Filed by Rovi Corporation Pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Companies:

Rovi Corporation (Commission File No. 000-53413) and

TiVo Inc. (Commission File No. 000-27141)

On and after Friday, April 29, 2016, Rovi Corporation will use the following materials in connection with certain investor presentations:

April 29, 2016 Rovi to Acquire TiVo +

Safe Harbor Statement Please review our SEC filings, including forms 10-Q and 10-K Forward-Looking Statements This presentation contains "forward-looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the proposed acquisition of TiVo, the integration of TiVo’s IP assets into Rovi’s products and solutions offerings, enhanced global reach, anticipated combined company revenue, synergies and financial results, future product offerings and expected transaction timing. A number of factors could cause Rovi’s and TiVo’s actual results to differ from anticipated results expressed in such forward-looking statements. Such factors include, among others, 1) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; 2) uncertainty as to the actual premium that will be realized by TiVo stockholders in connection with the proposed transaction; 3) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Rovi and TiVo; 4) uncertainty as to the long-term value of the combined companies’ common stock; 5) unpredictability and severity of natural disasters; 6) adequacy of Rovi’s or TiVo’s risk management and loss limitation methods; 7) the resolution of intellectual property claims; 8) seasonal trends that impact consumer electronics sales; 9) the combined companies’ ability to implement their business strategy; 10) adequacy of Rovi’s, TiVo’s or the combined companies’ loss reserves; 11) retention of key executives by Rovi and TiVo; 12) intense competition from a number of sources; 13) potential loss of business from one or more major licensees; 14) general economic and market conditions; 15) the integration of businesses the combined companies may acquire or new business ventures the combined companies may start; 16) evolving legal, regulatory and tax regimes; 17) the expected amount and timing of cost savings and operating synergies; 18) failure to receive the approval of the stockholders of either Rovi or TiVo; 19) litigation related to the transaction; 20) unexpected costs, charges or expenses resulting from the transaction; and 21) other developments in the DVR and advanced television solutions market, as well as management’s response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in Rovi’s Annual Report on Form 10-K for the period ended December 31, 2015, Rovi’s Quarterly Report on Form 10-Q for the period ended March 31, 2016, TiVo’s Annual Report on Form 10-K for the period ended January 31, 2016, and other securities filings which are on file with the Securities and Exchange Commission (available at www.sec.gov). Neither company assumes any obligation to update any forward-looking statements except as required by law. No Offer or Solicitation The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information Additional Information about the Proposed Transaction and Where to Find It This communication is not a solicitation of a proxy from any stockholder of Rovi, Titan Technologies Corporation or TiVo. In connection with the Agreement and Plan of Merger among Rovi, TiVo, Titan Technologies Corporation (“Parent”), Nova Acquisition Sub, Inc. and Titan Acquisition Sub, Inc., Rovi, TiVo and Parent intend to file relevant materials with the SEC, including a Registration Statement on Form S-4 filed by Parent that will contain a joint proxy statement/prospectus. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT ROVI, TIVO, PARENT AND THE PROPOSED TRANSACTION. Stockholders may obtain a free copy of the joint proxy statement/prospectus (when it becomes available), as well as any other documents filed by Rovi, Parent and TiVo with the Securities and Exchange Commission, at the Securities and Exchange Commission’s Web site at http://www.sec.gov. Stockholders may also obtain a free copy of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus from Rovi by directing a request to Rovi Investor Relations at 818-565-5200 and from TiVo by directing a request to MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York, 10016, (212) 929-5500, proxy@mackenziepartners.com. Participants in the Solicitation Rovi, Parent, TiVo and their respective directors and executive officers and other members of their management and employees may be deemed, under Securities and Exchange Commission rules, to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding Rovi’s directors and officers can be found in its proxy statement filed with the Securities and Exchange Commission on March 10, 2016 and information regarding TiVo’s directors and officers can be found in its proxy statement filed with the Securities and Exchange Commission on June 1, 2015. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests in the transaction, by security holdings or otherwise, will be contained in the Form S-4 and the joint proxy statement/prospectus that Parent will file with the Securities and Exchange Commission when it becomes available. Stockholders may obtain a free copy of these documents as described in the preceding paragraph.

Rovi’s Non-GAAP EPS is defined as diluted earnings per share from continuing operations, adding back non-cash items such as equity-based compensation, amortization of intangibles, amortization or write-off of note issuance costs, non-cash interest expense recorded on convertible debt under Accounting Standards Codification (“ASC”) 470-20 (formerly known as FSP APB 14-1), mark-to-market fair value adjustments for interest rate swaps; as well as items which impact comparability that are required to be recorded under GAAP, but that the Company believes are not indicative of its core operating results such as changes in the fair value of contingent consideration, gains from the release of Sonic payroll tax withholding liabilities related to a stock option review, transaction, transition and integration costs, contested proxy election costs, restructuring and asset impairment (benefit) charges, payments to note holders and for expenses in connection with the early redemption or modification of debt, gains on sale of strategic investments and discrete income and franchise tax items, including changes in reserves. Adjusted EBITDA is defined as operating income excluding depreciation, amortization of intangible assets, restructuring and asset impairment charges, equity-based compensation, retention earn-outs payable to former shareholders of businesses acquired and changes in contingent consideration, contested proxy election costs, changes in franchise tax reserves and transaction, transition and integration expenses. Rovi’s Non-GAAP Information

Use and Limitations of Non-GAAP Information Rovi’s management has evaluated and made operating decisions about its business operations primarily based upon Adjusted EBITDA and Non-GAAP EPS. Management uses Adjusted EBITDA and Non-GAAP EPS as measures as they exclude items management does not consider to be “core costs” or “core proceeds” when making business decisions. Therefore, management presents these Non-GAAP financial measures along with GAAP measures. For each such Non-GAAP financial measure, the adjustment provides management with information about the Rovi's underlying operating performance that enables a more meaningful comparison of its financial results in different reporting periods. For example, since Rovi does not acquire businesses on a predictable cycle, management excludes amortization of intangibles from acquisitions, transaction costs and transition and integration costs in order to make more consistent and meaningful evaluations of Rovi's operating expenses. Management also excludes the effect of restructuring and asset impairment (benefit) charges, expenses in connection with the early redemption or modification of debt and gains on sale of strategic investments. Management excludes the impact of equity-based compensation to help it compare current period operating expenses against the operating expenses for prior periods and to eliminate the effects of this non-cash item, which, because it is based upon estimates on the grant dates, may bear little resemblance to the actual values realized upon the future exercise, expiration, termination or forfeiture of the equity-based compensation, and which, as it relates to stock options and stock purchase plan shares, is required for GAAP purposes to be estimated under valuation models, including the Black-Scholes model used by Rovi Corporation. Management excludes non-cash interest expense recorded on convertible debt under ASC 470-20 and mark-to-market fair value adjustments for interest rate swaps as they are non-cash items and not considered “core costs” or meaningful when management evaluates Rovi's operating expenses. Management excludes discrete tax items, including changes in tax reserves, so that its Non-GAAP income tax expense and franchise tax expense reflect the current year cash taxes it accrues and pays.

Use and Limitations of Non-GAAP Information (Cont.) Management is using these Non-GAAP measures to help it make budgeting decisions, including decisions that affect operating expenses and operating margin. Further, Non-GAAP financial information helps management track actual performance relative to financial targets. Making Non-GAAP financial information available to investors, in addition to GAAP financial information, may also help investors compare Rovi's performance with the performance of other companies in our industry, which may use similar financial measures to supplement their GAAP financial information. Management recognizes that the use of Non-GAAP measures has limitations, including the fact that management must exercise judgment in determining which types of charges should be excluded from the Non-GAAP financial information. Because other companies, including companies similar to Rovi, may calculate their non-GAAP financial measures differently than Rovi calculates its Non-GAAP measures, these Non-GAAP measures may have limited usefulness in comparing companies. Management believes, however, that providing Non-GAAP financial information, in addition to GAAP financial information, facilitates consistent comparison of Rovi's financial performance over time. Rovi provides Non-GAAP financial information to the investment community, not as an alternative, but as an important supplement to GAAP financial information; to enable investors to evaluate Rovi's core operating performance in the same way that management does.

