UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22167

Virtus Strategy Trust

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9668

(Address of principal executive offices) (Zip code)

Jennifer Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 243-1574

Date of fiscal year end: September 30

Date of reporting period: September 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

| Virtus Convertible Fund |

| Virtus Duff & Phelps Water Fund |

| Virtus Global Allocation Fund |

| Virtus International Small-Cap Fund* |

| Virtus Newfleet Short Duration High Income Fund |

| Virtus NFJ Emerging Markets Value Fund |

| Virtus NFJ Global Sustainability Fund |

| Virtus Seix High Yield Income Fund |

| 1 | ||

| 2 | ||

| 5 | ||

| Fund | Fund Summary | Schedule of Investments |

| 9 | 37 | |

| 12 | 40 | |

| 16 | 41 | |

| 20 | 48 | |

| 23 | 50 | |

| 27 | 54 | |

| 30 | 56 | |

| 33 | 57 | |

| 62 | ||

| 66 | ||

| 68 | ||

| 71 | ||

| 78 | ||

| 98 | ||

| 99 | ||

| 100 | ||

| 101 | ||

President and Trustee, Virtus Funds

November 2023

| Beginning Account Value April 1, 2023 | Ending Account Value September 30, 2023 | Annualized Expense Ratio | Expenses Paid During Period* | |||||

Convertible Fund | ||||||||

| Class A | $ 1,000.00 | $ 989.90 | 0.96 % | $ 4.79 | ||||

| Class C | 1,000.00 | 985.70 | 1.73 | 8.61 | ||||

| Class P | 1,000.00 | 990.90 | 0.71 | 3.54 | ||||

| Institutional Class | 1,000.00 | 991.10 | 0.71 | 3.54 | ||||

| Class R6 | 1,000.00 | 991.50 | 0.62 | 3.10 | ||||

| Administrative Class | 1,000.00 | 990.00 | 0.93 | 4.64 | ||||

Duff & Phelps Water Fund | ||||||||

| Class A | 1,000.00 | 937.60 | 1.22 | 5.93 | ||||

| Class C | 1,000.00 | 934.10 | 1.97 | 9.55 | ||||

| Class P | 1,000.00 | 938.70 | 0.94 | 4.57 | ||||

| Institutional Class | 1,000.00 | 939.50 | 0.93 | 4.52 | ||||

Global Allocation Fund | ||||||||

| Class A | 1,000.00 | 966.10 | 0.52 | 2.56 | ||||

| Class C | 1,000.00 | 961.70 | 1.27 | 6.25 | ||||

| Class P | 1,000.00 | 966.50 | 0.32 | 1.58 | ||||

| Institutional Class | 1,000.00 | 965.80 | 0.29 | 1.43 | ||||

| Class R6 | 1,000.00 | 966.90 | 0.22 | 1.08 | ||||

| Administrative Class | 1,000.00 | 965.50 | 0.47 | 2.32 | ||||

International Small-Cap Fund | ||||||||

| Class A | 1,000.00 | 1,031.10 | 1.29 | 6.57 | ||||

| Class C | 1,000.00 | 1,027.00 | 2.04 | 10.37 | ||||

| Class P | 1,000.00 | 1,031.90 | 1.14 | 5.81 | ||||

| Institutional Class | 1,000.00 | 1,032.40 | 1.08 | 5.50 | ||||

| Class R6 | 1,000.00 | 1,032.40 | 1.03 | 5.25 | ||||

Newfleet Short Duration High Income Fund | ||||||||

| Class A | 1,000.00 | 1,045.20 | 0.87 | 4.46 | ||||

| Class C | 1,000.00 | 1,043.70 | 1.12 | 5.74 | ||||

| Class P | 1,000.00 | 1,045.80 | 0.66 | 3.38 | ||||

| Institutional Class | 1,000.00 | 1,046.30 | 0.61 | 3.13 | ||||

| Class R6 | 1,000.00 | 1,046.70 | 0.56 | 2.87 |

| Beginning Account Value April 1, 2023 | Ending Account Value September 30, 2023 | Annualized Expense Ratio | Expenses Paid During Period* | |||||

NFJ Emerging Markets Value Fund | ||||||||

| Class A | $1,000.00 | $ 974.60 | 1.14% | $ 5.64 | ||||

| Class C | 1,000.00 | 971.00 | 1.89 | 9.34 | ||||

| Class P | 1,000.00 | 975.60 | 0.99 | 4.90 | ||||

| Institutional Class | 1,000.00 | 975.20 | 0.89 | 4.41 | ||||

NFJ Global Sustainability Fund | ||||||||

| Class A | 1,000.00 | 976.60 | 0.94 | 4.66 | ||||

| Class P | 1,000.00 | 977.70 | 0.79 | 3.92 | ||||

| Institutional Class | 1,000.00 | 977.80 | 0.69 | 3.42 | ||||

Seix High Yield Income Fund | ||||||||

| Class A | 1,000.00 | 1,037.10 | 1.16 | 5.92 | ||||

| Class C | 1,000.00 | 1,034.50 | 1.84 | 9.38 | ||||

| Class P | 1,000.00 | 1,040.20 | 0.85 | 4.35 | ||||

| Institutional | 1,000.00 | 1,038.00 | 0.87 | 4.44 | ||||

| Administrative Class | 1,000.00 | 1,038.90 | 1.04 | 5.32 |

| * | Expenses are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (183) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

| Beginning Account Value April 1, 2023 | Ending Account Value September 30, 2023 | Annualized Expense Ratio | Expenses Paid During Period* | |||||

Convertible Fund | ||||||||

| Class A | $ 1,000.00 | $ 1,020.26 | 0.96 % | $ 4.86 | ||||

| Class C | 1,000.00 | 1,016.39 | 1.73 | 8.74 | ||||

| Class P | 1,000.00 | 1,021.51 | 0.71 | 3.60 | ||||

| Institutional Class | 1,000.00 | 1,021.51 | 0.71 | 3.60 | ||||

| Class R6 | 1,000.00 | 1,021.96 | 0.62 | 3.14 | ||||

| Administrative Class | 1,000.00 | 1,020.41 | 0.93 | 4.71 | ||||

Duff & Phelps Water Fund | ||||||||

| Class A | 1,000.00 | 1,018.95 | 1.22 | 6.17 | ||||

| Class C | 1,000.00 | 1,015.19 | 1.97 | 9.95 | ||||

| Class P | 1,000.00 | 1,020.36 | 0.94 | 4.76 | ||||

| Institutional Class | 1,000.00 | 1,020.41 | 0.93 | 4.71 | ||||

Global Allocation Fund | ||||||||

| Class A | 1,000.00 | 1,022.46 | 0.52 | 2.64 | ||||

| Class C | 1,000.00 | 1,018.70 | 1.27 | 6.43 | ||||

| Class P | 1,000.00 | 1,023.46 | 0.32 | 1.62 | ||||

| Institutional Class | 1,000.00 | 1,023.61 | 0.29 | 1.47 | ||||

| Class R6 | 1,000.00 | 1,023.97 | 0.22 | 1.12 | ||||

| Administrative Class | 1,000.00 | 1,022.71 | 0.47 | 2.38 |

| Beginning Account Value April 1, 2023 | Ending Account Value September 30, 2023 | Annualized Expense Ratio | Expenses Paid During Period* | |||||

International Small-Cap Fund | ||||||||

| Class A | $1,000.00 | $1,018.60 | 1.29% | $ 6.53 | ||||

| Class C | 1,000.00 | 1,014.84 | 2.04 | 10.30 | ||||

| Class P | 1,000.00 | 1,019.35 | 1.14 | 5.77 | ||||

| Institutional Class | 1,000.00 | 1,019.65 | 1.08 | 5.47 | ||||

| Class R6 | 1,000.00 | 1,019.90 | 1.03 | 5.22 | ||||

Newfleet Short Duration High Income Fund | ||||||||

| Class A | 1,000.00 | 1,020.71 | 0.87 | 4.41 | ||||

| Class C | 1,000.00 | 1,019.45 | 1.12 | 5.67 | ||||

| Class P | 1,000.00 | 1,021.76 | 0.66 | 3.35 | ||||

| Institutional Class | 1,000.00 | 1,022.01 | 0.61 | 3.09 | ||||

| Class R6 | 1,000.00 | 1,022.26 | 0.56 | 2.84 | ||||

NFJ Emerging Markets Value Fund | ||||||||

| Class A | 1,000.00 | 1,019.35 | 1.14 | 5.77 | ||||

| Class C | 1,000.00 | 1,015.59 | 1.89 | 9.55 | ||||

| Class P | 1,000.00 | 1,020.10 | 0.99 | 5.01 | ||||

| Institutional Class | 1,000.00 | 1,020.61 | 0.89 | 4.51 | ||||

NFJ Global Sustainability Fund | ||||||||

| Class A | 1,000.00 | 1,020.36 | 0.94 | 4.76 | ||||

| Class P | 1,000.00 | 1,021.11 | 0.79 | 4.00 | ||||

| Institutional Class | 1,000.00 | 1,021.61 | 0.69 | 3.50 | ||||

Seix High Yield Income Fund | ||||||||

| Class A | 1,000.00 | 1,019.25 | 1.16 | 5.87 | ||||

| Class C | 1,000.00 | 1,015.84 | 1.84 | 9.30 | ||||

| Class P | 1,000.00 | 1,020.81 | 0.85 | 4.31 | ||||

| Institutional | 1,000.00 | 1,020.71 | 0.87 | 4.41 | ||||

| Administrative Class | 1,000.00 | 1,019.85 | 1.04 | 5.27 |

| * | Expenses are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (183) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

September 30, 2023

September 30, 2023

September 30, 2023

| Ticker Symbols: | |

| Class A : ANZAX | |

| Class C: ANZCX | |

| Class P: ANCMX | |

| Institutional Class: ANNPX | |

| Class R6: VAADX | |

| Administrative Class: ANNAX |

Voya Investment Management Co., LLC

| ■ | The Fund is diversified and has an investment objective of seeking maximum total return, consisting of capital appreciation and current income. There is no guarantee that the Fund will meet its objective. |

