Exhibit 99.3

Supplemental Financial Information

Second Quarter 2013, Unaudited

August 5, 2013

Cole Real Estate Investments, Inc.

(f/k/a Cole Credit Property Trust III, Inc.)

Supplemental Unaudited Operating and Financial Data

As of and for the three months ended June 30, 2013

| | | | |

Highlights | | | 3 | |

| |

Financial Information | | | | |

Condensed Consolidated Unaudited Balance Sheets | | | 8 | |

Condensed Consolidated Unaudited Statements of Operations | | | 9 | |

Financial and Operational Statistics | | | 10 | |

Segment Reporting | | | 11 | |

Reconciliation of GAAP Net Income to Normalized EBITDA | | | 12 | |

Reconciliation of GAAP Net Income to FFO and AFFO | | | 13 | |

Adjusted G&A | | | 15 | |

Debt Overview | | | 16 | |

| |

Real Estate Investment | | | | |

Real Estate Portfolio Diversification | | | 17 | |

Same Store Summary | | | 18 | |

Tenant Diversification | | | 19 | |

Industry Diversification | | | 21 | |

Geographic Diversification | | | 22 | |

Lease Expirations | | | 24 | |

Multi-Tenant Property Summary | | | 25 | |

Unconsolidated Joint Venture Investment Summary | | | 28 | |

| |

Private Capital Management | | | | |

Managed Programs | | | 29 | |

| |

Terms and Definitions | | | 32 | |

2

Cole Real Estate Investments Announces Record Second Quarter 2013 Financial Results

Increasing the Dividend and Increasing Second Half 2013 Guidance

PHOENIX, August 5, 2013 – Cole Real Estate Investments, Inc. (NYSE: COLE), a market-leading net lease REIT, today announced record financial results for the second quarter ended June 30, 2013.

Second Quarter 2013 Consolidated Highlights

| | • | | NYSE Listing – Shares began trading on the NYSE on June 20, 2013 and received early inclusion in the MSCI U.S. REIT Index (RMS/RMZ) on July 3, 2013 |

| | • | | Record Operating Results – Reported consolidated revenue of $250.3 million and net income of $29.1 million, a 91% and 26% year-over-year increase from the second quarter of 2012, respectively |

| | • | | Record AFFO– Reported consolidated AFFO of $0.23 per diluted share, a 44% year-over-year increase from the second quarter of 2012, which includes $0.03 per diluted share from the private capital management segment |

| | • | | Accretive Acquisitions – $266 million was acquired in the second quarter 2013 with a weighted average annual lease yield of 7.7% and $1.3 billion of assets were acquired over the past four quarters with a weighted average annual lease yield of 7.8% |

| | • | | Robust Private Capital Flows – $508 million of capital was raised on behalf of our managed REITs in the second quarter 2013 and also achieved a record-breaking month of $509 million of capital raised during July |

| | • | | Increased Guidance – 10% increase in second half AFFO guidance to the new range of $0.42 to $0.47 per diluted share |

| | • | | Increased Dividends – Increased the annual distribution rate to $0.72 from $0.70 per share effective with the August dividend payable September 3, 2013, which represents an 11% increase over the past two quarters |

| | • | | Tender Offer – Commenced a modified “Dutch auction” tender offer to purchase $250 million of shares currently scheduled to expire on August 8, 2013 |

| | • | | Share Repurchase Program – Authorized to repurchase up to $250 million of shares in the open market starting on the 11th business day following completion of the tender offer |

Real Estate Investment Segment Highlights

| | • | | Revenue and net income of $167.6 million and $19.9 million, respectively |

| | • | | AFFO of $0.20 per diluted share, an increase of 25% over the second quarter of 2012 |

| | • | | Normalized EBITDA of $139.3 million, an increase of 27% over the second quarter of 2012 |

| | • | | Acquired six properties with a weighted average annual lease yield of 7.7% and generated an 18% net gain on five properties sold at a weighted average annual lease yield of 7.5% |

| | • | | Increased the unsecured credit facility to $1.4 billion from $858 million, extended the term of the revolving loans to June 2017 and the term loan to June 2018 and decreased the weighted average interest rate to 2.9% from 3.0% |

| | • | | Total portfolio occupancy of 99.1%, investment grade tenancy of 55%, and a weighted average remaining lease term of 12.2 years as of June 30, 2013 |

-more-

3

Private Capital Management Segment Highlights

| | • | | Revenue and net income of $82.6 million and $9.2 million, respectively |

| | • | | AFFO of $0.03 per diluted share and Normalized EBITDA of $15.1 million |

| | • | | Structured $1.1 billion of real estate acquisitions and $422 million of real estate financing on behalf of the managed REITs in the second quarter 2013 |

| | • | | Merger between Cole Credit Property Trust II, Inc. (“CCPT II”) and Spirit Realty Capital, Inc. (NYSE Ticker: SRC) completed on July 17, 2013 |

| | • | | Cole Corporate Income Trust, Inc. (“CCIT”) announced the close of its offering on September 30, 2013 and CCIT’s Board of Directors has determined to begin the evaluation of potential strategies to provide CCIT stockholders with liquidity |

Second Quarter 2013 Financial Results

Revenue

Consolidated revenue for the quarter ended June 30, 2013 increased 91% to $250.3 million, as compared to $131.4 million for the same quarter in 2012. This increase was due to an increase in revenue from the Real Estate Investment segment and the inclusion of revenue from the Private Capital Management segment, which was acquired on April 5, 2013.

Revenue for the Real Estate Investment segment for the quarter ended June 30, 2013 increased 28% to $167.6 million, as compared to $131.4 million for the same quarter in 2012. This increase was primarily due to a $1.0 billion increase in the average gross real estate assets net of gross intangible lease liabilities we owned, for the three months ended June 30, 2013, compared to the three months ended June 30, 2012. In addition, “same store” base rental revenue increased by 1.1% as compared to the year-ago quarter. Revenue for the Private Capital Management segment for the quarter ended June 30, 2013 was $82.6 million before reallowed fees and commissions.

4

Normalized EBITDA

Consolidated Normalized EBITDA increased 40% to $154.3 million for the quarter ended June 30, 2013, compared to $110.0 million for the same quarter in 2012. Normalized EBITDA for the Real Estate Investment segment increased 27% to $139.3 million for the quarter ended June 30, 2013, compared to $110.0 million for the year-ago quarter. Normalized EBITDA for the Private Capital Management segment was $15.0 million for the quarter ended June 30, 2013.

Net Income

Net income increased 26% to $29.1 million for the quarter ended June 30, 2013, compared to $23.1 million for the same quarter in 2012.

FFO and FFO per diluted share

Funds from Operations (FFO) for the quarter ended June 30, 2013, increased 17% to $76.2 million, or $0.16 per diluted share, as compared to $65.0 million, or $0.14 per diluted share, for the same quarter in 2012.

AFFO and AFFO per diluted share

Adjusted Funds from Operations (AFFO) for the quarter ended June 30, 2013, increased 44% to $110.8 million, or $0.23 per diluted share, as compared to $76.8 million, or $0.16 per diluted share, for the same quarter in 2012. AFFO for the Real Estate Investment segment increased 25% to $95.7 million, or $0.20 per diluted share for the quarter ended June 30, 2013, compared to $76.8 million, or $0.16 per diluted share, for the year-ago quarter. AFFO for the Private Capital Management segment was $15.1 million, or $0.03 per diluted share, for the quarter ended June 30, 2013.

Balance Sheet

As of June 30, 2013, Cole had total assets of $7.9 billion, unrestricted cash and cash equivalents of $167.5 million, total debt of $3.5 billion and $566.2 million available for borrowing under its senior unsecured credit facility. The leverage ratio of total debt to gross real estate and related assets was 47% and net debt, which represents total debt less cash, to annualized Normalized EBITDA was 5.4x.

During the second quarter, the Company increased the size of its senior unsecured credit facility to $1.4 billion from $858 million, extended the term of the revolving loans to June 2017 and the term loan to June 2018, while also decreasing the weighted average interest rate to 2.9% from 3.0%.

Tender Offer

On June 20, 2013, Cole commenced a modified “Dutch auction” tender offer to purchase for cash up to $250 million of shares of common stock on the terms and subject to the conditions described in its Offer to Purchase of that date. The tender offer and withdrawal rights will expire at 5:00 p.m. Eastern on August 8, 2013.

Increased Distributions

On August 2, 2013, Cole’s Board of Directors increased the amounts of the previously declared monthly dividends for August and September to $0.06 per share, representing an increase in the annual distribution rate to $0.72 from $0.70 per share. As previously announced, these dividends will be paid to stockholders of record as of August 30 and September 30, 2013, respectively, and the payments dates will be September 3 and October 1, 2013, respectively. The Board also declared a monthly dividend in the amount of $0.06 per share for the month of October 2013, which will be payable on November 1, 2013 to stockholders of record as of October 31, 2013.

5

Increased Second Half 2013 Guidance

The Company increased its guidance for the second half, as follows:

| | • | | Total revenue guidance increased by 18% to the range of $557 million to $585 million and is comprised of: |

| | • | | Real Estate Investment segment revenue in the range of $327 million to $335 million |

| | • | | Private Capital Management segment revenue (on a gross basis before reallowed fees and commissions) in the range of $230 million to $250 million |

| | • | | Normalized EBITDA guidance increased by 11% to the range of $297 million to $324 million |

| | • | | AFFO per diluted share guidance increased by 10% to the range of $0.42 to $0.47 |

Business Segment Descriptions

Real Estate Investment

As of June 30, 2013, the Company owned 1,014 properties in 48 states with 44.0 million rentable square feet, including properties owned through Consolidated Joint Ventures. Property types owned include single and multi-tenant retail, single tenant office and single tenant industrial. The Company also owned 21 CMBS bonds and three notes receivable and had interests in 12 properties with 2.3 million rentable square feet of commercial and retail space through Unconsolidated Joint Ventures. Total gross asset value of the portfolio was $7.5 billion.

During the second quarter of 2013, the Company acquired six properties for an aggregate purchase price of $266 million, which included one property acquired through a joint venture arrangement.

Also during the second quarter, the Company sold five properties for an aggregate sale price of $31.5 million, recognizing a $4.9 million gain on sale during the second quarter of 2013.

Private Capital Management

As of June 30, 2013, the Company through subsidiaries, collectively known as Cole Capital™, was the advisor to five publicly registered, non-listed REITs (“managed REITs”), for which it provides capital raising, acquisition, financing, leasing, asset management and shareholder services. As of June 30, 2013 the managed REITs, including CCPT II, owned 1,096 properties, with 37.0 million rentable square feet of single and multi-tenant retail and commercial space, representing $6.5 billion in gross real estate assets. Of the managed REITs properties, CCPT II owned 747 properties with 21.1 million square feet, representing $3.5 billion in gross real estate assets. On July 17, 2013, the merger of CCPT II and Spirit Realty Capital, Inc. was completed.

