19% for Class P, 0.09% for Class R6 and 0.44% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 18 | | September 30, 2018 | | | Annual Report | | |

Unaudited

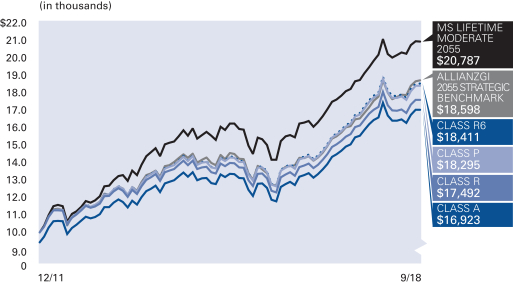

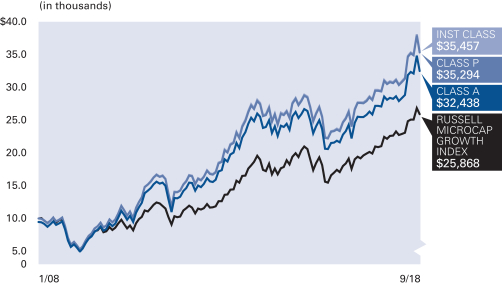

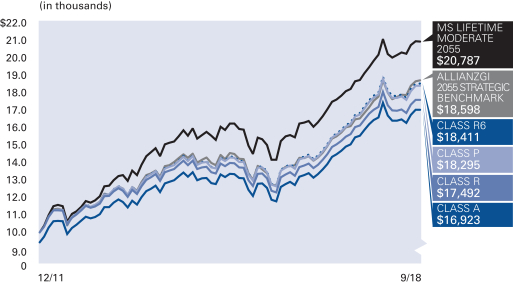

AllianzGI Retirement 2055 Fund

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Retirement 2055 Fund Class A | | | 7.19% | | | | 7.14% | | | | 8.97% | |

| | AllianzGI Retirement 2055 Fund Class A (adjusted) | | | 1.29% | | | | 5.93% | | | | 8.06% | |

| | AllianzGI Retirement 2055 Fund Class R | | | 6.86% | | | | 6.78% | | | | 8.60% | |

| | AllianzGI Retirement 2055 Fund Class P | | | 7.57% | | | | 7.48% | | | | 9.31% | |

| | AllianzGI Retirement 2055 Fund Class R6 | | | 7.62% | | | | 7.58% | | | | 9.41% | |

| | | AllianzGI Retirement 2055 Fund Administrative Class | | | 7.25% | | | | 7.19% | | | | 9.02% | |

| | Morningstar Lifetime Moderate 2055 Index | | | 9.48% | | | | 8.51% | | | | 11.39% | |

| | AllianzGI 2055 Strategic Benchmark | | | 11.07% | | | | 7.69% | | | | 9.58% | |

| | | Lipper Mixed-Asset Target 2055+ Funds Average | | | 9.55% | | | | 8.68% | | | | 11.03% | |

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.05% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Best Styles Global Equity | | | 58.6% | |

| AllianzGI Best Styles U.S. Equity | | | 18.6% | |

| AllianzGI Global Dynamic Allocation | | | 17.4% | |

| AllianzGI Emerging Markets Small-Cap | | | 1.0% | |

| Cash & Equivalents — Net | | | 4.4% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 19 |

Unaudited

AllianzGI Retirement 2055 Fund (cont’d)

| | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,036.90 | | $1,035.40 | | $1,039.20 | | $1,039.00 | | $1,037.30 |

| Expenses Paid During Period | | $2.50 | | $4.29 | | $0.97 | | $0.46 | | $2.25 |

| | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class R | | Class P | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,022.61 | | $1,020.86 | | $1,024.12 | | $1,024.62 | | $1,022.86 |

| Expenses Paid During Period | | $2.48 | | $4.26 | | $0.96 | | $0.46 | | $2.23 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.49% for Class A, 0.84% for Class R, 0.19% for Class P, 0.09% for Class R6 and 0.44% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 20 | | September 30, 2018 | | | Annual Report | | |

Unaudited

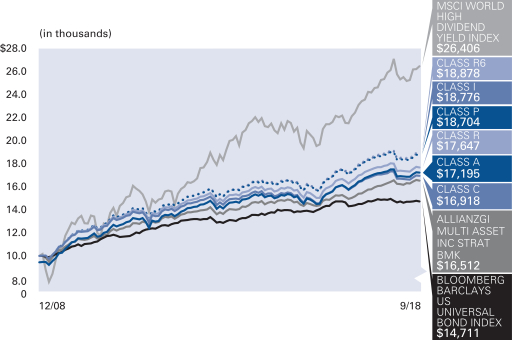

AllianzGI Multi Asset Income Fund (formerly AllianzGI Retirement Income Fund)

For the period of October 1, 2017 through September 30, 2018, as provided by the Multi-Asset US Group.