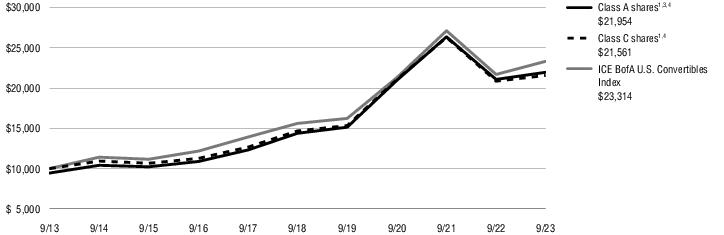

| ■ | For the fiscal year ended September 30, 2023, the Fund’s Class A shares at NAV returned 4.19%, Class C shares at NAV returned 3.37%, Class P shares at NAV returned 4.45%, Institutional Class shares at NAV returned 4.47%†, Class R6 shares at NAV returned 4.55% and Administrative Class shares at NAV returned 4.23%. For the fiscal year ended September 30, 2023, the ICE BofA U.S. Convertibles Index, the Fund’s style-specific benchmark appropriate for comparison, returned 7.49%. |

| Convertible Bonds and Notes | 91% | |

| Software | 14% | |

| Internet | 11 | |

| Entertainment | 6 | |

| All other Convertible Bonds and Notes | 60 | |

| Convertible Preferred Stocks | 6 | |

| Short-Term Investment | 2 | |

| Equity-Linked Note | 1 | |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||

| Class A shares at NAV2 | 4.19 % | 8.83 % | 8.79 % | — % | — | |

| Class A shares at POP3,4 | -1.54 | 7.60 | 8.18 | — | — | |

| Class C shares at NAV2 and with CDSC4 | 3.37 | 8.00 | 7.99 | — | — | |

| Class P shares at NAV2 | 4.45 | 9.10 | 9.07 | — | — | |

| Institutional Class shares at NAV2 | 4.47 5 | 9.11 | 9.11 | — | — | |

| Class R6 shares at NAV2 | 4.55 | — | — | -5.99 | 1/31/22 | |

| Administrative Class shares at NAV2 | 4.23 | 8.86 | 8.86 | — | — | |

| ICE BofA U.S. Convertibles Index | 7.49 | 8.36 | 8.83 | -4.87 6 | — | |

| Fund Expense Ratios7: Class A shares: Gross 1.10%, Net 0.97%; Class C shares: Gross 1.83%, Net 1.74%; Class P shares: Gross 0.84%, Net 0.72%; Institutional Class shares: Gross 0.84%, Net 0.72%; Class R6 shares: Gross 0.84%, Net 0.63%; Administrative Class shares: Gross 1.17%, Net 0.94%. | ||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | Total Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and semiannual report. |

| 6 | The since inception index return is from the inception date of Class R6 shares. |

| 7 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 27, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A : AWTAX | |

| Class C: AWTCX | |

| Class P: AWTPX | |

| Institutional Class: AWTIX |

Duff & Phelps Investment Management Co.

| ■ | The Fund is non-diversified and has an investment objective of seeking long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

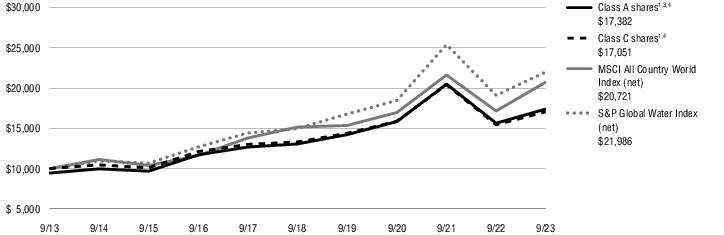

| ■ | For the fiscal year ended September 30, 2023, the Fund’s Class A shares at NAV returned 11.17%, Class C shares at NAV returned 10.40%, Class P shares at NAV returned 11.53%, and Institutional Class shares at NAV returned 11.55%. For the same period, the S&P Global Water Index (net), the Fund’s style-specific benchmark appropriate for comparison, returned 15.13% and MSCI All Country World Index (net), a broad-based index, returned 20.80%. |

| Water Utilities | 29% |

| Machinery | 20 |

| Life Sciences Tools & Services | 9 |

| Construction & Engineering | 8 |

| Commercial Services & Supplies | 7 |

| Building Products | 6 |

| Multi-Utilities | 6 |

| Trading Companies & Distributors | 5 |

| Electronic Equipment, Instruments & Components | 4 |

| Chemicals | 4 |

| Other | 2 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | ||

| Class A shares at NAV2 | 11.17 % | 5.88% | 6.28% | |

| Class A shares at POP3,4 | 5.06 | 4.69 | 5.68 | |

| Class C shares at NAV2 and with CDSC4 | 10.40 | 5.08 | 5.48 | |

| Class P shares at NAV2 | 11.53 | 6.17 | 6.57 | |

| Institutional Class shares at NAV2 | 11.55 | 6.19 | 6.59 | |

| MSCI All Country World Index (net) | 20.80 | 6.46 | 7.56 | |

| S&P Global Water Index (net) | 15.13 | 7.98 | 8.20 | |

| Fund Expense Ratios5: Class A shares: Gross 1.48%, Net 1.22%; Class C shares: Gross 2.22%, Net 1.97%; Class P shares: Gross 1.19%, Net 0.94%; Institutional Class shares: Gross 1.22%, Net 0.93%. | ||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 27, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A : PALAX | |

| Class C: PALCX | |

| Class P: AGAPX | |

| Institutional Class: PALLX | |

| Class R6: AGASX | |

| Administrative Class: AGAMX |

Virtus Investment Advisers, Inc.

| ■ | The Fund is diversified and has an investment objective of seeking after-inflation capital appreciation and current income. There is no guarantee that the Fund will meet its objectives. |

| ■ | For the fiscal year ended September 30, 2023, the Fund’s Class A shares at NAV returned 9.49%, Class C shares at NAV returned 8.55%, Class P shares at NAV returned 9.71%, Institutional Class shares at NAV returned 9.64%, Class R6 shares at NAV returned 9.71%, and Administrative Class shares at NAV returned 9.56%. For the same period, the 60% MSCI All Country World Index (net) / 40% Bloomberg U.S. Aggregate Bond Index, the Fund’s style-specific benchmark appropriate for comparison, returned 12.50%, Bloomberg U.S. Aggregate Bond Index and MSCI All Country World Index (net), both broad-based indexes, returned 0.64%, and 20.80%, respectively. |

| Affiliated Mutual Funds | 24% | |

| Corporate Bonds and Notes | 17 | |

| Banks | 6% | |

| Electric Utilities | 2 | |

| Financial Services | 2 | |

| All other Corporate Bonds and Notes | 7 | |

| Exchange-Traded Funds | 16 | |

| Common Stocks | 12 | |

| Software | 1 | |

| Healthcare Providers & Services | 1 | |

| Technology Hardware, Storage & Peripherals | 1 | |

| All other Common Stocks | 9 | |

| Mortgage-Backed Securities | 11 | |

| U.S. Government Securities | 7 | |

| Asset-Backed Securities | 6 | |

| Other (includes short-term investment) | 7 | |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||

| Class A shares at NAV2 | 9.49 % | 3.35 % | 3.95 % | — % | — | |

| Class A shares at POP3,4 | 3.46 | 2.19 | 3.36 | — | — | |

| Class C shares at NAV2 and with CDSC4 | 8.55 | 2.55 | 3.16 | — | — | |

| Class P shares at NAV2 | 9.71 | 3.55 | 4.19 | — | — | |

| Institutional Class shares at NAV2 | 9.64 | 3.59 | 4.18 | — | — | |

| Class R6 shares at NAV2 | 9.71 | 3.65 | — | 4.82 | 9/8/15 | |

| Administrative Class shares at NAV2 | 9.56 | 3.69 | 4.14 | — | — | |

| 60% MSCI All Country World Index (net) / 40% Bloomberg U.S. Aggregate Bond Index | 12.50 | 4.21 | 5.18 | 5.61 5 | — | |

| MSCI All Country World Index (net) | 20.80 | 6.46 | 7.56 | 8.62 5 | — | |

| Bloomberg U.S. Aggregate Bond Index | 0.64 | 0.10 | 1.13 | 0.63 5 | — | |

| Fund Expense Ratios6: Class A shares: Gross 1.51%, Net 0.77%; Class C shares: Gross 2.28%, Net 1.52%; Class P shares: Gross 1.25%, Net 0.57%; Institutional Class shares: Gross 1.26%, Net 0.54%; Class R6 shares: Gross 1.18%, Net 0.47%; Administrative Class shares: Gross 1.48%, Net 0.72%. | ||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 27, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A : AOPAX | |

| Class C: AOPCX | |

| Class P: ALOPX | |

| Institutional Class: ALOIX | |

| Class R6: AIISX |

Virtus Investment Advisers, Inc.

| ■ | The Fund is diversified and has an investment objective of seeking maximum long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

