0001424958 tsr:C000090189Member tsr:bench2024102981015_2310Member 2024-10-31 0001424958 tsr:bench2024122690472_2323Member 2022-10-31 0001424958 tsr:bench2024122790634_2312Member 2020-10-31 0001424958 tsr:C000065890Member 2015-10-31 0001424958 tsr:C000082787Member 2019-11-01 2024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22201

Direxion Shares ETF Trust

(Exact name of registrant as specified in charter)

1301 Avenue of the Americas (6th Ave.), 28th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Direxion Shares ETF Trust

1301 Avenue of the Americas (6th Ave.), 28th Floor

New York, NY 10019

(Name and address of agent for service)

1-800-851-0511

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”), is filed herewith. |

| | |

| Direxion Auspice Broad Commodity Strategy ETF | |

COM (Principal U.S. Listing Exchange: NYSE Arca, Inc.NYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Auspice Broad Commodity Strategy ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Auspice Broad Commodity Strategy ETF | $71 | 0.70% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Auspice Broad Commodity Strategy ETF seeks investment results, before fees and expenses, that track the Auspice Broad Commodity Index over a complete market cycle. The Auspice Broad Commodity Index seeks to capture the majority of the commodity upside returns, while seeking to mitigate downside risk. The Auspice Broad Commodity Index will use a quantitative methodology to track either long or flat positions in a diversified portfolio of 12 different commodity futures contracts, or “components”, which cover the energy, metal, and agricultural sectors. It attempts to incorporate dynamic risk management and contract rolling methods. For the Annual Period, the Auspice Broad Commodity Index returned -0.51%, while the Direxion Auspice Broad Commodity Strategy ETF returned 3.71%.

Commodities trended lower in 2023, and ended the year in red. Geopolitical tension has been a catalyst for commodity markets, as China, Ukraine, Russia, and other countries engulfed in conflict are important suppliers of different commodities, and issues in the supply chain can raise food prices. India is also playing a bigger role in commodity markets as demand increases due to population growth. As with the rest of the market, elevated inflation continued to plague commodities. Historically, higher inflation coincides with higher commodity prices, which played out over the course of the Annual Period. In 2024, metals led the group, with gold reaching all-time highs. Precious metals were especially strong performers, and COM ended the Annual Period long Gold and Silver. Agriculture and soft commodities were out of favor, and COM ended the Annual Period with very little exposure, being long only Sugar. Energy started out 2024 strong, but ended the Annual Period with poor performance, prompting COM to move out of all energy markets.

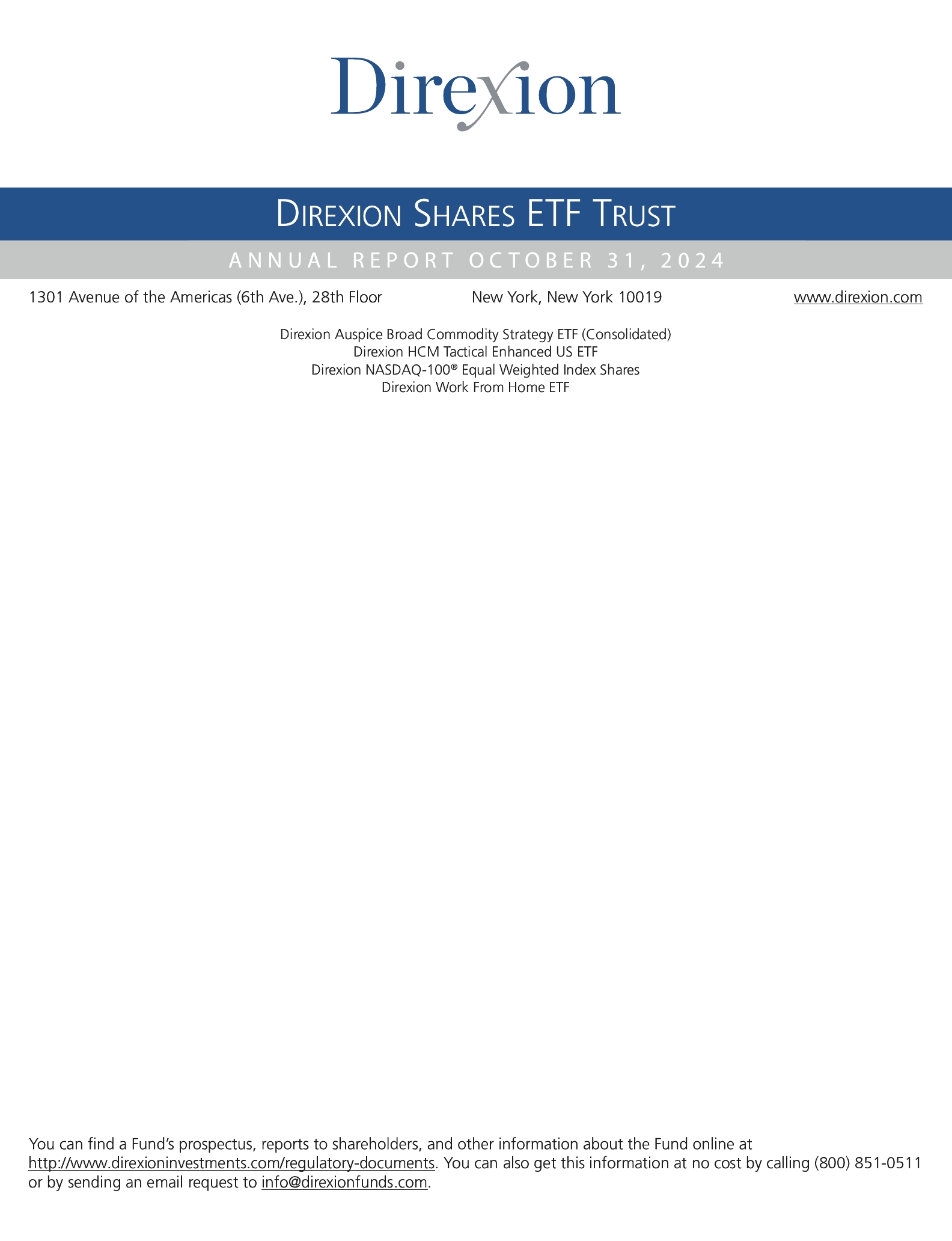

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion Auspice Broad Commodity Strategy ETF | PAGE 1 | TSR-AR-25460E307 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(03/30/2017) |

Direxion Auspice Broad Commodity Strategy ETF | 3.71 | 9.69 | 5.89 |

S&P 500® Index | 38.02 | 15.27 | 14.28 |

Auspice Broad Commodity Index | -0.51 | 8.01 | 4.09 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $271,835,220 |

Number of Holdings | 4 |

Net Advisory Fee | $1,344,204 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Futures Contracts | 33% |

Total (as % of net assets) | 33% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

| |

Security Type | (%) |

Short-Term Investments and Other Assets | 99.0% |

Futures Contracts | 1.0% |

| |

Top Holdings | (%) |

Dreyfus Government Cash Management Institutional Shares | 98.0% |

Gold February 2025 Futures | 0.7% |

Silver December 2024 Futures | 0.5% |

Sugar July 2025 Futures | 0.1% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Auspice Broad Commodity Strategy ETF | PAGE 2 | TSR-AR-25460E307 |

9528989497249597135681441014891154431103011840135361485121224181231996127550940397069221907912907136931362713558

| | |

| Direxion HCM Tactical Enhanced US ETF | |

HCMT (Principal U.S. Listing Exchange: NYSE Arca, Inc.NYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion HCM Tactical Enhanced US ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion HCM Tactical Enhanced US ETF | $143 | 1.15% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion HCM Tactical Enhanced U.S. Equity Strategy ETF utilizes the HCM-BuyLine®. The HCM-BuyLine® is a tactical proprietary indicator that uses technical indicators to identify broad trends in the U.S. equity markets to determine whether to invest in U.S. equity securities or cash and cash equivalents. The objective is to try to generate outperformance when U.S. equity markets are trending higher, and as a result, it has higher risk/return characteristics. The Fund will utilize leverage to achieve total exposure of up to 200% of the Fund’s net assets to the S&P Allocation, NASDAQ Allocation, and the Sector Allocation (together, the “Allocations”). A Sector Allocation of less than 40% may result in the Fund having less than 200% total exposure each day. When the Fund is invested in the U.S. equities market, the Fund will utilize leverage of up to 200% on a daily basis and the Fund’s performance for periods greater than a trading day will be the result of each day’s returns compounded over the period, which is very likely to differ from up to 200% of the daily performance of the Allocations, before fees and expenses.