Fund Insights

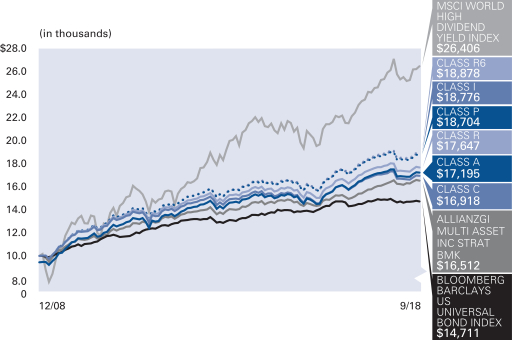

For the twelve-month period ended September 30, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI Multi Asset Income Fund (the “Fund”) returned 0.12%, outperforming the Bloomberg Barclays U.S. Universal Bond Index (the “benchmark”), which returned -1.00%.

Market Overview

At the start of the period, political developments in the U.S. and Japan helped drive returns for global equities. The passage of the Tax Cuts and Jobs Act in late December drove US equities on the hope that the lower corporate tax rate would result in higher capital investment and provide a further boost to economic growth. Japanese equities rallied after Prime Minister Shinzo Abe’s victory in snap elections in October was perceived as a mandate for him to continue with his market-friendly policies. However, political outcomes in the euro zone, including a failure to resolve the question of Catalonia’s secession from Spain and Angela Merkel’s failure to establish a coalition government by year-end, led to declines in European equities. Macroeconomic and policy uncertainty led to several new themes including (i) a re-emergence of volatility, (ii) renewed vigilance about the possibility of creeping inflation, and (iii) revised forecasts for the pace and magnitude of increases in the benchmark interest rate of the U.S. Federal Reserve.

In March, these factors, combined with the looming threat of a global trade war between the U.S. and its major trading partners weighed on markets. While the trade war rhetoric receded for the most part in April, it returned in late May with the U.S. administration imposing tariffs on steel and aluminum imports from the EU, Canada and Mexico. Since June, slower growth in world trade, among other factors, contributed to a loss in momentum in economic activity across advanced economies. The U.S., however, remained ahead of the pack of major economies in terms of growth.

Overall for the period, after touching peaks in January, most equity markets suffered corrections in February and March and then rallied to finish the period with strongly positive returns. Global equities returned more than 9.0% (MSCI ACWI) while U.S. equities (MSCI U.S.) returned nearly two times the global equity return. Among the worst performers for the period were equities in emerging markets—especially in local terms in markets where currencies depreciated strongly—as well as in Europe. Within the US, large cap stocks outperformed small cap stocks and growth outperformed value. US government bonds and global sovereign bonds each finished down. Monetary policy continued to tighten in developed economies. In total, the U.S. Federal Reserve raised rates four times, while the Bank of England raised rates twice. While rates remained on hold in other developed economies, the European Central Bank announced it would end its bond-buying program by the end of 2018 and the Bank of Japan gave itself more flexibility by expanding its target for the 10-year bond yield. In contrast, the central banks of several emerging markets countries raised rates as they sought to stem currency weakness.

Portfolio Review

The positive contributors to performance were overweight positions in U.S. and Japanese equities, mortgage REITs, preferred securities and leveraged loans. The main detractors were underweight exposure in European equities in March and April 2018, an underweight and selection in U.S. high yield, an overweight and selection in emerging market debt, an overweight in master limited partnerships and opportunistic allocations to Italian government bonds. With core bond positions, the overall effect on active performance was slightly positive, as negative contributions from overweight positions in U.S. Treasuries were offset by positive contributions from underlying active strategies such as PIMCO Income, AllianzGI Real Estate Debt and AllianzGI Short Duration High Income. The Fund has met its objective of distributing an attractive level of income, having had a distribution yield of 7.3% over the last 12 months.

Outlook

Recognizing that the expansion in global growth that started in mid-2016 may have peaked in some major economies, we are focused on the sources of further downside risks. Such risks include escalation in trade and diplomatic tensions between the U.S. and China, persistently higher oil prices, currency volatility weighing on vulnerable emerging markets and a more abrupt tightening in financial market conditions in major economies, among others.

We believe that U.S. equities remain the most attractive of developed market equities in the near term. In Europe, in light of the deteriorating macro backdrop, we continue to expect fiscal policy uncertainty in the periphery and the prospect of further tightening in monetary policy to weigh on European equities. We anticipate challenges for broad emerging markets equities and debt but see opportunities to differentiate within the asset class. The returns on fixed income assets in recent months have been almost invariably negative and we see limited prospect of a significant broad turnaround—especially given the trend of rising global inflation, rising interest rates globally and a still-healthy global growth dynamic. Again, however, opportunities exist to differentiate among sovereign bonds. We remain constructive on the U.S. dollar versus major developed currencies as of the end of the period.