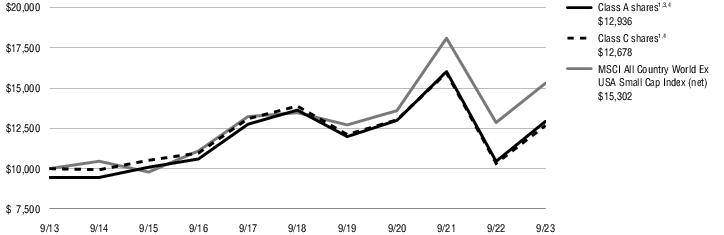

| ■ | For the fiscal year ended September 30, 2023, the Fund’s Class A shares at NAV returned 23.80%†, Class C shares at NAV returned 22.80%, Class P shares at NAV returned 24.00%, Institutional Class shares at NAV returned 24.05%†, and Class R6 shares at NAV returned 24.11%. For the same period, the MSCI All Country World Ex USA Small Cap Index (net), which serves as both the Fund’s broad-based and style-specific index appropriate for comparison, returned 19.01%. |

| Trading Companies & Distributors | 9% |

| Banks | 9 |

| Specialty Retail | 6 |

| Oil, Gas & Consumable Fuels | 6 |

| Metals & Mining | 4 |

| Machinery | 4 |

| Capital Markets | 4 |

| Insurance | 3 |

| Electronic Equipment, Instruments & Components | 3 |

| Semiconductors & Semiconductor Equipment | 3 |

| Other (includes short-term investment) | 49 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||

| Class A shares at NAV2 | 23.80 % 3 | -1.04 % | 3.19 % | — % | — | |

| Class A shares at POP4,5 | 16.99 | -2.15 | 2.61 | — | — | |

| Class C shares at NAV2 and with CDSC5 | 22.80 | -1.80 | 2.40 | — | — | |

| Class P shares at NAV2 | 24.00 | -0.89 | 3.35 | — | — | |

| Institutional Class shares at NAV2 | 24.05 3 | -0.83 | 3.41 | — | — | |

| Class R6 shares at NAV2 | 24.11 | -0.79 | — | 3.81 | 2/1/16 | |

| MSCI All Country World Ex USA Small Cap Index (net) | 19.01 | 2.58 | 4.35 | 6.25 6 | — | |

| Fund Expense Ratios7: Class A shares: Gross 1.79%, Net 1.26%; Class C shares: Gross 2.49%, Net 2.01%; Class P shares: Gross 1.37%, Net 1.11%; Institutional Class shares: Gross 1.47%, Net 1.05%; Class R6 shares: Gross 1.37%, Net 1.01%. | ||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | Total Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and semiannual report. |

| 4 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 5 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 6 | The since inception index return is from the inception date of Class R6 shares. |

| 7 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 27, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A : ASHAX | |

| Class C: ASHCX | |

| Class P: ASHPX | |

| Institutional Class: ASHIX | |

| Class R6: ASHSX |

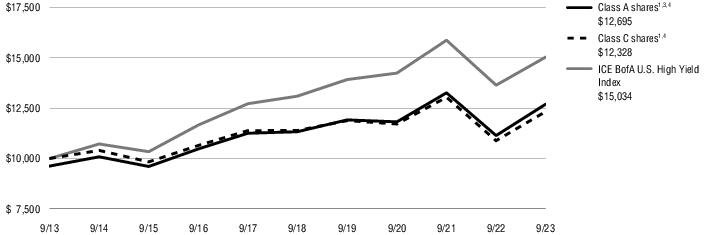

Newfleet Asset Management

| ■ | The Fund is diversified and has an investment objective of seeking a high level of current income with lower volatility than the broader high yield market. There is no guarantee that the Fund will meet its objective. |

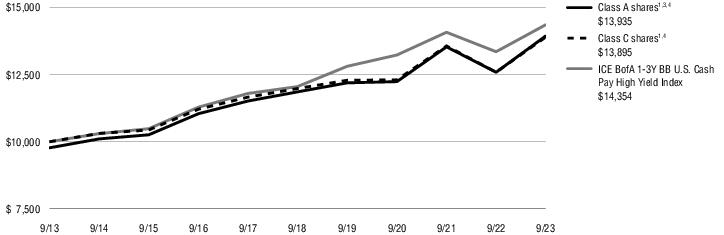

| ■ | For the fiscal year ended September 30, 2023, the Fund’s Class A shares at NAV returned 10.70%, Class C shares at NAV returned 10.37%, Class P shares at NAV returned 10.92%, Institutional Class shares at NAV returned 10.93%, and Class R6 shares at NAV returned 11.00%. For the same period, the ICE BofA 1-3 Year BB U.S. Cash Pay High Yield Index, the Fund’s style-specific benchmark appropriate for comparison, returned 7.50%. |

| Corporate Bonds and Notes | 88% | |

| Industrials | 15% | |

| Energy | 14 | |

| Consumer Discretionary | 13 | |

| All other Corporate Bonds and Notes | 46 | |

| Leveraged Loans | 11 | |

| Other | 1 | |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | Since inception | Inception date | ||

| Class A shares at NAV2 | 10.70 % | 3.28 % | 3.61 % | — % | — | |

| Class A shares at POP3,4 | 8.20 | 2.82 | 3.37 | — | — | |

| Class C shares at NAV2 and with CDSC4 | 10.37 | 3.01 | 3.34 | — | — | |

| Class P shares at NAV2 | 10.92 | 3.50 | 3.83 | — | — | |

| Institutional Class shares at NAV2 | 10.93 | 3.53 | 3.88 | — | — | |

| Class R6 shares at NAV2 | 11.00 | 3.60 | — | 3.66 | 2/1/17 | |

| ICE BofA 1-3 Year BB U.S. Cash Pay High Yield Index | 7.50 | 3.56 | 3.68 | 3.47 5 | — | |

| Fund Expense Ratios6: Class A shares: Gross 0.98%, Net 0.86%; Class C shares: Gross 1.24%, Net 1.11%; Class P shares: Gross 0.65%, Net 0.65%; Institutional Class shares: Gross 0.75%, Net 0.60%; Class R6 shares: Gross 0.66%, Net 0.55%. | ||||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 2.25% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The since inception index return is from the inception date of Class R6 shares. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 27, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A : AZMAX | |

| Class C: AZMCX | |

| Class P: AZMPX | |

| Institutional Class: AZMIX |

NFJ Investment Group, LLC

| ■ | The Fund is diversified and has an investment objective of seeking long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal year ended September 30, 2023, the Fund’s Class A shares at NAV returned 18.29%†, Class C shares at NAV returned 17.42%†, Class P shares at NAV returned 18.58%†, and Institutional Class shares at NAV returned 18.55%†. For the same period, the MSCI Emerging Markets Index (net), the Fund’s style-specific benchmark appropriate for comparison, returned 11.70%. |

| Financials | 18% |

| Information Technology | 18 |

| Consumer Discretionary | 16 |

| Industrials | 12 |

| Materials | 9 |

| Communication Services | 8 |

| Utilities | 7 |

| Other | 12 |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | ||

| Class A shares at NAV2 | 18.29 % 3 | 0.59% | 2.67% | |

| Class A shares at POP4,5 | 11.78 | -0.54 | 2.09 | |

| Class C shares at NAV2 and with CDSC5 | 17.42 3 | -0.14 | 1.91 | |

| Class P shares at NAV2 | 18.58 3 | 0.76 | 2.84 | |

| Institutional Class shares at NAV2 | 18.55 3 | 0.84 | 2.93 | |

| MSCI Emerging Markets Index (net) | 11.70 | 0.55 | 2.07 | |

| Fund Expense Ratios6: Class A shares: Gross 1.52%, Net 1.14%; Class C shares: Gross 2.24%, Net 1.89%; Class P shares: Gross 1.45%, Net 0.99%; Institutional Class shares: Gross 1.24%, Net 0.89%. | ||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | Total Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and semiannual report. |

| 4 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 5 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 27, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A : ASUAX | |

| Class P: ASTPX | |

| Institutional Class: ASTNX |

NFJ Investment Group, LLC

| ■ | The Fund is diversified and has an investment objective of seeking long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

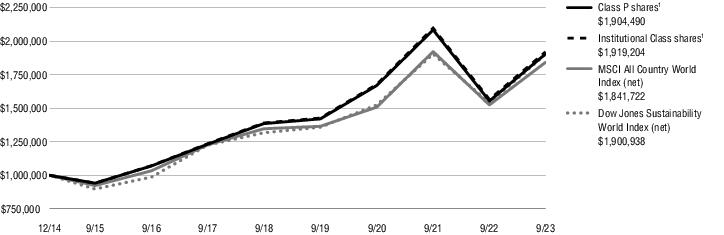

| ■ | For the fiscal year ended September 30, 2023, the Fund’s Class A shares at NAV returned 22.38%, Class P shares at NAV returned 22.61%, and Institutional Class shares at NAV returned 22.66%. For the same period, the MSCI All Country World Index (net), the Fund’s style-specific benchmark appropriate for comparison, returned 20.80% and Dow Jones Sustainability World Index (net), a broad-based index, returned 23.53%. |

| Software | 15% |

| Life Sciences Tools & Services | 11 |

| Healthcare Equipment & Supplies | 7 |

| Professional Services | 6 |

| Banks | 5 |

| Electric Utilities | 5 |

| Trading Companies & Distributors | 5 |

| Healthcare Providers & Services | 5 |

| Semiconductors & Semiconductor Equipment | 4 |

| Gas Utilities | 4 |

| Other | 33 |

| Total | 100% |

| 1 Year | 5 Years | Since inception | Inception date | ||

| Class A shares at NAV2 | 22.38 % | 6.42 % | 7.43 % | 12/9/14 | |

| Class A shares at POP3,4 | 15.65 | 5.23 | 6.74 | 12/9/14 | |

| Class P shares at NAV2 | 22.61 | 6.58 | 7.59 | 12/9/14 | |

| Institutional Class shares at NAV2 | 22.66 5 | 6.67 | 7.68 | 12/9/14 | |

| MSCI All Country World Index (net) | 20.80 | 6.46 | 7.18 6 | — | |

| Dow Jones Sustainability World Index (net) | 23.53 | 7.61 | 7.56 6 | — | |

| Fund Expense Ratios7: Class A shares: Gross 1.42%, Net 0.94%; Class P shares: Gross 1.13%, Net 0.79%; Institutional Class shares: Gross 1.06%, Net 0.69%. | |||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | Total Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and semiannual report. |

| 6 | The since inception index return is from the Fund’s inception date. |

| 7 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 27, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Ticker Symbols: | |

