December 6, 2010

Via EDGAR and Overnight Delivery

United States Securities and Exchange Commission

Division of Corporation Finance

Washington, DC 20549-6010

| China Century Dragon Media, Inc. |

| | Registration Statement on Form S-1/A |

On behalf of China Century Dragon Media, Inc., a Delaware corporation (the “Company”), we hereby transmit for filing pursuant to Rule 101(a) of Regulation S-T, Pre-Effective Amendment No. 5 on Form S-1/A (“Amendment No. 5”) to the registration statement on Form S-1 that was originally filed on May 14, 2010, as amended by Amendment No. 1 filed on June 29, 2010 (“Amendment No. 1”), Amendment No. 2 filed on August 24, 2010 (“Amendment No. 2”), Amendment No. 3 filed on September 30, 2010 and Amendment No. 4 filed on October 27, 2010. We are also forwarding to you via Federal Express two courtesy copies of this letter and Amendment No. 5, in a clean and marked version to show changes from the Amendment No. 4. We have been advised that changes in Amendment No. 5 compared against Amendment No. 4, as submitted herewith in electronic format, have been tagged.

Based upon the Staff’s review of Amendment No. 4, the Commission issued a comment letter dated November 5, 2010. The following consists of the Company’s responses to the Staff’s comment letter in identical numerical sequence. For the convenience of the Commission, each comment is repeated verbatim with the Company’s response immediately following.

Contractual Arrangements, page 7

| 1. | Comment: We note your response to comment two in our letter dated October 7, 2010. In particular, we note the last paragraph in which you state that the exercise of shareholder rights and share options by CD Media Huizhou through the contractual arrangements in order to control the operations of CD Media Beijing are not business activities and therefore not subject to review from a business license perspective. Please explain to us the basis for this statement. |

Response: Investment in other companies by a company is a legal right granted to all companies by the PRC Company Law. As long as the company is incorporated pursuant to the PRC Company Law, it can invest in other companies without describing such investment as a business activity in its business scope. By exercising the share options, CD Media Huizhou will purchase the shares of CD Media Beijing which will be regarded as CD Media Huizhou’s investment in CD Media Beijing. As such, making such investment in the form of exercising share options is a legal right of CD Media Huizhou and not subject to a review from a business license perspective. By exercising the share options, CD Media Huizhou will become the shareholder of CD Media Beijing and obtain its shareholder’s right. Shareholder’s right is also a legal right of which exercise is not subject to a review from a business license perspective.

Larry Spirgel

December 6, 2010

Page 2

Capitalization, page 38

| 2. | Comment: You state that the column labeled “As Adjusted” in your capitalization table reflects the receipt of estimated net proceeds of approximately $5.7 million. Tell us where these proceeds are reflected in the table. In this regard, we note that total stockholders’ equity was adjusted by $523 thousand. |

Response: The Company has corrected the disclosure in the “as adjusted” column in the capitalization table.

| 3. | Comment: Please explain to us why the “total stockholders’ equity” and the “total capitalization” amounts for the “Actual” column are different or revise. |

Response: The Company has revised the disclosure in the “Actual” column in the capitalization section. The amounts for “total stockholder’ equity” and “total capitalization” are now equal.