The Direxion HCM Tactical Enhanced U.S. Equity Strategy (HCMT) ETF was able to outperform the S&P 500 and Nasdaq 100 based on its enhanced equity exposure to the broader markets and a satellite position in the tech sector over the Annual Period. The large cap mega cap names, led by tech, continue to be at the forefront, and the Direxion HCM Tactical Enhanced U.S. Equity Strategy ETF was well-positioned to take advantage of this. For the Annual Period, the S&P 500® Index returned 38.02%, while the Direxion HCM Tactical Enhanced U.S. ETF returned 49.31%.

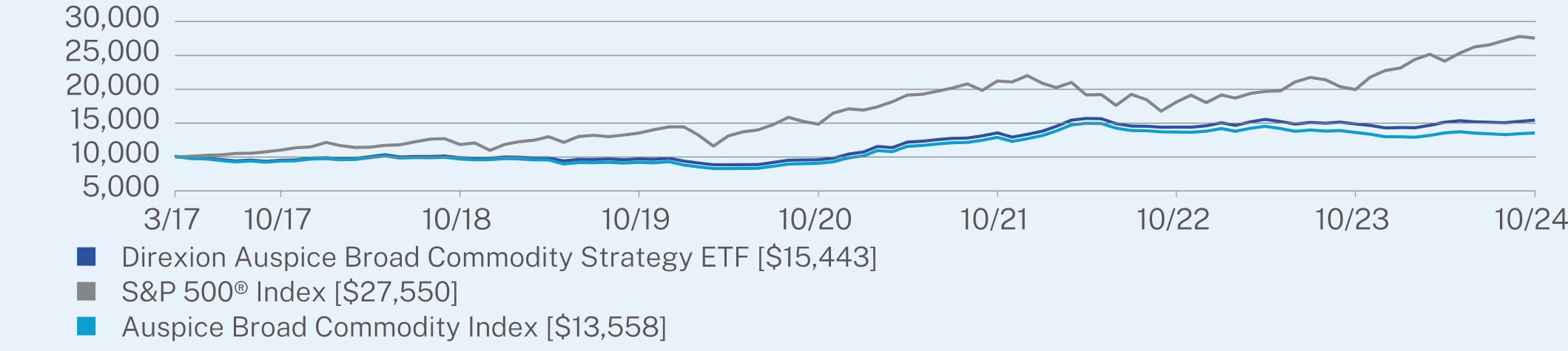

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion HCM Tactical Enhanced US ETF | PAGE 1 | TSR-AR-25461A726 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(06/22/2023) |

Direxion HCM Tactical Enhanced U.S. Equity Strategy ETF | 49.31 | 27.50 |

S&P 500® Index | 38.02 | 23.48 |

NASDAQ-100® Index | 39.19 | 24.82 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $388,622,719 |

Number of Holdings | 509 |

Net Advisory Fee | $3,137,384 |

Portfolio Turnover | 191% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | 106% |

Common Stocks | 80% |

Total (as % of net assets) | 186% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

| |

Security Type | (%) |

Common Stocks | 80.0% |

Short-Term Investments and Other Assets | 16.0% |

Total Return Swap Contracts | 4.0% |

| |

Top Holdings | (%) |

Apple, Inc. | 5.7% |

NVIDIA Corp. | 5.4% |

Microsoft Corp. | 5.0% |

Amazon.com, Inc. | 2.9% |

Meta Platforms, Inc. | 2.1% |

Alphabet, Inc. | 1.7% |

Alphabet, Inc. Class C | 1.4% |

Berkshire Hathaway, Inc. Class B | 1.4% |

Broadcom, Inc. | 1.3% |

Tesla, Inc. | 1.2% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion HCM Tactical Enhanced US ETF | PAGE 2 | TSR-AR-25461A726 |

932313921965613326971613524

| | |

| Direxion NASDAQ-100® Equal Weighted Index Shares | |

QQQE (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion NASDAQ-100® Equal Weighted Index Shares for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion NASDAQ-100® Equal Weighted Index Shares | $40 | 0.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion NASDAQ-100® Equal Weighted Index Shares seeks investment results, before fees and expenses, that track the NASDAQ-100® Equal Weighted Index. The NASDAQ-100® Equal Weighted Index is the equal weighted version of the NASDAQ-100® Index which includes approximately 100 of the largest domestic and international non-financial companies listed on the NASDAQ® Stock Market based on market capitalization selected by NASDAQ, Inc., the Index Provider. Equal weighting is a method of weighting index stocks whereby the same exposure is provided to both the smallest and largest companies included in the Index. The Index is rebalanced quarterly and reconstituted annually. For the Annual Period, the NASDAQ-100® Equal Weighted Index returned 26.35%, while the Direxion NASDAQ-100® Equal Weighted Index Shares returned 26.04%.

QQQE had a strong Annual Period, as technology was widely in favor, although there were periods of volatility, and the Annual Period ended with nearly 40% of the fund in the tech sector. Consumer discretionary names made up over 12% of the portfolio, and had a strong showing, with names such as Doordash and Booking Holdings in the top 10 performers. The top performers for QQQE over the course of the Annual Period were Nvidia, returning 213.76%, ARM Holdings, returning 179.69%, and Constellation Energy, returning 130.74%. The worst performing names were Dollar Tree Inc, returning -42.02%, Intel Corp., returning -41.31%, and Moderna Inc., returning -28.66%.

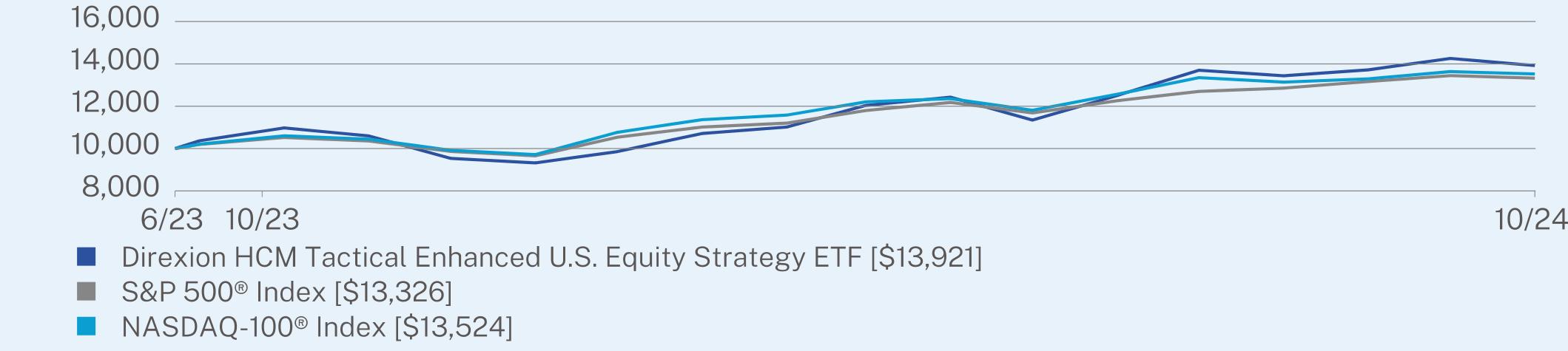

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion NASDAQ-100® Equal Weighted Index Shares | PAGE 1 | TSR-AR-25459Y207 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Direxion NASDAQ-100® Equal Weighted Index Shares | 26.04 | 13.27 | 12.51 |

