Larry Spirgel Assistant Director United States Securities and Exchange Commission Division of Corporation Finance 100 F Street NE Mail Stop 3720 Washington, DC 20549-6010 |

| China Century Dragon Media, Inc. |

| | Registration Statement on Form S-1/A |

On behalf of China Century Dragon Media, Inc., a Delaware corporation (the “Company”), we hereby transmit for filing pursuant to Rule 101(a) of Regulation S-T, Pre-Effective Amendment No. 2 on Form S-1/A (“Amendment No. 2”) to the registration statement on Form S-1 that was originally filed on May 14, 2010, as amended by Amendment No. 1 filed on June 29, 2010 (“Amendment No. 1”). We are also forwarding to you via Federal Express two courtesy copies of this letter and Amendment No. 2, in a clean and marked version to show changes from the Amendment No. 1. We have been advised that changes in Amendment No. 2 compared against Amendment No. 1, as submitted herewith in electronic format, have been tagged.

Based upon the Staff’s review of Amendment No. 1, the Commission issued a comment letter dated July 8, 2010. The following consists of the Company’s responses to the Staff’s comment letter in identical numerical sequence. For the convenience of the Commission, each comment is repeated verbatim with the Company’s response immediately following.

Recent Events, page 3

| 1. | Comment: We note that the estimated value of the shell was based on similar recent public shell transactions. Please disclose whether you are only referring to prior Westpark transactions. If you are referring to transactions similar to Westpark’s WRASP process, please identify them. |

Response: The Company has revised the disclosure to indicate that the estimated value of the shell was based on similar previous WestPark transactions.

| 2. | Comment: We note that the value of the shell was derived from its good corporate standing and timely reporting status, which would allow you to list your stock on a national securities exchange and raise capital at an appropriate price per share. Please explain how these factors would enable you to accomplish those goals. In other words, explain how these benefits would not be available to you had you not conducted the share exchange with the shell and simply attempted to conduct the private placement and this registered initial public offering. |

Response: The Company has revised the disclosure to explain how these factors have enabled and will enable the company to accomplish its goals regarding the private placement and the public offering.

| 3. | Comment: Please provide more information about the nature of the services provided by Keen Dragon Group and how those cervices differed from those provided by Westpark. |

Larry Spirgel

August 24, 2010

Page 2

Response: The Company has revised the disclosure to add additional information regarding the nature of the services provided by Keen Dragon and how such services differed from those provided by WestPark.

Certain Relationships and Related Transactions, page 5

| 4. | Comment: We note your response to comment 12 of our letter dated June 11, 2010. Please include in the table the value of the retained shares and warrants by Westpark and its affiliates. Confirm that you have disclosed all benefits received by Westpark from advising CD Media BVI in the share exchange transaction. Provide in the table a total dollar amount of benefits to Westpark and its affiliates. |

| | Response: The Company has revised the table to add the value of the shares and warrants retained by WestPark and its affiliates and a total dollar amount for the benefits to WestPark and its affiliates. The Company confirms that it has disclosed all benefits received by WestPark from advising CD Media BVI in the share exchange transaction. |

| 5. | Comment: Disclose that, while WestPark and its affiliates received registration rights covering all of their company securities for a registration statement to be filed approximately six months after the current registration statement was filed, the shareholders of CD Media BVI are subject to a 24-month lockup agreement from the date of the offering on the sale of the securities they received in the share exchange. |

| | Response: The Company has revised the disclosure to indicate that the shareholders of CD Media BVI are subject to a 24-month lock-up agreement from the date of the prospectus on the sale of the securities they received in the share exchange. |

| | Corporate Structure, page 4 |

| 6. | Comment: Please disclose the shortened versions of the companies’ names in your organizational chart so that chart serves as a more meaningful reference for the narrative disclosure. |

Response: The Company has revised the disclosure to include the shortened versions of the companies’ names in the organizational chart.

Contractual Arrangements, page 6

| 7. | Comment: Please disclose whether CD Media Huizhou is a wholly foreign owned enterprise under PRC law and whether it has received a business license. Disclose CD Media Huizhou’s approved business scope. Supplementally provide us with a copy of the business license as well as an English translation of the license. |

| | Response: The Company had added disclosure to indicate that CD Media Huizhou is a WFOE and that it has received a business license. The Company also added disclosure regarding the business scope of CD Media Huizhou approved by its license and has provided a copy of the business license along with an English translation of the license as Attachment A to this letter. |

| 8. | Comment: Please explain who the original shareholders of CD Media Beijing are and whether they continue to have any relationship with the company, its officers and directors or any affiliates. Please explain what benefit the current shareholders of CD Media Beijing received from entering into the contractual arrangements and what incentives they have to continue to perform. Finally, include risk factor disclosure regarding the risk of non-performance of the contractual arrangements highlighting the fact that you have no material relationship with the shareholders of CD Media Beijing. |

Response: The Company has revised the disclosure to indicate that the equity interests of CD Media Beijing were transferred to three individuals who are officers and/or directors of the Company. The Company has also added additional risk factor disclosure in this section regarding the risk of non-performance of the contractual arrangements.