| Class A : AYBAX | |

| Class C: AYBCX | |

| Class P: AYBPX | |

| Institutional: AYBIX | |

| Administrative Class: AYBVX |

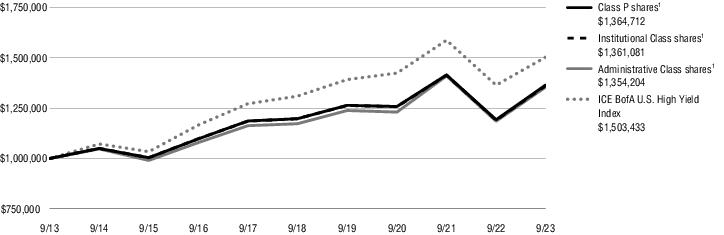

Seix Investment Advisors

| ■ | The Fund is diversified and has an investment objective of seeking a high level of current income and capital growth. There is no guarantee that the Fund will meet its objectives. |

| ■ | For the fiscal year ended September 30, 2023, the Fund’s Class A shares at NAV returned 13.95%†, Class C shares at NAV returned 13.24%†, Class P shares at NAV returned 14.42%†, Institutional Class shares at NAV returned 14.31%†, and Administrative Class shares at NAV returned 14.23%†. For the fiscal year ended September 30, 2023, the ICE BofA U.S. High Yield Index, the Fund’s style-specific benchmark appropriate for comparison, returned 10.19%. |

| Corporate Bonds and Notes | 89% | |

| Financials | 19% | |

| Consumer Discretionary | 18 | |

| Energy | 16 | |

| All other Corporate Bonds and Notes | 36 | |

| Affiliated Exchange-Traded Fund | 4 | |

| Common Stocks | 4 | |

| Preferred Stock | 2 | |

| Other (includes short-term investment) | 1 | |

| Total | 100% |

| 1 Year | 5 Years | 10 Years | ||

| Class A shares at NAV2 | 13.95 % 3 | 2.30% | 2.81% | |

| Class A shares at POP4,5 | 9.67 | 1.52 | 2.42 | |

| Class C shares at NAV2 and with CDSC5 | 13.24 3 | 1.60 | 2.12 | |

| Class P shares at NAV2 | 14.42 3 | 2.65 | 3.16 | |

| Institutional Class shares at NAV2 | 14.31 3 | 2.59 | 3.13 | |

| Administrative Class shares at NAV2 | 14.23 3 | 2.92 | 3.08 | |

| ICE BofA U.S. High Yield Index | 10.19 | 2.80 | 4.16 | |

| Fund Expense Ratios6: Class A shares: Gross 1.32%, Net 1.12%; Class C shares: Gross 1.87%, Net 1.81%; Class P shares: Gross 1.00%, Net 0.80%; Institutional Class shares: Gross 0.99%, Net 0.83%; Administrative Class shares: Gross 1.13%, Net 1.00%. | ||||

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | Total Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and semiannual report. |

| 4 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| 5 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 6 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective January 27, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