S&P 500® Index | 38.02 | 15.27 | 13.00 |

NASDAQ-100® Equal Weighted Index | 26.35 | 13.61 | 12.88 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $1,278,182,402 |

Number of Holdings | 102 |

Net Advisory Fee | $3,525,210 |

Portfolio Turnover | 34% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Common Stocks | 100% |

Total (as % of net assets) | 100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

| |

Index Composition | (%) |

Information Technology | 38.5% |

Consumer Discretionary | 12.7% |

Health Care | 11.3% |

Communication Services | 10.6% |

Industrials | 10.3% |

Consumer Staples | 7.6% |

Utilities | 4.0% |

Energy | 2.0% |

Financials | 1.1% |

Materials | 1.0% |

Real Estate | 0.9% |

| |

Top 10 Constituents of Index | (%) |

Pinduoduo, Inc. ADR | 1.2% |

Atlassian Corp. | 1.2% |

Booking Holdings, Inc. | 1.2% |

NVIDIA Corp. | 1.1% |

Lululemon Athletica, Inc. | 1.1% |

DoorDash, Inc. | 1.1% |

T-Mobile US, Inc. | 1.1% |

Fastenal Co. | 1.1% |

Illumina, Inc. | 1.1% |

The Trade Desk, Inc. | 1.1% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion NASDAQ-100® Equal Weighted Index Shares | PAGE 2 | TSR-AR-25459Y207 |

100001071611111140181457617431215603003422892257903250610000105201099413593145911668118301261552233424599339501000010749111871417014787177482203630815235492658933596

| | |

| Direxion Work From Home ETF | |

WFH (Principal U.S. Listing Exchange: NYSE Arca, Inc.NYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Work From Home ETF for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Work From Home ETF | $52 | 0.45% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Work From Home ETF seeks investment results, before fees and expenses, that track the Solactive Remote Work Index. The Solactive Remote Work Index is comprised of U.S. listed securities and American Depository Receipts (ADRs) of companies that provide products and services in at least one of the following business segments that facilitate the ability of people to work from home: remote communications, cyber security, online project and document management, and cloud computing technologies (“WFH Industries”). The Index consists of approximately 40 companies, namely, the top 10 ranked companies in each of the four WFH Industries. The Index is equal weighted at each semi-annual reconstitution and rebalance date. For the Annual Period, the Solactive Remote Work Index returned 31.77%, while the Direxion Work From Home ETF returned 31.94%.

WFH had a strong Annual Period, as it was highly weighted toward the technology, with over 80% of the fund in the tech sector. The top performers for WFH over the course of the Annual Period were Broadcom, returning 102.08%, DigitalOcean Holdings, returning 99.70%, and Meta Platforms, returning 82.55%. The worst performing names were Xerox Holdings, returning -32.85%, Joyy Inc., returning -13.56%, and Adobe Inc., returning -12.20%.

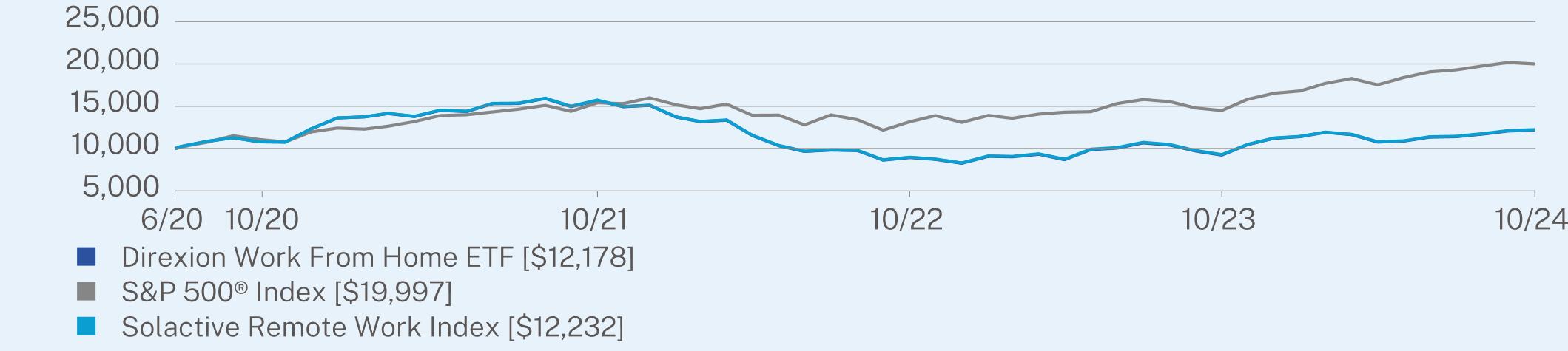

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(06/25/2020) |

Direxion Work From Home ETF | 31.94 | 4.63 |

S&P 500® Index | 38.02 | 17.26 |

Solactive Remote Work Index | 31.77 | 4.74 |

| Direxion Work From Home ETF | PAGE 1 | TSR-AR-25460G773 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $23,579,493 |

Number of Holdings | 41 |

Net Advisory Fee | $109,525 |

Portfolio Turnover | 33% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Common Stocks | 100% |

Total (as % of net assets) | 100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

| |

Index Composition | (%) |

Software | 55.9% |

Interactive Media & Services | 10.1% |

IT Services | 9.8% |

Semiconductors & Semiconductor Equipment | 5.2% |

Communications Equipment | 5.0% |

Technology Hardware, Storage & Peripherals | 4.0% |

Media | 2.8% |

Broadline Retail | 2.5% |

Diversified Telecommunication Services | 2.4% |

Electronic Equipment, Instruments & Components | 2.3% |

| |

Top 10 Constituents of Index | (%) |

RingCentral, Inc. | 2.9% |

DocuSign, Inc. | 2.8% |

Oracle Corp. | 2.8% |

Smartsheet, Inc. | 2.8% |

Altice USA, Inc. | 2.8% |

Salesforce, Inc. | 2.7% |

Pegasystems, Inc. | 2.7% |

Atlassian Corp. | 2.7% |

Datadog, Inc. | 2.7% |

Zscaler, Inc. | 2.7% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Work From Home ETF | PAGE 2 | TSR-AR-25460G773 |

10760156778936923012178107801540613155144891999710765157238970928212232

| | |

| Direxion Daily S&P 500® Bear 1X Shares | |

SPDN (Principal U.S. Listing Exchange: NYSE Arca, Inc.NYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily S&P 500® Bear 1X Shares for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily S&P 500® Bear 1X Shares | $40 | 0.45% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Daily S&P 500® Bear 1X Shares seeks to provide -100% of the daily return of the S&P 500® Index. The S&P 500® Index is a capitalization-weighted index composed of 500 domestic common stocks. Standard & Poor’s® selects the stocks comprising the S&P 500® Index on the basis of market capitalization, financial viability of the company and the public float, liquidity and price of a company’s shares outstanding. The index is a float-adjusted market capitalization-weighted index. To determine if the Fund has met its daily investment goals, the Advisor, Rafferty Asset Management, LLC maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio, or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the S&P 500® Index returned 38.02%. Given the daily investment objectives of the ETF and the path dependency of returns for longer periods, the annual return of the index alone should not generate expectations of annual performance of the ETF. The Direxion Daily S&P 500® Bear 1X Shares returned -21.21%, while the model indicated an expected return of -28.64%.