| 9. | Comment: Please explain why the annual service fee to be paid by CD Media Beijing to CD Media Huizhou has not yet been determined. Disclose when the parties expect to determine the annual service fee. Discuss what factors will be used to determine the fee, such as the annual return CD Media Huizhou expects to receive and any restrictions on the amount of CD Media Beijing’s net income that it may distribute to CD Media Huizhou. Discuss whether it is possible that the parties may decide to defer the payment of the service fee. |

Larry Spirgel

August 24, 2010

Page 3

Response: The Company has added disclosure to indicate that the annual service fee has not yet been determined and why it has not yet been determined. The Company has also added disclosure regarding the factors that will be used to determine the annual fee and that the parties may defer payment of the service fee.

| 10. | Comment: Please discuss the role of your Hong Kong subsidiary, CD Media (HK) Limited, in your organization, including with respect to your business operations and addressing PRC regulations. |

Response: The Company has added disclosure to the document to indicate that its Hong Kong subsidiary is a holding company and has no operations at this time.

Risk Factors, page 10

| 11. | Comment: Please add a risk factor regarding challenges faced, and the likelihood of receiving approval by PRC authorities for, using securities of the company (which is incorporated in the United States) as consideration in the PRC (e.g., to acquire PRC companies). |

Response: The Company has added risk factor disclosure regarding PRC government regulations governing the use of the Company’s securities as consideration in the PRC.

Risks Related To Our Corporate Structure, page 17

We rely principally on dividends and other distributions on equity..., page 18

| 12. | Comment: You refer to CD Media Huizhou as an operating subsidiary. Please disclose what operations CD Media Huizhou conducts. It appears that the only operations that CD Media Huizhou plans to conduct is providing technical and consulting services to CD Media Beijing through the exclusive business cooperation agreement. We further note that the annual service fee to be paid by CD Media Beijing to CD Media Huizhou has not been determined. Please revise this risk factor to reflect the actual operations of CD Media Huizhou and the likelihood that CD Media Huizhou would have any cash to distribute to the company. Provide a separate risk factor that discusses the risk that the company may not receive any cash from the operations of its subsidiaries or the operations of the PRC company with which it has contractual arrangements. |

Response: The Company has revised the disclosure to indicate that CD Media Huizhou is a subsidiary of the Company, rather than an operating subsidiary and to include disclosure on the operations of CD Media Huizhou. The Company has also added disclosure regarding the likelihood that CD Media Huizhou would have cash to distribute to the Company. The Company has added a risk factor discussing the risk that the company may not receive any cash from the operations of its subsidiaries or CD Media Beijing with which it has contractual arrangements.

Risks Related to Us Doing Business in China, page 19

The scope of the business license for CD Media Beijing ..., page 20

| 13. | Comment: Please disclose whether your business expansion plans as disclosed throughout the prospectus include any activities that are not covered by your business license. If so, identify those activities. |

Response: The Company has added disclosure to indicate that its current business license does not cover all of the business expansion plans described in the prospectus and has identified the activity which is not currently covered by the business license.

Recent PRC regulations relating to acquisitions of PRC companies..., page 20

| 14. | Comment: Please explain why you removed the reference to published reports relating to CSRC’s curtailment or suspension of overseas listings for Chinese private companies. |

Response: The Company removed the reference to published reports because it was unable to locate such reports after further research.

CD Media Beijing’s operation of business outside its registered address ..., page 22

Larry Spirgel

August 24, 2010

Page 4

| 15. | Comment: Please explain why you have not registered your address in Chaoyang District. |

| | Response: CD Media Beijing registered a branch at its address in the Chaoyang District on July 6, 2004. Therefore, disclosure related to the non-registration of the address in the Chaoyang District has been deleted from the prospectus. |

We face uncertainty from China’s Circular on Strengthening the Administration of Enterprise Income Tax..., page 22

| 16. | Comment: Specifically explain how Circular 698 could apply to the company and the offering. |

Response: The Company has added disclosure to explain how Circular 698 could apply to the Company and the offering.

| 17. | Comment: We note you sought the advice of PRC counsel regarding the application of and the risks associated with Circular 698. Please disclose whether PRC counsel was able to provide an opinion on the applicability of Circular 698. |

Response: The Company has included disclosure to indicate that it did not seek an opinion on the applicability of Circular 698 from its PRC counsel.

Government control of currency conversion may limit our ability to utilize our revenues, page 23

| 18. | Comment: Specifically explain how PRC governmental control of currency conversion would impact whether and how CD Media Huizhou could convert annual service fees received in Renminbi from CD Media Beijing into another currency, such as US dollars. |

Response: The Company has added disclosure to explain how and whether the PRC government’s control of currency conversion could impact CD Media Huizhou’s conversion of the annual service fee into another currency.

If we make equity compensation grants to persons who are PRC citizens..., page 24

| 19. | Comment: You disclose that you intend to adopt an equity compensation plan and make option grants to your officers and directors, most of whom are PRC citizens. Disclose whether you intend to comply with Circular 78. |

Response: The Company has added disclosure to indicate that it intends to comply with Circular 78 if it adopts an equity incentive plan.