| Par Value | Value | ||

| Convertible Bonds and Notes—89.1% | |||

| Auto Manufacturers—2.4% | |||

| Ford Motor Co. 0.000%, 3/15/26(1) | $ 17,320 | $ 17,017 | |

| Lucid Group, Inc. 144A 1.250%, 12/15/26(2) | 8,275 | 4,969 | |

| Rivian Automotive, Inc. 144A 4.625%, 3/15/29(2) | 9,220 | 13,351 | |

| 35,337 | |||

| Automotive Parts & Equipment—0.6% | |||

| Luminar Technologies, Inc. 144A 1.250%, 12/15/26(2) | 12,555 | 8,217 | |

| Banks—1.9% | |||

| Barclays Bank plc 0.000%, 2/18/25(1) | 16,485 | 16,755 | |

| BofA Finance LLC 0.600%, 5/25/27 | 10,080 | 10,765 | |

| 27,520 | |||

| Biotechnology—3.1% | |||

| Alnylam Pharmaceuticals, Inc. 1.000%, 9/15/27 | 860 | 794 | |

| Apellis Pharmaceuticals, Inc. 3.500%, 9/15/26 | 2,385 | 2,950 | |

| Bridgebio Pharma, Inc. | |||

| 2.500%, 3/15/27 | 6,800 | 6,494 | |

| 2.250%, 2/1/29 | 5,450 | 4,060 | |

| Halozyme Therapeutics, Inc. 1.000%, 8/15/28 | 6,005 | 5,607 | |

| Insmed, Inc. | |||

| 1.750%, 1/15/25 | 9,940 | 9,781 | |

| 0.750%, 6/1/28 | 5,525 | 5,481 | |

| Sarepta Therapeutics, Inc. 1.250%, 9/15/27 | 8,880 | 9,918 | |

| 45,085 | |||

| Chemicals—0.3% | |||

| Livent Corp. 4.125%, 7/15/25 | 1,930 | 4,180 | |

| Commercial Services—3.8% | |||

| Affirm Holdings, Inc. 0.000%, 11/15/26(1) | 27,810 | 20,754 | |

| Block, Inc. 0.125%, 3/1/25 | 8,005 | 7,429 | |

| Repay Holdings Corp. 144A 0.000%, 2/1/26(1)(2) | 16,410 | 13,241 | |

| Shift4 Payments, Inc. 0.500%, 8/1/27 | 16,815 | 14,367 | |

| 55,791 | |||

| Computers—5.9% | |||

| CyberArk Software Ltd. 0.000%, 11/15/24(1) | 10,595 | 12,211 | |

| Par Value | Value | ||

| Computers—continued | |||

| Lumentum Holdings, Inc. 144A 1.500%, 12/15/29(2) | $ 17,645 | $ 16,039 | |

| Parsons Corp. 0.250%, 8/15/25 | 11,515 | 14,618 | |

| Seagate HDD Cayman 144A 3.500%, 6/1/28(2) | 21,230 | 21,773 | |

| Varonis Systems, Inc. 1.250%, 8/15/25 | 6,205 | 7,248 | |

| Zscaler, Inc. 0.125%, 7/1/25 | 11,850 | 14,232 | |

| 86,121 | |||

| Electric Utilities—3.3% | |||

| FirstEnergy Corp. 144A 4.000%, 5/1/26(2) | 19,035 | 18,321 | |

| Southern Co. (The) 144A 3.875%, 12/15/25(2) | 30,620 | 29,763 | |

| 48,084 | |||

| Electronics—1.3% | |||

| Advanced Energy Industries, Inc. 144A 2.500%, 9/15/28(2) | 12,695 | 12,805 | |

| Vishay Intertechnology, Inc. 144A 2.250%, 9/15/30(2) | 5,950 | 5,828 | |

| 18,633 | |||

| Energy-Alternate Sources—2.1% | |||

| Array Technologies, Inc. 1.000%, 12/1/28 | 11,970 | 13,634 | |

| Sunnova Energy International, Inc. 2.625%, 2/15/28 | 27,400 | 16,837 | |

| 30,471 | |||

| Engineering & Construction—2.2% | |||

| Fluor Corp. 144A 1.125%, 8/15/29(2) | 20,275 | 20,954 | |

| Granite Construction, Inc. 144A 3.750%, 5/15/28(2) | 10,660 | 11,178 | |

| 32,132 | |||

| Entertainment—6.0% | |||

| DraftKings Holdings, Inc. 0.000%, 3/15/28(1) | 24,150 | 18,269 | |

| IMAX Corp. 0.500%, 4/1/26 | 20,075 | 18,720 | |

| Live Nation Entertainment, Inc. | |||

| 2.000%, 2/15/25 | 20,395 | 20,772 | |

| 144A 3.125%, 1/15/29(2) | 8,550 | 8,866 | |

| Penn Entertainment, Inc. 2.750%, 5/15/26 | 3,865 | 4,691 | |

| Par Value | Value | ||

| Entertainment—continued | |||

| Vail Resorts, Inc. 0.000%, 1/1/26(1) | $ 17,090 | $ 15,039 | |

| 86,357 | |||

| Environmental Services—1.0% | |||

| Tetra Tech, Inc. 144A 2.250%, 8/15/28(2) | 14,940 | 14,716 | |

| Financial Services—2.4% | |||

| Encore Capital Group, Inc. 144A 4.000%, 3/15/29(2) | 21,365 | 20,466 | |

| JPMorgan Chase Financial Co., LLC 0.500%, 6/15/27 | 12,525 | 13,899 | |

| 34,365 | |||

| Health Care REITs—2.4% | |||

| Welltower OP LLC 144A 2.750%, 5/15/28(2) | 34,340 | 35,045 | |

| Healthcare-Products—3.0% | |||

| Alphatec Holdings, Inc. 0.750%, 8/1/26 | 8,460 | 8,106 | |

| Exact Sciences Corp. 0.375%, 3/15/27 | 21,925 | 19,842 | |

| Integer Holdings Corp. 144A 2.125%, 2/15/28(2) | 8,195 | 8,904 | |

| Natera, Inc. 2.250%, 5/1/27 | 5,390 | 7,128 | |

| 43,980 | |||

| Internet—10.8% | |||

| Booking Holdings, Inc. 0.750%, 5/1/25 | 8,445 | 14,103 | |

| Match Group Financeco 3, Inc. 144A 2.000%, 1/15/30(2) | 9,855 | 8,580 | |

| Palo Alto Networks, Inc. 0.375%, 6/1/25 | 14,905 | 35,109 | |

| Snap, Inc. 0.750%, 8/1/26 | 4,440 | 3,889 | |

| Uber Technologies, Inc. 0.000%, 12/15/25(1) | 34,685 | 32,358 | |

| Wayfair, Inc. | |||

| 1.125%, 11/1/24 | 11,380 | 11,146 | |

| 1.000%, 8/15/26 | 14,710 | 12,025 | |

| 3.250%, 9/15/27 | 9,450 | 11,378 | |

| Zillow Group, Inc. 2.750%, 5/15/25 | 27,540 | 28,270 | |

| 156,858 | |||

| Leisure Time—2.5% | |||

| Carnival Corp. 5.750%, 10/1/24 | 2,369 | 3,540 | |

| NCL Corp., Ltd. 1.125%, 2/15/27 | 23,145 | 19,153 | |

| Royal Caribbean Cruises Ltd. | |||

| 2.875%, 11/15/23 | 6,295 | 7,088 | |

| Par Value | Value | ||

| Leisure Time—continued | |||

| 6.000%, 8/15/25 | $ 3,430 | $ 6,762 | |

| 36,543 | |||

| Media—5.0% | |||

| DISH Network Corp. 0.000%, 12/15/25(1) | 7,710 | 5,146 | |

| Liberty Broadband Corp. 144A 3.125%, 3/31/53(2) | 40,870 | 42,566 | |

| Liberty Media Corp. 144A 3.750%, 3/15/28(2) | 6,595 | 7,495 | |

| Liberty Media Corp.-Liberty Formula One 2.250%, 8/15/27 | 17,240 | 16,775 | |

| 71,982 | |||

| Mining—0.4% | |||

| SSR Mining, Inc. 2.500%, 4/1/39 | 5,615 | 5,828 | |

| Miscellaneous Manufacturing—1.5% | |||

| Axon Enterprise, Inc. 144A 0.500%, 12/15/27(2) | 20,025 | 21,327 | |

| Oil, Gas & Consumable Fuels—4.5% | |||

| EQT Corp. 1.750%, 5/1/26 | 2,150 | 5,967 | |

| Nabors Industries, Inc. 144A 1.750%, 6/15/29(2) | 8,915 | 7,841 | |

| Northern Oil & Gas, Inc. 144A 3.625%, 4/15/29(2) | 17,660 | 21,815 | |

| Pioneer Natural Resources Co. 0.250%, 5/15/25 | 9,125 | 22,351 | |

| Transocean, Inc. 4.625%, 9/30/29 | 2,605 | 6,757 | |

| 64,731 | |||

| Passenger Airlines—0.3% | |||

| American Airlines Group, Inc. 6.500%, 7/1/25 | 3,965 | 4,231 | |

| Pharmaceuticals—1.7% | |||

| Amphastar Pharmaceuticals, Inc. 144A 2.000%, 3/15/29(2) | 10,635 | 10,571 | |

| Dexcom, Inc. 0.250%, 11/15/25 | 6,035 | 5,688 | |

| Mirum Pharmaceuticals, Inc. 144A 4.000%, 5/1/29(2) | 6,725 | 8,495 | |

| 24,754 | |||

| Retail—2.0% | |||

| Freshpet, Inc. 144A 3.000%, 4/1/28(2) | 10,345 | 12,238 | |

| Par Value | Value | ||

| Retail—continued | |||

| Shake Shack, Inc. 0.000%, 3/1/28(1) | $ 22,370 | $ 16,582 | |

| 28,820 | |||

| Semiconductors—4.3% | |||

| MACOM Technology Solutions Holdings, Inc. 0.250%, 3/15/26 | 9,170 | 10,417 | |

| ON Semiconductor Corp. 144A 0.500%, 3/1/29(2) | 25,065 | 27,521 | |

| SMART Global Holdings, Inc. 2.000%, 2/1/29 | 3,800 | 4,986 | |

| Veeco Instruments, Inc. 144A 2.875%, 6/1/29(2) | 4,850 | 5,711 | |

| Wolfspeed, Inc. 0.250%, 2/15/28 | 21,390 | 14,417 | |

| 63,052 | |||

| Software—13.6% | |||

| Akamai Technologies, Inc. 0.125%, 5/1/25 | 24,155 | 28,489 | |

| Bentley Systems, Inc. 0.125%, 1/15/26 | 19,310 | 18,634 | |

| BILL Holdings, Inc. | |||

| 0.000%, 12/1/25(1) | 16,170 | 16,251 | |

| 0.000%, 4/1/27(1) | 3,940 | 3,189 | |

| Confluent, Inc. 0.000%, 1/15/27(1) | 11,185 | 9,123 | |

| CSG Systems International, Inc. 144A 3.875%, 9/15/28(2) | 3,600 | 3,503 | |

| Datadog, Inc. 0.125%, 6/15/25 | 9,420 | 11,054 | |

| Envestnet, Inc. 144A 2.625%, 12/1/27(2) | 6,640 | 6,052 | |

| HubSpot, Inc. 0.375%, 6/1/25 | 6,070 | 10,817 | |

| MicroStrategy, Inc. 0.750%, 12/15/25 | 11,315 | 12,178 | |

| MongoDB, Inc. 0.250%, 1/15/26 | 7,835 | 13,390 | |

| Splunk, Inc. | |||

| 1.125%, 9/15/25 | 10,430 | 11,207 | |

| 1.125%, 6/15/27 | 13,940 | 13,152 | |

| Tyler Technologies, Inc. 0.250%, 3/15/26 | 21,885 | 21,130 | |

| Workiva, Inc. 144A 1.250%, 8/15/28(2) | 19,970 | 19,701 | |

| 197,870 | |||

| Transportation—0.8% | |||

| Air Transport Services Group, Inc. 144A 3.875%, 8/15/29(2) | 11,940 | 11,719 | |

| Total Convertible Bonds and Notes (Identified Cost $1,276,184) | 1,293,749 | ||

| Shares | Value | ||

| Convertible Preferred Stocks—6.1% | |||

| Banks—2.6% | |||

| Wells Fargo & Co. Series L, 7.500% | 34,575 | $ 38,551 | |

| Electric Utilities—0.5% | |||

| NextEra Energy, Inc., 6.926% | 193,010 | 7,302 | |

| Financial Services—1.2% | |||

| Apollo Global Management, Inc., 6.750% | 310,155 | 17,089 | |

| Machinery—1.8% | |||

| Chart Industries, Inc. Series B, 6.750% | 190,060 | 12,673 | |

| RBC Bearings, Inc. Series A, 5.000% | 123,335 | 13,581 | |

| 26,254 | |||

| Total Convertible Preferred Stocks (Identified Cost $91,690) | 89,196 | ||

| Equity-Linked Note—0.5% | |||

| Financial Services—0.5% | |||

| Goldman Sachs Finance Corp.(3) | 8,170,000 | 7,151 | |

| Total Equity-Linked Note (Identified Cost $8,275) | 7,151 | ||

| Total Long-Term Investments—95.7% (Identified Cost $1,376,149) | 1,390,096 | ||

| Short-Term Investment—2.3% | |||

| Money Market Mutual Fund—2.3% | |||

| BlackRock Liquidity FedFund - Institutional Shares (seven-day effective yield 5.236%)(4) | 33,367,110 | 33,367 | |

| Total Short-Term Investment (Identified Cost $33,367) | 33,367 | ||

| TOTAL INVESTMENTS—98.0% (Identified Cost $1,409,516) | $1,423,463 | ||

| Other assets and liabilities, net—2.0% | 29,178 | ||

| NET ASSETS—100.0% | $1,452,641 | ||

| Abbreviation: | |

| LLC | Limited Liability Company |

| Footnote Legend: | |

| (1) | Issued with a zero coupon. Income is recognized through the accretion of discount. |

| (2) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2023, these securities amounted to a value of $479,571 or 33.0% of net assets. |

| (3) | The value of this security was determined using significant unobservable inputs and is reported as a Level 3 security in the Fair Value Hierarchy table located after the Schedule of Investments. |

| (4) | Shares of this fund are publicly offered, and its prospectus and annual report are publicly available. |

| Country Weightings (Unaudited)† | |

| United States | 91% |

| Cayman Islands | 3 |

| Canada | 2 |

| Bermuda | 1 |

| United Kingdom | 1 |

| Liberia | 1 |

| Israel | 1 |

| Total | 100% |

| † % of total investments as of September 30, 2023. | |

| Total Value at September 30, 2023 | Level 1 Quoted Prices | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs | ||||