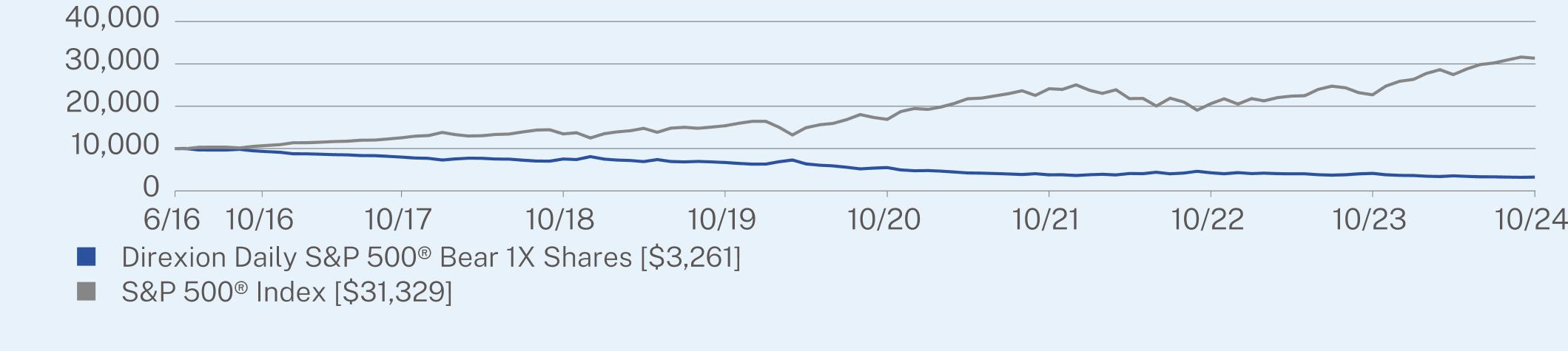

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(06/08/2016) |

Direxion Daily S&P 500® Bear 1X Shares | -21.21 | -13.45 | -12.49 |

S&P 500® Index | 38.02 | 15.27 | 14.56 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| Direxion Daily S&P 500® Bear 1X Shares | PAGE 1 | TSR-AR-25460E869 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. Annual returns are required to be shown and should not be interpreted as suggesting that the Fund should or should not be held for long periods of time. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $147,307,909 |

Number of Holdings | 4 |

Net Advisory Fee | $529,007 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap

Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

| |

Index Composition | (%) |

Information Technology | 31.7% |

Financials | 13.4% |

Health Care | 11.1% |

Consumer Discretionary | 10.0% |

Communication Services | 9.1% |

Industrials | 8.5% |

Consumer Staples | 5.8% |

Energy | 3.4% |

Utilities | 2.5% |

Real Estate | 2.3% |

Materials | 2.2% |

| |

Top 10 Constituents of Index | (%) |

Apple, Inc. | 7.1% |

NVIDIA Corp. | 6.8% |

Microsoft Corp. | 6.3% |

Amazon.com, Inc. | 3.6% |

Meta Platforms, Inc. | 2.6% |

Alphabet, Inc. | 2.1% |

Alphabet, Inc. Class C | 1.7% |

Berkshire Hathaway, Inc. Class B | 1.7% |

Broadcom, Inc. | 1.6% |

Tesla, Inc. | 1.4% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provides annual performance information, the Fund should not be expected to provide -100% of the return of the benchmark’s cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily S&P 500® Bear 1X Shares | PAGE 2 | TSR-AR-25460E869 |

982579967537671555103791427941393261101451254313464153931688824135206092269931329

| | |

| Direxion Daily AAPL Bear 1X Shares | |

AAPD (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily AAPL Bear 1X Shares for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily AAPL Bear 1X Shares | $84 | 0.95% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Daily AAPL Bear 1X Shares seeks daily investment results, before fees and expenses, of -100% of the performance of the common shares of Apple Inc. (NASDAQ: AAPL). Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. It also sells various related services. To determine if the Fund has met its daily investment goals, the Advisor, Rafferty Asset Management, LLC maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio, or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the common shares of Apple Inc. returned 32.29%. Given the daily investment objectives of the ETF and the path dependency of returns for longer periods, the annual return of the common shares alone should not generate expectations of annual performance of the ETF. The Direxion Daily AAPL Bear 1X Shares returned -22.47%, while the model indicated an expected return of -28.57%.