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 21 |

Unaudited

AllianzGI Multi Asset Income Fund (formerly AllianzGI Retirement Income Fund) (cont’d)

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | Since Inception† | |

| | | AllianzGI Multi Asset Income Fund Class A | | | 0.12% | | | | 3.61% | | | | 6.33% | |

| | AllianzGI Multi Asset Income Fund Class A (adjusted) | | | –5.39% | | | | 2.45% | | | | 5.71% | |

| | | AllianzGI Multi Asset Income Fund Class C | | | –0.64% | | | | 2.84% | | | | 5.54% | |

| | AllianzGI Multi Asset Income Fund Class C (adjusted) | | | –1.58% | | | | 2.84% | | | | 5.54% | |

| | AllianzGI Multi Asset Income Fund Class R | | | –0.20% | | | | 3.25% | | | | 5.99% | |

| | AllianzGI Multi Asset Income Fund Class P | | | 0.46% | | | | 3.93% | | | | 6.63% | |

| | AllianzGI Multi Asset Income Fund Institutional Class | | | 0.46% | | | | 3.97% | | | | 6.67% | |

| | AllianzGI Multi Asset Income Fund Class R6 | | | 0.56% | | | | 4.03% | | | | 6.73% | |

| | | AllianzGI Multi Asset Income Fund Administrative Class | | | 0.25% | | | | 3.46% | | | | 6.28% | |

| | Bloomberg Barclays U.S. Universal Bond Index | | | –1.00% | | | | 2.53% | | | | 4.04% | |

| | AllianzGI Multi Asset Income Strategic Benchmark | | | 2.71% | | | | 3.55% | | | | 5.28% | |

| | MSCI World High Dividend Yield Index | | | 4.80% | | | | 6.62% | | | | 10.47% | |

| | | Lipper Mixed-Asset Target Today Funds | | | 2.80% | | | | 3.82% | | | | 6.21% | |

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.20% for Class A shares, 1.95% for Class C shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.75% for Institutional Class, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.60% for Institutional Class, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

| | | | | | |

| 22 | | September 30, 2018 | | | Annual Report | | |

Unaudited

AllianzGI Multi Asset Income Fund (formerly AllianzGI Retirement Income Fund) (cont’d)