Description of Business, page 55

Advertising Packages, page 58

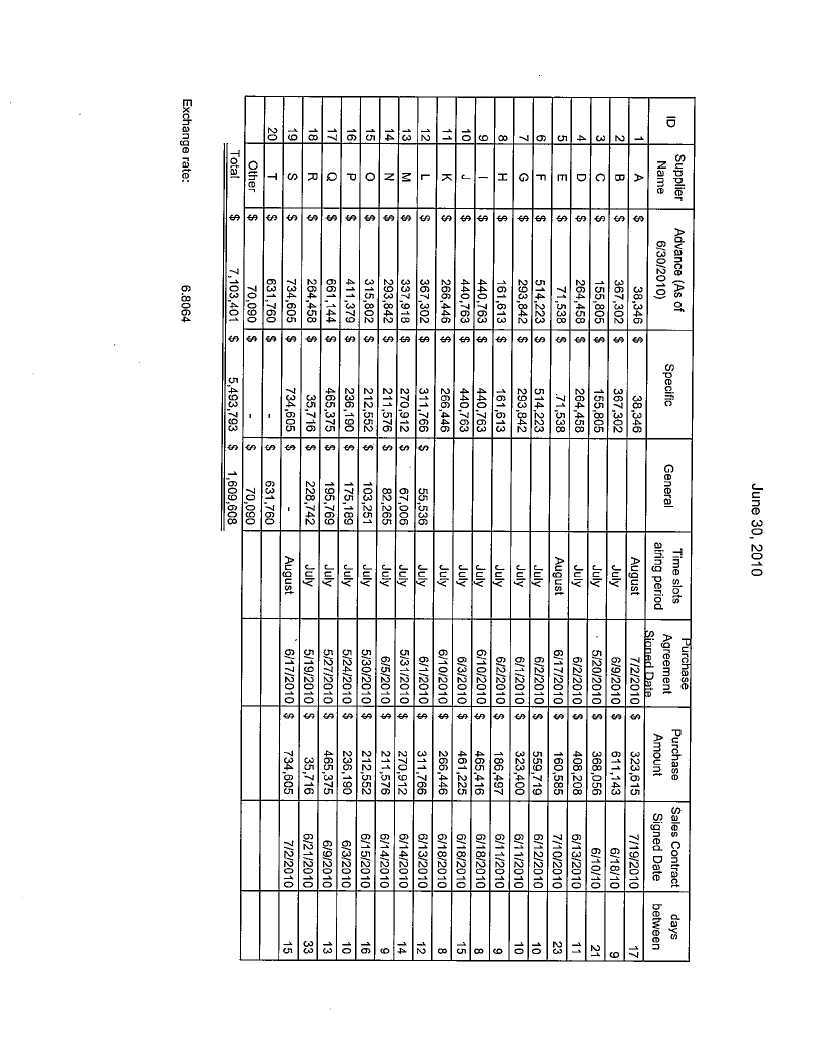

| 4. | Comment: We note your revised disclosure in response to comment six in our letter dated October 7, 2010. We continue to believe additional disclosure is required to explain what specific rights you obtain in exchange for advances which do not correspond to any specific advertising time. In other words, explain how these advances “secure the opportunity to buy the most desirable time slots.” We also note your statement in Note 4 to the financial statements that these advance payments give you “rights to purchase favorable time.” |

Response: The Company has added additional disclosure to Amendment No. 5 regarding the rights it obtains in exchange for advances.

Note 3. Summaries of Significant Accounting Policies, page F-10

j. Revenue recognition, page F-12

| 5. | Comment: It appears that, by purchasing blocks of time from agents for CCTV and then reselling the time to end customers or other agents, you are functioning by extension as an agent for CCTV. Explain to us why the company, acting as a subagent ultimately on behalf of CCTV, is not in substance also an agent for CCTV. |

Response: Please refer to the attached memorandum previously provided to the Commission.

| 6. | Comment: We note from the information provided to us in Attachment A of your letter dated October 27, 2010 that at month end the company had “specific advances — unsold” in only three of the last twelve months and the amounts of these advances were small. It also appears that these advances did not remain unsold for more than one month. In light of this information, we do not understand the rationale for your assertion that you have a high degree of inventory risk. Please explain in detail. |

Response: Please refer to the attached memorandum previously provided to the Commission.

| 7. | Comment: It appears CCTV, as the supplier of the air time for which your customers’ advertising will be televised and as the entity that is responsible for fulfilling the contracted service of televising the customer’s advertising, is the primary obligor in the television advertising arrangements that you sell. Please refer to the guidance in ASC 605-45-45-16 and advise us. |

Response: Please refer to the attached memorandum previously provided to the Commission.

Note 15. Condensed Parent Company Financial Information, page F-20

| 8. | Comment: We note your response to comment 14 from our letter dated October 7, 2010 and your added disclosure. It is not clear to us why you believe that all of the net assets of your Chinese subsidiaries are restricted. In this regard, you state that CD Media Huizhou is required to set aside only 10% of its after-tax profit each year. In addition, you have disclosed that, currently, CD Media Huizhou may convert RMB into U.S. Dollars to declare and pay dividends outside of the PRC without the approval of SAFE. Furthermore, you state at page 21 that CD Media Huizhou is restricted in its ability to transfer a portion of its net assets to you whether in the form of dividends, loans or advances. We also note that you have labeled your retained earnings of $13.9 million as “unrestricted” on your consolidated balance sheet. Please clarify these apparent inconsistencies and disclose in more detail the nature of the restrictions that cause all of the net assets of your Chinese subsidiaries to be restricted. |

Larry Spirgel

December 6, 2010

Page 3

Response: In general, PRC law allows foreign invested companies to declare and pay dividends, however, dividends can only be paid out of net profits of the Company’s direct subsidiary, CD Media Huizhou, and only when CD Media Huizhou has enough net assets to pay the dividends. During the periods presented in Amendment No. 5, substantially all of the net profits and net assets of the Company are held by CD Media Beijing, which is consolidated due to the VIE structure. As a result, dividends are restricted until such time that the Company generates net profits in its wholly-owned subsidiary, CD Media Huizhou, which will be derived from the management fees payable to CD Media Huizhou by CD Media Beijing pursuant to the Exclusive Business Cooperation Agreement.