6

About Cole Real Estate Investments, Inc.

Cole is a real estate investment trust that owns and operates a diversified portfolio of core commercial real estate investments primarily consisting of 1,014 necessity retail, office and industrial properties located throughout the United States. Cole’s portfolio comprises more than 44.0 million square feet of rentable space located in 48 states, including properties owned through consolidated joint venture arrangements. As of June 30, 2013, the rentable space at these properties was 99.1% leased and the weighted average remaining lease term was 12.2 years. As of June 30, 2013, the Company also owned 21 CMBS and three notes receivable. In addition, through unconsolidated joint venture arrangements, as of June 30, 2013, the Company had interests in 12 properties comprising 2.3 million rentable square feet of commercial and retail space.

As of June 30, 2013, the Company was the advisor to Cole Credit Property Trust, Inc. (“CCPT”), CCPT II, Cole Credit Property Trust IV, Inc. (“CCPT IV”), CCIT and Cole Real Estate Income Strategy (Daily NAV), Inc. (“INAV”, collectively with CCPT, CCPT II, CCPT IV and CCIT, the “Managed REITs”). In addition, the Company sponsored 1031 programs and performs property management services for the related properties (collectively, with the Managed REITs, the “Managed Programs”). As of June 30, 2013, the Managed Programs owned 1,096 properties, comprising 37.0 million rentable square feet of single and multi-tenant retail and commercial space. As of June 30, 2013, the rentable space at these properties was 97.5% leased.

Contact for Cole Real Estate Investments, Inc.

| | | | |

| Stephan Keller | | Aaron Halfacre, CFA | | Jessica Thorsheim |

| Executive Vice President, CFO | | Head of Strategic Relations | | Director, Investor Relations |

Our Investor Relations department can be reached via telephone at (877) 405-2653 or via email at investorrelations@colereit.com.

Forward-Looking Statements

Certain statements contained in this release may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about Cole’s plans, strategies, and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of Cole’s performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “would,” “could,” “should,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Cole makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements contained in this release, and does not intend, and undertakes no obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

7

COLE REAL ESTATE INVESTMENTS, INC.

(F/K/A COLE CREDIT PROPERTY TRUST III, INC.)

CONDENSED CONSOLIDATED UNAUDITED BALANCE SHEETS

(in thousands, except share and per share amounts)

| | | | | | | | |

| | | June 30, 2013 | | | December 31, 2012 | |

ASSETS | | | | | | | | |

Investment in real estate assets: | | | | | | | | |

Land | | $ | 1,525,353 | | | $ | 1,488,525 | |

Buildings and improvements, less accumulated depreciation of $249,446 and $187,448, respectively | | | 4,365,738 | | | | 4,218,182 | |

Acquired intangible lease assets, less accumulated amortization of $160,308 and $121,894, respectively | | | 853,137 | | | | 859,985 | |

| | | | | | | | |

Total investment in real estate assets, net | | | 6,744,228 | | | | 6,566,692 | |

Investment in notes receivable, net | | | 90,464 | | | | 90,358 | |

Investment in marketable securities | | | 10,499 | | | | 51,103 | |

Investment in marketable securities pledged as collateral | | | 257,518 | | | | 266,098 | |

Investment in unconsolidated entities | | | 94,932 | | | | 96,785 | |

| | | | | | | | |

Total investment in real estate assets and related assets, net | | | 7,197,641 | | | | 7,071,036 | |

Assets related to real estate held for sale, net | | | — | | | | 23,153 | |

Cash and cash equivalents | | | 167,474 | | | | 192,504 | |

Restricted cash | | | 25,502 | | | | 18,444 | |

Rents and tenant receivables, less allowance for doubtful accounts of $440 and $337, respectively | | | 97,956 | | | | 79,569 | |

Intangible assets, prepaid expenses and other assets, net | | | 104,332 | | | | 11,790 | |

Deferred financing costs, less accumulated amortization of $16,248 and $23,105, respectively | | | 61,835 | | | | 57,229 | |

Goodwill | | | 229,102 | | | | — | |

Leasehold improvements and property and equipment, net | | | 21,295 | | | | — | |

Due from affiliates | | | 8,036 | | | | — | |

| | | | | | | | |

Total assets | | $ | 7,913,173 | | | $ | 7,453,725 | |

| | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | | |

Notes payable and other borrowings | | $ | 3,501,428 | | | $ | 3,292,048 | |

Accounts payable and accrued expenses | | | 58,115 | | | | 42,756 | |

Due to affiliates | | | — | | | | 4,525 | |

Acquired below market lease intangibles, less accumulated amortization of $21,303 and $16,389, respectively | | | 114,934 | | | | 113,607 | |

Distributions payable | | | 28,501 | | | | 26,399 | |

Contingent consideration | | | 211,143 | | | | 5,341 | |

Derivative liabilities, deferred rent and other liabilities | | | 52,968 | | | | 51,639 | |

| | | | | | | | |

Total liabilities | | | 3,967,089 | | | | 3,536,315 | |

| | | | | | | | |

Commitments and contingencies | | | | | | | | |

Redeemable common stock | | | — | | | | 234,578 | |

| | | | | | | | |

EQUITY: | | | | | | | | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized, none issued and outstanding | | | — | | | | — | |

Common stock, $0.01 par value; 990,000,000 shares authorized and 489,808,175 and 479,547,099 shares outstanding, respectively | | | 4,898 | | | | 4,795 | |

Capital in excess of par value | | | 4,416,151 | | | | 4,068,015 | |

Accumulated distributions in excess of earnings | | | (510,539 | ) | | | (416,886 | ) |

Accumulated other comprehensive income | | | 18,856 | | | | 23,101 | |

| | | | | | | | |

Total stockholders’ equity | | | 3,929,366 | | | | 3,679,025 | |

Noncontrolling interests | | | 16,718 | | | | 3,807 | |

| | | | | | | | |

Total equity | | | 3,946,084 | | | | 3,682,832 | |

| | | | | | | | |

Total liabilities and equity | | $ | 7,913,173 | | | $ | 7,453,725 | |

| | | | | | | | |

8

COLE REAL ESTATE INVESTMENTS, INC.

(F/K/A COLE CREDIT PROPERTY TRUST III, INC.)

CONDENSED CONSOLIDATED UNAUDITED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Revenues: | | | | | | | | | | | | | | | | |

Real estate investment revenue | | $ | 159,812 | | | $ | 124,910 | | | $ | 312,089 | | | $ | 234,066 | |

Interest income on real estate-related investments | | | 7,837 | | | | 6,452 | | | | 15,785 | | | | 10,241 | |

Private capital management revenue | | | 82,643 | | | | — | | | | 82,643 | | | | — | |

| | | | | | | | | | | | | | | | |

Total revenue | | | 250,292 | | | | 131,362 | | | | 410,517 | | | | 244,307 | |

| | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

Reallowed fees and commissions | | | 38,962 | | | | — | | | | 38,962 | | | | — | |

General and administrative expenses | | | 41,436 | | | | 4,652 | | | | 45,467 | | | | 8,676 | |

Merger related stock-based compensation expense | | | 10,278 | | | | — | | | | 10,278 | | | | — | |

Property operating expenses | | | 17,507 | | | | 11,543 | | | | 33,129 | | | | 21,298 | |

Property and asset management expenses | | | 1,393 | | | | 10,988 | | | | 15,302 | | | | 21,043 | |

Merger and acquisition related expenses | | | 11,810 | | | | 17,438 | | | | 27,423 | | | | 32,819 | |

Depreciation and amortization | | | 56,393 | | | | 38,269 | | | | 104,110 | | | | 71,540 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 177,779 | | | | 82,890 | | | | 274,671 | | | | 155,376 | |

| | | | | | | | | | | | | | | | |

Operating income | | | 72,513 | | | | 48,472 | | | | 135,846 | | | | 88,931 | |

| | | | | | | | | | | | | | | | |

Other income (expense): | | | | | | | | | | | | | | | | |

Equity in income of unconsolidated entities | | | 972 | | | | 552 | | | | 2,281 | | | | 886 | |

Other (expense) income | | | (774 | ) | | | 675 | | | | (851 | ) | | | 3,992 | |

Interest expense | | | (48,938 | ) | | | (30,141 | ) | | | (88,007 | ) | | | (57,312 | ) |

| | | | | | | | | | | | | | | | |

Total other expense | | | (48,740 | ) | | | (28,914 | ) | | | (86,577 | ) | | | (52,434 | ) |

| | | | | | | | | | | | | | | | |

Income from continuing operations before income taxes | | | 23,773 | | | | 19,558 | | | | 49,269 | | | | 36,497 | |

Benefit from income taxes | | | 235 | | | | — | | | | 235 | | | | — | |

| | | | | | | | | | | | | | | | |

Income from continuing operations | | | 24,008 | | | | 19,558 | | | | 49,504 | | | | 36,497 | |

| | | | | | | | | | | | | | | | |

Discontinued operations: | | | | | | | | | | | | | | | | |

Income from discontinued operations | | | 195 | | | | 3,532 | | | | 838 | | | | 7,762 | |

Gain on sale of real estate assets | | | 4,931 | | | | — | | | | 19,007 | | | | 14,781 | |

| | | | | | | | | | | | | | | | |

Income from discontinued operations | | | 5,126 | | | | 3,532 | | | | 19,845 | | | | 22,543 | |

| | | | | | | | | | | | | | | | |

Net income | | | 29,134 | | | | 23,090 | | | | 69,349 | | | | 59,040 | |

Net income (loss) allocated to noncontrolling interests | | | 111 | | | | (133 | ) | | | 215 | | | | (120 | ) |

| | | | | | | | | | | | | | | | |

Net income attributable to the Company | | $ | 29,023 | | | $ | 23,223 | | | $ | 69,134 | | | $ | 59,160 | |

| | | | | | | | | | | | | | | | |

Basic earnings per share: | | | | | | | | | | | | | | | | |

Income from continuing operations | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.10 | | | $ | 0.08 | |

Income from discontinued operations | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.04 | | | $ | 0.05 | |

Net income attributable to the Company | | $ | 0.06 | | | $ | 0.05 | | | $ | 0.14 | | | $ | 0.13 | |

Diluted earnings per share: | | | | | | | | | | | | | | | | |

Income from continuing operations | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.10 | | | $ | 0.08 | |

Income from discontinued operations | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.04 | | | $ | 0.05 | |

Net income attributable to the Company | | $ | 0.06 | | | $ | 0.05 | | | $ | 0.14 | | | $ | 0.13 | |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 487,915,368 | | | | 473,159,051 | | | | 484,396,906 | | | | 470,033,648 | |

Diluted | | | 491,510,128 | | | | 473,159,051 | | | | 486,194,286 | | | | 470,033,648 | |

Distributions declared per common share issued | | $ | 0.17 | | | $ | 0.16 | | | $ | 0.33 | | | $ | 0.31 | |