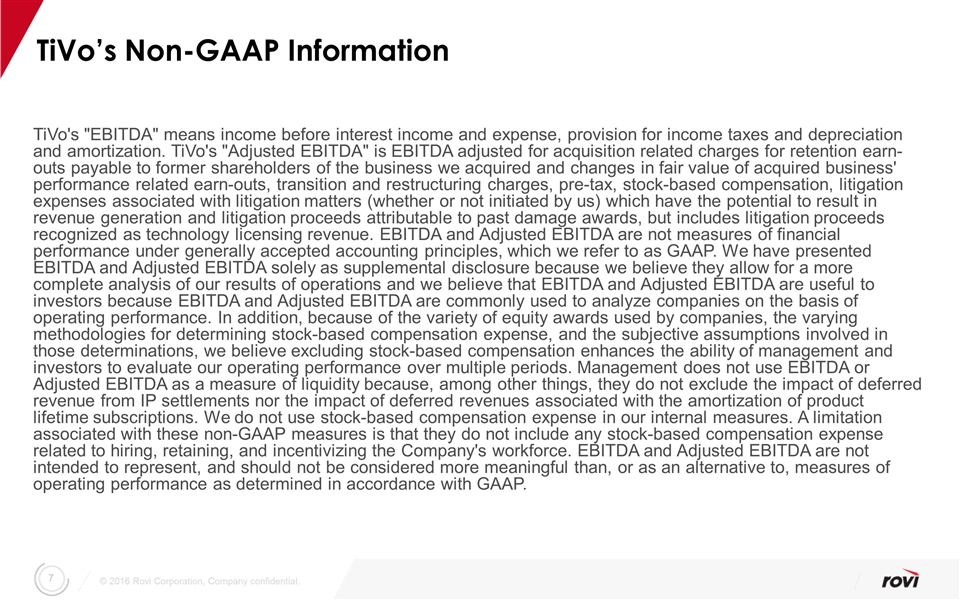

TiVo’s Non-GAAP Information TiVo's "EBITDA" means income before interest income and expense, provision for income taxes and depreciation and amortization. TiVo's "Adjusted EBITDA" is EBITDA adjusted for acquisition related charges for retention earn-outs payable to former shareholders of the business we acquired and changes in fair value of acquired business' performance related earn-outs, transition and restructuring charges, pre-tax, stock-based compensation, litigation expenses associated with litigation matters (whether or not initiated by us) which have the potential to result in revenue generation and litigation proceeds attributable to past damage awards, but includes litigation proceeds recognized as technology licensing revenue. EBITDA and Adjusted EBITDA are not measures of financial performance under generally accepted accounting principles, which we refer to as GAAP. We have presented EBITDA and Adjusted EBITDA solely as supplemental disclosure because we believe they allow for a more complete analysis of our results of operations and we believe that EBITDA and Adjusted EBITDA are useful to investors because EBITDA and Adjusted EBITDA are commonly used to analyze companies on the basis of operating performance. In addition, because of the variety of equity awards used by companies, the varying methodologies for determining stock-based compensation expense, and the subjective assumptions involved in those determinations, we believe excluding stock-based compensation enhances the ability of management and investors to evaluate our operating performance over multiple periods. Management does not use EBITDA or Adjusted EBITDA as a measure of liquidity because, among other things, they do not exclude the impact of deferred revenue from IP settlements nor the impact of deferred revenues associated with the amortization of product lifetime subscriptions. We do not use stock-based compensation expense in our internal measures. A limitation associated with these non-GAAP measures is that they do not include any stock-based compensation expense related to hiring, retaining, and incentivizing the Company's workforce. EBITDA and Adjusted EBITDA are not intended to represent, and should not be considered more meaningful than, or as an alternative to, measures of operating performance as determined in accordance with GAAP.

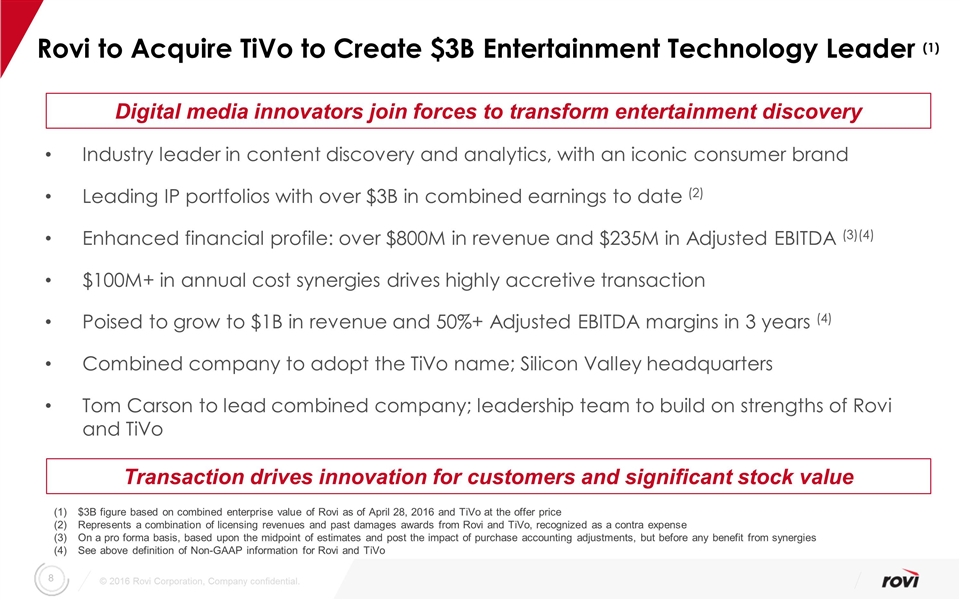

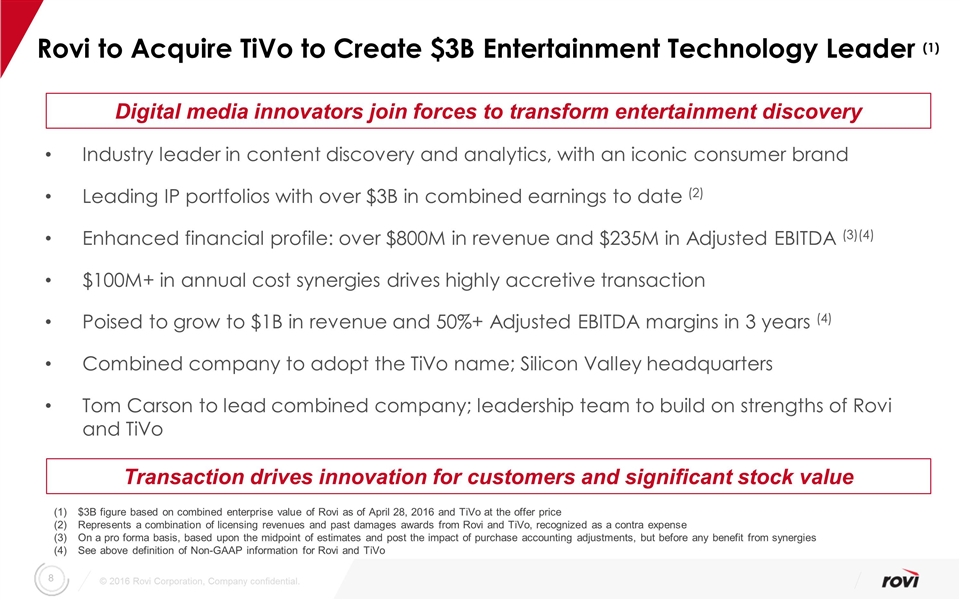

Rovi to Acquire TiVo to Create $3B Entertainment Technology Leader (1) Transaction drives innovation for customers and significant stock value Digital media innovators join forces to transform entertainment discovery Industry leader in content discovery and analytics, with an iconic consumer brand Leading IP portfolios with over $3B in combined earnings to date (2) Enhanced financial profile: over $800M in revenue and $235M in Adjusted EBITDA (3)(4) $100M+ in annual cost synergies drives highly accretive transaction Poised to grow to $1B in revenue and 50%+ Adjusted EBITDA margins in 3 years (4) Combined company to adopt the TiVo name; Silicon Valley headquarters Tom Carson to lead combined company; leadership team to build on strengths of Rovi and TiVo $3B figure based on combined enterprise value of Rovi as of April 28, 2016 and TiVo at the offer price Represents a combination of licensing revenues and past damages awards from Rovi and TiVo, recognized as a contra expense On a pro forma basis, based upon the midpoint of estimates and post the impact of purchase accounting adjustments, but before any benefit from synergies See above definition of Non-GAAP information for Rovi and TiVo