Under applicable PRC regulations, foreign-invested enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reaches 50.0% of its registered capital. These reserves are not distributable as cash dividends. On page 21 of Amendment No. 5, the Company states that CD Media Huizhou is restricted in its ability to transfer a portion of its net assets to the Company whether in the form of dividend, loans or advances. The portion of net assets refers to the reserves.

Since substantially all the assets come from CD Media Beijing at year-end 2009, these assets cannot be distributed outside China, as CD Media Beijing is a domestic company. CD Media Huizhou did not receive any management fee payments from CD Media Beijing in 2009. It has no retained earnings which can be declared and distributed as dividends outside China. Therefore, the Company believes that all of the net assets (approximately $15,687,000) of its Chinese subsidiaries are restricted. The Company removed the "unrestricted" label on the consolidated balance sheet.

Please do not hesitate to contact the undersigned at (310) 552-5086 with any questions.

Sincerely,

/s/ Melissa A. Brown, Esq.

Melissa A. Brown, Esq.

| cc: | Fu Haiming, China Century Dragon Media, Inc. |

John J. Harrington, United States Securities and Exchange Commission

Thomas J. Poletti, Esq.

| FROM: | GEORGE DUAN, CHIEF FINANCIAL OFFICER, CHINA CENTURY DRAGON MEDIA, INC. |

| SUBJECT: | REVENUE RECOGNITION: GROSS VS NET ANALYSIS |

The purpose of this memorandum is to state company’s position as to why we use the gross method of accounting to record our revenue instead of the net method.

We are in the business of purchasing and selling advertising time slots on China Central Television (CCTV). The main accounting literature related to revenue recognition, ASC 605-45, provides guidance as to whether an entity should report revenue gross or net of certain amounts paid to others.

| | Ø | Indicators of Gross Revenue Reporting |

| ² | The Entity Is the Primary Obligor in the Arrangement |

45-4 “Whether a supplier or an entity is responsible for providing the product or service desired by the customer is a strong indicator of the entity’s role in the transaction. If an entity is responsible for fulfillment, that fact is a strong indicator that an entity has risks and rewards of a principal in the transaction and that it should record revenue based on the amount billed to the customer.”

We are the primary obligor in our arrangements with our customers because the customer looks to us to fulfill the agreement, provide the advertising time slots, and to ensure satisfaction, which is clearly set forth in our customer contracts. In addition, our customers are end users of the time slots. Our customers are not CCTV, nor are our vendors (the advertising companies that supply the time slots). Furthermore, we do not receive a commission, fixed or otherwise, from CCTV, nor from our vendors. We enter into specific contracts to purchase time slots from our vendors; CCTV is not a party to any contact with any of our customers or vendors. Consequently, we are not agents of our vendors, nor subagents of CCTV.

Our customer sales contracts identify us as the provider of advertising time slots and require us, as the responsible party listed in the contract, to deliver the time slots to the customers. If the time slot is not delivered, our customers look to us to make it right. If we are unable to cure the problem to our customer’s satisfaction, they will take legal action against us based on our contracts. Our customers have no contracts, agreements, understandings or otherwise with CCTV, nor with our vendors. Consequently, our customers do not have any legal rights, remedies or recourse against CCTV, nor against our vendors.

We are not matchmakers of advertising time, as are many companies in our industry, due to the following factors:

| | - | We do not work for CCTV, nor for our vendors. |

| | - | We do not receive any commissions whatsoever for “matching” the end user to the supplier of advertising time slots. |

| | - | We do not receive payments, of any kind, from CCTV, nor from our vendors. |

| | - | We have specific contracts to purchase advertising time slots. These contracts convey legal rights to us as the owner of these time slots. Our customers are not a party to our purchase contracts. |

| | - | Through our sales contracts, we have the role as primary obligor and take responsibility for delivering the time slots to our customers. |

| | ² | The Entity Has General Inventory Risk— Before Customer Order Is Placed or Upon Customer Return |

45-5 “Unmitigated general inventory risk is a strong indicator that an entity has risks and regards as a principal in the transaction and, therefore, that it should record revenue gross based on the amount billed to the customer.”