9

Financial and Operational Statistics

The following table presents certain financial and real estate portfolio information as of and for the three months ended June 30, 2013:

| | | | |

Market Capitalization | | | | |

Shares outstanding(1) | | | 489,808,175 | |

Closing stock price | | $ | 11.44 | |

Market capitalization (thousands) | | $ | 5,603,406 | |

Total capitalization (thousands)(2) | | $ | 9,104,834 | |

Enterprise value (thousands)(3) | | $ | 8,937,360 | |

High stock close price | | $ | 11.55 | |

Low stock close price | | $ | 9.85 | |

Distributions declared per share(4) | | $ | 0.70 | |

Distribution yield(5) | | | 6.1 | % |

Financial Ratios | | | | |

Debt to enterprise value(3) (6) | | | 39.2 | % |

Annualized Normalized EBITDA (thousands)(7) (8) | | $ | 617,244 | |

Net debt to Annualized Normalized EBITDA(7) (8) (9) | | | 5.4 | |

Gross real estate and related assets (thousands)(10) | | $ | 7,462,923 | |

Total debt to gross real estate and related assets(6) (10) | | | 47.0 | % |

Unsecured debt to gross real estate and related assets(10) | | | 9.4 | % |

Distribution payout(11) | | | 76.1 | % |

Interest coverage ratio(7) (12) | | | 3.15 | |

Weighted average cost of debt(13) | | | 4.22 | % |

Weighted average years to maturity of debt(13) | | | 6.0 | |

Owned Property Information | | | | |

Number of properties | | | 1,014 | |

Number of tenants | | | 567 | |

Total square feet (thousands) | | | 44,035 | |

Occupancy(14) | | | 99.1 | % |

Weighted average remaining lease term (years)(15) | | | 12.2 | |

Percent of investment grade tenants(16) | | | 42.4 | % |

| (1) | Excludes shares held in escrow as these are not considered outstanding in accordance with GAAP. |

| (2) | Total capitalization represents market capitalization plus notes payable and other borrowings. |

| (3) | Enterprise value represents total capitalization less cash and cash equivalents. |

| (4) | Represents the annualized distribution per share based on the distribution rate in effect as of June 30, 2013. |

| (5) | Annualized distributions to closing stock price. |

| (6) | Debt represents notes payable and other borrowings. |

| (7) | Normalized EBITDA is a non-GAAP measure. See the Terms and Definitions section that begins on page 32 for a description of our non-GAAP measures and page 12 for a reconciliation of net income to Normalized EBITDA. |

| (8) | Annualized three months ended June 30, 2013. |

| (9) | Net debt represents total GAAP-basis debt less cash. |

| (10) | Gross real estate and related assets represents total gross real estate and related assets, including investments in notes receivables, marketable securities and net investment in unconsolidated entities, net of gross intangible lease liabilities. |

| (11) | Computed by dividing annualized distribution per share by annualized AFFO per share. |

| (12) | Computed by dividing Annualized Normalized EBITDA by interest expense. |

| (13) | Calculated based on the Company’s total debt outstanding of $3.5 billion, which includes $700.0 million outstanding under a senior unsecured credit facility. Rates ranging from 2.44% to 3.44% were used to calculate the variable debt payment obligations in future periods. These were the rates effective as of June 30, 2013. |

| (14) | Percent of leasable square feet for which there is a lease in place. |

| (15) | Calculated using the remaining non-cancelable lease terms. |

| (16) | Based on annualized rental revenue from tenants with credit ratings of BBB- or higher, excluding tenants with implied investment grade ratings. Tenant credit rating may reflect the credit rating of the parent company or a guarantor. |

10

Segment Reporting

The Company operates under two business segments - Real Estate Investment and Private Capital Management. The following table presents a summary of the financial results for each business segment (in thousands):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Real Estate Investment | | | | | | | | | | | | | | | | |

Rental and other property income | | $ | 144,756 | | | $ | 114,317 | | | $ | 283,334 | | | $ | 214,359 | |

Tenant reimbursement income | | | 15,056 | | | | 10,593 | | | | 28,755 | | | | 19,707 | |

Interest income on notes receivable | | | 1,936 | | | | 1,476 | | | | 3,859 | | | | 2,848 | |

Interest income on marketable securities | | | 5,901 | | | | 4,976 | | | | 11,926 | | | | 7,393 | |

| | | | | | | | | | | | | | | | |

Total real estate investment revenue | | | 167,649 | | | | 131,362 | | | | 327,874 | | | | 244,307 | |

| | | | | | | | | | | | | | | | |

General and administrative expenses | | | 12,757 | | | | 4,652 | | | | 16,788 | | | | 8,676 | |

Merger related stock-based compensation expense | | | 10,278 | | | | — | | | | 10,278 | | | | — | |

Property operating expenses | | | 17,507 | | | | 11,543 | | | | 33,129 | | | | 21,298 | |

Property and asset management expenses | | | 1,393 | | | | 10,988 | | | | 15,302 | | | | 21,043 | |

Merger and acquisition related expenses | | | 11,810 | | | | 17,438 | | | | 27,423 | | | | 32,819 | |

Depreciation and amortization | | | 50,335 | | | | 38,269 | | | | 98,052 | | | | 71,540 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 104,080 | | | | 82,890 | | | | 200,972 | | | | 155,376 | |

| | | | | | | | | | | | | | | | |

Total other expense(1) | | | (48,747 | ) | | | (28,914 | ) | | | (86,584 | ) | | | (52,434 | ) |

| | | | | | | | | | | | | | | | |

Income from continuing operations | | | 14,822 | | | | 19,558 | | | | 40,318 | | | | 36,497 | |

Income from discontinued operations | | | 5,126 | | | | 3,532 | | | | 19,845 | | | | 22,543 | |

| | | | | | | | | | | | | | | | |

Net income | | $ | 19,948 | | | $ | 23,090 | | | $ | 60,163 | | | $ | 59,040 | |

| | | | | | | | | | | | | | | | |

Private Capital Management | | | | | | | | | | | | | | | | |

Dealer manager fees, selling commissions and offering reimbursements | | $ | 51,818 | | | $ | — | | | $ | 51,818 | | | $ | — | |

Transaction service fees | | | 21,509 | | | | — | | | | 21,509 | | | | — | |

Management fees and reimbursements | | | 9,316 | | | | — | | | | 9,316 | | | | — | |

| | | | | | | | | | | | | | | | |

Total private capital management revenue | | | 82,643 | | | | — | | | | 82,643 | | | | — | |

| | | | | | | | | | | | | | | | |

Reallowed fees and commissions | | | 38,962 | | | | — | | | | 38,962 | | | | — | |

General and administrative expenses | | | 28,679 | | | | — | | | | 28,679 | | | | — | |

Depreciation and amortization | | | 6,058 | | | | — | | | | 6,058 | | | | — | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 73,699 | | | | — | | | | 73,699 | | | | — | |

| | | | | | | | | | | | | | | | |

Total other income | | | 7 | | | | — | | | | 7 | | | | — | |

Benefit from income taxes(2) | | | 235 | | | | — | | | | 235 | | | | — | |

| | | | | | | | | | | | | | | | |

Net income | | $ | 9,186 | | | $ | — | | | $ | 9,186 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Company | | | | | | | | | | | | | | | | |

Total revenue | | $ | 250,292 | | | $ | 131,362 | | | $ | 410,517 | | | $ | 244,307 | |

Total operating expenses | | | 177,779 | | | | 82,890 | | | | 274,671 | | | | 155,376 | |

Total other expense, net | | | (48,740 | ) | | | (28,914 | ) | | | (86,577 | ) | | | (52,434 | ) |

Benefit from income taxes | | | 235 | | | | — | | | | 235 | | | | — | |

| | | | | | | | | | | | | | | | |

Income from continuing operations | | | 24,008 | | | | 19,558 | | | | 49,504 | | | | 36,497 | |

Income from discontinued operations | | | 5,126 | | | | 3,532 | | | | 19,845 | | | | 22,543 | |

| | | | | | | | | | | | | | | | |

Net income | | $ | 29,134 | | | $ | 23,090 | | | $ | 69,349 | | | $ | 59,040 | |

| | | | | | | | | | | | | | | | |

| (1) | Primarily consists of interest expense. |

| (2) | While most of the business activities of the Company’s Private Capital Management segment are conducted through a subsidiary of the Company that is a taxable REIT subsidiary (“TRS”), revenues and expenses recorded in the TRS for tax purposes are not the same as those included in the Private Capital Management segment in accordance with GAAP. In future periods, we expect to recognize an income tax expense, not a benefit from income taxes. |

| | | | | | | | |

| | | Total Assets as of | |

| | | June 30, 2013 | | | December 31, 2012 | |

Real estate investment | | $ | 7,546,129 | | | $ | 7,453,725 | |

Private capital management | | | 367,044 | | | | — | |

| | | | | | | | |

Total company | | $ | 7,913,173 | | | $ | 7,453,725 | |

| | | | | | | | |

11

Reconciliation of GAAP Net Income to Normalized EBITDA

The calculations of EBITDA and Normalized EBITDA, and reconciliation to net income, which is the most directly comparable GAAP financial measure, are presented in the table below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2013 | | | Three Months Ended June 30, 2012 | |

| | | Total | | | Real Estate

Investment | | | Private Capital

Management | | | Total | | | Real Estate

Investment | | | Private Capital

Management | |

Net income attributable to the company | | $ | 29,023 | | | $ | 19,837 | | | $ | 9,186 | | | $ | 23,223 | | | $ | 23,223 | | | $ | — | |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | 48,938 | | | | 48,938 | | | | — | | | | 28,846 | | | | 28,846 | | | | — | |

Depreciation and amortization | | | 56,463 | | | | 50,405 | | | | 6,058 | | | | 41,294 | | | | 41,294 | | | | — | |

Benefit from income taxes | | | (235 | ) | | | — | | | | (235 | ) | | | — | | | | — | | | | — | |

Proportionate share of adjustments for unconsolidated joint ventures | | | 111 | | | | 111 | | | | — | | | | (133 | ) | | | (133 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA(1) | | | 134,300 | | | | 119,291 | | | | 15,009 | | | | 93,230 | | | | 93,230 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Management adjustments: | | | | | | | | | | | | | | | | | | | | | | | | |

Gain on sale of real estate assets | | | (4,931 | ) | | | (4,931 | ) | | | — | | | | (664 | ) | | | (664 | ) | | | — | |

Merger and acquisition related expenses | | | 11,810 | | | | 11,810 | | | | — | | | | 17,438 | | | | 17,438 | | | | — | |

Merger related stock-based compensation expense | | | 10,278 | | | | 10,278 | | | | — | | | | — | | | | — | | | | — | |