Under the New EIT Law, we and CD Media BVI may be classified as “resident enterprises” of China for tax purposes..., page 25

| 20. | Comment: We note the uncertainty regarding whether you would be treated as a “resident enterprise” and that you are evaluating appropriate organizational changes to avoid this treatment. Please reconcile this disclosure with the information provided in your response to comment 52 in our letter dated June 11, 2010 in which you indicate the belief that the company’s offshore entities meet the qualifications of a “resident enterprise.” |

Response: The Company’s previous response to comment 52 in the Staff’s letter dated June 11, 2010 indicating that the Company meets the qualifications of a resident enterprise was only a statement of the Company’s own belief and understanding. Whether the Company would be actually be recognized as a Chinese resident enterprise is subject to the ultimate judgment of the PRC tax authority, which is still uncertain based on the authority’s current policies and practice.

Shares eligible for future sale may adversely affect the market price..., page 27

| 21. | Comment: Since the company was a shell company prior to the share exchange with CD Media BVI, please revise your discussion to reflect the restrictions of Rule 144(i) of Regulation C. |

Response: The Company has revised the disclosure to include the restrictions of Rule 144(i).

The shareholders of CD Media BVI and their designee have significant influence over us, page 28

Larry Spirgel

August 24, 2010

Page 5

| 22. | Comment: We note your response to comment 19 in our letter dated June 11, 2010. Please further explain your reference to the designee of the shareholders of CD Media BVI. For example, explain what the shareholders of CD Media BVI designated and why. |

Response: Pursuant to the share exchange agreement, the shareholders of CD Media BVI were to receive a total of 19,100,000 shares of common stock of the Company in exchange for all of the issued and outstanding shares of CD Media BVI. The shareholders chose to issue a portion of those shares to a designee who was not a shareholder of CD Media BVI, and thus had no shares to exchange, in order to satisfy an obligation owed to the designee. Additional disclosure regarding the designee has been added to the prospectus. See “Summary – Recent Events – Share Exchange.”

Use of Proceeds, page 33

| 23. | Comment: We note your disclosure that there are no restrictions on the use of proceeds from this offering for investments in CD Media Beijing. However, in the following paragraph, you discuss restrictions to the extent you need to convert the proceeds of the offering into RMB. Please clarify this disclosure and explain the extent to which you will need to convert the proceeds into RMB in order to use it for the purposes set forth in this section. In addition, explain how the prohibition on the use of registered capital to repay Renminbi loans whose proceeds have not been used could restrict the use of the offering proceeds. |

Response: The Company has added disclosure to explain the extent to which it will need to convert the proceeds of the offering into RMB in order to use it for the purposes set forth in this section and to explain how the prohibition on the use of registered capital to repay RMB loans whose proceeds have not been used could restrict the use of the offering proceeds.

| 24. | Comment: Please explain what you mean by “program operation projects” with CCTV. |

| | Response: The Company will not be using any proceeds of the offering for program operating projects and such reference has been removed from the prospectus. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 39

| 25. | Comment: We note your response to comment 24 in our letter dated June 11, 2010. Please further expand your disclosure regarding the impact of your two new customers to explain the reasons for the large purchases and why you believe that sales of this magnitude will not continue in future quarters. Tell us whether you offered special pricing or other incentives that caused the new customers and one of your existing customers to make large purchases. |

Response: Upon further analysis of the amount of revenue attributed by the two new customers, the Company realized that the two new customers instead collectively only accounted for approximately 6% of fourth quarter 2009 revenues and 3% of fiscal 2009 revenues. The previous disclosure was due to a miscalculation of the revenue attributable by these two new customers. The disclosure regarding these two customers and fourth quarter 2009 results has been removed and additional disclosure has been added with respect to the fourth quarter 2009 operating results. The Company has added disclosure to indicate that it did not offer any special pricing or other incentives to it new or existing customers to make purchases from the Company.

Factors Affecting Our Results of Operations, page 40

Our Growth Strategy, page 41

| 26. | Comment: Please describe CCTV’s restrictions on companies that purchase advertising time directly and assess whether you meet those restrictions. If you believe you meet those restrictions, explain why you have not yet purchased time directly from CCTV. Also disclose whether you have ever attempted to purchase time directly from CCTV in the past. |

| | Response: The Company has revised the disclosure to indicate that while there are no actual restrictions imposed by CCTV on companies that purchase advertising time directly from CCTV, that there are economic and inventory risks for purchasing time directly from CCTV that the Company considers in purchasing time directly from CCTV. The Company has added disclosure indicating that it made a small purchase of advertising time directly from CCTV during the six months ended June 30, 2010. |

Larry Spirgel

August 24, 2010

Page 6

| 27. | Comment: We note that your expansion into production services and the opening of a production studio will require significant amounts of capital. Since none of the proceeds of the offering are being allocated for this purpose based on your disclosure, discuss how and when you expect to be able to embark on this expansion and its expected costs. |

Response: The Company has added disclose to indicate that it has no specific plans to open a production studio and currently has no estimate for the costs it expects to incur in opening such a studio.