| Assets: | |||||||

| Debt Instruments: | |||||||

| Convertible Bonds and Notes | $1,293,749 | $ — | $1,293,749 | $ — | |||

| Convertible Preferred Stocks | 89,196 | 89,196 | — | — | |||

| Equity-Linked Note | 7,151 | — | — | 7,151 | |||

| Money Market Mutual Fund | 33,367 | 33,367 | — | — | |||

| Total Investments | $1,423,463 | $122,563 | $1,293,749 | $7,151 |

| Shares | Value | ||

| Common Stocks—99.4% | |||

| Brazil—2.6% | |||

| Cia de Saneamento Basico do Estado de Sao Paulo ADR | 1,250,000 | $ 15,150 | |

| Canada—3.6% | |||

| Stantec, Inc. | 321,815 | 20,881 | |

| China—1.1% | |||

| China Water Affairs Group Ltd. | 10,300,000 | 6,669 | |

| France—5.7% | |||

| Veolia Environnement S.A. | 1,158,809 | 33,606 | |

| Japan—1.5% | |||

| Kurita Water Industries Ltd. | 254,600 | 8,883 | |

| Netherlands—2.9% | |||

| Aalberts N.V. | 115,000 | 4,216 | |

| Arcadis N.V. | 283,414 | 12,765 | |

| 16,981 | |||

| Switzerland—3.1% | |||

| Geberit AG Registered Shares | 20,404 | 10,231 | |

| Georg Fischer AG Registered Shares | 144,238 | 8,139 | |

| 18,370 | |||

| United Kingdom—14.3% | |||

| Ferguson plc | 55,000 | 9,046 | |

| Halma plc | 339,532 | 8,031 | |

| Pentair plc | 149,900 | 9,706 | |

| Severn Trent plc | 1,310,990 | 37,829 | |

| United Utilities Group plc | 1,646,339 | 19,046 | |

| 83,658 | |||

| Shares | Value | ||

| United States—64.6% | |||

| Advanced Drainage Systems, Inc. | 125,200 | $ 14,252 | |

| AECOM | 143,400 | 11,908 | |

| American Water Works Co., Inc. | 363,600 | 45,025 | |

| Badger Meter, Inc. | 90,500 | 13,020 | |

| Core & Main, Inc. Class A(1) | 620,000 | 17,887 | |

| Danaher Corp. | 173,700 | 43,095 | |

| Ecolab, Inc. | 124,200 | 21,039 | |

| Essential Utilities, Inc. | 1,207,690 | 41,460 | |

| Franklin Electric Co., Inc. | 101,700 | 9,075 | |

| IDEX Corp. | 60,700 | 12,627 | |

| Lindsay Corp. | 61,500 | 7,237 | |

| Mueller Water Products, Inc. Class A | 560,800 | 7,111 | |

| SJW Group | 98,239 | 5,905 | |

| Tetra Tech, Inc. | 179,000 | 27,213 | |

| Thermo Fisher Scientific, Inc. | 24,500 | 12,401 | |

| Valmont Industries, Inc. | 48,000 | 11,530 | |

| Veralto Corp.(1) | 30,000 | 2,537 | |

| Waste Management, Inc. | 93,700 | 14,284 | |

| Xylem, Inc. | 545,904 | 49,694 | |

| Zurn Elkay Water Solutions Corp. | 424,100 | 11,883 | |

| 379,183 | |||

| Total Common Stocks (Identified Cost $444,658) | 583,381 | ||

| Total Long-Term Investments—99.4% (Identified Cost $444,658) | 583,381 | ||

| TOTAL INVESTMENTS—99.4% (Identified Cost $444,658) | $583,381 | ||

| Other assets and liabilities, net—0.6% | 3,770 | ||

| NET ASSETS—100.0% | $587,151 | ||

| Abbreviation: | |

| ADR | American Depositary Receipt |

| Footnote Legend: | |

| (1) | Non-income producing. |

| Country Weightings (Unaudited)† | |

| United States | 65% |

| United Kingdom | 14 |

| France | 6 |

| Canada | 4 |

| Switzerland | 3 |

| Netherlands | 3 |

| Brazil | 3 |

| Other | 2 |

| Total | 100% |

| † % of total investments as of September 30, 2023. | |

| Total Value at September 30, 2023 | Level 1 Quoted Prices | ||

| Assets: | |||

| Equity Securities: | |||

| Common Stocks | $583,381 | $583,381 | |

| Total Investments | $583,381 | $583,381 |

| Par Value(1) | Value | ||

| U.S. Government Securities—6.1% | |||

| Tennessee Valley Authority 1.500%, 9/15/31 | $ 775 | $ 599 | |

| U.S. Treasury Bonds | |||

| 3.250%, 5/15/42 | 2,546 | 2,029 | |

| 2.250%, 2/15/52 | 4,000 | 2,455 | |

| 3.625%, 5/15/53 | 250 | 207 | |

| U.S. Treasury Notes | |||

| 2.625%, 5/31/27 | 2,200 | 2,045 | |

| 2.875%, 5/15/32 | 2,000 | 1,755 | |

| 3.375%, 5/15/33 | 3,600 | 3,265 | |

| Total U.S. Government Securities (Identified Cost $14,548) | 12,355 | ||

| Foreign Government Security—0.9% | |||

| Japan Government Thirty Year Bond 1.400%, 9/20/52 | 300,000 JPY | 1,893 | |

| Total Foreign Government Security (Identified Cost $2,234) | 1,893 | ||

| Mortgage-Backed Securities—10.4% | |||

| Agency—7.9% | |||

| Federal Home Loan Mortgage Multiclass Certificates 2021-P009, A2 1.878%, 1/25/31 | 921 | 738 | |

| Federal National Mortgage Association ACES | |||

| 2021-M1S, A2 1.429%, 12/25/30(2) | 2,000 | 1,551 | |

| 2021-M3G, A2 1.287%, 1/25/31(2) | 1,000 | 764 | |

| 2021-M2G, A2 1.421%, 3/25/31(2) | 1,000 | 765 | |

| 2021-M2S, A2 1.868%, 10/25/31(2) | 1,000 | 780 | |

| Government National Mortgage Association II | |||

| Pool #784446 3.000%, 2/20/48 | 651 | 545 | |

| Pool #784648 3.000%, 11/20/48 | 1,489 | 1,280 | |

| Pool #BV0838 2.500%, 8/20/50 | 4,096 | 3,336 | |

| Pool #MA6985 2.000%, 11/20/50 | 978 | 747 | |

| Pool #MA7366 2.000%, 5/20/51 | 1,740 | 1,380 | |

| Pool #CK8204 3.000%, 2/20/52 | 4,723 | 3,977 | |

| 15,863 | |||

| Par Value(1) | Value | ||

| Non-Agency—2.5% | |||

| BBCMS Mortgage Trust | |||

| 2018-TALL, A (1 month Term SOFR + 0.919%, Cap N/A, Floor 0.872%) 144A 6.252%, 3/15/37(2)(3) | $ 500 | $ 463 | |

| 2018-TALL, C (1 month Term SOFR + 1.318%, Cap N/A, Floor 1.271%) 144A 6.651%, 3/15/37(2)(3) | 200 | 158 | |

| BX Trust | |||

| 2023-LIFE, A 144A 5.045%, 2/15/28(3) | 500 | 470 | |

| 2018-BILT, A (1 month Term SOFR + 1.097%, Cap N/A, Floor 0.800%) 144A 6.430%, 5/15/30(2)(3) | 1,000 | 992 | |

| DBGS Mortgage Trust 2018-BIOD, A (1 month Term SOFR + 1.099%, Cap N/A, Floor 0.803%) 144A 6.431%, 5/15/35(2)(3) | 914 | 909 | |

| Grace Trust 2020-GRCE, A 144A 2.347%, 12/10/40(3) | 1,250 | 953 | |

| SLG Office Trust 2021-OVA, A 144A 2.585%, 7/15/41(3) | 1,500 | 1,170 | |

| 5,115 | |||

| Total Mortgage-Backed Securities (Identified Cost $25,683) | 20,978 | ||

| Asset-Backed Securities—5.4% | |||

| Agency—2.9% | |||

| United States Small Business Administration | |||

| 2017-20E, 1 2.880%, 5/1/37 | 1,137 | 1,011 | |

| 2020-20G, 1 1.030%, 7/1/40 | 1,689 | 1,332 | |

| 2020-25L, 1 1.210%, 12/1/45 | 1,226 | 923 | |

| 2021-25A, 1 1.280%, 1/1/46 | 2,594 | 1,956 | |

| 2021-25B, 1 1.340%, 2/1/46 | 523 | 400 | |

| 2021-25I, 1 1.560%, 9/1/46 | 226 | 173 | |

| 5,795 | |||

| Automobiles—0.3% | |||

| Toyota Auto Receivables Owner Trust 2021-B, A3 0.260%, 11/17/25 | 542 | 527 | |

| Par Value(1) | Value | ||

| Collateralized Loan Obligations—1.2% | |||

| Flatiron CLO 17 Ltd. 2017-1A, AR (3 month Term SOFR + 1.242%, Cap N/A, Floor 0.980%) 144A 6.606%, 5/15/30(2)(3) | $ 1,245 | $ 1,240 | |

| Venture 42 CLO Ltd. 2021-42A, A1A (3 month Term SOFR + 1.392%, Cap N/A, Floor 1.130%) 144A 6.700%, 4/15/34(2)(3) | 1,220 | 1,195 | |

| 2,435 | |||

| Consumer Loans—0.7% | |||

| OneMain Financial Issuance Trust | |||

| 2021-1A, A1 144A 1.550%, 6/16/36(3) | 500 | 434 | |

| 2022-S1, A 144A 4.130%, 5/14/35(3) | 1,000 | 960 | |

| 1,394 | |||

| Equipment—0.1% | |||

| Dell Equipment Finance Trust 2021-2, A3 144A 0.530%, 12/22/26(3) | 188 | 185 | |