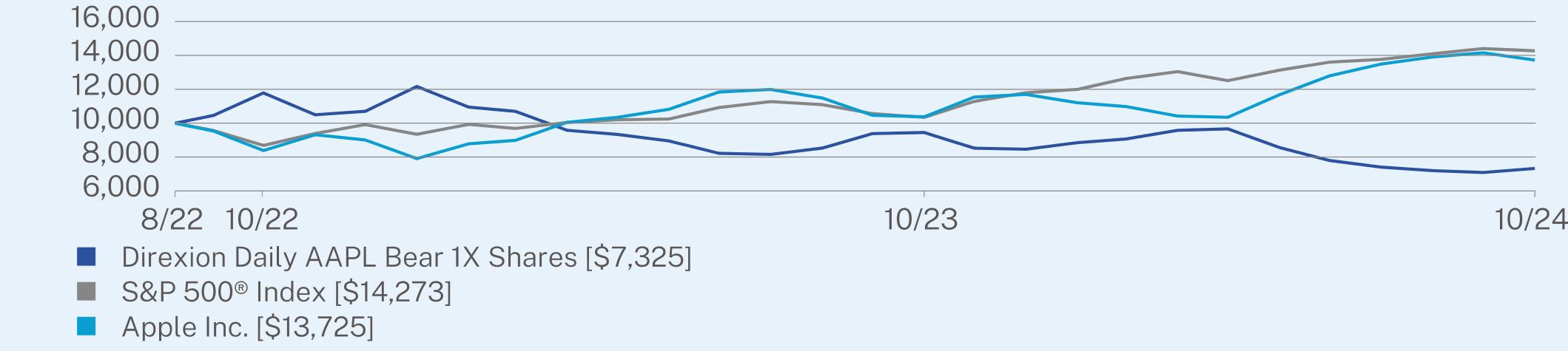

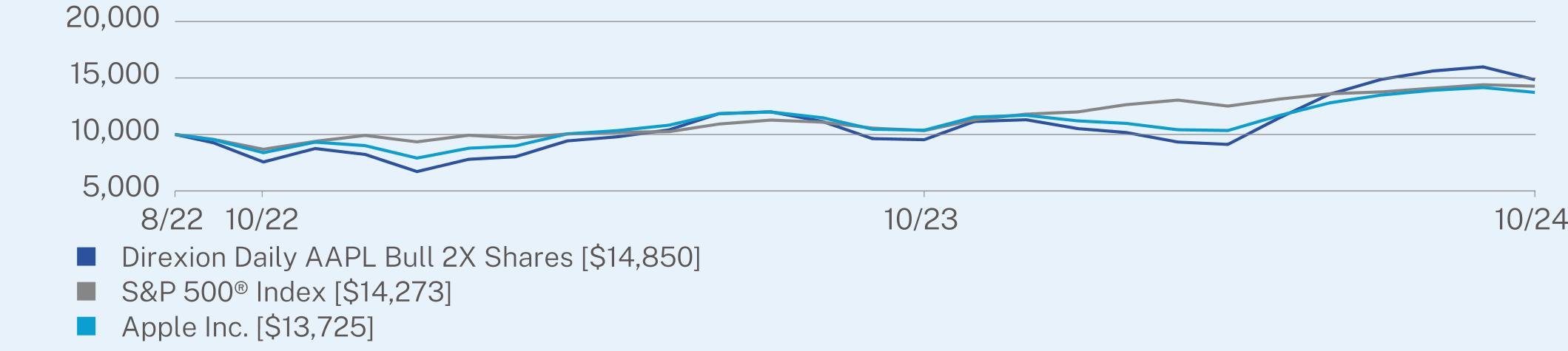

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(08/09/2022) |

Direxion Daily AAPL Bear 1X Shares | -22.47 | -13.03 |

S&P 500® Index | 38.02 | 17.30 |

Apple Inc. | 32.29 | 15.26 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| Direxion Daily AAPL Bear 1X Shares | PAGE 1 | TSR-AR-25461A304 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. Annual returns are required to be shown and should not be interpreted as suggesting that the Fund should or should not be held for long periods of time. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $25,497,898 |

Number of Holdings | 9 |

Net Advisory Fee | $230,548 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily AAPL Bear 1X Shares | PAGE 2 | TSR-AR-25461A304 |

10495944973259389103411427393161037513725

| | |

| Direxion Daily AMZN Bear 1X Shares | |

AMZD (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily AMZN Bear 1X Shares for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily AMZN Bear 1X Shares | $82 | 0.95% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Daily AMZN Bear 1X Shares seeks daily investment results, before fees and expenses, of -100% of the performance of the common shares of Amazon.com, Inc. (NASDAQ: AMZN). Amazon.com, Inc. engages in the retail sale of consumer products and subscriptions in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services. To determine if the Fund has met its daily investment goals, the Advisor, Rafferty Asset Management, LLC maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio, or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the common shares of Amazon.com, Inc. returned 40.06%. Given the daily investment objectives of the ETF and the path dependency of returns for longer periods, the annual return of the common shares alone should not generate expectations of annual performance of the ETF. The Direxion Daily AMZN Bear 1X Shares returned -27.68%, while the model indicated an expected return of -33.33%.

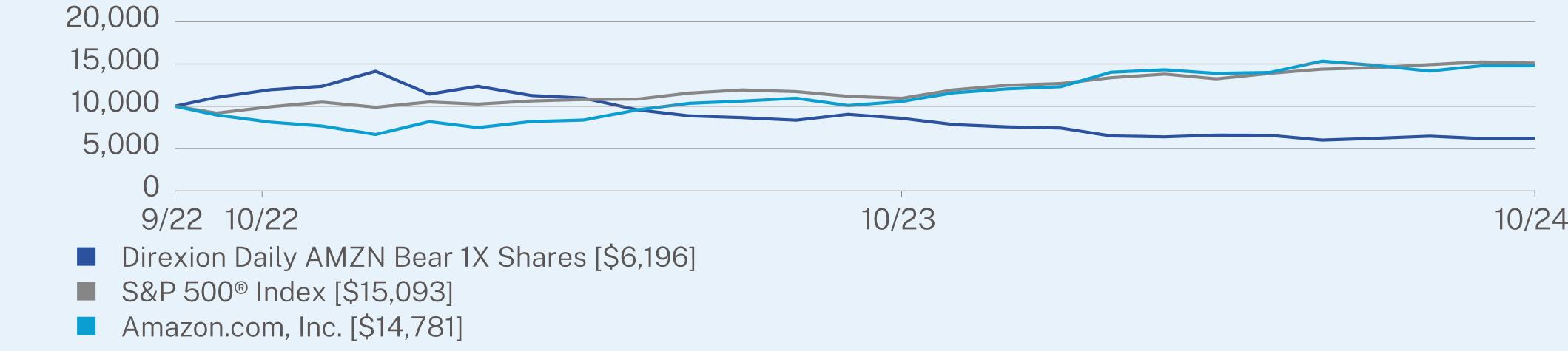

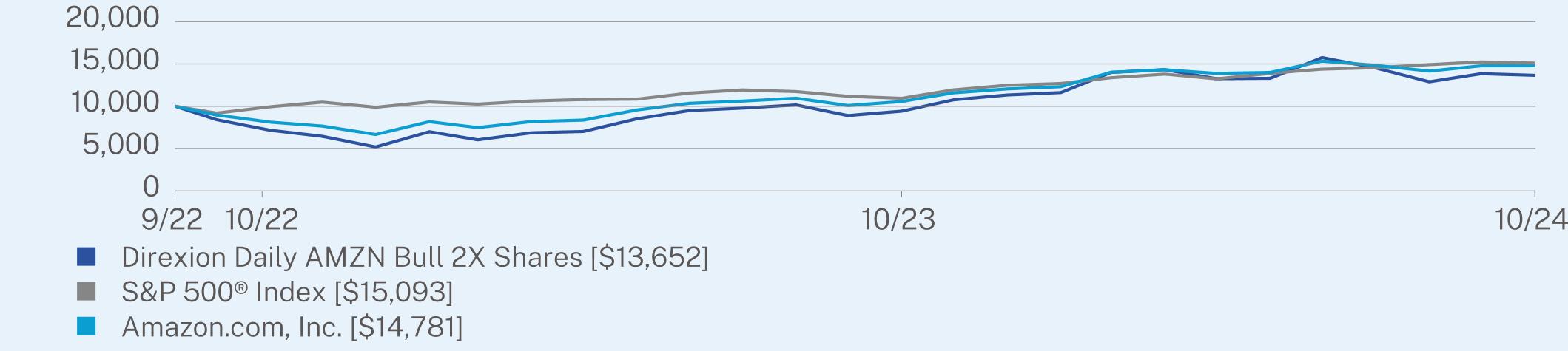

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(09/07/2022) |

Direxion Daily AMZN Bear 1X Shares | -27.68 | -19.95 |

S&P 500® Index | 38.02 | 21.09 |

Amazon.com, Inc. | 40.06 | 19.92 |

| Direxion Daily AMZN Bear 1X Shares | PAGE 1 | TSR-AR-25461A502 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. Annual returns are required to be shown and should not be interpreted as suggesting that the Fund should or should not be held for long periods of time. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $4,136,516 |

Number of Holdings | 5 |

Net Advisory Fee | $9,829 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily AMZN Bear 1X Shares | PAGE 2 | TSR-AR-25461A502 |

11948856961969929109361509381231055314781

| | |

| Direxion Daily AVGO Bear 1X Shares | |

AVS (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily AVGO Bear 1X Shares for the period of October 10, 2024 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily AVGO Bear 1X Shares | $6* | 0.95%** |

| * | Amount shown reflects the expense of the Fund from inception date through October 31, 2024. Expenses would be higher if the fund had been in operations for the entire period of this report. |

| ** | Percentage shown is annualized. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $2,731,746 |

Number of Holdings | 8 |

Net Advisory Fee | $0 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

| Direxion Daily AVGO Bear 1X Shares | PAGE 1 | TSR-AR-25461A551 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily AVGO Bear 1X Shares | PAGE 2 | TSR-AR-25461A551 |

| | |

| Direxion Daily GOOGL Bear 1X Shares | |

GGLS (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily GOOGL Bear 1X Shares for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily GOOGL Bear 1X Shares | $82 | 0.95% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Daily GOOGL Bear 1X Shares seeks daily investment results, before fees and expenses, of -100% of the performance of the class A shares of Alphabet Inc. (NASDAQ: GOOGL). Alphabet Inc. provides online advertising services in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. To determine if the Fund has met its daily investment goals, the Advisor, Rafferty Asset Management, LLC maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio, or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the common shares of Alphabet Inc. returned 37.90%. Given the daily investment objectives of the ETF and the path dependency of returns for longer periods, the annual return of the common shares alone should not generate expectations of annual performance of the ETF. The Direxion Daily GOOGL Bear 1X Shares returned -26.68%, while the model indicated an expected return of -32.47%.