Sales and Marketing Expenses, page 42

General and Administrative Expenses, page 42

| 28. | Comment: We note your response to comment 27 in our letter dated June 11, 2010. However, we are unable to locate your revised disclosure. Please disclose your expectation that these categories of expenses will not increase as a percentage of revenue in future periods. |

Response: The Company has revised the disclosure to indicate that it expects Sales and Marketing expenses to remain flat or slightly decrease as a percentage of revenue and that General and Administrative Expenses to increase as a percentage of revenues in future periods.

Results of Operations, page 44

| 29. | Comment: Considering the fact that the volume of advertising sold only increased minimally, your 146% revenue increase in the first quarter of 2010 does not appear to be fully explained. Please quantify the increase in average price per minute and explain the other material factors that led to the increase. For example, the notes to your financial statements indicate that you recognized significant revenues from the sale of program rights in the first quarter. Similarly revise your disclosure with respect to cost of revenues to fully explain that increase. |

Response: The Company had added disclosure regarding the increase in the average price per minute of advertising time sold in the comparable periods and to discuss the impact of revenues from the sale of program rights in the quarter ended June 30, 2010.

| 30. | Comment: We re-issue comment 28 in our letter dated June 11, 2010. Please explain the extent to which the increases in the volume of advertising time sold by you during 2009 can be attributed to each of the following factors: increased client demand; increased advertising inventory available for you to purchase; and increased funds available to you to make advance purchases or pay deposits for advertising time. To the extent any one of these factors has been a material driver of the increases, provide insight into the underlying causes of such increase. |

| | Response: The Company has revised the disclosure to indicate the extent to which each of the factors contributed to the increases in the volume of advertising time sold during 2009. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Factors Affecting Our Results of Operations – Revenue.” |

Liquidity and Capital Resources, page 47

| 31. | Comment: Please disclose the terms of the related party loans received in the first quarter of 2010. Also explain the purpose of each of these transactions, when you expect to repay these loans and the extent to which you intend to rely on related party financing in the future. |

| | Response: The Company has added disclosure to indicate the terms of the related party loans received in the first quarter of 2010 and repaid the loan in the second quarter of 2010. |

Contractual Obligations, page 48

| 32. | Comment: Throughout your prospectus, you disclose that you may make partial advance payments and/or deposits when you purchase advertising time. We also note that you reference contracts for remaining payments in your response to comment 50 in our letter dated June 11, 2010. Please explain to us why there were no additional obligations for the purchase of advertising time as of December 31, 2009, despite disclosing over $7 million in prepayments and deposits on your balance sheet as of that date. Also disclose the remaining amounts you are obligated to pay under the separate 2010 contracts referenced in your response letter. |

Larry Spirgel

August 24, 2010

Page 7

Response: We pay fifteen advertising agencies varying amounts of non-refundable advance payments in order to secure the ability to purchase upcoming time slots from them. However, the contracts we have entered into with these agencies do not specify any future purchase amount. The actual purchase amount is determined at a later date using a supplement to the original contract or a new contract. These advance payments can be applied to offset future obligations when we have determined the actual purchase amount for time slots. Since there are no specific contract amounts specifying future purchase, we do not have any additional obligations beyond the advance payments to disclose at year end. These advance payments are non-refundable, as they represent the minimum time that we are required to purchase during the upcoming year.

Quarterly Information, page 48

| 33. | Comment: We note that two large clients accounted for $15.2 million in revenue in the fourth quarter of 2009. Since this amounts to over 40% of your revenues in the fourth quarter and over 20% of full-year 2009 revenues, please identify these clients and describe the terms of your relationships with them. |

Response: The Company has removed the disclosure regarding the two customers. These two customers collectively only accounted for approximately 6% of fourth quarter 2009 revenues and 3% of 2009 revenues. The Company has added additional disclosure regarding the increase in results of operations for the quarter ended December 31, 2009.

Description of Business, page 51

| 34. | Comment: We note your response to comment 34 in our letter dated June 11, 2010. However, we are unable to locate any revised disclosure either in this section or the MD&A. Please provide disclosure explaining the film production aspect of your business. |

Response: The Company has added disclosure to explain its production consulting services portion of its business. The Company has changed the title of these services to more accurately reflect the nature of the services currently provided by the Company.

| 35. | Comment: We note your revised disclosure in response to comment 38 in our letter dated June 11, 2010. Considering that your purchases are made throughout the year without restriction to a set time or schedule and that you resell your time in less than a week, it is not clear to us what the CCTV program sets listed on pages 54 and 55 represent. Please revise your disclosure to explain. |

Response: The Company has added disclosure to explain that the program sets listed on page 56 of the prospectus are examples of typical program sets offered by the Company.

Management, page 61

| 36. | Comment: The disclosure of the backgrounds of Mr. Zhang and Mr. Fu indicates that each was employed by CD Media BVI before its incorporation on March 31, 2009. Please revise. |

Response: The Company has revised the disclosures to indicate the correct employment dates for these individuals.