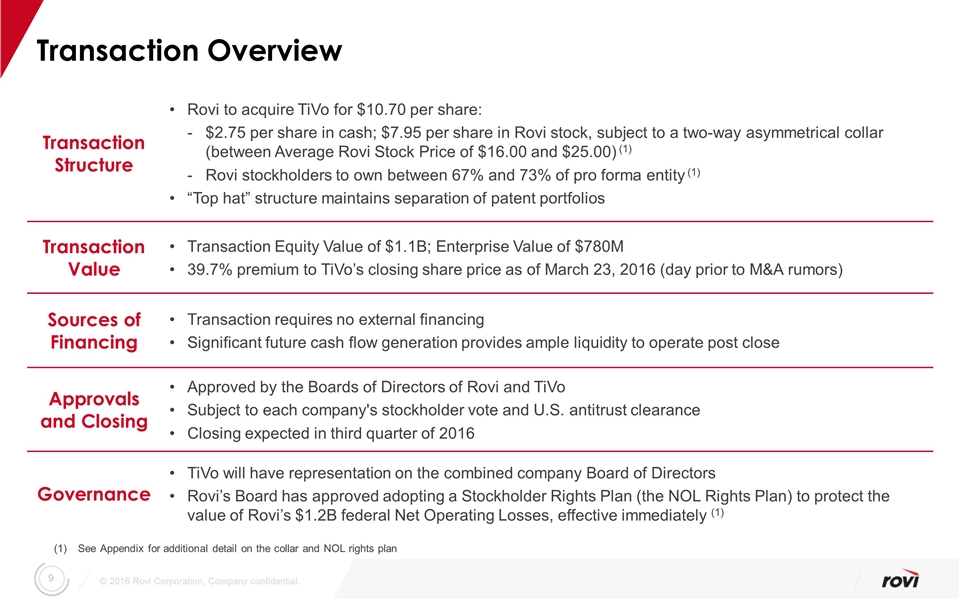

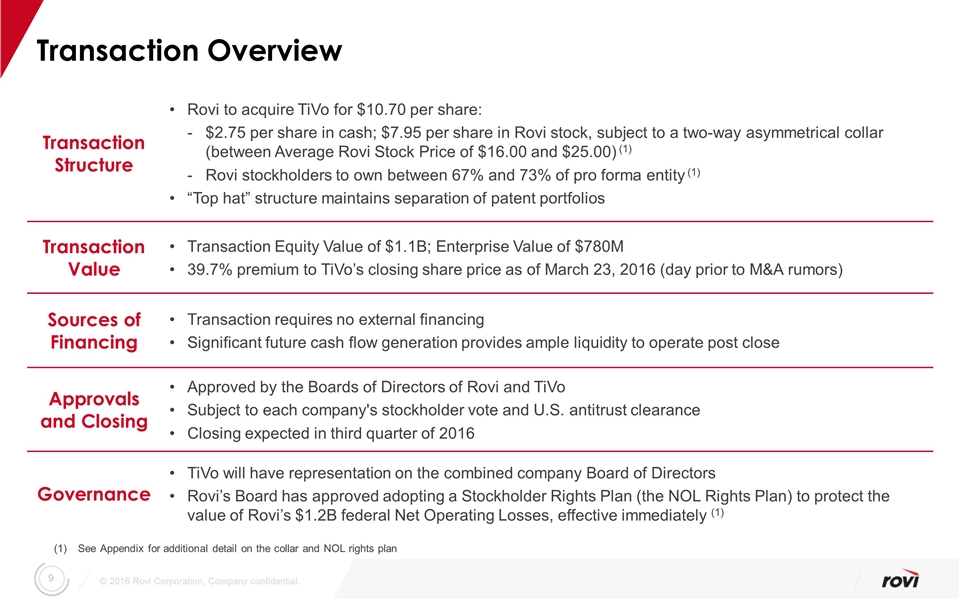

Transaction Overview Transaction Structure Rovi to acquire TiVo for $10.70 per share: $2.75 per share in cash; $7.95 per share in Rovi stock, subject to a two-way asymmetrical collar (between Average Rovi Stock Price of $16.00 and $25.00) (1) Rovi stockholders to own between 67% and 73% of pro forma entity (1) “Top hat” structure maintains separation of patent portfolios Transaction Value Transaction Equity Value of $1.1B; Enterprise Value of $780M 39.7% premium to TiVo’s closing share price as of March 23, 2016 (day prior to M&A rumors) Sources of Financing Transaction requires no external financing Significant future cash flow generation provides ample liquidity to operate post close Approvals and Closing Approved by the Boards of Directors of Rovi and TiVo Subject to each company's stockholder vote and U.S. antitrust clearance Closing expected in third quarter of 2016 Governance TiVo will have representation on the combined company Board of Directors Rovi’s Board has approved adopting a Stockholder Rights Plan (the NOL Rights Plan) to protect the value of Rovi’s $1.2B federal Net Operating Losses, effective immediately (1) See Appendix for additional detail on the collar and NOL rights plan Tom

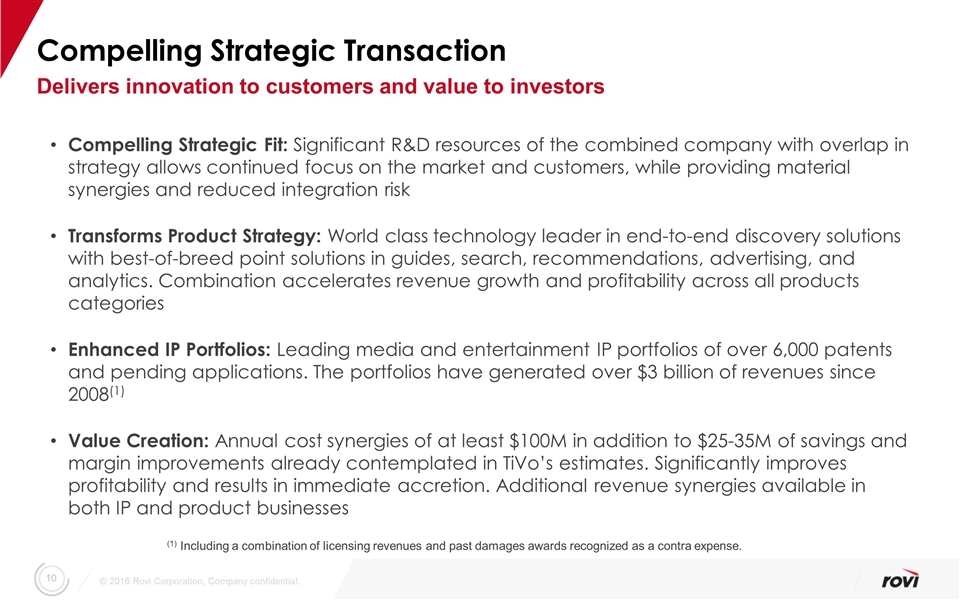

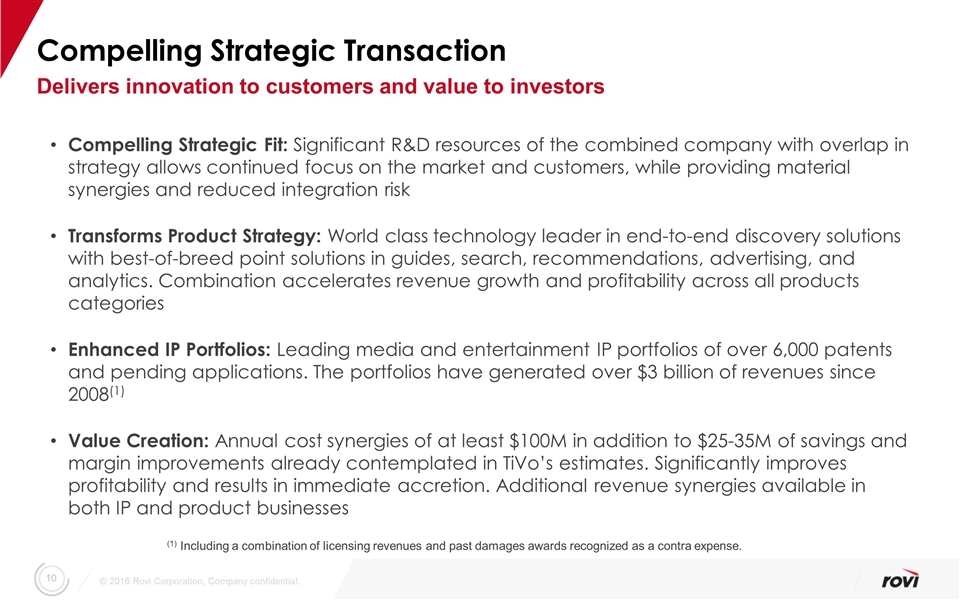

Compelling Strategic Transaction Delivers innovation to customers and value to investors Compelling Strategic Fit: Significant R&D resources of the combined company with overlap in strategy allows continued focus on the market and customers, while providing material synergies and reduced integration risk Transforms Product Strategy: World class technology leader in end-to-end discovery solutions with best-of-breed point solutions in guides, search, recommendations, advertising, and analytics. Combination accelerates revenue growth and profitability across all products categories Enhanced IP Portfolios: Leading media and entertainment IP portfolios of over 6,000 patents and pending applications. The portfolios have generated over $3 billion of revenues since 2008(1) Value Creation: Annual cost synergies of at least $100M in addition to $25-35M of savings and margin improvements already contemplated in TiVo’s estimates. Significantly improves profitability and results in immediate accretion. Additional revenue synergies available in both IP and product businesses (1) Including a combination of licensing revenues and past damages awards recognized as a contra expense.