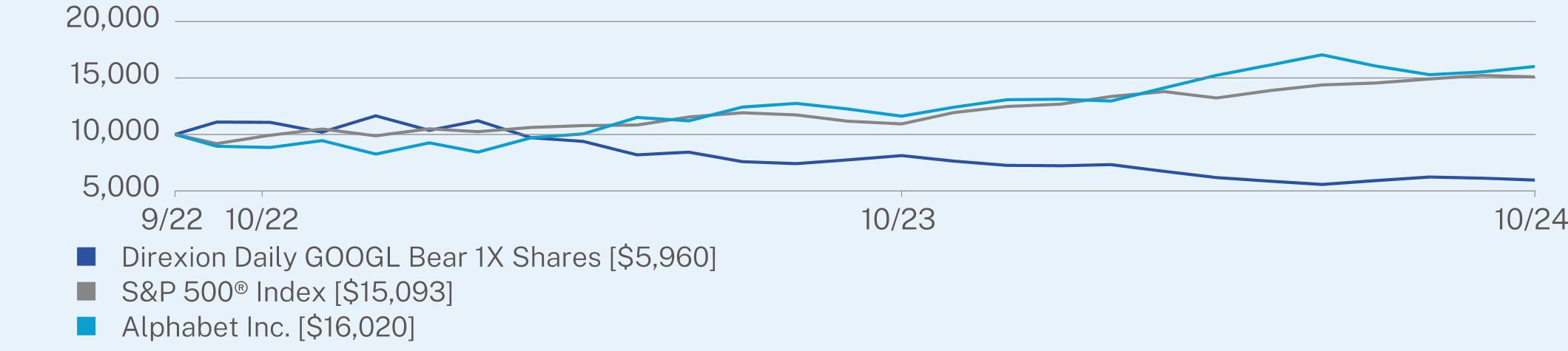

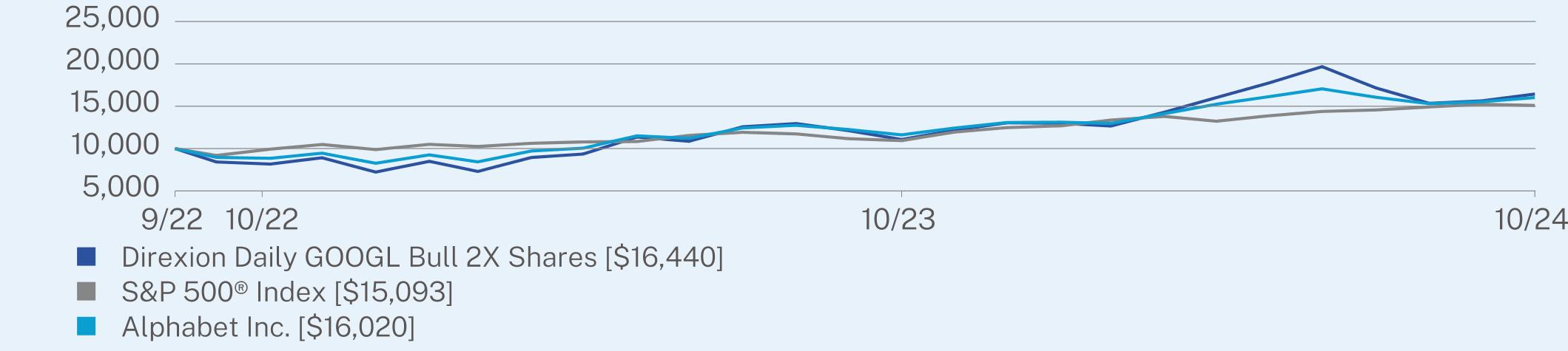

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(09/07/2022) |

Direxion Daily GOOGL Bear 1X Shares | -26.68 | -21.39 |

S&P 500® Index | 38.02 | 21.09 |

Alphabet Inc. | 37.90 | 24.50 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| Direxion Daily GOOGL Bear 1X Shares | PAGE 1 | TSR-AR-25461A601 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. Annual returns are required to be shown and should not be interpreted as suggesting that the Fund should or should not be held for long periods of time. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $4,116,235 |

Number of Holdings | 6 |

Net Advisory Fee | $8,812 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily GOOGL Bear 1X Shares | PAGE 2 | TSR-AR-25461A601 |

11072812859609929109361509388481161716020

| | |

| Direxion Daily META Bear 1X Shares | |

METD (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily META Bear 1X Shares for the period of June 5, 2024 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily META Bear 1X Shares | $35* | 0.95%** |

| * | Amount shown reflects the expense of the Fund from inception date through October 31, 2024. Expenses would be higher if the fund had been in operations for the entire period of this report. |

| ** | Percentage shown is annualized. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $6,197,898 |

Number of Holdings | 6 |

Net Advisory Fee | $0 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

| Direxion Daily META Bear 1X Shares | PAGE 1 | TSR-AR-25461A106 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily META Bear 1X Shares | PAGE 2 | TSR-AR-25461A106 |

| | |

| Direxion Daily MSFT Bear 1X Shares | |

MSFD (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily MSFT Bear 1X Shares for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily MSFT Bear 1X Shares | $88 | 0.95% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Daily MSFT Bear 1X Shares seeks daily investment results, before fees and expenses, of -100% of the performance of the common shares of Microsoft Corporation (NASDAQ: MSFT). Microsoft Corporation develops, licenses, and supports software, services, devices, and solutions worldwide. To determine if the Fund has met its daily investment goals, the Advisor, Rafferty Asset Management, LLC maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio, or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the common shares of Microsoft Corporation returned 20.18%. Given the daily investment objectives of the ETF and the path dependency of returns for longer periods, the annual return of the common shares alone should not generate expectations of annual performance of the ETF. The Direxion Daily MSFT Bear 1X Shares returned -13.83%, while the model indicated an expected return of -20.57%.