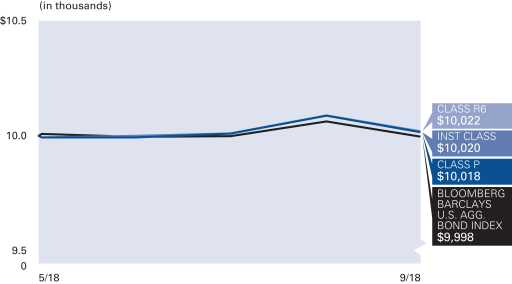

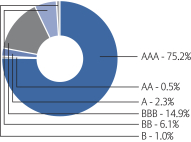

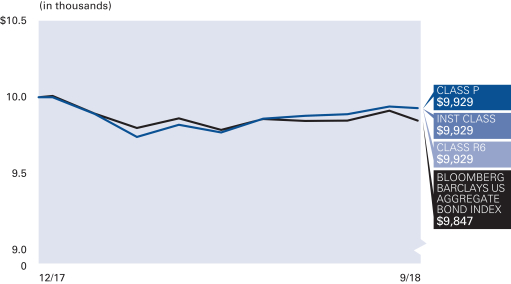

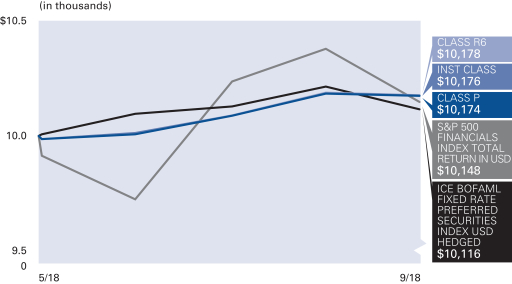

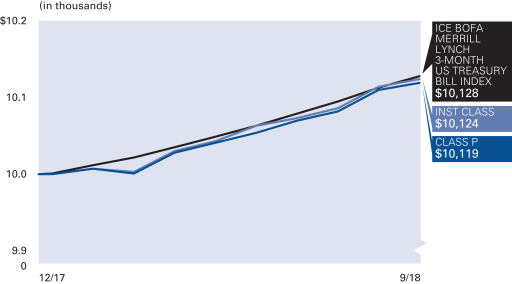

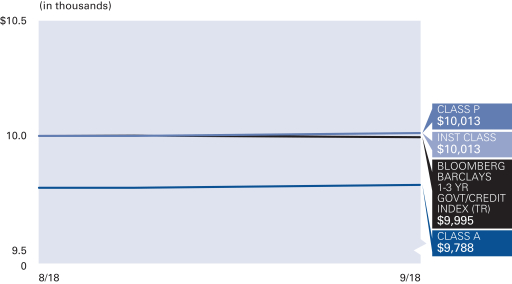

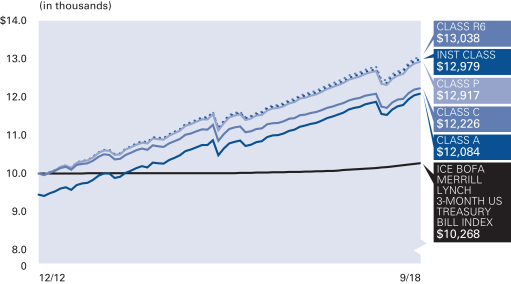

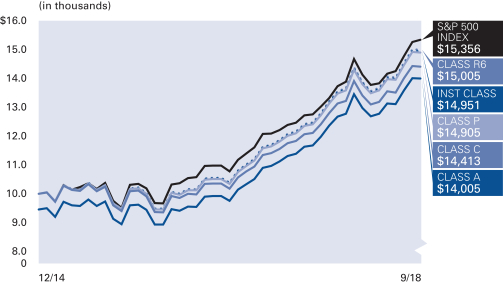

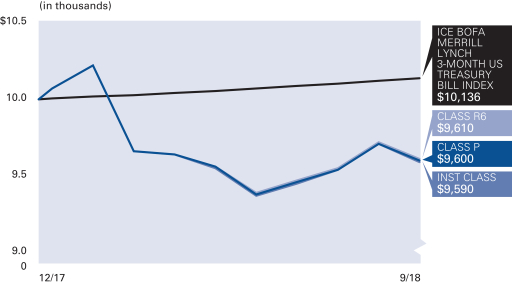

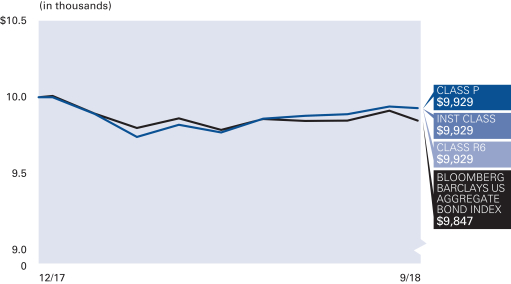

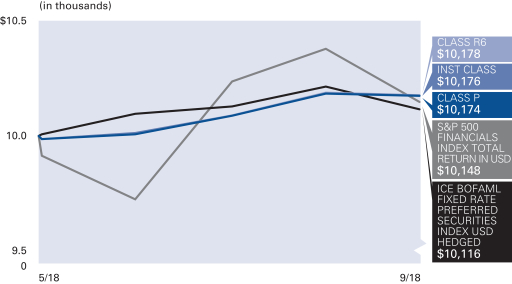

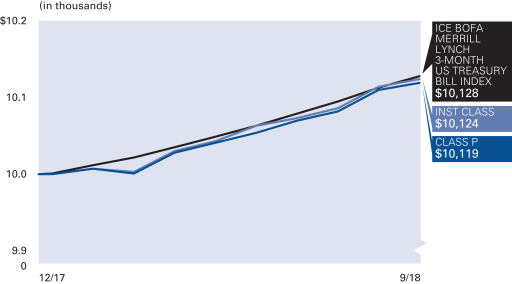

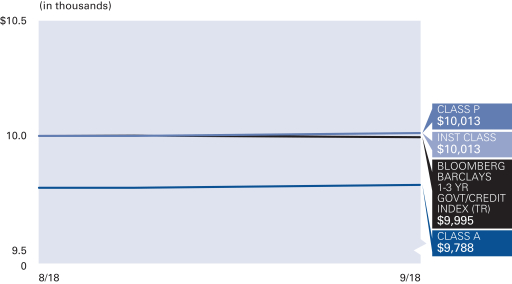

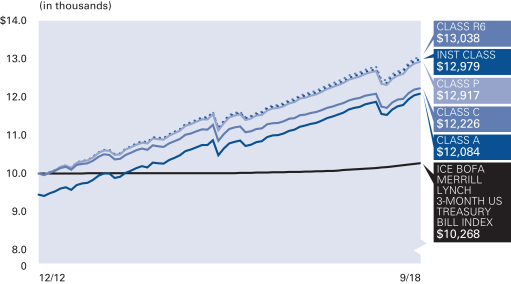

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| PIMCO Income | | | 15.2% | |