Certain Relationships and Related Transactions, page 66

| 37. | Comment: We note that you have identified Mr. Rappaport and Pintsopoulos as possible promoters. Please provide the disclosure required by Item 404(c) of Regulation S K for these persons. In addition, as requested in comment 42 in our letter dated June 11, 2010, please provide your analysis of why you believe that the other shareholders of the company prior to the share exchange are not promoters. |

Response: The Company has added disclosure to indicate that Mr. Rappaport and Mr. Pintspopulos did not receive any personal benefits from the Company other than the securities retained by them at the closing of the Share Exchange. Additionally, the Company has added disclosure regarding its analysis of why the other original shareholders of the company are not promoters.

Larry Spirgel

August 24, 2010

Page 8

| 38. | Comment: We note your response to comment 43 in our letter dated June 11, 2010. However, we are unable to locate any revised disclosure. Please clarify whether each of the SRKP security holders retained shares and warrants. If the share and warrant cancellations were pro rata, please confirm this through disclosure. If they were not, disclose how the relative number of cancellations were determined. |

Response: The Company has added disclosure to indicate that each of the SRKP security holders retained shares and warrants in the share exchange and to indicate how the relative number of cancellations were determined.

| 39. | Comment: Provide disclosure with respect to the two related party loans made in the first quarter of 2010 and referenced in Note 6 to the financial statements. |

Response: The Company has added disclosure regarding the two related party loans.

Legal Matters, page 80

| 40. | Comment: We note your response to comment 44 in our letter dated June 11, 2010. Please disclose that Mr. Poletti was involved in the founding of SRKP 25 and explain the nature of his interest in and connection to the company. We also note that Ms. Janine Frisco held securities prior to the share exchange and that she is identified as Mr. Poletti’s wife in the company’s most recent Form 10-K filing. Please confirm she no longer holds any securities and explain to us the circumstances of their disposition. |

Response: In August 2008, Thomas Poletti, a partner of K&L Gates LLP, and an original shareholder of SRKP 25, transferred all interest held by him, beneficial or otherwise, in SRKP 25 to Janine Frisco as her sole and separate property pursuant to a marital property settlement agreement. Ms. Frisco, effective as of the date of the Share Exchange Agreement, transferred all of her beneficial ownership in SRKP 25 to an unaffiliated third party for no consideration. Thus as of the date of the rendering of the 5.1 opinion, no direct or indirect ownership of the Company will be held by either Janine Frisco or Thomas Poletti. For this reason, we respectfully submit that no change to the Legal Matters need be made. Please note that in “Certain Transactions” the Company has disclosed the securityholdings of each shareholder of SRKP 25, including Ms. Frisco, immediately after the effectiveness of the Share Exchange. Please also note that SRKP 25 was formed and represented in connection with the share exchange and private placement financing by law firms other than K&L Gates - at no time did K&L Gates or any attorney of K&L Gates represent SRKP 25 or any entity affiliated with SRKP 25 or receive or was paid any direct or indirect benefit or remuneration benefit by SRKP 25 or any of its affiliated parties.

Note 1. Description of Business and Organization, page F-8

| 41. | Comment: Tell us how you intend to reflect the Share Exchange completed on April 30, 2010 and the related cancellation of 4,450,390 shares and 5,677,057 warrants in your financial statements for that period. Please provide us with the disclosures that you will make regarding the accounting treatment for this transaction. |

Response: The Share Exchange completed on April 30, 2010 will be accounted for as a reverse merger with CD Media (Holdings) Co., Limited as the accounting acquirer. The transaction will result in a recapitalization of SRKP 25. The cancellation of the 4,450,390 shares and 5,677,057 warrants will be treated as a contribution to capital by the shareholders of the public shell company, and will have no accounting impact (other than with respect to share and per share amounts and disclosures). All share and per share amounts will be retroactively restated to reflect the accounting for the reverse merger transaction.

The disclosures related to this transaction are included in Note 1 to the financial statements and read as follows:

On April 30, 2010, the Company completed the Share Exchange with CD Media BVI, the shareholders of CD Media BVI, CD Media HZ and CD Media Beijing. At the closing, CD Media BVI became a wholly-owned subsidiary of the Company and 100% of the issued and outstanding securities of CD Media BVI were exchanged for securities of the Company. An aggregate of 19,100,000 shares of common stock were issued to the shareholders of CD Media BVI and their designees. Prior to the closing of the Share Exchange, the stockholders of the Company agreed to the cancellation of an aggregate of 4,450,390 shares and 5,677,057 warrants to purchase shares of common stock held by them such that there were 2,646,000 shares of common stock and warrants to purchase 1,419,333 shares of common stock owned by them immediately after the Share Exchange.

Larry Spirgel

August 24, 2010

Page 9

Each warrant is entitled to purchase one share of the Company’s common stock at $0.0001 per share and expires five years from the closing of the Share Exchange. Immediately after the closing of the Share Exchange and closing of the Private Placement, the Company had outstanding 25,312,838 shares of common stock and warrants to purchase 1,419,333 shares of common stock. The Company did not have any Preferred Stock or options outstanding. The stockholders did not receive any consideration for the cancellation of the shares and warrants. The cancellation of the shares and warrants was accounted for as a contribution to capital.