Collectively responsible for inventing… Interactive Program Guide Digital Video Recorder Today we are positioned to lead… unified PayTV and OTT experiences natural language interactivity metadata driven user experiences personalized seamless media discovery deep data media analytics Few Companies Have Had More Impact On Television “There are exactly three companies in this world that are truly great at interface design – Apple, Google and TiVo.” -

Creates the largest independent entertainment software & technology provider… Search, Recommendation & Voice Entertainment Discovery Entertainment Metadata Media Analytics + Leading metadata provider 70+ Countries & 17 languages 7.5M Movies & TV shows 800 Sports Leagues 30M Music Tracks Improved integrated products Iconic brand Linear, VOD and OTT In guide advertising MSO and retail offerings Emerging market products Componentized cloud cloud DVR and OTA solutions Advanced search & recommendations Natural language and semantics Machine learning Knowledge Graph Dynamic viewing insights Promotional content boosting Census level viewership data Predictive analytics platform Tools for targeting media spend & improved yield Addressable television advertising Recognized data science leadership Data Driven Experience Defining

…With Iconic Consumer Brand Passionate consumer following Combine traditional video, OTT and on-demand content into one experience Multi-screen offerings on tablets, smartphones and other connected devices ~1M subscriptions generating ~$80M annual revenue Continued consumer innovation catering to the evolving video landscape “In a media market where streaming boxes are gaining ground, yet everyone has a DVR from their cable provider, TiVo does a phenomenal job of bridging the gap.” “The latest TiVo set-top box, all dressed in white, makes a bolder case to be your all-in-one video device.” “The reviews are coming in, and people who are really expert in this…are genuflecting.” “BOLT puts the company in a solid battle stance against whatever set tops Google, Apple, or Amazon might dream up.” “…BOLT: New DVR’s superpowers give new reason not to cut cable.”

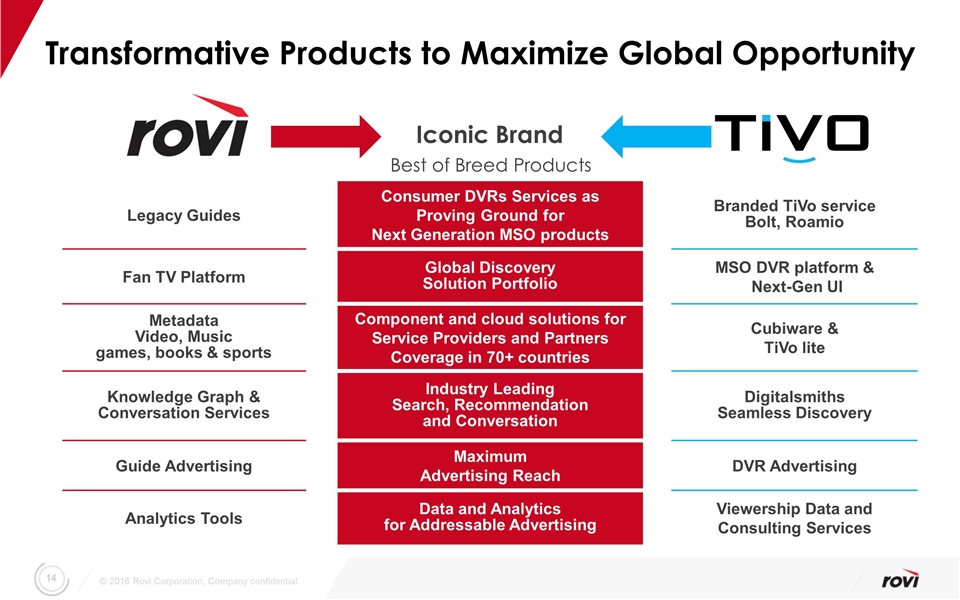

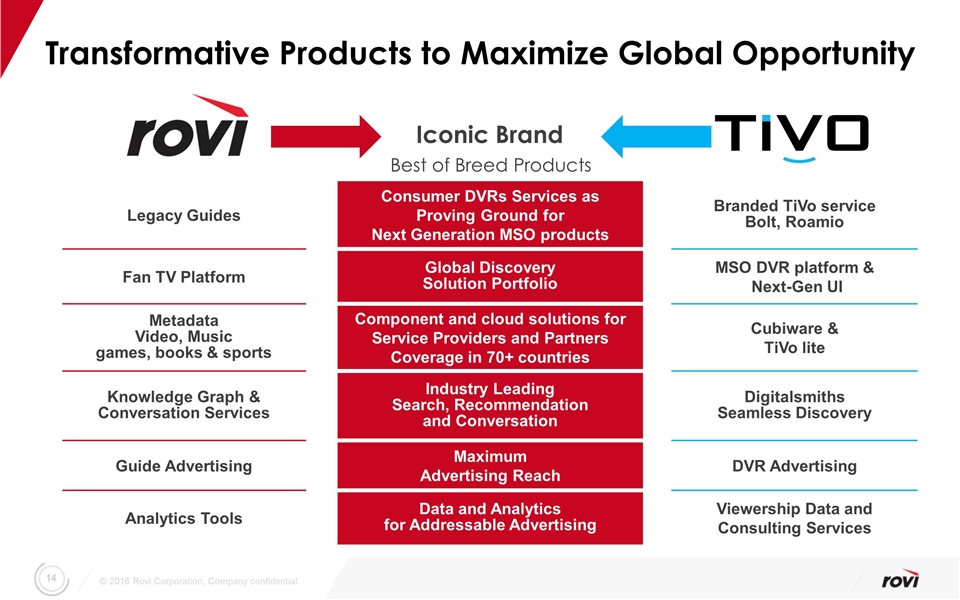

Transformative Products to Maximize Global Opportunity Iconic Brand Legacy Guides Consumer DVRs Services as Proving Ground for Next Generation MSO products Branded TiVo service Bolt, Roamio Fan TV Platform Global Discovery Solution Portfolio MSO DVR platform & Next-Gen UI Metadata Video, Music games, books & sports Component and cloud solutions for Service Providers and Partners Coverage in 70+ countries Cubiware & TiVo lite Knowledge Graph & Conversation Services Industry Leading Search, Recommendation and Conversation Digitalsmiths Seamless Discovery Guide Advertising Maximum Advertising Reach DVR Advertising Analytics Tools Data and Analytics for Addressable Advertising Viewership Data and Consulting Services Best of Breed Products