| Other—0.2% | |||

| Verizon Master Trust 2021-1, A 0.500%, 5/20/27 | 500 | 483 | |

| Total Asset-Backed Securities (Identified Cost $12,693) | 10,819 | ||

| Corporate Bonds and Notes—15.7% | |||

| Apparel—0.2% | |||

| Tapestry, Inc. 3.050%, 3/15/32 | 550 | 403 | |

| Auto Manufacturers—0.2% | |||

| Nissan Motor Acceptance Co. LLC 144A 7.050%, 9/15/28(3) | 435 | 435 | |

| Banks—5.3% | |||

| Bank of America Corp. | |||

| 3.384%, 4/2/26 | 425 | 407 | |

| 2.972%, 2/4/33 | 359 | 283 | |

| Barclays plc 7.437%, 11/2/33 | 825 | 847 | |

| BNP Paribas S.A. 144A 1.675%, 6/30/27(3) | 200 | 177 | |

| Citigroup, Inc. 1.281%, 11/3/25 | 940 | 888 | |

| Cooperatieve Rabobank UA 144A 1.106%, 2/24/27(3) | 750 | 666 | |

| Deutsche Bank AG 2.129%, 11/24/26 | 650 | 588 | |

| Par Value(1) | Value | ||

| Banks—continued | |||

| Fifth Third Bancorp. 1.707%, 11/1/27 | $ 525 | $ 454 | |

| Goldman Sachs Group, Inc. (The) 0.855%, 2/12/26 | 730 | 677 | |

| HSBC Holdings plc | |||

| 4.250%, 3/14/24 | 250 | 248 | |

| 2.804%, 5/24/32 | 780 | 604 | |

| JPMorgan Chase & Co. 5.350%, 6/1/34 | 185 | 175 | |

| Kreditanstalt fuer Wiederaufbau 1.000%, 10/1/26 | 1,500 | 1,340 | |

| Morgan Stanley | |||

| 4.210%, 4/20/28 | 250 | 235 | |

| Series I 0.864%, 10/21/25 | 560 | 528 | |

| Sumitomo Mitsui Financial Group, Inc. 0.508%, 1/12/24 | 428 | 422 | |

| Truist Financial Corp. 1.267%, 3/2/27 | 400 | 354 | |

| UBS AG 5.650%, 9/11/28 | 875 | 860 | |

| Wells Fargo & Co. | |||

| 2.879%, 10/30/30 | 625 | 520 | |

| 3.350%, 3/2/33 | 360 | 291 | |

| 10,564 | |||

| Biotechnology—0.3% | |||

| Amgen, Inc. | |||

| 5.150%, 3/2/28 | 300 | 295 | |

| 5.650%, 3/2/53 | 325 | 304 | |

| 599 | |||

| Commercial Services—0.2% | |||

| Ashtead Capital, Inc. 144A 4.000%, 5/1/28(3) | 475 | 432 | |

| Computers—0.2% | |||

| Leidos, Inc. 5.750%, 3/15/33 | 425 | 407 | |

| Electric Utilities—2.2% | |||

| AES Corp. (The) 5.450%, 6/1/28 | 475 | 458 | |

| DTE Electric Co. Series A 4.050%, 5/15/48 | 120 | 91 | |

| Duke Energy Florida LLC | |||

| 2.500%, 12/1/29 | 143 | 121 | |

| 2.400%, 12/15/31 | 250 | 198 | |

| Duke Energy Progress LLC 3.450%, 3/15/29 | 330 | 299 | |

| Enel Finance International N.V. 144A 5.500%, 6/15/52(3) | 575 | 477 | |

| MidAmerican Energy Co. | |||

| 3.650%, 4/15/29 | 250 | 228 | |

| 4.250%, 7/15/49 | 50 | 39 | |

| New York State Electric & Gas Corp. | |||

| 144A 5.650%, 8/15/28(3) | 150 | 149 | |

| Par Value(1) | Value | ||

| Electric Utilities—continued | |||

| 144A 2.150%, 10/1/31(3) | $ 255 | $ 190 | |

| Niagara Mohawk Power Corp. 144A 1.960%, 6/27/30(3) | 240 | 187 | |

| Northern States Power Co. 4.500%, 6/1/52 | 690 | 561 | |

| PacifiCorp. 5.350%, 12/1/53 | 650 | 539 | |

| Southern California Edison Co. 2.750%, 2/1/32 | 525 | 420 | |

| Wisconsin Public Service Corp. 2.850%, 12/1/51 | 670 | 391 | |

| 4,348 | |||

| Electronics—0.2% | |||

| Arrow Electronics, Inc. 6.125%, 3/1/26 | 300 | 299 | |

| Engineering & Construction—0.1% | |||

| Jacobs Engineering Group, Inc. 6.350%, 8/18/28 | 155 | 155 | |

| Entertainment—0.2% | |||

| Warnermedia Holdings, Inc. 5.050%, 3/15/42 | 510 | 394 | |

| Environmental Services—0.2% | |||

| Veralto Corp. 144A 5.450%, 9/18/33(3) | 440 | 426 | |

| Equity Real Estate Investment Trusts (REITs)—0.6% | |||

| AvalonBay Communities, Inc. 1.900%, 12/1/28 | 420 | 354 | |

| Boston Properties LP 3.400%, 6/21/29 | 500 | 419 | |

| Kimco Realty OP LLC 2.700%, 10/1/30 | 507 | 407 | |

| 1,180 | |||

| Financial Services—1.4% | |||

| Air Lease Corp. 5.850%, 12/15/27 | 450 | 444 | |

| American Express Co. 4.050%, 5/3/29 | 560 | 521 | |

| Capital One Financial Corp. 6.377%, 6/8/34 | 670 | 632 | |

| Charles Schwab Corp. (The) 6.136%, 8/24/34 | 425 | 414 | |

| Discover Financial Services | |||

| 4.100%, 2/9/27 | 190 | 174 | |

| 6.700%, 11/29/32 | 325 | 314 | |

| Synchrony Financial 4.375%, 3/19/24 | 375 | 370 | |

| 2,869 | |||

| Par Value(1) | Value | ||

| Food & Beverage—0.6% | |||

| Bacardi Ltd. 144A 5.250%, 1/15/29(3) | $ 665 | $ 643 | |

| PepsiCo, Inc. | |||

| 3.900%, 7/18/32 | 400 | 364 | |

| 2.875%, 10/15/49 | 200 | 131 | |

| 1,138 | |||

| Hand/Machine Tools—0.3% | |||

| Regal Rexnord Corp. 144A 6.050%, 4/15/28(3) | 675 | 657 | |

| Healthcare-Services—0.1% | |||

| HCA, Inc. 5.200%, 6/1/28 | 290 | 280 | |

| Machinery-Diversified—0.1% | |||

| Ingersoll Rand, Inc. 5.700%, 8/14/33 | 260 | 251 | |

| Multi-National—0.5% | |||

| International Bank for Reconstruction & Development (SOFR + 0.370%) 5.712%, 2/11/31(2) | 1,000 | 992 | |