Each member of the Company’s board of directors prior to the Share Exchange resigned, and Li Huihua and Fu Haiming were appointed to the board of directors of the Company, with Li Huihua serving as Chairman. Li Huihua was appointed as the Company’s Chief Executive Officer and Zhang Le was appointed as the Company’s Chief Financial Officer and Corporate Secretary. Each of these executives and directors were executives and directors of CD Media BVI and/or its subsidiaries immediately prior to the reverse merger.

Note 2. Summaries of Significant Accounting Policies, page F-9

e. Accounts receivable, page F-10

| 42. | Comment: Disclose within the second paragraph of this policy note that the company has a history of collecting 100% of its receivables, consistent with the representation provided to us in your response to comment 47. In addition, please explain to us the reasons for your success in collecting receivables. |

Response: The Company has added the following disclosure to the document:

As of June 30, 2010, December 31, 2009 and 2008, there was no allowance for doubtful accounts recorded as the Company has a history of collecting 100% of its receivables. We carefully screen the credit worthiness of our clients and do not grant credit to brand new clients.

i. Revenue recognition, page F-11

| 43. | Comment: We note your response to comment 48 in our letter dated June 11, 2010. Please address the following items: |

| · | You state that your inventory risk is a key factor in your determination that you are the primary obligor in your revenue arrangements. We note your statements at page 54 that no advertising time remained unsold at the end of March 31, 2010 and at page 55 that you typically resell your advertising time in less than one week. Based on these facts it appears to us that you do not have significant inventory risk. In order to help us better understand your revenue arrangements, please provide us with a description and timeline of an example transaction, including the process of determining which advertising time to purchase from third-party agents, the timing of acquiring the airtime including any deposits that are required, the process and timing of reselling the airtime, and the timing of the airing of the advertisements. |

| · | We note on page 55 that you conduct purchases throughout the year based on an evaluation of your and your customers’ needs. Clarify whether you obtain commitments, either formal or informal, from your customers prior to your acquisition of the advertising time. |

| · | Describe in more detail your process of seeking remedies from CCTV for defects in the advertising space. Tell us the frequency with which this occurs and the nature of the remedies obtained. |

| · | Tell us how you determine the pricing of the advertising time and bundled services sold to customers. Describe in detail the nature of the other services that you have provided during the recent fiscal periods. In this regard, we note your response to prior comment 51 that revenue from production-related services was nominal for the periods presented. |

Response: The Company has re-reviewed the issue of revenue recognition and continues to conclude that it acts as a principal in the purchase of advertising for resale and has the risks and rewards of a principal in the transaction. The Company has also reviewed the public filings of one of its China-based competitors, Charm Communications Inc., which has adopted the same accounting treatment as the Company has for a similar type of revenues. The Company does not believe that the fact that it had no unsold time at the end of the period is a pertinent factor in the evaluation of gross versus net presentation of revenue. The reason the Company has no unsold time slots at period end is because the demand for advertising time in China is at a high point and the Company is able to purchase (and re-sell) time slots that are desirable to advertisers. The Company purchases time slot rights on a non-refundable basis and is at-risk for the cost of such slots during the period that it owns such time slot rights and before they are sold to its customers. The Company is liable for such obligations without regard to whether or not it is able to sell such time slots before they expire and become worthless. Accordingly, there is a significant inventory risk in not being able to sell the time slots purchased before they expire and become worthless. Shown below is a description of a typical transaction:

Larry Spirgel

August 24, 2010

Page 10

On January 2, 2009, the Company signed a contract to purchase commercial time slots and make non-refundable advance payments to a third-party television advertising agency to purchase future time slots on a CCTV channel for the second quarter of 2009 (this is the at-risk inventory commitment date). Such purchase obligation is open-ended, but is at least equal to the amount of the advance payment, since the Company does not get a refund for the advance payments if it is unable to sell time slots equivalent to the advance payment amounts. On January 15, 2009, the Company signed a contract with the client to sell it the April 2009 monthly commercial time slots. The Company may periodically purchase additional time slots based on client demand.

The Company usually requests that its clients make a deposit payment upon signing the agreement, in amounts generally ranging from 20% to 40% of the total invoice amount.

The Company is required to make full payment for the time slots purchased two weeks before the commercial time is aired. On or around March 15, 2009, the Company made the remaining payment to the television adverting agency for the April 2009 commercial times it committed to purchase in January 2009. In turn, the Company then invoiced its clients for the remaining amount outstanding. The Company’s clients generally do not make further payment before airing the commercials. The Company then collects the remaining payment after the commercial is aired. At various period ends, the Company has significant accounts receivable, which represents a real collection risk.

As described above, the Company decides when to buy and become at risk for the payment obligation based on its judgment as to potential demand for time slots and informal indications from current or new customers. The Company also buys time slots for which it has no clear indication of interest from a customer, but which it believes it will be able to sell.

The Company’s pricing depends on the quality, ratings and target audience of the relevant television programs during which the advertisements will be broadcast, the sales prices of the Company’s competitors, general market conditions and market demand. The Company provides value-added services to clients as per their specific requirements, such as commercial time slot selection and concept suggestions to the clients for their advertisement production. The Company does not charge separately for those services. As a result, the pricing of the advertising time may be set differently under different circumstances.