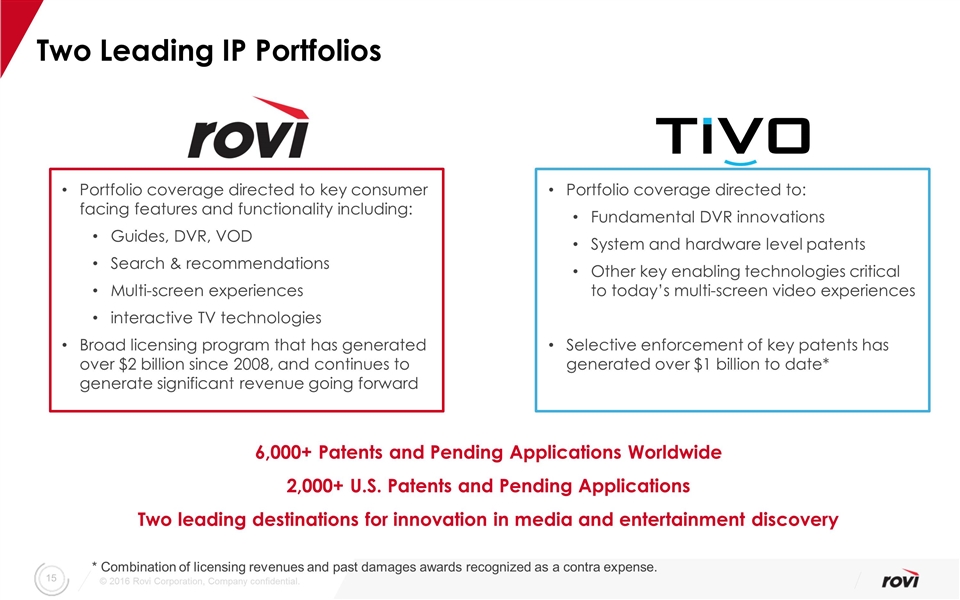

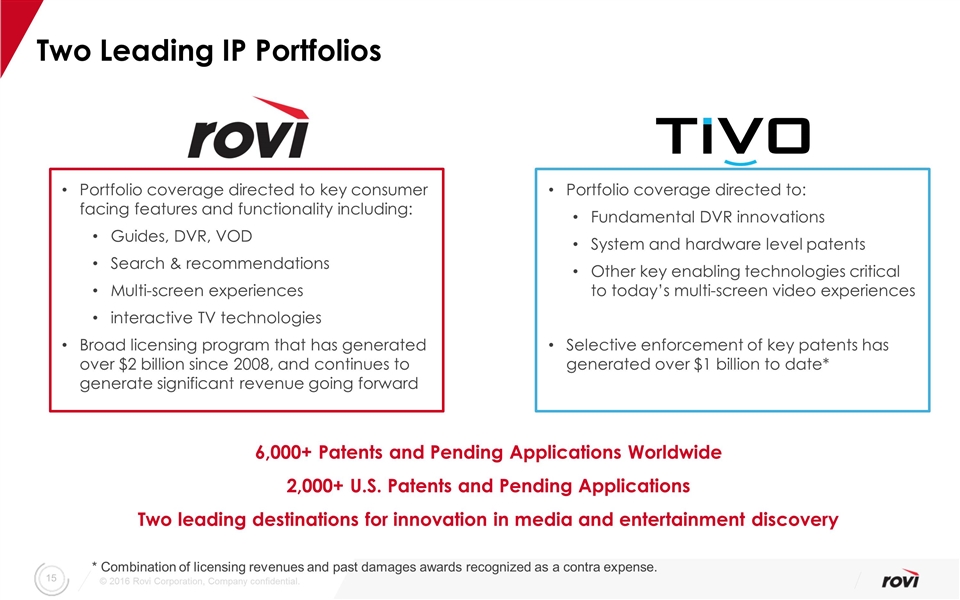

Two Leading IP Portfolios Portfolio coverage directed to key consumer facing features and functionality including: Guides, DVR, VOD Search & recommendations Multi-screen experiences interactive TV technologies Broad licensing program that has generated over $2 billion since 2008, and continues to generate significant revenue going forward Portfolio coverage directed to: Fundamental DVR innovations System and hardware level patents Other key enabling technologies critical to today’s multi-screen video experiences Selective enforcement of key patents has generated over $1 billion to date* 6,000+ Patents and Pending Applications Worldwide 2,000+ U.S. Patents and Pending Applications Two leading destinations for innovation in media and entertainment discovery * Combination of licensing revenues and past damages awards recognized as a contra expense.

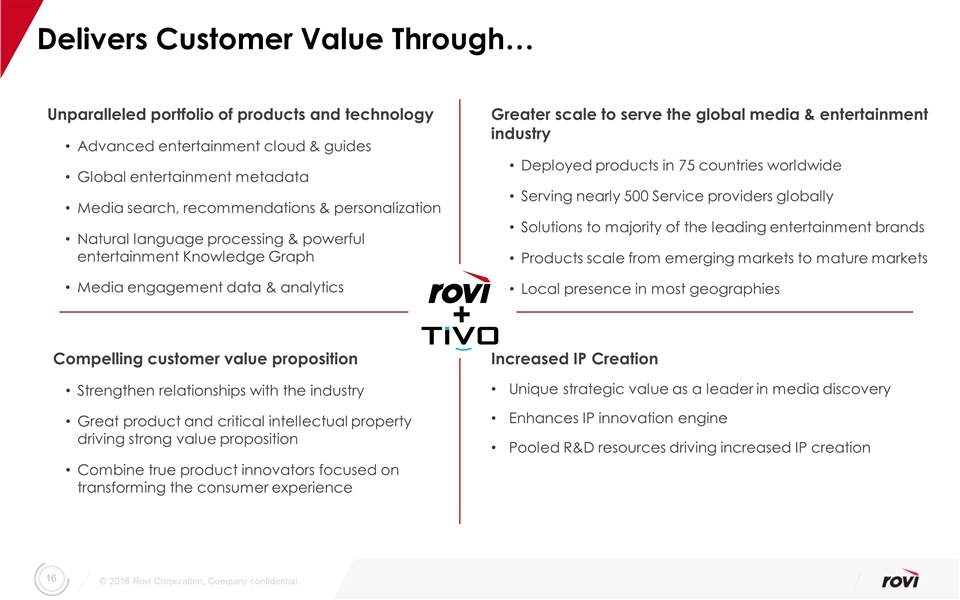

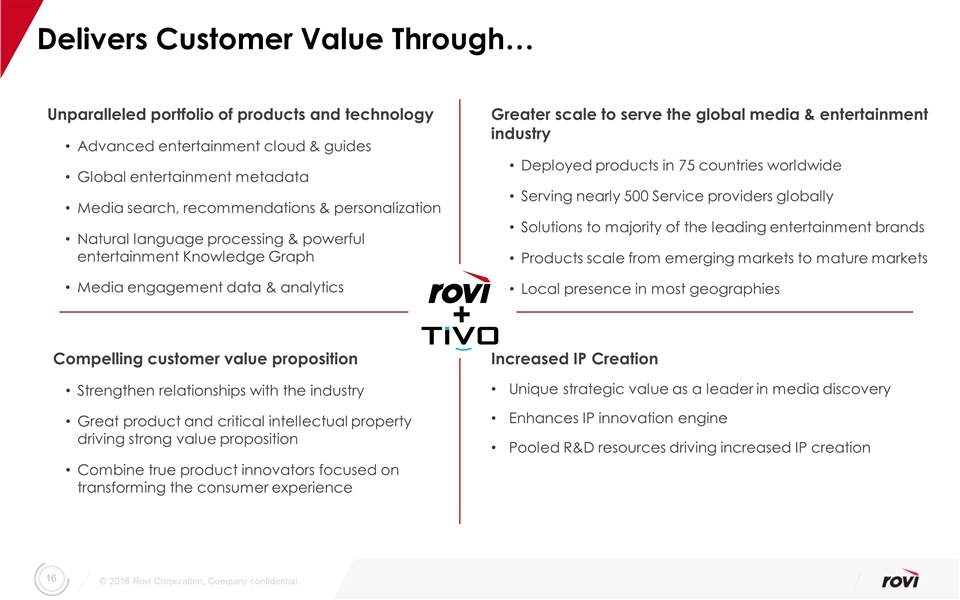

Delivers Customer Value Through… Compelling customer value proposition Strengthen relationships with the industry Great product and critical intellectual property driving strong value proposition Combine true product innovators focused on transforming the consumer experience Unparalleled portfolio of products and technology Advanced entertainment cloud & guides Global entertainment metadata Media search, recommendations & personalization Natural language processing & powerful entertainment Knowledge Graph Media engagement data & analytics + Greater scale to serve the global media & entertainment industry Deployed products in 75 countries worldwide Serving nearly 500 Service providers globally Solutions to majority of the leading entertainment brands Products scale from emerging markets to mature markets Local presence in most geographies Increased IP Creation Unique strategic value as a leader in media discovery Enhances IP innovation engine Pooled R&D resources driving increased IP creation