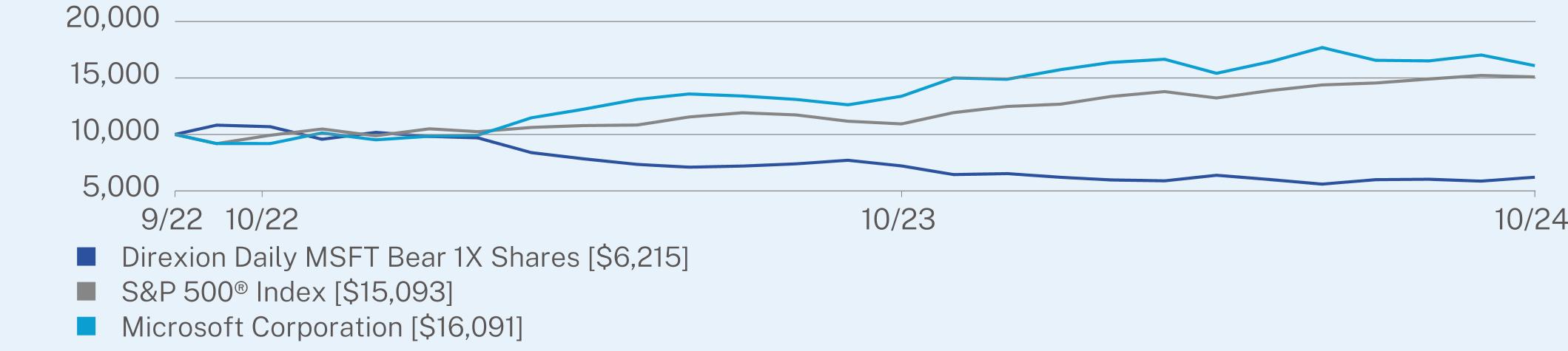

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(09/07/2022) |

Direxion Daily MSFT Bear 1X Shares | -13.83 | -19.84 |

S&P 500® Index | 38.02 | 21.09 |

Microsoft Corporation | 20.18 | 24.75 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| Direxion Daily MSFT Bear 1X Shares | PAGE 1 | TSR-AR-25461A403 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. Annual returns are required to be shown and should not be interpreted as suggesting that the Fund should or should not be held for long periods of time. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $7,882,824 |

Number of Holdings | 6 |

Net Advisory Fee | $41,188 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily MSFT Bear 1X Shares | PAGE 2 | TSR-AR-25461A403 |

10688721162159929109361509391921338816091

| | |

| Direxion Daily MU Bear 1X Shares | |

MUD (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily MU Bear 1X Shares for the period of October 10, 2024 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily MU Bear 1X Shares | $6* | 0.95%** |

| * | Amount shown reflects the expense of the Fund from inception date through October 31, 2024. Expenses would be higher if the fund had been in operations for the entire period of this report. |

| ** | Percentage shown is annualized. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $2,534,585 |

Number of Holdings | 6 |

Net Advisory Fee | $0 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

| Direxion Daily MU Bear 1X Shares | PAGE 1 | TSR-AR-25461A510 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily MU Bear 1X Shares | PAGE 2 | TSR-AR-25461A510 |

| | |

| Direxion Daily NFLX Bear 1X Shares | |

NFXS (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily NFLX Bear 1X Shares for the period of October 3, 2024 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily NFLX Bear 1X Shares | $7* | 0.95%** |

| * | Amount shown reflects the expense of the Fund from inception date through October 31, 2024. Expenses would be higher if the fund had been in operations for the entire period of this report. |

| ** | Percentage shown is annualized. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $4,657,331 |

Number of Holdings | 8 |

Net Advisory Fee | $0 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

| Direxion Daily NFLX Bear 1X Shares | PAGE 1 | TSR-AR-25461A205 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily NFLX Bear 1X Shares | PAGE 2 | TSR-AR-25461A205 |

| | |

| Direxion Daily NVDA Bear 1X Shares | |

NVDD (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily NVDA Bear 1X Shares for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily NVDA Bear 1X Shares | $60 | 0.95% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Daily NVDA Bear 1X Shares seeks daily investment results, before fees and expenses, of -100% of the performance of the common shares of NVIDIA Corporation (NASDAQ: NVDA). NVIDIA Corporation operates as a visual computing company worldwide. It operates in two segments, graphics and compute and networking. To determine if the Fund has met its daily investment goals, the Advisor, Rafferty Asset Management, LLC maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio, or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the common shares of NVIDIA Corporation returned 225.65%. Given the daily investment objectives of the ETF and the path dependency of returns for longer periods, the annual return of the common shares alone should not generate expectations of annual performance of the ETF. The Direxion Daily NVDA Bear 1X Shares returned -74.61%, while the model indicated an expected return of -76.66%.

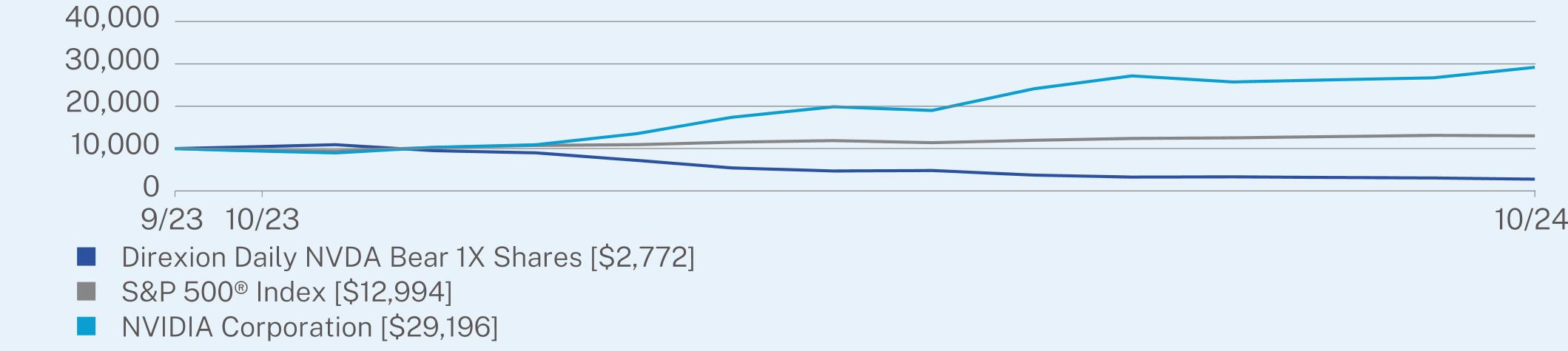

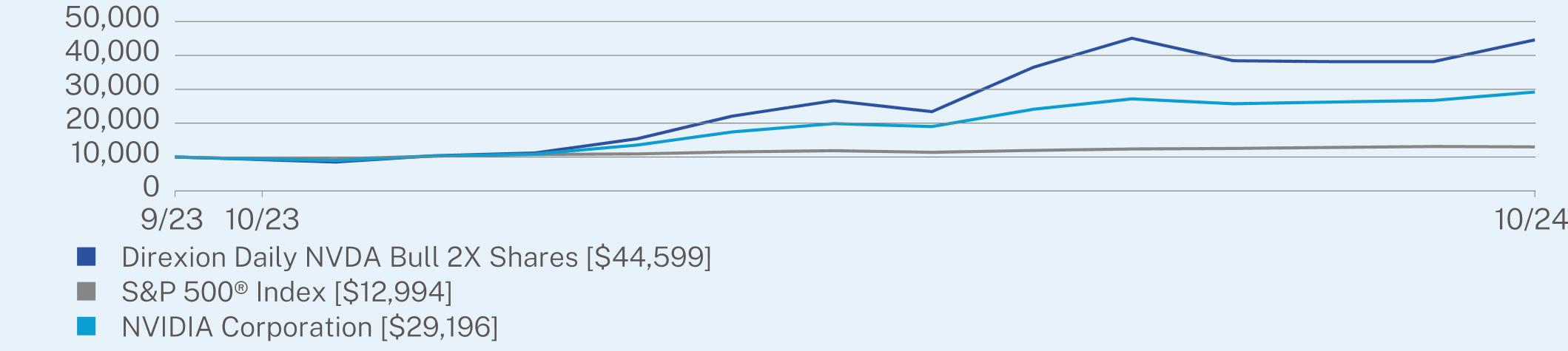

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(09/13/2023) |

Direxion Daily NVDA Bear 1X Shares | -74.61 | -67.73 |

S&P 500® Index | 38.02 | 25.98 |

NVIDIA Corporation | 225.65 | 157.19 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| Direxion Daily NVDA Bear 1X Shares | PAGE 1 | TSR-AR-25461A700 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. Annual returns are required to be shown and should not be interpreted as suggesting that the Fund should or should not be held for long periods of time. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $29,659,103 |

