/s/ Melissa A. Brown, Esq.

Melissa A. Brown, Esq.

cc: Fu Haiming, China Century Dragon Media, Inc.

| FROM: | GEORGE DUAN, CHIEF FINANCIAL OFFICER, CHINA CENTURY DRAGON MEDIA, INC. |

| SUBJECT: | REVENUE RECOGNITION: GROSS VS NET ANALYSIS |

The purpose of this memorandum is to state company’s position as to why we use the gross method of accounting to record our revenue instead of the net method.

We are in the business of purchasing and selling advertising time slots on China Central Television (CCTV). The main accounting literature related to revenue recognition, ASC 605-45, provides guidance as to whether an entity should report revenue gross or net of certain amounts paid to others.

| Ø | Indicators of Gross Revenue Reporting |

| ² | The Entity Is the Primary Obligor in the Arrangement |

45-4 “Whether a supplier or an entity is responsible for providing the product or service desired by the customer is a strong indicator of the entity’s role in the transaction. If an entity is responsible for fulfillment, that fact is a strong indicator that an entity has risks and rewards of a principal in the transaction and that it should record revenue based on the amount billed to the customer.”

We are the primary obligor in our arrangements with our customers because the customer looks to us to fulfill the agreement, provide the advertising time slots, and to ensure satisfaction, which is clearly set forth in our customer contracts. In addition, our customers are end users of the time slots. Our customers are not CCTV, nor are our vendors (the advertising companies that supply the time slots). Furthermore, we do not receive a commission, fixed or otherwise, from CCTV, nor from our vendors. We enter into specific contracts to purchase time slots from our vendors; CCTV is not a party to any contact with any of our customers or vendors. Consequently, we are not agents of our vendors, nor subagents of CCTV.

Our customer sales contracts identify us as the provider of advertising time slots and require us, as the responsible party listed in the contract, to deliver the time slots to the customers. If the time slot is not delivered, our customers look to us to make it right. If we are unable to cure the problem to our customer’s satisfaction, they will take legal action against us based on our contracts. Our customers have no contracts, agreements, understandings or otherwise with CCTV, nor with our vendors. Consequently, our customers do not have any legal rights, remedies or recourse against CCTV, nor against our vendors.

We are not matchmakers of advertising time, as are many companies in our industry, due to the following factors:

| - | We do not work for CCTV, nor for our vendors. |

| - | We do not receive any commissions whatsoever for “matching” the end user to the supplier of advertising time slots. |

| - | We do not receive payments, of any kind, from CCTV, nor from our vendors. |

| - | We have specific contracts to purchase advertising time slots. These contracts convey legal rights to us as the owner of these time slots. Our customers are not a party to our purchase contracts. |

| - | Through our sales contracts, we have the role as primary obligor and take responsibility for delivering the time slots to our customers. |

| ² | The Entity Has General Inventory Risk— Before Customer Order Is Placed or Upon Customer Return |

45-5 “Unmitigated general inventory risk is a strong indicator that an entity has risks and regards as a principal in the transaction and, therefore, that it should record revenue gross based on the amount billed to the customer.”