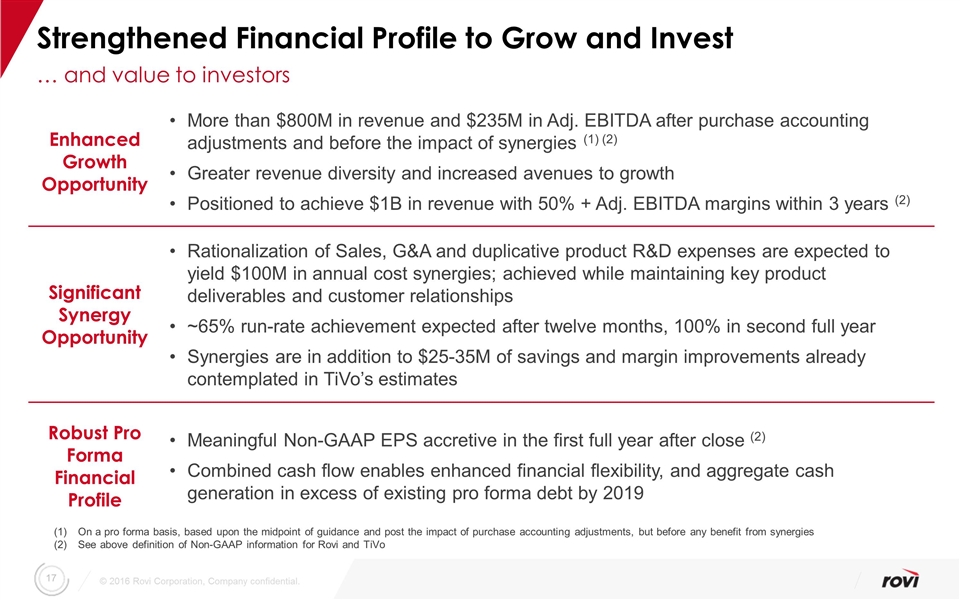

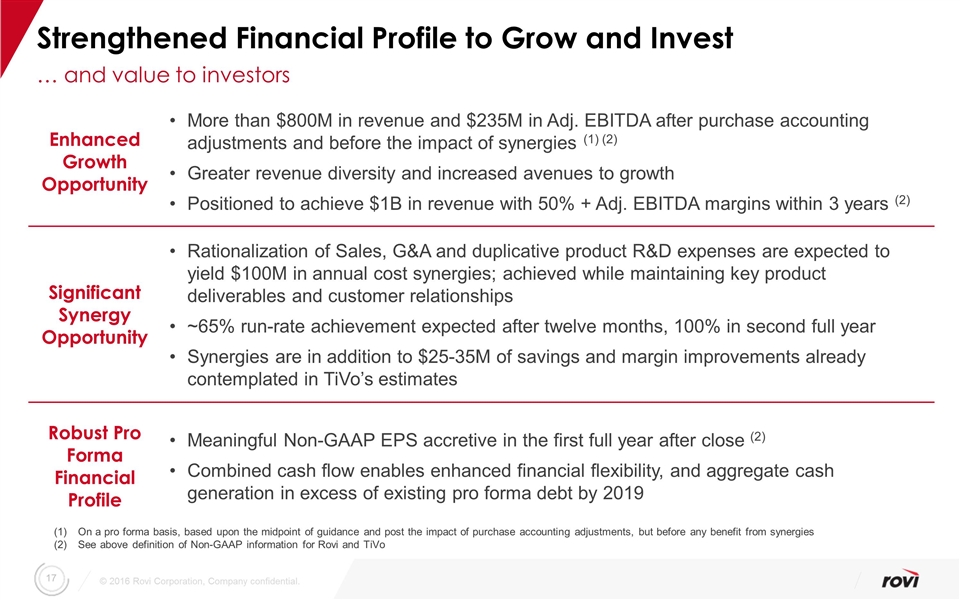

Strengthened Financial Profile to Grow and Invest Enhanced Growth Opportunity More than $800M in revenue and $235M in Adj. EBITDA after purchase accounting adjustments and before the impact of synergies (1) (2) Greater revenue diversity and increased avenues to growth Positioned to achieve $1B in revenue with 50% + Adj. EBITDA margins within 3 years (2) Significant Synergy Opportunity Rationalization of Sales, G&A and duplicative product R&D expenses are expected to yield $100M in annual cost synergies; achieved while maintaining key product deliverables and customer relationships ~65% run-rate achievement expected after twelve months, 100% in second full year Synergies are in addition to $25-35M of savings and margin improvements already contemplated in TiVo’s estimates Robust Pro Forma Financial Profile Meaningful Non-GAAP EPS accretive in the first full year after close (2) Combined cash flow enables enhanced financial flexibility, and aggregate cash generation in excess of existing pro forma debt by 2019 … and value to investors On a pro forma basis, based upon the midpoint of guidance and post the impact of purchase accounting adjustments, but before any benefit from synergies See above definition of Non-GAAP information for Rovi and TiVo

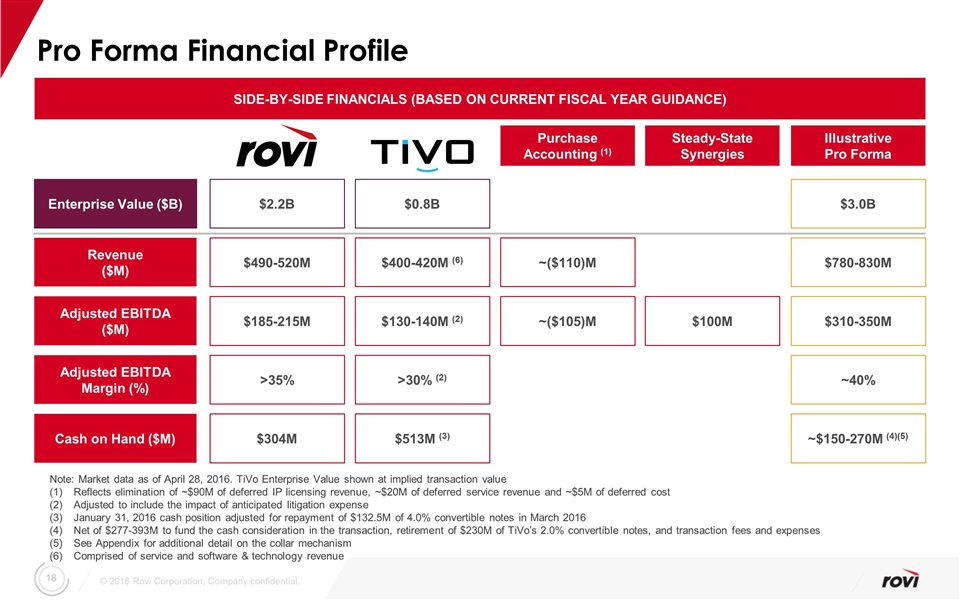

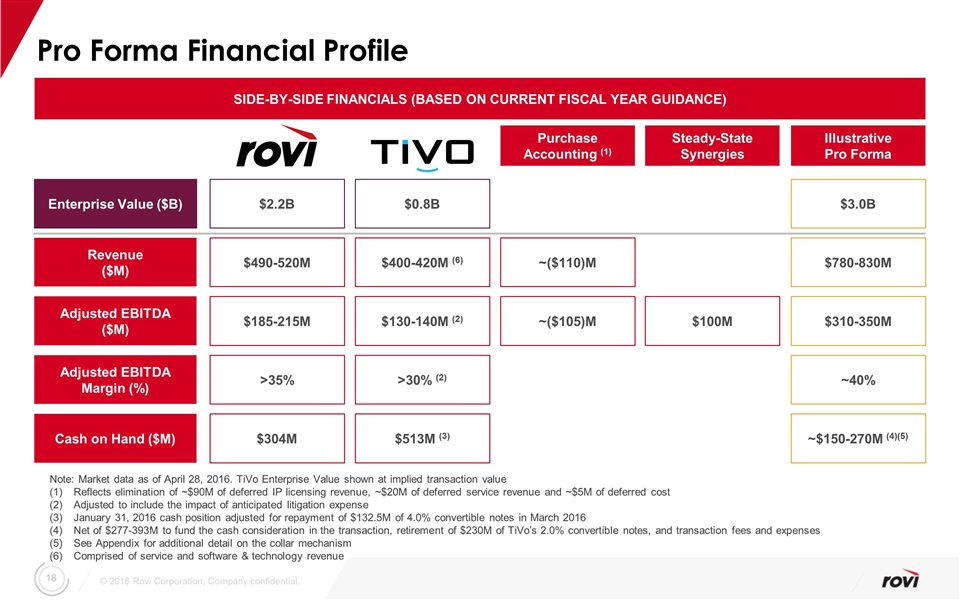

Pro Forma Financial Profile Note: Market data as of April 28, 2016. TiVo Enterprise Value shown at implied transaction value Reflects elimination of ~$90M of deferred IP licensing revenue, ~$20M of deferred service revenue and ~$5M of deferred cost Adjusted to include the impact of anticipated litigation expense January 31, 2016 cash position adjusted for repayment of $132.5M of 4.0% convertible notes in March 2016 Net of $277-393M to fund the cash consideration in the transaction, retirement of $230M of TiVo’s 2.0% convertible notes, and transaction fees and expenses See Appendix for additional detail on the collar mechanism Comprised of service and software & technology revenue SIDE-BY-SIDE FINANCIALS (BASED ON CURRENT FISCAL YEAR GUIDANCE) Enterprise Value ($B) $2.2B $0.8B $3.0B Adjusted EBITDA ($M) $185-215M $130-140M (2) $310-350M Revenue ($M) $490-520M $400-420M (6) $780-830M Adjusted EBITDA Margin (%) >35% >30% (2) ~40% Cash on Hand ($M) $304M $513M (3) ~$150-270M (4)(5) Illustrative Pro Forma Steady-State Synergies $100M Purchase Accounting (1) ~($105)M ~($110)M