Listing and tender offer expenses | | | 2,854 | | | | 2,854 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total adjustments | | | 20,011 | | | | 20,011 | | | | — | | | | 16,774 | | | | 16,774 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Normalized EBITDA(1) | | $ | 154,311 | | | $ | 139,302 | | | $ | 15,009 | | | $ | 110,004 | | | $ | 110,004 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | EBITDA and Normalized EBITDA are non-GAAP measures. See the Terms and Definitions section that begins on page 32 for a description of our non-GAAP measures. |

12

Reconciliation of GAAP Net Income to

Funds from Operations and Adjusted Funds from Operations

The calculations of funds from operations (FFO) and adjusted funds from operations (AFFO), and reconciliation to net income, which is the most directly comparable GAAP financial measure, are presented in the tables below (in thousands, except share and per share amounts):

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | June 30,

2013 | | | March 31,

2013 | | | December 31,

2012 | | | September 30,

2012 | | | June 30,

2012 | |

Total Company | | | | | | | | | | | | | | | | | | | | |

Net income attributable to the company | | $ | 29,023 | | | $ | 40,111 | | | $ | 125,611 | | | $ | 18,567 | | | $ | 23,223 | |

Depreciation and amortization of real property | | | 50,405 | | | | 47,835 | | | | 45,516 | | | | 44,380 | | | | 41,294 | |

Depreciation and amortization of real estate assets in unconsolidated joint ventures | | | 1,733 | | | | 1,860 | | | | 2,162 | | | | 1,549 | | | | 1,138 | |

Net gain on sale and condemnation of real estate assets | | | (4,931 | ) | | | (13,953 | ) | | | (93,676 | ) | | | — | | | | (664 | ) |

| | | | | | | | | | | | | | | | | | | | |

FFO - Total Company(1) | | | 76,230 | | | | 75,853 | | | | 79,613 | | | | 64,496 | | | | 64,991 | |

Merger and acquisition related expenses | | | 11,810 | | | | 15,613 | | | | 17,460 | | | | 13,612 | | | | 17,438 | |

Merger related stock-based compensation expense | | | 10,278 | | | | — | | | | — | | | | — | | | | — | |

Listing and tender offering expenses | | | 2,854 | | | | — | | | | — | | | | — | | | | — | |

Amortization of deferred financing costs | | | 3,958 | | | | 3,753 | | | | 5,477 | | | | 3,859 | | | | 3,379 | |

Straight-line rent adjustments | | | (8,881 | ) | | | (9,688 | ) | | | (8,942 | ) | | | (8,937 | ) | | | (8,209 | ) |

Above/below market lease intangibles amortization, net | | | 731 | | | | 888 | | | | 834 | | | | 535 | | | | 801 | |

Loss on derivatives and extinguishment of debt | | | 7,782 | | | | — | | | | 3,514 | | | | 9,263 | | | | — | |

Loss (gain) on the sale of marketable securities | | | 1,331 | | | | — | | | | (12,455 | ) | | | — | | | | — | |

Other amortization (accretion), net(2) | | | 4,547 | | | | (1,375 | ) | | | (1,524 | ) | | | (1,403 | ) | | | (1,190 | ) |

Proportionate share of adjustments for unconsolidated joint ventures | | | 121 | | | | 30 | | | | (567 | ) | | | (888 | ) | | | (409 | ) |

| | | | | | | | | | | | | | | | | | | | |

AFFO - Total Company(1) (3) | | $ | 110,761 | | | $ | 85,074 | | | $ | 83,410 | | | $ | 80,537 | | | $ | 76,801 | |

| | | | | | | | | | | | | | | | | | | | |

FFO per common share, basic | | $ | 0.16 | | | $ | 0.16 | | | $ | 0.17 | | | $ | 0.14 | | | $ | 0.14 | |

FFO per common share, diluted | | $ | 0.16 | | | $ | 0.16 | | | $ | 0.17 | | | $ | 0.14 | | | $ | 0.14 | |

AFFO per common share, basic | | $ | 0.23 | | | $ | 0.18 | | | $ | 0.17 | | | $ | 0.17 | | | $ | 0.16 | |

AFFO per common share, diluted | | $ | 0.23 | | | $ | 0.18 | | | $ | 0.17 | | | $ | 0.17 | | | $ | 0.16 | |

Distributions paid (including DRIP) | | $ | 83,791 | | | $ | 76,894 | | | $ | 77,246 | | | $ | 77,705 | | | $ | 76,419 | |

Weighted average shares outstanding, basic | | | 487,915,368 | | | | 480,819,849 | | | | 478,762,187 | | | | 476,353,149 | | | | 473,159,051 | |

Weighted average shares outstanding, diluted | | | 491,510,128 | | | | 480,819,849 | | | | 478,762,187 | | | | 476,353,149 | | | | 473,159,051 | |

13

Reconciliation of Net Income to

Funds from Operations and Adjusted Funds from Operations (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | June 30,

2013 | | | March 31,

2013 | | | December 31,

2012 | | | September 30,

2012 | | | June 30,

2012 | |

Real Estate Investment Segment | | | | | | | | | | | | | | | | | | | | |

Net income attributable to the company | | $ | 19,837 | | | $ | 40,111 | | | $ | 125,611 | | | $ | 18,567 | | | $ | 23,223 | |

Depreciation and amortization of real property | | | 50,405 | | | | 47,835 | | | | 45,516 | | | | 44,380 | | | | 41,294 | |

Depreciation and amortization of real estate assets in unconsolidated joint ventures | | | 1,733 | | | | 1,860 | | | | 2,162 | | | | 1,549 | | | | 1,138 | |

Net gain on sale and condemnation of real estate assets | | | (4,931 | ) | | | (13,953 | ) | | | (93,676 | ) | | | — | | | | (664 | ) |

| | | | | | | | | | | | | | | | | | | | |

FFO - Real Estate Investment Segment(1) | | | 67,044 | | | | 75,853 | | | | 79,613 | | | | 64,496 | | | | 64,991 | |

Merger and acquisition related expenses | | | 11,810 | | | | 15,613 | | | | 17,460 | | | | 13,612 | | | | 17,438 | |

Merger related stock-based compensation expense | | | 10,278 | | | | — | | | | — | | | | — | | | | — | |

Listing and tender offering expenses | | | 2,854 | | | | — | | | | — | | | | — | | | | — | |

Amortization of deferred financing costs | | | 3,958 | | | | 3,753 | | | | 5,477 | | | | 3,859 | | | | 3,379 | |

Straight-line rent adjustments | | | (8,881 | ) | | | (9,688 | ) | | | (8,942 | ) | | | (8,937 | ) | | | (8,209 | ) |

Above/below market lease intangibles amortization, net | | | 731 | | | | 888 | | | | 834 | | | | 535 | | | | 801 | |

Loss on derivatives and extinguishment of debt | | | 7,782 | | | | — | | | | 3,514 | | | | 9,263 | | | | — | |

Loss (gain) on the sale of marketable securities | | | 1,331 | | | | — | | | | (12,455 | ) | | | — | | | | — | |

Other accretion, net | | | (1,365 | ) | | | (1,375 | ) | | | (1,524 | ) | | | (1,403 | ) | | | (1,190 | ) |

Proportionate share of adjustments for unconsolidated joint ventures | | | 121 | | | | 30 | | | | (567 | ) | | | (888 | ) | | | (409 | ) |

| | | | | | | | | | | | | | | | | | | | |

AFFO - Real Estate Investment Segment(1) (3) | | $ | 95,663 | | | $ | 85,074 | | | $ | 83,410 | | | $ | 80,537 | | | $ | 76,801 | |

| | | | | | | | | | | | | | | | | | | | |

Private Capital Management Segment | | | | | | | | | | | | | | | | | | | | |

Net income attributable to the company | | $ | 9,186 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Other amortization, net | | | 5,912 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

AFFO - Private Capital Management Segment(1) (3) | | $ | 15,098 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | FFO and AFFO are non-GAAP measures. See the Terms and Definitions section that begins on page 32 for a description of our non-GAAP measures. |

| (2) | Primarily consists of CMBS accretion and amortization of intangible assets. |

| (3) | During the three months ended June 30, 2013, March 31, 2013, December 31, 2012, September 30, 2012 and June 30, 2012, the Company capitalized expenses incurred related to the ongoing maintenance of the properties, including tenant improvements and leasing commissions, of $983,000, $1.3 million, $1.4 million, $2.1 million, and $2.8 million, respectively. |

14

Adjusted G&A

The following table shows information regarding the Company’s general and administrative expenses (in thousands):

| | | | | | | | | | | | |

| | | Three Months Ended June 30, 2013 | |

| | | Total | | | Real Estate

Investment | | | Private Capital

Management | |

G&A | | $ | 41,436 | | | $ | 12,757 | | | $ | 28,679 | |

Less: | | | | | | | | | | | | |

Listing and tender offer expenses | | | 2,854 | | | | 2,854 | | | | — | |

Expense reimbursements from managed programs | | | 10,836 | | | | — | | | | 10,836 | |

| | | | | | | | | | | | |

Adjusted G&A(1) | | $ | 27,746 | | | $ | 9,903 | | | $ | 17,843 | |

| | | | | | | | | | | | |

| (1) | Adjusted G&A is a non-GAAP measure. See the Terms and Definitions section that begins on page 32 for a description of our non-GAAP measures. |

15

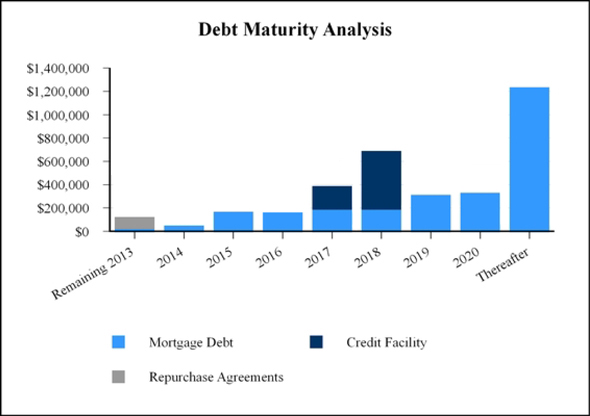

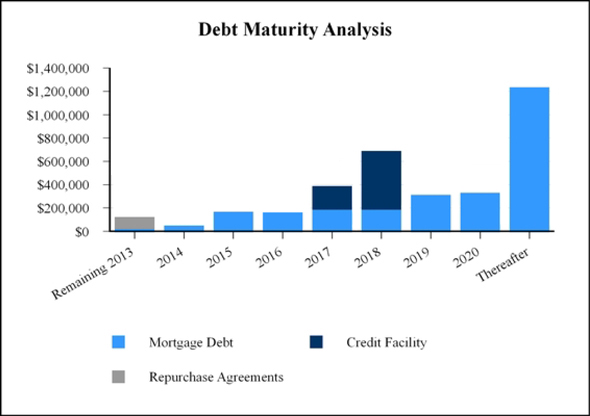

Debt Overview

As of June 30, 2013, the Company had $3.5 billion of debt outstanding, with a weighted average years to maturity of 6.0 years and weighted average interest rate of 4.22%. The following tables show certain information regarding the Company’s debt, as of June 30, 2013 (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | Minimum Interest