The Company is responsible to ensure that the commercials are aired at the proper time and during the proper program. Although it is a rare, problems do occur due to programming errors or interruptions for various reasons, including a breaking news story, a national disaster or a major national event. If the programs on CCTV are postponed or played again to a later time due to these reasons, the related advertising time will also be delayed or replayed. However, one of the Company’s commitments to its customers is to make sure that they get what they expect to receive, and it is the Company’s responsibility to make sure that the network airs the commercials properly, since the Company, not the customer, is responsible for dealing with the network.

In summary, the Company evaluated its advertising resale business to determine whether to recognize its revenues on a gross basis or net of the costs of obtaining the associated time slots from the television stations. The Company’s determination is based upon an assessment as to whether it acts as a principal or agent when providing its services. The Company has concluded that it act as principal. Factors that support its conclusion mainly include:

| o | the Company secures the advertising media resources from television channels through third party agents and, as a result, it bears the risk of ownership and is exposed to the risk that it may not be able to sell the purchased advertising media resources; |

Larry Spirgel

August 24, 2010

Page 11

| o | the Company is able to establish the prices it charges to its customers; and |

| o | the Company is obligated to pay the television advertising agency representing the television stations regardless of the collection from its advertising customers, and, as a result, it bears the delivery and billing risks for the revenues generated with respect to the services it provides it clients. |

Based on these factors, the Company believes that recognizing revenues on a gross basis is appropriate. Accordingly, the Company’s conclusion on the accounting for revenues is unchanged and the Company believes is in accordance with US GAAP.

| · | The Company does not obtain either formal or informal commitments from its customers prior to its acquisition of the advertising time. |

| · | In rare occasions there will be a disruption of scheduled television commercial time on CCTV because of unexpected breaking news. CCTV will replay the disrupted program and the commercials along with it shortly after the disruption or on a later day. |

| · | The Company determines the pricing of the advertising time and bundled services sold to customers based on the market condition and customer demand. One key factor is the price charged by CCTV or third party agencies. The Company also provides value-added services such as suggestions or concepts to customers for their advertisement production. However, the Company does not charge separately for these services if the customer purchases television commercial times from it. |

The Company derives minimal production consulting service revenues from designing and packaging content for public service announcements.

| 44. | Comment: We note your responses to comments 49 and 50 in our letter dated June 11, 2010. Please explain in greater detail the nature of the amounts recorded as “Prepayments and deposits for advertising slot purchases” by addressing the following items: |

| · | What is the distinction between prepayments and deposits? |

| · | To whom have you made these payments? |

| · | Based on your disclosure at page 54 that no advertising time remained unsold at the end of March 31, 2010, it appears that these payments do not relate to specific blocks of advertising time. Therefore, it is unclear to us what rights you expect to receive in exchange for the payments and how and when you expect to recover these amounts. |

| · | Please clarify your response to prior comment 50. Why were new contracts required in 2010 to define the remaining payments? What rights do you expect to receive from these remaining payments? |

Response: We have revised the financial statement caption in the filing and in future filings as follows: “Advances for Advertising Slots.”

| · | Prepayments should have been categorized as advances. |

| · | As stated above, the Company pays fifteen advertising agencies varying amounts of non-refundable advance payments in order to secure the ability to purchase upcoming time slots from them. However, the contracts the Company has entered into with these agencies do not specify any future purchase amount. The actual purchase amount is determined at a later date using a supplement to the original contract or a new contract. These advance payments can be applied to offset future obligations when the Company has determined the actual purchase amount for time slots. Since there are no specific contract amounts specifying future purchases, the Company does not have any additional obligations beyond the advance payments to disclose at year end. These advance payments are non-refundable, as they represent the minimum advertising time slots that the Company is required to purchase during the upcoming year. |

Larry Spirgel

August 24, 2010

Page 12

| · | The Company receives the right to purchase the advertising time slots in the future in exchange for the payment. The Company will work with vendors to figure out more specific purchases at a later date within a year. These advance payments represent the Company’s minimum purchases and will not be refunded even if the Company subsequently decides not to make a purchase. The Company did not have unsold advertising time at March 31, 2010 because it finds buyers for all the specific advertising time that it has purchased. The Company cannot sell advertising time slots not specified by agreement with its vendors. |

| · | Since the initial contracts signed with vendors do not specify the total purchase in the future, the Company will sign a new contract or a supplement to the original contract to spell out the detailed purchase, which is normally higher than the advance amount. The advance payment is used to offset the total obligation incurred for advertising time slots purchased. The Company will make additional payments for any advertising time slots purchased with an aggregate cost in excess of the advance payment. |

Note 4. Capitalized Television Cost, page F-16

| 45. | Comment: It is unclear why you have recorded the sale of your entire interest in “Chi Dan Zhong Xin” and “Xiao Mo Dou” as revenues and costs of sales in your income statement. It appears to us that the costs previously incurred for these series represented investments in these operations rather than revenue arrangements, since you neither produced nor distributed the series. Therefore, tell us your basis in the accounting literature for your presentation of the sale of your rights in the series as revenue and costs of sales instead of a non-operating gain. In addition, quantify the amount of revenue and costs of sales recorded in the quarter ended March 31, 2010 here and in MD&A and clarify whether any revenue was recognized for these arrangements in prior periods. Also, tell us how you reflected this transaction in your statement of cash flows for the quarter ended March 31, 2010. |

Response: ASC 926 applies to all producers and distributors that own or hold rights to distribute or exploit film. A distributor is defined as an enterprise or individual that owns or holds the right to distribute films. For purposes of this literature, the definition of films includes television series and similar products. Prior to the decision to sell the series, the Company owned 60% and 35% of the television and animation series, respectively. Based on this ownership percentage, the Company meets the criteria of a distributor as defined by ASC 926. In addition, the Company also meets the criteria of a producer because of both its significant investment in the TV series and its responsibilities to help market and promote the series.