| AllianzGI Short Duration High Income | | | 12.1% | |

| AllianzGI Real Estate Debt | | | 10.8% | |

| AllianzGI Europe Equity Dividend | | | 6.8% | |

| AllianzGI Emerging Markets Debt | | | 6.3% | |

| PIMCO Preferred and Capital Securities | | | 6.0% | |

| PIMCO Senior Floating Rate | | | 5.5% | |

| Vanguard Mortgage-Backed Securities | | | 4.0% | |

| Other | | | 29.7% | |

| Cash & Equivalents — Net | | | 3.6% | |

| | | | | | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,017.30 | | $1,014.00 | | $1,015.80 | | $1,019.20 | | $1,019.40 | | $1,019.60 | | $1,018.40 |

| Expenses Paid During Period | | $1.67 | | $5.45 | | $3.44 | | $0.15 | | $0.05 | | $0.01 | | $1.16 |

| | | | | | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,023.41 | | $1,019.65 | | $1,021.66 | | $1,024.92 | | $1,025.02 | | $1,025.06 | | $1,023.92 |

| Expenses Paid During Period | | $1.67 | | $5.47 | | $3.45 | | $0.15 | | $0.05 | | $0.01 | | $1.17 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.33% for Class A, 1.08% for Class C, 0.68% for Class R, 0.03% for Class P, 0.01% for Institutional Class, less than 0.005% for Class R6 and 0.23% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 23 |

Unaudited

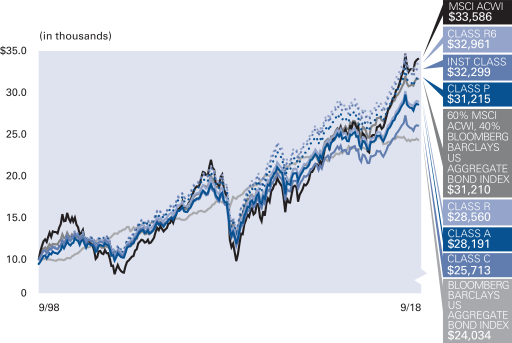

AllianzGI Global Allocation Fund

For the period of October 1, 2017 through September 30, 2018, as provided by the Multi-Asset US Group.

Fund Insights

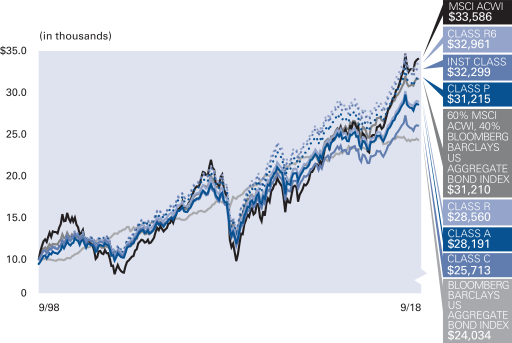

For the twelve-month period ended September 30, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI Global Allocation Fund (the “Fund”) returned 2.62%, underperforming the 60% MSCI ACWI, 40% Barclays U.S. Aggregate Bond Index (the “benchmark”), which returned 5.35%.

Market Overview

At the start of the period, political developments in the U.S. and Japan helped drive returns for global equities. The passage of the Tax Cuts and Jobs Act in late December drove US equities on the hope that the lower corporate tax rate would result in higher capital investment and provide a further boost to economic growth. Japanese equities rallied after Prime Minister Shinzo Abe’s victory in snap elections in October was perceived as a mandate for him to continue with his market-friendly policies. However, political outcomes in the euro zone, including a failure to resolve the question of Catalonia’s secession from Spain and Angela Merkel’s failure to establish a coalition government by year-end, led to declines in European equities. Macroeconomic and policy uncertainty led to several new themes including (i) a re-emergence of volatility, (ii) renewed vigilance about the possibility of creeping inflation, and (iii) revised forecasts for the pace and magnitude of increases in the benchmark interest rate of the U.S. Federal Reserve.

In March, these factors, combined with the looming threat of a global trade war between the U.S. and its major trading partners weighed on markets. While the trade war rhetoric receded for the most part in April, it returned in late May with the U.S. administration imposing tariffs on steel and aluminum imports from the EU, Canada and Mexico. Since June, slower growth in world trade, among other factors, contributed to a loss in momentum in economic activity across advanced economies. The U.S., however, remained ahead of the pack of major economies in terms of growth.