Rate | | | Maximum Interest

Rate | | | Weighted

Average Interest

Rate | | | Weighted

Average Years to

Maturity | | | Balance | |

Fixed rate debt | | | 2.75 | % | | | 6.83 | % | | | 4.74 | % | | | 6.8 | | | $ | 2,578,318 | |

Variable rate debt | |

| 1m LIBOR +

2.25 |

% | |

| 1m LIBOR +

3.25 |

% | | | 3.01 | % | | | 3.0 | | | | 96,843 | |

Construction facilities | |

| 1m LIBOR +

2.35 |

% | |

| 1m LIBOR +

2.35 |

% | | | 2.54 | % | | | 0.5 | | | | 26,752 | |

Credit facility - term loan | | | 3.30 | % | | | 3.30 | % | | | 3.30 | % | | | 4.9 | | | | 500,000 | |

Credit facility - revolving line of credit | |

| 1m LIBOR +

1.65 |

% | |

| 1m LIBOR +

2.25 |

% | | | 1.92 | % | | | 3.9 | | | | 200,000 | |

Repurchase agreements | |

| 3m LIBOR +

1.20 |

% | |

| 3m LIBOR +

1.75 |

% | | | 1.72 | % | | | 0.1 | | | | 100,057 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | | | | $ | 3,501,970 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Year of Maturity | | Balloon Payments | | | Amortizing Principal

Payments | | | Debt Maturity | |

Remaining 2013 | | $ | 126,809 | | | $ | 1,146 | | | $ | 127,955 | |

2014 | | | 51,809 | | | | 2,338 | | | | 54,147 | |

2015 | | | 174,000 | | | | 3,191 | | | | 177,191 | |

2016 | | | 162,836 | | | | 5,892 | | | | 168,728 | |

2017 | | | 387,089 | | | | 6,064 | | | | 393,153 | |

2018 | | | 685,385 | | | | 6,545 | | | | 691,930 | |

2019 | | | 307,648 | | | | 8,225 | | | | 315,873 | |

2020 | | | 330,065 | | | | 5,444 | | | | 335,509 | |

Thereafter | | | 1,235,294 | | | | 2,190 | | | | 1,237,484 | |

| | | | | | | | | | | | |

Total | | $ | 3,460,935 | | | $ | 41,035 | | | $ | 3,501,970 | |

| | | | | | | | | | | | |

16

Real Estate Portfolio Diversification

The following table presents diversifications of the Company’s real estate portfolio, including property type information, as of June 30, 2013:

| | | | | | | | | | | | | | | | | | | | |

| | | Number of

Investments | | | Rentable Square

Feet (thousands) | | | Annualized

Revenue(1)

(thousands) | | | % of

Annualized

Revenue | | | Weighted

Average Lease

Term

Remaining(2) | |

Freestanding retail | | | 886 | | | | 17,740 | | | $ | 270,685 | | | | 44.3 | % | | | 14.8 | |

Multi-tenant retail | | | 73 | | | | 11,056 | | | | 144,714 | | | | 23.8 | % | | | 7.5 | |

Office | | | 34 | | | | 5,940 | | | | 108,888 | | | | 17.9 | % | | | 11.8 | |

Industrial | | | 21 | | | | 9,299 | | | | 43,645 | | | | 7.2 | % | | | 12.4 | |

| | | | | | | | | | | | | | | | | | | | |

Total real estate assets | | | 1,014 | | | | 44,035 | | | | 567,932 | | | | 93.2 | % | | | 12.2 | |

Secured notes and CMBS | | | 24 | | | | N/A | | | | 22,364 | | | | 3.7 | % | | | N/A | |

Unconsolidated joint ventures | | | 12 | (3) | | | 2,306 | | | | 18,851 | | | | 3.1 | % | | | 7.7 | |

| | | | | | | | | | | | | | | | | | | | |

Total real estate and related assets | | | 1,050 | | | | 46,341 | | | $ | 609,147 | | | | 100.0 | % | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Annualized revenue for real estate assets represents the average annual base rental income over the respective lease terms, including adjustments for rent concessions or abatements, if any. Annualized revenue for the secured notes and CMBS represents average annual interest income over the respective loan term, excluding adjustments for accretion or amortization of discounts or premiums. Annualized revenue for the unconsolidated joint ventures represents the Company’s interest in the average annual base rental income over the respective lease terms, including adjustments for rent concessions or abatements, if any. |

| (2) | Calculated using the non-cancelable lease terms. |

| (3) | Represents properties owned by unconsolidated joint ventures. |

17

Same Store Summary

We review our stabilized operating results from properties that we owned for the entirety of both the current and prior year reporting periods, referred to as “same store.”

The following tables show our same store portfolio statistics, which include 700 properties, acquired prior to April 1, 2012 and owned through June 30, 2013, excluding properties acquired through the Unconsolidated Joint Ventures:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | | Increase/(Decrease) | |

| | | 2013 | | | 2012 | | | $ Change | | | % Change | |

Same store base rental revenue (1) | | $ | 101,769 | | | $ | 100,701 | | | $ | 1,068 | | | | 1.1 | % |

Same store other rental revenue | | | 4,994 | | | | 6,013 | | | | (1,019 | ) | | | (16.9 | )% |

| | | | | | | | | | | | | | | | |

Total same store rental revenue | | | 106,763 | | | | 106,714 | | | | 49 | | | | — | % |

Rental and other property income from income-producing properties acquired subsequent to March 31, 2012 and properties sold prior to June 30, 2013 | | | 37,993 | | | | 7,603 | | | | 30,390 | | | | 399.7 | % |

| | | | | | | | | | | | | | | | |

Total rental and other property income | | $ | 144,756 | | | $ | 114,317 | | | $ | 30,439 | | | | 26.6 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Base Rental Revenue (in thousands)(1) | |

| | | Number of | | | Three Months Ended June 30, | | | Increase/(Decrease) | |

Property Type | | Properties | | | 2013 | | | 2012 | | | $ Change | | | % Change | |

Freestanding retail | | | 598 | | | $ | 52,806 | | | $ | 52,581 | | | $ | 225 | | | | 0.4 | % |

Multi-tenant retail | | | 58 | | | | 26,178 | | | | 25,592 | | | | 586 | | | | 2.3 | % |

Office | | | 26 | | | | 15,784 | | | | 15,568 | | | | 216 | | | | 1.4 | % |

Industrial | | | 18 | | | | 7,001 | | | | 6,960 | | | | 41 | | | | 0.6 | % |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 700 | | | $ | 101,769 | | | $ | 100,701 | | | $ | 1,068 | | | | 1.1 | % |

| | | | | | | | | | | | | | | | | | | | |

The following tables show our same store portfolio statistics, which include 647 properties, acquired prior to January 1, 2012 and owned through June 30, 2013, excluding properties acquired through the Unconsolidated Joint Ventures:

| | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, | | | Increase/(Decrease) | |

| | | 2013 | | | 2012 | | | $ Change | | | % Change | |

Same store base rental revenue (1) | | $ | 186,924 | | | $ | 185,096 | | | $ | 1,828 | | | | 1.0 | % |

Same store other rental revenue | | | 9,293 | | | | 10,482 | | | | (1,189 | ) | | | (11.3 | )% |

| | | | | | | | | | | | | | | | |

Total same store rental revenue | | | 196,217 | | | | 195,578 | | | | 639 | | | | 0.3 | % |

Rental and other property income from income-producing properties acquired subsequent to December 31, 2011 and properties sold prior to June 30, 2013 | | | 87,117 | | | | 18,781 | | | | 68,336 | | | | 363.9 | % |

| | | | | | | | | | | | | | | | |

Total rental and other property income | | $ | 283,334 | | | $ | 214,359 | | | $ | 68,975 | | | | 32.2 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Base Rental Revenue (in thousands)(1) | |

| | | Number of | | | Six Months Ended June 30, | | | Increase/(Decrease) | |

Property Type | | Properties | | | 2013 | | | 2012 | | | $ Change | | | % Change | |

Freestanding retail | | | 555 | | | $ | 99,134 | | | $ | 98,789 | | | $ | 345 | | | | 0.3 | % |

Multi-tenant retail | | | 51 | | | | 44,492 | | | | 43,565 | | | | 927 | | | | 2.1 | % |

Office | | | 23 | | | | 29,296 | | | | 28,848 | | | | 448 | | | | 1.6 | % |

Industrial | | | 18 | | | | 14,002 | | | | 13,894 | | | | 108 | | | | 0.8 | % |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 647 | | | $ | 186,924 | | | $ | 185,096 | | | $ | 1,828 | | | | 1.0 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Base rental revenue represents contractual base rental revenue earned and does not include the impact of certain GAAP adjustments to rental revenue, such as straight-line rent and amortization of above market intangible lease assets and below market lease intangible liabilities. Such GAAP adjustments are included in the line item referred to as “same store other rental revenue.” |

18

Tenant Diversification

The following table shows certain information regarding the tenant diversification of the Company’s real estate portfolio, including consolidated joint ventures, as of June 30, 2013:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Tenant | | Number

of Leases | | | Number

of States | | | Leased

Square Feet

(thousands) | | | % of

Leased

Square

Feet | | | Annualized

Rental

Revenue(1)

(thousands) | | | % of

Annualized

Rental

Revenue | | | Weighted

Average Lease

Term

Remaining(2) | | | S&P Credit

Rating(3) |

1 | | Walgreens | | | 73 | | | | 30 | | | | 1,078 | | | | 2.5 | % | | $ | 27,229 | | | | 4.8 | % | | | 17.9 | | | BBB |

2 | | Albertson’s | | | 34 | | | | 6 | | | | 1,969 | | | | 4.5 | % | | | 24,074 | | | | 4.2 | % | | | 16.8 | | | B |

3 | | PetSmart | | | 42 | | | | 16 | | | | 1,300 | | | | 3.0 | % | | | 23,800 | | | | 4.2 | % | | | 8.3 | | | BB+ |

4 | | CVS | | | 54 | | | | 22 | | | | 860 | | | | 2.0 | % | | | 20,275 | | | | 3.6 | % | | | 18.1 | | | BBB+ |

5 | | BJ’s Wholesale Club | | | 3 | | | | 8 | | | | 2,230 | | | | 5.1 | % | | | 19,106 | | | | 3.4 | % | | | 17.7 | | | B |

6 | | Wal-Mart | | | 9 | | | | 7 | | | | 1,913 | | | | 4.4 | % | | | 15,320 | | | | 2.7 | % | | | 11.0 | | | AA |

7 | | Apollo Group | | | 1 | | | | 1 | | | | 600 | | | | 1.4 | % | | | 14,557 | | | | 2.6 | % | | | 17.8 | | | Not Rated |