Number of Holdings | 9 |

Net Advisory Fee | $85,182 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily NVDA Bear 1X Shares | PAGE 2 | TSR-AR-25461A700 |

109122772941512994896629196

| | |

| Direxion Daily TSLA Bear 1X Shares | |

TSLS (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily TSLA Bear 1X Shares for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily TSLA Bear 1X Shares | $71 | 0.88% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Daily TSLA Bear 1X Shares seeks daily investment results, before fees and expenses, of -100% of the performance of the common shares of Tesla, Inc. (NASDAQ: TSLA). Tesla, Inc. designs, manufactures and sells electric vehicles and electric vehicle powertrain components. To determine if the Fund has met its daily investment goals, the Advisor, Rafferty Asset Management, LLC maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio, or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the common shares of Tesla, Inc. returned 24.40%. Given the daily investment objectives of the ETF and the path dependency of returns for longer periods, the annual return of the common shares alone should not generate expectations of annual performance of the ETF. The Direxion Daily TSLA Bear 1X Shares returned -38.26%, while the model indicated an expected return of -42.89%.

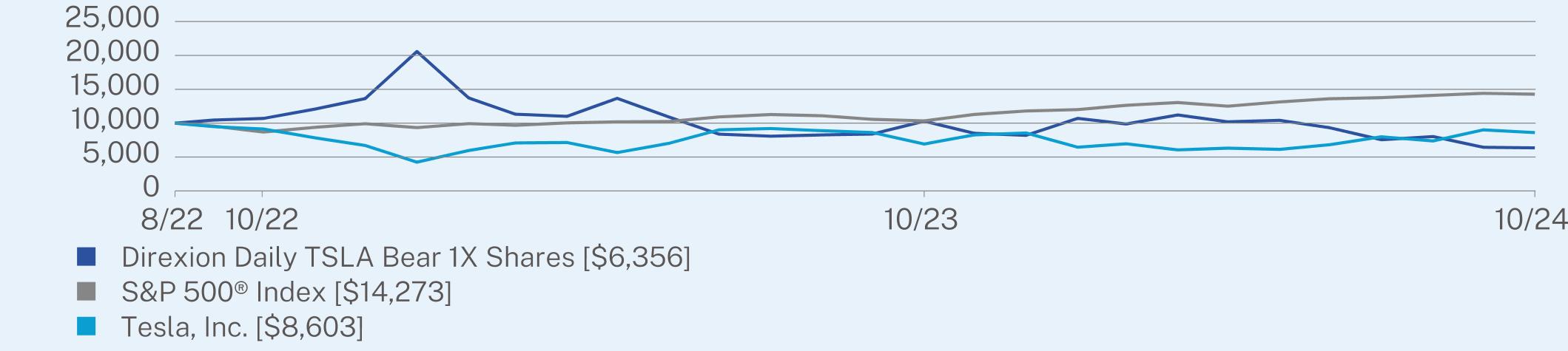

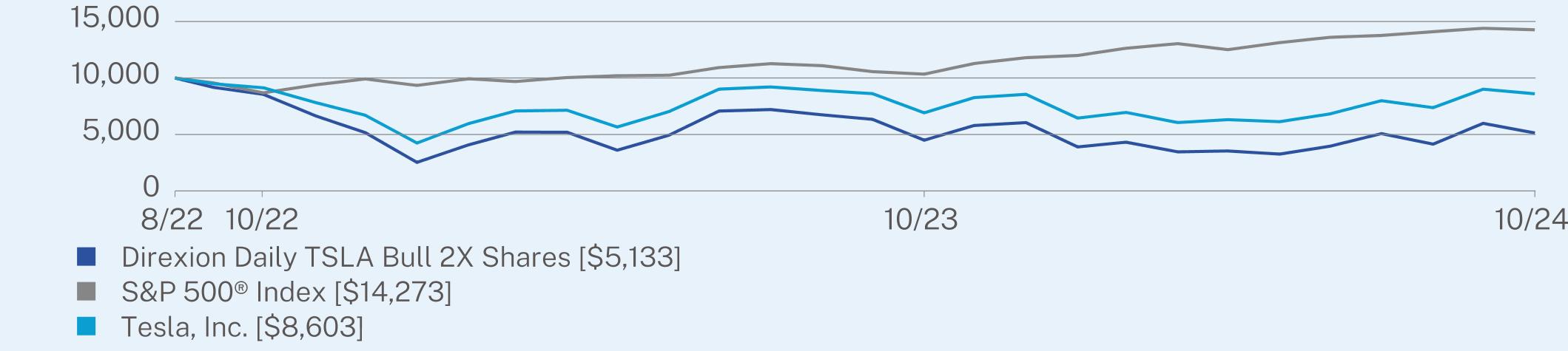

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses, were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(08/09/2022) |

Direxion Daily TSLA Bear 1X Shares | -38.26 | -18.39 |

S&P 500® Index | 38.02 | 17.30 |

Tesla, Inc. | 24.40 | -6.52 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| Direxion Daily TSLA Bear 1X Shares | PAGE 1 | TSR-AR-25460G260 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. Annual returns are required to be shown and should not be interpreted as suggesting that the Fund should or should not be held for long periods of time. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $44,021,932 |

Number of Holdings | 7 |

Net Advisory Fee | $384,239 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily TSLA Bear 1X Shares | PAGE 2 | TSR-AR-25460G260 |

1208410295635693891034114273783569158603

| | |

| Direxion Daily TSM Bear 1X Shares | |

TSMZ (Principal U.S. Listing Exchange: The Nasdaq Stock Market LLCNASDAQ) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily TSM Bear 1X Shares for the period of October 3, 2024 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily TSM Bear 1X Shares | $7* | 0.95%** |

| * | Amount shown reflects the expense of the Fund from inception date through October 31, 2024. Expenses would be higher if the fund had been in operations for the entire period of this report. |

| ** | Percentage shown is annualized. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $3,993,268 |

Number of Holdings | 7 |

Net Advisory Fee | $0 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | -100% |

Total (as % of net assets) | -100% |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of shorting and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. There is no guarantee that the Fund will achieve its stated investment objective. Although this report provide annual performance information, the Fund should not be expected to provide -100% of the return of the common shares’ cumulative return for periods longer or shorter than a trading day.

The Fund is distributed by ALPS Distributors, Inc.

| Direxion Daily TSM Bear 1X Shares | PAGE 1 | TSR-AR-25461A536 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Direxion at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Direxion or your financial intermediary.

| Direxion Daily TSM Bear 1X Shares | PAGE 2 | TSR-AR-25461A536 |

| | |

| Direxion Daily Crypto Industry Bear 1X Shares | |

REKT (Principal U.S. Listing Exchange: NYSE Arca, Inc.NYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Direxion Daily Crypto Industry Bear 1X Shares for the period of July 17, 2024 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Daily Crypto Industry Bear 1X Shares | $13* | 0.45%** |

| * | Amount shown reflects the expense of the Fund from inception date through October 31, 2024. Expenses would be higher if the fund had been in operations for the entire period of this report. |

| ** | Percentage shown is annualized. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $2,592,897 |

Number of Holdings | 5 |

Net Advisory Fee | $0 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Market Exposure | |

Total Return Swap

Contracts | -100% |

Total (as % of net assets) | -100% |