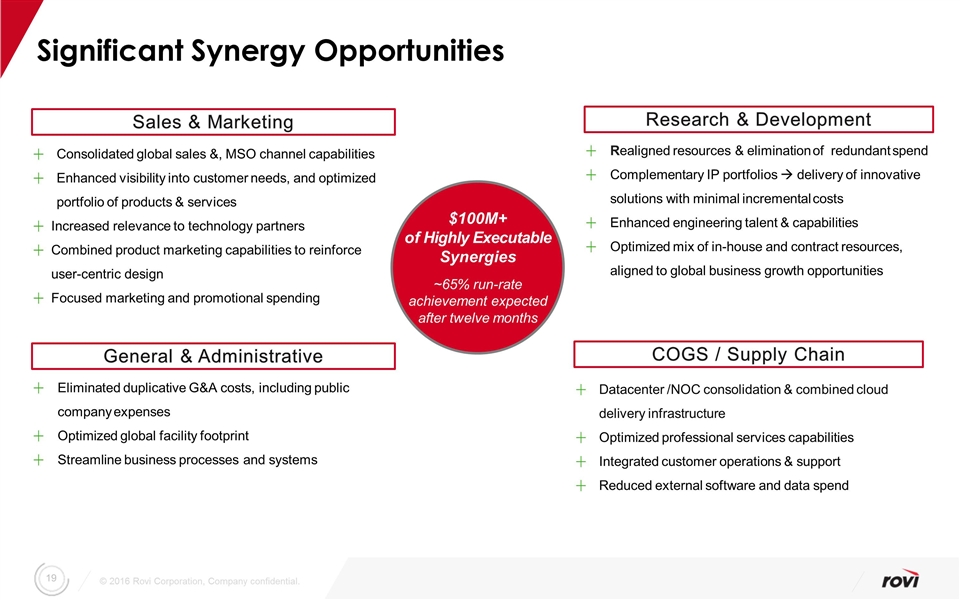

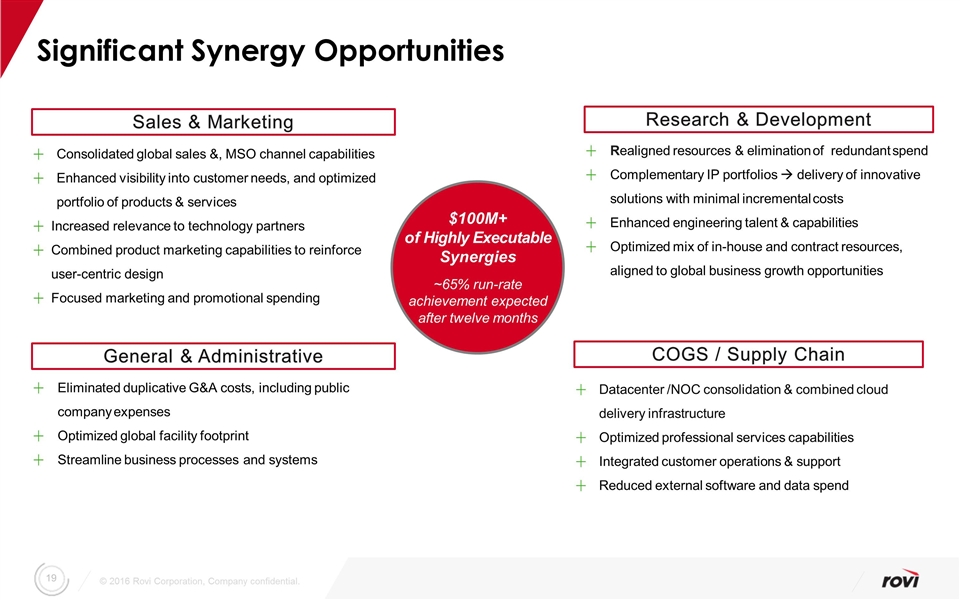

Significant Synergy Opportunities Sales & Marketing Consolidated global sales &, MSO channel capabilities Enhanced visibility into customer needs, and optimized portfolio of products & services Increased relevance to technology partners Combined product marketing capabilities to reinforce user-centric design Focused marketing and promotional spending Realigned resources & elimination of redundant spend Complementary IP portfolios à delivery of innovative solutions with minimal incremental costs Enhanced engineering talent & capabilities Optimized mix of in-house and contract resources, aligned to global business growth opportunities Eliminated duplicative G&A costs, including public company expenses Optimized global facility footprint Streamline business processes and systems Datacenter /NOC consolidation & combined cloud delivery infrastructure Optimized professional services capabilities Integrated customer operations & support Reduced external software and data spend $100M+ of Highly Executable Synergies ~65% run-rate achievement expected after twelve months Research & Development General & Administrative COGS / Supply Chain Peter

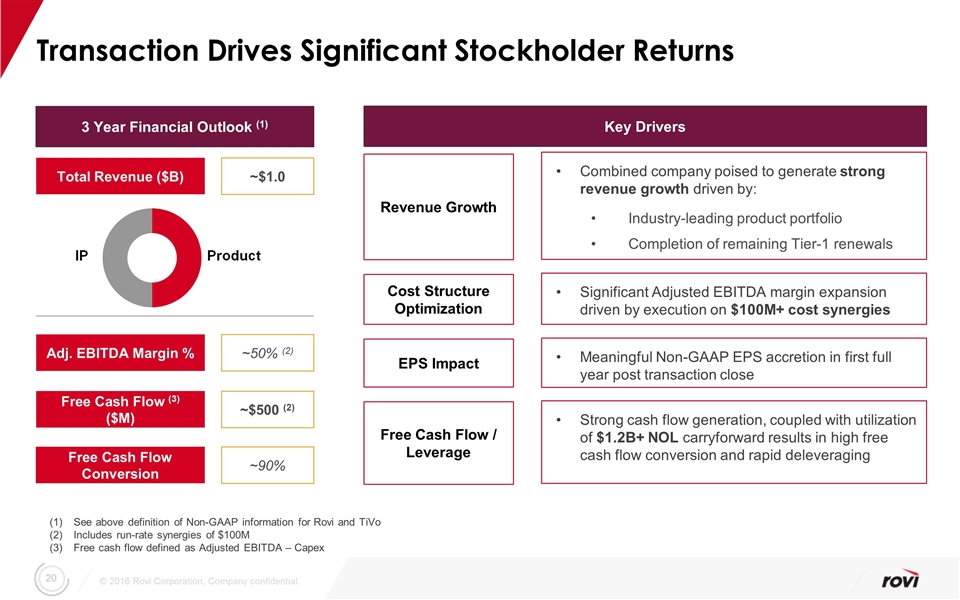

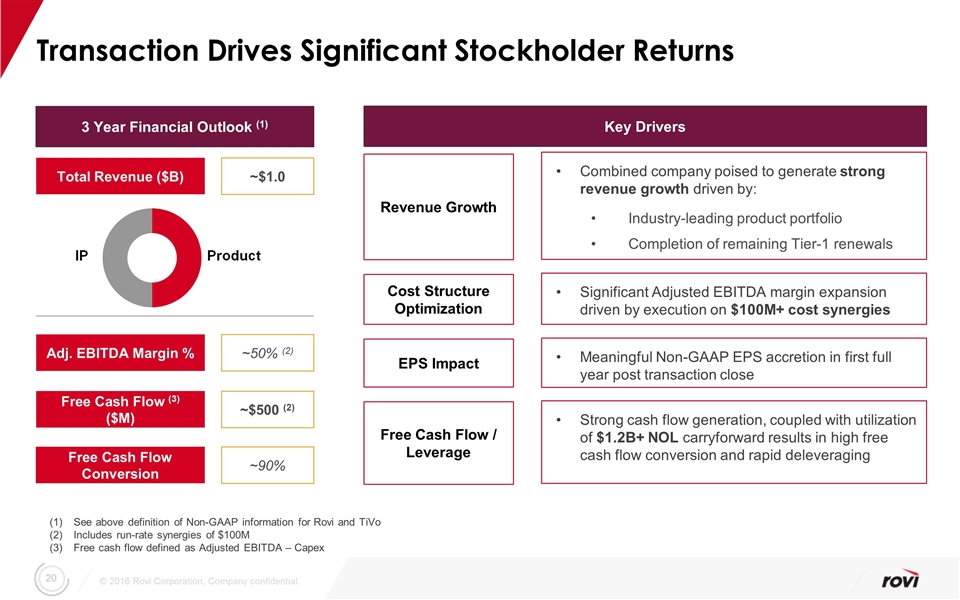

Transaction Drives Significant Stockholder Returns Combined company poised to generate strong revenue growth driven by: Industry-leading product portfolio Completion of remaining Tier-1 renewals Revenue Growth See above definition of Non-GAAP information for Rovi and TiVo Includes run-rate synergies of $100M Free cash flow defined as Adjusted EBITDA – Capex Free Cash Flow (3) ($M) Free Cash Flow Conversion ~$500 (2) 3 Year Financial Outlook (1) ~90% Total Revenue ($B) ~$1.0 Adj. EBITDA Margin % ~50% (2) Cost Structure Optimization EPS Impact Free Cash Flow / Leverage Key Drivers Significant Adjusted EBITDA margin expansion driven by execution on $100M+ cost synergies Meaningful Non-GAAP EPS accretion in first full year post transaction close Strong cash flow generation, coupled with utilization of $1.2B+ NOL carryforward results in high free cash flow conversion and rapid deleveraging Peter