8 | | L.A. Fitness | | | 17 | | | | 8 | | | | 752 | | | | 1.7 | % | | | 14,208 | | | | 2.5 | % | | | 11.0 | | | Not Rated |

9 | | Amazon | | | 3 | | | | 2 | | | | 3,048 | | | | 7.0 | % | | | 13,922 | | | | 2.5 | % | | | 13.3 | | | AA- |

10 | | Home Depot | | | 12 | | | | 8 | | | | 1,810 | | | | 4.1 | % | | | 13,207 | | | | 2.3 | % | | | 14.9 | | | A- |

11 | | Kohl’s | | | 19 | | | | 9 | | | | 1,499 | | | | 3.4 | % | | | 13,012 | | | | 2.3 | % | | | 15.1 | | | BBB+ |

12 | | Family Dollar | | | 140 | | | | 26 | | | | 1,185 | | | | 2.7 | % | | | 12,839 | | | | 2.3 | % | | | 13.8 | | | BBB- |

13 | | Tractor Supply | | | 42 | | | | 20 | | | | 875 | | | | 2.0 | % | | | 11,092 | | | | 2.0 | % | | | 11.7 | | | Not Rated |

14 | | Merrill Lynch | | | 1 | | | | 1 | | | | 482 | | | | 1.1 | % | | | 10,963 | | | | 1.9 | % | | | 11.4 | | | A |

15 | | Best Buy | | | 20 | | | | 12 | | | | 673 | | | | 1.5 | % | | | 9,506 | | | | 1.7 | % | | | 6.2 | | | BB |

16 | | On The Border | | | 27 | | | | 13 | | | | 190 | | | | 0.4 | % | | | 8,556 | | | | 1.5 | % | | | 16.8 | | | Not Rated |

17 | | Encana Oil & Gas, USA | | | 1 | | | | 1 | | | | 319 | | | | 0.7 | % | | | 7,806 | | | | 1.4 | % | | | 14.0 | | | Not Rated |

18 | | HealthNow | | | 1 | | | | 1 | | | | 430 | | | | 1.0 | % | | | 7,722 | | | | 1.4 | % | | | 11.1 | | | BBB- |

19 | | Stripes | | | 24 | | | | 2 | | | | 140 | | | | 0.3 | % | | | 6,932 | | | | 1.2 | % | | | 15.6 | | | Not Rated |

20 | | RSA Security | | | 1 | | | | 1 | | | | 328 | | | | 0.8 | % | | | 6,915 | | | | 1.2 | % | | | 10.7 | | | A |

21 | | Lowe’s | | | 9 | | | | 9 | | | | 1,204 | | | | 2.8 | % | | | 6,445 | | | | 1.1 | % | | | 13.8 | | | A- |

22 | | AT&T | | | 9 | | | | 7 | | | | 1,021 | | | | 2.3 | % | | | 6,279 | | | | 1.1 | % | | | 6.2 | | | A- |

23 | | Advance Auto Parts | | | 45 | | | | 10 | | | | 304 | | | | 0.7 | % | | | 5,885 | | | | 1.0 | % | | | 9.9 | | | BBB- |

24 | | Cigna | | | 2 | | | | 2 | | | | 299 | | | | 0.7 | % | | | 5,773 | | | | 1.0 | % | | | 9.2 | | | A+ |

25 | | Dick’s Sporting Goods | | | 10 | | | | 6 | | | | 472 | | | | 1.1 | % | | | 5,650 | | | | 1.0 | % | | | 6.5 | | | Not Rated |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Top 25 Tenants | | | 599 | | | | | | | | 24,981 | | | | 57.2 | % | | $ | 311,073 | | | | 54.9 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

19

Tenant Diversification (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Tenant | | Number

of Leases | | | Number

of States | | | Leased

Square Feet

(thousands) | | | % of

Leased

Square

Feet | | | Annualized

Rental

Revenue(1)

(thousands) | | | % of

Annualized

Rental

Revenue | | | Weighted

Average Lease

Term

Remaining(2) | | | S&P Credit

Rating(3) |

26 | | Academy Sports | | | 7 | | | | 4 | | | | 591 | | | | 1.4 | % | | $ | 5,464 | | | | 1.0 | % | | | 14.6 | | | B |

27 | | Outback Steakhouse | | | 20 | | | | 14 | | | | 124 | | | | 0.3 | % | | | 5,196 | | | | 0.9 | % | | | 18.8 | | | B+ |

28 | | Thorntons Oil | | | 23 | | | | 4 | | | | 79 | | | | 0.2 | % | | | 4,935 | | | | 0.9 | % | | | 12.5 | | | Not Rated |

29 | | Aaron Rents | | | 6 | | | | 17 | | | | 655 | | | | 1.5 | % | | | 4,912 | | | | 0.9 | % | | | 11.3 | | | Not Rated |

30 | | Ross | | | 16 | | | | 10 | | | | 466 | | | | 1.1 | % | | | 4,830 | | | | 0.9 | % | | | 4.4 | | | A- |

31 | | Bed Bath & Beyond | | | 16 | | | | 10 | | | | 431 | | | | 1.0 | % | | | 4,677 | | | | 0.8 | % | | | 4.9 | | | BBB+ |

32 | | VA Clinic | | | 1 | | | | 1 | | | | 66 | | | | 0.2 | % | | | 4,657 | | | | 0.8 | % | | | 16.7 | | | AA+ |

33 | | The Medicines Company | | | 1 | | | | 1 | | | | 179 | | | | 0.4 | % | | | 4,577 | | | | 0.8 | % | | | 10.4 | | | Not Rated |

34 | | Golden Corral | | | 22 | | | | 7 | | | | 234 | | | | 0.5 | % | | | 4,391 | | | | 0.8 | % | | | 13.9 | | | Not Rated |

35 | | Giant Eagle | | | 4 | | | | 1 | | | | 303 | | | | 0.7 | % | | | 4,365 | | | | 0.8 | % | | | 14.1 | | | Not Rated |

36 | | MedAssets | | | 1 | | | | 1 | | | | 231 | | | | 0.5 | % | | | 4,364 | | | | 0.8 | % | | | 14.7 | | | B+ |

37 | | Hobby Lobby | | | 10 | | | | 8 | | | | 552 | | | | 1.3 | % | | | 4,306 | | | | 0.8 | % | | | 7.6 | | | Not Rated |

38 | | Applebee’s | | | 9 | | | | 12 | | | | 95 | | | | 0.2 | % | | | 4,284 | | | | 0.8 | % | | | 15.0 | | | Not Rated |

39 | | Cracker Barrel | | | 12 | | | | 5 | | | | 120 | | | | 0.3 | % | | | 3,929 | | | | 0.7 | % | | | 15.0 | | | Not Rated |

40 | | Wendy’s | | | 9 | | | | 6 | | | | 107 | | | | 0.2 | % | | | 3,856 | | | | 0.7 | % | | | 19.1 | | | Not Rated |

41 | | FedEx | | | 8 | | | | 8 | | | | 390 | | | | 0.9 | % | | | 3,559 | | | | 0.6 | % | | | 7.6 | | | BBB |

42 | | Stop & Shop | | | 2 | | | | 2 | | | | 122 | | | | 0.3 | % | | | 3,521 | | | | 0.6 | % | | | 18.1 | | | BBB |

43 | | Sysmex | | | 1 | | | | 1 | | | | 163 | | | | 0.4 | % | | | 3,507 | | | | 0.6 | % | | | 13.3 | | | Not Rated |

44 | | Wells Fargo | | | 8 | | | | 7 | | | | 241 | | | | 0.6 | % | | | 3,414 | | | | 0.6 | % | | | 9.5 | | | AA- |

45 | | Ryan’s Buffet | | | 1 | | | | 9 | | | | 137 | | | | 0.3 | % | | | 3,373 | | | | 0.6 | % | | | 9.5 | | | Not Rated |

46 | | Igloo | | | 1 | | | | 1 | | | | 914 | | | | 2.1 | % | | | 3,345 | | | | 0.6 | % | | | 11.3 | | | Not Rated |

47 | | Banner Life Insurance Company | | | 1 | | | | 1 | | | | 116 | | | | 0.3 | % | | | 3,131 | | | | 0.6 | % | | | 13.2 | | | AA- |

48 | | Sam’s Club | | | 3 | | | | 3 | | | | 373 | | | | 0.9 | % | | | 3,109 | | | | 0.5 | % | | | 7.5 | | | AA |

49 | | Carmax | | | 2 | | | | 2 | | | | 116 | | | | 0.3 | % | | | 3,039 | | | | 0.5 | % | | | 15.4 | | | Not Rated |

50 | | Hanesbrands | | | 1 | | | | 1 | | | | 930 | | | | 2.1 | % | | | 2,993 | | | | 0.5 | % | | | 8.5 | | | BB |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Tenants 26—50 | | | 185 | | | | | | | | 7,735 | | | | 18.0 | % | | $ | 101,734 | | | | 18.1 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Top 50 Tenants | | | 784 | | | | | | | | 32,716 | | | | 75.2 | % | | $ | 412,807 | | | | 73.0 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Portfolio | | | 1,767 | | | | 48 | | | | 43,629 | | | | 100 | % | | $ | 567,932 | | | | 100.0 | % | | | | | | |

| (1) | Represents the average annual base rental income over the respective lease terms, including adjustments for rent concessions or abatements, if any. |

| (2) | Calculated using the non-cancelable lease terms. |

| (3) | Standard & Poor’s Credit rating may reflect the credit rating of the parent company or a guarantor. |

20

Industry Diversification

The following table shows certain information regarding the tenant industry diversification of the Company’s real estate portfolio, including consolidated joint ventures, as of June 30, 2013:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Industry | | Number of

Leases | | | Number of

Tenants | | | Number of

States | | | Leased Square

Feet

(thousands) | | | Annualized

Rental

Revenue(1)

(thousands) | | | % of

Annualized

Rental

Revenue | | | Weighted

Average Lease

Term Remaining

(2) | |

Grocery | | | 75 | | | | 25 | | | | 24 | | | | 4,014 | | | $ | 52,524 | | | | 9.1 | % | | | 15.3 | |

Drugstore | | | 127 | | | | 2 | | | | 36 | | | | 1,938 | | | | 47,504 | | | | 8.4 | % | | | 18.0 | |

Discount store | | | 228 | | | | 15 | | | | 32 | | | | 4,563 | | | | 44,030 | | | | 7.8 | % | | | 10.1 | |

Full service restaurant | | | 189 | | | | 80 | | | | 30 | | | | 1,100 | | | | 38,856 | | | | 6.8 | % | | | 14.6 | |

Home and garden | | | 69 | | | | 9 | | | | 29 | | | | 3,937 | | | | 31,442 | | | | 5.5 | % | | | 13.4 | |

Pet supplies | | | 49 | | | | 2 | | | | 18 | | | | 1,405 | | | | 25,438 | | | | 4.5 | % | | | 8.2 | |