Overall for the period, after touching peaks in January, most equity markets suffered corrections in February and March and then rallied to finish the period with strongly positive returns. Global equities returned more than 9.0% (MSCI ACWI) while U.S. equities (MSCI U.S.) returned nearly two times the global equity return. Among the worst performers for the period were equities in emerging markets—especially in local terms in markets where currencies depreciated strongly—as well as in Europe. Within the US, large cap stocks outperformed small cap stocks and growth outperformed value. US government bonds and global sovereign bonds each finished down. Monetary policy continued to tighten in developed economies. In total, the U.S. Federal Reserve raised rates four times, while the Bank of England raised rates twice. While rates remained on hold in other developed economies, the European Central Bank announced it would end its bond-buying program by the end of 2018 and the Bank of Japan gave itself more flexibility by expanding its target for the 10-year bond yield. In contrast, the central banks of several emerging markets countries raised rates as they sought to stem currency weakness.

Portfolio Review

The main contributors to performance for the period were allocations to equities, specifically equities in North America where the portfolio has an overweight. Selection effects in equities, however, were negative overall. The main detractor from performance was the Best Styles Global strategy, which was overweight the value factor and value underperformed for the period. This was partially offset by positive selection from the International Growth strategy, which contributed. Within the Opportunistic portion of the portfolio, a position in small cap U.S. equities added value helping to partially offset the negative effects from exposure to emerging market debt and managed futures (which was added as an opportunistic holding during the period). Allocation to U.S. government bonds and corporates also detracted. Finally, overall exposure to currencies detracted based on positions in the Canadian dollar, British pound and Japanese yen.

Outlook

Recognizing that the expansion in global growth that started in mid-2016 may have peaked in some major economies, we are focused on the sources of further downside risks. Such risks include escalation in trade and diplomatic tensions between the U.S. and China, persistently higher oil prices, currency volatility weighing on vulnerable emerging markets and a more abrupt tightening in financial market conditions in major economies, among others.

We believe that U.S. equities remain the most attractive of developed market equities in the near term. In Europe, in light of the deteriorating macro backdrop, we continue to expect fiscal policy uncertainty in the periphery and the prospect of further tightening in monetary policy to weigh on European equities. We anticipate challenges for broad emerging markets equities and debt but see opportunities to differentiate within the asset class. The returns on fixed income assets in recent months have been almost invariably negative and we see limited prospect of a significant broad turnaround—especially given the trend of rising global inflation, rising interest rates globally and a still-healthy global growth dynamic. Again, however, opportunities exist to differentiate among sovereign bonds. We remain constructive on the U.S. dollar versus major developed currencies as of the end of the period.

| | | | | | |

| 24 | | September 30, 2018 | | | Annual Report | | |

Unaudited

AllianzGI Global Allocation Fund (cont’d)

Average Annual Total Return for the period ended September 30, 2018

| | | | | | | | | | | | | | | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Global Allocation Fund Class A | | | 2.62% | | | | 4.55% | | | | 6.39% | | | | 5.62% | |

| | AllianzGI Global Allocation Fund Class A (adjusted) | | | –3.03% | | | | 3.37% | | | | 5.79% | | | | 5.32% | |

| | | AllianzGI Global Allocation Fund Class C | | | 1.90% | | | | 3.78% | | | | 5.60% | | | | 4.84% | |

| | AllianzGI Global Allocation Fund Class C (adjusted) | | | 0.97% | | | | 3.78% | | | | 5.60% | | | | 4.84% | |

| | AllianzGI Global Allocation Fund Class R | | | 2.43% | | | | 4.37% | | | | 6.18% | | | | 5.39% | |

| | AllianzGI Global Allocation Fund Class P | | | 2.92% | | | | 4.83% | | | | 6.64% | | | | 5.86% | |

| | AllianzGI Global Allocation Fund Institutional Class | | | 2.92% | | | | 4.77% | | | | 6.68% | | | | 6.04% | |

| | | AllianzGI Global Allocation Fund Administrative Class | | | 2.68% | | | | 4.59% | | | | 6.43% | | | | 5.67% | |

| | AllianzGI Global Allocation Fund Class R6 | | | 2.95% | | | | 4.89% | | | | 6.79% | | | | 6.14% | |

| | 60% MSCI ACWI, 40% Bloomberg Barclays U.S. Aggregate Index | | | 5.35% | | | | 6.15% | | | | 6.73% | | | | 5.86% | |

| | MSCI ACWI | | | 9.77% | | | | 8.67% | | | | 8.19% | | | | 6.24% | |

| | Bloomberg Barclays U.S. Aggregate Bond Index | | | –1.22% | | | | 2.16% | | | | 3.77% | | | | 4.48% | |

| | | Lipper Alternative Global Macro Funds | | | 2.33% | | | | 2.69% | | | | 4.47% | | | | 5.38% | |

† The Fund began operations on September 30, 1998. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on September 30, 1998.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 111 and 112 for more information. The Fund’s gross expense ratios are 1.53% for Class A shares, 2.28% for Class C shares, 1.72% for Class R shares, 1.26% for Class P shares, 1.36% for Institutional Class shares, 1.21% for Class R6 shares and 1.47% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2019. The Fund’s expense ratios net of this reduction are 1.01% for Class A shares, 1.78% for Class C shares, 1.21% for Class R shares, 0.81% for Class P shares, 0.81% for Institutional Class shares, 0.71% for Class R6 shares and 0.96% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2018, as further revised or supplemented from time to time.