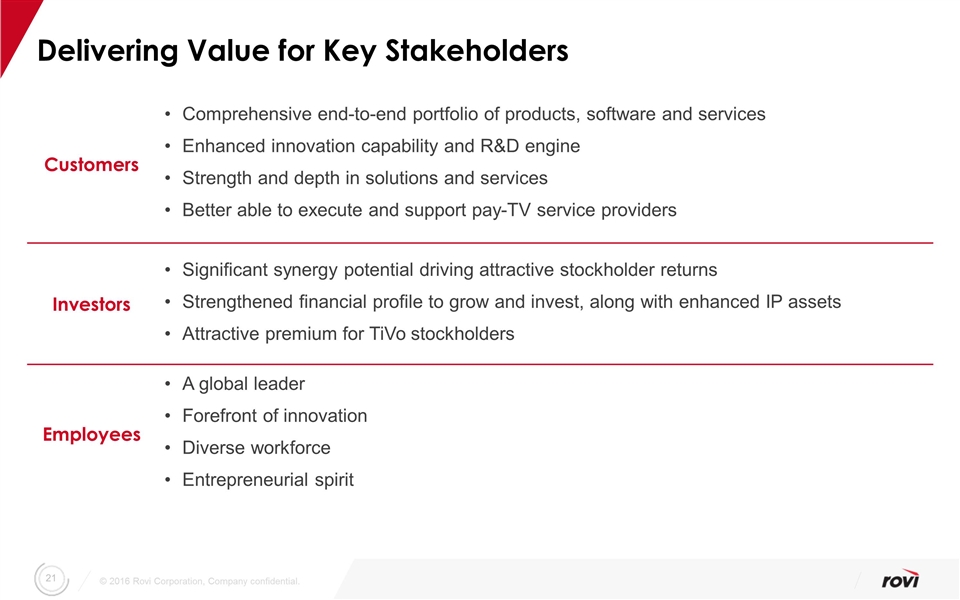

Delivering Value for Key Stakeholders Customers Comprehensive end-to-end portfolio of products, software and services Enhanced innovation capability and R&D engine Strength and depth in solutions and services Better able to execute and support pay-TV service providers Investors Significant synergy potential driving attractive stockholder returns Strengthened financial profile to grow and invest, along with enhanced IP assets Attractive premium for TiVo stockholders Employees A global leader Forefront of innovation Diverse workforce Entrepreneurial spirit

Revision and graphic cleanup Thank You.

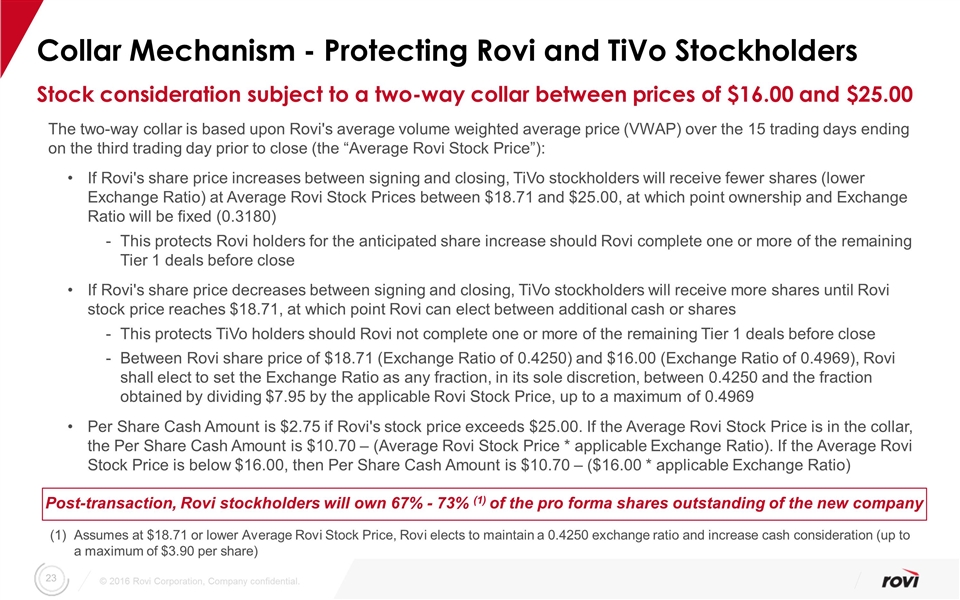

Collar Mechanism - Protecting Rovi and TiVo Stockholders Stock consideration subject to a two-way collar between prices of $16.00 and $25.00 Assumes at $18.71 or lower Average Rovi Stock Price, Rovi elects to maintain a 0.4250 exchange ratio and increase cash consideration (up to a maximum of $3.90 per share) The two-way collar is based upon Rovi's average volume weighted average price (VWAP) over the 15 trading days ending on the third trading day prior to close (the “Average Rovi Stock Price”): If Rovi's share price increases between signing and closing, TiVo stockholders will receive fewer shares (lower Exchange Ratio) at Average Rovi Stock Prices between $18.71 and $25.00, at which point ownership and Exchange Ratio will be fixed (0.3180) This protects Rovi holders for the anticipated share increase should Rovi complete one or more of the remaining Tier 1 deals before close If Rovi's share price decreases between signing and closing, TiVo stockholders will receive more shares until Rovi stock price reaches $18.71, at which point Rovi can elect between additional cash or shares This protects TiVo holders should Rovi not complete one or more of the remaining Tier 1 deals before close Between Rovi share price of $18.71 (Exchange Ratio of 0.4250) and $16.00 (Exchange Ratio of 0.4969), Rovi shall elect to set the Exchange Ratio as any fraction, in its sole discretion, between 0.4250 and the fraction obtained by dividing $7.95 by the applicable Rovi Stock Price, up to a maximum of 0.4969 Per Share Cash Amount is $2.75 if Rovi's stock price exceeds $25.00. If the Average Rovi Stock Price is in the collar, the Per Share Cash Amount is $10.70 – (Average Rovi Stock Price * applicable Exchange Ratio). If the Average Rovi Stock Price is below $16.00, then Per Share Cash Amount is $10.70 – ($16.00 * applicable Exchange Ratio) Post-transaction, Rovi stockholders will own 67% - 73% (1) of the pro forma shares outstanding of the new company

Protecting Rovi's Valuable NOLs Net Operating Loss (NOL) Rights Plan Concurrent with the approval of this transaction, Rovi’s Board approved the adoption of a Stockholder Rights Plan (the “NOL Rights Plan”), designed to protect Rovi’s $1.2 billion federal Net Operating Losses (NOLs) from the effect of Section 382 under the U.S. Internal Revenue Code, which can limit the use of the NOLs. The completion of the TiVo deal would move Rovi significantly closer to the 50 percent ownership change outlined in Section 382, and increase the likelihood of a loss of Rovi’s valuable NOLs. Rovi believes that its tax attributes represent an important corporate asset that can provide long-term stockholder benefits and should be protected. The NOL Rights Plan is similar to those adopted by numerous other public companies with significant tax assets. The NOL Rights Plan is set to expire at the earlier of completion or termination of the TiVo transaction. It is proposed that the certificate of incorporation of the new holding company will include a provision that would prohibit transfers of the holding company’s common stock that would adversely affect the holding company’s NOL tax asset following the closing. The stockholders of Rovi will be provided the opportunity to vote on the new holding company charter in connection with the approval of the transaction. Following the closing, the holding company board will, from time to time, review whether the continued effectiveness of the charter provision and any NOL Rights Plan that may be adopted continues to be in the best interests of the combined company and its stockholders.