Warehouse club | | | 7 | | | | 3 | | | | 11 | | | | 2,767 | | | | 24,200 | | | | 4.3 | % | | | 16.2 | |

Healthcare | | | 58 | | | | 44 | | | | 17 | | | | 899 | | | | 22,439 | | | | 4.0 | % | | | 11.2 | |

Financial services | | | 61 | | | | 29 | | | | 14 | | | | 859 | | | | 20,067 | | | | 3.5 | % | | | 12.0 | |

Limited service restaurant | | | 133 | | | | 57 | | | | 26 | | | | 730 | | | | 18,934 | | | | 3.3 | % | | | 11.3 | |

Convenience store | | | 82 | | | | 9 | | | | 16 | | | | 346 | | | | 17,567 | | | | 3.1 | % | | | 14.3 | |

Other professional services | | | 9 | | | | 8 | | | | 8 | | | | 953 | | | | 17,113 | | | | 3.0 | % | | | 11.1 | |

Fitness | | | 26 | | | | 9 | | | | 10 | | | | 882 | | | | 16,217 | | | | 2.9 | % | | | 10.7 | |

Specialty retail | | | 96 | | | | 44 | | | | 20 | | | | 1,310 | | | | 15,613 | | | | 2.7 | % | | | 8.1 | |

Education | | | 6 | | | | 5 | | | | 4 | | | | 632 | | | | 15,127 | | | | 2.7 | % | | | 17.4 | |

Department store | | | 27 | | | | 6 | | | | 10 | | | | 2,266 | | | | 15,081 | | | | 2.7 | % | | | 14.8 | |

Apparel | | | 111 | | | | 50 | | | | 12 | | | | 933 | | | | 14,552 | | | | 2.6 | % | | | 5.0 | |

Wholesale | | | 3 | | | | 1 | | | | 2 | | | | 3,048 | | | | 13,922 | | | | 2.5 | % | | | 13.3 | |

Sporting goods | | | 25 | | | | 9 | | | | 12 | | | | 1,256 | | | | 13,891 | | | | 2.4 | % | | | 10.3 | |

Manufacturing | | | 5 | | | | 5 | | | | 5 | | | | 3,207 | | | | 13,295 | | | | 2.3 | % | | | 10.5 | |

Electronics and appliances | | | 32 | | | | 6 | | | | 18 | | | | 930 | | | | 13,029 | | | | 2.3 | % | | | 6.8 | |

Automotive | | | 75 | | | | 9 | | | | 19 | | | | 613 | | | | 12,239 | | | | 2.2 | % | | | 12.5 | |

Insurance services | | | 8 | | | | 6 | | | | 7 | | | | 571 | | | | 11,756 | | | | 2.1 | % | | | 9.6 | |

Hobby, books and music | | | 46 | | | | 13 | | | | 17 | | | | 995 | | | | 9,957 | | | | 1.8 | % | | | 5.8 | |

Home furnishings | | | 40 | | | | 15 | | | | 13 | | | | 757 | | | | 8,899 | | | | 1.6 | % | | | 6.0 | |

Communications | | | 33 | | | | 9 | | | | 11 | | | | 1,076 | | | | 7,991 | | | | 1.4 | % | | | 5.6 | |

Mining and natural resources | | | 1 | | | | 1 | | | | 1 | | | | 319 | | | | 7,806 | | | | 1.4 | % | | | 14.0 | |

Office supplies | | | 23 | | | | 4 | | | | 11 | | | | 441 | | | | 6,434 | | | | 1.1 | % | | | 5.5 | |

Logistics (shipping, delivery, warehousing) | | | 11 | | | | 2 | | | | 11 | | | | 394 | | | | 3,674 | | | | 0.6 | % | | | 7.4 | |

Personal services | | | 95 | | | | 78 | | | | 14 | | | | 148 | | | | 3,642 | | | | 0.6 | % | | | 4.0 | |

Agriculture | | | 2 | | | | 2 | | | | 2 | | | | 156 | | | | 1,927 | | | | 0.3 | % | | | 12.7 | |

Technology | | | 1 | | | | 1 | | | | 1 | | | | 107 | | | | 1,594 | | | | 0.3 | % | | | 8.5 | |

Childcare | | | 8 | | | | 4 | | | | 5 | | | | 60 | | | | 868 | | | | 0.2 | % | | | 12.2 | |

Government and non-profit | | | 4 | | | | 3 | | | | 3 | | | | 10 | | | | 177 | | | | — | %(3) | | | 1.1 | |

Real estate services | | | 1 | | | | 1 | | | | 1 | | | | 4 | | | | 70 | | | | — | %(3) | | | 0.8 | |

Entertainment and recreation | | | 1 | | | | 1 | | | | 1 | | | | 3 | | | | 57 | | | | — | %(3) | | | 1.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 1,767 | | | | 567 | | | | 48 | | | | 43,629 | | | $ | 567,932 | | | | 100.0 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Represents the average annual base rental income over the respective lease terms, including adjustments for rent concessions or abatements, if any. |

| (2) | Calculated using the non-cancelable lease terms. |

| (3) | Represents less than 0.1% of total annualized rental revenue. |

21

Geographic Diversification

The following table shows certain information regarding the geographic diversification of the Company’s real estate portfolio, including consolidated joint ventures, as of June 30, 2013:

| | | | | | | | | | | | | | | | | | | | |

State | | Number of

Properties | | | % Leased | | | Rentable

Square Feet

(thousands) | | | Annualized

Rental Revenue (1)

(thousands) | | | % of

Annualized

Rental Revenue | |

Texas | | | 187 | | | | 99.3 | % | | | 6,446 | | | $ | 95,967 | | | | 16.9 | % |

Arizona | | | 41 | | | | 99.6 | % | | | 2,976 | | | | 48,996 | | | | 8.6 | % |

California | | | 22 | | | | 98.8 | % | | | 2,905 | | | | 40,401 | | | | 7.1 | % |

Florida | | | 81 | | | | 96.9 | % | | | 3,287 | | | | 39,864 | | | | 7.0 | % |

Illinois | | | 46 | | | | 98.2 | % | | | 1,548 | | | | 30,851 | | | | 5.4 | % |

Georgia | | | 40 | | | | 99.1 | % | | | 2,967 | | | | 28,963 | | | | 5.1 | % |

Michigan | | | 43 | | | | 94.2 | % | | | 1,690 | | | | 21,840 | | | | 3.8 | % |

New Jersey | | | 14 | | | | 100.0 | % | | | 894 | | | | 20,450 | | | | 3.6 | % |

Ohio | | | 71 | | | | 100.0 | % | | | 1,709 | | | | 18,114 | | | | 3.2 | % |

Virginia | | | 23 | | | | 97.4 | % | | | 1,336 | | | | 18,024 | | | | 3.2 | % |

South Carolina | | | 27 | | | | 100.0 | % | | | 2,148 | | | | 16,885 | | | | 3.0 | % |

Alabama | | | 24 | | | | 99.2 | % | | | 1,258 | | | | 16,085 | | | | 2.8 | % |

Tennessee | | | 19 | | | | 99.6 | % | | | 2,529 | | | | 15,577 | | | | 2.7 | % |

Massachusetts | | | 10 | | | | 100.0 | % | | | 1,222 | | | | 14,332 | | | | 2.5 | % |

North Carolina | | | 33 | | | | 100.0 | % | | | 1,498 | | | | 13,215 | | | | 2.3 | % |

Indiana | | | 44 | | | | 100.0 | % | | | 531 | | | | 10,101 | | | | 1.8 | % |

New York | | | 6 | | | | 100.0 | % | | | 640 | | | | 9,677 | | | | 1.7 | % |

Colorado | | | 15 | | | | 99.2 | % | | | 803 | | | | 9,123 | | | | 1.6 | % |

Louisiana | | | 31 | | | | 100.0 | % | | | 866 | | | | 9,032 | | | | 1.6 | % |

Pennsylvania | | | 15 | | | | 99.8 | % | | | 1,046 | | | | 8,037 | | | | 1.4 | % |

New Mexico | | | 18 | | | | 100.0 | % | | | 685 | | | | 7,739 | | | | 1.4 | % |

Nevada | | | 17 | | | | 100.0 | % | | | 699 | | | | 7,428 | | | | 1.3 | % |

Maryland | | | 6 | | | | 100.0 | % | | | 366 | | | | 7,346 | | | | 1.3 | % |

Oklahoma | | | 20 | | | | 100.0 | % | | | 386 | | | | 6,918 | | | | 1.2 | % |

Missouri | | | 26 | | | | 100.0 | % | | | 428 | | | | 6,316 | | | | 1.1 | % |

Wisconsin | | | 16 | | | | 99.7 | % | | | 381 | | | | 5,905 | | | | 1.0 | % |

Iowa | | | 14 | | | | 100.0 | % | | | 474 | | | | 4,787 | | | | 0.8 | % |

Kentucky | | | 18 | | | | 100.0 | % | | | 144 | | | | 3,755 | | | | 0.7 | % |

Nebraska | | | 5 | | | | 100.0 | % | | | 225 | | | | 3,739 | | | | 0.7 | % |

Maine | | | 14 | | | | 100.0 | % | | | 282 | | | | 3,325 | | | | 0.6 | % |

Mississippi | | | 11 | | | | 100.0 | % | | | 258 | | | | 2,899 | | | | 0.5 | % |

Arkansas | | | 13 | | | | 100.0 | % | | | 246 | | | | 2,671 | | | | 0.5 | % |

Minnesota | | | 8 | | | | 100.0 | % | | | 116 | | | | 2,649 | | | | 0.5 | % |

Kansas | | | 7 | | | | 100.0 | % | | | 205 | | | | 2,602 | | | | 0.5 | % |

Connecticut | | | 1 | | | | 100.0 | % | | | 70 | | | | 2,511 | | | | 0.4 | % |

Oregon | | | 1 | | | | 100.0 | % | | | 213 | | | | 2,489 | | | | 0.4 | % |

New Hampshire | | | 4 | | | | 100.0 | % | | | 126 | | | | 2,023 | | | | 0.4 | % |

Alaska | | | 2 | | | | 100.0 | % | | | 92 | | | | 1,615 | | | | 0.3 | % |

22

Geographic Diversification (Continued)

| | | | | | | | | | | | | | | | | | | | |

State | | Number of

Properties | | | %

Leased | | | Rentable

Square Feet

(thousands) | | | Annualized

Rental

Revenue(1)

(thousands) | | | % of

Annualized

Rental Revenue | |

Rhode Island | | | 1 | | | | 100.0 | % | | | 52 | | | $ | 1,010 | | | | 0.2 | % |