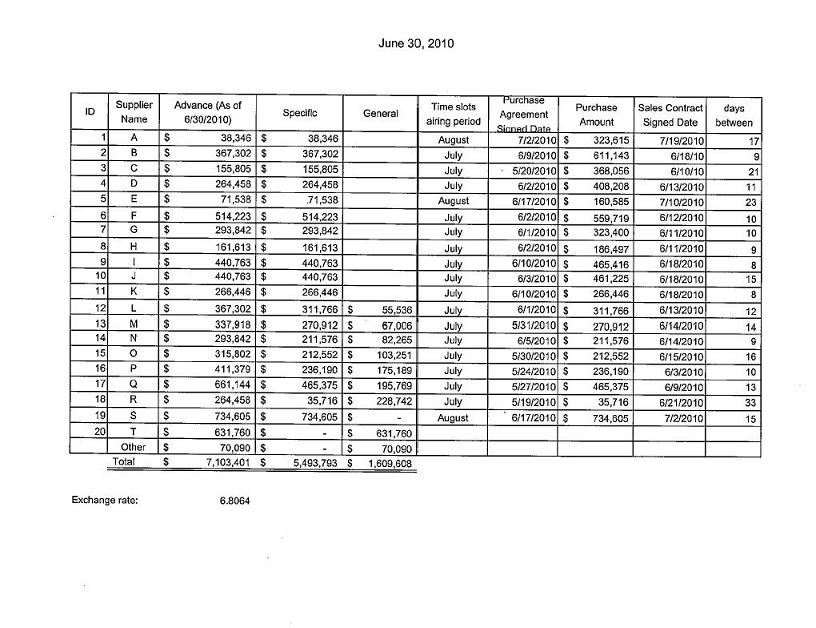

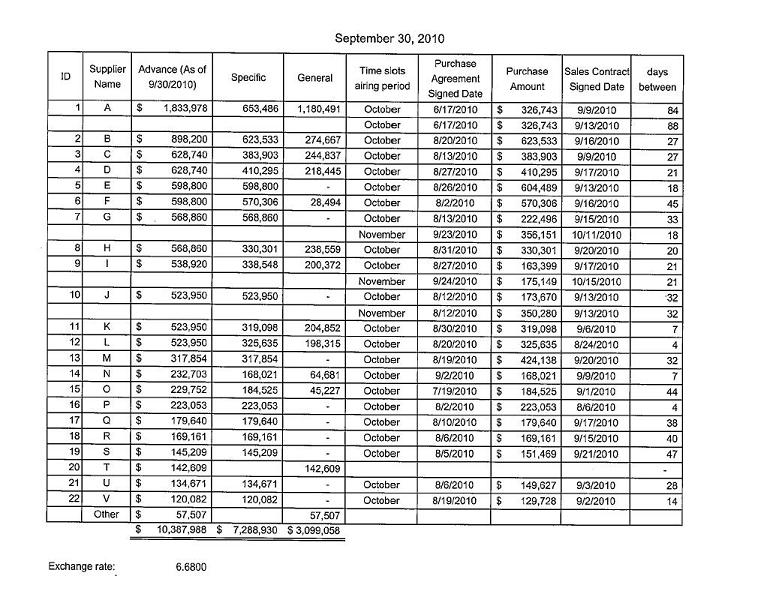

Our inventory risks are demonstrated in two ways. First, we sign general purchase agreements with our vendors, which obligate us to purchase at least a minimum amount of advertising time slots for the following year. Our risk under these contracts is unmitigated - we face penalties not only in the form of forfeited advances but also in fines or lawsuits if we do not make the purchase as contractually agreed. Advances take the form of partial or full payments to secure time slots before a specific purchase agreement is signed. Second, we sign specific purchase agreements further to the general purchase agreement whereby during the course of the year we specifically identify certain adverting time slots before we sell them to our customers. The price for these is part of the general purchase obligation but is specifically set forth in the specific purchase agreement. As an evidence of the risks we bear, in addition to loss potentially sufferable further to the general purchase agreement, we suffer loss if and when we cannot sell the advertising time slots we have purchased further to the specific purchase agreement.

Note that many other agencies in our industry earn fees of less than 5% on each sale, as they just place ads for their customers on CCTV. We have a gross margin of approximately 19%, which is primary due to the lower price we negotiate with vendors. The vendors give us the favorable price because we take significant inventory risk as a principal by signing contracts with them to purchase a significant amount of time slots in advance of sale and in advance of identification of a customer. We are under increasing cash flow pressure as time passes to meet the purchase contract target. We maintain a sales force of over 20 employees to market the time slots we have committed to purchase with our vendors. We have to demonstrate to potential customers the advantage of our time slots, and to propose a convincing cost and benefit analysis for them to use the time slots that we have purchased for their commercials. This practice is totally different from fee customers who retain a firm to look for appropriate media time slots and pay a commission.

| ² | The Entity Has Latitude in Establishing Price |

45-8 “If an entity has reasonable latitude……to establish the exchange price with a customer….that fact may indicate that the entity has risks and rewards of a principal in the transaction and that it should record revenue gross based on the amount billed to the customer.”

We have full control of establishing the price with our customers. Through negotiation and our assessment of market conditions, we price our time slots competitively and maximize our margin. Our prices are not in any way predetermined by our vendors or by CCTV.

| ² | The Entity Changes the Product or Performs Part of the Service |

Not applicable.

| ² | The Entity Is Involved in the Determination of Product or Service Specifications |

45-11 “If an entity must determine the nature, type, characteristics, or specifications of the product…ordered by the customer, that fact may indicate that the entity is primarily responsible for fulfillment and that it should record revenue gross based on the amount billed to a customer.”

We sell the commercial time slots for a package which appear in various TV programs and at different times over a weekly schedule. We obtain the rights from vendors to change the standard package that they sold us. We modify the frequency and length of the time slots or combinations of the TV programming in which the commercials appear. We are not just buying a single 15 second time slot and then turn around and sell it to our customers; we design our advertising time slot packaging in a way that is unique in the market to attract customers and avoid direct price competition from other competitors.

The Entity Has Physical Loss Inventory Risk—After Customer Order or During Shipping

Not applicable.

| ² | The Entity Has Credit Risk |

45-13 “Credit risk exists if an entity is responsible for collecting the sales price from a customer but must pay the amount owed to a supplier after the supplier performs, regardless of whether the sales price is fully collected.”

As stated above, neither our suppliers nor CCTV bear the credit risk. We are responsible for the evaluation of the creditworthiness of our customers, and we must pay our suppliers, regardless of whether our customers pay us, and we are totally and solely responsible for the collection of our accounts receivables.

| Ø | Indicators of Net Revenue Reporting |

| Ø | The Entity's Supplier Is the Primary Obligor in the Arrangement. |

See explanation above.

| Ø | The Amount the Entity Earns Is Fixed |

The price we charge our customers is never based on a fixed fee or a commission. We negotiate the price with customers individually based on the time slots sold and market conditions. The prevalent fixed commission earned by other advertising agencies is well below 5% of the purchase amount, and our gross margin is around 19%. We would not be able to earn such a high margin by acting as an agent charging fixed commissions.

| Ø | The Supplier Has Credit Risk |

Neither our suppliers nor CCTV bear the credit risk. We are responsible for evaluating the creditworthiness of our customers and collecting the accounts receivables.

Based on the above analysis of gross vs. net indicators, we have concluded that the gross indicators are stronger than the net indicators, and we have therefore recorded our revenues on a gross basis.