Our inventory risks are demonstrated in two ways. First, we sign general purchase agreements with our vendors, which obligate us to purchase at least a minimum amount of advertising time slots for the following year. Our risk under these contracts is unmitigated - we face penalties not only in the form of forfeited advances but also in fines or lawsuits if we do not make the purchase as contractually agreed. Advances take the form of partial or full payments to secure time slots before a specific purchase agreement is signed. Second, we sign specific purchase agreements further to the general purchase agreement whereby during the course of the year we specifically identify certain adverting time slots before we sell them to our customers. The price for these is part of the general purchase obligation but is specifically set forth in the specific purchase agreement. As an evidence of the risks we bear, in addition to loss potentially sufferable further to the general purchase agreement, we suffer loss if and when we cannot sell the advertising time slots we have purchased further to the specific purchase agreement.

Note that many other agencies in our industry earn fees of less than 5% on each sale, as they just place ads for their customers on CCTV. We have a gross margin of approximately 19%, which is primary due to the lower price we negotiate with vendors. The vendors give us the favorable price because we take significant inventory risk as a principal by signing contracts with them to purchase a significant amount of time slots in advance of sale and in advance of identification of a customer. We are under increasing cash flow pressure as time passes to meet the purchase contract target. We maintain a sales force of over 20 employees to market the time slots we have committed to purchase with our vendors. We have to demonstrate to potential customers the advantage of our time slots, and to propose a convincing cost and benefit analysis for them to use the time slots that we have purchased for their commercials. This practice is totally different from fee customers who retain a firm to look for appropriate media time slots and pay a commission.

| | ² | The Entity Has Latitude in Establishing Price |

45-8 “If an entity has reasonable latitude……to establish the exchange price with a customer….that fact may indicate that the entity has risks and rewards of a principal in the transaction and that it should record revenue gross based on the amount billed to the customer.”

We have full control of establishing the price with our customers. Through negotiation and our assessment of market conditions, we price our time slots competitively and maximize our margin. Our prices are not in any way predetermined by our vendors or by CCTV.

| | ² | The Entity Changes the Product or Performs Part of the Service |

Not applicable.

| | ² | The Entity Is Involved in the Determination of Product or Service Specifications |

45-11 “If an entity must determine the nature, type, characteristics, or specifications of the product…ordered by the customer, that fact may indicate that the entity is primarily responsible for fulfillment and that it should record revenue gross based on the amount billed to a customer.”

We sell the commercial time slots for a package which appear in various TV programs and at different times over a weekly schedule. We obtain the rights from vendors to change the standard package that they sold us. We modify the frequency and length of the time slots or combinations of the TV programming in which the commercials appear. We are not just buying a single 15 second time slot and then turn around and sell it to our customers; we design our advertising time slot packaging in a way that is unique in the market to attract customers and avoid direct price competition from other competitors.

The Entity Has Physical Loss Inventory Risk—After Customer Order or During Shipping

Not applicable.

| | ² | The Entity Has Credit Risk |

45-13 “Credit risk exists if an entity is responsible for collecting the sales price from a customer but must pay the amount owed to a supplier after the supplier performs, regardless of whether the sales price is fully collected.”

As stated above, neither our suppliers nor CCTV bear the credit risk. We are responsible for the evaluation of the creditworthiness of our customers, and we must pay our suppliers, regardless of whether our customers pay us, and we are totally and solely responsible for the collection of our accounts receivables.

| | Ø | Indicators of Net Revenue Reporting |

| | Ø | The Entity's Supplier Is the Primary Obligor in the Arrangement. |

See explanation above.

| | Ø | The Amount the Entity Earns Is Fixed |

The price we charge our customers is never based on a fixed fee or a commission. We negotiate the price with customers individually based on the time slots sold and market conditions. The prevalent fixed commission earned by other advertising agencies is well below 5% of the purchase amount, and our gross margin is around 19%. We would not be able to earn such a high margin by acting as an agent charging fixed commissions.

| | Ø | The Supplier Has Credit Risk |

Neither our suppliers nor CCTV bear the credit risk. We are responsible for evaluating the creditworthiness of our customers and collecting the accounts receivables.

Based on the above analysis of gross vs. net indicators, we have concluded that the gross indicators are stronger than the net indicators, and we have therefore recorded our revenues on a gross basis.