| Oil, Gas & Consumable Fuels—0.2% | |||

| BP Capital Markets America, Inc. 4.893%, 9/11/33 | 450 | 423 | |

| Paper & Forest Products—0.2% | |||

| Suzano Austria GmbH 3.750%, 1/15/31 | 460 | 379 | |

| Personal Care Products—0.4% | |||

| Haleon U.S. Capital LLC 144A 3.375%, 3/24/27(3) | 250 | 232 | |

| Kenvue, Inc. 144A 5.000%, 3/22/30(3) | 500 | 487 | |

| 719 | |||

| Pharmaceuticals—0.4% | |||

| Pfizer Investment Enterprises Pte Ltd. 5.110%, 5/19/43 | 950 | 872 | |

| Pipelines—0.0% | |||

| Energy Transfer LP 6.000%, 6/15/48 | 100 | 89 | |

| Semiconductors—0.3% | |||

| NXP B.V. 2.500%, 5/11/31 | 660 | 514 | |

| Software—0.6% | |||

| Autodesk, Inc. 2.400%, 12/15/31 | 442 | 348 | |

| Concentrix Corp. 6.650%, 8/2/26 | 395 | 393 | |

| Par Value(1) | Value | ||

| Software—continued | |||

| Oracle Corp. 3.600%, 4/1/50 | $ 680 | $ 440 | |

| 1,181 | |||

| Telecommunications—0.7% | |||

| AT&T, Inc. 5.400%, 2/15/34 | 675 | 632 | |

| Sprint Capital Corp. 6.875%, 11/15/28 | 200 | 206 | |

| T-Mobile USA, Inc. 3.875%, 4/15/30 | 700 | 620 | |

| 1,458 | |||

| Total Corporate Bonds and Notes (Identified Cost $34,253) | 31,464 | ||

| Shares | ||

| Preferred Stock—0.1% | ||

| Oil, Gas & Consumable Fuels—0.1% | ||

| Petroleo Brasileiro S.A., 10.350% | 18,800 | 129 |

| Total Preferred Stock (Identified Cost $99) | 129 | |

| Common Stocks—10.8% | ||

| Automobiles—0.2% | ||

| Tesla, Inc.(4) | 915 | 229 |

| Toyota Motor Corp. | 6,900 | 124 |

| Yamaha Motor Co., Ltd. | 2,700 | 71 |

| 424 | ||

| Banks—0.7% | ||

| Bank Central Asia Tbk PT | 292,800 | 167 |

| Bank Hapoalim BM | 5,795 | 51 |

| Bank Leumi Le-Israel BM | 8,221 | 68 |

| Bank Mandiri Persero Tbk PT | 1,175,900 | 458 |

| BDO Unibank, Inc. | 42,478 | 107 |

| BOC Hong Kong Holdings Ltd. | 41,000 | 112 |

| CTBC Financial Holding Co., Ltd. | 109,000 | 83 |

| HSBC Holdings plc | 8,953 | 70 |

| ICICI Bank Ltd. Sponsored ADR | 1,973 | 46 |

| JPMorgan Chase & Co. | 1,040 | 151 |

| Sumitomo Mitsui Trust Holdings, Inc. | 1,900 | 72 |

| 1,385 | ||

| Beverages—0.2% | ||

| Anadolu Efes Biracilik Ve Malt Sanayii AS | 24,898 | 96 |

| Coca-Cola Co. (The) | 1,888 | 106 |

| Coca-Cola Icecek AS | 2,685 | 39 |

| PepsiCo, Inc. | 823 | 139 |

| Shares | Value | ||

| Beverages—continued | |||

| Sino Grandness Food Industry Group Ltd.(4)(5) | 77,400 | $ — | |

| 380 | |||

| Broadline Retail—0.0% | |||

| Amazon.com, Inc.(4) | 393 | 50 | |

| Building Products—0.6% | |||

| Carrier Global Corp. | 5,052 | 279 | |

| Daikin Industries Ltd. | 1,300 | 204 | |

| Johnson Controls International plc | 3,687 | 196 | |

| Lennox International, Inc. | 854 | 320 | |

| Trane Technologies plc | 1,282 | 260 | |

| 1,259 | |||

| Chemicals—0.0% | |||

| Daicel Corp. | 5,500 | 46 | |

| Commercial Services & Supplies—0.1% | |||

| Waste Management, Inc. | 983 | 150 | |

| Communications Equipment—0.2% | |||

| Cisco Systems, Inc. | 7,649 | 411 | |

| Motorola Solutions, Inc. | 248 | 68 | |

| 479 | |||

| Consumer Staples Distribution & Retail—0.1% | |||

| Carrefour S.A. | 2,034 | 35 | |

| Walmart, Inc. | 1,425 | 228 | |

| 263 | |||

| Diversified Telecommunication Services—0.2% | |||

| Deutsche Telekom AG Registered Shares | 5,247 | 110 | |

| Koninklijke KPN NV | 18,677 | 62 | |

| Orange S.A. | 14,565 | 167 | |

| Swisscom AG Registered Shares | 119 | 71 | |

| Telefonica Deutschland Holding AG | 26,878 | 48 | |

| 458 | |||

| Electric Utilities—0.5% | |||

| Chubu Electric Power Co., Inc. | 37,600 | 480 | |

| Duke Energy Corp. | 899 | 79 | |

| Iberdrola S.A. | 3,124 | 35 | |

| Kansai Electric Power Co., Inc. (The) | 5,200 | 72 | |

| PG&E Corp.(4) | 19,154 | 309 | |

| 975 | |||

| Electrical Equipment—0.2% | |||

| ABB Ltd. Registered Shares | 6,999 | 251 | |

| Shares | Value | ||

| Electrical Equipment—continued | |||

| Signify N.V. | 6,294 | $ 170 | |

| 421 | |||

| Electronic Equipment, Instruments & Components—0.2% | |||

| Canon Marketing Japan, Inc. | 2,200 | 57 | |

| Delta Electronics, Inc. | 30,000 | 301 | |

| Yokogawa Electric Corp. | 3,600 | 70 | |

| 428 | |||

| Financial Services—0.1% | |||

| Visa, Inc. Class A | 1,046 | 241 | |

| Food Products—0.4% | |||

| Bunge Ltd. | 1,002 | 109 | |

| Hershey Co. (The) | 2,230 | 446 | |

| Mondelez International, Inc. Class A | 1,791 | 124 | |

| Nestle S.A. Registered Shares | 919 | 104 | |

| 783 | |||

| Gas Utilities—0.1% | |||

| Tokyo Gas Co. Ltd. | 8,100 | 184 | |

| Ground Transportation—0.2% | |||

| Hankyu Hanshin Holdings, Inc. | 8,100 | 276 | |

| Kintetsu Group Holdings Co. Ltd. | 2,100 | 60 | |

| 336 | |||

| Healthcare Providers & Services—0.9% | |||

| Cardinal Health, Inc. | 1,587 | 138 | |

| Cigna Group (The) | 2,129 | 609 | |

| DaVita, Inc.(4) | 2,949 | 279 | |

| Humana, Inc. | 728 | 354 | |

| Molina Healthcare, Inc.(4) | 800 | 262 | |

| Quest Diagnostics, Inc. | 432 | 53 | |

| UnitedHealth Group, Inc. | 358 | 180 | |

| 1,875 | |||

| Hotels, Restaurants & Leisure—0.1% | |||

| McDonald’s Corp. | 441 | 116 | |

| Household Durables—0.3% | |||

| Haseko Corp. | 2,700 | 34 | |

| PulteGroup, Inc. | 5,926 | 439 | |

| Sekisui House Ltd. | 2,900 | 58 | |

| 531 | |||

| Household Products—0.2% | |||

| Clorox Co. (The) | 2,842 | 372 | |

| Kimberly-Clark de Mexico SAB de C.V. Class A | 31,000 | 62 | |

| 434 | |||

| Shares | Value | ||

| Insurance—0.5% | |||

| Allianz SE Registered Shares | 314 | $ 75 | |

| Arch Capital Group Ltd.(4) | 3,850 | 307 | |

| Assicurazioni Generali SpA | 2,752 | 56 | |

| Chubb Ltd. | 1,037 | 216 | |

| Marsh & McLennan Cos., Inc. | 447 | 85 | |

| People’s Insurance Co. Group of China Ltd. (The) Class H | 322,000 | 116 | |

| Samsung Fire & Marine Insurance Co., Ltd. | 369 | 71 | |

| 926 | |||

| Interactive Media & Services—0.2% | |||

| Alphabet, Inc. Class A(4) | 924 | 121 | |

| Meta Platforms, Inc. Class A(4) | 783 | 235 | |

| 356 | |||

| IT Services—0.4% | |||

| Accenture plc Class A | 290 | 89 | |

| International Business Machines Corp. | 2,633 | 369 | |

| NEC Corp. | 5,600 | 310 | |

| 768 | |||

| Machinery—0.2% | |||

| Caterpillar, Inc. | 269 | 74 | |

| Ingersoll Rand, Inc. | 4,251 | 271 | |

| PACCAR, Inc. | 896 | 76 | |

| 421 | |||

| Marine Transportation—0.2% | |||

| Kuehne + Nagel International AG Registered Shares | 453 | 129 | |

| Mitsui OSK Lines Ltd. | 8,300 | 228 | |

| 357 | |||

| Mortgage Real Estate Investment Trusts (REITs)—0.1% | |||

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 6,211 | 132 | |

| Multi-Utilities—0.5% | |||

| Centrica plc | 153,983 | 290 | |

| Consolidated Edison, Inc. | 1,633 | 140 | |

| E.ON SE | 5,462 | 65 | |

| Engie S.A. | 13,677 | 210 | |

| National Grid plc | 6,791 | 81 | |

| NiSource, Inc. | 9,100 | 224 | |

| 1,010 | |||

| Shares | Value | ||

| Oil, Gas & Consumable Fuels—0.1% | |||

| Parkland Corp. | 5,400 | $ 158 | |

| Phillips 66 | 675 | 81 | |

| 239 | |||

| Pharmaceuticals—0.3% | |||

| Johnson & Johnson | 568 | 89 | |

| Merck & Co., Inc. | 2,821 | 290 | |

| Novartis AG Registered Shares | 1,530 | 157 | |

| Novo Nordisk A/S Class B | 1,263 | 115 | |

| 651 | |||

| Professional Services—0.1% | |||

| Automatic Data Processing, Inc. | 448 | 108 | |

| Booz Allen Hamilton Holding Corp. Class A | 784 | 85 | |

| 193 | |||

| Semiconductors & Semiconductor Equipment—0.3% | |||

| Broadcom, Inc. | 152 | 126 | |

| NVIDIA Corp. | 863 | 376 | |

| 502 | |||

| Software—1.1% | |||

| Adobe, Inc. (4) | 159 | 81 | |

| Cadence Design Systems, Inc.(4) | 711 | 167 | |

| Gen Digital, Inc. | 12,225 | 216 | |

| Microsoft Corp. | 2,482 | 784 | |

| Oracle Corp. | 2,376 | 252 | |

| Roper Technologies, Inc. | 947 | 459 | |

| Salesforce, Inc.(4) | 416 | 84 | |

| ServiceNow, Inc.(4) | 117 | 65 | |

| 2,108 | |||

| Specialty Retail—0.2% | |||

| AutoZone, Inc.(4) | 69 | 175 | |

| Home Depot, Inc. (The) | 360 | 109 | |

| O’Reilly Automotive, Inc.(4) | 235 | 214 | |

| 498 | |||

| Technology Hardware, Storage & Peripherals—0.7% | |||

| Apple, Inc. | 4,634 | 793 | |

| FUJIFILM Holdings Corp. | 1,279 | 74 | |

| Lite-On Technology Corp. | 35,000 | 132 | |

| Micro-Star International Co., Ltd. | 27,000 | 137 | |

| Quanta Computer, Inc. | 43,000 | 319 | |

| 1,455 | |||

| Textiles, Apparel & Luxury Goods—0.1% | |||

| Deckers Outdoor Corp.(4) | 316 | 162 | |

| Shares | Value | ||

| Trading Companies & Distributors—0.3% | |||

| ITOCHU Corp. | 5,300 | $ 192 | |

| Mitsui & Co., Ltd. | 3,400 | 123 | |

| Rexel SA | 10,149 | 229 | |

| Sojitz Corp. | 3,100 | 68 | |

| Sumitomo Corp. | 3,800 | 76 | |

| 688 | |||

| Transportation Infrastructure—0.0% | |||

| Kamigumi Co., Ltd. | 2,000 | 41 | |

| Total Common Stocks (Identified Cost $19,835) | 21,725 | ||

| Affiliated Mutual Funds—22.9% | |||

| Virtus Duff & Phelps Water Fund Institutional Shares(6)(7) | 350,002 | 6,034 | |

| Virtus NFJ Global Sustainability Fund Institutional Shares(6)(7) | 2,591,042 | 39,876 | |

| Total Affiliated Mutual Funds (Identified Cost $51,606) | 45,910 | ||

| Exchange-Traded Funds—15.4% | |||

| iShares ESG Aware MSCI USA ETF(7) | 131,711 | 12,369 | |

| iShares Trust iShares ESG Aware MSCI EAFE ETF(7) | 81,568 | 5,639 | |

| iShares, Inc. iShares ESG Aware MSCI EM ETF(7) | 67,904 | 2,056 | |

| PIMCO Enhanced Short Maturity Active ESG Exchange-Traded Fund(7) | 110,000 | 10,793 | |

| Total Exchange-Traded Funds (Identified Cost $31,589) | 30,857 | ||

| Affiliated Exchange-Traded Fund—2.1% | |||

| Capital Markets—2.1% | |||

| Virtus Duff & Phelps Clean Energy ETF(6)(7) | 244,000 | 4,170 | |

| Total Affiliated Exchange-Traded Fund (Identified Cost $4,512) | 4,170 | ||

| Total Long-Term Investments—89.8% (Identified Cost $197,052) | 180,300 | ||

| Shares | Value | ||

| Short-Term Investment—4.1% | |||

| Money Market Mutual Fund—4.1% | |||

| BlackRock Liquidity FedFund - Institutional Shares (seven-day effective yield 5.236%)(7) | 8,215,458 | $ 8,215 | |

| Total Short-Term Investment (Identified Cost $8,215) | 8,215 | ||

| TOTAL INVESTMENTS—93.9% (Identified Cost $205,267) | $188,515 | ||