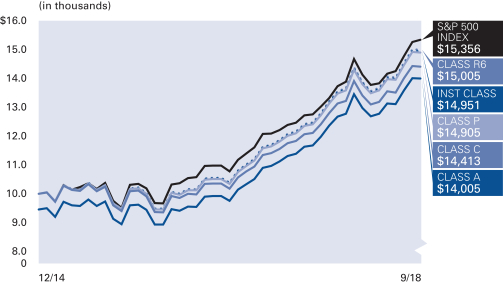

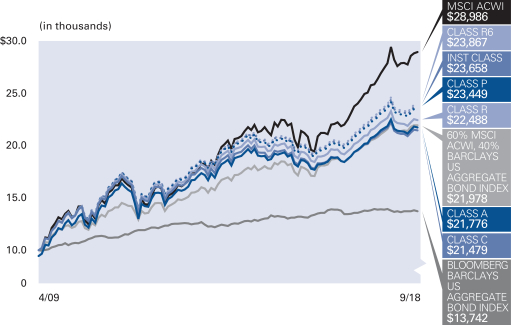

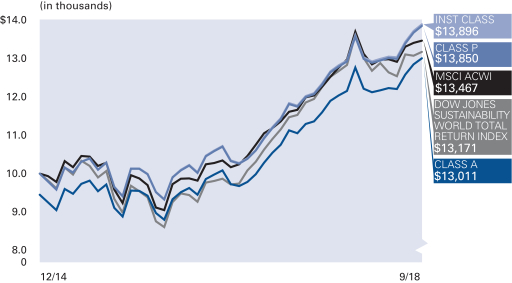

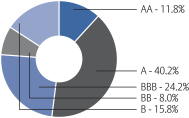

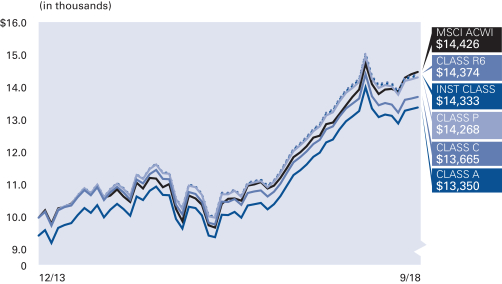

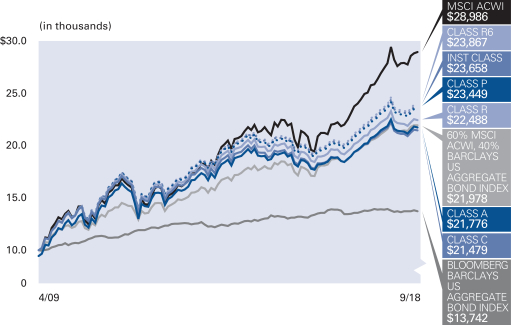

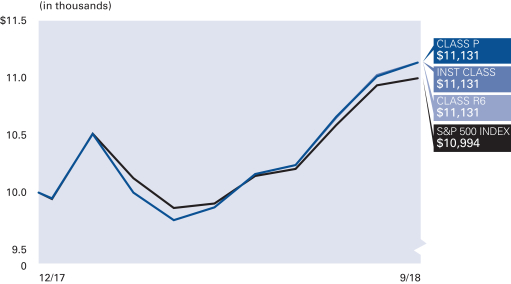

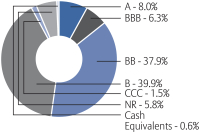

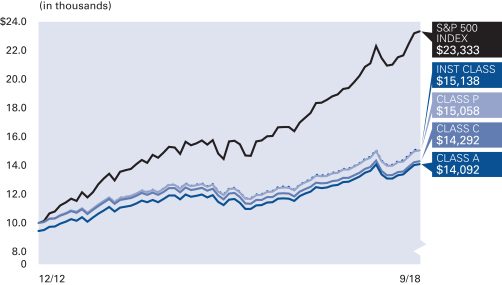

Cumulative Returns Through September 30, 2018

Fund Allocation (as of September 30, 2018)