Washington | | | 6 | | | | 100.0 | % | | | 40 | | | | 939 | | | | 0.2 | % |

North Dakota | | | 1 | | | | 100.0 | % | | | 70 | | | | 926 | | | | 0.2 | % |

Delaware | | | 2 | | | | 100.0 | % | | | 35 | | | | 624 | | | | 0.1 | % |

Idaho | | | 2 | | | | 100.0 | % | | | 24 | | | | 498 | | | | 0.1 | % |

Utah | | | 2 | | | | 100.0 | % | | | 63 | | | | 496 | | | | 0.1 | % |

South Dakota | | | 2 | | | | 100.0 | % | | | 22 | | | | 491 | | | | 0.1 | % |

West Virginia | | | 1 | | | | 100.0 | % | | | 11 | | | | 302 | | | | 0.1 | % |

Montana | | | 1 | | | | 100.0 | % | | | 16 | | | | 261 | | | | — | %(2) |

Vermont | | | 3 | | | | 100.0 | % | | | 7 | | | | 134 | | | | — | %(2) |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 1,014 | | | | 99.1 | % | | | 44,035 | | | $ | 567,932 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Represents the average annual base rental income over the respective lease terms, including adjustments for rent concessions or abatements, if any. |

| (2) | Represents less than 0.1% of total annualized rental revenue. |

23

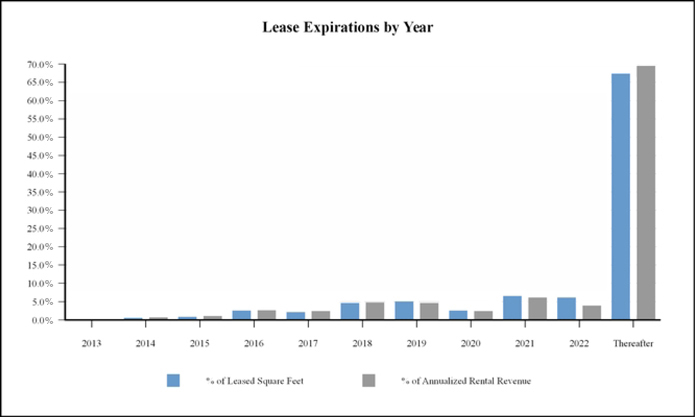

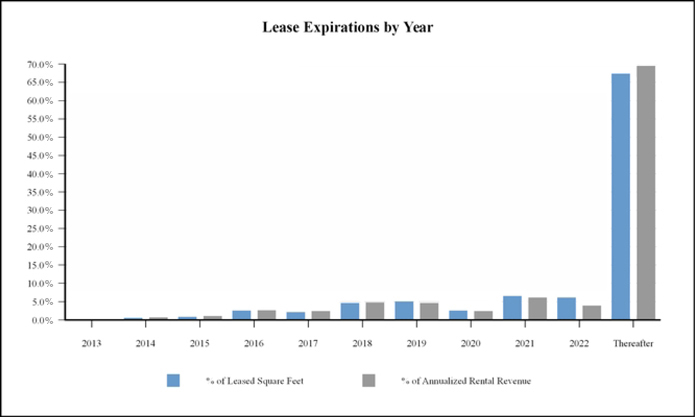

Lease Expirations

The following table shows certain information regarding the lease expirations of the Company’s real estate portfolio, including consolidated joint ventures, as of June 30, 2013, during each of the next ten years and thereafter, assuming no exercise of renewal options:

| | | | | | | | | | | | | | | | | | | | |

Lease Expiration Year | | Number of

Leases Expiring | | | Leased Square

Feet (thousands) | | | % of Leased

Square Feet | | | Annualized

Rental

Revenue(1)

(thousands) | | | % of

Annualized

Rental Revenue | |

2013 | | | 32 | | | | 93 | | | | 0.2 | % | | $ | 1,731 | | | | 0.3 | % |

2014 | | | 69 | | | | 289 | | | | 0.7 | % | | | 5,286 | | | | 0.9 | % |

2015 | | | 89 | | | | 446 | | | | 1.0 | % | | | 7,089 | | | | 1.2 | % |

2016 | | | 125 | | | | 1,164 | | | | 2.7 | % | | | 15,795 | | | | 2.8 | % |

2017 | | | 141 | | | | 1,013 | | | | 2.3 | % | | | 14,541 | | | | 2.6 | % |

2018 | | | 156 | | | | 2,115 | | | | 4.8 | % | | | 27,919 | | | | 4.9 | % |

2019 | | | 97 | | | | 2,255 | | | | 5.2 | % | | | 27,347 | | | | 4.8 | % |

2020 | | | 57 | | | | 1,169 | | | | 2.7 | % | | | 14,694 | | | | 2.6 | % |

2021 | | | 85 | | | | 2,919 | | | | 6.7 | % | | | 36,030 | | | | 6.3 | % |

2022 | | | 72 | | | | 2,737 | | | | 6.3 | % | | | 23,094 | | | | 4.1 | % |

Thereafter | | | 844 | | | | 29,429 | | | | 67.4 | % | | | 394,406 | | | | 69.5 | % |

| | | | | | | | | | | | | | | | | | | | |

Totals | | | 1,767 | | | | 43,629 | | | | 100.0 | % | | $ | 567,932 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Represents the average annual base rental income over the respective lease terms, including adjustments for rent concessions or abatements, if any. |

24

Multi-Tenant Property Summary

The following table shows certain information regarding the Company’s multi-tenant property investments, including consolidated joint ventures, as of June 30, 2013:

| | | | | | | | | | | | | | | | | | | | | | |

Property | | Location | | Type | | Rentable

Square

Feet

(thousands) | | | Occupancy | | | Purchase

Price

(thousands) | | | Annualized

Rental

Revenue(1)

(thousands) | | | Major Tenants |

Atascocita Commons | | Humble, TX | | Power Center | | | 318 | | | | 98.6 | % | | $ | 56,500 | | | $ | 4,605 | | | Kohl’s, TJ Maxx, Ross, Palais Royal, Office Depot, Petco |

Bellview Plaza | | Pensacola, FL | | Grocery | | | 84 | | | | 100.0 | % | | | 8,200 | | | | 833 | | | Publix, Planet Fitness |

Big Lots & Tractor Supply | | Northport, AL | | Anchored | | | 58 | | | | 100.0 | % | | | 3,314 | | | | 253 | | | Big Lots, Tractor Supply |

Breakfast Pointe | | Panama Beach City, FL | | Grocery | | | 96 | | | | 98.9 | % | | | 16,000 | | | | 1,341 | | | Publix, Office Depot |

Camp Creek Marketplace | | East Point, GA | | Power Center | | | 426 | | | | 97.0 | % | | | 76,350 | | | | 6,355 | | | BJ’s Wholesale Club, Marshall’s, Ross, TJ Maxx, Barnes & Noble, Staples, Petsmart, Old Navy |

Century Town Center | | Vero Beach, FL | | Power Center | | | 106 | | | | 92.4 | % | | | 14,775 | | | | 1,362 | | | Marshall’s |

Cleveland Towne Center | | Cleveland, TN | | Power Center | | | 154 | | | | 92.8 | % | | | 17,650 | | | | 1,732 | | | Ross, Bed Bath & Beyond, Michael’s, Electronic Express, Books-A-Million |

Crossroads Marketplace | | Warner Robbins, GA | | Anchored | | | 78 | | | | 98.5 | % | | | 11,250 | | | | 1,029 | | | Best Buy, Bed Bath & Beyond |

CVS & Huntington Bank | | Northville, MI | | Anchored | | | 16 | | | | 100.0 | % | | | 3,797 | | | | 292 | | | CVS |

CVS & Noble Roman | | Mishawaka, IN | | Anchored | | | 12 | | | | 100.0 | % | | | 4,611 | | | | 366 | | | CVS |

CVS & Tres Amigos | | Ringgold, GA | | Anchored | | | 15 | | | | 100.0 | % | | | 3,990 | | | | 323 | | | CVS |

Del Monte Plaza | | Reno, NV | | Grocery | | | 83 | | | | 100.0 | % | | | 18,300 | | | | 1,514 | | | Whole Foods, Sierra Trading Post |

Denver West Plaza | | Lakewood, CO | | Anchored | | | 71 | | | | 91.5 | % | | | 14,000 | | | | 1,215 | | | Best Buy, Office Depot |

Dimond Crossing | | Anchorage, AK | | Anchored | | | 85 | | | | 100.0 | % | | | 14,376 | | | | 1,348 | | | Petsmart, Bed Bath & Beyond |

East Valley Center(2) | | Saginaw, MI | | Power Center | | | 122 | | | | 66.6 | % | | | 4,366 | | | | 539 | | | Burlington Coat Factory |

Eastland Center | | West Covina, CA | | Power Center | | | 811 | | | | 97.3 | % | | | 145,900 | | | | 10,217 | | | Target, Wal-Mart, Burlington Coat Factory, Albertson’s, Dick’s Sporting Goods, Bed Bath & Beyond, Ashley Furniture, Marshall’s, Ross, CVS, Office Depot, DSW, Petsmart |

Evans Exchange(2) | | Evans, GA | | Power Center | | | 66 | | | | 97.5 | % | | | 13,356 | | | | 1,172 | | | Home Depot, Food Lion |

Evans Exchange(2) | | Evans, GA | | Power Center | | | 131 | | | | 100.0 | % | | | 6,044 | | | | 524 | | | Home Depot, Food Lion |

Fairlane Green | | Allen Park, MI | | Power Center | | | 273 | | | | 98.3 | % | | | 47,000 | | | | 4,769 | | | TJ Maxx, Bed Bath & Beyond, Barnes & Noble, Michael’s, Old Navy |

Falcon Valley | | Lenexa, KS | | Grocery | | | 77 | | | | 100.0 | % | | | 12,500 | | | | 1,016 | | | Price Chopper |

Folsum Gateway II | | Folsum, CA | | Power Center | | | 115 | | | | 96.8 | % | | | 36,000 | | | | 2,860 | | | Bed Bath & Beyond, Petsmart, DSW |

Glynn Isles | | Brunswick, GA | | Power Center | | | 192 | | | | 94.7 | % | | | 38,000 | | | | 2,801 | | | Dick’s Sporting Goods, Ross, Petsmart, Michael’s, Office Depot |

Greenway Commons | | Houston, TX | | Power Center | | | 253 | | | | 97.4 | % | | | 68,250 | | | | 4,596 | | | Costco, L.A. Fitness |

Highlands Ranch | | Highland Ranch, CO | | Anchored | | | 51 | | | | 100.0 | % | | | 6,346 | | | | 553 | | | Ross, Staples |

Hillside Town Center | | Chicago, IL | | Power Center | | | 167 | | | | 92.0 | % | | | 26,945 | | | | 2,463 | | | Ross, Home Goods, Michael’s, Staples |

Hobby Lobby Center | | Greenville, SC | | Anchored | | | 70 | | | | 100.0 | % | | | 6,300 | | | | 593 | | | Hobby Lobby |

Indian Lakes Crossing | | Virginia Beach, VA | | Grocery | | | 71 | | | | 95.8 | % | | | 14,200 | | | | 1,069 | | | Harris Teeter |

25