Because of the Company’s position as a producer and distributor, the Company recognized revenue and costs of sales based on ASC 926-605-25-1 and 926-605-25-11. The Company received a flat fee, which is fixed and determinable, and therefore, the Company recognized the entire amount of the fee in the period that persuasive evidence of a sale with a customer exists and the rights to the two projects were transferred to the buyer.

Note 6. Related Party Balance and Transactions, page F-17

| 46. | Comment: You state that Ms. Hailan Zhang is a shareholder of CD Media BVI. This appears inconsistent with the chart at page 6, which illustrates that CD Media BVI is wholly-owned by China Century Dragon Media, Inc. Please revise or advise. |

Response: The Company has revised the disclosure to indicate that Ms. Zhang was a former shareholder of CD Media BVI prior to the reverse merger.

Item 15. Recent sales of securities, page II-2

| 47. | Comment: We note your response to comment 53 in our letter dated June 11, 2010; however, we are unable to locate any revised disclosure. Please disclose the number of persons to whom you sold securities in each transaction. |

Response: The Company has added disclosure regarding the number of persons to whom securities were sold in each transaction.

Larry Spirgel

August 24, 2010

Page 13

Please do not hesitate to contact the undersigned at (310) 552-5086 with any questions.

Sincerely,

/s/ Melissa A. Brown, Esq.

Melissa A. Brown, Esq.

cc: Fu Haiming, China Century Dragon Media, Inc.

John J. Harrington, United States Securities and Exchange Commission

Thomas J. Poletti, Esq.

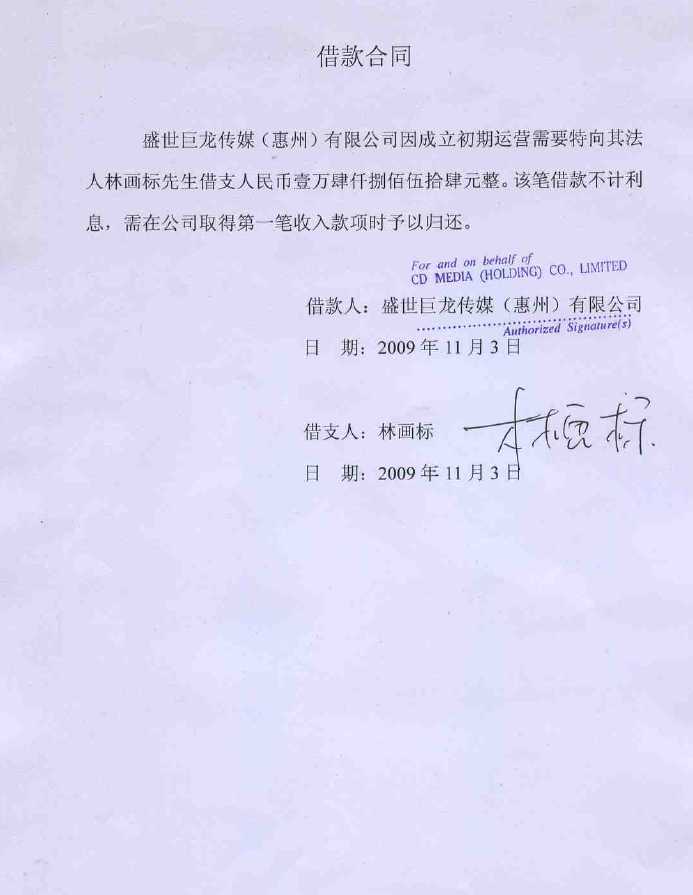

ATTACHMENT A

Business license

Registration no. 441300400031357

Incorporation date: November 2nd, 2009

Registration bureau: Huizhou Administration for Industry and Commerce

Name: Huizhou CD Media Co., Ltd. (Seriel no: 1073561)

Address: Room 801, No. 7, Wenchanger Road, Jiangbei, Huizhou City, Guangdong Province, China

Legal representative: lin hua biao

Registered capital: HKD 20,000,000

Paid-up capital: HKD 0.00

Company type: limited liability company (wholly foreign owned company)

Business scope: design, handle (as agent) and organize cultural communications (excluding news releases and advertisement making), provide cultural consulting services and to design images for advertising ( items prohibited by the law and administrative regulations are not allowed to operate)

Shareholder: CD MEDIA (HOLDING)CO. LIMITED

Operation period: from November, 2nd, 2009 to November, 2nd, 2039