| | | | |

| AllianzGI Best Styles Global Equity | | | 40.1% | |

| AllianzGI Advanced Core Bond | | | 24.7% | |

| AllianzGI Best Styles Global Managed Volatility | | | 11.0% | |

| AllianzGI International Growth | | | 5.7% | |

| AllianzGI Emerging Markets Debt | | | 4.4% | |

| AllianzGI PerformanceFee Managed Futures Strategy | | | 4.4% | |

| iShares iBoxx $ Investment Grade Corporate Bond | | | 3.1% | |

| iShares MBS | | | 2.0% | |

| Other | | | 2.4% | |

| Cash & Equivalents — Net | | | 2.2% | |

| | | | | | |

| | Annual Report | | | September 30, 2018 | | 25 |

Unaudited

AllianzGI Global Allocation Fund (cont’d)

| | | | | | | | | | | | | | |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,008.00 | | $1,004.30 | | $1,006.60 | | $1,009.40 | | $1,009.30 | | $1,009.90 | | $1,008.10 |

| Expenses Paid During Period | | $2.92 | | $6.53 | | $4.02 | | $1.71 | | $1.31 | | $1.31 | | $2.57 |

| | | | | | | | | | | | | | | |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Class R6 | | Administrative

Class |

| Beginning Account Value (4/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| Ending Account Value (9/30/18) | | $1,022.16 | | $1,018.55 | | $1,021.06 | | $1,023.36 | | $1,023.76 | | $1,023.76 | | $1,022.51 |

| Expenses Paid During Period | | $2.94 | | $6.58 | | $4.05 | | $1.72 | | $1.32 | | $1.32 | | $2.59 |

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.58% for Class A, 1.30% for Class C, 0.80% for Class R, 0.34% for Class P, 0.26% for Institutional Class, 0.26% for Class R6 and 0.51% for Administrative Class), multiplied by the average account value over the period, multiplied by 183/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| | | | | | |

| 26 | | September 30, 2018 | | | Annual Report | | |

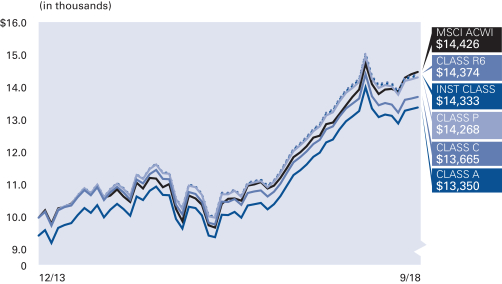

Unaudited

AllianzGI Best Styles Global Equity Fund

For the period of October 1, 2017 through September 30, 2018, as provided by Christian McCormick, Senior Product Specialist.

Fund Insights

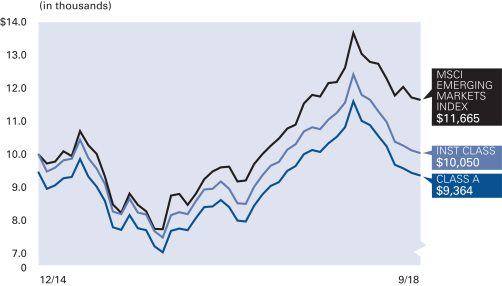

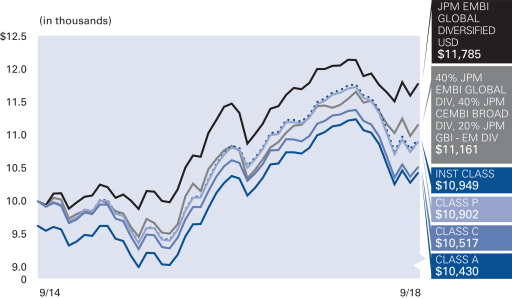

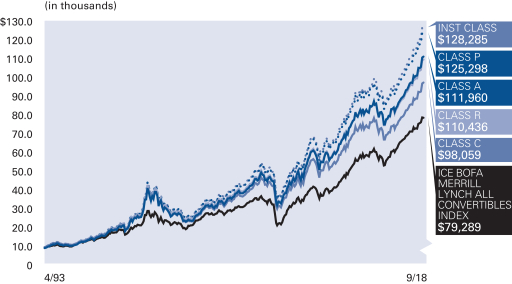

For the twelve-month period ended September 30, 2018, the Class A shares at net asset value (“NAV”) of the AllianzGI Best Styles Global Equity Fund (the “Fund”) returned 5.33%, underperforming the MSCI ACWI (the “benchmark”), which returned 9.77%.

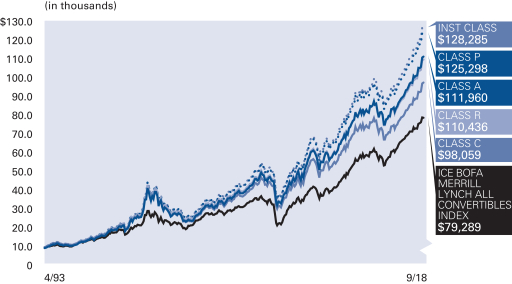

Market Overview